Find out more about our latest publications

Global Monetary Policy Divergence: Impacts on Korea’s Capital Flow and its Implications

Issue Papers 22-09 Jun. 30, 2022

- Research Topic Macrofinance

- Page 22

Amid signs of recovery in the real economy and higher inflation, major economies have increasingly taken different approaches to monetary policy. Starting this year, the US and the UK are tightening monetary policy at a faster pace while Europe and Japan maintain the expansionary monetary policy stance. Such divergence between advanced economies can be commonly observed in the two rate hike cycles of the US during the early 2000s. It has been found that in the previous rate hikes, the adverse effects such as abrupt capital outflows from emerging markets were only limited.

Korea has also seen the negative impact arising from monetary tightening of the US diminishing since the global financial crisis. According to the empirical analysis conducted by this article, monetary policy divergence between major economies plays a significant role in partially offsetting the effects of the US rate hikes on the overall capital flows in Korea. The analysis implies that if the monetary policy decoupling continues, greater external uncertainties such as accelerated monetary tightening by the US would have only a limited impact. However, considering that existing risk factors were unprecedented in the previous rate hike cycles of the US, it is advised against an optimistic outlook that the negative effects of rate hikes would be extremely limited.

Korea has recorded a current account surplus and tightened its FX soundness regulation, which has made its economic fundamentals stronger enough to respond to instability in the global financial market. Still, however, greater external uncertainties serve as major factors behind sudden capital flows in Korea and other emerging economies, which requires extra caution. More recently, a prolonged geopolitical conflict and a delayed recovery in global supply chains are raising the possibility that inflation would become entrenched. Accordingly, thorough preparation should be made to deal with various risk factors such as simultaneous monetary tightening implemented by central banks of advanced economies.

Korea has also seen the negative impact arising from monetary tightening of the US diminishing since the global financial crisis. According to the empirical analysis conducted by this article, monetary policy divergence between major economies plays a significant role in partially offsetting the effects of the US rate hikes on the overall capital flows in Korea. The analysis implies that if the monetary policy decoupling continues, greater external uncertainties such as accelerated monetary tightening by the US would have only a limited impact. However, considering that existing risk factors were unprecedented in the previous rate hike cycles of the US, it is advised against an optimistic outlook that the negative effects of rate hikes would be extremely limited.

Korea has recorded a current account surplus and tightened its FX soundness regulation, which has made its economic fundamentals stronger enough to respond to instability in the global financial market. Still, however, greater external uncertainties serve as major factors behind sudden capital flows in Korea and other emerging economies, which requires extra caution. More recently, a prolonged geopolitical conflict and a delayed recovery in global supply chains are raising the possibility that inflation would become entrenched. Accordingly, thorough preparation should be made to deal with various risk factors such as simultaneous monetary tightening implemented by central banks of advanced economies.

Ⅰ. 서론

최근 주요 선진국 통화정책 변화의 움직임이 점차 가속화되고 있다. 글로벌 금융위기 및 팬데믹 위기의 대응과정에서 막대한 유동성을 공급한 주요국 중앙은행이 최근 실물경기 회복세가 가시화되면서 통화정책 정상화의 시동을 걸고 있는 것이다. 특히 최근에는 우크라이나 사태 발발 등 대외환경 변화로 인해 주요국의 물가상승 압력이 급증하고 있어 주요국의 통화정책 정상화 속도는 예상보다 빠르게 진행될 가능성이 높아지고 있다. 올해 들어 이미 미국과 영국은 기준금리 인상과 더불어 중앙은행 보유자산을 축소하는 양적긴축에 돌입하고 있으며, 현재까지 완화적 통화정책을 유지해오고 있는 유럽중앙은행 또한 하반기 이후 긴축기조로 선회할 가능성이 확대되고 있는 상황이다.

주요국의 통화정책 변화는 우리나라 및 신흥국 자본유출입에 영향을 미치는 주요인중 하나로 기존의 많은 논문에서도 미국 등 선진국 금리 변화는 신흥국 자본유출입에 유의한 영향을 미치는 것으로 분석되고 있다. 다만 미국이 금리인상을 시작하였던 최근 시점에서는 이러한 영향이 다소 줄어들고 있는 것으로 보고된다. 우리나라의 경우에도 글로벌 금융위기 이후 여타국 대비 빠른 경기회복세를 보인 미국이 기준금리 인상 등 통화정책 정상화를 시도한 2016~2018년 기간 중 국내 금융시장에서의 급격한 자본유출 등 부정적 영향은 제한적이었던 것으로 나타나고 있다. 이러한 상황은 우리나라의 대외건전성 개선 등에 기인한 바도 있겠으나, 이와 더불어 해당 기간 중 미국을 제외한 주요 선진국의 완화적 통화정책 기조 유지에 따른 주요국 간 통화정책 차별화가 미국 금리 인상의 영향을 일부 상쇄시키고 있는 것으로 추정해 볼 수 있다.

본고에서는 최근 주요국 통화정책 변화 추이 분석과 더불어 주요국간 통화정책 차별화 발발 시점에서의 국내 자본유출입 변화요인을 살펴보았다. 본고의 분석은 최근 미국 등 주요국의 금리인상 속도가 가속화되고 있는 시점에서 주요국간 통화정책 차별화 발생 여부에 따른 국내 자본유출입 변동에 미치는 파급효과의 크기를 가늠하는데 도움을 줄 수 있을 것으로 기대된다. 본고의 구성은 다음과 같다. 제Ⅱ장에서는 주요 선진국의 최근 통화정책 추이 및 국내 자본유출입 현황을 분석하였다. 제Ⅲ장에서는 글로벌 통화정책 차별화에 따른 영향을 과거 사례 분석 및 실증분석을 통해 살펴보았으며, 제Ⅳ장에서는 본고의 분석에 따른 시사점을 제시하였다.

Ⅱ. 주요국 통화정책 및 국내 자본유출입 현황

최근 인플레이션 우려 확대 및 경기상황 변동 등으로 인해 주요국 중앙은행의 통화정책 변화의 움직임이 가속화되고 있다. 이미 미국 및 영국 중앙은행은 기준금리 인상과 더불어 연내 양적긴축1) 시행을 예고하고 있으며 현재까지 완화적 통화정책 기조를 유지하고 있는 유로존의 경우에도 물가상승 압력 고착화에 따른 통화정책 변화 가능성이 점증하고 있는 것으로 나타난다. 이러한 주요국의 통화정책 변화는 신흥국 및 국내로의 자본유출입 변동요인으로 작용할 것으로 예상된다. 이에 따라 본 장에서는 주요국의 최근 통화정책 변화 추이 및 최근 국내 금융시장에서의 증권투자자금 유출입 현황을 점검하였다.

1. 주요국 통화정책 현황

팬데믹 발발 이후 지난해 말까지 완화적 통화정책 기조를 유지해온 주요국(미국, 유로존, 영국, 일본 등) 중앙은행은 올해 초 이후 차별화된 변화의 모습을 보이고 있다. 팬데믹 상황에 따른 일시적 경제활동 제약 등으로 다소 주춤했던 주요국의 경제상황이 대규모 재정부양책 등에 힘입어 지난해 이후 뚜렷한 회복세를 보이고 있으며, 최근 인플레이션 압력이 고조되면서 미국 등 주요국을 중심으로 통화정책 변화의 움직임을 보이고 있는 것이다. 특히 최근에는 글로벌 공급망 차질에 따른 물가상승 압력 확대와 더불어 우크라이나 사태 발발로 인한 원자재 가격 상승 등 인플레이션 요인이 크게 부각되면서 주요 선진국을 중심으로 올해 중 빠른 속도로 통화긴축 행보를 이어갈 가능성이 높을 것으로 전망되고 있다.

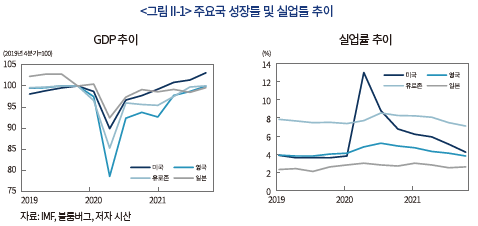

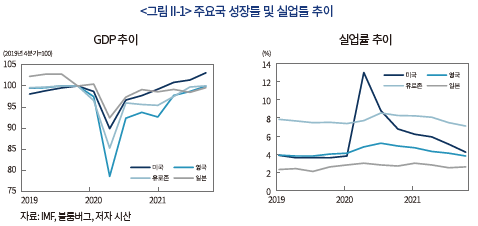

최근 주요국의 경기상황을 살펴보면 주요 선진국은 팬데믹 발발 이후 강력한 경기부양책 실시와 더불어 백신 보급 확산에 따른 경제 활동 재개가 본격화되면서 최근까지 견조한 회복세를 지속해오고 있는 것으로 나타난다. <그림 II-1>에서 나타난 바와 같이 주요국의 실질 GDP 등 경기지표는 팬데믹 발발 이전 시점(2019년 4분기) 수준을 대부분 회복한 것으로 나타나고 있으며, 특히 주요국의 고용상황 또한 팬데믹에 따른 일시적 노동수요 감소요인이 빠른 속도로 회복되는 모습을 보이고 있다. 다만 올해 초의 경우에는 지정학적 갈등 및 공급망 차질 지속 등의 부정적 요인이 부각되면서 미국의 경우 1분기 중 역성장(-1.4%, 전기 대비)을 기록 하는 등 성장 흐름이 다소 주춤하는 모습을 보이고 있다.2)

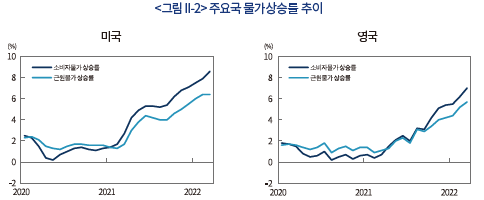

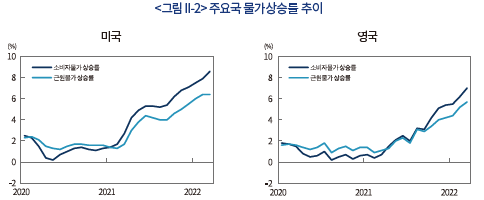

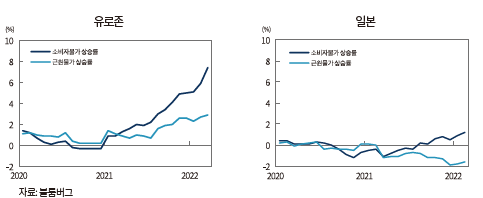

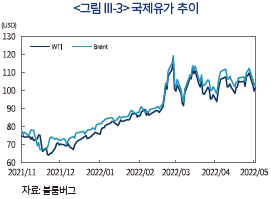

최근 주요국 경제상황에서 두드러지는 특징은 물가상승 압력이 크게 확대되고 있다는 점이다. 주요국의 팬데믹 대응과정에서의 완화적 통화·재정 정책과 더불어 글로벌 공급망 차질에 따른 원자재 가격 상승 등이 최근 소비자물가의 급격한 상승세를 초래하고 있는 것이다(Adrian&Gopinath, 2021). 특히 최근 우크라이나 사태 발발 이후 에너지 가격이 급등세를 보이면서 주요국의 물가상승 압력이 배가되고 있다. 2022년 3월 기준 각 지역의 소비자물가 상승률은 미국 8.6%, 영국 7.0%, 유로존 7.4% 등으로 일본(0.9%)3)을 제외한 주요국에서 모두 근래 최고치를 기록하고 있다. 다만 유로존의 경우에는 에너지 등을 제외한 근원물가 상승률은 2022년 3월 기준 약 2.9% 수준으로 에너지 가격 상승에 따른 소비자 물가 전이효과가 아직까지 크게 나타나고 있지 않다는 점에서 여타국 대비 물가상승 압력이 제한적인 수준인 것으로 평가되고 있다.

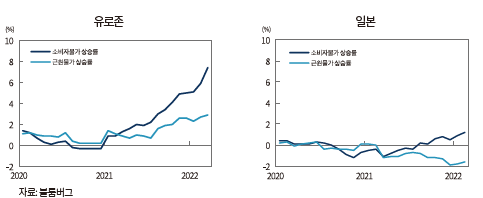

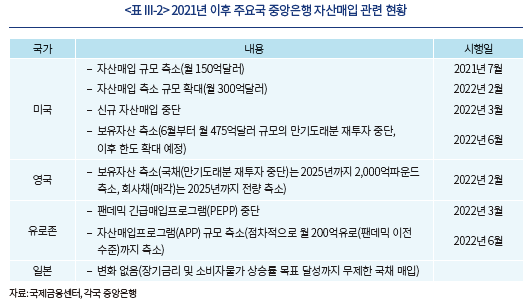

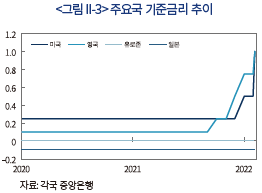

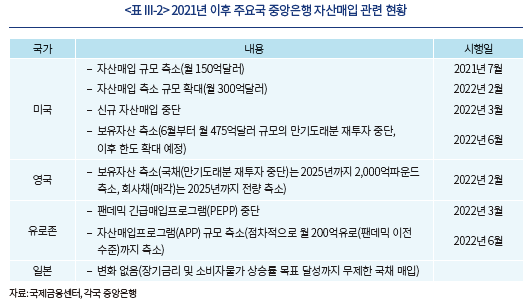

주요국별 상이한 경제상황에 따라 올해 초 이후 주요 선진국의 통화정책은 다음과 같은 차별화된 변화의 모습을 보이고 있다. 먼저 미국과 영국은 소비자물가 상승 위험이 크게 부각되면서 금리인상 및 양적긴축을 통한 통화정책 정상화의 속도가 가속화되고 있다.4) 미국은 이미 올해 두 차례에 걸쳐 기준금리 인상(75bp)을 단행하였으며 양적긴축을 통한 본격적인 통화정책 정상화 과정에 돌입하고 있다. 미연준은 이미 지난 3월 신규 자산매입을 중단한데 이어 6월부터는 중앙은행 보유자산을 축소하는 양적긴축 시행을 예고하고 있으며 양적긴축 규모는 하반기 중 더욱 확대될 것으로 전망되고 있다.5) 영국의 경우에도 이미 지난해 12월 금리인상을 시작한 이래 5월까지 총 4차례에 걸쳐 기준금리를 인상(85bp)하였으며, 올해 초 부터는 만기도래한 국채 보유분의 재투자 중단 및 회사채 매각 등 양적긴축을 실시하고 있다. 또한 영란은행은 정책금리가 1% 수준에 도달한 시점에서 중앙은행의 국채 보유분을 매각한다는 계획을 밝히고 있는 만큼 양적긴축 규모는 올해 하반기 중 더욱 확대될 것으로 예상되고 있다.

반면 유럽과 일본의 경우에는 현재까지 완화적 통화정책 기조를 유지하고 있는 것으로 나타난다. 유럽중앙은행은 최근 물가상승 압력 심화에도 불구하고 유로지역 경제의 상대적으로 낮은 성장세 및 근원물가 상승률 등을 반영하여 완화적 통화정책 기조 유지와 더불어 기존 자산매입 프로그램 또한 점진적 감소 전략을 유지할 것으로 예상된다.6) 이는 러시아 경제와 연관도가 높은 유로존 경제의 특성상 에너지 공급 제약에 따른 스태그플레이션 발발 가능성 등의 요인이 통화정책 결정에 일부 반영된 것으로 추정해볼 수 있다. 일본의 경우에도 최근 일시적으로 소비자물가 상승세가 나타나고 있으나, 에너지를 제외한 근원물가의 상승압력이 여전히 제한적이며 엔화 약세를 통한 수출기업의 수익확대 등 긍정적 효과가 나타나고 있는 만큼 단기간 내 통화긴축으로 선회할 가능성은 높지 않을 것으로 예상된다.7)

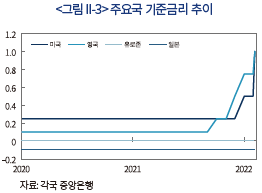

이러한 주요국의 통화정책 변화에 따라 주요국의 기준금리는 <그림 II-3>에 나타난 바와 같이 올해 초 이후 격차가 확대되는 양상을 보이고 있다. 이는 앞서 살펴본 바와 같이 최근 물가상승 위험 심화와 더불어 에너지 공급 차질에 따른 스태그플레이션 우려까지 대두되면서 각국별 경제상황에 따라 통화정책 변화가 차별화되고 있는 것으로 해석해 볼 수 있다. 따라서 향후 글로벌 통화정책 차별화 추이는 이러한 대외요인 변화에 따라 상이한 방향으로 전개될 개연성이 높을 것으로 예상된다. 최근 우크라이나 사태의 장기화 가능성과 더불어 글로벌 공급망 재편이라는 세계경제의 구조변화로 인해 단기간 내 물가상승 위험이 해소되기는 어려울 것이라는 전망이 확산되고 있기 때문이다. 이미 시장에서는 유로존 지역의 통화긴축 조기 실시 가능성이 점차 확대되는 것으로 나타나고 있으며8) 미국과 영국의 통화정책 정상화 속도 또한 가속화 전망이 주도적인 상황으로 향후 주요국의 통화정책 변화는 우리나라 및 주요 신흥국 자본유출입에 큰 영향을 미칠 수 있을 것으로 예상된다.

2. 최근 국내 자본유출입 현황

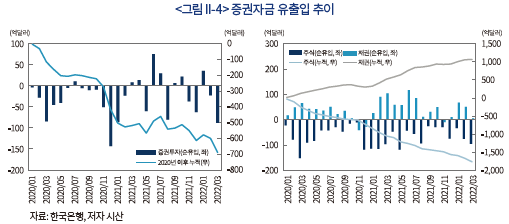

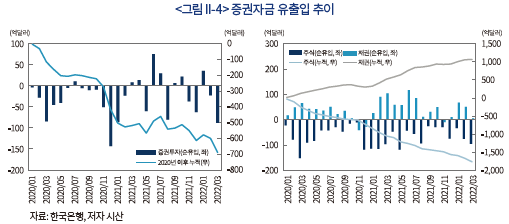

최근 국내 금융시장에서의 증권자금 유출입 추이를 살펴보면 팬데믹 발발 이후 최근까지 주식투자자금 위주의 순유출 추세가 지속되고 있는 것으로 나타난다. <그림 II-4>에 나타난 바와 같이 국내 증권자금 순유입분(해외투자자의 국내증권투자자금(유입)과 국내투자자의 해외증권투자자금(유출) 간 차액)9)은 2020년 1월 이후 최근까지 약 690억달러 규모의 순유출을 기록하고 있으며, 특히 주식투자자금 순유출이 최근 크게 확대되고 있는 것으로 나타난다. 즉 해당 기간 중 채권투자자금은 순유입(1,069억달러)을 기록하였으나 동기간 주식투자자금이 순유출(1,759억달러)을 기록하면서 국내 금융시장에서의 자본유출을 주도하고 있다. 특히 채권자금의 경우에는 국제금융시장의 변동성 확대에도 불구하고 최근까지 외국투자자의 국내채권자금 순유입 추세가 지속되고 있는 것으로 나타나고 있어 주식부문과 대비되는 모습을 보이고 있다.10)

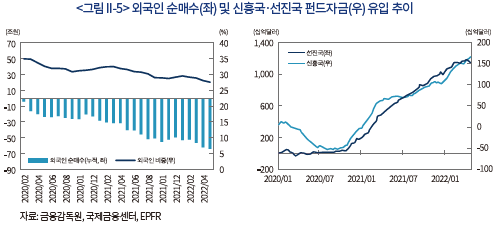

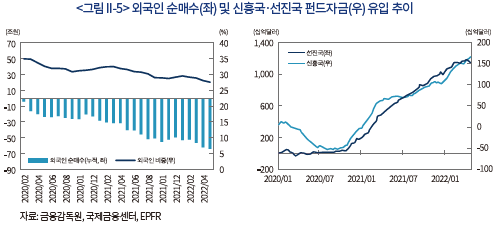

최근 주식투자자금의 지속적인 순유출 추세는 국내투자자의 해외주식투자 확대 및 외국인투자자의 국내주식투자 감소 등 양방향 요인이 모두 작용하고 있는 것으로 나타난다. 즉 2020년 1월~2022년 3월 기간 중 국내투자자의 해외주식투자 확대(1,417억달러)와 더불어 외국인투자자의 국내주식자금 순유출이 확대(342억달러)되면서 큰 폭의 순유출을 기록하고 있다. 특히 올해 들어 외국인의 국내주식 매도세는 더욱 확대되고 있는 것으로 나타난다. 올해 초 이후 월평균 외국인 순매도 규모는 약 3.4조원으로 전년 규모(2.2조원)를 상회하고 있으며, 지속적인 매도세로 인해 외국인 보유시총 비중은 약 28% 수준으로 2020년 초 대비 약 8%p 감소한 것으로 나타난다.11) 또한 <그림 II-5>에 나타난 바와 같이 여타 신흥국의 경우 올해 글로벌 주식펀드 자금이 유입세를 보이고 있는 것으로 나타나고 있다는 점에서 여타국과도 일부 차별화된 양상을 보이고 있다.12)

최근 외국인투자자의 국내주식 순매도 확대 추세는 미국의 통화긴축 가속화, 중국의 경제봉쇄 강화 조치 등 대외환경 변화에 큰 영향을 받고 있는 것으로 추정된다. 이는 비우호적 대외환경 변화가 최근 IT 업황에 대한 우려로 이어지면서 전기·전자 비중이 높은 국내 증시에 부정적 영향을 미치고 있는 것으로 볼 수 있다. 특히 올해 외국인의 국내 증시 순매도 업종은 대부분 전기전자 부문이 차지하고 있는 것으로 나타나고 있어 최근 글로벌 경제환경 변화가 외국인투자자의 국내주식 투자 감소에 영향을 미치고 있는 것으로 추정해 볼 수 있다.13)

Ⅲ. 글로벌 통화정책 차별화에 따른 영향 분석

최근 미국의 금리인상이 본격화되면서 주요 선진국간 통화정책 탈동조화 추세가 나타나고 있다. 글로벌 금융위기 및 팬데믹 위기의 대응 과정에서 주요국 통화정책이 동반 완화된 바 있으나 최근 경기회복 기대가 강화되면서 각국별 경제상황에 따라 통화정책 변화의 차별화가 나타나고 있는 것이다. 주요국간 통화정책 차별화는 과거 미국이 통화긴축을 선도하였던 사례에서도 관찰된다. 본장에서는 최근 글로벌 통화정책 차별화 시점에서의 주요 특징을 살펴보고 실증분석을 통해 통화정책 차별화가 국내 자본유출입에 미치는 영향 등을 살펴보았다.

1. 차별화 시점별 주요 배경 및 영향

각국의 통화정책은 원칙적으로 고용 상황 및 물가 등 자국 고유의 경제상황에 따라 독자적으로 결정된다. 따라서 주요국간 물가, 실업률 등 경기상황의 차이에 따른 주요국간 통화정책 차별화는 각국 경제 펀더멘털에 기인한 일반적인 상황으로 볼 수 있다. 그러나 최근 주요국의 통화정책 추이는 대부분 기간 중 동조화에 가까운 행보를 보인 것으로 나타난다. 이는 무엇보다 글로벌 금융위기 및 팬데믹 위기를 겪으면서 주요국 중앙은행의 동반 통화정책 완화 기조가 상당기간 지속되었기 때문으로 볼 수 있다. 일반적으로 경기하강기에는 주요국간 경기동조성이 높게 나타나고 있으며, 금리 인상기 대비 인하 시점의 주요국의 통화정책 변화는 즉각적으로 이루어지는 측면이 강한 것으로 나타나고 있기 때문이다.14)

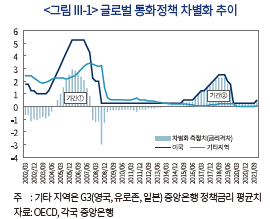

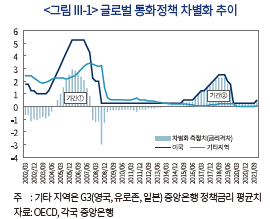

<그림 III-1>에 나타난 바와 같이 최근 주요국 간 통화정책 차별화가 두드러지게 나타난 시점은 미국 주도의 기준금리 인상이 진행되었던 2004~2006년(기간①) 및 2016~2018년(기간②)으로 나타난다.15) 기간①은 미연준이 17차례에 걸쳐 기준금리를 총 425bp 인상하였던 시점으로, 해당 기간 중 유로존은 소폭의 기준금리 인상(150bp)을 단행하였으나 일본, 영국 중앙은행이 기존 수준을 유지하면서 주요국 간 금리격차가 확대된 것으로 나타난다. 해당 차별화 시점은 인플레이션 압력이 제한적인 가운데 BRICs16)로 불리던 거대신흥국의 성장세가 두드러졌던 기간으로, 글로벌 증시가 동반 상승세를 보인 가운데 글로벌 증권자금 이동 급변 등 국제금융시장의 충격은 나타나지 않았던 것으로 파악된다.17)

두 번째 차별화 시점인 기간②는 미연준이 글로벌 금융위기 이후 지속해온 위기대응 통화정책 기조의 전환을 시도한 시점으로, 당시 미연준은 2015년 4분기~2018년 4분기 기간 중 9차례에 걸쳐 기준금리를 총 225bp 인상하였다.18) 반면 해당기간 중 미국을 제외한 여타 주요국이 완화적 통화정책 기조를 유지함에 따라 미국의 금리인상 폭이 제한적이었음에도 불구하고 주요국 간 기준금리 격차는 큰 폭으로 확대되었다. 당시에도 세계경제는 미국의 확장적 재정정책의 효과 등으로 인해 통화긴축의 여파는 크게 감지되지 않은 것으로 나타난다. 즉 기간①과 대비하여 신흥국 성장세는 일부 둔화되었으나 미국 등 선진국 중심의 세계경제 성장세가 지속되었으며, 장기금리 안정화 및 글로벌 주가 상승 등 미국 통화정책 정상화에 따른 긴축효과는 제한적이었던 것으로 나타나고 있다.

최근 두 차례의 글로벌 통화정책 차별화 시점 모두 미국의 통화긴축의 효과가 제한적이었다는 점은 주요국 간 통화정책 차별화가 미국 통화정책의 긴축효과를 일부 상쇄시키고 있는 것으로 추정해 볼 수 있다. 2000년대 이후 주요국 통화정책 변화와 연관되어 국제금융시장의 급격한 변화가 나타났던 시점은 2013년 미연준 의장의 자산매입 축소(tapering) 언급 시점이 유일한 것으로 나타나고 있으며19), 미연준의 실제 자산매입 축소가 시작된 2014년 및 2016년 이후 금리인상 시점에서의 미국 통화정책 변화의 영향은 제한적인 것으로 파악된다.20) 이는 특히 1990년대 미국 통화긴축의 여파로 신흥국의 급격한 자본유출이 발생하였던 과거의 경험과는 극명하게 대비되는 모습으로, 주요국 간 통화정책 차별화가 일정 부분 미국 주도의 금리인상에 따른 신흥국 파급효과를 경감시키고 있는 것으로 생각해 볼 수 있다.21)

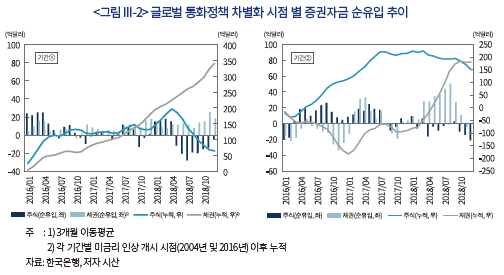

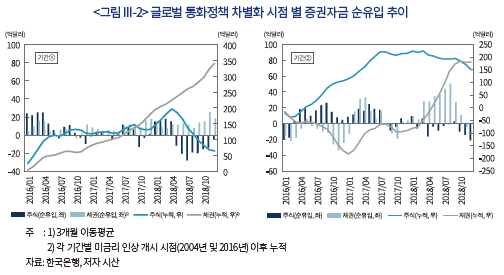

<그림 III-2>는 글로벌 통화정책 차별화 기간 중 외국인투자자의 국내 증권자금 유출입 추이를 보여주고 있다. 먼저 기간①의 경우 외국인투자자의 국내채권 투자자금은 지속적인 유입세를 기록한 것으로 나타나고 있으며, 국내주식 투자자금의 경우에는 2006년 중반 이후 순유출로 전환된 것으로 나타나고 있으나 해당 기간 중 소폭의 누적 순유입을 기록하고 있다. 기간②에서는 국내주식 투자자금의 경우 2016년 초반 이후 순유입 추세가 우세한 것으로 나타나고 있으며, 국내채권 투자자금의 경우에는 2017년 이후 뚜렷한 유입세로 전환된 것으로 나타난다.22) 또한 동기간 글로벌 펀드자금의 신흥국 자본유출입 추이도 국내의 상황과 유사하였던 것으로 나타나고 있어, 미국의 금리인상에 따른 국내 및 신흥국 자본유출입파급효과는 주요국 간 통화정책 차별화 여부에 따라 일부 상쇄효과가 나타나고 있는 것으로 추정된다. 다만 개별국의 자본유출입 변화는 해외요인과 더불어 다양한 국내요인에 따라 결정되고 있기에 이에 대한 추가적인 검증이 필요할 것으로 판단된다. 이에 다음 절에서는 주요국 간 통화정책 차별화가 국내 자본유출입 변화에 미치는 영향을 실증분석을 통해 추정하여 보았다.

2. 실증분석

국경간 자본유출입 결정요인을 분석하고 있는 기존 연구결과에 따르면 대내요인(pull factor)과 더불어 주요 선진국 금리 등 대외요인(push factor)이 개별국의 자본유출입을 결정하는 주요 요인이라는 다수의 증거들이 제시되고 있다. 특히 신흥국의 경우에는 대외요인이 상대적으로 중요한 영향을 미치고 있다는 다수의 연구결과가 제시되고 있으며23), 이러한 연구결과는 국제금융시장 상황에 영향을 미치는 주요 선진국의 통화정책 변화가 국내 자본유출입 변동에 크게 영향을 미치고 있음을 보여주고 있다.

한편 자본유출입 변동요인을 분석하고 있는 대다수의 기존 연구에서는 미국 통화정책 관련 변수를 국제금융시장의 위험도를 나타내는 주요 변수로 활용하고 있다.24) 그러나 최근에는 주요 선진국 간 통화정책 차별화 경향이 두드러지게 나타나면서 글로벌 통화정책 차별화가 자본유출입에 유의한 영향을 미치고 있다는 연구결과 또한 제시되고 있다. 예를 들어 Avdjiev et al.(2017)은 글로벌 금융위기 이후 미국 통화정책 변화에 따른 국경간 자본유출입 민감도는 글로벌 통화정책 차별화 정도에 따라 감소하는 것으로 추정하였으며, 홍콩 금융시장의 외국계 은행을 대상으로 자본유출입 결정요인을 분석한 He et al.(2017)의 연구에서도 글로벌 통화정책 차별화의 영향이 유의한 것으로 추정되었다.25)

우리나라를 대상으로 한 주요 연구에서도 미국 금리 등 대외요인은 국내 자본유출입에 유의한 영향을 미치고 있는 것으로 나타난다. 우리나라 국제수지를 활용하여 자본유출입 결정요인을 분석한 Kim et al.(2013)에서는 대외요인이 유의한 결정변수로 추정되었으며, 이승호(2021), 윤영진·박종욱(2019) 등 다수의 연구에서 대내요인과 더불어 대외요인의 유의성이 확인되었다. 한편 미국 통화정책 변화가 국내 금융시장 자본유출입에 미치는 영향을 분석한 서현덕·강태수(2019)의 연구에서는 2015년 이후 미국의 금리인상에 따른 영향이 일부 감소한 것으로 나타난다. 해당 기간은 앞서 살펴본 바와 같이 주요국 간 통화정책 차별화가 두드러지게 나타난 시점으로 국내의 경우에도 글로벌 통화정책 차별화가 미국 통화정책의 파급효과를 일부 상쇄시키고 있는 것으로 추측해 볼 수 있다.

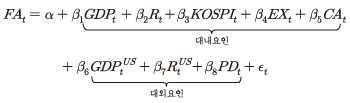

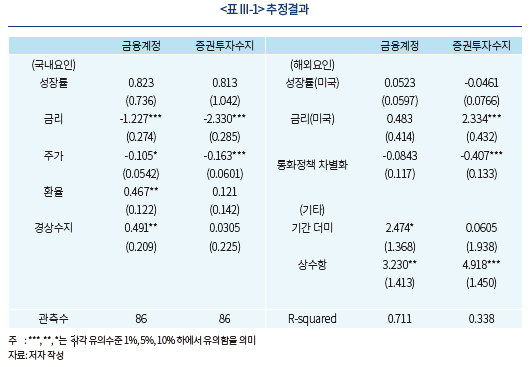

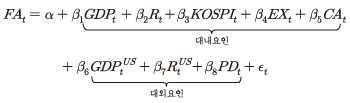

본 절에서는 주요국간 통화정책 차별화를 포함한 대내외 요인이 국내 자본유출입에 미치는 영향을 실증분석해 보았다. 분석모형의 종속변수(FA)로는 국제수지 금융계정 및 증권투자수지(GDP 대비 비중)를 사용하였다. 해당 변수는 내국인의 해외자산 순유출 및 외국인의 국내자산 순유입을 동시에 포함하고 있어 자본유출입을 동시에 포괄적으로 살펴볼 수 있다. 금융계정의 경우에는 중앙은행 외환보유액 증감분을 제외하여 민간부문의 자본유출입 변동을 살펴보았으며, 국제금융시장 변동요인에 상대적으로 민감하게 반응할 것으로 예상되는 증권투자수지를 별도로 설정하여 부문별 영향을 추정하였다. 추정기간은 2000년 이후 최근까지 분기별 자료를 활용하였으며, 글로벌 금융위기가 발생한 구간에 대해서는 기간더미변수를 활용하였다. 구체적인 분석모형은 다음과 같이 설정하였다.

여기서 대내요인으로는 국내 실질총생산 증가율(GDP), 국채 3년물 금리(R), 종합주가지수 증가율(KOSPI), 대미달러 환율 증가율(EX), GDP 대비 경상수지 비중(CA) 등을 포함하였으며, 대외요인으로는 미국 실질총생산 증가율(GDPUS), 미국 정책 금리(RUS) 및 글로벌 통화정책 차별화(PD) 변수를 포함하였다. 글로벌 통화정책 차별화 정도는 미국 기준금리와 영국·일본·유로존 기준금리 평균치와의 격차로 정의하였으며, 본 분석에서는 상호작용 효과 분석을 위해 미국 정책금리를 곱하여 상호작용 항으로 설정하였다.26) 분석에 포함된 모든 변수는 안정적인 시계열로 확인되었으며27), 추정방법으로는 설명변수에 내생성이 존재할 개연성을 고려하여 일반화적률법(Generalized Method of Moments: GMM)을 사용하였다.

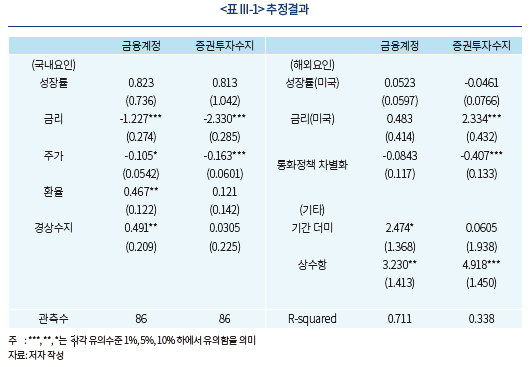

<표 III-1>은 본 절의 추정결과를 정리하였다. 먼저 금융계정을 종속 변수로 설정한 분석모형에서는 국내 금리, 주가, 환율 등 국내요인이 유의한 설명요인으로 추정되었다. 금융계정의 경우 증권투자와 더불어 국내요인에 따른 변동요인이 상대적으로 클 것으로 예상되는 해외직접투자 등을 동시에 포함하고 있어 국내요인의 영향력이 유의하게 나타나는 것으로 해석해 볼 수 있다. 한편 본 연구의 주요 관심변수인 글로벌 통화정책 차별화 변수의 경우 해당 모형에서는 유의성이 낮게 추정되었다. 다만 해당변수의 추정치가 음(-)의 값으로 나타나고 있어 방향성 측면에서는 글로벌 통화정책 차별화의 미국 통화정책 변화에 따른 자본유출입 민감도 상쇄효과와 일치하는 결과로 볼 수 있다.

증권투자수지를 대상으로 한 두 번째 분석모형에서는 금리, 주가 등 국내 변수와 더불어 미국 금리 및 글로벌 통화정책 차별화 관련 설명변수의 부호가 예상과 일치하게 추정되었으며 통계적 유의성 또한 확인되었다. 먼저 국내 금리 및 주가 상승은 증권투자수지를 개선(순유입 증가)시키는 것으로 나타났으며, 미국의 금리 상승은 반대 방향의 영향을 미치는 것으로 추정되었다. 특히 미국 금리 변수와 상호작용 항으로 설정한 글로벌 통화정책 차별화 변수가 유의한 음(-)의 값을 가지는 것으로 추정되었으며, 이는 미국의 통화정책 변화에 따른 국내 자본유출입 변화의 민감도가 글로벌 통화정책의 차별화 정도에 따라 일부 상쇄되고 있다는 본고의 추론과 일치하고 있다. 즉 추정결과에 따르면 미국의 금리인상이 국내 증권자금 유출입에 미치는 영향은 미국과 주요 선진국 간 금리격차 폭이 확대됨에 따라 그 효과가 감소하고 있는 것으로 나타난다.28) 이러한 분석결과는 최근 미국 통화긴축에 따른 국내 파급효과는 미국을 제외한 여타 선진국의 통화정책 변화의 방향에 따라 영향력의 크기가 결정될 수 있음을 시사하고 있다.

3. 최근 사례의 특수성 및 위험요인

앞서 살펴본 바와 같이 올해 들어 주요국의 통화정책 변화는 차별화의 방향으로 진행되는 것으로 나타나고 있어 본고의 분석결과에 따르면 최근 미국 금리인상에 따른 국내 자본유출입 압력 또한 제한적일 것이라는 추론이 가능하다. 또한 과거 미국이 금리인상을 선도한 시점에서도 국내 파급효과는 제한적이었던 것으로 나타나고 있는 만큼 최근 이러한 낙관적인 전망에 대한 기대가 커지고 있는 것으로 생각된다. 그러나 최근의 상황은 다음과 같은 측면에서 과거 미국의 금리인상 시점과는 차별화되고 있다는 점에서 주의할 필요가 있다.

먼저 최근 범세계적으로 나타나고 있는 물가상승 압력이 장기간 지속될 가능성이 높을 것이라는 전망이 확대되고 있는 만큼 향후 단기간 내 글로벌 동반 통화긴축으로의 급격한 선회 가능성 등의 위험요인에 유의할 필요가 있다. 이는 무엇보다 우크라이나 사태 발발에 따른 지정학적 리스크가 해소되지 않는 한 유가 상승기조는 당분간 지속될 것으로 예상되고 있기 때문이다.29) 또한 팬데믹 이후 주요 물가상승 요인으로 지목되고 있는 글로벌 공급망 둔화는 최근 중국의 봉쇄조치 강화와 더불어 회복속도가 지연되고 있으며, 일부에서는 최근의 상황이 자국 중심의 생산체계로 전환되어가는 구조적 변화의 과정으로 이에 따른 물가상승 압력은 당분간 지속될 것이라는 전망이 확대되고 있다. 주요국 물가상승 위험이 고착화되어 가고 있는 현 상황은 과거 미국 통화긴축 사례에서 나타나지 않았던 새로운 위험요인으로 향후 주요국 통화정책 변화의 방향이 동반 긴축으로 급격히 선회할 경우 우리나라 및 신흥국 자본유출입 압력이 배가될 수 있음에 유의할 필요가 있을 것으로 판단된다.

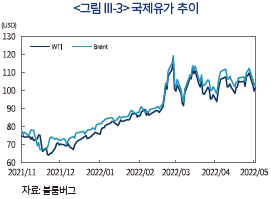

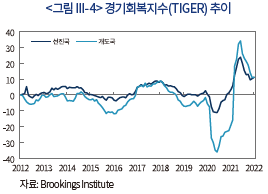

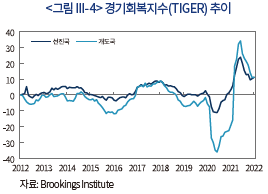

물가상승 위험과 더불어 최근에는 주요국의 스태그플레이션30) 위험 또한 점증하고 있다는 점에서도 주의가 필요할 것으로 예상된다. 우크라이나 사태의 장기화에 따른 러시아 디폴트 등의 최악의 사태 발발 시 러시아 경제와 연관도가 높은 유로존 등 주요국의 경기침체가 동시에 발발할 수 있기 때문이다. 최근에는 미국 경제 또한 2022년 1분기 전년 동기 대비 마이너스 성장을 기록하는 등 물가상승 압력과 더불어 경기둔화 가능성이 점증하고 있는 상황이다. 주요국의 실물경기 및 금융시장 동향을 종합적으로 고려하고 있는 글로벌 경기회복 지수(Tracking Index for Global Economic Recovery: TIGER)31)는 이미 2021년 말 이후 빠른 하락세를 보이고 있으며, 최근 IMF 또한 인플레이션 및 공급망 회복 차질 지속화 등을 반영하여 글로벌 경제 성장률을 하향 조정하고 있어 고물가 지속 및 경기둔화 가능성이 점차 확대되고 있는 실정이다.32)

마지막으로 주요국 중앙은행이 본격적인 통화정책 정상화에 돌입할 경우 글로벌 금융위기 이후 중앙은행의 자산매입으로 지속적인 상승세를 보여온 글로벌 유동성 상황이 급격한 반전을 보일 수 있다는 점에서도 과거 사례와는 차별화된 위험요인이 상존하고 있다. <표 III-2>에 정리한 바와 같이 미국 및 영국 등은 이미 중앙은행 보유자산 만기 도래분에 대한 재투자를 축소하는 방식으로 양적 긴축을 시작하고 있으며, 유럽중앙은행 또한 올해 중 신규자산 매입을 중단한 이후 하반기 중 양적긴축을 시작할 가능성이 점차 높아지고 있다.33) 이러한 주요국의 양적긴축 가속화는 글로벌 유동성 축소와 더불어 우리나라 및 신흥국의 외국인 투자자금 유출 압력으로 작용할 것으로 예상된다. 김한수(2017)의 연구결과에 따르면 글로벌 유동성 감소는 신흥국으로의 자본유입과 유의한 상관관계를 보이는 것으로 나타나고 있으며, 서현덕·강태수(2019) 및 허찬국 외(2014) 등의 연구에서도 미국의 양적긴축이 외국인 투자자금 유출 압력 증가로 이어진다는 분석결과를 제시하고 있다. 특히 향후 주요국의 통화정책 변화가 동반 긴축의 방향으로 선회할 경우 글로벌 유동성 축소에 따른 부정적 파급효과는 더욱 크게 나타날 수 있다는 점에서도 더욱 유의할 필요가 있을 것으로 판단된다.

Ⅳ. 요약 및 시사점

본고의 분석결과는 다음과 같이 요약된다. 먼저 최근 주요 선진국의 통화정책 변화는 본격적으로 통화긴축에 돌입하고 있는 미국·영국과 물가상승세 확대에도 불구하고 완화적 통화정책 기조를 최근까지 유지하고 있는 유로존·일본 등 주요국간 통화정책 탈동조화 추세가 나타나고 있다. 과거 미국이 금리인상을 선도하였던 2004~2006년 및 2016~2018년 기간 중에도 주요국간 통화정책 차별화 양상이 나타난 바 있으며 당시 신흥국의 급격한 자본유출 등 미국 금리인상에 따른 부정적 파급효과는 제한적이었던 것으로 나타난다.

본고의 실증분석 결과에서도 주요 선진국 간 통화정책 차별화는 미국 금리인상이 국내 자본유출입 변화에 미치는 영향을 일부 상쇄시키는 유의한 효과가 나타나고 있는 것으로 추정되었다. 이러한 결과는 과거에 비해 대외요인 변화에 따른 자본유출 압력이 제한적이라는 최근의 상황을 일부 설명하고 있는 것으로 해석된다. 즉 우리나라의 낮은 국가채무 수준 및 외환건전성 규제 강화 등 대외건전성 개선의 효과와 더불어 주요국 간 통화정책 차별화 또한 우리나라 단기 자본유출입 변동성 개선에 기여하고 있는 것으로 판단된다.

한편 앞서 살펴본 바와 같이 최근 주요국 간 통화정책 차별화 양상은 과거 사례와는 다음과 같은 점에서 차별화되고 있다는 점에 유의할 필요가 있다. 먼저 최근에는 세계경제의 구조적 변화와 지정학적 위험이 결합되면서 글로벌 인플레 위험의 고착화 가능성이 확대되고 있다. 이에 따라 향후 선진국의 통화정책 변화가 동반 긴축의 방향으로 동조화될 경우 우리나라 및 신흥국 자본유출 압력이 배가될 수 있음에 특히 유의할 필요가 있을 것이다. 또한 최근의 상황은 물가상승세 확대와 더불어 경기침체를 동반하는 스태그플레이션 발발 가능성 및 주요국 양적긴축 가속화에 따른 글로벌 유동성 위축 등의 불확실성이 더불어 점증하고 있는 상황으로, 과거의 경험을 바탕으로 미국 금리상승의 영향이 제한적일 것이라는 낙관적인 전망은 어려울 것으로 판단된다.

우리나라는 글로벌 금융위기 이후 대외 순자산국으로의 전환 및 대규모 경상수지 흑자 지속 등 국제금융시장 불안에 대응하는 경제 기초체력은 과거 어느 시점보다 강화된 것으로 판단된다. 그러나 여전히 대외불확실성 확대는 우리나라를 포함한 신흥국 경제의 급격한 자본유출입 변동을 초래하는 요인으로 나타나고 있는 만큼 이에 대한 철저한 대비가 필요할 것으로 판단된다. 특히 최근의 상황은 2000년대 이후 경험하지 못한 주요 선진국 중앙은행의 동반 긴축으로의

선회 가능성 및 중앙은행 보유자산 축소에 따른 글로벌 유동성 감소 등의 비우호적 대외환경이 전개될 가능성이 높아지고 있는 만큼 주요국의 통화정책 변화 및 자본유출입에 대한 모니터링을 강화할 필요가 있을 것이다. 또한 향후 자본유출입 변동성이 확대될 경우 글로벌 금융위기 이후 도입한 외환건전성조치를 적극 활용하여 대외건전성 관리를 철저히 할 필요가 있을 것으로 판단된다.

1) 양적긴축(Quantitative Tightening: QT)은 중앙은행의 보유자산 감축을 의미하며, 이는 중앙은행 보유자산의 만기도래분에 대한 재투자 축소 및 매각 등을 통해 진행됨

2) 유로존, 영국, 일본 등의 경우에도 2022년 1분기 성장률은 각각 0.2%, 0.9%, -1.8%(속보치 기준, 전기대비)로 낮은 수준을 기록함

3) 일본의 경우 소비자물가 상승세는 팬데믹 이전에도 저조하였으며 최근 에너지 가격 급등 영향으로 일시적으로 반등하였으나, 에너지를 제외한 근원물가는 여전히 마이너스 상승률(-1.2%)을 보이고 있음

4) 2020년 3월 기준 미국 및 영국의 소비자물가 상승률(8.6% 및 7.0%)은 지난 30년 이래 최대치를 기록하였음

5) 연준의 양적긴축(QT)은 연준 보유증권의 재투자 금액을 조절하는 방식으로 진행되며, 지난 5월 연방공개시장위원회(FOMC) 결정에 따르면 6~8월 중 월 475억달러(국채 300억달러, MBS/기관채 175억달러) 규모로 시작하고 9월부터는 월 950억달러(국채 600억달러, MBS/기관채 350억달러) 규모로 확대할 예정임

6) 유럽중앙은행은 현재까지 자산매입프로그램(APP) 및 팬데믹 긴급프로그램(PEPP)을 통해 양적완화 정책을 지속해오고 있으며, 지난 4월 통화정책회의에서는 2분기 중 매입규모를 단계적으로 축소하고 향후 경제상황에 따라 종료 여부를 결정할 것임을 발표한 바 있음

7) 일본은행은 2020년 4월 금융정책결정회의에서 현재 통화정책 방향을 유지하기로 결정한 바 있으며, 2% 물가상승률 목표를 안정적으로 달성하기 전까지 기존 방향을 지속할 방침임을 표명하고 있음

8) 국제금융센터(2022.5.2)에 따르면 시장에서는 연내 유럽중앙은행의 기준금리 인상이 단행될 것이라는 전망이 우세한 것으로 나타나고 있음

9) 한국은행 증권투자수지는 순유출(자산(내국인 해외증권투자) - 부채(외국인 국내증권투자))로 시산되나, 본고에서는 해석상 편의를 위해 역방향(순유입)으로 표시하였음

10) 해당 기간 중 외국인투자자는 2020년 1월~2022년 3월 기간 중 국내채권자금은 약 1,215억달러 순유입한 반면 국내주식자금은 342억달러 순유출된 것으로 나타남

11) 이승호(2021)에 따르면 2020년 이후 외국인투자자의 국내주식 순매도액 대비 유출액(국제수지통계 기준) 비중은 이전 국제금융시장 불확실성 확대 시점 대비 감소한 것으로 나타남

12) 개별국가별로는 한국, 대만 등 수출의존도가 높은 국가의 경우에는 순유출세를 보인 반면, 원자재 수출국 위주로 주식자금 순유입을 주도하고 있는 것으로 나타나고 있음

13) 국제금융센터(2022.5.11)에 따르면 올해 5월 10일까지 외국인 국내증시 순매도 금액(11.6조원) 중 전기전자 업종 비중이 약 92%에 달하는 것으로 나타남

14) 한국은행(2014)은 경기 상승기 대비 하강기에 국간간 경기동조성이 높은 수준으로 나타나고 있음을 보고하고 있음

15) 본고의 주요국 글로벌 통화정책 차별화는 G4(미국, 유로존, 영국, 일본) 국가 간 기준금리 격차로 정의하였으며, 이는 미국 기준금리와 영국, 유로존, 일본 기준금리 평균치간 격차로 측정하였음

16) BRICs는 브라질, 러시아, 인도, 중국 등 방대한 인구와 자원을 배경으로 경제대국으로 성장할 가능성이 높은 거대신흥국을 지칭하는 용어로, 2001년 골드만삭스 투자보고서에서 처음 사용된 이후 최근에는 남아공을 포함한 거대신흥국 5개국 그룹을 지칭하는 용어로 사용되고 있음

17) 당시 기준금리가 단기간 내 크게 상승하였음에도 불구하고 주가가 상승하고 장기국채 금리가 하락하는 등 금리인상의 효과가 나타나지 않았던 현상을 두고 미연준 의장의 발언을 인용해 “그린스펀 코넌드럼(Greenspan Conundrum)”이라 불리운 바 있음

18) 또한 미연준은 2017년 10월부터 만기도래 보유분에 대한 재투자를 축소하는 방식으로 양적긴축을 진행되었으며, 당시 4.5조달러에 달했던 연준 보유자산 규모는 2019년 9월 자산매입 재개 이전까지 약 3.8조달러 수준까지 감소하였음

19) IMF(2015)에 따르면 2013년 5월 미연준 의장의 테이퍼링 발언 이후 신흥국 펀드로부터 자금유출 규모는 2003년 6월~2014년 3월 기간 중 약 995억달러 수준으로 나타나고 있음

20) 김남종 외(2021)에 따르면 2013년 테이퍼링 언급 시점은 미연준이 최초로 통화정책 정상화 계획을 발표하였던 시점으로, 당시 소위 긴축발작(taper tantrum)은 경기회복세가 여전히 미진한 상태에서 상당부분 통화정책 커뮤니케이션 실패에 기인하고 있는 것으로 분석됨

21) 유럽중앙은행 창설 이전인 1994년 당시 미국과 독일 중앙은행 간 통화정책 차별화가 나타난 바 있으나, 이는 독일이 통일 이후 금리 정상화를 진행하였던 시점으로 실질금리의 경우에는 독일의 금리인하 후에도 미국 대비 높은 수준을 유지했던 것으로 나타남

22) 외국인의 국내주식 순매도 추세는 2015년 6월~2016년 1월까지 지속된 것으로 나타나며, 이후 2017년 8월까지 순매수가 이어지면서 외국인의 국내 시가총액 대비 보유비중은 28.6%에서 34.8%까지 반등하였음

23) 신흥국 자본유출입 결정요인 관련 다수의 연구결과를 종합한 Koepke(2015)의 논문에 따르면 신흥국 자본유출입을 설명하는 유의한 결정변수로 대외요인의 상대적 중요성이 큰 것으로 나타나고 있음

24) Kalemli-Ozcan(2019)은 미국을 제외한 주요 선진국의 금리와 VIX지수와의 상관관계는 상대적으로 낮게 나타나고 있어 국제금융시장 위험선호도 지표로서 미국 금리의 대표성을 강조하고 있음

25) 이들 연구에서는 외환스왑시장을 통한 달러화 자금조달이 가능한 유럽 등 주요 선진국의 경우 자국 유동성을 활용한 해외증권투자 자금조달이 가능함에 따라 미국과 차별화된 통화정책 기조는 신흥국 자본유출입에 간접적 영향을 미칠 수 있음을 설명하고 있음

26) 이는 주요 선진국 간 통화정책 차별화는 미국 금리변화에 따른 국내 파급효과에 간접적으로 영향을 미치고 있음을 나타내며, 실제 미국을 제외한 주요 선진국의 기준금리 변화 및 주요국 간 금리격차의 유의한 독립적 효과는 추정되지 않았음

27) Phillips-Perron 단위근(Uniit Root) 검정 결과 미국 금리는 5% 유의수준에서 기타 모든 변수는 1% 유의수준에서 귀무가설을 기각하였음

28) 예를 들어 다른 조건이 동일한 경우 주요 선진국 간 통화정책 차별화가 발생하지 않는 경우(PD=0)에는 미국의 1%p 금리인상은 국내 증권투자 수지(GDP 대비)를 약 2.3%p 개선(순유출)하는 것으로 나타나나, 통화정책 차별화가 발생하는 경우(PD=1) 동일한 미국 금리인상에 따른 국내 증권투자수지 개선 효과는 0.4%p 감소(2.3%p → 1.9%p)

29) 최근까지 미국 등 주요국의 러시아산 원유 금수 조치가 이어지고 있으며 최근에는 EU 또한 러시아산 원유수입의 단계적 축소 및 관세 부과 등을 검토하고 있는 것으로 알려져 있음(국제금융센터, 2022.5)

30) 스태그플레이션(stagflation)은 인플레이션과 경기침체가 동시에 발생하는 상황을 지칭함

31) 해당 지수는 미국 부르킹스 연구소(Brookings Institute)가 주요 20개국(G20)의 실물경기, 금융시장 변동성, 기업·소비자 신뢰지수 등 경기동향을 종합한 지수임

32) IMF는 지난 4월 세계경제전망(WEO) 보고서에서 2022년 세계경제 성장률을 기존(1월) 전망치 대비 0.8%p 하락한 3.6%로 전망하였음

33) 유럽중앙은행은 2022년 4월 정책위원회 회의에서 올해 3분기 중 자산매입프로그램(APP) 종료 가능성이 강화되고 있는 것으로 평가함

참고문헌

강태수·김경훈·서현덕·강은정, 2018, 미국 통화정책이 국내 금융시장에 미치는 영향 및 자본유출입 안정화방안, 대외경제정책연구원 연구보고서 18-04.

국제금융센터, 주간 국제금융 이슈 각호.

김남종·김현태·박해식, 2021.12, 미국 통화정책 정상황의 영향과 시사점, 한국금융연구원 정책분석보고서 2021-02.

김한수, 2017, 『글로벌 유동성 축소 반전 가능성 및 영향 분석』, 자본시장연구원 이슈보고서 17-11.

서현덕·강태수, 2019, 미국 통화정책이 국내 금융시장 및 자금유출입에 미치는 영향: TNP-VAR 모형 분석, 한국은행 경제분석 제25권 제2호.

윤영진·박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증분석, 『경제학연구』, 67(2).

이승호, 2021, 『최근 외국인투자자의 국내주식 매매행태와 자금유출입 변동요인 분석』, 자본시장연구원 이슈보고서 21-28.

한국은행, 2014, 『통화신용정책보고서』.

허찬국·김창배·남광희, 2014, 미국의 양적 완화 축소가 국내 금리, 환율, 자본유입에 미치는 영향 분석, 『한국경제연구』, 32(3).

Adrian, T., Gopinath, G., 2021, Addressing Inflation Pressures Amid an Enduring Pandemic, IMF Blog(2021.12.3).

Avdjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017, The shifting drivers of global liquidity, BIS working papers 644.

Chuhan, P., Claessenns, S., Mamingii, N., 1998, Equity and bond flows to Lattina America and Asia: The role of global and country factors, Journal of Development Economics 55(2).

Davis, S., Zlate, A., 2018, Monetary policy divergence and net capital flows: Accounting for endogenous policy responses, working paper 18-05, Federal Reserve Bank of Boston.

He, D., Wong, E., Ho, K., Tsang, A., 2017, Divergent monetaryu policies and insternational dollar credit: Evidence form bank-level data, ADBI working paper 741.

IMF, 2015, World Economic Outlook.

IMF, 2021, World Economic Outlook.

Kallemli-Ozcan, S., 2019, U.S. monetary policy and international risk spillover, NBER working paper 26297.

Kim, S., Kim, S. H., Choi, Y., 2013, Determinants of international capitla flows in Korea: push vs. pull factors, Korea and the World Economy 14(3).

Koepke, R., 2015, What drives capital flows to emerging markets? A survey of th empirical literature, IIF working paper.

최근 주요 선진국 통화정책 변화의 움직임이 점차 가속화되고 있다. 글로벌 금융위기 및 팬데믹 위기의 대응과정에서 막대한 유동성을 공급한 주요국 중앙은행이 최근 실물경기 회복세가 가시화되면서 통화정책 정상화의 시동을 걸고 있는 것이다. 특히 최근에는 우크라이나 사태 발발 등 대외환경 변화로 인해 주요국의 물가상승 압력이 급증하고 있어 주요국의 통화정책 정상화 속도는 예상보다 빠르게 진행될 가능성이 높아지고 있다. 올해 들어 이미 미국과 영국은 기준금리 인상과 더불어 중앙은행 보유자산을 축소하는 양적긴축에 돌입하고 있으며, 현재까지 완화적 통화정책을 유지해오고 있는 유럽중앙은행 또한 하반기 이후 긴축기조로 선회할 가능성이 확대되고 있는 상황이다.

주요국의 통화정책 변화는 우리나라 및 신흥국 자본유출입에 영향을 미치는 주요인중 하나로 기존의 많은 논문에서도 미국 등 선진국 금리 변화는 신흥국 자본유출입에 유의한 영향을 미치는 것으로 분석되고 있다. 다만 미국이 금리인상을 시작하였던 최근 시점에서는 이러한 영향이 다소 줄어들고 있는 것으로 보고된다. 우리나라의 경우에도 글로벌 금융위기 이후 여타국 대비 빠른 경기회복세를 보인 미국이 기준금리 인상 등 통화정책 정상화를 시도한 2016~2018년 기간 중 국내 금융시장에서의 급격한 자본유출 등 부정적 영향은 제한적이었던 것으로 나타나고 있다. 이러한 상황은 우리나라의 대외건전성 개선 등에 기인한 바도 있겠으나, 이와 더불어 해당 기간 중 미국을 제외한 주요 선진국의 완화적 통화정책 기조 유지에 따른 주요국 간 통화정책 차별화가 미국 금리 인상의 영향을 일부 상쇄시키고 있는 것으로 추정해 볼 수 있다.

본고에서는 최근 주요국 통화정책 변화 추이 분석과 더불어 주요국간 통화정책 차별화 발발 시점에서의 국내 자본유출입 변화요인을 살펴보았다. 본고의 분석은 최근 미국 등 주요국의 금리인상 속도가 가속화되고 있는 시점에서 주요국간 통화정책 차별화 발생 여부에 따른 국내 자본유출입 변동에 미치는 파급효과의 크기를 가늠하는데 도움을 줄 수 있을 것으로 기대된다. 본고의 구성은 다음과 같다. 제Ⅱ장에서는 주요 선진국의 최근 통화정책 추이 및 국내 자본유출입 현황을 분석하였다. 제Ⅲ장에서는 글로벌 통화정책 차별화에 따른 영향을 과거 사례 분석 및 실증분석을 통해 살펴보았으며, 제Ⅳ장에서는 본고의 분석에 따른 시사점을 제시하였다.

Ⅱ. 주요국 통화정책 및 국내 자본유출입 현황

최근 인플레이션 우려 확대 및 경기상황 변동 등으로 인해 주요국 중앙은행의 통화정책 변화의 움직임이 가속화되고 있다. 이미 미국 및 영국 중앙은행은 기준금리 인상과 더불어 연내 양적긴축1) 시행을 예고하고 있으며 현재까지 완화적 통화정책 기조를 유지하고 있는 유로존의 경우에도 물가상승 압력 고착화에 따른 통화정책 변화 가능성이 점증하고 있는 것으로 나타난다. 이러한 주요국의 통화정책 변화는 신흥국 및 국내로의 자본유출입 변동요인으로 작용할 것으로 예상된다. 이에 따라 본 장에서는 주요국의 최근 통화정책 변화 추이 및 최근 국내 금융시장에서의 증권투자자금 유출입 현황을 점검하였다.

1. 주요국 통화정책 현황

팬데믹 발발 이후 지난해 말까지 완화적 통화정책 기조를 유지해온 주요국(미국, 유로존, 영국, 일본 등) 중앙은행은 올해 초 이후 차별화된 변화의 모습을 보이고 있다. 팬데믹 상황에 따른 일시적 경제활동 제약 등으로 다소 주춤했던 주요국의 경제상황이 대규모 재정부양책 등에 힘입어 지난해 이후 뚜렷한 회복세를 보이고 있으며, 최근 인플레이션 압력이 고조되면서 미국 등 주요국을 중심으로 통화정책 변화의 움직임을 보이고 있는 것이다. 특히 최근에는 글로벌 공급망 차질에 따른 물가상승 압력 확대와 더불어 우크라이나 사태 발발로 인한 원자재 가격 상승 등 인플레이션 요인이 크게 부각되면서 주요 선진국을 중심으로 올해 중 빠른 속도로 통화긴축 행보를 이어갈 가능성이 높을 것으로 전망되고 있다.

최근 주요국의 경기상황을 살펴보면 주요 선진국은 팬데믹 발발 이후 강력한 경기부양책 실시와 더불어 백신 보급 확산에 따른 경제 활동 재개가 본격화되면서 최근까지 견조한 회복세를 지속해오고 있는 것으로 나타난다. <그림 II-1>에서 나타난 바와 같이 주요국의 실질 GDP 등 경기지표는 팬데믹 발발 이전 시점(2019년 4분기) 수준을 대부분 회복한 것으로 나타나고 있으며, 특히 주요국의 고용상황 또한 팬데믹에 따른 일시적 노동수요 감소요인이 빠른 속도로 회복되는 모습을 보이고 있다. 다만 올해 초의 경우에는 지정학적 갈등 및 공급망 차질 지속 등의 부정적 요인이 부각되면서 미국의 경우 1분기 중 역성장(-1.4%, 전기 대비)을 기록 하는 등 성장 흐름이 다소 주춤하는 모습을 보이고 있다.2)

반면 유럽과 일본의 경우에는 현재까지 완화적 통화정책 기조를 유지하고 있는 것으로 나타난다. 유럽중앙은행은 최근 물가상승 압력 심화에도 불구하고 유로지역 경제의 상대적으로 낮은 성장세 및 근원물가 상승률 등을 반영하여 완화적 통화정책 기조 유지와 더불어 기존 자산매입 프로그램 또한 점진적 감소 전략을 유지할 것으로 예상된다.6) 이는 러시아 경제와 연관도가 높은 유로존 경제의 특성상 에너지 공급 제약에 따른 스태그플레이션 발발 가능성 등의 요인이 통화정책 결정에 일부 반영된 것으로 추정해볼 수 있다. 일본의 경우에도 최근 일시적으로 소비자물가 상승세가 나타나고 있으나, 에너지를 제외한 근원물가의 상승압력이 여전히 제한적이며 엔화 약세를 통한 수출기업의 수익확대 등 긍정적 효과가 나타나고 있는 만큼 단기간 내 통화긴축으로 선회할 가능성은 높지 않을 것으로 예상된다.7)

이러한 주요국의 통화정책 변화에 따라 주요국의 기준금리는 <그림 II-3>에 나타난 바와 같이 올해 초 이후 격차가 확대되는 양상을 보이고 있다. 이는 앞서 살펴본 바와 같이 최근 물가상승 위험 심화와 더불어 에너지 공급 차질에 따른 스태그플레이션 우려까지 대두되면서 각국별 경제상황에 따라 통화정책 변화가 차별화되고 있는 것으로 해석해 볼 수 있다. 따라서 향후 글로벌 통화정책 차별화 추이는 이러한 대외요인 변화에 따라 상이한 방향으로 전개될 개연성이 높을 것으로 예상된다. 최근 우크라이나 사태의 장기화 가능성과 더불어 글로벌 공급망 재편이라는 세계경제의 구조변화로 인해 단기간 내 물가상승 위험이 해소되기는 어려울 것이라는 전망이 확산되고 있기 때문이다. 이미 시장에서는 유로존 지역의 통화긴축 조기 실시 가능성이 점차 확대되는 것으로 나타나고 있으며8) 미국과 영국의 통화정책 정상화 속도 또한 가속화 전망이 주도적인 상황으로 향후 주요국의 통화정책 변화는 우리나라 및 주요 신흥국 자본유출입에 큰 영향을 미칠 수 있을 것으로 예상된다.

최근 국내 금융시장에서의 증권자금 유출입 추이를 살펴보면 팬데믹 발발 이후 최근까지 주식투자자금 위주의 순유출 추세가 지속되고 있는 것으로 나타난다. <그림 II-4>에 나타난 바와 같이 국내 증권자금 순유입분(해외투자자의 국내증권투자자금(유입)과 국내투자자의 해외증권투자자금(유출) 간 차액)9)은 2020년 1월 이후 최근까지 약 690억달러 규모의 순유출을 기록하고 있으며, 특히 주식투자자금 순유출이 최근 크게 확대되고 있는 것으로 나타난다. 즉 해당 기간 중 채권투자자금은 순유입(1,069억달러)을 기록하였으나 동기간 주식투자자금이 순유출(1,759억달러)을 기록하면서 국내 금융시장에서의 자본유출을 주도하고 있다. 특히 채권자금의 경우에는 국제금융시장의 변동성 확대에도 불구하고 최근까지 외국투자자의 국내채권자금 순유입 추세가 지속되고 있는 것으로 나타나고 있어 주식부문과 대비되는 모습을 보이고 있다.10)

Ⅲ. 글로벌 통화정책 차별화에 따른 영향 분석

최근 미국의 금리인상이 본격화되면서 주요 선진국간 통화정책 탈동조화 추세가 나타나고 있다. 글로벌 금융위기 및 팬데믹 위기의 대응 과정에서 주요국 통화정책이 동반 완화된 바 있으나 최근 경기회복 기대가 강화되면서 각국별 경제상황에 따라 통화정책 변화의 차별화가 나타나고 있는 것이다. 주요국간 통화정책 차별화는 과거 미국이 통화긴축을 선도하였던 사례에서도 관찰된다. 본장에서는 최근 글로벌 통화정책 차별화 시점에서의 주요 특징을 살펴보고 실증분석을 통해 통화정책 차별화가 국내 자본유출입에 미치는 영향 등을 살펴보았다.

1. 차별화 시점별 주요 배경 및 영향

각국의 통화정책은 원칙적으로 고용 상황 및 물가 등 자국 고유의 경제상황에 따라 독자적으로 결정된다. 따라서 주요국간 물가, 실업률 등 경기상황의 차이에 따른 주요국간 통화정책 차별화는 각국 경제 펀더멘털에 기인한 일반적인 상황으로 볼 수 있다. 그러나 최근 주요국의 통화정책 추이는 대부분 기간 중 동조화에 가까운 행보를 보인 것으로 나타난다. 이는 무엇보다 글로벌 금융위기 및 팬데믹 위기를 겪으면서 주요국 중앙은행의 동반 통화정책 완화 기조가 상당기간 지속되었기 때문으로 볼 수 있다. 일반적으로 경기하강기에는 주요국간 경기동조성이 높게 나타나고 있으며, 금리 인상기 대비 인하 시점의 주요국의 통화정책 변화는 즉각적으로 이루어지는 측면이 강한 것으로 나타나고 있기 때문이다.14)

<그림 III-1>에 나타난 바와 같이 최근 주요국 간 통화정책 차별화가 두드러지게 나타난 시점은 미국 주도의 기준금리 인상이 진행되었던 2004~2006년(기간①) 및 2016~2018년(기간②)으로 나타난다.15) 기간①은 미연준이 17차례에 걸쳐 기준금리를 총 425bp 인상하였던 시점으로, 해당 기간 중 유로존은 소폭의 기준금리 인상(150bp)을 단행하였으나 일본, 영국 중앙은행이 기존 수준을 유지하면서 주요국 간 금리격차가 확대된 것으로 나타난다. 해당 차별화 시점은 인플레이션 압력이 제한적인 가운데 BRICs16)로 불리던 거대신흥국의 성장세가 두드러졌던 기간으로, 글로벌 증시가 동반 상승세를 보인 가운데 글로벌 증권자금 이동 급변 등 국제금융시장의 충격은 나타나지 않았던 것으로 파악된다.17)

최근 두 차례의 글로벌 통화정책 차별화 시점 모두 미국의 통화긴축의 효과가 제한적이었다는 점은 주요국 간 통화정책 차별화가 미국 통화정책의 긴축효과를 일부 상쇄시키고 있는 것으로 추정해 볼 수 있다. 2000년대 이후 주요국 통화정책 변화와 연관되어 국제금융시장의 급격한 변화가 나타났던 시점은 2013년 미연준 의장의 자산매입 축소(tapering) 언급 시점이 유일한 것으로 나타나고 있으며19), 미연준의 실제 자산매입 축소가 시작된 2014년 및 2016년 이후 금리인상 시점에서의 미국 통화정책 변화의 영향은 제한적인 것으로 파악된다.20) 이는 특히 1990년대 미국 통화긴축의 여파로 신흥국의 급격한 자본유출이 발생하였던 과거의 경험과는 극명하게 대비되는 모습으로, 주요국 간 통화정책 차별화가 일정 부분 미국 주도의 금리인상에 따른 신흥국 파급효과를 경감시키고 있는 것으로 생각해 볼 수 있다.21)

<그림 III-2>는 글로벌 통화정책 차별화 기간 중 외국인투자자의 국내 증권자금 유출입 추이를 보여주고 있다. 먼저 기간①의 경우 외국인투자자의 국내채권 투자자금은 지속적인 유입세를 기록한 것으로 나타나고 있으며, 국내주식 투자자금의 경우에는 2006년 중반 이후 순유출로 전환된 것으로 나타나고 있으나 해당 기간 중 소폭의 누적 순유입을 기록하고 있다. 기간②에서는 국내주식 투자자금의 경우 2016년 초반 이후 순유입 추세가 우세한 것으로 나타나고 있으며, 국내채권 투자자금의 경우에는 2017년 이후 뚜렷한 유입세로 전환된 것으로 나타난다.22) 또한 동기간 글로벌 펀드자금의 신흥국 자본유출입 추이도 국내의 상황과 유사하였던 것으로 나타나고 있어, 미국의 금리인상에 따른 국내 및 신흥국 자본유출입파급효과는 주요국 간 통화정책 차별화 여부에 따라 일부 상쇄효과가 나타나고 있는 것으로 추정된다. 다만 개별국의 자본유출입 변화는 해외요인과 더불어 다양한 국내요인에 따라 결정되고 있기에 이에 대한 추가적인 검증이 필요할 것으로 판단된다. 이에 다음 절에서는 주요국 간 통화정책 차별화가 국내 자본유출입 변화에 미치는 영향을 실증분석을 통해 추정하여 보았다.

국경간 자본유출입 결정요인을 분석하고 있는 기존 연구결과에 따르면 대내요인(pull factor)과 더불어 주요 선진국 금리 등 대외요인(push factor)이 개별국의 자본유출입을 결정하는 주요 요인이라는 다수의 증거들이 제시되고 있다. 특히 신흥국의 경우에는 대외요인이 상대적으로 중요한 영향을 미치고 있다는 다수의 연구결과가 제시되고 있으며23), 이러한 연구결과는 국제금융시장 상황에 영향을 미치는 주요 선진국의 통화정책 변화가 국내 자본유출입 변동에 크게 영향을 미치고 있음을 보여주고 있다.

한편 자본유출입 변동요인을 분석하고 있는 대다수의 기존 연구에서는 미국 통화정책 관련 변수를 국제금융시장의 위험도를 나타내는 주요 변수로 활용하고 있다.24) 그러나 최근에는 주요 선진국 간 통화정책 차별화 경향이 두드러지게 나타나면서 글로벌 통화정책 차별화가 자본유출입에 유의한 영향을 미치고 있다는 연구결과 또한 제시되고 있다. 예를 들어 Avdjiev et al.(2017)은 글로벌 금융위기 이후 미국 통화정책 변화에 따른 국경간 자본유출입 민감도는 글로벌 통화정책 차별화 정도에 따라 감소하는 것으로 추정하였으며, 홍콩 금융시장의 외국계 은행을 대상으로 자본유출입 결정요인을 분석한 He et al.(2017)의 연구에서도 글로벌 통화정책 차별화의 영향이 유의한 것으로 추정되었다.25)

우리나라를 대상으로 한 주요 연구에서도 미국 금리 등 대외요인은 국내 자본유출입에 유의한 영향을 미치고 있는 것으로 나타난다. 우리나라 국제수지를 활용하여 자본유출입 결정요인을 분석한 Kim et al.(2013)에서는 대외요인이 유의한 결정변수로 추정되었으며, 이승호(2021), 윤영진·박종욱(2019) 등 다수의 연구에서 대내요인과 더불어 대외요인의 유의성이 확인되었다. 한편 미국 통화정책 변화가 국내 금융시장 자본유출입에 미치는 영향을 분석한 서현덕·강태수(2019)의 연구에서는 2015년 이후 미국의 금리인상에 따른 영향이 일부 감소한 것으로 나타난다. 해당 기간은 앞서 살펴본 바와 같이 주요국 간 통화정책 차별화가 두드러지게 나타난 시점으로 국내의 경우에도 글로벌 통화정책 차별화가 미국 통화정책의 파급효과를 일부 상쇄시키고 있는 것으로 추측해 볼 수 있다.

본 절에서는 주요국간 통화정책 차별화를 포함한 대내외 요인이 국내 자본유출입에 미치는 영향을 실증분석해 보았다. 분석모형의 종속변수(FA)로는 국제수지 금융계정 및 증권투자수지(GDP 대비 비중)를 사용하였다. 해당 변수는 내국인의 해외자산 순유출 및 외국인의 국내자산 순유입을 동시에 포함하고 있어 자본유출입을 동시에 포괄적으로 살펴볼 수 있다. 금융계정의 경우에는 중앙은행 외환보유액 증감분을 제외하여 민간부문의 자본유출입 변동을 살펴보았으며, 국제금융시장 변동요인에 상대적으로 민감하게 반응할 것으로 예상되는 증권투자수지를 별도로 설정하여 부문별 영향을 추정하였다. 추정기간은 2000년 이후 최근까지 분기별 자료를 활용하였으며, 글로벌 금융위기가 발생한 구간에 대해서는 기간더미변수를 활용하였다. 구체적인 분석모형은 다음과 같이 설정하였다.

증권투자수지를 대상으로 한 두 번째 분석모형에서는 금리, 주가 등 국내 변수와 더불어 미국 금리 및 글로벌 통화정책 차별화 관련 설명변수의 부호가 예상과 일치하게 추정되었으며 통계적 유의성 또한 확인되었다. 먼저 국내 금리 및 주가 상승은 증권투자수지를 개선(순유입 증가)시키는 것으로 나타났으며, 미국의 금리 상승은 반대 방향의 영향을 미치는 것으로 추정되었다. 특히 미국 금리 변수와 상호작용 항으로 설정한 글로벌 통화정책 차별화 변수가 유의한 음(-)의 값을 가지는 것으로 추정되었으며, 이는 미국의 통화정책 변화에 따른 국내 자본유출입 변화의 민감도가 글로벌 통화정책의 차별화 정도에 따라 일부 상쇄되고 있다는 본고의 추론과 일치하고 있다. 즉 추정결과에 따르면 미국의 금리인상이 국내 증권자금 유출입에 미치는 영향은 미국과 주요 선진국 간 금리격차 폭이 확대됨에 따라 그 효과가 감소하고 있는 것으로 나타난다.28) 이러한 분석결과는 최근 미국 통화긴축에 따른 국내 파급효과는 미국을 제외한 여타 선진국의 통화정책 변화의 방향에 따라 영향력의 크기가 결정될 수 있음을 시사하고 있다.

3. 최근 사례의 특수성 및 위험요인

앞서 살펴본 바와 같이 올해 들어 주요국의 통화정책 변화는 차별화의 방향으로 진행되는 것으로 나타나고 있어 본고의 분석결과에 따르면 최근 미국 금리인상에 따른 국내 자본유출입 압력 또한 제한적일 것이라는 추론이 가능하다. 또한 과거 미국이 금리인상을 선도한 시점에서도 국내 파급효과는 제한적이었던 것으로 나타나고 있는 만큼 최근 이러한 낙관적인 전망에 대한 기대가 커지고 있는 것으로 생각된다. 그러나 최근의 상황은 다음과 같은 측면에서 과거 미국의 금리인상 시점과는 차별화되고 있다는 점에서 주의할 필요가 있다.

먼저 최근 범세계적으로 나타나고 있는 물가상승 압력이 장기간 지속될 가능성이 높을 것이라는 전망이 확대되고 있는 만큼 향후 단기간 내 글로벌 동반 통화긴축으로의 급격한 선회 가능성 등의 위험요인에 유의할 필요가 있다. 이는 무엇보다 우크라이나 사태 발발에 따른 지정학적 리스크가 해소되지 않는 한 유가 상승기조는 당분간 지속될 것으로 예상되고 있기 때문이다.29) 또한 팬데믹 이후 주요 물가상승 요인으로 지목되고 있는 글로벌 공급망 둔화는 최근 중국의 봉쇄조치 강화와 더불어 회복속도가 지연되고 있으며, 일부에서는 최근의 상황이 자국 중심의 생산체계로 전환되어가는 구조적 변화의 과정으로 이에 따른 물가상승 압력은 당분간 지속될 것이라는 전망이 확대되고 있다. 주요국 물가상승 위험이 고착화되어 가고 있는 현 상황은 과거 미국 통화긴축 사례에서 나타나지 않았던 새로운 위험요인으로 향후 주요국 통화정책 변화의 방향이 동반 긴축으로 급격히 선회할 경우 우리나라 및 신흥국 자본유출입 압력이 배가될 수 있음에 유의할 필요가 있을 것으로 판단된다.

본고의 분석결과는 다음과 같이 요약된다. 먼저 최근 주요 선진국의 통화정책 변화는 본격적으로 통화긴축에 돌입하고 있는 미국·영국과 물가상승세 확대에도 불구하고 완화적 통화정책 기조를 최근까지 유지하고 있는 유로존·일본 등 주요국간 통화정책 탈동조화 추세가 나타나고 있다. 과거 미국이 금리인상을 선도하였던 2004~2006년 및 2016~2018년 기간 중에도 주요국간 통화정책 차별화 양상이 나타난 바 있으며 당시 신흥국의 급격한 자본유출 등 미국 금리인상에 따른 부정적 파급효과는 제한적이었던 것으로 나타난다.

본고의 실증분석 결과에서도 주요 선진국 간 통화정책 차별화는 미국 금리인상이 국내 자본유출입 변화에 미치는 영향을 일부 상쇄시키는 유의한 효과가 나타나고 있는 것으로 추정되었다. 이러한 결과는 과거에 비해 대외요인 변화에 따른 자본유출 압력이 제한적이라는 최근의 상황을 일부 설명하고 있는 것으로 해석된다. 즉 우리나라의 낮은 국가채무 수준 및 외환건전성 규제 강화 등 대외건전성 개선의 효과와 더불어 주요국 간 통화정책 차별화 또한 우리나라 단기 자본유출입 변동성 개선에 기여하고 있는 것으로 판단된다.

한편 앞서 살펴본 바와 같이 최근 주요국 간 통화정책 차별화 양상은 과거 사례와는 다음과 같은 점에서 차별화되고 있다는 점에 유의할 필요가 있다. 먼저 최근에는 세계경제의 구조적 변화와 지정학적 위험이 결합되면서 글로벌 인플레 위험의 고착화 가능성이 확대되고 있다. 이에 따라 향후 선진국의 통화정책 변화가 동반 긴축의 방향으로 동조화될 경우 우리나라 및 신흥국 자본유출 압력이 배가될 수 있음에 특히 유의할 필요가 있을 것이다. 또한 최근의 상황은 물가상승세 확대와 더불어 경기침체를 동반하는 스태그플레이션 발발 가능성 및 주요국 양적긴축 가속화에 따른 글로벌 유동성 위축 등의 불확실성이 더불어 점증하고 있는 상황으로, 과거의 경험을 바탕으로 미국 금리상승의 영향이 제한적일 것이라는 낙관적인 전망은 어려울 것으로 판단된다.

우리나라는 글로벌 금융위기 이후 대외 순자산국으로의 전환 및 대규모 경상수지 흑자 지속 등 국제금융시장 불안에 대응하는 경제 기초체력은 과거 어느 시점보다 강화된 것으로 판단된다. 그러나 여전히 대외불확실성 확대는 우리나라를 포함한 신흥국 경제의 급격한 자본유출입 변동을 초래하는 요인으로 나타나고 있는 만큼 이에 대한 철저한 대비가 필요할 것으로 판단된다. 특히 최근의 상황은 2000년대 이후 경험하지 못한 주요 선진국 중앙은행의 동반 긴축으로의

선회 가능성 및 중앙은행 보유자산 축소에 따른 글로벌 유동성 감소 등의 비우호적 대외환경이 전개될 가능성이 높아지고 있는 만큼 주요국의 통화정책 변화 및 자본유출입에 대한 모니터링을 강화할 필요가 있을 것이다. 또한 향후 자본유출입 변동성이 확대될 경우 글로벌 금융위기 이후 도입한 외환건전성조치를 적극 활용하여 대외건전성 관리를 철저히 할 필요가 있을 것으로 판단된다.

1) 양적긴축(Quantitative Tightening: QT)은 중앙은행의 보유자산 감축을 의미하며, 이는 중앙은행 보유자산의 만기도래분에 대한 재투자 축소 및 매각 등을 통해 진행됨

2) 유로존, 영국, 일본 등의 경우에도 2022년 1분기 성장률은 각각 0.2%, 0.9%, -1.8%(속보치 기준, 전기대비)로 낮은 수준을 기록함

3) 일본의 경우 소비자물가 상승세는 팬데믹 이전에도 저조하였으며 최근 에너지 가격 급등 영향으로 일시적으로 반등하였으나, 에너지를 제외한 근원물가는 여전히 마이너스 상승률(-1.2%)을 보이고 있음

4) 2020년 3월 기준 미국 및 영국의 소비자물가 상승률(8.6% 및 7.0%)은 지난 30년 이래 최대치를 기록하였음

5) 연준의 양적긴축(QT)은 연준 보유증권의 재투자 금액을 조절하는 방식으로 진행되며, 지난 5월 연방공개시장위원회(FOMC) 결정에 따르면 6~8월 중 월 475억달러(국채 300억달러, MBS/기관채 175억달러) 규모로 시작하고 9월부터는 월 950억달러(국채 600억달러, MBS/기관채 350억달러) 규모로 확대할 예정임

6) 유럽중앙은행은 현재까지 자산매입프로그램(APP) 및 팬데믹 긴급프로그램(PEPP)을 통해 양적완화 정책을 지속해오고 있으며, 지난 4월 통화정책회의에서는 2분기 중 매입규모를 단계적으로 축소하고 향후 경제상황에 따라 종료 여부를 결정할 것임을 발표한 바 있음

7) 일본은행은 2020년 4월 금융정책결정회의에서 현재 통화정책 방향을 유지하기로 결정한 바 있으며, 2% 물가상승률 목표를 안정적으로 달성하기 전까지 기존 방향을 지속할 방침임을 표명하고 있음

8) 국제금융센터(2022.5.2)에 따르면 시장에서는 연내 유럽중앙은행의 기준금리 인상이 단행될 것이라는 전망이 우세한 것으로 나타나고 있음

9) 한국은행 증권투자수지는 순유출(자산(내국인 해외증권투자) - 부채(외국인 국내증권투자))로 시산되나, 본고에서는 해석상 편의를 위해 역방향(순유입)으로 표시하였음

10) 해당 기간 중 외국인투자자는 2020년 1월~2022년 3월 기간 중 국내채권자금은 약 1,215억달러 순유입한 반면 국내주식자금은 342억달러 순유출된 것으로 나타남

11) 이승호(2021)에 따르면 2020년 이후 외국인투자자의 국내주식 순매도액 대비 유출액(국제수지통계 기준) 비중은 이전 국제금융시장 불확실성 확대 시점 대비 감소한 것으로 나타남

12) 개별국가별로는 한국, 대만 등 수출의존도가 높은 국가의 경우에는 순유출세를 보인 반면, 원자재 수출국 위주로 주식자금 순유입을 주도하고 있는 것으로 나타나고 있음

13) 국제금융센터(2022.5.11)에 따르면 올해 5월 10일까지 외국인 국내증시 순매도 금액(11.6조원) 중 전기전자 업종 비중이 약 92%에 달하는 것으로 나타남

14) 한국은행(2014)은 경기 상승기 대비 하강기에 국간간 경기동조성이 높은 수준으로 나타나고 있음을 보고하고 있음

15) 본고의 주요국 글로벌 통화정책 차별화는 G4(미국, 유로존, 영국, 일본) 국가 간 기준금리 격차로 정의하였으며, 이는 미국 기준금리와 영국, 유로존, 일본 기준금리 평균치간 격차로 측정하였음

16) BRICs는 브라질, 러시아, 인도, 중국 등 방대한 인구와 자원을 배경으로 경제대국으로 성장할 가능성이 높은 거대신흥국을 지칭하는 용어로, 2001년 골드만삭스 투자보고서에서 처음 사용된 이후 최근에는 남아공을 포함한 거대신흥국 5개국 그룹을 지칭하는 용어로 사용되고 있음

17) 당시 기준금리가 단기간 내 크게 상승하였음에도 불구하고 주가가 상승하고 장기국채 금리가 하락하는 등 금리인상의 효과가 나타나지 않았던 현상을 두고 미연준 의장의 발언을 인용해 “그린스펀 코넌드럼(Greenspan Conundrum)”이라 불리운 바 있음

18) 또한 미연준은 2017년 10월부터 만기도래 보유분에 대한 재투자를 축소하는 방식으로 양적긴축을 진행되었으며, 당시 4.5조달러에 달했던 연준 보유자산 규모는 2019년 9월 자산매입 재개 이전까지 약 3.8조달러 수준까지 감소하였음

19) IMF(2015)에 따르면 2013년 5월 미연준 의장의 테이퍼링 발언 이후 신흥국 펀드로부터 자금유출 규모는 2003년 6월~2014년 3월 기간 중 약 995억달러 수준으로 나타나고 있음

20) 김남종 외(2021)에 따르면 2013년 테이퍼링 언급 시점은 미연준이 최초로 통화정책 정상화 계획을 발표하였던 시점으로, 당시 소위 긴축발작(taper tantrum)은 경기회복세가 여전히 미진한 상태에서 상당부분 통화정책 커뮤니케이션 실패에 기인하고 있는 것으로 분석됨

21) 유럽중앙은행 창설 이전인 1994년 당시 미국과 독일 중앙은행 간 통화정책 차별화가 나타난 바 있으나, 이는 독일이 통일 이후 금리 정상화를 진행하였던 시점으로 실질금리의 경우에는 독일의 금리인하 후에도 미국 대비 높은 수준을 유지했던 것으로 나타남

22) 외국인의 국내주식 순매도 추세는 2015년 6월~2016년 1월까지 지속된 것으로 나타나며, 이후 2017년 8월까지 순매수가 이어지면서 외국인의 국내 시가총액 대비 보유비중은 28.6%에서 34.8%까지 반등하였음

23) 신흥국 자본유출입 결정요인 관련 다수의 연구결과를 종합한 Koepke(2015)의 논문에 따르면 신흥국 자본유출입을 설명하는 유의한 결정변수로 대외요인의 상대적 중요성이 큰 것으로 나타나고 있음

24) Kalemli-Ozcan(2019)은 미국을 제외한 주요 선진국의 금리와 VIX지수와의 상관관계는 상대적으로 낮게 나타나고 있어 국제금융시장 위험선호도 지표로서 미국 금리의 대표성을 강조하고 있음

25) 이들 연구에서는 외환스왑시장을 통한 달러화 자금조달이 가능한 유럽 등 주요 선진국의 경우 자국 유동성을 활용한 해외증권투자 자금조달이 가능함에 따라 미국과 차별화된 통화정책 기조는 신흥국 자본유출입에 간접적 영향을 미칠 수 있음을 설명하고 있음

26) 이는 주요 선진국 간 통화정책 차별화는 미국 금리변화에 따른 국내 파급효과에 간접적으로 영향을 미치고 있음을 나타내며, 실제 미국을 제외한 주요 선진국의 기준금리 변화 및 주요국 간 금리격차의 유의한 독립적 효과는 추정되지 않았음

27) Phillips-Perron 단위근(Uniit Root) 검정 결과 미국 금리는 5% 유의수준에서 기타 모든 변수는 1% 유의수준에서 귀무가설을 기각하였음

28) 예를 들어 다른 조건이 동일한 경우 주요 선진국 간 통화정책 차별화가 발생하지 않는 경우(PD=0)에는 미국의 1%p 금리인상은 국내 증권투자 수지(GDP 대비)를 약 2.3%p 개선(순유출)하는 것으로 나타나나, 통화정책 차별화가 발생하는 경우(PD=1) 동일한 미국 금리인상에 따른 국내 증권투자수지 개선 효과는 0.4%p 감소(2.3%p → 1.9%p)

29) 최근까지 미국 등 주요국의 러시아산 원유 금수 조치가 이어지고 있으며 최근에는 EU 또한 러시아산 원유수입의 단계적 축소 및 관세 부과 등을 검토하고 있는 것으로 알려져 있음(국제금융센터, 2022.5)

30) 스태그플레이션(stagflation)은 인플레이션과 경기침체가 동시에 발생하는 상황을 지칭함

31) 해당 지수는 미국 부르킹스 연구소(Brookings Institute)가 주요 20개국(G20)의 실물경기, 금융시장 변동성, 기업·소비자 신뢰지수 등 경기동향을 종합한 지수임

32) IMF는 지난 4월 세계경제전망(WEO) 보고서에서 2022년 세계경제 성장률을 기존(1월) 전망치 대비 0.8%p 하락한 3.6%로 전망하였음

33) 유럽중앙은행은 2022년 4월 정책위원회 회의에서 올해 3분기 중 자산매입프로그램(APP) 종료 가능성이 강화되고 있는 것으로 평가함

참고문헌

강태수·김경훈·서현덕·강은정, 2018, 미국 통화정책이 국내 금융시장에 미치는 영향 및 자본유출입 안정화방안, 대외경제정책연구원 연구보고서 18-04.

국제금융센터, 주간 국제금융 이슈 각호.

김남종·김현태·박해식, 2021.12, 미국 통화정책 정상황의 영향과 시사점, 한국금융연구원 정책분석보고서 2021-02.

김한수, 2017, 『글로벌 유동성 축소 반전 가능성 및 영향 분석』, 자본시장연구원 이슈보고서 17-11.

서현덕·강태수, 2019, 미국 통화정책이 국내 금융시장 및 자금유출입에 미치는 영향: TNP-VAR 모형 분석, 한국은행 경제분석 제25권 제2호.

윤영진·박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증분석, 『경제학연구』, 67(2).

이승호, 2021, 『최근 외국인투자자의 국내주식 매매행태와 자금유출입 변동요인 분석』, 자본시장연구원 이슈보고서 21-28.

한국은행, 2014, 『통화신용정책보고서』.

허찬국·김창배·남광희, 2014, 미국의 양적 완화 축소가 국내 금리, 환율, 자본유입에 미치는 영향 분석, 『한국경제연구』, 32(3).

Adrian, T., Gopinath, G., 2021, Addressing Inflation Pressures Amid an Enduring Pandemic, IMF Blog(2021.12.3).

Avdjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017, The shifting drivers of global liquidity, BIS working papers 644.

Chuhan, P., Claessenns, S., Mamingii, N., 1998, Equity and bond flows to Lattina America and Asia: The role of global and country factors, Journal of Development Economics 55(2).

Davis, S., Zlate, A., 2018, Monetary policy divergence and net capital flows: Accounting for endogenous policy responses, working paper 18-05, Federal Reserve Bank of Boston.

He, D., Wong, E., Ho, K., Tsang, A., 2017, Divergent monetaryu policies and insternational dollar credit: Evidence form bank-level data, ADBI working paper 741.

IMF, 2015, World Economic Outlook.

IMF, 2021, World Economic Outlook.

Kallemli-Ozcan, S., 2019, U.S. monetary policy and international risk spillover, NBER working paper 26297.

Kim, S., Kim, S. H., Choi, Y., 2013, Determinants of international capitla flows in Korea: push vs. pull factors, Korea and the World Economy 14(3).

Koepke, R., 2015, What drives capital flows to emerging markets? A survey of th empirical literature, IIF working paper.