Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Key Characteristics of the Recent Surge in Individuals’ Bond Investment

Publication date Sep. 24, 2024

Summary

Since 2022, when market interest rates rapidly rose due to aggressive monetary tightening, individuals’ bond investment has significantly surged. The characteristics of this investment vary by bond type. Investments in Korea Treasury Bonds (KTBs) have expanded, particularly in ultra-long KTBs with remaining maturities exceeding 20 years. Despite the high risk of price volatility, retail investors purchasing ultra-long KTBs seem willing to assume this risk in pursuit of higher returns, largely driven by their expectations of future interest rate movements.

In the case of credit bonds, retail investors focused on subordinated or contingent convertible bonds prior to 2022, but there has been a notable increase in individuals investing in senior bonds since 2022. However, the increase in senior bond holdings does not necessarily reflect a shift toward safer investments as the share of low-rated senior bonds has increased. Rather, it suggests that retail investors are increasing their exposure to lower-rated bonds to seek higher yields.

The rise in individuals’ bond investment represents a positive development for the fixed-income market, as it broadens the investor base. It is also beneficial for the economy as a whole, as funds raised through KTBs and credit bonds directly support the economic activities of the government and companies. Going forward, the financial investment industry should step up its efforts, such as reducing transaction costs, to encourage retail investors’ participation in the bond market. Meanwhile, bonds are issued with different terms and conditions, so there are significant differences in the nature and extent of risks associated with bond investments. Therefore, the risks involved in bond investment should be fully explained to retail investors, and they should understand the investment risks before engaging in bond transactions as well.

In the case of credit bonds, retail investors focused on subordinated or contingent convertible bonds prior to 2022, but there has been a notable increase in individuals investing in senior bonds since 2022. However, the increase in senior bond holdings does not necessarily reflect a shift toward safer investments as the share of low-rated senior bonds has increased. Rather, it suggests that retail investors are increasing their exposure to lower-rated bonds to seek higher yields.

The rise in individuals’ bond investment represents a positive development for the fixed-income market, as it broadens the investor base. It is also beneficial for the economy as a whole, as funds raised through KTBs and credit bonds directly support the economic activities of the government and companies. Going forward, the financial investment industry should step up its efforts, such as reducing transaction costs, to encourage retail investors’ participation in the bond market. Meanwhile, bonds are issued with different terms and conditions, so there are significant differences in the nature and extent of risks associated with bond investments. Therefore, the risks involved in bond investment should be fully explained to retail investors, and they should understand the investment risks before engaging in bond transactions as well.

Surge in bond investment by individuals since 2022

Since 2022, net purchases of bonds by retail investors have remained at high levels. In the past when market interest rates were low, retail investors were not active in purchasing bonds. However, their bond investment has surged significantly following the aggressive monetary tightening that led to a spike in market interest rates in 2022 (Table 1).1) While the annual net bond purchase by retail investors was KRW 4.0 trillion on average between 2018 and 2021, it swelled to KRW 21.4 trillion in 2022 and KRW 40.0 trillion in 2023. Moreover, net bond purchases from January to July of this year amounted to KRW 27.3 trillion, indicating a sustained demand for bonds. This is in sharp contrast to individuals’ shift toward net selling in the stock market since 2023, highlighting the growing interest in bond investment among retail investors.

As a result, retail investors’ bond holdings, measured by the balance in the over-the-counter (OTC) market,2) have substantially increased (Figure 1). From January 2022 to July 2024, the total bond holdings by retail investors grew by KRW 43.5 trillion, with KTBs, financial bonds, and corporate bonds increasing by KRW 18.7 trillion, KRW 9.6 trillion, and KRW 7.7 trillion, respectively. This suggests that their investment has expanded across various types of bonds. However, the characteristics of this investment vary by bond type. In this context, this article explores these characteristics, with a particular focus on KTBs and private credit bonds.

Retail investors’ KTB holdings expand driven by purchases of ultra-long KTBs

A key feature of retail investment in KTBs is the notable increase in the share of ultra-long bonds with remaining maturities of more than 20 years (Figure 2). In 2022, when retail investment in KTBs began to rise, the net purchase of ultra-long KTBs amounted to only KRW 0.1 trillion, primarily owing to sharply increasing interest rates. However, as yields on KTBs have sustained a gradual decline since then (Figure 3), the net purchase of ultra-long KTBs by retail investors surged to KRW 4.7 trillion in 2023, with an additional KRW 3.2 trillion purchased from January to July 2024.

Between January 2022 and July 2024, individual holdings of KTBs increased by KRW 18.7 trillion, of which ultra-long KTBs with remaining maturities beyond 20 years accounted for KRW 7.8 trillion (Table 2). Consequently, the share of ultra-long bonds in KTB portfolios held by retail investors has grown significantly, reaching 40.8% as of July 2024.

The ultra-long KTBs held by retail investors are predominantly 30-year KTBs. As illustrated in Figure 4, 30-year KTBs exhibit a high sensitivity to interest rate fluctuations, resulting in significant price volatility compared to 3-year and 10-year KTBs. Thus, these ultra-long KTBs are generally favored by investors with an extended investment horizon. In Korea’s financial market, insurance companies with structurally long-term liabilities are the primary holders of ultra-long KTBs.

Despite the high price volatility, retail investors have increased their investment in ultra-long KTBs, which can be attributed to their risk-taking behavior to pursue higher returns based on expectations of market interest rate movements. The recent decline in KTB yields has led to a remarkable increase in the prices of ultra-long KTBs, achieving higher returns compared to short- and mid-term KTBs (Figure 5).3)

Retail investors’ credit bond4) investment grows with an increase in the share of low-rated senior bonds

Unlike KTBs, credit bonds are issued under various conditions, such as seniority and the issuer’s creditworthiness, which necessitate thorough analysis. When examining individual holdings of credit bonds by seniority, it is found that retail investors have significantly increased their exposure to credit bonds, especially in the senior bond category (Table 3).

Prior to 2022, individuals investing in credit bonds primarily focused on subordinated or contingent convertible bonds.5) As of the end of 2021, over half of the KRW 9.0 trillion in credit bonds held by individuals—KRW 5.1 trillion—was comprised of subordinated or contingent convertible bonds. Following the rapid rise in market interest rates in 2022, however, individual investment in credit bonds, especially in senior bonds, has seen a significant increase. From January 2022 to July 2024, investment in subordinated or contingent convertible bonds climbed by KRW 2.5 trillion, whereas investment in senior bonds saw a much larger increase of KRW 15.9 trillion. As a result, the share of senior bonds in individual credit bond portfolios grew substantially from 43.8% at the end of 2021 to 72.3% by the end of July 2024.

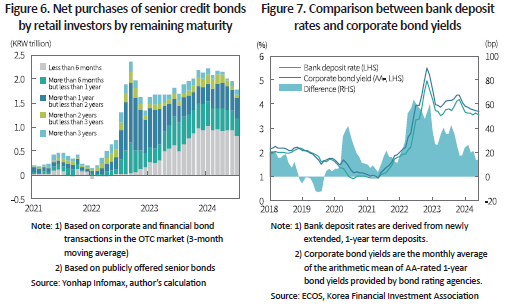

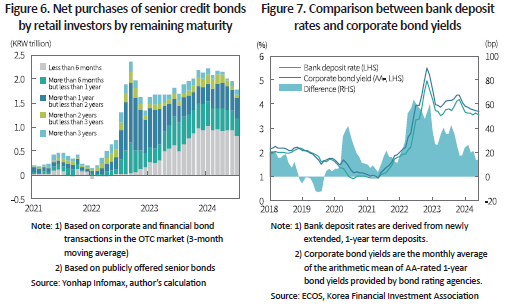

Meanwhile, Figure 6 categorizes the net purchases of senior bonds held by individuals by remaining maturity, indicating that bonds with less than two years to maturity account for the majority of the purchases.7) Given the high transaction costs of credit bonds,8) retail investors seem to buy short-term credit bonds with less than two years remaining and hold them until maturity to seek yields slightly higher than those offered by bank deposits (Figure 7).9) This contrasts sharply with the growth in KTB investing by individuals, which has been concentrated in ultra-long bonds.

Implications

The recent surge in individual investing in bonds represents a positive development for the fixed-income market, as it broadens the investor base. It is also beneficial for the economy as a whole, as funds raised through KTBs and credit bonds directly support the economic activities of the government and companies. For retail investors, the wide range of bond types provides opportunities for the diversification of investment portfolios.

Going forward, it is crucial for the financial investment industry to step up its efforts, such as reducing transaction costs, to facilitate the sustained growth of individual investing in bonds. Meanwhile, bonds are issued with different terms and conditions, so there are significant differences in the nature and extent of risks associated with bond investments. Therefore, the risks involved in bond investment should be fully explained to retail investors, and they should understand the investment risks before engaging in bond transactions as well.

1) This article examines domestic bond investments by individuals (excluding overseas bond investments). Individuals can trade various types of bonds on both the exchange-traded and over-the-counter (OTC) markets. As retail investors primarily trade with securities firms in the OTC market, this article analyzes their transaction data in the OTC market.

2) The analysis uses estimated bond holdings balance in the OTC market, excluding equity-linked bonds such as convertible bonds. The estimates reflect buy and sell transactions in the OTC market as well as matured bonds. However, it should be noted that the estimates do not reflect transactions in the exchange-traded market.

3) Over the previous 12 months (from August 2023 to July 2024), the total return index for KTBs with remaining maturities of 2-3 years, 7-10 years, and 20-30 years increased by 5.2%, 7.7%, and 17.5%, respectively.

4) When investing in credit bonds, retail investors primarily consider issuance conditions, such as credit ratings and yields, rather than the type of bond. Thus, this article analyzes both corporate bonds and financial bonds for credit bonds. Considering that special bonds are predominantly issued with an AAA rating based on implicit guarantee by the government, however, they are excluded from credit bonds.

5) Subordinated or contingent convertible bonds offer higher yields in exchange for lower repayment priority. Consequently, retail investors tend to prefer those bonds compared to institutional investors who are subject to asset quality requirements.

6) The share of A-rated or lower bonds in the total balance of credit bonds held by retail investors (including senior, subordinated or contingent convertible bonds) climbed from 28.5% at the end of 2022 to 33.3% at the end of 2023, and further to 34.5% by the end of July 2024.

7) From January 2022 to July 2024, 83.7% of individuals’ net purchases of senior bonds were the bonds with less than two years of remaining maturity. As of the end of July 2024, the weighted average duration of senior bonds held by retail investors stood at 0.76 years.

8) Credit bonds have lower liquidity than KTBs, leading to relatively higher transaction costs.

9) However, unlike bank deposits, bonds are not covered by depositor insurance.

Since 2022, net purchases of bonds by retail investors have remained at high levels. In the past when market interest rates were low, retail investors were not active in purchasing bonds. However, their bond investment has surged significantly following the aggressive monetary tightening that led to a spike in market interest rates in 2022 (Table 1).1) While the annual net bond purchase by retail investors was KRW 4.0 trillion on average between 2018 and 2021, it swelled to KRW 21.4 trillion in 2022 and KRW 40.0 trillion in 2023. Moreover, net bond purchases from January to July of this year amounted to KRW 27.3 trillion, indicating a sustained demand for bonds. This is in sharp contrast to individuals’ shift toward net selling in the stock market since 2023, highlighting the growing interest in bond investment among retail investors.

As a result, retail investors’ bond holdings, measured by the balance in the over-the-counter (OTC) market,2) have substantially increased (Figure 1). From January 2022 to July 2024, the total bond holdings by retail investors grew by KRW 43.5 trillion, with KTBs, financial bonds, and corporate bonds increasing by KRW 18.7 trillion, KRW 9.6 trillion, and KRW 7.7 trillion, respectively. This suggests that their investment has expanded across various types of bonds. However, the characteristics of this investment vary by bond type. In this context, this article explores these characteristics, with a particular focus on KTBs and private credit bonds.

A key feature of retail investment in KTBs is the notable increase in the share of ultra-long bonds with remaining maturities of more than 20 years (Figure 2). In 2022, when retail investment in KTBs began to rise, the net purchase of ultra-long KTBs amounted to only KRW 0.1 trillion, primarily owing to sharply increasing interest rates. However, as yields on KTBs have sustained a gradual decline since then (Figure 3), the net purchase of ultra-long KTBs by retail investors surged to KRW 4.7 trillion in 2023, with an additional KRW 3.2 trillion purchased from January to July 2024.

Between January 2022 and July 2024, individual holdings of KTBs increased by KRW 18.7 trillion, of which ultra-long KTBs with remaining maturities beyond 20 years accounted for KRW 7.8 trillion (Table 2). Consequently, the share of ultra-long bonds in KTB portfolios held by retail investors has grown significantly, reaching 40.8% as of July 2024.

Despite the high price volatility, retail investors have increased their investment in ultra-long KTBs, which can be attributed to their risk-taking behavior to pursue higher returns based on expectations of market interest rate movements. The recent decline in KTB yields has led to a remarkable increase in the prices of ultra-long KTBs, achieving higher returns compared to short- and mid-term KTBs (Figure 5).3)

Unlike KTBs, credit bonds are issued under various conditions, such as seniority and the issuer’s creditworthiness, which necessitate thorough analysis. When examining individual holdings of credit bonds by seniority, it is found that retail investors have significantly increased their exposure to credit bonds, especially in the senior bond category (Table 3).

Prior to 2022, individuals investing in credit bonds primarily focused on subordinated or contingent convertible bonds.5) As of the end of 2021, over half of the KRW 9.0 trillion in credit bonds held by individuals—KRW 5.1 trillion—was comprised of subordinated or contingent convertible bonds. Following the rapid rise in market interest rates in 2022, however, individual investment in credit bonds, especially in senior bonds, has seen a significant increase. From January 2022 to July 2024, investment in subordinated or contingent convertible bonds climbed by KRW 2.5 trillion, whereas investment in senior bonds saw a much larger increase of KRW 15.9 trillion. As a result, the share of senior bonds in individual credit bond portfolios grew substantially from 43.8% at the end of 2021 to 72.3% by the end of July 2024.

However, the increased investment in senior bonds does not necessarily imply a shift toward safer investments, as the share of low-rated senior bonds has increased. In Table 4, credit bonds held by individuals are categorized into senior bonds and subordinated or contingent convertible bonds, with the distribution of credit ratings provided for each group. When comparing the proportion of A-rated or lower bonds, typically classified as low-rated bonds, the senior bond group contains a higher proportion of low-rated bonds. This suggests that retail investors have expanded their exposure to higher-risk, low-rated bonds to pursue higher yields.6)

The recent surge in individual investing in bonds represents a positive development for the fixed-income market, as it broadens the investor base. It is also beneficial for the economy as a whole, as funds raised through KTBs and credit bonds directly support the economic activities of the government and companies. For retail investors, the wide range of bond types provides opportunities for the diversification of investment portfolios.

Going forward, it is crucial for the financial investment industry to step up its efforts, such as reducing transaction costs, to facilitate the sustained growth of individual investing in bonds. Meanwhile, bonds are issued with different terms and conditions, so there are significant differences in the nature and extent of risks associated with bond investments. Therefore, the risks involved in bond investment should be fully explained to retail investors, and they should understand the investment risks before engaging in bond transactions as well.

1) This article examines domestic bond investments by individuals (excluding overseas bond investments). Individuals can trade various types of bonds on both the exchange-traded and over-the-counter (OTC) markets. As retail investors primarily trade with securities firms in the OTC market, this article analyzes their transaction data in the OTC market.

2) The analysis uses estimated bond holdings balance in the OTC market, excluding equity-linked bonds such as convertible bonds. The estimates reflect buy and sell transactions in the OTC market as well as matured bonds. However, it should be noted that the estimates do not reflect transactions in the exchange-traded market.

3) Over the previous 12 months (from August 2023 to July 2024), the total return index for KTBs with remaining maturities of 2-3 years, 7-10 years, and 20-30 years increased by 5.2%, 7.7%, and 17.5%, respectively.

4) When investing in credit bonds, retail investors primarily consider issuance conditions, such as credit ratings and yields, rather than the type of bond. Thus, this article analyzes both corporate bonds and financial bonds for credit bonds. Considering that special bonds are predominantly issued with an AAA rating based on implicit guarantee by the government, however, they are excluded from credit bonds.

5) Subordinated or contingent convertible bonds offer higher yields in exchange for lower repayment priority. Consequently, retail investors tend to prefer those bonds compared to institutional investors who are subject to asset quality requirements.

6) The share of A-rated or lower bonds in the total balance of credit bonds held by retail investors (including senior, subordinated or contingent convertible bonds) climbed from 28.5% at the end of 2022 to 33.3% at the end of 2023, and further to 34.5% by the end of July 2024.

7) From January 2022 to July 2024, 83.7% of individuals’ net purchases of senior bonds were the bonds with less than two years of remaining maturity. As of the end of July 2024, the weighted average duration of senior bonds held by retail investors stood at 0.76 years.

8) Credit bonds have lower liquidity than KTBs, leading to relatively higher transaction costs.

9) However, unlike bank deposits, bonds are not covered by depositor insurance.