Find out more about our latest publications

M&A in Korea: Characteristics and Implications from the Perspective of Acquirers

Issue Papers 23-16 Aug. 24, 2023

- Research Topic Corporate Finance

- Page 26

Recently, the Korean M&A market has captured the attention of market participants due to regulatory authorities unveiling plans to enhance support for corporate M&A. As one of the classic investment and growth strategies of businesses, M&A effectively allocates investment opportunities to assist firms in securing growth prospects and plays a critical role in improving economic dynamics and industry structure. Based on the detailed data on domestic M&A deals, this report carried out a comprehensive and quantitative analysis on the current state and characteristics of Korea's M&A market. Additionally, it analyzed the key financial indicators that could influence deal participation from the perspective of acquirers.

According to the analyses, the Korean M&A market saw the deal size growing steadily between 2010 and 2022, and a significant part of the market has been driven by deals between buyers and sellers, and of non-listed businesses. On another note, the market has also witnessed increased participation by financial investors, including private equity. It seems that the higher valuation multiples in Korean M&A deals were influenced by several factors, including increased investment sources, larger acquisition financing due to low interest rates, and a greater appetite for growth sectors among these investors. Also found was that investors with a strategic focus on few specific sectors increasingly tend to acquire firms in other sectors, which implies an increase in growth-type acquisitions for investment opportunities. Finally, an empirical analysis of the financial leading indicators related to acquisitions revealed a direct correlation between acquisition activity and factors such as corporate size, which signifies access to acquisition financing and funding sources, as well as the proportion of debt, cash reserves, and the share of intangible assets representing innovation and value-adding capabilities.

The results of this report suggest the necessity to offer stronger access to acquisition financing to small-sized, innovative firms that have financial constraints but want to engage in acquisition deals. Towards that end, it is possible to consider financing via growth capital or matching investment. Also, further policy efforts are needed to facilitate IP financing and to enhance access to acquisition financing for the firms that have strength in intangible assets. Although highly likely to participate in acquisition deals, these firms can hardly access to external financing sources.

According to the analyses, the Korean M&A market saw the deal size growing steadily between 2010 and 2022, and a significant part of the market has been driven by deals between buyers and sellers, and of non-listed businesses. On another note, the market has also witnessed increased participation by financial investors, including private equity. It seems that the higher valuation multiples in Korean M&A deals were influenced by several factors, including increased investment sources, larger acquisition financing due to low interest rates, and a greater appetite for growth sectors among these investors. Also found was that investors with a strategic focus on few specific sectors increasingly tend to acquire firms in other sectors, which implies an increase in growth-type acquisitions for investment opportunities. Finally, an empirical analysis of the financial leading indicators related to acquisitions revealed a direct correlation between acquisition activity and factors such as corporate size, which signifies access to acquisition financing and funding sources, as well as the proportion of debt, cash reserves, and the share of intangible assets representing innovation and value-adding capabilities.

The results of this report suggest the necessity to offer stronger access to acquisition financing to small-sized, innovative firms that have financial constraints but want to engage in acquisition deals. Towards that end, it is possible to consider financing via growth capital or matching investment. Also, further policy efforts are needed to facilitate IP financing and to enhance access to acquisition financing for the firms that have strength in intangible assets. Although highly likely to participate in acquisition deals, these firms can hardly access to external financing sources.

Ⅰ. 서론

최근 정책당국이 기업 M&A 지원을 위한 제도 개선방안을 발표하는 등1) 국내 M&A 시장에 대한 시장참여자의 관심이 높다. 기업의 대표적인 투자방식 및 성장전략 중 하나로서 M&A는 혁신기업의 진입과 퇴출 등 경제의 역동성 제고를 통해 경제규모를 확대하고 생산성을 제고하는 긍정적 기능을 수행한다(Li, 2013; Dimopoulos et al, 2017; David, 2021). 또한 기업 관점에서 M&A는 인수기업과 인수대상 기업 간 투자기회의 재배분을 통하여 혁신 등 성장기회를 확보할 수 있는 수단을 제공한다(Levine, 2017; Celik et al, 2022; Jin et al, 2023). 한편 모험자본 생태계 관점에서 M&A는 벤처캐피탈 투자의 회수시장으로서의 역할(Phillips et al, 2017) 등 경제ㆍ산업구조의 효율성을 제고함에 있어서 핵심적인 역할을 수행한다.

2010년대 들어 국내 M&A 시장은 PE를 중심으로 한 재무적투자자의 시장 참여 확대에 힘입어 꾸준한 성장을 시현하였다. 동 기간 해외에서는 재무적투자자의 활발한 M&A 시장 참여 뿐만 아니라 플랫폼 기반의 대형 기술기업2)에 의한 기술 스타트업 인수가 크게 증가하였다. 이는 개방형 혁신(open innovation) 기조 하에서 M&A를 통해 성장기회를 확보하거나 혁신기회를 외부에서 조달하려는 기업 전략의 확산에 따른 결과이다.

최근 국내외 금리인상 기조 및 글로벌 경기 둔화, 그리고 저탄소 경제 전환, 디지털화, 산업 간 융ㆍ복합 등 경영환경 변화에 대한 기업의 대응 필요성이 높아지는 상황에서 국내 M&A 시장이 위축되는 모습이 나타나고 있다. M&A 지원을 위한 최근 제도 개선방안은 기업의 환경변화 대응 노력을 지원하기 위한 제반 정책으로서 기업의 사업재편과 구조조정에 대한 효율적인 지원 수단의 모색을 위해서는 국내 M&A 시장 현황과 특징에 대한 이해가 선결되어야 한다.

M&A가 경제의 역동성 제고에 미치는 영향과 정책 대응의 필요성을 고려할 때 그간 국내 M&A 전반의 현황과 특징에 대한 분석의 필요성이 높았음에도 불구하고 이를 포괄적ㆍ정량적으로 분석한 연구가 희소하였다. 대부분의 기존 국내 연구는 주로 상장기업 M&A를 중심으로 한 주가수익률 또는 기업회계 측면의 성과 분석, 피인수기업의 선행요인(antecedents) 분석 또는 상장기업 합병 시 합병비율 산정 방식에 대한 법제적 연구가 주종을 이루었다.3)

국내 M&A 시장에서 상장기업 M&A가 차지하는 비중은 거래규모와 건수에서 제한되어 있을 것으로 예상되므로 국내 M&A 시장의 전반적인 현황과 변화 추세를 파악하기 위해서는 비상장기업에 의한 M&A를 포함하는 M&A 시장 전반에 대한 정량적 분석이 필요하다. 한편 본 보고서는 그간 주종을 이루었던 피인수기업 관점의 M&A 연구에서 벗어나 인수기업 관점에서 M&A 거래를 분석하는 최근의 연구 경향(Haleblian et al, 2009)과 M&A 거래의 대부분이 인수자 주도의 거래인 현실(Masulis et al, 2018)을 반영하여 인수기업 관점에서 M&A 선행요인을 분석하되 재무적 선행요인에 국한하여 실증분석을 수행한다.4) 구체적으로 지난 10여 년간 국내 M&A 시장의 거래규모, 거래유형 및 인수자 유형별 비중과 특징, 거래가치평가(valuation) 등을 분석하고 인수기업 관점에서 M&A의 재무적 선행요인을 파악함으로써 기업 M&A 확대를 위한 정책적 시사점을 도출하고자 한다.

보고서의 구성은 다음과 같다. Ⅱ장에서는 국내 M&A 거래 데이터에 대한 분석을 바탕으로 국내 M&A의 거래규모, 거래유형 및 인수자 유형별 특징을 살펴보고 Ⅲ장에서는 인수기업 관점의 재무적 선행요인을 분석한다. Ⅳ장에서는 실증분석 결과를 바탕으로 정책적 시사점을 제시한다.

Ⅱ. 국내 M&A 현황과 추세

Ⅱ장에서는 M&A 거래 자료를 바탕으로 다양한 M&A 유형별 비중과 연도별 추이, 인수자 유형별 거래가치평가의 특징 그리고 업종을 기준으로 살펴본 전략적투자자(기업) 인수거래의 특징을 분석한다.

1. M&A 거래규모 및 유형

본 보고서는 더벨이 집계ㆍ발표하는 국내 M&A 거래 자료 중 2010년부터 2022년까지의 종결 기준 M&A 거래 자료를 가공하여 분석하였다. 원자료 중 중복 자료를 제외하고 추출된 총 4,868건의 M&A 거래 중 거래규모 자료가 존재하는 인수거래와 기타 M&A 유형인 합병, 분할, 주식교환, 영업양수도 및 자산양수도 방식을 포함하는 3,138건의 M&A 거래를 분석표본으로 선정하였다.5) 한편 Ⅲ장의 실증분석에서는 분석표본 중 전략적투자자(기업)의 인수거래인 2,439건의 M&A 거래를 분석한다. 본 보고서에서 국내 M&A는 매수자ㆍ매도자 중 일방, 또는 피인수기업이 국내에 소재하는 M&A로 정의한다.

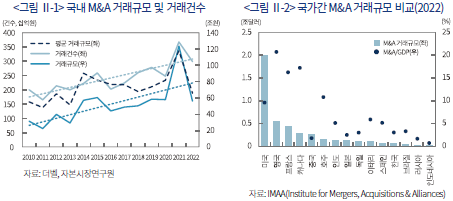

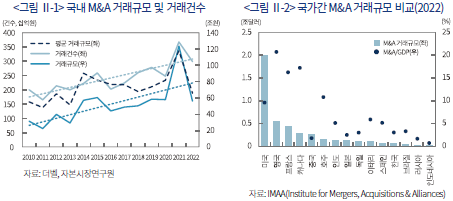

2010년 거래건수 200건, 거래규모 36.1조원 수준이었던 국내 M&A 시장은 2021년 거래건수 367건, 거래규모 123.4조원으로 정점을 기록하기까지 꾸준한 성장을 나타냈다. 2022년 들어 거래건수 299건, 거래규모 56.3조원으로 M&A 시장이 다소 위축되었음에도 불구하고 전체 기간을 살펴볼 때 꾸준한 성장을 이룬 것으로 평가된다. 평균 M&A 거래규모도 2010년 1,580억원에서 2022년 1,880억원으로 꾸준한 증가 추세가 이어지고 있다(<그림 Ⅱ-1>).

국내 M&A 시장의 상대적인 규모는 국가 간 비교를 통해 확인할 수 있다. 우리나라는 미국, 영국, 프랑스 등에 이어 전 세계에서 12번째로 M&A 거래규모가 크며 GDP 규모 대비 M&A 거래 비중(3.0%)은 10번째로서 브라질(3.3%), 독일(3.0%), 일본(2.5%)과 유사한 수준이다(<그림 Ⅱ-2>).

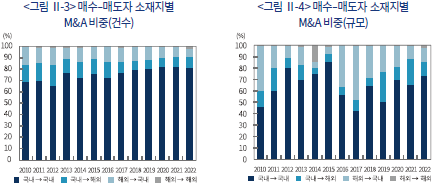

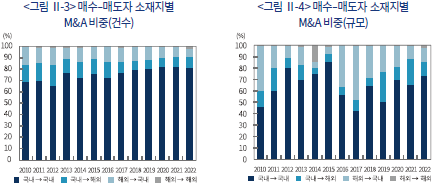

국내 M&A는 매수자와 매도자의 소재지를 기준으로 국내 매수자-매도자 간 M&A(in-in), 국내 매수자-해외 매도자 간 M&A(in-out), 해외 매수자-국내 매도자 간 M&A(out-in), 해외 매수자-해외 매도자 간 M&A(out-out)로 구분할 수 있다.6)7) 분석표본에서 in-in M&A는 건수(규모) 기준 76.6%(65.6%)을 차지하고 있으며 in-out M&A와 out-in M&A가 각각 11.4%(13.6%), 11.2%(19.1%)를 차지하고 있다. 한편 in-in M&A는 거래건수와 규모 비중 모두 표본 기간 증가하는 반면 in-out M&A와 out-in M&A 비중은 감소하는 추세가 나타나고 있어서 국내 M&A 시장이 국내 매수자-매도자 간 거래를 중심으로 형성되어왔음을 알 수 있다.

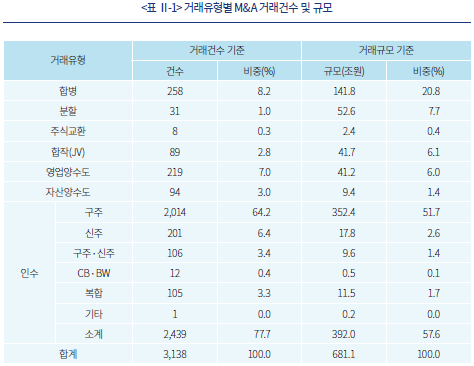

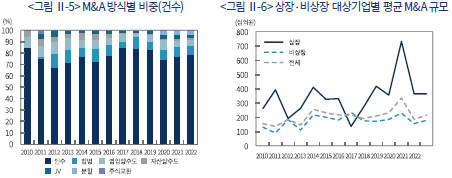

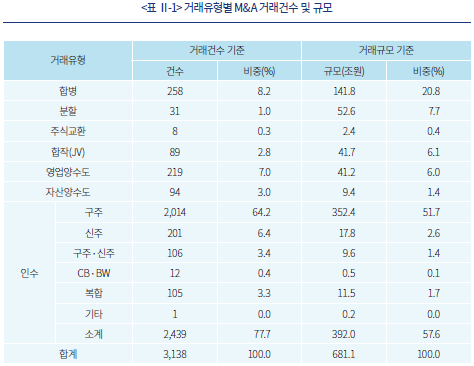

<표 Ⅱ-1>에 의하면 국내 M&A에서 가장 높은 비중을 차지하는 M&A 거래유형은 거래건수 2,439건, 거래규모 392.0조원을 차지하고 있는 인수(acquisition)로 전체 거래에서 각각 77.7%, 57.6%를 차지하고 있다. 이어서 합병과 영업양수도가 뒤를 잇고 있으며 M&A의 대표적 유형인 인수, 합병 및 영업양수도의 세 가지 방식이 건수 및 규모기준으로 각각 92.9%, 84.4%를 차지하고 있다. 또한 2010년대 중반 이후 인수건수의 비중이 점차로 증가하였음을 확인할 수 있다(<그림 Ⅱ-5>).

인수거래 2,439건 중 기업도산과 관련된 인수는 122건, 15.7조원으로 건수 및 규모기준 전체의 5.0%, 4.0%를 차지하고 있다. 인수 방식 중 가장 큰 비중을 차지하는 방식은 구주 인수로서 건수 및 규모 기준으로 각각 64.2%, 51.7%를 차지하고 있다.8)

한편 상장기업이 거래 대상기업9)인 M&A 비중은 건수 및 규모 기준으로 각각 19.8%, 33.4%에 불과하여 국내 M&A 시장에 대한 온전한 이해를 위해서는 비상장기업 M&A를 포함하여 분석할 필요가 있다. 한편 전술한 국내 평균 M&A 거래규모의 증가 추세는 상장 거래 대상기업의 거래규모가 증가함에 따른 결과임을 확인할 수 있다(<그림 Ⅱ-6>).

2. 재무적투자자 인수거래의 특징: 거래가치평가

인수거래에서의 매수자 유형은 크게 전략적투자자(기업)와 재무적투자자로 구분된다.10) 전략적투자자는 주로 시장ㆍ고객의 획득을 통한 성장과 가치창출 목적으로 인수를 추진하는 반면 재무적투자자는 저평가된 기업의 인수 또는 인수 후 가치제고 활동을 통한 투자수익 창출을 목적으로 인수거래를 수행한다. 전략적투자자와 재무적투자자는 M&A 거래에서 잠재적 인수자로서 경쟁하기도 하며 인수거래에서 매도ㆍ매수거래의 양 당사자로 참여하기도 한다.

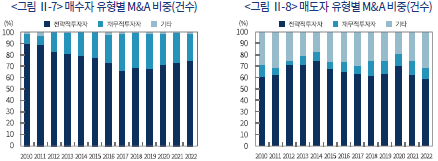

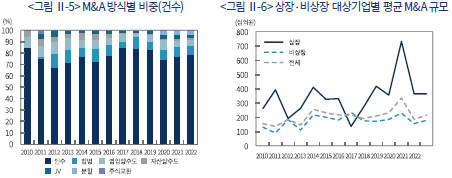

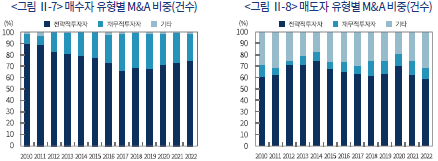

2010년대 들어 국내 M&A 시장의 두드러진 특징 중 하나는 바이아웃 펀드를 중심으로 한 PE의 급속한 성장세이다. 2005년 국내 도입된 PE는 2010년대 들어 급성장하며 기업 투자와 M&A 시장에서 주요 시장참여자로 자리매김하였다. <그림 Ⅱ-7>에 의하면 재무적투자자에 의한 인수는 727건으로 전체 인수거래의 24.1%를 차지하고 있으며 규모 기준으로는 20.0%를 차지하고 있다. 대부분 PE인 재무적투자자의 비중은 2010년부터 2017년까지 지속적으로 증가하여 2017년 32.6%를 기록한 후 2022년 20% 중반 대를 유지하고 있다. 거래규모 기준으로는 특정 연도의 특정 인수거래에 따라 비중의 차이가 큰 편이지만 대체로 20% 수준을 나타내고 있다. 한편 재무적투자자가 매도자인 경우는 거래건수 및 규모 기준으로 각각 9.2%, 12.9%를 차지하고 있다(<그림 Ⅱ-8>).11)

한편 M&A 거래규모의 증가는 기업자산 가격의 상승을 유발할 수 있다. 경기상승 전망이나 규제 및 기술변화 등으로 인수 수요는 증가하는 반면 인수 대상기업의 수는 한정될 수 있기 때문이다. 전략적투자자는 대상기업이 자신의 사업과 시너지를 창출할 가능성을 기대하고 인수에 나서는 경우가 많아 인수가격에 일정한 시너지 가치가 반영되는 것이 일반적이다. 반면 재무적투자자는 매각을 전제로 대상기업을 인수하므로 투자수익 창출을 위해 인수가를 낮추는 것이 중요하다. 따라서 일반적으로 전략적투자자의 인수가는 재무적투자자보다 높다(Shleifer et al, 1992; Bargeron et al, 2008; Gorbenko et al, 2014). 그러나 2000년대 이후 급증하는 자금모집과 저금리 추세를 바탕으로 재무적투자자들이 M&A 시장에서 역할을 강화해 온 가운데 한정된 M&A 대상기업에 대한 재무적투자자 간 경쟁이 심화될 경우 인수가의 상승이 불가피하다(Axelson et al, 2013; Martos-Vila et al, 2013).

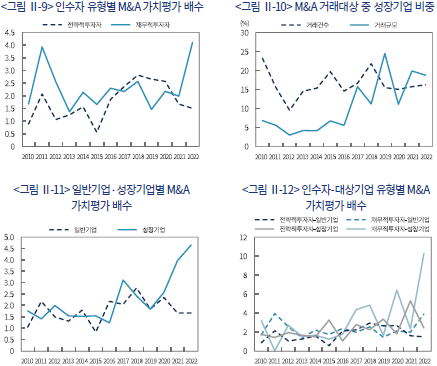

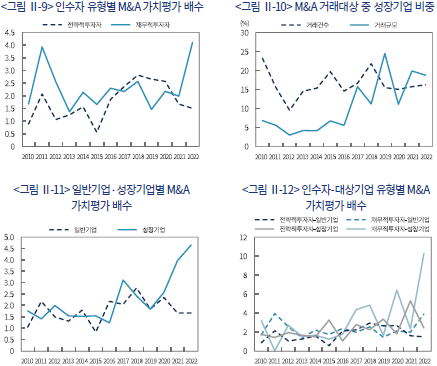

<그림 Ⅱ-9>는 국내 인수거래의 경우 거래가치평가 기준으로 재무적투자자가 전략적투자자보다 낮은 가격으로 인수한다는 통상적인 이론이 적용되고 있지 않음을 보여준다. 매출액 대비 기업가치(Enterprise Value: EV) 배수를 기준으로 전략적투자자가 재무적투자자보다 높은 인수 배수를 지불한 연도는 2018~2020년도의 3개 년도에 불과하다.12)13)

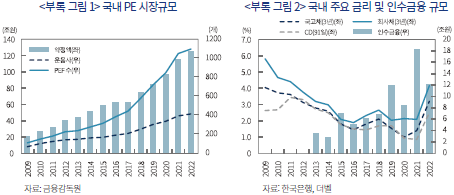

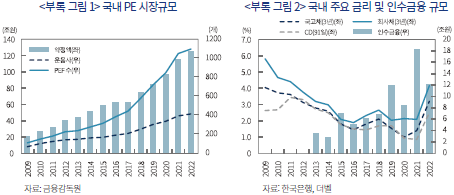

재무적투자자의 거래가치평가 배수가 전략적투자자에 비하여 낮지 않은 이유는 무엇보다 M&A 시장의 대표적인 재무적투자자인 PE의 자금모집 증가세와 저금리 추세로 인한 인수금융 규모의 증가를 들 수 있다. 표본기간 내 PE 약정액은 2009년말 17.2조원에서 2022년말 125.8조원 수준으로 연평균 15.2% 증가하였으며 금리는 회사채 3년물(AA-) 금리 기준으로 2009년 5.8%에서 점진적으로 하락하여 2022년 금리 급등 전까지 2%대 초반을 유지하였다. 한편 인수금융은 2013년 3.4조원에서 2021년 18.2조원으로 연평균 20.6% 증가한 후 2022년 금리 상승으로 12.5조원으로 급감하였다(<부록 그림 1> 및 <부록 그림 2>).

그러나 국내 재무적투자자의 거래가치평가 수준을 자금모집 증가와 인수금융 비용의 하락으로 인한 재무적투자자 인수 수요의 증가만으로 설명하기는 어려울 수 있다. 재무적투자자와 전략적투자자가 인수한 기업의 유형이 동일하지 않을 수 있기 때문이다. 구체적으로 재무적투자자의 인수가격이 상대적으로 높게 나타난 것은 재무적투자자가 인수하고자 하는 대상기업이 성장성이 높은 기업일 가능성이 있다. PE의 투자방식이 2000년대 들어 차입매수(Leveraged Buy-Out: LBO)와 같이 현금흐름이 안정적인 기업을 인수하는 방식에서 성장성이 뛰어난 기업을 인수하는 방식으로 점차 변모했기 때문이다(Boucly et al, 2011).

성장기업을 엄밀히 정의하는 것은 본 보고서의 범위에서 벗어나므로 바이오ㆍ제약, ICT 하드웨어ㆍ소프트웨어 등과 관련된 업종을 성장기업의 기준으로 삼아 국내 M&A 거래를 성장기업과 일반기업으로 개략적으로 분류하여 분석을 진행하였다. 분석 결과 인수 거래대상 중 성장기업 비중이 거래건수 면에서 2010년 이후 크게 증가하였다고 볼 수는 없으나 거래규모 면에서는 2016년을 기점으로 크게 증가하기 시작한 것을 확인할 수 있다(<그림 Ⅱ-10>).14) 성장기업의 인수 거래가치평가 배수가 표본 기간 중 전반적으로 상승한 이후 2020년부터 크게 증가한 것으로 나타나고 있다(<그림 Ⅱ-11>).15) 이러한 결과는 재무적투자자의 성장기업 인수 시의 거래가치평가가 다른 경우보다 높은 것과 연관된다(<그림 Ⅱ-12>).

3. 전략적투자자 인수거래의 특징: 인수업종 연관성

기업의 인수거래 참여 동기는 다양한데 가치창출 목적의 M&A 동기로는 시장지배력 강화(Kim et al, 1993), 효율성 개선(Banerjee et al, 1998)과 자원재배분을 들 수 있다(Haleblian et al, 2009).16) 특히 자원재배분은 자산과 투자기회의 기업 간 재배분(redeployment)을 통해 가치를 창출하고자 하는 인수 동기이다. 생산비용에 있어서 비교우위를 가지고 있지만 투자 기회의 고갈로 유기적으로(organically) 성장할 역량이 부족한 인수기업이 특허와 같은 무형자산과 투자기회를 획득하는 자원의 기업 간 재배분 수단으로 M&A를 활용할 수 있다(Levine, 2017). 이러한 성장 동기의 M&A는 다각화 또는 범위의 경제(economy of scope) 확대를 위한 연관업종 내 기업의 인수를 통하여 이루어질 가능성이 있다. 따라서 국내 기업 인수거래의 특징을 살펴볼 때 동일업종 기업의 인수 비중은 유용한 시사점을 제공할 수 있다.

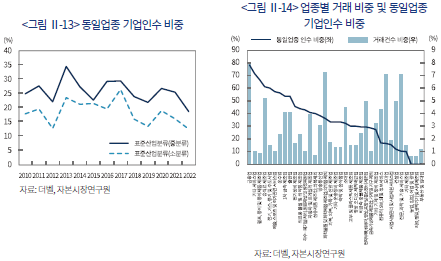

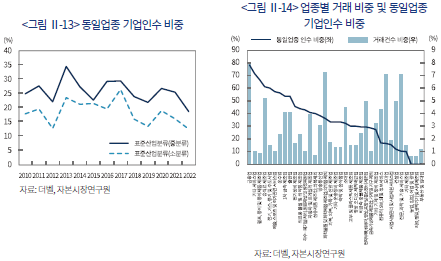

표준산업분류 상 중분류와 소분류 기준을 사용하여 기업의 인수거래 중 자신과 동일한 업종 내 기업을 인수한 거래의 비중을 나타내면 <그림 Ⅱ-13>과 같다. 중분류 기준으로 2013년 동일업종 기업인수 비중이 34.2%로 정점을 기록한 후 점차로 감소하는 추세를 나타내고 있다. 마찬가지로 소분류 기준으로도 2017년 이후 동일업종 기업인수 비중이 추세적인 감소세를 나타내고 있다.

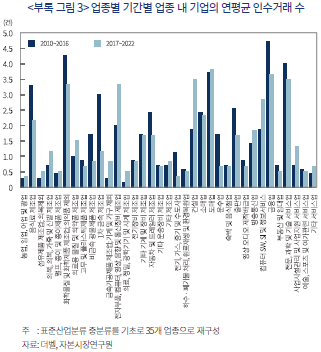

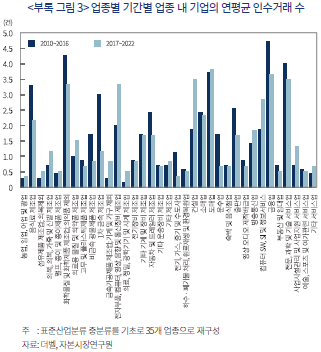

국내 기업의 타 업종 인수 비중 증가의 원인을 살펴보기 위해 표준산업분류를 35개 업종으로 재분류하고 동 기준에 따라 업종별로 인수거래 건수가 전체 인수거래에서 차지하는 비중과 업종별 동일업종 기업인수 비중을 살펴보았다. <그림 Ⅱ-14>에 의하면 동일업종 기업인수 비중이 낮은 컴퓨터 SW 업종, 도ㆍ소매업, 건설업, 전자부품업, 과학기술서비스업 등의 거래건수 비중이 상대적으로 높은 것을 알 수 있다. 즉 상대적으로 이들 업종이 관련 타 업종으로 인수거래를 확대해 나간 것을 확인할 수 있다. 표본기간을 2010~2016년의 전기와 2017~2022년의 후기로 구분하여 살펴본 결과 이들 업종 중 컴퓨터 SW, 건설업, 전자부품업 업종에 속하는 기업의 인수거래가 후기에 증가한 것을 확인할 수 있다(<부록 그림 3>).

4. 소결

국내 M&A 시장은 2010~2022년 간 거래규모가 꾸준히 성장하는 가운데 국내 매수자-매도자 간 거래의 비중이 높아지는 추세이며 M&A 방식으로 구주 거래 인수 방식이 핵심적인 비중을 차지하는 것으로 나타났다. 또한 상장기업이 거래 대상기업인 M&A 비중이 규모 기준으로 33.4%에 불과하여 비상장기업 M&A가 주종을 이루고 있는 것으로 나타났다.

인수자 유형을 기준으로 살펴보았을 때 동 기간 PE를 중심으로 한 재무적투자자의 국내 M&A 시장 참여가 확대되었는데 자금모집의 증가와 저금리로 인한 인수금융 증가 등 투자재원의 확대에 힘입은 것으로 분석된다. 한편 투자재원의 확대와 더불어 최근 재무적투자자의 성장업종 투자 확대는 전반적인 M&A 거래가치평가 배수의 증가로 나타난 것으로 판단된다. 전략적투자자의 경우에는 일부 업종을 중심으로 타 업종 기업의 인수 비중이 증가하는 추세가 발견되어 투자기회 획득을 위한 성장형 인수가 나타나는 것으로 분석되었다.

Ⅲ. 인수거래의 선행요인 분석

Ⅲ장에서는 분석표본 중 전략적투자자의 인수거래에 국한하여 이들의 인수거래와 연관성을 가질 수 있는 선행요인 재무변수를 설정하고 개별 선행요인의 설명력을 분석한 후 선행요인으로 구성된 다중 로짓회귀분석을 실시한다.17)

1. 선행요인

기업의 인수 결정에는 전술한 자원재배분과 같은 가치창출 동기, 경영자의 자만과 같은 행태적 동기 뿐만 아니라 기술변화, 규제환경, 자산가격ㆍ금리 등 금융환경, 그리고 개별기업의 제품시장 전략 및 재무적 특징 등 실로 복잡하고 다양한 요인이 영향을 미친다(Haleblian, 2009). 본 보고서는 이러한 복잡다기한 요인 중 인수기업의 재무적 선행요인에 초점을 맞추어 분석하되 통제변수로서 경제ㆍ산업ㆍ금융환경 변수를 포함한다. 먼저 고려할 수 있는 재무적 선행요인으로 기업규모, 성장성, 수익성, 현금흐름과 같은 기본적인 재무변수들을 설정한다. 기업규모는 총자산의 자연로그로, 성장성은 과거 3년간 연평균 매출액 증가율로, 수익성은 순이익을 총자산으로 나눈 총자산수익률(ROA)로, 현금흐름은 영업현금흐름을 총자산으로 나누어 사용한다. 또한 인수를 위한 가용 재원 또는 예비적(precautionary) 유동성을 포함하기 위해 현금ㆍ현금성자산을 총자산으로 나눈 현금 변수를 사용한다. 한편 자본구조와 자산구조의 특징을 포착하기 위해 자본구조 변수로는 장단기차입금비율을 사용하며, 자산구조 변수로는 재무상태표 상 무형자산을 사용하되 영업권을 차감한 무형자산 장부가액을 총자산으로 나누어 사용한다. 경제ㆍ산업ㆍ금융환경 변수로는 경제성장률, 산업성장률, 자산가격 지표(시장 PER), 금리 및 금리 스프레드를 사용한다. 마지막으로 성장업종 더미와 상장기업 더미를 포함하여 분석한다. 한편 이러한 설명변수로는 인수거래 발생년도의 직전년도 재무제표를 사용하였으며 인수기업의 외감기업 코드가 존재하고 인수거래 규모가 존재하는 인수거래로 한정하여 표본을 구성하였다.

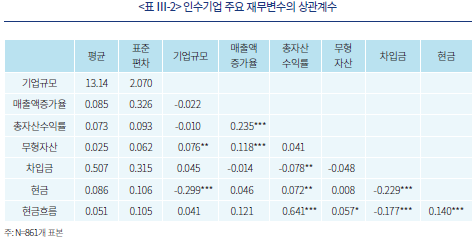

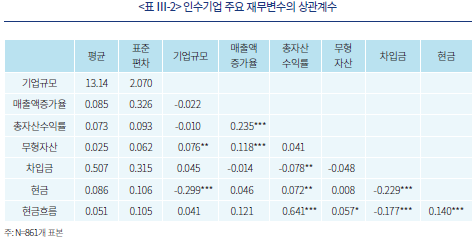

<표 Ⅲ-2>는 설명변수 간 상관계수를 나타낸 표이다. 설명변수 간 상관관계는 기업규모-보유현금 간 음(-)의 상관관계, 총자산수익률-현금흐름 간 양(+)의 상관관계를 제외하고는 전반적으로 절대치가 높지는 않은 것으로 나타났다.18)

2. 개별 선행요인과 인수거래의 관계

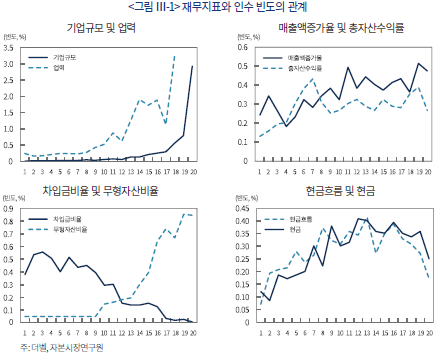

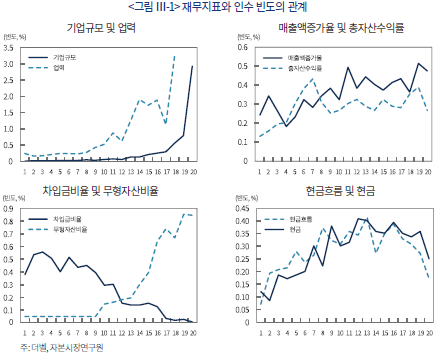

기업의 개별 선행요인과 인수거래의 관계를 살펴보기 위해 표본기간 재무자료가 존재하는 모든 외감기업을 모집단으로 설정하고 개별 재무변수의 크기에 따라 외감기업을 20분위로 나누어 각 분위 그룹 내 실제 인수가 발생한 빈도, 즉 실증분포(empirical distribution)를 산출하였다(<그림 Ⅲ-1>).19) 또한 기업 재무변수는 아니지만 업력에 따른 인수거래 참여 빈도를 살펴보기 위해 업력 기준의 실증분포도 함께 살펴본다.20)21) 한편 전체 외감기업 표본 수는 관련 재무지표의 존재 여부에 따라 다르다. 예를 들어, 기업규모의 외감기업 표본 수는 283,401개이며 매출액증가율의 표본 수는 198,712개이다.

먼저 기업규모를 살펴보면 인수거래의 빈도는 기업규모가 클수록 단조적으로(monotonically) 증가하고 있다. 이는 다른 조건이 동일하다면 인수자금의 외부조달 능력 또는 인수위험 차원에서 기업규모가 인수거래 참여 가능성에 큰 영향력을 미칠 수 있음을 의미한다. 업력 기준으로는 대체로 업력이 증가할수록 인수거래의 빈도가 증가하고 있어 기업은 업력이 쌓이고 성장이 정체되면서 기업인수를 통하여 외부로부터 성장동력을 찾는 경향을 나타냄을 알 수 있다(Levine, 2017).

매출액증가율과 총자산수익률로 대변되는 성장성과 수익성은 대체로 인수 빈도에 양(+)의 영향을 미치는 것으로 나타나지만 일정 수준 이상에서는 성장성과 수익성이 추가적으로 증가하더라도 인수 빈도에는 큰 영향을 미치지 않는 것으로 분석된다.

한편 자본구조와 자산구조 변수로서 차입금비율과 무형자산비율은 인수 빈도와 거의 단조적인 증감 패턴을 나타내었다. 즉 차입금비율이 높아질수록 인수 빈도는 감소하는데 이는 차입여력(unused debt capacity)이 인수에 영향을 미치는 중요한 요인임을 시사한다(Harford et al, 2009; Uysal, 2011). 무형자산비율의 경우에는 무형자산 비중이 높을수록 인수 빈도가 증가하고 있으며 특히 일정 수준 이상의 무형자산 비중을 가진 기업에서만 인수거래가 주로 발생하는 것을 확인할 수 있다. 통상 무형자산 비중이 높은 기업은 연구개발 투자가 많거나 브랜드 가치가 높으며 조직자본(organizational capital)22)23) 이 많은 기업이므로 인수거래를 통해 추가적인 가치창출을 시도함을 의미한다(Li, Qiu & Shen, 2018; Li, Wang & Zhang, 2018).

마지막으로 현금흐름 및 현금과 인수 빈도의 관계를 살펴보면 현금흐름과 현금 모두 일정 수준까지는 인수 빈도와 양(+)의 관계가 나타나지만 일정 수준을 초과하는 구간에서는 현금흐름 및 현금의 증가가 인수 빈도에 영향을 미치지 못하는 현상이 나타나며, 현금흐름이 최고로 높은 분위 그룹에서는 인수 빈도가 오히려 하락하는 모습이 나타난다. 기업의 현금보유 동인 중 예비적 동기나 대리인 동기의 경우24) 보유현금은 투자기회가 나타날 경우 활용할 수 있는 재원이므로 이러한 결과는 인수거래에 사용할 수 있는 재원의 중요성을 시사한다.

3. 인수거래의 다중 로짓회귀분석

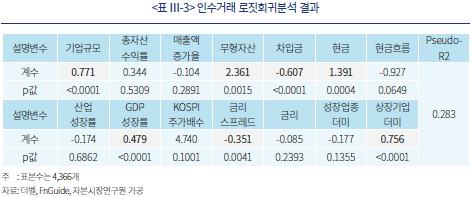

다음으로 인수거래 가능성과 연관된 재무적 선행요인을 종합적으로 분석하기 위해 재무적 선행요인에 대한 다중 로짓회귀분석을 수행한다. 이 때 기존 연구에서와 같이 인수거래 표본에 대하여 매칭표본을 구성하여 분석한다(Palepu, 1986; Huyghebaert et al, 2010). 구체적으로 인수기업의 외감기업 코드가 존재하는 1,128건의 인수거래 각각에 대하여 인수 직전년도 기준으로 표준산업분류 상 동일 소분류 업종이며 동일 업력을 가진 외감기업 중 최대 10개사를 매칭표본으로 선정한다.25)26) 이러한 방식으로 4,614개의 매칭표본이 추출되었으며 인수거래와 매칭표본을 합산한 5,742개 표본 중 선행요인이 모두 존재하는 4,366개의 표본을 최종 회귀분석 표본으로 선정하였다. 한편 선행요인으로는 기업규모, 총자산순이익률, 3년 평균 매출액증가율, 무형자산 비중, 차입금비중, 보유현금, 현금흐름을 설정하며 기타 통제변수로 산업매출액증가율, GDP성장률, KOSPI 주가수익비율, 금리스프레드, 금리, 성장업종더미와 상장기업더미를 설정하였다.

이상의 논의를 바탕으로 로짓회귀분석식을 설정하면 다음 식(1)과 같다.27)

인수더미 =

= 기업규모

기업규모 +

+ 총자산순이익률

총자산순이익률 +

+ 매출증가액

매출증가액 +

+ 무형자산 비중

무형자산 비중 +

+ 차입금비율

차입금비율 +

+

보유현금

보유현금 +

+ 현금흐름

현금흐름 +

+ 산업매출액증가율

산업매출액증가율 +

+ 성장률

성장률 +

+ 주가수익비율

주가수익비율 +

+

금리스프레드

금리스프레드 +

+ 금리

금리 +

+ 성장업종더미

성장업종더미 +

+ 상장기업더미

상장기업더미 +

+  식(1)

식(1)

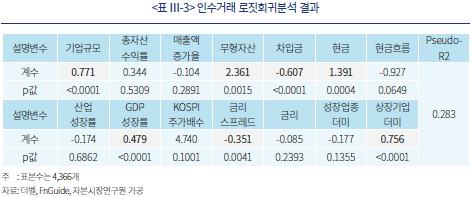

<표 Ⅲ-3>은 인수거래의 로짓회귀분석 결과를 나타낸 표이다. 회귀분석 결과 인수기업 관점에서 기업규모가 클수록, 무형자산 비중이 높을수록, 차입금 비중이 낮을수록, 보유현금 비중이 높을수록 인수거래에 참여할 가능성이 높은 것으로 분석되었으며, 이러한 결과는 1% 유의수준에서 통계적 유의성을 확보하였다. 그러나 총자산수익률, 매출액증가율, 현금흐름은 인수거래의 설명력에서 통계적 유의성이 부족하였다. 한편 통제변수 중에서는 GDP성장률이 높을수록, 금리스프레드가 낮을수록, 인수기업이 상장기업일수록 인수거래에 참여할 가능성이 높았으며 이러한 결과는 모두 1% 유의수준에서 통계적 유의성이 있었다. 다만 전반적인 자산가격 수준을 나타내는 KOSPI 주가수익비율이나 금리 수준은 추정계수 부호가 예상과 합치함에도 불구하고 통계적 유의성이 부족하였다. 마지막으로 성장업종 더미의 계수가 음(-)으로 나타나 제약ㆍ바이오, ICT 등 성장업종에서의 인수 빈도가 상대적으로는 타 업종의 인수 빈도에 비하여 낮은 것으로 추정되었다.

이러한 결과를 종합하면 다음과 같은 시사점이 있다. 첫째, 기업규모, 차입금 비중, 보유현금은 인수기업 입장에서 가장 큰 영향을 미치는 재무적 요소이며 이는 공통적으로 인수자금에 대한 접근성을 나타내는 것으로 풀이된다. 중소기업의 자금조달의 어려움, 차입금 비중이 나타내는 대출 여력, 투자기회를 놓치지 않기 위한 예비적 동기 또는 여유자금으로서의 보유현금 비중 등 인수재원의 확보 여부가 인수거래 참여 가능성과 밀접한 연관성을 갖는 것으로 분석된다. 물론 기업의 인수 동기는 매우 다양하여 인수자금에 대한 접근성과 같은 재무적 특징만으로 인수자금과 인수거래 참여 간 인과관계를 설정할 수 없으나 통상 대규모 투자로서 기업인수에 따르는 위험을 감안할 때 충분한 재무적 자원(financial resource)을 갖춘 기업이 인수거래에 참여할 가능성은 높다(Harford, 1999; Erel et al, 2021). 둘째, 자산 특성을 나타내는 지표로서 무형자산의 비중이 높은 기업은 연구개발 투자로 인한 특허 자산이 많고 상표권 등의 브랜드 가치가 높으며 조직자본이 구축된 기업이다. 따라서 무형자산 비중이 높은 기업은 혁신 및 가치창출 역량이 높은 기업이라고 할 수 있으며 이러한 역량을 바탕으로 인수 대상기업의 가치를 제고하거나 인수 대상기업 자산 또는 사업모델과의 시너지를 통하여 가치창출을 도모하는 것으로 풀이된다.

4. 소결

기업인수의 재무적 선행요인으로 기업규모, 매출액증가율(성장성), 총자산수익률(수익성), 차입금비율(자본구조), 무형자산 비중(자산구조), 보유현금 및 현금흐름을 설정하였다. 각 선행요인과 인수 빈도의 관계를 살펴본 결과 기업규모가 클수록, 차입금비율이 낮을수록, 무형자산비율이 높을수록 인수빈도가 거의 단조적으로 증가하였다. 보유현금 및 현금흐름은 모두 일정 수준까지에서만 인수 빈도와 양(+)의 관계가 나타났다.

인수거래 가능성과 연관된 재무적 선행요인을 종합적으로 분석하기 위해 재무적 선행요인과 경제 및 금융시장 통제변수를 포함한 로짓회귀분석을 수행한 결과 기업규모, 차입금, 보유현금과 무형자산 비중이 인수거래와 직접적으로 연관되는 것으로 나타났다. 기업규모, 차입금 및 보유현금은 인수재원에 대한 접근성과 재무적 자원을 나타내는 지표라고 할 수 있으며 대규모 투자로서 기업인수의 위험을 감안할 때 이러한 결과는 외부자금조달 능력이나 충분한 재무적 자원을 갖춘 기업이 인수거래에 참여할 가능성이 높음을 시사한다. 또한 무형자산 비중은 혁신 및 가치창출 역량을 나타내는 지표로서 분석 결과는 이러한 유형의 기업이 인수대상 기업을 활용한 기업가치 제고를 목적으로 인수거래에 참여할 가능성이 높음을 시사한다.

Ⅳ. 정책적 시사점

기업인수의 동기는 다양하고 가치파괴적 인수는 바람직하지 않지만 본 보고서의 실증분석은 다른 조건이 동일하고 인수기업의 재무적 선행요인에 국한한다면 잠재적 인수기업의 인수거래 참여에 재무적 제약이 존재할 수 있음을 시사한다. 즉 가치창출이 가능한 인수 기회를 보유한 잠재적 인수기업이 충분한 재무적 재원을 가지지 못했을 경우 가치창출의 기회를 살릴 수 있도록 최소한 인수재원에 대한 접근성이 확대될 필요가 있다. 인수재원에 대한 접근성 확대가 반드시 가치파괴적 인수로 이어지지는 않기 때문이다(Gao & Mohamed, 2018). 특히 사업재편 기업 등 특정 기업군의 인수거래 참여에 투자위험과 불확실성이 따른다면 일반 은행이나 자본시장을 통한 인수자금 공급이 어려울 수 있다(선병수, 2021).28) 이러한 경우 정책자금을 활용해 인수재원의 접근성을 제고한다면 자원재배분이라는 M&A의 긍정적 기능을 살릴 수 있는 방법이 될 수 있다. 이러한 관점에서 고려할 수 있는 정책방향은 다음과 같다.

첫째, 인수거래를 희망하는 중소ㆍ혁신기업의 인수재원 확보를 지원할 필요가 있다. 본문의 분석에서 살펴보았듯이 국내 인수거래는 규모가 큰 기업을 중심으로 이루어지고 있으며 중소ㆍ혁신기업의 인수거래 참여는 차입금 비중과 보유현금에 직접적인 영향을 받고 있다. 따라서 중소ㆍ혁신기업이 지분투자 유치를 통해 재무구조를 개선하거나 인수재원을 확보하는 것이 필요하다. 바이아웃과 더불어 PE의 대표적인 투자방식인 성장자본(growth capital) 투자는 기업 인수거래를 위한 재원 공급이 주요 목적 중 하나인 투자방식이다. 그러나 성장자본 투자의 대상이 규모가 작은 기업일 경우 거래비용이 높아 민간자금 조달이 잘 이루어지지 않는 경향이 있다. 반면 규모가 작은 중소ㆍ혁신기업 인수거래의 성과는 상대적으로 규모가 큰 기업 대비 높을 수 있다(Moeller et al, 2004). 따라서 시장수요를 참작하여 제한된 범위에서 성장자본 투자를 주 목적으로 하는 정책성 투자기구를 설정ㆍ운용하는 방식을 고려할 수 있다. 이러한 투자기구는 지분투자를 통하여 중소ㆍ혁신기업에 인수재원을 공급하거나 중소ㆍ혁신기업 경영자가 지분희석을 원하지 않을 경우 중소ㆍ혁신기업이 참여하는 인수거래에 공동투자자로 매칭투자를 할 수 있다. 이는 기존의 대출형 인수금융을 지분형 인수금융으로 보완하는 성격을 갖는다. 과거 경영참여형 사모펀드 제도 도입과 운영을 통해 국내 M&A 시장이 성장한 경험을 고려해 볼 때 이러한 투자기구를 통하여 중소ㆍ혁신기업의 인수거래 참여를 확대할 필요성이 높다고 할 수 있다.

둘째, 무형자산이 많은 기업은 인수거래에 참여할 가능성이 높음에도 불구하고 무형자산은 일반적으로 담보가치가 부족하여 외부자금조달이 상대적으로 어려우므로 무형자산이 많은 기업은 인수재원으로 내부자금조달에 의존할 가능성이 높다(OECD, 2021). 따라서 중소ㆍ혁신기업에서와 마찬가지로 무형자산 비중이 높으며 인수재원 접근성이 제한된 기업을 대상으로 성장자본을 공급하는 지분형 인수금융 투자기구를 고려할 수 있다. 이러한 투자기구는 해당 무형자산의 전략적 가치에 대한 이해도를 갖춘 전문운용사에 의한 운용이 필수적일 것이다. 다른 한편으로 무형자산 중 특허, 상표, 저작권 등과 같은 지식재산권(Intellectual Property: IP) 금융 활성화를 통하여 이들 기업이 보유한 IP를 활용하여 자금조달을 확대할 수 있도록 하여야 한다. 지식재산권은 평가비용이 크고 적정가치의 평가와 관련된 불확실성이 크므로 가치평가 비용의 지원, 공적 인증기관 활용, 평가모형의 개발 등 거래의 투명성과 신뢰성 제고를 위한 정책적 노력이 지속되어야 한다(박용린, 2018).

1) 금융위원회(2023. 5. 8)

2) 이른바 GAFAM(Google, Apple, Facebook, Amazon, Microsoft)으로 불리는 5대 대형 플랫폼 기술기업은 피인수기업 유형 중 데이터 기반(data-incentive) 피인수기업의 22.3%를 인수하였다(Jin et al, 2022).

3) 다양한 연구가 존재하나 대표적으로 심한택 외(2004), 강효석 외(2010), 최순영 외(2017), 박경서 외(2017), 이상은 외(2021)를 들 수 있다.

4) 기업의 인수 동기는 재무적 선행요인 뿐만 아니라 피인수기업과의 기술적ㆍ사업적 시너지, 성장 전략, 산업조직적 특징, M&A 경험 등과 같은 다양한 요인이 영향을 미칠 수 있으나 본 보고서는 이 중 재무적 요인에 초점을 맞춘다.

5) 경영권 인수의 기준으로는 50% 이상의 절대적 지분 기준 규모가 아닌 인수자가 1대 주주로 변경되는 거래를 기준으로 하였다.

6) 본 보고서에서 정의하는 국내 매수자-해외 매도자 간 M&A(in-out)와 해외 매수자-국내 매도자 간 M&A(out-in)는 일반적으로 국경 간 M&A(cross-border M&A)와 유사하나 소재지가 국내인 M&A 대상기업이 포함될 수 있어서 정확히 일치하는 개념은 아니다.

7) 국내 M&A 유형 중 in-in, in-out, out-in 유형은 M&A 대상기업이 국내 또는 해외에, out-out은 국내에 소재하는 경우이다.

8) 인수 방식별 인수 지분규모는 구주 78.6%, 신주 61.5% 등이며 인수거래 전체 평균은 75.6%이다.

9) 상장기업이 합병 거래의 일방인 거래를 포함한다.

10) M&A 거래의 인수자로 개인 또는 개인 공동보유자 등이 있을 수 있으나 비중이 매우 낮아 논의하지 않는다.

11) 핵심 재무적투자자로서 국내 PE 현황과 성과에 대해서는 박용린(2020)을 참고하기 바란다.

12) 재무구조로부터 독립된 순수한 사업 가치평가를 위해 EV/매출액 또는 EV/EBITDA 등을 사용하나 개별 M&A 대상기업의 재무제표가 음(-)의 EBITDA인 경우가 일부 존재하여 가치평가 기준으로 EV/매출액을 사용하였다. 또한 개별 기업의 가치평가 배수를 사용하는 대신 M&A 대상기업의 합계 매출액과 합계 EV를 산출한 후 가치평가 배수를 계산하였다. 마지막으로 EV = M&A가액/인수지분율 +차입금 – 보유현금으로 계산하였다.

13) 인수 시 가치평가 배수를 산출함에 있어 일반기업과 재무구조가 상이한 금융업과 부동산업을 제외하였다.

14) 구체적으로 성장기업을 표준산업분류 기준 중분류 업종 중 21(의료용 물질 및 의약품 제조업), 26(전자부품, 컴퓨터, 영상, 음향 및 통신장비 제조업), 27(의료, 정밀, 광학기기 및 시계 제조업), 58(출판업), 62ㆍ63(컴퓨터 SW, SI 및 정보서비스)의 6개 업종에 속한 기업으로 분류한다.

15) 실제 동 기간 소수 성장기업에 대한 재무적투자자의 대규모 인수거래가 발생하였다.

16) 기타 가치파괴적 인수 동기로는 대표적으로 경영자 자만(hubris) 또는 잉여현금흐름의 오남용을 강조하는 대리인 이론(Roll, 1986; Jensen, 1993)을 들 수 있으며 행태적 동기로서는 주식시장 가치평가 오류를 활용한 인수(Shleifer et al, 2003)를 들 수 있다.

17) 본 보고서의 초점은 인수 주체의 재무적 특징에 있으므로 기업재무적 특징이 큰 의미가 없는 재무적투자자의 인수 선행요인은 분석에서 제외한다. 또한 인수대상 기업 대신 인수기업의 선행요인을 분석하였으므로 국내 M&A 시장의 분석과 시사점 측면에서 다소 한계가 존재할 수 있다.

18) 상관계수가 높은 보유현금과 현금흐름을 회귀분석에 모두 포함함으로써 설명변수 간 경합(horse-racing)을 통해 최종적으로 설명력이 높은 선행요인을 구분할 수 있다.

19) 이 때 인수가 아닌 타 M&A 방식이 모집단에 포함되는 것을 방지하기 위하여 인수 이외 타 방식의 M&A 거래는 외감기업 표본에서 제외하였다.

20) 후술하는 다중 로짓회귀분석에서 매칭표본을 구성하기 위해 업력을 사용하였기 때문에 회귀분석 변수로서 업력을 포함하지 않았다.

21) 업력은 분위 그룹으로 나누는 대신 0~3년, 4년~7년 등 4년 단위의 그룹으로 나누었다.

22) 조직자본은 수요를 충족시키는 재화를 공급하기 위한 인적ㆍ물적 자본의 결합에 사용되는 지식으로 정의된다(Evenson & Westphal, 1995). 통상 조직자본은 경쟁강도가 높은 산업에서 지속가능한 경쟁우위를 제공하는 핵심 요소로 간주된다(Li, Wang & Zhang, 2018).

23) 무형자산 유형 간 상관관계에 대한 연구가 많지 않으나 조직자본과 보유 특허량이 중요한 상관관계가 있다는 연구가 존재한다(Francis et al, 2021).

24) 기업 현금보유의 동기에 대한 실증분석은 Opler et al.(1999)을 참조하기 바란다.

25) 매칭표본을 추출하는 외감기업에는 기업에 의한 인수거래 뿐만 아니라 합병, 분할 등 여타 방식의 M&A 거래를 수행한 기업을 제외하였다. 또한 매칭표본의 임의성(randomness)을 최대화하기 위해 기존 연구에서 통상적으로 사용하는 동일업종 표본에 추가하여 동일업력 기준을 추가하였다. 최대 10개의 매칭표본은 외감기업 코드 순으로 추출하였다.

26) 재무지표를 일반기업과 직접적으로 비교하기 어려운 금융업과 부동산 업종의 인수거래는 분석대상에서 제외하였다.

27) <그림 Ⅲ-1>의 보유현금 및 현금흐름과 인수거래 빈도 간 비선형관계를 반영하기 위해 보유현금 및 현금흐름의 자승변수를 추가하여 회귀분석을 수행한 결과 보유현금 자승변수의 계수는 1% 수준의 음(-)으로, 현금흐름 자승변수는 유의성 없는 음(-)으로 나타났으며 타 변수의 설명력과 부호는 유지되었다.

28) 국내 사업재편 지원제도는 2016년 제정된『기업활력제고를 위한 특별법』을 통해 공급과잉업종, 신산업 진출기업 등 사업재편이 필요한 기업에 대하여 상법ㆍ공정거래법 상 절차 간소화 및 규제유예, 과세이연 및 소요자금 금리우대 등을 지원하는 정책 프로그램이다.

참고문헌

금융위원회, 2020. 5. 8, 기업 M&A 지원 방안, 보도자료.

강효석ㆍ서재응, 2010, 코스닥기업의 인수합병이 인수기업의 경영성과에 미치는 영향, 한국증권학회지 제39권 2호, 191-223.

박경서ㆍ정찬식ㆍ김선민, 2017, 국내 M&A 제도현황과 개선방안: 소수주주권 강화를 중심으로, 한국증권학회지 제46권 1호, 1-33.

박용린, 2018, 무형자산의 부상과 기업금융 수요의 변화, 자본시장연구원 이슈보고서 18-13.

박용린, 2020, 국내 PEF의 평가와 향후 과제, 자본시장연구원 이슈보고서 20-29.

선병수, 2021, 지속성장 Report, 대한상공회의소 지속성장 이니셔티브 정책연구 보고서 제 2021-03호.

심한택ㆍ조정일ㆍ박용찬, 2004, M&A 대상기업의 재무적 특성: Out-In형 M&A와 In-In형 M&A의 비교, 대한경영학회지 제42호, 293-312.

이상은ㆍ김문겸, 2021, 중소기업 M&A의 ROE 변화: 전략적 투자자 대 재무적 투자자, 재무관리연구 제38권 제2호, 289-314.

최순영ㆍ김규림, 2017, 국내 M&A 시장의 특징 및 M&A 성과 결정요인 분석, 자본시장연구원 연구보고서 17-07.

Axelson, U., Jenkinson, T., Stromberg, P., Weisbach, M.S., 2013, Borrow Cheap, Buy High? The Determinants of Leverage and Pricing in Buyouts, The Journal of Finance 68(6), 2223-2267.

Banerjee, A., Eckard, E.W., 1998, Are mega-mergers anticompetitive? Evidence from the first great merger wave, Rand Journal of Economics 29(4), 803-827.

Bargeron, L.L., Schlingemann, F.P., Stulz, R.M., Zutter, C.J., 2008, Why do private acquirers pay solittle compared to public acquirers? Journal of Financial Economics 89(3), 375–390.

Boucly, Q., Sraer, D., Thesmar, D., 2011, Growth LBOs, Journal of Financial Economics 102(2), 432-453.

Celik, M.A., Tian, X., Wang, W., 2022, Acquiring Innovation under Information Frictions, The Review of Financial Studies 35(10), 4474–4517.

David, J.M., 2021, The Aggregate Implications of Mergers and Acquisitions, The Review of Economic Studies 44(4), 796–1830.

Dimopoulos, T., Sacchetto, S., 2017, Merger activity in industry equilibrium, Journal of Financial Economics 126(1), 200-226.

Erel, I., Jang, Y., Minton, B., Weisbach, M., 2021, Corporate Liquidity, Acquisitions, and Macroeconomic Conditions, Journal of Financial and Quantitative Analysis 56(2), 443-474.

Evenson, R.E., Westphal, L.E., 1995, Chapter 37 Technological change and technology strategy, Handbook of Development Economics 3(Part A), 2209-2299.

Francis, B., Mani, S.B., Sharma, Z., Wu, Qiang, 2021, The Impact of Organization Capital on Firm Innovation, Journal of Financial Stability 53.

Gao, N., Mohamed, A., 2018, Cash-rich acquirers do not always make bad acquisitions: New evidence, Journal of Corporate Finance 50(C), 243-264.

Gorbenko, A., Malenko, A., 2014, Strategic and Financial Bidders inTakeover Auctions, The Journal Of Finance 69(6), 2513-2555.

Haleblian, J., Devers, C.E., McNamara, G., Carpenter, M.A., Davison, R.B., 2009, Taking Stock of What We Know About Mergers and Acquisitions: A Review and Research Agenda, Journal of Management 35(3), 469–502.

Harford, J., 1999, Corporate cash reserves and acquisitions, Journal of Finance 54(6), 1969–1997.

Harford, J., Klasa, S., Walcott, N., 2009, Do firms have leverage targets? Evidence from acquisitions, Journal of Financial Economics 93(1), 1-14.

Huyghebaert, N., Luypaert, M., 2010, Antecedents of growth through mergers and acquisitions: Empirical results from Belgium, Journal of Business Research 63(4), 392-403.

Jensen, M.C., 1993, The modern industrial revolution, exit, and the failure of internal control systems, Journal of Finance 48(3), 831-880.

Jin, G.Z., Leccese, M., Wagman, L., 2022, How Do Top Acquirers Compare in Technology Mergers? New Evidence from an SP Taxonomy, Law & Economics Center at George Mason University Scalia Law School Research Paper Series No. 22-024.

Jin, G.Z., Leccese, M., Wagman, L., 2023, M&A and technological expansion, Journal of Economics & Management Strategy, Early View, 1–22.

Kim, E., Singal, V., 1993, Mergers and market power: Evidence from the airline industry. The American Economic Review 83(3), 549-569.

Levine, O., 2017, Acquiring growth, Journal of Financial Economics 126(2), 300-319.

Li, K., Qiu, B., Shen, R., 2018, Organization Capital and Mergers and Acquisitions, The Journal of Financial and Quantitative Analysis 53(4), 1871-1909.

Li, P., Li, F.W., Wang, B., Zhang, Z., 2018, Acquiring organizational capital, Finance Research Letters 25(C), 30-35.

Li, X., 2013, Productivity, restructuring, and the gains from takeovers, Journal of Financial Economics 109(1), 250-271.

Martos-Vila, M., Rhodes-Kropf, M., Harford, J., 2013, Financial vs. Strategic Buyers, Journal of Financial and Quantitative Analysis 54(6), 2635-2661.

Masulis, R.W., and Serif, A.R., 2018, Deal Initiation in Mergers and Acquisitions, The Journal of Financial and Quantitative Analysis 53(6), 2389–430.

Moeller, S.B., Schlingemann, F.P., Stulz, R.M., 2004, Firm size and the gains from acquisitions, Journal of Financial Economics 73(2), 201-228.

OECD, 2021, Bridging the gap in the financing of intangibles to support productivity: Background paper, An OECD contribution to the G20 Italian Presidency 2021.

Opler, T., Pinkowitz, L., Stulz, R., Williamson, R., 1999, The determinants and implications of corporate cash holdings, Journal of Financial Economics 52(1), 3-46.

Palepu, K.G., 1986., Predicting takeover targets: A methodological and empirical analysis, Journal of Accounting and Economics 8(1), 3-35.

Phillips, G.M., Zhdanov, A., 2017, Venture Capital Investments and Merger and Acquisition Activity Around the World, NBER working paper No. 24082.

Roll, R., 1986, The hubris hypothesis of corporate takeovers, Journal of Business 59(2), 197-216.

Shleifer, A., Vishny, R., 1992, Liquidation Values and Debt Capacity: A Market Equilibrium Approach, The Journal of Finance 47(4), 1343-1366.

Shleifer, A., Vishny, R., 2003, Stock market driven acquisitions, Journal of Financial Economics 70(3), 295-311.

Uysal, V.B., 2011, Deviation from the target capital structure and acquisition choices, Journal of Financial Economics 102(3), 602-620.

최근 정책당국이 기업 M&A 지원을 위한 제도 개선방안을 발표하는 등1) 국내 M&A 시장에 대한 시장참여자의 관심이 높다. 기업의 대표적인 투자방식 및 성장전략 중 하나로서 M&A는 혁신기업의 진입과 퇴출 등 경제의 역동성 제고를 통해 경제규모를 확대하고 생산성을 제고하는 긍정적 기능을 수행한다(Li, 2013; Dimopoulos et al, 2017; David, 2021). 또한 기업 관점에서 M&A는 인수기업과 인수대상 기업 간 투자기회의 재배분을 통하여 혁신 등 성장기회를 확보할 수 있는 수단을 제공한다(Levine, 2017; Celik et al, 2022; Jin et al, 2023). 한편 모험자본 생태계 관점에서 M&A는 벤처캐피탈 투자의 회수시장으로서의 역할(Phillips et al, 2017) 등 경제ㆍ산업구조의 효율성을 제고함에 있어서 핵심적인 역할을 수행한다.

2010년대 들어 국내 M&A 시장은 PE를 중심으로 한 재무적투자자의 시장 참여 확대에 힘입어 꾸준한 성장을 시현하였다. 동 기간 해외에서는 재무적투자자의 활발한 M&A 시장 참여 뿐만 아니라 플랫폼 기반의 대형 기술기업2)에 의한 기술 스타트업 인수가 크게 증가하였다. 이는 개방형 혁신(open innovation) 기조 하에서 M&A를 통해 성장기회를 확보하거나 혁신기회를 외부에서 조달하려는 기업 전략의 확산에 따른 결과이다.

최근 국내외 금리인상 기조 및 글로벌 경기 둔화, 그리고 저탄소 경제 전환, 디지털화, 산업 간 융ㆍ복합 등 경영환경 변화에 대한 기업의 대응 필요성이 높아지는 상황에서 국내 M&A 시장이 위축되는 모습이 나타나고 있다. M&A 지원을 위한 최근 제도 개선방안은 기업의 환경변화 대응 노력을 지원하기 위한 제반 정책으로서 기업의 사업재편과 구조조정에 대한 효율적인 지원 수단의 모색을 위해서는 국내 M&A 시장 현황과 특징에 대한 이해가 선결되어야 한다.

M&A가 경제의 역동성 제고에 미치는 영향과 정책 대응의 필요성을 고려할 때 그간 국내 M&A 전반의 현황과 특징에 대한 분석의 필요성이 높았음에도 불구하고 이를 포괄적ㆍ정량적으로 분석한 연구가 희소하였다. 대부분의 기존 국내 연구는 주로 상장기업 M&A를 중심으로 한 주가수익률 또는 기업회계 측면의 성과 분석, 피인수기업의 선행요인(antecedents) 분석 또는 상장기업 합병 시 합병비율 산정 방식에 대한 법제적 연구가 주종을 이루었다.3)

국내 M&A 시장에서 상장기업 M&A가 차지하는 비중은 거래규모와 건수에서 제한되어 있을 것으로 예상되므로 국내 M&A 시장의 전반적인 현황과 변화 추세를 파악하기 위해서는 비상장기업에 의한 M&A를 포함하는 M&A 시장 전반에 대한 정량적 분석이 필요하다. 한편 본 보고서는 그간 주종을 이루었던 피인수기업 관점의 M&A 연구에서 벗어나 인수기업 관점에서 M&A 거래를 분석하는 최근의 연구 경향(Haleblian et al, 2009)과 M&A 거래의 대부분이 인수자 주도의 거래인 현실(Masulis et al, 2018)을 반영하여 인수기업 관점에서 M&A 선행요인을 분석하되 재무적 선행요인에 국한하여 실증분석을 수행한다.4) 구체적으로 지난 10여 년간 국내 M&A 시장의 거래규모, 거래유형 및 인수자 유형별 비중과 특징, 거래가치평가(valuation) 등을 분석하고 인수기업 관점에서 M&A의 재무적 선행요인을 파악함으로써 기업 M&A 확대를 위한 정책적 시사점을 도출하고자 한다.

보고서의 구성은 다음과 같다. Ⅱ장에서는 국내 M&A 거래 데이터에 대한 분석을 바탕으로 국내 M&A의 거래규모, 거래유형 및 인수자 유형별 특징을 살펴보고 Ⅲ장에서는 인수기업 관점의 재무적 선행요인을 분석한다. Ⅳ장에서는 실증분석 결과를 바탕으로 정책적 시사점을 제시한다.

Ⅱ. 국내 M&A 현황과 추세

Ⅱ장에서는 M&A 거래 자료를 바탕으로 다양한 M&A 유형별 비중과 연도별 추이, 인수자 유형별 거래가치평가의 특징 그리고 업종을 기준으로 살펴본 전략적투자자(기업) 인수거래의 특징을 분석한다.

1. M&A 거래규모 및 유형

본 보고서는 더벨이 집계ㆍ발표하는 국내 M&A 거래 자료 중 2010년부터 2022년까지의 종결 기준 M&A 거래 자료를 가공하여 분석하였다. 원자료 중 중복 자료를 제외하고 추출된 총 4,868건의 M&A 거래 중 거래규모 자료가 존재하는 인수거래와 기타 M&A 유형인 합병, 분할, 주식교환, 영업양수도 및 자산양수도 방식을 포함하는 3,138건의 M&A 거래를 분석표본으로 선정하였다.5) 한편 Ⅲ장의 실증분석에서는 분석표본 중 전략적투자자(기업)의 인수거래인 2,439건의 M&A 거래를 분석한다. 본 보고서에서 국내 M&A는 매수자ㆍ매도자 중 일방, 또는 피인수기업이 국내에 소재하는 M&A로 정의한다.

2010년 거래건수 200건, 거래규모 36.1조원 수준이었던 국내 M&A 시장은 2021년 거래건수 367건, 거래규모 123.4조원으로 정점을 기록하기까지 꾸준한 성장을 나타냈다. 2022년 들어 거래건수 299건, 거래규모 56.3조원으로 M&A 시장이 다소 위축되었음에도 불구하고 전체 기간을 살펴볼 때 꾸준한 성장을 이룬 것으로 평가된다. 평균 M&A 거래규모도 2010년 1,580억원에서 2022년 1,880억원으로 꾸준한 증가 추세가 이어지고 있다(<그림 Ⅱ-1>).

국내 M&A 시장의 상대적인 규모는 국가 간 비교를 통해 확인할 수 있다. 우리나라는 미국, 영국, 프랑스 등에 이어 전 세계에서 12번째로 M&A 거래규모가 크며 GDP 규모 대비 M&A 거래 비중(3.0%)은 10번째로서 브라질(3.3%), 독일(3.0%), 일본(2.5%)과 유사한 수준이다(<그림 Ⅱ-2>).

국내 M&A는 매수자와 매도자의 소재지를 기준으로 국내 매수자-매도자 간 M&A(in-in), 국내 매수자-해외 매도자 간 M&A(in-out), 해외 매수자-국내 매도자 간 M&A(out-in), 해외 매수자-해외 매도자 간 M&A(out-out)로 구분할 수 있다.6)7) 분석표본에서 in-in M&A는 건수(규모) 기준 76.6%(65.6%)을 차지하고 있으며 in-out M&A와 out-in M&A가 각각 11.4%(13.6%), 11.2%(19.1%)를 차지하고 있다. 한편 in-in M&A는 거래건수와 규모 비중 모두 표본 기간 증가하는 반면 in-out M&A와 out-in M&A 비중은 감소하는 추세가 나타나고 있어서 국내 M&A 시장이 국내 매수자-매도자 간 거래를 중심으로 형성되어왔음을 알 수 있다.

<표 Ⅱ-1>에 의하면 국내 M&A에서 가장 높은 비중을 차지하는 M&A 거래유형은 거래건수 2,439건, 거래규모 392.0조원을 차지하고 있는 인수(acquisition)로 전체 거래에서 각각 77.7%, 57.6%를 차지하고 있다. 이어서 합병과 영업양수도가 뒤를 잇고 있으며 M&A의 대표적 유형인 인수, 합병 및 영업양수도의 세 가지 방식이 건수 및 규모기준으로 각각 92.9%, 84.4%를 차지하고 있다. 또한 2010년대 중반 이후 인수건수의 비중이 점차로 증가하였음을 확인할 수 있다(<그림 Ⅱ-5>).

인수거래 2,439건 중 기업도산과 관련된 인수는 122건, 15.7조원으로 건수 및 규모기준 전체의 5.0%, 4.0%를 차지하고 있다. 인수 방식 중 가장 큰 비중을 차지하는 방식은 구주 인수로서 건수 및 규모 기준으로 각각 64.2%, 51.7%를 차지하고 있다.8)

한편 상장기업이 거래 대상기업9)인 M&A 비중은 건수 및 규모 기준으로 각각 19.8%, 33.4%에 불과하여 국내 M&A 시장에 대한 온전한 이해를 위해서는 비상장기업 M&A를 포함하여 분석할 필요가 있다. 한편 전술한 국내 평균 M&A 거래규모의 증가 추세는 상장 거래 대상기업의 거래규모가 증가함에 따른 결과임을 확인할 수 있다(<그림 Ⅱ-6>).

2. 재무적투자자 인수거래의 특징: 거래가치평가

인수거래에서의 매수자 유형은 크게 전략적투자자(기업)와 재무적투자자로 구분된다.10) 전략적투자자는 주로 시장ㆍ고객의 획득을 통한 성장과 가치창출 목적으로 인수를 추진하는 반면 재무적투자자는 저평가된 기업의 인수 또는 인수 후 가치제고 활동을 통한 투자수익 창출을 목적으로 인수거래를 수행한다. 전략적투자자와 재무적투자자는 M&A 거래에서 잠재적 인수자로서 경쟁하기도 하며 인수거래에서 매도ㆍ매수거래의 양 당사자로 참여하기도 한다.

2010년대 들어 국내 M&A 시장의 두드러진 특징 중 하나는 바이아웃 펀드를 중심으로 한 PE의 급속한 성장세이다. 2005년 국내 도입된 PE는 2010년대 들어 급성장하며 기업 투자와 M&A 시장에서 주요 시장참여자로 자리매김하였다. <그림 Ⅱ-7>에 의하면 재무적투자자에 의한 인수는 727건으로 전체 인수거래의 24.1%를 차지하고 있으며 규모 기준으로는 20.0%를 차지하고 있다. 대부분 PE인 재무적투자자의 비중은 2010년부터 2017년까지 지속적으로 증가하여 2017년 32.6%를 기록한 후 2022년 20% 중반 대를 유지하고 있다. 거래규모 기준으로는 특정 연도의 특정 인수거래에 따라 비중의 차이가 큰 편이지만 대체로 20% 수준을 나타내고 있다. 한편 재무적투자자가 매도자인 경우는 거래건수 및 규모 기준으로 각각 9.2%, 12.9%를 차지하고 있다(<그림 Ⅱ-8>).11)

한편 M&A 거래규모의 증가는 기업자산 가격의 상승을 유발할 수 있다. 경기상승 전망이나 규제 및 기술변화 등으로 인수 수요는 증가하는 반면 인수 대상기업의 수는 한정될 수 있기 때문이다. 전략적투자자는 대상기업이 자신의 사업과 시너지를 창출할 가능성을 기대하고 인수에 나서는 경우가 많아 인수가격에 일정한 시너지 가치가 반영되는 것이 일반적이다. 반면 재무적투자자는 매각을 전제로 대상기업을 인수하므로 투자수익 창출을 위해 인수가를 낮추는 것이 중요하다. 따라서 일반적으로 전략적투자자의 인수가는 재무적투자자보다 높다(Shleifer et al, 1992; Bargeron et al, 2008; Gorbenko et al, 2014). 그러나 2000년대 이후 급증하는 자금모집과 저금리 추세를 바탕으로 재무적투자자들이 M&A 시장에서 역할을 강화해 온 가운데 한정된 M&A 대상기업에 대한 재무적투자자 간 경쟁이 심화될 경우 인수가의 상승이 불가피하다(Axelson et al, 2013; Martos-Vila et al, 2013).

<그림 Ⅱ-9>는 국내 인수거래의 경우 거래가치평가 기준으로 재무적투자자가 전략적투자자보다 낮은 가격으로 인수한다는 통상적인 이론이 적용되고 있지 않음을 보여준다. 매출액 대비 기업가치(Enterprise Value: EV) 배수를 기준으로 전략적투자자가 재무적투자자보다 높은 인수 배수를 지불한 연도는 2018~2020년도의 3개 년도에 불과하다.12)13)

재무적투자자의 거래가치평가 배수가 전략적투자자에 비하여 낮지 않은 이유는 무엇보다 M&A 시장의 대표적인 재무적투자자인 PE의 자금모집 증가세와 저금리 추세로 인한 인수금융 규모의 증가를 들 수 있다. 표본기간 내 PE 약정액은 2009년말 17.2조원에서 2022년말 125.8조원 수준으로 연평균 15.2% 증가하였으며 금리는 회사채 3년물(AA-) 금리 기준으로 2009년 5.8%에서 점진적으로 하락하여 2022년 금리 급등 전까지 2%대 초반을 유지하였다. 한편 인수금융은 2013년 3.4조원에서 2021년 18.2조원으로 연평균 20.6% 증가한 후 2022년 금리 상승으로 12.5조원으로 급감하였다(<부록 그림 1> 및 <부록 그림 2>).

그러나 국내 재무적투자자의 거래가치평가 수준을 자금모집 증가와 인수금융 비용의 하락으로 인한 재무적투자자 인수 수요의 증가만으로 설명하기는 어려울 수 있다. 재무적투자자와 전략적투자자가 인수한 기업의 유형이 동일하지 않을 수 있기 때문이다. 구체적으로 재무적투자자의 인수가격이 상대적으로 높게 나타난 것은 재무적투자자가 인수하고자 하는 대상기업이 성장성이 높은 기업일 가능성이 있다. PE의 투자방식이 2000년대 들어 차입매수(Leveraged Buy-Out: LBO)와 같이 현금흐름이 안정적인 기업을 인수하는 방식에서 성장성이 뛰어난 기업을 인수하는 방식으로 점차 변모했기 때문이다(Boucly et al, 2011).

성장기업을 엄밀히 정의하는 것은 본 보고서의 범위에서 벗어나므로 바이오ㆍ제약, ICT 하드웨어ㆍ소프트웨어 등과 관련된 업종을 성장기업의 기준으로 삼아 국내 M&A 거래를 성장기업과 일반기업으로 개략적으로 분류하여 분석을 진행하였다. 분석 결과 인수 거래대상 중 성장기업 비중이 거래건수 면에서 2010년 이후 크게 증가하였다고 볼 수는 없으나 거래규모 면에서는 2016년을 기점으로 크게 증가하기 시작한 것을 확인할 수 있다(<그림 Ⅱ-10>).14) 성장기업의 인수 거래가치평가 배수가 표본 기간 중 전반적으로 상승한 이후 2020년부터 크게 증가한 것으로 나타나고 있다(<그림 Ⅱ-11>).15) 이러한 결과는 재무적투자자의 성장기업 인수 시의 거래가치평가가 다른 경우보다 높은 것과 연관된다(<그림 Ⅱ-12>).

3. 전략적투자자 인수거래의 특징: 인수업종 연관성

기업의 인수거래 참여 동기는 다양한데 가치창출 목적의 M&A 동기로는 시장지배력 강화(Kim et al, 1993), 효율성 개선(Banerjee et al, 1998)과 자원재배분을 들 수 있다(Haleblian et al, 2009).16) 특히 자원재배분은 자산과 투자기회의 기업 간 재배분(redeployment)을 통해 가치를 창출하고자 하는 인수 동기이다. 생산비용에 있어서 비교우위를 가지고 있지만 투자 기회의 고갈로 유기적으로(organically) 성장할 역량이 부족한 인수기업이 특허와 같은 무형자산과 투자기회를 획득하는 자원의 기업 간 재배분 수단으로 M&A를 활용할 수 있다(Levine, 2017). 이러한 성장 동기의 M&A는 다각화 또는 범위의 경제(economy of scope) 확대를 위한 연관업종 내 기업의 인수를 통하여 이루어질 가능성이 있다. 따라서 국내 기업 인수거래의 특징을 살펴볼 때 동일업종 기업의 인수 비중은 유용한 시사점을 제공할 수 있다.

표준산업분류 상 중분류와 소분류 기준을 사용하여 기업의 인수거래 중 자신과 동일한 업종 내 기업을 인수한 거래의 비중을 나타내면 <그림 Ⅱ-13>과 같다. 중분류 기준으로 2013년 동일업종 기업인수 비중이 34.2%로 정점을 기록한 후 점차로 감소하는 추세를 나타내고 있다. 마찬가지로 소분류 기준으로도 2017년 이후 동일업종 기업인수 비중이 추세적인 감소세를 나타내고 있다.

국내 기업의 타 업종 인수 비중 증가의 원인을 살펴보기 위해 표준산업분류를 35개 업종으로 재분류하고 동 기준에 따라 업종별로 인수거래 건수가 전체 인수거래에서 차지하는 비중과 업종별 동일업종 기업인수 비중을 살펴보았다. <그림 Ⅱ-14>에 의하면 동일업종 기업인수 비중이 낮은 컴퓨터 SW 업종, 도ㆍ소매업, 건설업, 전자부품업, 과학기술서비스업 등의 거래건수 비중이 상대적으로 높은 것을 알 수 있다. 즉 상대적으로 이들 업종이 관련 타 업종으로 인수거래를 확대해 나간 것을 확인할 수 있다. 표본기간을 2010~2016년의 전기와 2017~2022년의 후기로 구분하여 살펴본 결과 이들 업종 중 컴퓨터 SW, 건설업, 전자부품업 업종에 속하는 기업의 인수거래가 후기에 증가한 것을 확인할 수 있다(<부록 그림 3>).

4. 소결

국내 M&A 시장은 2010~2022년 간 거래규모가 꾸준히 성장하는 가운데 국내 매수자-매도자 간 거래의 비중이 높아지는 추세이며 M&A 방식으로 구주 거래 인수 방식이 핵심적인 비중을 차지하는 것으로 나타났다. 또한 상장기업이 거래 대상기업인 M&A 비중이 규모 기준으로 33.4%에 불과하여 비상장기업 M&A가 주종을 이루고 있는 것으로 나타났다.

인수자 유형을 기준으로 살펴보았을 때 동 기간 PE를 중심으로 한 재무적투자자의 국내 M&A 시장 참여가 확대되었는데 자금모집의 증가와 저금리로 인한 인수금융 증가 등 투자재원의 확대에 힘입은 것으로 분석된다. 한편 투자재원의 확대와 더불어 최근 재무적투자자의 성장업종 투자 확대는 전반적인 M&A 거래가치평가 배수의 증가로 나타난 것으로 판단된다. 전략적투자자의 경우에는 일부 업종을 중심으로 타 업종 기업의 인수 비중이 증가하는 추세가 발견되어 투자기회 획득을 위한 성장형 인수가 나타나는 것으로 분석되었다.

Ⅲ. 인수거래의 선행요인 분석

Ⅲ장에서는 분석표본 중 전략적투자자의 인수거래에 국한하여 이들의 인수거래와 연관성을 가질 수 있는 선행요인 재무변수를 설정하고 개별 선행요인의 설명력을 분석한 후 선행요인으로 구성된 다중 로짓회귀분석을 실시한다.17)

1. 선행요인

기업의 인수 결정에는 전술한 자원재배분과 같은 가치창출 동기, 경영자의 자만과 같은 행태적 동기 뿐만 아니라 기술변화, 규제환경, 자산가격ㆍ금리 등 금융환경, 그리고 개별기업의 제품시장 전략 및 재무적 특징 등 실로 복잡하고 다양한 요인이 영향을 미친다(Haleblian, 2009). 본 보고서는 이러한 복잡다기한 요인 중 인수기업의 재무적 선행요인에 초점을 맞추어 분석하되 통제변수로서 경제ㆍ산업ㆍ금융환경 변수를 포함한다. 먼저 고려할 수 있는 재무적 선행요인으로 기업규모, 성장성, 수익성, 현금흐름과 같은 기본적인 재무변수들을 설정한다. 기업규모는 총자산의 자연로그로, 성장성은 과거 3년간 연평균 매출액 증가율로, 수익성은 순이익을 총자산으로 나눈 총자산수익률(ROA)로, 현금흐름은 영업현금흐름을 총자산으로 나누어 사용한다. 또한 인수를 위한 가용 재원 또는 예비적(precautionary) 유동성을 포함하기 위해 현금ㆍ현금성자산을 총자산으로 나눈 현금 변수를 사용한다. 한편 자본구조와 자산구조의 특징을 포착하기 위해 자본구조 변수로는 장단기차입금비율을 사용하며, 자산구조 변수로는 재무상태표 상 무형자산을 사용하되 영업권을 차감한 무형자산 장부가액을 총자산으로 나누어 사용한다. 경제ㆍ산업ㆍ금융환경 변수로는 경제성장률, 산업성장률, 자산가격 지표(시장 PER), 금리 및 금리 스프레드를 사용한다. 마지막으로 성장업종 더미와 상장기업 더미를 포함하여 분석한다. 한편 이러한 설명변수로는 인수거래 발생년도의 직전년도 재무제표를 사용하였으며 인수기업의 외감기업 코드가 존재하고 인수거래 규모가 존재하는 인수거래로 한정하여 표본을 구성하였다.

<표 Ⅲ-2>는 설명변수 간 상관계수를 나타낸 표이다. 설명변수 간 상관관계는 기업규모-보유현금 간 음(-)의 상관관계, 총자산수익률-현금흐름 간 양(+)의 상관관계를 제외하고는 전반적으로 절대치가 높지는 않은 것으로 나타났다.18)

2. 개별 선행요인과 인수거래의 관계

기업의 개별 선행요인과 인수거래의 관계를 살펴보기 위해 표본기간 재무자료가 존재하는 모든 외감기업을 모집단으로 설정하고 개별 재무변수의 크기에 따라 외감기업을 20분위로 나누어 각 분위 그룹 내 실제 인수가 발생한 빈도, 즉 실증분포(empirical distribution)를 산출하였다(<그림 Ⅲ-1>).19) 또한 기업 재무변수는 아니지만 업력에 따른 인수거래 참여 빈도를 살펴보기 위해 업력 기준의 실증분포도 함께 살펴본다.20)21) 한편 전체 외감기업 표본 수는 관련 재무지표의 존재 여부에 따라 다르다. 예를 들어, 기업규모의 외감기업 표본 수는 283,401개이며 매출액증가율의 표본 수는 198,712개이다.

먼저 기업규모를 살펴보면 인수거래의 빈도는 기업규모가 클수록 단조적으로(monotonically) 증가하고 있다. 이는 다른 조건이 동일하다면 인수자금의 외부조달 능력 또는 인수위험 차원에서 기업규모가 인수거래 참여 가능성에 큰 영향력을 미칠 수 있음을 의미한다. 업력 기준으로는 대체로 업력이 증가할수록 인수거래의 빈도가 증가하고 있어 기업은 업력이 쌓이고 성장이 정체되면서 기업인수를 통하여 외부로부터 성장동력을 찾는 경향을 나타냄을 알 수 있다(Levine, 2017).

매출액증가율과 총자산수익률로 대변되는 성장성과 수익성은 대체로 인수 빈도에 양(+)의 영향을 미치는 것으로 나타나지만 일정 수준 이상에서는 성장성과 수익성이 추가적으로 증가하더라도 인수 빈도에는 큰 영향을 미치지 않는 것으로 분석된다.

한편 자본구조와 자산구조 변수로서 차입금비율과 무형자산비율은 인수 빈도와 거의 단조적인 증감 패턴을 나타내었다. 즉 차입금비율이 높아질수록 인수 빈도는 감소하는데 이는 차입여력(unused debt capacity)이 인수에 영향을 미치는 중요한 요인임을 시사한다(Harford et al, 2009; Uysal, 2011). 무형자산비율의 경우에는 무형자산 비중이 높을수록 인수 빈도가 증가하고 있으며 특히 일정 수준 이상의 무형자산 비중을 가진 기업에서만 인수거래가 주로 발생하는 것을 확인할 수 있다. 통상 무형자산 비중이 높은 기업은 연구개발 투자가 많거나 브랜드 가치가 높으며 조직자본(organizational capital)22)23) 이 많은 기업이므로 인수거래를 통해 추가적인 가치창출을 시도함을 의미한다(Li, Qiu & Shen, 2018; Li, Wang & Zhang, 2018).

마지막으로 현금흐름 및 현금과 인수 빈도의 관계를 살펴보면 현금흐름과 현금 모두 일정 수준까지는 인수 빈도와 양(+)의 관계가 나타나지만 일정 수준을 초과하는 구간에서는 현금흐름 및 현금의 증가가 인수 빈도에 영향을 미치지 못하는 현상이 나타나며, 현금흐름이 최고로 높은 분위 그룹에서는 인수 빈도가 오히려 하락하는 모습이 나타난다. 기업의 현금보유 동인 중 예비적 동기나 대리인 동기의 경우24) 보유현금은 투자기회가 나타날 경우 활용할 수 있는 재원이므로 이러한 결과는 인수거래에 사용할 수 있는 재원의 중요성을 시사한다.

3. 인수거래의 다중 로짓회귀분석

다음으로 인수거래 가능성과 연관된 재무적 선행요인을 종합적으로 분석하기 위해 재무적 선행요인에 대한 다중 로짓회귀분석을 수행한다. 이 때 기존 연구에서와 같이 인수거래 표본에 대하여 매칭표본을 구성하여 분석한다(Palepu, 1986; Huyghebaert et al, 2010). 구체적으로 인수기업의 외감기업 코드가 존재하는 1,128건의 인수거래 각각에 대하여 인수 직전년도 기준으로 표준산업분류 상 동일 소분류 업종이며 동일 업력을 가진 외감기업 중 최대 10개사를 매칭표본으로 선정한다.25)26) 이러한 방식으로 4,614개의 매칭표본이 추출되었으며 인수거래와 매칭표본을 합산한 5,742개 표본 중 선행요인이 모두 존재하는 4,366개의 표본을 최종 회귀분석 표본으로 선정하였다. 한편 선행요인으로는 기업규모, 총자산순이익률, 3년 평균 매출액증가율, 무형자산 비중, 차입금비중, 보유현금, 현금흐름을 설정하며 기타 통제변수로 산업매출액증가율, GDP성장률, KOSPI 주가수익비율, 금리스프레드, 금리, 성장업종더미와 상장기업더미를 설정하였다.

이상의 논의를 바탕으로 로짓회귀분석식을 설정하면 다음 식(1)과 같다.27)

인수더미

<표 Ⅲ-3>은 인수거래의 로짓회귀분석 결과를 나타낸 표이다. 회귀분석 결과 인수기업 관점에서 기업규모가 클수록, 무형자산 비중이 높을수록, 차입금 비중이 낮을수록, 보유현금 비중이 높을수록 인수거래에 참여할 가능성이 높은 것으로 분석되었으며, 이러한 결과는 1% 유의수준에서 통계적 유의성을 확보하였다. 그러나 총자산수익률, 매출액증가율, 현금흐름은 인수거래의 설명력에서 통계적 유의성이 부족하였다. 한편 통제변수 중에서는 GDP성장률이 높을수록, 금리스프레드가 낮을수록, 인수기업이 상장기업일수록 인수거래에 참여할 가능성이 높았으며 이러한 결과는 모두 1% 유의수준에서 통계적 유의성이 있었다. 다만 전반적인 자산가격 수준을 나타내는 KOSPI 주가수익비율이나 금리 수준은 추정계수 부호가 예상과 합치함에도 불구하고 통계적 유의성이 부족하였다. 마지막으로 성장업종 더미의 계수가 음(-)으로 나타나 제약ㆍ바이오, ICT 등 성장업종에서의 인수 빈도가 상대적으로는 타 업종의 인수 빈도에 비하여 낮은 것으로 추정되었다.

이러한 결과를 종합하면 다음과 같은 시사점이 있다. 첫째, 기업규모, 차입금 비중, 보유현금은 인수기업 입장에서 가장 큰 영향을 미치는 재무적 요소이며 이는 공통적으로 인수자금에 대한 접근성을 나타내는 것으로 풀이된다. 중소기업의 자금조달의 어려움, 차입금 비중이 나타내는 대출 여력, 투자기회를 놓치지 않기 위한 예비적 동기 또는 여유자금으로서의 보유현금 비중 등 인수재원의 확보 여부가 인수거래 참여 가능성과 밀접한 연관성을 갖는 것으로 분석된다. 물론 기업의 인수 동기는 매우 다양하여 인수자금에 대한 접근성과 같은 재무적 특징만으로 인수자금과 인수거래 참여 간 인과관계를 설정할 수 없으나 통상 대규모 투자로서 기업인수에 따르는 위험을 감안할 때 충분한 재무적 자원(financial resource)을 갖춘 기업이 인수거래에 참여할 가능성은 높다(Harford, 1999; Erel et al, 2021). 둘째, 자산 특성을 나타내는 지표로서 무형자산의 비중이 높은 기업은 연구개발 투자로 인한 특허 자산이 많고 상표권 등의 브랜드 가치가 높으며 조직자본이 구축된 기업이다. 따라서 무형자산 비중이 높은 기업은 혁신 및 가치창출 역량이 높은 기업이라고 할 수 있으며 이러한 역량을 바탕으로 인수 대상기업의 가치를 제고하거나 인수 대상기업 자산 또는 사업모델과의 시너지를 통하여 가치창출을 도모하는 것으로 풀이된다.

4. 소결

기업인수의 재무적 선행요인으로 기업규모, 매출액증가율(성장성), 총자산수익률(수익성), 차입금비율(자본구조), 무형자산 비중(자산구조), 보유현금 및 현금흐름을 설정하였다. 각 선행요인과 인수 빈도의 관계를 살펴본 결과 기업규모가 클수록, 차입금비율이 낮을수록, 무형자산비율이 높을수록 인수빈도가 거의 단조적으로 증가하였다. 보유현금 및 현금흐름은 모두 일정 수준까지에서만 인수 빈도와 양(+)의 관계가 나타났다.

인수거래 가능성과 연관된 재무적 선행요인을 종합적으로 분석하기 위해 재무적 선행요인과 경제 및 금융시장 통제변수를 포함한 로짓회귀분석을 수행한 결과 기업규모, 차입금, 보유현금과 무형자산 비중이 인수거래와 직접적으로 연관되는 것으로 나타났다. 기업규모, 차입금 및 보유현금은 인수재원에 대한 접근성과 재무적 자원을 나타내는 지표라고 할 수 있으며 대규모 투자로서 기업인수의 위험을 감안할 때 이러한 결과는 외부자금조달 능력이나 충분한 재무적 자원을 갖춘 기업이 인수거래에 참여할 가능성이 높음을 시사한다. 또한 무형자산 비중은 혁신 및 가치창출 역량을 나타내는 지표로서 분석 결과는 이러한 유형의 기업이 인수대상 기업을 활용한 기업가치 제고를 목적으로 인수거래에 참여할 가능성이 높음을 시사한다.

Ⅳ. 정책적 시사점

기업인수의 동기는 다양하고 가치파괴적 인수는 바람직하지 않지만 본 보고서의 실증분석은 다른 조건이 동일하고 인수기업의 재무적 선행요인에 국한한다면 잠재적 인수기업의 인수거래 참여에 재무적 제약이 존재할 수 있음을 시사한다. 즉 가치창출이 가능한 인수 기회를 보유한 잠재적 인수기업이 충분한 재무적 재원을 가지지 못했을 경우 가치창출의 기회를 살릴 수 있도록 최소한 인수재원에 대한 접근성이 확대될 필요가 있다. 인수재원에 대한 접근성 확대가 반드시 가치파괴적 인수로 이어지지는 않기 때문이다(Gao & Mohamed, 2018). 특히 사업재편 기업 등 특정 기업군의 인수거래 참여에 투자위험과 불확실성이 따른다면 일반 은행이나 자본시장을 통한 인수자금 공급이 어려울 수 있다(선병수, 2021).28) 이러한 경우 정책자금을 활용해 인수재원의 접근성을 제고한다면 자원재배분이라는 M&A의 긍정적 기능을 살릴 수 있는 방법이 될 수 있다. 이러한 관점에서 고려할 수 있는 정책방향은 다음과 같다.

첫째, 인수거래를 희망하는 중소ㆍ혁신기업의 인수재원 확보를 지원할 필요가 있다. 본문의 분석에서 살펴보았듯이 국내 인수거래는 규모가 큰 기업을 중심으로 이루어지고 있으며 중소ㆍ혁신기업의 인수거래 참여는 차입금 비중과 보유현금에 직접적인 영향을 받고 있다. 따라서 중소ㆍ혁신기업이 지분투자 유치를 통해 재무구조를 개선하거나 인수재원을 확보하는 것이 필요하다. 바이아웃과 더불어 PE의 대표적인 투자방식인 성장자본(growth capital) 투자는 기업 인수거래를 위한 재원 공급이 주요 목적 중 하나인 투자방식이다. 그러나 성장자본 투자의 대상이 규모가 작은 기업일 경우 거래비용이 높아 민간자금 조달이 잘 이루어지지 않는 경향이 있다. 반면 규모가 작은 중소ㆍ혁신기업 인수거래의 성과는 상대적으로 규모가 큰 기업 대비 높을 수 있다(Moeller et al, 2004). 따라서 시장수요를 참작하여 제한된 범위에서 성장자본 투자를 주 목적으로 하는 정책성 투자기구를 설정ㆍ운용하는 방식을 고려할 수 있다. 이러한 투자기구는 지분투자를 통하여 중소ㆍ혁신기업에 인수재원을 공급하거나 중소ㆍ혁신기업 경영자가 지분희석을 원하지 않을 경우 중소ㆍ혁신기업이 참여하는 인수거래에 공동투자자로 매칭투자를 할 수 있다. 이는 기존의 대출형 인수금융을 지분형 인수금융으로 보완하는 성격을 갖는다. 과거 경영참여형 사모펀드 제도 도입과 운영을 통해 국내 M&A 시장이 성장한 경험을 고려해 볼 때 이러한 투자기구를 통하여 중소ㆍ혁신기업의 인수거래 참여를 확대할 필요성이 높다고 할 수 있다.

둘째, 무형자산이 많은 기업은 인수거래에 참여할 가능성이 높음에도 불구하고 무형자산은 일반적으로 담보가치가 부족하여 외부자금조달이 상대적으로 어려우므로 무형자산이 많은 기업은 인수재원으로 내부자금조달에 의존할 가능성이 높다(OECD, 2021). 따라서 중소ㆍ혁신기업에서와 마찬가지로 무형자산 비중이 높으며 인수재원 접근성이 제한된 기업을 대상으로 성장자본을 공급하는 지분형 인수금융 투자기구를 고려할 수 있다. 이러한 투자기구는 해당 무형자산의 전략적 가치에 대한 이해도를 갖춘 전문운용사에 의한 운용이 필수적일 것이다. 다른 한편으로 무형자산 중 특허, 상표, 저작권 등과 같은 지식재산권(Intellectual Property: IP) 금융 활성화를 통하여 이들 기업이 보유한 IP를 활용하여 자금조달을 확대할 수 있도록 하여야 한다. 지식재산권은 평가비용이 크고 적정가치의 평가와 관련된 불확실성이 크므로 가치평가 비용의 지원, 공적 인증기관 활용, 평가모형의 개발 등 거래의 투명성과 신뢰성 제고를 위한 정책적 노력이 지속되어야 한다(박용린, 2018).

1) 금융위원회(2023. 5. 8)

2) 이른바 GAFAM(Google, Apple, Facebook, Amazon, Microsoft)으로 불리는 5대 대형 플랫폼 기술기업은 피인수기업 유형 중 데이터 기반(data-incentive) 피인수기업의 22.3%를 인수하였다(Jin et al, 2022).

3) 다양한 연구가 존재하나 대표적으로 심한택 외(2004), 강효석 외(2010), 최순영 외(2017), 박경서 외(2017), 이상은 외(2021)를 들 수 있다.

4) 기업의 인수 동기는 재무적 선행요인 뿐만 아니라 피인수기업과의 기술적ㆍ사업적 시너지, 성장 전략, 산업조직적 특징, M&A 경험 등과 같은 다양한 요인이 영향을 미칠 수 있으나 본 보고서는 이 중 재무적 요인에 초점을 맞춘다.

5) 경영권 인수의 기준으로는 50% 이상의 절대적 지분 기준 규모가 아닌 인수자가 1대 주주로 변경되는 거래를 기준으로 하였다.

6) 본 보고서에서 정의하는 국내 매수자-해외 매도자 간 M&A(in-out)와 해외 매수자-국내 매도자 간 M&A(out-in)는 일반적으로 국경 간 M&A(cross-border M&A)와 유사하나 소재지가 국내인 M&A 대상기업이 포함될 수 있어서 정확히 일치하는 개념은 아니다.

7) 국내 M&A 유형 중 in-in, in-out, out-in 유형은 M&A 대상기업이 국내 또는 해외에, out-out은 국내에 소재하는 경우이다.

8) 인수 방식별 인수 지분규모는 구주 78.6%, 신주 61.5% 등이며 인수거래 전체 평균은 75.6%이다.

9) 상장기업이 합병 거래의 일방인 거래를 포함한다.

10) M&A 거래의 인수자로 개인 또는 개인 공동보유자 등이 있을 수 있으나 비중이 매우 낮아 논의하지 않는다.

11) 핵심 재무적투자자로서 국내 PE 현황과 성과에 대해서는 박용린(2020)을 참고하기 바란다.

12) 재무구조로부터 독립된 순수한 사업 가치평가를 위해 EV/매출액 또는 EV/EBITDA 등을 사용하나 개별 M&A 대상기업의 재무제표가 음(-)의 EBITDA인 경우가 일부 존재하여 가치평가 기준으로 EV/매출액을 사용하였다. 또한 개별 기업의 가치평가 배수를 사용하는 대신 M&A 대상기업의 합계 매출액과 합계 EV를 산출한 후 가치평가 배수를 계산하였다. 마지막으로 EV = M&A가액/인수지분율 +차입금 – 보유현금으로 계산하였다.

13) 인수 시 가치평가 배수를 산출함에 있어 일반기업과 재무구조가 상이한 금융업과 부동산업을 제외하였다.

14) 구체적으로 성장기업을 표준산업분류 기준 중분류 업종 중 21(의료용 물질 및 의약품 제조업), 26(전자부품, 컴퓨터, 영상, 음향 및 통신장비 제조업), 27(의료, 정밀, 광학기기 및 시계 제조업), 58(출판업), 62ㆍ63(컴퓨터 SW, SI 및 정보서비스)의 6개 업종에 속한 기업으로 분류한다.

15) 실제 동 기간 소수 성장기업에 대한 재무적투자자의 대규모 인수거래가 발생하였다.

16) 기타 가치파괴적 인수 동기로는 대표적으로 경영자 자만(hubris) 또는 잉여현금흐름의 오남용을 강조하는 대리인 이론(Roll, 1986; Jensen, 1993)을 들 수 있으며 행태적 동기로서는 주식시장 가치평가 오류를 활용한 인수(Shleifer et al, 2003)를 들 수 있다.

17) 본 보고서의 초점은 인수 주체의 재무적 특징에 있으므로 기업재무적 특징이 큰 의미가 없는 재무적투자자의 인수 선행요인은 분석에서 제외한다. 또한 인수대상 기업 대신 인수기업의 선행요인을 분석하였으므로 국내 M&A 시장의 분석과 시사점 측면에서 다소 한계가 존재할 수 있다.

18) 상관계수가 높은 보유현금과 현금흐름을 회귀분석에 모두 포함함으로써 설명변수 간 경합(horse-racing)을 통해 최종적으로 설명력이 높은 선행요인을 구분할 수 있다.

19) 이 때 인수가 아닌 타 M&A 방식이 모집단에 포함되는 것을 방지하기 위하여 인수 이외 타 방식의 M&A 거래는 외감기업 표본에서 제외하였다.

20) 후술하는 다중 로짓회귀분석에서 매칭표본을 구성하기 위해 업력을 사용하였기 때문에 회귀분석 변수로서 업력을 포함하지 않았다.

21) 업력은 분위 그룹으로 나누는 대신 0~3년, 4년~7년 등 4년 단위의 그룹으로 나누었다.

22) 조직자본은 수요를 충족시키는 재화를 공급하기 위한 인적ㆍ물적 자본의 결합에 사용되는 지식으로 정의된다(Evenson & Westphal, 1995). 통상 조직자본은 경쟁강도가 높은 산업에서 지속가능한 경쟁우위를 제공하는 핵심 요소로 간주된다(Li, Wang & Zhang, 2018).

23) 무형자산 유형 간 상관관계에 대한 연구가 많지 않으나 조직자본과 보유 특허량이 중요한 상관관계가 있다는 연구가 존재한다(Francis et al, 2021).

24) 기업 현금보유의 동기에 대한 실증분석은 Opler et al.(1999)을 참조하기 바란다.

25) 매칭표본을 추출하는 외감기업에는 기업에 의한 인수거래 뿐만 아니라 합병, 분할 등 여타 방식의 M&A 거래를 수행한 기업을 제외하였다. 또한 매칭표본의 임의성(randomness)을 최대화하기 위해 기존 연구에서 통상적으로 사용하는 동일업종 표본에 추가하여 동일업력 기준을 추가하였다. 최대 10개의 매칭표본은 외감기업 코드 순으로 추출하였다.

26) 재무지표를 일반기업과 직접적으로 비교하기 어려운 금융업과 부동산 업종의 인수거래는 분석대상에서 제외하였다.

27) <그림 Ⅲ-1>의 보유현금 및 현금흐름과 인수거래 빈도 간 비선형관계를 반영하기 위해 보유현금 및 현금흐름의 자승변수를 추가하여 회귀분석을 수행한 결과 보유현금 자승변수의 계수는 1% 수준의 음(-)으로, 현금흐름 자승변수는 유의성 없는 음(-)으로 나타났으며 타 변수의 설명력과 부호는 유지되었다.

28) 국내 사업재편 지원제도는 2016년 제정된『기업활력제고를 위한 특별법』을 통해 공급과잉업종, 신산업 진출기업 등 사업재편이 필요한 기업에 대하여 상법ㆍ공정거래법 상 절차 간소화 및 규제유예, 과세이연 및 소요자금 금리우대 등을 지원하는 정책 프로그램이다.

참고문헌

금융위원회, 2020. 5. 8, 기업 M&A 지원 방안, 보도자료.

강효석ㆍ서재응, 2010, 코스닥기업의 인수합병이 인수기업의 경영성과에 미치는 영향, 한국증권학회지 제39권 2호, 191-223.

박경서ㆍ정찬식ㆍ김선민, 2017, 국내 M&A 제도현황과 개선방안: 소수주주권 강화를 중심으로, 한국증권학회지 제46권 1호, 1-33.

박용린, 2018, 무형자산의 부상과 기업금융 수요의 변화, 자본시장연구원 이슈보고서 18-13.

박용린, 2020, 국내 PEF의 평가와 향후 과제, 자본시장연구원 이슈보고서 20-29.

선병수, 2021, 지속성장 Report, 대한상공회의소 지속성장 이니셔티브 정책연구 보고서 제 2021-03호.

심한택ㆍ조정일ㆍ박용찬, 2004, M&A 대상기업의 재무적 특성: Out-In형 M&A와 In-In형 M&A의 비교, 대한경영학회지 제42호, 293-312.

이상은ㆍ김문겸, 2021, 중소기업 M&A의 ROE 변화: 전략적 투자자 대 재무적 투자자, 재무관리연구 제38권 제2호, 289-314.

최순영ㆍ김규림, 2017, 국내 M&A 시장의 특징 및 M&A 성과 결정요인 분석, 자본시장연구원 연구보고서 17-07.

Axelson, U., Jenkinson, T., Stromberg, P., Weisbach, M.S., 2013, Borrow Cheap, Buy High? The Determinants of Leverage and Pricing in Buyouts, The Journal of Finance 68(6), 2223-2267.

Banerjee, A., Eckard, E.W., 1998, Are mega-mergers anticompetitive? Evidence from the first great merger wave, Rand Journal of Economics 29(4), 803-827.

Bargeron, L.L., Schlingemann, F.P., Stulz, R.M., Zutter, C.J., 2008, Why do private acquirers pay solittle compared to public acquirers? Journal of Financial Economics 89(3), 375–390.

Boucly, Q., Sraer, D., Thesmar, D., 2011, Growth LBOs, Journal of Financial Economics 102(2), 432-453.

Celik, M.A., Tian, X., Wang, W., 2022, Acquiring Innovation under Information Frictions, The Review of Financial Studies 35(10), 4474–4517.

David, J.M., 2021, The Aggregate Implications of Mergers and Acquisitions, The Review of Economic Studies 44(4), 796–1830.

Dimopoulos, T., Sacchetto, S., 2017, Merger activity in industry equilibrium, Journal of Financial Economics 126(1), 200-226.

Erel, I., Jang, Y., Minton, B., Weisbach, M., 2021, Corporate Liquidity, Acquisitions, and Macroeconomic Conditions, Journal of Financial and Quantitative Analysis 56(2), 443-474.

Evenson, R.E., Westphal, L.E., 1995, Chapter 37 Technological change and technology strategy, Handbook of Development Economics 3(Part A), 2209-2299.

Francis, B., Mani, S.B., Sharma, Z., Wu, Qiang, 2021, The Impact of Organization Capital on Firm Innovation, Journal of Financial Stability 53.

Gao, N., Mohamed, A., 2018, Cash-rich acquirers do not always make bad acquisitions: New evidence, Journal of Corporate Finance 50(C), 243-264.

Gorbenko, A., Malenko, A., 2014, Strategic and Financial Bidders inTakeover Auctions, The Journal Of Finance 69(6), 2513-2555.

Haleblian, J., Devers, C.E., McNamara, G., Carpenter, M.A., Davison, R.B., 2009, Taking Stock of What We Know About Mergers and Acquisitions: A Review and Research Agenda, Journal of Management 35(3), 469–502.

Harford, J., 1999, Corporate cash reserves and acquisitions, Journal of Finance 54(6), 1969–1997.

Harford, J., Klasa, S., Walcott, N., 2009, Do firms have leverage targets? Evidence from acquisitions, Journal of Financial Economics 93(1), 1-14.

Huyghebaert, N., Luypaert, M., 2010, Antecedents of growth through mergers and acquisitions: Empirical results from Belgium, Journal of Business Research 63(4), 392-403.

Jensen, M.C., 1993, The modern industrial revolution, exit, and the failure of internal control systems, Journal of Finance 48(3), 831-880.

Jin, G.Z., Leccese, M., Wagman, L., 2022, How Do Top Acquirers Compare in Technology Mergers? New Evidence from an SP Taxonomy, Law & Economics Center at George Mason University Scalia Law School Research Paper Series No. 22-024.

Jin, G.Z., Leccese, M., Wagman, L., 2023, M&A and technological expansion, Journal of Economics & Management Strategy, Early View, 1–22.

Kim, E., Singal, V., 1993, Mergers and market power: Evidence from the airline industry. The American Economic Review 83(3), 549-569.

Levine, O., 2017, Acquiring growth, Journal of Financial Economics 126(2), 300-319.

Li, K., Qiu, B., Shen, R., 2018, Organization Capital and Mergers and Acquisitions, The Journal of Financial and Quantitative Analysis 53(4), 1871-1909.

Li, P., Li, F.W., Wang, B., Zhang, Z., 2018, Acquiring organizational capital, Finance Research Letters 25(C), 30-35.

Li, X., 2013, Productivity, restructuring, and the gains from takeovers, Journal of Financial Economics 109(1), 250-271.

Martos-Vila, M., Rhodes-Kropf, M., Harford, J., 2013, Financial vs. Strategic Buyers, Journal of Financial and Quantitative Analysis 54(6), 2635-2661.

Masulis, R.W., and Serif, A.R., 2018, Deal Initiation in Mergers and Acquisitions, The Journal of Financial and Quantitative Analysis 53(6), 2389–430.

Moeller, S.B., Schlingemann, F.P., Stulz, R.M., 2004, Firm size and the gains from acquisitions, Journal of Financial Economics 73(2), 201-228.

OECD, 2021, Bridging the gap in the financing of intangibles to support productivity: Background paper, An OECD contribution to the G20 Italian Presidency 2021.

Opler, T., Pinkowitz, L., Stulz, R., Williamson, R., 1999, The determinants and implications of corporate cash holdings, Journal of Financial Economics 52(1), 3-46.

Palepu, K.G., 1986., Predicting takeover targets: A methodological and empirical analysis, Journal of Accounting and Economics 8(1), 3-35.

Phillips, G.M., Zhdanov, A., 2017, Venture Capital Investments and Merger and Acquisition Activity Around the World, NBER working paper No. 24082.

Roll, R., 1986, The hubris hypothesis of corporate takeovers, Journal of Business 59(2), 197-216.

Shleifer, A., Vishny, R., 1992, Liquidation Values and Debt Capacity: A Market Equilibrium Approach, The Journal of Finance 47(4), 1343-1366.

Shleifer, A., Vishny, R., 2003, Stock market driven acquisitions, Journal of Financial Economics 70(3), 295-311.

Uysal, V.B., 2011, Deviation from the target capital structure and acquisition choices, Journal of Financial Economics 102(3), 602-620.

<부록>