OPINION

2023 Feb/07

Need for Extending the Scope of Financial Instruments Eligible for Alternative Trading Systems

Feb. 07, 2023

PDF

- Summary

- In Korea, discussions about the alternative trading system (ATS) have centered around improving trading efficiency through competition between trading platforms for listed stocks. The scope of instruments eligible for the ATS is limited to listed stocks under the Financial Investment Services and Capital Markets Act. Notably, the ATS has been introduced to make securities trading efficient and achieve investor protection by applying regulatory requirements of transparency, accessibility and stability to trading venues. Its benefits are not confined to listed stock trading. ATSs being operated by major economies cover a wide range of instruments and transaction methods and handle a substantial proportion of trades involving financial instruments other than stocks such as exchange traded funds (ETFs), bonds and derivatives. In this respect, Korea needs to reform its ATS regulatory framework to ensure that the scope of instruments eligible for ATSs is extended and a different set of requirements apply to platforms depending on economic importance of trading venues and instrument-specific characteristics.

The launch of Korea’s first alternative trading system (ATS) is on the horizon. Last November, a total of 34 institutions including major securities firms and relevant organizations held an inaugural meeting of Nextrade, a corporation for operating an ATS, and announced a plan to apply for preliminary approval from the Financial Services Commission. This is the first ATS set to be established in Korea after the 2013 amendment to the Financial Investment Services and Capital Markets Act (the “FSCMA”) paved the ground for the formation and operation of an ATS (or multilateral trading facility). It is noteworthy that the launch of an ATS can trigger competition between trading platforms and bring about changes to relevant infrastructure and technology. Recently, the Korea Exchange (KRX) released its plan to reduce the tick size to lower implicit transaction costs in an effort to prepare for potential competition with ATSs.1)

An ATS has already become a key pillar of stock trading in major capital markets. In the past, a monopolistic stock trading platform was widely accepted as the most efficient system because fragmented trading venues were believed to reduce overall liquidity and eliminate the benefits of economies of scale. However, advancements in IT have lowered the costs of operating trading platforms and made it easier to compare and access different platforms. This has alleviated problems regarding economies of scale and liquidity fragmentation, which is attributable to the effect that physically separated trading venues are virtually consolidated. Accordingly, major economies’ regulatory framework for securities trading has been designed to accept various platforms and trading methods and pursue competition and investor protection by imposing requirements for transparency, accessibility and stability. Under the framework, investors select a platform that can guarantee the lowest possible cost and the best execution by comparing different trading venues, which is mostly implemented through an automated process. The US has seven regular stock exchanges, 33 ATSs and about 200 over-the-counter (OTC) markets for listed stocks.2) Currently, 70% of trades for NYSE-listed stocks are conducted on trading platforms other than the NYSE, which is also true for Nasdaq-listed stocks.

ATSs for financial instruments other than listed stocks

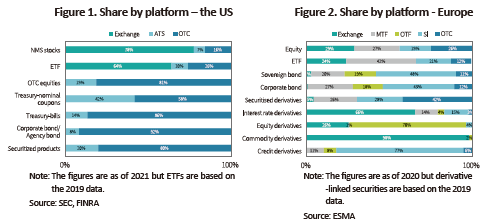

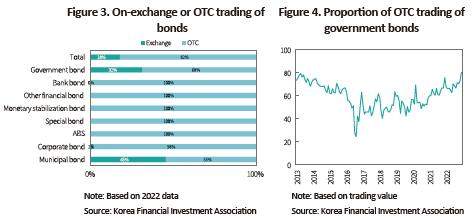

This article focuses on the fact that the ATS use is not only observed in the trading of listed stocks. ATSs account for a considerable proportion of trades involving ETFs, bonds and derivatives. In the case of the US shown in Figure 1, ATSs are responsible for 10% of ETFs, 19% of OTC equities, 42% of treasury bonds and notes, and 20% of securitized products (including ABS and MBS) in terms of trades executed via ATSs. In Europe, the share of ATS trading is larger than that of the US. European ATSs are categorized into the multilateral platform including the multilateral trading facility (MTF) and organized trading facility (OTF) and the bilateral platform such as systematic internaliser (SI). As illustrated in Figure 2, ATSs represent 63% of ETFs, 87% of government bonds, 88% of corporate bonds and 54% of securitised derivatives in terms of trades handled by ATSs in Europe.

In Korea, discussions about ATSs have centered around improving trading efficiency through competition between trading platforms for listed stocks. This is primarily attributable to factors behind the ATS introduction: inefficiencies arising from the KRX’s monopoly over listed stock trading and resultant high implicit transaction costs; lack of variety in trading services; and stalled trading technology development. Instruments tradable on ATSs are limited to listed stocks (including DR) under the FSCMA. On the other hand, regulatory changes regarding ATSs in North America and Europe suggest that the fundamental goal of the ATS introduction is to strengthen discipline for trading platforms, rather than promoting competition between them. When adopting its regulatory framework for ATSs, Regulation ATS, the US Securities and Exchange Commission (SEC) called for the regulation of ATSs on the grounds that they lacked transparency, accessibility and stability, were not fully supervised, and provided benefits only to limited participants.3) Considering that the alternative trading systems were already existent before the SEC adopted its regulatory framework, the SEC’s Regulation ATS should be understood as a tool for alleviating an adverse impact of trading platforms—not integrated into the regulatory framework—on investors and the entire securities trading system.

In this respect, it is understandable that ATSs take on a greater role in the trading of unlisted financial instruments in the US and Europe. Trading of unlisted instruments tends to be less efficient due to relatively low liquidity and fragmented trading channels. It is costly and time-consuming to look for a counterparty, negotiate terms, execute orders, and make payments. Furthermore, as securities brokers play a key role in this process, conflicts of interest are highly likely to occur. ATSs can concentrate liquidity and improve trading efficiency by furnishing specific trading procedures, transparent information and stable infrastructure. Hence, the purpose of ATSs in terms of unlisted financial instruments lies in enhancing efficiency through discipline, instead of competition.

When replacing the Markets in Financial Instruments Directive (MiFID) with MiFIDII in 2018, Europe introduced the organized trading facility (OTF) and expanded the role of the SIs. An OTF is a multilateral trading platform designed for trading of financial instruments excluding stocks (bonds, securitized products, derivatives and carbon credits). It allows operators to choose modes of trading at their discretion, which differentiates it from an MTF. OTFs permit various modes of trading such as voice trading and request for quote, given that brokers play a critical role in the trading of financial instruments other than stocks. An SI refers to a bilateral trading platform that executes client orders on its own account. At the time of the SI introduction in 2008, it was defined as a platform dedicated to stock trading but its trading scope was extended to other financial instruments under MiFID II. As shown in Figure 2, financial instruments excluding stocks are mostly traded via regulated trading platforms such as exchanges, MTFs, OTFs and SIs in Europe.

The US has recently beefed up its ATS regulation for treasury securities trading.4) An ATS was formerly defined as a trading platform that would match buyers and sellers to execute orders under certain criteria. But the SEC plans to add to the ATS category the communication protocol system (CPS) that offers the use of trading interests of buyers and sellers and supports negotiations of trading terms to execute orders. In addition, trading platforms in excess of certain trading volumes would be subject to the Fair Access Rule and the Regulation Systems Compliance and Integrity for regulating the technological stability of infrastructure. A tighter ATS regulation adopted by the SEC is in parallel with Europe’s policy direction of introducing the OTF and expanding the role of SIs.

Structure of OTC bond trading in Korea

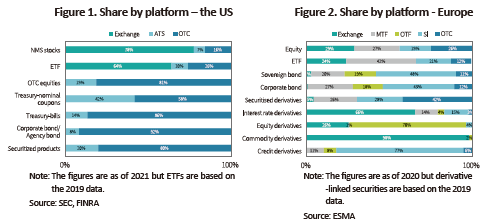

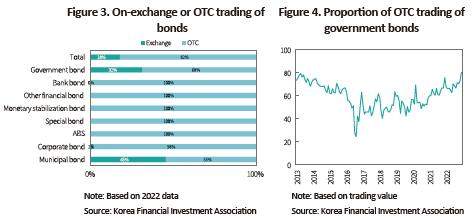

As of 2022, 82% of bond trading is carried out in OTC markets (Figure 3). It is safe to say that bonds excluding government bonds and municipal bonds are hardly traded via exchanges. Exchange-traded government bonds show a steady decline in the share of the total trading volume (Figure 4). In Korea’s bond market, OTC trading is primarily conducted through the K-BOND messenger service operated by Korea Financial Investment Association. In K-BOND, brokers offer a quote in their chatrooms or use request for quote to execute orders in the way of negotiated bilateral transactions. The tick size, the unit of trading value, the dealers’ quoted spread and brokerage fees are determined by accepted practices.

Under the regulatory frameworks adopted by the US and Europe, offering quotes or gathering trading interests for executing orders and furnishing a support system for trading procedures may be regarded as trading platform operation. This means K-BOND or chatroom services may fall into the category of trading platforms. It is notable that the K-BOND system and its chatrooms are not subject to any regulation and only brokers have obligation to report quote data and order execution results. Accordingly, such trading procedures hardly guarantee fairness and reliability. In an opaque, closed trading structure based on practices, it would be hard to expect trading efficiency and investor protection. ATSs, with transparency, accessibility and stability, only can provide a solution to improve trading efficiency in OTC bond trading that amounts to KRW 4,300 trillion in annual trading value.

Concluding remarks

As the merits of ATSs are not confined to trading of listed stocks, it is desirable to extend the scope of instruments eligible for ATSs into ETFs, bonds, unlisted stocks. In this regard, ATSs need to be recognized as a scheme designed to regulate trading platforms. This requires a significant departure from the existing concept of permitting the operation of ATSs. A more desirable approach is to regulate trading platforms to ensure that they are operated in a complete form of ATSs. On top of that, it is worth considering differentiating regulatory requirements applicable to ATSs, depending on a trading platform’s economic importance and instrument-specific characteristics.

1) The Korea Exchange press release, November 1, 2022, Prior notice of the amendment to detailed rules for the operational regulation of the securities and derivatives market for the purpose of improving the tick size structure.

2) As of October 2022

3) SEC, December 8, 1998, Adopting release for Regulation ATS.

4) SEC, March 18, 2022, Amendments regarding the definition of “Exchange” and Alternative Trading Systems (ATSs) that trade U.S. treasury and agency securities, National Market System (NMS) Stocks, and other securities.

An ATS has already become a key pillar of stock trading in major capital markets. In the past, a monopolistic stock trading platform was widely accepted as the most efficient system because fragmented trading venues were believed to reduce overall liquidity and eliminate the benefits of economies of scale. However, advancements in IT have lowered the costs of operating trading platforms and made it easier to compare and access different platforms. This has alleviated problems regarding economies of scale and liquidity fragmentation, which is attributable to the effect that physically separated trading venues are virtually consolidated. Accordingly, major economies’ regulatory framework for securities trading has been designed to accept various platforms and trading methods and pursue competition and investor protection by imposing requirements for transparency, accessibility and stability. Under the framework, investors select a platform that can guarantee the lowest possible cost and the best execution by comparing different trading venues, which is mostly implemented through an automated process. The US has seven regular stock exchanges, 33 ATSs and about 200 over-the-counter (OTC) markets for listed stocks.2) Currently, 70% of trades for NYSE-listed stocks are conducted on trading platforms other than the NYSE, which is also true for Nasdaq-listed stocks.

ATSs for financial instruments other than listed stocks

This article focuses on the fact that the ATS use is not only observed in the trading of listed stocks. ATSs account for a considerable proportion of trades involving ETFs, bonds and derivatives. In the case of the US shown in Figure 1, ATSs are responsible for 10% of ETFs, 19% of OTC equities, 42% of treasury bonds and notes, and 20% of securitized products (including ABS and MBS) in terms of trades executed via ATSs. In Europe, the share of ATS trading is larger than that of the US. European ATSs are categorized into the multilateral platform including the multilateral trading facility (MTF) and organized trading facility (OTF) and the bilateral platform such as systematic internaliser (SI). As illustrated in Figure 2, ATSs represent 63% of ETFs, 87% of government bonds, 88% of corporate bonds and 54% of securitised derivatives in terms of trades handled by ATSs in Europe.

In this respect, it is understandable that ATSs take on a greater role in the trading of unlisted financial instruments in the US and Europe. Trading of unlisted instruments tends to be less efficient due to relatively low liquidity and fragmented trading channels. It is costly and time-consuming to look for a counterparty, negotiate terms, execute orders, and make payments. Furthermore, as securities brokers play a key role in this process, conflicts of interest are highly likely to occur. ATSs can concentrate liquidity and improve trading efficiency by furnishing specific trading procedures, transparent information and stable infrastructure. Hence, the purpose of ATSs in terms of unlisted financial instruments lies in enhancing efficiency through discipline, instead of competition.

When replacing the Markets in Financial Instruments Directive (MiFID) with MiFIDII in 2018, Europe introduced the organized trading facility (OTF) and expanded the role of the SIs. An OTF is a multilateral trading platform designed for trading of financial instruments excluding stocks (bonds, securitized products, derivatives and carbon credits). It allows operators to choose modes of trading at their discretion, which differentiates it from an MTF. OTFs permit various modes of trading such as voice trading and request for quote, given that brokers play a critical role in the trading of financial instruments other than stocks. An SI refers to a bilateral trading platform that executes client orders on its own account. At the time of the SI introduction in 2008, it was defined as a platform dedicated to stock trading but its trading scope was extended to other financial instruments under MiFID II. As shown in Figure 2, financial instruments excluding stocks are mostly traded via regulated trading platforms such as exchanges, MTFs, OTFs and SIs in Europe.

The US has recently beefed up its ATS regulation for treasury securities trading.4) An ATS was formerly defined as a trading platform that would match buyers and sellers to execute orders under certain criteria. But the SEC plans to add to the ATS category the communication protocol system (CPS) that offers the use of trading interests of buyers and sellers and supports negotiations of trading terms to execute orders. In addition, trading platforms in excess of certain trading volumes would be subject to the Fair Access Rule and the Regulation Systems Compliance and Integrity for regulating the technological stability of infrastructure. A tighter ATS regulation adopted by the SEC is in parallel with Europe’s policy direction of introducing the OTF and expanding the role of SIs.

Structure of OTC bond trading in Korea

As of 2022, 82% of bond trading is carried out in OTC markets (Figure 3). It is safe to say that bonds excluding government bonds and municipal bonds are hardly traded via exchanges. Exchange-traded government bonds show a steady decline in the share of the total trading volume (Figure 4). In Korea’s bond market, OTC trading is primarily conducted through the K-BOND messenger service operated by Korea Financial Investment Association. In K-BOND, brokers offer a quote in their chatrooms or use request for quote to execute orders in the way of negotiated bilateral transactions. The tick size, the unit of trading value, the dealers’ quoted spread and brokerage fees are determined by accepted practices.

Concluding remarks

As the merits of ATSs are not confined to trading of listed stocks, it is desirable to extend the scope of instruments eligible for ATSs into ETFs, bonds, unlisted stocks. In this regard, ATSs need to be recognized as a scheme designed to regulate trading platforms. This requires a significant departure from the existing concept of permitting the operation of ATSs. A more desirable approach is to regulate trading platforms to ensure that they are operated in a complete form of ATSs. On top of that, it is worth considering differentiating regulatory requirements applicable to ATSs, depending on a trading platform’s economic importance and instrument-specific characteristics.

1) The Korea Exchange press release, November 1, 2022, Prior notice of the amendment to detailed rules for the operational regulation of the securities and derivatives market for the purpose of improving the tick size structure.

2) As of October 2022

3) SEC, December 8, 1998, Adopting release for Regulation ATS.

4) SEC, March 18, 2022, Amendments regarding the definition of “Exchange” and Alternative Trading Systems (ATSs) that trade U.S. treasury and agency securities, National Market System (NMS) Stocks, and other securities.