Find out more about our latest publications

Stablecoins: Risks and Policy Challenges

Issue Papers 22-28 Dec. 29, 2022

- Research Topic Macrofinance

- Page 20

The collapse of Terra has called into question the stability of stablecoins. This crisis might be understated as an exception limited to the algorithmic stablecoin, an uncommon type. However, as various problems have erupted from fiat-collateralized stablecoins, concerns have been growing over internal and external risks. For instance, fiat-collateralized stablecoins could lead to a loss of confidence or invite a speculative attack due to inadequate management of reserve assets. A sharp price drop in non-stablecoins such as Bitcoin could put downward price pressure on the entire stablecoin market. Furthermore, distress in the stablecoin market could be passed onto the traditional financial market as well as the crypto market. There is also a possibility that the supply of stablecoins would come into conflict with monetary policy.

With potential risks from stablecoins in mind, major economies have drafted specific criteria and plans for permission, operation and oversight. The US and EU categorize crypto assets into stablecoins and non-stablecoins and seek to design policies for both categories. On the other hand, Korea’s policy discussions about crypto assets primarily center around non-stablecoins, which raises concerns about a regulatory gap in stablecoins. In preparation for the rapid growth of Korea’s stablecoin market, the government needs to promptly build the related institutional framework.

First of all, Korea should gear its policy direction toward inducing the issuance of fiat-collateralized stablecoins rather than other types. In addition, regulations of stablecoins should be differentiated depending on the scope of use to keep a balance between technical neutrality and financial stability. It is also necessary to support the redemption of stablecoins, not covered by deposit insurance, by applying the supervisory guideline for prepaid electronic money. To prevent conflicts with monetary policy, it is worth considering measures for large stablecoin issuers that impose stricter regulation on prudence or a limit on the total issuance volume.

With potential risks from stablecoins in mind, major economies have drafted specific criteria and plans for permission, operation and oversight. The US and EU categorize crypto assets into stablecoins and non-stablecoins and seek to design policies for both categories. On the other hand, Korea’s policy discussions about crypto assets primarily center around non-stablecoins, which raises concerns about a regulatory gap in stablecoins. In preparation for the rapid growth of Korea’s stablecoin market, the government needs to promptly build the related institutional framework.

First of all, Korea should gear its policy direction toward inducing the issuance of fiat-collateralized stablecoins rather than other types. In addition, regulations of stablecoins should be differentiated depending on the scope of use to keep a balance between technical neutrality and financial stability. It is also necessary to support the redemption of stablecoins, not covered by deposit insurance, by applying the supervisory guideline for prepaid electronic money. To prevent conflicts with monetary policy, it is worth considering measures for large stablecoin issuers that impose stricter regulation on prudence or a limit on the total issuance volume.

Ⅰ. 논의 배경

스테이블 코인은 법화나 자산과의 교환 비율을 고정한 디지털 화폐로 정의할 수 있다. 2014년 최초의 스테이블 코인인 테더(Tether)1)가 등장한 이래, 다양한 유형의 스테이블 코인이 계속 출시되었다. 이들은 가상자산 시장에서의 화폐 및 탈중앙금융(이하 DeFi) 시장의 유동성 공급 수단으로 활용되면서 빠르게 성장해 왔다.

아직까지는 스테이블 코인이 일상적인 경제활동에서 폭넓게 사용되지는 않기 때문에 그 용도가 제한적이라는 점은 사실이다. 하지만 국경 없는 근 실시간 직접(near real-time peer-to-peer) 자금 이체와 스마트 계약을 이용한 금융 및 지급결제서비스 등이 가능하다는 장점이 있어 상당한 효용성이 잠재되어 있다. 그래서 최근 미국 내 지역 은행들이 스테이블 코인의 공동 발행을 추진2)하는 등 기존 금융기관들도 스테이블 코인 발행에 큰 관심을 보이고 있다.

스테이블 코인의 장점을 최대한 활용할 수 있다면 편의성과 거래비용 등의 측면에서 사용자의 후생을 크게 제고하는 효과를 기대할 수 있을 것이다. 하지만, 최근 발생한 테라의 붕괴와 함께, 대표적인 스테이블 코인인 테더의 준비자산 문제가 부각되면서 그 리스크에 대한 경각심도 높아지고 있다. 특히, 스테이블 코인이 가치 안정성이라는 원칙을 표방하고는 있지만, 이를 실제로 유지할 수 있는지에 대한 의구심과 직ㆍ간접적인 부작용에 대한 우려가 커지고 있다.

이에 따라 주요국들은 스테이블 코인의 리스크에 대한 대응 방안을 마련하는 데 속도를 내고 있다. 미국은 대통령 직속 워킹그룹의 정책 연구와 의회의 입법안 등을 통해 시장 규율 방안을 모색하는 한편, EU 회원국들은 관련 법안에 이미 합의하고 시행만을 기다리고 있는 상황이다. 국내의 경우, 비스테이블 코인에 대한 정책 방향은 구체화되고 있지만, 스테이블 코인에 대한 논의는 아직 부족한 실정이다. 이에 본고는 법화자산 담보형을 중심으로 스테이블 코인의 리스크를 종합적으로 평가하고 국내 정책 과제에 대해 논의하고자 한다. 여기에서 정책 과제의 경우, 가상자산 일반에 포괄적으로 적용되는 사항보다는 스테이블 코인의 고유한 특징과 관련된 사항을 중심으로 다루도록 하겠다.

본고의 구성은 다음과 같다. 먼저, Ⅱ장에서는 글로벌 시장에서의 스테이블 코인 현황과 주요 스테이블 코인의 특징에 대해 간략히 살펴본다. 이어 Ⅲ장에서는 스테이블 코인 시장의 내부적인 리스크와 관련된 주요 사례와 분석 결과를 제시하고, 외부효과 측면에서의 부정적인 영향에 대해 설명하도록 하겠다. 그리고 Ⅳ장에서 미국과 EU의 정책 방향에 대해 개관한 다음, Ⅴ장에서는 국내 정책 과제와 대응 방안에 대해 논의하도록 하겠다.

Ⅱ. 스테이블 코인 현황: 글로벌 시장

본 장에서는 글로벌 시장에서 발행ㆍ유통되고 있는 스테이블 코인의 현황에 대해 살펴보고자 한다. 여기에서는 먼저 시장 전반에 대해 개관하고, 다음으로 스테이블 코인을 유형별로 구분하여 대표적인 스테이블 코인과 특징에 대해 논의하도록 하겠다.

1. 개관

스테이블 코인은 가상자산 거래와 DeFi에서 지급결제 및 유동성 공급 수단 등으로 활용된다. 가상자산 시장은 기본적으로 블록체인을 기반3)으로 운영되므로 은행 계좌를 통한 지급결제에는 높은 거래비용과 상당한 처리 시간이 소요된다.4) 그리고 투자자가 거래플랫폼 간에 자금을 이전하는 데 법화보다는 스테이블 코인을 사용하는 것이 훨씬 편리하다는 장점이 있다. 이에 따라 고빈도(high frequency) 투자자 등 가상자산 전문 투자자들은 거래 효율성과 편의성이 높은 스테이블 코인을 활용하고 있다. 또한, 스테이블 코인은 프로그래밍이 가능하다는 장점이 있어 스마트 계약을 통해 가상자산 기반 금융거래를 자동 청산ㆍ결제하는 데에도 활용되고 있다. 다만, 일반적인 상거래에서 스테이블 코인이 사용되는 경우는 드물기 때문에 가상자산 시장 이외 부문에서의 활용도는 높지 않다. 과거 메타(Meta)가 추진했던 디엠(Diem) 프로젝트는 범용성에 주안점을 두고 있었으나, 2022년 1월에 해당 사업부를 매각하면서 디엠 발행계획은 백지화되었다. 하지만, 메타 이후에도 글로벌 결제서비스 기업인 페이팔(PayPal)이 범용 스테이블 코인 발행 프로젝트를 진행하고 있다. 페이팔의 사용자가 4억명 이상5)이라는 점을 감안하면, 전자상거래 등에서 해당 스테이블 코인이 상당 부분 활용될 가능성이 있는 것으로 보인다.

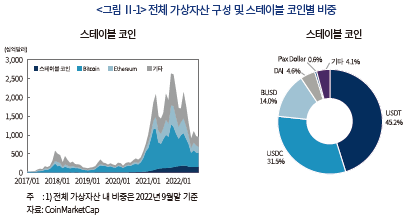

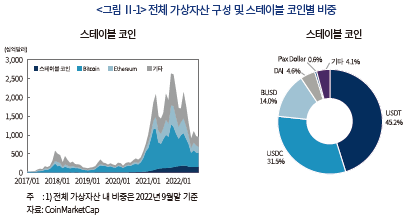

근래 다소 침체 국면을 보이고 있기는 하지만, 전반적으로 스테이블 코인 시장은 빠르게 성장한 것으로 평가된다. 2022년 9월 기준 스테이블 코인의 시가 총액은 약 1,504억달러로 2019년말과 비교할 때 30배 가까이 그 규모가 크게 확대되었다. 이는 앞서 언급했듯이 전반적인 가상자산 시장과 DeFi 등 가상자산 기반 금융거래가 확대된 데 따른 결과이다. 다만, <그림 Ⅱ-1>에서 나타나듯이, 전체 가상자산에 대한 스테이블 코인의 시가 총액 비중은 16% 내외로 동 시장의 규모 자체가 매우 큰 것으로 보기는 어렵다.6) 스테이블 코인 내 구성을 보면, 테더의 시가 총액이 45%의 비중으로 가장 크고, 다음으로 USD Coin(31%), 바이낸스(Binance) USD(14%), DAI(5%) 순으로, 소수의 스테이블 코인이 시가 총액의 대부분을 차지하고 있다.7)

이렇게 일부 코인이 시장의 성장을 주도하면서, 경쟁력을 상실하고 사실상 도태되는 스테이블 코인도 상당수 존재한다. Mizrach(2022)에 따르면, 2016년부터 2021년까지 발행된 65개의 스테이블 코인 중 63%에 해당하는 41개의 스테이블 코인은 거래가 거의 사라지면서 유명무실한 상태인 것으로 조사되었다.8) 그리고 스테이블 코인의 생존율은 여타 가상자산(비스테이블 코인)과 비교할 때도 큰 차이가 없는 것으로 나타났다. 이는 비스테이블 코인과 스테이블 코인이 평균 2년 6개월 정도의 짧은 기간 내에 도태된다는 점을 통해 확인할 수 있다(Mizrach, 2022).

2. 주요 스테이블 코인 및 특징

스테이블 코인은 크게 법화자산 담보형(fiat-collateralized), 가상자산 담보형(cryptocurrency-collateralized), 알고리즘형(algorithmic)의 세 유형으로 구분할 수 있다. 법화자산 담보형9)은 법화, 예금, 전통적인 유가증권(국채, 회사채, CP) 등을 준비자산으로 보유함으로써 가치를 고정하는 방식으로, 테더(USDT), USD Coin(USDC), 바이낸스 USD(BUSD), 팍스 달러(Pax Dollar), 제미니 달러(Gemini Dollar) 등이 그 예라 할 수 있다. 가상자산 담보형은 말 그대로 가상자산을 담보로 하여 발행하는 방식으로 DAI가 이 유형에 해당한다. DAI는 18개의 가상자산을 담보로 인정하고 있는데 그 중 스테이블 코인인 USD Coin의 비중이 50% 이상으로 가장 크고, 다음으로 이더리움이 10% 내외를 차지하고 있다. 알고리즘형은 프로그래밍된 공급량 조절 방식을 통해 가격을 고정하는 방식을 따른다. 동 유형의 스테이블 코인은 테라(Terra)가 대표적인데, 테라는 거버넌스 코인인 루나를 통해 수요와 공급을 조절하는 방식을 이용하였다. 알고리즘형은 2022년 상반기에 발생한 테라 사태로 시장의 신뢰를 잃었고, 현재 스테이블 코인 시장 내에서의 비중도 미미한 수준이다.

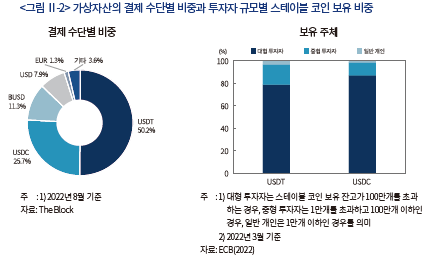

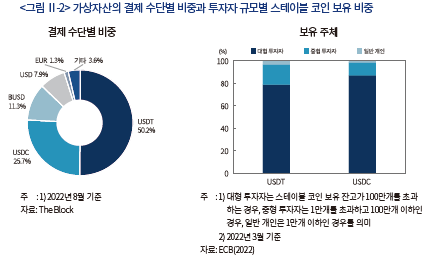

전술한 바와 같이 스테이블 코인은 가상자산 시장의 주요 지급결제 수단으로 사용되고 있다. 이에 따라 글로벌 가상자산 거래에서 스테이블 코인을 통한 결제 비중은 상당히 높은 수준이다. 전체 가상자산 거래(2022년 8월말)에서 테더를 이용한 비중은 50.2%, USDC는 25.7%, BUSD는 11.3%를 차지하고 있다(<그림 Ⅱ-2> 좌측). 동 상위 3개 스테이블 코인을 이용한 결제 비중의 합계는 약 87%로, 법화인 달러(7.9%)와 유로(1.3%)를 크게 넘어서는 수준이다. 따라서 글로벌 가상자산 거래에서는 법화가 아니라 스테이블 코인이 핵심적인 지급결제 수단이라는 점을 알 수 있다.10) 그리고 이러한 특징은 은행 계좌(예금)를 기반으로 가상자산 거래가 이루어지고 있는 국내 시장과는 큰 차이를 나타낸다.

글로벌 시장에서 스테이블 코인을 이용한 가상자산 거래는 일반 개인보다는 대형 전문 투자자를 중심으로 이루어지는 것으로 판단된다. ECB(2022)에 따르면, 시가 총액이 가장 큰 테더와 USDC의 경우 대형 투자자의 보유 비중이 80~90%에 이르는 것으로 분석11)되었다(<그림 Ⅱ-2> 우측). 반면, 일반 개인의 보유 비중은 3% 이하로 매우 낮은 수준으로 나타났다. 정보의 제약으로 인해 이러한 대형 투자자를 세분화하여 구체적인 성격을 확인하기는 어렵다. 다만, ECB(2022)는 테라 사태 발생 당시 시스템적인 충격이 크지 않았다는 점에서, 전통적인 금융과의 연계성이 낮은, 가상자산 전문 투자자들이 주요 보유자일 것으로 추론하였다.

Ⅲ. 스테이블 코인의 리스크

테라의 붕괴는 스테이블 코인의 리스크에 대해 상당한 위기감을 가지게 된 계기가 되었다. 테라는 시장가격이 1달러 아래로 하락하더라도 1개의 테라로 1달러의 가치만큼 루나로 교환되게 함으로써, 두 코인을 이용한 차익거래를 통해 가격이 유지되도록 설계되었다. 하지만, 테라 예치자에 대한 과도한 이자 지급으로 지속가능성에 대한 의문이 커지는 가운데, 2022년 5월 들어 테라와 루나의 대량 매도가 일시에 발생하였다. 그래서 결국 차익거래를 통한 가격 유지 기제가 무력화되면서 테라의 가격은 회복할 수 없는 수준으로 급락하고 사용자들의 원금(달러 기준) 회수가 불가능해졌다.

동 사례로 볼 때, 스테이블 코인과 관련된 일차적인 우려로 가격 안정성과 법화로의 교환 가능성(redeemability) 측면에서의 리스크를 들 수 있다. 이는 스테이블 코인 자체의 문제라는 점에서 내부 리스크12)라고도 할 수 있다. 아울러, 스테이블 코인이 자체 영역을 넘어 전통적인 금융시스템에까지 광범위하게 영향을 미칠 가능성도 있다. 이는 외부 효과 측면에서의 리스크로, 금융안정, 금융중개, 통화정책 등에 대한 부작용으로 이어질 수 있는 부분이다. 본 절에서는 법화자산 담보형을 중심으로 이러한 내ㆍ외부적인 리스크에 대해 논의하고자 한다.

1. 준비자산 운영과 내부 리스크: 테더 사례

테라 사태는 알고리즘형 스테이블 코인이라는 특수한 유형에 국한된 예외적인 사례로 간주될 수도 있다. 그러나 법화자산 담보형에서도 중요한 문제점들이 드러나면서 스테이블 코인 시장 전반에 대한 우려가 높아지고 있다. 특히 테더의 경우, 발행사가 여러 이유로 준비자산을 부실 운영할 수 있으며 이것이 근본적인 불안 요인이 될 수 있음을 보여주는 대표적인 사례로 생각된다.

앞 장에서 살펴본 바와 같이, 테더는 최대 규모의 스테이블 코인으로 테더 사(Tether Limited)에 의해 발행되고 있다. 테더 사는 발행액과 동일한 금액의 통화를 준비자산으로 보유13)한다는 점을 명시하고, 이를 근거로 테더의 안정성을 강조해 왔다. 하지만 2021년에 준비자산 부실이 밝혀지면서 테더 사는 뉴욕주 법원으로부터 1,850만달러의 벌금을 부과받게 되었다. 그리고 해당 조사 과정에서 계열사인 Bitfinex에 불법 대출을 제공하고 여기에서 8억 5,000만달러의 손실을 입음으로써 준비자산 부족이 발생하였다는 사실이 드러났다. 또한, 미 상품선물위원회(CFTC)의 조사 결과, 2016~2018년의 기간(26개월) 중 준비자산이 제대로 확보된 기간은 1/4에 불과해, 4,100만달러의 벌금이 추가로 부과되기도 하였다.

테더 사의 준비자산 부족은 관계사 부당 지원뿐만 아니라, 비트코인 가격 조작을 위해 테더를 허위 발행한 데 따른 결과라는 실증 연구도 있다. Griffin & Shams(2020)에 따르면, 비트코인 가격 하락 이후 테더의 발행이 이상 급증하면서 비트코인 가격이 다시 상승하였는데, 이때 동일한 지갑 주소에서 비트코인과 테더가 대량 입출금된 것으로 나타났다. 그리고 월말경에는 관계사인 Bitfinex가 자체 보유한 비트코인의 잔액이 크게 감소한 점도 관측되었다. 동 연구자들은, Bitfinex가 테더 사의 월말 준비자산 보고를 위해 그 직전에 비트코인을 현금화하면서 이러한 패턴이 나타나는 것으로 해석하였다. Bitfinex는 한동안 발행시장에서 테더를 독점적으로 공급해 왔다.14) 정상적인 운영 방식이라면, 테더 판매의 대가로 Bitfinex가 수취한 현금은 즉시 테더 사로 환입되고 준비자산으로 전환되어야 한다. 하지만 동 연구에 따르면, 테더 사는 Bitfinex를 통해 준비자산 없이 발행한 테더로 비트코인을 매입했다가 준비자산 보고 시점에 맞춰 비트코인을 현금화한 것으로 보인다.15)

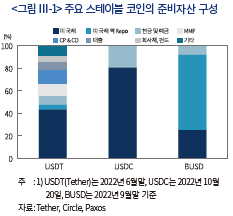

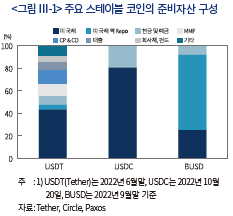

테더의 준비자산은 규모뿐만 아니라, 그 구성 측면에서도 문제점을 내포하고 있다. 스테이블 코인 발행사는 이윤극대화를 목적으로 고수익 위험자산에 준비자산을 투자하려는 유인이 높다.16) 실제로 <그림 Ⅲ-1>을 보면 테더의 준비자산 중 40% 이상은 CP, 회사채, 대출 등으로 상당 부분이 위험자산에 투자되어 있음을 알 수 있다. 대부분 안전자산으로 구성된 USDC나 BUSD와 비교할 때, 테더의 준비자산 구성은 안정성과 유동성이 부족해 보인다. 특히, 위험자산의 가격이 하락하면서 법화로의 교환 요구가 급증한다면 지급 불이행으로 이어질 수 있는 리스크를 내포하고 있다. MMF의 시초인 Reserve Primary Fund는 과도한 위험자산 보유로 인해 가격 붕괴를 겪고 결국 청산됨으로써 그 역사를 마감한 바 있다.17) 큰 틀에서 법화자산 담보형 스테이블 코인은 MMF와 유사한데18), 이러한 위험자산 보유로 인해 과거 MMF 시장의 불안이 스테이블 코인에서도 재현될 가능성이 있다.

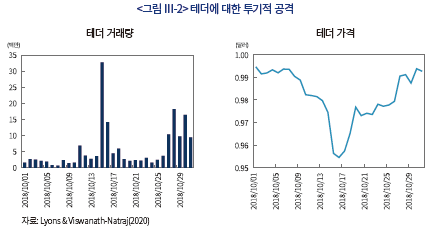

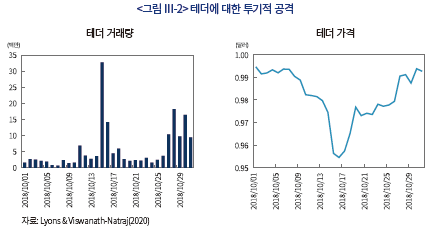

스테이블 코인의 준비자산 규모나 구성 측면에서의 취약성은 투기적인 공격을 자극할 수 있는 요인이 될 수 있다. 특히 2018년 발생했던 테더에 대한 투기적 공격은 이를 보여주는 사례로 생각된다. <그림 Ⅲ-2>의 좌측은 2018년 10월 중순경 테더의 거래량이 이례적으로 증가한 것을 나타내고 있다. 당시 일부 거래플랫폼에서 테더의 저가 매도가 집중적으로 발생했는데, 그 결과 테더의 가격이 0.95달러까지 하락한 바 있다(<그림 Ⅲ-2> 우측). 이러한 투기적 공격은 테더 사의 준비자산과 지급 능력에 대한 불신19)에 기인한 것으로 평가되는데(Lyons & Viswanath-Natraj, 2020; Eichengreen & Viswanath-Natraj, 2022), 준비자산이 부실화될 경우 여타 스테이블 코인도 그 대상이 될 수 있을 것이다.

2. 가상자산 시장과 내부 리스크

스테이블 코인의 안정성은 전반적인 가상자산 시장 상황에도 영향받을 수 있다. 즉, 비트코인 등 주요 가상자산의 불안으로 투자자가 대규모로 동 시장을 이탈(exit)한다면 스테이블 코인의 대량 매도와 가격 하락 압력이 발생할 수 있기 때문이다. 이러한 맥락에서 Eichengreen & Viswanath-Natraj(2022)는 비트코인의 가격 변동성 확대시 스테이블 코인 발행사의 지급불능(default) 위험이 높아진다는 점을 보인 바 있다. 그리고 본고의 분석에 따르면, 비트코인 수익률이 스테이블 코인의 가격에 유의한 영향을 미칠 수 있는 것으로 추정되었다. 특히 그러한 경향은 준비자산 부실 문제가 지적되어 온 테더에서 뚜렷하게 나타났다.

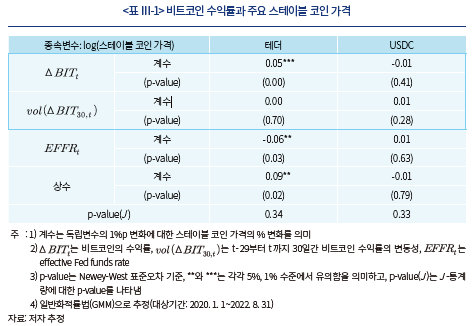

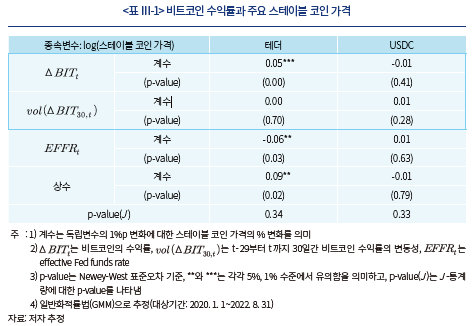

<표 Ⅲ-1>은 비트코인 가격 변화가 주요 스테이블 코인인 테더와 USDC 가격에 미치는 영향에 대해 분석한 결과를 제시하고 있다. 이는 일별 종가 자료를 이용하여 비트코인 수익률 및 수익률의 변동성이 각 스테이블 코인의 가격(로그변환)에 미치는 영향을 추정한 것이다. 이에 따르면, 비트코인 수익률의 변동성은 뚜렷한 영향이 없지만, 비트코인 수익률의 하락은 테더 가격에 유의한 하방 압력을 발생시킨다는 점을 알 수 있다.20) 다만, USDC의 경우에는 비트코인 수익률이나 수익률의 변동성이 특별한 영향을 미치지는 않는 것으로 나타났다. 따라서 동 결과는 준비자산 부실 문제가 존재하는 스테이블 코인(테더)의 경우, 비트코인 수익률 하락 시 가격 유지가 어려워질 수 있다는 점을 시사한다.

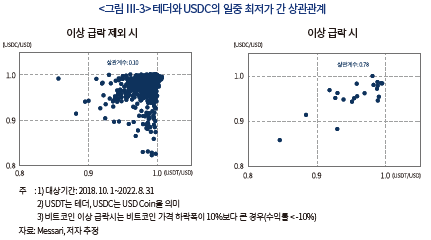

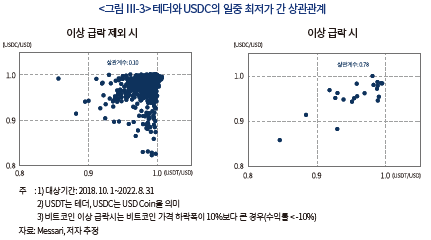

한편, 위의 분석은 평균적인 영향을 추정한 것이므로 시장 불안이 심화된 경우에 초점을 맞추어 스테이블 코인의 가격 변화를 확인하는 데에는 한계가 있다. 이러한 점을 고려하여 비트코인 가격 급락시 테더와 USDC의 가격 변화에 대해 추가로 살펴보았다. <그림 Ⅲ-3>은 비트코인의 일 수익률이 –10% 이상인 경우(왼쪽)와 –10%를 하회하면서 가격이 급락한 경우(오른쪽)의 테더와 USDC의 일중 최저가를 나타내고 있다. 먼저, 급락이 발생하지 않은 상황(왼쪽)을 보면, 테더와 USDC의 최저가 간의 상관계수는 0.10으로 특별한 상호 연관성이 나타나지 않는다. 반면, 비트코인 가격이 10%(절대값)를 넘어서는 크기로 급락한 경우(오른쪽)에 테더와 USDC의 최저가 간 상관계수는 0.78로, 매우 높은 정(+)의 상관관계를 보였다. 그리고 두 경우 최저가의 수준 측면에서도 차이가 있다. 비트코인 수익률이 –10% 미만일 때 최저가의 중위수는 0.96(테더와 USDC 공통)으로 –10% 이상일 때(0.99, 테더와 USDC 공통)에 비해 약 3% 낮은 것으로 산출되었다. 동 결과는 비트코인 가격 급락 시에는 테더와 USDC 가격 모두 일중 크게 하락하는 경향이 뚜렷하다는 점을 나타낸다. 이러한 사실은 비스테이블 코인 시장의 불안이 스테이블 코인 시장 전반에까지 광범위하게 확산될 수 있음을 시사한다. 특히, 여기에서는 발행사의 준비자산 부실 여부와는 무관하게 스테이블 코인의 가격 하락이 발생할 수 있다는 점에 주목할 필요가 있다.

3. 외부 효과21) 측면의 리스크

스테이블 코인은 여타 가상자산 및 기존 금융시스템과의 연계를 통해 여러 측면에서 부정적인 외부 효과를 유발할 위험이 있다. 그러한 첫 번째 예로 스테이블 코인 시장의 불안이 전체 가상자산 시장으로 확산되는 상황을 생각할 수 있다. 전술한 바와 같이 글로벌 가상자산 시장에서 스테이블 코인은 핵심적인 지급결제 수단으로 사용되고 있다. 만약 주요 스테이블 코인에서 지급불능 사태가 발생한다면 가상자산 투자자의 자금원이 사실상 증발하면서 전체 가상자산 시장의 유동성 위기로 확대될 우려가 있다.

아울러 스테이블 코인 시장의 불안이 전체 금융시장으로 전이될 위험에 대해서도 경계할 필요가 있다. 특히, 법화자산 담보형 스테이블 코인은 준비자산을 통해 전통적인 금융시장과 밀접하게 연결되어 있어 시스템 리스크의 주요 요인이 될 수 있다. 과거 미국의 MMF 런(MMF run: 대규모 환매 사태)은 MMF가 투자한 ABCP, CD, RP 부문 등에서 단기 금융시장의 자금 경색을 유발한 바 있다(Li et al., 2021). 법화자산 담보형은 예금, 단기증권, 대출 등을 준비자산으로 보유하고 있는데, 법화로의 인출 수요가 급증한다면 발행사는 준비자산을 대량 처분할 필요성이 커지게 될 것이다. 따라서 스테이블 코인 런이 발생한다면 해당 시장의 불안이 은행이나 자금시장으로까지 확산될 가능성이 있다.

스테이블 코인은 국내 금융중개 기능에도 부정적인 영향을 미칠 수 있다. 이는 외화 스테이블 코인의 사용이 확대될 때 크게 우려되는 부작용이라 할 수 있다. 해외 통화에 연동된 스테이블 코인은 대상 통화로 표시된 금융상품을 중심으로 준비자산을 구성할 것으로 예상된다. 따라서 외화 스테이블 코인에 대한 수요가 증가할 경우, 자본 유출이 확대되면서 국내 금융중개 기능이 약화될 수 있다. 다만, 국내 통화에 연동된 스테이블 코인(법화자산 담보형)이 국내 금융중개에 미치는 영향은 크지 않을 것으로 판단된다. 국내 통화 스테이블 코인이 요구불 예금이나 여타 저축 수단을 대체할 때, 개별 금융상품에 대한 수요의 구성은 변화할 수 있을 것이다. 하지만, 발행사가 국내 금융상품으로 준비자산을 축적한다면 해당 자금은 궁극적으로 국내 금융시스템 내에 남게 된다. 따라서 전체적인 관점에서는 금융기관들의 예탁금(deposit)과 자금 공급 능력이 축소되지 않을 것으로 판단된다.

이와 함께 스테이블 코인이 통화정책의 유효성에도 영향을 미칠 가능성이 있다. 만약, 스테이블 코인의 사용자 기반이 크게 확대된 상황에서 대형 발행사가 통화정책과 상충되는 방향으로 공급을 결정한다면 통화정책의 유효성을 크게 제약할 수 있다. 예컨대, 중앙은행이 긴축적인 통화정책을 운영하고 있는 와중에 스테이블 코인이 대규모로 무상지급(airdrop)된다면 통화정책의 긴축 효과를 약화시킬 우려가 존재한다.22) 그리고 외화 스테이블 코인이 국내 통화를 대체한다면, 국내 금융중개 기능 약화로 통화정책의 파급경로가 원활히 작동하지 않게 되어 통화정책의 효과가 축소될 소지가 있다.

Ⅳ. 미국과 EU의 대응 방향

주요국들은 스테이블 코인에 잠재된 리스크에 상당히 유의하면서 허가 및 운영 기준, 감독 방안 등을 구체화하고 있다. 여기에서는 대표적으로 미국과 EU의 사례를 중심으로 대응 방향에 대해 살펴보고자 한다.

1. 미국

미국에서는 2021년 11월 대통령 직속 워킹그룹(President’s Working Group on Financial Markets, 이하 PWG)이 스테이블 코인의 리스크를 관리하기 위한 정책 방향을 제시한 바 있다. PWG는 사용자 보호와 대량 인출 예방, 지급결제 시스템의 리스크 완화, 시스템 리스크와 경제력 집중 완화라는 세 측면이 입법의 기본 원칙이 되어야 함을 강조하였다. 구체적으로, 사용자 보호와 대량 인출 예방을 위해서는 예금자보험에 의해 법화 예치금이 보호되도록 하고 예금기관 수준의 감독 기준과 규제가 필요하다는 점을 밝혔다. 그리고 지급결제 시스템의 리스크 완화를 위해서는 스테이블 코인 발행자와 수탁 관리자(custodial wallet provider)에 대한 연방정부의 감독이 시행되어야 함을 지적하였다. 마지막으로 시스템 리스크와 경제력 집중 완화를 위해서는 스테이블 코인 발행자와 영리기업과의 제휴 활동을 제한할 필요가 있다고 보았다.

정부의 정책방향 검토와 함께, 미 의회에서는 사용자 보호와 금융안정을 목적으로 한 스테이블 코인 관련 법안이 발의된 바 있다. 해당 법안들은 예금자보험이나 협의의 은행(narrow banking) 방식 등을 통해 사용자 보호를 강화해야 한다는 점을 골자로 하고 있다. 아울러 최근에는 미 하원 금융서비스 위원들을 중심으로 알고리즘형 스테이블 코인 발행을 2년간 금지하는 법안을 준비하고 있는 것으로 알려졌다.23)

한편, 연방 차원의 법 제정과 시행까지는 상당한 시간이 소요되어 주 정부가 독자적으로 규제 방안을 정하여 시행한 경우도 있다. 뉴욕주는 2018년에 신탁회사에 대한 규제를 준용하여 Paxos사(Pax Dollar와 Binance USD 발행)와 Gemini사(Gemini Dollar 발행)의 스테이블 코인 발행을 허가한 바 있다. 또한, 2021년에는 문제가 되었던 테더와 관계사에 벌금을 부과하고 뉴욕주에 소재한 모든 개인 및 법인과의 거래를 금지하였다. 2022년 6월에는 규제 방향을 체계화하여「달러화 스테이블 코인에 관한 지침(Guidance on the Issuance of U.S. Dollar-Backed Stablecoins)」을 발표하고 허가, 상환의무, 준비자산, 감사 등에 관한 기준을 제시였다. 동 지침에 따르면, 스테이블 코인 발행자는 특수목적 신탁회사(limited purpose trust company)로 허가를 받아야 하며 이에 따라 예금과 대출 업무는 수행할 수 없게 된다. 상환과 관련해서는, 법화로의 인출 요구가 발생한 후 2영업일 이내에 사전 약정된 교환 비율에 따라 발행사가 법화를 지급해야 함을 명시하였다. 그리고 준비자산은 여타 자산과 분리하여 관리하되, 예금자보호 적용 대상인 금융기관에 예치하거나 국채, 국공채형 MMF 등 안전자산으로 보유하도록 하였다.24) 감사의 경우에는 외부 회계법인을 통해 월별 준비자산 현황 및 연간 감사 보고서를 작성해야 하는 의무를 부과하였다.

2. 유럽 연합(EU)

EU는 2022년 6월에 회원국들이 합의한 가상자산(Markets in Crypto-Assets: MiCA) 규제 법안25)을 통해 스테이블 코인에 대한 정책 방향을 제시한 바 있다. 동 법안은 스테이블 코인을 크게 자산연계형 토큰(asset-referenced tokens)과 전자화폐형 토큰(electronic money tokens)으로 나누어 정의하고 있다. 여기에서 자산연계형 토큰은 복수의 법화, 또는 하나 이상의 상품 및 가상자산의 가치를 벤치마크로 하여 가치를 안정적으로 유지하는 가상자산으로 정의된다.26) 그리고 전자화폐형은 하나의 법화를 벤치마크로 하여 가치를 안정적으로 유지하는 가상자산이자 지급수단으로 정의된다.27) 한편, 알고리즘형은 자산연계형이나 전자화폐형에 해당하지 않는 것으로 규정하여 스테이블 코인의 범주에서 사실상 제외되었다.

동 법안에서는 자산연계형은 신용기관(credit institution), 전자화폐형은 전자화폐사업자 및 신용기관이 발행하는 것을 허용하고, 이외의 경우는 별도 허가 사항으로 규정하였다. 그리고 상환과 관련해서는, 자산연계형과 전자화폐형 공통적으로 인출 요구 발생 시 2영업일 이내에 지급되어야 한다는 의무를 명시하였다. 준비자산의 경우, 두 유형 모두 유럽 증권시장 감독청과 중앙은행 협의체(European System of Central Banks)가 설정한 기준에 따라 시장ㆍ집중ㆍ신용리스크가 매우 낮고 유동성이 높은 금융자산에 한하여 투자할 수 있게 하였다. MiCA 규제 법안은 발행자에 대한 자기자본 요건도 설정하였는데, 이에 따르면 발행자는 2% 이상28)의 자기자본을 보유해야 할 의무가 있다. 아울러 별도로 지정된 중요 발행자(issuers of significant tokens)는 상기 기준의 1.5배에 해당하는 자본을 확보하고 스트레스 테스트를 실시해야 한다는 의무를 추가하였다. 동 법안은 이외에도, 감독, 공시, 지배구조 등에 대한 기준을 구체적으로 제시하고 있다.

Ⅴ. 국내 정책 과제 및 결론

미국과 EU는 가상자산을 스테이블 코인과 비스테이블 코인으로 명확하게 구분하고 두 시장에 대한 정책 설계를 함께 진행하고 있다. 반면, 국내에서 가상자산과 관련된 제도적인 논의는 주로 비스테이블 코인에 집중되어 있는 실정이다. 국내 스테이블 코인 시장이 아직 미미한 수준29)이기는 하지만, 향후 동 시장이 빠르게 성장할 가능성에 대비해야 할 것으로 생각된다. 특히, 가상자산의 국내 발행(ICO)이 허용되고 블록체인 기반의 지급결제가 일반화된다면, 국내에서도 스테이블 코인의 발행과 사용이 크게 확대될 가능성이 있다.30) 또한, 은행권에서도 신사업의 일환으로 스테이블 코인의 발행을 검토하는 등 기존 금융기관들도 시장 진입에 관심을 가지고 있다.31)

이상과 같이 다양한 목적을 가진 경제 주체들의 참가하면서 국내 스테이블 코인 시장이 급성장할 수 있으므로 제도 마련에 착수해야 할 것으로 보인다. 그리고 여기에서는 기본적으로 발행 가능한 스테이블 코인의 유형에 대한 정책 방향을 명확히 할 필요가 있다. 전술한 바와 같이 스테이블 코인은 크게 세 가지 유형으로 나누어 볼 수 있다. 이 중, 지급 보장 기제와 안정성 등을 고려할 때 법화자산 담보형 중심으로 발행을 유도하는 것이 바람직하다고 판단된다.32) 알고리즘형의 경우, 준비자산이 명시적으로 존재하지 않아 사용자 보호가 부족하고, 이로 인해 가격 불안이 쉽게 증폭될 수 있어 안정성 측면에서 취약점을 내포하고 있다. 그래서 미국과 EU 등 주요국들은 알고리즘형에 대해 상당히 부정적인 입장을 취하고 있다. 국내에서 알고리즘형의 발행을 직접적으로 제한하지 않을 경우, 제도적으로는 동 유형을 비스테이블 코인으로 분류하고 스테이블 코인이라는 명칭의 사용을 금지하는 것이 바람직하다고 생각된다. 한편, 가상자산 담보형은 과담보(over-collateralization) 등으로 안전장치를 보완하고 있으나 가상자산 가격의 높은 변동성으로 인해 가격 불안과 대량 인출 가능성이 큰 것으로 평가된다. 다만, 가상자산 담보형이 안정성 높은 법화자산형 스테이블 코인을 선별하여 담보로 하는 경우에는 긍정적으로 고려해 볼 여지가 있을 것이다.

스테이블 코인의 사용 범위(기능적인 범위)도 제도 설계에서 중요 고려사항이 되어야 할 것으로 생각된다. 이는 규제의 기술적 중립성과 금융안정 간의 균형을 조절하는 데 있어 기본적인 판단 기준이 될 것이다. 스테이블 코인은 가상자산 거래뿐만 아니라, 잠재적으로는 일반 상거래33), 금융 및 외환거래에까지 사용되면서 높은 범용성을 가질 수 있다. 스테이블 코인의 사용 범위가 넓어질수록 편의성과 기술혁신 동기가 높아질 수 있겠지만, 금융ㆍ경제적 상호연계성이 높아지면서 시스템 리스크가 확대될 소지가 있다. 이러한 점을 고려할 때 개별 스테이블 코인의 사용 범위에 따라 제도적인 안전장치가 차등 적용되어야 할 필요가 있다. 예컨대, 국내 가상자산 거래로만 범위가 한정된 스테이블 코인에는 선불전자지급수단 및 전자화폐 관련 법규34), 범위의 제한이 없는 경우에는 은행 부문과 외국환거래 관련 법규가 제도적인 벤치마크가 될 수 있을 것이다. 그리고 EU의 MiCA 규제 법안과 유사하게, 스테이블 코인의 시가 총액 및 거래량 등 규모도 함께 고려하여 예외 및 추가규제 사항을 적용할 필요가 있다고 생각된다.

전술된 방향을 따를 때, 일부 스테이블 코인에 대해서는 은행 수준의 규제나 예금보험이 적용되지 않아 지급 불이행에 대한 우려가 커질 수 있다. 따라서 해당 스테이블 코인의 경우, 지급 보장 기능을 강화하기 위해 엄격한 준비자산 관리와 보완 수단이 뒷받침되어야 할 것이다. 이를 위해 여러 대안을 고려할 수 있겠지만, 현행 규제체계 내에서는 선불전자지급수단에 대한 감독 지침을 참고할 수 있을 것으로 판단된다. 금융감독원의 「전자금융업자의 이용자 자금 보호 가이드라인」은 선불전자지급 수단 발행ㆍ관리업자가 사용자를 수익자 및 피보험자로 지정하여 선불충전금을 100%를 신탁35)하거나 지급보증보험에 가입하도록 하였다. 동 지침은 선불충전금이 비부보(예금보험)라는 점 때문에 시행된 예치금 관리 방안으로, 비부보 스테이블 코인에도 적용 가능한 것으로 보인다. 따라서 비부보 스테이블 코인에 대해 지급 의무를 명시하고, 구체적인 준비자산 관리 방안은 해당 지침을 준용하는 방향으로 제도를 설계할 수 있을 것으로 생각된다.

한편, 스테이블 코인 시장이 크게 확대되어 통화정책의 유효성이 약화될 가능성에도 대비해야 할 필요가 있다. 대형 발행사의 무상지급에 대해서는 추가적인 건전성 규제를 적용함으로써 그 남용과 통화정책과의 상충을 일차적으로는 방지할 수 있을 것으로 생각된다. 즉, 스테이블 코인의 무상지급은 발행사의 자본을 감소시키게 되므로 건전성 규제를 강화함으로써 그 남용을 어느 정도 제한하는 효과가 있을 것이다. 하지만, 동 규제의 실효성이 크지 않을 경우에는 발행사들과 정책당국 간 보완적인 협약36)을 통해 발행 총량을 직접적으로 관리하는 방안을 고려해 볼 필요도 있다.

이상에서는 스테이블 코인의 특징에 초점을 맞추어 관련된 주요 정책 과제를 제시하였다. 스테이블 코인에도 적용되는 일반적인 가상자산 관련 정책은 이미 상당 부분 논의가 진행되었기 때문에 본고에서 별도로 다루지는 않았다. 하지만, 이는 해당 사항들이 부차적이기 때문은 아니라는 점에 유념해야 할 것이다. 특히, 보안, 내부통제, 정보공개, 시장교란 등에 대한 규율은 스테이블 코인을 비롯한 전체 가상자산 시장이 정상적으로 기능하기 위한 필요조건이라 할 수 있다. 따라서 정책 마련에 속도를 내는 한편, 이러한 요소들을 종합적으로 반영함으로써 스테이블 코인 시장의 제도적인 공백을 최소화할 필요가 있다.

1) 당시 명칭은 Realcoin이었다.

2) https://www.usdfconsortium.com

3) 중앙화된 플랫폼를 이용한 거래의 경우, 실시간으로 블록체인에 거래가 기록되지는 않지만 최종적으로는 블록체인 상에서 거래가 체결ㆍ기록된다.

4) 예를 들어, Coinbase에서 미국 은행 계좌를 이용하여 거래할 경우 입출금에 1일 이상 소요되고 처리는 은행의 영업일 및 영업시간으로 한정된다.

5) 페이팔이 공시(https://investor.pypl.com/home/default.aspx)한 2022년 2분기 기준 자료이다.

6) 그러나, 스테이블 코인의 거래는 매우 활발하여 2021년 중 테더의 거래대금은 S&P500 전 종목의 거래대금을 추월하기도 하였다.

7) 2022년 9월말 기준 수치이다.

8) Mizrach(2022)이 이더리움 네트워크(메인넷)상 스테이블 코인을 대상으로 조사한 것으로, 분기별 거래량이 최대치 대비 1% 미만의 수준으로 낮아지는 경우 도태된(failed) 것으로 간주하였다.

9) 법화자산 담보형은 법화만이 아니라 법화를 기반으로 한(fiat-denominated) 전통적인 자산을 담보로 한다는 점을 밝혀 둔다.

10) 아울러 DeFi 시장에 공급되는 유동성의 약 45%가 스테이블 코인인 것으로 조사되었다(2022년 5월 기준, ECB(2022)).

11) 2022년 3월 기준 자료이다.

12) 결제 및 보안 리스크 등도 여기에 포함되지만 본고에서는 스테이블 코인의 고유 특징에 주안점을 두고 가격 안정성과 법화 교환 가능성 측면의 리스크를 중심으로 다루도록 하겠다.

13) 테더는 최초 발행 시기인 2014년부터 2019년 2월까지 “Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USDT is always equivalent to 1 USD.”라 명시했다.

14) 테더는 2019년 4월까지 Bitfinex만을 통해 공급되었다.

15) 투자자들은 전술한 내용과 같은 가격 조작이 발생했다고 보고, 테더 사와 Bitfinex에 대한 집단소송을 진행하고 있으며, 이 과정에서 뉴욕주 법원은 테더 사에 원장, 재무제표, 가상자산 거래 내역 등에 대한 정보 공개를 명령하였다(2022년 9월).

16) 준비자산 운용은 발행사의 중요한 수입(revenue)원이 된다. 테더 사에 대한 상세한 정보는 공개되어 있지 않지만, 경쟁사인 Circle의 손익계산서를 보면 2022년 상반기 수입 중 약 80%를 이자 수입이 차지하고 있다.

17) Reserve Primary Fund는 2007년 중반경까지는 자산담보부 어음(ABCP) 비중을 10% 미만으로 유지했으나 이후 그 비중을 60% 수준까지 급격히 증가시켰다. 2008년 리먼 브라더스가 파산하면서 환매 요구가 쇄도함에 따라 가격(좌당 1달러) 유지가 불가능해졌다.

18) MMF는 높은 가치 안정성을 추구하는 금융자산이라는 점을 표방해 왔다. 특히 미국의 MMF는 2010년대 중반까지 좌당 순자산가치를 1달러로 유지하는 고정 순자산가치 방식으로 운용되었다.

19) 당해 10월초, 테더는 반박문을 통해 이러한 의혹이 근거없는 풍문이라 주장한 바 있다(https://medium.com/bitfinex/a-response-to-recent-online-rumours-677de7c4d171).

20) 정량적으로는 비트코인 수익률이 10%p 하락할 경우, 테더 가격은 약 0.5% 정도 하락하는 것으로 분석된다. 2020년 이후 일별 자료를 보면 비트코인 수익률이 50%p 가까이 하락한 경우도 있는데, 이 경우 테더 가격에는 약 2.5%만큼의 하락 압력이 작용하는 것으로 추정할 수 있다. 단, 이는 평균적인 추정치로 비트코인 가격 하락 시에는 가상자산 전반에 대한 신뢰 문제가 부각되면서 그 영향이 확대될 수 있다.

21) 외부 효과는 제3자에 대한 영향을 의미하므로 스테이블 코인 시장 내에서도 외부 효과가 발생할 수 있지만, 본 절에서는 스테이블 코인 시장 외부에 대한 영향을 다루도록 하겠다.

22) 스테이블 코인 발행사가 시장지배력을 높이기 위해 무상지급 전략을 사용할 수 있을 것이다. 발행사가 이익잉여금(자본)으로 스테이블 코인의 무상지급분(부채)을 충당하고, 이익잉여금으로 축적한 자산을 무상지급분에 상응하는 준비자산으로 전환한다면, 스테이블 코인의 가격에 대한 영향 없이 발행량이 증가하게 될 것이다. 이렇게 발행사가 제공한 무상지급분은 소비에 활용될 수 있다.

23) https://www.bloomberg.com/news/articles/2022-09-20/house-stablecoin-bill-would-put-two-year-ban-on-terra-like-coins#xj4y7vzkg

24) 주 정부의 승인하에 수탁회사에 보관하는 것도 허용하였다.

25) 영문 명칭은 「Regulation of the European Parliament and of the Council on Markets in Crypto-Assets, and amending Directive (EU) 2019/1937」이다.

26) “‘asset-referenced token’ means a type of crypto-asset that purports to maintain a stable value by referring to the value of several fiat currencies that are legal tender, one or several commodities or one or several crypto-assets, or a combination of such assets.”(「Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937」)

27) “‘electronic money token’ or ‘e-money token’ means a type of crypto-asset the main purpose of which is to be used as a means of exchange and that purports to maintain a stable value by referring to the value of a fiat currency that is legal tender.”(「Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive(EU) 2019/1937」)

28) 자산연계형은 35만 유로, 준비금의 2%, 또는 전년도 고정간접비(fixed overhead)의 25%로 계산된 세 가지 수치 중 가장 큰 금액을 자본으로, 전자화폐형은 35만 유로의 최초 자본금과 함께 준비금의 2% 이상을 자본으로 유지해야 한다.

29) 원화 기반 스테이블 코인의 경우, 바이낸스 코리아가 BKRW를 출시한 바 있으나 2020년말 철수하였고, 원화 테라(KRT)도 2022년 5월 주요 거래플랫폼에서 상장 폐지된 바 있다. 외화 스테이블 코인(테더와 USDC)의 경우, 일부 중소 거래플랫폼에서 원화 또는 가상자산을 결제수단으로 하여 거래되고 있다.

30) 가상자산 및 증권형 토큰 거래에 스마트 계약을 적용하기 위해 스테이블 코인을 이용할 수 있을 것이다.

31) https://news.einfomax.co.kr/news/articleView.html?idxno=4186159

32) 테라 사태 이전에도 법화자산 담보형 스테이블 코인이 여타 유형보다 가격 안정성이 높은 것으로 분석되었다(Mizrach, 2022).

33) 미국의 경우, USDC의 발행사인 Circle이 비자와 마스터카드와 제휴하여 USDC 기반의 일반 결제서비스를 준비하고 있다.

34) 해당 전자지급수단에 대한 기본 법령은 「전자금융거래법」에 기초하고 있다. 최근 사용자 보호 부족으로「전자금융거래법」의 개정 필요성이 논의되는 가운데, 금융감독원은 제도의 미비를 보완하기 위해 「전자금융업자의 이용자 자금 보호 가이드라인」을 시행하고 있다. 동 가이드라인은 선불전자지급수단의 충전금은 선불업자의 고유 계정과 분리하여 은행 등 외부기관에 신탁하고 동 신탁자금은 국채 및 예금 등 안전자산으로 운용되도록 하였다. 또한 신탁상품에 즉시 가입하기 곤란한 경우에는 지급보증보험에 가입하는 것을 허용하였다. 다만, 이러한 내용은 행정지도 상 원칙이기 때문에 법적 강제력이 존재하지 않는다는 한계가 있다.

35) 신탁의 경우, 별도로 지정된 안전자산으로 운용하도록 지시해야 함을 명시하였다.

36) 발행사가 총량 관리에 참여하되, 정책당국이 위기시 발행사에 대한 유동성 공급을 약정함으로써 사회적 리스크를 분담하는 방안(Schwarcz, 2022)을 한 가지 예로 들 수 있다.

참고문헌

금융감독원, 2022. 9. 28, 「전자금융업자의 이용자 자금 보호 가이드라인」 개정 및 연장 사전예고, 업무자료.

Andriotis, A., 2022. 7. 9, Cryptocurrency is coming to your credit cards, Wallstreet Journal.

Arner, D., Auer, R., Frost, J., 2022, Stablecoins: Risks, potential and regulation, BIS Working Papers 905.

Eichengreen, B., Viswanath-Natraj, G., 2022, Stablecoins and central bank digital currencies: Policy and regulatory challenges, Asian Economic Papers 21(1), 29–46.

European Central Bank, 2022, Macroprudential Bulletin, Issue 18.

Financial Stability Board, 2022, Assessment of Risks to Financial Stability from Crypto-assets.

Griffin, J.M., Shams, A., 2020, Is bitcoin really untethered? Journal of Finance 75(4), 1913-1964.

Li, L., Li, Y., Macchiavelli, M., Zhou, X., 2021, Liquidity restrictions, runs, and central bank interventions: Evidence from money market funds, Review of Financial Studies 34(11), 5402-5437.

Lyons, R.K., Viswanath-Natraj, G., 2020, What keeps stablecoins stable? NBER Working Papers 27136.

Mizrach, B., 2022, Stablecoins: Survivorship, transactions costs and exchange microstructure. https://ssrn.com/abstract=3835219

President’s Working Group on Financial Markets, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, 2021, Report on Stablecoins.

Schwarcz, S.L., 2022, Regulating digital currencies: Towards an analytical framework, Boston University Law Review 102, 1037-1081.

스테이블 코인은 법화나 자산과의 교환 비율을 고정한 디지털 화폐로 정의할 수 있다. 2014년 최초의 스테이블 코인인 테더(Tether)1)가 등장한 이래, 다양한 유형의 스테이블 코인이 계속 출시되었다. 이들은 가상자산 시장에서의 화폐 및 탈중앙금융(이하 DeFi) 시장의 유동성 공급 수단으로 활용되면서 빠르게 성장해 왔다.

아직까지는 스테이블 코인이 일상적인 경제활동에서 폭넓게 사용되지는 않기 때문에 그 용도가 제한적이라는 점은 사실이다. 하지만 국경 없는 근 실시간 직접(near real-time peer-to-peer) 자금 이체와 스마트 계약을 이용한 금융 및 지급결제서비스 등이 가능하다는 장점이 있어 상당한 효용성이 잠재되어 있다. 그래서 최근 미국 내 지역 은행들이 스테이블 코인의 공동 발행을 추진2)하는 등 기존 금융기관들도 스테이블 코인 발행에 큰 관심을 보이고 있다.

스테이블 코인의 장점을 최대한 활용할 수 있다면 편의성과 거래비용 등의 측면에서 사용자의 후생을 크게 제고하는 효과를 기대할 수 있을 것이다. 하지만, 최근 발생한 테라의 붕괴와 함께, 대표적인 스테이블 코인인 테더의 준비자산 문제가 부각되면서 그 리스크에 대한 경각심도 높아지고 있다. 특히, 스테이블 코인이 가치 안정성이라는 원칙을 표방하고는 있지만, 이를 실제로 유지할 수 있는지에 대한 의구심과 직ㆍ간접적인 부작용에 대한 우려가 커지고 있다.

이에 따라 주요국들은 스테이블 코인의 리스크에 대한 대응 방안을 마련하는 데 속도를 내고 있다. 미국은 대통령 직속 워킹그룹의 정책 연구와 의회의 입법안 등을 통해 시장 규율 방안을 모색하는 한편, EU 회원국들은 관련 법안에 이미 합의하고 시행만을 기다리고 있는 상황이다. 국내의 경우, 비스테이블 코인에 대한 정책 방향은 구체화되고 있지만, 스테이블 코인에 대한 논의는 아직 부족한 실정이다. 이에 본고는 법화자산 담보형을 중심으로 스테이블 코인의 리스크를 종합적으로 평가하고 국내 정책 과제에 대해 논의하고자 한다. 여기에서 정책 과제의 경우, 가상자산 일반에 포괄적으로 적용되는 사항보다는 스테이블 코인의 고유한 특징과 관련된 사항을 중심으로 다루도록 하겠다.

본고의 구성은 다음과 같다. 먼저, Ⅱ장에서는 글로벌 시장에서의 스테이블 코인 현황과 주요 스테이블 코인의 특징에 대해 간략히 살펴본다. 이어 Ⅲ장에서는 스테이블 코인 시장의 내부적인 리스크와 관련된 주요 사례와 분석 결과를 제시하고, 외부효과 측면에서의 부정적인 영향에 대해 설명하도록 하겠다. 그리고 Ⅳ장에서 미국과 EU의 정책 방향에 대해 개관한 다음, Ⅴ장에서는 국내 정책 과제와 대응 방안에 대해 논의하도록 하겠다.

Ⅱ. 스테이블 코인 현황: 글로벌 시장

본 장에서는 글로벌 시장에서 발행ㆍ유통되고 있는 스테이블 코인의 현황에 대해 살펴보고자 한다. 여기에서는 먼저 시장 전반에 대해 개관하고, 다음으로 스테이블 코인을 유형별로 구분하여 대표적인 스테이블 코인과 특징에 대해 논의하도록 하겠다.

1. 개관

스테이블 코인은 가상자산 거래와 DeFi에서 지급결제 및 유동성 공급 수단 등으로 활용된다. 가상자산 시장은 기본적으로 블록체인을 기반3)으로 운영되므로 은행 계좌를 통한 지급결제에는 높은 거래비용과 상당한 처리 시간이 소요된다.4) 그리고 투자자가 거래플랫폼 간에 자금을 이전하는 데 법화보다는 스테이블 코인을 사용하는 것이 훨씬 편리하다는 장점이 있다. 이에 따라 고빈도(high frequency) 투자자 등 가상자산 전문 투자자들은 거래 효율성과 편의성이 높은 스테이블 코인을 활용하고 있다. 또한, 스테이블 코인은 프로그래밍이 가능하다는 장점이 있어 스마트 계약을 통해 가상자산 기반 금융거래를 자동 청산ㆍ결제하는 데에도 활용되고 있다. 다만, 일반적인 상거래에서 스테이블 코인이 사용되는 경우는 드물기 때문에 가상자산 시장 이외 부문에서의 활용도는 높지 않다. 과거 메타(Meta)가 추진했던 디엠(Diem) 프로젝트는 범용성에 주안점을 두고 있었으나, 2022년 1월에 해당 사업부를 매각하면서 디엠 발행계획은 백지화되었다. 하지만, 메타 이후에도 글로벌 결제서비스 기업인 페이팔(PayPal)이 범용 스테이블 코인 발행 프로젝트를 진행하고 있다. 페이팔의 사용자가 4억명 이상5)이라는 점을 감안하면, 전자상거래 등에서 해당 스테이블 코인이 상당 부분 활용될 가능성이 있는 것으로 보인다.

이렇게 일부 코인이 시장의 성장을 주도하면서, 경쟁력을 상실하고 사실상 도태되는 스테이블 코인도 상당수 존재한다. Mizrach(2022)에 따르면, 2016년부터 2021년까지 발행된 65개의 스테이블 코인 중 63%에 해당하는 41개의 스테이블 코인은 거래가 거의 사라지면서 유명무실한 상태인 것으로 조사되었다.8) 그리고 스테이블 코인의 생존율은 여타 가상자산(비스테이블 코인)과 비교할 때도 큰 차이가 없는 것으로 나타났다. 이는 비스테이블 코인과 스테이블 코인이 평균 2년 6개월 정도의 짧은 기간 내에 도태된다는 점을 통해 확인할 수 있다(Mizrach, 2022).

2. 주요 스테이블 코인 및 특징

스테이블 코인은 크게 법화자산 담보형(fiat-collateralized), 가상자산 담보형(cryptocurrency-collateralized), 알고리즘형(algorithmic)의 세 유형으로 구분할 수 있다. 법화자산 담보형9)은 법화, 예금, 전통적인 유가증권(국채, 회사채, CP) 등을 준비자산으로 보유함으로써 가치를 고정하는 방식으로, 테더(USDT), USD Coin(USDC), 바이낸스 USD(BUSD), 팍스 달러(Pax Dollar), 제미니 달러(Gemini Dollar) 등이 그 예라 할 수 있다. 가상자산 담보형은 말 그대로 가상자산을 담보로 하여 발행하는 방식으로 DAI가 이 유형에 해당한다. DAI는 18개의 가상자산을 담보로 인정하고 있는데 그 중 스테이블 코인인 USD Coin의 비중이 50% 이상으로 가장 크고, 다음으로 이더리움이 10% 내외를 차지하고 있다. 알고리즘형은 프로그래밍된 공급량 조절 방식을 통해 가격을 고정하는 방식을 따른다. 동 유형의 스테이블 코인은 테라(Terra)가 대표적인데, 테라는 거버넌스 코인인 루나를 통해 수요와 공급을 조절하는 방식을 이용하였다. 알고리즘형은 2022년 상반기에 발생한 테라 사태로 시장의 신뢰를 잃었고, 현재 스테이블 코인 시장 내에서의 비중도 미미한 수준이다.

전술한 바와 같이 스테이블 코인은 가상자산 시장의 주요 지급결제 수단으로 사용되고 있다. 이에 따라 글로벌 가상자산 거래에서 스테이블 코인을 통한 결제 비중은 상당히 높은 수준이다. 전체 가상자산 거래(2022년 8월말)에서 테더를 이용한 비중은 50.2%, USDC는 25.7%, BUSD는 11.3%를 차지하고 있다(<그림 Ⅱ-2> 좌측). 동 상위 3개 스테이블 코인을 이용한 결제 비중의 합계는 약 87%로, 법화인 달러(7.9%)와 유로(1.3%)를 크게 넘어서는 수준이다. 따라서 글로벌 가상자산 거래에서는 법화가 아니라 스테이블 코인이 핵심적인 지급결제 수단이라는 점을 알 수 있다.10) 그리고 이러한 특징은 은행 계좌(예금)를 기반으로 가상자산 거래가 이루어지고 있는 국내 시장과는 큰 차이를 나타낸다.

Ⅲ. 스테이블 코인의 리스크

테라의 붕괴는 스테이블 코인의 리스크에 대해 상당한 위기감을 가지게 된 계기가 되었다. 테라는 시장가격이 1달러 아래로 하락하더라도 1개의 테라로 1달러의 가치만큼 루나로 교환되게 함으로써, 두 코인을 이용한 차익거래를 통해 가격이 유지되도록 설계되었다. 하지만, 테라 예치자에 대한 과도한 이자 지급으로 지속가능성에 대한 의문이 커지는 가운데, 2022년 5월 들어 테라와 루나의 대량 매도가 일시에 발생하였다. 그래서 결국 차익거래를 통한 가격 유지 기제가 무력화되면서 테라의 가격은 회복할 수 없는 수준으로 급락하고 사용자들의 원금(달러 기준) 회수가 불가능해졌다.

동 사례로 볼 때, 스테이블 코인과 관련된 일차적인 우려로 가격 안정성과 법화로의 교환 가능성(redeemability) 측면에서의 리스크를 들 수 있다. 이는 스테이블 코인 자체의 문제라는 점에서 내부 리스크12)라고도 할 수 있다. 아울러, 스테이블 코인이 자체 영역을 넘어 전통적인 금융시스템에까지 광범위하게 영향을 미칠 가능성도 있다. 이는 외부 효과 측면에서의 리스크로, 금융안정, 금융중개, 통화정책 등에 대한 부작용으로 이어질 수 있는 부분이다. 본 절에서는 법화자산 담보형을 중심으로 이러한 내ㆍ외부적인 리스크에 대해 논의하고자 한다.

1. 준비자산 운영과 내부 리스크: 테더 사례

테라 사태는 알고리즘형 스테이블 코인이라는 특수한 유형에 국한된 예외적인 사례로 간주될 수도 있다. 그러나 법화자산 담보형에서도 중요한 문제점들이 드러나면서 스테이블 코인 시장 전반에 대한 우려가 높아지고 있다. 특히 테더의 경우, 발행사가 여러 이유로 준비자산을 부실 운영할 수 있으며 이것이 근본적인 불안 요인이 될 수 있음을 보여주는 대표적인 사례로 생각된다.

앞 장에서 살펴본 바와 같이, 테더는 최대 규모의 스테이블 코인으로 테더 사(Tether Limited)에 의해 발행되고 있다. 테더 사는 발행액과 동일한 금액의 통화를 준비자산으로 보유13)한다는 점을 명시하고, 이를 근거로 테더의 안정성을 강조해 왔다. 하지만 2021년에 준비자산 부실이 밝혀지면서 테더 사는 뉴욕주 법원으로부터 1,850만달러의 벌금을 부과받게 되었다. 그리고 해당 조사 과정에서 계열사인 Bitfinex에 불법 대출을 제공하고 여기에서 8억 5,000만달러의 손실을 입음으로써 준비자산 부족이 발생하였다는 사실이 드러났다. 또한, 미 상품선물위원회(CFTC)의 조사 결과, 2016~2018년의 기간(26개월) 중 준비자산이 제대로 확보된 기간은 1/4에 불과해, 4,100만달러의 벌금이 추가로 부과되기도 하였다.

테더 사의 준비자산 부족은 관계사 부당 지원뿐만 아니라, 비트코인 가격 조작을 위해 테더를 허위 발행한 데 따른 결과라는 실증 연구도 있다. Griffin & Shams(2020)에 따르면, 비트코인 가격 하락 이후 테더의 발행이 이상 급증하면서 비트코인 가격이 다시 상승하였는데, 이때 동일한 지갑 주소에서 비트코인과 테더가 대량 입출금된 것으로 나타났다. 그리고 월말경에는 관계사인 Bitfinex가 자체 보유한 비트코인의 잔액이 크게 감소한 점도 관측되었다. 동 연구자들은, Bitfinex가 테더 사의 월말 준비자산 보고를 위해 그 직전에 비트코인을 현금화하면서 이러한 패턴이 나타나는 것으로 해석하였다. Bitfinex는 한동안 발행시장에서 테더를 독점적으로 공급해 왔다.14) 정상적인 운영 방식이라면, 테더 판매의 대가로 Bitfinex가 수취한 현금은 즉시 테더 사로 환입되고 준비자산으로 전환되어야 한다. 하지만 동 연구에 따르면, 테더 사는 Bitfinex를 통해 준비자산 없이 발행한 테더로 비트코인을 매입했다가 준비자산 보고 시점에 맞춰 비트코인을 현금화한 것으로 보인다.15)

2. 가상자산 시장과 내부 리스크

스테이블 코인의 안정성은 전반적인 가상자산 시장 상황에도 영향받을 수 있다. 즉, 비트코인 등 주요 가상자산의 불안으로 투자자가 대규모로 동 시장을 이탈(exit)한다면 스테이블 코인의 대량 매도와 가격 하락 압력이 발생할 수 있기 때문이다. 이러한 맥락에서 Eichengreen & Viswanath-Natraj(2022)는 비트코인의 가격 변동성 확대시 스테이블 코인 발행사의 지급불능(default) 위험이 높아진다는 점을 보인 바 있다. 그리고 본고의 분석에 따르면, 비트코인 수익률이 스테이블 코인의 가격에 유의한 영향을 미칠 수 있는 것으로 추정되었다. 특히 그러한 경향은 준비자산 부실 문제가 지적되어 온 테더에서 뚜렷하게 나타났다.

3. 외부 효과21) 측면의 리스크

스테이블 코인은 여타 가상자산 및 기존 금융시스템과의 연계를 통해 여러 측면에서 부정적인 외부 효과를 유발할 위험이 있다. 그러한 첫 번째 예로 스테이블 코인 시장의 불안이 전체 가상자산 시장으로 확산되는 상황을 생각할 수 있다. 전술한 바와 같이 글로벌 가상자산 시장에서 스테이블 코인은 핵심적인 지급결제 수단으로 사용되고 있다. 만약 주요 스테이블 코인에서 지급불능 사태가 발생한다면 가상자산 투자자의 자금원이 사실상 증발하면서 전체 가상자산 시장의 유동성 위기로 확대될 우려가 있다.

아울러 스테이블 코인 시장의 불안이 전체 금융시장으로 전이될 위험에 대해서도 경계할 필요가 있다. 특히, 법화자산 담보형 스테이블 코인은 준비자산을 통해 전통적인 금융시장과 밀접하게 연결되어 있어 시스템 리스크의 주요 요인이 될 수 있다. 과거 미국의 MMF 런(MMF run: 대규모 환매 사태)은 MMF가 투자한 ABCP, CD, RP 부문 등에서 단기 금융시장의 자금 경색을 유발한 바 있다(Li et al., 2021). 법화자산 담보형은 예금, 단기증권, 대출 등을 준비자산으로 보유하고 있는데, 법화로의 인출 수요가 급증한다면 발행사는 준비자산을 대량 처분할 필요성이 커지게 될 것이다. 따라서 스테이블 코인 런이 발생한다면 해당 시장의 불안이 은행이나 자금시장으로까지 확산될 가능성이 있다.

스테이블 코인은 국내 금융중개 기능에도 부정적인 영향을 미칠 수 있다. 이는 외화 스테이블 코인의 사용이 확대될 때 크게 우려되는 부작용이라 할 수 있다. 해외 통화에 연동된 스테이블 코인은 대상 통화로 표시된 금융상품을 중심으로 준비자산을 구성할 것으로 예상된다. 따라서 외화 스테이블 코인에 대한 수요가 증가할 경우, 자본 유출이 확대되면서 국내 금융중개 기능이 약화될 수 있다. 다만, 국내 통화에 연동된 스테이블 코인(법화자산 담보형)이 국내 금융중개에 미치는 영향은 크지 않을 것으로 판단된다. 국내 통화 스테이블 코인이 요구불 예금이나 여타 저축 수단을 대체할 때, 개별 금융상품에 대한 수요의 구성은 변화할 수 있을 것이다. 하지만, 발행사가 국내 금융상품으로 준비자산을 축적한다면 해당 자금은 궁극적으로 국내 금융시스템 내에 남게 된다. 따라서 전체적인 관점에서는 금융기관들의 예탁금(deposit)과 자금 공급 능력이 축소되지 않을 것으로 판단된다.

이와 함께 스테이블 코인이 통화정책의 유효성에도 영향을 미칠 가능성이 있다. 만약, 스테이블 코인의 사용자 기반이 크게 확대된 상황에서 대형 발행사가 통화정책과 상충되는 방향으로 공급을 결정한다면 통화정책의 유효성을 크게 제약할 수 있다. 예컨대, 중앙은행이 긴축적인 통화정책을 운영하고 있는 와중에 스테이블 코인이 대규모로 무상지급(airdrop)된다면 통화정책의 긴축 효과를 약화시킬 우려가 존재한다.22) 그리고 외화 스테이블 코인이 국내 통화를 대체한다면, 국내 금융중개 기능 약화로 통화정책의 파급경로가 원활히 작동하지 않게 되어 통화정책의 효과가 축소될 소지가 있다.

Ⅳ. 미국과 EU의 대응 방향

주요국들은 스테이블 코인에 잠재된 리스크에 상당히 유의하면서 허가 및 운영 기준, 감독 방안 등을 구체화하고 있다. 여기에서는 대표적으로 미국과 EU의 사례를 중심으로 대응 방향에 대해 살펴보고자 한다.

1. 미국

미국에서는 2021년 11월 대통령 직속 워킹그룹(President’s Working Group on Financial Markets, 이하 PWG)이 스테이블 코인의 리스크를 관리하기 위한 정책 방향을 제시한 바 있다. PWG는 사용자 보호와 대량 인출 예방, 지급결제 시스템의 리스크 완화, 시스템 리스크와 경제력 집중 완화라는 세 측면이 입법의 기본 원칙이 되어야 함을 강조하였다. 구체적으로, 사용자 보호와 대량 인출 예방을 위해서는 예금자보험에 의해 법화 예치금이 보호되도록 하고 예금기관 수준의 감독 기준과 규제가 필요하다는 점을 밝혔다. 그리고 지급결제 시스템의 리스크 완화를 위해서는 스테이블 코인 발행자와 수탁 관리자(custodial wallet provider)에 대한 연방정부의 감독이 시행되어야 함을 지적하였다. 마지막으로 시스템 리스크와 경제력 집중 완화를 위해서는 스테이블 코인 발행자와 영리기업과의 제휴 활동을 제한할 필요가 있다고 보았다.

정부의 정책방향 검토와 함께, 미 의회에서는 사용자 보호와 금융안정을 목적으로 한 스테이블 코인 관련 법안이 발의된 바 있다. 해당 법안들은 예금자보험이나 협의의 은행(narrow banking) 방식 등을 통해 사용자 보호를 강화해야 한다는 점을 골자로 하고 있다. 아울러 최근에는 미 하원 금융서비스 위원들을 중심으로 알고리즘형 스테이블 코인 발행을 2년간 금지하는 법안을 준비하고 있는 것으로 알려졌다.23)

한편, 연방 차원의 법 제정과 시행까지는 상당한 시간이 소요되어 주 정부가 독자적으로 규제 방안을 정하여 시행한 경우도 있다. 뉴욕주는 2018년에 신탁회사에 대한 규제를 준용하여 Paxos사(Pax Dollar와 Binance USD 발행)와 Gemini사(Gemini Dollar 발행)의 스테이블 코인 발행을 허가한 바 있다. 또한, 2021년에는 문제가 되었던 테더와 관계사에 벌금을 부과하고 뉴욕주에 소재한 모든 개인 및 법인과의 거래를 금지하였다. 2022년 6월에는 규제 방향을 체계화하여「달러화 스테이블 코인에 관한 지침(Guidance on the Issuance of U.S. Dollar-Backed Stablecoins)」을 발표하고 허가, 상환의무, 준비자산, 감사 등에 관한 기준을 제시였다. 동 지침에 따르면, 스테이블 코인 발행자는 특수목적 신탁회사(limited purpose trust company)로 허가를 받아야 하며 이에 따라 예금과 대출 업무는 수행할 수 없게 된다. 상환과 관련해서는, 법화로의 인출 요구가 발생한 후 2영업일 이내에 사전 약정된 교환 비율에 따라 발행사가 법화를 지급해야 함을 명시하였다. 그리고 준비자산은 여타 자산과 분리하여 관리하되, 예금자보호 적용 대상인 금융기관에 예치하거나 국채, 국공채형 MMF 등 안전자산으로 보유하도록 하였다.24) 감사의 경우에는 외부 회계법인을 통해 월별 준비자산 현황 및 연간 감사 보고서를 작성해야 하는 의무를 부과하였다.

2. 유럽 연합(EU)

EU는 2022년 6월에 회원국들이 합의한 가상자산(Markets in Crypto-Assets: MiCA) 규제 법안25)을 통해 스테이블 코인에 대한 정책 방향을 제시한 바 있다. 동 법안은 스테이블 코인을 크게 자산연계형 토큰(asset-referenced tokens)과 전자화폐형 토큰(electronic money tokens)으로 나누어 정의하고 있다. 여기에서 자산연계형 토큰은 복수의 법화, 또는 하나 이상의 상품 및 가상자산의 가치를 벤치마크로 하여 가치를 안정적으로 유지하는 가상자산으로 정의된다.26) 그리고 전자화폐형은 하나의 법화를 벤치마크로 하여 가치를 안정적으로 유지하는 가상자산이자 지급수단으로 정의된다.27) 한편, 알고리즘형은 자산연계형이나 전자화폐형에 해당하지 않는 것으로 규정하여 스테이블 코인의 범주에서 사실상 제외되었다.

동 법안에서는 자산연계형은 신용기관(credit institution), 전자화폐형은 전자화폐사업자 및 신용기관이 발행하는 것을 허용하고, 이외의 경우는 별도 허가 사항으로 규정하였다. 그리고 상환과 관련해서는, 자산연계형과 전자화폐형 공통적으로 인출 요구 발생 시 2영업일 이내에 지급되어야 한다는 의무를 명시하였다. 준비자산의 경우, 두 유형 모두 유럽 증권시장 감독청과 중앙은행 협의체(European System of Central Banks)가 설정한 기준에 따라 시장ㆍ집중ㆍ신용리스크가 매우 낮고 유동성이 높은 금융자산에 한하여 투자할 수 있게 하였다. MiCA 규제 법안은 발행자에 대한 자기자본 요건도 설정하였는데, 이에 따르면 발행자는 2% 이상28)의 자기자본을 보유해야 할 의무가 있다. 아울러 별도로 지정된 중요 발행자(issuers of significant tokens)는 상기 기준의 1.5배에 해당하는 자본을 확보하고 스트레스 테스트를 실시해야 한다는 의무를 추가하였다. 동 법안은 이외에도, 감독, 공시, 지배구조 등에 대한 기준을 구체적으로 제시하고 있다.

Ⅴ. 국내 정책 과제 및 결론

미국과 EU는 가상자산을 스테이블 코인과 비스테이블 코인으로 명확하게 구분하고 두 시장에 대한 정책 설계를 함께 진행하고 있다. 반면, 국내에서 가상자산과 관련된 제도적인 논의는 주로 비스테이블 코인에 집중되어 있는 실정이다. 국내 스테이블 코인 시장이 아직 미미한 수준29)이기는 하지만, 향후 동 시장이 빠르게 성장할 가능성에 대비해야 할 것으로 생각된다. 특히, 가상자산의 국내 발행(ICO)이 허용되고 블록체인 기반의 지급결제가 일반화된다면, 국내에서도 스테이블 코인의 발행과 사용이 크게 확대될 가능성이 있다.30) 또한, 은행권에서도 신사업의 일환으로 스테이블 코인의 발행을 검토하는 등 기존 금융기관들도 시장 진입에 관심을 가지고 있다.31)

이상과 같이 다양한 목적을 가진 경제 주체들의 참가하면서 국내 스테이블 코인 시장이 급성장할 수 있으므로 제도 마련에 착수해야 할 것으로 보인다. 그리고 여기에서는 기본적으로 발행 가능한 스테이블 코인의 유형에 대한 정책 방향을 명확히 할 필요가 있다. 전술한 바와 같이 스테이블 코인은 크게 세 가지 유형으로 나누어 볼 수 있다. 이 중, 지급 보장 기제와 안정성 등을 고려할 때 법화자산 담보형 중심으로 발행을 유도하는 것이 바람직하다고 판단된다.32) 알고리즘형의 경우, 준비자산이 명시적으로 존재하지 않아 사용자 보호가 부족하고, 이로 인해 가격 불안이 쉽게 증폭될 수 있어 안정성 측면에서 취약점을 내포하고 있다. 그래서 미국과 EU 등 주요국들은 알고리즘형에 대해 상당히 부정적인 입장을 취하고 있다. 국내에서 알고리즘형의 발행을 직접적으로 제한하지 않을 경우, 제도적으로는 동 유형을 비스테이블 코인으로 분류하고 스테이블 코인이라는 명칭의 사용을 금지하는 것이 바람직하다고 생각된다. 한편, 가상자산 담보형은 과담보(over-collateralization) 등으로 안전장치를 보완하고 있으나 가상자산 가격의 높은 변동성으로 인해 가격 불안과 대량 인출 가능성이 큰 것으로 평가된다. 다만, 가상자산 담보형이 안정성 높은 법화자산형 스테이블 코인을 선별하여 담보로 하는 경우에는 긍정적으로 고려해 볼 여지가 있을 것이다.

스테이블 코인의 사용 범위(기능적인 범위)도 제도 설계에서 중요 고려사항이 되어야 할 것으로 생각된다. 이는 규제의 기술적 중립성과 금융안정 간의 균형을 조절하는 데 있어 기본적인 판단 기준이 될 것이다. 스테이블 코인은 가상자산 거래뿐만 아니라, 잠재적으로는 일반 상거래33), 금융 및 외환거래에까지 사용되면서 높은 범용성을 가질 수 있다. 스테이블 코인의 사용 범위가 넓어질수록 편의성과 기술혁신 동기가 높아질 수 있겠지만, 금융ㆍ경제적 상호연계성이 높아지면서 시스템 리스크가 확대될 소지가 있다. 이러한 점을 고려할 때 개별 스테이블 코인의 사용 범위에 따라 제도적인 안전장치가 차등 적용되어야 할 필요가 있다. 예컨대, 국내 가상자산 거래로만 범위가 한정된 스테이블 코인에는 선불전자지급수단 및 전자화폐 관련 법규34), 범위의 제한이 없는 경우에는 은행 부문과 외국환거래 관련 법규가 제도적인 벤치마크가 될 수 있을 것이다. 그리고 EU의 MiCA 규제 법안과 유사하게, 스테이블 코인의 시가 총액 및 거래량 등 규모도 함께 고려하여 예외 및 추가규제 사항을 적용할 필요가 있다고 생각된다.

전술된 방향을 따를 때, 일부 스테이블 코인에 대해서는 은행 수준의 규제나 예금보험이 적용되지 않아 지급 불이행에 대한 우려가 커질 수 있다. 따라서 해당 스테이블 코인의 경우, 지급 보장 기능을 강화하기 위해 엄격한 준비자산 관리와 보완 수단이 뒷받침되어야 할 것이다. 이를 위해 여러 대안을 고려할 수 있겠지만, 현행 규제체계 내에서는 선불전자지급수단에 대한 감독 지침을 참고할 수 있을 것으로 판단된다. 금융감독원의 「전자금융업자의 이용자 자금 보호 가이드라인」은 선불전자지급 수단 발행ㆍ관리업자가 사용자를 수익자 및 피보험자로 지정하여 선불충전금을 100%를 신탁35)하거나 지급보증보험에 가입하도록 하였다. 동 지침은 선불충전금이 비부보(예금보험)라는 점 때문에 시행된 예치금 관리 방안으로, 비부보 스테이블 코인에도 적용 가능한 것으로 보인다. 따라서 비부보 스테이블 코인에 대해 지급 의무를 명시하고, 구체적인 준비자산 관리 방안은 해당 지침을 준용하는 방향으로 제도를 설계할 수 있을 것으로 생각된다.

한편, 스테이블 코인 시장이 크게 확대되어 통화정책의 유효성이 약화될 가능성에도 대비해야 할 필요가 있다. 대형 발행사의 무상지급에 대해서는 추가적인 건전성 규제를 적용함으로써 그 남용과 통화정책과의 상충을 일차적으로는 방지할 수 있을 것으로 생각된다. 즉, 스테이블 코인의 무상지급은 발행사의 자본을 감소시키게 되므로 건전성 규제를 강화함으로써 그 남용을 어느 정도 제한하는 효과가 있을 것이다. 하지만, 동 규제의 실효성이 크지 않을 경우에는 발행사들과 정책당국 간 보완적인 협약36)을 통해 발행 총량을 직접적으로 관리하는 방안을 고려해 볼 필요도 있다.

이상에서는 스테이블 코인의 특징에 초점을 맞추어 관련된 주요 정책 과제를 제시하였다. 스테이블 코인에도 적용되는 일반적인 가상자산 관련 정책은 이미 상당 부분 논의가 진행되었기 때문에 본고에서 별도로 다루지는 않았다. 하지만, 이는 해당 사항들이 부차적이기 때문은 아니라는 점에 유념해야 할 것이다. 특히, 보안, 내부통제, 정보공개, 시장교란 등에 대한 규율은 스테이블 코인을 비롯한 전체 가상자산 시장이 정상적으로 기능하기 위한 필요조건이라 할 수 있다. 따라서 정책 마련에 속도를 내는 한편, 이러한 요소들을 종합적으로 반영함으로써 스테이블 코인 시장의 제도적인 공백을 최소화할 필요가 있다.

1) 당시 명칭은 Realcoin이었다.

2) https://www.usdfconsortium.com

3) 중앙화된 플랫폼를 이용한 거래의 경우, 실시간으로 블록체인에 거래가 기록되지는 않지만 최종적으로는 블록체인 상에서 거래가 체결ㆍ기록된다.

4) 예를 들어, Coinbase에서 미국 은행 계좌를 이용하여 거래할 경우 입출금에 1일 이상 소요되고 처리는 은행의 영업일 및 영업시간으로 한정된다.

5) 페이팔이 공시(https://investor.pypl.com/home/default.aspx)한 2022년 2분기 기준 자료이다.

6) 그러나, 스테이블 코인의 거래는 매우 활발하여 2021년 중 테더의 거래대금은 S&P500 전 종목의 거래대금을 추월하기도 하였다.

7) 2022년 9월말 기준 수치이다.

8) Mizrach(2022)이 이더리움 네트워크(메인넷)상 스테이블 코인을 대상으로 조사한 것으로, 분기별 거래량이 최대치 대비 1% 미만의 수준으로 낮아지는 경우 도태된(failed) 것으로 간주하였다.

9) 법화자산 담보형은 법화만이 아니라 법화를 기반으로 한(fiat-denominated) 전통적인 자산을 담보로 한다는 점을 밝혀 둔다.

10) 아울러 DeFi 시장에 공급되는 유동성의 약 45%가 스테이블 코인인 것으로 조사되었다(2022년 5월 기준, ECB(2022)).

11) 2022년 3월 기준 자료이다.

12) 결제 및 보안 리스크 등도 여기에 포함되지만 본고에서는 스테이블 코인의 고유 특징에 주안점을 두고 가격 안정성과 법화 교환 가능성 측면의 리스크를 중심으로 다루도록 하겠다.

13) 테더는 최초 발행 시기인 2014년부터 2019년 2월까지 “Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USDT is always equivalent to 1 USD.”라 명시했다.

14) 테더는 2019년 4월까지 Bitfinex만을 통해 공급되었다.

15) 투자자들은 전술한 내용과 같은 가격 조작이 발생했다고 보고, 테더 사와 Bitfinex에 대한 집단소송을 진행하고 있으며, 이 과정에서 뉴욕주 법원은 테더 사에 원장, 재무제표, 가상자산 거래 내역 등에 대한 정보 공개를 명령하였다(2022년 9월).

16) 준비자산 운용은 발행사의 중요한 수입(revenue)원이 된다. 테더 사에 대한 상세한 정보는 공개되어 있지 않지만, 경쟁사인 Circle의 손익계산서를 보면 2022년 상반기 수입 중 약 80%를 이자 수입이 차지하고 있다.

17) Reserve Primary Fund는 2007년 중반경까지는 자산담보부 어음(ABCP) 비중을 10% 미만으로 유지했으나 이후 그 비중을 60% 수준까지 급격히 증가시켰다. 2008년 리먼 브라더스가 파산하면서 환매 요구가 쇄도함에 따라 가격(좌당 1달러) 유지가 불가능해졌다.

18) MMF는 높은 가치 안정성을 추구하는 금융자산이라는 점을 표방해 왔다. 특히 미국의 MMF는 2010년대 중반까지 좌당 순자산가치를 1달러로 유지하는 고정 순자산가치 방식으로 운용되었다.

19) 당해 10월초, 테더는 반박문을 통해 이러한 의혹이 근거없는 풍문이라 주장한 바 있다(https://medium.com/bitfinex/a-response-to-recent-online-rumours-677de7c4d171).

20) 정량적으로는 비트코인 수익률이 10%p 하락할 경우, 테더 가격은 약 0.5% 정도 하락하는 것으로 분석된다. 2020년 이후 일별 자료를 보면 비트코인 수익률이 50%p 가까이 하락한 경우도 있는데, 이 경우 테더 가격에는 약 2.5%만큼의 하락 압력이 작용하는 것으로 추정할 수 있다. 단, 이는 평균적인 추정치로 비트코인 가격 하락 시에는 가상자산 전반에 대한 신뢰 문제가 부각되면서 그 영향이 확대될 수 있다.

21) 외부 효과는 제3자에 대한 영향을 의미하므로 스테이블 코인 시장 내에서도 외부 효과가 발생할 수 있지만, 본 절에서는 스테이블 코인 시장 외부에 대한 영향을 다루도록 하겠다.

22) 스테이블 코인 발행사가 시장지배력을 높이기 위해 무상지급 전략을 사용할 수 있을 것이다. 발행사가 이익잉여금(자본)으로 스테이블 코인의 무상지급분(부채)을 충당하고, 이익잉여금으로 축적한 자산을 무상지급분에 상응하는 준비자산으로 전환한다면, 스테이블 코인의 가격에 대한 영향 없이 발행량이 증가하게 될 것이다. 이렇게 발행사가 제공한 무상지급분은 소비에 활용될 수 있다.

23) https://www.bloomberg.com/news/articles/2022-09-20/house-stablecoin-bill-would-put-two-year-ban-on-terra-like-coins#xj4y7vzkg

24) 주 정부의 승인하에 수탁회사에 보관하는 것도 허용하였다.

25) 영문 명칭은 「Regulation of the European Parliament and of the Council on Markets in Crypto-Assets, and amending Directive (EU) 2019/1937」이다.

26) “‘asset-referenced token’ means a type of crypto-asset that purports to maintain a stable value by referring to the value of several fiat currencies that are legal tender, one or several commodities or one or several crypto-assets, or a combination of such assets.”(「Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937」)

27) “‘electronic money token’ or ‘e-money token’ means a type of crypto-asset the main purpose of which is to be used as a means of exchange and that purports to maintain a stable value by referring to the value of a fiat currency that is legal tender.”(「Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive(EU) 2019/1937」)

28) 자산연계형은 35만 유로, 준비금의 2%, 또는 전년도 고정간접비(fixed overhead)의 25%로 계산된 세 가지 수치 중 가장 큰 금액을 자본으로, 전자화폐형은 35만 유로의 최초 자본금과 함께 준비금의 2% 이상을 자본으로 유지해야 한다.

29) 원화 기반 스테이블 코인의 경우, 바이낸스 코리아가 BKRW를 출시한 바 있으나 2020년말 철수하였고, 원화 테라(KRT)도 2022년 5월 주요 거래플랫폼에서 상장 폐지된 바 있다. 외화 스테이블 코인(테더와 USDC)의 경우, 일부 중소 거래플랫폼에서 원화 또는 가상자산을 결제수단으로 하여 거래되고 있다.

30) 가상자산 및 증권형 토큰 거래에 스마트 계약을 적용하기 위해 스테이블 코인을 이용할 수 있을 것이다.

31) https://news.einfomax.co.kr/news/articleView.html?idxno=4186159

32) 테라 사태 이전에도 법화자산 담보형 스테이블 코인이 여타 유형보다 가격 안정성이 높은 것으로 분석되었다(Mizrach, 2022).

33) 미국의 경우, USDC의 발행사인 Circle이 비자와 마스터카드와 제휴하여 USDC 기반의 일반 결제서비스를 준비하고 있다.

34) 해당 전자지급수단에 대한 기본 법령은 「전자금융거래법」에 기초하고 있다. 최근 사용자 보호 부족으로「전자금융거래법」의 개정 필요성이 논의되는 가운데, 금융감독원은 제도의 미비를 보완하기 위해 「전자금융업자의 이용자 자금 보호 가이드라인」을 시행하고 있다. 동 가이드라인은 선불전자지급수단의 충전금은 선불업자의 고유 계정과 분리하여 은행 등 외부기관에 신탁하고 동 신탁자금은 국채 및 예금 등 안전자산으로 운용되도록 하였다. 또한 신탁상품에 즉시 가입하기 곤란한 경우에는 지급보증보험에 가입하는 것을 허용하였다. 다만, 이러한 내용은 행정지도 상 원칙이기 때문에 법적 강제력이 존재하지 않는다는 한계가 있다.

35) 신탁의 경우, 별도로 지정된 안전자산으로 운용하도록 지시해야 함을 명시하였다.

36) 발행사가 총량 관리에 참여하되, 정책당국이 위기시 발행사에 대한 유동성 공급을 약정함으로써 사회적 리스크를 분담하는 방안(Schwarcz, 2022)을 한 가지 예로 들 수 있다.

참고문헌

금융감독원, 2022. 9. 28, 「전자금융업자의 이용자 자금 보호 가이드라인」 개정 및 연장 사전예고, 업무자료.

Andriotis, A., 2022. 7. 9, Cryptocurrency is coming to your credit cards, Wallstreet Journal.

Arner, D., Auer, R., Frost, J., 2022, Stablecoins: Risks, potential and regulation, BIS Working Papers 905.

Eichengreen, B., Viswanath-Natraj, G., 2022, Stablecoins and central bank digital currencies: Policy and regulatory challenges, Asian Economic Papers 21(1), 29–46.

European Central Bank, 2022, Macroprudential Bulletin, Issue 18.

Financial Stability Board, 2022, Assessment of Risks to Financial Stability from Crypto-assets.

Griffin, J.M., Shams, A., 2020, Is bitcoin really untethered? Journal of Finance 75(4), 1913-1964.

Li, L., Li, Y., Macchiavelli, M., Zhou, X., 2021, Liquidity restrictions, runs, and central bank interventions: Evidence from money market funds, Review of Financial Studies 34(11), 5402-5437.

Lyons, R.K., Viswanath-Natraj, G., 2020, What keeps stablecoins stable? NBER Working Papers 27136.

Mizrach, B., 2022, Stablecoins: Survivorship, transactions costs and exchange microstructure. https://ssrn.com/abstract=3835219

President’s Working Group on Financial Markets, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, 2021, Report on Stablecoins.

Schwarcz, S.L., 2022, Regulating digital currencies: Towards an analytical framework, Boston University Law Review 102, 1037-1081.