Find out more about our latest publications

Korean Securities Firms' Real Estate PF: Risk Factors and Future Responses

Issue Papers 23-10 May. 22, 2023

- Research Topic Financial Services Industry

- Page 25

Real estate project financing in South Korea is characterized by a unique structure marked by high leverage and ongoing financing throughout a project. A slowdown in the market and other factors leading to decreased profitability in real estate development projects could expose the vulnerability of the financing structure, thereby increasing risks associated with real estate PF. An analysis was carried out on the yields on asset-backed commercial paper (ABCP) for real estate PF guaranteed by securities firms. The results revealed that in a stable market, credit ratings were the sole factor affecting yields, while during a crisis, several other factors came into play. This suggests a scenario in which the risk associated with real estate PF could be underestimated during periods of high profitability in real estate development projects. Therefore, investors involved in real estate PF should exercise caution when expanding their exposure to this market during a real estate boom.

It is also noteworthy that real estate PF is now more interconnected with financial firms and capital markets than ever before, thanks to a broader range of financial firms and a greater variety of financing options available in the market. However, the risk of real estate PF has increased as the market has deteriorated since 2022. The government and participants in this market should monitor not only the constructors, businesses, and financial firms involved in real estate PF, but also the whole macroeconomic environment including the money market and real estate market. Especially in 2023, they need to be vigilant regarding the potential for risk transfers between real estate PF, financial firms, and markets. Moreover, when extending liquidity and other policy support to real estate PF businesses, the government needs to enhance market discipline by thoroughly evaluating business feasibility and profitability, and enforcing stringent qualifications for policy support.

In the short term, securities firms that typically participate in this market through asset-backed securities (ABS) and refinancing should assess their own risks to secure additional liquidity or unwind their positions, while also preparing their responses in the event of any real estate PF business defaults. They should also adopt long-term strategies to enhance internal controls related to real estate PF. This includes establishing risk management standards for real estate PF that consider expected returns and risks, exercising caution against excessive risks or following trends with certain developers, and redesigning their staff remuneration policies and examination criteria that align with the nature of real estate PF. Additionally, it is essential to review the issuance of ABS with maturities that align with those of real estate PF loans.

It is also noteworthy that real estate PF is now more interconnected with financial firms and capital markets than ever before, thanks to a broader range of financial firms and a greater variety of financing options available in the market. However, the risk of real estate PF has increased as the market has deteriorated since 2022. The government and participants in this market should monitor not only the constructors, businesses, and financial firms involved in real estate PF, but also the whole macroeconomic environment including the money market and real estate market. Especially in 2023, they need to be vigilant regarding the potential for risk transfers between real estate PF, financial firms, and markets. Moreover, when extending liquidity and other policy support to real estate PF businesses, the government needs to enhance market discipline by thoroughly evaluating business feasibility and profitability, and enforcing stringent qualifications for policy support.

In the short term, securities firms that typically participate in this market through asset-backed securities (ABS) and refinancing should assess their own risks to secure additional liquidity or unwind their positions, while also preparing their responses in the event of any real estate PF business defaults. They should also adopt long-term strategies to enhance internal controls related to real estate PF. This includes establishing risk management standards for real estate PF that consider expected returns and risks, exercising caution against excessive risks or following trends with certain developers, and redesigning their staff remuneration policies and examination criteria that align with the nature of real estate PF. Additionally, it is essential to review the issuance of ABS with maturities that align with those of real estate PF loans.

Ⅰ. 검토 배경

2022년 상반기까지 지난 5년 동안 부동산시장 상승세가 이어진 가운데 비은행권을 중심으로 금융업권의 부동산PF 익스포져 규모는 2배 이상 증가했다. 부동산PF의 형태를 보면, 과거 금융사로부터의 직접 대출 위주에서 대출채권을 기초자산으로 한 유동화증권 발행을 통해 자금을 조달하는 구조가 증가하였으며, 증권사들이 부동산PF 유동화증권 시장에서 주요 채무보증 주체로서 역할을 하고 있다. 부동산PF 참여 금융업권의 확대와 자금 조달방식의 다양화로 인해 부동산PF와 금융사 및 자본시장 간 연계성이 과거보다 높아졌다고 할 수 있다. 증권사의 자본시장에서 역할을 감안하면1), 채무보증을 통하여 부동산PF에 참여하는 증권업은 이러한 연결고리에서 특히 중요한 위치에 있다고 볼 수 있다.

한편, 2022년 글로벌 인플레이션으로 인해 주요국들의 긴축적인 통화정책이 시행되면서 시장금리가 상승하였으며, 이러한 거시환경 변화가 경제 전반에 부정적인 영향을 끼치면서 부동산시장은 침체되었고 부동산PF 위험이 빠르게 증가하였다. 레고랜드 사건 이후 2022년 4분기 중에 부동산PF 부실 위험과 연동되면서 단기자금시장의 유동성 위기도 발생하였는데, 특히 부동산PF 유동화증권의 차환발행이 어려워지면서 채무보증을 수행한 증권사의 유동성 위험이 부각되었다. 부동산PF의 위험을 이해하고 관리하기 위해서는 관련 업권과 단기자금시장에 대한 종합적인 이해가 필요하다. 본고에서는 부동산PF와 금융사 및 단기자금시장 간 관계를 설명하고, 위험 발생의 원인을 종합적으로 살펴보려고 한다. 또한, 증권사보증의 부동산PF 유동화증권 정보와 발행금리 간의 관계를 분석하고 이를 기반으로 위험관리의 필요성과 정책적 시사점을 도출해 보고자 한다.

본고의 구성은 다음과 같다. Ⅱ장에서는 국내 부동산PF의 특징과 위험요인을 설명하고 부동산PF 시장 현황과 증권사의 부동산PF 채무보증 확대 배경을 살펴보았다. Ⅲ장에서는 부동산PF와 단기자금시장 간 관계를 살펴보고 증권사들이 채무보증한 부동산PF 유동화증권의 현황 및 발행금리 결정요인을 분석하였다. Ⅳ장에서는 증권사의 부동산PF에 대한 위험관리 방향과 정책적 시사점을 제시하였다.

Ⅱ. 국내 부동산PF의 특징과 위험요인

본 장에서는 국내 부동산PF의 구조와 특징을 설명하고, 부동산PF의 위험요인을 정리한다. 또한, 지난 5년간 금융업권의 부동산PF 익스포져 증가 배경과 함께, 증권업의 부동산PF 채무보증 확대 과정을 살펴본다.

1. 국내 부동산PF 자금조달 특징

가. 국내 부동산PF 시기별 특징

프로젝트 파이낸싱(Project Financing: PF)은 투자 대상이 되는 사업으로부터 발생하는 미래 현금흐름을 상환 재원으로 하여 자금을 조달하는 금융기법이며, 부동산PF는 투자 대상이 부동산 개발사업인 PF를 의미한다(김정주, 2022). 부동산 개발사업에서 시행사(developer)는 부동산 개발사업의 주체로서 자금조달을 포함하여 용지매입과 인허가 등 사업 초기부터 최종 분양까지의 전 과정을 담당하며, 시공사(constructor, 건설사)는 시행사로부터 사업발주를 받아 공사를 수행하는 역할을 한다.

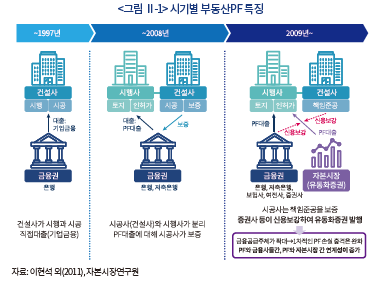

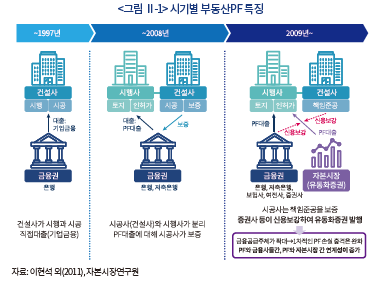

<그림 Ⅱ-1>은 국내 부동산PF의 시기별 특징을 보여준다.2) 1997년까지 건설사가 직접 은행으로부터 기업금융 대출을 받아 시행사 및 시공사 역할을 모두 담당하면서 부동산 개발사업을 진행하였다. 건설사가 용지매입, 개발, 분양을 수행하는 과정에서 대규모 자금이 투입되면서 유동성 위기에 직면하게 될 수 있었으며, 부동산시장 침체와 미분양 발생시에 건설업 전체 위험이 증가하게 되었다. 이후 2008년까지의 시기를 보면, 용지매입 및 인허가 등 사업 초기 위험과 분양 등 사업성 위험을 시공 위험과 분리하려는 시도가 진행되어 시행사와 시공사(건설사)가 분리되고 PF 형태를 갖추기 시작했다. 다만, 시행사가 차주인 부동산PF 대출을 시공사가 보증하면서, 여전히 사업 위험과 시공 위험이 분리되지 못하고 위험 대부분이 시공사로 전가되는 한계가 있었다.

글로벌 금융위기 이후 2009년부터는 역할이 좀 더 나누어졌다. 시공사는 시공에 집중하면서 책임준공을 보증하고, 금융권이 부동산 개발사업의 위험을 일부 부담하게 되었다. 부동산PF는 건설사 보증의 은행 대출 중심에서 제2금융권의 대출 및 건설사나 금융사가 보증한 유동화증권 발행 방식3)으로 다양화되었다. 금융공급 및 보증 주체가 다양해지면서 부동산PF 부실의 1차적인 충격은 분산되었다고 볼 수 있지만, 부동산PF 위험과 금융사 간 연계성은 증가하였다. 또한, 증권사 등이 신용보강을 하여 유동화증권을 발행하는 방식이 증가하면서 부동산PF와 단기자금 및 채권시장 간 연계성도 높아졌는데, 이에 대해서는 Ⅲ장에서 살펴본다.

나. 부동산PF 자금조달 및 손익 구조

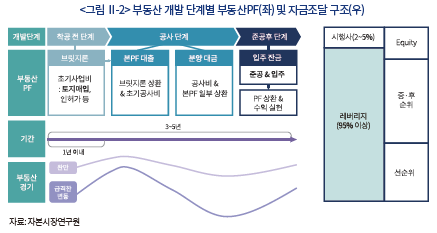

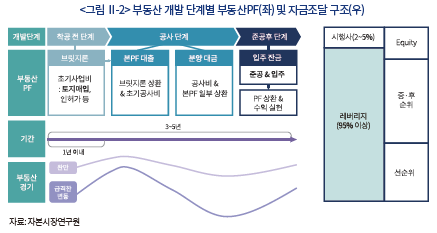

<그림 Ⅱ-2>에서 볼 수 있듯이 부동산 개발사업은 ‘착공 전 단계’, ‘공사 단계’, ‘준공 후 단계’로 구분할 수 있으며(김정주, 2022), 단계별로 부동산PF의 조달과 상환이 연결된다. 우선 착공 전 단계에서 토지매입, 인허가 등 초기사업비 조달을 위한 ‘브릿지론’이 실행된다. 개발과 분양이 진행되는 공사 단계에서 실행되는 ‘본PF 대출’ 자금은 브릿지론 상환 및 초기 공사대금으로 사용된다. 분양이 순조롭게 이루어진다면, 수분양자(분양을 받은 주체)들로부터 수취하게 되는 분양 계약금 및 중도금은 본PF 대출의 일부 상환과 공사대금으로 사용된다. 준공과 입주가 이루어지는 준공 후 단계에서는 수분양자들이 입주하면서 납입하는 잔금으로 본PF 대출 상환이 완료되고, 부동산 개발사업의 수익이 실현된다.

결국, 브릿지론과 본PF를 포함한 부동산PF의 상환 및 부동산 개발사업 수익의 재원은 수분양자들이 납입하는 분양대금이기 때문에, 공사와 분양 및 입주(잔금 납입)까지 완료되어야 부동산PF의 위험이 사라진다고 볼 수 있다. 부동산 개발사업 기간이 통상 3~5년인 장기인 점을 감안하면, 부동산PF는 개발 기간동안 부동산경기 변동이나 준공 불확실성 등 다양한 위험에 노출될 수밖에 없는 구조이다. 특히 개발사업 초기의 브릿지론은 수익성이나 인허가 등의 이유로 사업이 중단되거나 본PF 조달에 실패하는 경우 회수가 불가능할 수 있어서 불확실성과 손실 위험이 크다고 할 수 있다.

한편, 부동산PF 자금조달 구조의 특징으로 높은 레버리지를 들 수 있는데, 개발 주체인 시행사는 적은 자본금(통상 PF 자금의 2~5%)으로 사업에 참여하고 레버리지를 이용하여 사업자금을 조달한다(<그림 Ⅱ-2>의 오른쪽 그림). 높은 레버리지로 인해 시행사의 부담은 작지만, 사업의 불확실성에 대한 자본의 완충작용이 미흡하고 부동산PF 참여자들의 위험은 클 수밖에 없다. 자체 신용보강을 위해 트렌치(tranche) 구조를 사용하지만, 유동화증권을 발행하는 경우 통상 시공사나 금융사(주로 증권사)들의 신용보강이 포함된다.

2. 금융업권 부동산PF 확대 배경

가. 금융업권 부동산PF 현황

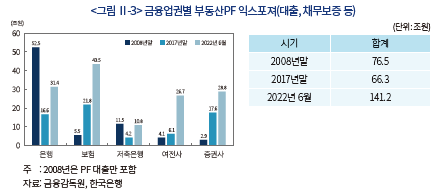

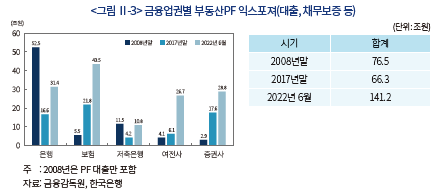

2022년 6월말 기준으로 주요 금융업권 부동산PF 익스포져(대출, 채무보증 등) 규모는 141조원으로 2017년말 대비 2배 이상 증가했다.4) <그림 Ⅱ-3>을 보면, 부동산PF는 과거 2008년 시기에는 은행과 저축은행 위주였지만, 2017년 이후 5년간 보험사, 여전사, 증권사의 부동산PF 참여 확대가 두드러진다. 기관별 참여 형태를 보면, 증권사는 채무보증을 통한 유동화증권 발행 위주이며, 그 외 금융기관들은 대부분 PF 대출이다.5)

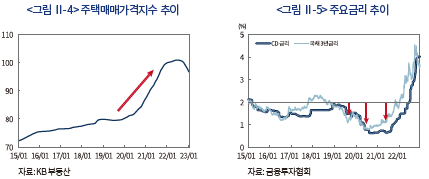

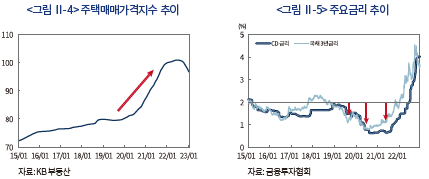

지난 2017~2022년 동안 부동산PF 확대 배경은 무엇보다도 부동산PF 및 부동산 개발사업의 수익성 증가라고 할 수 있다. 세부적으로 보면, 우선 부동산시장 상승 추세가 꾸준히 이어졌는데 특히 2020년 하반기부터 2021년까지 상승 속도가 가팔랐다(<그림 Ⅱ-4>). 이러한 부동산시장 환경에서 신규 분양이 순조롭게 이루어졌으며, 부동산PF의 안정적인 상환과 높은 수익을 기대할 수 있었다. 다음으로 저금리 기조의 지속이다. <그림 Ⅱ-5>를 보면, 2021년까지 CD금리와 국채3년물 금리는 대부분 2% 이하에서 유지되었으며, 특히 2020~2021년 동안에 1% 내외 수준까지 하락하기도 했다. 단기자금시장 여건도 양호하여 부동산PF 유동화증권의 차환발행도 안정적으로 유지되는 등 적은 비용으로 부동산PF 자금조달이 가능했으며 이는 부동산PF의 수익성 증가로 이어졌다. 마지막으로, 저물가가 유지되면서 건설비용의 불확실성도 크지 않았으며, 이러한 여건도 부동산 개발사업의 수익성에 긍정적인 영향을 끼쳤다.

한편, 저금리 상황에서 투자수익률 제고를 위해 금융사들도 부동산PF를 주요 수익원으로 인식하고 공격적으로 사업을 확장한 점도 부동산PF 규모 확대의 원인이라고 할 수 있다. 다른 금융사들과 달리 증권사들은 주로 채무보증과 유동화증권 발행 방식으로 부동산PF 규모를 확대하였는데, 다음에서 그 배경을 살펴보려고 한다.

나. 증권업의 부동산PF 채무보증 확대 배경

국내 증권사가 부동산PF에 참여하는 방식은 채무보증, 지분증권 매입(equity), 채무증권 매입(대출) 등 다양한데, 규제비율 산출 과정에서 익스포져 방식에 따라 위험값 산출 비율이 다르게 부여되고 있다. 채무보증과 지분증권의 경우 위험값 적용 비율은 각각 18%와 20%이며, 채무증권의 경우는 100%의 위험값이 부과(자본 차감)된다.6) 이러한 위험값 산출 비율의 차이로 인해, 증권사들 입장에서 채무보증을 활용하여 유동화증권을 발행하는 구조로 부동산PF에 참여하는 것이 규제비율 측면에서 유리하다.

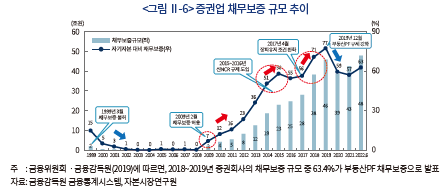

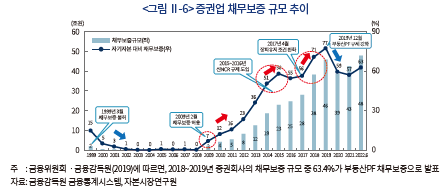

<그림 Ⅱ-6>은 국내 증권업 채무보증 규모 추이 및 제도 변화를 나타내고 있다. 1999년부터 사실상 금지7)되어 오던 증권사의 채무보증은 2009년 2월 시행된 자본시장법에서 증권사의 겸영업무 중 하나로 허용8)되었고, 특히 2013년부터 증권사 채무보증 규모는 급격히 증가하는 모습을 보였다. 당시에 글로벌 금융위기 이후 저금리 기조가 지속된 가운데 부동산 개발 및 부동산PF 수요가 증가하였는데, 시중은행의 경우 금융위기 이후 바젤Ⅲ 도입 등 건전성 규제가 강화됨에 따라 부동산PF 사업에 제약이 있었으며, 건설회사의 경우도 2011년 IFRS 시행으로 채무보증을 부채로 계상함에 따라 부동산PF 채무보증 규모 확대가 어려웠다. 따라서, 자연스럽게 비은행 금융사들의 부동산PF 참여가 증가하게 되었으며, 증권사 또한 부동산PF 채무보증 사업을 확대하였다.

특히 2013년 종합금융투자사업자(종투사) 제도 도입과 2015~2016년 순자본비율 제도 시행으로 대형 증권사의 위험투자 여력이 큰 폭으로 늘어남에 따라 증권사의 부동산PF 채무보증 규모는 빠른 속도로 증가했다(이석훈ㆍ장근혁, 2019). 또한, 2017년 4월 장외파생상품 업무 유지를 위한 위험액 제약이 완화9)된 것도 증권사의 부동산PF 채무보증 증가에 영향을 주었으며, 2019년 증권사의 전체 채무보증 규모는 46조원으로 자기자본의 77% 수준까지 증가했다. 증권사의 부동산PF 채무보증 규모가 빠르게 증가하자 금융당국은 2019년말 부동산PF 규제 강화 방안을 발표했다.10) 이후 증권사 채무보증 규모 및 자기자본 대비 채무보증 비율은 2021년까지 다소 감소하기도 했다.

한편, 지난 2022년 4분기 부동산PF 시장의 위기 상황을 보면, 부동산PF 참여방식에 따라 동일한 위험값을 부과하는 점에 대한 보완이 필요하다고 생각된다. 예를 들어 부동산PF 채무보증의 경우 지역, 시공사(건설사) 신용등급, 용도, LTV, 회수율, 브릿지론 여부 등에 따라 경제적 위험이 크게 차이가 남에도 불구하고 동일하게 18%의 위험값을 부과하고 있다. 따라서, 증권사는 위험액 대비 높은 수익 창출을 위해 고위험 부동산PF 채무보증을 선호할 개연성이 있다. 실제로, Ⅲ장에서 제시되는 바와 같이 시장지배력이 상대적으로 크지 않고 위험회피 성향이 낮은 소형 증권사일수록 고위험 부동산PF 채무보증 또는 브릿지론 비중이 높았던 것으로 확인되었다.11) 따라서 부동산PF의 참여 방식과 실질적인 위험이 합리적으로 위험값에 반영되는 방안을 고민해 볼 필요가 있다.

3. 부동산PF의 위험요인과 최근 부동산시장 현황

가. 부동산PF의 위험요인

부동산PF의 위험은 PF 대출(또는 equity)의 부실화로 이해할 수 있다. 1절에서 살펴본 바와 같이 사업 중단이나 미분양 발생이 부동산PF 위험의 직접적인 원인이며 부동산PF의 구조적인 특징도 부동산PF의 위험을 가중시킬 수 있다. 본 소절에서는 부동산PF의 위험요인을 부동산PF의 구조와 특징에 따른 구조적인 요인과 외부 시장요인으로 구분하고, 미분양이나 사업 중단 가능성과 연계하여 설명하려고 한다.

우선, 부동산PF의 구조적인 요인으로 자금조달 구조의 취약성과 시공사의 준공위험을 들 수 있다. 사업자금을 미리 확보하지 않고 단계적으로 자금을 조달하여 앞선 대출을 상환하는 구조나 유동화증권 차환발행 구조의 특성상, 순차적인 자금조달이 성공하지 못하게 되면 앞선 PF 대출의 상환자금이나 공사비 조달이 막히면서 공사 또는 사업이 중단되는 등 부동산PF에 부실이 발생하게 된다. 시행사가 적은 자본금으로 개발사업에 참여하고 높은 레버리지로 외부 자금을 조달하기 때문에 위험에 대한 완충 기능도 미흡하다고 할 수 있다. 예를 들어, 시행사가 브릿지론을 조달하여 토지매입 등 초기사업에 사용한 후 본PF 조달에 실패하게 된다면 공사 등 개발사업이 중단되고, 브릿지론을 제공한 금융사는 손실을 떠안게 된다. 착공과 본PF 실행 이후, 분양대금이 순조롭게 유입되지 않는다면 본FP 상환자금이나 공사대금이 제때 공급되지 못하면서 부동산PF 부실위험이 커진다. 단기유동화증권 발행으로 부동산PF 자금을 조달한 경우, 단기자금시장 유동성 경색으로 인해 유동화증권 차환발행에 실패하게 되면 채무보증한 금융사 및 부동산PF 부실 위험이 증가한다. 또한, 개발사업 진행 과정에서 공사를 진행하고 준공을 책임지는 시공사의 부실이 발생하는 경우, 공사가 완료되지 못하고 중단될 수 있는 준공위험이 존재한다.

외부 시장요인으로 부동산시장 침체, 시장금리 상승, 공사비용 증가 등을 들 수 있다. 이러한 시장요인들로 인해 부동산 개발사업의 수익성이 하락하게 되면, 미분양이 발생하면서 부동산PF의 부실로 이어질 수 있다. 특히 주목해야 할 사항은 시장요인이 양호할 때는 분양이 순조로울 가능성이 크며, 부동산PF의 구조적인 위험요인이 문제가 되지 않지만, 시장요인이 악화되는 시기에는 미분양 발생 가능성이 커지면서 부동산PF의 구조적인 요인이 부동산PF 위험 증가에 크게 영향을 끼치게 된다는 점이다. 따라서, 부동산PF 위험관리를 위해 외부 시장요인 악화에 대한 모니터링과 대비가 중요하다. 또한, 증권사들은 유동화 방식으로 조달하여 부동산PF에 참여하는 경우에 유동화증권 차환발행 과정에서 발생할 수 있는 유동성 위험을 추가로 관리할 필요가 있다. 2022년 4분기에 부각된 증권사의 부동산PF와 유동성 위험은 시장요인의 악화와 함께 특히 유동화증권 차환발행 구조의 취약성에 기인했다고 볼 수 있다.

나. 최근 부동산시장 현황

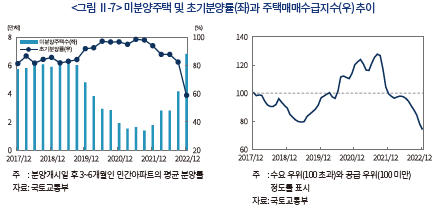

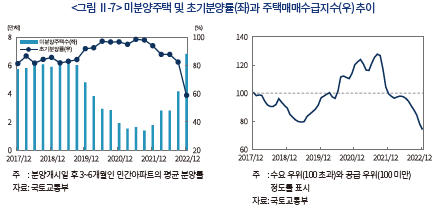

최근 부동산시장이 급격히 침체되는 등 시장요인이 악화되면서 부동산PF 위험이 증가하고 있다. 부동산가격은 2022년 하반기부터 하락세로 전환되었는데(<그림 Ⅱ-4>), <그림 Ⅱ-7>을 보면, 특히 미분양주택이 2022년부터 급격하게 증가하고 있으며(2021년말 1.8만채→2023년 1월 7.5만채), 민간아파트 초기분양률은 빠르게 하락하고 있다(2021년 4분기 94%→2022년 4분기 59%). 주택매매 수급지수도 2022년부터 100 미만(수요보다 공급이 우위)으로 급격히 하락하고 있다. 또한, 시장금리도 빠르게 상승하여 높은 수준에 머물고 있으며(<그림 Ⅱ-5>), 원자재가격이 크게 상승하면서 공사비용도 증가하였다. 이처럼 시장요인들이 크게 악화되면서, 부동산PF의 구조적인 요인도 부동산PF의 위험을 증폭시키고 있다.

Ⅲ. 부동산PF 유동화증권과 단기자금시장

부동산PF 참여 금융업권의 확대와 함께 자금 조달방식이 다양해지면서 부동산PF와 금융사 및 자본시장 간 연계성이 과거보다 높아졌다. 본 장에서는 부동산PF와 단기자금시장의 연결고리에 있는 PF 유동화증권12)에 대하여 살펴보려고 한다. 증권사는 주로 PF 유동화증권에 대한 채무보증을 통하여 부동산PF에 참여하기 때문에 PF 유동화증권은 증권업의 부동산PF 위험분석에 중요한 부분이다.

본 장의 통계와 분석은 한국예탁결제원의 증권정보포탈인 SEIBRO에 공시되고 있는 PF 관련 단기 유동화증권(ABCP, AB전단채) 자료 전체를 기반으로 이루어졌다. 이러한 자료는 2021년 1월부터 발행된 부동산PF 관련 유동화증권을 모두 포괄하고 있으며, 유동화증권의 신용등급, 발행일과 발행금액, 각 거래유형별(매출, 직접/유통물 매입) 거래량과 금리, 그리고 기초자산인 부동산PF 대출채권의 최초 시작일 및 최종 만기일과 그 외의 주요 사항(신용보강 기관, 개발사업 지역과 용도, 시공사) 등 유동화플랜의 상세 내용을 포함하고 있다.

1. 레고랜드 사건과 부동산PF 유동화증권

가. 부동산PF와 단기자금시장 간 위험의 전이

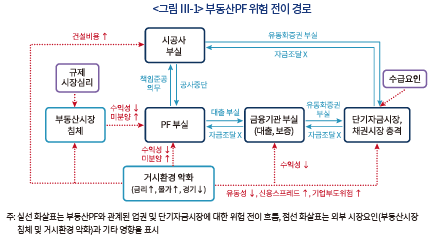

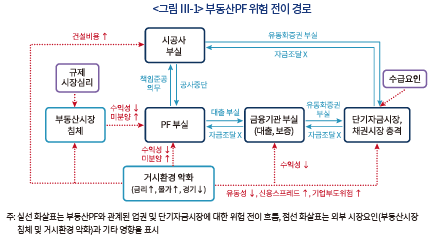

자본시장에서 역할이 큰 증권사들이 부동산PF 유동화증권에 대한 주요 채무보증 주체로서 역할을 하면서 부동산PF 자금조달의 효율성을 높인 측면도 있지만, PF 유동화증권 규모가 증가하면서 부동산PF와 자본시장 간 연계성이 높아졌다. <그림 Ⅲ-1>은 부동산PF와 관련된 위험의 전이 흐름을 보여준다. 2022년 4분기처럼 단기자금시장에 유동성 위기가 발생하게 되면 부동산PF 유동화증권 차환발행과 자금조달이 어려워지면서 증권사와 시공사가 어려움에 직면하게 되며 부동산PF 부실로 전이될 수 있다. 시공사의 부실이 발생하게 되면 부동산PF 경로를 거쳐서 금융기관과 단기자금시장이 충격을 받을 수 있다. 또한, 부동산시장 침체나 거시환경 악화는 부동산PF와 금융기관 및 단기자금시장에 부정적인 영향을 주면서 이러한 위험 전이 과정을 가속할 수 있다. 따라서, 부동산PF 위험을 관리하기 위해서는 시공사, 금융사, 단기자금시장 등 모든 관련 업권 및 부동산시장과 거시환경에 대한 종합적인 이해가 필요하다.

나. 레고랜드 사건 전후 부동산PF 유동화증권 금리 추이

먼저 2022년 10월 부동산PF 유동화증권 시장 악화에 대해 살펴보자. 연초부터 인플레이션으로 인해 통화긴축과 함께 금리가 상승하였다. 신용채권의 수급여건도 좋지 않았는데, 한전채, 은행채 등 고신용채권 공급이 증가했고, 고금리 은행 예금으로도 많은 자금이 유입되고 있었다. 이러한 상황에서 레고랜드 사건이 발생하고 투자자들의 위험회피 성향이 강해지면서 부동산PF 유동화증권 수요가 급격히 감소하였으며, 단기자금시장의 유동성 위험이 부각되었다.

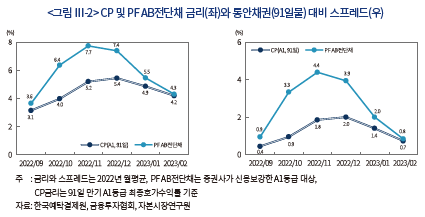

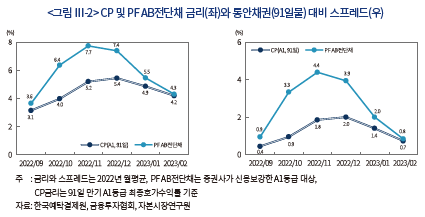

<그림 Ⅲ-2>의 금리 추이를 보면, 2022년 10월부터 CP 금리와 PF AB전단채 금리가 급등하였으며, 통안증권 91일물 대비 스프레드도 확대되었다. 여기서 주목할 사항은 PF 유동화증권 시장은 CP 시장과 구분되는 모습을 보였다는 점이다. 같은 A1등급 CP와 AB전단채 금리 및 스프레드 추이를 보면, 2022년 10~12월 동안 AB전단채 금리가 더 크게 상승하였음을 볼 수 있다. 동일 증권사가 발행한 CP 및 채무보증한 유동화증권 간 금리 차이가 확대되는 등 단기자금시장 내에서도 부동산PF와의 연관성에 따라 금리나 수요의 차이가 발생하였다.13)

악화하던 PF 유동화증권 시장 상황은 정부의 유동성 지원정책 이후 2022년 11월부터 점차 안정되었다. 특히 ‘CP 및 ABCP 매입프로그램’과 ‘ABCP 자기매입 규제 완화’와 같은 PF 유동화증권에 대한 직접적인 매수수요 확보정책14)이 유효했다고 평가할 수 있다. 2023년 들어서 시장금리가 하락하고 금융시장도 안정된 점은 PF 유동화증권 시장 안정에 도움이 되었다고 볼 수 있으며, 2월에는 PF AB전단채의 통안채권 대비 스프레드가 0.8%로 2022년 9월 수준을 회복하였다.

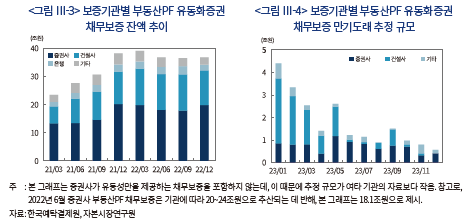

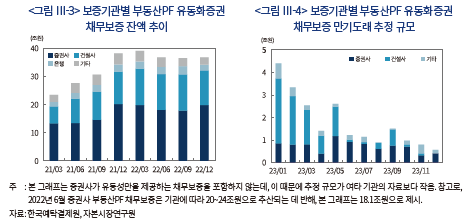

2. 증권업 부동산PF 유동화증권 채무보증 현황

부동산PF 유동화증권의 채무보증 잔액은 2021년 3월 23.5조원에서 2021년 12월 36.8조원으로 큰 폭의 증가세를 보였다. 그러나 2022년에 들어와서는 부동산시장의 침체와 금리 및 원자재가격의 상승 등으로 인해 부동산 개발사업의 수익성이 급격히 악화되면서 그 잔액이 정체되고 있는 모습을 보인다(<그림 Ⅲ-3>). 보증기관 유형별로는, 증권사와 건설사들이 부동산PF 유동화증권 채무보증의 대부분(80~87%)을 수행하고 있는 것으로 나타났다. 이들의 잔액은 2022년말 각각 19.8조원과 12.3조원에 달하고 있어, 규모 면에서도 작지 않다. 반면 은행과 기타 기관들(지방정부, 여타 금융업, 제조업)은 각각 2조원과 2.6조원에 불과한 채무보증 규모를 보이고 있어 유동화증권과 관련한 위험이 크지 않은 편이다.

<그림 Ⅲ–4>는 2023년 만기가 예상되는 부동산PF 유동화증권 채무보증의 규모를 나타내고 있다. 만기도래 규모는 2022년말 유동화가 진행 중인 부동산PF 대출채권의 최종 만기를 기준으로 추산하였다. 분석 결과, 2022년말 부동산PF 유동화증권 채무보증 잔액 대비 58.0%에 해당하는 21.4조원이 2023년 중에 만기도래할 것으로 보인다. 보증기관 유형별로 만기도래 금액을 보면, 건설사가 10.1조원(잔액 대비 81.6%), 증권사가 8.5조원(잔액 대비 43.1%), 그 외 보증기관이 2.7조원(잔액 대비 58.8%)으로 나타났다. 이러한 추산에 따르면 증권사가 보증한 건에서는 매월 8천억원 내외에서 만기가 도래할 것으로 보이는데, 이 중 채무변제가 되는 대신 만기가 연장되거나 부실채권으로 평가되는 규모에 따라 증권사의 위험 익스포져는 낮아지지 않고 오히려 높아질 수도 있다. 즉 2023년에 만기도래하는 부동산PF 유동화증권 대출채권이 적지 않아 이들의 채무변제 비율이 증권사의 건전성 및 유동성 개선에 매우 중요할 것으로 판단된다.

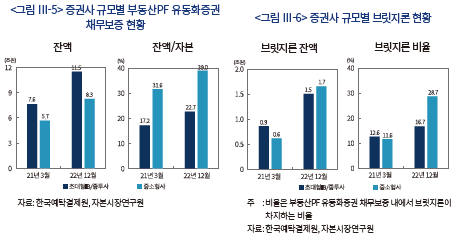

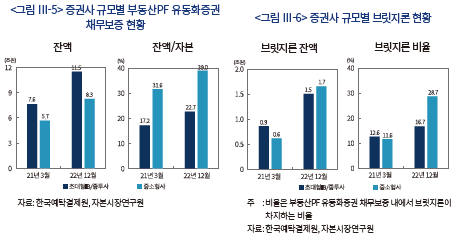

증권사의 부동산PF 유동화증권 현황과 관련한 최근 이슈를 좀 더 살펴보기 위해, 초대형IB/종투사로 구성된 자기자본 상위 8개 증권사 그룹과 그 외 16개 중소형사로 구성된 증권사 그룹으로 구분하였다. 분석은 두 증권사 그룹의 위험 익스포져가 어떠한 변화와 차이를 보이고 있는지, 이들이 보증한 PF 유동화증권이 2022년 9월말 레고랜드 사건을 전후하여 단기자금시장에서 어떻게 달리 평가되고 있는지에 초점을 두었다.

부동산PF 유동화증권의 채무보증 잔액은 두 증권사 그룹 모두 최근 2년 사이 높은 증가세를 보였다. <그림 Ⅲ-5>를 보면, 초대형IB/종투사 그룹의 유동화증권 채무보증 잔액은 2022년 12월 11.5조원으로 7.6조원이었던 2021년 3월 대비 50.8% 증가하였으며, 중소형사 그룹도 동기간 5.7조원에서 8.3조원으로 45.6% 증가하였다. 그러나 보증기관의 위험 익스포져 수준을 더 잘 나타내는 자기자본 대비 부동산PF 유동화증권 채무보증의 잔액 비율은 중소형사 그룹이 31.6%에서 39.0%로 7.4%p 상승하여 5.5%p(17.2%→22.7%) 상승한 초대형IB/종투사 그룹보다 수준과 증가율에서 모두 높았다.

<그림 Ⅲ-6>은 부동산PF 중 상대적으로 더 위험한 브릿지론15)의 규모와 비율을 증권사 그룹별로 제시하고 있다. 예탁결제원 SEIBRO 자료는 시공사의 유무만을 제시할 뿐, 본PF 대출채권과 브릿지론을 명시하여 구분하고 있지 않다. 다만 시공사가 정해져 있는 브릿지론이 소수에 불과하고 이 경우 불확실성(위험)도 상대적으로 작다고 볼 수 있기 때문에, 본 분석에서는 시공사의 유무에 따라 본PF와 브릿지론을 구분한다. 최근 2년 사이 브릿지론 규모는 초대형IB/종투사 그룹보다 중소형사 그룹에서 더 가파르게 증가하였다. 부동산PF 중 브릿지론의 비율도 초대형IB/종투사 그룹이 4.1%p(12.6%→16.7%) 증가에 그쳤지만, 중소형사 그룹은 무려 17.1%p(11.6%→28.7%) 증가하였다. 요컨대, 자기자본 대비 부동산PF 유동화증권 채무보증 잔액 비율과 부동산PF 중 브릿지론의 비율 모두 초대형IB/종투사 그룹보다 중소형사 그룹에서 빠르게 확대되었는데, 이는 부동산PF 위험관리에 있어서 두 증권사 그룹 간 차이가 있었음을 함의한다.

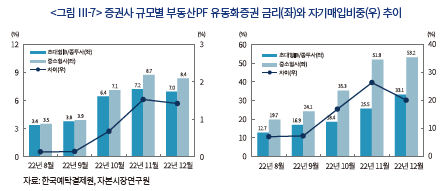

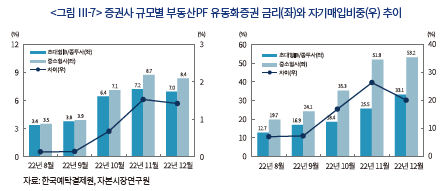

<그림 Ⅲ-7>은 2022년 8월부터 12월까지 두 증권사 그룹이 신용보강한 PF 유동화증권의 월별 평균 발행금리와 자기매입 비중의 추이를 보여주고 있다. PF 유동화증권의 평균 발행금리는 두 증권사 그룹 모두 9월 이후 급격히 상승한 모습을 보인다. 이 시기 대규모 부동산PF 사업장의 부도나 부실이 드러난 점이 없었으므로, 레고랜드 사건을 계기로 확대된 부동산PF에 대한 투자자들의 공포가 이러한 금리 급등의 주요 요인으로 생각된다. 발행금리의 상승과 동시에 두 증권사 그룹 간 금리의 차이도 0.2%p에서 1.5%p로 크게 확대되었는데, 이는 기관투자자들이 레고랜드 사건 이후 초대형IB/종투사 증권사보다는 중소형사 그룹의 PF 유동화증권에 대해 투자의 위험성을 더 크게 인식하고 높은 금리를 요구하였음을 의미한다.

증권사가 자사가 발행한 유동화증권을 직접 매입하는 것을 ‘자기매입’이라 한다. 분석에서 사용한 자기매입 금액은 예탁결제원 SEIBRO 내 PF 유동화증권 유통거래 자료에 있는 발행일로부터 이후 10영업일까지의 순(net) 매각대금을 해당 유동화증권의 발행액에서 차감하여 구하였다. 보통 발행금리가 높거나 투자자를 구하지 못할 때, 증권사들은 자기매입을 한다. 이러한 점에서 증권사의 자기매입 비중16)은 부정적인 발행시장의 여건을 보여준다. 분석 결과, 두 증권사 그룹 모두 자기매입 비중이 2022년 10~12월에 크게 높아졌고, 초대형IB/종투사보다 중소형사 그룹에서 더 가파르게 상승하였다.17) 이러한 결과로 볼 때, 레고랜드 사건 이후 중소형사들은 초대형IB/종투사가 발행한 PF 유동화증권의 금리보다 더 높은 금리를 제시하였음에도 불구하고 투자자 유치에 어려움이 많았던 것으로 판단된다.

위의 분석은 레고랜드 사건 이후 중소형사가 초대형IB/종투사보다 평균적으로 더 높은 금리로 PF 유동화증권을 발행하고 있음을 보여주고 있다. 그런데, 그 이유는 단순히 중소형사가 신용이 낮았을 뿐만 아니라, 이들이 보증한 부동산 개발사업 자체의 위험성이 컸거나 PF 관련 위험 익스포져가 초대형IB/종투사보다 많았기 때문일 수도 있다. 사실, 지난 10~12월은 부동산PF에 대한 시장의 우려가 커질 때 PF 유동화증권 세부 요인에 대해 투자자들이 요구하는 위험 프리미엄이 어떠한지 검토해볼 수 있는 좋은 시기이다. 따라서 이러한 기간을 포함한 부동산PF 유동화증권의 금리 결정요인 분석은 유동화증권의 세부 요인에 대한 위험성을 평가하는데 적절할 뿐만 아니라, 증권사 위험관리와 자본규제 방안에 관한 시사점을 제공할 수 있다.

3. 부동산PF 유동화증권 금리 결정요인 분석

본 소절에서는 부동산PF 유동화증권의 발행금리를 결정하는 요인이 시기에 따라 어떻게 다르게 나타나는지를 살펴본다. 특히 레고랜드 사건을 전후하여 유동화증권의 주요 특성에 따른 금리 민감도가 어떻게 변화하는지에 초점을 두고 월별 회귀분석을 수행한다. 이러한 분석을 위해 2022년 1월에서 12월 사이 증권사가 신용보강한 8,873건의 개별 부동산PF AB전단채 자료를 이용하였다.18) 회귀분석의 설명변수로는 유동화증권이 신용등급 A1 미만인지 여부와 만기 일수, 기초자산인 대출채권이 브릿지론인지 여부, 신용보강 증권사의 특징(중소형사인지 여부, 자기자본 대비 채무보증이 50%를 초과하는지 여부19))과 발행일의 시장 여건에 따른 금리변화를 통제하는 발행일 더미 변수를 설정하였으며, 종속변수로는 PF 유동화증권의 발행금리를 사용하였다. 여기서, 중소형사는 초대형IB/종투사에 해당하지 않는 증권사를 말한다.

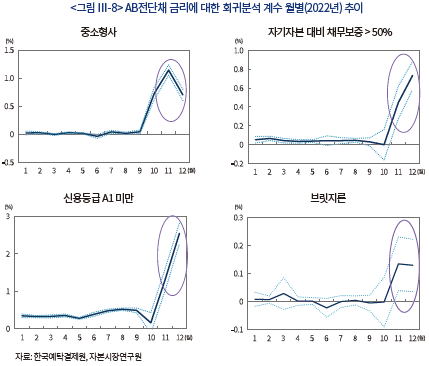

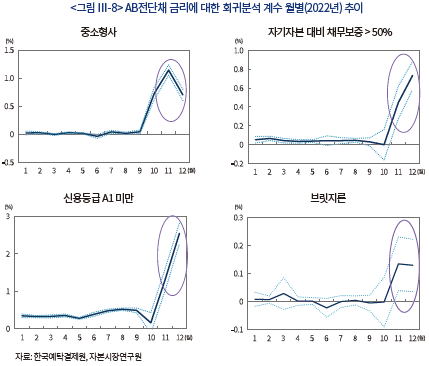

<그림 Ⅲ-8>은 PF 유동화증권의 금리 결정요인 회귀분석으로부터 구한 주요 변수의 월별 추정치를 선 그래프로 보여주고 있다.20) 그래프에서 실선은 월별 추정치를, 점선은 이러한 추정치의 95% 신뢰구간을 나타내고 있다. 분석결과, 중소형사와 초대형IB/종투사가 신용보강한 유동화증권 간 금리 차이는 1~9월 사이 0.05%p 이하에서 10~12월에 0.7~1.2%p로 크게 확대되었다. 자기자본 대비 채무보증이 50%를 초과한 증권사가 신용보강한 유동화증권의 금리는 그렇지 않은 증권사보다 1~9월 0.1%p 이하로 높았으나, 11~12월에는 0.43%p, 0.73%p 높아진 것으로 나타났다. <그림 Ⅲ-8>의 하단에서 볼 수 있듯이, 신용등급이 A1 미만과 A1인 유동화증권 간 금리 차이는 1~9월 사이 0.5%p 이하에 불과하였으나, 11월과 12월에는 각각 1.3%p와 1.5%p로 높아진 모습을 보였다. 브릿지론 유동화증권의 금리도 본PF 대출채권 대비 1~9월 사이에는 높지 않았으나 11~12월에는 약 0.13%p 높게 나왔다. 아래의 그림에서 제시하지는 않았으나, 유동화증권의 만기 일수 계수 추정치도 1~9월보다는 11~12월 사이에 좀 더 높았다.

분석 결과를 요약하자면, 시장이 안정적이었던 1~9월의 PF 유동화증권 금리는 신용등급에 따라 유의하지만 작은 차이를 보였을 뿐, 다른 요인들에 의해서는 거의 영향을 받지 않았다. 그러나 레고랜드 사건 이후 10~12월 사이에는, 신용보강 증권사가 중소형사인지 또 그러한 증권사의 채무보증 규모가 자기자본 대비 50%를 초과하는지, 유동화증권의 신용등급이 A1인지 그리고 기초자산이 브릿지론인지에 따라 금리 즉 위험 프리미엄이 크게 상승하였다. 이는 각 증권사가 양질의 부동산PF를 엄격히 선별하고 외부의 큰 충격에도 충분히 감내할 수 있는 위험 익스포져에서 채무보증 업무를 수행해야 한다는 점을 시사한다. 또한 부동산PF의 질이나 증권사 자본 대비 위험 익스포져 등에 따라 유동화증권 채무보증의 위험성이 매우 다르다는 점이 자본규제에 적절히 반영될 필요가 있어 보인다.

Ⅳ. 요약 및 시사점

국내 부동산PF의 특징으로 높은 레버리지와 사업기간 중 연속적인 자금조달 구조를 들 수 있다. 부동산시장 침체, 고금리 지속, 공사비용 증가 등 시장요인의 악화로 부동산 개발사업의 수익성이 떨어지게 되면 자금조달 구조의 취약성이 드러나면서 부동산PF의 위험이 증가하게 된다. 증권사가 신용보강한 PF 유동화증권 금리를 분석한 결과를 보면, 안정적인 시장 상황에서 신용등급만 유의하게 금리에 영향을 주지만, 투자심리가 크게 위축되면 신용등급뿐만 아니라 다른 요인들에 대한 위험 프리미엄이 상승함을 확인할 수 있었다. 이러한 점들로 볼 때 부동산 개발사업의 수익성이 높은 시기에 부동산PF의 위험은 과소평가될 가능성이 크다. 따라서 부동산PF 참여자들은 부동산 활황기 동안 부동산PF 익스포져 확대에 신중해야 하며, 시장요인이 악화되는 시나리오에서도 수익성이 크게 훼손되지 않고 사업이 유지될 수 있도록 부동산PF 취급 과정에서 위험관리를 강화할 필요가 있다. 또한, 유동화증권 차환발행 방식으로 부동산PF에 참여하는 증권사는 부동산PF와 단기자금시장 간 연계성이 높아져 있다는 점과 거시경제나 금융환경에 민감할 수 있는 단기자금시장의 속성을 고려하여 유동성 관리를 할 필요가 있다.

2022년부터 시장요인의 악화로 인해 부동산PF의 위험이 높아진 상황이다. 정부와 부동산PF 참여자들은 부동산PF 시공사, PF 사업장, 금융사 상황뿐만 아니라 단기자금시장과 부동산시장을 포함한 거시환경을 종합적으로 모니터링하며 대응할 필요가 있다. 특히 2023년은 부동산PF와 금융사 및 자본시장 간 위험 전이에 유의하여야 한다. 이러한 측면에서 단기자금시장 안정을 위한 채무보증 증권사 및 건설사에 대한 유동성 지원, PF 사업장 지원, 그리고 부동산 규제 완화 등 정부의 대책들은(금융위원회, 2023. 3. 6) 단기적으로 부동산PF 위험을 완화할 수 있을 것으로 생각된다. 다만, 유동성이나 PF 사업장 지원정책을 시행하는 과정에서 시장 규율이 훼손되지 않도록 정부는 사업성과 수익성을 엄격하게 평가하여 존속가치가 청산가치보다 높다고 인정되는 경우에만 지원을 제공하고 지원을 제공하는 경우에도 지원조건을 충분히 강화할 필요가 있다.

부동산PF와 단기자금시장에서 중요한 역할을 수행하고 있는 증권사들도 다음과 같은 방향으로 부동산PF 시장 안정을 위해 노력할 필요가 있다. 먼저 단기적인 대응으로, 첫째, 각사 상황에 맞도록 리스크를 평가하여야 한다. 증권사별로 보유하고 있는 부동산PF 위험 수준이 다르며, 손실 100억원 당 NCR이나 유동성비율 하락 효과도 다르다.21) 둘째, 위험평가를 기반으로 유동성 확보 계획을 수립할 필요가 있다. 2023년 들어서 자금시장 여건이 완화되고 있지만, 고금리 및 부동산침체가 지속될 가능성을 대비해야 한다. 과도한 위험을 보유하고 있는 증권사들은 부동산PF 포지션 매각도 고려해 볼 수 있다. 셋째, 부동산PF 시장 안정을 위한 대응도 필요하다. 여력이 있는 증권사들은 펀드를 활용한 유동화증권 매입 등 PF 사업장과 건설사의 유동성 확보 및 사업 재구조화 지원 방안을 생각해 볼 수도 있다.22) 넷째, 신용사건 발생에 대한 대응도 준비할 필요가 있다. PF 사업장 디폴트 발생에 대비하여 매각이나 정리절차를 수립하고, 부동산신탁사의 책임준공 확약 실행 가능성에 대한 점검도 필요하다.

중장기적인 증권사의 대응을 생각해 보자면, 우선 개별 증권사별로 기대수익과 위험을 고려한 부동산PF 위험관리 기준을 정비하여야 한다. 시공사(건설사)에 대한 위험관리 기준도 필요하며, 특히 익스포져의 과다한 쏠림을 유의하여야 한다. 아울러 공사 및 입주, 그리고 PF 상환 완료 이후에 위험이 해소되는 부동산PF의 특성을 고려한 임직원 성과보수체계 설계23)나 심사부서의 요건 정비 등 부동산PF 관련 내부통제 강화도 필요하다. 또한, 유동화증권 차환발행 위험을 완화하기 위해 PF대출과 만기를 매칭한 ABS 발행을 검토해 볼 필요도 있다. 현재는 공모발행 제한(금융위원회, 2020. 5. 18)이나 투자자 확보의 어려움 등의 한계가 있지만, 향후 업계와 금융당국의 논의가 필요하다고 생각된다.24)

한편, 중장기적으로 증권사의 부동산PF 채무보증에 대한 금융당국의 위험액 제도 정비도 요구된다. 먼저 부동산 PF의 위험 정도에 따라 위험액 산정 비율을 차등화할 필요가 있다. 위험 구분 지표로, 브릿지론 여부, 시공사, 지역, 용도 선ㆍ중ㆍ후순위, 시행사 자본/PF 규모, LTV(Loan to Value), STV(Subordinated financing to Value)(황보창ㆍ강철구, 2019) 등을 생각해 볼 수 있다. 또한 과다한 쏠림 방지를 위해 부동산PF 규모나 개별 건설사 익스포져에 대한 집중위험액 도입도 고려해 볼 수 있다.

1) 증권업은 RP, 채권, CP, 유동화증권 발행 등 다양한 금융 거래로 자본시장에서 자금조달자 및 자금공급자 역할을 수행하기 때문에 증권사의 유동성 상황은 자본시장 및 단기자금시장과 관련성이 크다(이석훈, 2020).

2) 2008년까지의 내용은 이현석 외(2011)를 참고하였다.

3) 증권사의 부동산PF 유동화증권 발행구조와 예시는 이석훈ㆍ장근혁(2019)을 참고하면 된다.

4) 금융업권 부동산PF 규모 통계는 분석기관에 따라 차이가 있는데, <그림 Ⅱ-3>은 금융감독원과 한국은행 자료 기준으로 정리하였다. 한편, 2022년 6월 이후 규모는 큰 변화가 없을 것으로 예상된다.

5) PF 대출 규모는 은행/보험/저축은행/여전사/증권사가 각각 28.3/43.3/10.7/26.7/3.3조원이다(한국은행, 2022. 9. 22). <그림 Ⅱ-3>과 비교해 보면 증권사 이외 기관들의 포지션은 대부분 PF 대출임을 알 수 있다.

6) 2019년말에 부동산PF 채무보증에 대한 위험값을 기존 12%에서 18%로 상향하였다. 부동산PF에 대한 지분증권은 시장성 없는 주식에 해당하는 20%의 위험계수를 부여한다. 기업금융 관련 대출의 경우 종합금융투자회사에 한해 완화된 신용위험값을 적용하고 있으나, 부동산PF 관련 대출은 2019년말 종합금융투자사업자도 100% 차감하도록 변경됨에 따라 모든 증권사의 부동산PF 대출시 위험값은 100%로 적용된다.

7) 1997년 4월 영업용순자본비율(Net Capital Ratio: NCR) 제도가 도입되기 이전에는 증권사가 채무보증 업무를 수행할 수 있었으나 1997년말 IMF 외환위기로 고려증권, 동서증권이 각각 회사채 채무보증에 따른 손실로 최종 부도 처리가 되자 1999년 3월부터 증권사에 대한 채무보증은 사실상 금지되었다. 2000년 4월 증권거래법 개정을 통해 일반 증권사는 채무보증 행위가 금지됨에 따라 2000년대 중반까지 증권사의 채무보증 규모는 1조원 내외로 미미했다.

8) 증권사가 채무보증 업무를 수행하려면 장외파생상품 투자매매업 인가가 필요하다.

9) 2017년 4월 이전에 장외파생상품 업무 유지를 위해서는 영업용순자본이 총위험액의 2배를 초과해야 했으나, 2017년 4월 자본시장법 제166조의2 제1항 제3호 개정으로 영업용순자본에서 총위험액을 뺀 금액이 필요자기자본의 150%를 초과하면 장외파생상품 업무 유지가 가능한 것으로 변경되었다. 변경 이후, 중대형 증권회사를 중심으로 PF 채무보증 등으로 위험액을 증가시킬 수 있는 여유가 생기면서, 증권업 전체적으로 PF 채무보증이 증가한 계기가 된 것으로 추론할 수 있다.

10) 총량 규제로 개별 증권사는 자기자본 대비 부동산PF 채무보증을 100% 이내로 유지해야 하며, 채무보증과 유동성부채를 합한 값이 유동성자산을 초과하지 않도록 관리(조정유동성비율 도입)해야 한다. 또한, 부동산PF 채무보증에 대한 위험값을 기존 12%에서 18%로 상향하고 대형 종투사에게 적용한 부동산PF 여신에 대한 신용위험값 적용 혜택을 폐지하였다(금융위원회, 2019.12).

11) 이효섭(2023)에 따르면 증권회사의 자기자본 규모가 낮을수록 통계적으로 유의한 수준에서 해당 증권회사의 PF 익스포져 규모(PF 브릿지론과 PF 채무보증의 합계) 비중이 큰 것으로 확인되었다.

12) PF 유동화증권은 대출채권 만기까지 차환발행하는 방식의 ABCP와 AB전단채 외에 대출채권의 만기를 매칭하여 발행하는 방식의 ABS나 AB사채 형태도 있다. 본 장에서는 증권사들의 유동성 문제가 불거졌던 만기 3개월 이하인 ABCP와 AB전단채를 대상으로 살펴본다. 통상 이들을 PF ABCP로 통칭한다.

13) CP와 ABCP(AB전단채)는 상품 종류가 다르므로 신용등급만으로 위험을 비교하는 데에 한계가 있다. 유동성이나 기초자산 위험이 부각되면 두 상품간 스프레드가 확대될 수 있다.

14) 채권안정펀드, 산업은행, 증권금융, 대형증권사(종투사) 등의 재원으로 증권사ㆍ건설사 보증의 PF ABCP 매입 및 차환발행 증권사에 유동성지원, 증권사가 자사보증 ABCP 매입시 위험값 완화 등을 들 수 있다(금융위원회, 2022. 10. 28; 금융위원회, 2023. 3. 9).

15) 2012년 저축은행의 부동산PF 위기는 지방 소재 시공사가 미정인 브릿지론의 높은 비중에서 비롯되었다(이석훈ㆍ장근혁, 2019; 이갑석ㆍ이현석, 2012).

16) 증권사의 자기매입 비중은 월 기준 해당 증권사가 자기매입한 총금액을 유동화증권의 총발행금액으로 나눈 비율로 구하였다.

17) 금융당국은 한시적으로 자기매입에 대한 위험액 적용비율을 100%에서 32%로 낮추었는데, 이러한 정책으로 인해 10~11월 증권사의 자기매입은 금리보다 더 두드러진 상승세를 나타낸 것으로 보인다.

18) 증권사의 부동산PF 자료는 AB전단채 외에도 ABCP도 있지만, ABCP의 경우 동기간 287건에 불과한데다 이들 대부분이 초대형IB/종투사가 신용보강하고 있어 분석에서 제외하였다.

19) 초대형IB/종투사는 모두 자기자본 대비 채무보증의 규모가 50% 이하였다.

20) 회귀분석의 결과는 부록에서 제시한다.

21) 손실 100억원 당 증권사의 필요자기자본 규모에 따라 NCR이 7~12% 정도 하락하며, 유동자산 규모에 따라 유동성비율 영향에 차이가 있다.

22) 금융당국도 민간 자율의 사업 재구조화를 지원할 계획을 발표했다(금융위원회, 2023. 3. 6).

23) 성과보수체계에 부동산PF의 위험이 제대로 반영되지 못한 점도 증권사들의 부동산PF 익스포저(위험) 증가 원인 중 하나로 볼 수도 있다. 한편, 금융당국은 금융업권 성과보수체계 제도개선방향을 논의 중이며, 장기성과에 기반한 성과보수 지급과 성과보수 산정 및 지급에 대한 공시 확대 등의 방안들이 검토되고 있다(금융위원회, 2023. 4. 20).

24) 금융당국은 단기적인 방안으로 PF ABCP에 대하여 HUG와 주택금융공사의 보증을 통한 만기매칭 대출 전환을 제안하기도 하였다(금융위원회, 2023. 3. 6).

참고문헌

고성수ㆍ류근묵, 2009, 금융기관 관점에서 본 부동산 프로젝트 파이낸싱 리스크 항목의 중요도 분석, 『부동산학연구』 15(1), 155~173.

금융위원회, 2020. 5. 18, 자산유동화제도 종합 개선방안, 보도자료.

금융위원회, 2022. 10. 28, 금융시장 점검ㆍ소통회의 개최, 보도자료.

금융위원회, 2023. 3. 6, 회사채ㆍ단기금융시장 및 부동산 PF 리스크 점검회의 개최, 보도자료.

금융위원회, 2023. 4. 20, 금융위 부위원장, 성과보수체계 제도개선방향에 대해 논의, 보도자료.

금융위원회ㆍ금융감독원, 2019. 12. 5, 부동산 익스포져 건전성 관리 방안, 보도자료.

김정주, 2022, 『‘부동산PF위기’ 원인 진단과 정책적 대응방안』, 한국건설산업연구원 건설이슈포커스.

김진ㆍ사공대창, 2009, 부동산 PF대출의 부실화 요인에 관한 연구, 『대한국토ㆍ도시계획 학회지』 국토계획 44(5), 175~191.

이갑석ㆍ이현석, 2012, 은행과 저축은행의 부동산PF 대출 특성 비교 분석 –기한의 이익 상실과 대손충당금을 중심으로–, 『부동산학연구』 18(1), 107~122.

이석훈, 2020,『코로나19로 인한 증권업의 유동성 이슈와 시사점』, 자본시장연구원 이슈보고서 20-16.

이석훈ㆍ장근혁, 2019, 『국내 증권업 부동산PF 유동화시장의 추이와 위험분석』, 자본시장연구원 이슈보고서 19-17.

이현석ㆍ신종칠ㆍ박성균, 2011, 시장변화에 따른 부동산PF 개선방안 연구, 『도시행정학 정보』 24(1), 107~123.

이효섭, 2023, 부동산 그림자금융의 리스크 진단 및 대응 방향, 자본시장포커스 2023-04호.

정효섭ㆍ이창원, 2022, 2023 Industry Outlook –증권-, 한국기업평가.

한국기업평가, 2022. 12. 15, 2023 Industry Credit Outlook: 증권업황 저하와 부동산PF 리스크의 이중고.

한국은행, 2022. 9. 22, 금융안정상황(2022년 9월), 보도자료.

한국은행, 2022. 10. 27, 한국은행, 단기금융시장 안정화 조치 시행, 보도자료.

황보창ㆍ강철구, 2019, 『부동산금융의 시대(Ⅱ)-금융기관은 Value의 변동성 위험에 노출』, 한국기업평가 Issue Report.

2022년 상반기까지 지난 5년 동안 부동산시장 상승세가 이어진 가운데 비은행권을 중심으로 금융업권의 부동산PF 익스포져 규모는 2배 이상 증가했다. 부동산PF의 형태를 보면, 과거 금융사로부터의 직접 대출 위주에서 대출채권을 기초자산으로 한 유동화증권 발행을 통해 자금을 조달하는 구조가 증가하였으며, 증권사들이 부동산PF 유동화증권 시장에서 주요 채무보증 주체로서 역할을 하고 있다. 부동산PF 참여 금융업권의 확대와 자금 조달방식의 다양화로 인해 부동산PF와 금융사 및 자본시장 간 연계성이 과거보다 높아졌다고 할 수 있다. 증권사의 자본시장에서 역할을 감안하면1), 채무보증을 통하여 부동산PF에 참여하는 증권업은 이러한 연결고리에서 특히 중요한 위치에 있다고 볼 수 있다.

한편, 2022년 글로벌 인플레이션으로 인해 주요국들의 긴축적인 통화정책이 시행되면서 시장금리가 상승하였으며, 이러한 거시환경 변화가 경제 전반에 부정적인 영향을 끼치면서 부동산시장은 침체되었고 부동산PF 위험이 빠르게 증가하였다. 레고랜드 사건 이후 2022년 4분기 중에 부동산PF 부실 위험과 연동되면서 단기자금시장의 유동성 위기도 발생하였는데, 특히 부동산PF 유동화증권의 차환발행이 어려워지면서 채무보증을 수행한 증권사의 유동성 위험이 부각되었다. 부동산PF의 위험을 이해하고 관리하기 위해서는 관련 업권과 단기자금시장에 대한 종합적인 이해가 필요하다. 본고에서는 부동산PF와 금융사 및 단기자금시장 간 관계를 설명하고, 위험 발생의 원인을 종합적으로 살펴보려고 한다. 또한, 증권사보증의 부동산PF 유동화증권 정보와 발행금리 간의 관계를 분석하고 이를 기반으로 위험관리의 필요성과 정책적 시사점을 도출해 보고자 한다.

본고의 구성은 다음과 같다. Ⅱ장에서는 국내 부동산PF의 특징과 위험요인을 설명하고 부동산PF 시장 현황과 증권사의 부동산PF 채무보증 확대 배경을 살펴보았다. Ⅲ장에서는 부동산PF와 단기자금시장 간 관계를 살펴보고 증권사들이 채무보증한 부동산PF 유동화증권의 현황 및 발행금리 결정요인을 분석하였다. Ⅳ장에서는 증권사의 부동산PF에 대한 위험관리 방향과 정책적 시사점을 제시하였다.

Ⅱ. 국내 부동산PF의 특징과 위험요인

본 장에서는 국내 부동산PF의 구조와 특징을 설명하고, 부동산PF의 위험요인을 정리한다. 또한, 지난 5년간 금융업권의 부동산PF 익스포져 증가 배경과 함께, 증권업의 부동산PF 채무보증 확대 과정을 살펴본다.

1. 국내 부동산PF 자금조달 특징

가. 국내 부동산PF 시기별 특징

프로젝트 파이낸싱(Project Financing: PF)은 투자 대상이 되는 사업으로부터 발생하는 미래 현금흐름을 상환 재원으로 하여 자금을 조달하는 금융기법이며, 부동산PF는 투자 대상이 부동산 개발사업인 PF를 의미한다(김정주, 2022). 부동산 개발사업에서 시행사(developer)는 부동산 개발사업의 주체로서 자금조달을 포함하여 용지매입과 인허가 등 사업 초기부터 최종 분양까지의 전 과정을 담당하며, 시공사(constructor, 건설사)는 시행사로부터 사업발주를 받아 공사를 수행하는 역할을 한다.

<그림 Ⅱ-1>은 국내 부동산PF의 시기별 특징을 보여준다.2) 1997년까지 건설사가 직접 은행으로부터 기업금융 대출을 받아 시행사 및 시공사 역할을 모두 담당하면서 부동산 개발사업을 진행하였다. 건설사가 용지매입, 개발, 분양을 수행하는 과정에서 대규모 자금이 투입되면서 유동성 위기에 직면하게 될 수 있었으며, 부동산시장 침체와 미분양 발생시에 건설업 전체 위험이 증가하게 되었다. 이후 2008년까지의 시기를 보면, 용지매입 및 인허가 등 사업 초기 위험과 분양 등 사업성 위험을 시공 위험과 분리하려는 시도가 진행되어 시행사와 시공사(건설사)가 분리되고 PF 형태를 갖추기 시작했다. 다만, 시행사가 차주인 부동산PF 대출을 시공사가 보증하면서, 여전히 사업 위험과 시공 위험이 분리되지 못하고 위험 대부분이 시공사로 전가되는 한계가 있었다.

글로벌 금융위기 이후 2009년부터는 역할이 좀 더 나누어졌다. 시공사는 시공에 집중하면서 책임준공을 보증하고, 금융권이 부동산 개발사업의 위험을 일부 부담하게 되었다. 부동산PF는 건설사 보증의 은행 대출 중심에서 제2금융권의 대출 및 건설사나 금융사가 보증한 유동화증권 발행 방식3)으로 다양화되었다. 금융공급 및 보증 주체가 다양해지면서 부동산PF 부실의 1차적인 충격은 분산되었다고 볼 수 있지만, 부동산PF 위험과 금융사 간 연계성은 증가하였다. 또한, 증권사 등이 신용보강을 하여 유동화증권을 발행하는 방식이 증가하면서 부동산PF와 단기자금 및 채권시장 간 연계성도 높아졌는데, 이에 대해서는 Ⅲ장에서 살펴본다.

나. 부동산PF 자금조달 및 손익 구조

<그림 Ⅱ-2>에서 볼 수 있듯이 부동산 개발사업은 ‘착공 전 단계’, ‘공사 단계’, ‘준공 후 단계’로 구분할 수 있으며(김정주, 2022), 단계별로 부동산PF의 조달과 상환이 연결된다. 우선 착공 전 단계에서 토지매입, 인허가 등 초기사업비 조달을 위한 ‘브릿지론’이 실행된다. 개발과 분양이 진행되는 공사 단계에서 실행되는 ‘본PF 대출’ 자금은 브릿지론 상환 및 초기 공사대금으로 사용된다. 분양이 순조롭게 이루어진다면, 수분양자(분양을 받은 주체)들로부터 수취하게 되는 분양 계약금 및 중도금은 본PF 대출의 일부 상환과 공사대금으로 사용된다. 준공과 입주가 이루어지는 준공 후 단계에서는 수분양자들이 입주하면서 납입하는 잔금으로 본PF 대출 상환이 완료되고, 부동산 개발사업의 수익이 실현된다.

결국, 브릿지론과 본PF를 포함한 부동산PF의 상환 및 부동산 개발사업 수익의 재원은 수분양자들이 납입하는 분양대금이기 때문에, 공사와 분양 및 입주(잔금 납입)까지 완료되어야 부동산PF의 위험이 사라진다고 볼 수 있다. 부동산 개발사업 기간이 통상 3~5년인 장기인 점을 감안하면, 부동산PF는 개발 기간동안 부동산경기 변동이나 준공 불확실성 등 다양한 위험에 노출될 수밖에 없는 구조이다. 특히 개발사업 초기의 브릿지론은 수익성이나 인허가 등의 이유로 사업이 중단되거나 본PF 조달에 실패하는 경우 회수가 불가능할 수 있어서 불확실성과 손실 위험이 크다고 할 수 있다.

한편, 부동산PF 자금조달 구조의 특징으로 높은 레버리지를 들 수 있는데, 개발 주체인 시행사는 적은 자본금(통상 PF 자금의 2~5%)으로 사업에 참여하고 레버리지를 이용하여 사업자금을 조달한다(<그림 Ⅱ-2>의 오른쪽 그림). 높은 레버리지로 인해 시행사의 부담은 작지만, 사업의 불확실성에 대한 자본의 완충작용이 미흡하고 부동산PF 참여자들의 위험은 클 수밖에 없다. 자체 신용보강을 위해 트렌치(tranche) 구조를 사용하지만, 유동화증권을 발행하는 경우 통상 시공사나 금융사(주로 증권사)들의 신용보강이 포함된다.

가. 금융업권 부동산PF 현황

2022년 6월말 기준으로 주요 금융업권 부동산PF 익스포져(대출, 채무보증 등) 규모는 141조원으로 2017년말 대비 2배 이상 증가했다.4) <그림 Ⅱ-3>을 보면, 부동산PF는 과거 2008년 시기에는 은행과 저축은행 위주였지만, 2017년 이후 5년간 보험사, 여전사, 증권사의 부동산PF 참여 확대가 두드러진다. 기관별 참여 형태를 보면, 증권사는 채무보증을 통한 유동화증권 발행 위주이며, 그 외 금융기관들은 대부분 PF 대출이다.5)

한편, 저금리 상황에서 투자수익률 제고를 위해 금융사들도 부동산PF를 주요 수익원으로 인식하고 공격적으로 사업을 확장한 점도 부동산PF 규모 확대의 원인이라고 할 수 있다. 다른 금융사들과 달리 증권사들은 주로 채무보증과 유동화증권 발행 방식으로 부동산PF 규모를 확대하였는데, 다음에서 그 배경을 살펴보려고 한다.

국내 증권사가 부동산PF에 참여하는 방식은 채무보증, 지분증권 매입(equity), 채무증권 매입(대출) 등 다양한데, 규제비율 산출 과정에서 익스포져 방식에 따라 위험값 산출 비율이 다르게 부여되고 있다. 채무보증과 지분증권의 경우 위험값 적용 비율은 각각 18%와 20%이며, 채무증권의 경우는 100%의 위험값이 부과(자본 차감)된다.6) 이러한 위험값 산출 비율의 차이로 인해, 증권사들 입장에서 채무보증을 활용하여 유동화증권을 발행하는 구조로 부동산PF에 참여하는 것이 규제비율 측면에서 유리하다.

특히 2013년 종합금융투자사업자(종투사) 제도 도입과 2015~2016년 순자본비율 제도 시행으로 대형 증권사의 위험투자 여력이 큰 폭으로 늘어남에 따라 증권사의 부동산PF 채무보증 규모는 빠른 속도로 증가했다(이석훈ㆍ장근혁, 2019). 또한, 2017년 4월 장외파생상품 업무 유지를 위한 위험액 제약이 완화9)된 것도 증권사의 부동산PF 채무보증 증가에 영향을 주었으며, 2019년 증권사의 전체 채무보증 규모는 46조원으로 자기자본의 77% 수준까지 증가했다. 증권사의 부동산PF 채무보증 규모가 빠르게 증가하자 금융당국은 2019년말 부동산PF 규제 강화 방안을 발표했다.10) 이후 증권사 채무보증 규모 및 자기자본 대비 채무보증 비율은 2021년까지 다소 감소하기도 했다.

한편, 지난 2022년 4분기 부동산PF 시장의 위기 상황을 보면, 부동산PF 참여방식에 따라 동일한 위험값을 부과하는 점에 대한 보완이 필요하다고 생각된다. 예를 들어 부동산PF 채무보증의 경우 지역, 시공사(건설사) 신용등급, 용도, LTV, 회수율, 브릿지론 여부 등에 따라 경제적 위험이 크게 차이가 남에도 불구하고 동일하게 18%의 위험값을 부과하고 있다. 따라서, 증권사는 위험액 대비 높은 수익 창출을 위해 고위험 부동산PF 채무보증을 선호할 개연성이 있다. 실제로, Ⅲ장에서 제시되는 바와 같이 시장지배력이 상대적으로 크지 않고 위험회피 성향이 낮은 소형 증권사일수록 고위험 부동산PF 채무보증 또는 브릿지론 비중이 높았던 것으로 확인되었다.11) 따라서 부동산PF의 참여 방식과 실질적인 위험이 합리적으로 위험값에 반영되는 방안을 고민해 볼 필요가 있다.

3. 부동산PF의 위험요인과 최근 부동산시장 현황

가. 부동산PF의 위험요인

부동산PF의 위험은 PF 대출(또는 equity)의 부실화로 이해할 수 있다. 1절에서 살펴본 바와 같이 사업 중단이나 미분양 발생이 부동산PF 위험의 직접적인 원인이며 부동산PF의 구조적인 특징도 부동산PF의 위험을 가중시킬 수 있다. 본 소절에서는 부동산PF의 위험요인을 부동산PF의 구조와 특징에 따른 구조적인 요인과 외부 시장요인으로 구분하고, 미분양이나 사업 중단 가능성과 연계하여 설명하려고 한다.

우선, 부동산PF의 구조적인 요인으로 자금조달 구조의 취약성과 시공사의 준공위험을 들 수 있다. 사업자금을 미리 확보하지 않고 단계적으로 자금을 조달하여 앞선 대출을 상환하는 구조나 유동화증권 차환발행 구조의 특성상, 순차적인 자금조달이 성공하지 못하게 되면 앞선 PF 대출의 상환자금이나 공사비 조달이 막히면서 공사 또는 사업이 중단되는 등 부동산PF에 부실이 발생하게 된다. 시행사가 적은 자본금으로 개발사업에 참여하고 높은 레버리지로 외부 자금을 조달하기 때문에 위험에 대한 완충 기능도 미흡하다고 할 수 있다. 예를 들어, 시행사가 브릿지론을 조달하여 토지매입 등 초기사업에 사용한 후 본PF 조달에 실패하게 된다면 공사 등 개발사업이 중단되고, 브릿지론을 제공한 금융사는 손실을 떠안게 된다. 착공과 본PF 실행 이후, 분양대금이 순조롭게 유입되지 않는다면 본FP 상환자금이나 공사대금이 제때 공급되지 못하면서 부동산PF 부실위험이 커진다. 단기유동화증권 발행으로 부동산PF 자금을 조달한 경우, 단기자금시장 유동성 경색으로 인해 유동화증권 차환발행에 실패하게 되면 채무보증한 금융사 및 부동산PF 부실 위험이 증가한다. 또한, 개발사업 진행 과정에서 공사를 진행하고 준공을 책임지는 시공사의 부실이 발생하는 경우, 공사가 완료되지 못하고 중단될 수 있는 준공위험이 존재한다.

외부 시장요인으로 부동산시장 침체, 시장금리 상승, 공사비용 증가 등을 들 수 있다. 이러한 시장요인들로 인해 부동산 개발사업의 수익성이 하락하게 되면, 미분양이 발생하면서 부동산PF의 부실로 이어질 수 있다. 특히 주목해야 할 사항은 시장요인이 양호할 때는 분양이 순조로울 가능성이 크며, 부동산PF의 구조적인 위험요인이 문제가 되지 않지만, 시장요인이 악화되는 시기에는 미분양 발생 가능성이 커지면서 부동산PF의 구조적인 요인이 부동산PF 위험 증가에 크게 영향을 끼치게 된다는 점이다. 따라서, 부동산PF 위험관리를 위해 외부 시장요인 악화에 대한 모니터링과 대비가 중요하다. 또한, 증권사들은 유동화 방식으로 조달하여 부동산PF에 참여하는 경우에 유동화증권 차환발행 과정에서 발생할 수 있는 유동성 위험을 추가로 관리할 필요가 있다. 2022년 4분기에 부각된 증권사의 부동산PF와 유동성 위험은 시장요인의 악화와 함께 특히 유동화증권 차환발행 구조의 취약성에 기인했다고 볼 수 있다.

나. 최근 부동산시장 현황

최근 부동산시장이 급격히 침체되는 등 시장요인이 악화되면서 부동산PF 위험이 증가하고 있다. 부동산가격은 2022년 하반기부터 하락세로 전환되었는데(<그림 Ⅱ-4>), <그림 Ⅱ-7>을 보면, 특히 미분양주택이 2022년부터 급격하게 증가하고 있으며(2021년말 1.8만채→2023년 1월 7.5만채), 민간아파트 초기분양률은 빠르게 하락하고 있다(2021년 4분기 94%→2022년 4분기 59%). 주택매매 수급지수도 2022년부터 100 미만(수요보다 공급이 우위)으로 급격히 하락하고 있다. 또한, 시장금리도 빠르게 상승하여 높은 수준에 머물고 있으며(<그림 Ⅱ-5>), 원자재가격이 크게 상승하면서 공사비용도 증가하였다. 이처럼 시장요인들이 크게 악화되면서, 부동산PF의 구조적인 요인도 부동산PF의 위험을 증폭시키고 있다.

부동산PF 참여 금융업권의 확대와 함께 자금 조달방식이 다양해지면서 부동산PF와 금융사 및 자본시장 간 연계성이 과거보다 높아졌다. 본 장에서는 부동산PF와 단기자금시장의 연결고리에 있는 PF 유동화증권12)에 대하여 살펴보려고 한다. 증권사는 주로 PF 유동화증권에 대한 채무보증을 통하여 부동산PF에 참여하기 때문에 PF 유동화증권은 증권업의 부동산PF 위험분석에 중요한 부분이다.

본 장의 통계와 분석은 한국예탁결제원의 증권정보포탈인 SEIBRO에 공시되고 있는 PF 관련 단기 유동화증권(ABCP, AB전단채) 자료 전체를 기반으로 이루어졌다. 이러한 자료는 2021년 1월부터 발행된 부동산PF 관련 유동화증권을 모두 포괄하고 있으며, 유동화증권의 신용등급, 발행일과 발행금액, 각 거래유형별(매출, 직접/유통물 매입) 거래량과 금리, 그리고 기초자산인 부동산PF 대출채권의 최초 시작일 및 최종 만기일과 그 외의 주요 사항(신용보강 기관, 개발사업 지역과 용도, 시공사) 등 유동화플랜의 상세 내용을 포함하고 있다.

1. 레고랜드 사건과 부동산PF 유동화증권

가. 부동산PF와 단기자금시장 간 위험의 전이

자본시장에서 역할이 큰 증권사들이 부동산PF 유동화증권에 대한 주요 채무보증 주체로서 역할을 하면서 부동산PF 자금조달의 효율성을 높인 측면도 있지만, PF 유동화증권 규모가 증가하면서 부동산PF와 자본시장 간 연계성이 높아졌다. <그림 Ⅲ-1>은 부동산PF와 관련된 위험의 전이 흐름을 보여준다. 2022년 4분기처럼 단기자금시장에 유동성 위기가 발생하게 되면 부동산PF 유동화증권 차환발행과 자금조달이 어려워지면서 증권사와 시공사가 어려움에 직면하게 되며 부동산PF 부실로 전이될 수 있다. 시공사의 부실이 발생하게 되면 부동산PF 경로를 거쳐서 금융기관과 단기자금시장이 충격을 받을 수 있다. 또한, 부동산시장 침체나 거시환경 악화는 부동산PF와 금융기관 및 단기자금시장에 부정적인 영향을 주면서 이러한 위험 전이 과정을 가속할 수 있다. 따라서, 부동산PF 위험을 관리하기 위해서는 시공사, 금융사, 단기자금시장 등 모든 관련 업권 및 부동산시장과 거시환경에 대한 종합적인 이해가 필요하다.

먼저 2022년 10월 부동산PF 유동화증권 시장 악화에 대해 살펴보자. 연초부터 인플레이션으로 인해 통화긴축과 함께 금리가 상승하였다. 신용채권의 수급여건도 좋지 않았는데, 한전채, 은행채 등 고신용채권 공급이 증가했고, 고금리 은행 예금으로도 많은 자금이 유입되고 있었다. 이러한 상황에서 레고랜드 사건이 발생하고 투자자들의 위험회피 성향이 강해지면서 부동산PF 유동화증권 수요가 급격히 감소하였으며, 단기자금시장의 유동성 위험이 부각되었다.

<그림 Ⅲ-2>의 금리 추이를 보면, 2022년 10월부터 CP 금리와 PF AB전단채 금리가 급등하였으며, 통안증권 91일물 대비 스프레드도 확대되었다. 여기서 주목할 사항은 PF 유동화증권 시장은 CP 시장과 구분되는 모습을 보였다는 점이다. 같은 A1등급 CP와 AB전단채 금리 및 스프레드 추이를 보면, 2022년 10~12월 동안 AB전단채 금리가 더 크게 상승하였음을 볼 수 있다. 동일 증권사가 발행한 CP 및 채무보증한 유동화증권 간 금리 차이가 확대되는 등 단기자금시장 내에서도 부동산PF와의 연관성에 따라 금리나 수요의 차이가 발생하였다.13)

악화하던 PF 유동화증권 시장 상황은 정부의 유동성 지원정책 이후 2022년 11월부터 점차 안정되었다. 특히 ‘CP 및 ABCP 매입프로그램’과 ‘ABCP 자기매입 규제 완화’와 같은 PF 유동화증권에 대한 직접적인 매수수요 확보정책14)이 유효했다고 평가할 수 있다. 2023년 들어서 시장금리가 하락하고 금융시장도 안정된 점은 PF 유동화증권 시장 안정에 도움이 되었다고 볼 수 있으며, 2월에는 PF AB전단채의 통안채권 대비 스프레드가 0.8%로 2022년 9월 수준을 회복하였다.

부동산PF 유동화증권의 채무보증 잔액은 2021년 3월 23.5조원에서 2021년 12월 36.8조원으로 큰 폭의 증가세를 보였다. 그러나 2022년에 들어와서는 부동산시장의 침체와 금리 및 원자재가격의 상승 등으로 인해 부동산 개발사업의 수익성이 급격히 악화되면서 그 잔액이 정체되고 있는 모습을 보인다(<그림 Ⅲ-3>). 보증기관 유형별로는, 증권사와 건설사들이 부동산PF 유동화증권 채무보증의 대부분(80~87%)을 수행하고 있는 것으로 나타났다. 이들의 잔액은 2022년말 각각 19.8조원과 12.3조원에 달하고 있어, 규모 면에서도 작지 않다. 반면 은행과 기타 기관들(지방정부, 여타 금융업, 제조업)은 각각 2조원과 2.6조원에 불과한 채무보증 규모를 보이고 있어 유동화증권과 관련한 위험이 크지 않은 편이다.

<그림 Ⅲ–4>는 2023년 만기가 예상되는 부동산PF 유동화증권 채무보증의 규모를 나타내고 있다. 만기도래 규모는 2022년말 유동화가 진행 중인 부동산PF 대출채권의 최종 만기를 기준으로 추산하였다. 분석 결과, 2022년말 부동산PF 유동화증권 채무보증 잔액 대비 58.0%에 해당하는 21.4조원이 2023년 중에 만기도래할 것으로 보인다. 보증기관 유형별로 만기도래 금액을 보면, 건설사가 10.1조원(잔액 대비 81.6%), 증권사가 8.5조원(잔액 대비 43.1%), 그 외 보증기관이 2.7조원(잔액 대비 58.8%)으로 나타났다. 이러한 추산에 따르면 증권사가 보증한 건에서는 매월 8천억원 내외에서 만기가 도래할 것으로 보이는데, 이 중 채무변제가 되는 대신 만기가 연장되거나 부실채권으로 평가되는 규모에 따라 증권사의 위험 익스포져는 낮아지지 않고 오히려 높아질 수도 있다. 즉 2023년에 만기도래하는 부동산PF 유동화증권 대출채권이 적지 않아 이들의 채무변제 비율이 증권사의 건전성 및 유동성 개선에 매우 중요할 것으로 판단된다.

부동산PF 유동화증권의 채무보증 잔액은 두 증권사 그룹 모두 최근 2년 사이 높은 증가세를 보였다. <그림 Ⅲ-5>를 보면, 초대형IB/종투사 그룹의 유동화증권 채무보증 잔액은 2022년 12월 11.5조원으로 7.6조원이었던 2021년 3월 대비 50.8% 증가하였으며, 중소형사 그룹도 동기간 5.7조원에서 8.3조원으로 45.6% 증가하였다. 그러나 보증기관의 위험 익스포져 수준을 더 잘 나타내는 자기자본 대비 부동산PF 유동화증권 채무보증의 잔액 비율은 중소형사 그룹이 31.6%에서 39.0%로 7.4%p 상승하여 5.5%p(17.2%→22.7%) 상승한 초대형IB/종투사 그룹보다 수준과 증가율에서 모두 높았다.

<그림 Ⅲ-7>은 2022년 8월부터 12월까지 두 증권사 그룹이 신용보강한 PF 유동화증권의 월별 평균 발행금리와 자기매입 비중의 추이를 보여주고 있다. PF 유동화증권의 평균 발행금리는 두 증권사 그룹 모두 9월 이후 급격히 상승한 모습을 보인다. 이 시기 대규모 부동산PF 사업장의 부도나 부실이 드러난 점이 없었으므로, 레고랜드 사건을 계기로 확대된 부동산PF에 대한 투자자들의 공포가 이러한 금리 급등의 주요 요인으로 생각된다. 발행금리의 상승과 동시에 두 증권사 그룹 간 금리의 차이도 0.2%p에서 1.5%p로 크게 확대되었는데, 이는 기관투자자들이 레고랜드 사건 이후 초대형IB/종투사 증권사보다는 중소형사 그룹의 PF 유동화증권에 대해 투자의 위험성을 더 크게 인식하고 높은 금리를 요구하였음을 의미한다.

위의 분석은 레고랜드 사건 이후 중소형사가 초대형IB/종투사보다 평균적으로 더 높은 금리로 PF 유동화증권을 발행하고 있음을 보여주고 있다. 그런데, 그 이유는 단순히 중소형사가 신용이 낮았을 뿐만 아니라, 이들이 보증한 부동산 개발사업 자체의 위험성이 컸거나 PF 관련 위험 익스포져가 초대형IB/종투사보다 많았기 때문일 수도 있다. 사실, 지난 10~12월은 부동산PF에 대한 시장의 우려가 커질 때 PF 유동화증권 세부 요인에 대해 투자자들이 요구하는 위험 프리미엄이 어떠한지 검토해볼 수 있는 좋은 시기이다. 따라서 이러한 기간을 포함한 부동산PF 유동화증권의 금리 결정요인 분석은 유동화증권의 세부 요인에 대한 위험성을 평가하는데 적절할 뿐만 아니라, 증권사 위험관리와 자본규제 방안에 관한 시사점을 제공할 수 있다.

3. 부동산PF 유동화증권 금리 결정요인 분석

본 소절에서는 부동산PF 유동화증권의 발행금리를 결정하는 요인이 시기에 따라 어떻게 다르게 나타나는지를 살펴본다. 특히 레고랜드 사건을 전후하여 유동화증권의 주요 특성에 따른 금리 민감도가 어떻게 변화하는지에 초점을 두고 월별 회귀분석을 수행한다. 이러한 분석을 위해 2022년 1월에서 12월 사이 증권사가 신용보강한 8,873건의 개별 부동산PF AB전단채 자료를 이용하였다.18) 회귀분석의 설명변수로는 유동화증권이 신용등급 A1 미만인지 여부와 만기 일수, 기초자산인 대출채권이 브릿지론인지 여부, 신용보강 증권사의 특징(중소형사인지 여부, 자기자본 대비 채무보증이 50%를 초과하는지 여부19))과 발행일의 시장 여건에 따른 금리변화를 통제하는 발행일 더미 변수를 설정하였으며, 종속변수로는 PF 유동화증권의 발행금리를 사용하였다. 여기서, 중소형사는 초대형IB/종투사에 해당하지 않는 증권사를 말한다.

<그림 Ⅲ-8>은 PF 유동화증권의 금리 결정요인 회귀분석으로부터 구한 주요 변수의 월별 추정치를 선 그래프로 보여주고 있다.20) 그래프에서 실선은 월별 추정치를, 점선은 이러한 추정치의 95% 신뢰구간을 나타내고 있다. 분석결과, 중소형사와 초대형IB/종투사가 신용보강한 유동화증권 간 금리 차이는 1~9월 사이 0.05%p 이하에서 10~12월에 0.7~1.2%p로 크게 확대되었다. 자기자본 대비 채무보증이 50%를 초과한 증권사가 신용보강한 유동화증권의 금리는 그렇지 않은 증권사보다 1~9월 0.1%p 이하로 높았으나, 11~12월에는 0.43%p, 0.73%p 높아진 것으로 나타났다. <그림 Ⅲ-8>의 하단에서 볼 수 있듯이, 신용등급이 A1 미만과 A1인 유동화증권 간 금리 차이는 1~9월 사이 0.5%p 이하에 불과하였으나, 11월과 12월에는 각각 1.3%p와 1.5%p로 높아진 모습을 보였다. 브릿지론 유동화증권의 금리도 본PF 대출채권 대비 1~9월 사이에는 높지 않았으나 11~12월에는 약 0.13%p 높게 나왔다. 아래의 그림에서 제시하지는 않았으나, 유동화증권의 만기 일수 계수 추정치도 1~9월보다는 11~12월 사이에 좀 더 높았다.

Ⅳ. 요약 및 시사점

국내 부동산PF의 특징으로 높은 레버리지와 사업기간 중 연속적인 자금조달 구조를 들 수 있다. 부동산시장 침체, 고금리 지속, 공사비용 증가 등 시장요인의 악화로 부동산 개발사업의 수익성이 떨어지게 되면 자금조달 구조의 취약성이 드러나면서 부동산PF의 위험이 증가하게 된다. 증권사가 신용보강한 PF 유동화증권 금리를 분석한 결과를 보면, 안정적인 시장 상황에서 신용등급만 유의하게 금리에 영향을 주지만, 투자심리가 크게 위축되면 신용등급뿐만 아니라 다른 요인들에 대한 위험 프리미엄이 상승함을 확인할 수 있었다. 이러한 점들로 볼 때 부동산 개발사업의 수익성이 높은 시기에 부동산PF의 위험은 과소평가될 가능성이 크다. 따라서 부동산PF 참여자들은 부동산 활황기 동안 부동산PF 익스포져 확대에 신중해야 하며, 시장요인이 악화되는 시나리오에서도 수익성이 크게 훼손되지 않고 사업이 유지될 수 있도록 부동산PF 취급 과정에서 위험관리를 강화할 필요가 있다. 또한, 유동화증권 차환발행 방식으로 부동산PF에 참여하는 증권사는 부동산PF와 단기자금시장 간 연계성이 높아져 있다는 점과 거시경제나 금융환경에 민감할 수 있는 단기자금시장의 속성을 고려하여 유동성 관리를 할 필요가 있다.

2022년부터 시장요인의 악화로 인해 부동산PF의 위험이 높아진 상황이다. 정부와 부동산PF 참여자들은 부동산PF 시공사, PF 사업장, 금융사 상황뿐만 아니라 단기자금시장과 부동산시장을 포함한 거시환경을 종합적으로 모니터링하며 대응할 필요가 있다. 특히 2023년은 부동산PF와 금융사 및 자본시장 간 위험 전이에 유의하여야 한다. 이러한 측면에서 단기자금시장 안정을 위한 채무보증 증권사 및 건설사에 대한 유동성 지원, PF 사업장 지원, 그리고 부동산 규제 완화 등 정부의 대책들은(금융위원회, 2023. 3. 6) 단기적으로 부동산PF 위험을 완화할 수 있을 것으로 생각된다. 다만, 유동성이나 PF 사업장 지원정책을 시행하는 과정에서 시장 규율이 훼손되지 않도록 정부는 사업성과 수익성을 엄격하게 평가하여 존속가치가 청산가치보다 높다고 인정되는 경우에만 지원을 제공하고 지원을 제공하는 경우에도 지원조건을 충분히 강화할 필요가 있다.

부동산PF와 단기자금시장에서 중요한 역할을 수행하고 있는 증권사들도 다음과 같은 방향으로 부동산PF 시장 안정을 위해 노력할 필요가 있다. 먼저 단기적인 대응으로, 첫째, 각사 상황에 맞도록 리스크를 평가하여야 한다. 증권사별로 보유하고 있는 부동산PF 위험 수준이 다르며, 손실 100억원 당 NCR이나 유동성비율 하락 효과도 다르다.21) 둘째, 위험평가를 기반으로 유동성 확보 계획을 수립할 필요가 있다. 2023년 들어서 자금시장 여건이 완화되고 있지만, 고금리 및 부동산침체가 지속될 가능성을 대비해야 한다. 과도한 위험을 보유하고 있는 증권사들은 부동산PF 포지션 매각도 고려해 볼 수 있다. 셋째, 부동산PF 시장 안정을 위한 대응도 필요하다. 여력이 있는 증권사들은 펀드를 활용한 유동화증권 매입 등 PF 사업장과 건설사의 유동성 확보 및 사업 재구조화 지원 방안을 생각해 볼 수도 있다.22) 넷째, 신용사건 발생에 대한 대응도 준비할 필요가 있다. PF 사업장 디폴트 발생에 대비하여 매각이나 정리절차를 수립하고, 부동산신탁사의 책임준공 확약 실행 가능성에 대한 점검도 필요하다.

중장기적인 증권사의 대응을 생각해 보자면, 우선 개별 증권사별로 기대수익과 위험을 고려한 부동산PF 위험관리 기준을 정비하여야 한다. 시공사(건설사)에 대한 위험관리 기준도 필요하며, 특히 익스포져의 과다한 쏠림을 유의하여야 한다. 아울러 공사 및 입주, 그리고 PF 상환 완료 이후에 위험이 해소되는 부동산PF의 특성을 고려한 임직원 성과보수체계 설계23)나 심사부서의 요건 정비 등 부동산PF 관련 내부통제 강화도 필요하다. 또한, 유동화증권 차환발행 위험을 완화하기 위해 PF대출과 만기를 매칭한 ABS 발행을 검토해 볼 필요도 있다. 현재는 공모발행 제한(금융위원회, 2020. 5. 18)이나 투자자 확보의 어려움 등의 한계가 있지만, 향후 업계와 금융당국의 논의가 필요하다고 생각된다.24)

한편, 중장기적으로 증권사의 부동산PF 채무보증에 대한 금융당국의 위험액 제도 정비도 요구된다. 먼저 부동산 PF의 위험 정도에 따라 위험액 산정 비율을 차등화할 필요가 있다. 위험 구분 지표로, 브릿지론 여부, 시공사, 지역, 용도 선ㆍ중ㆍ후순위, 시행사 자본/PF 규모, LTV(Loan to Value), STV(Subordinated financing to Value)(황보창ㆍ강철구, 2019) 등을 생각해 볼 수 있다. 또한 과다한 쏠림 방지를 위해 부동산PF 규모나 개별 건설사 익스포져에 대한 집중위험액 도입도 고려해 볼 수 있다.

1) 증권업은 RP, 채권, CP, 유동화증권 발행 등 다양한 금융 거래로 자본시장에서 자금조달자 및 자금공급자 역할을 수행하기 때문에 증권사의 유동성 상황은 자본시장 및 단기자금시장과 관련성이 크다(이석훈, 2020).

2) 2008년까지의 내용은 이현석 외(2011)를 참고하였다.

3) 증권사의 부동산PF 유동화증권 발행구조와 예시는 이석훈ㆍ장근혁(2019)을 참고하면 된다.

4) 금융업권 부동산PF 규모 통계는 분석기관에 따라 차이가 있는데, <그림 Ⅱ-3>은 금융감독원과 한국은행 자료 기준으로 정리하였다. 한편, 2022년 6월 이후 규모는 큰 변화가 없을 것으로 예상된다.

5) PF 대출 규모는 은행/보험/저축은행/여전사/증권사가 각각 28.3/43.3/10.7/26.7/3.3조원이다(한국은행, 2022. 9. 22). <그림 Ⅱ-3>과 비교해 보면 증권사 이외 기관들의 포지션은 대부분 PF 대출임을 알 수 있다.

6) 2019년말에 부동산PF 채무보증에 대한 위험값을 기존 12%에서 18%로 상향하였다. 부동산PF에 대한 지분증권은 시장성 없는 주식에 해당하는 20%의 위험계수를 부여한다. 기업금융 관련 대출의 경우 종합금융투자회사에 한해 완화된 신용위험값을 적용하고 있으나, 부동산PF 관련 대출은 2019년말 종합금융투자사업자도 100% 차감하도록 변경됨에 따라 모든 증권사의 부동산PF 대출시 위험값은 100%로 적용된다.

7) 1997년 4월 영업용순자본비율(Net Capital Ratio: NCR) 제도가 도입되기 이전에는 증권사가 채무보증 업무를 수행할 수 있었으나 1997년말 IMF 외환위기로 고려증권, 동서증권이 각각 회사채 채무보증에 따른 손실로 최종 부도 처리가 되자 1999년 3월부터 증권사에 대한 채무보증은 사실상 금지되었다. 2000년 4월 증권거래법 개정을 통해 일반 증권사는 채무보증 행위가 금지됨에 따라 2000년대 중반까지 증권사의 채무보증 규모는 1조원 내외로 미미했다.

8) 증권사가 채무보증 업무를 수행하려면 장외파생상품 투자매매업 인가가 필요하다.

9) 2017년 4월 이전에 장외파생상품 업무 유지를 위해서는 영업용순자본이 총위험액의 2배를 초과해야 했으나, 2017년 4월 자본시장법 제166조의2 제1항 제3호 개정으로 영업용순자본에서 총위험액을 뺀 금액이 필요자기자본의 150%를 초과하면 장외파생상품 업무 유지가 가능한 것으로 변경되었다. 변경 이후, 중대형 증권회사를 중심으로 PF 채무보증 등으로 위험액을 증가시킬 수 있는 여유가 생기면서, 증권업 전체적으로 PF 채무보증이 증가한 계기가 된 것으로 추론할 수 있다.

10) 총량 규제로 개별 증권사는 자기자본 대비 부동산PF 채무보증을 100% 이내로 유지해야 하며, 채무보증과 유동성부채를 합한 값이 유동성자산을 초과하지 않도록 관리(조정유동성비율 도입)해야 한다. 또한, 부동산PF 채무보증에 대한 위험값을 기존 12%에서 18%로 상향하고 대형 종투사에게 적용한 부동산PF 여신에 대한 신용위험값 적용 혜택을 폐지하였다(금융위원회, 2019.12).

11) 이효섭(2023)에 따르면 증권회사의 자기자본 규모가 낮을수록 통계적으로 유의한 수준에서 해당 증권회사의 PF 익스포져 규모(PF 브릿지론과 PF 채무보증의 합계) 비중이 큰 것으로 확인되었다.

12) PF 유동화증권은 대출채권 만기까지 차환발행하는 방식의 ABCP와 AB전단채 외에 대출채권의 만기를 매칭하여 발행하는 방식의 ABS나 AB사채 형태도 있다. 본 장에서는 증권사들의 유동성 문제가 불거졌던 만기 3개월 이하인 ABCP와 AB전단채를 대상으로 살펴본다. 통상 이들을 PF ABCP로 통칭한다.

13) CP와 ABCP(AB전단채)는 상품 종류가 다르므로 신용등급만으로 위험을 비교하는 데에 한계가 있다. 유동성이나 기초자산 위험이 부각되면 두 상품간 스프레드가 확대될 수 있다.

14) 채권안정펀드, 산업은행, 증권금융, 대형증권사(종투사) 등의 재원으로 증권사ㆍ건설사 보증의 PF ABCP 매입 및 차환발행 증권사에 유동성지원, 증권사가 자사보증 ABCP 매입시 위험값 완화 등을 들 수 있다(금융위원회, 2022. 10. 28; 금융위원회, 2023. 3. 9).

15) 2012년 저축은행의 부동산PF 위기는 지방 소재 시공사가 미정인 브릿지론의 높은 비중에서 비롯되었다(이석훈ㆍ장근혁, 2019; 이갑석ㆍ이현석, 2012).

16) 증권사의 자기매입 비중은 월 기준 해당 증권사가 자기매입한 총금액을 유동화증권의 총발행금액으로 나눈 비율로 구하였다.

17) 금융당국은 한시적으로 자기매입에 대한 위험액 적용비율을 100%에서 32%로 낮추었는데, 이러한 정책으로 인해 10~11월 증권사의 자기매입은 금리보다 더 두드러진 상승세를 나타낸 것으로 보인다.

18) 증권사의 부동산PF 자료는 AB전단채 외에도 ABCP도 있지만, ABCP의 경우 동기간 287건에 불과한데다 이들 대부분이 초대형IB/종투사가 신용보강하고 있어 분석에서 제외하였다.

19) 초대형IB/종투사는 모두 자기자본 대비 채무보증의 규모가 50% 이하였다.

20) 회귀분석의 결과는 부록에서 제시한다.

21) 손실 100억원 당 증권사의 필요자기자본 규모에 따라 NCR이 7~12% 정도 하락하며, 유동자산 규모에 따라 유동성비율 영향에 차이가 있다.

22) 금융당국도 민간 자율의 사업 재구조화를 지원할 계획을 발표했다(금융위원회, 2023. 3. 6).

23) 성과보수체계에 부동산PF의 위험이 제대로 반영되지 못한 점도 증권사들의 부동산PF 익스포저(위험) 증가 원인 중 하나로 볼 수도 있다. 한편, 금융당국은 금융업권 성과보수체계 제도개선방향을 논의 중이며, 장기성과에 기반한 성과보수 지급과 성과보수 산정 및 지급에 대한 공시 확대 등의 방안들이 검토되고 있다(금융위원회, 2023. 4. 20).

24) 금융당국은 단기적인 방안으로 PF ABCP에 대하여 HUG와 주택금융공사의 보증을 통한 만기매칭 대출 전환을 제안하기도 하였다(금융위원회, 2023. 3. 6).

참고문헌

고성수ㆍ류근묵, 2009, 금융기관 관점에서 본 부동산 프로젝트 파이낸싱 리스크 항목의 중요도 분석, 『부동산학연구』 15(1), 155~173.

금융위원회, 2020. 5. 18, 자산유동화제도 종합 개선방안, 보도자료.

금융위원회, 2022. 10. 28, 금융시장 점검ㆍ소통회의 개최, 보도자료.

금융위원회, 2023. 3. 6, 회사채ㆍ단기금융시장 및 부동산 PF 리스크 점검회의 개최, 보도자료.

금융위원회, 2023. 4. 20, 금융위 부위원장, 성과보수체계 제도개선방향에 대해 논의, 보도자료.

금융위원회ㆍ금융감독원, 2019. 12. 5, 부동산 익스포져 건전성 관리 방안, 보도자료.

김정주, 2022, 『‘부동산PF위기’ 원인 진단과 정책적 대응방안』, 한국건설산업연구원 건설이슈포커스.

김진ㆍ사공대창, 2009, 부동산 PF대출의 부실화 요인에 관한 연구, 『대한국토ㆍ도시계획 학회지』 국토계획 44(5), 175~191.

이갑석ㆍ이현석, 2012, 은행과 저축은행의 부동산PF 대출 특성 비교 분석 –기한의 이익 상실과 대손충당금을 중심으로–, 『부동산학연구』 18(1), 107~122.

이석훈, 2020,『코로나19로 인한 증권업의 유동성 이슈와 시사점』, 자본시장연구원 이슈보고서 20-16.

이석훈ㆍ장근혁, 2019, 『국내 증권업 부동산PF 유동화시장의 추이와 위험분석』, 자본시장연구원 이슈보고서 19-17.

이현석ㆍ신종칠ㆍ박성균, 2011, 시장변화에 따른 부동산PF 개선방안 연구, 『도시행정학 정보』 24(1), 107~123.

이효섭, 2023, 부동산 그림자금융의 리스크 진단 및 대응 방향, 자본시장포커스 2023-04호.

정효섭ㆍ이창원, 2022, 2023 Industry Outlook –증권-, 한국기업평가.

한국기업평가, 2022. 12. 15, 2023 Industry Credit Outlook: 증권업황 저하와 부동산PF 리스크의 이중고.

한국은행, 2022. 9. 22, 금융안정상황(2022년 9월), 보도자료.

한국은행, 2022. 10. 27, 한국은행, 단기금융시장 안정화 조치 시행, 보도자료.

황보창ㆍ강철구, 2019, 『부동산금융의 시대(Ⅱ)-금융기관은 Value의 변동성 위험에 노출』, 한국기업평가 Issue Report.