OPINION

2021 Sep/28

Reference Portfolio in Public Fund Asset Allocation: Significance and Implications

Sep. 28, 2021

PDF

- Summary

- A reference portfolio refers to a low-cost, passive portfolio designed to express a fund’s risk appetite. It typically consists of risk assets and safe assets. Recently, the National Pension Service Investment Management has been considering a shift from the existing two-phase asset allocation mechanism comprised of Strategic Asset Allocation (SAA) and Tactical Asset Allocation (TAA) towards a three-phase framework with a reference portfolio serving as a norm. Such a move to introduce a reference portfolio can offer implications for Korea’s other public funds in varying sizes that have adopted an asset allocation framework similar to that of the National Pension Service Investment Management.

In terms of fund management, a SAA is the most important investment decision making. SAA-related activities are not limited to allotting a target weight to a certain asset class. They should be understood as the overall asset management process ranging from defining asset classes based on exploration of sources of market returns (β) to setting out a benchmark that defines the market and determining optimal asset weights. When the SAA is recognized as a sophisticated investment decision and the overall investment process, whether SAA activities are appropriate should be subject to ex-post evaluation and reflected in asset management practices. In this evaluation, a reference portfolio can serve as criteria for gauging the properness of a SAA.

For effective fund management governance, those who make investment decisions are required to take direct responsibility for the consequences of their decisions. The same is true for the determination of a SAA—the investment decision of utmost importance in terms of fund management. In this regard, it is desirable to ensure that the fund management team assumes the role and responsibilities with regard to implementation of SAA activities. This means a three-phase asset allocation framework where the fund management committee is responsible for the reference portfolio establishment while all sub-category asset allocation activities including a SAA are primarily dealt with by the fund management team. Such reform in the asset allocation system can be applicable to Korea’s public funds being operated by OCIO as well as the National Pension Service. An essential prerequisite for effective operation of the reference portfolio framework is improvement in the performance review system of the fund management team. Also necessary is to expand the fund management team’s expertise and capabilities in asset allocation.

Introduction

With its AUM reaching KRW 1,000 trillion,1) the National Pension Service Investment Management (NPSIM) is seeking to reshape its asset allocation structure. Such restructuring aims to introduce a norm portfolio called the reference portfolio to the top tier of the current three-phase portfolio structure2) consisting of Strategic Asset Allocation (SAA) portfolio, Tactical Asset Allocation (TAA) portfolio and actual portfolio. A reference portfolio (RP) means a low-cost, passive portfolio in terms of format and serves as criteria for establishing a SAA that has been recognized as the most important element in fund management. Thus, asset allocation restructuring driven by a RP not only would have direct effects on asset management performance of the National Pension Service (NPS)—one of the systemically important financial institutions in Korea—but also offer great implications for a wide range of Korea’s public funds that are benchmarking the NPS fund management system.

The immediate reason for the NPSIM to seek to adopt the RP framework is a challenge it faces with regard to the SAA implementation such as establishment of asset classes. Fund management performance is primarily determined by a SAA. However, some have criticized the SAA executed by the NPS for being ‘controlled by non-experts without any long-term goal’, since in terms of asset liability management (ALM), the NPS’ target return and acceptable limits of risks have not been accurately specified and the Fund Management Committee of the NPS consisting of groups of representatives, instead of experts, selects a SAA. This issue can be hardly addressed by the NPSIM in the short term because it is extremely challenging to reasonably estimate the liability size of public pension plans. In particular, the NPS funding mechanism—the partially funded system—prevents ALM-based asset allocation that takes into account liabilities from being effectively implemented.3) It has been recommended to transform the Fund Management Committee, the highest governing body of the NPS, into an organization comprised of experts as a way of enhancing the SAA’s efficiency. However, the possibility that such restructuring could weaken the Fund Management Committee’s representativeness should be also taken into consideration, given the role and status of the NPS, a public pension plan that contains public assistance.

For these reasons, the SAA implemented by the NPS has rarely been subject to any ex-post assessment or review on appropriateness of asset allocation outcomes despite its importance. The performance and compensation subcommittee under the Fund Management Committee has continuously emphasized the need for evaluating whether the SAA properly operates. However, the absence of relevant criteria hinders the NPS from introducing a reasonable evaluation system that is either quantitative or qualitative. This is a common problem shared by all public funds in Korea that follow a multi-phase asset allocation structure with SAA being part of the first phase. The RP can serve as criteria for evaluating the SAA’s appropriateness or setting directions. This is why the RP is called the norm portfolio.

This article tries to shed new light on the role and significance of the SAA in fund management, and to explore the RP’s implications and the need for introducing the RP from the perspective of constructing the asset allocation framework. An overseas pension fund well known for its RP approach is Canada’s national pension fund, the Canada Pension Plan Investment Board (CPPIB). Another pension plan worth mentioning is New Zealand’s sovereign wealth fund, the New Zealand Superannuation Fund (NZSF). In the course of benchmarking, however, it is worth noting that RPs’ role and objective vary greatly by pension plan. In this regard, this article aims to discuss the role and the execution system of RPs suited to Korea’s public funds including the NPS.

Strategic asset allocation and norm portfolio

Pension funds that manage a wide range of financial assets over the long term primarily execute multi-level asset allocation strategies. With a SAA positioned at the top tier, these strategies are designed to allocate funds to the TAA and diverse asset management sub-schemes by phases. As for most pension funds excluding those pursuing active management strategies, actual portfolios rarely deviate from the SAA’s target asset weights. Therefore, the final fund management performance should be primarily determined by a SAA.4) This explains why in terms of fund management, a SAA is the most important decision-making process and a significant portion of management capability needs to be put into the establishment of a SAA portfolio.

The first step in implementing a SAA is exploring and specifying the market as a return source. Each market eligible for investment is defined as an asset class,5) and the SAA allocates weights for such defined asset classes. Asset classes usually set up a market index representing a certain market as a benchmark. In turn, this benchmark serves as an indicator for asset allocation in the fund management planning phase, while offering criteria for measuring excess returns in the evaluation phase. Taken together, a SAA refers to an overall management process where asset classes are specified based on search for a return source, a corresponding benchmark is established and optimal portfolio weights are allocated, rather than a simple process designed to allocate a weight to a certain asset class. The decision-making outcome should be directly attached to the one who has made a relevant decision to ensure efficient operation of the process. This is why efficiencies can hardly be enhanced under the current structure where the Fund Management Committee that is comprised of non-experts and not directly responsible for management performance approves decisions with regard to a SAA. The same is true for Korea’s most public funds that primarily depend on their management committees consisting of outside, non-standing experts.

If a SAA is recognized as the overall asset management process based on sophisticated investment decisions, ex-post evaluation should be conducted by any means to judge whether such decisions are appropriate or not. The scope of SAA evaluation needs to include the properness in terms of market-seeking strategies and establishment of asset classes and benchmarks as well as the impact of weights given to each asset class on aggregate returns. For instance, if equity investment via the public market is categorized into the asset class of ‘domestic stocks’ with the KOSPI set as a benchmark, whether this categorization is appropriate should be subject to assessment.6) However, all SAA-related activities are executed by the Fund Management Committee under the current fund management system, while the Committee’s determination is excluded from evaluation process. Meanwhile, detailed criteria are needed for an objective evaluation on the properness of a SAA. In this sense, the RP being discussed in this article can serve as a basis for such evaluation since under the RP framework, the SAA should be suited to the overall risk-return profile presented by the RP approach for the long term.

Reference portfolio: role and execution

A closer look at oversees pension plans reveals a stark difference in roles and characteristics of RPs. The CPPIB describes a RP as a globally diversified portfolio of publicly traded securities that could be invested in at very low cost to express the risk target,7) and the NZSF similarly defines it as a notional portfolio of passive, low-cost, and publicly traded investments suited to the fund’s long term investment horizon and risk profile.8) The two pension plans have the RP concept in common, despite some differences in its role. First of all, both of these plans view it as a low-cost, passive portfolio and clearly indicate that a RP aims to express their risk limits. This definition can be also applied to the role of the NPS’ RP in providing criteria for implementation and evaluation of a SAA.9)

The CPPIB, Canada’s public pension fund management institution is a frequently referenced foreign pension plan with regard to introduction of the RP framework. However, it is noteworthy that the CPPIB’s RP approach has a quite different objective from Korea’s. The RP of the NPS is designed to set out an elaborate asset allocation framework to maximize long-term market returns (β) sought by a SAA portfolio, while the CPPIB uses a RP to engage in flexible, active management that is not constrained by standardized asset allocation structure to achieve significant excess returns (α). This difference stems from varying mandates given to each fund because a RP plays a role in connecting a fund’s rhetorically expressed mandate to an actual portfolio. The CPPIB’s mandate is to ‘seek maximum returns without excessive risks to incur losses’ while the NPS aims to ‘achieve returns that surpass a nominal growth rate for the long term’. It has been widely known that the CPPIB sets forth an investment belief that strongly supports active management for excess returns and its RP approach has been adopted as a way of accomplishing such mandate.

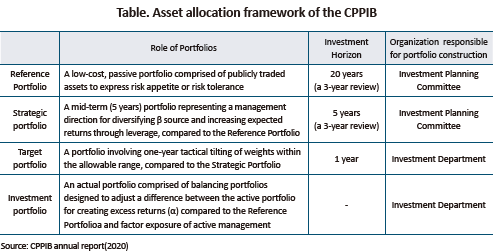

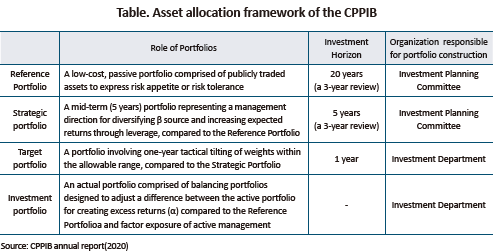

As shown in Table above, the CPPIB manages a multi-layer RP framework. If the NPS reshapes the current system into a three-phase asset allocation framework including a RP, its asset allocation approach would resemble the CPPIB’s in appearance, but the two vary hugely in terms of substance and significance. For example, the RP of the NPS, except for the actual portfolio, is comprised of virtual portfolios that are implemented by benchmarks and target weights while the RP approach adopted by the CPPIB is a passive portfolio consisting of publicly traded assets. Also, the NPS’ portfolio is based on a sequential structure having a hierarchy by phase, whereas the CPPIB has a two-phase structure comprised of the RP and actual portfolio with its SAA and TAA portfolios being additionally added as virtual portfolios for communication with its board of directors. The CPPIB’s SAA portfolio differs from the NPS’ in that it rarely provides a reference for active management and acts as an asset class-level institutional scheme designed for communications with the board of directors, rather than a separate active program. Given that it is designed to ‘express the appropriate risk level that sets forth the long-term fund management direction’, the CPPIB’s RP is identical to that of the NPS. However, what is notable is that the CPPIB clearly specifies its role as a ‘tool of measuring and controlling excess returns from active management’. To sum up, when trying to benchmark several overseas pension plans including the CPPIB to reform the asset allocation framework, a differentiated approach should be taken for defining a RP’s role and objective by taking into account characteristics and conditions of the NPS.

More importantly, Korea’s public funds including the NPS need to make sure that RPs are designed to express their risk appetite through a static allocation of risk assets (global stocks) and safe assets (domestic bonds).10) It is imperative to have a logical linkage to institutional variables via ALM or any other mechanisms to ensure that risk appetite expressed by a RP effectively functions in the fund management phase. A fund’s risk appetite that represents the weight of risk assets should be determined depending on long-term financial conditions such as expansion or contraction of the fund. Korea’s public funds need to keep in mind that unlike the CPPIB’s case, the introduction of a RP would not bolster their active management.

Conclusion and implications

Most public funds in Korea execute a mid- to long-term asset allocation by five years, and characterize a portfolio for one-year implementation as their SAA. Their SAA refers to a simple asset weight allocation to a fixed asset class, on which relevant committees consisting of outside experts are responsible for making decisions. However, construction and implementation of a SAA is not limited to determining a weight for a certain asset class. It should be broadly understood as the overall management process ranging from defining asset classes eligible for investment based on exploration of return sources, determining the market via benchmarking and optimizing asset weights to carrying out rebalancing on a permanent basis.

Sophisticated expertise and substantial independence11) are required to guarantee effective SAA activities. For the effective governance of fund management, it is necessary to ensure that investment performance—whether it is positive or negative—is directly dealt with by those who make such decisions. Thus far, external professionals belonging to the Fund Management Committee have not been accountable for the SAA-driven asset management performance. It seems unreasonable to hold responsible the fund management team not being in charge of SAA-related investment decision. This clearly explains why management capabilities and improvement efforts are insufficiently put into the SAA—the investment decision-making process of utmost importance. In this regard, it is recommendable to introduce the decision-making structure where the fund’s SAA activities are entirely characterized as the fund management team’s role and responsibility. This indicates that the RP establishment would be left to the hands of the Fund Management Committee while the fund management team is responsible for all sub-category activities including the SAA and other asset allocation schemes.12)

Furthermore, performance review of the fund management team should also be reshaped in order for the above-mentioned decision-making system to operate effectively. The fund management team’s performance that is currently limited to excess returns from active management including the TAA needs to be determined based on the fund’s overall performance including market returns. The impact of a SAA, together with appropriateness of asset class categorization and benchmarking effects, should also be subject to performance review. The outcome of performance review reflected in the fund management team’s performance compensation would promote interest alignment, one of the most important elements in the fund management governance. It is noteworthy that an essential prerequisite for the foregoing is improvement in expertise and capabilities of the fund management team with regard to SAA activities.

1) According to the fourth finance recalculation for 2018, the AUM is expected to surpass KRW 1,000 in value by 2022.

2) Strategic Asset Allocation portfolio, Tactical Asset Allocation portfolio and Actual portfolio

3) Pension plans are divided into the funded system and the pay-as-you-go system. ALM-based fund management method is only applicable to the funded system.

4) According to the 2019 performance evaluation of the National Pension Service, its SAA’s contribution to the three-year average return stands at 96.3% with its contribution to the five-year average posting 99.2%. If the range is extended to the 10-year average return, the SAA’s contribution reaches as high as 100.3%, indicating that the fund’s performance is entirely attributed to a SAA.

5) For instance, the National Pension Service Investment Management has set out five strategic asset classes such as domestic stocks, overseas stocks, domestic bonds, overseas bonds and alternative investment instruments.

6) The strategic benchmark of the National Pension Service’s domestic stocks tracks the KOSPI including stock dividend. Thus, the KOSDAQ is an off-benchmark that serves as a source of excess returns (α), instead of market returns (β), which results in underinvestment compared to market portfolio weights. The impact of such decisions on the fund’s long-term performance should be assessed quantitatively and then reflected in management practices.

7) CPPIB Annual Report, 2020, Globally diversified portfolio of publicly traded securities, that could be invested in at very low cost, to express the risk target.

8) NZSF Annual Report, 2020, A shadow or notional portfolio of passive, low-cost, listed investments suited to the fund’s long term investment horizon and risk profile.

9) The National Pension Service Investment Management is seeking to define the reference portfolio as a low-cost, passive portfolio or a group of asset classes that aligns with its long-term investment strategy.

10) It is common to have safe assets comprised of domestic bonds by taking into account the currency risk.

11) This generally means ‘independence from the government’ but recently ‘independence from the market’ has become another pressing issue.

12) As for large-scale public funds whose asset management is entrusted to OCIO, the fund management team refers to the OCIO firm. In other words, a fund in possession of assets establishes a reference portfolio and imposes the relevant mandate to the OCIO firm, whereas the OCIO firm has a full discretion to execute all asset allocation strategies including a SAA, building upon such mandate.

With its AUM reaching KRW 1,000 trillion,1) the National Pension Service Investment Management (NPSIM) is seeking to reshape its asset allocation structure. Such restructuring aims to introduce a norm portfolio called the reference portfolio to the top tier of the current three-phase portfolio structure2) consisting of Strategic Asset Allocation (SAA) portfolio, Tactical Asset Allocation (TAA) portfolio and actual portfolio. A reference portfolio (RP) means a low-cost, passive portfolio in terms of format and serves as criteria for establishing a SAA that has been recognized as the most important element in fund management. Thus, asset allocation restructuring driven by a RP not only would have direct effects on asset management performance of the National Pension Service (NPS)—one of the systemically important financial institutions in Korea—but also offer great implications for a wide range of Korea’s public funds that are benchmarking the NPS fund management system.

The immediate reason for the NPSIM to seek to adopt the RP framework is a challenge it faces with regard to the SAA implementation such as establishment of asset classes. Fund management performance is primarily determined by a SAA. However, some have criticized the SAA executed by the NPS for being ‘controlled by non-experts without any long-term goal’, since in terms of asset liability management (ALM), the NPS’ target return and acceptable limits of risks have not been accurately specified and the Fund Management Committee of the NPS consisting of groups of representatives, instead of experts, selects a SAA. This issue can be hardly addressed by the NPSIM in the short term because it is extremely challenging to reasonably estimate the liability size of public pension plans. In particular, the NPS funding mechanism—the partially funded system—prevents ALM-based asset allocation that takes into account liabilities from being effectively implemented.3) It has been recommended to transform the Fund Management Committee, the highest governing body of the NPS, into an organization comprised of experts as a way of enhancing the SAA’s efficiency. However, the possibility that such restructuring could weaken the Fund Management Committee’s representativeness should be also taken into consideration, given the role and status of the NPS, a public pension plan that contains public assistance.

For these reasons, the SAA implemented by the NPS has rarely been subject to any ex-post assessment or review on appropriateness of asset allocation outcomes despite its importance. The performance and compensation subcommittee under the Fund Management Committee has continuously emphasized the need for evaluating whether the SAA properly operates. However, the absence of relevant criteria hinders the NPS from introducing a reasonable evaluation system that is either quantitative or qualitative. This is a common problem shared by all public funds in Korea that follow a multi-phase asset allocation structure with SAA being part of the first phase. The RP can serve as criteria for evaluating the SAA’s appropriateness or setting directions. This is why the RP is called the norm portfolio.

This article tries to shed new light on the role and significance of the SAA in fund management, and to explore the RP’s implications and the need for introducing the RP from the perspective of constructing the asset allocation framework. An overseas pension fund well known for its RP approach is Canada’s national pension fund, the Canada Pension Plan Investment Board (CPPIB). Another pension plan worth mentioning is New Zealand’s sovereign wealth fund, the New Zealand Superannuation Fund (NZSF). In the course of benchmarking, however, it is worth noting that RPs’ role and objective vary greatly by pension plan. In this regard, this article aims to discuss the role and the execution system of RPs suited to Korea’s public funds including the NPS.

Strategic asset allocation and norm portfolio

Pension funds that manage a wide range of financial assets over the long term primarily execute multi-level asset allocation strategies. With a SAA positioned at the top tier, these strategies are designed to allocate funds to the TAA and diverse asset management sub-schemes by phases. As for most pension funds excluding those pursuing active management strategies, actual portfolios rarely deviate from the SAA’s target asset weights. Therefore, the final fund management performance should be primarily determined by a SAA.4) This explains why in terms of fund management, a SAA is the most important decision-making process and a significant portion of management capability needs to be put into the establishment of a SAA portfolio.

The first step in implementing a SAA is exploring and specifying the market as a return source. Each market eligible for investment is defined as an asset class,5) and the SAA allocates weights for such defined asset classes. Asset classes usually set up a market index representing a certain market as a benchmark. In turn, this benchmark serves as an indicator for asset allocation in the fund management planning phase, while offering criteria for measuring excess returns in the evaluation phase. Taken together, a SAA refers to an overall management process where asset classes are specified based on search for a return source, a corresponding benchmark is established and optimal portfolio weights are allocated, rather than a simple process designed to allocate a weight to a certain asset class. The decision-making outcome should be directly attached to the one who has made a relevant decision to ensure efficient operation of the process. This is why efficiencies can hardly be enhanced under the current structure where the Fund Management Committee that is comprised of non-experts and not directly responsible for management performance approves decisions with regard to a SAA. The same is true for Korea’s most public funds that primarily depend on their management committees consisting of outside, non-standing experts.

If a SAA is recognized as the overall asset management process based on sophisticated investment decisions, ex-post evaluation should be conducted by any means to judge whether such decisions are appropriate or not. The scope of SAA evaluation needs to include the properness in terms of market-seeking strategies and establishment of asset classes and benchmarks as well as the impact of weights given to each asset class on aggregate returns. For instance, if equity investment via the public market is categorized into the asset class of ‘domestic stocks’ with the KOSPI set as a benchmark, whether this categorization is appropriate should be subject to assessment.6) However, all SAA-related activities are executed by the Fund Management Committee under the current fund management system, while the Committee’s determination is excluded from evaluation process. Meanwhile, detailed criteria are needed for an objective evaluation on the properness of a SAA. In this sense, the RP being discussed in this article can serve as a basis for such evaluation since under the RP framework, the SAA should be suited to the overall risk-return profile presented by the RP approach for the long term.

Reference portfolio: role and execution

A closer look at oversees pension plans reveals a stark difference in roles and characteristics of RPs. The CPPIB describes a RP as a globally diversified portfolio of publicly traded securities that could be invested in at very low cost to express the risk target,7) and the NZSF similarly defines it as a notional portfolio of passive, low-cost, and publicly traded investments suited to the fund’s long term investment horizon and risk profile.8) The two pension plans have the RP concept in common, despite some differences in its role. First of all, both of these plans view it as a low-cost, passive portfolio and clearly indicate that a RP aims to express their risk limits. This definition can be also applied to the role of the NPS’ RP in providing criteria for implementation and evaluation of a SAA.9)

The CPPIB, Canada’s public pension fund management institution is a frequently referenced foreign pension plan with regard to introduction of the RP framework. However, it is noteworthy that the CPPIB’s RP approach has a quite different objective from Korea’s. The RP of the NPS is designed to set out an elaborate asset allocation framework to maximize long-term market returns (β) sought by a SAA portfolio, while the CPPIB uses a RP to engage in flexible, active management that is not constrained by standardized asset allocation structure to achieve significant excess returns (α). This difference stems from varying mandates given to each fund because a RP plays a role in connecting a fund’s rhetorically expressed mandate to an actual portfolio. The CPPIB’s mandate is to ‘seek maximum returns without excessive risks to incur losses’ while the NPS aims to ‘achieve returns that surpass a nominal growth rate for the long term’. It has been widely known that the CPPIB sets forth an investment belief that strongly supports active management for excess returns and its RP approach has been adopted as a way of accomplishing such mandate.

More importantly, Korea’s public funds including the NPS need to make sure that RPs are designed to express their risk appetite through a static allocation of risk assets (global stocks) and safe assets (domestic bonds).10) It is imperative to have a logical linkage to institutional variables via ALM or any other mechanisms to ensure that risk appetite expressed by a RP effectively functions in the fund management phase. A fund’s risk appetite that represents the weight of risk assets should be determined depending on long-term financial conditions such as expansion or contraction of the fund. Korea’s public funds need to keep in mind that unlike the CPPIB’s case, the introduction of a RP would not bolster their active management.

Conclusion and implications

Most public funds in Korea execute a mid- to long-term asset allocation by five years, and characterize a portfolio for one-year implementation as their SAA. Their SAA refers to a simple asset weight allocation to a fixed asset class, on which relevant committees consisting of outside experts are responsible for making decisions. However, construction and implementation of a SAA is not limited to determining a weight for a certain asset class. It should be broadly understood as the overall management process ranging from defining asset classes eligible for investment based on exploration of return sources, determining the market via benchmarking and optimizing asset weights to carrying out rebalancing on a permanent basis.

Sophisticated expertise and substantial independence11) are required to guarantee effective SAA activities. For the effective governance of fund management, it is necessary to ensure that investment performance—whether it is positive or negative—is directly dealt with by those who make such decisions. Thus far, external professionals belonging to the Fund Management Committee have not been accountable for the SAA-driven asset management performance. It seems unreasonable to hold responsible the fund management team not being in charge of SAA-related investment decision. This clearly explains why management capabilities and improvement efforts are insufficiently put into the SAA—the investment decision-making process of utmost importance. In this regard, it is recommendable to introduce the decision-making structure where the fund’s SAA activities are entirely characterized as the fund management team’s role and responsibility. This indicates that the RP establishment would be left to the hands of the Fund Management Committee while the fund management team is responsible for all sub-category activities including the SAA and other asset allocation schemes.12)

Furthermore, performance review of the fund management team should also be reshaped in order for the above-mentioned decision-making system to operate effectively. The fund management team’s performance that is currently limited to excess returns from active management including the TAA needs to be determined based on the fund’s overall performance including market returns. The impact of a SAA, together with appropriateness of asset class categorization and benchmarking effects, should also be subject to performance review. The outcome of performance review reflected in the fund management team’s performance compensation would promote interest alignment, one of the most important elements in the fund management governance. It is noteworthy that an essential prerequisite for the foregoing is improvement in expertise and capabilities of the fund management team with regard to SAA activities.

1) According to the fourth finance recalculation for 2018, the AUM is expected to surpass KRW 1,000 in value by 2022.

2) Strategic Asset Allocation portfolio, Tactical Asset Allocation portfolio and Actual portfolio

3) Pension plans are divided into the funded system and the pay-as-you-go system. ALM-based fund management method is only applicable to the funded system.

4) According to the 2019 performance evaluation of the National Pension Service, its SAA’s contribution to the three-year average return stands at 96.3% with its contribution to the five-year average posting 99.2%. If the range is extended to the 10-year average return, the SAA’s contribution reaches as high as 100.3%, indicating that the fund’s performance is entirely attributed to a SAA.

5) For instance, the National Pension Service Investment Management has set out five strategic asset classes such as domestic stocks, overseas stocks, domestic bonds, overseas bonds and alternative investment instruments.

6) The strategic benchmark of the National Pension Service’s domestic stocks tracks the KOSPI including stock dividend. Thus, the KOSDAQ is an off-benchmark that serves as a source of excess returns (α), instead of market returns (β), which results in underinvestment compared to market portfolio weights. The impact of such decisions on the fund’s long-term performance should be assessed quantitatively and then reflected in management practices.

7) CPPIB Annual Report, 2020, Globally diversified portfolio of publicly traded securities, that could be invested in at very low cost, to express the risk target.

8) NZSF Annual Report, 2020, A shadow or notional portfolio of passive, low-cost, listed investments suited to the fund’s long term investment horizon and risk profile.

9) The National Pension Service Investment Management is seeking to define the reference portfolio as a low-cost, passive portfolio or a group of asset classes that aligns with its long-term investment strategy.

10) It is common to have safe assets comprised of domestic bonds by taking into account the currency risk.

11) This generally means ‘independence from the government’ but recently ‘independence from the market’ has become another pressing issue.

12) As for large-scale public funds whose asset management is entrusted to OCIO, the fund management team refers to the OCIO firm. In other words, a fund in possession of assets establishes a reference portfolio and imposes the relevant mandate to the OCIO firm, whereas the OCIO firm has a full discretion to execute all asset allocation strategies including a SAA, building upon such mandate.