Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Challenges and Improvements of Publicly Offered Real Estate Funds in Korea: Insights from the German Model

Publication date Dec. 03, 2024

Summary

Korea’s market for publicly offered real estate funds (REFs) is experiencing a severe downturn, driven by the combined shocks of the Covid-19 pandemic and interest rate hikes. The market faces significant challenges, including the investment structure highly concentrated in a limited number of properties, small fund sizes, difficulties in building management expertise, and liquidity shortages. These structural limitations undermine the sustainable performance of publicly offered REFs, serving as an obstacle to creating stable investment opportunities for retail investors. In contrast, Germany’s open-ended REFs have consistently delivered stable returns to retail investors by diversifying across a wide range of assets, capitalizing on their extensive portfolio management experience. The German model offers valuable insights for addressing the structural challenges facing Korea’s publicly offered REFs.

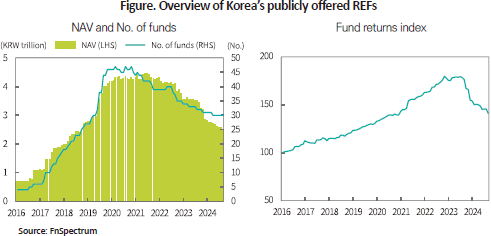

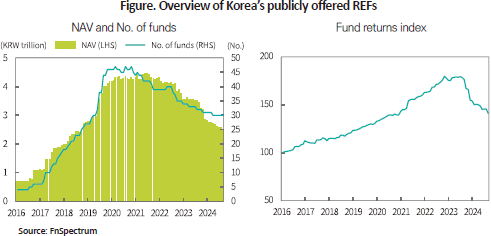

The market for publicly offered real estate funds (REFs) in Korea has faced significant challenges in the wake of the Covid-19 pandemic and interest rate hikes. Publicly offered REFs, which witnessed robust growth following regulatory relaxations in 2016,1) have gained popularity as medium-risk, medium-return investment products during a period of low interest rates. As of the end of 2015, the market’s net asset value (NAV) stood at KRW 0.7 trillion, growing nearly sixfold to KRW 4.2 trillion by the end of 2019. Over the same period, the number of these funds increased more than tenfold from four to 46.2) However, amid the Covid-19 pandemic, the widespread shift to remote work led to higher vacancy rates in commercial real estate, while interest rate hikes hindered the rollover of existing loans. As a result, the publicly offered REF market has undergone a significant downturn. As of the end of August 2024, the number of funds declined by 35% to 30, and total NAV fell by 40% to KRW 2.5 trillion compared to the end of 2019. Notably, although half of the remaining funds have already matured or are due to mature within the next year, no new funds have been launched since May 2022. If this trend continues, it could lead to the market’s demise.

In terms of performance, publicly offered REFs generated high returns in the low interest rate environment but have recently suffered significant declines in value. A net asset-weighted return index, set at 100 as of the end of 2015, climbed steadily to 180 by October 2022, reflecting an annualized return of 9% during this period.3) However, the index subsequently fell to 141 as of August 2024, leading to a plunge in the annualized return since 2015 to just 4%. Given that the valuation of REFs tends to lag broader market conditions, this downward trend in returns is expected to persist unless market sentiment improves. The recent performance has failed to meet investors’ expectations for medium-risk, medium-return outcomes from publicly offered REFs.

It is also noting that a growing number of funds have struggled to liquidate their real estate holdings and meet redemption requests upon maturity due to unfavorable market conditions. These funds typically maintain loan-to-value (LTV) ratios of around 60%, but falling collateral values and rising market interest rates have made loan rollovers more challenging. Furthermore, concerns have emerged about potential disadvantages faced by investors who consent to maturity extensions, compared to those who do not.4)

Identifying key challenges in publicly offered REFs

The key issues regarding publicly offered REFs can be summarized as follows. First, publicly offered REFs predominantly invest in a single property or a limited number of properties, which restricts their capability to reflect the broader real estate market’s performance and exposes investors to heightened asset-specific risks. REFs typically play an important role as alternative investment vehicles for diversifying traditional portfolios concentrated in stocks and bonds. However, their limited property holdings undermine the potential to achieve diversification benefits and make them more susceptible to unexpected events such as tenant lease non-renewals or difficulties in loan rollovers. Institutional investors can mitigate these risks by concurrently investing in multiple REFs, while retail investors lack such options. Consequently, retail investors in publicly offered REFs may be exposed to increased performance volatility, rather than reduced portfolio risk.

Second, the relatively small size of individual funds and the irregular supply of products constrain investment opportunities. As of the end of August 2024, the average NAV per REF merely amounted to KRW 80 billion. Even based on the total assets under management, 90% of funds launched since 2016 manage total assets below KRW 150 billion, and none of them exceed KRW 300 billion. In addition, the supply of products fluctuates depending on market conditions. For instance, during market downturns, no new funds are launched, leaving investors without investment options. Although more fund products are introduced in a favorable market environment, they are often relatively small in size and sell out quickly, restricting investors from allocating the desired amount of capital.5) The lack of flexibility in terms of investment timing and scale imposes significant limitations on investing in publicly offered REFs.

Third, ensuring consistent performance poses a significant challenge. Under the current closed-ended fund structure, it is almost impossible for fund managers to develop operational expertise, such as selecting high-quality assets and timely making buy-and-sell decisions. These funds are typically structured as one-off investment vehicles to hold specific properties until maturity, limiting fund managers’ role to managing already-acquired properties. The revenue model, which ties sales charges to the duration of the fund’s operation, incentivizes most fund managers to sell properties mechanically upon maturity. Asset management companies are strongly motivated to launch new funds to increase their assets under management (AUM), rather than focusing on the effective management of existing funds to generate excess returns. This has resulted in the proliferation of one-off investment products rather than fostering flagship funds with strong, sustainable long-term performance. Furthermore, many funds often borrow up to 60% of the real estate value to boost expected returns. This strategy exposes these funds to significant leverage risks—which can multiply losses driven by declining asset prices—and interest rate fluctuations upon loan rollovers, further undermining performance sustainability.

Finally, the mechanism designed to address liquidity issues is largely ineffective. Publicly offered REFs generally have a maturity of five years or more, during which redemptions are prohibited. Although these funds are often listed on exchanges to provide investors with liquidity, most funds are rarely traded, defeating the intended purpose of the mechanism. In principle, funds are expected to return investors’ capital at maturity. However, their limited property holdings prevent them from returning investment money due to liquidity shortages, particularly when suitable buyers cannot be secured promptly. Furthermore, if asset management companies seek to extend maturities under these conditions, equitable treatment issues may arise between investors who support the extension and those who oppose it. If opposing investors exercise their repurchase rights, forcing the fund to liquidate its most liquid assets, the remaining investors may be left with illiquid assets and face higher transaction costs.

Case study: Open-ended real estate funds in Germany

It is worth considering Germany’s open-ended REF structure.6) Germany exemplifies one of the most advanced markets for open-ended REFs. As of the end of 2023, the German open-ended REF market was valued at EUR 131 billion (KRW 188 trillion), around 60 times larger than Korea’s publicly offered REF market. Germany has a total of 52 open-ended REFs, with the average NAV of KRW 3.6 trillion per fund. For instance, Deka’s ImmobilienEuropa held net assets of EUR 18.4 billion (around KRW 26 trillion) as of the end of 2023. This fund manages a diversified portfolio of 140 properties with a total valuation of EUR 18.3 billion, spanning a mix of commercial real estate categories, including offices (68%), retail (11%), logistics facilities (8%), and hotels (5%). Its holdings are also diversified geographically across 16 countries, with properties located in Germany (34%), France (18%), the UK (16%), and the Netherlands (8%). Deka ImmobilienEuropa not only fully tracks real estate market performance but also diversifies individual risks, enabling retail investors to achieve portfolio diversification with this fund alone. In addition, as an open-ended REF, it allows investors to join the fund at any time, ensuring greater accessibility. In essence, Germany’s open-ended REFs empower retail investors to easily construct well-diversified portfolios.

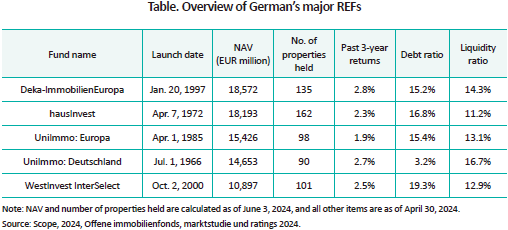

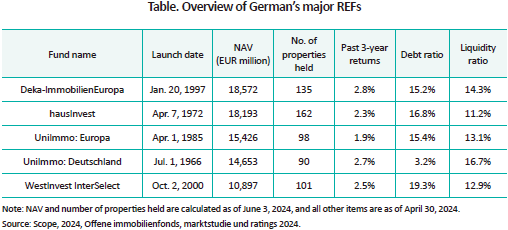

As of June 3, 2024, Germany had five REFs with assets exceeding EUR 10 billion, including Deka ImmobilienEuropa. The table below outlines the key characteristics of these funds. All five funds have built substantial management capabilities through years of operation and have achieved diversification by investing in approximately 100 properties. They operate with a low debt-to-net assets ratio of less than 20%, while maintaining liquidity levels of around 15% to meet redemption requests. Despite the Covid-19 pandemic crisis, these funds have consistently delivered stable returns without incurring losses over one-, three-, five-, and ten-year periods.7) This resilience can be attributed to a combination of experienced fund management, diversified portfolios, and low leverage ratios.

Germany’s REF system is distinguished by several notable features. One of its core strengths lies in the emphasis on the open-ended fund structure, which is more conducive to diversification across multiple properties compared to the closed-ended structure. However, given that these funds predominantly invest in illiquid assets, effective liquidity management tools are crucial to mitigate liquidity risk. To address this, Germany has implemented various liquidity management measures for open-ended REFs. Notably, investors are required to hold their investments for a minimum of two years, during which redemptions are prohibited. Even after this mandatory holding period, redeemed proceeds are paid out one year after the redemption request date, with no option to cancel the redemption once the request is made. These measures prevent frequent redemptions and fund runs, providing fund managers with sufficient time to predict cash flows and ensure liquidity over a one-year horizon.

Despite these safeguards, prolonged market downturns may result in a surge in redemption requests, complicating the liquidation of properties. To address such challenges, the German Investment Code (Kapitalanlagegesetzbuch, KAGB) outlines the following procedures. First, in the event of liquidity shortages, the asset management company is required to suspend redemptions and sell assets on reasonable terms. Second, if liquidity remains insufficient 12 months after the suspension, assets may be sold at a discount of up to 10% below market value, with redemptions still suspended. Third, if liquidity shortages persist for 24 months, the permissible discount increases to up to 20%. Fourth, after 36 months of insufficient liquidity, the asset management company’s authority is revoked and the fund is liquidated. These procedures are highly effective in addressing liquidity shortages over a three-year horizon, minimizing disruptions to fund operations during periods of distress. Moreover, the KAGB specifies safeguards to prevent the abuse of redemption suspensions, mandating a fund’s liquidation if redemptions are suspended more than three times within a five-year period (KAGB Sections 98 and 257). In addition, the KAGB enforces several regulatory provisions for open-ended REFs, including a diversification requirement that limits investments in a single property to 15% of total assets (Section 243); a liquidity requirement mandating that at least 5% of a fund’s assets be held in cash equivalents (Section 253); and a leverage requirement restricting borrowings to 30% of the fund’s property holdings (Section 254).

Conclusion

The first step in resolving the challenges faced by publicly offered REFs in Korea is to examine whether the existing fund structure is suitable for retail investors. Germany and other major European countries such as the UK and France have long developed open-ended REF frameworks that have undergone continuous improvements through multiple crises, including the 2008 global financial crisis, Brexit in 2016, and the Covid-19 pandemic in 2020. This experience can provide valuable guidance for Korea to design a REF framework tailored to the features of publicly offered funds.

However, even with a reasonable regulatory framework in place, substantial efforts from the industry are required to foster the development of the publicly offered REF market. In particular, building diversified real estate portfolios within funds necessitates active support from asset management companies and related stakeholders from the outset. Given the relatively smaller size of Korea’s asset management companies compared to their German counterparts, providing such support could be burdensome. As an alternative, it is worth considering utilizing the already established private RFEs. This approach could involve investing in private REFs through a fund-of-funds (FOF) structure or acquiring properties from maturing private funds to build diversified portfolios.

If Korea adopts an open-ended REF framework similar to Germany’s, it is crucial to clearly define the relationship with other funds, including structurally similar closed-ended publicly offered FOFs as well as real estate investment trusts (REITs), which are not classified as REFs under the Financial Investment Services and Capital Markets Act but share economic characteristics with REFs.

1) Refer to the press releases titled “Measures to innovate fund products to support the growth of national wealth” and “Legislative proposals on the Financial Investment Services and Capital Markets Act” published in May and September 2016.

2) In this article, the term “publicly offered real estate fund” refers to a fund that directly invests in real estate or makes indirect investments through privately-placed real estate funds or publicly offered real estate derivative funds. REITs or real estate funds that invest in listed securities differ widely in nature, which are thus, excluded from the analysis.

3) This figure reflects the value incorporating all distributions of publicly offered REFs.

4) Newsis, May 10, 2024, Investors in loss-making overseas real estate funds are struggling over maturity extension.

5) Dailian, June 27, 2017, Why are publicly offered real estate funds selling out quickly?, Dong-A Ilbo, March 12, 2019, KRW 750 billion in ten minutes… Publicly offered real estate funds sell out immediately”.

6) Germany’s open-ended REFs serves the same purpose of Korea’s publicly offered REF framework, in that they are easily accessible to retail investors.

7) The table in the main text only indicates the past three-year returns, but the original source from Scope (2024) includes returns for one, three, five, and ten years.

8) The development of Germany’s open-ended REF market can be attributed to the networks and financial backing of affiliated banks as well as the support from asset management companies, for which the universal bank structure of Germany’s financial services industry has played a pivotal role. For more detailed information, refer to the following book.

Sebastian, S., Strohsal, T., Woltering, R., 2017, German open-ended real estate funds, In Just, T., Maenning, W., (Eds.), Understanding German Real Estate Markets, 279–293, Springer International Publishing.

In terms of performance, publicly offered REFs generated high returns in the low interest rate environment but have recently suffered significant declines in value. A net asset-weighted return index, set at 100 as of the end of 2015, climbed steadily to 180 by October 2022, reflecting an annualized return of 9% during this period.3) However, the index subsequently fell to 141 as of August 2024, leading to a plunge in the annualized return since 2015 to just 4%. Given that the valuation of REFs tends to lag broader market conditions, this downward trend in returns is expected to persist unless market sentiment improves. The recent performance has failed to meet investors’ expectations for medium-risk, medium-return outcomes from publicly offered REFs.

It is also noting that a growing number of funds have struggled to liquidate their real estate holdings and meet redemption requests upon maturity due to unfavorable market conditions. These funds typically maintain loan-to-value (LTV) ratios of around 60%, but falling collateral values and rising market interest rates have made loan rollovers more challenging. Furthermore, concerns have emerged about potential disadvantages faced by investors who consent to maturity extensions, compared to those who do not.4)

Identifying key challenges in publicly offered REFs

The key issues regarding publicly offered REFs can be summarized as follows. First, publicly offered REFs predominantly invest in a single property or a limited number of properties, which restricts their capability to reflect the broader real estate market’s performance and exposes investors to heightened asset-specific risks. REFs typically play an important role as alternative investment vehicles for diversifying traditional portfolios concentrated in stocks and bonds. However, their limited property holdings undermine the potential to achieve diversification benefits and make them more susceptible to unexpected events such as tenant lease non-renewals or difficulties in loan rollovers. Institutional investors can mitigate these risks by concurrently investing in multiple REFs, while retail investors lack such options. Consequently, retail investors in publicly offered REFs may be exposed to increased performance volatility, rather than reduced portfolio risk.

Second, the relatively small size of individual funds and the irregular supply of products constrain investment opportunities. As of the end of August 2024, the average NAV per REF merely amounted to KRW 80 billion. Even based on the total assets under management, 90% of funds launched since 2016 manage total assets below KRW 150 billion, and none of them exceed KRW 300 billion. In addition, the supply of products fluctuates depending on market conditions. For instance, during market downturns, no new funds are launched, leaving investors without investment options. Although more fund products are introduced in a favorable market environment, they are often relatively small in size and sell out quickly, restricting investors from allocating the desired amount of capital.5) The lack of flexibility in terms of investment timing and scale imposes significant limitations on investing in publicly offered REFs.

Third, ensuring consistent performance poses a significant challenge. Under the current closed-ended fund structure, it is almost impossible for fund managers to develop operational expertise, such as selecting high-quality assets and timely making buy-and-sell decisions. These funds are typically structured as one-off investment vehicles to hold specific properties until maturity, limiting fund managers’ role to managing already-acquired properties. The revenue model, which ties sales charges to the duration of the fund’s operation, incentivizes most fund managers to sell properties mechanically upon maturity. Asset management companies are strongly motivated to launch new funds to increase their assets under management (AUM), rather than focusing on the effective management of existing funds to generate excess returns. This has resulted in the proliferation of one-off investment products rather than fostering flagship funds with strong, sustainable long-term performance. Furthermore, many funds often borrow up to 60% of the real estate value to boost expected returns. This strategy exposes these funds to significant leverage risks—which can multiply losses driven by declining asset prices—and interest rate fluctuations upon loan rollovers, further undermining performance sustainability.

Finally, the mechanism designed to address liquidity issues is largely ineffective. Publicly offered REFs generally have a maturity of five years or more, during which redemptions are prohibited. Although these funds are often listed on exchanges to provide investors with liquidity, most funds are rarely traded, defeating the intended purpose of the mechanism. In principle, funds are expected to return investors’ capital at maturity. However, their limited property holdings prevent them from returning investment money due to liquidity shortages, particularly when suitable buyers cannot be secured promptly. Furthermore, if asset management companies seek to extend maturities under these conditions, equitable treatment issues may arise between investors who support the extension and those who oppose it. If opposing investors exercise their repurchase rights, forcing the fund to liquidate its most liquid assets, the remaining investors may be left with illiquid assets and face higher transaction costs.

Case study: Open-ended real estate funds in Germany

It is worth considering Germany’s open-ended REF structure.6) Germany exemplifies one of the most advanced markets for open-ended REFs. As of the end of 2023, the German open-ended REF market was valued at EUR 131 billion (KRW 188 trillion), around 60 times larger than Korea’s publicly offered REF market. Germany has a total of 52 open-ended REFs, with the average NAV of KRW 3.6 trillion per fund. For instance, Deka’s ImmobilienEuropa held net assets of EUR 18.4 billion (around KRW 26 trillion) as of the end of 2023. This fund manages a diversified portfolio of 140 properties with a total valuation of EUR 18.3 billion, spanning a mix of commercial real estate categories, including offices (68%), retail (11%), logistics facilities (8%), and hotels (5%). Its holdings are also diversified geographically across 16 countries, with properties located in Germany (34%), France (18%), the UK (16%), and the Netherlands (8%). Deka ImmobilienEuropa not only fully tracks real estate market performance but also diversifies individual risks, enabling retail investors to achieve portfolio diversification with this fund alone. In addition, as an open-ended REF, it allows investors to join the fund at any time, ensuring greater accessibility. In essence, Germany’s open-ended REFs empower retail investors to easily construct well-diversified portfolios.

As of June 3, 2024, Germany had five REFs with assets exceeding EUR 10 billion, including Deka ImmobilienEuropa. The table below outlines the key characteristics of these funds. All five funds have built substantial management capabilities through years of operation and have achieved diversification by investing in approximately 100 properties. They operate with a low debt-to-net assets ratio of less than 20%, while maintaining liquidity levels of around 15% to meet redemption requests. Despite the Covid-19 pandemic crisis, these funds have consistently delivered stable returns without incurring losses over one-, three-, five-, and ten-year periods.7) This resilience can be attributed to a combination of experienced fund management, diversified portfolios, and low leverage ratios.

Germany’s REF system is distinguished by several notable features. One of its core strengths lies in the emphasis on the open-ended fund structure, which is more conducive to diversification across multiple properties compared to the closed-ended structure. However, given that these funds predominantly invest in illiquid assets, effective liquidity management tools are crucial to mitigate liquidity risk. To address this, Germany has implemented various liquidity management measures for open-ended REFs. Notably, investors are required to hold their investments for a minimum of two years, during which redemptions are prohibited. Even after this mandatory holding period, redeemed proceeds are paid out one year after the redemption request date, with no option to cancel the redemption once the request is made. These measures prevent frequent redemptions and fund runs, providing fund managers with sufficient time to predict cash flows and ensure liquidity over a one-year horizon.

Despite these safeguards, prolonged market downturns may result in a surge in redemption requests, complicating the liquidation of properties. To address such challenges, the German Investment Code (Kapitalanlagegesetzbuch, KAGB) outlines the following procedures. First, in the event of liquidity shortages, the asset management company is required to suspend redemptions and sell assets on reasonable terms. Second, if liquidity remains insufficient 12 months after the suspension, assets may be sold at a discount of up to 10% below market value, with redemptions still suspended. Third, if liquidity shortages persist for 24 months, the permissible discount increases to up to 20%. Fourth, after 36 months of insufficient liquidity, the asset management company’s authority is revoked and the fund is liquidated. These procedures are highly effective in addressing liquidity shortages over a three-year horizon, minimizing disruptions to fund operations during periods of distress. Moreover, the KAGB specifies safeguards to prevent the abuse of redemption suspensions, mandating a fund’s liquidation if redemptions are suspended more than three times within a five-year period (KAGB Sections 98 and 257). In addition, the KAGB enforces several regulatory provisions for open-ended REFs, including a diversification requirement that limits investments in a single property to 15% of total assets (Section 243); a liquidity requirement mandating that at least 5% of a fund’s assets be held in cash equivalents (Section 253); and a leverage requirement restricting borrowings to 30% of the fund’s property holdings (Section 254).

Conclusion

The first step in resolving the challenges faced by publicly offered REFs in Korea is to examine whether the existing fund structure is suitable for retail investors. Germany and other major European countries such as the UK and France have long developed open-ended REF frameworks that have undergone continuous improvements through multiple crises, including the 2008 global financial crisis, Brexit in 2016, and the Covid-19 pandemic in 2020. This experience can provide valuable guidance for Korea to design a REF framework tailored to the features of publicly offered funds.

However, even with a reasonable regulatory framework in place, substantial efforts from the industry are required to foster the development of the publicly offered REF market. In particular, building diversified real estate portfolios within funds necessitates active support from asset management companies and related stakeholders from the outset. Given the relatively smaller size of Korea’s asset management companies compared to their German counterparts, providing such support could be burdensome. As an alternative, it is worth considering utilizing the already established private RFEs. This approach could involve investing in private REFs through a fund-of-funds (FOF) structure or acquiring properties from maturing private funds to build diversified portfolios.

If Korea adopts an open-ended REF framework similar to Germany’s, it is crucial to clearly define the relationship with other funds, including structurally similar closed-ended publicly offered FOFs as well as real estate investment trusts (REITs), which are not classified as REFs under the Financial Investment Services and Capital Markets Act but share economic characteristics with REFs.

1) Refer to the press releases titled “Measures to innovate fund products to support the growth of national wealth” and “Legislative proposals on the Financial Investment Services and Capital Markets Act” published in May and September 2016.

2) In this article, the term “publicly offered real estate fund” refers to a fund that directly invests in real estate or makes indirect investments through privately-placed real estate funds or publicly offered real estate derivative funds. REITs or real estate funds that invest in listed securities differ widely in nature, which are thus, excluded from the analysis.

3) This figure reflects the value incorporating all distributions of publicly offered REFs.

4) Newsis, May 10, 2024, Investors in loss-making overseas real estate funds are struggling over maturity extension.

5) Dailian, June 27, 2017, Why are publicly offered real estate funds selling out quickly?, Dong-A Ilbo, March 12, 2019, KRW 750 billion in ten minutes… Publicly offered real estate funds sell out immediately”.

6) Germany’s open-ended REFs serves the same purpose of Korea’s publicly offered REF framework, in that they are easily accessible to retail investors.

7) The table in the main text only indicates the past three-year returns, but the original source from Scope (2024) includes returns for one, three, five, and ten years.

8) The development of Germany’s open-ended REF market can be attributed to the networks and financial backing of affiliated banks as well as the support from asset management companies, for which the universal bank structure of Germany’s financial services industry has played a pivotal role. For more detailed information, refer to the following book.

Sebastian, S., Strohsal, T., Woltering, R., 2017, German open-ended real estate funds, In Just, T., Maenning, W., (Eds.), Understanding German Real Estate Markets, 279–293, Springer International Publishing.