Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Thought on Stability of Household Debt during Monetary Tightening Cycles

Publication date Sep. 19, 2023

Summary

Amid increasing expectations for house price growth, household debt, especially mortgage loans, has been recently surging. With deregulation measures for the property market, expectations for house price increases seem to have been heightened in anticipation of lower interest rates resulting from slowing inflation.

Considering that households are increasingly burdened with principal and interest repayment due to monetary tightening, growing household indebtedness could hinder economic growth and stability, which requires caution. As benchmark rate hikes are reflected in lending rates, a greater burden of principal and interest repayment is being imposed on households and the resultant decline in disposable income serves as a factor behind a consumption slowdown. In the meantime, household financial solvency is likely to deteriorate further, particularly among low- and middle-income households that assume a heavier burden of debt service payment relative to their income.

Interest rates will possibly stay higher for longer owing to upward pressure on market interest rates arising from anxieties over domestic inflation and external factors. In this respect, it should be noted that the household burden of principal and interest repayment is likely to keep mounting for a considerable period. First of all, it is inevitable to gradually raise public utility rates and thus, uncertainties over inflation may increase going forward. On top of that, upward pressure on market interest rates arising from external factors could add to the household burden of principal and interest repayment.

In the face of the monetary tightening cycle, policy authorities of Korea have been taking proactive measures to ensure a soft landing for the property market. Amid a slowdown in household spending growth, ballooning household debt could weigh down on the macro economy in terms of growth and stability. Notably, there may be a trade-off between policy goals of a soft landing for the housing market and stable management of household debt. Accordingly, the government needs to reconcile its policy goals through sophisticated policy implementation. Meanwhile, authorities should provide objective prospects for future economic conditions to preclude economic entities from having overly optimistic expectations. Furthermore, households should manage the risk of real estate investment to a tolerable extent.

Considering that households are increasingly burdened with principal and interest repayment due to monetary tightening, growing household indebtedness could hinder economic growth and stability, which requires caution. As benchmark rate hikes are reflected in lending rates, a greater burden of principal and interest repayment is being imposed on households and the resultant decline in disposable income serves as a factor behind a consumption slowdown. In the meantime, household financial solvency is likely to deteriorate further, particularly among low- and middle-income households that assume a heavier burden of debt service payment relative to their income.

Interest rates will possibly stay higher for longer owing to upward pressure on market interest rates arising from anxieties over domestic inflation and external factors. In this respect, it should be noted that the household burden of principal and interest repayment is likely to keep mounting for a considerable period. First of all, it is inevitable to gradually raise public utility rates and thus, uncertainties over inflation may increase going forward. On top of that, upward pressure on market interest rates arising from external factors could add to the household burden of principal and interest repayment.

In the face of the monetary tightening cycle, policy authorities of Korea have been taking proactive measures to ensure a soft landing for the property market. Amid a slowdown in household spending growth, ballooning household debt could weigh down on the macro economy in terms of growth and stability. Notably, there may be a trade-off between policy goals of a soft landing for the housing market and stable management of household debt. Accordingly, the government needs to reconcile its policy goals through sophisticated policy implementation. Meanwhile, authorities should provide objective prospects for future economic conditions to preclude economic entities from having overly optimistic expectations. Furthermore, households should manage the risk of real estate investment to a tolerable extent.

Recent growth of household debt mainly driven by the housing market

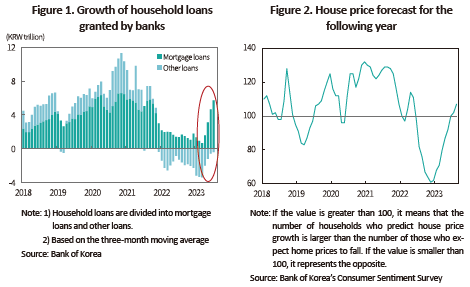

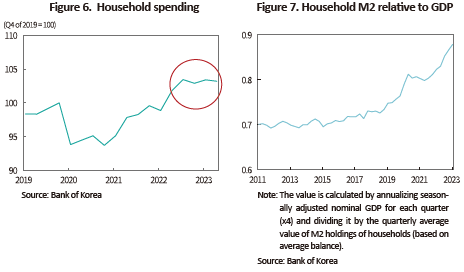

Household mortgage loans, of which growth has considerably slowed down on the back of Bank of Korea’s benchmark rate hikes and property price decreases, are recently rising at a rapid pace (Figure 1). This is an unusual event, given that debt growth tends to decline during a monetary tightening cycle. Mortgage loans climbed by an average of KRW 5.7 trillion per month between May and July of this year, which is quite a fast-paced increase considering that monthly average growth stood at KRW 5.5 trillion between January 2020 and October 2021, the period of significant expansion of funds flowing into the real estate market. Other loans (including credit loans, etc.) have kept falling since 2022, but the decline seems to have recently contracted.

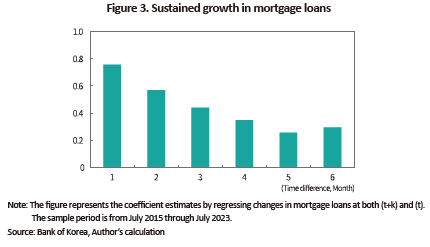

Recently ballooning household debt is largely attributable to higher expectations of households for an increase in home prices. This year, a growing number of households predict that housing prices will go up (Figure 2). With greatly relaxed property regulations, the expectations for home price rises seem to have been heightened in anticipation of lower interest rates caused by an inflation slowdown.1) The experience of the steep increases in property prices before and after the Covid-19 pandemic may also have influenced the formation of these expectations.

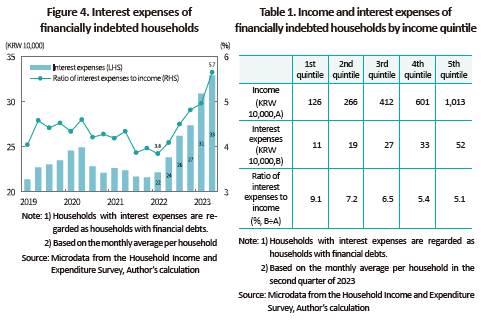

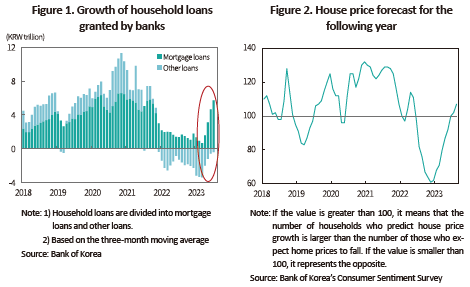

Fueled by expectations for house price increases, mortgage loans are highly likely to continue an upward trend for the time being. An analysis of the persistence of changes in mortgage loans (Figure 3) indicates sustained growth of mortgage loans. Increasing liquidity driven by loans could push up house prices, and the resultant expectation for price increases may, in turn, lead to an expansion of household borrowing. Korea has a high level of household debt compared to major economies,2) which requires a gradual deleveraging. Under the circumstances, close attention should be paid to the possibility of household debt growth, especially in the property market.

Amid the rising burden of debt service payment, household debt growth requires caution

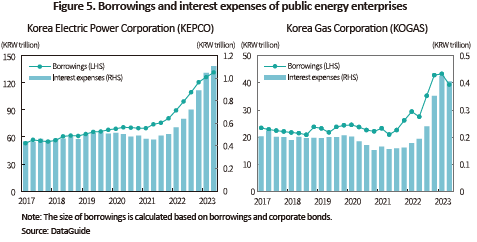

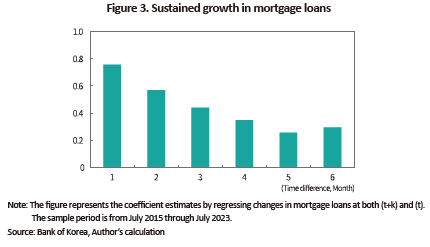

Considering that households are increasingly burdened with principal and interest repayment due to monetary tightening, growing household indebtedness could hinder economic growth and stability, which requires caution. Figure 4 illustrates the interest payment burden borne by households with financial debts, calculated from household survey microdata.3) As benchmark rate hikes are reflected in lending rates, the share of interest expenses in the income of financially indebted households (based on the household average) has swelled from 3.8% in the first quarter of 2022 to 5.7% in the second quarter of 2023. The household burden of debt service payment is presumed to have increased immensely, allowing for the amount of principal to be repaid, and the resultant decline in disposable income contributes to a slowdown in consumption.

Meanwhile, the burden of debt service payment varies depending on income level. Low- and middle-income households seem to take the brunt of such a burden more than their high-income counterparts. Table 1 shows the average monthly income and interest expenses per household by income quintile as of the second quarter of 2023.4) As illustrated in the table, the lower the household income, the greater the burden of interest expenses. Accordingly, household financial solvency is likely to deteriorate, particularly among low- and middle-income households.

Burden of debt service payment is likely to keep mounting, driven by higher-for-longer interest rates

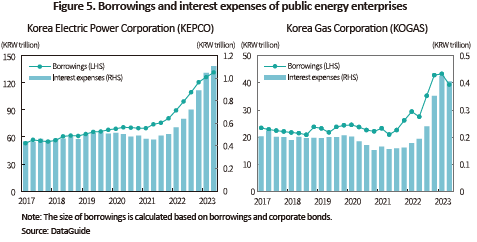

Interest rates will possibly stay higher for longer owing to upward pressure on market interest rates arising from anxieties over domestic inflation and external factors. In this respect, it is worth noting that the household burden of debt service payment is likely to keep mounting for a considerable period. First of all, although Korea has seen a significant slowdown in inflation, prices, particularly public utility rates, may resume an upward trend. Korea has held down utility fees such as electricity and gas rates to curb escalating prices, which has helped lower inflationary pressure across the economy. As a result, however, public energy enterprises have accumulated a great deal of deficit. They are dealing with such a burgeoning deficit by expanding borrowings, which has aggravated their financial position and driven up interest expenses (Figure 5). For this reason, it is inevitable to gradually raise utility fees and thus, uncertainties over inflation may increase going forward. Given that the hike in utility rates has a great knock-on effect on other prices and the inflation expectation of economic entities,5) inflationary pressure is highly likely to persist for a long period.

On top of that, upward pressure on market interest rates arising from external factors may add to the household burden of debt service payment. While the rate hiking cycle of the US Fed appears to largely come to an end, the Fed is expected to keep its rate at the current high level for a prolonged period as economic data came in better than expected. In addition, factors on the supply and demand sides such as the Fed’s continued quantitative tightening and the US Treasury’s expanded issuance of government bonds are driving up US Treasury bond yields. If Korea’s market interest rates go up in sync with the upward trend of global interest rates, it could increase burden of debt service payment on households.

Implications

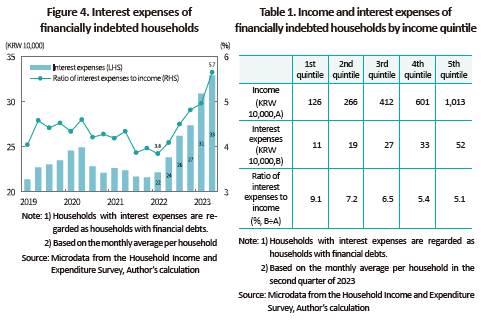

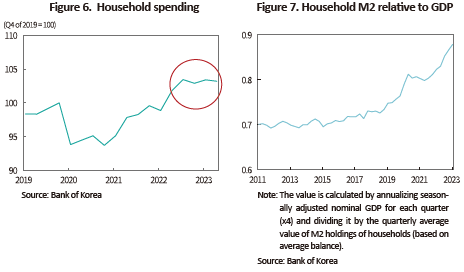

In the face of a monetary tightening cycle, policy authorities of Korea have been taking proactive measures to ensure a soft landing for the property market. Buoyed by expectations for house price rises, however, the growth of mortgage loans has accelerated, raising concerns about household debt. In particular, household debt has been recently surging amid a slowdown in household spending growth, which could weigh down on the macro economy in terms of growth and stability (Figure 6). Notably, there may be a trade-off between policy goals of a soft landing for the housing market and stable management of household debt. For this reason, the government needs to reconcile its policy goals through sophisticated policy implementation.

Meanwhile, authorities should provide objective prospects for future economic conditions to preclude economic entities from having overly optimistic expectations. Compared to the real economy, household liquidity has been on the rise for several years (Figure 7). If optimistic expectations become prevalent among households, such abundant liquidity held by households may contribute to amplifying fluctuations in the asset market.

Lastly, households should manage the risk of real estate investment to a tolerable extent. They also need to prepare for the possibility that changing economic conditions could lead to higher-for-longer interest rates.

1) In Korea, consumer price inflation (on a MoM basis) posted +6.3% in July 2022 and then continued to slow down, falling to +2.3% in July 2023. However, the increase in core prices (excluding food and energy prices) remains above 3%.

2) According to household debt statistics released by the BIS, Korea has a household debt-to-GDP ratio of 105% as of the end of 2022, the third highest level following Switzerland (128%) and Australia (112%).

3) The Household Income and Expenditure Survey conducted by Statistics Korea only investigates interest expenditures regarding household principal and interest repayment. Accordingly, this article regards households with interest expenses as financially indebted households and examines the burden of their interest expenses.

4) It should be noted that high-income households represent a large share of financially indebted households. As of the second quarter of 2023, households with financial debt corresponding to the 4th and 5th income quintiles represent 25.7% and 28.1%, respectively, which are higher than those in the 1st to 3rd income quintiles (7.8%, 17.0%, and 21.3%, respectively).

5) In the Consumer Sentiment Survey conducted from January to August 2023, respondents most frequently chose utility bills when asked about items affecting expected inflation.

Household mortgage loans, of which growth has considerably slowed down on the back of Bank of Korea’s benchmark rate hikes and property price decreases, are recently rising at a rapid pace (Figure 1). This is an unusual event, given that debt growth tends to decline during a monetary tightening cycle. Mortgage loans climbed by an average of KRW 5.7 trillion per month between May and July of this year, which is quite a fast-paced increase considering that monthly average growth stood at KRW 5.5 trillion between January 2020 and October 2021, the period of significant expansion of funds flowing into the real estate market. Other loans (including credit loans, etc.) have kept falling since 2022, but the decline seems to have recently contracted.

Recently ballooning household debt is largely attributable to higher expectations of households for an increase in home prices. This year, a growing number of households predict that housing prices will go up (Figure 2). With greatly relaxed property regulations, the expectations for home price rises seem to have been heightened in anticipation of lower interest rates caused by an inflation slowdown.1) The experience of the steep increases in property prices before and after the Covid-19 pandemic may also have influenced the formation of these expectations.

Considering that households are increasingly burdened with principal and interest repayment due to monetary tightening, growing household indebtedness could hinder economic growth and stability, which requires caution. Figure 4 illustrates the interest payment burden borne by households with financial debts, calculated from household survey microdata.3) As benchmark rate hikes are reflected in lending rates, the share of interest expenses in the income of financially indebted households (based on the household average) has swelled from 3.8% in the first quarter of 2022 to 5.7% in the second quarter of 2023. The household burden of debt service payment is presumed to have increased immensely, allowing for the amount of principal to be repaid, and the resultant decline in disposable income contributes to a slowdown in consumption.

Meanwhile, the burden of debt service payment varies depending on income level. Low- and middle-income households seem to take the brunt of such a burden more than their high-income counterparts. Table 1 shows the average monthly income and interest expenses per household by income quintile as of the second quarter of 2023.4) As illustrated in the table, the lower the household income, the greater the burden of interest expenses. Accordingly, household financial solvency is likely to deteriorate, particularly among low- and middle-income households.

Interest rates will possibly stay higher for longer owing to upward pressure on market interest rates arising from anxieties over domestic inflation and external factors. In this respect, it is worth noting that the household burden of debt service payment is likely to keep mounting for a considerable period. First of all, although Korea has seen a significant slowdown in inflation, prices, particularly public utility rates, may resume an upward trend. Korea has held down utility fees such as electricity and gas rates to curb escalating prices, which has helped lower inflationary pressure across the economy. As a result, however, public energy enterprises have accumulated a great deal of deficit. They are dealing with such a burgeoning deficit by expanding borrowings, which has aggravated their financial position and driven up interest expenses (Figure 5). For this reason, it is inevitable to gradually raise utility fees and thus, uncertainties over inflation may increase going forward. Given that the hike in utility rates has a great knock-on effect on other prices and the inflation expectation of economic entities,5) inflationary pressure is highly likely to persist for a long period.

On top of that, upward pressure on market interest rates arising from external factors may add to the household burden of debt service payment. While the rate hiking cycle of the US Fed appears to largely come to an end, the Fed is expected to keep its rate at the current high level for a prolonged period as economic data came in better than expected. In addition, factors on the supply and demand sides such as the Fed’s continued quantitative tightening and the US Treasury’s expanded issuance of government bonds are driving up US Treasury bond yields. If Korea’s market interest rates go up in sync with the upward trend of global interest rates, it could increase burden of debt service payment on households.

In the face of a monetary tightening cycle, policy authorities of Korea have been taking proactive measures to ensure a soft landing for the property market. Buoyed by expectations for house price rises, however, the growth of mortgage loans has accelerated, raising concerns about household debt. In particular, household debt has been recently surging amid a slowdown in household spending growth, which could weigh down on the macro economy in terms of growth and stability (Figure 6). Notably, there may be a trade-off between policy goals of a soft landing for the housing market and stable management of household debt. For this reason, the government needs to reconcile its policy goals through sophisticated policy implementation.

Meanwhile, authorities should provide objective prospects for future economic conditions to preclude economic entities from having overly optimistic expectations. Compared to the real economy, household liquidity has been on the rise for several years (Figure 7). If optimistic expectations become prevalent among households, such abundant liquidity held by households may contribute to amplifying fluctuations in the asset market.

Lastly, households should manage the risk of real estate investment to a tolerable extent. They also need to prepare for the possibility that changing economic conditions could lead to higher-for-longer interest rates.

2) According to household debt statistics released by the BIS, Korea has a household debt-to-GDP ratio of 105% as of the end of 2022, the third highest level following Switzerland (128%) and Australia (112%).

3) The Household Income and Expenditure Survey conducted by Statistics Korea only investigates interest expenditures regarding household principal and interest repayment. Accordingly, this article regards households with interest expenses as financially indebted households and examines the burden of their interest expenses.

4) It should be noted that high-income households represent a large share of financially indebted households. As of the second quarter of 2023, households with financial debt corresponding to the 4th and 5th income quintiles represent 25.7% and 28.1%, respectively, which are higher than those in the 1st to 3rd income quintiles (7.8%, 17.0%, and 21.3%, respectively).

5) In the Consumer Sentiment Survey conducted from January to August 2023, respondents most frequently chose utility bills when asked about items affecting expected inflation.