Find out more about our latest publications

Recent changes in US dollar funding market and its implications on Korea

Research Papers 21-02 Jan. 22, 2021

- Research Topic Macrofinance

- Page 66

The US dollar plays key role in the international financial market. Its functions as the foremost funding currency is reinforced by its use as a vehicle currency for foreign exchange transaction. Almost the half of all cross-border loans and international debt securities are denominated in US dollars, as well as over the three quarters of foreign exchange transactions occur over US dollars.

However, the experience of global dollar shortage during the global financial crisis(GFC) has led the changes in the US dollar funding market landscape after crisis. Non-US banks, which were the major suppliers of US dollar funding before GFC, has reduced its US dollar intermediation business, especially those from European region. Also US dollar funding is increasingly obtained through capital market as the banks conduct less US dollar intermediation. In the short-term dollar funding market, deviations from covered interest parity(CIP) persist since GFC and it is now characterized as low liquidity and higher cost market compare to pre GFC era.

In the case of Korea, abundant liquidity conditions in the spot foreign exchange market has been maintained until recently due to persistent current account surplus as well as the growth trend of incoming foreign portfolio investment. However, liquidity conditions of short-term dollar funding market, typically assessed by CIP deviations in the FX swap market, has been worsening since GFC. According to empirical results in this paper, recent structural changes in the global US dollar funding market influence short-term dollar funding market conditions in Korea through reduced US dollar loans from foreign branches of global banks in Korea.

This report provides the following implications for the Korea’s foreign exchange policies. First, one should closely monitor various cause of foreign exchange market volatility beyond what were considered before the structural changes. This would include changes in the risk appetite of non-banking sector, international debt market conditions, changes of broad dollar index, among others. It is worth stress again that since it is non-banking sector that led the US dollar credit growth recently the focus of foreign exchange market stability policies should extended to those sectors that are not in the locus of macro-prudential policy.

Also it is advised that Korea should maintain its attention on the stable overseas dollar funding sources because cross-border dollar loans through global banks are still the main source of dollar funding in the Korea’s foreign exchange market. In such a respect, one should carefully monitor and analyze impact of global regulatory reform on lending activities of non-US banks, as well as shifting business models of intermediaries. The paper also implies that it would be worthwhile to overhaul the existing macro-prudential policy framework in respond to the recent changes in the US dollar funding market landscape and the measures should be carefully adopted considering recent changes in the global US dollar funding market.

However, the experience of global dollar shortage during the global financial crisis(GFC) has led the changes in the US dollar funding market landscape after crisis. Non-US banks, which were the major suppliers of US dollar funding before GFC, has reduced its US dollar intermediation business, especially those from European region. Also US dollar funding is increasingly obtained through capital market as the banks conduct less US dollar intermediation. In the short-term dollar funding market, deviations from covered interest parity(CIP) persist since GFC and it is now characterized as low liquidity and higher cost market compare to pre GFC era.

In the case of Korea, abundant liquidity conditions in the spot foreign exchange market has been maintained until recently due to persistent current account surplus as well as the growth trend of incoming foreign portfolio investment. However, liquidity conditions of short-term dollar funding market, typically assessed by CIP deviations in the FX swap market, has been worsening since GFC. According to empirical results in this paper, recent structural changes in the global US dollar funding market influence short-term dollar funding market conditions in Korea through reduced US dollar loans from foreign branches of global banks in Korea.

This report provides the following implications for the Korea’s foreign exchange policies. First, one should closely monitor various cause of foreign exchange market volatility beyond what were considered before the structural changes. This would include changes in the risk appetite of non-banking sector, international debt market conditions, changes of broad dollar index, among others. It is worth stress again that since it is non-banking sector that led the US dollar credit growth recently the focus of foreign exchange market stability policies should extended to those sectors that are not in the locus of macro-prudential policy.

Also it is advised that Korea should maintain its attention on the stable overseas dollar funding sources because cross-border dollar loans through global banks are still the main source of dollar funding in the Korea’s foreign exchange market. In such a respect, one should carefully monitor and analyze impact of global regulatory reform on lending activities of non-US banks, as well as shifting business models of intermediaries. The paper also implies that it would be worthwhile to overhaul the existing macro-prudential policy framework in respond to the recent changes in the US dollar funding market landscape and the measures should be carefully adopted considering recent changes in the global US dollar funding market.

Ⅰ. 연구배경

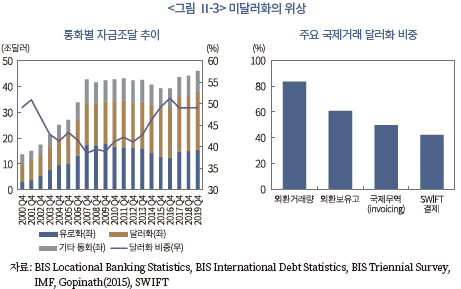

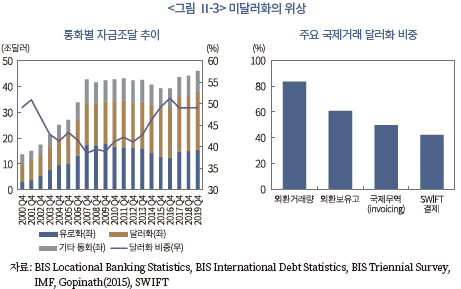

주요 국제통화의 대차가 일어나고 있는 글로벌 외화자금시장(funding market)에서 미달러화의 중요성은 여타 통화에 비해 독보적인 수준을 유지하고 있다. 즉, 미달러화는 대부분의 국가에서 외화자금의 주된 조달통화인 동시에 국경간(cross-border) 거래의 결제 및 가치저장 수단으로서 가장 폭넓게 활용되고 있다. 그 예로 국제무역이나, 국제결제 등 대부분의 국경간 거래의 절반 이상에 미달러화가 활용되고 있을 뿐만 아니라 전 세계 외환거래의 85%, 각국 외환보유고 보유통화의 61%의 비중을 점유하고 있다.

이러한 미달러화의 중요성을 감안할 때 글로벌 외화자금시장에서 미달러화 자금흐름이 원활히 작동하지 않을 경우 글로벌 금융불안이 발생하고 특히 통화의 국제화가 미흡한 신흥국의 달러자금 조달에 어려움이 커지면서 환율급등을 초래하는 요인이 될 수 있다. 지난 2008년 글로벌 금융위기(Global Financial Crisis: GFC)의 예에서 보듯이 미국 투자은행의 부실에서 촉발된 위기가 글로벌 금융위기로 급속히 확산된 것도 결국 전 세계 은행들의 디레버리징(deleveraging)에 따른 달러유동성 부족 현상이 전 세계적으로 확산된 데 직접적인 원인이 있다. 현재 우리나라의 경우에도 글로벌 외화자금시장을 통한 외자조달의 80% 이상이 미달러화로 이루어지고 있다는 점에서 미달러화 자금시장의 자금흐름과 구조변화는 국내 외화자금시장 및 외환부문의 전반적인 안정성에 적지 않은 영향을 미치는 요인이라 할 수 있다.

글로벌 금융위기 이후 미국 및 유럽 등 주요 선진국과 국제기구들은 은행들의 과도한 레버리지 확대가 글로벌 금융위기 발생의 근본적인 원인이었다는 인식하에 은행을 통한 과도한 외화자금의 조달과 무분별한 운용을 제한하는 다양한 규제를 도입하였다. 그 예로 국제결제은행의 바젤Ⅲ 유동성비율 규제나 미국의 머니마켓펀드(Money Market Fund: MMF) 개혁조치 등을 들 수 있는데 이러한 국제사회의 규제 조치는 주요 선진국 은행들의 건전성을 개선시키는 긍정적 변화를 가져온 것으로 평가된다.

그러나 한편으로는 글로벌 외화자금의 조달 및 공급 측면에서 미달러화 자금시장에 구조변화가 발생하고 있다. 즉, 외화자금의 조달 및 투자통화로서 미달러화의 중요성에 따라 미달러화에 대한 자금수요는 비은행금융기관 등을 중심으로 지속적으로 증가하고 있으나 각종 규제조치의 영향으로 글로벌 은행들의 미달러화 공급 기능은 이전보다 축소되었다. 그 결과 장기자금 수요자들의 은행차입을 통한 달러조달 의존도가 줄어든 대신 달러표시 해외채권발행에 의한 자금조달이 증가하였다. 또한 단기 자금시장에서는 달러자금조달을 위한 외환스왑 거래량이 크게 증가하였는데 과거와는 달리 미달러화와 교환되는 유로화나 엔화 등 주요 선진국 통화간 외환스왑시장(FX swap)에서도 단기적인 시장불균형이 빈번히 발생하고 거래비용이 상승하는 모습이 나타나고 있다. 최근 전 세계적인 코로나19(COVID-19) 위기의 발생으로 미달러화 유동성에 대한 위기감이 고조되며 시장수급의 불안정이 확대되자 미연준이 주요국 중앙은행과 국가간 통화스왑(bilateral swap agreement)을 통해 미달러화 유동성을 공급하였는데 이는 미달러화 자금의 원활한 흐름과 시장의 안정성을 유지하기 위한 미연준의 신속한 조치로 이해할 수 있다.

미달러화 자금시장의 구조변화는 우리나라의 외화자금조달에 영향을 미치는 중요한 요인이라 할 수 있다. 우리나라의 경우 전통적으로 미달러화 자금조달은 해외은행으로부터의 차입에 상당부분 의존해 옴에 따라 주요 선진국 은행들의 유동성 공급여력 축소는 우리나라의 외화유동성 조달에 어려움을 가중시키는 요인으로 작용할 수 있다. 특히 글로벌 외화자금시장의 불균형이 빈번히 나타나는 상황에서 외부충격이 발생하는 경우 국제금융시장의 신용경색 등으로 외화자금 조달비용이 상승하고 그 영향이 현물환(spot) 시장으로 전이되면서 원화환율을 급등시키는 요인이 될 수 있다. 금년 3월경 코로나19 위기로 국내 외환스왑시장의 불균형이 심화되고 환율이 크게 상승한 것은 이러한 대내외 달러화 자금조달시장의 구조변화에도 일부 영향을 받았을 것으로 생각된다.

본 보고서에서는 이러한 인식을 배경으로 글로벌 금융위기 이후 미달러화 자금시장 구조변화의 주된 특징과 우리나라의 외화자금시장에 미치는 영향을 분석해 보고자 한다. 본고의 구성은 다음과 같다. 제Ⅱ장에서 미달러화 자금시장 구조변화의 주요 특징을 살펴보았다. 이를 위해 미달러화 자금시장의 조달 및 운용 측면에서의 자금흐름 현황을 살펴보고 선진국 통화간 외환스왑시장의 불균형 현상을 설명하였다. 제Ⅲ장에서는 미달러화 자금시장 변화가 우리나라 외화자금시장에 미치는 영향을 분석하였다. 이를 위해 우리나라의 형태별 외화자금조달 추이와 외환스왑시장 불균형 현황을 분석한 후 글로벌 외화자금시장의 구조적 변화가 국내 외화자금시장에 미치는 영향에 대해 실증분석해 보았다. 제Ⅳ장에서는 이러한 논의를 토대로 시사점을 제시하였다.

Ⅱ. 미달러화 자금조달시장의 구조변화

본 장에서는 글로벌 금융위기 이후 미달러화 자금조달시장의 구조적인 변화 및 특징을 살펴보았다. 주요 국제거래의 기축 통화인 미달러화 자금조달시장은 막대한 유동성이 공급되고 있는 세계 최대의 자금조달시장이다. 주요 글로벌 기관은 미달러화 자금조달시장의 규모 우위를 통해 여타 통화 대비 상대적으로 낮은 자금조달 비용의 이점을 누릴 수 있으며, 다양한 상품 및 투자자 기반을 활용한 대규모 자금조달이 가능하다.

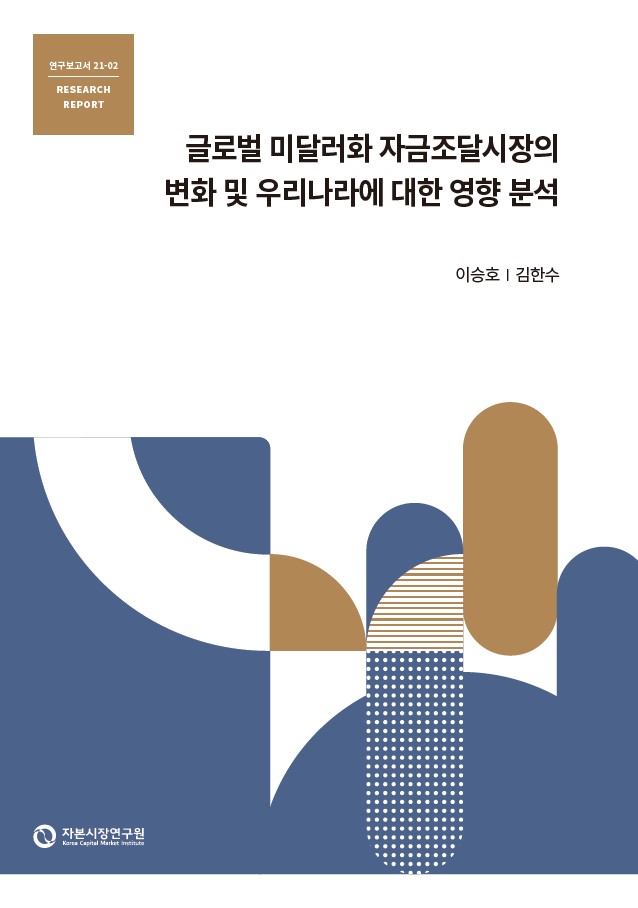

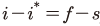

<표 Ⅱ-1>은 미달러화 자금조달시장의 주요 상품 및 시장 규모 등을 나타낸다. 대형 글로벌 은행, 헤지펀드, 머니마켓펀드(Money Market Fund: MMF) 등은 미달러화 자금조달시장의 주요 유동성 제공자 역할을 하고 있으며, 각국 은행, 기업, 정부 등 다양한 시장참가자가 자금조달자로서 시장에 참여하고 있다. 미달러화 자금조달시장의 주요 단기 상품으로는 환매조건부채권(Repo: RP), 기업어음(Commercial Paper: CP), 양도성 예금증서(Certificate of Deposit: CD) 및 외환스왑1) 등의 거래가 활발히 이루어지고 있으며, 중‧장기 자금조달 수단으로는 국경간 대출 및 달러화표시 채권발행 등이 대부분을 차지하고 있다.

전통적으로 달러화 자금조달시장은 대형 글로벌 은행이 자사의 신용을 바탕으로 달러화 자금을 조달하여 중개하는 달러화 중개 비즈니스 확대를 통해 성장하여 왔다. 특히 유럽계 은행은 글로벌 금융위기 이전 미달러화 중개 비즈니스 확대를 통해 글로벌 달러화 자금조달시장 성장세를 견인하였다. 그러나 최근에는 유럽계 은행 중심의 달러화 자금조달시장의 성장세가 크게 둔화되고 있으며, 기업 및 은행들은 자본시장을 통한 직접 달러화 자금조달 비중을 확대하는 등 뚜렷한 변화의 모습이 나타나고 있다. 본 장에서는 글로벌 미달러화 자금조달시장의 구조적 변화 및 특징을 달러자금의 수요 및 공급 주체 변화, 자금조달 형태 변화의 특징, 단기 미달러화 자금시장에 대한 영향 등의 측면에서 살펴보았다.

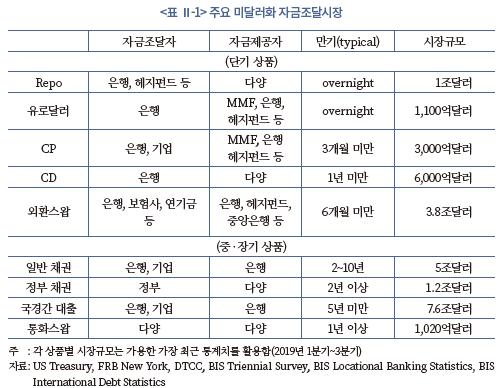

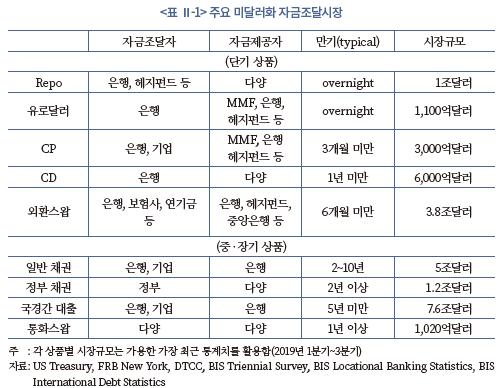

1. 미달러화 자금수요 증가세 지속

글로벌 미달러화 자금조달 규모는 비은행부문의 자금수요 증가세를 바탕으로 최근까지 확대 추세를 유지해오고 있다. 2019년말 기준 총 글로벌 달러화 자금조달 규모2)는 약 22조달러로 글로벌 금융위기 이전 최대치 대비 약 6조달러 증가한 수준을 기록하고 있다. 이를 달러화 자금조달의 목적에 따라 은행부문의 달러화 중개 비즈니스 확대(공급 측면) 및 비은행부문의 국제거래 수행을 위한 목적(수요 측면)으로 구분할 경우3), 미달러화에 대한 자금수요 증가는 주로 후자의 성장세에 기인한다. 다만, 글로벌 금융위기를 기점으로 글로벌 달러화 자금조달 총액 증가 폭은 크게 둔화된 모습이다. 글로벌 금융위기 이후 최근까지 글로벌 달러화 자금조달 총액의 연평균 성장률은 약 3.2%로 이전 기간(2000~2008년, 약 11.8%) 대비 크게 둔화되었다. 그 결과 글로벌 GDP 대비 달러화 자금조달 총액 비중은 2019년말 기준 약 25.7% 수준으로 2007년말(28.3%) 대비 소폭 감소한 것으로 나타나고 있다.

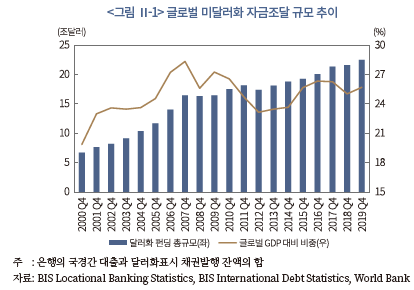

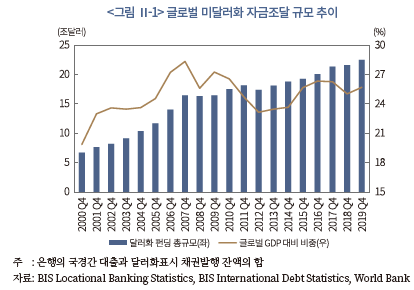

달러화 자금수요 측면에서의 자금조달 규모는 최근까지 높은 성장세를 유지하고 있는데 2019년말 기준 비은행부문의 달러화 자금조달 총액은 약 12조달러에 달하여 글로벌 금융위기 이전 최대치(2007년말 약 5.5조달러) 대비 두 배 이상 증가한 수준이다. 해당 부문의 연평균 증가율은 글로벌 금융위기 이전(2000~2007년) 및 이후(2009~2019년) 기간중 각각 9.7% 및 8.2% 수준을 나타내어 글로벌 금융위기 이후 기간중에도 비은행부문의 달러화 자금수요는 증가세가 이어지고 있는 것으로 나타나고 있다. 또한 동기간중 글로벌 달러화 자금조달 규모 확대가 비은행부문의 수요 확대를 중심으로 진행됨에 따라 전체 달러화 자금조달 규모(은행부문 포함) 대비 비은행부문의 비중도 크게 확대된 것으로 나타나고 있다. 즉, 2019년말 기준 달러화 자금조달 총액 대비 비은행부문의 조달액 비중은 약 53% 수준으로 나타나 최근 글로벌 자금조달시장의 규모 확대가 주로 비은행부문의 달러화 자금수요 확대에 크게 기인하고 있음을 보여주고 있다.4)

글로벌 금융위기 이후 비은행부문을 중심으로 한 미달러화 자금수요와 조달규모의 확대는 주로 다음과 같은 요인에 기인하고 있는 것으로 판단된다. 첫째, 국경간 거래통화로서의 미달러화의 위상이 여전히 높은 수준을 유지하고 있는 점을 들 수 있다. <그림 Ⅱ-3>에 나타난 바와 같이 최근 주요 국제거래 통계에서도 미달러화 비중은 글로벌 금융위기 이전과 비슷한 수준을 유지하고 있는 것으로 나타나고 있으며, 특히 글로벌 자금조달 통화로서의 미달러화 비중은 최근 더욱 확대된 것으로 나타나고 있다. 즉, 2019년말 기준 미달러화 자금조달 총액은 전체 국경간 자금조달 규모(모든 통화 표시 해외자산 포함)의 절반 이상을 차지하고 있다. 유로화의 경우에는 유럽 역내 국경간 거래에 대부분 활용(2019년말 기준 역내 비중은 약 85%)되고 있음을 감안할 때 글로벌 펀딩 통화로서 미달러화의 위상은 독보적이라 할 수 있다. 이는 2008년 글로벌 금융위기시 미달러화 유동성 위기의 경험에도 불구하고 국경간 거래 체결을 위한 실수요 측면에서의 미달러화 자금조달 수요 증가세가 지속되고 있는 것으로 볼 수 있다.

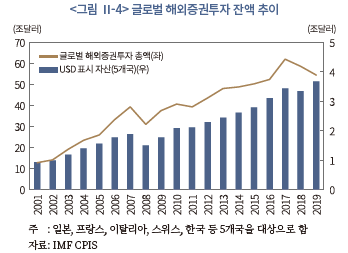

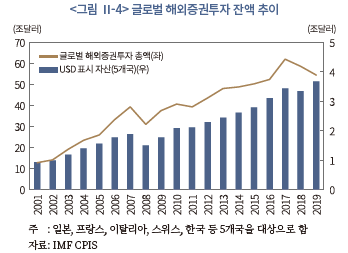

둘째, 주요국 기관투자자의 해외증권투자 확대 추세 또한 비은행금융기관의 달러화 자금수요 확대를 견인하고 있는 것으로 판단된다. IMF의 주요국 중앙은행 대상 서베이 조사(Coordinated Portfolio Investment Survey: CPIS)5)에 따르면, 총 글로벌 해외증권투자(채권 및 주식투자) 잔액은 2008년 대비 약 75% 증가한 55조달러에 달하는 것으로 나타나고 있다. 해외증권투자의 경우 미국 외 지역 투자의 경우에도 상당부문 미달러화 환전 및 헤지 등의 거래가 수반되고 있음을 감안할 때 최근 달러화 자금수요 확대 추세에 중요한 요인이 되고 있는 것으로 추정된다.6) 또한 개별 국가 사례에서도 주요국 기관투자자의 해외증권투자 확대 추세 및 달러화 자금수요 확대 추세가 나타나고 있다. BIS(2020)에 따르면 최근 동아시아 지역 기관투자자의 해외증권투자가 크게 확대되고 있으며, 특히 해외자산 대부분을 헤지하고 있는 것으로 추정되는 보험사의 해외자산 보유액이 빠르게 증가하고 있는 것으로 나타나고 있다.7)

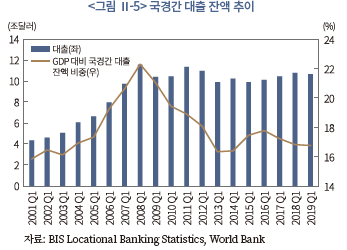

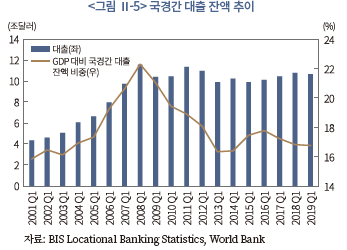

2. 글로벌 은행의 미달러화 공급 축소

달러화 자금의 중개업무를 담당하고 있는 글로벌 은행부문을 통한 달러화 자금공급은 글로벌 금융위기 이후 감소세로 전환된 것으로 나타나고 있다. <그림 Ⅱ-5>에서 보는 바와 같이 글로벌 은행의 국경간 대출 잔액으로 추정한 은행부문의 달러화 자금공급 규모는 2019년말 기준 약 11.6조달러를 기록하여 글로벌 금융위기 이전의 최대치 대비 약 8% 감소한 것으로 나타났다. 이러한 감소 추세는 은행부문의 달러화 자금공급 확대를 통해 글로벌 달러화 자금조달시장의 규모가 크게 확대되었던 이전 시점과 뚜렷한 대비를 보이고 있다. 특히 2019년말 기준 글로벌 GDP 대비 은행부문의 대출 비중은 글로벌 금융위기 이전 최대치(22%) 대비 약 5%p 이상 하락한 17% 수준으로, 달러화 자금수요 증가세에도 불구하고 은행부문의 달러화 자금중개 역량과 여력은 크게 감소하고 있다.

이러한 글로벌 은행의 달러화 자금공급 감소 추세는 글로벌 금융위기 이후 도입된 은행부문 건전성 규제 강화 조치에 상당 부분 기인하고 있는 것으로 보인다. 글로벌 금융위기 당시 은행부문의 달러화 중개 비즈니스 확대가 금융위기의 범세계적 확산을 초래한 주원인으로 지목되면서, 이후 글로벌 은행의 달러화 부채 확대를 제한하는 방향으로 규제가 강화되었기 때문이다.

<참고 Ⅱ-1>에서 정리한 바와 같이 주요국의 규제 강화는 은행의 달러화 부채 확대에 대응하여 규제 비용을 부과하는 공통점을 가지고 있으며, 특히 이는 글로벌 달러화 자금공급을 주도하고 있는 비미국계 은행의 자금조달에 큰 영향을 미치고 있는 것으로 나타나고 있다.8) Aldasoro et al.(2019) 및 Du et al.(2017) 등 최근 연구에서는 글로벌 금융위기 이후 규제 강화가 글로벌 달러화 자금시장의 유동성 감소 요인으로 작용하고 있으며, 특히 단기 달러화 자금조달 비용 상승요인으로 작용하고 있음을 실증적으로 보여주고 있다.

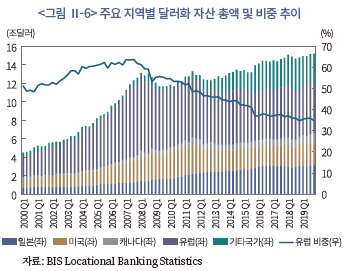

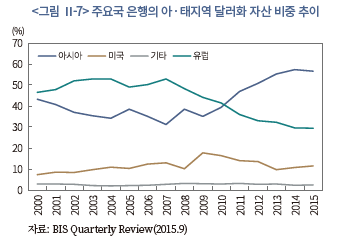

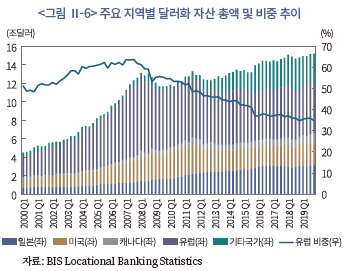

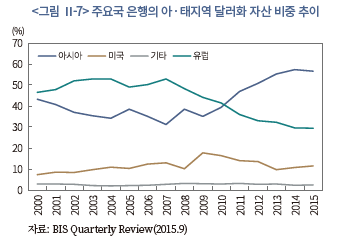

한편 글로벌 은행의 달러화 중개 비즈니스 변화는 지역별로 차별화된 양상을 보이고 있다. 이는 앞서 살펴본 규제적 요인과 더불어 비규제적 측면에서의 전략적 변화 요인 또한 지역별로 상이하게 나타나고 있는데 기인하는 것으로 추정된다. 즉, 글로벌 금융위기와 유럽재정위기 시에 극심한 달러화 유동성 위기를 경험한 바 있는 유럽계 은행들은 각종 규제조치 등의 영향으로 미달러화 중개 비즈니스를 빠르게 축소하고 있다. 반면 아시아 등 여타 지역 은행들은 미달러화 중개 업무에 보다 적극적으로 나서면서 새로운 수익원을 창출하고 미달러화 자금 공급자로서 유럽계 은행의 공백을 보전해 나가고 있는 모습을 보이고 있다.9)

<참고 Ⅱ-1> 글로벌 금융위기 이후 주요 건전성 규제 도입 현황

◇ 바젤Ⅲ 자본적정성 규제 (2015년 도입)

─ 신규 레버리지 비율 규제(총 익스포저 대비 자본 비율) 도입

• 해당 규제는 balance sheet의 구성보다는 전체 자산규모를 제한하기 위한 총량 규제로, 위험가중치 없이 적용

• 바젤Ⅲ 기준인 3%(최소비율로 표기, 이에 최대 레버리지 가능치는 자기자본의 약 33배 수준) 외 미국의 경우 대형은행에 대해 SLR(Supplementary Leverage Ratio) 적용 시 5~6% 수준

─ 기존 BIS 자기자본비율 규제 강화

• 기존(바젤Ⅱ) 8%에서 11.5~15%로 적용 기준 강화

→ (주요 영향) 총량 규제 및 기존 위험가중치 적용 자기자본비율 규제 강화를 통해 글로벌 은행의 달러화 부채 확대를 제한

◇ 바젤Ⅲ 유동성 규제 (2015년 도입)

─ LCR(향후 30일간 순현금 유출액 대비 고유동성자산 비중) 규제

• 부외 거래인 외환스왑거래 등에도 제한요인으로 작용

─ NFSR(필요안정자금 대비 가용안정자금 비중) 규제

• 위험가중치 적용을 통해 단기 및 무보증 자금조달을 제한

→ (주요 영향) 은행의 달러화 파생상품(외환스왑 등) 거래 규모 및 단기 달러화 차입 경로 등에 제약 요인으로 작용

◇ 미국 Volcker Rule (2010년 도입)

─ 은행 자기자본거래(proprietary trading) 금지

• 선물환, 스왑거래 등은 시장조성 목적 등 일부에 한해 허용

─ 해외자산 확대에 따른 예금보험공사(FDIC)의 보험요율 확대 적용

→ (주요 영향) 미국계 은행의 해외 대출 및 외환스왑시장 참여를 제한

◇ 미국 CP(MMF) 관련 규제 강화 (2016년 도입)

─ 프라임 MMF(은행 CP 투자 가능)에 대한 시가평가 적용 및 redemption fee 부과

→ (주요 영향) 비미국계 은행의 CP 발행을 통한 단기 자금조달을 제약

<그림 Ⅱ-6>에 나타난 바와 같이 유럽계 은행의 달러화 자산은 글로벌 금융위기 이후 큰 폭의 감소세를 보이고 있는 반면 동 기간중 기타 지역의 달러화 자산은 크게 증가한 것으로 나타나고 있다. 즉, 2019년말 기준 유럽계 은행의 달러화 자산 총액은 약 5.3조달러로 글로벌 금융위기 이전 최대치 대비 절반 수준으로 축소되었으며, 글로벌 금융위기 이전 60% 수준에 달했던 유럽계 은행의 비중은 현재 34% 수준으로 크게 축소된 것으로 나타난다.

이에 반해 일본, 캐나다, 호주 등 일부 기타지역 은행의 경우에는 글로벌 금융위기 이후 달러화 비즈니스 규모가 확대된 것으로 나타나고 있다. 앞서 살펴본 바와 같이 동아시아 주요국의 해외증권투자 확대에 따른 달러화 자금수요가 빠르게 증가하고 있으나, 주요 자금제공자인 유럽계 은행의 해당 지역에서의 비즈니스 축소로 인해 역내지역 은행의 역할이 강화된 것으로 생각된다. <그림 Ⅱ-7>에 나타난 바와 같이 아시아 지역 은행의 역내 비즈니스 비중은 2011년 이후 유럽계 은행의 비중을 초과하는 것으로 나타나고 있다.

3. 자본시장을 통한 자금조달 확대

달러화 자금수요의 지속적인 확대 추세에도 불구하고 주요 달러화 자금공급 주체인 은행의 중개 역량이 축소됨에 따라, 최근 주요기관의 달러화 자금조달은 자본시장을 통한 자금조달을 강화하는 방향으로 변화하고 있다. 2019년말 기준 주요기관의 채권발행을 통한 달러화 자금조달 총액은 2007년말 대비 두 배 이상 증가한 약 12조달러 수준으로, 전체 달러화 자금조달액의 약 52%를 차지하고 있다.10)

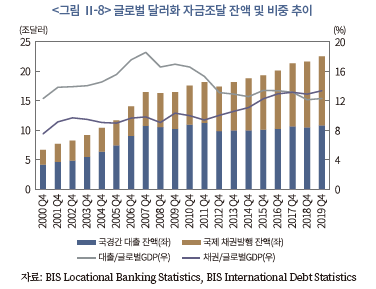

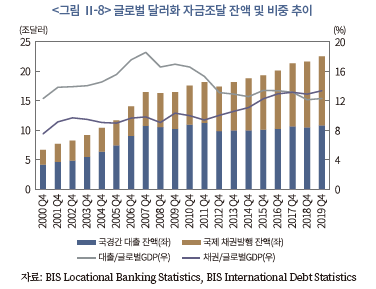

아래 <그림 Ⅱ-8>에 나타난 바와 같이 국경간 대출을 통한 달러화 자금조달 증가세가 2008년 이후 정체되고 있는 가운데 동기간 달러화표시 채권발행을 통한 자금조달 비중은 빠르게 확대되고 있다. 특히 2008~2019년 기간중 전체 달러화 자금조달 증가분(약 6조달러) 중 약 90%가 채권발행에 기인하고 있다. 이에 따라 2017년 4/4분기 이후 미달러화 자금의 조달수단으로서 채권발행 잔액이 은행의 대출 잔액을 상회하기 시작하였는데 2019년 기준으로 글로벌 GDP 대비 채권발행 및 은행대출을 통한 자금조달 비중은 각각 13.4% 및 12.3%를 나타내었다.

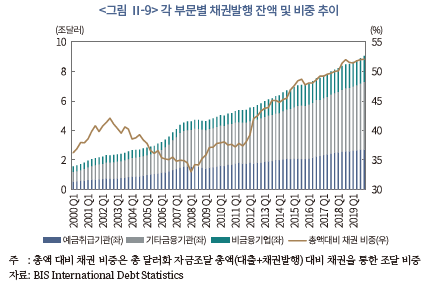

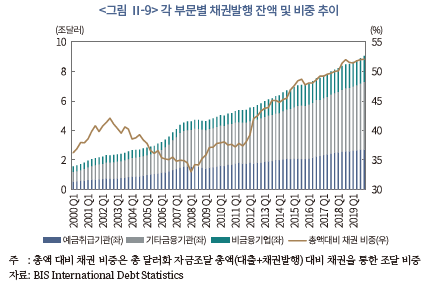

주요 기관의 채권발행을 통한 달러화 자금조달 확대 추세는 은행 및 비은행 양 주체에서 모두 관찰되고 있으나, 특히 비은행부문의 증가세가 상대적으로 큰 것으로 나타나고 있다. 이는 글로벌 은행의 달러화 자금공급 여력이 축소되고 최근 저금리 기조 등으로 채권발행 여건이 개선됨에 따라 비은행부문의 달러화표시 채권발행을 통한 자금조달이 꾸준히 증가해온 데 기인한다. 2019년말 기준 비은행금융기관의 채권발행을 통한 달러화 자금조달 잔액은 금융위기 직전 최대치 대비 약 두 배 증가한 약 5조달러 규모로 전체 달러화 채권발행 잔액의 약 40%를 차지하고 있으며 일반 기업의 달러화표시 채권발행 규모 또한 2007년말 대비 약 세 배 증가한 1.7조달러 수준을 기록하고 있다.11) 이는 기존 은행의 달러화 자금중개에 의존하였던 미달러화 자금조달 형태가 2008년 글로벌 금융위기를 계기로 점차 자본시장을 통한 직접 자금조달 방식으로 변화하고 있음을 의미한다.

최근 주요 연구에서도 자본시장을 통한 달러화 자금조달 확대 추세가 글로벌 달러화 자금시장 변화의 주요한 특징 중 하나로 지목되는 가운데 다음과 같은 다양한 연구결과들이 제시되고 있다. Shin(2013)은 글로벌 금융위기 이후 자본시장을 통한 달러화 신용 확대 추세를 새로운 글로벌 유동성 확대 국면(2nd Phase of Global Liquidity)으로 이전 시점과 구분하여 정의하였으며, Avdjiev et al.(2017b) 등은 주요 선진국의 양적완화로 인한 국제 채권발행 여건 개선 및 은행부문의 달러화 부채 축소 등이 이러한 추세를 견인하고 있음을 제시하고 있다. 또한 Aldasoro(2018)는 채권발행 중심의 달러화 자금조달 경로는 국제금융시장의 급격한 변동 국면에서 은행의 중개 채널 대비 급격한 유동성 악화가 나타날 수 있음을 지적하였으며, Du(2019)는 달러화 자금시장의 구조적 변화로 인해 미연준의 중앙은행 스왑라인을 통한 비상시 유동성 공급체계의 효율성 제고 필요성을 제안하고 있다.

4. 단기 미달러화 자금조달시장의 유동성 부족

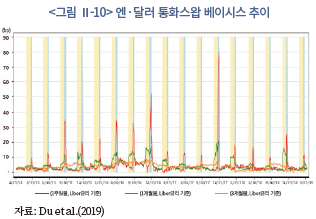

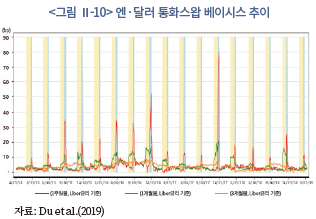

은행부문을 통한 달러화 자금공급 축소는 단기 자금조달시장에서도 두드러지게 나타나고 있다. 이는 글로벌 금융위기 이후 도입된 주요 건전성 규제 조치가 글로벌 은행의 단기 자금조달을 제한하는 방향으로 진행됨에 따라 은행의 단기 달러화 중개 역량이 위축된 데 상당 부분 기인하는 것으로 생각된다.12) 아래 <그림 Ⅱ-10>에 나타난 바와 같이 외환스왑을 통한 미달러화 단기 자금조달 비용(스왑베이시스)은 바젤Ⅲ 시행 시점인 2015년 이후 규제비율 보고 시점인 매 분기말 급상승하는 이상 패턴이 지속되고 있다.

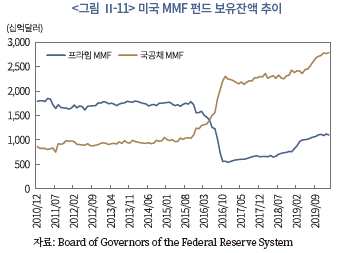

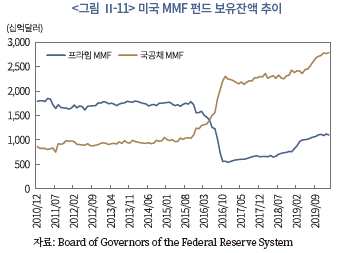

특히 비미국계 글로벌 은행의 단기 달러화 자금조달은 미국의 2016년 MMF 관련 규제 강화 조치 이후 크게 축소되고 있는 것으로 나타나고 있다.13) 미국의 MMF 시장은 달러화 예금 기반이 취약한 비미국계 은행의 중요한 단기 자금조달 경로로서 글로벌 금융위기 이전 유럽계 은행의 달러화 비즈니스 급성장 시기에 주요 재원으로 활용되어 왔다.14) 특히 미국 내 지점을 통해 CP 발행이 가능한 글로벌 대형 은행은 단기 무담보 도매 자금조달(unsecured wholesale funding)이 가능한 MMF 시장을 선호하였는데, 글로벌 금융위기 직전 미국 MMF 시장을 통한 비미국계 은행의 단기 자금조달 규모는 1조달러를 상회한 것으로 추정된다.

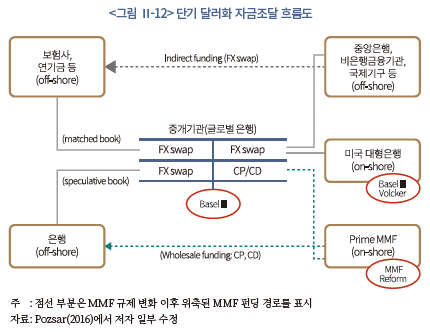

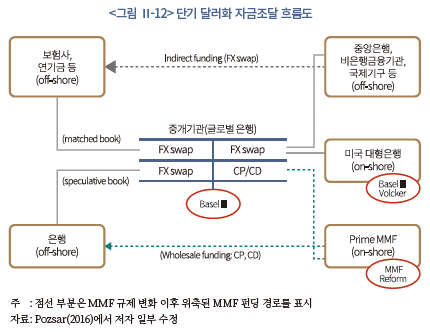

그러나 MMF의 CP 투자를 제한하는 최근 규제 변화는 비미국계 은행의 단기 달러화 자금조달을 위축시키는 결과로 작용하고 있다. 아래 <그림 Ⅱ-11>에 나타난 바와 같이 규제 도입 후 MMF 투자자금은 CP 등 상품에 투자 가능한 프라임 MMF에서 국공채 MMF로 대거 이동한 것으로 나타나고 있다.15) 이에 따라 비미국계 은행의 CP 발행을 통한 단기 자금조달 규모는 규제 도입 이전 시점 대비 절반 이하 수준으로 축소된 것으로 추정된다(Pozsar, 2016).

아래 <그림 Ⅱ-12>는 최근 단기 달러화 자금의 흐름 변화를 요약하여 설명하고 있다. 글로벌 금융위기 이전 대형 비미국계 은행은 프라임 MMF를 통한 단기 차입(CP 및 CD 발행)을 이용하여 무제한 달러화 자금조달이 가능한 것으로 간주되었다(<그림 Ⅱ-12>의 점선 부분). 또한 글로벌 대형 은행은 만기 불일치 리스크가 수반되는 거래(speculative book) 방식을 통해 미달러화 수요자에 대해 사실상 단기 달러화 자금의 무제한 공급이 가능하였다.16) 그러나 글로벌 금융위기 이후 해당 경로를 통한 자금조달 비용이 크게 상승함에 따라 비미국계 은행의 단기 달러화 자금공급이 크게 위축되고 있는 상황이다. 그 결과 최근 단기 달러화 자금시장의 자금공급은 미국계 대형 은행으로 집중되고 있으나, 미국 또한 규제 강화의 영향으로 기존과 같은 무제한 자금공급이 어려운 상황이다.17) 이러한 제한적인 달러화 자금공급 기반으로 인해 최근 단기 달러화 자금시장은 수급 불균형이 확대되고 있으며, 달러화 스왑시장의 불균형이 지속되는 등 단기 달러화 자금시장의 유동성 부족 현상이 나타나고 있는 것으로 보인다.18)

<참고 Ⅱ-2> 미국 MMF 개혁 조치의 주요 내용

◇ 배경: 2008년 대량환매사태로 인한 유동성 부족

─ 리먼브라더스 파산으로 인한 손실처리 과정에서 주요 MMF펀드의 주당 순자산가치를 기준가(1$) 이하로 고시한 이후 펀드런 발생

─ 이후 시장충격 발생 시 대규모 환매를 차단하기 위한 방편으로 2016년 10월 다음과 같은 개혁 조치 도입

◇ 주요 내용

─ 기관투자자 대상 프라임 MMF 순자산가치(Net Asset Value) 시가 평가 상시 적용

─ 유동성자산 비율에 연동된 환매수수료 부과 및 환매정지 권한 신설

• MMF의 주간 유동성자산이 펀드자산의 30%에 미달하는 경우 2% 이내 수준의 환매수수료(liquidity fee)를 부과하거나 최대 10일까지 환매를 정지할 수 있는 재량권 부여

• 주간 유동성자산 비율이 10%에 미달하면 환매수수료(기본 1%, 최대 2%)를 부과하도록 의무화

─ 정기적인 스트레스 테스트 의무화

• 주간 유동성자산 비율을 10% 이상 유지하고 변동성을 최소화하기 위해 주요 스트레스 상황(단기금리 상승, 자산 신용위험 증가, 스프레드 확대 등) 발생 시 예상되는 환매규모를 감안한 스트레스 테스트 실시를 의무화

─ 정부채 MMF는 해당 조치에서 면제되나, 해당 펀드의 정부채 편입 비중 상향 조정 (80%→99.5%)

◇ 영향 및 평가

─ 프라임 펀드의 수익 창출 기반 축소

• 주요 펀드는 수수료 부과를 피하기 위해 높은 수준의 유동성 유지(대부분 펀드의 유동성자산 비율은 50% 이상)

─ 안전자산으로서의 역할 축소

• 안전자산으로서의 유동성 공급통로(liquidity vehicle)에서 신용위험을 수반한 투자대상(credit vehicle)으로의 인식 변화

5. 외환스왑시장 불균형 확대

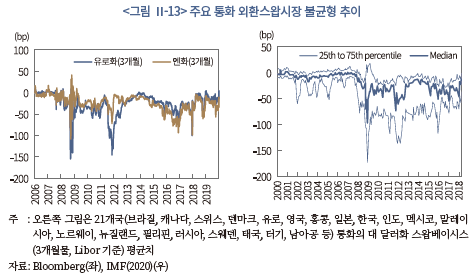

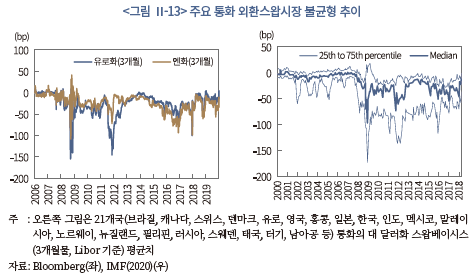

글로벌 금융위기 이후 단기 달러화 자금조달 수요가 외환스왑시장으로 집중됨에 따라 외환스왑을 통한 달러화 자금조달 비용이 상승하고 스왑시장의 불균형이 확대되는 현상이 나타나고 있다.19) 통상적으로 주요 선진국 통화간 외환스왑시장은 무위험금리평가이론(Covered Interest Rate Parity: CIRP)에 따라 균형 상태로 수렴하는 안정적인 시장의 모습을 보여 왔다.20) 즉, 자본이동에 제약이 없는 국제통화 간 차익거래 유인(환위험이 제거된 금리차익)이 존재하는 경우 금융기관의 재정거래 확대를 통해 균형 수준을 회복하게 된다. 금융기관은 외환스왑시장을 활용한 재정거래를 통해 무위험 수익 실현이 가능하기 때문이다. 이러한 측면에서 글로벌 금융위기시 및 유럽재정위기 당시 외환스왑시장의 불균형 확대는 달러화 자금시장의 단기적 유동성 악화에 기인한 일시적인 현상으로 설명할 수 있다.

그러나 <그림 Ⅱ-13>에 나타난 바와 같이 스왑시장의 불균형은 글로벌 금융위기 이후 최근까지 지속되고 있으며, 특히 대형 글로벌 은행의 건전성이 개선된 2014년 이후에도 불균형이 지속되고 있는 것으로 나타나고 있다. 외환스왑거래를 통한 달러화 자금조달을 위해서는 대출을 통한 직접 조달 비용 대비 높은 프리미엄을 지불해야 함에도 불구하고, 외환스왑시장의 달러화 자금수요가 지속되고 있는 것으로 풀이된다.

달러화 외환스왑시장의 불균형이 오랜 기간 지속되고 있는 최근의 상황은 앞서 살펴본 달러화 자금시장의 구조적 변화 요인에 기인하고 있다. 즉, 글로벌 금융위기 이후 규제 강화로 인해 비미국계 은행의 단기 달러화 자금조달 여력이 크게 위축되는 가운데 외환스왑시장의 주요 달러화 자금공급 주체인 글로벌 은행의 재정차익거래가 크게 감소하고 있는데 기인하는 것으로 볼 수 있다.

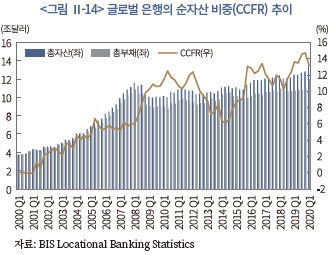

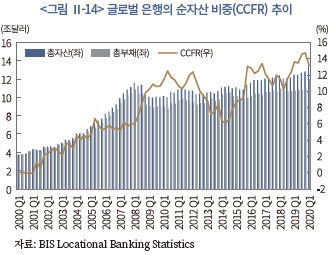

외환스왑시장의 달러화 자금 공급이 위축된 가운데 달러화 자금조달 수요는 은행 및 비은행 양 주체에서 모두 빠르게 증가하고 있는 것으로 나타나고 있다. <그림 Ⅱ-14>에 나타난 바와 같이 은행부문의 외환스왑시장을 통한 달러화 자금조달 수요는 최근 큰 폭으로 확대되었다.21) 2019년말 기준 글로벌 은행은 국경간 달러화 대출 총액의 약 14%를 외환스왑시장을 통한 자금조달에 의존하고 있으며, 글로벌 금융위기 이후 외환스왑시장에 대한 단기 자금조달 의존도가 크게 증가한 것으로 나타나고 있다.

비은행부문 또한 글로벌 해외증권투자 확대 추세에 따른 환헤지 목적의 외환스왑거래 수요 등의 영향으로 외환스왑시장에서의 자금조달이 크게 확대된 것으로 나타난다. 최근 BIS 통계에 따르면 글로벌 외환스왑 및 선물환거래 총액은 2019년 기준 약 60조달러로 2010년 대비 두 배 이상 증가한 것으로 나타나고 있으며22), 비은행금융기관의 비중은 2019년말 기준 55% 수준으로 은행부문 비중(32%)을 상회하고 있는 것으로 나타나고 있다.

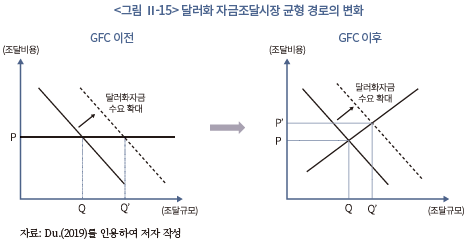

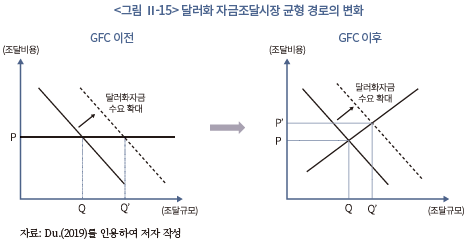

이러한 달러화 자금조달시장의 유동성 부족과 외환스왑시장의 불균형 확대는 조달시장의 균형 경로 변화를 통해 자금조달 비용의 상승을 초래하고 있는 것으로 보인다. 즉 아래 <그림 Ⅱ-15>에서 보는 바와 같이 달러화 자금조달시장의 구조적 변화로 인해 단기 자금시장의 공급곡선 기울기가 우상향으로 변화되고 있기 때문이다. 글로벌 은행의 달러화 부채 확대에 제한이 부재하였던 글로벌 금융위기 이전 시점과는 달리 부채 확대에 따른 비용이 발생하는 최근 상황에서는 달러화 자금공급 규모와 조달비용 간 양(+)의 상관관계가 나타나고 있다. 이러한 달러화 자금조달시장의 균형 경로 변화로 인해 최근 코로나19 사태에 따른 안전자산 선호도 확대 등 달러화 자금수요 확대가 달러화 자금조달시장의 단기 유동성 부족으로 연결될 수 있음을 보여주고 있다. 이와 관련하여 Du(2019)의 최근 연구에서는 역내‧외 달러화 자금조달 비용간 괴리로 추산하고 있는 달러화 자금조달시장의 불균형이 달러화 자금조달시장의 균형 경로 변화에 따른 새로운 균형점으로 해석될 수 있음을 주장하고 있다.

6. 소결

본 장에서 살펴본 글로벌 미달러화 자금조달시장의 구조적 변화는 다음과 같이 요약할 수 있다. 글로벌 금융위기 이후 달러화 자금조달 수요는 꾸준한 증가세를 유지하고 있는 반면, 글로벌 은행의 달러화 자금중개 기능은 글로벌 금융위기를 기점으로 위축되었다. 그 결과 글로벌 은행의 대출을 통한 글로벌 달러공급 기능이 축소되었는데 무엇보다 글로벌 금융위기 이후 은행의 건전성 제고를 위한 규제 강화가 주된 요인인 것으로 분석된다. 반면 최근에는 달러화표시 채권발행 등 자본시장을 통한 직접 자금조달 확대가 미달러화 신용공급의 주된 경로로 부상하고 있다.

한편 글로벌 금융위기 이후 구조적 변화로 인해 단기 달러화 자금조달시장은 점차 고비용‧저유동성 시장으로 변모하고 있다. 글로벌 달러화 자금공급을 주도하고 있는 비미국계 은행의 단기 달러화 자금조달이 크게 축소되었으며, 달러화 스왑시장을 통한 단기 달러화 자금조달이 급증하고 있다. 그 결과 무위험금리평가이론에 따른 균형이 존재하였던 달러화 스왑시장은 글로벌 금융위기 이후 최근까지 불균형이 지속되고 있으며, 일부에서는 이러한 외환스왑시장의 불균형이 새로운 달러화 자금시장의 균형 상태라는 해석이 제시되고 있다.

이러한 달러화 자금조달시장의 구조적 변화는 달러화 자금조달시장의 자금경색 발생 가능성이 과거보다 더 커졌음을 의미한다. 과거의 사례에서는 은행부문의 달러화 자금조달 상황의 급격한 악화가 달러화 유동성 위기의 주원인으로 작용하였다. 최근 달러화 자금시장에서의 구조적 변화는 안전자산 선호도 확대 및 달러화 자금중개 채널의 변화 등 다양한 변화요인으로 달러화 자금조달시장의 유동성 부족 현상이 초래될 수 있음을 시사하고 있다. 이미 올해 초 코로나19 확산 당시 글로벌 금융시장은 은행부문의 건전성이 유지되고 있는 상황 속에서도 안전자산 수요 확대에 따른 달러화 유동성 경색을 경험한 바 있으며, 최근 달러화 가치변화에 따른 달러화 자금조달시장의 영향이 확대되고 있다는 점 또한 달러화 유동성 부족이 다양한 변화요인에 의해 나타날 수 있음을 보여주고 있는 것으로 판단된다.23)

외화자금시장에서 은행의 달러화 차입 비중이 큰 우리나라는 더욱 글로벌 달러화 자금시장의 구조적 변화요인에 관심을 가질 필요가 있다. 외환시장 리스크 요인이 변화함에 따라 은행부문의 건전성이 유지되고 있는 상항 속에서도 외화자금시장의 유동성 경색이 나타날 수 있기 때문이다. 더욱이 최근 국내 외화자금시장은 이미 외환스왑시장의 불균형 등의 현상이 나타나고 있어, 글로벌 달러화 자금조달시장의 변화요인과의 관계 등에 대한 점검이 필요할 것이다. 제Ⅲ장에서는 최근 글로벌 달러화 자금조달시장의 구조적 변화요인이 국내 외화자금시장에 미치는 영향을 분석하고 시사점을 제시하였다.

Ⅲ. 국내 외화자금시장 현황 및 영향 분석

1. 외화자금조달 현황

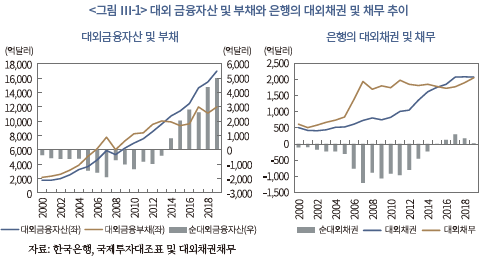

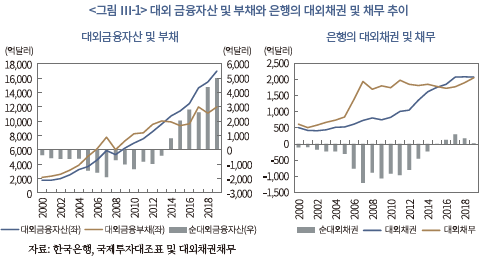

우리나라는 글로벌 금융위기 이후 큰 폭의 경상수지 흑자 기조와 외국인 증권투자자금의 꾸준한 유입 등으로 전체적인 국제수지가 흑자를 보이고 있다. 이에 따라 외환수급면에서 외화자금이 안정된 공급우위를 보이고 있으며 그 결과 거주자에 의한 대외투자도 꾸준히 증가하여 2019년말 현재 대외금융자산(외환보유액 포함)이 1조 6,997억달러로 대외금융부채(1조 1,988억달러)24)를 크게 상회하고 있다. 또한 최근 은행부문의 대외채권이 대외채무 규모를 상회하면서 통화불일치(currency mismatch)도 크게 개선되었다. 이러한 대외부문의 양호한 유동성 상황은 우리나라의 국가 신인도를 높이고 외평채가산금리나 CDS프리미엄 등 리스크프리미엄은 낮추어 양호한 외자조달 여건을 유지하는 데 도움을 주고 있다.

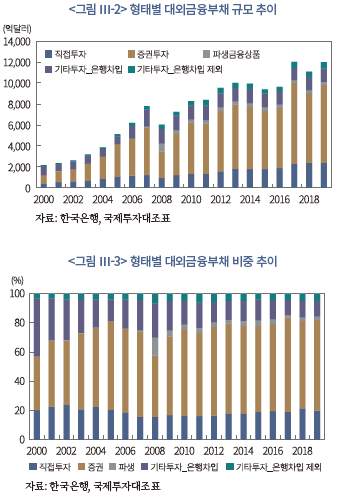

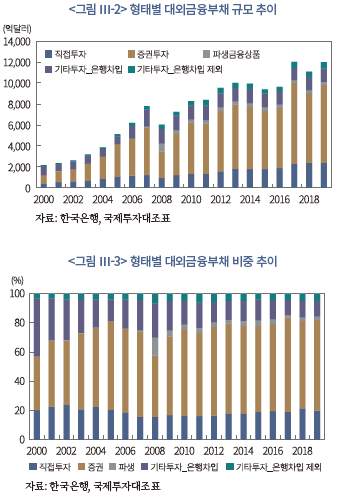

그러나 국제수지 흑자기조에 의한 외환공급 우위 기조를 거래형태별로 구분하여 살펴보면 경상수지 흑자나 외국인 증권투자자금은 주로 현물환시장으로 순유입되면서 큰 폭의 공급우위를 보이고 있는 반면 은행차입금과 같이 미달러화 자금을 빌려오는 외화자금시장(FX funding market)을 통한 외환순공급은 글로벌 금융위기 이후 축소된 모습으로 나타나고 있다. 즉 우리나라의 해외은행차입금 잔액은 글로벌 금융위기 이전인 2007년말의 1,629.1억달러에서 2019년말에는 1,294.7억달러로 크게 축소되었다. 또한 전체 대외금융부채에서 해외은행차입금이 차지하는 비중도 같은 기간중 20.9%에서 10.8%로 크게 하락한 것으로 나타나고 있다.

이러한 해외은행으로부터의 차입금 잔액의 감소는 글로벌 금융위기 이후 우리나라가 외환부문의 건전성 강화를 위해 선물환포지션한도제도나 외환건전성부담금 등과 같은 일련의 거시건전성 조치의 도입으로 국내은행들의 외화차입이 위축된 데도 일부 원인이 있겠으나 글로벌 금융위기 이후 글로벌 은행들에 대한 각종 규제조치 등으로 해외은행의 외환공급 여력이 축소된 데에도 원인이 있는 것으로 판단된다.

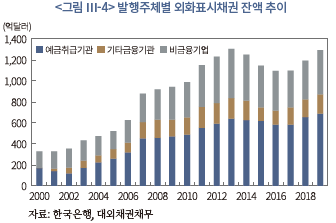

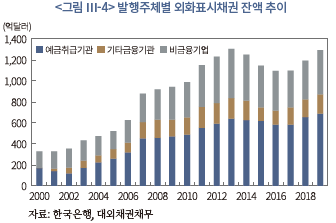

한편 우리나라에서 은행차입금과 더불어 주요 외화자금조달 경로로 이용되는 거주자 외화채권발행의 경우에는 글로벌 미달러화 자금시장과 유사하게 잔액이 견조하게 증가하는 모습이 나타나고 있다. 2019년말 현재 전체 채권발행 잔액은 1,294.7억달러로 이중 은행이 가장 큰 비중(53.1%)을 차지하고 있으나 증가속도 면에서는 글로벌 금융위기 이전과 비교하여 비은행부문이 은행을 앞서고 있다. 이는 해외은행으로부터의 차입을 통한 자금조달에 어려움이 커지면서 국내은행이나 비은행금융기관 그리고 기업들이 외화채권발행을 통한 미달러화 자금조달을 확대하고 있는 데 따른 것으로 보인다.

2. 국내 외환스왑시장 현황

외환스왑시장은 외화자금시장을 대표하는 시장으로서 두 통화간 자금의 대차가 일어나는 시장이다. 우리나라의 경우 전통적으로 외은지점(foreign bank branch)들이 해외 본점으로부터 은행차입금 형태로 외화자금을 들여와 국내은행들에게 외환스왑을 통해 외화유동성을 공급하는 형태가 외화자금공급의 주된 경로로 작용하여 왔다. 이 경우 외은지점은 국내은행들에게 외화를 공급하는 대신 계약기간 동안 원화를 수취하면서 미달러화와 원화간의 자금과부족을 해결하고 국내에서 영업활동을 영위하게 된다.

해외은행차입금을 통해 외환스왑시장에 외화유동성 공급이 늘어나는 경우에는 해외로부터 외화자금을 빌려오는 성격을 가지므로 우리나라 원화환율에 직접적인 영향을 주는 경상수지 흑자나 외국인 증권투자자금과 달리 외환스왑시장의 유동성과 가격에 영향을 미친다.25) 즉 은행차입금의 국내유입 증가시 외화자금시장의 유동성 공급이 늘어나므로 스왑레이트가 이론가격인 내외금리차를 상회하게 되며, 반대로 외화자금시장의 수요가 공급을 초과하는 경우에는 스왑레이트가 내외금리차를 하회하여 그 차이(내외금리차-스왑레이트)만큼 스왑시장의 불균형이 나타난다. 따라서 외환스왑시장에서 스왑레이트가 이론가와 괴리된 정도를 통해 외환스왑시장의 수요와 공급의 상대적 크기 즉 유동성 상황을 판단할 수 있다.

두 통화간에 외환스왑거래가 일어나는 경우 거래비용이나 리스크프리미엄 등이 없다면 스왑레이트와 내외금리차가 이론적으로 동일한 값을 가진다. 그러나 대부분의 신흥국 통화간에는 스왑레이트가 내외금리차를 어느 정도 하회하는 수요우위의 불균형이 관찰된다. 이는 신흥국 통화의 경우 비국제화된 통화를 가지고 있음에 따라 국가 리스크프리미엄의 존재에 따른 암묵적인 거래비용이 발생하고 글로벌 외화자금시장 상황에 따라 외화자금조달에 현실적인 어려움이 빈번히 발생하기 때문이다.

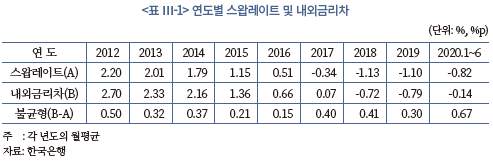

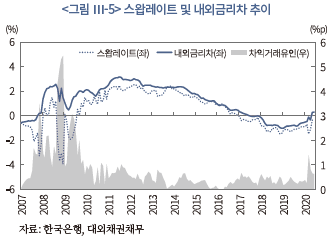

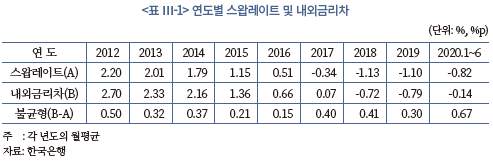

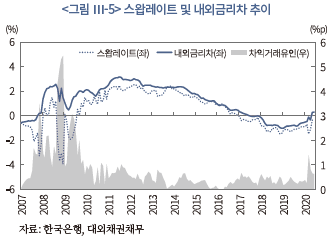

실제 글로벌 금융위기 이후 우리나라 외환스왑시장은 수요우위의 불균형이 확대된 것으로 나타나고 있다. 즉 외환스왑시장 불균형 규모는 2013년 9월~2016년 6월 기간중 월평균 20.9bp에서 2016년 7월~2020년 6월 중에는 40.1bp로 확대되었다. 이는 경상수지 및 전체 국제수지 흑자에 따라 우리나라 외환시장에 공급우위가 지속되고 있는 것과는 상반된 모습이다. 특히 코로나19 위기의 세계적 확산으로 글로벌 주가가 일시적으로 급락한 2020년 3~4월경에는 국내 증권사의 대규모 ELS 마진콜에 따른 단기 외화자금수요 확대로 유동성 부족이 심화되면서 3월중 불균형 규모가 139bp까지 확대되기도 하였다. 이는 외화자금시장의 구조적 수급 불안이 외부충격이 발생하면서 현물환시장 및 원화환율에 전이된 사례라 할 수 있다. 아래 <표 Ⅲ-1> 및 <그림 Ⅲ-5>는 글로벌 금융위기 이후 원/달러 스왑레이트와 내외금리차와의 괴리를 나타낸다. 이를 연도별로 보면 외환스왑 불균형 규모는 글로벌 금융위기 이후 2016년 까지는 대체로 하향 안정화 되는 모습을 보였으나 2017년 이후에는 불균형 규모가 확대되는 모습을 보이고 있다.

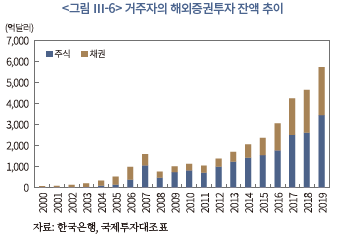

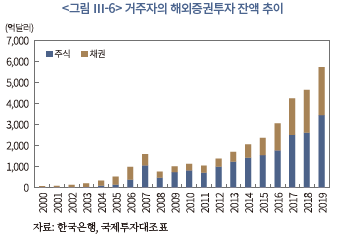

국내 외환스왑시장의 불균형은 비국제화된 통화로서 원화가 갖는 특성에 따라 국가 리스크프리미엄 등 거래비용이 존재하는 데다 글로벌 금융위기 이후 최근으로 오면서 다음과 같은 시장 수급요인의 영향을 받고 있기 때문으로 판단된다. 우선 외화자금의 수요 측면에서는 <그림 Ⅲ-6>에서 보듯이 2016년 이후 거주자의 해외증권투자가 큰 폭으로 증가하면서 환헤지를 위한 외화자금의 조달수요가 크게 늘어남에 따라 외환스왑시장에서의 외환수요가 크게 증가하였다. 특히 국내 투자자는 해외주식보다 해외채권에 투자하는 경우 투자에 따른 환율변동 위험을 회피하기 위한 환헤지 비율이 상대적으로 높은 것으로 알려지고 있다. 이는 채권투자의 특성상 환위험 없이 안정적인 투자수익을 획득하기 위한 전략으로 이해할 수 있다. 특히 해외채권에 대한 투자비중이 큰 국내 보험사의 경우 지급여력제도(Risk Based Capital: RBC)를 통해 보험업권 자체적으로 적극적인 환위험관리를 도모함으로써 국내 외환스왑시장의 수요를 확대시키는 요인으로 작용하고 있다.26) 다만, 해외투자 규모가 압도적으로 큰 국민연금기금의 경우에는 수년 전부터 해외주식은 물론 해외채권에 대해서도 환헤지정책을 중단한 바 있다.

한편 공급 측면에서 은행차입금의 축소도 수급 불균형의 중요한 원인으로 작용하고 있는 것으로 판단된다. 최근 은행차입금의 축소는 그간 우리나라의 외환부문 거시건전성 조치의 시행으로 해외은행으로부터의 자금 차입에 제약을 받는 국내적 요인과 미달러화 자금시장의 구조변화 등 해외요인이 혼재되어 있는 것으로 생각된다. 예를 들어 현재 국내에서 시행 중인 거시건전성 조치인 선물환포지션한도의 경우 은행의 자기자본 대비 선물환포지션한도를 제한하여 외은지점이 해외 본점으로부터 자금을 차입해 오는데 제약요건이 됨으로써 국내은행에 대한 유동성 공급이 위축되는 결과를 가져온다. 또한 해외은행의 경우에도 각종 규제도입으로 우리나라 은행에 대한 대출여력의 축소를 가져옴으로써 결과적으로 우리나라의 해외은행차입금 감소 요인으로 작용하고 있다.

3. 미달러화 자금조달시장 변화의 영향 분석

이 절에서는 글로벌 미달러화 자금시장의 구조변화가 국내 외환스왑시장 불균형에 미치는 영향을 실증분석해 보았다. 특히 미달러화 자금시장의 자금흐름이 글로벌 은행들의 행태변화를 통해 우리나라의 은행차입금 감소와 국내 외환스왑시장 불균형을 확대시키는 요인으로 작용하는지를 규명하는 데 분석의 초점을 두었다. 실증분석 방법으로는 회귀분석 방법 및 VAR모형의 충격반응 함수를 이용하였으며 추정기간은 2007년 이후 최근까지의 월별자료를 이용하였다.

가. 기존연구와의 차별성

글로벌 금융위기 이전 시점의 외환스왑시장의 불균형에 관한 기존의 연구에서는 스왑레이트가 이론가격인 내외금리차와 괴리를 보이면서 무위험금리평가(CIRP)로 부터 괴리가 발생하는 원인에 대해 주로 거래비용의 존재(Frenkel & Levich, 1977; Clinton, 1988; Bhar et al., 2004 등)나 신흥국의 정치적 위험에 따른 자본통제(capital control) 가능성(Dooley & Isard, 1980) 등을 주요 요인으로 보았다. 또한 신흥국의 미달러화에 대한 차입능력에 따라 외환스왑시장의 불균형이 확대되기도 하는 것으로 분석하였다(Szilagyi & Batten, 2006).

최근 연구에서는 미달러화 자금조달시장의 구조적 변화와 그 영향에 대한 관심이 커지고 있다. 기존연구의 주요 설명변수가 글로벌 금융위기 이후 외환스왑시장의 불균형이 장기간 지속되고 있는 현상을 충분히 설명하고 있지 못하고 있기 때문이다. Du et al.(2017)은 2012년 이후 주요 15개국 통화의 대 미달러화 외환스왑시장 불균형 원인을 분석한 결과 신용위험(credit risk) 등 기존연구의 주요 설명 변수는 불균형의 절반 수준을 설명하는 데 그치고 있음을 실증적으로 보여주었으며, 기존의 설명변수보다 글로벌 은행의 부채 확대에 따른 직‧간접적 비용 변화를 초래하고 있는 제도적 요인의 중요성을 주장하였다. Avdjiev et al.(2017a,2017b)은 미달러화 가치 변화가 외환스왑시장 불균형의 중요한 설명 변수로 작용하고 있다는 연구결과를 제시하였다. 이러한 연구 결과는 글로벌 금융위기 이후 글로벌 은행의 부채 확대를 제한하고 있는 제도적 요인과 미달러화 관련 영업확대의 그림자 비용으로 설명하고 있는 미달러화 가치 향방 등이 최근 외환스왑시장 불균형 확대의 주원인으로 작용하고 있음을 시사하고 있다.

한편 우리나라 외환스왑시장의 불균형 원인에 관한 기존의 연구에서는 은행들의 외화차입 능력(이승호, 2003)이 거래비용보다 더 중요한 요인으로 분석되었다. 또한 2003년 하반기 비거주자에 대해 일시적으로 시행되었던 NDF(Non-Deliverable Forward) 거래에 대한 외환포지션 규제(서현덕, 2005)와 당국의 외환시장개입(송치영‧김경수, 2008) 등 정책변수도 외환스왑시장에 영향을 미치는 것으로 나타났다. 해외요인 중에서는 글로벌 유동성이 우리나라의 외화자금조달 여건에 중요한 변수로 분석(정대희, 2012; Lee et al., 2014)된 바 있으며 글로벌 금융위기 전후 국제금융시장의 불확실성 증가와 우리나라 은행들의 신용위험이 외환스왑시장 불균형에 중요한 영향을 주는 것으로 분석(Baba & Shim, 2011)되기도 하였다. 아울러 외환스왑시장의 수요에 영향을 미치는 국내 기업 및 역외비거주자의 선물환 거래 등 외환수급요인의 중요성과 국가 리스크프리미엄이 외환스왑시장 불균형의 주요 원인으로 지적(이승호, 2014)되기도 하였다.

본 보고서의 실증 분석은 다음과 같은 점에서 기존의 연구들과 차별성을 보이고 있다. 첫째, 기존의 연구들이 주로 글로벌 금융위기 이전 미달러화 자금시장이 외화자금조달시장으로서의 기능과 역할에 큰 어려움이 없던 시기를 대상으로 하고 있는 점과 달리 글로벌 금융위기 이후 글로벌 은행에 대한 선진국의 각종 규제 조치 시행 등으로 미달러화 자금조달 비용이 커지고 그 결과 글로벌 은행들의 자금공급 기능은 과거보다 위축되고 있는 최근의 시기를 주요 분석대상으로 하고 있다. 즉, 글로벌 불확실성 증가로 안전자산에 대한 선호확대와 미달러화 자금중개 기능에 변화가 발생하고 있는 최근의 새로운 금융환경 하에서의 우리나라의 외환스왑시장 불균형 현상을 분석하였다.

둘째, 과거 글로벌 외화자금시장의 유동성 및 수급 불균형을 파악하는 주요 변수로 글로벌 유동성이나 주식시장의 변동성지수(VIX) 등이 중시되어 왔으나 본 연구에서는 이러한 요인들과 더불어 미달러화의 가치변화가 글로벌 은행의 대출 등 자금흐름에 영향을 주는 점을 고려하였다. 즉, 최근 주요 선진국 통화간 스왑시장에서의 불균형 확대의 주된 요인으로 인식되고 있는 미달러화 가치변화가 글로벌 은행들의 대출행태에 영향을 미친다는 점을 고려하여 이를 실증분석에 반영하였다.

셋째, 기존의 연구들은 우리나라 외환스왑 불균형에 영향을 미치는 다양한 국내외 요인들을 무차별하게 고려하고 있으나 본 보고서에서는 우리나라 외화자금유입의 주된 경로인 해외은행차입금에 대한 면밀한 분석에 초점을 둠으로써 우리나라 현실에 보다 부합하는 분석을 시도하였다. 특히 미달러화 자금시장 변화가 우리나라의 은행차입금 규모변화를 통해 외환스왑시장 불균형에 미치는 경로를 세부적으로 분석하기 위해 국내 거시건전성정책 등 국내요인을 제외하고 미달러화 자금시장변화 등 해외요인이 은행차입금 유출입에 미치는 영향을 구분하여 분석하였다.

나. 회귀분석 방법 및 추정 결과

본 연구에서는 국내 외환스왑시장의 불균형에 대한 실증분석을 위하여 우선 회귀분석 방법을 이용하여 설명하였다. 이를 위해 해외요인에 의한 은행차입금을 일차적으로 추정한 후 이를 이용하여 우리나라 외환스왑시장 불균형 원인을 분석하는 2단계 회귀추정 방법을 이용하였다.

스왑시장 불균형에 관한 주요 설명변수로는 국내요인으로 국가 리스크프리미엄의 대용변수인 외평채CDS프리미엄과 거주자의 해외채권투자액을 사용하였다. 전자의 경우 우리나라의 차입비용 상승으로, 후자의 경우에는 국내 스왑시장의 수요확대를 가져오는 요인이므로 스왑시장 불균형에 대해 양(+)의 예상부호를 갖는다.

해외요인들로는 국제금융시장 유동성 위험의 대용변수인 Libor-OIS 스프레드, 글로벌 주식시장의 변동성지수, 미달러화와 유로화간 스왑시장불균형 규모, 글로벌 유동성의 대용지표로서 G3국가의 통화량(M2) 등을 이용하였다. 글로벌 유동성 및 변동성 위험의 증가 그리고 미달러화와 유로화간 불균형의 확대는 글로벌 외화자금시장의 유동성 감소와 불균형 확대 요인으로 볼 수 있으므로 국내 스왑시장의 불균형에도 양(+)의 영향을 미칠 것으로 예상된다. 반면 G3국가의 통화량 증가는 다양한 경로를 통해 국내로의 외화유동성 유입을 증가시키는 요인이 되므로 국내 외환스왑시장 불균형과는 음(-)의 예상부호를 갖는다고 할 수 있다.

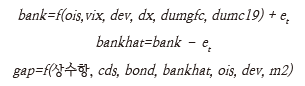

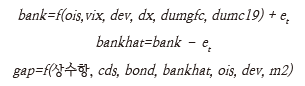

한편 국내요인과 해외요인이 혼재되어 있는 은행차입금이 증가하는 경우에는 외환스왑시장에 대한 공급을 늘리므로 불균형에 대해 음(-)의 예상부호를 갖는다. 본 보고서에서 실증분석의 주된 목적이 미달러화 자금시장 변화가 해외은행들의 국내은행에 대한 대출에 영향을 줌으로써 국내 외환스왑시장 불균형의 확대 요인으로 작용하는지를 파악하는데 초점이 있으므로 실제 은행차입금 데이터 대신 해외요인에 의한 추정치를 구하여 회귀추정에 사용하였다. 해외요인에 기인한 은행차입금 추정에는 위에서 사용된 해외요인 설명변수에 미달러화지수(US dollar index)를 추가로 포함하였다.27) 회귀추정식은 다음과 같이 2단계 추정방법을 사용하였다.

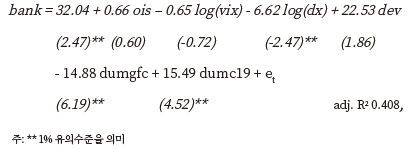

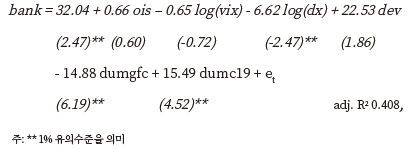

여기서 bank는 은행차입금, ois는 Libor-OIS 스프레드, vix는 변동성지수, dev는 미달러화와 유로화 스왑시장 불균형, dx는 미달러화지수, dumgfc는 글로벌금융위기 더미, dumc19는 코로나 위기 더미, gap은 내외금리차와 스왑레이트의 괴리, cds는 외평채CDS프리미엄을 각각 나타낸다. 더미변수는 각각 글로벌 금융위기시와 금년중 코로나 위기의 확산시 국내 외환스왑시장의 불균형이 크게 확대된 점을 고려하기 위함이다. 대부분의 변수들은 로그(log) 변환하였으며 여타변수와 달리 단위근(unit root)이 존재하는 거주자의 해외채권투자(bond) 변수는 일차 차분하여 안정적인 시계열을 확보하였다.

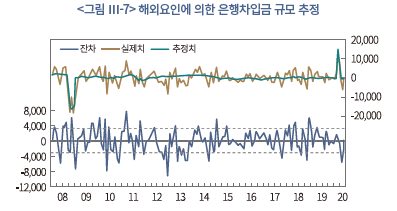

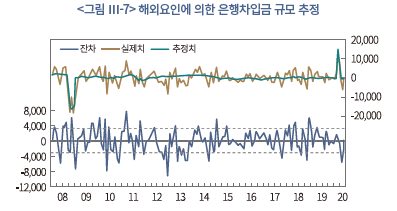

우선 해외요인에 기인한 은행차입금 규모를 추정하기 위해 실시한 회귀분석 결과는 아래와 같다. 즉, 국내은행의 차입금은 미달러화 강세시 안전자산 선호현상의 결과 차입금 규모가 감소하는 것으로 나타났으며 통계적 유의성도 높은 것으로 나타났다. 또한 글로벌 금융위기시와 코로나 위기시는 각각 차입금 규모 감소 및 증가가 유의하게 나타났다. 이러한 추정식을 이용한 은행차입금 추정 결과 및 추정치(fitted value)는 아래 그림과 같다.

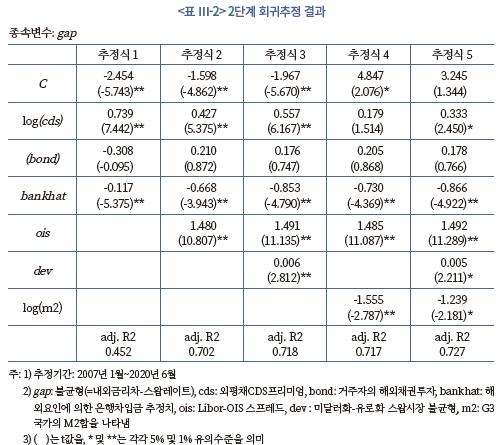

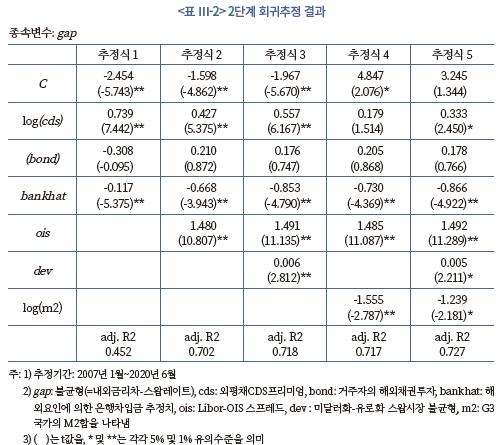

한편 위의 은행차입금 추정치를 포함한 우리나라 스왑시장 불균형 원인에 관한 회귀추정 결과는 아래의 <표 Ⅲ-2>에 제시하였다. 분석 결과 대부분의 설명변수가 예상부호와 일치하였으며 통계적 유의성도 높은 것으로 나타났다.

국내요인에 있어서는 우리나라 외환스왑시장 불균형은 외평채CDS프리미엄에 대해 통계적으로 유의한 양(+)의 값을 보였다. 이는 우리나라의 국가 리스크프리미엄이 확대되는 경우 외자조달비용 상승 등으로 외환스왑시장의 불균형이 확대됨을 의미한다.

국내 거주자의 해외채권투자는 예상과 같이 스왑시장 불균형에 대체로 양(+)의 영향을 미치는 것으로 나타났으나 통계적 유의성은 그리 높지 않은 것으로 분석되었다. 이는 국내 거주자의 해외채권투자시 환헤지에 따른 외환수요가 외환스왑시장의 수요 증가요인으로 작용할 것이라는 일반적인 예상과 다소 차이를 보이는 것으로 판단된다. 이러한 추정 결과는 최근 국민연금 등 대형 기관투자자들이 해외채권투자시 환헤지를 하지 않는 경향이 점차 늘어나고 있는데다 우리나라 해외채권투자 비중의 상당부분을 차지하고 있는 국내 보험사가 최근 위험관리 목적 등으로 해외채권투자 규모를 다소 축소하고 있는 데 따른 것으로 보인다.

해외요인 중에서는 글로벌 유동성 및 변동성 위험이 증가하는 경우와 미달러화와 유로화 스왑시장의 불균형 확대시에 국내 스왑시장의 불균형 확대에도 양(+)의 영향을 주는 것으로 나타났으며 통계적 유의성도 대부분 높은 것으로 나타났다. 이는 국내 스왑시장 불균형에 대한 해외요인들의 중요성이 국내요인 못지않게 매우 높음을 의미하는 것으로 볼 수 있다. 특히 회귀분석에서 주안점을 두고 있는 해외요인에 의한 은행차입금의 경우 모든 추정식에서 음(-)의 부호를 보여 예상과 일치하였으며 통계적 유의성도 매우 높은 것으로 나타났다. 이는 미달러화 자금시장으로 대표되는 해외 외화자금시장 변화에 의한 국내은행차입금 축소가 국내 스왑시장의 불균형 확대요인으로 작용하고 있음을 의미한다.

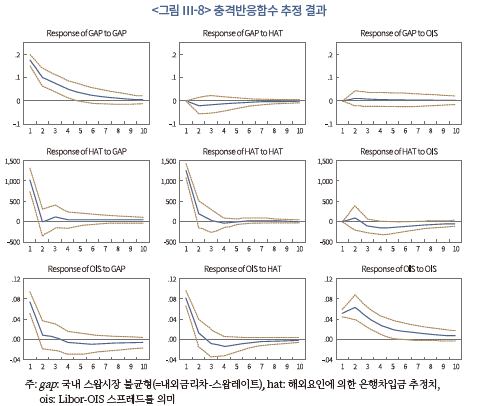

다. 충격반응함수 추정 결과

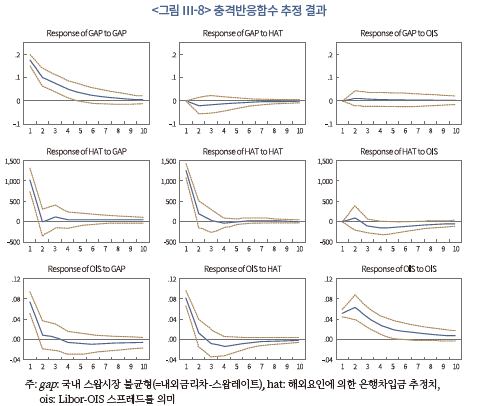

회귀추정에 대한 보완으로 벡터자기회귀모형(VAR)을 이용하여 국내 외환스왑시장의 불균형에 영향을 주는 요인에 대한 충격반응함수를 살펴보았다. 모형의 추정을 위한 변수로는 앞의 회귀추정에서 사용한 스왑시장불균형(gap), 해외요인에 의한 은행차입금(bankhat), 그리고 글로벌 유동성 위험의 대용지표(ois)의 세 변수로 구성하였다.28)

아래의 <그림 Ⅲ-8>에서 보는 바와 같이 글로벌 유동성 위험의 증가는 국내 스왑시장 불균형을 확대시키는 것으로 나타났으며 시차를 두고 해외은행차입금을 감소시키는 것으로 나타났다. 이는 글로벌 유동성 위험의 확대가 글로벌 은행들의 대출여력을 감소시킴으로써 우리나라에 대한 해외은행차입금의 감소 요인으로 작용하고 있음을 의미한다. 글로벌 유동성 변화가 해외은행차입금에 미치는 영향은 약 3개월의 시차를 두고 그 영향이 나타난 이후 상당기간 지속되는 것으로 추정되었다. 또한 해외은행차입금 유입은 국내 스왑시장의 불균형을 축소시키는 요인으로 나타나 앞서의 회귀추정 결과와 일관된 방향을 보였는데 대략 약 2개월의 시차를 두고 그 영향이 가장 크게 나타난 후 서서히 그 영향이 감소하는 것으로 보인다.

이러한 추정결과는 글로벌 요인에 의한 국내 스왑시장시장 불균형에 대한 영향이 적지 않음을 나타낸다. 특히 글로벌 미달러화 자금시장의 구조변화에 따른 해외은행의 대출금 축소가 국내 스왑시장의 불균형 확대요인으로 작용하고 있음을 확인시켜주는 결과로 볼 수 있다.

4. 소결

본 장에서는 우리나라의 외화자금 흐름과 외환스왑시장 현황에 대해 살펴본 후 글로벌 미달러화 자금시장 변화가 국내은행 차입금 변화를 통해 외환스왑시장에 미치는 영향을 분석해 보았다.

우리나라는 글로벌 금융위기 이후 경상수지 흑자 규모의 확대와 외국인의 국내 증권투자자금 순유입 증가 등으로 현물환시장을 통한 외환공급 우위가 이어지고 있는 것과 달리 해외은행차입금을 통한 외화자금시장은 수요 우위의 상반된 현상이 지속되고 있다. 이러한 외화자금시장의 유동성 감소는 외환스왑시장의 불균형 확대로 나타나고 있다. 이러한 이분화된 외환시장 구조는 외부충격 발생시 외화자금시장의 유동성 부족이 현물환시장으로 급속히 전이되며 환율을 상승시키는 요인으로 작용할 가능성이 있다.

우리나라 외환스왑시장의 불균형 원인에 대한 실증분석 결과에서는 국가 리스크프리미엄이나 거주자의 해외증권투자 확대 등 국내요인과 더불어 글로벌 유동성, 선진국간 스왑시장 불균형 등 해외요인에 의해서도 적지 않은 영향을 받는 것으로 파악되었다. 특히 해외요인에 기인한 은행차입금 유출입은 국내 외환스왑시장의 불균형에 유의한 영향을 미치는 것으로 나타났는데 이는 최근 국내 스왑시장 불균형 확대가 글로벌 미달러화 자금시장의 유동성 악화에 따른 글로벌 은행들의 우리나라에 대한 외화유동성 공급여력 감소에도 상당부분 기인함을 시사한다. 따라서 국내 스왑시장 불균형의 주원인으로 지목받는 거주자의 해외증권투자나 거시건전성 정책에 따른 은행차입 제약 못지않게 해외 미달러화 자금시장의 변화 추이에도 유의할 필요가 있을 것으로 판단된다.

Ⅳ. 결론 및 시사점

글로벌 미달러화 자금조달시장은 글로벌 금융위기를 기점으로 상당히 변화된 모습이 나타나고 있다. 전통적으로 글로벌 대형은행의 달러화 자금중개 업무를 통해 글로벌 달러화 자금수요를 충당하던 기존 달러화 자금시장의 구조는 최근 주요 기관의 달러화표시 채권발행 확대, 외환스왑시장을 통한 단기 자금조달 확대 등의 방향으로 변화하고 있다. 달러화 자금시장에서의 은행의 달러화 자금 공급역할은 축소되고 있으며, 특히 기존 글로벌 달러화 자금중개 비즈니스 확대를 주도하여 온 유럽계 은행의 비중이 크게 감소하고 있다. 또한 단기 달러화 자금조달시장은 상시적인 고비용‧저유동성 시장으로 변화하였으며, 일시적 불균형으로 해석되었던 외환스왑시장의 괴리는 최근의 구조적 변화를 감안할 때 새로운 균형으로 재해석되고 있다.

우리나라의 외화자금시장 또한 이러한 글로벌 달러화 자금조달시장의 구조적 변화에 영향을 받고 있는 것으로 나타나고 있다. 전통적으로 우리나라의 주된 외화차입 경로이던 국내은행의 해외은행차입금은 최근 글로벌 은행의 부채 확대에 따른 그림자 비용으로 해석되면서 차입금 규모가 축소되고 있다. 또한 글로벌 금융위기 이전과는 달리 글로벌 은행들의 달러화공급 여력이 축소되고 있는 구조적 변화는 국내은행의 해외차입 감소를 통해 간접적으로 원/달러 외환스왑시장의 불균형을 확대시키는 요인으로 작용하고 있는 것으로 확인되었다. 이와 함께 글로벌 유동성 위험이나 미달러화 자금시장의 불균형 등 해외요인들은 국내요인 못지않게 외환스왑시장의 불균형을 확대시키는 요인으로 작용하고 있는 것으로 분석되었다.

이러한 연구 결과는 국내 외화자금시장의 안정성 제고 측면에서 다음과 같은 시사점을 제시하고 있다. 첫째, 기존의 국내 외환시장 리스크 요인 외에도 최근 구조변화로 인해 글로벌 달러화 자금조달시장에 영향을 미치고 있는 다양한 위험요인에 대한 세심한 모니터링이 필요하다. 향후 달러화 자금유동성 경색이 은행의 외환부문 건전성 악화 외에도 글로벌 유동성 및 위험선호변화 등 다양한 국제금융시장의 구조적 변화 요인에 의해 나타날 수 있기 때문이다. 특히, 미국, 유럽 등 주요국의 은행부문 건전성 규제 변화는 달러화 자금시장의 공급 축소를 초래할 수 있음에 유의할 필요가 있을 것이다. 또한 미국 통화정책 변화에 따른 달러화 가치 변화는 글로벌 달러화 자금의 유동성 변화를 초래하는 주요 변수로 작용하고 있는 만큼 이에 따른 국내 외화자금시장의 변화 가능성에 유의할 필요가 있다.

둘째, 비은행부문의 달러화 수요가 크게 증가하고 있다는 점에서 달러화 자금의 유동성 경색이 비은행부문의 안전자산 선호도 확대 시점에 발발할 가능성이 높을 것으로 보이므로 이에 대한 철저한 대비가 필요할 것으로 판단된다. 올해 초 범세계적인 코로나19 확산에 따른 단기 달러화 자금시장의 유동성 악화 또한 일반 기업 및 비은행부문의 달러화 자금수요에 기인한 바가 큰 것으로 나타나고 있다. 특히 우리나라는 보험사 등 해외증권투자기관의 환헤지 수요가 지속되고 있는 상황에서 금년 3월경 경험한 국내 증권사 등 비은행금융기관의 급격한 외환수요가 재발될 경우에는 외화유동성 경색이 심화되면서 국내 외환스왑시장 및 외환시장 전체의 불안을 확대시킬 수 있음에 더욱 유의할 필요가 있을 것이다. 따라서 국내 증권사는 ELS 등 우발적 외화유동성 위험에 대비하여 상시적인 외화유동성 확보 노력을 자체적으로 강화하고 정책당국도 긴급시 이들 기관에 대한 외화유동성 공급채널을 마련해둘 필요가 있다.

셋째, 최근 국내외에서 모두 달러화 자금조달의 수단으로서 채권발행 비중이 커지고 있는 점은 향후 국제금융시장의 국제채권발행 여건 변화에 따라 달러화 자금경색 가능성을 유발할 수 있다. 채권발행을 통한 자금조달은 일반적으로 은행차입 대비 장기로 조달되고 있어 상대적으로 안정적인 것으로 인식되고 있으나, 은행 차입의 경우와 마찬가지로 롤오버 시점의 발행여건 악화는 해당 기관의 자금 압박 및 비용 상승을 통해 어려움을 초래할 수 있다. 특히 코로나 극복 이후 주요국의 통화정책 기조가 정상화 과정을 밟아 나가는 과정에서 금리변동성이 커지면서 발행채권에 대한 발행주체들의 상환부담이 늘어나지 않도록 보다 탄력적인 발행전략을 마련해 나갈 필요가 있을 것으로 생각된다. 이를 위해 전체 한국물 발행채권의 관점에서 발행시기나 만기구조의 다변화를 도모할 필요가 있다.

마지막으로 최근 달러화 자금조달시장의 변화는 구조적인 변화 요인에 기인하고 있는 만큼 향후 우리나라의 외화자금조달 전략 변화 또한 이러한 구조적 변화에 맞게 다변화하는 방향으로 유도할 필요가 있을 것으로 판단된다. 그간 외화차입의 주된 경로로 활용되어온 해외은행차입금이 대내외 여건변화로 축소되고 있는 만큼 안정적인 외자조달 경로를 모색해 나갈 필요가 있을 것으로 보인다. 특히 유럽계 은행을 통한 자금조달에 의존도가 높은 우리나라는 점차 국내은행의 미국 내 지점을 통한 직접 자금조달 등의 방안을 통해 달러화 자금이 조달될 수 있는 방향도 고려할 필요가 있을 것으로 생각된다. 아울러 글로벌 자금흐름에 구조변화를 보이고 있는 글로벌 은행의 미달러화 자금공급 축소 추세하에서 우리나라의 외환부문 안정을 위한 거시건전성 제도가 외화자금조달에 부정적 요인으로 작용하지 않도록 세심한 정책적 고려를 해 나갈 필요가 있을 것으로 보인다.

1) 외환스왑은 거래당사자가 현재 환율로 두 통화를 교환한 후 만기시 계약당시 정해놓은 선물환율로 재교환하는 거래임; 한편 통화스왑 또한 외환스왑과 유사하게 일정기간 두 통화를 교환하는 거래이나, 주로 1년 이상의 장기계약에 활용되고 계약기간중 교환된 통화에 대해 이자를 부담한다는 점에서 구별됨

2) 국제결제은행(BIS)의 달러화 유동성(Global Liquidity Indicators: GLI) 측정 기준에 따라 은행부문의 국경간 미달러화 대출 총액 및 전체(은행 및 비은행부문) 미달러화 표시 국제채권발행잔액으로 산정하였음

3) 본 연구에서는 IMF(2018) 등의 분류 방식에 따라 은행의 대 비은행부문 대출 및 비은행부문의 직접 달러화 자금조달(채권발행 등)을 달러화 자금수요로, 은행간 국경간 대출 잔액을 달러화 자금공급으로 정의하였는데, 이는 자금조달의 목적에 따른 분류 방법으로 일반적인 시장 균형 관점에서의 수요‧공급과는 차이가 있음

4) 글로벌 금융위기 이전 기간중 비은행부문의 자금조달 비중은 총액 대비 30~36% 수준을 기록하였으며, 2015년 이후 비은행부문 비중이 은행부문 비중을 초과하고 있음

5) CPIS 서베이에는 2019년 기준 약 90개국 중앙은행이 참여하고 있으며, 이들 국가 거주자의 전세계(약 240국 대상지역) 해외증권투자 보유잔액 통계를 보고하고 있음

6) 예를 들어 국내 기관이 브라질 채권에 투자하는 경우에도 원화-달러화 환전 및 헤지를 통해 달러화 자금을 조달한 이후 투자대상국 통화로 전환하고 있음. 또한 달러화표시 자산 총액을 보고하고 있는 5개국(<그림 Ⅱ-4> 참조)의 달러화표시 해외증권투자 잔액 증가추세 또한 빠른 속도로 확대되고 있는 것으로 나타나고 있음

7) BIS(2020) 조사에 따르면 2019년말 기준 동아시아 3개국(한국, 대만, 일본) 보험사의 해외증권투자 총액이 약 1.5조달러에 달하고 있으며, 달러화 헤지 비중은 일본 약 60%, 대만 약 50%에 달하는 것으로 추정됨

8) 은행부문 총 달러화 자산 총액 대비 비미국계 은행의 비중은 2019년 기준 약 80% 수준임

9) 미국의 경우에도 2011년 이후 국경간 달러화 대출 잔액이 감소 추세로 전환되었으며, 이는 당시 FDIC 예금보험료 적용 대상 확대에 따른 영향이 지배적인 것으로 추정됨

10) 글로벌 금융위기 이전 기간중 채권발행을 통한 조달 비중은 32~34% 수준

11) 은행부문의 달러화표시 채권발행 잔액 또한 2019년말 기준 약 2.7조달러로, 글로벌 금융위기 이전 대비 확대된 것으로 나타나고 있음

12) 예를 들어 바젤Ⅲ LCR 및 NFCR 규제의 경우 단기부채에 대해 높은 위험가중치(무담보 부채의 경우 100%의 위험가중치 적용 등)를 부과함으로써 은행부문의 단기부채 확대를 제한하는 요인으로 작용함

13) 미국 MMF 규제 개혁에 관한 주요 내용은 <참고 Ⅱ-2> 참조

14) 비미국계 은행 또한 미국 내 지점을 통해 달러화 예금을 유치할 수 있으나, 미국 은행법에 따라 비미국계 은행의 미국 내 예금액의 역외 대출 및 투자가 불가능함

15) 미국의 MMF는 국공채에 투자하는 국공채 MMF와 CP 및 CD 등에 주로 투자하고 있는 프라임 MMF로 분류되며, 최근 미국의 MMF 규제 강화는 기관형 프라임 MMF를 대상으로 이루어짐(자세한 내용은 <참고 Ⅱ-2> 참조)

16) 통상적으로 CP는 만기 1개월물 미만이 대부분 거래되고 있는 반면 외환스왑의 경우 3개월물이 주로 거래되고 있어, 이를 통한 중개방식은 만기 불일치 리스크를 수반하고 있음

17) 일반적으로 CP 발행을 통한 펀딩 비용이 외환스왑을 통한 비용 대비 유리한 것으로 나타나고 있으며, 전자의 경우 은행의 부채 확대를 통해 각종 규제 비율 산정에 포함됨에 따른 추가적인 비용이 발생함

18) Pozsar(2016)는 이러한 측면에서 최근의 달러화 유동성 부족(Global dollar shortage) 상황을 은행의 부채 확대 여력 위축에 따른 중개 자금의 부족(Shortage of banks; balance sheet to intermediate dollar) 현상으로 구분하여 설명하고 있음

19) 달러화 스왑시장의 불균형은 직접 달러화 자금조달 비용과 외환스왑을 통한 간접 조달 비용 간 차이(스왑베이시스(Currency-Currency Basis: CCB)로 표기);

20) 내외금리차와 해당 통화간 현‧선물 환율차이(스왑레이트)간 평형 상태를 지칭 ( , 로그화 단위 표시 기준); 외환스왑시장에서의 평형 수렴 현상은 글로벌 금융위기 전 시점까지는 대부분의 주요 선진국 통화에서 관찰되는 일반적 현상으로 받아들여짐

, 로그화 단위 표시 기준); 외환스왑시장에서의 평형 수렴 현상은 글로벌 금융위기 전 시점까지는 대부분의 주요 선진국 통화에서 관찰되는 일반적 현상으로 받아들여짐

21) 은행부문의 달러화 스왑시장을 통한 자금조달 비중은 IMF(2018) 등의 추정 방식에 따라 총자산 대비 순자산(총자산-총부채) 비중을 나타내고 있는 CCFR(Cross Currency Funding Ratio)을 통해 추정함; 즉, 대부분 은행의 경우 외환노출도를 제한하고 있음에 따라 은행의 오픈 외환포지션인 달러화 순자산에 해당하는 재원을 외환스왑을 통해 조달하고 있는 것으로 추정

22) 해당 통계는 모든 통화를 포함하고 있으나, 달러화가 포함된 계약이 90% 이상으로 추정됨(BIS Derivatives Statistics, 2019)

23) Bruno & Shin(2015)은 달러화 가치변화는 기업의 달러화 대출관련 신용도 변화를 통해 은행의 추가 대출 여력에 영향을 미친다는 점에서 은행의 달러화 자금조달의 그림자 비용으로 설명하고 있음

24) 우리나라 대외금융부채 중 미달러화가 전체 외환의 80.3%(2019년말 기준)를 차지

25) 해외은행차입금이 현물환율에 미치는 영향이 제한적인 것은 자금차입으로 외화자산과 외화부채가 동시에 늘어나 은행의 외환포지션에 변동이 일어나지 않기 때문임

26) 이는 해외채권투자를 위한 현물환매입과 동시에 환헤지를 위해 선물환매도를 행함으로써 외환스왑시장의 buy&sell 스왑거래가 증가함에 기인하고 있음

27) 미달러화지수의 상승시 미달러화 자금조달자의 상환위험이 커지므로 글로벌 은행의 대출이 감소하는 영향을 미치는 것으로 가정함

28) 외생성이 높을 것으로 보이는 변수의 순서에 따라 [gap, bankhat, ois]의 순으로 모형을 구성하였으며, 모형의 시차는 AIC에 따라 2(개월)를 적용

참고문헌

김한수, 2020, 코로나19 사태에 따른 외환시장 현황 및 시사점, 자본시장연구원『자본시장포커스』2020-09.

서현덕, 2005, 우리나라에서의 금리평형이론과 자본이동, 한국은행『외환국제금융 리뷰』.

송치영‧김경수, 2008, 원/달러 무위험 금리평형 이탈에 대한 실증연구, 한국응용경제학회『응용경제』10(3).

이승호, 2003, Deviation from covered interest rate parity in Korea, Journal of International Economic Studies 7(1), Korea Institute for International Economic Policy.

이승호, 2014,『우리나라 외환스왑시장의 불균형 및 환율과의 관계에 관한 연구』, 자본시장연구원 연구보고서 14-07.

이승호, 2020, 국내 증권사의 외화유동성 위기에 대한 평가와 과제, 자본시장연구원 『자본시장포커스』2020-16.

정대희, 2012,『우리나라 외환시장의 차익거래 유인에 대한 분석』, 한국개발연구원 한국개발연구 34(1), 30-52.

Adrian, T., Xie, P., 2020, The non-US bank demand for US dollar assets, IMF Working paper(WP/20/101)

Aldasoro, I., Ehlers, T., 2018, Global liquidity: Changing instrument and currency patters, BIS Quarterly Review 2018-09.

Aldasoro, I., Ehlers, T., 2018, The geography of dollar funding of non-US banks, BIS Quarterly Review 2018(12).

Aldasoro, I., Ehlers, T., Eren E., 2019, Global banks, dollar funding, and regulation, BIS Working papers No.708.

Aldasoro, I., Ehlers, T., McGuire, P., Perter, G., 2020, Global banks’ dollar funding needs and central bank swap lines, BIS Bulletin No.27.

Avdjiev, S., Du, W., Koch, C., Shin, H., 2017a, The dollar, bank leverage and the deviation from covered interest parity, BIS Working paper No.592.

Avdjiev, S., Eren, E., McGuire, P., 2020, Dollar funding costs during the Covid-19 crisis through the les of the FX swap market, BIS Bulletin No.1.

Avdjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017b, The shifting drivers of global liquidity, BIS Working paper No.644.

Baba, N., Shim, I., 2011, Dislocations in the won-dollar swap markets during the crisis of 2007-09, BIS Working papers No.344.

Barajas, A., Deghi, A., Raddatz, C., Seneviratne, D., Xie, P., Xu, Y., 2020, Global banks’ dollar funding: A source of financial vulnerability, IMF Working paper(WP/20/113).

Bhar, R., Kim, S.J., Pham, T., 2004, Exchange rate volatility and its impact on the transaction costs of covered interest rate parity, Japan and World Economy 16, 503-525.

BIS, 2020, US Dollar Funding: An International Perspective, CGFS Papers No.65.

Bruno, V., Shin, H. S., 2015, Capital flows and the risk-taking channel of monetary policy, Journal of Monetary Economics 71, 119-132.

Clinton, K., 1988, Transactions costs and covered interest parity, Journal of Political Economy 96, 358-370.

Dooley, M.P., Isard, P., 1980, Capital controls, political risks, and deviations from interest-rate parity, Journal of Political Economy 88(2).

Du, W., 2019, Commentary: Mind the Gap in Sovereign Debt Markets: The U.S. Treasury Basis and the Dollar Risk Factor, commentary at Federal Reserve Bank of Kansas City Jackson Hole Economic Policy Symposium.

Du, W., Hébert, Benjamin M., Huber, Amy, 2019, Are intermediary constrains priced? NBER Working paper No.26009.

Du, W., Tepper, A., Verdelhan, A., 2017, Deviations from covered interest parity, NBER Working paper No.23170.

Eren, E., Schrimpf, A., Sushko, V., 2020, US dollar funding markets during the Covid-19 crisis–the international dimension, BIS Bulletin No.15.

Erick, B., Lombardi, M., Mihaljek, Du., Shin, H., 2020, The dollar, bank leverage and real economic activity: an evolving relationship, BIS Working papers No.847.

Frenkel, J.A., Levich, R.M., 1977, Transaction costs and interest arbitrage: Tranquil versus turbulent periods, Journal of Political Economy 85, 1209-1226.

Gopinath, G., 2015, International Price System, 2015 Jackson Hole Symposium.

Iida, T., Kimura, T., Sudo, N. 2018, Deviations from covered interest rate parity and the dollar funding of global banks, Quarterly Journal of Economics 130(3).

IMF, 2018, Global Financial Stability Report April 2018: A Bumpy Road Ahead.

IMF, 2020, Strains in Offshore US Dollar Funding during the COVID-19 Crisis : Some Observations, IMF Analytic Notes.

Kreicher, L., McCauley, R., McGuire, P., 2013, The 2011 FDIC assessment on banks’ managed liabilities: interest rate and balance-sheet responses, BIS Working papers No.413.

Lee, I.H., Lee, S.H., and Shim, Ilhyock, 2014, “Deviation from Covered Interest Rate Parity in Asian Foreign-Exchange Swap Markets During the Financial Crisis of 2007-2009” in the Asian Capital Matket Development and Integration, ADB and KCMI, Oxford Press.

McGuire, P., Peter, G., 2012, The dollar shortage in global banking and the international policy response, International Finance 15(2).

Murau, S., 2018, Offshore Dollar Creation and the Emergence of the Post-2008 International Monetary System, IASS(Institute for Advanced Substantiality Studies) Discussion paper.

Pozsar, Z., 2016, From Exorbitant Privilege to Existential Trilemma, Credit Suisse Global Money Notes No.8.

Shin, H., 2013, The Second Phase of Global Liquidity and Its Impact on Emerging Economies, Keynote address at Federal Reserve bank of San Francisco Asia Economic Policy Conference.

Szilagyi, P., Batten, J., 2006, Arbitrage, Covered Interest Parity and Long-term Dependence Between the US Dollar and the Yen, IIIS Discussion paper, No.128.

Turner, P., 2013, The global long-term interest rate, financial risks and policy choices in EMEs, BIS Working papers No.441.

주요 국제통화의 대차가 일어나고 있는 글로벌 외화자금시장(funding market)에서 미달러화의 중요성은 여타 통화에 비해 독보적인 수준을 유지하고 있다. 즉, 미달러화는 대부분의 국가에서 외화자금의 주된 조달통화인 동시에 국경간(cross-border) 거래의 결제 및 가치저장 수단으로서 가장 폭넓게 활용되고 있다. 그 예로 국제무역이나, 국제결제 등 대부분의 국경간 거래의 절반 이상에 미달러화가 활용되고 있을 뿐만 아니라 전 세계 외환거래의 85%, 각국 외환보유고 보유통화의 61%의 비중을 점유하고 있다.

이러한 미달러화의 중요성을 감안할 때 글로벌 외화자금시장에서 미달러화 자금흐름이 원활히 작동하지 않을 경우 글로벌 금융불안이 발생하고 특히 통화의 국제화가 미흡한 신흥국의 달러자금 조달에 어려움이 커지면서 환율급등을 초래하는 요인이 될 수 있다. 지난 2008년 글로벌 금융위기(Global Financial Crisis: GFC)의 예에서 보듯이 미국 투자은행의 부실에서 촉발된 위기가 글로벌 금융위기로 급속히 확산된 것도 결국 전 세계 은행들의 디레버리징(deleveraging)에 따른 달러유동성 부족 현상이 전 세계적으로 확산된 데 직접적인 원인이 있다. 현재 우리나라의 경우에도 글로벌 외화자금시장을 통한 외자조달의 80% 이상이 미달러화로 이루어지고 있다는 점에서 미달러화 자금시장의 자금흐름과 구조변화는 국내 외화자금시장 및 외환부문의 전반적인 안정성에 적지 않은 영향을 미치는 요인이라 할 수 있다.

글로벌 금융위기 이후 미국 및 유럽 등 주요 선진국과 국제기구들은 은행들의 과도한 레버리지 확대가 글로벌 금융위기 발생의 근본적인 원인이었다는 인식하에 은행을 통한 과도한 외화자금의 조달과 무분별한 운용을 제한하는 다양한 규제를 도입하였다. 그 예로 국제결제은행의 바젤Ⅲ 유동성비율 규제나 미국의 머니마켓펀드(Money Market Fund: MMF) 개혁조치 등을 들 수 있는데 이러한 국제사회의 규제 조치는 주요 선진국 은행들의 건전성을 개선시키는 긍정적 변화를 가져온 것으로 평가된다.

그러나 한편으로는 글로벌 외화자금의 조달 및 공급 측면에서 미달러화 자금시장에 구조변화가 발생하고 있다. 즉, 외화자금의 조달 및 투자통화로서 미달러화의 중요성에 따라 미달러화에 대한 자금수요는 비은행금융기관 등을 중심으로 지속적으로 증가하고 있으나 각종 규제조치의 영향으로 글로벌 은행들의 미달러화 공급 기능은 이전보다 축소되었다. 그 결과 장기자금 수요자들의 은행차입을 통한 달러조달 의존도가 줄어든 대신 달러표시 해외채권발행에 의한 자금조달이 증가하였다. 또한 단기 자금시장에서는 달러자금조달을 위한 외환스왑 거래량이 크게 증가하였는데 과거와는 달리 미달러화와 교환되는 유로화나 엔화 등 주요 선진국 통화간 외환스왑시장(FX swap)에서도 단기적인 시장불균형이 빈번히 발생하고 거래비용이 상승하는 모습이 나타나고 있다. 최근 전 세계적인 코로나19(COVID-19) 위기의 발생으로 미달러화 유동성에 대한 위기감이 고조되며 시장수급의 불안정이 확대되자 미연준이 주요국 중앙은행과 국가간 통화스왑(bilateral swap agreement)을 통해 미달러화 유동성을 공급하였는데 이는 미달러화 자금의 원활한 흐름과 시장의 안정성을 유지하기 위한 미연준의 신속한 조치로 이해할 수 있다.

미달러화 자금시장의 구조변화는 우리나라의 외화자금조달에 영향을 미치는 중요한 요인이라 할 수 있다. 우리나라의 경우 전통적으로 미달러화 자금조달은 해외은행으로부터의 차입에 상당부분 의존해 옴에 따라 주요 선진국 은행들의 유동성 공급여력 축소는 우리나라의 외화유동성 조달에 어려움을 가중시키는 요인으로 작용할 수 있다. 특히 글로벌 외화자금시장의 불균형이 빈번히 나타나는 상황에서 외부충격이 발생하는 경우 국제금융시장의 신용경색 등으로 외화자금 조달비용이 상승하고 그 영향이 현물환(spot) 시장으로 전이되면서 원화환율을 급등시키는 요인이 될 수 있다. 금년 3월경 코로나19 위기로 국내 외환스왑시장의 불균형이 심화되고 환율이 크게 상승한 것은 이러한 대내외 달러화 자금조달시장의 구조변화에도 일부 영향을 받았을 것으로 생각된다.

본 보고서에서는 이러한 인식을 배경으로 글로벌 금융위기 이후 미달러화 자금시장 구조변화의 주된 특징과 우리나라의 외화자금시장에 미치는 영향을 분석해 보고자 한다. 본고의 구성은 다음과 같다. 제Ⅱ장에서 미달러화 자금시장 구조변화의 주요 특징을 살펴보았다. 이를 위해 미달러화 자금시장의 조달 및 운용 측면에서의 자금흐름 현황을 살펴보고 선진국 통화간 외환스왑시장의 불균형 현상을 설명하였다. 제Ⅲ장에서는 미달러화 자금시장 변화가 우리나라 외화자금시장에 미치는 영향을 분석하였다. 이를 위해 우리나라의 형태별 외화자금조달 추이와 외환스왑시장 불균형 현황을 분석한 후 글로벌 외화자금시장의 구조적 변화가 국내 외화자금시장에 미치는 영향에 대해 실증분석해 보았다. 제Ⅳ장에서는 이러한 논의를 토대로 시사점을 제시하였다.

Ⅱ. 미달러화 자금조달시장의 구조변화

본 장에서는 글로벌 금융위기 이후 미달러화 자금조달시장의 구조적인 변화 및 특징을 살펴보았다. 주요 국제거래의 기축 통화인 미달러화 자금조달시장은 막대한 유동성이 공급되고 있는 세계 최대의 자금조달시장이다. 주요 글로벌 기관은 미달러화 자금조달시장의 규모 우위를 통해 여타 통화 대비 상대적으로 낮은 자금조달 비용의 이점을 누릴 수 있으며, 다양한 상품 및 투자자 기반을 활용한 대규모 자금조달이 가능하다.

<표 Ⅱ-1>은 미달러화 자금조달시장의 주요 상품 및 시장 규모 등을 나타낸다. 대형 글로벌 은행, 헤지펀드, 머니마켓펀드(Money Market Fund: MMF) 등은 미달러화 자금조달시장의 주요 유동성 제공자 역할을 하고 있으며, 각국 은행, 기업, 정부 등 다양한 시장참가자가 자금조달자로서 시장에 참여하고 있다. 미달러화 자금조달시장의 주요 단기 상품으로는 환매조건부채권(Repo: RP), 기업어음(Commercial Paper: CP), 양도성 예금증서(Certificate of Deposit: CD) 및 외환스왑1) 등의 거래가 활발히 이루어지고 있으며, 중‧장기 자금조달 수단으로는 국경간 대출 및 달러화표시 채권발행 등이 대부분을 차지하고 있다.

전통적으로 달러화 자금조달시장은 대형 글로벌 은행이 자사의 신용을 바탕으로 달러화 자금을 조달하여 중개하는 달러화 중개 비즈니스 확대를 통해 성장하여 왔다. 특히 유럽계 은행은 글로벌 금융위기 이전 미달러화 중개 비즈니스 확대를 통해 글로벌 달러화 자금조달시장 성장세를 견인하였다. 그러나 최근에는 유럽계 은행 중심의 달러화 자금조달시장의 성장세가 크게 둔화되고 있으며, 기업 및 은행들은 자본시장을 통한 직접 달러화 자금조달 비중을 확대하는 등 뚜렷한 변화의 모습이 나타나고 있다. 본 장에서는 글로벌 미달러화 자금조달시장의 구조적 변화 및 특징을 달러자금의 수요 및 공급 주체 변화, 자금조달 형태 변화의 특징, 단기 미달러화 자금시장에 대한 영향 등의 측면에서 살펴보았다.

글로벌 미달러화 자금조달 규모는 비은행부문의 자금수요 증가세를 바탕으로 최근까지 확대 추세를 유지해오고 있다. 2019년말 기준 총 글로벌 달러화 자금조달 규모2)는 약 22조달러로 글로벌 금융위기 이전 최대치 대비 약 6조달러 증가한 수준을 기록하고 있다. 이를 달러화 자금조달의 목적에 따라 은행부문의 달러화 중개 비즈니스 확대(공급 측면) 및 비은행부문의 국제거래 수행을 위한 목적(수요 측면)으로 구분할 경우3), 미달러화에 대한 자금수요 증가는 주로 후자의 성장세에 기인한다. 다만, 글로벌 금융위기를 기점으로 글로벌 달러화 자금조달 총액 증가 폭은 크게 둔화된 모습이다. 글로벌 금융위기 이후 최근까지 글로벌 달러화 자금조달 총액의 연평균 성장률은 약 3.2%로 이전 기간(2000~2008년, 약 11.8%) 대비 크게 둔화되었다. 그 결과 글로벌 GDP 대비 달러화 자금조달 총액 비중은 2019년말 기준 약 25.7% 수준으로 2007년말(28.3%) 대비 소폭 감소한 것으로 나타나고 있다.

달러화 자금의 중개업무를 담당하고 있는 글로벌 은행부문을 통한 달러화 자금공급은 글로벌 금융위기 이후 감소세로 전환된 것으로 나타나고 있다. <그림 Ⅱ-5>에서 보는 바와 같이 글로벌 은행의 국경간 대출 잔액으로 추정한 은행부문의 달러화 자금공급 규모는 2019년말 기준 약 11.6조달러를 기록하여 글로벌 금융위기 이전의 최대치 대비 약 8% 감소한 것으로 나타났다. 이러한 감소 추세는 은행부문의 달러화 자금공급 확대를 통해 글로벌 달러화 자금조달시장의 규모가 크게 확대되었던 이전 시점과 뚜렷한 대비를 보이고 있다. 특히 2019년말 기준 글로벌 GDP 대비 은행부문의 대출 비중은 글로벌 금융위기 이전 최대치(22%) 대비 약 5%p 이상 하락한 17% 수준으로, 달러화 자금수요 증가세에도 불구하고 은행부문의 달러화 자금중개 역량과 여력은 크게 감소하고 있다.

<참고 Ⅱ-1>에서 정리한 바와 같이 주요국의 규제 강화는 은행의 달러화 부채 확대에 대응하여 규제 비용을 부과하는 공통점을 가지고 있으며, 특히 이는 글로벌 달러화 자금공급을 주도하고 있는 비미국계 은행의 자금조달에 큰 영향을 미치고 있는 것으로 나타나고 있다.8) Aldasoro et al.(2019) 및 Du et al.(2017) 등 최근 연구에서는 글로벌 금융위기 이후 규제 강화가 글로벌 달러화 자금시장의 유동성 감소 요인으로 작용하고 있으며, 특히 단기 달러화 자금조달 비용 상승요인으로 작용하고 있음을 실증적으로 보여주고 있다.

한편 글로벌 은행의 달러화 중개 비즈니스 변화는 지역별로 차별화된 양상을 보이고 있다. 이는 앞서 살펴본 규제적 요인과 더불어 비규제적 측면에서의 전략적 변화 요인 또한 지역별로 상이하게 나타나고 있는데 기인하는 것으로 추정된다. 즉, 글로벌 금융위기와 유럽재정위기 시에 극심한 달러화 유동성 위기를 경험한 바 있는 유럽계 은행들은 각종 규제조치 등의 영향으로 미달러화 중개 비즈니스를 빠르게 축소하고 있다. 반면 아시아 등 여타 지역 은행들은 미달러화 중개 업무에 보다 적극적으로 나서면서 새로운 수익원을 창출하고 미달러화 자금 공급자로서 유럽계 은행의 공백을 보전해 나가고 있는 모습을 보이고 있다.9)

<참고 Ⅱ-1> 글로벌 금융위기 이후 주요 건전성 규제 도입 현황

◇ 바젤Ⅲ 자본적정성 규제 (2015년 도입)

─ 신규 레버리지 비율 규제(총 익스포저 대비 자본 비율) 도입

• 해당 규제는 balance sheet의 구성보다는 전체 자산규모를 제한하기 위한 총량 규제로, 위험가중치 없이 적용

• 바젤Ⅲ 기준인 3%(최소비율로 표기, 이에 최대 레버리지 가능치는 자기자본의 약 33배 수준) 외 미국의 경우 대형은행에 대해 SLR(Supplementary Leverage Ratio) 적용 시 5~6% 수준

─ 기존 BIS 자기자본비율 규제 강화

• 기존(바젤Ⅱ) 8%에서 11.5~15%로 적용 기준 강화

→ (주요 영향) 총량 규제 및 기존 위험가중치 적용 자기자본비율 규제 강화를 통해 글로벌 은행의 달러화 부채 확대를 제한

◇ 바젤Ⅲ 유동성 규제 (2015년 도입)

─ LCR(향후 30일간 순현금 유출액 대비 고유동성자산 비중) 규제

• 부외 거래인 외환스왑거래 등에도 제한요인으로 작용

─ NFSR(필요안정자금 대비 가용안정자금 비중) 규제

• 위험가중치 적용을 통해 단기 및 무보증 자금조달을 제한

→ (주요 영향) 은행의 달러화 파생상품(외환스왑 등) 거래 규모 및 단기 달러화 차입 경로 등에 제약 요인으로 작용

◇ 미국 Volcker Rule (2010년 도입)

─ 은행 자기자본거래(proprietary trading) 금지

• 선물환, 스왑거래 등은 시장조성 목적 등 일부에 한해 허용

─ 해외자산 확대에 따른 예금보험공사(FDIC)의 보험요율 확대 적용

→ (주요 영향) 미국계 은행의 해외 대출 및 외환스왑시장 참여를 제한

◇ 미국 CP(MMF) 관련 규제 강화 (2016년 도입)

─ 프라임 MMF(은행 CP 투자 가능)에 대한 시가평가 적용 및 redemption fee 부과

→ (주요 영향) 비미국계 은행의 CP 발행을 통한 단기 자금조달을 제약

<그림 Ⅱ-6>에 나타난 바와 같이 유럽계 은행의 달러화 자산은 글로벌 금융위기 이후 큰 폭의 감소세를 보이고 있는 반면 동 기간중 기타 지역의 달러화 자산은 크게 증가한 것으로 나타나고 있다. 즉, 2019년말 기준 유럽계 은행의 달러화 자산 총액은 약 5.3조달러로 글로벌 금융위기 이전 최대치 대비 절반 수준으로 축소되었으며, 글로벌 금융위기 이전 60% 수준에 달했던 유럽계 은행의 비중은 현재 34% 수준으로 크게 축소된 것으로 나타난다.

달러화 자금수요의 지속적인 확대 추세에도 불구하고 주요 달러화 자금공급 주체인 은행의 중개 역량이 축소됨에 따라, 최근 주요기관의 달러화 자금조달은 자본시장을 통한 자금조달을 강화하는 방향으로 변화하고 있다. 2019년말 기준 주요기관의 채권발행을 통한 달러화 자금조달 총액은 2007년말 대비 두 배 이상 증가한 약 12조달러 수준으로, 전체 달러화 자금조달액의 약 52%를 차지하고 있다.10)

아래 <그림 Ⅱ-8>에 나타난 바와 같이 국경간 대출을 통한 달러화 자금조달 증가세가 2008년 이후 정체되고 있는 가운데 동기간 달러화표시 채권발행을 통한 자금조달 비중은 빠르게 확대되고 있다. 특히 2008~2019년 기간중 전체 달러화 자금조달 증가분(약 6조달러) 중 약 90%가 채권발행에 기인하고 있다. 이에 따라 2017년 4/4분기 이후 미달러화 자금의 조달수단으로서 채권발행 잔액이 은행의 대출 잔액을 상회하기 시작하였는데 2019년 기준으로 글로벌 GDP 대비 채권발행 및 은행대출을 통한 자금조달 비중은 각각 13.4% 및 12.3%를 나타내었다.

4. 단기 미달러화 자금조달시장의 유동성 부족

은행부문을 통한 달러화 자금공급 축소는 단기 자금조달시장에서도 두드러지게 나타나고 있다. 이는 글로벌 금융위기 이후 도입된 주요 건전성 규제 조치가 글로벌 은행의 단기 자금조달을 제한하는 방향으로 진행됨에 따라 은행의 단기 달러화 중개 역량이 위축된 데 상당 부분 기인하는 것으로 생각된다.12) 아래 <그림 Ⅱ-10>에 나타난 바와 같이 외환스왑을 통한 미달러화 단기 자금조달 비용(스왑베이시스)은 바젤Ⅲ 시행 시점인 2015년 이후 규제비율 보고 시점인 매 분기말 급상승하는 이상 패턴이 지속되고 있다.

그러나 MMF의 CP 투자를 제한하는 최근 규제 변화는 비미국계 은행의 단기 달러화 자금조달을 위축시키는 결과로 작용하고 있다. 아래 <그림 Ⅱ-11>에 나타난 바와 같이 규제 도입 후 MMF 투자자금은 CP 등 상품에 투자 가능한 프라임 MMF에서 국공채 MMF로 대거 이동한 것으로 나타나고 있다.15) 이에 따라 비미국계 은행의 CP 발행을 통한 단기 자금조달 규모는 규제 도입 이전 시점 대비 절반 이하 수준으로 축소된 것으로 추정된다(Pozsar, 2016).

◇ 배경: 2008년 대량환매사태로 인한 유동성 부족

─ 리먼브라더스 파산으로 인한 손실처리 과정에서 주요 MMF펀드의 주당 순자산가치를 기준가(1$) 이하로 고시한 이후 펀드런 발생

─ 이후 시장충격 발생 시 대규모 환매를 차단하기 위한 방편으로 2016년 10월 다음과 같은 개혁 조치 도입

◇ 주요 내용

─ 기관투자자 대상 프라임 MMF 순자산가치(Net Asset Value) 시가 평가 상시 적용

─ 유동성자산 비율에 연동된 환매수수료 부과 및 환매정지 권한 신설

• MMF의 주간 유동성자산이 펀드자산의 30%에 미달하는 경우 2% 이내 수준의 환매수수료(liquidity fee)를 부과하거나 최대 10일까지 환매를 정지할 수 있는 재량권 부여

• 주간 유동성자산 비율이 10%에 미달하면 환매수수료(기본 1%, 최대 2%)를 부과하도록 의무화

─ 정기적인 스트레스 테스트 의무화

• 주간 유동성자산 비율을 10% 이상 유지하고 변동성을 최소화하기 위해 주요 스트레스 상황(단기금리 상승, 자산 신용위험 증가, 스프레드 확대 등) 발생 시 예상되는 환매규모를 감안한 스트레스 테스트 실시를 의무화

─ 정부채 MMF는 해당 조치에서 면제되나, 해당 펀드의 정부채 편입 비중 상향 조정 (80%→99.5%)

◇ 영향 및 평가

─ 프라임 펀드의 수익 창출 기반 축소

• 주요 펀드는 수수료 부과를 피하기 위해 높은 수준의 유동성 유지(대부분 펀드의 유동성자산 비율은 50% 이상)

─ 안전자산으로서의 역할 축소

• 안전자산으로서의 유동성 공급통로(liquidity vehicle)에서 신용위험을 수반한 투자대상(credit vehicle)으로의 인식 변화

5. 외환스왑시장 불균형 확대

글로벌 금융위기 이후 단기 달러화 자금조달 수요가 외환스왑시장으로 집중됨에 따라 외환스왑을 통한 달러화 자금조달 비용이 상승하고 스왑시장의 불균형이 확대되는 현상이 나타나고 있다.19) 통상적으로 주요 선진국 통화간 외환스왑시장은 무위험금리평가이론(Covered Interest Rate Parity: CIRP)에 따라 균형 상태로 수렴하는 안정적인 시장의 모습을 보여 왔다.20) 즉, 자본이동에 제약이 없는 국제통화 간 차익거래 유인(환위험이 제거된 금리차익)이 존재하는 경우 금융기관의 재정거래 확대를 통해 균형 수준을 회복하게 된다. 금융기관은 외환스왑시장을 활용한 재정거래를 통해 무위험 수익 실현이 가능하기 때문이다. 이러한 측면에서 글로벌 금융위기시 및 유럽재정위기 당시 외환스왑시장의 불균형 확대는 달러화 자금시장의 단기적 유동성 악화에 기인한 일시적인 현상으로 설명할 수 있다.

그러나 <그림 Ⅱ-13>에 나타난 바와 같이 스왑시장의 불균형은 글로벌 금융위기 이후 최근까지 지속되고 있으며, 특히 대형 글로벌 은행의 건전성이 개선된 2014년 이후에도 불균형이 지속되고 있는 것으로 나타나고 있다. 외환스왑거래를 통한 달러화 자금조달을 위해서는 대출을 통한 직접 조달 비용 대비 높은 프리미엄을 지불해야 함에도 불구하고, 외환스왑시장의 달러화 자금수요가 지속되고 있는 것으로 풀이된다.

달러화 외환스왑시장의 불균형이 오랜 기간 지속되고 있는 최근의 상황은 앞서 살펴본 달러화 자금시장의 구조적 변화 요인에 기인하고 있다. 즉, 글로벌 금융위기 이후 규제 강화로 인해 비미국계 은행의 단기 달러화 자금조달 여력이 크게 위축되는 가운데 외환스왑시장의 주요 달러화 자금공급 주체인 글로벌 은행의 재정차익거래가 크게 감소하고 있는데 기인하는 것으로 볼 수 있다.

비은행부문 또한 글로벌 해외증권투자 확대 추세에 따른 환헤지 목적의 외환스왑거래 수요 등의 영향으로 외환스왑시장에서의 자금조달이 크게 확대된 것으로 나타난다. 최근 BIS 통계에 따르면 글로벌 외환스왑 및 선물환거래 총액은 2019년 기준 약 60조달러로 2010년 대비 두 배 이상 증가한 것으로 나타나고 있으며22), 비은행금융기관의 비중은 2019년말 기준 55% 수준으로 은행부문 비중(32%)을 상회하고 있는 것으로 나타나고 있다.

본 장에서 살펴본 글로벌 미달러화 자금조달시장의 구조적 변화는 다음과 같이 요약할 수 있다. 글로벌 금융위기 이후 달러화 자금조달 수요는 꾸준한 증가세를 유지하고 있는 반면, 글로벌 은행의 달러화 자금중개 기능은 글로벌 금융위기를 기점으로 위축되었다. 그 결과 글로벌 은행의 대출을 통한 글로벌 달러공급 기능이 축소되었는데 무엇보다 글로벌 금융위기 이후 은행의 건전성 제고를 위한 규제 강화가 주된 요인인 것으로 분석된다. 반면 최근에는 달러화표시 채권발행 등 자본시장을 통한 직접 자금조달 확대가 미달러화 신용공급의 주된 경로로 부상하고 있다.

한편 글로벌 금융위기 이후 구조적 변화로 인해 단기 달러화 자금조달시장은 점차 고비용‧저유동성 시장으로 변모하고 있다. 글로벌 달러화 자금공급을 주도하고 있는 비미국계 은행의 단기 달러화 자금조달이 크게 축소되었으며, 달러화 스왑시장을 통한 단기 달러화 자금조달이 급증하고 있다. 그 결과 무위험금리평가이론에 따른 균형이 존재하였던 달러화 스왑시장은 글로벌 금융위기 이후 최근까지 불균형이 지속되고 있으며, 일부에서는 이러한 외환스왑시장의 불균형이 새로운 달러화 자금시장의 균형 상태라는 해석이 제시되고 있다.

이러한 달러화 자금조달시장의 구조적 변화는 달러화 자금조달시장의 자금경색 발생 가능성이 과거보다 더 커졌음을 의미한다. 과거의 사례에서는 은행부문의 달러화 자금조달 상황의 급격한 악화가 달러화 유동성 위기의 주원인으로 작용하였다. 최근 달러화 자금시장에서의 구조적 변화는 안전자산 선호도 확대 및 달러화 자금중개 채널의 변화 등 다양한 변화요인으로 달러화 자금조달시장의 유동성 부족 현상이 초래될 수 있음을 시사하고 있다. 이미 올해 초 코로나19 확산 당시 글로벌 금융시장은 은행부문의 건전성이 유지되고 있는 상황 속에서도 안전자산 수요 확대에 따른 달러화 유동성 경색을 경험한 바 있으며, 최근 달러화 가치변화에 따른 달러화 자금조달시장의 영향이 확대되고 있다는 점 또한 달러화 유동성 부족이 다양한 변화요인에 의해 나타날 수 있음을 보여주고 있는 것으로 판단된다.23)

외화자금시장에서 은행의 달러화 차입 비중이 큰 우리나라는 더욱 글로벌 달러화 자금시장의 구조적 변화요인에 관심을 가질 필요가 있다. 외환시장 리스크 요인이 변화함에 따라 은행부문의 건전성이 유지되고 있는 상항 속에서도 외화자금시장의 유동성 경색이 나타날 수 있기 때문이다. 더욱이 최근 국내 외화자금시장은 이미 외환스왑시장의 불균형 등의 현상이 나타나고 있어, 글로벌 달러화 자금조달시장의 변화요인과의 관계 등에 대한 점검이 필요할 것이다. 제Ⅲ장에서는 최근 글로벌 달러화 자금조달시장의 구조적 변화요인이 국내 외화자금시장에 미치는 영향을 분석하고 시사점을 제시하였다.

Ⅲ. 국내 외화자금시장 현황 및 영향 분석

1. 외화자금조달 현황

우리나라는 글로벌 금융위기 이후 큰 폭의 경상수지 흑자 기조와 외국인 증권투자자금의 꾸준한 유입 등으로 전체적인 국제수지가 흑자를 보이고 있다. 이에 따라 외환수급면에서 외화자금이 안정된 공급우위를 보이고 있으며 그 결과 거주자에 의한 대외투자도 꾸준히 증가하여 2019년말 현재 대외금융자산(외환보유액 포함)이 1조 6,997억달러로 대외금융부채(1조 1,988억달러)24)를 크게 상회하고 있다. 또한 최근 은행부문의 대외채권이 대외채무 규모를 상회하면서 통화불일치(currency mismatch)도 크게 개선되었다. 이러한 대외부문의 양호한 유동성 상황은 우리나라의 국가 신인도를 높이고 외평채가산금리나 CDS프리미엄 등 리스크프리미엄은 낮추어 양호한 외자조달 여건을 유지하는 데 도움을 주고 있다.

한편 우리나라에서 은행차입금과 더불어 주요 외화자금조달 경로로 이용되는 거주자 외화채권발행의 경우에는 글로벌 미달러화 자금시장과 유사하게 잔액이 견조하게 증가하는 모습이 나타나고 있다. 2019년말 현재 전체 채권발행 잔액은 1,294.7억달러로 이중 은행이 가장 큰 비중(53.1%)을 차지하고 있으나 증가속도 면에서는 글로벌 금융위기 이전과 비교하여 비은행부문이 은행을 앞서고 있다. 이는 해외은행으로부터의 차입을 통한 자금조달에 어려움이 커지면서 국내은행이나 비은행금융기관 그리고 기업들이 외화채권발행을 통한 미달러화 자금조달을 확대하고 있는 데 따른 것으로 보인다.

외환스왑시장은 외화자금시장을 대표하는 시장으로서 두 통화간 자금의 대차가 일어나는 시장이다. 우리나라의 경우 전통적으로 외은지점(foreign bank branch)들이 해외 본점으로부터 은행차입금 형태로 외화자금을 들여와 국내은행들에게 외환스왑을 통해 외화유동성을 공급하는 형태가 외화자금공급의 주된 경로로 작용하여 왔다. 이 경우 외은지점은 국내은행들에게 외화를 공급하는 대신 계약기간 동안 원화를 수취하면서 미달러화와 원화간의 자금과부족을 해결하고 국내에서 영업활동을 영위하게 된다.

해외은행차입금을 통해 외환스왑시장에 외화유동성 공급이 늘어나는 경우에는 해외로부터 외화자금을 빌려오는 성격을 가지므로 우리나라 원화환율에 직접적인 영향을 주는 경상수지 흑자나 외국인 증권투자자금과 달리 외환스왑시장의 유동성과 가격에 영향을 미친다.25) 즉 은행차입금의 국내유입 증가시 외화자금시장의 유동성 공급이 늘어나므로 스왑레이트가 이론가격인 내외금리차를 상회하게 되며, 반대로 외화자금시장의 수요가 공급을 초과하는 경우에는 스왑레이트가 내외금리차를 하회하여 그 차이(내외금리차-스왑레이트)만큼 스왑시장의 불균형이 나타난다. 따라서 외환스왑시장에서 스왑레이트가 이론가와 괴리된 정도를 통해 외환스왑시장의 수요와 공급의 상대적 크기 즉 유동성 상황을 판단할 수 있다.

두 통화간에 외환스왑거래가 일어나는 경우 거래비용이나 리스크프리미엄 등이 없다면 스왑레이트와 내외금리차가 이론적으로 동일한 값을 가진다. 그러나 대부분의 신흥국 통화간에는 스왑레이트가 내외금리차를 어느 정도 하회하는 수요우위의 불균형이 관찰된다. 이는 신흥국 통화의 경우 비국제화된 통화를 가지고 있음에 따라 국가 리스크프리미엄의 존재에 따른 암묵적인 거래비용이 발생하고 글로벌 외화자금시장 상황에 따라 외화자금조달에 현실적인 어려움이 빈번히 발생하기 때문이다.

실제 글로벌 금융위기 이후 우리나라 외환스왑시장은 수요우위의 불균형이 확대된 것으로 나타나고 있다. 즉 외환스왑시장 불균형 규모는 2013년 9월~2016년 6월 기간중 월평균 20.9bp에서 2016년 7월~2020년 6월 중에는 40.1bp로 확대되었다. 이는 경상수지 및 전체 국제수지 흑자에 따라 우리나라 외환시장에 공급우위가 지속되고 있는 것과는 상반된 모습이다. 특히 코로나19 위기의 세계적 확산으로 글로벌 주가가 일시적으로 급락한 2020년 3~4월경에는 국내 증권사의 대규모 ELS 마진콜에 따른 단기 외화자금수요 확대로 유동성 부족이 심화되면서 3월중 불균형 규모가 139bp까지 확대되기도 하였다. 이는 외화자금시장의 구조적 수급 불안이 외부충격이 발생하면서 현물환시장 및 원화환율에 전이된 사례라 할 수 있다. 아래 <표 Ⅲ-1> 및 <그림 Ⅲ-5>는 글로벌 금융위기 이후 원/달러 스왑레이트와 내외금리차와의 괴리를 나타낸다. 이를 연도별로 보면 외환스왑 불균형 규모는 글로벌 금융위기 이후 2016년 까지는 대체로 하향 안정화 되는 모습을 보였으나 2017년 이후에는 불균형 규모가 확대되는 모습을 보이고 있다.

한편 공급 측면에서 은행차입금의 축소도 수급 불균형의 중요한 원인으로 작용하고 있는 것으로 판단된다. 최근 은행차입금의 축소는 그간 우리나라의 외환부문 거시건전성 조치의 시행으로 해외은행으로부터의 자금 차입에 제약을 받는 국내적 요인과 미달러화 자금시장의 구조변화 등 해외요인이 혼재되어 있는 것으로 생각된다. 예를 들어 현재 국내에서 시행 중인 거시건전성 조치인 선물환포지션한도의 경우 은행의 자기자본 대비 선물환포지션한도를 제한하여 외은지점이 해외 본점으로부터 자금을 차입해 오는데 제약요건이 됨으로써 국내은행에 대한 유동성 공급이 위축되는 결과를 가져온다. 또한 해외은행의 경우에도 각종 규제도입으로 우리나라 은행에 대한 대출여력의 축소를 가져옴으로써 결과적으로 우리나라의 해외은행차입금 감소 요인으로 작용하고 있다.

3. 미달러화 자금조달시장 변화의 영향 분석

이 절에서는 글로벌 미달러화 자금시장의 구조변화가 국내 외환스왑시장 불균형에 미치는 영향을 실증분석해 보았다. 특히 미달러화 자금시장의 자금흐름이 글로벌 은행들의 행태변화를 통해 우리나라의 은행차입금 감소와 국내 외환스왑시장 불균형을 확대시키는 요인으로 작용하는지를 규명하는 데 분석의 초점을 두었다. 실증분석 방법으로는 회귀분석 방법 및 VAR모형의 충격반응 함수를 이용하였으며 추정기간은 2007년 이후 최근까지의 월별자료를 이용하였다.

가. 기존연구와의 차별성

글로벌 금융위기 이전 시점의 외환스왑시장의 불균형에 관한 기존의 연구에서는 스왑레이트가 이론가격인 내외금리차와 괴리를 보이면서 무위험금리평가(CIRP)로 부터 괴리가 발생하는 원인에 대해 주로 거래비용의 존재(Frenkel & Levich, 1977; Clinton, 1988; Bhar et al., 2004 등)나 신흥국의 정치적 위험에 따른 자본통제(capital control) 가능성(Dooley & Isard, 1980) 등을 주요 요인으로 보았다. 또한 신흥국의 미달러화에 대한 차입능력에 따라 외환스왑시장의 불균형이 확대되기도 하는 것으로 분석하였다(Szilagyi & Batten, 2006).

최근 연구에서는 미달러화 자금조달시장의 구조적 변화와 그 영향에 대한 관심이 커지고 있다. 기존연구의 주요 설명변수가 글로벌 금융위기 이후 외환스왑시장의 불균형이 장기간 지속되고 있는 현상을 충분히 설명하고 있지 못하고 있기 때문이다. Du et al.(2017)은 2012년 이후 주요 15개국 통화의 대 미달러화 외환스왑시장 불균형 원인을 분석한 결과 신용위험(credit risk) 등 기존연구의 주요 설명 변수는 불균형의 절반 수준을 설명하는 데 그치고 있음을 실증적으로 보여주었으며, 기존의 설명변수보다 글로벌 은행의 부채 확대에 따른 직‧간접적 비용 변화를 초래하고 있는 제도적 요인의 중요성을 주장하였다. Avdjiev et al.(2017a,2017b)은 미달러화 가치 변화가 외환스왑시장 불균형의 중요한 설명 변수로 작용하고 있다는 연구결과를 제시하였다. 이러한 연구 결과는 글로벌 금융위기 이후 글로벌 은행의 부채 확대를 제한하고 있는 제도적 요인과 미달러화 관련 영업확대의 그림자 비용으로 설명하고 있는 미달러화 가치 향방 등이 최근 외환스왑시장 불균형 확대의 주원인으로 작용하고 있음을 시사하고 있다.

한편 우리나라 외환스왑시장의 불균형 원인에 관한 기존의 연구에서는 은행들의 외화차입 능력(이승호, 2003)이 거래비용보다 더 중요한 요인으로 분석되었다. 또한 2003년 하반기 비거주자에 대해 일시적으로 시행되었던 NDF(Non-Deliverable Forward) 거래에 대한 외환포지션 규제(서현덕, 2005)와 당국의 외환시장개입(송치영‧김경수, 2008) 등 정책변수도 외환스왑시장에 영향을 미치는 것으로 나타났다. 해외요인 중에서는 글로벌 유동성이 우리나라의 외화자금조달 여건에 중요한 변수로 분석(정대희, 2012; Lee et al., 2014)된 바 있으며 글로벌 금융위기 전후 국제금융시장의 불확실성 증가와 우리나라 은행들의 신용위험이 외환스왑시장 불균형에 중요한 영향을 주는 것으로 분석(Baba & Shim, 2011)되기도 하였다. 아울러 외환스왑시장의 수요에 영향을 미치는 국내 기업 및 역외비거주자의 선물환 거래 등 외환수급요인의 중요성과 국가 리스크프리미엄이 외환스왑시장 불균형의 주요 원인으로 지적(이승호, 2014)되기도 하였다.

본 보고서의 실증 분석은 다음과 같은 점에서 기존의 연구들과 차별성을 보이고 있다. 첫째, 기존의 연구들이 주로 글로벌 금융위기 이전 미달러화 자금시장이 외화자금조달시장으로서의 기능과 역할에 큰 어려움이 없던 시기를 대상으로 하고 있는 점과 달리 글로벌 금융위기 이후 글로벌 은행에 대한 선진국의 각종 규제 조치 시행 등으로 미달러화 자금조달 비용이 커지고 그 결과 글로벌 은행들의 자금공급 기능은 과거보다 위축되고 있는 최근의 시기를 주요 분석대상으로 하고 있다. 즉, 글로벌 불확실성 증가로 안전자산에 대한 선호확대와 미달러화 자금중개 기능에 변화가 발생하고 있는 최근의 새로운 금융환경 하에서의 우리나라의 외환스왑시장 불균형 현상을 분석하였다.

둘째, 과거 글로벌 외화자금시장의 유동성 및 수급 불균형을 파악하는 주요 변수로 글로벌 유동성이나 주식시장의 변동성지수(VIX) 등이 중시되어 왔으나 본 연구에서는 이러한 요인들과 더불어 미달러화의 가치변화가 글로벌 은행의 대출 등 자금흐름에 영향을 주는 점을 고려하였다. 즉, 최근 주요 선진국 통화간 스왑시장에서의 불균형 확대의 주된 요인으로 인식되고 있는 미달러화 가치변화가 글로벌 은행들의 대출행태에 영향을 미친다는 점을 고려하여 이를 실증분석에 반영하였다.

셋째, 기존의 연구들은 우리나라 외환스왑 불균형에 영향을 미치는 다양한 국내외 요인들을 무차별하게 고려하고 있으나 본 보고서에서는 우리나라 외화자금유입의 주된 경로인 해외은행차입금에 대한 면밀한 분석에 초점을 둠으로써 우리나라 현실에 보다 부합하는 분석을 시도하였다. 특히 미달러화 자금시장 변화가 우리나라의 은행차입금 규모변화를 통해 외환스왑시장 불균형에 미치는 경로를 세부적으로 분석하기 위해 국내 거시건전성정책 등 국내요인을 제외하고 미달러화 자금시장변화 등 해외요인이 은행차입금 유출입에 미치는 영향을 구분하여 분석하였다.

나. 회귀분석 방법 및 추정 결과

본 연구에서는 국내 외환스왑시장의 불균형에 대한 실증분석을 위하여 우선 회귀분석 방법을 이용하여 설명하였다. 이를 위해 해외요인에 의한 은행차입금을 일차적으로 추정한 후 이를 이용하여 우리나라 외환스왑시장 불균형 원인을 분석하는 2단계 회귀추정 방법을 이용하였다.

스왑시장 불균형에 관한 주요 설명변수로는 국내요인으로 국가 리스크프리미엄의 대용변수인 외평채CDS프리미엄과 거주자의 해외채권투자액을 사용하였다. 전자의 경우 우리나라의 차입비용 상승으로, 후자의 경우에는 국내 스왑시장의 수요확대를 가져오는 요인이므로 스왑시장 불균형에 대해 양(+)의 예상부호를 갖는다.

해외요인들로는 국제금융시장 유동성 위험의 대용변수인 Libor-OIS 스프레드, 글로벌 주식시장의 변동성지수, 미달러화와 유로화간 스왑시장불균형 규모, 글로벌 유동성의 대용지표로서 G3국가의 통화량(M2) 등을 이용하였다. 글로벌 유동성 및 변동성 위험의 증가 그리고 미달러화와 유로화간 불균형의 확대는 글로벌 외화자금시장의 유동성 감소와 불균형 확대 요인으로 볼 수 있으므로 국내 스왑시장의 불균형에도 양(+)의 영향을 미칠 것으로 예상된다. 반면 G3국가의 통화량 증가는 다양한 경로를 통해 국내로의 외화유동성 유입을 증가시키는 요인이 되므로 국내 외환스왑시장 불균형과는 음(-)의 예상부호를 갖는다고 할 수 있다.

한편 국내요인과 해외요인이 혼재되어 있는 은행차입금이 증가하는 경우에는 외환스왑시장에 대한 공급을 늘리므로 불균형에 대해 음(-)의 예상부호를 갖는다. 본 보고서에서 실증분석의 주된 목적이 미달러화 자금시장 변화가 해외은행들의 국내은행에 대한 대출에 영향을 줌으로써 국내 외환스왑시장 불균형의 확대 요인으로 작용하는지를 파악하는데 초점이 있으므로 실제 은행차입금 데이터 대신 해외요인에 의한 추정치를 구하여 회귀추정에 사용하였다. 해외요인에 기인한 은행차입금 추정에는 위에서 사용된 해외요인 설명변수에 미달러화지수(US dollar index)를 추가로 포함하였다.27) 회귀추정식은 다음과 같이 2단계 추정방법을 사용하였다.

우선 해외요인에 기인한 은행차입금 규모를 추정하기 위해 실시한 회귀분석 결과는 아래와 같다. 즉, 국내은행의 차입금은 미달러화 강세시 안전자산 선호현상의 결과 차입금 규모가 감소하는 것으로 나타났으며 통계적 유의성도 높은 것으로 나타났다. 또한 글로벌 금융위기시와 코로나 위기시는 각각 차입금 규모 감소 및 증가가 유의하게 나타났다. 이러한 추정식을 이용한 은행차입금 추정 결과 및 추정치(fitted value)는 아래 그림과 같다.

국내요인에 있어서는 우리나라 외환스왑시장 불균형은 외평채CDS프리미엄에 대해 통계적으로 유의한 양(+)의 값을 보였다. 이는 우리나라의 국가 리스크프리미엄이 확대되는 경우 외자조달비용 상승 등으로 외환스왑시장의 불균형이 확대됨을 의미한다.

국내 거주자의 해외채권투자는 예상과 같이 스왑시장 불균형에 대체로 양(+)의 영향을 미치는 것으로 나타났으나 통계적 유의성은 그리 높지 않은 것으로 분석되었다. 이는 국내 거주자의 해외채권투자시 환헤지에 따른 외환수요가 외환스왑시장의 수요 증가요인으로 작용할 것이라는 일반적인 예상과 다소 차이를 보이는 것으로 판단된다. 이러한 추정 결과는 최근 국민연금 등 대형 기관투자자들이 해외채권투자시 환헤지를 하지 않는 경향이 점차 늘어나고 있는데다 우리나라 해외채권투자 비중의 상당부분을 차지하고 있는 국내 보험사가 최근 위험관리 목적 등으로 해외채권투자 규모를 다소 축소하고 있는 데 따른 것으로 보인다.

다. 충격반응함수 추정 결과

회귀추정에 대한 보완으로 벡터자기회귀모형(VAR)을 이용하여 국내 외환스왑시장의 불균형에 영향을 주는 요인에 대한 충격반응함수를 살펴보았다. 모형의 추정을 위한 변수로는 앞의 회귀추정에서 사용한 스왑시장불균형(gap), 해외요인에 의한 은행차입금(bankhat), 그리고 글로벌 유동성 위험의 대용지표(ois)의 세 변수로 구성하였다.28)

아래의 <그림 Ⅲ-8>에서 보는 바와 같이 글로벌 유동성 위험의 증가는 국내 스왑시장 불균형을 확대시키는 것으로 나타났으며 시차를 두고 해외은행차입금을 감소시키는 것으로 나타났다. 이는 글로벌 유동성 위험의 확대가 글로벌 은행들의 대출여력을 감소시킴으로써 우리나라에 대한 해외은행차입금의 감소 요인으로 작용하고 있음을 의미한다. 글로벌 유동성 변화가 해외은행차입금에 미치는 영향은 약 3개월의 시차를 두고 그 영향이 나타난 이후 상당기간 지속되는 것으로 추정되었다. 또한 해외은행차입금 유입은 국내 스왑시장의 불균형을 축소시키는 요인으로 나타나 앞서의 회귀추정 결과와 일관된 방향을 보였는데 대략 약 2개월의 시차를 두고 그 영향이 가장 크게 나타난 후 서서히 그 영향이 감소하는 것으로 보인다.

이러한 추정결과는 글로벌 요인에 의한 국내 스왑시장시장 불균형에 대한 영향이 적지 않음을 나타낸다. 특히 글로벌 미달러화 자금시장의 구조변화에 따른 해외은행의 대출금 축소가 국내 스왑시장의 불균형 확대요인으로 작용하고 있음을 확인시켜주는 결과로 볼 수 있다.

본 장에서는 우리나라의 외화자금 흐름과 외환스왑시장 현황에 대해 살펴본 후 글로벌 미달러화 자금시장 변화가 국내은행 차입금 변화를 통해 외환스왑시장에 미치는 영향을 분석해 보았다.

우리나라는 글로벌 금융위기 이후 경상수지 흑자 규모의 확대와 외국인의 국내 증권투자자금 순유입 증가 등으로 현물환시장을 통한 외환공급 우위가 이어지고 있는 것과 달리 해외은행차입금을 통한 외화자금시장은 수요 우위의 상반된 현상이 지속되고 있다. 이러한 외화자금시장의 유동성 감소는 외환스왑시장의 불균형 확대로 나타나고 있다. 이러한 이분화된 외환시장 구조는 외부충격 발생시 외화자금시장의 유동성 부족이 현물환시장으로 급속히 전이되며 환율을 상승시키는 요인으로 작용할 가능성이 있다.

우리나라 외환스왑시장의 불균형 원인에 대한 실증분석 결과에서는 국가 리스크프리미엄이나 거주자의 해외증권투자 확대 등 국내요인과 더불어 글로벌 유동성, 선진국간 스왑시장 불균형 등 해외요인에 의해서도 적지 않은 영향을 받는 것으로 파악되었다. 특히 해외요인에 기인한 은행차입금 유출입은 국내 외환스왑시장의 불균형에 유의한 영향을 미치는 것으로 나타났는데 이는 최근 국내 스왑시장 불균형 확대가 글로벌 미달러화 자금시장의 유동성 악화에 따른 글로벌 은행들의 우리나라에 대한 외화유동성 공급여력 감소에도 상당부분 기인함을 시사한다. 따라서 국내 스왑시장 불균형의 주원인으로 지목받는 거주자의 해외증권투자나 거시건전성 정책에 따른 은행차입 제약 못지않게 해외 미달러화 자금시장의 변화 추이에도 유의할 필요가 있을 것으로 판단된다.

Ⅳ. 결론 및 시사점

글로벌 미달러화 자금조달시장은 글로벌 금융위기를 기점으로 상당히 변화된 모습이 나타나고 있다. 전통적으로 글로벌 대형은행의 달러화 자금중개 업무를 통해 글로벌 달러화 자금수요를 충당하던 기존 달러화 자금시장의 구조는 최근 주요 기관의 달러화표시 채권발행 확대, 외환스왑시장을 통한 단기 자금조달 확대 등의 방향으로 변화하고 있다. 달러화 자금시장에서의 은행의 달러화 자금 공급역할은 축소되고 있으며, 특히 기존 글로벌 달러화 자금중개 비즈니스 확대를 주도하여 온 유럽계 은행의 비중이 크게 감소하고 있다. 또한 단기 달러화 자금조달시장은 상시적인 고비용‧저유동성 시장으로 변화하였으며, 일시적 불균형으로 해석되었던 외환스왑시장의 괴리는 최근의 구조적 변화를 감안할 때 새로운 균형으로 재해석되고 있다.

우리나라의 외화자금시장 또한 이러한 글로벌 달러화 자금조달시장의 구조적 변화에 영향을 받고 있는 것으로 나타나고 있다. 전통적으로 우리나라의 주된 외화차입 경로이던 국내은행의 해외은행차입금은 최근 글로벌 은행의 부채 확대에 따른 그림자 비용으로 해석되면서 차입금 규모가 축소되고 있다. 또한 글로벌 금융위기 이전과는 달리 글로벌 은행들의 달러화공급 여력이 축소되고 있는 구조적 변화는 국내은행의 해외차입 감소를 통해 간접적으로 원/달러 외환스왑시장의 불균형을 확대시키는 요인으로 작용하고 있는 것으로 확인되었다. 이와 함께 글로벌 유동성 위험이나 미달러화 자금시장의 불균형 등 해외요인들은 국내요인 못지않게 외환스왑시장의 불균형을 확대시키는 요인으로 작용하고 있는 것으로 분석되었다.

이러한 연구 결과는 국내 외화자금시장의 안정성 제고 측면에서 다음과 같은 시사점을 제시하고 있다. 첫째, 기존의 국내 외환시장 리스크 요인 외에도 최근 구조변화로 인해 글로벌 달러화 자금조달시장에 영향을 미치고 있는 다양한 위험요인에 대한 세심한 모니터링이 필요하다. 향후 달러화 자금유동성 경색이 은행의 외환부문 건전성 악화 외에도 글로벌 유동성 및 위험선호변화 등 다양한 국제금융시장의 구조적 변화 요인에 의해 나타날 수 있기 때문이다. 특히, 미국, 유럽 등 주요국의 은행부문 건전성 규제 변화는 달러화 자금시장의 공급 축소를 초래할 수 있음에 유의할 필요가 있을 것이다. 또한 미국 통화정책 변화에 따른 달러화 가치 변화는 글로벌 달러화 자금의 유동성 변화를 초래하는 주요 변수로 작용하고 있는 만큼 이에 따른 국내 외화자금시장의 변화 가능성에 유의할 필요가 있다.

둘째, 비은행부문의 달러화 수요가 크게 증가하고 있다는 점에서 달러화 자금의 유동성 경색이 비은행부문의 안전자산 선호도 확대 시점에 발발할 가능성이 높을 것으로 보이므로 이에 대한 철저한 대비가 필요할 것으로 판단된다. 올해 초 범세계적인 코로나19 확산에 따른 단기 달러화 자금시장의 유동성 악화 또한 일반 기업 및 비은행부문의 달러화 자금수요에 기인한 바가 큰 것으로 나타나고 있다. 특히 우리나라는 보험사 등 해외증권투자기관의 환헤지 수요가 지속되고 있는 상황에서 금년 3월경 경험한 국내 증권사 등 비은행금융기관의 급격한 외환수요가 재발될 경우에는 외화유동성 경색이 심화되면서 국내 외환스왑시장 및 외환시장 전체의 불안을 확대시킬 수 있음에 더욱 유의할 필요가 있을 것이다. 따라서 국내 증권사는 ELS 등 우발적 외화유동성 위험에 대비하여 상시적인 외화유동성 확보 노력을 자체적으로 강화하고 정책당국도 긴급시 이들 기관에 대한 외화유동성 공급채널을 마련해둘 필요가 있다.

셋째, 최근 국내외에서 모두 달러화 자금조달의 수단으로서 채권발행 비중이 커지고 있는 점은 향후 국제금융시장의 국제채권발행 여건 변화에 따라 달러화 자금경색 가능성을 유발할 수 있다. 채권발행을 통한 자금조달은 일반적으로 은행차입 대비 장기로 조달되고 있어 상대적으로 안정적인 것으로 인식되고 있으나, 은행 차입의 경우와 마찬가지로 롤오버 시점의 발행여건 악화는 해당 기관의 자금 압박 및 비용 상승을 통해 어려움을 초래할 수 있다. 특히 코로나 극복 이후 주요국의 통화정책 기조가 정상화 과정을 밟아 나가는 과정에서 금리변동성이 커지면서 발행채권에 대한 발행주체들의 상환부담이 늘어나지 않도록 보다 탄력적인 발행전략을 마련해 나갈 필요가 있을 것으로 생각된다. 이를 위해 전체 한국물 발행채권의 관점에서 발행시기나 만기구조의 다변화를 도모할 필요가 있다.

마지막으로 최근 달러화 자금조달시장의 변화는 구조적인 변화 요인에 기인하고 있는 만큼 향후 우리나라의 외화자금조달 전략 변화 또한 이러한 구조적 변화에 맞게 다변화하는 방향으로 유도할 필요가 있을 것으로 판단된다. 그간 외화차입의 주된 경로로 활용되어온 해외은행차입금이 대내외 여건변화로 축소되고 있는 만큼 안정적인 외자조달 경로를 모색해 나갈 필요가 있을 것으로 보인다. 특히 유럽계 은행을 통한 자금조달에 의존도가 높은 우리나라는 점차 국내은행의 미국 내 지점을 통한 직접 자금조달 등의 방안을 통해 달러화 자금이 조달될 수 있는 방향도 고려할 필요가 있을 것으로 생각된다. 아울러 글로벌 자금흐름에 구조변화를 보이고 있는 글로벌 은행의 미달러화 자금공급 축소 추세하에서 우리나라의 외환부문 안정을 위한 거시건전성 제도가 외화자금조달에 부정적 요인으로 작용하지 않도록 세심한 정책적 고려를 해 나갈 필요가 있을 것으로 보인다.

1) 외환스왑은 거래당사자가 현재 환율로 두 통화를 교환한 후 만기시 계약당시 정해놓은 선물환율로 재교환하는 거래임; 한편 통화스왑 또한 외환스왑과 유사하게 일정기간 두 통화를 교환하는 거래이나, 주로 1년 이상의 장기계약에 활용되고 계약기간중 교환된 통화에 대해 이자를 부담한다는 점에서 구별됨

2) 국제결제은행(BIS)의 달러화 유동성(Global Liquidity Indicators: GLI) 측정 기준에 따라 은행부문의 국경간 미달러화 대출 총액 및 전체(은행 및 비은행부문) 미달러화 표시 국제채권발행잔액으로 산정하였음

3) 본 연구에서는 IMF(2018) 등의 분류 방식에 따라 은행의 대 비은행부문 대출 및 비은행부문의 직접 달러화 자금조달(채권발행 등)을 달러화 자금수요로, 은행간 국경간 대출 잔액을 달러화 자금공급으로 정의하였는데, 이는 자금조달의 목적에 따른 분류 방법으로 일반적인 시장 균형 관점에서의 수요‧공급과는 차이가 있음

4) 글로벌 금융위기 이전 기간중 비은행부문의 자금조달 비중은 총액 대비 30~36% 수준을 기록하였으며, 2015년 이후 비은행부문 비중이 은행부문 비중을 초과하고 있음

5) CPIS 서베이에는 2019년 기준 약 90개국 중앙은행이 참여하고 있으며, 이들 국가 거주자의 전세계(약 240국 대상지역) 해외증권투자 보유잔액 통계를 보고하고 있음

6) 예를 들어 국내 기관이 브라질 채권에 투자하는 경우에도 원화-달러화 환전 및 헤지를 통해 달러화 자금을 조달한 이후 투자대상국 통화로 전환하고 있음. 또한 달러화표시 자산 총액을 보고하고 있는 5개국(<그림 Ⅱ-4> 참조)의 달러화표시 해외증권투자 잔액 증가추세 또한 빠른 속도로 확대되고 있는 것으로 나타나고 있음

7) BIS(2020) 조사에 따르면 2019년말 기준 동아시아 3개국(한국, 대만, 일본) 보험사의 해외증권투자 총액이 약 1.5조달러에 달하고 있으며, 달러화 헤지 비중은 일본 약 60%, 대만 약 50%에 달하는 것으로 추정됨

8) 은행부문 총 달러화 자산 총액 대비 비미국계 은행의 비중은 2019년 기준 약 80% 수준임

9) 미국의 경우에도 2011년 이후 국경간 달러화 대출 잔액이 감소 추세로 전환되었으며, 이는 당시 FDIC 예금보험료 적용 대상 확대에 따른 영향이 지배적인 것으로 추정됨

10) 글로벌 금융위기 이전 기간중 채권발행을 통한 조달 비중은 32~34% 수준

11) 은행부문의 달러화표시 채권발행 잔액 또한 2019년말 기준 약 2.7조달러로, 글로벌 금융위기 이전 대비 확대된 것으로 나타나고 있음

12) 예를 들어 바젤Ⅲ LCR 및 NFCR 규제의 경우 단기부채에 대해 높은 위험가중치(무담보 부채의 경우 100%의 위험가중치 적용 등)를 부과함으로써 은행부문의 단기부채 확대를 제한하는 요인으로 작용함

13) 미국 MMF 규제 개혁에 관한 주요 내용은 <참고 Ⅱ-2> 참조

14) 비미국계 은행 또한 미국 내 지점을 통해 달러화 예금을 유치할 수 있으나, 미국 은행법에 따라 비미국계 은행의 미국 내 예금액의 역외 대출 및 투자가 불가능함

15) 미국의 MMF는 국공채에 투자하는 국공채 MMF와 CP 및 CD 등에 주로 투자하고 있는 프라임 MMF로 분류되며, 최근 미국의 MMF 규제 강화는 기관형 프라임 MMF를 대상으로 이루어짐(자세한 내용은 <참고 Ⅱ-2> 참조)

16) 통상적으로 CP는 만기 1개월물 미만이 대부분 거래되고 있는 반면 외환스왑의 경우 3개월물이 주로 거래되고 있어, 이를 통한 중개방식은 만기 불일치 리스크를 수반하고 있음

17) 일반적으로 CP 발행을 통한 펀딩 비용이 외환스왑을 통한 비용 대비 유리한 것으로 나타나고 있으며, 전자의 경우 은행의 부채 확대를 통해 각종 규제 비율 산정에 포함됨에 따른 추가적인 비용이 발생함

18) Pozsar(2016)는 이러한 측면에서 최근의 달러화 유동성 부족(Global dollar shortage) 상황을 은행의 부채 확대 여력 위축에 따른 중개 자금의 부족(Shortage of banks; balance sheet to intermediate dollar) 현상으로 구분하여 설명하고 있음

19) 달러화 스왑시장의 불균형은 직접 달러화 자금조달 비용과 외환스왑을 통한 간접 조달 비용 간 차이(스왑베이시스(Currency-Currency Basis: CCB)로 표기);

20) 내외금리차와 해당 통화간 현‧선물 환율차이(스왑레이트)간 평형 상태를 지칭 (

21) 은행부문의 달러화 스왑시장을 통한 자금조달 비중은 IMF(2018) 등의 추정 방식에 따라 총자산 대비 순자산(총자산-총부채) 비중을 나타내고 있는 CCFR(Cross Currency Funding Ratio)을 통해 추정함; 즉, 대부분 은행의 경우 외환노출도를 제한하고 있음에 따라 은행의 오픈 외환포지션인 달러화 순자산에 해당하는 재원을 외환스왑을 통해 조달하고 있는 것으로 추정

22) 해당 통계는 모든 통화를 포함하고 있으나, 달러화가 포함된 계약이 90% 이상으로 추정됨(BIS Derivatives Statistics, 2019)

23) Bruno & Shin(2015)은 달러화 가치변화는 기업의 달러화 대출관련 신용도 변화를 통해 은행의 추가 대출 여력에 영향을 미친다는 점에서 은행의 달러화 자금조달의 그림자 비용으로 설명하고 있음

24) 우리나라 대외금융부채 중 미달러화가 전체 외환의 80.3%(2019년말 기준)를 차지

25) 해외은행차입금이 현물환율에 미치는 영향이 제한적인 것은 자금차입으로 외화자산과 외화부채가 동시에 늘어나 은행의 외환포지션에 변동이 일어나지 않기 때문임

26) 이는 해외채권투자를 위한 현물환매입과 동시에 환헤지를 위해 선물환매도를 행함으로써 외환스왑시장의 buy&sell 스왑거래가 증가함에 기인하고 있음

27) 미달러화지수의 상승시 미달러화 자금조달자의 상환위험이 커지므로 글로벌 은행의 대출이 감소하는 영향을 미치는 것으로 가정함

28) 외생성이 높을 것으로 보이는 변수의 순서에 따라 [gap, bankhat, ois]의 순으로 모형을 구성하였으며, 모형의 시차는 AIC에 따라 2(개월)를 적용

참고문헌

김한수, 2020, 코로나19 사태에 따른 외환시장 현황 및 시사점, 자본시장연구원『자본시장포커스』2020-09.

서현덕, 2005, 우리나라에서의 금리평형이론과 자본이동, 한국은행『외환국제금융 리뷰』.

송치영‧김경수, 2008, 원/달러 무위험 금리평형 이탈에 대한 실증연구, 한국응용경제학회『응용경제』10(3).

이승호, 2003, Deviation from covered interest rate parity in Korea, Journal of International Economic Studies 7(1), Korea Institute for International Economic Policy.

이승호, 2014,『우리나라 외환스왑시장의 불균형 및 환율과의 관계에 관한 연구』, 자본시장연구원 연구보고서 14-07.

이승호, 2020, 국내 증권사의 외화유동성 위기에 대한 평가와 과제, 자본시장연구원 『자본시장포커스』2020-16.

정대희, 2012,『우리나라 외환시장의 차익거래 유인에 대한 분석』, 한국개발연구원 한국개발연구 34(1), 30-52.

Adrian, T., Xie, P., 2020, The non-US bank demand for US dollar assets, IMF Working paper(WP/20/101)

Aldasoro, I., Ehlers, T., 2018, Global liquidity: Changing instrument and currency patters, BIS Quarterly Review 2018-09.

Aldasoro, I., Ehlers, T., 2018, The geography of dollar funding of non-US banks, BIS Quarterly Review 2018(12).

Aldasoro, I., Ehlers, T., Eren E., 2019, Global banks, dollar funding, and regulation, BIS Working papers No.708.

Aldasoro, I., Ehlers, T., McGuire, P., Perter, G., 2020, Global banks’ dollar funding needs and central bank swap lines, BIS Bulletin No.27.

Avdjiev, S., Du, W., Koch, C., Shin, H., 2017a, The dollar, bank leverage and the deviation from covered interest parity, BIS Working paper No.592.

Avdjiev, S., Eren, E., McGuire, P., 2020, Dollar funding costs during the Covid-19 crisis through the les of the FX swap market, BIS Bulletin No.1.

Avdjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017b, The shifting drivers of global liquidity, BIS Working paper No.644.

Baba, N., Shim, I., 2011, Dislocations in the won-dollar swap markets during the crisis of 2007-09, BIS Working papers No.344.

Barajas, A., Deghi, A., Raddatz, C., Seneviratne, D., Xie, P., Xu, Y., 2020, Global banks’ dollar funding: A source of financial vulnerability, IMF Working paper(WP/20/113).

Bhar, R., Kim, S.J., Pham, T., 2004, Exchange rate volatility and its impact on the transaction costs of covered interest rate parity, Japan and World Economy 16, 503-525.

BIS, 2020, US Dollar Funding: An International Perspective, CGFS Papers No.65.

Bruno, V., Shin, H. S., 2015, Capital flows and the risk-taking channel of monetary policy, Journal of Monetary Economics 71, 119-132.

Clinton, K., 1988, Transactions costs and covered interest parity, Journal of Political Economy 96, 358-370.

Dooley, M.P., Isard, P., 1980, Capital controls, political risks, and deviations from interest-rate parity, Journal of Political Economy 88(2).

Du, W., 2019, Commentary: Mind the Gap in Sovereign Debt Markets: The U.S. Treasury Basis and the Dollar Risk Factor, commentary at Federal Reserve Bank of Kansas City Jackson Hole Economic Policy Symposium.

Du, W., Hébert, Benjamin M., Huber, Amy, 2019, Are intermediary constrains priced? NBER Working paper No.26009.

Du, W., Tepper, A., Verdelhan, A., 2017, Deviations from covered interest parity, NBER Working paper No.23170.

Eren, E., Schrimpf, A., Sushko, V., 2020, US dollar funding markets during the Covid-19 crisis–the international dimension, BIS Bulletin No.15.

Erick, B., Lombardi, M., Mihaljek, Du., Shin, H., 2020, The dollar, bank leverage and real economic activity: an evolving relationship, BIS Working papers No.847.

Frenkel, J.A., Levich, R.M., 1977, Transaction costs and interest arbitrage: Tranquil versus turbulent periods, Journal of Political Economy 85, 1209-1226.

Gopinath, G., 2015, International Price System, 2015 Jackson Hole Symposium.

Iida, T., Kimura, T., Sudo, N. 2018, Deviations from covered interest rate parity and the dollar funding of global banks, Quarterly Journal of Economics 130(3).

IMF, 2018, Global Financial Stability Report April 2018: A Bumpy Road Ahead.

IMF, 2020, Strains in Offshore US Dollar Funding during the COVID-19 Crisis : Some Observations, IMF Analytic Notes.

Kreicher, L., McCauley, R., McGuire, P., 2013, The 2011 FDIC assessment on banks’ managed liabilities: interest rate and balance-sheet responses, BIS Working papers No.413.

Lee, I.H., Lee, S.H., and Shim, Ilhyock, 2014, “Deviation from Covered Interest Rate Parity in Asian Foreign-Exchange Swap Markets During the Financial Crisis of 2007-2009” in the Asian Capital Matket Development and Integration, ADB and KCMI, Oxford Press.

McGuire, P., Peter, G., 2012, The dollar shortage in global banking and the international policy response, International Finance 15(2).

Murau, S., 2018, Offshore Dollar Creation and the Emergence of the Post-2008 International Monetary System, IASS(Institute for Advanced Substantiality Studies) Discussion paper.

Pozsar, Z., 2016, From Exorbitant Privilege to Existential Trilemma, Credit Suisse Global Money Notes No.8.

Shin, H., 2013, The Second Phase of Global Liquidity and Its Impact on Emerging Economies, Keynote address at Federal Reserve bank of San Francisco Asia Economic Policy Conference.

Szilagyi, P., Batten, J., 2006, Arbitrage, Covered Interest Parity and Long-term Dependence Between the US Dollar and the Yen, IIIS Discussion paper, No.128.

Turner, P., 2013, The global long-term interest rate, financial risks and policy choices in EMEs, BIS Working papers No.441.