Find out more about our latest publications

Business Development Companies: Characteristics and Implications from Foreign Schemes

Issue Papers 22-10 Jul. 05, 2022

- Research Topic Corporate Finance

- Page 26

A Business development company (BDC) slated to be introduced to Korea is a listed risk capital investment vehicle. BDCs are designed to contribute to creating a risk capital ecosystem through the public capital markets and offer an opportunity to make diversified investments in non-listed innovative firms. In this regard, Korea should examine similar schemes implemented in foreign countries such as the BDC of the US and the venture capital trust (VCT) of the UK to figure out how to properly operate BDCs (K-BDCs) that accommodate conditions of its risk capital market.

The US introduced the BDC as a closed-end investment company that was allowed to invest in privately-place securities by enacting the Small Business Incentive Act in 1980. The BDCs of the US are subject to relaxed regulations, compared to ordinary registered investment funds. The UK has operated the VCT that is a closed-end, listed investment vehicle characterized by favorable tax treatment for retail investors since 1995, aiming for expanding venture capital funding for early-stage firms. How the BDC and VCT schemes have been operated varies according to features of the risk capital markets of respective countries. More concretely, the BDC of the US has evolved into a debt-focused investment vehicle while the UK’s VCT has served as an equity-focused listed investment vehicle designed to facilitate venture capital investment.

To ensure the successful operation of the K-BDC scheme, the following aspects should be taken into consideration in terms of operational regulations, tax benefits, prevention of conflicts of interest and expandability. First, operational regulations should be established to ensure that K-BDCs are subject to a compulsory investment ratio similar to that of foreign schemes. Also, the regulations need to determine the minimum equity investment ratio and enable follow-on investment for supporting scale-up. Second, tax benefits should be offered only to equity-focused investment vehicles, for which sub-categories of investment vehicles could be defined. Third, considering that a wide range of business entities is expected to operate K-BDCs, including existing private VC funds and PE funds, asset management firms and securities firms, regulatory safeguards should be put in place to minimize the possibility of conflicts of interest that may arise from a firm operating both a private venture capital fund and a public K-BDC. Fourth, it is worth considering the possibility that K-BDCs would evolve into a listed investment vehicle that encompasses various investment strategies and target growth stages in the long run.

The US introduced the BDC as a closed-end investment company that was allowed to invest in privately-place securities by enacting the Small Business Incentive Act in 1980. The BDCs of the US are subject to relaxed regulations, compared to ordinary registered investment funds. The UK has operated the VCT that is a closed-end, listed investment vehicle characterized by favorable tax treatment for retail investors since 1995, aiming for expanding venture capital funding for early-stage firms. How the BDC and VCT schemes have been operated varies according to features of the risk capital markets of respective countries. More concretely, the BDC of the US has evolved into a debt-focused investment vehicle while the UK’s VCT has served as an equity-focused listed investment vehicle designed to facilitate venture capital investment.

To ensure the successful operation of the K-BDC scheme, the following aspects should be taken into consideration in terms of operational regulations, tax benefits, prevention of conflicts of interest and expandability. First, operational regulations should be established to ensure that K-BDCs are subject to a compulsory investment ratio similar to that of foreign schemes. Also, the regulations need to determine the minimum equity investment ratio and enable follow-on investment for supporting scale-up. Second, tax benefits should be offered only to equity-focused investment vehicles, for which sub-categories of investment vehicles could be defined. Third, considering that a wide range of business entities is expected to operate K-BDCs, including existing private VC funds and PE funds, asset management firms and securities firms, regulatory safeguards should be put in place to minimize the possibility of conflicts of interest that may arise from a firm operating both a private venture capital fund and a public K-BDC. Fourth, it is worth considering the possibility that K-BDCs would evolve into a listed investment vehicle that encompasses various investment strategies and target growth stages in the long run.

Ⅰ. 서론

정책당국은 지난 2019년 10월 모험자본 활성화와 일반투자자의 유망 비상장기업 투자 확대를 위해 미국 BDC(Business Development Company)를 벤치마킹한 기업성장집합투자기구의 도입을 발표하였다(금융위원회, 2019. 10. 7). 2021년 8월 기업성장집합투자기구 도입 안을 담은 자본시장법 개정안과 2022년 3월 수정안이 국회 통과를 거쳐 금년 중 입법이 예상되는데 개정안은 기업성장집합투자기구의 정의, 설립요건, 운용규제, 인가요건 등 기본적인 사항만을 규정하고 있으며 제도 운용과 관련된 세부사항을 결정하기 위한 논의가 진행되고 있다. 현재 금융투자업자와 벤처캐피탈 운용사 등 다양한 모험자본 중개기관의 관심이 높은 가운데 향후 국내 모험자본 시장 전반의 변화가 예상된다.1)

도입 예정인 기업성장집합투자기구는 해외 유사 제도를 벤치마킹하고 있으며 이러한 대표적인 해외 사례로는 미국 BDC와 영국 VCT(Venture Capital Trust)를 들 수 있다. 미국은 1980년 소기업투자촉진법 제정을 통하여 사모증권에 투자할 수 있는 폐쇄형 투자회사로서 BDC를 도입하였다. 한편 영국은 1995년 창업초기 기업에 대한 모험자본 공급 확대를 목적으로 세제혜택에 기반을 둔 VCT라는 공모ㆍ폐쇄형 투자회사 제도를 도입한 바 있다. 미국과 영국은 모두 모험자본 공급 확대를 목적으로 관련 제도를 도입하였으나 이러한 제도는 각국 모험자본 시장 전반의 특징과 성격을 반영하여 상이한 특색을 가지고 발전하여 왔다.

국내 기업성장집합투자기구 제도가 국내 현실에 부합하는 방향으로 운영되기 위해서는 해외 유사 제도의 운영사례 분석을 통해 바람직한 제도 운영의 시사점을 도출할 필요가 있다. BDC와 VCT 같은 상장형 모험자본 투자기구 제도의 성공적인 도입과 운용에는 폐쇄형ㆍ조합형 사모펀드 중심의 모험자본시장 전반과의 연계성 그리고 투자자보호에 대한 분석ㆍ평가가 필요하기 때문이다. 또한 각국 모험자본시장의 발전도 및 특징과 정합적인 제도 설계가 필요하다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 도입 예정인 기업성장집합투자기구의 특징을 살펴보고 해외사례로서 미국 BDC와 영국 VCT의 현황과 특징을 비교 분석한다. Ⅲ장에서는 기업성장집합투자기구 제도 도입과 관련하여 고려해야 할 해외사례의 시사점에 대하여 기술하며 Ⅳ장에서는 본 보고서를 마무리한다.

Ⅱ. 기업성장집합투자기구의 특징과 해외사례

1. 기업성장집합투자기구의 특징

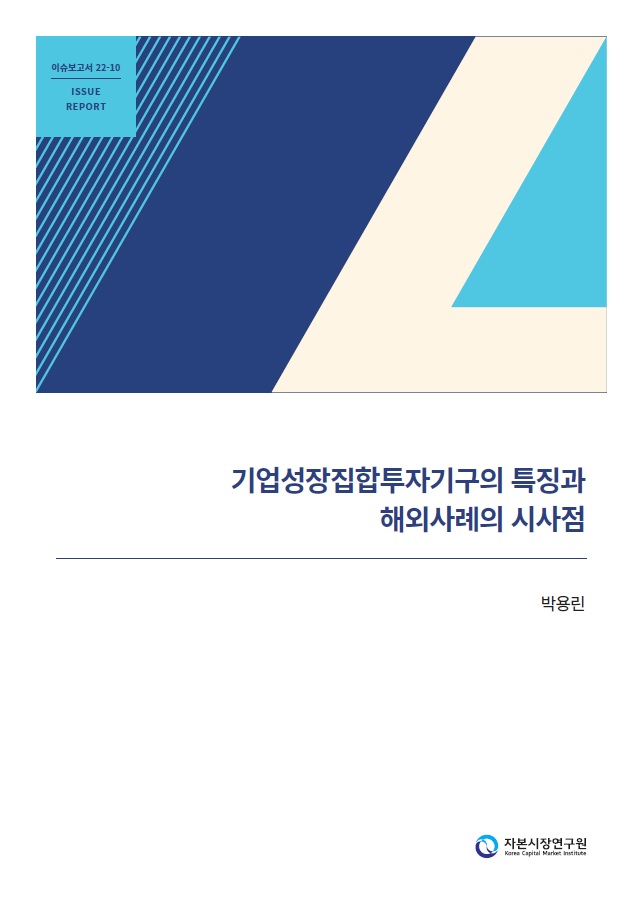

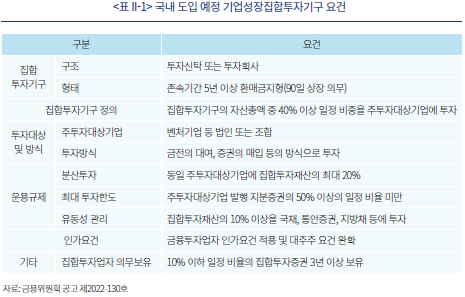

기업성장집합투자기구 제도 도입의 목적은 벤처기업 등의 성장을 적극적으로 지원하고 모험자본을 보다 원활하게 공급하기 위하여 성장 가능성이 높은 벤처기업 등에 금전의 대여, 증권의 매입 등의 방법으로 투자하는 상장 폐쇄형 투자기구를 설정ㆍ설립할 수 있도록 제도적 근거를 마련하는 것이다. 먼저 기업성장집합투자기구는 자산총액의 40% 이상의 일정 비율에 해당하는 금액을 초과하는 집합투자재산을 벤처기업 등(‘주투자대상기업’)에 금전 대여, 증권 매입 등의 방법으로 투자하는 투자기구로 정의된다.

운용규제로는 분산투자 의무, 최대 투자한도, 유동성 관리 의무가 부과된다. 첫째, 분산투자를 위해 자산총액의 20% 이하로서 일정 비율에 해당하는 금액 이하를 동일 주투자대상기업에 투자하여야 한다. 둘째, 최대 투자한도 관련하여 주투자대상기업 발행 지분증권 총수의 50% 이상으로서 일정 지분증권 수 이상의 투자가 금지된다. 셋째, 집합투자재산의 10% 이상으로서 일정 비율에 해당하는 금액 이상을 국채 등 안정적인 금융투자상품에 투자하여야 하며, 이때 주투자대상기업에 금전 대여가 가능하되 부동산 투자는 금지된다.

설정ㆍ설립 요건으로 기업성장집합투자기구는 투자신탁 또는 투자회사로서 존속기간 최소 5년 이상, 모집가액은 500억원 이하 일정액 이상의 환매금지형 집합투자기구로 설정ㆍ설립하여야 하며 집합투자증권 발행 후 90일 이내 상장하여야 한다.2) 기업성장집합투자업자는 10% 이하 일정 비율의 집합투자증권을 3년 이상의 일정 기간 동안 보유해야 한다. 마지막으로 인가요건으로 자본시장법 제12조 금융투자업자의 인가요건을 적용하되 이 중 대주주 요건 관련하여 완화된 인가요건을 적용하여 벤처캐피탈 운용사의 진입을 허용하도록 하였다.3)

2. 해외사례: 미국 BDC와 영국 VCT

국내 기업성장집합투자기구는 미국 BDC를 벤치마킹한 것으로 알려졌으나 미국 BDC와 같은 상장형 모험자본 펀드는 미국 뿐만 아니라 영국, 프랑스, 독일 등 기타 주요 선진국에도 존재하는 투자기구이다. 본 보고서에서는 이러한 해외 사례 중 시장규모와 운용성과 측면에서 잘 알려진 미국 BDC와 영국 VCT에 대하여 살펴본다.

가. 미국 BDC

1) 역사적 배경4)

1970년대 미국의 신생 혁신기업은 자본시장으로부터 소외된 채 성장을 위한 자금 확보가 어려운 상황이었는데 미국 의회는 이러한 문제의 원인을 개선하고자 일련의 청문회를 개최하였다. 이러한 개선 노력에 참여한 미국 VC 운용사들은 신생 혁신기업 자금난의 원인으로 VC가 1940년 투자회사법(Investment Company Act)상 규제를 받지 않고 공적 자본시장을 통해 자금을 조달할 수 없기 때문이라고 주장하였다. 즉, VC 운용사들은 투자회사법상 규제로 인하여 점차로 투자회사법의 규제를 적용받지 않는 사적 영역에서 투자활동을 영위하게 되었다는 것이다. 투자회사법은 예외 규정의 적용을 받지 않을 경우 뮤추얼펀드뿐만 아니라 VC도 규제 대상이 되며, 이에 따라 VC는 공적 자본시장 자금을 포기하는 대신 사모방식 펀드 운용을 통하여 투자회사법의 규제를 회피하게 되었다는 것이다. 이에 따라 미국 의회는 1980년 소기업투자촉진법(Small Business Incentive Act) 제정을 통해 규제가 완화된 투자회사법상 폐쇄형 투자회사로 BDC를 도입하였다.따라서 BDC는 투자회사법상 투자자보호의 유지를 전제로 VC 투자 확대를 위해 규제가 완화된 투자기구라고 할 수 있다.

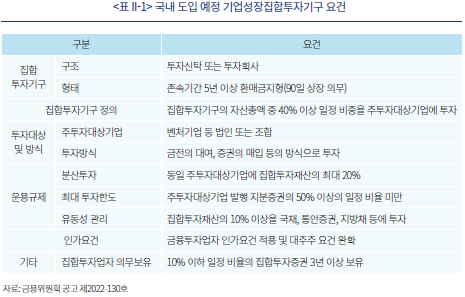

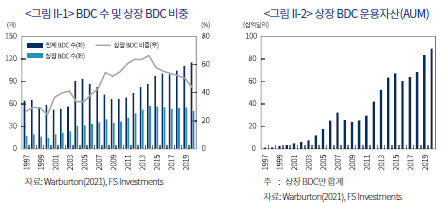

BDC는 도입 후 1년 동안 총 7개가 설립되었으며 이 중 2개가 상장되었으나5) 도입 초기 VC 투자기구로서 모험자본시장에서 많은 관심을 끌지는 못했다. 그러나 2000년대 중반 금융위기 전후 BDC는 많은 관심을 받으며 운용자산 규모가 크게 증가하기 시작했는데 여기에는 신생 혁신기업의 자금수요 증가와 금융위기 이후 모험자본시장에 의한 비상장기업 대출(private debt) 증가가 크게 기여했다. 2020년 말 기준 BDC는 총 115개이며6) 이 중 50개 상장 BDC의 운용자산 규모는 890억달러로 BDC는 미국 모험자본시장의 중요한 투자기구의 하나로 성장하였으며 그 과정에서 BDC를 활성화하기 위한 규제완화가 지속적으로 이루어졌다.7)

2) 운용규제

위에서 살펴본 바와 같이 BDC는 소규모 기업에 대한 VC 투자 확대를 위하여 등록 투자회사의 운용규제를 완화한 투자기구이다. BDC는 VC 투자 확대를 위하여 ‘적격 포트폴리오 기업’(eligible portfolio companies)에 투자하여야 하며8) 이와 관련하여 ‘중요한 경영지원’(signifi cant mana-gerial assistance)을 제공하여야 한다.9)10) 추가적으로 BDC의 법적 지위를 획득하기 위해서는 투자회사법상 BDC의 지위를 선택해야 하며 또한 1934년 증권거래법상 증권등록 의무와 일반 공개기업과 동일한 공시의무가 발생한다.

BDC는 자산의 70%를 투자회사법 Section 55에 열거된 적격 포트폴리오 기업이 발행한 증권에 신주 또는 대출 방식으로 투자하여야 하는데 적격 포트폴리오 기업은 미국 국내 기업으로서 투자회사가 아니며 비상장기업 또는 시가총액 2,500만달러 미만 상장기업이다(SEC Rule 2a-46, 2006). 이때, 70% 기준에는 유동성 확보를 위한 현금, 국채 및 만기 1년 미만의 유동자산이 포함되나 주목적 투자가 되어서는 안 된다. 총자산의 나머지 30%는 BDC의 재량에 따라 투자하는데 포트폴리오 분산과 투자자 배당 지급을 위한 자산에 투자하는 경우가 많다. 한편 BDC의 분산투자 요건은 미국 세법과 밀접한 관련이 있다. BDC는 일정 요건을 만족할 경우 세법상 규제투자회사(Regulated Investment Company: RIC) 자격을 신청할 수 있으며 세법상 RIC로 간주될 경우 법인세 면세 혜택이 적용된다.11) 이에는 분산투자 요건이 포함되는데 이에 따르면 동일기업 투자는 BDC 자산의 최대 25%로 제한된다.

3) 레버리지, 가치평가 및 기타 규제

BDC는 BDC로서의 법적 지위에 상응하여 1940년 투자회사법상 등록 폐쇄형 투자회사에 적용되는 규제와 비교하여 완화한 규제가 적용된다(투자회사법 Section 54~65). 구체적으로 BDC는 등록 폐쇄형 투자회사 대비 레버리지, 특수관계인 거래, 가치평가 및 공시에서 완화된 규제가 적용된다.

먼저 레버리지는 자산커버리지(asset coverage) 비율에 따라 규제되는데 이는 차입금 대비 순자본과 차입금 합계의 비율이다. 투자회사법상 등록 투자회사의 최소 자산커버리지 비율은 300%인 반면, BDC는 150%로써12) 이는 BDC가 출자금 대비 2배의 차입이 가능함을 의미한다. 이러한 레버리지 규제는 BDC가 자산의 일정 부분을 유동성 자산에 투자하는 이유가 되고 있다. 또한 BDC는 일반 등록 폐쇄형 펀드와 달리 다양한 순위(class)의 차입금 조달이 가능하며 옵션, 워런트, 기타 전환권 등의 발행이 가능하다.

특수관계자 거래 관련 규제도 일반 폐쇄형 펀드 대비 완화되어 있다. 먼저 주주, 임원, 종업원 등 BDC의 특수관계인(‘upstream’) 관련 사항으로 BDC 지배주주, 임원, 종업원 등의 이해관계인과 BDC의 거래가 금지된다(투자회사법 57(a)). BDC 지분의 5~25%를 보유한 비지배주주와 BDC의 거래는 BDC 이사회의 표결에 의해 결정된다(투자회사법 57(d)). 반면 BDC의 포트폴리오 기업과의 관계(‘downstream’)와 관련하여 포트폴리오 기업 이사회 참여 등 BDC의 일상적인 포트폴리오 기업에 대한 경영 관여를 고려할 때 BDC와 포트폴리오 기업 간 거래는 일반적으로 이해관계자 거래로 간주되지 않는다.

한편 유동성이 낮은 비상장기업에 투자하는 BDC의 속성으로 인하여 BDC는 공정가치(fair value)에 기초한 분기별 가치평가(valuation)가 허용되며 가치평가가 결정되는 과정에는 경영진, 이사회, 감사, 가치평가사 등이 참여한다. 한편 BDC는 일반 폐쇄형 펀드와 마찬가지로 주당 순자산가치(Net Asset Value: NAV) 이하의 가격으로 신주발행이 금지되나 BDC의 경우 이사회와 주주총회의 승인을 전제로 순자산가치 이하의 신주발행이 가능하다. 또한 BDC는 일반 폐쇄형 펀드와 달리 다른 BDC와의 M&A를 위한 신규 증권발행이 가능하다.

마지막으로 BDC는 투자회사법상 보고의무가 면제되나 사모 BDC가 아닌 경우 증권거래법(Se-curities Exchange Act) 상 Form 10-K, 10-Q, 8-K, 위임장권유신고서(proxy statement) 등 공개기업의 공시의무가 부과되며 2002년 Sarbanes-Oxley Act에 따른 내부회계관리 의무가 따른다.

4) 운용주체와 운용보수

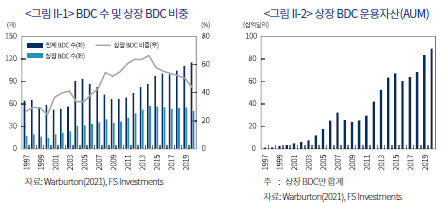

BDC는 위탁운용(external management) 또는 내부운용(internal management)이 모두 가능하나 대부분 위탁운용의 방식으로 운용되고 있다. <표 Ⅱ-2>에서 조사된 48개 상장 BDC 가운데 내부운용 방식을 채택하고 있는 BDC는 7개로서 전체의 14.6%에 불과하다. 내부운용은 BDC의 이사회 관리하에 성과보상 체계를 갖추고 운용인력을 자체 보유하는 방식이며 위탁운용은 BDC 이사회 관리 하에 외부 투자자문기관과의 위탁운용 계약을 통해 BDC 자산을 운용하는 방식으로서 운용보수를 제공한다. 이러한 운용보수는 통상 BDC 자산의 일정 비율로 산정되는 관리보수와 자본이득에 기초한 성과보수로 구성된다. 그러나 성과보수 비율은 20%를 초과할 수 없으며 자본이득에 기초한 성과보수를 수취하는 경우 BDC의 이익을 공유하는 방식의 성과보수를 동시에 수취할 수 없다. 또한 현행 위탁운용 BDC는 일정 기준수익률(예를 들어 7%)을 초과하는 이자ㆍ배당수입의 20%에 해당하는 성과보수를 수취하고 있다. 따라서 위탁운용 BDC의 보수체계는 일반적인 사모 VCㆍPE 펀드의 보수체계를 기본으로 하되 이자ㆍ배당 수입 기반의 성과보수를 반영하고 있다. 한편 내부운용의 경우 운용인력에 대한 성과보상은 스톡옵션 또는 이익공유 방식 중 하나를 선택하여야 한다.

5) BDC 시장 현황 및 구조

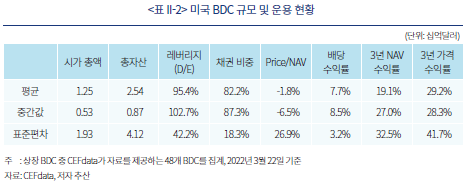

2022년 3월 22일 기준 48개 상장 BDC의 평균 시가총액과 자산 규모는 각각12.5억달러, 25.4억달러이다. 또한 평균 레버리지 비율은 95.4%이며 4개 주식형 BDC의 평균 레버리지 비율은 4.7%이다. 포트폴리오 중 채권 비중은 평균 82.2%이며 2019~2021년 3년간 NAV와 가격 기준 평균 총수익률은 각각 19.1%, 29.2%이다. NAV 대비 할인율의 평균은 –1.8%이며 배당수익률의 평균은 7.7%이다. 마지막으로 30일간 누적 거래대금 회전율은 0.18% 수준으로 제한된 유동성을 나타내고 있다.

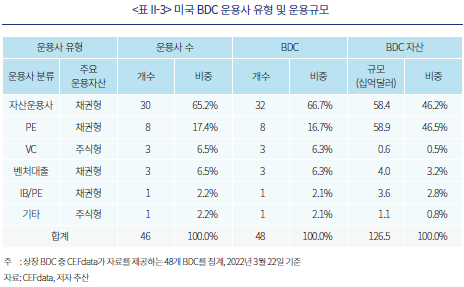

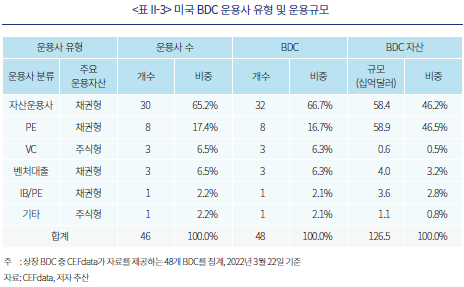

미국 BDC는 적격 포트폴리오 기업의 상장 여부와 규모에 대해서만 규정할 뿐 투자 방식이나 유형을 구분하여 규정하지 않는다. 일반적으로 BDC는 채권형(debt-focused)과 주식형(equity-fo-cused)으로 대별되는데 채권형은 상대적으로 안정적인 현금흐름이 발생하는 성장 단계의 적격 포트폴리오 기업에 대하여 대출과 후순위채권 투자 방식으로, 주식형은 스타트업에 대한 지분투자 방식으로 운용된다. 대다수의 BDC는 주식형보다 채권형으로 운용되고 있는데 <표 Ⅱ-3>에 의하면 48개의 상장 BDC 중 채권형이 개수 및 규모 기준으로 각각 91.6%, 98.7%의 절대 비중을 차지하고 있다. 이러한 원인으로는 BDC의 적격 투자방식이 대출이나 증권 투자로 포괄적으로 규정되어 있고 미국 세법상 RIC 지정과 법인세 면제 혜택을 통해 배당주로서 투자 수요를 충족시키고있으며 모험자본시장을 통한 비상장기업 대출(private debt)에 대한 수요가 급증하였기 때문으로 풀이된다(Chernenko et al., 2021).

한편 BDC 운용사 분포는 48개 상장 BDC를 기준으로 일반 자산운용사가 30개, PE 8개, VC 3개, 벤처대출(venture debt) 운용사 3개로서 자산운용 관련 전문운용사가 96%를 차지하고 있어 전통적으로 대체투자를 포함한 자산운용사들이 자금원을 다각화하는 차원에서 운용하고 있는 것으로 판단된다. 한편 스타트업에 대한 자금공급 기준으로 주식형 VC와 채권형 벤처대출 운용사가 각각 3개씩으로 운용사 수 및 자산 기준으로 각각 전체의 13.0%, 3.7%를 차지하고 있다.

나. 영국 VCT

1) 역사적 배경

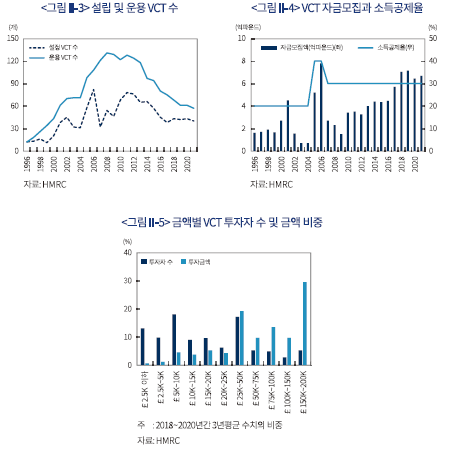

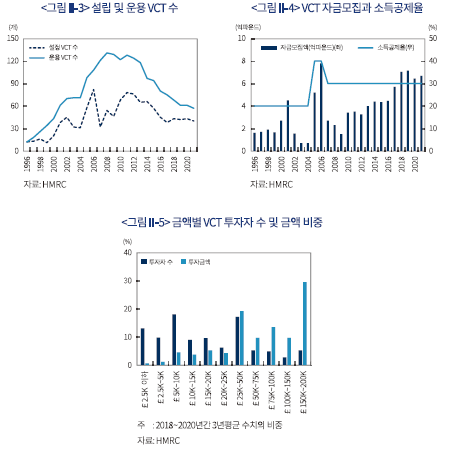

영국 VCT는 1995년 집권당이던 영국 보수당 정부가 일반 개인투자자들이 간접적으로 소규모 비상장 회사에 투자할 수 있도록 재정법(Finance Act)을 통해 도입한 상장 투자회사이다. VCT는 영국의 폐쇄형 투자회사인 투자신탁(investment trust)의 일종으로서 금융투자회사가 운용하며 적격 투자대상기업의 성장을 위해 자금과 기타 경영지원을 제공한다. VCT는 2021년 기준 57개의 VCT가 상장되어 있으며13)(<그림 Ⅱ-3>), 2021년 6.7억파운드, 도입 이후 누적 96.9억파운드의 자금을 모집하였다(<그림 Ⅱ-4>). VCT는 높은 수준의 소득공제 혜택이 특징인 투자수단으로서 자금모집이 소득공제율의 변화에 민감하게 반응해 왔다. VCT의 소득공제율은 1996~2004년간 20%, 2005~2006년간 40%에 이어 2007년부터 현재까지 30%로 유지되고 있는데 소득공제율이 20%에서 40%로 급증한 2005년의 자금모집은 5.2억파운드로 전년도 0.7억파운드 대비 7.4배 증가하였다(<그림 II-4>). 한편 VCT는 개인투자자만 투자가 가능하며 소득공제 신청 기준 투자자 수는 2018~2020년 평균 18,928명으로 투자 최대액인 15만~20만 파운드를 투자한 투자자의 비중이 투자자 수 및 금액 기준으로 각각 5.2%, 29.5%를 차지하고 있어 VCT는 위험감수 여력을 가진 고액소득자의 절세 투자수단으로 활용되는 경향이 있는 것으로 평가되고 있다(<그림 II-5>).

VCT는 소규모 기업이 지분투자를 유치하기 어려운 현실, 즉 자본갭(equity gap)에 대한 인식을 바탕으로 출범하였다(Rayna & Striukova, 2009). 전술한 바와 같이 영국 정부는 소규모 기업에 대한 개인투자자 자금의 원활한 유입을 위해 높은 수준의 소득공제 혜택을 제도 도입 초기부터 부여하였는데 이러한 매력적인 세제혜택에도 불구하고 일부 운용규제의 공백을 이용하여 제도가 추구하는 정책목표에 배치되는 투자가 보고되는 등 운용규제의 강화 필요성이 대두되었다. 예를 들어, VCT는 제도 출범 초기 스타트업에 대한 지분투자 확대를 위해 비상장기업 또는 AIM 상장기업으로서 천만파운드 미만 자산을 가진 영국 소재기업을 적격 투자대상의 기준으로 설정했으나 업력은 적격투자의 기준이 아니었다. 따라서 많은 VCT들이 일정 업력의 성숙기업을 대상으로 경영자인수(Management Buy-Out: MBO) 등 바이아웃 투자나 자산담보부 투자를 하는 등 제도 본연의 취지를 살리지 못했다. 이에 따라 영국 규제당국은 2015년 재정법(Finance Act)을 통해 운용규제를 강화하는 조치를 취하였는데 먼저 VCT 자산 중 적격투자대상(Qualifying Investment)의 비중을 초기 70%에서 80%로 상향 조정하였으며 증자로 모집되는 자금의 30%는 1년 이내에 투자하도록 규제를 강화하였다. 또한 업력과 관련하여 적격 투자기업을 매출 발생 후 7년 미만 기업에 한정하였으며 적격 투자기업에 투자된 자금은 기업 성장을 지원하기 위한 용도로 제한되었으며 M&A를 위한 인수금융이나 타 회사의 구주 취득이 금지되었다.

2) 운용규제14)

VCT로 승인되기 위해서는 영국 내 정상기업의 주식(shares) 또는 증권(securities)으로부터의 수입이 70% 이상으로써15) 보통주가 EU 규제시장(regulated market)에 상장되어야 하며16) 회계기간 내 수익의 15% 이상 내부유보가 금지된다. 또한 자산의 80% 이상이 적격투자대상에 투자되어야 하며17) 개별회사 투자한도는 15%이다. 적격투자는 신주 투자 또는 만기 5년 이상의 무담보 대출만을 포함하며 적격투자의 70% 이상이 보통주에 투자되어야 한다. 또한 유동성 관리를 위해 비적격투자대상에 투자할 수 있는데 자산의 20%를 한도로 7일 이내 현금화가 가능한 AIF, UCITS18) 등 펀드와 예금, 그리고 상장증권을 보유할 수 있다.

개별 투자대상과 관련하여도 VCT는 다양한 운용규제가 부과된다. 먼저 적격투자대상은 영국 소재 비상장기업 또는 AIM 또는 ISDX19) 상장기업이어야 한다. 또한 자산 및 종업원 규모, 건당 및 누적 투자규모, 보통주 투자비중, 업력, 자금 용도 등에 대한 규제가 존재한다. 먼저 총자산기준(gross asset test)이라 불리는 자산규모 제한이 있는데 자산 규모가 VCT 보통주 투자 전 1,500만파운드 이하인 기업에 투자가 이루어져야 하며, 보통주 투자 직후 자산규모가 1,600만파운드 이하여야 한다. 종업원 규모와 관련된 규제는 시간제 종업원 포함 종업원 수 250인(2018년 4월 6일 이후 지식집약적 기업20)에 대하여는 500인) 미만 기업이다. 건 당 최대 투자 한도는 백만파운드, 과거 12개월 피투자기업 당 한도는 5백만파운드(2018년 4월 6일 이후 지식집약적 기업에 대하여는 천만파운드), 전체 기간 피투자기업 당 한도는 1,200만파운드(2018년 4월 6일 이후 지식집약적 기업에 대하여는 천만파운드)로 제한된다. 마지막으로 피투자기업의 보통주 투자와 대출이 이루어질 경우 보통주 투자 규모는 전체 자금공급 규모의 10% 이상을 차지해야 한다.

한편 전술한 VCT 운용규제 강화와 관련하여 2018년 이후 도입된 대표적인 운용규제로 업력 제한, VCT 증자금의 사용 및 VCT 투자금의 M&A 용도 사용 금지를 들 수 있다. 먼저 업력 기준으로 적격투자대상 기업에 대한 VCT의 최초 투자는 매출 발생 후 7년(지식집약적 기업에 대하여는 10년) 내에 이루어져야 한다.21) VCT가 증자로 확보한 투자 재원은 당해 회계연도 말 이후 12개월 안에 증자금의 최소 30%가 적격투자대상에 투자되어야 한다. 또한 VCT 투자금은 주식, 영업양수도, 무형자산 양수도 포함 일체의 M&A를 위한 자금으로 사용되어서는 안 된다. 마지막으로 VCT는 세제혜택이 위험회피 투자에 이용되는 것을 방지하고자 자본위험조건(‘risk-to-capital’ condition)을 부과하고 있다. 이는 투자금이 피투자기업의 매출, 고객 및 고용 증가 등 지속가능한 성장과 발전을 위해 사용되고 투자자에게는 모험투자가 되어야 한다는 원칙중심 조건이다.

3) 세제혜택

VCT 제도는 세제혜택이 특징적인 대표적인 투자상품으로 인식되고 있듯이 VCT의 세제지원은 제도 안착의 결정적인 역할은 한 것으로 평가받고 있다. VCT 관련 세제혜택은 다음과 같다. 무엇보다 VCT는 수익의 85% 이상을 배당하는 투자회사로서 VCT 자체가 법인세를 면제받는다. 투자자의 세제혜택으로는 국제적으로 비교해도 높은 수준의 소득공제와 배당소득세 및 양도소득세 면제를 들 수 있다. 먼저 소득공제 관련하여 투자 후 5년 보유를 전제로 소득공제 혜택이 부여되는데1995년 출범 당시의 VCT 투자에 대한 소득공제 한도와 소득공제율은 각각 10만파운드, 20%였으나 2021년 현재는 20만파운드, 30%로 상향되었다. 그러나 VCT의 소득공제 혜택은 2025년 4월 일몰이 예정되어 있다(HM Treasury and HMRC, Finance Bill 2015). 한편 배당소득세 및 양도소득세는 1995년 이후 면제이나 VCT의 양도소득세 통산은 허용되지 않는다.

4) 레버리지, 가치평가 및 기타 규제

VCT의 레버리지는 세제혜택을 받기 위해 운용규제가 규정되어 있는 소득세법에 의해서가 아니라 개별 VCT의 정관에 의해 규정되고 있다. 정관상 일정 레버리지 한도를 부여하고 있음에도 불구하고 거의 모든 VCT는 적격투자대상과 보통주 투자 중심의 운용규제로 인하여 대부분의 경우 투자수익률 제고를 위한 차입은 이루어지고 있지 않다.

가치평가는 통상 분기별 또는 반기별로 시행되며 일반적인 사모 VC 펀드에서의 가치평가와 마찬가지로 비상장기업 지분 및 대출은 국제사모펀드가치평가지침(IPEV Guideline)에 따라 공정가치로, 상장기업 및 유동성이 높은 투자자산은 시가평가(mark-to-market) 후 합산하여 산정한다. 마지막으로 VCT 지배구조는 UK 스튜어드쉽 코드를 투자회사에 맞도록 적용한 AIC Code(2019)를 사용하는 경우가 대부분이다.

5) 운용주체와 운용보수

영국 VCT는 미국 BDC와 마찬가지로 위탁운용 또는 내부운용(self-management)이 모두 가능하나 VCT의 절대다수가 위탁운용 방식을 채택하고 있다. 자료가 존재하는 전체 60개 VCT 중 내부운용은 VCT 수, 운용사 수 및 운용자산 규모 기준으로 각각 5개, 2개, 3,200만파운드이며 전체에서차지하는 비율은 각각 8.3%, 9.1%, 0.5%에 불과하다. 내부운용을 채택하고 있는 VCT는 창업초기기업에 집중 투자하는 순수 VC형 운용사이다(<표 Ⅱ-3>).

한편 보수 구조는 일반 사모 VC 펀드에서의 보수 구조와 유사하게 통상 연간 운용자산 규모의 2%에 해당하는 관리보수, 1.5%에 해당하는 경상비용, 그리고 기준수익률을 초과한 NAV 증가분의 20%에 해당하는 성과보수를 수취한다. 자료가 존재하는 57개 VCT의 2022년 3월말 기준 관리보수와 경상비용을 합산한 비용은 자산가중평균 기준으로 총자산의 2.41%이며, 성과보수까지 합산한 총운용수수료는 3.23%이다.

6) VCT 시장 현황 및 구조

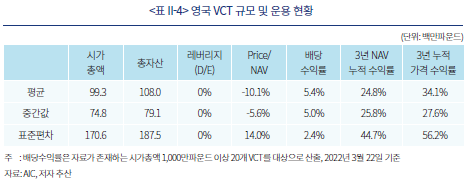

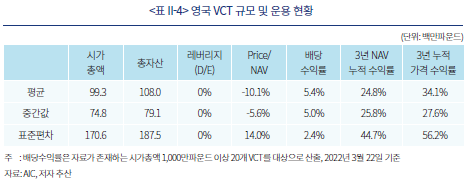

2022년 3월 22일 기준 60개 VCT의 평균 시가총액과 자산규모는 각각 9,930만파운드, 1억 800만파운드로서 미국 BDC와 비교하면 개별 투자기구 규모가 작은데 이는 VCT가 상대적으로 투자규모가 작은 업력 7년 미만의 창업초기 기업에 대한 보통주 중심의 투자기구로 운용되기 때문이다. 또한 VCT의 평균 레버리지 비율은 0%로서 채권형으로 운용되는 미국 BDC와 달리 운용규제로 인하여 VCT가 주식형으로 운용되고 있는 사실과 부합한다. 한편 2019~2021년 3년간 NAV 기준 및 가격 기준 평균 누적 수익률은 각각 24.8%, 34.1%이며 NAV 대비 할인율의 평균은 –10.1%, 자료가 존재하는 시가총액 1,000만파운드 이상 20개 VCT의 배당수익률 평균은 5.4%이다.(<표 II-4>).

VCT는 주요 투자대상에 따라 다양한 섹터와 기업성장 단계에 투자하는 일반 VCT(generalist VCT), 특정 섹터에 투자하는 특별 VCT(specialist VCT), AIM 상장 종목에 투자하는 AIM VCT로 나누어진다. 2022년 3월 기준 AIC(Association of Investment Company)에 등재된 62개 VCT 중 일반 VCT는 44개, 특별 VCT는 11개, AIM VCT는 7개로서 일반 VCT가 71.0%를 차지하고 있으며 특별 VCT와 AIM VCT는 각각 17.7%, 11.3%를 차지하고 있다. 마지막으로 VCT의 30일간 누적 거래대금 회전율은 0.40% 수준으로 제한된 유동성을 나타내고 있다.

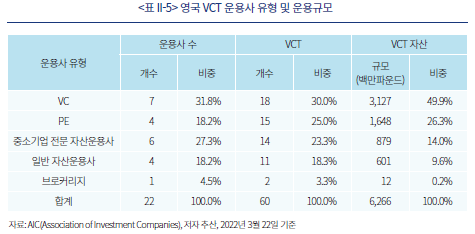

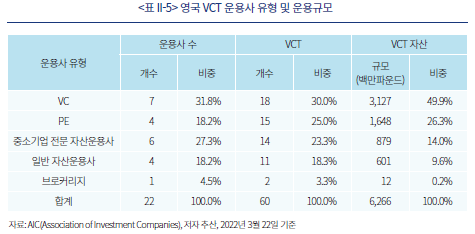

마지막으로 VCT 운용사 분포는 60개 VCT를 기준으로 VC 운용사가 7개, PE 운용사가 4개, 일반 자산운용사가 6개, 중소기업 전문 자산운용사가 4개, 브로커리지가 2개를 차지하고 있어 VCㆍPE 등 모험자본 전문 운용사들이 운용사 수, VCT 수, VCT 자산 규모 기준으로 각각 50.0%, 55.0%, 76.2%를 차지하는 시장구조를 형성하고 있다(<표 II-5>).

다. 미국 BDC, 영국 VCT와 국내 기업성장집합투자기구 비교

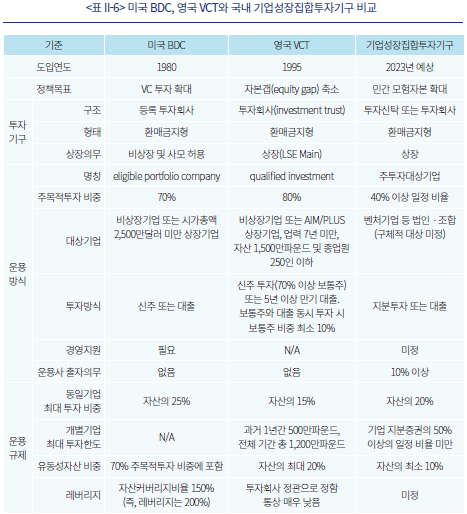

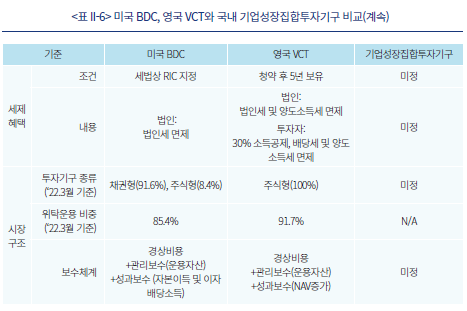

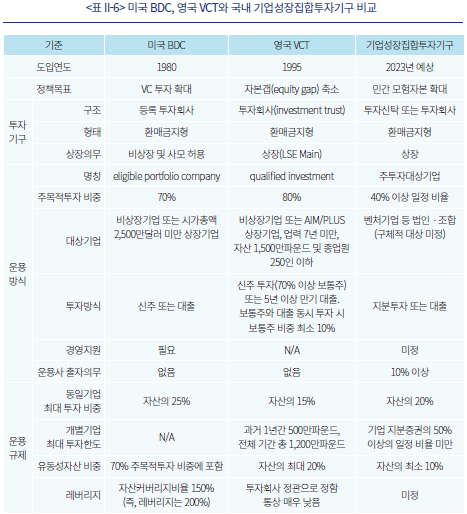

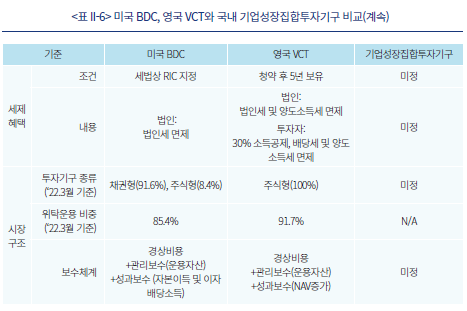

<표 II-6>은 미국 BDC와 영국 VCT의 특징 그리고 국내 도입 예정인 기업성장집합투자기구를 요약하고 비교한 표이다. 세 가지 폐쇄형 투자기구는 모두 각국 모험자본시장에서의 VC 투자 확대를 지향하고 있으나 영국 VCT가 적격투자대상 기업의 면모나 운용규제의 강도 측면에서 협의의 모험자본 확대에 충실한 제도적 특징을 보이고 있으며 이에 따라 투자위험을 보전할 수 있도록 세제혜택도 소득공제 위주로 제공하고 있다. 또한 이러한 이유로 영국 VCT는 주식형으로 운용되고 있으며 레버리지를 거의 활용하지 않고 있다.

한편 기업성장집합투자기구는 주목적투자 비중의 최저 하한을 40%로 정하고 있으나 해외의 유사 제도는 최소 70% 이상을 설정하고 있어 향후 적격 투자대상기업의 범위와 투자방식과 더불어전체적인 규제 수준을 설정할 필요가 있는데 국내 모험자본시장 현황과 잠재 운용사들의 주목적투자 분야 운용역량을 면밀히 평가할 필요가 있다.

기업성장집합투자기구가 해외 유사제도와 다른 특징 중 하나는 기업성장집합투자기구 설정ㆍ설립에 있어서 10% 이상의 운용사 출자의무를 부과하고 있는 것이다. 이는 사모시장에서 운용사와 투자자의 이해관계를 일치시키는 방법으로 사용되는 운용사 출자를 공모펀드에도 적용하는 방식이라고 할 수 있다. 해외 유사 제도에서는 평판시장이 작동하고 상장 투자회사로서 투자자보호를 위한 공시와 이사회를 통한 운용사 견제 장치가 있기 때문에 일반적으로 운용사의 출자의무가 부과되지는 않는다.

마지막으로 보수체계 관련하여 미국 BDC와 영국 VCT는 사모 VC 펀드를 모사하고 있는 만큼 운용사의 보수체계도 사모시장의 관행을 준용하여 통상 운용자산의 2% 이상의 관리보수와 기준수익률 초과 수익의 최대 20%를 수취하고 있으며 기타 펀드 운용과 관련된 비용 및 수수료가 부과되기도 한다.

Ⅲ. 해외사례를 통한 기업성장집합투자기구 운용의 시사점

기업성장집합투자기구는 특징상 상장 VC 펀드로서 일부 해외 국가에서 존재하여 왔으나 현재까지 국내에 도입된 적이 없는 제도로서 국내 모험자본시장에 끼치는 영향이 적지 않을 것으로 예상된다. 기업성장집합투자기구가 국내 모험자본시장에 안착하기 위해서는 기업성장집합투자기구의 정책적 역할과 모험자본시장의 상호연계성에 대한 이해에 기초한 제도 설계가 필요하다. 이하에서는 이러한 관점에서 본문에서 살펴본 미국 BDC와 영국 VCT의 운용사례를 바탕으로 기업성장집합투자기구 제도가 소기의 정책목표를 달성할 수 있도록 지향해야 할 방향에 대하여 운용규제, 세제지원, 이해상충 방지 및 중장기 확장성 관점에서 서술한다.

1. 운용규제

현재 기업성장집합투자기구의 자산 대비 주대상기업투자(또는 주목적투자) 비중은 40% 이상의 일정 비율 이상으로 설정되어 있다. 구체적인 제도의 시행 방향은 향후 시행령과 시행규칙에서 명확해질 것으로 예상되지만 의무 주목적투자 비중이 미국과 영국의 유사사례와 비교할 때 낮게 설정될 가능성이 있다.22) 이는 제도 도입 초기 투자처 발굴과 운용 안정성 제고 등 제도의 안착을 위해 운용사에 대한 편의를 제고하고자 하는 의도에 따른 설정이라고 볼 수 있다. 그러나 벤처기업 등 비상장 혁신기업에 대한 자금조달 확대라는 제도 도입의 취지를 고려하면 유사한 정책 목적을 가진 미국 BDC와 영국 VCT가 각각 70%와 80%에 달하는 주목적투자 비중을 가지고 있음을 참고할 필요가 있다.

또한 현재 적격투자 방식으로 벤처기업 등의 비상장 혁신기업과 투자조합의 지분투자와 대출 등이 모두 가능하도록 포괄적으로 규정되어 있으나 비상장 혁신기업의 자금조달은 지분투자가 높은 비중을 차지하므로 지분투자와 대출을 모두 허용하되 영국의 사례와 같이 지분투자가 일정 비율을 초과하도록 규제할 필요가 있다. 또한 지분투자의 경우에도 신주 투자 비중을 일정 비율 이상으로 설정하여 기업성장집합투자기구가 비상장 혁신기업의 성장 자금원을 공급할 수 있도록할 필요가 있다. 기업성장집합투자기구가 비상장 혁신기업의 장기 성장을 지원할 수 있는 인내자본(patient capital)으로 기능하기 위해서는 신주투자 중심의 주식형 기업성장집합투자기구가 중심적 역할을 할 필요가 있기 때문이다(Forman et al., 2015). 미국과 영국의 관련 제도 운용의 양태가 각국 모험자본시장의 특징과 세부 규제의 차이로 미국 BDC는 채권형으로, 영국 VCT는 주식형으로 상이한 모습으로 전개되어 왔다고 하더라도 제도 도입의 목적은 VC 자금원의 공적 자본시장으로의 확대라는 공통점을 가지고 있음을 유념할 필요가 있다. 마지막으로 이러한 투자방식에 대한 차별적 관점은 이하의 세제지원 검토 필요성과도 밀접하게 관련된다.

마지막으로 기업성장집합투자기구의 운용규제를 실제 모험자본시장 운용방식과 정합적인 방식으로 설계할 필요가 있다. 예를 들어 창업기업의 성장을 위해 국내 민간 모험자본의 유입이 필요한 이유는 정책자금 조성을 통한 스케일업 자금 지원에 한계가 있으므로 민간을 통해 효율적으로 성장지원 자금을 조달하기 위함이다. 따라서 이러한 정책목표와 시장관행을 담아낼 수 있도록 운용규제를 설정할 필요가 있다. 미국 BDC와 영국 VCT의 경우 최초 투자시점에 적격투자대상인 경우 최초 투자 이후의 기업 성장으로 인해 적격투자대상에 해당하는 규모를 초과하더라도 동 기업에 대한 후속투자(follow-on)도 적격투자로 인정하고 있다.

2. 세제지원

VC 투자는 피투자기업 성장단계의 차이에도 불구하고 본질적으로 높은 투자위험이 따른다. 이러한 이유로 민간자금의 유입이 잘 이루어지지 않아 대부분의 국가는 개인투자자 중심으로 VC 펀드 출자에 세제혜택을 부여하고 있다. 국내의 경우도 예외가 아니어서 다양한 VC 펀드23)에 출자하는 경우 출자금의 10%가 당해연도에 소득공제되며24) VC 펀드 출자로 취득한 출자지분에 대한 양도소득세와 VC 펀드가 투자한 주식이나 출자지분의 양도소득세가 면제된다.25) 해외 사례를 살펴보면 민간 중심으로 VC가 발달한 미국은 BDC를 포함하여 VC 출자에 대한 특별한 세제지원이 없는 반면 영국 VCT는 스타트업 투자를 유도하고 있기 때문에 개인투자자의 높은 투자위험을 보전하는 차원에서 VCT 법인세 면세, 개인투자자 출자액의 30% 소득공제, 양도소득세 및 배당소득세 면세 등 강한 세제혜택이 부여되고 있다.

일반적으로 VC 관련 세제혜택은 투자위험이 높은 지분투자, 그중에서도 보통주 투자에 부여되는 것이 일반적이며 대출 등으로 운용되는 경우 세제혜택이 부여되는 경우는 드물다. 따라서 세제혜택의 필요성은 전술한 기업성장집합투자기구 운용 유형과 밀접한 관련이 있을 것으로 예상된다. 만약 투자대상을 기준으로 단일 유형의 기업성장집합투자기구를 설정하는 경우 세제혜택을 부여하기 위해서는 영국 VCT와 같이 지분투자와 대출을 모두 허용하되 지분투자 중심의 투자기구로 설정할 필요가 있다. 만약 지분투자 비중에 따라 기업성장집합투자기구의 세부유형을 주식형과 채권형으로 설정하고 상이한 운용규제를 적용할 경우에는 주식형에 차별화된 세제혜택을 부여하는 것이 합리적일 것으로 판단된다.

민간 중심의 국내 VC 생태계가 조성되지 못한 현실과 기업성장집합투자기구가 사모 VC 펀드를 모사하는 투자기구라는 특징을 고려하면 주식형 기업성장집합투자기구에 대해서 일정 수준의 세제혜택을 부여하는 것이 세제 형평성에도 부합하고 제도의 성공적인 안착 가능성을 높이는 수단이 될 것으로 판단된다. 그러나 과도한 소득공제는 VC 시장의 구축효과로 이어질 가능성이 있으며(Cummings, 2007), 소득공제에 따르는 의무보유 기간은 투자기구 상장주식의 유동성 저하로 나타날 가능성이 있다(Hayley, 2016). 따라서 기업성장집합투자기구에 대해서 국내 사모 VC 펀드의 세제혜택과 유사한 수준의 세제혜택을 부여하되 소득공제 중심의 세제지원이 가져올 수 있는 부정적 효과를 감안할 필요가 있다.

3. 이해상충의 방지

미국 BDC와 영국 VCT의 사례는 기업성장집합투자기구의 운용주체로서 다양한 유형의 운용사가 참여할 수 있음을 시사한다. 미국과 영국은 자산운용사와 VCㆍPE 운용사가 대부분을 차지하는 가운데 IB, 브로커리지 등 증권사도 참여하는 시장이 형성되어 있다. 기업성장집합투자기구는 상장 VC 펀드와 유사하지만, 국내에 처음 도입되기 때문에 현실적으로 이를 운용할 운용사는 운용 경험을 축적한 기존 사모 VCㆍPE 및 자산운용사와 증권사에 국한될 것이다. 따라서 기존 운용사에 의한 사모 VC 펀드와 기업성장집합투자기구의 병행 운용 사례가 많을 것으로 예상되는데 이는 기업성장집합투자기구 운용으로 인해 기존 사모 VC 펀드의 운용을 중단할 유인이 낮기 때문이다.

VCㆍPE 펀드 운용사는 통상 일정 시점에 복수의 펀드를 운용하게 되는데 이러한 복수 펀드의 운용은 운용 사이클 전반, 특히 투자와 회수 단계에서 복수 펀드의 출자자 간 이해상충 문제를 야기할 수 있다(Duane Morris, 2015). 기업성장투자기구와 관련해 예상되는 대표적인 예로는 동일 운용사가 유사한 투자전략을 가진 사모 VC 펀드와 기업성장투자기구를 동시 운용할 경우 발굴한 매력적인 투자처의 투자기구 간 귀속의 문제(cherry-picking)와 공동투자(co-investment)에 참여한 투자기구 간 이해상충 가능성을 들 수 있다.26) 또한 사모 VC 펀드의 투자 회수 시 동일 계열 기업성장집합투자기구가 인수하는 경우와 사모 VC 펀드와 기업성장투자기구가 동일 피투자기업에 투자한 지분을 서로 다른 시기에 회수할 경우에도 이해상충 문제가 발생할 가능성이 있다.

운용사에 대한 평판시장이 작동하는 사모 VCㆍPE 시장에서는 이러한 펀드 간 또는 운용사와 펀드 간 이해상충이 기관출자자 중심의 운용사 통제와 출자자자문위원회(Limited Partner Advisory Committee: LPAC)와 같은 기구를 통해서 이루어진다. 그러나 자본시장 일반투자자의 출자로 이루어지는 기업성장집합투자기구와 같은 상장 투자기구는 투자자의 전문성 부족과 무임승차 문제로 운용사 통제가 이루어지기 어렵다. 이해상충 방지체계의 구비가 기업성장집합투자기구의 인가요건 중 하나이나 실제 제도 운용 과정에서 투자자보호가 온전히 이루어지기 위해서는 투명한 가치평가, 이해상충 가능성에 대한 정보공시와 더불어 기업성장집합투자기구의 신탁회사 또는 이사회의 독립성과 실질적 운용사 통제를 통한 이해상충 방지 기제가 작동하여야 하며 이를 위한 제도적 방안이 마련되어야 한다.

4. 중장기 확장성의 모색

모험자본시장은 다양한 성장단계의 기업군이 존재하고 투자자 측면에서도 직접투자, 사모펀드 등 간접투자와 재간접투자가 공존하는 복잡다기한 생태계이다. 기업성장집합투자기구가 민간 모험자본 생태계의 고도화를 위해 공적 자본시장을 통해 사적 자본시장을 모사하게 되는 투자기구임을 고려할 때 기업성장집합투자기구가 장기적으로 기업성장 단계에 따른 다양한 투자전략과 투자대상을 아우르는 상장 투자기구로 확장될 가능성을 염두에 둘 필요가 있다. 즉 기업성장집합투자기구 또는 이와 유사한 상장 투자기구를 통해서 VC뿐만 아니라 PE와 재간접펀드까지 포괄하는 모험자본 생태계 구조를 만들어 나갈 필요가 있다.

다양한 유형의 상장 모험자본 투자기구는 민간 모험자본시장의 확대와 수익 창출뿐만 아니라 모험자본시장 생태계의 선순환 구조 확립에 기여할 수 있다. 예를 들어 재간접펀드는 이중수수료에도 불구하고 비상장기업 분산투자를 극대화하고 사모 기관전용사모펀드에 대한 간접투자가 가능하게 하여 투자자보호와 안정적 수익창출이 가능하게 할 것이다. 또한 상장 재간접투자기구는 사모 VCㆍPE 펀드의 출자지분 거래를 통하여 모험자본 회수시장의 확대에 기여할 수 있다.

상장 모험자본 투자기구는 미국, 영국, 독일, 프랑스, 스웨덴, 스위스 등 해외 주요국을 중심으로 다수 활동하고 있다. 대표적으로 영국은 VCT 뿐만 아니라 VCㆍPE, VCㆍPE 재간접투자 등을 운용하는 다양한 폐쇄형 모험자본 투자회사(investment trust)가 런던증권거래소에 상장되어 있어 공적 자본시장을 통한 다양한 모험자본 투자가 이루어지고 있다. 2022년 3월 기준으로 영국의 상장 모험자본 투자회사는 86개, 시가총액 330억파운드 규모로서 전체 상장 폐쇄형 투자회사 시가총액의 14.8%를 차지하고 있다.27) 한편 모험자본시장이 사모 중심으로 발전한 미국의 경우 상장 폐쇄형 모험자본 투자기구는 BDC가 대표적이며 기타 대형 PE 운용사 중심의 상장 PE 관리회사(management company)가 상장되어 있다.

Ⅳ. 맺음말

기업성장집합투자기구의 의의는 공적 자본시장을 통해 비상장 혁신기업에 투자ㆍ회수할 수 있는 모험자본 생태계를 조성하고 투자자에 대하여는 다변화된 투자처로서의 비상장 혁신기업으로 투자기회를 확대하는 것이다. 국내 비상장 혁신기업의 자금조달은 정책자금과 대출에 절대적으로 의존하고 있고 민간자금이 비상장 혁신기업에 투자될 수 있는 체계적 통로가 없는 현실에서 기업성장집합투자기구는 국내 모험자본시장의 한 단계 발전을 위한 핵심적인 공적 자본시장 투자기구로서 자리매김할 것으로 예상된다.

성공적인 기업성장집합투자기구 제도 운용의 요체는 공적 자본시장 자금유입확대를 통한 자본형성(capital formation)과 제도의 지속가능성을 보장하는 투자자보호(investor protection) 간 균형을 조화롭게 이루어나가는 것이다. 이를 위해서 기업성장집합투자기구의 정책목표 달성을 위한 적절한 범위의 세제혜택 및 이와 정합적인 운용규제, 이해상충 방지와 공시 등 투자자보호 장치의 구축에 대한 면밀한 검토가 필요하다.

다만 제도적 완비에도 불구하고 기업성장집합투자기구의 성공적인 안착에는 무엇보다 운용 성과가 중요하다. 기업성장집합투자기구 운용은 분산투자를 통한 개별 비상장 혁신기업의 투자위험 통제, 운용사의 고성장 혁신기업에 대한 전문적인 발굴과 경영지원을 통한 수익창출 역량, 그리고 유동성 관리를 통한 안정적인 배당 현금흐름 창출능력이 모두 갖추어져야 한다. 또한 기업성장집합투자기구의 안정적인 운용은 사모 VC 펀드와 공모펀드 운용역량을 모두 필요로 한다. 따라서 국내 모험자본시장에서 활약해온 다양한 유형의 운용사들은 이러한 균형 잡힌 운용역량을 갖출 수 있도록 관련 전문인력의 영입 등 내부조직을 확충하거나 운용사 간 제휴 방식으로 이에 대응할 필요가 있다.

1) 기업성장집합투자기구와 유사한 국내 사례로 코스닥 시장 활성화 정책의 일환으로 2018년 도입된 코스닥 벤처펀드를 들 수 있다. 코스닥 벤처펀드는 벤처기업 신주에 집합투자재산의 15% 이상, 벤처기업 또는 벤처기업 해제 이후의 코스닥 상장 중소중견기업의 신주 구주에 35% 이상을 투자하는 공 사모 펀드로 코스닥 공모주 물량의 30% 우선배정과 3천만원 한도의 10% 소득공제 혜택(2022년말 일몰)을 투자자에게 부여하였다. 기업성장집합투자기구는 비상장기업에 중점을 두고 증권 매입과 자금 대여가 모두 가능한 공모 상장형 투자기구라는 측면에서 새롭게 도입되는 제도라고 할 수 있다.

2) 전문투자자의 투자금만으로 기업성장집합투자기구를 설정ㆍ설립하는 경우에는 동 조건의 충족 기간으로 최대 3년이 부여된다.

3) 대주주 요건 관련하여 금융투자업자의 변경인가 시 적용되는 완화 요건은 출자금이 차입금이 아닐 것, 최근 5년간 벌금형 이상 형사처벌 받은 사실이 없을 것, 부실 금융기관 또는 관련 대주주가 아닐 것이다(자본시장법 시행령 제19조의 2 별표 2).

4) 미국 BDC의 역사적 배경에 대한 이하의 설명은 Warburton(2020)을 따른다.가 존재한다. 2020년 기준 전체 BDC 수의 51%가 공모 상장, 24%가 공모 비상장, 35%가 사모 BDC이다(Eversheds Suther-land, 2021). 사모 비상장 BDC는 폐쇄형 사모펀드와 동일하게 만기 시점까지는 환매가 불가능하며, 공모 비상장 BDC의 경우 주기적인 출자지분 매입을 통해 투자자의 환매수요를 수용하고 있다. 마지막으로 상장 BDC는 상장주식의 거래뿐만 아니라 비정기적인 자사주 매입을 통하여 투자자의 회수 기회를 지원하고 있다.

5) 미국 BDC는 모집방식 및 상장에 대한 강제 규정이 없다. 따라서 BDC는 상장 BDC 이외에도 사모 BDC와 공모 비상장 BDC가 존재한다. 2020년 기준 전체 BDC 수의 51%가 공모 상장, 24%가 공모 비상장, 35%가 사모 BDC이다(Eversheds Suther-land, 2021). 사모 비상장 BDC는 폐쇄형 사모펀드와 동일하게 만기 시점까지는 환매가 불가능하며, 공모 비상장 BDC의 경우 주기적인 출자지분 매입을 통해 투자자의 환매수요를 수용하고 있다. 마지막으로 상장 BDC는 상장주식의 거래뿐만 아니라 비정기적인 자사주 매입을 통하여 투자자의 회수 기회를 지원하고 있다.

6) 상장 BDC의 수는 2014년 57개를 정점으로 이후 감소하는 추세를 보이고 있는데 이는 자발적인 BDC 등록 취소와 BDC간 인수 합병에 따른 결과이다.

7) 이러한 규제완화 사례로는 BDC에 대한 다양한 채무증권과 신주인수권, 옵션 등의 발행 허용, 투자대상 확대, 증권 취득 경로 확대가 이루어진 1996년 전국증권시장개선법(National Securities Markets Improvement Act: NSMIA), BDC가 신생성장기업(emerging growth company)으로 인정받을 경우 상장 절차의 간소화를 허용하고, 비상장 사모 BDC의 최대 주주수를 확대하여 비상장 사모 BDC 설정을 촉진하고자 한 2012년 JOBS 법, 그리고 BDC의 차입금 한도 확대를 허용한 2018년 소기업신용확대법(Small Business Credit Availability Act: SBCAA)을 들 수 있다.

8) 투자회사법상 투자한 자금의 용도에 대한 제한 규정은 존재하지 않는다.

9) 투자회사법 Section 55(a)는 BDC의 투자 대상으로서 적격 포트폴리오 기업 이외에 재무적 부실기업(fi nancially troubled companies)을 인정하고 있다.

10) ‘중요한 경영지원’은 사모 VC 운용사의 피투자기업 자문 및 경영지원을 모사하기 위한 법적 장치로서 자금조달 주선, 자금원 관리, 임원 채용, M&A 기회의 평가 등을 포괄하며 BDC가 이러한 경영지원을 제공할 역량을 갖추고 있어야 함을 의미한다. 다만, BDC의 의무는 경영지원 제공의 제의(off er)에 그치며 실제 포트폴리오 기업이 거절할 수 있다. 또한 복수의 BDC가 동일 포트폴리오 기업에 공동투자하는 경우, 어느 한 BDC에 경영지원이 제공되는 경우 모든 BDC가 경영지원을 제공한 것으로 간주되며 경영참여형 투자가 이루어지는 경우에도 경영지원 조건은 성립되는 것으로 간주된다(Warburton, 2020).

11) 이를 위한 핵심조건은 3가지가 있다(Grant Thornton, 2017). 첫째, BDC 수익의 90% 이상이 배당, 이자, 자본이득 등 양질의 수익이어야 한다(‘Good Income’), 둘째, 분기별로 분산투자 요건을 갖추어야 하는데 이는 현금, 미수금, 국채, BDC 자산의 5% 미만이고 당해 피투자기업 자산가치의 10% 미만인 증권투자 등의 합이 BDC 자산의 50% 이상이며 동일기업 투자는 BDC 자산의 최대 25%로 제한된다(‘Asset Diversification’). 셋째, 매년 이자ㆍ배당수입 및 단기 자본이득의 90% 이상을 주주에게 배당해야 한다.

12) 원래 BDC의 최소 자산커버리지 비율은 200%였으나 2018년 규제 완화에 따라 일정 조건을 만족할 경우 150%로 완화되었다.

13) VCT 수의 감소는 VCT간 인수합병에 따른 결과이다(HMRC, 2022).

14) 이하의 내용은 HM Revenue & Customs(2022)의 내용을 참고하였다.

15) 증권(securities)은 대출(loan), 무담보회사채(debenture)를 포함한다. 2018년 재정법(Finance Act) 개정 시 담보대출이 VCT 적격투자대상으로서의 증권(securities)에서 제외되었다.

16) 대부분 런던증권거래소(London Stock Exchange: LSE)에 상장된다. VCT의 상장은 VCT의 비정기적 자사주 매입과 더불어 투자 회수의 중요한 수단이다.

17) VCT 승인 후 3년 이내에 80% 적격투자 비중 의무를 충족해야 한다.

18) AIF는 Alternative Investment Fund, UCITS는 Undertakings for the Collective Investment in Transferable Securities를 의미한다.

19) ISDX(ICAP Securities and Derivatives Exchange)의 전신은 PLUS로서 PLUS Markets Group이 2012년 ICAP에 인수되어 개명된 이름이다.

20) 지식집약적 기업은 신생 혁신기업을 의미하는 용어로서 다음의 두 가지 조건을 만족하여야 한다. 즉 과거 3년 중 1년 이상 R&D 또는 혁신에 영업비용의 15% 이상을, 또는 과거 3년간 매년 10% 이상을 지출한 기업(‘operating costs’)으로서 최근 주요 사업용 지식재산을 창출한 기업 (‘innovation’) 또는 종업원의 20% 이상이 R&D 분야 관련 고학력자인 기업(‘skilled employee’)이다.

21) VCT의 후속투자(follow-on)는 동 기간 이후에도 가능하다.

22) 신설되는 기업성장집합투자기구가 자본시장법상 증권집합투자기구와 유사하므로 증권집합투자기구와 동일 수준의 주목적 투자비율인 40%를 설정한 것으로 판단된다.

23) 벤처투자조합, 신기술사업투자조합, 전문투자조합

24) 조특법 제16조 제1항. 동 소득공제는 2022년 말 일몰이 예정되어 있다.

25) 조특법 제14조 제1항

26) 미국 BDC의 경우 투자회사법 57(a)(4)은 SEC가 승인하는 경우를 제외하고는 BDC와 타 등록펀드 또는 운용사가 동일한 특수관계인 사모펀드와의 공동투자를 원칙적으로 금지하고 있다. 그러나 상당수의 사모 VCㆍPE 운용사가 BDC를 운용하고 있으며 투자규모와 운용 펀드의 소진 필요성 등으로 인해 공동투자가 많이 이루어지는 모험자본시장의 속성상 공동투자 규제의 완화에 대한 요구가 높다(Mayer Brown, 2018; Simpson & Thacher, 2020).

27) 영국의 상장 폐쇄형 투자회사는 모험자본뿐만 아니라 지역, 섹터, 주식, 채권, 인프라, 부동산 등 다양한 분야에 투자하고 있으며 전체 424개의 투자회사가 있다.

참고문헌

금융위원회, 2019. 10. 7, ‘기업성장투자기구(BDC)’ 제도 도입방안, 보도자료.

금융위원회, 2020. 1. 22a「, 비상장주식에 대한 공정가치 평가 관련 가이드라인」을 마련하였습니다. 보도자료.

금융위원회, 2020. 1. 22b, 투자대상이 비상장주식인 경우의 공정가치 평가 가이드라인. 보도자료(2020. 1. 22) 별첨자료.

금융위원회, 2022. 3. 31「, 자본시장과 금융투자업에 관한 법률」 일부개정법률(안) 재입법예고, 금융위원회 공고 제2022-130호.

AIC, 2019, The AIC Code of Corporate Governance.

Chernenko, S., Erel, I., Prilmeier, R., 2021, Why do firms borrow directly from nonbanks? Fisher College of Business WP 2018-03-013, Ohio State University.

Cumming, D.J., MacIntosh, J.G., 2007, Mutual funds that invest in private equity?

An analysis of labour-sponsored investment funds, Cambridge Journal of Economics 31, 445-487.

Cumming, D.J., 2007, The structure, governance and performance of UK Venture Capital Trusts, Journal of Corporate Law Studies 3(2), 401-427.

Duane Morris, 2015, Private Equity Fund Formation, Conflicts of Interest.

Eversheds Sutherland, 2020, BDC Roundtable 2020.

Forman, S.M., Lo, A.W., Schilling, M., Sweeney, G.K., 2015, Funding Translational Medicine via Public Markets: The Business Development Company, SSRN working paper.

Grant Thornton, 2017, Business development companies: understanding taxrelated opportunities and challenges.

Hayley, S., 2016, Reforming UK Venture Capital Trusts, working paper, Bayes Business School, City, University of London.

HM Revenue & Customs, 2022, Venture Capital Schemes Manual.

HM Treasury and HMRC, 2015, Finance Bill 2015.

IPEV, 2018, International Private Equity and Venture Capital Guidelines.

Mayer Brown, 2018, Business Development Companies.

Simpson & Thacher, 2020, Registered Funds Alert.

Rayna, T., Striukova, L., 2009, Public venture capital: missing link or weakest link?

International Journal of Entrepreneurship and Innovation Management 9(4), 453-465.

Warburton, A.J., 2020, Business Development Companies: Venture capital for retail investors, The Business Lawyer 76.

정책당국은 지난 2019년 10월 모험자본 활성화와 일반투자자의 유망 비상장기업 투자 확대를 위해 미국 BDC(Business Development Company)를 벤치마킹한 기업성장집합투자기구의 도입을 발표하였다(금융위원회, 2019. 10. 7). 2021년 8월 기업성장집합투자기구 도입 안을 담은 자본시장법 개정안과 2022년 3월 수정안이 국회 통과를 거쳐 금년 중 입법이 예상되는데 개정안은 기업성장집합투자기구의 정의, 설립요건, 운용규제, 인가요건 등 기본적인 사항만을 규정하고 있으며 제도 운용과 관련된 세부사항을 결정하기 위한 논의가 진행되고 있다. 현재 금융투자업자와 벤처캐피탈 운용사 등 다양한 모험자본 중개기관의 관심이 높은 가운데 향후 국내 모험자본 시장 전반의 변화가 예상된다.1)

도입 예정인 기업성장집합투자기구는 해외 유사 제도를 벤치마킹하고 있으며 이러한 대표적인 해외 사례로는 미국 BDC와 영국 VCT(Venture Capital Trust)를 들 수 있다. 미국은 1980년 소기업투자촉진법 제정을 통하여 사모증권에 투자할 수 있는 폐쇄형 투자회사로서 BDC를 도입하였다. 한편 영국은 1995년 창업초기 기업에 대한 모험자본 공급 확대를 목적으로 세제혜택에 기반을 둔 VCT라는 공모ㆍ폐쇄형 투자회사 제도를 도입한 바 있다. 미국과 영국은 모두 모험자본 공급 확대를 목적으로 관련 제도를 도입하였으나 이러한 제도는 각국 모험자본 시장 전반의 특징과 성격을 반영하여 상이한 특색을 가지고 발전하여 왔다.

국내 기업성장집합투자기구 제도가 국내 현실에 부합하는 방향으로 운영되기 위해서는 해외 유사 제도의 운영사례 분석을 통해 바람직한 제도 운영의 시사점을 도출할 필요가 있다. BDC와 VCT 같은 상장형 모험자본 투자기구 제도의 성공적인 도입과 운용에는 폐쇄형ㆍ조합형 사모펀드 중심의 모험자본시장 전반과의 연계성 그리고 투자자보호에 대한 분석ㆍ평가가 필요하기 때문이다. 또한 각국 모험자본시장의 발전도 및 특징과 정합적인 제도 설계가 필요하다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 도입 예정인 기업성장집합투자기구의 특징을 살펴보고 해외사례로서 미국 BDC와 영국 VCT의 현황과 특징을 비교 분석한다. Ⅲ장에서는 기업성장집합투자기구 제도 도입과 관련하여 고려해야 할 해외사례의 시사점에 대하여 기술하며 Ⅳ장에서는 본 보고서를 마무리한다.

Ⅱ. 기업성장집합투자기구의 특징과 해외사례

1. 기업성장집합투자기구의 특징

기업성장집합투자기구 제도 도입의 목적은 벤처기업 등의 성장을 적극적으로 지원하고 모험자본을 보다 원활하게 공급하기 위하여 성장 가능성이 높은 벤처기업 등에 금전의 대여, 증권의 매입 등의 방법으로 투자하는 상장 폐쇄형 투자기구를 설정ㆍ설립할 수 있도록 제도적 근거를 마련하는 것이다. 먼저 기업성장집합투자기구는 자산총액의 40% 이상의 일정 비율에 해당하는 금액을 초과하는 집합투자재산을 벤처기업 등(‘주투자대상기업’)에 금전 대여, 증권 매입 등의 방법으로 투자하는 투자기구로 정의된다.

운용규제로는 분산투자 의무, 최대 투자한도, 유동성 관리 의무가 부과된다. 첫째, 분산투자를 위해 자산총액의 20% 이하로서 일정 비율에 해당하는 금액 이하를 동일 주투자대상기업에 투자하여야 한다. 둘째, 최대 투자한도 관련하여 주투자대상기업 발행 지분증권 총수의 50% 이상으로서 일정 지분증권 수 이상의 투자가 금지된다. 셋째, 집합투자재산의 10% 이상으로서 일정 비율에 해당하는 금액 이상을 국채 등 안정적인 금융투자상품에 투자하여야 하며, 이때 주투자대상기업에 금전 대여가 가능하되 부동산 투자는 금지된다.

설정ㆍ설립 요건으로 기업성장집합투자기구는 투자신탁 또는 투자회사로서 존속기간 최소 5년 이상, 모집가액은 500억원 이하 일정액 이상의 환매금지형 집합투자기구로 설정ㆍ설립하여야 하며 집합투자증권 발행 후 90일 이내 상장하여야 한다.2) 기업성장집합투자업자는 10% 이하 일정 비율의 집합투자증권을 3년 이상의 일정 기간 동안 보유해야 한다. 마지막으로 인가요건으로 자본시장법 제12조 금융투자업자의 인가요건을 적용하되 이 중 대주주 요건 관련하여 완화된 인가요건을 적용하여 벤처캐피탈 운용사의 진입을 허용하도록 하였다.3)

국내 기업성장집합투자기구는 미국 BDC를 벤치마킹한 것으로 알려졌으나 미국 BDC와 같은 상장형 모험자본 펀드는 미국 뿐만 아니라 영국, 프랑스, 독일 등 기타 주요 선진국에도 존재하는 투자기구이다. 본 보고서에서는 이러한 해외 사례 중 시장규모와 운용성과 측면에서 잘 알려진 미국 BDC와 영국 VCT에 대하여 살펴본다.

가. 미국 BDC

1) 역사적 배경4)

1970년대 미국의 신생 혁신기업은 자본시장으로부터 소외된 채 성장을 위한 자금 확보가 어려운 상황이었는데 미국 의회는 이러한 문제의 원인을 개선하고자 일련의 청문회를 개최하였다. 이러한 개선 노력에 참여한 미국 VC 운용사들은 신생 혁신기업 자금난의 원인으로 VC가 1940년 투자회사법(Investment Company Act)상 규제를 받지 않고 공적 자본시장을 통해 자금을 조달할 수 없기 때문이라고 주장하였다. 즉, VC 운용사들은 투자회사법상 규제로 인하여 점차로 투자회사법의 규제를 적용받지 않는 사적 영역에서 투자활동을 영위하게 되었다는 것이다. 투자회사법은 예외 규정의 적용을 받지 않을 경우 뮤추얼펀드뿐만 아니라 VC도 규제 대상이 되며, 이에 따라 VC는 공적 자본시장 자금을 포기하는 대신 사모방식 펀드 운용을 통하여 투자회사법의 규제를 회피하게 되었다는 것이다. 이에 따라 미국 의회는 1980년 소기업투자촉진법(Small Business Incentive Act) 제정을 통해 규제가 완화된 투자회사법상 폐쇄형 투자회사로 BDC를 도입하였다.따라서 BDC는 투자회사법상 투자자보호의 유지를 전제로 VC 투자 확대를 위해 규제가 완화된 투자기구라고 할 수 있다.

BDC는 도입 후 1년 동안 총 7개가 설립되었으며 이 중 2개가 상장되었으나5) 도입 초기 VC 투자기구로서 모험자본시장에서 많은 관심을 끌지는 못했다. 그러나 2000년대 중반 금융위기 전후 BDC는 많은 관심을 받으며 운용자산 규모가 크게 증가하기 시작했는데 여기에는 신생 혁신기업의 자금수요 증가와 금융위기 이후 모험자본시장에 의한 비상장기업 대출(private debt) 증가가 크게 기여했다. 2020년 말 기준 BDC는 총 115개이며6) 이 중 50개 상장 BDC의 운용자산 규모는 890억달러로 BDC는 미국 모험자본시장의 중요한 투자기구의 하나로 성장하였으며 그 과정에서 BDC를 활성화하기 위한 규제완화가 지속적으로 이루어졌다.7)

위에서 살펴본 바와 같이 BDC는 소규모 기업에 대한 VC 투자 확대를 위하여 등록 투자회사의 운용규제를 완화한 투자기구이다. BDC는 VC 투자 확대를 위하여 ‘적격 포트폴리오 기업’(eligible portfolio companies)에 투자하여야 하며8) 이와 관련하여 ‘중요한 경영지원’(signifi cant mana-gerial assistance)을 제공하여야 한다.9)10) 추가적으로 BDC의 법적 지위를 획득하기 위해서는 투자회사법상 BDC의 지위를 선택해야 하며 또한 1934년 증권거래법상 증권등록 의무와 일반 공개기업과 동일한 공시의무가 발생한다.

BDC는 자산의 70%를 투자회사법 Section 55에 열거된 적격 포트폴리오 기업이 발행한 증권에 신주 또는 대출 방식으로 투자하여야 하는데 적격 포트폴리오 기업은 미국 국내 기업으로서 투자회사가 아니며 비상장기업 또는 시가총액 2,500만달러 미만 상장기업이다(SEC Rule 2a-46, 2006). 이때, 70% 기준에는 유동성 확보를 위한 현금, 국채 및 만기 1년 미만의 유동자산이 포함되나 주목적 투자가 되어서는 안 된다. 총자산의 나머지 30%는 BDC의 재량에 따라 투자하는데 포트폴리오 분산과 투자자 배당 지급을 위한 자산에 투자하는 경우가 많다. 한편 BDC의 분산투자 요건은 미국 세법과 밀접한 관련이 있다. BDC는 일정 요건을 만족할 경우 세법상 규제투자회사(Regulated Investment Company: RIC) 자격을 신청할 수 있으며 세법상 RIC로 간주될 경우 법인세 면세 혜택이 적용된다.11) 이에는 분산투자 요건이 포함되는데 이에 따르면 동일기업 투자는 BDC 자산의 최대 25%로 제한된다.

3) 레버리지, 가치평가 및 기타 규제

BDC는 BDC로서의 법적 지위에 상응하여 1940년 투자회사법상 등록 폐쇄형 투자회사에 적용되는 규제와 비교하여 완화한 규제가 적용된다(투자회사법 Section 54~65). 구체적으로 BDC는 등록 폐쇄형 투자회사 대비 레버리지, 특수관계인 거래, 가치평가 및 공시에서 완화된 규제가 적용된다.

먼저 레버리지는 자산커버리지(asset coverage) 비율에 따라 규제되는데 이는 차입금 대비 순자본과 차입금 합계의 비율이다. 투자회사법상 등록 투자회사의 최소 자산커버리지 비율은 300%인 반면, BDC는 150%로써12) 이는 BDC가 출자금 대비 2배의 차입이 가능함을 의미한다. 이러한 레버리지 규제는 BDC가 자산의 일정 부분을 유동성 자산에 투자하는 이유가 되고 있다. 또한 BDC는 일반 등록 폐쇄형 펀드와 달리 다양한 순위(class)의 차입금 조달이 가능하며 옵션, 워런트, 기타 전환권 등의 발행이 가능하다.

특수관계자 거래 관련 규제도 일반 폐쇄형 펀드 대비 완화되어 있다. 먼저 주주, 임원, 종업원 등 BDC의 특수관계인(‘upstream’) 관련 사항으로 BDC 지배주주, 임원, 종업원 등의 이해관계인과 BDC의 거래가 금지된다(투자회사법 57(a)). BDC 지분의 5~25%를 보유한 비지배주주와 BDC의 거래는 BDC 이사회의 표결에 의해 결정된다(투자회사법 57(d)). 반면 BDC의 포트폴리오 기업과의 관계(‘downstream’)와 관련하여 포트폴리오 기업 이사회 참여 등 BDC의 일상적인 포트폴리오 기업에 대한 경영 관여를 고려할 때 BDC와 포트폴리오 기업 간 거래는 일반적으로 이해관계자 거래로 간주되지 않는다.

한편 유동성이 낮은 비상장기업에 투자하는 BDC의 속성으로 인하여 BDC는 공정가치(fair value)에 기초한 분기별 가치평가(valuation)가 허용되며 가치평가가 결정되는 과정에는 경영진, 이사회, 감사, 가치평가사 등이 참여한다. 한편 BDC는 일반 폐쇄형 펀드와 마찬가지로 주당 순자산가치(Net Asset Value: NAV) 이하의 가격으로 신주발행이 금지되나 BDC의 경우 이사회와 주주총회의 승인을 전제로 순자산가치 이하의 신주발행이 가능하다. 또한 BDC는 일반 폐쇄형 펀드와 달리 다른 BDC와의 M&A를 위한 신규 증권발행이 가능하다.

마지막으로 BDC는 투자회사법상 보고의무가 면제되나 사모 BDC가 아닌 경우 증권거래법(Se-curities Exchange Act) 상 Form 10-K, 10-Q, 8-K, 위임장권유신고서(proxy statement) 등 공개기업의 공시의무가 부과되며 2002년 Sarbanes-Oxley Act에 따른 내부회계관리 의무가 따른다.

4) 운용주체와 운용보수

BDC는 위탁운용(external management) 또는 내부운용(internal management)이 모두 가능하나 대부분 위탁운용의 방식으로 운용되고 있다. <표 Ⅱ-2>에서 조사된 48개 상장 BDC 가운데 내부운용 방식을 채택하고 있는 BDC는 7개로서 전체의 14.6%에 불과하다. 내부운용은 BDC의 이사회 관리하에 성과보상 체계를 갖추고 운용인력을 자체 보유하는 방식이며 위탁운용은 BDC 이사회 관리 하에 외부 투자자문기관과의 위탁운용 계약을 통해 BDC 자산을 운용하는 방식으로서 운용보수를 제공한다. 이러한 운용보수는 통상 BDC 자산의 일정 비율로 산정되는 관리보수와 자본이득에 기초한 성과보수로 구성된다. 그러나 성과보수 비율은 20%를 초과할 수 없으며 자본이득에 기초한 성과보수를 수취하는 경우 BDC의 이익을 공유하는 방식의 성과보수를 동시에 수취할 수 없다. 또한 현행 위탁운용 BDC는 일정 기준수익률(예를 들어 7%)을 초과하는 이자ㆍ배당수입의 20%에 해당하는 성과보수를 수취하고 있다. 따라서 위탁운용 BDC의 보수체계는 일반적인 사모 VCㆍPE 펀드의 보수체계를 기본으로 하되 이자ㆍ배당 수입 기반의 성과보수를 반영하고 있다. 한편 내부운용의 경우 운용인력에 대한 성과보상은 스톡옵션 또는 이익공유 방식 중 하나를 선택하여야 한다.

5) BDC 시장 현황 및 구조

2022년 3월 22일 기준 48개 상장 BDC의 평균 시가총액과 자산 규모는 각각12.5억달러, 25.4억달러이다. 또한 평균 레버리지 비율은 95.4%이며 4개 주식형 BDC의 평균 레버리지 비율은 4.7%이다. 포트폴리오 중 채권 비중은 평균 82.2%이며 2019~2021년 3년간 NAV와 가격 기준 평균 총수익률은 각각 19.1%, 29.2%이다. NAV 대비 할인율의 평균은 –1.8%이며 배당수익률의 평균은 7.7%이다. 마지막으로 30일간 누적 거래대금 회전율은 0.18% 수준으로 제한된 유동성을 나타내고 있다.

한편 BDC 운용사 분포는 48개 상장 BDC를 기준으로 일반 자산운용사가 30개, PE 8개, VC 3개, 벤처대출(venture debt) 운용사 3개로서 자산운용 관련 전문운용사가 96%를 차지하고 있어 전통적으로 대체투자를 포함한 자산운용사들이 자금원을 다각화하는 차원에서 운용하고 있는 것으로 판단된다. 한편 스타트업에 대한 자금공급 기준으로 주식형 VC와 채권형 벤처대출 운용사가 각각 3개씩으로 운용사 수 및 자산 기준으로 각각 전체의 13.0%, 3.7%를 차지하고 있다.

1) 역사적 배경

영국 VCT는 1995년 집권당이던 영국 보수당 정부가 일반 개인투자자들이 간접적으로 소규모 비상장 회사에 투자할 수 있도록 재정법(Finance Act)을 통해 도입한 상장 투자회사이다. VCT는 영국의 폐쇄형 투자회사인 투자신탁(investment trust)의 일종으로서 금융투자회사가 운용하며 적격 투자대상기업의 성장을 위해 자금과 기타 경영지원을 제공한다. VCT는 2021년 기준 57개의 VCT가 상장되어 있으며13)(<그림 Ⅱ-3>), 2021년 6.7억파운드, 도입 이후 누적 96.9억파운드의 자금을 모집하였다(<그림 Ⅱ-4>). VCT는 높은 수준의 소득공제 혜택이 특징인 투자수단으로서 자금모집이 소득공제율의 변화에 민감하게 반응해 왔다. VCT의 소득공제율은 1996~2004년간 20%, 2005~2006년간 40%에 이어 2007년부터 현재까지 30%로 유지되고 있는데 소득공제율이 20%에서 40%로 급증한 2005년의 자금모집은 5.2억파운드로 전년도 0.7억파운드 대비 7.4배 증가하였다(<그림 II-4>). 한편 VCT는 개인투자자만 투자가 가능하며 소득공제 신청 기준 투자자 수는 2018~2020년 평균 18,928명으로 투자 최대액인 15만~20만 파운드를 투자한 투자자의 비중이 투자자 수 및 금액 기준으로 각각 5.2%, 29.5%를 차지하고 있어 VCT는 위험감수 여력을 가진 고액소득자의 절세 투자수단으로 활용되는 경향이 있는 것으로 평가되고 있다(<그림 II-5>).

VCT는 소규모 기업이 지분투자를 유치하기 어려운 현실, 즉 자본갭(equity gap)에 대한 인식을 바탕으로 출범하였다(Rayna & Striukova, 2009). 전술한 바와 같이 영국 정부는 소규모 기업에 대한 개인투자자 자금의 원활한 유입을 위해 높은 수준의 소득공제 혜택을 제도 도입 초기부터 부여하였는데 이러한 매력적인 세제혜택에도 불구하고 일부 운용규제의 공백을 이용하여 제도가 추구하는 정책목표에 배치되는 투자가 보고되는 등 운용규제의 강화 필요성이 대두되었다. 예를 들어, VCT는 제도 출범 초기 스타트업에 대한 지분투자 확대를 위해 비상장기업 또는 AIM 상장기업으로서 천만파운드 미만 자산을 가진 영국 소재기업을 적격 투자대상의 기준으로 설정했으나 업력은 적격투자의 기준이 아니었다. 따라서 많은 VCT들이 일정 업력의 성숙기업을 대상으로 경영자인수(Management Buy-Out: MBO) 등 바이아웃 투자나 자산담보부 투자를 하는 등 제도 본연의 취지를 살리지 못했다. 이에 따라 영국 규제당국은 2015년 재정법(Finance Act)을 통해 운용규제를 강화하는 조치를 취하였는데 먼저 VCT 자산 중 적격투자대상(Qualifying Investment)의 비중을 초기 70%에서 80%로 상향 조정하였으며 증자로 모집되는 자금의 30%는 1년 이내에 투자하도록 규제를 강화하였다. 또한 업력과 관련하여 적격 투자기업을 매출 발생 후 7년 미만 기업에 한정하였으며 적격 투자기업에 투자된 자금은 기업 성장을 지원하기 위한 용도로 제한되었으며 M&A를 위한 인수금융이나 타 회사의 구주 취득이 금지되었다.

2) 운용규제14)

VCT로 승인되기 위해서는 영국 내 정상기업의 주식(shares) 또는 증권(securities)으로부터의 수입이 70% 이상으로써15) 보통주가 EU 규제시장(regulated market)에 상장되어야 하며16) 회계기간 내 수익의 15% 이상 내부유보가 금지된다. 또한 자산의 80% 이상이 적격투자대상에 투자되어야 하며17) 개별회사 투자한도는 15%이다. 적격투자는 신주 투자 또는 만기 5년 이상의 무담보 대출만을 포함하며 적격투자의 70% 이상이 보통주에 투자되어야 한다. 또한 유동성 관리를 위해 비적격투자대상에 투자할 수 있는데 자산의 20%를 한도로 7일 이내 현금화가 가능한 AIF, UCITS18) 등 펀드와 예금, 그리고 상장증권을 보유할 수 있다.

개별 투자대상과 관련하여도 VCT는 다양한 운용규제가 부과된다. 먼저 적격투자대상은 영국 소재 비상장기업 또는 AIM 또는 ISDX19) 상장기업이어야 한다. 또한 자산 및 종업원 규모, 건당 및 누적 투자규모, 보통주 투자비중, 업력, 자금 용도 등에 대한 규제가 존재한다. 먼저 총자산기준(gross asset test)이라 불리는 자산규모 제한이 있는데 자산 규모가 VCT 보통주 투자 전 1,500만파운드 이하인 기업에 투자가 이루어져야 하며, 보통주 투자 직후 자산규모가 1,600만파운드 이하여야 한다. 종업원 규모와 관련된 규제는 시간제 종업원 포함 종업원 수 250인(2018년 4월 6일 이후 지식집약적 기업20)에 대하여는 500인) 미만 기업이다. 건 당 최대 투자 한도는 백만파운드, 과거 12개월 피투자기업 당 한도는 5백만파운드(2018년 4월 6일 이후 지식집약적 기업에 대하여는 천만파운드), 전체 기간 피투자기업 당 한도는 1,200만파운드(2018년 4월 6일 이후 지식집약적 기업에 대하여는 천만파운드)로 제한된다. 마지막으로 피투자기업의 보통주 투자와 대출이 이루어질 경우 보통주 투자 규모는 전체 자금공급 규모의 10% 이상을 차지해야 한다.

한편 전술한 VCT 운용규제 강화와 관련하여 2018년 이후 도입된 대표적인 운용규제로 업력 제한, VCT 증자금의 사용 및 VCT 투자금의 M&A 용도 사용 금지를 들 수 있다. 먼저 업력 기준으로 적격투자대상 기업에 대한 VCT의 최초 투자는 매출 발생 후 7년(지식집약적 기업에 대하여는 10년) 내에 이루어져야 한다.21) VCT가 증자로 확보한 투자 재원은 당해 회계연도 말 이후 12개월 안에 증자금의 최소 30%가 적격투자대상에 투자되어야 한다. 또한 VCT 투자금은 주식, 영업양수도, 무형자산 양수도 포함 일체의 M&A를 위한 자금으로 사용되어서는 안 된다. 마지막으로 VCT는 세제혜택이 위험회피 투자에 이용되는 것을 방지하고자 자본위험조건(‘risk-to-capital’ condition)을 부과하고 있다. 이는 투자금이 피투자기업의 매출, 고객 및 고용 증가 등 지속가능한 성장과 발전을 위해 사용되고 투자자에게는 모험투자가 되어야 한다는 원칙중심 조건이다.

3) 세제혜택

VCT 제도는 세제혜택이 특징적인 대표적인 투자상품으로 인식되고 있듯이 VCT의 세제지원은 제도 안착의 결정적인 역할은 한 것으로 평가받고 있다. VCT 관련 세제혜택은 다음과 같다. 무엇보다 VCT는 수익의 85% 이상을 배당하는 투자회사로서 VCT 자체가 법인세를 면제받는다. 투자자의 세제혜택으로는 국제적으로 비교해도 높은 수준의 소득공제와 배당소득세 및 양도소득세 면제를 들 수 있다. 먼저 소득공제 관련하여 투자 후 5년 보유를 전제로 소득공제 혜택이 부여되는데1995년 출범 당시의 VCT 투자에 대한 소득공제 한도와 소득공제율은 각각 10만파운드, 20%였으나 2021년 현재는 20만파운드, 30%로 상향되었다. 그러나 VCT의 소득공제 혜택은 2025년 4월 일몰이 예정되어 있다(HM Treasury and HMRC, Finance Bill 2015). 한편 배당소득세 및 양도소득세는 1995년 이후 면제이나 VCT의 양도소득세 통산은 허용되지 않는다.

4) 레버리지, 가치평가 및 기타 규제

VCT의 레버리지는 세제혜택을 받기 위해 운용규제가 규정되어 있는 소득세법에 의해서가 아니라 개별 VCT의 정관에 의해 규정되고 있다. 정관상 일정 레버리지 한도를 부여하고 있음에도 불구하고 거의 모든 VCT는 적격투자대상과 보통주 투자 중심의 운용규제로 인하여 대부분의 경우 투자수익률 제고를 위한 차입은 이루어지고 있지 않다.

가치평가는 통상 분기별 또는 반기별로 시행되며 일반적인 사모 VC 펀드에서의 가치평가와 마찬가지로 비상장기업 지분 및 대출은 국제사모펀드가치평가지침(IPEV Guideline)에 따라 공정가치로, 상장기업 및 유동성이 높은 투자자산은 시가평가(mark-to-market) 후 합산하여 산정한다. 마지막으로 VCT 지배구조는 UK 스튜어드쉽 코드를 투자회사에 맞도록 적용한 AIC Code(2019)를 사용하는 경우가 대부분이다.

5) 운용주체와 운용보수

영국 VCT는 미국 BDC와 마찬가지로 위탁운용 또는 내부운용(self-management)이 모두 가능하나 VCT의 절대다수가 위탁운용 방식을 채택하고 있다. 자료가 존재하는 전체 60개 VCT 중 내부운용은 VCT 수, 운용사 수 및 운용자산 규모 기준으로 각각 5개, 2개, 3,200만파운드이며 전체에서차지하는 비율은 각각 8.3%, 9.1%, 0.5%에 불과하다. 내부운용을 채택하고 있는 VCT는 창업초기기업에 집중 투자하는 순수 VC형 운용사이다(<표 Ⅱ-3>).

한편 보수 구조는 일반 사모 VC 펀드에서의 보수 구조와 유사하게 통상 연간 운용자산 규모의 2%에 해당하는 관리보수, 1.5%에 해당하는 경상비용, 그리고 기준수익률을 초과한 NAV 증가분의 20%에 해당하는 성과보수를 수취한다. 자료가 존재하는 57개 VCT의 2022년 3월말 기준 관리보수와 경상비용을 합산한 비용은 자산가중평균 기준으로 총자산의 2.41%이며, 성과보수까지 합산한 총운용수수료는 3.23%이다.

6) VCT 시장 현황 및 구조

2022년 3월 22일 기준 60개 VCT의 평균 시가총액과 자산규모는 각각 9,930만파운드, 1억 800만파운드로서 미국 BDC와 비교하면 개별 투자기구 규모가 작은데 이는 VCT가 상대적으로 투자규모가 작은 업력 7년 미만의 창업초기 기업에 대한 보통주 중심의 투자기구로 운용되기 때문이다. 또한 VCT의 평균 레버리지 비율은 0%로서 채권형으로 운용되는 미국 BDC와 달리 운용규제로 인하여 VCT가 주식형으로 운용되고 있는 사실과 부합한다. 한편 2019~2021년 3년간 NAV 기준 및 가격 기준 평균 누적 수익률은 각각 24.8%, 34.1%이며 NAV 대비 할인율의 평균은 –10.1%, 자료가 존재하는 시가총액 1,000만파운드 이상 20개 VCT의 배당수익률 평균은 5.4%이다.(<표 II-4>).

마지막으로 VCT 운용사 분포는 60개 VCT를 기준으로 VC 운용사가 7개, PE 운용사가 4개, 일반 자산운용사가 6개, 중소기업 전문 자산운용사가 4개, 브로커리지가 2개를 차지하고 있어 VCㆍPE 등 모험자본 전문 운용사들이 운용사 수, VCT 수, VCT 자산 규모 기준으로 각각 50.0%, 55.0%, 76.2%를 차지하는 시장구조를 형성하고 있다(<표 II-5>).

<표 II-6>은 미국 BDC와 영국 VCT의 특징 그리고 국내 도입 예정인 기업성장집합투자기구를 요약하고 비교한 표이다. 세 가지 폐쇄형 투자기구는 모두 각국 모험자본시장에서의 VC 투자 확대를 지향하고 있으나 영국 VCT가 적격투자대상 기업의 면모나 운용규제의 강도 측면에서 협의의 모험자본 확대에 충실한 제도적 특징을 보이고 있으며 이에 따라 투자위험을 보전할 수 있도록 세제혜택도 소득공제 위주로 제공하고 있다. 또한 이러한 이유로 영국 VCT는 주식형으로 운용되고 있으며 레버리지를 거의 활용하지 않고 있다.

한편 기업성장집합투자기구는 주목적투자 비중의 최저 하한을 40%로 정하고 있으나 해외의 유사 제도는 최소 70% 이상을 설정하고 있어 향후 적격 투자대상기업의 범위와 투자방식과 더불어전체적인 규제 수준을 설정할 필요가 있는데 국내 모험자본시장 현황과 잠재 운용사들의 주목적투자 분야 운용역량을 면밀히 평가할 필요가 있다.

기업성장집합투자기구가 해외 유사제도와 다른 특징 중 하나는 기업성장집합투자기구 설정ㆍ설립에 있어서 10% 이상의 운용사 출자의무를 부과하고 있는 것이다. 이는 사모시장에서 운용사와 투자자의 이해관계를 일치시키는 방법으로 사용되는 운용사 출자를 공모펀드에도 적용하는 방식이라고 할 수 있다. 해외 유사 제도에서는 평판시장이 작동하고 상장 투자회사로서 투자자보호를 위한 공시와 이사회를 통한 운용사 견제 장치가 있기 때문에 일반적으로 운용사의 출자의무가 부과되지는 않는다.

마지막으로 보수체계 관련하여 미국 BDC와 영국 VCT는 사모 VC 펀드를 모사하고 있는 만큼 운용사의 보수체계도 사모시장의 관행을 준용하여 통상 운용자산의 2% 이상의 관리보수와 기준수익률 초과 수익의 최대 20%를 수취하고 있으며 기타 펀드 운용과 관련된 비용 및 수수료가 부과되기도 한다.

기업성장집합투자기구는 특징상 상장 VC 펀드로서 일부 해외 국가에서 존재하여 왔으나 현재까지 국내에 도입된 적이 없는 제도로서 국내 모험자본시장에 끼치는 영향이 적지 않을 것으로 예상된다. 기업성장집합투자기구가 국내 모험자본시장에 안착하기 위해서는 기업성장집합투자기구의 정책적 역할과 모험자본시장의 상호연계성에 대한 이해에 기초한 제도 설계가 필요하다. 이하에서는 이러한 관점에서 본문에서 살펴본 미국 BDC와 영국 VCT의 운용사례를 바탕으로 기업성장집합투자기구 제도가 소기의 정책목표를 달성할 수 있도록 지향해야 할 방향에 대하여 운용규제, 세제지원, 이해상충 방지 및 중장기 확장성 관점에서 서술한다.

1. 운용규제

현재 기업성장집합투자기구의 자산 대비 주대상기업투자(또는 주목적투자) 비중은 40% 이상의 일정 비율 이상으로 설정되어 있다. 구체적인 제도의 시행 방향은 향후 시행령과 시행규칙에서 명확해질 것으로 예상되지만 의무 주목적투자 비중이 미국과 영국의 유사사례와 비교할 때 낮게 설정될 가능성이 있다.22) 이는 제도 도입 초기 투자처 발굴과 운용 안정성 제고 등 제도의 안착을 위해 운용사에 대한 편의를 제고하고자 하는 의도에 따른 설정이라고 볼 수 있다. 그러나 벤처기업 등 비상장 혁신기업에 대한 자금조달 확대라는 제도 도입의 취지를 고려하면 유사한 정책 목적을 가진 미국 BDC와 영국 VCT가 각각 70%와 80%에 달하는 주목적투자 비중을 가지고 있음을 참고할 필요가 있다.

또한 현재 적격투자 방식으로 벤처기업 등의 비상장 혁신기업과 투자조합의 지분투자와 대출 등이 모두 가능하도록 포괄적으로 규정되어 있으나 비상장 혁신기업의 자금조달은 지분투자가 높은 비중을 차지하므로 지분투자와 대출을 모두 허용하되 영국의 사례와 같이 지분투자가 일정 비율을 초과하도록 규제할 필요가 있다. 또한 지분투자의 경우에도 신주 투자 비중을 일정 비율 이상으로 설정하여 기업성장집합투자기구가 비상장 혁신기업의 성장 자금원을 공급할 수 있도록할 필요가 있다. 기업성장집합투자기구가 비상장 혁신기업의 장기 성장을 지원할 수 있는 인내자본(patient capital)으로 기능하기 위해서는 신주투자 중심의 주식형 기업성장집합투자기구가 중심적 역할을 할 필요가 있기 때문이다(Forman et al., 2015). 미국과 영국의 관련 제도 운용의 양태가 각국 모험자본시장의 특징과 세부 규제의 차이로 미국 BDC는 채권형으로, 영국 VCT는 주식형으로 상이한 모습으로 전개되어 왔다고 하더라도 제도 도입의 목적은 VC 자금원의 공적 자본시장으로의 확대라는 공통점을 가지고 있음을 유념할 필요가 있다. 마지막으로 이러한 투자방식에 대한 차별적 관점은 이하의 세제지원 검토 필요성과도 밀접하게 관련된다.

마지막으로 기업성장집합투자기구의 운용규제를 실제 모험자본시장 운용방식과 정합적인 방식으로 설계할 필요가 있다. 예를 들어 창업기업의 성장을 위해 국내 민간 모험자본의 유입이 필요한 이유는 정책자금 조성을 통한 스케일업 자금 지원에 한계가 있으므로 민간을 통해 효율적으로 성장지원 자금을 조달하기 위함이다. 따라서 이러한 정책목표와 시장관행을 담아낼 수 있도록 운용규제를 설정할 필요가 있다. 미국 BDC와 영국 VCT의 경우 최초 투자시점에 적격투자대상인 경우 최초 투자 이후의 기업 성장으로 인해 적격투자대상에 해당하는 규모를 초과하더라도 동 기업에 대한 후속투자(follow-on)도 적격투자로 인정하고 있다.

2. 세제지원

VC 투자는 피투자기업 성장단계의 차이에도 불구하고 본질적으로 높은 투자위험이 따른다. 이러한 이유로 민간자금의 유입이 잘 이루어지지 않아 대부분의 국가는 개인투자자 중심으로 VC 펀드 출자에 세제혜택을 부여하고 있다. 국내의 경우도 예외가 아니어서 다양한 VC 펀드23)에 출자하는 경우 출자금의 10%가 당해연도에 소득공제되며24) VC 펀드 출자로 취득한 출자지분에 대한 양도소득세와 VC 펀드가 투자한 주식이나 출자지분의 양도소득세가 면제된다.25) 해외 사례를 살펴보면 민간 중심으로 VC가 발달한 미국은 BDC를 포함하여 VC 출자에 대한 특별한 세제지원이 없는 반면 영국 VCT는 스타트업 투자를 유도하고 있기 때문에 개인투자자의 높은 투자위험을 보전하는 차원에서 VCT 법인세 면세, 개인투자자 출자액의 30% 소득공제, 양도소득세 및 배당소득세 면세 등 강한 세제혜택이 부여되고 있다.

일반적으로 VC 관련 세제혜택은 투자위험이 높은 지분투자, 그중에서도 보통주 투자에 부여되는 것이 일반적이며 대출 등으로 운용되는 경우 세제혜택이 부여되는 경우는 드물다. 따라서 세제혜택의 필요성은 전술한 기업성장집합투자기구 운용 유형과 밀접한 관련이 있을 것으로 예상된다. 만약 투자대상을 기준으로 단일 유형의 기업성장집합투자기구를 설정하는 경우 세제혜택을 부여하기 위해서는 영국 VCT와 같이 지분투자와 대출을 모두 허용하되 지분투자 중심의 투자기구로 설정할 필요가 있다. 만약 지분투자 비중에 따라 기업성장집합투자기구의 세부유형을 주식형과 채권형으로 설정하고 상이한 운용규제를 적용할 경우에는 주식형에 차별화된 세제혜택을 부여하는 것이 합리적일 것으로 판단된다.

민간 중심의 국내 VC 생태계가 조성되지 못한 현실과 기업성장집합투자기구가 사모 VC 펀드를 모사하는 투자기구라는 특징을 고려하면 주식형 기업성장집합투자기구에 대해서 일정 수준의 세제혜택을 부여하는 것이 세제 형평성에도 부합하고 제도의 성공적인 안착 가능성을 높이는 수단이 될 것으로 판단된다. 그러나 과도한 소득공제는 VC 시장의 구축효과로 이어질 가능성이 있으며(Cummings, 2007), 소득공제에 따르는 의무보유 기간은 투자기구 상장주식의 유동성 저하로 나타날 가능성이 있다(Hayley, 2016). 따라서 기업성장집합투자기구에 대해서 국내 사모 VC 펀드의 세제혜택과 유사한 수준의 세제혜택을 부여하되 소득공제 중심의 세제지원이 가져올 수 있는 부정적 효과를 감안할 필요가 있다.

3. 이해상충의 방지

미국 BDC와 영국 VCT의 사례는 기업성장집합투자기구의 운용주체로서 다양한 유형의 운용사가 참여할 수 있음을 시사한다. 미국과 영국은 자산운용사와 VCㆍPE 운용사가 대부분을 차지하는 가운데 IB, 브로커리지 등 증권사도 참여하는 시장이 형성되어 있다. 기업성장집합투자기구는 상장 VC 펀드와 유사하지만, 국내에 처음 도입되기 때문에 현실적으로 이를 운용할 운용사는 운용 경험을 축적한 기존 사모 VCㆍPE 및 자산운용사와 증권사에 국한될 것이다. 따라서 기존 운용사에 의한 사모 VC 펀드와 기업성장집합투자기구의 병행 운용 사례가 많을 것으로 예상되는데 이는 기업성장집합투자기구 운용으로 인해 기존 사모 VC 펀드의 운용을 중단할 유인이 낮기 때문이다.

VCㆍPE 펀드 운용사는 통상 일정 시점에 복수의 펀드를 운용하게 되는데 이러한 복수 펀드의 운용은 운용 사이클 전반, 특히 투자와 회수 단계에서 복수 펀드의 출자자 간 이해상충 문제를 야기할 수 있다(Duane Morris, 2015). 기업성장투자기구와 관련해 예상되는 대표적인 예로는 동일 운용사가 유사한 투자전략을 가진 사모 VC 펀드와 기업성장투자기구를 동시 운용할 경우 발굴한 매력적인 투자처의 투자기구 간 귀속의 문제(cherry-picking)와 공동투자(co-investment)에 참여한 투자기구 간 이해상충 가능성을 들 수 있다.26) 또한 사모 VC 펀드의 투자 회수 시 동일 계열 기업성장집합투자기구가 인수하는 경우와 사모 VC 펀드와 기업성장투자기구가 동일 피투자기업에 투자한 지분을 서로 다른 시기에 회수할 경우에도 이해상충 문제가 발생할 가능성이 있다.

운용사에 대한 평판시장이 작동하는 사모 VCㆍPE 시장에서는 이러한 펀드 간 또는 운용사와 펀드 간 이해상충이 기관출자자 중심의 운용사 통제와 출자자자문위원회(Limited Partner Advisory Committee: LPAC)와 같은 기구를 통해서 이루어진다. 그러나 자본시장 일반투자자의 출자로 이루어지는 기업성장집합투자기구와 같은 상장 투자기구는 투자자의 전문성 부족과 무임승차 문제로 운용사 통제가 이루어지기 어렵다. 이해상충 방지체계의 구비가 기업성장집합투자기구의 인가요건 중 하나이나 실제 제도 운용 과정에서 투자자보호가 온전히 이루어지기 위해서는 투명한 가치평가, 이해상충 가능성에 대한 정보공시와 더불어 기업성장집합투자기구의 신탁회사 또는 이사회의 독립성과 실질적 운용사 통제를 통한 이해상충 방지 기제가 작동하여야 하며 이를 위한 제도적 방안이 마련되어야 한다.

4. 중장기 확장성의 모색

모험자본시장은 다양한 성장단계의 기업군이 존재하고 투자자 측면에서도 직접투자, 사모펀드 등 간접투자와 재간접투자가 공존하는 복잡다기한 생태계이다. 기업성장집합투자기구가 민간 모험자본 생태계의 고도화를 위해 공적 자본시장을 통해 사적 자본시장을 모사하게 되는 투자기구임을 고려할 때 기업성장집합투자기구가 장기적으로 기업성장 단계에 따른 다양한 투자전략과 투자대상을 아우르는 상장 투자기구로 확장될 가능성을 염두에 둘 필요가 있다. 즉 기업성장집합투자기구 또는 이와 유사한 상장 투자기구를 통해서 VC뿐만 아니라 PE와 재간접펀드까지 포괄하는 모험자본 생태계 구조를 만들어 나갈 필요가 있다.

다양한 유형의 상장 모험자본 투자기구는 민간 모험자본시장의 확대와 수익 창출뿐만 아니라 모험자본시장 생태계의 선순환 구조 확립에 기여할 수 있다. 예를 들어 재간접펀드는 이중수수료에도 불구하고 비상장기업 분산투자를 극대화하고 사모 기관전용사모펀드에 대한 간접투자가 가능하게 하여 투자자보호와 안정적 수익창출이 가능하게 할 것이다. 또한 상장 재간접투자기구는 사모 VCㆍPE 펀드의 출자지분 거래를 통하여 모험자본 회수시장의 확대에 기여할 수 있다.

상장 모험자본 투자기구는 미국, 영국, 독일, 프랑스, 스웨덴, 스위스 등 해외 주요국을 중심으로 다수 활동하고 있다. 대표적으로 영국은 VCT 뿐만 아니라 VCㆍPE, VCㆍPE 재간접투자 등을 운용하는 다양한 폐쇄형 모험자본 투자회사(investment trust)가 런던증권거래소에 상장되어 있어 공적 자본시장을 통한 다양한 모험자본 투자가 이루어지고 있다. 2022년 3월 기준으로 영국의 상장 모험자본 투자회사는 86개, 시가총액 330억파운드 규모로서 전체 상장 폐쇄형 투자회사 시가총액의 14.8%를 차지하고 있다.27) 한편 모험자본시장이 사모 중심으로 발전한 미국의 경우 상장 폐쇄형 모험자본 투자기구는 BDC가 대표적이며 기타 대형 PE 운용사 중심의 상장 PE 관리회사(management company)가 상장되어 있다.

Ⅳ. 맺음말

기업성장집합투자기구의 의의는 공적 자본시장을 통해 비상장 혁신기업에 투자ㆍ회수할 수 있는 모험자본 생태계를 조성하고 투자자에 대하여는 다변화된 투자처로서의 비상장 혁신기업으로 투자기회를 확대하는 것이다. 국내 비상장 혁신기업의 자금조달은 정책자금과 대출에 절대적으로 의존하고 있고 민간자금이 비상장 혁신기업에 투자될 수 있는 체계적 통로가 없는 현실에서 기업성장집합투자기구는 국내 모험자본시장의 한 단계 발전을 위한 핵심적인 공적 자본시장 투자기구로서 자리매김할 것으로 예상된다.

성공적인 기업성장집합투자기구 제도 운용의 요체는 공적 자본시장 자금유입확대를 통한 자본형성(capital formation)과 제도의 지속가능성을 보장하는 투자자보호(investor protection) 간 균형을 조화롭게 이루어나가는 것이다. 이를 위해서 기업성장집합투자기구의 정책목표 달성을 위한 적절한 범위의 세제혜택 및 이와 정합적인 운용규제, 이해상충 방지와 공시 등 투자자보호 장치의 구축에 대한 면밀한 검토가 필요하다.

다만 제도적 완비에도 불구하고 기업성장집합투자기구의 성공적인 안착에는 무엇보다 운용 성과가 중요하다. 기업성장집합투자기구 운용은 분산투자를 통한 개별 비상장 혁신기업의 투자위험 통제, 운용사의 고성장 혁신기업에 대한 전문적인 발굴과 경영지원을 통한 수익창출 역량, 그리고 유동성 관리를 통한 안정적인 배당 현금흐름 창출능력이 모두 갖추어져야 한다. 또한 기업성장집합투자기구의 안정적인 운용은 사모 VC 펀드와 공모펀드 운용역량을 모두 필요로 한다. 따라서 국내 모험자본시장에서 활약해온 다양한 유형의 운용사들은 이러한 균형 잡힌 운용역량을 갖출 수 있도록 관련 전문인력의 영입 등 내부조직을 확충하거나 운용사 간 제휴 방식으로 이에 대응할 필요가 있다.

1) 기업성장집합투자기구와 유사한 국내 사례로 코스닥 시장 활성화 정책의 일환으로 2018년 도입된 코스닥 벤처펀드를 들 수 있다. 코스닥 벤처펀드는 벤처기업 신주에 집합투자재산의 15% 이상, 벤처기업 또는 벤처기업 해제 이후의 코스닥 상장 중소중견기업의 신주 구주에 35% 이상을 투자하는 공 사모 펀드로 코스닥 공모주 물량의 30% 우선배정과 3천만원 한도의 10% 소득공제 혜택(2022년말 일몰)을 투자자에게 부여하였다. 기업성장집합투자기구는 비상장기업에 중점을 두고 증권 매입과 자금 대여가 모두 가능한 공모 상장형 투자기구라는 측면에서 새롭게 도입되는 제도라고 할 수 있다.

2) 전문투자자의 투자금만으로 기업성장집합투자기구를 설정ㆍ설립하는 경우에는 동 조건의 충족 기간으로 최대 3년이 부여된다.

3) 대주주 요건 관련하여 금융투자업자의 변경인가 시 적용되는 완화 요건은 출자금이 차입금이 아닐 것, 최근 5년간 벌금형 이상 형사처벌 받은 사실이 없을 것, 부실 금융기관 또는 관련 대주주가 아닐 것이다(자본시장법 시행령 제19조의 2 별표 2).

4) 미국 BDC의 역사적 배경에 대한 이하의 설명은 Warburton(2020)을 따른다.가 존재한다. 2020년 기준 전체 BDC 수의 51%가 공모 상장, 24%가 공모 비상장, 35%가 사모 BDC이다(Eversheds Suther-land, 2021). 사모 비상장 BDC는 폐쇄형 사모펀드와 동일하게 만기 시점까지는 환매가 불가능하며, 공모 비상장 BDC의 경우 주기적인 출자지분 매입을 통해 투자자의 환매수요를 수용하고 있다. 마지막으로 상장 BDC는 상장주식의 거래뿐만 아니라 비정기적인 자사주 매입을 통하여 투자자의 회수 기회를 지원하고 있다.

5) 미국 BDC는 모집방식 및 상장에 대한 강제 규정이 없다. 따라서 BDC는 상장 BDC 이외에도 사모 BDC와 공모 비상장 BDC가 존재한다. 2020년 기준 전체 BDC 수의 51%가 공모 상장, 24%가 공모 비상장, 35%가 사모 BDC이다(Eversheds Suther-land, 2021). 사모 비상장 BDC는 폐쇄형 사모펀드와 동일하게 만기 시점까지는 환매가 불가능하며, 공모 비상장 BDC의 경우 주기적인 출자지분 매입을 통해 투자자의 환매수요를 수용하고 있다. 마지막으로 상장 BDC는 상장주식의 거래뿐만 아니라 비정기적인 자사주 매입을 통하여 투자자의 회수 기회를 지원하고 있다.

6) 상장 BDC의 수는 2014년 57개를 정점으로 이후 감소하는 추세를 보이고 있는데 이는 자발적인 BDC 등록 취소와 BDC간 인수 합병에 따른 결과이다.

7) 이러한 규제완화 사례로는 BDC에 대한 다양한 채무증권과 신주인수권, 옵션 등의 발행 허용, 투자대상 확대, 증권 취득 경로 확대가 이루어진 1996년 전국증권시장개선법(National Securities Markets Improvement Act: NSMIA), BDC가 신생성장기업(emerging growth company)으로 인정받을 경우 상장 절차의 간소화를 허용하고, 비상장 사모 BDC의 최대 주주수를 확대하여 비상장 사모 BDC 설정을 촉진하고자 한 2012년 JOBS 법, 그리고 BDC의 차입금 한도 확대를 허용한 2018년 소기업신용확대법(Small Business Credit Availability Act: SBCAA)을 들 수 있다.

8) 투자회사법상 투자한 자금의 용도에 대한 제한 규정은 존재하지 않는다.

9) 투자회사법 Section 55(a)는 BDC의 투자 대상으로서 적격 포트폴리오 기업 이외에 재무적 부실기업(fi nancially troubled companies)을 인정하고 있다.

10) ‘중요한 경영지원’은 사모 VC 운용사의 피투자기업 자문 및 경영지원을 모사하기 위한 법적 장치로서 자금조달 주선, 자금원 관리, 임원 채용, M&A 기회의 평가 등을 포괄하며 BDC가 이러한 경영지원을 제공할 역량을 갖추고 있어야 함을 의미한다. 다만, BDC의 의무는 경영지원 제공의 제의(off er)에 그치며 실제 포트폴리오 기업이 거절할 수 있다. 또한 복수의 BDC가 동일 포트폴리오 기업에 공동투자하는 경우, 어느 한 BDC에 경영지원이 제공되는 경우 모든 BDC가 경영지원을 제공한 것으로 간주되며 경영참여형 투자가 이루어지는 경우에도 경영지원 조건은 성립되는 것으로 간주된다(Warburton, 2020).

11) 이를 위한 핵심조건은 3가지가 있다(Grant Thornton, 2017). 첫째, BDC 수익의 90% 이상이 배당, 이자, 자본이득 등 양질의 수익이어야 한다(‘Good Income’), 둘째, 분기별로 분산투자 요건을 갖추어야 하는데 이는 현금, 미수금, 국채, BDC 자산의 5% 미만이고 당해 피투자기업 자산가치의 10% 미만인 증권투자 등의 합이 BDC 자산의 50% 이상이며 동일기업 투자는 BDC 자산의 최대 25%로 제한된다(‘Asset Diversification’). 셋째, 매년 이자ㆍ배당수입 및 단기 자본이득의 90% 이상을 주주에게 배당해야 한다.

12) 원래 BDC의 최소 자산커버리지 비율은 200%였으나 2018년 규제 완화에 따라 일정 조건을 만족할 경우 150%로 완화되었다.

13) VCT 수의 감소는 VCT간 인수합병에 따른 결과이다(HMRC, 2022).

14) 이하의 내용은 HM Revenue & Customs(2022)의 내용을 참고하였다.

15) 증권(securities)은 대출(loan), 무담보회사채(debenture)를 포함한다. 2018년 재정법(Finance Act) 개정 시 담보대출이 VCT 적격투자대상으로서의 증권(securities)에서 제외되었다.

16) 대부분 런던증권거래소(London Stock Exchange: LSE)에 상장된다. VCT의 상장은 VCT의 비정기적 자사주 매입과 더불어 투자 회수의 중요한 수단이다.

17) VCT 승인 후 3년 이내에 80% 적격투자 비중 의무를 충족해야 한다.

18) AIF는 Alternative Investment Fund, UCITS는 Undertakings for the Collective Investment in Transferable Securities를 의미한다.

19) ISDX(ICAP Securities and Derivatives Exchange)의 전신은 PLUS로서 PLUS Markets Group이 2012년 ICAP에 인수되어 개명된 이름이다.

20) 지식집약적 기업은 신생 혁신기업을 의미하는 용어로서 다음의 두 가지 조건을 만족하여야 한다. 즉 과거 3년 중 1년 이상 R&D 또는 혁신에 영업비용의 15% 이상을, 또는 과거 3년간 매년 10% 이상을 지출한 기업(‘operating costs’)으로서 최근 주요 사업용 지식재산을 창출한 기업 (‘innovation’) 또는 종업원의 20% 이상이 R&D 분야 관련 고학력자인 기업(‘skilled employee’)이다.

21) VCT의 후속투자(follow-on)는 동 기간 이후에도 가능하다.

22) 신설되는 기업성장집합투자기구가 자본시장법상 증권집합투자기구와 유사하므로 증권집합투자기구와 동일 수준의 주목적 투자비율인 40%를 설정한 것으로 판단된다.

23) 벤처투자조합, 신기술사업투자조합, 전문투자조합

24) 조특법 제16조 제1항. 동 소득공제는 2022년 말 일몰이 예정되어 있다.

25) 조특법 제14조 제1항

26) 미국 BDC의 경우 투자회사법 57(a)(4)은 SEC가 승인하는 경우를 제외하고는 BDC와 타 등록펀드 또는 운용사가 동일한 특수관계인 사모펀드와의 공동투자를 원칙적으로 금지하고 있다. 그러나 상당수의 사모 VCㆍPE 운용사가 BDC를 운용하고 있으며 투자규모와 운용 펀드의 소진 필요성 등으로 인해 공동투자가 많이 이루어지는 모험자본시장의 속성상 공동투자 규제의 완화에 대한 요구가 높다(Mayer Brown, 2018; Simpson & Thacher, 2020).

27) 영국의 상장 폐쇄형 투자회사는 모험자본뿐만 아니라 지역, 섹터, 주식, 채권, 인프라, 부동산 등 다양한 분야에 투자하고 있으며 전체 424개의 투자회사가 있다.

참고문헌

금융위원회, 2019. 10. 7, ‘기업성장투자기구(BDC)’ 제도 도입방안, 보도자료.

금융위원회, 2020. 1. 22a「, 비상장주식에 대한 공정가치 평가 관련 가이드라인」을 마련하였습니다. 보도자료.

금융위원회, 2020. 1. 22b, 투자대상이 비상장주식인 경우의 공정가치 평가 가이드라인. 보도자료(2020. 1. 22) 별첨자료.

금융위원회, 2022. 3. 31「, 자본시장과 금융투자업에 관한 법률」 일부개정법률(안) 재입법예고, 금융위원회 공고 제2022-130호.

AIC, 2019, The AIC Code of Corporate Governance.

Chernenko, S., Erel, I., Prilmeier, R., 2021, Why do firms borrow directly from nonbanks? Fisher College of Business WP 2018-03-013, Ohio State University.

Cumming, D.J., MacIntosh, J.G., 2007, Mutual funds that invest in private equity?

An analysis of labour-sponsored investment funds, Cambridge Journal of Economics 31, 445-487.

Cumming, D.J., 2007, The structure, governance and performance of UK Venture Capital Trusts, Journal of Corporate Law Studies 3(2), 401-427.

Duane Morris, 2015, Private Equity Fund Formation, Conflicts of Interest.

Eversheds Sutherland, 2020, BDC Roundtable 2020.

Forman, S.M., Lo, A.W., Schilling, M., Sweeney, G.K., 2015, Funding Translational Medicine via Public Markets: The Business Development Company, SSRN working paper.

Grant Thornton, 2017, Business development companies: understanding taxrelated opportunities and challenges.

Hayley, S., 2016, Reforming UK Venture Capital Trusts, working paper, Bayes Business School, City, University of London.

HM Revenue & Customs, 2022, Venture Capital Schemes Manual.

HM Treasury and HMRC, 2015, Finance Bill 2015.

IPEV, 2018, International Private Equity and Venture Capital Guidelines.

Mayer Brown, 2018, Business Development Companies.

Simpson & Thacher, 2020, Registered Funds Alert.

Rayna, T., Striukova, L., 2009, Public venture capital: missing link or weakest link?

International Journal of Entrepreneurship and Innovation Management 9(4), 453-465.

Warburton, A.J., 2020, Business Development Companies: Venture capital for retail investors, The Business Lawyer 76.