Find out more about our latest publications

The Effect of a Rise in Property Prices on Household Assets and Liabilities and Its Implications

Issue Papers 22-27 Dec. 26, 2022

- Research Topic Macrofinance

- Page 22

This article analyzes how property price rises have affected household assets and liabilities using household microdata. Over the past several years, households have accumulated wealth rapidly on the back of price hikes in real estate. But the pace of wealth growth has been uneven depending on the size of household wealth. High-net-worth households have accumulated wealth at a faster pace with a greater contribution of property price increases compared to household income. In Korea, high-net-worth households tend to own a larger share of their total assets in real estate. For that reason, a steep rise in property prices has a larger impact on wealthy households, thereby widening the wealth gap. In addition, the effect of property price rises on the household balance sheet has been heterogeneous across generations. Especially, financial liabilities held by households with heads aged 25-44, who have a relatively lower homeownership rate, have ballooned during the recent housing market boom.

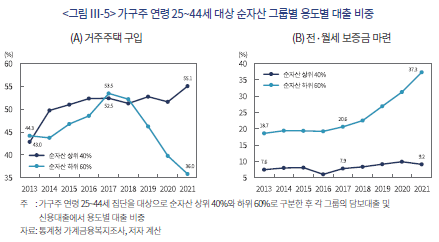

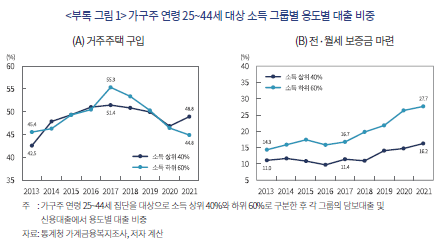

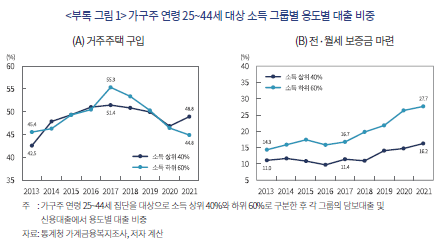

From the perspective of economic mobility, wealth mobility is lower than income mobility. Accordingly, the wealth gap which has been widened due to the property price increases is likely to persist. Furthermore, the quality and composition of financial liabilities of households with heads aged 25-44 have deteriorated. The proportion of heavily indebted households in the group has increased more sharply. And the purpose of loans taken out has varied depending on their household wealth. To be specific, the share of loans for leasehold (jeonse) or security deposits has been increasing among households in their bottom 60% net worth segment, while the share of loans for residential housing purchases has been increasing overall among households in their top 40%.

It is noteworthy that households in Korea regard real estate as a primary means of wealth accumulation. In this regard, more policy attention should be paid to the distribution of wealth as well as housing stability. Also, thorough monitoring of developments and risk factors in the housing market is needed to prevent financial vulnerabilities from materializing.

From the perspective of economic mobility, wealth mobility is lower than income mobility. Accordingly, the wealth gap which has been widened due to the property price increases is likely to persist. Furthermore, the quality and composition of financial liabilities of households with heads aged 25-44 have deteriorated. The proportion of heavily indebted households in the group has increased more sharply. And the purpose of loans taken out has varied depending on their household wealth. To be specific, the share of loans for leasehold (jeonse) or security deposits has been increasing among households in their bottom 60% net worth segment, while the share of loans for residential housing purchases has been increasing overall among households in their top 40%.

It is noteworthy that households in Korea regard real estate as a primary means of wealth accumulation. In this regard, more policy attention should be paid to the distribution of wealth as well as housing stability. Also, thorough monitoring of developments and risk factors in the housing market is needed to prevent financial vulnerabilities from materializing.

Ⅰ. 서론

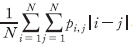

최근 수년간 부동산가격의 가파른 상승으로 부동산자산 가치가 크게 늘어난 가운데 주택 관련 대출도 빠르게 증가하면서 가계 재무구조 변화에 관한 관심이 높아졌다. 우리나라 가계는 주요국에 비해 실물자산 비중이 높은 편이다. 이에 따라 총량(aggregate)적 측면에서 최근 부동산가격 상승은 실물자산을 중심으로 가계의 부(wealth)1)가 빠르게 늘어나는 핵심 요인으로 작용한다. 하지만 미시적 측면에서 부동산가격 상승이 개별 가구에 미치는 영향은 각 가구의 재무구조에 따라 다르게 나타날 수 있다. 특히 가구의 자산 및 부채 구성이 경제적 특성에 따라 이질적인(heterogeneous) 경우, 총량 지표만으로는 부동산가격 변화가 가계에 미치는 영향을 정확히 이해하는 데 크게 제한적일 수 있다.

이에 본 보고서는 가구 마이크로데이터를 활용하여 최근 부동산가격 상승이 가계 자산과 부채에 미친 영향을 미시적인 관점에서 분석한다.2) 가계 대차대조표(household balance sheet)3)를 활용하여 순자산 규모, 가구주 연령 등 가구별 특성에 따른 자산ㆍ부채 구성의 특징을 살펴본다. 이를 바탕으로 부동산가격 상승의 영향이 가구 특성에 따라 어떻게 차별화되었는지 분석하고 시사점을 도출한다.

최근 수년간 가계 소득이 완만하게 증가한 데 반해 가계의 부는 부동산가격 상승에 주로 기인하여 빠른 속도로 늘어났다. 그러나 가구별 부의 증가 속도는 그 규모에 따라 불균등한 모습을 나타냈는데, 순자산 상위 가구일수록 부동산가격 상승기에 부가 더 빠르게 늘어났다. 순자산 상위 가구의 소득 증가율이 하위 가구보다 더 낮았음을 감안할 때, 소득보다는 자산가격 상승이 부의 변화에 더 중요한 요인으로 작용한 것으로 판단된다.

우리나라 가계는 각 연령대에서 순자산이 늘어날수록 부동산 비중이 확대되는 특성을 나타내는데 이는 부동산이 부의 증식 수단으로 적극 활용되고 있음을 나타낸다. 이러한 특성으로 인해 부동산가격의 가파른 상승은 상위 가구의 부를 더 크게 늘림으로써 가계 간 부의 격차를 확대하는 요인으로 작용한다.

부동산가격 상승이 가계에 미치는 영향은 세대별로도 크게 차별화되어 나타나고 있다. 주택소유율이 상대적으로 낮은 25~44세(가구주 연령 기준) 가구는 최근 부동산가격 상승기를 거치며 금융부채가 빠른 속도로 늘어났다. 특히, 자산형성 초기 단계에 해당하는 25~34세 가구는 전ㆍ월세 보증금 비중이 확대되는 가운데 금융부채가 가장 빠른 속도로 늘어나고 있다. 35~44세 가구도 주택구입 및 임차보증금 마련을 위한 대출을 중심으로 금융부채가 빠른 증가세를 보이고 있다.

부동산가격 상승의 영향을 평가해보면 먼저 심화된 부의 격차가 지속될 가능성이 크다. 부는 소득에 비해 계층 간 이동성이 낮은 경향을 나타내는데 이는 부의 측면에서 심화된 계층 간 격차가 고착화될 가능성을 시사한다. 자산형성 과정에서 소득의 역할이 작아지고 있는 점도 부의 불평등을 지속시키는 요인으로 작용할 수 있다. 다음으로 주택 관련 대출이 빠른 속도로 늘어난 25~44세 가구는 부채의 질과 구성이 악화되는 모습이다. 금리상승에 대한 위험이 높아진 가운데 과다차입 가구 비중이 확대되며 부채의 질이 악화되고 있다. 이에 더하여 25~44세 가구의 순자산 하위 그룹은 주택구입을 위한 대출 비중이 크게 축소된 반면 임차보증금 마련을 위한 대출 비중은 빠르게 확대되었다. 순자산 규모에 따라 주택 관련 대출 용도가 차별적으로 나타난다는 점에서 25~44세 가구의 부채는 구성적인 측면에서도 악화되는 모습이다.

향후 정책운영에 있어 국내 가계가 부동산을 자산증식의 주된 수단으로 활용하는 특성을 고려할 필요가 있다. 부동산시장 관련 정책적 관심을 주거 안정의 측면뿐 아니라 부의 분배적 측면에도 확대할 필요가 있다. 한편 주택시장을 중심으로 금융취약성이 높아지지 않도록 노력이 필요하다. 향후 부동산가격 하락 압력이 높아질 것으로 예상되는 가운데 금융불균형 축적으로 인해 주택시장 충격이 실물경기 위축으로 이어질 위험이 크다. 따라서 주택시장의 전개 상황 및 위험요인에 대한 면밀한 모니터링이 필요하다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 최근 부동산가격 상승기 가계 자산 및 부채의 변화를 분석한다. 먼저 가계 총량 지표의 변화를 살펴본 후, 마이크로데이터를 활용하여 가구 특성에 따른 자산과 부채 변화의 특징을 비교ㆍ분석한다. Ⅲ장에서는 부동산가격 상승이 가계에 미친 영향을 평가한다. 이를 바탕으로 Ⅳ장에서는 시사점을 도출한다.

Ⅱ. 최근 부동산가격 상승기 가계 자산 및 부채의 변화

1. 가계 총량 지표4) 분석

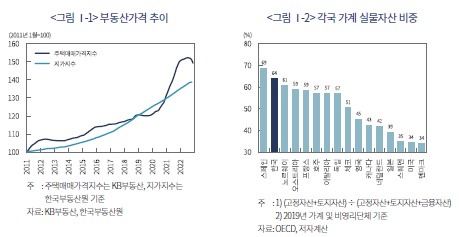

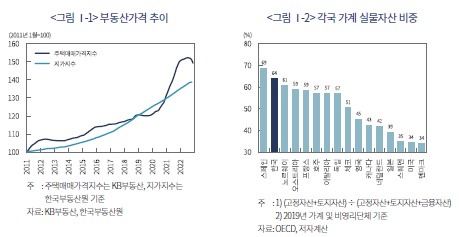

먼저 가계 총량 지표를 살펴보면 최근 수년간 소득에 비해 자산과 부채가 빠르게 증가하고 있음을 확인할 수 있다(<그림 Ⅱ-1> 참조). 가계 소득이 완만한 증가세를 이어가는 데 반해 자산과 부채는 2010년대 중반 이후 빠른 속도로 늘어나며 유량(flow) 변수와 저량(stock) 변수 간 격차가 확대되고 있다.5) 특히 2020년 코로나19 팬데믹 이후 그 격차가 더욱 확대되는 모습이다.

가계의 자산 규모가 부채 규모를 크게 상회함에 따라 부채 증가율이 높았음에도 불구하고 가계 순자산은 빠른 속도로 증가하였다.6) 소득 대비 순자산 배율은 2010년대 중반까지 8배 내외 수준을 지속하였으나 이후 빠르게 상승하여 2021년에는 10배까지 높아졌다(<그림 Ⅱ-2> 참조). 이러한 지표들은 가계의 부가 소득보다는 자산가격 상승에 주로 기인하여 늘어나고 있음을 시사한다.

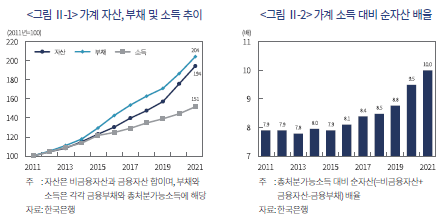

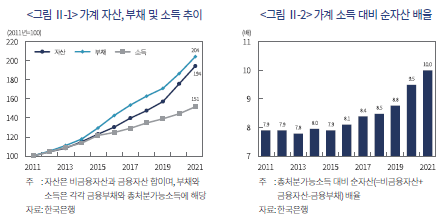

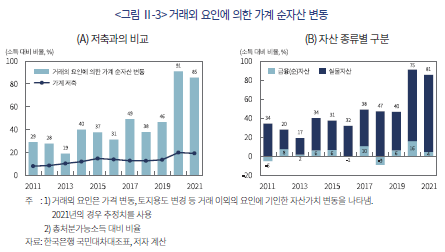

가계의 부는 소득, 소비 등 경제활동에 따른 저축뿐 아니라 보유자산의 가치 변동에 의해서도 크게 영향을 받는다.7) <그림 Ⅱ-3> (A)는 가격 변동 등 거래외 요인에 의한 가계 순자산 증감과 가계 저축을 비교하고 있는데 최근 들어 자산가격 상승의 영향이 저축에 비해 크게 확대되었음을 확인할 수 있다. 코로나19로 인한 소비 제약 등으로 2020년 이후 저축이 상당 규모 늘어났음에도 불구하고 자산가치 상승에 기인한 부의 증가가 이를 크게 상회한다는 점은 주목할 만하다.

거래외 요인에 의한 가계 순자산 변동을 자산 종류별로 구분해 보면 대부분 실물자산이 차지하고 있는데, 부동산가격 상승에 따른 자산가치 증가가 최근 들어 크게 확대되는 모습이다.(<그림 Ⅱ-3> (B) 참조). 실물자산 가격상승에 기인한 가계 순자산 증가는 2011~2016년 소득의 28%(연평균) 수준에서 2017~2019년에는 42%, 2020~2021년에는 78%로 지속적으로 확대되고 있다. 가계 실물자산이 대부분 건물과 토지로 구성되어 있음을 감안할 때8) 부동산가격 상승이 가계 순자산의 증가를 견인한 것으로 판단된다.

2. 가구 자산ㆍ부채의 미시적 분석

Ⅱ장 1절에서 부동산가격 상승기에 가계 순자산 총량이 크게 늘어났음을 확인할 수 있었다. 그렇지만 부동산가격 상승이 개별 가계에 미치는 영향을 면밀하게 파악하기 위해서는 부의 증가가 가계 전반에 걸쳐 균등하게 나타났는지, 부채 증가가 특정 그룹에 집중되지 않았는지 등 미시적인 관점에서도 분석할 필요가 있다. 가계의 자산 및 부채 구성이 상이한 경우, 개별 가구의 재무상황은 총량 지표와는 크게 다른 모습으로 변화할 수 있기 때문이다.

이에 Ⅱ장 2절에서는 가계금융복지조사 마이크로데이터를 활용하여 부동산가격 상승의 영향이 가구 특성에 따라 어떻게 차별화되었는지를 분석한다.9) 가계의 미시적 재무건전성 파악 등을 위해 통계청은 2012년부터 매년 2만 표본가구를 대상으로 가계금융복지조사를 실시하고 있다.10) 가계금융복지조사의 자산 및 부채 항목은 조사연도 3월말 시점을 기준으로, 소득과 원리금상환액은 전년을 기준으로 각각 작성된다.11)

가. 순자산 그룹별 분석

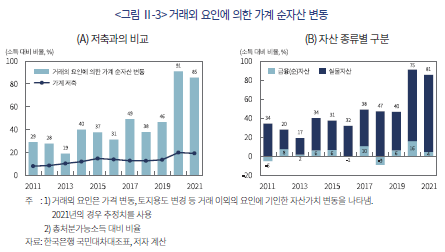

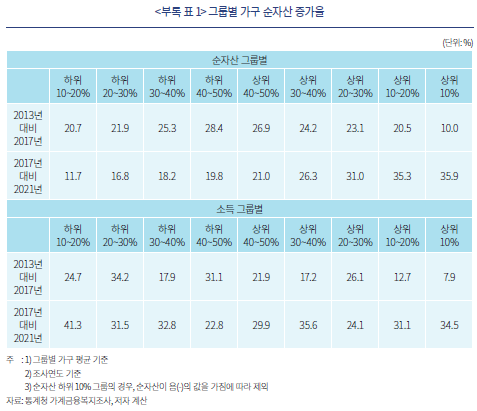

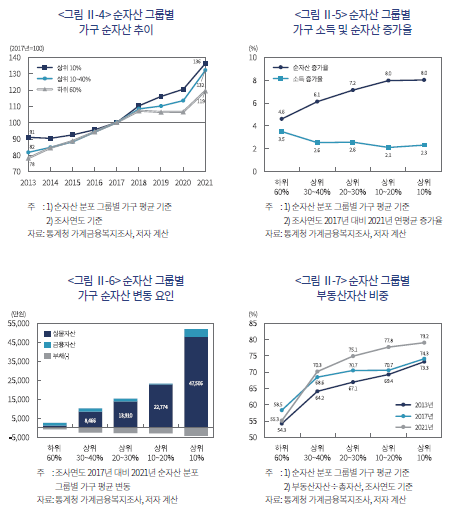

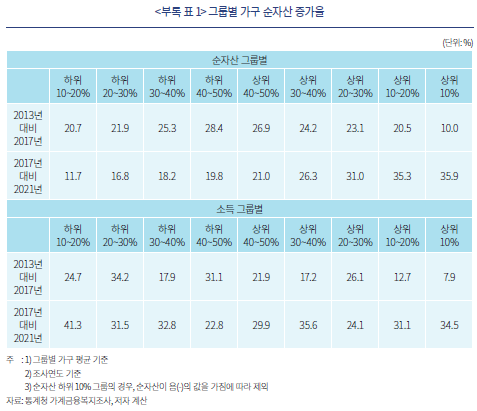

순자산을 기준으로 구분하여 살펴보면, 최근 순자산 상위 가구를 중심으로 부가 빠르게 증가하는 모습이다(<그림 Ⅱ-4> 참조). 2017년 대비 2021년 순자산 증가율은 상위 10%와 10~40% 가구가 각각 36%, 32%를 기록한 데 반해 하위 60% 가구는 이보다 낮은 19%에 그쳤다.12)

이와 같이 가계의 부가 불균등하게 늘어난 원인을 살펴보면 소득보다는 자산가격 상승이 부의 변화에 미친 영향력이 더 컸던 데 기인한다. <그림 Ⅱ-5>는 순자산 그룹별로 가구 소득과 순자산 증가율을 비교하고 있다. 가구 전반에 걸쳐 순자산이 소득에 비해 높은 증가세를 나타내고 있으나 그 정도는 순자산 규모에 따라 달라진다. 순자산 상위 가구는 하위 가구보다 소득 증가율이 낮았으나 순자산 증가율은 더 높았다. 이러한 결과는 자산가격 상승의 효과가 상위 가구에 더 강하게 작용하였음을 보여준다.

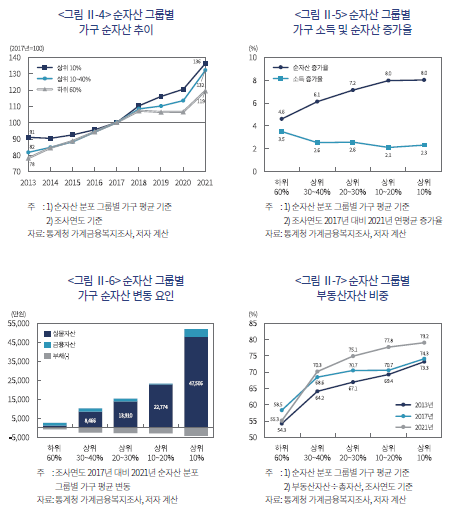

가계의 부가 불균등하게 늘어난 원인을 살펴보기 위해 순자산 변동을 대차대조표의 각 요인으로 분해하여 그룹별로 비교해 보았다.13) <그림 Ⅱ-6>은 2017년 이후 순자산 변동을 실물자산, 금융자산 및 부채 요인으로 분해하여 그룹별로 비교하고 있다. 그룹별 순자산 변동 규모가 크게 상이한 가운데 실물자산이 변동 요인의 대부분을 차지하고 있다. 순자산 상위 40% 가구는 실물자산이 큰 폭으로 늘어났는데, 상위 10%와 10~20% 가구의 실물자산 증가 규모는 각각 4.8억원, 2.3억원에 달한다. 반면 하위 60% 가구의 실물자산 증가는 이들 가구에 비해 미미한 수준에 그치고 있다. 이를 통해 가계의 부가 불균등하게 증가한 주요인은 실물자산임을 확인할 수 있다.

우리나라 가계는 순자산 상위 가구일수록 부동산자산 비중이 높은 특성을 나타낸다. <그림 Ⅱ-7>은 가계 자산에서 부동산이 차지하는 비중을 순자산 그룹별로 비교하고 있다. 부동산가격 상승으로 모든 그룹에서 최근 동 비중이 높아지는 경향을 나타내나 분석기간 전반에 걸쳐 순자산이 많은 그룹에서 부동산자산 비중이 높은 모습을 보인다. 이로 인해 부동산가격 상승에 기인한 자산 증가는 그 효과가 상위 가구에 집중되어 가계 간 부의 격차를 확대하는 요인으로 작용한다.

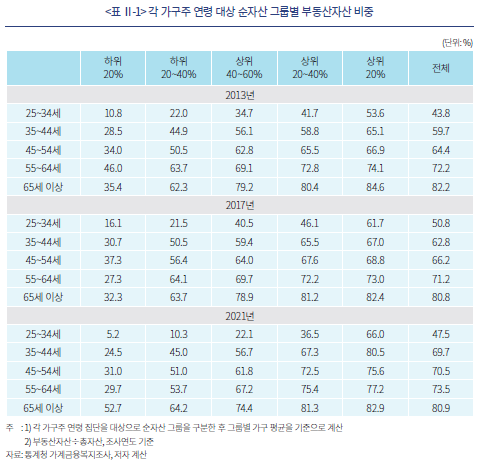

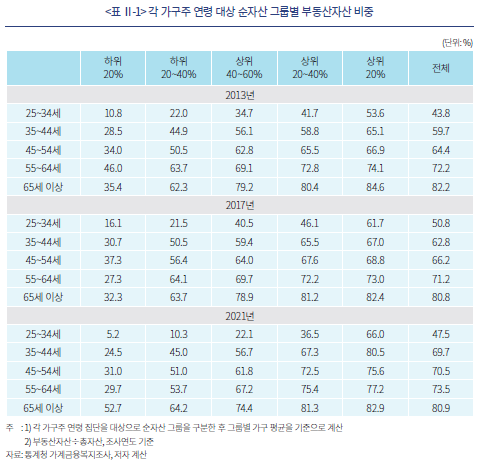

한편 가계의 자산구성을 더 자세히 살펴보기 위해 가구주 연령 및 순자산 규모에 따라 그룹을 세분화하여 부동산자산 비중을 비교해 보았다. <표 Ⅱ-1>은 가구주 연령을 기준으로 분류한 후, 동일 연령 집단을 다시 순자산 기준 5개 그룹으로 구분하여 각 그룹의 자산에서 부동산이 차지하는 비중을 비교하고 있다. 연령이 높아짐에 따라 대체로 부동산자산 비중이 확대될 뿐 아니라, 각 연령대에서 순자산이 늘어날수록 부동산 비중이 확대되는 것을 확인할 수 있다. 이는 우리나라 가계가 부동산을 부의 증식 수단으로 적극적으로 활용하고 있음을 의미한다. 이러한 특성으로 인해 가계 부의 분포는 부동산가격 변동에 크게 영향을 받는다.

최근 들어 자산가격 변화가 부의 불평등에 미치는 영향에 관심이 높아지고 있다. 미국 가계의 경제적 불평등을 연구한 Kuhn et al.(2020)은 가계 자산구성(portfolio composition) 및 레버리지가 부의 분포에 따라 상이한 모습을 나타내며, 이로 인해 자산가격 변동이 부의 불평등도 변화에 주요인으로 작용하고 있음을 강조하였다. 미국, 프랑스, 스페인 등 주요국의 경우 순자산 그룹별 가계 자산구성이 우리나라와 크게 다른 모습을 나타내는데, 순자산 상위 가구일수록 주식 등 금융자산 비중이 높은 반면 중하위 가구에서는 부동산자산 비중이 높은 특성을 보인다. 이에 따라 이들 국가에서는 부동산가격 상승이 부의 불평등도를 완화하는 요인으로 작용하는 데 반해 주식가격 상승은 주로 순자산 상위 가구의 부를 증가시키는 요인으로 작용한다(Kuhn et al., 2020; Garbinti et al., 2021; Martinez-Toledano, 2020). 6개 선진국을 대상으로 금융위기 이후 금리 및 자산가격 변동이 가계 자산과 부채에 미치는 영향을 분석한 Domanski et al.(2016)도 유사한 결과를 도출하였다.14)

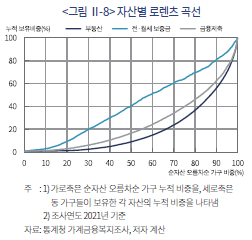

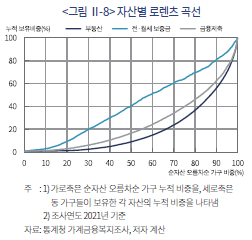

따라서 부의 분포에 따라 가계 자산이 어떻게 구성되어 있는지, 그리고 어느 자산에 부가 집중되어 있는지를 살펴보는 것은 자산가격 변동이 부의 불평등도에 미치는 영향을 이해하는 데 있어 중요성이 높다. <그림 Ⅱ-8>은 각 자산의 가계 간 분배 정도를 부의 분포에 따라 비교하고 있다. 그림의 가로축은 순자산을 기준으로 오름차순으로 정렬한 가구의 누적 비중을, 세로축은 동 가구들이 보유한 각 자산의 누적 비중을 나타낸다. 예를 들어 가로축 60%에 해당하는 세로축 값은 순자산 하위 60%가 보유하고 있는 각 자산의 비중을 의미한다.

그림을 통해 우리나라는 부동산자산이 매우 불균등하게 분포되어 있음을 확인할 수 있다. 2021년 기준 순자산 하위 60% 가구가 전체 부동산자산의 14.4%를 소유하고 있는 데 반해 상위 40% 가구가 소유한 비중은 85.6%에 달한다. 반면 임차보증금의 경우 하위 가구의 비중이 현저히 높게 나타나는데, 하위 60% 가구가 전체 전ㆍ월세보증금의 51.0%를 보유하고 있다.15) 순자산 상위 가구를 중심으로 부동산을 보유하고 있는 가계 자산구성의 특성은 부동산가격 상승에 따른 자산 증가 효과가 상위 가구에 집중됨을 시사하고 있다.

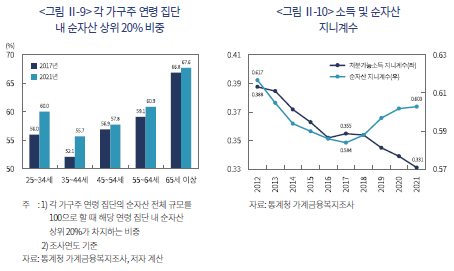

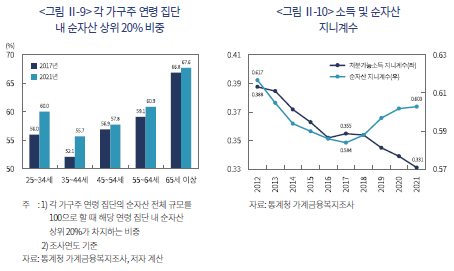

부동산가격 상승이 부를 불균등하게 증가시킴에 따라 가계 간 부의 격차가 확대되고 있다. <그림 Ⅱ-9>는 각 가구주 연령 집단의 순자산 전체 규모를 100으로 할 때 해당 연령 집단 내 순자산 상위 20%가 차지하는 비중을 나타낸다. 최근 부동산가격 상승기를 거치며 모든 연령 집단에서 상위 20%의 비중이 확대되며 부의 집중도가 높아지는 모습을 관찰할 수 있다. 특히 주택소유율이 상대적으로 낮은 25~44세 집단의 경우, 다른 연령 집단보다 상위 20%의 비중이 더 큰 폭으로 확대되었다.

소득 측면에서의 불평등이 꾸준히 완화되고 있음에도 불구하고 부의 불평등도는 최근 들어 악화되는 모습이다. 처분가능소득 지니계수의 지속적인 하락을 통해 소득 불평등도가 완화되고 있음을 확인할 수 있으나 순자산 지니계수는 오히려 2017년 이후 상승세로 전환하였다(<그림 Ⅱ-10> 참조).16) 이러한 결과는 부동산 중심의 자산가격 상승이 부의 격차를 확대하는 요인으로 더 강하게 작용하고 있음을 의미한다.

나. 가구주 연령 그룹별 분석

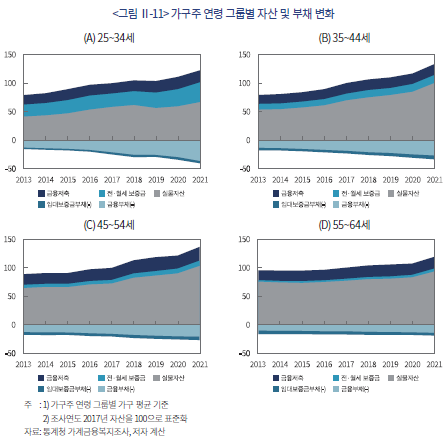

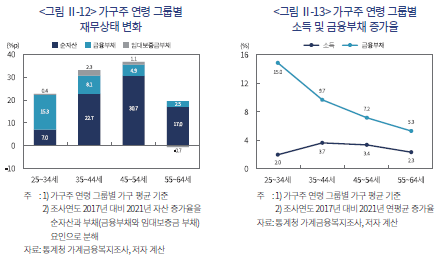

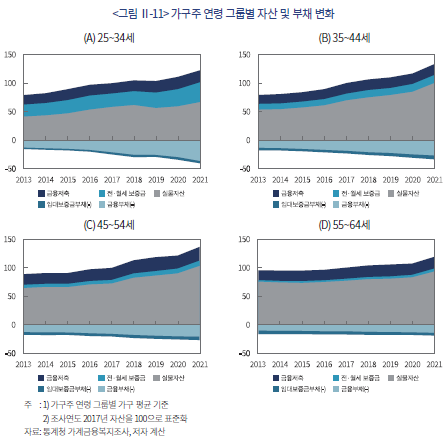

부동산가격 상승이 가계 재무구조에 미치는 영향은 세대별로도 크게 차별화되어 나타나고 있다. <그림 Ⅱ-11>은 가계 자산과 부채의 변화를 가구주 연령 그룹에 따라 비교하고 있다. 주택소유율이 낮고 자산형성 초기 단계에 해당하는 25~34세 가구는 전ㆍ월세 보증금 비중이 확대되는 가운데 금융부채가 가장 빠른 속도로 늘어나고 있다.17) 특히 여타 연령 그룹의 경우 부동산가격 상승으로 실물자산이 큰 폭 늘어난 데 반해, 상대적으로 부동산 비중이 낮은 25~34세 가구는 실물자산 증가가 소폭에 그쳤다. 한편 35~44세 가구도 주택구입 및 임차보증금 마련을 위한 대출을 중심으로 금융부채 증가세가 높은 편이나 부동산가격 상승으로 실물자산 가치도 늘어나면서 자산과 부채가 함께 증가하는 모습이다.

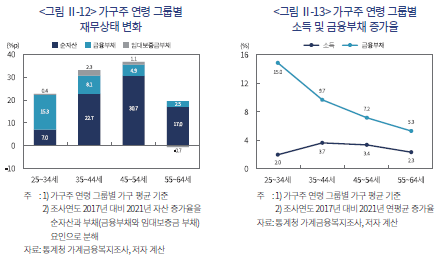

<그림 Ⅱ-12>는 2017년 대비 2021년 가구 자산 증가율을 순자산과 부채 요인으로 분해하여 세대별 재무상태의 변화를 비교하고 있는데, 가구주 연령이 낮은 그룹일수록 금융부채 의존도가 높아지는 모습을 확인할 수 있다. 먼저 25~34세 가구는 금융부채에 주로 기인하여 자산이 증가하였으며 다른 연령 그룹에 비해 순자산의 기여도가 크게 낮다. 35~44세 가구의 경우 대차대조표 확대에 있어 부채의 기여도가 적은 편이 아니나 부동산가격 상승에 따른 순자산의 기여도가 더 크게 나타나고 있다. 그러나 소득에 비해 금융부채가 훨씬 빠른 속도로 늘어났다는 점에서 25~44세 가구는 금리위험에 대한 노출도가 높아진 상황이다(<그림 Ⅱ-13> 참조).

Ⅲ. 부동산가격 상승의 영향 평가

1. 부의 격차: 심화된 격차가 지속될 가능성

부는 소득에 비해 가계 간 불평등도가 높을 뿐 아니라 계층 간 이동성 측면에서도 낮은 경향을 나타낸다. 최근 부동산가격 상승으로 순자산 상위 가구의 부가 더 크게 증가하였는데 이로 인해 심화된 부의 격차가 지속될 가능성이 크다.

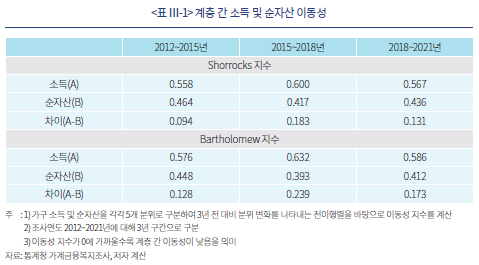

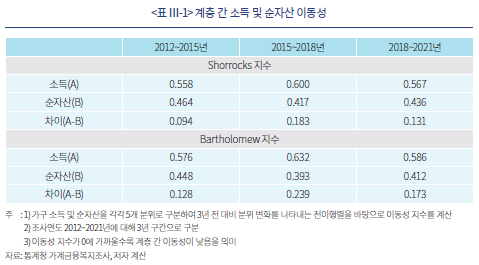

<표 Ⅲ-1>은 분위별 전이행렬(transition matrix)을 바탕으로 계산한 계층 간 소득 및 순자산 이동성 지수를 나타낸다. 전이행렬은 가구 소득과 순자산을 각각 5개 분위로 구분하여 3년 전 대비 분위 변화를 반영한다. Shorrocks 지수(Shorrocks, 1978)는 전이행렬의 대각 요소를 이용하여 분위 간 이동이 발생하는 비율을 나타내나 이동성의 크기가 고려되지 않는 단점이 있다. 반면 Bartholomew 지수(Bartholomew, 1967)는 분위 간 이동성 크기에 가중치를 부여하여 이동성의 확률뿐 아니라 거리를 함께 고려한다.18) 동 지표들은 0에 가까울수록 이동성이 낮음을 의미하는데, 분위 간 이동성이 전혀 없는 경우 0의 값을 갖는다.

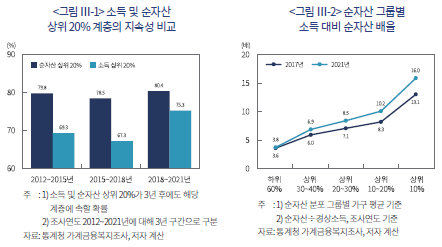

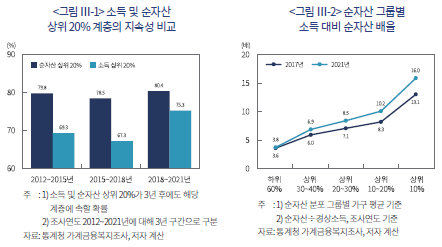

소득과 순자산에 대해 각각 계산한 이동성 지수를 비교해보면, 분석기간 전반에 걸쳐 순자산에서 더 작은 값을 기록하고 있다. 이를 통해 소득에 비해 순자산의 계층 간 이동성이 더 제한적임을 확인할 수 있다. <그림 Ⅲ-1>은 소득 및 순자산 상위 20% 계층이 3년 후에도 해당 계층에 속할 확률을 비교하고 있는데, 소득에 비해 순자산의 계층 지속성이 더 높은 모습을 나타낸다. 이와 같은 결과들은 부의 측면에서 심화된 계층 간 격차가 고착화될 가능성을 시사한다.

이와 함께 자산형성 과정에서 소득의 역할이 작아지고 있는 점도 부의 불평등을 지속시키는 요인으로 작용한다. 자산가격 상승으로 소득 대비 순자산 배율이 높아지는 경우, 부의 변화에 있어 저축의 중요성이 낮아진다(Kuhn et al., 2020). <그림 Ⅲ-2>는 순자산 그룹별로 가구 소득 대비 부의 배율을 나타낸다. 동 배율이 최근 순자산 상위 가구를 중심으로 높아지고 있다는 점에서 저축에 비해 자산가격 변동의 중요성이 더 커지는 모습이다. 이러한 변화는 소득과 부의 변화 간 상관관계를 약화시킬 가능성이 크다.

2. 25~44세 가구의 부채: 질과 구성의 악화

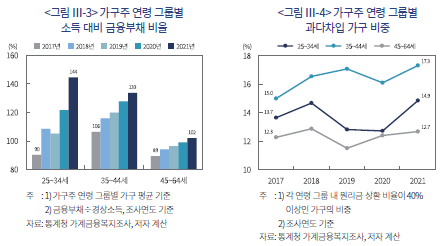

주택 구입 및 임차보증금 마련을 위한 대출 비중이 높은 25~44세(가구주 연령 기준) 가구는 최근 부동산가격 상승으로 소득에 비해 금융부채가 더 빠른 속도로 늘어나고 있다. 이로 인해 금리상승에 대한 위험이 높아진 가운데 과다차입 가구 비중이 확대되며 부채의 질이 악화되고 있다.

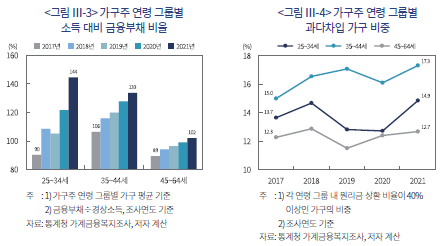

<그림 Ⅲ-3>은 가구주 연령 그룹별 소득 대비 금융부채 비율을 비교하고 있다. 자산축적 규모가 상대적으로 적은 25~44세 가구는 부채에 대한 의존도가 높은데 부동산가격 상승기와 맞물려 이들 가구의 금융부채 비율이 빠르게 높아지고 있다. 45~64세 가구의 경우 동 비율이 완만하게 상승하여 2021년 102%를 기록한 데 반해, 25~34세와 35~44세 가구는 상승폭이 확대되며 각각 144%, 133%까지 높아졌다.

금융부채의 빠른 증가로 25~44세 가구의 원리금 상환 부담이 커지고 있는데 과다차입 가구 비중이 확대되며 부채의 질이 나빠지는 모습이다(<그림 Ⅲ-4> 참조). 이들 가구는 과다한 부채로 인해 금리상승에 대한 취약성이 높아진 상황으로 2021년 하반기 이후 진행되고 있는 가파른 금리 상승세가 재무건전성 악화 요인으로 작용할 전망이다.

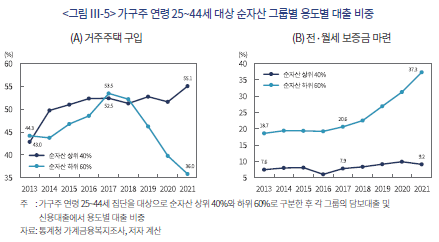

한편, 부동산가격 상승은 25~44세 가구의 대출 총량뿐 아니라 그 구성에도 영향을 미쳤다. 순자산 그룹에 따라 용도별 대출 비중을 비교해보면 상위그룹과 하위그룹이 크게 다른 모습이다. <그림 Ⅲ-5>는 25~44세 가구를 순자산 상위 40%와 하위 60% 그룹으로 구분한 후, 각 그룹의 담보대출 및 신용대출에서 거주주택 구입을 위한 대출과 임차보증금 마련 대출이 차지하는 비중을 비교하고 있다.

먼저 거주주택 구입을 위한 대출 비중을 살펴보면, 하위 60% 가구는 2017년 이후 큰 폭의 하락세가 지속되고 있는데 이는 상위 40% 가구의 경우 대체로 증가세를 이어가고 있는 모습과 대조된다. 반면, 전ㆍ월세 보증금 마련을 위한 대출의 비중은 하위 60% 가구에서 빠르게 확대되고 있다. 이러한 결과는 부동산가격 상승으로 하위 가구의 주택 구입 접근성이 위축되었음을 의미한다. 순자산 규모에 따라 주택 관련 대출 용도가 차별적으로 나타낸다는 점에서 25~44세 가구의 부채는 구성적인 측면에서도 악화되는 모습이다.19)

Ⅳ. 요약 및 시사점

본 보고서는 부동산가격 상승이 가계 자산과 부채에 미친 영향을 미시적인 관점에서 분석하였다. 최근 수년간 소득보다는 부동산가격 상승이 부의 변화에 더 중요한 요인으로 작용하였다. 우리나라 가계는 순자산 상위 가구일수록 부동산자산 비중이 높은 특성을 나타내는데 이로 인해 부동산가격의 가파른 상승은 상위 가구의 부를 더 크게 늘림으로써 가계 간 부의 격차를 확대하는 요인으로 작용한다. 한편 주택소유율이 상대적으로 낮은 25~44세 가구는 주택 관련 대출이 빠른 속도로 늘어나는 가운데 부채의 질과 구성이 악화되는 모습이다.

부동산을 자산증식의 주된 수단으로 활용하는 우리나라 가계의 특성을 정책운영에 고려할 필요가 있다. 경제활동을 통한 소득 창출에 비해 자산가격 변화는 단기간에 부의 분포를 변화시킨다. 순자산 상위 가구를 중심으로 부동산을 보유하고 있는 가계 자산구성의 특성으로 인해 부동산가격은 부의 불평등도 변화에 큰 영향을 미친다. 특히 계층 간 이동성 측면에서 부는 소득에 비해 낮은 경향을 나타내는데 부동산가격 상승으로 인해 심화된 부의 격차가 쉽게 완화되지 않고 지속될 가능성이 크다. 따라서 부동산시장 관련 정책적 관심을 주거 안정의 측면뿐 아니라 부의 분배적 측면에도 확대할 필요가 있다.

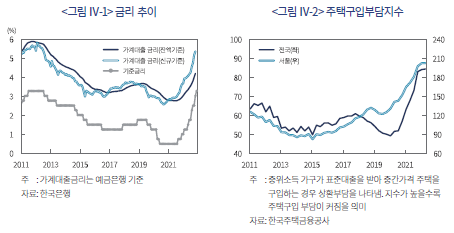

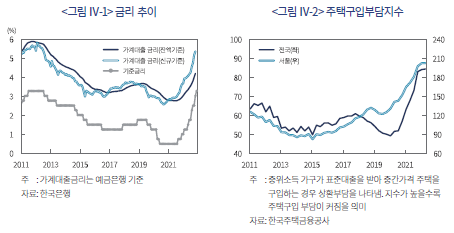

한편 주택시장을 중심으로 금융취약성이 높아지지 않도록 노력이 필요하다. 물가상승 압력에 대응하여 기준금리 인상 기조가 이어지면서 가계대출 금리가 가파른 상승세를 나타내고 있다. 소득에 비해 부동산가격이 크게 높아진 상황에서 금융환경의 긴축적 변화로 인한 주택구입 부담 증가, 경기둔화 우려 등으로 부동산가격 하락 압력이 높아질 것으로 예상된다.20) 주택시장을 중심으로 축적된 금융불균형으로 인해 주택시장 충격이 실물경기 위축으로 이어질 위험이 크다. 따라서 주택시장의 전개 상황 및 위험요인에 대한 면밀한 모니터링이 필요하다. 특히, 금융부채가 빠른 속도로 늘어난 25~44세 가구가 향후 재무건전성 악화로 경제의 취약고리로 작용할 가능성에 대한 대비가 필요하다.

1) 본 보고서에서는 부를 순자산(=자산-부채)과 동일한 의미로 사용한다.

2) 부동산가격이 2022년 중반 이후 하락세를 나타내고 있으나 수년 전에 비해서는 여전히 크게 높은 수준이다.

3) 회계학에서는 ‘balance sheet’을 ‘재무상태표’라는 용어로 사용하고 있다. 그러나 ‘대차대조표’라는 용어가 관용적으로 사용되는 점을 감안하여 본 보고서에서는 ‘대차대조표’로 사용한다.

4) 가계 총량 지표는 ‘가계 및 비영리단체’를 기준으로 편제됨에 따라 비영리단체를 포함한다. 한편, 가계 총량 지표에서는 개인 간 임대차 계약에 따른 보증금 자산과 부채가 제외되어 있다는 점에 유의할 필요가 있다.

5) 유량 변수는 소득, 소비와 같이 일정 기간 동안 변화 또는 발생한 양을 측정한다. 반면 자산, 부채와 같은 저량 변수는 특정 시점에서의 규모를 나타낸다.

6) 2021년 기준 가계가 보유한 총 자산(1경 3,837조원)은 부채(2,245조원)의 6.2배에 달한다. 이에 따라 자산에 비해 부채 증가율이 상대적으로 높았음에도 불구하고 가계 순자산은 소득에 비해 빠른 속도로 증가하였다. 2011년 순자산 규모를 100으로 했을 때 2021년 순자산 규모는 192에 해당한다.

7) 한편 대출 등 부채가 발생하는 경우 동일 규모의 자산이 동시에 늘어나므로 순자산은 변화하지 않는다. 금융자산을 이용하여 실물자산을 구입하는 경우에도 자산 구성이 변화할 뿐 순자산은 변화하지 않는다.

8) 가계 실물자산 중 건설자산 및 토지자산의 비중은 98%로 거의 대부분을 차지하고 있다(2008~2021년).

9) 본 보고서는 2021년까지의 가계금융복지조사 결과를 활용하여 분석하였다.

10) 가계금융복지조사는 표본조사 결과로 작성되는데, 전수조사 방식이 아니라는 점에서 최상위 계층이 과소 추정될 가능성이 존재한다.

11) 예를 들어, 2021년 가계금융복지조사의 자산과 부채는 2021년 3월말 시점을 기준으로 작성되며 소득과 원리금상환액은 2020년을 기준으로 작성된다.

12) 순자산 및 소득 그룹을 세분화하여 분석한 가구 순자산 증가율은 <부록 표 1>을 참고

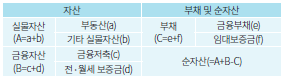

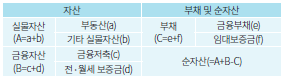

13) 가계금융복지조사를 바탕으로 가계 대차대조표를 아래와 같이 구성할 수 있는데 본 보고서에서 사용한 각 항목의 정의는 이와 같다.

14) Domanski et al.(2016)은 6개 국가(프랑스, 독일, 이탈리아, 스페인, 영국, 미국) 가계 서베이 조사를 바탕으로 시뮬레이션 분석을 통해 주식가격 상승이 부의 불평등을 악화시키는 요인으로 작용한 반면, 주택가격 회복은 불평등을 완화하는 효과가 있었음을 확인하였다.

15) 부동산가격 상승으로 2021년 자산 집중도가 소폭 변화하였으나 부동산가격 상승기 이전에 비해 큰 차이를 나타내는 것은 아니다. 2017년 기준 순자산 하위 60% 가구는 부동산자산의 17.4%를, 전ㆍ월세보증금의 45.2%를 보유하였다.

16) 지니계수는 경제적 불평등도를 측정하는 지표로서 계수가 높아질수록 불평등의 정도가 심화됨을 의미한다. 처분가능소득 지니계수는 소득의 불평등도를, 순자산 지니계수는 부의 불평등도를 각각 나타낸다.

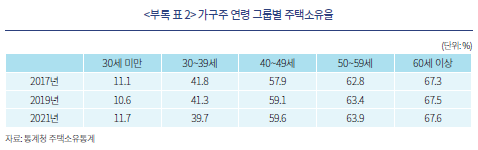

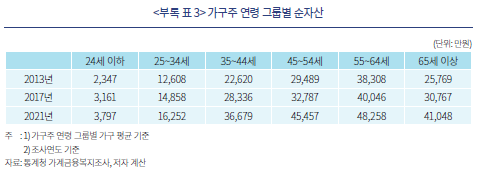

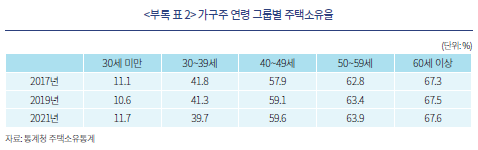

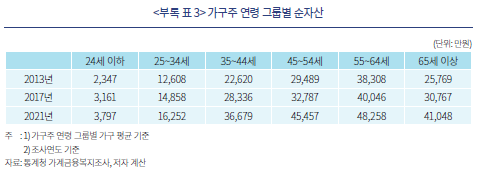

17) 가구주 연령 그룹별 주택소유율 및 순자산은 각각 <부록 표 2>와 <부록 표 3>을 참조

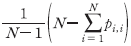

18) N×N 전이행렬의 (i, j) 요소를 로 정의할 때, Shorrocks 지수와 Bartholomew 지수는 각각

로 정의할 때, Shorrocks 지수와 Bartholomew 지수는 각각  ,

,  와 같이 계산된다.

와 같이 계산된다.

19) 소득을 기준으로 구분하여 살펴보면(<부록 그림 1> 참조) 순자산을 기준으로 구분한 경우에 비해 상ㆍ하위 그룹 간 차이가 크게 약화되는 모습이다. 이는 소득보다는 순자산이 주택 구입 가능성에 더 중요한 요인으로 작용하였음을 의미한다.

20) IMF(2022)는 고평가된 주택가격 수준, 향후 경제전망 악화가 주택가격의 하방 위험을 높이는 주요인으로 작용할 수 있다고 분석하였다.

참고문헌

Bartholomew, D. J., 1967, Stochastic models for social processes, Wiley: Chichester.

Domanski, D., Scatigna, M., Zabai, A., 2016, Wealth inequality and monetary policy, BIS Quarterly Review March.

Garbinti, B., Goupille-Lebret, J., Piketty, T., 2021, Accounting for wealth-inequality dynamics: methods, estimates, and simulations for France, Journal of the European Economic Association 19(1), 620-663.

International Monetary Fund (IMF), 2022, Global Financial Stability Report (October).

Kuhn, M., Schularick, M., Steins, U. I., 2020, Income and wealth inequality in America, 1949-2016, Journal of Political Economy 128(9), 3469-3519.

Martinez-Toledano, C., 2020, House price cycles, wealth inequality and portfolio reshuffling, WID.world working paper.

Shorrocks, A. F., 1978, The measurement of mobility, Econometrica: Journal of the Econometric Society, 1013-1024.

최근 수년간 부동산가격의 가파른 상승으로 부동산자산 가치가 크게 늘어난 가운데 주택 관련 대출도 빠르게 증가하면서 가계 재무구조 변화에 관한 관심이 높아졌다. 우리나라 가계는 주요국에 비해 실물자산 비중이 높은 편이다. 이에 따라 총량(aggregate)적 측면에서 최근 부동산가격 상승은 실물자산을 중심으로 가계의 부(wealth)1)가 빠르게 늘어나는 핵심 요인으로 작용한다. 하지만 미시적 측면에서 부동산가격 상승이 개별 가구에 미치는 영향은 각 가구의 재무구조에 따라 다르게 나타날 수 있다. 특히 가구의 자산 및 부채 구성이 경제적 특성에 따라 이질적인(heterogeneous) 경우, 총량 지표만으로는 부동산가격 변화가 가계에 미치는 영향을 정확히 이해하는 데 크게 제한적일 수 있다.

이에 본 보고서는 가구 마이크로데이터를 활용하여 최근 부동산가격 상승이 가계 자산과 부채에 미친 영향을 미시적인 관점에서 분석한다.2) 가계 대차대조표(household balance sheet)3)를 활용하여 순자산 규모, 가구주 연령 등 가구별 특성에 따른 자산ㆍ부채 구성의 특징을 살펴본다. 이를 바탕으로 부동산가격 상승의 영향이 가구 특성에 따라 어떻게 차별화되었는지 분석하고 시사점을 도출한다.

우리나라 가계는 각 연령대에서 순자산이 늘어날수록 부동산 비중이 확대되는 특성을 나타내는데 이는 부동산이 부의 증식 수단으로 적극 활용되고 있음을 나타낸다. 이러한 특성으로 인해 부동산가격의 가파른 상승은 상위 가구의 부를 더 크게 늘림으로써 가계 간 부의 격차를 확대하는 요인으로 작용한다.

부동산가격 상승이 가계에 미치는 영향은 세대별로도 크게 차별화되어 나타나고 있다. 주택소유율이 상대적으로 낮은 25~44세(가구주 연령 기준) 가구는 최근 부동산가격 상승기를 거치며 금융부채가 빠른 속도로 늘어났다. 특히, 자산형성 초기 단계에 해당하는 25~34세 가구는 전ㆍ월세 보증금 비중이 확대되는 가운데 금융부채가 가장 빠른 속도로 늘어나고 있다. 35~44세 가구도 주택구입 및 임차보증금 마련을 위한 대출을 중심으로 금융부채가 빠른 증가세를 보이고 있다.

부동산가격 상승의 영향을 평가해보면 먼저 심화된 부의 격차가 지속될 가능성이 크다. 부는 소득에 비해 계층 간 이동성이 낮은 경향을 나타내는데 이는 부의 측면에서 심화된 계층 간 격차가 고착화될 가능성을 시사한다. 자산형성 과정에서 소득의 역할이 작아지고 있는 점도 부의 불평등을 지속시키는 요인으로 작용할 수 있다. 다음으로 주택 관련 대출이 빠른 속도로 늘어난 25~44세 가구는 부채의 질과 구성이 악화되는 모습이다. 금리상승에 대한 위험이 높아진 가운데 과다차입 가구 비중이 확대되며 부채의 질이 악화되고 있다. 이에 더하여 25~44세 가구의 순자산 하위 그룹은 주택구입을 위한 대출 비중이 크게 축소된 반면 임차보증금 마련을 위한 대출 비중은 빠르게 확대되었다. 순자산 규모에 따라 주택 관련 대출 용도가 차별적으로 나타난다는 점에서 25~44세 가구의 부채는 구성적인 측면에서도 악화되는 모습이다.

향후 정책운영에 있어 국내 가계가 부동산을 자산증식의 주된 수단으로 활용하는 특성을 고려할 필요가 있다. 부동산시장 관련 정책적 관심을 주거 안정의 측면뿐 아니라 부의 분배적 측면에도 확대할 필요가 있다. 한편 주택시장을 중심으로 금융취약성이 높아지지 않도록 노력이 필요하다. 향후 부동산가격 하락 압력이 높아질 것으로 예상되는 가운데 금융불균형 축적으로 인해 주택시장 충격이 실물경기 위축으로 이어질 위험이 크다. 따라서 주택시장의 전개 상황 및 위험요인에 대한 면밀한 모니터링이 필요하다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서는 최근 부동산가격 상승기 가계 자산 및 부채의 변화를 분석한다. 먼저 가계 총량 지표의 변화를 살펴본 후, 마이크로데이터를 활용하여 가구 특성에 따른 자산과 부채 변화의 특징을 비교ㆍ분석한다. Ⅲ장에서는 부동산가격 상승이 가계에 미친 영향을 평가한다. 이를 바탕으로 Ⅳ장에서는 시사점을 도출한다.

Ⅱ. 최근 부동산가격 상승기 가계 자산 및 부채의 변화

1. 가계 총량 지표4) 분석

먼저 가계 총량 지표를 살펴보면 최근 수년간 소득에 비해 자산과 부채가 빠르게 증가하고 있음을 확인할 수 있다(<그림 Ⅱ-1> 참조). 가계 소득이 완만한 증가세를 이어가는 데 반해 자산과 부채는 2010년대 중반 이후 빠른 속도로 늘어나며 유량(flow) 변수와 저량(stock) 변수 간 격차가 확대되고 있다.5) 특히 2020년 코로나19 팬데믹 이후 그 격차가 더욱 확대되는 모습이다.

가계의 자산 규모가 부채 규모를 크게 상회함에 따라 부채 증가율이 높았음에도 불구하고 가계 순자산은 빠른 속도로 증가하였다.6) 소득 대비 순자산 배율은 2010년대 중반까지 8배 내외 수준을 지속하였으나 이후 빠르게 상승하여 2021년에는 10배까지 높아졌다(<그림 Ⅱ-2> 참조). 이러한 지표들은 가계의 부가 소득보다는 자산가격 상승에 주로 기인하여 늘어나고 있음을 시사한다.

거래외 요인에 의한 가계 순자산 변동을 자산 종류별로 구분해 보면 대부분 실물자산이 차지하고 있는데, 부동산가격 상승에 따른 자산가치 증가가 최근 들어 크게 확대되는 모습이다.(<그림 Ⅱ-3> (B) 참조). 실물자산 가격상승에 기인한 가계 순자산 증가는 2011~2016년 소득의 28%(연평균) 수준에서 2017~2019년에는 42%, 2020~2021년에는 78%로 지속적으로 확대되고 있다. 가계 실물자산이 대부분 건물과 토지로 구성되어 있음을 감안할 때8) 부동산가격 상승이 가계 순자산의 증가를 견인한 것으로 판단된다.

Ⅱ장 1절에서 부동산가격 상승기에 가계 순자산 총량이 크게 늘어났음을 확인할 수 있었다. 그렇지만 부동산가격 상승이 개별 가계에 미치는 영향을 면밀하게 파악하기 위해서는 부의 증가가 가계 전반에 걸쳐 균등하게 나타났는지, 부채 증가가 특정 그룹에 집중되지 않았는지 등 미시적인 관점에서도 분석할 필요가 있다. 가계의 자산 및 부채 구성이 상이한 경우, 개별 가구의 재무상황은 총량 지표와는 크게 다른 모습으로 변화할 수 있기 때문이다.

이에 Ⅱ장 2절에서는 가계금융복지조사 마이크로데이터를 활용하여 부동산가격 상승의 영향이 가구 특성에 따라 어떻게 차별화되었는지를 분석한다.9) 가계의 미시적 재무건전성 파악 등을 위해 통계청은 2012년부터 매년 2만 표본가구를 대상으로 가계금융복지조사를 실시하고 있다.10) 가계금융복지조사의 자산 및 부채 항목은 조사연도 3월말 시점을 기준으로, 소득과 원리금상환액은 전년을 기준으로 각각 작성된다.11)

가. 순자산 그룹별 분석

순자산을 기준으로 구분하여 살펴보면, 최근 순자산 상위 가구를 중심으로 부가 빠르게 증가하는 모습이다(<그림 Ⅱ-4> 참조). 2017년 대비 2021년 순자산 증가율은 상위 10%와 10~40% 가구가 각각 36%, 32%를 기록한 데 반해 하위 60% 가구는 이보다 낮은 19%에 그쳤다.12)

이와 같이 가계의 부가 불균등하게 늘어난 원인을 살펴보면 소득보다는 자산가격 상승이 부의 변화에 미친 영향력이 더 컸던 데 기인한다. <그림 Ⅱ-5>는 순자산 그룹별로 가구 소득과 순자산 증가율을 비교하고 있다. 가구 전반에 걸쳐 순자산이 소득에 비해 높은 증가세를 나타내고 있으나 그 정도는 순자산 규모에 따라 달라진다. 순자산 상위 가구는 하위 가구보다 소득 증가율이 낮았으나 순자산 증가율은 더 높았다. 이러한 결과는 자산가격 상승의 효과가 상위 가구에 더 강하게 작용하였음을 보여준다.

가계의 부가 불균등하게 늘어난 원인을 살펴보기 위해 순자산 변동을 대차대조표의 각 요인으로 분해하여 그룹별로 비교해 보았다.13) <그림 Ⅱ-6>은 2017년 이후 순자산 변동을 실물자산, 금융자산 및 부채 요인으로 분해하여 그룹별로 비교하고 있다. 그룹별 순자산 변동 규모가 크게 상이한 가운데 실물자산이 변동 요인의 대부분을 차지하고 있다. 순자산 상위 40% 가구는 실물자산이 큰 폭으로 늘어났는데, 상위 10%와 10~20% 가구의 실물자산 증가 규모는 각각 4.8억원, 2.3억원에 달한다. 반면 하위 60% 가구의 실물자산 증가는 이들 가구에 비해 미미한 수준에 그치고 있다. 이를 통해 가계의 부가 불균등하게 증가한 주요인은 실물자산임을 확인할 수 있다.

우리나라 가계는 순자산 상위 가구일수록 부동산자산 비중이 높은 특성을 나타낸다. <그림 Ⅱ-7>은 가계 자산에서 부동산이 차지하는 비중을 순자산 그룹별로 비교하고 있다. 부동산가격 상승으로 모든 그룹에서 최근 동 비중이 높아지는 경향을 나타내나 분석기간 전반에 걸쳐 순자산이 많은 그룹에서 부동산자산 비중이 높은 모습을 보인다. 이로 인해 부동산가격 상승에 기인한 자산 증가는 그 효과가 상위 가구에 집중되어 가계 간 부의 격차를 확대하는 요인으로 작용한다.

따라서 부의 분포에 따라 가계 자산이 어떻게 구성되어 있는지, 그리고 어느 자산에 부가 집중되어 있는지를 살펴보는 것은 자산가격 변동이 부의 불평등도에 미치는 영향을 이해하는 데 있어 중요성이 높다. <그림 Ⅱ-8>은 각 자산의 가계 간 분배 정도를 부의 분포에 따라 비교하고 있다. 그림의 가로축은 순자산을 기준으로 오름차순으로 정렬한 가구의 누적 비중을, 세로축은 동 가구들이 보유한 각 자산의 누적 비중을 나타낸다. 예를 들어 가로축 60%에 해당하는 세로축 값은 순자산 하위 60%가 보유하고 있는 각 자산의 비중을 의미한다.

그림을 통해 우리나라는 부동산자산이 매우 불균등하게 분포되어 있음을 확인할 수 있다. 2021년 기준 순자산 하위 60% 가구가 전체 부동산자산의 14.4%를 소유하고 있는 데 반해 상위 40% 가구가 소유한 비중은 85.6%에 달한다. 반면 임차보증금의 경우 하위 가구의 비중이 현저히 높게 나타나는데, 하위 60% 가구가 전체 전ㆍ월세보증금의 51.0%를 보유하고 있다.15) 순자산 상위 가구를 중심으로 부동산을 보유하고 있는 가계 자산구성의 특성은 부동산가격 상승에 따른 자산 증가 효과가 상위 가구에 집중됨을 시사하고 있다.

소득 측면에서의 불평등이 꾸준히 완화되고 있음에도 불구하고 부의 불평등도는 최근 들어 악화되는 모습이다. 처분가능소득 지니계수의 지속적인 하락을 통해 소득 불평등도가 완화되고 있음을 확인할 수 있으나 순자산 지니계수는 오히려 2017년 이후 상승세로 전환하였다(<그림 Ⅱ-10> 참조).16) 이러한 결과는 부동산 중심의 자산가격 상승이 부의 격차를 확대하는 요인으로 더 강하게 작용하고 있음을 의미한다.

부동산가격 상승이 가계 재무구조에 미치는 영향은 세대별로도 크게 차별화되어 나타나고 있다. <그림 Ⅱ-11>은 가계 자산과 부채의 변화를 가구주 연령 그룹에 따라 비교하고 있다. 주택소유율이 낮고 자산형성 초기 단계에 해당하는 25~34세 가구는 전ㆍ월세 보증금 비중이 확대되는 가운데 금융부채가 가장 빠른 속도로 늘어나고 있다.17) 특히 여타 연령 그룹의 경우 부동산가격 상승으로 실물자산이 큰 폭 늘어난 데 반해, 상대적으로 부동산 비중이 낮은 25~34세 가구는 실물자산 증가가 소폭에 그쳤다. 한편 35~44세 가구도 주택구입 및 임차보증금 마련을 위한 대출을 중심으로 금융부채 증가세가 높은 편이나 부동산가격 상승으로 실물자산 가치도 늘어나면서 자산과 부채가 함께 증가하는 모습이다.

Ⅲ. 부동산가격 상승의 영향 평가

1. 부의 격차: 심화된 격차가 지속될 가능성

부는 소득에 비해 가계 간 불평등도가 높을 뿐 아니라 계층 간 이동성 측면에서도 낮은 경향을 나타낸다. 최근 부동산가격 상승으로 순자산 상위 가구의 부가 더 크게 증가하였는데 이로 인해 심화된 부의 격차가 지속될 가능성이 크다.

<표 Ⅲ-1>은 분위별 전이행렬(transition matrix)을 바탕으로 계산한 계층 간 소득 및 순자산 이동성 지수를 나타낸다. 전이행렬은 가구 소득과 순자산을 각각 5개 분위로 구분하여 3년 전 대비 분위 변화를 반영한다. Shorrocks 지수(Shorrocks, 1978)는 전이행렬의 대각 요소를 이용하여 분위 간 이동이 발생하는 비율을 나타내나 이동성의 크기가 고려되지 않는 단점이 있다. 반면 Bartholomew 지수(Bartholomew, 1967)는 분위 간 이동성 크기에 가중치를 부여하여 이동성의 확률뿐 아니라 거리를 함께 고려한다.18) 동 지표들은 0에 가까울수록 이동성이 낮음을 의미하는데, 분위 간 이동성이 전혀 없는 경우 0의 값을 갖는다.

이와 함께 자산형성 과정에서 소득의 역할이 작아지고 있는 점도 부의 불평등을 지속시키는 요인으로 작용한다. 자산가격 상승으로 소득 대비 순자산 배율이 높아지는 경우, 부의 변화에 있어 저축의 중요성이 낮아진다(Kuhn et al., 2020). <그림 Ⅲ-2>는 순자산 그룹별로 가구 소득 대비 부의 배율을 나타낸다. 동 배율이 최근 순자산 상위 가구를 중심으로 높아지고 있다는 점에서 저축에 비해 자산가격 변동의 중요성이 더 커지는 모습이다. 이러한 변화는 소득과 부의 변화 간 상관관계를 약화시킬 가능성이 크다.

2. 25~44세 가구의 부채: 질과 구성의 악화

주택 구입 및 임차보증금 마련을 위한 대출 비중이 높은 25~44세(가구주 연령 기준) 가구는 최근 부동산가격 상승으로 소득에 비해 금융부채가 더 빠른 속도로 늘어나고 있다. 이로 인해 금리상승에 대한 위험이 높아진 가운데 과다차입 가구 비중이 확대되며 부채의 질이 악화되고 있다.

<그림 Ⅲ-3>은 가구주 연령 그룹별 소득 대비 금융부채 비율을 비교하고 있다. 자산축적 규모가 상대적으로 적은 25~44세 가구는 부채에 대한 의존도가 높은데 부동산가격 상승기와 맞물려 이들 가구의 금융부채 비율이 빠르게 높아지고 있다. 45~64세 가구의 경우 동 비율이 완만하게 상승하여 2021년 102%를 기록한 데 반해, 25~34세와 35~44세 가구는 상승폭이 확대되며 각각 144%, 133%까지 높아졌다.

금융부채의 빠른 증가로 25~44세 가구의 원리금 상환 부담이 커지고 있는데 과다차입 가구 비중이 확대되며 부채의 질이 나빠지는 모습이다(<그림 Ⅲ-4> 참조). 이들 가구는 과다한 부채로 인해 금리상승에 대한 취약성이 높아진 상황으로 2021년 하반기 이후 진행되고 있는 가파른 금리 상승세가 재무건전성 악화 요인으로 작용할 전망이다.

먼저 거주주택 구입을 위한 대출 비중을 살펴보면, 하위 60% 가구는 2017년 이후 큰 폭의 하락세가 지속되고 있는데 이는 상위 40% 가구의 경우 대체로 증가세를 이어가고 있는 모습과 대조된다. 반면, 전ㆍ월세 보증금 마련을 위한 대출의 비중은 하위 60% 가구에서 빠르게 확대되고 있다. 이러한 결과는 부동산가격 상승으로 하위 가구의 주택 구입 접근성이 위축되었음을 의미한다. 순자산 규모에 따라 주택 관련 대출 용도가 차별적으로 나타낸다는 점에서 25~44세 가구의 부채는 구성적인 측면에서도 악화되는 모습이다.19)

Ⅳ. 요약 및 시사점

본 보고서는 부동산가격 상승이 가계 자산과 부채에 미친 영향을 미시적인 관점에서 분석하였다. 최근 수년간 소득보다는 부동산가격 상승이 부의 변화에 더 중요한 요인으로 작용하였다. 우리나라 가계는 순자산 상위 가구일수록 부동산자산 비중이 높은 특성을 나타내는데 이로 인해 부동산가격의 가파른 상승은 상위 가구의 부를 더 크게 늘림으로써 가계 간 부의 격차를 확대하는 요인으로 작용한다. 한편 주택소유율이 상대적으로 낮은 25~44세 가구는 주택 관련 대출이 빠른 속도로 늘어나는 가운데 부채의 질과 구성이 악화되는 모습이다.

부동산을 자산증식의 주된 수단으로 활용하는 우리나라 가계의 특성을 정책운영에 고려할 필요가 있다. 경제활동을 통한 소득 창출에 비해 자산가격 변화는 단기간에 부의 분포를 변화시킨다. 순자산 상위 가구를 중심으로 부동산을 보유하고 있는 가계 자산구성의 특성으로 인해 부동산가격은 부의 불평등도 변화에 큰 영향을 미친다. 특히 계층 간 이동성 측면에서 부는 소득에 비해 낮은 경향을 나타내는데 부동산가격 상승으로 인해 심화된 부의 격차가 쉽게 완화되지 않고 지속될 가능성이 크다. 따라서 부동산시장 관련 정책적 관심을 주거 안정의 측면뿐 아니라 부의 분배적 측면에도 확대할 필요가 있다.

한편 주택시장을 중심으로 금융취약성이 높아지지 않도록 노력이 필요하다. 물가상승 압력에 대응하여 기준금리 인상 기조가 이어지면서 가계대출 금리가 가파른 상승세를 나타내고 있다. 소득에 비해 부동산가격이 크게 높아진 상황에서 금융환경의 긴축적 변화로 인한 주택구입 부담 증가, 경기둔화 우려 등으로 부동산가격 하락 압력이 높아질 것으로 예상된다.20) 주택시장을 중심으로 축적된 금융불균형으로 인해 주택시장 충격이 실물경기 위축으로 이어질 위험이 크다. 따라서 주택시장의 전개 상황 및 위험요인에 대한 면밀한 모니터링이 필요하다. 특히, 금융부채가 빠른 속도로 늘어난 25~44세 가구가 향후 재무건전성 악화로 경제의 취약고리로 작용할 가능성에 대한 대비가 필요하다.

<부록>

1) 본 보고서에서는 부를 순자산(=자산-부채)과 동일한 의미로 사용한다.

2) 부동산가격이 2022년 중반 이후 하락세를 나타내고 있으나 수년 전에 비해서는 여전히 크게 높은 수준이다.

3) 회계학에서는 ‘balance sheet’을 ‘재무상태표’라는 용어로 사용하고 있다. 그러나 ‘대차대조표’라는 용어가 관용적으로 사용되는 점을 감안하여 본 보고서에서는 ‘대차대조표’로 사용한다.

4) 가계 총량 지표는 ‘가계 및 비영리단체’를 기준으로 편제됨에 따라 비영리단체를 포함한다. 한편, 가계 총량 지표에서는 개인 간 임대차 계약에 따른 보증금 자산과 부채가 제외되어 있다는 점에 유의할 필요가 있다.

5) 유량 변수는 소득, 소비와 같이 일정 기간 동안 변화 또는 발생한 양을 측정한다. 반면 자산, 부채와 같은 저량 변수는 특정 시점에서의 규모를 나타낸다.

6) 2021년 기준 가계가 보유한 총 자산(1경 3,837조원)은 부채(2,245조원)의 6.2배에 달한다. 이에 따라 자산에 비해 부채 증가율이 상대적으로 높았음에도 불구하고 가계 순자산은 소득에 비해 빠른 속도로 증가하였다. 2011년 순자산 규모를 100으로 했을 때 2021년 순자산 규모는 192에 해당한다.

7) 한편 대출 등 부채가 발생하는 경우 동일 규모의 자산이 동시에 늘어나므로 순자산은 변화하지 않는다. 금융자산을 이용하여 실물자산을 구입하는 경우에도 자산 구성이 변화할 뿐 순자산은 변화하지 않는다.

8) 가계 실물자산 중 건설자산 및 토지자산의 비중은 98%로 거의 대부분을 차지하고 있다(2008~2021년).

9) 본 보고서는 2021년까지의 가계금융복지조사 결과를 활용하여 분석하였다.

10) 가계금융복지조사는 표본조사 결과로 작성되는데, 전수조사 방식이 아니라는 점에서 최상위 계층이 과소 추정될 가능성이 존재한다.

11) 예를 들어, 2021년 가계금융복지조사의 자산과 부채는 2021년 3월말 시점을 기준으로 작성되며 소득과 원리금상환액은 2020년을 기준으로 작성된다.

12) 순자산 및 소득 그룹을 세분화하여 분석한 가구 순자산 증가율은 <부록 표 1>을 참고

13) 가계금융복지조사를 바탕으로 가계 대차대조표를 아래와 같이 구성할 수 있는데 본 보고서에서 사용한 각 항목의 정의는 이와 같다.

14) Domanski et al.(2016)은 6개 국가(프랑스, 독일, 이탈리아, 스페인, 영국, 미국) 가계 서베이 조사를 바탕으로 시뮬레이션 분석을 통해 주식가격 상승이 부의 불평등을 악화시키는 요인으로 작용한 반면, 주택가격 회복은 불평등을 완화하는 효과가 있었음을 확인하였다.

15) 부동산가격 상승으로 2021년 자산 집중도가 소폭 변화하였으나 부동산가격 상승기 이전에 비해 큰 차이를 나타내는 것은 아니다. 2017년 기준 순자산 하위 60% 가구는 부동산자산의 17.4%를, 전ㆍ월세보증금의 45.2%를 보유하였다.

16) 지니계수는 경제적 불평등도를 측정하는 지표로서 계수가 높아질수록 불평등의 정도가 심화됨을 의미한다. 처분가능소득 지니계수는 소득의 불평등도를, 순자산 지니계수는 부의 불평등도를 각각 나타낸다.

17) 가구주 연령 그룹별 주택소유율 및 순자산은 각각 <부록 표 2>와 <부록 표 3>을 참조

18) N×N 전이행렬의 (i, j) 요소를

19) 소득을 기준으로 구분하여 살펴보면(<부록 그림 1> 참조) 순자산을 기준으로 구분한 경우에 비해 상ㆍ하위 그룹 간 차이가 크게 약화되는 모습이다. 이는 소득보다는 순자산이 주택 구입 가능성에 더 중요한 요인으로 작용하였음을 의미한다.

20) IMF(2022)는 고평가된 주택가격 수준, 향후 경제전망 악화가 주택가격의 하방 위험을 높이는 주요인으로 작용할 수 있다고 분석하였다.

참고문헌

Bartholomew, D. J., 1967, Stochastic models for social processes, Wiley: Chichester.

Domanski, D., Scatigna, M., Zabai, A., 2016, Wealth inequality and monetary policy, BIS Quarterly Review March.

Garbinti, B., Goupille-Lebret, J., Piketty, T., 2021, Accounting for wealth-inequality dynamics: methods, estimates, and simulations for France, Journal of the European Economic Association 19(1), 620-663.

International Monetary Fund (IMF), 2022, Global Financial Stability Report (October).

Kuhn, M., Schularick, M., Steins, U. I., 2020, Income and wealth inequality in America, 1949-2016, Journal of Political Economy 128(9), 3469-3519.

Martinez-Toledano, C., 2020, House price cycles, wealth inequality and portfolio reshuffling, WID.world working paper.

Shorrocks, A. F., 1978, The measurement of mobility, Econometrica: Journal of the Econometric Society, 1013-1024.