OPINION

2022 Mar/08

A Thought on Politically-themed Stocks Ahead of Korea’s 20th Presidential Election

Mar. 08, 2022

PDF

- Summary

- Ahead of the 20th presidential election, there are signs of the recurring politically-themed stock phenomenon that drives up stock prices due to vague connections with leading presidential candidates. As for politically-themed stocks affected by this year’s presidential election, the frequency of hitting an upper price limit has increased by 54% in 2021 when volatility in the stock market was reduced from 2020, showing a stark contrast to the 38% decline in the frequency of ordinary stocks. In the previous presidential elections, overheating of politically-themed stocks that was accompanied by a surge in credit loan-based trades tended to subside with the increase in short selling. This recurrent pattern is likely to change this year as investors who have a negative view of price hikes of politically-themed stocks would participate in the market only to a limited extent due to the short selling restriction imposed during the 20th presidential election. Notably, the themed stocks could tumble further than before although price plunges just prior to the election date could appear belatedly during the 20th presidential election, which requires investors to take a more cautious approach.

With the 20th presidential election just around the corner, Korea’s stock market is showing signs of the recurring politically-themed stock phenomenon. Under the circumstances, this article tries to discuss characteristics and considerations for investors regarding the politically-themed stocks related to the 20th political election.

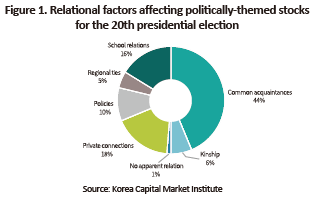

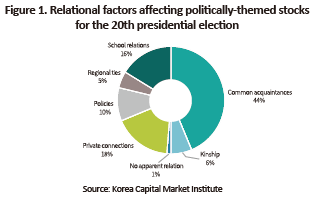

The politically-themed stock phenomenon recurring every five years

The politically-themed stock phenomenon refers to an extreme rally in the stock of a company whose management or controlling shareholder is allegedly linked to leading presidential candidates via school relations, regional ties, and kinship. In the previous presidential elections, sudden price plunges were commonly observed in politically-themed stocks as the elections drew nearer, regardless of their fundamental value.1) A total of 83 stocks are categorized by the media as politically-themed stocks associated with the two most popular candidates in the polls for the 20th presidential election. Most of them are deemed themed stocks due to common acquaintances (44%), private connections (18%), and school relations (16%) between presidential candidates and companies’ management which are the factors bearing no direct relation with the relevant companies’ business.

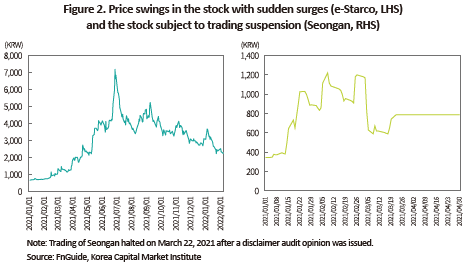

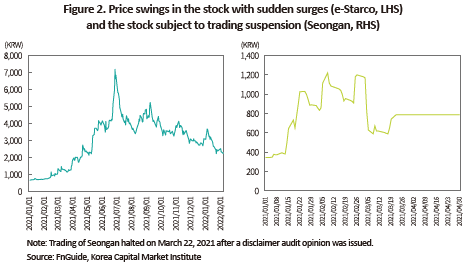

As in the previous presidential elections, politically-themed stocks related to the 20th presidential election have rallied widely, depending on fluctuations in poll results of candidates or major political events. Among those stocks, a stock posted a whopping 962% surge over the beginning of 2021, and some experienced drastic price hikes immediately after being classified as politically-themed stocks before their trading was abruptly suspended.

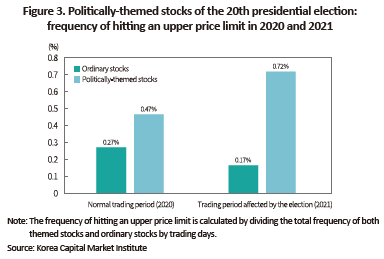

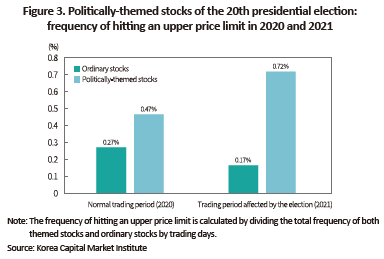

In addition to a few individual stocks, the politically-themed stocks affected by the 20th presidential election have displayed an unusual trend as a whole. In 2020, greater volatility in the stock market sent their stock prices higher 96 times. Furthermore, those stocks hit an upper price limit as many as 148 times, posting a 54.2% increase in frequency in 2021 when the politically-themed stock phenomenon picked up steam. On the contrary, the frequency of hitting a ceiling for ordinary stocks showed a 38.4% decline in 2021.

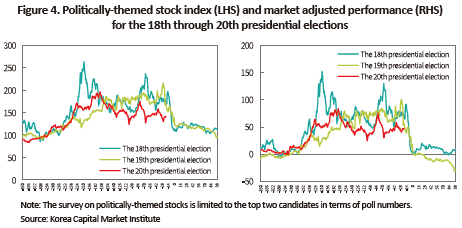

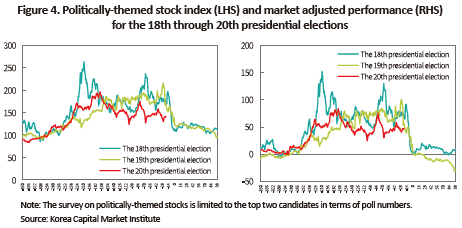

Abrupt surges of politically-themed stocks could not be prolonged. This article converted 64 stocks labeled as politically-themed stocks related to the top two candidates during the 18th through 19th presidential elections into a stock index2) to compare price swings with themed stocks of the 20th presidential election. The comparison result reveals that the index of both the 18th and 19th presidential elections went up as campaigns kicked into high gear. The themed stock index for this year’s presidential election has risen steadily until the end of June from early 2021. Despite a slight drop, the index remains higher compared to the early 2021 level. However, the stock index derived from the 18th and 19th elections started to plummet 13 to 24 trading days prior to the election dates. In an analysis of their market adjusted performance excluding the KOSPI performance, the politically-themed stock index exhibited similar price swings.

Implications of the short selling restriction

If the past price pattern in the stock market is repeated during this year’s presidential election, politically-themed stocks are highly likely to suffer abrupt plunges with the election being on the horizon. What is noteworthy is the restriction on short selling to be imposed on politically-themed stocks for the 20th presidential election, never found in previous presidential elections. Amid the spread of Covid-19 that broke out in February 2020, the financial market saw a steep drop in stock prices. In response to such plunges, a ban was imposed on short selling for all stocks as of March 16, 2020, while it has been partially permitted only for some stocks comprising KOSPI200 and KOSDAQ150. All the themed stocks affected by the 20th presidential election analyzed in this article are subject to the two-year short selling restriction and thus, should not be traded through short selling.

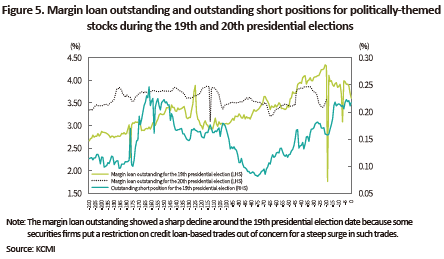

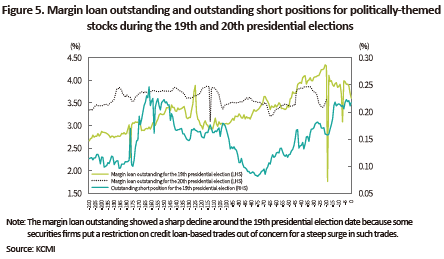

To assess the effects of the short selling restriction on politically-themed stocks, this article analyzed the margin loan outstanding and the outstanding short position regarding themed stocks for the 19th presidential election since these stocks were not subject to any restriction and their outstanding short positions were made available from June 2016. The analysis result reveals that the two outstanding balances are in sync with each other. In other words, surges in politically-themed stocks drove up the margin loan outstanding, leading to a rise in the outstanding short position. Small and medium stocks listed on the KOSDAQ, to which most politically-themed stocks belong, are rarely shorted. Notably, however, short selling was heavily concentrated on almost every politically-themed stock during the 19th presidential election, which partially contributed to constraining a further surge in stock prices. Compared to the stocks affected by the 19th presidential election, politically-themed stocks related to the 20th presidential election have a larger margin loan outstanding, but cannot be traded through short selling. This implies that the price trend of such themed stocks is likely to deviate from that of the past elections before and after the 20th presidential election date.

Considerations for investors

During campaigns of the 20th presidential election, short selling that forms part of the life cycle of politically-themed stocks is restricted, possibly weakening the previous trend that stock prices drop as the elections are approaching. In this year’s election, however, the decline in stock prices could be larger, which requires investors to take a more cautious approach. Investors engaging in short selling are likely to expect stocks to drop in prices under the assumption of overvalued politically-themed stocks. If their participation in the market is interrupted, the gloomy outlook for politically-themed stocks would be solidified in the market. This might send declining stock prices to further plummet in the bear market, although price plunges just prior to the election date—a problem observed in previous elections—could be alleviated. In this respect, investors need to be wary of changing conditions of the politically-themed stocks related to the 20th presidential election.

1) Nam, Gilnam, 2017, Politically-themed Stocks: Characteristics and Investment Risks, Issue Paper 17-04, Korea Capital Market Institute

2) This article assumed the phenomenon of politically-themed stocks was materialized from January 4, 2021, 291 days prior to the 20th presidential election date. Likewise, in terms of the 18th and 19th presidential elections, the politically-themed stock index was set as 100 points with 291 days ahead of the election dates.

The politically-themed stock phenomenon recurring every five years

The politically-themed stock phenomenon refers to an extreme rally in the stock of a company whose management or controlling shareholder is allegedly linked to leading presidential candidates via school relations, regional ties, and kinship. In the previous presidential elections, sudden price plunges were commonly observed in politically-themed stocks as the elections drew nearer, regardless of their fundamental value.1) A total of 83 stocks are categorized by the media as politically-themed stocks associated with the two most popular candidates in the polls for the 20th presidential election. Most of them are deemed themed stocks due to common acquaintances (44%), private connections (18%), and school relations (16%) between presidential candidates and companies’ management which are the factors bearing no direct relation with the relevant companies’ business.

If the past price pattern in the stock market is repeated during this year’s presidential election, politically-themed stocks are highly likely to suffer abrupt plunges with the election being on the horizon. What is noteworthy is the restriction on short selling to be imposed on politically-themed stocks for the 20th presidential election, never found in previous presidential elections. Amid the spread of Covid-19 that broke out in February 2020, the financial market saw a steep drop in stock prices. In response to such plunges, a ban was imposed on short selling for all stocks as of March 16, 2020, while it has been partially permitted only for some stocks comprising KOSPI200 and KOSDAQ150. All the themed stocks affected by the 20th presidential election analyzed in this article are subject to the two-year short selling restriction and thus, should not be traded through short selling.

To assess the effects of the short selling restriction on politically-themed stocks, this article analyzed the margin loan outstanding and the outstanding short position regarding themed stocks for the 19th presidential election since these stocks were not subject to any restriction and their outstanding short positions were made available from June 2016. The analysis result reveals that the two outstanding balances are in sync with each other. In other words, surges in politically-themed stocks drove up the margin loan outstanding, leading to a rise in the outstanding short position. Small and medium stocks listed on the KOSDAQ, to which most politically-themed stocks belong, are rarely shorted. Notably, however, short selling was heavily concentrated on almost every politically-themed stock during the 19th presidential election, which partially contributed to constraining a further surge in stock prices. Compared to the stocks affected by the 19th presidential election, politically-themed stocks related to the 20th presidential election have a larger margin loan outstanding, but cannot be traded through short selling. This implies that the price trend of such themed stocks is likely to deviate from that of the past elections before and after the 20th presidential election date.

During campaigns of the 20th presidential election, short selling that forms part of the life cycle of politically-themed stocks is restricted, possibly weakening the previous trend that stock prices drop as the elections are approaching. In this year’s election, however, the decline in stock prices could be larger, which requires investors to take a more cautious approach. Investors engaging in short selling are likely to expect stocks to drop in prices under the assumption of overvalued politically-themed stocks. If their participation in the market is interrupted, the gloomy outlook for politically-themed stocks would be solidified in the market. This might send declining stock prices to further plummet in the bear market, although price plunges just prior to the election date—a problem observed in previous elections—could be alleviated. In this respect, investors need to be wary of changing conditions of the politically-themed stocks related to the 20th presidential election.

1) Nam, Gilnam, 2017, Politically-themed Stocks: Characteristics and Investment Risks, Issue Paper 17-04, Korea Capital Market Institute

2) This article assumed the phenomenon of politically-themed stocks was materialized from January 4, 2021, 291 days prior to the 20th presidential election date. Likewise, in terms of the 18th and 19th presidential elections, the politically-themed stock index was set as 100 points with 291 days ahead of the election dates.