Find out more about our latest publications

Big Tech in Finance and Fair Competition

Research Papers 23-02 Jan. 27, 2023

- Research Topic Financial Services Industry

- Page 71

As the presence of large online platform companies called big tech grows in the provision of financial services, fair competition related to big techs is emerging as a major issue in the financial services industry. A recent BIS report predicts that big techs can eventually change the current market structure centered on financial services firms. The problem is that big techs can take the lead in the financial platform due to an inadequately prepared regulations rather than their potential technology and innovation capabilities. In this regard, it is necessary to secure fair competition related to big techs through proper regulations, and this study examines this issue focusing on the preparation of an appropriate regulatory system for big-techs’ anti-competitive behavior and the design of open banking that can promote fair competition.

Big techs have significant market power in their core platform. They can reduce costs by building an ecosystem consisting of services from multiple platforms on one platform, and also enjoy network effects. Big techs can also induce consumers to choose their own financial services through the design of the platform or ranking in search results, and can bundle subscription or use of a specific platform with financial products. Big techs can take advantage of this advantage to eventually limit competition by driving competitors out of the market or preventing the entry of potential competitors. In addition, big techs can utilize vast amounts of consumer data in the platform competition in the retail finance sector, and the gap in data held between big tech and competing platforms can lead to differences in service quality and undermine the competitive environment in the market. In response to this problem, many countries around the world are preparing systems for data portability and privacy. In particular, open banking, which gives financial consumers data portability to support fintechs’ entry into financial services sector, is being adopted in many countries.

Major countries such as the EU, the US, and the UK are preparing separate ex-ante regulations specifically focusing on big techs. Regulations in these countries include provisions to secure market competition, such as designation of regulated big tech, restrictions on data use, duty to provide data portability and interoperability, and ex-ante ban on corporate takeovers, and to prevent abuse of market dominance, such as prohibition of preferential treatment for own products.

Although open banking was introduced for the purpose of facilitating the advancement of fintechs into finance services sector, not only fintechs but also big techs benefit from the open banking, so fair competition of big techs related to open banking is also being discussed as an important issue.

In Korea, Naver and Kakao do not fall under big tech, but they are at the level that requires close monitoring according to the standards stipulated by Digital Markets Act (DMA) of EU. Therefore it is necessary to pay attention to the issue of fair competition related to their financial services business. As for the direction of the financial regulatory policy for fair competition, first, it is necessary to prepare an institutional device for mutual cooperation and coordination between the financial authority and the competition authority, and the financial authority need to respond to big techs’ anti-competitive business practices in order to protect financial consumers. Second, it is necessary to positively review to oblige big techs to share data with financial services firms subject to financial consumers’ consent.

Big techs have significant market power in their core platform. They can reduce costs by building an ecosystem consisting of services from multiple platforms on one platform, and also enjoy network effects. Big techs can also induce consumers to choose their own financial services through the design of the platform or ranking in search results, and can bundle subscription or use of a specific platform with financial products. Big techs can take advantage of this advantage to eventually limit competition by driving competitors out of the market or preventing the entry of potential competitors. In addition, big techs can utilize vast amounts of consumer data in the platform competition in the retail finance sector, and the gap in data held between big tech and competing platforms can lead to differences in service quality and undermine the competitive environment in the market. In response to this problem, many countries around the world are preparing systems for data portability and privacy. In particular, open banking, which gives financial consumers data portability to support fintechs’ entry into financial services sector, is being adopted in many countries.

Major countries such as the EU, the US, and the UK are preparing separate ex-ante regulations specifically focusing on big techs. Regulations in these countries include provisions to secure market competition, such as designation of regulated big tech, restrictions on data use, duty to provide data portability and interoperability, and ex-ante ban on corporate takeovers, and to prevent abuse of market dominance, such as prohibition of preferential treatment for own products.

Although open banking was introduced for the purpose of facilitating the advancement of fintechs into finance services sector, not only fintechs but also big techs benefit from the open banking, so fair competition of big techs related to open banking is also being discussed as an important issue.

In Korea, Naver and Kakao do not fall under big tech, but they are at the level that requires close monitoring according to the standards stipulated by Digital Markets Act (DMA) of EU. Therefore it is necessary to pay attention to the issue of fair competition related to their financial services business. As for the direction of the financial regulatory policy for fair competition, first, it is necessary to prepare an institutional device for mutual cooperation and coordination between the financial authority and the competition authority, and the financial authority need to respond to big techs’ anti-competitive business practices in order to protect financial consumers. Second, it is necessary to positively review to oblige big techs to share data with financial services firms subject to financial consumers’ consent.

Ⅰ. 서론

최근 전 세계적으로 빅테크(big tech)라 일컬어지는 대형 온라인 플랫폼 기업들이 금융에 진출하면서 소비자 개개인의 성향에 맞추거나 이용의 편의성에 초점을 둔 금융, 금융을 포함한 one-stop shopping 등의 소매금융 부문의 혁신에 대한 기대가 크다. 그러나 다른 한편에서는 빅테크가 대규모 고객정보와 핵심 플랫폼의 시장지배력 등을 지렛대로 기존 금융회사들을 제치고 소매금융 부문을 장악할 수 있다고 우려하고 있다.1) 이에 규제 당국이 빅테크의 금융진출에 대응하여 금융산업의 전통적인 감독의 적절성뿐 아니라 공정경쟁‧공정거래에 관한 이슈들을 중요하게 다루어야 할 필요성이 제기되고 있다.

빅테크라는 용어는 ‘대형(big) 기술(tech) 기업’을 의미하는 신조어로서 법적 용어는 아니며, 따라서 법적 또는 학술적으로 통일된 명확한 정의가 내려져 있지 않다. 그럼에도 불구하고 빅테크 관련 이슈를 다룬 다수의 문헌, 그리고 주요국의 관련 법령들에 따르면 대체로 ‘온라인 플랫폼을 보유하고 운영하는 대형 기술 기업’을 의미하는 것으로 빅테크를 정의할 수 있다.2) 다수 문헌이 공통적으로 빅테크에 해당한다고 보는 기업으로는 미국의 Google(Alphabet), Apple, Facebook(Meta), Amazon3), 중국의 Alibaba, Tencent 등이 있으며, 국내의 경우 네이버와 카카오가 빅테크에 가장 근접한 기업으로 언급된다.4)

최근 네이버와 카카오 등이 지급 서비스를 넘어 대출, 보험, 자산관리 등 다양한 금융서비스를 제공하기 시작하였는데, 이에 따른 긍정적인 영향은 매우 클 것으로 보인다. 소비자들은 빅테크 플랫폼에서 one-stop shopping으로 여러 다른 서비스와 금융을 동시에 이용할 수 있는 한편, 자신의 선호, 행태, 습관 등에 기반을 둔 맞춤형 금융서비스의 혜택도 받을 수 있다. 기존 금융회사나 핀테크 스타트업과는 달리, 이들은 여타 플랫폼 서비스와 금융을 결합할 수 있을 뿐 아니라 대규모 고객정보와 높은 IT 기술에 기반하고 있다는 장점이 있다. 이에 따라, 빅테크는 기존 금융회사에 상당한 경쟁 압박을 줄 뿐 아니라 금융의 편의성을 높이는 서비스 경쟁을 촉진할 것으로 기대되고 있다.

빅테크는 플랫폼 기반의 금융상품 중개나 클라우드 기반의 후선업무 등 기존 금융규제 체계에서 벗어난 사업모델로 금융에 진출하고 있다. 더욱이 이들은 여러 상업과 금융 부문의 자회사 간 복잡하게 결합하고 있다. 이러한 점 때문에, 빅테크의 금융 진출과 관련하여 여러 정책 차원의 논의가 진행되고 있다. 대표적으로 이들 그룹의 지배구조 상 이해상충 문제, 새로운 운영 위험, 현재의 금융규제 및 감독의 한계, 그리고 본 연구의 주제인 공정경쟁의 이슈들을 들 수 있다.5) 사실 빅테크는 자본력, 브랜드, 대규모 고객 기반 및 정보, IT 기술 등에서 금융회사와 차별화된 경쟁력을 가지고 금융에 진출하는 것이어서, 이들과 관련한 공정한 경쟁 환경은 향후 소매금융 부문의 발전에 중요한 요인이 될 수 있다. 앞서 언급한 바와 같이 빅테크가 장기적으로 현재의 금융회사 중심의 시장구조 판도까지 바꿀 수 있다고 전망되고 있는 가운데, 그것이 빅테크의 IT 기술과 혁신이 아닌 공정경쟁과 관련한 제도의 부재에서 비롯될 수 있다는 우려가 크다.

빅테크들은 자사의 대규모 고객 기반에서 여러 서비스를 상호 결합할 수 있어 번들링이나 자사상품의 우대 등과 같은 영업행위가 가능하다. 문제는 핵심 플랫폼의 시장지배적 지위에 기반한 빅테크의 이러한 영업행위가 인접한 플랫폼을 포획하는데 효과적인 동시에, 때때로 경쟁을 제한할 수 있다는 점이다. 실제로 주요국이나 우리나라 경쟁 당국은 일부 플랫폼에서 관찰된 빅테크의 경쟁제한적 영업행위에 대해 소송 등으로 대응하고 있다. 최근 주요국에서는 빅테크에 대해 별도의 사전규제를 마련하고 있는데, 이것을 통해 금융에 진출한 빅테크의 불공정경쟁 행위를 일정 부분 예방할 수 있을 것으로 보인다. 그러나 우리나라는 아직 별도의 빅테크 규제를 마련하지 않고 있어, 대형 온라인 플랫폼의 금융 진출에 이들의 공정경쟁과 관련한 관계 당국의 감독이 중요할 것으로 보인다. 최근 전 세계 여러 나라들은 핀테크의 금융 진출을 지원하고 소매금융 부문의 경쟁과 혁신을 촉진할 목적으로 오픈뱅킹을 도입하고 있다. 오픈뱅킹은 핀테크 등이 고객의 동의를 받으면 금융회사로부터 해당 고객의 계좌정보에 접근하여 이용할 수 있도록 하고 있는데, 이러한 제도가 대규모 고객정보를 보유한 빅테크에도 똑같이 적용되면서 이들의 정보공유 수혜가 공정경쟁의 이슈로 대두되고 있다.6) 특히 금융서비스는 다른 어떠한 부문보다도 정보량에 따라 경쟁력이 달라질 수 있으므로 금융회사와 빅테크 간 비대칭적인 정보공유의 이슈는 공정경쟁의 차원에서 중요하게 다루어질 필요가 있다. 이러한 관점에서, 본 연구는 금융에 진출한 빅테크의 경쟁제한적 영업행위의 가능성과 오픈뱅킹의 설계에 초점을 두고 논의하고 있다.

본 보고서의 구성은 다음과 같다. 이어질 Ⅱ장에서는 빅테크의 개념, 이들의 금융진출 요인, 현황과 전망 그리고 공정경쟁 이슈에 대해 논의한다. Ⅲ장에서는 국내외 빅테크에 대한 최근 규제 동향과 오픈뱅킹의 도입과 빅테크의 정보공유와 관련한 논의를 정리한다. Ⅳ장에서는 우리나라의 빅테크에 대해 검토하고 공정경쟁을 위한 금융당국의 정책 방향에 대해 제안한다.

Ⅱ. 빅테크의 금융 진출 현황과 공정경쟁 이슈

1. 빅테크의 개념과 금융 진출 요인

가. 빅테크의 개념과 특성

대형(big) 기술(tech) 기업을 의미하는 빅테크는 법적 또는 학술적으로 명확하게 정의된 개념은 아니며, 문헌에 따라 그 범위에서 약간의 차이가 존재한다. 그러나 빅테크 문제를 다룬 다수의 문헌들7)에 의하면 대체로 빅테크는 ‘온라인 플랫폼을 보유하고 운영하는 대형 기술 기업’을 의미하는 것으로 정리할 수 있으며, 빅테크의 범주에 포함되는 기업들에서는 다음과 같은 공통의 특성을 발견할 수 있다.

첫째, ‘온라인 플랫폼’을 보유하고 운영하는 기업이다. 플랫폼(platform)은 서로 다른 이용자(end-user) 그룹이 거래나 상호작용을 원활하게 할 수 있도록 제공된 물리적 또는 가상의 공간을 의미하며8), 온라인 플랫폼은 그중에서도 인터넷 상에서 작동하는 플랫폼을 지칭하는 것으로 이해할 수 있다. 그리고 플랫폼의 핵심적인 특징은 양면(two-sided) 사업모델, 즉 서로 다른 이용자 그룹을 상호 연결하는 서비스를 제공하고, 각 이용자 그룹에 이용료를 부과하는 사업모델을 채택하고 있다는 점이다. ‘플랫폼을 보유‧운영’하는 주체로서 빅테크는 한쪽 이용자 그룹인 이용업체(business user)9)와 다른 한쪽 이용자 그룹인 소비자(consumer)의 플랫폼 참여를 통제‧관리한다.

둘째, 온라인 데이터 사업(검색엔진, 소셜네트워크, 이커머스, 운영시스템(OS) 등)을 기반으로 성장하고, 그 사업에서 강력한 시장지배적 지위를 향유하고 있는 기업이다. 따라서 비금융 주력사업을 통하여 구축된 데이터 및 네트워크를 기반으로 금융산업에 진출한 빅테크는 처음부터 금융을 주력사업으로 하여 설립된 핀테크(fintech)10)와 구별된다. 즉 핀테크는 기존 금융회사의 비즈니스를 디지털 기술로 혁신함으로써 경쟁력을 구축하지만, 빅테크는 이 외에도 핵심 플랫폼의 시장지배력, 데이터, 네트워크 등을 활용하여 금융서비스의 경쟁력을 확보하고 있다.

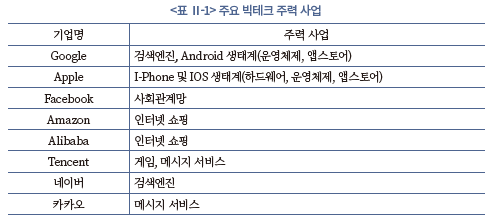

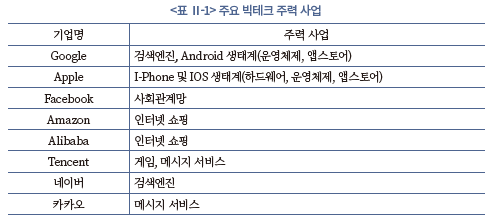

셋째, ‘대형’ 온라인 플랫폼 기업이다. 온라인 플랫폼의 규모를 측정하는 척도가 무엇인지, 척도별로 ‘대형’이라고 판단할 수 있는 기준(threshold)이 무엇인지에 대한 합의는 존재하지 않는다. 다만 보고서의 Ⅲ장에서 소개하는 EU와 미국의 빅테크 규율 법령에서 설정하고 있는 기준치가 참고될 수 있을 것이다. 주요 문헌들이 공통으로 빅테크에 해당한다고 보는 기업으로는 미국의 Google, Apple, Facebook, Amazon, 중국의 Alibaba, Tencent 등이 있으며, 국내에서는 네이버와 카카오가 빅테크에 가장 근접한 기업으로 언급되며11)12) , 이들의 주력사업은 <표 Ⅱ-1>에 정리되어 있다.

넷째, 빅테크 경쟁력의 핵심 원천은 플랫폼 참여자의 상호작용과 그 결과로 생산되는 데이터이다. 플랫폼이 클수록(즉 참여자가 많을수록) 상호작용은 급격하게 증가하고, 그에 따라 생산되는 데이터 역시 증가한다. 빅테크는 이 데이터를 분석하여 플랫폼 참여자의 니즈에 더 정밀하게 맞춘 서비스를 제공할 수 있으며, 그에 따라 플랫폼 참여자는 더욱 증가하게 되고, 다시 많은 데이터가 생산되는 활동에 진출하는 ‘DNA(Data-Network-Activities) loop’가 형성된다.13) 또한 양면시장이라는 플랫폼의 특성에 따른 네트워크 외부효과로 인하여 DNA loop를 통한 규모 및 범위의 경제 효과는 더욱 배가된다. 한편 방대한 데이터를 정교하게 분석함으로써 소비자와 공급자 간 미스매치가 크게 줄어들게 됨에 따라 후발 신생기업들이 진입할 수 있는 틈새시장이 점차 없어지는 효과도 발생한다.

나. 빅테크의 금융 진출 요인

최근 GAFA, Alibaba와 Tencent, 네이버와 카카오 등 빅테크에 해당할 수 있는 대형 온라인 플랫폼들이 지급(payment) 서비스를 넘어서 대출, 보험, 자산관리 등 다양한 금융서비스에 진출하고 있다. 현재 빅테크의 금융 진출은 금융산업의 발전 정도나 규제 수준, 이들의 금융 진출에 대한 국가별 규제 차이로 인해 다양하지만14), 이들의 금융 진출 요인은 상당한 것으로 보인다.

첫째, 빅테크는 자신의 플랫폼에 금융서비스를 추가하면 고객층을 넓힐 수 있고 여기서 생성된 정보를 이용하여 핵심 플랫폼의 서비스 질을 높일 수 있다. 빅테크는 일반적으로 검색, 소셜네트워크, 이커머스 등의 핵심 플랫폼 외에도 게임, 콘텐츠 유통, 지도, 광고, 예약 등 다양한 서비스를 제공하고 있다. 그런데 여기에 금융서비스가 추가되면 소비자들은 빅테크 플랫폼에서의 여러 활동이나 거래 시에 금융서비스를 즉각적이고 편리하게 받을 수 있다. 다른 한편, 금융서비스를 통해 수집한 소비자의 금융거래 정보는 빅테크 핵심 플랫폼의 서비스 질을 개선하고 수익을 높이는 데 중요한 투입 요소가 될 수 있다.

둘째, 온라인 소매금융의 가파른 성장과 빅테크 플랫폼의 경쟁력은 금융 진출의 또 다른 중요한 요인이다. IT 기술의 발달과 스마트폰의 보급으로 은행들은 지난 10여 년 사이 온라인 뱅킹을 빠르게 확대해 왔다. 이에 따라 최근에는 젊은 층뿐 아니라 중장년층의 금융소비자들도 온라인 뱅킹을 어렵지 않게 이용하고 있다. 이러한 추세는 온라인 금융서비스에 초점을 둔 빅테크의 금융 진출에 긍정적인 요인이다. 다른 한편으로는, 소비자들이 검색, 소셜네트워크, 이커머스 등을 이용하기 위해 일상적으로 빅테크 플랫폼을 이용하고 있다는 점이다. 즉 빅테크 플랫폼은 금융소비자에게 손쉽게 접근할 수 있다. 과거 오프라인 소매금융 고객 확보에 지점망과 ATM이 중요했듯이, 대규모 이용자들이 많은 시간 머물러 있는 빅테크 플랫폼은 온라인 소매금융에서 중요한 경쟁력이 될 수 있다.

셋째, 핀테크와 빅테크 등의 제3자 서비스 제공업자가 고객의 동의를 얻으면 금융회사로부터 고객 계좌 및 금융거래 정보를 받을 수 있는 오픈뱅킹의 도입이다. 이에 따라 핀테크뿐 아니라 빅테크도 고객의 금융정보에 접근할 수 있게 되었으며 금융산업에 진출하기가 한층 수월해졌다.

2. 빅테크의 금융 진출 현황과 전망

가. 빅테크의 금융 진출 현황

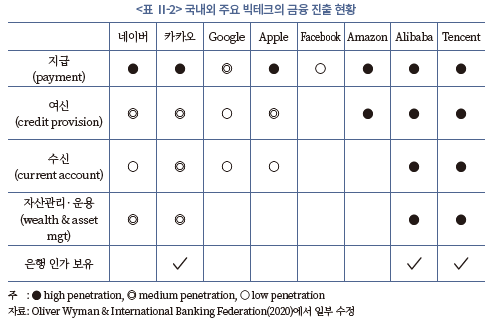

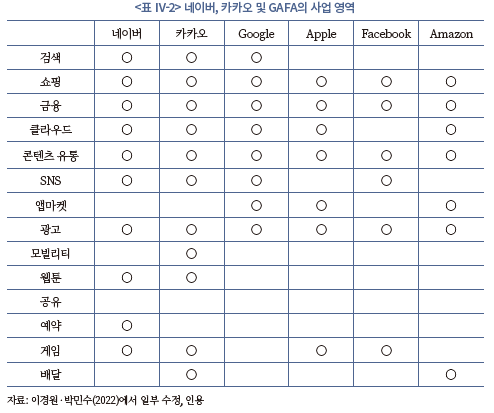

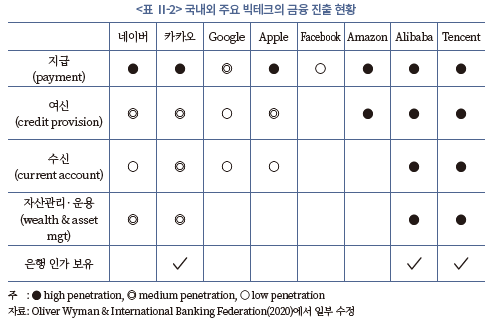

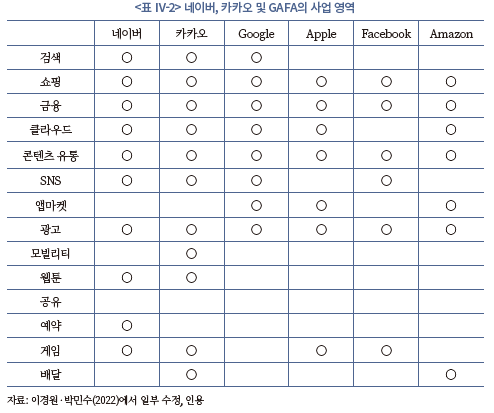

<표 Ⅱ-2>는 국내외 빅테크들의 금융 진출, 즉 금융서비스 영위 현황의 개요를 보여준다.

<표 Ⅱ-2>는 지급(payment) 서비스가 모든 빅테크들이 공통으로 가장 활발하게 진출해 있는 금융서비스임을 보여주고 있다. 지급 서비스의 경우, 이커머스와 같은 주력 사업에서 발생하는 수요 기반이 존재하고 소셜네트워크 등의 기존 사업과 효과적으로 결합하여 빠르게 시장점유율을 높일 수 있는 등 기존 사업과의 시너지가 크고 규제 부담이 상대적으로 작기 때문으로 보인다. 또한 인터넷 쇼핑몰을 보유하고 있는 빅테크들은 모두 여신 서비스를 영위하고 있는데, 이는 이용업체(즉 쇼핑몰 입점업체)를 대상으로 일종의 소상공인 대출을 제공할 수 있기 때문이다.

GAFA로 대표되는 미국의 빅테크들은 비교적 신중하면서 제한적인 형태로 금융에 진출하는 모습을 보인다. 이들은 공통적으로 상업은행과 같이 인가(license)가 필요하거나 강력한 규제가 적용되는 금융 영역에는 진출하지 않고 있다. 대신에 기존 금융회사 또는 핀테크와의 제휴를 통하여 금융서비스를 제공하는 전략을 채택하고 있다.15)

이와는 반대로 중국의 Alibaba와 Tencent는 초기부터 매우 적극적으로 금융에 진출해 왔다. 이 두 빅테크는 기존 금융회사의 인수 등을 통하여 은행, 보험 등 인가가 필요한 영역을 포함한 금융의 거의 모든 영역에 걸쳐 서비스를 제공하고 있다. 이 중에서 Alibaba의 경우 자회사 Ant Group이 금융 사업을 총괄 지배하는 조직 구조를 갖고 있다.

국내의 네이버와 카카오는 각기 다른 금융 진출의 형태를 보이고 있다. 네이버는 미국의 GAFA와 유사하게 인가가 필요한 영역에는 아직 진출하지 않고 있으며, 주로 기존 금융회사와의 제휴를 통하여 금융서비스를 제공하고 있다. 네이버는 2015년 6월 간편결제(지급)서비스인 네이버페이를 시작으로 금융서비스를 제공하기 시작하였으며, 2019년 11월 네이버파이낸셜을 설립하여 금융 부문을 자회사로 분사하였다. 체크카드, 신용카드, 환전에 이어, 2020년에는 미래에셋대우증권(현 미래에셋증권)의 CMA 개설을 대행해 주는 네이버통장을 출시하였다. 이 외에 입점업체를 대상으로 하는 대출 서비스도 제공하고 있다.

카카오는 네이버와는 달리 금융회사의 설립 또는 인수를 통하여 인가가 필요한 영역에 직접 진출하는 전략을 구사하고 있다. 2017년 인터넷은행인 카카오뱅크가 영업을 개시하였고, 2019년 보험 스타트업 인바이유를 인수하였다. 이어 2020년 바로투자증권을 인수하여 카카오페이증권으로 개명하면서 증권업에도 진출하였다. 최근 카카오페이는 디지털손해보험 자회사 본인가를 신청하여 금융감독원의 심사가 진행 중이다.

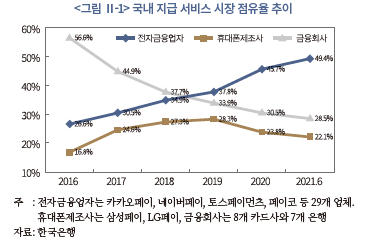

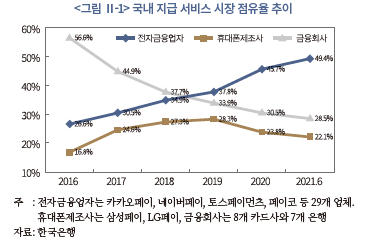

<그림 Ⅱ-1>에서 볼 수 있듯이, 국내의 빅테크들은 간편결제를 포함한 지급 서비스 부문에서 빠르게 성장하고 있다. 카카오페이와 네이버페이가 포함된 전자금융업자의 점유율은 2016년 26.6%에서 2021년 6월말 현재 49.4%로, 지난 5년 사이 가파른 상승세를 나타내고 있다. 2021년 6월 말 현재 22.1%의 점유율을 보이는 삼성페이가 포함된 휴대폰 제조사도 28.5%인 금융회사와 비교해서 상당히 높은 편이다.

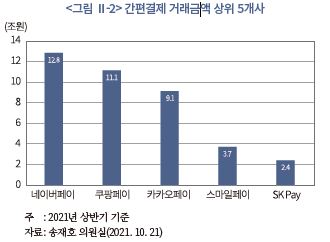

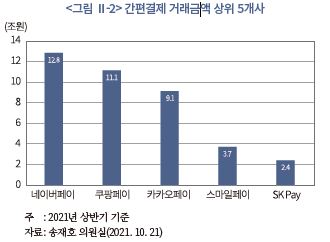

또한 <그림 Ⅱ-2>에서 볼 수 있듯이 간편결제업자 중에서 거래금액 상위 5개 업체 중 3개가 대형 온라인 플랫폼 사업자(네이버, 쿠팡, 카카오)로 나타났다. 이같이, 간편결제업자 중 대형 온라인 플랫폼들이 높은 점유율을 보이는 중요한 이유 중의 하나는 소비자들이 이러한 플랫폼에서 일상적으로 활동하고 또 쉽게 접근할 수 있기 때문으로 판단된다. 이러한 점으로 볼 때, 빅테크가 지급 서비스 외 진출하기 시작한 다른 소매금융 부문에서도 시장에 빠르게 침투할 가능성을 배제하기 어려워 보인다.

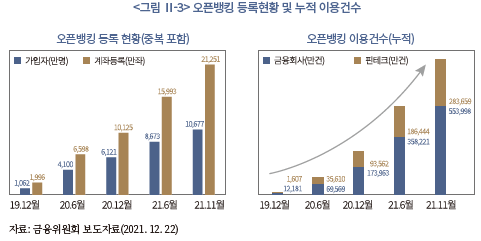

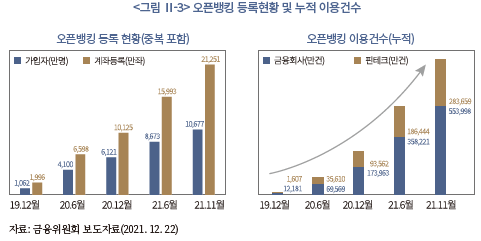

우리나라 오픈뱅킹은 2019년 12월 시행된 이후 2년 사이 가파른 성장세를 나타내고 있다. 2021년 11월 기준 오픈뱅킹 가입자 수는 중복을 포함하여 1억명을, 등록된 계좌 수는 2억좌를 넘었다. 오픈뱅킹의 누적 이용건수의 경우, 금융회사 전체는 55억건에 달하고 핀테크 전체는 금융회사의 절반 수준인 28억건에 달하는 것으로 나타났다. 무엇보다 빅테크를 포함한 핀테크들이 금융회사들과 같은 자체의 고객을 보유하고 있지 않음에도 불구하고 이들과 크게 다르지 않은 성장을 보이고 있음은 주목할 만하다.

2022년 1월 정부는 결제계좌 정보만을 공유하던 오픈뱅킹을 확대하여 예금‧대출, 보험, 금융투자상품 관련 고객거래 등의 정보도 받아 여러 금융서비스 업무를 수행할 수 있는 28개 마이데이터 사업자를 허가하였다. 당시 핀테크, 금융회사뿐 아니라 카카오와 네이버 등 대형 온라인 플랫폼들도 마이데이터 사업자로 진출하였다. 2022년 10월 기준 허가받은 마이데이터 사업자는 59개사로 9개월 사이 두 배 이상 증가한 상황이다.16) 더욱이 허가심의 중인 사업자의 수가 29개사로 마이데이터 사업자 수는 앞으로도 빠르게 증가할 것으로 보인다. 공식 출범한 지 3개월이 지난 2022년 4월 기준 마이데이터 가입자 수는 2,596만명으로 집계되었다. 업권별 마이데이터 가입자 수를 보면 은행권이 아닌 핀테크 부문에서 가장 많았다. 구체적으로 빅테크, 핀테크가 1,101만명으로 가장 많았고 은행, 저축은행이 721만명, 카드, 캐피탈이 653만명의 순으로 나왔다.17) 마이데이터에 참여하는 가입자와 참여기관의 증가 추세로 볼 때, 향후 금융회사와 소비자 간 금융상품을 중개하는 플랫폼 기반의 금융서비스 시장이 빠르게 성장할 것으로 보이며 이 시장을 두고 빅테크, 핀테크, 금융회사 간 경쟁이 치열해질 것으로 예상된다.

나. 빅테크와 금융회사 간 경쟁구조

금융회사들은 오랜 기간 안정적으로 금융서비스를 제공해 오면서 여러 경쟁우위를 구축하였다. 이들은 지역사회 곳곳에 있는 지점망으로 고객들과 형성한 깊은 유대관계를 통해 고객들에 관한 소프트(soft) 정보뿐 아니라 높은 신뢰와 충성심을 축적할 수 있었다. 또한 금융서비스의 성공과 실패를 많이 경험하였기에 고객에 필요한 금융상품을 잘 이해하고 있다. 금융회사들은 금융상품을 취급하는 과정에서 불거질 수 있는 금융소비자보호와 금융 리스크에 대해서도 깊이 있게 이해하고 있고 감독 당국과의 관계도 잘 설정하고 있다. 특히, 대형 금융회사들은 수십 년간 쌓은 시장의 평판과 고객 기반 등을 통해 견고한 시장지배력을 가지고 있다. 이러한 점 때문에, 소매금융 부문에서는 어떠한 새로운 경쟁자도 이들을 능가하기가 쉽지 않으리라고 예측되어 왔다. 그러나 소매금융 부문이 오프라인 중심에서 온라인 중심으로 급속하게 전환되면서, IT 기술을 기반으로 새로운 사업모델을 장착한 빅테크가 기존 금융회사와 다른 차별화된 경쟁력을 가지고 있어 위협적인 경쟁자로 부상하고 있다.

실제로 빅테크는 금융회사와 비교하여 여러 차별화된 경쟁우위를 가지고 있다. 이들은 금융회사와 달리 오프라인 중심의 점포망과 IT 구축 등 레거시(legacy) 시스템에 제약받지 않고 최첨단 IT 기술을 이용하여 소비자의 선호와 수요에 신속하고 유연하게 대응할 수 있다. 또한 원천적으로 모바일·디지털 중심의 고객 경험을 중시한 온라인 사업모델로 성장하였기에 소비자에게 편리한 금융서비스가 무엇인지 잘 이해하고 있다. 한편 빅테크는 온라인 부문에서 대규모 고객 기반과 높은 평판, 브랜드를 가지고 있고 자본력도 금융회사보다 작지 않다. 앞서 논의하였듯이, 빅테크는 자신의 여러 플랫폼에서 수집한 소비자의 선호와 행태에 관한 빅데이터와 이를 분석할 수 있는 IT 기술을 금융서비스에 활용할 수 있다. 예를 들면 빅테크는 검색 성향, 이커머스에서의 거래 결과, SNS 활동 등을 통해 수집한 고객정보를 맞춤형 금융서비스뿐 아니라 고객별 차등화된 가격 책정, 신용 심사 등에 활용할 수 있다.

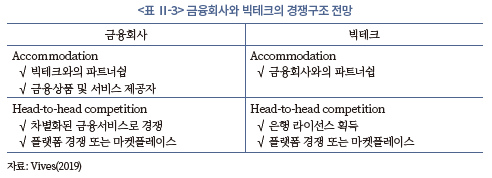

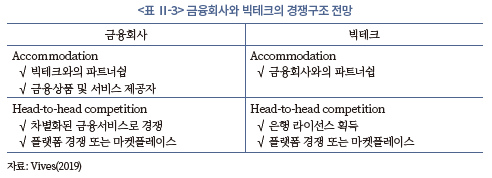

이상에서 살펴본 바와 같이, 대형 금융회사와 빅테크들은 서로 다른 차원에서 우월한 경쟁력을 가지고 있다. 따라서 빅테크의 금융 진출이 본격적으로 이루어졌을 경우 빅테크와 금융회사 중 경쟁력이 누가 더 클지 쉽게 예측하기 어렵다. 그러한 점 때문에, 빅테크의 금융 진출 그 자체만으로도 금융회사들에 상당한 경쟁 압박으로 작용하는 것으로 보인다. 최근 우리나라의 은행들이 대규모 IT 투자, IT 관련한 인력의 충원과 교육, 온라인 부문을 중심으로 하는 조직 개편을 긴박하게 단행하고 있는데, 카카오나 네이버와 같은 대형 온라인 플랫폼 기업들의 금융 진출에 따른 대응적인 측면이 크다. BIS 보고서는 지금까지의 여러 해외사례를 들어 소매금융 부문에서 금융회사와 빅테크 간 경쟁구조가 각 국가의 규제 상황, 금융 발전의 정도, 이들의 경쟁우위에 따라 다르게 나타날 수 있음을 지적하고 있다(BIS, 2019). Vives(2019)와 De la Mano & Padilla(2018) 등은 빅테크와 금융회사의 경쟁구조나 방식에 대해 아래와 같이 전망하고 있다.

경쟁 방식을 보면 빅테크는 주로 자신의 플랫폼 내 금융상품을 비교하는 마켓플레이스 또는 플랫폼을 통해 중개하고 있지만, 회사에 따라서는 은행 등의 금융회사 라이선스를 취득하여 금융상품을 직접 공급하기도 한다.18) 금융상품을 비교하거나 추천하는 마켓플레이스 서비스만을 제공하고 있는 빅테크로는, 우리나라 네이버와 미국이나 유럽 등의 GAFA를 들 수 있다.19) 카카오, 중국의 Alibaba와 Tencent가 은행 등의 금융회사 라이선스를 가지고 금융에 진출하고 있으며 이 경우 다른 금융회사의 금융상품을 중개하는 마켓플레이스 또는 플랫폼도 함께 제공하고 있다.

일부 대형 금융회사들은 자사와 경쟁사들의 금융상품을 비교해 주는 마켓플레이스를 운영하여 빅테크 플랫폼에 맞대응할 수 있을 것이다. 다른 금융회사들은 특정한 고객층을 목표로 금융서비스를 제공함으로써 빅테크에 대응할 수 있다. 현재 미국의 GAFA와 대형 금융회사들이 대출 및 신용카드 부문에서 협력하고 있듯이, 금융회사들과 빅테크는 시너지를 내기 위해 제휴할 수도 있다. 또한 금융회사들은 빅테크 플랫폼이든 대형 금융회사 플랫폼이든 이들의 마켓플레이스를 자신의 금융상품 판매채널로 이용할 것이다.

카카오, 중국의 Alibaba와 Tencent와 같이, 소매금융 마켓플레이스를 제공하면서 동시에 금융회사 라이선스를 취득한 빅테크는 소매금융 부문에서 유통과 제조 시장을 수직적으로 결합한 것이다. 그러나 빅테크는 금융상품을 제조하지 않고 마켓플레이스만을 제공하더라도 자신의 핵심 플랫폼과 수직결합의 형태를 보일 수 있다. 이를테면 빅테크의 검색엔진 플랫폼은 여러 금융상품 마켓플레이스에 검색 창을 제공하는 상위시장이 될 수 있다. 즉 빅테크는 자신의 여러 플랫폼 간 수직결합의 시너지를 활용할 수 있으며, 이는 금융회사의 플랫폼과 다른 점이라 할 수 있다.

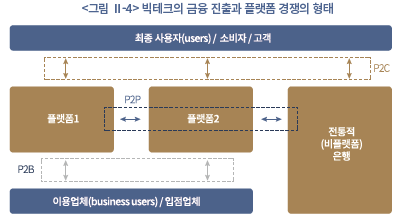

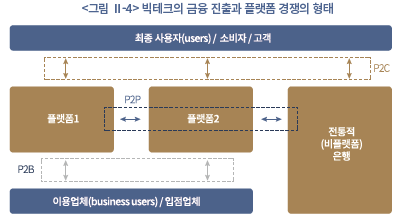

<그림 Ⅱ-4>에서 볼 수 있듯이, 빅테크들은 플랫폼 간 경쟁(Platform to Platform: P2P)에 참여할 뿐 아니라 플랫폼 내 경쟁(Platform to Business users: P2B)에 관여할 수 있다. 빅테크는 이와 같은 경쟁의 형태에서 고객 네트워크, 플랫폼 간 교차 보조, 시스템 호환성 등 다양한 전략적 도구를 이용할 수 있다. 특히 플랫폼 내 관리자로서 수직결합한 시장을 동시에 운영할 때, 자신의 독점적 지위를 지렛대로 삼을 수 있는 전략적 영업행위를 이용할 수 있다. 이를테면 플랫폼 내 번들링이나 자사상품의 우대 등의 영업행위, 고객정보의 활용, 배타적인 시스템 호환성 등을 추구할 수 있다. 다음 절에서는 이러한 빅테크의 경쟁 우위적인 요소와 불공정경쟁의 이슈를 좀 더 심층적으로 제시한다.

3. 빅테크의 공정경쟁 이슈

앞서 논의하였듯이, 빅테크는 일반적으로 검색엔진, 소셜네트워크, 이커머스, 운영시스템(OS) 등의 온라인 부문에서 시장지배력을 가진 대형 기술 기업으로 핵심 플랫폼과 인접한 여러 플랫폼에 진출하고 있다. 구글을 예로 들면, 검색엔진 외에 OS(운영시스템), 앱 마켓플레이스, 브라우저 서비스, 미디어 플레이어, 구글맵, 구글 쇼핑, 구글페이 등 다양한 플랫폼 서비스를 제공하고 있다. 사실 빅테크들은 자신의 핵심 플랫폼을 지렛대로 여러 플랫폼에 진출하며 독점력을 확대해가고 있는데, 이러한 플랫폼 진출의 동기 및 진출 과정에서의 전략들은 ‘플랫폼 포획(platform envelopment)’에 관한 이론을 통해 이해해 볼 수 있다. 특히, 빅테크는 플랫폼 서비스의 네트워크 특성과 수직결합의 그룹 형태를 하고 있어 인접한 플랫폼을 확장하는 과정에서 효율성 향상뿐 아니라 경쟁기업의 배제(foreclosure)나 진입저지(entry deterrence)를 함의하는 경쟁제한적 영업행위를 할 유인이 존재한다. 다른 한편으로, 빅테크가 축적한 대규모 고객정보는 경쟁 플랫폼과의 공정한 경쟁 환경을 저해하는 요인으로 작용할 수 있다. 본 절에서는 이러한 관점에서 빅테크와 관련한 공정경쟁 이슈를 논의하고자 한다.

가. 빅테크의 플랫폼 포획 전략과 공정경쟁 이슈

Eisenmann et al.(2011)은 시장지배력을 보유한 플랫폼이 자신의 고객과 중첩된 인접 플랫폼에 진출하여 플랫폼 간 시너지를 낼 수 있다면 설령 높은 전환비용과 네트워크 효과로 인해 산업구조가 견고했던 시장이라 하더라도 이러한 시장에 침투하여 장악할 수 있다는 ‘플랫폼 포획’에 관한 이론을 제시하였다. 이러한 이론에 따르면 빅테크는 전환비용이 높고 네트워크 효과가 강한 금융서비스 플랫폼에서도 상당한 파급력을 기대할 수 있다. 사실 빅테크의 금융 진출과 관련한 여러 문헌에서는 빅테크의 금융 진출이 단기적으로 소매금융 시장의 경쟁을 촉진하겠지만 장기적으로는 이들이 금융회사들을 제치고 독점적 지위를 누릴 수 있을 것으로 전망하고 있다.

Eisenmann et al.(2011)은 플랫폼 포획이 가능한 전제조건으로 플랫폼 고객 기반의 중첩과 소비자 또는 공급자 측면에서의 범위의 경제를 제시하였다.20) 즉, 플랫폼 포획 이론은 고객들이 추가된 플랫폼으로 인해 플랫폼 서비스 이용의 편리성이 향상되고 두 플랫폼 서비스를 제공하며 비용을 절감할 수 있다면 플랫폼 사업자가 시장지배적 지위를 지렛대로 삼아 신규로 진출한 플랫폼을 장악할 수 있음을 시사한다. 사실 빅테크는 핵심 플랫폼에서 시장지배적 지위를 가지고 있고 플랫폼 간 시너지를 내고 있어 플랫폼 포획 이론의 전제조건을 충족하고 있다. 이를테면 빅테크는 자신의 평판과 고객과의 관계, 대규모 고객정보 등을 추가 비용 없이 신규 플랫폼 마케팅에 활용할 수 있으며 고도의 IT 시스템을 여러 플랫폼에서 공동으로 이용할 수 있다. 고객들은 하나의 빅테크 플랫폼에서 여러 서비스를 이용하고 있으며 여러 플랫폼에서 생성된 자신의 정보에 기반한 향상된 서비스를 받을 수 있다. 빅테크는 다양한 유형의 고객들을 상호 매칭해 주는 다면(multi-sided) 플랫폼을 운영하고 있어 플랫폼 추가에 따른 네트워크 효과도 매우 클 수 있다.

Eisenmann et al.(2011)은 고객 기반의 중첩과 범위의 경제 등의 전제조건에 ‘번들링’ 전략을 더한다면 인접한 플랫폼을 포획할 가능성이 크다고 주장하고 있다.21) 번들링은 운영시스템(OS)이나 PC 또는 온라인 플랫폼에 새롭게 제공하는 서비스 앱을 선탑재하거나 특정 플랫폼의 구독을 전제로 여타 플랫폼의 서비스를 제공하는 등 다양한 형태로 나타날 수 있다. 번들링 상품에 대해서 가격을 차별적으로 매겨 더 많은 고객을 유인할 수 있다. 특정 플랫폼이나 상품, 서비스를 우대하는 행위도 넓게 보면 번들링의 한 형태로 볼 수 있다. Eisenmann et al.(2011)은 고객 기반이 상당히 중첩된다면 기존 플랫폼의 시장지배적 지위를 지렛대로 신규 플랫폼의 서비스를 효과적으로 번들링할 수 있으며 이를 통해 신규 플랫폼의 고객을 확장하는 데 성공할 가능성이 크다고 지적하고 있다. 그런데 이러한 번들링 전략은 빅테크의 다양한 플랫폼 포획에 중요한 전략으로 그 자체만을 볼 때 효율성에 기반하고 있지만 아래에서 논의하는 바와 같이 동태적으로는 경쟁제한적 함의를 내포할 수 있다.

시카고학파에 따르면, 수직결합에 있는 두 상품의 번들링 전략은 상위시장(upstream market)의 시장지배적 지위와 무관하게 소비자 후생에 부정적이지 않다. 즉 상위시장의 독점기업이 하위시장(downstream market) 상품과의 번들링을 통해 상위시장의 시장지배적 지위를 하위시장으로 확장할 수 없으며 이에 따라 소비자 후생에도 부정적인 영향을 줄 수 없다. 이들의 주장은 상위시장에서 시장지배력을 가진 기업이더라도 자신의 이러한 지위를 지렛대로 경쟁에 우위를 점할 수 없으므로 경쟁제한적 영업행위로 볼 수 없다는 것이다.

그러나 1990년대 이후 여러 문헌은 상위시장의 독점기업들이 하위시장의 자사상품과 번들링하거나 이를 우대하는 전략을 통해 하위시장까지 독점력을 확장하거나 상위시장의 독점력을 더욱 공고하게 유지할 수 있다는 이론들을 제기하기 시작하였다. Whinston(1990)은 규모의 경제가 있는 독점기업이 번들링을 이용하면 타겟인 독점적 경쟁(monopolistic competition)22) 시장에 있는 경쟁기업을 퇴출할 수 있다는 점을 지적하였다. 여기서, 번들링 전략이 독점기업 자신의 수익을 높일 수 있을 때 경쟁기업의 퇴출이나 잠재적 경쟁기업의 진입을 저지할 수 있다. 다만, 이를 위해서는 독점기업은 번들링하는 상품의 디자인 등을 통해 번들링 전략의 확고함(commitment)을 입증할 수 있어야 한다. 사실 Whinston(1990)의 가정은 전통적인 상품시장보다는 간접 네트워크 효과가 커 규모의 경제가 있는 플랫폼 시장에 부합한다. 이러한 점에서, Whinston(1990)이 제시한 이론은 최근 빅테크의 번들링 전략에 대한 경쟁 제한적 해석을 지지하고 있다.

Condorelli & Padilla(2020)는 빅테크의 자사상품 우대 전략이 경쟁기업의 판매 비용을 높여 경쟁력을 저해한다면 종국적으로는 경쟁 제한적 행위로 볼 수 있다고 주장한다. 이는 상위시장의 기업이 시장지배적 지위에 있지 않더라도 하위시장에 있는 경쟁기업의 비용을 높일 수 있을 때 이러한 시장에 진출하여 경쟁기업을 퇴출할 수 있다는 Ordover et al.(1990)의 이론에 바탕을 두고 있다.

빅테크는 시장지배적 지위, 네트워크 효과, 플랫폼 사이에서의 교차 보조, 규모의 경제, 범위의 경제 등의 특성이 있는데, 이러한 점 때문에 번들링이나 자사상품의 우대 전략을 활용하여 신규로 진출한 플랫폼에서 경쟁기업을 퇴출하거나 잠재 기업의 시장진입을 효과적으로 저지할 수 있다. 특히 빅테크들은 여러 플랫폼 시장에 진출하고 있는데, 그 이유는 이에 따른 고객정보와 간접 네트워크 효과를 이용하여 핵심 플랫폼의 독점력을 한층 강화할 수 있기 때문이다. 최근 빅테크들이 자신들의 공고한 시장지배력을 지렛대로 여러 인접한 플랫폼에서도 독점적 지위를 확대해 가고 있는 가운데, 여러 경쟁 당국은 일부 시장에서 이들의 자사상품의 우대 등을 경쟁 제한적 영업행위로 보고 소송 제기 등을 통하여 대응하고 있다.23)

요컨대, 빅테크가 여러 플랫폼 시장을 포획하는 과정에서 일부 전략적 영업행위는 종국적으로 핵심 플랫폼의 시장지배적 지위를 연관 플랫폼으로 확장하여 경쟁기업을 배제하거나 잠재적인 기업의 시장진입을 저지하는 등 산업의 역동성을 저해할 수 있다. 즉 Khan(2017)이 지적하고 있듯이, 빅테크의 일부 전략적 영업행위는 소비자 후생에 미치는 단기적인 영향뿐 아니라 동태적인 관점에서 공정한 경쟁 환경을 제한할 수 있다.

마지막으로, Smith & Geradin(2021)은 금융에 진출한 빅테크와 관련된 번들링과 자사상품 우대 행위의 예시로 다음과 같은 것들을 들고 있다. 빅테크는 자사의 특정한 금융상품을 쉽게 선택하도록 해당 상품에 대해서만 새로운 계정이나 별도의 인증 절차를 요구하지 않을 수 있다. 소비자가 제시된 결합 상품에 동의하지 않을 시 그 절차를 어렵게 할 수 있다. 예를 들면 소비자는 새로운 창을 열어 비동의를 위한 클릭 버튼을 눌러야 하거나 색상이나 디자인 등을 통해 동의를 유도할 수 있다. 빅테크는 특정한 플랫폼 구독자나 활동에 대해 자사 금융서비스의 할인 혜택을 제공할 수 있다. 빅테크는 핵심 플랫폼 등을 이용하여 소비자들의 금융상품 접근을 통제하거나 자사 금융상품의 판매에 우호적으로 프로그램을 운영할 수 있다. 빅테크는 소비자들이 쉽게 볼 수 있는 위치에 자사 금융상품을 배치하거나 그러한 상품의 선택을 유도하는 넛지(nudge)를 이용할 수 있다. 예를 들면 빅테크는 경쟁 금융회사의 금융상품을 검색 창 하단에 배치할 수 있고 자사의 페이 결제를 확인하는 방식으로 스마트폰 옆 버튼의 더블 클릭하는 방식과 같이 인체공학적 단축키를 미리 장착할 수 있다.

나. 빅테크의 데이터 우위와 공정경쟁 이슈

빅테크의 대규모 고객 데이터는 온라인 플랫폼 시장에서 경쟁력을 제고하는 데 매우 중요한 투입 요소일 뿐 아니라, 진입장벽의 원천이 될 수 있다. 이는 온라인 플랫폼이 더 많은 데이터를 통해 서비스의 질을 개선할 수 있고 데이터의 수집이나 활용에서 규모의 경제와 범위의 경제가 있어 비용 효율성 측면에서 상당한 경쟁 우위를 가질 수 있기 때문이다. 이를테면 소셜네트워크, 콘텐츠 공유 플랫폼, 예측 알고리즘 또는 고객별 표적 광고 등의 데이터 관련 플랫폼 서비스를 위해서는 최소한의 데이터가 필요할 뿐 아니라 이를 수집하여 처리하고 분석하는데 상당한 고정비용이 들어간다. 신규 고객이 플랫폼에 가입하여 데이터를 제공하면, 기존 고객들은 동일 플랫폼에서 이전보다 더 많은 정보를 공유할 수 있고 또 이에 기반한 알고리즘으로 향상된 서비스를 받을 수 있다. 더욱이, 특정한 플랫폼에서 수집된 데이터는 여러 다른 플랫폼 서비스에 중요한 투입 요소로 이용될 수 있다. 빅테크의 대규모 고객 데이터의 축적은 소비자들을 그들 서비스에 고착화(lock-in)시키는 결과를 초래할 수 있다. 예를 들어, 소비자가 다른 SNS로 전환하거나 여러 플랫폼을 동시에 이용하는 멀티호밍(multi-homing)을 하고 싶어도 이전에 이용하던 빅테크 플랫폼에 제공하였거나 거기서 생성된 사진, 콘텐츠 또는 프로필 등의 정보를 새로운 플랫폼에 다시 업로드해야 한다면 이를 포기할 수 있다. 이러한 이유로, 빅테크와 같은 대형 온라인 플랫폼들의 데이터 독점은 시장에 새롭게 진입하려는 플랫폼에 상당한 진입장벽으로 작용할 수 있다.

한편, 플랫폼 간 보유 데이터의 격차는 그 자체로 서비스의 질적인 차이를 만들 수 있는데, 이러한 점 때문에 빅테크는 플랫폼 스타트업들로부터 경쟁의 압박을 덜 받을 수 있다. 플랫폼 스타트업의 경우 데이터의 부재로 혁신적인 기술을 개발하는 데 어려움이 있을 수 있고 데이터 분석과 관련한 기술을 새롭게 개발하더라도 빅테크와의 데이터 격차로 인해 제대로 경쟁하지 못할 수 있다. 따라서 플랫폼 간 보유 데이터의 격차가 커질수록 플랫폼 스타트업들은 새로운 기술 개발에 투자할 유인이 낮아질 수 있다. 요컨대, 플랫폼 간 경쟁이 지금까지 축적한 데이터의 양에 의해 크게 결정되면 플랫폼 서비스나 이를 위한 기술 혁신이 저해될 수 있다.

최근 전 세계 많은 국가는 온라인 플랫폼 시장에서 발전하기 시작한 데이터 중심의 경제에 대비하여 데이터의 소유권과 보호에 관한 제도들을 마련하고 있다. 이러한 제도들로는 대표적으로 본 연구의 Ⅲ장에서 논의하고 있는 EU의 GDPR, 오픈뱅킹, 빅테크 규제 등을 들 수 있는데, 이들 모두 소비자의 데이터 주권을 강화하는 데이터 이동권(portability)을 다루고 있다. 데이터 이동권은 소비자들이 특정 플랫폼이 자신의 정보에 접근할 수 있고 공유할 수 있도록 자신이 이용하고 있는 플랫폼에 요청할 수 있는 권한이다. 이러한 데이터 이동권은 두 가지 측면에서 중요한 함의를 가진다. 첫째는, 데이터의 소유와 이용 권한이 이를 수집한 기업뿐 아니라 이를 생성하는데 이바지한 소비자에도 있다는 소비자의 데이터 주권을 인정하고 있다는 점이다. 둘째는, 빅테크와 같은 소수의 대형 플랫폼이나 대형 금융회사의 고객 데이터 독점으로 인한 시장의 불공정한 경쟁 환경에 대한 정책적 대응이라는 점이다.

데이터 이동권은 무수히 많은 플랫폼이 데이터를 중복으로 이용할 수 있는 비경합성(non-rivalry)에 기반을 두고 효율성을 추구하고 있다. 즉 여러 플랫폼이 데이터를 공유하더라도 사회적으로 추가 비용이 거의 들지 않는 한편, 플랫폼 기업들은 고객의 동의로 공유한 정보를 서비스 질 개선에 활용할 수 있다. 또한 소비자들은 데이터 이동권을 통해 이전에 이용하던 플랫폼에 제공하였거나 거기서 생성한 자신의 사진, 콘텐츠 또는 프로필 등의 정보를 새로운 플랫폼이 공유하도록 요구할 수 있으므로 더 다양한 플랫폼을 손쉽게 이용할 수 있다. 즉 이들은 여러 플랫폼을 동시에 이용하는 멀티호밍을 할 수 있으며 자신에게 더 맞는 서비스를 제공하는 플랫폼으로 전환할 수 있다.

또한 데이터 이동권은 플랫폼 간 공정한 경쟁 환경의 조성에 이바지하는 바가 클 수 있다. 소비자들은 신규 스타트업 플랫폼의 서비스가 만족스럽다면 데이터 이동권을 통해 언제든 자신의 데이터를 제공할 것이다. 따라서 스타트업 플랫폼들은 소비자의 니즈에 맞는 서비스 개발에 더 치중할 수 있게 되고 소비자 데이터를 별도로 확보하지 못했더라도 빅테크와 시장에서 경쟁할 수 있을 것이다. 설령 빅테크가 특정한 플랫폼에서 독과점을 형성하고 있더라도 신규 진입의 위협으로 인해 경쟁적인 시장의 결과가 유지될 수 있다.

Ⅲ. 국내외 빅테크 규제 및 오픈뱅킹 논의

지금까지 살펴본 빅테크의 대두 및 빅테크가 발휘하는 시장지배력, 그리고 그러한 시장지배력을 가능하게 만든 온라인 플랫폼 기업으로서의 경제적 특성은 오랜 기간에 걸쳐 형성되고 시행되어 온 독점방지 또는 공정경쟁 규제의 실효성에 대한 의문을 제기하게 만들었고, 그에 따라 효과적인 빅테크 규제에 대한 논의가 2010년대 후반부터 일어나기 시작했다. 그리고 이러한 논의의 결과로 EU, 미국, 영국 등의 주요국에서는 빅테크의 과도한 시장지배력 확장을 방지하고 공정경쟁을 확보하기 위한 새로운 규제를 마련하고 있다. 본 장에서는 주요국의 최근 규제 동향을 정리하고, 시장경합성을 확보함으로써 경쟁환경을 조성하기 위한 핵심적 요소의 하나인 데이터 문제에 대한 정책 동향을 오픈뱅킹을 통하여 알아본다.

1. 주요국의 빅테크 규제 동향

본 절에서는 EU, 미국, 영국, 일본 등 주요국과 더불어 한국의 빅테크 또는 온라인 플랫폼에 대한 공정경쟁 및 공정거래 규제 동향을 정리한다. 먼저 빅테크 규제의 필요성에 대하여 각국에서 진행되었던 주요한 논의들을 정리한 다음, 빅테크를 대상으로 P2P 또는 시장경합성 측면에 중점을 두고 있는 대표적인 규제로 EU와 미국의 입법안의 주요 내용을 정리한다. 이어서 빅테크 뿐 아니라 대부분의 온라인 플랫폼 사업자를 대상으로 P2B, 즉 플랫폼 사업자와 이용업체 간의 공정거래 측면에 중점을 두고 있는 일본과 한국 입법안의 주요 내용을 정리한다. 마지막 소절에서는 빅테크의 금융 진출과 관련하여 경쟁 당국과 금융 당국 간 협력의 필요성이 높아지고 있는 가운데, 그러한 협력 체계를 마련한 영국의 사례를 소개한다.

가. 빅테크 규제 필요성에 대한 논의

기존의 반독점 또는 공정경쟁 규제는 빅테크의 시장지배력 확대를 억제하는 데 있어서 효과적이지 못하다는 지적으로 가장 널리 알려진 논의는 Khan(2017)에서 제기되었다.24) Khan(2017)은 대표적 빅테크 기업인 Amazon의 성장 사례를 분석한 논문에서 약탈적 가격설정(predatory pricing)과 수직적 통합(vertical integration)이 Amazon 성장의 핵심 전략이며, 기존의 소비자 후생과 가격 중심의 사후적 규제로는 이러한 전략을 통한 빅테크의 성장을 효과적으로 규율할 수 없다고 지적하였다. 그 이유는 다면(multi-sided) 시장 비즈니스를 영위하는 플랫폼 기업의 특성상 시장 획정 및 기업의 행위가 반경쟁적인지 여부를 판단하는 것이 전통적 기업에 비하여 어려울 뿐 아니라, 반경쟁적 행위로 확정되어 처벌에 이르기까지 상당한 시간이 소요되고 그동안 해당 플랫폼 기업이 시장지배력을 확보한 후에는 원상회복이 거의 불가능하다는 것이다. 이러한 한계에 대응하기 위하여 Khan(2017)은 빅테크에 대해서는 규제 대상을 사전적으로 지정하고, 지정된 규제 대상의 금지행위 및 의무를 사전적으로 규정하는 사전적(ex-ante), 기관별(entity-based) 규제가 필요함을 주장한다.

미국 하원의 보고서(US House of Representatives, 2020)는 온라인 검색, 온라인 쇼핑, 소셜네크워크, 모바일 앱마켓, 모바일 운영체제(OS), 디지털 지도, 클라우드, 음성 지원, 웹 브라우저, 디지털 광고 시장에서 4개 빅테크, 즉 GAFA의 시장지배력을 조사하였다. 동 보고서는 1998년 이후 GAFA를 중심으로 한 빅테크들이 500개 이상의 기업을 인수했지만 단 한 건도 금지된 사례가 없고, 결과적으로 GAFA의 과도한 시장지배로 혁신이 위축되었고 데이터 오용 등 사회적 비용이 발생하고 있다고 지적하고 있다. 또한 빅테크들이 로비 등을 통하여 정책 결정 과정에서 영향력을 확대해 왔으며, 플랫폼 사업자와 언론기관 간 협상력에 불균형이 생기면서 뉴스의 신뢰도 역시 하락하였다고 주장한다. 동 보고서는 디지털 시장에서 경쟁을 복원하고 반독점 규제를 강화하기 위한 의회의 대응이 필요함을 강조한다.

EC의 Crémer 보고서(Crémer et al., 2019)는 극단적인 규모의 경제, 네트워크 외부성, 데이터의 역할이라는 3가지의 특징이 존재하는 디지털 시장에서 시장이 독점화되면 경쟁을 통한 혁신이 저해되고, 묶음판매(bundling)를 비롯한 다양한 형대의 지배력 전이(leverage) 전략을 취할 우려가 존재함을 지적하고, 디지털 시장의 공정한 경쟁환경을 만들기 위한 해결책으로 데이터 이동성(portability)과 상호운용성(interoperability)의 중요성을 강조하고 있다. 본 보고서는 후술하는 EU의 디지털시장법(Digital Markets Act: DMA)의 기초가 된 것으로 알려져 있다.

영국 정부 역시 디지털 시장에서 독점을 방지하고 경쟁을 촉진하기 위해서는 새로운 규제의 틀이 필요함을 인식하고, 이 문제를 연구하기 위한 전문가 그룹(Digital Competition Expert Panel)을 조직하여 2019년에 보고서(Furman Report)를 발간한 데 이어, 2021년에는 ‘디지털 시장을 위한 새로운 경쟁 촉진 체제(A new pro-competition regime for digital markets)’를 발표하고 이해 관계자들로부터 의견을 수렴하고 있다. 이 일련의 보고서들을 통하여 영국 정부는 경쟁 당국인 ‘Competition and Markets Authority(CMA)’ 내에 ‘Digital Markets Unit(DMU)’을 신설하였다.

이 외에 빅테크의 금융 진출과 관련하여 국제결제은행(BIS) 등에서 발간된 보고서(예를 들면 Carstens et al., 2021)에서도 금융규제의 근간이 되는 ‘동일기능-동일규제’라는 행위기반(activity-based) 규제는 경쟁 이슈에 대해서는 한계가 있으며 기관별 규제의 도입을 검토할 필요가 있음을 말하고 있다.

나. 빅테크를 대상으로 한 사전 규제: EU와 미국

EU와 미국은 규제 대상이 되는 플랫폼 사업자를 사전적으로 명확하게 지정하고, 그 사업자의 의무 및 금지행위를 규정한 다음 위반시 시장획정, 피해조사 등의 단계를 생략하고 곧바로 제재하는 사전적, 기관별 규제 법안을 마련하였다. 먼저 EU의 디지털시장법, 다음으로 미국의 패키지법을 소개한다.

1) EU 디지털시장법

가) 개요

2020년 12월, EU 집행위원회(Council)는 ‘EU 역내 디지털 부문에서 경합적(contestable)이고 공정한(fair) 시장을 보장하기 위한 조화된 규칙을 제정’한다는 취지 하에 「디지털시장법(Digital Markets Act: DMA)」의 초안을 발표하였다.25) 그리고 2022년 3월, EU 집행위원회 및 의회(Parliament)는 DMA에 대하여 잠정 합의(provisional political agreement)에 도달하였으며, 2022년 7월 유럽의회는 DMA를 최종 승인하였고, 2023년 4월경부터 발효‧시행될 예정이다.26)

나) 법 적용 대상 사업자: Gatekeeper

DMA의 적용 대상이 되는 ‘gatekeeper’는 핵심 플랫폼 서비스(core platform services)를 제공하는 사업자 중에서 지정된다. 핵심 플랫폼 서비스에는 온라인쇼핑과 앱스토어 등을 포함한 온라인 중개(intermediation), 온라인 검색엔진, 온라인 사회관계망, 동영상 공유(video-sharing), 운영체제(OS), 클라우드, 웹브라우저 등이 포함된다.

핵심 플랫폼 서비스를 제공하는 사업자 중에서 플랫폼 내부(internal) 시장에 유의미한 영향력을 행사하고, 이용업체가 최종사용자에게 도달하기 위한 중요한 게이트웨이의 역할을 하는 핵심 플랫폼 서비스를 운영하며, 자신의 사업에서 확고하고(entrenched) 지속적인(durable) 지위를 향유하거나 가까운 미래에 그러한 지위를 가질 것으로 예상되는 사업자를 gatekeeper로 지정한다.

또한 최근 3년간 EU 역내 연간 매출액이 75억유로 이상 또는 직전년도 평균 시가총액 750억유로 이상이면서 최소 3개 이상의 회원국에서 핵심 플랫폼 서비스를 제공하며, 직전년도 역내 월간 활성 사용자(Monthly Active Users: MAU) 4,500만 이상, 역내 월간 활성 이용업체(yearly active business users) 1만 이상으로 지난 3개 회계연도 각각에서 이 기준을 충족한 사업자를 gatekeeper로 추정(presume)한다.

다) Gatekeeper의 금지행위 및 의무

DMA는 플랫폼 사업자(즉 gatekeeper)와 이용업체 간에 발생할 수 있는 불공정행위를 중심으로 하는 P2B 유형과 플랫폼 간 경쟁에서 시장경합성을 저해할 수 있는 P2P 유형의 이슈를 모두 다루고 있다.

P2B 이슈와 관련된 gatekeeper의 금지행위 및 의무로는 이용업체가 제3자 온라인 중개 서비스를 통하여 상품‧서비스를 최종소비자에게 판매‧제공하는 것을 막는 행위, 이용업체가 자신의 핵심 플랫폼 서비스를 통하여 획득한 최종사용자에게 제안을 홍보하고 그 최종사용자가 해당 gatekeeper의 핵심 플랫폼 서비스를 이용하는지 여부에 관계 없이 계약을 맺는 것을 막는 행위, 최종사용자가 해당 gatekeeper의 핵심 플랫폼 서비스를 통하지 않고 이용업체로부터 획득한 콘텐츠, 구독 등을 이용업체의 앱을 이용하여 해당 gatekeeper의 핵심 플랫폼 서비스를 통하여 접근하고 사용하는 것을 막는 행위 등이 포함된다. 또한 이용업체의 상품‧서비스에 비하여 gatekeeper 자신의 상품‧서비스에게 유리한 순위를 부여하는 자사상품 우대 행위, 이용업체와 그 최종사용자 고객 사이에서 생성된 비공개 데이터를 이용업체와의 경쟁에 사용하는 행위 역시 금지된다. Gatekeeper는 광고 서비스를 제공하는 광고주(advertiser)와 게시자(publisher)의 요청에 따라 그들이 지불한 가격에 대한 정보를 제공해야 하고, 이용업체에게 데이터에 대한 고품질, 효과적, 연속적, 실시간 접근을 허용해야 하며, gatekeeper 자신의 앱스토어에 대하여 이용업체에게 공정하고 비차별적인 접속 조건을 적용해야 한다.

P2P 이슈, 즉 경쟁 플랫폼의 진입 장벽을 낮추고 시장의 경합성을 유지하기 위하여 gatekeeper의 운영체제를 이용하거나 호환되는 제3자의 앱 또는 앱스토어를 설치하고 사용하는 것과 이 앱‧앱스토어에 gatekeeper의 핵심 플랫폼 서비스가 아닌 다른 수단으로 접근하는 것을 허용할 의무, 생성된 데이터의 효과적인 이동성(portability) 및 상호운용성(interoperability) 제공 및 최종사용자의 데이터 이동을 용이하게 해주는 도구를 제공할 의무를 부과하고 있다.

또한 gatekeeper가 자신의 핵심 플랫폼 서비스에서 생성된 개인 데이터를 자신의 다른 서비스 또는 제3자의 서비스에서 생성된 개인 데이터와 결합하는 행위, 최종사용자가 핵심 플랫폼 서비스 상의 선탑(pre-installed) 앱을 삭제(un-install)하는 것을 막는 행위가 금지된다. 개인 데이터의 경우, 이용업체가 해당 gatekeeper의 핵심 플랫폼 서비스를 통하여 제공한 상품‧서비스에 대하여 최종사용자가 데이터 공유를 선택(opt-in)한 경우에만 접근 및 사용이 허용된다.

라) 제재

Gatekeeper의 금지행위 및 의무 위반에 대하여 EU Commission은 직전 회계연도 총 매출액의 10%를 초과하지 않는 범위에서, 적절한 정보 제공 불이행이나 잘못된 정보 제공에 대해서는 직전 회계연도 총 매출액의 1%를 초과하지 않는 범위에서 과징금을 부과할 수 있다. 이 외에 체계적(systematic)인 불이행이나 위반에 대해서 효과적인 행위제재(behavioral remedy) 수단이 없는 경우에는 사업의 분할(divestiture), 법적‧기능적‧구조적 분리 등을 포함하는 구조적 조치(structural remedy)를 부과할 수 있다.

2) 미국 패키지법

가) 개요

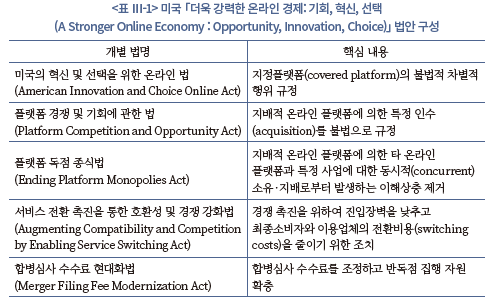

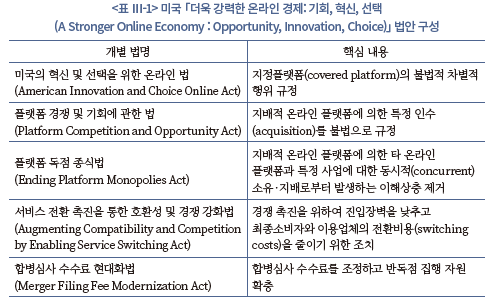

앞에서 서술한 바와 같은 빅테크의 시장지배력 및 공정경쟁에 대한 문제의식을 기반으로 미국 하원은 2021년 6월 11일「더욱 강력한 온라인 경제: 기회, 혁신, 선택(A Stronger Online Economy: Opportunity, Innovation, Choice)」으로 불리는 5개의 개별 법으로 구성된 초당적 패키지 법안을 발의하였고, 이 법안은 동년 6월 25일 하원 법제사법위원회를 통과하였다.27) <표 Ⅲ-1>은 본 패키지 법안의 구성을 정리하여 보여준다.

나) 법 적용 대상: 지정플랫폼(covered platform)

본 법안의 적용 대상은 ‘지정플랫폼(covered platform)’이며, 다음과 같은 조건에 해당되는 플랫폼으로서 연방거래위원회(Federal Trade Commission: FTC)와 법무부(Department of Justice: DOJ)가 지정한다.

① 지정일 현재, 또는 지정일 이전 1년 동안 미국 내 월간 활성 사용자 5,000만명 이상, 미국 내 월간 활성 이용업체 10만명 이상인 온라인 플랫폼

② 지정일 현재, 또는 지정일 이전 2년 동안 실질 연간 순매출(net annual sales) 또는 시가총액 6,000억달러 이상인 자에 의하여 소유 또는 지배되는 온라인 플랫폼

③ 온라인 플랫폼에서 상품이나 서비스를 판매‧제공하기 위한 핵심 거래 파트너(critical trading partner)

여기서 ‘핵심 거래 파트너’는 ‘이용업체가 자신의 고객에게 효과적으로 서비스하기 위하여 필요한 도구에 대한 접근을 제한하거나 방해할 수 있는 능력을 지닌 거래 파트너’로 정의되며, 간단하게는 플랫폼을 소유‧지배하면서 이용업체의 플랫폼 참여와 활동을 통제할 수 있는 사업자(기업)를 의미한다.

지정플랫폼으로 일단 지정되면 소유지배구조의 변화에 관계 없이 10년간 지위가 유지된다.

다) 지정플랫폼 사업자의 금지행위 및 의무

EU의 DMA와 마찬가지로 미국의 패키지법 역시 P2B와 P2P 두 유형의 이슈를 모두 다루고 있으며, 그 중에서「미국의 혁신 및 선택을 위한 온라인 법」은 P2B 이슈, 즉 주로 지정플랫폼과 플랫폼 이용업체 간에 발생하는 자사 우대(self-preferencing)와 같은 차별적 행위(discriminatory conduct)를 규율한다. 지정플랫폼을 소유‧지배‧운영하는 사업자는 플랫폼 이용업체에 대한 차별적 행위가 금지된다. 차별적 행위에는 플랫폼 사업자 자신의 상품‧서비스(자사상품)을 이용업체의 상품‧서비스보다 우대하는 행위, 유사한 지위에 놓인 이용업체 간 차별적 대우, 플랫폼 운영체제‧하드웨어‧소프트웨어에 대한 이용업체의 접근이나 상호운용(interoperate)을 제한하거나 방해하는 행위, 자사상품의 구매나 사용을 플랫폼 접근 또는 우대의 조건으로 이용업체에게 부과하는 행위, 이용업체와 고객 간에서 생산된 데이터를 플랫폼 사업자 자사상품의 제공에 사용하는 행위, 이용업체의 가격결정에 개입하거나 제한하는 행위, 법 집행기관에 문제를 제기한 이용업체에 대한 보복행위 등이 포함된다.

나머지 4개의 법은 P2P 이슈에 초점을 맞춘 법으로서「플랫폼 경쟁 및 기회에 관한 법」은 디지털 시장에서 경쟁과 기회의 증진을 위하여 지정플랫폼 사업자가 자신의 사업 또는 그 사업에 영향을 미치는 활동에 종사하는 타 사업자를 인수하는 것을 금지한다. 그리고 추진하고 있는 인수의 대상이 해당 지정플랫폼 사업자와 직접적 경쟁 관계에 있지 않거나, 인수가 해당 지정플랫폼 사업자의 시장에서의 지위를 강화하지 않는다는 명확한 증거를 해당 지정플랫폼 사업자가 제시한 경우에는 인수가 허용된다. 즉 입증책임은 인수를 추진하는 지정플랫폼 사업자가 지게 된다.

「플랫폼 독점 종식법」은 이해상충이 발생할 수 있는 가능성이 있는 가능성을 사전에 막기 위한 강력한 구조적 접근을 취하고 있다(양용현‧이화령, 2021). 즉 지정플랫폼에 사업자가 해당 지정플랫폼 이외의 사업을 소유‧지배함으로써 해당 지정플랫폼이 우월적 지위를 갖게 되거나, 경쟁 사업자 또는 잠재적 경쟁 사업자의 사업이 불리한 지위를 갖게 되거나 시장에서 배제될 때 이해상충이 발생하는 것으로 보며, 이 경우 그 사업을 소유‧지배하는 것은 금지된다.

「서비스 전환 촉진을 통한 호환성 및 경쟁 강화법」은 지정플랫폼 사업자에게 집입장벽을 낮추고 최종사용자와 이용업체의 플랫폼 전환비용(switching costs)을 줄이기 위하여 데이터 이동성(portability)과 상호운용성(interoperability)을 보장할 의무를 부과한다. 예를 들어 지정플랫폼은 경쟁 플랫폼과의 상호연동을 원활하게 유지할 수 있도록 투명하고 제3자가 접근할 수 있는 API(Application Programming Interface)를 포함한 인터페이스를 유지해야 한다.

라) 제재

지정플랫폼 사업자에 의한 금지 또는 불법행위가 적발되는 경우, 직전년도 미국 내 매출액의 15% 또는 금지행위로 인해 영향은 받은 미국 내 사업에서 발생한 매출액의 30% 중 큰 금액을 기준으로 그 이하의 민사제재금(civil penalty)이 부과된다. 또한 금지행위를 반복적으로 위반하는 지정플랫폼 사업자에 대해서 법원은 해당 사업자의 CEO가 직전 1년간 수령한 모든 보수를 몰수하도록 재무부에 요청할 수 있다.

3) EU DMA와 미국 패키지법의 비교

우선 법의 적용 대상, 즉 규제 대상에서 EU의 DMA와 미국 패키지법 사이에는 어느 정도 차이가 존재한다. 미국 패키지법의 규모 기준 중 시가총액 6,000억달러 이상인 플랫폼 기업은 2022년 8월 31일 현재 Google(Alphabet), Apple, Amazon의 3개사에 불과하다.28) 반면 EU DMA 규모 기준을 충족하는 플랫폼 기업은 보다 많으며, GAFA 외에 Booking.com, SAP, Alibaba 등의 기업들이 포함된다.29) 또한 미국의 지정플랫폼과 비교할 때 DMA에서는 현재 뿐 아니라 미래의 잠재적 시장지배력까지 gatekeeper의 지정 요건에 포함되어 있다. 특정 소수의 기업을 대상으로 하는 미국 패키지법에 비하여 보다 일반적인 의미의 빅테크를 대상으로 하는 EU DMA가 디지털 플랫폼 시장에서의 독점 방지에 대하여 보다 엄격한 접근을 취하고 있는 것으로 평가할 수 있다.

두 개의 법은 많은 부분에 있어서 유사한 내용의 금지행위 및 의무를 규정하고 있지만, 기업결합이나 인수합병의 영역에서는 미국 패키지법의 규제 강도가 더 높다. 미국 패키지법은 이 영역에서는 매우 강력한 사전규제를 마련하고 있는 반면, 기업결합의 사전적 금지와 같은 내용은 EU DMA에는 없다. 이는 법 적용 대상 기업이 3~4개로 극히 제한적인 만큼 이들에 대해서는 더 이상의 확장을 거의 불가능하게 만드는 수준의 강력한 사전규제를 적용하는 것으로 보인다. 반면 EU DMA에서는 기업결합을 사전적으로 금지하지는 않고 있지만, 체계적이고 반복적으로 법을 위반하는 기업에 대해서는 분할 등의 구조적(structural) 조치를 명할 수 있다는 사후적 제재 규정을 두고 있다.

두 법 모두 P2P 관련 규제에서 데이터 이동성 및 상호운용성의 보장 의무를 규정하고 있다. 시장경합성을 높이기 위해서는 최종사용자와 이용업체의 플랫폼 전환비용(switching costs)을 낮추는 것이 필요하며, 플랫폼 전환비용을 낮추는 데 있어서 데이터 이동성과 상호운용성은 필수적 요소라는 인식에 기반한 것으로 보인다.

다. 다수 플랫폼 사업자를 대상으로 한 P2B 규제: 일본, 한국

본 소절에서는 일본과 한국에서 최근 도입되었거나 도입이 추진되었던 온라인 플랫폼 규제의 주요 내용을 소개한다. 앞에서 소개한 EU DMA와 미국 패키지법과는 달리 일본과 한국의 규제는 P2P 규제, 즉 시장경합성을 높이기 위한 것은 아니고, P2B 규제, 즉 플랫폼 사업자와 플랫폼 이용업체 간의 공정거래를 확보하는 것에 초점을 맞추고 있다. 다만 한국에서는 2022년 들어 온라인 플랫폼 시장의 P2P 측면에 대한 기존 공정거래법 규제의 실효성을 높이기 위한 보완책으로 심사지침을 마련 중에 있다.

1) 일본 新디지털법

가) 개요

경제 및 일상 생활에서 디지털(온라인) 플랫폼의 영향력이 확대됨에 따라 플랫폼 사업자에 의한 일방적인 약관 변경이나 거래 거부 등 불공정 사례의 발생 빈도가 증가하고, 이용업체의 요청에 대한 플랫폼 사업자의 대응 절차나 체계가 불충분하다는 우려가 제기되었다. 이에 일본 국회는 2020년 5월 플랫폼 사업자와 이용업체 간의 거래 환경 정비를 목적으로 한「특정 디지털 플랫폼의 투명성 및 공정성 향상에 관한 법률(이하 新디지털법)」을 가결, 통과시켰다(법제처, 2021). 입법 목적에서 볼 수 있듯이 본 법은 플랫폼 사업자와 이용업체 간(P2B)에서의 공정거래 확보가 핵심이라고 할 수 있다.

나) 법 적용 대상

법의 적용 대상이 되는 ‘특정 디지털 플랫폼 사업자’는 대상 사업 분야에서 국민 생활 및 국민 경제에 미치는 영향의 크기, 해당 분야의 디지털 플랫폼 이용 집중도, 이용업체의 보호 필요성, 해당 분야에서 일정 규모(매출액, 이용자수) 도달 여부 등을 평가하여 지정된다. 구체적인 규모 요건은 일본 내 연매출 3,000억엔 이상인 생활용품, 식료품 등을 판매하는 온라인 사업자 또는 일본 내 연매출 2,000억엔 이상인 앱스토어 운영자로 규정되어 있다.

다) 주요 내용

동 법은 특정 디지털 플랫폼 사업자가 이용업체에게 플랫폼 제공 조건을 공개할 의무를 부과하고, 구체적인 공개 항목을 규정하고 있다. 여기에는 플랫폼 제공을 거부하는 경우 판단 기준, 플랫폼 제공과 더불어 다른 유상 서비스의 이용 등을 요청하는 경우 그 내용 및 이유, 검색 표시 순위 결정에 이용되는 주요 사항, 플랫폼 사업자가 취득‧사용하는 상품 등 제공 데이터의 내용 및 취득‧사용 조건, 이용업체에 의한 상품 등 제공 데이터의 취득 및 제3자에 대한 제공 가부(可否)와 그 내용‧방법‧조건, 이용업체가 고충 상담이나 협의 신청을 하기 위한 방법 등이 포함된다. 또한 플랫폼 사업자가 이용업체에게 제공 조건을 따르지 않는 거래 요청을 하는 경우, 제공 조건의 변경 등의 경우에는 사전에 그 내용이나 이유 등을 공개해야 한다. 또한 동 법은 플랫폼 사업자와 이용업체 간 상호 이해의 촉진을 도모하고 거래의 공정성을 확보하기 위하여 필요한 체제와 절차를 정비하고, 고충‧분쟁 처리 체제 등도 정비해야 함을 규정하고 있다.

2) 한국 온라인플랫폼 공정화법 및 심사지침

가) 온라인플랫폼 공정화법 개요

2020년 9월 공정거래위원회는「온라인플랫폼 중개거래의 공정화에 관한 법률(이하 온라인플랫폼 공정화법)」의 제정안을 입법예고하였다.30) 공정거래위원회는 본 법을 제정하는 배경으로 ‘온라인플랫폼의 우월적 지위가 강화되고 입점업체(이용업체)에 대한 불공정행위 등 피해발생 우려가 현실화되고 있지만 기존 정책 수단으로는 효과적 대응에 한계가 있다’는 점, 따라서 ‘온라인플랫폼-입점업체 간 거래관계의 투명성과 공정성을 제고하여 플랫폼 생태계의 공정하고 지속가능한 발전이 가능하도록 제도적 기반을 마련할 필요’가 있다는 점을 들고 있다. 즉, 본 법은 플랫폼 사업자와 이용업체 간(P2B)에서 발생할 수 있는 불공정행위의 규율을 목적으로 하고 있으며31), 일본의 新디지털법과 그 맥을 같이 한다고 볼 수 있다.

나) 법 적용 대상

다음의 세 가지 요건을 모두 충족하는 플랫폼 사업자는 온라인플랫폼 공정화법의 적용 대상이 된다. 첫째로 계약관계에 있는 입점업체와 최종소비자 간 상품‧용역 거래의 개시를 알선하는 서비스를 제공하는 사업자로 미국 패키지 법안에서의 지정플랫폼 사업자, 또는 EU DMA에서의 gatekeeper와 상통하는 개념으로 볼 수 있다. 둘째로 플랫폼 사업자 중 매출액(100억원 이내의 범위에서 대통령령으로 정함) 또는 중개거래 금액(1,000억원 이내의 범위에서 대통령령으로 정함)이 일정 규모 이상인 사업자이다. 이는 일본 新디지털법의 규모 기준보다 현저하게 작으며 따라서 대부분의 플랫폼 사업자가 적용 대상이 된다. 이는 P2B 문제는 비단 대형 플랫폼에만 국한된 문제가 아니고 플랫폼 규모와 상관없이 나타날 수 있는 문제라는 인식이 반영된 것으로 보인다. 그리고 국내 입점업체와 국내 최종소비자 간 거래를 중개하는 경우에는 플랫폼 사업자의 소재지 및 설립 시 준거 법률에 관계 없이 본 법을 적용한다.

다) 주요 내용

거래상 우월적 지위 여부의 판단에 있어서 기준이 되는 사항으로는 온라인 플랫폼 산업의 구조, 소비자‧입점업체의 플랫폼 이용 양태 및 집중도, 플랫폼 사업자와 입점업체 간 사업능력 격차, 온라인 플랫폼 이용업체의 온라인 플랫폼 중개서비스에 대한 거래의존도, 중개의 대상이 되는 재화 등의 특성 등이 포함된다.

플랫폼 사업자와 입점업체 간 거래관계의 투명성과 공정성을 제고하기 위하여 플랫폼 사업자에게 계약서 작성 및 교부 의무가 부과된다. 그리고 플랫폼 사업자가 계약 내용을 변경하거나 서비스를 제한‧중지‧해지하는 경우 사전통지가 의무화된다. 또한 기존 공정거래법상 거래상 지위 남용행위를 플랫폼 산업의 특성에 맞도록 구입 강제, 경제상 이익 제공 강요, 부당한 손해 전가, 불이익 제공, 경영 간섭 등을 포함하여 구체적으로 규정하였다. 표준계약서 제정, 상생협약 체결 권장 및 지원, 분쟁조정협의회 설치 등의 근거 역시 본 법에서 마련되었다.

라) 독과점 심사지침 제정 및 기업결합 심사기준 개정

2022년 1월 공정거래위원회는「온라인 플랫폼 사업자의 시장지배적 지위 남용행위 및 불공정거래행위에 대한 심사지침(이하 심사지침)」 제정안을 마련하여 행정예고하였다.32) 본 심사지침은 현행 공정거래법을 보완하여 플랫폼 분야의 독점력 남용행위를 효과적으로 규율하기 위하여 마련되고 있는 것으로, 온라인플랫폼 공정화법과는 달리 온라인 플랫폼 시장의 경합성 유지, 즉 P2P 측면에 주로 초점을 맞추고 있다.

본 심사지침은 온라인 플랫폼 사업자의 위반행위, 즉 시장지배적 지위의 남용 여부에 대한 판단을 위하여 시장획정, 시장지배력, 경쟁제한성 측면에서 온라인 플랫폼 분야의 경제적 측성을 고려한 판단 기준을 제시하는 것을 핵심 내용으로 하고 있다. 또한 멀티호밍 제한과 최혜대우 요구를 온라인 플랫폼 시장의 독점력을 유지 강화하는 법 위반행위로, 자사우대와 끼워팔기를 온라인 플랫폼 시장의 독점력을 지렛대(leverage)로 연관시장까지 독점화하는 법 위반행위로 규정하고 있다.33)

또한 공정거래위원회는 플랫폼 시장의 특성을 고려하여 플랫폼 기업의 M&A가 복함적 지배력을 강화하는 양상을 면밀히 평가할 수 있도록 현행「기업결합 심사기준」을 개정할 방침임을 밝혔다.34)

2. 오픈뱅킹과 빅테크의 경쟁 이슈

가. EU의 오픈뱅킹 배경과 주요 내용

EU는 2018년 지급결제서비스지침을 개정(Payment Service Directive 2: PSD2)하여 오픈뱅킹을 제시하였는데, 그 배경에는 핀테크의 시장진입을 원활히 하여 금융혁신과 경쟁을 촉진하려는 정책적 고려가 컸음을 알 수 있다. 2010년대 전후로 등장하기 시작한 핀테크 스타트업들은 빅데이터 분석기술, AI, 머신러닝에 기반한 맞춤형 자산관리, 금융상품 비교 등으로 금융소비자의 거래비용 절감과 금융 활동의 편리성을 추구하였다. 그런데 핀테크 사업자가 금융서비스를 제공하기 위해서는 고객의 지급지시 전송이나 계좌정보뿐 아니라 지급 계좌에 있는 자금 정보를 필수적으로 수집할 수 있어야 한다. 즉 핀테크의 지급 서비스의 실행 가능성은 고객 계좌를 보유한 은행 플랫폼에 접근할 수 있는지에 달려 있었다. 그러나 금융회사는 금융거래 정보를 공유하면 이들로부터 경쟁 압박이 커지고 수익이 감소할 수 있기 때문에 이들의 정보 접근 요청에 대해 협력할 유인이 적었다. 더군다나 2007년 도입된 지급결제서비스지침(Payment Service Directive: PSD) 하에서 은행은 지적 재산 및 보안 문제뿐만 아니라 평판 위험 및 책임상의 이유로 민감한 정보의 공유를 거부할 수 있었다. EU의 정책당국자들은 명확한 법적인 틀 없이는 은행의 계좌 서비스에 기반한 핀테크의 존재 자체가 심각하게 위험에 처할 수 있다고 보고 고객의 금융거래 정보에 대한 핀테크의 접근성을 시장에 맡기기보다 제도적으로 이를 보장하는 방안을 마련한 것이다.

PSD2는 지급지시서비스 제공업자(Payment Initiation Service Provider: PISP)와 계좌정보서비스 제공업자(Account Information Service Provider: AISP)로 구분하여 제3자 지급결제서비스 제공업자(Third Party Payment Service Provider: TPP)를 정의하고 있다. PISP는 금융소비자의 지급지시 요청 시에 은행 계좌로부터 온라인 판매자 등의 수취인 계좌로 대금 지급을 지시할 수 있으며, AISP는 금융소비자가 거래하는 다수의 은행 계좌정보, 거래 내역, 잔액 정보 등의 금융정보를 모아서 제공할 수 있다. 금융회사, 핀테크 등이 해당 업무를 수행하기 위해서는 관할 당국에 등록해야 한다. PSD2는 고객의 동의를 받은 TPP들이 은행 계좌 명세와 실시간 거래 등에 차별 없이 접근할 수 있도록 제도적으로 보장하는 계정접근규칙(Access-to-Account: XS2A)을 담고 있다. 이러한 PSD2의 정보공유 정책이 실효성을 가지기 위해서는 시장참가자 간의 원활한 데이터 접근과 교환을 지원하는 개방형 인터페이스(Open AppIication Programming Interface: Open API)의 표준화가 필수적이다. 이에 유럽연합은 XS2A 실행에 필요한 상호운용성과 높은 수준의 계정 데이터의 전송 보안을 보장하기 위하여 지급 서비스 제공자가 준수해야 하는 규제기술표준(Regulatory Technical Standards: RTS)에 관한 5가지 지침과 6가지 초안을 발표하였다.

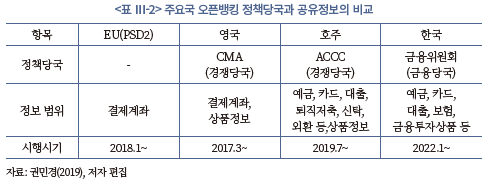

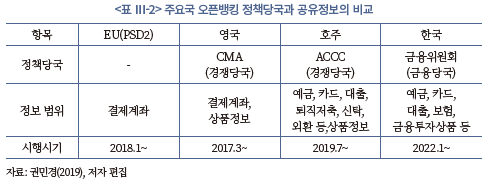

나. 주요국의 오픈뱅킹과 우리나라 마이데이터와의 비교

영국의 경쟁 당국인 CMA는 2016년 8월 은행산업 경쟁에 관한 조사보고서35)를 통해 경쟁을 촉진하는 방안 중의 하나로 오픈뱅킹을 제안하였고 이후 이를 주도적으로 설계하는 역할을 담당하고 있다. 또한 CMA는 오픈뱅킹 워킹그룹(Open Banking Working Group: OBWG)과 함께 PSD2보다 진일보한 Open API의 표준화를 이루어냈다. 더욱이 9개 주요 은행들이 이러한 표준화된 API를 의무적으로 채택하도록 하여 정보공유의 상호운용성을 효과적으로 구현하였다. 영국의 오픈뱅킹은 PSD2에서 요구하고 있는 결제계좌 정보 뿐 아니라 금융상품에 관한 정보도 Open API를 통해 핀테크와 공유할 것을 금융회사에 요구하고 있다. 요컨대, 영국의 오픈뱅킹은 2019년 9월에 본격 시행되었던 유럽의 PSD236)보다 도입 시기나 내용에서 모두 한발 앞서 진행되고 있다는 평가를 받고 있다.

호주 정부는 2018년 5월 소비자데이터권리(Consumer Data Right: CDR)를 시행하였다. CDR은 데이터 보유자에게 제3자(Accredited Data Recipient: ADR)가 자신의 정보를 공유할 수 있도록 요구할 수 있는 권한을 소비자에게 부여하고 있다. 현재 은행 부문에 한정하고 있는 CDR을 전 부문으로 확장하려는 목표를 가지고 있다. 영국, EU와 같이, 호주의 오픈뱅킹인 CDR 체제는 경쟁당국(Australian Competition & Consumer Commission: ACCC)이 마련할 수 있는 권한을 가지고 있으며, 핀테크의 진입장벽을 낮추어 금융산업의 경쟁을 촉진하려는 목적을 두고 있다. CDR은 결제계좌 정보 외에도 예금, 카드, 대출, 퇴직저축, 신탁, 외환 등에 관한 고객정보와 상품정보를 공유하고 있다(<표 Ⅲ-2>). 즉 호주에서는 결제계좌와 관련한 고객정보만을 다루고 있는 EU나 영국의 오픈뱅킹보다 넓은 범위의 정보를 공유하고 있다.

우리나라 오픈뱅킹은 결제인프라 개방, 서비스업 시설(마이데이터 사업과 마이페이먼트 사업37)), 관련법(데이터3법과 전자금융거래법) 정비 등 크게 3가지 방향으로 추진되고 있다. 정부는 2019년 12월 핀테크에 전체 금융기관이 공통으로 사용하는 Open API 기반의 결제망인 ‘오픈뱅킹 공동업무시스템’을 전면 개방하였다. 이에 금융회사와 핀테크는 고객의 동의 시 입‧출금 이체, 잔액, 거래내역, 계좌실명, 송금인 정보, 수취 조회 등의 정보에 접근할 수 있게 되었다. 우리나라는 2022년 1월 공유되는 정보와 업무의 범위, 참여기관을 확대하는 마이데이터 서비스를 시행하였다. 마이데이터 사업자는 본인신용정보 통합조회서비스를 비롯하여 데이터 분석 및 컨설팅, 신용정보 관리, 개인정보자기결정권 대리행사, 투자자문‧일임 업무 등 다양한 금융서비스를 제공할 수 있다. 또한 금융회사와 핀테크 간 공유할 수 있는 정보도 예‧적금 계좌잔액 및 거래내역, 카드, 대출, 보험, 선불충전금 및 통신료 내역, 각종 납세내역 등으로 크게 확대되었다.

정리하면, 우리나라 오픈뱅킹은 호주와 같이 공유하는 금융거래 정보의 범위에 있어서는 지급 서비스 부문을 중심으로 오픈뱅킹 제도를 마련한 EU와 영국보다는 넓다.38) 영국과 호주에서는 경쟁당국이 오픈뱅킹을 주도하고 있지만, 우리나라는 금융당국이 이를 관할하고 있다.

다. 오픈뱅킹의 데이터 공유 관련 반독점법의 한계와 정책적 함의

여기서는 정책당국이 오픈뱅킹을 반독점법을 근거로 하지 않고 현재와 같은 규제 방식으로 집행하게 되었는지에 대한 논의를 정리하고자 한다.

경쟁법 상의 필수설비원리(Essential Facility Doctrine: EFD)는 필수설비를 독점적으로 보유한 기업이 경쟁기업을 포함하여 그러한 설비의 접근을 요청하는 모든 이들과 이를 공유할 의무가 있다는 원칙이다.39) 이 원칙의 목적은 필수설비를 보유한 독점기업이 경쟁자를 배제하거나 하위시장으로 독점을 확장하는 것을 방지하는 것이다. 이러한 원칙은 주로 유럽의 경쟁당국이 잠재적 경쟁기업의 진입 저지나 경쟁제한적 행위에 효과적으로 대응할 수 있는 경쟁법적 논리로 발전되어 왔다. 유럽의 경쟁당국은 데이터를 기반으로 한 온라인 시장에서도 이를 적용하려 하였으나, 여러 소송에서 적합하지 않음을 확인하였다. 사실, 학자들 사이에서도 데이터를 필수설비로 간주할 수 있는지에 대한 이견이 있었다. 일부 학자들은 스크린 스크래핑 방식 등으로 접근이 가능한 데이터라면 필수설비로 볼 수 없다고 보았으며 다른 학자들은 접근할 수 있더라도 여러 장애로 인해 데이터의 복제가 실질적으로 어려우므로 필수시설일 수 있다고 보았다.

이 외에도 EFD의 원칙은 오픈뱅킹의 목적을 달성하는 데 적합하지 않다는 견해가 많았다. 먼저, EFD는 독점기업에만 적용되므로 다수의 은행에 금융거래 정보를 공유할 것을 요구할 수 없다. EFD는 기업들을 주체로 하여 데이터 거래에 대한 공정성을 다루고 있지만, 오픈뱅킹은 정보의 공유를 통제하는 주체를 소비자로 규정하고 있다. 더욱이 효과적인 데이터 공유를 위해서는 은행과 핀테크 간 상호운용성을 확보하는 표준화된 Open API가 필수적인 한편, 은행들이 제각기 다른 API를 통해 데이터를 개방한다면 핀테크들은 기술적인 문제로 인해 데이터를 공유하기 어렵다. 이는 오픈뱅킹 제도가 데이터 공유뿐 아니라 표준화된 Open API를 구현할 수 있는 기술에까지 요구사항으로 두고 있는 이유이다.

사실, 오픈뱅킹은 금융혁신을 목표로 기존의 경쟁법보다 한층 적극적인 규제적 접근 방식을 취하고 있다. 공급자 측면에서는 핀테크와 금융회사 간 기울어진 운동장을 해소하고 공정한 경쟁 환경을 조성하고자 금융거래 데이터의 공유를 제도적으로 요구하고 있다. 수요자 측면에서는 효과적인 데이터 이동권을 보장하여 기존 금융회사에 고착화(lock-in)되어 있는 금융소비자의 금융서비스 선택권을 확장해 주고 종국적으로는 경쟁을 촉진하고 있다.

라. 오픈뱅킹의 친경쟁적 정책 목표와 빅테크 이슈

현재의 오픈뱅킹 제도에서는 핀테크 스타트업뿐 아니라 빅테크도 TPP로 등록하면 고객의 동의를 통해 은행의 금융거래 정보에 접근할 수 있다. 이는 이러한 정보가 핀테크이든 빅테크이든 고객정보 분석을 이용한 금융서비스에 필수적이기 때문이다. 오픈뱅킹은 금융거래 정보에 초점을 두고 있어 주로 은행이 정보를 공유해야 하는 의무를 지고 있다. 그런데 빅테크는 핀테크 스타업과는 달리 대규모 거대 온라인 플랫폼으로서 소비자의 행태와 관련한 대규모 정보를 보유하고 있다. 즉 빅테크는 금융회사의 고객거래 정보에 접근할 수 있을 뿐만 아니라 자신이 보유한 고객의 행태적 정보를 이용할 수 있어, 금융회사보다 더 많은 정보를 가지고 경쟁할 수 있다. 이러한 점 때문에, 빅테크의 정보공유는 소매금융 부문의 정보공유를 기반으로 경합적인 시장환경을 만들고 금융혁신을 위한 경쟁의 장을 조성하겠다는 오픈뱅킹의 정책 목표에 반할 수 있다는 논란을 낳고 있다. 이에 빅테크에 상호호혜적으로 정보의 공유를 요구해야 한다는 학계의 논의도 나타나고 있다.

De la Mano & Padilla(2018)는 빅테크 플랫폼이 대출 부문에서 독과점을 형성하게 되면 금융의 안정성이 크게 훼손될 수 있다고 우려하였다. 은행과 달리, 빅테크는 플랫폼을 통해 대출상품의 중개만 하고 있어 부실 대출에 따른 비용을 부담하지 않는다. 그래서 빅테크는 대출의 질을 최적으로 관리하기보다는 대출의 규모를 늘리는 데 더 치중할 유인이 있다. 이커머스 수익을 높이거나 고객정보를 얻기 위해 대출을 과도하게 늘릴 수 있는데, 이 경우에도 대출의 질은 하락할 수 있다. 또한 대출 중개 시장에서 빅테크들의 시장점유율이 높아지면 은행들도 경쟁 압박 때문에 대출의 질보다 규모에 치중할 수 있다. 대출 경쟁에서 도태된 은행들은 수익을 확보하기 위해 위험자산에 과도하게 투자하려 할 것이다. De la Mano & Padilla(2018)는 이러한 점에서 빅테크 플랫폼 중심으로 독과점이 형성될 가능성을 줄일 필요성을 강조하며 그 방안으로 금융회사와 빅테크 간의 상호호혜적인 정보공유를 제안하였다.

Di Porto & Ghidini(2020) 또한 빅테크의 상호호혜적인 정보공유를 요구하는 오픈뱅킹을 주장하고 있다. 이들의 논거는 다음과 같다. 첫째, 핀테크 스타트업을 위한 우호적인 오픈뱅킹의 정책이 빅테크에도 동일하게 적용되면서, 소비자의 행동(선호, 습관, 행동)에 관한 정보를 보유한 빅테크가 그렇지 못한 금융회사들보다 경쟁에 있어 유리한 위치에 있게 되었다는 것이다. 즉 빅테크의 소매금융 시장 침투 또는 장악이 자체의 혁신보다는 오픈뱅킹 제도의 정보공유 수혜에서 비롯될 수 있다는 것이다. 둘째, 은행들도 소비자의 행동에 대한 데이터를 보유하면 데이터 분석 역량에 더 투자하게 되며 데이터 분석에 기반을 둔 금융혁신 경쟁이 증가할 수 있다는 것이다. 셋째, 빅테크도 금융회사에 고객정보를 공유하면 금융회사는 빅테크에 자신의 고객정보를 공유한 대가를 받게 되는 것이어서 현재보다 더 공정해진다는 것이다.

De la Mano & Padilla(2018)와 Di Porto & Ghidini(2020)는 모두 현재의 오픈뱅킹 제도에서 빅테크가 은행보다 경쟁우위에 있게 될 가능성을 더 크게 보고 있다. 반면 Borgogno & Colangelo(2020a, 2020b)는 대형은행들의 시장지배력을 강조하며 빅테크에 의한 경쟁 촉진의 가능성을 좀 더 지켜볼 필요가 있음을 주장하고 있다. 이들은 소비자들이 오랜 시간에 걸쳐 안정적으로 거래해 온 은행을 상당히 신뢰하고 있어 금융거래에 있어서는 은행을 먼저 찾을 것이라고 주장한다. 즉 은행이 소매금융의 문지기(gatekeeper)라고 보고 있다. 더욱이 최근 핀테크 스타트업들이 은행들과 경쟁하기보다는 오히려 협력40)하고 있는데, 이는 은행 플랫폼의 경쟁력을 한층 높일 것이라고 보았다. 이러한 상황에서 핀테크 스타트업이 아닌 빅테크가 유일하게 경쟁을 촉진할 수 있는데, 이들이 정보공유를 포함하여 여러 사전규제에 묶인다면 은행에 경쟁 압박을 줄 수 없고 현재와 같은 대형은행 중심의 과점화가 유지될 것이라고 보았다. 이들은 오픈뱅킹에 따른 소매금융 부문의 경쟁구조가 어떻게 변화하는지 좀 더 지켜보고 빅테크에 대한 규제를 검토할 필요가 있다고 제안하고 있다.

Ⅳ. 공정경쟁을 위한 금융정책 방향

1. 국내의 빅테크 기업

본절에서는 국내에서 빅테크에 해당한다고 볼 수 있는 기업은 어디인지에 대하여 논의한다. 전술한 바와 같이 빅테크는 ‘온라인 플랫폼을 보유하고 운영하는 대형 기술 기업’을 의미하는 바, 먼저 국내의 ‘온라인 플랫폼’ 기업에는 어떤 것들이 있는지 알아보고, 다음으로 이 기업들 중에서 빅테크라고 불릴 만한 ‘대형’ 기업은 어디인지를 판단해 본다.

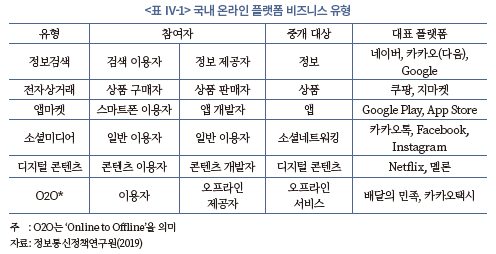

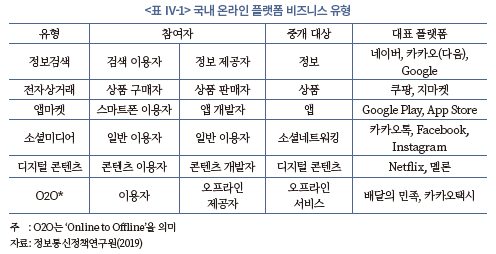

가. 국내 온라인 플랫폼

정보통신정책연구원(2019)은 온라인 플랫폼 내에서 거래되는 대상과 온라인 플랫폼 참여자 유형에 따라 온라인 플랫폼의 비즈니스 유형을 <표 Ⅳ-1>과 같이 6가지로 구분‧제시하고 있다. <표 Ⅳ-1>에 제시된 유형별 대표 플랫폼 중에서 Google, App Store(Apple), Facebook 등 외국(미국) 기업을 제외하면, 한국 플랫폼 기업으로는 네이버, 카카오(카카오톡, 카카오택시 포함), 쿠팡, 배달의 민족41) 등이 포함되어 있다.

이 중에서 쿠팡은 전자상거래, 배달의 민족(우아한 형제들)은 O2O 플랫폼 사업이 핵심이며 그 외 다른 플랫폼 사업은 미미한 반면, 네이버와 카카오는 거의 대부분의 온라인 플랫폼 사업에 진출하고 있다(<표 Ⅳ-2> 참조). 또한, 국내 시장에서 차지하는 이들의 시장점유율은 상당한 수준으로42) 국내 온라인 플랫폼 기업 중에서는 미국의 GAFA 등 빅테크에 비교적 근접한 것으로 볼 수 있다.

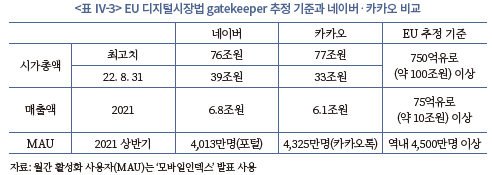

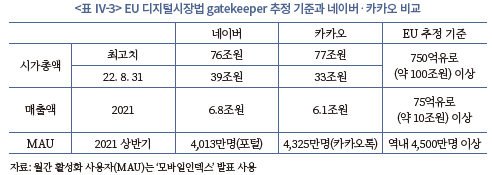

나. 대형 여부의 판단

플랫폼 및 그 플랫폼을 보유‧운영하는 기업의 규모가 어느 정도가 되어야 ‘대형’이며, 따라서 빅테크로 볼 수 있는지에 대한 합의된 기준은 존재하지 않는다. 본 소절에서는 Ⅲ장에서 살펴본, 대형 온라인 플랫폼 사업자에 대한 규율을 목적으로 입법되고 시행을 앞두고 있는 EU의 디지털시장법에서 규정하고 있는 규모 기준을 이용하여 국내 플랫폼 사업자, 그 중에서도 네이버와 카카오의 대형 여부를 판단해 보고자 한다.43)

EU 디지털시장법은 최근 3년 동안 연간 역내 매출액이 75억유로 이상 또는 직전년도 평균 시가총액이 750억유로 이상이고, 역내 월간 활성 사용자가 4,500만명 이상 또는 연간 활성화 이용업체가 1만명 이상이면서 최소 3개 이상의 회원국에서 핵심 플랫폼 서비스를 제공하는 사업자를 법 적용 대상인 ‘gatekeeper’로 추정(presume)한다.

<표 Ⅳ-3>이 보여주는 바와 같이 국내의 대표적 온라인 플랫폼 기업인 네이버와 카카오는 재무적 기준으로는 EU 디지털시장법 추정 기준에 도달하지 못하고 있다. 2022년 8월 31일 현재 양사의 시가총액은 추정 기준의 30~40% 수준, 매출액은 60~70% 수준을 나타내고 있다. 또한 월간 활성화 사용자 기준으로는 추정 기준에 거의 도달한 수치를 보여주고 있다.

그러나 이와 같은 단순 비교만으로 네이버와 카카오가 빅테크로 보기에는 아직 그 플랫폼 사업의 규모가 작다고 결론지을 수는 없다. 27개국으로 구성된 EU의 2021년도 역내 인구는 4억 4,700만명44)으로 한국의 약 8.6배, 역내 명목 GDP는 17조달러45)로 한국의 약 9.4배이다. 이와 같은 시장 규모의 차이를 고려할 때, 국내 시장에서 네이버와 카카오는 EU 역내 시장에서 ‘gatekeeper’가 차지하는 수준 이상의 지위를 갖고 있다는 추정은 충분히 가능하며, 따라서 이 2개 회사의 금융 진출에 대해서는 지속적인 관찰이 필요하다고 할 수 있다.

2. 공정경쟁을 위한 금융정책 방향

가. 빅테크 불공정경쟁 관련 금융정책 방향

금융산업에 진출한 빅테크에 대한 공정경쟁의 확보는 경쟁 당국만의 노력으로는 이루어지기 어렵다. 먼저 온라인 플랫폼 기업의 경쟁력을 결정하는 핵심 요소인 데이터와 관련해서는 개인정보 보호, 데이터 주체의 데이터 결정권 등의 이슈가 있다. 이것은 경쟁 당국의 소관이 아니다. 또한 ‘온라인’으로 사업을 하는 기업인 만큼 인터넷 이용과 관련하여 통신 당국의 관할에 속하는 영역이 있다. 빅테크의 경쟁제한적 영업행위나 새로운 플랫폼 기반의 금융서비스와 관련하여 금융소비자보호와 금융 안정성을 확보하기 위한 금융당국의 개입과 감독이 필요하다. 따라서 온라인 플랫폼 기업에 대한 효과적인 규제를 위해서는 관련 당국 간의 긴밀한 정보 공유‧교환 등을 통한 협력 체계를 구축하여 규제의 중복 또는 공백을 최소화할 필요가 있다.

영국 정부는 이러한 필요성에 대한 인식을 바탕으로 2020년 7월 ‘디지털 규제 협력 포럼(Digital Regulation Cooperation Forum: DRCF)’이라는 관련 당국 간 협의체를 발족시켰다. 발족 당시에는 경쟁 당국인 CMA, 데이터 문제를 관할하는 개인정보감독기구(Information Commissioner’s Office: ICO), 방송통신 규제기구(Office of Communications: Ofcom)로 구성된 3개 정부기관이 참여하였으며, 공통적 규제의 틀을 마련하여 당국별 개별적 규제로부터 초래될 수 있는 중복 또는 공백 최소화를 목표로 하고 있다. 특히 서비스 설계, 알고리즘 처리, 디지털 광고 및 서비스 암호화 같은 복잡한 이슈 중 일부에 대한 협력을 기대하고 있다. 금융당국인 FCA는 2021년에 정회원으로 DRCF에 참가하였을 뿐만 아니라, 2022년에는 금융 부문의 경쟁 문제에 더 적극적으로 대응할 것이며 DRCF를 통하여 CMA와 긴밀하게 협력할 것을 천명하였다(FCA, 2022). 이러한 영국 금융당국의 접근 방식은 온라인 플랫폼 기업들의 금융 진출이 활발하게 진행되고 있는 우리나라에서도 소매금융 부문의 공정경쟁을 확보하기 위한 제도적인 장치로 참고해 볼 만하다고 생각된다.

최근 유럽연합이 발간한 금융혁신의 규제장벽에 관한 전문가그룹 보고서(ROFIEG, 2019)에는 빅테크의 금융 진출과 관련하여 공정경쟁의 장을 마련하는 것을 권고안으로 채택하고 있다. 본 권고안에서는 금융서비스 제공에 있어서 빅테크에 의한 불공정한 차별이나 자사상품의 우대를 방지하기 위한 사전규제 도입의 필요성을 강조하고 있다. 이러한 점에서 볼 때, 유럽연합은 빅테크의 금융 진출에 따른 불공정경쟁의 이슈를 중요하게 다루는 것으로 보인다.

우리나라는 최근 빅테크의 경쟁제한적 영업행위에 대한 엄정한 법 집행을 위한 대책을 발표하였지만, 주요국들과는 달리 빅테크 규제를 별도로 마련하고 있지 않다. 빅테이터에 기반한 온라인 플랫폼의 사업모델에 기존 경쟁법을 적용하는 데 한계가 있다는 지적46)을 고려해 볼 때, 공정위가 현재의 공정거래법만으로 소매금융 부문에서 빅테크의 경쟁제한적 행위를 효과적으로 규율할 수 있다고 장담하기 어렵다. 더욱이 소매금융 시장에 온라인 플랫폼들의 침투가 확대됨에 따라 이들의 불공정한 영업행위가 금융소비자보호 문제를 초래하거나 금융 안정성에 부정적인 영향을 미칠 수 있다. 따라서 온라인 플랫폼의 금융중개에 대한 금융당국의 적극적인 모니터링과 감독이 필요할 것으로 판단된다. 더불어 빅테크의 영업행위가 경쟁을 제한하고 있는지를 평가하기 어렵더라도 금융소비자 후생에 부정적인 영향을 주고 있다는 점을 확인한다면, 금융당국이 금융소비자보호 차원에서 일정 부분 임무를 수행할 수 있다.

나. 오픈뱅킹 관련 정책 방향

우리나라 금융당국은 마이데이터 제도를 도입할 당시 금융산업의 경쟁에 미치는 영향보다는 금융소비자의 정보 주권 실현, 금융 포용성 강화 및 금융혁신 등 금융정책 측면에서의 의미를 강조하였다(금융위 보도자료, 2022.1.5). 금융당국이 오픈뱅킹에 대해 금융정책 측면을 강조하였지만, 금융회사와 핀테크, 빅테크 간 경쟁을 촉진하는 내용을 담고 있는 점은 해외와 다르지 않다. 자세히 들여다보면 해외는 경쟁 당국이 오픈뱅킹을 설계하여 운영하고 있어 앞으로도 금융산업의 경쟁구조에 미치는 영향에 초점을 두고 발전시킬 것으로 보인다. 이러한 점에서 볼 때 우리나라 금융당국 역시 오픈뱅킹 정책에 있어서 공정경쟁을 고려하는 것이 필요한 것으로 판단된다.

특히 금융당국은 다른 것보다도 빅테크와 관련한 오픈뱅킹의 이슈를 중요하게 다룰 필요가 있다. 이는 빅테크가 오픈뱅킹을 통해 접근할 수 있는 금융거래 정보 외에도 자신의 대규모 고객정보를 이용할 수 있어 금융회사나 핀테크보다도 우월한 지위에서 경쟁할 수도 있기 때문이다. 일부 학자들은 금융회사의 정보 우위를 완화하기 위하여 도입된 오픈뱅킹 제도가 빅테크에 정보 우위를 제공하며 또 다른 경쟁 왜곡을 초래할 수 있다고 지적한다. 빅테크가 자신이 보유한 소비자 선호, 행태, 습관 등의 정보를 이용하여 금융서비스를 혁신할 수 있다면 공정한 경쟁을 위해서는 금융회사나 핀테크도 이러한 정보를 이용할 수 있어야 한다.

1) Crisanto et al.(2021b), BIS(2019), De la Mano & Padilla(2018)

2) Bains et al.(2022), Shin(2019), Boissay et al.(2021), Carstens et al (2021), Crisanto et al.(2021a, 2021b), EU 디지털시장법 및 미국 패키지법(Ⅲ장 1절에서 서술) 등

3) 이 미국의 4개사를 각각의 머리글자를 따서 ‘GAFA’라고 부르기도 한다.

4) 국내에서 빅테크에 해당하는 기업의 판단에 대해서는 Ⅳ장 1절에서 다시 상세하게 살펴본다.

5) FSB(2019), Restoy(2021), Ehrentraud et al.(2022)

6) De la Mano & Padilla(2018), Di Porto & Ghidini(2019)

7) Bains et al.(2022), Shin(2019), Boissay et al.(2021), Carstens et al.(2021), Crisanto et al.(2021a), 손상호(2022) 등

8) 이상규(2014)

9) 흔히 플랫폼에 ‘입점’했다는 의미에서 ‘입점업체’라고 불리기도 한다.

10) 국내에서는 토스(비바리퍼블리카)가 대표적 사례이다.

11) Google과 Facebook은 각각 Alphabet과 Meta라는 모기업(지주회사) 산하로 재편되었으나, 본 보고서에서는 익숙한 이름이라는 점을 고려하여 이 명칭을 사용한다.

12) 본 보고서에서 국내의 네이버와 카카오를 빅테크로 보는 이유에 대해서는 보고서의 Ⅳ장 1절에서 다시 서술한다.

13) Shin(2019), Carstens et al.(2021)

14) Frost et al.(2019), FSB(2019)

15) 2021년 7월 Apple은 골드만삭스, 마스터카드와 제휴하여 신용카드를 출시했고, 골드만삭스와 협력하여 ‘Apple Pay Later’라는 이름의 BNPL(Buy Now Pay Later) 서비스를 준비 중이라고 발표하였다. Amazon은 2021년 8월 핀테크 기업인 ‘Affirm’과 제휴하여 Amazon Pay에 BNPL 결제 방식을 도입하였고, 2020년에는 골드만삭스와 제휴하여 리볼빙 방식을 대출 서비스 제공을 발표하였다.

16) 신용정보협회 홈페이지

17) 동아일보(2022. 4. 27)

18) 지급 부문은 대부분의 빅테크들이 라이선스를 취득하여 자신의 서비스를 직접 제공하고 있다.

19) McKinsey(2017)에 따르면, 금융상품의 유통(distribution)은 은행 전체 수익의 47%, 이익의 65%를 차지하고 있는 수익성이 높은 부문이다.

20) 최근 Condorelli & Padilla(2020)는 개인정보에 대한 수집 및 활용을 전제로 플랫폼 서비스에 대한 접근을 요구하는 행위(tying)를 통해 두 플랫폼 간 범위의 경제를 높일 수 있으며 이 또한 플랫폼 봉쇄를 구현하는 전략이라는 점을 밝혔다.

21) 예를 들면, 마이크로소프트사가 PC의 운영시스템인 윈도우에 인터넷 익스플로러를 결합하였는데, 이러한 전략으로 당시 브라우저 시장에서 높은 시장점유율을 보였던 넷스케이프 등을 제치고 독점적 지위를 차지할 수 있었다.

22) 독점적 경쟁 시장은 경쟁기업들이 상품을 차별화하여 상품 간 대체가 완전하지 않은 시장을 말한다. 이러한 시장에서는 소비자들이 각자 자신의 취향에 따라 특정한 상품을 선호하지만, 가격 정책에 따라 경쟁 상품으로 대체할 수 있다. 따라서 기업은 독점시장과 같이 가격에 우하향하는 수요에 직면한다. 독점적 경쟁 시장은 현실에서 가장 일반적으로 볼 수 있는 시장이다.

23) EC는 2017년 구글이 쇼핑검색 서비스에서 자사를 우대한 행위에 대해 독점금지법 위반으로 시정 명령과 함께 24억 2천만유로(약 3조 3천억원) 벌금을 부과하였다. 미국 법무부와 공정거래위원회(FTC)는 2020년 하원의 GAFA의 반독점 규제 위반행위에 관한 조사 결과와 자체 수사 결과에 기초해 주‧지방 검찰과 공동으로 구글과 페이스북을 상대로 반독점소송을 제기하였다. 구글의 경우, 자사 검색엔진을 스마트폰에 기본 탑재하도록 스마트폰 제조사와 통신사에 금전적 대가를 지불함으로써 경쟁사의 검색시장 진입을 막은 혐의를 받고 있다. 우리나라 공정위도 2020년 10월 네이버가 검색 알고리즘을 인위적으로 조정하여 자사 오픈마켓 입점 업체 상품을 우대하였다며 시정명령과 함께 과징금 약 267억원을 부과했다. 또한 공정위는 타사 가맹 택시를 호출 서비스에서 배제한 혐의로 카카오모빌리티를 조사하고 있다.

24) Khan은 현재 미국 연방거래위원회(Federal Trade Commission: FTC)의 의장이다.

25) DMA에 앞서 EU는 2019년 7월, ‘온라인 검색엔진’과 ‘온라인 중개서비스’를 제공하는 모든 온라인 플랫폼 사업자를 대상으로 이용업체와의 공정거래를 규율하는 ‘P2B 규칙(Platform to Business Regulation)’을 제정, 2020년 7월부터 시행하였다.

26) DMA 외에「디지털서비스법(Digital Services Act: DSA)」도 함께 승인되어 시행될 예정이다. DSA는 불법콘텐츠의 유통 방지 등 최종소비자 보호에 초점을 둔 법으로, 본 보고서에서는 DMA에 대해서만 소개한다.

27) 현재는 각각의 법 별로 상원 통과 절차가 진행 중이다.

28) Facebook(Meta)의 시가총액은 최대 1.07조달러에 달했으나, 2022년 8월 31일 현재 4,400억달러로 감소하였다. 2022년 8월 31일 현재 시가총액 6,000억달러를 초과하는 기업은 이 3개사와 Microsoft, Tesla 등 총 5개사이다. Microsoft는 상대적으로 빅테크 논쟁에서 벗어나 있는 것으로 보인다.

29) 그럼에도 불구하고 이 기준을 충족하는 플랫폼 사업자는 대부분 미국의 기업들이며, EU 기업으로는 SAP 등 극히 일부만 해당될 것으로 전망된다.(최계영, 2021)

30) 공정거래위원회(2020. 9. 28)

31) 신정부에서 민간기구를 통한 자율규제를 통해 온라인 플랫폼을 규율하기로 방침을 정함에 따라 본 법의 입법은 추진되지 않고 있다. 대신 ‘플랫폼 민간 자율기구’가 출범하였다(기획재정부, 2022. 8. 19).

32) 공정거래위원회(2022. 1. 6)

33) 공정거래위원회(2022. 10. 21)

34) 공정거래위원회(2022. 10. 21)

35) CMA(2016)

36) 유럽의 PSD2는 2018년 1월에 발효되었지만, 사용자보호에 관한 기술표준이 2019년 9월에 마련되었다.

37) 정부는 고객자금을 보유하지 않으면서도 하나의 앱(App)으로 고객의 모든 계좌에 대해 결제‧송금 등에 필요한 이체지시를 전달할 수 있는 마이페이먼트 제도를 추진하고 있다.

38) 최근 EU에서는 공유할 수 있는 고객의 금융거래 정보 범위를 확대하는 등의 PSD2 개정에 대한 논의가 있다(EC, 2022).

39) 필수설비이론은 ① 독점적 지위의 기업이 필수설비를 보유하고 있고, ② 경쟁자가 그러한 필수설비를 다른 채널로 조달하는 것이 불가능하고, ③ 필수설비를 보유한 독점적 지위의 기업이 경쟁자에 필수설비의 사용을 거부하고 ④ 또 필수설비를 제공할 수 있는 경우 독점적 사업자의 필수설비에 대한 거래 거절을 위법으로 보고 있다.

40) 은행은 핀테크와의 협력을 통해 이들의 혁신 및 IT 기술, 이들에 적용되는 규제 혜택을 간접적으로 공유할 수 있다. 핀테크는 은행과의 협력을 통해 이들이 가지고 있는 고객기반, 브랜드 및 평판, 규모의 경제, 대규모 창구 등에서 혜택을 얻을 수 있다.

41) ‘배달의 민족’은 플랫폼의 이름이고, 이 플랫폼을 운영하는 기업은 ‘우아한 형제들’이다.

42) 네이버의 국내 검색엔진 시장점유율은 2020년 55.7%에서 2021년 56.1%로 상승하였고(InternetTrend), 카카오의 국내 메신저 시장점유율은 2020년 5월 83%에서 2021년 8월 86%로 상승하였다(아이지에이웍스 빅데이터 분석 솔루션 모바일인덱스).

43) Ⅲ장에서 언급한 바와 같이 미국 패키지법의 규모 기준은 미국 내에서도 해당하는 기업이 Google, Apple, Amazon의 3개사에 불과할 정도로 크기 때문에 이를 국내 기업에 적용하는 것은 의미가 없다고 판단되어 EU 디지털시장법의 기준을 이용한다.

44) ec.europa.eu

45) IMF, World Economic Outlook Database

46) Khan(2017), Thiemann & Gonzaga(2016), Crémer et al.(2019)

참고문헌

공정거래위원회, 2020. 9. 28,「온라인플랫폼 공정화법」제정안 입법예고, 보도자료.

공정거래위원회, 2022. 1. 6, 플랫폼 분야의 경쟁제한행위 예방을 위한 심사지침 마련: 온라인 플랫폼 사업자의 시장지배적 지위 남용행위 등 심사지침 제정안 행정예고, 보도자료.

공정거래위원회, 2022. 10. 21, 독과점 온라인 플랫폼 시장의 경쟁촉진방안 추진: 플랫폼에 특화된 제도개선과 엄정한 법 집행, 보도자료.

권민경, 2019,『국내외 마이데이터 도입 현황 및 시사점』, 자본시장연구원, 이슈보고서 19-02.

금융위원회, 2020. 7. 27,「디지털금융 종합혁신방안」발표, 보도자료.

금융위원회, 2020. 9. 10, 디지털 금융혁신 및 빅테크-금융사간 “상호상생” 논의의 장인「디지털금융 협의회」를 출범하였습니다., 보도자료.

금융위원회, 2021. 1. 29,「2021 금융위 업무계획」중 디지털금융 혁신 세부과제, 보도자료.

금융위원회, 2021. 12. 22, 오픈뱅킹 시행 2년이 만든 디지털 금융혁신 성과 – 오픈뱅킹 전면시행 2년, 순가입자수 3천만명 돌파, 보도자료.

금융위원회, 2022. 1. 5, 새해부터 흩어진 내 금융정보를 더욱 안전하고 빠르고 편리하게 관리할 수 있게 됩니다(금융 마이데이터 전면시행), 보도자료.

기획재정부, 2022. 8. 19, 플랫폼 민간 자율기구 출범식 개최, 보도자료.

동아일보, 2022. 4. 27, ‘내 손안의 금융비서’ 마이데이터, 석달새 2,600만명 몰렸다.

법제처, 2021, 일본「특정 디지털 플랫폼 거래 투명화법」고찰.

손상호, 2022, 금융혁신 8대 과제, 한국금융연구원.

송재호 의원실, 2021. 10. 21, “1조원대 선불충전금, 이자는 기업 사금고?” 이용자도 몰랐던 충전금 이자, 공론화 필요성 제기. 보도자료.

양용현‧이화령, 2021, 미국의 플랫폼 반독점법안 도입과 시사점, KDI Focus 109호, 1-8.

이경원‧박민수, 2022,『온라인 플랫폼 시장에 대한 공정경쟁 정책』, 자본시장연구원 학술용역보고서.

이상규, 2014,『양면시장의 정의 및 조건』, 정보통신정책연구 17(4), 73-105.

정보통신정책연구원, 2019,『통신시장 경쟁상황 평가(2019년도)』, 정책연구 19-18.

최계영, 2021,『유럽연합 디지털 시장 법안(Digital Market Act: DMA) 주요 쟁점 분석』, KISDI Premium Report 21-02.

한국은행, 2018. 4. 2, 2017년중 전자지급서비스 이용 현황, 보도자료.

한국은행, 2021. 3. 29, 2020년중 전자지급서비스 이용 현황, 보도자료.

한국은행, 2021. 9. 13, 2021년 상반기중 전자지급서비스 이용 현황, 보도자료.

Bains, P., Sugimoto, N., Wilson, C., 2022, BigTech in financial services: Regulatory approaches and architecture, Fintech note 2022/002, IMF.

BIS, 2015, Data-sharing: Issues and good practices, IFC Report

BIS, 2019, Annual Economic Report.

Boissay, F., Ehlers, T., Gambacorta, L., Shin, H. S., 2021, Big techs in finance: On the new nexus between data privacy and competition, BIS working papers No.970.

Borgogno, O., Colangelo, G., 2020a, The data sharing paradox: BigTechs in finance, European Competition Journal 16(2-3), 492-511.

Borgogno, O., Colangelo, G., 2020b, Data, innovation and competition in finance: The case of the access to account rule, European Business Law Review 31(4), 573-610.

Borgogno, O., Manganelli, A., 2021, Financial technology and regulation: The competitive impact of open banking, Market and Competition Law Review 5(1), 105-139.

Carstens, A., Claessens, S., Restoy, F., Shin, H. S., 2021, Regulating big techs in finance, BIS Bulletin No.45.

Competition and Markets Authority (CMA), 2016, Retail Banking Market Investigation.

Condorelli, D., Padilla, J., 2020, Harnessing platform envelopment in the digital world, Journal of Competition Law and Economics 16(2), 143-187.

Crémer, J., De Montjoye, Y. A., Schweitzer, H., 2019, Competition policy for the digital era, European Commission.

Crisanto, J. C., Ehrentraud, J., Fabian, M., 2021a, Big techs in finance: Regulatory approaches and policy options, FSI Briefs No.12, Financial Stability Institute, BIS.

Crisanto, J. C., Ehrentraud, J., Lawson, A., Restoy, F., 2021b, Big tech regulations: What is going on? FSI insights on policy implementation No.36, Financial Stability Institute, BIS.

Croxson, K., Frost, J., Gambacorta, L., 2022, Platform-based business models and financial inclusion, BIS Papers.

De la Mano, M., Padilla, J., 2018, Big tech banking, SSRN working paper.

Digital Competition Expert Panel, 2019, Unlocking digital competition (Furman Report).

Di Porto, F., Ghidini, G., 2020, ‘I Access Your Data You Access Mine’. Setting a reciprocity clause for the ‘access to account rule’ in the payment services market, International Review of Intellectual Property and Competition Law – IIC 51, 307-329.

Ehrentraud, J., Evans, J., Monteil, A., Restoy, F., 2022, Big tech regulation: In search of a new framework, BIS FSI Occasional Papers.

Eisenmann, T., Parker, G., Van Alstyne, M., 2011, Platform envelopment, Strategic Management Journal 32, 1270-1285.

Euopean Commission, 2020, Communication from the commission to the european parliament, the council, the european economic and social committee and the committee of the regions, COM(2020) 66 final.

European Commission, 2022, Targeted consultation on open finance framework and data sharing in the financial sector, Consultation Document.

European Parliament, 2022, European Parliament legislative resolution of 5 July 2022 on the proposal for a regulation of the European Parliament and of the Council on contestable and fair markets in the digital sector (Digital Markets Act).

Expert Group on Regulatory Obstacles to Finance Innovation (ROFIEG), 2019, Thirty recommendations on regulation, innovation and finance - Final Report to the European Commission, European Commission.

Financial Conduct Authority, 2022, Our Strategy 2022 to 2025.

Financial Stability Board, 2019, Big tech in Finance: Market Developments and Potential Stability Implications.

Financial Stability Board, 2020, BigTech Firms in Finance in Emerging Market and Developing Economies.

Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., Zbinden, P., 2019, Big tech and the changing structure of financial intermediation, Economic Policy 34, 761-799.

Khan, L. M., 2017, Amazon’s antitrust paradox, Yale Law Journal 126, 710-805.

McKinsey, 2017, Remaking the Bank for An Ecosystem World.

OECD, 2021a, Data portability interoperability and digital platform competition, OECD Competition Committee Discussion Paper.

OECD, 2021b, Ex ante regulation in digital markets – Background Note By the Secretarist, DAF/COMP(2021)15

Oliver Wyman & International Banking Federation, 2020, Big Banks, Bigger Techs?

Open Banking Working Group, 2017, Open banking: Advancing customer-centricity, Euro Banking Association.

Ordover, J., Saloner, G., Salop, S., 1990, Equilibrium vertical foreclosure, American Economic Review 80, 127-142.

Restoy, F., 2021, Fintech regulation: How to achieve a level playing field, FSI Occasional Papers.

Shin, H., 2019, Big tech in finance: Opportunities and risks, BIS Annual Economic Report.

Smith, T., Geradin, D., 2021, Maintaining a level playing field when Big Tech disrupts the financial services sector, SSRN working paper.

Thiemann, A., Gonzaga, P., 2016, Big data: Bringing competition policy to the digital era –background note by the secretariat-, OECD paper, DAF/COMP(2016) 14.

UK Government, 2021, A New Pro-Competition Regime for Digital Markets.

US House of Representatives, 2020, Investigation on Competition In Digital Markets.

Vives, X., 2019, Digital disruption in banking, Annual Review of Financial Economics 11, 243-272.

Whinston, M., 1990, Tying, foreclosure and exclusion, American Economic Review 80, 837-859.

Zamil, R., Lawson, A., 2022, Gatekeeping the gatekeepers: When big techs and fintechs own banks – benefits, risks and policy options, FSI Insights on policy implementation No.39, BIS.

法律第三十八号(令二・六・三), 特定デジタルプラットフォームの透明性及び公正性の向上に関する法律

최근 전 세계적으로 빅테크(big tech)라 일컬어지는 대형 온라인 플랫폼 기업들이 금융에 진출하면서 소비자 개개인의 성향에 맞추거나 이용의 편의성에 초점을 둔 금융, 금융을 포함한 one-stop shopping 등의 소매금융 부문의 혁신에 대한 기대가 크다. 그러나 다른 한편에서는 빅테크가 대규모 고객정보와 핵심 플랫폼의 시장지배력 등을 지렛대로 기존 금융회사들을 제치고 소매금융 부문을 장악할 수 있다고 우려하고 있다.1) 이에 규제 당국이 빅테크의 금융진출에 대응하여 금융산업의 전통적인 감독의 적절성뿐 아니라 공정경쟁‧공정거래에 관한 이슈들을 중요하게 다루어야 할 필요성이 제기되고 있다.

빅테크라는 용어는 ‘대형(big) 기술(tech) 기업’을 의미하는 신조어로서 법적 용어는 아니며, 따라서 법적 또는 학술적으로 통일된 명확한 정의가 내려져 있지 않다. 그럼에도 불구하고 빅테크 관련 이슈를 다룬 다수의 문헌, 그리고 주요국의 관련 법령들에 따르면 대체로 ‘온라인 플랫폼을 보유하고 운영하는 대형 기술 기업’을 의미하는 것으로 빅테크를 정의할 수 있다.2) 다수 문헌이 공통적으로 빅테크에 해당한다고 보는 기업으로는 미국의 Google(Alphabet), Apple, Facebook(Meta), Amazon3), 중국의 Alibaba, Tencent 등이 있으며, 국내의 경우 네이버와 카카오가 빅테크에 가장 근접한 기업으로 언급된다.4)

최근 네이버와 카카오 등이 지급 서비스를 넘어 대출, 보험, 자산관리 등 다양한 금융서비스를 제공하기 시작하였는데, 이에 따른 긍정적인 영향은 매우 클 것으로 보인다. 소비자들은 빅테크 플랫폼에서 one-stop shopping으로 여러 다른 서비스와 금융을 동시에 이용할 수 있는 한편, 자신의 선호, 행태, 습관 등에 기반을 둔 맞춤형 금융서비스의 혜택도 받을 수 있다. 기존 금융회사나 핀테크 스타트업과는 달리, 이들은 여타 플랫폼 서비스와 금융을 결합할 수 있을 뿐 아니라 대규모 고객정보와 높은 IT 기술에 기반하고 있다는 장점이 있다. 이에 따라, 빅테크는 기존 금융회사에 상당한 경쟁 압박을 줄 뿐 아니라 금융의 편의성을 높이는 서비스 경쟁을 촉진할 것으로 기대되고 있다.

빅테크는 플랫폼 기반의 금융상품 중개나 클라우드 기반의 후선업무 등 기존 금융규제 체계에서 벗어난 사업모델로 금융에 진출하고 있다. 더욱이 이들은 여러 상업과 금융 부문의 자회사 간 복잡하게 결합하고 있다. 이러한 점 때문에, 빅테크의 금융 진출과 관련하여 여러 정책 차원의 논의가 진행되고 있다. 대표적으로 이들 그룹의 지배구조 상 이해상충 문제, 새로운 운영 위험, 현재의 금융규제 및 감독의 한계, 그리고 본 연구의 주제인 공정경쟁의 이슈들을 들 수 있다.5) 사실 빅테크는 자본력, 브랜드, 대규모 고객 기반 및 정보, IT 기술 등에서 금융회사와 차별화된 경쟁력을 가지고 금융에 진출하는 것이어서, 이들과 관련한 공정한 경쟁 환경은 향후 소매금융 부문의 발전에 중요한 요인이 될 수 있다. 앞서 언급한 바와 같이 빅테크가 장기적으로 현재의 금융회사 중심의 시장구조 판도까지 바꿀 수 있다고 전망되고 있는 가운데, 그것이 빅테크의 IT 기술과 혁신이 아닌 공정경쟁과 관련한 제도의 부재에서 비롯될 수 있다는 우려가 크다.

빅테크들은 자사의 대규모 고객 기반에서 여러 서비스를 상호 결합할 수 있어 번들링이나 자사상품의 우대 등과 같은 영업행위가 가능하다. 문제는 핵심 플랫폼의 시장지배적 지위에 기반한 빅테크의 이러한 영업행위가 인접한 플랫폼을 포획하는데 효과적인 동시에, 때때로 경쟁을 제한할 수 있다는 점이다. 실제로 주요국이나 우리나라 경쟁 당국은 일부 플랫폼에서 관찰된 빅테크의 경쟁제한적 영업행위에 대해 소송 등으로 대응하고 있다. 최근 주요국에서는 빅테크에 대해 별도의 사전규제를 마련하고 있는데, 이것을 통해 금융에 진출한 빅테크의 불공정경쟁 행위를 일정 부분 예방할 수 있을 것으로 보인다. 그러나 우리나라는 아직 별도의 빅테크 규제를 마련하지 않고 있어, 대형 온라인 플랫폼의 금융 진출에 이들의 공정경쟁과 관련한 관계 당국의 감독이 중요할 것으로 보인다. 최근 전 세계 여러 나라들은 핀테크의 금융 진출을 지원하고 소매금융 부문의 경쟁과 혁신을 촉진할 목적으로 오픈뱅킹을 도입하고 있다. 오픈뱅킹은 핀테크 등이 고객의 동의를 받으면 금융회사로부터 해당 고객의 계좌정보에 접근하여 이용할 수 있도록 하고 있는데, 이러한 제도가 대규모 고객정보를 보유한 빅테크에도 똑같이 적용되면서 이들의 정보공유 수혜가 공정경쟁의 이슈로 대두되고 있다.6) 특히 금융서비스는 다른 어떠한 부문보다도 정보량에 따라 경쟁력이 달라질 수 있으므로 금융회사와 빅테크 간 비대칭적인 정보공유의 이슈는 공정경쟁의 차원에서 중요하게 다루어질 필요가 있다. 이러한 관점에서, 본 연구는 금융에 진출한 빅테크의 경쟁제한적 영업행위의 가능성과 오픈뱅킹의 설계에 초점을 두고 논의하고 있다.

본 보고서의 구성은 다음과 같다. 이어질 Ⅱ장에서는 빅테크의 개념, 이들의 금융진출 요인, 현황과 전망 그리고 공정경쟁 이슈에 대해 논의한다. Ⅲ장에서는 국내외 빅테크에 대한 최근 규제 동향과 오픈뱅킹의 도입과 빅테크의 정보공유와 관련한 논의를 정리한다. Ⅳ장에서는 우리나라의 빅테크에 대해 검토하고 공정경쟁을 위한 금융당국의 정책 방향에 대해 제안한다.

Ⅱ. 빅테크의 금융 진출 현황과 공정경쟁 이슈

1. 빅테크의 개념과 금융 진출 요인

가. 빅테크의 개념과 특성

대형(big) 기술(tech) 기업을 의미하는 빅테크는 법적 또는 학술적으로 명확하게 정의된 개념은 아니며, 문헌에 따라 그 범위에서 약간의 차이가 존재한다. 그러나 빅테크 문제를 다룬 다수의 문헌들7)에 의하면 대체로 빅테크는 ‘온라인 플랫폼을 보유하고 운영하는 대형 기술 기업’을 의미하는 것으로 정리할 수 있으며, 빅테크의 범주에 포함되는 기업들에서는 다음과 같은 공통의 특성을 발견할 수 있다.

첫째, ‘온라인 플랫폼’을 보유하고 운영하는 기업이다. 플랫폼(platform)은 서로 다른 이용자(end-user) 그룹이 거래나 상호작용을 원활하게 할 수 있도록 제공된 물리적 또는 가상의 공간을 의미하며8), 온라인 플랫폼은 그중에서도 인터넷 상에서 작동하는 플랫폼을 지칭하는 것으로 이해할 수 있다. 그리고 플랫폼의 핵심적인 특징은 양면(two-sided) 사업모델, 즉 서로 다른 이용자 그룹을 상호 연결하는 서비스를 제공하고, 각 이용자 그룹에 이용료를 부과하는 사업모델을 채택하고 있다는 점이다. ‘플랫폼을 보유‧운영’하는 주체로서 빅테크는 한쪽 이용자 그룹인 이용업체(business user)9)와 다른 한쪽 이용자 그룹인 소비자(consumer)의 플랫폼 참여를 통제‧관리한다.

둘째, 온라인 데이터 사업(검색엔진, 소셜네트워크, 이커머스, 운영시스템(OS) 등)을 기반으로 성장하고, 그 사업에서 강력한 시장지배적 지위를 향유하고 있는 기업이다. 따라서 비금융 주력사업을 통하여 구축된 데이터 및 네트워크를 기반으로 금융산업에 진출한 빅테크는 처음부터 금융을 주력사업으로 하여 설립된 핀테크(fintech)10)와 구별된다. 즉 핀테크는 기존 금융회사의 비즈니스를 디지털 기술로 혁신함으로써 경쟁력을 구축하지만, 빅테크는 이 외에도 핵심 플랫폼의 시장지배력, 데이터, 네트워크 등을 활용하여 금융서비스의 경쟁력을 확보하고 있다.

셋째, ‘대형’ 온라인 플랫폼 기업이다. 온라인 플랫폼의 규모를 측정하는 척도가 무엇인지, 척도별로 ‘대형’이라고 판단할 수 있는 기준(threshold)이 무엇인지에 대한 합의는 존재하지 않는다. 다만 보고서의 Ⅲ장에서 소개하는 EU와 미국의 빅테크 규율 법령에서 설정하고 있는 기준치가 참고될 수 있을 것이다. 주요 문헌들이 공통으로 빅테크에 해당한다고 보는 기업으로는 미국의 Google, Apple, Facebook, Amazon, 중국의 Alibaba, Tencent 등이 있으며, 국내에서는 네이버와 카카오가 빅테크에 가장 근접한 기업으로 언급되며11)12) , 이들의 주력사업은 <표 Ⅱ-1>에 정리되어 있다.

나. 빅테크의 금융 진출 요인

최근 GAFA, Alibaba와 Tencent, 네이버와 카카오 등 빅테크에 해당할 수 있는 대형 온라인 플랫폼들이 지급(payment) 서비스를 넘어서 대출, 보험, 자산관리 등 다양한 금융서비스에 진출하고 있다. 현재 빅테크의 금융 진출은 금융산업의 발전 정도나 규제 수준, 이들의 금융 진출에 대한 국가별 규제 차이로 인해 다양하지만14), 이들의 금융 진출 요인은 상당한 것으로 보인다.

첫째, 빅테크는 자신의 플랫폼에 금융서비스를 추가하면 고객층을 넓힐 수 있고 여기서 생성된 정보를 이용하여 핵심 플랫폼의 서비스 질을 높일 수 있다. 빅테크는 일반적으로 검색, 소셜네트워크, 이커머스 등의 핵심 플랫폼 외에도 게임, 콘텐츠 유통, 지도, 광고, 예약 등 다양한 서비스를 제공하고 있다. 그런데 여기에 금융서비스가 추가되면 소비자들은 빅테크 플랫폼에서의 여러 활동이나 거래 시에 금융서비스를 즉각적이고 편리하게 받을 수 있다. 다른 한편, 금융서비스를 통해 수집한 소비자의 금융거래 정보는 빅테크 핵심 플랫폼의 서비스 질을 개선하고 수익을 높이는 데 중요한 투입 요소가 될 수 있다.

둘째, 온라인 소매금융의 가파른 성장과 빅테크 플랫폼의 경쟁력은 금융 진출의 또 다른 중요한 요인이다. IT 기술의 발달과 스마트폰의 보급으로 은행들은 지난 10여 년 사이 온라인 뱅킹을 빠르게 확대해 왔다. 이에 따라 최근에는 젊은 층뿐 아니라 중장년층의 금융소비자들도 온라인 뱅킹을 어렵지 않게 이용하고 있다. 이러한 추세는 온라인 금융서비스에 초점을 둔 빅테크의 금융 진출에 긍정적인 요인이다. 다른 한편으로는, 소비자들이 검색, 소셜네트워크, 이커머스 등을 이용하기 위해 일상적으로 빅테크 플랫폼을 이용하고 있다는 점이다. 즉 빅테크 플랫폼은 금융소비자에게 손쉽게 접근할 수 있다. 과거 오프라인 소매금융 고객 확보에 지점망과 ATM이 중요했듯이, 대규모 이용자들이 많은 시간 머물러 있는 빅테크 플랫폼은 온라인 소매금융에서 중요한 경쟁력이 될 수 있다.

셋째, 핀테크와 빅테크 등의 제3자 서비스 제공업자가 고객의 동의를 얻으면 금융회사로부터 고객 계좌 및 금융거래 정보를 받을 수 있는 오픈뱅킹의 도입이다. 이에 따라 핀테크뿐 아니라 빅테크도 고객의 금융정보에 접근할 수 있게 되었으며 금융산업에 진출하기가 한층 수월해졌다.

2. 빅테크의 금융 진출 현황과 전망

가. 빅테크의 금융 진출 현황

<표 Ⅱ-2>는 국내외 빅테크들의 금융 진출, 즉 금융서비스 영위 현황의 개요를 보여준다.

<표 Ⅱ-2>는 지급(payment) 서비스가 모든 빅테크들이 공통으로 가장 활발하게 진출해 있는 금융서비스임을 보여주고 있다. 지급 서비스의 경우, 이커머스와 같은 주력 사업에서 발생하는 수요 기반이 존재하고 소셜네트워크 등의 기존 사업과 효과적으로 결합하여 빠르게 시장점유율을 높일 수 있는 등 기존 사업과의 시너지가 크고 규제 부담이 상대적으로 작기 때문으로 보인다. 또한 인터넷 쇼핑몰을 보유하고 있는 빅테크들은 모두 여신 서비스를 영위하고 있는데, 이는 이용업체(즉 쇼핑몰 입점업체)를 대상으로 일종의 소상공인 대출을 제공할 수 있기 때문이다.

GAFA로 대표되는 미국의 빅테크들은 비교적 신중하면서 제한적인 형태로 금융에 진출하는 모습을 보인다. 이들은 공통적으로 상업은행과 같이 인가(license)가 필요하거나 강력한 규제가 적용되는 금융 영역에는 진출하지 않고 있다. 대신에 기존 금융회사 또는 핀테크와의 제휴를 통하여 금융서비스를 제공하는 전략을 채택하고 있다.15)

이와는 반대로 중국의 Alibaba와 Tencent는 초기부터 매우 적극적으로 금융에 진출해 왔다. 이 두 빅테크는 기존 금융회사의 인수 등을 통하여 은행, 보험 등 인가가 필요한 영역을 포함한 금융의 거의 모든 영역에 걸쳐 서비스를 제공하고 있다. 이 중에서 Alibaba의 경우 자회사 Ant Group이 금융 사업을 총괄 지배하는 조직 구조를 갖고 있다.

국내의 네이버와 카카오는 각기 다른 금융 진출의 형태를 보이고 있다. 네이버는 미국의 GAFA와 유사하게 인가가 필요한 영역에는 아직 진출하지 않고 있으며, 주로 기존 금융회사와의 제휴를 통하여 금융서비스를 제공하고 있다. 네이버는 2015년 6월 간편결제(지급)서비스인 네이버페이를 시작으로 금융서비스를 제공하기 시작하였으며, 2019년 11월 네이버파이낸셜을 설립하여 금융 부문을 자회사로 분사하였다. 체크카드, 신용카드, 환전에 이어, 2020년에는 미래에셋대우증권(현 미래에셋증권)의 CMA 개설을 대행해 주는 네이버통장을 출시하였다. 이 외에 입점업체를 대상으로 하는 대출 서비스도 제공하고 있다.

카카오는 네이버와는 달리 금융회사의 설립 또는 인수를 통하여 인가가 필요한 영역에 직접 진출하는 전략을 구사하고 있다. 2017년 인터넷은행인 카카오뱅크가 영업을 개시하였고, 2019년 보험 스타트업 인바이유를 인수하였다. 이어 2020년 바로투자증권을 인수하여 카카오페이증권으로 개명하면서 증권업에도 진출하였다. 최근 카카오페이는 디지털손해보험 자회사 본인가를 신청하여 금융감독원의 심사가 진행 중이다.

<그림 Ⅱ-1>에서 볼 수 있듯이, 국내의 빅테크들은 간편결제를 포함한 지급 서비스 부문에서 빠르게 성장하고 있다. 카카오페이와 네이버페이가 포함된 전자금융업자의 점유율은 2016년 26.6%에서 2021년 6월말 현재 49.4%로, 지난 5년 사이 가파른 상승세를 나타내고 있다. 2021년 6월 말 현재 22.1%의 점유율을 보이는 삼성페이가 포함된 휴대폰 제조사도 28.5%인 금융회사와 비교해서 상당히 높은 편이다.

나. 빅테크와 금융회사 간 경쟁구조

금융회사들은 오랜 기간 안정적으로 금융서비스를 제공해 오면서 여러 경쟁우위를 구축하였다. 이들은 지역사회 곳곳에 있는 지점망으로 고객들과 형성한 깊은 유대관계를 통해 고객들에 관한 소프트(soft) 정보뿐 아니라 높은 신뢰와 충성심을 축적할 수 있었다. 또한 금융서비스의 성공과 실패를 많이 경험하였기에 고객에 필요한 금융상품을 잘 이해하고 있다. 금융회사들은 금융상품을 취급하는 과정에서 불거질 수 있는 금융소비자보호와 금융 리스크에 대해서도 깊이 있게 이해하고 있고 감독 당국과의 관계도 잘 설정하고 있다. 특히, 대형 금융회사들은 수십 년간 쌓은 시장의 평판과 고객 기반 등을 통해 견고한 시장지배력을 가지고 있다. 이러한 점 때문에, 소매금융 부문에서는 어떠한 새로운 경쟁자도 이들을 능가하기가 쉽지 않으리라고 예측되어 왔다. 그러나 소매금융 부문이 오프라인 중심에서 온라인 중심으로 급속하게 전환되면서, IT 기술을 기반으로 새로운 사업모델을 장착한 빅테크가 기존 금융회사와 다른 차별화된 경쟁력을 가지고 있어 위협적인 경쟁자로 부상하고 있다.

실제로 빅테크는 금융회사와 비교하여 여러 차별화된 경쟁우위를 가지고 있다. 이들은 금융회사와 달리 오프라인 중심의 점포망과 IT 구축 등 레거시(legacy) 시스템에 제약받지 않고 최첨단 IT 기술을 이용하여 소비자의 선호와 수요에 신속하고 유연하게 대응할 수 있다. 또한 원천적으로 모바일·디지털 중심의 고객 경험을 중시한 온라인 사업모델로 성장하였기에 소비자에게 편리한 금융서비스가 무엇인지 잘 이해하고 있다. 한편 빅테크는 온라인 부문에서 대규모 고객 기반과 높은 평판, 브랜드를 가지고 있고 자본력도 금융회사보다 작지 않다. 앞서 논의하였듯이, 빅테크는 자신의 여러 플랫폼에서 수집한 소비자의 선호와 행태에 관한 빅데이터와 이를 분석할 수 있는 IT 기술을 금융서비스에 활용할 수 있다. 예를 들면 빅테크는 검색 성향, 이커머스에서의 거래 결과, SNS 활동 등을 통해 수집한 고객정보를 맞춤형 금융서비스뿐 아니라 고객별 차등화된 가격 책정, 신용 심사 등에 활용할 수 있다.

이상에서 살펴본 바와 같이, 대형 금융회사와 빅테크들은 서로 다른 차원에서 우월한 경쟁력을 가지고 있다. 따라서 빅테크의 금융 진출이 본격적으로 이루어졌을 경우 빅테크와 금융회사 중 경쟁력이 누가 더 클지 쉽게 예측하기 어렵다. 그러한 점 때문에, 빅테크의 금융 진출 그 자체만으로도 금융회사들에 상당한 경쟁 압박으로 작용하는 것으로 보인다. 최근 우리나라의 은행들이 대규모 IT 투자, IT 관련한 인력의 충원과 교육, 온라인 부문을 중심으로 하는 조직 개편을 긴박하게 단행하고 있는데, 카카오나 네이버와 같은 대형 온라인 플랫폼 기업들의 금융 진출에 따른 대응적인 측면이 크다. BIS 보고서는 지금까지의 여러 해외사례를 들어 소매금융 부문에서 금융회사와 빅테크 간 경쟁구조가 각 국가의 규제 상황, 금융 발전의 정도, 이들의 경쟁우위에 따라 다르게 나타날 수 있음을 지적하고 있다(BIS, 2019). Vives(2019)와 De la Mano & Padilla(2018) 등은 빅테크와 금융회사의 경쟁구조나 방식에 대해 아래와 같이 전망하고 있다.

경쟁 방식을 보면 빅테크는 주로 자신의 플랫폼 내 금융상품을 비교하는 마켓플레이스 또는 플랫폼을 통해 중개하고 있지만, 회사에 따라서는 은행 등의 금융회사 라이선스를 취득하여 금융상품을 직접 공급하기도 한다.18) 금융상품을 비교하거나 추천하는 마켓플레이스 서비스만을 제공하고 있는 빅테크로는, 우리나라 네이버와 미국이나 유럽 등의 GAFA를 들 수 있다.19) 카카오, 중국의 Alibaba와 Tencent가 은행 등의 금융회사 라이선스를 가지고 금융에 진출하고 있으며 이 경우 다른 금융회사의 금융상품을 중개하는 마켓플레이스 또는 플랫폼도 함께 제공하고 있다.

일부 대형 금융회사들은 자사와 경쟁사들의 금융상품을 비교해 주는 마켓플레이스를 운영하여 빅테크 플랫폼에 맞대응할 수 있을 것이다. 다른 금융회사들은 특정한 고객층을 목표로 금융서비스를 제공함으로써 빅테크에 대응할 수 있다. 현재 미국의 GAFA와 대형 금융회사들이 대출 및 신용카드 부문에서 협력하고 있듯이, 금융회사들과 빅테크는 시너지를 내기 위해 제휴할 수도 있다. 또한 금융회사들은 빅테크 플랫폼이든 대형 금융회사 플랫폼이든 이들의 마켓플레이스를 자신의 금융상품 판매채널로 이용할 것이다.

<그림 Ⅱ-4>에서 볼 수 있듯이, 빅테크들은 플랫폼 간 경쟁(Platform to Platform: P2P)에 참여할 뿐 아니라 플랫폼 내 경쟁(Platform to Business users: P2B)에 관여할 수 있다. 빅테크는 이와 같은 경쟁의 형태에서 고객 네트워크, 플랫폼 간 교차 보조, 시스템 호환성 등 다양한 전략적 도구를 이용할 수 있다. 특히 플랫폼 내 관리자로서 수직결합한 시장을 동시에 운영할 때, 자신의 독점적 지위를 지렛대로 삼을 수 있는 전략적 영업행위를 이용할 수 있다. 이를테면 플랫폼 내 번들링이나 자사상품의 우대 등의 영업행위, 고객정보의 활용, 배타적인 시스템 호환성 등을 추구할 수 있다. 다음 절에서는 이러한 빅테크의 경쟁 우위적인 요소와 불공정경쟁의 이슈를 좀 더 심층적으로 제시한다.

앞서 논의하였듯이, 빅테크는 일반적으로 검색엔진, 소셜네트워크, 이커머스, 운영시스템(OS) 등의 온라인 부문에서 시장지배력을 가진 대형 기술 기업으로 핵심 플랫폼과 인접한 여러 플랫폼에 진출하고 있다. 구글을 예로 들면, 검색엔진 외에 OS(운영시스템), 앱 마켓플레이스, 브라우저 서비스, 미디어 플레이어, 구글맵, 구글 쇼핑, 구글페이 등 다양한 플랫폼 서비스를 제공하고 있다. 사실 빅테크들은 자신의 핵심 플랫폼을 지렛대로 여러 플랫폼에 진출하며 독점력을 확대해가고 있는데, 이러한 플랫폼 진출의 동기 및 진출 과정에서의 전략들은 ‘플랫폼 포획(platform envelopment)’에 관한 이론을 통해 이해해 볼 수 있다. 특히, 빅테크는 플랫폼 서비스의 네트워크 특성과 수직결합의 그룹 형태를 하고 있어 인접한 플랫폼을 확장하는 과정에서 효율성 향상뿐 아니라 경쟁기업의 배제(foreclosure)나 진입저지(entry deterrence)를 함의하는 경쟁제한적 영업행위를 할 유인이 존재한다. 다른 한편으로, 빅테크가 축적한 대규모 고객정보는 경쟁 플랫폼과의 공정한 경쟁 환경을 저해하는 요인으로 작용할 수 있다. 본 절에서는 이러한 관점에서 빅테크와 관련한 공정경쟁 이슈를 논의하고자 한다.

가. 빅테크의 플랫폼 포획 전략과 공정경쟁 이슈

Eisenmann et al.(2011)은 시장지배력을 보유한 플랫폼이 자신의 고객과 중첩된 인접 플랫폼에 진출하여 플랫폼 간 시너지를 낼 수 있다면 설령 높은 전환비용과 네트워크 효과로 인해 산업구조가 견고했던 시장이라 하더라도 이러한 시장에 침투하여 장악할 수 있다는 ‘플랫폼 포획’에 관한 이론을 제시하였다. 이러한 이론에 따르면 빅테크는 전환비용이 높고 네트워크 효과가 강한 금융서비스 플랫폼에서도 상당한 파급력을 기대할 수 있다. 사실 빅테크의 금융 진출과 관련한 여러 문헌에서는 빅테크의 금융 진출이 단기적으로 소매금융 시장의 경쟁을 촉진하겠지만 장기적으로는 이들이 금융회사들을 제치고 독점적 지위를 누릴 수 있을 것으로 전망하고 있다.

Eisenmann et al.(2011)은 플랫폼 포획이 가능한 전제조건으로 플랫폼 고객 기반의 중첩과 소비자 또는 공급자 측면에서의 범위의 경제를 제시하였다.20) 즉, 플랫폼 포획 이론은 고객들이 추가된 플랫폼으로 인해 플랫폼 서비스 이용의 편리성이 향상되고 두 플랫폼 서비스를 제공하며 비용을 절감할 수 있다면 플랫폼 사업자가 시장지배적 지위를 지렛대로 삼아 신규로 진출한 플랫폼을 장악할 수 있음을 시사한다. 사실 빅테크는 핵심 플랫폼에서 시장지배적 지위를 가지고 있고 플랫폼 간 시너지를 내고 있어 플랫폼 포획 이론의 전제조건을 충족하고 있다. 이를테면 빅테크는 자신의 평판과 고객과의 관계, 대규모 고객정보 등을 추가 비용 없이 신규 플랫폼 마케팅에 활용할 수 있으며 고도의 IT 시스템을 여러 플랫폼에서 공동으로 이용할 수 있다. 고객들은 하나의 빅테크 플랫폼에서 여러 서비스를 이용하고 있으며 여러 플랫폼에서 생성된 자신의 정보에 기반한 향상된 서비스를 받을 수 있다. 빅테크는 다양한 유형의 고객들을 상호 매칭해 주는 다면(multi-sided) 플랫폼을 운영하고 있어 플랫폼 추가에 따른 네트워크 효과도 매우 클 수 있다.

Eisenmann et al.(2011)은 고객 기반의 중첩과 범위의 경제 등의 전제조건에 ‘번들링’ 전략을 더한다면 인접한 플랫폼을 포획할 가능성이 크다고 주장하고 있다.21) 번들링은 운영시스템(OS)이나 PC 또는 온라인 플랫폼에 새롭게 제공하는 서비스 앱을 선탑재하거나 특정 플랫폼의 구독을 전제로 여타 플랫폼의 서비스를 제공하는 등 다양한 형태로 나타날 수 있다. 번들링 상품에 대해서 가격을 차별적으로 매겨 더 많은 고객을 유인할 수 있다. 특정 플랫폼이나 상품, 서비스를 우대하는 행위도 넓게 보면 번들링의 한 형태로 볼 수 있다. Eisenmann et al.(2011)은 고객 기반이 상당히 중첩된다면 기존 플랫폼의 시장지배적 지위를 지렛대로 신규 플랫폼의 서비스를 효과적으로 번들링할 수 있으며 이를 통해 신규 플랫폼의 고객을 확장하는 데 성공할 가능성이 크다고 지적하고 있다. 그런데 이러한 번들링 전략은 빅테크의 다양한 플랫폼 포획에 중요한 전략으로 그 자체만을 볼 때 효율성에 기반하고 있지만 아래에서 논의하는 바와 같이 동태적으로는 경쟁제한적 함의를 내포할 수 있다.

시카고학파에 따르면, 수직결합에 있는 두 상품의 번들링 전략은 상위시장(upstream market)의 시장지배적 지위와 무관하게 소비자 후생에 부정적이지 않다. 즉 상위시장의 독점기업이 하위시장(downstream market) 상품과의 번들링을 통해 상위시장의 시장지배적 지위를 하위시장으로 확장할 수 없으며 이에 따라 소비자 후생에도 부정적인 영향을 줄 수 없다. 이들의 주장은 상위시장에서 시장지배력을 가진 기업이더라도 자신의 이러한 지위를 지렛대로 경쟁에 우위를 점할 수 없으므로 경쟁제한적 영업행위로 볼 수 없다는 것이다.

그러나 1990년대 이후 여러 문헌은 상위시장의 독점기업들이 하위시장의 자사상품과 번들링하거나 이를 우대하는 전략을 통해 하위시장까지 독점력을 확장하거나 상위시장의 독점력을 더욱 공고하게 유지할 수 있다는 이론들을 제기하기 시작하였다. Whinston(1990)은 규모의 경제가 있는 독점기업이 번들링을 이용하면 타겟인 독점적 경쟁(monopolistic competition)22) 시장에 있는 경쟁기업을 퇴출할 수 있다는 점을 지적하였다. 여기서, 번들링 전략이 독점기업 자신의 수익을 높일 수 있을 때 경쟁기업의 퇴출이나 잠재적 경쟁기업의 진입을 저지할 수 있다. 다만, 이를 위해서는 독점기업은 번들링하는 상품의 디자인 등을 통해 번들링 전략의 확고함(commitment)을 입증할 수 있어야 한다. 사실 Whinston(1990)의 가정은 전통적인 상품시장보다는 간접 네트워크 효과가 커 규모의 경제가 있는 플랫폼 시장에 부합한다. 이러한 점에서, Whinston(1990)이 제시한 이론은 최근 빅테크의 번들링 전략에 대한 경쟁 제한적 해석을 지지하고 있다.

Condorelli & Padilla(2020)는 빅테크의 자사상품 우대 전략이 경쟁기업의 판매 비용을 높여 경쟁력을 저해한다면 종국적으로는 경쟁 제한적 행위로 볼 수 있다고 주장한다. 이는 상위시장의 기업이 시장지배적 지위에 있지 않더라도 하위시장에 있는 경쟁기업의 비용을 높일 수 있을 때 이러한 시장에 진출하여 경쟁기업을 퇴출할 수 있다는 Ordover et al.(1990)의 이론에 바탕을 두고 있다.

빅테크는 시장지배적 지위, 네트워크 효과, 플랫폼 사이에서의 교차 보조, 규모의 경제, 범위의 경제 등의 특성이 있는데, 이러한 점 때문에 번들링이나 자사상품의 우대 전략을 활용하여 신규로 진출한 플랫폼에서 경쟁기업을 퇴출하거나 잠재 기업의 시장진입을 효과적으로 저지할 수 있다. 특히 빅테크들은 여러 플랫폼 시장에 진출하고 있는데, 그 이유는 이에 따른 고객정보와 간접 네트워크 효과를 이용하여 핵심 플랫폼의 독점력을 한층 강화할 수 있기 때문이다. 최근 빅테크들이 자신들의 공고한 시장지배력을 지렛대로 여러 인접한 플랫폼에서도 독점적 지위를 확대해 가고 있는 가운데, 여러 경쟁 당국은 일부 시장에서 이들의 자사상품의 우대 등을 경쟁 제한적 영업행위로 보고 소송 제기 등을 통하여 대응하고 있다.23)

요컨대, 빅테크가 여러 플랫폼 시장을 포획하는 과정에서 일부 전략적 영업행위는 종국적으로 핵심 플랫폼의 시장지배적 지위를 연관 플랫폼으로 확장하여 경쟁기업을 배제하거나 잠재적인 기업의 시장진입을 저지하는 등 산업의 역동성을 저해할 수 있다. 즉 Khan(2017)이 지적하고 있듯이, 빅테크의 일부 전략적 영업행위는 소비자 후생에 미치는 단기적인 영향뿐 아니라 동태적인 관점에서 공정한 경쟁 환경을 제한할 수 있다.

마지막으로, Smith & Geradin(2021)은 금융에 진출한 빅테크와 관련된 번들링과 자사상품 우대 행위의 예시로 다음과 같은 것들을 들고 있다. 빅테크는 자사의 특정한 금융상품을 쉽게 선택하도록 해당 상품에 대해서만 새로운 계정이나 별도의 인증 절차를 요구하지 않을 수 있다. 소비자가 제시된 결합 상품에 동의하지 않을 시 그 절차를 어렵게 할 수 있다. 예를 들면 소비자는 새로운 창을 열어 비동의를 위한 클릭 버튼을 눌러야 하거나 색상이나 디자인 등을 통해 동의를 유도할 수 있다. 빅테크는 특정한 플랫폼 구독자나 활동에 대해 자사 금융서비스의 할인 혜택을 제공할 수 있다. 빅테크는 핵심 플랫폼 등을 이용하여 소비자들의 금융상품 접근을 통제하거나 자사 금융상품의 판매에 우호적으로 프로그램을 운영할 수 있다. 빅테크는 소비자들이 쉽게 볼 수 있는 위치에 자사 금융상품을 배치하거나 그러한 상품의 선택을 유도하는 넛지(nudge)를 이용할 수 있다. 예를 들면 빅테크는 경쟁 금융회사의 금융상품을 검색 창 하단에 배치할 수 있고 자사의 페이 결제를 확인하는 방식으로 스마트폰 옆 버튼의 더블 클릭하는 방식과 같이 인체공학적 단축키를 미리 장착할 수 있다.

나. 빅테크의 데이터 우위와 공정경쟁 이슈

빅테크의 대규모 고객 데이터는 온라인 플랫폼 시장에서 경쟁력을 제고하는 데 매우 중요한 투입 요소일 뿐 아니라, 진입장벽의 원천이 될 수 있다. 이는 온라인 플랫폼이 더 많은 데이터를 통해 서비스의 질을 개선할 수 있고 데이터의 수집이나 활용에서 규모의 경제와 범위의 경제가 있어 비용 효율성 측면에서 상당한 경쟁 우위를 가질 수 있기 때문이다. 이를테면 소셜네트워크, 콘텐츠 공유 플랫폼, 예측 알고리즘 또는 고객별 표적 광고 등의 데이터 관련 플랫폼 서비스를 위해서는 최소한의 데이터가 필요할 뿐 아니라 이를 수집하여 처리하고 분석하는데 상당한 고정비용이 들어간다. 신규 고객이 플랫폼에 가입하여 데이터를 제공하면, 기존 고객들은 동일 플랫폼에서 이전보다 더 많은 정보를 공유할 수 있고 또 이에 기반한 알고리즘으로 향상된 서비스를 받을 수 있다. 더욱이, 특정한 플랫폼에서 수집된 데이터는 여러 다른 플랫폼 서비스에 중요한 투입 요소로 이용될 수 있다. 빅테크의 대규모 고객 데이터의 축적은 소비자들을 그들 서비스에 고착화(lock-in)시키는 결과를 초래할 수 있다. 예를 들어, 소비자가 다른 SNS로 전환하거나 여러 플랫폼을 동시에 이용하는 멀티호밍(multi-homing)을 하고 싶어도 이전에 이용하던 빅테크 플랫폼에 제공하였거나 거기서 생성된 사진, 콘텐츠 또는 프로필 등의 정보를 새로운 플랫폼에 다시 업로드해야 한다면 이를 포기할 수 있다. 이러한 이유로, 빅테크와 같은 대형 온라인 플랫폼들의 데이터 독점은 시장에 새롭게 진입하려는 플랫폼에 상당한 진입장벽으로 작용할 수 있다.

한편, 플랫폼 간 보유 데이터의 격차는 그 자체로 서비스의 질적인 차이를 만들 수 있는데, 이러한 점 때문에 빅테크는 플랫폼 스타트업들로부터 경쟁의 압박을 덜 받을 수 있다. 플랫폼 스타트업의 경우 데이터의 부재로 혁신적인 기술을 개발하는 데 어려움이 있을 수 있고 데이터 분석과 관련한 기술을 새롭게 개발하더라도 빅테크와의 데이터 격차로 인해 제대로 경쟁하지 못할 수 있다. 따라서 플랫폼 간 보유 데이터의 격차가 커질수록 플랫폼 스타트업들은 새로운 기술 개발에 투자할 유인이 낮아질 수 있다. 요컨대, 플랫폼 간 경쟁이 지금까지 축적한 데이터의 양에 의해 크게 결정되면 플랫폼 서비스나 이를 위한 기술 혁신이 저해될 수 있다.

최근 전 세계 많은 국가는 온라인 플랫폼 시장에서 발전하기 시작한 데이터 중심의 경제에 대비하여 데이터의 소유권과 보호에 관한 제도들을 마련하고 있다. 이러한 제도들로는 대표적으로 본 연구의 Ⅲ장에서 논의하고 있는 EU의 GDPR, 오픈뱅킹, 빅테크 규제 등을 들 수 있는데, 이들 모두 소비자의 데이터 주권을 강화하는 데이터 이동권(portability)을 다루고 있다. 데이터 이동권은 소비자들이 특정 플랫폼이 자신의 정보에 접근할 수 있고 공유할 수 있도록 자신이 이용하고 있는 플랫폼에 요청할 수 있는 권한이다. 이러한 데이터 이동권은 두 가지 측면에서 중요한 함의를 가진다. 첫째는, 데이터의 소유와 이용 권한이 이를 수집한 기업뿐 아니라 이를 생성하는데 이바지한 소비자에도 있다는 소비자의 데이터 주권을 인정하고 있다는 점이다. 둘째는, 빅테크와 같은 소수의 대형 플랫폼이나 대형 금융회사의 고객 데이터 독점으로 인한 시장의 불공정한 경쟁 환경에 대한 정책적 대응이라는 점이다.

데이터 이동권은 무수히 많은 플랫폼이 데이터를 중복으로 이용할 수 있는 비경합성(non-rivalry)에 기반을 두고 효율성을 추구하고 있다. 즉 여러 플랫폼이 데이터를 공유하더라도 사회적으로 추가 비용이 거의 들지 않는 한편, 플랫폼 기업들은 고객의 동의로 공유한 정보를 서비스 질 개선에 활용할 수 있다. 또한 소비자들은 데이터 이동권을 통해 이전에 이용하던 플랫폼에 제공하였거나 거기서 생성한 자신의 사진, 콘텐츠 또는 프로필 등의 정보를 새로운 플랫폼이 공유하도록 요구할 수 있으므로 더 다양한 플랫폼을 손쉽게 이용할 수 있다. 즉 이들은 여러 플랫폼을 동시에 이용하는 멀티호밍을 할 수 있으며 자신에게 더 맞는 서비스를 제공하는 플랫폼으로 전환할 수 있다.

또한 데이터 이동권은 플랫폼 간 공정한 경쟁 환경의 조성에 이바지하는 바가 클 수 있다. 소비자들은 신규 스타트업 플랫폼의 서비스가 만족스럽다면 데이터 이동권을 통해 언제든 자신의 데이터를 제공할 것이다. 따라서 스타트업 플랫폼들은 소비자의 니즈에 맞는 서비스 개발에 더 치중할 수 있게 되고 소비자 데이터를 별도로 확보하지 못했더라도 빅테크와 시장에서 경쟁할 수 있을 것이다. 설령 빅테크가 특정한 플랫폼에서 독과점을 형성하고 있더라도 신규 진입의 위협으로 인해 경쟁적인 시장의 결과가 유지될 수 있다.

Ⅲ. 국내외 빅테크 규제 및 오픈뱅킹 논의

지금까지 살펴본 빅테크의 대두 및 빅테크가 발휘하는 시장지배력, 그리고 그러한 시장지배력을 가능하게 만든 온라인 플랫폼 기업으로서의 경제적 특성은 오랜 기간에 걸쳐 형성되고 시행되어 온 독점방지 또는 공정경쟁 규제의 실효성에 대한 의문을 제기하게 만들었고, 그에 따라 효과적인 빅테크 규제에 대한 논의가 2010년대 후반부터 일어나기 시작했다. 그리고 이러한 논의의 결과로 EU, 미국, 영국 등의 주요국에서는 빅테크의 과도한 시장지배력 확장을 방지하고 공정경쟁을 확보하기 위한 새로운 규제를 마련하고 있다. 본 장에서는 주요국의 최근 규제 동향을 정리하고, 시장경합성을 확보함으로써 경쟁환경을 조성하기 위한 핵심적 요소의 하나인 데이터 문제에 대한 정책 동향을 오픈뱅킹을 통하여 알아본다.

1. 주요국의 빅테크 규제 동향

본 절에서는 EU, 미국, 영국, 일본 등 주요국과 더불어 한국의 빅테크 또는 온라인 플랫폼에 대한 공정경쟁 및 공정거래 규제 동향을 정리한다. 먼저 빅테크 규제의 필요성에 대하여 각국에서 진행되었던 주요한 논의들을 정리한 다음, 빅테크를 대상으로 P2P 또는 시장경합성 측면에 중점을 두고 있는 대표적인 규제로 EU와 미국의 입법안의 주요 내용을 정리한다. 이어서 빅테크 뿐 아니라 대부분의 온라인 플랫폼 사업자를 대상으로 P2B, 즉 플랫폼 사업자와 이용업체 간의 공정거래 측면에 중점을 두고 있는 일본과 한국 입법안의 주요 내용을 정리한다. 마지막 소절에서는 빅테크의 금융 진출과 관련하여 경쟁 당국과 금융 당국 간 협력의 필요성이 높아지고 있는 가운데, 그러한 협력 체계를 마련한 영국의 사례를 소개한다.

가. 빅테크 규제 필요성에 대한 논의

기존의 반독점 또는 공정경쟁 규제는 빅테크의 시장지배력 확대를 억제하는 데 있어서 효과적이지 못하다는 지적으로 가장 널리 알려진 논의는 Khan(2017)에서 제기되었다.24) Khan(2017)은 대표적 빅테크 기업인 Amazon의 성장 사례를 분석한 논문에서 약탈적 가격설정(predatory pricing)과 수직적 통합(vertical integration)이 Amazon 성장의 핵심 전략이며, 기존의 소비자 후생과 가격 중심의 사후적 규제로는 이러한 전략을 통한 빅테크의 성장을 효과적으로 규율할 수 없다고 지적하였다. 그 이유는 다면(multi-sided) 시장 비즈니스를 영위하는 플랫폼 기업의 특성상 시장 획정 및 기업의 행위가 반경쟁적인지 여부를 판단하는 것이 전통적 기업에 비하여 어려울 뿐 아니라, 반경쟁적 행위로 확정되어 처벌에 이르기까지 상당한 시간이 소요되고 그동안 해당 플랫폼 기업이 시장지배력을 확보한 후에는 원상회복이 거의 불가능하다는 것이다. 이러한 한계에 대응하기 위하여 Khan(2017)은 빅테크에 대해서는 규제 대상을 사전적으로 지정하고, 지정된 규제 대상의 금지행위 및 의무를 사전적으로 규정하는 사전적(ex-ante), 기관별(entity-based) 규제가 필요함을 주장한다.

미국 하원의 보고서(US House of Representatives, 2020)는 온라인 검색, 온라인 쇼핑, 소셜네크워크, 모바일 앱마켓, 모바일 운영체제(OS), 디지털 지도, 클라우드, 음성 지원, 웹 브라우저, 디지털 광고 시장에서 4개 빅테크, 즉 GAFA의 시장지배력을 조사하였다. 동 보고서는 1998년 이후 GAFA를 중심으로 한 빅테크들이 500개 이상의 기업을 인수했지만 단 한 건도 금지된 사례가 없고, 결과적으로 GAFA의 과도한 시장지배로 혁신이 위축되었고 데이터 오용 등 사회적 비용이 발생하고 있다고 지적하고 있다. 또한 빅테크들이 로비 등을 통하여 정책 결정 과정에서 영향력을 확대해 왔으며, 플랫폼 사업자와 언론기관 간 협상력에 불균형이 생기면서 뉴스의 신뢰도 역시 하락하였다고 주장한다. 동 보고서는 디지털 시장에서 경쟁을 복원하고 반독점 규제를 강화하기 위한 의회의 대응이 필요함을 강조한다.

EC의 Crémer 보고서(Crémer et al., 2019)는 극단적인 규모의 경제, 네트워크 외부성, 데이터의 역할이라는 3가지의 특징이 존재하는 디지털 시장에서 시장이 독점화되면 경쟁을 통한 혁신이 저해되고, 묶음판매(bundling)를 비롯한 다양한 형대의 지배력 전이(leverage) 전략을 취할 우려가 존재함을 지적하고, 디지털 시장의 공정한 경쟁환경을 만들기 위한 해결책으로 데이터 이동성(portability)과 상호운용성(interoperability)의 중요성을 강조하고 있다. 본 보고서는 후술하는 EU의 디지털시장법(Digital Markets Act: DMA)의 기초가 된 것으로 알려져 있다.