Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Rapid Growth of Executive Compensation and Need for Enhancing Shareholders’ Role in Listed Companies

Publication date Oct. 11, 2022

Summary

A median pay of the highest-paid executives at KOSPI 200 companies amounted to KRW 1.73 billion in 2021, with the executive-to-employee pay ratio reaching 19.2. Compared with S&P 500 CEO pay, KOSPI 200 executive compensation represents less than one tenth in terms of the absolute value and the pay ratio relative to rank-and-file employees. However, its cumulative growth rate has been rising sharply since 2013 to reach almost twice that of S&P 500 CEO pay. Notably, it has been observed in Korea’s listed companies that controlling shareholder executives tend to get paid more than CEOs or raise their pay, regardless of management performance, by using their corporate control. On top of that, some of them receive compensation from multiple affiliated companies where they hold positions concurrently. In this respect, it is necessary for Korea’s listed companies to empower shareholders to curb excessive top-management pay and consider adopting the Say-on-Pay vote system.

Korea’s listed companies have been disclosing executives’ pay in their annual reports since 2013. The disclosure initially targeted registered board members who received KRW 500 million or more in compensation, which has been expanded to cover the top five executives of each company from 2018. Whenever such disclosure is made, it has sparked a growing social interest in how much executives of major companies get paid.1) Against this backdrop, this article intends to compare KOSPI 200 executive compensation with S&P 500 CEO pay to understand the characteristics of executive remuneration provided by Korea’s listed companies and present policy improvements.

KOSPI 200 executive compensation vs. S&P 500 CEO pay

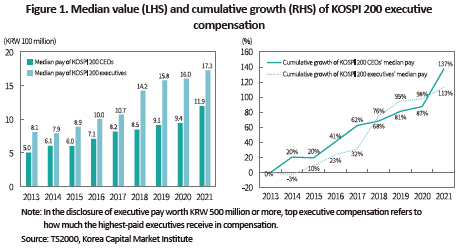

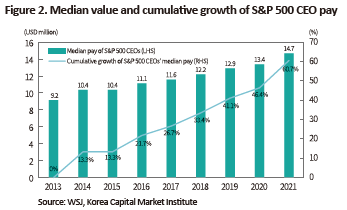

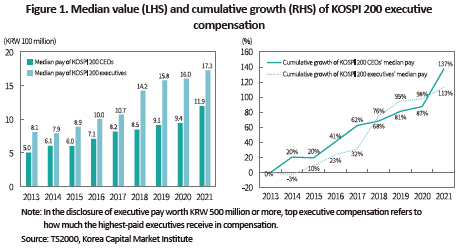

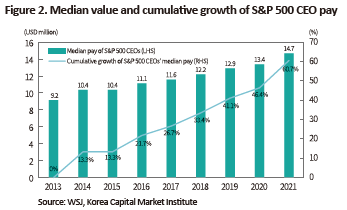

This article categorizes executive pay data disclosed in the 2021 annual reports of KOSPI 200 companies into CEO pay and compensation for highest-paid executives (“top executive compensation”) to calculate a median value of each category. The median value of the CEO pay and top executive compensation has risen 26.6% to KRW 1.19 billion and 7.7% to KRW 1.73 billion, respectively, on a YoY basis (the left-hand graph of Figure 1). On the other hand, the 2021 median CEO pay for S&P 500—representing major companies of the US—climbed 9.7% to $14.70 million from a year earlier, far surpassing KOSPI 200 executive compensation in the absolute value (Figure 2).

In Korea, cumulative growth of executive pay has been calculated since 2013. In terms of cumulative growth, the median S&P 500 CEO pay has increased 60.7% since 2013, while the median value of CEO pay and top executive compensation for KOSPI 200 has jumped 137.3% and 113.1% during the same period, respectively, 2.3 times and 1.9 times bigger than those of S&P 500 (the right-hand graph of Figure 1, Figure 2).

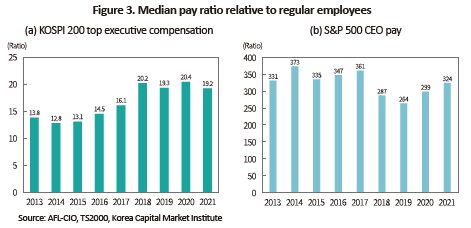

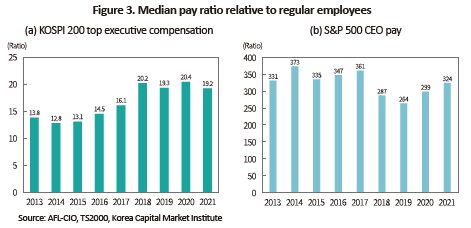

In addition, this article tries to figure out how much senior executives get paid compared to rank-and-file employees by dividing top executive compensation of KOSPI 200 and CEO pay of S&P 500 by regular employees’ pay. This calculation produces the ratio of KOSPI 200 top executive compensation and S&P 500 CEO pay to regular employees’ pay as 19.2 and 324, respectively. In KOSPI 200 companies, the pay ratio of senior executives to average employees has slightly declined from 20.4 of the previous year. As for S&P 500, the ratio has widened from 299 compared to a year ago and the gap in the absolute size is about 17 times bigger than that of KOSPI 200 (Figure 3).2) In terms of the absolute size and executive pay gap with employees, KOSPI 200 companies are outweighed by S&P 500 counterparts but are experiencing more rapid growth.

Controlling shareholder executives of Korea’s listed companies

In the US, only CEO pay data is available while KOSPI 200 executive compensation data can be classified into CEO pay and top executive pay. Such classification is possible because CEOs of US companies in charge of overall management affairs are normally the highest-paid executives but some executives in Korea’s listed companies are paid more than CEOs. An analysis of the 2021 KOSPI 200 data has found that the median top executive pay is greater than the median CEO pay by KRW 530 million.

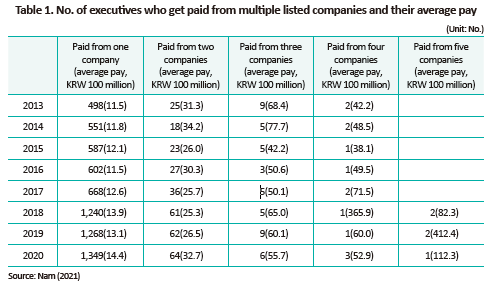

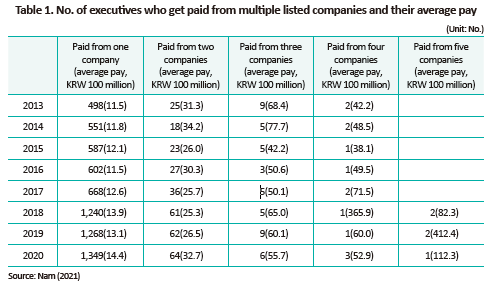

Most executives who get paid more than CEOs in Korea’s listed companies serve as executives who are controlling shareholders.3) Notably, those highest-paid executives or controlling shareholders tend to receive more compensation compared to previous years, even when their companies suffer a decline in operating profits or go into the red. This means those executives take in high compensation packages, regardless of corporate performance.4) Furthermore, a considerable number of them have been found to get paid from various listed subsidiaries where they hold positions concurrently. During the period from 2013 to 2020, a total of 381 executives received more than KRW 500 million in compensation from two to five listed companies at the same time and since 2018, this phenomenon has been intensifying (Table 1). It is commonplace in Korea’s listed companies that controlling shareholder executives make more than CEOs based on their corporate control, regardless of management performance. From a corporate governance perspective, this indicates the mechanism designed to curb excessive executive pay has not served its intended purpose.

Need for shareholders’ tighter control over executive pay

In Apple’s general meeting of shareholders held on March 4, 2022, its CEO Tim Cook’s $98.70 million pay plan5) was put to a vote. Like other listed companies in the US, Apple determines compensation plans for the CEO and other key executives through the Say-on-Pay vote in an annual shareholder meeting. This year, Norway’s $1.3 trillion sovereign wealth fund made it clear that it would oppose Tim Cook’s pay. About 95% of Apple shareholders approved the CEO’s pay in the 2021 meeting, whereas just 64.4% voted in favor of the 2022 compensation packages. Although the CEO compensation plan was not rejected by shareholders, such weakened support for the plan would prompt Apple’s management to take a more prudent approach to executive remuneration.

The Say-on-Pay vote that applies to executive pay of listed companies was introduced to the US through the 2010 Dodd-Frank Act. Companies do not necessarily have to reflect the result of the Say-on-Pay vote as it is a non-binding rule. As shown in Apple’s case, however, details of executive compensation plans are unveiled when the Say-on-Pay vote is put on the agenda for a shareholder meeting and a smaller proportion of shareholders in favor of the plan can be viewed as a warning sign to top management. The Say-on-Pay vote has been adopted by a dozen advanced countries, which has resulted in positive effects including a decline in the growth of executive pay and a higher association between executive compensation and corporate performance. In Korea’s listed companies with a unique corporate governance structure, the number of the highest-paid executives including controlling shareholder executives has been on the steady rise and executive pay is growing at a rapid pace. Given these circumstances, it is high time for Korea to consider adopting the Say-on-Pay vote system.

1) August 29, 2022, A listed company’s executive made KRW 36.1 billion in the first half alone…Who is the highest-paid executive?, The Chosun Ilbo.

2) It is notable that Korea and the US apply different standards for the disclosure of regular workers’ pay. The average compensation received by executives and employees in Korea’s listed companies is the average of entire employees’ pay excluding registered executive compensation. If a company has several highly-paid executives who do not serve as board members, the pay of regular employees may be overestimated. On the other hand, listed companies in the US calculate the pay of rank-and-file employees as the median pay of their entire employees, which comes closer to the actual value.

3) It is worth noting that in financial services companies, the compensation of employees can be affected by performance-based bonuses and lump-sum severance pay and key engineers are top talents in innovative companies. In most listed companies except for such companies, however, those who get paid higher than CEOs are controlling shareholder executives.

4) Nam, G.N., 2021, Listed companies’ executive pay and controlling shareholder executives, Issue Paper of Korea Capital Market Institute 21-18.

5) This represents 1,447 times the pay of Apple’s average employees.

KOSPI 200 executive compensation vs. S&P 500 CEO pay

This article categorizes executive pay data disclosed in the 2021 annual reports of KOSPI 200 companies into CEO pay and compensation for highest-paid executives (“top executive compensation”) to calculate a median value of each category. The median value of the CEO pay and top executive compensation has risen 26.6% to KRW 1.19 billion and 7.7% to KRW 1.73 billion, respectively, on a YoY basis (the left-hand graph of Figure 1). On the other hand, the 2021 median CEO pay for S&P 500—representing major companies of the US—climbed 9.7% to $14.70 million from a year earlier, far surpassing KOSPI 200 executive compensation in the absolute value (Figure 2).

In Korea, cumulative growth of executive pay has been calculated since 2013. In terms of cumulative growth, the median S&P 500 CEO pay has increased 60.7% since 2013, while the median value of CEO pay and top executive compensation for KOSPI 200 has jumped 137.3% and 113.1% during the same period, respectively, 2.3 times and 1.9 times bigger than those of S&P 500 (the right-hand graph of Figure 1, Figure 2).

In the US, only CEO pay data is available while KOSPI 200 executive compensation data can be classified into CEO pay and top executive pay. Such classification is possible because CEOs of US companies in charge of overall management affairs are normally the highest-paid executives but some executives in Korea’s listed companies are paid more than CEOs. An analysis of the 2021 KOSPI 200 data has found that the median top executive pay is greater than the median CEO pay by KRW 530 million.

Most executives who get paid more than CEOs in Korea’s listed companies serve as executives who are controlling shareholders.3) Notably, those highest-paid executives or controlling shareholders tend to receive more compensation compared to previous years, even when their companies suffer a decline in operating profits or go into the red. This means those executives take in high compensation packages, regardless of corporate performance.4) Furthermore, a considerable number of them have been found to get paid from various listed subsidiaries where they hold positions concurrently. During the period from 2013 to 2020, a total of 381 executives received more than KRW 500 million in compensation from two to five listed companies at the same time and since 2018, this phenomenon has been intensifying (Table 1). It is commonplace in Korea’s listed companies that controlling shareholder executives make more than CEOs based on their corporate control, regardless of management performance. From a corporate governance perspective, this indicates the mechanism designed to curb excessive executive pay has not served its intended purpose.

In Apple’s general meeting of shareholders held on March 4, 2022, its CEO Tim Cook’s $98.70 million pay plan5) was put to a vote. Like other listed companies in the US, Apple determines compensation plans for the CEO and other key executives through the Say-on-Pay vote in an annual shareholder meeting. This year, Norway’s $1.3 trillion sovereign wealth fund made it clear that it would oppose Tim Cook’s pay. About 95% of Apple shareholders approved the CEO’s pay in the 2021 meeting, whereas just 64.4% voted in favor of the 2022 compensation packages. Although the CEO compensation plan was not rejected by shareholders, such weakened support for the plan would prompt Apple’s management to take a more prudent approach to executive remuneration.

The Say-on-Pay vote that applies to executive pay of listed companies was introduced to the US through the 2010 Dodd-Frank Act. Companies do not necessarily have to reflect the result of the Say-on-Pay vote as it is a non-binding rule. As shown in Apple’s case, however, details of executive compensation plans are unveiled when the Say-on-Pay vote is put on the agenda for a shareholder meeting and a smaller proportion of shareholders in favor of the plan can be viewed as a warning sign to top management. The Say-on-Pay vote has been adopted by a dozen advanced countries, which has resulted in positive effects including a decline in the growth of executive pay and a higher association between executive compensation and corporate performance. In Korea’s listed companies with a unique corporate governance structure, the number of the highest-paid executives including controlling shareholder executives has been on the steady rise and executive pay is growing at a rapid pace. Given these circumstances, it is high time for Korea to consider adopting the Say-on-Pay vote system.

1) August 29, 2022, A listed company’s executive made KRW 36.1 billion in the first half alone…Who is the highest-paid executive?, The Chosun Ilbo.

2) It is notable that Korea and the US apply different standards for the disclosure of regular workers’ pay. The average compensation received by executives and employees in Korea’s listed companies is the average of entire employees’ pay excluding registered executive compensation. If a company has several highly-paid executives who do not serve as board members, the pay of regular employees may be overestimated. On the other hand, listed companies in the US calculate the pay of rank-and-file employees as the median pay of their entire employees, which comes closer to the actual value.

3) It is worth noting that in financial services companies, the compensation of employees can be affected by performance-based bonuses and lump-sum severance pay and key engineers are top talents in innovative companies. In most listed companies except for such companies, however, those who get paid higher than CEOs are controlling shareholder executives.

4) Nam, G.N., 2021, Listed companies’ executive pay and controlling shareholder executives, Issue Paper of Korea Capital Market Institute 21-18.

5) This represents 1,447 times the pay of Apple’s average employees.