Find out more about our latest publications

Assessment of the Fed’s Monetary Policy and its Implications for Interest Rates in Korea

Issue Papers 22-08 Jun. 13, 2022

- Research Topic Macrofinance

- Page 33

As the US has entered a rate hike cycle, there are growing concerns about the path of the Fed fund’s rate and its implications. Against this backdrop, this article analyzes the direction of US monetary policy and its risks, and explores how it would affect Korea’s financial market, especially market interest rates.

According to an analysis of US rate hike cycles since the 1970s, inflation tends to accelerate when the policy rate remains lower than the neutral rate of interest. This indicates that with the policy rate being around the neutral rate, it would be difficult to stabilize prices during the current rate hike cycle. Furthermore, even if the policy rate is pushed higher than the neutral rate, a much tighter monetary policy would be required considering the state of inflation at hand. In particular, given the late response of the Fed, unless inflation is curbed shortly by external drivers, the Fed is likely to lift interest rates well over the levels of the neutral rate. It will probably lead to the recurrence of monetary policy shocks.

If the Fed’s tightening is stronger than expected, it would transmit the shock to Korea’s financial market in the short run. The analysis has found that the Fed’s rate hike shock raises long end yields of Korea Treasury Bonds (KTBs) higher, influencing other market interest rates as well. Furthermore, it drives up the interest rates of corporate bonds and increases financing costs of banks, thereby pushing up the loan interest rate of households.

On top of that, prolonged tightening by the Fed could trigger an inversion in short-term government bond yields as well as policy rates between Korea and US. However, given the propensity of foreign investors, the gap in interest rates between the two countries is unlikely to have a significant effect on the overall capital flows. But it is worth noting that if the Fed’s tightening is added to growing downside risks to growth, it could escalate adverse effects, which requires extra caution.

The Fed’s tightening shock would aggravate the burden of financing on each economic player. This may require domestic policy responses, such as the purchase of KTBs and provision of liquidity, to cushion the blow. In addition, it is necessary to devise effective countermeasures by closely monitoring risks in the financial market and the possibility of such risks transmitting to the real economy.

According to an analysis of US rate hike cycles since the 1970s, inflation tends to accelerate when the policy rate remains lower than the neutral rate of interest. This indicates that with the policy rate being around the neutral rate, it would be difficult to stabilize prices during the current rate hike cycle. Furthermore, even if the policy rate is pushed higher than the neutral rate, a much tighter monetary policy would be required considering the state of inflation at hand. In particular, given the late response of the Fed, unless inflation is curbed shortly by external drivers, the Fed is likely to lift interest rates well over the levels of the neutral rate. It will probably lead to the recurrence of monetary policy shocks.

If the Fed’s tightening is stronger than expected, it would transmit the shock to Korea’s financial market in the short run. The analysis has found that the Fed’s rate hike shock raises long end yields of Korea Treasury Bonds (KTBs) higher, influencing other market interest rates as well. Furthermore, it drives up the interest rates of corporate bonds and increases financing costs of banks, thereby pushing up the loan interest rate of households.

On top of that, prolonged tightening by the Fed could trigger an inversion in short-term government bond yields as well as policy rates between Korea and US. However, given the propensity of foreign investors, the gap in interest rates between the two countries is unlikely to have a significant effect on the overall capital flows. But it is worth noting that if the Fed’s tightening is added to growing downside risks to growth, it could escalate adverse effects, which requires extra caution.

The Fed’s tightening shock would aggravate the burden of financing on each economic player. This may require domestic policy responses, such as the purchase of KTBs and provision of liquidity, to cushion the blow. In addition, it is necessary to devise effective countermeasures by closely monitoring risks in the financial market and the possibility of such risks transmitting to the real economy.

Ⅰ. 논의 배경

3월 FOMC를 기점으로 미 연준의 금리인상이 본격화되었다. 최근 미국의 물가상승률이 40년래 최고 수준에 이르는 등 인플레이션 위험이 증대되면서 연준이 지속적으로 대응강도를 높여나갈 가능성이 커졌다. 하지만 한편으로는 러시아-우크라이나 전쟁 이후 경기 둔화에 대한 우려가 확산되면서, 금리인상 경로 등에 대한 연준 내외의 이견과 정책 불확실성이 매우 큰 상황이다. 이에 따라 연준의 금리인상 강도와 파급효과에 대해 관심과 우려가 고조되고 있다.

2021년말 이후 연준의 금년말 정책금리 전망치가 이례적인 속도로 급격하게 상향 조정되고 있다.1) 이는 정책기조 전환에서 실기가 있었음을 시사하기도 하지만, 미국 내 물가 및 고용여건이 예기치 않게 급변함에 따라 일부 불가피했던 측면도 있었음을 보여준다. 하지만 결과적으로 연준이 금리인상 속도를 조절할 수 있는 정책대응 여지가 크게 축소되어 가파른 금리인상이 이어질 수 있다는 점은 우려스러운 대목이다.

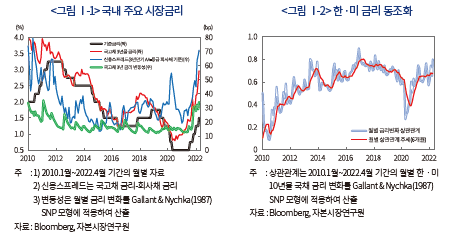

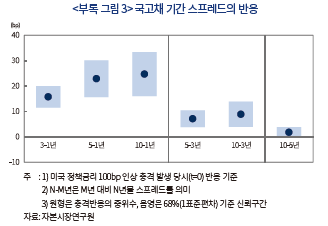

최근 국내 금융시장을 보면, 시장금리가 가파른 상승세를 나타내는 한편 변동성도 크게 확대되었다. <그림 Ⅰ-1>에 나타난 것처럼 국고채 3년물 금리는 최근 3% 수준까지 급등하였는데, 이는 2013년 이후 최고치에 해당한다. 또한 금리 변동성도 크게 상승하면서 2008년 글로벌 금융위기 이후 최고 수준에 근접하였다. 아울러 신용스프레드도 가파르게 확대되어 대우조선해양 사태 등으로 촉발된 2015년 회사채시장 침체기 및 2020년 팬데믹 위기 당시를 넘어서는 수준에 이르렀다.

이러한 상황에서 연준의 금리인상이 가속화된다면 국내 금융시장에 적지 않은 부담으로 작용할 가능성이 있다. <그림 Ⅰ-2>는 한ㆍ미 금리의 동조화 정도를 나타내는데, 최근 들어 국내 국고채 금리가 미국 금리에 동조화되는 경향이 뚜렷하게 강화되었음을 확인할 수 있다. 이러한 점을 볼 때, 연준의 금리인상 충격이 발생할 경우 이미 가파르게 상승한 국내 시장금리에 추가 상승요인으로 작용할 수 있음을 예상할 수 있다.

본고는 이러한 잠재적인 영향을 고려하여 연준의 통화정책 방향과 위험요인을 평가하고, 시장금리를 중심으로 국내 금융시장에 대한 파급효과를 분석한다. 이를 통해 미국 통화정책 충격의 발생 가능성을 점검하고 국내 시장금리 및 신용여건 등에 미칠 영향을 평가해본다. 다만, 본고에서는 연준이 6월부터 시작할 예정인 양적긴축에 대해서는 다루지 않는다는 점을 밝혀 둔다.2)

Ⅱ. 미국 통화정책 평가

1. 최근 미국 통화정책 관련 주요 논의

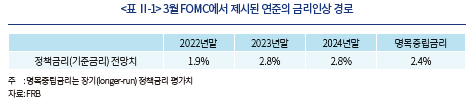

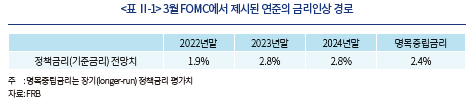

연준은 높은 물가상승률3)을 완화하고, 경제확장세 및 고용안정을 유지하기 위해 3월 FOMC에서 정책금리를 25bp(0~0.25% → 0.25~0.5%) 인상한데 이어, 5월에는 50bp(0.25~0.5% → 0.75~1.0%)를 인상하였다. <표 Ⅱ-1>에는 3월 FOMC에서 제시된 연준의 정책금리인상 경로가 정리되어 있다.

금번 금리인상의 특징을 높은 물가상승률에 대한 연준의 늦은 대응으로 요약할 수 있는 만큼 다양한 논란이 제기되고 있다. 우선 연준 내에서도 금리인상 경로에 대해 다양한 의견이 표출되고 있다. 파월(Powell) 의장을 비롯한 다수의 통화정책 담당자들은 정책금리를 신속하게 경기중립적인 수준까지 인상하는 방안을 적정 경로로 제시하였다. 파월의장은 정책금리가 중립금리 부근에 도달한 이후에는 경제 상황에 따라 추가 인상의 필요성을 판단할 수 있을 것으로 언급하였다. 반면, 블라드(Bullard) 세인트 루이스 연준 총재와 월러(Waller) 연준 이사 등은 금년말까지 정책금리를 중립금리보다 높게 인상해야 한다는 의견을 제기하였다(FRB 2022b; FT, 2022.4.13; Powell, 2022; WSJ, 2022. 4.14).

한편 연준이 금리인상을 통해 경기침체를 유발하지 않고 물가를 안정시킬 수 있을지에 대해서도 논란이 커지고 있다. 연준은 강한 거시경제 상황을 감안할 때, 경기확장세를 크게 훼손하지 않고 물가를 안정시킬 수 있을 것으로 기대하고 있다. 하지만 일부에서는 현재의 물가수준이 과도하게 높기 때문에 물가안정과 고용안정을 동시에 추구하는 정책 방향은 적절하지 않으며, 신속한 금리인상을 통해 물가를 하락시키는 데 집중할 필요가 있다는 의견을 제시하고 있다(Dudley, 2022.4.18; Summers, 2022.4.19).

2. 연준 통화정책 평가: 금리인상 강도

가. 중립금리의 개념 및 통화정책 함의

본 절에서는 연준 정책금리인상 경로의 준거로 다루어지는 중립금리의 개념과 통화정책적 활용에 대해 살펴본다. 실질중립금리(neutral real interest rate)는 경제가 잠재성장세만큼 성장하고 고용여건이 완전고용(자연실업률 수준의 실업률)에 도달하였으며, 물가가 안정된 상태에서의 단기실질금리로 정의된다(Laubach & Williams, 2003). 다시 말해 실질중립금리는 자본과 노동 등 생산요소의 활용이 균형수준(잠재수준)에서 이루어져 유휴생산능력(economic slack)이 존재하지 않는 상태, 즉 GDP갭(실제GDP-잠재GDP)과 실업률갭(실제실업률-자연실업률)이 제로이며, 물가는 상승 또는 하락 압력 없이 안정된 균형상태(경제의 기초체력)4)에 부합하는 실질균형금리(equilibrium real interest rate)를 의미한다.

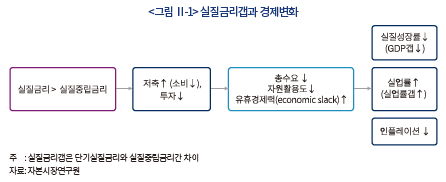

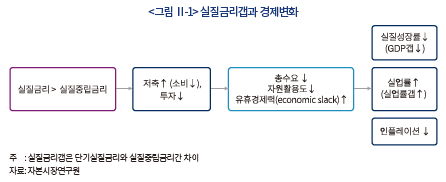

이론적으로는 경기가 변동하는 과정에서 단기실질금리가 실질중립금리보다 높아지면, 저축이 증가(소비 감소)하고 투자가 감소하여 총수요가 억제된다. 그 결과 경기가 위축되고 고용이 감소하면서 물가가 하락 압력을 받게 된다(Woodford, 2003; Larsen & McKeown, 2004). 이러한 내용은 <그림 Ⅱ-1>에 정리되어 있다.

따라서 중앙은행은 경기 과열이 우려되면, 실질정책금리를 실질중립금리보다 높게 인상하여 경제활동을 억제하고 물가상승 압력을 완화할 수 있다. 반대로 경제활동이 지속적으로 잠재수준에 미치지 못할 것으로 평가되면, 정책금리를 중립금리 이하로 인하함으로써, 총수요를 진작하여 경기를 부양하고 디플레이션을 방지할 수 있다(Archibald & Hunter, 2001; Fischer, 2016; Powell, 2016).

이상으로부터 중앙은행의 통화정책 기조(강도)는 정책금리를 중립금리보다 높게 또는 낮게 유지하는지에 따라, 긴축기조(정책금리>중립금리)와 완화기조(정책금리<중립금리)로 구분할 수 있다. 그런데 정책금리를 인상하더라도 중립금리보다 낮다면 통화정책 기조는 여전히 완화적인 수준에 머문다는 점에 유의해야 한다. 즉, 중앙은행의 금리인상 경로에서 정책금리가 중립금리를 상회하기 전까지는 경기 위축을 통해 물가상승 압력을 완화하는 본격적 긴축으로 볼 수 없으며, 금융완화의 정도를 축소하는 과정으로 이해할 필요가 있다(Kaplan, 2018). 한편 정책금리가 중립금리 수준에서 형성된다면 경기중립적 통화정책 기조로 파악할 수 있는데, 이는 중앙은행에 의해 경기가 인위적으로 부양되거나 위축되지 않는 상태를 의미한다.

나. 금번 정책금리인상기의 금리인상 강도 평가

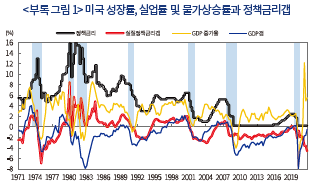

본 절에서는 연준이 경제여건(성장률, 실업률 및 물가상승률)의 변화에 따라 통화정책 강도를 어떻게 조절해 왔는지 알아보고, 최근 경제여건을 고려할 때 예상할 수 있는 금리인상 강도를 평가해 본다. 다음으로, 과거 금리인상기를 대상으로 금리인상 강도가 경제여건의 변화에 미친 영향을 살펴본다. 특히 여기에서는 물가상승률 변화에 초점을 맞추어 통화정책의 경기 조절 효과를 종합적으로 평가한다. 이를 통해 금번 금리인상기의 최종 정책금리 수준이 중립금리를 상회해야 할 필요성을 평가한다.

본고에서는 실질정책금리에서 실질중립금리를 차감하여 산출되는 실질정책금리갭을 통해 통화정책 강도를 파악한다.5) 여기서 실질정책금리는 연준이 결정하는 명목정책금리에서 기대물가상승률를 차감하여 도출한다. 실질중립금리는 관찰되지 않으므로 경제모형을 통해 추정해야 하는데, 본 연구에서는 Bauer & Rudebusch(2021)의 접근법을 채택하여 실질중립금리에 대한 대표적 모형에서 산출된 실질중립금리의 평균치를 사용한다.6) 다음으로 기대물가상승률은 Holston et al.(2007) 방법에 따라 과거 4분기 동안의 전분기 대비 Core PCE 상승률 평균치를 적용한다. 실질정책금리갭과 명목정책금리갭은 모두 중립금리와 정책금리의 차이를 나타내므로 이하에서는 정책금리갭(기준금리갭)으로 통칭한다.

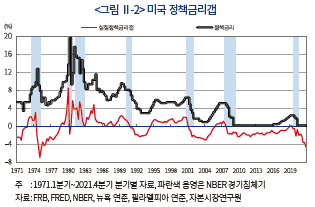

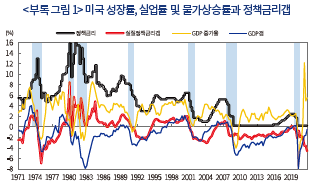

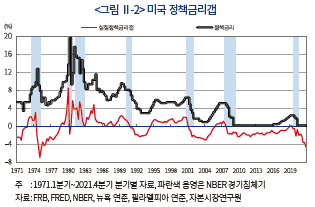

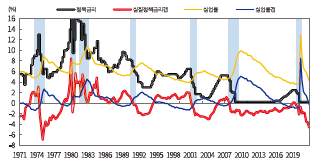

<그림 Ⅱ-2>에는 실질중립금리 추청치로부터 산출된 정책금리갭이 나타나있다.7) 우선 1971년 이후 이루어진 미국의 금리인상은 대부분 정책금리가 중립금리를 상회하는 수준에서 마무리된 것으로 확인되었다. 금리인상이 중립금리 부근에서 마무리된 것은 2015~2018년 인상기가 유일한 것으로 나타났다.

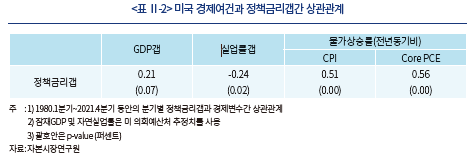

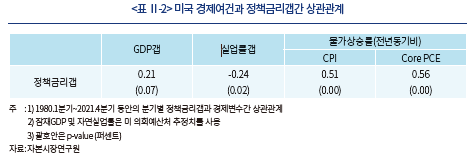

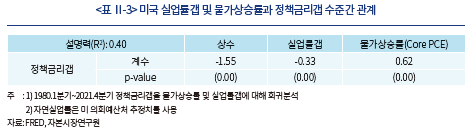

한편 정책금리갭은 경제여건과 밀접히 연관된 것으로 나타났는데8), <표 Ⅱ-2>에는 정책금리갭과 GDP갭, 실업률갭 및 물가상승률간 상관관계가 요약되어 있다. 동 상관관계를 이용하면 최근 경제여건에 부합하는 정책금리갭 수준을 대략적으로 추정해 볼 수 있다.

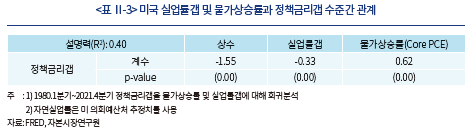

<표 Ⅱ-3>에는 이를 위해 정책금리갭을 실업률갭과 물가상승률에 대해 회귀분석한 결과가 정리되어 있다.9) 동 회귀식에 금년 4월 실업률갭(–0.6%)10) 및 물가상승률(4.9%)을 대입하면, 정책금리갭은 1.3~2.2% 범위(95% 신뢰구간)에 있는 것으로 추정된다. 물론, 연준의 금리인상 경로는 물가상승률과 고용여건을 중심으로 한 경제여건의 변화에 따라 결정될 것이며, 제시된 정책금리갭 추정치는 대략적인 의미로만 고려할 필요가 있겠으나, 3월 FOMC에서 제시된 금번 금리인상기의 최종 정책금리갭 0.4%11) 수준과 격차가 작지 않은 것으로 판단된다. 이는 물가상승률이 빠르게 하락하지 않거나 실업률이 증가하지 않을 경우, 금번 인상기의 최종 정책금리 전망치가 크게 높아질 가능성이 있음을 시사한다.

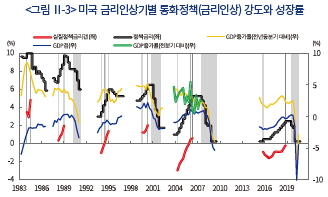

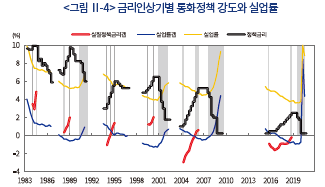

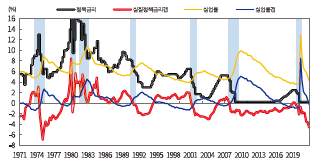

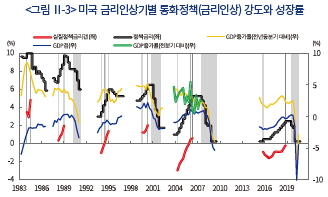

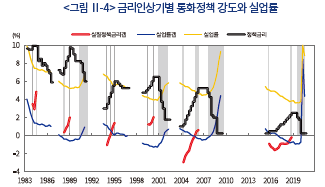

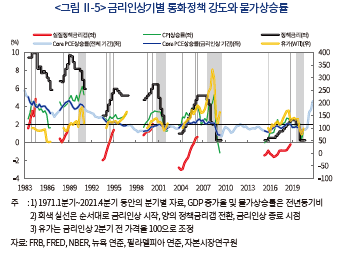

아래에서는 통화정책 강도별로 정책금리인상이 경제여건의 변화에 미친 영향을 살펴본다. <그림 Ⅱ-1>에 정리된 내용은 이론적 관계에 근거하고 있으므로 실제 효과를 살펴볼 필요가 있다. <그림 Ⅱ-3>~<그림 Ⅱ-5>에는 1983년 1분기부터 2021년 4분기까지 총 6회의 금리인상기별 정책금리갭과 경제여건의 변화가 나타나있다.12)

첫째, <그림 Ⅱ-3>에서 알 수 있듯이, 금리를 인상하더라도 정책금리가 중립금리보다 낮을 경우(음의 정책금리갭)에는 대체로 성장세가 확대되고 GDP갭이 증가하였다.13) 반면 정책금리가 중립금리를 상회하는 수준(양의 정책금리갭)까지 인상될 경우에는 금리를 인상하는 동안 또는 금리인상이 마무리된 직후부터 성장률이 하락하고 GDP갭이 축소되었음을 알 수 있다. 따라서, 중립금리 수준 이하에서 이루어지는 금리인상은 경기 위축을 유발하지 않는 것으로 볼 수 있으며, 정책금리가 중립금리보다 높아야 본격적인 긴축 효과가 나타나는 것으로 이해할 수 있다.

둘째, <그림 Ⅱ-4>에서 확인할 수 있듯이, 실업률과 실업률갭은 정책금리갭이 음의 값을 유지하는 동안 하락세를 나타냈다. 정책금리갭이 양의 값을 갖는 동안에도 감소세가 유지되었으며, 금리인상 종반부 또는 금리인상이 종료된 직후에 상승세로 전환하는 경향을 확인할 수 있다. <그림 Ⅱ-3>과 <그림 Ⅱ-4>를 비교해 보면, 실업률은 성장률보다 시차를 두고 정책금리인상에 반응하는 것으로 파악할 수 있다.14)

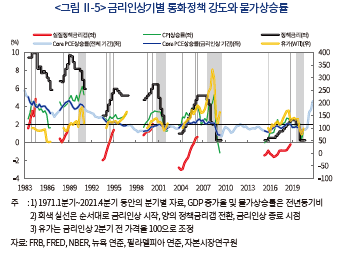

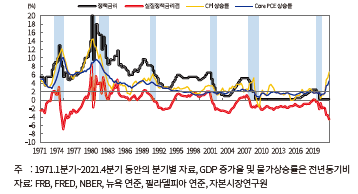

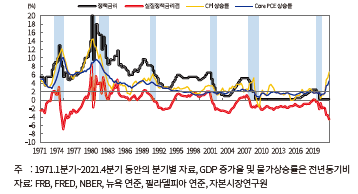

셋째, <그림 Ⅱ-5>에는 정책금리인상에 따른 물가상승률(전년동기비 CPI 및 Core PCE 상승률) 변화가 나타나 있다. 우선 1994~1995년, 2004~2006년 및 2015~2018년 인상기를 살펴보면, 정책금리가 중립금리를 하회(음의 정책금리갭)할 경우 물가상승세가 확대되었음을 알 수 있다.15) 정책금리갭이 음의 값을 가질 때에는 금리인상기라 할지라도 통화정책이 여전히 완화기조이며, 성장세가 확대된다는 점을 감안하면 물가상승세가 확대될 가능성이 충분한 것으로 판단된다. 다음으로 정책금리가 중립금리를 상회(양의 정책금리갭)하는 경우에도 금리인상기 내에서는 대체로 물가상승세가 완화되지 않은 것으로 확인되었다.16) 결과적으로 정책금리를 중립금리보다 높게 인상하는 긴축에 돌입해도, 성장률이 둔화되는 정도에 비해 물가상승률이 하락하는 효과는 크지 않은 것으로 판단할 수 있다.

한편 금리인상이 종료된 후(종료 후 4분기 기준)에는 Core PCE 및 CPI 모두 상승세 둔화가 비교적 일관되게 나타나는 것으로 확인되었다. 우선 Core PCE의 경우 금리인상이 종료된 후에는 대부분 상승률이 낮아진 것으로 나타났다. 다만, 일부 인상기를 제외할 경우 둔화폭이 크지 않은 것을 알 수 있다. 물가상승률이 큰 폭으로 하락한 사례로는 1988~1989년 인상기를 들 수 있다. 당시 금리인상 종료시점의 Core PCE 상승률이 4.65%에 달하였으나, 4분기 후에는 3.77% 수준까지 하락하였다. 그런데, 동 시기의 경우 물가상승률이 현재 수준에 미치지 못함에도 긴축의 강도가 매우 강해, 금리인상기의 최종 정책금리갭이 2%에 달했다는 점에 주목할 필요가 있다. CPI 상승률 또한 금리인상이 마무리된 후에는 대부분 하락한 것으로 나타났으나, Core PCE에 비해 둔화세가 지속되지 않는 경우가 많은 것을 확인할 수 있다. 이와 같은 현상은 유가 변동을 원인으로 볼 수 있는데, <그림 Ⅱ-5>에 나타난 것처럼 CPI 상승률은 유가 추이에 밀접하게 연관된 것으로 판단된다.

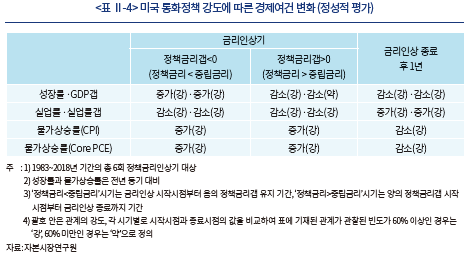

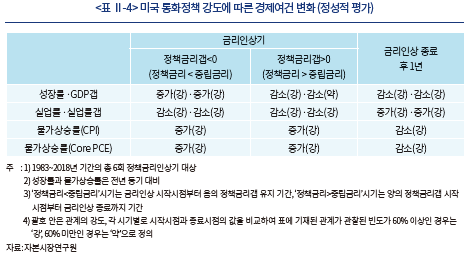

지금까지 살펴본 금리인상 강도에 따른 경제여건의 변화를 정리하면 <표 Ⅱ-4>와 같은데, 대체로 <그림 Ⅱ-1>에 제시된 관계에 부합하는 것으로 판단된다. 즉, 금리인상기일지라도 정책금리가 중립금리보다 낮은 수준에 머문다면, 성장률이 확대(GDP갭 확대)되어 실업률은 하락(실업률갭 축소)하고 물가상승세가 확대되는 경향이 확인되었다. 다음으로, 정책금리를 중립금리보다 높은 수준까지 인상하는 통화긴축 상태에 진입하면, 경기가 위축되어 성장률이 감소(GDP갭 감소)하는 경향이 존재한다. 실업률과 물가상승률은 성장률보다 늦게 통화긴축에 반응하는데, 특히 물가의 경우 통화정책 강도와 관계없이 정책금리인상이 마무리된 후에야 상승세가 축소된다. 이는 정책금리를 중립금리 이상으로 인상하더라도 물가상승세가 완화되기까지 상당한 시간이 필요할 수 있음을 시사한다.

다. 미국 통화정책 종합평가 및 위험요인

미국 경제가 강한 성장세를 보이고 있으나, 최근과 같이 높은 물가상승률이 지속되면 경제에 미치는 부작용이 적지 않을 것으로 예상된다. 따라서 금번 금리인상의 목표는 물가상승세의 점진적 둔화가 아닌 조속한 하향 안정화에 있어야 할 것이다. 본고의 분석에 따르면, 연준의 금리인상 강도 및 속도가 크게 강화될 필요가 있는 것으로 판단된다.

우선, 정책금리가 중립금리보다 낮을 때에는 물가상승세가 확대되는 경향이 있다는 점을 감안할 때, 파월의장 등이 제시한 중립금리 수준의 정책금리는 물가상승세 완화를 위한 최소한의 필요조건인 것으로 판단된다. 더구나 1970년 이후 사례를 고려할 때, 정책금리를 중립금리보다 높게 인상하더라도 긴축의 강도가 대폭 강화되지 않는 한, 물가상승률이 외생적 요인에 의해 약화되지 않으면 금리인상기 내에서는 물가안정이 용이하지 않을 가능성이 있다. 이런 관점에서 볼 때, 금번 금리인상기의 최종 정책금리가 연준이 3월 FOMC에서 전망한 수준보다 큰 폭으로 중립금리를 상회할 가능성이 있다. 아울러 최근 미국의 금융여건이 과도하게 완화적인데다 금리인상이 늦게 시작되었기 때문에, 역사적인 기준으로 보더라도 금리인상 속도가 통상적인 인상폭인 25bp를 상회할 필요가 큰 상황이다.17)

이상을 종합하면, 단기간내 물가안정이 가시화되지 않는다면 연준이 예상보다 큰 폭으로, 더 빠르게 금리를 인상하는 통화정책 충격이 반복될 가능성이 있는 것으로 판단된다. 미국발 통화정책 충격은 우리나라와 신흥국 경제에 작지 않은 영향을 줄 것으로 예상된다. 이에 다음 장에서는 연준의 통화정책 충격이 국내 금리 및 신용시장 여건에 미치는 영향에 대해 살펴본다.

Ⅲ. 국내 금리에 대한 영향

본 장에서는 미 연준의 통화정책이 국내 금리에 미치는 영향과 시사점에 대해 논의한다. Kearns et al.(2018)은 다수의 국가를 대상으로 미국, ECB 등 주요국 중앙은행의 통화정책이 유발하는 대외 파급효과를 분석한 바 있다. 동 연구에 따르면, 미국의 통화정책 충격에 대해 여타 국가의 시장금리는 차별화된 반응을 보이는데, 전반적으로 단기금리보다는 장기금리가 상대적으로 크게 반응하는 것으로 나타났다. 다만, Kearns et al.(2018)은 국가 그룹별18) 평균 효과만을 제시하고 있기 때문에 국내 금리에 미치는 영향을 구체적으로 평가하기 어렵다는 한계가 있었다. 본 장의 분석은 국내 금리에 대한 파급 효과에 초점을 맞춤으로써 그러한 제약을 보완하여 보다 시의성 있는 결과를 제시할 수 있을 것이다.

1. 분석 모형

연준의 통화정책이 국내 금리에 미치는 영향은 만기별 국고채 금리, 회사채 금리, COFIX 및 금융채 금리, 가계대출 금리 등의 충격반응을 통해 분석한다. 통화정책 충격으로는 Bu et al.(2021)이 FOMC 전후 미 국채 금리 변화를 통해 식별한 자료를 이용하였다. 동 분석에서 국고채는 1ㆍ3ㆍ5ㆍ10년물, 회사채는 3년물 AA-등급을 대상으로 하였다. 금융채의 경우, 주택담보대출 등에서 지표 금리로 적용되는 은행채 5년물(AAA등급)19)의 금리가 사용된다. 그리고 COFIX 및 금융채 금리와 연관지어 가계 및 기업대출 금리(신규취급액, 예금은행 기준)20)의 반응도 분석한다.

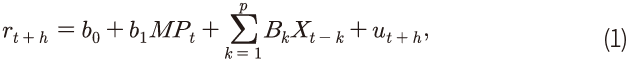

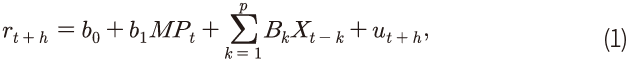

각 금리 지표들의 충격반응은 아래의 모형을 바탕으로 Jordà(2005)의 국소투영법(local projection)을 이용하여 추정된다.

여기에서  는 분석 대상 금리,

는 분석 대상 금리,  는 통화정책 충격,

는 통화정책 충격,  는

는  의 시차가 적용된 통제변수들의 벡터로 정의된다. 통제변수(

의 시차가 적용된 통제변수들의 벡터로 정의된다. 통제변수( )로는 산업생산지수(로그 변환), 소비자물가지수(로그 변환), 콜 금리, 환율(로그 변환), KOSPI 지수(로그 변환)를 포함하여 국내 거시ㆍ금융변수가 미치는 영향을 고려하였다. 분석은 월별 자료를 바탕으로 하였으며 대상 기간은 2010년 1월에서 2020년 12월이다. 동 기간은 금융위기 이후부터 Bu et al.(2021)의 통화정책 충격 자료가 가용한 마지막 시점에 해당한다.

)로는 산업생산지수(로그 변환), 소비자물가지수(로그 변환), 콜 금리, 환율(로그 변환), KOSPI 지수(로그 변환)를 포함하여 국내 거시ㆍ금융변수가 미치는 영향을 고려하였다. 분석은 월별 자료를 바탕으로 하였으며 대상 기간은 2010년 1월에서 2020년 12월이다. 동 기간은 금융위기 이후부터 Bu et al.(2021)의 통화정책 충격 자료가 가용한 마지막 시점에 해당한다.

2. 국고채 금리

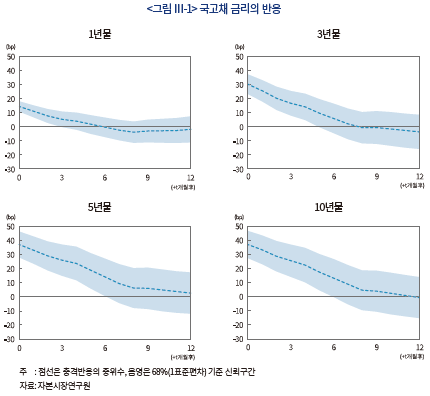

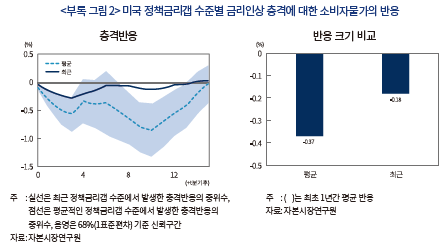

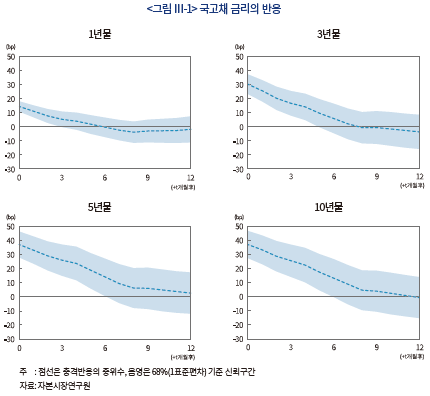

<그림 Ⅲ-1>은 미국 정책금리 100bp 인상 충격에 해당하는 긴축 충격 발생 시 만기별 국고채 금리의 반응을 나타내고 있다. 좌측 상단부터 우측 하단까지의 그림에는 1ㆍ3ㆍ5ㆍ10년물의 충격반응이 제시되어 있다. 먼저, 여기에서는 연준의 금리인상 충격 발생 시 각 국고채 금리는 단기적으로 유의하게 상승한다는 점을 확인할 수 있다. 각 국고채 금리는 공통적으로 금리인상 충격이 발생한 당시(t=0) 가장 큰 반응을 나타나는데, 최대 충격반응은 1년물은 +14bp, 3년물은 +30bp, 5년물은 +37bp, 10년물은 +37bp로 추정된다.

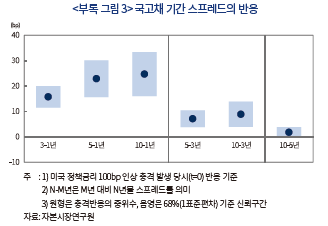

<그림 Ⅲ-1>에서 나타나는 또 다른 특징으로, 대체로 장기금리일수록 반응 정도가 크다는 점을 들 수 있다. 이는 일차적으로 각 만기물별 반응의 크기를 비교함으로써 알 수 있지만, 보다 엄밀하게는 기간 스프레드의 충격반응 추정을 통해서도 유의하게 확인된다. <부록 그림 3>은 1년물 대비, 3년물 대비, 5년물 대비 기간 스프레드의 충격반응을 나타내고 있는데 각 기간 스프레드는 대부분 통계적으로 유의하게 확대됨을 보여준다. 이러한 결과는 연준의 금리인상 충격이 만기 측면에서 미국과 국내 금리에 차별화된 영향을 미친다는 사실을 시사한다. 즉, 연준의 금리인상 충격은 미국 내 단기금리에 상대적으로 큰 영향을 미치면서 장단기금리차가 축소21)되는 반면, 우리나라의 경우 장기금리에 상대적으로 큰 영향을 미치면서 장단기금리차가 확대된다는 점이다.

이러한 특징과 관련하여, Kearns et al.(2018)은 연준의 통화정책 충격이 주로 리스크 프리미엄 경로를 통해 여타 국가의 장단기금리차를 확대시키는 것으로 분석하였다.22) 동 연구에 따르면, 금융개방도가 높은 국가일수록 글로벌 위험추구(risk appetite) 및 금융상황에 크게 영향 받으면서 장기금리가 미국의 통화정책에 크게 반응하는 것으로 추정되었다. 국내 금융시장의 개방도가 상당히 높다는 점23)을 감안하면, 리스크 프리미엄 경로의 중요성을 강조한 Kearns et al. (2018)의 설명이 유효한 것으로 판단된다. 그리고 이러한 점은 연준의 통화정책 충격이 주로 기간 프리미엄을 통해 국내 장기금리에 영향을 미치는 것으로 풀이된다.24) 그래서, 만약 미국의 금리인상 충격이 리스크 프리미엄을 통해 영향을 준다면, 이를 반영하는 기간 프리미엄 상승을 통해 국내 장기금리를 높이는 것으로 생각할 수 있다.

3. 회사채 및 금융채ㆍCOFIX 금리

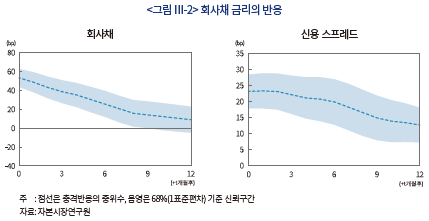

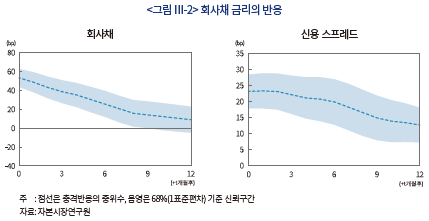

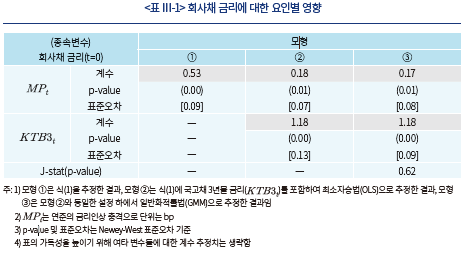

본 절에서는 연준의 금리인상 충격 발생 시 회사채와 금융채 등 여타 시중금리의 반응을 분석한 결과에 대해 논의한다. 먼저 <그림 Ⅲ-2>의 좌측 그림은 미국 정책금리 100bp 인상 충격 발생 시 회사채 금리의 반응을 나타내고 있다. 회사채 금리는 충격 발생 당시(t=0) 약 50bp 상승하였다가 이후 점진적으로 낮아지는 모습을 보인다. 회사채의 반응은 동일 만기의 국고채(3년물)보다 크게 나타나는데, 이에 따라 미국의 금리인상 충격 발생 시 회사채와 국고채 금리의 격차인 신용 스프레드도 확대된다(<그림 Ⅲ-2> 우측).

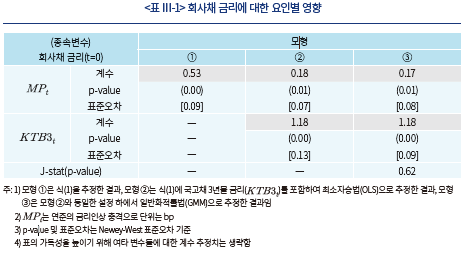

회사채 금리 상승은 일차적으로 벤치마크 무위험 이자율인 국고채 금리가 상승하는 데 따른 것으로 볼 수 있다. 이는 식 (1)을 이용하여 회사채 충격반응을 추정한 모형에 국고채 3년물 금리를 설명변수로 포함함으로써 확인할 수 있다. <표 Ⅲ-1>의 모형 ②와 ③은 충격 발생 시점(t=0)을 기준으로 하여, 동일 시점의 국고채 3년물 금리를 포함한 경우 국고채 금리에 대한 계수 추정치를 나타내고 있다. 동 표에서 모형 ②는 최소자승법(OLS)을 이용한 추정 결과이며, 모형 ③은 잠재적으로 존재할 수 있는 국고채와 회사채 금리 간 상호 영향을 고려하여 일반화적률법(GMM)으로 추정한 것이다. 모형 ①은 식 (1)에 따라 추정한 결과로, <그림 Ⅲ-2>의 t=0에 해당하는 추정 결과이다.

<표 Ⅲ-1>을 보면, 앞서 언급한 바와 같이 국고채 3년물 금리를 포함한 경우 동 변수에 대한 계수 추정치가 1에 가깝게 추정된다는 점을 알 수 있다. 그리고 이에 따라 독립변수로 추가된 국고채 3년물 금리가 미국 통화정책 충격의 설명력을 어느 정도 흡수하는 것으로 보인다. 즉, 국고채 금리가 포함되지 않은 모형 ①에서 미국 금리인상 충격의 계수는 0.53이었는데, 동 변수가 포함되면서 계수는 0.18(모형 ②) 및 0.17(모형 ③)로 작아졌다. 하지만, 그럼에도 미국 통화정책 충격의 계수는 1% 수준에서 유의하며 여전히 설명력을 가진다는 사실을 환기할 필요가 있다. 이는 미국 통화정책이 무위험 이자율인 국고채 금리뿐만 아니라, <그림 Ⅲ-2>의 우측과 같이 리스크 프리미엄인 신용 스프레드를 통해 영향을 미치기 때문으로 판단할 수 있다.

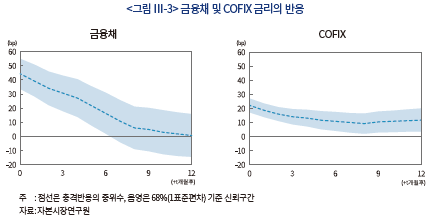

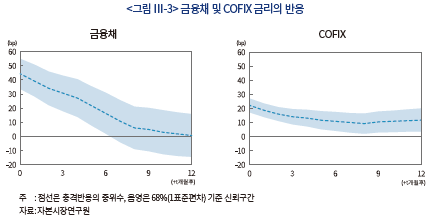

다음으로 <그림 Ⅲ-3>은 연준의 금리인상(100bp) 충격 발생 시 은행의 자금 조달비용을 반영하는 금융채 5년물과 COFIX 금리의 반응을 나타내고 있다. 장기 조달비용에 해당하는 금융채 5년물 금리의 경우, 충격 발생 시 40bp 내외 상승하였다가 점차 충격 이전 수준으로 낮아지는 것으로 추정된다. 그리고 단기 조달비용인 COFIX 금리는 약 20bp 상승하였다가 낮아지는 모습을 보인다. 따라서 단기금리지표인 COFIX 금리보다는 장기금리지표인 금융채 5년물의 반응이 크게 나타나 국고채와 유사한 패턴을 보인다. 연준의 긴축 충격은 대체로 단기적으로 영향을 미치지만 지속성은 COFIX 금리가 금융채나 국고채 1년물보다 대체로 큰 것으로 나타났다.

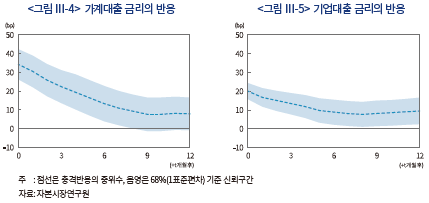

은행의 자금조달 비용이 증가할 경우 대출 금리도 상승 압력을 받게 된다. 특히 가계대출의 상당 부분을 차지하는 주택담보대출의 경우, 주로 금융채 5년물 및 COFIX 금리에 연동25)되어 결정된다. 따라서 전술된 결과는 미국의 금리인상 충격이 궁극적으로 가계대출 금리에도 영향을 줄 수 있다는 점을 시사한다.

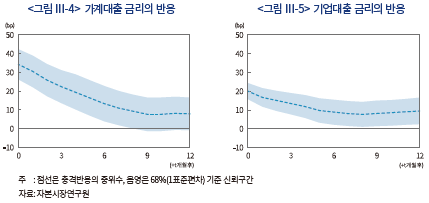

이러한 사실은 <그림 Ⅲ-4>에 제시된 가계대출 금리의 충격반응을 통해 직접적으로 확인할 수 있다. 이 그림은 연준의 금리인상 충격 발생 시(t=0) 가계대출 금리가 35bp 내외 유의하게 상승함을 보여준다. 가계대출 금리는 만기 구분 없이 전체 신규 대출의 평균 금리(금액 가중)를 적용했기 때문에 금융채 금리 등과의 스프레드를 직접 비교하기는 어렵다. 다만, 대체로 COFIX와 금융채 금리 상승폭 사이의 크기를 나타내면서 두 지표 금리의 움직임을 평균적으로 반영하는 것으로 보인다.

아울러, <그림 Ⅲ-5>는 기업대출 금리의 반응을 나타내고 있다. 연준의 금리인상 충격 발생 시 기업대출 금리도 상승하는데, 초기 반응(t=0)은 약 20bp로 추정된다. 분석에 사용된 기업대출 금리는 가계대출 금리와 마찬가지로 평균 금리의 반응으로 만기가 구분되지 않는다. 다만, 기업대출의 경우 COFIX나 CD(3개월) 금리 등 단기 지표 금리에 연동된 대출 비중26)이 높은데, 이러한 특징으로 인해 COFIX와 유사한 반응을 보이는 것으로 판단된다.

Ⅳ. 미 연준의 통화정책과 내외 금리차

금융 개방도가 높은 국내 금융시장의 특성상, 내외 금리차는 채권 자금을 중심으로 자본유출입에 영향을 줄 수 있다. 특히 최근 연준의 긴축 강도가 커질 것으로 예상되면서 한ㆍ미 간 내외 금리차 및 금리 역전 여부에 대한 관심이 높아지고 있다. 본 장에서는 금리 역전이 발생했던 과거 사례에 대해 분석하고, 이를 바탕으로 향후 한ㆍ미 간 금리 역전 가능성에 대해 논의해 보고자 한다.

1. 과거 사례: 주요 내외 금리 역전기

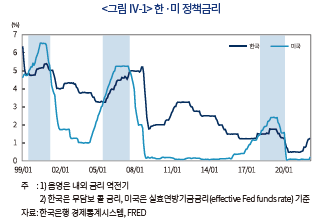

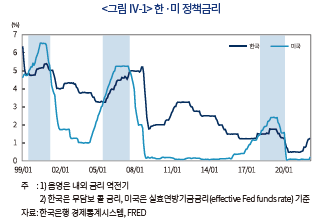

내외 금리 역전은 일시적인 충격보다는 통화정책의 기조에 주로 영향을 받는 것으로 판단된다. 통화정책 지표인 정책금리의 경우, 한국은행이 금리 중심의 통화정책27) 운영으로 전환한 이래 크게 3개의 기간에서 한ㆍ미 간 역전이 발생한 것으로 볼 수 있다. 그 시기는 1999년 7월~2001년 3월, 2005년 7월~2007년 8월, 2018년 3월~2020년 2월로, <그림 Ⅳ-1>의 음영으로 표시된 구간에 해당한다.

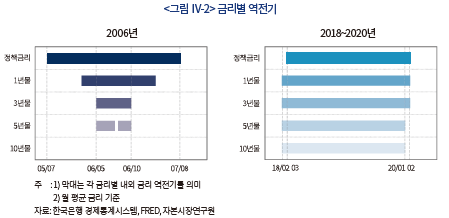

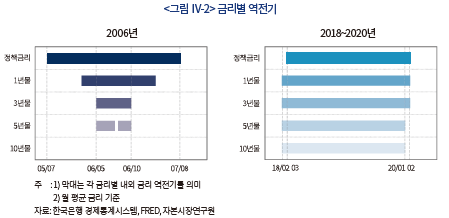

이와 같이 양국의 정책금리가 역전된 기간에는 국채 금리도 역전되는 경향이 뚜렷하게 나타난다.28) 특히, 최근 두 번의 미국 금리인상기를 보면, 장단기 전반에 걸친 금리 역전이 공통적으로 발생했다는 점을 확인할 수 있다. <그림 Ⅳ-2>는 월별 자료를 기준(2000년 1월 이후)으로 해당 금리인상기에서 장단기금리의 역전이 발생했던 시기를 보여주고 있다.

여기에서는 2006년 5~10월(이하 ‘2006년 역전기’)과 2018년 3월~2020년 1월(이하 ‘2018년 역전기’)의 두 기간이 정책금리부터 5년 이상의 장기금리가 역전된 시기에 해당한다. 2006년 역전기의 경우 장기금리 역전 이전에 정책금리 역전이 선행되고, 장기간 지속되었다는 점이 특징이다. 다만, 당시 10년물의 역전은 발생하지 않았고 장단기금리가 모두 역전된 기간이 짧은 편이다. 반면, 2018년 역전기의 경우 정책금리 역전 직전에 1년물에서 10년물까지의 만기 구간에서 국채 금리가 이미 역전되었고 이것이 장기간 지속되었다는 점이 두드러진다.

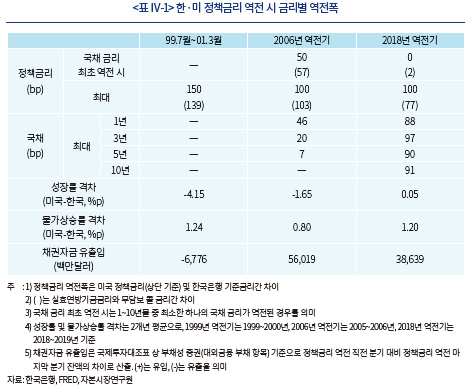

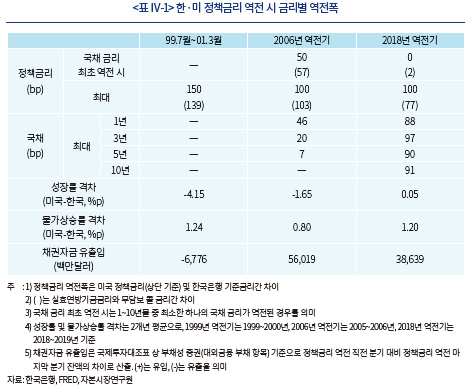

<표 Ⅳ-1>은 각 기간별로 국채 금리가 최초로 역전되었을 때의 정책금리 역전폭과 역전 기간 중 금리별 최대 역전폭 등을 요약하고 있다. 먼저, 국채 금리가 최초로 역전되었을 때의 정책금리 역전폭을 보면 2006년 역전기에는 50bp, 2018년 역전기에는 0bp로 나타난다. 즉, 2018년의 경우 2006년 역전기에 비해 정책금리의 역전폭이 작았음에도 국채 금리의 역전이 발생했음을 알 수 있다.

다음으로 최대 역전폭을 보면, 2018년 역전기 당시 정책금리의 최대 역전폭은 여타 기간에 비해 더 크지는 않지만, 국채 금리의 최대 역전폭은 더 큰 편이다. 2018년 역전기에 한ㆍ미 정책금리는 최대 100bp(미국은 목표 범위 상단 기준) 역전되었고, 1년물 및 5년물의 최대 역전폭은 각각 88bp 및 90bp로 나타났다. 2006년 역전기에도 한ㆍ미 정책금리는 최대 100bp 역전되었지만 1년물 및 5년물의 최대 역전폭은 46bp 및 7bp로 2018년에 비해 작은 수준이다. 여타 기간과 비교할 때, 2018년 역전기의 경우 미국에 대비한 국내 성장률 및 물가상승률이 상대적으로 낮았던 기간이다. 이러한 거시경제 상황이 금리에 반영되면서 역전폭이 확대되는 데 영향을 준 것으로 판단된다. 또한, 당시 연준의 양적긴축이 진행되면서 미 장기금리에 상승 압력이 존재했던 점도 장기금리의 역전폭 확대에 영향을 미친 것으로 볼 수 있다.

<표 Ⅳ-1>의 마지막 행에는 정책금리 역전 발생 시 외국인의 채권투자자금 유출입액이 제시되어 있다. 2006년 및 2018년 역전기의 경우, 정책금리가 최대 100bp까지 역전되기는 했으나 외국인의 채권투자자금은 오히려 유입된 것으로 나타났다. 특히 2018년의 경우, 장단기 내외 금리가 역전된 기간이 2년 가까이 지속되었지만 이 기간 중 외국인의 채권투자자금은 약 390억달러 유입되었다. 이러한 순유입은 외국인의 채권투자자금이 금리 역전 초반에 유출되었다가 역전 종반에 대규모 유입으로 반전된 데 따른 것이 아니라, 자금 유입이 전반적으로 지속된 데 따른 결과로 보인다.29)

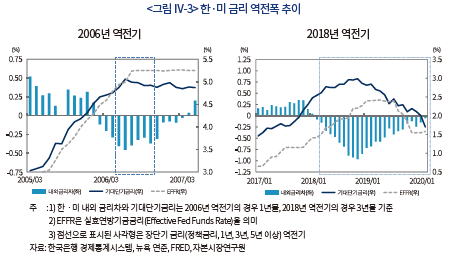

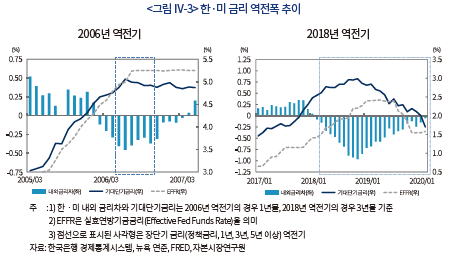

다음으로, 한ㆍ미 간 금리 역전이 발생할 경우 이러한 상황이 어느 정도 지속되었는지에 대해 살펴보고자 한다. 최근 두 번의 역전 사례에서 장단기 국채 금리의 역전폭은 대체로 긴축 사이클 종반까지 확대되는 경향이 있다. 즉, 연준의 긴축 사이클이 종반에 접어들어 긴축 속도가 늦춰지고 이러한 신호30)가 시장기대에 반영되면서 장단기 국채 금리의 역전폭이 점차 축소되는 것을 볼 수 있다.

<그림 Ⅳ-3>은 2006년 역전기의 경우 1년물, 2018년 역전기의 경우 3년물을 대상으로 내외 금리차와 연준의 정책금리, 그리고 미 국채 금리에 내재된 기대 단기금리31)를 나타내고 있다. 이에 따르면, 2006년 역전기의 경우 미국의 정책금리인상이 종료(동결)되기 2개월 전, 2018년 역전기의 경우 4개월 전에 역전폭이 정점에 이른 후 점차 축소되는 모습을 보인다. 정책금리 전망에 밀접하게 영향받는 기대 단기금리도 동일한 시기에 정점을 나타내었다가 이후 횡보하거나 하락하는 것을 볼 수 있다.

2. 향후 내외 금리 역전 가능성

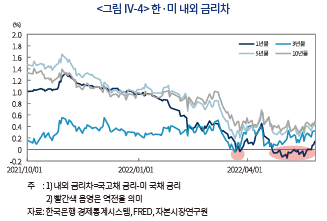

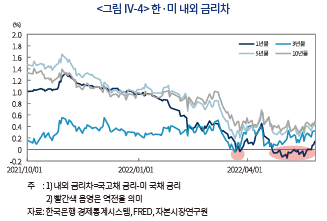

본 절에서는 앞서 살펴본 과거 사례를 바탕으로 향후 내외 금리 역전 가능성과 전개 방향에 대해 논의한다. <그림 Ⅳ-4>는 최근 한ㆍ미 내외 금리차 추이를 각 만기별로 나타내고 있다. 내외 금리차는 전반적으로 축소되고 있는 모습을 보이고 있는데, 국채 1년 및 3년물 금리는 금년 3~5월 및 3월 중에 각각 일시적으로 역전된 바 있다. 5년 이상 장기금리도 작년 4분기 초에 비해 양국 간 격차가 상당폭 축소된 것으로 보인다.

최근의 경우 한국은행이 기준금리를 앞서 인상했다는 점에서 연준의 금리인상이 선행되었던 과거 역전기와는 다소 차이가 있다. 단, 연준 주요 인사들의 시각과 시장참가자들의 전망 등을 고려할 때 금년 중 양국의 정책금리32)가 역전될 가능성이 높은 것으로 판단된다. 이에 따라 정책금리에 민감하게 영향받는 단기(국채 1년물) 금리도 비슷한 시기에 역전될 가능성이 큰 것으로 보인다.

장기금리의 경우 역전될지 여부가 상대적으로 불투명하지만, 2018년보다는 2006년 역전기에 가까운 형태(단기금리 역전 이후 장기금리 역전)로 역전될 가능성이 큰 것으로 생각된다. 최근 금융ㆍ경제 상황을 보면, 일부 여건은 오히려 2018년 역전기와 비슷한 측면이 있다는 점은 사실이다. 즉, 금년 미국의 성장률33)과 물가상승률이 한국보다 높을 것으로 전망되고, 연준의 금리인상과 양적긴축이 함께 진행될 것이라는 점은 2018년 역전기와 유사한 부분이다. 하지만 소비와 생산 위축으로 미국 경제가 침체(recession)에 빠질 수 있다는 우려가 상존하고 있어 이것이 미국 장기금리 상승을 제약하고 있는 것으로 보인다. 이러한 점을 고려할 때 한·미 장기금리가 단기금리만큼 빠르게 역전되지는 않을 것으로 판단된다. 하지만, 연준의 금리인상이 미국 경제의 연착륙을 유도하는 가운데 경기침체에 대한 우려가 조기에 불식된다면 장기금리가 이른 시기에 역전될 가능성도 있다.

앞 절의 사례 분석에 따르면, 미 연준의 가파른 금리인상이 이어지는 상황에서는 한·미 국채 금리가 역전되고 역전폭도 한동안 확대되었던 것으로 나타났다. 이에 비추어 볼 때 향후 단기금리를 중심으로 국채 금리가 역전될 경우, 내외금리 역전은 연준의 금리인상이 종료된 이후에 해소될 수 있을 것으로 판단된다. 다만, 장단기 내외 금리 역전이 발생하더라도 단지 동 요인으로 인해 외국인의 채권투자자금이 대규모로 유출될 것이라 단정하기는 어렵다. 앞서 살펴본 것처럼, 2006년 역전기와 2018년 역전기의 경우 내외 금리 역전 시에도 채권투자자금은 오히려 유입된 바 있다. 외국인의 국내 채권투자가 장기 투자 중심34)으로 변화했다는 점을 고려하면 내외 금리차보다는 국가 신인도와 거시경제의 안정성 등이 채권자금의 유출입에 상대적으로 큰 영향을 줄 것으로 생각된다.

Ⅴ. 요약 및 시사점

미 연준의 금리인상 경로에 대한 불확실성이 커지고 있다. 본고의 분석에 따르면 연준의 금리인상 강도가 크게 강화될 가능성이 있는 것으로 나타났다. 현재의 높은 물가상승률을 고려하면 중립금리 수준의 정책금리로는 물가안정을 기대하기 쉽지 않은 상황이다. 그리고 정책금리를 중립금리보다 높게 인상하더라도 긴축의 강도가 크게 강화될 필요가 있는 것으로 분석되었다. 아울러 연준의 대응이 늦어진 만큼, 외생적 요인에 의해 물가상승세가 완화되지 않으면, 가파른 속도로 중립금리를 크게 상회하는 수준까지 금리가 인상되고, 이 과정에서 통화정책 충격이 반복될 가능성이 존재한다.

이상과 같이 연준의 긴축이 예상보다 높은 강도로 진행될 경우 단기적으로 국내 금융시장에 충격으로 작용하게 될 전망이다. 연준의 금리인상 충격은 일차적으로 장기 구간을 중심으로 국고채 금리를 상승시키고, 회사채와 COFIX, 은행채 금리 등 시중금리에도 상승 압력을 유발하는 것으로 나타났다. 그리고 주요 지표 금리의 반응에 따라 이에 연동된 가계 및 가계대출 금리도 유의하게 높아지는 것으로 분석되었다. 이러한 결과는 미 연준의 금리인상 충격이 국내 금융상황에도 긴축적으로 작용하면서 금융비용이 광범위하게 상승하게 된다는 점을 의미한다.

아울러 연준의 긴축이 지속될 경우, 한ㆍ미 정책금리뿐만 아니라 1년물 등 단기금리를 중심으로 국채 금리도 역전될 가능성이 높은 것으로 판단된다. 하지만, 외국인 증권 투자에서 주식의 비중이 높고, 채권 투자에서 장기 투자자의 비중이 높아 내외 금리차가 전체 자본 유출입에 미치는 영향은 크지 않을 것으로 생각된다. 다만, 경기의 하방 위험이 커지고 있는 상황에서 연준의 긴축이 가세할 경우, 국내 금융시장에 대한 외국인들의 투자 유인이 전반적으로 약화될 가능성이 있으므로 이에 유의할 필요가 있을 것이다.

최근 국내외 경기 둔화에 대한 우려가 증대되면서 가계의 소득과 기업의 실적 전망이 밝지만은 않아 보인다. 이러한 여건 하에서 연준의 긴축 충격으로 국내 금융상황이 악화된다면 경제 주체들의 자금조달에 애로와 부담이 가중될 수 있다. 따라서 필요한 경우에는 적극적인 정책 대응을 통해 동 충격을 완충해야 할 것으로 생각된다. 특히, 국내 금리가 금융ㆍ경제 여건에 비해 과도하게 상승하거나 금융시장의 변동성이 지나치게 확대될 경우, 국고채 매입이나 유동성 공급 등을 통해 시장의 안정을 도모할 필요가 있을 것이다. 아울러 금융시장의 잠재적인 불안 요소를 점검하고 이것이 실물 부문으로 전이될 가능성에 유의하면서 대응 방안을 준비해 나가야 할 것으로 판단된다.

<부록 1> 경제여건에 따른 연준의 정책금리갭 결정

<부록 2> 연준의 금리인상 속도 평가

금번 금리인상은 금융완화의 정도가 과도한 상황에서 늦게 시작된 만큼, 통상적인 경우보다 한층 가파르게 금리가 인상될 것으로 예상된다. 이에 아래에서는 금번 금리인상이 과거보다 얼마나 빠른 속도로 진행될 수 있는지를 살펴본다. 편의상 정책금리갭에 의해 측정되는 통화정책 강도를 금융완화의 정도로 표현한다.

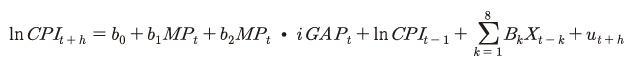

금번에 예상되는 정책금리인상 속도는 연준이 시장의 기대보다 빠르게 금리를 인상하는 통화정책 충격(monetary policy shock)의 효과를 통해 분석할 수 있다. 구체적으로 금융완화 정도에 따라 통화정책 충격이 소비자물가(CPI) 변화에 미치는 영향을 분석하고, 금번 및 통상(평균)적인 금융완화 여건에서 물가에 대한 영향을 비교한다. 이를 통해, 평균적인 금융완화 수준일 때와 유사한 물가안정 효과를 얻기 위해 금번 인상기에서 어느 정도의 통화정책 충격이 필요한지 추정해 볼 수 있다.

금융완화 정도에 따라 달라지는 통화정책 충격의 효과는 금융완화 수준과 통화정책 충격간의 상호작용을 통해 평가할 수 있다. 이러한 점에 착안하면 아래와 같이 상호작용항을 포함한 국소투영법(local projection: Jordà, 2005)을 이용하여 통화정책 충격이 소비자물가에 미치는 효과를 살펴볼 수 있다.

위 식에서  는 소비자물가지수(로그 변환),

는 소비자물가지수(로그 변환),  는 통화정책 충격을 의미한다.

는 통화정책 충격을 의미한다.  는 정책금리갭으로 측정된 금융완화의 정도로, 통화정책 충격과 상호작용하는 항이다.

는 정책금리갭으로 측정된 금융완화의 정도로, 통화정책 충격과 상호작용하는 항이다.  는

는  의 시차가 적용된 통제변수로, GDP와 유가(WTI)를 사용하였다. 다음으로 통화정책 충격(

의 시차가 적용된 통제변수로, GDP와 유가(WTI)를 사용하였다. 다음으로 통화정책 충격( )은 Bu et al.(2021)이 FOMC 전후 국채 금리 변화를 통해 식별한 자료를 이용하였다. 계수인

)은 Bu et al.(2021)이 FOMC 전후 국채 금리 변화를 통해 식별한 자료를 이용하였다. 계수인  과

과  는 통화정책 자체 및 상호작용에 의한 영향을 나타내는데, 계수가 음의 값을 갖는 경우 금리인상으로 물가가 낮아짐을 의미한다. 분석대상 기간은 Bu et al. (2021)의 통화정책 충격 자료가 가용한 1994년 1분기에서 2020년 4분기까지이다.

는 통화정책 자체 및 상호작용에 의한 영향을 나타내는데, 계수가 음의 값을 갖는 경우 금리인상으로 물가가 낮아짐을 의미한다. 분석대상 기간은 Bu et al. (2021)의 통화정책 충격 자료가 가용한 1994년 1분기에서 2020년 4분기까지이다.

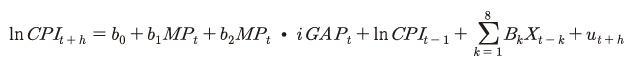

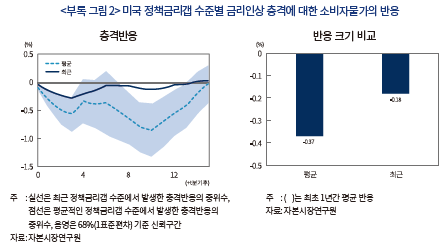

<부록 그림 2>에는 100bp의 정책금리인상 충격이 발생했을 때 소비자물가의 반응이 나타나 있다. 좌측 그림의 점선과 실선은 각각 정책금리갭이 분석기간 동안의 평균 수준인 경우와 2022년 1분기 수준인 경우의 충격반응을 보여준다. 추정 결과에 따르면 충격 발생 후 약 1년간 물가가 통계적으로 유의하게 하락35)하는데, 정책금리갭이 과거 평균 수준인 경우가 하락폭이 크다는 것을 확인할 수 있다. 이는 통화정책 충격이 물가에 미치는 영향이 통화정책의 완화정도(정책금리갭)에 따라 다른데, 현재는 완화 정도가 크기 때문에 효과가 상대적으로 작다는 것을 의미한다.

위 그림에서 우측 막대그래프는 정책금리갭 수준에 따른 통화정책 충격 발생 후 최초 1년간 물가의 충격반응을 비교한다. 여기에서 ‘(평균)’은 과거 평균 수준의 정책금리갭 수준에서, ‘(최근)’은 최근(2022년 1분기) 정책금리갭 수준에서의 물가 하락 효과를 나타낸다. 동 결과에 따르면 최근의 정책금리갭 수준에서 금리인상 충격이 물가에 미치는 연간 효과(-0.18%)가 과거 평균(-0.37%)의 절반 정도라는 점을 알 수 있다. 이는 현재와 같이 금융완화 정도가 높은 상황에서 과거 평균 수준의 효과를 얻기 위해서는, 통상적인 경우에 비해 약 2배의 금리인상 충격이 필요함을 의미한다.

이상의 결과는 연준이 가시적인 물가안정을 위해 큰 폭의 금리인상을 여러 차례 시행할 필요가 크다는 점을 시사한다. 물론 금리인상이 진행됨에 따라 완화 정도가 계속 축소되고 통화정책 강도가 증가함에 따라, 필요한 충격의 크기는 줄어들 수 있다. 하지만 물가상승세 둔화가 확인되기 전까지는 금리인상 속도를 계속 높여 나갈 필요가 있는 것으로 판단된다.

<부록 3> 미국 금리인상 충격에 대한 국내 금리의 반응

1) 2021년 12월 FOMC에서 제시된 금년말 미국 정책금리 전망치는 0.875%였으나, 금년 3월 FOMC 전망치는 1.875%로 크게 상향조정되었다.

2) 일부에서는 양적긴축이 연간 1회(25bp) 금리인상의 효과가 있을 것이라는 견해를 제기하고 있으나, 파월(Powell) 의장이 지적한 바와 같이 양적긴축이 얼만큼의 금리인상 효과가 있을지는 매우 불확실한 것으로 판단된다(FRB, 2022a). 양적긴축의 영향에 대해서는 동 정책이 시행된 이후에 면밀한 분석이 필요한 것으로 판단되므로, 본고에서는 연준 통화정책의 핵심 수단인 정책금리에 초점을 맞추고자 한다.

3) 미국 물가는 CPI 및 Core PCE 상승률이 각각 1981년 이후 최고치인 8.5%(3월)와 5.4%(2월)를 기록하였다. 당초 미국 물가상승은 내구재 등 일부 품목에 대한 수요 증가가 공급 감소와 맞물려 시작되었으나(Tauber & Zandweghe, 2021), 금년에는 상승세가 서비스 품목까지 확산되고 있다. 여기에 러시아-우크라이나 전쟁 및 중국 봉쇄조치로 물가 불확실성이 크게 확대된 상태이다.

4) 잠재성장률과 자연실업률은 물가의 하락·상승 압력을 유발하지 않으며 지속가능한 최대 수준의 경제 산출량(output) 및 고용 수준을 의미하므로 경제의 기초체력으로 볼 수 있다.

5) 정책금리갭은 Neiss & Nelson(2003) 및 Larsen & McKeown(2004) 등 다양한 연구에서 통화정책 강도를 측정하는 변수로 사용된다.

6) 본고에서는 Laubach & Williams(2003), Holston et al.(2007), Lubik & Matthes(2015) 및 Del Negro et al.(2017)에서 산출된 실질중립금리의 평균치를 사용한다.

7) 본문에는 제시되지 않았지만 중앙은행에서 사용도가 높은 Laubach & Williams(2003) 및 Holston et al.(2007)에서 산출된 정책금리갭은 <그림 Ⅱ-2>에 제시된 정책금리갭과 세부 수치에는 다소 차이가 있으나, 매우 유사한 특성을 갖는 것으로 확인되었다.

8) 연준의 경제여건(성장률, 실업률 및 물가상승률)에 따른 정책금리갭 결정은 <부록 그림 1>에 보다 상세히 제시되어 있다. 우선 성장세가 저조하여 GDP갭이 음의 값(GDP<잠재GDP)을 갖거나, 고용여건이 악화되어 실업률갭이 양의 값(실업률>자연실업률)을 가지면, 정책금리를 중립금리보다 낮게 유지한 것으로 확인된다. 반대로 성장세가 확대되어 GDP갭이 양의 값을 갖거나, 고용여건이 개선되어 실업률갭이 음의 값을 가지면, 정책금리를 중립금리보다 높게 인상하여 경기 과열을 방지하였다. 다음으로 물가상승 압력이 높을수록 정책금리갭이 확대되는 경향을 확인할 수 있다.

9) GDP갭과 실업률갭간에는 매우 높은 상관관계(-0.83)가 존재하는 것으로 나타났으며, <표 Ⅱ-2>에 제시된 것처럼 GDP갭보다 실업률갭이 정책금리갭과 높은 상관관계를 가지므로, 정책금리갭 추정시 실업률갭을 사용하였다.

10) 실업률갭은 금년 4월 실업률 3.6%에서 2분기 자연실업률 4.4%을 차감하여 산출하였다.

11) 3월 FOMC에서 제시된 금번 금리인상기의 최종 정책금리 및 중립금리 전망치가 각각 2.8%와 2.4% 수준이므로 정책금리갭은 0.4%(=2.8%-2.4%)가 된다.

12) 1971~1982년까지의 금리인상기에서는 금리를 인상하는 동안 경기침체가 발생하였으므로 추가로 논의하지 않기로 한다.

13) 대표적인 사례로 2015~2018년 인상기를 들 수 있다. 동 시기의 금리인상은 글로벌 금융위기 이후 경제여건이 점진적으로 중립 수준에 근접함에 따라, 정책금리를 중립금리 수준까지 정상화한 과정으로 볼 수 있다(Yellen, 2017). 이로 인해, 당시 정책금리인상은 연준의 명목중립금리 평가치인 2.5% 수준(본고의 정책금리갭 추정치는 –0.2%)에서 종료되었다. <그림 Ⅱ-3>에서 알 수 있듯이 당시 정책금리인상에도 불구하고 성장률이 꾸준히 상승하였으며, GDP갭 또한 점진적으로 확대되었다.

14) 중립금리 수준에서 금리인상이 마무리된 2015~2018년 인상기의 경우, 금리인상 종료 후에도 실업률이 하락세를 유지하였다. 당시 실업률은 금리인상이 종료된 2018년 12월의 3.9%에서 하락세를 유지하여 2020년 2월에는 1970년 이후 최저치인 3.5%를 기록하였다.

15) 1994~1995년 인상기에서는 정책금리갭에 관계없이 금리인상기 동안 Core PCE 상승세가 완화된 것으로 나타났다. 하지만 Core PCE 상승률이 금리인상 이전부터 추세적으로 하락했으므로 물가상승세 축소를 금리인상 효과로 보는데 무리가 있다. Goodfriend(2002)에 따르면 동 시기의 금리인상은 1992년부터 유지된 제로 실질금리로 인플레이션 발생 우려가 증가함에 따라 선제적으로 단행된 금리인상이었다.

16) 1984년에는 금리를 인상하는 동안 Core PCE 상승률이 하락하였다. 하지만 금리인상 이전부터 Core PCE가 추세적으로 하락했다는 점을 감안할 필요가 있다.

17) 금번 금리인상기의 금리인상 속도에 대해서는 <부록 2>를 참고하기 바란다.

18) Kearns et al.(2018)은 47개국(한국 포함)을 선진국(유로ㆍ이외 지역) 2개 그룹과 신흥국(아시아ㆍ남미ㆍ유럽ㆍ이외 지역) 4개 그룹으로 분류하여 이들 6개의 그룹을 대상으로 분석하였다.

19) 금융투자협회 데이터베이스에서 제공하는 금융채I(은행채)/무보증/AAA의 민평 평균 자료를 이용하였다. 점유율 측면에서 대표성이 높은 주요 은행들이 AAA 등급이라는 점을 고려하여 해당 등급을 기준으로 하였다.

20) 한국은행 경제통계시스템에서 제공하는 예금은행의 전체 신규대출에 대한 가중평균 금리로 만기에 따라 구분되지는 않는다.

21) 이는 Gertler & Karadi(2015), Miranda-Agrippino & Ricco(2021) 등 기존 연구에서 잘 알려진 사실이다.

22) Kearns et al.(2018)이 실물 경로(domestic economic condition channel: 무역 의존도), 환율 체제 경로(FX regime channel: 고정 및 변동 환율 여부), 리스크 프리미엄 경로(risk premium channel: 금융 개방도)의 영향에 대해 분석한 결과, 금융개방도가 높아 글로벌 리스크 프리미엄의 전이 정도가 큰 국가일수록 미국 통화정책 충격에 대해 장기금리가 보다 강하게 반응하는 것으로 나타났다.

23) 국가별 금융 개방도를 측정하는 Chinn-Ito 지수에 따르면 우리나라의 금융 개방도는 비교대상 182개국 중 최상위 그룹에 속한다.

24) 장기금리는 위험 중립적인 금리 성분인 기대 단기금리(expected nominal short rate 또는 risk-neutral yield)와 리스크 프리미엄 성분인 기간 프리미엄(term premium)으로 분해될 수 있다. 이와 관련된 자세한 내용은 Adrian et al.(2013) 등에서 다루고 있다.

25) 은행의 가계대출에서 주택담보대출 비중(21.4/4분기 기준)은 58%에 이른다. 주택담보대출 중 변동금리형은 COFIX 금리, 고정금리형(혼합형)은 금융채 5년물에 주로 연동된다.

26) 2010년 1월~2021년 12월의 기업대출(은행 기준) 증가액 중 단기금리에 연동된 운전자금(만기 1년 이내)의 비중은 약 62%에 이른다. 시설자금의 경우에도 3개월이나 6개월 만기의 단기 지표 금리에 주로 연동되는 경향이 있다. 실증 분석에 따르면 기업대출 금리에서 단기금리(COFIX와 3개월 CD 금리 평균)가 반영되는 정도는 장기금리(금융채 AAA 5년물)의 3배 이상으로 월등히 높게 나타난다.

27) 한국은행은 1999년 5월부터 통화정책 방향에서 콜 금리 목표를 구체적으로 제시하였다.

28) 2000년 1월~2022년 3월까지 월별 자료 기준으로 국채 금리가 역전되었을 때 정책금리가 역전된 경우의 비율은 1년물은 100%, 3년물은 97%, 5년물은 82%, 10년물은 50%이다.

29) <표 Ⅳ-1>에 제시되지는 않았지만, 분기별 추이를 보면 이러한 점을 확인할 수 있다.

30) 2006년 역전기의 경우, 당해 6월 정책금리인상 직후 주요 언론은 “Central bank policy-makers raise key rate to 5.25%; some investors see hints of a pause in increases.”(CNN, 2006.6.29, https://money.cnn.com/2006/06/29/news/economy/fed_rates/)로 보도하면서 긴축 감속 신호가 나타났음을 시사한 바 있다. 2018년 역전기에는 FOMC(2018년 12월)의 예상 정책금리 점도표(dot plot)를 통해 그러한 신호가 전달된 바 있다.

31) 기대 단기금리는 뉴욕 연준이 Adrian et. al.(2013)에 따라 추정하여 제공하는 자료이다.

32) 시장참가자들은 미 연준이 당분간 강도 높은 금리인상을 이어갈 것으로 예상하고 있다. 금년말까지 한국은행은 2.75% 수준, 연준은 2.75%를 상회하는 수준으로 정책금리를 인상할 것으로 전망되고 있다. 그리고 미국의 인플레이션 압력이 단기간 내에 크게 약화되지 않는 한, 내년 중 정책금리 역전폭이 추가 확대될 것으로 생각된다.

33) 주요 투자은행들은 금년 한국과 미국의 경제성장률을 각각 2.7% 및 3.0%로 전망(22.4월말 조사 기준, 국제금융센터)하고 있다.

34) 외국인 채권 투자자 중에서는 중앙은행 및 국부펀드 등 중장기 투자자가 2/3 이상(2021년말 기준)을 차지한다.

35) 추정 결과, 충격발생 당시(t=0)는 1%, 1분기 후에는 5%, 2분기 후에는 10% 수준에서 상호작용 항에 대한 계수가 유의한 것으로 나타났다.

참고문헌

Adrian, T., Crump, R. K., Moench, E., 2013, Pricing the term structure with linear regressions, Journal of Financial Economics 110(1), 110-138.

Archibald, J., Hunter, L., 2001, What is the neutral real interest rate, and how can we use it? Reserve Bank of New Zealand Bulletin 64(3).

Bauer, M.D., Rudebusch, G.D., 2021, Interest rates under falling stars, American Economic Review 110(5), 1316-1654.

Bu, C., Rogers, J., Wu, W., 2021, A unified measure of Fed monetary policy shocks, Journal of Monetary Economics 118, 331–349.

Bullard, J., 2022, Removing monetary policy accommodation, Federal Reserve Bank of ST. Louis.

Del Negro, M., Giannoni, M.P., Giannone, D., Tambalotti, A., 2017, Safety, liquidity, and the natural rate of interest, Brookings Papers on Economic Activity Spring 2017.

Dudley, B., 2022. 4. 18, The slower the Fed, the harder the landing, Bloomberg Opinion.

Federal Reserve Board, 2022a, Transcript of Chair Powell’s press conference May 4.

Federal Reserve Board, 2022b, Transcript of Chair Powell’s press conference March 16.

Financial Times, 2022. 4. 13, FirstFT: Fed official says it is ‘fantasy’ to think modest rate rises will tame inflation.

Fischer, S., 2016, Why are interest rates so low? Causes and implications, Federal Reserve Board.

Fisher, J.F., Gourio, F., Krane, S., 2017, Changes in the risk-management environment for monetary policy, Federal Reserve Bank of Chicago Essays on Issues Number 377.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica 55(2), 363-390.

Gertler, M., Karadi, P., 2015, Monetary policy surprises, credit costs, and economic activity, American Economic Journal: Macroeconomics 7(1), 44–76.

Goodfriend, M., 2002, The phase of U.S. monetary policy: 1987 to 2001, Federal Reserve Bank of Richmond Economic Quarterly 88(4).

Hamilton, J. D., Kim, D., 2002, A reexamination of the predictability of economic activity using the yield spread, Journal of Money, Credit and Banking 34(2), 340-360.

Holston, K., Laubach, T., Williams, J.C., 2017, Measuring the natural rate of interest: International trends and determinants, Journal of International Economics 108.

Jordà, Ò., 2005, Estimation and inference of impulse responses by local projections, American Economic Review 95(1), 161-182.

Kaplan, R.S., 2018, The neutral rate of interest, Federal Reserve Bank of Dallas.

Kearns, J., Schrimpf, A., Xia, F. D., 2018, Explaining monetary spillovers: The matrix reloaded, BIS working papers No. 757.

Larsen, J.D., McKeown, J., 2004, The informational content of empirical measures of real interest rate and output gaps for the United Kingdom, Bank of England working paper No. 224.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4).

Lubik, T.A., Matthes, C., 2015, Calculating the natural rate of interest: A comparison of two alternative approaches, Federal Reserve Bank of Richmond Economic Brief 10.

Miranda-Agrippino, S., Ricco, 2021, The transmission of monetary policy shocks, American Economic Journal: Macroeconomics 13(3),74-107.

Neiss, K.S., Nelson, E., 2003, The real-interest-rate gap as an inflation indicator, Macroeconomic Dynamics 7, 239-262.

Powell, J.H., 2016, Recent developments and long-run challenges, Federal Reserve Board.

Powell, J.H., 2022, Restoring price stability, Federal Reserve Board.

Summers, L.H., 2022. 4. 19, The Fed must do much more to fight inflation. And fast time, Washington Post Opinion.

Tauber, K., Zandweghe, W.V., 2021, Why has durable goods spending been so strong during the COVID-19 pandemic?, Federal Reserve Bank of Cleveland Economic Commentary 2021-16.

Wall Street Journal, 2022. 4. 14, Fed’s John Williams says half-point rate rise is reasonable option for may.

Woodford, M., 2003, Interest and Prices: Foundations of a Theory of Monetary Policy, Princeton University Press, Princeton, N.J.

Yellen, J.L., 2017, Inflation dynamics and monetary policy, Federal Reserve Board.

3월 FOMC를 기점으로 미 연준의 금리인상이 본격화되었다. 최근 미국의 물가상승률이 40년래 최고 수준에 이르는 등 인플레이션 위험이 증대되면서 연준이 지속적으로 대응강도를 높여나갈 가능성이 커졌다. 하지만 한편으로는 러시아-우크라이나 전쟁 이후 경기 둔화에 대한 우려가 확산되면서, 금리인상 경로 등에 대한 연준 내외의 이견과 정책 불확실성이 매우 큰 상황이다. 이에 따라 연준의 금리인상 강도와 파급효과에 대해 관심과 우려가 고조되고 있다.

2021년말 이후 연준의 금년말 정책금리 전망치가 이례적인 속도로 급격하게 상향 조정되고 있다.1) 이는 정책기조 전환에서 실기가 있었음을 시사하기도 하지만, 미국 내 물가 및 고용여건이 예기치 않게 급변함에 따라 일부 불가피했던 측면도 있었음을 보여준다. 하지만 결과적으로 연준이 금리인상 속도를 조절할 수 있는 정책대응 여지가 크게 축소되어 가파른 금리인상이 이어질 수 있다는 점은 우려스러운 대목이다.

최근 국내 금융시장을 보면, 시장금리가 가파른 상승세를 나타내는 한편 변동성도 크게 확대되었다. <그림 Ⅰ-1>에 나타난 것처럼 국고채 3년물 금리는 최근 3% 수준까지 급등하였는데, 이는 2013년 이후 최고치에 해당한다. 또한 금리 변동성도 크게 상승하면서 2008년 글로벌 금융위기 이후 최고 수준에 근접하였다. 아울러 신용스프레드도 가파르게 확대되어 대우조선해양 사태 등으로 촉발된 2015년 회사채시장 침체기 및 2020년 팬데믹 위기 당시를 넘어서는 수준에 이르렀다.

이러한 상황에서 연준의 금리인상이 가속화된다면 국내 금융시장에 적지 않은 부담으로 작용할 가능성이 있다. <그림 Ⅰ-2>는 한ㆍ미 금리의 동조화 정도를 나타내는데, 최근 들어 국내 국고채 금리가 미국 금리에 동조화되는 경향이 뚜렷하게 강화되었음을 확인할 수 있다. 이러한 점을 볼 때, 연준의 금리인상 충격이 발생할 경우 이미 가파르게 상승한 국내 시장금리에 추가 상승요인으로 작용할 수 있음을 예상할 수 있다.

Ⅱ. 미국 통화정책 평가

1. 최근 미국 통화정책 관련 주요 논의

연준은 높은 물가상승률3)을 완화하고, 경제확장세 및 고용안정을 유지하기 위해 3월 FOMC에서 정책금리를 25bp(0~0.25% → 0.25~0.5%) 인상한데 이어, 5월에는 50bp(0.25~0.5% → 0.75~1.0%)를 인상하였다. <표 Ⅱ-1>에는 3월 FOMC에서 제시된 연준의 정책금리인상 경로가 정리되어 있다.

한편 연준이 금리인상을 통해 경기침체를 유발하지 않고 물가를 안정시킬 수 있을지에 대해서도 논란이 커지고 있다. 연준은 강한 거시경제 상황을 감안할 때, 경기확장세를 크게 훼손하지 않고 물가를 안정시킬 수 있을 것으로 기대하고 있다. 하지만 일부에서는 현재의 물가수준이 과도하게 높기 때문에 물가안정과 고용안정을 동시에 추구하는 정책 방향은 적절하지 않으며, 신속한 금리인상을 통해 물가를 하락시키는 데 집중할 필요가 있다는 의견을 제시하고 있다(Dudley, 2022.4.18; Summers, 2022.4.19).

2. 연준 통화정책 평가: 금리인상 강도

가. 중립금리의 개념 및 통화정책 함의

본 절에서는 연준 정책금리인상 경로의 준거로 다루어지는 중립금리의 개념과 통화정책적 활용에 대해 살펴본다. 실질중립금리(neutral real interest rate)는 경제가 잠재성장세만큼 성장하고 고용여건이 완전고용(자연실업률 수준의 실업률)에 도달하였으며, 물가가 안정된 상태에서의 단기실질금리로 정의된다(Laubach & Williams, 2003). 다시 말해 실질중립금리는 자본과 노동 등 생산요소의 활용이 균형수준(잠재수준)에서 이루어져 유휴생산능력(economic slack)이 존재하지 않는 상태, 즉 GDP갭(실제GDP-잠재GDP)과 실업률갭(실제실업률-자연실업률)이 제로이며, 물가는 상승 또는 하락 압력 없이 안정된 균형상태(경제의 기초체력)4)에 부합하는 실질균형금리(equilibrium real interest rate)를 의미한다.

이론적으로는 경기가 변동하는 과정에서 단기실질금리가 실질중립금리보다 높아지면, 저축이 증가(소비 감소)하고 투자가 감소하여 총수요가 억제된다. 그 결과 경기가 위축되고 고용이 감소하면서 물가가 하락 압력을 받게 된다(Woodford, 2003; Larsen & McKeown, 2004). 이러한 내용은 <그림 Ⅱ-1>에 정리되어 있다.

따라서 중앙은행은 경기 과열이 우려되면, 실질정책금리를 실질중립금리보다 높게 인상하여 경제활동을 억제하고 물가상승 압력을 완화할 수 있다. 반대로 경제활동이 지속적으로 잠재수준에 미치지 못할 것으로 평가되면, 정책금리를 중립금리 이하로 인하함으로써, 총수요를 진작하여 경기를 부양하고 디플레이션을 방지할 수 있다(Archibald & Hunter, 2001; Fischer, 2016; Powell, 2016).

나. 금번 정책금리인상기의 금리인상 강도 평가

본 절에서는 연준이 경제여건(성장률, 실업률 및 물가상승률)의 변화에 따라 통화정책 강도를 어떻게 조절해 왔는지 알아보고, 최근 경제여건을 고려할 때 예상할 수 있는 금리인상 강도를 평가해 본다. 다음으로, 과거 금리인상기를 대상으로 금리인상 강도가 경제여건의 변화에 미친 영향을 살펴본다. 특히 여기에서는 물가상승률 변화에 초점을 맞추어 통화정책의 경기 조절 효과를 종합적으로 평가한다. 이를 통해 금번 금리인상기의 최종 정책금리 수준이 중립금리를 상회해야 할 필요성을 평가한다.

본고에서는 실질정책금리에서 실질중립금리를 차감하여 산출되는 실질정책금리갭을 통해 통화정책 강도를 파악한다.5) 여기서 실질정책금리는 연준이 결정하는 명목정책금리에서 기대물가상승률를 차감하여 도출한다. 실질중립금리는 관찰되지 않으므로 경제모형을 통해 추정해야 하는데, 본 연구에서는 Bauer & Rudebusch(2021)의 접근법을 채택하여 실질중립금리에 대한 대표적 모형에서 산출된 실질중립금리의 평균치를 사용한다.6) 다음으로 기대물가상승률은 Holston et al.(2007) 방법에 따라 과거 4분기 동안의 전분기 대비 Core PCE 상승률 평균치를 적용한다. 실질정책금리갭과 명목정책금리갭은 모두 중립금리와 정책금리의 차이를 나타내므로 이하에서는 정책금리갭(기준금리갭)으로 통칭한다.

한편 정책금리갭은 경제여건과 밀접히 연관된 것으로 나타났는데8), <표 Ⅱ-2>에는 정책금리갭과 GDP갭, 실업률갭 및 물가상승률간 상관관계가 요약되어 있다. 동 상관관계를 이용하면 최근 경제여건에 부합하는 정책금리갭 수준을 대략적으로 추정해 볼 수 있다.

첫째, <그림 Ⅱ-3>에서 알 수 있듯이, 금리를 인상하더라도 정책금리가 중립금리보다 낮을 경우(음의 정책금리갭)에는 대체로 성장세가 확대되고 GDP갭이 증가하였다.13) 반면 정책금리가 중립금리를 상회하는 수준(양의 정책금리갭)까지 인상될 경우에는 금리를 인상하는 동안 또는 금리인상이 마무리된 직후부터 성장률이 하락하고 GDP갭이 축소되었음을 알 수 있다. 따라서, 중립금리 수준 이하에서 이루어지는 금리인상은 경기 위축을 유발하지 않는 것으로 볼 수 있으며, 정책금리가 중립금리보다 높아야 본격적인 긴축 효과가 나타나는 것으로 이해할 수 있다.

둘째, <그림 Ⅱ-4>에서 확인할 수 있듯이, 실업률과 실업률갭은 정책금리갭이 음의 값을 유지하는 동안 하락세를 나타냈다. 정책금리갭이 양의 값을 갖는 동안에도 감소세가 유지되었으며, 금리인상 종반부 또는 금리인상이 종료된 직후에 상승세로 전환하는 경향을 확인할 수 있다. <그림 Ⅱ-3>과 <그림 Ⅱ-4>를 비교해 보면, 실업률은 성장률보다 시차를 두고 정책금리인상에 반응하는 것으로 파악할 수 있다.14)

한편 금리인상이 종료된 후(종료 후 4분기 기준)에는 Core PCE 및 CPI 모두 상승세 둔화가 비교적 일관되게 나타나는 것으로 확인되었다. 우선 Core PCE의 경우 금리인상이 종료된 후에는 대부분 상승률이 낮아진 것으로 나타났다. 다만, 일부 인상기를 제외할 경우 둔화폭이 크지 않은 것을 알 수 있다. 물가상승률이 큰 폭으로 하락한 사례로는 1988~1989년 인상기를 들 수 있다. 당시 금리인상 종료시점의 Core PCE 상승률이 4.65%에 달하였으나, 4분기 후에는 3.77% 수준까지 하락하였다. 그런데, 동 시기의 경우 물가상승률이 현재 수준에 미치지 못함에도 긴축의 강도가 매우 강해, 금리인상기의 최종 정책금리갭이 2%에 달했다는 점에 주목할 필요가 있다. CPI 상승률 또한 금리인상이 마무리된 후에는 대부분 하락한 것으로 나타났으나, Core PCE에 비해 둔화세가 지속되지 않는 경우가 많은 것을 확인할 수 있다. 이와 같은 현상은 유가 변동을 원인으로 볼 수 있는데, <그림 Ⅱ-5>에 나타난 것처럼 CPI 상승률은 유가 추이에 밀접하게 연관된 것으로 판단된다.

지금까지 살펴본 금리인상 강도에 따른 경제여건의 변화를 정리하면 <표 Ⅱ-4>와 같은데, 대체로 <그림 Ⅱ-1>에 제시된 관계에 부합하는 것으로 판단된다. 즉, 금리인상기일지라도 정책금리가 중립금리보다 낮은 수준에 머문다면, 성장률이 확대(GDP갭 확대)되어 실업률은 하락(실업률갭 축소)하고 물가상승세가 확대되는 경향이 확인되었다. 다음으로, 정책금리를 중립금리보다 높은 수준까지 인상하는 통화긴축 상태에 진입하면, 경기가 위축되어 성장률이 감소(GDP갭 감소)하는 경향이 존재한다. 실업률과 물가상승률은 성장률보다 늦게 통화긴축에 반응하는데, 특히 물가의 경우 통화정책 강도와 관계없이 정책금리인상이 마무리된 후에야 상승세가 축소된다. 이는 정책금리를 중립금리 이상으로 인상하더라도 물가상승세가 완화되기까지 상당한 시간이 필요할 수 있음을 시사한다.

미국 경제가 강한 성장세를 보이고 있으나, 최근과 같이 높은 물가상승률이 지속되면 경제에 미치는 부작용이 적지 않을 것으로 예상된다. 따라서 금번 금리인상의 목표는 물가상승세의 점진적 둔화가 아닌 조속한 하향 안정화에 있어야 할 것이다. 본고의 분석에 따르면, 연준의 금리인상 강도 및 속도가 크게 강화될 필요가 있는 것으로 판단된다.

우선, 정책금리가 중립금리보다 낮을 때에는 물가상승세가 확대되는 경향이 있다는 점을 감안할 때, 파월의장 등이 제시한 중립금리 수준의 정책금리는 물가상승세 완화를 위한 최소한의 필요조건인 것으로 판단된다. 더구나 1970년 이후 사례를 고려할 때, 정책금리를 중립금리보다 높게 인상하더라도 긴축의 강도가 대폭 강화되지 않는 한, 물가상승률이 외생적 요인에 의해 약화되지 않으면 금리인상기 내에서는 물가안정이 용이하지 않을 가능성이 있다. 이런 관점에서 볼 때, 금번 금리인상기의 최종 정책금리가 연준이 3월 FOMC에서 전망한 수준보다 큰 폭으로 중립금리를 상회할 가능성이 있다. 아울러 최근 미국의 금융여건이 과도하게 완화적인데다 금리인상이 늦게 시작되었기 때문에, 역사적인 기준으로 보더라도 금리인상 속도가 통상적인 인상폭인 25bp를 상회할 필요가 큰 상황이다.17)

이상을 종합하면, 단기간내 물가안정이 가시화되지 않는다면 연준이 예상보다 큰 폭으로, 더 빠르게 금리를 인상하는 통화정책 충격이 반복될 가능성이 있는 것으로 판단된다. 미국발 통화정책 충격은 우리나라와 신흥국 경제에 작지 않은 영향을 줄 것으로 예상된다. 이에 다음 장에서는 연준의 통화정책 충격이 국내 금리 및 신용시장 여건에 미치는 영향에 대해 살펴본다.

Ⅲ. 국내 금리에 대한 영향

본 장에서는 미 연준의 통화정책이 국내 금리에 미치는 영향과 시사점에 대해 논의한다. Kearns et al.(2018)은 다수의 국가를 대상으로 미국, ECB 등 주요국 중앙은행의 통화정책이 유발하는 대외 파급효과를 분석한 바 있다. 동 연구에 따르면, 미국의 통화정책 충격에 대해 여타 국가의 시장금리는 차별화된 반응을 보이는데, 전반적으로 단기금리보다는 장기금리가 상대적으로 크게 반응하는 것으로 나타났다. 다만, Kearns et al.(2018)은 국가 그룹별18) 평균 효과만을 제시하고 있기 때문에 국내 금리에 미치는 영향을 구체적으로 평가하기 어렵다는 한계가 있었다. 본 장의 분석은 국내 금리에 대한 파급 효과에 초점을 맞춤으로써 그러한 제약을 보완하여 보다 시의성 있는 결과를 제시할 수 있을 것이다.

1. 분석 모형

연준의 통화정책이 국내 금리에 미치는 영향은 만기별 국고채 금리, 회사채 금리, COFIX 및 금융채 금리, 가계대출 금리 등의 충격반응을 통해 분석한다. 통화정책 충격으로는 Bu et al.(2021)이 FOMC 전후 미 국채 금리 변화를 통해 식별한 자료를 이용하였다. 동 분석에서 국고채는 1ㆍ3ㆍ5ㆍ10년물, 회사채는 3년물 AA-등급을 대상으로 하였다. 금융채의 경우, 주택담보대출 등에서 지표 금리로 적용되는 은행채 5년물(AAA등급)19)의 금리가 사용된다. 그리고 COFIX 및 금융채 금리와 연관지어 가계 및 기업대출 금리(신규취급액, 예금은행 기준)20)의 반응도 분석한다.

각 금리 지표들의 충격반응은 아래의 모형을 바탕으로 Jordà(2005)의 국소투영법(local projection)을 이용하여 추정된다.

2. 국고채 금리

<그림 Ⅲ-1>은 미국 정책금리 100bp 인상 충격에 해당하는 긴축 충격 발생 시 만기별 국고채 금리의 반응을 나타내고 있다. 좌측 상단부터 우측 하단까지의 그림에는 1ㆍ3ㆍ5ㆍ10년물의 충격반응이 제시되어 있다. 먼저, 여기에서는 연준의 금리인상 충격 발생 시 각 국고채 금리는 단기적으로 유의하게 상승한다는 점을 확인할 수 있다. 각 국고채 금리는 공통적으로 금리인상 충격이 발생한 당시(t=0) 가장 큰 반응을 나타나는데, 최대 충격반응은 1년물은 +14bp, 3년물은 +30bp, 5년물은 +37bp, 10년물은 +37bp로 추정된다.

이러한 특징과 관련하여, Kearns et al.(2018)은 연준의 통화정책 충격이 주로 리스크 프리미엄 경로를 통해 여타 국가의 장단기금리차를 확대시키는 것으로 분석하였다.22) 동 연구에 따르면, 금융개방도가 높은 국가일수록 글로벌 위험추구(risk appetite) 및 금융상황에 크게 영향 받으면서 장기금리가 미국의 통화정책에 크게 반응하는 것으로 추정되었다. 국내 금융시장의 개방도가 상당히 높다는 점23)을 감안하면, 리스크 프리미엄 경로의 중요성을 강조한 Kearns et al. (2018)의 설명이 유효한 것으로 판단된다. 그리고 이러한 점은 연준의 통화정책 충격이 주로 기간 프리미엄을 통해 국내 장기금리에 영향을 미치는 것으로 풀이된다.24) 그래서, 만약 미국의 금리인상 충격이 리스크 프리미엄을 통해 영향을 준다면, 이를 반영하는 기간 프리미엄 상승을 통해 국내 장기금리를 높이는 것으로 생각할 수 있다.

3. 회사채 및 금융채ㆍCOFIX 금리

본 절에서는 연준의 금리인상 충격 발생 시 회사채와 금융채 등 여타 시중금리의 반응을 분석한 결과에 대해 논의한다. 먼저 <그림 Ⅲ-2>의 좌측 그림은 미국 정책금리 100bp 인상 충격 발생 시 회사채 금리의 반응을 나타내고 있다. 회사채 금리는 충격 발생 당시(t=0) 약 50bp 상승하였다가 이후 점진적으로 낮아지는 모습을 보인다. 회사채의 반응은 동일 만기의 국고채(3년물)보다 크게 나타나는데, 이에 따라 미국의 금리인상 충격 발생 시 회사채와 국고채 금리의 격차인 신용 스프레드도 확대된다(<그림 Ⅲ-2> 우측).

은행의 자금조달 비용이 증가할 경우 대출 금리도 상승 압력을 받게 된다. 특히 가계대출의 상당 부분을 차지하는 주택담보대출의 경우, 주로 금융채 5년물 및 COFIX 금리에 연동25)되어 결정된다. 따라서 전술된 결과는 미국의 금리인상 충격이 궁극적으로 가계대출 금리에도 영향을 줄 수 있다는 점을 시사한다.

이러한 사실은 <그림 Ⅲ-4>에 제시된 가계대출 금리의 충격반응을 통해 직접적으로 확인할 수 있다. 이 그림은 연준의 금리인상 충격 발생 시(t=0) 가계대출 금리가 35bp 내외 유의하게 상승함을 보여준다. 가계대출 금리는 만기 구분 없이 전체 신규 대출의 평균 금리(금액 가중)를 적용했기 때문에 금융채 금리 등과의 스프레드를 직접 비교하기는 어렵다. 다만, 대체로 COFIX와 금융채 금리 상승폭 사이의 크기를 나타내면서 두 지표 금리의 움직임을 평균적으로 반영하는 것으로 보인다.

Ⅳ. 미 연준의 통화정책과 내외 금리차

금융 개방도가 높은 국내 금융시장의 특성상, 내외 금리차는 채권 자금을 중심으로 자본유출입에 영향을 줄 수 있다. 특히 최근 연준의 긴축 강도가 커질 것으로 예상되면서 한ㆍ미 간 내외 금리차 및 금리 역전 여부에 대한 관심이 높아지고 있다. 본 장에서는 금리 역전이 발생했던 과거 사례에 대해 분석하고, 이를 바탕으로 향후 한ㆍ미 간 금리 역전 가능성에 대해 논의해 보고자 한다.

1. 과거 사례: 주요 내외 금리 역전기

내외 금리 역전은 일시적인 충격보다는 통화정책의 기조에 주로 영향을 받는 것으로 판단된다. 통화정책 지표인 정책금리의 경우, 한국은행이 금리 중심의 통화정책27) 운영으로 전환한 이래 크게 3개의 기간에서 한ㆍ미 간 역전이 발생한 것으로 볼 수 있다. 그 시기는 1999년 7월~2001년 3월, 2005년 7월~2007년 8월, 2018년 3월~2020년 2월로, <그림 Ⅳ-1>의 음영으로 표시된 구간에 해당한다.

여기에서는 2006년 5~10월(이하 ‘2006년 역전기’)과 2018년 3월~2020년 1월(이하 ‘2018년 역전기’)의 두 기간이 정책금리부터 5년 이상의 장기금리가 역전된 시기에 해당한다. 2006년 역전기의 경우 장기금리 역전 이전에 정책금리 역전이 선행되고, 장기간 지속되었다는 점이 특징이다. 다만, 당시 10년물의 역전은 발생하지 않았고 장단기금리가 모두 역전된 기간이 짧은 편이다. 반면, 2018년 역전기의 경우 정책금리 역전 직전에 1년물에서 10년물까지의 만기 구간에서 국채 금리가 이미 역전되었고 이것이 장기간 지속되었다는 점이 두드러진다.

다음으로 최대 역전폭을 보면, 2018년 역전기 당시 정책금리의 최대 역전폭은 여타 기간에 비해 더 크지는 않지만, 국채 금리의 최대 역전폭은 더 큰 편이다. 2018년 역전기에 한ㆍ미 정책금리는 최대 100bp(미국은 목표 범위 상단 기준) 역전되었고, 1년물 및 5년물의 최대 역전폭은 각각 88bp 및 90bp로 나타났다. 2006년 역전기에도 한ㆍ미 정책금리는 최대 100bp 역전되었지만 1년물 및 5년물의 최대 역전폭은 46bp 및 7bp로 2018년에 비해 작은 수준이다. 여타 기간과 비교할 때, 2018년 역전기의 경우 미국에 대비한 국내 성장률 및 물가상승률이 상대적으로 낮았던 기간이다. 이러한 거시경제 상황이 금리에 반영되면서 역전폭이 확대되는 데 영향을 준 것으로 판단된다. 또한, 당시 연준의 양적긴축이 진행되면서 미 장기금리에 상승 압력이 존재했던 점도 장기금리의 역전폭 확대에 영향을 미친 것으로 볼 수 있다.

<표 Ⅳ-1>의 마지막 행에는 정책금리 역전 발생 시 외국인의 채권투자자금 유출입액이 제시되어 있다. 2006년 및 2018년 역전기의 경우, 정책금리가 최대 100bp까지 역전되기는 했으나 외국인의 채권투자자금은 오히려 유입된 것으로 나타났다. 특히 2018년의 경우, 장단기 내외 금리가 역전된 기간이 2년 가까이 지속되었지만 이 기간 중 외국인의 채권투자자금은 약 390억달러 유입되었다. 이러한 순유입은 외국인의 채권투자자금이 금리 역전 초반에 유출되었다가 역전 종반에 대규모 유입으로 반전된 데 따른 것이 아니라, 자금 유입이 전반적으로 지속된 데 따른 결과로 보인다.29)

2. 향후 내외 금리 역전 가능성

본 절에서는 앞서 살펴본 과거 사례를 바탕으로 향후 내외 금리 역전 가능성과 전개 방향에 대해 논의한다. <그림 Ⅳ-4>는 최근 한ㆍ미 내외 금리차 추이를 각 만기별로 나타내고 있다. 내외 금리차는 전반적으로 축소되고 있는 모습을 보이고 있는데, 국채 1년 및 3년물 금리는 금년 3~5월 및 3월 중에 각각 일시적으로 역전된 바 있다. 5년 이상 장기금리도 작년 4분기 초에 비해 양국 간 격차가 상당폭 축소된 것으로 보인다.

장기금리의 경우 역전될지 여부가 상대적으로 불투명하지만, 2018년보다는 2006년 역전기에 가까운 형태(단기금리 역전 이후 장기금리 역전)로 역전될 가능성이 큰 것으로 생각된다. 최근 금융ㆍ경제 상황을 보면, 일부 여건은 오히려 2018년 역전기와 비슷한 측면이 있다는 점은 사실이다. 즉, 금년 미국의 성장률33)과 물가상승률이 한국보다 높을 것으로 전망되고, 연준의 금리인상과 양적긴축이 함께 진행될 것이라는 점은 2018년 역전기와 유사한 부분이다. 하지만 소비와 생산 위축으로 미국 경제가 침체(recession)에 빠질 수 있다는 우려가 상존하고 있어 이것이 미국 장기금리 상승을 제약하고 있는 것으로 보인다. 이러한 점을 고려할 때 한·미 장기금리가 단기금리만큼 빠르게 역전되지는 않을 것으로 판단된다. 하지만, 연준의 금리인상이 미국 경제의 연착륙을 유도하는 가운데 경기침체에 대한 우려가 조기에 불식된다면 장기금리가 이른 시기에 역전될 가능성도 있다.

앞 절의 사례 분석에 따르면, 미 연준의 가파른 금리인상이 이어지는 상황에서는 한·미 국채 금리가 역전되고 역전폭도 한동안 확대되었던 것으로 나타났다. 이에 비추어 볼 때 향후 단기금리를 중심으로 국채 금리가 역전될 경우, 내외금리 역전은 연준의 금리인상이 종료된 이후에 해소될 수 있을 것으로 판단된다. 다만, 장단기 내외 금리 역전이 발생하더라도 단지 동 요인으로 인해 외국인의 채권투자자금이 대규모로 유출될 것이라 단정하기는 어렵다. 앞서 살펴본 것처럼, 2006년 역전기와 2018년 역전기의 경우 내외 금리 역전 시에도 채권투자자금은 오히려 유입된 바 있다. 외국인의 국내 채권투자가 장기 투자 중심34)으로 변화했다는 점을 고려하면 내외 금리차보다는 국가 신인도와 거시경제의 안정성 등이 채권자금의 유출입에 상대적으로 큰 영향을 줄 것으로 생각된다.

Ⅴ. 요약 및 시사점

미 연준의 금리인상 경로에 대한 불확실성이 커지고 있다. 본고의 분석에 따르면 연준의 금리인상 강도가 크게 강화될 가능성이 있는 것으로 나타났다. 현재의 높은 물가상승률을 고려하면 중립금리 수준의 정책금리로는 물가안정을 기대하기 쉽지 않은 상황이다. 그리고 정책금리를 중립금리보다 높게 인상하더라도 긴축의 강도가 크게 강화될 필요가 있는 것으로 분석되었다. 아울러 연준의 대응이 늦어진 만큼, 외생적 요인에 의해 물가상승세가 완화되지 않으면, 가파른 속도로 중립금리를 크게 상회하는 수준까지 금리가 인상되고, 이 과정에서 통화정책 충격이 반복될 가능성이 존재한다.

이상과 같이 연준의 긴축이 예상보다 높은 강도로 진행될 경우 단기적으로 국내 금융시장에 충격으로 작용하게 될 전망이다. 연준의 금리인상 충격은 일차적으로 장기 구간을 중심으로 국고채 금리를 상승시키고, 회사채와 COFIX, 은행채 금리 등 시중금리에도 상승 압력을 유발하는 것으로 나타났다. 그리고 주요 지표 금리의 반응에 따라 이에 연동된 가계 및 가계대출 금리도 유의하게 높아지는 것으로 분석되었다. 이러한 결과는 미 연준의 금리인상 충격이 국내 금융상황에도 긴축적으로 작용하면서 금융비용이 광범위하게 상승하게 된다는 점을 의미한다.

아울러 연준의 긴축이 지속될 경우, 한ㆍ미 정책금리뿐만 아니라 1년물 등 단기금리를 중심으로 국채 금리도 역전될 가능성이 높은 것으로 판단된다. 하지만, 외국인 증권 투자에서 주식의 비중이 높고, 채권 투자에서 장기 투자자의 비중이 높아 내외 금리차가 전체 자본 유출입에 미치는 영향은 크지 않을 것으로 생각된다. 다만, 경기의 하방 위험이 커지고 있는 상황에서 연준의 긴축이 가세할 경우, 국내 금융시장에 대한 외국인들의 투자 유인이 전반적으로 약화될 가능성이 있으므로 이에 유의할 필요가 있을 것이다.

최근 국내외 경기 둔화에 대한 우려가 증대되면서 가계의 소득과 기업의 실적 전망이 밝지만은 않아 보인다. 이러한 여건 하에서 연준의 긴축 충격으로 국내 금융상황이 악화된다면 경제 주체들의 자금조달에 애로와 부담이 가중될 수 있다. 따라서 필요한 경우에는 적극적인 정책 대응을 통해 동 충격을 완충해야 할 것으로 생각된다. 특히, 국내 금리가 금융ㆍ경제 여건에 비해 과도하게 상승하거나 금융시장의 변동성이 지나치게 확대될 경우, 국고채 매입이나 유동성 공급 등을 통해 시장의 안정을 도모할 필요가 있을 것이다. 아울러 금융시장의 잠재적인 불안 요소를 점검하고 이것이 실물 부문으로 전이될 가능성에 유의하면서 대응 방안을 준비해 나가야 할 것으로 판단된다.

<부록 1> 경제여건에 따른 연준의 정책금리갭 결정

금번 금리인상은 금융완화의 정도가 과도한 상황에서 늦게 시작된 만큼, 통상적인 경우보다 한층 가파르게 금리가 인상될 것으로 예상된다. 이에 아래에서는 금번 금리인상이 과거보다 얼마나 빠른 속도로 진행될 수 있는지를 살펴본다. 편의상 정책금리갭에 의해 측정되는 통화정책 강도를 금융완화의 정도로 표현한다.

금번에 예상되는 정책금리인상 속도는 연준이 시장의 기대보다 빠르게 금리를 인상하는 통화정책 충격(monetary policy shock)의 효과를 통해 분석할 수 있다. 구체적으로 금융완화 정도에 따라 통화정책 충격이 소비자물가(CPI) 변화에 미치는 영향을 분석하고, 금번 및 통상(평균)적인 금융완화 여건에서 물가에 대한 영향을 비교한다. 이를 통해, 평균적인 금융완화 수준일 때와 유사한 물가안정 효과를 얻기 위해 금번 인상기에서 어느 정도의 통화정책 충격이 필요한지 추정해 볼 수 있다.

금융완화 정도에 따라 달라지는 통화정책 충격의 효과는 금융완화 수준과 통화정책 충격간의 상호작용을 통해 평가할 수 있다. 이러한 점에 착안하면 아래와 같이 상호작용항을 포함한 국소투영법(local projection: Jordà, 2005)을 이용하여 통화정책 충격이 소비자물가에 미치는 효과를 살펴볼 수 있다.

<부록 그림 2>에는 100bp의 정책금리인상 충격이 발생했을 때 소비자물가의 반응이 나타나 있다. 좌측 그림의 점선과 실선은 각각 정책금리갭이 분석기간 동안의 평균 수준인 경우와 2022년 1분기 수준인 경우의 충격반응을 보여준다. 추정 결과에 따르면 충격 발생 후 약 1년간 물가가 통계적으로 유의하게 하락35)하는데, 정책금리갭이 과거 평균 수준인 경우가 하락폭이 크다는 것을 확인할 수 있다. 이는 통화정책 충격이 물가에 미치는 영향이 통화정책의 완화정도(정책금리갭)에 따라 다른데, 현재는 완화 정도가 크기 때문에 효과가 상대적으로 작다는 것을 의미한다.

이상의 결과는 연준이 가시적인 물가안정을 위해 큰 폭의 금리인상을 여러 차례 시행할 필요가 크다는 점을 시사한다. 물론 금리인상이 진행됨에 따라 완화 정도가 계속 축소되고 통화정책 강도가 증가함에 따라, 필요한 충격의 크기는 줄어들 수 있다. 하지만 물가상승세 둔화가 확인되기 전까지는 금리인상 속도를 계속 높여 나갈 필요가 있는 것으로 판단된다.

<부록 3> 미국 금리인상 충격에 대한 국내 금리의 반응

1) 2021년 12월 FOMC에서 제시된 금년말 미국 정책금리 전망치는 0.875%였으나, 금년 3월 FOMC 전망치는 1.875%로 크게 상향조정되었다.

2) 일부에서는 양적긴축이 연간 1회(25bp) 금리인상의 효과가 있을 것이라는 견해를 제기하고 있으나, 파월(Powell) 의장이 지적한 바와 같이 양적긴축이 얼만큼의 금리인상 효과가 있을지는 매우 불확실한 것으로 판단된다(FRB, 2022a). 양적긴축의 영향에 대해서는 동 정책이 시행된 이후에 면밀한 분석이 필요한 것으로 판단되므로, 본고에서는 연준 통화정책의 핵심 수단인 정책금리에 초점을 맞추고자 한다.

3) 미국 물가는 CPI 및 Core PCE 상승률이 각각 1981년 이후 최고치인 8.5%(3월)와 5.4%(2월)를 기록하였다. 당초 미국 물가상승은 내구재 등 일부 품목에 대한 수요 증가가 공급 감소와 맞물려 시작되었으나(Tauber & Zandweghe, 2021), 금년에는 상승세가 서비스 품목까지 확산되고 있다. 여기에 러시아-우크라이나 전쟁 및 중국 봉쇄조치로 물가 불확실성이 크게 확대된 상태이다.

4) 잠재성장률과 자연실업률은 물가의 하락·상승 압력을 유발하지 않으며 지속가능한 최대 수준의 경제 산출량(output) 및 고용 수준을 의미하므로 경제의 기초체력으로 볼 수 있다.

5) 정책금리갭은 Neiss & Nelson(2003) 및 Larsen & McKeown(2004) 등 다양한 연구에서 통화정책 강도를 측정하는 변수로 사용된다.

6) 본고에서는 Laubach & Williams(2003), Holston et al.(2007), Lubik & Matthes(2015) 및 Del Negro et al.(2017)에서 산출된 실질중립금리의 평균치를 사용한다.

7) 본문에는 제시되지 않았지만 중앙은행에서 사용도가 높은 Laubach & Williams(2003) 및 Holston et al.(2007)에서 산출된 정책금리갭은 <그림 Ⅱ-2>에 제시된 정책금리갭과 세부 수치에는 다소 차이가 있으나, 매우 유사한 특성을 갖는 것으로 확인되었다.

8) 연준의 경제여건(성장률, 실업률 및 물가상승률)에 따른 정책금리갭 결정은 <부록 그림 1>에 보다 상세히 제시되어 있다. 우선 성장세가 저조하여 GDP갭이 음의 값(GDP<잠재GDP)을 갖거나, 고용여건이 악화되어 실업률갭이 양의 값(실업률>자연실업률)을 가지면, 정책금리를 중립금리보다 낮게 유지한 것으로 확인된다. 반대로 성장세가 확대되어 GDP갭이 양의 값을 갖거나, 고용여건이 개선되어 실업률갭이 음의 값을 가지면, 정책금리를 중립금리보다 높게 인상하여 경기 과열을 방지하였다. 다음으로 물가상승 압력이 높을수록 정책금리갭이 확대되는 경향을 확인할 수 있다.

9) GDP갭과 실업률갭간에는 매우 높은 상관관계(-0.83)가 존재하는 것으로 나타났으며, <표 Ⅱ-2>에 제시된 것처럼 GDP갭보다 실업률갭이 정책금리갭과 높은 상관관계를 가지므로, 정책금리갭 추정시 실업률갭을 사용하였다.

10) 실업률갭은 금년 4월 실업률 3.6%에서 2분기 자연실업률 4.4%을 차감하여 산출하였다.

11) 3월 FOMC에서 제시된 금번 금리인상기의 최종 정책금리 및 중립금리 전망치가 각각 2.8%와 2.4% 수준이므로 정책금리갭은 0.4%(=2.8%-2.4%)가 된다.

12) 1971~1982년까지의 금리인상기에서는 금리를 인상하는 동안 경기침체가 발생하였으므로 추가로 논의하지 않기로 한다.

13) 대표적인 사례로 2015~2018년 인상기를 들 수 있다. 동 시기의 금리인상은 글로벌 금융위기 이후 경제여건이 점진적으로 중립 수준에 근접함에 따라, 정책금리를 중립금리 수준까지 정상화한 과정으로 볼 수 있다(Yellen, 2017). 이로 인해, 당시 정책금리인상은 연준의 명목중립금리 평가치인 2.5% 수준(본고의 정책금리갭 추정치는 –0.2%)에서 종료되었다. <그림 Ⅱ-3>에서 알 수 있듯이 당시 정책금리인상에도 불구하고 성장률이 꾸준히 상승하였으며, GDP갭 또한 점진적으로 확대되었다.

14) 중립금리 수준에서 금리인상이 마무리된 2015~2018년 인상기의 경우, 금리인상 종료 후에도 실업률이 하락세를 유지하였다. 당시 실업률은 금리인상이 종료된 2018년 12월의 3.9%에서 하락세를 유지하여 2020년 2월에는 1970년 이후 최저치인 3.5%를 기록하였다.

15) 1994~1995년 인상기에서는 정책금리갭에 관계없이 금리인상기 동안 Core PCE 상승세가 완화된 것으로 나타났다. 하지만 Core PCE 상승률이 금리인상 이전부터 추세적으로 하락했으므로 물가상승세 축소를 금리인상 효과로 보는데 무리가 있다. Goodfriend(2002)에 따르면 동 시기의 금리인상은 1992년부터 유지된 제로 실질금리로 인플레이션 발생 우려가 증가함에 따라 선제적으로 단행된 금리인상이었다.

16) 1984년에는 금리를 인상하는 동안 Core PCE 상승률이 하락하였다. 하지만 금리인상 이전부터 Core PCE가 추세적으로 하락했다는 점을 감안할 필요가 있다.

17) 금번 금리인상기의 금리인상 속도에 대해서는 <부록 2>를 참고하기 바란다.

18) Kearns et al.(2018)은 47개국(한국 포함)을 선진국(유로ㆍ이외 지역) 2개 그룹과 신흥국(아시아ㆍ남미ㆍ유럽ㆍ이외 지역) 4개 그룹으로 분류하여 이들 6개의 그룹을 대상으로 분석하였다.

19) 금융투자협회 데이터베이스에서 제공하는 금융채I(은행채)/무보증/AAA의 민평 평균 자료를 이용하였다. 점유율 측면에서 대표성이 높은 주요 은행들이 AAA 등급이라는 점을 고려하여 해당 등급을 기준으로 하였다.

20) 한국은행 경제통계시스템에서 제공하는 예금은행의 전체 신규대출에 대한 가중평균 금리로 만기에 따라 구분되지는 않는다.

21) 이는 Gertler & Karadi(2015), Miranda-Agrippino & Ricco(2021) 등 기존 연구에서 잘 알려진 사실이다.

22) Kearns et al.(2018)이 실물 경로(domestic economic condition channel: 무역 의존도), 환율 체제 경로(FX regime channel: 고정 및 변동 환율 여부), 리스크 프리미엄 경로(risk premium channel: 금융 개방도)의 영향에 대해 분석한 결과, 금융개방도가 높아 글로벌 리스크 프리미엄의 전이 정도가 큰 국가일수록 미국 통화정책 충격에 대해 장기금리가 보다 강하게 반응하는 것으로 나타났다.

23) 국가별 금융 개방도를 측정하는 Chinn-Ito 지수에 따르면 우리나라의 금융 개방도는 비교대상 182개국 중 최상위 그룹에 속한다.

24) 장기금리는 위험 중립적인 금리 성분인 기대 단기금리(expected nominal short rate 또는 risk-neutral yield)와 리스크 프리미엄 성분인 기간 프리미엄(term premium)으로 분해될 수 있다. 이와 관련된 자세한 내용은 Adrian et al.(2013) 등에서 다루고 있다.

25) 은행의 가계대출에서 주택담보대출 비중(21.4/4분기 기준)은 58%에 이른다. 주택담보대출 중 변동금리형은 COFIX 금리, 고정금리형(혼합형)은 금융채 5년물에 주로 연동된다.

26) 2010년 1월~2021년 12월의 기업대출(은행 기준) 증가액 중 단기금리에 연동된 운전자금(만기 1년 이내)의 비중은 약 62%에 이른다. 시설자금의 경우에도 3개월이나 6개월 만기의 단기 지표 금리에 주로 연동되는 경향이 있다. 실증 분석에 따르면 기업대출 금리에서 단기금리(COFIX와 3개월 CD 금리 평균)가 반영되는 정도는 장기금리(금융채 AAA 5년물)의 3배 이상으로 월등히 높게 나타난다.

27) 한국은행은 1999년 5월부터 통화정책 방향에서 콜 금리 목표를 구체적으로 제시하였다.

28) 2000년 1월~2022년 3월까지 월별 자료 기준으로 국채 금리가 역전되었을 때 정책금리가 역전된 경우의 비율은 1년물은 100%, 3년물은 97%, 5년물은 82%, 10년물은 50%이다.

29) <표 Ⅳ-1>에 제시되지는 않았지만, 분기별 추이를 보면 이러한 점을 확인할 수 있다.

30) 2006년 역전기의 경우, 당해 6월 정책금리인상 직후 주요 언론은 “Central bank policy-makers raise key rate to 5.25%; some investors see hints of a pause in increases.”(CNN, 2006.6.29, https://money.cnn.com/2006/06/29/news/economy/fed_rates/)로 보도하면서 긴축 감속 신호가 나타났음을 시사한 바 있다. 2018년 역전기에는 FOMC(2018년 12월)의 예상 정책금리 점도표(dot plot)를 통해 그러한 신호가 전달된 바 있다.

31) 기대 단기금리는 뉴욕 연준이 Adrian et. al.(2013)에 따라 추정하여 제공하는 자료이다.

32) 시장참가자들은 미 연준이 당분간 강도 높은 금리인상을 이어갈 것으로 예상하고 있다. 금년말까지 한국은행은 2.75% 수준, 연준은 2.75%를 상회하는 수준으로 정책금리를 인상할 것으로 전망되고 있다. 그리고 미국의 인플레이션 압력이 단기간 내에 크게 약화되지 않는 한, 내년 중 정책금리 역전폭이 추가 확대될 것으로 생각된다.

33) 주요 투자은행들은 금년 한국과 미국의 경제성장률을 각각 2.7% 및 3.0%로 전망(22.4월말 조사 기준, 국제금융센터)하고 있다.

34) 외국인 채권 투자자 중에서는 중앙은행 및 국부펀드 등 중장기 투자자가 2/3 이상(2021년말 기준)을 차지한다.

35) 추정 결과, 충격발생 당시(t=0)는 1%, 1분기 후에는 5%, 2분기 후에는 10% 수준에서 상호작용 항에 대한 계수가 유의한 것으로 나타났다.

참고문헌

Adrian, T., Crump, R. K., Moench, E., 2013, Pricing the term structure with linear regressions, Journal of Financial Economics 110(1), 110-138.

Archibald, J., Hunter, L., 2001, What is the neutral real interest rate, and how can we use it? Reserve Bank of New Zealand Bulletin 64(3).

Bauer, M.D., Rudebusch, G.D., 2021, Interest rates under falling stars, American Economic Review 110(5), 1316-1654.

Bu, C., Rogers, J., Wu, W., 2021, A unified measure of Fed monetary policy shocks, Journal of Monetary Economics 118, 331–349.

Bullard, J., 2022, Removing monetary policy accommodation, Federal Reserve Bank of ST. Louis.

Del Negro, M., Giannoni, M.P., Giannone, D., Tambalotti, A., 2017, Safety, liquidity, and the natural rate of interest, Brookings Papers on Economic Activity Spring 2017.

Dudley, B., 2022. 4. 18, The slower the Fed, the harder the landing, Bloomberg Opinion.

Federal Reserve Board, 2022a, Transcript of Chair Powell’s press conference May 4.

Federal Reserve Board, 2022b, Transcript of Chair Powell’s press conference March 16.

Financial Times, 2022. 4. 13, FirstFT: Fed official says it is ‘fantasy’ to think modest rate rises will tame inflation.

Fischer, S., 2016, Why are interest rates so low? Causes and implications, Federal Reserve Board.

Fisher, J.F., Gourio, F., Krane, S., 2017, Changes in the risk-management environment for monetary policy, Federal Reserve Bank of Chicago Essays on Issues Number 377.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica 55(2), 363-390.

Gertler, M., Karadi, P., 2015, Monetary policy surprises, credit costs, and economic activity, American Economic Journal: Macroeconomics 7(1), 44–76.

Goodfriend, M., 2002, The phase of U.S. monetary policy: 1987 to 2001, Federal Reserve Bank of Richmond Economic Quarterly 88(4).

Hamilton, J. D., Kim, D., 2002, A reexamination of the predictability of economic activity using the yield spread, Journal of Money, Credit and Banking 34(2), 340-360.

Holston, K., Laubach, T., Williams, J.C., 2017, Measuring the natural rate of interest: International trends and determinants, Journal of International Economics 108.

Jordà, Ò., 2005, Estimation and inference of impulse responses by local projections, American Economic Review 95(1), 161-182.

Kaplan, R.S., 2018, The neutral rate of interest, Federal Reserve Bank of Dallas.

Kearns, J., Schrimpf, A., Xia, F. D., 2018, Explaining monetary spillovers: The matrix reloaded, BIS working papers No. 757.

Larsen, J.D., McKeown, J., 2004, The informational content of empirical measures of real interest rate and output gaps for the United Kingdom, Bank of England working paper No. 224.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4).

Lubik, T.A., Matthes, C., 2015, Calculating the natural rate of interest: A comparison of two alternative approaches, Federal Reserve Bank of Richmond Economic Brief 10.

Miranda-Agrippino, S., Ricco, 2021, The transmission of monetary policy shocks, American Economic Journal: Macroeconomics 13(3),74-107.

Neiss, K.S., Nelson, E., 2003, The real-interest-rate gap as an inflation indicator, Macroeconomic Dynamics 7, 239-262.

Powell, J.H., 2016, Recent developments and long-run challenges, Federal Reserve Board.

Powell, J.H., 2022, Restoring price stability, Federal Reserve Board.

Summers, L.H., 2022. 4. 19, The Fed must do much more to fight inflation. And fast time, Washington Post Opinion.

Tauber, K., Zandweghe, W.V., 2021, Why has durable goods spending been so strong during the COVID-19 pandemic?, Federal Reserve Bank of Cleveland Economic Commentary 2021-16.

Wall Street Journal, 2022. 4. 14, Fed’s John Williams says half-point rate rise is reasonable option for may.

Woodford, M., 2003, Interest and Prices: Foundations of a Theory of Monetary Policy, Princeton University Press, Princeton, N.J.

Yellen, J.L., 2017, Inflation dynamics and monetary policy, Federal Reserve Board.