Find out more about our latest publications

Impacts of tightening monetary policy on stock market in Korea

Issue Papers 22-04 Mar. 30, 2022

- Research Topic Macrofinance

- Page 19

As inflation spreads across a wide range of sectors, it seems quite difficult to mitigate the current inflationary pressure. Accordingly, Bank of Korea is expected to respond more strongly to inflation, leading to growing interest in the impacts on the stock market. Against this backdrop, this study identifies monetary policy shocks in terms of interest rates and M2 separately, and investigates how such shocks would affect stock prices.

In this article, impulse responses of stock prices are estimated for aggregate indices—the KOSPI and the KOSDAQ index, and industry portfolios. The results indicate that contractionary M2 shocks, rather than interest rate shocks, tend to have more significant effects on stock prices. In particular, falls in stock prices are pronounced in the KOSPI and IT, industrial materials, raw materials and consumer discretionary sectors. Furthermore, while stock prices exhibit a strong correlation with industrial production among macroeconomic and financial indicators, industries having stronger correlations with production are more susceptible to monetary policy shocks. This implies that business cycles serve as an important channel through which monetary policy influences stock prices, whose responses could vary depending on sensitivity to business cycles.

One additional takeaway is that, despite the contractionary impacts, stock prices recover in a short period of time. In other words, domestic monetary policy could have a short-term effect on stock prices to some extent, but it hardly would change their trends. Therefore, a desirable approach is to pay attention to developments of the real economy and manage related risks, rather than overreacting to monetary policy.

In this article, impulse responses of stock prices are estimated for aggregate indices—the KOSPI and the KOSDAQ index, and industry portfolios. The results indicate that contractionary M2 shocks, rather than interest rate shocks, tend to have more significant effects on stock prices. In particular, falls in stock prices are pronounced in the KOSPI and IT, industrial materials, raw materials and consumer discretionary sectors. Furthermore, while stock prices exhibit a strong correlation with industrial production among macroeconomic and financial indicators, industries having stronger correlations with production are more susceptible to monetary policy shocks. This implies that business cycles serve as an important channel through which monetary policy influences stock prices, whose responses could vary depending on sensitivity to business cycles.

One additional takeaway is that, despite the contractionary impacts, stock prices recover in a short period of time. In other words, domestic monetary policy could have a short-term effect on stock prices to some extent, but it hardly would change their trends. Therefore, a desirable approach is to pay attention to developments of the real economy and manage related risks, rather than overreacting to monetary policy.

Ⅰ. 논의 배경

최근 가파른 물가 상승세가 지속되면서 통화정책의 대응 강도가 높아질 것으로 전망되고 있다. 국내 소비자물가는 지난해 11월 3.8%까지 상승하여 2011년 12월(4.2%) 이래 가장 높은 상승률을 나타내었고, 이후에도 3% 후반의 상승률을 이어가고 있다. 이에 따라 한국은행은 지난해 8월부터 3차례의 금리 인상을 통해 기준금리를 코로나19 이전 수준(1.25%)까지 높이면서 인플레이션 압력에 대응한 바 있다. 하지만 최근의 인플레이션은 원유 등 국제원자재 관련 품목뿐만 아니라, 각종 개인서비스 부문까지 확산되고 있어 물가 상승세가 쉽게 진정되기는 어려울 것으로 보인다. 이러한 상황과 함께 한국은행이 현재의 기준금리가 여전히 완화적인 수준이라고 인식1)하고 있다는 점을 감안할 때, 금융완화 정도가 추가적으로 축소될 가능성이 높은 것으로 생각된다.

통화정책은 경기 및 물가뿐만 아니라 개별 자산 가격에도 광범위한 파급효과를 유발할 수 있다. 특히 대표적인 금융자산인 주식의 경우, 총수요와 위험추구 성향 등을 통해 통화정책의 영향을 받는 것으로 생각된다. 여기에서 총수요는 소비 및 자본재 수요 등 기업의 실적을 결정하는 주요 요인으로, 긴축적인 통화정책은 이를 위축시키는 경향이 있다. 총수요를 통한 영향은 거시경제학의 통상적인 기제를 반영하고 있어 통화정책의 전통적인 파급효과에 따른 결과로 볼 수 있다. 한편, 위험추구 성향을 통한 영향은 리스크 프리미엄을 통해 위험자산의 할인율을 변화시키는 데 따른 것이다. 이는 금융위기 이후 부각된 관점인데, 그 대표적인 사례로 미 연준의 포워드 가이던스2)가 리스크 프리미엄을 하락시켜 주가 상승에 영향을 미친 것을 들 수 있다(Hattori et al., 2016).

코로나19 이후 국내 주식시장은 개인 투자자의 참여가 증가하면서(김민기ㆍ김준석, 2021) 그 저변이 크게 확대되었다. 이에 따라 통화정책이 주가에 미치는 영향에 대한 관심이 한층 증대되고 구체화되었을 것으로 생각된다. 본고는 이러한 배경을 바탕으로 국내 통화정책이 주가에 미치는 영향에 대해 실증 분석하고 시사점을 제공하고자 한다. 동 분석에서는 통화정책이 경기와 물가 등 거시경제 지표들과 상호작용한다는 점을 감안하여, 부호제약을 이용한 벡터자기회귀(sign restricted vector autoregression, 이하 부호제약 VAR) 모형을 바탕으로 외생적인 통화정책 충격을 식별하고 통화정책이 주가에 미치는 영향을 추정한다. 통화정책 충격은 금리와 유동성 측면으로 나누어 각각 식별하고, 동 충격에 대한 반응은 KOSPI 및 KOSDAQ 지수뿐만 아니라 업종 포트폴리오 수준으로 세분화하여 분석하도록 하겠다. 아울러 업종 포트폴리오의 충격반응이 주요 거시ㆍ금융변수와의 연관성 측면에서 어떠한 특징을 가지는지에 대해서도 살펴보고자 한다. 업종 포트폴리오3)에 기초한 동 분석은, 업종별 반응의 민감도와 통화정책이 영향을 미치는 경로 간의 관계를 이해4)하는데 도움이 될 것으로 생각된다. 이하에서는 통화정책 결정 시 주식시장의 움직임 등에 대해 기술통계량을 중심으로 먼저 개관한 다음, VAR 모형을 이용한 분석 결과에 대해 자세히 논의하도록 하겠다.

Ⅱ. 개관: 통화정책 결정과 주가의 변화

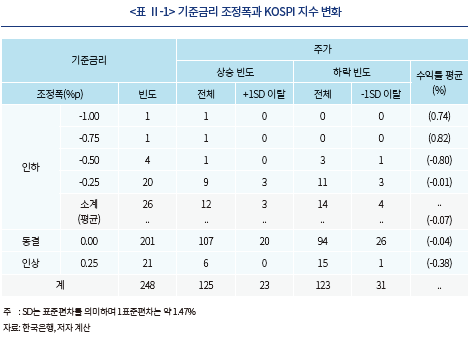

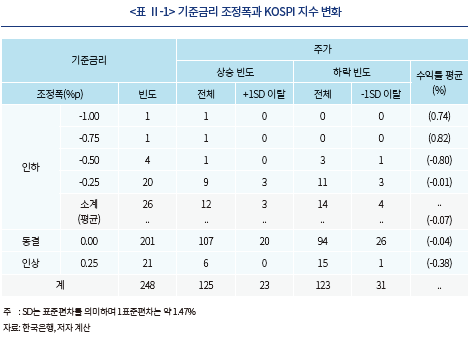

한국은행은 2000년 1월부터 2022년 1월까지 총 248회 기준금리를 결정하였고, 이 중 26회는 기준금리를 인하, 21회는 인상하였다. 기준금리 조정폭은 대부분 25bp(41회)이지만, 국내외 금융시장의 불안이 크게 고조되었던 9/11테러 이후, 금융위기, 코로나19 확산 초기에는 50~100bp까지 인하되기도 하였다. <표 Ⅱ-1>은 기준금리 결정 전일과 당일의 자료를 이용하여 기준금리 조정폭별 전일 대비 KOSPI 지수의 상승ㆍ하락 빈도를 나타내고 있다.

먼저 금리 조정 시 주가지수의 변동 양상을 보면, 금리 인하 시 주가가 상승한 경우는 12회, 하락한 경우는 14회로 비슷한 빈도를 보였다. 금리가 75bp 및 100bp 인하되었던 경우 주가지수는 평균적으로 상승하는 경향을 보였으나, 50bp와 25bp 인하되었던 경우에는 오히려 소폭 하락하는 것으로 나타나 일관된 패턴이 관측되지는 않는다. 다음으로 금리 인상 시 주가의 상승 및 하락 빈도는 각각 6회와 15회로, 금리 인상 이후 주가가 하락한 경우가 많았던 것으로 나타났다. 이에 따라 금리 인상 시 전일 대비 KOSPI 지수의 평균적인 변화는 하락으로 나타나는데, 그 폭은 -0.38% 정도로 크지는 않았던 것으로 평가된다. 한편, 기준금리는 201회 동결되었는데, 그 중 주가가 상승한 빈도는 107회, 하락한 빈도는 94회로 상승한 경우가 상대적으로 많았지만 평균적인 등락폭은 0%에 가까운 수준이다.

아울러 <표 Ⅱ-1>은 ‘+1SD 이탈’ 및 ‘-1SD 이탈’ 열에 주가지수의 변화가 일상적인 변동성5)을 넘어섰던 빈도도 제시하고 있다. 이러한 변동폭이 나타났던 경우는 총 54회로, 약 22%의 비율(248회 대비)에 해당한다. 여기에서 금리 조정(인상 또는 인하) 시와 동결 시 각각의 경우 수익률이 ±1표준편차를 넘어섰던 비율6)은 약 17% 및 23%로, 동결 시의 경우가 오히려 약간 높지만 큰 차이는 없는 것으로 보인다. 따라서 기준금리가 조정되더라도 동결된 경우에 비해 주가의 급등락 경향이 높아지지는 않은 것으로 판단된다.

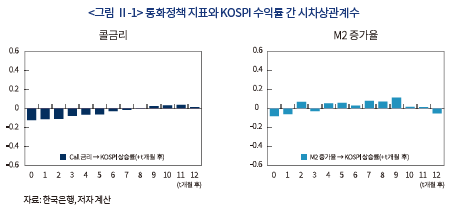

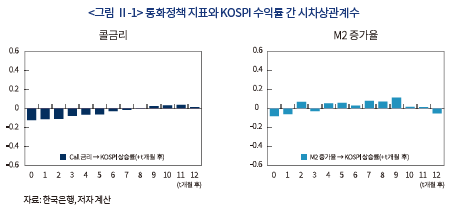

한편, <그림 Ⅱ-1>은 월별 자료를 이용하여 주요 통화정책 지표와 주가지수 간의 상관관계를 나타내고 있다. 왼쪽 그림은 콜금리와 0~12개월 후 KOSPI 수익률의 시차상관계수로 6개월 정도까지는 음(-)의 상관관계를 보이고 있다. 하지만 가장 강한 음의 상관관계를 보인 시점(0개월)의 경우 상관계수는 -0.12에 불과하여 상관관계가 뚜렷하지는 않은 것으로 판단된다. <그림 Ⅱ-1>의 오른쪽은 통화량(M2) 증가율과 KOSPI 수익률 간의 시차상관계수를 나타내고 있다. M2 증가율과 KOSPI 수익률의 경우, 초기에는 약한 음의 상관관계를 보였다가 4~9개월 후는 양(+)의 상관관계를 보였다. 하지만, 모든 대상 시점에서 상관계수의 절대값은 0.11를 넘지 않는 수준이다. 이상의 결과를 보면, 상관계수를 기준으로 통화정책 지표와 주가지수 간의 관계에 대해 명확히 특징짓기는 어려워 보인다.

Ⅲ. 긴축적 통화정책의 주가에 대한 영향

본 장에서는 계량 모형으로 추정된 통화정책의 영향에 대해 구체적으로 살펴보도록 한다. 동 분석에서는 전반적인 시장 지수와 업종별 포트폴리오를 대상으로 통화정책의 영향을 각각 추정하고, 결과에 나타난 주요 특징과 시사점에 대해 논의하고자 한다. 여기에서는 부호제약 VAR 모형을 바탕으로 통화정책의 충격(예상되지 않은 통화정책의 변화)을 식별하고 각 변수들의 반응을 추정하였다. 분석에 이용될 VAR 모형은 다음과 같이 설정된다.

식 (1)에서  는 내생변수 벡터,

는 내생변수 벡터,  는 의 시차변수 벡터이며

는 의 시차변수 벡터이며  은 상수항 벡터,

은 상수항 벡터,  는 계수 행렬,

는 계수 행렬,  는 오차항의 벡터로 정의된다. 동 모형을 통해 식별된 통화정책 충격은 직교성(orthogonality)을 가지므로 추정된 충격반응을 인과관계 측면에서 해석할 수 있다. 부호제약은 Peersman(2005), Fry & Pagan(2011) 등 기존 연구를 따라, 긴축적인 통화정책 충격발생 초기에는 생산이 위축되고 물가가 하락하는 형태로 설정되었다.7)

는 오차항의 벡터로 정의된다. 동 모형을 통해 식별된 통화정책 충격은 직교성(orthogonality)을 가지므로 추정된 충격반응을 인과관계 측면에서 해석할 수 있다. 부호제약은 Peersman(2005), Fry & Pagan(2011) 등 기존 연구를 따라, 긴축적인 통화정책 충격발생 초기에는 생산이 위축되고 물가가 하락하는 형태로 설정되었다.7)

동 분석에서 생산과 물가 지표로는 산업생산지수(로그변환)와 소비자물가지수(로그변환)를 각각 사용하였다. 또한 신용 스프레드(회사채 AA-등급 3년물 금리와 국고채 3년물 금리 차이)를 포함하여 전반적인 금융상황과의 영향 관계도 고려하였다. 동 분석에서는 먼저 콜금리를 통화정책의 지표로 이용하여 통화정책 충격의 영향을 추정하고, 별도로 M2(로그변환)를 통화정책 지표로 이용하여 그 영향을 추정하였다. 본 연구의 직접적인 관심인 통화정책의 주가에 대한 영향은 KOSPI와 KOSDAQ 지수의 충격반응과 각 업종 포트폴리오8)의 충격반응을 각각 추정하여 분석된다. 표본기간은 2000년 1월부터 2021년 10월까지이며 VAR 모형의 시차는 AIC(Akaike Information Criterion)에 따라 4개월이 적용되었다.

1. 통화정책의 영향: 금리 충격

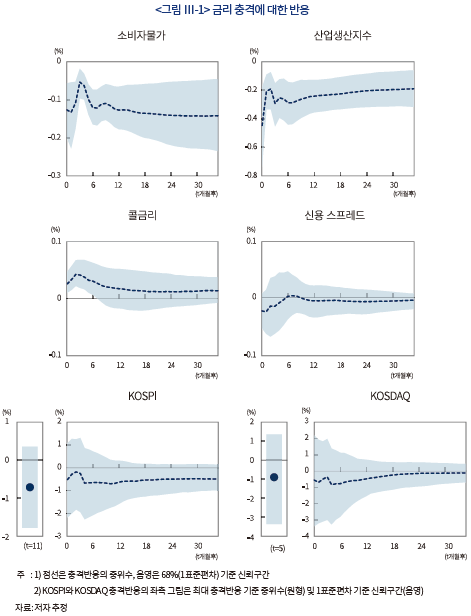

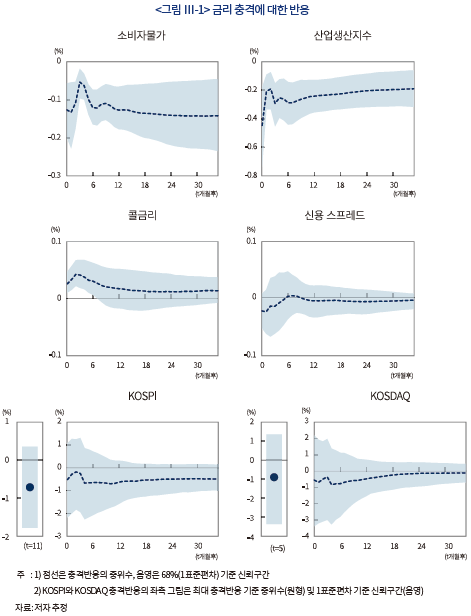

여기에서는 먼저 금리 인상 충격 발생 시 주가의 반응을 분석한 결과에 대해 논의하고자 한다. <그림 Ⅲ-1>은 KOSPI 및 KOSDAQ 지수와 여타 지표들의 월 단위 충격반응을 36개월에 걸쳐 나타내고 있다. 그림에서 점선은 충격반응의 중위수(median), 음영은 1표준편차 기준 신뢰구간을 의미한다. KOSPI와 KOSDAQ 지수의 반응에서 왼쪽에 각각 추가된 그림은 최대 하락폭(시점은 KOSPI: t=11, KOSDAQ: t=5)만을 별도로 표시한 것이다. 추정 결과에 따르면, 금리 인상 충격 발생 당시 KOSPI 및 KOSDAQ 지수는 하락하는 것으로 나타나 방향성 측면에서는 이론적인 예상과 일치하지만, 신뢰구간이 매우 넓어 불확실성이 큰 것으로 평가된다. 그리고 장기적으로도 충격반응의 신뢰구간이 0을 포함하면서 유의한 반응이 관측되지는 않는다. 이러한 결과를 볼 때, 금리 인상 충격에 대한 반응을 바탕으로 통화정책이 주식시장 전반에 유의미한 효과를 유발하는 것으로 판단하기는 어려운 것으로 생각된다.

한편 여타 지표들의 반응에 대해 간략히 살펴보면, 소비자물가와 산업생산지수는 부호제약에 따라 충격 발생 이전에 비해 한동안 하락하는 모습을 보인다. 신용 스프레드의 경우, 사전적으로는 금리 인상 충격 발생 시 금융상황이 악화되면서 동 지표가 상승할 것으로 예상된다. 하지만 실제로는 충격 직후 오히려 하락하는 반응을 보였다가 5~6개월 이후 거의 원래의 수준으로 회귀하는 것으로 나타났다. 다만, 신용 스프레드가 초기에 하락하는 반응은 신뢰구간이 넓게 나타나 동 결과를 바탕으로 유의미한 영향을 평가하기는 어려워 보인다.

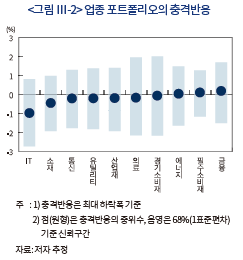

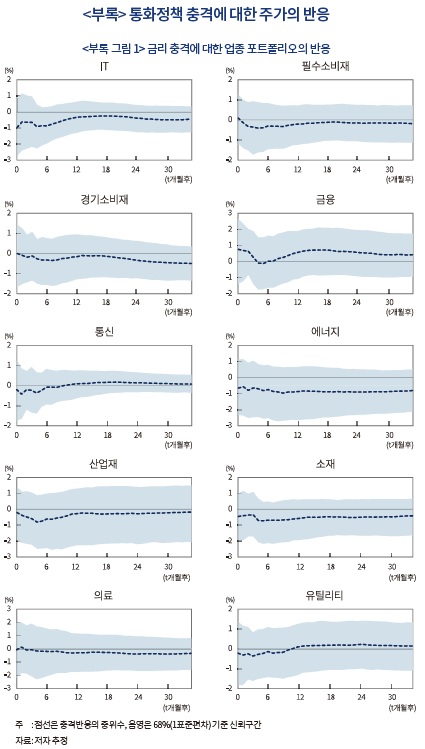

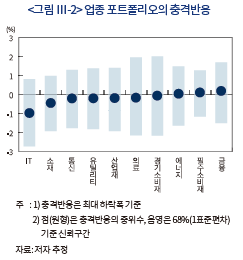

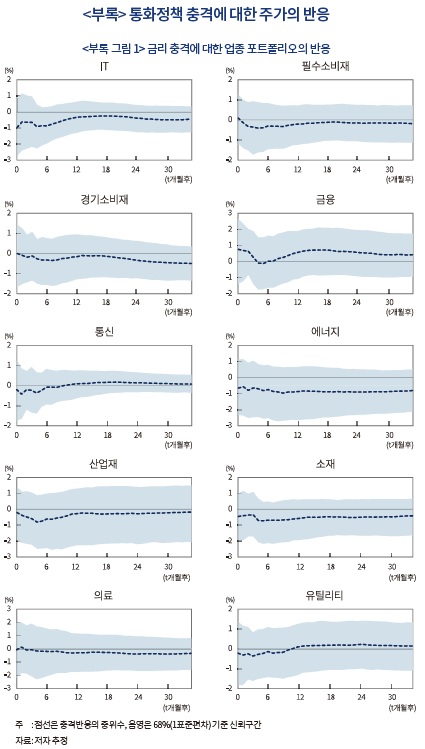

다음으로 <그림 Ⅲ-2>는 업종 포트폴리오로 세분화하여 추정한 충격반응을 나타내고 있다. 여기에서는 지면을 절약하기 위해 포트폴리오별로 중위수 기준의 최대 하락폭(점)과 신뢰구간(음영)만을 표시하였다.9) 이 그림은 충격반응의 크기 순서대로 포트폴리오의 반응을 제시하고 있다. 업종별 포트폴리오의 경우에도 이전의 결과와 크게 다르지 않은 것으로 나타났다. 중위수 반응을 기준으로 보면, IT 부문의 경우 여타 업종에 비해 상대적으로 큰 하락폭을 보이기는 하지만, 신뢰구간이 양(+)과 음(-)의 구간에 걸쳐 넓게 분포되어 유의미한 결과로 해석하기는 어려워 보인다. 그리고 모든 업종에서 전 기간의 충격반응이 0과 다르지 않은 것으로 추정되었다. 한편, 소비자물가, 산업생산지수, 신용 스프레드의 반응은 KOSPI 및 KOSDAQ 지수를 이용한 추정 결과와 거의 동일하므로 관련 논의는 생략하도록 하겠다.

2. 통화정책의 영향: 유동성 충격

앞 절의 추정 결과를 바탕으로 볼 때, 금리 측면에서의 통화정책 충격이 국내 주식시장에 미치는 영향은 미미하거나, 높은 추정 오차로 인해 불확실성이 큰 것으로 해석할 수도 있다. 하지만 이를 바탕으로 일반화된 결론을 내리기보다는, 통화정책은 유동성에도 직접적인 영향을 미친다는 점을 고려하여 유동성을 기준으로 통화정책의 효과를 평가해 볼 필요도 있다. 특히, 기준금리가 동일한 수준으로 유지되더라도, 경제 여건에 따라 통화정책의 긴축ㆍ완화 정도가 다르게 작용하면서 유동성의 움직임이 기준금리와는 다른 양상을 띨 수 있다. 또한 한국은행이 기준금리 이외의 정책 수단10)을 별도로 활용하면서 시중 유동성에 영향을 미쳐 왔다는 점도 감안할 필요가 있다. 따라서 이하에서는 통화정책의 충격을 유동성을 통해 식별11)하고 주가의 충격반응을 살펴보도록 한다.

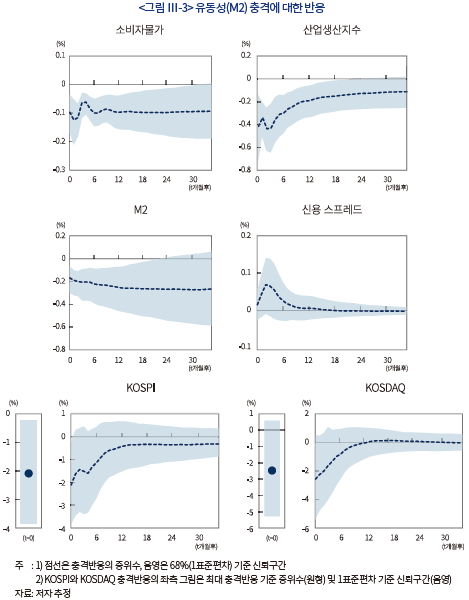

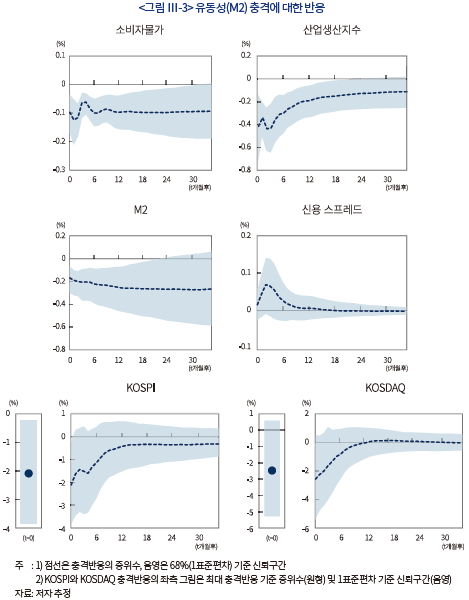

<그림 Ⅲ-3>은 유동성(M2) 감소 충격 발생 시 소비자물가, 산업생산지수, 신용 스프레드와 KOSPI 및 KOSDAQ 지수의 반응을 나타내고 있다. KOSPI 지수의 경우, 기준금리 인상 충격에 비해 유동성 감소 충격 발생 시(t=0) 상대적으로 뚜렷하게 하락하는 모습이다. 정량적인 측면에서 보면, M2가 약 0.2% 감소할 경우12) KOSPI 지수는 동일(t=0) 시점에 약 2% 내외 하락하는 것으로 추정되었다. 다만, 1~2개월 후에는 유의성이 낮아지면서 이전 수준의 주가로 회복되는 것으로 나타난다.한편, KOSDAQ 지수는 크기와 방향 측면에서 KOSPI 지수와 유사한 반응을 보이기는 하지만 유의성은 상대적으로 낮은 것으로 추정되었다. 여타 변수들의 반응을 보면, 산업생산지수의 경우 초기 6개월 정도까지는 금리 충격 발생 시에 비해 상대적으로 완만하게 회복되는 경향을 나타내었다. 그리고 신용 스프레드는 방향성 측면에서 금리 충격 발생 시와는 상이한 반응을 보였다. 금리충격 발생 시 신용 스프레드는 소폭 하락하였지만 유동성 충격 발생 시에는 소폭 상승하였다. 유의성이 높지는 않지만 방향성의 경우 유동성 충격에 대한 반응이 일반적인 예상에 부합하는 것으로 생각된다.13

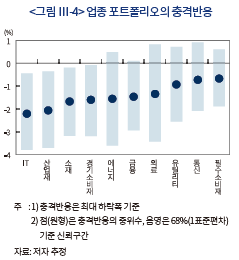

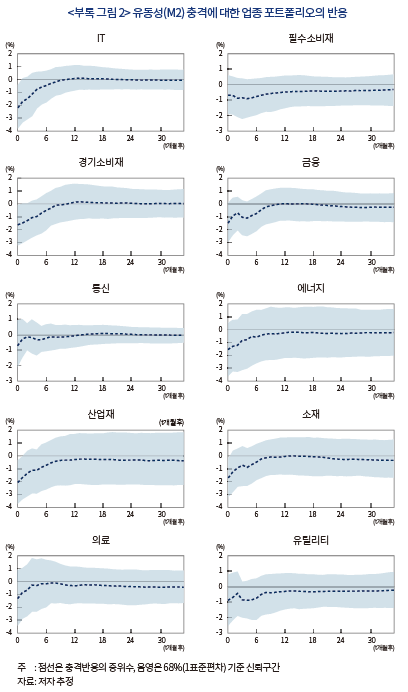

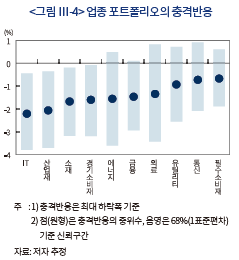

<그림 Ⅲ-4>는 M2 감소 충격14)에 대한 업종 포트폴리오의 반응을 요약하고 있다. 추정에서 주가가 가장 크게 하락하는 시점은 모두 충격 발생 시점(t=0)과 일치한다. 동 분석 결과에서는 IT, 산업재, 소재 및 경기소비재 부문의 하락폭(중위수 기준 약 -2% 내외)이 크고 유의성이 상대적으로 높은 것으로 나타났다. 반면, 유틸리티나 통신, 필수소비재 등의 하락폭(중위수 기준)은 IT나 산업재의 절반에 미치지 못하는 수준이며 유의성도 높지 않은 것으로 분석된다.

다만, 이러한 결과가 통화정책에 대한 반응을 기준으로 시장중립적 전략을 적극 고려해야 한다는 점을 의미하지는 않는다. 단순히 충격반응의 중위수만으로 볼 때, 긴축 충격 발생에 대비하여 주가 하락폭이 큰 IT 부문에 숏 포지션, 하락폭이 작은 필수 소비재 등에 롱 포지션을 취해 초과수익률을 얻을 수 있을 것으로 오해할 소지가 있다. 하지만 <그림 Ⅲ-4>가 나타내는 바와 같이, IT 업종의 주가가 상대적으로 뚜렷하게 하락할지라도 각 업종별 반응의 신뢰구간은 넓은 영역에 분포되어 있다는 점을 유념할 필요가 있다. 따라서 직관적으로도 동 전략에는 높은 불확실성이 내재되어 있음을 알 수 있다.

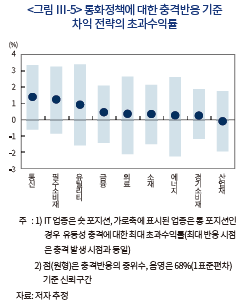

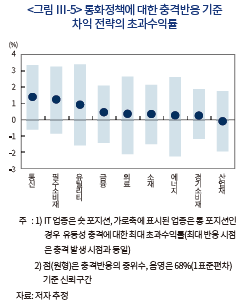

이러한 점은 추가적인 실증 분석을 통해서도 확인되었다. 동 분석에서는 IT 업종에 숏, 이외 각 업종에 롱 포지션을 취하여 9개 쌍(pair)을 구성하고, 긴축적인 통화정책(유동성) 충격 발생 시 초과수익률의 반응을 추정해 보았다. <그림 Ⅲ-5>는 최대 하락 반응을 기준으로 해당 결과를 요약하고 있다. 이에 따르면, 긴축적인 통화정책 충격 발생 시 각 롱-숏 포지션을 통한 초과수익률의 신뢰구간은 모두 양(+)과 음(-)의 영역에 걸쳐 넓게 분포되어, 통계적으로 유의한 차익을 얻기는 어려운 것으로 나타났다. 동 결과를 바탕으로 볼 때 위에서 언급된 시장중립적 전략은 유효성이 부족하다는 점에 유의해야 할 필요가 있다.

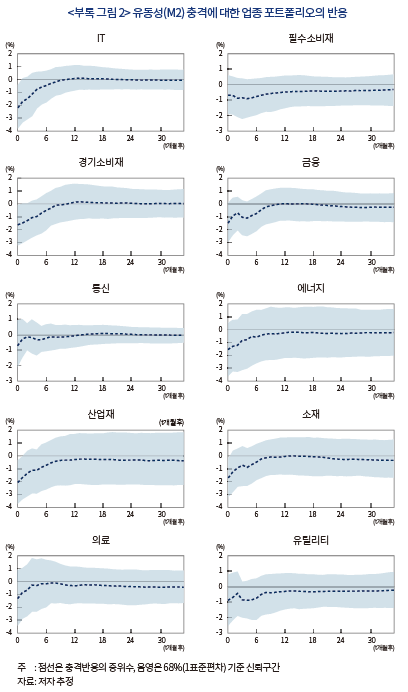

한편, 참고를 위해 <부록 그림 2>에 각 포트폴리오의 전체 충격반응을 수록하였다. 여기에서는 IT, 산업재 부문 등 충격 발생 당시(t=0) 반응의 유의성이 높았던 포트폴리오들도 1~2개월 후에는 충격 발생 전과 큰 차이가 없는 수준으로 주가가 회복되는 모습을 볼 수 있다. 즉, KOSPI 지수뿐만 아니라 세부 포트폴리오 수준에서도 유동성 충격이 주가에 미치는 영향은 지속성이 크지 않다는 점을나타내고 있다.

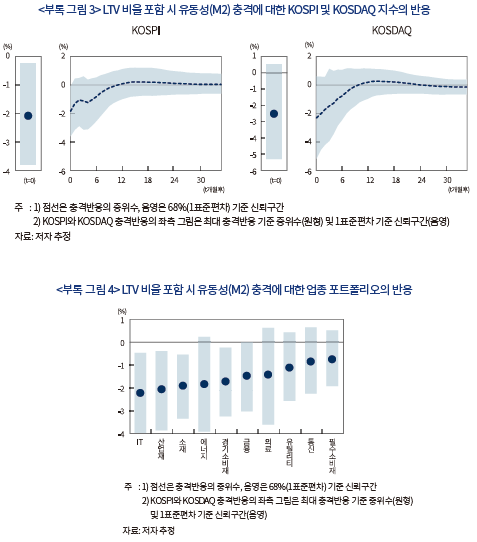

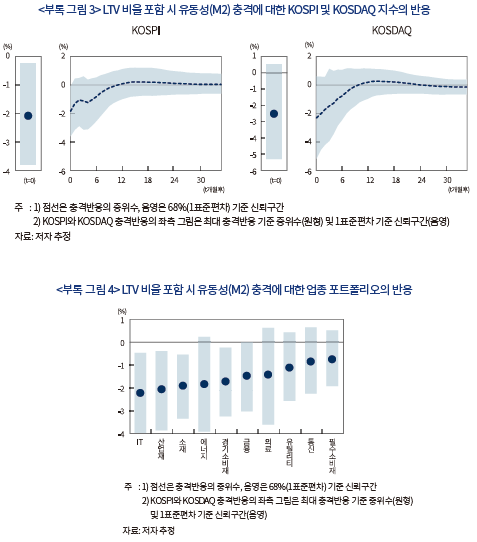

아울러 VAR 모형에 LTV(Loan-To-Value) 비율을 포함하여 추정한 강건성15) 분석 결과를 <부록 그림 3>과 <부록 그림 4>에 수록하였다. 유동성은 통화정책뿐만 아니라 대출규제 등 거시건전성정책에 따라 변화할 수 있으므로 거시건전성정책의 영향이 유동성에 반영되었을 가능성이 있다. 이를 감안하여 LTV 비율16)을 통제하여 모형을 재추정해 보았는데, 이 경우에도 KOSPI 및 KOSDAQ 지수와 업종 포트폴리오의 반응은 전술된 결과와 유사하게 나타났다. 즉, 유동성 감소 충격발생 시 KOSPI 지수와 IT, 산업재, 소재, 경기소비재 부문이 뚜렷하게 하락하는 반응을 보였다.17) 그리고 이 경우에도 유동성 충격이 주가에 미치는 영향은 지속성이 크지 않은 것으로 나타났다.

3.충격반응과 거시경제적 연관성

유동성 감소 충격에 대한 업종 포트폴리오의 반응을 추정한 결과, IT, 산업재, 소재 및 경기소비재 부문의 주가 하락이 상대적으로 크고 뚜렷하게 나타났다. 이러한 반응 정도 차이는 각 부문의 고유한 특성을 반영한 결과로 생각할 수 있다. 본고의 분석에서는 주요 거시ㆍ금융변수를 바탕으로 모형이 설정되었으므로, 동 결과에는 거시경제적인 연관성이 어느 정도 반영되어 있을 것으로 생각할 수 있다. 이러한 점에 착안하여 이하에서는 포트폴리오 수익률과 거시ㆍ금융변수 간 상관계수가 충격반응을 특징지을 수 있는지 살펴보고자 한다. 여기에서 수익률과의 상관계수는 산업생산증가율, 소비자물가 상승률, 신용 스프레드를 대상으로 산출하여 VAR 모형 내 변수와의 관계를 기본적으로 고려하였다. 또한, 신용 스프레드와 더불어 금융상황을 반영하는 변수인 대출 증가율18)과의 상관계수에 대해서도 추가적으로 살펴보았다.

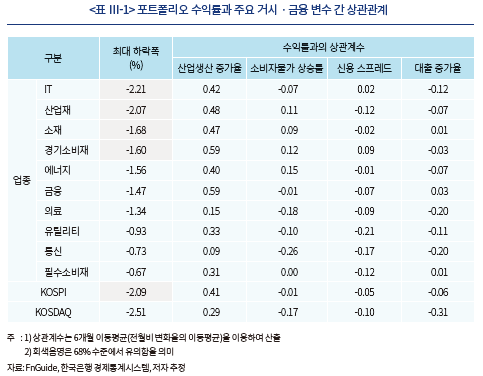

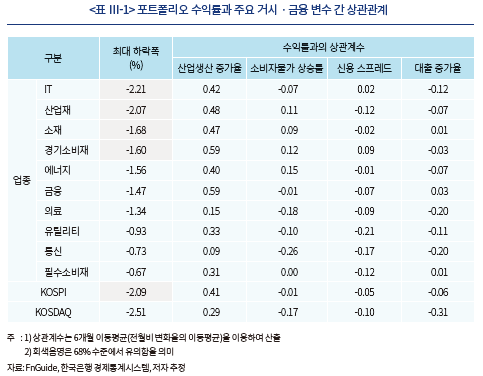

<표 Ⅲ-1>은 포트폴리오별 충격반응(최대 하락폭) 및 포트폴리오 수익률과 거시ㆍ금융변수 간 상관계수(6개월 이동평균 기준)를 나타내고 있다. 동 결과에서는 두 가지 특징을 확인할 수 있다. 첫 번째로 실물경제 활동을 반영하는 산업생산 증가율이 인플레이션이나 금융상황(신용스프레드 및 대출증가율)보다 수익률과의 상관관계(절대값)가 전반적으로 크다는 점이다. 업종 포트폴리오 수익률과 산업생산 증가율 간 상관계수는 상당수 0.4 이상으로 여타 변수와의 상관관계보다 한층 강하게 나타난다. 두 번째로 부문별로는 산업생산 증가율과 수익률 간 정(+)의 상관관계가 높을수록 통화정책(유동성) 충격에 대한 반응 정도가 큰 경향을 보인다는 점이다. 이러한 특징은, 충격반응의 정도가 크고 뚜렷한 업종(IT, 산업재, 소재, 경기소비재)과 그렇지 않은 업종(의료,유틸리티, 통신, 필수소비재)을 대비해 봄으로써 알 수 있다. 상위 업종의 경우 충격반응과 산업생산 증가율과의 상관계수는 평균 약 -1.9% 및 0.5로 산출되는데, 이는 하위 업종(충격반응: 평균 약 -0.9%, 산업생산 증가율과의 상관계수: 평균 약 0.2)보다 2배 이상 큰 수준이다. 이러한 결과로 볼때, 전반적으로는 경기와 수익률 간의 상관관계가 큰 부문일수록 통화정책 충격에 대한 반응 정도가 뚜렷한 것으로 판단된다. 전술된 두 가지 특징은 통화정책이 실물 경제활동을 통해 주식시장에 상대적으로 큰 영향을 미치므로, 경기와의 상관관계가 높은 업종의 주가가 크게 반응한다는점으로 해석된다.

Ⅳ. 요약 및 시사점

본고에서는 국내 통화정책이 주가에 미치는 영향을 금리 충격과 유동성 충격에 대한 반응 측면에서 각각 분석하였다. 동 분석에서는 유동성 측면에서의 통화정책 충격이 주식시장에 미치는 영향이 보다 뚜렷하게 나타났다. 즉, 예상보다 큰 폭의 유동성 감소는 주가의 하락 요인으로 작용하였는데, 이는 KOSPI 지수뿐만 아니라 업종별로 세분화된 포트폴리오 수준에서도 어느 정도 확인될수 있었다. 한편, 업종 포트폴리오를 대상으로 추가적으로 분석한 결과, 전반적으로 여타 지표에비해 산업생산지수와 주가와의 상관관계가 강하게 나타났다. 아울러 동 상관관계가 높은 업종일수록 통화정책 충격에 대한 반응 정도가 큰 것으로 추정되었다. 이 결과는 통화정책이 주가에 영향을 미치는 경로로 경기의 중요성이 높고, 경기에 대한 민감도에 따라 통화정책의 영향이 차별화된다는 점을 의미하는 것으로 볼 수 있다.

이상의 결과에 따르면, 긴축적인 통화정책 충격은 KOSPI 지수를 하락시키는 등 주식시장에 다소 부정적인 영향을 미치는 것으로 생각할 수 있다. 하지만 이보다는, 통화정책 충격이 발생하더라도 주가에 미친 영향은 지속성이 크지 않았다는 점을 강조할 필요가 있다. 즉, 긴축 충격 발생시 KOSPI 지수와 주요 업종의 주가가 하락하기는 했지만, 모두 1~2개월 내에 충격 이전 수준을 회복하는 모습이 나타났다는 점이다.

동 결과는 최근 상황과 관련하여 중요한 시사점을 제공한다. 지난해부터 높은 물가 상승세가 지속되면서 한국은행의 통화정책방향에 대한 관심이 높아지고 있다. 통화정책의 불확실성이 높은 경우, 시장 참가자들은 통화정책을 하나의 리스크 요인으로 인식하고 이에 기민하게 대응하고자 하는 유인을 가질 수 있다. 그러나 앞서 강조한 바와 같이, 국내 통화정책이 단기적으로 주가와 시장의 변동성에 다소 영향을 줄 수는 있지만 중장기적인 흐름을 크게 변화시키지는 않을 것으로 판단된다. 따라서 통화정책 방향에 따라 과민 반응하기보다는 실물경제 상황에 주목하는 것이 보다 바람직한 접근일 것이라 생각된다.

최근의 물가 상승세는 코로나19 이후 국내 수요 회복과 함께 글로벌 공급망 문제, 지정학적 리스크 등 대외 부문의 부정적 공급 충격이 함께 작용한 결과로 볼 수 있다. 향후 공급 측면에서의 인플레이션 압력이 완화되는 한편 경기 회복에 따른 수요 측 요인의 영향이 커진다면, 이에 따른 인플레이션은 주가에 부정적인 신호로만 작용하지는 않을 것이다. 따라서 인플레이션에 대응한 국내 통화정책 자체만을 고려하기보다는, 인플레이션을 주도하는 요인에 대한 분석과 전망을 바탕으로 리스크에 대비해 나갈 필요가 있을 것이다.

1) 한국은행은 1.25%의 기준금리는 실물경제 상황에 비해 여전히 완화적인 수준이라는 입장을 표명하였다(2022년 1월 통화정책방향 관련 총재 기자간담회). 아울러 시장참여자들이 연내 추가 인상을 예상하고 있는 데 대해 합리적인 전망을 토대로 한 기대라 평가한 바도 있다(2022년 2월 통화정책방향 관련 총재 기자간담회).

2) 미 연준은 2011년 8월에 2013년 중반까지, 2012년 1월에 2014년 후반까지, 2013년 9월에 2015년 중반까지 정책금리를 0% 수준에서 유지할 것이라고 발표함으로써 장기간에 걸쳐 단기금리 경로를 고정하겠다는 입장을 공식화하였다. 이러한 포워드 가이던스는 금융시장에서의 위험추구 성향을 높여 리스크 프리미엄의 하락요인으로 작용할 수 있다(Adrian & Shin, 2010).

3) Bernanke & Kuttner(2005)가 미국의 업종 포트폴리오를 대상으로 분석한 결과, 하이테크 부문과 당시 신기술 업종이었던 통신업(이동통신 서비스 포함) 부문의 반응이 강하고 유의한 반면, 에너지와 유틸리티 부문의 반응은 약하고 유의하지 않게 나타났다.

4) 예를 들어 긴축적인 통화정책이 실물 경제활동과 금융상황에 부정적인 영향을 미친다면, 경기와 금융비용 모두에 대해 민감한 업종이 그렇지 않은 업종보다 상대적으로 강한 반응을 보일 것으로 예상할 수 있다.

5) 2000년 1월 ~ 2021년 12월 중 일별 수익률의 1표준편차를 의미한다. 전체 대상기간 중 일간 수익률이 1표준편차를 벗어난 비율은 약 21%이다.

6) 동 비율은 금리 조정 시에는 금리 조정 빈도 대비, 금리 동결 시에는 금리 동결 빈도 대비 기준으로 산출한 수치이다.

7) 부호제약은 Fry & Pagan(2011) 등 주요 연구를 따라 6개월간 유지되도록 설정하였다.

8) 업종 포트폴리오를 대상으로 한 분석에서는 FnGuide의 10개 업종 포트폴리오 자료를 이용하였다. 동 업종 포트폴리오는 IT, 경기소비재, 금융, 산업재, 소재, 에너지, 유틸리티, 의료, 통신, 필수소비재로 구성된다.

9) 전체 충격반응은 부록(<부록 그림 1>)에 수록하였다.

10) 한국은행은 공개시장운영 뿐만 아니라 여러 유동성 조절수단을 활용하고 관련 제도를 도입ㆍ활용해 왔다. 그러한 예로, 금융위기 및 코로나19 발생 직후 시행한 유동성 공급정책(국고채 단순매입, RP 거래한도 확대, 대출정책 등), 증권대차 도입(2011년), 2016년과 2022년의 시장안정화 조치(국고채 단순매입) 등을 들 수 있다.

11) 유동성을 이용한 식별에서는 긴축적인 통화정책 충격이 유동성(M2), 산업생산지수, 소비자물가에 음(-)의 영향을 미치는 것으로 부호제약을 설정하였다.

12) 통화정책의 1표준편차 충격에 해당하는 크기로, 2021년 10월 M2(말잔) 기준으로는 약 6조원이 감소하는 충격으로 환산된다.

13) 본고에 수록되지는 않았지만, 후술될 업종 기준 포트폴리오를 대상으로 한 분석에서는 신용 스프레드가 1표준편차 수준에서 유의하게 상승하는 반응을 나타내었다.

14) 2021년 10월 M2(말잔) 기준으로 약 5조원이 감소하는 충격에 해당한다.

15) 대외요인인 미국과 중국의 주가(S&P500 및 항셍지수)를 통제한 경우에도 추정 결과는 유사하게 나타났다.

16) IMF의 Integrated Macroprudential Policy Database에서 제공되는 LTV 비율(국내 평균) 시계열 자료를 사용하였다.

17) LTV를 포함한 경우에도 금리 충격에 대해서는 전반적으로 뚜렷한 반응이 나타나지 않았다.

18) 장기 시계열이 존재하는 은행 대출 기준 자료를 사용하였다.

참고문헌

김민기ㆍ김준석, 2021,『코로나19 국면의 개인투자자: 투자행태와 투자성과』, 자본시장연구원 이슈보고서, 2021-3.

Adrian, T., Shin, H.S., 2010, Financial intermediaries and monetary economics, Federal Reserve Bank of New York Staff Reports, No. 398.

Bernanke, B.S., Kuttner, K.N., 2005, What explains the stock market’s reaction to Federal Reserve policy? Journal of Finance 60(3), 1221-1257.

Fry, R., Pagan, A.R., 2011, Sign restrictions and in structural vector autoregressions: A critical review, Journal of Economic Literature 49(4), 946-960.

Hattori, M., Schrimpf, A., Sushko, V., 2016, The response of tail risk perceptions to unconventional monetary policy, American Economic Journal: Macroeconomics 8(2), 111-136.

Peersman, G., 2005, What caused the millennium slowdown? Evidence based on autoregressions, Journal of Applied Econometrics 20(2), 185-207.

최근 가파른 물가 상승세가 지속되면서 통화정책의 대응 강도가 높아질 것으로 전망되고 있다. 국내 소비자물가는 지난해 11월 3.8%까지 상승하여 2011년 12월(4.2%) 이래 가장 높은 상승률을 나타내었고, 이후에도 3% 후반의 상승률을 이어가고 있다. 이에 따라 한국은행은 지난해 8월부터 3차례의 금리 인상을 통해 기준금리를 코로나19 이전 수준(1.25%)까지 높이면서 인플레이션 압력에 대응한 바 있다. 하지만 최근의 인플레이션은 원유 등 국제원자재 관련 품목뿐만 아니라, 각종 개인서비스 부문까지 확산되고 있어 물가 상승세가 쉽게 진정되기는 어려울 것으로 보인다. 이러한 상황과 함께 한국은행이 현재의 기준금리가 여전히 완화적인 수준이라고 인식1)하고 있다는 점을 감안할 때, 금융완화 정도가 추가적으로 축소될 가능성이 높은 것으로 생각된다.

통화정책은 경기 및 물가뿐만 아니라 개별 자산 가격에도 광범위한 파급효과를 유발할 수 있다. 특히 대표적인 금융자산인 주식의 경우, 총수요와 위험추구 성향 등을 통해 통화정책의 영향을 받는 것으로 생각된다. 여기에서 총수요는 소비 및 자본재 수요 등 기업의 실적을 결정하는 주요 요인으로, 긴축적인 통화정책은 이를 위축시키는 경향이 있다. 총수요를 통한 영향은 거시경제학의 통상적인 기제를 반영하고 있어 통화정책의 전통적인 파급효과에 따른 결과로 볼 수 있다. 한편, 위험추구 성향을 통한 영향은 리스크 프리미엄을 통해 위험자산의 할인율을 변화시키는 데 따른 것이다. 이는 금융위기 이후 부각된 관점인데, 그 대표적인 사례로 미 연준의 포워드 가이던스2)가 리스크 프리미엄을 하락시켜 주가 상승에 영향을 미친 것을 들 수 있다(Hattori et al., 2016).

코로나19 이후 국내 주식시장은 개인 투자자의 참여가 증가하면서(김민기ㆍ김준석, 2021) 그 저변이 크게 확대되었다. 이에 따라 통화정책이 주가에 미치는 영향에 대한 관심이 한층 증대되고 구체화되었을 것으로 생각된다. 본고는 이러한 배경을 바탕으로 국내 통화정책이 주가에 미치는 영향에 대해 실증 분석하고 시사점을 제공하고자 한다. 동 분석에서는 통화정책이 경기와 물가 등 거시경제 지표들과 상호작용한다는 점을 감안하여, 부호제약을 이용한 벡터자기회귀(sign restricted vector autoregression, 이하 부호제약 VAR) 모형을 바탕으로 외생적인 통화정책 충격을 식별하고 통화정책이 주가에 미치는 영향을 추정한다. 통화정책 충격은 금리와 유동성 측면으로 나누어 각각 식별하고, 동 충격에 대한 반응은 KOSPI 및 KOSDAQ 지수뿐만 아니라 업종 포트폴리오 수준으로 세분화하여 분석하도록 하겠다. 아울러 업종 포트폴리오의 충격반응이 주요 거시ㆍ금융변수와의 연관성 측면에서 어떠한 특징을 가지는지에 대해서도 살펴보고자 한다. 업종 포트폴리오3)에 기초한 동 분석은, 업종별 반응의 민감도와 통화정책이 영향을 미치는 경로 간의 관계를 이해4)하는데 도움이 될 것으로 생각된다. 이하에서는 통화정책 결정 시 주식시장의 움직임 등에 대해 기술통계량을 중심으로 먼저 개관한 다음, VAR 모형을 이용한 분석 결과에 대해 자세히 논의하도록 하겠다.

Ⅱ. 개관: 통화정책 결정과 주가의 변화

한국은행은 2000년 1월부터 2022년 1월까지 총 248회 기준금리를 결정하였고, 이 중 26회는 기준금리를 인하, 21회는 인상하였다. 기준금리 조정폭은 대부분 25bp(41회)이지만, 국내외 금융시장의 불안이 크게 고조되었던 9/11테러 이후, 금융위기, 코로나19 확산 초기에는 50~100bp까지 인하되기도 하였다. <표 Ⅱ-1>은 기준금리 결정 전일과 당일의 자료를 이용하여 기준금리 조정폭별 전일 대비 KOSPI 지수의 상승ㆍ하락 빈도를 나타내고 있다.

먼저 금리 조정 시 주가지수의 변동 양상을 보면, 금리 인하 시 주가가 상승한 경우는 12회, 하락한 경우는 14회로 비슷한 빈도를 보였다. 금리가 75bp 및 100bp 인하되었던 경우 주가지수는 평균적으로 상승하는 경향을 보였으나, 50bp와 25bp 인하되었던 경우에는 오히려 소폭 하락하는 것으로 나타나 일관된 패턴이 관측되지는 않는다. 다음으로 금리 인상 시 주가의 상승 및 하락 빈도는 각각 6회와 15회로, 금리 인상 이후 주가가 하락한 경우가 많았던 것으로 나타났다. 이에 따라 금리 인상 시 전일 대비 KOSPI 지수의 평균적인 변화는 하락으로 나타나는데, 그 폭은 -0.38% 정도로 크지는 않았던 것으로 평가된다. 한편, 기준금리는 201회 동결되었는데, 그 중 주가가 상승한 빈도는 107회, 하락한 빈도는 94회로 상승한 경우가 상대적으로 많았지만 평균적인 등락폭은 0%에 가까운 수준이다.

한편, <그림 Ⅱ-1>은 월별 자료를 이용하여 주요 통화정책 지표와 주가지수 간의 상관관계를 나타내고 있다. 왼쪽 그림은 콜금리와 0~12개월 후 KOSPI 수익률의 시차상관계수로 6개월 정도까지는 음(-)의 상관관계를 보이고 있다. 하지만 가장 강한 음의 상관관계를 보인 시점(0개월)의 경우 상관계수는 -0.12에 불과하여 상관관계가 뚜렷하지는 않은 것으로 판단된다. <그림 Ⅱ-1>의 오른쪽은 통화량(M2) 증가율과 KOSPI 수익률 간의 시차상관계수를 나타내고 있다. M2 증가율과 KOSPI 수익률의 경우, 초기에는 약한 음의 상관관계를 보였다가 4~9개월 후는 양(+)의 상관관계를 보였다. 하지만, 모든 대상 시점에서 상관계수의 절대값은 0.11를 넘지 않는 수준이다. 이상의 결과를 보면, 상관계수를 기준으로 통화정책 지표와 주가지수 간의 관계에 대해 명확히 특징짓기는 어려워 보인다.

본 장에서는 계량 모형으로 추정된 통화정책의 영향에 대해 구체적으로 살펴보도록 한다. 동 분석에서는 전반적인 시장 지수와 업종별 포트폴리오를 대상으로 통화정책의 영향을 각각 추정하고, 결과에 나타난 주요 특징과 시사점에 대해 논의하고자 한다. 여기에서는 부호제약 VAR 모형을 바탕으로 통화정책의 충격(예상되지 않은 통화정책의 변화)을 식별하고 각 변수들의 반응을 추정하였다. 분석에 이용될 VAR 모형은 다음과 같이 설정된다.

동 분석에서 생산과 물가 지표로는 산업생산지수(로그변환)와 소비자물가지수(로그변환)를 각각 사용하였다. 또한 신용 스프레드(회사채 AA-등급 3년물 금리와 국고채 3년물 금리 차이)를 포함하여 전반적인 금융상황과의 영향 관계도 고려하였다. 동 분석에서는 먼저 콜금리를 통화정책의 지표로 이용하여 통화정책 충격의 영향을 추정하고, 별도로 M2(로그변환)를 통화정책 지표로 이용하여 그 영향을 추정하였다. 본 연구의 직접적인 관심인 통화정책의 주가에 대한 영향은 KOSPI와 KOSDAQ 지수의 충격반응과 각 업종 포트폴리오8)의 충격반응을 각각 추정하여 분석된다. 표본기간은 2000년 1월부터 2021년 10월까지이며 VAR 모형의 시차는 AIC(Akaike Information Criterion)에 따라 4개월이 적용되었다.

1. 통화정책의 영향: 금리 충격

여기에서는 먼저 금리 인상 충격 발생 시 주가의 반응을 분석한 결과에 대해 논의하고자 한다. <그림 Ⅲ-1>은 KOSPI 및 KOSDAQ 지수와 여타 지표들의 월 단위 충격반응을 36개월에 걸쳐 나타내고 있다. 그림에서 점선은 충격반응의 중위수(median), 음영은 1표준편차 기준 신뢰구간을 의미한다. KOSPI와 KOSDAQ 지수의 반응에서 왼쪽에 각각 추가된 그림은 최대 하락폭(시점은 KOSPI: t=11, KOSDAQ: t=5)만을 별도로 표시한 것이다. 추정 결과에 따르면, 금리 인상 충격 발생 당시 KOSPI 및 KOSDAQ 지수는 하락하는 것으로 나타나 방향성 측면에서는 이론적인 예상과 일치하지만, 신뢰구간이 매우 넓어 불확실성이 큰 것으로 평가된다. 그리고 장기적으로도 충격반응의 신뢰구간이 0을 포함하면서 유의한 반응이 관측되지는 않는다. 이러한 결과를 볼 때, 금리 인상 충격에 대한 반응을 바탕으로 통화정책이 주식시장 전반에 유의미한 효과를 유발하는 것으로 판단하기는 어려운 것으로 생각된다.

다음으로 <그림 Ⅲ-2>는 업종 포트폴리오로 세분화하여 추정한 충격반응을 나타내고 있다. 여기에서는 지면을 절약하기 위해 포트폴리오별로 중위수 기준의 최대 하락폭(점)과 신뢰구간(음영)만을 표시하였다.9) 이 그림은 충격반응의 크기 순서대로 포트폴리오의 반응을 제시하고 있다. 업종별 포트폴리오의 경우에도 이전의 결과와 크게 다르지 않은 것으로 나타났다. 중위수 반응을 기준으로 보면, IT 부문의 경우 여타 업종에 비해 상대적으로 큰 하락폭을 보이기는 하지만, 신뢰구간이 양(+)과 음(-)의 구간에 걸쳐 넓게 분포되어 유의미한 결과로 해석하기는 어려워 보인다. 그리고 모든 업종에서 전 기간의 충격반응이 0과 다르지 않은 것으로 추정되었다. 한편, 소비자물가, 산업생산지수, 신용 스프레드의 반응은 KOSPI 및 KOSDAQ 지수를 이용한 추정 결과와 거의 동일하므로 관련 논의는 생략하도록 하겠다.

앞 절의 추정 결과를 바탕으로 볼 때, 금리 측면에서의 통화정책 충격이 국내 주식시장에 미치는 영향은 미미하거나, 높은 추정 오차로 인해 불확실성이 큰 것으로 해석할 수도 있다. 하지만 이를 바탕으로 일반화된 결론을 내리기보다는, 통화정책은 유동성에도 직접적인 영향을 미친다는 점을 고려하여 유동성을 기준으로 통화정책의 효과를 평가해 볼 필요도 있다. 특히, 기준금리가 동일한 수준으로 유지되더라도, 경제 여건에 따라 통화정책의 긴축ㆍ완화 정도가 다르게 작용하면서 유동성의 움직임이 기준금리와는 다른 양상을 띨 수 있다. 또한 한국은행이 기준금리 이외의 정책 수단10)을 별도로 활용하면서 시중 유동성에 영향을 미쳐 왔다는 점도 감안할 필요가 있다. 따라서 이하에서는 통화정책의 충격을 유동성을 통해 식별11)하고 주가의 충격반응을 살펴보도록 한다.

<그림 Ⅲ-3>은 유동성(M2) 감소 충격 발생 시 소비자물가, 산업생산지수, 신용 스프레드와 KOSPI 및 KOSDAQ 지수의 반응을 나타내고 있다. KOSPI 지수의 경우, 기준금리 인상 충격에 비해 유동성 감소 충격 발생 시(t=0) 상대적으로 뚜렷하게 하락하는 모습이다. 정량적인 측면에서 보면, M2가 약 0.2% 감소할 경우12) KOSPI 지수는 동일(t=0) 시점에 약 2% 내외 하락하는 것으로 추정되었다. 다만, 1~2개월 후에는 유의성이 낮아지면서 이전 수준의 주가로 회복되는 것으로 나타난다.한편, KOSDAQ 지수는 크기와 방향 측면에서 KOSPI 지수와 유사한 반응을 보이기는 하지만 유의성은 상대적으로 낮은 것으로 추정되었다. 여타 변수들의 반응을 보면, 산업생산지수의 경우 초기 6개월 정도까지는 금리 충격 발생 시에 비해 상대적으로 완만하게 회복되는 경향을 나타내었다. 그리고 신용 스프레드는 방향성 측면에서 금리 충격 발생 시와는 상이한 반응을 보였다. 금리충격 발생 시 신용 스프레드는 소폭 하락하였지만 유동성 충격 발생 시에는 소폭 상승하였다. 유의성이 높지는 않지만 방향성의 경우 유동성 충격에 대한 반응이 일반적인 예상에 부합하는 것으로 생각된다.13

<그림 Ⅲ-4>는 M2 감소 충격14)에 대한 업종 포트폴리오의 반응을 요약하고 있다. 추정에서 주가가 가장 크게 하락하는 시점은 모두 충격 발생 시점(t=0)과 일치한다. 동 분석 결과에서는 IT, 산업재, 소재 및 경기소비재 부문의 하락폭(중위수 기준 약 -2% 내외)이 크고 유의성이 상대적으로 높은 것으로 나타났다. 반면, 유틸리티나 통신, 필수소비재 등의 하락폭(중위수 기준)은 IT나 산업재의 절반에 미치지 못하는 수준이며 유의성도 높지 않은 것으로 분석된다.

이러한 점은 추가적인 실증 분석을 통해서도 확인되었다. 동 분석에서는 IT 업종에 숏, 이외 각 업종에 롱 포지션을 취하여 9개 쌍(pair)을 구성하고, 긴축적인 통화정책(유동성) 충격 발생 시 초과수익률의 반응을 추정해 보았다. <그림 Ⅲ-5>는 최대 하락 반응을 기준으로 해당 결과를 요약하고 있다. 이에 따르면, 긴축적인 통화정책 충격 발생 시 각 롱-숏 포지션을 통한 초과수익률의 신뢰구간은 모두 양(+)과 음(-)의 영역에 걸쳐 넓게 분포되어, 통계적으로 유의한 차익을 얻기는 어려운 것으로 나타났다. 동 결과를 바탕으로 볼 때 위에서 언급된 시장중립적 전략은 유효성이 부족하다는 점에 유의해야 할 필요가 있다.

아울러 VAR 모형에 LTV(Loan-To-Value) 비율을 포함하여 추정한 강건성15) 분석 결과를 <부록 그림 3>과 <부록 그림 4>에 수록하였다. 유동성은 통화정책뿐만 아니라 대출규제 등 거시건전성정책에 따라 변화할 수 있으므로 거시건전성정책의 영향이 유동성에 반영되었을 가능성이 있다. 이를 감안하여 LTV 비율16)을 통제하여 모형을 재추정해 보았는데, 이 경우에도 KOSPI 및 KOSDAQ 지수와 업종 포트폴리오의 반응은 전술된 결과와 유사하게 나타났다. 즉, 유동성 감소 충격발생 시 KOSPI 지수와 IT, 산업재, 소재, 경기소비재 부문이 뚜렷하게 하락하는 반응을 보였다.17) 그리고 이 경우에도 유동성 충격이 주가에 미치는 영향은 지속성이 크지 않은 것으로 나타났다.

3.충격반응과 거시경제적 연관성

유동성 감소 충격에 대한 업종 포트폴리오의 반응을 추정한 결과, IT, 산업재, 소재 및 경기소비재 부문의 주가 하락이 상대적으로 크고 뚜렷하게 나타났다. 이러한 반응 정도 차이는 각 부문의 고유한 특성을 반영한 결과로 생각할 수 있다. 본고의 분석에서는 주요 거시ㆍ금융변수를 바탕으로 모형이 설정되었으므로, 동 결과에는 거시경제적인 연관성이 어느 정도 반영되어 있을 것으로 생각할 수 있다. 이러한 점에 착안하여 이하에서는 포트폴리오 수익률과 거시ㆍ금융변수 간 상관계수가 충격반응을 특징지을 수 있는지 살펴보고자 한다. 여기에서 수익률과의 상관계수는 산업생산증가율, 소비자물가 상승률, 신용 스프레드를 대상으로 산출하여 VAR 모형 내 변수와의 관계를 기본적으로 고려하였다. 또한, 신용 스프레드와 더불어 금융상황을 반영하는 변수인 대출 증가율18)과의 상관계수에 대해서도 추가적으로 살펴보았다.

<표 Ⅲ-1>은 포트폴리오별 충격반응(최대 하락폭) 및 포트폴리오 수익률과 거시ㆍ금융변수 간 상관계수(6개월 이동평균 기준)를 나타내고 있다. 동 결과에서는 두 가지 특징을 확인할 수 있다. 첫 번째로 실물경제 활동을 반영하는 산업생산 증가율이 인플레이션이나 금융상황(신용스프레드 및 대출증가율)보다 수익률과의 상관관계(절대값)가 전반적으로 크다는 점이다. 업종 포트폴리오 수익률과 산업생산 증가율 간 상관계수는 상당수 0.4 이상으로 여타 변수와의 상관관계보다 한층 강하게 나타난다. 두 번째로 부문별로는 산업생산 증가율과 수익률 간 정(+)의 상관관계가 높을수록 통화정책(유동성) 충격에 대한 반응 정도가 큰 경향을 보인다는 점이다. 이러한 특징은, 충격반응의 정도가 크고 뚜렷한 업종(IT, 산업재, 소재, 경기소비재)과 그렇지 않은 업종(의료,유틸리티, 통신, 필수소비재)을 대비해 봄으로써 알 수 있다. 상위 업종의 경우 충격반응과 산업생산 증가율과의 상관계수는 평균 약 -1.9% 및 0.5로 산출되는데, 이는 하위 업종(충격반응: 평균 약 -0.9%, 산업생산 증가율과의 상관계수: 평균 약 0.2)보다 2배 이상 큰 수준이다. 이러한 결과로 볼때, 전반적으로는 경기와 수익률 간의 상관관계가 큰 부문일수록 통화정책 충격에 대한 반응 정도가 뚜렷한 것으로 판단된다. 전술된 두 가지 특징은 통화정책이 실물 경제활동을 통해 주식시장에 상대적으로 큰 영향을 미치므로, 경기와의 상관관계가 높은 업종의 주가가 크게 반응한다는점으로 해석된다.

본고에서는 국내 통화정책이 주가에 미치는 영향을 금리 충격과 유동성 충격에 대한 반응 측면에서 각각 분석하였다. 동 분석에서는 유동성 측면에서의 통화정책 충격이 주식시장에 미치는 영향이 보다 뚜렷하게 나타났다. 즉, 예상보다 큰 폭의 유동성 감소는 주가의 하락 요인으로 작용하였는데, 이는 KOSPI 지수뿐만 아니라 업종별로 세분화된 포트폴리오 수준에서도 어느 정도 확인될수 있었다. 한편, 업종 포트폴리오를 대상으로 추가적으로 분석한 결과, 전반적으로 여타 지표에비해 산업생산지수와 주가와의 상관관계가 강하게 나타났다. 아울러 동 상관관계가 높은 업종일수록 통화정책 충격에 대한 반응 정도가 큰 것으로 추정되었다. 이 결과는 통화정책이 주가에 영향을 미치는 경로로 경기의 중요성이 높고, 경기에 대한 민감도에 따라 통화정책의 영향이 차별화된다는 점을 의미하는 것으로 볼 수 있다.

이상의 결과에 따르면, 긴축적인 통화정책 충격은 KOSPI 지수를 하락시키는 등 주식시장에 다소 부정적인 영향을 미치는 것으로 생각할 수 있다. 하지만 이보다는, 통화정책 충격이 발생하더라도 주가에 미친 영향은 지속성이 크지 않았다는 점을 강조할 필요가 있다. 즉, 긴축 충격 발생시 KOSPI 지수와 주요 업종의 주가가 하락하기는 했지만, 모두 1~2개월 내에 충격 이전 수준을 회복하는 모습이 나타났다는 점이다.

동 결과는 최근 상황과 관련하여 중요한 시사점을 제공한다. 지난해부터 높은 물가 상승세가 지속되면서 한국은행의 통화정책방향에 대한 관심이 높아지고 있다. 통화정책의 불확실성이 높은 경우, 시장 참가자들은 통화정책을 하나의 리스크 요인으로 인식하고 이에 기민하게 대응하고자 하는 유인을 가질 수 있다. 그러나 앞서 강조한 바와 같이, 국내 통화정책이 단기적으로 주가와 시장의 변동성에 다소 영향을 줄 수는 있지만 중장기적인 흐름을 크게 변화시키지는 않을 것으로 판단된다. 따라서 통화정책 방향에 따라 과민 반응하기보다는 실물경제 상황에 주목하는 것이 보다 바람직한 접근일 것이라 생각된다.

최근의 물가 상승세는 코로나19 이후 국내 수요 회복과 함께 글로벌 공급망 문제, 지정학적 리스크 등 대외 부문의 부정적 공급 충격이 함께 작용한 결과로 볼 수 있다. 향후 공급 측면에서의 인플레이션 압력이 완화되는 한편 경기 회복에 따른 수요 측 요인의 영향이 커진다면, 이에 따른 인플레이션은 주가에 부정적인 신호로만 작용하지는 않을 것이다. 따라서 인플레이션에 대응한 국내 통화정책 자체만을 고려하기보다는, 인플레이션을 주도하는 요인에 대한 분석과 전망을 바탕으로 리스크에 대비해 나갈 필요가 있을 것이다.

1) 한국은행은 1.25%의 기준금리는 실물경제 상황에 비해 여전히 완화적인 수준이라는 입장을 표명하였다(2022년 1월 통화정책방향 관련 총재 기자간담회). 아울러 시장참여자들이 연내 추가 인상을 예상하고 있는 데 대해 합리적인 전망을 토대로 한 기대라 평가한 바도 있다(2022년 2월 통화정책방향 관련 총재 기자간담회).

2) 미 연준은 2011년 8월에 2013년 중반까지, 2012년 1월에 2014년 후반까지, 2013년 9월에 2015년 중반까지 정책금리를 0% 수준에서 유지할 것이라고 발표함으로써 장기간에 걸쳐 단기금리 경로를 고정하겠다는 입장을 공식화하였다. 이러한 포워드 가이던스는 금융시장에서의 위험추구 성향을 높여 리스크 프리미엄의 하락요인으로 작용할 수 있다(Adrian & Shin, 2010).

3) Bernanke & Kuttner(2005)가 미국의 업종 포트폴리오를 대상으로 분석한 결과, 하이테크 부문과 당시 신기술 업종이었던 통신업(이동통신 서비스 포함) 부문의 반응이 강하고 유의한 반면, 에너지와 유틸리티 부문의 반응은 약하고 유의하지 않게 나타났다.

4) 예를 들어 긴축적인 통화정책이 실물 경제활동과 금융상황에 부정적인 영향을 미친다면, 경기와 금융비용 모두에 대해 민감한 업종이 그렇지 않은 업종보다 상대적으로 강한 반응을 보일 것으로 예상할 수 있다.

5) 2000년 1월 ~ 2021년 12월 중 일별 수익률의 1표준편차를 의미한다. 전체 대상기간 중 일간 수익률이 1표준편차를 벗어난 비율은 약 21%이다.

6) 동 비율은 금리 조정 시에는 금리 조정 빈도 대비, 금리 동결 시에는 금리 동결 빈도 대비 기준으로 산출한 수치이다.

7) 부호제약은 Fry & Pagan(2011) 등 주요 연구를 따라 6개월간 유지되도록 설정하였다.

8) 업종 포트폴리오를 대상으로 한 분석에서는 FnGuide의 10개 업종 포트폴리오 자료를 이용하였다. 동 업종 포트폴리오는 IT, 경기소비재, 금융, 산업재, 소재, 에너지, 유틸리티, 의료, 통신, 필수소비재로 구성된다.

9) 전체 충격반응은 부록(<부록 그림 1>)에 수록하였다.

10) 한국은행은 공개시장운영 뿐만 아니라 여러 유동성 조절수단을 활용하고 관련 제도를 도입ㆍ활용해 왔다. 그러한 예로, 금융위기 및 코로나19 발생 직후 시행한 유동성 공급정책(국고채 단순매입, RP 거래한도 확대, 대출정책 등), 증권대차 도입(2011년), 2016년과 2022년의 시장안정화 조치(국고채 단순매입) 등을 들 수 있다.

11) 유동성을 이용한 식별에서는 긴축적인 통화정책 충격이 유동성(M2), 산업생산지수, 소비자물가에 음(-)의 영향을 미치는 것으로 부호제약을 설정하였다.

12) 통화정책의 1표준편차 충격에 해당하는 크기로, 2021년 10월 M2(말잔) 기준으로는 약 6조원이 감소하는 충격으로 환산된다.

13) 본고에 수록되지는 않았지만, 후술될 업종 기준 포트폴리오를 대상으로 한 분석에서는 신용 스프레드가 1표준편차 수준에서 유의하게 상승하는 반응을 나타내었다.

14) 2021년 10월 M2(말잔) 기준으로 약 5조원이 감소하는 충격에 해당한다.

15) 대외요인인 미국과 중국의 주가(S&P500 및 항셍지수)를 통제한 경우에도 추정 결과는 유사하게 나타났다.

16) IMF의 Integrated Macroprudential Policy Database에서 제공되는 LTV 비율(국내 평균) 시계열 자료를 사용하였다.

17) LTV를 포함한 경우에도 금리 충격에 대해서는 전반적으로 뚜렷한 반응이 나타나지 않았다.

18) 장기 시계열이 존재하는 은행 대출 기준 자료를 사용하였다.

참고문헌

김민기ㆍ김준석, 2021,『코로나19 국면의 개인투자자: 투자행태와 투자성과』, 자본시장연구원 이슈보고서, 2021-3.

Adrian, T., Shin, H.S., 2010, Financial intermediaries and monetary economics, Federal Reserve Bank of New York Staff Reports, No. 398.

Bernanke, B.S., Kuttner, K.N., 2005, What explains the stock market’s reaction to Federal Reserve policy? Journal of Finance 60(3), 1221-1257.

Fry, R., Pagan, A.R., 2011, Sign restrictions and in structural vector autoregressions: A critical review, Journal of Economic Literature 49(4), 946-960.

Hattori, M., Schrimpf, A., Sushko, V., 2016, The response of tail risk perceptions to unconventional monetary policy, American Economic Journal: Macroeconomics 8(2), 111-136.

Peersman, G., 2005, What caused the millennium slowdown? Evidence based on autoregressions, Journal of Applied Econometrics 20(2), 185-207.