Find out more about our latest publications

Bonus Issues Turning into Thematic Stocks and Role of Informed Traders

Issue Papers 22-21 Nov. 01, 2022

- Research Topic Corporate Finance

- Page 21

Since 2020, newly listed and loss-making companies in the pharmaceutical and biotech sectors have issued bonus shares in the name of the shareholder return policy. The prices of bonus shares have soared immediately after disclosure, which has overheated the bonus share market as is the case with the politically themed stocks. More recently, some listed companies that mainly contribute to turning bonus shares into thematic stocks have increased the number of new shares allocated to each shareholder to an unprecedented level in order to grab the attention of retail investors. As a result, the price of bonus shares and the turnover ratio tend to surge immediately after the disclosure and on the ex-rights date. However, this is a short-lived phenomenon that cannot enhance shareholder returns.

The response to bonus issues is sharply divided by type of investors, suggesting that retail investors and informed traders recognize the value of information regarding bonus issues differently. Retail investors show a massive net buying trend after bonus issues are disclosed, while institutional investors who act as informed traders consistently continue the net selling of bonus shares. Foreign investors tend to change their position over the course of stock trading to actively create more investing opportunities. In some cases, corporate insiders and early investors took advantage of bonus issue disclosure to sell their holdings. In the meantime, how informed traders react to bonus issue disclosure has been affected by regulatory changes in short selling. As the role of informed traders is limited by short-selling regulation, bonus shares show a larger price increase for a prolonged period.

If a company disguises a bonus issue as its shareholder return policy to attract retail investors, it could be tantamount to abusing the bonus issue system. Accordingly, specifying the purpose of bonus issues should be mandatory when a bonus issue is disclosed. If informed traders take on a greater role, the themed stock phenomenon where a share price keeps surging regardless of its intrinsic value could be curbed in the early stages. Hence, it is necessary not to excessively limit the role of informed traders when regulatory measures are devised.

The response to bonus issues is sharply divided by type of investors, suggesting that retail investors and informed traders recognize the value of information regarding bonus issues differently. Retail investors show a massive net buying trend after bonus issues are disclosed, while institutional investors who act as informed traders consistently continue the net selling of bonus shares. Foreign investors tend to change their position over the course of stock trading to actively create more investing opportunities. In some cases, corporate insiders and early investors took advantage of bonus issue disclosure to sell their holdings. In the meantime, how informed traders react to bonus issue disclosure has been affected by regulatory changes in short selling. As the role of informed traders is limited by short-selling regulation, bonus shares show a larger price increase for a prolonged period.

If a company disguises a bonus issue as its shareholder return policy to attract retail investors, it could be tantamount to abusing the bonus issue system. Accordingly, specifying the purpose of bonus issues should be mandatory when a bonus issue is disclosed. If informed traders take on a greater role, the themed stock phenomenon where a share price keeps surging regardless of its intrinsic value could be curbed in the early stages. Hence, it is necessary not to excessively limit the role of informed traders when regulatory measures are devised.

Ⅰ. 들어가는 말

국내 상장기업은 유동성을 높이거나 기업에 유리한 재무정보를 시장에 전달하기 위한 목적으로 주주의 추가 부담 없이 무상증자, 주식분할, 주식배당의 형태로 무상주를 발행할 수 있다. 그중에서도 무상증자는 이사회결의만으로 주식수를 손쉽게 늘릴 수 있어 주주총회 보통결의가 필요한 주식배당이나 주주총회 특별결의가 필요한 주식분할에 비해 무상주 발행 수단으로 선호되었다.

그런데 2020년 이후에는 신규상장기업, 제약 및 바이오 적자기업이 중심이 되어 주주환원을 명분으로 대거 무상증자를 발표하였다.1) 실제로 이 시기 상당수 무상증자 기업의 주가는 무상증자 공시 직후 급등2)하면서 무상증자 주식은 기업의 내재가치와 관계없이 특정한 이벤트로 인해 주가 급등락이 이어지는 테마주3)로 분류되었다.4) 무상증자 테마주 현상이 심화되자 금융감독원은 2022년 7월 무상증자가 기업가치에 미치는 영향이 없고 주가 등락에 따른 위험 요인으로 인해 투자에 유의가 필요하다는 경고까지 발표하였다.5)

무상증자 관련 기존 연구들은 주로 무상증자의 공시효과를 분석하거나 주식분할 및 주식배당과 주가 성과와 유동성 개선 효과를 비교하는 데 초점이 맞추어져 있다. 따라서 최근 무상증자 테마주 현상의 특징을 알아보기 위해서는 팬데믹 이후 무상증자가 과거 무상증자에 비해 어떤 면에서 차이가 있는지, 무상증자의 명분으로 내세운 주주환원 정책은 근거가 있는지, 투자자 유형별 반응은 어떻게 다른지를 분석할 필요가 있다.

또한 무상증자가 크게 늘어난 기간은 공매도 전면금지(2020년 3월 16일~2021년 5월 2일)와 부분허용(2021년 5월 3일~) 시기와 겹치고 있어 정보거래자의 무상증자 주식 거래에 제약이 가해졌다고 할 수 있다. 만약 공매도 규제별로 무상증자 주식에 대한 정보거래자의 매매행태에 차이가 있다면 기업가치와 무관한 테마주 현상에서 정보거래자의 역할을 확인할 수 있을 것이다.

이에 본고에서는 팬데믹 기간 나타난 무상증자 주식 열풍과 정보거래자의 역할을 실증적으로 분석함으로써 문제점을 식별하고 정책 시사점을 도출하고자 한다. 그러기 위해 Ⅱ장에서는 2020년 이후 무상증자의 주요 특징을 유동성 및 수익성과 착시효과의 관점에서 알아본다. Ⅲ장에서는 투자자 유형별로 무상증자 주식에 대한 매매행태 차이를 분석한다. 또한 공매도 규제 단계별 무상증자의 주가 특징을 KOSPI200 및 KOSDAQ150 주가지수 편입과 미편입 주식으로 구분하여 살펴봄으로써 공매도 규제가 무상증자 주가에 어떤 영향을 미쳤는지 분석한다. Ⅳ장에서는 분석 결과를 정리하고 정책 시사점을 제시한다.

Ⅱ. 무상증자 주식의 테마주化

1. 무상증자 현황

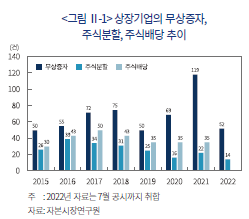

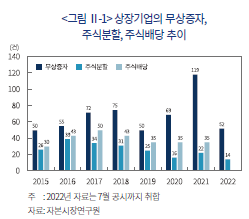

무상주 발행의 수단인 무상증자, 주식분할, 주식배당 중 무상증자의 시행이 가장 간소하다고 해서 주식분할과 주식배당을 무상증자가 모두 대체할 수 있는 것은 아니다. 무상주의 발행 목적이 유동성 제고인 경우 주식분할은 다른 두 가지 방식보다 주식수의 획기적 증가가 가능하기에 거래량이 가장 많이 증가한다(김현석ㆍ서정원, 2018). 또한 박영규(2019)에 따르면 주가 수준이 높고 기업 규모가 작을수록 상장기업은 주식배당보다 무상증자를 선호하였다. 실제로도 2015~2019년 기간 무상증자는 50~80건, 주식분할은 20~40건, 주식배당은 30~50건 범위에서 세 가지 무상주 발행 방식은 안정적인 모습을 보였다(<그림 Ⅱ-1> 참조). 그런데 2020년부터 국내 상장기업의 무상증자6)는 증가하였으나 주식분할 및 주식배당은 감소하거나 정체하고 있다. 특히 2021년에는 119건의 무상증자 공시가 있었고 2022년에는 7월까지 52건의 무상증자 공시가 이어지고 있어 팬데믹 발발 후 무상증자가 대폭 증가했다고 할 수 있다.

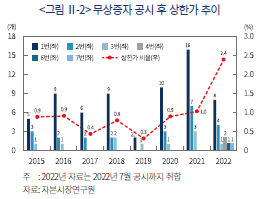

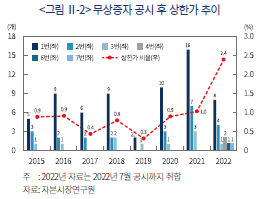

2020년부터 무상증자가 빠르게 증가한 것과 함께 무상증자 주식의 과열 현상도 관측되기 시작하였다. 또한 2015년부터 2022년 7월까지 무상증자 주식의 공시 직전 거래일부터 30거래일까지 상한가 빈도를 비교하면 2021년과 2022년 각각 39번과 40번 상한가에 이르렀으며, 무상증자 종목수와 측정기간을 표준화하여 비교한 상한가 비율7)에서는 2022년의 경우 다른 해의 2~8배에 이를 정도로 상한가 빈도가 높았다(<그림 Ⅱ-2> 참조).8) 한편 상한가를 1번 이상 경험했던 무상증자 주식은 102개인데, 이중 23개 주식은 상장기간이 1년 이하로 상장 직후 무상증자를 발표하고 주가가 급등했다고 할 수 있다. 특히 2020년 이후 상장 1년 이하 상한가 종목은 13개로 이 중에는 무상증자 공시 후 4번의 상한가와 6번의 상한가에 이른 종목들도 존재하였다.

이러한 무상증자 주식의 주가 급등 현상은 한국거래소의 관련 시장조치 적발 건수에서도 확인된다. 2012년 11월 도입된 ‘단기과열종목’9)으로 지정된 무상증자 주식은 11개인데 이 중 2020년 이후는 7개를 차지하였다. 또한 2020년 신설된 ‘스팸관여과다종목’10)으로 지정된 무상증자 주식도 6개에 이르고 있으며 이 중 4개는 2022년에 지정되었다.

2. 무상증자 주식의 유동성 및 수익성 검토

전통적으로 기업의 무상주 발행을 설명하는 유력한 가설로 유동성가설과 신호가설이 있다. 두 가설을 무상증자에 적용11)하면 유동성가설은 무상증자로 주가를 적정 수준으로 낮추면 소액 거래자들이 유입되면서 주식의 거래 유동성을 높일 수 있다는 것이고, 신호가설에 따르면 무상증자는 향후 기업의 수익성 개선 등 기업가치가 양호하다는 정보를 투자자에게 전달하기 위한 수단이라는 것이다(Grinblatt et al., 1984; Brennan & Copeland, 1988; Ikenberry et al., 1996; Muscarella et al., 1996; 김현석ㆍ서정원, 2018; 박영규, 2021).12)

먼저 유동성가설을 살펴보면 기존 국내 무상증자 관련 유동성가설 연구에서는 무상증자로 인해 유동성 개선 효과가 있다는 연구가 다수이나 모두 일관된 결과를 보이는 것은 아니다. 박영규(2021)의 연구에서는 무상증자의 유동성 개선 효과가 주식배당에 비해 유의미하게 나타났고, 조은영ㆍ양철원(2017)도 무상증자 주식의 유동성 개선 효과를 확인하였으나, 김현석ㆍ서정원(2018)의 연구에서는 주식분할만이 유동성 개선 효과가 나타나고 무상증자 주식에서는 유의미한 유동성 증가 효과를 관측하지 못하였다.

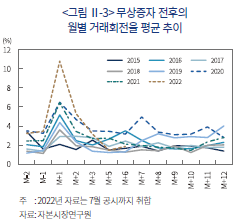

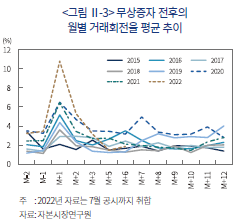

2015년부터 무상증자 공시를 기준으로 직전 월별 거래회전율 평균13)과 공시 직후 월별 거래회전율 평균을 산출해서 연도별로 비교해 보면 공통적으로 공시부터 한 달 동안의 거래회전율이 가장 높게 나타난다(<그림 Ⅱ-3> 참조). 특히 전체적으로는 공시 직전 한 달(M-1) 동안 거래회전율에 비해 공시 직후 한 달(M+1) 동안 거래회전율은 평균 2.5배 증가한 후 두 달째(M+2) 1.5배, 석 달째(M+3) 1.2배로 점차 하락하였다. 그러나 2022년에는 공시 직후 3개월간 공시 직전 대비 각각 3.1배, 1.5배, 0.9배의 추이를 보이면서 무상증자로 인한 유동성 개선 효과 지속 기간이 상대적으로 짧게 나타났다. 실제로 각 무상증자 공시별로 공시 직전 한 달의 거래회전율과 공시 직후 12개월간 월별 거래회전율을 paired t-test로 분석하면 2015~2019년 기간에는 2015년을 제외하고 모두 공시 후 3개월 후에도 유의한 거래회전율 증가가 나타나고 있으나 2020년부터는 공시 후 2개월 이내의 단기적 증가만 나타났다(<표 Ⅱ-1> 참조).14)

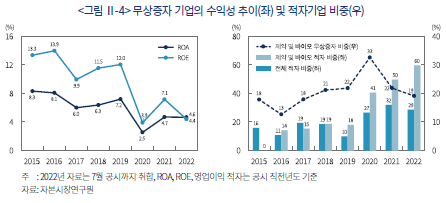

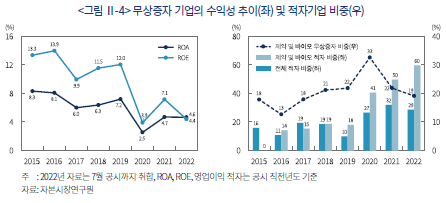

다음으로 무상증자가 신호가설에 따라 기업의 긍정적 정보를 내보이기 위한 수단이라고 한다면 2020년 이후 무상증자 기업의 수익성(ROA, ROE) 하락을 설명하기 어렵다(<그림 Ⅱ-4> 좌 참조).15) 더욱이 2015~2019년 기간 무상증자 기업 중 직전 사업연도 적자기업 비중이 평균 15%였으나 2020~2022년 7월 기간에는 29.3%까지 증가하였다(<그림 Ⅱ-4> 우 참조). 특히 무상증자 기업 중 18%를 차지해 가장 비중이 큰 제약 및 바이오 업종16)의 경우 적자기업 비중이 2015~2019년 기간 13%였으나 2020~2022년 7월 기간에는 50.3%로 급증하면서 무상증자 기업의 수익성 악화를 주도하였다. 따라서 2020년 이후 상장기업의 무상증자 결정이 전통적인 두 가지 가설로 충분히 설명된다고 보기는 어렵다.

3. 착시효과: 권리락과 신주배정수

2020년부터 무상증자가 증가한 데에는 적자 상태의 제약 및 바이오 기업의 무상증자와 함께 상장 1년 이하의 신규상장기업의 무상증자가 한몫하고 있다. 2015~2019년 기간 상장 1년 이하 기업의 무상증자 비중은 13.6%였으나 2020~2022년 7월 기간에는 15.6%로 늘어났고 2022년에는 23.1%로 증가하였다. 이들 신규상장기업은 상장 이후 저조한 주가 흐름에 대한 투자자들의 불만을 잠재우기 위해 주주환원 정책을 내세워 무상증자를 결정하는 경향이 있다.

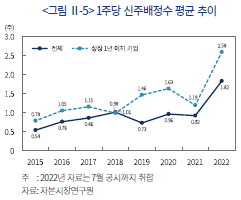

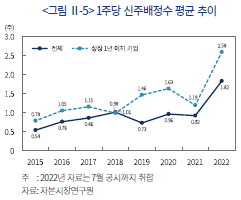

그러나 신규상장기업의 무상증자는 투자자의 관심을 끌기 위해 과거 무상증자에 비해 과도한 신주배정수17)를 설정하고 있어 단기성 주가부양 목적이 강하다고 할 수 있다. 상장 1년 이하 무상증자 기업들은 2015~2019년 기간에 평균적으로 1주당 신주 1.13주를 배정하였으나 2022년에는 2.58주(최대 8주)로 신주배정수를 대폭 늘렸다(<그림 Ⅱ-5> 참조). 신주배정수가 많을수록 권리락일18) 시초가 하락 조정 폭이 커지는데 이렇게 되면 주가가 싸졌다고 착각한 투자자들이 매수에 나서는 착시효과(김현석ㆍ서정원, 2018)가 더 강하게 나타날 수 있다.19)

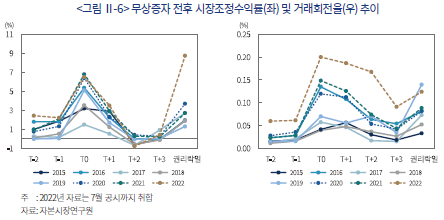

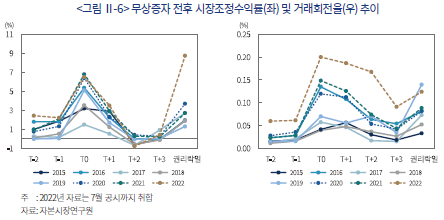

실제로 무상증자 공시일과 권리락일에 거래가 증가하면서 무상증자 주식은 높은 시장조정수익률20)과 거래회전율이 관측되고 있는데 이러한 특징은 2020년 이후 더 강해졌다(<그림 Ⅱ-6> 참조). 특히 권리락일의 시장조정수익률은 신주배정수가 가장 컸던 2022년에 8.67%로 급등하였으며, 공시일의 거래회전율도 최고치에 이르러 착시효과가 커졌다고 할 수 있다.

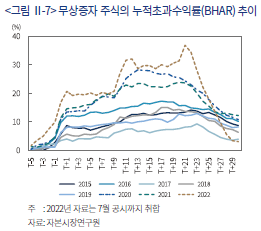

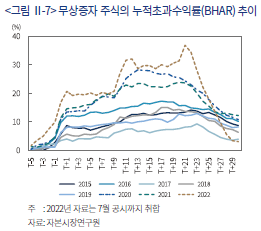

무상증자 주식의 공시효과를 살펴보기 위해 누적초과수익률(Buy-and-Hold Abnormal Return: BHAR)21)을 아래의 산식으로 산출하면 2020~2022년의 무상증자 주식의 누적초과수익률이 크게 증가했음을 알 수 있다(<그림 Ⅱ-7> 참조). 특히 10거래일(T+10) 근처에서 누적초과수익률이 급등하는 것은 권리락일 효과 때문으로 2022년 값이 유난히 큰 것을 알 수 있다.

무상증자 주식의 공시 전 5거래일부터 누적초과수익률을 종속변수로 하고 신주배정수, 신규상장기업 더미, 2020~2022년 더미, 제약 및 바이오 업종 더미와 공통변수22)를 설명변수로 하는 회귀분석을 수행해 보면 공시효과가 크게 약화되는 30거래일 구간을 제외하고 신주배정수가 클수록 누적초과수익률이 매우 유의하게 커지는 것을 알 수 있다(<표 Ⅱ-2> 참조). 또한 상장기간 1년 이하의 신규상장기업, 2020년 이후 무상증자 기업, 제약 및 바이오 업종이 대부분의 구간에서 유의미한 효과를 보였다. 또한 공통변수 중에서는 시가총액이 작고 PBR이 낮은 기업에서 누적초과수익률이 커지는 것으로 나타나고 있어 이들 기업에서 무상증자를 활용할 유인이 크다고 할 수 있다.

한편 무상증자 주식의 누적초과수익률은 공시일로부터 30거래일만 지나도 시장수익률에 수렴하는 모습을 보이고 있으며 주가 급등 폭이 가장 컸던 2022년 무상증자 기업은 더 빠르게 수렴하고 있다. 따라서 주주환원을 위해 무상증자를 결정했다는 주장은 무상증자 공시 후 주가 상승이 단기간에 그치고 있는 상황에서 실증적으로 지지받기는 어렵다.

Ⅲ. 투자자별 매매 특징과 정보거래자 역할

1. 투자자별 매매행태

상장기업의 무상증자 공시가 기업가치의 변화 없이 투자자의 관심을 끌기 위한 목적이 크다고 했을 때 무상증자 공시에 대한 투자자 반응은 정보거래자와 비정보거래자 간에 동일하지 않을 가능성이 크다. 반대로 일부 무상증자 기업의 주장대로 무상증자가 주주환원 정책이라고 한다면 투자자 유형에 따라 반응 차이가 크지 않을 것이다.

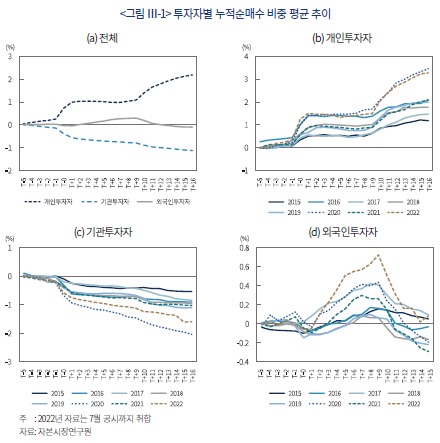

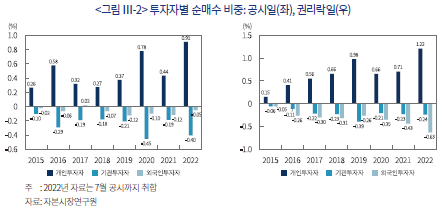

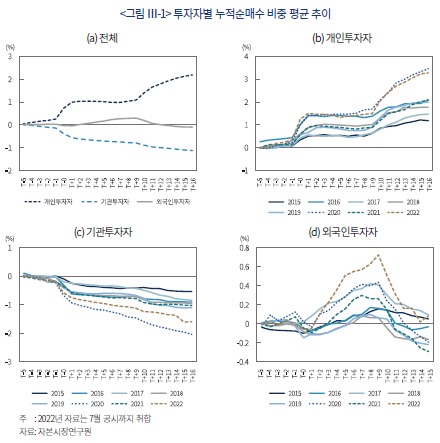

무상증자에 따른 투자자별 반응 차이를 확인하기 위해 무상증자 공시 직후 개인투자자, 기관투자자, 외국인투자자의 누적순매수 비중23)을 비교하면 개인투자자는 무상증자 주식을 꾸준히 순매수하였으며, 특히 공시일과 권리락일에 순매수 비중을 급격히 높였음을 알 수 있다(<그림 Ⅲ-1> 참조). 반면에 기관투자자는 개인투자자와 정반대의 매매행태를 보여 순매도를 지속하였다. 외국인투자자의 경우 상대적으로 뚜렷하지 않은 매매행태를 보였는데 세부적으로 보면 공시일과 익일에는 순매도 포지션이었으나 그 직후 순매수 포지션으로 돌아섰다가 권리락일부터 매도를 늘리면서 13거래일부터는 누적순매도 포지션을 취하였다.

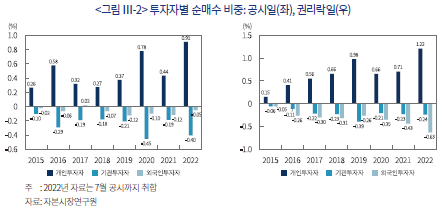

이러한 투자자별 매매행태의 차이는 기간에 관계없이 일관되게 나타나고 있으나 2020년 이후에는 방향성이 더 강화되고 있다. 공시일과 권리락일 투자자별 순매수 비중을 비교하면 2020년 이후 개인투자자의 순매수 비중과 기관투자자 및 외국인투자자의 순매도 비중 크기가 더 커졌음을 알 수 있다(<그림 Ⅲ-2> 참조). 특히 외국인투자자는 공시일 순매도 비중보다 권리락일 순매도 비중이 더 크게 나타나 공시일 이후 순매수한 주식을 권리락일에 대거 매도한 것으로 보인다.

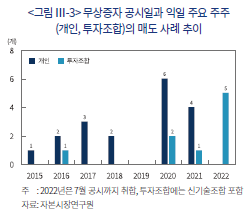

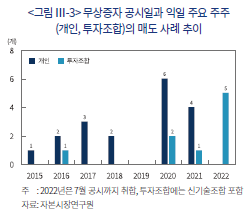

한편 일부 무상증자 기업 주요 주주들의 매매행태도 주목할 필요가 있다. 주가 상승의 기대감이 가장 큰 무상증자 공시일과 다음날 주요 주주의 주식 매매를 분석해보면 대주주 또는 임직원의 자기회사 주식의 매도 사례는 비록 소수이나 2020년 이후 증가하는 추세이다(<그림 Ⅲ-3> 참조)24). 또한 2019년까지 1건에 불과했던 투자조합의 무상증자 공시일과 다음날 주식 매도25)가 2020년부터 증가하여 2022년에는 5건에 이르고 있어 무상증자가 투자조합의 투자회수 기회로 활용되는 면이 있다고 할 수 있다. 따라서 내부자와 투자조합의 공시 직후 주식매도는 개인투자자에 비해 우월한 정보를 가지고 있는 내부자와 주요 주주들이 무상증자 공시로 개인투자자의 매수가 집중되는 시기를 이용한 기회주의적 행태로 해석될 수 있다.26)

정리해 보면, 무상증자 공시에 따른 투자자별 대응은 큰 차이를 보이고 있다. 개인투자자의 순매수 일변도와 달리 기관투자자는 지속적으로 순매도 포지션을 유지하고 있으며, 외국인투자자는 공시일에 순매도 포지션을 취하고 있으나 그 후에는 순매수로 전환하여 권리락일의 개인투자자 대량 매수에 매도로 대응하는 유연한 전략을 채택하고 있다. 한편 무상증자 공시가 2020년 이후 주가의 급등으로 이어지면서 내부자 및 투자조합의 매도도 관측되고 있다.

결국 무상증자 공시로 인한 개인투자자와 정보거래자의 매매행태 차이는 주주환원의 근거를 찾기 어려우며 단기적으로 개인투자자의 관심을 끌려는 것이 무상증자의 실제 의도임을 보여준다고 하겠다. 또한 개인투자자의 일방적인 순매수는 내부자 및 주요 주주의 사익추구에 유리한 기회를 제공한다고 할 수 있다.

2. 공매도 규제 단계별 무상증자 수익률 특징

무상증자 공시에 대해 정보거래자들이 전략적으로 매매를 한다면 규제 변화에 대해서도 개인투자자와는 다른 대응을 보일 가능성이 크다. 무상증자가 증가하기 시작한 2020년에서 2022년 7월 사이에는 팬데믹 발발로 인한 충격으로부터 시장보호를 명분으로 공매도 규제를 시행한 기간이기도 하다. 팬데믹 기간 공매도 규제는 2단계로 나눌 수 있는데 1단계는 전면금지 기간으로 2020년 3월 16일부터 2021년 5월 2일까지이다. 2단계는 부분허용 기간으로 2021년 5월 3일부터 분석 마지막 기간인 2022년 7월까지 지속되고 있으며, KOSPI200과 KOSDAQ150지수 편입 종목에 한해서 제한적으로 공매도를 허용했다.

따라서 팬데믹 이전을 전면허용 기간으로 본다면 2015~2022년 7월은 공매도 규제 수준에 따라 3개의 기간으로 나눌 수 있다. 무상증자 공시 기업을 KOSPI200 및 KOSDAQ150 지수 편입 종목(이하 주가지수 편입 종목)과 미편입 종목으로 구분하여 공시효과를 비교하면 공매도 규제별로 무상증자의 주가 영향을 분석할 수 있게 된다.

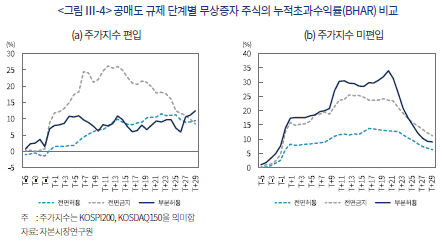

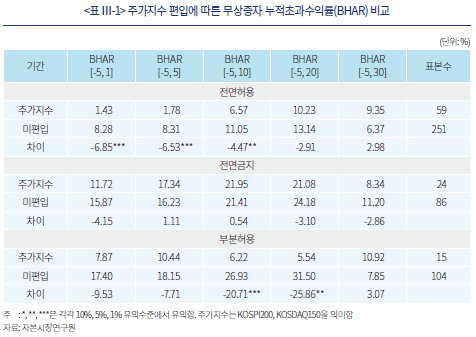

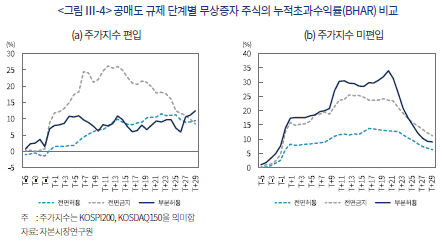

이에 따라 전체 무상증자 표본을 무상증자 공시 5거래일 전(T-5)부터 30거래일(T+30)까지 누적초과수익률을 주가지수 편입 여부와 공매도 규제 3단계별로 산출하면 <그림 Ⅲ-4>와 같다. 먼저 (b)의 주가지수 미편입 무상증자 종목을 보면 전면허용 기간에서 누적초과수익률은 공시일 다음 거래일에 8.3%, 17거래일에 13.7%까지 증가한 후 계속 하락하여 30거래일에는 6.4%로 줄어드는 모습을 보인다. 그런데 공매도 전면금지 기간에서는 공시일 다음 거래일에 15.9%, 13거래일에 25.5%까지 누적초과수익률이 증가한 후 30거래일에는 11.2%로 감소하며 전면허용 기간에 비해 누적초과수익률이 대폭 증가하는 모습을 보인다. 주가지수 미편입 종목은 공매도 부분허용 조치에 영향을 받지 않는 상황에서 부분허용 기간에서도 전면제한 기간과 비슷하게 공시 직후에 높은 수익률 값을 보이고 있으며 권리락 효과가 중간에 더해져 11거래일에 30.3%, 20거래일에는 33.9%까지 누적초과수익률이 증가하였다. 반면에 무상증자 공시 기업 중 주가지수 편입 종목의 누적초과수익률 추이를 보면 전면허용 기간과 전면금지 기간에서는 미편입 종목과 유사한 모습을 보이지만 부분허용 기간에서는 미편입 종목과 달리 수익률의 증가 폭이 상당히 둔화되는 모습을 보인다(<그림 Ⅲ-4> (a) 참조).

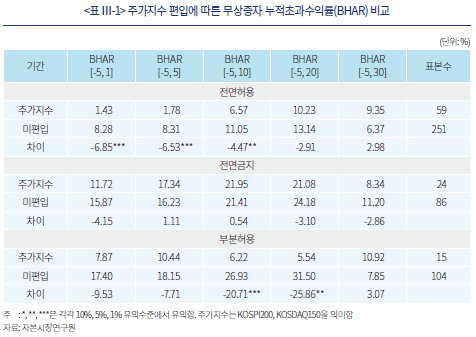

KOSPI200과 KOSDAQ150 지수 편입에 따라 공매도 부분허용 기간 누적초과수익률이 뚜렷한 차이를 보이는 것은 이 기간에서만 두 집단이 공매도 허용과 금지로 나뉘기 때문으로 해석할 수 있다. 부분허용 기간에서의 두 집단 간 누적초과수익률 차이는 특히 공시 후 10거래일과 20거래일에서 20% 이상 벌어지고 있으며 통계적으로도 유의한 수준이다(<표 Ⅲ-1> 참조). 즉, 부분허용 기간에서 주가지수 편입 종목의 무상증자 공시는 미편입 종목과 달리 공매도로 인해 주가 급등이 억제되었을 수 있다.

따라서 공매도 규제 변화는 정보거래자의 무상증자 주식의 매매에 영향을 미쳤다고 할 수 있다. 구체적으로는 공매도 금지로 인해 정보거래자가 공시직후와 권리락일 개인투자자의 매수에 대응한 매도 포지션 구축이 어려워지면서 누적초과수익률이 과도하게 상승하는 현상이 나타났다고 할 수 있다.

Ⅳ. 맺는말

2020년 이후 상장기업의 무상증자 증가 현상은 그 이전 시기와 비교할 때 유동성 제고나 기업가치에 대한 긍정 신호 전달 등 전통적 무상증자 동인에서 벗어나 있으며 일부 기업들이 주장하는 주주환원과도 거리가 멀다. 오히려 상당수 무상증자는 개인투자자의 관심 유도를 통한 단기적 주가 부양에 초점이 맞추어져 있다. 무상증자에 따른 권리락일의 착시효과를 극대화하기 위해 신주배정수를 급격히 올리는 것이 대표적 사례라고 할 수 있다.

한편 무상증자에 대한 투자자들의 반응은 정보거래자인 기관투자자 및 외국인투자자와 개인투자자 간 뚜렷한 차이를 보이고 있다. 개인투자자가 무상증자의 착시효과에 적극적으로 반응하여 순매수 포지션을 취하고 있으며 내부자와 주요 주주들은 이에 편승하여 보유 주식을 매도하는 기회로 활용하고 있다. 반면 기관투자자는 개인투자자와 정반대의 순매도 포지션을 취하며 외국인투자자는 권리락일의 매도 기회 확대를 위해 중간에 매매 포지션을 변경하며 투자 기회를 극대화하고 있다. 투자자 유형에 따른 상이한 반응은 무상증자가 모든 주주에게 유익한 주주환원이라는 주장과 배치된다고 할 수 있다.

따라서 최근 무상증자 과열은 기업 경영상의 합리적 결정보다는 개인투자자의 유입을 목적으로 한 무상증자 남용에 가깝다고 할 수 있어 이를 방지하기 위한 제도적 개선이 요구된다. 현재 상장기업의 무상증자는 ‘주요사항보고서’를 통해 무상증자의 기본 요건29)에 대해서만 공시하고 있는데 무상증자의 목적 항목을 주요사항보고서에 추가할 필요가 있다. 상장기업이 무상증자의 목적을 구체적으로 공시해야 한다면 주주환원 정책으로 무상증자를 홍보하고 활용하기는 어려워질 것이다.

또한 공매도 규제 변화에 따라 정보거래자의 무상증자 대응에 차이가 존재하였는데 공매도 제한과 같이 정보거래자의 역할을 제한할수록 무상증자 주가 과열이 확대되는 현상이 나타났다. 결과적으로 무상증자 테마주처럼 기업의 내재가치와 직접적 관련 없이 주가가 급등하는 경우 정보거래자의 역할이 중요하다고 할 수 있다. 테마주 현상에서 정보거래자의 역할이 확대된다면 주가 급등의 정도와 지속 기간이 그렇지 않은 경우보다 감소할 가능성이 크다. 반대로 규제로 인해 정보거래자의 매매가 과도하게 제한되는 경우 테마주 현상은 보다 심화될 위험이 있다.

1) 매일경제(2021. 10. 7), 머니투데이(2022. 7. 4)

2) 코스닥기업 노터스는 2022년 5월 9일 무상증자 발표 시점부터 6월 9일까지 7번의 상한가를 기록하였다.

3) 테마주에 관해서는 남길남(2017)을 참조한다.

4) 한국경제(2022. 6. 21)

5) 금융감독원(2022. 7. 25)

6) 본고에서 무상증자는 무상증자 공시를 기준으로 삼고 있으며 유무상증자 공시는 분석에서 제외하고 있다.

7) 상한가 비율은 100*총 상한가 회수/(무상증자 종목수*32거래일)로 계산한다.

8) 무상증자 주식의 상한가 비율은 전체 상장주식의 연간 상한가 비율(100*상장주식 연간 총 상한가 회수/상장주식 연간 총 거래일수)에 비해서도 높게 나타났으며 특히 2022년은 더욱 높았다. 2015~2021년 기간 무상증자 주식의 상한가 비율은 전체 상장주식 상한가 비율의 1.7배(2015)에서 5.7배(2021)까지 높았는데 2022년에는 15.4배에 이르렀다.

9) 단기과열종목 지정 제도는 단기적 이상급등 및 과열 현상이 지속되는 종목에 대한 시장 경고 목적으로 도입되었다.

10) 스팸관여과다종목 지정 제도는 유사투자자문업체, 리딩방, 각종 SNS 등의 주식매수추천 스팸메세지로 인한 투자자피해를 최소화하기 위해 ‘스팸문자 현황을 시장경보제도에 편입’하여 투자주의 종목으로 즉시 지정하는 제도로 스팸문자 신고 건수(월평균 약 10만건)와 주가 또는 거래량이 일정 기준 이상 증가한 종목을 ‘스팸관여종목’으로 적출하고 스팸관여종목이 최근 5일중 2일 이상 적출된 경우 ‘스팸관여과다’로 즉시 지정한다.

11) 무상주 관련 유동성가설과 신호가설은 무상증자와 동일한 무상주 발행 형태가 없는 미국 주식시장에서 주식배당과 주식분할을 대상으로 정립되었다.

12) 유동성가설과 신호가설은 세부적으로 최적거래가격범위가설, 유보이익가설, 주의환기가설 등 여러 세부 가설들로 나뉘며 서로 배타적이라고 할 수도 없다. 본고에서는 거래회전율로 측정한 유동성 제고 효과와 기업의 긍정적 가치를 수익성 지표로 단순화하여 무상증자 기업의 특징과 공시 반응을 살펴본다.

13) 일별 거래회전율은 일별 거래량을 총 발행주식수로 나누어 산출하며 월별 거래회전율 평균은 일별 거래회전율의 평균으로 계산한다.

14) 2021년의 경우 공시 후 9개월(M+9)과 10개월(M+10)의 거래회전율은 공시 전 1개월(M-1)보다 유의하게 감소함으로써 유동성 증가가 단기적 현상에 그쳤을 뿐만 아니라 오히려 유동성은 무상증자 이전보다 줄어들었다고 할 수 있다. 또한 유동성 분석에는 별도로 Amihud의 비유동성(illiquidity) 지표(Amihud, 2002)를 함께 사용했으며 전체적인 결론은 유사하게 나타났다.

15) 2015~2019년 무상증자 공시 기업의 전년도 ROA와 ROE 평균은 각각 7.2%와 12.2%인데 2020~2022년 7월까지 무상증자 공시 기업의 해당 평균은 각각 4%와 5.6%에 그치고 있다. 다만 수익성이 계속 나빠져 결국 주가가 하락할 가능성이 크다면 경영진이 무상증자를 통해 주가를 일부러 낮출 유인은 크지 않기에 수익성이 낮은 기업의 무상증자를 기업가치가 양호하다는 신호가설로 해석할 여지는 존재한다. 또한 잉여금을 자본금으로 전입하여 총자본에서 차지하는 자본금의 비중을 높이게 되면 자본금을 분모로 하는 자본잠식률을 낮추게 되므로 자본잠식으로 인한 상장폐지 위험을 통제하기 위해 무상증자를 활용하는 것으로도 해석될 수 있다.

16) 업종은 에프엔가이드의 FnGuide Industry Classification Standard에 따른 23개 분류를 따르고 있다.

17) 무상증자에 따라 기존 1주당 받는 신주 개수를 의미한다.

18) 무상증자 주식의 권리락일은 공시일부터 평균 11.1 거래일이다.

19) Woolridge(1983)와 Eades et al.(1984)의 주식배당에 따른 배당락일 주가 변화 연구에서도 기업가치의 변화 없이 형식적인 가격조정으로 비정상적인 주가 변동이 나타나는 착시효과에 대해 명확한 이유를 찾을 수 없는 시장의 불완전성이나 비효율성으로 설명하고 있다.

20) 시장조정수익률은 KOSPI와 KOSDAQ의 시가총액가중수익률을 시장수익률로 설정하고 무상증자주식수익률에서 이를 차감하여 계산한다.

21) 본고에서는 상장기간 1년 이하 기업의 무상증자 비중이 14.5%에 달하고 이들 기업에 대한 분석 필요성이 커서 과거자료가 필요(파라미터 추정을 위해)하지 않은 BHAR을 이용하여 벤치마크(KOSPI와 KOSDAQ의 시가총액가중 수익률) 대비 누적초과수익률을 계산하고 있다.

22) 공통변수는 공시일 전 6거래일부터 20거래일까지 15거래일의 시가총액, PBR, 거래회전율의 평균값, 직전년도 ROE를 사용하였다.

23) 누적순매수 비중은 누적순매수 수량을 총 발행주식수로 나눈 백분율 값이다.

24) 개인 주주와 투자조합의 매도는 공시일부터 5거래일까지 분석기간을 확장해도 큰 차이를 보이지 않아 공시일과 익일에 이들의 매도가 집중되었다고 할 수 있다. 한편 관련 정보는 ‘주식등의 대량보유상황보고서’ 공시 내용을 분석하여 식별하였다.

25) 기업 초기 단계에 재무적투자자로 투자한 투자조합의 상장 이후 주식 매도는 투자회수로 해석된다.

26) 또한 무상증자 기업의 재무활동과 관련하여 무상증자 공시와 인접하여 나타나는 특기할 사건으로는 전환사채 발행 및 전환권청구가 있다. 보통주로의 전환이 가능한 대신 매우 낮은 금리로 자금을 조달할 수 있는 전환사채는 주가의 변동에 따라 가치가 직접적으로 영향을 받을 수밖에 없다. 그런데 2015~2019년 기간 무상증자 공시 전후 60일 동안의 발행 빈도를 비교하면 전후 발행 빈도가 거의 동일하였는데 2020~2022년 7월 기간에는 공시 전 전환사채 발행이 대부분이다. 보통주로의 전환권청구도 2015~2019년 기간에는 무상증자 공시 이후에 대부분이 행사되었으나 2020~2022년 7월 기간에는 무상증자 공시 이전에 대부분 행사되어 큰 대조를 보였다. 전환사채 발행과 전환권청구 시점의 변화 자체만으로 무상증자 공시 시점을 이용한 발행자와 투자자의 기회주의적 행태라고 단정할 수는 없으나 단기적인 주가 급등을 초래하는 무상증자 공시가 기업 재무활동에 중요한 사건으로 활용될 가능성은 존재한다고 하겠다.

27) 공매도잔고율은 실제 공개일까지 2거래일 정도 차이가 발생하고 있어 정확한 일별 대응 비교는 곤란하다.

28) 공매도 전면금지 기간에도 기존 포지션의 유지 허용 등으로 인해 최소한의 공매도 수량은 존재한다.

29) 신주의 종류와 수, 액면가액, 발행주식총수, 신주배정기준일, 신주배정수 등이다.

참고문헌

금융감독원, 2022. 7. 25, 상장기업 무상증자 관련 투자자 유의사항 안내.

김현석ㆍ서정원, 2018, 무상증자, 액면분할, 주식배당: 주가와 거래량 효과, 『한국증권학회지』 47(1), 27-67.

남길남, 2017, 『대통령 선거 국면의 정치테마주 특징과 시사점』, 자본시장연구원 이슈보고서 2017-04호.

류두진ㆍ양희진ㆍ주강진ㆍ정준영, 2017, 주식분할과 무상증자: 결정요인과 공시효과에 대한 실증분석, 『한국증권학회지』 46(4), 879-900.

매일경제, 2021. 10. 7, SK케미칼 무상증자 주주환원 정책 강화.

머니투데이, 2022. 7. 4, “주주 달래자”... 제약ㆍ바이오사, 올해도 줄줄이 무상증자.

박영규, 2019, 주식배당과 무상증자의 결정요인, 『Journal of the Korean Data analysis Society』 21(3), 1373-1382.

박영규, 2021, 주식배당과 무상증자의 주가와 유동성효과, 『산업혁신연구』 37(4), 47-75.

조은영ㆍ양철원, 2017, 무상증자에 대한 유동성 가설 검증, 『한국증권학회지』 46(2), 423-458.

한국경제, 2022. 6. 21, 고점 찍고 수직낙하...널뛰는 ‘무증 테마주’.

Amihud, Y., 2002, Illiquidity and stock returns: Cross-section and time-series effects, Journal of Financial Markets 5(1), 31-56.

Atiase R.K., 1980, Predisclosure Informational Asymmetries, Firm Capitalization, Financial Reports, and Security Price Behavior, Unpublished Ph. D dissertation, University of California, Berkeley.

Brennan, M.J., Copeland, T.E., 1988, Stock splits, stock prices, and transaction costs, Journal of Financial Economics 22(1), 83-101.

De Long, J.B., Shleifer, A., Summers, L.H., Waldmann, R.J., 1989, The size and incidence of the losses from noise trading, The Journal of Finance 44(3), 681-696.

De Long, J.B., Shleifer, A., Summers, L.H., Waldmann, R.J., 1990, Noise trader risk in financial markets, Journal of Political Economy 98(4), 703-738.

Diamond, D.W., Verrecchia, R.E., 1987, Constraints on short-selling and asset price adjustment to private information, Journal of Financial Economics 18(2), 277-311.

Eades, K.M., Hess, P.J., Kim, E.H., 1984, On interpreting security returns during the ex-dividend period, Journal of Financial Economics 13(1), 3-34.

Grinblatt, M.S., Masulis, R.W., Titman, S., 1984, The valuation effects of stock splits and stock dividends, Journal of Financial Economics 13(4), 461-490.

Ikenberry, D.L., Rankine, G., Stice, E.K., 1996, What do stock splits really signal? Journal of Financial and Quantitative Analysis 31(3), 357-375.

Khanal, A.R., Mishra, A.K., 2017, Stock price reactions to stock dividend announcements: A case from a sluggish economic period, The North American Journal of Economics and Finance 42, 338-345.

Lin, J.C., Singh, A.K., Yu, W., 2009, Stock splits, trading continuity, and the cost of equity capital, Journal of Financial Economics 93(3), 474-489.

Muscarella, C.J., Vetsuypens, M.R., 1996, Stock splits: Signaling or liquidity? The care of ADR ‘solo-splits’, Journal of Financial Economics 42(1), 3-26.

Woolridge, J.R., 1983, Ex-date stock price adjustment to stock dividends: A note. The Journal of Finance 38(1), 247-255.

국내 상장기업은 유동성을 높이거나 기업에 유리한 재무정보를 시장에 전달하기 위한 목적으로 주주의 추가 부담 없이 무상증자, 주식분할, 주식배당의 형태로 무상주를 발행할 수 있다. 그중에서도 무상증자는 이사회결의만으로 주식수를 손쉽게 늘릴 수 있어 주주총회 보통결의가 필요한 주식배당이나 주주총회 특별결의가 필요한 주식분할에 비해 무상주 발행 수단으로 선호되었다.

그런데 2020년 이후에는 신규상장기업, 제약 및 바이오 적자기업이 중심이 되어 주주환원을 명분으로 대거 무상증자를 발표하였다.1) 실제로 이 시기 상당수 무상증자 기업의 주가는 무상증자 공시 직후 급등2)하면서 무상증자 주식은 기업의 내재가치와 관계없이 특정한 이벤트로 인해 주가 급등락이 이어지는 테마주3)로 분류되었다.4) 무상증자 테마주 현상이 심화되자 금융감독원은 2022년 7월 무상증자가 기업가치에 미치는 영향이 없고 주가 등락에 따른 위험 요인으로 인해 투자에 유의가 필요하다는 경고까지 발표하였다.5)

무상증자 관련 기존 연구들은 주로 무상증자의 공시효과를 분석하거나 주식분할 및 주식배당과 주가 성과와 유동성 개선 효과를 비교하는 데 초점이 맞추어져 있다. 따라서 최근 무상증자 테마주 현상의 특징을 알아보기 위해서는 팬데믹 이후 무상증자가 과거 무상증자에 비해 어떤 면에서 차이가 있는지, 무상증자의 명분으로 내세운 주주환원 정책은 근거가 있는지, 투자자 유형별 반응은 어떻게 다른지를 분석할 필요가 있다.

또한 무상증자가 크게 늘어난 기간은 공매도 전면금지(2020년 3월 16일~2021년 5월 2일)와 부분허용(2021년 5월 3일~) 시기와 겹치고 있어 정보거래자의 무상증자 주식 거래에 제약이 가해졌다고 할 수 있다. 만약 공매도 규제별로 무상증자 주식에 대한 정보거래자의 매매행태에 차이가 있다면 기업가치와 무관한 테마주 현상에서 정보거래자의 역할을 확인할 수 있을 것이다.

이에 본고에서는 팬데믹 기간 나타난 무상증자 주식 열풍과 정보거래자의 역할을 실증적으로 분석함으로써 문제점을 식별하고 정책 시사점을 도출하고자 한다. 그러기 위해 Ⅱ장에서는 2020년 이후 무상증자의 주요 특징을 유동성 및 수익성과 착시효과의 관점에서 알아본다. Ⅲ장에서는 투자자 유형별로 무상증자 주식에 대한 매매행태 차이를 분석한다. 또한 공매도 규제 단계별 무상증자의 주가 특징을 KOSPI200 및 KOSDAQ150 주가지수 편입과 미편입 주식으로 구분하여 살펴봄으로써 공매도 규제가 무상증자 주가에 어떤 영향을 미쳤는지 분석한다. Ⅳ장에서는 분석 결과를 정리하고 정책 시사점을 제시한다.

Ⅱ. 무상증자 주식의 테마주化

1. 무상증자 현황

무상주 발행의 수단인 무상증자, 주식분할, 주식배당 중 무상증자의 시행이 가장 간소하다고 해서 주식분할과 주식배당을 무상증자가 모두 대체할 수 있는 것은 아니다. 무상주의 발행 목적이 유동성 제고인 경우 주식분할은 다른 두 가지 방식보다 주식수의 획기적 증가가 가능하기에 거래량이 가장 많이 증가한다(김현석ㆍ서정원, 2018). 또한 박영규(2019)에 따르면 주가 수준이 높고 기업 규모가 작을수록 상장기업은 주식배당보다 무상증자를 선호하였다. 실제로도 2015~2019년 기간 무상증자는 50~80건, 주식분할은 20~40건, 주식배당은 30~50건 범위에서 세 가지 무상주 발행 방식은 안정적인 모습을 보였다(<그림 Ⅱ-1> 참조). 그런데 2020년부터 국내 상장기업의 무상증자6)는 증가하였으나 주식분할 및 주식배당은 감소하거나 정체하고 있다. 특히 2021년에는 119건의 무상증자 공시가 있었고 2022년에는 7월까지 52건의 무상증자 공시가 이어지고 있어 팬데믹 발발 후 무상증자가 대폭 증가했다고 할 수 있다.

이러한 무상증자 주식의 주가 급등 현상은 한국거래소의 관련 시장조치 적발 건수에서도 확인된다. 2012년 11월 도입된 ‘단기과열종목’9)으로 지정된 무상증자 주식은 11개인데 이 중 2020년 이후는 7개를 차지하였다. 또한 2020년 신설된 ‘스팸관여과다종목’10)으로 지정된 무상증자 주식도 6개에 이르고 있으며 이 중 4개는 2022년에 지정되었다.

전통적으로 기업의 무상주 발행을 설명하는 유력한 가설로 유동성가설과 신호가설이 있다. 두 가설을 무상증자에 적용11)하면 유동성가설은 무상증자로 주가를 적정 수준으로 낮추면 소액 거래자들이 유입되면서 주식의 거래 유동성을 높일 수 있다는 것이고, 신호가설에 따르면 무상증자는 향후 기업의 수익성 개선 등 기업가치가 양호하다는 정보를 투자자에게 전달하기 위한 수단이라는 것이다(Grinblatt et al., 1984; Brennan & Copeland, 1988; Ikenberry et al., 1996; Muscarella et al., 1996; 김현석ㆍ서정원, 2018; 박영규, 2021).12)

먼저 유동성가설을 살펴보면 기존 국내 무상증자 관련 유동성가설 연구에서는 무상증자로 인해 유동성 개선 효과가 있다는 연구가 다수이나 모두 일관된 결과를 보이는 것은 아니다. 박영규(2021)의 연구에서는 무상증자의 유동성 개선 효과가 주식배당에 비해 유의미하게 나타났고, 조은영ㆍ양철원(2017)도 무상증자 주식의 유동성 개선 효과를 확인하였으나, 김현석ㆍ서정원(2018)의 연구에서는 주식분할만이 유동성 개선 효과가 나타나고 무상증자 주식에서는 유의미한 유동성 증가 효과를 관측하지 못하였다.

2015년부터 무상증자 공시를 기준으로 직전 월별 거래회전율 평균13)과 공시 직후 월별 거래회전율 평균을 산출해서 연도별로 비교해 보면 공통적으로 공시부터 한 달 동안의 거래회전율이 가장 높게 나타난다(<그림 Ⅱ-3> 참조). 특히 전체적으로는 공시 직전 한 달(M-1) 동안 거래회전율에 비해 공시 직후 한 달(M+1) 동안 거래회전율은 평균 2.5배 증가한 후 두 달째(M+2) 1.5배, 석 달째(M+3) 1.2배로 점차 하락하였다. 그러나 2022년에는 공시 직후 3개월간 공시 직전 대비 각각 3.1배, 1.5배, 0.9배의 추이를 보이면서 무상증자로 인한 유동성 개선 효과 지속 기간이 상대적으로 짧게 나타났다. 실제로 각 무상증자 공시별로 공시 직전 한 달의 거래회전율과 공시 직후 12개월간 월별 거래회전율을 paired t-test로 분석하면 2015~2019년 기간에는 2015년을 제외하고 모두 공시 후 3개월 후에도 유의한 거래회전율 증가가 나타나고 있으나 2020년부터는 공시 후 2개월 이내의 단기적 증가만 나타났다(<표 Ⅱ-1> 참조).14)

2020년부터 무상증자가 증가한 데에는 적자 상태의 제약 및 바이오 기업의 무상증자와 함께 상장 1년 이하의 신규상장기업의 무상증자가 한몫하고 있다. 2015~2019년 기간 상장 1년 이하 기업의 무상증자 비중은 13.6%였으나 2020~2022년 7월 기간에는 15.6%로 늘어났고 2022년에는 23.1%로 증가하였다. 이들 신규상장기업은 상장 이후 저조한 주가 흐름에 대한 투자자들의 불만을 잠재우기 위해 주주환원 정책을 내세워 무상증자를 결정하는 경향이 있다.

그러나 신규상장기업의 무상증자는 투자자의 관심을 끌기 위해 과거 무상증자에 비해 과도한 신주배정수17)를 설정하고 있어 단기성 주가부양 목적이 강하다고 할 수 있다. 상장 1년 이하 무상증자 기업들은 2015~2019년 기간에 평균적으로 1주당 신주 1.13주를 배정하였으나 2022년에는 2.58주(최대 8주)로 신주배정수를 대폭 늘렸다(<그림 Ⅱ-5> 참조). 신주배정수가 많을수록 권리락일18) 시초가 하락 조정 폭이 커지는데 이렇게 되면 주가가 싸졌다고 착각한 투자자들이 매수에 나서는 착시효과(김현석ㆍ서정원, 2018)가 더 강하게 나타날 수 있다.19)

무상증자 주식의 공시효과를 살펴보기 위해 누적초과수익률(Buy-and-Hold Abnormal Return: BHAR)21)을 아래의 산식으로 산출하면 2020~2022년의 무상증자 주식의 누적초과수익률이 크게 증가했음을 알 수 있다(<그림 Ⅱ-7> 참조). 특히 10거래일(T+10) 근처에서 누적초과수익률이 급등하는 것은 권리락일 효과 때문으로 2022년 값이 유난히 큰 것을 알 수 있다.

무상증자 주식의 공시 전 5거래일부터 누적초과수익률을 종속변수로 하고 신주배정수, 신규상장기업 더미, 2020~2022년 더미, 제약 및 바이오 업종 더미와 공통변수22)를 설명변수로 하는 회귀분석을 수행해 보면 공시효과가 크게 약화되는 30거래일 구간을 제외하고 신주배정수가 클수록 누적초과수익률이 매우 유의하게 커지는 것을 알 수 있다(<표 Ⅱ-2> 참조). 또한 상장기간 1년 이하의 신규상장기업, 2020년 이후 무상증자 기업, 제약 및 바이오 업종이 대부분의 구간에서 유의미한 효과를 보였다. 또한 공통변수 중에서는 시가총액이 작고 PBR이 낮은 기업에서 누적초과수익률이 커지는 것으로 나타나고 있어 이들 기업에서 무상증자를 활용할 유인이 크다고 할 수 있다.

한편 무상증자 주식의 누적초과수익률은 공시일로부터 30거래일만 지나도 시장수익률에 수렴하는 모습을 보이고 있으며 주가 급등 폭이 가장 컸던 2022년 무상증자 기업은 더 빠르게 수렴하고 있다. 따라서 주주환원을 위해 무상증자를 결정했다는 주장은 무상증자 공시 후 주가 상승이 단기간에 그치고 있는 상황에서 실증적으로 지지받기는 어렵다.

Ⅲ. 투자자별 매매 특징과 정보거래자 역할

1. 투자자별 매매행태

상장기업의 무상증자 공시가 기업가치의 변화 없이 투자자의 관심을 끌기 위한 목적이 크다고 했을 때 무상증자 공시에 대한 투자자 반응은 정보거래자와 비정보거래자 간에 동일하지 않을 가능성이 크다. 반대로 일부 무상증자 기업의 주장대로 무상증자가 주주환원 정책이라고 한다면 투자자 유형에 따라 반응 차이가 크지 않을 것이다.

무상증자에 따른 투자자별 반응 차이를 확인하기 위해 무상증자 공시 직후 개인투자자, 기관투자자, 외국인투자자의 누적순매수 비중23)을 비교하면 개인투자자는 무상증자 주식을 꾸준히 순매수하였으며, 특히 공시일과 권리락일에 순매수 비중을 급격히 높였음을 알 수 있다(<그림 Ⅲ-1> 참조). 반면에 기관투자자는 개인투자자와 정반대의 매매행태를 보여 순매도를 지속하였다. 외국인투자자의 경우 상대적으로 뚜렷하지 않은 매매행태를 보였는데 세부적으로 보면 공시일과 익일에는 순매도 포지션이었으나 그 직후 순매수 포지션으로 돌아섰다가 권리락일부터 매도를 늘리면서 13거래일부터는 누적순매도 포지션을 취하였다.

결국 무상증자 공시로 인한 개인투자자와 정보거래자의 매매행태 차이는 주주환원의 근거를 찾기 어려우며 단기적으로 개인투자자의 관심을 끌려는 것이 무상증자의 실제 의도임을 보여준다고 하겠다. 또한 개인투자자의 일방적인 순매수는 내부자 및 주요 주주의 사익추구에 유리한 기회를 제공한다고 할 수 있다.

2. 공매도 규제 단계별 무상증자 수익률 특징

무상증자 공시에 대해 정보거래자들이 전략적으로 매매를 한다면 규제 변화에 대해서도 개인투자자와는 다른 대응을 보일 가능성이 크다. 무상증자가 증가하기 시작한 2020년에서 2022년 7월 사이에는 팬데믹 발발로 인한 충격으로부터 시장보호를 명분으로 공매도 규제를 시행한 기간이기도 하다. 팬데믹 기간 공매도 규제는 2단계로 나눌 수 있는데 1단계는 전면금지 기간으로 2020년 3월 16일부터 2021년 5월 2일까지이다. 2단계는 부분허용 기간으로 2021년 5월 3일부터 분석 마지막 기간인 2022년 7월까지 지속되고 있으며, KOSPI200과 KOSDAQ150지수 편입 종목에 한해서 제한적으로 공매도를 허용했다.

따라서 팬데믹 이전을 전면허용 기간으로 본다면 2015~2022년 7월은 공매도 규제 수준에 따라 3개의 기간으로 나눌 수 있다. 무상증자 공시 기업을 KOSPI200 및 KOSDAQ150 지수 편입 종목(이하 주가지수 편입 종목)과 미편입 종목으로 구분하여 공시효과를 비교하면 공매도 규제별로 무상증자의 주가 영향을 분석할 수 있게 된다.

이에 따라 전체 무상증자 표본을 무상증자 공시 5거래일 전(T-5)부터 30거래일(T+30)까지 누적초과수익률을 주가지수 편입 여부와 공매도 규제 3단계별로 산출하면 <그림 Ⅲ-4>와 같다. 먼저 (b)의 주가지수 미편입 무상증자 종목을 보면 전면허용 기간에서 누적초과수익률은 공시일 다음 거래일에 8.3%, 17거래일에 13.7%까지 증가한 후 계속 하락하여 30거래일에는 6.4%로 줄어드는 모습을 보인다. 그런데 공매도 전면금지 기간에서는 공시일 다음 거래일에 15.9%, 13거래일에 25.5%까지 누적초과수익률이 증가한 후 30거래일에는 11.2%로 감소하며 전면허용 기간에 비해 누적초과수익률이 대폭 증가하는 모습을 보인다. 주가지수 미편입 종목은 공매도 부분허용 조치에 영향을 받지 않는 상황에서 부분허용 기간에서도 전면제한 기간과 비슷하게 공시 직후에 높은 수익률 값을 보이고 있으며 권리락 효과가 중간에 더해져 11거래일에 30.3%, 20거래일에는 33.9%까지 누적초과수익률이 증가하였다. 반면에 무상증자 공시 기업 중 주가지수 편입 종목의 누적초과수익률 추이를 보면 전면허용 기간과 전면금지 기간에서는 미편입 종목과 유사한 모습을 보이지만 부분허용 기간에서는 미편입 종목과 달리 수익률의 증가 폭이 상당히 둔화되는 모습을 보인다(<그림 Ⅲ-4> (a) 참조).

KOSPI200과 KOSDAQ150 지수 편입에 따라 공매도 부분허용 기간 누적초과수익률이 뚜렷한 차이를 보이는 것은 이 기간에서만 두 집단이 공매도 허용과 금지로 나뉘기 때문으로 해석할 수 있다. 부분허용 기간에서의 두 집단 간 누적초과수익률 차이는 특히 공시 후 10거래일과 20거래일에서 20% 이상 벌어지고 있으며 통계적으로도 유의한 수준이다(<표 Ⅲ-1> 참조). 즉, 부분허용 기간에서 주가지수 편입 종목의 무상증자 공시는 미편입 종목과 달리 공매도로 인해 주가 급등이 억제되었을 수 있다.

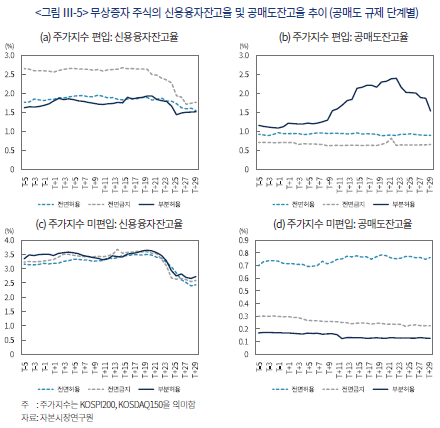

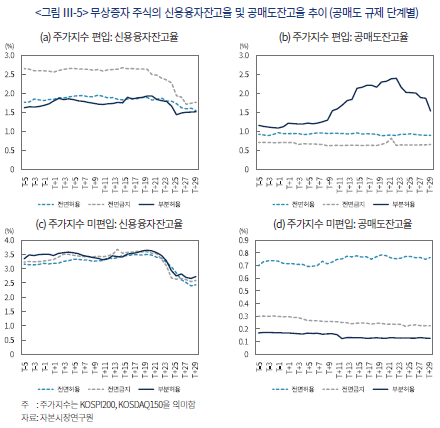

실제로 공매도 규제 단계별로 신용융자잔고율과 공매도잔고율27)의 추이를 비교하면 주가지수 편입 종목의 경우 신용융자잔고율은 전면금지 기간을 최고로 전체적으로는 무상증자 공시 직전부터 1.6~2.6% 범위로 시작하여 공시 후 10거래일까지 유지하다가 20거래일부터는 하락하는 추이를 보인다(<그림 Ⅲ-5> (a) 참조). 공매도잔고율은 전면금지 기간이 최하 수준이고28) 전면허용 기간에는 0.9% 내외의 안정적 추이를 보였으나 부분허용 기간에서는 1.2%로 시작하여 권리락일 근처인 10거래일에 1.5%, 20거래일에는 2.3%까지 늘어난 후 하락하는 특징을 보였다(<그림 Ⅲ-5> (b) 참조).

반면에 주가지수 미편입 무상증자 종목의 경우 신용융자잔고의 추이는 공매도 규제 단계에 따른 차이 없이 20거래일을 정점으로 하락하고 있다(<그림 Ⅲ-5> (c) 참조). 공매도잔고비율은 전면허용 기간에서 가장 높은 값을 보이고 있으나 주가지수 편입 종목에 비해서는 상당히 낮은 0.7% 수준에 불과하며 전면금지와 부분허용 기간에서는 0.3% 이하의 매우 낮은 비율로 안정적인 추이를 보이고 있다. 즉, 공매도 부분허용 기간에서 주가지수 편입여부에 따라 10거래일과

20거래일의 누적초과수익률에서 유의한 차이가 나타나는 것은 10거래일에서 20거래일까지의 공매도 수량 증가에 영향을 받았다고 할 수 있다.

반면에 주가지수 미편입 무상증자 종목의 경우 신용융자잔고의 추이는 공매도 규제 단계에 따른 차이 없이 20거래일을 정점으로 하락하고 있다(<그림 Ⅲ-5> (c) 참조). 공매도잔고비율은 전면허용 기간에서 가장 높은 값을 보이고 있으나 주가지수 편입 종목에 비해서는 상당히 낮은 0.7% 수준에 불과하며 전면금지와 부분허용 기간에서는 0.3% 이하의 매우 낮은 비율로 안정적인 추이를 보이고 있다. 즉, 공매도 부분허용 기간에서 주가지수 편입여부에 따라 10거래일과

20거래일의 누적초과수익률에서 유의한 차이가 나타나는 것은 10거래일에서 20거래일까지의 공매도 수량 증가에 영향을 받았다고 할 수 있다.

따라서 공매도 규제 변화는 정보거래자의 무상증자 주식의 매매에 영향을 미쳤다고 할 수 있다. 구체적으로는 공매도 금지로 인해 정보거래자가 공시직후와 권리락일 개인투자자의 매수에 대응한 매도 포지션 구축이 어려워지면서 누적초과수익률이 과도하게 상승하는 현상이 나타났다고 할 수 있다.

Ⅳ. 맺는말

2020년 이후 상장기업의 무상증자 증가 현상은 그 이전 시기와 비교할 때 유동성 제고나 기업가치에 대한 긍정 신호 전달 등 전통적 무상증자 동인에서 벗어나 있으며 일부 기업들이 주장하는 주주환원과도 거리가 멀다. 오히려 상당수 무상증자는 개인투자자의 관심 유도를 통한 단기적 주가 부양에 초점이 맞추어져 있다. 무상증자에 따른 권리락일의 착시효과를 극대화하기 위해 신주배정수를 급격히 올리는 것이 대표적 사례라고 할 수 있다.

한편 무상증자에 대한 투자자들의 반응은 정보거래자인 기관투자자 및 외국인투자자와 개인투자자 간 뚜렷한 차이를 보이고 있다. 개인투자자가 무상증자의 착시효과에 적극적으로 반응하여 순매수 포지션을 취하고 있으며 내부자와 주요 주주들은 이에 편승하여 보유 주식을 매도하는 기회로 활용하고 있다. 반면 기관투자자는 개인투자자와 정반대의 순매도 포지션을 취하며 외국인투자자는 권리락일의 매도 기회 확대를 위해 중간에 매매 포지션을 변경하며 투자 기회를 극대화하고 있다. 투자자 유형에 따른 상이한 반응은 무상증자가 모든 주주에게 유익한 주주환원이라는 주장과 배치된다고 할 수 있다.

따라서 최근 무상증자 과열은 기업 경영상의 합리적 결정보다는 개인투자자의 유입을 목적으로 한 무상증자 남용에 가깝다고 할 수 있어 이를 방지하기 위한 제도적 개선이 요구된다. 현재 상장기업의 무상증자는 ‘주요사항보고서’를 통해 무상증자의 기본 요건29)에 대해서만 공시하고 있는데 무상증자의 목적 항목을 주요사항보고서에 추가할 필요가 있다. 상장기업이 무상증자의 목적을 구체적으로 공시해야 한다면 주주환원 정책으로 무상증자를 홍보하고 활용하기는 어려워질 것이다.

또한 공매도 규제 변화에 따라 정보거래자의 무상증자 대응에 차이가 존재하였는데 공매도 제한과 같이 정보거래자의 역할을 제한할수록 무상증자 주가 과열이 확대되는 현상이 나타났다. 결과적으로 무상증자 테마주처럼 기업의 내재가치와 직접적 관련 없이 주가가 급등하는 경우 정보거래자의 역할이 중요하다고 할 수 있다. 테마주 현상에서 정보거래자의 역할이 확대된다면 주가 급등의 정도와 지속 기간이 그렇지 않은 경우보다 감소할 가능성이 크다. 반대로 규제로 인해 정보거래자의 매매가 과도하게 제한되는 경우 테마주 현상은 보다 심화될 위험이 있다.

1) 매일경제(2021. 10. 7), 머니투데이(2022. 7. 4)

2) 코스닥기업 노터스는 2022년 5월 9일 무상증자 발표 시점부터 6월 9일까지 7번의 상한가를 기록하였다.

3) 테마주에 관해서는 남길남(2017)을 참조한다.

4) 한국경제(2022. 6. 21)

5) 금융감독원(2022. 7. 25)

6) 본고에서 무상증자는 무상증자 공시를 기준으로 삼고 있으며 유무상증자 공시는 분석에서 제외하고 있다.

7) 상한가 비율은 100*총 상한가 회수/(무상증자 종목수*32거래일)로 계산한다.

8) 무상증자 주식의 상한가 비율은 전체 상장주식의 연간 상한가 비율(100*상장주식 연간 총 상한가 회수/상장주식 연간 총 거래일수)에 비해서도 높게 나타났으며 특히 2022년은 더욱 높았다. 2015~2021년 기간 무상증자 주식의 상한가 비율은 전체 상장주식 상한가 비율의 1.7배(2015)에서 5.7배(2021)까지 높았는데 2022년에는 15.4배에 이르렀다.

9) 단기과열종목 지정 제도는 단기적 이상급등 및 과열 현상이 지속되는 종목에 대한 시장 경고 목적으로 도입되었다.

10) 스팸관여과다종목 지정 제도는 유사투자자문업체, 리딩방, 각종 SNS 등의 주식매수추천 스팸메세지로 인한 투자자피해를 최소화하기 위해 ‘스팸문자 현황을 시장경보제도에 편입’하여 투자주의 종목으로 즉시 지정하는 제도로 스팸문자 신고 건수(월평균 약 10만건)와 주가 또는 거래량이 일정 기준 이상 증가한 종목을 ‘스팸관여종목’으로 적출하고 스팸관여종목이 최근 5일중 2일 이상 적출된 경우 ‘스팸관여과다’로 즉시 지정한다.

11) 무상주 관련 유동성가설과 신호가설은 무상증자와 동일한 무상주 발행 형태가 없는 미국 주식시장에서 주식배당과 주식분할을 대상으로 정립되었다.

12) 유동성가설과 신호가설은 세부적으로 최적거래가격범위가설, 유보이익가설, 주의환기가설 등 여러 세부 가설들로 나뉘며 서로 배타적이라고 할 수도 없다. 본고에서는 거래회전율로 측정한 유동성 제고 효과와 기업의 긍정적 가치를 수익성 지표로 단순화하여 무상증자 기업의 특징과 공시 반응을 살펴본다.

13) 일별 거래회전율은 일별 거래량을 총 발행주식수로 나누어 산출하며 월별 거래회전율 평균은 일별 거래회전율의 평균으로 계산한다.

14) 2021년의 경우 공시 후 9개월(M+9)과 10개월(M+10)의 거래회전율은 공시 전 1개월(M-1)보다 유의하게 감소함으로써 유동성 증가가 단기적 현상에 그쳤을 뿐만 아니라 오히려 유동성은 무상증자 이전보다 줄어들었다고 할 수 있다. 또한 유동성 분석에는 별도로 Amihud의 비유동성(illiquidity) 지표(Amihud, 2002)를 함께 사용했으며 전체적인 결론은 유사하게 나타났다.

15) 2015~2019년 무상증자 공시 기업의 전년도 ROA와 ROE 평균은 각각 7.2%와 12.2%인데 2020~2022년 7월까지 무상증자 공시 기업의 해당 평균은 각각 4%와 5.6%에 그치고 있다. 다만 수익성이 계속 나빠져 결국 주가가 하락할 가능성이 크다면 경영진이 무상증자를 통해 주가를 일부러 낮출 유인은 크지 않기에 수익성이 낮은 기업의 무상증자를 기업가치가 양호하다는 신호가설로 해석할 여지는 존재한다. 또한 잉여금을 자본금으로 전입하여 총자본에서 차지하는 자본금의 비중을 높이게 되면 자본금을 분모로 하는 자본잠식률을 낮추게 되므로 자본잠식으로 인한 상장폐지 위험을 통제하기 위해 무상증자를 활용하는 것으로도 해석될 수 있다.

16) 업종은 에프엔가이드의 FnGuide Industry Classification Standard에 따른 23개 분류를 따르고 있다.

17) 무상증자에 따라 기존 1주당 받는 신주 개수를 의미한다.

18) 무상증자 주식의 권리락일은 공시일부터 평균 11.1 거래일이다.

19) Woolridge(1983)와 Eades et al.(1984)의 주식배당에 따른 배당락일 주가 변화 연구에서도 기업가치의 변화 없이 형식적인 가격조정으로 비정상적인 주가 변동이 나타나는 착시효과에 대해 명확한 이유를 찾을 수 없는 시장의 불완전성이나 비효율성으로 설명하고 있다.

20) 시장조정수익률은 KOSPI와 KOSDAQ의 시가총액가중수익률을 시장수익률로 설정하고 무상증자주식수익률에서 이를 차감하여 계산한다.

21) 본고에서는 상장기간 1년 이하 기업의 무상증자 비중이 14.5%에 달하고 이들 기업에 대한 분석 필요성이 커서 과거자료가 필요(파라미터 추정을 위해)하지 않은 BHAR을 이용하여 벤치마크(KOSPI와 KOSDAQ의 시가총액가중 수익률) 대비 누적초과수익률을 계산하고 있다.

22) 공통변수는 공시일 전 6거래일부터 20거래일까지 15거래일의 시가총액, PBR, 거래회전율의 평균값, 직전년도 ROE를 사용하였다.

23) 누적순매수 비중은 누적순매수 수량을 총 발행주식수로 나눈 백분율 값이다.

24) 개인 주주와 투자조합의 매도는 공시일부터 5거래일까지 분석기간을 확장해도 큰 차이를 보이지 않아 공시일과 익일에 이들의 매도가 집중되었다고 할 수 있다. 한편 관련 정보는 ‘주식등의 대량보유상황보고서’ 공시 내용을 분석하여 식별하였다.

25) 기업 초기 단계에 재무적투자자로 투자한 투자조합의 상장 이후 주식 매도는 투자회수로 해석된다.

26) 또한 무상증자 기업의 재무활동과 관련하여 무상증자 공시와 인접하여 나타나는 특기할 사건으로는 전환사채 발행 및 전환권청구가 있다. 보통주로의 전환이 가능한 대신 매우 낮은 금리로 자금을 조달할 수 있는 전환사채는 주가의 변동에 따라 가치가 직접적으로 영향을 받을 수밖에 없다. 그런데 2015~2019년 기간 무상증자 공시 전후 60일 동안의 발행 빈도를 비교하면 전후 발행 빈도가 거의 동일하였는데 2020~2022년 7월 기간에는 공시 전 전환사채 발행이 대부분이다. 보통주로의 전환권청구도 2015~2019년 기간에는 무상증자 공시 이후에 대부분이 행사되었으나 2020~2022년 7월 기간에는 무상증자 공시 이전에 대부분 행사되어 큰 대조를 보였다. 전환사채 발행과 전환권청구 시점의 변화 자체만으로 무상증자 공시 시점을 이용한 발행자와 투자자의 기회주의적 행태라고 단정할 수는 없으나 단기적인 주가 급등을 초래하는 무상증자 공시가 기업 재무활동에 중요한 사건으로 활용될 가능성은 존재한다고 하겠다.

27) 공매도잔고율은 실제 공개일까지 2거래일 정도 차이가 발생하고 있어 정확한 일별 대응 비교는 곤란하다.

28) 공매도 전면금지 기간에도 기존 포지션의 유지 허용 등으로 인해 최소한의 공매도 수량은 존재한다.

29) 신주의 종류와 수, 액면가액, 발행주식총수, 신주배정기준일, 신주배정수 등이다.

참고문헌

금융감독원, 2022. 7. 25, 상장기업 무상증자 관련 투자자 유의사항 안내.

김현석ㆍ서정원, 2018, 무상증자, 액면분할, 주식배당: 주가와 거래량 효과, 『한국증권학회지』 47(1), 27-67.

남길남, 2017, 『대통령 선거 국면의 정치테마주 특징과 시사점』, 자본시장연구원 이슈보고서 2017-04호.

류두진ㆍ양희진ㆍ주강진ㆍ정준영, 2017, 주식분할과 무상증자: 결정요인과 공시효과에 대한 실증분석, 『한국증권학회지』 46(4), 879-900.

매일경제, 2021. 10. 7, SK케미칼 무상증자 주주환원 정책 강화.

머니투데이, 2022. 7. 4, “주주 달래자”... 제약ㆍ바이오사, 올해도 줄줄이 무상증자.

박영규, 2019, 주식배당과 무상증자의 결정요인, 『Journal of the Korean Data analysis Society』 21(3), 1373-1382.

박영규, 2021, 주식배당과 무상증자의 주가와 유동성효과, 『산업혁신연구』 37(4), 47-75.

조은영ㆍ양철원, 2017, 무상증자에 대한 유동성 가설 검증, 『한국증권학회지』 46(2), 423-458.

한국경제, 2022. 6. 21, 고점 찍고 수직낙하...널뛰는 ‘무증 테마주’.

Amihud, Y., 2002, Illiquidity and stock returns: Cross-section and time-series effects, Journal of Financial Markets 5(1), 31-56.

Atiase R.K., 1980, Predisclosure Informational Asymmetries, Firm Capitalization, Financial Reports, and Security Price Behavior, Unpublished Ph. D dissertation, University of California, Berkeley.

Brennan, M.J., Copeland, T.E., 1988, Stock splits, stock prices, and transaction costs, Journal of Financial Economics 22(1), 83-101.

De Long, J.B., Shleifer, A., Summers, L.H., Waldmann, R.J., 1989, The size and incidence of the losses from noise trading, The Journal of Finance 44(3), 681-696.

De Long, J.B., Shleifer, A., Summers, L.H., Waldmann, R.J., 1990, Noise trader risk in financial markets, Journal of Political Economy 98(4), 703-738.

Diamond, D.W., Verrecchia, R.E., 1987, Constraints on short-selling and asset price adjustment to private information, Journal of Financial Economics 18(2), 277-311.

Eades, K.M., Hess, P.J., Kim, E.H., 1984, On interpreting security returns during the ex-dividend period, Journal of Financial Economics 13(1), 3-34.

Grinblatt, M.S., Masulis, R.W., Titman, S., 1984, The valuation effects of stock splits and stock dividends, Journal of Financial Economics 13(4), 461-490.

Ikenberry, D.L., Rankine, G., Stice, E.K., 1996, What do stock splits really signal? Journal of Financial and Quantitative Analysis 31(3), 357-375.

Khanal, A.R., Mishra, A.K., 2017, Stock price reactions to stock dividend announcements: A case from a sluggish economic period, The North American Journal of Economics and Finance 42, 338-345.

Lin, J.C., Singh, A.K., Yu, W., 2009, Stock splits, trading continuity, and the cost of equity capital, Journal of Financial Economics 93(3), 474-489.

Muscarella, C.J., Vetsuypens, M.R., 1996, Stock splits: Signaling or liquidity? The care of ADR ‘solo-splits’, Journal of Financial Economics 42(1), 3-26.

Woolridge, J.R., 1983, Ex-date stock price adjustment to stock dividends: A note. The Journal of Finance 38(1), 247-255.