OPINION

2022 Jul/12

The Fed’s Tightening and Interest Rates of Korea: Impacts and Implications

Jul. 12, 2022

PDF

- Summary

- Despite a string of interest rate increases by the Fed, upside risks to inflation remain higher in the US. Unless structural inflationary pressures are alleviated, the Fed's tightening shocks are likely to recur, raising its policy rate aggressively. An empirical analysis indicates that the Fed’s tightening shocks drive up a wide range of market interest rates in Korea, thereby adversely affecting financial conditions. In particular, such shocks have been found to raise long end yields of Korea Treasury Bonds (KTBs) higher, influencing other market interest rates as well. Furthermore, while corporate bond yields and financing costs for banks pick up, interest rates rise for both household loans and corporate loans.

These results suggest that policymakers in Korea are faced with a difficult choice between price stability and financial conditions, as the Fed aggravates the burden of financing costs. Since price stability is also an urgent issue for Korea, Bank of Korea should maintain its current monetary policy stance focusing on disinflation. However, if jitters persist in the market by the Fed’s shock, stabilization measures needs to be implemented to cushion the blow.

The Fed has entered a rate hike cycle since March this year. Initially, it viewed surging inflation as temporary and decided to tolerate an overshooting in inflation based on the Average Inflation Targeting regime. Contrary to its outlook, higher inflation has dragged on, forcing the Fed to suddenly shift to tightening. Starting with a 25 basis point (bp) rate hike in March 2022, it raised the policy rate by 50 bp in May and 75 bp in July, which is expected to reach over 3% at the end of this year.1)

Despite a string of interest rate increases by the Fed, upside risks to inflation remain higher in the US. In April, the US saw consumer prices rising 0.3% (based on a seasonally adjusted, MoM increase), a significant decline from the increase of 1.2% in March. Back then, some cautiously speculated that inflation reached its peak. However, concerns have been raised again as consumer prices climbed 1.0% in May.

Recently, a tight labor market and expected inflation rises as well as increases in service prices have a sustained impact on the US economy.2) It is conceivable that the policy rate could increase well over the levels suggested by the FOMC unless structural inflationary pressures are eased. Notably, given that de-anchoring of inflation expectations accelerated inflation during the Great Inflation,3) the Fed is likely to strive to anchor expected inflation by taking aggressive measures. If economic players feel price stability not guaranteed, the US policy rate would be lifted higher than expected, potentially leading to the recurrence of monetary tightening shocks.

As shown by recent market indicators, the Fed’s monetary policy shocks are projected to have an extensive impact on the financial markets in Korea and abroad. Against this backdrop, this article examines how the shocks from the Fed’s rate hikes would affect Korea’s financial market, especially market interest rates, and discusses its implications.

The impact of the Fed’s rate hike shocks on interest rates in Korea

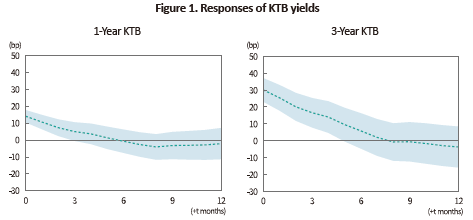

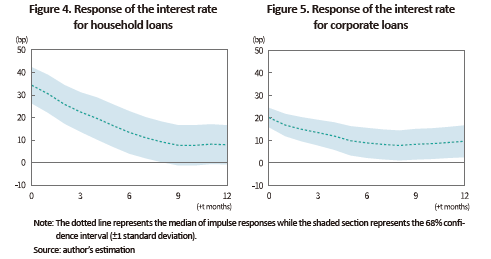

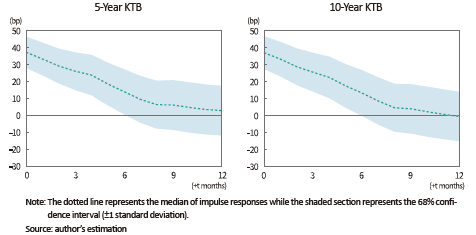

The Fed’s rate hike shocks have been found to drive up a wide range of financial costs borne by economic players in Korea. This can be further analyzed through impulse responses4) of Korea Treasury Bond (KTB) yields by maturity, corporate bond yields, COFIX rate and commercial bank bond yields, and loan interest rates of households. Figure 1 illustrates how KTB yields change by maturity when a 100 bp of the Fed’s rate hike shock hits. The four graphs placed in Figure 1 show impulse responses of yields on 1-, 3-, 5- and 10-year KTBs, indicating that each yield rises significantly in the short term.

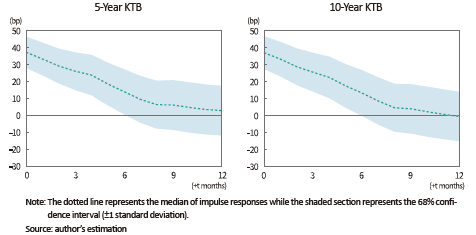

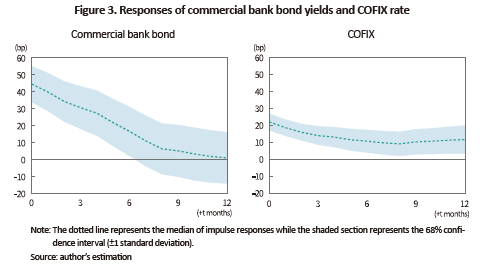

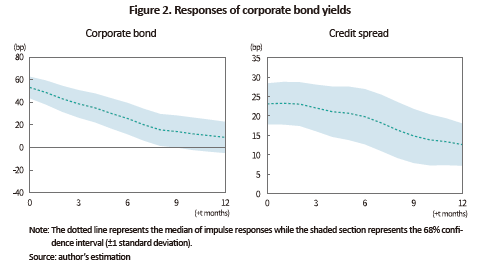

As KTB yields that serve as a benchmark risk-free rate are on the rise, yields on corporate bonds and commercial bank bonds follow suit. In Figure 2, the left-hand graph shows the impulse response of yields on the 3-year, AA-rated corporate bonds. The yields decline gradually after gaining about 50 bp at impact (t=0). Corporate bonds tend to display a greater impulse response than KTBs with the same maturity of three years, probably because the tightening shock worsens financial conditions as well. Accordingly, this has resulted in a significant credit spread widening as shown in the right-hand graph of Figure 2.

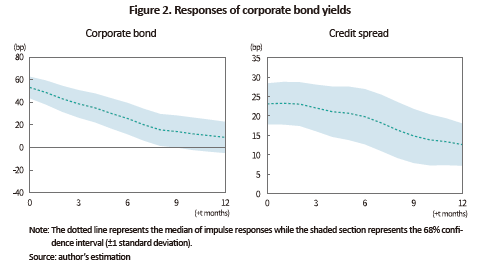

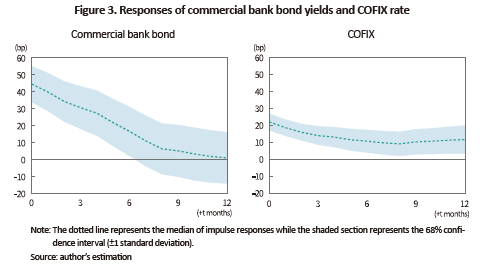

Figure 3 shows impulse responses of COFIX and 5-year commercial bank bonds—the indicators for banks’ financing costs—to the Fed’s rate hike shock (100 bp). At impact, the yield on 5-year commercial bank bonds, reflecting long-term financing costs of banks, climbs around 40 bp and then returns to the previous levels over time. The COFIX rate, capturing short-term financing costs of banks, is projected to rise about 20 bp before going down. This suggests that compared with a short-term rate such as COFIX rate, long-term rates such as a 5-year commercial bank bond yield are more sensitive to tightening shocks, which follow a similar pattern to KTB yields. On the other hand, the Fed’s tightening shocks usually have a short-term impact while the impact tends to last longer for COFIX rate than for the yield on 1-year KTBs.

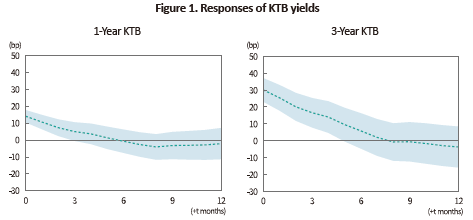

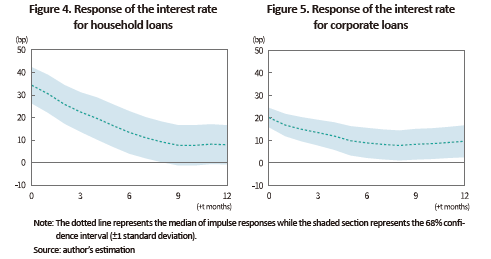

The increase in financing costs of banks puts upward pressure on lending rates. As for mortgages taking up a significant proportion of household loans, the rates are primarily linked5) to the 5-year commercial bank bond yields and COFIX rate. As mentioned above, this implies that the US rate hike shock eventually could influence the loan interest rate of households, which can be directly demonstrated by the impulse response of household loan rates in Figure 4. The graph in Figure 4 reveals that the Fed’s rate hike shock could drive up loan interest rates of households by around 35 bp. This estimation uses the average interest rate of the aggregate new loans of all maturities (based on weighted loan amount) to derive the household loan rates. Thus, it is difficult to calculate the spread between household loan rates and commercial bank bond yields directly. However, increases in the household loan rates are between those in COFIX rate and the commercial bank bond yield, roughly representing the average of the two.

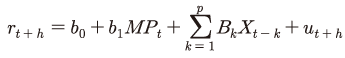

Figure 5 indicates the impulse response of corporate loan interest rates. The Fed’s rate hike shocks raise the interest rate for corporate loans, which could rise nearly 20 bp as an initial response (t=0). Like household loan rates, corporate loan rates used for this analysis represent the response of average interest rates regardless of maturities. It is notable that corporate loans mainly linked to short-term benchmark rates such as COFIX or CD rates (for three months) take up a larger proportion, which explains why the interest rate for corporate loans displays a similar response to COFIX rate.

Implications

In this analysis, the Fed’s rate hike shock has been found to raise a wide range of market interest rates in Korea while adversely affecting financing conditions. This result implies that Korea’s policymakers are faced with a difficult choice between price stability and financial conditions. Currently, inflation is a critical issue to be resolved in Korea as well as in the US. In May this year, Korea saw consumer prices reaching 5.4% (Y0Y), the highest rise since the global financial crisis. Accordingly, there is a growing need for Bank of Korea (B0K) to tackle inflationary pressures by raising the base rate. On the other hand, however, if the Fed’s tightening shock weighs on Korea’s financial conditions amid growing downside risks to growth, it would aggravate the burden of financing on each economic player. This may put a constraint on aggressive rate hikes by BoK.

Higher inflation can not only have a negative influence6) over the real economy but cause instability in the financial and foreign exchange markets. In this respect, BoK should maintain its current monetary policy with a focus on disinflation. Nevertheless, if jitters persist in the financial market by the Fed’s shock, the policymakers should take market stabilization measures to cushion the blow. For instance, it may improve market conditions to some extent by purchasing KTBs or implementing other tools, such as a temporary cutback on KTB issuance and a buyback. As these measures may go against the monetary policy direction toward price stability, they are only recommended when necessary. Additionally, the policy response should center on mid- and long-end yields, rather than short-end ones that could immensely dilute the effect of the base rate hikes in Korea. This strategy would help more or less reduce conflicts with monetary policy. Moreover, it would be effective, given the empirical result that mid- and long-end yields are more susceptible to the Fed’s tightening shocks.

1) The figure has been derived from the FOMC’s policy rate forecast (median projection) released in June 2022.

2) According to the University of Michigan survey (for the next 12 months), the consumers’ expectation of inflation jumped to 5.4% in April 2022, up from 3.0% in January 2021 and 4.8% in December 2021.

3) The Great Inflation refers to the period of prolonged higher inflation that lasted from the mid-1960s to the early 1980s.

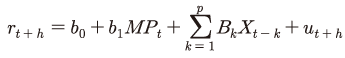

4) Impulse responses are estimated based on the following specification by using Jordà(2005)’s local projection.

(

( is the interest rate to be analyzed,

is the interest rate to be analyzed,  is the Fed’s monetary policy shock, and

is the Fed’s monetary policy shock, and  is a vector of control variables with a lag of

is a vector of control variables with a lag of  ). The sample period is from January 2010 to December 2020.

). The sample period is from January 2010 to December 2020.

5) Mortgages represent 58% of the aggregate household loans extended by banks (as of the fourth quarter of 2021). Adjustable-rate mortgages are linked to COFIX while fixed-rate mortgages (hybrid type) are linked to 5-year commercial bank bonds.

6) For more details, see Bernanke (2006).

References

Bernanke, B. S., 2006, The benefits of price stability, Speech 171, Board of Governors of the Federal Reserve System.

Bu, C., Rogers, J., Wu, W., 2021, A unified measure of Fed monetary policy shocks, Journal of Monetary Economics 118, 331–349.

Kearns, J., Schrimpf, A., Xia, F. D., 2018, Explaining monetary spillovers: The matrix reloaded, BIS working papers No. 757.

Despite a string of interest rate increases by the Fed, upside risks to inflation remain higher in the US. In April, the US saw consumer prices rising 0.3% (based on a seasonally adjusted, MoM increase), a significant decline from the increase of 1.2% in March. Back then, some cautiously speculated that inflation reached its peak. However, concerns have been raised again as consumer prices climbed 1.0% in May.

Recently, a tight labor market and expected inflation rises as well as increases in service prices have a sustained impact on the US economy.2) It is conceivable that the policy rate could increase well over the levels suggested by the FOMC unless structural inflationary pressures are eased. Notably, given that de-anchoring of inflation expectations accelerated inflation during the Great Inflation,3) the Fed is likely to strive to anchor expected inflation by taking aggressive measures. If economic players feel price stability not guaranteed, the US policy rate would be lifted higher than expected, potentially leading to the recurrence of monetary tightening shocks.

As shown by recent market indicators, the Fed’s monetary policy shocks are projected to have an extensive impact on the financial markets in Korea and abroad. Against this backdrop, this article examines how the shocks from the Fed’s rate hikes would affect Korea’s financial market, especially market interest rates, and discusses its implications.

The impact of the Fed’s rate hike shocks on interest rates in Korea

The Fed’s rate hike shocks have been found to drive up a wide range of financial costs borne by economic players in Korea. This can be further analyzed through impulse responses4) of Korea Treasury Bond (KTB) yields by maturity, corporate bond yields, COFIX rate and commercial bank bond yields, and loan interest rates of households. Figure 1 illustrates how KTB yields change by maturity when a 100 bp of the Fed’s rate hike shock hits. The four graphs placed in Figure 1 show impulse responses of yields on 1-, 3-, 5- and 10-year KTBs, indicating that each yield rises significantly in the short term.

Figure 5 indicates the impulse response of corporate loan interest rates. The Fed’s rate hike shocks raise the interest rate for corporate loans, which could rise nearly 20 bp as an initial response (t=0). Like household loan rates, corporate loan rates used for this analysis represent the response of average interest rates regardless of maturities. It is notable that corporate loans mainly linked to short-term benchmark rates such as COFIX or CD rates (for three months) take up a larger proportion, which explains why the interest rate for corporate loans displays a similar response to COFIX rate.

In this analysis, the Fed’s rate hike shock has been found to raise a wide range of market interest rates in Korea while adversely affecting financing conditions. This result implies that Korea’s policymakers are faced with a difficult choice between price stability and financial conditions. Currently, inflation is a critical issue to be resolved in Korea as well as in the US. In May this year, Korea saw consumer prices reaching 5.4% (Y0Y), the highest rise since the global financial crisis. Accordingly, there is a growing need for Bank of Korea (B0K) to tackle inflationary pressures by raising the base rate. On the other hand, however, if the Fed’s tightening shock weighs on Korea’s financial conditions amid growing downside risks to growth, it would aggravate the burden of financing on each economic player. This may put a constraint on aggressive rate hikes by BoK.

Higher inflation can not only have a negative influence6) over the real economy but cause instability in the financial and foreign exchange markets. In this respect, BoK should maintain its current monetary policy with a focus on disinflation. Nevertheless, if jitters persist in the financial market by the Fed’s shock, the policymakers should take market stabilization measures to cushion the blow. For instance, it may improve market conditions to some extent by purchasing KTBs or implementing other tools, such as a temporary cutback on KTB issuance and a buyback. As these measures may go against the monetary policy direction toward price stability, they are only recommended when necessary. Additionally, the policy response should center on mid- and long-end yields, rather than short-end ones that could immensely dilute the effect of the base rate hikes in Korea. This strategy would help more or less reduce conflicts with monetary policy. Moreover, it would be effective, given the empirical result that mid- and long-end yields are more susceptible to the Fed’s tightening shocks.

1) The figure has been derived from the FOMC’s policy rate forecast (median projection) released in June 2022.

2) According to the University of Michigan survey (for the next 12 months), the consumers’ expectation of inflation jumped to 5.4% in April 2022, up from 3.0% in January 2021 and 4.8% in December 2021.

3) The Great Inflation refers to the period of prolonged higher inflation that lasted from the mid-1960s to the early 1980s.

4) Impulse responses are estimated based on the following specification by using Jordà(2005)’s local projection.

(

( is the interest rate to be analyzed,

is the interest rate to be analyzed,  is the Fed’s monetary policy shock, and

is the Fed’s monetary policy shock, and  is a vector of control variables with a lag of

is a vector of control variables with a lag of  ). The sample period is from January 2010 to December 2020.

). The sample period is from January 2010 to December 2020.5) Mortgages represent 58% of the aggregate household loans extended by banks (as of the fourth quarter of 2021). Adjustable-rate mortgages are linked to COFIX while fixed-rate mortgages (hybrid type) are linked to 5-year commercial bank bonds.

6) For more details, see Bernanke (2006).

References

Bernanke, B. S., 2006, The benefits of price stability, Speech 171, Board of Governors of the Federal Reserve System.

Bu, C., Rogers, J., Wu, W., 2021, A unified measure of Fed monetary policy shocks, Journal of Monetary Economics 118, 331–349.

Kearns, J., Schrimpf, A., Xia, F. D., 2018, Explaining monetary spillovers: The matrix reloaded, BIS working papers No. 757.