Find out more about our latest publications

Analysis On the Financial Performance of Bankruptcy Filings in Korea

Research Papers 21-06 Dec. 14, 2021

- Research Topic Corporate Finance

- Page 73

This report explores the efficiency of corporate rehabilitation under the “Debtor Rehabilitation and Bankruptcy Act”, the equivalent of Chapter 11 in the US, using 1,530 hand-collected bankruptcy filings made by external financial audit corporations in Korea from 2006 through 2020. The empirical analysis of this report centers around the characteristics of authorized filings, corporate reorganization process itself, financial performance post exit, and the relation between the types of corporate distress and the mode of exit.

The main results of the analyses are as follows. First, the corporate rehabilitation appears to successfully screen the inflow of distressed companies with low turnaround potential. Second, post-exit financial performance did not improve compared to pre-filing performance for the five years post exit. Third, debt-asset ratio of the authorized filings which exited through capital structure readjustment seems to have been sufficient implying corporate reorganization was efficient in its intrinsic role. Fourth, the mode of exit was consistent with the types of corporate distress, i.e., the firms with business distress and marginal firms exited more through M&A than through capital structure readjustment and the firms with financial distress and non-marginal firms exited more through capital structure readjustment than through M&A, consistent with asset redeployment role of corporate rehabilitation.

Enhancing the efficiency of corporate rehabilitation requires the followings. First, systematic turnaround of marginal firms though corporate reorganization is difficult, therefore it is advised that marginal firms are induced to go through preemptive M&A or that the plan of reorganization gets endorsed on the condition that the firms go through asset sale. Second, management and creditors need to be incentivized for active restructuring and value enhancement through devices such as equity buy-back options and strengthened creditor rights and monitoring. Third, provision of post exit public financing is necessary for proper turnaround of newly exited firms for the first few post exit years when private capital is scarce. Fourth, acquisition demand in the capital markets for firms in corporate reorganization, one of the main driving forces for efficient corporate restructuring and asset redeployment, should be heightened.

The main results of the analyses are as follows. First, the corporate rehabilitation appears to successfully screen the inflow of distressed companies with low turnaround potential. Second, post-exit financial performance did not improve compared to pre-filing performance for the five years post exit. Third, debt-asset ratio of the authorized filings which exited through capital structure readjustment seems to have been sufficient implying corporate reorganization was efficient in its intrinsic role. Fourth, the mode of exit was consistent with the types of corporate distress, i.e., the firms with business distress and marginal firms exited more through M&A than through capital structure readjustment and the firms with financial distress and non-marginal firms exited more through capital structure readjustment than through M&A, consistent with asset redeployment role of corporate rehabilitation.

Enhancing the efficiency of corporate rehabilitation requires the followings. First, systematic turnaround of marginal firms though corporate reorganization is difficult, therefore it is advised that marginal firms are induced to go through preemptive M&A or that the plan of reorganization gets endorsed on the condition that the firms go through asset sale. Second, management and creditors need to be incentivized for active restructuring and value enhancement through devices such as equity buy-back options and strengthened creditor rights and monitoring. Third, provision of post exit public financing is necessary for proper turnaround of newly exited firms for the first few post exit years when private capital is scarce. Fourth, acquisition demand in the capital markets for firms in corporate reorganization, one of the main driving forces for efficient corporate restructuring and asset redeployment, should be heightened.

Ⅰ. 연구배경

기업의 구조조정은 국민경제 자원의 재배분을 통하여 기업부문의 효율성과 총생산성을 제고한다는 측면에서 매우 중요한 과제로서 효율적 구조조정 시스템의 운영은 이러한 과제를 운영하기 위한 전제조건이다.1) 기업구조조정은 사전적 기업구조조정과 사후적 기업구조조정으로 구분된다. 사전적 기업구조조정은 정상 기업이 사업구조나 재무구조의 개선을 통하여 성장성과 수익성을 제고하여 기업가치를 높이는 일련의 경영활동이다. 반면 사후적 기업구조조정은 사업의 수익성 악화나 과다한 부채로 인하여 채무 상환이 어려워진 기업의 채무를 채권자와의 사적 협의나 법원을 통하여 조정하는 방식이다. 채권자와의 사적 협의는 일반적으로 워크아웃(workout)이라고 불리며 우리나라는 채권단 자율협약과 같은 순수 워크아웃 방식과 「기업구조조정 촉진법(이하 기촉법)」과 같은 법률 기반의 워크아웃 제도가 있다. 반면 국내의 경우 법원을 통한 기업구조조정은 「채무자 회생 및 파산에 관한 법률(이하 채무자회생법)」상의 기업회생 제도에 의해 이루어진다.

워크아웃은 기존 경영진의 경영이 가능하고 워크아웃 사실이 대외적으로 공개되지 않아 비밀유지가 가능하며 상거래 채권자와 지속적인 거래관계 유지를 통하여 경영개선을 도모할 수 있는 장점이 있는 반면, 채권단 내 다수의 채권자가 있을 경우 합의 지연과 이에 따라 자금지원이 지연되는 경우가 많고 법적 구속력 부족과 느슨한 신용평가 등으로 불충분한 채무조정이 이루어질 가능성이 상대적으로 높다. 반면 기업회생은 법원의 감독 하에 구조조정이 이루어지므로 절차상의 투명성이 제고되며 회사의 채무 전체가 채무조정의 대상으로 구속되고 우발채무가 단절되는 효과가 있다. 또한 기존 경영진이 관리인으로 회생계획안을 수행하므로 경영진의 기업회생 신청 유인이 마련된다. 반면 기업회생 절차의 단점은 기업회생 신청 사실이 공개되므로 회사의 신인도 하락으로 거래조건이 악화되어 정상화가 지연되고, 기존 경영자 관리인의 사적 이익 추구 가능성이 상존하며 신규 자금조달이 어렵다는 점이다. 한편 기촉법을 통한 워크아웃은 우리나라의 특징적인 제도로서 전원 동의를 원칙으로 하는 일반 워크아웃과 달리 채권단의 집합적 의사결정 과정의 효율성과 신속성을 지원하기 위하여 표결에 의한 의사결정을 법제화한 워크아웃 방식이다. 마지막으로 파산은 계속기업가치가 청산가치보다 낮은 경우 회사 재산을 환가하여 채권자들에게 나누어주는 절차이다.

대부분의 국가는 우리나라와 마찬가지로 사적 방식과 법원 중심의 기업구조조정 제도를 가지고 있는데 법원을 통한 채무조정 방식의 대표적인 제도가 바로 1978년 제정된 미국 연방도산법(Federal Bankruptcy Code) 11장 Reorganization, 이른바 Chapter 11로 불리는 재건형 도산 절차이다. Chapter 11은 제정 이후 각국의 도산 절차에 많은 영향을 끼쳐왔는데 우리나라의 기업회생 제도는 미국 Chapter 11을 벤치마킹하여 도입되었다. 우리나라의 경우 채무자회생법 제정 이전 이른바 도산 3법(파산법, 화의법, 회사정리법2))으로 기업구조조정 관련 법률이 나뉘어져 있었으나 미비한 점이 많아3) 외환위기 직후 시장에 의한 구조조정 제도인 워크아웃 제도를 도입하고 파산법, 화의법, 회사정리법을 2006년 채무자회생법4)으로 통합 정리하였다.

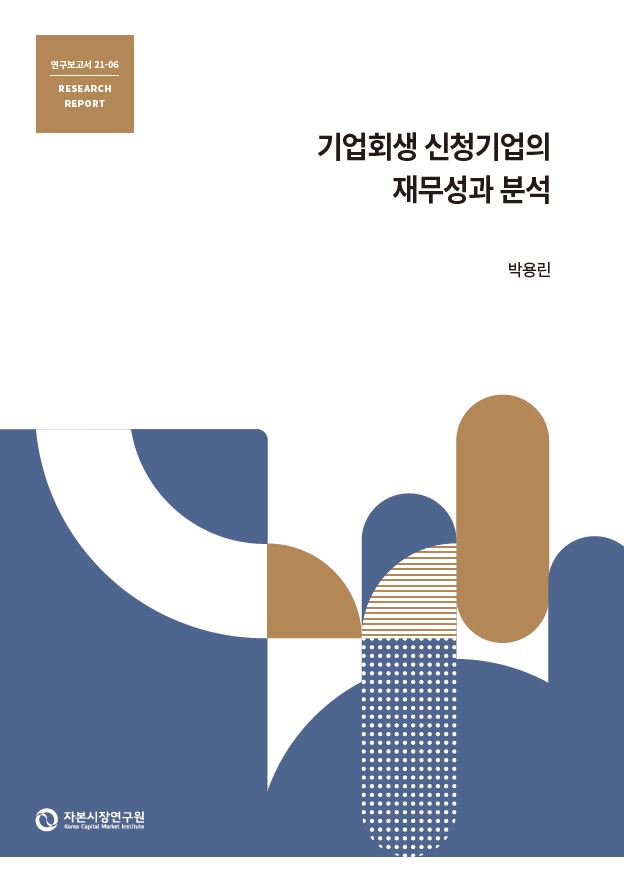

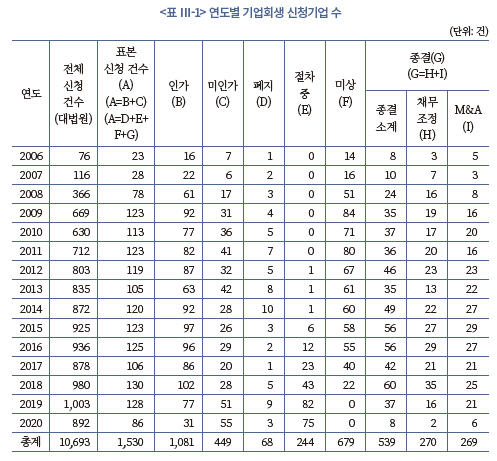

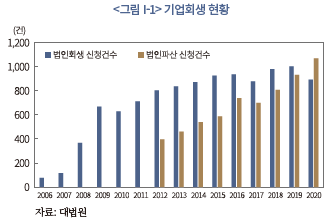

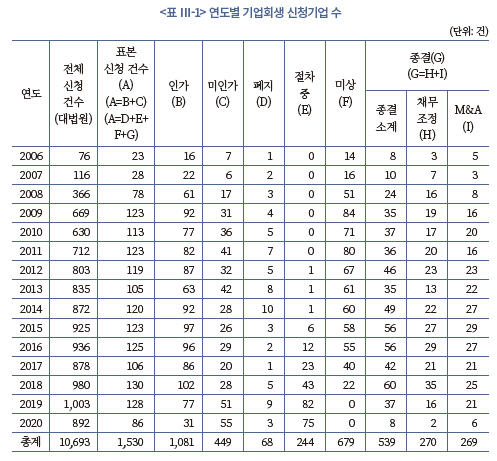

우리나라의 기업회생 제도는 2006년 채무자회생법의 제정에 따라 현재까지 15년이 경과하며 기업회생 사례가 축적되어 왔다. <표 Ⅰ-1>의 대법원 통계에 의하면 제도 도입년도인 2006년의 기업회생 신청 건은 76건에 불과하였으나 2020년의 경우 총 892건의 기업회생 신청이 이루어지며 기업회생을 활용한 구조조정 규모가 크게 증가하였으며 동 기간 누적 기업회생 신청 건수는 총 10,693건에 이르고 있다.

그러나 기업회생이 국내 사후적 기업구조조정의 핵심 제도 중 하나로서 그 중요성이 증가하여 왔음에도 불구하고 현재까지 기업회생 사례에 관한 데이터의 집계와 공개가 이루어지지 않아 기업회생 절차의 효율성에 대한 학계 및 연구기관의 연구가 희소한 현실이다. 기업구조조정이 국민경제 전체의 생산성 개선에 미치는 영향을 고려할 때 기업구조조정의 개선방향 모색을 위해서는 기업회생 신청기업의 특징과 제도 효과의 정량적 분석이 필요하다. 특히 코로나19 이후 산업구조 변화에 따른 기업의 재무적‧사업적 건전성의 변화가 예상됨에 따라 향후 구조조정 수요 대응을 위한 연구자료 축적이 필요한 상황이다.

본 보고서는 이러한 관점에서 공개적으로 입수 가능한 외감기업 자료를 활용하여 기업회생의 효율성을 분석하고자 한다. 구체적으로 2006년부터 2020년까지 15년간 기업회생을 신청한 외감기업을 집계하여 이들 기업의 재무적 특징과 기업회생 결과를 분석함으로써 기업회생 제도의 효율성 제고를 위한 정책적 시사점을 도출하고자 한다. 먼저 기업회생 신청기업의 특징으로서 신청 전 재무변수의 특징과 변화, 기업회생 신청기업과 한계기업과의 관계, 기업회생에 이르게 된 부실의 유형 등을 기준으로 기업회생 신청기업을 분석한다. 기업회생 제도의 효율성 분석에서는 기업회생 인가 및 종결, 종결 시 M&A 비중 등과 관련된 기업회생의 효율성을 분석한다. 특히, 기업회생 신청에 이르게 된 부실유형을 재무적 부실(financial distress)과 사업적 부실(economic distress), 그리고 한계기업과 비한계기업으로 구분하고 부실유형에 따른 종결방식과 종결 후 재무성과와의 연관성 분석을 통해 기업회생의 효율성을 분석한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 보고서의 분석을 위한 사전 단계로서 채무자회생법 상 기업회생 제도를 간략히 소개한다. 이어서 기업구조조정 관련 국내 연구와 미국 Chapter 11 관련 해외 연구문헌을 소개하고 이후의 실증분석을 위한 네 가지 연구질문을 설정한다. Ⅲ장에서는 분석표본의 수집 방법과 구조를 설명하며 기업회생 절차의 특징과 기업회생 신청기업의 신청 전 재무성과를 분석한다. Ⅳ장에서는 Ⅱ장에서 도출한 네 가지 연구질문에 대한 실증분석을 수행하여 기업회생의 효율성을 분석한다. 마지막으로 Ⅴ장에서는 본 보고서의 결론을 제시하고 정책적 시사점을 도출한다.

Ⅱ. 연구방법론

Ⅱ장에서는 본 보고서가 다루고자 하는 채무자회생법 상 기업회생 제도를 소개하고 기업회생 제도의 효율성 평가와 관련된 국내외 기존 연구를 살펴보며 이로부터 본 보고서가 분석하고자 하는 네 가지 연구질문을 도출한다.

1. 기업회생 개관

국내 기업회생을 주관하는 채무자회생법의 목적은 ‘재정적 어려움으로 인하여 파탄에 직면해 있는 채무자에 대하여 채권자‧주주‧지분권자 등 이해관계인의 법률관계를 조정하여 채무자 또는 그 사업의 효율적인 회생을 도모하거나(즉, 기업회생), 회생이 어려운 채무자의 재산을 공정하게 환가‧배당하는 것(즉, 파산)’이다(제1조).

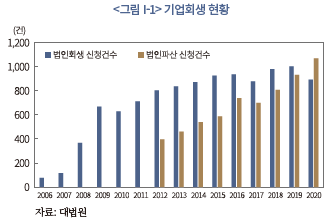

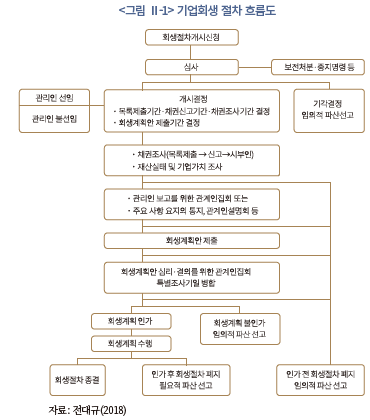

기업회생의 절차는 다음과 같다(<그림 Ⅱ-1> 참조). 먼저 기업회생 신청자격은 채무자(제34조 1항), 전체 채권액 기준 1/10이상을 보유한 채권자, 그리고 전체 자기자본의 1/10이상을 보유한 주주(제34조 2항)가 신청 가능하다. 신청 후 7일 이내에 포괄적 금지명령5)이 내려지며(제45조), 신청 후 1개월 이내에 법원이 절차 개시 여부를 결정하여야 한다(제49조). 개시 결정 후에는 회생담보권자와 회생채권자의 채권은 회생계획안(Plan of Reorganization: POR)에 의하지 않고는 변제가 불가능하다(제58조).

한편, 법원은 기업회생 절차의 집행자인 관리인으로 기존 경영자를 임명하여야 한다(제74조 2항). 이것이 통상 기존경영자관리인(Debtor-In-Possession: DIP)으로 불리는 제도로서 미국 Chapter 11과 기업회생의 가장 큰 변화이자 특징이다. 다만 예외적으로 채무자의 재정적 파탄이 채무 기업의 이사 또는 지배인이 행한 재산의 유용 또는 은닉이나 중대한 책임이 있는 부실경영에 기인하는 경우 또는 채권자협의회의 요청이 있는 경우로서 상당한 이유가 있는 경우 법원은 제3자를 관리인으로 선임할 수 있다(제74조 2항).

관리인은 기업회생 절차 개시 후 4개월 이내에 채권자 등의 목록제출 및 채권신고를 통해 회생담보권과 회생채권을 조사 확정하여 이를 법원에 보고하여야 한다(제92조). 주로 회계법인인 조사위원에 의해 작성되는 조사보고서에 의해 계속기업가치가 청산가치보다 크다고 인정되면 법원은 관리인에게 회생계획안 제출을 명령하며, 관리인은 명령 이후 4개월 이내에 회생계획안을 법원에 제출해야 한다(제220조).6)7) 회생계획안이란 채무자의 향후 사업수익에 대한 추정을 기초로 채권자 등 이해관계인의 권리를 변경하여 회생채무 등을 변제하는 계획이다. 회생계획안이 제출되면 관계인집회에서 각 채권자 및 주주조별로 회생계획안의 동의 여부를 결정하며 모든 조가 동의하면 회생계획안이 가결되는데(제236조)8), 이때 필요한 의결기준은 회생담보권자조, 회생채권자조, 주주조별로 각각 의결권 행사 총액의 3/4, 2/3, 1/2이다(제237조). 관리인은 회생절차 개시결정부터 채무자의 업무 수행권과 재산의 관리 처분권을 가지고(제56조 1항) 회생계획안 인가 이후 회생계획안의 내용을 수행하며(제257조), 법원은 채무자, 회생담보권자‧주주‧지분권자, 관리인 등에 대하여 회생계획의 수행에 필요한 명령을 할 수 있다(제258조). 한편 회생계획에 따른 변제가 시작되면 회생계획의 수행에 지장이 없을 경우 관리인, 회생채권자 또는 회생담보권자의 신청에 의하거나 법원의 직권으로 회생절차의 종결 결정을 한다(제283조 제1항). 반면, 회생계획안이 기한 내 제출되지 못하거나 관계인집회에서 부결되는 경우(제286조 1항), 회생계획안 제출 전후 청산가치가 계속기업가치보다 큰 것이 명백할 경우(제286조 2항), 회생계획안 인가 후 회생계획을 수행할 수 없는 것이 명백하게 된 경우 등(제288조)의 경우에는 회생절차가 폐지된다.

2. 선행연구

본 보고서의 연구범위와 직접적으로 연관되는 국내외 연구로는 기업회생 제도의 벤치마킹 대상인 미국 Chapter 11이 기업의 재무성과에 미친 영향을 분석하는 일련의 연구와 종결방식으로서 M&A가 Chapter 11의 효율성에 미친 영향에 대한 연구를 들 수 있다.

가. 기업회생 또는 Chapter 11 기업의 재무성과

Chapter 11 기업의 재무성과에 관한 해외 연구의 시초는 Hotchkiss(1995)라고 할 수 있으며 이후 다양한 관련 연구가 나타났다. Hotchkiss(1995)는 1979~1988년의 10년간 197개 미국 Chapter 11 종결기업을 대상으로 이들 기업의 종결 후 재무성과를 분석하였다. Chapter 11을 종결한 표본기업은 종결 후 3년간 수익성과 성장성이 저조하였으며 저조한 재무성과는 Chapter 11의 기존경영자관리인(DIP) 제도와 관련이 깊음을 실증 분석하였다.

Hotchkiss & Mooradian(1997)은 1980~1993년의 14년간 미국 Chapter 11을 포함한 288개 구조조정 기업에 대하여 벌처투자자(vulture investor)가 경영권을 획득한 경우 구조조정 이후 수익성이 우수함을 실증하여 기업구조조정에서 외부투자자의 통제(control)와 모니터링(monitoring)이 중요함을 분석하였다.

Hotchkiss & Mooradian(1998)은 1979~1992년의 14년간 M&A로 Chapter 11을 종결한 55개 기업의 수익성이 비교 대상 기업 대비 높은 것으로 나타나 M&A가 Chapter 11에서 효율적인 자산재배분(asset redeployment)에 기여함을 실증하였다.

Denis & Rodgers(2007)는 1985~1994년의 10년간 Chapter 11을 신청한 279개 기업을 대상으로 영업성과가 우수한 소규모 기업과 영업이익률이 높은 산업 소속 기업의 Chapter 11 잔류 기간이 짧음을 실증분석하였다. 또한 Chapter 11 신청 전 산업조정 영업이익률이 높고 이익률 증가율이 상대적으로 높은 기업의 재무성과가 우수한 것으로 나타나 Chapter 11이 잠재성이 높은 기업의 성공적 회생을 지원함을 발견하였다. 또한 Chapter 11 절차 중 자산부채 규모를 대폭 감소시킨 기업의 성과가 우수한 것으로 나타나 절차 진행 중의 구조조정 강도가 종결 후 재무성과에 중요한 역할을 수행하는 것으로 분석되었다.

Kalay et al.(2007)은 1991~1998년간 459개의 Chapter 11 기업에 대하여 Chapter 11 기간 동안 영업실적이 대폭 개선되었음을 보여 Chapter 11 절차가 도산기업에 순기능을 제공하는 것을 실증하였다. 이 때 부채비율이 높은 기업의 영업실적 개선이 높으며, 복잡한 채무구조는 영업실적 개선에 부정적 효과를 나타내는 것으로 분석되었다.

Lemmon et al.(2009)는 부실 유형을 구분하고 Chapter 11이 계속가치 보존과 자산재배분(asset redeployment)에 기여함을 분석하였다. Lemmon et al.(2009)은 1991~2004년간 Chapter 11을 신청한 505개의 상장기업과 주요 비상장기업에 대하여 Chapter 11에 이르게 된 부실 유형을 재무적 부실과 사업적 부실로 구분하였다. Chapter 11이 효율적으로 운영되기 위해서는 재무적 부실은 계속기업가치를 보존하는 방식, 즉 채무조정 방식으로 종결되는 것이 바람직하며, 사업적 부실은 자산재배분 방식 즉, M&A 방식의 종결 또는 청산이 바람직함을 주장한 가운데 미국 Chapter 11 기업은 이와 부합되는 방식으로 종결되었음을 실증하였다.

한편 Chapter 11의 성과와 효율성에 대하여 다수의 정량적 분석이 이루어진 미국 중심의 해외 연구와 달리 국내의 경우는 기업회생에 특화된 연구가 제한적이다. 오수근(2015)을 제외한 국내 연구의 대부분은 채무자회생법 이전 시기나 광의의 사전적 구조조정 또는 부도예측 모형 등을 분석한 연구이다.9)

먼저 박찬웅(2004)은 1992~2004년간 33개 구조조정 기업을 대상으로 배열기법 분석을 통해 기업구조조정 경로와 절차에 따라 개별 기업구조조정 사례를 5개 군락으로 분류하고 이러한 경로가 기업구조조정에 소요되는 기간에 미치는 영향을 분석하였다. 분석 결과 업력이 낮을수록, 매출액이 클수록 기업의 정상화에 소요되는 시간이 짧은 것으로 분석되었다. 또한 부도 전 기업 상태의 악화 속도는 정상화 속도에 영향이 없으나 부도 과정의 사건 배열 순서는 정상화 속도에 영향을 미치는 것으로 나타났다.

신동령(2005)은 2000~2004년간 부실화된 242개 비금융 상장·비상장기업의 재무적 특징을 분석하고 1:1 매칭기업을 추가한 분석표본에 대하여 부실예측 모형을 설정하고 부실예측 결과를 통해 동 모형의 정확성을 분석하였다.

오수근(2015)은 국내 기업회생 신청기업에 대하여 기업회생 절차의 특징과 신청기업의 재무 상태를 조사하였다. 2006~2012년의 7년간 751건의 국내 기업회생 신청기업에 대하여 신청, 개시결정, 인가, 폐지 또는 종결로 이어지는 절차의 평균 소요기간, 신청서와 조사보고서 상 자산‧부채 규모, 부채비율 및 부채구성을 분석하였다.

장정현‧최철(2019)은 2000~2016년간 1,686개 비금융 상장기업에 대하여 기업수명주기 단계별 구조조정 전략의 선택과 재무적 곤경에 처한 기업이 선택하는 자산‧운영‧재무 구조조정 전략이 기업 정상화에 미치는 영향을 실증적으로 분석하였다. 분석 결과, 성숙기에 실시된 자산 구조조정과 성장기‧쇠퇴기에 실시된 사업 구조조정, 특히 성장기에 실시된 자산축소와 쇠퇴기에 실시된 정리해고는 정상화의 가능성을 높이는 것으로 나타났다.

나. Chapter 11과 M&A의 관계

Chapter 11의 효율성과 관련된 연구는 M&A가 Chapter 11의 효율성 제고에 미친 영향에 대한 연구로 확대되었다. 먼저 채권자, 주주 등 관련 당사자들의 합의에 따른 채무조정 방식, 즉 재건형 기업구조조정 절차로 설계된 Chapter 11이 부실기업 자산의 효율적인 활용을 담보하는지에 대한 논란이 제도 도입 초기부터 지속되었다. Chapter 11은 회사 재건을 위해 도산 기업의 경영자를 관리인으로 하는 기존경영자관리인(DIP) 제도를 두고 있는데 이는 채무자 친화적(debtor-friendly) 구조조정 방식으로서 종종 절대우선의 원칙이 위반되며(Absolute Priority Deviation: APD)10) 채권자로부터 주주로 부가 이전되는 사례가 나타났다.

Baird(1993)와 Bradley & Rosenzweig(1992)는 기존경영자관리인(DIP)이 기업 자원을 최적의 사용자에게 배분할 적절한 인센티브가 없음을 주장하였으며 Jensen(1991)은 이러한 상황에서 M&A가 도산기업 자산의 효율적인 재활용을 유도하기 위한 중요한 기제임을 주장하였다.

한편 1990년대 이후 Chapter 11의 성격의 변화에 대한 일련의 연구가 나타나기 시작했다. 이러한 변화는 채권자 권리 강화와 같은 채권자 친화적(creditor-friendly) 관행의 정착과 Chapter 11에서의 M&A 활용 증가로 나타났는데 이와 관련된 연구는 다음과 같다.

Bharath et al.(2010)은 Chapter 11이 채권자 친화적인 구조조정 방식으로 변모하였으며 그 원인으로 DIP금융과 주요임직원유지플랜(Key Employees Retention Plan: KERP)이 있음을 주장하였다. DIP금융을 통해 채권자 권리의 강화와 구조조정 협상력의 제고가 이루어졌으며 경영진 교체의 빈도도 증가하였다. 한편 주요임직원유지플랜은 임직원 성과와 구조조정 속도를 보상과 연동하여 구조조정의 인센티브를 부여하였다.

한편 Chapter 11에서의 M&A 빈도 증가의 원인에 대한 연구가 최근 나타나고 있다. Roe(2017)는 복잡한 수직계열화 산업조직에서 계약기반 산업조직으로의 변화, 자본시장 발달에 따른 M&A 시장의 성장, 시장의 효율성에 대한 법원의 신뢰 증가가 그 원인임을 주장하였다. Baird & Rasmussen(2002)은 기업 전체 및 사업부 매각이 가능해진 M&A의 전문성 심화에 따라 Chapter 11에서 M&A의 비중이 증가하였음을 주장하였다.

Chapter 11에서의 M&A의 효과에 대한 연구로는 Hotchkiss & Mooradian(1998), Waldock(2019)과 Gilson et al.(2019)이 있다. Hotchkiss & Mooradian(1998)은 M&A가 효율적인 자산재배분에 기여함을 실증하였는데 M&A를 통해 종결된 경우 동종산업 기업에 인수된 사례가 다수이고, M&A를 통해 종결된 기업의 종결 후 재무성과가 상대적으로 우수하며, M&A를 통한 종결을 추진한 Chapter 11 상장기업의 매수자와 매도자 모두 양의 초과수익률이 발생하였다. Waldock(2019)은 Chapter 11의 기초통계 분석을 통해 Chapter 11이 M&A를 염두에 두고 활용되는 경향이 있으며 부실기업 투자자의 존재가 Chapter 11의 효율성을 개선시키고 있음을 보이고 있다. Gilson et al.(2019)은 M&A가 부실기업 자산의 효율적 재활용 수단으로서 기능하고 있으며 M&A가 채권자 회수율을 높이는 등 회수 가치를 최대화하는 것을 실증하고 있다.

마지막으로 M&A 인수 주체의 하나인 재무적 투자자의 존재로 Chapter 11을 통한 구조조정의 신속성과 효율성이 제고되었음을 실증하는 연구가 있다. Hotchkiss & Mooradian(1997)은 벌처투자자의 존재가 종결 후 재무성과를 제고하며, Jiang et al.(2012)은 헤지펀드의 존재가 회생(turnaround) 가능성과 후순위채권자 회수율을 높이며, Hotchkiss et al.(2014)은 사모펀드(Private Equity: PE)가 포트폴리오 기업의 부실을 효율적으로 해소함을 보고하고 있다.

3. 연구질문

본 보고서의 주요 목적은 국내 기업회생 제도가 사후적 기업구조조정의 핵심기제로 계속기업가치 보존과 자원 재배분이라는 구조조정 제도 본연의 역할을 충실히 수행하는지 분석하는 것이다. 이를 위해 기업회생 신청기업의 재무적 특징을 살펴보고 신청기업의 재무적 특징과 연관되어 기업회생 제도가 효율적으로 운영되고 있는지를 분석한다.

기업회생 신청기업의 재무성과를 통하여 기업회생의 효율성을 평가하는데 있어 한 가지 유념할 것은 사적 워크아웃이나 기촉법 상 워크아웃, 파산 등 대체 기업구조조정 수단이 존재하는 상황에서 기업회생 신청은 무작위적인 결과가 아니라 이해관계자의 자가선택(self-selection)에 의해 이루어지는 결과이라는 것이다. 즉 기업회생 절차가 기업 재무성과에 미치는 영향은 어떠한 기업이 워크아웃이나 파산 대신 기업회생을 신청하게 되는지에 영향을 받는다. 기업의 구조조정 방식 선택에 관한 일련의 연구는 기업의 부실화 정도가 심하고 채무구조가 단순한 소규모 기업의 경우 기업구조조정 수단으로써 Chapter 11을 선택하는 경향이 있음을 보고하고 있다(Chatterjee et al.,1996; Yost, 2002; John et al., 2003).11) 만약 기업회생을 신청하는 기업이 부실화 정도가 심한 소규모 기업이며 이러한 기업의 회생(turnaround) 가능성이 상대적으로 낮다면 기업회생 신청기업의 신청 전후의 재무적 성과로 판단하는 기업회생의 효율성 평가에는 하향편의(downward bias)가 발생할 수 있다.

이러한 배경 하에 기업회생 신청기업의 재무적 특징으로 기업회생 신청 직전년도의 기업규모와 매출액성장률, 영업이익률, 부채비율 등 제반 재무지표, 그리고 이들 지표의 신청 전 연도별 변화를 분석한다. 또한 이후의 기업회생 효율성 분석에서 중요하게 사용될 기업의 부실 유형의 하나로 재무적 부실(financial distress)과 사업적 부실(economic distress)을 구분한다. 재무적 부실기업은 사업 자체의 내재가치 창출 능력은 우수하나 과다한 부채 즉 재무구조 문제로 부실에 이르게 된 기업이며 사업적 부실기업은 재무구조는 양호하나 사업 자체의 수익성이 나쁜 기업으로 정의한다. 한편 또 다른 부실 유형으로서 부실의 만성화 여부에 따라 기업회생 신청기업을 한계기업과 비한계기업으로 구분한다. 이 때 한계기업은 일반적인 정의의 따라 이자보상배율 1 미만이 3년 이상 지속된 기업으로 정의한다. 이자보상배율 기준은 영업이익이 낮아서 한계기업이 될 수도 있고 지급이자 규모가 커서 한계기업이 될 수도 있으므로 재무적 부실 또는 사업적 부실과 같은 부실 유형과는 독립적이다.

이와 같이 기업회생 신청기업의 재무성과와 부실 유형에 대한 구분을 바탕으로 국내 기업회생 제도의 효율성을 기업회생 인가 단계의 효율성, 종결 후 재무성과를 통한 효율성, 종결방식 중 채무조정의 효율성, 그리고 마지막으로 부실유형과 종결방식 간 상관관계 관점에서 평가한다. 구체적으로 다음의 네 가지 관점에서 기업회생의 효율성을 평가한다.

첫째, 기업회생 신청기업 중 인가기업이 기각 기업 대비 재무적 성과가 상대적으로 우수한지의 여부이다. 즉, 기업회생의 비효율성은 회생 가능한 기업이 청산되거나, 회생 가능하지 않은 기업이 기업회생 절차에 잔류하거나 채무조정을 통해 종결될 때 발생하므로 기업회생 제도의 운영이 이러한 가능성을 차단하는 방향으로 이루어지는지 분석하는 것이다. Denis & Rodgers(2007)은 Chapter 11의 성공 기업은 Chapter 11 신청 전 재무성과가 상대적으로 우수한 기업들이었음을 보여주고 있다.

둘째, 기업회생 종결 이후의 기업 재무성과를 살펴봄으로써 기업회생의 효율성을 평가하는 것이다. 기업회생 종결 이후의 재무성과를 살펴보아야 하는 이유는 비효율적 기업이 기업회생 절차 내 생존할 경우 이러한 비효율성이 종결 후의 기업 재무성과에 나타날 가능성이 있기 때문이다. 이는 Chapter 11 절차 중과 종결 후 재무성과를 연구한 Hotchkiss(1995), Denis & Rodgers(2007), Kalay et al.(2007), Lemmon et al.(2009)에서의 연구동기와 동일한 맥락이라고 할 수 있다.

셋째, 채무조정을 통해 기업회생 절차를 종결하는 기업의 경우 적정한 채무조정이 이루어지는가의 여부이다. 이는 채무조정을 통해 기업을 재건하는 재건형 구조조정 절차로서의 기업회생의 취지와 직결되는 문제이다. 만약 채무조정이 효율적으로 이루어진다면 특정 기업의 기업회생 신청 전 부채비율 수준과 관계없이 종결 후 부채비율이 사업 재건이 가능한 유사한 수준으로 수렴되어야 하기 때문이다.

넷째, 부실 유형별 기업회생 종결방식이 자산재배분과 정합적인가의 여부이다. 먼저 재무적 부실과 사업적 부실 관련하여 재무적 부실기업은 계속기업으로서의 가치창출은 이루어지고 있으나 과도한 부채비율로 부실에 이르게 되었으므로 기업회생 절차 본연의 역할인 채무조정을 통해 회생이 필요한 반면 사업적 부실기업은 기업의 내재가치가 훼손된 기업으로서 기존 경영자를 통해서는 자산을 수익성 있게 활용하기 어려운 기업이므로 소유권의 이전, 즉 M&A를 통해 기업회생 절차의 종결이 이루어지는 것이 정합적이다. 이는 부실유형과 종결방식과의 연계를 분석한 Lemmon et al.(2009)과 궤를 같이하는 관점이다. 이러한 관점은 부실의 또 다른 유형인 한계기업과 비한계기업에도 적용될 수 있다. 한계기업은 만성적 부실기업으로서 자산의 수익성 있는 활용이 어려운 기업이므로 M&A를 통한 종결이 필요한 반면 비한계기업은 채무조정을 통한 종결의 여지가 상대적으로 높다.

Ⅲ. 국내 기업회생의 특징

Ⅲ장에서는 보고서의 실증분석에 사용되는 국내 외감기업의 기업회생 신청 사례를 집계한 분석표본에 대하여 집계 및 분류 방법과 표본의 특징을 서술하고 이를 바탕으로 국내 기업회생 절차의 특징과 신청기업의 신청 전 연도별 재무성과를 살펴본다.

1. 분석표본

먼저 본 보고서는 2006~2020년간 금융감독원 기업공시 사이트(dart.fss.or.kr)에 감사보고서를 제출한 12월 결산 외감기업을 대상으로 검색어로 ‘회생’을 사용하여 관련 감사보고서를 추출한 후 이를 검독하여 기업회생의 신청, 종결 및 폐지 여부를 확인하고 표본을 수집하였다. 이 때, 상장기업의 경우 사업보고서를 병행 참조하여 감사보고서에 기재되지 않은 기업회생 관련 자료와 일자를 추출하였다.

확인된 기업회생 신청기업에 대하여 감사보고서 상 신청일, 인가일, 종결일 또는 폐지일의 명시 또는 ‘절차 중’ 언급 여부를 기준으로 표본기업을 분류하였다. 인가일자가 존재하는 경우 인가기업으로 분류하였으며 신청일만 있고 인가일 또는 종결일이 없으면 미인가기업으로 분류하였다. 만일 종결일이 존재하는데 인가일이 없을 경우에도 인가기업으로 분류하였으며 이 경우 기업회생 체류 기간 계산에는 해당 자료를 포함하지 않았다. 종결일이 존재하는 경우 종결기업으로 분류하였으며 종결일이 없어도 감사보고서 상의 지분구조 변경을 살펴본 결과 M&A를 통한 종결이 명확한 경우에는 종결기업으로 분류하였다. 다만 인가일과 마찬가지로 이 경우에도 기업회생 체류 기간 계산에는 포함하지 않았다. 마지막으로 회생절차의 폐지일이 감사보고서 상 존재하면 회생절차 폐지기업으로 분류하였다.

한편 인가일이 최근인 경우 보고서 작성 시점에 기업회생 절차가 진행 중일 경우가 있다. 따라서 인가일이 최근 2년 내에 있었으나 2020년 감사보고서 상 종결일이 없을 경우와 신청일이 최근 2년 내에 있었으나 2020년 감사보고서 상 인가일이 없을 경우 ‘절차 중’이라는 감사보고서 상 명시적 언급이 없는 경우에도 ‘절차 중’으로 분류하였다. 마찬가지로 기업회생 신청 또는 인가기업의 감사보고서가 최근년도 이전에 공시 중단되는 경우가 있을 수 있으며 이 경우 이들 기업이 자산 매각과 채무변제 또는 파산 등으로 외감기업 지정이 해제되었을 가능성이 있다. 따라서 감사보고서 상 인가일은 있으나 종결일이 없으면서 2020년도 또는 그 이전년도 재무제표가 공시되지 않은 기업의 경우, 그리고 신청일은 있으나 인가일이 없으면서 2020년도 또는 그 이전년도 재무제표가 공시되지 않은 기업을 ‘미상’으로 분류하였다.

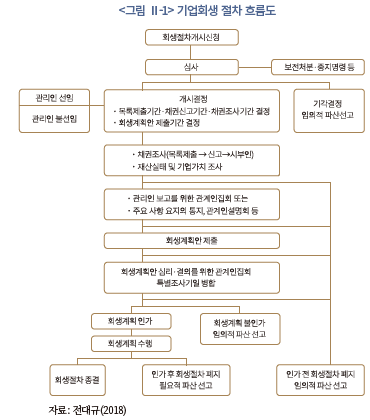

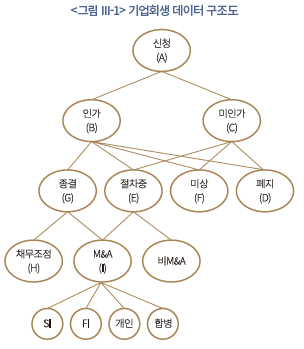

마지막으로 기업회생 종결일이 감사보고서 상에 명시된 기업회생 종결기업에 대하여 감사보고서 상의 지분변동 상황을 분석하여 종결방식으로서 채무조정과 M&A를 구분하였다. 이 경우 기존 채무의 출자전환을 제외하고 별도의 신규 외부투자자가 존재하지 않는 경우를 채무조정으로, 기타의 경우를 M&A로 분류하였다. 또한 인수 주체에 따라 M&A를 통한 종결기업을 전략적 투자자(Strategic Investor: SI), 재무적 투자자(Financial Investor: FI), 개인, 합병의 네 가지 경우로 분류하였다. <그림 Ⅲ-1>은 이러한 방식으로 분류된 기업회생 관련 자료의 분류 계통도이며 <표 III-1>은 이렇게 집계된 연도별 기업회생 신청기업 수와 경과를 나타낸 표이다.

<표 Ⅲ-1>에서 신청기업(A)은 인가기업(B)과 미인가기업(C)으로 분류되며, 이들 신청기업의 경과 상태는 폐지(D), 절차 중(E), 미상(F), 종결(G)의 하나로 분류된다. 또한 종결기업은 채무조정(H)과 M&A(I) 방식으로 구분된다. 이렇게 2006~2020년간 총 1,530개의 기업회생 신청 건을 바탕으로 한 분석표본이 수집되었다. 분석표본의 연평균 기업회생 신청 건수는 102건이며 연도별로 비교적 균일한 분포를 보이고 있다. 특히 2020년을 제외하고는 2009년 이후 연도별 표본 수는 매년 100건 이상이다.

분석표본은 외감기업 대상이므로 국내 전체 기업회생 신청 건수와는 차이가 있으며 분석표본의 대표성을 살펴볼 필요가 있다. 표본기간 대법원이 공표하는 기업회생 신청의 전체 규모는 10,693건으로서 표본기업 수는 표본기간 전체 기업회생 신청 건수 대비 14.3%이다. 전체 기업회생 신청 건수 대비 외감기업의 기업회생 신청 건수는 2006년 30.3%에서 2020년 9.6%로 연도별로 꾸준하게 감소하는 추세에 있어 최근으로 올수록 외감기업 지정 기준보다 규모가 작은 기업의 기업회생 신청 비중이 높아지는 것을 확인할 수 있다.

2. 분석변수

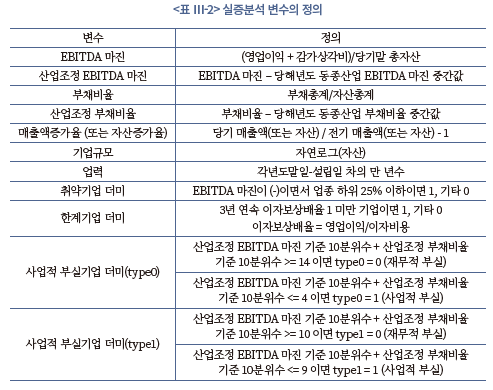

본 보고서에서 초점을 두는 기업 재무성과 지표는 기존 연구문헌의 관례를 따라 현금흐름 수익성을 대표하는 EBITDA 마진과 안정성을 대표하는 부채비율이며 필요한 경우 성장성을 대표하는 매출액증가율과 자산증가율을 사용한다. EBITDA 마진은 당기말 총자산 대비 영업이익과 감가상각비를 합산한 현금흐름으로, 부채비율은 총자산 대비 부채총계로 정의한다. 이러한 재무성과 지표는 성장성 지표를 제외하고 모두 산업별 수익성과 재무구조를 반영한 산업조정(industry-adjusted) 재무변수이다. 구체적으로 Lemmon et al.(2009)을 따라 개별 신청기업에 대하여 해당 표준산업 분류상 소분류 업종 내 외감기업이 4개 이상이면 해당 업종 외감기업 전체의 재무성과 지표의 당해년도 중간값을 신청기업의 재무성과 지표에서 차감하고 소분류 업종 내 외감기업이 4개 미만이면 중분류 업종의 외감기업 전체의 재무성과 지표 중간값을 차감한다. 만일 중분류 업종 내 외감기업이 4개 미만이면, 대분류 업종의 외감기업 전체의 재무성과 지표 중간값을 신청기업의 재무성과 지표에서 차감한다.

본 보고서의 분석을 위해 기업회생 신청기업을 부실유형에 따라 구분한다. 구체적으로 기업회생 신청기업을 부실의 근원에 초점을 둔 사업적 부실(economic distress)과 재무적 부실(financial distress), 그리고 부실의 만성화에 초점을 둔 한계기업과 비한계기업으로 구분한다. 이 때 사업적 부실기업은 부채비율과 같은 재무구조에는 문제가 없으나 EBITDA 마진과 같은 사업의 수익성이 낮은 기업으로 정의된다. 반면 재무적 부실기업은 사업의 수익성은 나쁘지 않지만 부채비율이 높아 채무조정을 통한 경영 정상화가 필요한 기업이다. 한계기업은 일반적으로 채택되는 정의를 따라 3년 연속 이자보상배율이 1 미만인 기업으로 정의하며, 이때 이자보상배율은 영업이익을 이자비용으로 나눈 값을 사용한다.

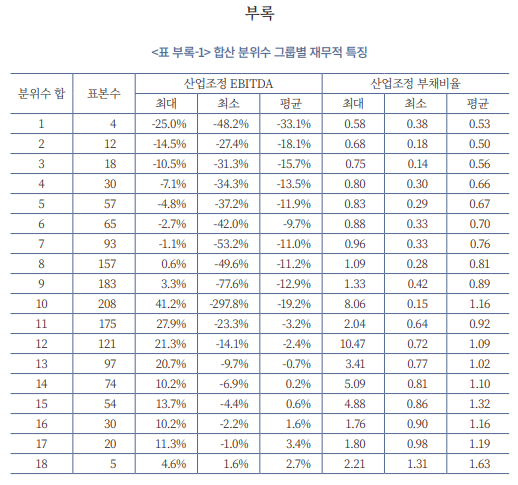

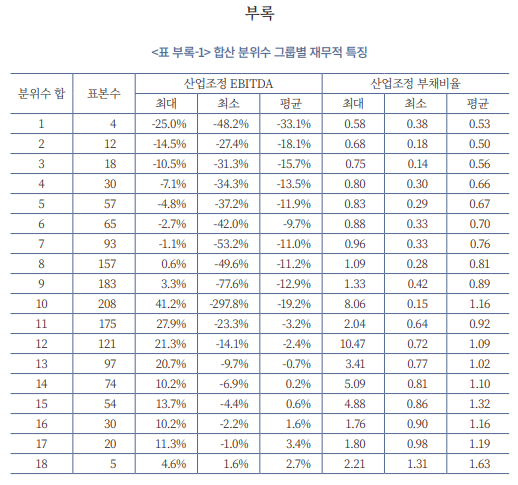

Lemmon et al.(2009)을 따라 사업적 부실기업과 재무적 부실기업을 구분하는 방식을 설명하면 다음과 같다. 먼저 당해년도 외감기업 전체를 산업조정 EBITDA 마진과 산업조정 부채비율을 기준으로 각각 10분위 그룹을 만든다. 산업조정 EBITDA 마진과 산업조정 부채비율 최상위 그룹의 분위수는 9이며 최하위 그룹의 분위수는 0이다. 재무적 부실기업은 부채비율은 높으나 EBITDA 마진은 양호한 기업이므로 부채비율 분위수는 높고 EBITDA 마진 분위수도 높은 기업이다. 반면 사업적 부실기업은 부채비율은 낮으나 EBITDA 마진이 낮은 기업이므로 부채비율 분위수가 낮고 EBITDA 마진 분위수도 낮은 기업이다. 따라서 개별 기업이 소속된 산업조정 EBITDA 마진 그룹의 분위수와 산업조정 부채비율 그룹의 분위수를 합산한 수치는 부실유형을 구분하는 기준으로서 각 분위수의 합산 수는 사업적 부실에서 재무적 부실로 단조증가(monotonic increase)한다. 최종적으로 합산 분위수를 바탕으로 협의(type0)와 광의(type1)의 사업적 부실기업 더미변수를 설정한다. 협의의 사업적 부실기업 더미변수는 합산 분위수가 14이상일 경우를 재무적 부실기업으로, 합산 분위수가 4이하일 경우를 사업적 부실기업으로 정의한 더미변수이다. 반면 광의의 사업적 부실기업 더미변수는 합산 분위수가 10이상일 경우를 재무적 부실기업으로, 합산 분위수가 9이하일 경우를 사업적 부실기업으로 정의한 더미변수이다.12)

한편 재무성과가 특별히 나쁜 취약기업을 별도로 분류하여 더미변수를 설정한다. 구체적으로 Denis et al.(2007)을 따라 표준산업분류상 소분류 업종 내 기업이 4개 이상이면서 EBITDA 마진이 음(-)이며 동 업종 내 하위 25%(q25) 이하이면 1, 기타이면 0인 더미변수를 설정한다. 만일 소분류 업종 내 기업이 4개 미만이면 중분류 업종의 하위 25%를 적용하고, 중분류 업종 내 기업이 4개 미만이면 대분류 업종의 하위 25%를 적용한다.

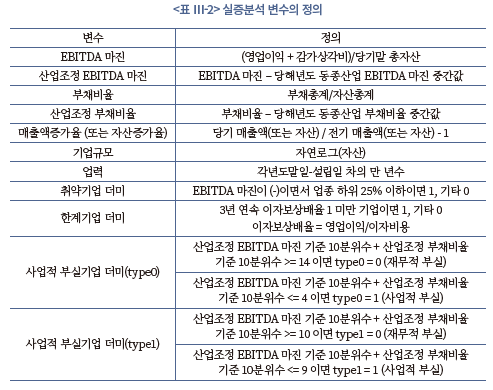

다음 <표 Ⅲ-2>는 본 보고서에서 사용되는 주요 실증분석 변수를 정의한 표이다.

3. 기업회생의 특징

가. 기업회생 절차

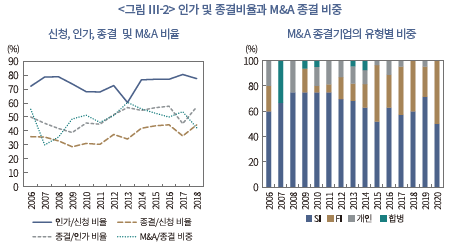

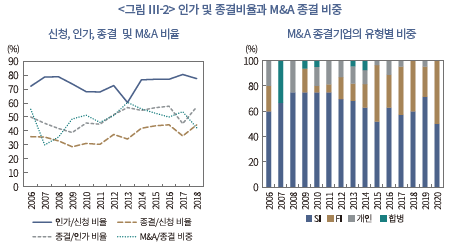

기업회생 절차의 특징으로는 다양한 측면을 살펴볼 수 있으나 대표적인 지표로서 기업회생 인가율과 종결율, 각 종결방식의 비중 그리고 절차 존속기간을 살펴본다. <그림 Ⅲ-2>와 <그림 Ⅲ-3>은 이를 나타낸 그림이다. 먼저 <그림 Ⅲ-2>는 2009년 이후 표본기업의 기업회생 신청 건수 대비 인가 건수(‘인가율’)와 인가 건수 대비 종결 건수(‘종결율’)의 비중이 추세적으로 증가하는 것을 보여주고 있다. 2006~2018년간 분석표본의 기업회생 인가율과 종결율의 평균은 각각 73.9%, 50.8%이며 종결방식 중 M&A의 비중은 평균 49.0%이다.13) 대법원에 의하면 2010~2019년간 전체 기업회생 인가율의 연도별 평균은 50% 수준이고, 종결율의 연도별 평균은 59%이므로(대법원, 2021)14) 외감기업 표본의 인가율은 대법원 기업회생 통계보다 높은 반면, 종결율은 대법원 기업회생 통계보다 다소 낮다. 이는 외감기업의 규모가 전체 기업회생 신청기업 대비 상대적으로 커서 자산 가치나 고용 규모 등 사회적 관점에서 외감기업 재건의 의의와 가능성이 상대적으로 높은 반면 부실에 이른 원인이 다소 복잡하여 기업회생 절차를 통한 구조조정이 어렵기 때문인 것으로 풀이된다.

<그림 Ⅲ-2>는 또한 기업회생 종결방식의 하나인 M&A를 통한 종결의 비중이 연도별로 변화를 나타내고 있음에도 불구하고 M&A를 통한 종결 중 재무적 투자자의 비중이 지속적으로 증가하고 있는 것을 나타낸다. 실제로 수집된 연구표본에서 재무적 투자자 중 가장 높은 비중을 차지하는 것은 PEF, 특히 기업재무안정 PEF인데, 2012년 이후 재무적 투자자의 비중이 증가한 것은 2010년에 기업재무안정 PEF가 도입된 것에 큰 영향을 받은 것으로 분석된다. 2010년 5.0%에 불과했던 재무적 투자자의 M&A 내 비중은 2020년 50.0%까지 증가하였다.

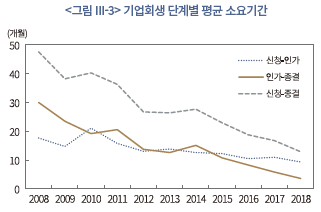

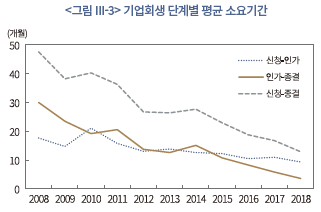

한편 2006년 채무자회생법 제정 이후 기업회생 절차 소요기간은 지속적으로 감소하고 있다. 2008년의 경우 신청부터 인가까지 17.6개월, 인가부터 종결까지 30.0개월이 소요되어 신청부터 종결까지 평균 47.6개월이 소요되었으나 이후 절차 소요기간이 감소하기 시작하여 2018년의 경우 신청부터 인가까지 평균 9.3개월, 인가부터 종결까지 3.6개월로 총 12.9개월이 소요되었다.15) 이러한 최근의 절차 소요기간은 미국과 비교하여도 짧다고 할 수 있다.16) 국내 기업회생의 절차 소요기간이 지속적으로 단축되고 있는 것은 법원이 시장 친화적이며 신속한 기업구조조정의 필요성을 공감함에 따라 신속한 절차 집행을 위한 노력이 이루어지고 있기 때문으로 풀이된다.17) 이러한 절차 소요기간의 단축이 기업구조조정에 충분한 시간을 제공하지 못 할 수 있다는 우려가 있을 수 있다. 이와 관련하여 Ⅳ장에서는 기업회생 소요기간의 단축이 종결 후 재무성과에 어떠한 영향을 미쳤는지 분석한다.

나. 기업회생 신청기업

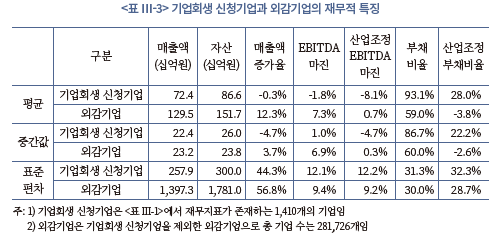

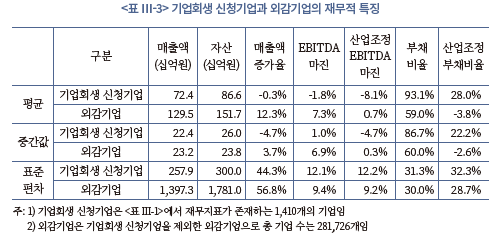

다음으로 기업회생 신청기업이 일반 외감기업과 비교하여 어떠한 재무적 특징을 갖는지 살펴본다. <표 Ⅲ-3>은 기업회생 신청기업의 규모와 성장성, 수익성 및 안정성 관련한 대표적인 재무성과 지표를 나타낸 표이다. 먼저 기업회생 신청기업은 일반 외감기업과 비교하여 두드러진 규모의 차이가 없다. 기업회생 신청기업의 매출액과 자산의 중간값은 각각 224억원, 260억원으로서 외감기업의 중간값 232억원, 238억원과 유사한 수준이다. 반면 기업회생 신청기업은 예상되듯이 낮은 성장성, 수익성 및 안정성을 나타내고 있다. 기업회생 신청기업의 매출액증가율, EBITDA 마진 및 부채비율의 중간값은 각각 –4.7%, 1.0%, 86.7%로서 외감기업과 비교하여 매출액은 감소하고 있으며 열악한 현금흐름 수익성과 재무구조를 나타내고 있다.

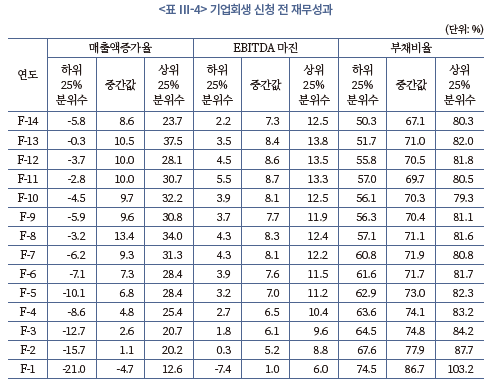

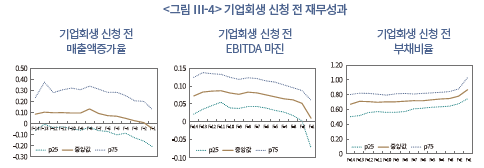

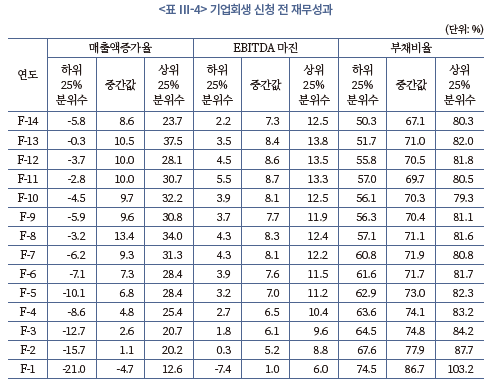

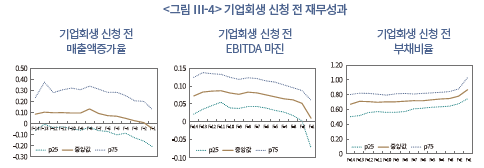

한편 기업회생 신청기업의 부실화와 관련하여 이들 기업이 어떠한 재무성과의 경로(trajectory)를 통해 기업회생 신청에 이르는지 살펴보는 것은 기업회생 신청기업의 특징을 파악하는데 도움이 될 수 있다. <표 Ⅲ-4>와 <그림 Ⅲ-4>는 매출액증가율, EBITDA 마진, 부채비율 측면에서 기업회생 신청기업의 신청년도 이전 연도별 재무성과를 나타낸 표와 그림이다.18) 표본의 중간값 기준으로 기업회생 신청기업의 매출액증가율은 기업회생 신청 7년 전 9.3%에서부터 서서히 감소하기 시작하여 신청 직전년도의 –4.7%에 이르기까지 지속적으로 감소하고 있다. EBITDA 마진은 매출액증가율과 유사한 시기에 서서히 감소하기 시작하다 신청 직전년도에 이르러 1.0%로 급격히 악화되는 모습이 나타나고 있다. 또한 부채비율도 유사한 시기인 신청년도 8년전 71.1%에서부터 악화되기 시작하여 신청 직전년도에는 86.7% 수준까지 증가하고 있다. 따라서 기업회생 신청에 이르기까지 재무성과의 변화는 먼저 매출액증가율의 둔화가 신청 7년전과 같이 이른 시기에 나타나기 시작한 이후 수익성이 서서히 악화되다가 기업회생 신청년도에 가까워질수록 매출액의 급감, 수익성의 급격한 악화와 부채비율의 급등과 같은 모습을 보인다. 이러한 결과는 성장 동력의 상실이 기업 부실화의 근본 원인이 될 수 있으며 성장 동력의 회복이 적절한 시기에 이루어지지 않을 경우 이후 기업의 부실이 가속화되며 기업회생에 이르게 될 가능성이 있음을 시사한다.

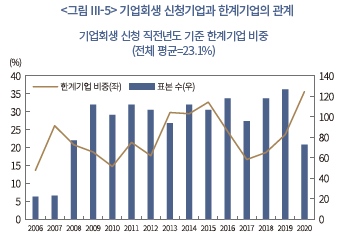

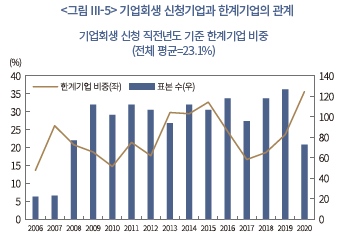

마지막으로 기업회생 신청기업은 부실화된 기업이므로 신청기업 중 통상적으로 인식되는 부실기업인 한계기업의 비중이 어떠한지 살펴볼 필요가 있다. 이와 관련하여 <그림 Ⅲ-5>를 살펴보면 최근의 상승에도 불구하고 표본기간 내 기업회생 신청기업 중 신청 직전년도 기준 한계기업 비중은 평균 23.1%에 불과하다. 이는 기업회생이 만성화된 부실기업인 한계기업보다는 재무상태가 급격히 악화된 기업이 주로 활용하는 제도라는 것을 시사한다. 기업회생 신청기업 중 한계기업의 비중이 제한적인 것은 무엇보다 한계기업의 기업회생 신청 기피를 들 수 있다. 기업회생은 가장 큰 특징인 기존경영자관리인(DIP) 제도에도 불구하고 회생채무의 출자전환 및 외부자금 유치로 기업회생 종결 후 기존경영자관리인의 지분이 상당히 낮아지는 것이 일반적이다. 이러한 이유로 사업성을 상실하였지만 외부자금 조달이 가능한 한계기업은 불가피한 경우가 아니면 기업회생 신청을 꺼리는 것이 현실이다.

Ⅳ. 기업회생의 효율성 분석

Ⅳ장에서는 기업회생의 효율성을 평가하기 위하여 II장에서 설정한 다음의 네 가지 연구질문에 따라 실증분석을 수행한다. 첫째, 국내 기업회생 절차가 회생 가능성이 있는 기업회생 신청기업에 대하여만 기업회생 인가가 이루어지는지 살펴본다. 둘째, 기업회생 절차 종결 이후의 재무성과 분석을 통해 기업회생 절차 후 재무구조와 수익성 개선 등 기업 체질 개선이 충분히 이루어지는지 살펴본다. 이 때 기업회생 신청기업의 부실유형과 종결방식별로 종결 후 재무성과를 상세히 살펴본다. 셋째, 채무조정을 통해 재무구조를 개선하는 방식으로 기업회생 절차가 종결되는 경우 채무조정이 충분히 이루어지는지 분석한다. 넷째, 회생기업의 M&A를 통해 기업회생 절차가 종결되는 경우 종결방식으로서 M&A가 회생기업의 부실 유형과 어떠한 관계를 가지는지 살펴본다.19)

1. 인가기업과 미인가 기각기업의 재무성과

기업회생이 효율적으로 운영되기 위해서는 회생(turnaround) 가능성이 낮은 기업의 기업회생 절차 유입과 이를 통한 비효율적 과잉투자 가능성을 차단해야 한다. 이를 위해서는 기업회생 신청기업 중 인가기업이 미인가 기각기업 대비 재무성과의 관점에서 어떻게 차별화되는지를 분석하여야 한다.20) 따라서 비교 대상을 기업회생 인가기업과 미인가 기각기업으로 구분하여 규모, 수익성 및 부채비율의 차이를 살펴본다.21) 이 때 미인가 기각기업은 기업회생을 신청하였으나 회생절차의 개시결정이 이루어지지 않은 기업, 개시결정이 이루어졌으나 기일 내 회생계획안이 마련되지 못하거나 주주 및 채권자 조의 표결 결과 회생계획안이 부결된 미인가 기업을 포함한다.

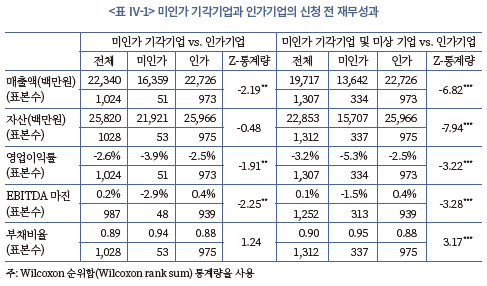

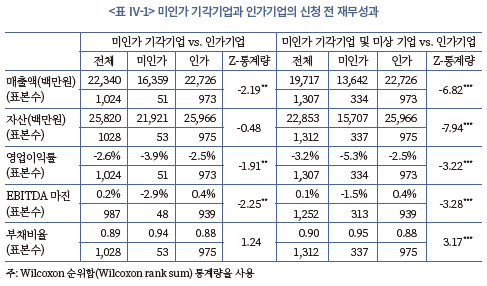

<표 Ⅳ-1>은 인가기업과 미인가 기각기업의 기업회생 신청 전 재무성과의 분석 결과를 나타낸 표이다. 인가기업과 미인가 기각기업의 매출액 중간값은 각각 227억원, 164억원으로 인가기업의 매출액이 미인가 기각기업보다 5% 수준에서 유의하게 큰 것으로 나타났다.22) 한편 인가기업의 영업이익률과 EBITDA 마진의 중간값은 각각 –2.5%, 0.4%로서 미인가 기각기업의 –3.9%, -2.9% 대비 5% 수준에서 통계적으로 유의하게 큰 것으로 나타났다. 반면 자산과 부채비율의 경우 인가기업의 중간값이 미인가 기각기업의 중간값보다 크지만 두 표본집단 간 차이는 통계적으로 유의하지 않았다.

한편 Ⅲ장 1절에서 서술한 바와 같이 외감기업 감사보고서 상에는 기업회생 신청에 대한 공시 이후 외감기업 지정이 해제되면서 감사보고서 공시의무 면제에 따라 이후의 기업회생 절차의 경과가 보고되지 않은 신청 건이 다수 존재한다. 이러한 경우는 대부분 부실화에 따라 기업 규모가 축소되면서 공시의무가 면제된 경우일 가능성이 높으므로 이를 미인가 기업으로 간주하여 분석하면 추가적인 시사점을 얻을 수 있다. 이러한 표본을 미인가 기각기업에 포함하여 인가기업과 미인가 기각기업의 재무성과를 비교하면 앞서의 비교보다 재무성과의 차이가 확대되는 것을 확인할 수 있다. <표 Ⅳ-1>의 오른쪽에서 인가기업의 매출액, 자산, 영업이익률, EBITDA 마진의 중간값은 모두 미인가 기각기업보다 1% 수준에서 통계적으로 유의하게 큰 것으로 나타나며 인가기업의 부채비율은 미인가 기각기업보다 1% 수준에서 통계적으로 작은 것으로 나타난다.23) 이는 전술한 바와 같이 통계가 누락된 기업은 부실화 정도가 심한 기업이었을 가능성을 시사한다.

종합하면 기업회생 신청기업 중 인가기업은 미인가 기각기업 대비 재무적 성과가 우수한 것으로 나타난다. 미인가 기각기업은 인가기업 대비 소규모이며 영업이익률과 현금흐름, 재무안정성 측면에서 통계적으로 유의한 열위에 있다.

2. 기업회생 종결 이후 재무성과

기업회생 절차가 효율적이라고 한다면 비효율적 기업의 기업회생 절차 유입과 이를 통한 비효율적 투자결정이 발생할 가능성이 적으며 이는 종결 후의 재무성과에 나타날 가능성이 높다. 이를 위해 기업회생 절차를 종결한 기업에 한하여 이들 기업의 신청 전 8년부터 종결 후 5년까지의 EBITDA 마진 및 산업조정 EBITDA 마진, 부채비율 및 산업조정 부채비율, 매출액증가율과 자산증가율을 분석한다.

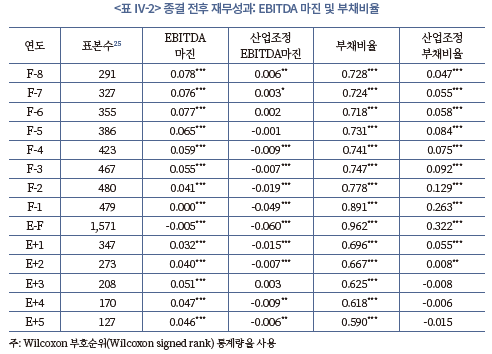

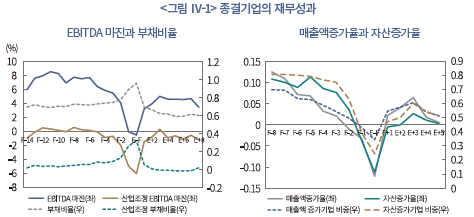

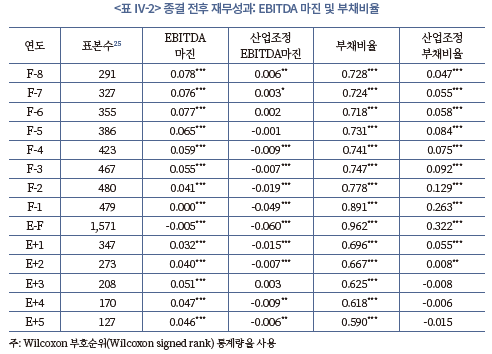

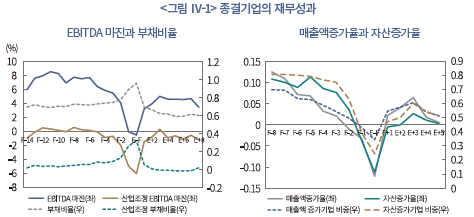

<표 Ⅳ-2> 및 <그림 Ⅳ-1>의 왼쪽 그림은 기업회생 종결기업의 EBITDA 마진과 부채비율의 변화를, <표 Ⅳ-3> 및 <그림 Ⅳ-1>의 오른쪽 그림은 매출액증가율과 자산증가율을 나타낸 표이다. 먼저 <표 Ⅳ-2>에서 기업회생 종결기업의 종결 후 수익성 회복은 종결 후 5년 내에 이루어지지 못하는 것으로 나타났다. EBITDA 마진 및 산업조정 EBITDA 마진은 종결 후 5년까지(E+5) 수익성 악화 개시 시점인 기업회생 신청 3년 전(F-3)으로 회귀하지 못하는 것으로 분석된다. 즉, 종결 후 5년차 연도의 EBITDA 마진의 중간값은 4.6%로 신청 3년 전 수준인 5.5%에 미치지 못하고 있다. 또한 종결 후 5년차 연도의 산업조정 EBITDA 마진의 중간값은 –0.6%로 신청 5년 전 수준인 –0.1% 수준을 회복하지 못하고 있다.24) 반면 종결기업의 부채비율과 산업조정 부채비율은 모두 신청 전 부채비율 대비 크게 개선되었다. 종결기업의 부채비율은 종결 이후 지속적으로 낮아져 기업회생 신청 이전 8년간의 부채비율보다 낮았다. 산업조정 부채비율도 종결 이후 지속적으로 낮아지고 있으며 기업회생 신청 전 소속업종의 부채비율 대비 통계적으로 유의한 수준으로 높았던 부채비율이 통계적으로 유의한 수준은 아니지만 종결 이후 3년차부터(E+3) 소속업종의 부채비율 중간값보다 낮아지고 있다. EBITDA 마진과 부채비율 관련된 이러한 상반된 결과는 채권자, 주주, 경영자 등 이해관계자 간 채무조정이 본질적 기능인 기업회생 절차가 본연의 기능을 충실히 수행하고 있으나 향후 기업의 체질 개선이라는 관점에서 역할을 확대할 여지가 있음을 시사한다.

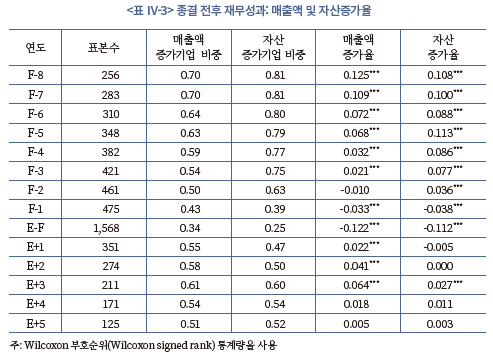

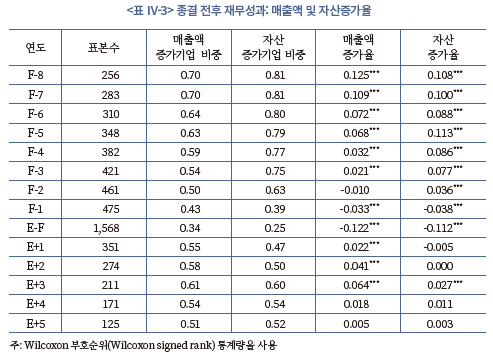

한편 성장성 관점에서 기업회생 종결기업은 종결 후 5년간 성장성을 일정 부분 회복한 것으로 분석된다. 그러나 수익성과 마찬가지로 종결 후 5년간의 성과는 신청 5년 전 정상 기업 당시의 수준에 미달하고 있다. 종결 후 매출액증가율과 자산증가율이 가장 높은 연도는 종결 후 3년째로서 매출액증가율은 6.4%, 자산증가율은 2.7% 수준이다. 이러한 수준은 매출액증가율 기준으로는 기업회생 신청 5년 전 매출액증가율인 6.8%, 자산증가율 기준으로는 기업회생 신청 직전년도를 제외하고는 어떤 기간보다도 낮은 수준이다. 비록 통계적으로 유의하지는 않지만26) 기업회생 종결 이후 5년간 매출액과 자산의 증가가 이루어지고 있음에도 기업회생 신청 전 수준으로의 회복이 쉽게 이루어지지 않고 있음을 알 수 있다.27)

한편, 종결 후 재무성과와 관련하여 종결기업의 종결방식 및 부실유형과 같은 다양한 특성에 따라 종결 후 재무성과의 차이가 있을 수 있다. 이하에서는 종결기업의 세부 특성으로 종결방식, 신청 직전년도의 부실유형 그리고 기업회생 신청시기별로 구분하고 각각의 경우에 대하여 종결 후 재무성과를 살펴본다.

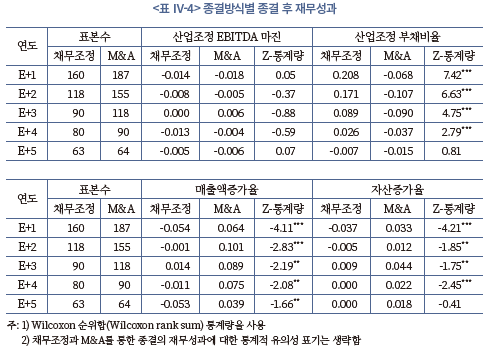

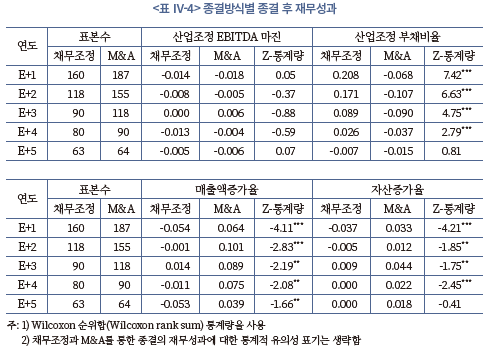

먼저 <표 Ⅳ-4>는 종결방식으로서 채무조정과 M&A를 통한 종결기업을 구분하고 종결 후 재무성과를 나타낸 표이며 지면 관계 상 종결 후의 산업조정 재무성과만을 제시한다. 먼저 M&A를 통한 종결기업은 종결 후 2년에서 4년까지 채무조정을 통한 종결기업보다 산업조정 EBITDA 마진이 높았으나 통계적 유의성은 없었다. 한편 산업조정 부채비율은 채무조정을 통한 종결 이후 점차 감소하고 있으나 M&A를 통한 종결보다 통계적으로 유의하게 높았다. 이는 M&A 자체가 외부투자자의 유상증자 등 자본의 유입으로 이루어지는 경우가 많은 반면 채무조정은 영업으로부터의 현금흐름으로 조정된 채무를 변제를 하는 경우가 많기 때문인 것으로 풀이된다. 그럼에도 불구하고 채무조정을 통한 종결기업은 종결 후 5년차에 M&A를 통한 종결기업의 산업조정 부채비율에 수렴하는 모습이 나타나고 있다.

반면 성장성 측면에서 M&A를 통한 종결방식은 종결 후 5년 동안 채무조정을 통한 종결방식보다 일관되게 높은 것으로 분석된다.28) 예를 들어, 채무조정을 통한 종결기업의 종결 후 5년차 연도의 매출액증가율과 자산증가율은 각각 –5.3%, 0.0%이나 M&A를 통한 종결기업은 각각 3.9%, 1.8%로서 M&A를 통한 종결기업이 성장성 측면에서 채무조정을 통한 종결기업보다 높음을 알 수 있다. 종결방식별 매출액증가율과 자산증가율의 차이는 종결 후 5년차 연도의 자산증가율을 제외하고는 모두 5% 이상 수준에서 통계적으로 유의하다. 이러한 종결방식과 관련된 성장률의 차이에는 M&A를 통한 종결의 경우 경영권 인수 시 신규자금 유입과 더불어 경영권을 획득한 대주주의 적극적인 성장 의지 등이 작용한 것으로 해석된다. 종합하면 채무조정과 M&A를 통한 종결은 종결 후 수익성에서 유의한 차이가 발견되지 않는 반면, 부채비율은 M&A를 통한 종결이 종결 후 5년간 채무조정을 통한 종결보다 통계적으로 유의하게 낮은 수준으로 유지되었다.

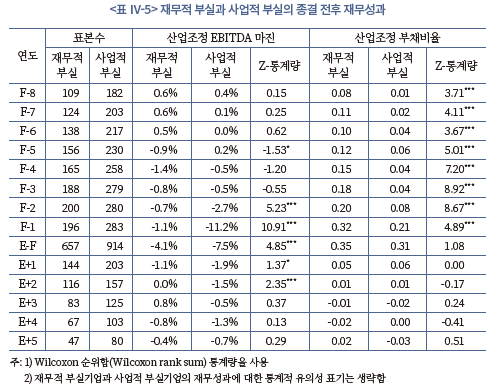

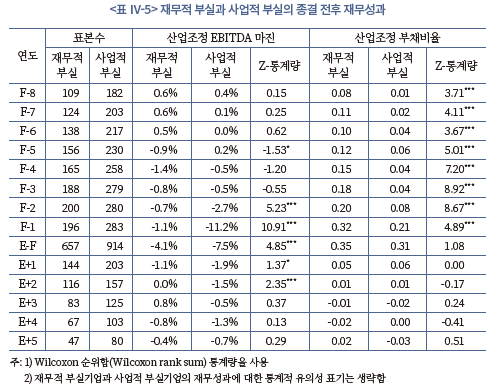

한편 부실유형에 따른 종결 이후의 재무성과를 재무적 부실과 사업적 부실로 나누어 살펴보고 이어서 한계기업과 비한계기업의 경우를 살펴본다. <표 Ⅳ-5>는 재무적 부실기업과 사업적 부실기업의 종결 후 재무성과를 산업조정 부채비율과 산업조정 EBITDA 마진으로 나누어 나타낸 표이다. 먼저 산업조정 부채비율을 살펴보면 재무적 부실기업은 기업회생 신청 직전년도까지 산업조정 부채비율이 사업적 부실기업보다 1% 수준에서 통계적으로 유의하게 높았으나 종결 이후 산업조정 부채비율의 절대치가 감소하며 사업적 부실기업의 산업조정 부채비율과 통계적으로 유의한 차이가 나타나지 않게 되었다. 물론 사업적 부실기업도 신청 직전년도에 산업조정 부채비율이 크게 증가하였으나 기업회생 기간 동안의 채무조정으로 종결 직후 재무적 부실기업과 유사한 수준으로 산업조정 부채비율이 하락한 모습을 확인할 수 있다. 종합하면 사업적 부실기업은 기업회생 신청 전 재무적 부실기업 대비 수익성이 좋은 기업이었으나 기업회생 신청 2년 전부터 수익성의 급격한 악화가 발생하였으며 종결 후 2년까지는 재무적 부실기업의 수익성에 미치지 못하고 있다. 반면 재무적 부실기업은 기업회생 신청 전에는 산업조정 부채비율이 사업적 부실기업보다 높았으나 종결 이후 사업적 부실기업과의 유의한 차이는 없었다.

반면 사업적 부실기업의 산업조정 EBITDA 마진은 사업적 부실기업의 정의가 의미하는 바와 같이 기업회생 신청 2년 전부터 급격히 하락하여 신청 직전년도에 –11.2%로 급감한 이후 종결 후에는 점진적으로 산업조정 EBITDA 마진이 증가하기 시작하여 종결 후 5년차 연도에 –0.7%로 증가하였다. 반면 재무적 부실기업은 기업회생 신청 전 사업적 부실기업만큼 산업조정 EBITDA 마진의 악화는 없었으며 신청 직전년도에 –1.1%를 기록한 이후 등락을 거쳐 종결 후 5년차 연도에 –0.4%를 기록하고 있다. 산업조정 EBITDA 마진의 경우에는 재무적 부실기업과 사업적 부실기업 간의 차이가 기업회생 신청 2년 전부터 종결 후 2년차 연도까지 통계적으로 유의한 것으로 나타났다. 산업조정 부채비율에서와 마찬가지로 부실유형 간 산업조정 EBITDA 차이의 소멸과 산업 중간 재무성과로의 수렴은 적어도 부실유형으로서 사업적 부실과 재무적 부실에 대하여는 채무조정이라는 기업회생의 본원적 기능과 회생 역량이 발휘되고 것으로 해석될 수 있다.

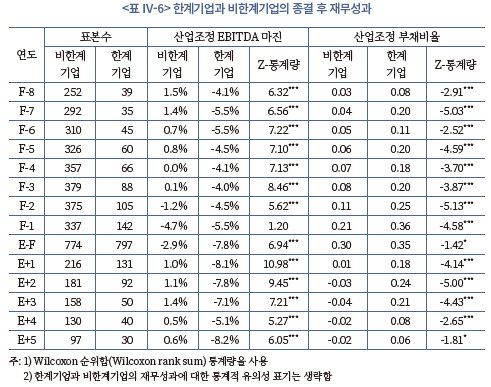

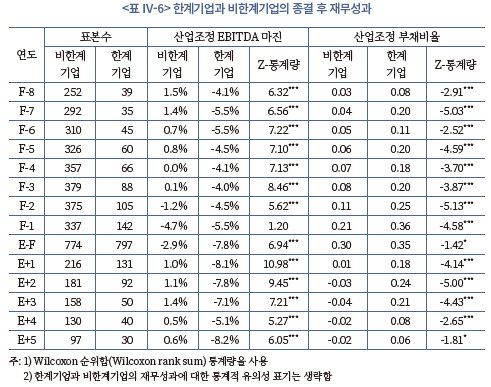

다음으로 종결기업을 부실유형으로서 한계기업과 비한계기업으로 나누어 종결 후 재무성과를 비교해 본다. 이 때 한계기업과 비한계기업으로 구분하는 기준은 기업회생 신청 직전년도의 한계기업 여부이다. <표 Ⅳ-6>은 한계기업과 비한계기업의 종결 후 재무성과를 비교한 표이다. 먼저 산업조정 EBITDA 마진을 살펴보면 한계기업은 기업회생 신청 8년 전부터 종결 후 5년차 연도까지 산업조정 EBITDA 마진이 비한계기업보다 대폭 낮았으며 이러한 차이는 기업회생 신청 직전년도를 제외하고는 1% 수준에서 통계적으로 유의하다. 비한계기업의 산업조정 EBITDA 마진은 기업회생 신청 2년전 –1.2%, 직전년도 -4.7%로 하락하다가 종결 1년 후 1.0%로 개선되기 시작하는 반면, 한계기업은 기업회생 신청 전 2년간은 각각 –4.5%, -5.5%였으나 종결 후 1년차 연도에는 –8.1%로 악화되고 있다. 한계기업의 비한계기업 간 수익성 차이는 기업회생 신청 전 뿐만 아니라 종결 이후 최소 5년간 지속되고 있다. 한편 한계기업의 산업조정 부채비율은 종결 후 4년 이후부터 대폭 개선되고 있으나 종결 후 5년 동안 비한계기업 대비 높은 산업조정 부채비율을 나타내고 있으며 이러한 차이는 기업회생 기간과 종결 후 5년차 연도를 제외하고는 1% 수준에서 통계적으로 유의하다. 한계기업이 기업회생 절차 종결 후 산업조정 부채비율의 개선이 나타남에도 불구하고 산업조정 EBITDA로 대표되는 수익성의 개선이 이루어지지 못하는 것은 기업회생이 적어도 한계기업과 같은 부실기업의 회생 지원 역량에 한계가 있음을 시사한다.

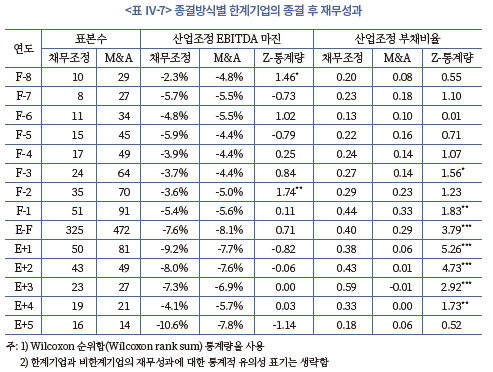

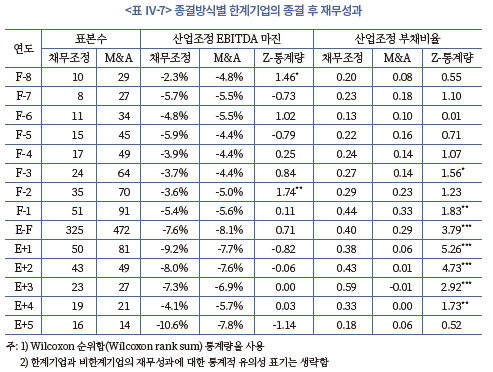

한편 한계기업이 비한계기업과 비교하여 종결 후 재무성과의 개선이 이루어지지 않는 결과가 특정 종결방식에 기인하는 현상인지 확인할 필요가 있다. 한계기업은 기업의 내재가치가 훼손된 기업으로서 차별화된 경영전략을 가진 매수자의 M&A 이후 재무성과의 변화가 있을 수 있기 때문이다. <표 IV-7>에 의하면 한계기업의 산업조정 EBITDA는 종결 후 5년간 M&A를 통한 종결이 채무조정을 통한 종결보다 대체적으로 높지만 통계적인 유의성은 없었다. 반면 산업조정 부채비율은 M&A를 통한 종결이 채무조정을 통한 종결보다 통계적으로 유의하게 높은 것으로 나타났다. 이는 기업회생 관련 M&A는 대부분 유상증자를 통한 재무구조 개선이 이루어지기 때문이다.

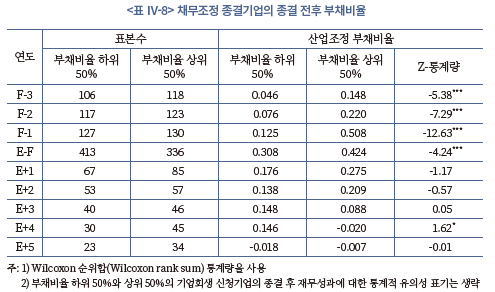

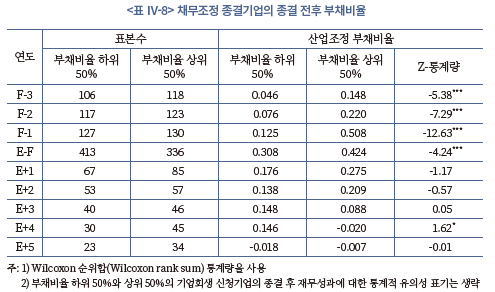

3. 채무조정 종결기업의 부채비율 변화

기업회생의 주목적은 이해관계자의 채권‧채무 조정을 통한 기업 재건이므로 채무조정을 통한 종결기업의 경우에는 기업회생의 효율성을 평가하기 위하여 회생 절차 중 적정한 채무조정이 이루어지는가를 살펴볼 필요가 있다. 채무조정이 효율적으로 이루어지기 위해서는 부채비율 감소폭이 적정해야 하며 기업회생 신청 전 산업조정 부채비율과 관계없이 종결 후 산업조정 부채비율이 유사한 수준으로 수렴해야 한다. 이를 위해 채무조정을 통한 종결기업 중 기업회생 신청 전 산업조정 부채비율을 기준으로 신청기업을 상위 50% 기업과 하위 50% 기업으로 나누고 이들의 종결 후 산업조정 부채비율을 살펴본다. <표 Ⅳ-8>은 그 결과를 나타낸 표이다.

<표 Ⅳ-8>에 의하면 산업조정 부채비율이 신청 전 부채비율과 상관없이 종결 후 5년차에 소폭 음(-)으로 나타나 산업 중간 수준의 부채비율로 감소되었다. 또한 산업조정 부채비율 하위 50%의 기업회생 신청 전 3년간의 산업조정 부채비율은 각각 4.6%, 7.6%, 12.5%인 반면 동기간 산업조정 부채비율 상위 50%는 14.8%, 22.0%, 50.8%로서 이들 간의 차이는 3개년 모두 1% 수준에서 통계적으로 유의하다. 그러나 기업회생 종결 후에는 산업조정 부채비율 하위 50%와 상위 50%간 차이가 감소하고 있으며 차이는 통계적으로 유의하지 않다. 오히려 종결 후 3년차 및 4년차 연도의 경우에는 두 기업군의 산업조정 부채비율이 역전되는 모습까지 나타나고 있다. 이러한 결과는 기업회생 절차 중인 기업(이하 회생기업)의 체질 개선 여부와는 독립적으로 기업회생이 채무조정을 통한 기업 재건이라는 본연의 역할을 충실히 수행하고 있음을 시사한다.

4. 부실유형과 종결방식의 관계

기업회생의 효율성 분석을 위한 네 번째 기준으로 부실유형에 대하여 기업회생이 어떠한 종결방식으로 종결되느냐를 분석한다. 사업적 부실기업이나 한계기업은 기업의 내재가치가 훼손된 기업으로서 기존 경영자를 통해서는 자산을 수익성 있게 활용하기 어려운 기업이므로 소유권의 이전, 즉 M&A를 통한 자산재배분(asset redeployment)이 필요한 기업이라고 할 수 있다. 이러한 관점에서 부실유형과 종결방식의 관계는 기업회생의 효율성을 가늠할 수 있는 중요한 지표의 하나라고 할 수 있다. 본 절에서는 먼저 부실유형에 따라 기업회생 신청기업을 재무적 부실과 사업적 부실, 그리고 한계기업과 비한계기업으로 각각 분류하고 이러한 부실유형과 M&A를 통한 종결의 관계를 살펴본다. 이어서 부실유형을 세분화하여 부실기업을 비한계기업-재무적 부실기업, 비한계기업-사업적 부실기업, 한계기업-재무적 부실기업, 한계기업-사업적 부실기업의 쌍으로 구분하고 세분화된 부실유형과 M&A를 통한 종결과의 관계를 살펴본다.

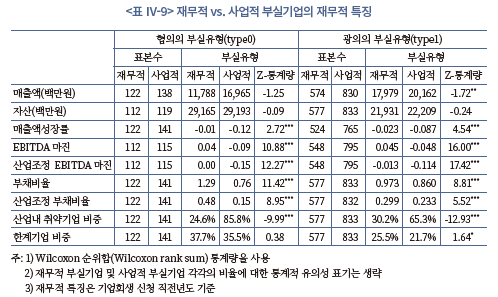

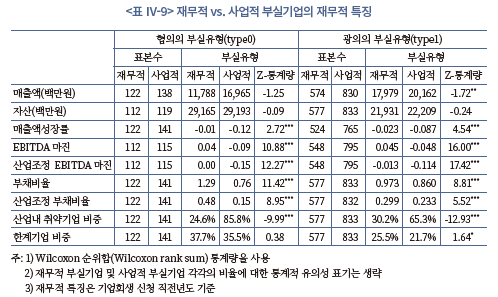

먼저 부실유형을 재무적 부실과 사업적 부실로 나눈 분석 결과를 살펴본다. <표 Ⅳ-9>는 Ⅲ장에서 정의된 협의와 광의의 부실유형에 따라 사업적 부실과 재무적 부실을 구분하고 이들의 재무적 특징을 나타낸 표이다. 협의의 부실유형(type0)의 경우 재무적 부실기업은 사업적 부실기업 대비 매출액과 자산이 작았지만 차이의 통계적 유의성은 없다. 반면 재무적 부실기업의 매출액증가율, EBITDA 마진, 산업조정 EBITDA 마진, 부채비율, 산업조정 부채비율은 모두 사업적 부실기업보다 1% 수준에서 통계적으로 유의한 수준으로 높았다. 또한 재무적 부실기업의 산업 내 취약기업 비중은 24.6%인 반면 사업적 부실기업은 85.8%로 나타나 그 차이는 1% 수준에서 통계적으로 유의하였다. 한편 광의의 부실유형(type1)의 경우 재무적 부실기업과 사업적 부실기업 간 재무지표의 차이는 협의의 부실유형보다 작았으나 표본 수의 증가에 따라 통계적 유의성은 강화되었다. 마지막으로 한계기업과 비한계기업은 사업적 부실기업과 재무적 부실기업에 고루 존재하고 있다. 협의의 부실유형 기준으로 분류한 재무적 부실기업과 사업적 부실기업 중 한계기업 비중은 각각 37.7%, 35.5%이며 광의의 부실유형 기준으로는 각각 25.5%, 21.7%이다. 다시 말해 부실유형으로서 한계기업-비한계기업 간 구분은 재무적-사업적 부실유형과 독립적인 부실유형이라고 할 수 있다.

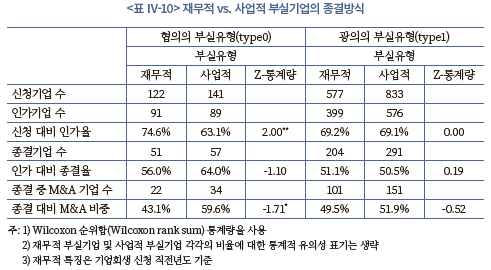

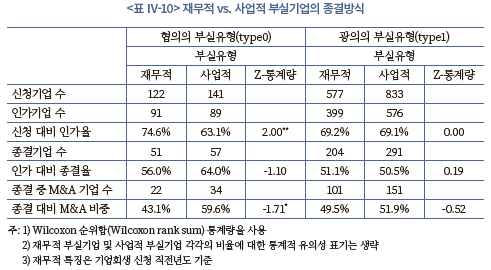

<표 Ⅳ-10>은 재무적 부실기업과 사업적 부실기업의 기업회생 인가율, 종결율과 종결 중 M&A를 통한 종결의 비중을 나타낸 표이다. 협의의 부실유형의 경우 재무적 부실기업의 신청 대비 인가율은 74.6%로 사업적 부실기업의 63.1%보다 5% 수준에서 유의하게 높지만 인가 대비 종결율은 56.0%로 사업적 부실기업 64.0%보다 낮았으나 통계적으로 유의하지는 않았다. 종결 대비 M&A 비중은 재무적 부실기업이 43.1%, 사업적 부실기업이 59.6%로 나타나 10% 수준에서 통계적으로 유의하게 사업적 부실기업이 M&A에 의해 종결되는 비중이 높은 것으로 나타났다. 한편 광의의 부실유형에서는 재무적 부실기업과 사업적 부실기업 간 인가율, 종결율과 종결 대비 M&A 비중이 유사하게 나타났으며 차이의 통계적 유의성은 없었다.

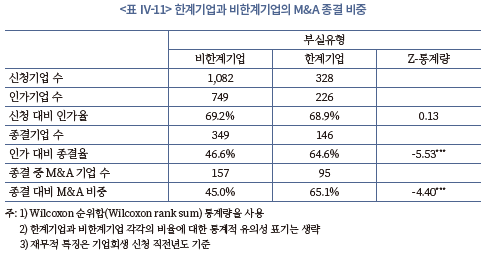

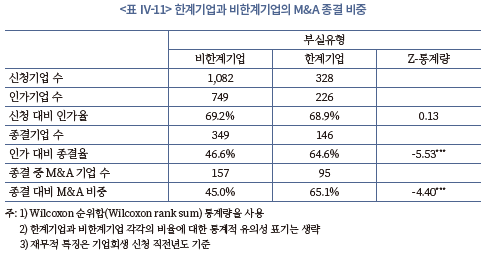

한편 <표 Ⅳ-11>에 따르면 부실유형으로서 한계기업과 비한계기업의 인가율은 각각 68.9%, 69.2%로서 통계적으로 유의한 차이가 없는 반면 한계기업과 비한계기업의 종결율은 각각 64.6%, 46.6%로서 한계기업이 1% 수준에서 통계적으로 유의하게 높다. 또한 한계기업과 비한계기업의 종결 대비 M&A 비중은 각각 65.1%, 45.0%로서 한계기업이 1% 수준에서 통계적으로 유의하게 높다. 즉 기업회생은 M&A를 통해 한계기업을 처리하는 비중이 높아 자산재배분의 역할에 충실함을 알 수 있다. 한계기업이 예상과 달리 종결율이 높은 것은 한계기업의 종결방식으로 M&A 비중이 높은 것이 원인이라고 할 수 있다. <표 Ⅳ-10>과 <표 Ⅳ-11>의 결과를 종합하면, 기업회생은 부실유형 구분 방식과는 관계없이 기업의 내재가치가 훼손된 부실기업의 자산재배분의 역할을 수행하고 있음을 시사한다.

마지막으로 한계기업과 비한계기업, 그리고 광의의 재무적 부실과 사업적 부실 여부에 따른 구분을 바탕으로 부실유형을 세분화하고 이들 세분화된 부실유형과 M&A를 통한 종결과의 관계를 살펴본다. 구체적으로 부실기업을 비한계기업-재무적 부실기업, 비한계기업-사업적 부실기업, 한계기업-재무적 부실기업, 한계기업-사업적 부실기업의 쌍으로 구분하여 앞서의 분석을 수행한다.

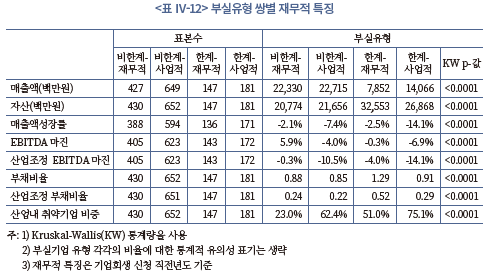

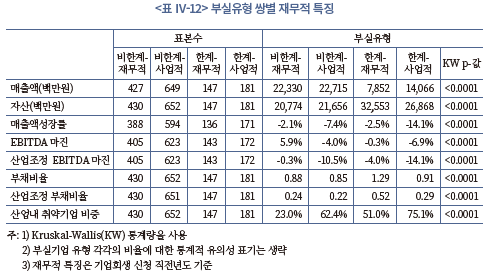

<표 Ⅳ-12>는 세분화된 부실유형의 재무적 특징을 나타낸 표이다. 전체적으로 네 가지 부실유형은 재무적 특징에서 뚜렷한 차이를 나타내고 있다. 먼저 매출액은 비한계기업이 상대적으로 큰 반면 자산은 한계기업이 큰 것으로 나타났다. 이는 한계기업, 특히 한계기업-재무적 부실기업이 자산을 효율적으로 사용하고 있지 못함을 나타낸다. 기업 내재가치의 훼손이 만성적인 한계기업-사업적 부실기업은 부실유형 중 가장 낮은 매출액증가율(–14.1%), EBITDA 마진(–6.9%) 및 산업조정 EBITDA 마진(-14.1%)을 나타내고 있으며 산업 내 취약기업 비중도 75.1%를 차지하고 있다. 한편 부채비율과 산업조정 부채비율은 한계기업-재무적 부실기업이 각각 1.29, 0.52로 가장 높다.29)

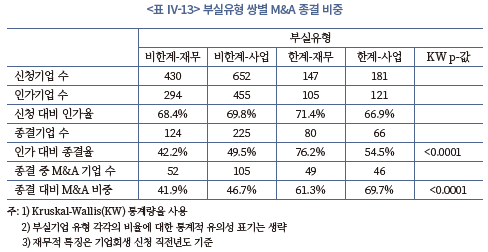

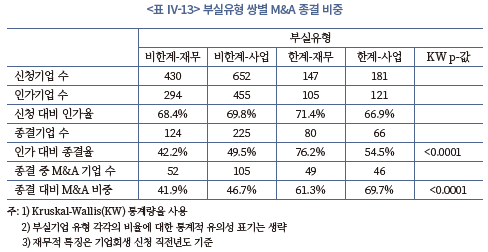

<표 Ⅳ-13>은 상세 부실기업 유형에 따른 인가율, 종결율 및 종결 대비 M&A 비중을 살펴본 표이다. 먼저 인가율은 상세 부실기업 유형 간 특별한 차이가 없는 것으로 나타났다. 종결율의 경우 비한계기업-재무적 부실기업은 42.2%, 비한계기업-사업적 부실기업은 49.5%로 나타난 반면, 한계기업-재무적 부실기업은 76.2%, 한계기업-사업적 부실기업은 54.5%로서 한계기업 관련 세부 부실유형의 종결율이 높다. 특히 한계기업-재무적 부실기업의 종결율이 가장 높아 한계기업이라 하더라도 재무적 부실기업이면 기업회생 절차가 종결될 가능성이 높은 것을 알 수 있다. 마지막으로 종결 대비 M&A 비중은 비한계기업-재무적 부실기업의 41.9%, 비한계기업-사업적 부실기업의 46.7%와 비교하여 한계기업-재무적 부실기업 61.3%, 한계기업-사업적 부실기업 69.7%로 나타나 한계기업 관련 부실기업이 M&A를 통해 종결되는 경우가 많은 것으로 나타났다. 한계기업 부실유형의 종결율이 높은 것은 앞서와 마찬가지 이유로 이들 기업이 M&A를 통해 종결하는 경우가 많기 때문으로 풀이된다.

종합하면 재무적 부실 또는 사업적 부실과 한계기업 여부로 부실기업 유형을 상세 분류할 경우 한계기업과 관련된 한계기업-재무적 부실기업 과 한계기업-사업적 부실기업의 종결 대비 M&A 비중이 높아 기업회생이 자산재배분 기능을 수행하고 있다고 평가할 수 있다. 특히 만성적 저수익성이 가장 심한 한계기업-사업적 부실기업은 낮은 종결율에도 불구하고 M&A 종결 비중이 가장 높아 기업회생이 자산재배분 기능을 수행하는 것으로 분석된다. 이러한 결과는 사업적 부실기업이나 한계기업, 나아가서 한계기업-사업적 부실기업이 M&A를 통한 자산재배분이 필요하다는 가설을 지지하는 결과이다.

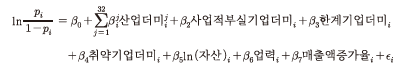

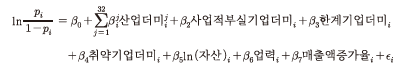

지금까지는 부실유형과 M&A를 통한 종결과의 관계를 분석하기 위해 단변량(univariate) 분석을 수행하였다. 이하에서는 M&A를 통한 종결 여부를 종속변수로, 부실유형과 기타 M&A를 통한 종결 여부에 영향을 미칠 수 있는 변수들을 독립변수로 하는 다변량(multivariate) 로짓 회귀분석을 수행한다. pi를 기업 i가 M&A를 통해 종결될 확률이라고 하면 다음과 같은 로짓 회귀식을 설정할 수 있다.

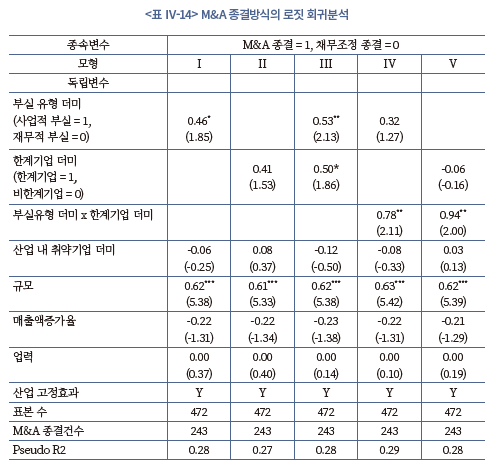

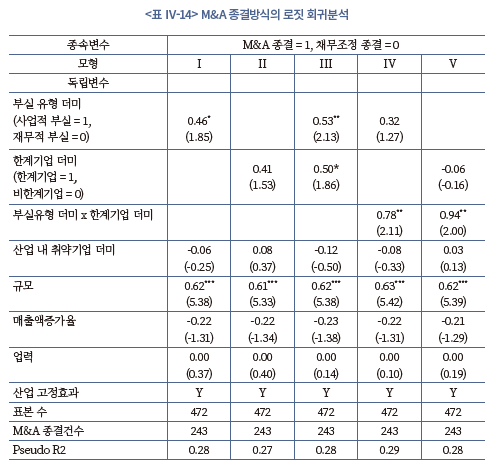

독립변수로는 사업적 부실기업 더미, 한계기업 더미, 산업 내 취약기업 더미, 규모, 업력, 매출액증가율을 사용하며 33개 산업에 대한 산업고정효과(industry fixed effect)를 통제하였다. 표본 수는 총 472개이며 이 중 M&A를 통한 종결 건수는 243개이다. <표 Ⅳ-14>는 회귀분석 결과를 나타낸 표이다.

모형 Ⅰ은 사업적 부실더미와 통제변수만을 독립변수로 하는 회귀식으로 사업적 부실더미가 10%에서 유의한 수준으로 양(+)의 계수 값을 갖는 것으로 나타나 단변량 분석에서의 결과를 지지하고 있다. 모형 Ⅱ는 한계기업 더미와 통제변수만을 독립변수로 하는 회귀식으로서 한계기업 더미가 모형 Ⅰ에서와 같은 유사한 크기의 양(+)의 값을 가지나 통계적 유의성을 확보하지 못하였다. 그러나 모형 Ⅲ에서 사업적 부실더미와 한계기업 더미를 동시에 사용한 결과 부실기업을 포착하는 각 더미의 독립적 특징으로 인하여 사업적 부실기업 더미는 5% 수준에서 유의한 0.53의 양(+)의 값을, 한계기업 더미는 10% 수준에서 유의한 0.50의 양(+)의 계수를 갖는 것으로 분석되었다. 모형 Ⅳ는 사업적 부실기업 더미에 사업적 부실기업 더미와 한계기업 더미의 상호작용(interaction) 더미를 추가한 모형으로서 사업적 부실기업 더미의 설명력이 없어지는 반면 상호작용 더미의 계수는 5% 수준에서 유의한 0.78로 나타나 실질적으로 사업적 부실기업 가운데 한계기업이 M&A를 통한 종결에 유의한 영향을 미치고 있음을 알 수 있다. 이러한 결과는 모형 Ⅴ에서 한계기업 더미에 대하여도 나타나고 있다. 모형 Ⅴ는 한계기업 더미에 사업적 부실기업 더미와 한계기업 더미의 상호작용 더미를 추가한 모형으로서 한계기업 더미가 음(-)으로 전환되고 설명력이 없어지는 반면 상호작용 더미의 계수는 5% 수준에서 유의한 0.94로서 실질적으로 한계기업 가운데 사업적 부실기업이 M&A를 통한 종결에 유의한 영향을 미치고 있음을 알 수 있다. 따라서 한계기업-사업적 부실기업의 종결방식이 M&A를 통한 자산재배분에 중요한 함의가 있음을 살펴볼 수 있다. 회귀분석 결과는 단변량 분석의 결과와 마찬가지로 한계기업과 사업적 부실기업에 대하여 종결방식 중 M&A가 활용되는 비중이 높아 기업회생의 자산재배분 역할과 정합적인 결과라고 할 수 있다.

Ⅴ. 결론 및 시사점

본 보고서의 분석결과는 국내 기업회생 제도가 채무조정을 통한 기업 재건이라는 기업회생의 목적에 비교적 충실한 역할을 수행하고 있으며 효율적 제도 운영을 위한 노력이 이루어지고 있음을 시사한다. 구체적으로 기업회생 신청기업, 종결 전후의 재무성과, 부실유형과 종결방식의 관계에 대한 다음과 같은 실증분석 결과가 도출되었다.

첫째, 기업회생은 회생 가능성이 낮은 부실기업의 기업회생 절차 유입을 차단하는 역할을 하고 있다. 둘째, 기업회생 종결기업의 종결 후 수익성이나 성장성 회복은 종결 후 5년 내에 이루어지지 못하고 있어 기업회생이 진정한 회생(turnaround)을 이끌어내는 기업재건 역량 측면에서는 다소 미흡한 것으로 나타나고 있다. 이와 관련하여 M&A를 통한 종결은 종결기업의 성장성 회복 측면에서 채무조정을 통한 종결보다 우수하지만 수익성 측면에서는 채무조정을 통한 종결과 차이가 나타나지 않았다. 또한 사업적 부실기업의 경우 채무조정의 개선이 이루어진 반면 재무적 부실기업과 마찬가지로 수익성 회복은 지연되었으며 한계기업은 회생절차 종결 후에도 재무성과의 회복을 기대하기 어려워 기업회생은 한계기업의 구조조정에는 효과가 제한적인 것으로 분석되었다. 셋째, 채무조정을 통한 종결에서의 채무조정은 효율적으로 이루어지는 것으로 평가되었다. 이는 이해관계자의 채권‧채무 조정을 통한 기업재건이 기본적인 목적인 기업회생이 본질적인 역할에 충실함을 의미한다. 넷째, 기업회생은 자산재배분의 역할을 수행하는 것으로 분석되었다. 한계기업, 사업적 부실기업, 그리고 한계기업-사업적 부실기업은 모두 M&A를 통한 종결 비중이 타 부실유형보다 높은 것으로 나타나며 이는 기업구조조정 수단으로써 기업회생의 기본적 유용성을 시사한다.

이러한 기업회생의 효율성과 그간의 성과에도 불구하고 본문의 분석에서 나타나듯이 종결기업의 재무성과 회복이 지연되는 것은 선별 과정을 거친 기업의 구조조정을 통한 진정한 회생이라는 측면에서는 다소 아쉬운 결과라고 할 수 있다. 그리고 이러한 결과는 본질적으로 법적 절차인 기업회생에서 파생되는 측면도 있을 것이다. 따라서 향후 국내 기업회생의 효율성이 제고되기 위해서는 기업회생 인가, 인가 후 회생계획안 수행, 종결 등 단계별 개선방향과 같은 미시적 관행 개선과 더불어 M&A 시장 발전과 DIP금융 활성화 등 자본시장을 포함한 중장기적‧거시적 금융환경의 개선이 필요하다. 이와 관련된 시사점과 향후 정책 방향은 다음과 같다.

첫째, 본문의 분석에서 살펴본 바와 같이 만성적 부실기업인 한계기업은 기업회생을 통한 재건이 현실적으로 어렵다. 한계기업은 내재가치의 심한 훼손으로 자산을 효율적으로 활용하지 못하는 기업이다. 따라서 한계기업은 기업회생 신청 전 부실 단계에서 M&A를 통한 사전적 구조조정을 유도하거나 기업회생 신청 시 M&A를 전제로 한 회생계획안의 경우에만 인가를 허용하는 등 엄격한 인가 기준을 적용하거나 청산을 유도할 필요가 있다.

둘째, 기업회생 절차가 진행 중인 기업의 가치제고 또는 구조조정을 독려할 수 있는 인센티브가 필요하다. 기업회생의 종결방식과 관계없이 대부분의 기업회생 종결기업은 수익성 회복이 가장 극복하기 어려운 과제이다. 기업회생 절차 소요기간이 짧은 상황에서 기업의 실질적인 체질 개선을 위한 기업회생 운영 상의 기제가 필요하다. 이는 크게 기존경영자관리인의 인센티브 강화와 채권자 권리 강화의 방향으로 개선할 수 있다. 먼저 기존경영자관리인과 관련하여 기업회생은 감자와 출자전환에 의해 지분율이 대폭 축소된 기존경영자관리인이 경영을 지속하게 되므로 종결 이후 기업 정상화에 대한 기존경영자관리인의 인센티브가 약할 수 있다.30) 따라서 기존경영자관리인이 기업회생 종결 전후에 출자전환 지분을 인수할 수 있는 옵션 등을 도입할 필요가 있다.31) 한편 채권자를 통한 구조조정 효율화는 구조조정전문임원(Chief Restructuring Officer: CRO)이나 DIP금융 공급자를 통해 이루어질 수 있다. 그러나 현재 국내 CRO는 미국과 달리 기업회생 절차 중 구조조정을 실질적으로 주도하는 적극적 역할을 수행하지 못하고 있다.32) 또한 미국의 경우 DIP금융 채권자, 특히 자본시장 투자자는 DIP금융 공급자의 권리 강화를 통해 회생기업의 구조조정 노력을 견인하고 있으나 국내 DIP금융 채권자는 제한된 범위의 권리만을 가지고 있다.33)

셋째, 채무조정을 통한 종결기업의 경우 의미 있는 기업재건이 완성되기 위해서는 회생절차 종결 이후 수익성과 성장성을 회복하게 되는 시점까지 자금조달이 필요하다. 기업회생의 종결은 회생채무의 변제 가능성에 초점을 맞추고 있으므로 사업의 정상화까지 필요한 운영자금 및 시설자금에 대한 고려는 충분하지 않은 것이 일반적이다. 이러한 이유로 채무조정을 통한 종결기업의 경우 수익성 및 성장성 회복이 지연되는 경우가 많다. 회생절차 종결기업의 기업재건은 많은 경우 고객확보와 수주확대를 통해 이루어지는데 이들 기업은 기업회생 신청기업이라는 낙인효과로 인해 현금거래를 강요받거나 각종 보증금 등 다양한 운영자금이 필요하다. 문제는 기업회생 종결기업의 경우 종결 후 일정 기간(예를 들어, 3년)이 경과하기 전까지 민간은행 여신을 조달할 수 없는 것이 현실이다. 이에 대응하고자 현재 일부 국내 정책금융기관을 중심으로 정책성 여신이 공급되고 있으나 이러한 종결기업에 대한 체계적‧선별적 자금지원 체계를 구축할 필요가 있으며 중장기적으로는 정책성 여신을 대체할 민간자금의 공급 확대를 위한 인센티브 부여 등 다양한 정책이 필요하다.

넷째, 다양한 유형의 자본시장 투자자의 존재는 기업회생이 효율적으로 이루어질 수 있는 중요한 환경요인이다. 재무적 투자자는 기업회생 절차의 선별기능과 기업재건, 그리고 전략적 투자자에 의한 회생기업 인수 시점까지 가교 역할을 수행하여 M&A를 통한 자산재배분이 효율적으로 이루어지는 기업회생 생태계의 구축에 큰 기여를 한다. 다수의 연구에서 분석된 바 1990년대 이후 미국 Chapter 11의 효율성 개선은 미국 자본시장에서의 M&A 확대와 밀접한 관련이 있었음을 유념할 필요가 있다. 국내에서도 2017년 이후 기업재무안정 PEF 등 사모펀드 중심 재무적 투자자의 회생기업 인수가 증가하고 있는데 향후 회생기업 M&A를 위한 수요기반의 추가적인 확대가 필요하다.

1) 기업구조조정이 자원 배분의 효율성 제고를 통하여 총생산성을 높이는 효과가 있음을 연구한 대표적인 연구로는 Hsieh & Klenow(2009)와 McGowan et al.(2018)이 있다. Hsieh & Klenow(2009)는 자원 재배분을 통하여 최선의 배분 효율성이 달성되었을 경우 추가적으로 달성할 수 있는 총생산성을 추정하였으며 McGowan et al.(2018)은 혼잡효과(congestion effect) 분석을 통해 한계기업의 구조조정이 비한계기업과 경제 전반의 생산성에 미치는 부정적인 영향을 실증 분석하였다. 한편 국내 연구로 박용린 외(2021)는 혼잡효과 분석을 통해 한계기업 비중의 증가가 국내 기업부문 전반의 고용과 설비투자 위축, 그리고 일반기업의 부가가치와 경제 총생산성을 저하시키는 것을 보고하고 있다.

2) 법원을 통한 기업구조조정 방식을 지칭하는 용어로 법정관리(court receivership)라는 용어가 일반적으로 사용되는 계기가 된 법률이다.

3) 도산 3법(파산법, 화의법, 회사정리법)은 모두 1962년 제정되었으나 각 법률마다 적용 대상이 다르고, 기업의 경우 회사정리 절차와 화의 절차로 이원화되어 있어서 효율성이 떨어지는 문제가 있었다. 예를 들어, 회사정리법 하의 법정관리 제도에서는 기존 경영자의 경영권 상실로 인해 기업들이 회사정리 절차보다 채무자가 관리 처분권을 잃지 않고 사업을 계속할 수 있는 화의 절차를 선호하는 경향이 나타났다(전대규, 2018).

4) 이러한 이유로 채무자회생법이 통합도산법으로 불리기도 한다. 통합도산법은 기업 외에도 개인 채무자의 회생과 파산 등 도산 절차의 전반을 포괄하고 있다.

5) 포괄적 금지명령은 회생절차 개시신청이 있는 경우 개시결정이 있을 때까지 법원이 모든 회생채권자 및 회생담보권자에 대하여 강제집행, 가압류, 가처분 또는 담보권 실행을 위한 경매절차의 금지를 명할 수 있도록 하는 것이다(전대규, 2018). Chapter 11 상 automatic stay에 해당한다.

6) 채무자 뿐만 아니라 회생채권‧회생담보권 목록에 기재되어 있거나 신고한 회생채권자‧회생담보권자‧주주‧지분권자도 회생계획안을 제출할 수 있다(제221조 2항).

7) 한편, 채무자 부채의 2분의 1이상에 해당하는 채권을 가진 채권자 또는 이러한 채권자의 동의를 얻은 채무자는 회생절차 개시의 신청이 있은 때부터 회생절차 개시 전까지 회생계획안을 작성하여 법원에 제출할 수 있는데(제223조), 이를 이른바 사전계획안(P-Plan)이라 부른다.

8) 그러나 만약 동의를 얻지 못하는 조가 있을 경우에도 법원은 권리보호 조항을 정하고 회생인가 결정을 내릴 수 있다(제244조). 즉, 강제인가(cram-down) 권리를 가지고 있다.

9) 오수근(2015)의 경우에도 기업회생 신청기업 표본 구축 후 절차 진행 상의 특징을 분석하고 있으나 회생 절차의 경제적 분석은 이루어지고 있지 않다.

10) 절대우선의 원칙(Absolute Priority: AP)은 선순위 권리자(예를 들어, 채권자)가 그 권리의 완전한 만족을 얻기 전에는 후순위 권리자(예를 들어, 주주)가 전혀 변제받을 수 없음을 의미한다.

11) Chatterjee et al.(1996)은 채권자간 조정 가능성이 낮을수록, 수익성과 부채비율 등 재무성과가 나쁠수록, 채무구조가 단순하고 기업규모가 작을수록 워크아웃보다 Chapter 11을 선택할 가능성이 높음을, John et al.(2013)은 자산 유동성이 낮고 부실의 간접비용이 클수록, 지분의 옵션가치가 높을수록 기업은 Chapter 11을 선택할 가능성이 높음을 보고하고 있으며 워크아웃을 선택하는 기업의 계속기업가치가 Chapter 11을 선택하는 기업보다 높음을 실증하고 있다. 또한 Yost(2002)는 M/B(Market-to-Book)가 낮은 산업 소속 기업일수록, 자산수익성이 낮을수록, 단기채무의 채권자 수가 적을수록, 자산 대비 장기부채 비율이 낮을수록 워크아웃 대신 Chapter 11을 선택하는 경향이 높음을 보고하고 있다.

12) 분위수 합산수 그룹별 표본 수, 산업조정 EBITDA와 산업조정 부채비율의 최대값, 최소값 및 평균은 <표 부록-1>을 참조하기 바란다.

13) 신청부터 인가 및 종결까지 소요되는 시간을 감안하여 최근년도를 제외하고 2006년부터 2018년까지의 자료를 사용하였다. 2006~2020년간 전체 외감기업 표본의 평균은 크게 다르지 않으며 기업회생 인가율은 평균 70.7%, 종결율은 평균 49.9%이고 종결방식 중 M&A의 비중은 평균 49.0%이다.

14) 대법원이 발간하는 사법연감에는 연도별 기업회생 신청 건수와 인가 및 종결 건수가 기재되어 있으나 이는 당해연도 신청 건수 전체와 인가 건수 전체를 합산한 수치로 본 연구보고서에서 분석하는 인가율과 종결율과는 차이가 있다.

15) 2019년과 2020년 기업회생 신청기업의 경우 종결까지의 절차 소요기간 산정에 편의성이 발생할 수 있어 제외하였다.

16) 연구문헌에 의하면 1985~1994년간 미국 Chapter 11의 신청부터 종결까지 절차 소요기간은 평균 22.0개월이며(Denis & Rodgers, 2007), 2000~2005년간 절차 소요기간은 16.2개월(Bharath et al., 2010)이다.

17) 채무자회생법은 회생계획에 따른 변제가 시작되면 법원은 관리인 또는 목록에 기재되어 있거나 신고한 회생채권자 또는 회생담보권자의 신청에 의하거나 직권으로 회생절차 종결의 결정을 한다고 명시하고 있다(제283조). 2017년 설립되어 서울과 수도권의 기업회생 사건을 전담하는 서울회생법원은 이러한 추세를 가속화하고 있다. 서울회생법원은 회생계획안에 따른 인가 결정 후 변제가 시작되고 회생계획 수행에 지장이 있다고 인정되는 경우가 아닌 경우 조기종결을 원칙으로 하고 있다.

18) 기업회생 신청년도와 종결년도의 표기와 관련하여 기업회생 신청년도를 F(File)로, 기업회생 종결년도를 E(Exit)로 나타낸다. 따라서 F-1은 기업회생 신청 직전년도이며 E-F는 기업회생 신청년도부터 종결년도까지의 기업회생

절차 중의 기간이라고 할 수 있다. 이하의 본문에서는 이러한 표기법을 준용한다.

19) 본 보고서의 분석, 특히 기업회생 종결 후의 재무성과 분석은 II장 3절 연구질문에서 논의한 바와 같이 기업회생 신청기업의 특성에 따른 구조조정 방식의 선택, 즉 사전적인(ex ante) 자가선택(self-selection)의 효과와 기업회생 절차의 사후적(ex post) 효과가 혼재하고 있음을 유념할 필요가 있다.

20) 물론 회생 가능한 기업과 회생 가능하지 않은 기업을 사전적으로 판단할 수는 없다. 다만 기업회생 인가의 경우 회생계획안에서 계속기업가치가 청산가치보다 높아야 하며 이해관계자의 표결에 의한 동의가 있어야 하므로 본 보고서의 분석은 인가기업이 사전적으로 회생가능한 기업의 대리변수임을 전제로 한다.

21) 기업회생이 회생 가능성이 낮은 기업의 기업회생 절차 유입을 차단하는 효과와 관련하여 추가적으로 한계기업의 인가율을 고려할 수 있다. 이에 관하여는 4절의 내용과 <표 IV-14>를 참조하기 바란다.

22) 비교 기업군의 재무성과는 정규성이 보장되지 않으므로 표본 분포의 위치모수(중간값) 비교를 위해 비모수(non-parametric) 검정방식인 Wilcoxon 순위합 검정(Wilcoxon rank sum) 통계량을 사용한다. Wilcoxon 순위합 검정 통계량은 독립적 이표본(two-sample) 위치모수에 대한 검정을 위해 가장 널리 사용되는 비모수 검정법이며 통계적 유의성 확인을 위해 표준정규분포로 근사된 Z-통계량을 사용한다.

23) 본 보고서의 모든 표에서 ***, **, *는 각각 1%, 5%, 10% 수준에서 유의함을 의미하며 비교 기업군 간 차이에 대한 검정통계량은 좌측-우측 기준이다.

24) 다만 이러한 국내 기업회생 종결기업의 EBITDA 마진 관련 저조한 성과는 Hotchkiss(1995)의 결과와 비교하여 양호한 수준이다. Hotchkiss(1995)에서는 종결 후 5년간(E+1부터 E+5까지) 누계 산업조정 EBITDA 마진이 –25.8%로 나타난 반면 동 기간 국내 기업회생 종결기업의 경우는 -3.4%이다.

25) <표 IV-2>에서 종결 후 5년간 분석표본 수의 감소가 관찰되며 누락 표본의 62%는 외감기업 지정 해제에 의한 감사보고서 부재로, 38%는 기업회생 종결이 비교적 최근에 이루어져 종결 후 5년간의 재무제표가 존재하지 않은 이유로 발생하였다. 따라서 외감기업 지정 해제의 원인이 기업의 부실화일 경우 종결 후 재무성과 해석에 있어 상향편의(upward bias)가 발생할 가능성이 있다.

26) 대응표본(paired sample)의 위치모수에 대한 검정 방법으로 비모수 검정방법인 Wilcoxon 부호순위(Wilcoxon signed rank) 검정을 사용한다. 통계적 유의성 확인을 위해 표준정규분포로 근사된 Z-통계량을 사용한다.

27) 국내 기업회생 종결기업의 더딘 성장성 회복과 관련된 이러한 결과는 Hotchkiss(1995)와 대비하여도 낮은 수준으로서 Hotchkiss(1995)에서는 E+2에서 E+5까지 매출과 자산의 누적성장률은 각각 21.4%, 9.7%이나 국내 기업회생의 경우 각각 12.8%, 4.1%에 불과한 것으로 분석된다.

28) 기업규모에 미치는 영향을 고려하여 M&A 중 6건의 합병 표본은 분석에서 제외하였다.

29) Kruskal-Wallis 통계량은 다중표본 간 분포의 차이를 검정하는 비모수 통계량이다.

30) 2000년대 초반부터 상당 수 미국 Chapter 11 기업의 경우 주요임직원유지플랜(Key Employment Retention Plan: KERP)과 같이 핵심 임직원에 대한 인센티브의 제공을 통하여 구조조정의 속도와 종결 가능성, 종결 시 기업가치 등을 제고하고 있다. KERP은 주요 임직원의 일정 기간 의무근속 유도를 위한 성과급 지급 방식에 따른 형평성 논란 이후 2005년에 제정된 BAPCPA 법(Bankruptcy Abuse Prevention and Consumer Protection Act of 2005)에 따라 재무성과 및 구조조정 속도와 연동된 성과급 지급 방식으로 변하였다(Goyal et al., 2015). KERP의 일부는 채권자에 의해 주도되고 있는 등 Chapter 11에서의 채권자 권리 강화와 전반적 효율성 개선과 밀접한 관련이 있다(Skeel, 2003; Bharath et al., 2010; Jiang et al., 2012).

31) 미국 ABI(American Bankruptcy Institute)는 2015년 Chapter 11 개혁안에서 중소기업의 성공적인 재건에 필수적인 기존 경영자의 구조조정 인센티브를 고양하고자 중소기업지분유지계획(SME Equity Retention Plan)을 제안한 바 있다. 이는 회생채권의 출자 전환 시 상환전환우선주(Redeemable Convertible Preferred Shares: RCPS)를 발행하도록 하여 경영자가 인가 후 3년 이내에 경영 성과를 통해 상환전환우선주를 소각하거나 경영자의 자금으로 매수할 수 있는 권리를 부여하는 방식이다(ABI, 2015; 서울회생법원, 2017).

32) 미국의 CRO를 벤치마킹한 국내 CRO는 채권자협의회를 대리하여 기존경영자관리인에 대한 적극적이고 실질적인 견제를 실행하기 위해 2011년 서울중앙지방법원에 의해 도입되었다. 그러나 회생기업 중심으로 운영되고 기업회생 신청 전부터 기업구조조정업무에 깊이 관여하는 미국 CRO와 달리 국내 CRO의 업무는 기업회생 절차 진행에 대한 감독, 자문, 검토 등의 지원 업무에 가까운 것이 현실이다(박승두 외, 2018).

33) DIP금융 채권자의 권리 강화를 통한 구조조정 촉진에 대한 상세한 사항은 박용린(2019)을 참조하기 바란다.

참고문헌

대법원, 2021,『2021 사법연감』.

박승두‧안청헌, 2018, 미국의 기업회생절차상 CRO(구조조정담당임원) 제도,『경영법률』28(3), 113-140.

박용린, 2019, 『기업회생을 위한 DIP금융의 역할 확대 방안』, 자본시장연구원 이슈보고서 19-06.

박용린‧노산하‧이상호, 2021, 『기업부문 배분효율성 제고를 위한 자본시장의 역할』, 자본시장연구원 연구총서 21-02.

박찬웅, 2004, 부도 기업 회생과정에 대한 조직론적 접근: 배열 분석기법(sequence analysis)을 중심으로,『사회발전연구』55-84.

서울회생법원, 2017, 중소기업 맞춤형 회생절차(S-Track) 심포지엄 자료집.

신동령, 2005, 부실기업의 재무적 특징과 부실예측모형에 관한 연구: 상장기업과 비상장기업의 비교를 중심으로,『회계정보연구』23(2), 137-165.

오수근, 2015, 기업회생제도(2006-2012)에 관한 실증적 연구,『상사법연구』34(1), 361-389.

장정현‧최철, 2019, 수명주기별 기업구조조정전략의 선택과 그 유효성에 관한 연구, 『금융공학연구』 18(4), 37-75.

전대규, 2018, 『채무자회생법』, 법문사.

American Bankruptcy Institute, 2015, Commission to Study the Reform of Chapter 11: 2012~2014 Final Report and Recommendations.

Baird D.G., 1993, Revisiting auctions in chapter 11, Journal of Law and Economics 36, 633-653.

Baird, D.G, Rasmussen, R.K., 2002, The end of bankruptcy, Stanford Law Review 55, 751-788.

Bharath, S.T., Panchapegesan, V., Werner, I.M., 2010, The changing nature of Chapter 11, Fisher College of Business WP 2008-03-003.

Bradley, M., Rosenzweig, M., 1992, The untenable case for chapter 11, The Yale Law Journal 101, 1043-1095.

Chatterjee, S., Dhillon, U.S., Ramirez, G.G., 1996, Resolution of financial distress: Debt restructurings via Chapter 11, prepackaged bankruptcies, and workouts, Financial Management 25(1), 5-18.

Denis, D.K., Rodgers, K.J., 2007, Chapter 11: Duration, outcome, and post-reorganization performance, Journal of Financial and Quantitative Analysis 42(1), 101-118.

Gilson, S., Hotchkiss, E., Osborn, M., Walcock, L., 2019, Cashing out: The rise of M&A in bankruptcy, Harvard Business School working paper No.15-057.

Goyal, V., Wang, W., 2015, Provision of management incentives in bankrupt firms, Journal of Law, Finance, and Accounting 2(1), 87-123.

Hsieh, C.T., Klenow, P.J., 2009, Misallocation and manufacturing TFP in China and India, Quarterly Journal of Economics 124(4), 1403-1448.

Hotchkiss, E.S., 1995, Postbankruptcy performance and management turnover, The Journal of Finance 50, 3-21.

Hotchkiss, E.S., Mooradian, R.M., 1997, Vulture investors and the market for control of distressed firms, Journal of Financial Economics 43, 401–432.

Hotchkiss, E.S., Mooradian, R.M., 1998, Acquisitions as a means of restructuring firms in Chapter 11, Journal of Financial Intermediation 7(3), 240-262.

Hotchkiss, E.S., Mooradian, R.M., 2004, Post-bankruptcy performance of public companies, Boston College and Northeastern University working paper.

Hotchkiss, E.S., John, K., Mooradian, R.M., Thorburn, K.S., 2007, Bankruptcy and the resolution of financial distress, In Espen Eckbo, B. (Eds.), Handbook of Empirical Corporate Finance, Volume 2, Chapter 14, 1-54.

Hotchkiss, E.S., Stromberg, P., Smith, D.C., 2014, Private equity and the resolution of financial distress, ECGI-Finance working paper No.331/2012.

Jensen, M.C., 1991, Corporate control and the politics of finance, Journal of Applied Corporate Finance 4, 13-33.

Jiang, W., Kai, L., Wang, W., 2012, Hedge funds and chapter 11, The Journal of Finance 67(2), 513-559.

John, K., Mateti, R.S., Vasudevan G., 2013, Resolution of financial distress: A theory of the choice between Chapter 11 and workouts, Journal of Financial Stability 9(2), 196-209.

Kalay, A., Singhal, R., Tashjian, E., 2007, Is Chapter 11 costly? Journal of Financial Economics 84(3), 772-796.

Lemmon, M., Ma, Y., Tashjian, E., 2009, Survival of the fittest? Financial and economic distress and restructuring outcomes in Chapter 11, SSRN working paper.

McGowan, M.A., Andrews, D., Millot, V., 2018, The walking dead? Zombie firms and productivity performance in OECD countries, Economic Policy 33(96), 685-736.

Mooradian, R., 1994, The effect of bankruptcy protection on investment: Chapter 11 as a screening device, The Journal of Finance 49, 1403-1430.

Skeel, D.A., 2003, Creditor’s ball: The ‘new’ new corporate governance in Chapter 11, University of Pennsylvania Law Review 152, 917-995.

Roe, M.J., 2017, Three ages of bankruptcy, Harvard Business Law Review 7, 187-219.

Waldock, K., 2019, A typology of U.S. corporate bankruptcy, SSRN working paper.

Yost, 2002, The Choice Among Traditional Chapter 11, Prepackaged Bankruptcy, and Out-of-Court Restructuring, Ph.d Dissertation.

기업의 구조조정은 국민경제 자원의 재배분을 통하여 기업부문의 효율성과 총생산성을 제고한다는 측면에서 매우 중요한 과제로서 효율적 구조조정 시스템의 운영은 이러한 과제를 운영하기 위한 전제조건이다.1) 기업구조조정은 사전적 기업구조조정과 사후적 기업구조조정으로 구분된다. 사전적 기업구조조정은 정상 기업이 사업구조나 재무구조의 개선을 통하여 성장성과 수익성을 제고하여 기업가치를 높이는 일련의 경영활동이다. 반면 사후적 기업구조조정은 사업의 수익성 악화나 과다한 부채로 인하여 채무 상환이 어려워진 기업의 채무를 채권자와의 사적 협의나 법원을 통하여 조정하는 방식이다. 채권자와의 사적 협의는 일반적으로 워크아웃(workout)이라고 불리며 우리나라는 채권단 자율협약과 같은 순수 워크아웃 방식과 「기업구조조정 촉진법(이하 기촉법)」과 같은 법률 기반의 워크아웃 제도가 있다. 반면 국내의 경우 법원을 통한 기업구조조정은 「채무자 회생 및 파산에 관한 법률(이하 채무자회생법)」상의 기업회생 제도에 의해 이루어진다.

워크아웃은 기존 경영진의 경영이 가능하고 워크아웃 사실이 대외적으로 공개되지 않아 비밀유지가 가능하며 상거래 채권자와 지속적인 거래관계 유지를 통하여 경영개선을 도모할 수 있는 장점이 있는 반면, 채권단 내 다수의 채권자가 있을 경우 합의 지연과 이에 따라 자금지원이 지연되는 경우가 많고 법적 구속력 부족과 느슨한 신용평가 등으로 불충분한 채무조정이 이루어질 가능성이 상대적으로 높다. 반면 기업회생은 법원의 감독 하에 구조조정이 이루어지므로 절차상의 투명성이 제고되며 회사의 채무 전체가 채무조정의 대상으로 구속되고 우발채무가 단절되는 효과가 있다. 또한 기존 경영진이 관리인으로 회생계획안을 수행하므로 경영진의 기업회생 신청 유인이 마련된다. 반면 기업회생 절차의 단점은 기업회생 신청 사실이 공개되므로 회사의 신인도 하락으로 거래조건이 악화되어 정상화가 지연되고, 기존 경영자 관리인의 사적 이익 추구 가능성이 상존하며 신규 자금조달이 어렵다는 점이다. 한편 기촉법을 통한 워크아웃은 우리나라의 특징적인 제도로서 전원 동의를 원칙으로 하는 일반 워크아웃과 달리 채권단의 집합적 의사결정 과정의 효율성과 신속성을 지원하기 위하여 표결에 의한 의사결정을 법제화한 워크아웃 방식이다. 마지막으로 파산은 계속기업가치가 청산가치보다 낮은 경우 회사 재산을 환가하여 채권자들에게 나누어주는 절차이다.

대부분의 국가는 우리나라와 마찬가지로 사적 방식과 법원 중심의 기업구조조정 제도를 가지고 있는데 법원을 통한 채무조정 방식의 대표적인 제도가 바로 1978년 제정된 미국 연방도산법(Federal Bankruptcy Code) 11장 Reorganization, 이른바 Chapter 11로 불리는 재건형 도산 절차이다. Chapter 11은 제정 이후 각국의 도산 절차에 많은 영향을 끼쳐왔는데 우리나라의 기업회생 제도는 미국 Chapter 11을 벤치마킹하여 도입되었다. 우리나라의 경우 채무자회생법 제정 이전 이른바 도산 3법(파산법, 화의법, 회사정리법2))으로 기업구조조정 관련 법률이 나뉘어져 있었으나 미비한 점이 많아3) 외환위기 직후 시장에 의한 구조조정 제도인 워크아웃 제도를 도입하고 파산법, 화의법, 회사정리법을 2006년 채무자회생법4)으로 통합 정리하였다.

우리나라의 기업회생 제도는 2006년 채무자회생법의 제정에 따라 현재까지 15년이 경과하며 기업회생 사례가 축적되어 왔다. <표 Ⅰ-1>의 대법원 통계에 의하면 제도 도입년도인 2006년의 기업회생 신청 건은 76건에 불과하였으나 2020년의 경우 총 892건의 기업회생 신청이 이루어지며 기업회생을 활용한 구조조정 규모가 크게 증가하였으며 동 기간 누적 기업회생 신청 건수는 총 10,693건에 이르고 있다.

본 보고서는 이러한 관점에서 공개적으로 입수 가능한 외감기업 자료를 활용하여 기업회생의 효율성을 분석하고자 한다. 구체적으로 2006년부터 2020년까지 15년간 기업회생을 신청한 외감기업을 집계하여 이들 기업의 재무적 특징과 기업회생 결과를 분석함으로써 기업회생 제도의 효율성 제고를 위한 정책적 시사점을 도출하고자 한다. 먼저 기업회생 신청기업의 특징으로서 신청 전 재무변수의 특징과 변화, 기업회생 신청기업과 한계기업과의 관계, 기업회생에 이르게 된 부실의 유형 등을 기준으로 기업회생 신청기업을 분석한다. 기업회생 제도의 효율성 분석에서는 기업회생 인가 및 종결, 종결 시 M&A 비중 등과 관련된 기업회생의 효율성을 분석한다. 특히, 기업회생 신청에 이르게 된 부실유형을 재무적 부실(financial distress)과 사업적 부실(economic distress), 그리고 한계기업과 비한계기업으로 구분하고 부실유형에 따른 종결방식과 종결 후 재무성과와의 연관성 분석을 통해 기업회생의 효율성을 분석한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 보고서의 분석을 위한 사전 단계로서 채무자회생법 상 기업회생 제도를 간략히 소개한다. 이어서 기업구조조정 관련 국내 연구와 미국 Chapter 11 관련 해외 연구문헌을 소개하고 이후의 실증분석을 위한 네 가지 연구질문을 설정한다. Ⅲ장에서는 분석표본의 수집 방법과 구조를 설명하며 기업회생 절차의 특징과 기업회생 신청기업의 신청 전 재무성과를 분석한다. Ⅳ장에서는 Ⅱ장에서 도출한 네 가지 연구질문에 대한 실증분석을 수행하여 기업회생의 효율성을 분석한다. 마지막으로 Ⅴ장에서는 본 보고서의 결론을 제시하고 정책적 시사점을 도출한다.

Ⅱ. 연구방법론

Ⅱ장에서는 본 보고서가 다루고자 하는 채무자회생법 상 기업회생 제도를 소개하고 기업회생 제도의 효율성 평가와 관련된 국내외 기존 연구를 살펴보며 이로부터 본 보고서가 분석하고자 하는 네 가지 연구질문을 도출한다.

1. 기업회생 개관

국내 기업회생을 주관하는 채무자회생법의 목적은 ‘재정적 어려움으로 인하여 파탄에 직면해 있는 채무자에 대하여 채권자‧주주‧지분권자 등 이해관계인의 법률관계를 조정하여 채무자 또는 그 사업의 효율적인 회생을 도모하거나(즉, 기업회생), 회생이 어려운 채무자의 재산을 공정하게 환가‧배당하는 것(즉, 파산)’이다(제1조).

기업회생의 절차는 다음과 같다(<그림 Ⅱ-1> 참조). 먼저 기업회생 신청자격은 채무자(제34조 1항), 전체 채권액 기준 1/10이상을 보유한 채권자, 그리고 전체 자기자본의 1/10이상을 보유한 주주(제34조 2항)가 신청 가능하다. 신청 후 7일 이내에 포괄적 금지명령5)이 내려지며(제45조), 신청 후 1개월 이내에 법원이 절차 개시 여부를 결정하여야 한다(제49조). 개시 결정 후에는 회생담보권자와 회생채권자의 채권은 회생계획안(Plan of Reorganization: POR)에 의하지 않고는 변제가 불가능하다(제58조).

한편, 법원은 기업회생 절차의 집행자인 관리인으로 기존 경영자를 임명하여야 한다(제74조 2항). 이것이 통상 기존경영자관리인(Debtor-In-Possession: DIP)으로 불리는 제도로서 미국 Chapter 11과 기업회생의 가장 큰 변화이자 특징이다. 다만 예외적으로 채무자의 재정적 파탄이 채무 기업의 이사 또는 지배인이 행한 재산의 유용 또는 은닉이나 중대한 책임이 있는 부실경영에 기인하는 경우 또는 채권자협의회의 요청이 있는 경우로서 상당한 이유가 있는 경우 법원은 제3자를 관리인으로 선임할 수 있다(제74조 2항).

관리인은 기업회생 절차 개시 후 4개월 이내에 채권자 등의 목록제출 및 채권신고를 통해 회생담보권과 회생채권을 조사 확정하여 이를 법원에 보고하여야 한다(제92조). 주로 회계법인인 조사위원에 의해 작성되는 조사보고서에 의해 계속기업가치가 청산가치보다 크다고 인정되면 법원은 관리인에게 회생계획안 제출을 명령하며, 관리인은 명령 이후 4개월 이내에 회생계획안을 법원에 제출해야 한다(제220조).6)7) 회생계획안이란 채무자의 향후 사업수익에 대한 추정을 기초로 채권자 등 이해관계인의 권리를 변경하여 회생채무 등을 변제하는 계획이다. 회생계획안이 제출되면 관계인집회에서 각 채권자 및 주주조별로 회생계획안의 동의 여부를 결정하며 모든 조가 동의하면 회생계획안이 가결되는데(제236조)8), 이때 필요한 의결기준은 회생담보권자조, 회생채권자조, 주주조별로 각각 의결권 행사 총액의 3/4, 2/3, 1/2이다(제237조). 관리인은 회생절차 개시결정부터 채무자의 업무 수행권과 재산의 관리 처분권을 가지고(제56조 1항) 회생계획안 인가 이후 회생계획안의 내용을 수행하며(제257조), 법원은 채무자, 회생담보권자‧주주‧지분권자, 관리인 등에 대하여 회생계획의 수행에 필요한 명령을 할 수 있다(제258조). 한편 회생계획에 따른 변제가 시작되면 회생계획의 수행에 지장이 없을 경우 관리인, 회생채권자 또는 회생담보권자의 신청에 의하거나 법원의 직권으로 회생절차의 종결 결정을 한다(제283조 제1항). 반면, 회생계획안이 기한 내 제출되지 못하거나 관계인집회에서 부결되는 경우(제286조 1항), 회생계획안 제출 전후 청산가치가 계속기업가치보다 큰 것이 명백할 경우(제286조 2항), 회생계획안 인가 후 회생계획을 수행할 수 없는 것이 명백하게 된 경우 등(제288조)의 경우에는 회생절차가 폐지된다.

본 보고서의 연구범위와 직접적으로 연관되는 국내외 연구로는 기업회생 제도의 벤치마킹 대상인 미국 Chapter 11이 기업의 재무성과에 미친 영향을 분석하는 일련의 연구와 종결방식으로서 M&A가 Chapter 11의 효율성에 미친 영향에 대한 연구를 들 수 있다.

가. 기업회생 또는 Chapter 11 기업의 재무성과

Chapter 11 기업의 재무성과에 관한 해외 연구의 시초는 Hotchkiss(1995)라고 할 수 있으며 이후 다양한 관련 연구가 나타났다. Hotchkiss(1995)는 1979~1988년의 10년간 197개 미국 Chapter 11 종결기업을 대상으로 이들 기업의 종결 후 재무성과를 분석하였다. Chapter 11을 종결한 표본기업은 종결 후 3년간 수익성과 성장성이 저조하였으며 저조한 재무성과는 Chapter 11의 기존경영자관리인(DIP) 제도와 관련이 깊음을 실증 분석하였다.

Hotchkiss & Mooradian(1997)은 1980~1993년의 14년간 미국 Chapter 11을 포함한 288개 구조조정 기업에 대하여 벌처투자자(vulture investor)가 경영권을 획득한 경우 구조조정 이후 수익성이 우수함을 실증하여 기업구조조정에서 외부투자자의 통제(control)와 모니터링(monitoring)이 중요함을 분석하였다.

Hotchkiss & Mooradian(1998)은 1979~1992년의 14년간 M&A로 Chapter 11을 종결한 55개 기업의 수익성이 비교 대상 기업 대비 높은 것으로 나타나 M&A가 Chapter 11에서 효율적인 자산재배분(asset redeployment)에 기여함을 실증하였다.

Denis & Rodgers(2007)는 1985~1994년의 10년간 Chapter 11을 신청한 279개 기업을 대상으로 영업성과가 우수한 소규모 기업과 영업이익률이 높은 산업 소속 기업의 Chapter 11 잔류 기간이 짧음을 실증분석하였다. 또한 Chapter 11 신청 전 산업조정 영업이익률이 높고 이익률 증가율이 상대적으로 높은 기업의 재무성과가 우수한 것으로 나타나 Chapter 11이 잠재성이 높은 기업의 성공적 회생을 지원함을 발견하였다. 또한 Chapter 11 절차 중 자산부채 규모를 대폭 감소시킨 기업의 성과가 우수한 것으로 나타나 절차 진행 중의 구조조정 강도가 종결 후 재무성과에 중요한 역할을 수행하는 것으로 분석되었다.

Kalay et al.(2007)은 1991~1998년간 459개의 Chapter 11 기업에 대하여 Chapter 11 기간 동안 영업실적이 대폭 개선되었음을 보여 Chapter 11 절차가 도산기업에 순기능을 제공하는 것을 실증하였다. 이 때 부채비율이 높은 기업의 영업실적 개선이 높으며, 복잡한 채무구조는 영업실적 개선에 부정적 효과를 나타내는 것으로 분석되었다.

Lemmon et al.(2009)는 부실 유형을 구분하고 Chapter 11이 계속가치 보존과 자산재배분(asset redeployment)에 기여함을 분석하였다. Lemmon et al.(2009)은 1991~2004년간 Chapter 11을 신청한 505개의 상장기업과 주요 비상장기업에 대하여 Chapter 11에 이르게 된 부실 유형을 재무적 부실과 사업적 부실로 구분하였다. Chapter 11이 효율적으로 운영되기 위해서는 재무적 부실은 계속기업가치를 보존하는 방식, 즉 채무조정 방식으로 종결되는 것이 바람직하며, 사업적 부실은 자산재배분 방식 즉, M&A 방식의 종결 또는 청산이 바람직함을 주장한 가운데 미국 Chapter 11 기업은 이와 부합되는 방식으로 종결되었음을 실증하였다.

한편 Chapter 11의 성과와 효율성에 대하여 다수의 정량적 분석이 이루어진 미국 중심의 해외 연구와 달리 국내의 경우는 기업회생에 특화된 연구가 제한적이다. 오수근(2015)을 제외한 국내 연구의 대부분은 채무자회생법 이전 시기나 광의의 사전적 구조조정 또는 부도예측 모형 등을 분석한 연구이다.9)

먼저 박찬웅(2004)은 1992~2004년간 33개 구조조정 기업을 대상으로 배열기법 분석을 통해 기업구조조정 경로와 절차에 따라 개별 기업구조조정 사례를 5개 군락으로 분류하고 이러한 경로가 기업구조조정에 소요되는 기간에 미치는 영향을 분석하였다. 분석 결과 업력이 낮을수록, 매출액이 클수록 기업의 정상화에 소요되는 시간이 짧은 것으로 분석되었다. 또한 부도 전 기업 상태의 악화 속도는 정상화 속도에 영향이 없으나 부도 과정의 사건 배열 순서는 정상화 속도에 영향을 미치는 것으로 나타났다.

신동령(2005)은 2000~2004년간 부실화된 242개 비금융 상장·비상장기업의 재무적 특징을 분석하고 1:1 매칭기업을 추가한 분석표본에 대하여 부실예측 모형을 설정하고 부실예측 결과를 통해 동 모형의 정확성을 분석하였다.

오수근(2015)은 국내 기업회생 신청기업에 대하여 기업회생 절차의 특징과 신청기업의 재무 상태를 조사하였다. 2006~2012년의 7년간 751건의 국내 기업회생 신청기업에 대하여 신청, 개시결정, 인가, 폐지 또는 종결로 이어지는 절차의 평균 소요기간, 신청서와 조사보고서 상 자산‧부채 규모, 부채비율 및 부채구성을 분석하였다.

장정현‧최철(2019)은 2000~2016년간 1,686개 비금융 상장기업에 대하여 기업수명주기 단계별 구조조정 전략의 선택과 재무적 곤경에 처한 기업이 선택하는 자산‧운영‧재무 구조조정 전략이 기업 정상화에 미치는 영향을 실증적으로 분석하였다. 분석 결과, 성숙기에 실시된 자산 구조조정과 성장기‧쇠퇴기에 실시된 사업 구조조정, 특히 성장기에 실시된 자산축소와 쇠퇴기에 실시된 정리해고는 정상화의 가능성을 높이는 것으로 나타났다.

나. Chapter 11과 M&A의 관계

Chapter 11의 효율성과 관련된 연구는 M&A가 Chapter 11의 효율성 제고에 미친 영향에 대한 연구로 확대되었다. 먼저 채권자, 주주 등 관련 당사자들의 합의에 따른 채무조정 방식, 즉 재건형 기업구조조정 절차로 설계된 Chapter 11이 부실기업 자산의 효율적인 활용을 담보하는지에 대한 논란이 제도 도입 초기부터 지속되었다. Chapter 11은 회사 재건을 위해 도산 기업의 경영자를 관리인으로 하는 기존경영자관리인(DIP) 제도를 두고 있는데 이는 채무자 친화적(debtor-friendly) 구조조정 방식으로서 종종 절대우선의 원칙이 위반되며(Absolute Priority Deviation: APD)10) 채권자로부터 주주로 부가 이전되는 사례가 나타났다.

Baird(1993)와 Bradley & Rosenzweig(1992)는 기존경영자관리인(DIP)이 기업 자원을 최적의 사용자에게 배분할 적절한 인센티브가 없음을 주장하였으며 Jensen(1991)은 이러한 상황에서 M&A가 도산기업 자산의 효율적인 재활용을 유도하기 위한 중요한 기제임을 주장하였다.

한편 1990년대 이후 Chapter 11의 성격의 변화에 대한 일련의 연구가 나타나기 시작했다. 이러한 변화는 채권자 권리 강화와 같은 채권자 친화적(creditor-friendly) 관행의 정착과 Chapter 11에서의 M&A 활용 증가로 나타났는데 이와 관련된 연구는 다음과 같다.

Bharath et al.(2010)은 Chapter 11이 채권자 친화적인 구조조정 방식으로 변모하였으며 그 원인으로 DIP금융과 주요임직원유지플랜(Key Employees Retention Plan: KERP)이 있음을 주장하였다. DIP금융을 통해 채권자 권리의 강화와 구조조정 협상력의 제고가 이루어졌으며 경영진 교체의 빈도도 증가하였다. 한편 주요임직원유지플랜은 임직원 성과와 구조조정 속도를 보상과 연동하여 구조조정의 인센티브를 부여하였다.

한편 Chapter 11에서의 M&A 빈도 증가의 원인에 대한 연구가 최근 나타나고 있다. Roe(2017)는 복잡한 수직계열화 산업조직에서 계약기반 산업조직으로의 변화, 자본시장 발달에 따른 M&A 시장의 성장, 시장의 효율성에 대한 법원의 신뢰 증가가 그 원인임을 주장하였다. Baird & Rasmussen(2002)은 기업 전체 및 사업부 매각이 가능해진 M&A의 전문성 심화에 따라 Chapter 11에서 M&A의 비중이 증가하였음을 주장하였다.

Chapter 11에서의 M&A의 효과에 대한 연구로는 Hotchkiss & Mooradian(1998), Waldock(2019)과 Gilson et al.(2019)이 있다. Hotchkiss & Mooradian(1998)은 M&A가 효율적인 자산재배분에 기여함을 실증하였는데 M&A를 통해 종결된 경우 동종산업 기업에 인수된 사례가 다수이고, M&A를 통해 종결된 기업의 종결 후 재무성과가 상대적으로 우수하며, M&A를 통한 종결을 추진한 Chapter 11 상장기업의 매수자와 매도자 모두 양의 초과수익률이 발생하였다. Waldock(2019)은 Chapter 11의 기초통계 분석을 통해 Chapter 11이 M&A를 염두에 두고 활용되는 경향이 있으며 부실기업 투자자의 존재가 Chapter 11의 효율성을 개선시키고 있음을 보이고 있다. Gilson et al.(2019)은 M&A가 부실기업 자산의 효율적 재활용 수단으로서 기능하고 있으며 M&A가 채권자 회수율을 높이는 등 회수 가치를 최대화하는 것을 실증하고 있다.

마지막으로 M&A 인수 주체의 하나인 재무적 투자자의 존재로 Chapter 11을 통한 구조조정의 신속성과 효율성이 제고되었음을 실증하는 연구가 있다. Hotchkiss & Mooradian(1997)은 벌처투자자의 존재가 종결 후 재무성과를 제고하며, Jiang et al.(2012)은 헤지펀드의 존재가 회생(turnaround) 가능성과 후순위채권자 회수율을 높이며, Hotchkiss et al.(2014)은 사모펀드(Private Equity: PE)가 포트폴리오 기업의 부실을 효율적으로 해소함을 보고하고 있다.

3. 연구질문

본 보고서의 주요 목적은 국내 기업회생 제도가 사후적 기업구조조정의 핵심기제로 계속기업가치 보존과 자원 재배분이라는 구조조정 제도 본연의 역할을 충실히 수행하는지 분석하는 것이다. 이를 위해 기업회생 신청기업의 재무적 특징을 살펴보고 신청기업의 재무적 특징과 연관되어 기업회생 제도가 효율적으로 운영되고 있는지를 분석한다.

기업회생 신청기업의 재무성과를 통하여 기업회생의 효율성을 평가하는데 있어 한 가지 유념할 것은 사적 워크아웃이나 기촉법 상 워크아웃, 파산 등 대체 기업구조조정 수단이 존재하는 상황에서 기업회생 신청은 무작위적인 결과가 아니라 이해관계자의 자가선택(self-selection)에 의해 이루어지는 결과이라는 것이다. 즉 기업회생 절차가 기업 재무성과에 미치는 영향은 어떠한 기업이 워크아웃이나 파산 대신 기업회생을 신청하게 되는지에 영향을 받는다. 기업의 구조조정 방식 선택에 관한 일련의 연구는 기업의 부실화 정도가 심하고 채무구조가 단순한 소규모 기업의 경우 기업구조조정 수단으로써 Chapter 11을 선택하는 경향이 있음을 보고하고 있다(Chatterjee et al.,1996; Yost, 2002; John et al., 2003).11) 만약 기업회생을 신청하는 기업이 부실화 정도가 심한 소규모 기업이며 이러한 기업의 회생(turnaround) 가능성이 상대적으로 낮다면 기업회생 신청기업의 신청 전후의 재무적 성과로 판단하는 기업회생의 효율성 평가에는 하향편의(downward bias)가 발생할 수 있다.

이러한 배경 하에 기업회생 신청기업의 재무적 특징으로 기업회생 신청 직전년도의 기업규모와 매출액성장률, 영업이익률, 부채비율 등 제반 재무지표, 그리고 이들 지표의 신청 전 연도별 변화를 분석한다. 또한 이후의 기업회생 효율성 분석에서 중요하게 사용될 기업의 부실 유형의 하나로 재무적 부실(financial distress)과 사업적 부실(economic distress)을 구분한다. 재무적 부실기업은 사업 자체의 내재가치 창출 능력은 우수하나 과다한 부채 즉 재무구조 문제로 부실에 이르게 된 기업이며 사업적 부실기업은 재무구조는 양호하나 사업 자체의 수익성이 나쁜 기업으로 정의한다. 한편 또 다른 부실 유형으로서 부실의 만성화 여부에 따라 기업회생 신청기업을 한계기업과 비한계기업으로 구분한다. 이 때 한계기업은 일반적인 정의의 따라 이자보상배율 1 미만이 3년 이상 지속된 기업으로 정의한다. 이자보상배율 기준은 영업이익이 낮아서 한계기업이 될 수도 있고 지급이자 규모가 커서 한계기업이 될 수도 있으므로 재무적 부실 또는 사업적 부실과 같은 부실 유형과는 독립적이다.

이와 같이 기업회생 신청기업의 재무성과와 부실 유형에 대한 구분을 바탕으로 국내 기업회생 제도의 효율성을 기업회생 인가 단계의 효율성, 종결 후 재무성과를 통한 효율성, 종결방식 중 채무조정의 효율성, 그리고 마지막으로 부실유형과 종결방식 간 상관관계 관점에서 평가한다. 구체적으로 다음의 네 가지 관점에서 기업회생의 효율성을 평가한다.

첫째, 기업회생 신청기업 중 인가기업이 기각 기업 대비 재무적 성과가 상대적으로 우수한지의 여부이다. 즉, 기업회생의 비효율성은 회생 가능한 기업이 청산되거나, 회생 가능하지 않은 기업이 기업회생 절차에 잔류하거나 채무조정을 통해 종결될 때 발생하므로 기업회생 제도의 운영이 이러한 가능성을 차단하는 방향으로 이루어지는지 분석하는 것이다. Denis & Rodgers(2007)은 Chapter 11의 성공 기업은 Chapter 11 신청 전 재무성과가 상대적으로 우수한 기업들이었음을 보여주고 있다.

둘째, 기업회생 종결 이후의 기업 재무성과를 살펴봄으로써 기업회생의 효율성을 평가하는 것이다. 기업회생 종결 이후의 재무성과를 살펴보아야 하는 이유는 비효율적 기업이 기업회생 절차 내 생존할 경우 이러한 비효율성이 종결 후의 기업 재무성과에 나타날 가능성이 있기 때문이다. 이는 Chapter 11 절차 중과 종결 후 재무성과를 연구한 Hotchkiss(1995), Denis & Rodgers(2007), Kalay et al.(2007), Lemmon et al.(2009)에서의 연구동기와 동일한 맥락이라고 할 수 있다.

셋째, 채무조정을 통해 기업회생 절차를 종결하는 기업의 경우 적정한 채무조정이 이루어지는가의 여부이다. 이는 채무조정을 통해 기업을 재건하는 재건형 구조조정 절차로서의 기업회생의 취지와 직결되는 문제이다. 만약 채무조정이 효율적으로 이루어진다면 특정 기업의 기업회생 신청 전 부채비율 수준과 관계없이 종결 후 부채비율이 사업 재건이 가능한 유사한 수준으로 수렴되어야 하기 때문이다.

넷째, 부실 유형별 기업회생 종결방식이 자산재배분과 정합적인가의 여부이다. 먼저 재무적 부실과 사업적 부실 관련하여 재무적 부실기업은 계속기업으로서의 가치창출은 이루어지고 있으나 과도한 부채비율로 부실에 이르게 되었으므로 기업회생 절차 본연의 역할인 채무조정을 통해 회생이 필요한 반면 사업적 부실기업은 기업의 내재가치가 훼손된 기업으로서 기존 경영자를 통해서는 자산을 수익성 있게 활용하기 어려운 기업이므로 소유권의 이전, 즉 M&A를 통해 기업회생 절차의 종결이 이루어지는 것이 정합적이다. 이는 부실유형과 종결방식과의 연계를 분석한 Lemmon et al.(2009)과 궤를 같이하는 관점이다. 이러한 관점은 부실의 또 다른 유형인 한계기업과 비한계기업에도 적용될 수 있다. 한계기업은 만성적 부실기업으로서 자산의 수익성 있는 활용이 어려운 기업이므로 M&A를 통한 종결이 필요한 반면 비한계기업은 채무조정을 통한 종결의 여지가 상대적으로 높다.

Ⅲ. 국내 기업회생의 특징

Ⅲ장에서는 보고서의 실증분석에 사용되는 국내 외감기업의 기업회생 신청 사례를 집계한 분석표본에 대하여 집계 및 분류 방법과 표본의 특징을 서술하고 이를 바탕으로 국내 기업회생 절차의 특징과 신청기업의 신청 전 연도별 재무성과를 살펴본다.

1. 분석표본

먼저 본 보고서는 2006~2020년간 금융감독원 기업공시 사이트(dart.fss.or.kr)에 감사보고서를 제출한 12월 결산 외감기업을 대상으로 검색어로 ‘회생’을 사용하여 관련 감사보고서를 추출한 후 이를 검독하여 기업회생의 신청, 종결 및 폐지 여부를 확인하고 표본을 수집하였다. 이 때, 상장기업의 경우 사업보고서를 병행 참조하여 감사보고서에 기재되지 않은 기업회생 관련 자료와 일자를 추출하였다.

확인된 기업회생 신청기업에 대하여 감사보고서 상 신청일, 인가일, 종결일 또는 폐지일의 명시 또는 ‘절차 중’ 언급 여부를 기준으로 표본기업을 분류하였다. 인가일자가 존재하는 경우 인가기업으로 분류하였으며 신청일만 있고 인가일 또는 종결일이 없으면 미인가기업으로 분류하였다. 만일 종결일이 존재하는데 인가일이 없을 경우에도 인가기업으로 분류하였으며 이 경우 기업회생 체류 기간 계산에는 해당 자료를 포함하지 않았다. 종결일이 존재하는 경우 종결기업으로 분류하였으며 종결일이 없어도 감사보고서 상의 지분구조 변경을 살펴본 결과 M&A를 통한 종결이 명확한 경우에는 종결기업으로 분류하였다. 다만 인가일과 마찬가지로 이 경우에도 기업회생 체류 기간 계산에는 포함하지 않았다. 마지막으로 회생절차의 폐지일이 감사보고서 상 존재하면 회생절차 폐지기업으로 분류하였다.

한편 인가일이 최근인 경우 보고서 작성 시점에 기업회생 절차가 진행 중일 경우가 있다. 따라서 인가일이 최근 2년 내에 있었으나 2020년 감사보고서 상 종결일이 없을 경우와 신청일이 최근 2년 내에 있었으나 2020년 감사보고서 상 인가일이 없을 경우 ‘절차 중’이라는 감사보고서 상 명시적 언급이 없는 경우에도 ‘절차 중’으로 분류하였다. 마찬가지로 기업회생 신청 또는 인가기업의 감사보고서가 최근년도 이전에 공시 중단되는 경우가 있을 수 있으며 이 경우 이들 기업이 자산 매각과 채무변제 또는 파산 등으로 외감기업 지정이 해제되었을 가능성이 있다. 따라서 감사보고서 상 인가일은 있으나 종결일이 없으면서 2020년도 또는 그 이전년도 재무제표가 공시되지 않은 기업의 경우, 그리고 신청일은 있으나 인가일이 없으면서 2020년도 또는 그 이전년도 재무제표가 공시되지 않은 기업을 ‘미상’으로 분류하였다.

마지막으로 기업회생 종결일이 감사보고서 상에 명시된 기업회생 종결기업에 대하여 감사보고서 상의 지분변동 상황을 분석하여 종결방식으로서 채무조정과 M&A를 구분하였다. 이 경우 기존 채무의 출자전환을 제외하고 별도의 신규 외부투자자가 존재하지 않는 경우를 채무조정으로, 기타의 경우를 M&A로 분류하였다. 또한 인수 주체에 따라 M&A를 통한 종결기업을 전략적 투자자(Strategic Investor: SI), 재무적 투자자(Financial Investor: FI), 개인, 합병의 네 가지 경우로 분류하였다. <그림 Ⅲ-1>은 이러한 방식으로 분류된 기업회생 관련 자료의 분류 계통도이며 <표 III-1>은 이렇게 집계된 연도별 기업회생 신청기업 수와 경과를 나타낸 표이다.

2. 분석변수

본 보고서에서 초점을 두는 기업 재무성과 지표는 기존 연구문헌의 관례를 따라 현금흐름 수익성을 대표하는 EBITDA 마진과 안정성을 대표하는 부채비율이며 필요한 경우 성장성을 대표하는 매출액증가율과 자산증가율을 사용한다. EBITDA 마진은 당기말 총자산 대비 영업이익과 감가상각비를 합산한 현금흐름으로, 부채비율은 총자산 대비 부채총계로 정의한다. 이러한 재무성과 지표는 성장성 지표를 제외하고 모두 산업별 수익성과 재무구조를 반영한 산업조정(industry-adjusted) 재무변수이다. 구체적으로 Lemmon et al.(2009)을 따라 개별 신청기업에 대하여 해당 표준산업 분류상 소분류 업종 내 외감기업이 4개 이상이면 해당 업종 외감기업 전체의 재무성과 지표의 당해년도 중간값을 신청기업의 재무성과 지표에서 차감하고 소분류 업종 내 외감기업이 4개 미만이면 중분류 업종의 외감기업 전체의 재무성과 지표 중간값을 차감한다. 만일 중분류 업종 내 외감기업이 4개 미만이면, 대분류 업종의 외감기업 전체의 재무성과 지표 중간값을 신청기업의 재무성과 지표에서 차감한다.

본 보고서의 분석을 위해 기업회생 신청기업을 부실유형에 따라 구분한다. 구체적으로 기업회생 신청기업을 부실의 근원에 초점을 둔 사업적 부실(economic distress)과 재무적 부실(financial distress), 그리고 부실의 만성화에 초점을 둔 한계기업과 비한계기업으로 구분한다. 이 때 사업적 부실기업은 부채비율과 같은 재무구조에는 문제가 없으나 EBITDA 마진과 같은 사업의 수익성이 낮은 기업으로 정의된다. 반면 재무적 부실기업은 사업의 수익성은 나쁘지 않지만 부채비율이 높아 채무조정을 통한 경영 정상화가 필요한 기업이다. 한계기업은 일반적으로 채택되는 정의를 따라 3년 연속 이자보상배율이 1 미만인 기업으로 정의하며, 이때 이자보상배율은 영업이익을 이자비용으로 나눈 값을 사용한다.

Lemmon et al.(2009)을 따라 사업적 부실기업과 재무적 부실기업을 구분하는 방식을 설명하면 다음과 같다. 먼저 당해년도 외감기업 전체를 산업조정 EBITDA 마진과 산업조정 부채비율을 기준으로 각각 10분위 그룹을 만든다. 산업조정 EBITDA 마진과 산업조정 부채비율 최상위 그룹의 분위수는 9이며 최하위 그룹의 분위수는 0이다. 재무적 부실기업은 부채비율은 높으나 EBITDA 마진은 양호한 기업이므로 부채비율 분위수는 높고 EBITDA 마진 분위수도 높은 기업이다. 반면 사업적 부실기업은 부채비율은 낮으나 EBITDA 마진이 낮은 기업이므로 부채비율 분위수가 낮고 EBITDA 마진 분위수도 낮은 기업이다. 따라서 개별 기업이 소속된 산업조정 EBITDA 마진 그룹의 분위수와 산업조정 부채비율 그룹의 분위수를 합산한 수치는 부실유형을 구분하는 기준으로서 각 분위수의 합산 수는 사업적 부실에서 재무적 부실로 단조증가(monotonic increase)한다. 최종적으로 합산 분위수를 바탕으로 협의(type0)와 광의(type1)의 사업적 부실기업 더미변수를 설정한다. 협의의 사업적 부실기업 더미변수는 합산 분위수가 14이상일 경우를 재무적 부실기업으로, 합산 분위수가 4이하일 경우를 사업적 부실기업으로 정의한 더미변수이다. 반면 광의의 사업적 부실기업 더미변수는 합산 분위수가 10이상일 경우를 재무적 부실기업으로, 합산 분위수가 9이하일 경우를 사업적 부실기업으로 정의한 더미변수이다.12)

한편 재무성과가 특별히 나쁜 취약기업을 별도로 분류하여 더미변수를 설정한다. 구체적으로 Denis et al.(2007)을 따라 표준산업분류상 소분류 업종 내 기업이 4개 이상이면서 EBITDA 마진이 음(-)이며 동 업종 내 하위 25%(q25) 이하이면 1, 기타이면 0인 더미변수를 설정한다. 만일 소분류 업종 내 기업이 4개 미만이면 중분류 업종의 하위 25%를 적용하고, 중분류 업종 내 기업이 4개 미만이면 대분류 업종의 하위 25%를 적용한다.

다음 <표 Ⅲ-2>는 본 보고서에서 사용되는 주요 실증분석 변수를 정의한 표이다.

가. 기업회생 절차

기업회생 절차의 특징으로는 다양한 측면을 살펴볼 수 있으나 대표적인 지표로서 기업회생 인가율과 종결율, 각 종결방식의 비중 그리고 절차 존속기간을 살펴본다. <그림 Ⅲ-2>와 <그림 Ⅲ-3>은 이를 나타낸 그림이다. 먼저 <그림 Ⅲ-2>는 2009년 이후 표본기업의 기업회생 신청 건수 대비 인가 건수(‘인가율’)와 인가 건수 대비 종결 건수(‘종결율’)의 비중이 추세적으로 증가하는 것을 보여주고 있다. 2006~2018년간 분석표본의 기업회생 인가율과 종결율의 평균은 각각 73.9%, 50.8%이며 종결방식 중 M&A의 비중은 평균 49.0%이다.13) 대법원에 의하면 2010~2019년간 전체 기업회생 인가율의 연도별 평균은 50% 수준이고, 종결율의 연도별 평균은 59%이므로(대법원, 2021)14) 외감기업 표본의 인가율은 대법원 기업회생 통계보다 높은 반면, 종결율은 대법원 기업회생 통계보다 다소 낮다. 이는 외감기업의 규모가 전체 기업회생 신청기업 대비 상대적으로 커서 자산 가치나 고용 규모 등 사회적 관점에서 외감기업 재건의 의의와 가능성이 상대적으로 높은 반면 부실에 이른 원인이 다소 복잡하여 기업회생 절차를 통한 구조조정이 어렵기 때문인 것으로 풀이된다.

<그림 Ⅲ-2>는 또한 기업회생 종결방식의 하나인 M&A를 통한 종결의 비중이 연도별로 변화를 나타내고 있음에도 불구하고 M&A를 통한 종결 중 재무적 투자자의 비중이 지속적으로 증가하고 있는 것을 나타낸다. 실제로 수집된 연구표본에서 재무적 투자자 중 가장 높은 비중을 차지하는 것은 PEF, 특히 기업재무안정 PEF인데, 2012년 이후 재무적 투자자의 비중이 증가한 것은 2010년에 기업재무안정 PEF가 도입된 것에 큰 영향을 받은 것으로 분석된다. 2010년 5.0%에 불과했던 재무적 투자자의 M&A 내 비중은 2020년 50.0%까지 증가하였다.

다음으로 기업회생 신청기업이 일반 외감기업과 비교하여 어떠한 재무적 특징을 갖는지 살펴본다. <표 Ⅲ-3>은 기업회생 신청기업의 규모와 성장성, 수익성 및 안정성 관련한 대표적인 재무성과 지표를 나타낸 표이다. 먼저 기업회생 신청기업은 일반 외감기업과 비교하여 두드러진 규모의 차이가 없다. 기업회생 신청기업의 매출액과 자산의 중간값은 각각 224억원, 260억원으로서 외감기업의 중간값 232억원, 238억원과 유사한 수준이다. 반면 기업회생 신청기업은 예상되듯이 낮은 성장성, 수익성 및 안정성을 나타내고 있다. 기업회생 신청기업의 매출액증가율, EBITDA 마진 및 부채비율의 중간값은 각각 –4.7%, 1.0%, 86.7%로서 외감기업과 비교하여 매출액은 감소하고 있으며 열악한 현금흐름 수익성과 재무구조를 나타내고 있다.

Ⅳ장에서는 기업회생의 효율성을 평가하기 위하여 II장에서 설정한 다음의 네 가지 연구질문에 따라 실증분석을 수행한다. 첫째, 국내 기업회생 절차가 회생 가능성이 있는 기업회생 신청기업에 대하여만 기업회생 인가가 이루어지는지 살펴본다. 둘째, 기업회생 절차 종결 이후의 재무성과 분석을 통해 기업회생 절차 후 재무구조와 수익성 개선 등 기업 체질 개선이 충분히 이루어지는지 살펴본다. 이 때 기업회생 신청기업의 부실유형과 종결방식별로 종결 후 재무성과를 상세히 살펴본다. 셋째, 채무조정을 통해 재무구조를 개선하는 방식으로 기업회생 절차가 종결되는 경우 채무조정이 충분히 이루어지는지 분석한다. 넷째, 회생기업의 M&A를 통해 기업회생 절차가 종결되는 경우 종결방식으로서 M&A가 회생기업의 부실 유형과 어떠한 관계를 가지는지 살펴본다.19)

1. 인가기업과 미인가 기각기업의 재무성과

기업회생이 효율적으로 운영되기 위해서는 회생(turnaround) 가능성이 낮은 기업의 기업회생 절차 유입과 이를 통한 비효율적 과잉투자 가능성을 차단해야 한다. 이를 위해서는 기업회생 신청기업 중 인가기업이 미인가 기각기업 대비 재무성과의 관점에서 어떻게 차별화되는지를 분석하여야 한다.20) 따라서 비교 대상을 기업회생 인가기업과 미인가 기각기업으로 구분하여 규모, 수익성 및 부채비율의 차이를 살펴본다.21) 이 때 미인가 기각기업은 기업회생을 신청하였으나 회생절차의 개시결정이 이루어지지 않은 기업, 개시결정이 이루어졌으나 기일 내 회생계획안이 마련되지 못하거나 주주 및 채권자 조의 표결 결과 회생계획안이 부결된 미인가 기업을 포함한다.

<표 Ⅳ-1>은 인가기업과 미인가 기각기업의 기업회생 신청 전 재무성과의 분석 결과를 나타낸 표이다. 인가기업과 미인가 기각기업의 매출액 중간값은 각각 227억원, 164억원으로 인가기업의 매출액이 미인가 기각기업보다 5% 수준에서 유의하게 큰 것으로 나타났다.22) 한편 인가기업의 영업이익률과 EBITDA 마진의 중간값은 각각 –2.5%, 0.4%로서 미인가 기각기업의 –3.9%, -2.9% 대비 5% 수준에서 통계적으로 유의하게 큰 것으로 나타났다. 반면 자산과 부채비율의 경우 인가기업의 중간값이 미인가 기각기업의 중간값보다 크지만 두 표본집단 간 차이는 통계적으로 유의하지 않았다.

한편 Ⅲ장 1절에서 서술한 바와 같이 외감기업 감사보고서 상에는 기업회생 신청에 대한 공시 이후 외감기업 지정이 해제되면서 감사보고서 공시의무 면제에 따라 이후의 기업회생 절차의 경과가 보고되지 않은 신청 건이 다수 존재한다. 이러한 경우는 대부분 부실화에 따라 기업 규모가 축소되면서 공시의무가 면제된 경우일 가능성이 높으므로 이를 미인가 기업으로 간주하여 분석하면 추가적인 시사점을 얻을 수 있다. 이러한 표본을 미인가 기각기업에 포함하여 인가기업과 미인가 기각기업의 재무성과를 비교하면 앞서의 비교보다 재무성과의 차이가 확대되는 것을 확인할 수 있다. <표 Ⅳ-1>의 오른쪽에서 인가기업의 매출액, 자산, 영업이익률, EBITDA 마진의 중간값은 모두 미인가 기각기업보다 1% 수준에서 통계적으로 유의하게 큰 것으로 나타나며 인가기업의 부채비율은 미인가 기각기업보다 1% 수준에서 통계적으로 작은 것으로 나타난다.23) 이는 전술한 바와 같이 통계가 누락된 기업은 부실화 정도가 심한 기업이었을 가능성을 시사한다.

종합하면 기업회생 신청기업 중 인가기업은 미인가 기각기업 대비 재무적 성과가 우수한 것으로 나타난다. 미인가 기각기업은 인가기업 대비 소규모이며 영업이익률과 현금흐름, 재무안정성 측면에서 통계적으로 유의한 열위에 있다.

기업회생 절차가 효율적이라고 한다면 비효율적 기업의 기업회생 절차 유입과 이를 통한 비효율적 투자결정이 발생할 가능성이 적으며 이는 종결 후의 재무성과에 나타날 가능성이 높다. 이를 위해 기업회생 절차를 종결한 기업에 한하여 이들 기업의 신청 전 8년부터 종결 후 5년까지의 EBITDA 마진 및 산업조정 EBITDA 마진, 부채비율 및 산업조정 부채비율, 매출액증가율과 자산증가율을 분석한다.

<표 Ⅳ-2> 및 <그림 Ⅳ-1>의 왼쪽 그림은 기업회생 종결기업의 EBITDA 마진과 부채비율의 변화를, <표 Ⅳ-3> 및 <그림 Ⅳ-1>의 오른쪽 그림은 매출액증가율과 자산증가율을 나타낸 표이다. 먼저 <표 Ⅳ-2>에서 기업회생 종결기업의 종결 후 수익성 회복은 종결 후 5년 내에 이루어지지 못하는 것으로 나타났다. EBITDA 마진 및 산업조정 EBITDA 마진은 종결 후 5년까지(E+5) 수익성 악화 개시 시점인 기업회생 신청 3년 전(F-3)으로 회귀하지 못하는 것으로 분석된다. 즉, 종결 후 5년차 연도의 EBITDA 마진의 중간값은 4.6%로 신청 3년 전 수준인 5.5%에 미치지 못하고 있다. 또한 종결 후 5년차 연도의 산업조정 EBITDA 마진의 중간값은 –0.6%로 신청 5년 전 수준인 –0.1% 수준을 회복하지 못하고 있다.24) 반면 종결기업의 부채비율과 산업조정 부채비율은 모두 신청 전 부채비율 대비 크게 개선되었다. 종결기업의 부채비율은 종결 이후 지속적으로 낮아져 기업회생 신청 이전 8년간의 부채비율보다 낮았다. 산업조정 부채비율도 종결 이후 지속적으로 낮아지고 있으며 기업회생 신청 전 소속업종의 부채비율 대비 통계적으로 유의한 수준으로 높았던 부채비율이 통계적으로 유의한 수준은 아니지만 종결 이후 3년차부터(E+3) 소속업종의 부채비율 중간값보다 낮아지고 있다. EBITDA 마진과 부채비율 관련된 이러한 상반된 결과는 채권자, 주주, 경영자 등 이해관계자 간 채무조정이 본질적 기능인 기업회생 절차가 본연의 기능을 충실히 수행하고 있으나 향후 기업의 체질 개선이라는 관점에서 역할을 확대할 여지가 있음을 시사한다.

먼저 <표 Ⅳ-4>는 종결방식으로서 채무조정과 M&A를 통한 종결기업을 구분하고 종결 후 재무성과를 나타낸 표이며 지면 관계 상 종결 후의 산업조정 재무성과만을 제시한다. 먼저 M&A를 통한 종결기업은 종결 후 2년에서 4년까지 채무조정을 통한 종결기업보다 산업조정 EBITDA 마진이 높았으나 통계적 유의성은 없었다. 한편 산업조정 부채비율은 채무조정을 통한 종결 이후 점차 감소하고 있으나 M&A를 통한 종결보다 통계적으로 유의하게 높았다. 이는 M&A 자체가 외부투자자의 유상증자 등 자본의 유입으로 이루어지는 경우가 많은 반면 채무조정은 영업으로부터의 현금흐름으로 조정된 채무를 변제를 하는 경우가 많기 때문인 것으로 풀이된다. 그럼에도 불구하고 채무조정을 통한 종결기업은 종결 후 5년차에 M&A를 통한 종결기업의 산업조정 부채비율에 수렴하는 모습이 나타나고 있다.

반면 성장성 측면에서 M&A를 통한 종결방식은 종결 후 5년 동안 채무조정을 통한 종결방식보다 일관되게 높은 것으로 분석된다.28) 예를 들어, 채무조정을 통한 종결기업의 종결 후 5년차 연도의 매출액증가율과 자산증가율은 각각 –5.3%, 0.0%이나 M&A를 통한 종결기업은 각각 3.9%, 1.8%로서 M&A를 통한 종결기업이 성장성 측면에서 채무조정을 통한 종결기업보다 높음을 알 수 있다. 종결방식별 매출액증가율과 자산증가율의 차이는 종결 후 5년차 연도의 자산증가율을 제외하고는 모두 5% 이상 수준에서 통계적으로 유의하다. 이러한 종결방식과 관련된 성장률의 차이에는 M&A를 통한 종결의 경우 경영권 인수 시 신규자금 유입과 더불어 경영권을 획득한 대주주의 적극적인 성장 의지 등이 작용한 것으로 해석된다. 종합하면 채무조정과 M&A를 통한 종결은 종결 후 수익성에서 유의한 차이가 발견되지 않는 반면, 부채비율은 M&A를 통한 종결이 종결 후 5년간 채무조정을 통한 종결보다 통계적으로 유의하게 낮은 수준으로 유지되었다.

반면 사업적 부실기업의 산업조정 EBITDA 마진은 사업적 부실기업의 정의가 의미하는 바와 같이 기업회생 신청 2년 전부터 급격히 하락하여 신청 직전년도에 –11.2%로 급감한 이후 종결 후에는 점진적으로 산업조정 EBITDA 마진이 증가하기 시작하여 종결 후 5년차 연도에 –0.7%로 증가하였다. 반면 재무적 부실기업은 기업회생 신청 전 사업적 부실기업만큼 산업조정 EBITDA 마진의 악화는 없었으며 신청 직전년도에 –1.1%를 기록한 이후 등락을 거쳐 종결 후 5년차 연도에 –0.4%를 기록하고 있다. 산업조정 EBITDA 마진의 경우에는 재무적 부실기업과 사업적 부실기업 간의 차이가 기업회생 신청 2년 전부터 종결 후 2년차 연도까지 통계적으로 유의한 것으로 나타났다. 산업조정 부채비율에서와 마찬가지로 부실유형 간 산업조정 EBITDA 차이의 소멸과 산업 중간 재무성과로의 수렴은 적어도 부실유형으로서 사업적 부실과 재무적 부실에 대하여는 채무조정이라는 기업회생의 본원적 기능과 회생 역량이 발휘되고 것으로 해석될 수 있다.

기업회생의 주목적은 이해관계자의 채권‧채무 조정을 통한 기업 재건이므로 채무조정을 통한 종결기업의 경우에는 기업회생의 효율성을 평가하기 위하여 회생 절차 중 적정한 채무조정이 이루어지는가를 살펴볼 필요가 있다. 채무조정이 효율적으로 이루어지기 위해서는 부채비율 감소폭이 적정해야 하며 기업회생 신청 전 산업조정 부채비율과 관계없이 종결 후 산업조정 부채비율이 유사한 수준으로 수렴해야 한다. 이를 위해 채무조정을 통한 종결기업 중 기업회생 신청 전 산업조정 부채비율을 기준으로 신청기업을 상위 50% 기업과 하위 50% 기업으로 나누고 이들의 종결 후 산업조정 부채비율을 살펴본다. <표 Ⅳ-8>은 그 결과를 나타낸 표이다.

<표 Ⅳ-8>에 의하면 산업조정 부채비율이 신청 전 부채비율과 상관없이 종결 후 5년차에 소폭 음(-)으로 나타나 산업 중간 수준의 부채비율로 감소되었다. 또한 산업조정 부채비율 하위 50%의 기업회생 신청 전 3년간의 산업조정 부채비율은 각각 4.6%, 7.6%, 12.5%인 반면 동기간 산업조정 부채비율 상위 50%는 14.8%, 22.0%, 50.8%로서 이들 간의 차이는 3개년 모두 1% 수준에서 통계적으로 유의하다. 그러나 기업회생 종결 후에는 산업조정 부채비율 하위 50%와 상위 50%간 차이가 감소하고 있으며 차이는 통계적으로 유의하지 않다. 오히려 종결 후 3년차 및 4년차 연도의 경우에는 두 기업군의 산업조정 부채비율이 역전되는 모습까지 나타나고 있다. 이러한 결과는 기업회생 절차 중인 기업(이하 회생기업)의 체질 개선 여부와는 독립적으로 기업회생이 채무조정을 통한 기업 재건이라는 본연의 역할을 충실히 수행하고 있음을 시사한다.

기업회생의 효율성 분석을 위한 네 번째 기준으로 부실유형에 대하여 기업회생이 어떠한 종결방식으로 종결되느냐를 분석한다. 사업적 부실기업이나 한계기업은 기업의 내재가치가 훼손된 기업으로서 기존 경영자를 통해서는 자산을 수익성 있게 활용하기 어려운 기업이므로 소유권의 이전, 즉 M&A를 통한 자산재배분(asset redeployment)이 필요한 기업이라고 할 수 있다. 이러한 관점에서 부실유형과 종결방식의 관계는 기업회생의 효율성을 가늠할 수 있는 중요한 지표의 하나라고 할 수 있다. 본 절에서는 먼저 부실유형에 따라 기업회생 신청기업을 재무적 부실과 사업적 부실, 그리고 한계기업과 비한계기업으로 각각 분류하고 이러한 부실유형과 M&A를 통한 종결의 관계를 살펴본다. 이어서 부실유형을 세분화하여 부실기업을 비한계기업-재무적 부실기업, 비한계기업-사업적 부실기업, 한계기업-재무적 부실기업, 한계기업-사업적 부실기업의 쌍으로 구분하고 세분화된 부실유형과 M&A를 통한 종결과의 관계를 살펴본다.

먼저 부실유형을 재무적 부실과 사업적 부실로 나눈 분석 결과를 살펴본다. <표 Ⅳ-9>는 Ⅲ장에서 정의된 협의와 광의의 부실유형에 따라 사업적 부실과 재무적 부실을 구분하고 이들의 재무적 특징을 나타낸 표이다. 협의의 부실유형(type0)의 경우 재무적 부실기업은 사업적 부실기업 대비 매출액과 자산이 작았지만 차이의 통계적 유의성은 없다. 반면 재무적 부실기업의 매출액증가율, EBITDA 마진, 산업조정 EBITDA 마진, 부채비율, 산업조정 부채비율은 모두 사업적 부실기업보다 1% 수준에서 통계적으로 유의한 수준으로 높았다. 또한 재무적 부실기업의 산업 내 취약기업 비중은 24.6%인 반면 사업적 부실기업은 85.8%로 나타나 그 차이는 1% 수준에서 통계적으로 유의하였다. 한편 광의의 부실유형(type1)의 경우 재무적 부실기업과 사업적 부실기업 간 재무지표의 차이는 협의의 부실유형보다 작았으나 표본 수의 증가에 따라 통계적 유의성은 강화되었다. 마지막으로 한계기업과 비한계기업은 사업적 부실기업과 재무적 부실기업에 고루 존재하고 있다. 협의의 부실유형 기준으로 분류한 재무적 부실기업과 사업적 부실기업 중 한계기업 비중은 각각 37.7%, 35.5%이며 광의의 부실유형 기준으로는 각각 25.5%, 21.7%이다. 다시 말해 부실유형으로서 한계기업-비한계기업 간 구분은 재무적-사업적 부실유형과 독립적인 부실유형이라고 할 수 있다.

한편 <표 Ⅳ-11>에 따르면 부실유형으로서 한계기업과 비한계기업의 인가율은 각각 68.9%, 69.2%로서 통계적으로 유의한 차이가 없는 반면 한계기업과 비한계기업의 종결율은 각각 64.6%, 46.6%로서 한계기업이 1% 수준에서 통계적으로 유의하게 높다. 또한 한계기업과 비한계기업의 종결 대비 M&A 비중은 각각 65.1%, 45.0%로서 한계기업이 1% 수준에서 통계적으로 유의하게 높다. 즉 기업회생은 M&A를 통해 한계기업을 처리하는 비중이 높아 자산재배분의 역할에 충실함을 알 수 있다. 한계기업이 예상과 달리 종결율이 높은 것은 한계기업의 종결방식으로 M&A 비중이 높은 것이 원인이라고 할 수 있다. <표 Ⅳ-10>과 <표 Ⅳ-11>의 결과를 종합하면, 기업회생은 부실유형 구분 방식과는 관계없이 기업의 내재가치가 훼손된 부실기업의 자산재배분의 역할을 수행하고 있음을 시사한다.

<표 Ⅳ-12>는 세분화된 부실유형의 재무적 특징을 나타낸 표이다. 전체적으로 네 가지 부실유형은 재무적 특징에서 뚜렷한 차이를 나타내고 있다. 먼저 매출액은 비한계기업이 상대적으로 큰 반면 자산은 한계기업이 큰 것으로 나타났다. 이는 한계기업, 특히 한계기업-재무적 부실기업이 자산을 효율적으로 사용하고 있지 못함을 나타낸다. 기업 내재가치의 훼손이 만성적인 한계기업-사업적 부실기업은 부실유형 중 가장 낮은 매출액증가율(–14.1%), EBITDA 마진(–6.9%) 및 산업조정 EBITDA 마진(-14.1%)을 나타내고 있으며 산업 내 취약기업 비중도 75.1%를 차지하고 있다. 한편 부채비율과 산업조정 부채비율은 한계기업-재무적 부실기업이 각각 1.29, 0.52로 가장 높다.29)

종합하면 재무적 부실 또는 사업적 부실과 한계기업 여부로 부실기업 유형을 상세 분류할 경우 한계기업과 관련된 한계기업-재무적 부실기업 과 한계기업-사업적 부실기업의 종결 대비 M&A 비중이 높아 기업회생이 자산재배분 기능을 수행하고 있다고 평가할 수 있다. 특히 만성적 저수익성이 가장 심한 한계기업-사업적 부실기업은 낮은 종결율에도 불구하고 M&A 종결 비중이 가장 높아 기업회생이 자산재배분 기능을 수행하는 것으로 분석된다. 이러한 결과는 사업적 부실기업이나 한계기업, 나아가서 한계기업-사업적 부실기업이 M&A를 통한 자산재배분이 필요하다는 가설을 지지하는 결과이다.

모형 Ⅰ은 사업적 부실더미와 통제변수만을 독립변수로 하는 회귀식으로 사업적 부실더미가 10%에서 유의한 수준으로 양(+)의 계수 값을 갖는 것으로 나타나 단변량 분석에서의 결과를 지지하고 있다. 모형 Ⅱ는 한계기업 더미와 통제변수만을 독립변수로 하는 회귀식으로서 한계기업 더미가 모형 Ⅰ에서와 같은 유사한 크기의 양(+)의 값을 가지나 통계적 유의성을 확보하지 못하였다. 그러나 모형 Ⅲ에서 사업적 부실더미와 한계기업 더미를 동시에 사용한 결과 부실기업을 포착하는 각 더미의 독립적 특징으로 인하여 사업적 부실기업 더미는 5% 수준에서 유의한 0.53의 양(+)의 값을, 한계기업 더미는 10% 수준에서 유의한 0.50의 양(+)의 계수를 갖는 것으로 분석되었다. 모형 Ⅳ는 사업적 부실기업 더미에 사업적 부실기업 더미와 한계기업 더미의 상호작용(interaction) 더미를 추가한 모형으로서 사업적 부실기업 더미의 설명력이 없어지는 반면 상호작용 더미의 계수는 5% 수준에서 유의한 0.78로 나타나 실질적으로 사업적 부실기업 가운데 한계기업이 M&A를 통한 종결에 유의한 영향을 미치고 있음을 알 수 있다. 이러한 결과는 모형 Ⅴ에서 한계기업 더미에 대하여도 나타나고 있다. 모형 Ⅴ는 한계기업 더미에 사업적 부실기업 더미와 한계기업 더미의 상호작용 더미를 추가한 모형으로서 한계기업 더미가 음(-)으로 전환되고 설명력이 없어지는 반면 상호작용 더미의 계수는 5% 수준에서 유의한 0.94로서 실질적으로 한계기업 가운데 사업적 부실기업이 M&A를 통한 종결에 유의한 영향을 미치고 있음을 알 수 있다. 따라서 한계기업-사업적 부실기업의 종결방식이 M&A를 통한 자산재배분에 중요한 함의가 있음을 살펴볼 수 있다. 회귀분석 결과는 단변량 분석의 결과와 마찬가지로 한계기업과 사업적 부실기업에 대하여 종결방식 중 M&A가 활용되는 비중이 높아 기업회생의 자산재배분 역할과 정합적인 결과라고 할 수 있다.

본 보고서의 분석결과는 국내 기업회생 제도가 채무조정을 통한 기업 재건이라는 기업회생의 목적에 비교적 충실한 역할을 수행하고 있으며 효율적 제도 운영을 위한 노력이 이루어지고 있음을 시사한다. 구체적으로 기업회생 신청기업, 종결 전후의 재무성과, 부실유형과 종결방식의 관계에 대한 다음과 같은 실증분석 결과가 도출되었다.

첫째, 기업회생은 회생 가능성이 낮은 부실기업의 기업회생 절차 유입을 차단하는 역할을 하고 있다. 둘째, 기업회생 종결기업의 종결 후 수익성이나 성장성 회복은 종결 후 5년 내에 이루어지지 못하고 있어 기업회생이 진정한 회생(turnaround)을 이끌어내는 기업재건 역량 측면에서는 다소 미흡한 것으로 나타나고 있다. 이와 관련하여 M&A를 통한 종결은 종결기업의 성장성 회복 측면에서 채무조정을 통한 종결보다 우수하지만 수익성 측면에서는 채무조정을 통한 종결과 차이가 나타나지 않았다. 또한 사업적 부실기업의 경우 채무조정의 개선이 이루어진 반면 재무적 부실기업과 마찬가지로 수익성 회복은 지연되었으며 한계기업은 회생절차 종결 후에도 재무성과의 회복을 기대하기 어려워 기업회생은 한계기업의 구조조정에는 효과가 제한적인 것으로 분석되었다. 셋째, 채무조정을 통한 종결에서의 채무조정은 효율적으로 이루어지는 것으로 평가되었다. 이는 이해관계자의 채권‧채무 조정을 통한 기업재건이 기본적인 목적인 기업회생이 본질적인 역할에 충실함을 의미한다. 넷째, 기업회생은 자산재배분의 역할을 수행하는 것으로 분석되었다. 한계기업, 사업적 부실기업, 그리고 한계기업-사업적 부실기업은 모두 M&A를 통한 종결 비중이 타 부실유형보다 높은 것으로 나타나며 이는 기업구조조정 수단으로써 기업회생의 기본적 유용성을 시사한다.

이러한 기업회생의 효율성과 그간의 성과에도 불구하고 본문의 분석에서 나타나듯이 종결기업의 재무성과 회복이 지연되는 것은 선별 과정을 거친 기업의 구조조정을 통한 진정한 회생이라는 측면에서는 다소 아쉬운 결과라고 할 수 있다. 그리고 이러한 결과는 본질적으로 법적 절차인 기업회생에서 파생되는 측면도 있을 것이다. 따라서 향후 국내 기업회생의 효율성이 제고되기 위해서는 기업회생 인가, 인가 후 회생계획안 수행, 종결 등 단계별 개선방향과 같은 미시적 관행 개선과 더불어 M&A 시장 발전과 DIP금융 활성화 등 자본시장을 포함한 중장기적‧거시적 금융환경의 개선이 필요하다. 이와 관련된 시사점과 향후 정책 방향은 다음과 같다.

첫째, 본문의 분석에서 살펴본 바와 같이 만성적 부실기업인 한계기업은 기업회생을 통한 재건이 현실적으로 어렵다. 한계기업은 내재가치의 심한 훼손으로 자산을 효율적으로 활용하지 못하는 기업이다. 따라서 한계기업은 기업회생 신청 전 부실 단계에서 M&A를 통한 사전적 구조조정을 유도하거나 기업회생 신청 시 M&A를 전제로 한 회생계획안의 경우에만 인가를 허용하는 등 엄격한 인가 기준을 적용하거나 청산을 유도할 필요가 있다.

둘째, 기업회생 절차가 진행 중인 기업의 가치제고 또는 구조조정을 독려할 수 있는 인센티브가 필요하다. 기업회생의 종결방식과 관계없이 대부분의 기업회생 종결기업은 수익성 회복이 가장 극복하기 어려운 과제이다. 기업회생 절차 소요기간이 짧은 상황에서 기업의 실질적인 체질 개선을 위한 기업회생 운영 상의 기제가 필요하다. 이는 크게 기존경영자관리인의 인센티브 강화와 채권자 권리 강화의 방향으로 개선할 수 있다. 먼저 기존경영자관리인과 관련하여 기업회생은 감자와 출자전환에 의해 지분율이 대폭 축소된 기존경영자관리인이 경영을 지속하게 되므로 종결 이후 기업 정상화에 대한 기존경영자관리인의 인센티브가 약할 수 있다.30) 따라서 기존경영자관리인이 기업회생 종결 전후에 출자전환 지분을 인수할 수 있는 옵션 등을 도입할 필요가 있다.31) 한편 채권자를 통한 구조조정 효율화는 구조조정전문임원(Chief Restructuring Officer: CRO)이나 DIP금융 공급자를 통해 이루어질 수 있다. 그러나 현재 국내 CRO는 미국과 달리 기업회생 절차 중 구조조정을 실질적으로 주도하는 적극적 역할을 수행하지 못하고 있다.32) 또한 미국의 경우 DIP금융 채권자, 특히 자본시장 투자자는 DIP금융 공급자의 권리 강화를 통해 회생기업의 구조조정 노력을 견인하고 있으나 국내 DIP금융 채권자는 제한된 범위의 권리만을 가지고 있다.33)

셋째, 채무조정을 통한 종결기업의 경우 의미 있는 기업재건이 완성되기 위해서는 회생절차 종결 이후 수익성과 성장성을 회복하게 되는 시점까지 자금조달이 필요하다. 기업회생의 종결은 회생채무의 변제 가능성에 초점을 맞추고 있으므로 사업의 정상화까지 필요한 운영자금 및 시설자금에 대한 고려는 충분하지 않은 것이 일반적이다. 이러한 이유로 채무조정을 통한 종결기업의 경우 수익성 및 성장성 회복이 지연되는 경우가 많다. 회생절차 종결기업의 기업재건은 많은 경우 고객확보와 수주확대를 통해 이루어지는데 이들 기업은 기업회생 신청기업이라는 낙인효과로 인해 현금거래를 강요받거나 각종 보증금 등 다양한 운영자금이 필요하다. 문제는 기업회생 종결기업의 경우 종결 후 일정 기간(예를 들어, 3년)이 경과하기 전까지 민간은행 여신을 조달할 수 없는 것이 현실이다. 이에 대응하고자 현재 일부 국내 정책금융기관을 중심으로 정책성 여신이 공급되고 있으나 이러한 종결기업에 대한 체계적‧선별적 자금지원 체계를 구축할 필요가 있으며 중장기적으로는 정책성 여신을 대체할 민간자금의 공급 확대를 위한 인센티브 부여 등 다양한 정책이 필요하다.

넷째, 다양한 유형의 자본시장 투자자의 존재는 기업회생이 효율적으로 이루어질 수 있는 중요한 환경요인이다. 재무적 투자자는 기업회생 절차의 선별기능과 기업재건, 그리고 전략적 투자자에 의한 회생기업 인수 시점까지 가교 역할을 수행하여 M&A를 통한 자산재배분이 효율적으로 이루어지는 기업회생 생태계의 구축에 큰 기여를 한다. 다수의 연구에서 분석된 바 1990년대 이후 미국 Chapter 11의 효율성 개선은 미국 자본시장에서의 M&A 확대와 밀접한 관련이 있었음을 유념할 필요가 있다. 국내에서도 2017년 이후 기업재무안정 PEF 등 사모펀드 중심 재무적 투자자의 회생기업 인수가 증가하고 있는데 향후 회생기업 M&A를 위한 수요기반의 추가적인 확대가 필요하다.