OPINION

2023 Nov/21

Growth of the Synthetic ETF Market and Investor Considerations

Nov. 21, 2023

PDF

- Summary

- The Korean synthetic ETF market is growing rapidly. This year alone, the sum of market capitalization has already increased by 121%, and a certain synthetic ETF has ranked first in the entire ETF market capitalization list, all of which has significantly enhanced the status of synthetic ETFs in Korea. Traditional ETFs hold constituents of the target index, while synthetic ETFs track the index by entering into swap agreements with brokerage firms. When investing in synthetic ETFs, investors need to understand the differences in investment strategies between the two ETF types and examine counterparty risk, the risk of tracking errors and the level of costs embedded in swap agreements. Additionally, it should be noted that among US-listed ETFs, some may act as synthetic ETFs although they do not include the term ‘synthetic’ in their names, which requires caution for investors. In the US, specific terms and conditions of swap agreements are disclosed, but this is not the case in Korea. For this reason, efforts should be made to increase disclosure items of swap agreements to help investors better understand ETFs and make informed decisions.

In September 2023, the Korean ETF (Exchange-Traded Fund) market witnessed a remarkable event. The ‘KODEX 200’, which had held the top position in market capitalization since the establishment of the Korean ETF market in 2002, handed over its leading position to another product for the first time in 21 years. The new leader is the ‘TIGER CD Rate Investment KIS (Synth)’ which has been on the market for only three years. As suggested by the term ‘synthetic’ in its name, this ETF differs from traditional ETFs (physical ETFs) in that it uses swap agreements rather than replicating the return of a selected index. As of September 19, 2023, the ‘KODEX KOFR Active (Synth)’ and ‘KODEX CD Rate Active (Synth)’, both of which fall under the synthetic ETF category, occupy the third and fourth positions in the Korean ETF market in terms of market capitalization. Unlike in the past when physical ETFs dominated the market, synthetic ETFs have built a strong presence. Against this backdrop, this article examines the structure, characteristics and market status of synthetic ETFs and highlights critical considerations for investors.

Structure and characteristics

ETFs are broadly classified into physical ETFs and synthetic ETFs based on their investment strategies. Physical ETFs are traditional ETFs that track a benchmark index by directly holding the securities included in the benchmark. On the other hand, synthetic ETFs enter into swap agreements aimed to deliver the return of the benchmark index with brokerage firms, rather than holding the index’s securities. As for ETFs tracking the Euro Stoxx 50, the physical type directly holds representative European securities such as LVMH, SAP, Siemens and others, while the synthetic type normally enters into a swap agreement with a brokerage firm that promises to deliver the return of the target index, instead of holding securities.

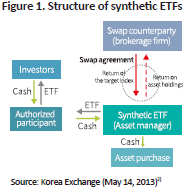

Figure 1 presents the management structure of synthetic ETFs.1) They typically purchase a reference basket with the cash received from investors and then enter into swap agreements with brokerage firms. The key term of the agreements involves “delivering the return of the reference basket to the brokerage firm and, in exchange, achieving the return of the target index”. The reference basket often consists of securities unrelated to the target index. For example, a synthetic ETF tracking the Euro Stoxx 50 may hold Korean won deposits as a reference basket and sign a swap agreement under which the return of the Euro Stoxx 50 is achieved in exchange for the deposit interest paid to the brokerage firm.

One of the advantages of synthetic ETFs is that they can easily track a target index. For smaller funds, it may be impossible to fully replicate the performance of a global stock index composed of thousands of stocks. With swap agreements, however, these funds can conveniently track relevant indices. Another case in point is foreign over-the-counter bonds. Their limited accessibility in the Korean market makes it challenging for domestically listed ETFs to fully replicate global bond indices. In this case, they can efficiently track those indices by signing a swap agreement with a brokerage firm. Likewise, it can be more convenient for leveraged or inverse ETFs to utilize swap agreements as they face more difficulties physically replicating relevant indices than 1x products. As such, synthetic ETFs enable investors to track global stock and bond indices and leveraged and inverse indices, which are difficult to physically replicate. This can give a wide range of investment choices to Korean investors and enhance the diversity of the Korean ETF market.

Market status

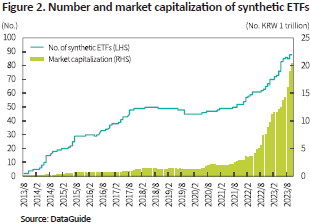

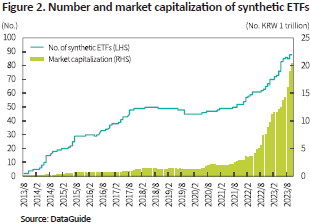

The Korean synthetic ETF market has been rapidly growing in recent years. Since their introduction in Korea in August 2013, synthetic ETFs have been on the rise in terms of market capitalization and the number of listed products. As of October 19, 2023, there are 88 synthetic ETFs listed with the total market capitalization of KRW 20 trillion. This represents a 96% increase in the number of products and 1,495% growth in market capitalization compared to before the outbreak of the Covid-19 pandemic at the end of 2019. This year alone, the number of listed ETFs and market capitalization have climbed by 26% and 121%, respectively. Amid such sharp growth, the share of synthetic ETFs in the ETF market has significantly increased to 19%, up from 12% at the end of 2022.

The recent drastic growth of synthetic ETFs stems from the popularity of domestic ETFs tracking short-term interest rates. As rising market interest rates have caused both stock and bond prices to fall, investors are flocking to highly stable ETFs tracking short-term interest rates. When market interest rates increase, bond prices generally decline. But short-term interest rate ETFs are advantageous in that they offer potentially higher returns thanks to shorter maturities. Additionally, their interest compounds on a daily basis and these ETFs can be easily liquidated in the market, unlike bank deposits. This feature highly appeals to investors who want to manage short-term cash holdings. As of October 19, 2023, top Korean synthetic ETFs are, in the order of market capitalization, the TIGER CD Rate Investment KIS (Synth) (KRW 7.1 trillion), the KODEX KOFR Rate Active (Synth) (KRW 3.9 trillion), the KODEX CD Rate Active (Synth) (KRW 3.3 trillion) and the TIGER KOFR Rate Active (Synth) (KRW 2.2 trillion), with their combined market capitalization amounting to a whopping KRW 16 trillion.

Even except for ETFs tracking short-term interest rates, the synthetic ETF market shows a sustained growth trend. Factors such as increasing demand for overseas investment and diversified underlying indices for leveraged and inverse ETFs have led to a range of benchmark indices for ETFs. Accordingly, this makes it more difficult to physically replicate such indices, which has prompted the launch of synthetic ETFs.

Considerations for investors

When investing in synthetic ETFs, investors should be aware of the following three considerations. First, the most prominent risk of synthetic ETFs is counterparty risk. BlackRock’s CEO Larry Fink said in 2011 that if you buy a Lyxor synthetic ETF, you would become an unsecured creditor of Société Générale (SocGen). He pointed out the risk that worsening financial conditions of the brokerage firm, the counterparty to the swap agreement, may hinder investors from achieving promised returns. This risk has come to the fore in the wake of the 2008 global financial crisis, which has been warned of by international organizations such as the IMF and BIS. With stricter regulations placed by each country and voluntary efforts made by synthetic ETF providers, however, counterparty risk related to synthetic ETFs has now been better managed. In the past, foreign synthetic ETF providers entered into swap agreements only with an investment bank, their parent company, making counterparty risk being concentrated on a single company. Currently, they enter into a swap agreement with multiple counterparties, dispersing the risk. On top of that, various measures have been taken to reduce counterparty risk and increase transparency, including obtaining sufficient collateral from counterparties and disclosing the specific statement of collaterals. Korea has also taken global-level measures to manage counterparty risk related to synthetic ETFs, allowing investors to access this information through public disclosure.

The second investor consideration is the risk posed by tracking errors. Synthetic ETFs are generally designed to achieve the return of the target index through swap agreements. However, if the counterparty refuses to sign the agreement extension or a new counterparty cannot be found upon the maturity of swap agreements, it can give rise to significant tracking errors. A tracking error may also occur when unexpected gains or losses arise from an ETF’s reference basket. Most synthetic ETFs tend to hold stable assets such as Korean won deposits, government bonds, and short-term interest rate products as a reference basket. However, it should be noted that some of them hold assets unrelated to the target index. For example, product A previously tracked the stock market index of country B while holding Korean stocks as a reference basket. Under a swap agreement, product A promised to deliver the KOSPI200 return in exchange for achieving the return of country B’s stock market index from the counterparty. Accordingly, investors in product A were burdened to consider tracking errors not only for the return of country B’s stock market index but also for the KOSPI200 return.3) Among popular synthetic ETFs tracking short-term interest rates, some adopt an active investment approach by investing in assets other than constituents of the target index, which requires caution for investors when making investment decisions.

Lastly, costs associated with a swap agreement should be taken into account. As for a synthetic ETF, actual investment is made not within the fund but by its counterparty, which is typically a brokerage firm. Consequently, the synthetic ETF pays certain costs to the brokerage firm as a compensation for asset management. For example, if a synthetic ETF tracking the Euro Stoxx 50 enters into a swap agreement with a counterparty under which it promises to pay interest on Korean deposits in exchange for achieving the return of the target index, the actual amount to be paid to the counterparty would be Korean deposit interest plus α. Here, the α amount is known as the swap spread, which typically has a positive value. But it should be noted that the swap spread is not included in the total expense·cost amount disclosed by synthetic ETFs. Although being reflected in the fund’s return, the swap spread is regarded as mark-to-market gains or losses from the swap agreement and thus, is not considered explicit costs such as management fees or trading costs. Furthermore, as the swap spread may vary depending on the target index and types of reference baskets, the small size of the swap spread does not necessarily indicate that it is more favorable to investors. As such, properly evaluating synthetic ETF costs embedded in swap agreements is not an easy task for investors.

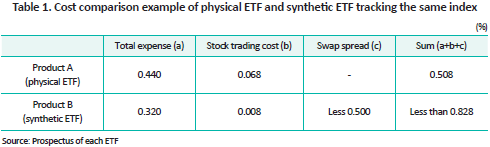

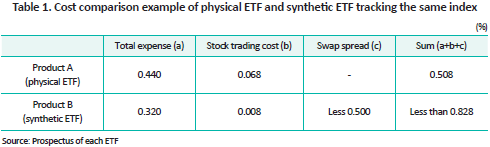

In this respect, it is worth considering the following case. As for Korean ETF products A and B, which track the same index, product A physically replicates the target index and product B is managed as a synthetic ETF. Their costs are shown in Table 1. In the case of product A, a fund manager makes portfolio investments by directly trading constituents of the target index and thus, its total expenses including management fees are relatively higher than those of product B. Product A has to bear a greater trading cost in that it engages in the actual trading of stocks. An investor unfamiliar with the characteristics of synthetic ETFs may conclude that product B is more cost-effective than product A. In terms of synthetic ETFs, however, investors should take into account costs associated with the swap agreement in addition to the total expense and trading costs. Product B discloses a swap spread level of ‘within 0.5%’. Given that this value is derived from the swap spread paid to counterparties over the past year, there is a high likelihood that product A is more cost-effective than product B.4)

US case and implications

In the wake of the Covid-19 pandemic, there has been a significant increase in Korean investors who directly trade US-listed stocks. According to the Korea Securities Depository, ETFs, known by their ticker symbols ‘TQQQ’ and ‘SQQQ’, have steadily made the top list of ETFs favored by Korean investors. These ETFs that track the NASDAQ-100 index with +3x and -3x leverage, respectively have gained significant popularity in Korea. In addition, ETFs known by their tickers ‘SOXL’ and ‘SOXS’ rank first and third, respectively in terms of trading volume as of October 2023. They track the performance of the US semiconductor index with +3 and -3 leverage. Although these US leveraged and inverse ETFs do not include the term ‘synthetic’ in their names, their substantial utilization of swap agreements makes them fall under the synthetic ETF category. According to recent disclosures, TQQQ builds 256% of its total 300% long position and SQQQ builds -295% of its total -300% short position by using swap agreements, the pattern similarly followed by SOXL and SOXS. When investing in US ETFs as mentioned above, investors should be aware of these features of synthetic ETFs.

US synthetic ETFs disclose the details of swap agreements in a transparent manner, which helps investors make decisions. US asset managers operating these ETFs such as ProShares or Direxion make public what they pay and achieve under swap agreements by disclosing their asset holdings. To be more specific, the SEC’s Investment Company Reporting Modernization Rules have made it mandatory to disclose the terms and conditions of swap agreements since 2016. Regulation 17 CFR 210.12-13C specifies that the information regarding each swap agreement must be disclosed, including the terms of payments to be received, the terms of payments to be paid, maturity dates, notional amount, and unrealized appreciation/depreciation.

In Korea, synthetic ETFs disclose various information regarding swap agreements such as risk exposure amount for each counterparty, collateral valuation and the risk assessment ratio. But there is only limited information regarding what and how much each synthetic ETF pays and achieves from each counterparty. Starting this year, swap spreads are calculated and reported in the prospectus by each fund, but it is often indicated as within the ‘0.00%’ range, making it difficult to figure out the exact level of swap spreads. It is also challenging to compare the swap spread of synthetic ETFs with that of other ETFs, due to difficulties in standardization. If the terms of swap agreements are fully disclosed in Korea as is the case in the US, it would be of great help to investors in understanding synthetic ETFs and comparing various products.

1) This article focuses on unfunded swap agreements. Funded swap agreements may have slightly different structures or characteristics.

2) Korea Exchange, May 14, 2013, Establishing specific criteria for adopting synthetic ETFs, press release.

3) However, this structure is not necessarily unfavorable to investors. It is speculated that product A has adopted this structure to reduce taxes imposed on investors by tapping into the fact that Korean stocks are exempted from capital gains tax.

4) It is not desirable to make investment decisions based solely on costs. Different investment strategies affect not only costs but also tracking errors, dividend payments, and taxes. Accordingly, investors need to take into consideration these various aspects when making actual investments.

Structure and characteristics

ETFs are broadly classified into physical ETFs and synthetic ETFs based on their investment strategies. Physical ETFs are traditional ETFs that track a benchmark index by directly holding the securities included in the benchmark. On the other hand, synthetic ETFs enter into swap agreements aimed to deliver the return of the benchmark index with brokerage firms, rather than holding the index’s securities. As for ETFs tracking the Euro Stoxx 50, the physical type directly holds representative European securities such as LVMH, SAP, Siemens and others, while the synthetic type normally enters into a swap agreement with a brokerage firm that promises to deliver the return of the target index, instead of holding securities.

Figure 1 presents the management structure of synthetic ETFs.1) They typically purchase a reference basket with the cash received from investors and then enter into swap agreements with brokerage firms. The key term of the agreements involves “delivering the return of the reference basket to the brokerage firm and, in exchange, achieving the return of the target index”. The reference basket often consists of securities unrelated to the target index. For example, a synthetic ETF tracking the Euro Stoxx 50 may hold Korean won deposits as a reference basket and sign a swap agreement under which the return of the Euro Stoxx 50 is achieved in exchange for the deposit interest paid to the brokerage firm.

One of the advantages of synthetic ETFs is that they can easily track a target index. For smaller funds, it may be impossible to fully replicate the performance of a global stock index composed of thousands of stocks. With swap agreements, however, these funds can conveniently track relevant indices. Another case in point is foreign over-the-counter bonds. Their limited accessibility in the Korean market makes it challenging for domestically listed ETFs to fully replicate global bond indices. In this case, they can efficiently track those indices by signing a swap agreement with a brokerage firm. Likewise, it can be more convenient for leveraged or inverse ETFs to utilize swap agreements as they face more difficulties physically replicating relevant indices than 1x products. As such, synthetic ETFs enable investors to track global stock and bond indices and leveraged and inverse indices, which are difficult to physically replicate. This can give a wide range of investment choices to Korean investors and enhance the diversity of the Korean ETF market.

Market status

The Korean synthetic ETF market has been rapidly growing in recent years. Since their introduction in Korea in August 2013, synthetic ETFs have been on the rise in terms of market capitalization and the number of listed products. As of October 19, 2023, there are 88 synthetic ETFs listed with the total market capitalization of KRW 20 trillion. This represents a 96% increase in the number of products and 1,495% growth in market capitalization compared to before the outbreak of the Covid-19 pandemic at the end of 2019. This year alone, the number of listed ETFs and market capitalization have climbed by 26% and 121%, respectively. Amid such sharp growth, the share of synthetic ETFs in the ETF market has significantly increased to 19%, up from 12% at the end of 2022.

The recent drastic growth of synthetic ETFs stems from the popularity of domestic ETFs tracking short-term interest rates. As rising market interest rates have caused both stock and bond prices to fall, investors are flocking to highly stable ETFs tracking short-term interest rates. When market interest rates increase, bond prices generally decline. But short-term interest rate ETFs are advantageous in that they offer potentially higher returns thanks to shorter maturities. Additionally, their interest compounds on a daily basis and these ETFs can be easily liquidated in the market, unlike bank deposits. This feature highly appeals to investors who want to manage short-term cash holdings. As of October 19, 2023, top Korean synthetic ETFs are, in the order of market capitalization, the TIGER CD Rate Investment KIS (Synth) (KRW 7.1 trillion), the KODEX KOFR Rate Active (Synth) (KRW 3.9 trillion), the KODEX CD Rate Active (Synth) (KRW 3.3 trillion) and the TIGER KOFR Rate Active (Synth) (KRW 2.2 trillion), with their combined market capitalization amounting to a whopping KRW 16 trillion.

Even except for ETFs tracking short-term interest rates, the synthetic ETF market shows a sustained growth trend. Factors such as increasing demand for overseas investment and diversified underlying indices for leveraged and inverse ETFs have led to a range of benchmark indices for ETFs. Accordingly, this makes it more difficult to physically replicate such indices, which has prompted the launch of synthetic ETFs.

Considerations for investors

When investing in synthetic ETFs, investors should be aware of the following three considerations. First, the most prominent risk of synthetic ETFs is counterparty risk. BlackRock’s CEO Larry Fink said in 2011 that if you buy a Lyxor synthetic ETF, you would become an unsecured creditor of Société Générale (SocGen). He pointed out the risk that worsening financial conditions of the brokerage firm, the counterparty to the swap agreement, may hinder investors from achieving promised returns. This risk has come to the fore in the wake of the 2008 global financial crisis, which has been warned of by international organizations such as the IMF and BIS. With stricter regulations placed by each country and voluntary efforts made by synthetic ETF providers, however, counterparty risk related to synthetic ETFs has now been better managed. In the past, foreign synthetic ETF providers entered into swap agreements only with an investment bank, their parent company, making counterparty risk being concentrated on a single company. Currently, they enter into a swap agreement with multiple counterparties, dispersing the risk. On top of that, various measures have been taken to reduce counterparty risk and increase transparency, including obtaining sufficient collateral from counterparties and disclosing the specific statement of collaterals. Korea has also taken global-level measures to manage counterparty risk related to synthetic ETFs, allowing investors to access this information through public disclosure.

The second investor consideration is the risk posed by tracking errors. Synthetic ETFs are generally designed to achieve the return of the target index through swap agreements. However, if the counterparty refuses to sign the agreement extension or a new counterparty cannot be found upon the maturity of swap agreements, it can give rise to significant tracking errors. A tracking error may also occur when unexpected gains or losses arise from an ETF’s reference basket. Most synthetic ETFs tend to hold stable assets such as Korean won deposits, government bonds, and short-term interest rate products as a reference basket. However, it should be noted that some of them hold assets unrelated to the target index. For example, product A previously tracked the stock market index of country B while holding Korean stocks as a reference basket. Under a swap agreement, product A promised to deliver the KOSPI200 return in exchange for achieving the return of country B’s stock market index from the counterparty. Accordingly, investors in product A were burdened to consider tracking errors not only for the return of country B’s stock market index but also for the KOSPI200 return.3) Among popular synthetic ETFs tracking short-term interest rates, some adopt an active investment approach by investing in assets other than constituents of the target index, which requires caution for investors when making investment decisions.

Lastly, costs associated with a swap agreement should be taken into account. As for a synthetic ETF, actual investment is made not within the fund but by its counterparty, which is typically a brokerage firm. Consequently, the synthetic ETF pays certain costs to the brokerage firm as a compensation for asset management. For example, if a synthetic ETF tracking the Euro Stoxx 50 enters into a swap agreement with a counterparty under which it promises to pay interest on Korean deposits in exchange for achieving the return of the target index, the actual amount to be paid to the counterparty would be Korean deposit interest plus α. Here, the α amount is known as the swap spread, which typically has a positive value. But it should be noted that the swap spread is not included in the total expense·cost amount disclosed by synthetic ETFs. Although being reflected in the fund’s return, the swap spread is regarded as mark-to-market gains or losses from the swap agreement and thus, is not considered explicit costs such as management fees or trading costs. Furthermore, as the swap spread may vary depending on the target index and types of reference baskets, the small size of the swap spread does not necessarily indicate that it is more favorable to investors. As such, properly evaluating synthetic ETF costs embedded in swap agreements is not an easy task for investors.

In this respect, it is worth considering the following case. As for Korean ETF products A and B, which track the same index, product A physically replicates the target index and product B is managed as a synthetic ETF. Their costs are shown in Table 1. In the case of product A, a fund manager makes portfolio investments by directly trading constituents of the target index and thus, its total expenses including management fees are relatively higher than those of product B. Product A has to bear a greater trading cost in that it engages in the actual trading of stocks. An investor unfamiliar with the characteristics of synthetic ETFs may conclude that product B is more cost-effective than product A. In terms of synthetic ETFs, however, investors should take into account costs associated with the swap agreement in addition to the total expense and trading costs. Product B discloses a swap spread level of ‘within 0.5%’. Given that this value is derived from the swap spread paid to counterparties over the past year, there is a high likelihood that product A is more cost-effective than product B.4)

US case and implications

In the wake of the Covid-19 pandemic, there has been a significant increase in Korean investors who directly trade US-listed stocks. According to the Korea Securities Depository, ETFs, known by their ticker symbols ‘TQQQ’ and ‘SQQQ’, have steadily made the top list of ETFs favored by Korean investors. These ETFs that track the NASDAQ-100 index with +3x and -3x leverage, respectively have gained significant popularity in Korea. In addition, ETFs known by their tickers ‘SOXL’ and ‘SOXS’ rank first and third, respectively in terms of trading volume as of October 2023. They track the performance of the US semiconductor index with +3 and -3 leverage. Although these US leveraged and inverse ETFs do not include the term ‘synthetic’ in their names, their substantial utilization of swap agreements makes them fall under the synthetic ETF category. According to recent disclosures, TQQQ builds 256% of its total 300% long position and SQQQ builds -295% of its total -300% short position by using swap agreements, the pattern similarly followed by SOXL and SOXS. When investing in US ETFs as mentioned above, investors should be aware of these features of synthetic ETFs.

US synthetic ETFs disclose the details of swap agreements in a transparent manner, which helps investors make decisions. US asset managers operating these ETFs such as ProShares or Direxion make public what they pay and achieve under swap agreements by disclosing their asset holdings. To be more specific, the SEC’s Investment Company Reporting Modernization Rules have made it mandatory to disclose the terms and conditions of swap agreements since 2016. Regulation 17 CFR 210.12-13C specifies that the information regarding each swap agreement must be disclosed, including the terms of payments to be received, the terms of payments to be paid, maturity dates, notional amount, and unrealized appreciation/depreciation.

In Korea, synthetic ETFs disclose various information regarding swap agreements such as risk exposure amount for each counterparty, collateral valuation and the risk assessment ratio. But there is only limited information regarding what and how much each synthetic ETF pays and achieves from each counterparty. Starting this year, swap spreads are calculated and reported in the prospectus by each fund, but it is often indicated as within the ‘0.00%’ range, making it difficult to figure out the exact level of swap spreads. It is also challenging to compare the swap spread of synthetic ETFs with that of other ETFs, due to difficulties in standardization. If the terms of swap agreements are fully disclosed in Korea as is the case in the US, it would be of great help to investors in understanding synthetic ETFs and comparing various products.

1) This article focuses on unfunded swap agreements. Funded swap agreements may have slightly different structures or characteristics.

2) Korea Exchange, May 14, 2013, Establishing specific criteria for adopting synthetic ETFs, press release.

3) However, this structure is not necessarily unfavorable to investors. It is speculated that product A has adopted this structure to reduce taxes imposed on investors by tapping into the fact that Korean stocks are exempted from capital gains tax.

4) It is not desirable to make investment decisions based solely on costs. Different investment strategies affect not only costs but also tracking errors, dividend payments, and taxes. Accordingly, investors need to take into consideration these various aspects when making actual investments.