Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Globalization in Retreat and a Potential Shift in Inflation Dynamics

Publication date Dec. 19, 2023

Summary

The recent surge in global inflation, prompted by the pandemic and the Russia-Ukraine war, shows signs of stabilization. The slowdown in inflation is expected to persist, driven by measures such as monetary tightening. However, a potential return to the low inflation era remains uncertain from a long-term perspective. The shift toward deglobalization represents a strong economic structural change that can reshape the prevailing inflation trend, given that globalization has contributed to maintaining low inflation by reducing structural costs and intensifying corporate competition since the 1990s.

The low inflation regime can be understood in the context of the downward stabilization of trend inflation. Trend inflation in Korea and the US plunged in the 1990s, marked by hyper-globalization, and remained stable before the COVID pandemic. The analysis of the impact of economic structural variables on trend inflation suggests that the decline in trend inflation during the hyper-globalization period was triggered primarily by globalization. It indicates that the global low inflation environment, which has persisted since the 1990s, can be attributed to the advancement in globalization.

Apart from the debate about whether deglobalization is fully initiated, it should be noted that free trade and geopolitical stability—key conditions for the effects (efficiency) of globalization—have been significantly compromised. The retreat from globalization implies the potential end of the low inflation regime. Despite some side effects, the low inflation trend has provided various benefits to economic agents and financial markets. It is worth considering that any change in the inflation regime could pose significant challenges to the global economy and financial markets. Hence, proactive measures should be taken to prepare for potential difficulties arising from an inflationary shift.

The low inflation regime can be understood in the context of the downward stabilization of trend inflation. Trend inflation in Korea and the US plunged in the 1990s, marked by hyper-globalization, and remained stable before the COVID pandemic. The analysis of the impact of economic structural variables on trend inflation suggests that the decline in trend inflation during the hyper-globalization period was triggered primarily by globalization. It indicates that the global low inflation environment, which has persisted since the 1990s, can be attributed to the advancement in globalization.

Apart from the debate about whether deglobalization is fully initiated, it should be noted that free trade and geopolitical stability—key conditions for the effects (efficiency) of globalization—have been significantly compromised. The retreat from globalization implies the potential end of the low inflation regime. Despite some side effects, the low inflation trend has provided various benefits to economic agents and financial markets. It is worth considering that any change in the inflation regime could pose significant challenges to the global economy and financial markets. Hence, proactive measures should be taken to prepare for potential difficulties arising from an inflationary shift.

The surge in global inflation triggered by the COVID pandemic and the Russia-Ukraine war shows signs of stabilization. Although inflation in major economies still exceeds central bank targets substantially, the prevailing view suggests that the cumulative effects of monetary tightening would lead to a sustained slowdown in inflation. Despite short-term expectations for significant inflation alleviation, there are differing opinions and uncertainties regarding whether a return to the low inflation era is possible in the long term. The potential shift in inflation is attributed to noticeable changes in the global economic structure, which are presumed to be linked with the low inflation regime (Lagarde, 2023).1) Against this backdrop, this article delves into how the retreat from globalization, a key driver of economic structural changes, influences inflation trends, and presents relevant implications.2)

Understanding inflation: Trend inflation and cyclical inflation

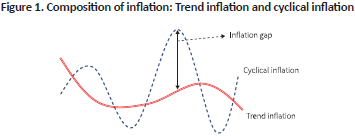

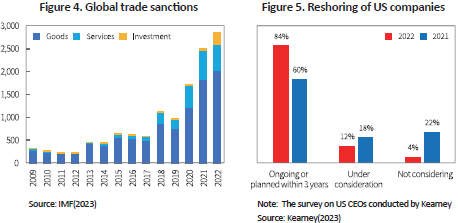

The inflation regime can be understood from the perspective of long-term inflation, specifically trend inflation. Trend inflation is often defined as the long-term trend of price increases, excluding cyclical (temporary) factors, which represents equilibrium inflation taking into account not only the overall demand of the economy but also the supply capacity. Based on this definition, actual inflation can be decomposed into the inflation gap (actual inflation – trend inflation) arising from trend inflation and cyclical factors, as illustrated in Figure 1. According to the Phillips curve theory, the inflation gap is determined by economic slack factors such as the GDP gap and unemployment rate gap.3) In addition, from the perspective of the Taylor rule, central banks control the inflation gap by raising or cutting the benchmark interest rate to induce economic slack to stay within an appropriate level.

Trend inflation and low-inflation regime in Korea and the US

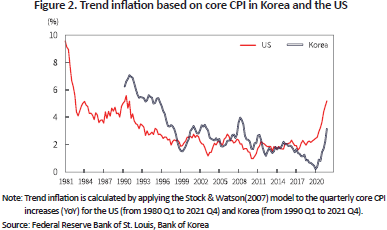

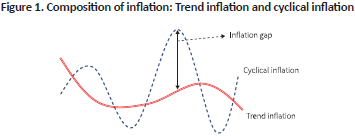

As trend inflation cannot be observed, it should be estimated through a model. Figure 2 shows trend inflation for Korea and the US, derived from the representative trend inflation model, the Stock & Watson (2007) model. The following are key features of trend inflation changes in the US after the 1980s. The US trend inflation plunged in the early to mid-1980s. Subsequently, it showed a gradual decline over a long period from the early 1990s to the early 2000s before reaching a stable level. After hovering around the Fed’s inflation target of approximately 2% before the pandemic, the US trend inflation shifted towards an upturn in the aftermath of the pandemic. What is interesting is that trend inflation in Korea shares similar features with that of the US, albeit with some differences. As illustrated in Figure 2, both Korea and the US have seen a downward stabilization in trend inflation since around the 1990s, contributing to a low interest rate environment.

The impact of globalization on the downward stabilization of trend inflation

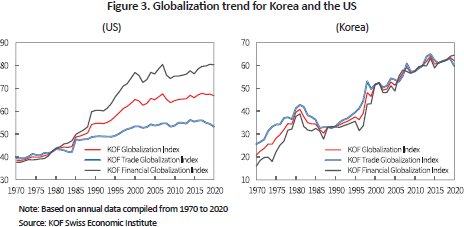

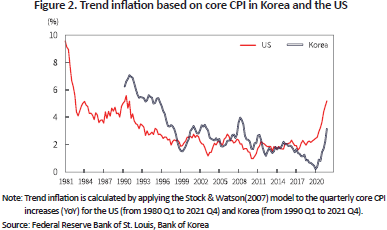

To gauge the potential termination of the low inflation regime, it is crucial to examine whether the progress of globalization has contributed to the downward stabilization of trend inflation, as shown in Figure 2. To this end, this article first analyzes changes in globalization in Korea and the US. Figure 3 exhibits the KOF Globalization Index released by KOF Swiss Economic Institute. The KOF Globalization Index is a comprehensive measure of globalization, taking into account quantitative indicators related to trade statistics and global value chains (GVC), as well as institutional aspects such as trade regulations and trade agreements. In Figure 3, the KOF Globalization Index consists of two sub-dimensions: trade globalization and financial globalization indices.

In Figure 3, it is evident that both Korea and the US experienced significant advancements in globalization around 1990. Existing literature on globalization trends also points out that while globalization showed signs of progress from the 1970s, hyper-globalization fully came into play in the 1990s (Attinasi & Balati, 2021). In the US, globalization slowed down (slowbalization) after the global financial crisis. In contrast, Korea has continued to make progress in globalization even after the global financial crisis. In terms of the KOF Globalization Index, it is noteworthy that Korea entered a phase of stagnation in globalization around 2013.

There is a growing controversy over whether the potential retreat from globalization signals a shift in the low inflation regime. While some argue that the retreat from globalization will mark the end of the low inflation era (December 5, 2021, The Wall Street Journal), others contend that such concerns are exaggerated (May 26, 2022, The Financial Times). Those expecting the end of low inflation suggest that the current inflation may stabilize thanks to the monetary tightening of central banks, but in the long term, the world is unlikely to return to the low inflation trend observed in the past. On the other hand, the latter viewpoint indicates that if central banks successfully manage prices, the fundamental inflation regime will remain largely unchanged. Academic opinions are also divided over the relationship between globalization and inflation. Some studies suggest that globalization has played a role in fostering a low inflation environment by reducing structural costs and intensifying competition among companies.4) Others point out that as inflation is a monetary phenomenon, globalization may exert a temporary influence on inflation, while medium to long-term inflation is ultimately determined (controlled) by monetary policy.

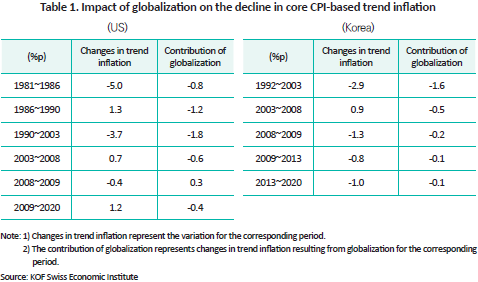

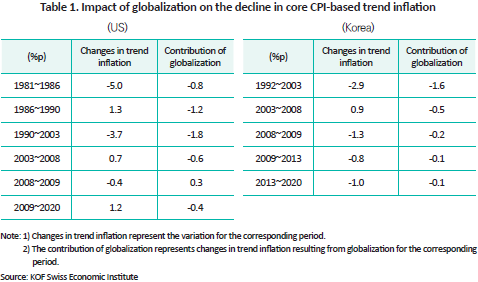

Table 1 presents the historical decomposition of trend inflation derived from the analysis of factors influencing core CPI-based trend inflation in Korea and the US, as illustrated in Figure 2,5) particularly focusing on the variation of trend inflation resulting from globalization (contribution of globalization). The following insights can be drawn from Table 1. First, both Korea and the US have experienced the impact of globalization as a fundamental contributor to low inflation (a factor behind declining trend inflation), except for during the period of global financial crisis in the case of the US. In particular, even during periods when trend inflation increased, globalization placed a persistent downward pressure on inflation. However, after globalization entered a phase of stagnation (2008 to 2009 for the US; around 2013 for Korea), the impact of globalization on the downward stabilization of trend inflation was curtailed substantially. Second, as observed in Figure 2, trend inflation in both countries took a nosedive during the era of hyper-globalization around the 1990s and then remained flat before the outbreak of the pandemic. The sharp decline in trend inflation during the hyper-globalization era is estimated to have primarily stemmed from globalization. Table 2 shows that in the hyper-globalization period (1990 to 2003 for the US; 1992 to 2003 for Korea), trend inflation in both countries fell by 3.7 percentage points (US) and 2.9 percentage points (Korea), respectively, among which the decrease of 1.8 percentage points (US) and 1.6 percentage points (Korea) can be attributed to globalization. These findings imply that globalization in retreat may drive up trend inflation down the road.6)

Assessment of recent globalization trends

Diverse perspectives have emerged regarding the possibility that factors such as the US-China trade dispute, the COVID pandemic and the Russia-Ukraine war would prompt a substantial decline in globalization. Despite considerable uncertainty about further developments in globalization, the benefits of globalization are likely to significantly diminish compared to the past in terms of its impact on inflation, for the following reasons. As discussed in this article, globalization has contributed to the low inflation regime by enhancing cost efficiency and facilitating competition. With advancements in globalization, however, the entire production process becomes fragmented based on cost efficiency, as witnessed in global value chains and thus, greater efficiency induced by globalization entails a decrease in stability and resilience. Accordingly, the absence of stability and resilience can lead to limitations in pursuing efficiency. For these reasons, the hyper-globalization period since the 1990s has been underpinned by not only technological innovation enabling global value chains but also institutional support from the introduction of the free trade system (World Bank, 2020).

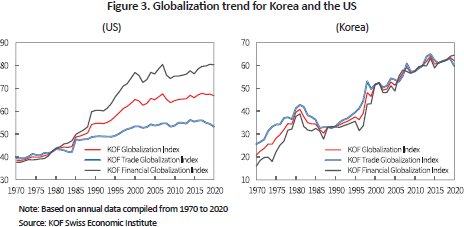

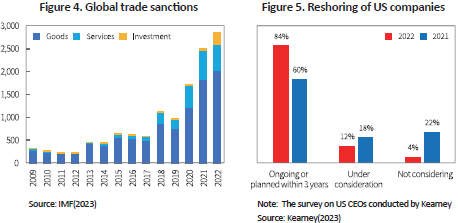

However, factors such as escalating geopolitical risks from the US-China trade dispute and the Russia-Ukraine war are likely to threaten institutional stability, a critical prerequisite for globalization effects (Goldberg & Reed, 2023). As demonstrated in Figure 4, the number of global trade sanctions has soared since 2018. Consequently, the global supply chain, which has played a pivotal role in economic globalization, is undergoing a restructuring shift from (efficiency-oriented) outsourcing and offshoring to (stability and resilience-oriented) reshoring and friend-shoring. In the US, reshoring has gained momentum in 2022, causing the share of imports from China to slide to the early 2000s levels.

A potential shift in inflation regime and its implications

The global low inflation regime, which has persisted since the 1990s, can be largely attributed to the progress in globalization. It is notable that despite differing opinions over whether deglobalization has been set in motion, free trade and geopolitical stability, key requirements for globalization effects (globalization efficiency), have been greatly compromised. Even from a conservative viewpoint, globalization is likely to suffer a serious setback. As indicated in this article, the retreat from globalization may signal the potential end of the previous low inflation regime. These findings suggest that while the steep post-pandemic inflation trend may subside in the short term, driven by central banks’ monetary tightening, returning to the previous low inflation regime may be challenging from a long-term perspective. The sustained low inflation trend that dates back to the 1980s has brought about certain side effects but has provided various benefits to economic agents and financial markets. It is worth considering that any change in the inflation regime could pose significant challenges to the global economy and financial markets. Hence, proactive measures should be taken to prepare for potential difficulties arising from an inflationary shift.

1) Lagarde, C., 2023, Policymaking in an age of shifts and breaks, ECB.

2) Economic structural variables that may lead to a shift in the inflation regime include globalization as well as a demographic shift and climate change.

3) When inflation is divided into trend inflation and cyclical inflation, the traditional Phillips curve can be expressed as (Inflation) = (Trend inflation) + (Idle production capacity) x (Sensitivity of inflation to idle production capacity).

4) Fierce competition among companies arising from globalization can transform corporate behavior of determining prices and wages, leading to a decline in trend inflation (Guerrieri et al., 2010). Domestic companies that face competition from their global counterparts are incentivized to reduce their desired markup to maintain market shares. According to the New Keynesian Phillips curve theory, as the markup decreases, corporate pricing power is curtailed and thus, the degree of price transmission of marginal costs falls, resulting in lower inflation. Additionally, intensified competition among companies can cause less efficient companies to exit. Consequently, globalization can serve as a structural factor influencing the decline in inflation through improvements in productivity (reduction in marginal costs).

5) The determinants of trend inflation are analyzed by using each country’s trend inflation shown in Figure 2 as the dependent variable and selecting expected inflation (the US), GDP gap, the KOF Globalization Index, demographic structure (elderly dependency ratio), and raw material prices as independent variables. The Autoregressive Distributed Lag (ARDL) Model is applied for this analysis. With estimation results from the ARDL analysis, the contribution of each factor to changes in trend inflation can be calculated over different periods. Table 1 exhibits only the contribution of globalization to trend inflation among other factors derived from the historical decomposition.

6) Although not explicitly shown in Table 2, population aging (a decrease in the working-age population and an increased ratio of the elderly population) has been found to significantly affect trend inflation in Korea and the US. In the US, population aging began to act as a contributor to the increase in trend inflation around 2008-2009. As for Korea, aging was considered a factor contributing to the decline in trend inflation until 2020; however, it is projected to transition to a contributor to the rise in trend inflation around 2025 (Kang, H.J., Baek, I.S. and Jang, G.H., 2023).

References

Attinasi, M.G., Balatti, M., 2021, Globalisation and its implications for inflation in advanced economies, ECB Economic Bulletin, Issue 4.

Financial Times (FT), 2022. 5. 26, The death of globalisation has been greatly exaggerated.

Goldberg, P.K., Reed, T., 2023, Is the global economy deglobalizing? And if so, why? and what is next?, NBER Working Paper No. 31115.

Guerrieri, L., Gust, C., Lopez-Salido, J.D., 2010, International competition and inflation: A New Keynesian Perspective, American Economic Journal: Macroeconomics 2(4), 247-280.

IMF, 2023, Globalization’s peak: Trade plateaus and restrictions rise, marking a new era for globalization, IMF Finance & Development 60(2).

Kearney, 2023, America is ready for reshoring. Are you?, KEARENY.

Stock, J.H. and Watson, M.W., 2007, Why has U.S. inflation become harder to forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Wall Street Journal (WSJ), 2021. 12. 5, Retreat from globalization adds to inflation risk.

World Bank, 2020, World Development Report 2020: Trading for development in the age of global value chains. Washington, DC: World Bank.

[Korean]

Kang, H.J., Baek, I.S. and Jang, G.H., 2023, Assessing the possibility of structural changes in interest rate trends, KCMI inaugural seminar presentation material.

Understanding inflation: Trend inflation and cyclical inflation

The inflation regime can be understood from the perspective of long-term inflation, specifically trend inflation. Trend inflation is often defined as the long-term trend of price increases, excluding cyclical (temporary) factors, which represents equilibrium inflation taking into account not only the overall demand of the economy but also the supply capacity. Based on this definition, actual inflation can be decomposed into the inflation gap (actual inflation – trend inflation) arising from trend inflation and cyclical factors, as illustrated in Figure 1. According to the Phillips curve theory, the inflation gap is determined by economic slack factors such as the GDP gap and unemployment rate gap.3) In addition, from the perspective of the Taylor rule, central banks control the inflation gap by raising or cutting the benchmark interest rate to induce economic slack to stay within an appropriate level.

Trend inflation and low-inflation regime in Korea and the US

As trend inflation cannot be observed, it should be estimated through a model. Figure 2 shows trend inflation for Korea and the US, derived from the representative trend inflation model, the Stock & Watson (2007) model. The following are key features of trend inflation changes in the US after the 1980s. The US trend inflation plunged in the early to mid-1980s. Subsequently, it showed a gradual decline over a long period from the early 1990s to the early 2000s before reaching a stable level. After hovering around the Fed’s inflation target of approximately 2% before the pandemic, the US trend inflation shifted towards an upturn in the aftermath of the pandemic. What is interesting is that trend inflation in Korea shares similar features with that of the US, albeit with some differences. As illustrated in Figure 2, both Korea and the US have seen a downward stabilization in trend inflation since around the 1990s, contributing to a low interest rate environment.

The impact of globalization on the downward stabilization of trend inflation

To gauge the potential termination of the low inflation regime, it is crucial to examine whether the progress of globalization has contributed to the downward stabilization of trend inflation, as shown in Figure 2. To this end, this article first analyzes changes in globalization in Korea and the US. Figure 3 exhibits the KOF Globalization Index released by KOF Swiss Economic Institute. The KOF Globalization Index is a comprehensive measure of globalization, taking into account quantitative indicators related to trade statistics and global value chains (GVC), as well as institutional aspects such as trade regulations and trade agreements. In Figure 3, the KOF Globalization Index consists of two sub-dimensions: trade globalization and financial globalization indices.

In Figure 3, it is evident that both Korea and the US experienced significant advancements in globalization around 1990. Existing literature on globalization trends also points out that while globalization showed signs of progress from the 1970s, hyper-globalization fully came into play in the 1990s (Attinasi & Balati, 2021). In the US, globalization slowed down (slowbalization) after the global financial crisis. In contrast, Korea has continued to make progress in globalization even after the global financial crisis. In terms of the KOF Globalization Index, it is noteworthy that Korea entered a phase of stagnation in globalization around 2013.

There is a growing controversy over whether the potential retreat from globalization signals a shift in the low inflation regime. While some argue that the retreat from globalization will mark the end of the low inflation era (December 5, 2021, The Wall Street Journal), others contend that such concerns are exaggerated (May 26, 2022, The Financial Times). Those expecting the end of low inflation suggest that the current inflation may stabilize thanks to the monetary tightening of central banks, but in the long term, the world is unlikely to return to the low inflation trend observed in the past. On the other hand, the latter viewpoint indicates that if central banks successfully manage prices, the fundamental inflation regime will remain largely unchanged. Academic opinions are also divided over the relationship between globalization and inflation. Some studies suggest that globalization has played a role in fostering a low inflation environment by reducing structural costs and intensifying competition among companies.4) Others point out that as inflation is a monetary phenomenon, globalization may exert a temporary influence on inflation, while medium to long-term inflation is ultimately determined (controlled) by monetary policy.

Table 1 presents the historical decomposition of trend inflation derived from the analysis of factors influencing core CPI-based trend inflation in Korea and the US, as illustrated in Figure 2,5) particularly focusing on the variation of trend inflation resulting from globalization (contribution of globalization). The following insights can be drawn from Table 1. First, both Korea and the US have experienced the impact of globalization as a fundamental contributor to low inflation (a factor behind declining trend inflation), except for during the period of global financial crisis in the case of the US. In particular, even during periods when trend inflation increased, globalization placed a persistent downward pressure on inflation. However, after globalization entered a phase of stagnation (2008 to 2009 for the US; around 2013 for Korea), the impact of globalization on the downward stabilization of trend inflation was curtailed substantially. Second, as observed in Figure 2, trend inflation in both countries took a nosedive during the era of hyper-globalization around the 1990s and then remained flat before the outbreak of the pandemic. The sharp decline in trend inflation during the hyper-globalization era is estimated to have primarily stemmed from globalization. Table 2 shows that in the hyper-globalization period (1990 to 2003 for the US; 1992 to 2003 for Korea), trend inflation in both countries fell by 3.7 percentage points (US) and 2.9 percentage points (Korea), respectively, among which the decrease of 1.8 percentage points (US) and 1.6 percentage points (Korea) can be attributed to globalization. These findings imply that globalization in retreat may drive up trend inflation down the road.6)

Assessment of recent globalization trends

Diverse perspectives have emerged regarding the possibility that factors such as the US-China trade dispute, the COVID pandemic and the Russia-Ukraine war would prompt a substantial decline in globalization. Despite considerable uncertainty about further developments in globalization, the benefits of globalization are likely to significantly diminish compared to the past in terms of its impact on inflation, for the following reasons. As discussed in this article, globalization has contributed to the low inflation regime by enhancing cost efficiency and facilitating competition. With advancements in globalization, however, the entire production process becomes fragmented based on cost efficiency, as witnessed in global value chains and thus, greater efficiency induced by globalization entails a decrease in stability and resilience. Accordingly, the absence of stability and resilience can lead to limitations in pursuing efficiency. For these reasons, the hyper-globalization period since the 1990s has been underpinned by not only technological innovation enabling global value chains but also institutional support from the introduction of the free trade system (World Bank, 2020).

However, factors such as escalating geopolitical risks from the US-China trade dispute and the Russia-Ukraine war are likely to threaten institutional stability, a critical prerequisite for globalization effects (Goldberg & Reed, 2023). As demonstrated in Figure 4, the number of global trade sanctions has soared since 2018. Consequently, the global supply chain, which has played a pivotal role in economic globalization, is undergoing a restructuring shift from (efficiency-oriented) outsourcing and offshoring to (stability and resilience-oriented) reshoring and friend-shoring. In the US, reshoring has gained momentum in 2022, causing the share of imports from China to slide to the early 2000s levels.

A potential shift in inflation regime and its implications

The global low inflation regime, which has persisted since the 1990s, can be largely attributed to the progress in globalization. It is notable that despite differing opinions over whether deglobalization has been set in motion, free trade and geopolitical stability, key requirements for globalization effects (globalization efficiency), have been greatly compromised. Even from a conservative viewpoint, globalization is likely to suffer a serious setback. As indicated in this article, the retreat from globalization may signal the potential end of the previous low inflation regime. These findings suggest that while the steep post-pandemic inflation trend may subside in the short term, driven by central banks’ monetary tightening, returning to the previous low inflation regime may be challenging from a long-term perspective. The sustained low inflation trend that dates back to the 1980s has brought about certain side effects but has provided various benefits to economic agents and financial markets. It is worth considering that any change in the inflation regime could pose significant challenges to the global economy and financial markets. Hence, proactive measures should be taken to prepare for potential difficulties arising from an inflationary shift.

1) Lagarde, C., 2023, Policymaking in an age of shifts and breaks, ECB.

2) Economic structural variables that may lead to a shift in the inflation regime include globalization as well as a demographic shift and climate change.

3) When inflation is divided into trend inflation and cyclical inflation, the traditional Phillips curve can be expressed as (Inflation) = (Trend inflation) + (Idle production capacity) x (Sensitivity of inflation to idle production capacity).

4) Fierce competition among companies arising from globalization can transform corporate behavior of determining prices and wages, leading to a decline in trend inflation (Guerrieri et al., 2010). Domestic companies that face competition from their global counterparts are incentivized to reduce their desired markup to maintain market shares. According to the New Keynesian Phillips curve theory, as the markup decreases, corporate pricing power is curtailed and thus, the degree of price transmission of marginal costs falls, resulting in lower inflation. Additionally, intensified competition among companies can cause less efficient companies to exit. Consequently, globalization can serve as a structural factor influencing the decline in inflation through improvements in productivity (reduction in marginal costs).

5) The determinants of trend inflation are analyzed by using each country’s trend inflation shown in Figure 2 as the dependent variable and selecting expected inflation (the US), GDP gap, the KOF Globalization Index, demographic structure (elderly dependency ratio), and raw material prices as independent variables. The Autoregressive Distributed Lag (ARDL) Model is applied for this analysis. With estimation results from the ARDL analysis, the contribution of each factor to changes in trend inflation can be calculated over different periods. Table 1 exhibits only the contribution of globalization to trend inflation among other factors derived from the historical decomposition.

6) Although not explicitly shown in Table 2, population aging (a decrease in the working-age population and an increased ratio of the elderly population) has been found to significantly affect trend inflation in Korea and the US. In the US, population aging began to act as a contributor to the increase in trend inflation around 2008-2009. As for Korea, aging was considered a factor contributing to the decline in trend inflation until 2020; however, it is projected to transition to a contributor to the rise in trend inflation around 2025 (Kang, H.J., Baek, I.S. and Jang, G.H., 2023).

References

Attinasi, M.G., Balatti, M., 2021, Globalisation and its implications for inflation in advanced economies, ECB Economic Bulletin, Issue 4.

Financial Times (FT), 2022. 5. 26, The death of globalisation has been greatly exaggerated.

Goldberg, P.K., Reed, T., 2023, Is the global economy deglobalizing? And if so, why? and what is next?, NBER Working Paper No. 31115.

Guerrieri, L., Gust, C., Lopez-Salido, J.D., 2010, International competition and inflation: A New Keynesian Perspective, American Economic Journal: Macroeconomics 2(4), 247-280.

IMF, 2023, Globalization’s peak: Trade plateaus and restrictions rise, marking a new era for globalization, IMF Finance & Development 60(2).

Kearney, 2023, America is ready for reshoring. Are you?, KEARENY.

Stock, J.H. and Watson, M.W., 2007, Why has U.S. inflation become harder to forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Wall Street Journal (WSJ), 2021. 12. 5, Retreat from globalization adds to inflation risk.

World Bank, 2020, World Development Report 2020: Trading for development in the age of global value chains. Washington, DC: World Bank.

[Korean]

Kang, H.J., Baek, I.S. and Jang, G.H., 2023, Assessing the possibility of structural changes in interest rate trends, KCMI inaugural seminar presentation material.