Find out more about our latest publications

Taxation of Virtual Asset Income in Korea: Problems and Solutions

Issue Papers 22-23 Nov. 30, 2022

- Research Topic Capital Markets

- Page 27

The 2022 amendment to the Income Tax Act aimed at delaying virtual asset taxation until January 1, 2025 is currently pending in the National Assembly. The Korean government has set forth the principle of “establishing legal system before levying a tax” as the ground for deferring virtual asset taxation. The principle gives priority to making a fair and reasonable virtual asset taxation system as well as setting rules and regulations on the crypto market. This article has found that in terms of virtual asset taxation reform, Korea is outstripped by major global economies. Against this backdrop, this article intends to examine legislative challenges regarding the tax treatment and classification of gains from virtual asset transactions as other income category and the virtual asset-specific tax regime, and to present desirable policy responses.

As for taxation on income generated from transactions of virtual assets under the Income Tax Act, a convenient tax system is needed for taxpayers to budget and plan. What is also needed is to encourage long-term investments in high-quality virtual assets and adhere to the principle of levying a tax on the “net” income. To this end, investors should be allowed to offset capital gains and losses of virtual assets and investment properties and to carry forward the net loss for subsequent years. Specific rules on crypto taxation and authoritative interpretations regarding what constitutes income from crypto lending are almost nonexistent. For taxation on income from crypto lending and DeFi, the tax authority should conduct policy research. They also need to notify market participants of a specific tax policy before specific rules on virtual asset taxation comes into force.

For the advancement of Korea’s virtual asset tax regime, it is desirable to establish an efficient virtual asset taxation system and launch an internationally competitive tax service platform for virtual assets. To achieve this goal, Korea’s tax authority should have sufficient discussions to present comprehensive and detailed guidelines for virtual asset taxation.

As for taxation on income generated from transactions of virtual assets under the Income Tax Act, a convenient tax system is needed for taxpayers to budget and plan. What is also needed is to encourage long-term investments in high-quality virtual assets and adhere to the principle of levying a tax on the “net” income. To this end, investors should be allowed to offset capital gains and losses of virtual assets and investment properties and to carry forward the net loss for subsequent years. Specific rules on crypto taxation and authoritative interpretations regarding what constitutes income from crypto lending are almost nonexistent. For taxation on income from crypto lending and DeFi, the tax authority should conduct policy research. They also need to notify market participants of a specific tax policy before specific rules on virtual asset taxation comes into force.

For the advancement of Korea’s virtual asset tax regime, it is desirable to establish an efficient virtual asset taxation system and launch an internationally competitive tax service platform for virtual assets. To achieve this goal, Korea’s tax authority should have sufficient discussions to present comprehensive and detailed guidelines for virtual asset taxation.

Ⅰ. 서언

국내 가상자산 과세제도는 2020년 세법개정안을 통해 처음 도입되었다. 2020년 12월 29일 개정된 소득세법(법률 제17757호)에 따르면, 거주자가 가상자산의 양도 및 대여로부터 얻은 소득은 기타소득으로 신고하여 납부하여야 하며 해당 과세제도는 2022년 1월 1일 이후 시행하기로 하였다. 그러나 국가가 가상자산 거래자를 위한 보호제도의 마련 없이 세금 부담만 가중시킨다는 비난 여론이 커지자, 정부와 국회는 소득세법상 가상자산 과세제도의 시행을 유예하였다.1) 현재는 가상자산 소득과세 시행 시기를 2025년 1월 1일 이후로 유예하는 2022년 세법개정안이 국회에 상정되어 있다.

우리 정부는 가상자산 과세 유예의 근거로 ‘선정비, 후과세’의 원칙을 들고 있다. ‘선정비, 후과세’ 원칙에 있어서의 ‘선정비’는 가상자산 거래자 보호체계의 정비에 국한되는 것이 아니라, 가상자산 과세체계를 글로벌 정합성에 맞게 공정하고 합리적으로 정비하는 정책과제를 포함한다고 할 수 있다. 본 연구의 결과 국내 가상자산 과세제도 정비의 수준은 글로벌 주요국 수준에 미치지 못하는 것으로 분석되었다. 2021년 PwC의 가상자산 세금 관련 보고서에 따르더라도, 우리나라의 가상자산 과세제도 정비의 수준은 글로벌 주요국 대비 하위권인 것으로 나타난다.2)

본고는 국내 가상자산 과세제도의 선진화에 기여하는 것을 목적으로 가상자산소득 과세제도의 주요 쟁점을 분석하고, 국내 가상자산 입법 제도와 해외 입법 사례를 설명한다. 본고에서 다루는 주요 과세 분야는 국내 가상자산 기타소득 과세제도와 가상자산에 특유한 과세제도이다. 국내 가상자산 기타소득 과세제도에 관하여, 가상자산 양도로부터의 이익 과세와 가상자산 대여로부터의 이익 과세를 제도적으로 분석하고, 해외 주요국 과세제도를 살펴본 후, 국내 가상자산 기타소득세제 정비의 과제 및 방향을 논한다. 가상자산에 특유한 과세제도에 관하여, 가상자산 블록 검증(작업증명 방식의 채굴, 지분증명 방식의 검증)의 대가로 받은 소득과세, 하드포크와 에어드랍 관련 과세를 제도적으로 분석하고, 해외 주요국 과세제도를 살펴본 후, 가상자산에 특유한 과세제도 정비의 과제 및 방향을 논한다. 마지막으로 본고의 결어 부분에서 국내 가상자산 과세제도 발전 방향을 제시한다.

Ⅱ. 국내 가상자산 기타소득 과세제도 분석

1. 국내 가상자산 기타소득 과세제도 개요

가. 기타소득 및 분리과세 체계

현행 소득세법상 가상자산의 양도 및 대여로부터의 소득은 기타소득으로서 분리과세 된다.3) 과세당국은 가상자산소득을 기타소득으로 과세하는 이유에 관하여, “가상자산에 대한 국제회계기준, 현행 소득세 과세체계 등을 종합적으로 감안하여 기타소득으로 분류”하였다고 설명한다.4) 즉, 국제회계기준 해석위원회(International Financial Reporting Interpretations Committee: IFRIC)는 가상자산을 판매목적으로 보유하는 경우 재고자산으로 처리하고, 그렇지 않은 경우 무형자산으로 처리한다. 또한 국내 소득세법상 상표권 등 무형자산은 기타소득으로 과세한다. 따라서 무형자산인 가상자산은 기타소득으로 과세해야 한다는 것이 과세당국의 논리이다. 그러나 정작 이미 투자자산 또는 자본자산의 일종으로 가상자산을 과세하고 손익통산 등을 허용하는 미국, 영국, 독일 등 주요국의 해외 과세 입법례를 종합적으로 감안하지 않은 점은 아쉬운 부분이다.

가상자산 양도 및 대여로부터의 소득은 종합소득과세표준에 합산되지 않는 ‘분리과세 기타소득’이다.5) 양도소득은 종합소득과세표준에 합산되지 않기 때문에, 가상자산 양도로부터의 소득도 양도소득세적 성격을 감안하여 분리과세 대상으로 정한 것으로 보인다. 가상자산 대여로부터의 소득은 이자소득과 유사하며, 이자소득은 종합소득과세의 대상이 된다. 그러나 이자소득은 “금전 사용에 따른 대가로서의 성격”6)을 가짐에 반하여, 가상자산 대여로부터의 소득은 금전이 아닌 가상자산 사용에 따른 대가로서의 성격을 가진다. 따라서 가상자산 대여소득을 이자소득과 같이 반드시 종합소득과세의 대상으로 하여야 하는 것은 아니다.

현행 가상자산 기타소득 과세에 관하여, 과세대상 자산 및 거래, 세액계산 방식, 손익통산 방식, 신고 방식 등이 주요 이슈가 된다. 이러한 이슈를 사안별로 살펴보면 다음과 같다.

나. 과세의 대상 자산 및 대상 소득

국내 소득세법상 가상자산 과세의 대상 자산은 ‘특정 금융거래정보의 보고 및 이용 등에 관한 법률’(이하 ‘특금법’)에서 규정한 가상자산이다. 따라서 과세대상 자산은 “경제적 가치를 지닌 것으로서 전자적으로 거래 또는 이전될 수 있는 전자적 증표” 중 특금법상 예외 사항에 해당하지 않는 것이다.7) 특금법은 가상자산을 매우 포괄적으로 정의하고 있기 때문에, 대부분의 신종 디지털자산의 양도 및 대여로부터의 소득은 과세 대상이 될 것이다. 그러나 특금법상의 예외 사항에 해당하는 게임머니, 선불전자지급수단, 전자화폐, 전자어음 등의 양도 및 대여로부터의 소득은 가상자산 소득과세 대상이 아니다. 또한 증권형 토큰은 본질적으로 증권이기 때문에, 증권형 토큰 양도로부터의 소득은 일반적으로 금융투자소득으로 해석할 수 있다. 특금법 해석상으로도 증권형 토큰은 가상자산 개념의 예외라기보다는 금융회사의 금융거래의 대상인 금융자산이며 원칙적으로 가상자산이 아니라고 해석하는 것이 합리적이다.8)

국내 소득세법상 자산의 양도 및 대여로부터의 소득은 포괄적 과세대상이 아닌 열거적 과세대상이다. 따라서 새롭게 등장한 가상자산 관련 소득과세를 위해 가상자산의 양도 및 대여로부터의 소득을 기타소득 대상으로 추가한 것이다. 가상자산의 ‘양도’로부터의 소득에서 ‘양도’는 매매와 교환을 포함하는 개념이다.9) 따라서 가상자산 원화마켓에서 가상자산을 매도하는 행위와 마찬가지로, 기축가상자산마켓(BTC마켓, ETH마켓 등)에서 가상자산을 기축가상자산10)과 교환하는 행위도 가상자산소득 대상거래가 된다.

가상자산의 대여로부터의 발생하는 기타소득 과세는 주로 가상자산 렌딩(lending) 등의 거래로부터의 소득을 대상으로 한다. 가상자산 대여행위는 탈중앙화금융인 DeFi(Decentralized Finance)의 핵심적 부분이다. 이러한 가상자산 대여행위로부터의 소득은 국내 소득세법상 열거된 이자소득의 유형에 포함되지 않으며, “금전 사용에 따른 대가로서의 성격”을 가지고 있지 않다.11) 따라서 신뢰성 있는 발행인이 발행한 안정적인 스테이블코인 대여로부터의 이익은 이용자들이 이자와 같이 인식하더라도 금융소득 종합과세의 대상이 되지 않는다. 과세당국은 아직 기타소득 과세대상인 가상자산의 대여행위를 유형화하거나 구체적 예시를 들어 구체적 과세 방안을 시장참여자에게 알리지 않고 있다. 또한 소득세법상 가상자산 대여의 개념이 지분증명을 위한 스테이킹(staking)을 포함하는지에 대해서도 입장이 불명확하다.

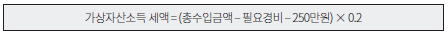

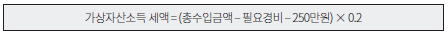

다. 세액계산 방식

국내 소득세법상 가상자산소득에 대한 세액은 총수입금액에서 필요경비를 빼고(가상자산소득금액), 다시 기본공제액(연 250만원)을 뺀 금액에, 세율(20%)을 곱한 값으로 한다.12) 이를 산식으로 나타내면 아래와 같다.

필요경비는 양도로부터의 가상자산소득과 대여로부터의 가상자산소득에 있어 다르다. 가상자산 양도차익에 대한 과세에 있어 필요경비는 실제 취득가액과 부대비용을 합한 금액이다. 부대비용은 거래비용(거래 수수료 등) 및 세무비용(세무사 수수료 등)을 포함한다. 가상자산의 취득가액을 산정함에 있어, 원칙적으로 가상자산주소별로 선입선출법을 사용한다. 다만 특금법상 신고가 수리된 가상자산사업자(이하 ‘신고수리가상자산사업자’)를 통해 거래되는 가상자산의 취득가액 산정에 있어서는 이동평균법을 적용한다.13) 가상자산 기타소득과세 시행일 전에 이미 보유한 가상자산의 취득가액은 해당 시행일 전일 당시의 시가와 실제 취득가액 중 큰 금액으로 의제한다.14) 가상자산 간의 교환에 따른 양도차익 과세에 있어, “기축가상자산의 가액에 교환거래의 대상인 가상자산과 기축가상자산 간의 교환비율을 적용하여 계산”한다.15) 이 경우 시가고시가상자산사업자16)를 통해 거래된 기축가상자산의 가액은 교환 시점의 해당 자산에 대한 금전 교환 가액으로 한다. 외국통화에 연동되는 기축가상자산의 가액은 교환거래일의 기준환율 또는 재정환율에 따른 환산 가액으로 한다.

소득세법은 가상자산 대여에 대한 과세에 있어 필요경비에 대해서는 따로 규정하고 있지 않다. 그 이유는 가상자산 대여소득을 이자소득과 유사한 것으로 보아 이자소득의 입법례17)에 따라 필요경비를 인정하지 않기 때문인 것으로 추정된다. 그러나 DeFi에서 발생한 대여소득에서 관련 수수료 부분을 필요경비로 인정할 필요가 있다는 점에서, 가상자산 대여소득의 필요경비 인정범위에 대한 입법적 논의가 요구된다.

라. 손익통산 및 신고 방식

국내 소득세법상 가상자산소득금액은 해당 과세기간의 소득금액이기 때문에 해당 과세연도의 손익을 합산하여 산출한다.18) 그러나 해당 과세연도의 가상자산 결손금을 다음 과세연도로 이월하여 다음 과세연도의 가상자산소득에서 공제할 수 있는 이월공제 제도가 금융투자소득의 경우와는 다르게 인정되지 않는다. 또한 동일 과세기간 중의 가상자산손익과 금융투자손익과의 통산도 허용되지 않는다.

해당 과세기간 중에 가상자산소득이 있는 거주자는 다음 연도 종합소득세 신고기간(5월 1일부터 5월 31일)에 해당 기타소득의 과세표준을 납세지 관할 세무서장에게 신고하여야 한다.19) 소득세법상 가상자산사업자는 가상자산 거래내역 등의 제출의무가 있기 때문에, 가상자산 양도로부터의 소득에 관한 과세정보는 과세당국이 어느 정도 확보하였다고 볼 수 있다. 그러나 가상자산 대여로부터의 소득에 대한 납세대상자 파악 및 대상자 고지 등에 관한 과세시스템은 아직 구축되어 있지 못하다. 관련 과세시스템 구축의 장애 요인으로 가상자산 대여로부터의 소득에 관한 구체적인 과세가이드라인이 마련되어 있지 않은 점 등을 들 수 있다.

비거주자의 국내원천 가상자산소득에 대해서는, 가상자산사업자가 법이 정한 기간 내20)에 원천징수하여 납세지 관할 세무서 등(한국은행, 체신관서 포함)에 납부하여야 한다. 현재 외국인 투자자의 국내 가상자산 투자가 폭넓게 허용되고 있지 않기 때문에, 해당 법조항이 시행되더라도 가상자산사업자의 비거주자 가상자산소득 원천징수에 관한 과세 실무상의 큰 문제는 발생하지 않을 것으로 예상된다. 그러나 향후 국내 가상자산시장에 글로벌 투자자들의 참여가 확대되었을 때에 대비하여 가상자산사업자 및 과세당국이 외국인 투자자의 과세정보를 확보할 수 있는 법적 근거가 충분한지에 대한 점검이 필요하다.

2. 해외 주요국 과세제도와의 비교

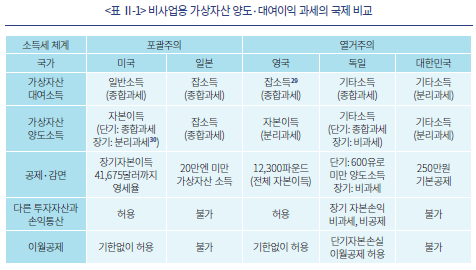

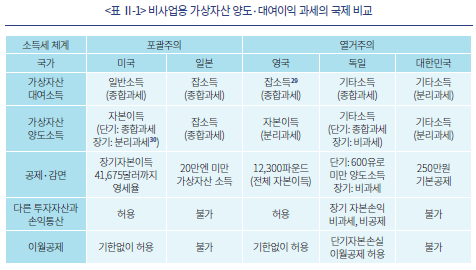

가. 가상자산 양도차익에 대한 과세

대부분의 국가에서 가상자산은 화폐가 아닌 자산으로 취급되기 때문에, 가상자산의 매매 또는 교환으로 인한 개인의 양도차익은 양도소득 과세대상이라 할 수 있다. 미국의 과세당국인 IRS(Internal Revenue Service)는 2014년 가상자산 과세 관련 고시(Notice 2014-21)를 통해, 가상자산은 연방세법상 자산(property)이라는 점을 분명히 밝혔다. 가상자산의 매매 또는 교환은 자산의 양도로서 일반 자본이득세(capital gains tax)의 적용 대상이 된다. 따라서 양도한 가상자산의 보유기간 1년을 기준으로 단기자본이득과 장기자본이득으로 나누어, 단기자본이득은 종합소득세율(최대 37%)로 과세하고 장기자본이득은 장기자본이득세율(최대 20%)로 과세한다. 1년 이하 보유한 비트코인 등 가상자산으로 물건을 구입하고 해당 교환(양도)에 따라 자본이득이 발생하는 경우, 해당 자본이득에 대해 고율의 종합소득세를 부담하여야 한다. 이러한 점에서 가상자산을 결제수단으로 사용함에 있어 세부담이 매우 크다. 이에 대해 현재 미국 의회에 계류 중인 ‘책임있는 금융혁신법안’(Responsible Financial Innovation Act)은 재화 또는 용역을 구매하기 위한 개인적인 거래(personal transaction)에 비트코인 등 가상자산(virtual currency)을 사용하는 경우, 가상자산 손익이 200달러 미만인 거래에 대해서는 자본이득세를 부과하지 않는다고 규정하고 있다.21)

미국과 더불어 영국, 캐나다, 호주 등 영미권 국가에서도 개인의 가상자산 양도로 인한 차익에 대해서는 해당 양도행위가 사업성을 가지지 않는 이상 자본이득세를 부과한다. 독일의 경우, 사업성이 없는 사적 매매(private sale)로 인한 가상자산의 양도차익에 대해서는 해당 가상자산의 보유기간 1년을 기준으로 장단기로 나누어 과세 여부를 달리한다. 즉, 해당 가상자산을 1년 초과하여 장기 보유한 경우에는 비과세하고, 1년 이하의 기간동안 단기 보유한 경우에는 종합과세한다. 단기 보유 가상자산의 양도차익을 과세함에 있어, 과세연도당 양도차익이 600유로 이하인 경우에는 과세하지 않는다.

일본의 경우, 가상자산의 양도로 인한 소득을 잡소득(miscellaneous income)으로 분류하여 종합과세의 대상으로 한다. 따라서 양도소득세로서 분리과세되지 않고 근로소득 등과 합산되어 종합과세되기 때문에, 일본의 가상자산 거래자는 가상자산 양도차익에 대해 글로벌 대비 높은 세율을 부담한다.

나. 가상자산 대여이익에 대한 과세

가상자산 대여로부터의 이익에 대해서는 주요국에서 종합소득(미국 등) 또는 잡소득(일본 등)으로 과세한다. 그런데 가상자산 양도로부터의 이익에 대한 과세 논의에 비해 가상자산 대여로부터의 이익에 대한 과세 논의는 상대적으로 미진하다. 그 이유는 가상자산 양도차익 과세가 대여이익 과세에 비해 세원 규모가 크고 중요하여 과세당국이 과세 정책 수립에 적극적인 점에서 찾을 수 있다.22) 또한 DeFi 거래의 복잡성과 익명성으로 인해 실태 파악과 세원 확보가 용이하지 못한 점도 이유로 들 수 있다.

가상자산 대여행위는 분산원장 네트워크에서 가상자산의 교환을 통해 이루어지기 때문에 ‘금전’ 사용에 대한 대가라는 전통적 이자 개념을 적용하기는 어렵다. 그러나 DeFi 시장참가자들은 가상자산 대여의 대가로 가상자산을 받는 이익창출행위를 이자농사(yield farming)라고 명명한다. 이자농사에 있어 가상자산 보유자는 DeFi 대출 프로토콜 또는 탈중앙화거래소(DEX) 유동성 공급을 위해 자신의 가상자산을 맡기고 이에 대한 대가를 수취한다. 이러한 대가의 수취가 가상자산 대여자가 가상자산을 받는 형식으로 이루어진 경우, 추가적으로 받은 가상자산은 종합소득 또는 잡소득에 합산된다.

미국 등 많은 국가에서 가상자산 공급의 대가로 새로운 가상자산을 받은 것이 아니라 예치자 권리의 증표로서 받게 되는 가상자산의 가치가 증가하는 경우에는, 해당 가상자산을 양도하였을 때 자본이득세를 부과할 것이다. 예를 들어, DeFi 대출플랫폼인 컴파운드(Compound)23)에 자산담보형 스테이블코인인 DAI를 1,000개 공급하고 예치된 DAI에 상응하는 cDAI를 지급 받은 경우, 1년 뒤 cDAI의 가치가 1,100 DAI가 되었다면 해당 가치증가분은 종합소득과세의 대상이 되기보다는 자본이득(양도소득)과세의 대상이 될 것이다.

DeFi 대출이 기존의 금전 대출과 다른 특성을 보임에 따라 글로벌 주요국 과세당국은 관련 과세 방안에 관해 활발한 논의를 이어가고 있다. 이러한 논의는 DeFi 서비스 예치자에게 지급하는 거버넌스 토큰에 관한 과세, 스마트계약에 따른 자동채무상환대출(self-repaying loans)에 있어 부채가 탕감됨으로써 얻는 이익(debt cancellation income)에 대한 과세 등을 포함하고 있다. 글로벌 주요 과세당국은 이러한 DeFi 과세에 관한 논의 및 조사를 진행하고 있으며 향후 관련 세법 개정과 과세가이드라인 발표가 있을 것으로 예상된다.

다. 가상자산 양도에 따른 손익의 통산 및 손실 이월공제

최근 비트코인이 새로운 하나의 자산군(asset class)으로 부각됨에 따라24), 가상자산 양도손익을 다른 투자자산 양도손익과 손익통산하는 이슈가 중요해지고 있다. 세법상 가상자산을 투자자산으로 인정하고, 다른 투자자산과 양도손익을 포괄적으로 통산하여 전체 투자의 순소득에 대해서만 과세하게 되면 자산배분 포트폴리오가 다양해지고 자산시장이 활성화되는 효과를 기대할 수 있다. 자산시장의 활성화를 중시하는 미국은 사업용 자산이 아닌 가상자산을 자본자산25)으로 인식하고 해당 가상자산의 양도손익을 주식 등 다른 투자자산의 양도손익과 통산한다. 또한 해당 과세연도에 소득공제되지 못하고 남은 단기자본손실 또는 장기자본손실은 장단기의 속성을 유지한 채 기간의 제한 없이 미래의 과세연도 손실공제를 위해 사용될 수 있다. 이러한 가상자산 자본손실에 대한 이월공제 제도는 미국 투자자산시장에서 가상자산 장기투자를 육성하고 투자자들의 납세부담을 경감시키는 효과를 가질 수 있다.

미국과 더불어 영국, 호주, 캐나다 등 영연방 국가들도 대부분 가상자산과 다른 투자자산간의 양도손익 통산을 인정하고 가상자산 순양도차손에 대한 이월공제를 허용한다.26) 가상자산과 다른 투자자산간의 손익통산과 이월공제의 인정 여부는 특정 국가의 소득세법 체계가 포괄주의인지 열거주의인지의 여부와는 큰 관련성이 없다. 이는 포괄주의 소득세제를 채택한 미국과 열거주의 소득세제를 채택한 영국이 유사한 방식으로 가상자산 양도차익의 손익통산과 이월공제를 허용하고 있다는 점에서도 잘 나타난다. 그러나 가상자산의 양도로 인한 차익을 양도소득 내지는 자본이득으로 인정하지 않고 잡소득으로 분류하는 국가에서는 가상자산과 다른 투자자산간의 손익통산을 허용하지 않는다. 대표적으로 일본은 가상자산의 양도차익을 투자자산의 양도소득으로 보지 않고 잡소득으로 본다.27) 따라서 다른 종합소득에서 가상자산 투자손실을 공제하거나 다음 과세연도로 이월할 수 없고, 누진세율로 종합과세되어 세부담이 크다. 이러한 가상자산 양도차익에 대한 과중한 세금은 일본 가상자산시장 활성화에 저해 요소가 되는 것으로 지적되어 왔다. 이에 일본암호자산비즈니스협회(JCBA)는 지난 7월 29일 가상자산의 양도차익을 종합소득과세에서 신고분리과세로 하고 손실에 대한 3년간의 이월공제를 허용하는 것을 주요 골자로 하는 2023년도 세제 개정 요망서를 금융청에 제출하였다.28)

종합해보면, 가상자산 시가총액 측면에서 중국을 제외하고 상위국가인 미국, 일본, 영국, 독일 중 1년 이상의 장기자본이득에 대하여 손익통산과 이월공제를 허용하지 않는 국가(독일은 비과세)는 일본 뿐이며, 일본에서는 관련 세제 개선 요구가 큰 실정이다.

3. 소결: 국내 가상자산 기타소득세제 정비의 과제 및 방향

국내 소득세법상 가상자산 기타소득세제 정비의 과제 및 방향은 가상자산 양도로부터의 소득과세와 가상자산 대여로부터의 소득과세로 나누어 살펴볼 수 있다. 먼저 가상자산 양도로부터의 소득과세에 있어서는 납세자가 취득가액 등 과세정보를 확보하고 세액을 산정ㆍ납부함에 있어 편의성을 높일 수 있는 과세시스템 확보가 필요하다. 또한 외국인(비거주자) 투자자의 가상자산소득세에 대해 국내 가상자산사업자가 실효성 있는 원천징수를 하기 위해, 가상자산사업자의 비거주자 납세정보에 관한 접근 권한을 법적으로 보장하여야 할 것이다.

우량한 가상자산 장기투자를 육성하고 ‘순’소득 과세의 원칙에 충실하기 위해, 가상자산과 다른 투자자산간의 양도손익 통산을 인정하고 가상자산 순양도차손에 대한 이월공제를 허용하는 방안을 논의하여야 한다. 이러한 논의에 있어 비트코인 등 가상자산이 하나의 자산군으로 자리 잡아 가고 있고, 미국 등 해외 주요국에서 관련 손익통산과 이월공제를 폭넓게 인정하고 있다는 점을 고려하여야 할 것이다. 다만 국회의 입법 논의과정에서 가상자산을 하나의 자산군으로 공식적으로 인정하는 것에 대한 국민 정서와 납세자 수용성도 고려하여야 한다.

가상자산 대여로부터의 소득과세에 관해서는, 가상자산 대여소득이 무엇인가에 관한 구체적 규정과 적극적인 유권해석이 필요하다. 가상자산 대출플랫폼 예치 개념과 스테이킹 개념에 대한 구분 등에 관해 과세당국은 구분 기준 및 과세 방안을 제시하여야 한다. 또한 DeFi 서비스 수수료를 가상자산의 대여로 인한 소득의 필요경비로 인정할 것인지에 대한 논의도 필요하다.

Ⅲ. 가상자산에 특유한 과세제도 분석

효율적이고 공정한 가상자산 과세체계를 구축하기 위해서는 가상자산의 특성을 반영한 과세 원칙을 정립하여야 한다. 전통적 자산에 대한 과세와는 다른 가상자산 과세의 특수성은 작업증명 방식의 채굴(이하 ‘POW 채굴’), 지분증명 방식의 검증(이하 ‘POS 검증’), 에어드랍 및 하드포크 과세에서 나타난다. 본 장에서는 블록체인 거래 검증의 대가, 에어드랍 및 하드포크에 관한 과세의 핵심 논점 및 국내외 제도를 분석한다.

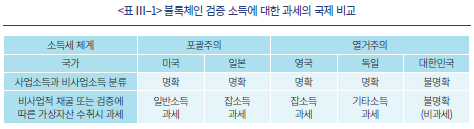

1. 블록체인 거래 검증의 대가에 대한 과세

가. POW 채굴에 관한 소득과세

1) 주요 개념 및 국내 과세제도

채굴(mining)이란 가상자산의 거래를 검증하고 해당 거래가 기록된 블록을 생성하는 기능을 하는 분산원장 프로토콜상의 절차를 의미한다.31) 채굴은 작업증명(Proof-of-Work: POW)32) 방식의 합의 알고리즘을 채택한 분산원장 프로토콜의 블록 검증 방식이다. 채굴에 대한 보상은 거래 검증 및 블록 생성에 대한 대가로 새롭게 생성된 가상자산을 받는 방식과 함께 거래수수료의 일부를 채굴자가 받는 방식으로도 이루어진다.33)

“소득 있는 곳에 과세 있다”는 조세의 기본원칙상, 블록체인 거래의 검증에 대한 대가로서 수령하는 소득에 대해서도 원칙상 과세를 하는 것이 바람직하다. 순자산증가설에 따른 포괄주의 과세원칙이 반영된 국내 법인세법에 따라, 국내 법인의 채굴행위는 과세대상이며 채굴에 드는 비용에 대해서도 합리적 범위에서 공제가 가능할 것이다. 그러나 과세대상 소득을 포괄주의가 아닌 열거주의 방식으로 규정하는 국내 소득세법 체계에 있어 가상자산 채굴행위 과세에 대한 법적 근거는 불분명하다. 과세당국은 아직까지 가상자산 채굴로 인한 소득과세 방안에 대한 분명한 입장을 밝히지 않고 있다.

국내 소득세법상 가상자산 채굴에 따른 소득에 대한 과세 근거로는 사업소득과 기타소득 관련 규정을 들 수 있다. 가상자산 채굴로 인한 소득이 사업성이 있다면 사업소득 과세규정의 적용가능성을 살펴보아야 하고, 사업성이 없다면 기타소득 과세규정의 적용가능성을 살펴보아야 할 것이다. 개인 납세자가 영리를 목적으로 자신의 계산과 위험으로 계속ㆍ반복적으로 가상자산 채굴을 하는 경우, 해당 채굴행위에서 발생하는 소득이 소득세법상 사업소득세 과세대상인지를 확인하여야 한다. 국내 소득세법상 사업소득은 열거된 소득 이외에 열거된 소득과 ‘유사한 소득’으로서 영리목적성, 독립성, 계속ㆍ반복성을 갖춘 소득도 포함하는 소득유형별 포괄주의 방식으로 과세되기 때문에, 과세대상 소득의 범위가 매우 넓다고 할 수 있다.34) 가상자산 채굴사업으로 인한 소득은 현행 사업소득업종 중 ‘정보통신업’ 또는 ‘과학 및 기술서비스업’에서 발생하는 소득과 유사하다고 볼 여지가 있다.35) 그러나 과세당국은 가상자산 채굴사업으로 인한 소득의 사업소득 인정기준을 명확히 밝히지 않고 있어 법적 불확실성36)이 큰 실정이다. 이러한 법적 불확실성으로 인해 가상자산 채굴사업에 종사하는 사업자가 관련 사업비용 공제가 안 되거나 불측의 세금을 부담하는 피해가 발생하여서는 안 될 것이다.37) 따라서 과세당국은 가상자산 채굴사업이 소득세법상 사업소득으로 분류되는 기준을 명확히 시장참가자에게 알리는 것이 바람직하다.

가상자산 채굴로 인한 소득이 사업성이 없다면 기타소득 과세규정의 적용가능성을 살펴보아야 할 것이다. 국내 소득세법이 열거주의를 채택하고 있고 가상자산 관련 기타소득(가상자산소득)에 관하여 가상자산을 “양도하거나 대여함으로써 발생하는 소득”38)으로 열거하고 있기 때문에, 소득세법 개정 없이 가상자산 채굴로부터 발생하는 사업성 없는 소득을 기타소득으로 해석하기는 어려운 것으로 사료된다. 따라서 사업성이 없이 개인이 채굴한 가상자산은 취득시 과세되지 않고 양도시 과세된다고 보아야 할 것이다. 이 경우 취득가액은 0원이라 할 수 있으며, 채굴에 소요되는 전기요금은 필요경비로서 인정한다는 것이 과세당국의 방침이다.39)

2) 해외 주요국 과세제도

대부분의 해외 주요국은 개인의 채굴로 인한 소득과세를 해당 채굴행위가 사업성이 있는지의 여부에 따라 사업소득과 비사업소득으로 나누어 과세한다. 미국 IRS는 이미 2014년 가상자산 과세 관련 고시(Notice 2014-21)를 통해, 납세자의 채굴행위가 개인의 사업(trade or business)으로 행해지는 경우 해당 채굴 수익에서 비용을 제외한 순수익에 대해 자영업세(self-employment tax)40)를 부과한다는 점을 명확히 밝혔다. 사업성이 없는 채굴행위로 인한 소득은 채굴자가 해당 가상자산을 수령하는 시점을 기준으로 공정시장가치(Fair Market Value: FMV)를 산정하여 해당 채굴자의 연간 총소득에 귀속시켜 종합과세한다. 해당 FMV는 해당 채굴자가 채굴 받은 가상자산을 매각하는 경우, 양도차익 계산에 있어 해당 가상자산의 취득가액이 된다.

일본의 경우에도 사업성이 있는 채굴행위를 통해 발생하는 소득은 사업소득으로 과세된다.41) 또한 사업성이 없는 채굴로 인한 소득은 잡소득으로 과세된다.42) 일본의 잡소득은 법령에 구체적으로 열거되지 않아도 포괄주의 원칙에 따라 종합과세가 된다는 점에서 국내 소득세법상 기타소득과 다르다. 채굴행위로 인해 발생하는 소득금액을 산정함에 있어, 채굴된 가상자산을 납세자가 취득하는 시점의 시가가 기준이 되며, 전기료 등의 필요경비는 소득금액에서 공제된다.43)

영국에서도 사업성이 인정되는 행위(trade)로서 가상자산 채굴을 하는 경우, 해당 채굴로 인해 발생한 소득에 대해 사업소득으로 과세한다.44) 만약 채굴로 인해 발생한 소득에 사업성이 인정되지 않는 경우, 해당 소득은 잡소득45)으로 종합과세되며 전기료 등의 필요경비 공제도 가능하다. 그러나 잡소득의 필요경비 공제의 범위는 사업소득의 필요경비 공제의 경우보다 협소하다. 예를 들어 채굴기 구입비용은 사업소득의 비용으로 공제가 가능하지만, 잡소득의 비용으로 공제받기는 어렵다.46)

미국, 일본, 영국, 독일에서는 가상자산 채굴로 인해 새로 생성된 가상자산을 취득하거나 수수료를 받는 경우, 해당 가상자산을 취득시기의 시가로 과세한다. 그러나 싱가포르, 호주는 사업자가 아닌 개인이 채굴을 통해 가상자산을 취득한 경우, 이를 취미(hobby) 활동으로 보고 취득 시점에 과세하지 않는다. 향후 해당 가상자산의 처분에 따른 양도차익에 대해 싱가포르는 과세하지 않으며47), 호주는 필요경비의 인정 없이 자본이득과세를 한다.48)

나. POS 검증에 관한 소득과세

1) 주요 개념 및 국내 과세제도

블록체인 합의 알고리즘으로서의 작업증명 방식은 대규모 전력량 사용에 따른 환경문제 등으로 비판받고 있다. 따라서 추세적으로 작업증명 대신 지분증명(Proof-of-Stake: POS)49) 방식의 합의 알고리즘 사용이 대세가 되어가고 있다. 최근 이더리움이 머지(Merge) 업그레이드를 통해 작업증명에서 지분증명으로 네트워크 합의 알고리즘을 바꾼 사실도 이러한 추세를 잘 반영하고 있다.

지분증명 방식은 불특정인의 채굴행위가 아닌 검증인의 인증행위를 기반으로 하는 블록체인 네트워크의 합의 알고리즘이다. 지분증명 방식에서 검증인은 무작위로 결정되지만 검증인의 지분 비율이 높을수록 선정될 확률이 높아진다. 검증인이 되기 위해서는 최소한의 보유량(이더리움의 경우 32개)을 예탁하여야 하는데 이러한 검증을 위한 예탁을 스테이킹(staking)이라고 한다. 스테이킹된 가상자산은 스마트 계약에 따라 처분이 제한(lock)된다. 스테이킹을 요구함에 따라 검증인은 검증을 하지 않거나 부실 검증을 한 경우 스테이킹된 물량이 강제적으로 몰수(slashing)되는 제재를 받게 된다. 개인이 직접 검증인을 하기 위해서는 일정 규모 이상의 가상자산을 예치하여야 하며, 거래처리, 증명집계, 데이터저장, 블록생성 등을 위한 시간, 노력, 전문성이 필요하다. 따라서 많은 가상자산 보유자들은 가상자산거래업자, 유동성 스테이킹 전문업체 등의 스테이킹 서비스를 이용한다.

작업증명 방식에서 채굴자는 주로 해당 프로토콜로부터 채굴 보상을 받지만, 지분증명 방식에서 스테이킹 서비스 이용자는 주로 블록체인 네트워크의 거래자들로부터 수수료를 수취하는 형태로 검증 보상을 받는다. 이러한 보상 방식의 차이로 인해 POW 채굴로부터의 소득과 POS 검증으로부터의 소득에 대한 과세시점은 서로 달라야 한다고 주장할 수도 있다. POW 채굴을 통해 가상자산을 수취한 경우, 해당 가상자산은 채굴자에 의해 제조된 것으로 보고 해당 가상자산의 취득시점에 과세하지 않고 처분시점에 과세할 수 있다. 그러나 POS 검증을 통해 가상자산을 수취한 경우, 해당 가상자산이 검증의 대가로서 거래수수료에서 지급된 것이라면 해당 가상자산의 취득시기에 해당 소득에 대한 과세를 해야 한다고 주장할 수 있다.50)

POW 채굴에 관한 소득과세 법리가 정립되어가는 수준에 비하여 POS 검증에 관한 소득과세 법리는 아직 명확히 확립되어 있지 않다. 우리 과세당국은 검증의 대가로 받는 가상자산의 과세에 관하여 공식적인 유권해석을 내지 않고 있다. 그러나 지분증명 방식의 합의 알고리즘을 통해 취득하는 가상자산의 규모가 추세적으로 확대되어 향후 국가의 주요 세원으로 자리 잡을 수 있다. 이러한 점에서, 우리 과세당국이 블록체인 검증의 대가인 소득에 대한 과세시점에 관해 보다 진지하게 고민하고 관련 과세방침을 시장참여자에게 명확히 알려야 할 필요성이 크다.

2) 해외 주요국 과세제도

국제적으로 POS 검증에 대한 소득과세에 관한 과세당국의 유권해석은 POW 채굴에 대한 소득과세에 대한 유권해석에 비해 상대적으로 적다. 다만 블록체인 검증에 대한 대가인 소득(가상자산 형태)이라는 점에서 POW 채굴과 POS 검증의 과세 원칙을 동일시하여 취득시 시가로 과세하는 국가가 다수이다. 특히 미국, 일본과 같이 포괄주의 소득과세 체계를 가진 국가의 경우, 블록 검증의 대가에 대해서는 채굴 작업이냐 지분 검증이냐에 관계없이 과세 대상 소득으로서 종합과세한다는 과세 논리가 명확하다.

미국 IRS는 2014년 “재화 또는 용역의 대가로서 가상자산을 지급받은 납세자는” 지급받은 날짜의 FMV로 해당 소득을 총소득에 합산하도록 고시하였다.51) 이에 따라 지분증명 네트워크에서 직접적인 검증활동 또는 스테이킹을 통해 취득한 가상자산은 채굴의 경우와 같이 해당 가상자산 취득시를 기준으로 과세된다. 그러나 실무적으로 블록체인 검증 대가의 취득시기는 계좌에 입고되었다고 표시된 시점이 아닌 실제 납세자가 해당 가상자산을 지배(control)할 수 있는 시점으로 본다. 따라서 스테이킹 락업(lockup) 기간에는 납세자의 계좌에 보상받은 가상자산이 표시된다고 하여도, 락업이 해제되어 해당 납세자가 보상받은 가상자산을 사용ㆍ수익ㆍ처분할 수 있는 날짜의 FMV로 소득을 산정해야 할 것이다.52) IRS의 POW 채굴 대가에 대한 취득시 소득과세 원칙에 대해, 최근 POS 검증인 단체인 POSA(Proof of Stake Alliance)는 검증 대가인 소득의 과세시기를 취득시기가 아닌 처분시기로 할 것을 주장하고 있다.53) 현재 미 의회에 상정된 ‘책임있는 금융혁신법안’은 블록체인 거래 검증(채굴, 스테이킹 등)의 대가로 받은 소득의 과세를 해당 소득의 취득시가 아닌 처분시로 이연하는 내용의 소득세법(Internal Revenue Code) 개정 조항을 포함하고 있다.54)

미국과 더불어 일본, 영국, 독일 등 대규모 가상자산시장을 가진 국가는 대부분 POW 채굴 및 POS 검증의 대가로 받은 소득에 대해 취득시 FMV 기준 과세를 원칙으로 한다. 이러한 취득시 과세원칙은 블록 검증에 따른 가상자산 취득을 서비스 제공에 대한 대가로 보는 인식을 바탕으로 한다. 따라서 블록 검증을 수익의 의사 없이 단순히 취미로만 하는 경우, 블록 검증에 따라 취득한 가상자산에 대해 취득시점에 과세하지 말아야 한다고 주장할 수 있다.55) 또한 미국 POSA가 주장하는 바와 같이 블록 검증에 따라 취득한 가상자산을 ‘새롭게 만들어진 자산’으로 보는 경우에도, 해당 소득을 취득시점에 과세하지 않고 처분시점에 과세해야 한다고 주장할 수 있다.

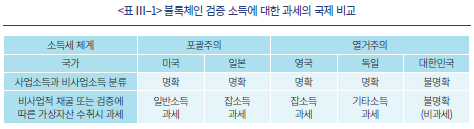

글로벌 주요국은 대부분 블록체인 검증 대가인 소득의 사업성이 인정되는 경우, 해당 소득을 사업소득으로 과세하며 비사업소득에 비해 폭넓게 필요경비를 인정한다. 미국, 일본, 영국, 독일, 우리나라의 블록체인 검증 소득에 대한 과세를 비교하면 아래 표와 같다. 지분증명 합의 알고리즘에 있어 검증의 대가로 받는 소득이 새로운 세원으로 부각됨에 따라, 향후 블록체인 검증 소득에 대한 과세 논의가 더욱 활발해지고 의미 있는 글로벌 과세 방향이 제시될 것으로 기대된다.

2. 하드포크와 에어드랍 과세

가. 주요 개념 및 국내 과세제도

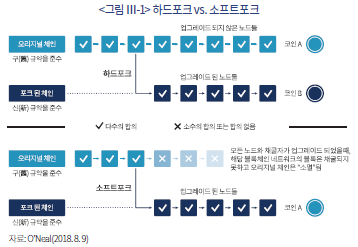

1) 하드포크

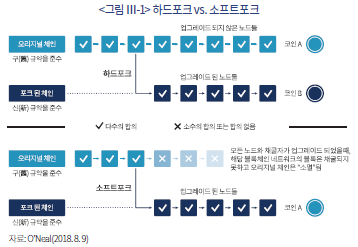

하드포크(hard fork)란 블록체인 네트워크의 통신규약 즉 프로토콜(protocol)을 근본적으로 변화시켜 새로운 분산원장(new ledger)과 이전 분산원장(legacy ledger)의 호환이 불가능하게 만드는 소프트웨어 업그레이드이다. 하드포크를 위해 새로운 프로토콜로 업그레이드된 노드는 새로운 블록체인 네트워크를 만들어지게 된다. 하드포크의 대표적인 예로, 2017년 하드포크로 인해 비트코인 네트워크가 기존의 비트코인(BTC)과 새로운 비트코인 캐시(BCH)로 분리된 사례를 들 수 있다.

소프트포크(soft fork)는 블록체인 네트워크의 프로토콜을 개선시킨다는 점에 있어 하드포크와 같다. 그러나 블록체인 네트워크를 분리시키는 정도의 근본적 업그레이드는 이루어지지 않기 때문에 기존(original) 네트워크와 호환성ㆍ계속성을 유지한다는 점에서 하드포크와 다르다. 소프트포크의 대표적인 예로, 2017년 비트코인 업그레이드를 위해 이루어진 세그윗(SegWit)포크를 들 수 있다. 하드포크와 소프트포크의 차이점은 아래 그림에 잘 나타나 있다.

소프트포크는 블록체인 네트워크의 분리를 발생시키지 않기 때문에, 새로운 가상자산의 무상취득으로 인한 과세 이슈를 직접적으로 유발하지 않는다. 하드포크를 통해 기존 하나의 블록체인 네트워크가 두 개로 분화되었으나 해당 네트워크의 가상자산 보유자가 새로운 가상자산을 무상으로 취득하지 않는 경우, 과세 이슈는 발생하지 않는다.56) 하드포크의 결과 해당 네트워크의 가상자산 보유자가 기존에 보유한 가상자산에 더하여 새로운 가상자산을 무상으로 취득하는 경우, 에어드랍 관련 과세 이슈가 발생한다. 국내 ‘상속세 및 증여세법’(이하 ‘상증법’)상 증여의 개념은 매우 포괄적으로 정의되어 있기 때문에, 하드포크로 인해 새롭게 형성된 블록체인 네트워크에서 가상자산을 무상으로 취득하는 경우 증여세 대상이 될 수 있다. 이 경우 해당 가상자산의 무상 취득 여부, 재산 또는 이익의 이전 시기, 증여재산가액 등이 이슈가 된다. 이러한 이슈는 후술하는 에어드랍의 경우에서와 같이 해결하여야 할 것이다.

2) 에어드랍

가상자산의 에어드랍(airdrop)이란 마케팅 등을 목적으로 기존 가상자산 보유자의 지갑 주소로 가상자산을 배분하는 행위를 의미한다. 에어드랍 주체의 경제적 유인은 에어드랍을 통해 해당 가상자산의 유동성이 증가하고, 대중적 인지도가 높아지며, 시장가격이 상승할 수 있다는 점에서 찾을 수 있다. 국내 상증법 해석상 에어드랍을 통해 가상자산을 수취한 자는 타인으로부터 무형의 재산을 이전받았다는 점57)에서 증여세 납부 의무가 있다고 볼 수 있다. 무상으로 가상자산을 에어드랍 받은 경우, 해당 가상자산은 국내 상증법에 따른 “무상으로 이전받은 재산 또는 이익”으로 볼 수 있으며58), 국내 거주자는 “증여세 과세대상이 되는 모든 증여재산”에 대하여 증여세를 납부 할 의무가 있다.59) 다만 에어드랍을 받은 국내 거주자가 일정한 활동에 대한 보상으로 에어드랍을 받은 경우의 과세 방식에 대해 아직 과세당국은 분명한 입장을 밝히고 있지 않다. 관련하여 마케팅에 기여한 가상자산 보유자에게만 선별적으로 가상자산을 에어드랍함으로써 증여세 적용을 회피하려는 경우, 해당 에어드랍으로 인해 발생한 소득에 대해서는 과세를 하지 못하는 과세 공백이 발생할 수 있다.60)

에어드랍을 통해 가상자산을 받은 경우, 해당 증여재산의 취득시기에 관한 상증법령 규정이나 관련 유권해석은 없다. 그러나 상증법 해석상 증여재산인 가상자산을 “인도한 날 또는 사실상의 사용일”을 취득시기로 보아야 할 것이다.61) 그런데 수증자가 가상자산거래업자를 통해 에어드랍의 원인이 되는 기초 가상자산을 취득하고 해당 가상자산을 거래소에 보관하고 있는 경우, 에어드랍된 가상자산을 수증자에게 인도한 시기에 관한 해석이 갈릴 여지가 있다. 즉, 발행인이 가상자산거래업자의 지갑으로 에어드랍을 통해 가상자산을 이전한 시기가 증여를 받은 날인지, 해당 가상자산거래업자가 이용자에게 에어드랍된 가상자산을 분배하여 이용자가 해당 가상자산을 지배할 수 있게 한 시기가 증여일인지에 대한 명확한 유권해석이 없다. 과세당국은 질의회신을 통해 “실질적인 재산 및 이익의 이전 여부 등과 관련한 거래상황 등을 고려하여 사실판단”62)을 한다고만 밝히고 있다. 상증법 해석상 에어드랍된 가상자산이 수증자에게 ‘이전’ 또는 ‘인도’되었다고 볼 수 있는 시기는 수증자가 해당 가상자산에 접근하여 사용ㆍ수익ㆍ처분할 수 있는 시기로 해석하는 것이 타당하다. 따라서 발행인이 가상자산거래업자에게 에어드랍한 가상자산을 해당 업자가 이용자의 고객계좌로 이전하고 이용자가 해당 가상자산을 처분하고 지배할 수 있는 시기를 증여일로 보아야 할 것이다.

에어드랍을 통해 증여받은 가상자산의 증여재산가액은 증여받은 가상자산의 유형에 따라 다음과 같이 평가한다. “국세청장이 고시하는 가상자산사업자의 사업장에서 거래되는 가상자산”의 경우, 증여일을 전후한 한달간 “해당 가상자산사업자가 공시하는 일평균가액의 평균액”으로 증여재산가액을 평가한다.63) 그 밖의 가상자산의 경우, 국세청장이 고시하는 “가상자산사업자 외의 가상자산사업자 및 이에 준하는 사업자의 사업장에서 공시하는 거래일의 일평균가액 또는 종료시각에 공시된 시세가액 등 합리적으로 인정되는 가액”으로 증여재산가액을 평가한다.64) 이 경우 해당 증여재산가액은 무상 취득한 가상자산을 양도하여 기타소득 과세대상(2025년 1월 1일 이후)이 되는 경우 필요경비(취득가액)로서도 의의를 갖는다.

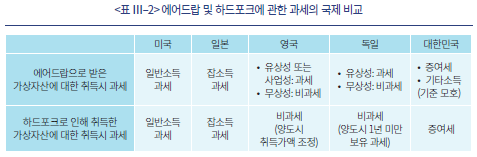

나. 해외 주요국 과세제도

에어드랍으로 받은 가상자산에 대해 대다수의 국가는 해당 가상자산의 취득시 시가를 소득으로 인식하여 과세한다. 물론 증여의 목적으로 에어드랍한 경우 증여세 규정을 적용할 수 있다. 그러나 미국, 영국 등 증여에 있어 수증자에게 과세하지 않는 국가의 경우, 에어드랍으로 가상자산을 취득한 자에 대한 기본적인 세금을 증여세로 구성할 수는 없다.

에어드랍에 대해 증여세를 부과하는 국가에서도 적극적으로 마케팅 활동에 참여하거나 마케팅 정보를 제공한 자에게만 선별적으로 에어드랍이 이루어진 경우, 에어드랍의 유상성이 증가하여 에어드랍을 받은 자에 대한 증여세 부과의 법적 근거가 취약해 질 수 있다. 에어드랍에 대한 대가로서 가상자산을 취득한 경우, 미국, 일본, 영국, 독일은 증여세가 아닌 소득세를 부과한다. 싱가포르, 호주는 사업자가 아닌 개인이 에어드랍으로 취득한 가상자산을 일종의 횡재(windfall)로 의제하여 과세하지 않는다. 이 경우 향후 해당 가상자산의 양도 시점에 자본이득세를 부과하는데, 무상취득한 가상자산의 취득가액은 0이 될 수 있다.

하드포크가 발생하여 기존에 보유한 가상자산의 프로토콜이 바뀌는 경우, 프로토콜 변경을 원인으로 해당 가상자산에 대해 세금이 부과되지는 않는다. 하드포크 이후 기존의 가상자산에 더하여 새로운 가상자산이 에어드랍 되는 경우 무상으로 새롭게 가상자산을 받는 경우가 대부분이기 때문에, 유상성에 따른 증여세 회피 문제는 크지 않다. 하드포크 후 새롭게 분화된 네트워크에서 에어드랍 받은 가상자산을 취득하였으나 유통시장이 형성되어 있지 않아 해당 가상자산의 시가를 모르는 경우가 있을 수 있다. 이 경우 하드포크 에어드랍에 대한 취득시 과세는 이루어지지 않고, 향후 양도시 취득가액을 0으로 하여 산정된 자본이득세가 부과될 수 있다.

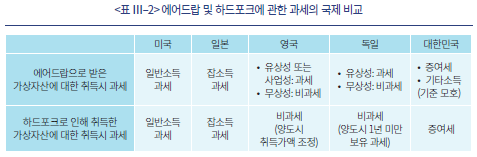

미국, 일본, 영국, 독일, 우리나라의 에어드랍 및 하드포크에 관련된 과세를 비교하면 아래 표와 같다.

3. 소결: 가상자산에 특유한 과세제도 정비의 과제 및 방향

가상자산에 특유한 과세제도 정비에 있어, 블록체인 거래 검증의 대가에 대한 과세제도와 하드포크 및 에어드랍에 대한 과세제도의 정비가 중요하다. POW 채굴에 대한 과세에 있어, 개인의 가상자산 채굴사업으로 인한 소득을 사업소득으로 과세하는 방안에 대해 과세당국의 입장이 분명하지 않기 때문에 법적 불확실성이 높고 세원 확보가 되지 않는 문제점이 있다. 이러한 과세당국의 태도는 국내 소득세법상의 소득유형별 포괄주의 원칙에 배치된다. 과세당국은 가상자산업계와 전문가들의 의견을 반영하여 가상자산 채굴사업이 소득세법상 사업소득으로 해석되는지의 여부 및 관련 과세방안을 빠른 시일 내에 결정하여 시장참여자에게 알려야 한다. 또한 과세당국은 블록체인 거래 검증의 두 가지 방식인 POW 채굴과 POS 검증에 대해 동일한 과세원칙을 적용할지에 대해 결정하여야 할 것이다. 이 경우 POS 검증을 위한 스테이킹과 대출플랫폼 예치에 대한 명확한 구별 기준, 블록체인 거래 검증의 사업성 요건에 대한 명확한 기준을 제시하여야 한다.

하드포크 관련 과세에 있어, 과세당국은 새로 취득된 가상자산의 무상성, 재산 또는 이익의 이전 시기, 증여재산가액 등에 관한 명확한 기준을 고시하여야 한다. 에어드랍 관련 과세에 있어, 일률적으로 증여세 과세원칙을 적용하는 것이 바람직한지에 대한 정책적 검토가 필요하다. 에어드랍에 따른 가상자산 무상 취득에 대하여 증여세를 적용하는 것이 큰 문제가 있다고는 할 수 없다. 다만 개인사업자가 에어드랍을 통해 수취한 가상자산에 대한 사업소득 인정 여부, 마케팅 대가로 주는 에어드랍 대상 가상자산에 대한 과세 공백 등을 종합적으로 고려하여 국제적 정합성에 맞는 과세방안을 재정립할 필요성이 크다.

Ⅳ. 결어: 국내 가상자산 과세제도 발전 방향

개인 납세자에 대한 국내 가상자산 과세제도를 가상자산거래의 특성과 국제적 비교를 바탕으로 분석한 결과에 따르면, 국내 가상자산 과세제도의 정비 수준은 국제적 수준에 미치지 못한다. 가상자산 과세제도의 입법적 미비를 해결하기 위한 시간을 확보한다는 차원에서 현재 국회에서 논의되는 소득세법 개정안의 가상자산 기타소득과세 시행시기 2년 유예(2025년 1월 1일부터) 조치는 필요하다. 가상자산 관련 상속ㆍ증여세와 사업소득세는 이미 시행 중이며, 가상자산 기타소득세제 정비에 상당한 시간이 소요될 수 있다는 점에서 가상자산 과세제도는 조속히 정비하여야 할 것이다.

국내 가상자산 과세제도의 정비는 과세 불확실성을 줄이고 과세 공백을 메우는 방향으로 추진되어야 한다. 먼저 가상자산 기타소득세제의 정비에 있어, 효율적인 가상자산 양도소득 과세를 위해 과세시스템을 정비하여야 한다. 특히 분산된 가상자산거래업자의 과세정보(거래정보, 취득가액 등) 통합시스템을 구축하여 이용자와 과세당국의 편의성을 증대시킬 필요가 있다. 또한 가상자산 대여로부터의 소득에 관한 과세 불확실성을 줄이기 위해, 가상자산 대여소득의 명확한 정의, 사업소득과의 구분, 필요경비의 인정 범위에 관한 적극적인 유권해석이 있어야 하며 필요한 경우 관련 법령의 개정이 필요하다. 또한 장기적으로 가상자산 양도로부터의 소득을 기타소득이 아닌 양도소득으로 규정하고, 다른 투자자산과의 손익통산 및 이월공제를 인정할지에 대한 논의가 필요하다.

블록체인 거래 검증의 대가에 대한 과세제도 중 POW 채굴에 관한 소득과세에 있어, 과세당국은 관련 소득에 대한 사업소득 과세요건(사업성 요건)을 분명히 정하여 고시함으로써 과세 불확실성을 줄이고 과세 공백을 해소하여야 한다. 과세당국은 POS 검증에 관한 소득과세에 관하여 POW 채굴에 관한 소득과세와 동일한 원칙을 적용할지에 대해서도 결정하여야 한다. 또한 과세당국은 검증을 위한 스테이킹과 대출플랫폼 예치에 대한 명확한 구별 기준, 검증의 사업성 요건에 대한 명확한 기준을 제시하고 시장참여자에게 고지하여야 한다.

하드포크와 에어드랍 관련 과세에 있어, 과세당국은 다음과 같은 과세 불확실성을 줄이는 노력을 하여야 한다. 과세당국은 하드포크와 에어드랍으로 인해 새로 취득된 가상자산의 무상성, 재산 또는 이익의 이전 시기, 증여재산가액 등에 관한 명확한 기준을 고시하여야 한다. 장기적으로, 과세당국은 에어드랍으로 인한 가상자산 취득에 대한 일률적 증여세 과세에 대한 재검토가 필요하다. 이러한 재검토를 함에 있어, 과세당국은 개인사업자가 에어드랍을 통해 수취한 가상자산에 대한 사업소득 인정 여부, 마케팅 대가로 주는 에어드랍 대상 가상자산에 대한 과세 공백 등을 함께 고려할 필요가 있다.

국내 가상자산소득 납세의무 준수율과 관련 세무서비스 수준을 제고하기 위해서는 공공부문에서 효율적 가상자산 과세시스템이 구축되고 민간부문에서 편의성 높은 가상자산 세액계산 프로그램이65) 많이 출시될 필요가 있다. 이러한 가상자산 세무서비스 인프라를 확충하기 위해서는 과세의 합리성 및 예측가능성을 높여야 한다. 따라서 과세당국은 충분한 논의를 거쳐 해외 주요국의 사례에서와 같이 종합적이고 구체적인 가상자산 과세가이드라인을 발표하여야 할 것이다.

1) “2021년 5월부터 가상자산 관련 제도 정비 및 과세체계 확립의 필요성 등을 이유로 가상자산 과세유예가 논의되었고, 2021. 12. 8. 소득세법(제18578호) 개정으로 1년간 가상자산소득 과세제도의 시행이 유예되어 2023년부터 가상자산소득에 대한 과세가 이뤄질 예정”이었다. 이에 관하여 국회입법조사처(2022a, p.226)를 참조한다.

2) PwC(2021, p.6)

3) 소득세법 제21조제1항제27호

4) 기획재정부(2020. 7. 22, p.44)

5) 소득세법 제14조제3항제8호

6) 소득세법 제16조제1항

7) 특금법 제2조제3호

8) 특금법 제2조제2호

9) 소득세법 제88조제1호 참조

10) 기축가상자산이란 비트코인, 이더리움 등 “교환거래를 할 때 교환가치의 기준이 되는 가상자산을 말한다.” 소득세법시행령 제88조제3항

11) 소득세법 제16조제1항

12) 소득세법 제64조의3제2항

13) 소득세법시행령 제88조제1항

14) 소득세법 제37조제5항

15) 소득세법시행령 제88조제3항

16) 시가고시가상자산사업자란 “신고수리가상자산사업자 중 국세청장이 고시하는 사업자”를 의미한다. 소득세법시행령 제88조제2항제1호

17) 이자소득의 필요경비는 인정되지 않기 때문에, 소득세법상 “이자소득금액은 해당 과세기간의 총수입금액으로 한다.” 소득세법 제16조제2항

18) 국회입법조사처(2022b, p.3)

19) 소득세법 제70조제1항 및 제2항

20) “가상자산 또는 현금을 인출하는 달의 다음 달 10일(매년 1월 1일부터 12월 31일까지 인출하지 아니한 경우 그 다음 연도 1월 10일)” 소득세법 제156조제16항

21) Responsible Financial Innovation Act §201

22) 또 다른 이유는 과세행정상 양도차익 과세에 있어 중앙화된 거래소를 운영하는 가상자산거래업자를 활용하는 것이 대여이익 과세에 있어 분산화된 DeFi 사업자를 활용하는 것보다 용이하다는 점에서 찾을 수 있다.

23) 컴파운드에 관한 이해를 위해서는, Gildon(2022, p.120)을 참조한다.

24) 작년 5월 21일 골드만삭스는 비트코인 등 가상자산이 새로운 하나의 자산군으로 시장에서 인식되고 있다는 취지의 보고서를 발간하였다(Goldman Sachs, 2021). “가상자산에 대한 투자 수요가 개인과 더불어 기관투자자로 확대”되고 있다(최순영, 2022, p.6).

25) 가상자산이 자본자산으로 분류되는 경우와 비자본자산으로 분류되는 경우에 관한 설명은, IRS(2022a, p.20)를 참조

26) 캐나다의 경우, 양도손익의 50%만 과세 또는 공제의 대상이 되는 특징을 갖는다(CRA, 2022).

27) 특정 과세연도에 가상자산소득이 20만엔 미만인 경우에는 과세하지 않는다(Koinly, 2022b).

28) JCBA(2022. 7. 28)

29) 가상자산 대여를 통해 정하여진 수익을 정기적으로 받는 경우는 잡소득(miscellaneous income)으로서 종합과세가 된다. 그러나 가상자산 대여의 외관을 갖추었지만, 정해지지 않은 수익을 일시적으로 받는 등 수익이 자본이득적 성격을 가지는 경우 자본이득과세의 대상이 된다. HMRC(2022b)

30) 본고에서 사용하는 ‘분리과세’라는 용어는 국내 소득세법 체계상의 분리과세와 분류과세를 포함하는 개념이다. 가상자산 자본이득(양도소득)은 결집효과가 높다는 점에서 종합소득과 구분하여 과세표준과 세액을 달리 계산하여 과세한다. 따라서 분류과세라는 용어를 사용하는 것이 더 적합할 수 있지만, 국내 가상자산 양도로부터의 소득은 실질이 결집효과가 있는 양도소득임에도 불구하고 가상자산 대여로부터의 소득과 같이 기타소득으로서 분리과세 된다. 이러한 점을 고려할 때, 개념상의 혼란을 피하고 양도소득이 종합소득과 분리되어 과세 된다는 점을 강조하여 본고에서는 분류과세도 분리과세라 칭한다.

31) OECD(2020, p.13)

32) 작업증명 개념에 대해서는, 권민경ㆍ조성훈(2018, p.54)을 참조한다.

33) 거래수수료의 일부를 블록 검증에 대한 보상으로 받는 경우, 채굴자는 수수료가 높은 거래를 우선적으로 검증하려는 인센티브를 가지게 된다.

블록 검증자에 대해 거래수수료를 재원으로 하는 보상이 가능하기 때문에, 비트코인 발행량이 예정 총량에 도달하더라도 해당 블록체인 네트워크의 운영·유지가 가능하다.

34) 소득세법 제19조제1항제21호

35) “정보통신업”에서 발생하는 사업소득은 소득세법 제19조제1항제10호, “전문, 과학 및 기술서비스업”에서 발생하는 사업소득은 소득세법 제19조제1항제13호에서 규정한다.

36) 가상자산 채굴사업으로 인한 소득을 “넓게 보면 제13호의 전문, 과학 및 기술서비스업 또는 그와 유사한 업종으로 볼 여지는 있을 것으로 생각된다”는 주장이 있다(조세일보, 2018. 1. 19).

반면 가상자산 채굴사업로 인한 소득은 “「소득세법」 제19조 제1항 제1호 내지 제20호에 해당되지 않으며 제21호에서 규정하는 제1호 내지 제20호와 유사한 소득에 해당되는지에 대한 논란의 여지가 있어 사업소득으로 과세되지 않을 가능성”이 있다는 주장도 있다(신상화 외, 2018, p.26).

37) 가상자산 관련 사업소득세 과세대상과 비교하여, 부가가치세 과세대상에 대해서는 과세당국의 입장이 상대적으로 명확한 편이다. 과세당국은 “가상자산의 공급은 부가가치세 과세대상에 해당하지 아니”한다고 명확히 유권해석하였다(기획재정부, 2021. 3. 2).

38) 소득세법 제21조제1항제27호

39) 파이낸셜뉴스(2021. 5. 6)

40) 단 자영업으로 인한 순수익이 400달러 미만인 경우에는 자영업세의 적용을 받지 않는다(IRS, 2022b).

41) 所得税法 第二十七条

42) 일본의 잡소득은 급여소득, 사업소득, 이자소득, 배당소득, 부동산소득, 산림소득, 퇴직소득, 양도소득, 일시소득 등 9종의 소득에 해당하지 않는 나머지 소득을 포괄하는 개념이다. 所得税法 第三十五条

43) 国税庁(2021, p.10)

44) HMRC(2022a)

해당 채굴행위가 사업성이 있는지를 판단하기 위해서는 행위의 정도, 조직, 위험, 상업성 요소를 종합적으로 판단하여야 한다.

45) Income Tax (Trading and Other Income) Act 2005 §§ 687-689

46) Houston(2021, p.19)

47) IRAS(2020, p.11)

48) Koinly(2022a)

49) 지분증명 개념에 대해서는, 권민경ㆍ조성훈(2018, p.62)을 참조한다.

50) POS 스테이킹으로부터의 수익은 검증 서비스에 대한 대가라는 특성으로 인해 가상자산 예치에 따른 이자소득이나 투자소득과 구별된다. “스테이킹 리워드는 네트워크를 유지하기 위해 블록을 생성하고 검증하는 행위에 대한 보상이지 제삼자 수익의 일부를 수취하는 행위가 아니다.” 최윤영ㆍ정석문(2022, p.1)

51) IRS(2014, pp.2-3)

52) 이에 관하여 2022년 8월 30일에 작성된 Coinbase User Agreement의 1.5.2. & 1.5.4.를 참조한다.

53) 관련한 대표적인 사례로 가상자산 테조스(Tezos)의 블록체인 검증을 위해 스테이킹을 한 납세자가 IRS의 화해 요구를 거절하고 IRS를 상대로 소송을 제기한 Jarrett et al v. USA를 들 수 있다. 해당 사건에서 원고는 검증의 대가로 받은 가상자산은 ‘새롭게 만들어진 자산’(newly created property)으로서 농부의 농작물, 예술가의 창작물과 같이 해당 자산을 매각할 때 과세되어야 한다고 주장하였다(The Jarretts, 2021. 5. 26).

해당 사건에서 IRS는 원고에게 블록 검증 대가 수령시의 소득에 대한 세금을 환급하였으나 그 이유를 밝히지는 않았다. 2022년 10월 3일 POSA의 보도자료에 따르면, Jarrett 사건에서 피고인 IRS의 소각하 신청(motion to dismiss)이 법원에서 받아들여졌으나 원고인 Jarrett은 항소를 진행 중이다. 이에 관하여 POSA(2022. 10. 3)를 참조한다.

54) Responsible Financial Innovation Act §208

55) 싱가포르는 취미 활동인 채굴로 인한 가상자산 취득시 해당 소득에 대해 과세하지 않는다(IRAS, 2020, p.10).

56) IRS(2019, p.5)

57) “증여란 그 행위 또는 거래의 명칭ㆍ형식ㆍ목적 등과 관계없이 직접 또는 간접적인 방법으로 타인에게 무상으로 유형ㆍ무형의 재산 또는 이익을 이전(移轉)(현저히 낮은 대가를 받고 이전하는 경우를 포함한다)하거나 타인의 재산가치를 증가시키는 것을 말한다.” 상증법 제2조제6호

58) 상증법 제4조제1항

59) 상증법 제4조의2제1항

60) 에어드랍을 마케팅 목적의 경품 또는 사례금으로 보고 국내 가상자산거래업자가 기타소득으로 원천징수한 사례가 있다. 김지호(2022. 7. 12). 그러나 에어드랍을 경품 또는 사례금으로 보는 과세기준이 명확하지 않다.

61) 상증법시행령 제24조제1항제4호

62) 국세청(2022. 7. 25)

63) 상증법시행령 제60조제2항제1호

64) 상증법시행령 제60조제2항제2호

65) 미국의 Koinly, CoinTracker 등의 가상자산 세액계산 프로그램은 가상자산거래시설의 거래정보, 과세당국의 신고서식 등과의 연결성 및 호환성을 높여 가상자산소득 납세자의 편의성을 높인다. Koinly 웹페이지(https://koinly.io) 참조

참고문헌

국세청, 2022. 7. 25, 상증: 기획재정부 재산세제과-814, 질의회신.

국회입법조사처, 2022a, 『2022 국정감사 이슈 분석 IV』, 국정감사관련 연구보고서.

국회입법조사처, 2022b, 『주요국의 가상자산 소득과세 제도 현황과 시사점』, NARS 현안분석 제249호.

권민경ㆍ조성훈, 2018, 『4차 산업혁명과 자본시장: 인공지능과 블록체인』, 자본시장연구원 조사보고서 18-04.

기획재정부, 2020. 7. 22, 2020년 세법개정안 문답자료, 보도자료.

기획재정부, 2021. 3. 2, 부가가치세제과-145, 질의회신.

김지호, 2022. 7. 12, 가상자산 소득세 과세 유예기간에도 발생할 세금 이슈들, 세움 택스 가상자산과 세무이야기.

신상화ㆍ홍성희ㆍ정훈, 2018, 『암호화폐 과세제도 및 과세인프라 연구』, 한국조세재정연구원 연구발간자료 18-07.

조세일보, 2018. 1. 19, ‘가상화폐’ 과세쟁점 검토(上).

최순영, 2022, 『글로벌 금융회사의 가상자산 사업 현황』, 자본시장연구원 이슈보고서 22-17.

최윤영ㆍ정석문, 2022, 『2022년 하반기 비트코인과 이더리움의 탈중앙화 트렌드』, 코빗 리서치.

파이낸셜뉴스, 2021. 5. 6, 정부, 채굴한 가상자산 전기료 제하고 소득세 매긴다.

CRA, 2022, T4037 Capital Gains.

Gildon Z., 2022, Mastering Decentralized Finance.

Goldman Sachs, 2021, Crypto: A New Asset Class?

HM Revenue & Customs, 2022a, Cryptoassets Manual, CRYPTO21150: Cryptoassets for Individuals: Income Tax Mining Transactions.

HM Revenue & Customs, 2022b, Cryptoassets Manual, CRYPTO61212: Decentralised Finance: Lending and staking: Income tax: Making a DeFi loan: Taxing Provisions.

Houston, I., 2021, How Crypto is Taxed in the UK.

IRAS, 2020, e-Tax Guide: Income Tax Treatment of Digital Tokens.

IRS, 2014, Notice 2014-21.

IRS, 2019, Rev. Rul. 2019-24.

IRS, 2022a, Sales and Other Dispositions of Assets.

IRS, 2022b, Topic No. 554 Self-Employment Tax.

JCBA, 2022. 7. 28, 2023年度税制改正に関する要望書.

Koinly, 2022a, Australia Crypto Tax Guide.

Koinly, 2022b, Japan Crypto Tax Guide.

OECD, 2020, Taxing Virtual Currencies.

O’Neal, S., 2018. 8. 9, Can crypto exchanges be trusted with hard forks? Cointelegraph.

POSA, 2022. 10. 3, Court grants motion to dismiss, POSA supports Jarrett’s appeal in pursuit of clarity for all stakers.

PwC, 2021, Annual Global Crypto Tax Report 2021.

Schmidt, N., Bernstein, J., Richter, S., Zarlenga, L., 2020, Taxation of Crypto Assets.

The Jarretts, 2021. 5. 26, Cryptocurrency case filed against the IRS raises important questions about the taxation of newly created property, PR Newswire.

国税庁, 2021, 暗号資産に関する税務上の取扱いについて(FAQ).

<해외 법률안>

Income Tax (Trading and Other Income) Act 2005, 2022 (UK).

Lummis-Gillibrand Responsible Financial Innovation Act (RFIA), 2022, S.4356 (USA).

Proposal for a Regulation of the European Parliament and of the Council on MiCA (Markets in Crypto-assets), 2020, COM/2020/593 Final (EU).

국내 가상자산 과세제도는 2020년 세법개정안을 통해 처음 도입되었다. 2020년 12월 29일 개정된 소득세법(법률 제17757호)에 따르면, 거주자가 가상자산의 양도 및 대여로부터 얻은 소득은 기타소득으로 신고하여 납부하여야 하며 해당 과세제도는 2022년 1월 1일 이후 시행하기로 하였다. 그러나 국가가 가상자산 거래자를 위한 보호제도의 마련 없이 세금 부담만 가중시킨다는 비난 여론이 커지자, 정부와 국회는 소득세법상 가상자산 과세제도의 시행을 유예하였다.1) 현재는 가상자산 소득과세 시행 시기를 2025년 1월 1일 이후로 유예하는 2022년 세법개정안이 국회에 상정되어 있다.

우리 정부는 가상자산 과세 유예의 근거로 ‘선정비, 후과세’의 원칙을 들고 있다. ‘선정비, 후과세’ 원칙에 있어서의 ‘선정비’는 가상자산 거래자 보호체계의 정비에 국한되는 것이 아니라, 가상자산 과세체계를 글로벌 정합성에 맞게 공정하고 합리적으로 정비하는 정책과제를 포함한다고 할 수 있다. 본 연구의 결과 국내 가상자산 과세제도 정비의 수준은 글로벌 주요국 수준에 미치지 못하는 것으로 분석되었다. 2021년 PwC의 가상자산 세금 관련 보고서에 따르더라도, 우리나라의 가상자산 과세제도 정비의 수준은 글로벌 주요국 대비 하위권인 것으로 나타난다.2)

본고는 국내 가상자산 과세제도의 선진화에 기여하는 것을 목적으로 가상자산소득 과세제도의 주요 쟁점을 분석하고, 국내 가상자산 입법 제도와 해외 입법 사례를 설명한다. 본고에서 다루는 주요 과세 분야는 국내 가상자산 기타소득 과세제도와 가상자산에 특유한 과세제도이다. 국내 가상자산 기타소득 과세제도에 관하여, 가상자산 양도로부터의 이익 과세와 가상자산 대여로부터의 이익 과세를 제도적으로 분석하고, 해외 주요국 과세제도를 살펴본 후, 국내 가상자산 기타소득세제 정비의 과제 및 방향을 논한다. 가상자산에 특유한 과세제도에 관하여, 가상자산 블록 검증(작업증명 방식의 채굴, 지분증명 방식의 검증)의 대가로 받은 소득과세, 하드포크와 에어드랍 관련 과세를 제도적으로 분석하고, 해외 주요국 과세제도를 살펴본 후, 가상자산에 특유한 과세제도 정비의 과제 및 방향을 논한다. 마지막으로 본고의 결어 부분에서 국내 가상자산 과세제도 발전 방향을 제시한다.

Ⅱ. 국내 가상자산 기타소득 과세제도 분석

1. 국내 가상자산 기타소득 과세제도 개요

가. 기타소득 및 분리과세 체계

현행 소득세법상 가상자산의 양도 및 대여로부터의 소득은 기타소득으로서 분리과세 된다.3) 과세당국은 가상자산소득을 기타소득으로 과세하는 이유에 관하여, “가상자산에 대한 국제회계기준, 현행 소득세 과세체계 등을 종합적으로 감안하여 기타소득으로 분류”하였다고 설명한다.4) 즉, 국제회계기준 해석위원회(International Financial Reporting Interpretations Committee: IFRIC)는 가상자산을 판매목적으로 보유하는 경우 재고자산으로 처리하고, 그렇지 않은 경우 무형자산으로 처리한다. 또한 국내 소득세법상 상표권 등 무형자산은 기타소득으로 과세한다. 따라서 무형자산인 가상자산은 기타소득으로 과세해야 한다는 것이 과세당국의 논리이다. 그러나 정작 이미 투자자산 또는 자본자산의 일종으로 가상자산을 과세하고 손익통산 등을 허용하는 미국, 영국, 독일 등 주요국의 해외 과세 입법례를 종합적으로 감안하지 않은 점은 아쉬운 부분이다.

가상자산 양도 및 대여로부터의 소득은 종합소득과세표준에 합산되지 않는 ‘분리과세 기타소득’이다.5) 양도소득은 종합소득과세표준에 합산되지 않기 때문에, 가상자산 양도로부터의 소득도 양도소득세적 성격을 감안하여 분리과세 대상으로 정한 것으로 보인다. 가상자산 대여로부터의 소득은 이자소득과 유사하며, 이자소득은 종합소득과세의 대상이 된다. 그러나 이자소득은 “금전 사용에 따른 대가로서의 성격”6)을 가짐에 반하여, 가상자산 대여로부터의 소득은 금전이 아닌 가상자산 사용에 따른 대가로서의 성격을 가진다. 따라서 가상자산 대여소득을 이자소득과 같이 반드시 종합소득과세의 대상으로 하여야 하는 것은 아니다.

현행 가상자산 기타소득 과세에 관하여, 과세대상 자산 및 거래, 세액계산 방식, 손익통산 방식, 신고 방식 등이 주요 이슈가 된다. 이러한 이슈를 사안별로 살펴보면 다음과 같다.

나. 과세의 대상 자산 및 대상 소득

국내 소득세법상 가상자산 과세의 대상 자산은 ‘특정 금융거래정보의 보고 및 이용 등에 관한 법률’(이하 ‘특금법’)에서 규정한 가상자산이다. 따라서 과세대상 자산은 “경제적 가치를 지닌 것으로서 전자적으로 거래 또는 이전될 수 있는 전자적 증표” 중 특금법상 예외 사항에 해당하지 않는 것이다.7) 특금법은 가상자산을 매우 포괄적으로 정의하고 있기 때문에, 대부분의 신종 디지털자산의 양도 및 대여로부터의 소득은 과세 대상이 될 것이다. 그러나 특금법상의 예외 사항에 해당하는 게임머니, 선불전자지급수단, 전자화폐, 전자어음 등의 양도 및 대여로부터의 소득은 가상자산 소득과세 대상이 아니다. 또한 증권형 토큰은 본질적으로 증권이기 때문에, 증권형 토큰 양도로부터의 소득은 일반적으로 금융투자소득으로 해석할 수 있다. 특금법 해석상으로도 증권형 토큰은 가상자산 개념의 예외라기보다는 금융회사의 금융거래의 대상인 금융자산이며 원칙적으로 가상자산이 아니라고 해석하는 것이 합리적이다.8)

국내 소득세법상 자산의 양도 및 대여로부터의 소득은 포괄적 과세대상이 아닌 열거적 과세대상이다. 따라서 새롭게 등장한 가상자산 관련 소득과세를 위해 가상자산의 양도 및 대여로부터의 소득을 기타소득 대상으로 추가한 것이다. 가상자산의 ‘양도’로부터의 소득에서 ‘양도’는 매매와 교환을 포함하는 개념이다.9) 따라서 가상자산 원화마켓에서 가상자산을 매도하는 행위와 마찬가지로, 기축가상자산마켓(BTC마켓, ETH마켓 등)에서 가상자산을 기축가상자산10)과 교환하는 행위도 가상자산소득 대상거래가 된다.

가상자산의 대여로부터의 발생하는 기타소득 과세는 주로 가상자산 렌딩(lending) 등의 거래로부터의 소득을 대상으로 한다. 가상자산 대여행위는 탈중앙화금융인 DeFi(Decentralized Finance)의 핵심적 부분이다. 이러한 가상자산 대여행위로부터의 소득은 국내 소득세법상 열거된 이자소득의 유형에 포함되지 않으며, “금전 사용에 따른 대가로서의 성격”을 가지고 있지 않다.11) 따라서 신뢰성 있는 발행인이 발행한 안정적인 스테이블코인 대여로부터의 이익은 이용자들이 이자와 같이 인식하더라도 금융소득 종합과세의 대상이 되지 않는다. 과세당국은 아직 기타소득 과세대상인 가상자산의 대여행위를 유형화하거나 구체적 예시를 들어 구체적 과세 방안을 시장참여자에게 알리지 않고 있다. 또한 소득세법상 가상자산 대여의 개념이 지분증명을 위한 스테이킹(staking)을 포함하는지에 대해서도 입장이 불명확하다.

다. 세액계산 방식

국내 소득세법상 가상자산소득에 대한 세액은 총수입금액에서 필요경비를 빼고(가상자산소득금액), 다시 기본공제액(연 250만원)을 뺀 금액에, 세율(20%)을 곱한 값으로 한다.12) 이를 산식으로 나타내면 아래와 같다.

필요경비는 양도로부터의 가상자산소득과 대여로부터의 가상자산소득에 있어 다르다. 가상자산 양도차익에 대한 과세에 있어 필요경비는 실제 취득가액과 부대비용을 합한 금액이다. 부대비용은 거래비용(거래 수수료 등) 및 세무비용(세무사 수수료 등)을 포함한다. 가상자산의 취득가액을 산정함에 있어, 원칙적으로 가상자산주소별로 선입선출법을 사용한다. 다만 특금법상 신고가 수리된 가상자산사업자(이하 ‘신고수리가상자산사업자’)를 통해 거래되는 가상자산의 취득가액 산정에 있어서는 이동평균법을 적용한다.13) 가상자산 기타소득과세 시행일 전에 이미 보유한 가상자산의 취득가액은 해당 시행일 전일 당시의 시가와 실제 취득가액 중 큰 금액으로 의제한다.14) 가상자산 간의 교환에 따른 양도차익 과세에 있어, “기축가상자산의 가액에 교환거래의 대상인 가상자산과 기축가상자산 간의 교환비율을 적용하여 계산”한다.15) 이 경우 시가고시가상자산사업자16)를 통해 거래된 기축가상자산의 가액은 교환 시점의 해당 자산에 대한 금전 교환 가액으로 한다. 외국통화에 연동되는 기축가상자산의 가액은 교환거래일의 기준환율 또는 재정환율에 따른 환산 가액으로 한다.

소득세법은 가상자산 대여에 대한 과세에 있어 필요경비에 대해서는 따로 규정하고 있지 않다. 그 이유는 가상자산 대여소득을 이자소득과 유사한 것으로 보아 이자소득의 입법례17)에 따라 필요경비를 인정하지 않기 때문인 것으로 추정된다. 그러나 DeFi에서 발생한 대여소득에서 관련 수수료 부분을 필요경비로 인정할 필요가 있다는 점에서, 가상자산 대여소득의 필요경비 인정범위에 대한 입법적 논의가 요구된다.

라. 손익통산 및 신고 방식

국내 소득세법상 가상자산소득금액은 해당 과세기간의 소득금액이기 때문에 해당 과세연도의 손익을 합산하여 산출한다.18) 그러나 해당 과세연도의 가상자산 결손금을 다음 과세연도로 이월하여 다음 과세연도의 가상자산소득에서 공제할 수 있는 이월공제 제도가 금융투자소득의 경우와는 다르게 인정되지 않는다. 또한 동일 과세기간 중의 가상자산손익과 금융투자손익과의 통산도 허용되지 않는다.

해당 과세기간 중에 가상자산소득이 있는 거주자는 다음 연도 종합소득세 신고기간(5월 1일부터 5월 31일)에 해당 기타소득의 과세표준을 납세지 관할 세무서장에게 신고하여야 한다.19) 소득세법상 가상자산사업자는 가상자산 거래내역 등의 제출의무가 있기 때문에, 가상자산 양도로부터의 소득에 관한 과세정보는 과세당국이 어느 정도 확보하였다고 볼 수 있다. 그러나 가상자산 대여로부터의 소득에 대한 납세대상자 파악 및 대상자 고지 등에 관한 과세시스템은 아직 구축되어 있지 못하다. 관련 과세시스템 구축의 장애 요인으로 가상자산 대여로부터의 소득에 관한 구체적인 과세가이드라인이 마련되어 있지 않은 점 등을 들 수 있다.

비거주자의 국내원천 가상자산소득에 대해서는, 가상자산사업자가 법이 정한 기간 내20)에 원천징수하여 납세지 관할 세무서 등(한국은행, 체신관서 포함)에 납부하여야 한다. 현재 외국인 투자자의 국내 가상자산 투자가 폭넓게 허용되고 있지 않기 때문에, 해당 법조항이 시행되더라도 가상자산사업자의 비거주자 가상자산소득 원천징수에 관한 과세 실무상의 큰 문제는 발생하지 않을 것으로 예상된다. 그러나 향후 국내 가상자산시장에 글로벌 투자자들의 참여가 확대되었을 때에 대비하여 가상자산사업자 및 과세당국이 외국인 투자자의 과세정보를 확보할 수 있는 법적 근거가 충분한지에 대한 점검이 필요하다.

2. 해외 주요국 과세제도와의 비교

가. 가상자산 양도차익에 대한 과세

대부분의 국가에서 가상자산은 화폐가 아닌 자산으로 취급되기 때문에, 가상자산의 매매 또는 교환으로 인한 개인의 양도차익은 양도소득 과세대상이라 할 수 있다. 미국의 과세당국인 IRS(Internal Revenue Service)는 2014년 가상자산 과세 관련 고시(Notice 2014-21)를 통해, 가상자산은 연방세법상 자산(property)이라는 점을 분명히 밝혔다. 가상자산의 매매 또는 교환은 자산의 양도로서 일반 자본이득세(capital gains tax)의 적용 대상이 된다. 따라서 양도한 가상자산의 보유기간 1년을 기준으로 단기자본이득과 장기자본이득으로 나누어, 단기자본이득은 종합소득세율(최대 37%)로 과세하고 장기자본이득은 장기자본이득세율(최대 20%)로 과세한다. 1년 이하 보유한 비트코인 등 가상자산으로 물건을 구입하고 해당 교환(양도)에 따라 자본이득이 발생하는 경우, 해당 자본이득에 대해 고율의 종합소득세를 부담하여야 한다. 이러한 점에서 가상자산을 결제수단으로 사용함에 있어 세부담이 매우 크다. 이에 대해 현재 미국 의회에 계류 중인 ‘책임있는 금융혁신법안’(Responsible Financial Innovation Act)은 재화 또는 용역을 구매하기 위한 개인적인 거래(personal transaction)에 비트코인 등 가상자산(virtual currency)을 사용하는 경우, 가상자산 손익이 200달러 미만인 거래에 대해서는 자본이득세를 부과하지 않는다고 규정하고 있다.21)

미국과 더불어 영국, 캐나다, 호주 등 영미권 국가에서도 개인의 가상자산 양도로 인한 차익에 대해서는 해당 양도행위가 사업성을 가지지 않는 이상 자본이득세를 부과한다. 독일의 경우, 사업성이 없는 사적 매매(private sale)로 인한 가상자산의 양도차익에 대해서는 해당 가상자산의 보유기간 1년을 기준으로 장단기로 나누어 과세 여부를 달리한다. 즉, 해당 가상자산을 1년 초과하여 장기 보유한 경우에는 비과세하고, 1년 이하의 기간동안 단기 보유한 경우에는 종합과세한다. 단기 보유 가상자산의 양도차익을 과세함에 있어, 과세연도당 양도차익이 600유로 이하인 경우에는 과세하지 않는다.

일본의 경우, 가상자산의 양도로 인한 소득을 잡소득(miscellaneous income)으로 분류하여 종합과세의 대상으로 한다. 따라서 양도소득세로서 분리과세되지 않고 근로소득 등과 합산되어 종합과세되기 때문에, 일본의 가상자산 거래자는 가상자산 양도차익에 대해 글로벌 대비 높은 세율을 부담한다.

나. 가상자산 대여이익에 대한 과세

가상자산 대여로부터의 이익에 대해서는 주요국에서 종합소득(미국 등) 또는 잡소득(일본 등)으로 과세한다. 그런데 가상자산 양도로부터의 이익에 대한 과세 논의에 비해 가상자산 대여로부터의 이익에 대한 과세 논의는 상대적으로 미진하다. 그 이유는 가상자산 양도차익 과세가 대여이익 과세에 비해 세원 규모가 크고 중요하여 과세당국이 과세 정책 수립에 적극적인 점에서 찾을 수 있다.22) 또한 DeFi 거래의 복잡성과 익명성으로 인해 실태 파악과 세원 확보가 용이하지 못한 점도 이유로 들 수 있다.

가상자산 대여행위는 분산원장 네트워크에서 가상자산의 교환을 통해 이루어지기 때문에 ‘금전’ 사용에 대한 대가라는 전통적 이자 개념을 적용하기는 어렵다. 그러나 DeFi 시장참가자들은 가상자산 대여의 대가로 가상자산을 받는 이익창출행위를 이자농사(yield farming)라고 명명한다. 이자농사에 있어 가상자산 보유자는 DeFi 대출 프로토콜 또는 탈중앙화거래소(DEX) 유동성 공급을 위해 자신의 가상자산을 맡기고 이에 대한 대가를 수취한다. 이러한 대가의 수취가 가상자산 대여자가 가상자산을 받는 형식으로 이루어진 경우, 추가적으로 받은 가상자산은 종합소득 또는 잡소득에 합산된다.

미국 등 많은 국가에서 가상자산 공급의 대가로 새로운 가상자산을 받은 것이 아니라 예치자 권리의 증표로서 받게 되는 가상자산의 가치가 증가하는 경우에는, 해당 가상자산을 양도하였을 때 자본이득세를 부과할 것이다. 예를 들어, DeFi 대출플랫폼인 컴파운드(Compound)23)에 자산담보형 스테이블코인인 DAI를 1,000개 공급하고 예치된 DAI에 상응하는 cDAI를 지급 받은 경우, 1년 뒤 cDAI의 가치가 1,100 DAI가 되었다면 해당 가치증가분은 종합소득과세의 대상이 되기보다는 자본이득(양도소득)과세의 대상이 될 것이다.

DeFi 대출이 기존의 금전 대출과 다른 특성을 보임에 따라 글로벌 주요국 과세당국은 관련 과세 방안에 관해 활발한 논의를 이어가고 있다. 이러한 논의는 DeFi 서비스 예치자에게 지급하는 거버넌스 토큰에 관한 과세, 스마트계약에 따른 자동채무상환대출(self-repaying loans)에 있어 부채가 탕감됨으로써 얻는 이익(debt cancellation income)에 대한 과세 등을 포함하고 있다. 글로벌 주요 과세당국은 이러한 DeFi 과세에 관한 논의 및 조사를 진행하고 있으며 향후 관련 세법 개정과 과세가이드라인 발표가 있을 것으로 예상된다.

다. 가상자산 양도에 따른 손익의 통산 및 손실 이월공제

최근 비트코인이 새로운 하나의 자산군(asset class)으로 부각됨에 따라24), 가상자산 양도손익을 다른 투자자산 양도손익과 손익통산하는 이슈가 중요해지고 있다. 세법상 가상자산을 투자자산으로 인정하고, 다른 투자자산과 양도손익을 포괄적으로 통산하여 전체 투자의 순소득에 대해서만 과세하게 되면 자산배분 포트폴리오가 다양해지고 자산시장이 활성화되는 효과를 기대할 수 있다. 자산시장의 활성화를 중시하는 미국은 사업용 자산이 아닌 가상자산을 자본자산25)으로 인식하고 해당 가상자산의 양도손익을 주식 등 다른 투자자산의 양도손익과 통산한다. 또한 해당 과세연도에 소득공제되지 못하고 남은 단기자본손실 또는 장기자본손실은 장단기의 속성을 유지한 채 기간의 제한 없이 미래의 과세연도 손실공제를 위해 사용될 수 있다. 이러한 가상자산 자본손실에 대한 이월공제 제도는 미국 투자자산시장에서 가상자산 장기투자를 육성하고 투자자들의 납세부담을 경감시키는 효과를 가질 수 있다.

미국과 더불어 영국, 호주, 캐나다 등 영연방 국가들도 대부분 가상자산과 다른 투자자산간의 양도손익 통산을 인정하고 가상자산 순양도차손에 대한 이월공제를 허용한다.26) 가상자산과 다른 투자자산간의 손익통산과 이월공제의 인정 여부는 특정 국가의 소득세법 체계가 포괄주의인지 열거주의인지의 여부와는 큰 관련성이 없다. 이는 포괄주의 소득세제를 채택한 미국과 열거주의 소득세제를 채택한 영국이 유사한 방식으로 가상자산 양도차익의 손익통산과 이월공제를 허용하고 있다는 점에서도 잘 나타난다. 그러나 가상자산의 양도로 인한 차익을 양도소득 내지는 자본이득으로 인정하지 않고 잡소득으로 분류하는 국가에서는 가상자산과 다른 투자자산간의 손익통산을 허용하지 않는다. 대표적으로 일본은 가상자산의 양도차익을 투자자산의 양도소득으로 보지 않고 잡소득으로 본다.27) 따라서 다른 종합소득에서 가상자산 투자손실을 공제하거나 다음 과세연도로 이월할 수 없고, 누진세율로 종합과세되어 세부담이 크다. 이러한 가상자산 양도차익에 대한 과중한 세금은 일본 가상자산시장 활성화에 저해 요소가 되는 것으로 지적되어 왔다. 이에 일본암호자산비즈니스협회(JCBA)는 지난 7월 29일 가상자산의 양도차익을 종합소득과세에서 신고분리과세로 하고 손실에 대한 3년간의 이월공제를 허용하는 것을 주요 골자로 하는 2023년도 세제 개정 요망서를 금융청에 제출하였다.28)

종합해보면, 가상자산 시가총액 측면에서 중국을 제외하고 상위국가인 미국, 일본, 영국, 독일 중 1년 이상의 장기자본이득에 대하여 손익통산과 이월공제를 허용하지 않는 국가(독일은 비과세)는 일본 뿐이며, 일본에서는 관련 세제 개선 요구가 큰 실정이다.

국내 소득세법상 가상자산 기타소득세제 정비의 과제 및 방향은 가상자산 양도로부터의 소득과세와 가상자산 대여로부터의 소득과세로 나누어 살펴볼 수 있다. 먼저 가상자산 양도로부터의 소득과세에 있어서는 납세자가 취득가액 등 과세정보를 확보하고 세액을 산정ㆍ납부함에 있어 편의성을 높일 수 있는 과세시스템 확보가 필요하다. 또한 외국인(비거주자) 투자자의 가상자산소득세에 대해 국내 가상자산사업자가 실효성 있는 원천징수를 하기 위해, 가상자산사업자의 비거주자 납세정보에 관한 접근 권한을 법적으로 보장하여야 할 것이다.

우량한 가상자산 장기투자를 육성하고 ‘순’소득 과세의 원칙에 충실하기 위해, 가상자산과 다른 투자자산간의 양도손익 통산을 인정하고 가상자산 순양도차손에 대한 이월공제를 허용하는 방안을 논의하여야 한다. 이러한 논의에 있어 비트코인 등 가상자산이 하나의 자산군으로 자리 잡아 가고 있고, 미국 등 해외 주요국에서 관련 손익통산과 이월공제를 폭넓게 인정하고 있다는 점을 고려하여야 할 것이다. 다만 국회의 입법 논의과정에서 가상자산을 하나의 자산군으로 공식적으로 인정하는 것에 대한 국민 정서와 납세자 수용성도 고려하여야 한다.

가상자산 대여로부터의 소득과세에 관해서는, 가상자산 대여소득이 무엇인가에 관한 구체적 규정과 적극적인 유권해석이 필요하다. 가상자산 대출플랫폼 예치 개념과 스테이킹 개념에 대한 구분 등에 관해 과세당국은 구분 기준 및 과세 방안을 제시하여야 한다. 또한 DeFi 서비스 수수료를 가상자산의 대여로 인한 소득의 필요경비로 인정할 것인지에 대한 논의도 필요하다.

Ⅲ. 가상자산에 특유한 과세제도 분석

효율적이고 공정한 가상자산 과세체계를 구축하기 위해서는 가상자산의 특성을 반영한 과세 원칙을 정립하여야 한다. 전통적 자산에 대한 과세와는 다른 가상자산 과세의 특수성은 작업증명 방식의 채굴(이하 ‘POW 채굴’), 지분증명 방식의 검증(이하 ‘POS 검증’), 에어드랍 및 하드포크 과세에서 나타난다. 본 장에서는 블록체인 거래 검증의 대가, 에어드랍 및 하드포크에 관한 과세의 핵심 논점 및 국내외 제도를 분석한다.

1. 블록체인 거래 검증의 대가에 대한 과세

가. POW 채굴에 관한 소득과세

1) 주요 개념 및 국내 과세제도

채굴(mining)이란 가상자산의 거래를 검증하고 해당 거래가 기록된 블록을 생성하는 기능을 하는 분산원장 프로토콜상의 절차를 의미한다.31) 채굴은 작업증명(Proof-of-Work: POW)32) 방식의 합의 알고리즘을 채택한 분산원장 프로토콜의 블록 검증 방식이다. 채굴에 대한 보상은 거래 검증 및 블록 생성에 대한 대가로 새롭게 생성된 가상자산을 받는 방식과 함께 거래수수료의 일부를 채굴자가 받는 방식으로도 이루어진다.33)

“소득 있는 곳에 과세 있다”는 조세의 기본원칙상, 블록체인 거래의 검증에 대한 대가로서 수령하는 소득에 대해서도 원칙상 과세를 하는 것이 바람직하다. 순자산증가설에 따른 포괄주의 과세원칙이 반영된 국내 법인세법에 따라, 국내 법인의 채굴행위는 과세대상이며 채굴에 드는 비용에 대해서도 합리적 범위에서 공제가 가능할 것이다. 그러나 과세대상 소득을 포괄주의가 아닌 열거주의 방식으로 규정하는 국내 소득세법 체계에 있어 가상자산 채굴행위 과세에 대한 법적 근거는 불분명하다. 과세당국은 아직까지 가상자산 채굴로 인한 소득과세 방안에 대한 분명한 입장을 밝히지 않고 있다.

국내 소득세법상 가상자산 채굴에 따른 소득에 대한 과세 근거로는 사업소득과 기타소득 관련 규정을 들 수 있다. 가상자산 채굴로 인한 소득이 사업성이 있다면 사업소득 과세규정의 적용가능성을 살펴보아야 하고, 사업성이 없다면 기타소득 과세규정의 적용가능성을 살펴보아야 할 것이다. 개인 납세자가 영리를 목적으로 자신의 계산과 위험으로 계속ㆍ반복적으로 가상자산 채굴을 하는 경우, 해당 채굴행위에서 발생하는 소득이 소득세법상 사업소득세 과세대상인지를 확인하여야 한다. 국내 소득세법상 사업소득은 열거된 소득 이외에 열거된 소득과 ‘유사한 소득’으로서 영리목적성, 독립성, 계속ㆍ반복성을 갖춘 소득도 포함하는 소득유형별 포괄주의 방식으로 과세되기 때문에, 과세대상 소득의 범위가 매우 넓다고 할 수 있다.34) 가상자산 채굴사업으로 인한 소득은 현행 사업소득업종 중 ‘정보통신업’ 또는 ‘과학 및 기술서비스업’에서 발생하는 소득과 유사하다고 볼 여지가 있다.35) 그러나 과세당국은 가상자산 채굴사업으로 인한 소득의 사업소득 인정기준을 명확히 밝히지 않고 있어 법적 불확실성36)이 큰 실정이다. 이러한 법적 불확실성으로 인해 가상자산 채굴사업에 종사하는 사업자가 관련 사업비용 공제가 안 되거나 불측의 세금을 부담하는 피해가 발생하여서는 안 될 것이다.37) 따라서 과세당국은 가상자산 채굴사업이 소득세법상 사업소득으로 분류되는 기준을 명확히 시장참가자에게 알리는 것이 바람직하다.

가상자산 채굴로 인한 소득이 사업성이 없다면 기타소득 과세규정의 적용가능성을 살펴보아야 할 것이다. 국내 소득세법이 열거주의를 채택하고 있고 가상자산 관련 기타소득(가상자산소득)에 관하여 가상자산을 “양도하거나 대여함으로써 발생하는 소득”38)으로 열거하고 있기 때문에, 소득세법 개정 없이 가상자산 채굴로부터 발생하는 사업성 없는 소득을 기타소득으로 해석하기는 어려운 것으로 사료된다. 따라서 사업성이 없이 개인이 채굴한 가상자산은 취득시 과세되지 않고 양도시 과세된다고 보아야 할 것이다. 이 경우 취득가액은 0원이라 할 수 있으며, 채굴에 소요되는 전기요금은 필요경비로서 인정한다는 것이 과세당국의 방침이다.39)

2) 해외 주요국 과세제도

대부분의 해외 주요국은 개인의 채굴로 인한 소득과세를 해당 채굴행위가 사업성이 있는지의 여부에 따라 사업소득과 비사업소득으로 나누어 과세한다. 미국 IRS는 이미 2014년 가상자산 과세 관련 고시(Notice 2014-21)를 통해, 납세자의 채굴행위가 개인의 사업(trade or business)으로 행해지는 경우 해당 채굴 수익에서 비용을 제외한 순수익에 대해 자영업세(self-employment tax)40)를 부과한다는 점을 명확히 밝혔다. 사업성이 없는 채굴행위로 인한 소득은 채굴자가 해당 가상자산을 수령하는 시점을 기준으로 공정시장가치(Fair Market Value: FMV)를 산정하여 해당 채굴자의 연간 총소득에 귀속시켜 종합과세한다. 해당 FMV는 해당 채굴자가 채굴 받은 가상자산을 매각하는 경우, 양도차익 계산에 있어 해당 가상자산의 취득가액이 된다.

일본의 경우에도 사업성이 있는 채굴행위를 통해 발생하는 소득은 사업소득으로 과세된다.41) 또한 사업성이 없는 채굴로 인한 소득은 잡소득으로 과세된다.42) 일본의 잡소득은 법령에 구체적으로 열거되지 않아도 포괄주의 원칙에 따라 종합과세가 된다는 점에서 국내 소득세법상 기타소득과 다르다. 채굴행위로 인해 발생하는 소득금액을 산정함에 있어, 채굴된 가상자산을 납세자가 취득하는 시점의 시가가 기준이 되며, 전기료 등의 필요경비는 소득금액에서 공제된다.43)

영국에서도 사업성이 인정되는 행위(trade)로서 가상자산 채굴을 하는 경우, 해당 채굴로 인해 발생한 소득에 대해 사업소득으로 과세한다.44) 만약 채굴로 인해 발생한 소득에 사업성이 인정되지 않는 경우, 해당 소득은 잡소득45)으로 종합과세되며 전기료 등의 필요경비 공제도 가능하다. 그러나 잡소득의 필요경비 공제의 범위는 사업소득의 필요경비 공제의 경우보다 협소하다. 예를 들어 채굴기 구입비용은 사업소득의 비용으로 공제가 가능하지만, 잡소득의 비용으로 공제받기는 어렵다.46)

미국, 일본, 영국, 독일에서는 가상자산 채굴로 인해 새로 생성된 가상자산을 취득하거나 수수료를 받는 경우, 해당 가상자산을 취득시기의 시가로 과세한다. 그러나 싱가포르, 호주는 사업자가 아닌 개인이 채굴을 통해 가상자산을 취득한 경우, 이를 취미(hobby) 활동으로 보고 취득 시점에 과세하지 않는다. 향후 해당 가상자산의 처분에 따른 양도차익에 대해 싱가포르는 과세하지 않으며47), 호주는 필요경비의 인정 없이 자본이득과세를 한다.48)

나. POS 검증에 관한 소득과세

1) 주요 개념 및 국내 과세제도

블록체인 합의 알고리즘으로서의 작업증명 방식은 대규모 전력량 사용에 따른 환경문제 등으로 비판받고 있다. 따라서 추세적으로 작업증명 대신 지분증명(Proof-of-Stake: POS)49) 방식의 합의 알고리즘 사용이 대세가 되어가고 있다. 최근 이더리움이 머지(Merge) 업그레이드를 통해 작업증명에서 지분증명으로 네트워크 합의 알고리즘을 바꾼 사실도 이러한 추세를 잘 반영하고 있다.

지분증명 방식은 불특정인의 채굴행위가 아닌 검증인의 인증행위를 기반으로 하는 블록체인 네트워크의 합의 알고리즘이다. 지분증명 방식에서 검증인은 무작위로 결정되지만 검증인의 지분 비율이 높을수록 선정될 확률이 높아진다. 검증인이 되기 위해서는 최소한의 보유량(이더리움의 경우 32개)을 예탁하여야 하는데 이러한 검증을 위한 예탁을 스테이킹(staking)이라고 한다. 스테이킹된 가상자산은 스마트 계약에 따라 처분이 제한(lock)된다. 스테이킹을 요구함에 따라 검증인은 검증을 하지 않거나 부실 검증을 한 경우 스테이킹된 물량이 강제적으로 몰수(slashing)되는 제재를 받게 된다. 개인이 직접 검증인을 하기 위해서는 일정 규모 이상의 가상자산을 예치하여야 하며, 거래처리, 증명집계, 데이터저장, 블록생성 등을 위한 시간, 노력, 전문성이 필요하다. 따라서 많은 가상자산 보유자들은 가상자산거래업자, 유동성 스테이킹 전문업체 등의 스테이킹 서비스를 이용한다.

작업증명 방식에서 채굴자는 주로 해당 프로토콜로부터 채굴 보상을 받지만, 지분증명 방식에서 스테이킹 서비스 이용자는 주로 블록체인 네트워크의 거래자들로부터 수수료를 수취하는 형태로 검증 보상을 받는다. 이러한 보상 방식의 차이로 인해 POW 채굴로부터의 소득과 POS 검증으로부터의 소득에 대한 과세시점은 서로 달라야 한다고 주장할 수도 있다. POW 채굴을 통해 가상자산을 수취한 경우, 해당 가상자산은 채굴자에 의해 제조된 것으로 보고 해당 가상자산의 취득시점에 과세하지 않고 처분시점에 과세할 수 있다. 그러나 POS 검증을 통해 가상자산을 수취한 경우, 해당 가상자산이 검증의 대가로서 거래수수료에서 지급된 것이라면 해당 가상자산의 취득시기에 해당 소득에 대한 과세를 해야 한다고 주장할 수 있다.50)

POW 채굴에 관한 소득과세 법리가 정립되어가는 수준에 비하여 POS 검증에 관한 소득과세 법리는 아직 명확히 확립되어 있지 않다. 우리 과세당국은 검증의 대가로 받는 가상자산의 과세에 관하여 공식적인 유권해석을 내지 않고 있다. 그러나 지분증명 방식의 합의 알고리즘을 통해 취득하는 가상자산의 규모가 추세적으로 확대되어 향후 국가의 주요 세원으로 자리 잡을 수 있다. 이러한 점에서, 우리 과세당국이 블록체인 검증의 대가인 소득에 대한 과세시점에 관해 보다 진지하게 고민하고 관련 과세방침을 시장참여자에게 명확히 알려야 할 필요성이 크다.

2) 해외 주요국 과세제도

국제적으로 POS 검증에 대한 소득과세에 관한 과세당국의 유권해석은 POW 채굴에 대한 소득과세에 대한 유권해석에 비해 상대적으로 적다. 다만 블록체인 검증에 대한 대가인 소득(가상자산 형태)이라는 점에서 POW 채굴과 POS 검증의 과세 원칙을 동일시하여 취득시 시가로 과세하는 국가가 다수이다. 특히 미국, 일본과 같이 포괄주의 소득과세 체계를 가진 국가의 경우, 블록 검증의 대가에 대해서는 채굴 작업이냐 지분 검증이냐에 관계없이 과세 대상 소득으로서 종합과세한다는 과세 논리가 명확하다.

미국 IRS는 2014년 “재화 또는 용역의 대가로서 가상자산을 지급받은 납세자는” 지급받은 날짜의 FMV로 해당 소득을 총소득에 합산하도록 고시하였다.51) 이에 따라 지분증명 네트워크에서 직접적인 검증활동 또는 스테이킹을 통해 취득한 가상자산은 채굴의 경우와 같이 해당 가상자산 취득시를 기준으로 과세된다. 그러나 실무적으로 블록체인 검증 대가의 취득시기는 계좌에 입고되었다고 표시된 시점이 아닌 실제 납세자가 해당 가상자산을 지배(control)할 수 있는 시점으로 본다. 따라서 스테이킹 락업(lockup) 기간에는 납세자의 계좌에 보상받은 가상자산이 표시된다고 하여도, 락업이 해제되어 해당 납세자가 보상받은 가상자산을 사용ㆍ수익ㆍ처분할 수 있는 날짜의 FMV로 소득을 산정해야 할 것이다.52) IRS의 POW 채굴 대가에 대한 취득시 소득과세 원칙에 대해, 최근 POS 검증인 단체인 POSA(Proof of Stake Alliance)는 검증 대가인 소득의 과세시기를 취득시기가 아닌 처분시기로 할 것을 주장하고 있다.53) 현재 미 의회에 상정된 ‘책임있는 금융혁신법안’은 블록체인 거래 검증(채굴, 스테이킹 등)의 대가로 받은 소득의 과세를 해당 소득의 취득시가 아닌 처분시로 이연하는 내용의 소득세법(Internal Revenue Code) 개정 조항을 포함하고 있다.54)

미국과 더불어 일본, 영국, 독일 등 대규모 가상자산시장을 가진 국가는 대부분 POW 채굴 및 POS 검증의 대가로 받은 소득에 대해 취득시 FMV 기준 과세를 원칙으로 한다. 이러한 취득시 과세원칙은 블록 검증에 따른 가상자산 취득을 서비스 제공에 대한 대가로 보는 인식을 바탕으로 한다. 따라서 블록 검증을 수익의 의사 없이 단순히 취미로만 하는 경우, 블록 검증에 따라 취득한 가상자산에 대해 취득시점에 과세하지 말아야 한다고 주장할 수 있다.55) 또한 미국 POSA가 주장하는 바와 같이 블록 검증에 따라 취득한 가상자산을 ‘새롭게 만들어진 자산’으로 보는 경우에도, 해당 소득을 취득시점에 과세하지 않고 처분시점에 과세해야 한다고 주장할 수 있다.

글로벌 주요국은 대부분 블록체인 검증 대가인 소득의 사업성이 인정되는 경우, 해당 소득을 사업소득으로 과세하며 비사업소득에 비해 폭넓게 필요경비를 인정한다. 미국, 일본, 영국, 독일, 우리나라의 블록체인 검증 소득에 대한 과세를 비교하면 아래 표와 같다. 지분증명 합의 알고리즘에 있어 검증의 대가로 받는 소득이 새로운 세원으로 부각됨에 따라, 향후 블록체인 검증 소득에 대한 과세 논의가 더욱 활발해지고 의미 있는 글로벌 과세 방향이 제시될 것으로 기대된다.

2. 하드포크와 에어드랍 과세

가. 주요 개념 및 국내 과세제도

1) 하드포크

하드포크(hard fork)란 블록체인 네트워크의 통신규약 즉 프로토콜(protocol)을 근본적으로 변화시켜 새로운 분산원장(new ledger)과 이전 분산원장(legacy ledger)의 호환이 불가능하게 만드는 소프트웨어 업그레이드이다. 하드포크를 위해 새로운 프로토콜로 업그레이드된 노드는 새로운 블록체인 네트워크를 만들어지게 된다. 하드포크의 대표적인 예로, 2017년 하드포크로 인해 비트코인 네트워크가 기존의 비트코인(BTC)과 새로운 비트코인 캐시(BCH)로 분리된 사례를 들 수 있다.

소프트포크(soft fork)는 블록체인 네트워크의 프로토콜을 개선시킨다는 점에 있어 하드포크와 같다. 그러나 블록체인 네트워크를 분리시키는 정도의 근본적 업그레이드는 이루어지지 않기 때문에 기존(original) 네트워크와 호환성ㆍ계속성을 유지한다는 점에서 하드포크와 다르다. 소프트포크의 대표적인 예로, 2017년 비트코인 업그레이드를 위해 이루어진 세그윗(SegWit)포크를 들 수 있다. 하드포크와 소프트포크의 차이점은 아래 그림에 잘 나타나 있다.

2) 에어드랍

가상자산의 에어드랍(airdrop)이란 마케팅 등을 목적으로 기존 가상자산 보유자의 지갑 주소로 가상자산을 배분하는 행위를 의미한다. 에어드랍 주체의 경제적 유인은 에어드랍을 통해 해당 가상자산의 유동성이 증가하고, 대중적 인지도가 높아지며, 시장가격이 상승할 수 있다는 점에서 찾을 수 있다. 국내 상증법 해석상 에어드랍을 통해 가상자산을 수취한 자는 타인으로부터 무형의 재산을 이전받았다는 점57)에서 증여세 납부 의무가 있다고 볼 수 있다. 무상으로 가상자산을 에어드랍 받은 경우, 해당 가상자산은 국내 상증법에 따른 “무상으로 이전받은 재산 또는 이익”으로 볼 수 있으며58), 국내 거주자는 “증여세 과세대상이 되는 모든 증여재산”에 대하여 증여세를 납부 할 의무가 있다.59) 다만 에어드랍을 받은 국내 거주자가 일정한 활동에 대한 보상으로 에어드랍을 받은 경우의 과세 방식에 대해 아직 과세당국은 분명한 입장을 밝히고 있지 않다. 관련하여 마케팅에 기여한 가상자산 보유자에게만 선별적으로 가상자산을 에어드랍함으로써 증여세 적용을 회피하려는 경우, 해당 에어드랍으로 인해 발생한 소득에 대해서는 과세를 하지 못하는 과세 공백이 발생할 수 있다.60)

에어드랍을 통해 가상자산을 받은 경우, 해당 증여재산의 취득시기에 관한 상증법령 규정이나 관련 유권해석은 없다. 그러나 상증법 해석상 증여재산인 가상자산을 “인도한 날 또는 사실상의 사용일”을 취득시기로 보아야 할 것이다.61) 그런데 수증자가 가상자산거래업자를 통해 에어드랍의 원인이 되는 기초 가상자산을 취득하고 해당 가상자산을 거래소에 보관하고 있는 경우, 에어드랍된 가상자산을 수증자에게 인도한 시기에 관한 해석이 갈릴 여지가 있다. 즉, 발행인이 가상자산거래업자의 지갑으로 에어드랍을 통해 가상자산을 이전한 시기가 증여를 받은 날인지, 해당 가상자산거래업자가 이용자에게 에어드랍된 가상자산을 분배하여 이용자가 해당 가상자산을 지배할 수 있게 한 시기가 증여일인지에 대한 명확한 유권해석이 없다. 과세당국은 질의회신을 통해 “실질적인 재산 및 이익의 이전 여부 등과 관련한 거래상황 등을 고려하여 사실판단”62)을 한다고만 밝히고 있다. 상증법 해석상 에어드랍된 가상자산이 수증자에게 ‘이전’ 또는 ‘인도’되었다고 볼 수 있는 시기는 수증자가 해당 가상자산에 접근하여 사용ㆍ수익ㆍ처분할 수 있는 시기로 해석하는 것이 타당하다. 따라서 발행인이 가상자산거래업자에게 에어드랍한 가상자산을 해당 업자가 이용자의 고객계좌로 이전하고 이용자가 해당 가상자산을 처분하고 지배할 수 있는 시기를 증여일로 보아야 할 것이다.

에어드랍을 통해 증여받은 가상자산의 증여재산가액은 증여받은 가상자산의 유형에 따라 다음과 같이 평가한다. “국세청장이 고시하는 가상자산사업자의 사업장에서 거래되는 가상자산”의 경우, 증여일을 전후한 한달간 “해당 가상자산사업자가 공시하는 일평균가액의 평균액”으로 증여재산가액을 평가한다.63) 그 밖의 가상자산의 경우, 국세청장이 고시하는 “가상자산사업자 외의 가상자산사업자 및 이에 준하는 사업자의 사업장에서 공시하는 거래일의 일평균가액 또는 종료시각에 공시된 시세가액 등 합리적으로 인정되는 가액”으로 증여재산가액을 평가한다.64) 이 경우 해당 증여재산가액은 무상 취득한 가상자산을 양도하여 기타소득 과세대상(2025년 1월 1일 이후)이 되는 경우 필요경비(취득가액)로서도 의의를 갖는다.

나. 해외 주요국 과세제도

에어드랍으로 받은 가상자산에 대해 대다수의 국가는 해당 가상자산의 취득시 시가를 소득으로 인식하여 과세한다. 물론 증여의 목적으로 에어드랍한 경우 증여세 규정을 적용할 수 있다. 그러나 미국, 영국 등 증여에 있어 수증자에게 과세하지 않는 국가의 경우, 에어드랍으로 가상자산을 취득한 자에 대한 기본적인 세금을 증여세로 구성할 수는 없다.

에어드랍에 대해 증여세를 부과하는 국가에서도 적극적으로 마케팅 활동에 참여하거나 마케팅 정보를 제공한 자에게만 선별적으로 에어드랍이 이루어진 경우, 에어드랍의 유상성이 증가하여 에어드랍을 받은 자에 대한 증여세 부과의 법적 근거가 취약해 질 수 있다. 에어드랍에 대한 대가로서 가상자산을 취득한 경우, 미국, 일본, 영국, 독일은 증여세가 아닌 소득세를 부과한다. 싱가포르, 호주는 사업자가 아닌 개인이 에어드랍으로 취득한 가상자산을 일종의 횡재(windfall)로 의제하여 과세하지 않는다. 이 경우 향후 해당 가상자산의 양도 시점에 자본이득세를 부과하는데, 무상취득한 가상자산의 취득가액은 0이 될 수 있다.

하드포크가 발생하여 기존에 보유한 가상자산의 프로토콜이 바뀌는 경우, 프로토콜 변경을 원인으로 해당 가상자산에 대해 세금이 부과되지는 않는다. 하드포크 이후 기존의 가상자산에 더하여 새로운 가상자산이 에어드랍 되는 경우 무상으로 새롭게 가상자산을 받는 경우가 대부분이기 때문에, 유상성에 따른 증여세 회피 문제는 크지 않다. 하드포크 후 새롭게 분화된 네트워크에서 에어드랍 받은 가상자산을 취득하였으나 유통시장이 형성되어 있지 않아 해당 가상자산의 시가를 모르는 경우가 있을 수 있다. 이 경우 하드포크 에어드랍에 대한 취득시 과세는 이루어지지 않고, 향후 양도시 취득가액을 0으로 하여 산정된 자본이득세가 부과될 수 있다.

미국, 일본, 영국, 독일, 우리나라의 에어드랍 및 하드포크에 관련된 과세를 비교하면 아래 표와 같다.

3. 소결: 가상자산에 특유한 과세제도 정비의 과제 및 방향

가상자산에 특유한 과세제도 정비에 있어, 블록체인 거래 검증의 대가에 대한 과세제도와 하드포크 및 에어드랍에 대한 과세제도의 정비가 중요하다. POW 채굴에 대한 과세에 있어, 개인의 가상자산 채굴사업으로 인한 소득을 사업소득으로 과세하는 방안에 대해 과세당국의 입장이 분명하지 않기 때문에 법적 불확실성이 높고 세원 확보가 되지 않는 문제점이 있다. 이러한 과세당국의 태도는 국내 소득세법상의 소득유형별 포괄주의 원칙에 배치된다. 과세당국은 가상자산업계와 전문가들의 의견을 반영하여 가상자산 채굴사업이 소득세법상 사업소득으로 해석되는지의 여부 및 관련 과세방안을 빠른 시일 내에 결정하여 시장참여자에게 알려야 한다. 또한 과세당국은 블록체인 거래 검증의 두 가지 방식인 POW 채굴과 POS 검증에 대해 동일한 과세원칙을 적용할지에 대해 결정하여야 할 것이다. 이 경우 POS 검증을 위한 스테이킹과 대출플랫폼 예치에 대한 명확한 구별 기준, 블록체인 거래 검증의 사업성 요건에 대한 명확한 기준을 제시하여야 한다.

하드포크 관련 과세에 있어, 과세당국은 새로 취득된 가상자산의 무상성, 재산 또는 이익의 이전 시기, 증여재산가액 등에 관한 명확한 기준을 고시하여야 한다. 에어드랍 관련 과세에 있어, 일률적으로 증여세 과세원칙을 적용하는 것이 바람직한지에 대한 정책적 검토가 필요하다. 에어드랍에 따른 가상자산 무상 취득에 대하여 증여세를 적용하는 것이 큰 문제가 있다고는 할 수 없다. 다만 개인사업자가 에어드랍을 통해 수취한 가상자산에 대한 사업소득 인정 여부, 마케팅 대가로 주는 에어드랍 대상 가상자산에 대한 과세 공백 등을 종합적으로 고려하여 국제적 정합성에 맞는 과세방안을 재정립할 필요성이 크다.

Ⅳ. 결어: 국내 가상자산 과세제도 발전 방향

개인 납세자에 대한 국내 가상자산 과세제도를 가상자산거래의 특성과 국제적 비교를 바탕으로 분석한 결과에 따르면, 국내 가상자산 과세제도의 정비 수준은 국제적 수준에 미치지 못한다. 가상자산 과세제도의 입법적 미비를 해결하기 위한 시간을 확보한다는 차원에서 현재 국회에서 논의되는 소득세법 개정안의 가상자산 기타소득과세 시행시기 2년 유예(2025년 1월 1일부터) 조치는 필요하다. 가상자산 관련 상속ㆍ증여세와 사업소득세는 이미 시행 중이며, 가상자산 기타소득세제 정비에 상당한 시간이 소요될 수 있다는 점에서 가상자산 과세제도는 조속히 정비하여야 할 것이다.

국내 가상자산 과세제도의 정비는 과세 불확실성을 줄이고 과세 공백을 메우는 방향으로 추진되어야 한다. 먼저 가상자산 기타소득세제의 정비에 있어, 효율적인 가상자산 양도소득 과세를 위해 과세시스템을 정비하여야 한다. 특히 분산된 가상자산거래업자의 과세정보(거래정보, 취득가액 등) 통합시스템을 구축하여 이용자와 과세당국의 편의성을 증대시킬 필요가 있다. 또한 가상자산 대여로부터의 소득에 관한 과세 불확실성을 줄이기 위해, 가상자산 대여소득의 명확한 정의, 사업소득과의 구분, 필요경비의 인정 범위에 관한 적극적인 유권해석이 있어야 하며 필요한 경우 관련 법령의 개정이 필요하다. 또한 장기적으로 가상자산 양도로부터의 소득을 기타소득이 아닌 양도소득으로 규정하고, 다른 투자자산과의 손익통산 및 이월공제를 인정할지에 대한 논의가 필요하다.

블록체인 거래 검증의 대가에 대한 과세제도 중 POW 채굴에 관한 소득과세에 있어, 과세당국은 관련 소득에 대한 사업소득 과세요건(사업성 요건)을 분명히 정하여 고시함으로써 과세 불확실성을 줄이고 과세 공백을 해소하여야 한다. 과세당국은 POS 검증에 관한 소득과세에 관하여 POW 채굴에 관한 소득과세와 동일한 원칙을 적용할지에 대해서도 결정하여야 한다. 또한 과세당국은 검증을 위한 스테이킹과 대출플랫폼 예치에 대한 명확한 구별 기준, 검증의 사업성 요건에 대한 명확한 기준을 제시하고 시장참여자에게 고지하여야 한다.

하드포크와 에어드랍 관련 과세에 있어, 과세당국은 다음과 같은 과세 불확실성을 줄이는 노력을 하여야 한다. 과세당국은 하드포크와 에어드랍으로 인해 새로 취득된 가상자산의 무상성, 재산 또는 이익의 이전 시기, 증여재산가액 등에 관한 명확한 기준을 고시하여야 한다. 장기적으로, 과세당국은 에어드랍으로 인한 가상자산 취득에 대한 일률적 증여세 과세에 대한 재검토가 필요하다. 이러한 재검토를 함에 있어, 과세당국은 개인사업자가 에어드랍을 통해 수취한 가상자산에 대한 사업소득 인정 여부, 마케팅 대가로 주는 에어드랍 대상 가상자산에 대한 과세 공백 등을 함께 고려할 필요가 있다.

국내 가상자산소득 납세의무 준수율과 관련 세무서비스 수준을 제고하기 위해서는 공공부문에서 효율적 가상자산 과세시스템이 구축되고 민간부문에서 편의성 높은 가상자산 세액계산 프로그램이65) 많이 출시될 필요가 있다. 이러한 가상자산 세무서비스 인프라를 확충하기 위해서는 과세의 합리성 및 예측가능성을 높여야 한다. 따라서 과세당국은 충분한 논의를 거쳐 해외 주요국의 사례에서와 같이 종합적이고 구체적인 가상자산 과세가이드라인을 발표하여야 할 것이다.

1) “2021년 5월부터 가상자산 관련 제도 정비 및 과세체계 확립의 필요성 등을 이유로 가상자산 과세유예가 논의되었고, 2021. 12. 8. 소득세법(제18578호) 개정으로 1년간 가상자산소득 과세제도의 시행이 유예되어 2023년부터 가상자산소득에 대한 과세가 이뤄질 예정”이었다. 이에 관하여 국회입법조사처(2022a, p.226)를 참조한다.

2) PwC(2021, p.6)

3) 소득세법 제21조제1항제27호

4) 기획재정부(2020. 7. 22, p.44)

5) 소득세법 제14조제3항제8호

6) 소득세법 제16조제1항

7) 특금법 제2조제3호

8) 특금법 제2조제2호

9) 소득세법 제88조제1호 참조

10) 기축가상자산이란 비트코인, 이더리움 등 “교환거래를 할 때 교환가치의 기준이 되는 가상자산을 말한다.” 소득세법시행령 제88조제3항

11) 소득세법 제16조제1항

12) 소득세법 제64조의3제2항

13) 소득세법시행령 제88조제1항

14) 소득세법 제37조제5항

15) 소득세법시행령 제88조제3항

16) 시가고시가상자산사업자란 “신고수리가상자산사업자 중 국세청장이 고시하는 사업자”를 의미한다. 소득세법시행령 제88조제2항제1호

17) 이자소득의 필요경비는 인정되지 않기 때문에, 소득세법상 “이자소득금액은 해당 과세기간의 총수입금액으로 한다.” 소득세법 제16조제2항

18) 국회입법조사처(2022b, p.3)

19) 소득세법 제70조제1항 및 제2항

20) “가상자산 또는 현금을 인출하는 달의 다음 달 10일(매년 1월 1일부터 12월 31일까지 인출하지 아니한 경우 그 다음 연도 1월 10일)” 소득세법 제156조제16항

21) Responsible Financial Innovation Act §201

22) 또 다른 이유는 과세행정상 양도차익 과세에 있어 중앙화된 거래소를 운영하는 가상자산거래업자를 활용하는 것이 대여이익 과세에 있어 분산화된 DeFi 사업자를 활용하는 것보다 용이하다는 점에서 찾을 수 있다.

23) 컴파운드에 관한 이해를 위해서는, Gildon(2022, p.120)을 참조한다.

24) 작년 5월 21일 골드만삭스는 비트코인 등 가상자산이 새로운 하나의 자산군으로 시장에서 인식되고 있다는 취지의 보고서를 발간하였다(Goldman Sachs, 2021). “가상자산에 대한 투자 수요가 개인과 더불어 기관투자자로 확대”되고 있다(최순영, 2022, p.6).

25) 가상자산이 자본자산으로 분류되는 경우와 비자본자산으로 분류되는 경우에 관한 설명은, IRS(2022a, p.20)를 참조

26) 캐나다의 경우, 양도손익의 50%만 과세 또는 공제의 대상이 되는 특징을 갖는다(CRA, 2022).

27) 특정 과세연도에 가상자산소득이 20만엔 미만인 경우에는 과세하지 않는다(Koinly, 2022b).

28) JCBA(2022. 7. 28)

29) 가상자산 대여를 통해 정하여진 수익을 정기적으로 받는 경우는 잡소득(miscellaneous income)으로서 종합과세가 된다. 그러나 가상자산 대여의 외관을 갖추었지만, 정해지지 않은 수익을 일시적으로 받는 등 수익이 자본이득적 성격을 가지는 경우 자본이득과세의 대상이 된다. HMRC(2022b)

30) 본고에서 사용하는 ‘분리과세’라는 용어는 국내 소득세법 체계상의 분리과세와 분류과세를 포함하는 개념이다. 가상자산 자본이득(양도소득)은 결집효과가 높다는 점에서 종합소득과 구분하여 과세표준과 세액을 달리 계산하여 과세한다. 따라서 분류과세라는 용어를 사용하는 것이 더 적합할 수 있지만, 국내 가상자산 양도로부터의 소득은 실질이 결집효과가 있는 양도소득임에도 불구하고 가상자산 대여로부터의 소득과 같이 기타소득으로서 분리과세 된다. 이러한 점을 고려할 때, 개념상의 혼란을 피하고 양도소득이 종합소득과 분리되어 과세 된다는 점을 강조하여 본고에서는 분류과세도 분리과세라 칭한다.

31) OECD(2020, p.13)

32) 작업증명 개념에 대해서는, 권민경ㆍ조성훈(2018, p.54)을 참조한다.

33) 거래수수료의 일부를 블록 검증에 대한 보상으로 받는 경우, 채굴자는 수수료가 높은 거래를 우선적으로 검증하려는 인센티브를 가지게 된다.

블록 검증자에 대해 거래수수료를 재원으로 하는 보상이 가능하기 때문에, 비트코인 발행량이 예정 총량에 도달하더라도 해당 블록체인 네트워크의 운영·유지가 가능하다.

34) 소득세법 제19조제1항제21호

35) “정보통신업”에서 발생하는 사업소득은 소득세법 제19조제1항제10호, “전문, 과학 및 기술서비스업”에서 발생하는 사업소득은 소득세법 제19조제1항제13호에서 규정한다.

36) 가상자산 채굴사업으로 인한 소득을 “넓게 보면 제13호의 전문, 과학 및 기술서비스업 또는 그와 유사한 업종으로 볼 여지는 있을 것으로 생각된다”는 주장이 있다(조세일보, 2018. 1. 19).

반면 가상자산 채굴사업로 인한 소득은 “「소득세법」 제19조 제1항 제1호 내지 제20호에 해당되지 않으며 제21호에서 규정하는 제1호 내지 제20호와 유사한 소득에 해당되는지에 대한 논란의 여지가 있어 사업소득으로 과세되지 않을 가능성”이 있다는 주장도 있다(신상화 외, 2018, p.26).

37) 가상자산 관련 사업소득세 과세대상과 비교하여, 부가가치세 과세대상에 대해서는 과세당국의 입장이 상대적으로 명확한 편이다. 과세당국은 “가상자산의 공급은 부가가치세 과세대상에 해당하지 아니”한다고 명확히 유권해석하였다(기획재정부, 2021. 3. 2).

38) 소득세법 제21조제1항제27호

39) 파이낸셜뉴스(2021. 5. 6)

40) 단 자영업으로 인한 순수익이 400달러 미만인 경우에는 자영업세의 적용을 받지 않는다(IRS, 2022b).

41) 所得税法 第二十七条

42) 일본의 잡소득은 급여소득, 사업소득, 이자소득, 배당소득, 부동산소득, 산림소득, 퇴직소득, 양도소득, 일시소득 등 9종의 소득에 해당하지 않는 나머지 소득을 포괄하는 개념이다. 所得税法 第三十五条

43) 国税庁(2021, p.10)

44) HMRC(2022a)

해당 채굴행위가 사업성이 있는지를 판단하기 위해서는 행위의 정도, 조직, 위험, 상업성 요소를 종합적으로 판단하여야 한다.

45) Income Tax (Trading and Other Income) Act 2005 §§ 687-689

46) Houston(2021, p.19)

47) IRAS(2020, p.11)

48) Koinly(2022a)

49) 지분증명 개념에 대해서는, 권민경ㆍ조성훈(2018, p.62)을 참조한다.

50) POS 스테이킹으로부터의 수익은 검증 서비스에 대한 대가라는 특성으로 인해 가상자산 예치에 따른 이자소득이나 투자소득과 구별된다. “스테이킹 리워드는 네트워크를 유지하기 위해 블록을 생성하고 검증하는 행위에 대한 보상이지 제삼자 수익의 일부를 수취하는 행위가 아니다.” 최윤영ㆍ정석문(2022, p.1)

51) IRS(2014, pp.2-3)

52) 이에 관하여 2022년 8월 30일에 작성된 Coinbase User Agreement의 1.5.2. & 1.5.4.를 참조한다.

53) 관련한 대표적인 사례로 가상자산 테조스(Tezos)의 블록체인 검증을 위해 스테이킹을 한 납세자가 IRS의 화해 요구를 거절하고 IRS를 상대로 소송을 제기한 Jarrett et al v. USA를 들 수 있다. 해당 사건에서 원고는 검증의 대가로 받은 가상자산은 ‘새롭게 만들어진 자산’(newly created property)으로서 농부의 농작물, 예술가의 창작물과 같이 해당 자산을 매각할 때 과세되어야 한다고 주장하였다(The Jarretts, 2021. 5. 26).

해당 사건에서 IRS는 원고에게 블록 검증 대가 수령시의 소득에 대한 세금을 환급하였으나 그 이유를 밝히지는 않았다. 2022년 10월 3일 POSA의 보도자료에 따르면, Jarrett 사건에서 피고인 IRS의 소각하 신청(motion to dismiss)이 법원에서 받아들여졌으나 원고인 Jarrett은 항소를 진행 중이다. 이에 관하여 POSA(2022. 10. 3)를 참조한다.

54) Responsible Financial Innovation Act §208

55) 싱가포르는 취미 활동인 채굴로 인한 가상자산 취득시 해당 소득에 대해 과세하지 않는다(IRAS, 2020, p.10).

56) IRS(2019, p.5)

57) “증여란 그 행위 또는 거래의 명칭ㆍ형식ㆍ목적 등과 관계없이 직접 또는 간접적인 방법으로 타인에게 무상으로 유형ㆍ무형의 재산 또는 이익을 이전(移轉)(현저히 낮은 대가를 받고 이전하는 경우를 포함한다)하거나 타인의 재산가치를 증가시키는 것을 말한다.” 상증법 제2조제6호

58) 상증법 제4조제1항

59) 상증법 제4조의2제1항

60) 에어드랍을 마케팅 목적의 경품 또는 사례금으로 보고 국내 가상자산거래업자가 기타소득으로 원천징수한 사례가 있다. 김지호(2022. 7. 12). 그러나 에어드랍을 경품 또는 사례금으로 보는 과세기준이 명확하지 않다.

61) 상증법시행령 제24조제1항제4호

62) 국세청(2022. 7. 25)

63) 상증법시행령 제60조제2항제1호

64) 상증법시행령 제60조제2항제2호

65) 미국의 Koinly, CoinTracker 등의 가상자산 세액계산 프로그램은 가상자산거래시설의 거래정보, 과세당국의 신고서식 등과의 연결성 및 호환성을 높여 가상자산소득 납세자의 편의성을 높인다. Koinly 웹페이지(https://koinly.io) 참조

참고문헌

국세청, 2022. 7. 25, 상증: 기획재정부 재산세제과-814, 질의회신.

국회입법조사처, 2022a, 『2022 국정감사 이슈 분석 IV』, 국정감사관련 연구보고서.

국회입법조사처, 2022b, 『주요국의 가상자산 소득과세 제도 현황과 시사점』, NARS 현안분석 제249호.

권민경ㆍ조성훈, 2018, 『4차 산업혁명과 자본시장: 인공지능과 블록체인』, 자본시장연구원 조사보고서 18-04.

기획재정부, 2020. 7. 22, 2020년 세법개정안 문답자료, 보도자료.

기획재정부, 2021. 3. 2, 부가가치세제과-145, 질의회신.

김지호, 2022. 7. 12, 가상자산 소득세 과세 유예기간에도 발생할 세금 이슈들, 세움 택스 가상자산과 세무이야기.

신상화ㆍ홍성희ㆍ정훈, 2018, 『암호화폐 과세제도 및 과세인프라 연구』, 한국조세재정연구원 연구발간자료 18-07.

조세일보, 2018. 1. 19, ‘가상화폐’ 과세쟁점 검토(上).

최순영, 2022, 『글로벌 금융회사의 가상자산 사업 현황』, 자본시장연구원 이슈보고서 22-17.

최윤영ㆍ정석문, 2022, 『2022년 하반기 비트코인과 이더리움의 탈중앙화 트렌드』, 코빗 리서치.

파이낸셜뉴스, 2021. 5. 6, 정부, 채굴한 가상자산 전기료 제하고 소득세 매긴다.

CRA, 2022, T4037 Capital Gains.

Gildon Z., 2022, Mastering Decentralized Finance.

Goldman Sachs, 2021, Crypto: A New Asset Class?

HM Revenue & Customs, 2022a, Cryptoassets Manual, CRYPTO21150: Cryptoassets for Individuals: Income Tax Mining Transactions.

HM Revenue & Customs, 2022b, Cryptoassets Manual, CRYPTO61212: Decentralised Finance: Lending and staking: Income tax: Making a DeFi loan: Taxing Provisions.

Houston, I., 2021, How Crypto is Taxed in the UK.

IRAS, 2020, e-Tax Guide: Income Tax Treatment of Digital Tokens.

IRS, 2014, Notice 2014-21.

IRS, 2019, Rev. Rul. 2019-24.

IRS, 2022a, Sales and Other Dispositions of Assets.

IRS, 2022b, Topic No. 554 Self-Employment Tax.

JCBA, 2022. 7. 28, 2023年度税制改正に関する要望書.

Koinly, 2022a, Australia Crypto Tax Guide.

Koinly, 2022b, Japan Crypto Tax Guide.

OECD, 2020, Taxing Virtual Currencies.

O’Neal, S., 2018. 8. 9, Can crypto exchanges be trusted with hard forks? Cointelegraph.

POSA, 2022. 10. 3, Court grants motion to dismiss, POSA supports Jarrett’s appeal in pursuit of clarity for all stakers.

PwC, 2021, Annual Global Crypto Tax Report 2021.

Schmidt, N., Bernstein, J., Richter, S., Zarlenga, L., 2020, Taxation of Crypto Assets.

The Jarretts, 2021. 5. 26, Cryptocurrency case filed against the IRS raises important questions about the taxation of newly created property, PR Newswire.

国税庁, 2021, 暗号資産に関する税務上の取扱いについて(FAQ).

<해외 법률안>

Income Tax (Trading and Other Income) Act 2005, 2022 (UK).

Lummis-Gillibrand Responsible Financial Innovation Act (RFIA), 2022, S.4356 (USA).

Proposal for a Regulation of the European Parliament and of the Council on MiCA (Markets in Crypto-assets), 2020, COM/2020/593 Final (EU).