Find out more about our latest publications

Foreign Exchange Business of Korea’s Securities Firms: Current State and Implications

Issue Papers 23-01 Jan. 02, 2023

- Research Topic Financial Services Industry

- Page 20

This report intends to explore how Korea’s securities firms currently conduct foreign exchange business and present improvements and challenges for reinforcing their FX business capability. Korean securities firms’ incompetence in the FX business may stem from a lack of their effort, but it is also attributable to limitations in the Foreign Exchange Transactions Act. Securities firms are restricted from securing foreign currency funds and are not permitted to remit or receive foreign currency. Foreign exchange trading (currency exchange) by securities firms is only allowed for investment purposes and opening an FX account is also limited.

This situation requires the Korean government to depart from the FX bank-centric concept deeply rooted in the Foreign Exchange Transactions Act and to encourage non-banking financial institutions such as securities firms to improve their FX business capabilities. Notably, when securities firms carry out typical FX services specified by the Financial Investment Services and Capital Markets Act, their FX business practices, such as currency exchange, account settlement and foreign currency remittance, are interconnected with each other. Accordingly, it should be noted that partial deregulation hardly helps non-banking institutions to comprehensively handle business practices. This implies sweeping deregulation will play a critical role in strengthening the capability of FX and global finance business across the financial services industry by enhancing the external soundness of non-banking financial institutions. Relaxed regulations are also crucial in increasing convenience in financial investment transactions and improving efficiency in financial intermediary services by reducing trading costs.

In this respect, Korean securities firms need to exert diversified and proactive efforts as follows. First, they should establish a comprehensive FX service system for cross-border investments including investment brokerage, foreign currency remittance and settlement, entrustment and custody of foreign currency securities, and FX hedging. Second, FX businesses of securities firms should evolve into a foreign currency transaction platform through an electronic business system to meet the growing demand for digital finance. Third, it is also necessary to overhaul the internal FX management system regarding monitoring and risk control.

This situation requires the Korean government to depart from the FX bank-centric concept deeply rooted in the Foreign Exchange Transactions Act and to encourage non-banking financial institutions such as securities firms to improve their FX business capabilities. Notably, when securities firms carry out typical FX services specified by the Financial Investment Services and Capital Markets Act, their FX business practices, such as currency exchange, account settlement and foreign currency remittance, are interconnected with each other. Accordingly, it should be noted that partial deregulation hardly helps non-banking institutions to comprehensively handle business practices. This implies sweeping deregulation will play a critical role in strengthening the capability of FX and global finance business across the financial services industry by enhancing the external soundness of non-banking financial institutions. Relaxed regulations are also crucial in increasing convenience in financial investment transactions and improving efficiency in financial intermediary services by reducing trading costs.

In this respect, Korean securities firms need to exert diversified and proactive efforts as follows. First, they should establish a comprehensive FX service system for cross-border investments including investment brokerage, foreign currency remittance and settlement, entrustment and custody of foreign currency securities, and FX hedging. Second, FX businesses of securities firms should evolve into a foreign currency transaction platform through an electronic business system to meet the growing demand for digital finance. Third, it is also necessary to overhaul the internal FX management system regarding monitoring and risk control.

Ⅰ. 검토 배경

개방경제하의 우리나라에서 대외부문의 중요성이 커지는 가운데 최근 들어 거시경제환경도 빠르게 변화하고 있다. 과거 외환부족국에서 자본수출국으로 이행한 지 오래이고 대외거래도 수출입 등 경상거래 중심에서 자본 및 금융거래의 비중이 점차 커지고 있다. 특히 국가간 대규모 자본이동이 크게 확대되면서 금융시장의 변동성이 증가하고 대외거래와 금융안정에서 비은행금융기관이 차지하는 중요성이 높아지고 있다.

이러한 여건변화에도 불구하고 우리나라의 대외거래를 총괄하는 법체계는 여전히 은행 중심으로 운영되면서 국내 증권사는 외국환은행과 달리 기타외국환업무취급기관으로 분류되어 원칙적으로 모법인 자본시장법과 직접적인 업무 연관이 있는 경우에만 외국환업무의 수행이 가능하고 다양한 자본거래시 사전신고를 요하는 경우도 많다. 그 결과 국내 증권사 등 금융투자기관들의 외환업무역량과 위험관리도 상대적으로 미흡한 실정이다.

최근과 같이 대내외 금융시장의 연계성이 커지고 다양한 금융상품의 출현과 국경간 자본이동이 활발해지고 있는 상황에서 이들 비은행금융기관의 취약성은 전체 금융시스템의 안정은 물론 금융산업 전체의 균형적인 발전에도 부정적인 영향을 주고 있는 것으로 생각된다. 이런 점에서 본고에서는 우리나라 증권사를 중심으로 외국환업무와 관련한 법제도와 외국환업무 현황을 실제 사례와 함께 종합적으로 살펴봄으로써 이들 기관의 외환업무 역량 강화를 위한 개선방향과 향후 과제를 도출해 보고자 한다.

본고의 구성은 다음과 같다. 제Ⅱ장에서는 우선 국내 증권사의 외국환업무 수행과 관련한 외국환거래법을 자본시장법과 비교하여 살펴보고 실제 국내 증권사의 외국환업무 현황을 외화증권의 매매 및 중개, 자금의 조달 및 운용 등으로 구분하여 살펴보았다. 제Ⅲ장에서는 국내 증권사의 실제 외국환업무 사례를 다양하게 설명하고 제Ⅳ장에서는 제도 개선방향 및 향후 과제를 언급하였다.

Ⅱ. 국내 증권사의 외국환업무 현황

1. 외국환업무에 관한 법적 여건

우리나라의 외국환거래법 제3조에서 명시하고 있는 “외국환업무”는 ① 외국환의 발행 또는 매매1), ② 대한민국과 외국 간의 지급ㆍ추심(推尋) 및 수령2), ③ 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, ④ 비거주자와의 예금, 금전의 대차 또는 보증, 그리고 ⑤ 기타 시행령 제14조에서 정하는 업무로 규정되어 있다. 국내 증권사의 경우 위에 열거된 모든 외국환업무의 취급이 가능한 은행(외국환은행)과 달리 기타외국환업무취급기관으로 분류되어 외국환업무의 허용범위에 있어 법적 제약이 있다. 즉, 국내 증권사는 위의 외국환업무중 ②지급ㆍ추심(推尋) 및 수령 업무의 취급이 불가능하고 ③과 ④의 경우에 있어서도 예금업무의 취급이 불가능하다. 따라서 증권사에 대해 허용가능한 외국환업무는 외국환거래법 시행령 제14조 제4호에서 명시하고 있는 업무 중 예금 및 대한민국과 외국 간의 지급ㆍ추심 및 수령 업무를 제외하고 「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」에 따른 업무와 직접 관련된 외국환업무를 영위할 수 있는 것으로 이해할 수 있다.3)

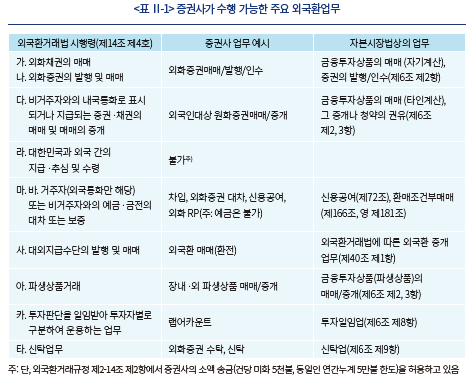

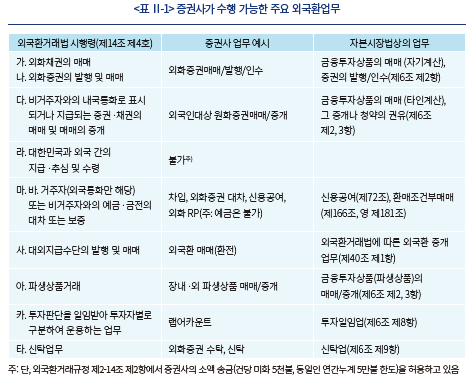

<표 Ⅱ-1>은 외국환거래법 시행령상의 외국환업무를 자본시장법상의 증권사 업무와 연결지어 재해석한 표이다. 예를 들어 증권사의 고유업무로서 자본시장법상 금융투자상품의 매매

(자기계산), 증권의 발행/인수(제6조 제2항)에 명시된 업무는 외국환거래법 시행령 제14조 제4호 나목의 외화증권의 발행 및 매매와 관련되어 있다. 마찬가지로 다목의 비거주자와의 원화증권 중개와 관련한 증권사 업무는 자본시장법상 금융투자상품의 매매(타인계산), 그 중개나 청약의 권유(제6조 제3항) 업무와 관련이 있는 것으로 이해할 수 있다. 그러나 (외화)예금 업무의 경우 은행법상 은행의 고유업무로서 증권사에 대해서는 허용되지 않으며 외환의 지급 및 수령의 경우에도 은행에만 허용되는 외국환업무로 규정되어 있다.

뿐만 아니라 증권사가 외국환업무를 영위하기 위해서는 자본시장법상 업무와 직접 관련성이 있는지의 여부를 사전신고를 통해 당국으로부터의 실질적인 승인을 받아야 할 뿐만 아니라 법상으로 허용되는 업무의 경우에도 하위규정상의 제약이 존재한다. 예를 들어 증권사가 외화를 차입하고자 하는 경우 시행령상 허용되어 있으나 한국은행의 외화대출 용도 제한 규정의 적용을 받으므로 외화자금의 차입 용도가 해외에서의 실수요 목적에 부합하는지 여부에 따라 외화차입이 허용되지 않는 경우가 발생한다. 또한 증권사의 외환 매매에 있어서는 은행간시장에 대한 참여가 자유롭게 허용되나 대고객에 대한 환전의 경우 투자목적 이외의 일반 환전은 허용되지 않는 것이 그 예이다.4)

2. 주요 외국환업무 현황

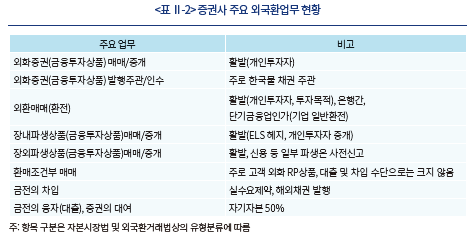

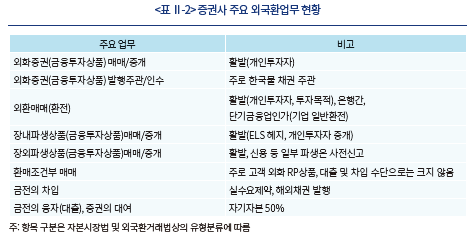

현재 국내 증권사의 주요 외국환업무를 금융투자상품의 매매 및 중개, 외화자금 조달 및 운용으로 구분하여 살펴보자. <표 II-2>에서 보는 바와 같이 외화증권이나 장내파생상품의 매매 및 중개의 경우 증권사의 고유업무로서 법적 제약이 거의 없으므로 대체로 활발히 이루어지고 있다. 그러나 이를 제외한 외화자금의 차입이나 외화신용공여 등은 매우 미미한 수준에 머물고 있다. 아래에서는 이에 대해 자세히 살펴보았다.

가. 금융투자상품의 중개 및 매매 업무

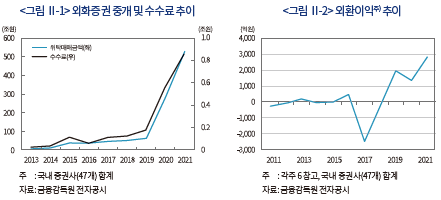

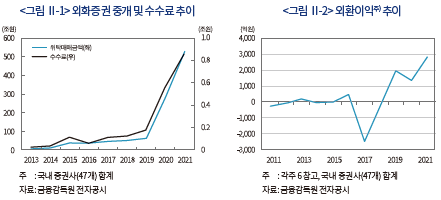

최근 국내 증권사의 외국환업무는 외화증권 중개 및 이와 관련한 외환매매(환전)를 중심으로 가파른 성장세를 보이고 있다. 이는 개인이나 기관투자자를 중심으로 한 해외증권투자가 최근 빠르게 증가함에 따라 증권사들도 이에 적극적으로 대응하여 투자중개에 필요한 서비스와 인프라를 제공한 결과라고 할 수 있다. <그림 Ⅱ-1>에 나타난 바와 같이 외화증권 중개와 관련된 위탁매매 금액은 2012년 4.1조원에서 2019년 63.8조원까지 크게 증가하였으며 코로나 팬데믹을 거치면서 비약적으로 늘어나 2021년에는 528조원까지 급증했다. 이에 따라 외화증권 위탁매매 수수료 수입도 큰 폭으로 증가하여 2021년에는 약 9천억원에 달하였다.

증권사의 외환매매(환전) 업무는 위의 <표 Ⅱ-2>에서 제시된 증권사의 고유 업무 중 투자목적과 직접적으로 관련된 경우에 허용된다.5) 국내 증권사들은 주로 해외투자와 연계된 고객 환전을 수행하고 있는데, 외화증권 투자자들은 증권사를 통해 원화를 외화로 환전한 후 외화증권 매입이 가능하다. 증권사를 통한 투자목적 환전은 투자 편의를 제공하면서 개인투자자들의 외화증권투자 활성화에 기여한 것으로 생각된다.

<그림 Ⅱ-2>는 증권사들의 외환이익 추이를 나타낸 그래프로 개인들의 해외증권투자가 급증하기 시작한 2019년부터 크게 증가하는 모습을 보이고 있는데, 이는 외화증권 중개 규모가 큰 증권사들 중심으로 외환이익이 증가한 점을 감안할 때 고객에 대한 환전 관련 이익이 상당부분 기여하고 있음을 추론해 볼 수 있다.6)

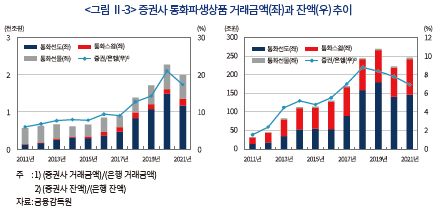

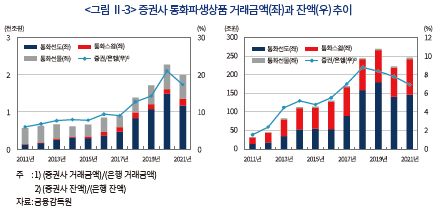

통화관련 장내ㆍ외파생상품에 대한 중개 및 매매도 증권사의 주요 외국환업무라고 할 수 있다. 장내ㆍ외파생상품은 외환 관련 거래(대고객 및 고유 거래 포함)에서 발생하는 환위험을 헤지하거나 외화자금의 조달 및 운용 용도로도 사용된다. <그림 Ⅱ-3>을 보면, 통화선도를 중심으로 증권사들의 통화파생상품 거래나 잔액이 가파른 증가세를 보이고 있다. 은행 대비 증권사들의 거래규모나 잔액 비율(<그림 Ⅱ-3> 그래프의 실선>)을 보더라도 2011년 대비 3배 이상 높아졌는데 이는 외환스왑시장에서 외자의 조달을 위한 buy&sell 스왑거래가 크게 늘어나면서 통화선도 거래규모 및 잔액이 크게 증가한 결과라 할 수 있다.7) 또한 최근 가파른 판매증가를 보여 온 해외지수 주식연계증권(ELS)에 대한 헤지를 위해 해외 주식파생상품 매매가 활발히 이루어지면서 해외 장내파생상품의 매매나 중개 규모도 꾸준히 증가하고 있다.

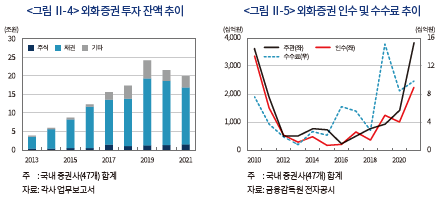

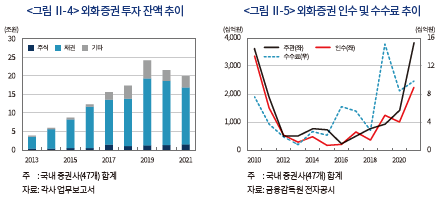

증권사의 외화증권 매매와 관련된 외화증권 투자 규모는 채권을 중심으로 증가하였다(그림 Ⅱ-4>). 이는 최근 우리나라의 풍부한 외화유동성을 바탕으로 투자수익률 제고를 위한 해외증권투자 증가 추세와 관련이 있으며, 증권사들의 외화자금에 대한 주요 투자 및 운용수단8)으로 외화채권이 중요한 역할을 하고 있음을 시사한다.

이처럼 국내 투자자들의 해외증권투자와 관련된 증권사의 중개나 매매 업무가 활성화되고 있는 것에 반해, 증권사의 증권발행이나 자체자금을 이용한 인수업무 실적은 미미하다. <그림 Ⅱ-5>는 국내 증권사들의 외화증권 발행에 대한 주관/인수 및 관련 수수료 추이를 나타내는데, 2021년중 일시적인 증가에도 불구하고 10여년 전 수준에서 크게 벗어나지 않고 있는데 주로 한국물(KP) 발행에 대한 주관업무인 것으로 조사되었다.

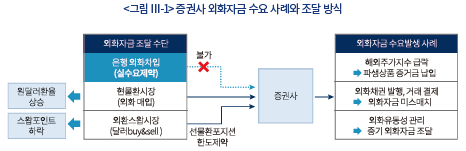

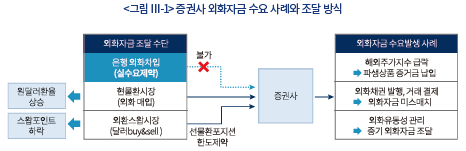

나. 외화자금 조달 및 운용

증권사의 외화자금 조달은 원화자금 조달의 경우와 달리 현실적으로 많은 제약이 있다. 원화자금 조달의 경우 증권사는 예금 수신 이외의 다양한 방법으로 자금 조달이 가능한데 국고채 전문딜러(Primary Dealer) 참여 증권사는 콜시장에도 참여할 수 있고, 단기금융업(초대형IB) 인가를 받은 증권사의 경우 발행어음 업무도 가능하다. 반면, 외화자금 조달의 경우에는 외화예금의 수신이 불가능할 뿐만 아니라, 외국환은행들이 참여하고 있는 은행간 대출시장 참여도 허용되지 않는다. 또한 증권사들은 일반 기업과 마찬가지로 국내 은행으로부터 외화대출을 받기 위해서는 한국은행의 외화대출 용도제한 규정에 의해 해외사용 목적의 실수요 증빙과정을 필요로 한다.9)

해외(비거주자)로부터 차입에 대한 법적 제약은 없으므로10) 외화채권 발행으로 외화자금 조달이 가능하나 실제로는 신용도가 높은 일부 대형증권사들의 경우에만 발행 실적이 일부 있을 뿐이다. 외화발행어음의 경우에도 단기금융업 인가를 받은 증권사(초대형 IB)만 가능한데, 실제 그 규모가 크지 않으며 용도도 제한되어 있다.

대고객 상품과 연결되어 있는 외화RP, 외화파생결합증권도 증권사들의 외화자금 조달 수단으로 사용될 수 있으나 증권사들은 상품 구조에 따라 이를 매칭(matching)하여 조달한 외화자금을 운용하므로 실제 외화자금의 가용능력에 제약이 따른다. 외화RP 조달의 경우 대부분 고객상품11)이며, 조달한 외화자금으로 외화채권을 매입하고 매입한 외화채권은 고객에게 RP담보로 제공된다. 외화파생결합증권 발행으로 조달한 외화자금도 헤지를 위한 파생상품 거래나 원금 운용을 위한 외화채권 매입(또는 외화예금 가입)에 사용되는 데 그치고 있다.12)

따라서 국내 증권사들이 매칭운용의 제약 없이 사용가능한 외화조달 수단은 은행간 외환시장(interbank market)에 참여하여 원화를 대가로 현물환을 매입하거나 외환스왑(FX swap)이나 통화스왑(currency swap: CRS)을 이용하는 방법에 대부분 의존하고 있다고 할 수 있다.

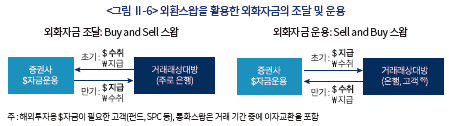

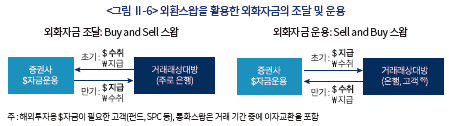

<그림 Ⅱ-6>의 왼쪽 그림은 외환스왑이나 통화스왑 거래를 이용한 외화자금 조달 흐름을 보여준다. 국내 증권사들은 주로 은행을 거래상대방으로 하여 buy&sell 스왑을 통해 외화조달 주체가 된다. <그림 Ⅱ-3>을 보면, 금융위기 이후 2011년경부터 증권사의 통화선도(및 통화스왑) 거래규모나 잔액이 크게 증가하였는데, 이는 증권사들의 외화자금 조달 수요 증가를 반영한 것으로 해석할 수 있다.13) 외환스왑 거래의 만기 도래시 증권사들은 sell&buy 스왑으로 유동성을 제공하거나14) 만기연장을 하는 경우가 일반적이다. 이러한 증권사의 외환스왑 거래는 선물환포지션한도15)로 인해 자금조달 규모가 제한을 받을 뿐만 아니라 외화자금시장의 유동성 상황이 악화되는 경우 스왑레이트의 추가적인 하락 요인으로 작용하면서 외화자금 조달비용이 커지는 구조적 취약성을 갖는다고 할 수 있다.

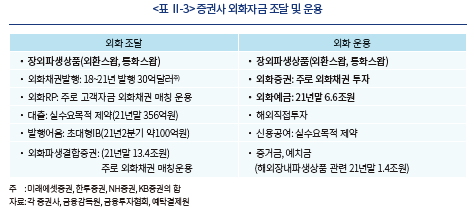

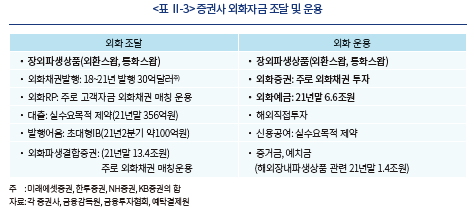

<표 Ⅱ-3>은 국내 증권사의 외화자금 조달 및 운용업무 현황을 정리한 표이다. 외화조달 측면을 보면 외환스왑이나 통화스왑 등 외환시장을 통한 직접적인 외화조달 이외의 여타 조달수단들의 경우 금액이 미미한 것으로 판단된다.

한편 외화자금 운용에 있어서는 실질적인 제한이 거의 없으나16), 외화자금 조달의 제약으로 인해 운용가능한 외화유동성이 제한되어 있고 대고객 상품과 연계된 외화자금은 매칭된 운용방식을 적용받음에 따라 실제 다양하고 적극적인 외화자금 운용에는 제약이 클 수밖에 없을 것으로 생각된다.

주요 운용수단으로는 장외파생상품인 외환스왑이나 통화스왑을 들 수 있다. <그림 Ⅱ-6>의 오른쪽 그림은 외환스왑이나 통화스왑 거래를 이용한 외화자금 운용 흐름을 보여준다. 은행이 거래상대방이 되기도 하지만, 증권사는 해외투자자(투자기관 또는 SPC)에게 해외투자 자금을 제공하는 거래를 통해 수익을 창출하기도 한다. 이러한 거래는 증권사의 통화선도(및 통화스왑) 거래나 잔액을 증가시킨 요인으로 작용한다.

또한 실질적인 외화자금 운용수단으로 외화증권 투자를 들 수 있는데, <그림 Ⅱ-4>에 나타난 바와 같이 최근 외화채권을 중심으로 한 증권사의 외화증권 투자 규모가 크게 증가하고 있다. 외화RP나 외화파생결합증권처럼 외화자금조달과 매칭하여 외화채권을 운용하는 상품이 증가한 측면도 있으며, 원화채권 대비 수익률 제고 및 투자 다변화를 위한 증권사들의 외화채권 투자가 확대되면서 외화채권이 주요 외화자금 운용수단으로 자리매김하고 있다고 생각된다.

그 밖의 외화자금 운용수단으로는 단기자금 운용과 외화유동성 관리를 위한 외화예금이나 금융거래의 증거금(예치금 포함)을 들 수 있다. <표 Ⅱ-3>에서와 같이 2021년말 증권사의 외화예금 잔액은 6.6조원에 달하는 것으로 나타났다. 또한, ELS 헤지운용을 포함한 해외 장내파생상품 거래 증거금이나 예치금도 2021년말 1.5조원 수준을 나타내고 있다.

Ⅲ. 증권사의 외국환업무 사례 및 개선방향

제Ⅱ장에서 살펴본 바와 같이 국내 증권사는 고유업무와의 직접 관련성에 따라 외국환업무를 수행할 수 있다. 그러나 현실적으로 외화조달상의 제약, 해외로의 외화송금 불가능, 투자목적 자금에 대한 계정보유 제한 등으로 증권사 고유의 투자매매 및 투자중개를 행함에 있어 한계 또한 적지 않은 것으로 파악된다. 본 장에서는 증권사의 외국환업무 수행과정에서 발생하는 구체적인 제약 사례를 살펴보고 제도개선 방향에 대해 논의하고자 한다.

1. 외화유동성 확보 및 관리 애로 사례

최근 증권사의 해외증권투자나 해외 금융시장 연계상품 판매의 증가 등 외환관련 업무가 증가하면서 외화자금에 대한 수요도 함께 커지고 있다. 그 예로 외화채권 발행과정에서 발행과 운용(예를 들면 기존 채권 상환) 날짜 간에 괴리가 발생하거나, 연관 거래간 수취와 지급 결제일의 차이가 발생하는 경우 일시적으로 외화자금의 미스매치로 인한 외화자금 수요가 발생하기도 한다. 또한, 해외 금융시장 연계상품의 판매 및 운용 과정에서 마진콜(margin call) 등으로 일시적이고 긴급한 대규모 외화자금 수요를 초래하기도 하며 유동성 관리를 위해 중장기 외화자금의 조달이 필요한 경우가 발생하기도 한다. 이에 따라 증권사의 적정 외화유동성 확보와 이의 효율적인 관리가 매우 중요해지고 있다.

증권사의 외화유동성 관리 미흡이 금융안정을 저해한 대표적인 사례로 2020년 코로나 팬데믹 발생으로 해외주가지수가 급락하면서 증권사가 판매한 ELS 헤지와 연계된 대규모 마진콜이 발생한 것을 들 수 있다. 당시 해외로부터의 대규모 마진콜 발생 등으로 긴급한 외화유동성 확보가 요구되는 상황에서 증권사는 국내 외국환은행으로부터 신속한 외화차입을 통해 유동성을 확보하고자 노력하였다. 그러나 제Ⅱ장 2절에서 살펴본 바와 같이 증권사는 해당 외화자금의

용도가 실수요 목적임을 인정받지 못함에 따라 외화자금조달에 어려움을 겪으면서 일시적으로 유동성 위기에 직면한 바 있다. 당시 국내 대부분의 증권사는 외화자금 조달 수단으로 현물환시장에서 외화를 긴급하게 매입하고자 하였고 이러한 현물환 거래는 원/달러 환율이 한때 1,300원 가까이 급등하는 요인으로 작용하였다. 또한 일부 자금을 외환스왑시장을 활용하여 조달하였는데 그 결과 스왑레이트가 하락하고 외화자금시장 전체의 외환수요 증가로 이어져 외환스왑시장의 유동성 악화를 초래한 바 있다.

이처럼 외환시장을 통한 직접적인 외화조달은 특히 글로벌 금융시장의 불확실성이 높은 상황에서 외환수요를 더욱 가중시킴으로써 환율 상승, 스왑포인트 하락 등을 통해 금융안정성을 더욱 저해하는 요인으로 작용한다. 코로나 팬데믹이 발생했던 2020년 3월의 유동성 위기 상황은 증권사들의 외화유동성 및 환위험 등 리스크 관리상의 문제점 못지않게 증권사의 외화차입 제약 등 외화자금 조달상의 구조적 제약도 근본 원인이었던 사례라 할 수 있다.17)

2. 외국인의 국내 채권투자 중개 사례

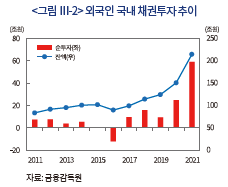

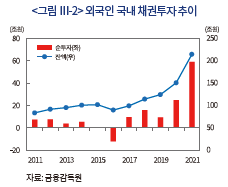

외국인(비거주자)이 외화자금을 국내로 유입하여 국내 채권에 투자하는 사례를 살펴보자. <그림 Ⅲ-2>를 보면, 외국인의 국내 채권투자는 2017년부터 빠르게 증가하고 있다. 이와 관련하여 국내 증권사는 투자중개업자로서 주도적인 역할을 담당하고 있음에도 불구하고, 외국인의 국내 채권투자 과정에서 투자중개업자로서 증권사의 외국환업무가 일부 제약을 받고 있다.

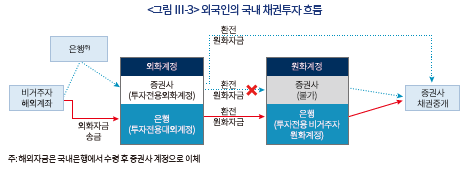

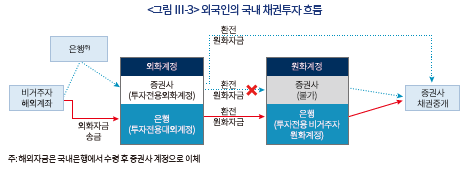

현재 주로 행해지는 자금의 흐름을 보면, <그림 Ⅲ-3>의 실선과 같이 외국인의 외화투자자금이 국내로 유입되면서 국내 은행의 투자전용대외계정으로 보내진다. 이후 은행에서 원화자금으로 환전된 후 은행의 원화계정에 예치되며 마지막으로 외국인투자자는 증권사(투자중개업자)를 통해 원화채권을 매입하게 된다.

증권사는 외국인의 국내 채권투자와 관련하여 증권사 명의로 은행에 개설된 ‘투자전용외화계정’18)을 이용하여 비거주자의 외화자금을 수취한 후 투자목적 환전을 해줄 수는 있으나, 이를 통해 보유하게 된 원화자금을 처리할 비거주자 원화계정의 개설이 불가능하다.19) 또한 해외로부터의 외화자금 수령시 증권사의 송금 및 수령 제한으로 인하여 은행을 거쳐 투자전용외화계정에 외화자금을 수취하게 된다. 따라서 외국인투자자의 입장에서는 은행을 통한 원화 및 외화계정의 개설과 환전 등 일련의 거래가 증권사에 비해 훨씬 편리하다고 할 수 있다. 결국 <그림 Ⅲ-3>의 실선과 같은 업무흐름으로 자금 관련 처리는 주로 은행들이 수행하게 되고, 증권사는 외국인의 국내채권투자 과정에서 채권중개업무만 수행하게 된다.

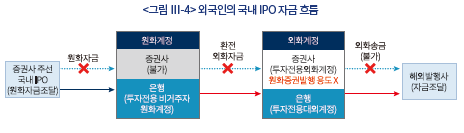

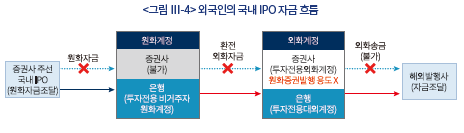

3. 외국인의 국내 IPO 주선 사례

비거주자(예: 싱가포르 거주 해외기업)가 국내에서 IPO로 투자금을 조달하여 이를 외화로 환전 후 다시 본국으로 송금한 사례를 살펴보자. IPO 주선은 증권사 고유의 업무이므로 국내 증권사가 담당하였다.

이 사례의 경우 앞의 사례와 유사하게 IPO로 조달한 원화자금에 대해 증권사를 통한 비거주자 원화계정 처리가 가능한 지가 불분명하다. 다만, 증권사의 IPO 관련 환전은 가능하므로20) 원화계정을 거치지 않고 원화자금을 외화로 환전하여 바로 증권사의 투자전용외화계정으로 보내는 방식도 고려해 볼 수 있다. 그러나 원화증권 발행자금의 경우 법에 명시된 투자전용외화계정의 설치목적에 부합되지 않아 실행가능 여부가 현재로서는 명확치 않은 것으로 파악되고 있다.21) 결국 외국인의 국내 IPO 과정에서 제도적인 제약으로 인해 증권사는 종합적인 서비스를 제공하지 못하고 IPO 주선업무만 수행하게 되며, IPO 이후의 원화자금 환전 및 외화송금 등 외환관련 업무는 모두 은행을 통해 이루어지게 된다.

4. 국내 투자자의 외화증권투자 중개 사례

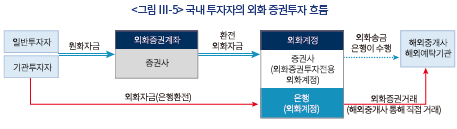

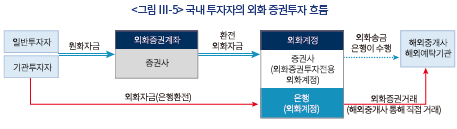

개인이나 기관투자자 등 국내 투자자의 해외 외화증권에 투자하는 사례를 살펴보자. 개인투자자자의 경우 국내 증권사에 외화증권거래 계좌를 개설하고 증권사를 통해 환전을 하게 된다. 증권사는 해외 중개업자를 선정한 후 외화증권의 매입을 의뢰하면 해외 중개기관이 실제적인 증권의 중개를 담당한다. 이 과정에서 국내 증권사는 해외 예탁기관에 외화를 송금해야 할 필요성이 있으나 현재 법상으로는 대외결제를 위한 소액을 제외한 외화송금은 은행을 통해서만 가능하다(<그림 Ⅲ-5>의 겹줄 화살표 흐름>). 따라서 개인투자자의 해외증권투자시 국내 증권사는 은행에 대해 해외송금 관련 비용을 지불해야 한다.

한편, 개인투자자와 달리 기관투자자는 국내 증권사에 위탁하지 않고, 직접 해외중개기관을 통해 외화증권을 거래할 수 있어22) 국내 증권사의 역할이 배제되는 경우가 발생한다. 즉 <그림 Ⅲ-5>의 실선 화살표 흐름처럼 기관투자자의 해외증권투자시 주로 은행을 통해 환전과 해외송금이 이루어진 후 해외 중개기관을 경유하여 증권의 매매가 이루어진다. 기관투자자의 입장에서는 증권사를 이용할 경우 외화의 송금을 위해 또다시 은행을 경유해야 하므로 거래의 불편이 발생하기 때문이다. 이는 국내 증권사의 입장에서 주고객인 자산운용사 및 연기금 등 대형 기관투자자를 대상으로 한 외화증권 중개 업무가 미미한 이유의 하나로 생각된다. 이와 유사하게 국내 자산운용사의 해외펀드 수탁업무도 외화송금 제약으로 증권사가 수행하기 어렵다고 할 수 있다.

Ⅳ. 개선방향 및 과제

그간 우리나라의 대외건전성이 크게 강화되고 거시경제환경 변화로 대내외 금융투자가 빠르게 늘어나면서 국내 증권사 등 비은행금융기관의 외환업무 여건과 역할에도 변화가 요구되고 있다. 특히 전 세계적으로 국가간 자본이동이 확대되고 대외거래에서 차지하는 자본 및 금융거래의 비중이 높아지면서 은행보다 상대적으로 비은행금융기관의 중요성이 확대되고 있다. 이런 점에서 국내 증권사 등 비은행금융기관의 외환업무 역량 강화는 금융안정은 물론 금융산업의 균형적 발전과 경제 활성화에도 중요한 과제로 생각된다.

본 보고서에서 분석한 바와 같이 아직까지 국내 증권사들은 부분적이고 단편적인 외환업무에 치중하면서 외환업무역량은 초보적인 수준에 머물러 있는 것으로 판단된다. 이는 증권사들의 자체 노력이 부족했던 점도 원인이겠으나 현재 우리나라 외국환 법령체계 하에서 증권사는 기타외국환업무취급기관으로 분류되어 외환업무의 허용범위에 있어 외국환은행과 차별적인 대우를 받아온 데에도 상당부분 원인이 있는 것으로 생각된다. 국내 증권사는 은행과 달리 외화자금의 조달이 주로 국내 외환시장을 통해서 이루어져 적정 외화유동성의 확보에 어려움이 있고 증권사 고유의 투자매매 및 중개 업무를 함에 있어서도 해외에 대한 외화송금이나 수령이 허용되지 않는다. 외환매매도 투자목적인 경우로 제한되고 계정의 설치도 자유롭지 못하다는 점에서 외환업무 범위의 확장에 제약을 받고 있는 것이 사실이다. 이런 점에서 금번 정부의 신외환법 추진과정에서 이러한 점이 충분히 반영될 필요가 있다.

먼저 당국은 우리나라 외국환법령에 뿌리 깊게 자리 잡고 있는 외국환은행중심주의를 탈피하여 증권사 등 비은행금융기관이 외환업무 역량을 강화해 나갈 수 있도록 법제도 개선을 고려할 필요가 있다. 제III장에서 살펴본 사례에서와 같이 현재 국내 증권사는 금융투자상품의 매매나 중개, IPO 등과 같은 증권사 본연의 업무를 수행함에 있어 외국환업무와 관련한 환전, 계정처리, 외화송금 등 개별 업무가 제한되어 있고, 또한 개별 업무가 상호 연결되어 있다는 점에서 전체적인 외환업무의 수행에 제약이 크다. 따라서 정부는 부분적인 규제 완화만으로는 증권사의 체계적이고 종합적인 외환업무 수행이 사실상 어렵다는 점에 각별히 유념하여 적어도 자본규모나 위험관리능력 등 일정 요건을 만족하는 증권사에 대해서 우선적으로 외국환업무의 범위를 은행 수준으로 확대해 나가는 방안도 고려할 필요가 있을 것으로 보인다.

이러한 법제도 개선이 이루어질 경우 증권사의 외환업무역량 확대는 물론 금융산업의 균형적인 발전과 금융안정 달성, 그리고 금융투자자의 편의성 제고 등 많은 긍정적 효과가 기대된다. 앞의 사례에서 살펴본 바와 같이 증권사가 외화자금 조달, 국경간 금융투자상품 중개ㆍ매매 과정에서 외환부문 서비스를 종합적으로 제공할 수 있는 제도적 기반을 갖출 경우 전략적으로 국경간 중개ㆍ매매 업무에 특화된 외국환업무 체계를 구축할 유인이 커지면서 증권사의 외환업무 역량이 증가할 것으로 기대된다. 이는 비단 금융업권간의 형평성 문제이기보다는 비은행금융기관의 위기대응역량 확충을 통해 우리나라 금융산업 전체의 외환 및 국제금융업무 역량을 제고시키고 대외건전성이 한층 강화되는 효과를 가져올 것으로 기대된다. 뿐만 아니라 국내 금융투자자 및 외국인 투자자들의 입장에서 보더라도 국내 증권사를 통한 종합적인 외국환업무 서비스가 가능해질 경우 금융투자 거래의 편의성이 증진될 뿐만 아니라 다양한 형태의 거래비용 절감이 발생함으로써 투자자의 편익과 효용이 증가할 것으로 판단된다.

이러한 긍정적 기대효과를 실현하기 위해서는 국내 증권사도 다음과 같은 방향으로 다각적이고 선제적으로 외환업무역량 강화에 노력해 나가야 할 시점으로 생각된다. 첫째, 증권사는 국경간 투자와 관련하여 투자중개, 외화자금 이체ㆍ결제, 외화증권 수탁ㆍ보관 및 환헤지에 이르기까지 종합적인 외환부문 서비스 체계를 구축하여 새로운 업무영역의 창출을 위해 노력할 필요가 있다. 국내 증권시장에 진입하는 비거주자 대상 외환관련 서비스를 총괄하는 통합형 중개서비스는 대형사는 물론 중소형 증권사들도 접근가능성이 있을 것으로 보인다. 또한 국내 투자자의 해외증권투자와 관련해서는 주요 글로벌 투자은행의 경우와 같이 국내 대형 연기금 등 기관투자자 대상 외환부문 서비스 구축에 적극적으로 나설 필요가 있다.

둘째, 최근의 디지털금융 확대 추세에 부응하여 증권사의 외환업무도 전자거래시스템을 활용한 외환거래 플랫폼으로 발전시켜 나갈 필요가 있다. 외환 전자거래시스템은 증권 부문의 대고객 전자거래시스템(HTS) 기술을 대고객 외환시장의 API에 접목함으로써 연기금 등 기관투자자에 대한 해외증권투자나 환헤지 등 외환관련 종합서비스의 제공으로 발전시켜 나갈 필요가 있다. 이를 위해서는 현재 부분적으로 허용되는 증권사의 외환매매에 대한 제약을 완화하여 개인, 기업 및 기관투자자들의 증권사와의 거래유인을 높여나가는 것이 무엇보다 긴요할 것으로 보인다. 중장기적으로는 대내외 투자자금과 관련한 증권사의 프라임 브로커리지(prime brokerage: PB) 역할을 확충하는 방안도 고려해 볼 수 있을 것으로 생각된다.

셋째, 증권사들은 내부적인 외환관리시스템의 정비에도 노력하여야 한다. 이를 위해서는 외환업무 범위의 확대에 따른 외환익스포져 증가에 대비하여 외화표시 대차대조표 개발이나 당국에 대한 보고체계 등 외환부문의 모니터링 체계를 갖추어 나갈 필요가 있다. 또한 비상시에 대비한 적정 외화유동성을 확보하는 한편 각 증권사의 특성에 맞는 환위험 관리 방안을 마련하고 외환관련 금융상품의 개발 및 외화표시 자산과 부채의 최적 포트폴리오를 구성하는 전략도 중요한 과제라 생각된다. 아울러 다양하고 빈번한 외환거래의 체결부터 종결 및 결제까지의 일련의 거래 과정에 대한 체계적인 관리시스템을 갖춤으로써 운영위험 관리에도 힘 쓸 필요가 있다.

1) ‘외국환 매매’는 관행상 통용되는 용어로 대고객에 대해 이루어지는 ‘환전’ 개념을 포함한다.

2) ‘지급ㆍ추심(推尋) 및 수령’은 관행상 통용되는 용어로 ‘송금(당발, 타발)’을 의미한다. 본 보고서에서는 관행상 ‘환전’이나

‘송금’으로 용어를 사용하였다.

3) 외국환거래규정 제2-14조 제1항을 참조하였다.

4) 다만, 2018년에는 단기금융업 허가를 받은 대형 증권사에 대해서는 기업에 대한 투자목적 이외의 일반 환전이 허용되었다.

5) 기획재정부의 유권해석에 의해 개인투자자의 투자목적 환전은 위탁계좌에서 자유롭게 가능하다.

6) 외환이익은 ‘외환차익-외환차손’을 나타낸다. 외환차익과 외환차손은 외화(자산, 부채 포함)를 원화로 바꿀 때 발생하는 이익이나 손실이다. 외환이익 항목에는 고객의 외화증권자금 환전에 관련된 이익 외에 다른 환전이나 외환 거래과정에서 발생하는 환차손익이 포함되어 있다.

7) 외환스왑 및 통화스왑에 대해서는 나 및 다절에서 좀 더 자세히 살펴본다.

8) 이에 대해서는 다절에서 살펴본다.

9) ‘외국환거래업무 취급세칙 제2-9조’의 외화대출 규제를 받는다.

10) 거주자로부터 외화차입은 실수요제약이 있지만, 비거주자로부터 차입에 대한 제약은 없다. 다만, 금액이 5천만불을 초과하고 기간이 1년을 초과하는 차입은 기획재정부 신고사항이다.

11) 보유 외화채권을 담보로 은행으로부터 외화자금을 조달하기도 하는데, 규모는 크지 않다.

12) 발행사의 리스크관리를 위해 상품구조의 복제를 목적으로 운용을 해야 하며, ‘파생결합증권 및 파생결합사채의 발행 및 운용에 관한 모범규준’에 의해서도 운용 방식에 제약을 받는다.

13) 외환스왑으로 외화자금을 조달하면, 현물환과 통화선도(forward)로 회계처리된다. 은행의 경우는 수출업체(조선사 등)와 체결하는 선물환(outright forward, 통화선도로 회계처리) 거래가 많지만, 증권사들의 통화선도는 대부분 외환스왑과 연계된 거래라고 볼 수 있다.

14) 이를 편의상 외화자금의 운용으로 분류하여 설명하였다.

15) 국내 증권사에 적용되는 선물환포지션한도는 자기자본 대비 50%이다(금융투자업자규정 제3-48조). 가령, 자기자본 4조원인 증권사가 외환스왑으로 조달할 수 있는 외화 한도는 2조원이다.

16) 투자거래에 따라 자본거래에 대한 사전신고를 요한다.

17) 한국은행은 이후 ‘외화대출 취급지침’을 개정(2020. 9. 14)하여 증권사의 ‘해외 파생상품 증거금 납입’을 해외실수요 목적으로 인정하여 이와 관련한 외화차입을 허용하는 것으로 변경하였다.

18) 비거주자는 외국환은행에 투자중개업자 명의로 ‘투자전용외화계정’을 개설할 수 있다(외국환거래규정 제7-38조 제1항). 그러나 같은 방식으로 원화계정의 개설은 허용되지 않는다. 반면, 비거주자는 외국환은행에 본인 명의의 원화 및 외화계정을 개설할 수 있다(외국환거래규정 제7-37조 제1항).

19) 당국(기획재정부)도 이러한 문제점 해소를 위해 환전 후 원화계정을 거치지 않고 바로 원화자금으로 국내 증권투자가 가능하도록(그림의 점선) 유권해석을 발표하였지만(기획재정부 2020. 6. 4), 주식과 달리 채권은 투자 규모가 크기 때문에(통상 1억달러 이상) 아직 일선에서는 업무에 혼선이 있는 상황이다.

20) 실제 환전업무 수행도 관행상 유권해석이 필요하다.

21) 외국인투자자의 국내원화증권 취득 및 매각 또는 인정된 증권대차거래 또는 환매조건부매매가 가능하나(외국환거래규정 7-38조 제1항), 국내원화증권 발행은 명시되어 있지 않다.

22) ‘외국환거래규정 제7-33조 제4항’에 의해 일반투자자(보통 개인투자자)가 외화증권을 매매하고자 하는 경우에는 증권사(투자중개업자)를 통해 외화증권의 매매를 위탁하여야 한다. 다만, 기관투자자는 이러한 의무대상에 포함되지 않는다.

참고문헌

금융위원회, 2022. 3. 2, 「금융기관의 해외진출에 관한 규정」 개정, 보도자료.

기획재정부, 2020. 6. 4, 융복합ㆍ비대면 확산과 경쟁촉진을 통한 외환서비스 혁신 방안, 보도 자료.

기획재정부, 2021. 12. 20, 「2022년 경제정책방향」 발표, 보도자료.

김한수, 2021, 『국내투자자의 해외주식 직접투자 접근성 분석 및 시사점』, 자본시장연구원 이슈보고서 21-30.

이승호, 2022a, 거시경제환경 변화에 따른 외국환거래법의 개편 필요성과 방향, 자본시장연구원 『자본시장포커스』 2022-05호.

이승호, 2022b, 『외국환거래법의 개편 필요성 및 방향에 대한 고찰』, 자본시장연구원 이슈보고서 22-20.

주현수, 2016, 『한국과 아시아 증권사간의 국제금융업무 비교 분석』, 자본시장연구원 조사보고서 16-02.

한국은행, 2016, 『한국의 외환제도와 외환시장』.

BIS, 2022, Triennial Central Bank Survey: OTC Foreign Exchange Turnover in April 2022.

Ding, L., Hiltrop J., 2010, The electronic trading systems and bid-ask spreads in the foreign exchange market, Journal of International Financial Markets, Institutions and Money 20(4), 323-345.

개방경제하의 우리나라에서 대외부문의 중요성이 커지는 가운데 최근 들어 거시경제환경도 빠르게 변화하고 있다. 과거 외환부족국에서 자본수출국으로 이행한 지 오래이고 대외거래도 수출입 등 경상거래 중심에서 자본 및 금융거래의 비중이 점차 커지고 있다. 특히 국가간 대규모 자본이동이 크게 확대되면서 금융시장의 변동성이 증가하고 대외거래와 금융안정에서 비은행금융기관이 차지하는 중요성이 높아지고 있다.

이러한 여건변화에도 불구하고 우리나라의 대외거래를 총괄하는 법체계는 여전히 은행 중심으로 운영되면서 국내 증권사는 외국환은행과 달리 기타외국환업무취급기관으로 분류되어 원칙적으로 모법인 자본시장법과 직접적인 업무 연관이 있는 경우에만 외국환업무의 수행이 가능하고 다양한 자본거래시 사전신고를 요하는 경우도 많다. 그 결과 국내 증권사 등 금융투자기관들의 외환업무역량과 위험관리도 상대적으로 미흡한 실정이다.

최근과 같이 대내외 금융시장의 연계성이 커지고 다양한 금융상품의 출현과 국경간 자본이동이 활발해지고 있는 상황에서 이들 비은행금융기관의 취약성은 전체 금융시스템의 안정은 물론 금융산업 전체의 균형적인 발전에도 부정적인 영향을 주고 있는 것으로 생각된다. 이런 점에서 본고에서는 우리나라 증권사를 중심으로 외국환업무와 관련한 법제도와 외국환업무 현황을 실제 사례와 함께 종합적으로 살펴봄으로써 이들 기관의 외환업무 역량 강화를 위한 개선방향과 향후 과제를 도출해 보고자 한다.

본고의 구성은 다음과 같다. 제Ⅱ장에서는 우선 국내 증권사의 외국환업무 수행과 관련한 외국환거래법을 자본시장법과 비교하여 살펴보고 실제 국내 증권사의 외국환업무 현황을 외화증권의 매매 및 중개, 자금의 조달 및 운용 등으로 구분하여 살펴보았다. 제Ⅲ장에서는 국내 증권사의 실제 외국환업무 사례를 다양하게 설명하고 제Ⅳ장에서는 제도 개선방향 및 향후 과제를 언급하였다.

Ⅱ. 국내 증권사의 외국환업무 현황

1. 외국환업무에 관한 법적 여건

우리나라의 외국환거래법 제3조에서 명시하고 있는 “외국환업무”는 ① 외국환의 발행 또는 매매1), ② 대한민국과 외국 간의 지급ㆍ추심(推尋) 및 수령2), ③ 외국통화로 표시되거나 지급되는 거주자와의 예금, 금전의 대차 또는 보증, ④ 비거주자와의 예금, 금전의 대차 또는 보증, 그리고 ⑤ 기타 시행령 제14조에서 정하는 업무로 규정되어 있다. 국내 증권사의 경우 위에 열거된 모든 외국환업무의 취급이 가능한 은행(외국환은행)과 달리 기타외국환업무취급기관으로 분류되어 외국환업무의 허용범위에 있어 법적 제약이 있다. 즉, 국내 증권사는 위의 외국환업무중 ②지급ㆍ추심(推尋) 및 수령 업무의 취급이 불가능하고 ③과 ④의 경우에 있어서도 예금업무의 취급이 불가능하다. 따라서 증권사에 대해 허용가능한 외국환업무는 외국환거래법 시행령 제14조 제4호에서 명시하고 있는 업무 중 예금 및 대한민국과 외국 간의 지급ㆍ추심 및 수령 업무를 제외하고 「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」에 따른 업무와 직접 관련된 외국환업무를 영위할 수 있는 것으로 이해할 수 있다.3)

<표 Ⅱ-1>은 외국환거래법 시행령상의 외국환업무를 자본시장법상의 증권사 업무와 연결지어 재해석한 표이다. 예를 들어 증권사의 고유업무로서 자본시장법상 금융투자상품의 매매

(자기계산), 증권의 발행/인수(제6조 제2항)에 명시된 업무는 외국환거래법 시행령 제14조 제4호 나목의 외화증권의 발행 및 매매와 관련되어 있다. 마찬가지로 다목의 비거주자와의 원화증권 중개와 관련한 증권사 업무는 자본시장법상 금융투자상품의 매매(타인계산), 그 중개나 청약의 권유(제6조 제3항) 업무와 관련이 있는 것으로 이해할 수 있다. 그러나 (외화)예금 업무의 경우 은행법상 은행의 고유업무로서 증권사에 대해서는 허용되지 않으며 외환의 지급 및 수령의 경우에도 은행에만 허용되는 외국환업무로 규정되어 있다.

2. 주요 외국환업무 현황

현재 국내 증권사의 주요 외국환업무를 금융투자상품의 매매 및 중개, 외화자금 조달 및 운용으로 구분하여 살펴보자. <표 II-2>에서 보는 바와 같이 외화증권이나 장내파생상품의 매매 및 중개의 경우 증권사의 고유업무로서 법적 제약이 거의 없으므로 대체로 활발히 이루어지고 있다. 그러나 이를 제외한 외화자금의 차입이나 외화신용공여 등은 매우 미미한 수준에 머물고 있다. 아래에서는 이에 대해 자세히 살펴보았다.

최근 국내 증권사의 외국환업무는 외화증권 중개 및 이와 관련한 외환매매(환전)를 중심으로 가파른 성장세를 보이고 있다. 이는 개인이나 기관투자자를 중심으로 한 해외증권투자가 최근 빠르게 증가함에 따라 증권사들도 이에 적극적으로 대응하여 투자중개에 필요한 서비스와 인프라를 제공한 결과라고 할 수 있다. <그림 Ⅱ-1>에 나타난 바와 같이 외화증권 중개와 관련된 위탁매매 금액은 2012년 4.1조원에서 2019년 63.8조원까지 크게 증가하였으며 코로나 팬데믹을 거치면서 비약적으로 늘어나 2021년에는 528조원까지 급증했다. 이에 따라 외화증권 위탁매매 수수료 수입도 큰 폭으로 증가하여 2021년에는 약 9천억원에 달하였다.

증권사의 외환매매(환전) 업무는 위의 <표 Ⅱ-2>에서 제시된 증권사의 고유 업무 중 투자목적과 직접적으로 관련된 경우에 허용된다.5) 국내 증권사들은 주로 해외투자와 연계된 고객 환전을 수행하고 있는데, 외화증권 투자자들은 증권사를 통해 원화를 외화로 환전한 후 외화증권 매입이 가능하다. 증권사를 통한 투자목적 환전은 투자 편의를 제공하면서 개인투자자들의 외화증권투자 활성화에 기여한 것으로 생각된다.

<그림 Ⅱ-2>는 증권사들의 외환이익 추이를 나타낸 그래프로 개인들의 해외증권투자가 급증하기 시작한 2019년부터 크게 증가하는 모습을 보이고 있는데, 이는 외화증권 중개 규모가 큰 증권사들 중심으로 외환이익이 증가한 점을 감안할 때 고객에 대한 환전 관련 이익이 상당부분 기여하고 있음을 추론해 볼 수 있다.6)

이처럼 국내 투자자들의 해외증권투자와 관련된 증권사의 중개나 매매 업무가 활성화되고 있는 것에 반해, 증권사의 증권발행이나 자체자금을 이용한 인수업무 실적은 미미하다. <그림 Ⅱ-5>는 국내 증권사들의 외화증권 발행에 대한 주관/인수 및 관련 수수료 추이를 나타내는데, 2021년중 일시적인 증가에도 불구하고 10여년 전 수준에서 크게 벗어나지 않고 있는데 주로 한국물(KP) 발행에 대한 주관업무인 것으로 조사되었다.

증권사의 외화자금 조달은 원화자금 조달의 경우와 달리 현실적으로 많은 제약이 있다. 원화자금 조달의 경우 증권사는 예금 수신 이외의 다양한 방법으로 자금 조달이 가능한데 국고채 전문딜러(Primary Dealer) 참여 증권사는 콜시장에도 참여할 수 있고, 단기금융업(초대형IB) 인가를 받은 증권사의 경우 발행어음 업무도 가능하다. 반면, 외화자금 조달의 경우에는 외화예금의 수신이 불가능할 뿐만 아니라, 외국환은행들이 참여하고 있는 은행간 대출시장 참여도 허용되지 않는다. 또한 증권사들은 일반 기업과 마찬가지로 국내 은행으로부터 외화대출을 받기 위해서는 한국은행의 외화대출 용도제한 규정에 의해 해외사용 목적의 실수요 증빙과정을 필요로 한다.9)

해외(비거주자)로부터 차입에 대한 법적 제약은 없으므로10) 외화채권 발행으로 외화자금 조달이 가능하나 실제로는 신용도가 높은 일부 대형증권사들의 경우에만 발행 실적이 일부 있을 뿐이다. 외화발행어음의 경우에도 단기금융업 인가를 받은 증권사(초대형 IB)만 가능한데, 실제 그 규모가 크지 않으며 용도도 제한되어 있다.

대고객 상품과 연결되어 있는 외화RP, 외화파생결합증권도 증권사들의 외화자금 조달 수단으로 사용될 수 있으나 증권사들은 상품 구조에 따라 이를 매칭(matching)하여 조달한 외화자금을 운용하므로 실제 외화자금의 가용능력에 제약이 따른다. 외화RP 조달의 경우 대부분 고객상품11)이며, 조달한 외화자금으로 외화채권을 매입하고 매입한 외화채권은 고객에게 RP담보로 제공된다. 외화파생결합증권 발행으로 조달한 외화자금도 헤지를 위한 파생상품 거래나 원금 운용을 위한 외화채권 매입(또는 외화예금 가입)에 사용되는 데 그치고 있다.12)

따라서 국내 증권사들이 매칭운용의 제약 없이 사용가능한 외화조달 수단은 은행간 외환시장(interbank market)에 참여하여 원화를 대가로 현물환을 매입하거나 외환스왑(FX swap)이나 통화스왑(currency swap: CRS)을 이용하는 방법에 대부분 의존하고 있다고 할 수 있다.

<그림 Ⅱ-6>의 왼쪽 그림은 외환스왑이나 통화스왑 거래를 이용한 외화자금 조달 흐름을 보여준다. 국내 증권사들은 주로 은행을 거래상대방으로 하여 buy&sell 스왑을 통해 외화조달 주체가 된다. <그림 Ⅱ-3>을 보면, 금융위기 이후 2011년경부터 증권사의 통화선도(및 통화스왑) 거래규모나 잔액이 크게 증가하였는데, 이는 증권사들의 외화자금 조달 수요 증가를 반영한 것으로 해석할 수 있다.13) 외환스왑 거래의 만기 도래시 증권사들은 sell&buy 스왑으로 유동성을 제공하거나14) 만기연장을 하는 경우가 일반적이다. 이러한 증권사의 외환스왑 거래는 선물환포지션한도15)로 인해 자금조달 규모가 제한을 받을 뿐만 아니라 외화자금시장의 유동성 상황이 악화되는 경우 스왑레이트의 추가적인 하락 요인으로 작용하면서 외화자금 조달비용이 커지는 구조적 취약성을 갖는다고 할 수 있다.

주요 운용수단으로는 장외파생상품인 외환스왑이나 통화스왑을 들 수 있다. <그림 Ⅱ-6>의 오른쪽 그림은 외환스왑이나 통화스왑 거래를 이용한 외화자금 운용 흐름을 보여준다. 은행이 거래상대방이 되기도 하지만, 증권사는 해외투자자(투자기관 또는 SPC)에게 해외투자 자금을 제공하는 거래를 통해 수익을 창출하기도 한다. 이러한 거래는 증권사의 통화선도(및 통화스왑) 거래나 잔액을 증가시킨 요인으로 작용한다.

또한 실질적인 외화자금 운용수단으로 외화증권 투자를 들 수 있는데, <그림 Ⅱ-4>에 나타난 바와 같이 최근 외화채권을 중심으로 한 증권사의 외화증권 투자 규모가 크게 증가하고 있다. 외화RP나 외화파생결합증권처럼 외화자금조달과 매칭하여 외화채권을 운용하는 상품이 증가한 측면도 있으며, 원화채권 대비 수익률 제고 및 투자 다변화를 위한 증권사들의 외화채권 투자가 확대되면서 외화채권이 주요 외화자금 운용수단으로 자리매김하고 있다고 생각된다.

그 밖의 외화자금 운용수단으로는 단기자금 운용과 외화유동성 관리를 위한 외화예금이나 금융거래의 증거금(예치금 포함)을 들 수 있다. <표 Ⅱ-3>에서와 같이 2021년말 증권사의 외화예금 잔액은 6.6조원에 달하는 것으로 나타났다. 또한, ELS 헤지운용을 포함한 해외 장내파생상품 거래 증거금이나 예치금도 2021년말 1.5조원 수준을 나타내고 있다.

Ⅲ. 증권사의 외국환업무 사례 및 개선방향

제Ⅱ장에서 살펴본 바와 같이 국내 증권사는 고유업무와의 직접 관련성에 따라 외국환업무를 수행할 수 있다. 그러나 현실적으로 외화조달상의 제약, 해외로의 외화송금 불가능, 투자목적 자금에 대한 계정보유 제한 등으로 증권사 고유의 투자매매 및 투자중개를 행함에 있어 한계 또한 적지 않은 것으로 파악된다. 본 장에서는 증권사의 외국환업무 수행과정에서 발생하는 구체적인 제약 사례를 살펴보고 제도개선 방향에 대해 논의하고자 한다.

1. 외화유동성 확보 및 관리 애로 사례

최근 증권사의 해외증권투자나 해외 금융시장 연계상품 판매의 증가 등 외환관련 업무가 증가하면서 외화자금에 대한 수요도 함께 커지고 있다. 그 예로 외화채권 발행과정에서 발행과 운용(예를 들면 기존 채권 상환) 날짜 간에 괴리가 발생하거나, 연관 거래간 수취와 지급 결제일의 차이가 발생하는 경우 일시적으로 외화자금의 미스매치로 인한 외화자금 수요가 발생하기도 한다. 또한, 해외 금융시장 연계상품의 판매 및 운용 과정에서 마진콜(margin call) 등으로 일시적이고 긴급한 대규모 외화자금 수요를 초래하기도 하며 유동성 관리를 위해 중장기 외화자금의 조달이 필요한 경우가 발생하기도 한다. 이에 따라 증권사의 적정 외화유동성 확보와 이의 효율적인 관리가 매우 중요해지고 있다.

증권사의 외화유동성 관리 미흡이 금융안정을 저해한 대표적인 사례로 2020년 코로나 팬데믹 발생으로 해외주가지수가 급락하면서 증권사가 판매한 ELS 헤지와 연계된 대규모 마진콜이 발생한 것을 들 수 있다. 당시 해외로부터의 대규모 마진콜 발생 등으로 긴급한 외화유동성 확보가 요구되는 상황에서 증권사는 국내 외국환은행으로부터 신속한 외화차입을 통해 유동성을 확보하고자 노력하였다. 그러나 제Ⅱ장 2절에서 살펴본 바와 같이 증권사는 해당 외화자금의

용도가 실수요 목적임을 인정받지 못함에 따라 외화자금조달에 어려움을 겪으면서 일시적으로 유동성 위기에 직면한 바 있다. 당시 국내 대부분의 증권사는 외화자금 조달 수단으로 현물환시장에서 외화를 긴급하게 매입하고자 하였고 이러한 현물환 거래는 원/달러 환율이 한때 1,300원 가까이 급등하는 요인으로 작용하였다. 또한 일부 자금을 외환스왑시장을 활용하여 조달하였는데 그 결과 스왑레이트가 하락하고 외화자금시장 전체의 외환수요 증가로 이어져 외환스왑시장의 유동성 악화를 초래한 바 있다.

이처럼 외환시장을 통한 직접적인 외화조달은 특히 글로벌 금융시장의 불확실성이 높은 상황에서 외환수요를 더욱 가중시킴으로써 환율 상승, 스왑포인트 하락 등을 통해 금융안정성을 더욱 저해하는 요인으로 작용한다. 코로나 팬데믹이 발생했던 2020년 3월의 유동성 위기 상황은 증권사들의 외화유동성 및 환위험 등 리스크 관리상의 문제점 못지않게 증권사의 외화차입 제약 등 외화자금 조달상의 구조적 제약도 근본 원인이었던 사례라 할 수 있다.17)

외국인(비거주자)이 외화자금을 국내로 유입하여 국내 채권에 투자하는 사례를 살펴보자. <그림 Ⅲ-2>를 보면, 외국인의 국내 채권투자는 2017년부터 빠르게 증가하고 있다. 이와 관련하여 국내 증권사는 투자중개업자로서 주도적인 역할을 담당하고 있음에도 불구하고, 외국인의 국내 채권투자 과정에서 투자중개업자로서 증권사의 외국환업무가 일부 제약을 받고 있다.

현재 주로 행해지는 자금의 흐름을 보면, <그림 Ⅲ-3>의 실선과 같이 외국인의 외화투자자금이 국내로 유입되면서 국내 은행의 투자전용대외계정으로 보내진다. 이후 은행에서 원화자금으로 환전된 후 은행의 원화계정에 예치되며 마지막으로 외국인투자자는 증권사(투자중개업자)를 통해 원화채권을 매입하게 된다.

증권사는 외국인의 국내 채권투자와 관련하여 증권사 명의로 은행에 개설된 ‘투자전용외화계정’18)을 이용하여 비거주자의 외화자금을 수취한 후 투자목적 환전을 해줄 수는 있으나, 이를 통해 보유하게 된 원화자금을 처리할 비거주자 원화계정의 개설이 불가능하다.19) 또한 해외로부터의 외화자금 수령시 증권사의 송금 및 수령 제한으로 인하여 은행을 거쳐 투자전용외화계정에 외화자금을 수취하게 된다. 따라서 외국인투자자의 입장에서는 은행을 통한 원화 및 외화계정의 개설과 환전 등 일련의 거래가 증권사에 비해 훨씬 편리하다고 할 수 있다. 결국 <그림 Ⅲ-3>의 실선과 같은 업무흐름으로 자금 관련 처리는 주로 은행들이 수행하게 되고, 증권사는 외국인의 국내채권투자 과정에서 채권중개업무만 수행하게 된다.

3. 외국인의 국내 IPO 주선 사례

비거주자(예: 싱가포르 거주 해외기업)가 국내에서 IPO로 투자금을 조달하여 이를 외화로 환전 후 다시 본국으로 송금한 사례를 살펴보자. IPO 주선은 증권사 고유의 업무이므로 국내 증권사가 담당하였다.

4. 국내 투자자의 외화증권투자 중개 사례

개인이나 기관투자자 등 국내 투자자의 해외 외화증권에 투자하는 사례를 살펴보자. 개인투자자자의 경우 국내 증권사에 외화증권거래 계좌를 개설하고 증권사를 통해 환전을 하게 된다. 증권사는 해외 중개업자를 선정한 후 외화증권의 매입을 의뢰하면 해외 중개기관이 실제적인 증권의 중개를 담당한다. 이 과정에서 국내 증권사는 해외 예탁기관에 외화를 송금해야 할 필요성이 있으나 현재 법상으로는 대외결제를 위한 소액을 제외한 외화송금은 은행을 통해서만 가능하다(<그림 Ⅲ-5>의 겹줄 화살표 흐름>). 따라서 개인투자자의 해외증권투자시 국내 증권사는 은행에 대해 해외송금 관련 비용을 지불해야 한다.

한편, 개인투자자와 달리 기관투자자는 국내 증권사에 위탁하지 않고, 직접 해외중개기관을 통해 외화증권을 거래할 수 있어22) 국내 증권사의 역할이 배제되는 경우가 발생한다. 즉 <그림 Ⅲ-5>의 실선 화살표 흐름처럼 기관투자자의 해외증권투자시 주로 은행을 통해 환전과 해외송금이 이루어진 후 해외 중개기관을 경유하여 증권의 매매가 이루어진다. 기관투자자의 입장에서는 증권사를 이용할 경우 외화의 송금을 위해 또다시 은행을 경유해야 하므로 거래의 불편이 발생하기 때문이다. 이는 국내 증권사의 입장에서 주고객인 자산운용사 및 연기금 등 대형 기관투자자를 대상으로 한 외화증권 중개 업무가 미미한 이유의 하나로 생각된다. 이와 유사하게 국내 자산운용사의 해외펀드 수탁업무도 외화송금 제약으로 증권사가 수행하기 어렵다고 할 수 있다.

그간 우리나라의 대외건전성이 크게 강화되고 거시경제환경 변화로 대내외 금융투자가 빠르게 늘어나면서 국내 증권사 등 비은행금융기관의 외환업무 여건과 역할에도 변화가 요구되고 있다. 특히 전 세계적으로 국가간 자본이동이 확대되고 대외거래에서 차지하는 자본 및 금융거래의 비중이 높아지면서 은행보다 상대적으로 비은행금융기관의 중요성이 확대되고 있다. 이런 점에서 국내 증권사 등 비은행금융기관의 외환업무 역량 강화는 금융안정은 물론 금융산업의 균형적 발전과 경제 활성화에도 중요한 과제로 생각된다.

본 보고서에서 분석한 바와 같이 아직까지 국내 증권사들은 부분적이고 단편적인 외환업무에 치중하면서 외환업무역량은 초보적인 수준에 머물러 있는 것으로 판단된다. 이는 증권사들의 자체 노력이 부족했던 점도 원인이겠으나 현재 우리나라 외국환 법령체계 하에서 증권사는 기타외국환업무취급기관으로 분류되어 외환업무의 허용범위에 있어 외국환은행과 차별적인 대우를 받아온 데에도 상당부분 원인이 있는 것으로 생각된다. 국내 증권사는 은행과 달리 외화자금의 조달이 주로 국내 외환시장을 통해서 이루어져 적정 외화유동성의 확보에 어려움이 있고 증권사 고유의 투자매매 및 중개 업무를 함에 있어서도 해외에 대한 외화송금이나 수령이 허용되지 않는다. 외환매매도 투자목적인 경우로 제한되고 계정의 설치도 자유롭지 못하다는 점에서 외환업무 범위의 확장에 제약을 받고 있는 것이 사실이다. 이런 점에서 금번 정부의 신외환법 추진과정에서 이러한 점이 충분히 반영될 필요가 있다.

먼저 당국은 우리나라 외국환법령에 뿌리 깊게 자리 잡고 있는 외국환은행중심주의를 탈피하여 증권사 등 비은행금융기관이 외환업무 역량을 강화해 나갈 수 있도록 법제도 개선을 고려할 필요가 있다. 제III장에서 살펴본 사례에서와 같이 현재 국내 증권사는 금융투자상품의 매매나 중개, IPO 등과 같은 증권사 본연의 업무를 수행함에 있어 외국환업무와 관련한 환전, 계정처리, 외화송금 등 개별 업무가 제한되어 있고, 또한 개별 업무가 상호 연결되어 있다는 점에서 전체적인 외환업무의 수행에 제약이 크다. 따라서 정부는 부분적인 규제 완화만으로는 증권사의 체계적이고 종합적인 외환업무 수행이 사실상 어렵다는 점에 각별히 유념하여 적어도 자본규모나 위험관리능력 등 일정 요건을 만족하는 증권사에 대해서 우선적으로 외국환업무의 범위를 은행 수준으로 확대해 나가는 방안도 고려할 필요가 있을 것으로 보인다.

이러한 법제도 개선이 이루어질 경우 증권사의 외환업무역량 확대는 물론 금융산업의 균형적인 발전과 금융안정 달성, 그리고 금융투자자의 편의성 제고 등 많은 긍정적 효과가 기대된다. 앞의 사례에서 살펴본 바와 같이 증권사가 외화자금 조달, 국경간 금융투자상품 중개ㆍ매매 과정에서 외환부문 서비스를 종합적으로 제공할 수 있는 제도적 기반을 갖출 경우 전략적으로 국경간 중개ㆍ매매 업무에 특화된 외국환업무 체계를 구축할 유인이 커지면서 증권사의 외환업무 역량이 증가할 것으로 기대된다. 이는 비단 금융업권간의 형평성 문제이기보다는 비은행금융기관의 위기대응역량 확충을 통해 우리나라 금융산업 전체의 외환 및 국제금융업무 역량을 제고시키고 대외건전성이 한층 강화되는 효과를 가져올 것으로 기대된다. 뿐만 아니라 국내 금융투자자 및 외국인 투자자들의 입장에서 보더라도 국내 증권사를 통한 종합적인 외국환업무 서비스가 가능해질 경우 금융투자 거래의 편의성이 증진될 뿐만 아니라 다양한 형태의 거래비용 절감이 발생함으로써 투자자의 편익과 효용이 증가할 것으로 판단된다.

이러한 긍정적 기대효과를 실현하기 위해서는 국내 증권사도 다음과 같은 방향으로 다각적이고 선제적으로 외환업무역량 강화에 노력해 나가야 할 시점으로 생각된다. 첫째, 증권사는 국경간 투자와 관련하여 투자중개, 외화자금 이체ㆍ결제, 외화증권 수탁ㆍ보관 및 환헤지에 이르기까지 종합적인 외환부문 서비스 체계를 구축하여 새로운 업무영역의 창출을 위해 노력할 필요가 있다. 국내 증권시장에 진입하는 비거주자 대상 외환관련 서비스를 총괄하는 통합형 중개서비스는 대형사는 물론 중소형 증권사들도 접근가능성이 있을 것으로 보인다. 또한 국내 투자자의 해외증권투자와 관련해서는 주요 글로벌 투자은행의 경우와 같이 국내 대형 연기금 등 기관투자자 대상 외환부문 서비스 구축에 적극적으로 나설 필요가 있다.

둘째, 최근의 디지털금융 확대 추세에 부응하여 증권사의 외환업무도 전자거래시스템을 활용한 외환거래 플랫폼으로 발전시켜 나갈 필요가 있다. 외환 전자거래시스템은 증권 부문의 대고객 전자거래시스템(HTS) 기술을 대고객 외환시장의 API에 접목함으로써 연기금 등 기관투자자에 대한 해외증권투자나 환헤지 등 외환관련 종합서비스의 제공으로 발전시켜 나갈 필요가 있다. 이를 위해서는 현재 부분적으로 허용되는 증권사의 외환매매에 대한 제약을 완화하여 개인, 기업 및 기관투자자들의 증권사와의 거래유인을 높여나가는 것이 무엇보다 긴요할 것으로 보인다. 중장기적으로는 대내외 투자자금과 관련한 증권사의 프라임 브로커리지(prime brokerage: PB) 역할을 확충하는 방안도 고려해 볼 수 있을 것으로 생각된다.

셋째, 증권사들은 내부적인 외환관리시스템의 정비에도 노력하여야 한다. 이를 위해서는 외환업무 범위의 확대에 따른 외환익스포져 증가에 대비하여 외화표시 대차대조표 개발이나 당국에 대한 보고체계 등 외환부문의 모니터링 체계를 갖추어 나갈 필요가 있다. 또한 비상시에 대비한 적정 외화유동성을 확보하는 한편 각 증권사의 특성에 맞는 환위험 관리 방안을 마련하고 외환관련 금융상품의 개발 및 외화표시 자산과 부채의 최적 포트폴리오를 구성하는 전략도 중요한 과제라 생각된다. 아울러 다양하고 빈번한 외환거래의 체결부터 종결 및 결제까지의 일련의 거래 과정에 대한 체계적인 관리시스템을 갖춤으로써 운영위험 관리에도 힘 쓸 필요가 있다.

1) ‘외국환 매매’는 관행상 통용되는 용어로 대고객에 대해 이루어지는 ‘환전’ 개념을 포함한다.

2) ‘지급ㆍ추심(推尋) 및 수령’은 관행상 통용되는 용어로 ‘송금(당발, 타발)’을 의미한다. 본 보고서에서는 관행상 ‘환전’이나

‘송금’으로 용어를 사용하였다.

3) 외국환거래규정 제2-14조 제1항을 참조하였다.

4) 다만, 2018년에는 단기금융업 허가를 받은 대형 증권사에 대해서는 기업에 대한 투자목적 이외의 일반 환전이 허용되었다.

5) 기획재정부의 유권해석에 의해 개인투자자의 투자목적 환전은 위탁계좌에서 자유롭게 가능하다.

6) 외환이익은 ‘외환차익-외환차손’을 나타낸다. 외환차익과 외환차손은 외화(자산, 부채 포함)를 원화로 바꿀 때 발생하는 이익이나 손실이다. 외환이익 항목에는 고객의 외화증권자금 환전에 관련된 이익 외에 다른 환전이나 외환 거래과정에서 발생하는 환차손익이 포함되어 있다.

7) 외환스왑 및 통화스왑에 대해서는 나 및 다절에서 좀 더 자세히 살펴본다.

8) 이에 대해서는 다절에서 살펴본다.

9) ‘외국환거래업무 취급세칙 제2-9조’의 외화대출 규제를 받는다.

10) 거주자로부터 외화차입은 실수요제약이 있지만, 비거주자로부터 차입에 대한 제약은 없다. 다만, 금액이 5천만불을 초과하고 기간이 1년을 초과하는 차입은 기획재정부 신고사항이다.

11) 보유 외화채권을 담보로 은행으로부터 외화자금을 조달하기도 하는데, 규모는 크지 않다.

12) 발행사의 리스크관리를 위해 상품구조의 복제를 목적으로 운용을 해야 하며, ‘파생결합증권 및 파생결합사채의 발행 및 운용에 관한 모범규준’에 의해서도 운용 방식에 제약을 받는다.

13) 외환스왑으로 외화자금을 조달하면, 현물환과 통화선도(forward)로 회계처리된다. 은행의 경우는 수출업체(조선사 등)와 체결하는 선물환(outright forward, 통화선도로 회계처리) 거래가 많지만, 증권사들의 통화선도는 대부분 외환스왑과 연계된 거래라고 볼 수 있다.

14) 이를 편의상 외화자금의 운용으로 분류하여 설명하였다.

15) 국내 증권사에 적용되는 선물환포지션한도는 자기자본 대비 50%이다(금융투자업자규정 제3-48조). 가령, 자기자본 4조원인 증권사가 외환스왑으로 조달할 수 있는 외화 한도는 2조원이다.

16) 투자거래에 따라 자본거래에 대한 사전신고를 요한다.

17) 한국은행은 이후 ‘외화대출 취급지침’을 개정(2020. 9. 14)하여 증권사의 ‘해외 파생상품 증거금 납입’을 해외실수요 목적으로 인정하여 이와 관련한 외화차입을 허용하는 것으로 변경하였다.

18) 비거주자는 외국환은행에 투자중개업자 명의로 ‘투자전용외화계정’을 개설할 수 있다(외국환거래규정 제7-38조 제1항). 그러나 같은 방식으로 원화계정의 개설은 허용되지 않는다. 반면, 비거주자는 외국환은행에 본인 명의의 원화 및 외화계정을 개설할 수 있다(외국환거래규정 제7-37조 제1항).

19) 당국(기획재정부)도 이러한 문제점 해소를 위해 환전 후 원화계정을 거치지 않고 바로 원화자금으로 국내 증권투자가 가능하도록(그림의 점선) 유권해석을 발표하였지만(기획재정부 2020. 6. 4), 주식과 달리 채권은 투자 규모가 크기 때문에(통상 1억달러 이상) 아직 일선에서는 업무에 혼선이 있는 상황이다.

20) 실제 환전업무 수행도 관행상 유권해석이 필요하다.

21) 외국인투자자의 국내원화증권 취득 및 매각 또는 인정된 증권대차거래 또는 환매조건부매매가 가능하나(외국환거래규정 7-38조 제1항), 국내원화증권 발행은 명시되어 있지 않다.

22) ‘외국환거래규정 제7-33조 제4항’에 의해 일반투자자(보통 개인투자자)가 외화증권을 매매하고자 하는 경우에는 증권사(투자중개업자)를 통해 외화증권의 매매를 위탁하여야 한다. 다만, 기관투자자는 이러한 의무대상에 포함되지 않는다.

참고문헌

금융위원회, 2022. 3. 2, 「금융기관의 해외진출에 관한 규정」 개정, 보도자료.

기획재정부, 2020. 6. 4, 융복합ㆍ비대면 확산과 경쟁촉진을 통한 외환서비스 혁신 방안, 보도 자료.

기획재정부, 2021. 12. 20, 「2022년 경제정책방향」 발표, 보도자료.

김한수, 2021, 『국내투자자의 해외주식 직접투자 접근성 분석 및 시사점』, 자본시장연구원 이슈보고서 21-30.

이승호, 2022a, 거시경제환경 변화에 따른 외국환거래법의 개편 필요성과 방향, 자본시장연구원 『자본시장포커스』 2022-05호.

이승호, 2022b, 『외국환거래법의 개편 필요성 및 방향에 대한 고찰』, 자본시장연구원 이슈보고서 22-20.

주현수, 2016, 『한국과 아시아 증권사간의 국제금융업무 비교 분석』, 자본시장연구원 조사보고서 16-02.

한국은행, 2016, 『한국의 외환제도와 외환시장』.

BIS, 2022, Triennial Central Bank Survey: OTC Foreign Exchange Turnover in April 2022.

Ding, L., Hiltrop J., 2010, The electronic trading systems and bid-ask spreads in the foreign exchange market, Journal of International Financial Markets, Institutions and Money 20(4), 323-345.