Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Thought on the Recent Incident of Stock Price Crash

Publication date Aug. 08, 2023

Summary

As the recent incident of stock price crash has become known to be related to market manipulation, financial authorities have come up with measures to eradicate unfair trading practices, such as market manipulation. Also, the National Assembly has passed an amendment to the Financial Investment Services and Capital Markets Act that strengthens punishment for unfair trading practices. However, the possibility of stock price crash will not disappear solely by eradicating market manipulation. Stock prices could be overpriced and may crash if negative information on a firm is not disclosed in a timely manner and accumulates for a long period of time, or if investors follow a trend of rising prices. The likelihood of overpricing increases with lower accounting transparency, weaker bases for market participants such as analysts, institutional investors, and short-sellers who are capable of discovering negative information. At the same time, those conditions could create conditions ripe for market manipulation. A more fundamental solution is to strengthen information efficiency of the stock market. This could effectively lower the possibility of stock price crash and market manipulation, both of which have a more serious negative impact on the stock market than individual investors' financial losses.

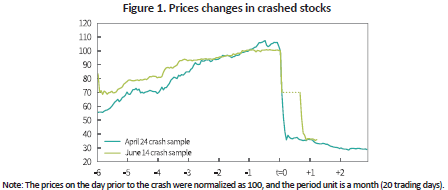

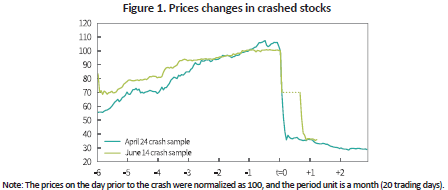

On April 24, 2023, there was an event where the prices of eight stocks, which had been on an upward trend for a considerably long period of time, all hit the lower price limit simultaneously. It was later found that the stock prices had been inflated by market manipulation, but crashed at one point when some investors sold their shares as financial authorities began investigating the case. The crash appears to have been accelerated by automated liquidations on the contracts for differences used for market manipulation. Also on June 14, five other stocks hit the lower price limit simultaneously, which appears to be related to another market manipulation quite similar to the April 24 case. The eight stocks related to the April 24 crash are currently traded 70% lower on average than the price on the day prior to the crash, while the five stocks of the June 14 crash are priced 65% lower.

After the crash, financial authorities acted quickly to come up with measures to prevent recurrence. Aiming to enhance their ability to detect and respond to unfair trading practices, they decided to bolster collaboration between relevant institutions, to advance their market monitoring function, and to enhance the contract for differences (CFD) practice, which has been fraudulently misused for market manipulation. In addition, the National Assembly passed the amendment to the FSCMA, which had not been passed for the past three years, at its plenary session. The amendment not only specified the criteria for calculating unjust gains, but also added a new penalty that allows for the confiscation of up to two times the unjust gains. The revised law also allows punishment to be reduced or exempted in the case of voluntary or internal reporting of such unfair practices.

Follow-up discussions related to stock market crash appear to center on eradicating unfair trading practices such as market manipulation. Market manipulation is a criminal act that must be eradicated, but a point worth noting is that many investors suffered huge losses due to the two crashes. Unfair trading practices are a problem regardless of the outcomes, so are stock price crashes regardless of the causes. The recent incident has garnered significant attention as a case that combined both factors. The question is: Without unfair trading practices, will stock prices stop crashing? Because this is not the case, it is necessary to view the recent incidents from the perspective of not only unfair trading practices, but also stock price crash.

Stock price crash risk

The possibility of an unexpected stock price crash causes financial losses for investors, but more seriously, has an adverse impact on the stock market as a whole. If investors demand a premium for such a crash risk, this may lead to a decline in stock valuation and an increase in a firm's cost of capital. Also, we cannot rule out the possibility where a crash in one stock is transferred to another via economic or behavioral paths, and ultimately leads to systemic risk. Another downside is that the risk of crash could enfeeble the investor base in the stock market because investors who incurred heavy losses from the crash are likely to scale down their stock holdings or leave the market. The 13 stocks involved in the recent two incidents have still slumped, which is understood as a phenomenon where those stocks are losing demand and investor confidence.

It is worth looking at how frequent a price crash occurs in the Korean stock market. Here, a stock price crash is defined as an extreme case where the difference between the 5-day returns on an individual stock and the market1) becomes -50% or less. An analysis on all listed stocks over 10 years2) reveals that there are a total of 119 stock price crashes–approximately once a month–whose periods do not overlap. The number of listed companies that experienced a crash is 103, which is quite significant. If the threshold in the above definition is relaxed to 20-day returns, a total of 320 listed companies have experienced 418 crashes. The result means that one out of eight listed companies experienced a stock price crash during the period, which is somewhat shocking.

Background and factors behind stock price crash

Let's examine the reasons behind individual stocks' price crash, except for the cases resulting from clear reasons such as a macroeconomic shock, or overvaluation by price manipulation. Based on the existing literature, the most plausible hypothesis is that stock price crash is a phenomenon that occurs when a long-term accumulation of negative information is disclosed to the market at once (Jin and Myers, 2006). Managers have incentives to conceal or delay the disclosure of negative information for the purpose of career management or monetary/non-monetary rewards. Furthermore, when managers have a tendency of overconfidence, they are likely to downplay the significance of negative information and exaggerate positive information. This leads to stock overvaluation. When it reached to a point where it is hard to conceal negative information any longer, the accumulated negative information is distributed to the market at once, causing a stock price crash. A case in point is the Enron-Worldcom scandal that occurred in the early 2000s. Empirical analyses have reported that the higher stock-linked compensation to management (especially the CFO) and the younger the manager, the higher the risk of a stock price crash (Kim et al., 2011; Andreou et al., 2017).

Another hypothesis is that it can be attributed to the behavioral biases of investors. When investors believe that the past trend of returns will continue, or follow other investors' trading strategies, this causes an overvaluation in stock prices, eventually resulting in a crash. The phenomenon of abrupt price plunges after a sudden rise observed in so-called theme stocks falls under this category. Empirical evidence suggests that individual investors tend to pay attention to stocks whose prices are on the rise, and the risk of a stock price crash increases when individual investors' interest soars (Cheng et al., 2021; Cui et al., 2022).

Next, it is worth looking at internal and external corporate conditions that could affect the possibility of a stock price crash. The first condition is accounting transparency. The lower the accounting transparency, the higher the possibility of hidden negative information on corporate performance and the higher the risk of stock price crash (Hutton et al., 2009). Also found is that the possibility of stock price crash rises with more earnings management, lower accounting conservatism, and lower accounting readability and comparability. The possibility of crash has fallen since the introduction of the IFRS.

Second, the role of institutional investors could be one of the conditions. Institutional investors have capabilities and incentives to monitor corporate decisions, and bolster transparency of corporate information. Via those actions, they rein in the emergence of negative information in a preemptive manner, prevent negative information from being concealed, and thereby reduce the risk of stock price crash. Such an effect is reported to be strong among long-term investors including pension funds who have a high incentive to monitor business management.

Third, analysts have a role to play in this area. Analysts serve to mitigate information asymmetry between firms and investors as they mobilize diverse information sources and analysis techniques so as to produce information more valuable than plain corporate disclosure. It is empirically reported that stocks with less analyst coverage are more likely to have a price crash (Kim et al., 2019). In a similar vein, attention from individual investors and media are suggested one of the factors reducing the chance of stock price crash (Xu et al., 2021). This means that the more market participants pay attention to corporate activities, the higher the possibility of negative information being disclosed and the lower the possibility of a stock price crash. However, analyst bias towards an optimistic outlook could act as a factor that could increase the likelihood of stock price crash (Xu et al., 2013). Likewise, an abrupt increase in individual investor attention for a short period of time is related to behavioral bias, which can cause an overvaluation and a price crash.

Fourth, it is worth looking at the role of short-selling. As known widely, short sellers play a role of helping discover and reflect negative information in stock prices, thereby reducing the possibility of the accumulation. It is analyzed that short selling appears to have the ability to predict a crash in stock prices, and that easing restrictions on short selling reduces the possibility of stock price crash (Callen and Fang, 2015; Deng et al., 2020).3)

Korea's stock market: Evaluation and implications

Based on the factors discussed above, the Korean stock market appears to have characteristics of vulnerability to the risk of stock price crash. First, it is hard to regard Korea having high accounting transparency. Korea is ranked 37th out of 141 countries in the strength of auditing and reporting standard as of 2019 (Schwab, 2019), and 27th out of 42 countries in the level of earnings management in listed companies as of 2021 (Kim and Kang, 2023). Although the rankings show a trend of long-term improvement, further improvement is necessary in this area compared to major countries in North America and Europe. In terms of institutional investors, the share of institutional holdings in the Korean stock market is only 18%, which is far from the OECD average of 30% (OECD, 2022). The gap widens further if including public sector holdings by public pension funds and sovereign wealth funds. The same is observed in the area of analyst coverage. Of all listed companies, 72% have not been covered by analysts for the past year. This figure rose to 81% when it comes to KOSDAQ-listed companies. Moreover, 92% of analyst opinions are Buy, which is far from discovering negative information.4) Lastly, short selling is currently prohibited for stocks other than constituents of KOSPI200 and KOSDAQ150. Even in the stocks allowed for short selling, it is hard to view their short selling transactions as active compared to major economies.

Let's go back to the recent incident of stock price crash. Those who engaged in market manipulation are likely to have targeted stocks whose price would not be quickly adjusted to a fair level when manipulated to be overvalued. It is highly likely for the manipulators to narrow down their target to stocks with a small percentage of institutional holdings, no analyst coverage, little attention from investors and media, and short sale restriction. This is consistent with the characteristics of stocks that were previously reviewed and identified as having a high possibility of experiencing a stock price crash. Regardless of who caused an overvaluation–internal management, external manipulators, or individual investors with behavioral biases, there is an inevitable possibility of stock price crash if the overvaluation is not effectively and timely resolved but accumulates over time. The fundamental task for reducing the risk of stock price crash is to strengthen the institutional foundation for resolving information asymmetry such as accounting and disclosure, and the role of market participants including institutional investors, analysts, and short sellers, who can actively discover negative information. Furthermore, such effort can help eradicate market manipulation as the conditions for a stock price crash also provides fertile soil for market manipulation.

1) The data were calculated using the weighted average of the returns on the KOSPI and KOSDAQ indices.

2) Excluded from the data are KONEX-listed companies, stocks in the watch list, and SPACs.

3) In addition, there are other factors that are reported to be related to the risk of stock price crash: disciplinary mechanisms such as threats to corporate control, and social responsibility activities; cultural factors such as religion and social trust; and information asymmetry factors such as intangible assets and innovation strategies.

4) Kyunghyang Daily, July 16, 2023. Analyst reports recommend to buy all the time, only 0.15% saying “sell”.

References

An, H., Zhang, T., 2013, Stock price synchronicity, crash risk, and institutional investors, Journal of Corporate Finance 21, 1-15.

Andreou, P.C., Louca, C., Petrou, A.P., 2017, CEO age and stock price crash risk, Review of Finance 21(3), 1287-1325.

Callen, J.L., Fang, X., 2015, Short interest and stock price crash risk, Journal of Banking & Finance 60, 181-194.

Cheng, F., Wang, C., Chiao, C., Yao, S., Fang, Z., 2021, Retail attention, retail trades, and stock price crash risk, Emerging Markets Review 49, 100821.

Cui, X., Sensoy, A., Nguyen, D.K., Yao, S., Wu, Y., 2022, Positive information shocks, investor behavior and stock price crash risk, Journal of Economic Behavior & Organization 197, 493-518.

Deng, X., Gao, L., Kim, J.B., 2020, Short-sale constraints and stock price crash risk: Causal evidence from a natural experiment, Journal of Corporate Finance 60, 101498.

Hutton, A.P., Marcus, A.J., Tehranian, H., 2009, Opaque financial reports, R2, and crash risk, Journal of financial Economics 94(1), 67-86.

Jin, L., Myers, S.C., 2006, R2 around the world: New theory and new tests, Journal of Financial Economics 79(2), 257-292.

Kim, J.B., Li, Y., Zhang, L., 2011, CFOs versus CEOs: Equity incentives and crashes, Journal of Financial Economics 101(3), 713-730.

Kim, J.B., Lu, L.Y., Yu, Y., 2019, Analyst coverage and expected crash risk: Evidence from exogenous changes in analyst coverage, The Accounting Review 94(4), 345-364.

OECD, 2022, Corporate ownership and concentration: Background note for the OECD-Asia Roundtable on Corporate Governance (October 2022)

Schwab, K., 2019, The Global Competitiveness Report 2019, World Economic Forum.

Xu, N., Jiang, X., Chan, K.C., Yi, Z., 2013, Analyst coverage, optimism, and stock price crash risk: Evidence from China, Pacific-Basin, Finance Journal 25, 217-239.

Xu, Y., Xuan, Y., Zheng, G., 2021, Internet searching and stock price crash risk: Evidence from a quasi-natural experiment, Journal of Financial Economics 141(1), 255-275.

[Korean]

J. S. Kim & S. H. Kang, 2023, An Analysis on the Cause behind Korea Discount, KCMI Issue Paper 23-05.

After the crash, financial authorities acted quickly to come up with measures to prevent recurrence. Aiming to enhance their ability to detect and respond to unfair trading practices, they decided to bolster collaboration between relevant institutions, to advance their market monitoring function, and to enhance the contract for differences (CFD) practice, which has been fraudulently misused for market manipulation. In addition, the National Assembly passed the amendment to the FSCMA, which had not been passed for the past three years, at its plenary session. The amendment not only specified the criteria for calculating unjust gains, but also added a new penalty that allows for the confiscation of up to two times the unjust gains. The revised law also allows punishment to be reduced or exempted in the case of voluntary or internal reporting of such unfair practices.

Follow-up discussions related to stock market crash appear to center on eradicating unfair trading practices such as market manipulation. Market manipulation is a criminal act that must be eradicated, but a point worth noting is that many investors suffered huge losses due to the two crashes. Unfair trading practices are a problem regardless of the outcomes, so are stock price crashes regardless of the causes. The recent incident has garnered significant attention as a case that combined both factors. The question is: Without unfair trading practices, will stock prices stop crashing? Because this is not the case, it is necessary to view the recent incidents from the perspective of not only unfair trading practices, but also stock price crash.

Stock price crash risk

The possibility of an unexpected stock price crash causes financial losses for investors, but more seriously, has an adverse impact on the stock market as a whole. If investors demand a premium for such a crash risk, this may lead to a decline in stock valuation and an increase in a firm's cost of capital. Also, we cannot rule out the possibility where a crash in one stock is transferred to another via economic or behavioral paths, and ultimately leads to systemic risk. Another downside is that the risk of crash could enfeeble the investor base in the stock market because investors who incurred heavy losses from the crash are likely to scale down their stock holdings or leave the market. The 13 stocks involved in the recent two incidents have still slumped, which is understood as a phenomenon where those stocks are losing demand and investor confidence.

It is worth looking at how frequent a price crash occurs in the Korean stock market. Here, a stock price crash is defined as an extreme case where the difference between the 5-day returns on an individual stock and the market1) becomes -50% or less. An analysis on all listed stocks over 10 years2) reveals that there are a total of 119 stock price crashes–approximately once a month–whose periods do not overlap. The number of listed companies that experienced a crash is 103, which is quite significant. If the threshold in the above definition is relaxed to 20-day returns, a total of 320 listed companies have experienced 418 crashes. The result means that one out of eight listed companies experienced a stock price crash during the period, which is somewhat shocking.

Background and factors behind stock price crash

Let's examine the reasons behind individual stocks' price crash, except for the cases resulting from clear reasons such as a macroeconomic shock, or overvaluation by price manipulation. Based on the existing literature, the most plausible hypothesis is that stock price crash is a phenomenon that occurs when a long-term accumulation of negative information is disclosed to the market at once (Jin and Myers, 2006). Managers have incentives to conceal or delay the disclosure of negative information for the purpose of career management or monetary/non-monetary rewards. Furthermore, when managers have a tendency of overconfidence, they are likely to downplay the significance of negative information and exaggerate positive information. This leads to stock overvaluation. When it reached to a point where it is hard to conceal negative information any longer, the accumulated negative information is distributed to the market at once, causing a stock price crash. A case in point is the Enron-Worldcom scandal that occurred in the early 2000s. Empirical analyses have reported that the higher stock-linked compensation to management (especially the CFO) and the younger the manager, the higher the risk of a stock price crash (Kim et al., 2011; Andreou et al., 2017).

Another hypothesis is that it can be attributed to the behavioral biases of investors. When investors believe that the past trend of returns will continue, or follow other investors' trading strategies, this causes an overvaluation in stock prices, eventually resulting in a crash. The phenomenon of abrupt price plunges after a sudden rise observed in so-called theme stocks falls under this category. Empirical evidence suggests that individual investors tend to pay attention to stocks whose prices are on the rise, and the risk of a stock price crash increases when individual investors' interest soars (Cheng et al., 2021; Cui et al., 2022).

Next, it is worth looking at internal and external corporate conditions that could affect the possibility of a stock price crash. The first condition is accounting transparency. The lower the accounting transparency, the higher the possibility of hidden negative information on corporate performance and the higher the risk of stock price crash (Hutton et al., 2009). Also found is that the possibility of stock price crash rises with more earnings management, lower accounting conservatism, and lower accounting readability and comparability. The possibility of crash has fallen since the introduction of the IFRS.

Second, the role of institutional investors could be one of the conditions. Institutional investors have capabilities and incentives to monitor corporate decisions, and bolster transparency of corporate information. Via those actions, they rein in the emergence of negative information in a preemptive manner, prevent negative information from being concealed, and thereby reduce the risk of stock price crash. Such an effect is reported to be strong among long-term investors including pension funds who have a high incentive to monitor business management.

Third, analysts have a role to play in this area. Analysts serve to mitigate information asymmetry between firms and investors as they mobilize diverse information sources and analysis techniques so as to produce information more valuable than plain corporate disclosure. It is empirically reported that stocks with less analyst coverage are more likely to have a price crash (Kim et al., 2019). In a similar vein, attention from individual investors and media are suggested one of the factors reducing the chance of stock price crash (Xu et al., 2021). This means that the more market participants pay attention to corporate activities, the higher the possibility of negative information being disclosed and the lower the possibility of a stock price crash. However, analyst bias towards an optimistic outlook could act as a factor that could increase the likelihood of stock price crash (Xu et al., 2013). Likewise, an abrupt increase in individual investor attention for a short period of time is related to behavioral bias, which can cause an overvaluation and a price crash.

Fourth, it is worth looking at the role of short-selling. As known widely, short sellers play a role of helping discover and reflect negative information in stock prices, thereby reducing the possibility of the accumulation. It is analyzed that short selling appears to have the ability to predict a crash in stock prices, and that easing restrictions on short selling reduces the possibility of stock price crash (Callen and Fang, 2015; Deng et al., 2020).3)

Korea's stock market: Evaluation and implications

Based on the factors discussed above, the Korean stock market appears to have characteristics of vulnerability to the risk of stock price crash. First, it is hard to regard Korea having high accounting transparency. Korea is ranked 37th out of 141 countries in the strength of auditing and reporting standard as of 2019 (Schwab, 2019), and 27th out of 42 countries in the level of earnings management in listed companies as of 2021 (Kim and Kang, 2023). Although the rankings show a trend of long-term improvement, further improvement is necessary in this area compared to major countries in North America and Europe. In terms of institutional investors, the share of institutional holdings in the Korean stock market is only 18%, which is far from the OECD average of 30% (OECD, 2022). The gap widens further if including public sector holdings by public pension funds and sovereign wealth funds. The same is observed in the area of analyst coverage. Of all listed companies, 72% have not been covered by analysts for the past year. This figure rose to 81% when it comes to KOSDAQ-listed companies. Moreover, 92% of analyst opinions are Buy, which is far from discovering negative information.4) Lastly, short selling is currently prohibited for stocks other than constituents of KOSPI200 and KOSDAQ150. Even in the stocks allowed for short selling, it is hard to view their short selling transactions as active compared to major economies.

Let's go back to the recent incident of stock price crash. Those who engaged in market manipulation are likely to have targeted stocks whose price would not be quickly adjusted to a fair level when manipulated to be overvalued. It is highly likely for the manipulators to narrow down their target to stocks with a small percentage of institutional holdings, no analyst coverage, little attention from investors and media, and short sale restriction. This is consistent with the characteristics of stocks that were previously reviewed and identified as having a high possibility of experiencing a stock price crash. Regardless of who caused an overvaluation–internal management, external manipulators, or individual investors with behavioral biases, there is an inevitable possibility of stock price crash if the overvaluation is not effectively and timely resolved but accumulates over time. The fundamental task for reducing the risk of stock price crash is to strengthen the institutional foundation for resolving information asymmetry such as accounting and disclosure, and the role of market participants including institutional investors, analysts, and short sellers, who can actively discover negative information. Furthermore, such effort can help eradicate market manipulation as the conditions for a stock price crash also provides fertile soil for market manipulation.

1) The data were calculated using the weighted average of the returns on the KOSPI and KOSDAQ indices.

2) Excluded from the data are KONEX-listed companies, stocks in the watch list, and SPACs.

3) In addition, there are other factors that are reported to be related to the risk of stock price crash: disciplinary mechanisms such as threats to corporate control, and social responsibility activities; cultural factors such as religion and social trust; and information asymmetry factors such as intangible assets and innovation strategies.

4) Kyunghyang Daily, July 16, 2023. Analyst reports recommend to buy all the time, only 0.15% saying “sell”.

References

An, H., Zhang, T., 2013, Stock price synchronicity, crash risk, and institutional investors, Journal of Corporate Finance 21, 1-15.

Andreou, P.C., Louca, C., Petrou, A.P., 2017, CEO age and stock price crash risk, Review of Finance 21(3), 1287-1325.

Callen, J.L., Fang, X., 2015, Short interest and stock price crash risk, Journal of Banking & Finance 60, 181-194.

Cheng, F., Wang, C., Chiao, C., Yao, S., Fang, Z., 2021, Retail attention, retail trades, and stock price crash risk, Emerging Markets Review 49, 100821.

Cui, X., Sensoy, A., Nguyen, D.K., Yao, S., Wu, Y., 2022, Positive information shocks, investor behavior and stock price crash risk, Journal of Economic Behavior & Organization 197, 493-518.

Deng, X., Gao, L., Kim, J.B., 2020, Short-sale constraints and stock price crash risk: Causal evidence from a natural experiment, Journal of Corporate Finance 60, 101498.

Hutton, A.P., Marcus, A.J., Tehranian, H., 2009, Opaque financial reports, R2, and crash risk, Journal of financial Economics 94(1), 67-86.

Jin, L., Myers, S.C., 2006, R2 around the world: New theory and new tests, Journal of Financial Economics 79(2), 257-292.

Kim, J.B., Li, Y., Zhang, L., 2011, CFOs versus CEOs: Equity incentives and crashes, Journal of Financial Economics 101(3), 713-730.

Kim, J.B., Lu, L.Y., Yu, Y., 2019, Analyst coverage and expected crash risk: Evidence from exogenous changes in analyst coverage, The Accounting Review 94(4), 345-364.

OECD, 2022, Corporate ownership and concentration: Background note for the OECD-Asia Roundtable on Corporate Governance (October 2022)

Schwab, K., 2019, The Global Competitiveness Report 2019, World Economic Forum.

Xu, N., Jiang, X., Chan, K.C., Yi, Z., 2013, Analyst coverage, optimism, and stock price crash risk: Evidence from China, Pacific-Basin, Finance Journal 25, 217-239.

Xu, Y., Xuan, Y., Zheng, G., 2021, Internet searching and stock price crash risk: Evidence from a quasi-natural experiment, Journal of Financial Economics 141(1), 255-275.

[Korean]

J. S. Kim & S. H. Kang, 2023, An Analysis on the Cause behind Korea Discount, KCMI Issue Paper 23-05.