Find out more about our latest publications

Exploring relationships between climate risks and asset prices: A survey

Survey Papers 23-01 Jan. 19, 2023

- Research Topic Other

- Page 83

This report examines the implications climate risk on capital markets and asset prices. Climate change is one of the most important issues in our generation and may have significant impacts on the economy. This report provides a comprehensive literature review on the relationship between climate risk and asset prices and conducts an empirical analysis to test whether transition risk is associated with stock returns in Korea. This reports aims to advance our understanding of the financial risks linked to climate change and its implications on asset prices.

The report begins by providing an introduction to financial risks caused by climate change. It explains the two main types of climate-related financial risks: physical risk, resulting from the natural disasters and weather changes due to climate change, and transition risk, resulting from the transition to a decarbonized economy. It discusses how physical and transition risks impact companies and transmit to the economy and financial markets.

The second chapter then surveys the literature on the relationship between climate risks and asset prices. The chapter reviews the rapidly growing literature that studies the effects of climate risk on asset prices, and finds that climate risks have substantial effects on the prices of assets that are exposed to such risks. This chapter then turns to discussion of scenario-based climate risk assessment methodologies and presents examples of climate stress testing by central banks.

Finally, the third chapter examines whether climate-related risks, in particular, transition risks, are priced in Korean stock market by using the compliance with the Korean emission trading scheme as a proxy for transition risks. The result shows that stocks of firms that are subject to the emission trading scheme, or relatively more exposed to transition risks, tend to have higher abnormal returns and this pattern is more pronounced after the Paris Agreement. This result thus indicates that transition risk may have significant effects on asset prices, and emphasizes the need to make efforts to understand the financial implications of climate risk and develop methodologies to assess the impact of climate risks.

The report begins by providing an introduction to financial risks caused by climate change. It explains the two main types of climate-related financial risks: physical risk, resulting from the natural disasters and weather changes due to climate change, and transition risk, resulting from the transition to a decarbonized economy. It discusses how physical and transition risks impact companies and transmit to the economy and financial markets.

The second chapter then surveys the literature on the relationship between climate risks and asset prices. The chapter reviews the rapidly growing literature that studies the effects of climate risk on asset prices, and finds that climate risks have substantial effects on the prices of assets that are exposed to such risks. This chapter then turns to discussion of scenario-based climate risk assessment methodologies and presents examples of climate stress testing by central banks.

Finally, the third chapter examines whether climate-related risks, in particular, transition risks, are priced in Korean stock market by using the compliance with the Korean emission trading scheme as a proxy for transition risks. The result shows that stocks of firms that are subject to the emission trading scheme, or relatively more exposed to transition risks, tend to have higher abnormal returns and this pattern is more pronounced after the Paris Agreement. This result thus indicates that transition risk may have significant effects on asset prices, and emphasizes the need to make efforts to understand the financial implications of climate risk and develop methodologies to assess the impact of climate risks.

Ⅰ. 서론

2021년 8월 기후변화에 관한 정부간 협의체(Intergovernmental Panel on Climate Change: IPCC)는 현재의 지구온난화는 인간이 배출한 온실가스에 의한 것임이 사실상 확실하다고 평가하며, 이와 같은 추세로 지구온난화가 지속될 경우 2040년 이전에 지구 평균온도가 산업화 이전 대비 1.5℃ 이상 높아지며 대형 산불, 폭염, 한파, 사이클론 등 극한 기후 현상도 더욱 빈번해질 것으로 전망하였다.1) 코로나19를 비롯하여 미국 텍사스 한파, 아마존 산불, 베이루트 폭발 사고, 인도와 방글라데시 사이클론 발생 등 최근 1~2년 사이에 발생한 전 지구적 재난들이 모두 공통적으로 지구온난화라는 근본 원인으로 상호 연결되어 있다는 분석 결과도 제시되고 있다(UNU-EHS, 2021).

이처럼 기후변화가 인간의 온실가스 배출활동에 기인한 것임이 명백해짐에 따라, 기후변화 문제 해결을 위한 국제사회의 온실가스 감축 노력 또한 강화되고 있다. 2015년 파리협정에서 전 세계 195개국이 지구 평균온도 상승폭을 산업화 이전 대비 2℃ 이하로 유지하고 더 나아가 1.5℃ 이하로 억제하기 위해 노력한다는 목표를 설정한 이후, 각국은 국가별 온실가스 감축 목표와 저탄소발전전략을 수립하는 등 기후변화 대응에 적극적으로 나서고 있다. 이미 우리나라를 포함한 92개국이 넷제로(Net-Zero) 목표를 설정하였으며 그 중 60개 이상의 국가들이 2050년까지 넷제로를 달성하겠다고 선언하였다.2) 마찬가지로 글로벌 주요 연기금과 대형 기관투자자들도 화석연료 개발사업에 대한 금융지원을 중단하고 포트폴리오 내 화석연료 관련 자산 비중을 줄이겠다고 밝히며 기후변화 대응에 적극 동참하고 있다. 지난 2019년 캘리포니아공무원연기금(CalPERS)을 비롯한 7개 기관투자자들이 모여 2050년 투자 포트폴리오의 넷제로 달성을 목표로 발족한 단체인 글로벌 넷제로 투자자연합(Net Zero Asset Owner Alliance: NZAOA)의 경우, 설립 4년이 지난 현재 70개 이상의 회원기관을 두고 있으며, 총 운용자산도 설립 당시 2조 5천억달러에서 10조달러 규모로 3배 이상 증가한 것으로 전해지고 있다.

이처럼 기후변화는 기상이변, 자연재해를 유발함으로써 실물자산에 물리적인 피해를 입힐 수 있을 뿐만 아니라, 기후변화 대응 정책이 시행되는 과정에서 화석연료 의존 산업과 같이 탄소집약적인 산업의 수익성 악화, 자산가치 하락 등 이행리스크를 유발할 수 있다. 더 나아가 물리적리스크와 이행리스크는 이러한 리스크에 노출된 기업과 관련한 금융자산을 보유하고 있는 금융회사에까지 손실을 입힐 수 있으며, 이는 다시 금융기관 간, 실물경제와 금융시장 간 상호작용을 거쳐 시스템 리스크로도 확대될 수 있다. 이에 해외 학계, 중앙은행, 민간 금융업계에서는 기후변화를 중요한 리스크 요인으로 인식하고 기후리스크가 투자 포트폴리오 및 금융기관의 건전성에 미치는 영향에 대한 연구를 활발하게 진행하고 있다. 이러한 배경에 기반하여 본 연구는 다음과 같은 조사 및 분석을 수행하였다. 먼저, 기후리스크가 자산가격에 미치는 영향에 관한 해외 선행연구 결과를 검토하고, 그 다음으로 저탄소 경제로의 전환과정에서 발행하는 이행리스크가 실제로 국내 주식수익률에 유의한 영향을 미치고 있는지 확인하기 위한 실증분석을 실시하였다.

본 연구의 구성은 다음과 같다. Ⅱ장에서는 기후리스크의 개념과 주요 특징, 그리고 이러한 기후리스크가 실물경제 및 금융 부문에 미치는 영향에 대해 논의한다. Ⅲ장에서는 기후리스크와 자산가격의 관계에 관한 선행연구를 검토하고, 최근 주요국 중앙은행과 감독당국에서 개발 중인 시나리오 기반의 기후리스크 평가 모형과 분석 사례를 살펴본다. Ⅳ장에서는 국내 주식시장에서 이행리스크와 주식수익률의 관계에 대한 실증분석 결과를 제시한다. 마지막으로 Ⅴ장에서는 주요 결과를 요약하고 시사점을 논의한다.

Ⅱ. 기후리스크의 유형과 금융부문에 대한 영향

이 장에서는 본 분석에 들어가기에 앞서 기후변화가 야기할 수 있는 기후리스크의 두 가지 주요 유형인 물리적리스크와 이행리스크의 개념과 주요 특징, 그리고 이러한 기후 리스크의 현황과 경제적 손실 등에 대해 국제기구 및 연구기관에서 발표한 통계자료를 살펴봄으로써 기후리스크가 실물경제 및 금융부문에 어떠한 영향을 미칠 수 있는지 알아보고자 한다.

1. 기후리스크의 개념과 유형

기후리스크는 기후변화로 인한 기상이변, 자연재해에 따른 물리적 자산의 손상, 온실가스 배출 감축 정책 시행에 따른 비용 상승과 같이 기후변화로 인해 초래되는 물리적 피해나 경제적 손실을 의미한다. 기후리스크는 리스크의 발생 원인에 따라 크게 물리적리스크(physical risk)와 이행리스크(transition risk)로 구분된다. 물리적리스크는 기후변화로 인한 태풍, 홍수, 폭염 등과 같은 자연재해나 해수면 상승, 산림 파괴, 해양 산성화 등과 같은 자연환경의 변화에서 발생하는 위험을 의미한다. 이행리스크는 급격한 온실가스 배출 감축 정책의 시행, 저탄소 설비 투자 등으로 인한 생산 비용의 증가, 탈탄소 자금 흐름으로 인한 자금조달 비용의 상승, 재생 에너지 관련 기술 혁신, 소비자 선호변화로 인한 제품 수요 감소 등과 같이 저탄소, 친환경 경제로 이행되는 과정에서 발생할 수 있는 위험을 의미한다.

이러한 물리적리스크와 이행리스크는 기업의 원활한 사업 운영을 저해하고 재무 상태에도 직간접적인 영향을 미칠 뿐만 아니라, 이러한 기후리스크에 노출된 기업과 관련한 주식, 채권, 대출 등 금융자산을 보유한 금융회사에도 신용위험, 시장위험을 유발할 수 있다. 이하에서는 기후리스크를 물리적리스크와 이행리스크로 구분하여, 각각의 기후리스크가 실물경제와 금융부문에 미치는 영향에 대해 좀 더 구체적으로 살펴보기로 한다.

가. 물리적리스크

앞서 언급한 바와 같이 산업화 이후 진행된 지구온난화는 전 지구적으로 폭염, 집중 호우, 홍수, 가뭄, 산불 등과 같은 기상이변과 자연재해의 발생 빈도와 심도를 증가시키고 있다. 인류가 적극적으로 탄소 감축 노력을 전개하여 지구 기온 상승폭을 산업화 이전 대비 1.5℃ 미만으로 제한하는 가장 낙관적인 시나리오를 가정하더라도 기후변화로 인한 재해의 빈도와 강도는 현재보다 더욱 증가할 것으로 전망되고 있다. 지구온난화를 1.5℃ 미만으로 제한하더라도 북극의 겨울 온도는 4.5℃까지 상승하고 9월 북극 빙하가 완전히 사라질 확률이 최소 6%에 이르며, 만일 산업화 이전 대비 지구온도가 2℃, 2.4℃, 4.3℃만큼 상승하면 북극 빙하가 소멸될 확률이 각각 28%, 50%, 95%로 증가할 것으로 전망되고 있다(Olson et al., 2019). 또한, 지구온난화가 심해질수록 지중해 연안, 남아프리카와 같이 건조한 지역이 사막화되고 상대적으로 습도가 높은 지역은 더욱 습해지면서 폭우의 빈도와 강도가 증가하는 기후 양극화 현상이 심화할 것으로 전망되고 있다.

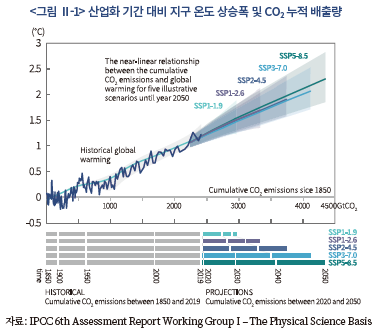

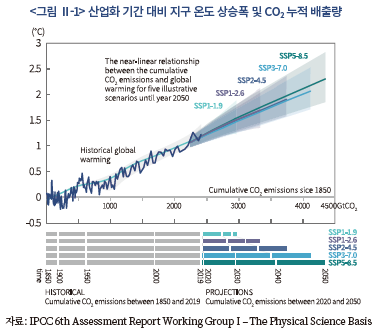

가장 최근 발표된 IPCC의 제6차 평가보고서(AR6)의 제1실무그룹(WG1) 보고서에 따르면, 최근 지구 평균 온도(2011~2020년 기준)는 산업화 이전 대비 1.09℃ 상승하였으며, 이는 2014년 제5차 평가보고서(AR5) 발표 당시의 온도 상승폭 0.78℃(2003~2012년 기준)에 비해 약 0.3℃ 이상 증가한 수치이다. 또한, 이산화탄소 누적 배출량은 AR5 발표 당시(1850~2011년 누적) 약 1,890Gt에서 현재(1850~2019년 누적) 2,390Gt으로 8년간 약 27% 증가한 것으로 평가되었다.

<그림 Ⅱ-1>은 IPCC AR6 제1실무그룹 보고서에 수록된 1850년부터 2019년까지 지구 온도변화를 CO2 누적 배출량의 함수로 나타낸 그래프이다. 검은 실선은 1850년부터 2019년까지 실제 관측된 CO2 누적 배출량과 온도변화를, 회색 영역은 CO2 누적 배출량에 상응하는 지구 온도변화의 구간추정 결과를 나타낸다.3) 그리고 채색된 영역은 5개 기후변화 시나리오인 공통사회경제경로(Shared Socio-economic Pathway: SSP), SSP1-1.9, SSP1-2.6, SSP2-4.5, SSP3-7.0, SSP5-8.5에서의 CO2 누적 배출량과 그에 상응하는 지구 온도변화 구간추정치를 나타낸다. 그리고 각 채색된 영역의 중앙 실선은 각 시나리오에서 CO2 누적배출량으로 추정된 지구온도 전망추정치의 중간값을 나타낸 것이다. 그리고 하단의 그림은 각각의 시나리오에 대해 1850~2019년 기간의 실제 CO2 누적 배출량과 2020~2050년 기간의 CO2 누적 배출량 예상값을 보여주고 있다. 이를 보면, 지구온난화와 이산화탄소 누적 배출량은 선형적인 관계가 있으며, 이는 지구온난화를 제한하기 위해 온실가스 감축이 중요함을 시사한다.

아울러, AR6 제1실무그룹 보고서는 인류가 초래한 기후변화는 지구 전 지역에 걸쳐 기상이변을 일으키고 있다고 강조하였다. 1950년대 이후 폭염을 비롯한 이상고온과 가뭄이 동시다발적으로 발생하거나 폭우의 빈도와 강도가 증가하고 있으며, 지구온난화가 심화될수록 이러한 변화의 규모가 더 커질 것으로 전망하였다. 예를 들어, 지구 평균기온이 1℃ 상승할 때마다 산업화 시기(1850~1900년)에 약 50년에 한 번 발생할 만한 기상이변이 4.8배 더 빈번하게 발생하며, 이러한 빈도는 1.5℃ 상승 시 8.6배, 2℃ 상승 시 13.9배, 4℃ 상승 시 39.2배로 지구온난화가 심각해지면서 더 증가할 것으로 전망하였다. 또한, 10년에 한 번 발생할만한 폭우의 발생 빈도도 산업화시기에 비해 1.3배 증가하였으며, 지구 온도가 1℃ 상승할 때마다 일간 폭우 발생 확률이 7% 가량 상승할 것으로 예상하였다.

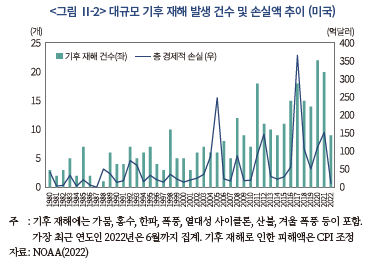

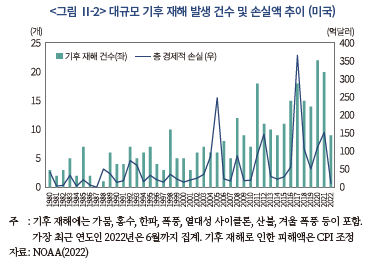

또한, 이러한 물리적리스크는 이미 상당한 경제적 비용을 초래하고 있는 것으로 전해지고 있다. 미국 국립해양대기청(National Oceanic and Atmospheric Administration: NOAA)의 통계에 따르면 미국에서는 1980~2022년 상반기까지 330건 이상의 가뭄, 홍수, 한파, 폭풍, 열대성 저기압, 산불, 겨울 폭풍 등 기상이변 및 기후 재해가 발생하였고, 이로 인한 총 경제적 손실액은 약 2조 2천억달러에 이르는 것으로 추산되고 있다.4) <그림 Ⅱ-2>는 1980년부터 2022년 6월까지 미국에서 발생한 손실액이 10억달러 이상인 기후 관련 재해의 빈도와 그로 인한 총 경제적 손실액의 시계열 추이를 보여주고 있다. 기후 관련 재해로 인한 경제적 손실 규모는 1980년 424억달러(3건)에서 2021년 1,526억달러(20건)로 40여 년간 3.6배 이상 증가하였으며, 최근 7년(2015~2021년)에 들어서는 1998년, 2008년, 2011~2013년에만 간헐적으로 발생하였던 피해액 10억달러 이상의 대규모 기후 재해가 매해 연이어 발생한 것으로 조사되었다. 즉, 최근으로 올수록 기후 재해의 빈도와 그로 인한 경제적 손실이 급격하게 증가하고 있으며, NOAA는 이러한 가장 큰 원인으로 기후변화를 지적하고 있다.

그러나 여기서 어떤 기업 또는 자산이 이러한 기후 재해 자체에 많이 노출되어 있다고 해서 물리적리스크에 따른 충격도 크다고 볼 수는 없다. 어떤 자산에 대한 물리적리스크의 영향을 평가하기 위해서는, 이러한 기후 재해에 대한 해당 자산의 익스포저(exposure)뿐만 아니라, 이러한 재해에 대해 어느 정도 취약성(vulnerability)을 가지는지도 종합적으로 고려되어야 한다(Caldecott, 2017). 예를 들어, 저지대 해안 지역에 있는 건물들은 모두 동일하게 해수면 상승으로 인한 침수 위험에 노출되어 있다고 볼 수 있겠지만, 배수펌프나 차수대와 같은 시설이 설치된 건물은 이러한 시설이 갖춰지지 않은 건물에 비해 침수 위험에 상대적으로 덜 취약할 것이다. 즉, 동일한 물리적리스크에 노출되어 있더라도 이에 대한 대응 수준에 따라 실제 겪게 될 물리적리스크 충격의 정도는 자산마다 상당히 다를 수 있다.

따라서 실제 어떤 기업 또는 자산에 미치는 물리적리스크의 영향을 정확히 평가하기 위해서는 기후 재해의 발생 빈도에 대한 예측 자료와 함께 기업의 재해 및 재난 관리 체제, 풍수해 보험 가입 여부 등 기후리스크에 대한 대응 및 복구 능력 수준을 종합적으로 검토할 필요가 있다. 여기서 기후 재해에 대한 노출도는 지리적 위치의 영향을 많이 받는 만큼, 기업의 생산시설, 물리적 자산의 위치 정보와 비영리기관이나 민간의 연구기관에서 제공하는 지역별 기상 데이터를 연계하여 추정할 수 있다. 반면, 기업의 취약성을 파악하기 위해서는 기업이 기후 재해에 대비하여 어느 정도의 자본을 지출했는지, 공급망 관리를 어떻게 하고 있는지, 재해 복구 예산 및 계획을 어떻게 마련하고 있는지 등과 같은 기후 재해에 대한 기업의 대비 현황에 관한 세부적인 정보가 필요한데 이는 대부분 기업이 자발적으로 제공하는 정보에 의존하고 있어, 일반투자자들과 같이 정보 접근성에 제약이 존재하는 경우에는 이를 정확히 평가하기 어려운 측면이 있다(TCFD, 2017).

이와 함께, 물리적리스크는 기업이 보유한 물리적 자산에 직접적인 피해를 주기도 하지만, 노동생산성 하락, 공급망 교란과 같은 다른 간접적인 경로를 통해서도 기업에 부정적인 영향을 미칠 수 있다. 예를 들어, 국제노동기구(International Labour Organization, 2019)는 1995년에 발생한 이상 고온 현상으로 인해 전 세계 노동시간의 약 1.4%가 감소하였으며(이는 약 3,500만 개의 정규직 일자리가 사라진 것과 같음), 이로 인한 GDP 손실은 약 2,800억달러에 이른다고 하였다. 아울러, 2030년까지 지구 기온이 1.3℃ 더 상승한다면 전 세계 노동시간의 2.2%가 줄어들며(이는 약 8,000만 개의 정규직 일자리가 사라지는 것과 같음), 이로 인해 약 2조 4천억달러의 GDP 손실이 발생할 것으로 전망하였다. 특히, 기온 상승으로 인한 노동생산성 하락 충격은 저소득 국가에서 더욱 심각한 것으로 나타났다. 기온 상승으로 인한 중상위 소득 국가에서의 연간 GDP 손실은 약 1% 미만으로 추정되었던 데 비해, 중위 소득 이하의 국가에서의 손실은 약 1.5~4.0%에 이르는 것으로 추정되었다. 마찬가지로 IMF(2018)도 지금과 같은 추세로 지구온난화가 지속될 경우 2100년 저소득 국가의 연간 경제적 손실이 최대 9%까지 이를 수 있다고 전망하며 기후 변화 충격의 양극화 문제를 지적한 바 있다.

그리고 기후변화에 따른 물리적리스크는 항만, 철도, 도로, 전기, 통신 시설 등을 비롯한 공급 기반 시설을 훼손하여 기업의 운영 중단을 야기할 수 있다. 일례로 2021년 말 말레이시아에서 발생한 태풍으로 인해 동남아시아의 주요 항구가 폐쇄되면서 대만의 TSMC의 반도체 공급에 차질이 발생하였고 이로 인해 반도체를 제때 납품받지 못한 일부 미국 자동차 제조업체가 공장 가동을 전면 중단한 사례가 있다. 이러한 공급망 교란은 기후변화로 인한 극한 기상 현상이 증가하면서 앞으로 그 빈도가 더욱 증가할 것으로 예상되고 있다.5)

나. 이행리스크

앞서 언급한 바와 같이 기후변화는 물리적리스크와 함께 기후변화 완화을 위한 저탄소 경제로의 전환에 따른 이행리스크(transition risks)를 발생시킬 수 있다. 먼저, 이행리스크가 미칠 경제적 충격의 크기를 가늠해보기 위한 차원에서 파리협약의 1.5℃ 제한 목표 달성을 위해 어느 정도의 저탄소 전환 노력이 필요한지 살펴보기로 한다.

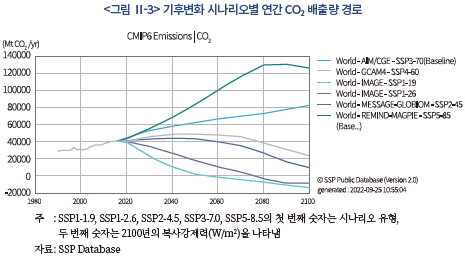

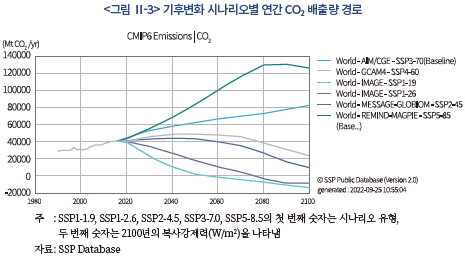

<그림 Ⅱ-3>은 IPCC에서 기후변화 완화 및 적응 노력의 정도에 따라 5가지 유형(SSP1~SSP5)으로 분류한 기후변화 시나리오인 공통사회경제 경로(SSP)를 보여주고 있다.6) 그림의 세로축은 연간 CO2 배출량(백만 톤)을 나타내며, 각 실선은 각 시나리오의 대표 경로(representative pathway)를 나타낸다. 이에 따르면, 추가적인 탄소 감축 노력이 시행되지 않고 현재와 같은 추세로 온실가스 배출이 지속되는 경우, 즉, SSP3 시나리오 경로를 따르는 경우에는, 연간 CO2 배출량은 2100년에 80Gt을 넘어서고 산업화 이전 대비 약 4~5℃의 기온 상승이 일어날 것으로 추정된다.

반면, 기후변화 완화와 적응 노력이 적극적으로 시행되어 파리협약의 1.5℃ 제한 목표를 달성하는 경로인 SSP1-1.9(즉, 2100년의 복사강제력을 1.9W/m2 수준으로 제한)에서는 현재 연간 약 40Gt에 달하는 배출량이 2020~2040년 사이 급격히 감소하여 2050년에는 넷제로(net-zero) 상태에 도달해야 하며, 2100년에는 약 10Gt의 이산화탄소 순흡수가 이뤄져야 함을 알 수 있다.7)

이처럼 기후 목표를 달성하는 데 필요한 배출량 감축 속도와 변화의 크기를 감안할 때, IPCC(2018)에서는 탄소세나 배출권거래제와 같은 전통적인 탄소가격정책의 시행만으로는 충분하지 않으며, 대기 중에 이미 배출되었던 온실가스를 포집해서 저장하는 기술, 바이오 에너지 개발과 같은 저탄소 혁신 기술에 대한 대규모의 투자가 이뤄져야 한다고 강조하였다. 예를 들어, 1.5℃ 제한 목표를 달성하기 위해서는 2016~2035년 기간 동안 현재 화석연료 중심의 에너지 시스템의 저탄소 전환에 매년 약 2조 4천억달러(2010년 US달러 기준)의 투자가 이뤄져야 할 것으로 추산하였다.

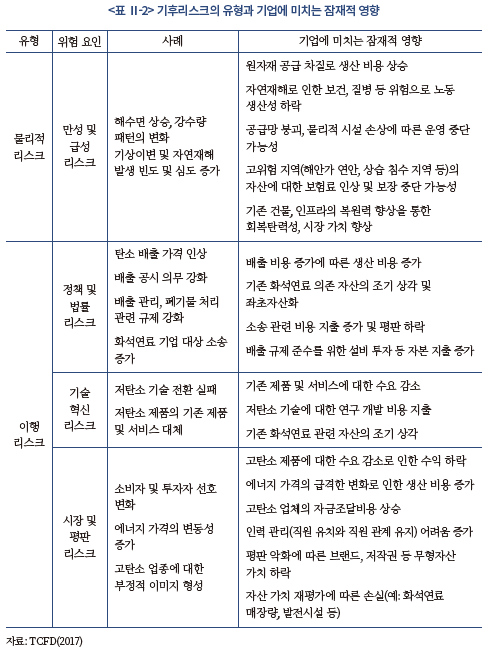

이와 같이 기후변화 완화를 위해 전 세계적으로 저탄소 전환이 빠르게 추진된다면 이는 기존 산업과 세계 경제에도 중대한 영향을 미칠 수 있다. TCFD에 따르면 이러한 저탄소 전환이 유발할 수 있는 이행리스크는 크게 정책 위험, 저탄소 에너지 기술 혁신 위험, 소비자 선호 변화에 따른 평판위험 등이 포함될 수 있다. 먼저, 정책리스크는 탄소세 및 배출권 가격 인상과 같은 탄소 감축 규제, 저탄소 기술 및 설비 전환, 에너지 효율 개선 등의 정책으로 인해 기업의 생산 비용이 증가하거나 기존 화석연료 관련 설비가 좌초자산(stranded assets)으로 전락하게 될 위험을 의미한다.8) 대표적인 사례로 2020년 독일에서는 2038년까지 석탄화력발전소를 폐쇄하는 내용을 담은 탈석탄법이 통과되었는데, 이러한 폐쇄 대상 석탄발전소에는 2020년에 가동을 시작한 신규 석탄발전소인 다텔른-4(Datteln-4)도 포함되어 있었다. 이는 석탄화력발전소의 운영 기간이 통상 30~50년 정도임을 감안할 때, 다텔른의 경우 가동 후 18년 이내에 좌초자산으로 전환됨을 의미한다고 볼 수 있다.

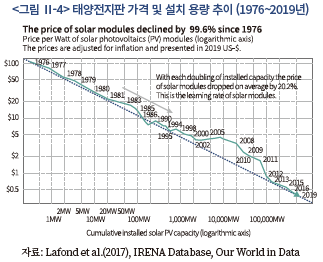

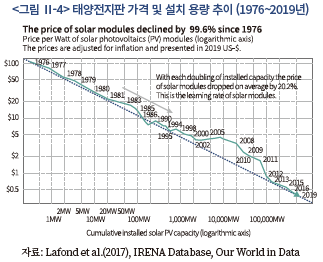

또 다른 이행리스크의 예로서 저탄소 에너지 기술 혁신, 저탄소 산업구조 변경에 따른 기존 고탄소, 화석연료 의존 산업의 경쟁력 약화 가능성을 생각해 볼 수 있다. 2021년 기준 현재 전 세계 전력 생산(약 28,214 TWh)의 원천별 비중은 석탄 36%, 가스 23%, 수력 15%, 원자력 10%, 풍력 6.5%, 태양열 3.6%, 바이오 에너지, 조력 등을 포함한 기타 재생에너지 2.7% 등의 순으로 화석연료가 여전히 절대적으로 큰 비중을 차지하고 있다(BP, 2022). 그러나 최근 재생에너지 기술 진보, 정부 지원, 보급 확대에 따른 규모의 경제 구현 등에 따라 재생에너지 발전 비용이 크게 하락하면서 석탄화력발전과 비교해서 비용 경쟁력을 갖추고 있다. 예를 들어, 독일, 호주, 일본 등 신재생에너지 확대정책을 적극 추진하였던 일부 국가에서는 신재생에너지를 이용한 전력생산비용이 화석연료 전력 생산비용과 같아지는 그리드 패리티(grid parity)를 이미 달성한 것으로 전해지고 있다. 또한, 다소 극적인 사례로, <그림 Ⅱ-4>에서 보는 바와 같이 태양전지판(solar panel)의 가격의 경우 1976년 와트(watt)당 약 106달러(2019년 물가 기준) 수준에서 2019년 0.38달러로 99.6% 가량 크게 하락하였고, 이와 함께 설치 용량 또한 1976년 0.3MW에서 2019년 10만MW로 기하급수적으로 증가한 것으로 확인되고 있다.

마지막으로, 기후변화로 인해 소비자나 이해당사자들의 선호가 변화하면서 온실가스를 과다 배출하거나 환경에 부정적인 영향을 미치는 제품을 생산하는 기업은 평판 또는 법률 소송 리스크에 직면할 수 있다. London School of Economics의 Setzer & Higham(2021)에 따르면, 1986~2020년 기간 동안 기후 관련 소송 건 수는 약 1,500건으로 이중 절반 이상이 2015년 이후에 발생한 것으로 최근 관련 소송 건 수가 급격히 증가하고 있다. 이러한 기후소송은 기후 관련 규제 위반에 대한 행정 소송, 기후변화로 인한 인권 침해 관련 소송, 유해물질 배출 기업을 상대로 한 피해와 손실 보상 소송, 불충분한 기후 관련 정보 공시 또는 그린워싱 관련 소송 등으로 그 범주도 다양한 것으로 보고되고 있다.

이러한 기업 및 금융기관에 대한 기후 소송의 대표적인 사례로는 2021년 네덜란드의 Milieudefensie v. Royal Dutch Shell 사건과 2018년 호주의 McVeigh v. Retail Employees Superannuation Pty Ltd 사건을 들 수 있다. Milieudefensie v. Royal Dutch Shell 사건은 다국적 석유 및 가스회사인 Shell에 대해 시민과 환경단체가 제기한 민사소송에서 네덜란드 헤이그 지방법원이 피고인 Shell에게 파리협정 목표에 따라 2030년까지 2019년 배출량 수준의 45%를 감축할 의무가 존재한다고 인정한 판결로, 민간 기업에 대한 기후변화의 책임을 묻는 민사소송에 유의미한 전환점을 마련한 사건으로 평가되고 있다. 한편, McVeigh v. Retail Employees Superannuation Pty Ltd 사건은 호주 연금 펀드 회원인 Mark McVeigh가 연금 수탁자인 Retail Employees Superannuation Trust(Rest)를 상대로 기후변화 리스크 및 이러한 리스크를 해결하기 위한 전략을 공개하지 않아 기업법을 위반하였다고 주장하면서 호주연방법원에 제기한 소송이다. 소송은 재판이 시작되기 전 REST와 원고 간 합의로 일단락되었지만, 이 사건은 글로벌 연기금, 국부 펀드 등을 비롯한 자산 관리자에 대해 기후리스크의 심각성을 인지하고 이와 관련한 재무적 위험을 관리할 책임이 있음을 상기시켜 주었다.

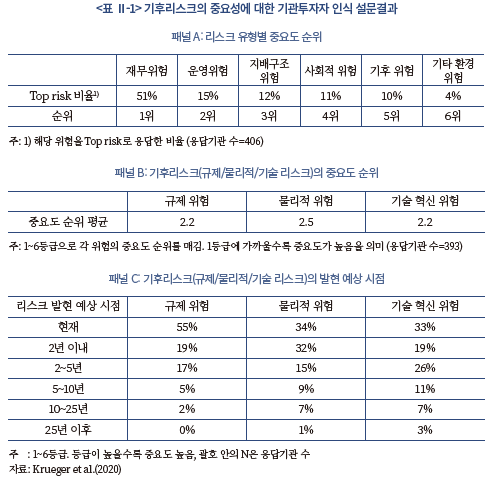

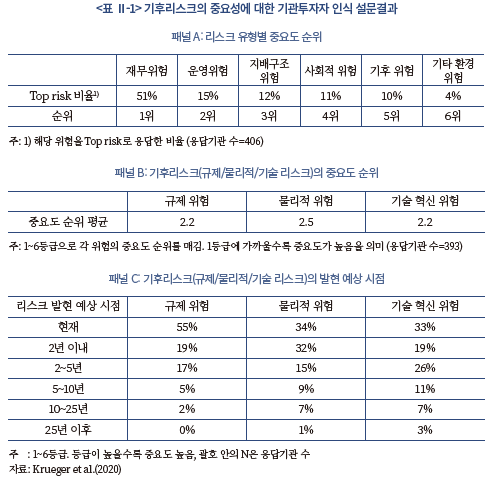

이 외에도 투자자들 역시 기후변화 리스크를 진지하게 받아들이며 기업에 행동 변화를 요구하고 있다. 대표적으로 기후행동 100+(Climate Action 100+)는 온실가스 배출량이 높은 기업을 대상으로 배출 저감을 촉구하는 투자자 이니셔티브로, CalPERS, 블랙락 등을 비롯한 전체 운용자산 규모가 50조달러 이상인 약 500개 이상의 연기금, 기관투자자들이 이에 가입되어 있다. 그리고 최근에는 넷제로 자산소유자 연합(Net-Zero Asset Owner Alliance), 넷제로 자산운용사 이니셔티브(Net-Zero Asset Managers Initiative), 넷제로 은행 연합(Net-Zero Banking Alliance) 등과 같이 2050년 넷제로 및 지구온난화 1.5℃ 제한 목표 달성을 지원하는 금융기관의 연합체도 등장하였다. 아울러, Krueger et al.(2020)의 439개의 글로벌 기관투자자들을 대상으로 한 설문조사 결과에서도 투자자들이 기후변화 리스크를 중요하게 받아들이고 있음이 확인되었다. 이하 <표 Ⅱ-1>의 설문조사 결과에 따르면, 투자자들은 기후리스크를 재무리스크, 운영리스크와 같은 전통적인 리스크에 비해서는 상대적으로 중요도가 낮은 것으로 평가하고 있지만, 기후리스크 자체의 중요성은 높게 평가하고 있었다. 특히, 기후변화 관련 규제 위험과 기술 변화 위험과 같은 이행리스크를 물리적리스크 보다 더 중요하게 받아들이고 있었으며, 응답 기관의 90% 이상이 이러한 리스크가 향후 10년 이내 발현될 것으로 예상하였다.

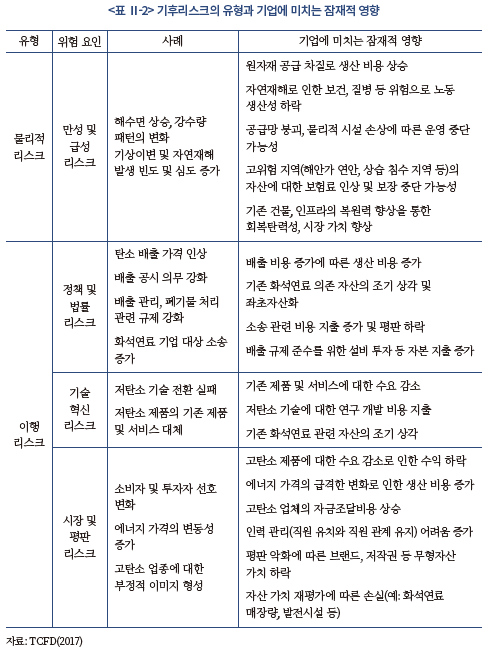

마지막으로, 다음의 <표 Ⅱ-2>는 지금까지 논의한 물리적리스크와 이행리스크의 유형과 기업에 미치는 잠재적인 영향에 대해 정리한 것이다.

2. 기후변화가 금융부문에 미치는 영향

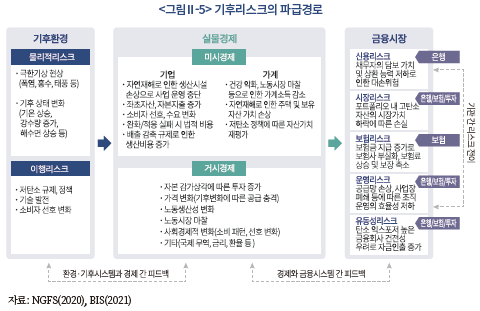

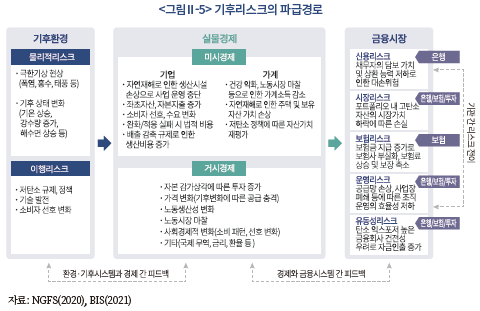

기후변화는 앞서 논의한 바와 같이 실물 부문에 물리적리스크와 이행리스크를 유발하며, 이는 또한 운영리스크, 신용리스크, 보험리스크, 유동성리스크 등의 다양한 경로를 통해 금융시장에도 전이될 수 있다. 아래의 중앙은행 및 감독기구의 녹색금융 협의체(Network for Greening the Financial System: NGFS)에서 제시한 <그림 Ⅱ-5>를 보면, 기후리스크는 기업 및 가계에 사업 운영 중단, 자산의 물리적 손상, 소득 상실, 자산 가치 하락 등의 충격을 유발할 수 있으며, 이와 함께 공급망 충격에 따른 물가 상승, 극한 기후에 따른 노동생산성 하락, 소비자 선호 변화 등과 같은 거시경제변수에도 영향을 미칠 수 있다. 그리고 이러한 실물경제 충격은 이와 연계된 금융부문에도 신용리스크, 시장리스크, 보험리스크, 운영리스크, 유동성리스크 등 다양한 경로로 영향을 미칠 수 있다. 또한, 이는 개별 금융회사에 영향을 미치는 것에서 더 나아가, 금융기관 간, 실물경제와 금융부문 간 피드백을 통해 시스템 리스크로 확대될 수 있다.

먼저, 운영리스크(operational risk)는 일반적으로 잘못된 내부 프로세스나 시스템, 직원 오류, 외생적 충격 등으로 인해 발생할 수 있는 손실 위험을 의미하는데, 여기서 기후변화와 관련한 운영리스크는 기후변화로 인해 사업 운영의 연속성이 훼손되는 위험을 의미한다. 예를 들어, 산불, 태풍, 홍수 등과 같은 기후 관련 자연재해로 인해 기업의 생산 설비, 창고, 데이터 센터, 공급망, 인적 자원 등에 손상이 발생하여 사업이 중단되는 경우가 이에 포함된다. 그러나 운영리스크는 이러한 물리적리스크 뿐만 아니라 이행리스크에 의해서도 발생할 수 있다. 예를 들어, 어떤 고탄소 사업 구조를 가진 기업이 저탄소 전환 흐름에 맞추어 기존 사업 방식을 전환하는 데 실패할 경우, 다른 저탄소 기술을 기반으로 한 기업과의 경쟁에서 밀릴 수 있으며, 고탄소 산업이라는 부정적인 이미지 형성에 따라 제품 수요가 감소하거나 자금 조달 비용이 상승하게 되면 이는 결과적으로 사업 운영에 차질을 유발할 수 있다.

이러한 운영리스크 이외에도 기후변화로 인한 기상이변의 증가는 기업의 채무불이행 위험을 높임으로써 금융회사의 신용리스크(credit risk)에도 부정적인 영향을 미칠 수 있다. 앞서 언급한 바와 같이 급작스러운 기상이변이나 자연재해와 같은 물리적리스크로 인해 기업의 운영이 중단되고 자산이 손상되면, 이는 기업의 수익 창출 능력, 대출 상환 능력, 담보 능력 약화로 이어져 결과적으로 금융회사의 신용리스크가 증가할 수 있다. 또한, 이행리스크도 신용리스크를 야기할 수 있다. 대표적인 예로 화석연료 발전 기업의 좌초자산 위험에 따른 금융회사 포트폴리오의 신용리스크가 증가하는 경우를 생각해볼 수 있다. 즉, 저탄소 정책으로 인해 화석연료 발전시설이 애초 의도한 경제 수명을 채우지 못하고 중도에 폐쇄되거나, 보유한 화석연료 매장량의 상당량이 사용되지 못하고 좌초될 경우, 이는 해당 기업의 부채비율 상승, 수익 손실로 이어져 이와 연계된 금융회사의 신용리스크를 증가시킬 수 있다.9) 실제로 최근 글로벌 신용평가사인 S&P는 저탄소 에너지 전환, 석유 및 가스 가격의 불안정성 등의 요인으로 인해 석유 및 가스 생산업체의 미래 수익률 악화, 채무불이행 가능성이 상승할 수 있다고 평가하며, Exxon Mobil, Chevron, CononoPhillips, BP 등 글로벌 정유 회사들의 신용등급을 하향 조정한 바 있다.10) 이와 함께, 최근 시장규모가 빠르게 증가하고 있는 지속가능연계채권(sustainability-linked bonds), 지속가능연계대출(sustainability-linked loans)과 같은 금융상품의 등장도 이러한 기후리스크와 신용리스크의 연계성을 뒷받침하고 있다. 여기서 지속가능연계채권 및 대출은 발행 기업이 탄소배출량 감축 등과 같이 사전에 합의한 특정한 지속가능성 목표를 달성하였을 경우 금리가 낮아지도록 설계된 성과연동형 채권 또는 대출을 의미하는데, 이러한 계약 구조에는 기후변화 대응과 같은 지속가능성 성과의 향상이 신용위험을 낮추는 데 긍정적으로 작용할 수 있다는 관점이 암묵적으로 내재되어 있다고 볼 수 있다.11)

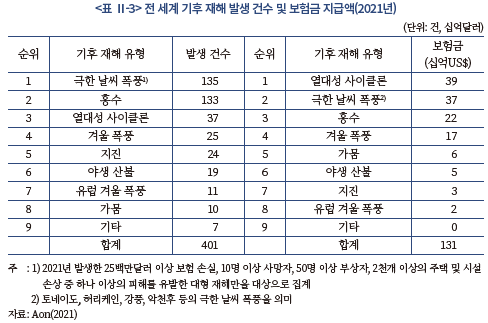

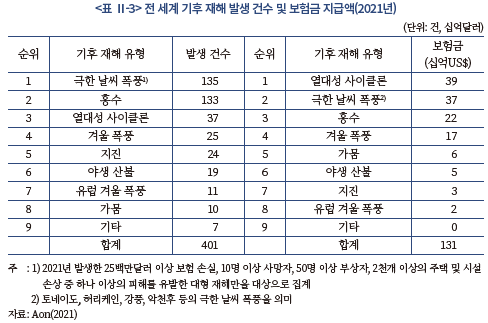

이외에도 기후 재해 발생에 따른 물리적, 인적 피해의 증가로 보험금 지급 규모가 늘어나면서 보험회사의 건전성 악화, 보험료 상승, 보장범위 축소와 같은 보험리스크(insurance risk)가 증가할 수 있다. 실제로 보험사들의 분석 결과에 따르면 지난 수십 년 동안 자연재해로 인한 보험 손실 규모는 꾸준히 증가하고 있는 것으로 전해지고 있다. 재보험 중개회사인 Aon(2021)에 따르면, 2021년 한 해 동안 발생한 기후재난으로 인한 전 세계 보험 지급액은 약 1,300억달러에 달하는 것으로 추정되었으며, 이는 전년 대비 18%, 21세기 평균 대비 76% 증가한 수치이다. 미국에서 발생한 허리케인 아이다(Ida)와 유럽의 홍수로 인한 경제적 손실 규모만 최소 1,080억달러로 추정되었으며, 이 중 약 390억달러의 손실에 대해 보험금이 지급 되었다. 마찬가지로 Swiss Re(2022)에서도 2021년 자연재해로 인해 전 세계적으로 약 2,700억달러의 경제적 손실이 발생한 것으로 추정하였으며, 이 중 약 1,110억달러의 손실에 대해 보험금이 지급되었다고 보고하였다. 즉, 이러한 사례는 기후변화에 따른 경제적 손실이 대규모 보험 손실로 이어질 수 있음을 보여주고 있다. 더욱이 이러한 자연재해는 지구온난화가 진행되면서 더욱 자주 발생할 것으로 예상되면서 보험업계에서는 이러한 기후리스크 관리 부담이 앞으로 더욱 가중될 것으로 전망하고 있다.12) 그리고 기후리스크로 인해 보험사들의 손해율이 높아지게 되면 이러한 피해는 보험료 인상, 보장한도 축소, 보험가입한도 제한 등을 통해 궁극적으로 보험의 소비자인 기업과 가계에까지 전가될 수 있다.

마지막으로, 앞서 살펴본 운영, 신용, 보험 리스크 등에 비해 비록 발생 가능성은 상대적으로 낮지만, 기후변화는 금융회사에 유동성리스크(liquidity risk)를 유발할 수도 있다. 예를 들어, 태풍, 호우 등 자연 재해로 인한 피해 복구를 위해 기업과 가계가 갑자기 예금을 인출하거나 대출을 늘리게 되면, 은행의 유동성 상황이 급격히 악화될 수 있다(BCBS, 2021). 여기에 추가적으로 금융회사가 유동성 확보를 위해 보유자산을 대량으로 매각하게 되면, 이는 자칫 자산가격 폭락, 금융회사의 자금조달여력 악화, 시장 유동성 고갈 등의 악순환을 초래하게되고 상호 연계된 금융회사 간 전염효과를 통해 금융시스템 전체의 시스템리스크를 촉발할 수 있다.

UN 기후특사인 마크 카니(Mark Carney)는 이러한 상황을 빗대어 ‘기후 민스키 모멘트(climate minsky moment)’라고 표현한 바 있다.13) 이는 긴 호황 끝에 자산 가치가 갑작스럽게 급락하는 금융시장의 불안정성을 의미하는 민스키 모멘트처럼 기후리스크에 대한 투자자들의 인식이 급격하게 전환되면서 나타날 수 있는 금융위기를 의미한다. 투자자들이 비록 현재는 기후리스크를 인식하지 않고 있다 하더라도 미래의 어느 시점에 저탄소 전환을 인식하게 되면, 기후리스크에 노출된 자산 가치에 대한 광범위하고 전면적인 재평가가 일어날 수 있다. 이때 이러한 재평가에 따른 자산 가치 손실이 일정한 임계점을 넘게 되면, 전체 금융 시스템의 안정성이 붕괴되는 기후 민스키 모멘트가 발생할 수 있다. 물론 단기간에 이와 같은 기후변화에 따른 금융 위기가 나타날 가능성은 현재로서는 높다고 볼 수는 없겠지만, BIS, IMF, FSB 등의 국제기구들은 기후변화로 인한 금융위기, 이른바 ‘그린스완(green swan)’의 발생 가능성을 배제하지 않고 있으며 기후리스크에 대한 선제적 대응을 위한 기후 스트레스 테스트 모형 개발, 기후리스크 공시 확대 등의 노력을 꾸준히 전개하고 있다.

Ⅲ. 기후리스크와 자산가격의 관계에 대한 선행연구

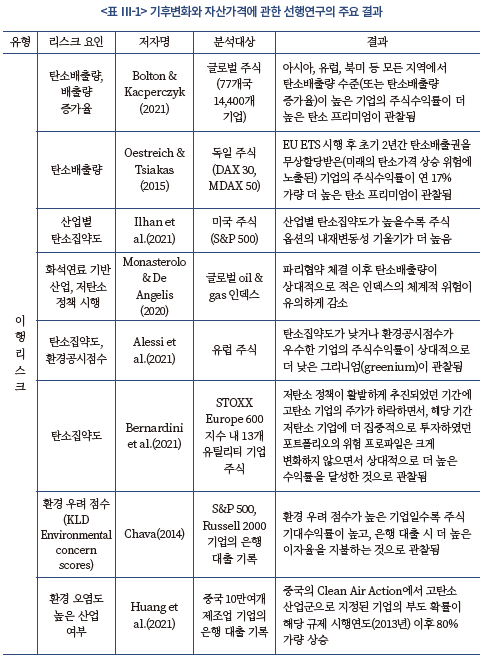

앞선 장에서 기후리스크의 유형과 기후리스크가 금융시장에 미치는 영향에 대해 개념적으로 살펴보았다. 이번 장에서는 기후변화와 자산가격의 관계를 분석한 선행연구들을 살펴보고 그 시사점을 고찰해보고자 한다. 기후변화와 자산가격의 관계에 관한 선행연구들은 크게 다음과 같은 두 가지 질문에 초점을 두고 있는데, 하나는 기후리스크가 자산가격에 긍정 또는 부정적인 영향을 미치는지를 실증적으로 규명하는 연구이고, 다른 하나는 기후리스크가 자산가격에 얼마나 효율적으로 반영되고 있는지, 즉, 투자자들이 기후리스크를 어느 정도로 중요하게 인식하고 있는지를 분석하는 연구이다(Campiglio et al., 2020). 이하에서는 이러한 질문에 대한 기존 연구 결과를 살펴보고, 이를 바탕으로 기후리스크가 실제 자산가격에 유의한 영향을 미치는지, 그리고 시장에서는 이를 얼마나 효율적으로 반영하고 있는지 알아보고자 한다.

이와 함께, 최근에는 기후변화와 같이 매우 장기간(대체로 수십년 또는 그 이상)에 걸쳐 진행되고 불확실성이 높은 문제를 이러한 과거 데이터에 기반을 둔 실증분석으로 다루기에는 한계가 있다는 인식에 따라, 주요국 중앙은행과 감독기구를 중심으로 시나리오 분석을 이용한 기후리스크 분석 모형 개발이 시도되고 있다. 이러한 시나리오 기법은 미래지향적(forward looking) 접근법으로 기후리스크와 같이 불확실한 미래 상황에 대한 대응 전략을 수립하는 데 있어서 특히 효과적인 것으로 평가되고 있다. 이에 따라 본 장의 후반부에서는 이러한 시나리오 기반의 기후리스크 분석이 어떻게 진행되는지, 그 분석 결과는 어떻게 활용될 수 있는지, 주요국 중앙은행과 금융기관의 실제 테스트 사례를 통해 간략히 살펴보고자 한다.

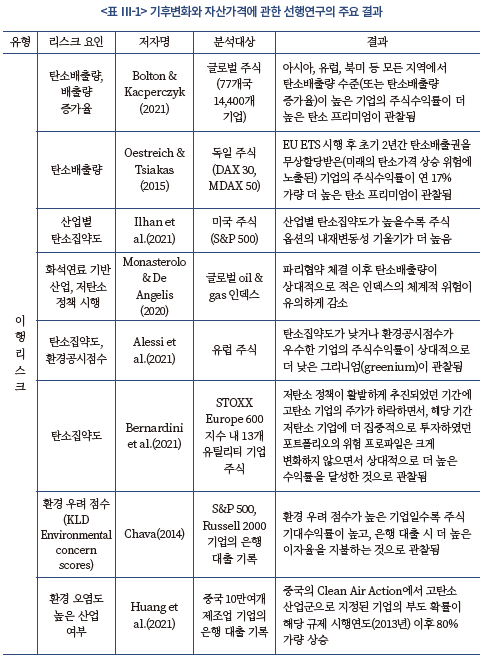

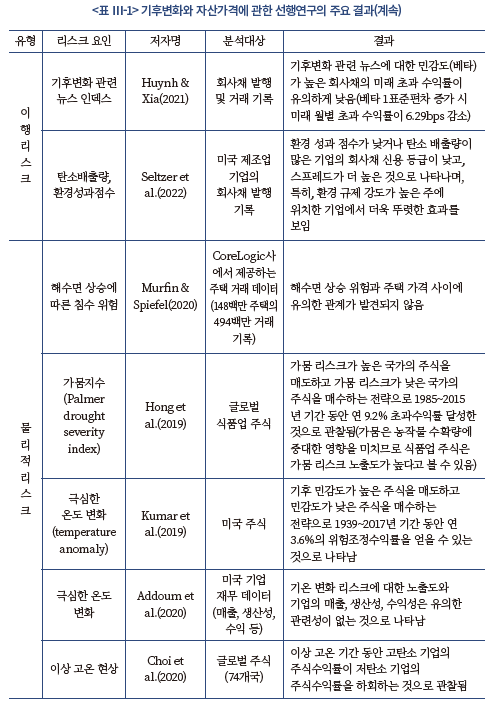

1. 기후변화가 자산가격에 미치는 영향에 관한 연구

해외 선행연구에 따르면 기후변화는 자산의 유형, 산업 특성 등에 따라 매우 다른 영향을 미칠 수 있다. 예를 들어, 주식의 경우에는 기후변화 관련 새로운 위험이 발견되면 이러한 정보가 비교적 신속히 가격에 반영되는데, 한 번 정해진 계약 조건이 상당 기간 지속되는 대출이나 고정금리 채권과 같은 경우에는 이러한 기후 관련 정보가 시차를 두고 반영될 가능성이 높다. 또한, 기후변화는 산업에 따라 자산 가치에 상이한 영향을 미칠 수 있다. 예를 들어 저탄소 전환이 진행되면서 화석연료 발전이나 고탄소 업종은 탄소배출비용 상승으로 자산 가치가 하락할 위험이 높지만, 이와 반대로 재생에너지나 저탄소 업종은 자본유입, 수요 확대 등으로 인해 자산 가치가 상승할 수 있다. 이에 따라, 이하에서는 주식, 채권, 부동산 등 자산 유형별로 선행연구를 구분하여 기후변화가 자산 가치에 미치는 영향을 살펴보기로 한다.

가. 기후변화와 주식 가격의 관계에 관한 연구

기후변화가 주식 가격에 미치는 영향에 관한 선행연구는 주로 탄소 프리미엄(탄소배출량 수준이 높은 주식에 대한 양(+)의 초과수익률)이 존재하는지, 기상이변, 자연재해와 같은 기후변화 관련 뉴스가 보도되었을 때 해당 리스크에 노출된 주식 가격이 하락하는지, 또는 탄소감축 정책이 시행되었을 때 산업별 주식 가격이 어떻게 변화하는지 등에 대한 주제를 중심으로 이루어져 왔다.

이 중에서 탄소 프리미엄과 관련하여서 가장 주목할 만한 연구로는 Bolton & Kacperczyk(2022)를 들 수 있다. 이들은 77개국의 14,400개 상장기업의 2005년부터 2018년까지의 주식수익률 데이터와 기업별 탄소배출량 정보를 포함한 기업 수준의 미시데이터를 활용하여 탄소 프리미엄이 존재하는지 분석하였다. 만일 탄소 프리미엄이 존재한다면, 이는 투자자들이 탄소배출량이 높은 기업에 초과수익률을 요구하고 있다는 것으로 저탄소 전환에 따른 이행리스크가 주식 가격에 반영되고 있다고 해석할 수 있다. 분석결과, 대부분의 국가들에서 탄소 프리미엄은 기업의 탄소배출량 수준과 연간 배출량 증가율에 대해 유의한 양(+)의 상관관계를 보였는데, 직접 배출량(scope 1 emissions)이 1 표준편차만큼 증가할 때 연간 수익률이 평균적으로 약 1.1% 상승하는 것으로 나타났다.

그리고 이러한 탄소 프리미엄의 크기는 기업의 탄소배출량 뿐만 아니라 기후변화 대응 정책의 강도, 기후변화에 대한 사회적 인식, 경제발전수준 등에도 영향을 받는 것으로 나타났다. 예를 들어, 탄소 프리미엄은 북미, 유럽, 아시아 모든 지역에서 유의한 양(+)의 값을 보이고는 있지만, 단기적인 탄소 프리미엄의 크기는 일반적으로 경제발전수준이 낮고, 제조업 중심 산업구조를 가진, 헬스케어 산업이 상대적으로 덜 발달한 국가일수록 더 높은 것으로 나타났다. 한편, 장기적인 탄소 프리미엄은 국가의 기후변화 대응 정책 강도가 높을수록 더 큰 것으로 나타나, 저탄소 정책이 상당 기간 지속될 것이라는 투자자들의 기대가 주식 가격에 반영되고 있다고 해석하였다.14) 특히, 탄소 프리미엄은 2015년 파리협정 체결 이후 그 값이 더욱 뚜렷하게 증가하는 양상을 보이며, 파리협약을 기점으로 기후변화에 대한 투자자들의 인식이 확대되고 있다고 보았다.

탄소배출권거래제 도입, 파리협정과 같은 저탄소 정책의 강화에 따라 관련 정책 리스크에 노출된 기업의 주식 가치가 하락할 수 있음을 보인 연구도 있다. 예를 들어, Oestreich & Tsiakas(2015)는 독일과 영국 주식시장에서 EU의 배출권거래제 시행이 주식수익률에 미치는 영향을 분석하였는데, 배출권거래제 시행 초기에 탄소배출량이 높은 그룹이 배출량이 낮은 그룹에 비해 평균적으로 더 높은 비정상 초과수익률을 보이는 것을 발견함으로써, 탄소 프리미엄이 존재한다고 주장하였다. 그리고 Ilhan et al.(2021)는 파리협정 이후 탄소집약적 기업의 주식에 대한 풋 옵션 가격이 파리협약 이후 유의하게 증가한 반면 트럼프 당선 이후 상대적으로 대중의 기후변화에 대한 관심이 수그러든 시기에는 감소하는 것을 보임으로써, 투자자들이 탄소 배출 리스크에 대해 추가적인 보상을 요구하고 있다고 결론지었다. 이와 유사한 맥락에서, Monasterolo & de Angelis(2020)는 파리협정이 체결된 2015년을 전후로 미국, 유럽 등 글로벌 주식 시장에서 저탄소 지수(정식 명칭에 친환경, 그린, 재생에너지 등이 포함된 주가지수로 S&P Global Clean Energy, World Renewable Energy, Wilderhill Clean Energy 등이 포함)와 고탄소 지수(석유, 천연가스 등 화석연료 관련 주가지수로 S&P 500 Integrated Oil & Gas, FTSE World Oil & Gas 등이 포함)의 성과를 비교하였는데, 마코위츠 모형에서 구성한 최적 포트폴리오에서 저탄소 지수의 비중은 파리협정 이전에는 54%에서 파리협정 이후에는 88%로 증가하고, 반면에 고탄소 지수의 비중은 46%에서 12%로 감소하는 것을 보였다.

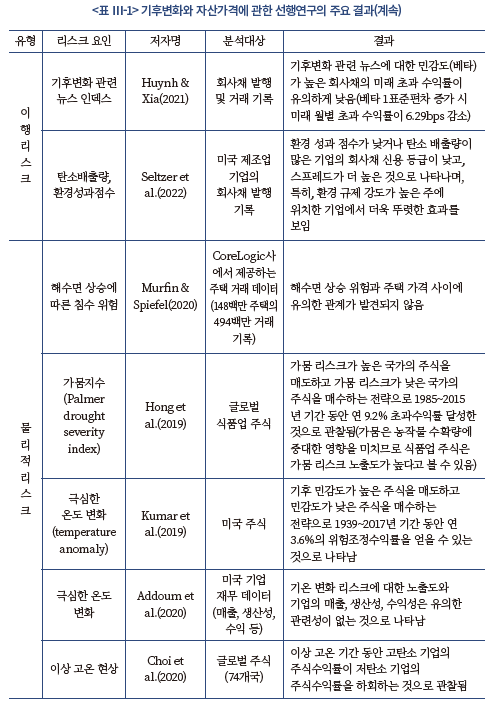

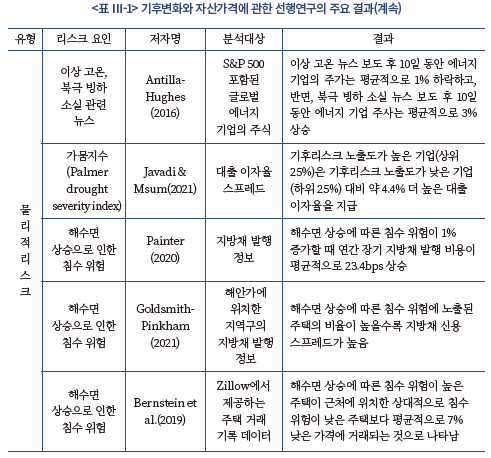

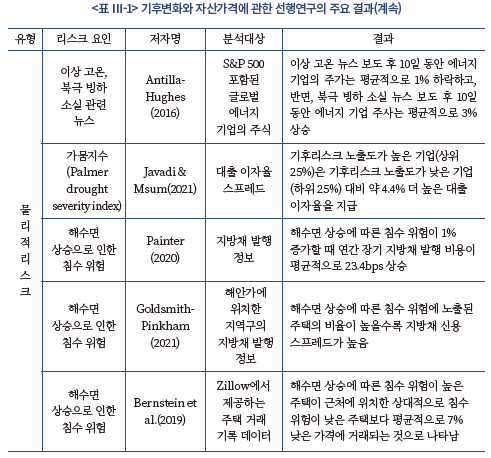

탄소 프리미엄이나 탄소 감축 정책과 같은 이행리스크에 초점을 맞춘 연구들과 달리 기후변화에 따른 물리적리스크가 주식 가격에 미치는 영향을 분석한 연구도 있다. 대표적으로, Choi et al.(2020)은 기상이변에 대한 개인투자자들의 반응과 그에 따른 주식수익률의 변화를 분석하였다. 이들은 이상 고온 현상이 발생한 도시에 거주하는 투자자들이 기후변화 관련 검색을 더 많이 하는 등 기후변화에 대해 더 많은 관심을 나타냈으며, 이상 고온 현상이 발생한 기간 중에 탄소 집약적인 기업의 주식을 더 많이 매각하는 것을 발견하였다. 특히, 이러한 현상은 기후변화에 대한 논의가 활발해지기 시작한 2000년대 이후에 더 뚜렷하게 관찰되었다. 이러한 결과는 기관투자자들보다 상대적으로 지속가능성 이슈에 관심이 적다고 알려진 개인투자자들도 기후리스크 요인을 투자결정에 반영하고 있음을 보여주고 있다. 마찬가지로, Anttila-Hughs(2016)은 기상이변, 자연재해 관련 뉴스를 물리적리스크의 지표로 사용하여 이러한 뉴스가 보도되었을 때 화석연료 발전 기업의 주가가 어떻게 변화하였는지 분석하였다. 분석결과, 이상 고온 관련 뉴스가 보도된 후 약 10일간 화석연료 관련 기업들의 주가가 하락하고, 반면 극지방 빙하 소실 관련 뉴스가 보도된 후에는 이들 기업의 주가가 상승하는 것을 발견하였다. 이러한 결과에 대해 저자는 빙하의 소실로 인해 극지방 근처에 매장되어 있는 석유와 천연가스의 추출이 상대적으로 수월해지면서 단기적으로 이들 기업에 대해 비용 절감의 효과가 기대되기 때문으로 해석하였다.

한편, 탄소 프리미엄에 대응하는 개념으로서 그린 프리미엄(저탄소 기업의 주식이 고탄소 기업의 주식에 비해 음(-)의 초과 수익률을 보임)의 존재를 규명하거나, 이행리스크로 인해 저탄소, 친환경 주식의 가치가 상승할 수 있음을 보인 연구들도 있다. 예를 들어, Alessi et al.(2021)은 유럽 주식을 대상으로 탄소배출량이 적거나 환경 공시 수준이 우수한 기업의 주식이 유의한 음(-)의 초과수익률을 보이는 것을 발견하였으며, 이러한 결과를 바탕으로 그린 프리미엄이 존재한다고 주장하였다. 그리고 Bernardini et al.(2021)은 저탄소 전환 정책의 시행에 따라 산업별로 주식 가치가 어떻게 변화하는지 분석하였다. 분석결과, 저탄소 전환 정책이 활발히 추진되었던 기간에 재생에너지, 친환경 제품 개발, IT, 의약품, 식료품 제조 등과 같이 저탄소 업종 주식에 대한 녹색 프리미엄이 존재함을 보였다. 구체적으로, 매월 저탄소 주식 포트폴리오에서 고탄소 주식 포트폴리오의 수익률을 차감하여 구성한 무차익포트폴리오의 비정상수익률(알파)은 전체 분석 기간(2006~2016년)에서 비유의한 0.49%로 나타난 반면, 제3기 EU 배출권거래제가 시행된 기간(2012~2016년)에는 1.25%로 더 높은 값을 보였으며 1% 수준에서 통계적으로 유의하였다. 이러한 결과를 바탕으로 저자는 저탄소 전환 정책이 추진되었던 기간 동안 저탄소 기업에 더 집중적으로 투자하였던 포트폴리오는 위험 프로파일은 크게 변하지 않으면서 동시에 더 높은 수익을 거두었으며, 이행리스크는 저탄소 기업들에게 긍정적인 기회로 작용할 수 있다고 주장하였다.

나. 기후변화와 대출, 채권, 부동산 가격의 관계에 대한 연구

앞서 살펴본 주식 관련 연구에 비해 상대적으로 연구 사례는 적지만, 기후변화가 기업의 대출금리, 채권, 부동산 가격 등에 미치는 영향을 분석한 연구도 최근 들어 활발히 진행되고 있다. Chava(2014)는 유해 폐기물 및 유독성 화학 물질 배출과 같은 환경 관련 부정적 이슈에 연루된 기업은 그렇지 않은 기업에 비해 상대적으로 더 높은 은행 대출 이자율을 지불하고, 친환경 제품 생산, 온실가스 배출 저감 기술 개발 기업 등과 같이 친환경 기업은 상대적으로 낮은 대출 이자율을 지불한다는 것을 발견하였다. 마찬가지로 Javadi & Masum(2021), Huang et al.(2022)은 기후변화로 인한 자연 재해 위험에 더 많이 노출된 기업은 은행 차입 시 대출금리, 담보 요건 등에 있어서 더 불리한 대출 조건을 제시받을 가능성이 높음을 확인하였다. 이러한 결과는 은행이 기후리스크를 채무불이행 위험에 영향을 미칠 수 있는 요인으로 인식하고 있으며, 아울러 기후리스크에 노출된 기업에 대한 대출에 따른 평판 리스크를 고려하고 있을 가능성을 보여주고 있다. 이러한 명시적인 이자비용 뿐만 아니라 기후리스크는 주가에 내재된 자기자본비용과도 유의한 관련성을 보인다는 연구결과도 있다. Hyunh et al.(2020)은 주식 가격으로부터 추정된 자기자본비용이 가뭄의 강도와 유의한 양(+)의 관련성이 있음을 보였는데, 이들의 추정에 따르면 심각한 가뭄 위험에 노출된 지역에 본사가 위치하는 기업이 그렇지 않은 기업에 비해 평균적으로 약 92bp 높은 자기자본비용을 부담하는 것으로 나타났다.

채권과 관련한 연구로는 해수면 상승 위험과 같은 물리적리스크가 지방채 가격에 미치는 영향, 저탄소 이행리스크가 회사채 가격에 미치는 영향을 분석한 연구들이 있다. Painter(2020)는 기후리스크가 미국의 지방채 발행 비용에 미치는 영향을 분석하였는데, GDP 대비 해수면 상승으로 인한 연간 평균 손실액 비율로 측정한 기후리스크 노출도가 높은 카운티에서 더 많은 지방채 발행 비용을 지불한다는 결과를 제시하였다. 기후리스크 노출도가 1% 상승할 경우, 연간 장기채 발행 비용이 평균적으로 23.4bp 유의하게 증가하는 것으로 추정되었으며, 이는 단기 채권이 아닌 만기가 25년 이상인 장기 채권에서 더 뚜렷하게 나타났다. 그리고 이와 비슷한 맥락에서, Goldsmith-Pinkham(2021)은 지방채 가격에 해수면 상승 위험 리스크에 대한 프리미엄이 반영되고 있음을 발견하였고, 특히 투자자들의 기후변화에 대한 관심이 증가하기 시작한 2013년 이후 리스크 프리미엄이 더욱 상승하는 것을 보였다.

이와 함께 기후변화가 회사채에 미치는 영향에 대해서도 주목할 만한 연구결과가 발표되고 있다. Huynh et al.(2021)는 이전에 Engle et al.(2020)이 개발한 기후변화 관련 뉴스 인덱스를 기후리스크의 대용치로 사용하여 기후리스크가 회사채 가격에 미치는 영향을 분석하였는데, 기후리스크를 효과적으로 헷지하는(즉, 기후리스크 인덱스와 채권 수익률간 공분산 값이 높은) 채권의 미래 수익률이 더 낮다는 것을 발견하였다. 이는 기후리스크를 헷지하는 채권의 가격이 더 높게 평가되고 있다는 것으로, 채권 투자자들이 기후리스크를 투자 결정에 반영하고 있음을 시사하고 있다. 그리고 Seltzer et al.(2022)은 탄소 집약적 업종에 속하거나 환경성과점수가 낮은 기업일수록 채권 신용등급이 낮고 신용스프레드가 큰 경향이 있으며, 이러한 경향은 환경 관련 규제가 더 엄격한 지역에 본사를 둔 기업에서 더 두드러지게 나타남을 발견하였다.

마지막으로 부동산과 관련한 연구는 주로 해수면 상승, 허리케인 등과 같은 물리적리스크가 부동산 가격에 영향을 미치는지를 검증하는 연구가 주를 이루고 있는 가운데, 문헌마다 다소 혼재된 결과를 보이고 있다. 대표적으로 Bernstein et al.(2019)은 미국의 해안가 근처에 위치한 주택을 대상으로 해수면 상승으로 인한 침수 위험에 더 많이 노출된(즉, 해발고도가 더 낮은 곳에 위치한) 주택은 그렇지 않은 주택에 비해 더 낮은 가격에 거래된다는 사실을 발견하였다. 예를 들어, 해수면이 1foot, 2-3feet, 4-5feet, 6feet 상승 시 침수될 수 있는 주택은 각각 약 14.7%, 13.8%, 7.8%, 4.4% 만큼 할인된 가격에 거래되는 것으로 추정되었다. 마찬가지로 Nguyen et al.(2020)는 해수면 상승 위험에 더 많이 노출된 주택에 대한 모기지 대출금리가 더 높으며, 이러한 금리 차이는 해안 침수, 홍수, 허리케인과 같은 재해가 더 빈번하게 발생하거나, 지역주민의 기후변화에 대한 믿음이 더 강한 지역에서 더 크다는 것을 발견하였다.

그러나 이와 대조적으로 해수면 상승 위험이 주택가격에 별다른 영향을 미치지 않는다는 연구결과도 있다. Murfin and Spiefel(2020)은 주택 가격에 영향을 미치는 다른 일반적인 변수들(예를 들어, 주택 규모, 연식, 교통, 학군 등)을 통제하였을 경우에는 해수면 상승으로 인한 침수 위험에 더 많이 노출된 주택이라고 해서 더 낮은 가격에 거래되는 것은 아니라는 실증분석 결과를 제시하며, 기후리스크와 부동산 가격 간에는 유의한 관계가 없다고 주장하였다. 또한, Ewing et al.(2007)과 Zhang(2016)은 자연재해가 주택 가격에 부정적인 영향을 미칠 수는 있지만, 그 영향은 대체로 한 달 또는 1년 미만 한시적으로만 나타난다는 결과를 제시하였다.

아래의 <표 Ⅲ-1>은 지금까지 언급한 문헌을 포함한 기후변화가 자산가격에 미치는 영향에 관한 선행연구를 정리한 것이다.

다. 소결

지금까지 기후변화와 자산가격에 관한 선행연구를 검토한 결과를 종합하면, 기후리스크는 주식, 대출, 채권, 부동산 등 다양한 유형의 자산에 걸쳐 관련 리스크에 노출된 자산에 대해 대체로 부정적인 영향을 미치고 있는 것으로 확인된다. 이러한 실증연구는 기후리스크와 자산가격이 유의한 관련성을 가진다는 증거를 제시하고는 있으나, 기후리스크가 얼마나 효율적으로 자산가격에 반영되고 있는지에 대해서 추가적인 검증이 필요하다. 시장 가격이 효율적인지 엄밀하게 검증하는 것은 불가능하지만, 시장이 효율적으로 기후리스크를 반영하고 있다면 최소한 다음과 같은 조건은 충족할 것으로 기대할 수 있다. 예를 들어, 현재 시점에 공개된 기후변화 관련 사건이나 예측 정보는 이미 투자자들의 기대에 반영되어 있어야 하므로 이러한 정보를 이용해 미래 주가수익률을 설명할 수 없어야 할 것이고, 기상이변과 같은 새로운 기후리스크가 발생하였을 때 투자자들이 이에 매우 신속히 반응하는 모습이 관찰되어야 할 것이다.

그런데 이와 관련한 실증연구를 살펴보면 대체로 시장은 기후리스크를 효율적으로 반영하고 있지 않다는 결과가 다소 우세한 것으로 보인다. Hong et al.(2019)는 전 세계 식품 기업을 대상으로 현재 시점의 가뭄 예측 결과와 미래 주가수익률 간에 유의한 양(+)의 관계가 있음을 보이며, 식품 생산량에 중대한 영향을 미치는 물리적리스크인 가뭄 위험이 기업의 주가에 효율적으로 반영되고 있지 않다고 주장하였다. 비슷한 맥락에서, Kumar et al.(2019)도 비정상적인 기온 변화에 더 높은 변동성을 보이는 주식일수록 수익률이 낮은 경향이 있음을 보이고, 이를 이용한 매매 전략(즉, 기온변화에 더 높은 변동성을 보이는 주식을 매도하고 낮은 변동성을 보이는 주식을 매수하는 전략)으로 1931년부터 2017년 기간 동안 연 3.6%의 위험조정수익률을 얻을 수 있음을 보이며 주식시장이 기후리스크를 충분히 반영하지 않고 있다고 평가하였다. 또한, Cheema-Fox et al.(2021)와 Ravina & Kaffel(2019)도 저탄소 포트폴리오를 매수하고 고탄소 포트폴리오를 매도하는 롱숏 포트폴리오의 수익률이 분석 기간 동안 시장 수익률을 유의하게 상회한다는 결과를 제시하였으며, Addoum et al.(2020)과 Griffin et al.(2022)은 이상 고온 사건이 애널리스트의 실적 전망이나 해당 위험에 노출된 기업의 주가에 반영되고 있지 않음을 보이며 시장은 기후리스크에 효율적으로 반응하지 않는다는 가설을 지지하였다.

마지막으로, 지금까지 살펴본 선행연구는 기후변화가 자산가격에 유의한 영향을 미치고 있다는 실증적 근거를 제시하고는 있지만, 기후리스크가 미래의 자산가격, 포트폴리오, 그리고 금융시스템 전체에 어떤 영향을 미칠지, 그리고 그러한 충격이 발생했을 때 그에 따른 손실 규모는 어느 정도일지에 대해서까지 알려주지는 않는다. 물론, 해마다 다른 양상으로 전개되고 있는 이상기후 현상에서도 알 수 있듯이, 고도의 복잡성, 비선형, 불확실성을 내포한 기후변화의 경로와 그에 따른 영향을 과거 데이터나 추세 분석을 통해 예측하기란 일정한 한계가 있을 수밖에 없다.

이러한 이유로 NGFS, TCFD 등을 비롯한 주요 기후금융 관련 국제기구는 금융시장 참여자들이 기후리스크에 보다 효과적으로 대응할 수 있도록 좀 더 유연하고 미래지향적인 방법이라 할 수 있는 시나리오 기반의 기후리스크 평가 기법을 활용할 것을 제안하고 있다. 시나리오 분석은 미래에 발생할 수 있는 여러 다양한 상황을 그려보고, 각 상황에서의 대응 방안을 미리 생각해보는 과정으로, 기후 재해과 같이 정확한 발생 시점을 예측하기란 매우 어렵지만, 한 번 발생하면 경제와 사회 전반에 막대한 피해를 미칠 수 있는 리스크에 능동적으로 대처할 수 있도록 도와주는 효과적인 수단으로 인식되고 있다. 이에 다음 장에서는 이러한 시나리오 기반의 기후리스크 평가 방법과 실제 활용 사례를 살펴보고자 한다.

2. 시나리오 기반 기후리스크 평가 기법 및 활용 사례

이전 장에서 기후리스크는 자산가격에 유의한 영향을 미치고 있음을 보여주는 선행연구들을 살펴보았다. 그러나 이처럼 과거 데이터에 기반을 둔 계량적 분석만으로는 미래의 기후리스크에 효과적으로 대응하기 어렵다는 것도 알 수 있었다. 높은 불확실성과 복잡성을 지니는 기후리스크를 다루는 데는 좀 더 유연하고 미래지향적인 접근법이 효과적일 수 있으며, 시나리오 기반의 기후리스크 예측 및 평가 기법이 최근 유력한 대안으로 제시되고 있음도 언급하였다. 이에 이 장에서는 이러한 시나리오 기반의 기후리스크 분석 방법이 어떻게 진행되고, 이의 대표적인 활용사례로 주요국 중앙은행의 기후 스트레스 테스트 사례를 살펴보고자 한다.

가. 시나리오 기반 기후리스크 분석의 필요성

기후변화는 태양 에너지 변화, 화산활동 등과 같은 자연적 요인과 인류의 화석연료 사용, 도시화에 따른 토지 변화, 삼림 파괴 등과 같은 인위적 요인의 복잡한 상호작용에 따라 진행되면서 생태계와 사회, 경제에 광범위한 영향을 미치는 것으로 알려져 있다. 이러한 높은 복잡성으로 인해 일반적으로 기후변화로 인한 물리적 피해의 발생 시점과 그 규모를 정확히 예측하기가 어려운 것으로 인식되고 있다. 기후변화의 영향을 평가하는 가장 권위 있는 국제기구인 IPCC에서도 경험적 관측 및 실험 결과, 통계적 분석, 시뮬레이션 등 다양한 방법을 종합적으로 활용해 미래 기후변화의 영향을 추정하고는 있지만, 기후변화 대응 정책의 전개 방향, 저탄소 기술의 발전 속도, 인구 및 경제 성장 등과 같은 사회, 경제 환경의 변화에 따라 예측 결과가 크게 달라질 수 있음을 언급하고 있다(IPCC, 2015; IPCC, 2022). 결과적으로, 이러한 기후변화 문제가 지닌 고도의 불확실성은 민간 기업과 금융회사들이 기후변화가 미래 기업의 운영, 전략, 수익 기회에 어떠한 영향을 미칠지, 그리고 해당 기업과 관련한 자산을 보유하고 있는 금융회사의 포트폴리오에는 어떠한 잠재적 손실을 초래할지 예측하고 대응하는 것을 어렵게 한다.

그러나 국제사회가 파리협정에서 약속한 기후 목표를 달성하기 위해서, 그리고 무엇보다 기업과 금융회사를 비롯한 자본시장의 이해관계자들이 기후리스크에 자신들이 어느 정도 취약한지 인식하고 이에 효과적으로 대처할 수 있으려면 기후리스크를 사전에 파악하고 대응 방안을 마련할 필요가 있다. TCFD(2017)에서 언급한 바와 같이 시나리오 분석은 기후리스크처럼 불확실하지만, 미래 어느 시점에서 일어날 가능성이 높고 중장기적으로 심각한 피해를 초래할 수 있는 문제를 이해하는 데 효과적인 수단이 될 수 있기 때문이다. 또한 시나리오 분석을 통해 조직의 의사결정자들은 미래에 처할 수 있는 다양한 상황에 대한 전략적 사고를 강화할 수 있고, 조직의 전략, 재무, 사업 계획을 점검하고 조정할 수 있다.

시나리오 분석은 미래에 전개될 수 있는 다양한 상황을 가정하고 각 상황이 가져올 수 있는 잠재적인 영향을 가늠해보는 일련의 프로세스를 의미한다(TCFD, 2017). 즉, 시나리오 분석은 다른 미래예측기법과 달리 특정한 수치나 확률에 대한 예측(prediction)을 의미하는 것이 아니며, 일정한 조건에 특정한 추세가 지속된다고 가정할 때 미래가 어떻게 전개될지 그려보고, 각 시나리오에서의 대응 전략을 모색하는 작업이다. 이는 서술적인 묘사의 형태를 가진 정성적인 분석이 될 수도 있고, 수치 데이터와 모델링을 이용한 정량적 분석이 될 수도 있다. 그러나 어떠한 형식이든 내적 일관성, 논리성, 그리고 명확하고 합리적인 가정에 근거한 설득력 있는 시나리오를 설정할 것을 필요로 한다. 후속하는 절에서는 시나리오 분석의 프로세스와 실제 활용 사례를 살펴보기로 한다.

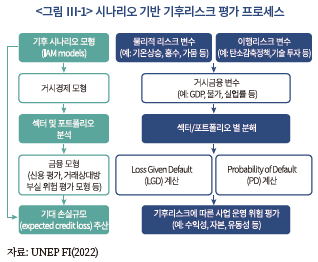

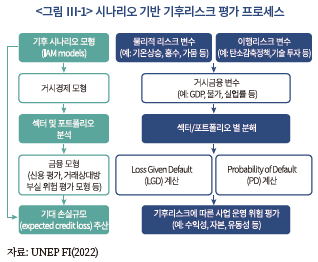

나. 시나리오 기반 기후리스크 분석 프로세스

시나리오 기반의 기후리스크 평가 프로세스는 일반적으로 기후변화 시나리오 설정, 기후리스크의 거시경제 변수에 대한 영향 추정, 거시경제 충격을 산업별 또는 섹터별로 분해, 그리고 마지막으로 이러한 산업별 부가가치 변화에 따른 금융기관의 신용위험 및 시장위험 추정의 순으로 진행된다(<그림 Ⅲ-1> 참고).

이러한 기후리스크 평가 프로세스는 상호 유기적으로 연계되어 함께 작동하도록 설계된 단일의 모형이기보다는, 기후, 경제, 금융 시스템 등 각기 다른 여러 모형들이 결합된 구조를 보이고 있다. 따라서 이러한 기후리스크 측정 프로세스는 그 구조가 상당히 복잡할 뿐만 아니라, 분석에 사용된 데이터, 접근방식, 기후 및 거시 부문 모형, 단순화 가정 등의 조합에 따라 다양한 방식으로 진행될 수 있다. 즉, 기후환경, 거시경제, 금융시스템 간의 상호작용을 완전하게 설명할 수 있는 표준화된 모형이 아직 마련되어 있지 않다고 볼 수 있다. 최근 각국 중앙은행을 중심으로 기후 스트레스 테스트 모형 개발이 진행되면서 이러한 시나리오 기반의 기후리스크 측정 모형에 상당한 진전이 있었지만, 그럼에도 불구하고 중앙은행의 기후 스트레스 테스트 모형은 아직 초기 단계로 인식되고 있다(UNEP FI, 2022).15) 이하에서는 프랑스, 영국, 네덜란드를 비롯한 주요국 중앙은행의 기후 스트레스 테스트 모형 개발 사례를 참고로 하여 시나리오 기반의 기후리스크 분석이 실행되는 과정에 대해 좀 더 살펴보고자 한다.

1) 기후변화 시나리오 설정

일반적인 기후 스트레스 테스트의 첫 단계에서는 기후변화 시나리오를 구성하고, 각 기후 시나리오에서의 기후리스크 관련 변수들의 시간에 따른 변화 경로를 도출하는 작업이 이뤄진다. 이러한 기후 시나리오는 미래의 발생 가능한 지구 평균온도 변화 경로와 이에 대응하는 탄소배출량 경로, 최종 에너지 사용량 경로, 탄소가격 경로, 에너지 믹스 경로, 에너지 부문 투자 경로, 인구 및 GDP 성장 경로 등으로 구성되는데, 이는 통합평가모형(Integrated Assessment Models: IAMs)의 시뮬레이션 결과로 산출된다.16)

이러한 기후 시나리오를 개별 기관이 자체적으로 개발하는 것은 현실적으로 매우 어려운 작업이기 때문에, 다음 <표 Ⅲ-2>에서 보는 바와 같이 우리나라를 비롯한 프랑스, 영국 중앙은행은 NGFS에서 제안한 기후변화 시나리오를 기초로 기후 시나리오를 설정하고 있다.17) 예를 들어, 우리나라는 NGFS의 질서있는 이행(orderly transition) 시나리오와 유사한 1.5℃ 시나리오와 2℃ 시나리오, 그리고 저탄소 정책이 시행되지 않고 현재와 같이 배출량이 지속되는 기준(baseline) 시나리오의 세 가지 시나리오를 설정하였으며 물리적리스크는 고려하지 않았다. 프랑스와 영국은 질서있는 저탄소 이행을 통한 2℃ 이내 시나리오, 저탄소 이행이 2030년 이후 뒤늦게 시행 되는 무질서한 이행(disorderly transition) 시나리오, 그리고 최악의 시나리오로서 더 이상 추가적인 저탄소 정책이 시행되지 않아 4℃ 이상의 평균온도 상승이 예상되는 BAU(Business As Usual) 시나리오의 세 가지 시나리오를 상정하였다. 그리고 이들은 BAU시나리오에서 이행리스크 뿐만 아니라 해수면 상승, 홍수 등과 같은 물리적리스크도 함께 고려하였는데, 이러한 물리적리스크는 특히 2050년 이후 크게 증가할 것으로 가정하였다. 마지막으로, 네덜란드 중앙은행(DNB) NGFS의 시나리오가 발표되기 전에 기후 스트레스를 먼저 실시하였기 때문에, NGFS의 시나리오가 아닌 자체적으로 개발한 시나리오를 사용하였다. 이들은 물리적리스크는 고려하지 않고 이행리스크만 고려하였는데, 향후 5년 이내 탄소세를 급격하게 인상하거나($100/ton 인상), 재생에너지 기술 확산이 빠르게 이루어지는 경우(재생에너지 비중이 2배 이상 증가)의 조합에 따른 네 가지 시나리오를 설정하였다.18)

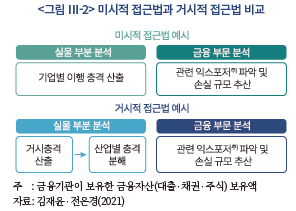

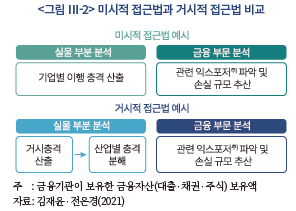

먼저, 거시적 접근법은 거시경제모형을 사용하여 기후리스크에 따라 GDP, 물가, 이자율, 고용, 에너지 수요 및 가격 등의 주요 거시 변수의 중장기 반응을 추정하고, 이러한 거시적 충격을 다시 산업별 충격으로 분해하는 하향식 분석 방식을 의미한다. 기후리스크에 따른 거시 충격을 분석하는 방법은 정형화되어 있지 않으며, 분석기관마다 사용하는 모형의 종류도 매우 다양하다. 예를 들어, 네덜란드, 영국, 프랑스 등을 비롯한 유럽계 중앙은행 스트레스 테스트에서는 다국가 거시계량모형인 영국경제사회연구소의 National Institute’s Global Econometric Model(이하 NiGEM) 모형을 주로 사용하고 있으나, 그 외 민간 연구소들과 학계에서 개발된 모형들도 사용하고 있다. 예를 들어, Cambridge Econometics의 에너지 시스템, 기후 환경, 경제 부문 간 상호작용을 모형화한 글로벌 거시경제모형인 E3ME 모형, 마찬가지로 경제 부문과 에너지 부문, 비에너지 부문(농업 및 제조업) 간의 상호작용을 모델링한 Vivid Economics의 ViEW모형, Battiston et al.(2019)의 CLIMAFIN 모형 등이 기후리스크에 따른 거시경제 충격을 분석하는 데 사용되고 있다.

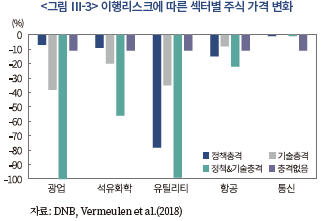

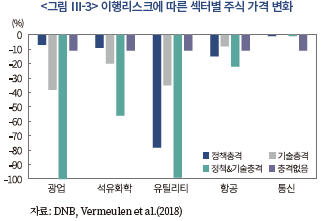

실제 거시적 접근법을 활용한 기후리스크 평가 사례로서, 네덜란드 중앙은행의 Vermeulen et al.(2018)에서 실시한 기후 스트레스 테스트에서는 NiGEM 모형을 사용하여 탄소세 인상, 저탄소 기술 혁신 등의 이행리스크에 따른 금융부문 영향을 추정하였다. 이들은 NiGEM 모형을 이용해 이행리스크에 따른 GDP 변화를 추정하고, 이를 다시 산업별 온실가스 배출량 지표(Transition Vulnerability Factor: TVF)의 크기에 따라 56개의 산업별 영향으로 분해한 다음, NiGEM 모형에서 산출된 섹터별 주가에 TVF를 구함으로써 섹터별 손실 규모를 추산하였다.19)

이하 <그림 Ⅲ-3>은 산업에 따라 이행리스크로 인한 자산 가치 손실이 크게 차이가 날 수 있음을 보여주고 있다. 예를 들어, 탄소세 인상 시나리오에서 유틸리티 업종은 –78% 수익률로 가장 큰 손실이 발생하지만, 에너지 기술 충격 시나리오에서는 광업이 –38%로 가장 큰 손실이 발생하는 것으로 나타난다. 한편, 두 가지 충격이 모두 발생하는 시나리오에서는 유틸리티, 광업 모두 –100% 수익률을 보이며 주식 가치가 거의 완전히 사라지는 것으로 나타난다. 한편, 항공 산업은 탄소세 인상 시나리오에서 –15%, 에너지 기술 충격 시나리오에서는 –8%, 모든 충격 시나리오에서는 –22%로 다른 업종에 비해 손실 규모가 다소 적은 것으로 나타나는데, 이는 화석연료 가격 하락에 따라 운송비용이 감소함에 따른 이익 효과 때문이다. 다른 업종과 대조적으로, 통신은 어떠한 이행리스크도 일어나지 않는 시나리오(confidence scenario)에서 가장 손실율이 크게 나타나는데, 이는 이행 리크스가 일어나지 않으면서 동시에 경기 침체가 발생하면서 수익성이 악화되기 때문이다.

이와 달리 미시적 접근법은 개별 경제주체에 초점을 맞춘 상향식 분석 방법으로, 기업 단위 미시 데이터를 기반으로 기후리스크에 따른 기업별 충격을 먼저 산출한 후 이를 합산하여 산업별 또는 포트폴리오별 이행리스크 영향을 추정하는 방식이다. 예를 들어, 한국은행의 김재윤, 전은경(2021)은 개별 기업 분석에 기반하여 이행리스크로 인한 은행의 BIS 비율 변화를 추정하였다. 이들은 일차적으로 탄소배출량 감축 규제 강화, 탄소 가격 상승, 저탄소 기술 발전 등을 기업의 생산비용 결정 요인으로 가정하고, 기업 단위 미시 데이터를 활용해 이러한 생산비용 증감에 따른 기업별 부가가치 변화를 추정하였다. 그리고 이러한 기업별 부가가치 변동을 산업별로 합산하여 산업별 부가가치 변화를 추정하였다. 아울러, 이행리스크에 따른 국내 은행의 손실규모를 추정하기 위해, 일차적으로 개별 기업의 이행리스크에 따른 손익 전망치를 우선 산출한 후, 현금흐름 할인법, 재무적 부도율 및 부도손실률 함수와 같은 재무 모형을 이용하여 해당 기업과 연관된 주식, 채권, 대출 가치 변화를 산출하여 이를 국내은행이 보유한 포트폴리오에 연계함으로써 은행의 손실규모를 산출하였다.20) 그 결과, 이들은 이행리스크에 의한 고탄소 기업의 부도율 상승 및 주가 하락에 따라 1.5℃ 시나리오에서 2050년 국내은행의 BIS 비율이 규제비율을 0.7%p 가량 하회할 것으로 전망하였다.

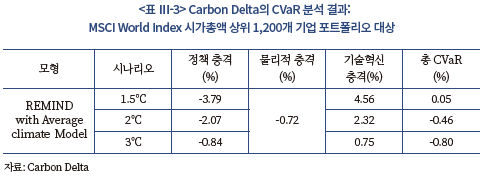

미시적 접근법을 사용한 또 다른 사례로서는 UNEP FI(2021)에서 사용된 Carbon Delta 모형이 있다. Carbon Delta는 이상고온, 태풍, 홍수 등과 같은 자연재해로 인한 사업 운영 중단에 따른 손실, 탄소 가격 상승에 따른 생산비용 상승 등의 기후 비용(climate costs)과 저탄소 기술 관련 특허 보유에 따른 잠재적 수익 증가 등의 기후 이익(climate profits)를 합산하는 방식으로 기업의 미래 순이익 변화를 추정하였다. 아울러, 이를 바탕으로 기업의 Climate Value at Risk(이하 CVaR)를 구하였는데, 이는 앞서 구한 기후 비용과 기후 이익 합계의 현재가치와 현 시점의 기업의 시장가치의 비율로 계산된다.21) 마찬가지로 포트폴리오 CVaR는 기업별 CVaR을 해당 포트폴리오 내 기업의 편입 비중을 가중치로 가중평균하여 산출할 수 있다.

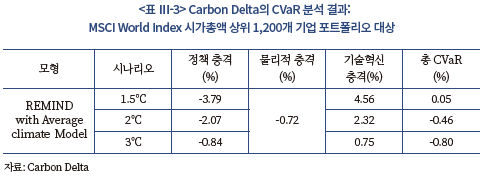

아래 <표 Ⅲ-3>은 Carbon Delta의 방식을 MSCI World Index의 시가총액 기준 상위 1,200개 주식 포트폴리오에 적용하여 산출된 포트폴리오 CVaR을 보여주고 있다. 포트폴리오 CVaR은 1.5℃, 2℃, 3℃ 시나리오에서 각각 +0.05%, -0.46%, -0.80%로 기온상승폭이 높아질수록 포트폴리오 손실의 크기도 증가하는 모습을 보이고 있다. 이러한 Carbon Delta의 분석 결과는 물리적리스크는 동일하다는 가정(모든 시나리오에서 –0.72%로 고정)하게 추정된 것이므로, 이러한 포트폴리오 CVaR의 변화폭은 저탄소 전환 노력의 정도, 즉, 이행리스크에 따른 충격 규모를 의미한다고 해석할 수 있다.22) 여기서 또 한가지 흥미로운 점은 포트폴리오의 CVaR의 상당부분은 저탄소 전환 정책리스크(policy risk)뿐만 아니라, 저탄소 기술 기회(technology opportunity)에 의해서도 좌우된다는 점이다. 예를 들어, 저탄소 이행이 둔화될수록 정책리스크는 1.5℃ 시나리오에서 –3.79%, 3℃ 시나리오에서 –0.84%로 줄어들지만, 반면 저탄소 기술에 따른 잠재적 이익 실현의 기회(technology opportunity)가 4.56%에서 0.75%로 더 크게 감소하면서, 결과적으로 포트폴리오 CVaR는 +0.05%에서 –0.80%로 순손실을 입는 것으로 나타난다.

Ⅳ. 이행리스크와 주식수익률의 관계에 대한 실증분석

앞서 기후변화와 자산가격에 관한 선행연구를 검토한 결과, 기후변화는 주식, 채권, 부동산 등 다양한 유형의 자산 가치에 부정적인 영향을 미친다는 증거가 대체로 우세한 것을 알 수 있었다. 그러나 일부에서는 시장이 기후리스크를 효율적으로 반영하고 있지 않으며, 기후 재해에 대한 노출도와 기업의 수익성, 해수면 상승에 따른 침수 위험과 주택 가격 등 기후리스크와 자산 가치 간에 유의한 관련성이 없다는 결과도 존재하였다. 종합하면, 기후변화와 자산가격의 관계는 아직 명확히 정립되어 있지 않으며 이에 대한 추가적인 연구가 좀 더 이뤄져야 할 필요가 있다.

이러한 선행연구 검토를 바탕으로, 본 장에서는 저탄소 정책의 시행에 따른 이행리스크가 국내 주식시장에서도 관찰되는지 확인해 보고자 하였다. 특히, 앞서 이행리스크를 유발하는 대표적인 저탄소 정책의 하나로 제시되었던 탄소 배출권거래제를 이행리스크의 대용치로 활용하여 국내 주식시장에서의 이행리스크와 주식수익률의 관계를 분석하고자 한다. 배출권거래제 대상 기업은 탄소 감축 정책의 강화에 따른 탄소가격 상승 위험에 직접적으로 노출되어 있기 때문에, 배출권거래제 적용 여부는 이행리스크의 지표로 활용될 수 있으며, 일례로 Oestreich & Tsiakas(2015)는 EU ETS 배출권거래제 대상 기업의 비정상 초과수익률을 분석함으로써 이행리스크 프리미엄을 추정한 바 있다.

구체적으로 본 장에서는 2012년 7월부터 2021년 12월까지의 월별 주식수익률 자료와 연도별 배출권거래제 대상 기업 정보를 이용하여 배출권거래제 대상 기업과 배출권거래제 비대상 기업의 누적수익률 추이를 살펴보고, 두 그룹간의 비정상 초과수익률의 차이를 비교하여 보고자 한다. 만약 배출권거래제 대상 그룹이 비대상 그룹에 비해 평균적으로 더 높은 초과수익률을 보인다면, 이는 국내 주식시장의 투자자들이 이행리스크를 투자결정에 반영하고 있음을 간접적으로 시사하고 있다고 볼 수 있을 것이다.23)

본 장의 구성은 다음과 같다. 1절에서는 우리나라 배출권거래제 개요 및 배출권 할당 기업 선정 기준에 대해 간략히 살펴보고, 2절에서는 연구에 사용된 자료와 변수를 설명하고, 3절에서는 배출권거래제 대상 기업과 비대상 기업의 주식수익률의 차이를 실증적으로 분석한다.

1. 국내 배출권거래제 개요

우리나라는 2012년 「온실가스 배출권 할당 및 거래에 관한 법률(2012년 5월」을 제정하여 배출권거래제 도입을 위한 법적 기반을 마련하고, 「배출권거래제 기본계획(’14.1월)」, 「온실가스 배출권거래제 제1차 계획기간 국가 배출권 할당계획(’14.9월)」등의 관련 세부 지침을 수립하여 2015년 1월 1일부터 배출권거래제를 시행하여 오고 있다. 배출권거래제는 일정 수준 이상 온실가스를 배출하는 기업 및 사업장을 대상으로 연 단위 배출권을 할당하여 할당범위 내에서만 배출행위를 할 수 있도록 허용하고, 할당된 기업의 온실가스 배출량을 평가하여 여분 또는 부족분의 배출권에 대해서는 기업 간 거래를 허용하는 시장 기반의 온실가스 감축제도이다(온실가스종합정보센터, 2022). 기업은 배출권 여유분을 팔거나, 부족분에 대해서는 경매 또는 시장거래를 통해 확보할 수 있어 이러한 배출권거래제는 직접규제 기반의 제도보다 비용 효율적인 탄소감축 수단으로 인식되고 있다.

우리나라 정부는 국가온실가스 감축목표를 효과적으로 달성하기 위하여 배출권 총수량을 정하고 이를 기업별로 할당하는 계획기간별 국가 배출권 할당계획을 수립하여 운영하고 있다. 관리대상물질은 이산화탄소(CO2), 메탄(CH4), 아산화질소(N2O), 수소불화탄소(HFCS), 과불화탄소(PFCS), 육불화황(SF6) 6가지 항목으로, 할당방식은 과거 배출량을 근거로 배출권을 할당방식(Grandfathering: GF)과 제품생산량 등 과거 활동 대비 배출량을 근거로 배출효율성 기준 할당방식(Benchmark: BM)으로 구분된다.24) 2015년부터 시행된 국내 배출권거래제는 제1차 계획기간(’15~’17년), 제2차 계획기간(’18~’20년)을 거쳐 현재 제3차 계획기간(’21~’25년)이 시행 중에 있으며, 감축 목표가 점진적으로 강화되고 있는 추세이다. 예를 들어, 제1차 계획기간에는 제도 안착을 위해 할당량의 100%를 무상으로 할당하였던 반면, 제2차 계획기간은 유상할당 대상 업종 내 기업에 할당되는 배출권의 3%를, 제3차 계획기간은 10%를 유상 할당하였다.

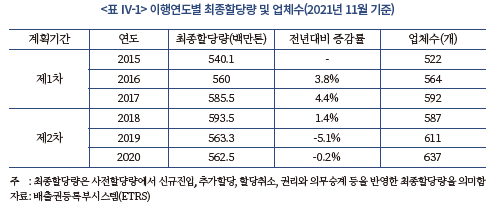

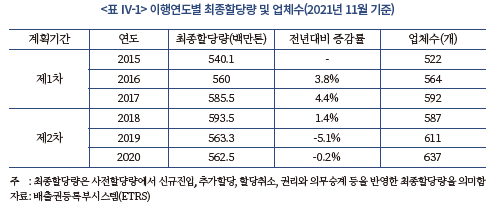

현재 배출권거래제 적용대상(즉, 배출권 할당대상)의 지정은 최근 3년간 연평균 온실가스 배출량이 12.5만톤(CO2eq) 이상인 업체 또는 2만 5천톤(CO2eq) 이상인 사업장을 하나 이상 보유한 업체에 적용된다. 할당대상으로 지정된 업체는 계획기간 시작 4개월 전 정부에 할당신청서를 제출하고 정부로부터 할당량을 통보받게 되는데, 이를 사전할당량이라고 한다. 제2차(제3차) 계획기간부터는 유상할당 업종에 해당하는 할당대상업체에 대해 전체 할당량의 3%(10%)가 사전할당에서 공제되고, 공제된 할당량은 배출권 시장에서 경매를 통해 유상으로 구매할 수 있도록 하였다. 제1~3차 계획기간의 할당대상 업체 수와 최종할당량은 다음의 <표 Ⅳ-1>과 같다.

2. 자료 및 기초통계량

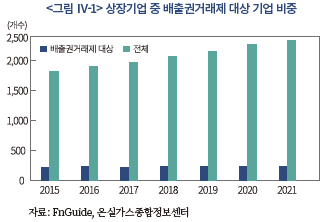

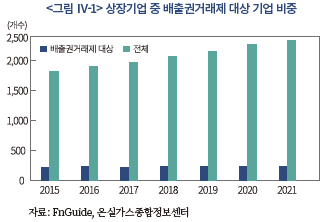

본 연구는 한국거래소에 상장되어있는 기업들의 2012년 7월부터 2021년 12월까지의 월별 주가 정보, 재무제표 자료 및 연도별 배출권거래제 대상 기업 자료를 이용하였다. 월별 주가 정보 및 기업의 재무 자료 등은 FnGuide에서, 연도별 배출권거래제 대상 기업 정보는 온실가스종합정보센터에서 구하였다. 이 중 금융업을 제외한 기업들을 대상으로 하며, 관리종목, 자본잠식상태인 기업, 온실가스 배출량 정보가 존재하지 않는 기업들을 표본에서 제외하였다. 그 결과 상장기업 2,276개사와 배출권거래제 대상 기업 252개사가 최종 분석 대상으로 선정되었다. 즉, 배출권 대상 기업은 기업 수 기준 전체 상장기업의 약 11%, 2021년 초 시가총액 기준으로는 약 55%에 해당한다.

여기서 본 보고서의 결과 해석에 있어 한 가지 주의해야 할 점이 있다. 우리나라에서 배출권거래제는 2015년부터 시행되었으므로 2012년부터 2014년의 배출권거래제 참여 기업 정보는 존재하지 않는다. 한편, 본 절의 분석결과는 배출권거래제 시행 이전인 2012~2014년 기간까지 모두 포함하여 도출한 것으로, 엄밀히 말해 해당 기간에 대한 배출권거래제 대상 기업의 효과를 추정할 수는 없다. 그럼에도 불구하고 해당 기간을 분석 기간에 포함한 이유는 다음과 같다. 먼저, 우리나라는 배출권거래제 도입 이전인 2011년부터 온실가스 에너지 목표관리제도를 이미 시행하고 있었으므로 온실가스 감축 규제는 이미 배출권거래제 도입 이전부터 시행되고 있었다고 볼 수 있다. 아울러, 2012년에 국회에서 배출권거래제 법안이 통과되었고, 해당 기간 온실가스 배출량 및 에너지 소비량에 대한 명세서 정보가 이미 공개되고 있었으므로, 투자자들은 목표관리제도 하의 기업들의 일부가 배출권 할당 기업으로 편입될 것을 사전적으로 어느 정도 예상하였을 수 있다. 이러한 논리를 바탕으로, 본 고에서는 2015년 배출권거래제 참여 기업 정보를 2012~2014년 기간의 배출권거래제 예상 기업이라고 가정하고 분석을 수행하였다.25)

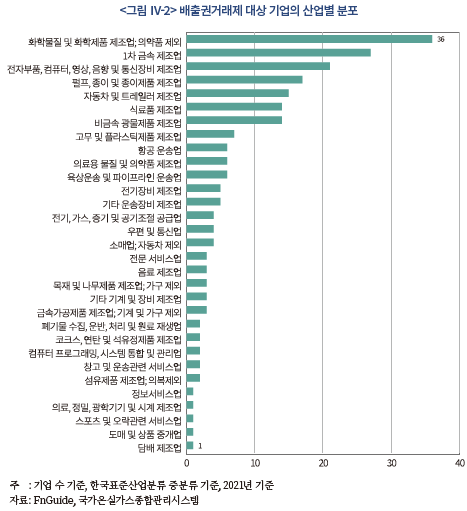

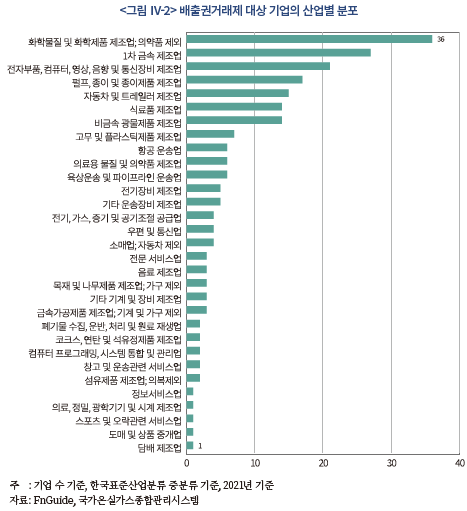

<그림 Ⅳ-1>은 배출권거래제가 시행된 2015년 이후 전체 분석 대상 기업 중 배출권거래제 대상 기업의 비중의 추이를 보여주는데, 2015년 214개, 2021년 223개로 최근으로 올수록 소폭 증가하고 있으나, 전체 기업 대비 비중은 10% 내외의 낮은 수준을 유지하고 있다. 그리고 <그림 Ⅳ-2>는 2021년 기준 배출권거래제 대상 기업의 산업별 분포를 나타내는데, 이는 기업 수를 기준으로 하였을 때, 화학물질 및 화학제품 제조업(의약품 제외) 36개사(16%), 1차 금속 제조업 27개사(12%), 전자부품, 컴퓨터, 영상, 음향 및 통신장비 제조업 21개사(9%), 펄프, 종이 및 종이제품 제조업 17개사(8%), 자동차 및 트레일러 제조업 17개사(8%), 식료품 제조업 14개사(6%), 비금속 광물제품 제조업 14개사(6%) 등의 순으로 탄소집약적 산업의 비중이 높은 것을 확인할 수 있다.

분석에 사용된 변수는 다음과 같다. 주식수익률은 월별 보유기간수익률을 사용하였고, 초과수익률을 계산하기 위한 무위험 수익률의 대용치로는 CD91일물의 월별 수익률을 사용하였다. 기업의 이행리스크를 측정하기 위한 지표로서는 해당 연도에 배출권 할당 기업 지정 여부를 사용하였다. 기존 문헌의 방식을 따라, CAPM의 시장베타(Beta)는 과거 1년의 일별 주식수익률과 KOSPI 지수 수익률을 이용해 매월 추정하였고, 기업규모(ME)는 월말 시가총액의 자연로그값, 장부가치 대 시장가치비율(B/M)은 전년도(t-1년) 자본총계에서 우선주 자본금을 차감한 값과 당해연도(t년) 7월부터 그 다음해(t+1년) 6월까지의 월말 시가총액의 비율로 계산하였다. 극단치의 영향을 배제하기 위해 분석에 사용된 연속형 변수에 대해서는 상하위 1%에서 윈저화(Winsorize)하였다.

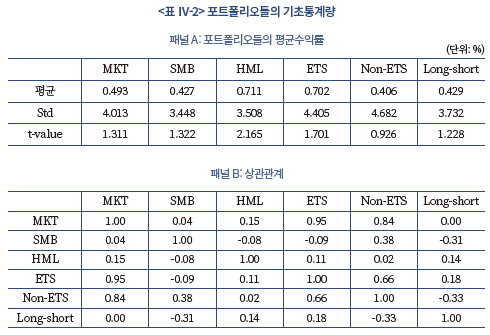

다음으로는 배출권거래제에 따른 이행리스크와 주식수익률 간의 관계를 살펴보기 위해 거래제 대상 업체 지정 여부에 따라 매년 주식을 두 개 그룹으로 분류하여 포트폴리오(배출권거래제 대상 그룹, 비대상 그룹)를 구성하였다. 각 포트폴리오는 매년 12월말마다 재구성(rebalancing)되며 다음해 1월부터 12월까지 각 포트폴리오의 월별 가치가중(value-weighted) 평균수익률을 계산하였다. 그리고 이들 포트폴리오들의 월별 수익률에서 무위험수익률을 차감하여 배출권거래제 대상 기업의 시장초과수익률(ETS)과 비대상 기업의 시장초과수익률(Non-ETS)를 구하고, 아울러 두 포트폴리오의 수익률을 차감한 무차익포트폴리오(Long-short)를 구성하였다. 이와 함께 CAPM, Fama-French 3요인 모형에 사용된 시장초과수익률(MKT)은 KOSPI 지수의 월별 수익률에서 무위험수익률을 차감하여 구하고, 그 외 기업규모(Small Minus Big: SMB), 가치(High Minus Low: HML) 관련 모방포트폴리오들은 Fama-French(1993)와 동일한 방법으로 구성하였다.

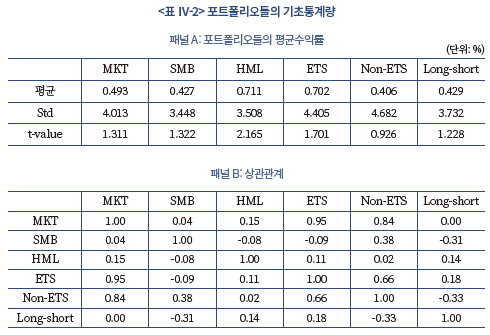

<표 Ⅳ-2>는 이러한 방법에 따라 구성된 포트폴리오들의 기초통계량과 상관계수를 보여주고 있다. 이행리스크 노출 정도를 나타내는 ETS는 10% 수준에서 유의한 양(+)의 평균수익률(0.7%)을 보이고 있다. 반면에, Non-ETS는 ETS보다 낮은 평균 수익률(0.41%)을 보이며, Long-short ETS 또한 양의 수익률(0.43%)를 보이고 있으나 둘 다 통계적으로 유의하지는 않다. 한편, 3개의 요인의 경우 HML을 제외하고 평균수익률이 전반적으로 0과 유의하게 다르지 않은 것으로 나타난다. 즉, 배출권거래제 대상 기업은 비대상 기업에 비해 더 높은 주식수익률을 보이고 있다. 다만 이러한 결과는 그룹 간 평균수익률을 단순 비교한 것이기 때문에 엄밀한 분석을 위해서는 주식수익률에 영향을 미치는 다른 요인들을 통제할 필요가 있다.

3. 배출권거래제 시행에 따른 이행리스크와 주식수익률의 관계에 대한 실증분석

앞서 배출권거래제 대상 기업은 비대상 기업에 비해 평균적으로 더 높은 주식수익률을 보이는 것을 확인하였다. 이 절에서는 이러한 배출권거래제 시행에 따른 주식수익률의 차이가 일반적인 주식수익률 결정 요인의 영향을 통제한 이후에도 여전히 유효한지 확인해 보기 위해, 앞서 배출권거래제 적용 여부를 기준으로 구분한 두 개의 포트폴리오(ETS, Non-ETS)의 월별 초과수익률에 대해 CAPM, Fama-French 3요인 모형을 이용하여 시계열 회귀분석을 실시하였다.

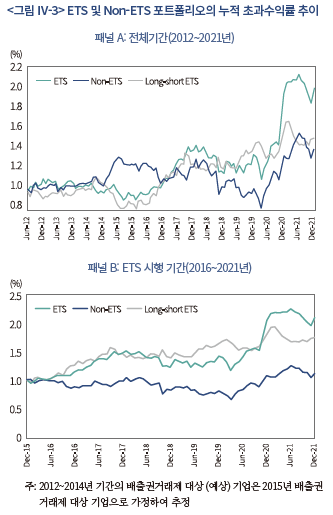

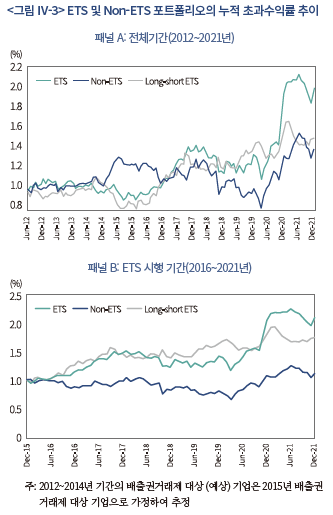

회귀분석에 앞서 배출권거래제 적용 여부에 따라 분류된 두 개의 포트폴리오(ETS, Non-ETS)의 누적 초과수익률의 시계열 추이를 살펴보면 몇 가지 흥미로운 특징이 발견된다. <그림 Ⅳ-3>은 2012년부터 2021년까지의 ETS 포트폴리오와 Non-ETS 포트폴리오의 누적 초과수익률의 시계열 추이를 보여주고 있는데, 패널 A는 2012년 7월부터 2021년 12월 기간의 누적 초과수익률을, 패널 B는 배출권거래제가 시행된 이후인 2016년 1월부터 2021년 12월 기간의 누적 초과수익률을 보여주고 있다. 먼저, 패널 A를 보면 배출권거래제가 시행된 2016년 이전에는 배출권거래제 대상 그룹인 ETS의 수익률이 시장의 평균수익률과 큰 차이를 보이지 않다가 배출권거래제가 시행된 이후부터는 시장의 평균수익률을 상회하는 모습을 보이고 있으며, 최근으로 올수록 그 증가세가 더욱 확대되고 있다. 반면에, 배출권거래제 비대상 그룹인 Non-ETS의 수익률은 어떤 일관된 패턴을 보이지 않고 있다. Non-ETS 포트폴리오는 배출권거래제 시행 전 시장의 평균수익률을 상회하였다가 배출권거래제 시행 후 수익률이 감소하였고, 최근 코로나19 이후 주식시장이 반등하면서 수익률이 다시 상승하는 모습을 보이고 있지만 ETS 포트폴리오와 달리 어떤 일관된 패턴을 보이지 않고 있다. 아울러, ETS와 Non-ETS 포트폴리오의 무차익포트폴리오(Long-short ETS)의 수익률은 배출권거래제 시행 이후 전반적으로 증가하는 양상을 보여주고 있다. 마찬가지로, 패널 B는 배출권거래제 시행 이후부터의 포트폴리오 누적수익률을 나타낸 것인데, 앞서와 같이 배출권거래제 대상 기업의 수익률이 꾸준히 증가하고 있음을 확인할 수 있다.26)

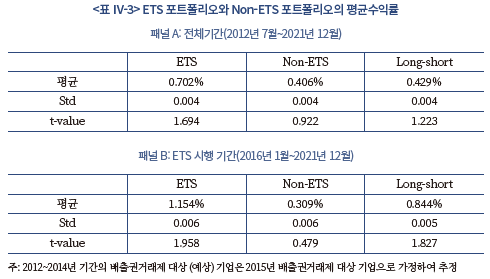

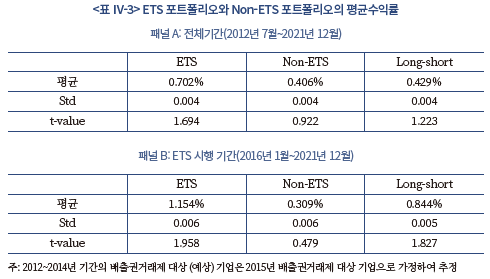

추가적으로 기간별 수익률 변화를 살펴보기 위해, 전체 분석 기간에서의 ETS 포트폴리오와 Non-ETS 포트폴리오의 평균수익률을 계산하고, 배출권거래제 시행 이후인 2016년 이후 기간에서의 두 포트폴리오의 평균수익률을 계산하여 비교하여 본 결과가 <표 Ⅳ-3>에 제시되어 있다. <그림 Ⅳ-3>과 마찬가지로 ETS 포트폴리오의 평균수익률은 전체기간에서 0.7%(t-value=1.69), 배출권거래제 시행 기간에서 1.15%(t-value=1.96)으로 배출권거래제 이후 배출권거래제 대상 기업의 주식수익률이 유의하게 증가한 것을 확인할 수 있다. 또한, 무차익포트폴리오의 평균수익률 또한 전체기간에서는 0.43%, 배출권거래제 시행 이후에는 0.84%로 상승하였고, 통계적 유의성 또한 증가한 것을 알 수 있다.

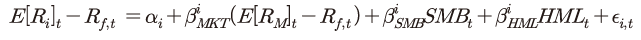

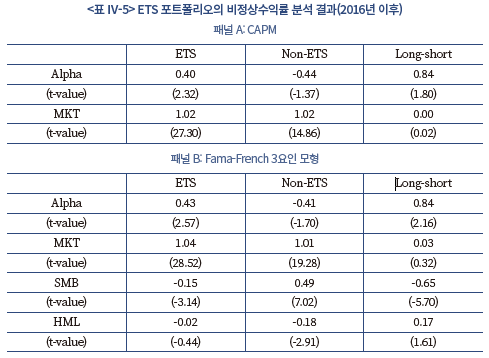

마지막으로 이러한 배출권거래제 대상 여부에 따른 초과수익률의 차이가 일반적인 자산가격결정 요인을 통제한 이후에도 여전히 유효한지 살펴보고자 한다. 이를 위해, 앞서 배출권거래제 대상 여부에 따라 구분한 두 개의 포트폴리오(ETS, Non-ETS)와 이들의 무차익포트폴리오의 월별 초과수익률에 대해 CAPM, Fama-French 3요인 모형을 적용하여 시계열 회귀분석을 실시한 후 비정상수익률(알파)의 유의성을 검정하였다. 예를 들어, Fama-French 3요인 모형을 이용하였을 경우 시계열 회귀분석 모형은 다음과 같다.

여기서  는 포트폴리오 i의 월별 평균수익률,

는 포트폴리오 i의 월별 평균수익률,  는 무위험이자율,

는 무위험이자율,  는 시장포트폴리오의 월별 평균수익률

는 시장포트폴리오의 월별 평균수익률  ,

,  ,

,  , 는 각각 위험요인 MKT, SMB, HML의 민감도(factor loading)를 나타낸다. 여기서 주요 관심 변수는 비정상수익률

, 는 각각 위험요인 MKT, SMB, HML의 민감도(factor loading)를 나타낸다. 여기서 주요 관심 변수는 비정상수익률 로, 이 값이 통계적으로 0과 유의하게 다르다면, 배출권거래제 시행으로 인해 일반적인 자산가격모형으로 설명할 수 없는 비정상수익률이 발생하였다고 해석할 수 있다.

로, 이 값이 통계적으로 0과 유의하게 다르다면, 배출권거래제 시행으로 인해 일반적인 자산가격모형으로 설명할 수 없는 비정상수익률이 발생하였다고 해석할 수 있다.

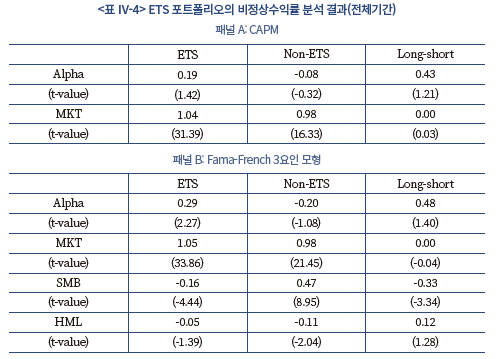

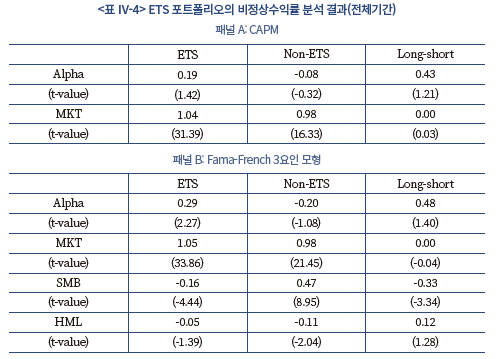

<표 Ⅳ-4>는 ETS 및 Non-ETS 포트폴리오, 무위험포트폴리오의 초과수익률에 대해 CAPM 및 Fama-French 3요인 모형을 적용하여 시계열 회귀분석을 실시한 결과를 보여주고 있다. 패널 A는 CAPM, 패널 B는 각각 Fama-French 3요인 모형을 이용하여 추정한 결과를 보여주고 있다. 먼저, 패널 A의 CAPM 결과를 보면 ETS 포트폴리오는 0.19의 비정상수익률을 보이고는 있으나 통계적으로 유의하지는 않다. 마찬가지로 무위험포트폴리오도 양(+)의 비정상수익률을 보이고 있지만 역시 통계적으로 유의하지 않다. 한편 패널 B의 3요인 모형 결과를 보면 ETS 포트폴리오는 0.29의 비정상수익률을 보이며 5% 수준에서 통계적으로 유의하다.

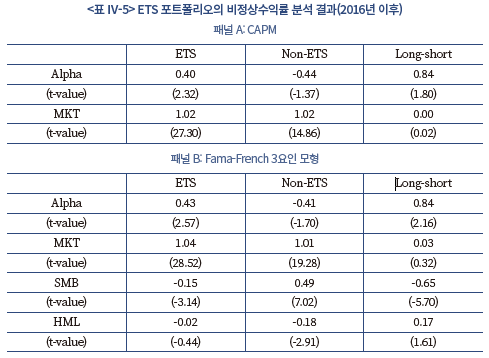

한편, <표 Ⅳ-5>는 동일한 분석을 배출권거래제 시행 후인 2016~2021년 기간에 대해 시행한 결과를 보여주고 있다. 앞서 누적수익률의 시계열 추이에서 본 바와 같이 ETS 포트폴리오의 비정상수익률이 전체기간 대비 더 크고 유의한 값을 보이는 것을 확인할 수 있다. CAPM의 결과에서도 ETS 포트폴리오는 5% 수준에서 통계적으로 유의한 0.4%의 비정상수익률을 보이고 있으며, 3요인 모형의 비정상수익률 또한 5% 수준에서 유의한 0.43%로, <표 Ⅳ-4>의 결과에 비해 크기와 통계적 유의성 모두 증가한 것으로 확인된다. 즉, 배출권거래제 시행에 따른 이행리스크가 그러한 리스크에 노출된 주식의 비정상수익률에 유의한 영향을 미치고 있음을 보여주고 있다. 요약하면, 이상의 결과는 일반적인 자산가격결정 요인들로 설명되지 않는 주식수익률의 변동이 배출권거래제 도입에 따른 이행리스크에 기인하고 있음을 나타내며, 이는 결과적으로 탄소감축 정책의 시행에 따른 이행리스크가 국내 주식수익률에도 유의한 영향을 미칠 수 있음을 보여주고 있다.

Ⅴ. 결론

본 고에서는 기후리스크가 자산가격에 미치는 영향을 이해하기 위한 목적으로 기후변화와 자산가격의 관계에 관한 선행연구 결과를 검토하고, 배출권거래제의 도입과 실증적 자산가격결정 모형을 이용하여 국내 주식시장에서 이행리스크와 주식수익률 간에 유의한 관계가 존재하는지 분석하였다. 분석결과, 해외의 선행연구들은 기후리스크가 주식, 채권, 부동산 등 다양한 유형의 자산 가치에 유의한 영향을 미치고 있다는 결과를 제시하고 있었다. 또한, 시나리오 기반의 리스크 평가 기법을 사용한 주요국 중앙은행의 스트레스 테스트 결과도 온실가스 감축 과정에서 발생하는 이행리스크로 인해 고탄소 산업의 자산가치가 하락하면서 이와 연계된 금융자산을 보유한 금융기관에까지 상당한 손실을 초래할 수 있음을 보여주고 있었다.

그리고 2012년부터 2021년까지의 국내 주식시장 데이터와 배출권거래제 지정 기업 정보 자료를 이용하여 저탄소 정책 시행에 따른 이행리스크가 주식수익률에 미치는 영향을 분석한 결과, 이행리스크는 주식수익률과 유의한 양(+)의 관계를 가지는 것을 확인하였다. 이행리스크의 지표로 사용된 배출권거래제 대상 기업 지정 여부는 시장, 기업규모, 가치 등 다른 기업특성을 반영하는 요인들을 통제한 후에도 주식수익률과 유의한 양의 관계를 보였으며, 이러한 경향은 2016년 이후 최근으로 올수록 더욱 강해지는 모습을 보였다. 물론 이러한 결과는 이행리스크의 프리미엄을 실제로 엄밀하게 규명한 것은 아니지만, 향후 국내에서도 저탄소 전환에 따른 이행리스크가 주식수익률에 중요한 영향을 미치는 요인이 될 수 있음을 간접적으로 시사하고 있다.

종합하면, 본 연구는 기후리스크와 자산가격의 관계에 대한 선행연구 조사 및 검토를 통해 기후리스크에 대한 이해를 도모하고, 향후 기후리스크가 자산가격에 영향을 미치는 중요한 금융리스크가 될 수 있음을 확인하였다는 점에서 의의가 있다. 그리고 이러한 결과는 국내 금융회사도 기후리스크를 중요한 금융리스크의 하나로 인식하여, 기후리스크 평가 모형 개발, 기후변화 리스크를 고려한 투자 포트폴리오 관리 체계 마련 등 기후리스크에 선제적으로 대응할 필요가 있음을 시사하고 있다.

참고로 국내 금융회사들이 기후리스크를 고려한 투자 포트폴리오 관리 체계 수립, 기후리스크 평가 모형 등을 실제로 구현하는 데 있어서는 우리보다 먼저 기후리스크 관리의 중요성을 인식하고 관리해 온 해외 금융기관의 사례를 참고하는 게 도움이 될 수 있다. 예를 들어, HSBC, BlackRock, Goldman Sachs 등을 비롯한 글로벌 금융회사는 이미 수년 전부터 투자 의사결정과정 전반에서 재무적 리스크와 함께 기후리스크를 주요 위험요소로 고려하고, 기후리스크가 높은 산업에 대한 익스포저를 산정하여 지속적으로 관리하고 있는 것으로 전해지고 있다. HSBC의 경우, 회사 전체에서 기후리스크를 체계적으로 관리, 감독하고 기후변화 대응을 촉진하기 위해 이사회에 지속가능경영 및 기후리스크 관리 전반에 대한 감독 책임을 부여하고, 석유, 가스, 화학산업 등 이행리스크가 높은 산업에 대한 익스포저를 지속적으로 측정하여 관리하고 있다. 그리고 BlackRock에서는 자체적으로 개발한 카본베타(Carbon Beta)라는 탄소 가격에 대한 기업 가치의 민감도 측정 기법을 활용하여 탄소세 및 배출권거래제와 같은 탄소 가격 정책이 자사의 투자 포트폴리오에 미치는 영향을 검토하고 있다. 또한, 이를 내부 리스크 관리 플랫폼인 알라딘(Aladdin)에 통합함으로써 자사의 기관 고객들이 알라딘 플랫폼을 통해 투자 포트폴리오에 대한 기후리스크 영향을 식별하고 관리할 수 있도록 지원하고 있다. 마찬가지로 Goldman Sachs에서도 이사회 산하의 리스크 위원회에 기후리스크를 포함한 비재무적 리스크에 대한 관리 및 감독 책임을 부여하여 기후리스크 관리를 강화하고 있다.

아울러 금융회사는 기업의 책임있는 행동을 유도함으로써 기후리스크를 낮추는 데 기여할 수 있다. 예를 들어, 기후리스크를 관리하지 않는 기업에 대해서는 거래한도를 제한하거나 추가적인 거래비용을 부과하고, 탄소감축, 에너지효율 개선을 달성한 기업에 대해서는 이자율을 낮춰주는 등의 금융계약 조건을 활용하거나, 기업에 탄소배출량을 포함한 기후리스크 관련 정보 공시를 확대하도록 요구함으로써 기업의 온실가스 감축을 유도할 수 있을 것이다. 즉, 금융회사는 포트폴리오 조정을 기후리스크를 관리하는 일차적 수단으로 활용하면서, 기업이 지속가능한 사업 관행으로 전환하도록 유도함으로써 장기적인 관점에서 기후리스크를 줄이는 데 기여할 수 있을 것이다.

1) IPCC는 유엔(UN)의 기상학 전문 기구인 세계 기상 기구(WMO)와 국제 연합 환경 계획(UNEP)에 의해 1988년 설립된 조직으로 인간의 활동에 의한 지구온난화의 위험을 평가하는 기구이다. IPCC는 기후변화에 관한 국제 연합 기본 협약(INFCCC)의 실행을 돕기 위해 기후변화 관련 과학적 근거를 분석, 취합한 보고서(Assessment Reports: AR)를 주기적(5~7년)으로 발간하는 것을 주 임무로 삼고 있다. 현재까지 총 5차례의 평가보고서를 발표하였으며, 2014년 발간한 제5차 평가보고서(AR5)는 2015년 파리협정의 주요한 근거자료로 활용되었다. 2021년에는 제6차 종합보고서의 사전 작업으로 3개 실무그룹 보고서가 발표되었고, 2023년 3월 제6차 종합보고서 발간이 예정되어 있다. 이번 발표된 IPCC 제6차 평가보고서의 제1실무그룹 보고서는 기후변화의 과학적 근거를 제시하고 있다(https://www.ipcc.ch/about/).

2) https://www.climatewatchdata.org/net-zero-tracker?indicator=nz_year

3) SSP 시나리오는 IPCC 제6차 평가보고서에서 사용된 기후변화 시나리오로, 2100년 기준 복사강제력 수준과 미래 기후변화 대응 수준에 따른 인구, 경제, 토지이용 등 미래의 사회경제구조 변화도 함께 고려한 공통사회경제 경로를 의미한다. 이는 기후변화 적응 및 온실가스 감축 정도에 따라 5가지 유형으로 분류되며, SSP1-2.6, SSP2-4.5, SSP3-7.0, SSP5-8.5의 네 경로가 IPCC AR6의 표준경로로 사용되었다. 여기서 SSP의 첫 번째 숫자는 사회발전과 온실가스 감축 정도에 따라 구분된 시나리오 종류를 의미하며, 두 번째 숫자는 2100년의 예상 복사강제력(이산화탄소, 메탄, 아산화질소 등과 같이 기후에 영향을 미치는 인자에 따라 지구대기시스템의 에너지 균형이 어떻게 변화하는지 나타낸 척도로 이 값이 양수이면 해당 인자가 지구온난화에 기여함을 의미)을 나타낸다. SSP1-1.9는 사회경제가 지속가능한 성장을 이루면서 동시에 온실가스도 감축하여 2100년의 복사강제력이 1.9W/m2 수준으로 제한되는 경우를 의미한다. SSP1-2.6은 재생에너지 기술 발달로 화석연료 사용이 감소하고 친환경적이고 지속가능한 경제 성장을 이루어 2100년 복사강제력이 2.6W/m2 수준으로 제한되는 경우, SSP2-4.5는 기후변화 완화 및 사회경제 발전이 중간 정도로 이뤄지면서 2100년 예상 복사강제력이 4.5W/m2가 되는 경우, SSP3-7.0은 기후변화 완화 정책이 소극적으로 이뤄지고 기술 발전이 늦어 사회구조가 기후변화에 취약하게 되는 경우로 2100년 복사강제력이 7.0W/m2로 증가하는 경우, 마지막으로, SSP5-8.5은 산업기술의 빠른 발전에 중심을 두어 화석연료 사용이 늘어나고 도시 위주의 무분별한 개발이 확대되며 2100년 복사강제력이 8.5W/m2 까지 증가하는 경우를 의미한다.

4) NOAA는 이러한 재해 비용 평가액에는 주거 및 상업용 건물의 물리적 손상, 사업 중단 및 주거 상실로 인한 손실, 도로, 교량, 제방 등의 공공 시설물의 붕괴 또는 파손, 농작물, 가축, 목재, 농업용 시설 등의 피해, 산불 진압 및 재해 복구비용 등과 같이 직접적으로 측정이 가능한 항목들이 주로 포함되며, 재해로 인한 정신적 피해나 질병, 인명 손실, 생태계 파괴, 자연 자원의 손실 등과 같이 실제 손실이 발생하였지만 측정이 어려운 항목은 반영되지 않고 있다는 점에서 상당히 보수적으로 계산된 것이라고 언급하였다.

5) https://e360.yale.edu/features/how-climate-change-is-disrupting-the-global-supply-chain

6) SSP에 대한 설명은 주석 3)을 참조하기 바란다.

7) 마찬가지로 IPCC(2018)에서도 2100년에 산업화 이전 대비 지구 기온의 상승 폭을 1.5℃ 미만으로 제한하기 위해서는 전 지구의 CO2 순배출량을 2030년까지 2010년 대비 최소 45%까지 감소, 2050년에는 넷제로에 도달해야 한다고 전망한 바 있다.

8) 좌초자산은 시장 환경의 급격한 변화로 가치가 하락하여 조기 상각되거나 부채로 전환되는 자산을 의미한다.

9) 참고로 최근 Nature에 게재된 연구에 따르면 지구온난화를 1.5℃로 제한하려면 현 석유 및 가스 매장량의 60%, 석탄 매장량의 90%가 사용되지 않고 좌초되어야 한다고 추정하였으며(Welsby et al. 2021), 이처럼 좌초자산 위험에 노출되어 있는 석유 및 가스 매장량의 자산 가치는 약 1조 4천억달러로 추정되었다(Semieniuk et al., 2022).

10) S&P Global Ratings, 2021.01.26, S&P Global Ratings Takes Multiple Rating Actions On Major Oil And Gas Companies To Factor In Greater Industry Risks, Press Releases.

11) Climate Bond Initiative에 따르면 글로벌 지속가능연계채권 발행액은 2021년 1,888억달러(총 277개)로 전년 대비 약 941%의 높은 성장률을 보이고 있다. 한편, 지속가능연계채권의 핵심성과지표(KPI)의 선정, 지속가능성 목표의 측정, 보고, 검증 등에 관한 가이드라인은 국제자본시장협회(International Capital Market Association: ICMA)에서, 그리고 지속가능연계대출 가이드라인은 대출시장협회(Loan Market Association), 대출신디케이션무역협회(Loan Syndications and Trading Association), 아시아태평양대출시장협회(Asia Pacific Loan Market Association)에서 제시하고 있다.

12) Vautard et al.(2020)은 기후 시뮬레이션 모델링을 이용하여 2019년 서유럽에서 발생한 극심한 폭염과 같은 사건이 인위적 기후변화가 없었다고 가정할 경우 1천년에 1번 미만으로 발생하지만, 기후변화 요인을 추가하였을 경우 50~150년에 1번 가량 발생한다는 결과를 제시하였다.

13) Speech by Mr Mark Carney at Lloyd’s of London, 2015.10.9, Breaking the tragedy of the horizon - climate change and financial stability.

14) 이들은 탄소배출량 수준 자체는 시간에 걸쳐 크게 변하지 않는다는 점에서 탄소배출량 증가율의 변화에 대한 프리미엄을 단기적인 탄소리스크 프리미엄으로, 탄소배출량의 절대 수준에 대한 프리미엄을 장기적인 탄소리스크 프리미엄으로 명명하였다.

15) NGFS(2021)에 따르면 2021년 10월 기준 한국을 비롯한 31개의 중앙은행 및 감독기구들이 기후 스트레스 테스트 모형을 개발 중이며, 이 중 프랑스 중앙은행, 이탈리아 중앙은행, 유럽은행관리국(EBA), 유럽중앙은행(ECB) 4개 기관은 개발을 완료한 것으로 전해지고 있다.

16) IAM은 기후, 환경, 에너지, 사회경제구조 등 자연적 요소와 인위적 요소를 결합한 기후경제통합 시스템 모형을 말한다. 대표적인 초기 IAM으로는 Nordhaus에 의해 개발된 Dynamic Integrated Assessment Model of Climate and the Economy(이하 DICE) 모형이 있다. 이러한 모형은 이후 컴퓨터 연산능력, 데이터 처리기술의 발달에 따라 더욱 고도화되었고, 기후변화에 관한 글로벌 협의체인 IPCC의 기후변화 영향 평가에 고정적으로 활용되고 있다. 2021년 IPCC 제6차 평가보고서(AR6)에서는 MESSAGE, IMAGE, GCAM, REMIND, WITCH, AIM/CGE 등의 6가지 IAM의 분석 결과를 바탕으로 가장 최신의 기후변화 시나리오인 공통사회경제경로(Shared Socioeconomic Pathways, SSP)를 제시하였다.

17) NGFS의 기후 시나리오에 대해서는 <부록1>에서 별도로 설명한다.

18) 이러한 네 가지 시나리오는 (1)탄소세 인상 충격만 발생하는 시나리오, (2)재생에너지 기술 혁신 충격만 발생하는 시나리오, (3)탄소세 인상과 재생에너지 기술 충격이 복합적으로 발생하는 시나리오, 그리고 (4)이러한 정책 충격, 기술 충격 모두 발생하지 않는 시나리오로 구성된다.

19) TVF는 부가가치 한 단위 창출을 위해 배출되는 직접(Scope1) 및 간접(Scope2, Scope3) 온실가스 배출량을 의미하며, 이 지표가 높을수록 탄소 가격 상승, 배출량 감축과 같은 이행리스크에 더 취약하다고 해석할 수 있다.

20) 추가로 이들은 모형의 단순화를 위해 금융기관의 자산구성이 기준시점과 동일하게 유지된다는 정적 대차대조표(static balance sheet)를 가정하였다. 이들은 금융기관이 기후리스크에 대응하여 포트폴리오를 변경할 수 있다는 동적 대차대조표(dynamic balance sheet) 가정은 금융기관의 대응을 모형에 반영할 수 있다는 장점이 있으나 모형의 불확실성을 증가시킬 수 있다는 단점이 있다고 설명하였다.

21) CVaR의 구체적인 산식은 ‘CVaR=[기후 비용(climate costs)과 기후 수익(climate profits)을 합산한 값의 현재가치]/기업의 시장가치’이다.

22) Carbon Delta는 저탄소 이행리스크를 1.5℃, 2℃, 3℃시나리오로 나누어 분석한 것과 달리, 물리적리스크에 대해서는 탄소배출감축 노력이 행해지지 않는 BAU 단일의 시나리오를 가정하였다.

23) 본 보고서는 기후변화와 자산가격의 관계에 대한 개념적 설명과 문헌조사 및 사례연구에 초점을 두고 있으며, 본 장의 목적 또한 탄소 배출권거래제와 같은 저탄소 정책의 시행에 따른 이행리스크가 국내 주식수익률에 영향을 미치는 요인으로서 고려될 수 있을지 가능성을 검토해보고자 하는 것으로, 실제 이행리스크 프리미엄의 존재 여부를 엄밀히 규명하고자 하는 것은 아니다. 이를 위해서는 실증적 자산가격모형을 이용한 분석이 추가로 수행되어야 할 것이며, 이는 후속 연구 과제로 남겨둔다.

24) 현재, 시멘트, 정유, 항공, 발전, 집단에너지, 산업단지, 폐기물 등 7개 업종에 대해서만 BM방식이 적용되고 있다.

25) 참고로, 손인성(2019)도 이와 유사한 논리를 바탕으로 제1차 계획기간 배출권거래제의 성과를 분석한 바 있다.

26) 한편, 2015년 12월은 역사상 가장 중요한 기후변화협약으로 일컬어지는 파리협약이 체결된 시기이기도 하다. 이는 당시 배출권거래제 시행과 더불어 투자자를 비롯한 많은 이해관계자들이 기후변화 문제에 관심을 보이게 된 중요한 계기가 되었을 수 있다.

참고문헌

김재윤 · 전은경, 2021. 기후변화 이행리스크와 금융안정, 한국은행 『조사통계월보』 75-12.

손인성, 2019, 「온실가스 배출권거래제 제1차 계획기간의 성과 분석」, 에너지경제연구원 기본연구보고서 19-09.

온실가스종합정보센터, 2022, 제2차 계획기간 2018-2020 배출권거래제 운영결과 보고서.

ACPR, 2020, Scenarios and main assumptions of the ACPR pilot climate exercise.

ACPR, 2021, A first assessment of financial risks stemming from climate change: The main results of the 2020 climate pilot exercise, Analyses Et Syntheses, no 122-2021.

Addoum, J. M., Ng, D. T., Ortiz-Bobea, A., 2020, Temperature shocks and establishment sales, The Review of Financial Studies, 33(3), 1331-1366.

Alessi, L., Ossola, E., Panzica, R., 2021, What greenium matters in the stock market? The role of greenhouse gas emissions and environmental disclosures. Journal of Financial Stability, 54, 100869.

Allen, T., Dees, S., Caicedo Graciano, C. M., Chouard, V., Clerc, L., de Gaye, A. et al., 2020, Climate-related scenarios for financial stability assessment: an application to France.

Anttila-Hughes, J. K., 2016, Financial market response to extreme events indicating climatic change, The European Physical Journal Special Topics, 225(3), 527-538.

Battiston, S., Mandel, A., Monasterolo, I., 2019, CLIMAFIN handbook: pricing forward-looking climate risks under uncertainty, Available at SSRN 3476586.

BCBS, 2021, Climate-related risk drivers and their transmission channels.

Bernardini, E., Di Giampaolo, J., Faiella, I., Poli, R., 2021, The impact of carbon risk on stock returns: evidence from the European electric utilities, Journal of Sustainable Finance & Investment, 11(1), 1-26.

Bernstein, A., Gustafson, M. T., & Lewis, R., 2019, Disaster on the horizon: The price effect of sea level rise, Journal of Financial Economics, 134(2), 253-272.

BIS, 2021, Stress-testing banks for climate change – a comparison of practices.

BOE, 2020, Update on the Bank’s approach to the Climate Biennial Exploratory Scenario in selected areas.

BOE, 2021, Guidance for participants of the 2021 Biennial Exploratory Scenario: financial risks from climate change.

Bolton, P., Kacperczyk, M. T., 2022, Global Pricing of Carbon-Transition Risk, Available at SSRN 3550233.

BP, 2022, Statistical Review of World Energy.

Caldecott, B., 2017, Introduction to special issue: stranded assets and the environment, Journal of Sustainable Finance & Investment, 7(1), 1-13.

Campiglio, E., Monnin, P., von Jagow, A., 2019, Climate risks in financial assets, Council on Economic Policies.

Chava, S., 2014, Environmental externalities and cost of capital, Management science, 60(9), 2223-2247.

Cheema-Fox, A., LaPerla, B. R., Serafeim, G., Turkington, D., & Wang, H. S., 2021, Decarbonization factors, The Journal of Impact and ESG Investing.

Choi, D., Gao, Z., Jiang, W., 2020, Attention to global warming, The Review of Financial Studies, 33(3), 1112-1145.

Cochrane, J. H., 2009, Asset pricing: Revised edition, Princeton university press.

Engle, R. F., Giglio, S., Kelly, B., Lee, H., Stroebel, J., 2020, Hedging climate change news, The Review of Financial Studies, 33(3), 1184-1216.

Ewing, B. T., Kruse, J. B., Wang, Y., 2007, Local housing price index analysis in wind-disaster-prone areas, Natural Hazards, 40(2), 463-483.

Fama, E. F., & French, K. R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics, 33(1), 3-56.

Goldsmith-Pinkham, P. S., Gustafson, M., Lewis, R., Schwert, M., 2021, Sea level rise exposure and municipal bond yields, Jacobs Levy Equity Management Center for Quantitative Financial Research Paper.

Griffin, P. A., Lont, D. H., Lubberink, M. J. P., 2022, The Effects of Extreme Temperature Heat Spells on Financial Performance, Available at SSRN 4181024.

Hong, H., Li, F. W., Xu, J., 2019, Climate risks and market efficiency, Journal of Econometrics, 208(1), 265-281.

Huang, H. H., Kerstein, J., Wang, C., Wu, F., 2022, Firm climate risk, risk management, and bank loan financing, Strategic Management Journal, 43(13), 2849-2880.

Huynh, T. D., Xia, Y., 2021, Climate change news risk and corporate bond returns, Journal of Financial and Quantitative Analysis, 56(6), 1985-2009.

Ilhan, E., Sautner, Z., Vilkov, G., 2021, Carbon tail risk, The Review of Financial Studies, 34(3), 1540-1571.

IMF, 2018, The Effects of Weather Shocks on Economic Activity: What are the Channels of Impact? Working Paper.

International Labour Organization, 2019, Working on a warmer planet: The impact of heat stress on labour productivity and decent work.

IPCC, 2014, IPCC Fifth Assessment Report—Synthesis Report.

IPCC, 2018, Global warming of 1.5℃.

IPCC WG1, 2021, AR6 Climate Change 2021:The Physical Science Basis.

IPCC WG2, 2021, AR6 Climate Change 2021: Impacts, Adaptation and Vulnerability.

Javadi, S., Masum, A. A., 2021, The impact of climate change on the cost of bank loans, Journal of Corporate Finance, 69, 102019.

Krueger, P., Sautner, Z., Starks, L. T., 2020, The importance of climate risks for institutional investors, The Review of Financial Studies, 33(3), 1067-1111.

Kumar, A., Xin, W., Zhang, C., 2019, Climate sensitivity and predictable returns, Available at SSRN 3331872.

Lafond, F., Bailey, A. G., Bakker, J. D., Rebois, D., Zadourian, R., McSharry, P., Farmer, J. D., 2018, How well do experience curves predict technological progress? A method for making distributional forecasts, Technological Forecasting and Social Change, 128, 104-117.

Murfin, J., Spiegel, M., 2020, Is the risk of sea level rise capitalized in residential real estate? The Review of Financial Studies, 33(3), 1217-1255.

Monasterolo, I., De Angelis, L., 2020, Blind to carbon risk? An analysis of stock market reaction to the Paris Agreement, Ecological Economics, 170, 106571.

NGFS, 2020, Guide to climate scenario analysis for central banks and supervisors.

NGFS, 2022, NGFS Scenarios for central banks and supervisors.

Nguyen, D. D., Ongena, S., Qi, S., Sila, V., 2020, Climate change risk and the cost of mortgage credit, Swiss Finance Institute Research Paper, (20-97).

NOAA National Centers for Environmental Information (NCEI), 2022, U.S. Billion-Dollar Weather and Climate Disasters.

Oestreich, A. M., Tsiakas, I., 2015, Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme, Journal of Banking & Finance, 58, 294-308.

Olson, R., An, SI., Fan, Y. et al., 2019, A novel method to test non-exclusive hypotheses applied to Arctic ice projections from dependent models, Nature Communications, 10, 3016.

Painter, M., 2020, An inconvenient cost: The effects of climate change on municipal bonds, Journal of Financial Economics, 135(2), 468-482.

Ravina, A., Hentati Kaffel, R., 2019, The impact of low-carbon policy on stock returns, Available at SSRN 3444168.

Seltzer, L. H., Starks, L., Zhu, Q., 2022, Climate regulatory risk and corporate bonds, National Bureau of Economic Research, No. w2994.

Semieniuk, G., Holden, P.B., Mercure, JF. et al., 2022, Stranded fossil-fuel assets translate to major losses for investors in advanced economies. Nature Climate Change, 12, 532–538.

Setzer, J., Higham, C., 2021, Global trends in climate change litigation: 2021 snapshot, Grantham Research Institute on Climate Change and the Environment.

TCFD, 2017, Recommendations of the task force on climate-related financial disclosures.

UNEP FI, 2021, Good Practice Guide to Climate Stress Testing.

UNU-EHS, 2021, Interconnected Disaster Risks 2020/2021.

Vautard, R., van Aalst, M., Boucher, O., Drouin, A., Haustein, K., Kreienkamp, F., et al., 2020, Human contribution to the record-breaking June and July 2019 heatwaves in Western Europe, Environmental Research Letters, 15(9), 094077.

Vermeulen, R., Schets, E., Lohuis, M., Kölbl, B., Jansen, D. J., & Heeringa, W., 2019, The heat is on: A framework for measuring financial stress under disruptive energy transition scenarios, DeNederlandscheBank(DNB), 190, 107205.

Welsby, D., Price, J., Pye, S., Ekins, P., 2021, Unextractable fossil fuels in a 1.5℃ world, Nature, 597(7875), 230-234.

Zhang, L., 2016, Flood hazards impact on neighborhood house prices: A spatial quantile regression analysis, Regional Science and Urban Economics, 60, 12-19.

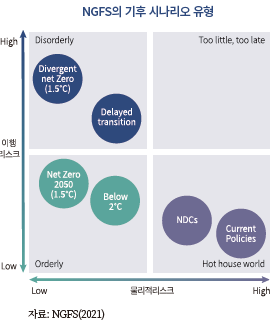

<부록> NGFS의 기후 시나리오

NGFS는 기후 및 환경 관련 금융리스크 관리 모범사례 공유, 지속가능한 경제로의 이행 지원 등을 목적으로 2017년 12월 설립된 전 세계 중앙은행 및 감독기구의 자발적 논의체이다. 2022년 6월 기준 우리나라의 한국은행, 금융위원회, 금융감독원을 비롯한 116개 중앙은행 및 감독기구가 회원으로 가입되어 있다. NGFS는 각국 중앙은행이 기후리스크 분석 모형 개발에 기초자료로 활용할 수 있도록 2020년 6월과 2021년 6월 두 차례에 걸쳐 GCAM, MESSAGE-GLOBIOM, REMIND-MAgPIE 등 세 가지 기후경제 통합평가모형(IAM)을 이용해 산출한 기후변화 시나리오를 발표하였다.

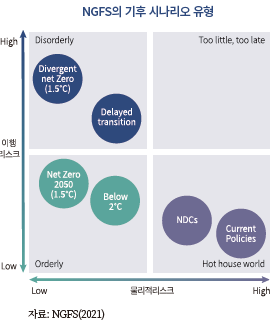

NGFS의 기후 시나리오는 물리적리스크에 영향을 미치는 ‘지구 평균온도 상승폭’ 그리고 이행리스크에 영향을 미치는 ‘기후변화 대응 정책 진전 속도’, ‘기술 혁신 속도’, ‘탄소제거기술 활용도’, ‘기후변화 대응의 지역 격차’ 등의 기준에 따라 다음의 6가지 시나리오로 구성된다. 첫 번째 유형은 질서있는 이행(orderly transition) 시나리오로서 2050년 넷제로를 달성하고 기온상승을 1.5℃로 억제하는 시나리오(Net Zero 2050)와 2/3의 확률로 기온상승을 2℃ 미만으로 제한하는 시나리오(Below 2℃)의 두 종류가 제시되고 있다. 이는 저탄소 정책이 즉각적으로 이뤄짐으로써 이행리스크와 물리적리스크가 모두 최소화되는 가장 이상적인 시나리오로 볼 수 있다.

두 번째 유형은 무질서한 이행(disorderly transition) 시나리오로서 기후변화 대응정책이 국가별로 상이하게 전개되는 분산된 넷제로 시나리오(Divergent net Zero 1.5℃)와 저탄소 전환 정책이 뒤늦게 시행되는 지연된 전환 시나리오(Delayed 2℃)가 이 범주에 포함된다. 이는 저탄소 정책의 지역적 격차가 크거나 또는 저탄소 전환 정책이 너무 늦게 시행됨으로써 비록 물리적리스크는 낮지만 이행리스크가 매우 높아지는 시나리오를 의미한다.

그리고 마지막 유형은 온실세계(hot house world) 시나리오로서 현재와 같이 국가별로 느슨한 온실가스 감축 목표가 유지되는 국가온실가스감축목표(NDCs) 시나리오와 기후변화 대응 정책의 부재로 현재와 같은 배출량 증가 추세가 지속되는 현행정책(Current Policies) 시나리오가 이에 포함된다. 이는 현재와 같이 불충분한 국가별 온실가스 감축 정책이 유지되거나 배출량 증가 추세가 지속됨으로써 이행리스크는 매우 낮지만, 지구 평균온도가 산업화 이전 대비 2.5~3℃까지 상승하면서 물리적리스크가 매우 높아지는 시나리오를 의미한다.

2021년 8월 기후변화에 관한 정부간 협의체(Intergovernmental Panel on Climate Change: IPCC)는 현재의 지구온난화는 인간이 배출한 온실가스에 의한 것임이 사실상 확실하다고 평가하며, 이와 같은 추세로 지구온난화가 지속될 경우 2040년 이전에 지구 평균온도가 산업화 이전 대비 1.5℃ 이상 높아지며 대형 산불, 폭염, 한파, 사이클론 등 극한 기후 현상도 더욱 빈번해질 것으로 전망하였다.1) 코로나19를 비롯하여 미국 텍사스 한파, 아마존 산불, 베이루트 폭발 사고, 인도와 방글라데시 사이클론 발생 등 최근 1~2년 사이에 발생한 전 지구적 재난들이 모두 공통적으로 지구온난화라는 근본 원인으로 상호 연결되어 있다는 분석 결과도 제시되고 있다(UNU-EHS, 2021).

이처럼 기후변화가 인간의 온실가스 배출활동에 기인한 것임이 명백해짐에 따라, 기후변화 문제 해결을 위한 국제사회의 온실가스 감축 노력 또한 강화되고 있다. 2015년 파리협정에서 전 세계 195개국이 지구 평균온도 상승폭을 산업화 이전 대비 2℃ 이하로 유지하고 더 나아가 1.5℃ 이하로 억제하기 위해 노력한다는 목표를 설정한 이후, 각국은 국가별 온실가스 감축 목표와 저탄소발전전략을 수립하는 등 기후변화 대응에 적극적으로 나서고 있다. 이미 우리나라를 포함한 92개국이 넷제로(Net-Zero) 목표를 설정하였으며 그 중 60개 이상의 국가들이 2050년까지 넷제로를 달성하겠다고 선언하였다.2) 마찬가지로 글로벌 주요 연기금과 대형 기관투자자들도 화석연료 개발사업에 대한 금융지원을 중단하고 포트폴리오 내 화석연료 관련 자산 비중을 줄이겠다고 밝히며 기후변화 대응에 적극 동참하고 있다. 지난 2019년 캘리포니아공무원연기금(CalPERS)을 비롯한 7개 기관투자자들이 모여 2050년 투자 포트폴리오의 넷제로 달성을 목표로 발족한 단체인 글로벌 넷제로 투자자연합(Net Zero Asset Owner Alliance: NZAOA)의 경우, 설립 4년이 지난 현재 70개 이상의 회원기관을 두고 있으며, 총 운용자산도 설립 당시 2조 5천억달러에서 10조달러 규모로 3배 이상 증가한 것으로 전해지고 있다.

이처럼 기후변화는 기상이변, 자연재해를 유발함으로써 실물자산에 물리적인 피해를 입힐 수 있을 뿐만 아니라, 기후변화 대응 정책이 시행되는 과정에서 화석연료 의존 산업과 같이 탄소집약적인 산업의 수익성 악화, 자산가치 하락 등 이행리스크를 유발할 수 있다. 더 나아가 물리적리스크와 이행리스크는 이러한 리스크에 노출된 기업과 관련한 금융자산을 보유하고 있는 금융회사에까지 손실을 입힐 수 있으며, 이는 다시 금융기관 간, 실물경제와 금융시장 간 상호작용을 거쳐 시스템 리스크로도 확대될 수 있다. 이에 해외 학계, 중앙은행, 민간 금융업계에서는 기후변화를 중요한 리스크 요인으로 인식하고 기후리스크가 투자 포트폴리오 및 금융기관의 건전성에 미치는 영향에 대한 연구를 활발하게 진행하고 있다. 이러한 배경에 기반하여 본 연구는 다음과 같은 조사 및 분석을 수행하였다. 먼저, 기후리스크가 자산가격에 미치는 영향에 관한 해외 선행연구 결과를 검토하고, 그 다음으로 저탄소 경제로의 전환과정에서 발행하는 이행리스크가 실제로 국내 주식수익률에 유의한 영향을 미치고 있는지 확인하기 위한 실증분석을 실시하였다.

본 연구의 구성은 다음과 같다. Ⅱ장에서는 기후리스크의 개념과 주요 특징, 그리고 이러한 기후리스크가 실물경제 및 금융 부문에 미치는 영향에 대해 논의한다. Ⅲ장에서는 기후리스크와 자산가격의 관계에 관한 선행연구를 검토하고, 최근 주요국 중앙은행과 감독당국에서 개발 중인 시나리오 기반의 기후리스크 평가 모형과 분석 사례를 살펴본다. Ⅳ장에서는 국내 주식시장에서 이행리스크와 주식수익률의 관계에 대한 실증분석 결과를 제시한다. 마지막으로 Ⅴ장에서는 주요 결과를 요약하고 시사점을 논의한다.

Ⅱ. 기후리스크의 유형과 금융부문에 대한 영향

이 장에서는 본 분석에 들어가기에 앞서 기후변화가 야기할 수 있는 기후리스크의 두 가지 주요 유형인 물리적리스크와 이행리스크의 개념과 주요 특징, 그리고 이러한 기후 리스크의 현황과 경제적 손실 등에 대해 국제기구 및 연구기관에서 발표한 통계자료를 살펴봄으로써 기후리스크가 실물경제 및 금융부문에 어떠한 영향을 미칠 수 있는지 알아보고자 한다.

1. 기후리스크의 개념과 유형

기후리스크는 기후변화로 인한 기상이변, 자연재해에 따른 물리적 자산의 손상, 온실가스 배출 감축 정책 시행에 따른 비용 상승과 같이 기후변화로 인해 초래되는 물리적 피해나 경제적 손실을 의미한다. 기후리스크는 리스크의 발생 원인에 따라 크게 물리적리스크(physical risk)와 이행리스크(transition risk)로 구분된다. 물리적리스크는 기후변화로 인한 태풍, 홍수, 폭염 등과 같은 자연재해나 해수면 상승, 산림 파괴, 해양 산성화 등과 같은 자연환경의 변화에서 발생하는 위험을 의미한다. 이행리스크는 급격한 온실가스 배출 감축 정책의 시행, 저탄소 설비 투자 등으로 인한 생산 비용의 증가, 탈탄소 자금 흐름으로 인한 자금조달 비용의 상승, 재생 에너지 관련 기술 혁신, 소비자 선호변화로 인한 제품 수요 감소 등과 같이 저탄소, 친환경 경제로 이행되는 과정에서 발생할 수 있는 위험을 의미한다.

이러한 물리적리스크와 이행리스크는 기업의 원활한 사업 운영을 저해하고 재무 상태에도 직간접적인 영향을 미칠 뿐만 아니라, 이러한 기후리스크에 노출된 기업과 관련한 주식, 채권, 대출 등 금융자산을 보유한 금융회사에도 신용위험, 시장위험을 유발할 수 있다. 이하에서는 기후리스크를 물리적리스크와 이행리스크로 구분하여, 각각의 기후리스크가 실물경제와 금융부문에 미치는 영향에 대해 좀 더 구체적으로 살펴보기로 한다.

가. 물리적리스크

앞서 언급한 바와 같이 산업화 이후 진행된 지구온난화는 전 지구적으로 폭염, 집중 호우, 홍수, 가뭄, 산불 등과 같은 기상이변과 자연재해의 발생 빈도와 심도를 증가시키고 있다. 인류가 적극적으로 탄소 감축 노력을 전개하여 지구 기온 상승폭을 산업화 이전 대비 1.5℃ 미만으로 제한하는 가장 낙관적인 시나리오를 가정하더라도 기후변화로 인한 재해의 빈도와 강도는 현재보다 더욱 증가할 것으로 전망되고 있다. 지구온난화를 1.5℃ 미만으로 제한하더라도 북극의 겨울 온도는 4.5℃까지 상승하고 9월 북극 빙하가 완전히 사라질 확률이 최소 6%에 이르며, 만일 산업화 이전 대비 지구온도가 2℃, 2.4℃, 4.3℃만큼 상승하면 북극 빙하가 소멸될 확률이 각각 28%, 50%, 95%로 증가할 것으로 전망되고 있다(Olson et al., 2019). 또한, 지구온난화가 심해질수록 지중해 연안, 남아프리카와 같이 건조한 지역이 사막화되고 상대적으로 습도가 높은 지역은 더욱 습해지면서 폭우의 빈도와 강도가 증가하는 기후 양극화 현상이 심화할 것으로 전망되고 있다.

가장 최근 발표된 IPCC의 제6차 평가보고서(AR6)의 제1실무그룹(WG1) 보고서에 따르면, 최근 지구 평균 온도(2011~2020년 기준)는 산업화 이전 대비 1.09℃ 상승하였으며, 이는 2014년 제5차 평가보고서(AR5) 발표 당시의 온도 상승폭 0.78℃(2003~2012년 기준)에 비해 약 0.3℃ 이상 증가한 수치이다. 또한, 이산화탄소 누적 배출량은 AR5 발표 당시(1850~2011년 누적) 약 1,890Gt에서 현재(1850~2019년 누적) 2,390Gt으로 8년간 약 27% 증가한 것으로 평가되었다.

<그림 Ⅱ-1>은 IPCC AR6 제1실무그룹 보고서에 수록된 1850년부터 2019년까지 지구 온도변화를 CO2 누적 배출량의 함수로 나타낸 그래프이다. 검은 실선은 1850년부터 2019년까지 실제 관측된 CO2 누적 배출량과 온도변화를, 회색 영역은 CO2 누적 배출량에 상응하는 지구 온도변화의 구간추정 결과를 나타낸다.3) 그리고 채색된 영역은 5개 기후변화 시나리오인 공통사회경제경로(Shared Socio-economic Pathway: SSP), SSP1-1.9, SSP1-2.6, SSP2-4.5, SSP3-7.0, SSP5-8.5에서의 CO2 누적 배출량과 그에 상응하는 지구 온도변화 구간추정치를 나타낸다. 그리고 각 채색된 영역의 중앙 실선은 각 시나리오에서 CO2 누적배출량으로 추정된 지구온도 전망추정치의 중간값을 나타낸 것이다. 그리고 하단의 그림은 각각의 시나리오에 대해 1850~2019년 기간의 실제 CO2 누적 배출량과 2020~2050년 기간의 CO2 누적 배출량 예상값을 보여주고 있다. 이를 보면, 지구온난화와 이산화탄소 누적 배출량은 선형적인 관계가 있으며, 이는 지구온난화를 제한하기 위해 온실가스 감축이 중요함을 시사한다.

아울러, AR6 제1실무그룹 보고서는 인류가 초래한 기후변화는 지구 전 지역에 걸쳐 기상이변을 일으키고 있다고 강조하였다. 1950년대 이후 폭염을 비롯한 이상고온과 가뭄이 동시다발적으로 발생하거나 폭우의 빈도와 강도가 증가하고 있으며, 지구온난화가 심화될수록 이러한 변화의 규모가 더 커질 것으로 전망하였다. 예를 들어, 지구 평균기온이 1℃ 상승할 때마다 산업화 시기(1850~1900년)에 약 50년에 한 번 발생할 만한 기상이변이 4.8배 더 빈번하게 발생하며, 이러한 빈도는 1.5℃ 상승 시 8.6배, 2℃ 상승 시 13.9배, 4℃ 상승 시 39.2배로 지구온난화가 심각해지면서 더 증가할 것으로 전망하였다. 또한, 10년에 한 번 발생할만한 폭우의 발생 빈도도 산업화시기에 비해 1.3배 증가하였으며, 지구 온도가 1℃ 상승할 때마다 일간 폭우 발생 확률이 7% 가량 상승할 것으로 예상하였다.

따라서 실제 어떤 기업 또는 자산에 미치는 물리적리스크의 영향을 정확히 평가하기 위해서는 기후 재해의 발생 빈도에 대한 예측 자료와 함께 기업의 재해 및 재난 관리 체제, 풍수해 보험 가입 여부 등 기후리스크에 대한 대응 및 복구 능력 수준을 종합적으로 검토할 필요가 있다. 여기서 기후 재해에 대한 노출도는 지리적 위치의 영향을 많이 받는 만큼, 기업의 생산시설, 물리적 자산의 위치 정보와 비영리기관이나 민간의 연구기관에서 제공하는 지역별 기상 데이터를 연계하여 추정할 수 있다. 반면, 기업의 취약성을 파악하기 위해서는 기업이 기후 재해에 대비하여 어느 정도의 자본을 지출했는지, 공급망 관리를 어떻게 하고 있는지, 재해 복구 예산 및 계획을 어떻게 마련하고 있는지 등과 같은 기후 재해에 대한 기업의 대비 현황에 관한 세부적인 정보가 필요한데 이는 대부분 기업이 자발적으로 제공하는 정보에 의존하고 있어, 일반투자자들과 같이 정보 접근성에 제약이 존재하는 경우에는 이를 정확히 평가하기 어려운 측면이 있다(TCFD, 2017).

이와 함께, 물리적리스크는 기업이 보유한 물리적 자산에 직접적인 피해를 주기도 하지만, 노동생산성 하락, 공급망 교란과 같은 다른 간접적인 경로를 통해서도 기업에 부정적인 영향을 미칠 수 있다. 예를 들어, 국제노동기구(International Labour Organization, 2019)는 1995년에 발생한 이상 고온 현상으로 인해 전 세계 노동시간의 약 1.4%가 감소하였으며(이는 약 3,500만 개의 정규직 일자리가 사라진 것과 같음), 이로 인한 GDP 손실은 약 2,800억달러에 이른다고 하였다. 아울러, 2030년까지 지구 기온이 1.3℃ 더 상승한다면 전 세계 노동시간의 2.2%가 줄어들며(이는 약 8,000만 개의 정규직 일자리가 사라지는 것과 같음), 이로 인해 약 2조 4천억달러의 GDP 손실이 발생할 것으로 전망하였다. 특히, 기온 상승으로 인한 노동생산성 하락 충격은 저소득 국가에서 더욱 심각한 것으로 나타났다. 기온 상승으로 인한 중상위 소득 국가에서의 연간 GDP 손실은 약 1% 미만으로 추정되었던 데 비해, 중위 소득 이하의 국가에서의 손실은 약 1.5~4.0%에 이르는 것으로 추정되었다. 마찬가지로 IMF(2018)도 지금과 같은 추세로 지구온난화가 지속될 경우 2100년 저소득 국가의 연간 경제적 손실이 최대 9%까지 이를 수 있다고 전망하며 기후 변화 충격의 양극화 문제를 지적한 바 있다.

그리고 기후변화에 따른 물리적리스크는 항만, 철도, 도로, 전기, 통신 시설 등을 비롯한 공급 기반 시설을 훼손하여 기업의 운영 중단을 야기할 수 있다. 일례로 2021년 말 말레이시아에서 발생한 태풍으로 인해 동남아시아의 주요 항구가 폐쇄되면서 대만의 TSMC의 반도체 공급에 차질이 발생하였고 이로 인해 반도체를 제때 납품받지 못한 일부 미국 자동차 제조업체가 공장 가동을 전면 중단한 사례가 있다. 이러한 공급망 교란은 기후변화로 인한 극한 기상 현상이 증가하면서 앞으로 그 빈도가 더욱 증가할 것으로 예상되고 있다.5)

나. 이행리스크

앞서 언급한 바와 같이 기후변화는 물리적리스크와 함께 기후변화 완화을 위한 저탄소 경제로의 전환에 따른 이행리스크(transition risks)를 발생시킬 수 있다. 먼저, 이행리스크가 미칠 경제적 충격의 크기를 가늠해보기 위한 차원에서 파리협약의 1.5℃ 제한 목표 달성을 위해 어느 정도의 저탄소 전환 노력이 필요한지 살펴보기로 한다.

<그림 Ⅱ-3>은 IPCC에서 기후변화 완화 및 적응 노력의 정도에 따라 5가지 유형(SSP1~SSP5)으로 분류한 기후변화 시나리오인 공통사회경제 경로(SSP)를 보여주고 있다.6) 그림의 세로축은 연간 CO2 배출량(백만 톤)을 나타내며, 각 실선은 각 시나리오의 대표 경로(representative pathway)를 나타낸다. 이에 따르면, 추가적인 탄소 감축 노력이 시행되지 않고 현재와 같은 추세로 온실가스 배출이 지속되는 경우, 즉, SSP3 시나리오 경로를 따르는 경우에는, 연간 CO2 배출량은 2100년에 80Gt을 넘어서고 산업화 이전 대비 약 4~5℃의 기온 상승이 일어날 것으로 추정된다.

반면, 기후변화 완화와 적응 노력이 적극적으로 시행되어 파리협약의 1.5℃ 제한 목표를 달성하는 경로인 SSP1-1.9(즉, 2100년의 복사강제력을 1.9W/m2 수준으로 제한)에서는 현재 연간 약 40Gt에 달하는 배출량이 2020~2040년 사이 급격히 감소하여 2050년에는 넷제로(net-zero) 상태에 도달해야 하며, 2100년에는 약 10Gt의 이산화탄소 순흡수가 이뤄져야 함을 알 수 있다.7)

이와 같이 기후변화 완화를 위해 전 세계적으로 저탄소 전환이 빠르게 추진된다면 이는 기존 산업과 세계 경제에도 중대한 영향을 미칠 수 있다. TCFD에 따르면 이러한 저탄소 전환이 유발할 수 있는 이행리스크는 크게 정책 위험, 저탄소 에너지 기술 혁신 위험, 소비자 선호 변화에 따른 평판위험 등이 포함될 수 있다. 먼저, 정책리스크는 탄소세 및 배출권 가격 인상과 같은 탄소 감축 규제, 저탄소 기술 및 설비 전환, 에너지 효율 개선 등의 정책으로 인해 기업의 생산 비용이 증가하거나 기존 화석연료 관련 설비가 좌초자산(stranded assets)으로 전락하게 될 위험을 의미한다.8) 대표적인 사례로 2020년 독일에서는 2038년까지 석탄화력발전소를 폐쇄하는 내용을 담은 탈석탄법이 통과되었는데, 이러한 폐쇄 대상 석탄발전소에는 2020년에 가동을 시작한 신규 석탄발전소인 다텔른-4(Datteln-4)도 포함되어 있었다. 이는 석탄화력발전소의 운영 기간이 통상 30~50년 정도임을 감안할 때, 다텔른의 경우 가동 후 18년 이내에 좌초자산으로 전환됨을 의미한다고 볼 수 있다.

또 다른 이행리스크의 예로서 저탄소 에너지 기술 혁신, 저탄소 산업구조 변경에 따른 기존 고탄소, 화석연료 의존 산업의 경쟁력 약화 가능성을 생각해 볼 수 있다. 2021년 기준 현재 전 세계 전력 생산(약 28,214 TWh)의 원천별 비중은 석탄 36%, 가스 23%, 수력 15%, 원자력 10%, 풍력 6.5%, 태양열 3.6%, 바이오 에너지, 조력 등을 포함한 기타 재생에너지 2.7% 등의 순으로 화석연료가 여전히 절대적으로 큰 비중을 차지하고 있다(BP, 2022). 그러나 최근 재생에너지 기술 진보, 정부 지원, 보급 확대에 따른 규모의 경제 구현 등에 따라 재생에너지 발전 비용이 크게 하락하면서 석탄화력발전과 비교해서 비용 경쟁력을 갖추고 있다. 예를 들어, 독일, 호주, 일본 등 신재생에너지 확대정책을 적극 추진하였던 일부 국가에서는 신재생에너지를 이용한 전력생산비용이 화석연료 전력 생산비용과 같아지는 그리드 패리티(grid parity)를 이미 달성한 것으로 전해지고 있다. 또한, 다소 극적인 사례로, <그림 Ⅱ-4>에서 보는 바와 같이 태양전지판(solar panel)의 가격의 경우 1976년 와트(watt)당 약 106달러(2019년 물가 기준) 수준에서 2019년 0.38달러로 99.6% 가량 크게 하락하였고, 이와 함께 설치 용량 또한 1976년 0.3MW에서 2019년 10만MW로 기하급수적으로 증가한 것으로 확인되고 있다.

이러한 기업 및 금융기관에 대한 기후 소송의 대표적인 사례로는 2021년 네덜란드의 Milieudefensie v. Royal Dutch Shell 사건과 2018년 호주의 McVeigh v. Retail Employees Superannuation Pty Ltd 사건을 들 수 있다. Milieudefensie v. Royal Dutch Shell 사건은 다국적 석유 및 가스회사인 Shell에 대해 시민과 환경단체가 제기한 민사소송에서 네덜란드 헤이그 지방법원이 피고인 Shell에게 파리협정 목표에 따라 2030년까지 2019년 배출량 수준의 45%를 감축할 의무가 존재한다고 인정한 판결로, 민간 기업에 대한 기후변화의 책임을 묻는 민사소송에 유의미한 전환점을 마련한 사건으로 평가되고 있다. 한편, McVeigh v. Retail Employees Superannuation Pty Ltd 사건은 호주 연금 펀드 회원인 Mark McVeigh가 연금 수탁자인 Retail Employees Superannuation Trust(Rest)를 상대로 기후변화 리스크 및 이러한 리스크를 해결하기 위한 전략을 공개하지 않아 기업법을 위반하였다고 주장하면서 호주연방법원에 제기한 소송이다. 소송은 재판이 시작되기 전 REST와 원고 간 합의로 일단락되었지만, 이 사건은 글로벌 연기금, 국부 펀드 등을 비롯한 자산 관리자에 대해 기후리스크의 심각성을 인지하고 이와 관련한 재무적 위험을 관리할 책임이 있음을 상기시켜 주었다.

이 외에도 투자자들 역시 기후변화 리스크를 진지하게 받아들이며 기업에 행동 변화를 요구하고 있다. 대표적으로 기후행동 100+(Climate Action 100+)는 온실가스 배출량이 높은 기업을 대상으로 배출 저감을 촉구하는 투자자 이니셔티브로, CalPERS, 블랙락 등을 비롯한 전체 운용자산 규모가 50조달러 이상인 약 500개 이상의 연기금, 기관투자자들이 이에 가입되어 있다. 그리고 최근에는 넷제로 자산소유자 연합(Net-Zero Asset Owner Alliance), 넷제로 자산운용사 이니셔티브(Net-Zero Asset Managers Initiative), 넷제로 은행 연합(Net-Zero Banking Alliance) 등과 같이 2050년 넷제로 및 지구온난화 1.5℃ 제한 목표 달성을 지원하는 금융기관의 연합체도 등장하였다. 아울러, Krueger et al.(2020)의 439개의 글로벌 기관투자자들을 대상으로 한 설문조사 결과에서도 투자자들이 기후변화 리스크를 중요하게 받아들이고 있음이 확인되었다. 이하 <표 Ⅱ-1>의 설문조사 결과에 따르면, 투자자들은 기후리스크를 재무리스크, 운영리스크와 같은 전통적인 리스크에 비해서는 상대적으로 중요도가 낮은 것으로 평가하고 있지만, 기후리스크 자체의 중요성은 높게 평가하고 있었다. 특히, 기후변화 관련 규제 위험과 기술 변화 위험과 같은 이행리스크를 물리적리스크 보다 더 중요하게 받아들이고 있었으며, 응답 기관의 90% 이상이 이러한 리스크가 향후 10년 이내 발현될 것으로 예상하였다.

기후변화는 앞서 논의한 바와 같이 실물 부문에 물리적리스크와 이행리스크를 유발하며, 이는 또한 운영리스크, 신용리스크, 보험리스크, 유동성리스크 등의 다양한 경로를 통해 금융시장에도 전이될 수 있다. 아래의 중앙은행 및 감독기구의 녹색금융 협의체(Network for Greening the Financial System: NGFS)에서 제시한 <그림 Ⅱ-5>를 보면, 기후리스크는 기업 및 가계에 사업 운영 중단, 자산의 물리적 손상, 소득 상실, 자산 가치 하락 등의 충격을 유발할 수 있으며, 이와 함께 공급망 충격에 따른 물가 상승, 극한 기후에 따른 노동생산성 하락, 소비자 선호 변화 등과 같은 거시경제변수에도 영향을 미칠 수 있다. 그리고 이러한 실물경제 충격은 이와 연계된 금융부문에도 신용리스크, 시장리스크, 보험리스크, 운영리스크, 유동성리스크 등 다양한 경로로 영향을 미칠 수 있다. 또한, 이는 개별 금융회사에 영향을 미치는 것에서 더 나아가, 금융기관 간, 실물경제와 금융부문 간 피드백을 통해 시스템 리스크로 확대될 수 있다.

이러한 운영리스크 이외에도 기후변화로 인한 기상이변의 증가는 기업의 채무불이행 위험을 높임으로써 금융회사의 신용리스크(credit risk)에도 부정적인 영향을 미칠 수 있다. 앞서 언급한 바와 같이 급작스러운 기상이변이나 자연재해와 같은 물리적리스크로 인해 기업의 운영이 중단되고 자산이 손상되면, 이는 기업의 수익 창출 능력, 대출 상환 능력, 담보 능력 약화로 이어져 결과적으로 금융회사의 신용리스크가 증가할 수 있다. 또한, 이행리스크도 신용리스크를 야기할 수 있다. 대표적인 예로 화석연료 발전 기업의 좌초자산 위험에 따른 금융회사 포트폴리오의 신용리스크가 증가하는 경우를 생각해볼 수 있다. 즉, 저탄소 정책으로 인해 화석연료 발전시설이 애초 의도한 경제 수명을 채우지 못하고 중도에 폐쇄되거나, 보유한 화석연료 매장량의 상당량이 사용되지 못하고 좌초될 경우, 이는 해당 기업의 부채비율 상승, 수익 손실로 이어져 이와 연계된 금융회사의 신용리스크를 증가시킬 수 있다.9) 실제로 최근 글로벌 신용평가사인 S&P는 저탄소 에너지 전환, 석유 및 가스 가격의 불안정성 등의 요인으로 인해 석유 및 가스 생산업체의 미래 수익률 악화, 채무불이행 가능성이 상승할 수 있다고 평가하며, Exxon Mobil, Chevron, CononoPhillips, BP 등 글로벌 정유 회사들의 신용등급을 하향 조정한 바 있다.10) 이와 함께, 최근 시장규모가 빠르게 증가하고 있는 지속가능연계채권(sustainability-linked bonds), 지속가능연계대출(sustainability-linked loans)과 같은 금융상품의 등장도 이러한 기후리스크와 신용리스크의 연계성을 뒷받침하고 있다. 여기서 지속가능연계채권 및 대출은 발행 기업이 탄소배출량 감축 등과 같이 사전에 합의한 특정한 지속가능성 목표를 달성하였을 경우 금리가 낮아지도록 설계된 성과연동형 채권 또는 대출을 의미하는데, 이러한 계약 구조에는 기후변화 대응과 같은 지속가능성 성과의 향상이 신용위험을 낮추는 데 긍정적으로 작용할 수 있다는 관점이 암묵적으로 내재되어 있다고 볼 수 있다.11)

이외에도 기후 재해 발생에 따른 물리적, 인적 피해의 증가로 보험금 지급 규모가 늘어나면서 보험회사의 건전성 악화, 보험료 상승, 보장범위 축소와 같은 보험리스크(insurance risk)가 증가할 수 있다. 실제로 보험사들의 분석 결과에 따르면 지난 수십 년 동안 자연재해로 인한 보험 손실 규모는 꾸준히 증가하고 있는 것으로 전해지고 있다. 재보험 중개회사인 Aon(2021)에 따르면, 2021년 한 해 동안 발생한 기후재난으로 인한 전 세계 보험 지급액은 약 1,300억달러에 달하는 것으로 추정되었으며, 이는 전년 대비 18%, 21세기 평균 대비 76% 증가한 수치이다. 미국에서 발생한 허리케인 아이다(Ida)와 유럽의 홍수로 인한 경제적 손실 규모만 최소 1,080억달러로 추정되었으며, 이 중 약 390억달러의 손실에 대해 보험금이 지급 되었다. 마찬가지로 Swiss Re(2022)에서도 2021년 자연재해로 인해 전 세계적으로 약 2,700억달러의 경제적 손실이 발생한 것으로 추정하였으며, 이 중 약 1,110억달러의 손실에 대해 보험금이 지급되었다고 보고하였다. 즉, 이러한 사례는 기후변화에 따른 경제적 손실이 대규모 보험 손실로 이어질 수 있음을 보여주고 있다. 더욱이 이러한 자연재해는 지구온난화가 진행되면서 더욱 자주 발생할 것으로 예상되면서 보험업계에서는 이러한 기후리스크 관리 부담이 앞으로 더욱 가중될 것으로 전망하고 있다.12) 그리고 기후리스크로 인해 보험사들의 손해율이 높아지게 되면 이러한 피해는 보험료 인상, 보장한도 축소, 보험가입한도 제한 등을 통해 궁극적으로 보험의 소비자인 기업과 가계에까지 전가될 수 있다.

UN 기후특사인 마크 카니(Mark Carney)는 이러한 상황을 빗대어 ‘기후 민스키 모멘트(climate minsky moment)’라고 표현한 바 있다.13) 이는 긴 호황 끝에 자산 가치가 갑작스럽게 급락하는 금융시장의 불안정성을 의미하는 민스키 모멘트처럼 기후리스크에 대한 투자자들의 인식이 급격하게 전환되면서 나타날 수 있는 금융위기를 의미한다. 투자자들이 비록 현재는 기후리스크를 인식하지 않고 있다 하더라도 미래의 어느 시점에 저탄소 전환을 인식하게 되면, 기후리스크에 노출된 자산 가치에 대한 광범위하고 전면적인 재평가가 일어날 수 있다. 이때 이러한 재평가에 따른 자산 가치 손실이 일정한 임계점을 넘게 되면, 전체 금융 시스템의 안정성이 붕괴되는 기후 민스키 모멘트가 발생할 수 있다. 물론 단기간에 이와 같은 기후변화에 따른 금융 위기가 나타날 가능성은 현재로서는 높다고 볼 수는 없겠지만, BIS, IMF, FSB 등의 국제기구들은 기후변화로 인한 금융위기, 이른바 ‘그린스완(green swan)’의 발생 가능성을 배제하지 않고 있으며 기후리스크에 대한 선제적 대응을 위한 기후 스트레스 테스트 모형 개발, 기후리스크 공시 확대 등의 노력을 꾸준히 전개하고 있다.

Ⅲ. 기후리스크와 자산가격의 관계에 대한 선행연구

앞선 장에서 기후리스크의 유형과 기후리스크가 금융시장에 미치는 영향에 대해 개념적으로 살펴보았다. 이번 장에서는 기후변화와 자산가격의 관계를 분석한 선행연구들을 살펴보고 그 시사점을 고찰해보고자 한다. 기후변화와 자산가격의 관계에 관한 선행연구들은 크게 다음과 같은 두 가지 질문에 초점을 두고 있는데, 하나는 기후리스크가 자산가격에 긍정 또는 부정적인 영향을 미치는지를 실증적으로 규명하는 연구이고, 다른 하나는 기후리스크가 자산가격에 얼마나 효율적으로 반영되고 있는지, 즉, 투자자들이 기후리스크를 어느 정도로 중요하게 인식하고 있는지를 분석하는 연구이다(Campiglio et al., 2020). 이하에서는 이러한 질문에 대한 기존 연구 결과를 살펴보고, 이를 바탕으로 기후리스크가 실제 자산가격에 유의한 영향을 미치는지, 그리고 시장에서는 이를 얼마나 효율적으로 반영하고 있는지 알아보고자 한다.

이와 함께, 최근에는 기후변화와 같이 매우 장기간(대체로 수십년 또는 그 이상)에 걸쳐 진행되고 불확실성이 높은 문제를 이러한 과거 데이터에 기반을 둔 실증분석으로 다루기에는 한계가 있다는 인식에 따라, 주요국 중앙은행과 감독기구를 중심으로 시나리오 분석을 이용한 기후리스크 분석 모형 개발이 시도되고 있다. 이러한 시나리오 기법은 미래지향적(forward looking) 접근법으로 기후리스크와 같이 불확실한 미래 상황에 대한 대응 전략을 수립하는 데 있어서 특히 효과적인 것으로 평가되고 있다. 이에 따라 본 장의 후반부에서는 이러한 시나리오 기반의 기후리스크 분석이 어떻게 진행되는지, 그 분석 결과는 어떻게 활용될 수 있는지, 주요국 중앙은행과 금융기관의 실제 테스트 사례를 통해 간략히 살펴보고자 한다.

1. 기후변화가 자산가격에 미치는 영향에 관한 연구

해외 선행연구에 따르면 기후변화는 자산의 유형, 산업 특성 등에 따라 매우 다른 영향을 미칠 수 있다. 예를 들어, 주식의 경우에는 기후변화 관련 새로운 위험이 발견되면 이러한 정보가 비교적 신속히 가격에 반영되는데, 한 번 정해진 계약 조건이 상당 기간 지속되는 대출이나 고정금리 채권과 같은 경우에는 이러한 기후 관련 정보가 시차를 두고 반영될 가능성이 높다. 또한, 기후변화는 산업에 따라 자산 가치에 상이한 영향을 미칠 수 있다. 예를 들어 저탄소 전환이 진행되면서 화석연료 발전이나 고탄소 업종은 탄소배출비용 상승으로 자산 가치가 하락할 위험이 높지만, 이와 반대로 재생에너지나 저탄소 업종은 자본유입, 수요 확대 등으로 인해 자산 가치가 상승할 수 있다. 이에 따라, 이하에서는 주식, 채권, 부동산 등 자산 유형별로 선행연구를 구분하여 기후변화가 자산 가치에 미치는 영향을 살펴보기로 한다.

가. 기후변화와 주식 가격의 관계에 관한 연구

기후변화가 주식 가격에 미치는 영향에 관한 선행연구는 주로 탄소 프리미엄(탄소배출량 수준이 높은 주식에 대한 양(+)의 초과수익률)이 존재하는지, 기상이변, 자연재해와 같은 기후변화 관련 뉴스가 보도되었을 때 해당 리스크에 노출된 주식 가격이 하락하는지, 또는 탄소감축 정책이 시행되었을 때 산업별 주식 가격이 어떻게 변화하는지 등에 대한 주제를 중심으로 이루어져 왔다.

이 중에서 탄소 프리미엄과 관련하여서 가장 주목할 만한 연구로는 Bolton & Kacperczyk(2022)를 들 수 있다. 이들은 77개국의 14,400개 상장기업의 2005년부터 2018년까지의 주식수익률 데이터와 기업별 탄소배출량 정보를 포함한 기업 수준의 미시데이터를 활용하여 탄소 프리미엄이 존재하는지 분석하였다. 만일 탄소 프리미엄이 존재한다면, 이는 투자자들이 탄소배출량이 높은 기업에 초과수익률을 요구하고 있다는 것으로 저탄소 전환에 따른 이행리스크가 주식 가격에 반영되고 있다고 해석할 수 있다. 분석결과, 대부분의 국가들에서 탄소 프리미엄은 기업의 탄소배출량 수준과 연간 배출량 증가율에 대해 유의한 양(+)의 상관관계를 보였는데, 직접 배출량(scope 1 emissions)이 1 표준편차만큼 증가할 때 연간 수익률이 평균적으로 약 1.1% 상승하는 것으로 나타났다.

그리고 이러한 탄소 프리미엄의 크기는 기업의 탄소배출량 뿐만 아니라 기후변화 대응 정책의 강도, 기후변화에 대한 사회적 인식, 경제발전수준 등에도 영향을 받는 것으로 나타났다. 예를 들어, 탄소 프리미엄은 북미, 유럽, 아시아 모든 지역에서 유의한 양(+)의 값을 보이고는 있지만, 단기적인 탄소 프리미엄의 크기는 일반적으로 경제발전수준이 낮고, 제조업 중심 산업구조를 가진, 헬스케어 산업이 상대적으로 덜 발달한 국가일수록 더 높은 것으로 나타났다. 한편, 장기적인 탄소 프리미엄은 국가의 기후변화 대응 정책 강도가 높을수록 더 큰 것으로 나타나, 저탄소 정책이 상당 기간 지속될 것이라는 투자자들의 기대가 주식 가격에 반영되고 있다고 해석하였다.14) 특히, 탄소 프리미엄은 2015년 파리협정 체결 이후 그 값이 더욱 뚜렷하게 증가하는 양상을 보이며, 파리협약을 기점으로 기후변화에 대한 투자자들의 인식이 확대되고 있다고 보았다.

탄소배출권거래제 도입, 파리협정과 같은 저탄소 정책의 강화에 따라 관련 정책 리스크에 노출된 기업의 주식 가치가 하락할 수 있음을 보인 연구도 있다. 예를 들어, Oestreich & Tsiakas(2015)는 독일과 영국 주식시장에서 EU의 배출권거래제 시행이 주식수익률에 미치는 영향을 분석하였는데, 배출권거래제 시행 초기에 탄소배출량이 높은 그룹이 배출량이 낮은 그룹에 비해 평균적으로 더 높은 비정상 초과수익률을 보이는 것을 발견함으로써, 탄소 프리미엄이 존재한다고 주장하였다. 그리고 Ilhan et al.(2021)는 파리협정 이후 탄소집약적 기업의 주식에 대한 풋 옵션 가격이 파리협약 이후 유의하게 증가한 반면 트럼프 당선 이후 상대적으로 대중의 기후변화에 대한 관심이 수그러든 시기에는 감소하는 것을 보임으로써, 투자자들이 탄소 배출 리스크에 대해 추가적인 보상을 요구하고 있다고 결론지었다. 이와 유사한 맥락에서, Monasterolo & de Angelis(2020)는 파리협정이 체결된 2015년을 전후로 미국, 유럽 등 글로벌 주식 시장에서 저탄소 지수(정식 명칭에 친환경, 그린, 재생에너지 등이 포함된 주가지수로 S&P Global Clean Energy, World Renewable Energy, Wilderhill Clean Energy 등이 포함)와 고탄소 지수(석유, 천연가스 등 화석연료 관련 주가지수로 S&P 500 Integrated Oil & Gas, FTSE World Oil & Gas 등이 포함)의 성과를 비교하였는데, 마코위츠 모형에서 구성한 최적 포트폴리오에서 저탄소 지수의 비중은 파리협정 이전에는 54%에서 파리협정 이후에는 88%로 증가하고, 반면에 고탄소 지수의 비중은 46%에서 12%로 감소하는 것을 보였다.