Find out more about our latest publications

Current State of Overseas CVC and its Implications for Holding Company CVCs

Issue Papers 22-24 Dec. 12, 2022

- Research Topic Corporate Finance

- Page 27

The 2021 amendment to the Monopoly Regulation and Fair Trade Act has permitted Korea’s non-financial holding companies to establish Corporate Venture Capital (CVC). CVC firms established by non-financial holding companies are expected to contribute to the sound development and qualitative advancement of Korea’s startup ecosystem which has already achieved quantitative growth, as is the case with other economies. Notably, non-financial holding company CVC is subject to stricter regulations, considering Korea’s unique economic structure where economic power is heavily concentrated in large companies. Against this backdrop, the purpose and investment activities of CVC should be fully understood to ensure that CVC firms created by holding companies overcome the limitations of existing CVC created by non-holding companies and catalyze the development of Korea’s startup ecosystem.

Overseas CVC firms have been established for various purposes and have become major players in the startup ecosystem through collaboration with independent venture capital (VC), which are key factors behind their success. A quantitative analysis has found that in terms of the size of funding and investment, CVC is larger than independent VC. It also tends to engage in overseas investment and joint investment projects more frequently and exhibit better exit performance. In addition, overseas CVC has diversified into internal or external financing strategies and the selection of initial fundraising strategy depends on overall capital market conditions at the time of establishment.

Among regulations on non-financial holding company CVC, the duty of creating a wholly-owned subsidiary and the ban on the operation of non-investment financial businesses seem not to run counter to practices of overseas CVC. But there is room for easing external financing regulation to the extent that current regulation allowed as an exception to the separation of financial and industrial capital is enforced. Above all, the 40% ceiling on external financing by each fund, applicable to non-financial holding company CVC, should be revised to 40% of CVC’s total investment in funds with the aim of increasing autonomy in the composition of fund investors. What is needed over the medium term is thorough monitoring for developments in the startup investment ecosystem with regard to non-financial holding company CVC. In addition, competent authorities should gradually alleviate regulations by taking into account how the market reacts to such developments.

Overseas CVC firms have been established for various purposes and have become major players in the startup ecosystem through collaboration with independent venture capital (VC), which are key factors behind their success. A quantitative analysis has found that in terms of the size of funding and investment, CVC is larger than independent VC. It also tends to engage in overseas investment and joint investment projects more frequently and exhibit better exit performance. In addition, overseas CVC has diversified into internal or external financing strategies and the selection of initial fundraising strategy depends on overall capital market conditions at the time of establishment.

Among regulations on non-financial holding company CVC, the duty of creating a wholly-owned subsidiary and the ban on the operation of non-investment financial businesses seem not to run counter to practices of overseas CVC. But there is room for easing external financing regulation to the extent that current regulation allowed as an exception to the separation of financial and industrial capital is enforced. Above all, the 40% ceiling on external financing by each fund, applicable to non-financial holding company CVC, should be revised to 40% of CVC’s total investment in funds with the aim of increasing autonomy in the composition of fund investors. What is needed over the medium term is thorough monitoring for developments in the startup investment ecosystem with regard to non-financial holding company CVC. In addition, competent authorities should gradually alleviate regulations by taking into account how the market reacts to such developments.

Ⅰ. 서론

정부는 공정거래법 개정(2020. 12. 29)과 시행(2021. 12. 30)을 통해 국내 일반지주회사가 ‘기업주도형 벤처캐피탈’(Corporate Venture Capital: CVC, 이하 CVC)을 설립할 수 있도록 허용하였다. 개정된 공정거래법은 금산분리 원칙의 예외를 인정하는 방식으로 일반지주회사에 CVC 설립을 허용하되 경제력 집중 억제를 위한 자기자본 투자와 CVC를 통한 대주주의 사익편취를 방지하기 위해 강한 설립ㆍ운용규제와 사후보고 의무를 부과하고 있다.

CVC는 일반적으로 ‘비상장 스타트업에 대한 대기업의 소수지분 투자’로 정의되는데1) 2), 현재 대형 기술기업을 중심으로 다수의 해외 기업들이 CVC를 운용 중이며 글로벌 VC(Venture Capital) 시장과 혁신기업 생태계의 질적 심화에 상당한 기여를 하고 있다. 이러한 관점에서 일반지주회사에 허용된 CVC는 양적으로 성장한 우리나라 스타트업 생태계의 건전한 발전과 질적 성숙에 긍정적인 역할을 할 것으로 기대되고 있다. 그런데 일반지주회사 CVC가 국내 스타트업 생태계 발전의 촉매제 역할을 하기 위해서는 CVC 운용 목적과 투자 행위에 대한 실증적 이해를 바탕으로 CVC의 긍정적 기능이 발휘될 수 있도록 규제체계 등 제반운용 환경이 정비되어야 한다.

특히 대기업집단으로의 경제력 집중이라고 하는 우리나라 경제구조의 특수성을 감안하여 일반지주회사 CVC의 긍정적 기능은 살리면서 금산분리 원칙의 훼손이나 경제력 집중과 대주주 사익편취 가능성 등 잠재적 부작용을 최소화할 수 있는 방향으로 제도 개선을 꾸준히 모색할 필요가 있다. 요컨대 이는 잠재적 부작용의 가능성을 최소화하면서 운용 자율성을 제고하는 방향의 규제환경 개선이어야 한다.

본 보고서는 CVC 운용에 대한 실증적 이해를 위해 CVC 운용 목적과 방식에 대한 기존 연구와 더불어 해외 CVC의 현황과 특징을 글로벌 사모시장 데이터 공급기관인 Preqin 자료를 활용하여 정량적으로 분석하였다. 특히 국내 일반지주회사 CVC의 운용 및 향후 성과가 CVC 설립, 자금조달 및 운용규제와 밀접한 관련이 있을 것으로 예상되므로 이러한 측면에 초점을 맞추어 해외 CVC 현황과 특징을 분석한다. 본 보고서는 일반지주회사 CVC가 CVC의 본질적 기능에 충실하면서도 금산분리 원칙을 감안한 한국형 CVC로 안착할 수 있도록 해외 CVC 현황에 대한 실증적 기초 자료를 제공한다.

보고서의 구성은 다음과 같다. Ⅱ장에서는 CVC 일반론으로서 CVC의 이론적 배경과 CVC가 글로벌 VC 시장과 스타트업 생태계에서 차지하는 의의와 역할을 살펴본다. Ⅲ장에서는 해외 CVC의 현황과 특징을 지배구조, 자금모집-투자-회수의 운용 사이클 각 측면에서 일반 VC와의 비교를 중심으로 정량적으로 분석하고 투자재원 조달의 특징을 분석한다. Ⅳ장에서는 Ⅲ장의 분석 결과를 기반으로 국내 일반지주회사 CVC 제도의 규제 관련 시사점을 도출하며 Ⅴ장에서 결론을 맺는다.

Ⅱ. CVC의 의의와 역할

Ⅱ장에서는 CVC 투자의 의의, 성장 배경, 설립 동기, 국가별 분포, 구조 및 투자재원 조달 방식, 일반 VC와의 관계 등 CVC 일반론을 연구문헌과 기초 통계를 중심으로 간략히 서술하여 이후의 논의를 위한 기초를 제공한다.

1. CVC의 의의와 발전 양상

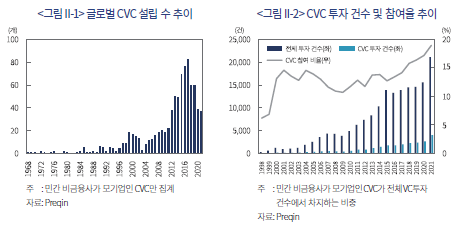

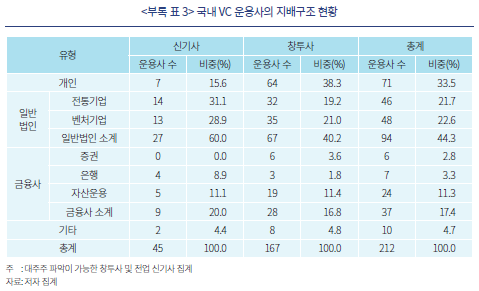

전술한 바와 같이 CVC는 스타트업에 대한 대기업의 소수지분 투자로 정의되는데 CVC는 지난 10여년간 설립 CVC 수가 급증하며 미국을 비롯한 글로벌 VC 생태계에서 그 중요성이 크게 증가하였다. 특히 2010년 이후의 성장세가 두드러지는데, <그림 Ⅱ-1>에 의하면 2010년 이후 모기업이 비금융회사인 CVC의 신규 설립 수는 표본 상 1968년 이후 전체 CVC의 73.0%에 이를 정도로 지난 10여년의 성장세는 두드러지며 다양한 지역, 산업, 기술 유형의 기업이 CVC를 설립ㆍ운용하는 중이다. 또한 <그림 Ⅱ-2>에 의하면 해외 일반 VC와 CVC의 투자건수를 합산한 전체 투자건수에서 CVC가 차지하는 비중이 2009년도 10.7%에서 2021년 18.9%까지 상승하는 추세가 나타나고 있다.3)

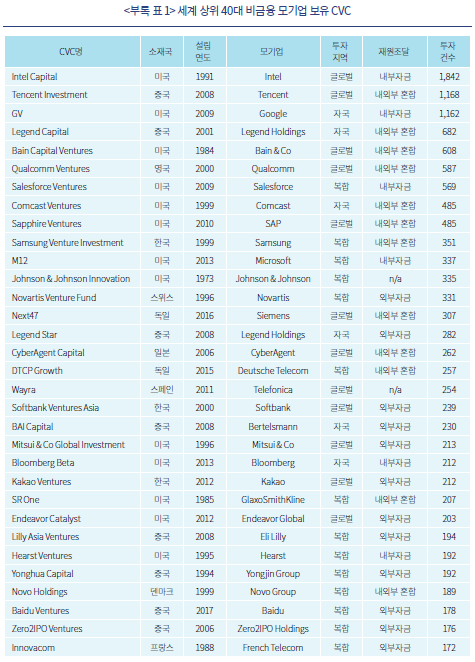

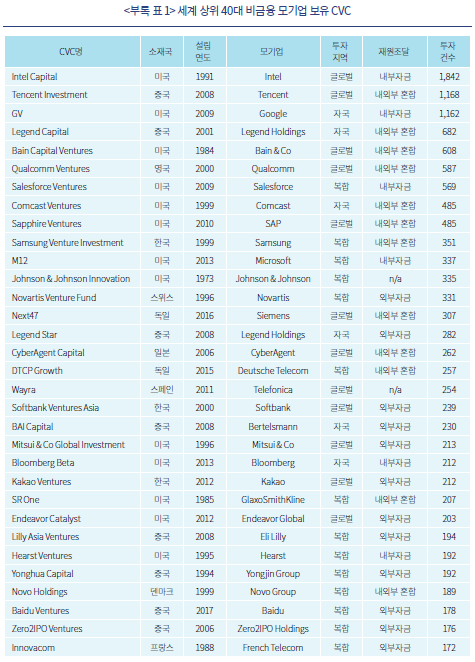

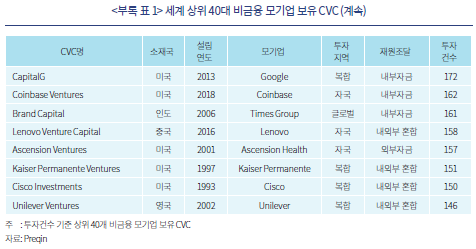

본 보고서의 분석에 사용된 943개 CVC의 소재지 국가별 분포를 살펴보면 표본상 CVC가 존재하는 총 56개국 중 미국이 350개(37.1%)로 가장 많은 비중을 차지하고 있고, 이어서 일본 90개(9.5%), 중국 58개(6.2%), 독일 54개(5.7%), 영국 40개(4.2%), 한국 37개(3.9%), 싱가포르 26개(2.8%), 인도 25개(2.7%), 프랑스 24개(2.5%), 캐나다 20개(2.1%)로 상위 10개국이 전체의 76.8%를 차지하고 있다.4)

일반적으로 VC는 사업 아이디어보다 투자재원을 많이 보유한 투자자와 투자재원은 부족하나 사업 아이디어가 있는 창업자를 연결하는 중개 역할을 한다. CVC는 VC의 일종으로서 VC의 중개 역할에 더하여 모기업의 노하우와 사업 역량을 피투자기업인 스타트업에 지원함과 동시에 혁신적인 아이디어를 스타트업으로부터 구하려는 동기를 가진 투자방식이다(Strebulaev & Wang, 2021). 이에 따라 많은 기업들이 스타트업 창업자 및 생태계와의 연계를 도모하고 있고 CVC를 통하여 최신의 혁신 동향에 대한 정보 습득을 목적으로 CVC를 설립하고 있으며 스타트업은 CVC 모기업의 기술, 전문성 및 네트워크를 활용하여 성장에 도움을 받고 있다(NVCA, 2016). 관련 연구는 CVC가 피투자기업의 기업가치를 증가시키고(Dushnitsky & Lenox, 2006), 모기업에 대하여는 혁신성과를 개선하는(Dushnitsky & Lenox 2005) 것을 실증하고 있다.

CVC는 미국을 중심으로 1960년대부터 시작되어 현재까지 4차례의 ‘CVC 물결(wave)’을 거치며 성장해왔다. 각각의 물결에 대한 설명은 CB Insights(2017)와 Dushnitsky(2015)를 따른다. 먼저 1차 물결은 1960년대 중반 양호한 현금흐름을 바탕으로 기업 다각화의 일환으로 시작되었는데 당시 미국을 대표하는 다양한 업종의 대기업이 CVC 물결을 주도하였다. 2차 물결은 1978년 미국 자본이득세 인하와 1979년 ERISA(Employee Retirement Income Security Act)의 수정안으로 기관투자자의 VC 투자가 확산되고 개인컴퓨터의 등장으로 기술기업이 성장함에 따라 시작되었다. 3차 물결은 1990년대 인터넷 등 기술발전 그리고 VC가 독립적인 자산군으로 성장함에 따라 동반 성장하였다. 이때 다양한 다국적 기업이 CVC를 설립하였으며 2000년까지 전체 VC 투자 규모의 15%를 차지하며 VC 시장의 주요 투자자 중 하나로 부상하였다. 마지막으로 4차 물결은 2003년 이후 시작되었는데 투자 업종 관점에서는 인터넷, 반도체, 통신, 바이오 등 3차 물결과 유사함에도 불구하고 CVC의 지속력이 높아진 것으로 평가된다(Lerner, 2013; Dushnitsky, 2015). 즉 2000년대 들어 기업 혁신활동의 중심이 기존 내부 R&D에서 개방형 혁신(open innovation)5)으로 변하고 CVC를 개방형 혁신의 핵심 전략으로 선택하는 기업의 비중이 높아진 것이다. 종합적으로 CVC는 2000년 초반 이후의 3차 물결까지는 다수의 CVC가 분명한 전략적 동기가 부족한 가운데 전반적인 VC 시장의 활황세에 고무되어 설립ㆍ운용되다 주식시장 급락에 따라 대부분의 CVC가 폐쇄되는 양상이 반복되었지만 4차 물결에 접어들면서 지속력을 갖춘 투자자 군으로 자리매김하는 모습이 나타나고 있는 것이다.

2. CVC의 설립ㆍ운용 동기

CVC는 대형 기술기업의 개방형 혁신을 위한 핵심 수단으로서 CVC의 설립ㆍ운용에는 시장잠재력이 높은 기술이나 제품의 동향을 파악하고 피투자기업과 향후 사업관계를 맺으려고 하는 전략적 동기가 일반적으로 작용하지만(Dushnitsky, 2006; Maula, 2007; Basu et al., 2016) 반드시 전략적 동기만이 아니라 투자수익 창출이라는 재무적 동기도 고려하는 복합적(pluralistic) 목표를 갖는다(Chesbrough, 2002; Dushnitsky & Lenox, 2006). 최근 15개국 주요 CVC를 대상으로 한 실리콘밸리은행의 서베이에 의하면 응답한 164개 CVC의 34%가 전략적 동기에, 17%는 재무적 동기에 중점을 둔 반면, 나머지 49%는 전략적 동기와 재무적 동기 모두를 고려하는 것으로 조사되었다(Silicon Valley Bank, 2022).

CVC의 전략적 동기와 관련하여 이를 구체적으로 세분하여 살펴보면 크게 3가지 동기로 분류된다. 첫째, 학습동기(learning motive)로서 이는 신기술, 신시장 및 신사업 모델에 대한 이해 증진과 이를 통한 혁신역량 배양 동기이다(이른바 ‘window on technology’ 또는 ‘external R&D’). 둘째, 대기업의 핵심 제품과 서비스에 대한 보완적인(complementary) 수요 창출 및 관련 생태계 구축을 목표로 하는 동기이다(이른바 ‘leverage’ 동기). 셋째, 향후 전략적 제휴 및 인수를 위한 중간 단계로서 CVC를 활용하기 위한 동기이다. 다만, 이와 관련하여 M&A는 개방형 혁신의 한 수단으로서 독립적인 의미를 가질 수는 있으나 CVC의 본질적인 목적은 M&A가 아니다(Dushnitsky, 2015; Strebulaev & Wang, 2021).6)

3. CVC의 구조 및 투자재원 조달 방식

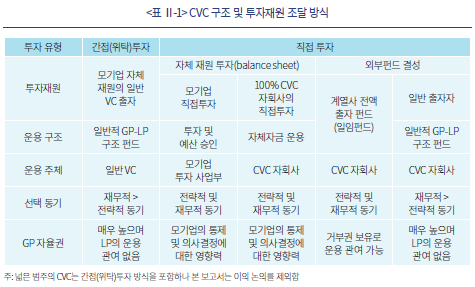

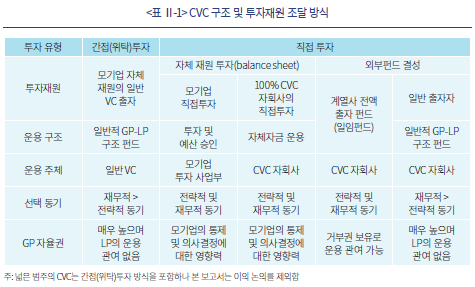

CVC를 운영하는 방식에 대하여 살펴보면 다음과 같다. 먼저 모기업이 직접 투자를 하지 않고 일반 VC 펀드에 출자하여 간접적으로 스타트업에 투자하는 경우이다(이른바 ‘CVC as LP’). 다만 이 경우는 벤처투자 시장에 대한 몰입도 측면에서 강도가 낮고 일반 VC 시장에 편입되는 방식이므로 본 보고서에는 별도로 다루지 않는다.

한편 직접 스타트업에 투자하는 CVC 방식은 두 가지로 구분된다. 첫째, 별도의 CVC 전담 자회사를 설립하지 않고 모기업 내 사업부에서 CVC 투자를 전담하는 구조이다. 이는 연도별로 별도 예산을 배정받아 예산 범위 내에서 투자하는 방식(balance sheet)과 개별 투자 건에 대하여 별도의 예산과 승인을 받는 방식(deal by deal)으로 구분된다. 둘째, 모기업이 100% 자회사(wholly-owned subsidiary)를 설립하고 CVC 투자를 동 자회사가 전담하는 경우이다. 이 경우 CVC 자회사는 자체 자본을 활용하여 스타트업에 직접 투자하거나(balance sheet), 외부펀드 결성을 통하여 스타트업에 투자한다. 이때 펀드는 계열사 일임방식(separately managed)이거나 다양한 출자자가 출자하는 일반 펀드결성 방식(commingled)이다(<표 Ⅱ-1> 참조).

전술한 CVC의 조직구조 중 모기업 사업부에서 수행하는 CVC보다는 100% 자회사 형태의 CVC 방식이 모기업의 스타트업 투자 시장에 대한 적극적 참여 의지와 지속가능성을 공동투자가 중요한 스타트업 투자 생태계 내의 일반 VC에 효과적으로 전달할 가능성이 높으며 모기업의 기회주의적 행동 가능성에 대한 창업자의 우려를 감소시킬 수 있다(Winters & Murfin, 1988).

4. CVC와 일반 VC와의 관계

CVC가 활동하는 영역은 일반 VC와 동일하게 스타트업 투자 시장이다. CVC를 재무적 동기만을 가지고 투자하는 일반 VC와 비교하면 투자대상 발굴 측면에서는 일반 VC와 매우 유사하나 투자 의사결정 과정에서 상당한 차이를 나타낸다. 예를 들어, VC 투자에 익숙하지 않은 모기업 경영진의 설득 등 복잡한 내부절차를 거쳐야 하는 경우가 많아 투자결정 속도가 느릴 수 있으며 내부 의사결정 절차를 거치는 과정에서 의사결정의 왜곡 가능성이 높다(Strebulaev & Wang, 2021). 또한 CVC는 모기업의 전략적 동기와 같은, 일반 VC와 상이한 투자 동기가 작용하므로 일반 VC의 주요 투자방식인 마일스톤 투자나 후속투자와 같은 공동투자 방식을 따르지 않을 수 있어 일반 VC의 운용방식과 상충의 요소가 있다.

그럼에도 불구하고 CVC의 성공적 운용과 관련하여 중요한 것은 일반 VC와의 관계 형성을 통하여 지속력을 갖춘 주요 시장참여자로 인정받는 것이다(Ernst & Young, 2009). 이를 위해 일반 VC 등 스타트업 투자 생태계 내 주요 플레이어와의 공동투자(syndication) 등 협력 관계 구축과 스타트업 투자 생태계로의 동화가 필수적이다. 요컨대, CVC는 일반 VC 운용 방식과 모기업 내 조직운영 원칙 간 간극을 조화롭게 극복해야 하는 과제를 안고 있다(Souitaris et al., 2012; Jeon & Maula, 2022).

CVC와 일반 VC는 스타트업 투자에 있어 경쟁자일 수도 있지만 스타트업 지원에 있어서 보완적인 역량을 보유하고 있다. 예를 들어, 일반 VC가 스타트업의 핵심 직원 선발과 조직 구조조정에서 차별화된 역량을 가지고 있다면, CVC는 신규 해외 고객 소개와 신기술 정보 지원 차원에서 차별화된 역량을 보유하고 있다(Maula et al., 2005). 일반 VC와 CVC의 보완적인 관계는 CVC가 다수의 공동투자에 참여하는 계기가 되고 있으며 공동투자에 적극적인 CVC는 전략적 목적과 높은 투자 실적을 달성할 뿐만 아니라 피투자기업의 실패율을 낮춤으로써 공동투자 파트너인 일반 VC에게도 도움이 되고 있다(Hochberg et al., 2007; Hill et al., 2009).

Ⅲ. 해외 CVC의 현황과 특징

Ⅲ장에서는 해외 CVC의 현황과 특징을 자금모집-투자-회수의 운용 사이클 각 측면의 주요 지표를 중심으로 정량적으로 분석한다. 특히 투자와 관련하여 CVC의 전략적 투자 동기와 밀접한 관련이 있는 해외투자 비중, 그리고 VC 투자 생태계 내 일반 VC와의 동화를 위한 공동투자 현황을 분석한다. 마지막으로 국내 일반지주회사 CVC 규제와 직접적으로 관련되는 해외 CVC의 투자재원 조달 방식에 관하여 살펴본다.

1. 운용 사이클

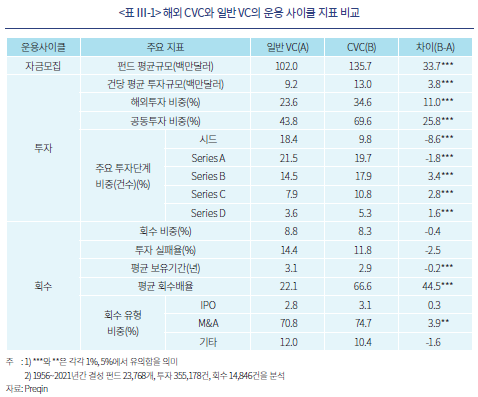

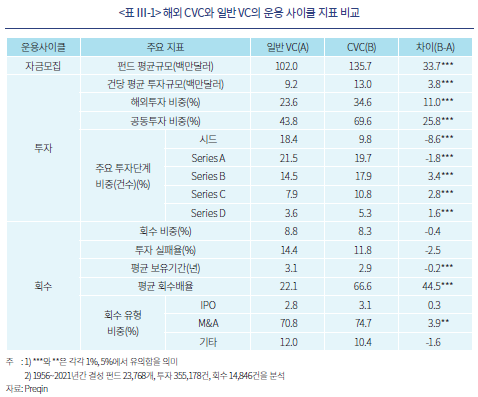

<표 Ⅲ-1>은 자금모집-투자-회수의 VC 운용 사이클별 주요 지표별 해외 일반 VC와 CVC의 운용상 차이점을 정량적으로 분석한 표이다. 먼저 자금모집 관련해서 CVC가 결성하는 펀드의 평균 규모는 1억 3,570만달러로 일반 VC의 1억200만달러보다 33.0% 크다. 또한 CVC의 투자 건당 평균 투자규모는 1,300만달러로서 일반 VC의 920만달러보다 41.3% 크다. 해외투자 비중은 34.6%로서 일반 VC의 23.6%보다 11.0%p 크고 투자건 중 타 VC 또는 CVC와의 공동투자 비중은 69.6%로서 VC의 공동투자 비중보다 25.8%p 높다. 마지막으로 투자단계별 분포를 보면 일반 VC의 투자단계가 주로 시드(18.4%)와 series A(21.5%)에 집중된 반면, CVC는 Series A(19.7%), Series B(17.9%)를 포함하여 시드부터 Series D까지의 스타트업 성장단계에 고루 분포되어 있다. 한편 CVC와 일반 VC 간 투자 지표 차이는 모두 통계적으로 1%에서 유의하다.

회수와 관련하여 포트폴리오 기업 중 회수된 투자의 비중과 투자 실패율은 일반 VC가 CVC 대비 소폭 높지만 통계적 유의성은 없다. 반면 회수까지의 평균 보유기간은 CVC가 2.9년으로서 일반 VC보다 낮으며, 투자원금 대비 회수금액인 회수배율의 평균은 CVC가 66.6배로서 일반 VC의 22.1배보다 높은 것으로 나타났다. 마지막으로 회수 유형은 잘 알려져 있듯이 일반 VC와 CVC 모두 IPO 비중은 낮고 M&A 비중은 높은 가운데 CVC의 M&A 비중이 74.7%로서 일반 VC의 70.8%보다 3.9%p 높은 것으로 나타나 CVC가 개방형 혁신의 수단으로서 M&A와 관련성이 높은 것으로 분석된다.

종합하면 해외 CVC는 일반 VC와 비교하여 펀드 규모와 건당 투자규모가 크고 CVC의 전략적 동기를 구현하기 위한 해외투자와 투자 생태계 내 동화를 위한 공동투자에 적극적이며 다양한 성장단계에 분산투자하는 것으로 이해된다. 회수와 관련하여 회수 비중이나 투자 실패율은 일반 VC와 유사하여 회수 역량의 차이점은 발견하기 어렵지만 회수 수익률이 높아 CVC 모기업의 기술, 전문성 및 네트워크를 활용하여 피투자기업의 기업가치를 증가시키는 것으로 분석된다 (Dushnitsky & Lenox, 2006). 또한 CVC의 회수 방식으로서 M&A 비중이 일반 VC 대비 유의하게 높아 투자 생태계 내의 기업 네트워크에 강점이 있음을 시사한다.

2. 투자재원 조달 방식

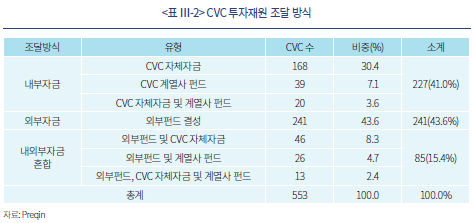

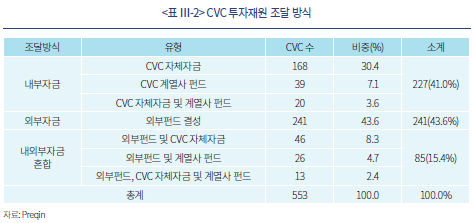

CVC의 투자재원 조달 방식은 내부자금 조달, 외부자금 조달, 그리고 내부와 외부자금의 혼합방식이 모두 사용되고 있다. 내부자금 조달은 모기업의 투자 사업부 또는 모기업의 100% 자회사 형식으로 운용하는 CVC에서 자체자금을 사용하거나(balance sheet 방식), CVC 자회사를 통하여 계열사 전용펀드를 운용하는 방식으로 구분된다. <표 Ⅲ-2>에 의하면 투자재원 조달 방식으로서 내부자금을 사용하는 CVC는 자체자금 방식(balance sheet)이 168개(30.4%), 계열사 펀드운용 39개(7.1%), 자체자금과 계열사 펀드운용 복합방식 20개(3.6%)로 재원조달 방식에 대한 자료가 존재하는 전체 553개 CVC 중 총 227개, 41.0%의 CVC가 사용하고 있다. 한편 외부펀드 결성, 즉 일반 VC 펀드 결성을 통하여 투자재원을 조달하는 CVC는 241개로서 전체의 43.6%이다. 마지막으로 외부자금과 내부자금을 혼합하여 투자재원을 조달하는 CVC는 85개로서 전체의 15.4%이다. 이러한 결과를 통해 볼 때 해외 CVC는 투자재원 조달에 있어 내부자금을 사용하는 CVC와 외부자금을 조달하여 사용하는 CVC가 균형을 이루고 있다고 할 수 있다.7)

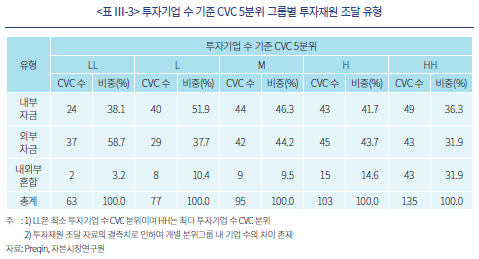

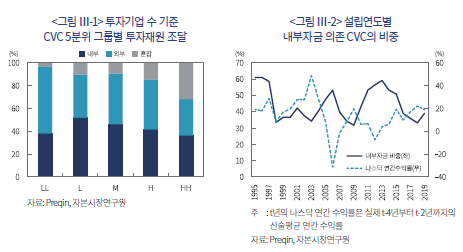

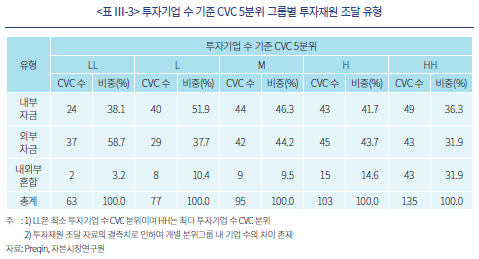

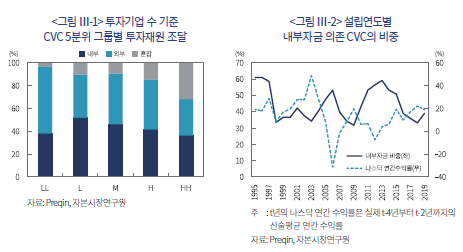

이러한 CVC 투자재원 조달 방식은 CVC 모기업의 자금력과 자체자금 사용의지 뿐만 아니라 스타트업 투자 시장 내에서의 특정 CVC의 지배적 위치에 따른 외부자금 모집 가능성과도 밀접한 관련이 있을 수 있다. 이러한 관점에서 데이터 상에 존재하는 CVC 별 투자 건수를 기준으로 CVC의 업력과 지명도를 고려한 투자재원 조달 분포를 살펴볼 필요가 있다. 구체적으로, 표본 상 CVC의 투자 건수에 따라 CVC를 5분위로 나누고 각 분위별 투자재원 조달 방식의 분포를 살펴본다(<표 Ⅲ-3> 및 <그림 Ⅲ-1>).

<표 Ⅲ-3>에 의하면 내부자금에만 의존하는 CVC의 비중은 최하위분위(LL)와 하위분위(L)의 경우 각각 38.1%, 51.9%이지만 최상위분위(HH)는 36.3%로 감소하고 있으며, 내외부자금을 혼합하는 CVC 비중은 최하위분위(LL), 하위분위(L)의 경우 각각 3.2%, 10.4%에서 최상위분위(HH) 31.9%로 증가하고 있다. 투자기업 수가 많은 CVC는 내부자금 조달 비중이 상대적으로 낮고 내외부 혼합의 비중이 높은 것으로 나타난다. 이는 스타트업 투자 시장에서의 시장 참여도와 외부자금 조달이 양(+)의 상관관계를 가지고 있음을 의미한다. 즉 스타트업 투자에 적극적인 CVC의 경우 투자자간 위험공유(risk sharing) 목적 또는 자체 재원의 한계로 인하여 내부자금 조달에 대한 의존도를 낮추고 외부자금을 유치하고자 하는 경향이 나타남을 의미한다. 물론 투자의 트랙 레코드가 축적되면서 외부자금 모집이 가능해지는 측면도 작용한다. 마지막으로 투자 건수가 가장 많은 최상위분위(HH)의 CVC 중 외부자금에만 의존하는 CVC 비중은 31.9%로서 분위그룹 중 가장 낮은 수준으로 나타나 외부자금만으로는 적극적인 CVC 투자를 수행하기 어려운 것을 시사한다.

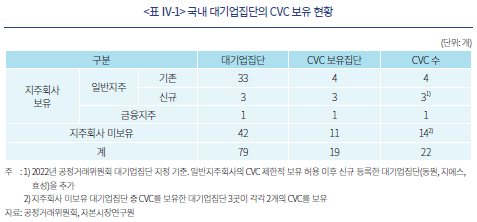

마지막으로 설립된 연도를 기준으로 당해 설립된 CVC 중 내부자금에만 의존하는 CVC의 비중을 살펴보면 <그림 Ⅲ-2>와 같다. 먼저 1995년부터 2019년까지 설립연도별로 내부자금에 의존하는 CVC 비중을 구한 결과 시기별로 상승과 하락을 반복하는 양상이 나타났다. 이는 전반적 자본시장 상황에 따른 출자 자금 시장의 축소 및 확대와 밀접한 관련이 있는 것으로 추정된다.8)

글로벌 자금시장과 내부자금에 의존하는 CVC 비중과의 관계를 알아보기 위해 특정 CVC 설립연도(t)와 과거 2년전 기준(t-2) 3년간 나스닥 지수의 연간 수익률의 산술평균(즉 t-4에서 t-2까지의 산술평균)을 구하여 표기하면 <그림 Ⅲ-2>와 같다. 요컨대 해외 CVC의 경우 CVC가 설립되는 특정 시기의 금융시장 상황에 따라 외부자금 조달이 가능할 경우 이를 활용하고자 하는 유인이 작동하였음을 알 수 있다. 과거 3년간 나스닥 시장의 수익률이 높을(낮을) 경우 신규 CVC 중 내부자금 조달을 선택하는 CVC의 비중이 낮아지는(높아지는) 관계가 관찰된다. 요컨대 해외 CVC의 경우 투자재원 조달 방식은 절대적인 것이 아니며 CVC가 설립되는 특정 시기의 전반적인 금융시장 상황에 따라 투자재원 조달의 양상이 다르게 나타남을 알 수 있다.

Ⅳ. 국내 일반지주회사 CVC 제도 관련 시사점

Ⅳ장에서는 먼저 일반지주회사 CVC가 도입되기9) 전부터 존재해 온 국내 비지주회사 CVC의 현황과 문제점을 살펴보고 일반지주회사 CVC가 금산분리 원칙 완화에 따르는 부작용을 최소화 및 일반지주회사 CVC의 순기능 제고를 위해 현행 규제의 평가와 개선사항에 대하여 논의한다.

1. 국내 비지주회사 CVC의 현황과 문제점

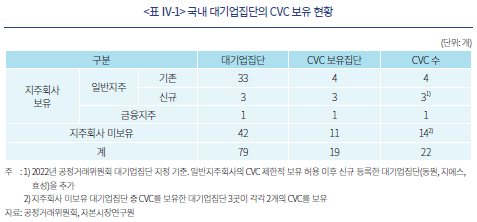

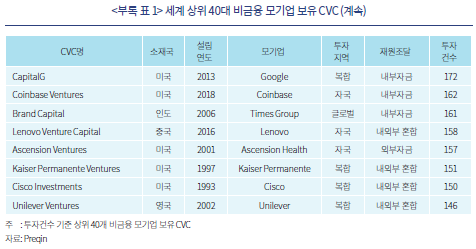

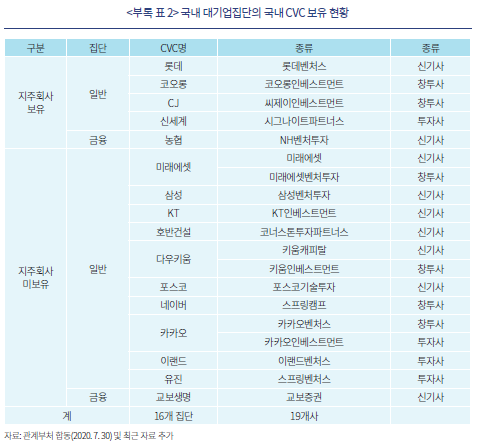

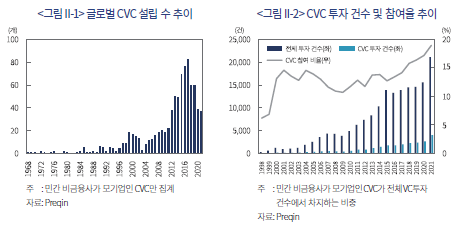

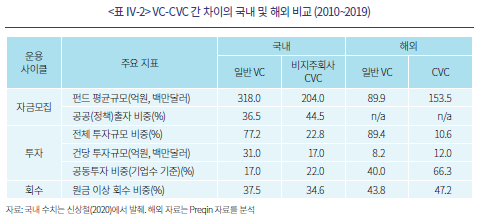

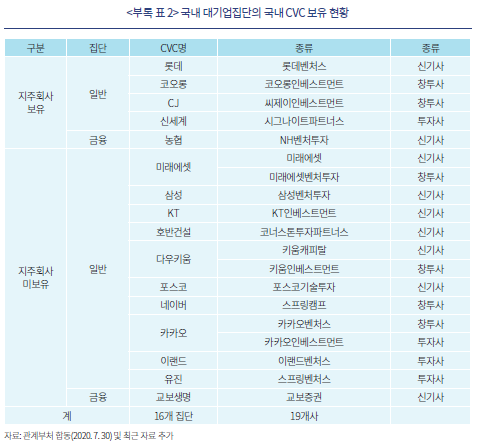

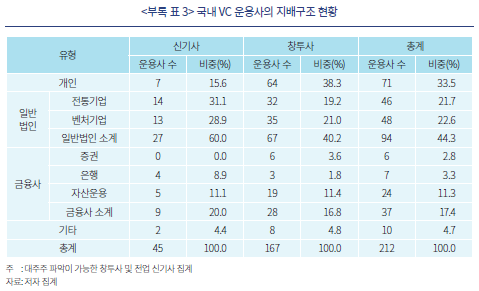

CVC는 그간 일반지주회사의 자회사가 아닌 형태로 국내에 존재해왔다. 일반지주회사 체제가 아닌 대기업집단은 CVC 설립ㆍ운영에 제약이 없으며 일반지주회사라 하더라도 지주회사 체제 밖에서 중소기업창업투자회사(이하 창투사)나 신기사의 형태로 CVC를 운영해왔다(<표 Ⅳ-1> 참조). 또한 성공한 벤처기업이나 전통 중견기업 상당수가 창투사 또는 신기사의 설립을 통하여 CVC를 운영해왔다(<부록 표 3> 참조).

다만 일반지주회사 체제 외에서 운영되어 온 일부 대형 CVC를 제외하고는 일반적으로 국내 CVC는 미국, 유럽 등 해외에서 관찰되는 CVC 운영의 양태와는 조금 다른 양상을 보여 왔다. 즉, 전략적 동기가 상대적으로 두드러지지 않은 가운데 투자회사로서 스타트업 발굴보다는 모기업 납품사에 대한 투자 집행과 같은 위험회피적인 방식으로 운영되어왔으며(신영수, 2021), 따라서 진정한 CVC도 일반 VC도 아닌 상태로 운용되어왔다(신영수, 2019; 신상철, 2020).

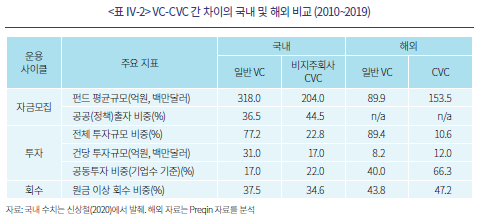

국내 비지주회사 CVC의 현황과 문제점을 구체적으로 살펴보기 위해 비지주회사 CVC가 국내 일반 VC와 비교하여 자금모집-투자-회수 각 단계에서 어떠한 차이를 나타내는지, 그리고 이러한 차이점은 해외 CVC와 해외 일반 VC 간 차이와 어떻게 다른지 살펴볼 필요가 있다. 신상철(2020)은 국내 비지주회사 CVC 분석을 위하여 비금융법인이 대주주인 63개 창투사의 2010~2019년 간의 운용 행태를 연구하였다. 표본이 창투사에 한정되어 국내 전반의 비지주회사 CVC에 대한 포괄적인 분석의 한계가 있음에도 불구하고 동 기간 Preqin 데이터를 사용하여 해외 CVC 및 일반 VC의 현황과 비교 분석함으로써 국내 기존 비지주회사 CVC의 현황과 문제점을 살펴볼 수 있다(<표 Ⅳ-2> 참조).

먼저 국내 일반 VC와 비지주회사 CVC가 전체 투자 규모에서 차지하는 비중은 각각 77.2%, 22.8%인 반면 해외의 경우 일반 VC가 89.4%, CVC가 10.6%를 차지하고 있어 국내 비지주회사 CVC의 투자 비중이 해외와 비교하여 높은 것으로 나타났다. 즉, 전체 규모 측면에서 국내 스타트업 투자 생태계에서 비지주회사 CVC가 차지하는 중요성이 작지 않은 것이다. 그러나 운용의 실질 측면을 고려하면 이와 상반된 결과가 나타난다.

첫째, 국내 일반 VC 펀드의 평균 규모는 318억원인 반면 국내 비지주회사 CVC는 204억원이며, 건당 투자규모도 일반 VC가 31억원인 반면 국내 비지주회사 CVC는 17억원에 불과하여 비지주회사 CVC가 일반 VC보다 영세한 투자 양태를 보이고 있다. 이는 CVC가 일반 VC보다 펀드의 평균 규모와 건당 투자 규모에서 더 큰 해외의 경우와 반대이다. 이는 국내 비지주회사 CVC가 스타트업 투자 생태계에서 피투자기업 성장을 적극적으로 지원할 수 있는 주도적인 투자자가 되기 어렵다는 것을 시사한다. 둘째, 회수의 경우 원금 이상 회수 비율이 국내 일반 VC가 37.5%, 비지주회사 CVC가 34.6%로 일반 VC가 소폭 높은 반면, 해외의 경우는 CVC가 47.2%, 일반 VC가 43.8%로 CVC가 소폭 높은 것으로 나타나 해외와 달리 국내 비지주회사 CVC의 회수 역량이 다소 낮은 것으로 나타난다. 셋째, 국내의 공공ㆍ정책자금 비중이 높은 점을 감안하더라도 비지주회사 CVC가 일반 VC보다 공공ㆍ정책자금의 출자비중이 높은 것은 국내 비지주회사 CVC가 민간 재원조달을 통하여 운용 자율성을 확보하는 데에 한계가 있음을 시사한다. 마지막으로 공동투자 비중은 국내 비지주회사 CVC가 22.0%로 국내 일반 VC의 17.0%보다 소폭 높은 것으로 나타나지만 해외 CVC의 66.3%에는 크게 미치지 못하는 상황이다. 종합적으로 국내 비지주회사 CVC는 비금융법인이 대주주라는 소유구조에도 불구하고 해외 스타트업 투자 생태계에서 관찰되는 CVC 운영 양태를 보여주고 있지 못한 것으로 평가할 수 있다.

2. 일반지주회사 CVC 규제에 대한 시사점

앞서 살펴본 바와 같이 국내에는 기존에 비지주회사 CVC가 존재하고 있었으나 민간 재원을 바탕으로 기업 성장을 지원하고 국내 투자 생태계의 주요 일원으로서 주도적인 역할을 담당하기에는 규모 및 역량의 한계가 있었음을 살펴보았다. 이러한 상황은 다수 비지주회사 CVC가 해외 CVC와 달리 기술, 전문성, 네트워크 등 경영자원 측면에서 제한적 역량을 가지고 있기 때문으로 풀이된다. 이러한 이유로 대기업집단이 상당 부분을 차지하는 일반지주회사 CVC가 기술력과 풍부한 경영자원을 바탕으로 국내 스타트업 생태계에서 CVC 본연의 역할을 해주기를 기대하는 것이다. 이를 위해서는 일반지주회사 CVC가 국내의 특수 상황에서 발생하는 부작용을 유발하지 않으면서 스타트업 투자 생태계 관행과 정합적인 방식으로 운용될 수 있도록 규제환경의 정비가 필요하다. 이는 제도 초창기인 현 시점에서 규제 총량은 존치하되 규제 한도 내에서의 운용 자율성 제고를 의미하며, 좀 더 구체적으로는 펀드별 운용규제에서 전체 운용자산 기준 규제로 전환하는 것이라고 할 수 있다.

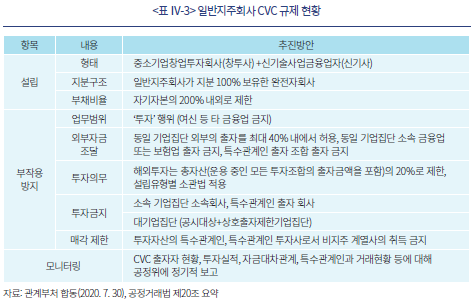

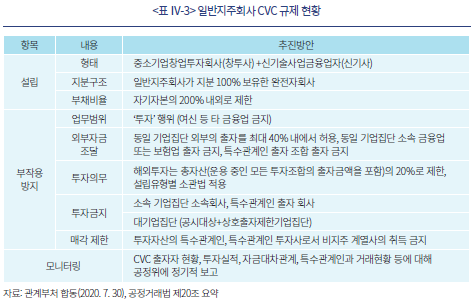

개정 공정거래법 상 일반지주회사 CVC와 관련된 규제는 <표 Ⅳ-3>과 같다. 이러한 규제는 금산분리에 대한 예외 최소화, 타인자본을 이용한 지배력 확장 억제, 지배주주 일가 사익편취 방지의 목적으로 마련되었다. 한편 금산분리와 경제력 집중 억제라는 규제 목적 외에 국내 벤처투자 확대라는 상이한 정책목표가 일반지주회사 CVC에 동시에 투영되어 있다. 이하에서는 주요 규제 항목별로 현행 규제를 논의하고 해외 CVC 사례로부터의 시사점을 바탕으로 개선사항을 제시한다.

먼저 공정거래법은 금산분리 원칙에 대한 예외를 최소화하기 위해 일반지주회사 CVC 운용과 관련하여 투자만 허용하고 있으며 대출 등 타 금융업 수행을 금지하고 있다. VC는 일반적인 GP-LP 구조에서 본질적으로 타인 자금을 위탁받아 투자를 통해 대리 운용하고 수익을 위탁자에게 반환하는 방식이므로 금융업에 속한다고 할 수 있는데 이미 금산분리 원칙의 예외를 허용한 이상 예외를 최소화하기 위해 대출과 같은 일반 금융업 수행을 금지한 것이다. 이와 관련하여 CVC는 VC의 일종이며 VC는 지분투자가 본질인 투자방식이므로 투자 외의 대출 등 타 금융업 수행을 금지하는 것은 스타트업 투자 활성화를 도모하면서도 금산분리 원칙에 대한 예외 최소화와 정합적인 규제 방식이라고 할 수 있다.

한편 타인자본을 이용한 지배력 확장을 억제하기 위한 규제로는 크게 3가지를 들 수 있다. 먼저 일반지주회사 CVC는 일반지주회사의 100% 자회사로 설립하여야 하고 일반지주회사 CVC의 총부채가 자기자본의 200%를 초과할 수 없으며 펀드 결성 시 외부출자 비중을 최대 40%로 제한하였다. 각각에 대하여 살펴보면 다음과 같다.

첫째, 일반지주회사 CVC를 일반지주회사의 100% 자회사로 설립하도록 의무화한 것은 상당수 글로벌 CVC가 모기업의 투자 관련 사업부를 통하여 또는 100% CVC 자회사를 설립한 후 CVC 프로그램을 운영하는 상황을 고려할 때 해외 CVC 시장의 일반적인 관행을 크게 벗어나는 규제라고 할 수 없다. 또한 Ⅱ장에서 살펴본 바와 같이 모기업의 100% 자회사인 CVC는 스타트업 투자 시장에 대한 적극적 참여 의지와 지속가능성을 시장 참여자에게 신호할 수 있어 스타트업 투자 생태계 내 안착에 도움이 될 수 있다(Winters & Murfin, 1988).

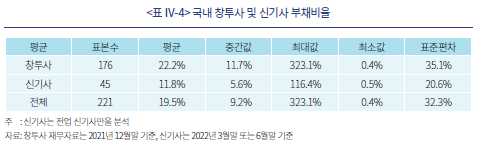

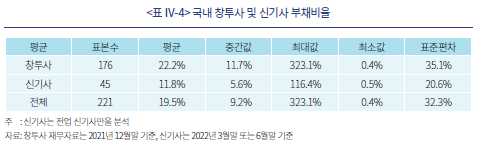

둘째, 일반지주회사 CVC의 200% 부채비율 제한 관련하여 국내 창투사 차입한도가 자기자본의 2,000%10), 신기사는 1,000%11)로 되어 있음에도 불구하고 창투사와 신기사의 평균 부채비율이 각각 22.2%, 11.8%에 머무르고 있음을 고려할 때 추가적인 규제 완화는 필요하지 않은 것으로 판단된다.

셋째, 일반지주회사 CVC의 펀드 결성 시 외부출자 규모를 펀드 전체 규모의 최대 40%로 제한한 것과 관련하여 펀드 결성을 통한 타인 자금조달의 폐해는 대기업이 일반지주회사 CVC를 통해 많은 유망한 스타트업에 투자 또는 이를 인수하게 되는 경우 발생할 수 있는 경제력 집중 가능성이라고 할 수 있다. 이와 관련하여 먼저 고려할 것은 외부 투자금 유치를 통한 투자는 타인자본을 통한 경제력 확장이라고 하기에 한계가 있음을 고려할 필요가 있다. 타인의 ‘투자’ 자본은 위험공유(risk-sharing) 목적이며 일반지주회사 CVC는 운용보수만을 수취하고 위험인수의 대가인 나머지 투자수익을 출자액에 비례하여 외부 출자자에게 배분하므로 차입금을 통한 투자와 비교하여 경제력 집중의 폐해가 상대적으로 낮다. 무엇보다 만약 일반지주회사 CVC 운용과 관련하여 타인의 투자 자본을 이용한 사익편취가 발생하면 이는 평판을 근거로 하는 스타트업 투자 시장에서 자사의 평판에 악영향을 미치게 되어 향후 계열사를 제외한 외부 자금모집은 불가능하다.

III장에서 살펴본 바와 같이 스타트업 투자에 적극적인 해외 CVC의 경우 내부자금 조달에 대한 의존도를 낮추고 외부자금을 유치하고자 하는 경향이 관찰된다. 이러한 현상의 원인으로는 첫째, 업종이나 투자 분야에 따라 위험-수익 프로파일과 투자수익 창출의 양상이 상이하며 다양한 분야에 분산투자할 경우 자체 자금의 투자 효율성과 위험분산 차원에서 외부출자 유치의 필요성을 느낄 수 있기 때문이다.12) 둘째, VC와 차별화되는 CVC의 운용 능력에 기인한다. 즉, II장에서 살펴본 바와 같이 CVC는 전략적 목적에도 불구하고 신규 해외 고객 소개와 신기술 정보 지원 측면에서 일반 VC와 보완적인 관계를 가지고 있어(Maula et al., 2005) CVC가 다수 공동투자에 참여하며 이는 투자 실패율을 낮추는 역할을 한다(Hochberg et al., 2007; Hill et al., 2009). 따라서 출자자 입장에서는 차별화된 운용 역량을 보유한 CVC 출자 수요가 존재한다.

일반지주회사 CVC는 해외 CVC와 본질상 동일한 투자주체로서 전술한 외부자금 유치의 필요성이 존재한다. 즉, 분산투자와 위험공유의 필요성이 존재하며 일반지주회사 CVC가 비지주회사 CVC와 차별화된 기술과 경영자원을 가지고 있다면 일반지주회사 CVC 펀드에 대한 출자수요가 발생할 것으로 예상된다. 그런데 무엇보다 중요한 것은 모기업의 100% 자회사 형식으로 존재하는 일반지주회사 CVC는 독립된 법인으로서 외부출자 유치를 배제할 경우 자본금을 통해 투자재원을 확보해야 함과 동시에 투자인력 유지 등 경상비용을 지출해야 한다. 즉 독립된 회사로서 경영의 지속가능성 확보를 위해 운용규모의 확대와 이를 통한 운용보수 수취가 본질적으로 필요하다. 이러한 필요성은 일반지주회사 CVC가 자체 자금만을 투자하는 투자회사 또는 모기업 투자 사업부가 아닌 100% 자회사 설립 방식으로 규제되기 때문에 발생한다.

일반지주회사 CVC 펀드의 외부출자 한도 규제 개선과 관련하여 고려할 수 있는 것은 개별 펀드의 외부출자 한도를 40%로 설정하는 대신 벤처투자법의 의무투자 비율 산정 방식 또는 금번 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)에서의 일반지주회사 CVC의 해외투자 한도 사례를 준용하여13) 일반지주회사 CVC의 총자산 기준으로 외부 출자 한도를 40%가 되도록 하여 개별 펀드 출자자 구성의 자율성을 확대하는 것이다.14) 출자자를 펀드의 출자 목적에 따라 구분할 경우 투자 대상의 선정과 회수 등에서 운용 편의성이 제고될 수 있다. 일반지주회사 CVC의 현행 펀드별 외부자금 한도 규제 하에서는 단일 또는 소수 외부 기업 출자자의 전략적 목적의 펀드 결성수요가 있을 경우 일반지주회사 CVC가 이를 수용하기 어렵다.15)

넷째, 현행 공정거래법은 일반지주회사 CVC 운영과 관련한 지배주주 일가의 사익편취를 방지하기 위해 소속 기업집단 지배주주 일가 지분 보유 기업에 대한 CVC의 투자와 지배주주 일가로의 CVC 스타트업 보유 지분 매각을 금지하고 있다. 이와 관련하여 계열사들이 위험을 부담해 스타트업에 투자하고 성공 시 지배주주 일가 지분이 높은 계열사가 취득할 가능성 등 다양한 사익편취 가능성의 완전한 배제는 불가능하므로 이와 관련된 현행 규제는 불가피하다고 할 수 있다. 그러므로 이러한 관점에서 CVC의 출자자 현황, 투자실적, 자금 대차관계, 특수관계인과의 거래현황 등 공정위에 대한 정기적 운용 보고를 통한 공정위의 모니터링을 집행해 나갈 필요가 있다.

마지막으로 일반지주회사 CVC의 해외투자 한도는 총자산의 20%로 제한되는데 이에는 일반지주회사 CVC가 국내 스타트업 투자 확대에 일조하도록 하려는 정책적 고려가 반영되어 있다. 물론 국내 스타트업 투자 확대는 그 자체로 의미있는 정책 목표가 될 수 있으나 신기술과 신사업 모델에 기반을 둔 신시장이 국경을 초월하여 창출되고 있는 현재의 글로벌 스타트업 투자 생태계 현실을 고려하면 CVC 투자에 적합한 스타트업을 국내에 국한할 필요는 없을 것이다. 단기적으로는 동 규제를 존치하되 중장기적으로는 해외투자를 통해 축적한 CVC 투자 경험이 국내 스타트업 투자에 활용되어 국내 CVC 투자 및 운용의 질적 수준이 높아질 수 있도록(Dushnitsky, 2015; Belderbos et al., 2018) 해외투자 한도를 점진적으로 높여갈 필요가 있다.

Ⅴ. 맺음말

일반지주회사 CVC의 제한적 허용 정책의 성과는 향후 시장 반응과 업계 동향에 따라 결정될 것으로 판단된다. 이는 일반지주회사 CVC의 자금조달, 투자, 사후보고 등 일반지주회사 CVC 운영의 제반 사항에 대하여 국내 창투사와 신기사 등 기존 VC와 비교하여 규제 수준이 높기 때문이다.

일반지주회사 CVC가 국내 스타트업 투자 생태계에 안착하기 위해서는 일반지주회사 CVC가 금산분리 원칙을 훼손하지 않으면서도 국내 스타트업 투자 생태계의 질적 발전을 실질적으로 이끌어낼 수 있는 주체로서 자리매김해야 한다. 이를 위해서는 CVC라는 투자 주체의 속성과 운용 원리에 대한 이해를 바탕으로 한 규제환경이 마련되어야 한다. 해외 사례를 보면 CVC는 스타트업 생태계 내에서 독립적인 투자 주체라기보다는 생태계 주요 참여자 중 하나로서 많은 경우 일반 VC와 공동투자 과정을 통해 투자처 발굴과 모니터링, 회수의 전 과정에서 밀접한 영향을 서로 주고 받으며 활동한다. 따라서 CVC는 스타트업 투자 생태계의 관행과 제반 환경에 동화하고자 하는 의지도 강하다(Dutshinsky, 2015). 일반지주회사 CVC 제도는 국내의 특수 상황에서 발생하는 부작용을 억제하면서 스타트업 투자 생태계의 실제 관행과 작동 원리를 반영한 것이어야 한다.

현행 일반지주회사 CVC는 제도 도입의 초창기로서 구체적인 성과평가가 어려우며 일부 규제는 스타트업 투자의 의지를 가지고 있는 CVC라면 본질적으로 스타트업 투자가 불가능한 수준의 규제라고 할 수는 없으나 일반지주회사 CVC의 운용규제 일부는 규제 총량의 변화 없이도 가능할 것으로 판단되므로 일반지주회사 CVC에 대한 스타트업 투자 생태계의 동향을 면밀히 모니터링하며 시장 반응의 양태에 따라 향후 규제 완화를 모색할 필요가 있다.

1) CVC의 정의는 다양하지만 Dushnitsky & Lenox(2005)에 의하면 ‘direct minority equity investments made by established firms in privately held young and entrepreneurial startups’로 정의된다. 본 보고서는 기업규모가 대기업에 미치지 못하지만 특정 분야나 섹터의 주요 기업이 전략적ㆍ재무적 목적으로 수행하는 스타트업 투자도 CVC 투자에 포함한다.

2) CVC의 정의는 일반 VC와 마찬가지로 ‘투자’를 의미하지만 본 보고서에서는 문헌에서의 관례와 일반적인 사용례를 따라 투자를 위한 조직 또는 프로그램의 의미를 포함하는 용어로 사용한다.

3) 해외 CVC 운영 현황에 대한 본 보고서의 분석을 위해 2022년 7월말 기준 Preqin 데이터베이스를 활용하여 CVC 프로그램, CVC가 운용 중이거나 과거 운용하였던 펀드, 그리고 CVC의 투자 내역에 대한 자료를 구성하였다. 본 보고서는 국내 일반지주회사 CVC에 초점을 맞추고 있으므로 집계한 CVC 자료에서 모기업이 금융회사이거나 국영 모기업인 CVC, 그리고 자산운용 계열사인 CVC를 배제하여 총 943개의 민간 비금융 모기업의 자회사 또는 사업부 CVC를 대상으로 분석을 수행하였다.

4) 데이터베이스 상 우리나라 비금융 모기업 CVC도 38개 포함되어 있으나 국내 전체 VC 중 CVC로 분류될 수 있는 표본과 다소 괴리가 있으며 본 보고서는 해외 CVC 운영 현황에 대한 일차적인 자료 집계에 중점을 두고 있으므로 실증분석에서 산출하는 국내 CVC에 대한 통계는 보조적으로 참고할 필요가 있다. 또한 이는 Ⅳ장에서 논의하는 신상철(2020)의 국내 비지주회사 CVC 표본과도 상이하다.

5) Chesbrough(2003)에 의하면 개방형 혁신(open innovation)은 기술 진보를 목표로 하는 기업이 내부 아이디어뿐만 아니라 외부 아이디어를 활용하며 시장진입을 위해 내부와 외부 모두의 시장접근 방식을 활용하는 패러다임으로 정의된다(paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology).

6) 이를 뒷받침하듯 Köhn(2018)이 분석한 미국 CVC가 1996~2016년간 투자한 901건의 투자 중 14%만이 모기업의 인수로 귀결되었으며 Benson & Ziedonis(2010)에 의하면 1987~2003년 간 61건의 모기업 인수 건 중 17%만이 CVC의 피투자기업이었다.

7) 이러한 결과는 표본 중 가장 많은 비중을 차지하는 미국 내 CVC만을 한정하여 분석한 경우와 국내 CVC를 전체 표본에서 배제하고 분석한 결과에 대해서도 유사하게 나타난다. 미국내 CVC만을 대상으로 하는 분석의 경우 투자재원 조달 비중은 내부자금 43.2%, 외부자금 38.9%, 혼합방식 17.9%이며 국내 CVC를 표본에서 제외할 경우에는 내부자금 43.2%, 외부자금 40.5%, 혼합방식 16.2%로 나타났다.

8) 설립연도 기준으로 내부자금 조달을 선택하는 CVC의 비중은 1990년대 이후 주요 시기별로 구분된다. 그러한 시기는 1990년말의 인터넷 붐과 직후의 붕괴, 2007~2008년 금융위기 전까지의 글로벌 유동성 확장 시기, 금융위기 이후 2010년대말까지의 글로벌 유동성의 재확장 시기라고 할 수 있다. 내부자금 조달을 선택하는 CVC의 비중은 각 시기별 유동성의 규모와 음(-)의 상관관계가 관찰된다.

9) 국내 일반지주회사에 CVC 설립이 허용된 이후 현재까지 몇몇 국내 일반지주회사의 CVC 설립이 이루어졌다. 2022년 4월 동원그룹이 동원기술투자, 같은해 5월 GS그룹이 GS벤처스를, 7월 현대코퍼레이션이 프롤로그벤처스를, 9월 효성그룹이 효성벤처스를 신기술금융사업자(이하 신기사)로 등록하였으며 CJ그룹은 8월 CJ인베스트먼트 인수를 통해 설립하였다.

10)「벤처투자 촉진에 관한 법률」 제43조에 의하면 창투사는 사업수행에 필요한 재원을 충당하기 위하여 자본금과 적립금 총액의 20배 이내의 범위에서 상법상 사채를 발행할 수 있다.

11)「여신전문금융업법」 제48조에 의하면 여신전문금융회사로서 신기사는 총자산이 자기자본의 10배에 해당하는 금액을 초과하여서는 안 된다.

12) 또한 자기자본으로 전략적 투자를 하기 위해 벤처투자를 하는 것이 CVC의 주요 차별성이라는 인식이 존재하나 전략적 목적만을 가지고 자체 자금만으로 스타트업에 투자하는 해외 CVC는 글로벌 선도 CVC에 집중되어 있다.

13) 공정거래법 제20조 제3항 제5호 라목은 총자산을 운용 중인 모든 투자조합의 출자금액을 포함하는 것으로 정의하고 있으나 이를 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)에서 자신의 자산총계 및 자신이 운용 중인 모든 투자조합의 출자금액 중 자신의 자산총계에 포함되는 금액을 제외한 나머지 출자금액의 합계로 명확히 하였다.

14) 이때, 총자산은 벤처투자법의 정의를 준용하여 자본금과 운용 중인 모든 펀드의 출자금액 합으로 정의하거나 최근 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)의 일반지주회사 CVC 해외투자 한도와 같이 자산총계 및 자신이 운용 중인 모든 투자조합의 출자금액 중 자신의 자산총계에 포함되는 금액을 제외한 나머지 출자금액의 합계로 정의할 수 있다.

15) 해외의 대표적 실례로 Intel Capital이 Dell, Boeing, GE, Morgan Stanley 등의 외부 기업 출자를 받아 CVC 펀드를 운용한 사례가 있다(Röhm, 2018).

참고문헌

관계부처 합동, 2020. 7. 30, 일반지주회사의 CVC 제한적 보유 추진방안, 보도자료.

신상철, 2020, 『기업주도형 벤처캐피탈(CVC)의 도입방안 연구』, 중소벤처기업연구원 정책연구보고서 20-05.

신영수, 2019, 벤처지주회사 및 기업형 벤처캐피탈과 관련한 최근 규제 개편안의 법적 쟁점과 과제, 『IT와 법연구』 18, 75-94.

신영수, 2021, 개정 공정거래법상 CVC(기업형 벤처캐피탈) 관련 규정에 대한 평가와 전망, 『경영법률』 31(4), 165-188.

Basu, S., Wadhwa, A., Kotha, S., 2016, Corporate venture capital: important themes and future directions, In Zahra, S.A., Neubaum, D.O., Hayton, J.C. (Eds.), Handbook of Research on Corporate Entrepreneurship. Edward Elgar Publishing Limited, Cheltenham, UK, 203-234.

Belderbos, R., Jacob, J., Lokshin, B., 2018, Corporate ventur capital(CVC) investments and technological performance: Geographic diversity and the interplay with technology alliances, Journal of Business Venturing 33(1), 20-34.

Benson, D., Ziedonis, R.H., 2010, Corporate venture capital and the returns to acquiring portfolio companies, Journal of Financial Economics 98(3), 478-499.

CB Insights, 2017, The History of CVC: From Exxon and DuPont to Xerox and Microsoft, How Corporates Began Chasing ‘The Future’.

Chesbrough, H.W., 2002, Making sense of corporate venture capital, Harvard Business Review 80(3), 90-99.

Chesbrough, H.W., 2003, Open Innovation: The New Imperative for Creating and Profiting from Technology, Boston: Harvard Business School Press.

Dushnitsky, G., 2006, Corporate venture capital: Past evidence and future directions, In Casson, M., Yeung, B., Basu, A., Wadeson, N. (Eds.), Oxford Handbook of Entrepreneurship, Oxford University Press, London, UK, 387-431.

Dushnitsky, G., 2015, Corporate venture capital in the twenty-first century: An integral part of firms’ innovation toolkit, In Cumming, C. (Eds.), The Oxford Handbook of Venture Capital, Oxford University Press, 156-210.

Dushnitsky, G., Lenox, M.J., 2005, When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates, Research Policy 34(5), 615-639.

Dushnitsky, G., Lenox, M.J., 2006, When does corporate venture capital investment create firm value? Journal of Business Venturing 21(6), 753-772.

Ernst & Young, 2009, Global Corporate Venture Capital Report.

Fan, J.S., 2018, Catching disruption: Regulating corporate venture capital, Columbus Business Law Review, 341-425.

Hill, S.A., Maula, M.V.J., Birkinshaw, J.M., Murray, G.C., 2009, Transferability of the venture capital model to the corporate context: Implications for the performance of corporate venture units, Strategic Entrepreneurship Journal 3(1), 3-27.

Hochberg, Y., Ljungqvist, A., Lu, Y., 2007, Whom you know matters: Venture capital networks and investment performance, Journal of Finance 62(1), 251-302

Jeon, E., Maula, M., 2022, Progress toward understanding tensions in corporate venture capital: A systematic review, Journal of Business Venturing 37 forthcoming.

Köhn, 2018, Where entrepreneurship and finance meet: startup valuation and acquisition in the venture capital and corporate context, ph.d. dissertation, University of Hohenheim.

Lerner, J., 2013, Corporate Venturing, Harvard Business Review.

Maula, M.V.J., 2007, Corporate venture capital as a strategic tool for corporations, In Landström, H. (Eds.), Handbook of Research on Venture Capital, Edward Elgar Publishing Ltd, Cheltenham, UK, 371-392.

Maula, M.V.J., Autio, E., Murray, G.C., 2005, Corporate venture capitalists and independent venture capitalists: What do they know, who do they know, and should entrepreneurs care? Venture Capital 77(1), 3-19.

NVCA, 2016, Corporate Venture Engagement in Entrepreneurial Ecosystem Continues to Rise.

Röhm, P., 2018, The phenomenon of corporate venture capital from an entrepreneurial finance perspective, ph.d. dissertation, University of Hohenheim.

Silicon Valley Bank, 2022, The State of CVC: A Deep Dive into the Dynamics of Corporate Venture Capital(CVC) Ecosystem.

Souitaris, V., Zerbinati, S., Liu, G., 2012, Which iron cage? Endo-and exoisomorphism in corporate venture capital programs, Academy of Management Journal 55(2), 477-505.

Strebulaev, I.A., Wang, A., 2021, Organizational structure and decision-making in corporate venture capital, SSRN working paper.

Winters, T.E., Murfin, D.L., 1988, Venture capital investing for corporate development objectives, Journal of Business Venturing 3(3), 207-222.

정부는 공정거래법 개정(2020. 12. 29)과 시행(2021. 12. 30)을 통해 국내 일반지주회사가 ‘기업주도형 벤처캐피탈’(Corporate Venture Capital: CVC, 이하 CVC)을 설립할 수 있도록 허용하였다. 개정된 공정거래법은 금산분리 원칙의 예외를 인정하는 방식으로 일반지주회사에 CVC 설립을 허용하되 경제력 집중 억제를 위한 자기자본 투자와 CVC를 통한 대주주의 사익편취를 방지하기 위해 강한 설립ㆍ운용규제와 사후보고 의무를 부과하고 있다.

CVC는 일반적으로 ‘비상장 스타트업에 대한 대기업의 소수지분 투자’로 정의되는데1) 2), 현재 대형 기술기업을 중심으로 다수의 해외 기업들이 CVC를 운용 중이며 글로벌 VC(Venture Capital) 시장과 혁신기업 생태계의 질적 심화에 상당한 기여를 하고 있다. 이러한 관점에서 일반지주회사에 허용된 CVC는 양적으로 성장한 우리나라 스타트업 생태계의 건전한 발전과 질적 성숙에 긍정적인 역할을 할 것으로 기대되고 있다. 그런데 일반지주회사 CVC가 국내 스타트업 생태계 발전의 촉매제 역할을 하기 위해서는 CVC 운용 목적과 투자 행위에 대한 실증적 이해를 바탕으로 CVC의 긍정적 기능이 발휘될 수 있도록 규제체계 등 제반운용 환경이 정비되어야 한다.

특히 대기업집단으로의 경제력 집중이라고 하는 우리나라 경제구조의 특수성을 감안하여 일반지주회사 CVC의 긍정적 기능은 살리면서 금산분리 원칙의 훼손이나 경제력 집중과 대주주 사익편취 가능성 등 잠재적 부작용을 최소화할 수 있는 방향으로 제도 개선을 꾸준히 모색할 필요가 있다. 요컨대 이는 잠재적 부작용의 가능성을 최소화하면서 운용 자율성을 제고하는 방향의 규제환경 개선이어야 한다.

본 보고서는 CVC 운용에 대한 실증적 이해를 위해 CVC 운용 목적과 방식에 대한 기존 연구와 더불어 해외 CVC의 현황과 특징을 글로벌 사모시장 데이터 공급기관인 Preqin 자료를 활용하여 정량적으로 분석하였다. 특히 국내 일반지주회사 CVC의 운용 및 향후 성과가 CVC 설립, 자금조달 및 운용규제와 밀접한 관련이 있을 것으로 예상되므로 이러한 측면에 초점을 맞추어 해외 CVC 현황과 특징을 분석한다. 본 보고서는 일반지주회사 CVC가 CVC의 본질적 기능에 충실하면서도 금산분리 원칙을 감안한 한국형 CVC로 안착할 수 있도록 해외 CVC 현황에 대한 실증적 기초 자료를 제공한다.

보고서의 구성은 다음과 같다. Ⅱ장에서는 CVC 일반론으로서 CVC의 이론적 배경과 CVC가 글로벌 VC 시장과 스타트업 생태계에서 차지하는 의의와 역할을 살펴본다. Ⅲ장에서는 해외 CVC의 현황과 특징을 지배구조, 자금모집-투자-회수의 운용 사이클 각 측면에서 일반 VC와의 비교를 중심으로 정량적으로 분석하고 투자재원 조달의 특징을 분석한다. Ⅳ장에서는 Ⅲ장의 분석 결과를 기반으로 국내 일반지주회사 CVC 제도의 규제 관련 시사점을 도출하며 Ⅴ장에서 결론을 맺는다.

Ⅱ. CVC의 의의와 역할

Ⅱ장에서는 CVC 투자의 의의, 성장 배경, 설립 동기, 국가별 분포, 구조 및 투자재원 조달 방식, 일반 VC와의 관계 등 CVC 일반론을 연구문헌과 기초 통계를 중심으로 간략히 서술하여 이후의 논의를 위한 기초를 제공한다.

1. CVC의 의의와 발전 양상

전술한 바와 같이 CVC는 스타트업에 대한 대기업의 소수지분 투자로 정의되는데 CVC는 지난 10여년간 설립 CVC 수가 급증하며 미국을 비롯한 글로벌 VC 생태계에서 그 중요성이 크게 증가하였다. 특히 2010년 이후의 성장세가 두드러지는데, <그림 Ⅱ-1>에 의하면 2010년 이후 모기업이 비금융회사인 CVC의 신규 설립 수는 표본 상 1968년 이후 전체 CVC의 73.0%에 이를 정도로 지난 10여년의 성장세는 두드러지며 다양한 지역, 산업, 기술 유형의 기업이 CVC를 설립ㆍ운용하는 중이다. 또한 <그림 Ⅱ-2>에 의하면 해외 일반 VC와 CVC의 투자건수를 합산한 전체 투자건수에서 CVC가 차지하는 비중이 2009년도 10.7%에서 2021년 18.9%까지 상승하는 추세가 나타나고 있다.3)

본 보고서의 분석에 사용된 943개 CVC의 소재지 국가별 분포를 살펴보면 표본상 CVC가 존재하는 총 56개국 중 미국이 350개(37.1%)로 가장 많은 비중을 차지하고 있고, 이어서 일본 90개(9.5%), 중국 58개(6.2%), 독일 54개(5.7%), 영국 40개(4.2%), 한국 37개(3.9%), 싱가포르 26개(2.8%), 인도 25개(2.7%), 프랑스 24개(2.5%), 캐나다 20개(2.1%)로 상위 10개국이 전체의 76.8%를 차지하고 있다.4)

일반적으로 VC는 사업 아이디어보다 투자재원을 많이 보유한 투자자와 투자재원은 부족하나 사업 아이디어가 있는 창업자를 연결하는 중개 역할을 한다. CVC는 VC의 일종으로서 VC의 중개 역할에 더하여 모기업의 노하우와 사업 역량을 피투자기업인 스타트업에 지원함과 동시에 혁신적인 아이디어를 스타트업으로부터 구하려는 동기를 가진 투자방식이다(Strebulaev & Wang, 2021). 이에 따라 많은 기업들이 스타트업 창업자 및 생태계와의 연계를 도모하고 있고 CVC를 통하여 최신의 혁신 동향에 대한 정보 습득을 목적으로 CVC를 설립하고 있으며 스타트업은 CVC 모기업의 기술, 전문성 및 네트워크를 활용하여 성장에 도움을 받고 있다(NVCA, 2016). 관련 연구는 CVC가 피투자기업의 기업가치를 증가시키고(Dushnitsky & Lenox, 2006), 모기업에 대하여는 혁신성과를 개선하는(Dushnitsky & Lenox 2005) 것을 실증하고 있다.

2. CVC의 설립ㆍ운용 동기

CVC는 대형 기술기업의 개방형 혁신을 위한 핵심 수단으로서 CVC의 설립ㆍ운용에는 시장잠재력이 높은 기술이나 제품의 동향을 파악하고 피투자기업과 향후 사업관계를 맺으려고 하는 전략적 동기가 일반적으로 작용하지만(Dushnitsky, 2006; Maula, 2007; Basu et al., 2016) 반드시 전략적 동기만이 아니라 투자수익 창출이라는 재무적 동기도 고려하는 복합적(pluralistic) 목표를 갖는다(Chesbrough, 2002; Dushnitsky & Lenox, 2006). 최근 15개국 주요 CVC를 대상으로 한 실리콘밸리은행의 서베이에 의하면 응답한 164개 CVC의 34%가 전략적 동기에, 17%는 재무적 동기에 중점을 둔 반면, 나머지 49%는 전략적 동기와 재무적 동기 모두를 고려하는 것으로 조사되었다(Silicon Valley Bank, 2022).

CVC의 전략적 동기와 관련하여 이를 구체적으로 세분하여 살펴보면 크게 3가지 동기로 분류된다. 첫째, 학습동기(learning motive)로서 이는 신기술, 신시장 및 신사업 모델에 대한 이해 증진과 이를 통한 혁신역량 배양 동기이다(이른바 ‘window on technology’ 또는 ‘external R&D’). 둘째, 대기업의 핵심 제품과 서비스에 대한 보완적인(complementary) 수요 창출 및 관련 생태계 구축을 목표로 하는 동기이다(이른바 ‘leverage’ 동기). 셋째, 향후 전략적 제휴 및 인수를 위한 중간 단계로서 CVC를 활용하기 위한 동기이다. 다만, 이와 관련하여 M&A는 개방형 혁신의 한 수단으로서 독립적인 의미를 가질 수는 있으나 CVC의 본질적인 목적은 M&A가 아니다(Dushnitsky, 2015; Strebulaev & Wang, 2021).6)

3. CVC의 구조 및 투자재원 조달 방식

CVC를 운영하는 방식에 대하여 살펴보면 다음과 같다. 먼저 모기업이 직접 투자를 하지 않고 일반 VC 펀드에 출자하여 간접적으로 스타트업에 투자하는 경우이다(이른바 ‘CVC as LP’). 다만 이 경우는 벤처투자 시장에 대한 몰입도 측면에서 강도가 낮고 일반 VC 시장에 편입되는 방식이므로 본 보고서에는 별도로 다루지 않는다.

한편 직접 스타트업에 투자하는 CVC 방식은 두 가지로 구분된다. 첫째, 별도의 CVC 전담 자회사를 설립하지 않고 모기업 내 사업부에서 CVC 투자를 전담하는 구조이다. 이는 연도별로 별도 예산을 배정받아 예산 범위 내에서 투자하는 방식(balance sheet)과 개별 투자 건에 대하여 별도의 예산과 승인을 받는 방식(deal by deal)으로 구분된다. 둘째, 모기업이 100% 자회사(wholly-owned subsidiary)를 설립하고 CVC 투자를 동 자회사가 전담하는 경우이다. 이 경우 CVC 자회사는 자체 자본을 활용하여 스타트업에 직접 투자하거나(balance sheet), 외부펀드 결성을 통하여 스타트업에 투자한다. 이때 펀드는 계열사 일임방식(separately managed)이거나 다양한 출자자가 출자하는 일반 펀드결성 방식(commingled)이다(<표 Ⅱ-1> 참조).

전술한 CVC의 조직구조 중 모기업 사업부에서 수행하는 CVC보다는 100% 자회사 형태의 CVC 방식이 모기업의 스타트업 투자 시장에 대한 적극적 참여 의지와 지속가능성을 공동투자가 중요한 스타트업 투자 생태계 내의 일반 VC에 효과적으로 전달할 가능성이 높으며 모기업의 기회주의적 행동 가능성에 대한 창업자의 우려를 감소시킬 수 있다(Winters & Murfin, 1988).

CVC가 활동하는 영역은 일반 VC와 동일하게 스타트업 투자 시장이다. CVC를 재무적 동기만을 가지고 투자하는 일반 VC와 비교하면 투자대상 발굴 측면에서는 일반 VC와 매우 유사하나 투자 의사결정 과정에서 상당한 차이를 나타낸다. 예를 들어, VC 투자에 익숙하지 않은 모기업 경영진의 설득 등 복잡한 내부절차를 거쳐야 하는 경우가 많아 투자결정 속도가 느릴 수 있으며 내부 의사결정 절차를 거치는 과정에서 의사결정의 왜곡 가능성이 높다(Strebulaev & Wang, 2021). 또한 CVC는 모기업의 전략적 동기와 같은, 일반 VC와 상이한 투자 동기가 작용하므로 일반 VC의 주요 투자방식인 마일스톤 투자나 후속투자와 같은 공동투자 방식을 따르지 않을 수 있어 일반 VC의 운용방식과 상충의 요소가 있다.

그럼에도 불구하고 CVC의 성공적 운용과 관련하여 중요한 것은 일반 VC와의 관계 형성을 통하여 지속력을 갖춘 주요 시장참여자로 인정받는 것이다(Ernst & Young, 2009). 이를 위해 일반 VC 등 스타트업 투자 생태계 내 주요 플레이어와의 공동투자(syndication) 등 협력 관계 구축과 스타트업 투자 생태계로의 동화가 필수적이다. 요컨대, CVC는 일반 VC 운용 방식과 모기업 내 조직운영 원칙 간 간극을 조화롭게 극복해야 하는 과제를 안고 있다(Souitaris et al., 2012; Jeon & Maula, 2022).

CVC와 일반 VC는 스타트업 투자에 있어 경쟁자일 수도 있지만 스타트업 지원에 있어서 보완적인 역량을 보유하고 있다. 예를 들어, 일반 VC가 스타트업의 핵심 직원 선발과 조직 구조조정에서 차별화된 역량을 가지고 있다면, CVC는 신규 해외 고객 소개와 신기술 정보 지원 차원에서 차별화된 역량을 보유하고 있다(Maula et al., 2005). 일반 VC와 CVC의 보완적인 관계는 CVC가 다수의 공동투자에 참여하는 계기가 되고 있으며 공동투자에 적극적인 CVC는 전략적 목적과 높은 투자 실적을 달성할 뿐만 아니라 피투자기업의 실패율을 낮춤으로써 공동투자 파트너인 일반 VC에게도 도움이 되고 있다(Hochberg et al., 2007; Hill et al., 2009).

Ⅲ. 해외 CVC의 현황과 특징

Ⅲ장에서는 해외 CVC의 현황과 특징을 자금모집-투자-회수의 운용 사이클 각 측면의 주요 지표를 중심으로 정량적으로 분석한다. 특히 투자와 관련하여 CVC의 전략적 투자 동기와 밀접한 관련이 있는 해외투자 비중, 그리고 VC 투자 생태계 내 일반 VC와의 동화를 위한 공동투자 현황을 분석한다. 마지막으로 국내 일반지주회사 CVC 규제와 직접적으로 관련되는 해외 CVC의 투자재원 조달 방식에 관하여 살펴본다.

1. 운용 사이클

<표 Ⅲ-1>은 자금모집-투자-회수의 VC 운용 사이클별 주요 지표별 해외 일반 VC와 CVC의 운용상 차이점을 정량적으로 분석한 표이다. 먼저 자금모집 관련해서 CVC가 결성하는 펀드의 평균 규모는 1억 3,570만달러로 일반 VC의 1억200만달러보다 33.0% 크다. 또한 CVC의 투자 건당 평균 투자규모는 1,300만달러로서 일반 VC의 920만달러보다 41.3% 크다. 해외투자 비중은 34.6%로서 일반 VC의 23.6%보다 11.0%p 크고 투자건 중 타 VC 또는 CVC와의 공동투자 비중은 69.6%로서 VC의 공동투자 비중보다 25.8%p 높다. 마지막으로 투자단계별 분포를 보면 일반 VC의 투자단계가 주로 시드(18.4%)와 series A(21.5%)에 집중된 반면, CVC는 Series A(19.7%), Series B(17.9%)를 포함하여 시드부터 Series D까지의 스타트업 성장단계에 고루 분포되어 있다. 한편 CVC와 일반 VC 간 투자 지표 차이는 모두 통계적으로 1%에서 유의하다.

회수와 관련하여 포트폴리오 기업 중 회수된 투자의 비중과 투자 실패율은 일반 VC가 CVC 대비 소폭 높지만 통계적 유의성은 없다. 반면 회수까지의 평균 보유기간은 CVC가 2.9년으로서 일반 VC보다 낮으며, 투자원금 대비 회수금액인 회수배율의 평균은 CVC가 66.6배로서 일반 VC의 22.1배보다 높은 것으로 나타났다. 마지막으로 회수 유형은 잘 알려져 있듯이 일반 VC와 CVC 모두 IPO 비중은 낮고 M&A 비중은 높은 가운데 CVC의 M&A 비중이 74.7%로서 일반 VC의 70.8%보다 3.9%p 높은 것으로 나타나 CVC가 개방형 혁신의 수단으로서 M&A와 관련성이 높은 것으로 분석된다.

종합하면 해외 CVC는 일반 VC와 비교하여 펀드 규모와 건당 투자규모가 크고 CVC의 전략적 동기를 구현하기 위한 해외투자와 투자 생태계 내 동화를 위한 공동투자에 적극적이며 다양한 성장단계에 분산투자하는 것으로 이해된다. 회수와 관련하여 회수 비중이나 투자 실패율은 일반 VC와 유사하여 회수 역량의 차이점은 발견하기 어렵지만 회수 수익률이 높아 CVC 모기업의 기술, 전문성 및 네트워크를 활용하여 피투자기업의 기업가치를 증가시키는 것으로 분석된다 (Dushnitsky & Lenox, 2006). 또한 CVC의 회수 방식으로서 M&A 비중이 일반 VC 대비 유의하게 높아 투자 생태계 내의 기업 네트워크에 강점이 있음을 시사한다.

CVC의 투자재원 조달 방식은 내부자금 조달, 외부자금 조달, 그리고 내부와 외부자금의 혼합방식이 모두 사용되고 있다. 내부자금 조달은 모기업의 투자 사업부 또는 모기업의 100% 자회사 형식으로 운용하는 CVC에서 자체자금을 사용하거나(balance sheet 방식), CVC 자회사를 통하여 계열사 전용펀드를 운용하는 방식으로 구분된다. <표 Ⅲ-2>에 의하면 투자재원 조달 방식으로서 내부자금을 사용하는 CVC는 자체자금 방식(balance sheet)이 168개(30.4%), 계열사 펀드운용 39개(7.1%), 자체자금과 계열사 펀드운용 복합방식 20개(3.6%)로 재원조달 방식에 대한 자료가 존재하는 전체 553개 CVC 중 총 227개, 41.0%의 CVC가 사용하고 있다. 한편 외부펀드 결성, 즉 일반 VC 펀드 결성을 통하여 투자재원을 조달하는 CVC는 241개로서 전체의 43.6%이다. 마지막으로 외부자금과 내부자금을 혼합하여 투자재원을 조달하는 CVC는 85개로서 전체의 15.4%이다. 이러한 결과를 통해 볼 때 해외 CVC는 투자재원 조달에 있어 내부자금을 사용하는 CVC와 외부자금을 조달하여 사용하는 CVC가 균형을 이루고 있다고 할 수 있다.7)

<표 Ⅲ-3>에 의하면 내부자금에만 의존하는 CVC의 비중은 최하위분위(LL)와 하위분위(L)의 경우 각각 38.1%, 51.9%이지만 최상위분위(HH)는 36.3%로 감소하고 있으며, 내외부자금을 혼합하는 CVC 비중은 최하위분위(LL), 하위분위(L)의 경우 각각 3.2%, 10.4%에서 최상위분위(HH) 31.9%로 증가하고 있다. 투자기업 수가 많은 CVC는 내부자금 조달 비중이 상대적으로 낮고 내외부 혼합의 비중이 높은 것으로 나타난다. 이는 스타트업 투자 시장에서의 시장 참여도와 외부자금 조달이 양(+)의 상관관계를 가지고 있음을 의미한다. 즉 스타트업 투자에 적극적인 CVC의 경우 투자자간 위험공유(risk sharing) 목적 또는 자체 재원의 한계로 인하여 내부자금 조달에 대한 의존도를 낮추고 외부자금을 유치하고자 하는 경향이 나타남을 의미한다. 물론 투자의 트랙 레코드가 축적되면서 외부자금 모집이 가능해지는 측면도 작용한다. 마지막으로 투자 건수가 가장 많은 최상위분위(HH)의 CVC 중 외부자금에만 의존하는 CVC 비중은 31.9%로서 분위그룹 중 가장 낮은 수준으로 나타나 외부자금만으로는 적극적인 CVC 투자를 수행하기 어려운 것을 시사한다.

마지막으로 설립된 연도를 기준으로 당해 설립된 CVC 중 내부자금에만 의존하는 CVC의 비중을 살펴보면 <그림 Ⅲ-2>와 같다. 먼저 1995년부터 2019년까지 설립연도별로 내부자금에 의존하는 CVC 비중을 구한 결과 시기별로 상승과 하락을 반복하는 양상이 나타났다. 이는 전반적 자본시장 상황에 따른 출자 자금 시장의 축소 및 확대와 밀접한 관련이 있는 것으로 추정된다.8)

글로벌 자금시장과 내부자금에 의존하는 CVC 비중과의 관계를 알아보기 위해 특정 CVC 설립연도(t)와 과거 2년전 기준(t-2) 3년간 나스닥 지수의 연간 수익률의 산술평균(즉 t-4에서 t-2까지의 산술평균)을 구하여 표기하면 <그림 Ⅲ-2>와 같다. 요컨대 해외 CVC의 경우 CVC가 설립되는 특정 시기의 금융시장 상황에 따라 외부자금 조달이 가능할 경우 이를 활용하고자 하는 유인이 작동하였음을 알 수 있다. 과거 3년간 나스닥 시장의 수익률이 높을(낮을) 경우 신규 CVC 중 내부자금 조달을 선택하는 CVC의 비중이 낮아지는(높아지는) 관계가 관찰된다. 요컨대 해외 CVC의 경우 투자재원 조달 방식은 절대적인 것이 아니며 CVC가 설립되는 특정 시기의 전반적인 금융시장 상황에 따라 투자재원 조달의 양상이 다르게 나타남을 알 수 있다.

Ⅳ. 국내 일반지주회사 CVC 제도 관련 시사점

Ⅳ장에서는 먼저 일반지주회사 CVC가 도입되기9) 전부터 존재해 온 국내 비지주회사 CVC의 현황과 문제점을 살펴보고 일반지주회사 CVC가 금산분리 원칙 완화에 따르는 부작용을 최소화 및 일반지주회사 CVC의 순기능 제고를 위해 현행 규제의 평가와 개선사항에 대하여 논의한다.

1. 국내 비지주회사 CVC의 현황과 문제점

CVC는 그간 일반지주회사의 자회사가 아닌 형태로 국내에 존재해왔다. 일반지주회사 체제가 아닌 대기업집단은 CVC 설립ㆍ운영에 제약이 없으며 일반지주회사라 하더라도 지주회사 체제 밖에서 중소기업창업투자회사(이하 창투사)나 신기사의 형태로 CVC를 운영해왔다(<표 Ⅳ-1> 참조). 또한 성공한 벤처기업이나 전통 중견기업 상당수가 창투사 또는 신기사의 설립을 통하여 CVC를 운영해왔다(<부록 표 3> 참조).

국내 비지주회사 CVC의 현황과 문제점을 구체적으로 살펴보기 위해 비지주회사 CVC가 국내 일반 VC와 비교하여 자금모집-투자-회수 각 단계에서 어떠한 차이를 나타내는지, 그리고 이러한 차이점은 해외 CVC와 해외 일반 VC 간 차이와 어떻게 다른지 살펴볼 필요가 있다. 신상철(2020)은 국내 비지주회사 CVC 분석을 위하여 비금융법인이 대주주인 63개 창투사의 2010~2019년 간의 운용 행태를 연구하였다. 표본이 창투사에 한정되어 국내 전반의 비지주회사 CVC에 대한 포괄적인 분석의 한계가 있음에도 불구하고 동 기간 Preqin 데이터를 사용하여 해외 CVC 및 일반 VC의 현황과 비교 분석함으로써 국내 기존 비지주회사 CVC의 현황과 문제점을 살펴볼 수 있다(<표 Ⅳ-2> 참조).

먼저 국내 일반 VC와 비지주회사 CVC가 전체 투자 규모에서 차지하는 비중은 각각 77.2%, 22.8%인 반면 해외의 경우 일반 VC가 89.4%, CVC가 10.6%를 차지하고 있어 국내 비지주회사 CVC의 투자 비중이 해외와 비교하여 높은 것으로 나타났다. 즉, 전체 규모 측면에서 국내 스타트업 투자 생태계에서 비지주회사 CVC가 차지하는 중요성이 작지 않은 것이다. 그러나 운용의 실질 측면을 고려하면 이와 상반된 결과가 나타난다.

첫째, 국내 일반 VC 펀드의 평균 규모는 318억원인 반면 국내 비지주회사 CVC는 204억원이며, 건당 투자규모도 일반 VC가 31억원인 반면 국내 비지주회사 CVC는 17억원에 불과하여 비지주회사 CVC가 일반 VC보다 영세한 투자 양태를 보이고 있다. 이는 CVC가 일반 VC보다 펀드의 평균 규모와 건당 투자 규모에서 더 큰 해외의 경우와 반대이다. 이는 국내 비지주회사 CVC가 스타트업 투자 생태계에서 피투자기업 성장을 적극적으로 지원할 수 있는 주도적인 투자자가 되기 어렵다는 것을 시사한다. 둘째, 회수의 경우 원금 이상 회수 비율이 국내 일반 VC가 37.5%, 비지주회사 CVC가 34.6%로 일반 VC가 소폭 높은 반면, 해외의 경우는 CVC가 47.2%, 일반 VC가 43.8%로 CVC가 소폭 높은 것으로 나타나 해외와 달리 국내 비지주회사 CVC의 회수 역량이 다소 낮은 것으로 나타난다. 셋째, 국내의 공공ㆍ정책자금 비중이 높은 점을 감안하더라도 비지주회사 CVC가 일반 VC보다 공공ㆍ정책자금의 출자비중이 높은 것은 국내 비지주회사 CVC가 민간 재원조달을 통하여 운용 자율성을 확보하는 데에 한계가 있음을 시사한다. 마지막으로 공동투자 비중은 국내 비지주회사 CVC가 22.0%로 국내 일반 VC의 17.0%보다 소폭 높은 것으로 나타나지만 해외 CVC의 66.3%에는 크게 미치지 못하는 상황이다. 종합적으로 국내 비지주회사 CVC는 비금융법인이 대주주라는 소유구조에도 불구하고 해외 스타트업 투자 생태계에서 관찰되는 CVC 운영 양태를 보여주고 있지 못한 것으로 평가할 수 있다.

앞서 살펴본 바와 같이 국내에는 기존에 비지주회사 CVC가 존재하고 있었으나 민간 재원을 바탕으로 기업 성장을 지원하고 국내 투자 생태계의 주요 일원으로서 주도적인 역할을 담당하기에는 규모 및 역량의 한계가 있었음을 살펴보았다. 이러한 상황은 다수 비지주회사 CVC가 해외 CVC와 달리 기술, 전문성, 네트워크 등 경영자원 측면에서 제한적 역량을 가지고 있기 때문으로 풀이된다. 이러한 이유로 대기업집단이 상당 부분을 차지하는 일반지주회사 CVC가 기술력과 풍부한 경영자원을 바탕으로 국내 스타트업 생태계에서 CVC 본연의 역할을 해주기를 기대하는 것이다. 이를 위해서는 일반지주회사 CVC가 국내의 특수 상황에서 발생하는 부작용을 유발하지 않으면서 스타트업 투자 생태계 관행과 정합적인 방식으로 운용될 수 있도록 규제환경의 정비가 필요하다. 이는 제도 초창기인 현 시점에서 규제 총량은 존치하되 규제 한도 내에서의 운용 자율성 제고를 의미하며, 좀 더 구체적으로는 펀드별 운용규제에서 전체 운용자산 기준 규제로 전환하는 것이라고 할 수 있다.

개정 공정거래법 상 일반지주회사 CVC와 관련된 규제는 <표 Ⅳ-3>과 같다. 이러한 규제는 금산분리에 대한 예외 최소화, 타인자본을 이용한 지배력 확장 억제, 지배주주 일가 사익편취 방지의 목적으로 마련되었다. 한편 금산분리와 경제력 집중 억제라는 규제 목적 외에 국내 벤처투자 확대라는 상이한 정책목표가 일반지주회사 CVC에 동시에 투영되어 있다. 이하에서는 주요 규제 항목별로 현행 규제를 논의하고 해외 CVC 사례로부터의 시사점을 바탕으로 개선사항을 제시한다.

한편 타인자본을 이용한 지배력 확장을 억제하기 위한 규제로는 크게 3가지를 들 수 있다. 먼저 일반지주회사 CVC는 일반지주회사의 100% 자회사로 설립하여야 하고 일반지주회사 CVC의 총부채가 자기자본의 200%를 초과할 수 없으며 펀드 결성 시 외부출자 비중을 최대 40%로 제한하였다. 각각에 대하여 살펴보면 다음과 같다.

첫째, 일반지주회사 CVC를 일반지주회사의 100% 자회사로 설립하도록 의무화한 것은 상당수 글로벌 CVC가 모기업의 투자 관련 사업부를 통하여 또는 100% CVC 자회사를 설립한 후 CVC 프로그램을 운영하는 상황을 고려할 때 해외 CVC 시장의 일반적인 관행을 크게 벗어나는 규제라고 할 수 없다. 또한 Ⅱ장에서 살펴본 바와 같이 모기업의 100% 자회사인 CVC는 스타트업 투자 시장에 대한 적극적 참여 의지와 지속가능성을 시장 참여자에게 신호할 수 있어 스타트업 투자 생태계 내 안착에 도움이 될 수 있다(Winters & Murfin, 1988).

둘째, 일반지주회사 CVC의 200% 부채비율 제한 관련하여 국내 창투사 차입한도가 자기자본의 2,000%10), 신기사는 1,000%11)로 되어 있음에도 불구하고 창투사와 신기사의 평균 부채비율이 각각 22.2%, 11.8%에 머무르고 있음을 고려할 때 추가적인 규제 완화는 필요하지 않은 것으로 판단된다.

III장에서 살펴본 바와 같이 스타트업 투자에 적극적인 해외 CVC의 경우 내부자금 조달에 대한 의존도를 낮추고 외부자금을 유치하고자 하는 경향이 관찰된다. 이러한 현상의 원인으로는 첫째, 업종이나 투자 분야에 따라 위험-수익 프로파일과 투자수익 창출의 양상이 상이하며 다양한 분야에 분산투자할 경우 자체 자금의 투자 효율성과 위험분산 차원에서 외부출자 유치의 필요성을 느낄 수 있기 때문이다.12) 둘째, VC와 차별화되는 CVC의 운용 능력에 기인한다. 즉, II장에서 살펴본 바와 같이 CVC는 전략적 목적에도 불구하고 신규 해외 고객 소개와 신기술 정보 지원 측면에서 일반 VC와 보완적인 관계를 가지고 있어(Maula et al., 2005) CVC가 다수 공동투자에 참여하며 이는 투자 실패율을 낮추는 역할을 한다(Hochberg et al., 2007; Hill et al., 2009). 따라서 출자자 입장에서는 차별화된 운용 역량을 보유한 CVC 출자 수요가 존재한다.

일반지주회사 CVC는 해외 CVC와 본질상 동일한 투자주체로서 전술한 외부자금 유치의 필요성이 존재한다. 즉, 분산투자와 위험공유의 필요성이 존재하며 일반지주회사 CVC가 비지주회사 CVC와 차별화된 기술과 경영자원을 가지고 있다면 일반지주회사 CVC 펀드에 대한 출자수요가 발생할 것으로 예상된다. 그런데 무엇보다 중요한 것은 모기업의 100% 자회사 형식으로 존재하는 일반지주회사 CVC는 독립된 법인으로서 외부출자 유치를 배제할 경우 자본금을 통해 투자재원을 확보해야 함과 동시에 투자인력 유지 등 경상비용을 지출해야 한다. 즉 독립된 회사로서 경영의 지속가능성 확보를 위해 운용규모의 확대와 이를 통한 운용보수 수취가 본질적으로 필요하다. 이러한 필요성은 일반지주회사 CVC가 자체 자금만을 투자하는 투자회사 또는 모기업 투자 사업부가 아닌 100% 자회사 설립 방식으로 규제되기 때문에 발생한다.

일반지주회사 CVC 펀드의 외부출자 한도 규제 개선과 관련하여 고려할 수 있는 것은 개별 펀드의 외부출자 한도를 40%로 설정하는 대신 벤처투자법의 의무투자 비율 산정 방식 또는 금번 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)에서의 일반지주회사 CVC의 해외투자 한도 사례를 준용하여13) 일반지주회사 CVC의 총자산 기준으로 외부 출자 한도를 40%가 되도록 하여 개별 펀드 출자자 구성의 자율성을 확대하는 것이다.14) 출자자를 펀드의 출자 목적에 따라 구분할 경우 투자 대상의 선정과 회수 등에서 운용 편의성이 제고될 수 있다. 일반지주회사 CVC의 현행 펀드별 외부자금 한도 규제 하에서는 단일 또는 소수 외부 기업 출자자의 전략적 목적의 펀드 결성수요가 있을 경우 일반지주회사 CVC가 이를 수용하기 어렵다.15)

넷째, 현행 공정거래법은 일반지주회사 CVC 운영과 관련한 지배주주 일가의 사익편취를 방지하기 위해 소속 기업집단 지배주주 일가 지분 보유 기업에 대한 CVC의 투자와 지배주주 일가로의 CVC 스타트업 보유 지분 매각을 금지하고 있다. 이와 관련하여 계열사들이 위험을 부담해 스타트업에 투자하고 성공 시 지배주주 일가 지분이 높은 계열사가 취득할 가능성 등 다양한 사익편취 가능성의 완전한 배제는 불가능하므로 이와 관련된 현행 규제는 불가피하다고 할 수 있다. 그러므로 이러한 관점에서 CVC의 출자자 현황, 투자실적, 자금 대차관계, 특수관계인과의 거래현황 등 공정위에 대한 정기적 운용 보고를 통한 공정위의 모니터링을 집행해 나갈 필요가 있다.

마지막으로 일반지주회사 CVC의 해외투자 한도는 총자산의 20%로 제한되는데 이에는 일반지주회사 CVC가 국내 스타트업 투자 확대에 일조하도록 하려는 정책적 고려가 반영되어 있다. 물론 국내 스타트업 투자 확대는 그 자체로 의미있는 정책 목표가 될 수 있으나 신기술과 신사업 모델에 기반을 둔 신시장이 국경을 초월하여 창출되고 있는 현재의 글로벌 스타트업 투자 생태계 현실을 고려하면 CVC 투자에 적합한 스타트업을 국내에 국한할 필요는 없을 것이다. 단기적으로는 동 규제를 존치하되 중장기적으로는 해외투자를 통해 축적한 CVC 투자 경험이 국내 스타트업 투자에 활용되어 국내 CVC 투자 및 운용의 질적 수준이 높아질 수 있도록(Dushnitsky, 2015; Belderbos et al., 2018) 해외투자 한도를 점진적으로 높여갈 필요가 있다.

Ⅴ. 맺음말

일반지주회사 CVC의 제한적 허용 정책의 성과는 향후 시장 반응과 업계 동향에 따라 결정될 것으로 판단된다. 이는 일반지주회사 CVC의 자금조달, 투자, 사후보고 등 일반지주회사 CVC 운영의 제반 사항에 대하여 국내 창투사와 신기사 등 기존 VC와 비교하여 규제 수준이 높기 때문이다.

일반지주회사 CVC가 국내 스타트업 투자 생태계에 안착하기 위해서는 일반지주회사 CVC가 금산분리 원칙을 훼손하지 않으면서도 국내 스타트업 투자 생태계의 질적 발전을 실질적으로 이끌어낼 수 있는 주체로서 자리매김해야 한다. 이를 위해서는 CVC라는 투자 주체의 속성과 운용 원리에 대한 이해를 바탕으로 한 규제환경이 마련되어야 한다. 해외 사례를 보면 CVC는 스타트업 생태계 내에서 독립적인 투자 주체라기보다는 생태계 주요 참여자 중 하나로서 많은 경우 일반 VC와 공동투자 과정을 통해 투자처 발굴과 모니터링, 회수의 전 과정에서 밀접한 영향을 서로 주고 받으며 활동한다. 따라서 CVC는 스타트업 투자 생태계의 관행과 제반 환경에 동화하고자 하는 의지도 강하다(Dutshinsky, 2015). 일반지주회사 CVC 제도는 국내의 특수 상황에서 발생하는 부작용을 억제하면서 스타트업 투자 생태계의 실제 관행과 작동 원리를 반영한 것이어야 한다.

현행 일반지주회사 CVC는 제도 도입의 초창기로서 구체적인 성과평가가 어려우며 일부 규제는 스타트업 투자의 의지를 가지고 있는 CVC라면 본질적으로 스타트업 투자가 불가능한 수준의 규제라고 할 수는 없으나 일반지주회사 CVC의 운용규제 일부는 규제 총량의 변화 없이도 가능할 것으로 판단되므로 일반지주회사 CVC에 대한 스타트업 투자 생태계의 동향을 면밀히 모니터링하며 시장 반응의 양태에 따라 향후 규제 완화를 모색할 필요가 있다.

<부록>

1) CVC의 정의는 다양하지만 Dushnitsky & Lenox(2005)에 의하면 ‘direct minority equity investments made by established firms in privately held young and entrepreneurial startups’로 정의된다. 본 보고서는 기업규모가 대기업에 미치지 못하지만 특정 분야나 섹터의 주요 기업이 전략적ㆍ재무적 목적으로 수행하는 스타트업 투자도 CVC 투자에 포함한다.

2) CVC의 정의는 일반 VC와 마찬가지로 ‘투자’를 의미하지만 본 보고서에서는 문헌에서의 관례와 일반적인 사용례를 따라 투자를 위한 조직 또는 프로그램의 의미를 포함하는 용어로 사용한다.

3) 해외 CVC 운영 현황에 대한 본 보고서의 분석을 위해 2022년 7월말 기준 Preqin 데이터베이스를 활용하여 CVC 프로그램, CVC가 운용 중이거나 과거 운용하였던 펀드, 그리고 CVC의 투자 내역에 대한 자료를 구성하였다. 본 보고서는 국내 일반지주회사 CVC에 초점을 맞추고 있으므로 집계한 CVC 자료에서 모기업이 금융회사이거나 국영 모기업인 CVC, 그리고 자산운용 계열사인 CVC를 배제하여 총 943개의 민간 비금융 모기업의 자회사 또는 사업부 CVC를 대상으로 분석을 수행하였다.

4) 데이터베이스 상 우리나라 비금융 모기업 CVC도 38개 포함되어 있으나 국내 전체 VC 중 CVC로 분류될 수 있는 표본과 다소 괴리가 있으며 본 보고서는 해외 CVC 운영 현황에 대한 일차적인 자료 집계에 중점을 두고 있으므로 실증분석에서 산출하는 국내 CVC에 대한 통계는 보조적으로 참고할 필요가 있다. 또한 이는 Ⅳ장에서 논의하는 신상철(2020)의 국내 비지주회사 CVC 표본과도 상이하다.

5) Chesbrough(2003)에 의하면 개방형 혁신(open innovation)은 기술 진보를 목표로 하는 기업이 내부 아이디어뿐만 아니라 외부 아이디어를 활용하며 시장진입을 위해 내부와 외부 모두의 시장접근 방식을 활용하는 패러다임으로 정의된다(paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology).

6) 이를 뒷받침하듯 Köhn(2018)이 분석한 미국 CVC가 1996~2016년간 투자한 901건의 투자 중 14%만이 모기업의 인수로 귀결되었으며 Benson & Ziedonis(2010)에 의하면 1987~2003년 간 61건의 모기업 인수 건 중 17%만이 CVC의 피투자기업이었다.

7) 이러한 결과는 표본 중 가장 많은 비중을 차지하는 미국 내 CVC만을 한정하여 분석한 경우와 국내 CVC를 전체 표본에서 배제하고 분석한 결과에 대해서도 유사하게 나타난다. 미국내 CVC만을 대상으로 하는 분석의 경우 투자재원 조달 비중은 내부자금 43.2%, 외부자금 38.9%, 혼합방식 17.9%이며 국내 CVC를 표본에서 제외할 경우에는 내부자금 43.2%, 외부자금 40.5%, 혼합방식 16.2%로 나타났다.

8) 설립연도 기준으로 내부자금 조달을 선택하는 CVC의 비중은 1990년대 이후 주요 시기별로 구분된다. 그러한 시기는 1990년말의 인터넷 붐과 직후의 붕괴, 2007~2008년 금융위기 전까지의 글로벌 유동성 확장 시기, 금융위기 이후 2010년대말까지의 글로벌 유동성의 재확장 시기라고 할 수 있다. 내부자금 조달을 선택하는 CVC의 비중은 각 시기별 유동성의 규모와 음(-)의 상관관계가 관찰된다.

9) 국내 일반지주회사에 CVC 설립이 허용된 이후 현재까지 몇몇 국내 일반지주회사의 CVC 설립이 이루어졌다. 2022년 4월 동원그룹이 동원기술투자, 같은해 5월 GS그룹이 GS벤처스를, 7월 현대코퍼레이션이 프롤로그벤처스를, 9월 효성그룹이 효성벤처스를 신기술금융사업자(이하 신기사)로 등록하였으며 CJ그룹은 8월 CJ인베스트먼트 인수를 통해 설립하였다.

10)「벤처투자 촉진에 관한 법률」 제43조에 의하면 창투사는 사업수행에 필요한 재원을 충당하기 위하여 자본금과 적립금 총액의 20배 이내의 범위에서 상법상 사채를 발행할 수 있다.

11)「여신전문금융업법」 제48조에 의하면 여신전문금융회사로서 신기사는 총자산이 자기자본의 10배에 해당하는 금액을 초과하여서는 안 된다.

12) 또한 자기자본으로 전략적 투자를 하기 위해 벤처투자를 하는 것이 CVC의 주요 차별성이라는 인식이 존재하나 전략적 목적만을 가지고 자체 자금만으로 스타트업에 투자하는 해외 CVC는 글로벌 선도 CVC에 집중되어 있다.

13) 공정거래법 제20조 제3항 제5호 라목은 총자산을 운용 중인 모든 투자조합의 출자금액을 포함하는 것으로 정의하고 있으나 이를 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)에서 자신의 자산총계 및 자신이 운용 중인 모든 투자조합의 출자금액 중 자신의 자산총계에 포함되는 금액을 제외한 나머지 출자금액의 합계로 명확히 하였다.

14) 이때, 총자산은 벤처투자법의 정의를 준용하여 자본금과 운용 중인 모든 펀드의 출자금액 합으로 정의하거나 최근 지주회사 관련 규정에 관한 해석지침 개정안(2022. 9. 29)의 일반지주회사 CVC 해외투자 한도와 같이 자산총계 및 자신이 운용 중인 모든 투자조합의 출자금액 중 자신의 자산총계에 포함되는 금액을 제외한 나머지 출자금액의 합계로 정의할 수 있다.

15) 해외의 대표적 실례로 Intel Capital이 Dell, Boeing, GE, Morgan Stanley 등의 외부 기업 출자를 받아 CVC 펀드를 운용한 사례가 있다(Röhm, 2018).

참고문헌

관계부처 합동, 2020. 7. 30, 일반지주회사의 CVC 제한적 보유 추진방안, 보도자료.

신상철, 2020, 『기업주도형 벤처캐피탈(CVC)의 도입방안 연구』, 중소벤처기업연구원 정책연구보고서 20-05.

신영수, 2019, 벤처지주회사 및 기업형 벤처캐피탈과 관련한 최근 규제 개편안의 법적 쟁점과 과제, 『IT와 법연구』 18, 75-94.

신영수, 2021, 개정 공정거래법상 CVC(기업형 벤처캐피탈) 관련 규정에 대한 평가와 전망, 『경영법률』 31(4), 165-188.

Basu, S., Wadhwa, A., Kotha, S., 2016, Corporate venture capital: important themes and future directions, In Zahra, S.A., Neubaum, D.O., Hayton, J.C. (Eds.), Handbook of Research on Corporate Entrepreneurship. Edward Elgar Publishing Limited, Cheltenham, UK, 203-234.

Belderbos, R., Jacob, J., Lokshin, B., 2018, Corporate ventur capital(CVC) investments and technological performance: Geographic diversity and the interplay with technology alliances, Journal of Business Venturing 33(1), 20-34.

Benson, D., Ziedonis, R.H., 2010, Corporate venture capital and the returns to acquiring portfolio companies, Journal of Financial Economics 98(3), 478-499.

CB Insights, 2017, The History of CVC: From Exxon and DuPont to Xerox and Microsoft, How Corporates Began Chasing ‘The Future’.

Chesbrough, H.W., 2002, Making sense of corporate venture capital, Harvard Business Review 80(3), 90-99.

Chesbrough, H.W., 2003, Open Innovation: The New Imperative for Creating and Profiting from Technology, Boston: Harvard Business School Press.

Dushnitsky, G., 2006, Corporate venture capital: Past evidence and future directions, In Casson, M., Yeung, B., Basu, A., Wadeson, N. (Eds.), Oxford Handbook of Entrepreneurship, Oxford University Press, London, UK, 387-431.

Dushnitsky, G., 2015, Corporate venture capital in the twenty-first century: An integral part of firms’ innovation toolkit, In Cumming, C. (Eds.), The Oxford Handbook of Venture Capital, Oxford University Press, 156-210.

Dushnitsky, G., Lenox, M.J., 2005, When do incumbents learn from entrepreneurial ventures? Corporate venture capital and investing firm innovation rates, Research Policy 34(5), 615-639.

Dushnitsky, G., Lenox, M.J., 2006, When does corporate venture capital investment create firm value? Journal of Business Venturing 21(6), 753-772.

Ernst & Young, 2009, Global Corporate Venture Capital Report.

Fan, J.S., 2018, Catching disruption: Regulating corporate venture capital, Columbus Business Law Review, 341-425.

Hill, S.A., Maula, M.V.J., Birkinshaw, J.M., Murray, G.C., 2009, Transferability of the venture capital model to the corporate context: Implications for the performance of corporate venture units, Strategic Entrepreneurship Journal 3(1), 3-27.

Hochberg, Y., Ljungqvist, A., Lu, Y., 2007, Whom you know matters: Venture capital networks and investment performance, Journal of Finance 62(1), 251-302

Jeon, E., Maula, M., 2022, Progress toward understanding tensions in corporate venture capital: A systematic review, Journal of Business Venturing 37 forthcoming.

Köhn, 2018, Where entrepreneurship and finance meet: startup valuation and acquisition in the venture capital and corporate context, ph.d. dissertation, University of Hohenheim.

Lerner, J., 2013, Corporate Venturing, Harvard Business Review.

Maula, M.V.J., 2007, Corporate venture capital as a strategic tool for corporations, In Landström, H. (Eds.), Handbook of Research on Venture Capital, Edward Elgar Publishing Ltd, Cheltenham, UK, 371-392.

Maula, M.V.J., Autio, E., Murray, G.C., 2005, Corporate venture capitalists and independent venture capitalists: What do they know, who do they know, and should entrepreneurs care? Venture Capital 77(1), 3-19.

NVCA, 2016, Corporate Venture Engagement in Entrepreneurial Ecosystem Continues to Rise.

Röhm, P., 2018, The phenomenon of corporate venture capital from an entrepreneurial finance perspective, ph.d. dissertation, University of Hohenheim.

Silicon Valley Bank, 2022, The State of CVC: A Deep Dive into the Dynamics of Corporate Venture Capital(CVC) Ecosystem.

Souitaris, V., Zerbinati, S., Liu, G., 2012, Which iron cage? Endo-and exoisomorphism in corporate venture capital programs, Academy of Management Journal 55(2), 477-505.

Strebulaev, I.A., Wang, A., 2021, Organizational structure and decision-making in corporate venture capital, SSRN working paper.

Winters, T.E., Murfin, D.L., 1988, Venture capital investing for corporate development objectives, Journal of Business Venturing 3(3), 207-222.