Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Thought on Downside Risks to the Korean Economy in 2023

Publication date Jan. 17, 2023

Summary

As persistent external uncertainties and the threat of stagflation are expected to keep raising interest rates this year, the Korean economy is likely to face financial market strains, owing to rising household debt payment pressures, the spike in corporate financing costs and the decline in property prices. In light of these developments, monetary policy, one of the key pillars of macroeconomic policy, should be geared toward minimizing the real economy’s contraction and sustaining financial stability as well as recovering price stability. In terms of fiscal policy, Korea should expand spending to facilitate private investment and improve productivity in the corporate sector. Also necessary is to maintain fiscal soundness and shore up sovereign creditworthiness in preparation for external uncertainties. Additionally, it needs to bolster international cooperation frameworks in consultation with other economies to better deal with geopolitical risks while stepping up efforts to establish economic security.

The Korean economy suffered heavily from a surge in prices, rising interest rates and high exchange rates last year. With uncertain external conditions to continue into 2023, economic prospects for Korea from major international institutions hardly look promising. While inflation remains elevated for now, its growth is projected to slow to around 1%.

Against this backdrop, this article examines economic forecasts for Korea by sector and potential changes in economic developments contributing to the outlook. It also discusses worrying factors expected to undermine financial stability and increase downside risks to the Korean economy, and takes a brief look at implications for its macroeconomic policy.

Mounting threat of stagflation in 2023

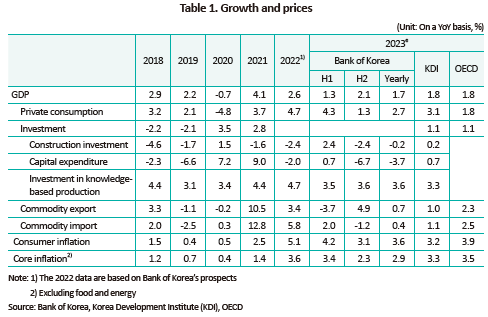

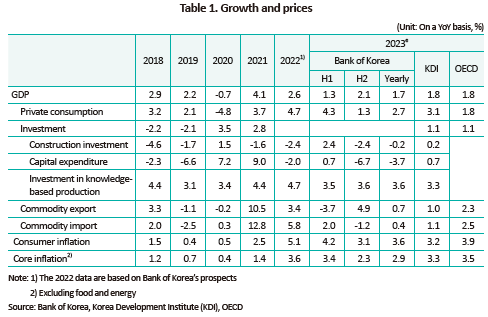

Growth in Korea’s real economy is expected to slump to 1.7% in 2023 (Bank of Korea’s forecast), significantly lower than the 2.6% that was anticipated last year and the lowest level after the Covid-19 pandemic. Weaker growth is attributable to a combination of internal and external factors: an inflation-driven decline in national disposable income, sluggish consumption and investment arising from high interest rates and the faltering property market, and slowing exports resulting from the simultaneous slowdown in both advanced and emerging economies.

By sector, private consumption, investment and imports and exports are all projected to perform poorer than the previous year. Notably, shrinking real purchasing power driven by inflation, rising interest rates and the downturn in the real estate sector have curtailed consumer confidence. As a result, private consumption is expected to slide to 2.7% this year from 4.7% in 2022. The decrease in capital expenditures is likely to expand on the back of weaker global demand and financing cost increases. In addition, construction investment is projected to remain lackluster as the property market slows down and the unsold inventory of new apartments is increasing.

The export sector which showed a relatively robust growth trend is forecast to fall into a slump in 2023 amid a global economic recession. The slowdown would be especially prominent for semiconductors and IT by sector and for Korea’s exports to China by region. As higher energy prices boost imports, the current account surplus is expected to remain the same as last year ($28 billion). Consequently, the net import sector would be responsible for only 0.3%p of growth (1.4%p from domestic demand).

On the other hand, domestic inflation is projected to keep going up for some time, raising concerns over stagflation. The increase in the consumer price index is anticipated to decline from 5.1% in 2022 to 4.2% in the first half and 3.1% in the second half of 2023, showing a downward trend but it would remain higher. Core inflation, a measure of consumer prices excluding food and energy items, is expected to climb 2.9% in 2023, far exceeding the target of 2%. The war in Ukraine and the trade conflict between the US and China have caused disruptions to global supply chains, thereby pushing up energy and raw material prices. The Korean won has weakened against the US dollar, sending import prices skyrocketing. These developments have primarily driven surging inflation.

External uncertainties to continue into this year

The pessimistic outlook for the Korean economy mainly stems from external factors: the abrupt shift in the US Federal Reserve’s monetary policy in the wake of the pandemic, the US-China trade tensions and geopolitical risks such as the prolonged war in Ukraine. These uncertainties seem to persist for a longer period in 2023.

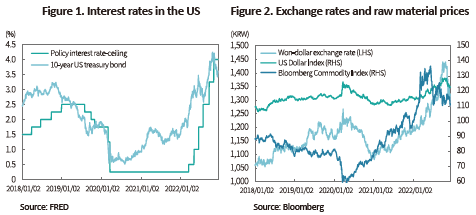

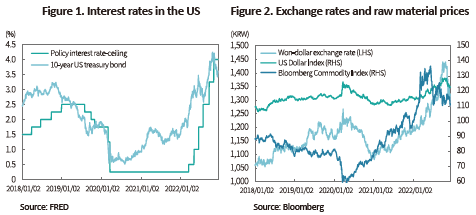

First of all, radical changes in the Fed’s monetary policy have magnified concerns over higher interest rates and the global economic slowdown, causing jitters in the Korean economy. In the aftermath of the Covid-19 crisis, the Fed injected massive liquidity by keeping the policy rate near zero and implementing quantitative easing in hopes of stimulating economic recovery. However, such policy measures have been found to provide excess liquidity and lead to speculative demand for raw materials. Furthermore, after the Russian invasion of Ukraine in February 2022, grain and energy prices spiked globally in February 2022, sending prices skyrocketing. Under these circumstances, the Fed took a sharp shift toward aggressive monetary tightening, increasing volatility in the global financial market. Its contractionary measures such as policy rate hikes are expected to continue well into 2023, despite signs of the slower pace of interest rate rises. In September 2022, the Federal Open Market Committee (FOMC) projected the policy rate to top 5% in 2023 but this projection has been revised down to mid-5% or higher in December.

Most economies including Korea strive to pursue monetary policy coordination with the US Fed to avert capital outflows and stabilize the currency value, leading to a steep rise in interest rates across the globe. This round of interest rate increases is expected to put a damper on domestic consumption and investment and the resultant economic downturn seems to exacerbate exports. Furthermore, rate hikes by the Fed have led to the dollar’s super strength in 20 years, while both major currencies such as the yen and the euro and emerging economies’ currencies have lost their value against the dollar simultaneously. This has helped spread inflation globally.

How fast and how much the Fed raises interest rates would hinge on inflation developments or economic conditions and employment indicators in the US. The pace and degree of rate hikes by the Fed determine how the global economy and trade will fare, which, in turn, heavily affects Korea’s macroeconomic indicators such as growth and prices.

Geopolitical risks persist, adding inflationary pressure to major economies. Global prices of grains and energy that soared amid the prolonged war in Ukraine have dipped slightly but remain higher than pre-war levels. International oil prices are projected to fluctuate within the range of $90 per barrel this year (based on Dubai crude oil). However, factors for the oil price rise including the ongoing war and sanctions on Russia are mixed with the cause for the decline such as concerns over the global recession, which would further increase volatility in oil prices. Major international forecasters predict that prices of natural gas and grains will be subject to downward stabilization but remain high. In addition, global supply chain strains triggered by the US-China trade conflict not only raise prices of core minerals or raw materials but pose a threat to the economic security of countries around the world.

Growing concerns over Korea’s financial stability

Given the external uncertainties stated above, the current upward trend of interest rates is likely to continue into the first half of 2023 in Korea, raising concerns over financial stability. Factors that could impair financial stability and magnify downside risks are huge household debts and rising debt payment pressures, higher financing costs and worsening financial solvency in the corporate sector, and financial market instability driven by the decline in property prices and the sluggish real economy.

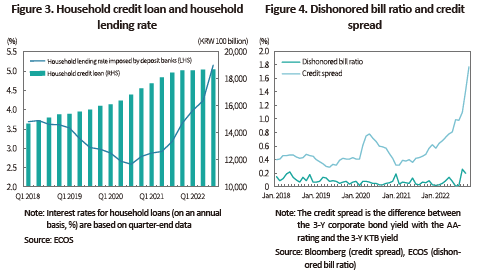

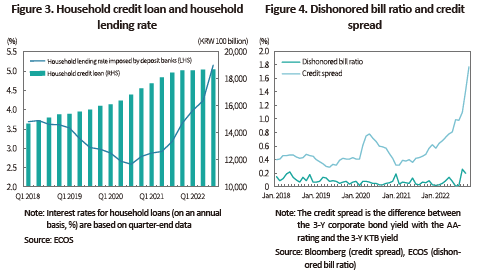

First, a surge in domestic interest rates is expected to aggravate household debt payment pressure.1) Korea’s household debts amount to KRW 1,871 trillion (released by Bank of Korea) as of the end of the third quarter of 2022. This equals to around 106% of Korea’s GDP, much larger than the critical level of 80% suggested by the Bank for International Settlements (BIS), and represents the fastest growth across the globe. If leasehold (jeonse) deposits not included in such debts are taken into account, household debts would be estimated at 130% as a share of GDP.2) The interest payment burden borne by households has already been growing. Household lending rates imposed by domestic deposit banks averaged 2.88% in the first quarter of 2020, which jumped to 5.15% in the third quarter of 2022. This could weaken domestic consumption and growth and increase the default risk of financially vulnerable groups, thereby hurting the balance sheets of financial institutions.

Second, interest rate rises are likely to generate tighter financing conditions and higher financing costs and thus, raise insolvency risk for companies. A prime example is the credit spread (credit bond yields minus Korea Treasury Bond yields) that has shot up above the long-term average or pre-pandemic levels. This is attributable to the fact that market players have tightened guard against credit risk amid mounting worries over rate hikes and an economic slowdown, which is well demonstrated by the Gangwon-do Legoland crisis that took place in October 2022. Additionally, the Korea Electric Power Corp (KEPCO) and other blue chips have recently boosted issuance of special bonds and bank bonds to compensate for a deficit increase. As a result, companies with relatively lower credit ratings have been forced to reduce corporate bond issues sharply and have struggled with financing. On the positive side, the debt ratio for companies represents around 117% (as of end-2021) as a share of GDP, with the dishonored bill ratio remaining at 0.2%. But if another round of rate hikes eats away at domestic consumption and exports and spurs the economic downturn, corporate financial health could deteriorate further, which requires caution.

Third, the recent house price slump has called into question financial stability and increasingly had an adverse impact on the real economy. In Korea, property prices (calculated based on the nationwide data of actual transaction prices) jumped up 14.3% in 2020, immediately after the outbreak of Covid-19, and 16.4% in 2021 but suffered a drop of 7.4% from January through October 2022. Despite the government’s attempt to ease regulations, property prices are projected to keep falling for quite a long time, owing to the prospect of interest rate rises and expectations for a further price decline. According to a recent analysis by the International Monetary Fund (IMF), Korea’s property market showed an abnormally upward trend and could slide further below pre-Covid 19 levels, driven by interest rate hikes and the real sector growth falling short of the potential growth rate.3) It should be noted that mortgage loans make up a substantial portion of household debts in Korea and are mostly subject to variable interest rates. Considering these, a plunge in property prices is expected to depress domestic consumption and construction business activities and stunt Korea’s growth. It is equally worrying that domestic securities firms suffer growing losses from the debt guarantee for real estate PF-related ABCP. This suggests that downside risks to the property market could deal a huge blow to the real economy and financial stability.

Summary and implications

In 2023, the Korean economy will be faced with the risk of stagflation characterized by elevated inflation arising from lingering external uncertainties and the real economy’s contraction. With domestic interest rates expected to keep rising, there is a high possibility that mounting pressure for household debt payment, rising financing costs and a slump in the property market will cause strains in the financial market. To meet such daunting challenges, Korea should gear its macroeconomic policy toward minimizing the contraction in the real economy and staving off financial instability as well as stabilizing prices.

Tight monetary policy is required for the time being. Given positive changes in the Fed’s aggressive tightening and global capital flows, however, it is more desirable to take a flexible approach to monetary policy based on domestic economic developments or financial stability. As consumption and investment are expected to shrink this year, fiscal policy should seek to expand spending to boost private investment and improve corporate productivity while trying to pursue regulatory reform. What is also needed are fiscal rules and fiscal soundness to tackle external uncertainties and shore up sovereign creditworthiness. In addition, it is necessary to step up efforts to attain economic security. The need for a stable supply of energy and core materials and components has been growing in the aftermath of the US-China trade tensions and the protracted war in Ukraine. This will require concerted global efforts to overcome challenges.

1) The Survey on Systemic Risk conducted by Bank of Korea has found that household debt payment pressures (69.4%) pose a bigger threat to financial stability than tight financing conditions for companies (62.5%).

2) Kim, S.J., May 3, 2022, Korea’s real household debts of KRW 2,713 trillion to amount to 130% of GDP, Joongang Ilbo Opinion.

3) IMF, December 2022, Housing Market Stability and Affordability in the Asia-Pacific Region, Departmental Papers.

Against this backdrop, this article examines economic forecasts for Korea by sector and potential changes in economic developments contributing to the outlook. It also discusses worrying factors expected to undermine financial stability and increase downside risks to the Korean economy, and takes a brief look at implications for its macroeconomic policy.

Mounting threat of stagflation in 2023

Growth in Korea’s real economy is expected to slump to 1.7% in 2023 (Bank of Korea’s forecast), significantly lower than the 2.6% that was anticipated last year and the lowest level after the Covid-19 pandemic. Weaker growth is attributable to a combination of internal and external factors: an inflation-driven decline in national disposable income, sluggish consumption and investment arising from high interest rates and the faltering property market, and slowing exports resulting from the simultaneous slowdown in both advanced and emerging economies.

By sector, private consumption, investment and imports and exports are all projected to perform poorer than the previous year. Notably, shrinking real purchasing power driven by inflation, rising interest rates and the downturn in the real estate sector have curtailed consumer confidence. As a result, private consumption is expected to slide to 2.7% this year from 4.7% in 2022. The decrease in capital expenditures is likely to expand on the back of weaker global demand and financing cost increases. In addition, construction investment is projected to remain lackluster as the property market slows down and the unsold inventory of new apartments is increasing.

The export sector which showed a relatively robust growth trend is forecast to fall into a slump in 2023 amid a global economic recession. The slowdown would be especially prominent for semiconductors and IT by sector and for Korea’s exports to China by region. As higher energy prices boost imports, the current account surplus is expected to remain the same as last year ($28 billion). Consequently, the net import sector would be responsible for only 0.3%p of growth (1.4%p from domestic demand).

On the other hand, domestic inflation is projected to keep going up for some time, raising concerns over stagflation. The increase in the consumer price index is anticipated to decline from 5.1% in 2022 to 4.2% in the first half and 3.1% in the second half of 2023, showing a downward trend but it would remain higher. Core inflation, a measure of consumer prices excluding food and energy items, is expected to climb 2.9% in 2023, far exceeding the target of 2%. The war in Ukraine and the trade conflict between the US and China have caused disruptions to global supply chains, thereby pushing up energy and raw material prices. The Korean won has weakened against the US dollar, sending import prices skyrocketing. These developments have primarily driven surging inflation.

The pessimistic outlook for the Korean economy mainly stems from external factors: the abrupt shift in the US Federal Reserve’s monetary policy in the wake of the pandemic, the US-China trade tensions and geopolitical risks such as the prolonged war in Ukraine. These uncertainties seem to persist for a longer period in 2023.

First of all, radical changes in the Fed’s monetary policy have magnified concerns over higher interest rates and the global economic slowdown, causing jitters in the Korean economy. In the aftermath of the Covid-19 crisis, the Fed injected massive liquidity by keeping the policy rate near zero and implementing quantitative easing in hopes of stimulating economic recovery. However, such policy measures have been found to provide excess liquidity and lead to speculative demand for raw materials. Furthermore, after the Russian invasion of Ukraine in February 2022, grain and energy prices spiked globally in February 2022, sending prices skyrocketing. Under these circumstances, the Fed took a sharp shift toward aggressive monetary tightening, increasing volatility in the global financial market. Its contractionary measures such as policy rate hikes are expected to continue well into 2023, despite signs of the slower pace of interest rate rises. In September 2022, the Federal Open Market Committee (FOMC) projected the policy rate to top 5% in 2023 but this projection has been revised down to mid-5% or higher in December.

Most economies including Korea strive to pursue monetary policy coordination with the US Fed to avert capital outflows and stabilize the currency value, leading to a steep rise in interest rates across the globe. This round of interest rate increases is expected to put a damper on domestic consumption and investment and the resultant economic downturn seems to exacerbate exports. Furthermore, rate hikes by the Fed have led to the dollar’s super strength in 20 years, while both major currencies such as the yen and the euro and emerging economies’ currencies have lost their value against the dollar simultaneously. This has helped spread inflation globally.

How fast and how much the Fed raises interest rates would hinge on inflation developments or economic conditions and employment indicators in the US. The pace and degree of rate hikes by the Fed determine how the global economy and trade will fare, which, in turn, heavily affects Korea’s macroeconomic indicators such as growth and prices.

Geopolitical risks persist, adding inflationary pressure to major economies. Global prices of grains and energy that soared amid the prolonged war in Ukraine have dipped slightly but remain higher than pre-war levels. International oil prices are projected to fluctuate within the range of $90 per barrel this year (based on Dubai crude oil). However, factors for the oil price rise including the ongoing war and sanctions on Russia are mixed with the cause for the decline such as concerns over the global recession, which would further increase volatility in oil prices. Major international forecasters predict that prices of natural gas and grains will be subject to downward stabilization but remain high. In addition, global supply chain strains triggered by the US-China trade conflict not only raise prices of core minerals or raw materials but pose a threat to the economic security of countries around the world.

Given the external uncertainties stated above, the current upward trend of interest rates is likely to continue into the first half of 2023 in Korea, raising concerns over financial stability. Factors that could impair financial stability and magnify downside risks are huge household debts and rising debt payment pressures, higher financing costs and worsening financial solvency in the corporate sector, and financial market instability driven by the decline in property prices and the sluggish real economy.

First, a surge in domestic interest rates is expected to aggravate household debt payment pressure.1) Korea’s household debts amount to KRW 1,871 trillion (released by Bank of Korea) as of the end of the third quarter of 2022. This equals to around 106% of Korea’s GDP, much larger than the critical level of 80% suggested by the Bank for International Settlements (BIS), and represents the fastest growth across the globe. If leasehold (jeonse) deposits not included in such debts are taken into account, household debts would be estimated at 130% as a share of GDP.2) The interest payment burden borne by households has already been growing. Household lending rates imposed by domestic deposit banks averaged 2.88% in the first quarter of 2020, which jumped to 5.15% in the third quarter of 2022. This could weaken domestic consumption and growth and increase the default risk of financially vulnerable groups, thereby hurting the balance sheets of financial institutions.

Second, interest rate rises are likely to generate tighter financing conditions and higher financing costs and thus, raise insolvency risk for companies. A prime example is the credit spread (credit bond yields minus Korea Treasury Bond yields) that has shot up above the long-term average or pre-pandemic levels. This is attributable to the fact that market players have tightened guard against credit risk amid mounting worries over rate hikes and an economic slowdown, which is well demonstrated by the Gangwon-do Legoland crisis that took place in October 2022. Additionally, the Korea Electric Power Corp (KEPCO) and other blue chips have recently boosted issuance of special bonds and bank bonds to compensate for a deficit increase. As a result, companies with relatively lower credit ratings have been forced to reduce corporate bond issues sharply and have struggled with financing. On the positive side, the debt ratio for companies represents around 117% (as of end-2021) as a share of GDP, with the dishonored bill ratio remaining at 0.2%. But if another round of rate hikes eats away at domestic consumption and exports and spurs the economic downturn, corporate financial health could deteriorate further, which requires caution.

Summary and implications

In 2023, the Korean economy will be faced with the risk of stagflation characterized by elevated inflation arising from lingering external uncertainties and the real economy’s contraction. With domestic interest rates expected to keep rising, there is a high possibility that mounting pressure for household debt payment, rising financing costs and a slump in the property market will cause strains in the financial market. To meet such daunting challenges, Korea should gear its macroeconomic policy toward minimizing the contraction in the real economy and staving off financial instability as well as stabilizing prices.

Tight monetary policy is required for the time being. Given positive changes in the Fed’s aggressive tightening and global capital flows, however, it is more desirable to take a flexible approach to monetary policy based on domestic economic developments or financial stability. As consumption and investment are expected to shrink this year, fiscal policy should seek to expand spending to boost private investment and improve corporate productivity while trying to pursue regulatory reform. What is also needed are fiscal rules and fiscal soundness to tackle external uncertainties and shore up sovereign creditworthiness. In addition, it is necessary to step up efforts to attain economic security. The need for a stable supply of energy and core materials and components has been growing in the aftermath of the US-China trade tensions and the protracted war in Ukraine. This will require concerted global efforts to overcome challenges.

1) The Survey on Systemic Risk conducted by Bank of Korea has found that household debt payment pressures (69.4%) pose a bigger threat to financial stability than tight financing conditions for companies (62.5%).

2) Kim, S.J., May 3, 2022, Korea’s real household debts of KRW 2,713 trillion to amount to 130% of GDP, Joongang Ilbo Opinion.

3) IMF, December 2022, Housing Market Stability and Affordability in the Asia-Pacific Region, Departmental Papers.