Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Sustainability, Stakeholder Capitalism, ESG and the Public Market: Implications of the Long-Term Stock Exchange

Publication date Sep. 27, 2022

Summary

Long-term sustainability, stakeholder capitalism and ESG are the issues that have been in the spotlight in the capital market for the last decade. In the US, the Long-Term Stock Exchange (LTSE), a new public market, was launched in May 2019 after gaining approval from the Securities and Exchange Commission (SEC) with the aim of supporting companies and investors who advocate such values. To serve its intended purpose, the LTSE requires companies seeking to list shares on the LTSE to prepare earnings reports linked to the long-term business plan, ban the compensation plan for executives that rewards short term performance and introduce the tenure voting system that awards greater voting power to shares held for a longer duration. Since the initial listing of two companies in August 2021, any other company has yet to join the LTSE.

The LTSE offers an interesting test bed that could be used to understand how founders and managers of companies as well as public market investors view long-term sustainability and stakeholder capitalism. If specific data on the LTSE is accumulated going forward and measuring the success of the LTSE model becomes feasible, it would be possible to provide an answer to the question of whether such values can be incorporated into the public market or be better achieved in the private market.

The LTSE offers an interesting test bed that could be used to understand how founders and managers of companies as well as public market investors view long-term sustainability and stakeholder capitalism. If specific data on the LTSE is accumulated going forward and measuring the success of the LTSE model becomes feasible, it would be possible to provide an answer to the question of whether such values can be incorporated into the public market or be better achieved in the private market.

“Pursuit of long-term sustainability over short-term performance”, “transition to stakeholder capitalism aiming to serve the interests of various stakeholders from shareholder capitalism designed to maximize shareholder value”, and “support for ESG value” are the hottest issues that have been actively discussed in the capital market over the past decade. These issues give rise to a fundamental question: How can the new set of values be integrated into and be compatible with the stock market with over 300 years of history, especially the public market?1) More concretely, it remains unclear whether investors of the public market could accept poor financial results of an ESG-oriented company.2)

The Long-Term Stock Exchange (LTSE), one of the new US stock exchanges, has been created to address such uncertainties. It is worth exploring how the LTSE works in that it could offer significant implications for the question raised above.

Overview of the LTSE

The LTSE is a national securities exchange based in San Francisco that was founded by Eric Ries3) as a startup and approved by the Securities and Exchange Commission (SEC) in May 2019. Since attracting a Series A investment from Marc Andreessen and other investors in July 2016, it has raised capital worth a total of $169.4 million from angel investors and venture capitalists including Series C funding from James Walton4) that was secured in June 2022.5) As the Covid-19 pandemic delayed the commencement of its operations despite the approval from the SEC, Asana and Twilio became the first companies that signed up for the LTSE on August 26, 2021. As dual listing is allowed by the LTSE, shares of Asana and Twilio are also traded on the New York Stock Exchange (NYSE).

The key feature of the LTSE lies in its philosophy and direction.6) The LTSE intends to promote a market where a company’s founder and management can push forward a long-term goal aligned with corporate vision without the pressure to hit a short-term target, long-term investors are regarded as owners and treated better than short-term traders, and companies serve the interests of not only shareholders but also all stakeholders. To put its philosophy into practice, the LTSE requires those seeking to join the LTSE to adhere to listing requirements based on the following five principles.7)

First, long term-oriented companies should take into consideration a wide range of stakeholders and both companies and stakeholders need to recognize the essential role played by each other in their long-term success. More concretely, this means a company should be managed with a focus on which group of stakeholders would influence its long-term prosperity, what impact the company could have on the environment and communities, how to approach values like diversity and inclusion, and how the company would invest in its employees.

Second, a company with a log-term mindset should measure its financial performance over long time horizons that stretch from years to decades and put priority on long term decision-making. To this end, the company needs to make strategic decisions by taking into account how long the time horizon should be, how to align its performance indicators with the long-term horizon, how to reflect the long-term horizon in its corporate strategy, how to practically prioritize long-term plans across the entire company, and what compensation it would offer for the contribution that employees and other stakeholders make to its long-term gains.

Third, the company seeking long-term results should align its compensation plans for executives and directors with long term performance.

Fourth, the board of directors of a long term-oriented company needs to engage in the long-term strategy establishment and conduct an explicit oversight through the assessment of long-term performance indicators.

Lastly, a long term-focused company should encourage long-term shareholders to engage in its operation by keeping up continuous communication.

The founding philosophy and listing requirements advocated by the LTSE have stemmed from the problems that its founder Eric Ries has raised for a long time. He has pointed out that a company’s founder and management find it extremely difficult to pursue sustainable innovation from a long-term perspective, mainly due to strong pressures from public market investors focusing on short-term financial results and objectives. Based on the analysis, Eric Ries has argued that corporate governance designed to reinforce the controlling power of the founder and management should be adopted to enable a company to implement a long-term strategy underpinned by its founding philosophy and vision. This thinking has motivated him to create a new stock exchange where companies with such a governance structure go public and their shares are traded. The name of the LTSE manifests such a founding philosophy.

Another prominent feature is that the LTSE requires companies to adopt the concept of tenure voting to minimize the effects of shareholders who prefer short-term trading and improve the level of accountability by reinforcing their connection with long-term shareholders.8) On top of that, it also asks companies to prepare quarterly earnings reports from the perspective of the long-term business plan while discouraging them to give short-term incentives to executives by limiting executive bonuses linked to any performance target of less than a year.

Assessment and implications of the LTSE

In the US, founders and managers of startups have argued that a majority of them are reluctant to go public due to concerns over the short-termism of public market investors and the potential weakening of management power arising from the decline in post-IPO shareholding ratio, or the loss of control over managerial decision-making. According to them, such reluctance of becoming a public company is one of the factors behind a continuous drop in the number of US listed companies starting in 1996.9) Researchers have studied whether investors participating in the public market tend to prioritize short-term performance, which has led to mixed results. Asker et al. (2014) suggest that compared with private companies, public companies invest substantially less and are less responsive to changes in investment opportunities, especially in industries where stock prices are most sensitive to earnings news, which is consistent with the hypothesis that short-termist pressures distort investment decisions.10) From a slightly different perspective, Starks et al. (2017) show that longer-term investors weigh their portfolios towards high ESG firms and such investors are more patient so that they are less likely to sell a high ESG firm even after disappointing earnings reports are issued.11)12)

These findings imply that the LTSE could offer an appealing IPO market to companies (startups) that focus on long-term growth and advocate the value of stakeholder capitalism and ESG but refrain from being listed on existing stock exchanges. It is also expected that investors who show an interest in such values would participate in the market. Furthermore, listing on the LTSE itself could underscore a company’s commitment to long-term growth, stakeholder capitalism and ESG issues. This has probably prompted Eric Ries to establish the LTSE. However, his outlook for the LTSE seems to be somewhat inconsistent with the market reality. Contrary to the initial expectation for active participation of innovative and promising startups, it has taken one year and three months for just two companies to get listed on the LTSE since the approval was issued from the SEC and no additional listings have taken place since then. What implications would this have?

First, this can be attributed to the limitations of a newly established stock exchange. Even if a listed company advocates what the LTSE aims for, it would be hard to decide to go public through a new exchange with no listed companies. This is especially true if there is no clue as to the potential number of participating investors or trading volume and the level of valuation to be given. There is a possibility that the LTSE allows dual listing as a solution to this problem.13)

Another contributing factor is that against the LTSE CEO’s expectation, the number of founders, managers and initial investors (including angel investors) who support the values represented by the LTSE may not be enough to form a strong demand base.

Also notable are difficulties in putting the LTSE model into practice in the public market. This means many companies consider the private market a more viable option to protect controlling power for the long-term vision, pursue stakeholder capitalism or ESG values and find shareholders who support such a strategy. In particular, the US has the most sophisticated private market in the world and thus, companies may find no incentives to turn to the public market.

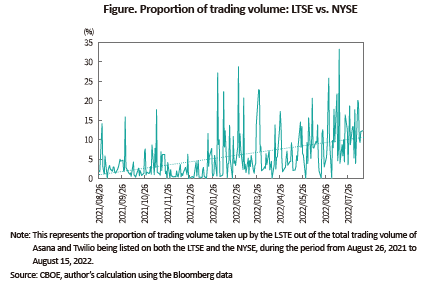

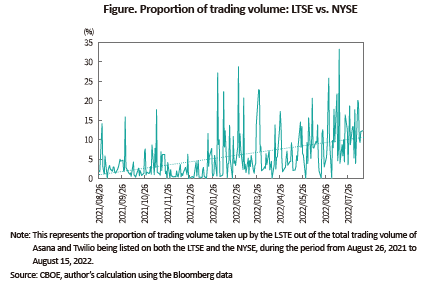

On the other hand, investors seem to find some promising prospects in the LTSE. The Figure below illustrates the proportion of trading volume represented by the LTSE out of the total trading volume of Asana and Twilio (the two companies’ combined trading volume on both the NYSE (New York Stock Exchange) and the LTSE) from the initial trade on the LTSE as of August 26, 2021 until August 15, 2022.14)

In terms of the aggregate trading volume of the two listed companies, the proportion of the LTSE has recently climbed to over 10% from the initial proportion of less than 2%, albeit with wider daily variations. Considering the nature of the LTSE focusing on long-term investors, its turnover ratio may be lower than that of the NYSE. Nevertheless, the increase in the proportion of trading volume suggests that its investor base is gradually on the rise. Notably, the considerable size of funding that the LTSE has recently secured from venture capital firms (as of June 2022) shows that some investors are optimistic about the LTSE’s potential.

The LTSE serves as an interesting test bed that researchers could use to understand how both founders and management of companies and public market investors view long-term sustainability and stakeholder capitalism. In this regard, an empirical analysis should be conducted to find an answer to the questions raised above. If specific data on the LTSE is accumulated going forward, more relevant research would be conducted regarding such data and the success of the LTSE model would be measured more accurately. This will provide a clue to the question of whether the public market could embrace the newly emerging values.

1) In this article, the public market means a marketplace where companies’ shares are listed and unspecified investors sell and buy the shares. Generally, a stock exchange falls under the category.

2) The March 2021 case of Danone, a France-based food company, reveals such uncertainties.

3) Eric Ries is the author of ‘The lean startup’.

Ries, 2011, The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses, Crown Publishing.

4) James Walton is the son of Walmart founder Sam Walton.

5) Crunchbase

6) Aside from the LTSE, the US has seen the emergence of new stock exchanges representing distinctive concepts and strategies over the past several years. The IEX pursues reducing the effect of high-frequency trading, MIAX Pearl Equities (MIAX) aims for greater stock market share based on the business of options exchanges, and Members Exchange (MEMX) advocates the interests of its member companies (brokerage firms). Some US representative securities firms are participating in the MEMX, including Citadel, Morgan Stanley, Fidelity, Charles Schwab, etc.

7) https://ltse.com

8) It is no surprise that tenure voting faces concerns and objections. The SEC Commissioner Robert Jackson Jr. opposed the LTSE’s listing requirements before it gained approval from the SEC.

Wall Street Journal, 2018. 11. 27, Silicon Valley’s stock-exchange plan snagged by opposition at SEC.

9) The potential factors behind the decline in the number of US listed companies are summed up in Cho (2021).

Cho, S.H., 2021, Public vs. Private Corporation, Public vs. Private Market, KCMI Capital Market Focus, 2021-06.

10) Asker, J., Farre-Mensa, J., Ljungqvist, 2014, Corporate investment and stock market listing: A puzzle?, Review of Financial Studies 28, 342-390.

11) Starks, L., Venkat, P., Zhu, Q., 2017, Corporate ESG profiles and investor horizons, SSRN.

12) As claimed by Bebchuk (2021), some argue that there is no evidence public market investors favor short-term trading and that problems of short-termism could be alleviated by designing an appropriate compensation plan for managers.

Bebchuk, 2021, Don’t let the short-termism bogeyman scare you, Harvard Business Review, Jan-Feb.

13) Wall Street Journal, 2021. 6. 24, Twilio, Asana to list on Long-Term Stock Exchange as ESG push continues.

14) The LTSE has yet to provide trading volume data of listed companies. The LTSE trading volume shown in the Figure is derived from the exchange-specific trading volume data provided by the CBOE while the NYSE trading volume by company comes from the Bloomberg data.

The Long-Term Stock Exchange (LTSE), one of the new US stock exchanges, has been created to address such uncertainties. It is worth exploring how the LTSE works in that it could offer significant implications for the question raised above.

Overview of the LTSE

The LTSE is a national securities exchange based in San Francisco that was founded by Eric Ries3) as a startup and approved by the Securities and Exchange Commission (SEC) in May 2019. Since attracting a Series A investment from Marc Andreessen and other investors in July 2016, it has raised capital worth a total of $169.4 million from angel investors and venture capitalists including Series C funding from James Walton4) that was secured in June 2022.5) As the Covid-19 pandemic delayed the commencement of its operations despite the approval from the SEC, Asana and Twilio became the first companies that signed up for the LTSE on August 26, 2021. As dual listing is allowed by the LTSE, shares of Asana and Twilio are also traded on the New York Stock Exchange (NYSE).

The key feature of the LTSE lies in its philosophy and direction.6) The LTSE intends to promote a market where a company’s founder and management can push forward a long-term goal aligned with corporate vision without the pressure to hit a short-term target, long-term investors are regarded as owners and treated better than short-term traders, and companies serve the interests of not only shareholders but also all stakeholders. To put its philosophy into practice, the LTSE requires those seeking to join the LTSE to adhere to listing requirements based on the following five principles.7)

First, long term-oriented companies should take into consideration a wide range of stakeholders and both companies and stakeholders need to recognize the essential role played by each other in their long-term success. More concretely, this means a company should be managed with a focus on which group of stakeholders would influence its long-term prosperity, what impact the company could have on the environment and communities, how to approach values like diversity and inclusion, and how the company would invest in its employees.

Second, a company with a log-term mindset should measure its financial performance over long time horizons that stretch from years to decades and put priority on long term decision-making. To this end, the company needs to make strategic decisions by taking into account how long the time horizon should be, how to align its performance indicators with the long-term horizon, how to reflect the long-term horizon in its corporate strategy, how to practically prioritize long-term plans across the entire company, and what compensation it would offer for the contribution that employees and other stakeholders make to its long-term gains.

Third, the company seeking long-term results should align its compensation plans for executives and directors with long term performance.

Fourth, the board of directors of a long term-oriented company needs to engage in the long-term strategy establishment and conduct an explicit oversight through the assessment of long-term performance indicators.

Lastly, a long term-focused company should encourage long-term shareholders to engage in its operation by keeping up continuous communication.

The founding philosophy and listing requirements advocated by the LTSE have stemmed from the problems that its founder Eric Ries has raised for a long time. He has pointed out that a company’s founder and management find it extremely difficult to pursue sustainable innovation from a long-term perspective, mainly due to strong pressures from public market investors focusing on short-term financial results and objectives. Based on the analysis, Eric Ries has argued that corporate governance designed to reinforce the controlling power of the founder and management should be adopted to enable a company to implement a long-term strategy underpinned by its founding philosophy and vision. This thinking has motivated him to create a new stock exchange where companies with such a governance structure go public and their shares are traded. The name of the LTSE manifests such a founding philosophy.

Another prominent feature is that the LTSE requires companies to adopt the concept of tenure voting to minimize the effects of shareholders who prefer short-term trading and improve the level of accountability by reinforcing their connection with long-term shareholders.8) On top of that, it also asks companies to prepare quarterly earnings reports from the perspective of the long-term business plan while discouraging them to give short-term incentives to executives by limiting executive bonuses linked to any performance target of less than a year.

Assessment and implications of the LTSE

In the US, founders and managers of startups have argued that a majority of them are reluctant to go public due to concerns over the short-termism of public market investors and the potential weakening of management power arising from the decline in post-IPO shareholding ratio, or the loss of control over managerial decision-making. According to them, such reluctance of becoming a public company is one of the factors behind a continuous drop in the number of US listed companies starting in 1996.9) Researchers have studied whether investors participating in the public market tend to prioritize short-term performance, which has led to mixed results. Asker et al. (2014) suggest that compared with private companies, public companies invest substantially less and are less responsive to changes in investment opportunities, especially in industries where stock prices are most sensitive to earnings news, which is consistent with the hypothesis that short-termist pressures distort investment decisions.10) From a slightly different perspective, Starks et al. (2017) show that longer-term investors weigh their portfolios towards high ESG firms and such investors are more patient so that they are less likely to sell a high ESG firm even after disappointing earnings reports are issued.11)12)

These findings imply that the LTSE could offer an appealing IPO market to companies (startups) that focus on long-term growth and advocate the value of stakeholder capitalism and ESG but refrain from being listed on existing stock exchanges. It is also expected that investors who show an interest in such values would participate in the market. Furthermore, listing on the LTSE itself could underscore a company’s commitment to long-term growth, stakeholder capitalism and ESG issues. This has probably prompted Eric Ries to establish the LTSE. However, his outlook for the LTSE seems to be somewhat inconsistent with the market reality. Contrary to the initial expectation for active participation of innovative and promising startups, it has taken one year and three months for just two companies to get listed on the LTSE since the approval was issued from the SEC and no additional listings have taken place since then. What implications would this have?

First, this can be attributed to the limitations of a newly established stock exchange. Even if a listed company advocates what the LTSE aims for, it would be hard to decide to go public through a new exchange with no listed companies. This is especially true if there is no clue as to the potential number of participating investors or trading volume and the level of valuation to be given. There is a possibility that the LTSE allows dual listing as a solution to this problem.13)

Another contributing factor is that against the LTSE CEO’s expectation, the number of founders, managers and initial investors (including angel investors) who support the values represented by the LTSE may not be enough to form a strong demand base.

Also notable are difficulties in putting the LTSE model into practice in the public market. This means many companies consider the private market a more viable option to protect controlling power for the long-term vision, pursue stakeholder capitalism or ESG values and find shareholders who support such a strategy. In particular, the US has the most sophisticated private market in the world and thus, companies may find no incentives to turn to the public market.

On the other hand, investors seem to find some promising prospects in the LTSE. The Figure below illustrates the proportion of trading volume represented by the LTSE out of the total trading volume of Asana and Twilio (the two companies’ combined trading volume on both the NYSE (New York Stock Exchange) and the LTSE) from the initial trade on the LTSE as of August 26, 2021 until August 15, 2022.14)

The LTSE serves as an interesting test bed that researchers could use to understand how both founders and management of companies and public market investors view long-term sustainability and stakeholder capitalism. In this regard, an empirical analysis should be conducted to find an answer to the questions raised above. If specific data on the LTSE is accumulated going forward, more relevant research would be conducted regarding such data and the success of the LTSE model would be measured more accurately. This will provide a clue to the question of whether the public market could embrace the newly emerging values.

1) In this article, the public market means a marketplace where companies’ shares are listed and unspecified investors sell and buy the shares. Generally, a stock exchange falls under the category.

2) The March 2021 case of Danone, a France-based food company, reveals such uncertainties.

3) Eric Ries is the author of ‘The lean startup’.

Ries, 2011, The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses, Crown Publishing.

4) James Walton is the son of Walmart founder Sam Walton.

5) Crunchbase

6) Aside from the LTSE, the US has seen the emergence of new stock exchanges representing distinctive concepts and strategies over the past several years. The IEX pursues reducing the effect of high-frequency trading, MIAX Pearl Equities (MIAX) aims for greater stock market share based on the business of options exchanges, and Members Exchange (MEMX) advocates the interests of its member companies (brokerage firms). Some US representative securities firms are participating in the MEMX, including Citadel, Morgan Stanley, Fidelity, Charles Schwab, etc.

7) https://ltse.com

8) It is no surprise that tenure voting faces concerns and objections. The SEC Commissioner Robert Jackson Jr. opposed the LTSE’s listing requirements before it gained approval from the SEC.

Wall Street Journal, 2018. 11. 27, Silicon Valley’s stock-exchange plan snagged by opposition at SEC.

9) The potential factors behind the decline in the number of US listed companies are summed up in Cho (2021).

Cho, S.H., 2021, Public vs. Private Corporation, Public vs. Private Market, KCMI Capital Market Focus, 2021-06.

10) Asker, J., Farre-Mensa, J., Ljungqvist, 2014, Corporate investment and stock market listing: A puzzle?, Review of Financial Studies 28, 342-390.

11) Starks, L., Venkat, P., Zhu, Q., 2017, Corporate ESG profiles and investor horizons, SSRN.

12) As claimed by Bebchuk (2021), some argue that there is no evidence public market investors favor short-term trading and that problems of short-termism could be alleviated by designing an appropriate compensation plan for managers.

Bebchuk, 2021, Don’t let the short-termism bogeyman scare you, Harvard Business Review, Jan-Feb.

13) Wall Street Journal, 2021. 6. 24, Twilio, Asana to list on Long-Term Stock Exchange as ESG push continues.

14) The LTSE has yet to provide trading volume data of listed companies. The LTSE trading volume shown in the Figure is derived from the exchange-specific trading volume data provided by the CBOE while the NYSE trading volume by company comes from the Bloomberg data.