Find out more about our latest publications

Korea’s Potential Inclusion in the WGBI: Effects and Implications

Issue Papers 23-02 Jan. 09, 2023

- Research Topic Capital Markets

- Page 23

The FTSE World Government Bond Index (WGBI) consisting of sovereign bonds issued by major economies is a leading index which is used as a benchmark index for major global pension funds. As a primary sovereign debt index, the WGBI contributes to inviting investment funds benchmarked against the index and enhancing the credibility of its member’s government bond market. A candidate country should fulfill various requirements including considerable market size, a stable institutional framework and convenience for international transactions.

Korea has recently been added to the FTSE Fixed Income Country Classification Watch List, which is considered a pre-WGBI inclusion stage. This is attributable to the Korean government’s active effort to address limited market accessibility that has served as an obstacle to Korea’s inclusion in the WGBI. Considering that Korea seems to meet all the criteria excluding restricted market access, FTSE Russell is likely to officially add Korea to the WGBI.

Korea’s WGBI membership is expected to attract more funds tracking the index and stabilize the sovereign debt market and FX market. This report finds that global economies newly added to the WGBI have experienced statistically significant effects including the increase in government bond prices and currency appreciation. The analysis of the domestic market predicts that the inclusion will have positive effects on government bond yields and exchange rates. While the influx of foreign investors is losing momentum, Korea’s joining the WGBI is expected to bring about economic benefits as it ensures a stable stream of funds to the sovereign bond market. Given that funds benchmarked against the WGBI tend to prefer long-term investments, WGBI membership is likely to further stabilize the domestic FX market and financial market.

Greater capital inflows resulting from WGBI inclusion should entail adverse effects of raising susceptibility to external factors, which requires caution. Notably, FTSE specifies conditions for the exclusion from the index and thus, failure in meeting relevant requirements could initiate the exclusion process. In this respect, Korea needs to consider expanding the domestic bond investor base and invigorating overseas stock investments as measures to mitigate external shocks while preparing for inclusion in the WGBI.

Korea has recently been added to the FTSE Fixed Income Country Classification Watch List, which is considered a pre-WGBI inclusion stage. This is attributable to the Korean government’s active effort to address limited market accessibility that has served as an obstacle to Korea’s inclusion in the WGBI. Considering that Korea seems to meet all the criteria excluding restricted market access, FTSE Russell is likely to officially add Korea to the WGBI.

Korea’s WGBI membership is expected to attract more funds tracking the index and stabilize the sovereign debt market and FX market. This report finds that global economies newly added to the WGBI have experienced statistically significant effects including the increase in government bond prices and currency appreciation. The analysis of the domestic market predicts that the inclusion will have positive effects on government bond yields and exchange rates. While the influx of foreign investors is losing momentum, Korea’s joining the WGBI is expected to bring about economic benefits as it ensures a stable stream of funds to the sovereign bond market. Given that funds benchmarked against the WGBI tend to prefer long-term investments, WGBI membership is likely to further stabilize the domestic FX market and financial market.

Greater capital inflows resulting from WGBI inclusion should entail adverse effects of raising susceptibility to external factors, which requires caution. Notably, FTSE specifies conditions for the exclusion from the index and thus, failure in meeting relevant requirements could initiate the exclusion process. In this respect, Korea needs to consider expanding the domestic bond investor base and invigorating overseas stock investments as measures to mitigate external shocks while preparing for inclusion in the WGBI.

Ⅰ. 서론

세계국채지수(World Government Bond Index: WGBI)는 세계 3대 채권지수 중 하나로 주요국 연기금 등 초우량 글로벌 투자자가 벤치마크 지수로 활용하고 있는 대표적인 글로벌 채권지수이다. 현재 WGBI는 미국 등 주요 선진국 국채와 더불어 지난해 기준 세계 국내총생산(GDP) 상위 10개국 중 한국과 인도를 제외한 8개국 등 주요 23개국 국채를 포함하고 있다. 이러한 측면에서 WGBI는 외국인 자금유입 확대와 더불어 편입국 국채시장의 신뢰도 제고의 효과를 제공하는 선진 채권지수로서의 성격이 크게 두드러진다.

우리나라는 최근 원화가치 하락 및 한ㆍ미 정책금리 격차 확대 등으로 외국인 투자자의 유입 모멘텀이 크게 약화되면서 안정적인 국채투자자 기반 구축 측면에서 WGBI 편입에 매우 적극적인 모습을 보이고 있다. 이는 특히 선진 채권지수로서 WGBI의 대표성 및 막대한 추종자금 규모 등을 고려할 때 우리나라 국채의 WGBI 편입은 자본유입 확대와 더불어 대외신인도 제고를 통한 이른바 ‘원화채 디스카운트’ 극복에도 도움이 될 것으로 기대되기 때문이다. 최근 정부는 2009년 WGBI 편입 추진 당시 제약요인으로 작용하였던 외국인 국채투자 비과세 조치의 조기 시행과 더불어 국제예탁결제기구 연계 추진 등 지수편입을 목표로 다각도의 노력을 펼치고 있다. 이러한 노력의 결과로 지난 9월 우리나라는 WGBI 편입의 전단계로 간주되고 있는 관찰대상국 리스트에 편입되었으며 내년 중 정식 편입될 가능성이 클 것으로 예상된다.

본고에서는 우리나라의 WGBI 편입환경 분석과 더불어 지수편입에 따른 경제적 효과 등을 살펴보았다. 특히 최근 WGBI에 신규 편입된 해외사례 분석을 통해 우리나라 국채 편입 시 예상되는 영향을 살펴보았으며, 이를 통해 지수편입에 따른 자본유입 규모 및 경제적 영향 등을 분석하였다. 본고의 구성은 다음과 같다. Ⅱ장에서는 WGBI 일반현황 및 편입조건과 더불어 우리나라 국채의 편입 가능성을 살펴보았다. 이어서 Ⅲ장에서는 주요 해외사례를 통해 지수편입에 따른 경제적 영향을 살펴보고, 지수편입이 국내경제에 미치는 영향을 분석하였다. 마지막 Ⅳ장에서는 요약 및 시사점을 제시하였다.

Ⅱ. WGBI 개요 및 편입환경 분석

최근 우리나라는 WGBI 편입 전단계로 볼 수 있는 관찰대상국 리스트에 등재되면서 지수편입에 대한 기대감이 높아지고 있다. 본장에서는 해당 지수의 일반현황 및 편입조건 등을 정리하고, 우리나라 국채의 WGBI 편입 가능성 및 예상 일정 등을 살펴본다.

1. WGBI 개요

가. 일반현황

WGBI는 영국의 FTSE Russell이 관장하고 있는 주요국 국채로 구성된 글로벌 채권지수다. 일반적으로 세계 3대 채권지수로는 WGBI와 더불어 블룸버그ㆍ바클레이즈 글로벌 종합지수(Bloomberg-Barclays Global Aggregative Index: BBGA) 및 JP Morgan 신흥국 국채 지수(Government Bond Index-Emerging Markets: GBI-EM) 등이 꼽히고 있으며, 현재 우리나라 국채는 3대 채권지수 중 BBGA 구성 종목에만 포함되어 있다.1) WGBI 구성 종목에는 총 23개국 1,170개 종목의 국공채가 포함되어 있으며, 현재 해당 지수를 추종하고 있는 민간자금은 약 2.5~3조달러에 달하는 것으로 추정된다.2) 특히 WGBI는 미국, 일본, 영국 등 주요 선진국 국채를 포함하고 있어 일반적으로 선진국 채권지수로 인식되고 있으며, 주요 연기금 등 초우량 글로벌 투자자의 추종 비중이 높은 가장 대표적인 글로벌 채권지수로 알려져 있다.3)

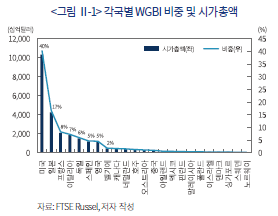

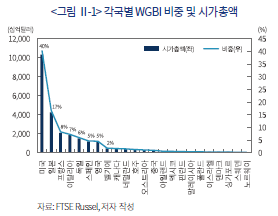

WGBI 구성 종목에는 주요 선진국 국채와 더불어 중국(2021년 10월 편입), 멕시코(2010년 4월 편입), 말레이시아(2007년 4월 편입) 등 신흥국의 국채 또한 포함되어 있으며, 각국별 지수 내 비중은 매월 말 해당국 시가총액 비중에 따라 업데이트된다. 최근 자료에 따르면 현재 최대 비중을 차지하고 있는 미국 국채의 경우 지수 내 비중이 약 40%에 달하는 것으로 나타나고 있으며, 이어서 일본 17%, 프랑스 8% 등의 순으로 높은 비중을 차지하고 있다. 또한 2021년 10월 이후 지수편입이 진행 중인 중국의 비중은 현재 약 1%로 이미 신흥국 중 가장 높은 비중을 차지하고 있으며, 편입 완료 시 지수 내 비중은 약 5.25%로 예상된다.4)

나. WGBI 편입기준

FTSE Russel은 WGBI 편입기준으로 시장 규모 및 유동성 측면에서의 정량적 조건과 더불어 국제거래 편의성, 진입장벽 등 시장접근성 측면에서의 정성적 조건을 제시하고 있다. 해당 기준에 따른 신규 편입 결정은 반기별로 시행되는 정기 리뷰를 통해 진행되며, 편입기준 충족이 단기일 내 완료될 것으로 예상되는 경우 먼저 관찰대상국(Watch List)으로 지정한 이후 시장참가자 인터뷰 등을 포함한 심사과정을 거쳐 편입 관련 구체적 계획을 발표한다.5) 단, 정량기준 미달에 따른 WGBI 퇴출의 경우에는 매월 구성 종목 재조정(rebalancing) 심사를 통해 기준 미달 다음 달부터 즉시 퇴출 절차가 진행된다.

WGBI의 정량적 기준에는 편입 대상국 국채시장 규모 및 유동성, 국가 신용등급 등의 항목을 포함하고 있다. 신규 편입의 경우 해당국 국채 발행잔액은 액면가 기준 미달러화 500억달러(또는 400억유로ㆍ5조엔)을 상회하여야 하며, 해당 기준 절반 이하로 발행잔액 감소 시에는 퇴출 조항이 작동한다.6) 국채 발행 규모 관련 편입기준은 <표 Ⅱ-1>에 나타난 바와 같이 국가별로 차등 적용하고 있으며, 발행 규모 미달에 따른 퇴출 조항은 적용되지 않는다. 이와 더불어 WGBI는 국가 신용도 측면에서도 구체적인 편입기준(S&P ‘A-’ 또는 무디스 ‘A3’ 이상)을 제시하고 있으며, 해당 기준의 경우에도 일정 등급 이하로 신용등급이 하락하는 경우 퇴출 절차가 진행된다.7)

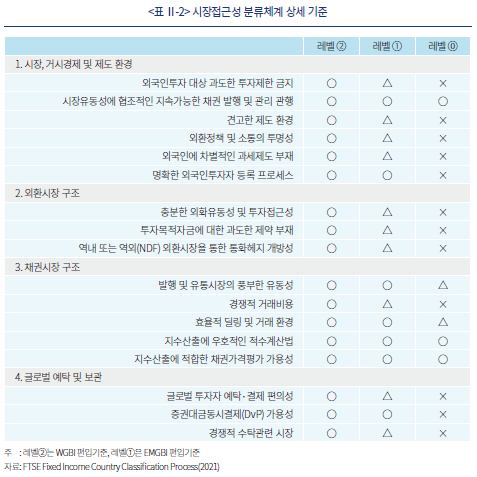

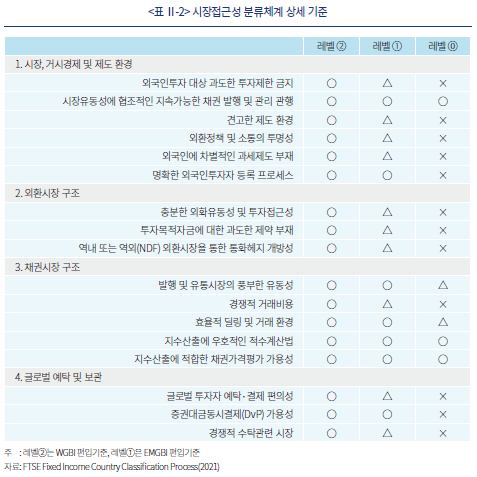

시장접근성 측면에서의 정성적 조건으로는 FTSE Russell의 채권시장 국가분류체계(Fixed Income Country Classification)에 따른 등급 기준이 적용되고 있다. 해당 분류체계는 대상국의 거시경제, 외환시장 및 채권시장 구조, 글로벌 예탁ㆍ보관기관 연계성 측면에서의 접근성을 평가하여 3단계(레벨 0~2)로 시장접근성 등급을 구분하며, WGBI 편입을 위해서는 가장 높은 수준의 시장접근성 등급(레벨2)이 요구된다. 우리나라의 FTSE의 시장접근성 등급은 현재 레벨1 수준으로 편입기준에 미치지 못하고 있으나, 최근 시장접근성 등급 상향조정이 가능한 관찰대상국 리스트에 등재된 바 있다. FTSE Russell의 시장접근성 분류체계의 상세한 내용은 <표 Ⅱ-2>에 정리된 바와 같다.

2. 편입 가능성 및 예상 일정

우리나라 국채시장은 정량적 측면에서의 WGBI 편입조건은 이미 모두 충족하고 있는 것으로 파악된다. 즉, 2022년 3월말 기준 국채 발행잔액은 약 884조원으로 WGBI의 시장규모 기준(500억달러)을 상회하고 있으며, 올해 신규 발행규모 또한 약 167조원에 이를 것으로 예상되어 양 조건 모두 WGBI의 편입기준을 크게 상회한다. 또한 현재 우리나라의 신용등급은 ‘AA(S&P)’ 및 ‘Aa2(Moody’s)’ 등으로 이미 WGBI 편입 최소기준을 충족하고 있어 향후 WGBI 편입 여부는 정성적 기준인 시장접근성 등급 상향조정 여부에 따라 결정될 것으로 예상된다.

현재 FTSE의 소득별 분류기준 상 선진국으로 분류되나 시장접근성 등급 레벨1로 평가되고 있는 국가는 우리나라와 스위스가 유일하다.8) 우리나라의 경우 WGBI 시장접근성 저평가 항목은 비거주자 조세체계, 외환시장 개방성, 글로벌 예탁기관 이용 편의성 등으로 파악된다. 특히 FTSE는 외국인 국채투자자에 대한 비과세 적용을 시장접근성 상향조정을 위한 명시적인 조건으로 제시하고 있어, 비거주자 원천징수 의무를 부과하고 있는 현행 조세체계는 가장 대표적인 WGBI 시장접근성 저평가 요인으로 부각된다.9)

외환시장 측면에서는 외국인의 역내ㆍ외 외환시장 연계성ㆍ개방성 및 제3자 외환거래(third party FX) 등의 일부 제약요인이 저평가 원인으로 작용하고 있다. 특히 비거주자의 국내 증권투자 시 외환거래 상대방 제한, 외환시장의 24시간 연계 불가, 비거주자의 은행간 외환시장 참여 제한 등이 부정적 요인으로 작용하고 있는 것으로 파악된다. 또한 글로벌 예탁기관 접근성 측면에서는 국제예탁결제기구(International Central Securities Depository: ICSD) 연계성 측면에서 낮은 평가가 이루어지고 있는 것으로 추정된다.

현재 우리나라는 WGBI 편입을 목표로 시장접근성 관련 제도개선 및 인프라 구축에 적극적으로 나서고 있는 것으로 파악된다. 특히 최근 정부는 비거주자의 국채 및 통안증권 투자 시 이자 및 양도소득을 비과세하는 세법개정안을 국회에 제출하였다.10) 비거주자의 국채 투자시 원천징수 면제는 국제적 관행으로 최근 WGBI에 편입된 중국을 포함한 대부분 국가에서 시행하고 있는 것으로 파악된다.11) 또한 우리나라는 이미 국채에 투자하는 비거주자의 본국 대부분과 조세협정을 맺고 있는 만큼 사실상 비거주자 입장에서 납세하는 금액은 동일하다고 볼 수 있다.12) 따라서 비거주에 대한 비과세 적용은 세제혜택 측면보다는 거래편의성 측면이 크게 작용하고 있는 것으로 볼 수 있으며, 특히 원천징수 면제는 국제예탁결제기구 연계 시스템 구축 및 활용성 개선에도 기여한다는 점에서 시장접근성 상향조정 요인으로 작용할 가능성이 높은 것으로 판단된다.13)

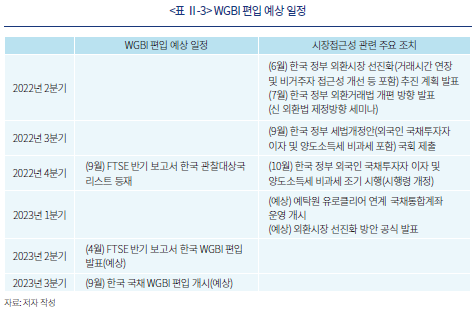

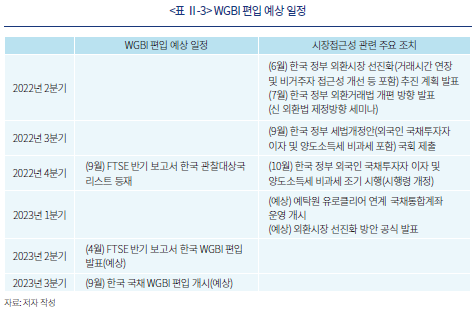

이러한 최근 정부의 지수편입을 위한 적극적인 노력 등을 감안할 때 우리나라 국채의 WGBI 편입은 내년 중 이루어질 가능성이 높을 것으로 예상된다. <표 Ⅱ-3>에서는 최근 시장접근성 관련 주요 제도개선 및 인프라 구축 현황과 WGBI 편입 예상 일정을 정리하였다. 특히 최근 정부는 외국인 국채투자자 비과세 조치의 조기 시행을 발표하였으며, 예탁원을 통한 ICSD 연계계좌 운영 계획 또한 제시하고 있는 만큼 지수편입 가능성은 크게 높아진 것으로 생각된다. 또한 올해 초 정부는 비거주자의 국내 은행간 외환시장 참여 허용 등을 포함한 외환시장 선진화 계획을 발표한 바 있으며, 최근 외환거래법 전면 개편작업 진행 등 다양한 외환시장 개방성 제고 조치가 진행되고 있는 것으로 파악되는 만큼 단기간 내 지수편입이 이루어질 것으로 기대해 볼 수 있다. 다만 WGBI 편입심사는 다수의 시장참가자 면담 등을 포함하고 있는 만큼, 제도 및 인프라 개선과 더불어 실질적인 업무 편의성 개선이 이루어지는 방향으로 시장접근성 개선을 추진할 필요가 있을 것으로 판단된다.

Ⅲ. WGBI 편입에 따른 영향 분석

WGBI에 신규 편입되는 경우 지수 추종자금의 대규모 유입과 더불어 국채시장 및 외환시장 등 편입국 경제 전반에 걸쳐 다양한 영향을 미칠 것으로 예상된다. 본장에서는 주요 해외사례 분석 및 다양한 실증분석 등을 통해 지수편입에 따른 경제적 영향을 살펴보고 우리나라 신규 편입 시 예상되는 자본유입 규모 및 경제적 영향 등을 살펴보고자 한다.

1. 지수편입에 따른 자본유입 확대

가. 해외사례

주요 벤치마크 지수편입은 편입국의 즉각적인 자본유입 확대를 견인할 것으로 예상된다. 특히 특정 벤치마크 지수 추종전략을 명시화하고 있는 패시브 펀드 등의 경우에는 지수편입과 동시에 편입국 자산에 대한 투자가 진행된다. 이러한 지수편입에 따른 자본유입 확대 효과는 다수의 기존 연구에서도 제시되고 있다. 예를 들어 전세계 약 800여개 채권투자펀드의 자산배분 전략을 분석한 Raddatz et al.(2017)의 연구에서는 대상 펀드의 70% 이상이 주요 벤치마크 지수 편입 및 비중 변화 등에 따라 통계적으로 유의한 자산배분 변화가 나타나고 있음을 보여주고 있으며, 32개국 액티브 및 패시브 펀드의 자산배분 전략을 분석한 Cremers et al.(2016)에서도 벤치마크 지수 추종전략이 유의한 영향을 미치고 있는 것으로 나타난다.

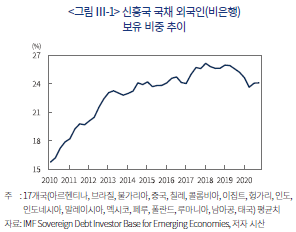

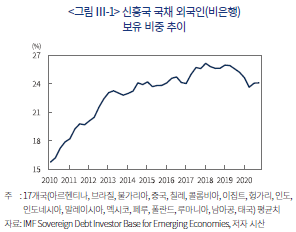

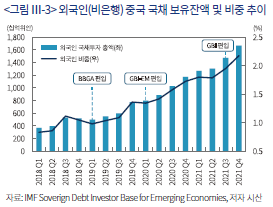

특히 채권 부문 벤치마크 지수 편입은 신흥국 자본유입 확대에 큰 영향을 미치고 있는 것으로 파악된다. 아래 <그림 Ⅲ-1>은 GBI-EM 또는 WGBI에 포함된 주요 신흥국 국채시장의 외국인(비은행) 비중 추이를 보여주고 있다. 2020년 말 기준 해당 신흥국 그룹의 비은행 부문 외국인 투자자금 비중은 약 24%로 2010년 대비 약 10%p 확대된 수준으로 나타난다. 또한 신흥국의 자본유입 규모를 추정하고 있는 다수의 연구에서도 글로벌 채권지수 편입은 신흥국 자본유입 확대에 큰 영향을 미치는 것으로 나타난다. Arslanalp et al.(2020)에 따르면 주요 채권지수 추종자금의 신흥국 국채시장 유입 규모는 2000년대 초반 이후 약 3배 이상 증가하였으며, 2019년 중 주요 신흥국 국채시장으로 유입된 외국인 투자자금의 약 40%가 주요 글로벌 채권지수 추종자금으로 추정되고 있다.

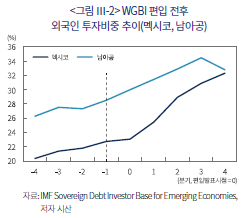

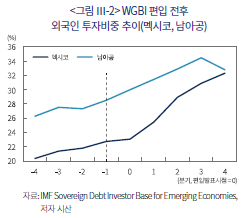

벤치마크 지수편입에 따른 자본유입의 효과는 최근 WGBI에 신규 편입된 멕시코, 남아프리카 공화국 등 주요국 사례에서도 관찰된다.14) 아래 <그림 Ⅲ-2>에 나타난 바와 같이 2010년 4월 및 2012년 4월 WGBI에 신규 편입된 멕시코와 남아프리카공화국 국채시장의 외국인(비은행) 비중은 편입 이후 각각 40% 및 20% 상승한 것으로 나타난다. 또한 신규 편입 대상국 국채의 실제 지수 내 편입은 편입발표 이후 일정 기간(약 3~6개월) 이후 시작되고 있음에도 불구하고 해당국으로의 자본유입 확대는 편입발표와 동시에 확대되고 있는 것으로 나타난다. 이러한 현상은 지수편입에 따른 채권가격 상승 등을 고려한 패시브 펀드 등의 선투자 수요와 더불어 해당 지수 추종자금 외 여타 액티브 자금의 추가 유입 또한 진행되고 있음을 시사한다.

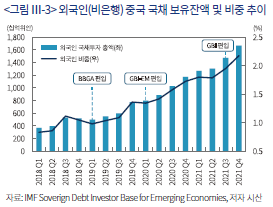

가장 최근 WGBI에 편입된 중국의 경우에도 지수편입에 따른 자본유입 확대가 진행되고 있는 것으로 나타난다. 중국은 2021년 9월 WGBI 편입과 더불어 현재 주요 글로벌 채권지수에 모두 가입하고 있다. 중국의 각 지수 편입에 따른 예상 자본유입 규모는 BBGA(2019년 4월 편입) 1,200억달러, JP Morgan GBI-EM(2020년 2월 편입) 200억달러, WGBI 1,500억달러로 추산되고 있으며, 실제 2019년 1분기 이후 외국인(비은행) 국채투자 신규유입액은 2,000억달러를 상회하는 것으로 나타나고 있다. 특히 중국의 경우 WGBI 편입이 장기간(36개월)에 걸쳐 진행되고 있음에도 불구하고 현재까지 자본유입 규모는 지수편입에 따른 추정치를 상회하고 있는 것으로 나타난다.15)

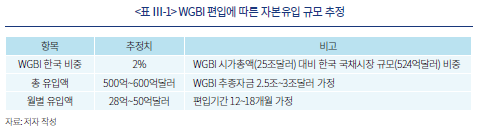

나. 국내 유입자본 규모 추정

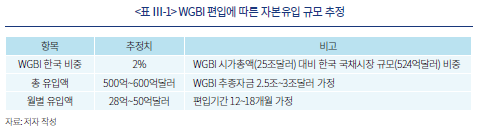

우리나라 국채의 WGBI 편입에 따른 예상 자본유입 규모는 <표 Ⅲ-1>과 같이 추정해 볼 수 있다. 즉, WGBI 편입 시 우리나라 국채시장 비중은 약 2% 수준으로 예상되며 주요 글로벌 투자은행의 WGBI 추종자금 추정치를 반영하여 지수편입 이후 자본유입 규모를 추정하면 총 500억~600억달러의 WGBI 추종자금이 유입될 것으로 추정해 볼 수 있다.16) 또한 WGBI 편입이 통상적으로 12~18개월 기간에 걸쳐 이루지는 점을 감안할 때, 지수편입 이후 월평균 자본유입 규모는 약 28억~50억달러 수준이 될 것으로 예상된다.17) 한편 이러한 추정치는 WGBI 추종자금 유입만을 고려한 추정치로, 해외사례에 나타난 바와 같이 지수편입에 따른 추가적인 자본유입 가능성을 고려할 때 지수편입에 따른 실제 자본유입 규모는 추정치를 상회할 가능성이 클 것으로 판단된다.

2. 경제적 영향 분석

WGBI 편입에 따른 예상 자본유입 규모는 올해 국채 발행 예정액의 절반에 달하는 수준으로 국채시장의 수요충격과 더불어 다양한 경제적 영향을 미칠 것으로 예상된다. 본절에서는 WGBI 편입에 따른 경제적 영향을 주요 해외사례 및 실증분석 등을 통해 살펴보았다.

가. 해외사례

완전 개방경제를 가정하고 있는 일반적 경제이론에 따르면 비거주자의 국채 투자 확대는 자국 경제상황에 영향을 미치는 요인으로 작용하지 않는다. 이는 해당 모형에서 외국인의 국채 투자는 투자대상국의 신용도 및 국제금리 등에 따라 결정되며, 투자대상국의 환율 또한 금리평형(interat parity) 이론에 따를 것으로 예상되기 때문이다. 그러나 실제 다수의 연구에 따르면 비거주자의 국채 투자자금 유입은 투자대상국의 국채수익률 및 환율 등에 유의한 영향을 미치고 있는 것으로 나타난다.18) 이러한 현상은 투자자의 선호도가 자산배분 결정에 반영되고 있음을 제시하고 있는 선호영역이론(Preferred Habitat Theory)이 실제 외국인 투자자의 투자행태를 설명하고 있음을 시사한다. 즉 해당 이론에 따르면 벤치마크 지수편입 등 투자자 선호도 변화요인은 투자대상국 국채시장의 수요충격으로 작용하여 해당국 채권시장 및 외환시장 등에 영향을 미치는 것으로 설명할 수 있다.

주요 글로벌 채권지수 편입사례를 분석한 다수의 연구 결과에서도 주요 채권지수편입은 편입국으로 자본유입 확대와 더불어 편입국 경제에 다양한 영향을 미치고 있는 것으로 나타난다. 예를 들어 GBI-EM 신규 편입 16개국 사례를 분석한 Williams & Pandolfi(2017)의 연구에서는 지수편입에 따른 자본유입 확대는 편입국 국채시장 가격변화에 유의한 양(+)의 영향을 미치고 있는 것으로 추정되었으며19), WGBI 및 GBI-EM 편입사례를 분석한 Broner et al.(2021)의 연구에서도 지수편입 이후 편입국의 채권시장 수익률 하락 및 통화가치 절상 등의 경제적 영향이 통계적으로 유의하게 나타나고 있음을 보고하고 있다.

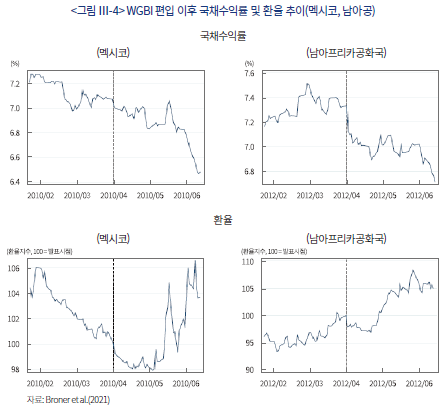

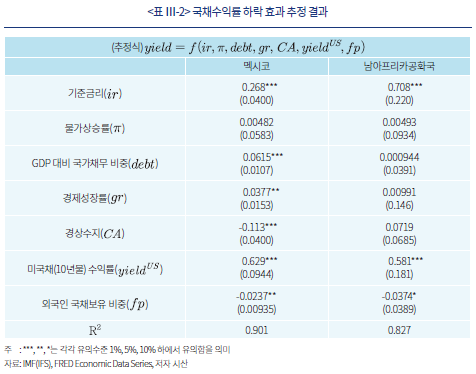

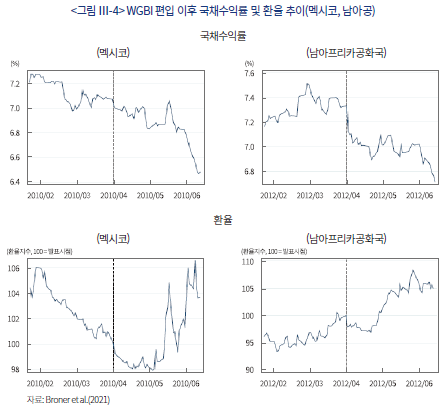

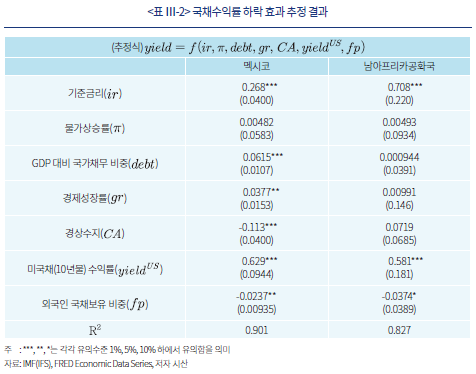

WGBI 편입에 따른 경제적 영향은 최근 해당 지수에 신규 편입된 멕시코 및 남아프리카공화국 사례 등을 통해 살펴볼 수 있다. <그림 Ⅲ-4>에 나타난 바와 같이 해당 지수 편입국 모두 WGBI 편입발표 시점을 전후하여 기존 연구와 동일한 방향의 경제적 영향이 관찰된다.20) 또한 이러한 WGBI 편입에 따른 경제적 영향은 본고의 실증분석에서도 통계적으로 유의한 것으로 확인된다. 아래 <표 Ⅲ-2>는 2010년 이후 WGBI에 신규 편입된 멕시코 및 남아프리카공화국 국채시장의 외국인(비은행) 비중 확대에 따른 국채수익률 하락 효과를 추정한 분석결과를 제시하고 있다.21) 동 분석에 따르면 멕시코의 경우 지수편입 이후 비은행 외국인 투자자 비중 1%p 확대에 따른 국채수익률 하락 효과는 약 △2.4bp로 추정되었으며, 남아프리카공화국의 경우에도 유의한 음(-)의 효과가 나타나고 있는 것으로 추정된다.

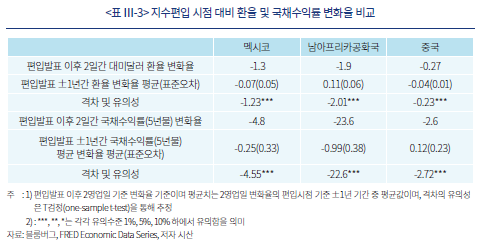

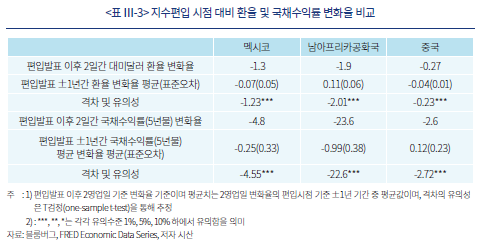

또한 앞서 살펴본 바와 같이 편입국 국채의 실제 WGBI 편입은 지수편입 발표 이후 일정 기간 시차를 두고 진행되고 있음에도 불구하고 편입국으로의 자본유입 확대 등의 경제적 영향은 편입발표와 동시에 나타나고 있다. <표 Ⅲ-3>에서는 이러한 지수편입 발표에 따른 단기적 영향 및 통계적 유의성을 살펴보았다.22) 해당 분석 결과에 따르면 중국, 멕시코, 남아프리카공화국 등 최근 WGBI 신규 진입사례 모두 편입발표 직후 국채수익률 및 대미달러화 환율 하락 등의 효과가 즉각적으로 나타났으며, 이러한 영향은 편입 전후 2년 기간 중 해당 변수 변화율 평균치와 통계적으로 유의한 격차를 보이고 있는 것으로 나타난다. 이러한 결과는 WGBI 편입이 실제 지수편입에 따른 추종자금 유입 등 경제적 효과 외에도 국채시장 신뢰도 제고 등의 부수적 효과로 인해 편입발표와 동시에 편입국 경제에 영향을 미칠 수 있음을 시사하고 있다.

한편 지수편입에 따른 실물경제 부문의 영향은 국내 기업의 성격 등에 따라 각기 다른 방향으로 나타날 수 있을 것으로 예상된다. 예컨대 국채수익률 하락은 국내 금융기관의 재무제표 개선을 통해 재정확대에 따른 구축효과(crowding out) 개선 등 실물 부문에 긍정적 영향으로 작용하는 반면, 지수편입에 따른 환율 절상 압력 확대는 수출기업의 경쟁력 하락 등의 부정적 효과 또한 초래할 수 있다. 기존 연구에서도 지수편입이 국내 기업 등에 미치는 영향은 각 부문별로 차별화되어 나타나는 것으로 보고되고 있다. 예를 들어 Pandolfi & Williams(2020)는 국채시장 수요충격에 따른 기업의 수익성 개선 효과가 국내 금융기관 및 정부관련 기업 등에서 상대적으로 높게 나타나고 있음을 보고하고 있으며, Broner et al.(2021)의 연구에서는 지수편입 이후 수출기업의 수익성 하락이 유의하게 나타나고 있음을 실증분석을 통해 제시하고 있다.

나. 국내 경제에 미치는 영향

1) 채권시장

앞서 살펴본 WGBI 편입에 따른 국채수익률 하락 효과는 우리나라의 경우에도 유사하게 나타날 것으로 예상된다. 이는 우리나라의 경우 특히 기존 외국인 국채 보유잔액 대비 WGBI 편입에 따른 신규 자금유입 규모가 클 것으로 예상되고 있어 국채시장의 주요 수요충격 요인으로 작용할 가능성이 높기 때문이다.23) 기획재정부ㆍ한국조세재정연구원(2021)의 자료를 참고하여 WGBI 편입에 따른 국채수익률 하락 효과를 추정하면, WGBI 편입 이후 총 600억달러의 자금이 유입될 것으로 가정하는 경우 국채수익률 하락폭은 5년물 기준 약 25~70bp 수준이다.24)

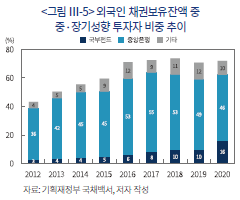

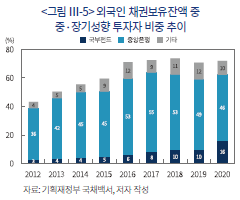

또한 WGBI 편입은 우리나라 국채시장 투자자 저변 다각화 측면에서 긍정적 영향을 미칠 것으로 기대된다. 이는 WGBI 편입으로 유입되는 자금의 성격이 기존 채권투자자금과는 상이할 것으로 예상되기 때문이다. 우리나라의 외국인 국채 보유자는 단기성 재정거래자와 중ㆍ장기성 투자자로 분류되며, 후자의 경우에는 <그림 Ⅲ-5>에 나타난 바와 같이 국부펀드 및 중앙은행 등이 대부분을 차지하고 있다.25) 따라서 민간부문 장기성향 투자자 비중이 높은 WGBI 추종자금의 성격을 감안할 할 때 WGBI 편입에 따른 신규자금 유입은 외국인 국채보유 듀레이션 장기화 등의 긍정적 영향을 미칠 것으로 예상해 볼 수 있다. 또한 WGBI 편입을 위해 진행 중인 국제예탁결제기구 연계를 통한 청산ㆍ결제 인프라 구축 등이 완성될 경우 우리나라 국채의 담보 활용성 개선 등을 통해 구조적인 외국인 수요 확대 요인으로 작용할 수 있을 것으로 예상된다.

2) 외환시장

WGBI 편입에 따른 통화절상 효과는 외환시장의 높은 변동성 및 중앙은행의 시장개입 관행 등을 감안할 때 예측이 쉽지 않은 부분이다. 앞서 살펴본 기존 연구에서는 지수편입에 따른 통화절상 효과가 통계적으로 유의한 것으로 나타나고 있으나 각국별 통화절상 폭 등은 상이한 것으로 나타난다. 예를 들어 Broner et al.(2021)의 연구에서는 지수편입에 따른 환율효과는 유의한 양의 관계로 추정되었으나, 자본유입 규모와 통화 절상폭과는 유의한 상관관계가 추정되지 않았다.26) 이러한 연구결과는 지수편입에 따른 통화가치 절상의 효과는 각국별로 상이하게 나타날 수 있음을 시사하고 있다.

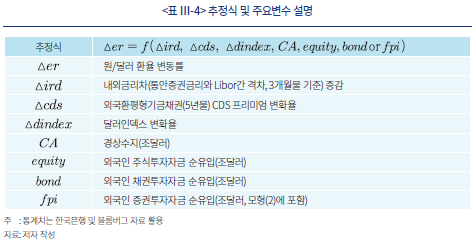

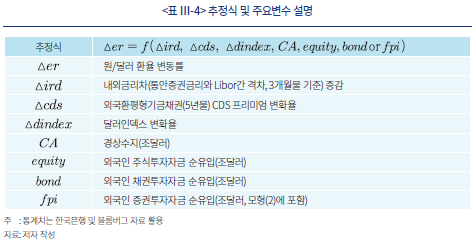

본절에서는 국내 외환시장의 환율 결정요인을 실증분석을 통해 추정하여 WGBI 편입에 따른 외환시장 영향을 추정하여 보았다. 본고의 분석모형은 유위험이자율평형(uncovered interest rate parity) 조건에 외국인 증권투자 등 외환수급 요인을 추가한 기존문헌의 추정모형을 참조하여 <표 Ⅲ-4>와 같이 설정하였다. 분석자료는 2010년 1월~2021년 12월 기간 월별자료를 활용하였으며, 분석에 포함된 모든 변수는 ADF(Augmented Dicky-Fuller) 검정 결과 안정적인 시계열로 확인되었다. 추정방법으로는 OLS 모형과 함께 설명변수의 내생성 가능성을 고려하여 GMM(Generalized Methods of Moments) 모형을 사용하였다.27)

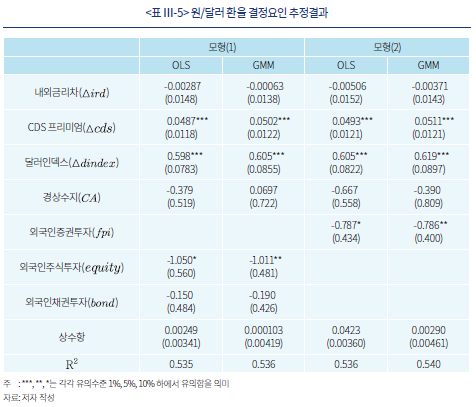

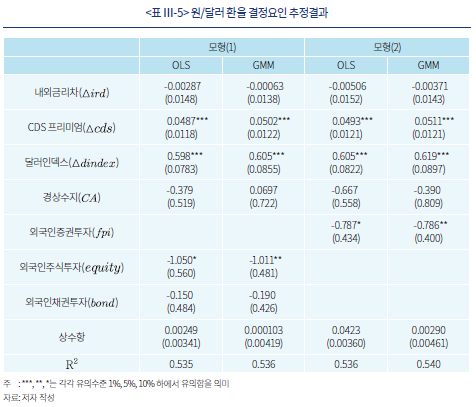

<표 Ⅲ-5>는 추정모형의 회귀분석 결과를 보여주고 있다. 먼저 대부분 통제변수는 이론적 예상 방향과 일치하는 것으로 추정되었다. 즉, 우리나라 신인도를 나타내고 있는 CDS 프리미엄 변화율 및 대외불확실성 변수로 설정된 달러인덱스 변화율은 예상과 일치하는 유의한 양(+)의 관계로 추정되었다. 내외금리차 증감 및 경상수지의 경우에는 통계적 유의성이 높지 않았으나, OLS 모형에서는 이론과 일치하는 음(-)의 관계를 보이는 것으로 나타났다. 또한 외국인 주식투자자금 순유입 변수의 경우에도 이론과 일치한 유의한 음(-)의 관계를 보이는 것으로 추정되었다.

본고의 주요 관심사항인 외국인 채권투자자금 순유입 추정계수의 경우에는 이론과 일치하는 음(-)의 관계가 나타났으나 통계적 유의성이 낮게 추정되었다. 이는 우리나라 국채에 투자하는 외국인의 거래방식이 단기차익거래 및 환헤지 비중이 높다는 점에서 채권자금 유입에 따른 환율 변동요인이 상대적으로 제한적으로 작용하는 것으로 추정된다. 또한 외국인 채권투자자금의 유ㆍ출입 시점과 현물환시장에서의 환전 시점이 상이함에 따라 외환시장에 미치는 효과가 일부 과소 추정되었을 가능성도 생각해 볼 수 있을 것이다.

한편 앞서 살펴본 바와 같이 WGBI 편입에 따른 신규 채권자금 유입은 민간부문 장기성향 투자자금 위주로 진행될 것으로 예상된다. 따라서 지수편입에 따른 환율효과는 과거 단기 재정거래 및 중앙은행 등 공적자금 위주의 채권자금 유입과는 상이할 것으로 생각해 볼 수 있다. 이러한 측면을 고려하여 본고에서는 전반적인 외국인 증권자금 유입이 원/달러 환율에 미치는 영향을 추정하여 지수편입에 따른 환율효과를 예상해 보았다. 즉 모형(2)의 외국인 증권자금 추정계수를 통해 지수편입에 따른 환율효과를 추정하였으며, 이에 따르면 WGBI 편입 이후 매월 50억달러 규모의 신규자금이 12개월간 유입될 경우 지수편입에 따른 원/달러 환율 하락폭은 약 4.8% 수준으로 예상된다.

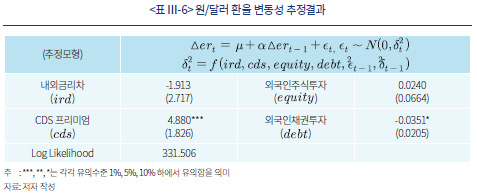

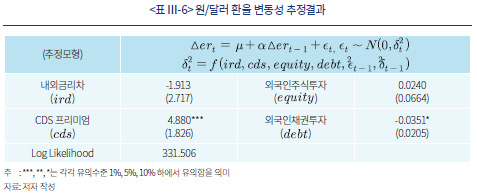

한편 지수편입에 따른 외국인 채권자금 유입 확대가 외환시장 변동성에 미치는 영향은 제한적일 것으로 예상된다. 기존 연구에 따르면 채권자금 유입이 신흥국 외환시장 변동성 확대에 미치는 영향은 제한적인 것으로 나타나고 있으며28), 본고의 실증분석에서도 국내 채권자금 유입은 원/달러 환율 변동성 감소요인으로 작용하고 있는 것으로 나타난다. 아래 <표 Ⅲ-6>은 GARCH 시계열 모형을 통해 외국인 증권자금 유입에 따른 원/달러 환율변동성 효과를 추정한 분석 결과를 제시하고 있다.29) 해당 분석 결과에 나타난 바와 같이 외국인 채권자금 유입은 국내 원/달러 환율 변동성과 음(-)의 관계를 보이고 있는 만큼 지수편입이 외환시장 변동성 확대요인으로 작용할 여지는 제한적일 것으로 판단된다. 또한 장기성향의 WGBI 추종자금의 성격 등을 감안할 때 지수편입은 외환시장 스왑베이시스 축소 등 시장 효율성 개선과 더불어 변동성 측면에서도 긍정적인 효과를 견인할 수 있을 것으로 기대해 볼 수 있다.

Ⅳ. 요약 및 시사점

우리나라는 현재 WGBI의 시장접근성 등급 상향 전단계인 관찰대상국 리스트에 등재되어 있는 상황으로 조만간 정식 WGBI 편입 가능성이 클 것으로 예상된다. 주요 대형 연기금 등이 벤치마크 지수로 활용하고 있는 WGBI는 해당 지수 추종자금 규모 및 선진 채권지수로서의 대표성 등으로 지수편입에 따른 긍정적 영향이 매우 클 것으로 예상된다. 특히 최근 원화 약세, 한ㆍ미 금리격차 확대 등으로 외국인 유입 모멘텀이 약화된 상황에서 안정적 자금조달처를 제공한다는 측면에서 지수편입에 따른 경제적 편익이 클 것으로 예상되며, 안정적인 글로벌 수요를 바탕으로 원화채 디스카운트 해소 및 국내 금융시장 안정성 제고에도 도움이 될 것으로 판단된다.

앞서 살펴본 바와 같이 WGBI 편입은 국채수익률 하락 및 통화가치 상승 등의 긍정적 경제효과를 견인할 것으로 예상된다. 특히 주요 벤치마크 지수에 신규 편입된 주요 해외사례에서 이러한 경제적 영향이 통계적으로 유의한 것으로 나타나고 있는 만큼 우리나라 또한 지수편입은 경제적 영향에 긍정적으로 작용할 것으로 기대된다. 본고의 분석결과에 따르면 WGBI 편입은 외국인 국채투자 매수기반 확대를 통한 금리상승 압력 완화 및 원/달러 환율의 하향 안정화를 유도할 것으로 예상된다. 또한 외국인 자금유입 확대를 통한 달러화 유동성 개선 효과는 외환시장 효율성 제고 및 변동성 축소에도 기여할 수 있을 것으로 기대된다.

한편 WGBI 편입에 따른 자본유입 확대가 대외요인 변화에 따른 급격한 변동성 확대 또한 초래할 수 있다는 점에서는 주의가 요구된다. 예컨대 WGBI는 명시적인 퇴출 조항을 포함하고 있어 국가 신용등급의 기준치 미달 등 최악의 이벤트 발발 시 급격한 자본유출 가능성이 상존한다. 다만 지수 추종자금의 장기적 성향 등을 고려할 때 일반적인 상황에서 자본유출 압력으로 작용할 여지는 크지 않을 것으로 예상되나 전반적인 대외요인 민감도가 상승한다는 점에서는 주의를 기울일 필요가 있을 것이다. 또한 지수편입에 따른 외환시장 효율성 개선은 한편으로 외국인의 차익거래 기회 축소에 따른 현ㆍ선물 연계 투자 확대 등 채권시장 변동성 증대 요인으로 작용할 수 있다는 점에서도 유의할 필요가 있을 것이다. 이러한 측면에서 WGBI 편입과 더불어 국내 채권투자자 기반 확대 및 해외증권투자 활성화 등을 통한 대외충격 완화 방안을 동시에 고려할 필요가 있을 것으로 생각된다.

1) 신흥국 국채로 구성된 JP Morgan GBI-EM의 경우에는 해당 지수산정 회사의 국가 등급 분류상 우리나라는 선진국으로 분류되어 있어 편입 대상이 아님

2) 주요 글로벌 투자은행 추정치 기준임(FTSE Market Navigation: Fixed Income, 2021년 5월 참조)

3) 특히 WGBI는 세계 최대 연기금인 일본 공적연금펀드(Government Pension Investment Fund: GPIF)의 패시브 자산운용 부문 벤치마크 지수로 활용되고 있음(GPIF 홈페이지 참조)

4) 단, 최대 WGBI 추종자금인 GPIF는 중국 시장의 투명성 이슈 등으로 인해 중국 국채를 제외한 WGBI 종목에만 투자할 것임을 밝히고 있음(Financial Times, 2019. 9. 29)

5) WGBI의 시장접근성 등급 상향 조정은 관찰대상국 등재 이후 최소 6개월 검토기간을 걸쳐 이루지며, 이미 시장접근성 기준을 충족하고 있는 국가의 경우에는 양적기준 충족 시 즉시 편입이 이루어지는 경우도 존재함

6) 스위스의 경우 2018년 8월 기준 국채 발행잔액 기준치 미달(미달러화 기준 190억달러)로 인해 익월 해당 지수 편입종목에서 퇴출되었음

7) 남아프리카공화국의 경우 2020년 3월 무디스 신용등급이 ‘Ba1’으로 강등되었으며, 이에 따라 익월부터 퇴출절차가 시작됨

8) FTSE는 2022년 9월 채권시장 국가분류 보고서에서 비거주자 원천징수를 유지하고 있는 스위스의 시장접근성을 레벨1로 평가하였음

9) 우리나라는 2009년 비거주자의 채권투자에 대한 비과세 조치 시행 이후 WGBI 관찰대상국에 편입된 바 있으나, 2011년 1월 비과세 조치 철회 이후 편입 시도가 무산되었음

10) 또한 기획재정부는 10월 18일 세법개정안 입법예고를 통해 동 비과세 적용을 2022년 10월 17일부터 조기 시행할 예정임을 발표하였음

11) 자국 국채에 투자하는 비거주자에 대한 원천징수 면제는 주요 선진국 대부분 모두 시행하고 있으며, 이는 일반적으로 안정적인 재정운용에 대한 혜택 및 거래편의성 제공의 측면에서 일반적 관행으로 인식되고 있음(Norreggard, 1997)

12) 국채투자자에 대한 원천징수의 경우 비거주의 수익에 대한 세금은 우리나라에서 선징수하게 되며, 이후 해당 투자자는 본국에 국내에서의 선징수분에 대한 증빙서류(국세청 납부필증) 제출을 통해 양국간 조세협약에 따른 공제가 진행됨

13) 연합인포맥스(2022. 8. 24)에 따르면 한국예탁결제원은 내년 중 유로클리어와 연계하여 국채통합계좌 운영을 준비 중인 것으로 알려짐

14) 본장의 분석은 글로벌 금융위기 이후 WGBI 신규 편입사례인 멕시코, 남아프리카, 중국 등을 대상으로 진행하였으며, 가장 최근 사례(뉴질랜드, 2022년 11월 편입) 및 2000년대 초반 편입사례(싱가포르, 노르웨이, 폴란드, 말레이시아) 등은 분석대상에 포함하지 않음

15) 중국은 2019년 1분기~2020년 4분기 기간 중 BBGA 및 JP Morgan GBI-EM 편입에 따른 예상 자본유입 규모 대비 1.4배 규모의 자금이 유입되었음

16) WGBI 편입 시 국채 만기별 편입종목은 국가별로 상이한 것으로 알려져 있으나, 국내의 경우 3년물, 5년물, 10년물, 30년물 등이 포함될 것으로 가정하였으며, 통안채는 해당 비중 시산에서 제외하였음

17) WGBI 편입기간은 중국의 경우 최대 기간인 36개월에 걸쳐 진행된 반면 이스라엘의 경우에는 한달에 걸쳐 진행되는 등 국가별로 상이함

18) Arslanalp & Poghosyan(2016)은 외국인의 국채투자 확대가 주요 선진국 국채시장 수익률 하락 요인으로 작용하고 있다는 실증적 연구결과를 제시하고 있으며, Peiris(2013)는 신흥국의 경우에도 동 효과가 강력하게 나타나고 있음을 보고하고 있음

19) 해당 연구에서는 벤치마크 변화에 따른 자본유입(Flows Implied by Rebalancing: FIIR) 표준편차의 ‘1’단위 상승은 벤치마크 편입 시점 기준 ±5 영업일 간 국채수익률 8bp 상승을 견인하는 것으로 보고됨

20) 멕시코의 경우 WGBI 편입 이후 약 2개월에 걸쳐 국채수익률 60bp 하락 및 통화가치 6% 절상 등의 효과가 나타남

21) 본절의 실증분석 모형은 Caporale & Williams(2002) 등의 채권수익률 결정요인 추정모형을 참조하여 설정하였으며, 지수편입에 따른 효과 추정을 위해 각국별 분석 대상기간은 지수편입 이후 최근까지 시점으로 한정하였음

22) 해당 분석에서는 WGBI 편입국의 편입발표 직후 관련 경제변수의 변화율과 편입발표 시점 전후 2년 기간 중 평균 변화율 간 격차 및 통계적 유의성을 추정하였음

23) WGBI 편입에 따른 채권자금 예상 유입 규모는 2021년 말 외국인 채권보유잔액의 약 1/3에 달할 것으로 예상됨

24) 해당 자료에서는 국채 10년물 1조원 발행시 국채금리(5년물 기준)는 약 0.4~1.0bp 상승효과가 나타나는 것으로 분석하고 있으며, 본고에서는 지수편입에 따른 국채시장 수요충격을 국채 발행량으로 역으로 대체하여 금리변동폭을 추정하였음

25) 국부펀드 및 중앙은행은 이미 조세협정에 따라 국채 투자시 원천징수 면제가 적용되고 있어 세제개편에 따른 추가 유입 가능성은 제한적임

26) 해당 연구에서 국채수익률의 경우에는 자본유입 규모와 유의한 상관관계가 추정되었음

27) GMM 모형에서는 내생성 검정을 통해 경상수지를 내생변수로 설정하고, 동 변수의 시차변수를 도구변수로 활용하였음

28) 신흥국 10개국을 대상으로 주식 및 채권자금 유입에 따른 환율 변동성 효과를 분석한 Caporale et al.(2017)의 연구에서는 주식자금의 경우 환율 변동성 확대 요인으로 추정되었으나, 채권자금 유입 확대는 환율 변동성 완화효과를 견인하는 것으로 보고됨

29) 해당 추정모형은 Caporale et al.(2017)을 참조하여 GARCH(1,1)을 통한 환율 변화율 추정식에 주식자금 및 채권자금 유입을 조건부 분산식에 추가하여 설정하였으며, 앞의 분석과 동일한 월별 데이터를 활용하여 2010년 1월~2021년 12월 기간을 대상으로 추정하였음

참고문헌

김정한ㆍ임형준ㆍ이지언, 2010,『외국인 채권투자 확대에 따른 국내 금융시장의 영향과 대응방안』, 한국금융연구원 금융 VIP 시리즈 2010-07.

기획재정부ㆍ한국조세재정연구원, 2021, 2021 조세특례 예비타당성 평가: 개인투자용 국채상품 도입방안.

양대정ㆍ최경욱, 2019, 외국인 증권투자자금 유출입의 원/달러환율 영향력 분석,『사회과학연구』45(3).

연합인포맥스, 2022. 8. 24, 최상대 2차관, 유로클리어 등으로 외국인 국채 투자 활성화.

이승호, 2022,『MSCI 선진국지수 편입의 효과, 선결과제 및 시사점』, 자본시장연구원 이슈보고서 22-06.

Arslanalp, S., Tusda, T., 2014, Tracking global demand for emerging market sovereign debt, IMF working paper 14/39.

Arslanalp, S., Poghosyan, T., 2016, Foreign investor flows and sovereign bond yields in advanced economies, Journal of Banking and Financiao Economics 2(6), 45-67.

Arslanalp, S., Drakopoulos, D., Goel, R., Koepke, R., 2020, Benchmark driven investments in emerging market bond markets: Taking stock, IMF working paper 20/192.

Broner, F., Martin, F., Pandolfi, L., Williams, T., 2021, Winners and losers from sovereign debt inflows, Journal of International Economics 130(103446).

Carporale, G., Ali, F., Spagnolo, F., Spagnolo, N., 2017, International portfolio flows and exchange rate volatility in emergin Asian markets, Journal of International Money and Finance 76, 1-15.

Carporale, G., Williams, G., 2002, Long-term nominal interest rates and domestic fundamentals, Review of Financial Economics 11, 119-30.

Cremers, M., Ferreira, A., Matos, P., Starks, L., 2016, Indexing and active fund management: International evidence, Journal of Financial Economics 120, 539-560.

Financial Times, 2019. 9. 29, World’s biggest pension fund shuns renminbi-denominated sovereign bonds.

FTSE, 2021, Fixed Income Country Classification Process.

Norregaard, J., 1997, The tax treatment of government bonds, IMF working paper No.97/25.

Pandolfi, L., Williams, T., 2020, Real Effects of Sovereign Debt Inflow Shocks, AEA Papers and Proceedings 110: 511-15.

Peiris, S., 2013, Foreign participation in local currency bond markets of emerging economies, Journal of International Commerce, Economics and Policy 4(3), 1-15.

Raddatz, C., Schmukler, L., Williams, T., 2017, International asset allocations and capital flows: The benchmark effect, Journal of International Economics 108, 413-430.

Williams, T., Pandolfi, L., 2017, Capital flows and sovereign debt markets: Evidence form index rebalancing, Institute for International Economics Policy working paper series 2017-11.

세계국채지수(World Government Bond Index: WGBI)는 세계 3대 채권지수 중 하나로 주요국 연기금 등 초우량 글로벌 투자자가 벤치마크 지수로 활용하고 있는 대표적인 글로벌 채권지수이다. 현재 WGBI는 미국 등 주요 선진국 국채와 더불어 지난해 기준 세계 국내총생산(GDP) 상위 10개국 중 한국과 인도를 제외한 8개국 등 주요 23개국 국채를 포함하고 있다. 이러한 측면에서 WGBI는 외국인 자금유입 확대와 더불어 편입국 국채시장의 신뢰도 제고의 효과를 제공하는 선진 채권지수로서의 성격이 크게 두드러진다.

우리나라는 최근 원화가치 하락 및 한ㆍ미 정책금리 격차 확대 등으로 외국인 투자자의 유입 모멘텀이 크게 약화되면서 안정적인 국채투자자 기반 구축 측면에서 WGBI 편입에 매우 적극적인 모습을 보이고 있다. 이는 특히 선진 채권지수로서 WGBI의 대표성 및 막대한 추종자금 규모 등을 고려할 때 우리나라 국채의 WGBI 편입은 자본유입 확대와 더불어 대외신인도 제고를 통한 이른바 ‘원화채 디스카운트’ 극복에도 도움이 될 것으로 기대되기 때문이다. 최근 정부는 2009년 WGBI 편입 추진 당시 제약요인으로 작용하였던 외국인 국채투자 비과세 조치의 조기 시행과 더불어 국제예탁결제기구 연계 추진 등 지수편입을 목표로 다각도의 노력을 펼치고 있다. 이러한 노력의 결과로 지난 9월 우리나라는 WGBI 편입의 전단계로 간주되고 있는 관찰대상국 리스트에 편입되었으며 내년 중 정식 편입될 가능성이 클 것으로 예상된다.

본고에서는 우리나라의 WGBI 편입환경 분석과 더불어 지수편입에 따른 경제적 효과 등을 살펴보았다. 특히 최근 WGBI에 신규 편입된 해외사례 분석을 통해 우리나라 국채 편입 시 예상되는 영향을 살펴보았으며, 이를 통해 지수편입에 따른 자본유입 규모 및 경제적 영향 등을 분석하였다. 본고의 구성은 다음과 같다. Ⅱ장에서는 WGBI 일반현황 및 편입조건과 더불어 우리나라 국채의 편입 가능성을 살펴보았다. 이어서 Ⅲ장에서는 주요 해외사례를 통해 지수편입에 따른 경제적 영향을 살펴보고, 지수편입이 국내경제에 미치는 영향을 분석하였다. 마지막 Ⅳ장에서는 요약 및 시사점을 제시하였다.

Ⅱ. WGBI 개요 및 편입환경 분석

최근 우리나라는 WGBI 편입 전단계로 볼 수 있는 관찰대상국 리스트에 등재되면서 지수편입에 대한 기대감이 높아지고 있다. 본장에서는 해당 지수의 일반현황 및 편입조건 등을 정리하고, 우리나라 국채의 WGBI 편입 가능성 및 예상 일정 등을 살펴본다.

1. WGBI 개요

가. 일반현황

WGBI는 영국의 FTSE Russell이 관장하고 있는 주요국 국채로 구성된 글로벌 채권지수다. 일반적으로 세계 3대 채권지수로는 WGBI와 더불어 블룸버그ㆍ바클레이즈 글로벌 종합지수(Bloomberg-Barclays Global Aggregative Index: BBGA) 및 JP Morgan 신흥국 국채 지수(Government Bond Index-Emerging Markets: GBI-EM) 등이 꼽히고 있으며, 현재 우리나라 국채는 3대 채권지수 중 BBGA 구성 종목에만 포함되어 있다.1) WGBI 구성 종목에는 총 23개국 1,170개 종목의 국공채가 포함되어 있으며, 현재 해당 지수를 추종하고 있는 민간자금은 약 2.5~3조달러에 달하는 것으로 추정된다.2) 특히 WGBI는 미국, 일본, 영국 등 주요 선진국 국채를 포함하고 있어 일반적으로 선진국 채권지수로 인식되고 있으며, 주요 연기금 등 초우량 글로벌 투자자의 추종 비중이 높은 가장 대표적인 글로벌 채권지수로 알려져 있다.3)

WGBI 구성 종목에는 주요 선진국 국채와 더불어 중국(2021년 10월 편입), 멕시코(2010년 4월 편입), 말레이시아(2007년 4월 편입) 등 신흥국의 국채 또한 포함되어 있으며, 각국별 지수 내 비중은 매월 말 해당국 시가총액 비중에 따라 업데이트된다. 최근 자료에 따르면 현재 최대 비중을 차지하고 있는 미국 국채의 경우 지수 내 비중이 약 40%에 달하는 것으로 나타나고 있으며, 이어서 일본 17%, 프랑스 8% 등의 순으로 높은 비중을 차지하고 있다. 또한 2021년 10월 이후 지수편입이 진행 중인 중국의 비중은 현재 약 1%로 이미 신흥국 중 가장 높은 비중을 차지하고 있으며, 편입 완료 시 지수 내 비중은 약 5.25%로 예상된다.4)

나. WGBI 편입기준

FTSE Russel은 WGBI 편입기준으로 시장 규모 및 유동성 측면에서의 정량적 조건과 더불어 국제거래 편의성, 진입장벽 등 시장접근성 측면에서의 정성적 조건을 제시하고 있다. 해당 기준에 따른 신규 편입 결정은 반기별로 시행되는 정기 리뷰를 통해 진행되며, 편입기준 충족이 단기일 내 완료될 것으로 예상되는 경우 먼저 관찰대상국(Watch List)으로 지정한 이후 시장참가자 인터뷰 등을 포함한 심사과정을 거쳐 편입 관련 구체적 계획을 발표한다.5) 단, 정량기준 미달에 따른 WGBI 퇴출의 경우에는 매월 구성 종목 재조정(rebalancing) 심사를 통해 기준 미달 다음 달부터 즉시 퇴출 절차가 진행된다.

시장접근성 측면에서의 정성적 조건으로는 FTSE Russell의 채권시장 국가분류체계(Fixed Income Country Classification)에 따른 등급 기준이 적용되고 있다. 해당 분류체계는 대상국의 거시경제, 외환시장 및 채권시장 구조, 글로벌 예탁ㆍ보관기관 연계성 측면에서의 접근성을 평가하여 3단계(레벨 0~2)로 시장접근성 등급을 구분하며, WGBI 편입을 위해서는 가장 높은 수준의 시장접근성 등급(레벨2)이 요구된다. 우리나라의 FTSE의 시장접근성 등급은 현재 레벨1 수준으로 편입기준에 미치지 못하고 있으나, 최근 시장접근성 등급 상향조정이 가능한 관찰대상국 리스트에 등재된 바 있다. FTSE Russell의 시장접근성 분류체계의 상세한 내용은 <표 Ⅱ-2>에 정리된 바와 같다.

2. 편입 가능성 및 예상 일정

우리나라 국채시장은 정량적 측면에서의 WGBI 편입조건은 이미 모두 충족하고 있는 것으로 파악된다. 즉, 2022년 3월말 기준 국채 발행잔액은 약 884조원으로 WGBI의 시장규모 기준(500억달러)을 상회하고 있으며, 올해 신규 발행규모 또한 약 167조원에 이를 것으로 예상되어 양 조건 모두 WGBI의 편입기준을 크게 상회한다. 또한 현재 우리나라의 신용등급은 ‘AA(S&P)’ 및 ‘Aa2(Moody’s)’ 등으로 이미 WGBI 편입 최소기준을 충족하고 있어 향후 WGBI 편입 여부는 정성적 기준인 시장접근성 등급 상향조정 여부에 따라 결정될 것으로 예상된다.

현재 FTSE의 소득별 분류기준 상 선진국으로 분류되나 시장접근성 등급 레벨1로 평가되고 있는 국가는 우리나라와 스위스가 유일하다.8) 우리나라의 경우 WGBI 시장접근성 저평가 항목은 비거주자 조세체계, 외환시장 개방성, 글로벌 예탁기관 이용 편의성 등으로 파악된다. 특히 FTSE는 외국인 국채투자자에 대한 비과세 적용을 시장접근성 상향조정을 위한 명시적인 조건으로 제시하고 있어, 비거주자 원천징수 의무를 부과하고 있는 현행 조세체계는 가장 대표적인 WGBI 시장접근성 저평가 요인으로 부각된다.9)

외환시장 측면에서는 외국인의 역내ㆍ외 외환시장 연계성ㆍ개방성 및 제3자 외환거래(third party FX) 등의 일부 제약요인이 저평가 원인으로 작용하고 있다. 특히 비거주자의 국내 증권투자 시 외환거래 상대방 제한, 외환시장의 24시간 연계 불가, 비거주자의 은행간 외환시장 참여 제한 등이 부정적 요인으로 작용하고 있는 것으로 파악된다. 또한 글로벌 예탁기관 접근성 측면에서는 국제예탁결제기구(International Central Securities Depository: ICSD) 연계성 측면에서 낮은 평가가 이루어지고 있는 것으로 추정된다.

현재 우리나라는 WGBI 편입을 목표로 시장접근성 관련 제도개선 및 인프라 구축에 적극적으로 나서고 있는 것으로 파악된다. 특히 최근 정부는 비거주자의 국채 및 통안증권 투자 시 이자 및 양도소득을 비과세하는 세법개정안을 국회에 제출하였다.10) 비거주자의 국채 투자시 원천징수 면제는 국제적 관행으로 최근 WGBI에 편입된 중국을 포함한 대부분 국가에서 시행하고 있는 것으로 파악된다.11) 또한 우리나라는 이미 국채에 투자하는 비거주자의 본국 대부분과 조세협정을 맺고 있는 만큼 사실상 비거주자 입장에서 납세하는 금액은 동일하다고 볼 수 있다.12) 따라서 비거주에 대한 비과세 적용은 세제혜택 측면보다는 거래편의성 측면이 크게 작용하고 있는 것으로 볼 수 있으며, 특히 원천징수 면제는 국제예탁결제기구 연계 시스템 구축 및 활용성 개선에도 기여한다는 점에서 시장접근성 상향조정 요인으로 작용할 가능성이 높은 것으로 판단된다.13)

이러한 최근 정부의 지수편입을 위한 적극적인 노력 등을 감안할 때 우리나라 국채의 WGBI 편입은 내년 중 이루어질 가능성이 높을 것으로 예상된다. <표 Ⅱ-3>에서는 최근 시장접근성 관련 주요 제도개선 및 인프라 구축 현황과 WGBI 편입 예상 일정을 정리하였다. 특히 최근 정부는 외국인 국채투자자 비과세 조치의 조기 시행을 발표하였으며, 예탁원을 통한 ICSD 연계계좌 운영 계획 또한 제시하고 있는 만큼 지수편입 가능성은 크게 높아진 것으로 생각된다. 또한 올해 초 정부는 비거주자의 국내 은행간 외환시장 참여 허용 등을 포함한 외환시장 선진화 계획을 발표한 바 있으며, 최근 외환거래법 전면 개편작업 진행 등 다양한 외환시장 개방성 제고 조치가 진행되고 있는 것으로 파악되는 만큼 단기간 내 지수편입이 이루어질 것으로 기대해 볼 수 있다. 다만 WGBI 편입심사는 다수의 시장참가자 면담 등을 포함하고 있는 만큼, 제도 및 인프라 개선과 더불어 실질적인 업무 편의성 개선이 이루어지는 방향으로 시장접근성 개선을 추진할 필요가 있을 것으로 판단된다.

Ⅲ. WGBI 편입에 따른 영향 분석

WGBI에 신규 편입되는 경우 지수 추종자금의 대규모 유입과 더불어 국채시장 및 외환시장 등 편입국 경제 전반에 걸쳐 다양한 영향을 미칠 것으로 예상된다. 본장에서는 주요 해외사례 분석 및 다양한 실증분석 등을 통해 지수편입에 따른 경제적 영향을 살펴보고 우리나라 신규 편입 시 예상되는 자본유입 규모 및 경제적 영향 등을 살펴보고자 한다.

1. 지수편입에 따른 자본유입 확대

가. 해외사례

주요 벤치마크 지수편입은 편입국의 즉각적인 자본유입 확대를 견인할 것으로 예상된다. 특히 특정 벤치마크 지수 추종전략을 명시화하고 있는 패시브 펀드 등의 경우에는 지수편입과 동시에 편입국 자산에 대한 투자가 진행된다. 이러한 지수편입에 따른 자본유입 확대 효과는 다수의 기존 연구에서도 제시되고 있다. 예를 들어 전세계 약 800여개 채권투자펀드의 자산배분 전략을 분석한 Raddatz et al.(2017)의 연구에서는 대상 펀드의 70% 이상이 주요 벤치마크 지수 편입 및 비중 변화 등에 따라 통계적으로 유의한 자산배분 변화가 나타나고 있음을 보여주고 있으며, 32개국 액티브 및 패시브 펀드의 자산배분 전략을 분석한 Cremers et al.(2016)에서도 벤치마크 지수 추종전략이 유의한 영향을 미치고 있는 것으로 나타난다.

특히 채권 부문 벤치마크 지수 편입은 신흥국 자본유입 확대에 큰 영향을 미치고 있는 것으로 파악된다. 아래 <그림 Ⅲ-1>은 GBI-EM 또는 WGBI에 포함된 주요 신흥국 국채시장의 외국인(비은행) 비중 추이를 보여주고 있다. 2020년 말 기준 해당 신흥국 그룹의 비은행 부문 외국인 투자자금 비중은 약 24%로 2010년 대비 약 10%p 확대된 수준으로 나타난다. 또한 신흥국의 자본유입 규모를 추정하고 있는 다수의 연구에서도 글로벌 채권지수 편입은 신흥국 자본유입 확대에 큰 영향을 미치는 것으로 나타난다. Arslanalp et al.(2020)에 따르면 주요 채권지수 추종자금의 신흥국 국채시장 유입 규모는 2000년대 초반 이후 약 3배 이상 증가하였으며, 2019년 중 주요 신흥국 국채시장으로 유입된 외국인 투자자금의 약 40%가 주요 글로벌 채권지수 추종자금으로 추정되고 있다.

우리나라 국채의 WGBI 편입에 따른 예상 자본유입 규모는 <표 Ⅲ-1>과 같이 추정해 볼 수 있다. 즉, WGBI 편입 시 우리나라 국채시장 비중은 약 2% 수준으로 예상되며 주요 글로벌 투자은행의 WGBI 추종자금 추정치를 반영하여 지수편입 이후 자본유입 규모를 추정하면 총 500억~600억달러의 WGBI 추종자금이 유입될 것으로 추정해 볼 수 있다.16) 또한 WGBI 편입이 통상적으로 12~18개월 기간에 걸쳐 이루지는 점을 감안할 때, 지수편입 이후 월평균 자본유입 규모는 약 28억~50억달러 수준이 될 것으로 예상된다.17) 한편 이러한 추정치는 WGBI 추종자금 유입만을 고려한 추정치로, 해외사례에 나타난 바와 같이 지수편입에 따른 추가적인 자본유입 가능성을 고려할 때 지수편입에 따른 실제 자본유입 규모는 추정치를 상회할 가능성이 클 것으로 판단된다.

WGBI 편입에 따른 예상 자본유입 규모는 올해 국채 발행 예정액의 절반에 달하는 수준으로 국채시장의 수요충격과 더불어 다양한 경제적 영향을 미칠 것으로 예상된다. 본절에서는 WGBI 편입에 따른 경제적 영향을 주요 해외사례 및 실증분석 등을 통해 살펴보았다.

가. 해외사례

완전 개방경제를 가정하고 있는 일반적 경제이론에 따르면 비거주자의 국채 투자 확대는 자국 경제상황에 영향을 미치는 요인으로 작용하지 않는다. 이는 해당 모형에서 외국인의 국채 투자는 투자대상국의 신용도 및 국제금리 등에 따라 결정되며, 투자대상국의 환율 또한 금리평형(interat parity) 이론에 따를 것으로 예상되기 때문이다. 그러나 실제 다수의 연구에 따르면 비거주자의 국채 투자자금 유입은 투자대상국의 국채수익률 및 환율 등에 유의한 영향을 미치고 있는 것으로 나타난다.18) 이러한 현상은 투자자의 선호도가 자산배분 결정에 반영되고 있음을 제시하고 있는 선호영역이론(Preferred Habitat Theory)이 실제 외국인 투자자의 투자행태를 설명하고 있음을 시사한다. 즉 해당 이론에 따르면 벤치마크 지수편입 등 투자자 선호도 변화요인은 투자대상국 국채시장의 수요충격으로 작용하여 해당국 채권시장 및 외환시장 등에 영향을 미치는 것으로 설명할 수 있다.

주요 글로벌 채권지수 편입사례를 분석한 다수의 연구 결과에서도 주요 채권지수편입은 편입국으로 자본유입 확대와 더불어 편입국 경제에 다양한 영향을 미치고 있는 것으로 나타난다. 예를 들어 GBI-EM 신규 편입 16개국 사례를 분석한 Williams & Pandolfi(2017)의 연구에서는 지수편입에 따른 자본유입 확대는 편입국 국채시장 가격변화에 유의한 양(+)의 영향을 미치고 있는 것으로 추정되었으며19), WGBI 및 GBI-EM 편입사례를 분석한 Broner et al.(2021)의 연구에서도 지수편입 이후 편입국의 채권시장 수익률 하락 및 통화가치 절상 등의 경제적 영향이 통계적으로 유의하게 나타나고 있음을 보고하고 있다.

WGBI 편입에 따른 경제적 영향은 최근 해당 지수에 신규 편입된 멕시코 및 남아프리카공화국 사례 등을 통해 살펴볼 수 있다. <그림 Ⅲ-4>에 나타난 바와 같이 해당 지수 편입국 모두 WGBI 편입발표 시점을 전후하여 기존 연구와 동일한 방향의 경제적 영향이 관찰된다.20) 또한 이러한 WGBI 편입에 따른 경제적 영향은 본고의 실증분석에서도 통계적으로 유의한 것으로 확인된다. 아래 <표 Ⅲ-2>는 2010년 이후 WGBI에 신규 편입된 멕시코 및 남아프리카공화국 국채시장의 외국인(비은행) 비중 확대에 따른 국채수익률 하락 효과를 추정한 분석결과를 제시하고 있다.21) 동 분석에 따르면 멕시코의 경우 지수편입 이후 비은행 외국인 투자자 비중 1%p 확대에 따른 국채수익률 하락 효과는 약 △2.4bp로 추정되었으며, 남아프리카공화국의 경우에도 유의한 음(-)의 효과가 나타나고 있는 것으로 추정된다.

나. 국내 경제에 미치는 영향

1) 채권시장

앞서 살펴본 WGBI 편입에 따른 국채수익률 하락 효과는 우리나라의 경우에도 유사하게 나타날 것으로 예상된다. 이는 우리나라의 경우 특히 기존 외국인 국채 보유잔액 대비 WGBI 편입에 따른 신규 자금유입 규모가 클 것으로 예상되고 있어 국채시장의 주요 수요충격 요인으로 작용할 가능성이 높기 때문이다.23) 기획재정부ㆍ한국조세재정연구원(2021)의 자료를 참고하여 WGBI 편입에 따른 국채수익률 하락 효과를 추정하면, WGBI 편입 이후 총 600억달러의 자금이 유입될 것으로 가정하는 경우 국채수익률 하락폭은 5년물 기준 약 25~70bp 수준이다.24)

또한 WGBI 편입은 우리나라 국채시장 투자자 저변 다각화 측면에서 긍정적 영향을 미칠 것으로 기대된다. 이는 WGBI 편입으로 유입되는 자금의 성격이 기존 채권투자자금과는 상이할 것으로 예상되기 때문이다. 우리나라의 외국인 국채 보유자는 단기성 재정거래자와 중ㆍ장기성 투자자로 분류되며, 후자의 경우에는 <그림 Ⅲ-5>에 나타난 바와 같이 국부펀드 및 중앙은행 등이 대부분을 차지하고 있다.25) 따라서 민간부문 장기성향 투자자 비중이 높은 WGBI 추종자금의 성격을 감안할 할 때 WGBI 편입에 따른 신규자금 유입은 외국인 국채보유 듀레이션 장기화 등의 긍정적 영향을 미칠 것으로 예상해 볼 수 있다. 또한 WGBI 편입을 위해 진행 중인 국제예탁결제기구 연계를 통한 청산ㆍ결제 인프라 구축 등이 완성될 경우 우리나라 국채의 담보 활용성 개선 등을 통해 구조적인 외국인 수요 확대 요인으로 작용할 수 있을 것으로 예상된다.

2) 외환시장

WGBI 편입에 따른 통화절상 효과는 외환시장의 높은 변동성 및 중앙은행의 시장개입 관행 등을 감안할 때 예측이 쉽지 않은 부분이다. 앞서 살펴본 기존 연구에서는 지수편입에 따른 통화절상 효과가 통계적으로 유의한 것으로 나타나고 있으나 각국별 통화절상 폭 등은 상이한 것으로 나타난다. 예를 들어 Broner et al.(2021)의 연구에서는 지수편입에 따른 환율효과는 유의한 양의 관계로 추정되었으나, 자본유입 규모와 통화 절상폭과는 유의한 상관관계가 추정되지 않았다.26) 이러한 연구결과는 지수편입에 따른 통화가치 절상의 효과는 각국별로 상이하게 나타날 수 있음을 시사하고 있다.

본절에서는 국내 외환시장의 환율 결정요인을 실증분석을 통해 추정하여 WGBI 편입에 따른 외환시장 영향을 추정하여 보았다. 본고의 분석모형은 유위험이자율평형(uncovered interest rate parity) 조건에 외국인 증권투자 등 외환수급 요인을 추가한 기존문헌의 추정모형을 참조하여 <표 Ⅲ-4>와 같이 설정하였다. 분석자료는 2010년 1월~2021년 12월 기간 월별자료를 활용하였으며, 분석에 포함된 모든 변수는 ADF(Augmented Dicky-Fuller) 검정 결과 안정적인 시계열로 확인되었다. 추정방법으로는 OLS 모형과 함께 설명변수의 내생성 가능성을 고려하여 GMM(Generalized Methods of Moments) 모형을 사용하였다.27)

한편 앞서 살펴본 바와 같이 WGBI 편입에 따른 신규 채권자금 유입은 민간부문 장기성향 투자자금 위주로 진행될 것으로 예상된다. 따라서 지수편입에 따른 환율효과는 과거 단기 재정거래 및 중앙은행 등 공적자금 위주의 채권자금 유입과는 상이할 것으로 생각해 볼 수 있다. 이러한 측면을 고려하여 본고에서는 전반적인 외국인 증권자금 유입이 원/달러 환율에 미치는 영향을 추정하여 지수편입에 따른 환율효과를 예상해 보았다. 즉 모형(2)의 외국인 증권자금 추정계수를 통해 지수편입에 따른 환율효과를 추정하였으며, 이에 따르면 WGBI 편입 이후 매월 50억달러 규모의 신규자금이 12개월간 유입될 경우 지수편입에 따른 원/달러 환율 하락폭은 약 4.8% 수준으로 예상된다.

한편 지수편입에 따른 외국인 채권자금 유입 확대가 외환시장 변동성에 미치는 영향은 제한적일 것으로 예상된다. 기존 연구에 따르면 채권자금 유입이 신흥국 외환시장 변동성 확대에 미치는 영향은 제한적인 것으로 나타나고 있으며28), 본고의 실증분석에서도 국내 채권자금 유입은 원/달러 환율 변동성 감소요인으로 작용하고 있는 것으로 나타난다. 아래 <표 Ⅲ-6>은 GARCH 시계열 모형을 통해 외국인 증권자금 유입에 따른 원/달러 환율변동성 효과를 추정한 분석 결과를 제시하고 있다.29) 해당 분석 결과에 나타난 바와 같이 외국인 채권자금 유입은 국내 원/달러 환율 변동성과 음(-)의 관계를 보이고 있는 만큼 지수편입이 외환시장 변동성 확대요인으로 작용할 여지는 제한적일 것으로 판단된다. 또한 장기성향의 WGBI 추종자금의 성격 등을 감안할 때 지수편입은 외환시장 스왑베이시스 축소 등 시장 효율성 개선과 더불어 변동성 측면에서도 긍정적인 효과를 견인할 수 있을 것으로 기대해 볼 수 있다.

Ⅳ. 요약 및 시사점

우리나라는 현재 WGBI의 시장접근성 등급 상향 전단계인 관찰대상국 리스트에 등재되어 있는 상황으로 조만간 정식 WGBI 편입 가능성이 클 것으로 예상된다. 주요 대형 연기금 등이 벤치마크 지수로 활용하고 있는 WGBI는 해당 지수 추종자금 규모 및 선진 채권지수로서의 대표성 등으로 지수편입에 따른 긍정적 영향이 매우 클 것으로 예상된다. 특히 최근 원화 약세, 한ㆍ미 금리격차 확대 등으로 외국인 유입 모멘텀이 약화된 상황에서 안정적 자금조달처를 제공한다는 측면에서 지수편입에 따른 경제적 편익이 클 것으로 예상되며, 안정적인 글로벌 수요를 바탕으로 원화채 디스카운트 해소 및 국내 금융시장 안정성 제고에도 도움이 될 것으로 판단된다.

앞서 살펴본 바와 같이 WGBI 편입은 국채수익률 하락 및 통화가치 상승 등의 긍정적 경제효과를 견인할 것으로 예상된다. 특히 주요 벤치마크 지수에 신규 편입된 주요 해외사례에서 이러한 경제적 영향이 통계적으로 유의한 것으로 나타나고 있는 만큼 우리나라 또한 지수편입은 경제적 영향에 긍정적으로 작용할 것으로 기대된다. 본고의 분석결과에 따르면 WGBI 편입은 외국인 국채투자 매수기반 확대를 통한 금리상승 압력 완화 및 원/달러 환율의 하향 안정화를 유도할 것으로 예상된다. 또한 외국인 자금유입 확대를 통한 달러화 유동성 개선 효과는 외환시장 효율성 제고 및 변동성 축소에도 기여할 수 있을 것으로 기대된다.

한편 WGBI 편입에 따른 자본유입 확대가 대외요인 변화에 따른 급격한 변동성 확대 또한 초래할 수 있다는 점에서는 주의가 요구된다. 예컨대 WGBI는 명시적인 퇴출 조항을 포함하고 있어 국가 신용등급의 기준치 미달 등 최악의 이벤트 발발 시 급격한 자본유출 가능성이 상존한다. 다만 지수 추종자금의 장기적 성향 등을 고려할 때 일반적인 상황에서 자본유출 압력으로 작용할 여지는 크지 않을 것으로 예상되나 전반적인 대외요인 민감도가 상승한다는 점에서는 주의를 기울일 필요가 있을 것이다. 또한 지수편입에 따른 외환시장 효율성 개선은 한편으로 외국인의 차익거래 기회 축소에 따른 현ㆍ선물 연계 투자 확대 등 채권시장 변동성 증대 요인으로 작용할 수 있다는 점에서도 유의할 필요가 있을 것이다. 이러한 측면에서 WGBI 편입과 더불어 국내 채권투자자 기반 확대 및 해외증권투자 활성화 등을 통한 대외충격 완화 방안을 동시에 고려할 필요가 있을 것으로 생각된다.

1) 신흥국 국채로 구성된 JP Morgan GBI-EM의 경우에는 해당 지수산정 회사의 국가 등급 분류상 우리나라는 선진국으로 분류되어 있어 편입 대상이 아님

2) 주요 글로벌 투자은행 추정치 기준임(FTSE Market Navigation: Fixed Income, 2021년 5월 참조)

3) 특히 WGBI는 세계 최대 연기금인 일본 공적연금펀드(Government Pension Investment Fund: GPIF)의 패시브 자산운용 부문 벤치마크 지수로 활용되고 있음(GPIF 홈페이지 참조)

4) 단, 최대 WGBI 추종자금인 GPIF는 중국 시장의 투명성 이슈 등으로 인해 중국 국채를 제외한 WGBI 종목에만 투자할 것임을 밝히고 있음(Financial Times, 2019. 9. 29)

5) WGBI의 시장접근성 등급 상향 조정은 관찰대상국 등재 이후 최소 6개월 검토기간을 걸쳐 이루지며, 이미 시장접근성 기준을 충족하고 있는 국가의 경우에는 양적기준 충족 시 즉시 편입이 이루어지는 경우도 존재함

6) 스위스의 경우 2018년 8월 기준 국채 발행잔액 기준치 미달(미달러화 기준 190억달러)로 인해 익월 해당 지수 편입종목에서 퇴출되었음

7) 남아프리카공화국의 경우 2020년 3월 무디스 신용등급이 ‘Ba1’으로 강등되었으며, 이에 따라 익월부터 퇴출절차가 시작됨

8) FTSE는 2022년 9월 채권시장 국가분류 보고서에서 비거주자 원천징수를 유지하고 있는 스위스의 시장접근성을 레벨1로 평가하였음

9) 우리나라는 2009년 비거주자의 채권투자에 대한 비과세 조치 시행 이후 WGBI 관찰대상국에 편입된 바 있으나, 2011년 1월 비과세 조치 철회 이후 편입 시도가 무산되었음

10) 또한 기획재정부는 10월 18일 세법개정안 입법예고를 통해 동 비과세 적용을 2022년 10월 17일부터 조기 시행할 예정임을 발표하였음

11) 자국 국채에 투자하는 비거주자에 대한 원천징수 면제는 주요 선진국 대부분 모두 시행하고 있으며, 이는 일반적으로 안정적인 재정운용에 대한 혜택 및 거래편의성 제공의 측면에서 일반적 관행으로 인식되고 있음(Norreggard, 1997)

12) 국채투자자에 대한 원천징수의 경우 비거주의 수익에 대한 세금은 우리나라에서 선징수하게 되며, 이후 해당 투자자는 본국에 국내에서의 선징수분에 대한 증빙서류(국세청 납부필증) 제출을 통해 양국간 조세협약에 따른 공제가 진행됨

13) 연합인포맥스(2022. 8. 24)에 따르면 한국예탁결제원은 내년 중 유로클리어와 연계하여 국채통합계좌 운영을 준비 중인 것으로 알려짐

14) 본장의 분석은 글로벌 금융위기 이후 WGBI 신규 편입사례인 멕시코, 남아프리카, 중국 등을 대상으로 진행하였으며, 가장 최근 사례(뉴질랜드, 2022년 11월 편입) 및 2000년대 초반 편입사례(싱가포르, 노르웨이, 폴란드, 말레이시아) 등은 분석대상에 포함하지 않음

15) 중국은 2019년 1분기~2020년 4분기 기간 중 BBGA 및 JP Morgan GBI-EM 편입에 따른 예상 자본유입 규모 대비 1.4배 규모의 자금이 유입되었음

16) WGBI 편입 시 국채 만기별 편입종목은 국가별로 상이한 것으로 알려져 있으나, 국내의 경우 3년물, 5년물, 10년물, 30년물 등이 포함될 것으로 가정하였으며, 통안채는 해당 비중 시산에서 제외하였음

17) WGBI 편입기간은 중국의 경우 최대 기간인 36개월에 걸쳐 진행된 반면 이스라엘의 경우에는 한달에 걸쳐 진행되는 등 국가별로 상이함

18) Arslanalp & Poghosyan(2016)은 외국인의 국채투자 확대가 주요 선진국 국채시장 수익률 하락 요인으로 작용하고 있다는 실증적 연구결과를 제시하고 있으며, Peiris(2013)는 신흥국의 경우에도 동 효과가 강력하게 나타나고 있음을 보고하고 있음

19) 해당 연구에서는 벤치마크 변화에 따른 자본유입(Flows Implied by Rebalancing: FIIR) 표준편차의 ‘1’단위 상승은 벤치마크 편입 시점 기준 ±5 영업일 간 국채수익률 8bp 상승을 견인하는 것으로 보고됨

20) 멕시코의 경우 WGBI 편입 이후 약 2개월에 걸쳐 국채수익률 60bp 하락 및 통화가치 6% 절상 등의 효과가 나타남

21) 본절의 실증분석 모형은 Caporale & Williams(2002) 등의 채권수익률 결정요인 추정모형을 참조하여 설정하였으며, 지수편입에 따른 효과 추정을 위해 각국별 분석 대상기간은 지수편입 이후 최근까지 시점으로 한정하였음

22) 해당 분석에서는 WGBI 편입국의 편입발표 직후 관련 경제변수의 변화율과 편입발표 시점 전후 2년 기간 중 평균 변화율 간 격차 및 통계적 유의성을 추정하였음

23) WGBI 편입에 따른 채권자금 예상 유입 규모는 2021년 말 외국인 채권보유잔액의 약 1/3에 달할 것으로 예상됨

24) 해당 자료에서는 국채 10년물 1조원 발행시 국채금리(5년물 기준)는 약 0.4~1.0bp 상승효과가 나타나는 것으로 분석하고 있으며, 본고에서는 지수편입에 따른 국채시장 수요충격을 국채 발행량으로 역으로 대체하여 금리변동폭을 추정하였음

25) 국부펀드 및 중앙은행은 이미 조세협정에 따라 국채 투자시 원천징수 면제가 적용되고 있어 세제개편에 따른 추가 유입 가능성은 제한적임

26) 해당 연구에서 국채수익률의 경우에는 자본유입 규모와 유의한 상관관계가 추정되었음

27) GMM 모형에서는 내생성 검정을 통해 경상수지를 내생변수로 설정하고, 동 변수의 시차변수를 도구변수로 활용하였음

28) 신흥국 10개국을 대상으로 주식 및 채권자금 유입에 따른 환율 변동성 효과를 분석한 Caporale et al.(2017)의 연구에서는 주식자금의 경우 환율 변동성 확대 요인으로 추정되었으나, 채권자금 유입 확대는 환율 변동성 완화효과를 견인하는 것으로 보고됨

29) 해당 추정모형은 Caporale et al.(2017)을 참조하여 GARCH(1,1)을 통한 환율 변화율 추정식에 주식자금 및 채권자금 유입을 조건부 분산식에 추가하여 설정하였으며, 앞의 분석과 동일한 월별 데이터를 활용하여 2010년 1월~2021년 12월 기간을 대상으로 추정하였음

참고문헌

김정한ㆍ임형준ㆍ이지언, 2010,『외국인 채권투자 확대에 따른 국내 금융시장의 영향과 대응방안』, 한국금융연구원 금융 VIP 시리즈 2010-07.

기획재정부ㆍ한국조세재정연구원, 2021, 2021 조세특례 예비타당성 평가: 개인투자용 국채상품 도입방안.

양대정ㆍ최경욱, 2019, 외국인 증권투자자금 유출입의 원/달러환율 영향력 분석,『사회과학연구』45(3).

연합인포맥스, 2022. 8. 24, 최상대 2차관, 유로클리어 등으로 외국인 국채 투자 활성화.

이승호, 2022,『MSCI 선진국지수 편입의 효과, 선결과제 및 시사점』, 자본시장연구원 이슈보고서 22-06.

Arslanalp, S., Tusda, T., 2014, Tracking global demand for emerging market sovereign debt, IMF working paper 14/39.

Arslanalp, S., Poghosyan, T., 2016, Foreign investor flows and sovereign bond yields in advanced economies, Journal of Banking and Financiao Economics 2(6), 45-67.

Arslanalp, S., Drakopoulos, D., Goel, R., Koepke, R., 2020, Benchmark driven investments in emerging market bond markets: Taking stock, IMF working paper 20/192.

Broner, F., Martin, F., Pandolfi, L., Williams, T., 2021, Winners and losers from sovereign debt inflows, Journal of International Economics 130(103446).

Carporale, G., Ali, F., Spagnolo, F., Spagnolo, N., 2017, International portfolio flows and exchange rate volatility in emergin Asian markets, Journal of International Money and Finance 76, 1-15.

Carporale, G., Williams, G., 2002, Long-term nominal interest rates and domestic fundamentals, Review of Financial Economics 11, 119-30.

Cremers, M., Ferreira, A., Matos, P., Starks, L., 2016, Indexing and active fund management: International evidence, Journal of Financial Economics 120, 539-560.

Financial Times, 2019. 9. 29, World’s biggest pension fund shuns renminbi-denominated sovereign bonds.

FTSE, 2021, Fixed Income Country Classification Process.

Norregaard, J., 1997, The tax treatment of government bonds, IMF working paper No.97/25.

Pandolfi, L., Williams, T., 2020, Real Effects of Sovereign Debt Inflow Shocks, AEA Papers and Proceedings 110: 511-15.

Peiris, S., 2013, Foreign participation in local currency bond markets of emerging economies, Journal of International Commerce, Economics and Policy 4(3), 1-15.

Raddatz, C., Schmukler, L., Williams, T., 2017, International asset allocations and capital flows: The benchmark effect, Journal of International Economics 108, 413-430.

Williams, T., Pandolfi, L., 2017, Capital flows and sovereign debt markets: Evidence form index rebalancing, Institute for International Economics Policy working paper series 2017-11.