Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Recent Issues and Challenges in KTB Market

Publication date Jun. 29, 2021

Summary

As internal and external demand contracted significantly due to Covid-19, the Korean government has been supporting economic recovery with an expansionary fiscal policy. Accordingly, the issuance of KTBs has sharply risen, causing a supply and demand imbalance that could increase an upward pressure on the interest rates. On another front, the Bank of Korea is signaling an earlier-than-expected rate hike on account of financial stability concerns such as rising household debt. As the upward trend of interest rates continues amid stronger global economic recovery, any additional upward pressure—for example, an imbalance between KTB supply and demand, or a base rate increase—could further exacerbate the stability of the financial markets. For an effective policy mix, the government and the Bank of Korea need to respond with more efficient fiscal spending and more prudent monetary policy, respectively. In addition, the KTB issuance system needs an improvement that sets its limit on the net increase for more flexible issuance depending on market conditions.

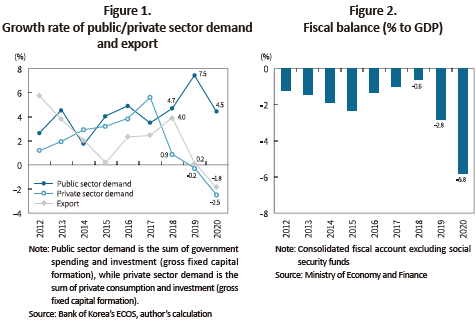

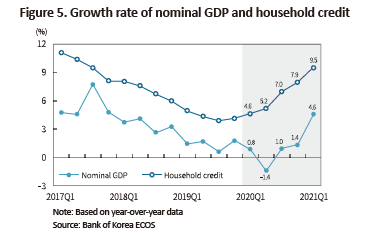

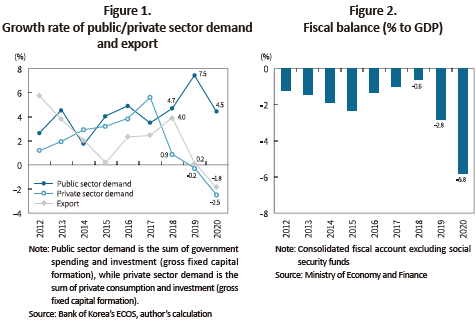

As the Covid-19 shock seriously undermined the growth driver of the private sector, fiscal policy had to play a more active role. Accordingly, governments around the globe increased fiscal spending immensely aiming to overcome the pandemic crisis. Korea, too, saw its internal and external demand deteriorating significantly, with its private sector demand and exports falling 2.5% and 1.8%, respectively. However, the Korean government increased its spending and investment by 4.5%, which effectively helped prevent the domestic economy from contracting sharply (Figure 1). Notably, the sizable increase in fiscal spending came with a higher fiscal deficit. The ratio of the consolidated fiscal balance excluding social security funds to GDP decreased from –2.8% in 2019 to –5.8% in 2020 (Figure 2).1)

For expansionary fiscal policy, the issuance of Korea Treasury Bonds (KTBs) increased dramatically, which could give rise to some risk factors. The market interest rate is on the steady rise as the solid recovery of the global economy continues. Although further fiscal support is necessary for economic recovery, it might be difficult to finance fiscal spending if market conditions lead to a steep increase in KTB yields. Against the backdrop, this article first explores the recent key issues in the KTB market, and then discusses the implications and future challenges.

KTB issuance increasing steeply

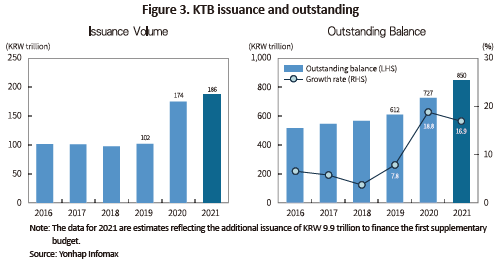

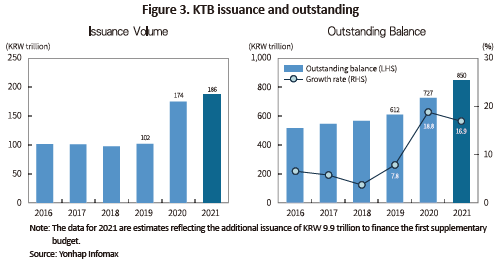

The steep increase in KTB issuance is raising concerns about the demand and supply imbalance. Figure 3 illustrates the issuance volume and outstanding balance of KTBs. The annual issuance of KTBs hovered around KRW 100 trillion between 2016 and 2019, but steeply went up to KRW 174 trillion in 2020 when the government had to increase fiscal spending in response to the Covid-19 pandemic. As fiscal expansion is expected to continue, the issuance is estimated to reach KRW 186 trillion in 2021, reflecting the additional issuance of KRW 9.9 trillion to finance the first supplementary budget. The outstanding balance of KTBs is expected to reach KRW 850 trillion as of the end of 2021.

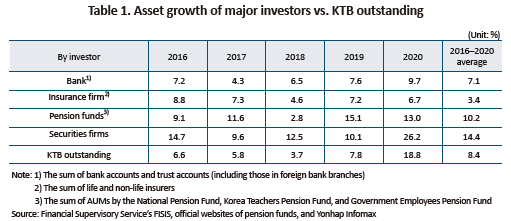

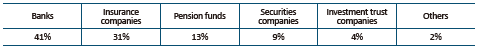

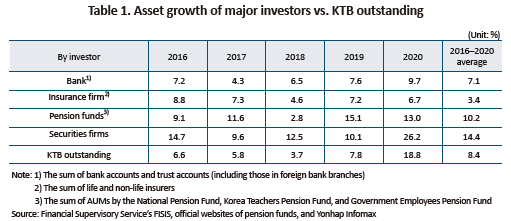

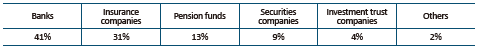

Given the asset growth of major KTB investors, the recent sharp increase in KTB issuance could lead to an imbalance between supply and demand. The outstanding amount of KTBs increased 18.8% and 16.9% in 2020 and 2021, respectively, outpacing the 5-year average of institutional investors’ asset growth (Table 1). The average growth rate of asset stood at less than 10% in banks and insurance companies which hold over 70% of the total KTBs outstanding.2) Also, the weight of domestic fixed income in pension funds’ portfolios is decreasing. Those two factors could widen the supply and demand imbalance of KTBs.3)

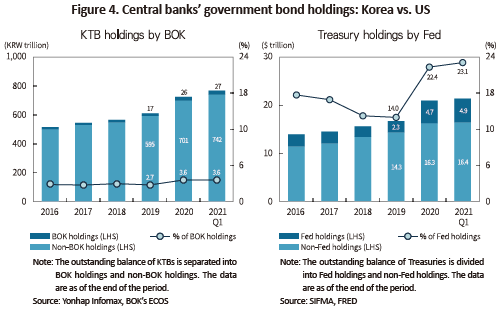

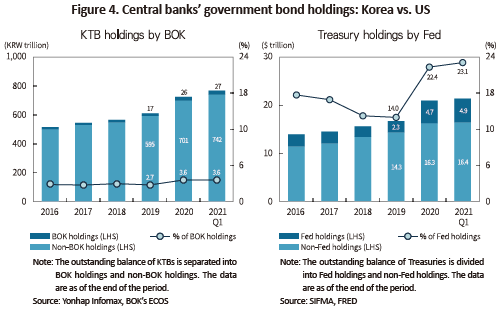

Moreover, Korea’s central bank has relatively less capacity for purchasing government bonds, as compared to major economies carrying out quantitative easing. As of the end of March 2021, the US Fed held 23.1% of Treasury securities, while the Bank of Korea held only 3.6% of KTBs due to differences in their monetary policy operations (Figure 4).4) Accordingly, the pace of increase in the government bonds that need to be purchased by the market is higher in Korea than the US. Between January 2020 and March 2021, the growth of non-BOK holdings of KTBs stood at 24.7%, far exceeding that of non-Fed Treasury holdings at 14.6%.

As illustrated above, the concerns about the imbalance in KTB supply and demand are putting an upward pressure on the interest rates. If more KTBs are issued to finance another round of the supplementary budget, that could increase the upside risk to the interest rates as well as the volatility in the financial markets.

Higher possibility of an earlier-than-expected base rate hike

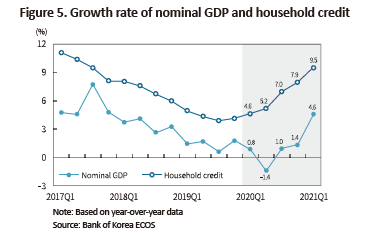

In 2021, the Korean economy is projected to recover mainly led by exports and capital investment. However, the household debt has increased far more than the real economy amid accommodative financial conditions, which is fueling concerns about financial unrest (Figure 5). Accordingly, the Bank of Korea hinted an earlier-than-expected rate hike at its May monetary policy press conference, which is increasing the possibility of a base rate hike this year.5)

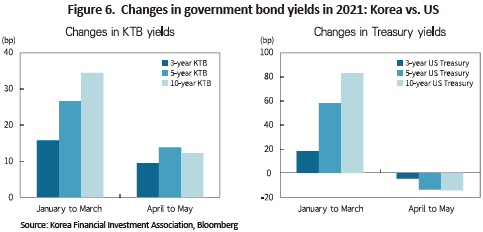

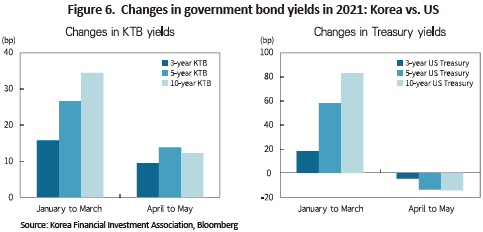

While KTB yields are rising owing to the stronger global recovery and the imbalance between supply and demand of KTBs, the likelihood of a rate hike is also putting upward pressure on the yields. In particular, US Treasury yields and KTB yields were in sync, rising together between January and March in 2021, whereas only KTB yields were on the rise during April and May (Figure 6). This is in stark contrast to US Treasury yields that reversed lower due to the slow recovery in employment. Thus, the recent increase in KTB yields are mostly attributable to domestic factors.

An upward trend is observed in not only long-term bonds with 10-year or longer maturities, but also the bonds with shorter maturities such as 3-year and 5-year bonds. Most corporate bond yields are determined based on 3-year or 5-year KTB yields. When the yields on those shorter-term KTBs rise quickly, corporate financing becomes more expensive and this could deter economic recovery.

Implications and challenges ahead

The recent developments require more than ever the Bank of Korea and the government to work together for sharing their views on the current economic and financial conditions and to be alert to any market unrest caused by higher interest rate volatility. As interest rates are rising amid stronger real economic recovery both in Korea and abroad, any additional upward pressure such as an imbalance in KTB supply and demand or a base rate hike could destabilize the financial markets. Hence, economic recovery should be backed by an effective policy mix between fiscal and monetary policies. If there is another supplementary budget that requires more KTB issuance, that could trigger an interest rate increase in the overall financial markets. This is calling for higher efficiency in government spending.6) The Bank of Korea should closely monitor economic conditions while considering more prudent monetary policy operations.

In addition, the KTB issuance system needs to be improved for more flexible issuance depending on market conditions. Currently, the government shall first acquire approval of the annual total issuance limit for KTBs from the National Assembly, and accordingly issue KTBs within the limit. Since the issuance for exchanges and buybacks is included in the annual total issuance limit, they are not fully capitalized. When volatility rises due to rapid interest rate increases, bond exchanges and buybacks are useful for stabilizing the bond market as well as reducing the issuance cost.7) The National Finance Act should be amended in the direction that sets the issuance limit on the net increase, as is the case for developed economies including the US and the UK.8)

1) Social security funds are accumulated for the government’s future financial obligations and thus could possibly misrepresent the government’s actual fiscal capacity. In this regard, the consolidated fiscal balance excluding social security funds describes a more accurate picture of fiscal conditions.

2) As of end-2020, the shares of KTB holdings by major institutional investors are as follows (Ministry of Economy and Finance, 2021).

3) The National Pension Fund decreased the weight of domestic fixed income in its portfolios drastically from 64% in 2011 to 39% in 2020, and will further reduce the weight to around 25% by 2025.

4) In 2020, the Fed unveiled unlimited asset purchases aiming to stabilize Treasury yields, which accordingly led to a large increase in its Treasury holdings (Baek, 2020). Meanwhile, the Bank of Korea’s KTB purchases aim to ease the volatility of market interest rates, and thus are small-sized compared to the Fed’s asset purchase programs.

5) During the press conference right after the monetary policy decision meeting on May 27, 2021, BOK Governor Lee Juyeol underscored the need for reining in the increase in household debt to prevent the financial imbalance from growing further, hinting a possibility of a base rate hike this year depending on how economic conditions will pan out.

6) The IMF presented the need for policy adjustments taking into account the pandemic developments, the strength of economic recovery, and others, and recommended well-targeted fiscal support to affected households and firms (IMF, 2021).

7) Any distortion in the yield curve such as an inversion could be addressed using bond exchanges or buybacks. For example, if a bond with a specific maturity is undervalued (high-yield), a bond exchange which retires the corresponding maturity and issues an overvalued (low-yield) maturity can normalize the yield curve and save the issuance cost (World Bank Group, 2015). In March 2021, there was an inversion between 10-year and 30-year KTB yields, but it was hard to address that under the current system.

8) Major developed economies use the annual net issuance or the overall outstanding balance of government bonds as a basis for parliamentary approval (Kim et al., 2014).

References

IMF, 2021, World Economic Outlook: Managing Divergent Recoveries.

World Bank Group, 2015, Bond Buybacks and Exchanges: Background Note.

(Korean)

Ministry of Economy and Finance, 2021, Korea treasury bonds 2020.

Kim, P.K., Baek, I.S., and Hwang S.W, 2014, The policy characteristics of foreign government bond markets and their implications on KTB Market, KCMI Survey Paper 14-01.

Baek, I.S., 2020, Covid-19 responses: Need for lowering KTB yields with asset purchases (QE), KCMI Issue Paper 20-08.

KTB issuance increasing steeply

The steep increase in KTB issuance is raising concerns about the demand and supply imbalance. Figure 3 illustrates the issuance volume and outstanding balance of KTBs. The annual issuance of KTBs hovered around KRW 100 trillion between 2016 and 2019, but steeply went up to KRW 174 trillion in 2020 when the government had to increase fiscal spending in response to the Covid-19 pandemic. As fiscal expansion is expected to continue, the issuance is estimated to reach KRW 186 trillion in 2021, reflecting the additional issuance of KRW 9.9 trillion to finance the first supplementary budget. The outstanding balance of KTBs is expected to reach KRW 850 trillion as of the end of 2021.

Higher possibility of an earlier-than-expected base rate hike

In 2021, the Korean economy is projected to recover mainly led by exports and capital investment. However, the household debt has increased far more than the real economy amid accommodative financial conditions, which is fueling concerns about financial unrest (Figure 5). Accordingly, the Bank of Korea hinted an earlier-than-expected rate hike at its May monetary policy press conference, which is increasing the possibility of a base rate hike this year.5)

An upward trend is observed in not only long-term bonds with 10-year or longer maturities, but also the bonds with shorter maturities such as 3-year and 5-year bonds. Most corporate bond yields are determined based on 3-year or 5-year KTB yields. When the yields on those shorter-term KTBs rise quickly, corporate financing becomes more expensive and this could deter economic recovery.

The recent developments require more than ever the Bank of Korea and the government to work together for sharing their views on the current economic and financial conditions and to be alert to any market unrest caused by higher interest rate volatility. As interest rates are rising amid stronger real economic recovery both in Korea and abroad, any additional upward pressure such as an imbalance in KTB supply and demand or a base rate hike could destabilize the financial markets. Hence, economic recovery should be backed by an effective policy mix between fiscal and monetary policies. If there is another supplementary budget that requires more KTB issuance, that could trigger an interest rate increase in the overall financial markets. This is calling for higher efficiency in government spending.6) The Bank of Korea should closely monitor economic conditions while considering more prudent monetary policy operations.

In addition, the KTB issuance system needs to be improved for more flexible issuance depending on market conditions. Currently, the government shall first acquire approval of the annual total issuance limit for KTBs from the National Assembly, and accordingly issue KTBs within the limit. Since the issuance for exchanges and buybacks is included in the annual total issuance limit, they are not fully capitalized. When volatility rises due to rapid interest rate increases, bond exchanges and buybacks are useful for stabilizing the bond market as well as reducing the issuance cost.7) The National Finance Act should be amended in the direction that sets the issuance limit on the net increase, as is the case for developed economies including the US and the UK.8)

1) Social security funds are accumulated for the government’s future financial obligations and thus could possibly misrepresent the government’s actual fiscal capacity. In this regard, the consolidated fiscal balance excluding social security funds describes a more accurate picture of fiscal conditions.

2) As of end-2020, the shares of KTB holdings by major institutional investors are as follows (Ministry of Economy and Finance, 2021).

3) The National Pension Fund decreased the weight of domestic fixed income in its portfolios drastically from 64% in 2011 to 39% in 2020, and will further reduce the weight to around 25% by 2025.

4) In 2020, the Fed unveiled unlimited asset purchases aiming to stabilize Treasury yields, which accordingly led to a large increase in its Treasury holdings (Baek, 2020). Meanwhile, the Bank of Korea’s KTB purchases aim to ease the volatility of market interest rates, and thus are small-sized compared to the Fed’s asset purchase programs.

5) During the press conference right after the monetary policy decision meeting on May 27, 2021, BOK Governor Lee Juyeol underscored the need for reining in the increase in household debt to prevent the financial imbalance from growing further, hinting a possibility of a base rate hike this year depending on how economic conditions will pan out.

6) The IMF presented the need for policy adjustments taking into account the pandemic developments, the strength of economic recovery, and others, and recommended well-targeted fiscal support to affected households and firms (IMF, 2021).

7) Any distortion in the yield curve such as an inversion could be addressed using bond exchanges or buybacks. For example, if a bond with a specific maturity is undervalued (high-yield), a bond exchange which retires the corresponding maturity and issues an overvalued (low-yield) maturity can normalize the yield curve and save the issuance cost (World Bank Group, 2015). In March 2021, there was an inversion between 10-year and 30-year KTB yields, but it was hard to address that under the current system.

8) Major developed economies use the annual net issuance or the overall outstanding balance of government bonds as a basis for parliamentary approval (Kim et al., 2014).

References

IMF, 2021, World Economic Outlook: Managing Divergent Recoveries.

World Bank Group, 2015, Bond Buybacks and Exchanges: Background Note.

(Korean)

Ministry of Economy and Finance, 2021, Korea treasury bonds 2020.

Kim, P.K., Baek, I.S., and Hwang S.W, 2014, The policy characteristics of foreign government bond markets and their implications on KTB Market, KCMI Survey Paper 14-01.

Baek, I.S., 2020, Covid-19 responses: Need for lowering KTB yields with asset purchases (QE), KCMI Issue Paper 20-08.