Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Thought on Directions for the Sound SPAC Market Development

Publication date Oct. 12, 2021

Summary

As SPACs have surged in popularity in the US since the Covid-19 spread intensified in 2020, Korea is also witnessing a growing interest in SPACs. There is a widespread perception that compared with traditional IPOs, SPACs offer a less-uncertain, low-cost alternative route to companies who plan to go public, and serve as a relatively safer investment target. However, researchers who analyzed the SPAC market found that going public via a SPAC merger is more expensive than traditional IPOs and in addition, can bring about investment losses. Furthermore, the structure of SPACs may give rise to conflicts of interest between SPAC sponsors and public investors.

Therefore, SPACs need to perform a transparent and sufficient corporate disclosure to facilitate the growth and development of the sound SPAC market and to minimize concerns about investor protection. In this regard, the supervisory authorities should play a role in ensuring that such disclosures are properly implemented by SPACs. At the same time, investors who intend to invest in a SPAC should interpret disclosed information based on a thorough understanding of the structure and intrinsic features of SPACs, and also recognize the possibility of suffering losses from their investment in a SPAC before making any investment decisions.

Therefore, SPACs need to perform a transparent and sufficient corporate disclosure to facilitate the growth and development of the sound SPAC market and to minimize concerns about investor protection. In this regard, the supervisory authorities should play a role in ensuring that such disclosures are properly implemented by SPACs. At the same time, investors who intend to invest in a SPAC should interpret disclosed information based on a thorough understanding of the structure and intrinsic features of SPACs, and also recognize the possibility of suffering losses from their investment in a SPAC before making any investment decisions.

A special purpose acquisition company (hereinafter referred to as ‘SPAC’) refers to a blank check company that is founded with the sole purpose of merging with an unlisted firm. A SPAC is a joint-stock company created by sponsors and raises funds through an IPO. After being listed on the public stock market, it seeks to merge with a proper unlisted firm that would be later transformed into a listed firm. If a SPAC fails to find a suitable merger target within a certain timeframe or SPAC shareholders vote against a proposed merger deal, the shareholders would get back their original investment, plus the interest accrued for the period and the SPAC would be liquidated. Since its introduction in the late 1990s,1) a SPAC has offered an alternative to traditional IPOs, gradually increasing its presence in the IPO market.

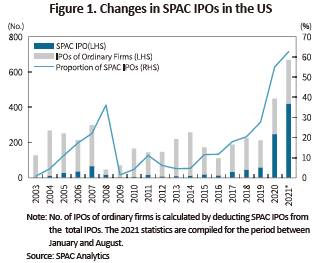

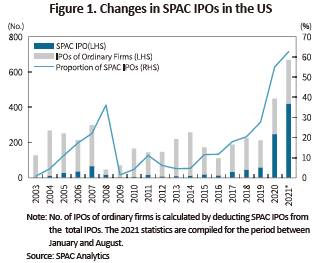

SPACs that continued a moderate growth until 2019 have surged in popularity since the Covid-19 escalated into a pandemic in 2020. As illustrated in Figure 1, 59 IPOs were carried out by SPACs in 2019, while the number of SPACs who completed IPOs more than quadrupled to 248 in 2020. As this trend has continued well into 2021, a total of 421 IPOs have been done by SPACs up until the end of August, taking up 63% of the total IPOs completed in the US stock market.

Amid the recent SPAC craze in the US, other countries around the world are paying more attention to SPACs. For instance, the UK HM Treasury and the FCA announced their plan to ease regulations on SPAC IPOs,2) and the Singapore Exchange (SGX) recently permitted SPACs to go public.3) Under the circumstances, some raise concerns that the sudden popularity of SPACs may turn out to be a bubble, which may inflict damage on investors.

This article intends to identify structural characteristics of SPACs, present discussions about SPACs’ functions and advantages and disadvantages based on relevant academic studies, and explore the role that supervisory authorities and investors should play in facilitating the development of the sound SPAC market.

Current status of SPACs in Korea

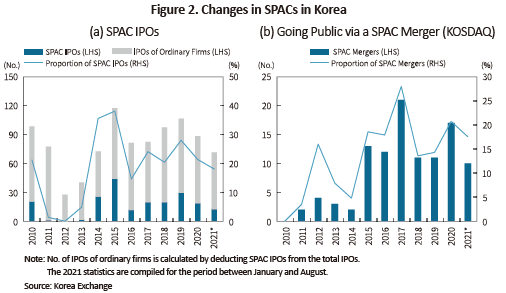

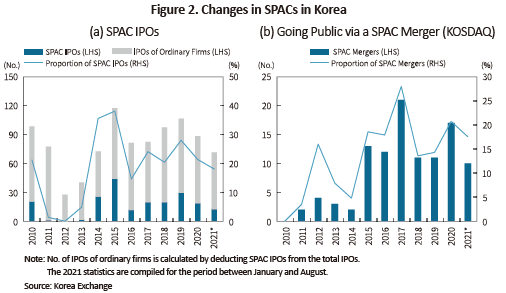

Figure 2 shows changes in SPACs in Korea. After its introduction according to the 2009 revision to the Financial Investment Services and Capital Markets Act, 21 SPACs went public in 2010 and after a slight downward trend, SPAC IPOs picked up again in 2014 and 2015. With about 20 SPACs becoming listed annually, Korea, unlike the US, has hardly seen a gradual increase over time or any explosive surge from 2020 in terms of SPAC IPOs. In Korea, most SPAC IPOs have been carried out in the KOSDAQ while only four SPACs have gone public in the securities market over the past 12 years.

In 2017, the number of firms listed on the stock exchange through a merger with SPACs hit a record high of 21, while 17 firms went public in 2020 with the same approach. All listings by way of merging with SPACs were implemented on the KOSDAQ. Out of the total newly-listed firms on the KOSDAQ, those who merged with SPACs for IPOs accounted for 28% in 2017 and 21% in 2020.

Discussions on SPACs: structure and advantages and disadvantages

A SPAC is created in the form of a joint-stock company by a few sponsors who acquire shares issued upon the SPAC’s incorporation and provide their paid-in capital. After incorporation, the SPAC raises funds from public investors through an IPO and then its shares would be listed on the stock market.4) Generally, SPACs in the US issue units that combine common shares with warrants and set the offering price at $10. The sponsors (or executives) of SPACs are not supposed to use the capital raised from investors through an IPO that should be separately placed in an escrow account or kept by financial institutions. The sponsors are typically compensated by retaining 20% of the SPAC shares as promotes,5) plus preemptive rights to purchase new shares. The sponsors seek to identify an unlisted firm for a merger. Once a suitable merger target is selected, the SPAC would proceed with a merger with the target firm that would become a listed company by a resolution at a general meeting of shareholders. If the sponsors fail to find any suitable unlisted firm or to complete the proposed merger with the firm due to rejection of shareholders within a fixed term,6) the original investment and interest accrued during the period should be returned and the SPAC would be liquidated. Furthermore, a shareholder who opposes the merger deal can exercise a redemption right.

There are a few reasons why firms who plan to be listed on the public market through public offering choose a merger with a SPAC over traditional IPOs. First, it could reduce uncertainty about the size of the capital to be raised through an IPO. The IPO proceeds that are placed in a separate account are regarded as the capital set aside for the business combination with an unlisted firm. Furthermore, a SPAC IPO is free from the effects of traditional IPOs such as changing conditions in the IPO market or IPO underpricing.7) For these reasons, going public via merging with a SPAC is widely perceived to be less expensive than a conventional IPO approach.8)

Second, a SPAC may serve as an alternative route of going public for companies whose business structure poses a challenge for a traditional IPO. A case in point is a company of which business is built upon a certain innovative technology or business model that is not suitable for public disclosure, which hampers their corporate value from being properly assessed. For these companies, an IPO through a SPAC merger can be more advantageous than a traditional IPO. Bai et al (2021) presented an opinion that investment banks act as underwriters in the traditional IPO market by matching larger and safer firms with public investors, while the SPAC sponsors (or executives) play a role as non-bank certification intermediaries in matching smaller and riskier firms with yield-seeking investors who prefer high-risk investment, which leads to segmented going-public markets for traditional IPOs and SPAC IPOs.9)

Third, SPAC mergers in the US can avail themselves of a safe harbor regarding projections of returns/profits and other forward-looking statements under the business combination laws, while companies going public in an IPO are not covered by the safe harbor against liability under the securities laws.10) This implies that SPACs offer a company preparing for an IPO an opportunity to seek regulatory arbitrage.

Lastly, some argue that a SPAC is a safer bet for investors than a company going public through a conventional IPO. This appears to be reasonable given that the IPO proceeds of a SPAC are separately held and once a SPAC fails to complete a merger deal, investors can get back their original investment and accrued interest. In addition, shareholders who oppose the merger are granted a redemption right to purchase SPAC shares.

However, not all potential advantages of SPACs are supported by academic studies. As for the argument that SPACs offer a less expensive, less uncertain way of going public than a traditional IPO, Gahng et al (2021) and Klausner et al (2021) indicated that the SPAC’s per-share value11) is priced at about $7, instead of $10,12) given SPAC underwriting fees (typically 5.5% of IPO proceeds), 20% of shares acquired by the sponsors as promotes and redemptions of SPAC shareholders not approving a merger. The researchers also found that the total cost of companies going public via a SPAC merger represents 15.1% of the post-issue market cap, while the cost of traditional IPOs accounts for just 3.3%.

If a SPAC is liquidated after failing to complete a business combination, the SPAC sponsors who own SPAC promotes and warrants (convertible bonds for SPAC sponsors in Korea) would receive no compensation. In other words, the sponsors would be compensated only upon the completion of a merger with an unlisted company and the size of their compensation would be linked to the post-merger company’s performance (share price). Compared to ordinary SPAC investors, however, the sponsors put in a much smaller amount of money to acquire promote shares and thus, they could earn profits even if post-merger shares show a weak performance. Thus, this structure motivates the sponsors to execute a merger deal if circumstances allow. The average share performance after business combinations tends to remain lackluster. This is well demonstrated in Gahng et al (2021) that presented the average post-merger, one-year return of -7.3% in the US. Furthermore, post-merger dilution may occur depending on whether the sponsors exercise their warrants.

Meanwhile, investment in SPACs may be safe in that the original investment and accrued interest would be returned, if a merger fails. However, this logic remains only valid for investors participating in an IPO via a SPAC merger. Once a merged company goes public, investors who purchase the company’s shares in the stock market would still be exposed to risks of price volatility and they are likely to get back less than their original investment if the purchase price is higher than the IPO price.

The role of supervisory authorities and investors

A sudden popularity of SPACs in the US is attributed to the perception that companies going public via a SPAC merger are less susceptible to uncertainties about IPOs proceeds than those opting for a traditional IPO amid higher stock market volatility triggered by the Covid-19 pandemic. Furthermore, a strong preference for SPACs enabling a speedier IPO process and an abrupt increase in presence of retail investors in the US stock market are mentioned as main factors behind a surge in SPACs.13) Korea has adopted restrictions on qualifications of the SPAC sponsors or executives, whereas in the US, celebrities such as famous athletes are participating in SPACs as sponsors and using their reputation to attract public investors.14) Under the circumstances, concerns have been raised over the overheating SPAC market that may cause damages to investors, and supervisory authorities have come up with countermeasures. Over the period between March and April 2021, the SEC released the Investor Alert to caution investors not to make investment decisions based solely on celebrity involvement (March 10 2021, SEC), and unveiled the plans to scrutinize SPACs’ structure and information disclosure (March 31 2021, SEC) and their accounting in the financial statements (April 12 2021, SEC). After these announcements, the number of SPAC IPOs declined to 125 during the period between April and August of 2021 from 296 in the first half. In Korea as well, questions over investor protection have been raised. For example, the Korea Exchange found suspicious unfair transactions regarding share prices of some SPACs15) and the Financial Supervisory Service presented issues that prospective investors should carefully consider when investing in SPACs.16)

A transparency and sufficient disclosure of SPACs is essential to facilitate the growth and development of the SPAC market and to minimize concerns about investor protection. The securities registration statement to be filed by a SPAC for an IPO should include information on the SPAC sponsors (or executives) such as their career background, details of industries or groups of businesses17) that SPACs have an eye on, and issuance structure of shares and convertible bonds (warrants for the US SPACs) such as compensation schemes for the SPAC sponsors. Also, the information of the merger target company should be accurately specified in the securities registration statement to be filed for the business combination. After the filing is completed, it is the supervisory authorities’ role to strictly evaluate such statements to ensure faithfulness and accuracy of disclosed information. When considering investing in a SPAC, investors should interpret disclosed information based on a meticulous understanding of the intrinsic features of a SPAC. After investing in a SPAC, they need to thoroughly review a merger deal proposed by the SPAC executives and, if necessary, should defend their own interests by voting against the merger or exercising their redemption right. As stated above, investors should be aware that only those participating in the SPAC IPO are entitled to the protection of their investment principal while other investors who purchase the SPAC shares in the stock market may suffer losses.

1) Ritter’s database indicates that in the US, SPACs issuing shares emerged in 1997 while SPACs issuing units (to be explained below) entered the market in 2003 (https://site.warrington.ufl.edu/ritter/files/IPOs-SPACs.pdf).

2) UK HM Treasury (March 3 2021), FCA (2021)

3) SGX (September 2 2021)

4) As for SPACs-related schemes, this article refers to Gahng et al (2021) and Klausner et al (2021) to obtain the US cases while consulting relevant materials released by the Korea Exchange for Korea’s cases.

5) Promotes mean shares given to the SPAC sponsors as a compensation, which are separated from the SPAC capital. The promotes are not attached to the redemption right and are typically subject to a lock-up provision after an IPO (Gahng et al, 2021).

6) The term for a SPAC to complete a merger is two years in the US, three years in Korea.

7) Kang Sohyun∙Joon-Seok Kim (2018)

8) The US startups seem to believe that IPO underwriters (investment banks) tend to price their offerings low to ensure that institutional investors attain high returns (The Economist, February 20 2021).

9) In this regard, the SPAC sponsors function similarly to private equity GPs (Gahng et al, 2021).

10) Klausner et al (2021)

11) The amount of capital delivered per share from an IPO via a SPAC merger.

12) In many cases, the SPAC sponsors and the merger target company tend to predetermine the minimum amount of capital that the SPAC is supposed to provide to the company upon the completion of a merger, and to attract a few PIPE (private investment in public equity) investors, in addition to existing investors (Gahng et al, 2021).

13) Hong, Ji-Yeun (2020)

14) The celebrities who serve as SPAC sponsors include Shaquille O’Neal (former professional basketball player), Stephen Curry (professional basketball player) and Serena Williams (professional tennis player) (Crunchbase News, Mach 11 2021).

15) Korea Exchange (August 25 2021)

16) Financial Supervisory Service (August 27 2021)

17) A company engaging in ESG management may be included.

References

Financial Supervisory Service, August 27 2021, Issues worthy of consideration for SPAC investors, press release.

Korea Exchange, August 25 2021, A special audit on SPACs showing an abnormal surge in share prices: results and notable issues, press release.

Bai, J., Ma, A., Zheng, M., 2021, Segmented going-public markets and the demand for SPACs, SSRN #3746490.

Crunchbase News, March 11 2021, Athletes and celebrities join the SPAC boom, SEC takes notice.

Economist, February 20 2021, What the SPAC craze means for tech investing.

FCA, 2021, Investor protection measures for special purpose acquisition companies: Changes to the listing rules, Policy Statement PS21/10.

Gahng, M., Ritter, J. R., Zhang, D., 2021, SPACs, SSRN #3775847.

Klausner, M., Ohlrogge, M., Ruan, E., 2021, A sober look at SPACs, ECGI Working Paper No.746/2021.

SEC, March 10 2021, Celebrity involvement with SPACs, Investor Alerts and Bulletins.

SEC, March 31 2021, Financial reporting and auditing considerations of companies merging with SPACs, Public Statement.

SEC, April 21 2021, Staff statement on accounting and reporting considerations for warrants issued by special purpose acquisition companies, Public Statement.

SGX, September 2 2021, SGX introduces SPAC listing framework, News release.

UK HM Treasury, March 3 2021, UK Listings Review.

(Korean)

Kang, S.H., Kim, J.S., 2018, Comparative Analysis on New Listing Routes on the KOSDAQ, KCMI Issue Paper 18-11.

Hong, J.Y., 2020, A Surge in SPAC IPOs in the US for 2020 and Relevant Implications , KCMI Capital Market Focus 2020-27.

SPACs that continued a moderate growth until 2019 have surged in popularity since the Covid-19 escalated into a pandemic in 2020. As illustrated in Figure 1, 59 IPOs were carried out by SPACs in 2019, while the number of SPACs who completed IPOs more than quadrupled to 248 in 2020. As this trend has continued well into 2021, a total of 421 IPOs have been done by SPACs up until the end of August, taking up 63% of the total IPOs completed in the US stock market.

This article intends to identify structural characteristics of SPACs, present discussions about SPACs’ functions and advantages and disadvantages based on relevant academic studies, and explore the role that supervisory authorities and investors should play in facilitating the development of the sound SPAC market.

Current status of SPACs in Korea

Figure 2 shows changes in SPACs in Korea. After its introduction according to the 2009 revision to the Financial Investment Services and Capital Markets Act, 21 SPACs went public in 2010 and after a slight downward trend, SPAC IPOs picked up again in 2014 and 2015. With about 20 SPACs becoming listed annually, Korea, unlike the US, has hardly seen a gradual increase over time or any explosive surge from 2020 in terms of SPAC IPOs. In Korea, most SPAC IPOs have been carried out in the KOSDAQ while only four SPACs have gone public in the securities market over the past 12 years.

In 2017, the number of firms listed on the stock exchange through a merger with SPACs hit a record high of 21, while 17 firms went public in 2020 with the same approach. All listings by way of merging with SPACs were implemented on the KOSDAQ. Out of the total newly-listed firms on the KOSDAQ, those who merged with SPACs for IPOs accounted for 28% in 2017 and 21% in 2020.

A SPAC is created in the form of a joint-stock company by a few sponsors who acquire shares issued upon the SPAC’s incorporation and provide their paid-in capital. After incorporation, the SPAC raises funds from public investors through an IPO and then its shares would be listed on the stock market.4) Generally, SPACs in the US issue units that combine common shares with warrants and set the offering price at $10. The sponsors (or executives) of SPACs are not supposed to use the capital raised from investors through an IPO that should be separately placed in an escrow account or kept by financial institutions. The sponsors are typically compensated by retaining 20% of the SPAC shares as promotes,5) plus preemptive rights to purchase new shares. The sponsors seek to identify an unlisted firm for a merger. Once a suitable merger target is selected, the SPAC would proceed with a merger with the target firm that would become a listed company by a resolution at a general meeting of shareholders. If the sponsors fail to find any suitable unlisted firm or to complete the proposed merger with the firm due to rejection of shareholders within a fixed term,6) the original investment and interest accrued during the period should be returned and the SPAC would be liquidated. Furthermore, a shareholder who opposes the merger deal can exercise a redemption right.

There are a few reasons why firms who plan to be listed on the public market through public offering choose a merger with a SPAC over traditional IPOs. First, it could reduce uncertainty about the size of the capital to be raised through an IPO. The IPO proceeds that are placed in a separate account are regarded as the capital set aside for the business combination with an unlisted firm. Furthermore, a SPAC IPO is free from the effects of traditional IPOs such as changing conditions in the IPO market or IPO underpricing.7) For these reasons, going public via merging with a SPAC is widely perceived to be less expensive than a conventional IPO approach.8)

Second, a SPAC may serve as an alternative route of going public for companies whose business structure poses a challenge for a traditional IPO. A case in point is a company of which business is built upon a certain innovative technology or business model that is not suitable for public disclosure, which hampers their corporate value from being properly assessed. For these companies, an IPO through a SPAC merger can be more advantageous than a traditional IPO. Bai et al (2021) presented an opinion that investment banks act as underwriters in the traditional IPO market by matching larger and safer firms with public investors, while the SPAC sponsors (or executives) play a role as non-bank certification intermediaries in matching smaller and riskier firms with yield-seeking investors who prefer high-risk investment, which leads to segmented going-public markets for traditional IPOs and SPAC IPOs.9)

Third, SPAC mergers in the US can avail themselves of a safe harbor regarding projections of returns/profits and other forward-looking statements under the business combination laws, while companies going public in an IPO are not covered by the safe harbor against liability under the securities laws.10) This implies that SPACs offer a company preparing for an IPO an opportunity to seek regulatory arbitrage.

Lastly, some argue that a SPAC is a safer bet for investors than a company going public through a conventional IPO. This appears to be reasonable given that the IPO proceeds of a SPAC are separately held and once a SPAC fails to complete a merger deal, investors can get back their original investment and accrued interest. In addition, shareholders who oppose the merger are granted a redemption right to purchase SPAC shares.

However, not all potential advantages of SPACs are supported by academic studies. As for the argument that SPACs offer a less expensive, less uncertain way of going public than a traditional IPO, Gahng et al (2021) and Klausner et al (2021) indicated that the SPAC’s per-share value11) is priced at about $7, instead of $10,12) given SPAC underwriting fees (typically 5.5% of IPO proceeds), 20% of shares acquired by the sponsors as promotes and redemptions of SPAC shareholders not approving a merger. The researchers also found that the total cost of companies going public via a SPAC merger represents 15.1% of the post-issue market cap, while the cost of traditional IPOs accounts for just 3.3%.

If a SPAC is liquidated after failing to complete a business combination, the SPAC sponsors who own SPAC promotes and warrants (convertible bonds for SPAC sponsors in Korea) would receive no compensation. In other words, the sponsors would be compensated only upon the completion of a merger with an unlisted company and the size of their compensation would be linked to the post-merger company’s performance (share price). Compared to ordinary SPAC investors, however, the sponsors put in a much smaller amount of money to acquire promote shares and thus, they could earn profits even if post-merger shares show a weak performance. Thus, this structure motivates the sponsors to execute a merger deal if circumstances allow. The average share performance after business combinations tends to remain lackluster. This is well demonstrated in Gahng et al (2021) that presented the average post-merger, one-year return of -7.3% in the US. Furthermore, post-merger dilution may occur depending on whether the sponsors exercise their warrants.

Meanwhile, investment in SPACs may be safe in that the original investment and accrued interest would be returned, if a merger fails. However, this logic remains only valid for investors participating in an IPO via a SPAC merger. Once a merged company goes public, investors who purchase the company’s shares in the stock market would still be exposed to risks of price volatility and they are likely to get back less than their original investment if the purchase price is higher than the IPO price.

The role of supervisory authorities and investors

A sudden popularity of SPACs in the US is attributed to the perception that companies going public via a SPAC merger are less susceptible to uncertainties about IPOs proceeds than those opting for a traditional IPO amid higher stock market volatility triggered by the Covid-19 pandemic. Furthermore, a strong preference for SPACs enabling a speedier IPO process and an abrupt increase in presence of retail investors in the US stock market are mentioned as main factors behind a surge in SPACs.13) Korea has adopted restrictions on qualifications of the SPAC sponsors or executives, whereas in the US, celebrities such as famous athletes are participating in SPACs as sponsors and using their reputation to attract public investors.14) Under the circumstances, concerns have been raised over the overheating SPAC market that may cause damages to investors, and supervisory authorities have come up with countermeasures. Over the period between March and April 2021, the SEC released the Investor Alert to caution investors not to make investment decisions based solely on celebrity involvement (March 10 2021, SEC), and unveiled the plans to scrutinize SPACs’ structure and information disclosure (March 31 2021, SEC) and their accounting in the financial statements (April 12 2021, SEC). After these announcements, the number of SPAC IPOs declined to 125 during the period between April and August of 2021 from 296 in the first half. In Korea as well, questions over investor protection have been raised. For example, the Korea Exchange found suspicious unfair transactions regarding share prices of some SPACs15) and the Financial Supervisory Service presented issues that prospective investors should carefully consider when investing in SPACs.16)

A transparency and sufficient disclosure of SPACs is essential to facilitate the growth and development of the SPAC market and to minimize concerns about investor protection. The securities registration statement to be filed by a SPAC for an IPO should include information on the SPAC sponsors (or executives) such as their career background, details of industries or groups of businesses17) that SPACs have an eye on, and issuance structure of shares and convertible bonds (warrants for the US SPACs) such as compensation schemes for the SPAC sponsors. Also, the information of the merger target company should be accurately specified in the securities registration statement to be filed for the business combination. After the filing is completed, it is the supervisory authorities’ role to strictly evaluate such statements to ensure faithfulness and accuracy of disclosed information. When considering investing in a SPAC, investors should interpret disclosed information based on a meticulous understanding of the intrinsic features of a SPAC. After investing in a SPAC, they need to thoroughly review a merger deal proposed by the SPAC executives and, if necessary, should defend their own interests by voting against the merger or exercising their redemption right. As stated above, investors should be aware that only those participating in the SPAC IPO are entitled to the protection of their investment principal while other investors who purchase the SPAC shares in the stock market may suffer losses.

1) Ritter’s database indicates that in the US, SPACs issuing shares emerged in 1997 while SPACs issuing units (to be explained below) entered the market in 2003 (https://site.warrington.ufl.edu/ritter/files/IPOs-SPACs.pdf).

2) UK HM Treasury (March 3 2021), FCA (2021)

3) SGX (September 2 2021)

4) As for SPACs-related schemes, this article refers to Gahng et al (2021) and Klausner et al (2021) to obtain the US cases while consulting relevant materials released by the Korea Exchange for Korea’s cases.

5) Promotes mean shares given to the SPAC sponsors as a compensation, which are separated from the SPAC capital. The promotes are not attached to the redemption right and are typically subject to a lock-up provision after an IPO (Gahng et al, 2021).

6) The term for a SPAC to complete a merger is two years in the US, three years in Korea.

7) Kang Sohyun∙Joon-Seok Kim (2018)

8) The US startups seem to believe that IPO underwriters (investment banks) tend to price their offerings low to ensure that institutional investors attain high returns (The Economist, February 20 2021).

9) In this regard, the SPAC sponsors function similarly to private equity GPs (Gahng et al, 2021).

10) Klausner et al (2021)

11) The amount of capital delivered per share from an IPO via a SPAC merger.

12) In many cases, the SPAC sponsors and the merger target company tend to predetermine the minimum amount of capital that the SPAC is supposed to provide to the company upon the completion of a merger, and to attract a few PIPE (private investment in public equity) investors, in addition to existing investors (Gahng et al, 2021).

13) Hong, Ji-Yeun (2020)

14) The celebrities who serve as SPAC sponsors include Shaquille O’Neal (former professional basketball player), Stephen Curry (professional basketball player) and Serena Williams (professional tennis player) (Crunchbase News, Mach 11 2021).

15) Korea Exchange (August 25 2021)

16) Financial Supervisory Service (August 27 2021)

17) A company engaging in ESG management may be included.

References

Financial Supervisory Service, August 27 2021, Issues worthy of consideration for SPAC investors, press release.

Korea Exchange, August 25 2021, A special audit on SPACs showing an abnormal surge in share prices: results and notable issues, press release.

Bai, J., Ma, A., Zheng, M., 2021, Segmented going-public markets and the demand for SPACs, SSRN #3746490.

Crunchbase News, March 11 2021, Athletes and celebrities join the SPAC boom, SEC takes notice.

Economist, February 20 2021, What the SPAC craze means for tech investing.

FCA, 2021, Investor protection measures for special purpose acquisition companies: Changes to the listing rules, Policy Statement PS21/10.

Gahng, M., Ritter, J. R., Zhang, D., 2021, SPACs, SSRN #3775847.

Klausner, M., Ohlrogge, M., Ruan, E., 2021, A sober look at SPACs, ECGI Working Paper No.746/2021.

SEC, March 10 2021, Celebrity involvement with SPACs, Investor Alerts and Bulletins.

SEC, March 31 2021, Financial reporting and auditing considerations of companies merging with SPACs, Public Statement.

SEC, April 21 2021, Staff statement on accounting and reporting considerations for warrants issued by special purpose acquisition companies, Public Statement.

SGX, September 2 2021, SGX introduces SPAC listing framework, News release.

UK HM Treasury, March 3 2021, UK Listings Review.

(Korean)

Kang, S.H., Kim, J.S., 2018, Comparative Analysis on New Listing Routes on the KOSDAQ, KCMI Issue Paper 18-11.

Hong, J.Y., 2020, A Surge in SPAC IPOs in the US for 2020 and Relevant Implications , KCMI Capital Market Focus 2020-27.