Find out more about our latest publications

Key Issues of Split-Off and Chain Listing

Issue Papers 22-07 Jun. 02, 2022

- Research Topic Corporate Finance

- Page 26

Recently, split-offs and IPOs after split-off of listed companies have sparked social controversy. But discussions regarding the issue are limited to a few large companies. This article conducts an empirical analysis of disclosures of 377 split-offs and 157 chain listings for the past 12 years from 2010 to 2021. The analysis result indicates that a growing number of split-offs have been conducted for various purposes including controlling shareholders’ pursuit of interests, investment attraction, sell-off and restructuring, which makes aspects of split-offs more complicated. A split-off disclosure is recognized as a negative signal in the KOSPI market for the short term. However, enterprise value of the split-off company, measured by the market to book ratio of equity capital, has improved significantly in the medium and long term and shown an upward trend compared to the average enterprise value in the same business category. Considering this, it is hard to say that split-offs would take a toll on enterprise value.

On the other hand, there are only 17 IPOs after split-off between 2010 and 2021, which makes it difficult to conduct an empirical analysis. Notwithstanding, chain listings involving a parent company and its subsidiary including IPOs after split-off account for 20% of newly listed companies every year. Subsidiaries that go public after split-off have lower enterprise value, compared to other newly listed companies and parent companies already listed on the stock exchange tend to experience a significant decline in enterprise value. Accordingly, IPOs after split-off and chain listings could have a negative impact on enterprise value.

Although it is hard to find any regulation on split-offs and IPOs after split-off in major economies, Southeast Asian countries regulate chain listings by applying listing requirements. When examining empirical analysis results and overseas cases regarding split-offs, it is necessary to apply regulatory measures for protecting minority shareholders specified in the recent revision to corporate governance reports not only to large companies but also to other listed companies. With respect to chain listings including an IPO after split-off, regulatory measures such as improving corporate governance or imposing stricter listing requirements should be put in place to boost enterprise value of listed companies.

On the other hand, there are only 17 IPOs after split-off between 2010 and 2021, which makes it difficult to conduct an empirical analysis. Notwithstanding, chain listings involving a parent company and its subsidiary including IPOs after split-off account for 20% of newly listed companies every year. Subsidiaries that go public after split-off have lower enterprise value, compared to other newly listed companies and parent companies already listed on the stock exchange tend to experience a significant decline in enterprise value. Accordingly, IPOs after split-off and chain listings could have a negative impact on enterprise value.

Although it is hard to find any regulation on split-offs and IPOs after split-off in major economies, Southeast Asian countries regulate chain listings by applying listing requirements. When examining empirical analysis results and overseas cases regarding split-offs, it is necessary to apply regulatory measures for protecting minority shareholders specified in the recent revision to corporate governance reports not only to large companies but also to other listed companies. With respect to chain listings including an IPO after split-off, regulatory measures such as improving corporate governance or imposing stricter listing requirements should be put in place to boost enterprise value of listed companies.

Ⅰ. 들어가는 말

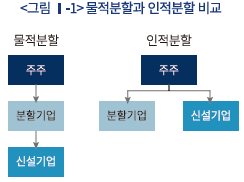

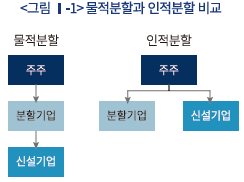

물적분할은 1998년 12월 외환위기 극복 과정에서 기업구조조정을 원활하게 진행하기 위해 상법에 도입한 기업분할의 한 유형이다. 물적분할과 비교되는 인적분할이 분할의 대가인 신설기업의 주식을 분할기업의 주주에게 귀속시키는 것과 달리 물적분할에서는 분할기업에게 귀속시켜 신설기업이 분할기업의 100% 자회사가 되는 차이가 있다.

최근 물적분할에 대한 사회적 관심이 증대된 데는 대기업들이 잇달아 핵심 사업부를 물적분할하고 일부 신설기업은 기업공개(이른바 ‘쪼개기상장’)까지 하면서 기존 분할기업의 소액주주들이 반발하고 나섰기 때문이다. 소액주주들은 신규 사업부문의 빠른 성장을 기대하고 주주가 되었는데 해당 사업부문이 물적분할 되어 분할기업의 자회사로 바뀌면 분할기업의 소액주주들은 신설기업을 간접적으로만 소유하게 되어 신설기업의 주요 의사결정에서 배제되는 것을 문제 삼고 있다. 또한 신설기업이 기업공개를 하게 되면 분할기업의 시장가치에 보유 자회사 주식의 시장가치가 할인되어 반영됨에 따라 분할기업의 기업가치가 훼손된다고 주장한다. 그 결과 물적분할 공시 직후 일부 분할기업의 주가가 급락하는 현상이 나타나고 있다.1)

물적분할에 대한 사회적 관심이 커지자 국회에서는 관련 입법발의가 이어지고 있으며2) 제20대 대통령직 인수위원회는 물적분할 관련 주주 보호를 110대 국정과제로 설정하였다.3) 규제안은 물적분할 자체를 제한해야 한다거나, 물적분할 자회사의 상장을 금지해야 한다는 강력한 규제안에서부터 물적분할에 반대하는 주주에게 주식매수청구권을 부여하거나 분할기업 주주들에게 자회사 주식에 대한 신주인수권을 제공하거나 또는 자회사의 공모주를 우선 배정 받도록 하자는 방안까지 다양하다. 그런데 지금까지 물적분할 및 쪼개기상장과 관련된 논의는 문제가 된 일부 대기업 사례에만 초점이 맞추어져 있어 실제 물적분할과 모자기업 동시상장의 실태에 근거하지 못한 한계가 있다.

이에 본고에서는 물적분할 및 모자기업의 동시상장과 관련하여 실증적 분석을 통해 문제점을 확인하고 대안을 모색하고자 한다. 그러기 위해 Ⅱ장에서는 물적분할의 주요 이슈를 물적분할의 현황 및 증가 배경, 공시효과, 기업가치에 미치는 영향으로 나누어 분석한다. Ⅲ장에서는 물적분할 기업의 자회사 상장을 포함해 모자기업 동시상장의 현황을 알아보고 동시상장 모자기업의 기업가치 특징을 분석한다. Ⅳ장에서는 주요국의 물적분할과 모자기업 동시상장의 실태와 제도적 특징을 비교 분석한다. 마지막으로 Ⅴ장에서는 맺는말로 마무리한다.

Ⅱ. 물적분할의 주요 이슈

1. 물적분할 현황 및 증가 배경

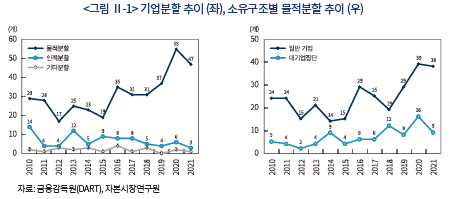

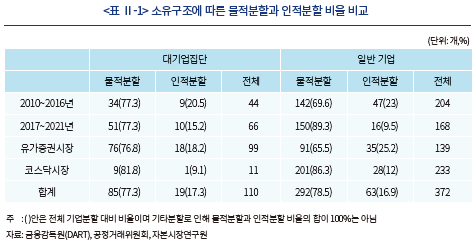

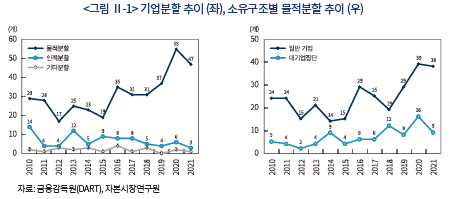

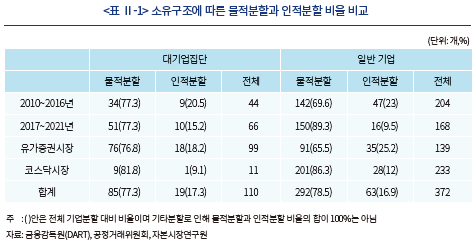

2010년부터 2021년까지 12년 동안의 482개의 국내 상장기업의 기업분할 공시를 물적분할, 인적분할, 기타분할(분할합병 등 복합적인 분할)로 구분하면 물적분할 377개, 인적분할 82개, 기타분할 23개이다. 기업분할 중에서 물적분할은 연평균 31.3개(78% 비중)를 차지하였는데 최근 5년(2017~2021년) 동안에는 연평균 40개(86% 비중)로 크게 증가하였다. 이에 비해 인적분할은 다소 감소하는 추세이다(<그림 Ⅱ-1>(좌) 참조).

물적분할 공시 증가에는 소유구조에 따른 특징이 존재한다. 전통적으로 재벌 기업(대기업집단)4)은 물적분할을 선호하였는데5) 최근 5년 동안에는 대기업집단이 아닌 일반 기업의 물적분할이 두드러지게 늘어나고 있다(<그림 Ⅱ-1> (우) 참조). 대기업집단의 물적분할 비율은 2010~2016년과 2017~2021년 모두 77.3%로 변동이 없으나 일반 기업은 69.6%에서 89.3%로 19.7%p나 증가하였다. 또한 시장을 구분해 보면 코스닥에 상장한 일반 기업이 가장 많이 물적분할을 해왔다고 할 수 있다(<표 Ⅱ-1> 참조).

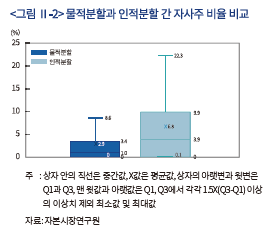

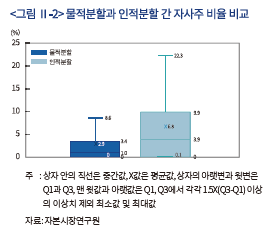

대표적 기업분할 유형인 물적분할과 인적분할을 구별하는 재무적 특징으로는 기업이 보유하고 있는 자사주 비율이 있다. 과거 인적분할은 자사주를 활용하여 지배주주가 신설기업에 대한 지분을 손쉽게 늘릴 수 있었으며(이른바 ‘자사주 마법’), 그로 인해 지주회사로 탈바꿈하는데 주로 사용되었다.6) 물적분할 기업의 자사주 보유 비율은 평균 2.9%이나 인적분할 기업은 6.8%로 높았으며 두 집단의 자사주 비율 차이는 1% 유의수준 t-test에서 유의함을 보였다(<그림 Ⅱ-2> 참조). 그런데 자사주를 이용한 인적분할에 대해 사회적 비판이 증가하면서 기업들도 인적분할을 덜 선호하게 되었다고 할 수 있다.

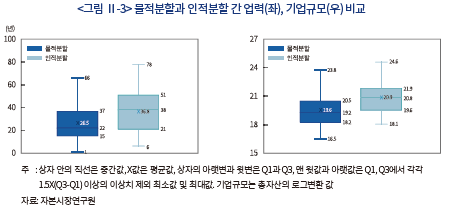

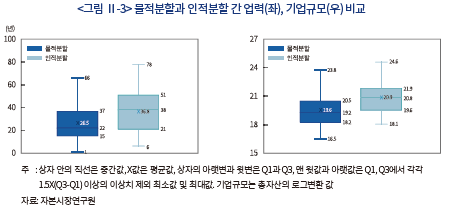

물적분할과 인적분할 기업의 또 다른 차이는 업력과 기업규모이다. 물적분할 기업의 업력은 평균 26.5년으로 인적분할 기업의 36.8년에 비해 10년이나 젊으며 기업규모도 유의하게 작게 나타나고 있다.7) 인적분할 기업에 비해 물적분할 기업의 업력이 짧고 규모가 작은 것은 재벌이 아닌 일반 기업 및 코스닥 기업의 물적분할 증가 추세와 맞물려 있다고 할 수 있다(<그림 Ⅱ-3> 참조).

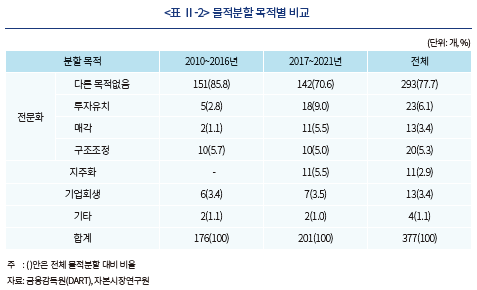

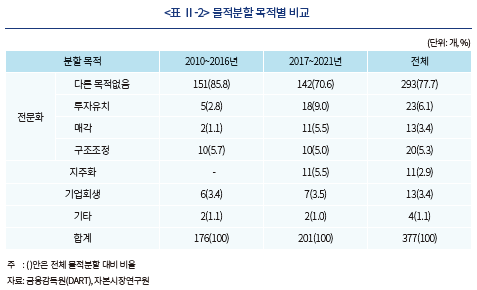

최근 5년 동안 물적분할 증가의 또 다른 요인으로는 물적분할 목적의 다변화이다. 물적분할 공시 중 분할목적 항목을 분석해 보면 언급비율이 가장 높은 것은 92.6%인 ‘전문화8)’라고 할 수 있다. 그런데 2010~2016년 기간에는 전문화 목적만 기술한 물적분할이 85.8%였으나 2017~2021년 기간에는 70.6%로 감소하였고 대신에 전문화 목적과 함께 투자유치, 매각, 구조조정의 분할목적을 함께 병기한 비율이 9.7%에서 19.4%로 크게 증가했다(<표 Ⅱ-2> 참조). 특히 투자유치와 매각을 분할목적으로 설정한 경우는 2.8%와 1.1%에서 각각 9%와 5.5%로 대폭 증가했음을 알 수 있다. 또한 지주회사로 전환하기 위한 물적분할이 2010~2016년 기간에는 없다가 2017년부터 나타난 것은 인적분할을 통한 지주회사 전환이 감소하면서 그 수요가 일부 대체되었다고 해석할 수 있다.

2. 물적분할 공시효과 분석

물적분할 공시효과에 대해서는 여러 연구가 수행되었으나 공통적인 결과를 보여주지 않고 있다. 일부 연구에서는 긍정적 효과가 관측되기도 하지만 다른 연구에서는 부정적 효과를 보일 때도 있으며 유가증권시장과 코스닥시장에서의 효과가 반대이거나 유의성이 다르게 나타나기도 한다.9) 이에 반해 미국의 기업분할 공시효과에 대한 분석은 Hite & Owers(1983), Cusatis et al.(1993)에서 보듯이 대체로 유의한 효과를 보여 기업분할이 기업가치 제고를 위한 기업 재편으로 투자자에게 인식되고 있다. 이러한 차이는 국내의 경우 물적분할 등 기업분할의 역사가 미국에 비해 짧고 시기별로 기업분할의 목적이 달랐으며 유가증권시장과 코스닥시장 간 투자자 구성이나 기업특성에 있어서 시장 차이도 컸기 때문으로 해석할 수 있다. 따라서 최근 자료에 근거한 물적분할 공시효과의 실증분석이 필요하다.

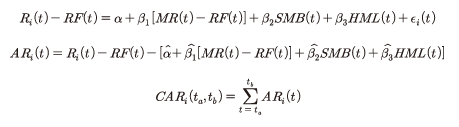

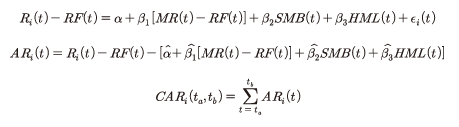

물적분할 기업의 공시효과에 대한 실증분석을 위해 물적분할과 인적분할 공시 기업의 초과수익률(Abnormal Return: AR)과 공시일 기준 [-20, 20]거래일의 누적초과수익률(Cumulative Ab-normal Return: CAR)을 산출하였다. 초과수익률과 누적초과수익률은 유가증권시장 및 코스닥시장의 시가총액 가중 시장수익률(MR), CD90일 금리로 사용한 무위험수익률(RF) 및 Fama-French 3요인 모델의 SMB, HML 지수를 반영하여 추정하였다.10)

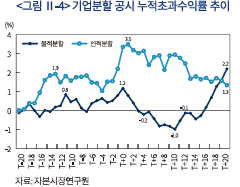

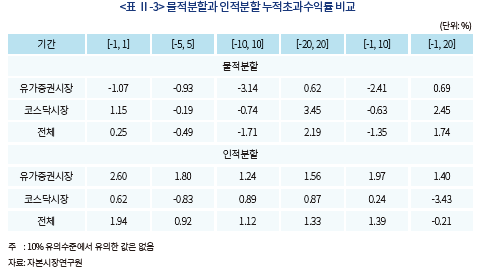

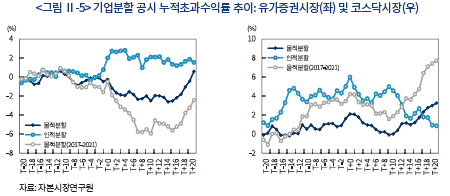

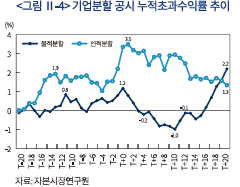

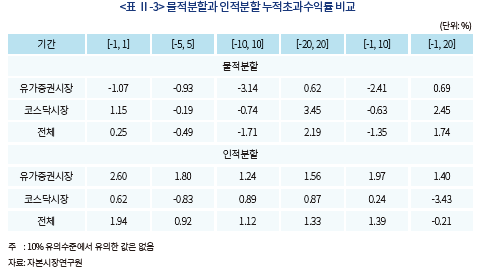

분석 결과 물적분할의 누적초과수익률은 공시 전에는 낮은 양의 값을 보이며 특별한 변동을 나타내지 않으나 공시일 직전 거래일(T-1)부터 상승하여 공시일(T+0)에는 1.2%까지 상승해 긍정적 효과가 나타났다(<그림 Ⅱ-4> 참조). 그러나 누적초과수익률은 T+1부터 T+10의 –0.99%까지 계속 하락함으로써 물적분할에 대한 반응이 부정적으로 바뀌었다고 할 수 있다. 다만 T+11부터 누적초과수익률이 반등하여 T+16부터 양의 값이 되면서 부정적 효과는 상쇄되는 모습을 보였다. 한편 인적분할은 공시 전인 T-16부터 누적초과수익률이 상승하였고 T-3부터 재상승함으로써 인적분할에 대한 기대감이 공시 전부터 나타났으며 공시 후에도 완만하게 하락함으로써 물적분할에 비해 긍정적 효과를 보였다고 할 수 있다. 그런데 분석 기간 누적초과수익률 모두 10% 유의수준에서 유의하지 않았기에 물적분할과 인적분할의 공시효과가 강하다고 할 수는 없다(<표 Ⅱ-3> 참조).

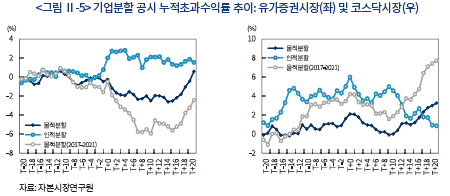

물적분할의 공시효과를 유가증권시장과 코스닥시장으로 구분하면 시장 간 차이도 뚜렷하다(<그림 Ⅱ-5> 참조). 유가증권시장에서 물적분할 기업의 누적초과수익률은 공시일까지 특별한 움직임을 보이지 않다가 T+1부터 하락하여 T+14에는 –2.6%까지 떨어져 부정적 효과를 보였으며 특히 최근 5년 동안에는 T+10에 –5.94%까지 하락해 물적분할에 대한 시장의 반응이 더 악화되었다. 이에 비해 인적분할은 공시일부터 누적초과수익률이 2.03%로 오르며 물적분할에 비해 긍정적 효과를 나타냈다.

코스닥시장에서 물적분할 공시는 공시일 누적초과수익률이 2.1%에 이르렀고 그 후 누적초과수익률이 다소 하락한 후에도 양의 수익률을 보이면서 전체적으로 긍정적 효과를 보였다. 더욱이 최근 5년 동안에는 공시일 누적초과수익률이 4.19%로 유가증권시장과 대조적 모습을 보였다. 물적분할에 대한 반응이 유가증권시장과 코스닥시장에서 다르게 나타나는 것은 미디어와 소액주주들이 유가증권시장의 대기업 물적분할에 관심이 집중되면서 유가증권시장의 부정적 반응이 코스닥시장에 비해 커진 것도 한 요인일 수 있다.

3. 물적분할 전후 기업가치 변화 분석

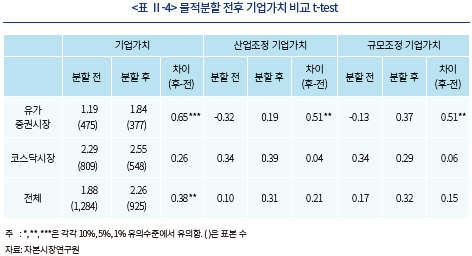

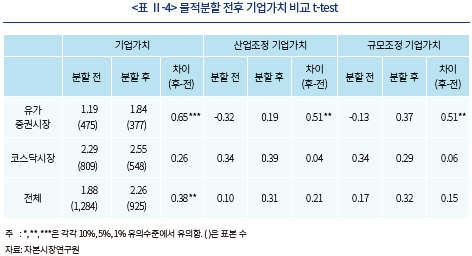

기업가치를 자기자본의 시장가치-장부가치 비율(market to book ratio)11)로 측정하였을 때 물적분할은 기업가치에 의미있는 변화를 주는 것으로 나타나고 있다. 물적분할 전후의 기업가치 변화에 대한 분석은 2010~2021년 기간 동안 물적분할을 한 189개 상장기업의 물적분할 이전 기간 기업가치 표본 1,284개와 물적분할 이후 기업가치 표본 925개를 산출하여 비교하였다(<표 Ⅱ-4> 참조).12) 물적분할 기업의 물적분할 이전 기업가치는 평균 1.88이었으나 물적분할 후에는 평균 20.2% 증가한 2.26이었다.13) 특히 유가증권 기업의 기업가치 증가율 평균은 54.7%로 코스닥 기업의 증가율 평균 11.5%에 비해 커서 물적분할이 유가증권시장에서 더 효과적이었다고 할 수 있다. 물적분할 기업의 기업가치 변화를 상대적으로 측정하기 위해 각 시점별로 기업가치에서 산업14)평균 기업가치를 차감한 산업조정 기업가치를 계산하면 물적분할 전에는 각 기업의 기업가치가 산업평균보다 0.1 높았으나 물적분할 후에는 0.31로 높아지면서 산업평균과 비교한 상대적 기업가치도 증가하였다. 특히 유가증권시장에서는 물적분할 기업들이 분할 전에는 산업평균 기업가치를 0.32만큼 하회할 정도로 기업가치가 낮았으나 분할 후에는 산업평균을 0.19만큼 상회할 정도로 기업가치가 개선되었다.

물적분할에 따른 기업가치 증가는 통계적 유의성도 높은 편으로 물적분할 기업 전체와 유가증권 기업의 물적분할 후 기업가치 증가는 각각 5%와 1% 유의수준에서 유의하였다. 또한 유가증권 기업의 물적분할 전후 산업조정 기업가치 차이는 5%에서 유의성을 보였다. 한편 물적분할 이후 분할기업과 신설기업의 업종이 달라지는 경우 산업조정 기업가치가 이를 제대로 반영하지 못하는 문제가 나타날 수 있다.15) 이를 보완하기 위해 기업규모별 평균을 차감한 규모조정 기업가치16)를 산출하여 비교하였으나 산업조정 기업가치 비교와 유사한 결과를 보였다.

물적분할 이후 기업가치가 개선되는 현상은 물적분할의 목적이 대부분 전문화에 따른 효율성 및 경쟁력 제고인 점을 고려하면 당연한 결과일 수 있으나 물적분할 공시가 기업가치를 훼손시켜 주가를 떨어뜨리는 사건으로 간주하는 대중적 시각17)과는 대비되고 있기에 의미가 있다고 할 수 있다. 특히 유가증권시장에서는 물적분할의 부정적 공시효과와 대조적으로 기업가치 개선효과가 뚜렷이 나타나고 있어 단기적으로는 물적분할 공시효과가 시장에 따라 부정적 효과를 보인다고 해도 중장기적으로는 기업가치가 향상되었다고 할 수 있다.18)

Ⅲ. 모자기업 동시상장의 주요 이슈

1. 모자기업 동시상장 현황

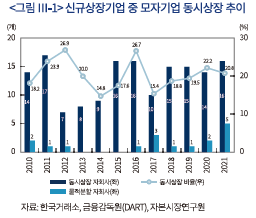

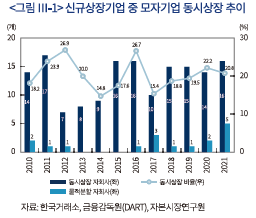

물적분할에 대한 사회적 인식이 악화된 데는 핵심성장 사업부의 미래 가치를 보고 투자한 소액주주들이 물적분할로 신설기업을 간접 소유할 수밖에 없게 되고 쪼개기상장으로 모자기업이 동시상장하게 되면 분할기업의 기업가치도 훼손된다고 생각하기 때문이다.19) 그런데 2010~2021년 기간 신규상장기업 788개 중 최대주주가 또 다른 상장기업으로 신규상장기업을 설립하였거나 인수한 기업을 모자기업 동시상장으로 정의20)하면 동시상장의 한 형태인 물적분할 신설기업의 상장은 17개21)에 불과해 쪼개기상장이 일반적이라고 볼 수는 없다(<그림 Ⅲ-1> 참조).

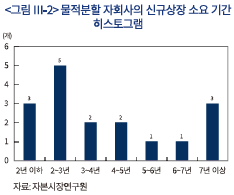

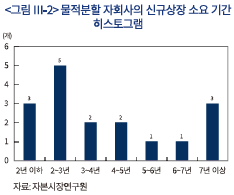

특히 물적분할 신설기업으로 신규상장한 17개 기업들은 분할기일부터 상장까지 평균 4.4년 소요되었는데 10개(59%) 기업은 4년 이하가 걸렸지만 5개 기업은 5년 이상(최장 13.5년) 소요됨으로써 물적분할 당시 기업공개를 계획했다고 보기 어려운 경우도 다수라고 할 수 있다(<그림 Ⅲ-2> 참조).22) 결과적으로 처음부터 기업공개를 목적으로 하는 물적분할은 최근에야 부각된 현상으로 과거에는 드물었다고 할 수 있다. 따라서 물적분할 쪼개기상장의 문제를 실증적으로 파악하기 위해서는 매년 13개(자회사 상장 기준) 정도로 전체 신규상장의 20%를 차지하고 있고 기업가치 측면에서 물적분할 쪼개기상장과 동질적인 모자기업 동시상장으로 논의를 확대할 필요가 있다.

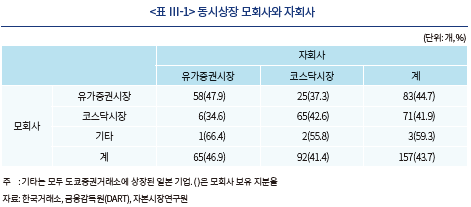

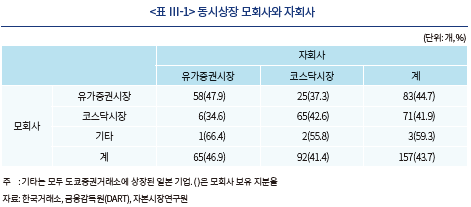

전체 동시상장 기업을 분석하면 2010~2021년 기간 유가증권시장과 코스닥시장에 신규 상장한 동시상장 기업은 157개로 자회사 상장 시장 기준으로는 유가증권기업 65개, 코스닥기업 92개이다(<표 Ⅲ-1> 참조). 이들 기업의 모회사들은 유가증권기업 83개, 코스닥기업 71개이며 나머지 3개는 도쿄증권거래소 상장기업이다.23) 결과적으로 동시상장 기업의 자회사는 코스닥시장에 주로 상장되어 있으나 모회사들은 유가증권시장에 더 많이 포진해 있다고 할 수 있다. 한편 동시상장 모회사는 평균 43.7%의 자회사 지분을 보유하고 있어 상법상의 모회사 기준인 50%에 비해서는 낮은 비율을 보유하고 있다.

2. 동시상장 기업의 기업가치 분석

가. 동시상장 자회사의 기업가치 특징

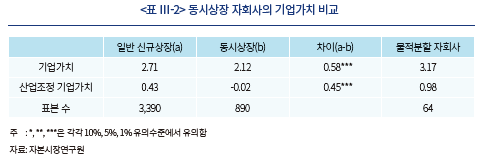

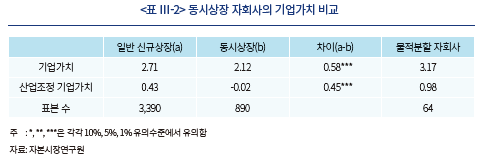

동시상장 기업의 기업가치가 일반 신규상장기업과 차이가 나는지 비교하면 전체 동시상장 자회사의 기업가치 평균은 2.12로 일반 신규상장기업의 2.71에 비해 0.58만큼 유의적으로 낮게 나타나고 있다(<표 Ⅲ-2> 참조). 또한 산업조정 기업가치도 동시상장 자회사는 일반 신규상장기업에 비해 유의하게 낮아 벤치마크 비교에서도 동시상장 자회사의 기업가치가 낮다고 할 수 있다. 특히 동시상장 자회사의 산업조정 기업가치는 음의 값으로 시장 평균에 비해서도 기업가치가 떨어진다고 할 수 있다. 다만 물적분할 자회사의 기업가치는 표본 수가 작고 유의성도 낮으나 일반 신규상장기업에 비해 기업가치가 높게 나타나 다른 동시상장 자회사와 구별되는 특징을 보이고 있다. 물적분할 자회사의 높은 기업가치는 성장성이 높은 사업분야에 특화되었기 때문일 수 있다.

나. 동시상장 모회사의 기업가치 특징

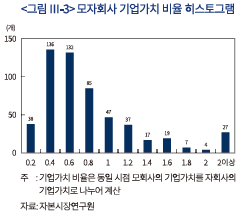

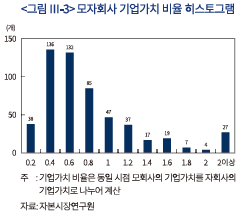

동시상장 모회사의 기업가치도 자회사 상장에 영향을 받고 있다. 2010~2021년 기간 동시상장 모자기업 중 자회사 상장 이후 동일 시점에 기업가치를 산출할 수 있는 모회사와 자회사의 대응 표본 549쌍의 기업가치를 비교하면 모회사 기업가치 평균은 1.07로 자회사 기업가치 평균 1.81에 비해 유의하게 낮았다.24) 모회사의 기업가치를 대응되는 자회사의 기업가치로 나눈 기업가치 비율은 평균 0.73으로 동시상장 모회사의 기업가치가 신규상장한 자회사에 비해 27% 낮다고 할 수 있다. 동시상장 모회사의 기업가치 비율을 히스토그램으로 보면 대부분 자회사 기업가치의 0.2~0.4, 0.4~0.6, 0.6~0.8 구간에 집중되어 있음을 알 수 있다(<그림 Ⅲ-3> 참조).

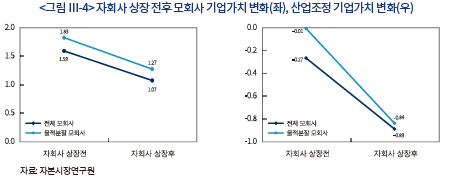

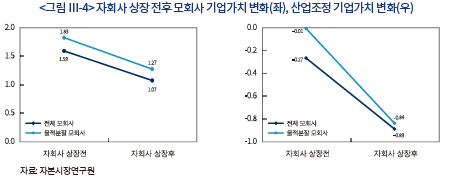

동시상장 모회사의 기업가치가 자회사에 비해 낮게 관측되는 현상은 자회사의 기업가치가 신규상장 직후 시점으로 성장성이 높을 때라는 점을 고려해도 유의할 부분이 있다. 이들 모회사의 기업가치는 원래부터 자회사에 비해 대폭 할인된 것이 아니라 자회사가 신규상장 이후에 기업가치가 하락하는 특징을 보이기 때문이다(<그림 Ⅲ-4> 참조). 전체 동시상장 모회사의 자회사 상장 이전 기업가치 평균은 1.59였으나 자회사 상장 이후에는 1.07로 유의하게 하락하였으며 산업조정 기업가치도 –0.27에서 –0.89로 유의하게 낮아졌다. 또한 물적분할 모회사의 기업가치도 자회사 상장 이후 하락함으로써 다른 동시상장 모회사의 특징을 공유한다고 할 수 있다.25)

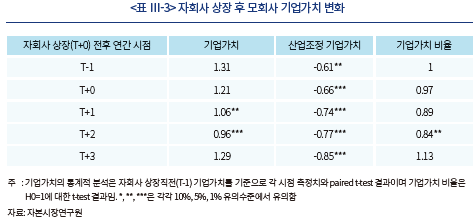

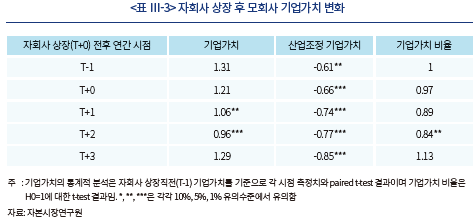

자회사의 상장 직전 시점부터 상장 후 3년까지 총 5년간 기업가치를 온전히 산출할 수 있는 모회사 64개의 기업가치 변화를 추적해 보면 동시상장 모회사의 기업가치가 자회사 상장 이후 시간에 따라 어떻게 영향을 받는지 구체적으로 알 수 있다. 모회사의 자회사 상장직전(T-1) 기업가치 평균은 1.31이었으나 자회사가 상장한 해(T+0)는 1.21로 하락하였고 그 다음 해(T+1)에는 1.06, 2년 후(T+2)는 0.96으로 떨어지면서 상장직전(T-1) 기업가치에 비해 유의하게 하락하였다(<표 Ⅲ-3> 참조). 상장직전(T-1) 대비 기업가치 비율도 상장 후 2년 후(T+2)에는 0.84로 유의하게 감소하였다.26)

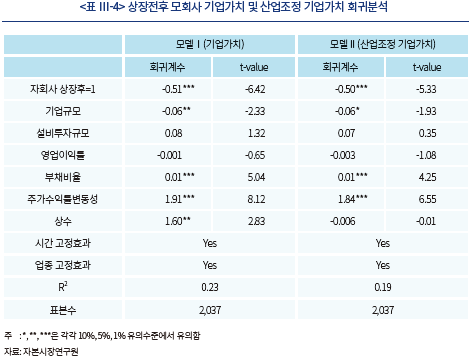

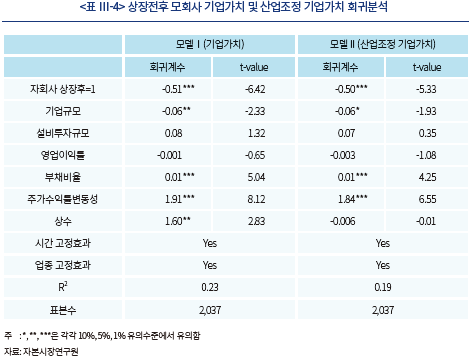

동시상장 모회사의 기업가치가 자회사 상장 이후 하락하는 현상은 전체 모자기업 표본을 대상으로 한 회귀분석에서도 확인되고 있다. 동시상장 모회사의 기업가치 회귀분석은 지주회사 할인효과를 분석했던 박진 외(2019)의 모델을 참조하여 동시상장 모회사의 기업가치와 산업조정 기업가치를 자회사 상장 전과 상장 후로 나누어 분석하였다.27)

회귀분석 결과 자회사 상장 이후 모회사의 기업가치는 유의하게 하락하였다(<표 Ⅲ-4>(모델 Ⅰ) 참조). 또한 이러한 모회사 기업가치 할인 현상은 기업가치의 상대적 비교에서도 재확인되고 있다. 모회사의 산업조정 기업가치도 동일한 회귀모형으로 분석하면 자회사 상장 이후 모회사 산업조정 기업가치는 자회사 상장 이전보다 유의하게 하락하였다(<표 Ⅲ-4>(모델 Ⅱ) 참조).

결과적으로 물적분할 쪼개기상장을 비롯해 모자기업의 동시상장은 기업가치 측면에서 부정적 효과가 뚜렷이 나타난다고 할 수 있다. 동시상장 자회사의 기업가치가 다른 신규상장기업에 비해 낮은 것은 물론 이미 상장되어 있는 모회사는 자회사 상장으로 기업가치가 유의하게 하락하면서 동시상장은 모자기업 모두의 기업가치에 부정적 요인이 되고 있다.

Ⅳ. 해외사례 비교 및 시사점

1. 물적분할 제도 비교

물적분할은 프랑스, 독일 등 대륙법계 국가에 특화된 제도라고 할 수 있다(황남석, 2016). 이에 반해 미국에서는 대부분의 주에서 기업분할을 별도의 회사법으로 규제하고 있지 않으며 기업분할의 기본적 형태는 인적분할이나 다양한 변형이 가능하기에 물적분할 형태의 기업분할도 허용된다고 할 수 있다.28)

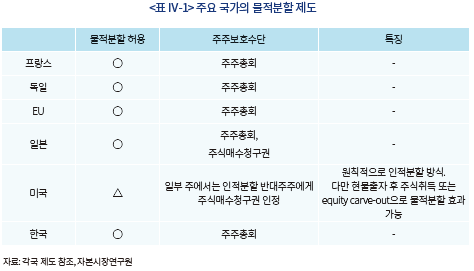

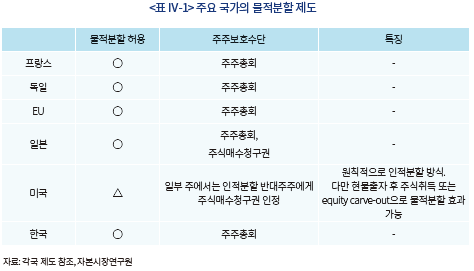

프랑스와 독일은 물적분할로 인한 소액주주의 피해 가능성에 대해 원칙적으로는 주주총회결의29) 참석을 통한 주주권한 행사 이외의 별도 보호 조치를 두고 있지 않다(<표 Ⅳ-1> 참조). 일본은 다른 국가에 비해 뒤늦은 시점인 2000년 물적분할을 도입하였는데 주주총회결의에 추가하여 물적분할에 반대하는 주주에게 주식매수청구권을 부여함으로써 소액주주를 보호하고 있다(허인, 2006; 황남석, 2016).

국내 물적분할 제도에서는 주주총회 특별결의 이외에 별도의 소액주주 보호 장치를 두고 있지 않다. 따라서 물적분할에 대한 소액주주의 권리가 주주총회결의로 충분하지 않다면30) 일본 사례처럼 주주 간 이해충돌을 보다 근본적으로 조정할 수 있는 주식매수청구권과 같은 별도의 수단을 도입할 필요가 있다. 이와 관련하여 2022년 3월 금융당국은 기업지배구조보고서 가이드라인을 개정하여 물적분할 등 기업의 소유구조 변경 시 주주보호를 위한 기업의 정책을 마련하여 보고서에 기술하도록 함으로써 기업지배구조보고서를 작성해야 하는 대형 상장기업의 물적분할을 제한하는 개선안을 발표하였다.31) 기업지배구조보고서를 통한 물적분할 규제는 비록 연성규범 형태로 규제 강도가 강하다고 할 수는 없지만 보고서 작성 대상 대기업의 물적분할 추진이 과거에 비해 훨씬 신중해질 것으로 기대할 수 있다. 문제는 현행 기업지배구조보고서 작성 대상 기업이 유가증권시장의 일부 대기업에 그치고 있으며 2026년 전면 시행 계획도 유가증권시장에만 국한되고 있어 최근 물적분할의 절반정도를 차지하고 있는 코스닥기업32)은 예외로 남는 점이라고 할 수 있다.

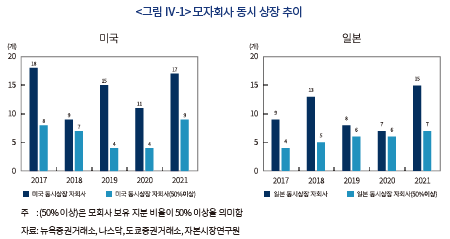

2. 모자기업 동시상장 규제 비교

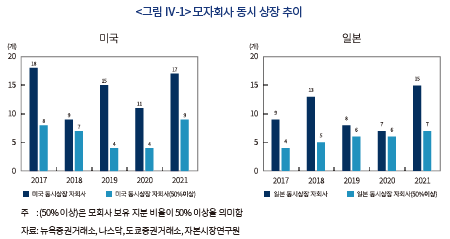

주요 선진국들은 모자기업 동시상장을 명시적으로 규제하지 않고 있다. 실제로 2017년부터 2021년까지 5년 동안 뉴욕증권거래소와 나스닥에 신규상장하는 기업들의 소유구조를 조사해 보면 매년 평균 14개의 상장기업이 기존 상장기업의 자회사33)로 추정되며 이들 회사의 모회사 보유 지분율은 평균 49.3%34)에 이르고 있다. 일본 도쿄증권거래소도 연평균 10.4개의 동시상장 기업이 조사되고 있는데 모회사 보유 지분율 평균은 48.7%이다(<그림 Ⅳ-1> 참조). 미국과 일본의 모자기업 동시상장은 전체 신규상장기업 중 미국 5.7%, 일본 9.8%로 같은 기간 국내 비율 19.3%에 비하면 낮지만 연간 동시상장 개수는 같은 기간 연평균 14개인 국내와 비슷한 수준이다. 다만 미국과 일본 동시상장 모회사의 자회사 보유 지분율은 국내 43.7%에 비해 5%p 이상 높게 나타나고 있다.

미국에서 모자기업 동시상장과 관련이 있는 규제는 뉴욕증권거래소와 나스닥의 상장규정 중 ‘피지배기업(controlled company)’ 규정이다(ISS, 2016). 피지배기업은 50%이상 의결권을 보유하고 있는 지배주주가 존재하는 기업으로 지배주주는 상장기업뿐만 아니라 비상장기업 또는 개인 등이 될 수 있어 모자기업 동시상장을 포함한다. 이들 기업은 투자자가 피지배기업임을 알 수 있도록 공시해야 하는 제약이 있지만 엄밀히 보면 상장제한을 위한 규제라기보다 기존 상장규정의 예외 조치에 가깝다. 우선 피지배기업은 상장 신청 기업이 자의적으로 선택할 수 있으며 피지배기업이 되면 투자자에게 독립적인 기업이 아니라는 부정적 인상을 주지만 한편으로는 기본적인 상장요건이라고 할 수 있는 독립이사의 이사회 과반 구성 등 일반적인 상장기업에 요구되는 기업지배구조 요건을 적용받지 않아도 된다. 일본도 별도의 강행규정으로 모자기업 동시상장을 규제하고 있지 않으며 도쿄증권거래소는 기업지배구조보고서 등 연성규범으로 상장기업 간 지분관계 해소를 도모하고 있다. 실제로 도쿄증권거래소에 상장된 동시상장 기업은 2014년 324개로 전체 상장기업의 9.5%에서 2021년에는 293개, 8%로 감소하고 있다(TSE, 2021).

한편 동남아시아 국가들은 모자기업 동시상장에 대해 명시적인 규제 조항을 두고 있다.35) 싱가포르거래소는 상장규정을 통해 동시상장 자회사의 상장 신청 시 자산 및 영업범위의 중복성 심사를 통과해야만 상장을 할 수 있도록 하고 있으며 말레이시아거래소는 2022년부터 모자기업의 경우 지배관계를 중단해야만 상장신청이 가능하도록 규제 수준을 강화하였다.

아직 국내에서는 동시상장에 대한 명시적 규제 조치는 없다.36) 그러나 실증분석에서 나타났듯이 물적분할 쪼개기상장을 포함해서 동시상장은 신규상장 자회사와 모회사 모두 기업가치가 상대적으로 낮거나 자회사 상장 이후 하락하고 있어 대책 마련이 요구된다. 동남아시아 국가들처럼 직접적 규제도 필요하다면 고려해야겠지만 일본이 상장기업의 기업지배구조 개선을 통해 동시상장 기업의 확대를 억제했던 방식을 먼저 참조할 필요가 있다.

Ⅴ. 맺는말

물적분할에 대한 실증적 분석 결과 물적분할의 공시효과 및 물적분할로 인한 분할기업의 기업가치 변화는 중층적 특성을 보인다고 할 수 있다. 재벌 기업 등 일부 기업의 지배주주가 물적분할을 선호하는 데는 사적이익 추구 동인 때문일 수 있지만 최근 들어 구조조정, 투자유치, 매각, 기업회생, 지주회사 전환 등 물적분할의 목적이 다양해지고 있고 재벌 기업이 아닌 일반 기업의 비중도 증가하고 있어 물적분할의 양태는 복잡해지고 있다. 또한 물적분할 공시가 단기적으로는 부정적 뉴스로 인식되고 있고 특히 유가증권시장에서 이런 경향이 심화되고 있으나 중장기적으로는 기업가치 제고에 긍정적으로 작동한다고 할 수 있다.

물적분할 쪼개기상장의 사례는 많지 않지만 기업가치 관점에서 볼 때 이를 포함한 모자기업 동시상장에 대해서는 관심을 기울일 필요가 있다. 실증분석 결과 동시상장 자회사는 신규상장기업 중에서 기업가치가 상대적으로 낮아 신규상장기업의 질을 떨어뜨리는 면이 있으며 이미 상장되어 있는 동시상장 모회사의 기업가치는 물적분할 모회사를 비롯하여 자회사 상장 이후 유의하게 하락하고 있다.

결과적으로 물적분할에 대해 기업가치 제고 여부에 관계없이 일방적으로 규제하는 것은 합리적인 규제방향이라고 할 수 없다. 물적분할이 지배주주의 사익추구 도구로 남용되지 않도록 방지하면서 주주 간 이해충돌을 최소화하고 조정할 수 있도록 해야 한다. 제도적으로는 지배주주 또는 경영진이 물적분할 추진 과정에서 소액주주 보호 조치를 세우도록 한 기업지배구조보고서 요건을 유가증권시장 상위 대기업뿐만 아니라 코스닥기업에도 확장하여 적용할 필요성이 있다. 물적분할 쪼개기상장을 포함해 모자기업 동시상장과 관련해서는 상장기업의 기업가치 제고라는 관점에서 상장심사 강화와 기업지배구조 개선을 통해 점차적으로 상장기업 간 모자관계를 해소하는 것이 필요하다.

1) 이상훈(2020a)에서는 2020년 9월 LG화학의 배터리사업 부문의 물적분할 공시를 회사법적 관점에서 분석하면서 지배주주와 소액주주의 이해충돌을 물적분할의 핵심 문제점으로 제기하고 있다.

2) 대표적으로 민주당 소속 이용우 의원은 2022년 3월 21일과 23일 각각 물적분할의 반대주주에게 주식매수청구권을 부여하거나 물적분할 자회사가 상장하는 경우 분할회사의 소액주주에게 신주의 50% 이상을 우선 배정하도록 하는 입법안을 대표발의하였다.

3) 110대 국정과제 중 36번째 과제인 ‘자본시장 혁신과 투자자 신뢰 제고로 모험자본 활성화’의 하위 과제로 신사업을 분할하여 별도 자회사로 상장하는 경우 모회사 소액주주의 권리가 침해되지 않게 정비하도록 하고 있다.

4) 재벌 기업은 공정거래위원회가 지정한 자산총액 5조원 이상의 대기업집단 중 총수가 존재하는 기업을 의미한다.

5) 물적분할은 신설기업이 분할기업의 100% 자회사가 되기에 지배주주의 의도에 따라 손쉽게 다양한 목적으로 개편될 수 있는 것도 대기업집단의 선호 요인으로 볼 수 있다. 송은해(2018)에 따르면 2015~2017년 기간 물적분할의 44.9%에서 신설기업의 지분구조가 바뀌었으며 지배구조 개편은 분할기일로부터 2개월 내에 집중되었다.

6) 인적분할을 통한 지주회사 전환과정에서 자사주에 대한 신주배정 또는 현물출자 등을 통해 지배주주 또는 지주회사가 지배력을 손쉽게 확대하는 것을 ‘자사주 마법’이라고 부르며 이에 대한 보다 자세한 설명은 이상훈(2020b)와 천준범(2020)을 참조한다.

7) 두 집단의 업력과 기업규모 차이는 1% 유의수준 t-test에서 유의함을 보였다.

8) 분할목적에 전문화, 경영효율화, 경쟁력 제고가 적어도 한번 이상 표시되어 있는 경우 전문화로 분류하고 있다.

9) 물적분할의 공시효과에 대한 기존 연구 중 기현희(2010)는 2001~2008년 기간 유가증권시장의 70개 분할공시를 분석하여 물적분할에서 부정적 시장 반응을 인적분할에서는 긍정적 반응을 관측했으며, 강내철ㆍ진태홍(2012)는 2001~2010년까지 374개의 분할공시를 분석하여 물적분할의 공시효과가 인적분할이나 분할매각보다 작게 나타나는 것을 보였고, 김상우ㆍ남명수(2013)는 2001~2010년까지 기업분할 공시 265개를 분석하여 공시일에 유가증권시장에서 물적분할 기업의 수익률이 유의한 양의 값을 보이나 코스닥시장과 인적분할 기업의 경우 효과가 소멸됨을 보였다. 조용대ㆍ김동하(2015)는 2000~2014년 6월까지 349개 기업분할을 분석하여 유가증권시장에서는 인적분할의 효과가 물적분할보다 높게 나타나지만 코스닥시장에서는 반대임을 보였으며, 신용균ㆍ한만용(2016)은 2008~2014년까지 유가증권시장에 상장되어 기업분할을 공시한 122개 표본을 분석하여 물적분할보다 인적분할 공시효과가 높음을 보였다. 김종국 외(2016)은 2000~2012년 9월까지 기업분할 공시 302개를 분석하여 물적분할 공시효과가 미미하나 유가증권시장에서는 인적분할 공시효과가 부정적으로 코스닥시장에서는 긍정적으로 나타나 분할유형과 시장에 따른 차이를 확인하였다.

10) Fama-French 3요인 모델 회귀계수는 분할공시일 –30일부터 -395일 기간에서 추정하였으며 SMB, HML 지수는 에프엔가이드 제공 자료를 사용하였다. 단, 2010~2021년 기간 2회 이상 기업분할을 공시한 기업들은 추정 기간이 중복되고 복합 효과 가능성으로 인해 최초 분할공시만 초과수익률 계산에 편입함으로써 최종적으로 물적분할 공시 284개, 인적분할 공시 66개를 분석 대상으로 하였다.

11) 자기자본의 시장가치-장부가치 비율은 보통주 시가총액/(자기자본-우선주 자본금)으로 산출하며 기업가치를 자기자본의 시장가치-장부가치 비율로 사용하는 것은 일반적이라고 할 수 있으나 본고에서는 토빈q를 보조지표로 활용하여 두 분석의 본질적인 차이가 없음을 확인하였다.

12) 물적분할 기준 시점은 분할기일이다. 또한 물적분할 공시를 발표했으나 철회, 주주총회 부결 등으로 분할되지 못한 기업들은 표본에서 제외하였다.

13) 물적분할 이전 기업가치는 각 기업별 분할기일 이전 연간 기업가치를 모두 평균한 값이며 물적분할 이후 기업가치도 해당 기간 전체 평균이다.

14) 산업 분류는 에프엔가이드의 FnGuide Industry Classification Standard를 따르고 있다.

15) 기업분할이 관련 업종에서 발생하는지 비관련 업종에서 발생하는지는 기업분할에서 중요한 이슈이므로 신설기업의 업종에 대한 고려 없이 분할기업이 속한 산업평균 기업가치만 기준으로 비교하는 것은 적절하지 않을 수 있다.

16) 규모조정 기업가치는 물적분할 기업의 기업가치에서 동일시점 총자산 기준 상장기업 10등급 구간 중 소속 구간의 기업가치 평균을 차감하여 계산하였다.

17) 물적분할 반대 국민청원이 대표적이다.

18) 물적분할 이후 기업가치가 제고되는 이유를 본고에서는 별도로 분석하고 있지 않으나 박경진 외(2005), 오현탁 외(2006) 등 기존 기업분할 연구에서는 서로 다른 업종으로 기업이 분할되는 비관련 기업분할에서 기업가치 증가를 공통적으로 보고하고 있어 물적분할을 통해 신사업에 도전하는 사례의 증가가 한 요인이 될 수 있다.

19) 박진 외(2019)의 연구에서는 2002~2017년 기간 모자기업 동시상장의 한 형태라고 할 수 있는 지주회사와 자회사의 기업가치를 분석하여 지주회사가 비지주회사에 비해 기업가치가 유의적으로 낮게 할인되고 있음을 확인하였다.

20) 본고에서 모회사는 상법상의 정의(제342조의2 제1항의 자회사 발행주식의 50% 이상을 소유하고 있는 기업)가 아니라 인수 또는 설립을 통해 신규상장기업의 최대주주가 된 상장기업을 지칭한다. 신규상장기업의 모자관계만 분석 대상으로 삼았기에 인적분할에 따른 신설기업의 재상장이나 기존 상장회사 간 모자관계는 제외하며 스팩상장이나 이전상장도 포함되지 않는다.

21) 다만 1개는 물적분할로 신설된 후 다른 상장회사에 매각되어 신규상장한 경우이고 다른 1개는 재무자료 식별이 곤란하여 기업가치 분석에서는 15개 기업만 물적분할 동시상장으로 분류한다.

22) 한편 상장까지 3년 이하의 기업들마저 물적분할 당시 모회사의 공시에 신설기업의 기업공개에 대해 어떤 정보도 제공하지 않은 것으로 나타나 분할공시가 전반적으로 충실하지 못했다고 할 수 있다.

23) 모회사가 도쿄증권거래소에 상장된 3개 동시상장 기업은 실증분석에서 제외하였다.

24) 모자기업 간 대응되는 기업가치의 차이를 paired t-test로 분석하면 1% 유의수준에서 유의하게 나타났다.

25 ) 자회사 상장 전후 물적분할 모회사의 기업가치 비교(t-test)는 5% 유의수준에서 유의하였으며 나머지 비교(t-test)는 모두 1% 유의수준에서 유의하게 나타났다.

26) 비록 3년 후(T+3) 기업가치 평균은 상장직전(T-1)과 비슷한 수준으로 상승했고 기업가치 비율은 오히려 1을 초과했지만 산업조정 기업가치는 오히려 더 낮아져 상장 후 3년 후(T+3) 시점에 모회사의 기업가치가 의미있는 수준으로 회복되었다고 보기는 어렵다.

27) 회귀분석의 공통 설명변수는 박진 외(2019)의 기업가치 회귀분석에서 사용한 기업규모(log(총자산)), 설비투자규모(∆유형자산/전년도 매출액), 영업이익률(EBIT/매출액), 부채비율, 주가수익률변동성으로 설정하였으며 각 변수의 기술통계량과 상관계수 행렬은 부록에 표시하였다.

28) 미국의 기업분할 유형 중 equity carve-out을 국내 물적분할과 동일한 형태로 소개하기도 하나 equity carve-out은 기업분할로 자회사를 설립하고 그 지분을 부분적으로 공개매각하는 방식으로 엄밀하게 비교하면 기업분할 후 100% 자회사로 남는 국내 물적분할 자체보다는 물적분할 후 자회사를 기업공개하는 쪼개기상장까지 아우른 것에 대응된다고 할 수 있다. 따라서 현실적으로 물적분할 쪼개기상장이 제한적으로만 나타나는 국내 물적분할 상황에서는 미국의 equity carve-out이 국내 물적분할과 동일한 형태라고 할 수는 없다.

29) 프랑스, 일본 등 물적분할을 제도적으로 도입한 국가에서 물적분할에 대한 주주총회결의는 결의 수준이 강화된 특별결의를 통과하도록 하고 있다.

30) 이상훈(2020a)은 물적분할은 지배주주에 의한 부의 편취이므로 주주총회결의가 소액주주에 대한 적절한 보호 수단이 될 수 없다고 주장한다.

31) 기업지배구조보고서 개정으로 (세부원칙 2-③) ‘기업은 합병, 영업양수도, 분할, 주식의 포괄적 교환 및 이전 등과 같은 기업의 소유구조 또는 주요 사업의 변동에 있어 소액주주 의견수렴, 반대주주 권리보호 등 주주보호 방안을 강구하여야 한다.’를 신설하였으며, 해당 사건이 발생하는 경우 기업지배구조보고서에 소액주주 의견수렴, 반대주주 권리보호 등 주주보호를 위한 회사의 정책을 설명하고 이와 같은 정책이 없는 경우 그 사유 및 향후계획 등을 설명하도록 하였다.

32) Ⅱ장 1절 물적분할 현황을 참조한다.

33) 신규상장기업의 최대주주가 투자회사 또는 재무적 투자목적이 아닌 상장기업이면 모자기업 동시상장으로 분류하였다.

34) 미국에서 기업에 대한 지배관계는 차등의결권을 고려하여야 하나 본고에서는 분석의 한계로 단순 지분율로 표시하였다.

35) 싱가포르, 말레이시아, 인도네시아, 태국 등 동남아시아 증권거래소들은 상장규정 안에 ‘chain listing’이라는 항목으로 모자기업 동시상장에 대한 규제 조항을 두고 있다.

36) 다만 상장심사 과정에서 동시상장 자회사의 모회사 의존성과 지배구조 독립성에 대한 검토가 진행되고 있다.

참고문헌

강내철ㆍ진태홍, 2012, 기업분할 방법과 공시효과,『재무관리연구』29(1), 57-80.

권기범, 2009, 물적분할,『서울법학』17(1), 1-25.

권택호, 2019, 기업의 관련 다각화와 기업가치,『재무관리연구』36(4), 33-62.

기현희, 2010, 분할공시에 대한 주가반응과 기업특성,『경영교육연구』61(1), 43-66.

김동민, 2005, 會社分割에 있어서 少數株主의 權利保護에 관한 硏究 -日本의 改正商法의 規定을 중심으로-,『사회과학연구』21, 1-26.

김동민, 2007, 會社分割에 있어서 分割反對株主의 株式買受請求權에 관한 小考,『기업법연구』21(4), 215-240.

김상우ㆍ남명수, 2013, 기업분할이 주가에 미치는 영향에 관한 연구,『기업경영연구』20(5), 195-214.

김은수, 2021, 회사 분할에 관한 법적연구 -기업가치에 대한 이해관계를 중심으로-,『경영법률』31(2), 179-206.

김종국ㆍ김수경ㆍ변영태, 2016, 기업분할에 따른 주주의 부의 단기성과에 관한 연구 –유가증권시장과 코스닥시장의 비교분석-,『지역산업연구』39(3), 179-200.

박경진ㆍ신현한ㆍ장진호, 2005, 기업분할과 경영성과,『전략경영연구』8(2), 81-104.

박진ㆍ서정원ㆍ강신우, 2019, 한국주식시장의 지주회사 디스카운트,『한국증권학회지』48(6), 755-788.

서재웅, 2021, 기업분할 공시가 주주의 부에 미치는 영향,『글로벌경영연구』33(2), 65-81.

송은해, 2018, 물적분할 기업의 후속 지배구조 개편 현황 분석, KCGS 리포트 8(7), 4-9.

신용균ㆍ한만용, 2016, 기업분할 형태와 공시효과,『경영컨설팅연구』16(3), 99-113.

오현탁ㆍ이현상ㆍ전세환ㆍ김종만, 2006, 기업분할이 기업가치에 미치는 영향에 관한 실증적 연구,『 산업경제연구』19(3), 1027-1049.

윤석현, 2004, 會社分割의 迅速性과 株主의利 益保護,『법조』53(12), 112-145.

이동영ㆍ김상균, 2017, 분할신설기업의 지배구조와 성과 관계,『전략경영연구』20(2), 27-54.

이상욱, 2007, 기업분할 결정요인은 무엇인가? : 한국의 기업분할을 중심으로, 『경영학연구』36(3), 791-821.

이상훈, 2017, 한국 기업집단 지배구조 문제의 본질과 바람직한 상법 개정 –주주의 비례적 이익관점에서-,『상사법연구』 36(2), 211-262.

이상훈, 2020a, 물적분할과 지주사 디스카운트 –LG화학의 사례를 소재로-,『법학논고』71, 201-334.

이상훈, 2020b, 인적분할과 자사주마법,『상사법연구』39(2), 367-412.

이성호, 2007, 독일과 프랑스의 지주회사 사례분석 및 시사점,『질서경제저널』10(2), 25-38.

이은정, 2021,『분할 등 기업구조개편의 효과 분석: LG화학과 ㈜LG를 중심으로』, 경제개혁연대 연구보고서 21-01.

이정환ㆍ이진주ㆍ박남규, 2012, 한국기업의 지배구조가 기업분할 유형선택에 미치는 영향에관한 연구,『전략경영연구』15(1), 65-87.

조용대ㆍ김동하, 2015, 이사회의 기업분할 결의가 기업가치에 미치는 영향 분석,『대한경영학회지』28(1), 179-201.

천준범, 2020,『법은 어떻게 부자의 무기가 되는가: 알면 벌고 모르면 당하는 ‘재벌법’의 10가지 비밀』, 부키.

허인, 2006, 회사분할에 있어서 소수주주의 보호,『외법논집』21, 313-332.

황남석, 2012, 미국 회사법상의 회사분할제도에 관한 연구,『증권법연구』12(3), 261-298.

황남석, 2016, 상법상 물적분할제도의 쟁점 및 입법적 개선방안,『상사법연구』34(4), 129-157.

Campello, M., Graham, J.R., 2013, Do stock prices influence corporate decisions?

Evidence from the technology bubble, Journal of Financial Economics 107(1), 89-110.

Cusatis, P.J., Miles, J.A., Woolridge, J.R., 1993, Restructuring through spinoffs: The stock market evidence, Journal of Financial Economics 33(3), 293-311.

Davis Polk, 2014, Corporate Governance Practices in U.S. Initial Public Offerings.

Huson, M.R., MacKinnon, G., 2003, Corporate spinoff s and information asymmetry between investors, Journal of Corporate Finance 9(4), 481-503.

Hite, G.L., Owers, J.E., 1983, Security price reactions around corporate spin-off announcements, Journal of Financial Economics 12(4), 409-436.

ISS, 2016, 2016 ISS Study on Controlled Companies.

John, K., Ofek, E., 1995, Asset sales and increase in focus, Journal of Financial Economics, 37(1) 105-126.

Krishnaswami, S., Subramaniam, V., 1999, Information asymmetry, valuation, and the corporate spin-off decision, Journal of Financial Economics 53(1), 73-112.

Pástor, ., Pietro, V., 2003, Stock valuation and learning about profi tability, The Journal of Finance 58(5), 1749-1789.

., Pietro, V., 2003, Stock valuation and learning about profi tability, The Journal of Finance 58(5), 1749-1789.

TSE, 2021, TSE-Listed Companies White Paper on Corporate Gorvernance 2021.

물적분할은 1998년 12월 외환위기 극복 과정에서 기업구조조정을 원활하게 진행하기 위해 상법에 도입한 기업분할의 한 유형이다. 물적분할과 비교되는 인적분할이 분할의 대가인 신설기업의 주식을 분할기업의 주주에게 귀속시키는 것과 달리 물적분할에서는 분할기업에게 귀속시켜 신설기업이 분할기업의 100% 자회사가 되는 차이가 있다.

최근 물적분할에 대한 사회적 관심이 증대된 데는 대기업들이 잇달아 핵심 사업부를 물적분할하고 일부 신설기업은 기업공개(이른바 ‘쪼개기상장’)까지 하면서 기존 분할기업의 소액주주들이 반발하고 나섰기 때문이다. 소액주주들은 신규 사업부문의 빠른 성장을 기대하고 주주가 되었는데 해당 사업부문이 물적분할 되어 분할기업의 자회사로 바뀌면 분할기업의 소액주주들은 신설기업을 간접적으로만 소유하게 되어 신설기업의 주요 의사결정에서 배제되는 것을 문제 삼고 있다. 또한 신설기업이 기업공개를 하게 되면 분할기업의 시장가치에 보유 자회사 주식의 시장가치가 할인되어 반영됨에 따라 분할기업의 기업가치가 훼손된다고 주장한다. 그 결과 물적분할 공시 직후 일부 분할기업의 주가가 급락하는 현상이 나타나고 있다.1)

이에 본고에서는 물적분할 및 모자기업의 동시상장과 관련하여 실증적 분석을 통해 문제점을 확인하고 대안을 모색하고자 한다. 그러기 위해 Ⅱ장에서는 물적분할의 주요 이슈를 물적분할의 현황 및 증가 배경, 공시효과, 기업가치에 미치는 영향으로 나누어 분석한다. Ⅲ장에서는 물적분할 기업의 자회사 상장을 포함해 모자기업 동시상장의 현황을 알아보고 동시상장 모자기업의 기업가치 특징을 분석한다. Ⅳ장에서는 주요국의 물적분할과 모자기업 동시상장의 실태와 제도적 특징을 비교 분석한다. 마지막으로 Ⅴ장에서는 맺는말로 마무리한다.

Ⅱ. 물적분할의 주요 이슈

1. 물적분할 현황 및 증가 배경

2010년부터 2021년까지 12년 동안의 482개의 국내 상장기업의 기업분할 공시를 물적분할, 인적분할, 기타분할(분할합병 등 복합적인 분할)로 구분하면 물적분할 377개, 인적분할 82개, 기타분할 23개이다. 기업분할 중에서 물적분할은 연평균 31.3개(78% 비중)를 차지하였는데 최근 5년(2017~2021년) 동안에는 연평균 40개(86% 비중)로 크게 증가하였다. 이에 비해 인적분할은 다소 감소하는 추세이다(<그림 Ⅱ-1>(좌) 참조).

2. 물적분할 공시효과 분석

물적분할 공시효과에 대해서는 여러 연구가 수행되었으나 공통적인 결과를 보여주지 않고 있다. 일부 연구에서는 긍정적 효과가 관측되기도 하지만 다른 연구에서는 부정적 효과를 보일 때도 있으며 유가증권시장과 코스닥시장에서의 효과가 반대이거나 유의성이 다르게 나타나기도 한다.9) 이에 반해 미국의 기업분할 공시효과에 대한 분석은 Hite & Owers(1983), Cusatis et al.(1993)에서 보듯이 대체로 유의한 효과를 보여 기업분할이 기업가치 제고를 위한 기업 재편으로 투자자에게 인식되고 있다. 이러한 차이는 국내의 경우 물적분할 등 기업분할의 역사가 미국에 비해 짧고 시기별로 기업분할의 목적이 달랐으며 유가증권시장과 코스닥시장 간 투자자 구성이나 기업특성에 있어서 시장 차이도 컸기 때문으로 해석할 수 있다. 따라서 최근 자료에 근거한 물적분할 공시효과의 실증분석이 필요하다.

물적분할 기업의 공시효과에 대한 실증분석을 위해 물적분할과 인적분할 공시 기업의 초과수익률(Abnormal Return: AR)과 공시일 기준 [-20, 20]거래일의 누적초과수익률(Cumulative Ab-normal Return: CAR)을 산출하였다. 초과수익률과 누적초과수익률은 유가증권시장 및 코스닥시장의 시가총액 가중 시장수익률(MR), CD90일 금리로 사용한 무위험수익률(RF) 및 Fama-French 3요인 모델의 SMB, HML 지수를 반영하여 추정하였다.10)

코스닥시장에서 물적분할 공시는 공시일 누적초과수익률이 2.1%에 이르렀고 그 후 누적초과수익률이 다소 하락한 후에도 양의 수익률을 보이면서 전체적으로 긍정적 효과를 보였다. 더욱이 최근 5년 동안에는 공시일 누적초과수익률이 4.19%로 유가증권시장과 대조적 모습을 보였다. 물적분할에 대한 반응이 유가증권시장과 코스닥시장에서 다르게 나타나는 것은 미디어와 소액주주들이 유가증권시장의 대기업 물적분할에 관심이 집중되면서 유가증권시장의 부정적 반응이 코스닥시장에 비해 커진 것도 한 요인일 수 있다.

기업가치를 자기자본의 시장가치-장부가치 비율(market to book ratio)11)로 측정하였을 때 물적분할은 기업가치에 의미있는 변화를 주는 것으로 나타나고 있다. 물적분할 전후의 기업가치 변화에 대한 분석은 2010~2021년 기간 동안 물적분할을 한 189개 상장기업의 물적분할 이전 기간 기업가치 표본 1,284개와 물적분할 이후 기업가치 표본 925개를 산출하여 비교하였다(<표 Ⅱ-4> 참조).12) 물적분할 기업의 물적분할 이전 기업가치는 평균 1.88이었으나 물적분할 후에는 평균 20.2% 증가한 2.26이었다.13) 특히 유가증권 기업의 기업가치 증가율 평균은 54.7%로 코스닥 기업의 증가율 평균 11.5%에 비해 커서 물적분할이 유가증권시장에서 더 효과적이었다고 할 수 있다. 물적분할 기업의 기업가치 변화를 상대적으로 측정하기 위해 각 시점별로 기업가치에서 산업14)평균 기업가치를 차감한 산업조정 기업가치를 계산하면 물적분할 전에는 각 기업의 기업가치가 산업평균보다 0.1 높았으나 물적분할 후에는 0.31로 높아지면서 산업평균과 비교한 상대적 기업가치도 증가하였다. 특히 유가증권시장에서는 물적분할 기업들이 분할 전에는 산업평균 기업가치를 0.32만큼 하회할 정도로 기업가치가 낮았으나 분할 후에는 산업평균을 0.19만큼 상회할 정도로 기업가치가 개선되었다.

물적분할 이후 기업가치가 개선되는 현상은 물적분할의 목적이 대부분 전문화에 따른 효율성 및 경쟁력 제고인 점을 고려하면 당연한 결과일 수 있으나 물적분할 공시가 기업가치를 훼손시켜 주가를 떨어뜨리는 사건으로 간주하는 대중적 시각17)과는 대비되고 있기에 의미가 있다고 할 수 있다. 특히 유가증권시장에서는 물적분할의 부정적 공시효과와 대조적으로 기업가치 개선효과가 뚜렷이 나타나고 있어 단기적으로는 물적분할 공시효과가 시장에 따라 부정적 효과를 보인다고 해도 중장기적으로는 기업가치가 향상되었다고 할 수 있다.18)

Ⅲ. 모자기업 동시상장의 주요 이슈

1. 모자기업 동시상장 현황

물적분할에 대한 사회적 인식이 악화된 데는 핵심성장 사업부의 미래 가치를 보고 투자한 소액주주들이 물적분할로 신설기업을 간접 소유할 수밖에 없게 되고 쪼개기상장으로 모자기업이 동시상장하게 되면 분할기업의 기업가치도 훼손된다고 생각하기 때문이다.19) 그런데 2010~2021년 기간 신규상장기업 788개 중 최대주주가 또 다른 상장기업으로 신규상장기업을 설립하였거나 인수한 기업을 모자기업 동시상장으로 정의20)하면 동시상장의 한 형태인 물적분할 신설기업의 상장은 17개21)에 불과해 쪼개기상장이 일반적이라고 볼 수는 없다(<그림 Ⅲ-1> 참조).

가. 동시상장 자회사의 기업가치 특징

동시상장 기업의 기업가치가 일반 신규상장기업과 차이가 나는지 비교하면 전체 동시상장 자회사의 기업가치 평균은 2.12로 일반 신규상장기업의 2.71에 비해 0.58만큼 유의적으로 낮게 나타나고 있다(<표 Ⅲ-2> 참조). 또한 산업조정 기업가치도 동시상장 자회사는 일반 신규상장기업에 비해 유의하게 낮아 벤치마크 비교에서도 동시상장 자회사의 기업가치가 낮다고 할 수 있다. 특히 동시상장 자회사의 산업조정 기업가치는 음의 값으로 시장 평균에 비해서도 기업가치가 떨어진다고 할 수 있다. 다만 물적분할 자회사의 기업가치는 표본 수가 작고 유의성도 낮으나 일반 신규상장기업에 비해 기업가치가 높게 나타나 다른 동시상장 자회사와 구별되는 특징을 보이고 있다. 물적분할 자회사의 높은 기업가치는 성장성이 높은 사업분야에 특화되었기 때문일 수 있다.

동시상장 모회사의 기업가치도 자회사 상장에 영향을 받고 있다. 2010~2021년 기간 동시상장 모자기업 중 자회사 상장 이후 동일 시점에 기업가치를 산출할 수 있는 모회사와 자회사의 대응 표본 549쌍의 기업가치를 비교하면 모회사 기업가치 평균은 1.07로 자회사 기업가치 평균 1.81에 비해 유의하게 낮았다.24) 모회사의 기업가치를 대응되는 자회사의 기업가치로 나눈 기업가치 비율은 평균 0.73으로 동시상장 모회사의 기업가치가 신규상장한 자회사에 비해 27% 낮다고 할 수 있다. 동시상장 모회사의 기업가치 비율을 히스토그램으로 보면 대부분 자회사 기업가치의 0.2~0.4, 0.4~0.6, 0.6~0.8 구간에 집중되어 있음을 알 수 있다(<그림 Ⅲ-3> 참조).

Ⅳ. 해외사례 비교 및 시사점

1. 물적분할 제도 비교

물적분할은 프랑스, 독일 등 대륙법계 국가에 특화된 제도라고 할 수 있다(황남석, 2016). 이에 반해 미국에서는 대부분의 주에서 기업분할을 별도의 회사법으로 규제하고 있지 않으며 기업분할의 기본적 형태는 인적분할이나 다양한 변형이 가능하기에 물적분할 형태의 기업분할도 허용된다고 할 수 있다.28)

프랑스와 독일은 물적분할로 인한 소액주주의 피해 가능성에 대해 원칙적으로는 주주총회결의29) 참석을 통한 주주권한 행사 이외의 별도 보호 조치를 두고 있지 않다(<표 Ⅳ-1> 참조). 일본은 다른 국가에 비해 뒤늦은 시점인 2000년 물적분할을 도입하였는데 주주총회결의에 추가하여 물적분할에 반대하는 주주에게 주식매수청구권을 부여함으로써 소액주주를 보호하고 있다(허인, 2006; 황남석, 2016).

2. 모자기업 동시상장 규제 비교

주요 선진국들은 모자기업 동시상장을 명시적으로 규제하지 않고 있다. 실제로 2017년부터 2021년까지 5년 동안 뉴욕증권거래소와 나스닥에 신규상장하는 기업들의 소유구조를 조사해 보면 매년 평균 14개의 상장기업이 기존 상장기업의 자회사33)로 추정되며 이들 회사의 모회사 보유 지분율은 평균 49.3%34)에 이르고 있다. 일본 도쿄증권거래소도 연평균 10.4개의 동시상장 기업이 조사되고 있는데 모회사 보유 지분율 평균은 48.7%이다(<그림 Ⅳ-1> 참조). 미국과 일본의 모자기업 동시상장은 전체 신규상장기업 중 미국 5.7%, 일본 9.8%로 같은 기간 국내 비율 19.3%에 비하면 낮지만 연간 동시상장 개수는 같은 기간 연평균 14개인 국내와 비슷한 수준이다. 다만 미국과 일본 동시상장 모회사의 자회사 보유 지분율은 국내 43.7%에 비해 5%p 이상 높게 나타나고 있다.

한편 동남아시아 국가들은 모자기업 동시상장에 대해 명시적인 규제 조항을 두고 있다.35) 싱가포르거래소는 상장규정을 통해 동시상장 자회사의 상장 신청 시 자산 및 영업범위의 중복성 심사를 통과해야만 상장을 할 수 있도록 하고 있으며 말레이시아거래소는 2022년부터 모자기업의 경우 지배관계를 중단해야만 상장신청이 가능하도록 규제 수준을 강화하였다.

아직 국내에서는 동시상장에 대한 명시적 규제 조치는 없다.36) 그러나 실증분석에서 나타났듯이 물적분할 쪼개기상장을 포함해서 동시상장은 신규상장 자회사와 모회사 모두 기업가치가 상대적으로 낮거나 자회사 상장 이후 하락하고 있어 대책 마련이 요구된다. 동남아시아 국가들처럼 직접적 규제도 필요하다면 고려해야겠지만 일본이 상장기업의 기업지배구조 개선을 통해 동시상장 기업의 확대를 억제했던 방식을 먼저 참조할 필요가 있다.

Ⅴ. 맺는말

물적분할에 대한 실증적 분석 결과 물적분할의 공시효과 및 물적분할로 인한 분할기업의 기업가치 변화는 중층적 특성을 보인다고 할 수 있다. 재벌 기업 등 일부 기업의 지배주주가 물적분할을 선호하는 데는 사적이익 추구 동인 때문일 수 있지만 최근 들어 구조조정, 투자유치, 매각, 기업회생, 지주회사 전환 등 물적분할의 목적이 다양해지고 있고 재벌 기업이 아닌 일반 기업의 비중도 증가하고 있어 물적분할의 양태는 복잡해지고 있다. 또한 물적분할 공시가 단기적으로는 부정적 뉴스로 인식되고 있고 특히 유가증권시장에서 이런 경향이 심화되고 있으나 중장기적으로는 기업가치 제고에 긍정적으로 작동한다고 할 수 있다.

물적분할 쪼개기상장의 사례는 많지 않지만 기업가치 관점에서 볼 때 이를 포함한 모자기업 동시상장에 대해서는 관심을 기울일 필요가 있다. 실증분석 결과 동시상장 자회사는 신규상장기업 중에서 기업가치가 상대적으로 낮아 신규상장기업의 질을 떨어뜨리는 면이 있으며 이미 상장되어 있는 동시상장 모회사의 기업가치는 물적분할 모회사를 비롯하여 자회사 상장 이후 유의하게 하락하고 있다.

결과적으로 물적분할에 대해 기업가치 제고 여부에 관계없이 일방적으로 규제하는 것은 합리적인 규제방향이라고 할 수 없다. 물적분할이 지배주주의 사익추구 도구로 남용되지 않도록 방지하면서 주주 간 이해충돌을 최소화하고 조정할 수 있도록 해야 한다. 제도적으로는 지배주주 또는 경영진이 물적분할 추진 과정에서 소액주주 보호 조치를 세우도록 한 기업지배구조보고서 요건을 유가증권시장 상위 대기업뿐만 아니라 코스닥기업에도 확장하여 적용할 필요성이 있다. 물적분할 쪼개기상장을 포함해 모자기업 동시상장과 관련해서는 상장기업의 기업가치 제고라는 관점에서 상장심사 강화와 기업지배구조 개선을 통해 점차적으로 상장기업 간 모자관계를 해소하는 것이 필요하다.

1) 이상훈(2020a)에서는 2020년 9월 LG화학의 배터리사업 부문의 물적분할 공시를 회사법적 관점에서 분석하면서 지배주주와 소액주주의 이해충돌을 물적분할의 핵심 문제점으로 제기하고 있다.

2) 대표적으로 민주당 소속 이용우 의원은 2022년 3월 21일과 23일 각각 물적분할의 반대주주에게 주식매수청구권을 부여하거나 물적분할 자회사가 상장하는 경우 분할회사의 소액주주에게 신주의 50% 이상을 우선 배정하도록 하는 입법안을 대표발의하였다.

3) 110대 국정과제 중 36번째 과제인 ‘자본시장 혁신과 투자자 신뢰 제고로 모험자본 활성화’의 하위 과제로 신사업을 분할하여 별도 자회사로 상장하는 경우 모회사 소액주주의 권리가 침해되지 않게 정비하도록 하고 있다.

4) 재벌 기업은 공정거래위원회가 지정한 자산총액 5조원 이상의 대기업집단 중 총수가 존재하는 기업을 의미한다.

5) 물적분할은 신설기업이 분할기업의 100% 자회사가 되기에 지배주주의 의도에 따라 손쉽게 다양한 목적으로 개편될 수 있는 것도 대기업집단의 선호 요인으로 볼 수 있다. 송은해(2018)에 따르면 2015~2017년 기간 물적분할의 44.9%에서 신설기업의 지분구조가 바뀌었으며 지배구조 개편은 분할기일로부터 2개월 내에 집중되었다.

6) 인적분할을 통한 지주회사 전환과정에서 자사주에 대한 신주배정 또는 현물출자 등을 통해 지배주주 또는 지주회사가 지배력을 손쉽게 확대하는 것을 ‘자사주 마법’이라고 부르며 이에 대한 보다 자세한 설명은 이상훈(2020b)와 천준범(2020)을 참조한다.

7) 두 집단의 업력과 기업규모 차이는 1% 유의수준 t-test에서 유의함을 보였다.

8) 분할목적에 전문화, 경영효율화, 경쟁력 제고가 적어도 한번 이상 표시되어 있는 경우 전문화로 분류하고 있다.

9) 물적분할의 공시효과에 대한 기존 연구 중 기현희(2010)는 2001~2008년 기간 유가증권시장의 70개 분할공시를 분석하여 물적분할에서 부정적 시장 반응을 인적분할에서는 긍정적 반응을 관측했으며, 강내철ㆍ진태홍(2012)는 2001~2010년까지 374개의 분할공시를 분석하여 물적분할의 공시효과가 인적분할이나 분할매각보다 작게 나타나는 것을 보였고, 김상우ㆍ남명수(2013)는 2001~2010년까지 기업분할 공시 265개를 분석하여 공시일에 유가증권시장에서 물적분할 기업의 수익률이 유의한 양의 값을 보이나 코스닥시장과 인적분할 기업의 경우 효과가 소멸됨을 보였다. 조용대ㆍ김동하(2015)는 2000~2014년 6월까지 349개 기업분할을 분석하여 유가증권시장에서는 인적분할의 효과가 물적분할보다 높게 나타나지만 코스닥시장에서는 반대임을 보였으며, 신용균ㆍ한만용(2016)은 2008~2014년까지 유가증권시장에 상장되어 기업분할을 공시한 122개 표본을 분석하여 물적분할보다 인적분할 공시효과가 높음을 보였다. 김종국 외(2016)은 2000~2012년 9월까지 기업분할 공시 302개를 분석하여 물적분할 공시효과가 미미하나 유가증권시장에서는 인적분할 공시효과가 부정적으로 코스닥시장에서는 긍정적으로 나타나 분할유형과 시장에 따른 차이를 확인하였다.

10) Fama-French 3요인 모델 회귀계수는 분할공시일 –30일부터 -395일 기간에서 추정하였으며 SMB, HML 지수는 에프엔가이드 제공 자료를 사용하였다. 단, 2010~2021년 기간 2회 이상 기업분할을 공시한 기업들은 추정 기간이 중복되고 복합 효과 가능성으로 인해 최초 분할공시만 초과수익률 계산에 편입함으로써 최종적으로 물적분할 공시 284개, 인적분할 공시 66개를 분석 대상으로 하였다.

11) 자기자본의 시장가치-장부가치 비율은 보통주 시가총액/(자기자본-우선주 자본금)으로 산출하며 기업가치를 자기자본의 시장가치-장부가치 비율로 사용하는 것은 일반적이라고 할 수 있으나 본고에서는 토빈q를 보조지표로 활용하여 두 분석의 본질적인 차이가 없음을 확인하였다.

12) 물적분할 기준 시점은 분할기일이다. 또한 물적분할 공시를 발표했으나 철회, 주주총회 부결 등으로 분할되지 못한 기업들은 표본에서 제외하였다.

13) 물적분할 이전 기업가치는 각 기업별 분할기일 이전 연간 기업가치를 모두 평균한 값이며 물적분할 이후 기업가치도 해당 기간 전체 평균이다.

14) 산업 분류는 에프엔가이드의 FnGuide Industry Classification Standard를 따르고 있다.

15) 기업분할이 관련 업종에서 발생하는지 비관련 업종에서 발생하는지는 기업분할에서 중요한 이슈이므로 신설기업의 업종에 대한 고려 없이 분할기업이 속한 산업평균 기업가치만 기준으로 비교하는 것은 적절하지 않을 수 있다.

16) 규모조정 기업가치는 물적분할 기업의 기업가치에서 동일시점 총자산 기준 상장기업 10등급 구간 중 소속 구간의 기업가치 평균을 차감하여 계산하였다.

17) 물적분할 반대 국민청원이 대표적이다.

18) 물적분할 이후 기업가치가 제고되는 이유를 본고에서는 별도로 분석하고 있지 않으나 박경진 외(2005), 오현탁 외(2006) 등 기존 기업분할 연구에서는 서로 다른 업종으로 기업이 분할되는 비관련 기업분할에서 기업가치 증가를 공통적으로 보고하고 있어 물적분할을 통해 신사업에 도전하는 사례의 증가가 한 요인이 될 수 있다.

19) 박진 외(2019)의 연구에서는 2002~2017년 기간 모자기업 동시상장의 한 형태라고 할 수 있는 지주회사와 자회사의 기업가치를 분석하여 지주회사가 비지주회사에 비해 기업가치가 유의적으로 낮게 할인되고 있음을 확인하였다.

20) 본고에서 모회사는 상법상의 정의(제342조의2 제1항의 자회사 발행주식의 50% 이상을 소유하고 있는 기업)가 아니라 인수 또는 설립을 통해 신규상장기업의 최대주주가 된 상장기업을 지칭한다. 신규상장기업의 모자관계만 분석 대상으로 삼았기에 인적분할에 따른 신설기업의 재상장이나 기존 상장회사 간 모자관계는 제외하며 스팩상장이나 이전상장도 포함되지 않는다.

21) 다만 1개는 물적분할로 신설된 후 다른 상장회사에 매각되어 신규상장한 경우이고 다른 1개는 재무자료 식별이 곤란하여 기업가치 분석에서는 15개 기업만 물적분할 동시상장으로 분류한다.

22) 한편 상장까지 3년 이하의 기업들마저 물적분할 당시 모회사의 공시에 신설기업의 기업공개에 대해 어떤 정보도 제공하지 않은 것으로 나타나 분할공시가 전반적으로 충실하지 못했다고 할 수 있다.

23) 모회사가 도쿄증권거래소에 상장된 3개 동시상장 기업은 실증분석에서 제외하였다.

24) 모자기업 간 대응되는 기업가치의 차이를 paired t-test로 분석하면 1% 유의수준에서 유의하게 나타났다.

25 ) 자회사 상장 전후 물적분할 모회사의 기업가치 비교(t-test)는 5% 유의수준에서 유의하였으며 나머지 비교(t-test)는 모두 1% 유의수준에서 유의하게 나타났다.

26) 비록 3년 후(T+3) 기업가치 평균은 상장직전(T-1)과 비슷한 수준으로 상승했고 기업가치 비율은 오히려 1을 초과했지만 산업조정 기업가치는 오히려 더 낮아져 상장 후 3년 후(T+3) 시점에 모회사의 기업가치가 의미있는 수준으로 회복되었다고 보기는 어렵다.

27) 회귀분석의 공통 설명변수는 박진 외(2019)의 기업가치 회귀분석에서 사용한 기업규모(log(총자산)), 설비투자규모(∆유형자산/전년도 매출액), 영업이익률(EBIT/매출액), 부채비율, 주가수익률변동성으로 설정하였으며 각 변수의 기술통계량과 상관계수 행렬은 부록에 표시하였다.

28) 미국의 기업분할 유형 중 equity carve-out을 국내 물적분할과 동일한 형태로 소개하기도 하나 equity carve-out은 기업분할로 자회사를 설립하고 그 지분을 부분적으로 공개매각하는 방식으로 엄밀하게 비교하면 기업분할 후 100% 자회사로 남는 국내 물적분할 자체보다는 물적분할 후 자회사를 기업공개하는 쪼개기상장까지 아우른 것에 대응된다고 할 수 있다. 따라서 현실적으로 물적분할 쪼개기상장이 제한적으로만 나타나는 국내 물적분할 상황에서는 미국의 equity carve-out이 국내 물적분할과 동일한 형태라고 할 수는 없다.

29) 프랑스, 일본 등 물적분할을 제도적으로 도입한 국가에서 물적분할에 대한 주주총회결의는 결의 수준이 강화된 특별결의를 통과하도록 하고 있다.

30) 이상훈(2020a)은 물적분할은 지배주주에 의한 부의 편취이므로 주주총회결의가 소액주주에 대한 적절한 보호 수단이 될 수 없다고 주장한다.

31) 기업지배구조보고서 개정으로 (세부원칙 2-③) ‘기업은 합병, 영업양수도, 분할, 주식의 포괄적 교환 및 이전 등과 같은 기업의 소유구조 또는 주요 사업의 변동에 있어 소액주주 의견수렴, 반대주주 권리보호 등 주주보호 방안을 강구하여야 한다.’를 신설하였으며, 해당 사건이 발생하는 경우 기업지배구조보고서에 소액주주 의견수렴, 반대주주 권리보호 등 주주보호를 위한 회사의 정책을 설명하고 이와 같은 정책이 없는 경우 그 사유 및 향후계획 등을 설명하도록 하였다.

32) Ⅱ장 1절 물적분할 현황을 참조한다.

33) 신규상장기업의 최대주주가 투자회사 또는 재무적 투자목적이 아닌 상장기업이면 모자기업 동시상장으로 분류하였다.

34) 미국에서 기업에 대한 지배관계는 차등의결권을 고려하여야 하나 본고에서는 분석의 한계로 단순 지분율로 표시하였다.

35) 싱가포르, 말레이시아, 인도네시아, 태국 등 동남아시아 증권거래소들은 상장규정 안에 ‘chain listing’이라는 항목으로 모자기업 동시상장에 대한 규제 조항을 두고 있다.

36) 다만 상장심사 과정에서 동시상장 자회사의 모회사 의존성과 지배구조 독립성에 대한 검토가 진행되고 있다.

참고문헌

강내철ㆍ진태홍, 2012, 기업분할 방법과 공시효과,『재무관리연구』29(1), 57-80.

권기범, 2009, 물적분할,『서울법학』17(1), 1-25.

권택호, 2019, 기업의 관련 다각화와 기업가치,『재무관리연구』36(4), 33-62.

기현희, 2010, 분할공시에 대한 주가반응과 기업특성,『경영교육연구』61(1), 43-66.

김동민, 2005, 會社分割에 있어서 少數株主의 權利保護에 관한 硏究 -日本의 改正商法의 規定을 중심으로-,『사회과학연구』21, 1-26.

김동민, 2007, 會社分割에 있어서 分割反對株主의 株式買受請求權에 관한 小考,『기업법연구』21(4), 215-240.

김상우ㆍ남명수, 2013, 기업분할이 주가에 미치는 영향에 관한 연구,『기업경영연구』20(5), 195-214.

김은수, 2021, 회사 분할에 관한 법적연구 -기업가치에 대한 이해관계를 중심으로-,『경영법률』31(2), 179-206.

김종국ㆍ김수경ㆍ변영태, 2016, 기업분할에 따른 주주의 부의 단기성과에 관한 연구 –유가증권시장과 코스닥시장의 비교분석-,『지역산업연구』39(3), 179-200.

박경진ㆍ신현한ㆍ장진호, 2005, 기업분할과 경영성과,『전략경영연구』8(2), 81-104.

박진ㆍ서정원ㆍ강신우, 2019, 한국주식시장의 지주회사 디스카운트,『한국증권학회지』48(6), 755-788.

서재웅, 2021, 기업분할 공시가 주주의 부에 미치는 영향,『글로벌경영연구』33(2), 65-81.

송은해, 2018, 물적분할 기업의 후속 지배구조 개편 현황 분석, KCGS 리포트 8(7), 4-9.

신용균ㆍ한만용, 2016, 기업분할 형태와 공시효과,『경영컨설팅연구』16(3), 99-113.

오현탁ㆍ이현상ㆍ전세환ㆍ김종만, 2006, 기업분할이 기업가치에 미치는 영향에 관한 실증적 연구,『 산업경제연구』19(3), 1027-1049.

윤석현, 2004, 會社分割의 迅速性과 株主의利 益保護,『법조』53(12), 112-145.

이동영ㆍ김상균, 2017, 분할신설기업의 지배구조와 성과 관계,『전략경영연구』20(2), 27-54.

이상욱, 2007, 기업분할 결정요인은 무엇인가? : 한국의 기업분할을 중심으로, 『경영학연구』36(3), 791-821.

이상훈, 2017, 한국 기업집단 지배구조 문제의 본질과 바람직한 상법 개정 –주주의 비례적 이익관점에서-,『상사법연구』 36(2), 211-262.

이상훈, 2020a, 물적분할과 지주사 디스카운트 –LG화학의 사례를 소재로-,『법학논고』71, 201-334.

이상훈, 2020b, 인적분할과 자사주마법,『상사법연구』39(2), 367-412.

이성호, 2007, 독일과 프랑스의 지주회사 사례분석 및 시사점,『질서경제저널』10(2), 25-38.

이은정, 2021,『분할 등 기업구조개편의 효과 분석: LG화학과 ㈜LG를 중심으로』, 경제개혁연대 연구보고서 21-01.

이정환ㆍ이진주ㆍ박남규, 2012, 한국기업의 지배구조가 기업분할 유형선택에 미치는 영향에관한 연구,『전략경영연구』15(1), 65-87.

조용대ㆍ김동하, 2015, 이사회의 기업분할 결의가 기업가치에 미치는 영향 분석,『대한경영학회지』28(1), 179-201.

천준범, 2020,『법은 어떻게 부자의 무기가 되는가: 알면 벌고 모르면 당하는 ‘재벌법’의 10가지 비밀』, 부키.

허인, 2006, 회사분할에 있어서 소수주주의 보호,『외법논집』21, 313-332.

황남석, 2012, 미국 회사법상의 회사분할제도에 관한 연구,『증권법연구』12(3), 261-298.

황남석, 2016, 상법상 물적분할제도의 쟁점 및 입법적 개선방안,『상사법연구』34(4), 129-157.

Campello, M., Graham, J.R., 2013, Do stock prices influence corporate decisions?

Evidence from the technology bubble, Journal of Financial Economics 107(1), 89-110.

Cusatis, P.J., Miles, J.A., Woolridge, J.R., 1993, Restructuring through spinoffs: The stock market evidence, Journal of Financial Economics 33(3), 293-311.

Davis Polk, 2014, Corporate Governance Practices in U.S. Initial Public Offerings.

Huson, M.R., MacKinnon, G., 2003, Corporate spinoff s and information asymmetry between investors, Journal of Corporate Finance 9(4), 481-503.

Hite, G.L., Owers, J.E., 1983, Security price reactions around corporate spin-off announcements, Journal of Financial Economics 12(4), 409-436.

ISS, 2016, 2016 ISS Study on Controlled Companies.

John, K., Ofek, E., 1995, Asset sales and increase in focus, Journal of Financial Economics, 37(1) 105-126.

Krishnaswami, S., Subramaniam, V., 1999, Information asymmetry, valuation, and the corporate spin-off decision, Journal of Financial Economics 53(1), 73-112.

Pástor,

TSE, 2021, TSE-Listed Companies White Paper on Corporate Gorvernance 2021.