Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Recent Corporate Bond Issuance Landscape and Implications for Corporate Financing

Publication date Mar. 19, 2024

Summary

Corporate financing through bond issuance has increased significantly this year. Issuance conditions have been favorable driven by declining market interest rates, with the widened credit spreads serving as an incentive for investing in corporate bonds.

However, market interest rates have risen rapidly over the years, resulting in higher interest costs for corporate bond issuers. Although medium-term market interest rates are projected to decrease, the decline is expected to be modest, implying a sustained increase in interest burden for corporate bond issuers. Notably, demand for refinancing is anticipated to increase this year due to a substantial rise in corporate bonds reaching maturity. The recent financial statements of non-financial companies with maturing corporate bonds indicate relatively tight liquidity conditions. Consequently, more companies are likely to opt for refinancing over redeeming maturing bonds using their own funds, potentially increasing interest burden due to rising refinancing rates.

While a gradual decline in market interest rates is anticipated to give a boost to corporate bond issuance, delays in rate cuts or heightened credit risks could undermine investor sentiment in corporate bonds. For this reason, companies should prioritize enhancing liquidity management and closely monitor financing conditions. Additionally, vulnerable companies may encounter greater financial strain, driven by deteriorating performance and rising financing costs. Therefore, policy authorities should keep a close eye on the financing environment for vulnerable companies and respond promptly to market uncertainties.

However, market interest rates have risen rapidly over the years, resulting in higher interest costs for corporate bond issuers. Although medium-term market interest rates are projected to decrease, the decline is expected to be modest, implying a sustained increase in interest burden for corporate bond issuers. Notably, demand for refinancing is anticipated to increase this year due to a substantial rise in corporate bonds reaching maturity. The recent financial statements of non-financial companies with maturing corporate bonds indicate relatively tight liquidity conditions. Consequently, more companies are likely to opt for refinancing over redeeming maturing bonds using their own funds, potentially increasing interest burden due to rising refinancing rates.

While a gradual decline in market interest rates is anticipated to give a boost to corporate bond issuance, delays in rate cuts or heightened credit risks could undermine investor sentiment in corporate bonds. For this reason, companies should prioritize enhancing liquidity management and closely monitor financing conditions. Additionally, vulnerable companies may encounter greater financial strain, driven by deteriorating performance and rising financing costs. Therefore, policy authorities should keep a close eye on the financing environment for vulnerable companies and respond promptly to market uncertainties.

Corporate bond issuance rises sharply amid favorable issuance conditions

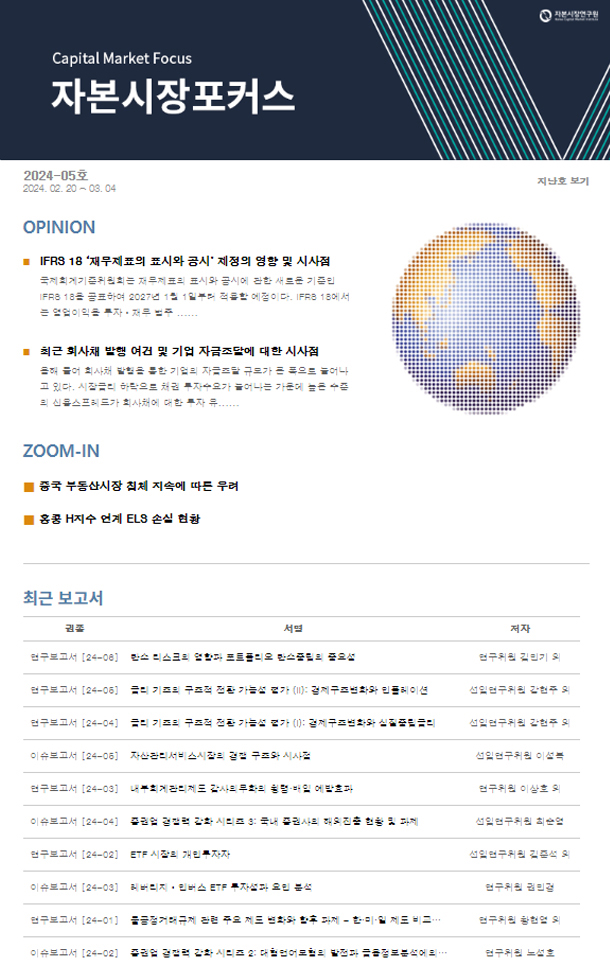

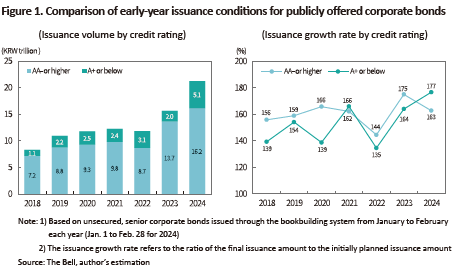

This year has seen a significant increase in corporate financing through the issuance of corporate bonds. Typically, there is an uptick in corporate bond issuance at the start of each year, driven by institutional investors executing their fund allocations. However, even allowing for this early-year effect, corporate bond issuance is showing a clear upward trajectory this year (Figure 1). Issuance volume has increased for not only bonds with credit ratings of AA- or higher but also those with relatively lower ratings of A+ or below, indicating favorable conditions for corporate bond issuance. With the growing demand for corporate bonds from institutional investors, issuers have raised more funds than planned. Both the AA- or higher group and the A+ or below group have issued bonds at 163% and 177% of the initially planned amounts, respectively.

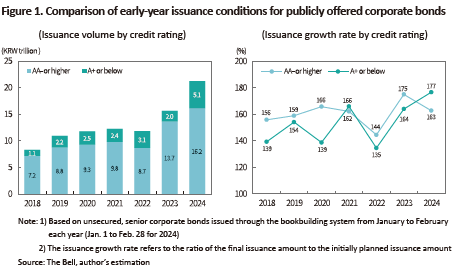

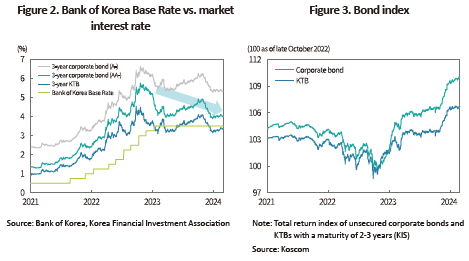

The favorable conditions for corporate bond issuance primarily stem from a downward trend in market interest rates and the consequent improvement in investor sentiment (Figure 2). Although there is uncertainty about the timing, the US Fed and the Bank of Korea are expected to begin to cut rates within this year. The resulting decline in market interest rates (leading to bond price increases) is driving up investor demand for bonds.

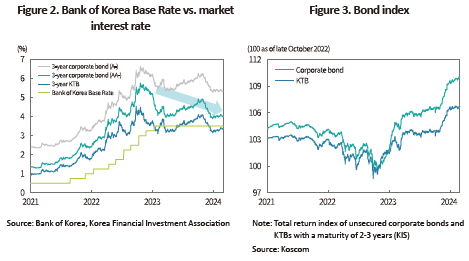

In addition, the sustained wide gap between corporate bonds and Korea Treasury Bonds (KTBs) (known as credit spread) has incentivized investing in corporate bonds. Following the substantial widening of credit spreads after the Legoland crisis in October 2022, corporate bond coupon rates have been set at elevated levels. Consequently, investors have been able to gain higher interest income from corporate bond investments, compared to investing in risk-free KTBs. This is demonstrated by a comparison of investment returns between corporate bonds and KTBs since October 2022, as illustrated in Figure 3, where corporate bonds have yielded higher returns.

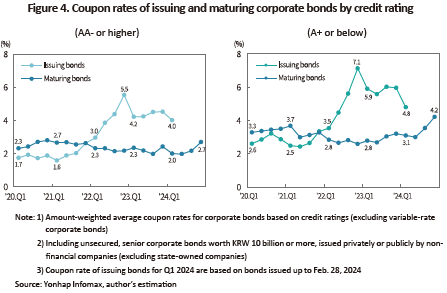

Corporate bond issuers’ interest burden will continue to rise

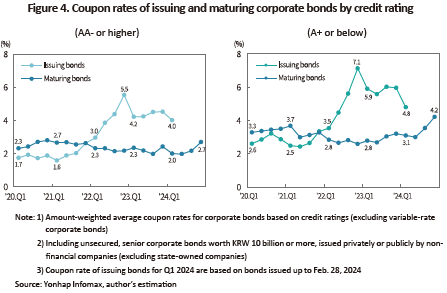

The significant growth in corporate bond issuance and the increased utilization of corporate bonds as a means of financing are positive developments. However, it should be noted that market interest rates have risen rapidly over the years, resulting in higher interest costs for issuers. In Figure 4, the coupon rates of issuing corporate bonds are compared to those of maturing bonds by credit rating. Since the second half of 2022, the coupon rate of issuing bonds has significantly surpassed that of maturing bonds, resulting in a notable rise in the interest burden on corporate bond issuers. While medium-term market interest rates are expected to show a downward slide, a rapid decline is unlikely,1) suggesting a sustained increase in interest burden for these issuers.

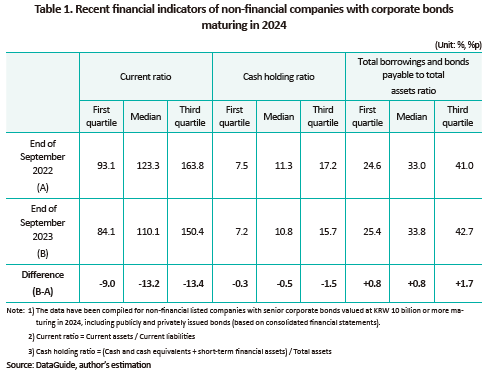

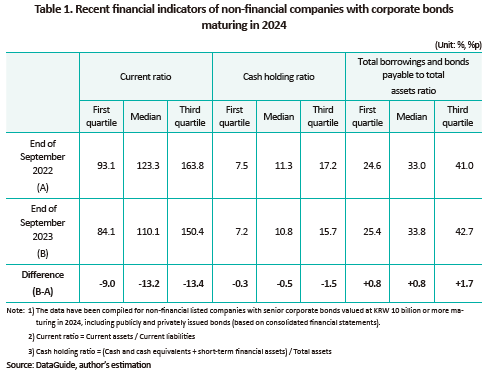

In particular, a substantial increase in the volume of corporate bonds reaching maturity this year2) is expected to stimulate corporate demand for refinancing. Upon examining recent financial statements of non-financial companies with corporate bonds maturing in 2024 (Table 1), there has been a decline in both the liquidity ratio and cash holdings, signaling tight liquidity conditions. This suggests that more companies may opt for refinancing to manage liquidity instead of using their own funds to redeem maturing corporate bonds. These companies have become more dependent on borrowing, which is expected to lead to an increase in interest burden due to rising refinancing rates.

Implications for corporate financing

With considerable growth in corporate bonds reaching maturity this year, corporate bond issuance is anticipated to go up, primarily driven by refinancing needs. Market interest rates are expected to continue a gradual decline amidst expectations for benchmark rate cuts by the Bank of Korea, which will facilitate corporate bond issuance. However, delays in rate cuts or heightened credit risks could undermine investor sentiment in corporate bonds. Furthermore, investor demand for corporate bonds may weaken if the early-year fund execution by institutional investors wears off. Hence, companies should enhance liquidity management and remain vigilant regarding financing conditions.

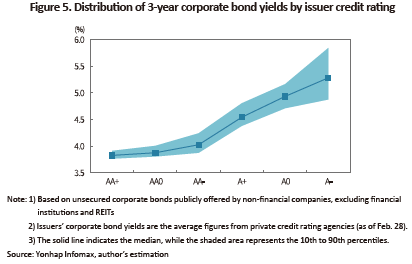

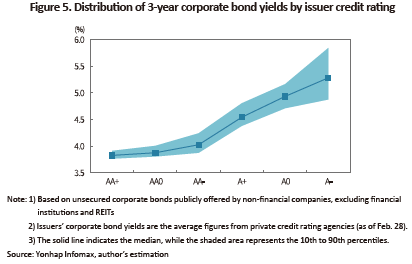

Meanwhile, the distribution of issuers’ corporate bond yields by credit rating (Figure 5) shows that lower-rated issuers tend to experience a widening dispersion within their respective rating groups. This suggests that companies with lower credit ratings may suffer a sharp rise in interest costs when their profitability and financial stability deteriorate. As a result, struggling companies, particularly those in sluggish sectors like construction, may encounter greater challenges due to weak corporate performance and rising financing costs. Therefore, policy authorities need to continue monitoring the financing conditions faced by vulnerable companies and respond promptly to market instability.

1) Bank of Korea (BOK) Governor Rhee Chang-yong expressed the opinion that it would be challenging to cut the policy rate within the first half of the year, considering the economic outlook of the Bank of Korea (at the Governor’s press conference on monetary policy direction in February 2024).

2) Maturity volume of ordinary corporate bonds (including both public and private placements): KRW 54.9 trillion in 2022 → KRW 58.6 trillion in 2023 → KRW 69.9 trillion in 2024 (source: Yonhap Infomax)

This year has seen a significant increase in corporate financing through the issuance of corporate bonds. Typically, there is an uptick in corporate bond issuance at the start of each year, driven by institutional investors executing their fund allocations. However, even allowing for this early-year effect, corporate bond issuance is showing a clear upward trajectory this year (Figure 1). Issuance volume has increased for not only bonds with credit ratings of AA- or higher but also those with relatively lower ratings of A+ or below, indicating favorable conditions for corporate bond issuance. With the growing demand for corporate bonds from institutional investors, issuers have raised more funds than planned. Both the AA- or higher group and the A+ or below group have issued bonds at 163% and 177% of the initially planned amounts, respectively.

In addition, the sustained wide gap between corporate bonds and Korea Treasury Bonds (KTBs) (known as credit spread) has incentivized investing in corporate bonds. Following the substantial widening of credit spreads after the Legoland crisis in October 2022, corporate bond coupon rates have been set at elevated levels. Consequently, investors have been able to gain higher interest income from corporate bond investments, compared to investing in risk-free KTBs. This is demonstrated by a comparison of investment returns between corporate bonds and KTBs since October 2022, as illustrated in Figure 3, where corporate bonds have yielded higher returns.

The significant growth in corporate bond issuance and the increased utilization of corporate bonds as a means of financing are positive developments. However, it should be noted that market interest rates have risen rapidly over the years, resulting in higher interest costs for issuers. In Figure 4, the coupon rates of issuing corporate bonds are compared to those of maturing bonds by credit rating. Since the second half of 2022, the coupon rate of issuing bonds has significantly surpassed that of maturing bonds, resulting in a notable rise in the interest burden on corporate bond issuers. While medium-term market interest rates are expected to show a downward slide, a rapid decline is unlikely,1) suggesting a sustained increase in interest burden for these issuers.

With considerable growth in corporate bonds reaching maturity this year, corporate bond issuance is anticipated to go up, primarily driven by refinancing needs. Market interest rates are expected to continue a gradual decline amidst expectations for benchmark rate cuts by the Bank of Korea, which will facilitate corporate bond issuance. However, delays in rate cuts or heightened credit risks could undermine investor sentiment in corporate bonds. Furthermore, investor demand for corporate bonds may weaken if the early-year fund execution by institutional investors wears off. Hence, companies should enhance liquidity management and remain vigilant regarding financing conditions.

Meanwhile, the distribution of issuers’ corporate bond yields by credit rating (Figure 5) shows that lower-rated issuers tend to experience a widening dispersion within their respective rating groups. This suggests that companies with lower credit ratings may suffer a sharp rise in interest costs when their profitability and financial stability deteriorate. As a result, struggling companies, particularly those in sluggish sectors like construction, may encounter greater challenges due to weak corporate performance and rising financing costs. Therefore, policy authorities need to continue monitoring the financing conditions faced by vulnerable companies and respond promptly to market instability.

1) Bank of Korea (BOK) Governor Rhee Chang-yong expressed the opinion that it would be challenging to cut the policy rate within the first half of the year, considering the economic outlook of the Bank of Korea (at the Governor’s press conference on monetary policy direction in February 2024).

2) Maturity volume of ordinary corporate bonds (including both public and private placements): KRW 54.9 trillion in 2022 → KRW 58.6 trillion in 2023 → KRW 69.9 trillion in 2024 (source: Yonhap Infomax)