Find out more about our latest publications

Securities Sector’s Financial Soundness in Korea Presented through Comparison with Foreign Regulatory Frameworks

Survey Papers 22-01 Feb. 21, 2022

- Research Topic Other

- Page 88

Although securities firms have played a pivotal role in the development of capital markets, in-depth research on financial soundness regulations that have the greatest impact on their business activities has rarely been undertaken. Since its first introduction to Korea in 1997, the previous Net Capital Ratio rule had been in place for about 20 years. In 2016, the financial authorities decided to adopt the new Net Capital Ratio approach (new NCR) with a view to enhancing global competitiveness and expanding risk investment capabilities. However, a systematic analysis of how the introduction of the new NCR has affected Korea’s securities sector has not been sufficiently conducted. In this regard, this report intends to take a look at financial soundness regulations on the securities industry in major economies like the US, Europe, and Japan, countries with a long history of the capital requirements regulation, and to examine changes that the adoption of the new NCR has brought about to Korea’s securities sector. In addition, it would analyze regulatory divergence between Korea and other advanced countries, aiming for presenting directions for regulatory improvement in the prudential framework to which Korea’s securities firms are subject.

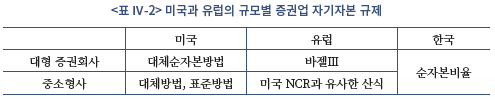

As shown in the analysis of regulations on the securities sector’s financial health in major economies, the US NCR has evolved based on the philosophy of company liquidations-related liquidity requirements with a top priority of protecting customers’ assets in case of an insolvency event. The US introduced the NCR in 1934 when the Securities Exchange Act came into effect, and established the current capital requirement formula after undergoing several revisions such as the 1975 introduction of the Uniform Net Capital Role. The current NCR approach can be classified into three types: the basic method, the alternative method, and the alternative net capital method. European countries including the UK use a Basel-style approach that has emphasized the importance of preventing bankruptcies of securities firms under the regulatory philosophy of the going concern-based prudential framework. The previous Basel-based regulation on the securities sector is similar to the capital requirements to which commercial banks are subject. Europe is expected to significantly improve regulations on the securities industry’s financial soundness from the second half of 2021. This means that in practical terms, European countries would shift towards the US NCR approach.

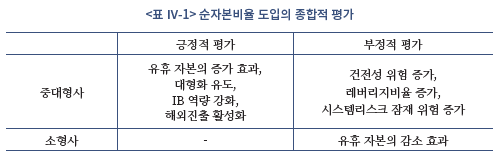

Amid the worsening financial health of securities firms in the mid-1990s, Korea introduced the previous NCR rule in April 1997 by benchmarking Japan’s capital requirements framework. The previous NCR rule laid the foundation for the regulatory framework for the securities sector’s financial health, which helped securities firms overcome the 1997 Asian financial crisis and the 2008 global financial crisis. Since the new NCR was implemented in 2016, Korea’s securities industry has seen a sharp increase in equity capital amount, expanded into overseas markets, and considerably increased profitability in IB businesses. Given this performance, the new NCR appears to have achieved its policy objectives. On the other hand, some brokerage firms have seen a surge in the issuance of derivative-linked securities and the debt guarantee value over the same period, which increased prudential risks in some segments. Furthermore, small securities firms have suffered reduced investment capabilities and worsening profitability. This highlights that the impact that the new NCR approach had on the securities industry varied by size of firms.

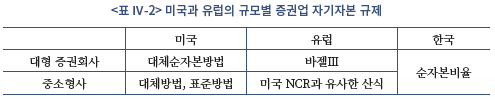

Additionally, this report undertook a comparative analysis of capital adequacy requirements for the securities sector in both Korea and major economies. The analysis reveals that in terms of calculating the capital adequacy ratio, the net operating capital, and gross risks, Korea’s regulatory regime is more stringent than those of other countries. Korea is not much different from its counterparts when it comes to the calculation of capital adequacy ratios. However, its regulatory scheme can be considered more rigorous given that Korea is applying a single capital adequacy ratio to brokerage firms regardless of their size. What is also notable is that it is hard to find any government around the world that has adopted a leverage ratio regulation as part of the prompt corrective action system. Against this backdrop, the introduction of the leverage ratio regulation to the securities sector appears to be a somewhat stringent regulatory measure.

The following suggestions should be taken into consideration to improve Korea’s regulatory framework with respect to the securities industry’s financial soundness. First, the financial authorities need to provide more flexibility to the application of capital adequacy ratios depending on the size and function of securities firms. For instance, it may be desirable to apply the Basel-style capital requirements to IB securities giants and to allow small- and medium-sized brokerage firms to choose between the net capital ratio and the Basel-based approach. Second, the net operating capital and gross risks should be calculated in proportion to economic risks. Third, it is necessary to keep to a minimum the use of capital requirements for achieving policy objectives. Lastly, in the long run, the leverage ratio system should be employed only to curb systemic risks. In this regard, the potential systemic risk of the securities sector needs to be assessed on a regular basis, and if the risk assessment shows that the risk level remains low, the regulatory threshold of leverage ratios should be reduced.

As shown in the analysis of regulations on the securities sector’s financial health in major economies, the US NCR has evolved based on the philosophy of company liquidations-related liquidity requirements with a top priority of protecting customers’ assets in case of an insolvency event. The US introduced the NCR in 1934 when the Securities Exchange Act came into effect, and established the current capital requirement formula after undergoing several revisions such as the 1975 introduction of the Uniform Net Capital Role. The current NCR approach can be classified into three types: the basic method, the alternative method, and the alternative net capital method. European countries including the UK use a Basel-style approach that has emphasized the importance of preventing bankruptcies of securities firms under the regulatory philosophy of the going concern-based prudential framework. The previous Basel-based regulation on the securities sector is similar to the capital requirements to which commercial banks are subject. Europe is expected to significantly improve regulations on the securities industry’s financial soundness from the second half of 2021. This means that in practical terms, European countries would shift towards the US NCR approach.

Amid the worsening financial health of securities firms in the mid-1990s, Korea introduced the previous NCR rule in April 1997 by benchmarking Japan’s capital requirements framework. The previous NCR rule laid the foundation for the regulatory framework for the securities sector’s financial health, which helped securities firms overcome the 1997 Asian financial crisis and the 2008 global financial crisis. Since the new NCR was implemented in 2016, Korea’s securities industry has seen a sharp increase in equity capital amount, expanded into overseas markets, and considerably increased profitability in IB businesses. Given this performance, the new NCR appears to have achieved its policy objectives. On the other hand, some brokerage firms have seen a surge in the issuance of derivative-linked securities and the debt guarantee value over the same period, which increased prudential risks in some segments. Furthermore, small securities firms have suffered reduced investment capabilities and worsening profitability. This highlights that the impact that the new NCR approach had on the securities industry varied by size of firms.

Additionally, this report undertook a comparative analysis of capital adequacy requirements for the securities sector in both Korea and major economies. The analysis reveals that in terms of calculating the capital adequacy ratio, the net operating capital, and gross risks, Korea’s regulatory regime is more stringent than those of other countries. Korea is not much different from its counterparts when it comes to the calculation of capital adequacy ratios. However, its regulatory scheme can be considered more rigorous given that Korea is applying a single capital adequacy ratio to brokerage firms regardless of their size. What is also notable is that it is hard to find any government around the world that has adopted a leverage ratio regulation as part of the prompt corrective action system. Against this backdrop, the introduction of the leverage ratio regulation to the securities sector appears to be a somewhat stringent regulatory measure.

The following suggestions should be taken into consideration to improve Korea’s regulatory framework with respect to the securities industry’s financial soundness. First, the financial authorities need to provide more flexibility to the application of capital adequacy ratios depending on the size and function of securities firms. For instance, it may be desirable to apply the Basel-style capital requirements to IB securities giants and to allow small- and medium-sized brokerage firms to choose between the net capital ratio and the Basel-based approach. Second, the net operating capital and gross risks should be calculated in proportion to economic risks. Third, it is necessary to keep to a minimum the use of capital requirements for achieving policy objectives. Lastly, in the long run, the leverage ratio system should be employed only to curb systemic risks. In this regard, the potential systemic risk of the securities sector needs to be assessed on a regular basis, and if the risk assessment shows that the risk level remains low, the regulatory threshold of leverage ratios should be reduced.

Ⅰ. 서론

증권회사1)는 금융투자상품의 중개와 매매, 자산관리 업무 등을 통해 금융소비자의 니즈를 제고하고 금융혁신과 자본시장의 공정한 경쟁을 촉진하여 금융투자산업의 건전한 발전을 도모하는 것을 목표2)로 한다. 증권회사가 위험자산을 과도하게 보유하거나 위험관리에 소홀하면 대규모 손실 위험에 노출되어 증권회사가 파산의 위험에 처하게 되고, 이로 인해 고객 자산의 손실 뿐 아니라 경우에 따라서는 시스템리스크까지 초래할 수 있다. 이에 주요국 감독당국은 증권회사의 파산을 사전에 예방하고 증권회사 파산시 투자자 재산을 안전하게 보호하기 위해 자기자본 규제, 레버리지비율 규제 등 건전성 규제를 마련하고 있다. 미국은 1967~1970년 증권사무위기(Paperwork Crisis) 및 1970년대초 오일쇼크 영향으로 다수의 브로커-딜러가 파산함에 따라 1975년 브로커-딜러에 대한 자기자본 규제를 확대 개편했다. 영국, 유럽, 일본 등 주요 국가들은 1987년 10월 블랙먼데이 사태를 계기로 각각 1988년, 1996년, 1990년에 증권업에 대한 자기자본 규제를 도입했다. 한국은 일본의 자기자본 규제 제도를 벤치마크하여 1997년 4월에 이르러서야 증권회사에 대한 자기자본 규제를 도입했다.

제조업 중심에서 하이테크 산업 중심으로 산업구조가 재편됨에 따라 모험자본 공급과 노후소득 증대를 담당하는 자본시장의 중요성은 더욱 커졌다. 증권회사가 자본시장의 발전에 중추적인 역할을 수행함에도 불구하고 증권회사의 영업활동에 가장 큰 영향을 미쳐 온 건전성 규제 제도에 대해서는 관련 연구가 많지 않다.3) IOSCO 등 국제 증권감독기구에서 증권업 건전성 규제 필요성 및 규제 방향에 대해 간헐적인 연구가 수행되었으나, 바젤위원회와 금융안정위원회(FSB)가 은행업 건전성 규제에 대해 체계적인 분석을 통해 제도 개선을 꾸준히 추진해 온 것과 비교하면 국제적으로 증권업에 대한 심도 있는 연구가 많지 않다. 특히 한국에서는 증권회사의 건전성 규제에 대한 연구가 부족하다. 1997년4월 자기자본 규제를 도입할 당시 일본 제도를 상당수 벤치마크하여 관련 연구가 부족했으며 2016년 순자본비율 제도 시행 이후에도 자기자본 규제의 의의와 영향에 대해 깊이 있는 분석이 많지 않았다.

한국 증권업 자기자본 규제가 글로벌 증권업 자기자본 규제의 변화 방향을 제대로 따라가지 못했다는 지적도 있다. 미국은 1975년 브로커-딜러에 대한 자기자본 규제를 도입한 이후, 표준방법, 대체방법, 대체순자본방법 등을 발전키시며 브로커-딜러로 하여금 선택적으로 자기자본 규제 방식을 사용하도록 했다. 유럽과 영국은 2021년 상반기에 증권회사에 대한 자기자본 규제 체계를 전면 개편하여 시스템리스크 잠재 위험을 보유한 대형 증권회사에 대해서는 은행업의 바젤 방식 규제를 따르도록 하고, 중소형 증권회사에 대해서는 규모에 따라 간소한 (미)NCR 방식의 자기자본 규제를 따르도록 했다. 과거 글로벌 증권업 자기자본 규제 체계가 바젤 방식과 (미)NCR 방식으로 양분되었던 것이 이제는 (미)NCR 방식으로 수렴되는 것으로 이해할 수 있다. 또한 증권회사의 업무 범위가 확대되고 은행과 증권회사간 업무범위의 격차가 줄어듦에 따라 대출을 일정 규모 이상 수행하는 대형 증권회사에 대해 은행업의 바젤 규제를 적용하고 있는 것도 최근 글로벌 증권업 자기자본 규제의 주된 변화라고 할 수 있다. 한국은 2016년 순자본비율 제도가 전면적으로 시행되었으나, 증권회사 규모에 상관없이 획일적으로 자기자본 규제 제도를 적용하고 있으며 다소 엄격한 레버리지비율 규제를 적용하는 등 증권업 규제의 국제적 정합성과 다소 거리가 있는 것으로 보인다.

특히 과거 한국 증권업 건전성 규제는 주요국 대비 다소 엄격하며, 영업행위 규제 목적으로 (구)NCR 산식이 활용되는 등 증권회사의 파산을 사전에 예방하고자 하는 건전성 규제의 의의와 거리가 먼 것이라는 지적이 많았다. (구)NCR 제도는 바젤 방식 규제에 가까워 계속기업 관점의 건전성 규제에 가깝다는 지적이 대표적이다. 증권업은 본래 금융투자상품의 중개와 자기매매업을 핵심 업무로 하고 있고, 한국의 경우 주식계좌의 예탁금이 별도 기관에 안전하게 예치되어 있어 증권회사 파산시 투자자 손실 위험으로 전이될 가능성이 낮다. 즉, 미국과 유럽의 주요 국가처럼 증권업에 대해서는 파산시 투자자 재산과 선순위 채권자를 우선적으로 보호하려는 유동성 규제 철학으로 바꾸어야 한다는 지적이 많았다. 또한 자기자본 규제 비율이 증권회사의 업무를 제한하는 목적으로 사용된다는 지적도 많다. 예를 들어 국내 증권회사가 국고채전문딜러(PD), ELW 유동성공급자, 국민연금 전담 중개회사 등으로 선정되려면 매우 높은 수준의 자기자본 규제 비율을 유지해야 하는 것이 대표적이다. 자기자본 규제 비율이 경제적 위험에 비례하여 설계되기보다, 금융당국의 정책 목적으로 활용된 사례도 많다. 파생상품에 대한 과도한 포지션을 제한하기 위해 주요국 사례에서 찾기 힘든 깊은외가격 옵션위험액을 별도로 부과하거나, 부동산으로 자금이 쏠림는 혁상을 억제하기 위해 증권회사의 부동산 관련 포지션에 할증위험액을 부과하는 것이 대표적이다.

2016년부터 본격적으로 시행된 순자본비율 제도의 의의와 금융투자산업에 미치는 영향 관련해서도 깊이 있는 연구가 많지 않다. 2014년 당시 금융위원회는 순자본비율 제도 도입의 목표로 증권회사의 자본효율성 제고, M&A 업무 등 IB업무 역량 강화, 해외진출 활성화 등을 꼽았다.4) 실제 순자본비율 제도 도입 이후 상당수 증권회사가 유휴 자본을 추가로 보유하지 않아도 되어 자기자본 확충을 통해 위험을 지고 수익을 창출할 기회가 많아졌다. 순자본비율 체계 도입으로 증권회사의 자본 효율성이 개선되었을 뿐 아니라 해외진출이 활성화되고 IB부문의 사업 역량이 강화된 것이 순자본비율 도입의 긍정적 효과라고 판단한다. 순자본비율 체계 도입에 따른 우려도 존재한다. 일부 증권회사는 순자본비율 도입 이후 ELSㆍDLS 발행 및 자체헤지 포지션을 늘리고, 부동산PF 관련 채무보증을 확대하는 등 금융당국의 순자본비율 도입 취지와 다소 거리가 먼 사업전략을 구사하기도 했다. 일부 증권회사가 파생상품 및 채무보증 등의 업무를 늘리면서 증권회사의 시스템리스크 잠재 위험이 커졌으며, (구)NCR 기준 건전성 위험은 예전보다 악화되었다. 이러한 이유로 국내 주요 신용평가회사들은 증권회사에 대한 리스크 요인을 분석할 때 순자본비율을 사용하기보다 (구)NCR 지표를 건전성 리스크를 측정하는 주된 지표로 활용하고 있다.

증권업을 둘러싼 국내외 주요 환경 변화 속에서 본 보고서는 글로벌 주요국 증권업의 건전성 규제 현황 및 변화 방향을 체계적으로 분석하여 한국 증권업 건전성 규제의 바람직한 개선 방향을 제시하고자 한다. 본 연구의 구성은 다음과 같다. 우선, Ⅱ장에서는 미국 NCR 방식과 유럽 바젤 방식 등 해외 증권업 건전성 규제 현황을 살펴보고 주요 특징을 알아본다. Ⅲ장에서는 글로벌 증권업 건전성 규제와의 비교 분석을 통해 한국 증권업 건전성 규제를 진단하고자 한다. Ⅳ장에서는 한국 증권업의 자기자본 규제 및 레버리지비율 규제 등 증권업 건전성 규제의 바람직한 개선 방향을 제시한다.

Ⅱ. 해외 증권업 건전성 규제 현황 및 시사점

증권회사에 대한 건전성 규제 도입 배경은 국가마다 상이하다. 미국은 1934년 증권거래법과 함께 브로커-딜러에 대한 자기자본 규제를 도입5)했으며, SEC에 등록된 전체 브로커-딜러에 대한 자기자본 규제는 1975년 도입했다. 영국(1988년), 유럽(1996년), 일본(1990년) 등의 선진국은 1987년 블랙먼데이 사태를 계기로 자기자본 규제를 도입했다. 동시기에 선진국 대형은행들이 부실화되면서 국제결제은행(BIS) 산하 바젤위원회는 1988년 은행에 대한 자기자본 규제 합의안(예: BIS 비율 8%)을 발표했으며 이후 영국, 독일, 프랑스, 일본 등은 증권업에 대해 미국 NCR 방식 대신 바젤 방식 규제를 적용했다. 반면 홍콩, 중국, 인도 등 아시아 국가들은 증권업에 대해 미국 NCR 방식의 규제를 도입했다.

한국은 1997년 전후로 일부 증권회사의 재무건전성이 크게 악화됨에 따라 일본 자기자본 비율 규제를 벤치마크하여 영업용순자본비율 제도를 도입했다. 2015~16년에는 자본시장의 역동성 제고를 목표로 미국 NCR 방식에 가까운 순자본비율 제도를 도입했으며, 과도한 레버리지 활용을 억제하기 위해 레버리지비율 제도를 별도로 도입했다. 한국 증권업의 자기자본 규제는 총위험액을 초과하는 일정 수준의 잉여자본을 축적해야 하는 점에서 미국 NCR 방식과 유사하나, 위험액 산출 방식은 바젤 방식을 준용하고 있어 한국 순자본비율 제도는 미국 NCR 방식과 바젤 방식이 혼용되어 발전한 것으로 판단된다. 따라서 한국 증권업 자기자본 규제의 특징을 이해하고 증권업의 바람직한 자기자본 규제 방향을 도출하려면 미국 NCR 제도와 바젤 방식 제도를 깊이 있게 연구하는 것이 선행되어야 한다. 이에 본 절에서는 미국 NCR 제도와 바젤 방식 제도를 비교하고 두 제도의 특징을 비교분석한 IOSCO 가이드라인을 소개하고자 한다.

1. 미국 NCR 규제 방식

미국 브로커-딜러(Broker-Dealer)는 파산시 투자자와 채권자를 보호하기 위해 일정 수준 이상의 자기자본을 보유해야 한다. SEC Rule 15c3-1에서는 브로커-딜러에 대한 순자본 의무사항을 규정하고 있으며, 브로커-딜러의 업무범위, 규모 등에 따라 SEC 규정에서 정한 순자본 요건을 충족해야 한다. 브로커-딜러는 자신의 순자본(Net Capital)을 최소순자본(Minimum Net Capital) 이상을 항상 유지해야 하는데 해당 규제를 통상 NCR(Net Capital Ratio) 규제로 통칭한다. 만약 브로커-딜러들이 SEC 규정에서 정한 자기자본 요건을 충족하지 않으면 적기시정조치에 따라 경영개선 권고, 경영개선 명령 등을 부과받아 파산절차를 따라야 한다. 미국 NCR 제도는 브로커-딜러 파산시 투자자와 채권자에게 약속한 투자금을 안전하게 돌려주는 것을 주된 목적으로 하는 점에서 청산기업 관점(Gone Concern)의 유동성 규제에 가깝다. 반면 은행들이 주로 사용하는 바젤 방식 자기자본 규제는 금융회사의 파산을 사전에 예방하는 것을 목적으로 하는 계속기업 관점(Going Concern)의 건전성 규제에 가깝다. 즉 미국 NCR 제도는 브로커-딜러의 파산시 회수율을 높이고자 유동성 자산의 보유를 강조하고 있으며, 바젤 방식 자기자본 규제는 부도위험을 줄이고자 자본의 질과 자산의 건전성 관리를 강조하고 있다. 본 절에서는 미국 NCR의 규제 배경과 주요 규제 산식에 대해 소개하고 미국 NCR 규제의 특징을 도출하고자 한다.

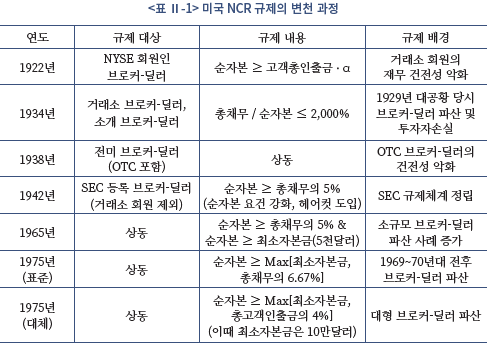

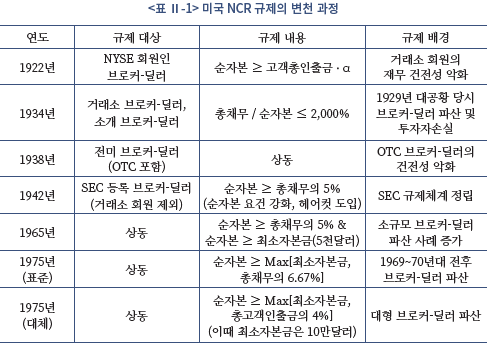

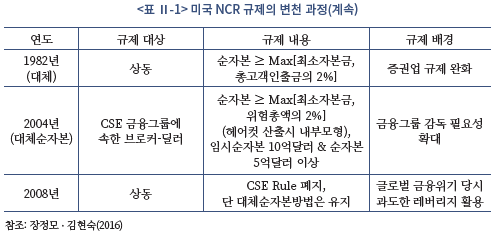

가. 자기자본 규제 연혁

세계 1차 대전 이후 글로벌 금융 중심지가 영국에서 미국으로 옮겨감에 따라 미국 거래소 산업은 빠르게 발전했다. 1920년 12월 956pt에 불과했던 다우존스지수는 1929년 7월 5,184pt까지 큰 폭으로 상승했다. 당시 주가지수 상승 장세에서 일부 거래소 회원의 대규모 손실로 투자자 보호 이슈가 제기되자, 뉴욕증권거래소(NYSE)는 1922년부터 거래소 회원인 브로커-딜러에게 순자본을 일정 수준 이상으로 보유하도록 규제를 도입했다.6) 거래소 회원에 한해 자기자본 규제가 도입된 것이다. 1929년 하반기부터 대공황이 본격화되며 주가지수는 큰 폭으로 하락했으며7) 상당수 브로커-딜러들이 파산했다. 당시 브로커-딜러의 파산으로 투자자와 채권자들이 투자금을 제대로 회수하지 못해 대규모 손실이 발생했다.

SEC는 대공황을 계기로 투자자 보호 강화를 위해 1934년 브로커-딜러의 자기자본 규제를 포함한 증권거래법을 도입하였다. 1934년 증권거래법 도입 당시 초기 SEC Rule 8(b)에서는 브로커-딜러와 해당 브로커-딜러를 통해 거래하는 모든 브로커-딜러는 총채무 비율을 순자본의 20배 이내로 유지하도록 규정했다. 브로커-딜러의 단순 레버리지비율을 일정 수준(약 21배) 이내로 규정한 것으로, 거래소 회원들이 신용대출 업무 등 과도한 부채 사용을 억제하기 위해 도입한 것이다. 1938년에는 거래소 회원뿐 아니라 OTC 브로커-딜러에게도 해당 레버리지비율 규제를 적용했다. 1942년에는 SEC에 등록된 모든 브로커-딜러에게 해당 레버리지비율 규제를 적용했으며, 이때 순자본 요건을 강화하고 순자본에서 차감 기준이 되는 헤어컷 규정을 마련하였다. 이후 1965년까지 SEC는 해당 자기자본 규정을 통해 브로커-딜러의 진입과 건전성을 규율했으며, 순자본이 5천달러 미만인 영세 브로커-딜러의 숫자가 급격히 늘자 SEC는 1965년에 최소자본금 요건을 추가했다. 구체적으로 일반업무를 취급하는 브로커-딜러는 5천달러의 최소순자본금과 더불어 총채무의 5% 이상 순자본을 보유해야 하며, 고객계정을 보유하지 않은 브로커-딜러는 2천 5백달러의 최소순자본금과 총채무의 5% 이상 순자본 유지 의무가 부여되었다.

1967~70년 증권사무위기(Paperwork Crisis)가 발생하자 거래소 회원 중 상당수 브로커-딜러가 파산했다. 1971년 8월 닉슨선언으로 금태환 중단 등 브레튼 우즈 체계가 붕괴되고 1973년 1차 오일쇼크가 발생하자 글로벌 외환시장과 자본시장의 변동성은 크게 확대되었다. 당시 금융시장의 변동성 확대로 상당수 브로커-딜러가 파산하였으며, 일반투자자들도 대규모 손실을 입게 되었다. 이에 SEC는 브로커-딜러의 순자본 규제를 대폭 개선하는 방안을 검토하였으며, 1975년 통일 순자본규제(Uniform Net Capital Rule)를 발표했다. SEC는 SEC Rule 15c3-1 규정을 통해 브로커-딜러의 최소자본금을 5천달러에서 2만 5천달러로 대폭 상향했으며, 순자본을 총채무의 5% 이상 보유에서 총채무의 6.67% 이상 보유로 상향하는 등 레버리지비율을 강화했다. 이와 같은 순자본규제는 표준방법 NCR 제도로 불린다. SEC는 표준방법 NCR 외에 대체방법 NCR을 도입했다. 브로커-딜러는 표준방법 NCR 또는 대체방법 NCR 중 하나를 선택할 수 있는데, 도입 당시 대체방법 NCR 요건을 만족하려면 최소순자본이 10만달러 이상이거나 총고객인출금의 4% 이상을 순자본으로 보유하도록 했다.8) 당시 순자본 산식 개정과 더불어 SEC는 SEC Rule 15c3-3을 제정하여 고객에게 지불해야 할 의무가 있는 부채성 계정은 브로커-딜러의 운용계정에서 분리하도록 구분계리 의무를 부여했다.

1987년 블랙먼데이 사태를 계기로 국제적으로 증권업 자기자본 규제는 새로운 국면을 맞이했다. 주가지수 급락으로 대규모 브로커-딜러가 파산했으며, 이는 은행, 타 브로커-딜러의 손실뿐 아니라 일반투자자의 손실로도 이어졌다. 1988년 바젤위원회는 은행의 자기자본 규제 시행안(BIS 비율 8%로 불림)을 발표했으며 IOSCO 등 국제증권감독기구는 증권회사에 대해서도 엄격한 자기자본 요건을 부과해야 한다는 의견을 제기했다. 대표적으로 IOSCO(1990) 보고서에서는 미국(의장국), 영국, 프랑스, 일본 증권감독 책임자들이 참여하여 증권업에 대한 공통 자기자본 규제 권고안을 발표했다. 1992년 SEC는 고객 계정을 보유한 브로커-딜러의 최소자본금 요건을 기존 10만달러에서 25만달러로 상향하는 등 자기자본 규제를 강화했으며, 초대형 브로커-딜러에 대한 규제 강화 필요성이 제기되었다. 한편 2004년에는 금융그룹(Consolidated Supervised Entities: CSE)에 속하는 금융회사가 지켜할 진입 규제, 건전성 규제, 영업행위 규제 등이 마련되었으며9) CSE 브로커-딜러는별도의 대체순자본 규제를 준수해야 했다. 임시순자본이 10억달러 이상이고 순자본이 5억달러 이상인 CSE 브로커-딜러는 SEC로부터 내부모형 승인을 받아 위험액(헤어컷과 유사)을 산출하고 이를 임시순자본에서 차감하여 순자본을 계산해야 한다. 내부모형은 바젤위원회가 정한 시장리스크 소요자기자본 산출 및 신용리스크 소요자기자본 산출과 비슷하다. SEC는 대형 브로커-딜러에 대해 대체순자본방법의 사용을 허용하고 있어, 일정자본요건을 만족하는 대형 브로커-딜러는 선택적으로 대체순자본방법을 사용할 수 있다.

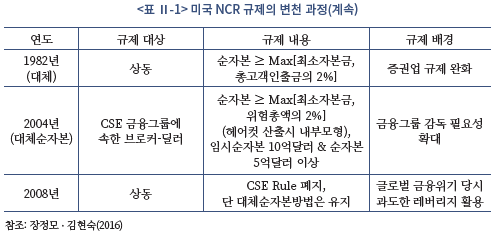

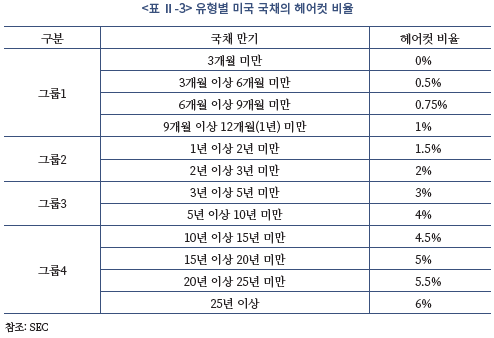

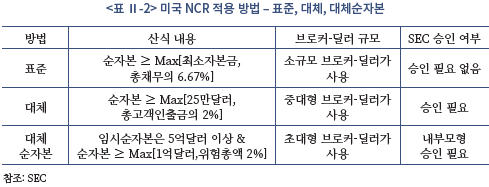

나. NCR 방법 – 표준방법, 대체방법, 대체순자본방법

2020년 현재 SEC에 등록한 브로커-딜러는 반드시 표준방법, 대체방법, 대체순자본방법 중 하나를 자본규제 요건으로 충족해야 한다. 먼저 표준방법을 사용할 경우 SEC Rule 15c3-1에 따라 순자본이 최소자본금보다 크거나10) 또는 순자본이 총채무의 1/15(6.67%)보다 커야 한다(이하 표<Ⅱ-2>). 이때 순자본은 순자산에서 후순위채권 등을 더한 뒤 비유동상자산과 헤어컷을 고려한 평가손인정비율을 차감하여 계산한다. 최소자본금은 표준방법, 대체방법, 대체순자본방법에 관계없이 브로커-딜러의 업무 범위에 따라 5천달러에서 25만달러 등으로 상이하다. 표준방법의 경우 최소자본금이 크지 않으면, 순자본이 총채무의 1/15보다 항상 커야 하는데 이를 자본 대비 자산 규모로 환산하면 약 16배 이내의 레버리지비율을 지켜야 하는 것과 유사하다. 통상 자본규모가 영세한 소규모 브로커-딜러들이 표준방법을 사용하는 것으로 알려져 있다.

다음으로 브로커-딜러는 표준방법 대신 대체방법 또는 대체순자본방법을 자기자본 요건으로 사용할 수 있다. 통상 중대형 브로커-딜러가 대체방법을 사용하는데, 순자본은 25만달러 이상이거나 총고객인출금의 2% 이상 보유해야 한다. 대체방법을 사용하는 경우 SEC의 승인이 필요하다. 한편 초대형 브로커-딜러의 경우 대체순자본방법을 사용할 수 있는데, 대체순자본방법은 대체방법과 큰 차이가 없으나 평가손인정비율 계산시 내부모형을 사용할 수 있는 점이 가장 큰 차이점이다. 만약 대체순자본방법을 사용하기 위해서는 임시순자본이 5억달러 이상이고, 동시에 순자본이 1억달러 이상이거나 순자본이 위험총액의 2% 이상을 보유해야 한다. 장정모ㆍ김현숙(2016) 연구에 따르면 자산규모가 10억달러(약 1.1조원) 이상인 중대형 브로커-딜러의 96.5%가 대체방법을 사용하는 것으로 확인되었다. 그 외 대체순자본방법을 사용하는 브로커-딜러는 BOA 증권, 씨티그룹 증권, 골드만삭스 증권, JP모건 증권, 모건스탠리 증권 등 5개에 불과한 것으로 알려져 있다.

다. 순자본과 헤어컷 산출 방식의 정의

SEC Rule 15c3-1(c)(2)에서는 ① 미실현이익의 손익, ② 이연세, ③ 1년 이상의 후순위채권 등을 합산하고, ④ 현금화가 어려운 자산, ⑤ 기타채무 등은 차감하여 순자본을 정의한다. 만약 미실현이익 계정에서 손실이 발생하면 순자본에서 차감하며, 보유하고 있는 파생상품 등은 시가평가를 통해 미실현이익 또는 손실로 평가한다. IOSCO(1989)에 따르면 브로커-딜러 파산시 가용할 수 있는 자본을 고려하여 자본을 유연하게 정의하기 위해 만기 1년 이상의 후순위채권을 순자본에 반영하는 것으로 볼 수 있다. 투자자가 1년 이내에 회수할 수 있는 자산은 순자본에서 차감하여 현금화가 불가능한 자산 역시 차감하는 것을 원칙으로 한다.

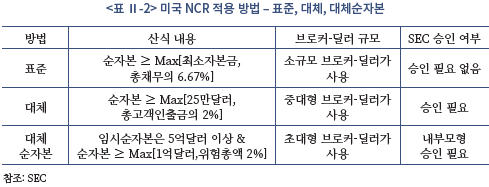

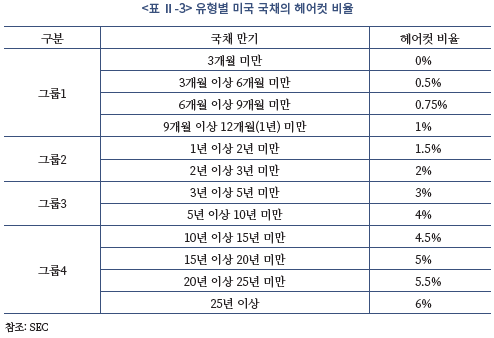

헤어컷 산출 방식은 SEC Rule 15c3-1(c)(2)(vi)에서 자세하게 정의하고 있다. 우선 보유 자산을 국채, 회사채, 전환사채, 어음, 주식, 기타 증권, 파생상품 등으로 구분한 뒤 만기, 신용등급, 기타 상품유형에 따라 세분화된 헤어컷을 적용하고 있다. 예를 들어 만기가 3개월 이상 6개월 미만 남은 국채는 매수와 매도 포지션을 상계하고 남은 시장가치의0.5%를 차감하며, 만기가 25년 이상 남은 국채는 상계 포지션 시장가치의 6%를 차감한다(표 <Ⅱ-3> 참조). 지방채는 국채보다 다소 높은 헤어컷을 적용한다. 정규거래소 등 유동성이 충분한 시장에서 거래되는 주식의 경우 15%를 차감하며 정규거래소 외 유동성이낮은 시장에서 거래되는 경우 40%를 차감한다. 전환사채의 경우 주식부문과 채권부문으로 나누어 각각 헤어컷을 적용한다. 유동화가 어려울 것으로 예상되는 자산은 100% 차감을 원칙으로 한다.

라. 레버리지비율 규제

SEC는 모든 등록 브로커-딜러에게 일괄적으로 레버리지비율 규제를 적용하지는 않는다. 표준방법을 사용하는 소형 브로커-딜러의 경우, 총채무 비율이 다소 높을 경우 순자본을 총채무의 1/15 이상으로 유지해야 한다. 총자산이 순자본과 총채무의 합으로 이해한다면, 레버리지비율(순자본 대비 총자산 비율)은 1,600% 이내로 관리해야 한다. 대체방법과 대체순자본방법을 사용하는 중대형 브로커-딜러 개별회사에게는 별도로 레버리지비율 준수 의무를 부여하지 않는다.

한편, FINRA는 SEA Rule 15c3-1에서 브로커-딜러가 속한 금융그룹의 레버리지가 1,100%를 넘지 않도록 명시하고 있다.11) 대체방법 또는 대체순자본방법을 사용하는 개별 브로커-딜러는 레버리지비율 준수 의무는 없으나 금융그룹 전체로는 1,100% 이내의 레버리지비율을 지키도록 규율하고 있다. 또한 은행 그룹에 속한 브로커-딜러는 은행 지주회사 규제중 하나로 금융그룹 전체가 바젤위원회에서 정한 별도의 레버리지비율 규제를 준수해야 한다.12)

요약하면, 표준모형을 사용하는 소형 브로커-딜러는 표준모형 안에 1,600%의 레버리지비율을 내재하기 때문에 순자본 대비 16배 이내로 총자산 규모를 관리해야 한다. 표준모형 외에 대체모형, 대체순자본모형을 사용하는 중대형 브로커-딜러는 개별 회사 차원에서는 레버리지비율 규제 의무는 없으나 금융그룹 전체로는 1,100%의 레버리지비율을 준수하도록 규정하고 있다.

2. 바젤 방식의 건전성 규제

1970년대 초 국제 통화 변동성이 확대되고 금융기관의 건전성 우려13)가 제기되자 국제 금융시장 안정을 목적으로 G10개국 중앙은행 총재는 합의하에 1975년 2월 바젤은행감독위원회(Basel Committee on Banking Supervision: BCBS)를 설치했다. BCBS는 국제결제은행(Bank for International Committee: BIS)의 산하 위원회로 은행감독 관련 국제표준을 제정하고 효율적인 감독 업무를 위해 가이드라인을 개발하고 있다. 설립 초기에는 G10개 국가가 참여했으나 현재 한국14)을 포함한 28개 국가의 중앙은행, 금융감독기구들이 BIS의 회원으로 참여하고 있다. BCBS는 금융시장 안전성 제고를 목표로 1988년 7월 바젤Ⅰ으로 불리는 자기자본 규제안을 발표했으며, 바젤회원국들은 1992년부터 바젤Ⅰ(BIS 비율 8%) 규제안을 준수하기 시작하여 1997년말 규제 준수를 최종 이행하기로 합의했다. 1996~97년 아시아 외환외기로 국제 자본시장 변동성이 확대되고, 일부 대형 금융회사들이 시장리스크 포지션에서 대규모 손실이 발생하자 BCBS는 시장리스크와 유동성리스크 강화를 포함한 바젤Ⅱ 규제안을 발표했다. 바젤Ⅱ는 1999년 6월 초안이 발표된 이후 2004년 6월 확정하였으며, 바젤회원국과 7개의 비회원국들은 바젤Ⅱ를 준수하기로 합의했다. 바젤Ⅱ는 2007년 1월부터 시행을 시작했으며, 2009년 7월에는 스트레스 위험평가 방식 및 유동화 증권 규제 강화를 포함한 바젤2.5가 시행되었다. 바젤Ⅱ 시행에도 불구하고 2008년 글로벌 금융위기가 발생하자 BCBS는 보다 강화된 규제안인 바젤Ⅲ 를 준비했다. 바젤Ⅲ에서는 자본의 질적 요건 강화, 장외파생상품 위험평가 산출 강화, 레버리지비율 규제 강화, 경기완충자본 비율 도입, 유동성커버리지비율 도입, 순안정자금조달비율 도입을 포함했으며 2013년부터 2020년까지 순차적으로 규제안을 준수하도록 합의했다. 2017년말에는 위험가중자산의 산출 방식을 대폭 강화한 바젤Ⅲ 최종안이 발표되어 2022년부터 시행될 계획이다.15)

은행업에 대해서는 바젤을 중심으로 자기자본 규제안이 마련되어 1992년부터 국제 표준안이 시행되었으나, 당시 증권업에 대해서는 국제 표준 규제안이 마련되지 못했다. 미국의 경우 1975년부터 통일 NCR 규제가 마련되었으나 영국, 유럽, 아시아 대부분 국가는 증권업에 대해 일관된 자기자본 규제를 가지고 있지 않았다. 이에 국제증권감독기구(IOSCO)는 1989년, 1990년 보고서 발표를 통해 증권업 자기자본 규제 필요성을 제기했으며, 영국, EU, 일본 등 주요 선진국은 BCBS의 바젤Ⅰ 합의안을 벤치마크하여 증권업에 대한 자기자본 규제를 마련했다. 바젤 방식 자기자본 규제는 미국 NCR 규제와 달리 계속기업 관점의 건전성 규제로, 증권회사의 파산 위험을 최소로 하는 것을 목표로 한다. 본 절에서는 바젤 방식 규제에 보다 가까운 영국, 유럽, 일본의 증권업 자기자본 규제를 소개하고 바젤 방식 규제의 특징을 도출하고자 한다.

가. 바젤 방식의 규제 연혁

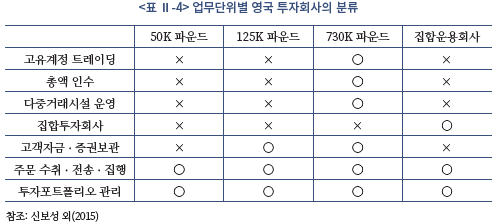

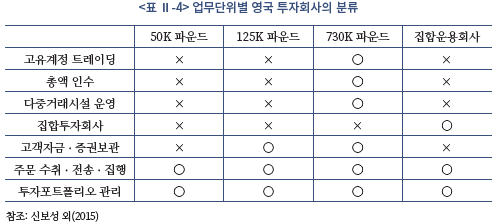

1979년 마가렛 대처가 영국 총리에 취임한 이후 영국은 신자유주의 모토 하에 금융시장에 대한 자율규제 원칙을 강조해 왔다. 1986년 금융서비스법(Financial Services Act, 1986)이 제정되어 자율규제 중심의 증권회사 자기자본 규제 체계가 마련되었다.16) 1986년 10월 대규모 금융규제 완화 정책으로 불리는 빅뱅(Big Bang)의 영향으로 자율규제 중심의 규제 원칙은 더욱 강조되었다. 1987년 블랙먼데이 사태 이후 다수의 영국 증권회사도 대규모 손실을 입자, 1988년 4월 투자자 보호를 목적으로 자율규제 형태의 자기자본 규제가 도입되었다.17) 2000년 금융서비스시장법(FSMA, 2000) 도입 이후 금융감독기구가 금융감독청(FSA)로 단일화되고18) 금융업권간 통합 규제 체계가 마련되었다. 영국 FCA는 증권회사를 투자회사(investment firms)의 범주로 분류19)하고 있으며, FCA에서 제정한 IFPRU 지침에서는 투자회사의 업무 범위에 따라 최소 자본금을 규율하고 있다. FCA를 통해 인가받은 영국 투자회사는 EU에서 정한 CRD(Capital Requirements Directive) Ⅳ20) 자기자본 요건을 준수해야 한다. 최근 EU의 금융투자회사에 대한 건전성 규제 개편 영향으로 2022년 1월부터 영국 투자회사는 새로운 건전성 규제를 준수해야 한다.21) CRD Ⅳ는 바젤Ⅲ 산식을 거의 그대로 준용한 것으로 영국 투자회사의 자기자본 요건을 규율하고 있다.22)

1987년 블랙먼데이 사태 이후 증권업 자기자본 규제의 필요성이 제기되자 영국(1988년 4월), 프랑스(1989년 1월) 등은 바젤Ⅰ 모형을 기초로 금융투자회사에 대한 자기자본 규제를 도입했다. 그러나 대부분 유럽 국가들은 증권업에 대한 자기자본 규제를 마련하지 못했다.23) 1990년대 초 유럽 통합(EU)이 본격적으로 논의되면서 유럽의회(EC)는 1993년 EU 통합을 앞두고 금융투자회사(investment firms)에 대한 자기자본 규제안을 도입하기로 발표했다. 은행에 대한 건전성 규제지침인 CAD(Capital Adequacy Directive)를 금융투자회사에 대해서도 유사하게 적용하는 것으로, 금융투자회사에 대한 자기자본 규제는 1996년부터 본격적으로 시행되었다. EU의 자본규제 지침인 CRD는 금융투자회사뿐 아니라 은행, 보험회사 등에 모두 공통적으로 적용된다는 점에서 바젤 규제와 다르다. 2007년부터 시행된 EU의 CRD는 바젤Ⅰ, 바젤Ⅱ, 바젤2.5, 바젤Ⅲ 등의 개정에 맞추어 2009년, 2010년, 2013년에 CRD Ⅱ, CRD Ⅲ, CRD Ⅳ 등으로 개정되었으며 2021년 6월말부터 CRD Ⅴ가 시행될 예정이다.

2021년 6월말부터 유럽 금융투자회사에 대해서는 규모, 업무범위 등에 따라 새로운 자기자본 규제안이 적용된다. 2022년 1월부터는 영국 투자회사들도 EU가 제정한 새로운 자기자본 규제안을 준수해야 한다.24) 기존 CRD Ⅳ 규제는 은행과 금융투자회사에게 동일한 자기자본 규제를 부과함에 따라 금융회사의 리스크 규모와 금융시스템 내 차지하는 중요성 등을 충분히 반영하지 못한다는 지적이 많았다. 이에, 금융투자회사를 규모(Size), 시스템적 중요성(Systemic Importance), 타 금융회사들과의 연계성(Interconnectedness), 복잡성(Complexity) 등을 기반으로 분류한 후, 위험수준에 맞게 새로운 자기자본 규제를 적용하도록 개선했다. 새로운 규제안에서 금융투자회사를 위험수준에 따라 세 그룹(Class 1, 2, 3)으로 나눈 뒤, 은행과 위험 수준이 크게 다르지 않은 첫 번째 그룹(Class 1)에 대해서는 기존처럼 CRD Ⅳ 규제를 적용하도록 했다. 시스템적 중요도가 낮고, 중소형 규모의 두 번째 그룹(Class 2)과 시스템적 중요성이 없다고 볼 수 있는 소형 규모의 세 번째 그룹(Class 3)에 대해서는 미국 NCR 방식과 유사하게 필요자기자본을 일정 수준 이상 유지하도록 했다.25)

일본은 1987년 블랙먼데이 사태 이후 경영안정성 제고 및 투자자 보호를 목적으로 1990년 새로운 자기자본 규제안을 마련했다. IOSCO(1989), IOSCO(1990) 등에 따르면 일본은 바젤 방식을 벤치마크하여 당시 일본 증권회사의 상황을 반영하는 자기자본 규제 비율 산식을 개발했다. 2006년 (구)증권거래법, (구)금융선물거래법 등이 금융상품거래법으로 통합되면서 한국의 증권회사와 유사한 제1종금융투자업자들은 120% 이상의 자기자본 규제 비율을 준수해야 한다. 금융투자상품거래법이 개정되는 과정에서 일부 자기자본 규제 비율 산식이 변경되었으나, 미국, 영국, EU처럼 자기자본 규제 비율 산식의 큰 변화는 없었다. 한국 금융당국은 1997년 일본 자기자본 규제 비율을 벤치마크하여 (구)NCR 제도를 도입한 것으로 알려져 있다.

나. 바젤 방식의 자기자본 비율 산식

본 절에서는 영국, EU의 은행 및 대형 금융투자회사들이 따르고 있는 CRD Ⅳ의 자기자본 규제 산식과 2021년 하반기 이후 중소형 EU 금융투자회사와 영국 투자회사들에게 새롭게 적용된 자기자본 규제 비율 산식을 소개한다. 시스템적으로 중요한 금융회사로 선정된 금융투자회사의 경우 자기자본 규제뿐 아니라 유동성 커버리지 비율(LCR), 순안정자금 조달 비율(NSFR), 레버리지비율 등 바젤 규제 전체를 준수해야 한다. 반면 시스템적으로 중요성이 낮은 중소형 금융투자회사들은 EU, FCA 등에서 정한 자기자본 규제 외의 LCR, NSFR, 레버리지비율 규제 등은 대부분 적용받지 않는다.

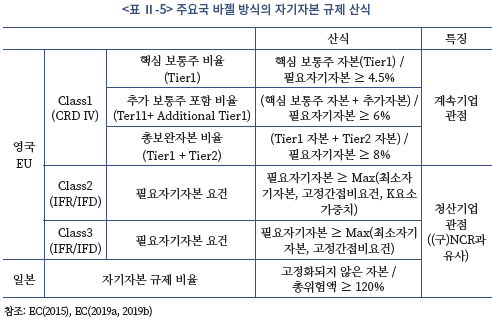

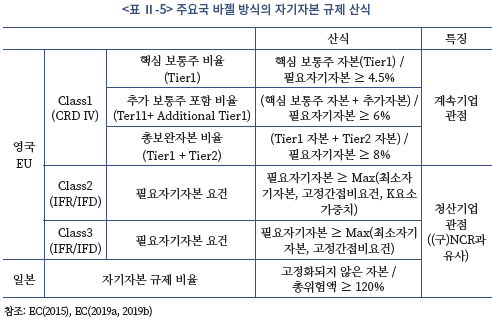

은행과 대형 금융투자회사들에게 적용되는 CRD Ⅳ의 자기자본 규제를 살펴보면 영국과 EU의 금융투자회사들은 필요자기자본 대비 보통주자본(Common Equity Tier: Tier1)은 4.5% 이상을 유지해야 하며, 추가 보통주자본까지 포함한 총보통주자본비율은 6% 이상 보유해야 한다(이하 <표 Ⅱ-5> 참조). Tier1은 자본의 질이 우량한 것으로, Tier1 비율 4.5%, 총Tier1 비율 6% 규제는 계속기업관점 자본(Going Concern Capital) 규제로 불린다. 또한 영구채, 후순위채권 등 보완자본(Tier2)까지 포함한 자본(Tier1 Capital과 Tier2 Capital의 합계)은 전체 필요자기자본(위험가중자산)의 8% 이상 보유해야 한다. 이는 BIS 비율 8% 규제와 유사하다. Tier2 자본은 청산시 보완자본의 역할을 하는 것으로, Tier1과 Tier2의 합계 비율 8%는 청산기업관점 자본(Gone Concern Capital) 규제로 불린다. 분모에 해당하는 필요자기자본은 시장위험액, 신용위험액, 운영위험액 등을 합산하여 산출한다. 미국 NCR 산식과 달리 자본의 질을 세분화하여 단계별로 엄격한 규제 비율을 적용하는 것이 특징이다. 영국과 EU의 금융투자회사가 만일 CRD Ⅳ에 정한 자기자본 규제 비율을 충족하지 않으면 금융감독에게 보고한 이후 규제 비율 준수를 위해 노력해야 한다. 만약 보고 의무나 규제 비율 준수 의무를 소홀히 하면 과징금 부과 등의 제재를 받는다.26)

2021년 하반기와 2022년 상반기에 EU 및 영국내 중소형 금융투자회사들은 IFR (Investment Firms Regulation)과 IFD(Investment Firm Directive) 규정에 따라 새로운 자기자본 규제를 적용받는다. 중소형 금융투자회사들에게 적용될 새로운 자기자본 규제 산식은 바젤의 CRD Ⅳ 방식이 아닌 미국 NCR 방식에 보다 가까워진 것이 특징이다. 과거 CRD Ⅳ와 CRR27) 규정은 금융투자회사의 규모와 업무 유형을 고려하지 않고 획일적으로 적용했다는 점에서 비판이 제기되었다. 이에 새로운 건전성 규제 방안에서는 대형 은행의 SIFI 선정 방식과 유사하게 시스템적으로 중요한 회사로 분류된 대형 금융투자회사들은 Class1 유형으로 분류하고, 이들에게는 기존 CRD Ⅳ와 CRR 규제를 동일하게 적용한다. 총자산이 300억유로(약 42조원) 이상이고 자기매매 거래와 인수 거래 중 하나를 본질적 업무로 수행하는 회사 등이 Class1에 해당된다. Class2 유형은 운용자산이 12억유로 이상이거나, 부외항목을 포함한 자산총계가 1억유로 이상이거나, 파생상품 거래 규모가 10억유로 이상이거나, 고객 자산을 보유하거나, 자기매매 거래를 수행하거나, 거래상대방 신용위험을 가지거나, 과거 2년간 금융투자업으로부터 발생한 영업이익이 3천만유로 이상 등의 조건 중 하나 이상의 조건을 만족하는 금융투자회사가 해당된다. Class2 유형의 금융투자회사는 최소자기자본요건(PMC: Permanent Minimum Capital Requirement), 고정간접비요건(FOR: Fixed Overhead Requirements), K-요소 가중치요건(K-Factor Requirement) 중 큰 값보다 높은 필요자기자본(Own Funds)을 보유해야 한다.28) Class3 유형은 Class1과 Class2에 속하지 않은 소규모 금융투자회사들로 최소자기자본요건(PMC: Permanent Minimum Capital Requirement), 고정간접비요건(FOR: Fixed Overhead Requirements) 중 큰 값 이상으로 필요자기자본(Own Funds)를 보유해야 한다.

EU는 금융투자회사에 대한 자기자본 규제 산식 개선 외에도 금융투자회사들의 건전성 제고를 위해 새롭게 유동성 규제(Liquid Asset Requirements)와 집중위험(Concen-tration Risk) 규제를 도입했다. 유동성위험 규제 준수를 위해 EU내 금융투자회사들은 고정간접비요건(FOR)의 1/3 이상에 해당하는 금액만큼 순유동성 자산을 보유해야 한다. 집중위험 규제 준수를 위해 필요자기자본의 25%를 초과하는 금액 이상으로 특정 고객의 위험 익스포져를 가져갈 수 없도록 했으며, 특정 금융산업 위험 익스포져를 필요자기자본의 25%와 1억 5천만유로 이상으로 초과할 수 없도록 하였다. EU와 영국내 금융투자회사들은 이와 관련한 건전성 규제 항목을 금융당국에 주기적으로 보고하고 임계수준을 항상 지켜야 한다. 만약 금융투자회사들이 IFR/IFD 관련 규제를 준수하지 않는 경우, 과징금 부과 등을 포함한 제재를 받을 수 있다.

일본은 고정화되지 않은 자기자본을 총위험액으로 나눈 값을 자기자본 규제 비율로 정의하고, 제1종 금융투자회사들은 해당 자기자본 규제 비율 120% 이상을 유지해야 한다. 분자에 해당하는 고정화되지 않은 자기자본은 기본자본과 보완자본을 합산하고 공제자산을 차감하여 계산한다. 분모에 해당하는 총위험액은 바젤의 필요자기자본 산식과 유사하게 시장위험액, 거래상대방위험액(신용위험액), 기초적위험액(운영위험액)을 합산하여 산출한다. 일본 자기자본 규제 비율 산식은 한국이 1990년대말부터 2014년까지 도입했던 (구)NCR 산식과 매우 유사하다. 일본 증권회사들은 매월말 자기자본 규제 비율을 산출하여 금융청에 보고해야 하며, 보고 의무를 위반하거나 일정 기간 동안 자기자본 규제 비율이 임계수준을 하회할 경우 영업정지 등의 조치를 받을 수 있다.

다. 바젤 방식의 순자본과 위험액 산출 방식

CRD Ⅳ의 경우 자본 항목을 보통주 자본(Tier1), 추가 보통주 자본(Additional Tier1), 보완자본(Tier2) 등으로 구분하여 각각의 자본 항목들에 대해 비율 준수 의무를 부과하고 있다. 보통주 자본은 보통주식, 이익이영금 등 자본의 질이 높은 것들이 포함된다. 추가 보통주 자본은 우선주, 신종자본증권 등이 포함된다. 보완자본에는 영구채, 장기 후순위채권 등이 포함된다. 차감 항목으로는 영업권 및 무형자산, 이연법인세자산, 영업손실, 비유동자산 등이 포함된다. CRD Ⅳ의 순자본 산식은 바젤Ⅲ의 순자본 산식과 매우 유사하다.

CRD Ⅳ의 필요자기자본(위험가중자산)은 바젤 방식과 유사하게 시장리스크 필요자기자본(시장위험액), 신용리스크 필요자기자본(신용위험액), 운영리스크 필요자기자본 (운영위험액)을 합하여 계산한다. 시장위험액과 신용위험액의 경우 각각 표준모형과 내부모형이 존재하는데, 표준모형의 경우 위험자산의 종류, 만기 등에 따라 미리 산정한 위험계수를 곱하여 위험액을 산출한다. 예를 들어 시장위험액 산출시 표준모형은 위험을 주식위험, 금리위험, 수익증권위험(펀드위험), 외환위험, 인수위험 등으로 나누고 자산의 특징, 만기 등에 따라 위험계수를 곱하여 산출한다. 내부모형은 금융투자회사가 스스로 정한 VaR(Value At Risk) 등의 모형을 금융당국에서 승인하면, 해당 모형에 근거하여 위험값을 산출한다. 운영위험은 기초지표법, 표준방법, 고급측정법 등으로 구분하며 표준방법과 고급측정법을 사용하기 위해서는 금융당국의 승인이 필요하다.

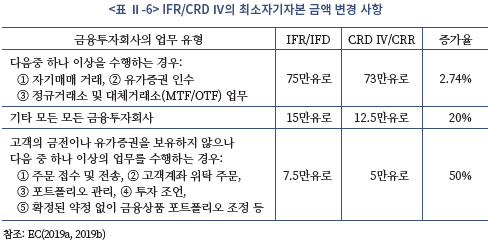

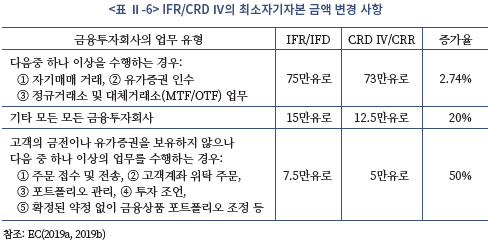

2021년 하반기부터 적용될 예정인 IFR/IFD에 따르면 Class2와 Class3 유형의 금융투자회사는 업무 유형에 따라 각각 75만유로(약 10.3억원), 15만유로(약 2억원), 7만 5천유로(약 1억원)의 최소자기자본 금액을 보유해야 한다. 자기매매 거래와 인수 거래, 정규거래소 업무 등을 수행하면 75만유로 이상의 최소자기자본 금액을 보유해야 하며, 그 외 업무 유형의 금융투자회사가 고객으로부터 금전이나 유가증권들을 위탁받아 투자매매업 업무를 수행하면 15만유로 이상의 최소자기자본을 보유해야 한다. 단순 투자중개업을 수행하는 경우에는 7만 5천유로 이상의 최소자기자본을 보유해야 한다. IFR/IFD에서 정의한 최소자기자본 금액은 CRD Ⅳ/CRR에서 정의한 최소자기자본 금액(각각 73만유로, 12만 5천 유로, 5만유로)보다 소폭 인상되었다.

<표 Ⅱ-5>와 같이 유럽 및 영국내 Class2 또는 Class3 유형의 금융투자회사는 최소자기자본 요건 외에도 고정간접비요건(FOR)을 고려하여 필요자기자본을 보유해야 한다. 이때 고정간접비요건은 금융투자회사의 전년도 고정간접비(Fixed Overhead Costs)의 25%로 부여하고 있어 금융투자회사로 하여금 분기 단위의 고정간접비 이상으로 필요자기자본을 요구하는 것으로 이해할 수 있다. 다음으로 Class2 유형의 금융투자회사에 대해 K-요소 가중치(K-Factor)를 고려해 필요자기자본을 보유하도록 규율하고 있다. K-요소 가중치는 바젤의 총위험액 산정 방식을 금융투자회사에 맞게 개선한 것으로, K-요소 가중치는 고객에 대한 위험(RtC: Risk to Client), 시장에 대한 위험(RtM: Risk to Market), 기업(RtF: Risk to Firm)에 대한 위험의 합으로 계산한다. 이때 고객에 대한 위험(RtC)은 CRD Ⅳ의 운영위험 산정 방식에 기초를 둔 것으로 금융투자회사의 운용자산(K-AUM), 고객 위탁주문 처리 규모(K-COH), 보호 및 관리 자산(K-ASA), 고객 보유 자금(K-CMH) 등에 일정 위험 계수를 곱한 뒤 이를 합하여 산출한다(RtM = K-AUM + K-COH + K-ASA + K-CMH). 시장에 대한 위험(RtM)은 순포지션 위험(K-NPR)과 청산 증거금 규모(K-CMG) 중 큰 금액으로 산정한다(RtM = Max(K-NPR, K-CMG)). 순포지션 위험은 자기매매 거래에 대해 CRR 방식으로 계산한 순포지션 위험을 뜻하며, 청산 증거금 규모는청산회원들이 과거 3개월 기준 일간 증거금을 산출한 규모 중 세 번째로 큰 값으로 정의한다. 마지막으로 기업에 대한 위험(RtF)은 거래상대방 부도위험(K-TCD), 일변 순매매 포지션 위험(K-DTF), 거래 집중 위험(K-CON)에 일정 위험 계수를 곱한 뒤에 이를 합하여산출한다(RtF = K-TCD + K-DTF + K-CON). 일본은 순자본의 개념으로 고정화되지 않은 자기자본을 산출하고 있다. 고정화되지 않은 자기자본은 기본항목과 보완항목을 합산하고 공제자산을 차감하여 계산한다. 기본항목은 자본금, 신주납입금, 법정준비금, 평가차액금을 합하고 이익잉여금, 결손금은 제외하며 보완항목은 평가차액금, 일반대손충당금, 후순위채권으로 구성된다. 공제자산은 고정자산, 이연자산, 관계회사가 발행한 유가증권, 유동자산 중 자기회사주식, 단기대출금 등으로 이루어진다.

일본 증권회사의 총위험액은 바젤 방식과 유사하게 시장위험액, 거래상대방위험액(신용위험액), 기초위험액(운영위험액)을 합하여 산출한다. 시장위험액은 일반위험액과 개별위험액으로 구분하며 자산 유형별로는 주식위험, 금리위험, 외환위험, 상품위험, 파생상품위험으로 구분한다. 시장위험액의 산출 방법은 위험자산의 특성, 만기별로 위험계수를 곱하여 산출하는 방식인 표준모형과 VaR(Value At Risk)를 고려한 내부모형 모두를 사용할 수 있다. 내부모형을 사용할 경우 감독당국의 승인이 필요하다. 거래상대방위험액은 거래상대방의 유형, 신용등급, 만기 등에 따라 사전에 부여된 위험값을 곱하여 산출한다. 기초위험액은 예상치 못한 사고나 주문처리 오류시 발생할 수 있는 필요자기자본을 뜻하며 직전 1년간 영업비용 합계의 25%를 곱하여 산출한다.

라. 레버리지비율 규제

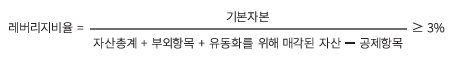

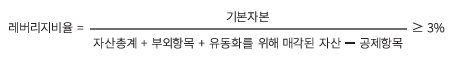

영국, 유럽, 일본 등의 개별 증권회사는 별도의 레버리지비율 규제를 받지는 않는다. 다만 규모, 연계성 측면에서 시스템적으로 중요한 금융회사로 선정된 경우, 해당 증권회사는 바젤에서 정한 레버리지비율 규제를 준수해야 한다. 2021년 하반기와 2022년 상반기부터 각각 EU와 영국의 Class1으로 분류된 대형 금융투자회사들은 은행과 동일하게 레버리지비율 규제를 준수해야 한다. 개별 증권회사를 자회사로 둔 영국, 유럽의 은행계 금융회사는 바젤에서 정한 레버리지비율을 준수해야 한다. 이때 적용되는 레버리지비율 산식은 기본자본을 자산총계와 부외항목 등의 합으로 나눈 것으로 3% 이상을 항상 유지해야 한다. 바젤의 레버리지비율 산식은 통상 금융회사에게 적용되는 단순레버리지비율 산식의 역수로 이해할 수 있으며, 자산총계 항목에 부외항목과 유동화를 위해 매각된 자산이 포함된다는 것이 특징이다.

3. IOSCO의 규제 권고안

1987년 블랙먼데이 사태 이후 미국, 영국, 유럽 등에서 다수의 증권회사들이 파산하고 투자자손실로 이어지자, 국제증권감독기구(IOSCO)는 바젤 규제와 유사하게 증권업에 대해서도 국제 표준 자기자본 규제의 도입 필요성을 제기했다. 본 절에서는 1989년, 1990년, 2014년 IOSCO가 발표한 국제 증권업 자기자본 규제 권고안 보고서를 기초로 증권업 자기자본 규제의 목적, 규제 원칙, 규제 방향 등을 소개한다.

가. IOSCO(1989)

블랙먼데이 사태 이후 국제적으로 증권회사에 대한 부실 가능성이 커지자 미국, 영국, 프랑스, 일본 등 IOSCO 주요 회원국은 1989년 공동으로 증권업에 대한 자기자본 규제 필요성 및 증권업 자기자본 규제 원칙을 발표했다. 우선 IOSCO(1989) 보고서는 바젤의 은행업 자기자본 규제 원칙과 유사하게 증권업에 대해서도 국제적으로 공통의 자기자본 규제안 제정의 필요성을 제기했다. 다음으로 증권업에 대한 자기자본 규제 원칙을 제시했다. 첫째, 유동성과 파산시 지급능력을 고려하여 증권회사는 일정 수준의 유동성 자산을 보유해야 한다(원칙 1). 둘째, 시장성 자산은 시가평가를 통해 예상 손실 위험을 정확히 반영해야 한다(원칙 2). 셋째, 측정이 어려운 자산에 대한 위험(A), 부외계정을 포함한 포지션에 대한 위험(B), 결제위험(C) 등을 종합적으로 고려하여 위험에 비례하여 필요자기자본(위험가중자산 또는 총위험액)을 산출해야 한다(원칙 3).

IOSCO(1989)는 또한 순자본 산출과 관련해서 파산시 가용할 수 있는 자본을 고려하여 자본을 유연하게 정의할 필요가 있다고 언급했다. 예를 들어 후순위채권은 순자본으로 산정할 수 있음을 제안했다. 필요자기자본(위험가중자산)은 증권회사가 수행하는 업무 유형에 따라 산정 방식이 달라질 수 있음을 제시했으며, 필요자기자본을 보수적으로 산정할 경우 증권회사의 핵심 업무에 제한을 받을 수 있기 때문에 자본시장의 경쟁시스템을 억제할 정도로 필요자기자본을 높게 설정하는 것은 바람직하지 않다고 주장했다. 증권회사의 파산 위험을 최소화하는 것보다 파산했을 때 투자자 보호를 우선하는 것이 보다 중요한 원칙임을 밝힌 것이다. 마지막으로 증권회사에 대한 자기자본 규제는 적절한 방법으로 기록하고 감독당국에 주기적으로 보고해야 함을 제시했다.

나. IOSCO(1990)

미국, 영국, 일본, 프랑스 등 IOSCO 주요 회원국은 1990년 11월 칠레 산티에고(Santiego)에서 개최한 연중회의에서 필요자기자본(위험가중자산) 산출에 관한 세부 원칙을 제시했다. 미국, 영국, 일본, 프랑스 모두 1990년 당시 증권회사에 대한 자기자본 규제를 마련하고 있었으나, 세부 산출 항목에 있어서 다소 차이가 있었다. IOSCO(1990) 보고서의 주요 목표는 4개 국가들 사이의 규제 차이를 최소화하고 증권회사 보유 포지션에 대한 실질 위험을 반영하는 것이었다.

먼저 주식 포지션 위험 산정에 관한 원칙을 제시했다. 주식 관련 시장위험액은 증권회사가 자기매매 포지션으로 보유한 주식 포트폴리오의 가격 변화 위험을 반영해야 한다. 주식ㆍ채권 포트폴리오의 가격 변화 위험이 클수록 시장리스크와 관련된 필요자기자본 (시장위험액)이 증가하도록 설계되어야 함을 뜻한다. 헤지거래 목적으로 주식 파생상품을 보유하거나 자기매매 포지션과 반대 포지션을 보유한 경우 위험액은 감소해야 한다. 유동성이 낮을수록 위험계수 또는 헤어컷 비율을 높이는 것을 제안했다. 당시 4개 국가에서는 유동성 수준을 4개 수준(매우 유동적(Most Liquid), 유동적(Liquid), 대체시장(Other Marketable), 비유동적(Unmarketable))로 구분하여 위험계수 또는 헤어컷 비율을 다르게 적용했다. 개별 주식에 과도한 포지션을 보유하면 추가로 위험액을 가산할 수 있음을 언급했다. 예를 들어 발행주식의 10%(예시) 이상을 보유하면 매도할 때 시장가격의 충격이 발생할 수 있으며, 위기상황에서 유동성이 급격히 하락할 수 있음을 주장했다. 또한 경쟁매매 기반의 시장경제 원칙을 존중하는 것이 필요함을 제시했다. 시장포지션 위험 산정이 보편적인 시장 관행에 부정적인 영향을 미치는 것은 바람직하지 않으며, 시장위험액을 산출하는 것이 너무 복잡하거나 규제 준수 비용이 높지 않아야 함을 제시했다.

채권 포지션과 관련해서는 시장위험액과 신용위험액 산출에 관한 원칙을 제시했다. 채권 포지션의 위험가중치는 발행자와 만기에 따라 달라져야 한다. 정부, 국가기관이 발행한 채권은 위험가중치를 낮게 부여하고, 일반 회사채의 위험가중치는 높게 부여하는 것을 제안했다. 채권의 만기가 길수록, 채권의 변동성이 클수록, 유동성이 낮을수록 위험가중치는 커져야 한다. 발행자가 같은 채권에 대해 채권 매입 포지션과 매도 포지션의 위험은 상쇄될 수 있으며, 채권 파생상품으로 현물 포지션과 반대 방향의 거래를 수행했을 때도 위험이 줄어들 수 있어야 한다. 후순위채권을 보완자본으로 인정하는 원칙도 제시했다. 당시 바젤위원회는 은행 자기자본 규제에서 후순위채권을 보완자본으로 인정하고 있었으며 미국, 영국, 프랑스의 증권회사는 후순위채권을 발행하여 보완자본으로 사용하고 있었기 때문이다.

다. IOSCO(2014)

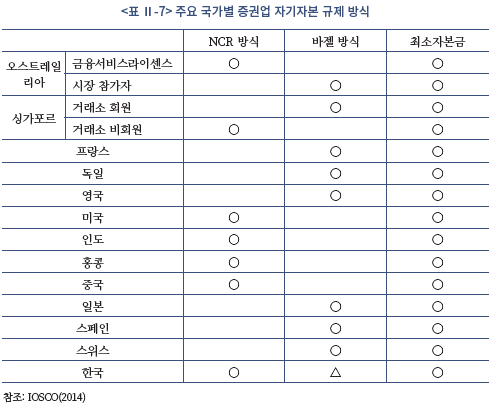

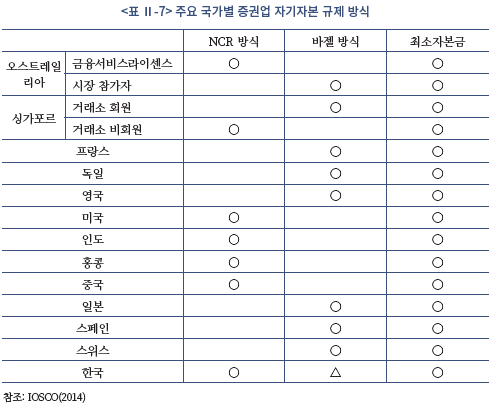

2008년 글로벌 금융위기 이후 은행에 대한 건전성 규제는 대폭 강화되었으나 IOS-CO(1989) 보고서 이후 증권회사의 건전성 규제 개선 방안에 대해서는 심도 있는 논의가 없었다. 이에 IOSCO는 2014년 보고서 발표를 통해 주요국에서 사용하고 있는 증권업 자기자본 규제를 비교분석하고 순자본, 필요자기자본(위험가중자산) 산출 등 일부 항목에 대해 개선 필요성을 도출하고자 하였다. IOSCO(2014) 보고서에 따르면 증권업에 대한 자기자본 규제를 도입하는 국가는 미국 NCR 방식과 바젤 방식 중 하나를 채택하는 것으로 발표했다(<표 Ⅱ-7> 참조). 우선 바젤 규제가 도입되었던 시기에 선제적으로 증권업 자기자본 규제를 채택하였던 영국, 프랑스, 독일, 스위스, 스페인 등 주요 유럽 국가들과 일본은 바젤 방식 규제를 채택하고 있다. 뒤늦게 증권업에 대해 자기자본 규제를 도입했던 인도, 홍콩, 중국 등은 미국 NCR 방식 규제를 채택하고 있으며 오스트레일리아, 싱가포르 등은 증권회사 유형에 따라 각기 다른 자기자본 규제 방식을 선택하고 있다. 한국은 미국 NCR 방식을 채택하는 것으로 발표했다. 그러나 본 저자는 자기자본 비율 산식은 미국 NCR 방식을 따르고 있으나, 순자본과 위험액 산출 방법은 일본과 바젤 방식을 채택하고 있어 미국 NCR과 바젤 방식을 혼용하고 있는 것으로 판단한다.

IOSCO(2014) 보고서는 미국 NCR 방식과 바젤 방식의 자기자본 규제에 대하여 규제적용 대상 범위(Regulatory Scope), 순자본 산정 방식(Component of Capital), 필요자기자본(위험가중자산)의 산출 방법(Risk Capture), 자기자본비율 산식(Prudential Standards), 내부모형 사용 여부(Use of Internal Model), 연결위험 반영 여부(Risks posed by Group Entities) 등을 비교분석하였다. 우선 미국 NCR 방식과 바젤 방식의 규제적용 대상 범위는 소폭 다르다. 미국과 유럽을 기준으로 비교하면 미국 NCR 방식은 단순 브로커-딜러 업무를 수행하는 금융투자상품 중개업자, 자기매매업자에게 적용하는 반면, 바젤 방식은 금융투자상품 중개업자, 자기매매업자뿐 아니라 자산운용회사, 자문일임업자, 시장인프라 기관(거래소 등) 등에게도 적용된다. 영국ㆍ유럽의 자기자본 규제 적용 대상 범위가 미국 NCR의 규제 적용 대상 범위보다 훨씬 넓다. 영국ㆍ유럽에서 도입했던 CRD Ⅳ 규제는 은행, 보험회사에게도 적용되는 등 금융회사에게 동일한 원칙29)으로 건전성 규제를 적용하는 것으로 이해할 수 있다.

순자본 산출과 관련해서는 미국 NCR 방식과 바젤 방식에서 큰 차이가 없다. 두 규제방식 모두 단기간 회수가 가능한 자산들을 순자본에 포함하고 있으며, 회계상 부채로 분류되는 항목들은 차감하는 것을 원칙으로 한다. 예를 들어 부동산, 무형자산 등 유동성이 낮은 자산들은 순자본에서 차감하고 있으며, 영업손실, 이연법인세 자산들 역시 차감하고 있다. 미국 NCR에서는 만기 1년 이상의 후순위채권을 보완자본으로 인정하여 순자본에 가산하고 있으며, 영국, 유럽의 CRD Ⅳ 규제는 후순위채권을 보완자본으로 인정하고 있으나 잔존만기 5년 미만 후순위채권에 대해 매 1년마다 20%씩 차감하여 순자본에 가산하고 있다.

필요자기자본(위험가중자산) 산출 체계는 미국 NCR과 바젤 방식이 큰 차이가 없다. 미국 NCR은 시장리스크와 신용리스크를 헤어컷 방식으로 순자본에서 차감하고 있으며, 바젤 방식은 시장리스크 필요자기자본, 신용리스크 필요자기자본을 별도로 합산하여 위험액을 산출하고 있다. 바젤 방식에서는 시장리스크, 신용리스크 외에 별도로 운영리스크를 합산하고 있는 것이 미국 NCR 방식과 구별된다. 시장 포지션에 대해서는 미국 NCR이 바젤 방식보다 보수적으로 산출하고 있다. 미국 NCR은 유동성 수준을 두 가지 경우로 구분하여, 상장주식 등 단기간 환매가 가능한 시장자산은 15~25%의 헤어컷을 부여하고 있으며 비상장주식 등 단기간 환매가 불가능한 자산은 100% 차감하는 것을 원칙으로 한다. 바젤 방식 중 표준모형은 주식 포지션에 대해 개별위험값 8%와 일반위험값 8%를 합산30)하여 총 16%의 위험가중치를 부여하고 있다. 바젤 방식에서는 정규거래소에서거래되지 않은 비상장주식에 대해 유동성 수준에 따라 보다 높은 위험가중치를 부여하고 있다. 채권의 경우도 발행자, 만기 등에 따라 미국 NCR은 0~12%의 헤어컷, 바젤 방식은 0~25%의 위험가중치를 부여하고 있는데 세부 항목별로는 위험값 반영 수준이 비슷한 것으로 확인했다.

자기자본비율 산식 체계에 있어서는 미국 NCR 방식과 바젤 방식이 차이가 난다. 미국 NCR 방식의 경우 증권회사가 규모에 따라 표준방법, 대체방법, 대체순자본방법 등을 선택할 수 있는 반면, 바젤 방식은 모든 증권회사가 하나의 자기자본 규제 비율을 준수해야 한다.31) 또한 미국 NCR 방식은 순자본이 필요자기자본 또는 최소자본금보다 크도록 설계되어 있어 비율 방식 규제로 보기 어려우나 바젤 방식은 필요자기자본(위험가중자산) 대비 순자본 비율이 임계수준을 넘도록 설계하고 있어 비율 방식 규제로 볼 수 있다. 다만 미국 NCR 방식의 경우 최소순자본을 필요자기자본(위험가중자산)으로 이해하면 순자본 대비 최소순자본이 100% 이상을 유지하는 것으로 변환할 수 있어 넓은 의미의 비율 방식 규제로도 볼 수 있다. 이에 IOSCO(2014)에서는 미국 NCR 방식과 바젤 방식의 자기자본비율 산식은 큰 틀에서 유사하다고 판단하고 있다.

내부모형의 사용 관련해서는 미국 NCR 방식과 바젤 방식이 차이가 난다. 미국 NCR의 경우 대부분 증권회사가 사용하고 있는 표준방법과 대체방법 모두 증권회사가 자율적으로 개발한 내부모형을 인정하지 않는다. 미국에서는 임시순자본이 10억달러 이상이고 순자본이 5억달러 이상인 CSE 브로커-딜러가 SEC로부터 사전 승인을 받은 경우에만 헤어컷 산출시 내부모형을 사용할 수 있다. 반면 바젤 방식의 경우 시장리스크, 신용리스크, 운영리스크 등의 필요자기자본(위험가중자산) 산출시 내부모형 사용을 인정하고 있다. VaR(Value At Risk) 방법 등을 활용한 내부모형을 사용하면 포트폴리오의 위험을 보다 효과적으로 관리할 수 있기 때문에 표준등급법에 기초한 미국 NCR 방식보다 바젤 방식이 보다 현대 포트폴리오 이론에 가깝다고 볼 수 있다.

금융그룹 전체에 대해 연결 자기자본 규제를 적용하는 부분도 미국 NCR 방식과 바젤 방식이 다르다. 바젤 방식은 연결기준(Consolidated based) 자기자본 규제 도입을 원칙으로 한다. 바젤 방식 규제는 증권회사의 파산이 증권회사를 소유한 금융그룹의 손실로 전이될 위험을 최소화하는 것을 목표로 한다. 따라서 바젤 방식에서는 증권회사의 모회사 그룹에 대해서도 순자본, 필요자기자본 등을 산출하며 증권회사 모회사 그룹도 자기자본비율 규제를 준수해야 한다. 반면 미국 NCR 방식에서는 개별 증권회사만 자기자본규제를 준수하면 된다. IOSCO(2014) 보고서는 미국 SEC가 브로커-딜러에 대해 연결 감독을 수행한다는 점에서 미국 NCR 방식과 바젤 방식의 규제 차이가 크지 않다고 판단한다. 실제, 미국 SEC는 브로커-딜러를 소유한 금융그룹에 대한 감독을 위해 별도의 계열(Affiliate) 브로커-딜러 감독 프로그램을 운영하고 있다. 브로커-딜러는 연결 회사에 대한자금 지원, 연결대상 회사의 자본적정성, 위험관리 사항 등을 주기적으로 SEC에 보고해야 하며, SEC는 브로커-딜러의 연결 금융회사에 대해 재무상황, 기업경영 활동 등을 면밀히 모니터링해야 한다.

이상을 종합하면 IOSCO(2014) 보고서는 미국 NCR 방식과 바젤 방식의 규제 차이는 크지 않은 것으로 판단했다. 자기자본 규제 적용 대상, 내부모형 사용 여부, 연결감독 적용 여부 등 면에서 미국 NCR 방식과 바젤 방식이 다소 차이가 나지만, 필요자기자본(위험가중자산) 대비 일정 수준 이상의 순자본을 보유하도록 하는 규제 원칙은 큰 차이가 없음을 강조하고 있다. 각국의 상황에 맞추어 증권회사의 업무범위에 따라 순자본과 위험액 산출 방식을 유연하게 적용하되, 투자자 보호를 위해 일정 수준 이상 유동성이 높은 순자본을 보유하고, 순자본 대비 과도한 위험자산을 보유하는 것을 억제하고 있다. 또한 증권회사의 파산으로 연결대상 금융회사의 대규모 손실로 전염되는 것을 막기 위해 연결 감독의 중요성을 강조하고 있다.

Ⅲ. 한국 증권업 건전성 규제 진단

한국은 1996년말 증권회사의 부실 가능성이 확대되자 금융당국은 1997년 4월 증권업의 경영안정성 제고 및 투자자 보호를 목표로 일본 자기자본 규제 제도를 기초로 하여 증권회사에 대한 자기자본 규제안을 도입했다. 이후 2014년까지 큰 폭의 제도개선 없이 (구) NCR 제도 체계를 유지해 왔다. 금융당국은 2014년 자본시장의 역동성 제고 및 글로벌 종합금융투자회사로의 도약을 목표로 미국 NCR 방식과 유사한 순자본비율 제도를 도입했으며, 대형 금융투자회사의 건전성 강화를 목표로 레버리지비율 제도를 새롭게 도입했다. 당시 증권업 건전성 규제의 개선은 일본식 바젤 방식 규제에서 미국 NCR 방식 규제로의 변화를 뜻한다. 증권업 건전성 규제 체계가 큰 폭으로 변화했음에도 불구하고, 증권업 건전성 규제에 대한 체계적인 연구는 많지 않았다. 특히 증권업 자기자본 규제는 개별 증권회사의 업무범위를 직접 또는 간접적으로 제한할 수 있기 때문에 자기자본 규제의 산식 뿐 아니라 세부 산출 방법에 대한 체계적인 연구가 필요하다. 이에 본 연구에서는 한국 증권업 자기자본 규제의 연혁, 산식, 순자본과 위험액 산출 방식 등을 선진국 규제와의 비교분석 방법을 통해 살펴보고자 한다.

1. 한국 증권업 자기자본 규제 현황

가. 한국 증권업 자기자본 규제의 연혁

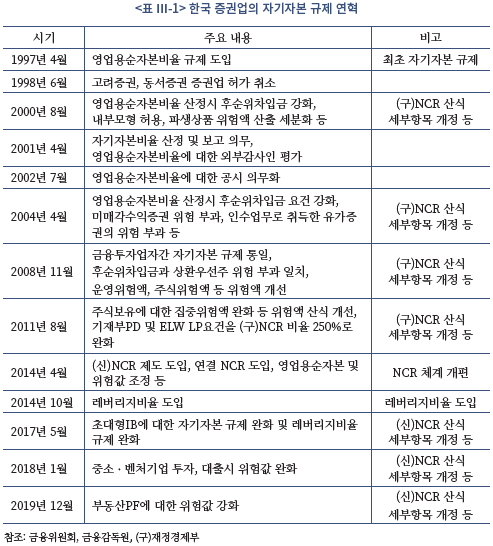

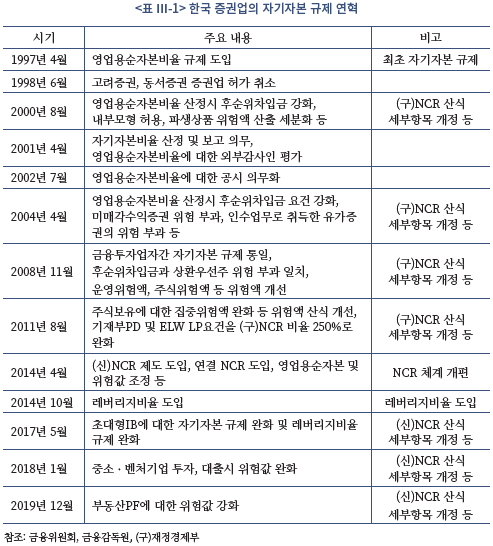

1996년 들어 한국의 경상수지 적자 규모가 확대되었다. 1997년 1월 한보그룹이 부도에 처하자, 대기업에 자금을 빌려주었거나 대기업 채권에 지급보증을 수행해왔던 은행, 증권회사, 종금사의 경영상태가 크게 악화되었다. 당시 은행감독원은 바젤Ⅰ 도입을 통해 자기자본비율 8% 규제안을 도입했으나 증권회사에 대해서는 별도의 건전성 규제가 없었다. 1997년 4월 금융당국은 증권회사의 경영안정성 제고와 투자자 보호를 목표로 영업용순자본비율 규제(NCR 규제)를 도입했다.32) 1997년 4월 증권회사에 대해 NCR 규제를 도입했으나, 당시 증권회사의 건전성 위험은 다소 커졌다.

1997년 전후 한보그룹, 기아그룹의 부도 위기로 대기업들이 자금을 구하기 어려워지자, 대기업이 발행한 회사채에 지급보증을 수행했던 다수의 증권사들이 대규모 손실을 기록했다. 1997년 12월 업계 8위 규모의 고려증권이 회사채보증의 대규모 손실로 최종 부도 처리되었으며, 1998년 1월에는 업계 4위 규모의 동서증권이 그룹 계열사의 손실 여파로 최종 부도 처리가 되었다.33) 1997년 하반기 10여개 증권회사들은 150%의 (구)NCR 임계수준을 넘지 못했으나, 유상증자와 후순위채권 발행 등을 통해 1998년초에는 4개 증권회사를 제외한 대부분 증권회사가 (구)NCR 150%를 상회했다. 1998년 6월 금융감독위원회는 은행 및 비은행 금융기관에 대한 금융구조조정 추진방안을 발표했는데34), 증권회사에 대해서는 영업용순자본비율 및 재산-채무 비율 보고서를 보고받아 자산실사 후에 신속하게 적기시정조치를 취할 계획임을 발표했다. 1998년 6월 재정경제부 증권제도과는 부도사건 발생 후 경영개선 명령을 적절하게 이행하지 못했다는 이유로 고려증권과 동서증권에 대한 증권업 허가를 취소했으며, 1998년 12월에는 한국산업은행의 자회사 한국산업증권에 대한 증권업 허가를 취소했다. 1999년 들어 (구)NCR 비율 미준수 및 경영개선 명령 미이행 등의 이유로 재정경제부는 한남투자증권(1999년 1월), 장은증권(1999년 3월), 동방페레그린증권(1999년 4월)에 대해 증권업 허가를 취소했다. 1999년 9월말 기준 모든 국내 증권회사가 양(+)의 순이익을 기록하는 등 국내 증권업의 수익성과 건전성이 크게 개선되었는데, 이는 1997년 도입한 영업용순자본비율 규제가 증권회사의 건전 경영을 유도하는 데 긍정적인 영향을 미쳤기 때문으로 판단한다.

2000년 들어 국내 증권회사가 양호한 실적과 건전성을 기록함에 따라 영업용순자본비율((구)NCR) 규제는 큰 틀의 변화가 없이 유지되었다. 2000년 8월에는 BIS 방식의 자기자본 규제 산식과의 정합성 제고를 위해, 후순위차입금의 요건을 강화하고, 위험액 산정시 표준모형 외에 내부모형을 허용하고, 파생상품 관련 위험액 및 신용집중위험액 산식을 구체화했다.35) 2001년 4월 증권회사의 자기자본 관리제도 개편 방안이 시행됨에 따라 증권회사는 분기별로 영업용순자본비율을 금융감독원장에게 보고해야 하며, 영업용순자본비율이 150% 미만이 되는 경우, 또는 영업용순자본비율이 20% 이상 감소하거나 총위험액이 20% 이상 증가하는 경우 즉시 금융감독원장에게 보고하도록 규정했다. 더불어 영업용순자본비율 산정의 신뢰도를 제고하기 위해, 매반기별로 영업용순자본비율에 대한 외부감사인의 평가를 받도록 했다.36) 2002년 7월에는 증권업 건전성 위험에 대한 공시 강화를 목표로, 증권회사의 재무현황 및 영업용순자본비율에 대한 비교공시를 도입했다. 2004년 4월에는 증권회사의 재무건전성 기준 강화를 위해 영업용순자본비율 산정시 후순위차입의 인정요건을 강화했으며, 미매각수익증권에 대해 영업용순자본에서 차감하도록 했다. 또한 인수업무로 취득한 유가증권에 대해 실질적인 위험액으로 반영하도록 개선했다.37)

금융당국은 2006년말 자본시장법 제정 추진에 맞추어 투자은행(IB) 육성을 목표로 영업용순자본비율 개선을 추진하기로 밝혔다.38) 이후 수차례 전문가 태스크포스(T.F)를 통해 금융당국은 2009년 2월 자본시장법 시행 시기에 맞추어 2008년 11월말 금융투자업자의 자기자본 규제 개편 방안을 발표했다. 금융투자업자간 규제차익 방지를 위해, 증권회사, 선물회사, 자산운용회사, 전업신탁회사에 대해 자기자본 규제를 통합했으며 후순위차입금과 상환우선주 인정기준을 동일화했다. 운영위험액, 신용위험액, 주식위험액, 금리위험액, 옵션위험액, 집합투자위험액, 외환위험액 등의 위험액 산출 상식을 국제적 정합성에 맞추어 상당 부분 수정했다.39) 자본시장법 시행에 맞추어 영업용순자본비율 산식을 상당폭 개선했으나 당시 (구)NCR 규제는 특정 영업행위을 제한하는 진입 규제 역할을 하고 있고, 은행, 보험업권보다 보수적으로 위험액을 산출한다는 지적이 많았다. 이에 금융당국은 2011년 8월 증권업 자기자본 규제 부담을 완화하는 방향으로 영업용순자본비율 산정방식을 개선했다. 주식보유에 대한 집중위험액 산정방식을 완화하는 등 실질 위험에 맞추어 위험액 산식을 개선하고자 했으며, 타기관의 업무 요건 중에서 자본시장법상 규제 수준보다 높은 기재부 PD, 거래소 ELW LP의 업무 요건을 완화했다.40)

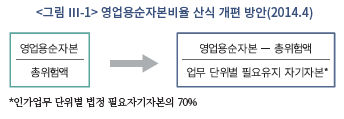

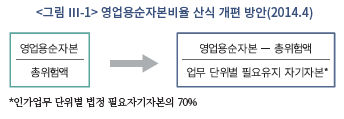

(구)NCR 산식이 IB업무와 해외진출 등 증권업의 주요 영업을 과도하게 제약한다는 지적이 일자, 2014년 들어 금융당국은 자본시장 역동성 제고를 목표로 증권업 자기자본 규제 비율 산식을 큰 폭으로 개선했다.41) 우선 영업용순자본비율 산출체계를 BIS 방식의 총위험액 대비 영업용순자본 비율 관점에서 업무 단위별 필요유지 자기자본 대비 영업용순자본과 총위험액의 차이로 개편했다(<그림 Ⅲ-1>). NCR 산출체계 개편에 따라 적기시정조치 부과 기준을 150%(경영개선 권고), 120%(경영개선 요구), 100%(경영개선 명령)에서 각각 100%, 50%, 0%로 변경했다. 다음으로 은행 및 보험업권과의 형평성 제고를 위해 연결 순자본비율을 도입하여, K-IFRS 연결재무제표상 종속회사를 보유하고 있는 모든 증권회사에 대해 연결 NCR을 적용하도록 했다. 그 외 영업용순자본의 인정범위를 확대하고, 주요 영업용순자본 차감 항목을 조정하고 위험값을 합리적으로 조정하여 국내 증권회사의 IB업무와 해외진출 활성화를 도모하고자 했다. 한편, 자산운용회사의 건전성 위험과 증권업의 건전성 위험이 상이하다는 의견이 제기되자 2014년 9월 자산운용회사에 대해서는 영업용순자본비율 제도를 폐지하고 최소영업자본액 제도를 도입했으며 부동산신탁회사는 영업용순자본비율제도를 유지하고 있다.42)

2014년 상반기에 발표되어 2015~2016년부터 시행된 증권업 순자본비율((신)NCR) 제도는 중형ㆍ대형 증권회사에게 자기자본 규제의 부담을 덜어주었다는 점에서 증권업 건전성 규제를 완화한 것으로 이해할 수 있다. 순자본비율 제도 도입으로 증권회사가 자기자본 대비 과도한 차입을 통해 자산규모가 급격히 증가할 수 있는 위험을 줄이기 위해 금융당국은 2014년말 적기시정조치 기준으로 레버리지비율 규제를 도입했다.43) 레버리지비율이 1,100% 이상이거나, 2년 연속 당기순이익이 적자이고 레버리지비율이 900% 이상인 증권회사에게 경영개선 권고 등을 수행함으로써 과도한 레버리지 사용을 억제하도록 했다. 2017년 들어 금융당국은 초대형 투자은행(IB) 육성을 위해 자기자본이 3조원 이상인 증권회사에 대해 종합금융투자사업자 신규 업무를 부여하고, 자기자본 기준 4조원 또는 8조원 등 일정 요건을 갖춘 증권회사에게 기업대출의 위험값 완화44) 및 레버리지비율 규제 완화45) 등의 인센티브를 제시했다.46) 2018년초 금융당국은 생산적 분야로 모험자본 공급을 확대하기 위해, 은행, 보험, 증권회사의 자기자본 규제개편안을 발표했다.47) 증권회사가 중소기업 및 벤처투자기업 주식에 장기로 투자할 경우, 위험값을 완화했으며 중소기업 및 벤처투자기업에게 신용대출을 수행할 때 영업용순자본을 100% 차감하는 대신 대출자산의 위험 수준에 따라 신용위험값을 차등화하여 부과하도록 했다. 이와 같은 자기자본 규제 개선 방안은 정책 목표를 수행하기 위해 건전성 규제를 완화한 것으로 이해할 수 있다. 반대로 쏠림현상 억제를 목적으로 건전성 규제를 강화한 사례도 있다. 부동산PF에 대한 채무보증 규모가 빠르게 증가하자, 2019년말 금융당국은 자기자본 규제 개선 등을 포함한 부동산PF 익스포져 건전성 관리 방안을 발표했다. 당시 증권회사의 부동산PF 채무보증에 대해 신용위험값을 12%에서 18%로 상향하고, 종합금융투자사업자가 부동산PF 대출 수행시 적용받은 레버리지비율 산정 인센티브를 축소했다.

나. 자기자본 규제 산식

2015~2016년 시행된48) 증권업 순자본비율((신)NCR) 산식은 필요유지 자기자본 대비 잉여순자본(영업용순자본에서 총위험액을 차감한 금액) 비율로 계산한다(<그림 Ⅲ-1> 참조). 이때 분모의 필요유지 자기자본은 증권회사의 인허가 업무 단위별 필요자기자본의 70%로 산정하며, 자본시장법상 전문투자자와 일반투자자를 대상으로 모든 금융투자업 업무를 영위한다고 가정하면 약 1,386억원(=1,980억원 × 70%)으로 산출된다. 분모는 영업용순자본에서 총위험액을 차감한 금액으로 영업용순자본과 총위험액을 산정하는 방식은 (구)NCR의 내용과 큰 변화가 없다.

증권회사 등 주요 금융투자회사는 자본적정성 유지를 위해 순자본비율을 100% 이상 유지해야 한다. 만약 순자본비율이 50~100% 사이에 있으면 금융당국으로부터 경영개선 권고를 받으며, 순자본비율이 0~50% 사이에 있으면 경영개선 요구를 받는다. 순자본비율이 0% 미만인 경우 경영개선 명령 조치를 받게 된다.

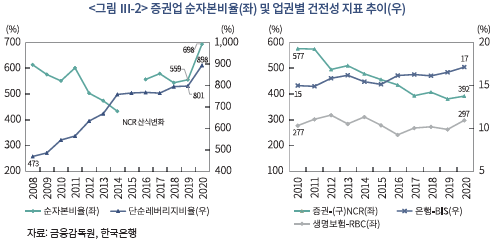

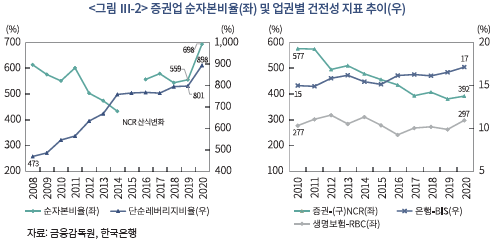

2016년말 순자본비율 제도가 전면 시행된 이후, 한국 증권업의 평균 순자본비율은 큰 폭으로 향상되어, 2020년말 국내 증권업 평균 순자본비율은 698%를 기록하고 있다(그림 <Ⅲ-2>) 참조). 순자본비율 제도가 시행되기 이전인 2014년말과 비교하면 2020년말 순자본비율은 적기시정조치 임계수준을 큰 폭으로 상회하는 것으로 관찰된다. 순자본비율 전면 개편 이후 순자본비율의 절대 수준이 향상되어 증권업의 자본적정성이 개선된 것으로도 볼 수 있으나, 단순 레버리지비율을 살펴보면 자본총계 대비 자산총계는 빠르게 증가한 것으로 나타나 순자본비율과 레버리지비율은 서로 상이한 움직임을 보여주고 있다. 실제 은행업, 보험업권의 건전성 지표와 (구)NCR 지표를 비교하면, 2014년 이후 증권업의 (구)NCR 지표는 지속적으로 감소한 반면, 은행업과 보험의 건전성 지표는 향상되거나 큰 변화를 보이지 않고 있다.

다. 영업용순자본 및 총위험액 산출 산식

다. 영업용순자본 및 총위험액 산출 산식

1) 영업용순자본

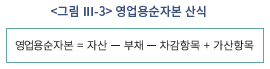

영업용순자본은 순자본비율 산출 기준 날짜에 증권회사의 순자산 가치를 뜻하는 지표로, 재무상태표상 자산에서 부채를 차감한 이후에 차감항목을 제외하고 가산항목을 더하여 산출한다(<그림 Ⅲ-3> 참조). 이때 재무상태표는 증권회사의 연결재무상태표를 기준으로 한다. 차감항목은 재무상태표상 자산으로 분류되는 항목이더라도 현금화가 곤란한 자산을 포함하며, 증권회사가 즉시 유동화가 가능한 자산이거나 유동화를 위해 담보로 제공한 자산에 대해서는 차감항목에서 제외하는 것을 원칙으로 한다.

차감항목으로는49) ① 투자부동산을 포함한 유형자산, ② 선급금, 선급법인세, 이연법인세자산, 선급비용, 선급부가가치세, ③ 대출채권에 설정된 담보가액을 초과하는 대출채권 금액, ④ 자본시장법상 특수관계인 채권, ⑤ 자회사 결손액 중 증권회사 소유지분 해당액, ⑥ 지급 의무가 발생한 채무보증금액(관련 충당금은 제외), ⑦ 경영참여형 사모집합투자기구의 무한책임사원인 경우 그 경영참여형 사모집합투자기구의 결손액, ⑧ 신탁계정대여금의 16%(부동산신탁회사의 경우), ⑨ 상환우선주 발행에 의한 자본금 및 자본잉여금(자본으로 분류시), ⑩ 임차보증금 및 전세권 금액, ⑪ 대손준비금 잔액, ⑫ 신용위험 변동으로 인한 금융부채의 누적미실현평가손익, ⑬ 간주원가 적용에 따른 유형자산 등 재평가이익, ⑭ 시장성이 인정되는 무형자산을 제외한 모든 무형자산, ⑮ 지급예정 현금배당액, ⑯ 금융투자협회 가입비, ⑰ 자산평가손실 등을 포함한다. 차감항목 포함 대상 중에서 이슈가 되는 항목은 상환우선주 자본금 및 자본잉여금이다. 상환우선주는 일정 만기 경과후에 상환해야 한다는 점에서 부채의 성격이 강하다는 주장과 국제적으로 상환우선주는잔존기간 등에 따라 상당만큼 보완자본으로 인정을 받는 추세라는 주장이 있다. 이에 금융당국은 잔존기간이 5년 미만이 되는 경우 상환우선주 금액에 대해 일정 비율만큼 곱한금액50)을 차감에서 제외하고 있다.

가산항목은 재무상태표상 부채에 포함되어 있으나, 실질적으로 채무이행 의무가 없거나, 미래손실에 대비하여 유보시킨 항목, 그리고 보완자본 기능을 하는 항목들을 포함한다. 가산항목으로는 ① 자산건전성 분류 대상에 적립된 대손충당금(고정이하 충당금 등 제외), ② 후순위차입금 또는 후순위사채, ③ 금융리스부채, ④ 부채로 분류되는 상환우선주, ⑤ 자산평가이익 등을 포함한다. 가산항목 중에서 이슈가 되는 항목은 후순위차입금 (또는 후순위사채)과 부채로 분류되는 상환우선주로, 두 항목 모두 보완자본 성격을 가지기 때문에 영업용순자본에서 전액 차감하는 것은 바람직하지 않을 수 있다는 주장이 있다. 이에 금융당국은 일정 요건을 만족하는 후순위차입금(또는 후순위사채)과 부채로 분류되는 상환우선주에 대해 보완자본으로 인정하여 순재산액의 최대 50%까지 가산을 허용하고 있다. 다만 상환우선주의 차감항목과 유사하게, 잔존기간이 5년 미만이 되는 경우 1년 경과시마다 가산금액을 20%씩 축소하도록 규정하고 있다.

2) 총위험액

증권회사의 총위험액은 위기상황에서 발생할 수 있는 손실을 계량화한 것이다. 이때 총위험액은 리스크 요인별로 시장위험액, 신용위험액, 운영위험액으로 구분하여 산출한 뒤, 이를 합산한다(<그림 Ⅲ-4> 참조). 시장위험액, 신용위험액, 운영위험액의 산출 방식은 바젤 방식과 유사한 것으로 국내외 주요 은행 등은 시장리스크, 신용리스크, 운영리스크의 소요자기자본을 각각 산출하여 이를 합산한 금액을 총위험액으로 사용하고 있다.

가) 시장위험액

시장위험은 증권회사가 보유한 주식, 채권, 외환, 펀드, 일반상품, 파생상품 등의 시장가격 변동으로 발생할 수 있는 손실을 계량화한 것으로, 각각 일반위험액과 개별위험액으로 구분하여 산정한 후에 이를 합산하여 산출한다. 일반위험액은 재무경제학에서 정의하는 체계적 위험(Systematic Risk)을 계량적으로 측정하려는 것이며, 개별위험액은 비체계적 위험(Unsystematic Risk)을 측정하려는 것이다. 파생상품의 위험액은 기초자산의 위험으로 분해하여 기초자산별 위험액에 반영하며 기초자산 위험액에 반영하기 어려운 비선형 위험은 옵션위험액으로 산출한다. 즉 시장위험액은 주식위험액, 금리위험액, 외환위험액, 집합투자증권등위험액, 일반상품위험액, 옵션위험액을 합하여 산출한다.

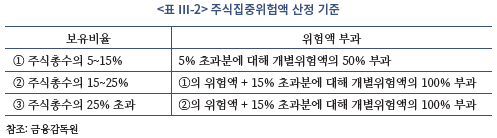

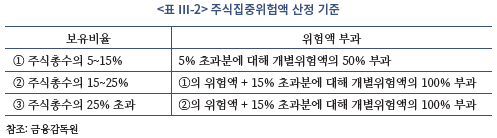

주식위험액의 경우 주식시장별로 개별위험액과 일반위험액으로 구분하여 산출하는데51), 주식시장은 유가증권시장 등 시장성 있는 주식과 비시장성 주식으로 구분하여 개별위험값의 위험계수를 차등하여 적용한다. 개별위험액 산출시 유동성-분산도 기준을 별도로 두어, 유동성 및 분산도가 높다고 판단한 경우 낮은 위험계수를 부과하며 유동성 및 분산도가 낮은 경우 높은 위험계수를 부과한다. 예를 들어 국내 유가증권시장에서 거래되는 주식 중 KOSPI200 종목에 편입된 경우, 개별위험값 4%와 일반위험값 8%를 합산하여 총 12%의 주식위험액을 반영한다. 반면 KOSPI200 종목에 포함되지 못해 유동성-분산도 기준을 충족하지 못하면 개별위험값 8%와 일반위험값 8%를 합산하여 총 16%의 주식위험액을 반영한다. 주식위험액 산출시 개별위험액, 일반위험액과 별도로 주식집중위험액을 가산한다. 주식집중위험액은 특정 기업의 주식을 발행주식 총수의 5%를 초과하여 보유하거나 공매도를 수행하는 경우 5%, 15%, 25% 초과분에 대해 개별위험액의 50~200%를 가산한다(<표 Ⅲ-2> 참조). 주식집중위험액은 바젤 방식이나 미국 NCR 방식에서는 찾기 어려운 방식으로, 증권회사가 주식 포지션을 보유할 때 발생할 수 있는 예상 손실을 계량화 했다고 보기 어렵다. 오히려 주식집중위험액을 부과하는 것은 증권회사가 특정 기업의 주식 보유을 발행주식 총수의 일정 수준 이내로 제한하려는 목적이 큰 것으로 보인다.

금리위험액은 고정금리채권, 변동금리채권, 기업어음, 자산유동화증권, 양도성예금증서 등 채권에 해당하는 자산에 대해 예상손실 금액을 계량화한 것이다. 주식위험액과 유사하게 시장금리 변화에 따라 발생할 수 있는 손실예상금액을 일반위험액으로 정의하고, 개별채권 보유시 채권 발행인의 신용사건으로부터 발생할 수 있는 손실예상금액을 개별위험액으로 정의하여 각각 계산한다. 일반위험액의 경우 잔존만기 및 이표금리 수준에 따라 사전에 정한 위험값을 곱하여 산출한다. 개별위험액은 시가로 평가된 채권포지션 금액에 해당 채권의 신용등급 및 만기에 따라 부여된 위험값을 곱하여 산출한다. 국채의 경우신용사건이 발생하지 않는다고 가정하여 위험값은 0%를 부과하며 잔존만기가 2년 이상남은 AAA 등급 회사채의 경우 위험값은 1%를 부과한다.52) 금리 관련 파생상품의 경우, 기초상품의 적정 포지션으로 분해하여 개별위험액과 일반위험액을 각각 산출한다. 이때 금리 관련 자산의 포지션간 금리변동에 의한 손익이 반대이고, 발행인, 이표금리, 만기, 발행통화 등이 동일한 경우 매입포지션과 매도포지션의 위험액은 상계할 수 있다.

외환위험액은 달러, 유로화 등 외국통화로 표시된 자산 및 부채의 환율변동에 따른 예상손실을 계량화한 것이다. 외환위험액 산정에 앞서, 외환포지션을 통화별로 매입포지션과 매도포지션으로 나누고, 이를 상계하여 순포지션을 계산한다. 원화로 환산한 통화별 순매입포지션 또는 순매도포지션을 통화별로 집계하여 전체 통화에 대한 순매입포지션 합계액과 순매도포지션 합계액을 구한 뒤, 이중 큰 금액에 대해 8%를 곱하여 외환위험액을 산출한다. 이때 금에 대해서는 순포지션에 위험값 8%를 곱하여 외환위험액에 합산한다.

집합투자증권위험액은 증권회사가 보유한 집합투자증권, 수익증권, ETF 등의 시장가격 변동에 따른 손실 위험을 계량화한 것이다. 집합투자증권위험액은 편입자산을 기초자산 포지션으로 분해하여 기초자산의 위험액 산정방법을 적용한다. 편입자산의 기초자산 분해가 곤란한 경우, 두 가지 경우로 나누어 집합투자증권위험액을 산출한다. 우선 집합투자증권에 대해 적격 신용평가기관의 신용등급이 있는 경우, 신용등급에 따라 1.6~12%의 위험값을 부과한다. 집합투자증권에 대해 적격 신용평가기관의 신용등급이 없는 경우, 약관 또는 정관상 기초자산의 최대 편입한도에 따라 부동산 및 유형자산(24%), 주식(12%), 채권(4%), 외국통화(8%) 등의 위험값을 부과하여 집합투자증권위험액을 산출한다. 2018년 7월에는 가계부채와 부동산 금융상품으로의 쏠림을 억제하기 위해 부동산 관련 집합투자증권의 위험값을 24%에서 60%로 2.5배 상향하기도 했다.

일반상품위험액은 농산물, 축산물, 광산물 등 주식, 채권, 집합투자증권 등에 속하지 않은 일반상품(Commodity)들에 대해 가격 변동에 따른 손실 위험을 계량적으로 측정한 것이다. 일반상품을 기초로 한 파생상품의 경우, 주식, 채권과 유사하게 기초자산별로 매입 또는 매도 포지션을 분해하여 위험액을 산출한다. 일반상품위험액은 간편법 또는 만기사다리법 중 하나의 방식으로 산출할 수 있다.

옵션위험액은 바젤위원회에서 정한 델타플러스법에 근거하여 델타위험액, 감마위험액, 베가위험액을 합산하여 산출한다. 델타위험액은 기초자산 한 단위 변화에 따른 옵션 가격의 증감액을 뜻하며, 기초자산의 시장가격에 델타를 곱하여 순환산포지션을 산출한뒤 이를 기초자산 종류별로 구분하여 표준방법에 의해 시장위험액을 산출한다. 감마위험액은 기초자산의 델타 한 단위 변화에 따른 옵션 가격의 증감액을 뜻하며, 옵션포지션의 1/2에 감마값과 상정변동폭의 제곱값을 곱하여 산출하며 감마값이 음(-)인 경우에만 산출한다.53) 베가위험액은 기초자산의 변동성 한 단위 변화에 따른 옵션 가격의 증감액을 뜻하며, 옵션포지션의 1/4에 베가값과 기초자산의 변동성을 곱하여 산출한다.54) 델타플러스법과 달리 깊은외가격 옵션위험액을 별도로 산출하여 합산하는 것이 구별된다. 깊은외가격 옵션위험액은 행사될 확률이 낮은 콜옵션 또는 풋옵션을 매도한 포지션에 대해 기초자산별 포지션을 구분한 뒤 기초자산의 시장위험액의 20%만큼 곱하여 산출한다.

나) 신용위험액

신용위험액은 거래상대방의 채무 불이행 가능성을 고려한 손실 위험을 뜻한다. 신용위험액을 산정하는 대상에는 ① 예금, 예치금, 콜론, ② 증권의 대여 및 차입, ③ 환매조건부매도 및 환매조건부매수, ④ 대고객 신용공여, ⑤ 채무보증, ⑥ 대여금, 미수금, 미수수익, 기타 금전채권, ⑦ 잔여계약기간이 3개월 미만인 임차보증금, 전세권, ⑧ 선물, 선도, 스왑 등의 파생상품, ⑨ 사모사채, ⑩ 대출채권, ⑪ 한도대출약정 등을 포함한다. 이때 영업용순자본에서 차감하는 채무보증, 사모사채, 대출채권 등은 신용위험액 산정 대상에서 제외한다.

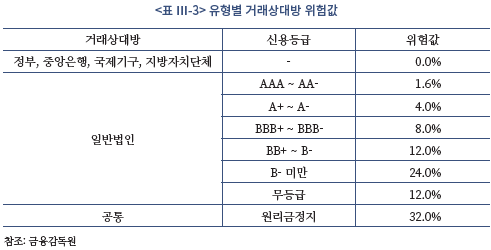

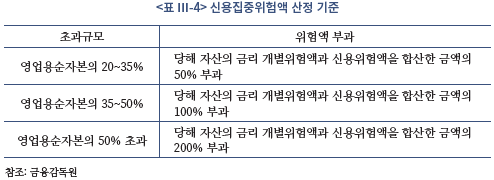

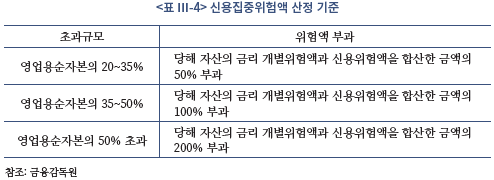

신용위험액을 산정할 때 경감을 받거나 가산을 할 수 있다. 거래상대방 또는 제3자로부터 담보를 제공 받는 경우, 신용위험액 산정 금액에서 담보금액을 차감한다. 적격 담보로 인정될 수 있는 자산으로는 현금 및 예ㆍ적금, 금(Gold), BB- 이상 신용등급을 가진 정부 및 공공기관 발행채권, 투자등급(BBB-) 이상의 회사채와 상장주식 등이 해당된다. 신용위험액 산정시 일정 요건을 만족하는 경우 신용집중위험액을 가산한다. 신용집중위험액은 동일인 또는 동일기업집단을 대상으로 한 금리위험액 산정포지션과 신용위험액 산정포지션의 합계가 영업용순자본의 20%를 초과할 때 부과한다. <표 Ⅲ-4>와 같이 금리위험액과 신용위험액의 합계가 영업용순자본의 20%, 35%, 50%를 초과할 때 마다 누적하여 금리개별위험액과 신용위험액을 합산한 금액의 각각 50%, 100%, 200%를 부과한다. 신용집중위험액은 바젤 방식과 미국 NCR 방식에는 찾기 어려운 위험 산출 항목으로, 동일기업집단이 신용위험을 과도하게 지지 않도록 하는 정책 목적 규제에 가까운 것으로 볼 수 있다. 한편 결제기일을 초과한 채권 등에 대해서는 결제기일 경과기간에 비례하여 일정 부분 신용위험액을 가산한다. 경과일이 0~15일인 경우 16%, 경과일이 16~30일인 경우 32%, 경과일이 31~60일인 경우 48%, 경과일이 60일을 초과하면 영업용순자본에서 차감한다.

다) 운영위험액

운영위험액은 증권회사가 사고, 착오, 위법행위, 기타 예상치 못한 사건으로부터 발생할 수 있는 손실 가능성을 계량화한 것이다. 운영위험액은 시장위험액, 신용위험액 등과 달리 보유 자산 포지션의 손실 가능성을 계량화하는 것이 어렵다. 운영위험액을 객관적으로 측정하기 어려움에도 불구하고 금융회사의 대규모 손실 사건은 운영리스크 관리를 소홀히 해서 발생하였다. 이에 바젤위원회는 운영리스크 산정 표준방법 등을 도입하여 금융회사의 영업활동을 세분화하고 영업활동별로 위험값을 부과하여 해당 위험값과 영업활동별 영업수익을 고려하여 운영위험액을 산출하고 있다.

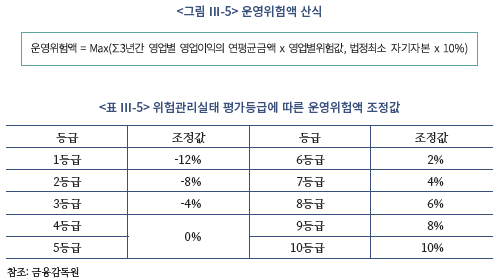

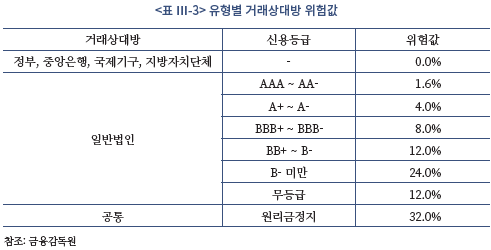

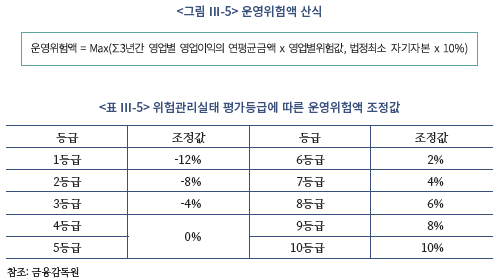

한국 증권업 자기자본 규제 비율 산정시 바젤의 운영리스크 표준방법을 준용하여 운영위험액을 산출하고 있다. 운영위험액은 최근 3년간 영업별 영업이익의 연평균금액과 영업별 위험계수를 곱한 금액과 법정최소자기자본금액의 10% 중에서 큰 값으로 정의하고 있다. 증권회사의 영업은 투자중개업, 증권 투자매매업, 파생상품 투자매매업, 투자은행업, 자산관리업 등으로 구분하여 각각 12%, 18%, 18%, 18%, 12% 등의 위험값을 부과하고 있다. 운영위험액은 금융당국의 위험관리실태 평가등급에 따라 최대 12%의 경감을 받거나 10%의 할증을 받을 수 있다(<표 Ⅲ-5> 참조).

2. 한국 증권업 자기자본 규제 진단

가. 순자본비율 도입의 의의

2014년 금융위원회는 자기자본 규제 비율을 (구)NCR 비율 체계에서 순자본비율 체계로 바꿈으로써 금융투자회사의 모험자본 공급 확대와 해외진출을 적극 지원하고, 손실흡수능력을 제고시켜 자본시장의 역동성 제고를 도모하고자 했다. 순자본비율 체계는 2015년 자율 전환 시기를 거쳐, 2016년부터 전 금융투자회사에 대해 적용이 되었으며, 순자본비율 체계 전환 이후 금융당국의 정책 추진 방향에 부합하고, 부작용 등 우려가 제기되지 않았는지 체계적인 분석이 필요하다.

우선 2014년 도입한 순자본비율 도입으로 한국 증권업 자기자본 규제는 미국 NCR 방식에 보다 가까워진 것으로 판단한다. 본 보고서의 Ⅱ장 2절에서 살펴보았듯이, 2021년 하반기부터 영국과 유럽의 금융투자회사 자기자본 규제 방식은 영업용순자본을 위험액에 비례하여 보유해야 하는 방식에서 위험액 대비 임계수준을 초과한 수준까지만 영업용순자본을 보유하는 방식인 미국 NCR 방식으로 변경된다. 은행업무를 수행하는 대형 금융투자회사는 은행과 동일한 바젤 규제를 적용받으며, 투자매매업과 투자중개업, 자산관리업 위주로 수행하는 금융투자회사들은 청산기업 관점의 유동성 규제 방식에 가까운 (미)NCR 방식의 규제를 적용받는다. 미국 등 기존 NCR 방식을 따르는 주요 국가의 증권업 자기자본 규제 산식은 큰 변화가 없는 가운데, 전통적인 투자매매업과 투자중개업을 수행하는 금융투자회사들의 자기자본 규제는 (미)NCR 방식으로 수렴하는 것으로 볼 수 있다.55) 즉 순자본비율 규제는 위험액 대비 순자본이 임계값을 초과하는 방식으로 변경되었기 때문에 (미)NCR 방식에 가까워졌고, 이는 한국 자기자본 규제가 주요국 증권업 자기자본 규제 철학에 가까워진 것으로 판단한다.

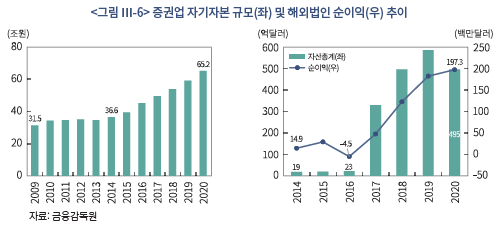

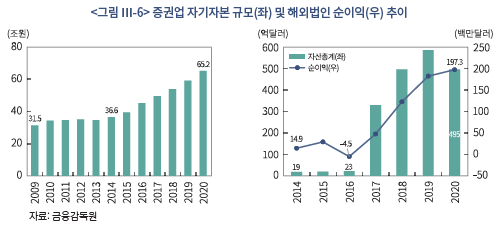

다음으로 금융당국이 순자본비율 도입 당시 추구했던 글로벌IB로서의 경쟁력 강화 부분이 어느 정도 달성되었는지 살펴보고자 한다. 2014년 순자본비율 체계로 전환시 금융당국은 한국 증권회사를 글로벌IB와 견줄 수 있도록 충분한 자기자본 규모를 갖춘 초대형IB로 육성하고, 해외진출을 촉진시키고 IB업무 역량 제고를 통해 기업금융을 확대하려는 목표를 제시했다.56) 첫째, 한국 증권회사의 대형화 육성 측면에서는 그 목표를 달성했다고 판단한다. 2020년말 국내 증권회사의 자기자본 총계는 65.2조원으로 2014년말 36.6조원 대비 28.8조원(78.1%) 증가했다. 동기간 아시아 최대 증권회사인 노무라 그룹의 자기자본 규모가 227억 달러에서 248억 달러로 9.3% 증가에 그쳤고, 글로벌 금융위기 직후 국내 증권회사의 자기자본 총계가 5.1조원(16.2%) 증가한 것과 비교하면 2014년말 자기자본 규제 체계 개편 이후 국내 증권회사의 자기자본 규모가 큰 폭으로 증가했다 (<그림 Ⅲ-6> 참조). 2015년 순자본비율 체계 도입 이후 대형 증권회사를 중심으로 잉여자본을 충분히 활용할 수 있게 됨에 따라 순영업이익이 크게 증가했고, 2016년 초대형IB 제도 도입으로 기업금융 인가 취득을 위해 대형회사의 유상증자가 크게 증가한 점도 긍정적인 영향을 미쳤다.

둘째, 자기자본 규제 체계 개선 이후 국내 증권회사의 해외진출 규모가 증가했다. 당시 연결 기준 순자본비율 규제 체계를 도입하며, 해외 현지법인 설립에 따른 출자지분이 영업용순자본의 차감 항목에서 제외되는 등 국내 증권회사의 해외진출 활성화를 도모하고자 했다. 실제 2014년말 국내 증권회사의 해외법인 자산총계 규모는 19억달러(약 2.1조원)에 불과했으나 2020년말 해외법인 자산총계 규모는 495억달러(약 5.5조원)로 26배나 증가했다(<그림 Ⅲ-6> 참조). 국내 증권회사의 적극적인 해외진출과 현지화 전략에 힘입어 해외법인의 순이익도 큰 폭으로 개선되었다. 2014년 국내 증권회사 해외법인의 순이익은 약 1,500만달러(약 180억원)에 불과했으나 2020년 해외법인의 순이익은 약 1억9,700만달러(약 2,340억원)로 13배 증가했다. 중국, 인도, 베트남, 인도네시아 등 동남아시아 국가에서 자본시장 중개 수요가 빠르게 늘고 있어, 향후 국내 증권회사의 해외법인수익성 증가 현상은 지속될 것으로 전망한다.

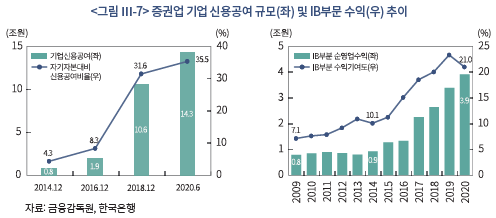

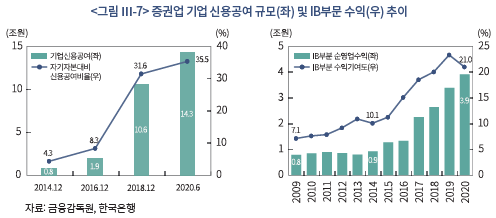

셋째, 자기자본 규제 개편 이후 국내 증권회사의 IB부문 사업 역량이 개선되었다. 당시 자기자본 규제 비율 산식 개선으로 대형 증권회사들은 필요 이상의 유휴 자본을 보유하지 않아도 되어 기업금융 등에 대규모 자본투자를 수행하는 것이 용이해졌다. 또한 기업에 대한 3개월 이상 대출 금액을 영업용순자본에서 차감하는 대신 신용위험액으로 반영함에 따라 기업대출에 대한 위험 산출이 합리적으로 변경되었으며, M&A 관련 출자지분이 영업용순자본 차감 항목에서 제외되어 M&A 업무가 보다 수월해졌다. <그림 Ⅲ-7>에서 보듯이 국내 증권회사의 기업 신용공여 규모는 2014년 0.8조원에서 2020년 상반기 14.3조원으로 약 18배 증가했다. 동기간 자기자본 대비 기업 신용공여 규모 비율도 4.3%에서 35.5%로 크게 늘었다. 2014년말 자기자본 규제 개편과 더불어 2016년 도입한 초대형IB 육성 정책도 국내 증권회사의 IB부문 역량 제고에 크게 기여했다. 2014년 국내 증권회사의 IB부문 영업수익은 0.9조원으로 전체 영업수익의 10.1%에 불과했으나, 2020년 IB부문 영업수익은 3.9조원으로 전체 영업수익의 21%까지 확대되었다.

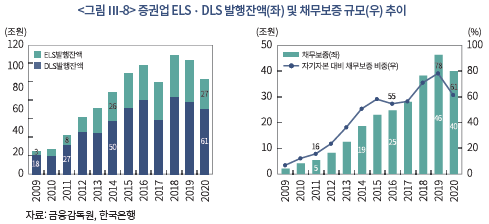

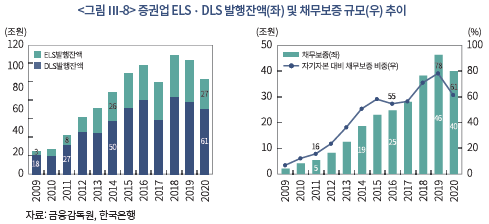

2014년 자기자본 규제 체계 개편에 대한 우려도 존재한다. 일부 증권회사의 경우 자기자본 확충을 통해 모험자본 공급과 해외진출 확대를 추진하기보다 ELSㆍDLS 발행과 부동산PF 채무보증 확대를 통해 보다 높은 수익성을 추구하려는 경향이 관찰되었다. <그림 Ⅲ-8>에서 보듯이 최근 5년간 ELSㆍDLS 발행잔액 및 채무보증 규모가 큰 폭으로 증가했다. 2014년말 ELSㆍDLS 발행잔액은 76조원을 기록했으나, 2019~2020년에는 약 90~100조원 수준을 기록하고 있다. 동기간 국내 증권회사의 채무보증 규모 역시 19조원에서 40조원으로 약 2배 증가했다. ELSㆍDLS 발행과 부동산PF 채무보증 부문은 꼬리 위험을 내재한 사업으로, 위기 상황이 발생하지 않으면 위험 대비 높은 수익을 추구할 수 있으나 위기 상황 발생시 상당한 규모의 손실이 발생할 수 있는 위험을 가지고 있다. 이에 BIS, FSB 등 주요국 국제감독기구는 ELSㆍDLS 발행과 부동산PF 채무보증을 시스템리스크 잠재 위험이 높은 부문으로 분류하고 있다. 따라서 2014년 자기자본 규제 체계 개편 이후 일부 증권회사를 중심으로 ELSㆍDLS 발행과 부동산PF 채무보증 규모를 늘린 것은 금융당국의 추진한 모험자본 공급과 해외진출 등의 취지와 부합하지 않는 것으로 판단한다.

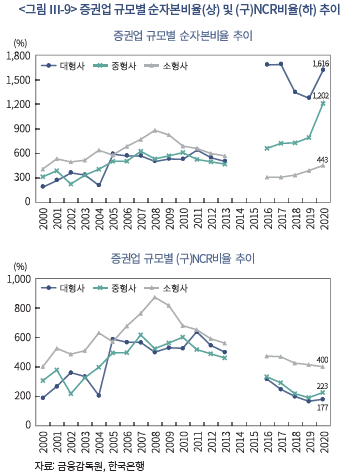

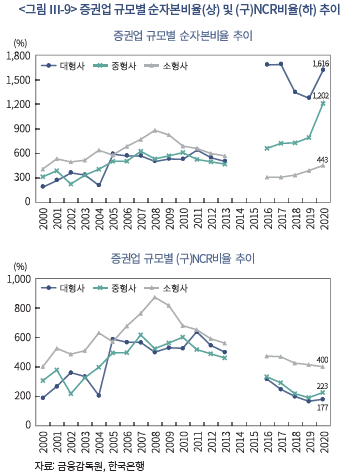

2016년 자기자본 규제 개편이 본격적으로 시행된 이후 증권회사 규모별로 순자본비율의 변화 양상은 다르게 관찰된다. 우선 대형 증권회사와 중형 증권회사57)의 순자본비율은 자기자본 규제 개편 이후 큰 폭으로 증가했다. 2020년말 대형ㆍ중형 증권회사의 순자본비율은 각각 1,616%와 1,202%로 2014년말(423%, 401%) 대비 각각 1,193%p, 801%p 증가했다(그림 <Ⅲ-9>) 참조). 그러나 소형 증권회사의 순자본비율은 자기자본 규제 개편 이후 오히려 다소 감소했다. 2020년말 소형 증권회사의 순자본비율은 443%로 2014년말 588% 대비 145%p 줄었다. 순자본비율 산식에 필요한 필요유지 자기자본은 대형, 중형, 소형 증권회사 모두 거의 동일하지만, 분자항목인 총위험액 대비 영업용순자본 금액은 자기자본 규모에 비례할 가능성이 크기 때문이다. 실제 증권회사 규모별로 (구)NCR 비율 추이를 살펴보면, 대형, 중형, 소형 증권회사 모두 자기자본 규제 개편 이후 (구)NCR 비율이 감소했다. 바젤 방식의 건전성 위험 관점에서는 국내 증권회사 전체적으로 자기자본대비 총위험액이 다소 증가했으며, 대형 증권회사일수록 자기자본 대비 예상손실규모 비율이 증가한 것으로 이해할 수 있다. 즉, 대형 및 중형 증권회사의 경우 자기자본 규제 개편 이후 자기자본 규제 준수 부담이 다소 줄었으나 소형 증권회사는 자기자본 규제 준수부담이 다소 확대된 것으로 판단할 수 있다. 이에 국내 주요 신용평가회사는 국내 증권회사에 대한 건전성 위험을 측정하는 항목으로 순자본비율 대신 (구)NCR 비율을 주로 사용하는 것으로 알려져 있다.

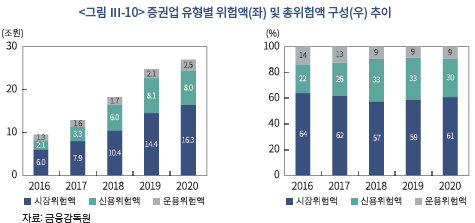

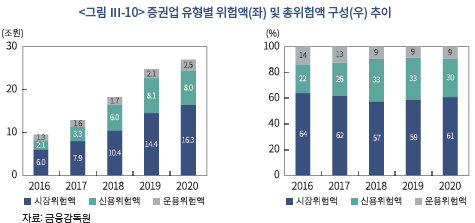

증권회사의 총위험액을 유형별로 살펴보면 순자본비율 체계 개편 이후 신용위험액 비중이 비교적 크게 증가한 것으로 확인된다(<그림 Ⅲ-10> 참조). 2020년말 국내 증권회사의 신용위험액은 8조원으로 2016년말58) 2.1조원 대비 약 4배 증가했으며, 신용위험액이 차지하는 비중 역시 2016년말 23%에서 2020년말 30%로 7%p 증가했다. 동기간 시장위험액은 6조원에서 16.3조원으로 2.7배 증가했고, 시장위험액이 차지하는 비중은 64%에서 61%로 3%p 감소한 것을 고려하면 신용위험액 비중이 상대적으로 크게 증가했다. 2016년 이후 국내 증권회사의 기업 신용공여 규모가 큰 폭으로 증가했고, 영업용순자본에서 차감했던 신용리스크 관련 항목을 신용위험액으로 반영함에 따라 총위험액 중 신용위험액 비중이 증가한 것이다. 순자본비율 체계 개편 이후 국내 증권회사들이 신용리스크를 보다 많이 떠안고 기업금융 업무를 확대해 온 것으로 평가할 수 있다. 다만 국내 증권회사의신용위험액 비중은 시장위험액의 절반 수준에 불과하여 국내 은행의 사업리스크 구성과는 다소 구별된다고 볼 수 있다.

나. 증권업 자기자본 규제의 규제 격차 분석

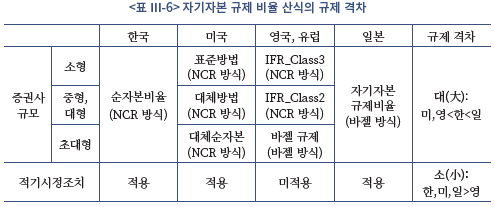

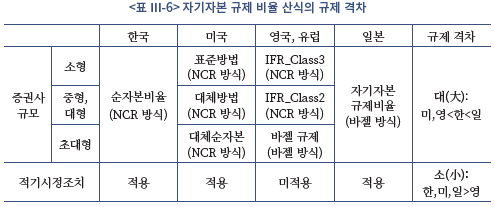

1) 자기자본 규제 비율

순자본비율 도입으로 한국 증권업과 주요 선진국 증권업의 자기자본 규제 격차는 다소 완화된 것으로 판단한다(<표 Ⅲ-6> 참조). (구)NCR비율은 일본 자기자본 규제 비율을 벤치마크한 것으로, 계속기업 관점에서 건전성 위험을 중요시하는 바젤 방식의 자기자본 규제 철학에 가까웠다. 한국 증권회사의 고객예탁금은 외부기관에 별도 예치되어 있고, 증권회사의 대규모 손실이 투자자 및 타 금융회사의 손실로 전이될 가능성이 높지 않아 바젤 방식의 자기자본 규제는 다소 엄격한 규제라는 인식이 컸었다. 금융위원회(2014)에서 발표한 바와 같이, 2016년부터 본격적으로 시행된 한국 순자본비율 규제는 청산기업 관점에서 유동성 위험을 중요시하는 미국 NCR 방식에 가까워졌다. 최근 영국과 유럽의 금융당국이 증권업 자기자본 규제 방식을 실질적으로 미국 NCR 방식으로 전환함에 따라 국제적으로 증권업 자기자본 규제 방식은 미국 NCR 방식으로 수렴해가고 있다고 판단한다. 이에 한국의 순자본비율 규제는 (구)NCR 규제보다 주요국 자기자본 규제 방식에 보다 가까워진 것으로 보인다.

다만 증권회사의 규모에 따라 자기자본 규제 비율의 선택 사항이 없다는 측면에서 한국의 규제 강도가 미국, 영국, 유럽 등에 비해 다소 높은 것으로 보인다. 예를 들어, 미국 증권회사는 표준방법, 대체방법을 선택적으로 사용할 수 있으며 일정 규모를 초과한 대형 증권회사의 경우 내부모형을 고려한 대체순자본방법과 표준방법, 대체방법 등을 선택적으로 사용할 수 있다. 2021년 하반기부터 적용될 새로운 자기자본 규제 체계에서, 유럽과 영국의 증권회사 역시 증권회사의 규모에 따라 자기자본 규제 비율 산식을 다르게 적용하고 있다. 업무 범위가 협소하고 규모가 작은 소형 증권회사는 간소한 NCR 방식 규제를 적용받으며, 중형사와 대형 증권회사의 경우 (미)NCR 방식의 자기자본 규제를 적용받는다.

초대형 증권회사의 자기자본 규제 방식에 있어서도 국가별로 다소 차이가 난다. 미국 초대형 증권회사가 은행의 여신 업무 등을 확대하여 시스템적 중요기관(SIFI: Systemi-cally Important Financial Institution)으로 선정되면, SEC의 자기자본 규제 비율 준수 의무 외에도 바젤위원회에서 정한 보통주자본비율 규제, 유동성비율 규제 등을 준수해야 한다. 유럽과 영국의 초대형 증권회사가 은행의 여신 업무 등을 확대하여 시스템적 중요기관 또는 이와 유사한 위험을 가진 기관으로 선정되면, 대형 은행처럼 바젤 방식의 자기자본 규제를 준수해야 한다. 반면 한국 초대형 증권회사의 경우 여신 기능 규모에 상관없이 중소형 증권회사와 동일한 순자본비율 규제를 적용받는다. 한국에서는 은행과 은행 계열 금융지주회사에 대해서만 시스템적 중요기관 여부를 판단하기 때문에 초대형 증권회사에 대해서는 공식적으로 시스템리스크 잠재 위험 여부를 살펴보지 않고 있다. 다만 한국의 초대형 증권회사가 은행 계열 금융지주회사의 자회사로 편입된 경우, 해당 금융지주회사 전체적으로 적용받는 바젤 규제를 준수해야 한다. 증권회사의 모회사 또는 연결 대상 금융회사가 은행업을 영위하여 바젤 규제를 적용받는 부분은 한국과 주요국 모두 동일한 사항이다.

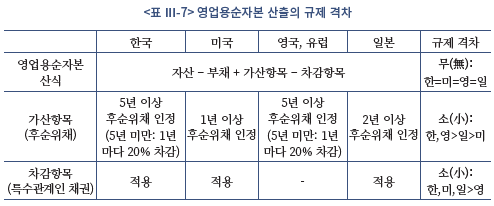

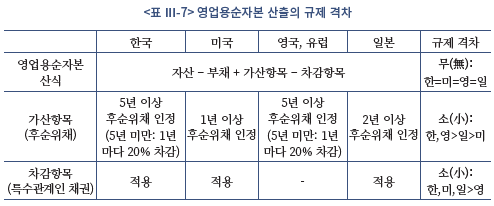

2) 영업용순자본

영업용순자본은 증권회사가 보유한 유동화 가능 순재산을 기준으로 산출한다는 점에서 한국과 주요국의 규제 격차가 크지 않다(<표 Ⅲ-7> 참조). 한국, 미국, 영국, 유럽, 일본 등 주요국 감독당국은 증권회사의 재무상태표상 자산에서 부채를 차감한 것을 기준으로 영업용순자본을 산출하며 현금화 가능여부에 따라 가산항목을 더하고 차감항목을 제외한다. 이때 국가마다 가산항목과 차감항목을 정하는 현금화 가능 기준이 다소 상이하다. 예를 들어 미국은 1년 이내에 현금화가 가능한 순재산들을 영업용순자본에 포함시키고 있으며, 한국은 즉시 현금화가 가능한 순재산들을 영업용순자본에 포함시키는 것을 원칙으로 하고 있어59), 한국 증권업의 현금화 가능 시기의 판단 기준이 다소 엄격한 것으로 보인다.

가산항목과 차감항목 관련해서는 주요 국가들에서 큰 차이가 없으나, 가산항목에 포함되는 후순위채권에 대해 한국이 다소 엄격한 규제를 부과하는 것으로 보인다. 미국은 잔존만기가 1년 이상인 후순위채권을 보완자본으로 인정하여 가산항목에 반영하며, 일본은 잔존만기가 2년 이상인 후순위채권을 가산항목에 반영한다. 반면 한국은 잔존만기가 5년 이상인 후순위채권에 대해 100% 가산항목에 반영하며, 잔존만기가 5년 미만의 후순위채권에 대해 5년 기준 시점에서 1년 단위로 잔존만기가 짧을수록 20% 금액을 할인하여 가산항목에 반영한다. 영국과 유럽의 경우 2021년 하반기 자기자본 규제 체계 개선으로 한국과 동일한 방식으로 후순위채를 순자본에 반영하고 있다. 차감항목 중에서는 특수관계인채권을 100% 차감하는 것이 다소 엄격한 규제로 볼 수 있다. 미국, 일본 등도 계열회사 등 특수관계인채권을 차감하는 것을 원칙으로 하고 있으나, 한국의 경우 특수관계인의범위가 넓어60) 규제가 다소 엄격하다는 지적이 있다.

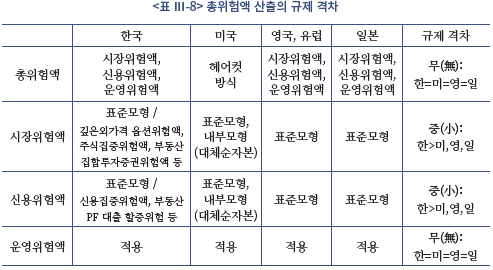

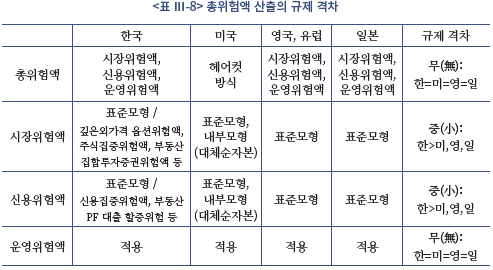

3) 총위험액

총위험액을 산출하는 방식에 있어서는 한국과 주요 국가들간 큰 차이가 없다(<표 Ⅲ-8> 참조). 한국, 영국, 유럽, 일본 등에서는 총위험액을 시장위험액, 신용위험액, 운영위험액 등의 합으로 정의하며 미국에서는 헤어컷 방식으로 산출한다. 한국 금융당국은 시장위험액과 신용위험을 산출할 때 표준모형 외에 내부모형 사용을 허용하였으나, 해당 위험액 산출시 감독당국으로부터 내부모형을 승인받아 사용하는 국내 증권회사의 사례는 찾기 힘들다. 반면 미국의 경우 상당수 대형 증권회사들은 SEC로부터 내부모형을 승인받아 자체 계산한 헤어컷 방식으로 총위험액을 산출하고 있다.

총위험액을 구성하는 시장위험액, 신용위험액 등을 산출하는 방법에 있어서 한국과 주요 국가들 간에 다소 규제 격차가 존재한다. 한국, 미국, 영국, 일본 등은 금융투자상품 기초 자산별 특징을 고려하여 위험값을 부과하며, 기초자산 유형에 따라 주식위험액, 금리위험액, 일반상품위험액, 집합투자증권위험액, 옵션위험액 등을 산출하고 이를 합산하여 시장위험액을 산출한다. 기초자산별 위험값은 개별 국가의 감독당국이 기초자산의 손실 위험을 계량화하여 정하는데, 미국이 상대적으로 위험값을 엄격하게 부과하고 있으며 한국의 위험값은 타 국가들 대비 높지 않다.

그러나 한국의 경우 시장위험액 산출시 기초자산의 경제적 위험을 고려하지 않고, 정책적 목적을 고려하여 다소 높은 위험값을 부과하는 사례가 다수 관찰된다. 옵션위험액 산출시 국제적으로 표준화된 델타플러스 산출 방식 외에 깊은외가격 옵션위험액을 별도로 산출하는 것이 대표적이다. 감독당국이 증권회사로 하여금 외가격옵션에 대해 과도한 매도포지션의 보유를 제한할 목적으로 해당 깊은외가격 옵션위험액을 추가한 것으로 보인다. 주식위험액 산출시 개별위험액, 일반위험액과 별도로 주식집중위험액을 부과하는 것도 미국, 영국, 유럽, 일본 등의 규정에서는 찾기 어렵다. 주식집중위험액은 특정 기업의 주식을 발행주식 총수의 5%를 초과하여 보유하거나 공매도를 수행하는 경우 초과분에 대해 할증위험액을 부과하는 것으로, 감독당국이 증권회사로 하여금 특정 기업의 주식 보유를 발행주식 총수의 일정 수준 이내로 제한하려는 정책 목적이 크다. 집합투자증권위험액 산출과 관련해서 최근 가계부채 증가와 부동산 금융상품으로의 쏠림을 억제하기 위해 부동산 관련 집합투자증권의 위험값을 24%에서 60%로 상향한 것도 경제적 위험보다는 정책 목적으로 시장위험액을 부과한 사례로 꼽을 수 있다. 깊은외가격 옵션위험액, 주식집중위험액, 부동산 관련 집합투자증권위험액 등은 주요국 총위험액 산출 사례에서는 찾기 어려운 항목들로,한국 금융당국이 경제적 위험을 고려해서 시장위험액을 부과했다기보다 정책 목적으로 시장위험액을 부과한 사례로 볼 수 있다.

한국의 신용위험액 산출 방식은 기초자산별 거래상대방 부도위험과 만기 등을 고려하여 위험계수를 부과하는 방식으로, 큰 틀에서는 한국, 미국, 영국, 유럽, 일본 등에서 차이가 나지 않는다. 다만 세부 항목에서 경제적 위험보다는 정책 목적을 고려하여 신용위험액을 부과한 사례가 관찰된다. 동일인 또는 동일기업집단을 대상으로 한 금리위험액 산정포지션과 신용위험액 산정포지션의 합계가 영업용순자본의 20%를 초과할 때 부과하는 신용집중위험액이 대표적이다. 신용집중위험액은 주요 국가에서는 찾기 어려운 위험산출 항목으로, 동일기업집단간 여신 활동을 억제하려는 정책 목적 규제에 가까운 것으로 볼 수 있다. 부동산PF 대출의 거래상대방 위험값에 가중치를 부여한 규정도 정책 목적규제로 볼 수 있다. 2018년 7월 금융당국은 부동산 금융상품 쏠림을 억제하기 위해 종합금융투자회사가 만기 1년을 초과하는 부동산PF 대출을 수행하는 경우 거래상대방 위험값에 1.5배의 할증위험액을 부과했다. 신용집중위험액과 부동산PF 대출에 대한 할증위험값 부과 등은 경제적 위험을 고려하기보다 정책 목적 규제로 볼 수 있다.

3. 한국 증권업 레버리지비율 규제의 논의

가. 레버리지비율 도입의 의의

레버리지비율 규제는 자기자본 대비 총부채 규모를 일정 비율 이내로 제한하는 규제로, 금융회사로 하여금 자기자본 대비 과도한 부채의 사용을 억제함으로써 금융회사의 파산을 예방하고 금융회사 파산으로 타 금융회사까지 손실이 전이될 위험을 최소화하는 것을 주된 목적으로 한다. 즉 레버리지비율 규제는 시스템리스크 억제를 목표로 하는 건전성 규제 수단으로 자기자본 규제의 보완수단으로 활용하는 것이다. 자기자본 규제는 금융회사가 보유한 자산을 중심으로 손실 위험 비례의 원칙을 적용하고 있으나, 레버리지비율 규제는 금융회사가 보유한 부채를 중심으로 채권자의 최대 손실 억제 원칙을 적용하는 점에서 구별된다.

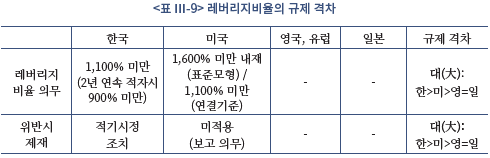

2008년 글로벌 금융위기 이전에는 대형 금융회사에 대해 레버리지비율을 일정 수준 이내로 제한을 둔 사례를 찾기 어려웠으나, 2009년 G20 피츠버그 정상회담에서 글로벌 금융위기의 재발을 막고 금융안정을 제고하기 위해 장외파생상품 규제 개혁과 더불어 레버리지비율 규제 도입 방안을 발표했다.61) 바젤은행감독위원회(BCBS)는 2015년부터 글로벌 주요 은행들에 대해 레버리지비율 공시를 의무화했으며, 2018년부터 자체 산정한 레버리지비율 3%을 준수하도록 규정했다.62) 증권업에 대해 레버리지비율 규제를 적용한 사례는 미국 외에는 찾기 어렵다. 미국은 1930년대 브로커-딜러에게 건전성 규제를 도입할 당시 총채무 비율을 순자본의 20배 이내로 규정한 사례가 있으며 1975년 통일 순자본규제 도입 이후 표준방법을 사용하는 소형 브로커-딜러에게 총채무 규모가 일정 수준을 초과하는 경우 총채무를 순자본의 15배 이내로 유지하는 방향으로 규율하고 있다.63)

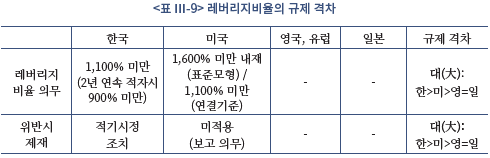

나. 증권업 레버리지비율 규제의 규제 격차 분석

증권회사에 대해 엄격한 레버리지비율 규제를 적용하는 국가는 한국을 제외하고는 찾기 어렵다. 한국은 2016년 순자본비율 시행에 맞추어 파생결합증권의 과도한 발행 등 과도한 부채 증가를 억제하는 것을 목표로 증권회사에 대해 레버리지비율 규제를 도입했다. 증권업 레버리지비율을 조정총자본64) 대비 조정총자산65)의 비율로 정의하고, 해당 레버리지비율이 1,100% 이상이거나 2년 연속 적자이고 레버리지비율이 900% 이상인 회사에게는 경영개선 권고 명령을 내리고, 레버리지비율이 1,300% 이상이거나 2년 연속 적자이고 레버리지비율이 1,100% 이상인 회사에게 경영개선 요구를 조치하는 등 적기시정조치 규제를 부여했다. 이때 발행어음 조달로 운영한 자산 또는 종합투자계좌(IMA) 수탁금 운영 자산은 조정총자산에서 제외함으로써 초대형IB 인가 취득 증권회사에게 유인부합적인 인센티브를 제공했다.

한국이 증권회사에 대해 적기시정조치의 일환으로 엄격한 레버리지비율 규제 의무를 부과하는 것과 달리, 영국, 유럽, 일본 등 주요 국가에서는 증권업에 대해 레버리지비율 준수 의무를 부과하지 않는다. 미국의 경우 개별 브로커-딜러와 브로커-딜러의 연결회사에게 적용하는 레버리지비율 규제 강도가 다르다. 우선 표준방법을 사용하는 소형 브로커-딜러가 다소 높은 수준의 총채무를 보유한 경우, 총채무를 자기자본의 15배 이내로 유지해야 하는 의무를 자기자본 규제의 일환으로 부과했다.66) 그 외 대체방법과 대체순자본방법을 사용하는 브로커-딜러의 경우 개별 회사가 레버지지비율을 일정 수준 이내로 유지할 의무는 없다. 다만 브로커-딜러의 연결기준 회사의 레버리지가 1,100%를 상회하는 경우 금융당국에게 보고할 의무가 부여된다. 레버리지비율 보고 의무와 관련해서, 한국과 달리 적기시정조치 의무를 부여하는 것은 아니므로 미국 브로커-딜러의 규제 강도는 한국에 비해서 다소 낮은 것으로 판단한다.

Ⅳ. 한국 증권업 건전성 규제의 바람직한 방향

본 연구에서는 주요국 증권업 건전성 규제를 소개하고 한국 증권업 건전성 규제와의 규제 격차 분석을 통해 한국 증권업 자기자본 규제를 진단하였다. 우선, Ⅱ장에서는 미국 NCR 방식 규제, 유럽의 바젤 방식 규제, IOSCO의 증권업 규제 권고안을 분석하고 주요국 증권업 규제의 특징을 분석하였다. Ⅲ장에서는 한국 증권업의 자기자본 규제를 소개하고 순자본비율 규제 도입이 증권업에 미치는 영향을 수익성, 건전성, 해외진출, 사업범위 다변화 등 다양한 각도로 분석하였다. 또한 한국 증권업 건전성 규제를 자기자본 규제와 레버리지비율 규제로 구분하고 각각 해외 주요국 자기자본 규제 및 레버리지비율 규제와 비교 분석을 통해 규제 격차를 진단하였다. 본 절에서는 앞장의 분석을 기초로 한국 증권업 건전성 규제를 종합적으로 평가하고 부정적 평가에 대한 우려를 최소화하며 동시에 건전성 규제의 본연의 의의를 제고하는 방향으로 한국 증권업 규제의 개선 방향을 제시하였다.

1. 한국 증권업 건전성 규제의 종합 평가

주요국 증권업 건전성 규제를 살펴본 결과 미국 NCR 방식은 청산기업 관점의 유동성 규제에 보다 가깝고, 바젤 방식은 계속기업 관점의 건전성 규제에 보다 가깝다는 것이 차별화된 특징이다. 2021년 하반기 이후 유럽 바젤 방식의 규제가 대폭 개선됨에 따라 유럽내 증권업 건전성 규제는 실질적으로 미국 NCR 방식으로 변화되는 것으로 볼 수 있다. 시스템리스크 위험에 노출된 초대형 증권회사를 제외하고는 유럽내 주요 증권회사의 자기자본 규제는 규모별로 유동성 규제 철학에 보다 가까운 미국 NCR 방식에 가까워졌다. IOSCO는 1987년 블랙먼데이 사태를 계기로 글로벌 주요 국가로 하여금 증권업 자기자본 규제 도입 필요성을 제시했으며, 보유 자산의 경제적 위험에 비례하여 위험액을 산출하고 관련 손실을 충분히 커버할 수 있을 정도로 순유동성 자산을 보유하는 것을 권고하고 있다.

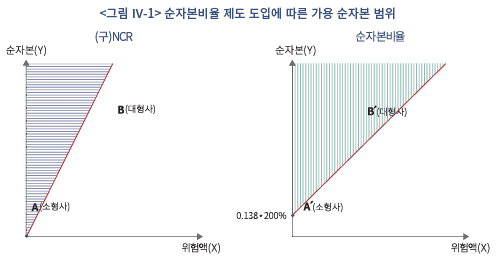

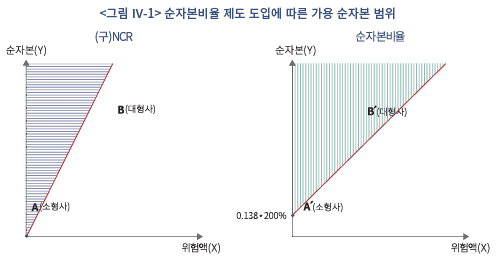

한국 증권업 자기자본 규제는 2016년 순자본비율 시행 이후 바젤 방식과 미국 NCR 방식이 혼합된 방식에서 미국 NCR 방식 규제에 보다 가까워졌다. 순자본 및 위험액 산출 관련해서는 큰 변화가 있지는 않았으며 자기자본 규제 비율 산식이 바젤 방식에서 미국 NCR 방식으로 바뀐 것이 가장 큰 변화로 요약할 수 있다. 바젤 방식의 (구)NCR 산식은 위험액에 비례하여 영업용순자본을 많이 보유하는 방식이었으나, 미국 NCR 방식을 벤치마크한 순자본비율에서는 임계수준의 위험액(필요자기자본의 70% 등)만 초과해서 영업용순자본을 보유하면 되므로, (구)NCR 산식에 비해 충분히 유휴자본을 활용할 수 있게 되었다. <그림 Ⅳ-1>에서 보듯이 과거 장외파생상품 업무를 취급할 수 있는 기준인 200% 이상의 (구)NCR 비율을 유지하기 위해서는 파란색 위험액의 2배를 초과하는 순자본에 대해서만(좌, 파란색 빗금영역) 유휴 자본으로 활용할 수 있었다. 반면 순자본비율 도입으로 가용 순자본의 범위(우, 초록색 빗금영역)는 우측 방향으로 크게 확대된 것을 확인할 수 있다.

한편 순자본비율 제도의 도입에 따른 가용 순자본 확대의 효과는 증권회사 규모별로 다르게 나타났다. <그림 Ⅳ-1>에서 보듯이 (구)NCR에서 자기자본 규제 비율 준수에 큰 문제가 없었던 소형 증권회사 A는 순자본비율 제도 하에서(A´) 자기자본 규제 비율을 준수하는 데 어려움이 있다. 즉 소형 증권회사의 경우 순자본비율 제도 도입으로 유휴 자본을 활용하는 데 제약이 따를 수 있다. 반면 대형 증권회사의 경우 유휴 자본이 증가하는 효과를 누릴 수 있다. (구)NCR에서 유휴 자본을 활용하는데 제약을 받았던 대형 증권회사 B는 순자본비율 제도 하에서(B´) 충분히 자기자본 규제 비율을 준수할 수 있게 된다. 즉 상당수 중대형 증권회사들은 순자본비율 도입으로 유휴 자본이 증가하는 효과를 누릴 수 있다.

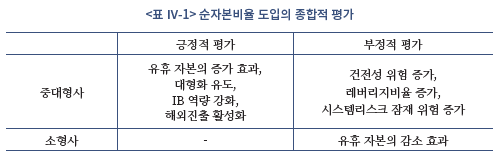

이처럼 상당수 중대형 증권회사들은 순자본비율 도입 이후 유휴 자본이 크게 증가하는 등 2014년 금융위원회가 발표한 순자본비율 도입의 정책적 목표를 어느 정도 달성한 것으로 판단한다. 구체적으로 순자본비율 도입 이후 한국 증권업의 자기자본 규모가 빠르게 늘고 해외법인 진출도 적극적으로 수행하였을 뿐 아니라 IB부문 수익이 큰 폭으로 증가했다. 반면 순자본비율 도입 이후 건전성 위험이 다소 증가하고 시스템리스크 위험이 확대되는 등 순자본비율 제도 도입의 부정적 평가도 일부 존재한다. 순자본비율 도입이후 파생결합증권 발행규모 및 부동산PF에 대한 채무보증 규모가 빠르게 증가하는 등순자본비율 도입에 따른 위험투자 여력 증가에도 불구하고 일부 증권회사는 그림자금융에 대한 사업을 늘렸다. 이처럼 고위험 사업 비중이 증가함에 따라 순자본비율 도입 이후(구)NCR 비율이 큰 폭으로 하락하고 타 금융업과 달리 레버리지비율이 증가하는 등 순자본비율 제도가 의도하지 않았던 건전성 위험이 부각되었다. 순자본비율 증가에도 불구하고 과거 건전성 지표((구)NCR 등)는 다소 악화되고 있는 등 순자본비율 지표가 금융회사의 건전성을 관리하는 데 효과적인 수단인지에 대한 의구심이 제기되고 있다. 한편 소형증권회사의 경우 순자본비율 도입으로 위험투자 여력이 상대적으로 감소함에 따라 수익성을 개선하고 업무범위를 다변화하는 데 다소 제한이 따른 것으로 판단한다.

한국 증권업 자기자본 규제를 주요국과 비교 분석한 결과, 자기자본 규제 비율, 영업용순자본, 그리고 총위험액을 산출하는 부분에 있어서 주요국 대비 대체로 규제 강도가 높은 것으로 파악되었다. 우선 자기자본 규제 비율 산출에 있어서는 한국과 주요 국가와 큰 차이가 없으나 한국의 경우 증권회사 규모에 상관없이 동일한 자기자본 규제 비율을 적용하는 점에서 규제 강도가 다소 높다. 국제적으로 은행업 기능을 영위하며 시스템리스크 잠재 위험이 큰 글로벌IB들은 엄격한 바젤 규제를 적용받으며, 은행업 기능을 영위하지 않거나 시스템리스크 위험이 없는 중소형 증권회사는 미국 NCR 방식과 가까운 자기자본 규제 비율 산식을 적용받는다.

영업용순자본 산출에 있어서는 한국과 주요 국가간 큰 차이가 없는 가운데, 가산항목으로 후순위채를 인정하는 요건이 한국이 주요국 대비 소폭 엄격하다. 총위험액 산출에 있어서 한국이 주요국 대비 다소 규제 강도가 높다. 한국에는 해외 주요국에서 찾기 어려운 깊은외가격 옵션위험액, 주식집중위험액, 신용집중위험액 등이 있으며 부동산 투자 쏠림 억제를 위해 부동산PF 익스포져에 대해 높은 수준의 할증위험액을 부과하는 것이 구별되는 특징이다. 한편 한국 증권업에 대해 적기시정조치의 일환으로 레버리지비율 규제를 도입한 가운데, 적기시정조치의 일환으로 레버리지비율 규제를 도입한 국가는 찾기 어렵다.

2. 자기자본 규제 개선 방향

증권업 자기자본 규제는 IOSCO 권고안에 따라 국제적 정합성에 부합하고, 경제적 위험에 비례하여 설계하며, 증권업 규모와 기능별로 유연하게 설계되는 것이 바람직하다. 또한 건전성 규제의 본질에 부합할 수 있도록 파산 위험을 사전에 예방할 수 있고, 만일의 경우 증권회사 파산시 고객재산을 안전하게 보호할 수 있는 방향으로 설계되어야 할 것이다. 또한 건전성 규제는 정책 목적의 수단으로 활용하는 것을 최소화하며, 동일기능에 대해서는 동일규제 원칙을 적용하는 것이 바람직할 것이다.

위와 같은 자기자본 규제의 바람직한 방향을 기초로 한국 증권업 자기자본 규제의 세 가지 개선 방향을 제시한다. 첫째, 국제적 정합성 제고를 위해 증권회사 규모별, 기능별로 유연하게 자기자본 규제 비율을 적용하는 제도를 검토할 필요가 있다(<표 Ⅳ-2> 참조). 미국은 브로커-딜러로 하여금 표준방법, 대체방법, 대체순자본방법을 선택할 수 있도록 하며, 유럽은 초대형 증권회사에게 은행의 바젤 방식 규제를 적용하고, 중소형 증권회사에게는 규모에 따라 Class2, Class3 등 상이한 자기자본 규제 비율을 적용하고 있다. 순자본비율 도입 이후 초대형IB 증권회사를 중심으로 건전성 위험이 다소 악화되었고, 소형 증권회사는 위험투자 여력이 줄고 수익성과 건전성 모두 다소 악화되는 것으로 관찰되었다. 이에 동일기능ㆍ동일기능 원칙, 그리고 국제적 정합성 제고를 위해 기업여신 업무를 확대하고 있는 초대형IB 증권회사를 대상으로 시스템리스크 잠재 위험을 측정하고, 이를 기초로 일정 규모를 초과하고 동시에 시스템리스크 잠재 위험이 큰 초대형IB 증권회사에 대해 바젤 방식의 자기자본 규제의 적용을 검토할 필요가 있다. 이때 바젤 방식의 적용에 따른 영향을 고려하기 위해 장기적인 관점에서 바젤Ⅱ, 바젤2.5 등의 적용을 단계적으로 고려할 수 있다. 중소형 증권회사들도 규모와 기능별로 유연하게 위험투자 방식을 선택할 수 있도록 순자본비율과 바젤 방식의 규제 비율을 선택적으로 사용할 수 있는 제도를 검토할 필요가 있다. 만약 순자본비율과 바젤 방식에 기초한 (구)NCR 방식 등을 선택적으로 사용할 수 있다면 소형 증권회사를 중심으로 유휴 자본이 증가하는 효과를 기대할 수 있다. 더불어 소형 회사들도 중대형 증권회사들처럼 특화 IB사업에 대한 역량 강화 및 해외진출 활성화 등을 기대할 수 있다. 한편 자기자본 규제 비율의 선택적 사용시 감독당국은 증권업 전체에 대한 건전성 위험을 관리하는 비용이 증가하며, 소형 증권회사들을 중심으로 건전성 위험이 다소 악화될 수 있는 가능성을 배제할 수 없을 것이다.

둘째, 경제적 위험에 비례하여 영업용순자본과 총위험액을 산출하는 것이 필요하다. 경제적으로 유사한 기능을 수행하는 보유 자산에 대해 동일기능-동일규제의 원칙에 따라 위험액 산출 방식을 일치시키는 것이 바람직할 것이다. 이러한 관점에서 기업여신, 사모사채, 매출채권 등은 신용리스크 항목으로 보아 동일하게 신용위험액으로 산출하는 것을 제안한다. 또한 보유 자산의 손실 위험을 계량화하기 어려운 경우 국제적 정합성에 따라 영업용순자본과 총위험액을 산출하는 것이 필요하다. 예를 들어 주요국 자기자본 규제 사례에서 찾기 어려운 주식집중위험액, 신용집중위험액 등의 위험 산출 항목은 폐지 또는 완화하는 것이 바람직하다. 시장위험액, 신용위험과 관련된 세부 항목들의 위험값은 미국, 유럽 등의 위험값과 큰 차이가 나지 않도록 설계하며 보유 자산의 위험을 객관적이고 정확하게 반영할 수 있도록 내부모형의 활용을 적극적으로 유도할 필요가 있다.

셋째, 정책 목적을 위해 자기자본 규제를 활용하는 것을 최소화할 필요가 있다. 한국 증권업 자기자본 규제는 파생상품 및 부동산 투자에 대한 쏠림을 억제하기 위해 각종 할증 위험값을 부과하고 있다. 예를 들어, 깊은외가격 옵션위험액은 국제적으로 찾기 어려운 위험액 항목으로 옵션 매도 포지션 투자를 제한하기 위한 목적으로 설계되었으며 부동산PF에 대해 할증 위험값을 부과하는 제도 역시 부동산에 대한 과도한 익스포져를 줄이기 위한 목적으로 도입되었다. 반대로 중소 벤처기업에 대한 혁신투자를 유도하고 정책 목적을 위해 특정 분야로 자금투자를 유도하기 위해 특정 자산에 대한 위험값을 완화해주는 사례도 존재할 수 있다. 그러나 건전성 규제를 정책 목적의 수단으로 활용하는 것은 바람직하지 않다. 정책 목적을 위해 증권업의 건전성 위험을 제대로 측정하지 않으면 건전성 규제의 본질적 목적인 파산 예방과 금융소비자 보호 기능을 훼손할 수 있기 때문이다.

3. 레버리지비율 규제 개선 방향

레버리지비율 규제는 금융회사에 대한 시스템리스크 억제 목적이거나 자기자본 규제의 보완 수단으로만 활용하는 것이 바람직하다. 미국, 유럽의 대형 은행 및 시스템리스크 잠재 위험을 가진 글로벌IB들은 대부분 레버리지비율 규제를 적용받고 있다. 또한 미국에서 표준모형을 적용받은 소형 브로커-딜러의 경우 적기시정조치는 아니나 형식적으로 레버리지비율 준수 의무가 약한 조건으로 부여된 것이 사실이다. 즉 금융회사에 대한 레버리지비율 규제는 시스템리스크 억제 목적이나 자기자본 규제의 보완 수단으로 활용되고 있다.

한편 레버리지비율 규제를 시스템리스크 억제 목적 이외의 목적으로 활용할 경우 금융회사의 성장을 직접적으로 제한할 수 있으므로, 레버리지비율 제도 도입 및 그 임계수준에 대해서는 신중한 접근이 필요하다. 레버리지비율 규제를 엄격하게 적용할 경우 증권회사의 위험투자 총량을 직접적으로 제한함에 따라 증권업의 모험자본 공급 및 금융중개 기능을 크게 위축시킬 수 있기 때문이다.

한국 증권업에 도입된 레버리지비율 규제는 자기자본 규제의 보완 수단으로 활용하기보다 시스템리스크 억제 목적으로 활용하는 것이 바람직하다고 판단한다. 한국 순자본비율 제도는 주요국 자기자본 규제 대비 비교적 엄격하고 영업용순자본 및 위험액 산식 등에서 있어서 촘촘히 설계되어 있다. 또한 레버리지비율을 자기자본 규제의 보완 수단으로 활용한 사례는 미국 소형 브로커-딜러 사례 외에는 찾기 어려운데, 미국 소형 브로커-딜러의 업무범위와 규모는 한국 증권업과 비교하면 매우 협소할 뿐 아니라 미국 표준모형에 내재된 레버리지비율은 또는(Or) 조건으로 실질적으로 자기자본 규제로서의 구속력이 크지 않다.

시스템리스크 억제 목적으로 레버리지비율 규제를 활용하기 위해 한국 증권업에 대한 시스템리스크 잠재 위험을 정기적으로 평가하고, 이를 기초로 레버리지비율 규제의 임계수준을 정하는 과정이 필요할 것이다. 한국 레버리지비율 제도는 적기시정조치에 연동되어 있고 규제 준수 수준 또한 매우 높게 설정되어 있는 등 규제 강도가 다소 높다. 이에 장기적으로 레버리지비율 규제의 임계 수준을 현재 1,100% 미만에서 시스템리스크 잠재 위험 수준을 반영하여 완화하는 것을 제안한다.

레버리지비율 규제 도입 당시 ELSㆍDLS 발행의 급격한 증가를 억제하는 것을 목표로 두었는데, 최근 ELSㆍDLS 발행 및 헤지운용 관련 엄격한 규제가 도입된 만큼 증권업 시스템리스크 잠재 위험이 높지 않다는 전제 하에 레버리지비율 규제는 다소 완화하는 방향을 검토할 필요가 있다. 한편, 시스템리스크 억제 목적으로 레버리지비율 제도를 활용한다면 시스템리스크 잠재 위험이 거의 없는 소형 증권회사에 대해서는 레버리지비율 제도의 적용 배제를 검토할 필요가 있다. 앞선 절에서 소형 증권회사에 대한 자기자본 규제의 선택적 제공을 제안하였는데 이는 규제 관리 비용이 증가하며, 건전성 위험이 증가할 수 있는 우려가 있으므로 소형 증권회사에 대해서는 자기자본 규제의 선택적 제공 대신 레버리지비율 규제 적용의 배제를 검토해볼 수 있다.

1) 증권회사는「자본시장과 금융투자업에 관한 법률」 등에서 주로 사용하는 법적 용어는 아니나, 유사한 용어인 금융투자업자 또는 금융투자회사보다 널리 사용되며 자기자본 규제와 레버리지비율 규제를 주로 적용 받는다는 점에서 본 보고서에서는 증권회사라는 용어를 주로 사용한다.

2) 자본시장과 금융투자업에 관한 법률 제1조(제정 목적) 참조

3) 증권업 건전성 규제와 관련해서는 장정모ㆍ김현숙(2016), 빈기범ㆍ강경훈ㆍ정무권(2015), 박용린ㆍ이석훈(2017) 연구 등이 존재한다.

4) 금융위원회(2014) 참조

5) 이하 IOSCO(1989, 1990) 참조하기 바란다. 한편 장정모ㆍ김현숙(2016) 연구에 따르면 1934년 증권거래법 도입 초기에는 뉴욕 거래소와 같은 일부 거래소의 멤버들은 자기자본 규제 준수 의무에서 제외되었다.

6) 신보성 외(2015), 장정모ㆍ김현숙(2016) 참조

7) 다우존스지수는 1932년 6월 812 포인트(pt)까지 하락했다.

8) 1982년 대체방법 요건이 총고객인출금의 4% 이상에서 2% 이상으로 완화되었다.

9) 장정모ㆍ김현숙(2016) 연구에 따르면 2008년 당시 CSE Rule이 느슨했다는 비판이 일자, 2008년 CSE Rule은 폐지되었으며 이후 자기자본 규제는 대체로 강화되었다.

10) SEC Rule 15c3-1(a), “Every broker or dealer must at all times have and maintain net capital no less than the greater of the highest minimum requirement applicable to its ratio requirement under paragraph (a)(1) of this section, or to any of its activities under paragraph (a)(2) of this section, and must otherwise not be insolvent as that term is defined in paragraph (c)(16) of this section” 참조

11) SEA Rule 15c3-1(e)(2)(v), “The broker or dealer is subject to the aggregate indebtedness limitations of paragraph (a) of this section, the aggregate indebtedness of any of the consolidated entities exceeds 1000 percent of its net capital”

12) 바젤위원회에서 정한 은행 그룹의 레버리지비율 산식은 2장 2절에서 다룬다.

13) 1974년 9월 독일 헤르슈타트은행(Herstatt)이 파산하자 국제 금융시장이 큰 혼란에 빠졌으며 주요국 중앙은행을 중심으로 금융안정 제고 필요성이 제기되었다.

14) 한국은 2009년 3월 BIS 회원으로 공식 참여했다.

15) BIS(2017) 참조

16) 신보성 외(2015) 참조

17) IOSCO(1990) 참조

18) 2012년 FSA는 소비자보호 및 영업행위를 감독하는 FCA와 건전성을 감독하는 RPA로 분리했다.

19) 금융투자상품 중개ㆍ자기매매(인수 포함) 뿐 아니라 집합운용을 수행하는 회사를 금융투자회사(investment firm)로 정의하고 있으며, 최소 자본금 요건에 따라 50K/125K/730K 회사 등으로 구분하여 업무 범위를 정하고있 다.

20) CRD 규제는 EU 금융기관에 대한 통합 건전성 규제 지침이었던 CAD(Capital Adequacy Directive)를 기초로 하여, 바젤Ⅱ 시행과 함께 2007년 1월부터 마련된 건전성 규제 지침이다. 바젤Ⅲ 개정을 반영하여 2013년 CRD Ⅳ가 마련되었으며, 2021년 6월 28일부터 CRD Ⅳ대신 CRD Ⅴ가 시행될 예정이다.

21) FCA IFPRU 3.1.4~3.1.7 참조

22) 본 장의 ‘나. 절’에서 자세히 소개한다.

23) IOSCO(1989) 참조

24) EC(2019a, 2019b) 참조

25) 유럽에서 개정된 자기자본 규제 산식은 <표 Ⅱ-5> 등을 참조하기 바란다.

26) 신보성 외(2015) 참조

27) CRR(Capital Requirements Regulation)은 금융회사에 대한 필요자본 규정을 뜻하며, EU 필요자본지침(CRD)의 하위 규정 성격을 갖는다.

28) IFR/IFD에서 정한 최소자기자본요건(PMC), 고정간접비요건(FOR), K-요소 가중치요건에 대한 상세한 설명은 본 장의 ‘다. 절’에서 자세히 소개한다.

29) Ⅱ장 2절에서 살펴본 바와 같이, 영국ㆍ유럽에서 증권업에 대해 적용하는 건전성 규제는 CRD Ⅳ를 기초로 하고 있으며, 규모, 업무범위 등에 따라 규제 적용 범위가 소폭 다르다.

30) Capital Requirements Regulation, Article 341~342 참조

31) 영국, 유럽의 금융투자회사는 2020년부터 자기자본 규모 등에 따라 세 가지로 구분된 자기자본 규제 비율을 준수할 수 있도록 증권업 자기자본 규제가 세분화되었다.

32) 최장봉ㆍ가경수(1997) 참조

33) 금융위원회 홈페이지(‘금융산업의 구조조정 시기’) 참조

34) 금융감독위원회(1998.6.19)

35) 금융감독원(2000a) 참조

36) 금융감독원(2000b) 참조

37) 금융감독원(2004) 참조

38) 금융감독원(2006) 참조

39) 금융감독원(2008) 참조

40) 금융위원회ㆍ금융감독원(2011) 참조

41) 금융위원회ㆍ금융감독원(2014) 참조

42) 금융위원회(2014) 참조

43) 금융위원회(2014) 참조

44) 과거 만기 3개월 이상 대출은 영업용순자본에서 100% 차감하였으나, 기업대출이 허용된 종합금융투자회사가 취급하는 대출은 신용도에 따라 위험값을 차등하여 적용했다.

45) 종합금융투자회사의 발행어음 및 종합투자계좌(IMA) 업무 관련 운용자산은 레버리지비율 산정시 제외하도록 했다.

46) 금융위원회ㆍ금융감독원(2017) 참조

47) 금융위원회(2018) 참조

48) 순자본비율 제도는 2015년에 선택적으로 적용되고, 2016년부터 의무화되었다.

49) 금융감독원(2018) 참조

50) 잔존기간 4년 이상 5년 미만: 80% 비율, 잔존기간 3년 이상 4년 미만: 60%, 잔존기간 2년 이상 3년 미만: 40%, 잔존기간 1년 이상 2년 미만: 20%, 잔존기간 1년 미만시 전액 차감

51) 자세한 산식은 금융감독원(2018) 자료를 참조하기 바란다.

52) 자세한 위험값은 금융감독원(2018) 자료를 참고하기 바란다.

53) 감마위험액 = 옵션포지션 × 0.5 × 감마값 × (상정변동폭)2

54) 베가위험액 = 옵션포지션 × 0.25 × 베가값 × (기초자산의 변동성)

55) 한국의 종합금융투자회사가 기업금융 사업을 확대하여 시스템리스크 위험이 커진다면, 이들 초대형 금융투자회사에 대해서는 바젤 방식의 자기자본 규제를 적용하는 것이 국제적 정합성에 보다 부합하는 것으로도 볼 수 있다.

56) 금융위원회(2014) 참조

57) 자기자본 규모 1~5위 증권회사를 대형 증권회사로, 6~10위 증권회사를 중형 증권회사로, 자기자본 기준 11위 이하 증권회사는 소형 증권회사로 분류했다.

58) <그림 Ⅲ-10>에서 제시한 증권업 유형별 위험액 자료는 2016년부터 자료 취득이 가능한 관계로, 앞선 분석과 다르게 2014년말 기점이 아닌 2016년말 기점으로 비교하였다.

59) 금융감독원(2018)에 따르면 ‘즉시 현금화가 가능한 순재산‘의 판단 기준은 세부 항목마다 구체적으로 정하고 있다.

60) 최준선(2016) 등의 연구에 따르면 한국의 경우 특수관계인의 범위가 경제적 관계(계열사 출자, 채권-채무 관계 등)를 넘어 혈연관계를 포함하는 등 다소 넓은 범위를 다루고 있다.

61) 금융위원회(2010) 참조

62) 바젤위원회에서 정한 레버리지비율의 산식은 ‘Ⅱ장 2절. 라) 레버리지비율’ 부분을 참조하기 바란다.

63) 미국 증권업에 대한 레버리지비율 규제는 ‘Ⅱ장 1절. 라) 레버리지비율’ 부분을 참조하기 바란다.

64) 조정총자본은 자기자본에서 대손준비금을 차감한 값으로 계산한다.

65) 조정총자산은 총자산에서 투자자예치금, 종금계정자산, 대손준비금, 장내거래미수금, 위탁매매미수금, 장외 외국환 거래 미수금, 공모주 청약 관련 미수금을 차감하여 계산한다.

66) 이하 ‘Ⅱ장 1절. 라) 레버리지비율’ 부분 참조

참고문헌

금융감독원, 2000. 8. 2, 증권회사의 자기자본 관리제도 개편방안, 보도자료.

금융감독원, 2000, 증권회사의 자기자본관리제도 개편방안에 따른 영업용순자본비율 산정기준(공개초안), 2001년 4월 시행 예정안.

금융감독원, 2004. 4. 13, 증권회사의 재무건전성 기준 강화 및 회계투명성 확보방안, 보도자료.

금융감독원, 2006. 11. 21, 증권회사 영업용순자본비율 제도 개편 추진, 보도자료.

금융감독원, 2008. 11. 14, 금융투자업자의 자기자본 규제 개편내용 설명회 개최, 보도자료.

금융감독원, 2018, 금융투자업자의 NCR 산정기준 해설, 업무참고자료(2018년 1월).

금융감독위원회, 1998. 6. 19, 금융구조조정 추진방안, 보도자료.

금융위원회, 2010, FSB와 글로벌 금융규제개혁, 정책 책자(2010년 4월).

금융위원회, 2014. 10. 29,『증권사 NCR제도 개편방안』,『금융규제 개혁방안』등의 시행을 위한 규정개정안 금융위원회 의결, 보도자료.

금융위원회, 2018. 1. 19, 생산적 금융을 위한 자본규제 등 개편방안 마련, 보도자료.

금융위원회ㆍ금융감독원, 2011. 8. 31, 금융투자업자 영업용순자본비율(NCR) 규제 개선방안, 보도자료.

금융위원회ㆍ금융감독원, 2014. 4. 8, 자본시장 역동성 제고를 위한 증권회사 NCR제도 개선 방안, 보도자료.

금융위원회ㆍ금융감독원, 2017. 5. 2, 『초대형 투자은행 육성방안』및『공모펀드 시장 활성화』를 위한 자본시장법 시행령 및 금융투자업규정 개정, 보도자료.

빈기범ㆍ강경훈ㆍ정무권, 2015, 증권사 NCR 규제와 투자자 보호,『재무관리연구』32(4), 203-218.

박용린ㆍ이석훈, 2017, 국내 증권업 자본규제 평가 및 시사점, 자본시장연구원 연구보고서 17-03.

신보성ㆍ권재현ㆍ김종민ㆍ이효섭ㆍ천창민, 2015, 글로벌 금융규제 흐름과 우리나라 금융규제개혁의 바람직한 방향, 자본시장연구원 연구총서 15-02.

장정모ㆍ김현숙, 2016, 미국 NCR의 제도적 특징과 발전과정, 자본시장연구원 조사보고서 16-05.

최장봉ㆍ가경수, 1997, 우리나라와 BIS, 미국 및 일본의 금융기관에 대한 자본규제, 한국조세재정연구원 연구보고서.

최준선, 2016, 상법상 특수관계인 개념의 문제점,『경영법률』26(4), 1-34.

BIS, 2017, Basel Ⅲ: Finalizing Post-Crisis Reforms, BCBS paper(2017/12/7).

EC, 2015, Capital Requirements Regulation and Directive–CRR/CRD Ⅳ, Rule Book.

EC, 2019a, Proposal for a Regulation of the European Parliament And of the Council on the Prudential Requirements of Investment and Amending Regulations, recommendation paper.

EC, 2019b, Regulation on the Prudential Requirements of Investment Firms and Amending Regulations(2019. 11. 27).

IOSCO, 1989, Capital Adequacy Standards for Securities Firms, working paper.

IOSCO, 1990, Capital Requirements for Multinational Securities Firms, working paper.

IOSCO, 2014, A Comparison and Analysis of Prudential Standards in the Securities Sector, consultation paper.

증권회사1)는 금융투자상품의 중개와 매매, 자산관리 업무 등을 통해 금융소비자의 니즈를 제고하고 금융혁신과 자본시장의 공정한 경쟁을 촉진하여 금융투자산업의 건전한 발전을 도모하는 것을 목표2)로 한다. 증권회사가 위험자산을 과도하게 보유하거나 위험관리에 소홀하면 대규모 손실 위험에 노출되어 증권회사가 파산의 위험에 처하게 되고, 이로 인해 고객 자산의 손실 뿐 아니라 경우에 따라서는 시스템리스크까지 초래할 수 있다. 이에 주요국 감독당국은 증권회사의 파산을 사전에 예방하고 증권회사 파산시 투자자 재산을 안전하게 보호하기 위해 자기자본 규제, 레버리지비율 규제 등 건전성 규제를 마련하고 있다. 미국은 1967~1970년 증권사무위기(Paperwork Crisis) 및 1970년대초 오일쇼크 영향으로 다수의 브로커-딜러가 파산함에 따라 1975년 브로커-딜러에 대한 자기자본 규제를 확대 개편했다. 영국, 유럽, 일본 등 주요 국가들은 1987년 10월 블랙먼데이 사태를 계기로 각각 1988년, 1996년, 1990년에 증권업에 대한 자기자본 규제를 도입했다. 한국은 일본의 자기자본 규제 제도를 벤치마크하여 1997년 4월에 이르러서야 증권회사에 대한 자기자본 규제를 도입했다.

제조업 중심에서 하이테크 산업 중심으로 산업구조가 재편됨에 따라 모험자본 공급과 노후소득 증대를 담당하는 자본시장의 중요성은 더욱 커졌다. 증권회사가 자본시장의 발전에 중추적인 역할을 수행함에도 불구하고 증권회사의 영업활동에 가장 큰 영향을 미쳐 온 건전성 규제 제도에 대해서는 관련 연구가 많지 않다.3) IOSCO 등 국제 증권감독기구에서 증권업 건전성 규제 필요성 및 규제 방향에 대해 간헐적인 연구가 수행되었으나, 바젤위원회와 금융안정위원회(FSB)가 은행업 건전성 규제에 대해 체계적인 분석을 통해 제도 개선을 꾸준히 추진해 온 것과 비교하면 국제적으로 증권업에 대한 심도 있는 연구가 많지 않다. 특히 한국에서는 증권회사의 건전성 규제에 대한 연구가 부족하다. 1997년4월 자기자본 규제를 도입할 당시 일본 제도를 상당수 벤치마크하여 관련 연구가 부족했으며 2016년 순자본비율 제도 시행 이후에도 자기자본 규제의 의의와 영향에 대해 깊이 있는 분석이 많지 않았다.

한국 증권업 자기자본 규제가 글로벌 증권업 자기자본 규제의 변화 방향을 제대로 따라가지 못했다는 지적도 있다. 미국은 1975년 브로커-딜러에 대한 자기자본 규제를 도입한 이후, 표준방법, 대체방법, 대체순자본방법 등을 발전키시며 브로커-딜러로 하여금 선택적으로 자기자본 규제 방식을 사용하도록 했다. 유럽과 영국은 2021년 상반기에 증권회사에 대한 자기자본 규제 체계를 전면 개편하여 시스템리스크 잠재 위험을 보유한 대형 증권회사에 대해서는 은행업의 바젤 방식 규제를 따르도록 하고, 중소형 증권회사에 대해서는 규모에 따라 간소한 (미)NCR 방식의 자기자본 규제를 따르도록 했다. 과거 글로벌 증권업 자기자본 규제 체계가 바젤 방식과 (미)NCR 방식으로 양분되었던 것이 이제는 (미)NCR 방식으로 수렴되는 것으로 이해할 수 있다. 또한 증권회사의 업무 범위가 확대되고 은행과 증권회사간 업무범위의 격차가 줄어듦에 따라 대출을 일정 규모 이상 수행하는 대형 증권회사에 대해 은행업의 바젤 규제를 적용하고 있는 것도 최근 글로벌 증권업 자기자본 규제의 주된 변화라고 할 수 있다. 한국은 2016년 순자본비율 제도가 전면적으로 시행되었으나, 증권회사 규모에 상관없이 획일적으로 자기자본 규제 제도를 적용하고 있으며 다소 엄격한 레버리지비율 규제를 적용하는 등 증권업 규제의 국제적 정합성과 다소 거리가 있는 것으로 보인다.

특히 과거 한국 증권업 건전성 규제는 주요국 대비 다소 엄격하며, 영업행위 규제 목적으로 (구)NCR 산식이 활용되는 등 증권회사의 파산을 사전에 예방하고자 하는 건전성 규제의 의의와 거리가 먼 것이라는 지적이 많았다. (구)NCR 제도는 바젤 방식 규제에 가까워 계속기업 관점의 건전성 규제에 가깝다는 지적이 대표적이다. 증권업은 본래 금융투자상품의 중개와 자기매매업을 핵심 업무로 하고 있고, 한국의 경우 주식계좌의 예탁금이 별도 기관에 안전하게 예치되어 있어 증권회사 파산시 투자자 손실 위험으로 전이될 가능성이 낮다. 즉, 미국과 유럽의 주요 국가처럼 증권업에 대해서는 파산시 투자자 재산과 선순위 채권자를 우선적으로 보호하려는 유동성 규제 철학으로 바꾸어야 한다는 지적이 많았다. 또한 자기자본 규제 비율이 증권회사의 업무를 제한하는 목적으로 사용된다는 지적도 많다. 예를 들어 국내 증권회사가 국고채전문딜러(PD), ELW 유동성공급자, 국민연금 전담 중개회사 등으로 선정되려면 매우 높은 수준의 자기자본 규제 비율을 유지해야 하는 것이 대표적이다. 자기자본 규제 비율이 경제적 위험에 비례하여 설계되기보다, 금융당국의 정책 목적으로 활용된 사례도 많다. 파생상품에 대한 과도한 포지션을 제한하기 위해 주요국 사례에서 찾기 힘든 깊은외가격 옵션위험액을 별도로 부과하거나, 부동산으로 자금이 쏠림는 혁상을 억제하기 위해 증권회사의 부동산 관련 포지션에 할증위험액을 부과하는 것이 대표적이다.

2016년부터 본격적으로 시행된 순자본비율 제도의 의의와 금융투자산업에 미치는 영향 관련해서도 깊이 있는 연구가 많지 않다. 2014년 당시 금융위원회는 순자본비율 제도 도입의 목표로 증권회사의 자본효율성 제고, M&A 업무 등 IB업무 역량 강화, 해외진출 활성화 등을 꼽았다.4) 실제 순자본비율 제도 도입 이후 상당수 증권회사가 유휴 자본을 추가로 보유하지 않아도 되어 자기자본 확충을 통해 위험을 지고 수익을 창출할 기회가 많아졌다. 순자본비율 체계 도입으로 증권회사의 자본 효율성이 개선되었을 뿐 아니라 해외진출이 활성화되고 IB부문의 사업 역량이 강화된 것이 순자본비율 도입의 긍정적 효과라고 판단한다. 순자본비율 체계 도입에 따른 우려도 존재한다. 일부 증권회사는 순자본비율 도입 이후 ELSㆍDLS 발행 및 자체헤지 포지션을 늘리고, 부동산PF 관련 채무보증을 확대하는 등 금융당국의 순자본비율 도입 취지와 다소 거리가 먼 사업전략을 구사하기도 했다. 일부 증권회사가 파생상품 및 채무보증 등의 업무를 늘리면서 증권회사의 시스템리스크 잠재 위험이 커졌으며, (구)NCR 기준 건전성 위험은 예전보다 악화되었다. 이러한 이유로 국내 주요 신용평가회사들은 증권회사에 대한 리스크 요인을 분석할 때 순자본비율을 사용하기보다 (구)NCR 지표를 건전성 리스크를 측정하는 주된 지표로 활용하고 있다.

증권업을 둘러싼 국내외 주요 환경 변화 속에서 본 보고서는 글로벌 주요국 증권업의 건전성 규제 현황 및 변화 방향을 체계적으로 분석하여 한국 증권업 건전성 규제의 바람직한 개선 방향을 제시하고자 한다. 본 연구의 구성은 다음과 같다. 우선, Ⅱ장에서는 미국 NCR 방식과 유럽 바젤 방식 등 해외 증권업 건전성 규제 현황을 살펴보고 주요 특징을 알아본다. Ⅲ장에서는 글로벌 증권업 건전성 규제와의 비교 분석을 통해 한국 증권업 건전성 규제를 진단하고자 한다. Ⅳ장에서는 한국 증권업의 자기자본 규제 및 레버리지비율 규제 등 증권업 건전성 규제의 바람직한 개선 방향을 제시한다.

Ⅱ. 해외 증권업 건전성 규제 현황 및 시사점

증권회사에 대한 건전성 규제 도입 배경은 국가마다 상이하다. 미국은 1934년 증권거래법과 함께 브로커-딜러에 대한 자기자본 규제를 도입5)했으며, SEC에 등록된 전체 브로커-딜러에 대한 자기자본 규제는 1975년 도입했다. 영국(1988년), 유럽(1996년), 일본(1990년) 등의 선진국은 1987년 블랙먼데이 사태를 계기로 자기자본 규제를 도입했다. 동시기에 선진국 대형은행들이 부실화되면서 국제결제은행(BIS) 산하 바젤위원회는 1988년 은행에 대한 자기자본 규제 합의안(예: BIS 비율 8%)을 발표했으며 이후 영국, 독일, 프랑스, 일본 등은 증권업에 대해 미국 NCR 방식 대신 바젤 방식 규제를 적용했다. 반면 홍콩, 중국, 인도 등 아시아 국가들은 증권업에 대해 미국 NCR 방식의 규제를 도입했다.