Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Assessment of Recent Corporate Financing Conditions in Korea

Publication date Apr. 04, 2023

Summary

Although monetary tightening has continued, corporate financing is on a sharp rise. The growth of corporate financing stems from increased demand for funds for production and investment activities, driven by a surge in prices of raw materials and producer goods. Another factor behind such growth is that export prices have declined more quickly than import prices, thereby aggravating corporate profitability.

In 2023, corporate financing conditions have improved as a whole on a YoY basis but there remains risk factors. Above all, it is worth noting the divergence in issuance conditions by credit rating in the corporate bond market. Companies with lower credit ratings tend to show high reliance on policy support. In terms of bank loans, if banks adopt tougher rules for credit risk management amid prospects for slowing growth, they are highly likely to reduce funding for individual business owners and SMEs that lack creditworthiness or collateral for loans. In the meantime, funding for state-owned energy enterprises has continued climbing on the back of their high credit ratings. But if greater volatility in the financial market dampens investor sentiment, such a trend could exacerbate the financing conditions of low-rated firms.

Considering that demand for corporate financing has recently been growing, an abrupt increase in market volatility may trigger financial instability, especially in the corporate sector. Hence, the authorities and Bank of Korea should work on preventing market volatility from further escalating. They also need to pre-emptively identify and protect against vulnerable factors. Private sector agents including companies should step up risk management with a focus on liquidity risk.

In 2023, corporate financing conditions have improved as a whole on a YoY basis but there remains risk factors. Above all, it is worth noting the divergence in issuance conditions by credit rating in the corporate bond market. Companies with lower credit ratings tend to show high reliance on policy support. In terms of bank loans, if banks adopt tougher rules for credit risk management amid prospects for slowing growth, they are highly likely to reduce funding for individual business owners and SMEs that lack creditworthiness or collateral for loans. In the meantime, funding for state-owned energy enterprises has continued climbing on the back of their high credit ratings. But if greater volatility in the financial market dampens investor sentiment, such a trend could exacerbate the financing conditions of low-rated firms.

Considering that demand for corporate financing has recently been growing, an abrupt increase in market volatility may trigger financial instability, especially in the corporate sector. Hence, the authorities and Bank of Korea should work on preventing market volatility from further escalating. They also need to pre-emptively identify and protect against vulnerable factors. Private sector agents including companies should step up risk management with a focus on liquidity risk.

Amid persistent higher inflation, monetary policy tightening has continued. Central banks strive to induce tighter financial conditions such as a rise in market interest rates and a decline in risky asset prices by lifting the policy rate, in an effort to reduce the aggregate demand and mitigate inflationary pressures. During the process, the growth of private credit usually slows down. Despite a recent shift to tighter financial conditions, however, corporate financing has been on a sharp increase. Against this backdrop, this article looks at the background of the increased demand for corporate financing, assesses recent financing conditions, and presents relevant implications.1)

Background of the increased demand for corporate financing

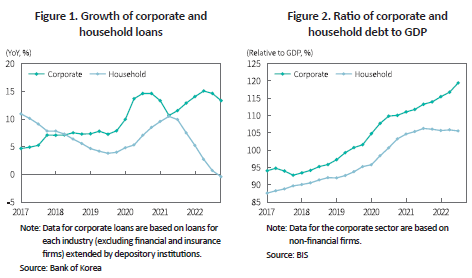

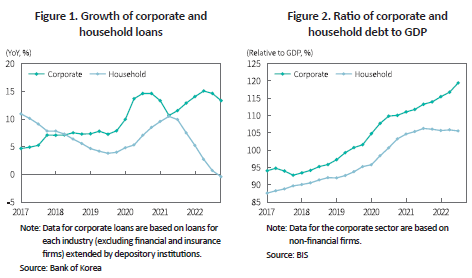

Although Bank of Korea has kept its base rate higher since the second half of 2021, the size of corporate financing has continued to grow significantly (Figure 1). Depository institutions expanded corporate (excluding financial and insurance firms) loans by 13.0% in 2021 and 13.4% in 2022, which is in stark contrast to the sluggish growth of household loans driven by falling property prices and rising interest rates. Accordingly, the leverage ratio (the ratio of debt to GDP) for companies has been on the rise while the household leverage ratio has experienced a moderate decline since the second half of 2021 (Figure 2).

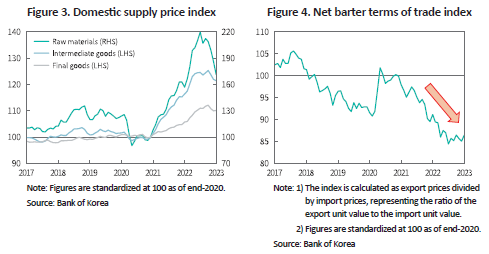

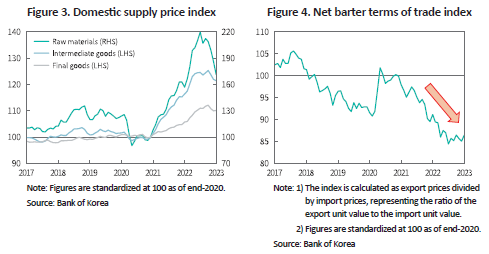

The background of the increased demand for corporate financing is as follows. First of all, prices of raw materials and producer goods have been sharply rising on the back of rises in international commodity prices and the won/dollar exchange rate. As illustrated in Figure 3, the prices of raw materials and intermediate goods have soared compared to the price of final goods. Since the rise in production costs has not been fully passed on to sales prices, demand for corporate financing has grown. Furthermore, recent higher inflation has increased necessary funds for construction and facilities investment.2)

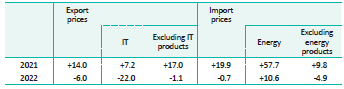

In the perspective of terms of trade, energy import prices remain higher while export prices of IT products such as semiconductors exhibit a downward trend.3) Figure 4 shows that terms of trade representing the ratio of exchange between exports and imports become worse, dragging down the profitability of firms. This indicates that companies have increasingly raised funds from the financial sector.

Recent corporate financing conditions and risk factors

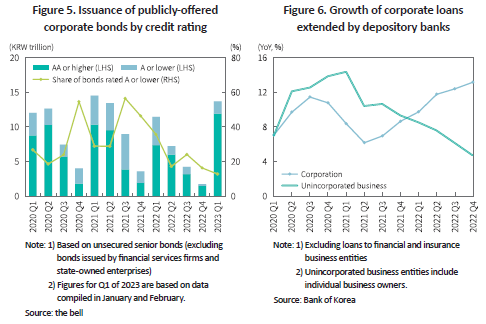

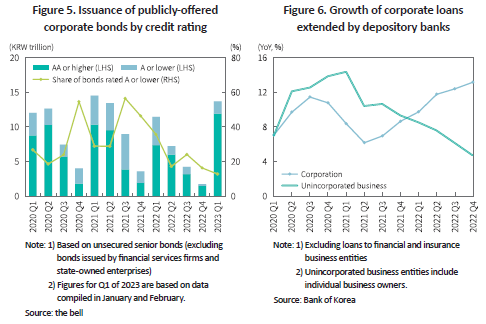

In 2023, corporate financing conditions have improved as a whole on a YoY basis but there remains risk factors. The primary market for publicly-offered corporate bonds in Korea, which contracted considerably in the second half of 2022, has seen a surge in bond issuance in early 2023, owing to institutional investors’ fund execution and improved investment sentiment driven by a slowdown in rate rises (Figure 5). But corporate bonds rated A or lower take up a smaller share in entire bond issues, which represents a divergence in issuance conditions by credit rating.4) Accordingly, companies with lower credit ratings tend to show high reliance on policy support. Financing support via Korea Credit Guarantee Fund’s P-CBO5) commenced in February this year, earlier than in previous years. Out of support funds worth KRW 285 billion, more than 50% was provided to construction firms and specialized credit finance companies that have been recently struggling with funding.

Bank loans extended to corporations have continued an upward trend, whereas the growth of loans for unincorporated business entities including individual business owners has been sluggish (Figure 6). Amid prospects for slowing growth, banks are expected to adopt tougher rules for credit risk management of their loan assets. If this happens, they are highly likely to reduce funding for individual business owners and SMEs who lack creditworthiness or collateral for loans.

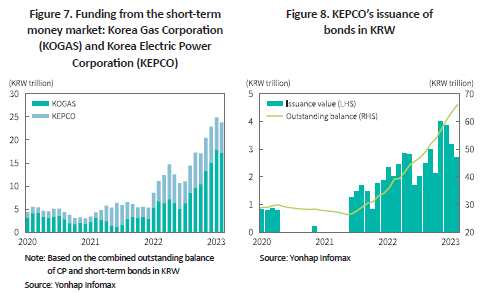

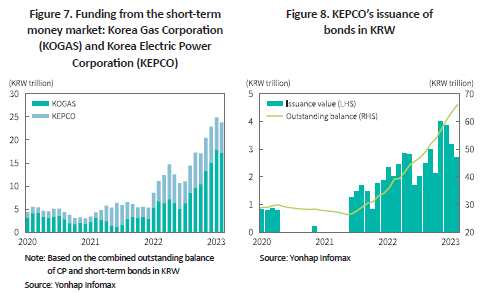

In the meantime, the amount of funds that state-owned energy enterprises raise from the short-term money market and corporate bond market has been climbing sharply. As part of an effort to ease inflationary pressure, the increase in public utility rates was limited and thus, state-owned energy enterprises are issuing CP, short-term bonds and corporate bonds based on their high credit ratings to raise necessary funds (Figure 7 & 8).6) The upward trend in their financing is projected to continue for the time being. If greater volatility in the financial market dampens investor sentiment, such a trend could exacerbate financing conditions of low-rated companies.

Implications

With tighter monetary policy in response to high inflation, financial conditions need to tighten in an orderly manner not undermining the financial market’s resource allocation function. But with a higher level of private debt, tighter financial conditions are likely to cause jitters in the financial market, which could increase downside risks to the economy.7)

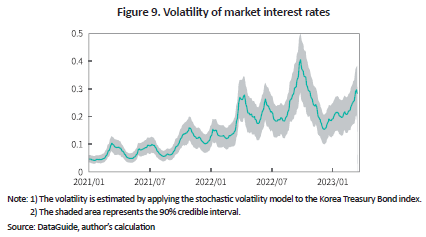

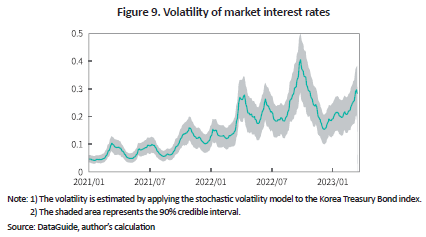

Meanwhile, as central banks of major economies keep tightening their monetary policy, concerns have been growing over economic slowdown and financial instability. With a slow decline in US inflation and the collapse of Silicon Valley Bank (SVB), uncertainties over the Fed’s monetary policy are growing. This has also pushed up the volatility of market interest rates in Korea (Figure 9).

Considering rising production costs driven by inflation and the consequent higher demand for corporate financing, an abrupt increase in market volatility may trigger financial instability, especially for companies with lower credit ratings. Hence, the authorities and Bank of Korea should work on preventing volatility in the financial market from further escalating. They also need to pre-emptively identify and protect against vulnerable factors. With the outlook for tough economic conditions, companies and other private sector agents should step up risk management with a focus on liquidity risk.

1) This article focuses on financing conditions for non-financial firms.

2) The 2022 rate of inflation (deflator) by expenditure item: Private consumption +4.3%, government spending +2.8%, construction investment +7.6%, facilities investment +5.4%

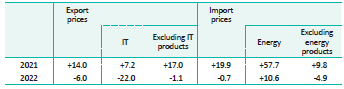

3) The rate of export/import prices rises (USD, YoY %):

4) Divergence in issuance conditions by credit rating is partly attributed to the fact that Korea’s bond market stabilization fund provides support only for corporate bonds with AA- or higher.

5) It refers to the corporate financing support program that issues P-CBO (Primary Collateralized Bond Obligation) based on underlying assets comprised of corporate bonds issued by individual companies. Korea Credit Guarantee Fund guarantees the principal and interest payment of senior P-CBO.

6) Although not included in national guarantee debts, the bonds issued by KEPCO and KOGAS are assigned with the highest credit rating in Korea because the government is expected to support them if needed.

7) Amid increased vulnerabilities from cumulative private debts related to real estate, greater volatility of property prices arising from rate hikes has resulted in financial instability. This can explain the recent rise in default risk for real estate PF loans.

Background of the increased demand for corporate financing

Although Bank of Korea has kept its base rate higher since the second half of 2021, the size of corporate financing has continued to grow significantly (Figure 1). Depository institutions expanded corporate (excluding financial and insurance firms) loans by 13.0% in 2021 and 13.4% in 2022, which is in stark contrast to the sluggish growth of household loans driven by falling property prices and rising interest rates. Accordingly, the leverage ratio (the ratio of debt to GDP) for companies has been on the rise while the household leverage ratio has experienced a moderate decline since the second half of 2021 (Figure 2).

In the perspective of terms of trade, energy import prices remain higher while export prices of IT products such as semiconductors exhibit a downward trend.3) Figure 4 shows that terms of trade representing the ratio of exchange between exports and imports become worse, dragging down the profitability of firms. This indicates that companies have increasingly raised funds from the financial sector.

Recent corporate financing conditions and risk factors

In 2023, corporate financing conditions have improved as a whole on a YoY basis but there remains risk factors. The primary market for publicly-offered corporate bonds in Korea, which contracted considerably in the second half of 2022, has seen a surge in bond issuance in early 2023, owing to institutional investors’ fund execution and improved investment sentiment driven by a slowdown in rate rises (Figure 5). But corporate bonds rated A or lower take up a smaller share in entire bond issues, which represents a divergence in issuance conditions by credit rating.4) Accordingly, companies with lower credit ratings tend to show high reliance on policy support. Financing support via Korea Credit Guarantee Fund’s P-CBO5) commenced in February this year, earlier than in previous years. Out of support funds worth KRW 285 billion, more than 50% was provided to construction firms and specialized credit finance companies that have been recently struggling with funding.

Bank loans extended to corporations have continued an upward trend, whereas the growth of loans for unincorporated business entities including individual business owners has been sluggish (Figure 6). Amid prospects for slowing growth, banks are expected to adopt tougher rules for credit risk management of their loan assets. If this happens, they are highly likely to reduce funding for individual business owners and SMEs who lack creditworthiness or collateral for loans.

Implications

With tighter monetary policy in response to high inflation, financial conditions need to tighten in an orderly manner not undermining the financial market’s resource allocation function. But with a higher level of private debt, tighter financial conditions are likely to cause jitters in the financial market, which could increase downside risks to the economy.7)

Meanwhile, as central banks of major economies keep tightening their monetary policy, concerns have been growing over economic slowdown and financial instability. With a slow decline in US inflation and the collapse of Silicon Valley Bank (SVB), uncertainties over the Fed’s monetary policy are growing. This has also pushed up the volatility of market interest rates in Korea (Figure 9).

Considering rising production costs driven by inflation and the consequent higher demand for corporate financing, an abrupt increase in market volatility may trigger financial instability, especially for companies with lower credit ratings. Hence, the authorities and Bank of Korea should work on preventing volatility in the financial market from further escalating. They also need to pre-emptively identify and protect against vulnerable factors. With the outlook for tough economic conditions, companies and other private sector agents should step up risk management with a focus on liquidity risk.

1) This article focuses on financing conditions for non-financial firms.

2) The 2022 rate of inflation (deflator) by expenditure item: Private consumption +4.3%, government spending +2.8%, construction investment +7.6%, facilities investment +5.4%

3) The rate of export/import prices rises (USD, YoY %):

4) Divergence in issuance conditions by credit rating is partly attributed to the fact that Korea’s bond market stabilization fund provides support only for corporate bonds with AA- or higher.

5) It refers to the corporate financing support program that issues P-CBO (Primary Collateralized Bond Obligation) based on underlying assets comprised of corporate bonds issued by individual companies. Korea Credit Guarantee Fund guarantees the principal and interest payment of senior P-CBO.

6) Although not included in national guarantee debts, the bonds issued by KEPCO and KOGAS are assigned with the highest credit rating in Korea because the government is expected to support them if needed.

7) Amid increased vulnerabilities from cumulative private debts related to real estate, greater volatility of property prices arising from rate hikes has resulted in financial instability. This can explain the recent rise in default risk for real estate PF loans.