Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Assessment on Global Financial Groups’ 2020 Earnings

Publication date Jan. 05, 2021

Summary

Despite Covid-19’s shock to the global economy, many of the global financial groups are more than weathering the storm. The recently released third-quarter earnings show that major global financial groups posted a YoY increase in revenues. While Covid-19 negatively impacted the retail and commercial banking business of global financial groups, it was more than made up by the large increase in trading revenues, on the back of higher market volatility. As global uncertainties subside in 2021, trading revenues are expected to fall. On the other hand, investment banking fees are expected to increase as the global economies enter a recovery phase and corporate financing demand along with M&A and restructuring activities climbs.

The recently released third-quarter earnings by global financial groups are providing a clearer picture on their performance for the year. Earlier on the year, the prevailing prospect was that the global spread of Covid-19 would dampen earnings of global financial groups. However, earnings results so far have beaten such concerns, showing quite a few global financial groups have not only performed well but also benefited from the pandemic environment.

A substantial number of global financial groups reported an earnings surprise in the third quarter of 2020 beating analyst projections. Furthermore, there is a significant YoY increase in their cumulative revenues for the first three quarters of 2020. Notably, such an upbeat result is attributable to a dramatic revenue increase in their trading business where increased market volatility has been a benefit. By contrast, Covid-19 made global financial groups increase their provision for losses, which adversely impacted their retail and commercial banking operations. Thus, the fortunes of global financial groups have been differentiated by their business structure, with those firms with greater trading operations coming out on top.

Better than expected earnings amidst Covid-19

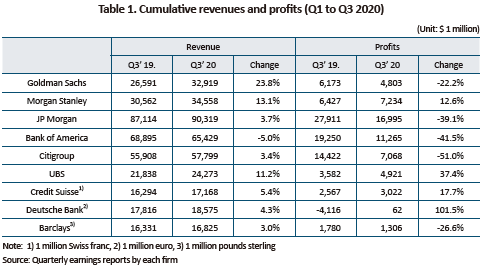

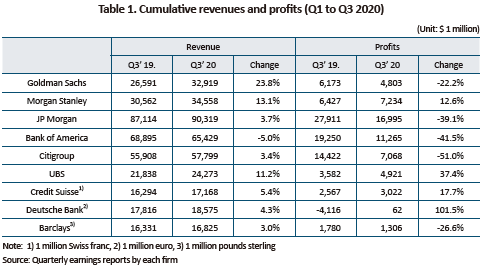

To assess the impact of Covid-19 in 2020, this article compares earnings of nine major full-service financial groups engaging in investment banking, trading, wealth management, asset management, and retail/commercial banking.1) Except for Bank of America, for all financial groups the 2020 Q1–Q3 cumulative revenues went up significantly compared to the same period last year. The YoY increase in cumulative revenues up to the third quarter of 2020 was over 10% for Goldman Sachs (23.8%), Morgan Stanley (13.1%) and UBS (11.2%). Even those with substantial retail and commercial banking businesses—such as JP Morgan (3.7%), Citigroup (3.4%), and Barclays (3.0%)—performed well, posting a 3% or higher YoY increase in cumulative revenue up to the third quarter.

On the other hand, cumulative profits for the first three quarters of 2020 were divergent across financial groups. The YoY increase in revenue during the period translated into increased profits for some players including Morgan Stanley (12.6%), UBS (37.4%), Credit Suisse (17.7%) and Deutsche Bank (101.5%). However, others such as JP Morgan (-39.1%), Bank of America (-41.5%), Citigroup (-51.0%) and Barclays (-26.6%) saw their YoY net profits fall drastically despite posting solid revenues increases, primarily due to substantial increases in provisions for losses.2) In the case of Goldman Sachs, who reported the largest increase in cumulative revenue among the nine players analyzed in this article, profits plunge 22.2% due to the legal costs and penalties related to Malaysia’s 1MDB scandal.3)

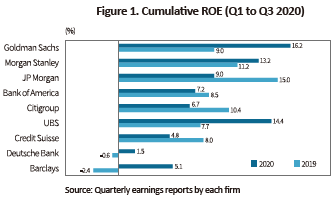

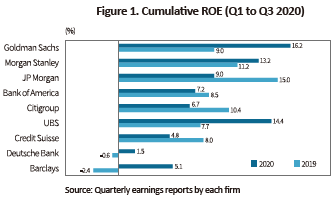

Returns on equity were also different across players. Average ROE for the first three quarters of 2020 stood at 8.7%, a 1.3 percentage point increase from the previous year’s average of 7.4%. Of the nine financial groups analyzed, ROE increased for five financial groups, but fell in the case of four firms, on a YoY basis. Notably, Goldman Sachs, Morgan Stanley, and UBS posted ROEs of over 10% up to the third quarter of 2020 thanks to their trading business. Also, Deutsche Bank and Barclays, who recorded negative ROEs in 2019, managed to return to positive profits this year to improve their ROEs. However, there was a YoY decrease in ROE among some players, due to increased provision for losses in the case of JP Morgan, Bank of America and Citigroup, and due to worse than expected performance of the wealth management business in the case of Credit Suisse.

Solid results driven by trading business

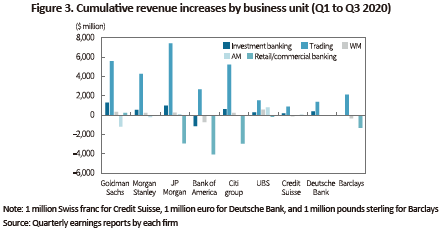

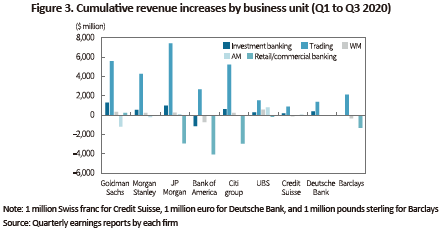

The 2020 earnings of global financial groups were primarily determined by the trading and retail/commercial banking businesses. Of the nine financial groups analyzed, the average YoY change in revenue by business unit for the first three quarters of 2020 stood at 12.5% in investment banking, 36.3% in trading, 1.2% in wealth management, 4.0% in asset management, and –2.0% in retail/commercial banking. Thus, differing market conditions across business sectors, along with the particular revenue structure combined to determine the performance of the individual financial groups.

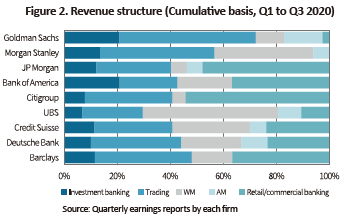

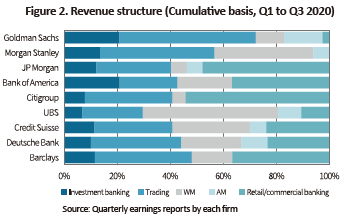

Figure 2 illustrates the cumulative revenue structure for the first three quarters of 2020 in the nine global financial groups analyzed. The share of trading revenue accounts for over 30% in Goldman Sachs, Morgan Stanley, Deutsche Bank and Barclays, whereas retail/commercial banking represents over 30% in the case of JP Morgan, Bank of America, Citigroup, and Barclays. The business environment of 2020 gave an upper hand to the players with substantial investment banking and trading businesses, while those more oriented to retail/commercial banking were relatively at a disadvantage. In the first half of 2020, corporate demand for financing increased amid the low interest rate environment and abundant market liquidity, to push up investment banking revenues. Furthermore, trading operations benefited from rising market volatility due to the lingering Covid-19 pandemic and uncertainties around the US presidential election. By contrast, the economic recession triggered by Covid-19 contracted corporate and household lending, credit card use, and auto loans, all of which adversely affected retail and commercial banking operations.

Figure 3 shows how revenues in each business unit of the nine financial groups changed for the first three quarters of 2020 compared to the previous year of 2019. Particularly notable are a large increase in trading revenues and a decrease in retail/commercial banking revenues, in the case of all the financial groups. And in terms of the level of revenue change, with the exception of Bank of America, the increase in trading revenues far exceeded the decrease in retail and commercial banking revenues. Thus, for the most part, the main determinant of the 2020 earnings of the major financial groups was the difference in level between trading revenue gains and retail/commercial banking revenue falls.

Conclusion

Despite the impact of the Covid-19 pandemic, many global financial groups managed to report solid earnings in 2020. Barring a major break from the current trend in the fourth quarter, some financial groups are expected to post the largest earnings since the 2008 global financial crisis. The economic shock from Covid-19 has been negative for most industries and companies. However some companies in select industries such as the IT sector, due to rise in online activities, and the financial services sector, due to increased market volatility, have actually benefitted under the current environment. Korean securities firms have also performed well this year, as a large number of new retail investors took to stock trading, driving up brokerage revenues.4)

Whether the current market conditions will carry on over to 2021 remains a question mark. With the uncertainty surrounding the US presidential election now behind us, and as more Covid-19 vaccines getting approval and vaccinations taking place, the global economy is expected to get back on track and market volatility fall in the process. This will likely reduce trading revenues of global financial groups, while improving their revenues in retail/commercial banking. Also expected is a revenue increase in investment banking operations related to corporate financing, M&A, and corporate restructuring during the course of the recovery in the real economy. As such, Korea’s securities firms also need to prepare their business strategies to take into account the changing market environment in the coming year.

1) Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America, Citigroup, UBS, Credit Suisse, Deutsche Bank, and Barclays

2) The nine financial groups’ cumulative provisions for losses during the first three quarters of 2020 shot up 229.0% on average compared to 2019.

3) According to the quarterly earnings report of Goldman Sachs, “other expenses” included in its cumulative operating expenses for the first three quarters of 2020 increased from $1.56 billion in 2019 to $5.03 billion in 2020, most of which is in the area of provisions for legal expenses.

4) There is difference between global financial groups and Korea’s securities firms: While increased trading revenues in global financial groups were largely led by institutional investors, retail investors’ stock trading was the main factor behind Korean player’s brokerage revenue increase.

A substantial number of global financial groups reported an earnings surprise in the third quarter of 2020 beating analyst projections. Furthermore, there is a significant YoY increase in their cumulative revenues for the first three quarters of 2020. Notably, such an upbeat result is attributable to a dramatic revenue increase in their trading business where increased market volatility has been a benefit. By contrast, Covid-19 made global financial groups increase their provision for losses, which adversely impacted their retail and commercial banking operations. Thus, the fortunes of global financial groups have been differentiated by their business structure, with those firms with greater trading operations coming out on top.

Better than expected earnings amidst Covid-19

To assess the impact of Covid-19 in 2020, this article compares earnings of nine major full-service financial groups engaging in investment banking, trading, wealth management, asset management, and retail/commercial banking.1) Except for Bank of America, for all financial groups the 2020 Q1–Q3 cumulative revenues went up significantly compared to the same period last year. The YoY increase in cumulative revenues up to the third quarter of 2020 was over 10% for Goldman Sachs (23.8%), Morgan Stanley (13.1%) and UBS (11.2%). Even those with substantial retail and commercial banking businesses—such as JP Morgan (3.7%), Citigroup (3.4%), and Barclays (3.0%)—performed well, posting a 3% or higher YoY increase in cumulative revenue up to the third quarter.

On the other hand, cumulative profits for the first three quarters of 2020 were divergent across financial groups. The YoY increase in revenue during the period translated into increased profits for some players including Morgan Stanley (12.6%), UBS (37.4%), Credit Suisse (17.7%) and Deutsche Bank (101.5%). However, others such as JP Morgan (-39.1%), Bank of America (-41.5%), Citigroup (-51.0%) and Barclays (-26.6%) saw their YoY net profits fall drastically despite posting solid revenues increases, primarily due to substantial increases in provisions for losses.2) In the case of Goldman Sachs, who reported the largest increase in cumulative revenue among the nine players analyzed in this article, profits plunge 22.2% due to the legal costs and penalties related to Malaysia’s 1MDB scandal.3)

The 2020 earnings of global financial groups were primarily determined by the trading and retail/commercial banking businesses. Of the nine financial groups analyzed, the average YoY change in revenue by business unit for the first three quarters of 2020 stood at 12.5% in investment banking, 36.3% in trading, 1.2% in wealth management, 4.0% in asset management, and –2.0% in retail/commercial banking. Thus, differing market conditions across business sectors, along with the particular revenue structure combined to determine the performance of the individual financial groups.

Figure 2 illustrates the cumulative revenue structure for the first three quarters of 2020 in the nine global financial groups analyzed. The share of trading revenue accounts for over 30% in Goldman Sachs, Morgan Stanley, Deutsche Bank and Barclays, whereas retail/commercial banking represents over 30% in the case of JP Morgan, Bank of America, Citigroup, and Barclays. The business environment of 2020 gave an upper hand to the players with substantial investment banking and trading businesses, while those more oriented to retail/commercial banking were relatively at a disadvantage. In the first half of 2020, corporate demand for financing increased amid the low interest rate environment and abundant market liquidity, to push up investment banking revenues. Furthermore, trading operations benefited from rising market volatility due to the lingering Covid-19 pandemic and uncertainties around the US presidential election. By contrast, the economic recession triggered by Covid-19 contracted corporate and household lending, credit card use, and auto loans, all of which adversely affected retail and commercial banking operations.

Despite the impact of the Covid-19 pandemic, many global financial groups managed to report solid earnings in 2020. Barring a major break from the current trend in the fourth quarter, some financial groups are expected to post the largest earnings since the 2008 global financial crisis. The economic shock from Covid-19 has been negative for most industries and companies. However some companies in select industries such as the IT sector, due to rise in online activities, and the financial services sector, due to increased market volatility, have actually benefitted under the current environment. Korean securities firms have also performed well this year, as a large number of new retail investors took to stock trading, driving up brokerage revenues.4)

Whether the current market conditions will carry on over to 2021 remains a question mark. With the uncertainty surrounding the US presidential election now behind us, and as more Covid-19 vaccines getting approval and vaccinations taking place, the global economy is expected to get back on track and market volatility fall in the process. This will likely reduce trading revenues of global financial groups, while improving their revenues in retail/commercial banking. Also expected is a revenue increase in investment banking operations related to corporate financing, M&A, and corporate restructuring during the course of the recovery in the real economy. As such, Korea’s securities firms also need to prepare their business strategies to take into account the changing market environment in the coming year.

1) Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America, Citigroup, UBS, Credit Suisse, Deutsche Bank, and Barclays

2) The nine financial groups’ cumulative provisions for losses during the first three quarters of 2020 shot up 229.0% on average compared to 2019.

3) According to the quarterly earnings report of Goldman Sachs, “other expenses” included in its cumulative operating expenses for the first three quarters of 2020 increased from $1.56 billion in 2019 to $5.03 billion in 2020, most of which is in the area of provisions for legal expenses.

4) There is difference between global financial groups and Korea’s securities firms: While increased trading revenues in global financial groups were largely led by institutional investors, retail investors’ stock trading was the main factor behind Korean player’s brokerage revenue increase.