Find out more about our latest publications

Bigtech and financial stability

Research Papers 23-04 Feb. 06, 2023

- Research Topic Financial Services Industry

- Page 81

As the Fourth Industrial Revolution continues to accelerate, big techs equipped with innovative ICT are increasingly entering the financial services industry. Amid their expansion into banking, insurance, securities and electronic finance sectors, major big techs based in Korea and overseas have been praised for their positive role in offering more convenient, affordable and universal financial services. On the other hand, there are concerns that big techs may neglect their duty of consumer protection and threaten financial stability while rapidly taking up share in the financial market. A case in point is Wirecard, a fast-growing European big tech, which went bankrupt in June 2020. Its bankruptcy caused a massive loss to Wirecard users, which was transmitted to associated financial services firms. This has raised the need to monitor financial risks from big techs’ expansion into the financial sector and to regulate relevant big techs. Korea also has experienced the suspension of Kakao financial services arising from the Pangyo data center fire in October 2022 and the Mergepoint scandal in August 2021. These cases inflicted huge damages on users, thereby leading to the need for regulating large-scale fintechs or big techs. As the market share of Korean and global big techs is growing in the financial services industry, it is likely to compromise the interests of financial consumers and impair financial stability. However, Korea has a lack of research on how to enhance financial stability in preparation for big techs’ penetration into the financial sector.

Global financial supervisory organizations including the Bank for International Settlements (BIS), the Financial Stability Board (FSB) and the International Monetary Fund (IMF) have found that big techs’ entry into finance could offer economic benefits such as improving the convenience of financial consumers, addressing information asymmetries and cutting down costs for searching and transaction. But they also argue that big techs’ data monopolies and network externalities could hurt the interests of financial consumers and pose a threat to financial stability. The organizations have presented decreased welfare of financial consumers resulting from price and product differentiation strategies, mis-selling, unfair business practices and abuse of information as side effects of data monopolies, while pointing out unnecessary concentration within the financial services industry, deteriorating financial soundness and the increase in systematic risks as risks from network externalities. Korea’s big techs could be exposed to such risks. What should be also noted is that they are subject to less strict regulations and have a wider work scope and greater market dominance based on ICT, compared to financial services firms, although they provide essential financial services. This makes Korean big techs more susceptible to financial risks than their foreign counterparts.

In this article, big techs are defined as service providers that qualify for online platform provision, undertaking of essential financial services, and scale and user requirements to analyze financial risks posed by Korea’s big techs. According to analysis results, big techs have lower core financial risks than financial services firms such as market and credit risks, while showing higher operation risks. As for concentration and reputation, big techs exhibit higher risks. But it is hard to say that their risks regarding liquidity, law and system are higher than those of their counterparts in the financial services industry. Considering that big techs see risks related to credit, operation, liquidity, concentration and system increasing at a more rapid pace, compared to financial services firms, it is necessary to thoroughly monitor relevant risks. In addition, this article explores the possibility that increased risks of big techs would endanger other financial institutions, financial markets and infrastructure. Notably, market and credit risks of big techs are less likely to spread to financial institutions, whereas operation risks of big techs could be transmitted. Furthermore, big techs could offer poor brokerage services for non-traditional assets such as real estate P2P lending, brokerage of unlisted stocks and digital assets, which potentially undermine the stability of the financial market. Also, ICT-related disruptions and hacking incidents caused by big techs could disrupt financial infrastructure.

As stated above, Korea’s big techs are experiencing rapid growth of major financial risks while increasingly providing essential financial services. Accordingly, they are likely to destabilize financial institutions, financial markets and infrastructure. To make the financial system more stable, Korea’s authorities should devise specific regulations for big techs. First, big techs offering essential financial services should be subject to regulations applicable to financial services firms in terms of market entry, financial soundness, business practices and consumer protection. For instance, as a way of resolving ambiguity between advertisement and intermediary services, advertisement regulation can apply to continuous information provision involving unidentified products and consumers while strict rules of investment solicitation can be applicable to other intermediary services. Second, major big techs engaging in essential financial services should be designated as financial conglomerates and be subject to more rigorous regulations regarding financial soundness and liquidity. Third, it is necessary to impose the internal control obligation, applicable to financial services firms, on big techs, specify supervisors’ liability according to big tech executives’ roles and liabilities, and establish the incentive system to reinforce internal control. Fourth, preliminary oversight activities should be harmonized with ex-post supervision. In this respect, stress tests should be regularly conducted for each channel disrupting financial institutions, financial markets and infrastructure, and supervisory measures for financial services firms should equally apply to financial services provided by big techs.

Global financial supervisory organizations including the Bank for International Settlements (BIS), the Financial Stability Board (FSB) and the International Monetary Fund (IMF) have found that big techs’ entry into finance could offer economic benefits such as improving the convenience of financial consumers, addressing information asymmetries and cutting down costs for searching and transaction. But they also argue that big techs’ data monopolies and network externalities could hurt the interests of financial consumers and pose a threat to financial stability. The organizations have presented decreased welfare of financial consumers resulting from price and product differentiation strategies, mis-selling, unfair business practices and abuse of information as side effects of data monopolies, while pointing out unnecessary concentration within the financial services industry, deteriorating financial soundness and the increase in systematic risks as risks from network externalities. Korea’s big techs could be exposed to such risks. What should be also noted is that they are subject to less strict regulations and have a wider work scope and greater market dominance based on ICT, compared to financial services firms, although they provide essential financial services. This makes Korean big techs more susceptible to financial risks than their foreign counterparts.

In this article, big techs are defined as service providers that qualify for online platform provision, undertaking of essential financial services, and scale and user requirements to analyze financial risks posed by Korea’s big techs. According to analysis results, big techs have lower core financial risks than financial services firms such as market and credit risks, while showing higher operation risks. As for concentration and reputation, big techs exhibit higher risks. But it is hard to say that their risks regarding liquidity, law and system are higher than those of their counterparts in the financial services industry. Considering that big techs see risks related to credit, operation, liquidity, concentration and system increasing at a more rapid pace, compared to financial services firms, it is necessary to thoroughly monitor relevant risks. In addition, this article explores the possibility that increased risks of big techs would endanger other financial institutions, financial markets and infrastructure. Notably, market and credit risks of big techs are less likely to spread to financial institutions, whereas operation risks of big techs could be transmitted. Furthermore, big techs could offer poor brokerage services for non-traditional assets such as real estate P2P lending, brokerage of unlisted stocks and digital assets, which potentially undermine the stability of the financial market. Also, ICT-related disruptions and hacking incidents caused by big techs could disrupt financial infrastructure.

As stated above, Korea’s big techs are experiencing rapid growth of major financial risks while increasingly providing essential financial services. Accordingly, they are likely to destabilize financial institutions, financial markets and infrastructure. To make the financial system more stable, Korea’s authorities should devise specific regulations for big techs. First, big techs offering essential financial services should be subject to regulations applicable to financial services firms in terms of market entry, financial soundness, business practices and consumer protection. For instance, as a way of resolving ambiguity between advertisement and intermediary services, advertisement regulation can apply to continuous information provision involving unidentified products and consumers while strict rules of investment solicitation can be applicable to other intermediary services. Second, major big techs engaging in essential financial services should be designated as financial conglomerates and be subject to more rigorous regulations regarding financial soundness and liquidity. Third, it is necessary to impose the internal control obligation, applicable to financial services firms, on big techs, specify supervisors’ liability according to big tech executives’ roles and liabilities, and establish the incentive system to reinforce internal control. Fourth, preliminary oversight activities should be harmonized with ex-post supervision. In this respect, stress tests should be regularly conducted for each channel disrupting financial institutions, financial markets and infrastructure, and supervisory measures for financial services firms should equally apply to financial services provided by big techs.

Ⅰ. 서론

빅테크는 인공지능, 빅데이터 등 혁신 기술과 플랫폼에 기반을 두고 온라인에서 다양한 서비스를 제공하는 대형 ICT 회사를 뜻한다. 빅테크 기업으로는 미국에 본사를 둔 구글, 아마존, 애플, 페이스북, 중국의 알리바바, 바이두, 일본의 라쿠텐 등이 존재하며 한국에서는 네이버, 카카오 등을 꼽을 수 있다. 이들 빅테크들은 빅데이터 분석 능력과 네트워크 외부효과에 힘입어 다수의 소비자들에게 이전보다 편리한 서비스를 제공해주고 정보 비대칭을 해소해주며 거래비용과 탐색비용을 절감해주는 등 경제적 순기능을 제공해왔다. 그러나 이들 빅테크들은 단기간에 시장 지배력을 확대함으로써 독점적 지위를 누리고 급격한 가격 인상 정책을 펼치는 등 소비자 후생을 저해할 수 있다는 부작용을 초래하기도 했다. 미국 연방거래위원회(Federal Trade Commission: FTC)의 위원장을 맡고 있는 Kahn 교수는 ‘아마존의 반독점 패러독스(Amazon’s Antitrust Paradox)’라는 논문을 통해 주요 빅테크들이 초기에 적자를 감수하고 시장 지배력을 확대한 뒤에 약탈적 가격 정책과 수직적 통합 전략을 통해 사회적 후생을 감소할 수 있음을 지적하였다. Kahn(2017)의 연구 등을 계기로, 미국, 유럽, 일본, 중국 등 주요국 정부는 공정경쟁 환경 조성을 목표로 빅테크 또는 온라인 플랫폼 사업자를 규율하는 법을 제정하고 구체적 규율 방안을 마련하였다.1)

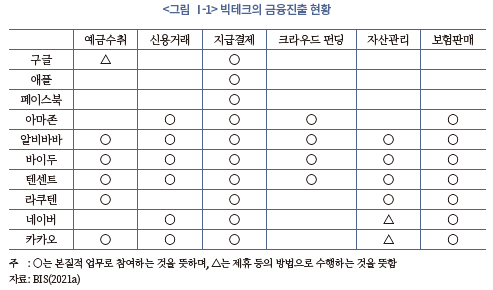

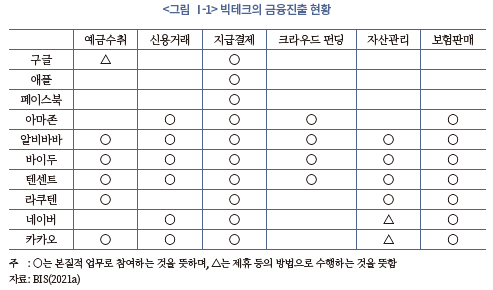

빅테크들은 초기에 양면 플랫폼에 기반을 두고 검색, 인터넷 쇼핑, 정보통신, 미디어, 운송, 유통 등의 산업에 진출하여 시장 지배력을 확대하였으나 점차 서비스 범위를 금융산업으로 확장하고 있다. 예를 들어 구글, 아마존, 애플, 페이스북 등은 별도의 지급결제 서비스를 제공하고 있으며 아마존은 신용대출, 보험상품 판매 등을 수행하고 있다(이하 <그림 Ⅰ-1> 참조). 중국, 일본, 한국의 주요 빅테크들은 라이센스를 취득하거나 제휴 등의 방법을 통해 은행업, 보험업, 여신전문금융업의 본질적 업무를 수행하고 있다. 네이버가 네이버파이낸셜, NF보험서비스를 설립하고, 카카오 그룹이 카카오뱅크, 카카오페이, 카카오페이증권, 카카오페이손해보험 등의 자회사 및 손자회사를 설립하여 예적금 수신 및 대출, 선불전자지급수단 발행 및 관리, 금융투자상품 중개, 보험상품 판매 등의 업무를 수행하는 것이 대표적이다. 빅테크로 정의하기는 다소 어렵지만 잠재 빅테크 또는 대형 핀테크로 볼 수 있는 KT, 토스(비바리퍼플리카)가 각각 케이뱅크, 토스뱅크, 토스증권, 토스보험대리점, 토스페이먼츠 등의 자회사를 설립하여 금융서비스 진출을 확대하고 있는 것도 대형 ICT 기반 회사의 금융진출 사례로 꼽을 수 있다.

빅테크가 금융서비스 제공을 확대하는 과정에서 혁신성, 편리성 등의 기대효과 못지않게 부작용에 대한 우려도 제기되고 있다. 금융회사는 자금의 공급자와 수요자를 중개함으로써 경제주체의 자원을 효율적으로 배분하는 역할을 수행하는데, 만약 금융회사의 부실로 금융 중개 기능이 위축되면 해당 금융회사와 거래를 수행한 다수의 가계와 기업들이 큰 손해를 입을 수 있을 뿐 아니라 다른 금융회사의 부실로도 전이될 수 있어 경제 전반의 위기를 초래할 수 있다. 이와 같은 이유로 금융산업에 대해서는 강도 높은 진입 규제와 건전성 규제를 부여하고 있으며, 금융안정과 소비자 보호를 위해 엄격한 영업행위 규제와 소비자보호 규제를 마련하고 있다. 따라서 다수의 빅테크들이 상대적으로 약한 규제를 적용받고 금융서비스를 제공하면 쏠림이나 불완전판매 등으로 금융소비자 피해가 발생할 수 있고, 해당 빅테크의 부실로 금융안정을 위협할 가능성도 있다.

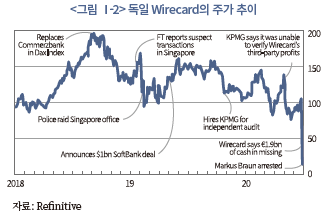

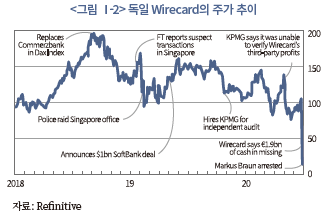

실제 2020년 6월 유럽에서 잠재 빅테크로 급부상한 와이어카드(wirecard) 회사가 회계 부정 이슈로 파산하면서 빅테크의 금융진출 확대에 대한 우려가 커졌다. 와이어카드는 1999년 독일 뮌헨에서 설립한 이후 비대면 지급결제 및 각종 ICT 기반 금융서비스를 제공해 오면서 빠른 규모로 성장했으며 이에 2018년 9월에는 독일 코메르츠뱅크를 대신해 DAX30 지수에 편입되고 도이치뱅크를 넘어선 시가총액을 기록하는 등 대형 핀테크 회사로 성장했다. 그러나 2020년 들어 외부 회계감사법인의 감사를 계기로 해외 예치자산의 부정 계상 의혹이 드러나자 와이어카드 주가는 일주일 만에 95% 가까이 하락했으며 2020년 6월말 파산을 신청했다(<그림 Ⅰ-2> 참조). 당시 와이어카드의 파산으로 와이어카드의 주주와 채권자로 참여했던 소프트뱅크, 크레딧스위스, 그리고 다수의 일반 투자자들이 수조원의 금전적 손실을 기록했으며 와이어카드 플랫폼을 통해 금융거래를 수행한 이용자들도 상당한 피해를 보았다.2) 빅테크로 볼 수는 없으나 한국에서도 대형 핀테크 회사의 부실로 다수의 금융소비자가 피해를 입은 사례가 발생했다. 2020년 4월 한국에서 설립된 머지포인트는 대형마트, 외식업체의 통합 포인트 멤버십 관리 서비스를 제공해 왔는데, 자산과 부채의 건전성 관리가 매우 미흡한 상황에서 2021년 8월 대규모 환매 요청이 발생하자 지급불능 사태를 선언했다. 당시 머지포인트를 할인 구매했던 이용자들은 해당 포인트를 이용할 가맹점이 사라지자 즉시 환불을 요구했으나, 다수의 이용자들은 투자금액 전액을 환불받지 못하는 등 약 2,500억원의 피해를 입은 것으로 알려졌다. 2022년 10월에는 판교 데이터센터 화재로 카카오 그룹이 제공해온 뱅킹, 페이 등 주요 금융서비스가 수일 동안 중단되어 대규모 이용자 피해가 발생하기도 했다.

국내외 빅테크들이 금융서비스를 확대함에 따라 금융리스크를 증가시키고 나아가 금융안정을 훼손할 수 있다는 우려가 제기되고 있으나 이와 관련한 연구는 많지 않다.3) 최근 빅테크에 관한 연구는 주로 공정거래 질서 수립 관점에서 수행된 가운데 빅테크가 어떠한 유형의 금융리스크에 대해 얼마나 많은 금융리스크를 내재하고 있는지를 체계적으로 분석한 연구는 찾기 어렵다. 한국은 해외 주요국과 달리 빅테크에게 특화된 은행업 라이센스를 제공하며 단기간에 인터넷전문은행이 빠르게 성장함에 따라 빅테크로 인한 시스템리스크 개연성도 제기되고 있다. 이에 전통적인 금융회사들은 빅테크들이 적은 규제를 받고 금융서비스 진출을 확대함에 따라 금융안정 훼손 등 다양한 부작용이 발생할 수 있기 때문에 빅테크와 금융회사에 대해 동일기능-동일규제 원칙을 적용해야 한다고 주장하고 있다. 한편 빅테크들은 혁신 ICT 기술에 기반을 두고 과거보다 편리하고, 저렴하며, 장소에 구애받지 않고 누구나 사용할 수 있는 금융서비스를 제공하기 때문에 규제 혜택을 제공해서라도 빅테크의 금융진출을 장려해야 한다는 입장이다. 즉 금융과 비금융 서비스의 융합을 통해 금융서비스의 경계가 모호해지는 빅블러(Big Blur) 시대에 금융혁신과 금융소비자 보호, 그리고 금융안정을 균형 있게 추구하기 위한 금융규제 체계를 정립하는 것이 무엇보다 중요한 과제이다.

이에 본 연구에서는 빅테크의 금융진출 현황과 관련 문헌 연구를 통해 빅테크의 금융리스크를 다각도로 분석하고, 금융안정 제고를 목표로 빅테크의 규율 방안을 제시하고자 한다. 우선 Ⅱ장에서 빅테크의 금융진출로 인한 금융리스크 개연성을 문헌과 사례 중심으로 살펴본다. Ⅲ장에서는 빅테크의 금융리스크를 시장위험, 신용위험, 운영위험, 유동성위험, 법적위험, 평판위험, 시스템위험 등으로 구분하여 분석하고 금융기관, 금융시장, 금융인프라 채널별로 금융안정을 훼손할 수 있는 경로를 진단하고자 한다. 이를 기초로 Ⅳ장에서는 금융안정 제고를 위한 빅테크의 규율 방안을 제시하고자 한다.

Ⅱ. 빅테크의 금융리스크 개연성

빅테크의 금융진출 확대로 인한 금융리스크 수준을 체계적으로 분석한 연구는 많지 않다. 빅테크가 시장 지배력을 확대하며 다양한 산업 분야로 업무 범위를 넓힌 것은 불과 수년 내에 불과하며, 최근 빅테크가 시장 지배력을 확대하며 부작용을 야기한 것은 독과점 및 약탈적 가격정책 등 주로 공정경쟁 이슈와 관련한 것이 많았기 때문으로 보인다. 또한 주요국 빅테크들은 은행업, 보험업, 증권업 등 금융업의 본질적 업무 수행과 관련해서는 라이센스 취득을 통한 직접적 진출보다 기존 금융회사의 전략적 제휴를 통해 간접적으로 금융서비스를 제공해왔기 때문에 빅테크의 금융진출 확대로 인한 금융리스크 개연성 및 금융안정 훼손 가능성에 대한 우려는 크지 않았다. 그러나 2020년 6월 독일 와이어카드 파산 사건 및 2022년 10월 카카오 금융서비스 중단 사태를 계기로 빅테크 또는 대형 핀테크의 금융안정 훼손 가능성을 우려하는 목소리가 커졌다. 특히 한국 빅테크들은 특화된 은행업 라이센스 취득을 통해 예적금 수신, 대출 등 은행업의 본질적 업무를 수행하며 시장 점유율을 빠르게 늘리고 있고, 빅테크의 업무범위 또한 매우 넓어 금융리스크 개연성이 커지고 있고 나아가 금융안정을 훼손할 개연성도 제기되고 있다. 이에 본 절에서는 최근 국제기구를 중심으로 빅테크의 금융리스크 개연성을 연구한 문헌들을 소개하고, 이를 기초로 한국 빅테크의 금융리스크 개연성을 살펴보고자 한다.

1. 문헌 연구

가. 빅테크의 금융진출로 인한 위험

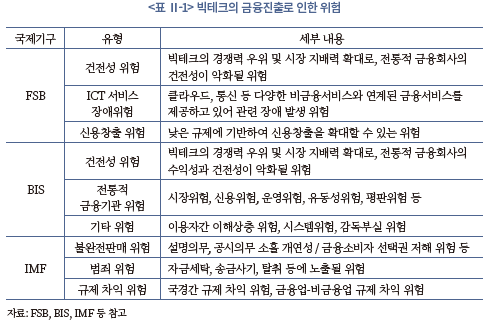

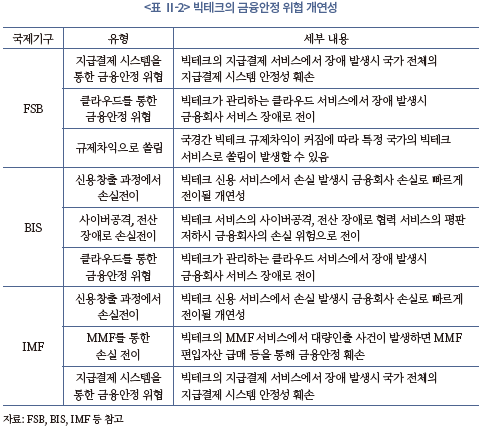

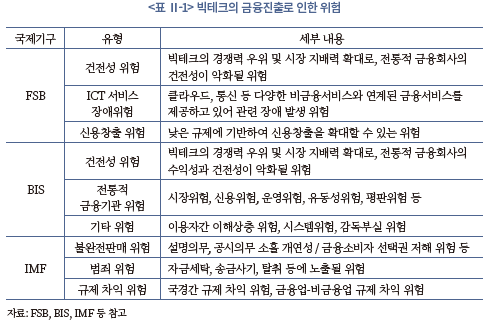

FSB(2019)는 빅테크들이 데이터 우위를 바탕으로 시장 점유율을 빠르게 늘리면서 전통적 금융회사의 수익성이 줄어들어 건전성이 악화될 수 있는 위험을 지적했다(이하 <표 Ⅱ-1> 참조). 예를 들어 빅테크들이 고금리 기반의 수신성 금융상품을 출시하여 시장 점유율을 늘리면 전통적 금융회사들은 고객 이탈을 방지하기 위해 수신 상품의 금리를 올리는 전략을 수행함에 따라 장기적으로 전통적 금융회사들의 수익성이 저하될 수 있다. 빅테크들은 클라우드(cloud) 서비스를 통해 비금융회사들과 데이터베이스, 통신 등 다양한 업무 제휴를 수행하고 있는데 관련 시스템 장애가 발생할 경우 빅테크가 제공하는 금융서비스도 오작동이 발생할 수 있는 위험이 있다. 그 외에도 FSB(2019)는 빅테크의 과도한 신용창출로 인한 위험을 제기했다. 빅테크는 P2P 대출, 크라우드 펀딩, 기타 투자성 상품 중개 등의 기능을 제공하며 과도한 신용을 창출할 수 있는데 해당 신용창출은 전통적 금융회사와 달리 규제를 거의 받지 않거나 규제 수준이 낮기 때문에 부실화될 개연성이 클 수 있다.

BIS도 다수의 보고서를 통해 빅테크의 금융진출로 인한 잠재 위험을 소개하였다. BIS(2021a)는 빅테크들이 일반 금융회사처럼 시장위험, 신용위험 등의 핵심적 금융위험과 유동성위험, 운영위험, 신용창출위험 등의 비핵심적 금융위험에 노출될 수 있음을 제시했다. BIS(2022)는 빅테크들이 데이터 독점력을 통해 플랫폼 이용자간 이해상충(conflicts of interests) 위험이 클 수 있으며, 시장 지배력을 통한 독과점 위험, 대형화로 인한 시스템위험, 서비스 복잡성으로 인한 감독 부실 위험 등이 있음을 소개했다. BIS(2019)는 빅테크들이 네트워크 효과와 빅데이터 분석 능력을 통해 금융산업 내 시장 점유율을 빠르게 늘리면서 전통적 금융회사들의 수익성과 건전성을 위협할 수 있는 등의 금융안정 위협 개연성을 제기했다.

IMF(2022)는 빅테크가 편리성, 효율성, 보편성 등 다양한 경제적 순기능에도 불구하고 빅데이터와 머신러닝 등을 통해 시장 점유율을 빠르게 늘리면서 다양한 위험요인을 가질 수 있음을 지적하고 있다. 우선 빅테크들은 번들링을 통해 소비자 선택권을 감소시키고, 금융상품의 설명의무와 공시의무 등을 소홀히 수행하며 시장 지배력을 확보한 이후 높은 수수료를 측정하는 등 금융소비자 보호를 약화시킬 수 있는 위험을 지적하고 있다. 다음으로 빅테크들은 국경간 자금세탁(money laundering), 송금 사기(fraud), 탈취(theft) 등의 위험에 노출되어 있으며 빅테크의 이용자들이 블록체인 기술 등 혁신 기술을 인지하지 못하고 빅테크의 금융서비스에 종속될 수 있는 위험을 언급했다. 또한 빅테크들은 국경에 큰 구애를 받지 않고 금융서비스를 제공함에 따라 국경간 규제 차익 위험에 노출되어 있으며 금융서비스와 비금융서비스의 경계가 모호해짐에 따라 업권간 규제 차익 위험에 노출되어 있음을 제기했다.

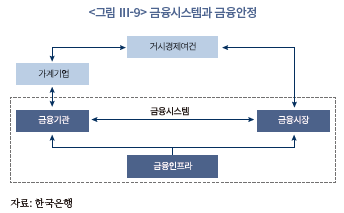

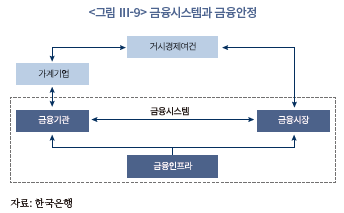

나. 빅테크의 금융안정 훼손 개연성4)

금융안정은 금융시스템이 불안하지 않은 상태로, 금융시스템의 구성 요소인 금융기관, 금융시장, 금융인프라가 모두 불안하지 않은 상태를 뜻한다.5) 이때 금융기관의 안정은 금융기관이 건전하여 자금의 공급자와 수요자를 연결해주는 중개기관으로서 본연의 역할을 잘 수행하는 것을 뜻한다. 즉 빅테크가 금융기관의 안정을 훼손한다는 것은 빅테크의 부실 또는 영향력 확대로 전통적 금융기관들이 자금중개 업무를 안정적으로 수행할 수 없는 상태를 뜻한다. 다음으로 금융시장의 안정은 가계, 기업, 금융기관, 정부 등 주요 시장 참가자들이 신뢰를 갖고 금융시장에서 필요한 자금을 조달하고 여유자금을 운용하는데 장애가 없는 상태를 뜻한다. 따라서 빅테크가 금융시장의 안정을 훼손한다는 것은 빅테크의 파산 등으로 금융시장의 가격 변동성이 커지거나 유동성이 부족한 상태가 발생하는 것을 뜻할 수 있다. 마지막으로 금융인프라의 안정은 지급결제시스템, 금융안정망, 기타 시장 인프라 등이 효율적으로 구축되어 장애 없이 안정적으로 운영되는 상태를 뜻한다. 만약 빅테크가 금융인프라의 안정성을 훼손한다면, 빅테크의 부실 또는 장애로 인해 지급결제시스템 등 주요 금융인프라가 정상적으로 작동하지 않는 상태가 발생할 수 있는 것을 뜻한다.

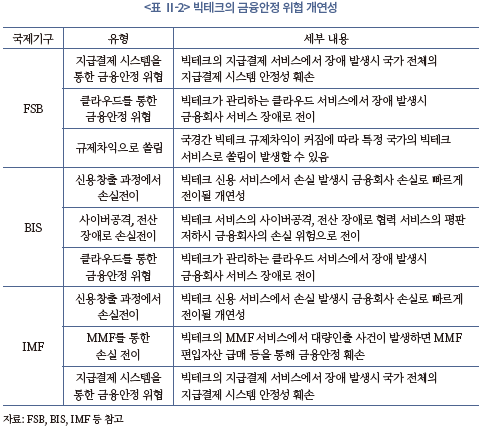

FSB(2022)는 COVID19 이후 전 세계적으로 비대면 금융서비스에 대한 수요가 늘면서 빅테크와 대형 핀테크의 영향력이 커졌고, 빅테크들이 인공지능, 빅데이터, 블록체인 등 혁신 기술을 빠르게 접목하는 과정에서 금융서비스의 취약성을 완벽하게 검증하지 못했기 때문에 빅테크가 금융안정을 위협할 수 있음을 주장하였다. 구체적으로 빅테크들은 사이버공격, 송금사기, 해킹 등에 취약하고 대형 금융회사 등과 공동 플랫폼 개발 등을 통해 연계성이 커지고 있어, 플랫폼에 기반을 둔 금융서비스에서 장애가 발생하는 경우 지급결제시스템 등 금융인프라의 안정성이 훼손될 수 있음을 지적하였다. 또한 빅테크들은 데이터를 독점적으로 사용하고 있기 때문에 클라우드 서비스에서 장애가 발생하거나 데이터의 해킹, 위변조 등이 발생하면 해당 클라우드 서비스를 사용하고 있는 전통적 금융회사들도 막대한 피해를 입을 수 있음을 우려하고 있다. 그 외에도 FSB(2022)는 주요국들이 빅테크에 대해 서로 상이한 규제 정책을 펼치는 점도 금융안정을 훼손할 수 있는 있는 잠재 위험으로 보고 있다. 빅테크들은 국경에 구애받지 않고 금융서비스를 제공하는 경향이 많은데, 특정 국가에서 낮은 규제를 적용한다면 해당 국가의 빅테크 금융서비스로 쏠림이 발생할 수 있기 때문이다.

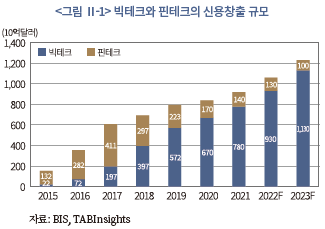

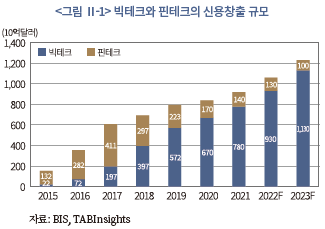

BIS는 빅테크들이 지급결제 서비스 등 신용창출 규모를 확대함에 따라 금융안정을 위협할 수 있음을 제시하고 있다. BIS 데이터를 활용해 빅테크와 핀테크의 신용창출 규모6)를 추정한 결과, 2021년말 빅테크의 신용창출 규모는 7,800억달러로 2016년말 720억달러 대비 10배 이상 증가했다(<그림 Ⅱ-1> 참조). 2021년 기준 빅테크의 신용창출 규모는 글로벌 금융산업 신용창출 규모의 10% 내외에 불과하나 빅테크의 신용창출 규모가 빠르게 증가하고 있어 향후 빅테크들은 금융안정을 충분히 위협할 수 있을 것으로 예상할 수 있다. 구체적으로, BIS(2022)는 빅테크가 신용창출을 확대하는 과정에서 전통적인 금융회사와 협력 기반의 금융서비스를 제공하는 것이 금융안정 훼손 위험을 증가시킬 수 있다고 말하고 있다. 빅테크와 금융회사간 협력을 통해 제공된 금융서비스는 고객 편의성 제고를 목적으로 단기간에 도입된 경향이 높은 만큼 서비스의 투명성이 낮고 사이버보안 등에 취약할 수 있기 때문에 해당 금융서비스에서 부실이나 장애가 발생하면 빅테크와 금융회사의 평판을 저하시킬 뿐 아니라 연계 서비스의 장애로 이어져 빅테크와 금융회사의 건전성을 악화시킬 수 있다. 또한 빅테크들이 클라우드 서비스의 관리주체로서 금융서비스의 영역을 확대하고 있는데 전통적 금융회사들도 클라우드 서비스의 의존도를 높이고 있어 해당 클라우드 서비스에서 장애 및 해킹 등의 사고가 발생할 경우 전통적 금융회사들의 서비스 장애로 이어지는 등 금융기관 및 금융인프라의 안정성을 훼손할 수 있는 우려가 있다.

IMF(2022) 역시 빅테크가 기존 금융회사들과 협력 기반 금융서비스 제공을 통해 밀접히 연결되어 있어 빅테크의 부실화시 대형 금융회사들의 손실로 빠르게 전이될 수 있는 우려를 제기했다. 예를 들어 빅테크는 금융회사와 제휴를 통해 신용대출 서비스를 제공하고 있는데 이때 빅테크는 신용위험의 2%만 책임지고 나머지 신용위험의 98%는 대형 금융회사가 부담하는 형태로 금융서비스를 제공하는 사례가 많음을 논거로 제시했다. 이와 같은 이유로 빅테크들은 보다 위험한 금융서비스를 제공할 유인이 커져 장기적으로 금융안정에 부정적 영향을 미칠 수 있음을 언급했다. IMF(2022)는 신용대출 서비스 외에도 빅테크가 제공하는 MMF가 시스템위험을 키워 MMF의 대량인출 사건이 발생하면 금융안정을 훼손할 수 있는 부작용이 있음을 경고했다. 빅테크는 온라인 쇼핑, 검색, 통신 등 다양한 비금융서비스를 운영하면서 동시에 지급결제 서비스를 제공하고 있는데 충전금 또는 여유자금의 일부를 MMF에 가입하도록 유인하는 사례가 많다. 빅테크가 운영하는 MMF는 고금리를 제시하기 때문에 MMF의 편입자산 중에서 비유동자산 비중이 높아 급격한 시장금리 상승 등 위기상황시 MMF 대량인출 사건에 취약할 수 있다는 지적이다. 그뿐 아니라 중국, 인도 등 일부 국가에서 대형 빅테크의 지급결제 서비스 점유율이 50%를 상회하는 것으로 알려진 가운데 빅테크의 지급결제 서비스에서 장애가 발생할 경우 국가 전체의 지급결제 시스템에서 장애가 발생하는 등 금융인프라의 안정성을 위협할 수 있음을 주장했다.

2. DNA 효과로 인한 빅테크의 금융리스크 개연성

가. DNA 효과가 빅테크에 미치는 영향

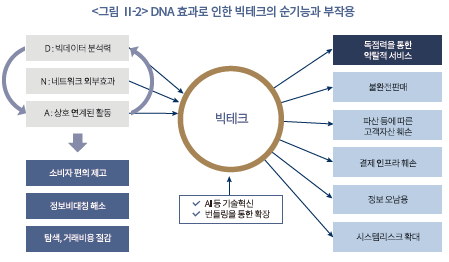

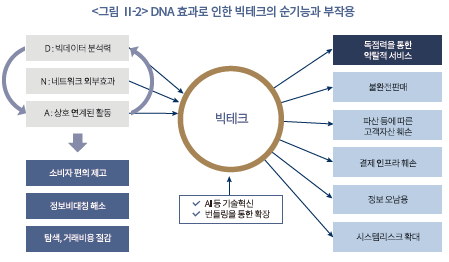

인공지능, 빅데이터 등 ICT 기술혁신과 COVID19 이후 비대면 수요 증가로 경제 구조는 대면 중심에서 비대면 중심으로 바뀌었다. 디지털 경제로 전환되는 과정에서 빅테크는 ICT 기술력과 빅데이터 분석 능력 등에 힘입어 소비자의 니즈에 맞는 혁신 서비스들을 저렴한 비용으로 신속하게 공급하며 괄목할만한 성장을 이루었다. 빅테크의 빠른 성장 동인은 데이터 확보 및 분석 능력(Data Analysis), 네트워크 외부효과(Network Externality), 상호 연계된 활동(Interwoven Activities) 등을 꼽을 수 있는데 빅테크가 금융서비스를 빠르게 확장하게 된 배경도 이와 같은 DNA 효과7)에서 찾아볼 수 있다. 예를 들어 빅테크들은 온라인 검색, 쇼핑 등 비금융서비스를 통해 확보한 이용자 정보를 활용해 맞춤형 금융상품을 저렴한 비용으로 제공할 수 있으며, 금융 플랫폼을 통해 다수의 소비자와 공급자를 연결시킴으로써 신규 소비자와 공급자가 더 많이 참여할 수 있는 환경을 제공해왔다. 이와 같은 경쟁력에 힘입어 빅테크들은 더 많은 금융소비자들에게 저렴하고 편리한 맞춤형 금융서비스를 제공할 수 있게 되었다. 이처럼 DNA 효과는 빅테크로 하여금 소비자 편익을 제고하고, 정보비대칭을 해소하며 거래비용과 탐색비용을 절감해주는 등 긍정적 역할을 수행하는데 기여했다(이하 <그림 Ⅱ-2> 참조).

이와 달리 DNA 효과는 빅테크의 금융진출을 가속화시키고 시장 점유율 확대를 통해 불공정거래, 불완전판매, 시스템리스크 확대, 기타 금융안정 훼손 가능성 등을 높이는 등 부작용을 초래할 우려도 제기된다. 빅테크가 금융산업 내 시장 지배력을 확보한 이후 판매마진 또는 수수료를 인상하여 금융소비자의 후생을 저해하는 것을 예상할 수 있다. 그뿐 아니라 빅데이터 분석을 통해 소비자들에게 특정 금융상품만을 선택하거나 또는 선택하지 못하도록 유도할 수 있다. 그 외에도 네트워크 외부효과를 통해 빅테크가 규모의 경제를 실현한 이후 수많은 플랫폼 이용자들의 정보보호를 소홀히 하거나 금융서비스의 장애로 금융소비자 또는 타 금융회사에게 금전적 손실을 미칠 가능성도 존재한다.

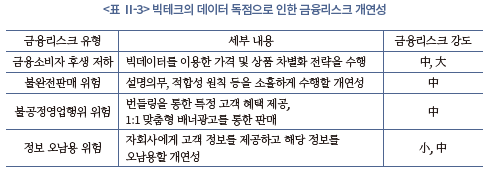

나. 데이터 독점으로 인한 금융리스크 개연성

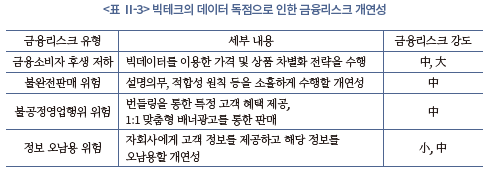

빅테크들이 온라인 검색, 쇼핑, 미디어, 통신 등 비금융서비스를 통해 이용자 빅데이터를 확보하고 해당 빅데이터를 금융서비스에 적용하는 과정에서 다양한 금융리스크를 야기할 수 있다. 우선 빅테크들은 다양한 유형의 플랫폼 서비스를 통해 확보한 고객 데이터를 이용해 이익 증대를 목적으로 가격 차별화 또는 상품 차별화 전략을 수행할 수 있다. 특정 기업이 독점적 시장 지배력을 확보한 이후 가격 차별화 또는 상품 차별화 전략을 수행하면 해당 기업의 이익은 증가할 수 있으나 소비자 후생은 감소하는 부작용이 생길 수 있다. 예를 들어 빅테크들은 온라인 검색, 쇼핑, 미디어, 통신 등의 서비스를 이용할 때 모은 정보를 활용하여 금융소비자의 나이, 성별, 소득, 재산, 거주지, 건강정보, 위험회피성향 등을 손쉽게 파악할 수 있는데, 빅테크들이 고위험 금융상품을 투자하기에 적합하지 않은 소비자에게 판매보수가 높은 고위험 금융상품 위주로 광고 또는 권유하는 전략을 수행할 수 있다.8)

상품 차별화 또는 가격 차별화 외에도 빅테크들은 비대면 플랫폼을 통해 금융상품을 광고하거나 중개하기 때문에 설명의무, 적합성의 원칙 등을 소홀히 할 개연성도 있다. 빅테크는 빅데이터를 분석하여 특정 금융소비자가 금융상품 가입에 관심이 많지 않다고 판단하면 시간과 비용을 들여 엄격한 설명의무, 적합성 테스트를 수행할 유인이 크지 않을 수 있다. 불완전판매 위험 뿐 아니라 빅데이터를 활용해 불공정 영업행위를 수행할 개연성도 존재한다. 금융소비자 보호에 관한 법률(이하 금소법)에서는 금융상품판매업자로 하여금 우월적 지위를 이용해 금융소비자의 권익을 침해하는 행위를 금지할 것을 명시9)하고 있는데, 빅테크들은 특정 금융소비자가 선호하는 번들링 서비스를 제공하거나 1:1 맞춤형 배너광고를 제시함으로써 손쉽게 금융상품을 판매하는 등 금소법 규제를 회피할 개연성이 있다. 그 외에도 빅테크들은 빅데이터 정보를 오남용할 위험이 존재한다. 빅테크는 다수의 비금융회사와 금융회사를 자회사 또는 손자회사로 두고 있는데 이들 자회사, 손자회사들에게 고객 정보를 제공하는 과정에서 고객 정보보호를 소홀히 함으로써 소비자 피해를 초래할 수 있다.

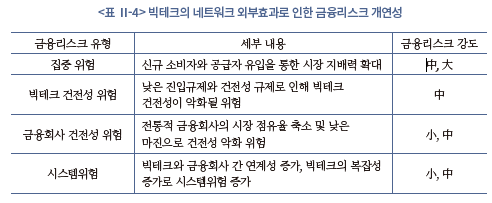

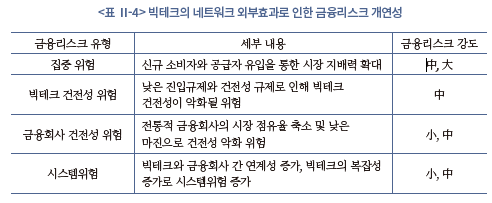

다. 네트워크 외부효과로 인한 금융리스크 개연성

네트워크 외부효과란 빅테크가 보유한 플랫폼 기술과 빅데이터를 기초로 네트워크를 형성하고, 견고하게 형성된 네트워크는 신규 고객의 참여를 촉진시켜 다시 새로운 고객 데이터 기반을 구축하며 빅테크의 시장 지배력이 커지는 현상을 뜻한다. 예를 들어 빅테크 플랫폼에 참여하는 소비자가 증가하면 금융상품 공급자 입장에서 잠재 고객이 늘어나 더 많은 공급자가 참여할 것으로 기대할 수 있다. 이때 금융상품의 공급자가 늘면 금융소비자는 금융상품의 선택폭이 넓어지기 때문에 신규 소비자의 유입이 증가하는 효과로 이어질 수 있다. 이 같은 네트워크 외부효과로 인해 빅테크는 금융서비스 분야에서 시장 점유율을 빠르게 늘리며 독점적 지위를 누릴 수 있다.

빅테크의 네트워크 외부효과로 인해 빅테크의 시장 지배력이 커지는 등 금융산업 내 집중위험이 커질 수 있다. 빅테크는 금융회사보다 낮은 진입 규제와 건전성 규제를 받기 때문에 네트워크 외부효과 유지를 위해 수익성과 건전성이 악화될 수 있다. 상당수 빅테크가 초기에 적자를 감수하고 공격적으로 마케팅 비용을 지불하는 것도 향후 빅테크의 건전성 악화를 초래할 수 있다. 빅테크가 시장 지배력을 확대하는 과정에서 전통적 금융회사의 건전성이 악화될 수 있는 위험도 존재한다. 전통적 금융회사들은 고객 이탈을 방지하기 위해 낮은 마진을 유지하는 정책을 펼칠 수 있는데, 만약 빅테크의 경쟁력 우위로 인해 전통적 금융회사의 시장 점유율이 하락한다면 해당 금융회사의 수익성과 건전성이 악화될 수 있는 위험에 노출될 수 있다. 또한 빅테크의 금융서비스 확대로 금융산업 내 경쟁이 치열해지면 전통적 금융회사들은 수익률 저하를 극복하기 위해 고위험 투자를 늘려 건전성이 악화될 수 있다. 금융회사의 빅테크의 네트워크 외부효과로 빅테크와 타 금융회사들과의 연계성이 커지고 제공하는 금융서비스가 복잡해짐에 따라 시스템위험에 노출될 수 있는 개연성도 커질 수 있다. 시스템위험은 통상 규모, 연계성, 복잡성, 레버리지 등에 비례하는 것으로 알려져 있는데 빅테크의 특징상 규모와 레버리지가 큰 가운데 네트워크 외부효과로 타 금융회사들과 연계성이 커지고 제공하는 금융서비스의 복잡성이 커지면 시스템위험도 증가하는 것으로 예상할 수 있다.

3. 한국 빅테크의 금융리스크 개연성

가. 낮은 규제강도

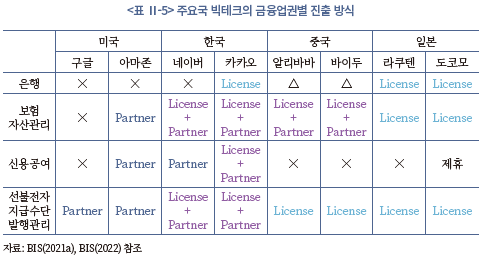

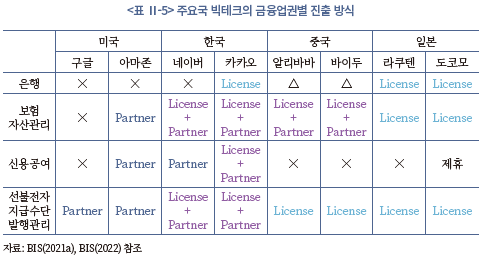

한국 빅테크는 주로 특화된 금융업 라이센스를 취득하고 은행업, 보험업, 여신전문금융업 등 금융업의 본질적 업무를 수행하고 있기 때문에 주요국 대비 금융리스크가 클 것으로 예상할 수 있다. 주요국 빅테크의 은행업 진출 현황을 살펴보면, 미국 빅테크들은 은행업 라이센스를 취득하지 못해 예적금 수취 및 대출 업무 등 은행업을 수행하지 못하고 있으며 한국, 일본, 중국 등의 빅테크는 온라인 영업에 특화된 은행업 라이센스를 취득하여 예적금 수취 및 대출 서비스를 제공해왔던 것으로 알려져 있다(이하 <표 Ⅱ-5> 참조). 최근 중국 정부는 주요 빅테크 그룹에 대해 신용대출 업무를 분리시키도록 명령했으며, 금융서비스를 제공해온 주요 빅테크들에게 금융지주회사 형태로 전환할 것을 권고함에 따라 중국 내 빅테크들은 은행업을 영위하는 것이 어려워졌음을 알 수 있다. 즉 빅테크에게 특화된 은행업 라이센스를 제공하여 예적금 수취 및 대출업 등의 경쟁과 혁신을 유도한 국가는 많지 않은 가운데, 한국 빅테크들은 인터넷전문은행업 진출을 통해 시장 점유율을 빠르게 늘려온 것으로 판단할 수 있다.

은행업 외에도 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 업무 등에 있어서도 주요국과 한국 빅테크의 금융진출 방식에 다소 차이가 있다. 미국의 경우 아마존을 제외하고는 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 발행 및 관리 업무 등에 거의 참여하지 않고 있으며 빅테크들이 해당 금융서비스를 제공할 때 라이센스 취득 방식이 아니라 기존 금융회사와의 제휴를 통해 금융서비스를 제공하고 있다. 반면 한국의 카카오, 네이버 등 주요 빅테크는 라이센스 취득과 금융회사와의 전략적 제휴 방식을 모두 활용하여 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 발행 및 관리 업무 등 대부분의 금융서비스에 진출해왔다. 중국 빅테크는 한국과 유사하게 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 업무 등 거의 모든 비은행권 금융서비스를 제공해왔는데 최근 중국 정부의 규제 강화로 빅테크 내부에서 신용공여, 선불전자지급수단 발행 및 관리 업무를 수행하는 것이 어려워졌다. 일본 빅테크는 선불전자지급수단 업무 등은 허가를 통해 가능하나 신용공여 업무 등은 적극적으로 수행하지 않거나 기존 금융회사와 전략적 제휴를 통해 관련 서비스를 제공하고 있다. 즉 한국 빅테크들은 주요국 빅테크들과 비교해 손쉽게 라이센스를 취득하여 다양한 비은행권 금융서비스를 제공한다고 말할 수 있다.

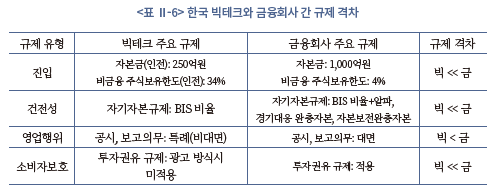

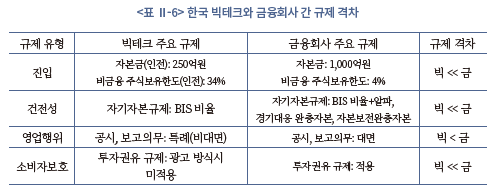

한국 내 빅테크가 금융회사보다 낮은 규제 강도를 적용받아온 것도 한국 빅테크의 잠재 금융리스크가 클 것으로 예상하는 이유이다. 은행업 진출을 예로 들면, 한국 빅테크는 경쟁 촉진과 금융소비자의 편익 제고를 목적으로 인터넷전문은행업 진입 규제에 있어서 금융회사보다 낮은 규제를 적용받았다(<표 Ⅱ-6> 참조). 구체적으로 인터넷전문은행 라이센스 취득을 위한 자본금 요건은 250억원으로 일반 상업은행 설립에 필요한 자본금 요건(1,000억원)의 1/4 수준에 불과하다.10) 또한 인터넷전문은행 설립시 적용되는 주식 보유한도 규제는 일반 상업은행에게 적용하는 규제 수준에 비해 훨씬 낮다.11) 인터넷전문은행은 건전성 규제도 낮은 수준을 적용받고 있다. 인터넷전문은행과 상업은행 모두 BIS 비율 규제를 적용받는 점에서 건전성 규제의 공통점이 있으나 국내 주요 상업은행은 대부분 시스템적 중요기관(Systemically Important Financial Institutions: SIFIs)으로 선정되어 BIS 비율 규제 외에 추가 자본을 적립하고, 경기대응 완충자본, 자본보전 완충자본 등을 별도로 적립해야 할 뿐 아니라 레버리지비율 규제 등도 준수해야 한다. 반면 인터넷전문은행은 국내 SIFIs로 지정되지 않았기 때문에 추가자본, 경기대응 완충자본, 자본보전 완충자본 등의 적립 의무, 금산법에 따른 자체정상화 및 부실정리계획 제도 등을 적용받지 않는다. 한편 상업은행 외에도 여신전문금융회사, 증권회사 등은 엄격한 레버리지비율 규제를 적용받지만 빅테크가 제휴를 통해 선불전자지급수단, 금융상품 중개 업무 등을 수행하는 경우 건전성 규제를 거의 적용받지 않는다.

영업행위 규제 관련해서도 빅테크는 금융회사보다 낮은 규제를 적용받고 있다. 빅테크가 대주주로 있는 인터넷전문은행의 경우 업무 부담 완화를 위해 공시의무와 보고의무에 있어서 특례를 부여하고 있다. 예를 들어 인터넷전문은행은 인터넷홈페이지 등을 통해 전자적 방법으로 관련 서류를 공시함으로써 상업은행에게 적용하는 본점, 지점, 영업점에서의 서류 게시, 비치 또는 열람제공 의무를 갈음할 수 있다.12) 또한 상업은행이 주요 업무를 수행할 때 대면 기반으로 보고 또는 신고의무를 수행해야 하는데 인터넷전문은행의 경우 비대면으로 보고 또는 신고의무를 수행하는 것을 허용하고 있다.13) 소비자보호 규제 관련해서도 빅테크들은 1:1 맞춤형 배너광고 등을 통해 금융상품을 손쉽게 판매해왔는데 해당 행위는 금융상품의 중개 행위로 보는 것이 모호하므로 금소법상 설명의무, 적합성의 원칙, 부당권유 금지 조항 등 엄격한 투자권유 규제를 적용받지 않았다.

나. 넓은 업무범위

다음으로 한국 빅테크의 업무범위가 매우 넓은 것도 한국 빅테크의 금융리스크 개연성이 큰 이유로 꼽을 수 있다. 실제 한국 빅테크는 <표 Ⅱ-5>에서 볼 수 있듯이 은행업, 보험 및 금융상품 중개업, 여신전문금융업, 선불전자지급수단 발행 및 관리업, 전자지급결제대행업 등 거의 모든 유형의 금융서비스에 진출하고 있다. 우선 카카오 그룹은 카카오뱅크, 카카오페이, 카카오벤처스, 카카오인베스트먼트 등을 자회사로 두고 있으며 카카오페이의 자회사로는 카카오페이증권, 카카오페이손해보험, 케이피보험서비스를 두고 있다. 즉 카카오 그룹은 자회사 또는 손자회사를 통해 은행업, 보험업, 증권업, 선불전자지급수단 발행 및 관리업 등 거의 모든 유형의 금융업에 라이센스 취득 방식으로 진출했다. 네이버는 네이버파이낸셜, 라인파이낸셜플러스 등을 자회사로 두고 있으며 네이버파이낸셜은 NH보험회사를 자회사로 두고 있다. 네이버는 선불전자지급수단 발행 및 관리업, 전자지급결제대행업, 보험대리점업 등을 라이센스에 기반하여 수행하고 있으며 증권업, 자산관리업 등은 기존 금융회사와 제휴 등의 방법으로 서비스를 제공하고 있다.

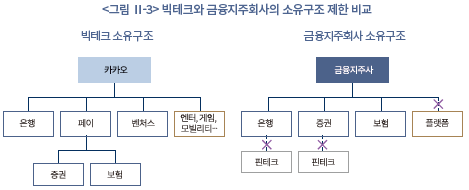

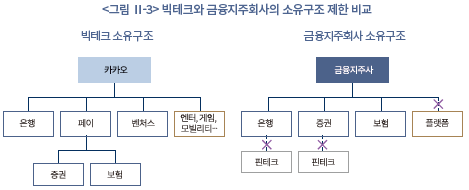

한국 빅테크는 금융회사 뿐 아니라 비금융회사의 소유를 통해 업무범위를 넓힐 수 있는 장점이 있다. 카카오와 네이버 그룹 모두 온라인 검색, 쇼핑, 미디어, 엔터테인, 여행, 모빌리티 등 비금융서비스업 회사를 자회사 또는 손자회사로 두고 있는데 금융회사가 비금융서비스업 회사를 자회사 또는 손자회사로 두는 것에 엄격한 제한을 두고 있는 것과 비교된다(<그림 Ⅱ-3> 참조). 금융산업의 구조개선에 관한 법률(이하 금산법)에서는 주요 금융회사로 하여금 비금융회사 주식의 5% 이상 보유를 통한 지배력 향유 또는 비금융회사 주식의 20% 초과소유 행위를 금지하고 있다.14) 유사하게 은행법15)과 보험업법16)에서는 은행과 보험회사로 하여금 해당 금융업과 관련이 없는 비금융회사에 15% 이상 출자하는 것을 제한하고 있다. 즉 한국 빅테크는 다양한 유형의 비금융서비스 진출을 통해 네트워크 외부효과와 빅데이터 분석 능력을 키우고 이를 통해 시장 지배력을 높이는 것이 금융회사에 비해 훨씬 수월하다고 말할 수 있다.

다. 빠른 디지털 전환 속도

다. 빠른 디지털 전환 속도

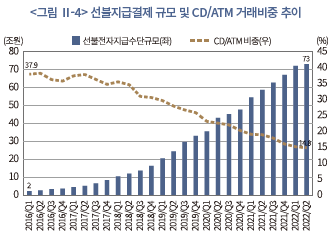

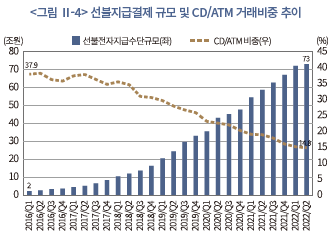

마지막으로 한국 금융산업의 디지털 전환 속도가 매우 빠른 점도 한국 빅테크의 금융리스크 개연성을 확대시키는 요인이 될 수 있다. 4차 산업혁명의 영향으로 산업 및 경제 구조가 비대면 중심으로 바뀌면서 한국 금융산업 역시 비대면 서비스 비중이 급격히 증가했다. 대표적으로 온라인 쇼핑, 미디어, 금융거래 등 비대면 지급결제 수요가 증가하면서 페이(pay) 서비스로 불리는 선불지급결제 규모가 큰 폭으로 증가한 반면 COVID19 이후 대면 거래 수요가 감소하면서 현금 인출 및 지급거래를 대표하는 CD/ATM 거래 비중은 크게 줄었다. <그림 Ⅱ-4>에서 볼 수 있듯이, 2022년 2분기에 선불지급결제 규모는 73조원으로 2016년 1분기의 2조원과 비교해서 36배 증가하는 등 선불지급결제 규모의 연평균 증가율은 105%에 이른다. 동기간 CD/ATM 거래비중이 37.9%에서 14.8%로 감소한 것과 비교하면 대면 거래 비중이 줄고 비대면 거래 비중이 큰 폭으로 증가한 것으로 추정할 수 있다.

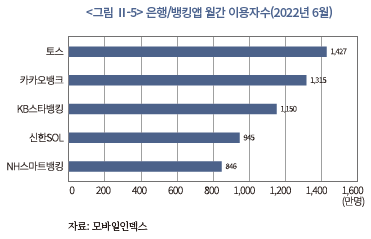

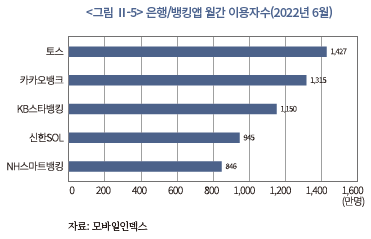

금융업 세부 유형별로 살펴보아도 한국 금융산업의 빠른 디지털 전환 속도를 체감할 수 있다. 모바일인덱스에서 발표하는 모바일 은행/뱅킹앱의 월간 이용자수(2022년 6월 기준)를 살펴보면 토스, 카카오뱅크 등 대형 핀테크 회사와 빅테크가 각각 1,427만명, 1,315만명으로 1~2위를 차지하고 있고 대형 상업은행에서 출시한 뱅킹앱들이 이들보다 못미치는 이용건수를 기록하며 3~5위를 기록하고 있다. 대형 상업은행의 자기자본 규모나 예적금 규모는 인터넷전문은행에 비해 월등히 높지만 온라인 이용 비중은 인터넷전문은행이 훨씬 높은 비중을 차지하고 있어 예적금 수취, 대출 등 은행업 본질적 업무에 있어서 인터넷전문은행의 점유율이 빠르게 늘고 있는 것으로 예상할 수 있다. 또한 송금/결제 관련 앱이용자수는 삼성페이(1,552만), 카카오페이(367만), PAYCO(290만) 순서로 1~3위를 차지하고 있는데 비대면 지급결제 분야에 있어서도 대형 핀테크 또는 빅테크가 시장 지배력을 갖고 빠르게 성장해온 것으로 보인다.

이상을 요약하면 빅테크가 금융서비스를 제공할 때 네크워크 외부효과, 데이터 독점력, 비금융 번들링 서비스 등을 통해 금융산업 내 시장 지배력을 확대할 것으로 예상할 수 있다. 문제는 빅테크가 금융산업 내 영향력을 확대하는 과정에서 금융소비자 편익 제고 등 긍정적 효과 못지않게 다양한 금융리스크를 초래할 수 있는 부작용이 우려된다는 점이다. 예를 들어 빅테크의 데이터 독점으로 인한 금융소비자 후생 감소 위험, 불완전판매 위험, 불공정영업행위 위험, 정보 오남용 위험 등을 가질 수 있으며 빅테크의 네트워크 외부효과로 인해 집중위험, 빅테크와 금융회사의 건전성 위험, 시스템위험 등을 키울 수 있다. 특히 한국 빅테크는 금융회사와 비교해 규제 수준이 낮고, 취급하는 업무범위가 매우 넓으며, 디지털 전환 속도가 매우 빠르기 때문에 빅테크로 인한 금융리스크 개연성이 더욱 클 것으로 예상할 수 있다.

Ⅲ. 빅테크의 금융리스크 분석

1. 분석 대상 빅테크의 범위

한국 빅테크의 금융리스크 수준을 분석하기에 앞서 연구 대상 범위가 되는 빅테크를 정의할 필요가 있다. 우선 빅테크는 다소 추상적인 개념으로 법적으로 명확하게 정의하는 것은 쉽지 않다. FSB(2019)는 빅테크를 다수의 소비자를 대상으로 플랫폼 기반 서비스를 제공하는 대형 ICT 회사로 정의했으며 구글, 애플, 아마존, 마이크로소프트, 알리바바, 텐센트를 빅테크 기업으로 분류했다. BIS(2022)는 빅테크를 플랫폼 기반의 ICT 서비스를 메인 서비스로 제공하는 대형회사로 정의했으며 한국에서는 카카오, KT 등을 금융업에 진출한 빅테크로 분류했으며 토스는 빅테크가 아닌 핀테크로 분류했다. IMF(2022) 역시 빅테크를 획일적으로 정의하는 것은 쉽지 않음을 언급했으며 양면 플랫폼 서비스를 통해 다수의 소비자와 서비스 공급자를 연결해주며 시장 지배력을 확장해가는 대형 기술 기반 회사를 빅테크로 정의하고 있다.

한편 유럽, 미국, 중국 등은 빅테크 또는 온라인 플랫폼 회사의 독점력 남용으로 소비자 피해가 발생하는 것을 억제하기 위해 빅테크 또는 온라인 플랫폼에 대한 규제안을 마련했으며 해당 규제안에서 빅테크를 계량적으로 정의하고 있다. 예를 들어 유럽 디지털시장법(Digital Market Act: DMA)에서는 3년간 연간 매출액이 75억유로(약 10조 5천억원17)) 이상이거나 시가총액 또는 시장가치가 750억유로(약 105조원) 이상이고, 월간 이용자수가 4,500만명을 초과하고, 해당 플랫폼을 이용하는 사업자수가 연간 10,000개를 초과하는 조건을 모두 만족하는 플랫폼 회사를 게이트키퍼(Gatekeeper)로 정의했다. 유럽 디지털시장법(DMA)에서는 이렇게 정한 게이트키퍼로 하여금 이용자의 활동으로 얻은 정보를 이용자와 경쟁하는데 사용하는 것을 제한하고 자사 상품 또는 서비스를 우대하는 행위 등을 금지했으며 이용자로 하여금 타 서비스로 이동하는 행위 제한을 금지하였다.

미국은 유럽의 규제안을 참고하여 빅테크의 독점력 남용 및 불공정거래 행위를 억제하기 위해 5개의 플랫폼 규제안을 마련했다.18) 이때 규제 대상이 되는 대형 플랫폼 회사는 시가총액이 6천억달러(약 836조원19)) 이상이고 미국 내 월간 이용자수가 5,000만명을 초과하고, 해당 플랫폼을 이용하는 사업자수가 연간 100,000개를 초과하는 조건을 모두 만족하는 회사로 정의했다. 일본의 경우 온라인 플랫폼 사업자의 공정경쟁 환경 조성을 목적으로 특정 디지털 플랫폼의 투명성 및 공정성 향상에 관한 법률을 제정하여 대형 온라인 플랫폼 사업자로 하여금 상품노출 순서 결정기준을 공개하도록 하고 해당 플랫폼 사업자가 계약조건을 변경하는 경우 사전통지 의무 등을 부여했다. 일본 플랫폼 규제안을 적용받는 기업은 일본 내 플랫폼 기업 중에서 연간 매출액 기준 2천억엔(약 2조원20)) 이상의 앱스토어 운영자나 연간 매출액 기준 3천억엔(약 3조원) 이상의 온라인 중개 사업자 등이 해당된다. 이상을 요약하면 유럽, 미국, 일본 등 주요국은 빅테크 또는 온라인 플랫폼을 규제하기 위해 매출액 또는 시가총액 등의 규모 요건, 플랫폼 이용자수 요건, 플랫폼 입점 사업자수 요건 등을 명시하고 있다.

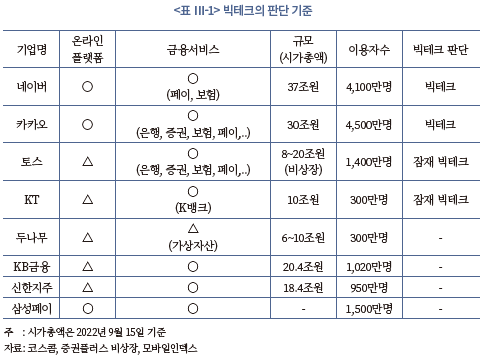

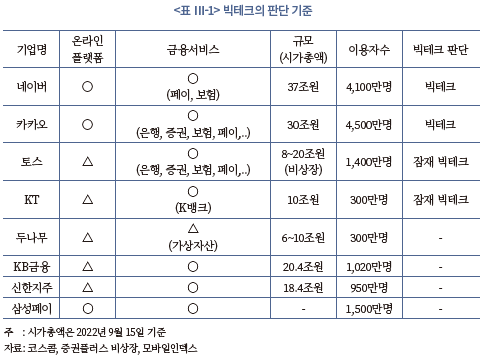

이에 본 연구에서는 주요국 빅테크 또는 온라인 플랫폼 규제안에서 정의한 온라인 플랫폼 요건, 규모 요건, 이용자수 요건을 기준으로 빅테크를 정의하고 해당 빅테크에 대해 금융리스크 분석을 수행하고자 한다. 구체적으로 ① 온라인에서 양면 플랫폼 서비스를 제공하며 ② 금융업의 본질적 업무와 관련한 금융서비스를 제공하며 ③ 시가총액이 10조원 이상이거나 10조원과 유사한 수준이며 ④ 플랫폼 월간 이용자수가 2,000만명 이상인 조건들을 모두 만족하는 기업에 대해 빅테크로 정의하고, 해당 빅테크의 금융리스크를 분석하고자 한다. 또한 ①과 ②의 조건을 모두 만족하고 ③ 또는 ④의 조건을 만족하는 경우에 한해 잠재 빅테크(또는 대형 핀테크)로 정의하고 해당 잠재 빅테크에 대해서도 금융리스크 수준을 분석한다. 이와 같은 조건에 따르면 <표 Ⅲ-1>에서 확인할 수 있듯이 한국 내 빅테크는 네이버, 카카오가 해당되며 잠재 빅테크로는 토스, KT 등이 해당될 수 있다.21) 일반 금융회사는 주가 수익률 정보 수집이 용이한 은행 기반 금융지주회사, 대형 보험회사, 대형 증권회사를 대상으로 하였다.

2. 유형별 금융리스크22) 분석

가. 핵심 금융위험

본 연구에서 빅테크의 금융리스크는 핵심 금융위험과 비핵심 금융위험 그리고 시스템위험으로 구분하여 금융리스크 수준을 분석하고자 한다. 금융회사의 경우 핵심 금융위험은 시장위험, 신용위험, 운영위험 등으로 구성하는데 해당 위험들은 자기자본 규제 비율을 측정할 때 분모 값으로 사용되는 경우가 많다. 즉 시장위험, 신용위험, 운영위험 등이 커지면 자기자본 규제 비율이 낮아지도록 설계되어 있다. 이와 같은 시장위험, 신용위험, 운영위험 등은 국내외 금융감독기구가 표준화된 위험 산출 방식을 제시하고 있어 금융회사에 대해서는 계량화된 방법으로 해당 위험을 측정하는 것이 가능하다. 다만 금융업에 진출한 빅테크에 대해 시장위험, 신용위험, 운영위험 등을 상업은행과 동일한 수준으로 측정하는 것에 한계가 있으므로 본 연구에서는 시장위험가중자산, 신용위험가중자산, 순이익, 자산총계 대비 월간 이용자수 등을 빅테크의 시장위험, 신용위험, 운영위험의 대용치로 사용하여 빅테크와 금융회사 간 위험 수준을 비교한다.

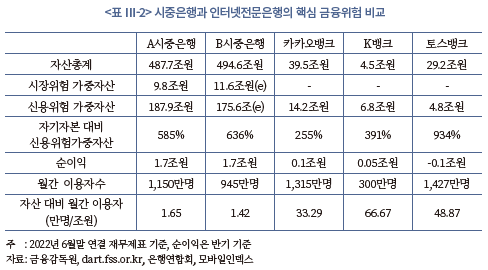

1) 시장위험과 신용위험

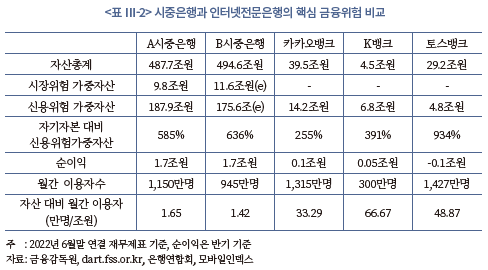

우선 2022년 6월말 기준 주요 시중은행과 빅테크 계열 인터넷전문은행의 핵심 금융위험을 비교하면 시장위험과 신용위험의 경우 시중은행이 빅테크 또는 잠재 빅테크에 비해 높은 것을 확인할 수 있다. 이는 주요 시중은행의 경우 오랜 기간에 걸쳐 가계 및 기업 수신과 여신 업무 등을 통해 각각 700조원 규모의 자산을 축적해왔기 때문으로 추정할 수 있다. 반면 빅테크 계열 인터넷전문은행은 설립된 지 수년에 불과하고 온라인에서 개인을 대상으로 수신과 여신 업무를 수행해왔기 때문에 자산 규모가 시중은행의 1/10 수준에도 미치지 못하는 등 시장위험과 신용위험의 절대 수준은 크지 않다.23) 다만 운영위험 측면에서는 빅테크 계열 인터넷전문은행이 시중 은행보다 크다고 말할 수 있다. <표 Ⅲ-2>에서 볼 수 있듯이 2022년 6월말 3개 인터넷전문은행의 상반기 평균 순이익은 200억원 내외에 불과한데 동기간 대형 시중은행의 상반기 평균 순이익은 1.7조원을 기록하고 있다. 자산규모 대비 월간 이용자수를 비교해도 인터넷전문은행이 시중은행을 크게 상회하고 있어 다수의 이용자를 대상으로 서비스를 제공하는 과정에서 인터넷전문은행이 시스템 오작동, 내부통제 미흡 등 각종 운영위험을 보다 많이 내재한 것으로 추정할 수 있다.

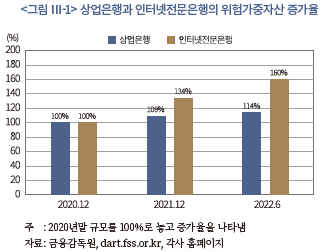

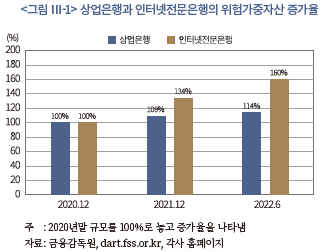

신용위험의 절대 수준은 대형 상업은행이 빅테크 계열 인터넷전문은행보다 훨씬 높으나 빅테크 계열 인터넷전문은행의 신용위험 증가율은 상업은행보다 높다.24) <그림 Ⅲ-1>에서 보듯이 2022년 6월말 기준 대형 상업은행의 위험가중자산 규모는 2020년말 대비 14%p 증가했으나 빅테크 계열 인터넷전문은행의 위험가중자산은 해당 기간 동안 60%p 증가하는 등 상업은행 증가율보다 약 4배 높다. 최근 인터넷전문은행이 시장 점유율 확대를 위해 시중은행보다 높은 예금금리를 제공하고 동시에 시중은행보다 낮은 대출금리를 제시함에 따라 신용위험의 절대 수준이 큰 폭으로 증가한 것으로 추정된다. 실제 2020년말 3개 인터넷전문은행의 원화대출금 잔액 비중은 국내 전체 은행들 잔액의 2.22%에 불과했으나 2022년 1분기말 3.16%로 1년 3개월만에 약 1%p 증가했다.25)

2) 운영위험

금융회사의 운영위험은 부적절하거나 잘못된 내부 프로세스, 인력, 시스템 및 외부 사건으로 인해 발생하는 손실 위험을 뜻한다. 2022년 10월 판교 데이터센터의 화재로 카카오 그룹이 제공해 온 금융서비스, SNS 서비스가 수일 동안 중단되어 대규모 이용자 피해가 발생한 사건이 운영위험이 현실화된 대표적 사례로 꼽을 수 있다.26) 당시 판교 데이터센터 화재로 카카오톡 뿐 아니라 카카오뱅크, 카카오페이 등 주요 금융서비스가 중단되어 계좌이체, 입출금, 결제서비스 등이 최대 127시간 30분 동안 중단되었으며 데이터센터 화재 사고 이후 첫 거래일에 카카오 그룹 주식의 시가총액은 개장 10분 만에 3조원 넘게 하락하기도 했다.27) 이처럼 운영위험은 평상시에 위험 수준을 객관적으로 측정하기 어려우나 운영위험이 현실화되면 매우 큰 규모의 피해가 발생할 수 있는 특징을 가진다.

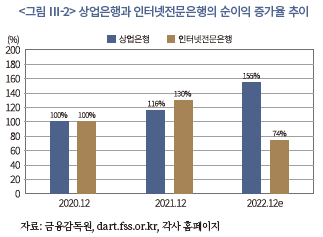

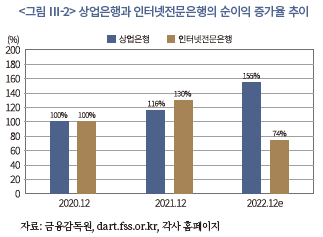

본 연구는 운영위험 측정의 한계를 고려하여 바젤위원회 등에서 제안한 순이익 규모 측정을 통해 상업은행과 인터넷전문은행의 운영위험 수준을 비교하고자 한다. 최근 인터넷전문은행의 시장 점유율은 늘고 있으나 순이익 규모가 줄고 있어 인터넷전문은행의 운영위험이 상대적으로 큰 폭으로 증가한 것으로 예상할 수 있다. <그림 Ⅲ-2>에서 보듯이 2022년 12월말 기준 인터넷전문은행의 연간 예상순이익은 약 700억원으로 2020년말 대비 약 30% 감소한 반면 대형 상업은행의 연간 순이익은 해당 기간 동안 55% 증가했다. 최근 인터넷전문은행이 예적금 수신 및 대출 업무 관련해서 시장 점유율을 늘려왔지만 순이익은 오히려 감소하고 있어 내부통제에 충분한 인적, 물적 자원을 투자하는 것이 쉽지 않을 수 있다고 예상할 수 있다. 즉 금융회사가 업무 범위를 확대하고 고객 수를 늘리는 과정에서 순이익이 감소하면 내부통제 미흡 등으로 예상치 못한 손실이 발생할 확률이 증가할 수 있다.

나. 비핵심 금융위험

빅테크의 비핵심 금융위험으로 유동성위험, 집중위험, 법률위험 수준을 분석하고자 한다. 이들 비핵심 금융위험은 객관적인 수치로 측정하는 것이 어렵기 때문에 빅테크와 전통적 금융회사 위험 구성 요소를 비교하는 방식으로 위험 수준을 살펴보고자 한다. 금융회사의 유동성위험은 자산과 부채 간 만기 불일치로 인해 현재 또는 미래의 지급 의무를 상환하지 못할 위험과 위기 상황 발생으로 보유자산을 현금화하는 과정에서 손실이 발생하는 위험을 뜻하는데, 본 연구에서는 해당 빅테크의 관련 위험을 정확히 측정하기 어렵기 때문에 빅테크의 유동성 규제 비율과 현금성 자산 비율 등을 측정하여 유동성위험 수준을 살펴보고자 한다. 금융회사의 집중위험은 거래상대방 또는 조달과 운영 과정에서 특정 주체의 의존도가 높은 상황에서 발생할 수 있는 위험을 뜻하는 것으로 빅테크의 예적금 또는 대출의 편중도 등을 추정하여 해당 위험 수준을 살펴보고자 한다. 법률위험은 빅테크들이 각종 계약이나 행정규제 의무를 이행하지 못함에 따라 발생하는 손실 위험을 뜻하는데, 빅테크가 외부 기업들과 체결한 계약 내용을 수집하는 것은 한계가 있어 빅테크와 금융회사에서 발생한 금융사고와 민원건수를 통해 위험 수준을 측정하고자 한다. 그 외에 비금융위험으로 분류되는 평판위험 등도 정량적 방법으로 측정하는 것에 한계가 있어 ESG 등급, 긍정-부정 뉴스 비중 등을 통해 간접적으로 비교 분석하고자 한다.

1) 유동성위험

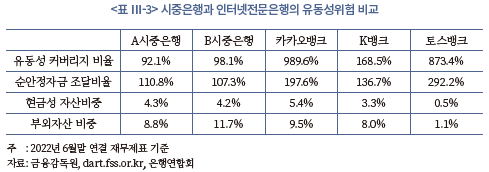

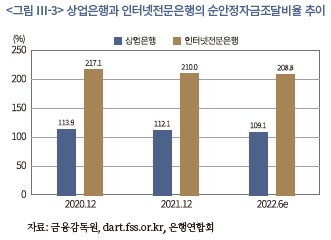

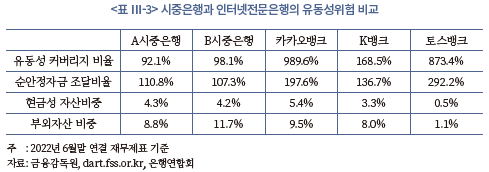

바젤위원회는 대형 은행의 유동성 위험을 관리하기 위해 유동성커버리지비율(Liquidity Coverage Ratio: LCR), 순안정자금조달비율(Net Stable Funding Ratio: NSFR) 등이 일정 수준 이상을 유지하도록 권고하고 있다. 유동성커버리지비율은 고유동성자산을 순현금유출액으로 나눈 값으로 정의하는데 금융회사가 고유동성자산이 충분하지 않거나 순현금유출액이 많으면 유동성커버리지비율이 낮아지는데, 금융당국은 은행업 라이센스를 보유한 금융회사로 하여금 유동성커버리지비율이 일정 수준 이상 유지하도록 규율하고 있다.28) 2022년 6월말 기준 대형 상업은행과 인터넷전문은행의 유동성커버리지비율을 비교하면 각각 95.1%와 677.2%로 인터넷전문은행이 다소 높은 값을 유지하고 있다(이하 <표 Ⅲ-3> 참조). 이는 상업은행이 기업 대출 비중이 높고 외환, 보증 등 업무 범위가 넓어 고유동성자산 비중이 상대적으로 작고 인터넷전문은행의 경우 업력이 짧아 순현금유출액 규모가 상대적으로 작기 때문인 것으로 예상할 수 있다. 특히 주요 인터넷전문은행은 대형 상업은행에 비해 고금리 예적금 상품 출시 비중이 높아 순수신 규모가 빠르게 증가했으며 수신 자금으로 국채, 금융채 등 고유동성 자산을 매입했기 때문에 유동성커버리지비율이 높게 산출된 것으로 추론할 수 있다.29) 한편 순안정자금조달비율은 금융회사의 자산부채구조에 내재된 유동성위험을 보다 정확히 측정하기 위해 도입한 지표로 1년내 유출 가능성이 큰 부채 규모를 충족할 수 있는 장기 안정적 조달자금을 보유한 비중을 뜻한다. 구체적으로 순안정자금조달비율은 총안정자금가용금액을 총안정자금조달필요금액으로 나눈 값으로 정의하며 해당 비율이 100% 이상 유지하도록 규율하고 있다. 2022년 6월말 기준 대형 상업은행과 인터넷전문은행의 순안정자금조달비율을 비교하면 각각 109.1%와 208.8%로 규제 비율인 100%를 상회하는 가운데 인터넷전문은행이 다소 높은 값을 유지하고 있다. 이는 유동성커버리지비율과 유사하게 대형 상업은행이 인터넷전문은행보다 기업 대출, 보증, 장외파생상품 등 업무범위가 넓은데 기인한 것으로 보인다.

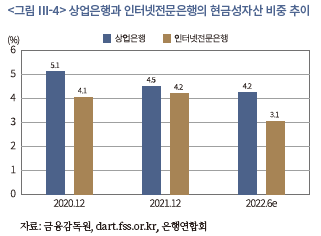

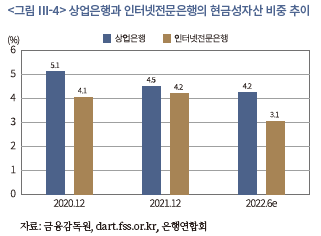

다음으로 대형 상업은행과 인터넷전문은행의 유동성 자산규모를 질적인 측면에서 비교하고자 한다. 먼저 대형 상업은행의 현금 및 예치금(이하 현금성자산) 비중은 전체 자산규모의 4.2%를 차지하고 있으며 인터넷전문은행의 현금성자산 비중은 전체 자산규모의 3.1%를 차지하고 있다. 즉 현금성 자산 보유 관련해서는 상업은행이 인터넷전문은행보다 다소 높은 수준을 유지한 것으로 예상할 수 있다. 유동성 위험이 큰 부외자산 규모를 살펴보면 상업은행의 부외자산 비중은 전체 자산규모의 10.3%로 인터넷전문은행의 부외자산 비중인 6.2%보다 다소 높다. 한편 토스뱅크를 제외하면 상업은행과 빅테크의 부외자산 비중은 10.3%와 8.8%로 큰 차이가 나지 않고 있어 인터넷전문은행이 상업은행보다 유동성위험 수준이 낮다고 말할 수는 없다.

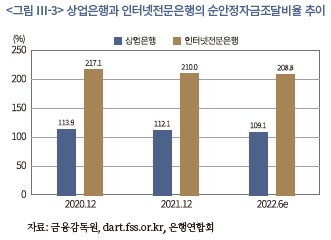

주요 유동성위험 지표의 추이를 살펴보면 순안정자금조달비율은 상업은행과 인터넷전문은행 모두 2020년말 이후 소폭 감소하고 있다. 2020년말 상업은행과 인터넷전문은행의 평균 순안정자금조달비율은 113.9%와 217.1%였는데 2022년 6월말 기준 평균 순안정자금조달비율은 109.1%와 208.8%로 각각 4.8%p와 8.3%p 감소했다(<그림 Ⅲ-3> 참조). 한편 해당기간 동안 인터넷전문은행의 현금성자산 비중은 4.1%에서 3.1%로 1.0%p 감소했으며 상업은행의 현금성자산 비중은 5.1%에서 4.2%로 0.9%p 감소했다. 즉 인터넷전문은행과 상업은행의 주요 유동성위험 지표는 하락한 가운데 인터넷전문은행의 유동성위험 증가 비율이 소폭 높은 것으로 예상할 수 있다. 특히 현금성자산 비중의 경우 최근 6개월 동안 인터넷전문은행의 감소폭이 큰 것으로 확인된다. 이는 2020년 이후 인터넷전문은행의 예적금 수취 및 대출 업무의 시장점유율이 꾸준히 상승하는 과정에서 인터넷전문은행들이 수익성 개선을 목적으로 유동성위험이 큰 자산 비중을 늘려왔기 때문으로 추론할 수 있다.

이상을 종합하면 유동성커버리지비율, 순안정자금조달비율 등의 유동성위험 지표는 인터넷전문은행이 상업은행보다 높고 현금성 자산 비중은 인터넷전문은행이 다소 낮다. 부외자산 비중은 신생 인터넷전문은행을 제외하면 상업은행과 인터넷전문은행 간에 큰 차이가 있다고 말할 수 없다. 즉 주요 유동성위험 지표는 인터넷전문은행이 상업은행보다 높지만 인터넷전문은행의 현금성 자산 비중과 부외자산 비중 등은 상업은행보다 높거나 비슷한 수준을 유지하고 있어 전반적으로 인터넷전문은행의 유동성위험 수준이 상업은행보다 크거나 작다고 말하기는 어렵다. 다만 최근 주요 유동성위험 지표와 관련해서 인터넷전문은행의 하락폭이 다소 높은 것으로 관찰되는 만큼 향후 인터넷전문은행의 유동성위험 역시 면밀히 모니터링하는 것이 필요할 것이다.

2) 집중위험

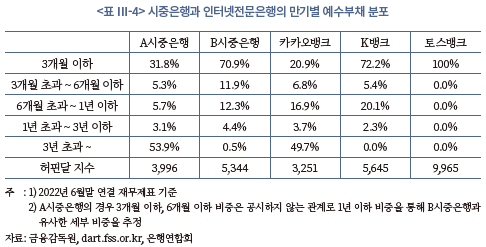

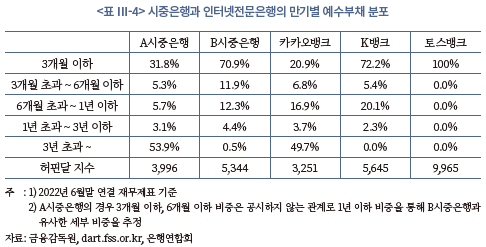

금융회사의 집중위험은 자금의 조달과 운용 과정에서 특정 주체와 산업의 의존도가 높거나 신용위험을 내재한 자산에서 특정 거래상대방의 부도 위험에 과도하게 노출된 경우 발생할 수 있는 손실위험을 뜻한다. 우선 자금의 조달과 관련해서 빅테크 계열 인터넷전문은행이 대형 상업은행보다 집중위험이 높다고 말할 수 있다. 2022년 6월말 기준 대형 상업은행과 인터넷전문은행의 만기별 예수부채 분포를 살펴보면 인터넷전문은행의 1년 이하 예수부채 비중은 65%로 대형 상업은행의 1년 이하 예수부채 비중(40%)보다 25%p 높다(이하 <표 Ⅲ-4> 참조). 즉 인터넷전문은행의 예적금 고객 중에서 만기가 1년 이하 고객 비중이 전체의 2/3로 매우 높아 예적금 고객의 대량 인출 사태가 발생하거나 예적금 고객의 재가입율이 현저히 낮아지는 경우 조달 위험이 증가할 수 있다. 특히 일부 인터넷전문은행의 경우 가상자산 투자를 목적으로 예치한 고객 비중이 높아 가상자산 시장이 급락하거나 신뢰가 무너지면 대규모 예치금 인출 상태가 발생할 수 있어 뱅크런 사태에 직면할 개연성도 배제할 수 없다.30)

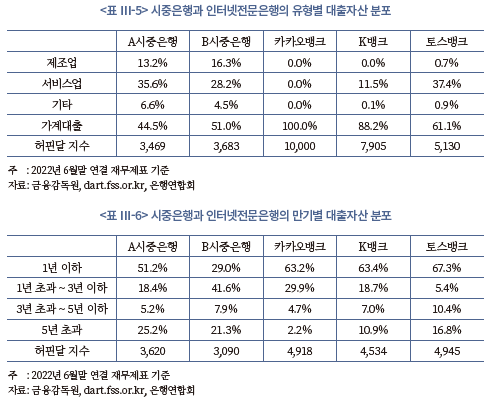

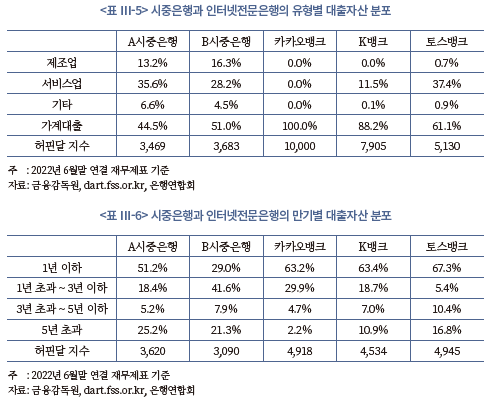

다음으로 자산의 운용 측면에서도 빅테크 계열 인터넷전문은행의 집중위험이 대형 상업은행보다 높다고 말할 수 있다. 2022년 6월말 기준 대형 상업은행과 인터넷전문은행의 유형별 대출자산 분포를 살펴보면 인터넷전문은행의 대출자산은 대부분 가계대출로 구성된 반면 상업은행의 대출자산은 제조업, 서비스업, 가계대출 등으로 비교적 고르게 분포되어 있다(<표 Ⅲ-5> 참조). 유형별 대출자산 비중에 대해 허핀달 지수를 비교해보면 인터넷전문은행의 평균 허핀달 지수는 7,700으로 매우 집중화되어 있으나 상업은행의 평균 허핀달 지수는 3,500으로 상대적으로 집중도가 낮다. 즉, 인터넷전문은행의 경우 가계대출 자산에서 동시 다발적으로 부실이 발생할 경우 유형별로 신용위험을 분산시키기 어려워 대규모 손실을 기록할 수 있다. 또한 만기별로 대출자산 분포를 비교하더라도 빅테크 계열 인터넷전문은행의 집중도가 상업은행보다 높은 것으로 확인된다. <표 Ⅲ-6>에서 볼 수 있듯이 만기별 대출자산 비중에 대해 허핀달 지수를 계산하면 인터넷전문은행의 평균 허핀달 지수는 4,800으로 상업은행의 평균 허핀달 지수(약 3,400)보다 높다. 인터넷전문은행의 경우 1년 이하의 대출자산 비중이 전체 대출자산의 2/3를 차지하는데 인터전문은행 및 상업은행간 대출금리 경쟁이 치열한 상황에서 만기에 도래한 대출자산이 연장되지 않고 타 인터넷전문은행으로 이동하면 수익성이 급격히 줄어들 위험에 노출될 수 있다.

3) 법률위험

법률위험은 금융회사가 본질적 업무, 부수 업무 등을 수행하는 과정에서 행정규제 준수 의무 또는 거래 상대방과의 계약 의무를 이행하지 못함에 따라 발생하는 손실 위험을 뜻하며 넓은 범위에서 금융회사가 분쟁 등으로 인해 소송을 제기할 때 발생할 수 있는 비용을 포함한다. 구체적으로 금융회사가 담합 금지 행위, 불공정거래 및 불완전판매 금지 행위 등을 위반하여 사법부와 행정부로부터 벌금, 과징금, 과태료를 부과받을 수 있는데 해당 벌금과 행정 제재금에 비례하여 법률위험의 수준을 측정할 수 있다. 이때 벌금, 과징금 등은 금융사고로 인한 소비자 피해 금액 또는 금융회사의 손실 금액 등에 연동된 경우가 많아서 잠재적 법률위험은 금융사고 발생건수, 금융소비자 민원건수 등을 통해 추정할 수 있다. 본 연구에서는 자료 수집의 제약으로 인해 잠재적 법률위험 중심으로 금융회사와 빅테크 계열 인터넷전문은행의 법률위험을 비교하고자 한다.

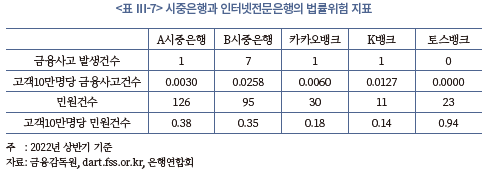

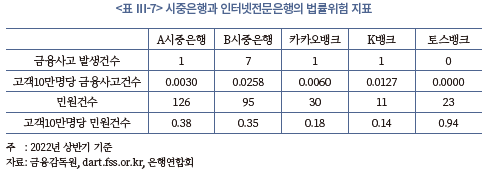

2022년 상반기 기준 대형 상업은행과 인터넷전문은행의 주요 법률위험 지표를 살펴보면 금융사고 발생건수와 민원건수 모두 대형 상업은행이 인터넷전문은행보다 높은 수준을 기록하고 있다(이하 <표 Ⅲ-7> 참조). 이는 최근 대형 상업은행에서 내부자 자금횡령 사건 등 내부통제 미흡으로 인한 금융사고가 다수 발생했기 때문으로 보인다. 다만 고객 10만명당 금융사고건수와 민원건수를 비교하면 인터넷전문은행이 대형 상업은행보다 법률위험이 낮다고 말할 수 없다. <표 Ⅲ-7>에서 볼 수 있듯이, 인터넷전문은행의 고객 10만명당 평균 민원건수는 0.42건으로 상업은행의 고객 10만명당 평균 민원건수(0.37)보다 높으며 고객 10만명당 금융사고건수는 인터넷전문은행(0.0062)이 대형 상업은행의 수준(0.0098)보다 낮다. 즉 영업규모를 통제하고 비교하면 대형 상업은행의 법률위험 수준이 빅테크 계열 인터넷전문은행의 위험 수준보다 낮다고 말할 수 없다.

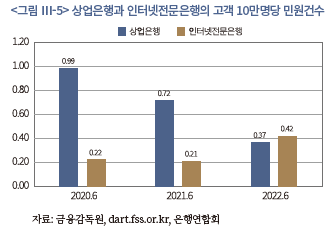

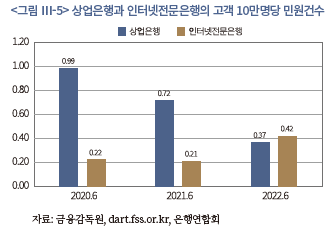

법률위험의 절대 수준은 인터넷전문은행과 상업은행 간에 큰 차이가 있다고 보기 어려우나, 인터넷전문은행의 법률위험 증가 속도는 상업은행과 비교해 다소 빠르다. <그림 Ⅲ-5>에서 볼 수 있듯이, 최근 2년 동안 대형 상업은행의 고객 10만명당 민원건수는 0.22(2020년 상반기)에서 0.42(2022년 상반기)로 약 2배 증가했으나, 동기간 대형 상업은행의 고객 10만명당 민원건수는 0.99(2020년 상반기)에서 0.37(2022년 상반기)로 약 1/3 수준으로 감소했다. 대형 상업은행의 경우 2020년 전후 사모펀드, DLF 등의 불완전판매 이슈로 고객 민원이 크게 증가한 이후 내부통제를 강화하며 고객 10만명당 민원건수는 감소한 것으로 예상할 수 있다. 반면 빅테크 계열 인터넷전문은행은 최근 금융서비스 범위를 확대하고 적극적으로 신규 고객을 유치함에 따라 고객 10만명당 민원건수는 빠르게 증가한 것으로 보인다. 즉 2022년 6월말 기준으로는 빅테크 계열 인터넷전문은행이 금융회사보다 법률위험 수준이 크다고 말할 수 없으나, 최근 인터넷전문은행의 법률위험 수준이 상대적으로 빠르게 증가하는 부분은 주목할 부분이다.

4) 평판위험

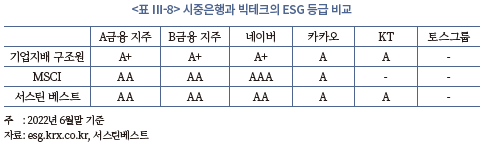

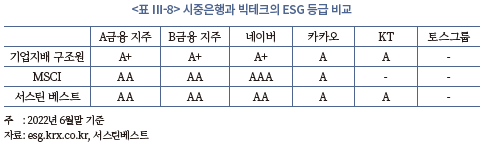

평판위험은 금융회사가 금융소비자, 잠재 고객, 거래상대방 금융회사, 주주, 금융당국 등 주요 이해관계자에게 부정적 인식을 미쳐 현재 또는 장래의 순이익 또는 건전성이 악화될 수 있는 위험을 뜻한다. 바젤위원회는 금융회사의 평판위험에 대해 객관적으로 측정하기 어렵다고 판단하여, 평판위험을 운영위험의 한 종류로 보아 운영리스크 소요자기자본 산출 식에서 간접적으로 평판위험 수준을 포함하고 있다. 이처럼 금융회사와 빅테크의 평판위험을 객관적으로 측정하는 것은 한계가 있기 때문에 최근 기업의 비재무적 가치 위험 측정에 널리 활용되는 ESG 등급을 비교 분석하여 대형 금융회사와 빅테크의 평판위험을 간접적으로 비교하고자 한다. 2022년 6월말 기준 대형 금융회사와 빅테크의 ESG 등급을 살펴보면 금융회사의 ESG 평가등급이 빅테크와 비교해 대체로 1~2단계 높거나 같은 수준을 기록하고 있다(<표 Ⅲ-8> 참조). 또한 일부 빅테크 또는 잠재 빅테크의 경우 지속가능경영보고서를 공시하지 않는 등 객관적인 ESG 평가등급이 부재한 것으로 확인된다.

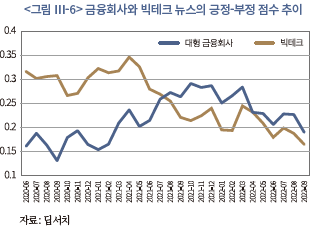

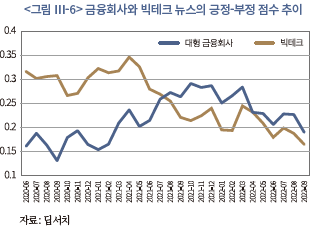

금융회사와 빅테크의 평판위험 수준 추이를 긍정-부정 언론 노출 비중을 통해 살펴볼 수 있다. 기업 관련 뉴스들에 대해 긍정-부정 점수 비율 추이를 살펴보면31), 2021년 7월 이전에는 빅테크에 대해 긍정적인 뉴스 빈도수가 높았으나 2021년 7월 이후부터 2022년 9월 현재에는 빅테크에 대해 긍정적인 뉴스 비중은 꾸준히 줄었다. 반면 대형 금융회사의 경우 2021년 7월 이전에는 긍정적인 뉴스 비중이 낮았으나 이후 점차 증가했는데 이는 2020~2021년 사이에 사모펀드 및 DLF 관련 불완전판매 사건으로 대형 금융회사에 대해 부정적 인식이 증가했던 것과 관련되어 있다. 한편 2021년 7월 이후부터 2022년 9월 현재까지 금융회사의 긍정 뉴스 비중이 빅테크보다 높은 수준을 유지하고 있는데, <그림 Ⅲ-5>에서 볼 수 있듯이 빅테크에 대해 고객 민원건수가 증가하는 등 최근 빅테크에 대한 부정적 인식이 다소 증가한 것으로 보인다. 즉, 최근 1년여간 동안에는 빅테크의 평판위험 수준이 대형 금융회사보다 다소 큰 것으로 추정할 수 있다.

다. 시스템위험

1) 분석방법론

금융회사가 내재한 시스템위험은 개별 금융회사의 손실이 다른 금융회사의 손실로 전이될 가능성이 높고 이로 인해 금융시장의 변동성이 확대되고 실물경제에 충격을 줄 수 있는 위험으로 정의할 수 있다.32) 시스템위험은 경기 순응성을 가지고 있어 경기침체 국면에서 위험의 절대 수준이 큰 폭으로 증가하여 금융안정성을 심각하게 위협할 수 있기 때문에 금융회사 또는 빅테크의 시스템위험을 선제적으로 관리하는 것이 무엇보다 중요하다. 이론적으로 시스템위험을 정확하게 측정하는 것은 한계가 있는 가운데 실무적으로 크게 지표기준법과 전이위험측정법을 통해 금융회사의 잠재 시스템위험을 측정할 수 있다.33) 지표기준법은 국제 금융감독기구가 대형 상업은행에게 주로 적용하는 방법으로 금융회사의 규모, 상호연계성, 대체가능성, 복잡성, 국내 특수성 등의 평가항목 지표를 가중 평균하여 산출한다. 이때 해당 점수가 높은 금융회사들을 글로벌 시스템적 중요금융기관(Global Systemically Important Financial Institutions: G-SIFI)으로 선정하여 별도의 추가자본 적립 의무를 부여하고 있다. 한국 역시 금융감독당국이 지표기준법을 사용하여 국내 시스템적 중요 은행(Domestic Systemically Important Bank: D-SIB)을 선정하고 있는데 빅테크에 대해서는 상호연계성, 대체가능성, 복잡성, 국내 특수성 등의 지표를 적용하는 것이 어렵기 때문에 지표기준법을 통해 빅테크의 시스템위험을 측정하는 것은 한계가 있다.

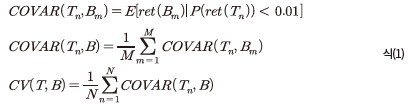

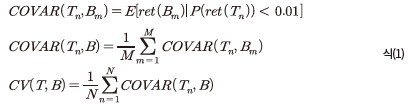

이에 본 연구에서는 전이위험측정법을 통해 빅테크의 시스템위험을 간접적으로 측정하려고 한다. 전이위험측정법에는 COVAR(Conditional Value At Risk), 신용 부도상관계수 모형(Credit Correlation), 극단치 추정방법(Expected Shortfall), 네트워크 모형 등 다양한 방법론이 있는데 본 연구는 주가수익률 자료를 통해 비교적 간편하게 손실전이 위험을 측정할 수 있는 COVAR 방법을 사용하고자 한다. COVAR 방법론은 확률분포의 극단치 값을 하회했을 때 확률변수의 기댓값으로 정의할 수 있는데, 특정 금융회사 또는 빅테크가 위기 상황을 맞이해 손실을 기록했을 때 해당 손실이 타 금융회사 또는 빅테크로 전이되는 정도를 측정하는데 유용하게 활용할 수 있다. 최근 COVAR 방법을 통해 금융회사와 핀테크 회사의 시스템위험을 측정하는 연구들이 수행되었는데34), 본 연구는 손실전이 위험을 측정하는데 유용하게 활용할 수 있는 산식을 통해 금융회사와 빅테크의 손실 전이 위험을 측정하고자 한다.35) 구체적으로 아래 식(1)에서 COVAR(Tn, Bm)은 n번째 빅테크에서 1퍼센타일 미만의 손실이 발생했을 때 m번째 은행에서 발생한 평균손실로 정의했다. COVAR(Tn, B)는 n번째 빅테크에서 1퍼센타일 미만의 손실이 발생했을 때 은행업 전체의 평균 손실을 뜻하며, CV(T, B)는 n개 빅테크의 COVAR(Tn, B)를 평균한 값으로 정의한다. 즉 CV(T, B)는 특정 빅테크(T)에서 극단적 손실 발생시 은행업(B)으로 전이되는 손실 정도를 뜻한다.

위의 식에서 빅테크는 네이버, 카카오36)를 포함했으며 은행, 보험회사, 증권회사 등은 한국거래소 상장회사로 은행업, 보험업, 증권업을 대표하는 15개 기업을 대상으로 하였다.37) 해당 빅테크와 금융회사의 손실 또는 이익은 2017년 1월 1일부터 2022년 8월 31일 동안 일간 수익률의 변동폭으로 측정했으며, 극단적 상황은 해당 기간 동안에 발행확률 1퍼센타일 미만의 극단적 손실을 기록한 날짜들로 가정했다.

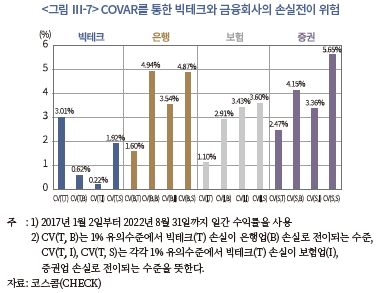

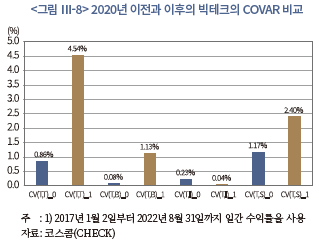

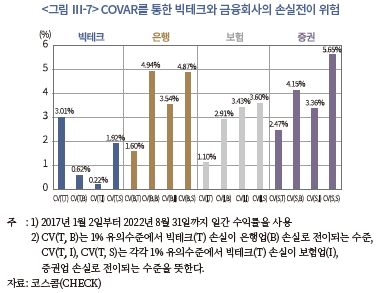

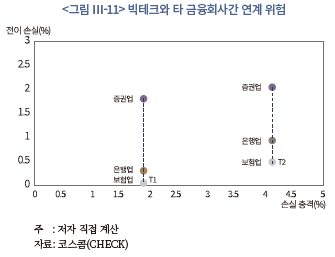

2) COVAR를 통한 빅테크의 손실전이 위험

COVAR 방법론을 통해 빅테크와 금융회사의 손실전이 위험을 측정한 결과, 2017년 1월부터 2022년 8월말 기간 동안 빅테크의 손실전이 위험은 금융회사의 손실전이 위험보다 낮은 것으로 확인되었다. <그림 Ⅲ-7>에서 볼 수 있듯이, 1% 유의수준에서 빅테크의 극단적 손실은 타 금융회사의 0.92% 손실38)로 전이되었다. 반면 1% 유의수준에서 은행업의 극단적 손실은 타 금융회사의 3.34% 손실로 전이되었으며, 증권업의 극단적 손실은 타 금융회사의 3.33% 손실로 전이되었다. 보험업의 경우 1% 유의수준에서 손실은 타 금융회사의 2.54% 손실로 전이되었다. 즉 빅테크와 주요 금융회사의 손실전이 위험을 비교하면, 은행업, 증권업, 보험업, 빅테크 순서로 손실전이 위험이 높은 것으로 확인된다. 은행업과 증권업, 보험업은 각각 자산-부채 관계로 연계성이 높고, 금융업 포트폴리오의 하위 섹터로 구성되어 기관투자자 매매의 동조화 현상이 크기 때문에 빅테크 대비 손실전이 위험이 큰 것으로 추정할 수 있다. 빅테크의 손실전이 위험이 금융회사보다 낮게 관찰된 것은 빅테크가 금융서비스에 본격적으로 진출한 것이 최근 시기이고 금융업 관련 자산규모가 크지 않은데 기인할 수 있다. 또한 빅테크는 GICS 분류상 정보기술 분야로 속해 금융업과 수익률 상관관계가 낮았던 점도 빅테크의 손실전이 위험이 상대적으로 낮게 관찰된 이유로 꼽을 수 있다.

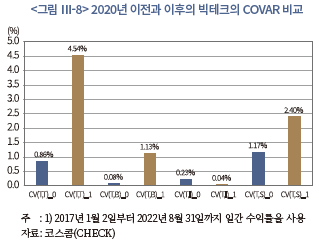

2020년초 코로나19가 확산된 이후 한국 빅테크가 금융업 분야에서 시장 점유율을 빠르게 늘렸기 때문에 빅테크의 시스템위험 수준 변화를 살펴보기 위해 손실전이 위험 분석 구간을 2017년 1월부터 2019년 12월까지와 2020년 1월부터 2022년 8월말까지로 구분하여 살펴보았다. <그림 Ⅲ-8>에서 확인할 수 있듯이 2020년 이후 빅테크의 손실전이 위험은 2020년 이전보다 약 4배 증가한 것으로 확인되었다. 구체적으로 COVID19 확산 이전 시기에 1% 유의수준에서 빅테크의 극단적 손실은 타 금융회사의 0.58% 손실로 전이되었으나, COVID19 확산 이후 시기에 1% 유의수준에서 빅테크의 극단적 손실은 타 금융회사의 2.02% 손실로 전이되었다. 은행업, 보험업, 증권업에 대해 동일하게 2020년 이전과 이후로 구분하여 COVAR 변화를 측정한 결과 은행업, 보험업, 증권업 모두 2020년 이후 COVAR는 2020년 이전보다 2.5~2.6배 증가했다. 즉 빅테크의 손실전이 위험이 타 금융회사의 손실위험보다 큰 폭으로 증가했다고 판단할 수 있다. 이는 2020년 이후 빅테크의 금융서비스 진출이 늘고, 비대면 금융서비스 수요 증가로 빅테크의 금융서비스 시장 점유율이 빠르게 증가한 것과 관련된 것으로 보인다.

3. 금융안정 위협 경로 분석

금융안정(financial stability)은 금융시스템이 불안하지 않은 상태로 정의하며39), 금융안정의 구성 요소로는 금융기관의 안정, 금융시장의 안정, 금융인프라의 안정 등이 존재한다. 금융기관의 안정은 금융기관들이 건전하게 운영되어 금융기관 본연의 역할인 자금중개 기능을 원활하게 수행하는 상태를 뜻한다. 금융시장의 안정은 주식시장, 채권시장, 단기자금시장, 외환시장 등 주요 금융시장의 유동성이 충분하고 가격 변동성이 크지 않아 시장 참여자들이 시장 가격에 자산을 사고‧팔수 있고 기업과 금융회사는 예상되는 시장 가격에 기초하여 자금을 조달하고 운영할 수 있는 상태를 뜻한다. 마지막으로 금융인프라의 안정성은 지급결제시스템, 한국거래소, 예탁결제원 등 주요 금융시장인프라 기관들이 효율적으로 구축되어 장애나 사고 없이 운영되는 상태를 뜻한다. 본 연구에서는 빅테크가 금융서비스 진출을 확대함에 따라 금융기관의 안정성, 금융시장의 안정성, 금융인프라의 안정성을 위협할 수 있는지 여부를 각각의 안정성 훼손 경로를 분석하여 진단하고자 한다.

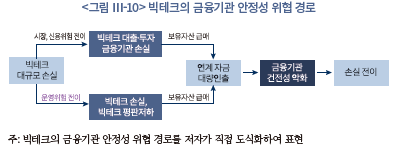

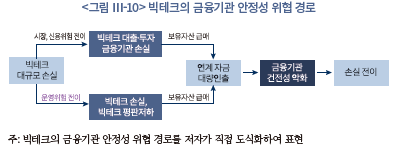

가. 빅테크의 금융기관 안정성 위협 경로

빅테크는 금융회사로부터 대출을 받거나, 주식이나 채권을 발행함으로써 금융회사와 자산-부채 연계성을 가질 수 있다. 예를 들어 빅테크가 자금이 필요할 때 은행을 통해 대출을 받을 수 있으며, 보험회사‧증권회사 등은 빅테크와 전략적 제휴 관계 등을 목적으로 빅테크 주식에 지분투자를 수행할 수 있다(이하 <그림 Ⅲ-10>). 이때 빅테크가 대규모 손실을 기록하여 건전성과 수익성이 악화되면 빅테크에게 자금을 빌려준 금융회사와 지분 또는 채권 투자를 수행한 금융회사 역시 상당한 투자손실을 기록할 수 있다. 예를 들어 일본 소프트뱅크의 비전펀드가 투자하는 빅테크 또는 잠재빅테크가 부실화될 경우 소프트뱅크의 손실로 이어져 소프트뱅크의 주가가 하락하는 사례를 생각할 수 있다. 또한 빅테크와 금융회사 간 직접적인 자산-부채 관계 외에도 빅테크가 금융회사와 전략적 제휴 관계를 맺은 상태에서 빅테크의 운영위험이 증가한 경우 빅테크와 연계 서비스를 제공해온 금융회사의 수익성 감소로 이어져 금융회사의 건전성이 악화될 수 있다.

<그림 Ⅲ-10>을 기초로 빅테크의 금융기관 안정성 위협 가능성을 진단하면, 빅테크가 신용위험과 시장위험을 통해 금융기관 안정성을 위협할 개연성은 크지 않은 것으로 판단한다. 우선 <표 Ⅲ-2>, <그림 Ⅲ-1>에서 확인하였듯이 빅테크의 시장위험과 신용위험 수준은 금융회사 대비 크지 않기 때문에, 빅테크의 시장위험과 신용위험 관련 부실이 금융회사의 손실로 전이될 가능성은 크지 않아 보인다. 또한 빅테크는 금융기관으로부터 대출을 받아 조달한 규모가 크지 않고, 금융기관 역시 금산분리 규제로 인해 빅테크 지분을 일정 수준 이상 보유하기 어렵기 때문에 시장위험과 신용위험 채널로 금융기관의 안정성을 위협할 가능성은 크지 않다. 다만 빅테크의 운영위험을 통해 금융기관의 안정성을 위협할 개연성은 무시할 수 없다. 최근 빅테크의 운영위험 증가 속도가 다소 빠른 가운데, 빅테크와 금융회사 간 제휴 서비스가 확대되고 있어 빅테크의 ICT 서비스 장애 또는 평판위험 증가로 제휴 금융서비스의 수익성이 악화될 수 있다. 예를 들어 빅테크가 내부통제 미흡 등으로 평판위험이 크게 저하된 경우 연계 금융서비스를 이용하는 고객이 이탈하고 예치금을 대량 인출하는 과정에서 금융기관의 건전성이 악화될 수 있다.

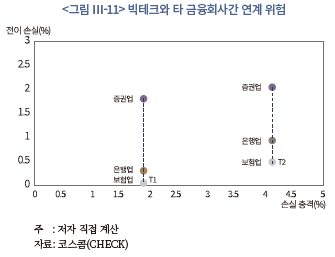

한편 COVAR를 통해 빅테크의 극단적 손실이 금융회사의 손실로 전이되는 수준을 측정하면, 첫 번째 빅테크의 1퍼센타일 손실 발생시 증권업, 은행업, 보험업은 각각 2.04%, 0.93%, 0.48%의 손실을 기록했으며 두 번째 빅테크의 1퍼센타일 손실 발생시 증권업, 은행업, 보험업은 각각 1.80%, 0.30%, 0.04%의 손실을 기록했다(<그림 Ⅲ-11> 참조). 즉, 두 빅테크의 손실이 금융회사의 손실로 미치는 영향은 큰 차이가 없는 가운데 빅테크는 증권업, 은행업, 보험업 순서로 손실 연계성이 큰 것으로 확인되었다. 이는 빅테크와 증권회사 모두 손익 변동성과 평판위험이 크고 시장위험 증가에 민감하게 반응하기 때문으로 추론할 수 있다. 다만 빅테크의 1퍼센타일 손실 규모보다 금융업권의 전이손실 규모가 작기 때문에 빅테크가 시장위험과 신용위험 등 핵심 금융위험 채널을 통해 증권업, 은행업, 보험업의 손실로 전이된다고 보기는 어렵다.

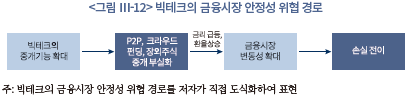

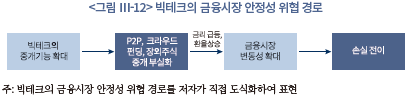

나. 빅테크의 금융시장 안정성 위협 경로

빅테크가 금융시장 중개 기능을 확대함에 따라 빅테크의 부실로 금융시장의 안정성을 위협할 수 있다. 국내외 주요 빅테크 또는 잠재 빅테크는 부동산 P2P 대출, 크라우드 펀딩(crowd funding) 플랫폼, 비상장주식 중개 플랫폼, 가상자산 중개 플랫폼, 음악 저작권료 참여 청구권 중개 플랫폼 등 다양한 투자성 상품의 중개 서비스를 제공하고 있다. 일부 빅테크는 상장주식, 채권 등 전통적 자산의 중개 업무를 수행하고 있으나 빅테크가 상장주식, 채권 등을 중개하는 비중이 크지 않아 해당 빅테크의 부실로 금융시장의 안정성을 위협할 개연성은 크지 않아 보인다. 문제는 빅테크가 부동산 P2P 대출, 크라우드 펀딩, 비상장주식 중개, 가상자산 중개 등의 업무를 수행하는 과정에서 해당 기능이 부실화될 경우 금융시장의 안정성을 위협할 수 있다는 점이다. 예를 들어 부동산 P2P 대출, 증권형 크라우드 펀딩의 거래 규모가 큰 폭으로 증가한 상황에서 해당 P2P 대출 중개 플랫폼이나 크라우드 펀딩 플랫폼이 부실화될 경우 해당 중개시장의 거래가 급격히 줄어들고 가격 변동성이 커져 다수의 이용자 피해로 이어질 수 있다. 그뿐 아니라 P2P 대출, 증권형 크라우드펀딩, 비상장주식 등의 가치가 하락하고 중개 기능을 수행하는 빅테크가 부실화되면 빅테크가 보유한 전통 자산들과 비전통 자산들을 시장에 급매로 처분함에 따라 금융시장의 변동성이 확대될 개연성을 배제할 수 없다(<그림 Ⅲ-12> 참조). 예를 들어 중국 알리바바 그룹의 계열회사가 P2P 대출, 가상자산 중개 등을 확대하고 있는데 해당 P2P 대출과 가상자산 중개 기능이 부실화될 경우 유동성 확보를 위해 보유자산을 급매하는 현상이 관찰되고 이로 인해 금융시장의 변동성이 확대될 것을 예상할 수 있다.

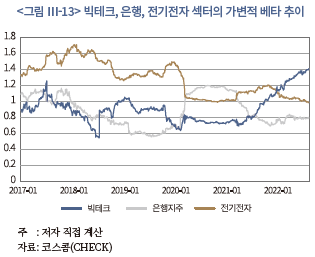

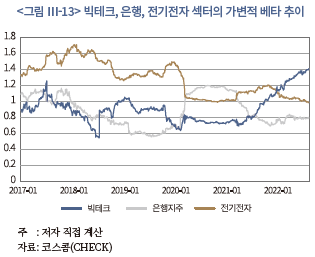

빅테크와 주식시장 간 상관관계 정도를 가변적 베타(표준화된 공분산 위험)를 통해 측정하면, 과거 빅테크의 가변적 베타는 주요 업종의 가변적 베타와 비교해서 높은 수준이 아니었으나 최근에는 금융 및 전기전자 업종 대비 높은 수준으로 증가했다. <그림 Ⅲ-13>에서 볼 수 있듯이, 2022년 8월말 기준 빅테크의 가변적 베타는 1.4로 전기전자 업종(1.0), 금융지주 업종(0.8) 대비 다소 높다. 즉 빅테크와 주식시장 간 표준화된 공분산 위험은 타 업종의 공분산 위험보다 높고, 해당 공분산 위험의 증가 속도도 빠른 것으로 확인할 수 있다. 따라서 금융시장 전체적으로 위험이 증가했을 때 빅테크의 손실 위험이 더 클 수 있음을 시사하며, 빅테크의 시장위험과 금융시장의 시장위험 간 상관관계도 더 증가할 것으로 판단할 수 있다. 빅테크가 부동산 P2P 대출, 비상장주식 중개, 외환송금 서비스, 가상자산 중개 등으로 업무범위를 확대하면서 빅테크와 채권시장, 주식시장, 외환시장, 가상자산시장 등과 연계성이 커지고 있어 빅테크의 손실이 금융시장의 불안정성을 확대시킬 개연성을 배제할 수 없다.

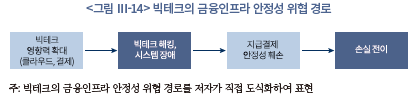

다. 빅테크의 금융인프라 안정성 위협 경로

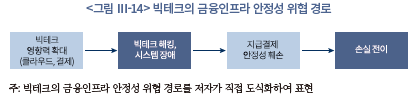

빅테크는 금융회사와 전략적 제휴 또는 라이센스 취득을 통해 지급지시, 결제대행, 외화송금, 주식 중개, 예적금 수취 및 대출 업무 등을 수행하면서 해당 금융서비스의 영향력을 확대하고 있다. 만약 빅테크가 운영하는 금융서비스가 해킹을 당하거나 시스템 장애가 발생한 경우 빅테크가 대규모 손실을 기록하거나 빅테크 이용자가 큰 피해를 입을 수 있을 뿐 아니라 소액결제시스템, 외환결제시스템, 증권결제시스템 등의 안정성까지 위협할 수 있다(이하 <그림 Ⅲ-14> 참조). 예를 들어, 해외 주식 중개 서비스를 제공하고 있는 빅테크가 고시 환율과 다른 값으로 환전 서비스를 수행하여 특정 고객이 무위험 차익거래 수익을 거둘 수 있는데 이때 빅테크 또는 빅테크와 제휴한 금융회사는 대규모 손실을 기록할 수 있다.40) 만약 해당 무위험 차익거래 기회가 오랜 시간 동안 지속되면 빅테크 또는 제휴 금융회사가 대규모 손실을 기록하고 외환결제시스템의 안정성까지 위협할 수 있다. 그 외에 빅테크 또는 잠재 빅테크가 주식 중개 서비스를 제공하고 있는데 관련 ICT 서비스 장애로 짧은 시간 동안에 오류를 가진 주문이 대규모로 발생하면 빅테크 또는 제휴 금융회사가 상당한 손실을 기록할 뿐 아니라 증권결제시스템에 과부하가 걸리거나 결제 사고가 초래되어 증권결제시스템의 안정성을 위협할 수 있다.

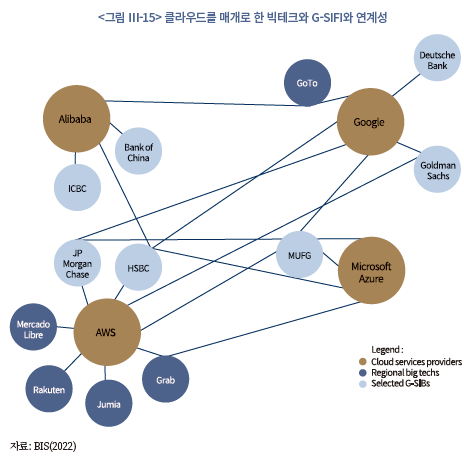

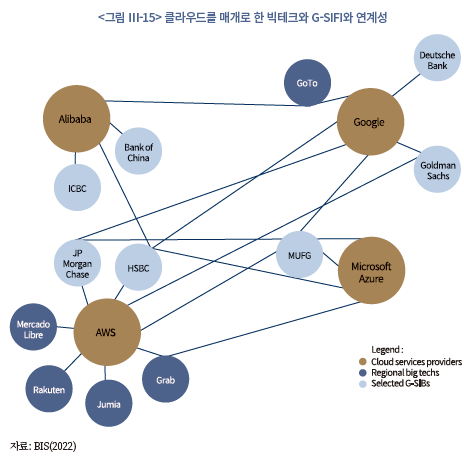

주요 금융감독기구 역시 빅테크가 금융서비스 영향력을 확대하는 과정에서 금융인프라의 안정성을 위협할 개연성을 제시하고 있다. BIS(2022)에 따르면 빅테크는 고객 관련 빅데이터를 확보하기 위해 자사 또는 타사가 보유한 대규모 클라우드(cloud) 서비스를 사용하고 있는데, 글로벌 대형 금융기관들 역시 디지털 전환을 목표로 동일한 클라우드 서비스를 사용하고 있어 클라우드 서비스를 매개로 빅테크와 대형 금융기관 간 연계성이 커지고 있다. 이에, 빅테크가 제공하고 있는 클라우드 서비스에서 장애가 발생하거나 해킹 사고가 발생하면 해당 클라우드 서비스를 사용하고 있는 다수의 금융회사도 관련 서비스에 장애가 발생하거나 상당한 손실을 기록할 수 있다. 실제 <그림 Ⅲ-15>에서 보듯이, 구글, 아마존, 마이크로소프트, 알리바바 등 주요 빅테크는 자사의 클라우드 서비스를 보유하고 있는데 골드만삭스, JP모건, HSBC 등 글로벌 금융회사들은 해당 클라우드 서비스를 복수로 이용하는 경우가 많아 클라우드 서비스를 매개로 하여 빅테크와 대형 금융회사 간 연계성이 커지고 있는 것을 확인할 수 있다. 따라서 빅테크가 제공하는 클라우드 서비스에서 장애나 해킹 사고가 발생하면 클라우드 연계 채널을 통해 글로벌 금융회사뿐 아니라 자국 대형 금융회사의 서비스도 오작동할 수 있는 등 금융인프라의 안정성을 위협할 수 있다.

Ⅳ. 결론 및 정책 시사점

본 연구에서는 빅테크가 금융진출을 빠르게 확대하는 과정에서 긍정적 효과 못지않게 금융리스크 개연성 및 금융안정 위협 가능성 등 우려가 존재할 수 있음을 살펴보았다. Ⅱ장에서는 빅테크의 데이터 독점 및 네트워크 외부효과로 인해 집중위험, 불완전판매 위험, 건전성위험, 시스템위험 등 금융리스크 개연성이 존재하며 한국 빅테크의 경우 낮은 규제강도, 넓은 업무범위, 빠른 장악력으로 인해 빅테크의 금융리스크 개연성이 더 클 수 있음을 제시하였다. Ⅲ장에서는 계량적 방법을 기초로 한국 빅테크의 금융리스크 수준을 측정하였는데, 한국 빅테크의 금융리스크 수준은 금융회사와 비교하여 신용위험, 시장위험 등 전통적 금융위험 수준은 높지 않으나 운영위험, 집중위험, 평판위험 등은 빅테크가 금융회사보다 다소 높고 신용위험, 운영위험, 유동성위험, 집중위험, 시스템위험 등의 경우 최근 빅테크의 증가 속도가 다소 빠름을 보였다. 더불어 한국 빅테크가 금융진출을 확대하는 과정에서 운영위험을 통해 금융기관의 안정성을 위협할 수 있고, 부동산 P2P 대출, 비상장주식 중개, 가상자산 중개 등 비시장성 자산 중개를 통해 금융시장 안정을 위협할 수 있으며 빅테크의 ICT 장애 및 해킹 등으로 금융인프라의 안정을 위협할 수 있음을 제시했다.

본 절에서는 해외 주요 금융감독기구가 제안한 빅테크 규제 방향을 소개하며 이를 기초로 한국 빅테크의 금융진출로 인한 긍정적 효과는 유지하되 금융안정 위협 가능성을 최소화하는 방향으로 한국 빅테크의 금융안정 제고 방안들을 제시하고자 한다. 구체적으로 한국 빅테크와 금융회사간 규제 격차를 줄이고, 넓은 업무범위를 합리적으로 규율하며 빠른 장악력에 따른 부작용을 최소화하기 위해 빅테크에 대해 동일기능-동일규제 원칙 적용, 합리적 금산분리 규제 적용, 내부통제 강화 등을 제시하며 금융안정 위협 경로별로 스트레스 테스트 정례화 등 사전적 감독과 사후적 감독의 조화를 제시한다.

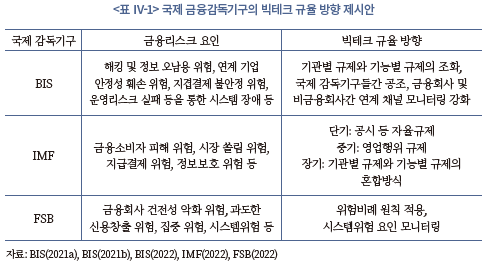

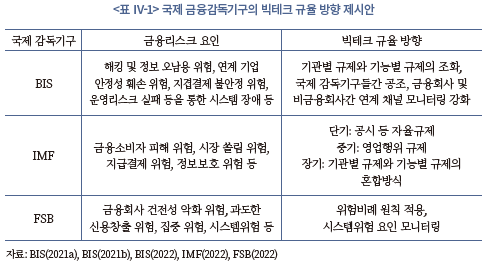

가. 해외 금융감독기구의 빅테크 규율 방향

빅테크는 데이터 독점과 네트워크 외부효과로 인해 금융산업 내 시장 점유율을 빠르게 늘릴 수 있으며, 이 과정에서 불완전판매 위험, 불공정영업행위 위험, 정보 오남용 위험, 집중위험, 건전성 위험, 시스템위험 등이 커질 수 있다. 주요 국제 금융감독기구들은 빅테크의 DNA 효과로 인한 주요 위험들을 선제적으로 관리하기 위해 다양한 빅테크 규율 방향을 제시해왔다. BIS, IMF, FSB 등이 제안한 빅테크 규율 방향을 요약하면 기관별 규제 방식, 기능별 규제와 기관별 규제의 혼합 방식, 글로벌 금융감독기관들과의 공조 강화, 스트레스 테스트 강화를 통한 시스템위험 요인 모니터링 강화 등으로 구분할 수 있다(이하 <표 Ⅳ-1> 참조).

BIS(2021a; 2021b)는 빅테크에 대해 자율규제 또는 기능별 규제 방식만으로는 금융안정을 제고하는데 한계가 있을 수 있으므로 장기적으로 기능별 규제 방식과 기관별 규제 방식의 조화가 필요함을 주장했으며 빅테크 규율을 위해 주요국 금융감독기구들간 공조가 중요함을 제시했다. BIS(2022)는 빅테크가 금융서비스 또는 비금융서비스를 확대함에 따라 내부 금융회사간 연계성이 커질 뿐 아니라 클라우드 등을 통해 비금융 플랫폼 기업과의 연계성이 커지고 있으므로 해당 연계 채널을 통해 위험이 전이되지 않도록 연계 채널별로 모니터링을 강화할 필요가 있음을 제안했다. BIS 금융안정연구소 위원장인 Fernando Restoy는 상당한 규모의 금융서비스를 제공하고 있는 빅테크에 대해 기관별 규제 방식을 적용하고 나아가 복합금융그룹 지정을 통해 기존 은행지주 그룹과 유사한 건전성 규제와 영업행위 규제 등을 적용할 필요가 있음을 주장하기도 했다.41) IMF(2022)는 빅테크의 금융리스크 개연성을 줄이기 위해 단기, 중기, 장기로 나누어 금융당국의 규율 방안을 제시했다. 구체적으로 단기에는 빅테크로 하여금 공시 등 자율규제를 유도하고 중기에는 영업행위 규제 방식을 적용하며 최종 단계에서는 기관별 규제와 기능별 규제의 혼합 방식을 제안했다. FSB(2022)는 빅테크의 위험에 비례하여 감독 강도를 강화하는 규율이 바람직하며, 시스템위험을 확대할 수 있는 요인별로 스트레스 테스트 수행 등 모니터링 강화가 필요함을 제시했다.

나. 동일기능-동일규제 원칙 적용

4차 산업혁명의 영향으로 ICT 기술과 금융업과의 융합을 통해 비대면 혁신서비스의 출현이 가속화하면서 핀테크 또는 빅테크에 대해서는 낮은 규제 강도를 적용해야 한다는 의견이 제기되었다. 이에 정부는 핀테크 혁신을 유도함으로써 금융소비자의 편익을 증대시키고 금융서비스 관련 일자리 창출을 도모하고자 2019년 4월 금융혁신특별법을 제정하였으며 은행업의 혁신과 경쟁을 촉진하기 위해 2019년 1월 인터넷전문은행법을 제정하였다. 정부의 금융혁신 정책에 힘입어 한국 빅테크는 인터넷전문은행을 설립하고 보험업, 증권업, 여신금융업, 전자금융업 등으로 업무범위를 확대하며 과거보다 편리하고 저렴하며 접근성이 용이한 금융서비스들을 제공해온 것은 부인할 수 없다. 더불어 한국 빅테크가 혁신적인 금융서비스를 확대한 것은 전통적인 금융회사들의 디지털 전환을 가속화하는 등 금융산업 내 경쟁을 촉진시켰다. 이처럼 한국 빅테크는 수년 여간 금융산업의 혁신과 경쟁 촉진에 긍정적 기여를 한 것으로 보인다.

다만 한국 빅테크가 금융진출을 확대하고 시장 점유율을 빠르게 늘리면서 금융리스크가 증가하고 금융안정을 위협할 수 있는 개연성이 제기되고 있다. 특히 한국 빅테크는 주요국과 다르게 라이센스에 기반하여 은행업, 보험업, 증권업 등 금융업의 본질적 업무들에 진출하고 있다. 금융업은 다른 산업과 다르게 금융업 취급기관이 부실화될 경우 다수의 금융소비자가 상당한 금전적 손실을 입을 수 있을 뿐 아니라 금융안정을 위협하여 실물경제의 침체로까지 이어질 수 있기 때문에 엄격하고 촘촘한 규율 체계를 가지고 있다. 따라서 빅테크가 은행업, 보험업 등 본질적 업무를 제공하고 금융산업 내 시장 점유율을 빠르게 늘리고 있다면 금융회사와 동일한 수준의 진입 규제, 건전성 규제, 영업행위 규제, 소비자보호 규제를 적용받는 것이 바람직할 것이다. 만약 금융당국이 혁신성에 초점을 두고 빅테크에 대해 본질적 업무의 일부 기능만을 제공하는 것으로 인허가를 내준 경우 해당 업무범위의 위험 수준에 비례하여 건전성 규제, 영업행위 규제 등을 적용하는 것은 긍정적일 수 있다. 한편 빅테크 또는 핀테크가 제공하는 금융서비스의 혁신성이 매우 높다고 판단한 경우이거나 금융업과 경계가 모호한 금융서비스에 대해서는 네거티브 원칙을 적용하여 주요 영업행위 규제의 면제를 검토해볼 수 있다.

빅테크에 대해 동일기능-동일규제 원칙을 적용하는 데 있어 광고와 중개의 범위를 해석하는 것이 가장 큰 쟁점 중에 하나이다. 빅테크가 고객 데이터의 우위를 기초로 온라인에서 맞춤형 배너광고를 제시하는 것은 규제 강도가 낮은 광고로 볼 것인지 아니면 규제 강도가 높은 중개 또는 판매로 볼 것인지가 이슈가 된다. 금융소비자보호법 등에서 금융상품 중개 또는 판매시 설명의무, 적합성의 원칙, 부당권유 금지 등의 엄격한 투자권유 규제를 부여한 것은 금융상품판매업자로 하여금 금융소비자의 위험성향을 인지하고 해당 위험성향에 적합한 다수의 금융상품을 제시함으로써 금융소비자의 후생 증진에 기여하는 것을 목표로 한다. 만약 빅테크가 고객 데이터의 분석을 통해 고객에게 적합하지 않은 고위험 금융상품이나 판매마진이 높은 상품에 한정해서만 1:1 배너광고를 통해 제시하면 판매에서 고위험 상품으로의 쏠림이 나타날 수 있다. 위험을 충분히 감내하기 어려운 경제주체들이 고위험 금융투자상품에 대한 투자와 운용을 늘리면 위기 상황에서 금융안정을 위협할 뿐 마니라 금융소비자의 대규모 피해로 이어질 수 있다. 따라서 금융소비자 이익보다 금융상품 판매자 또는 빅테크의 이익 증대를 목적으로 맞춤형 광고를 제시하는 것은 중개 또는 판매로 보아 설명의무, 적합성의 원칙, 부당권유 금지 등 엄격한 투자권유 규제를 적용하는 것이 필요하다. 구체적으로 빅테크가 금융소비자를 식별하지 않고, 금융소비자에 적합하지 않은 금융상품을 식별하지 않으며, 광고를 지속적으로 수행하는 경우에 한해 광고 규제를 적용하고 그렇지 않은 광고에 대해서는 중개로 보아 엄격한 투자권유 규제를 적용하는 것이 바람직할 것이다.

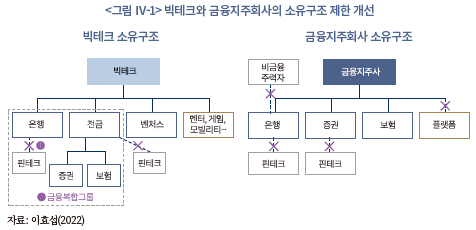

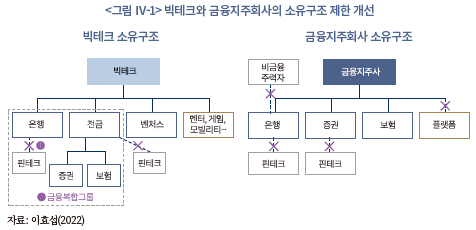

다. 합리적 금산분리 규제 적용

한국 빅테크가 금융회사보다 넓은 업무범위를 영위할 수 있는 점도 한국 빅테크가 금융리스크 개연성이 클 수 있는 요인임을 살펴보았다. 이에, 금융업의 본질적 업무를 수행하고 있는 주요 빅테크에 대해서도 금융회사와 유사하게 소유구조 제한을 검토할 필요가 있다. <그림 Ⅳ-1>에서 볼 수 있듯이, 금융지주회사는 비금융 플랫폼 회사를 자회사로 소유하는 것에 제한이 있으며 비금융주력자가 은행의 지분을 일정 이상 보유할 수 없고 은행, 보험회사, 증권회사 역시 자회사로 비금융회사를 소유하는 데에 제약이 있다.42) 반면 빅테크는 자회사, 손자회사가 비금융회사 또는 금융회사를 소유하는데 제한이 없거나 비금융회사가 빅테크 계열 은행을 소유하는데 제약이 약하기 때문에 계열사 지분 출자를 통해 손쉽게 업무범위를 확대할 수 있고 계열 회사간 정보 공유 등을 통해 시너지를 창출할 수 있다. 문제는 빅테크 계열 금융회사가 부실화되면 해당 빅테크 계열 금융회사의 손실이 빅테크 계열 자회사 또는 손자회사의 손실로 빠르게 전이될 수 있기 때문에 빅테크 이용자의 손실로도 전이될 수 있다. 따라서 본질적 금융업을 수행하고 있고 시스템리스크 잠재 위험이 일정 수준을 초과하는 빅테크에 대해 금융회사와 유사한 금산분리 규제를 적용하여 빅테크 계열 금융회사의 출자한도 및 비금융회사에 대한 지분투자 한도 적용을 검토할 필요가 있다.

다음으로 본질적 금융업을 두 개 이상 수행하는 빅테크가 일정 규모 이상의 금융업을 영위하는 경우, 해당 빅테크에 대해 금융복합기업집단으로 지정하여 기존 금융복합기업집단과 동일한 규제를 적용할 필요가 있다. BIS(2021b)는 본질적 금융업을 영위하는 빅테크에 대해 기능별 규제 방식(activity-based approach)보다 기관별 규제 방식(entity-based approach)이 적절할 수 있음을 제시했으며 Restoy(2022)는 해당 빅테크에 대해 금융복합그룹(financial conglomerate)으로 지정하여 건전성 규제, 유동성 규제, 영업행위 규제 등이 필요할 수 있음을 주장했다. 한국도 기존 금융복합기업집단 규율 체계와의 규제 정합성 제고를 위해 일정 요건을 만족하는 빅테크에 대해 금융복합기업집단으로 지정하고 해당 빅테크로 하여금 소유지배구조, 내부통제체제, 위험관리체제, 자본적정성, 내부거래 등의 규율 준수 및 관련 공시를 유도할 필요가 있다.

라. 빅테크의 내부통제 강화

한국 빅테크는 인공지능(AI), 빅데이터 분석 등 우수한 ICT 기술력을 통해 금융산업 내 시장 점유율을 빠르게 늘려오면서 금융리스크 개연성 등 다양한 우려가 제기되고 있다. 예를 들어, 빅테크가 금융산업 내 영향력을 확대하는 과정에서 운영위험, 집중위험, 법률위험, 평판위험, 시스템위험 등이 빠르게 증가할 수 있고 특히 운영위험을 통해 금융기관과 금융인프라의 안정성을 위협할 수 있음을 살펴보았다. 이에 본질적 금융업을 수행하는 빅테크들은 해킹 및 ICT 관련 시스템 장애 예방과 정보보호 강화 등 내부통제를 강화하는 것이 필요하다. 현재 은행, 보험회사, 증권회사 등 주요 금융회사는 금융회사의 지배구조에 관한 법률(이하 지배구조법)에 따라 내부통제기준을 마련하고 준법감시인 선임을 통해 임직원의 내부통제기준 준수를 유도하고 있다. 이때 인터넷전문은행, 전자금융업자 등 빅테크 계열 금융 자회사는 지배구조법에서 정한 내부통제기준 마련 의무가 적용되지 않아 빅테크가 금융회사보다 내부통제를 다소 소홀히 다루어 왔다.

빅테크의 금융산업 내 영향력이 확대되고 ICT 관련 시스템 장애 및 해킹 사고도 증가하고 있어 빅테크로 하여금 내부통제 강화를 유도하는 것이 매우 중요하다. 본질적 금융업을 수행하는 빅테크가 일정 요건을 만족하는 경우 지배구조법에서 정한 내부통제기준 마련 의무를 부여하고, 빅테크의 주요 임원들에게 역할에 맞는 감독자 책임을 부여할 필요가 있다. 빅테크의 내부통제기준 마련과 관련해서는 해킹 및 ICT 시스템 장애 예방, 고객 정보보호 강화, 금융인프라의 안정성 제고, 업무 연속성 계획(Business Continuity Plan: BCP) 및 재난 복구 계획(Disaster Recovery Plan: DRP) 등에 관한 구체적인 내용을 빅테크의 내부통제기준에 반영할 필요가 있다. 특히 영국 FCA의 사례를 참고하여43) 빅테크의 업무에 있어서 중요한 위험관리책임자(Chief Risk Officer: CRO), 정보보호책임자(Chief Information Security Officer: CISO), 최고기술책임자(Chief Technology Officer: CTO), 금융소비자보호책임자(Chief Consumer Officer: CCO) 등에 대해 구체적인 역할과 책임을 부여하고 해당 부서 직원의 업무수행 전반에 관해 감독자 책임을 명시할 필요가 있다. 이때 감독자 책임의 면책 조항으로 합리적인 내부통제 구축 및 운영 의무를 부여한다면 빅테크 임직원들로 하여금 자율적인 내부통제 강화를 유도할 수 있을 것으로 기대한다. 그 외에도 빅테크가 내부통제를 충실히 마련하고 구축 및 운영한 것으로 판단하면 향후 빅테크에 대한 행정 제재금 감면 등 다양한 인센티브 제시를 검토할 수 있다.

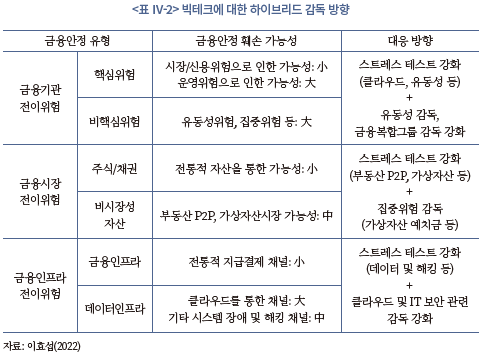

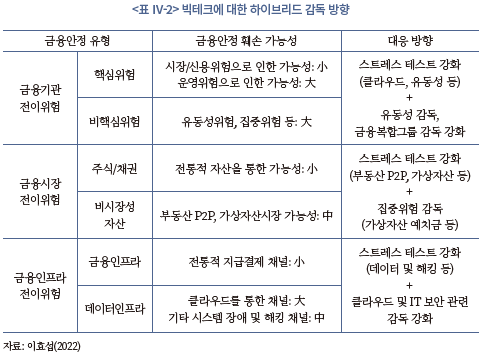

마. 사전적 감독과 사후적 감독의 조화

한국 금융당국은 주요 국제 금융감독기구들의 빅테크 규율 방안을 참고하고 한국 빅테크의 금융안정 위협 개연성을 고려하여 사전적 감독과 사후적 감독을 조화롭게 운영하는 하이브리드 감독을 수행하는 것이 바람직하다. 우선 빅테크의 금융진출 확대시 위험전이 채널별로 사전적 스트레스 테스트를 강화하는 것이 필요하다(이하 <표 Ⅳ-2> 참조). 첫째 금융기관 전이 위험 관련해서는 빅테크의 운영위험 채널을 통해 금융기관의 손실로 전이될 개연성이 존재하므로 클라우드 및 IT 시스템 장애 등과 관련해서 스트레스 테스트를 정례화하고 빅테크의 유동성위험 관리를 위해 유동성 위험 관련 스트레스 테스트를 도입할 필요가 있다. 둘째, 금융기관 전이 위험 관련해서 부동산 P2P 대출, 가상자산시장 중개 등을 통해 금융시장 위험으로 전이될 개연성이 있으므로 부동산 P2P 시장, 가상자산 시장에서 위기 상황별 스트레스 테스트를 수행함으로써 금융시장의 변동성 확대 위험을 최소화할 수 있다. 셋째, 금융인프라 전이 위험 관련해서 ICT 인프라 장애 및 해킹으로 인해 지급결제 안정성을 위협할 개연성이 존재하므로 네트워크 트래픽 및 극단치 데이터, 그리고 해킹 관련 스트레스 테스트를 정례화할 필요가 있다. 빅테크의 사후적 감독 관련해서는 빅테크가 수행하는 라이센스 기반 금융업에 대해 금융회사와 동일한 감독을 수행하는 것이 바람직하다. 이때 빅테크가 금융회사보다 다소 취약한 것으로 알려진 운영위험, 유동성위험, 집중위험, 불완전판매 위험 등에 대한 감독을 강화하는 노력이 필요하다. 빅테크의 운영위험, 유동성위험을 효율적으로 관리하기 위해 핵심 금융업을 수행하는 빅테크가 일정 요건을 갖춘 경우 금융복합그룹 감독을 수행하고 가상자산 관련 예치금 등 특정 금융서비스와 관련한 조달과 운영의 과도한 의존 비중을 낮추도록 유도해야 한다. 빅테크의 불완전판매 위험을 최소화하기 위해서는 광고와 중개 규제 적용의 모호성을 해소하고 단기, 중기, 장기 등으로 구분하여 자율규제와 영업행위 규제, 그리고 기관별 규제를 조화롭게 운영하는 것이 필요할 것이다.

1) 이석훈‧조성훈(2022), 김현수‧강인규(2021) 참조.

2) http://ft.com/wirecard 참조

3) 빅테크의 금융진출 확대에 따른 부작용에 대한 국내 연구로는 이보미(2020), 김범수‧윤지환(2022), 오상승‧손경국‧조근태(2022) 등이 있다.

4) 본 연구에서 ‘빅테크의 금융안정 훼손 위험’은 빅테크의 부실 또는 영향력 확대로 인한 금융기관의 안정성 훼손, 금융시장의 안정성 훼손, 금융인프라의 안정성 훼손 등 전이(contagion) 위험을 중심으로 살펴본다.

5) 세계은행 및 한국은행 홈페이지 참조.

6) BIS와 TABInsights에 따르면 빅테크와 핀테크가 창출하는 신용규모는 대체신용(alternative credit)으로 불리는데, 빅테크와 핀테크가 제공하는 신용카드 결제 규모, P2P 대출, 벤처대출, 기타 각종 신용대출 규모 등을 포함한다.

7) 데이터 분석 능력(Data Analysis), 네트워크 외부효과(Network Externality), 상호 연계된 활동(Interwoven Activities)의 첫째 단어 또는 둘째 단어의 영어 약자를 붙여 DNA 효과로 부른다.

8) 이때 금융상품의 특성상 판매마진이 상품가격에 포함된 경우가 많기 때문에, 빅테크가 소비자 유형에 따라 판매마진을 다르게 책정하더라도 이를 확인하는 것은 쉽지 않다. 또한 빅테크들이 소비자의 건강정보를 분석하여 특정 유형의 보험상품 중심으로 맞춤형 광고나 투자권유를 수행하는 전략을 수행하는 것도 가능하다. 건강상태가 악화된 금융소비자는 높은 비용을 지불하더라도 관련 보험상품을 가입할 유인이 있기 때문에 소비자 후생을 악화시킬 위험이 존재한다.

9) 금융소비자 보호에 관한 법률 제20조 제1항 참조.

10) 인터넷전문은행 설립 및 운영에 관한 특례법(이하 인터넷전문은행법) 제4조.

11) 인터넷전문은행 설립시 비금융주력자의 의결권 있는 주식의 보유 한도는 발행주식 총수의 34%로 일반 상업은행에게 적용하고 있는 주식 보유한도 수준인 4% 대비 임계수준이 높게 설정되어 있다.

12) 인터넷전문은행법 제17조 참조.

13) 인터넷전문은행법 제18조 참조.

14) 금융산업의 구조개선에 관한 법률(이하 금산법) 제24조 제1항 참조.

15) 은행법 제37조 제1항 참조.

16) 보험업법 제109조 참조.

17) 2022년 9월 14일 현재 1유로당 1,393.25원을 적용했다.

18) 이와 관련한 자세한 내용은 이석훈‧조성훈(2022) 연구를 참조한다.

19) 2022년 9월 14일 현재 1달러당 1,394원을 적용했다.

20) 2022년 9월 14일 현재 100엔당 974원을 적용했다.

21) <표 Ⅲ-1>에서 확인할 수 있듯이 네이버, 카카오는 ①~④ 조건을 모두 만족하며 토스, KT는 ①과 ②는 만족한다고 볼 수 있으나(토스, KT는 양면 플랫폼 서비스 제공자로 볼 수 없다는 의견도 존재한다) ④ 조건은 만족하지 않는다.

22) BIS(2021a), IMF(2022), FSB(2022) 등은 빅테크의 금융서비스 확대로 금융안정을 위협하고 금융소비자 피해를 야기하는 등 다양한 금융리스크를 제시했는데 본 연구는 금융안정 리스크(financial stability risk) 중심으로 금융리스크를 분석한다.

23) 자기자본 대비 신용위험가중자산 규모는 토스뱅크가 제일 높다.

24) 인터넷전문은행의 시장위험가중자산 규모는 매우 작은 것으로 보고되어, 대형 상업은행과 빅테크 계열 인터넷전문은행의 시장위험 절대 수준은 비교하지 않는다.

25) 금융감독원 금융통계정보시스템 참조.

26) 매일경제(2022. 10. 15), “판교 데이터센터 화재로 카카오 서비스 무더기 장애” 등 참조.

27) YTN(2022. 10. 17), “증시 개장 10분 만에 3조원 증발...바닥 뚫은 카카오” 참조.

28) 2020년 4월 코로나19 확산을 계기로 금융당국은 유동성커버리지비율 임계수준을 100% 이상 유지하는 것에서 85% 이상 유지하는 것으로 완화했으며, 2022년 6월에는 해당 임계수준을 단계적으로 높여 2023년 7월에는 시중은행의 유동커버리지비율이 100% 이상 유지하도록 발표했다.

29) 주요 인터넷전문은행은 양도성예금증서나 은행채 발행을 한 적이 거의 없어 현금유출 규모가 매우 작은 부분도 인터넷전문은행의 유동성커버리지비율이 높게 측정되는 이유로 꼽을 수 있다.

30) 국회 정무위원회 윤창현 의원실 보도에 따르면, 2022년 3월말 기준 특정 인터넷전문은행에 예치된 A가상자산거래소의 투자 현금 규모는 5.6조원으로 해당 인터넷전문은행 예치금 전체 규모(11조 5천억원)의 49%를 차지하고 있다.

31) 딥서치(www.deepsearch.com)에서 인공지능과 빅데이터 기반으로 제공하는 월간 기업 긍정-부정 뉴스 비중의 6개월 이동평균 값을 사용하였다.

32) FSB‧IMF‧BIS(2009), BIS(2010) 참조.

33) 이효섭(2020) 참조.

34) Adrian & Brunnermeier(2016), Franco et al.(2020) 참조.

35) 이명활(2020), 이효섭(2020) 등 참조.

36) 카카오는 카카오페이, 카카오뱅크 주식을 각각 47.05%, 27.20% 소유하고 있는 대주주로 카카오 상장주식을 대상으로 분석을 수행하였다.

37) 은행업을 대표하는 상장회사로 KB금융, 신한지주, 우리금융, 하나금융지주, 기업은행을 사용했으며 보험업을 대표하는 상장회사로 삼성화재, DB손해보험, 현대해상, 메리츠화재, 코리안리를 사용했다. 증권업을 대표하는 상장회사로는 미래에셋대우증권, NH투자증권, 한국금융지주, 삼성증권, 메리츠증권을 사용했다.

38) 1% 유의수준에서 빅테크의 극단적 손실은 은행업, 보험업, 증권업의 0.62%, 0.22%, 1.92% 손실로 각각 전이되었다.

39) 세계은행, 한국은행 홈페이지 참조.

40) 동아일보(2022. 9. 29), “환율 1440원 찍은 날... 토스증권 1298원에 환전 사고” 등 참조.

41) Restoy(2022) 참조.

42) 금융회사는 비금융회사 주식의 5% 이상 보유를 통한 지배력 향유 또는 비금융회사 주식의 20% 이상 소유하는 행위를 금지하고 있으며 은행업법과 보험업법에서 금융업과 관련 없는 비금융회사에게 15% 이상 출자하는 것을 금지하고 있다.

43) 이효섭‧이석훈(2022) 참조.

참고문헌

김범수‧윤지환, 2022, 핀테크 확대가 금융안정에 미치는 영향, 『금융안정연구』23(1), 95-121.

김현수‧강인규, 2021, 온라인 플랫폼 서비스에 관한 이용자보호 체계방안 연구, 방송통신위원회 방통융합정책연구 KCC-2021-11.

안영철‧맹수석, 2022, 금융플랫폼 운영자인 빅테크 기업에 관한 법적 쟁점과 입법적 과제, 『기업법연구』36(2), 87-112.

오상승‧손경국‧조근태, 2022, 빅테크 예탁금 보호 모델에 관한 연구, 『지급결제 학회지』14(1), 271-292.

이명활, 2020, 글로벌 금융 불안과 우리나라 주가의 연계성, 금융연구원 VIP 리포트 2020-13.

이보미, 2020, 빅테크의 금융서비스가 금융안정에 미치는 영향, 금융연구원 VIP 리포트 2020-17.

이석훈‧조성훈, 2022, 빅테크의 금융진출과 공정경쟁, 자본시장연구원 25주년 개원기념세미나 주제발표(2022. 9. 29).

이효섭, 2020, 증권업 시스템리스크 진단 및 대응과제, 자본시장연구원 이슈보고서 20-13.

이효섭, 2021, 빅테크와 금융회사의 규제 격차로 인한 금융리스크 분석, 자본시장연구원 자본시장포커스 2021-20호.

이효섭, 2022, 빅테크의 금융진출과 금융안정, 자본시장연구원 25주년 개원기념세미나 주제발표(2022. 9. 29).

이효섭‧이석훈, 2022, 주요국 내부통제 제도 현황 및 한국 내부통제 제도 개선 방향, 자본시장연구원 연구보고서 22-01.

조성욱, 2022, Government Policies to Help Digital Economy Flourish, 자본시장연구원 25주년 개원기념세미나 Keynote Speech(2022. 9. 29).

Adrian, T., Brunnermeier, M.K., 2016, COVAR, American Economic Review, 106(7), 1705-1741.

BIS, 2009, System Risk: How to Deal It? BIS Research Paper.

BIS, 2019, Big Tech in Finance: Opportunities and Risks, BIS Annual Economic Report 2019.

BIS, 2021a, Big Techs in Finance: Regulatory Approaches and Policy Options, FSI Brief No 12.

BIS, 2021b, Regulating Big Techs in Finance: BIS Bulletin No 45.

BIS, 2022, Gatekeeping the Gatekeepers: When Big Techs and Fintechs Own Banks – Benefits, Risks, and Policy Options, FSI Insights No 39.

Franco, L., A. L. Garcia, V. Husetovic, and J. Lassiter, 2020, Does Fintech Contribute to Systemic Risk? Evidence from the US and Europe, ADBI working paper No. 1132.

Frost, J., L. Gambacorta, Y. Huang, H. S. Shin, and P. Zbinden, 2019, BigTech and the Changing Structure of Financial Intermediation, Economic Policy, 34(100), 761-799.

FSB‧IMF‧BIS, 2009, Guidance to Access the Systemic Importance of Financial Institutions, Markets and Instruments: Initial Considerations, Recommended Paper.

FSB, 2019, BigTech in Finance: Market Developments and Potential Financial Stability Implications, Research Paper.

FSB, 2022, Fintech and Market Structure in the COVID-19 Pandemic, Research Paper.

IMF, 2022, BigTech in Financial Services: Regulatory Approaches and Architecture, Fintech Notes 2022-002.

Khan, L.M., 2017, Amazon’s Antitrust Paradox, The Yale Law Journal, January.

F. Restoy, 2022, Big Tech Regulation: In Search of a New Framework, 자본시장연구원 25주년 개원기념세미나 Keynote Speech(2022. 9. 29).

빅테크는 인공지능, 빅데이터 등 혁신 기술과 플랫폼에 기반을 두고 온라인에서 다양한 서비스를 제공하는 대형 ICT 회사를 뜻한다. 빅테크 기업으로는 미국에 본사를 둔 구글, 아마존, 애플, 페이스북, 중국의 알리바바, 바이두, 일본의 라쿠텐 등이 존재하며 한국에서는 네이버, 카카오 등을 꼽을 수 있다. 이들 빅테크들은 빅데이터 분석 능력과 네트워크 외부효과에 힘입어 다수의 소비자들에게 이전보다 편리한 서비스를 제공해주고 정보 비대칭을 해소해주며 거래비용과 탐색비용을 절감해주는 등 경제적 순기능을 제공해왔다. 그러나 이들 빅테크들은 단기간에 시장 지배력을 확대함으로써 독점적 지위를 누리고 급격한 가격 인상 정책을 펼치는 등 소비자 후생을 저해할 수 있다는 부작용을 초래하기도 했다. 미국 연방거래위원회(Federal Trade Commission: FTC)의 위원장을 맡고 있는 Kahn 교수는 ‘아마존의 반독점 패러독스(Amazon’s Antitrust Paradox)’라는 논문을 통해 주요 빅테크들이 초기에 적자를 감수하고 시장 지배력을 확대한 뒤에 약탈적 가격 정책과 수직적 통합 전략을 통해 사회적 후생을 감소할 수 있음을 지적하였다. Kahn(2017)의 연구 등을 계기로, 미국, 유럽, 일본, 중국 등 주요국 정부는 공정경쟁 환경 조성을 목표로 빅테크 또는 온라인 플랫폼 사업자를 규율하는 법을 제정하고 구체적 규율 방안을 마련하였다.1)

빅테크들은 초기에 양면 플랫폼에 기반을 두고 검색, 인터넷 쇼핑, 정보통신, 미디어, 운송, 유통 등의 산업에 진출하여 시장 지배력을 확대하였으나 점차 서비스 범위를 금융산업으로 확장하고 있다. 예를 들어 구글, 아마존, 애플, 페이스북 등은 별도의 지급결제 서비스를 제공하고 있으며 아마존은 신용대출, 보험상품 판매 등을 수행하고 있다(이하 <그림 Ⅰ-1> 참조). 중국, 일본, 한국의 주요 빅테크들은 라이센스를 취득하거나 제휴 등의 방법을 통해 은행업, 보험업, 여신전문금융업의 본질적 업무를 수행하고 있다. 네이버가 네이버파이낸셜, NF보험서비스를 설립하고, 카카오 그룹이 카카오뱅크, 카카오페이, 카카오페이증권, 카카오페이손해보험 등의 자회사 및 손자회사를 설립하여 예적금 수신 및 대출, 선불전자지급수단 발행 및 관리, 금융투자상품 중개, 보험상품 판매 등의 업무를 수행하는 것이 대표적이다. 빅테크로 정의하기는 다소 어렵지만 잠재 빅테크 또는 대형 핀테크로 볼 수 있는 KT, 토스(비바리퍼플리카)가 각각 케이뱅크, 토스뱅크, 토스증권, 토스보험대리점, 토스페이먼츠 등의 자회사를 설립하여 금융서비스 진출을 확대하고 있는 것도 대형 ICT 기반 회사의 금융진출 사례로 꼽을 수 있다.

실제 2020년 6월 유럽에서 잠재 빅테크로 급부상한 와이어카드(wirecard) 회사가 회계 부정 이슈로 파산하면서 빅테크의 금융진출 확대에 대한 우려가 커졌다. 와이어카드는 1999년 독일 뮌헨에서 설립한 이후 비대면 지급결제 및 각종 ICT 기반 금융서비스를 제공해 오면서 빠른 규모로 성장했으며 이에 2018년 9월에는 독일 코메르츠뱅크를 대신해 DAX30 지수에 편입되고 도이치뱅크를 넘어선 시가총액을 기록하는 등 대형 핀테크 회사로 성장했다. 그러나 2020년 들어 외부 회계감사법인의 감사를 계기로 해외 예치자산의 부정 계상 의혹이 드러나자 와이어카드 주가는 일주일 만에 95% 가까이 하락했으며 2020년 6월말 파산을 신청했다(<그림 Ⅰ-2> 참조). 당시 와이어카드의 파산으로 와이어카드의 주주와 채권자로 참여했던 소프트뱅크, 크레딧스위스, 그리고 다수의 일반 투자자들이 수조원의 금전적 손실을 기록했으며 와이어카드 플랫폼을 통해 금융거래를 수행한 이용자들도 상당한 피해를 보았다.2) 빅테크로 볼 수는 없으나 한국에서도 대형 핀테크 회사의 부실로 다수의 금융소비자가 피해를 입은 사례가 발생했다. 2020년 4월 한국에서 설립된 머지포인트는 대형마트, 외식업체의 통합 포인트 멤버십 관리 서비스를 제공해 왔는데, 자산과 부채의 건전성 관리가 매우 미흡한 상황에서 2021년 8월 대규모 환매 요청이 발생하자 지급불능 사태를 선언했다. 당시 머지포인트를 할인 구매했던 이용자들은 해당 포인트를 이용할 가맹점이 사라지자 즉시 환불을 요구했으나, 다수의 이용자들은 투자금액 전액을 환불받지 못하는 등 약 2,500억원의 피해를 입은 것으로 알려졌다. 2022년 10월에는 판교 데이터센터 화재로 카카오 그룹이 제공해온 뱅킹, 페이 등 주요 금융서비스가 수일 동안 중단되어 대규모 이용자 피해가 발생하기도 했다.

이에 본 연구에서는 빅테크의 금융진출 현황과 관련 문헌 연구를 통해 빅테크의 금융리스크를 다각도로 분석하고, 금융안정 제고를 목표로 빅테크의 규율 방안을 제시하고자 한다. 우선 Ⅱ장에서 빅테크의 금융진출로 인한 금융리스크 개연성을 문헌과 사례 중심으로 살펴본다. Ⅲ장에서는 빅테크의 금융리스크를 시장위험, 신용위험, 운영위험, 유동성위험, 법적위험, 평판위험, 시스템위험 등으로 구분하여 분석하고 금융기관, 금융시장, 금융인프라 채널별로 금융안정을 훼손할 수 있는 경로를 진단하고자 한다. 이를 기초로 Ⅳ장에서는 금융안정 제고를 위한 빅테크의 규율 방안을 제시하고자 한다.

Ⅱ. 빅테크의 금융리스크 개연성

빅테크의 금융진출 확대로 인한 금융리스크 수준을 체계적으로 분석한 연구는 많지 않다. 빅테크가 시장 지배력을 확대하며 다양한 산업 분야로 업무 범위를 넓힌 것은 불과 수년 내에 불과하며, 최근 빅테크가 시장 지배력을 확대하며 부작용을 야기한 것은 독과점 및 약탈적 가격정책 등 주로 공정경쟁 이슈와 관련한 것이 많았기 때문으로 보인다. 또한 주요국 빅테크들은 은행업, 보험업, 증권업 등 금융업의 본질적 업무 수행과 관련해서는 라이센스 취득을 통한 직접적 진출보다 기존 금융회사의 전략적 제휴를 통해 간접적으로 금융서비스를 제공해왔기 때문에 빅테크의 금융진출 확대로 인한 금융리스크 개연성 및 금융안정 훼손 가능성에 대한 우려는 크지 않았다. 그러나 2020년 6월 독일 와이어카드 파산 사건 및 2022년 10월 카카오 금융서비스 중단 사태를 계기로 빅테크 또는 대형 핀테크의 금융안정 훼손 가능성을 우려하는 목소리가 커졌다. 특히 한국 빅테크들은 특화된 은행업 라이센스 취득을 통해 예적금 수신, 대출 등 은행업의 본질적 업무를 수행하며 시장 점유율을 빠르게 늘리고 있고, 빅테크의 업무범위 또한 매우 넓어 금융리스크 개연성이 커지고 있고 나아가 금융안정을 훼손할 개연성도 제기되고 있다. 이에 본 절에서는 최근 국제기구를 중심으로 빅테크의 금융리스크 개연성을 연구한 문헌들을 소개하고, 이를 기초로 한국 빅테크의 금융리스크 개연성을 살펴보고자 한다.

1. 문헌 연구

가. 빅테크의 금융진출로 인한 위험

FSB(2019)는 빅테크들이 데이터 우위를 바탕으로 시장 점유율을 빠르게 늘리면서 전통적 금융회사의 수익성이 줄어들어 건전성이 악화될 수 있는 위험을 지적했다(이하 <표 Ⅱ-1> 참조). 예를 들어 빅테크들이 고금리 기반의 수신성 금융상품을 출시하여 시장 점유율을 늘리면 전통적 금융회사들은 고객 이탈을 방지하기 위해 수신 상품의 금리를 올리는 전략을 수행함에 따라 장기적으로 전통적 금융회사들의 수익성이 저하될 수 있다. 빅테크들은 클라우드(cloud) 서비스를 통해 비금융회사들과 데이터베이스, 통신 등 다양한 업무 제휴를 수행하고 있는데 관련 시스템 장애가 발생할 경우 빅테크가 제공하는 금융서비스도 오작동이 발생할 수 있는 위험이 있다. 그 외에도 FSB(2019)는 빅테크의 과도한 신용창출로 인한 위험을 제기했다. 빅테크는 P2P 대출, 크라우드 펀딩, 기타 투자성 상품 중개 등의 기능을 제공하며 과도한 신용을 창출할 수 있는데 해당 신용창출은 전통적 금융회사와 달리 규제를 거의 받지 않거나 규제 수준이 낮기 때문에 부실화될 개연성이 클 수 있다.

BIS도 다수의 보고서를 통해 빅테크의 금융진출로 인한 잠재 위험을 소개하였다. BIS(2021a)는 빅테크들이 일반 금융회사처럼 시장위험, 신용위험 등의 핵심적 금융위험과 유동성위험, 운영위험, 신용창출위험 등의 비핵심적 금융위험에 노출될 수 있음을 제시했다. BIS(2022)는 빅테크들이 데이터 독점력을 통해 플랫폼 이용자간 이해상충(conflicts of interests) 위험이 클 수 있으며, 시장 지배력을 통한 독과점 위험, 대형화로 인한 시스템위험, 서비스 복잡성으로 인한 감독 부실 위험 등이 있음을 소개했다. BIS(2019)는 빅테크들이 네트워크 효과와 빅데이터 분석 능력을 통해 금융산업 내 시장 점유율을 빠르게 늘리면서 전통적 금융회사들의 수익성과 건전성을 위협할 수 있는 등의 금융안정 위협 개연성을 제기했다.

IMF(2022)는 빅테크가 편리성, 효율성, 보편성 등 다양한 경제적 순기능에도 불구하고 빅데이터와 머신러닝 등을 통해 시장 점유율을 빠르게 늘리면서 다양한 위험요인을 가질 수 있음을 지적하고 있다. 우선 빅테크들은 번들링을 통해 소비자 선택권을 감소시키고, 금융상품의 설명의무와 공시의무 등을 소홀히 수행하며 시장 지배력을 확보한 이후 높은 수수료를 측정하는 등 금융소비자 보호를 약화시킬 수 있는 위험을 지적하고 있다. 다음으로 빅테크들은 국경간 자금세탁(money laundering), 송금 사기(fraud), 탈취(theft) 등의 위험에 노출되어 있으며 빅테크의 이용자들이 블록체인 기술 등 혁신 기술을 인지하지 못하고 빅테크의 금융서비스에 종속될 수 있는 위험을 언급했다. 또한 빅테크들은 국경에 큰 구애를 받지 않고 금융서비스를 제공함에 따라 국경간 규제 차익 위험에 노출되어 있으며 금융서비스와 비금융서비스의 경계가 모호해짐에 따라 업권간 규제 차익 위험에 노출되어 있음을 제기했다.

금융안정은 금융시스템이 불안하지 않은 상태로, 금융시스템의 구성 요소인 금융기관, 금융시장, 금융인프라가 모두 불안하지 않은 상태를 뜻한다.5) 이때 금융기관의 안정은 금융기관이 건전하여 자금의 공급자와 수요자를 연결해주는 중개기관으로서 본연의 역할을 잘 수행하는 것을 뜻한다. 즉 빅테크가 금융기관의 안정을 훼손한다는 것은 빅테크의 부실 또는 영향력 확대로 전통적 금융기관들이 자금중개 업무를 안정적으로 수행할 수 없는 상태를 뜻한다. 다음으로 금융시장의 안정은 가계, 기업, 금융기관, 정부 등 주요 시장 참가자들이 신뢰를 갖고 금융시장에서 필요한 자금을 조달하고 여유자금을 운용하는데 장애가 없는 상태를 뜻한다. 따라서 빅테크가 금융시장의 안정을 훼손한다는 것은 빅테크의 파산 등으로 금융시장의 가격 변동성이 커지거나 유동성이 부족한 상태가 발생하는 것을 뜻할 수 있다. 마지막으로 금융인프라의 안정은 지급결제시스템, 금융안정망, 기타 시장 인프라 등이 효율적으로 구축되어 장애 없이 안정적으로 운영되는 상태를 뜻한다. 만약 빅테크가 금융인프라의 안정성을 훼손한다면, 빅테크의 부실 또는 장애로 인해 지급결제시스템 등 주요 금융인프라가 정상적으로 작동하지 않는 상태가 발생할 수 있는 것을 뜻한다.

FSB(2022)는 COVID19 이후 전 세계적으로 비대면 금융서비스에 대한 수요가 늘면서 빅테크와 대형 핀테크의 영향력이 커졌고, 빅테크들이 인공지능, 빅데이터, 블록체인 등 혁신 기술을 빠르게 접목하는 과정에서 금융서비스의 취약성을 완벽하게 검증하지 못했기 때문에 빅테크가 금융안정을 위협할 수 있음을 주장하였다. 구체적으로 빅테크들은 사이버공격, 송금사기, 해킹 등에 취약하고 대형 금융회사 등과 공동 플랫폼 개발 등을 통해 연계성이 커지고 있어, 플랫폼에 기반을 둔 금융서비스에서 장애가 발생하는 경우 지급결제시스템 등 금융인프라의 안정성이 훼손될 수 있음을 지적하였다. 또한 빅테크들은 데이터를 독점적으로 사용하고 있기 때문에 클라우드 서비스에서 장애가 발생하거나 데이터의 해킹, 위변조 등이 발생하면 해당 클라우드 서비스를 사용하고 있는 전통적 금융회사들도 막대한 피해를 입을 수 있음을 우려하고 있다. 그 외에도 FSB(2022)는 주요국들이 빅테크에 대해 서로 상이한 규제 정책을 펼치는 점도 금융안정을 훼손할 수 있는 있는 잠재 위험으로 보고 있다. 빅테크들은 국경에 구애받지 않고 금융서비스를 제공하는 경향이 많은데, 특정 국가에서 낮은 규제를 적용한다면 해당 국가의 빅테크 금융서비스로 쏠림이 발생할 수 있기 때문이다.

BIS는 빅테크들이 지급결제 서비스 등 신용창출 규모를 확대함에 따라 금융안정을 위협할 수 있음을 제시하고 있다. BIS 데이터를 활용해 빅테크와 핀테크의 신용창출 규모6)를 추정한 결과, 2021년말 빅테크의 신용창출 규모는 7,800억달러로 2016년말 720억달러 대비 10배 이상 증가했다(<그림 Ⅱ-1> 참조). 2021년 기준 빅테크의 신용창출 규모는 글로벌 금융산업 신용창출 규모의 10% 내외에 불과하나 빅테크의 신용창출 규모가 빠르게 증가하고 있어 향후 빅테크들은 금융안정을 충분히 위협할 수 있을 것으로 예상할 수 있다. 구체적으로, BIS(2022)는 빅테크가 신용창출을 확대하는 과정에서 전통적인 금융회사와 협력 기반의 금융서비스를 제공하는 것이 금융안정 훼손 위험을 증가시킬 수 있다고 말하고 있다. 빅테크와 금융회사간 협력을 통해 제공된 금융서비스는 고객 편의성 제고를 목적으로 단기간에 도입된 경향이 높은 만큼 서비스의 투명성이 낮고 사이버보안 등에 취약할 수 있기 때문에 해당 금융서비스에서 부실이나 장애가 발생하면 빅테크와 금융회사의 평판을 저하시킬 뿐 아니라 연계 서비스의 장애로 이어져 빅테크와 금융회사의 건전성을 악화시킬 수 있다. 또한 빅테크들이 클라우드 서비스의 관리주체로서 금융서비스의 영역을 확대하고 있는데 전통적 금융회사들도 클라우드 서비스의 의존도를 높이고 있어 해당 클라우드 서비스에서 장애 및 해킹 등의 사고가 발생할 경우 전통적 금융회사들의 서비스 장애로 이어지는 등 금융기관 및 금융인프라의 안정성을 훼손할 수 있는 우려가 있다.

가. DNA 효과가 빅테크에 미치는 영향

인공지능, 빅데이터 등 ICT 기술혁신과 COVID19 이후 비대면 수요 증가로 경제 구조는 대면 중심에서 비대면 중심으로 바뀌었다. 디지털 경제로 전환되는 과정에서 빅테크는 ICT 기술력과 빅데이터 분석 능력 등에 힘입어 소비자의 니즈에 맞는 혁신 서비스들을 저렴한 비용으로 신속하게 공급하며 괄목할만한 성장을 이루었다. 빅테크의 빠른 성장 동인은 데이터 확보 및 분석 능력(Data Analysis), 네트워크 외부효과(Network Externality), 상호 연계된 활동(Interwoven Activities) 등을 꼽을 수 있는데 빅테크가 금융서비스를 빠르게 확장하게 된 배경도 이와 같은 DNA 효과7)에서 찾아볼 수 있다. 예를 들어 빅테크들은 온라인 검색, 쇼핑 등 비금융서비스를 통해 확보한 이용자 정보를 활용해 맞춤형 금융상품을 저렴한 비용으로 제공할 수 있으며, 금융 플랫폼을 통해 다수의 소비자와 공급자를 연결시킴으로써 신규 소비자와 공급자가 더 많이 참여할 수 있는 환경을 제공해왔다. 이와 같은 경쟁력에 힘입어 빅테크들은 더 많은 금융소비자들에게 저렴하고 편리한 맞춤형 금융서비스를 제공할 수 있게 되었다. 이처럼 DNA 효과는 빅테크로 하여금 소비자 편익을 제고하고, 정보비대칭을 해소하며 거래비용과 탐색비용을 절감해주는 등 긍정적 역할을 수행하는데 기여했다(이하 <그림 Ⅱ-2> 참조).

이와 달리 DNA 효과는 빅테크의 금융진출을 가속화시키고 시장 점유율 확대를 통해 불공정거래, 불완전판매, 시스템리스크 확대, 기타 금융안정 훼손 가능성 등을 높이는 등 부작용을 초래할 우려도 제기된다. 빅테크가 금융산업 내 시장 지배력을 확보한 이후 판매마진 또는 수수료를 인상하여 금융소비자의 후생을 저해하는 것을 예상할 수 있다. 그뿐 아니라 빅데이터 분석을 통해 소비자들에게 특정 금융상품만을 선택하거나 또는 선택하지 못하도록 유도할 수 있다. 그 외에도 네트워크 외부효과를 통해 빅테크가 규모의 경제를 실현한 이후 수많은 플랫폼 이용자들의 정보보호를 소홀히 하거나 금융서비스의 장애로 금융소비자 또는 타 금융회사에게 금전적 손실을 미칠 가능성도 존재한다.

빅테크들이 온라인 검색, 쇼핑, 미디어, 통신 등 비금융서비스를 통해 이용자 빅데이터를 확보하고 해당 빅데이터를 금융서비스에 적용하는 과정에서 다양한 금융리스크를 야기할 수 있다. 우선 빅테크들은 다양한 유형의 플랫폼 서비스를 통해 확보한 고객 데이터를 이용해 이익 증대를 목적으로 가격 차별화 또는 상품 차별화 전략을 수행할 수 있다. 특정 기업이 독점적 시장 지배력을 확보한 이후 가격 차별화 또는 상품 차별화 전략을 수행하면 해당 기업의 이익은 증가할 수 있으나 소비자 후생은 감소하는 부작용이 생길 수 있다. 예를 들어 빅테크들은 온라인 검색, 쇼핑, 미디어, 통신 등의 서비스를 이용할 때 모은 정보를 활용하여 금융소비자의 나이, 성별, 소득, 재산, 거주지, 건강정보, 위험회피성향 등을 손쉽게 파악할 수 있는데, 빅테크들이 고위험 금융상품을 투자하기에 적합하지 않은 소비자에게 판매보수가 높은 고위험 금융상품 위주로 광고 또는 권유하는 전략을 수행할 수 있다.8)

상품 차별화 또는 가격 차별화 외에도 빅테크들은 비대면 플랫폼을 통해 금융상품을 광고하거나 중개하기 때문에 설명의무, 적합성의 원칙 등을 소홀히 할 개연성도 있다. 빅테크는 빅데이터를 분석하여 특정 금융소비자가 금융상품 가입에 관심이 많지 않다고 판단하면 시간과 비용을 들여 엄격한 설명의무, 적합성 테스트를 수행할 유인이 크지 않을 수 있다. 불완전판매 위험 뿐 아니라 빅데이터를 활용해 불공정 영업행위를 수행할 개연성도 존재한다. 금융소비자 보호에 관한 법률(이하 금소법)에서는 금융상품판매업자로 하여금 우월적 지위를 이용해 금융소비자의 권익을 침해하는 행위를 금지할 것을 명시9)하고 있는데, 빅테크들은 특정 금융소비자가 선호하는 번들링 서비스를 제공하거나 1:1 맞춤형 배너광고를 제시함으로써 손쉽게 금융상품을 판매하는 등 금소법 규제를 회피할 개연성이 있다. 그 외에도 빅테크들은 빅데이터 정보를 오남용할 위험이 존재한다. 빅테크는 다수의 비금융회사와 금융회사를 자회사 또는 손자회사로 두고 있는데 이들 자회사, 손자회사들에게 고객 정보를 제공하는 과정에서 고객 정보보호를 소홀히 함으로써 소비자 피해를 초래할 수 있다.

네트워크 외부효과란 빅테크가 보유한 플랫폼 기술과 빅데이터를 기초로 네트워크를 형성하고, 견고하게 형성된 네트워크는 신규 고객의 참여를 촉진시켜 다시 새로운 고객 데이터 기반을 구축하며 빅테크의 시장 지배력이 커지는 현상을 뜻한다. 예를 들어 빅테크 플랫폼에 참여하는 소비자가 증가하면 금융상품 공급자 입장에서 잠재 고객이 늘어나 더 많은 공급자가 참여할 것으로 기대할 수 있다. 이때 금융상품의 공급자가 늘면 금융소비자는 금융상품의 선택폭이 넓어지기 때문에 신규 소비자의 유입이 증가하는 효과로 이어질 수 있다. 이 같은 네트워크 외부효과로 인해 빅테크는 금융서비스 분야에서 시장 점유율을 빠르게 늘리며 독점적 지위를 누릴 수 있다.

빅테크의 네트워크 외부효과로 인해 빅테크의 시장 지배력이 커지는 등 금융산업 내 집중위험이 커질 수 있다. 빅테크는 금융회사보다 낮은 진입 규제와 건전성 규제를 받기 때문에 네트워크 외부효과 유지를 위해 수익성과 건전성이 악화될 수 있다. 상당수 빅테크가 초기에 적자를 감수하고 공격적으로 마케팅 비용을 지불하는 것도 향후 빅테크의 건전성 악화를 초래할 수 있다. 빅테크가 시장 지배력을 확대하는 과정에서 전통적 금융회사의 건전성이 악화될 수 있는 위험도 존재한다. 전통적 금융회사들은 고객 이탈을 방지하기 위해 낮은 마진을 유지하는 정책을 펼칠 수 있는데, 만약 빅테크의 경쟁력 우위로 인해 전통적 금융회사의 시장 점유율이 하락한다면 해당 금융회사의 수익성과 건전성이 악화될 수 있는 위험에 노출될 수 있다. 또한 빅테크의 금융서비스 확대로 금융산업 내 경쟁이 치열해지면 전통적 금융회사들은 수익률 저하를 극복하기 위해 고위험 투자를 늘려 건전성이 악화될 수 있다. 금융회사의 빅테크의 네트워크 외부효과로 빅테크와 타 금융회사들과의 연계성이 커지고 제공하는 금융서비스가 복잡해짐에 따라 시스템위험에 노출될 수 있는 개연성도 커질 수 있다. 시스템위험은 통상 규모, 연계성, 복잡성, 레버리지 등에 비례하는 것으로 알려져 있는데 빅테크의 특징상 규모와 레버리지가 큰 가운데 네트워크 외부효과로 타 금융회사들과 연계성이 커지고 제공하는 금융서비스의 복잡성이 커지면 시스템위험도 증가하는 것으로 예상할 수 있다.

가. 낮은 규제강도

한국 빅테크는 주로 특화된 금융업 라이센스를 취득하고 은행업, 보험업, 여신전문금융업 등 금융업의 본질적 업무를 수행하고 있기 때문에 주요국 대비 금융리스크가 클 것으로 예상할 수 있다. 주요국 빅테크의 은행업 진출 현황을 살펴보면, 미국 빅테크들은 은행업 라이센스를 취득하지 못해 예적금 수취 및 대출 업무 등 은행업을 수행하지 못하고 있으며 한국, 일본, 중국 등의 빅테크는 온라인 영업에 특화된 은행업 라이센스를 취득하여 예적금 수취 및 대출 서비스를 제공해왔던 것으로 알려져 있다(이하 <표 Ⅱ-5> 참조). 최근 중국 정부는 주요 빅테크 그룹에 대해 신용대출 업무를 분리시키도록 명령했으며, 금융서비스를 제공해온 주요 빅테크들에게 금융지주회사 형태로 전환할 것을 권고함에 따라 중국 내 빅테크들은 은행업을 영위하는 것이 어려워졌음을 알 수 있다. 즉 빅테크에게 특화된 은행업 라이센스를 제공하여 예적금 수취 및 대출업 등의 경쟁과 혁신을 유도한 국가는 많지 않은 가운데, 한국 빅테크들은 인터넷전문은행업 진출을 통해 시장 점유율을 빠르게 늘려온 것으로 판단할 수 있다.

은행업 외에도 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 업무 등에 있어서도 주요국과 한국 빅테크의 금융진출 방식에 다소 차이가 있다. 미국의 경우 아마존을 제외하고는 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 발행 및 관리 업무 등에 거의 참여하지 않고 있으며 빅테크들이 해당 금융서비스를 제공할 때 라이센스 취득 방식이 아니라 기존 금융회사와의 제휴를 통해 금융서비스를 제공하고 있다. 반면 한국의 카카오, 네이버 등 주요 빅테크는 라이센스 취득과 금융회사와의 전략적 제휴 방식을 모두 활용하여 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 발행 및 관리 업무 등 대부분의 금융서비스에 진출해왔다. 중국 빅테크는 한국과 유사하게 보험‧자산관리 상품 판매, 소액 신용공여, 선불전자지급수단 업무 등 거의 모든 비은행권 금융서비스를 제공해왔는데 최근 중국 정부의 규제 강화로 빅테크 내부에서 신용공여, 선불전자지급수단 발행 및 관리 업무를 수행하는 것이 어려워졌다. 일본 빅테크는 선불전자지급수단 업무 등은 허가를 통해 가능하나 신용공여 업무 등은 적극적으로 수행하지 않거나 기존 금융회사와 전략적 제휴를 통해 관련 서비스를 제공하고 있다. 즉 한국 빅테크들은 주요국 빅테크들과 비교해 손쉽게 라이센스를 취득하여 다양한 비은행권 금융서비스를 제공한다고 말할 수 있다.

영업행위 규제 관련해서도 빅테크는 금융회사보다 낮은 규제를 적용받고 있다. 빅테크가 대주주로 있는 인터넷전문은행의 경우 업무 부담 완화를 위해 공시의무와 보고의무에 있어서 특례를 부여하고 있다. 예를 들어 인터넷전문은행은 인터넷홈페이지 등을 통해 전자적 방법으로 관련 서류를 공시함으로써 상업은행에게 적용하는 본점, 지점, 영업점에서의 서류 게시, 비치 또는 열람제공 의무를 갈음할 수 있다.12) 또한 상업은행이 주요 업무를 수행할 때 대면 기반으로 보고 또는 신고의무를 수행해야 하는데 인터넷전문은행의 경우 비대면으로 보고 또는 신고의무를 수행하는 것을 허용하고 있다.13) 소비자보호 규제 관련해서도 빅테크들은 1:1 맞춤형 배너광고 등을 통해 금융상품을 손쉽게 판매해왔는데 해당 행위는 금융상품의 중개 행위로 보는 것이 모호하므로 금소법상 설명의무, 적합성의 원칙, 부당권유 금지 조항 등 엄격한 투자권유 규제를 적용받지 않았다.

다음으로 한국 빅테크의 업무범위가 매우 넓은 것도 한국 빅테크의 금융리스크 개연성이 큰 이유로 꼽을 수 있다. 실제 한국 빅테크는 <표 Ⅱ-5>에서 볼 수 있듯이 은행업, 보험 및 금융상품 중개업, 여신전문금융업, 선불전자지급수단 발행 및 관리업, 전자지급결제대행업 등 거의 모든 유형의 금융서비스에 진출하고 있다. 우선 카카오 그룹은 카카오뱅크, 카카오페이, 카카오벤처스, 카카오인베스트먼트 등을 자회사로 두고 있으며 카카오페이의 자회사로는 카카오페이증권, 카카오페이손해보험, 케이피보험서비스를 두고 있다. 즉 카카오 그룹은 자회사 또는 손자회사를 통해 은행업, 보험업, 증권업, 선불전자지급수단 발행 및 관리업 등 거의 모든 유형의 금융업에 라이센스 취득 방식으로 진출했다. 네이버는 네이버파이낸셜, 라인파이낸셜플러스 등을 자회사로 두고 있으며 네이버파이낸셜은 NH보험회사를 자회사로 두고 있다. 네이버는 선불전자지급수단 발행 및 관리업, 전자지급결제대행업, 보험대리점업 등을 라이센스에 기반하여 수행하고 있으며 증권업, 자산관리업 등은 기존 금융회사와 제휴 등의 방법으로 서비스를 제공하고 있다.

한국 빅테크는 금융회사 뿐 아니라 비금융회사의 소유를 통해 업무범위를 넓힐 수 있는 장점이 있다. 카카오와 네이버 그룹 모두 온라인 검색, 쇼핑, 미디어, 엔터테인, 여행, 모빌리티 등 비금융서비스업 회사를 자회사 또는 손자회사로 두고 있는데 금융회사가 비금융서비스업 회사를 자회사 또는 손자회사로 두는 것에 엄격한 제한을 두고 있는 것과 비교된다(<그림 Ⅱ-3> 참조). 금융산업의 구조개선에 관한 법률(이하 금산법)에서는 주요 금융회사로 하여금 비금융회사 주식의 5% 이상 보유를 통한 지배력 향유 또는 비금융회사 주식의 20% 초과소유 행위를 금지하고 있다.14) 유사하게 은행법15)과 보험업법16)에서는 은행과 보험회사로 하여금 해당 금융업과 관련이 없는 비금융회사에 15% 이상 출자하는 것을 제한하고 있다. 즉 한국 빅테크는 다양한 유형의 비금융서비스 진출을 통해 네트워크 외부효과와 빅데이터 분석 능력을 키우고 이를 통해 시장 지배력을 높이는 것이 금융회사에 비해 훨씬 수월하다고 말할 수 있다.

마지막으로 한국 금융산업의 디지털 전환 속도가 매우 빠른 점도 한국 빅테크의 금융리스크 개연성을 확대시키는 요인이 될 수 있다. 4차 산업혁명의 영향으로 산업 및 경제 구조가 비대면 중심으로 바뀌면서 한국 금융산업 역시 비대면 서비스 비중이 급격히 증가했다. 대표적으로 온라인 쇼핑, 미디어, 금융거래 등 비대면 지급결제 수요가 증가하면서 페이(pay) 서비스로 불리는 선불지급결제 규모가 큰 폭으로 증가한 반면 COVID19 이후 대면 거래 수요가 감소하면서 현금 인출 및 지급거래를 대표하는 CD/ATM 거래 비중은 크게 줄었다. <그림 Ⅱ-4>에서 볼 수 있듯이, 2022년 2분기에 선불지급결제 규모는 73조원으로 2016년 1분기의 2조원과 비교해서 36배 증가하는 등 선불지급결제 규모의 연평균 증가율은 105%에 이른다. 동기간 CD/ATM 거래비중이 37.9%에서 14.8%로 감소한 것과 비교하면 대면 거래 비중이 줄고 비대면 거래 비중이 큰 폭으로 증가한 것으로 추정할 수 있다.

Ⅲ. 빅테크의 금융리스크 분석

1. 분석 대상 빅테크의 범위

한국 빅테크의 금융리스크 수준을 분석하기에 앞서 연구 대상 범위가 되는 빅테크를 정의할 필요가 있다. 우선 빅테크는 다소 추상적인 개념으로 법적으로 명확하게 정의하는 것은 쉽지 않다. FSB(2019)는 빅테크를 다수의 소비자를 대상으로 플랫폼 기반 서비스를 제공하는 대형 ICT 회사로 정의했으며 구글, 애플, 아마존, 마이크로소프트, 알리바바, 텐센트를 빅테크 기업으로 분류했다. BIS(2022)는 빅테크를 플랫폼 기반의 ICT 서비스를 메인 서비스로 제공하는 대형회사로 정의했으며 한국에서는 카카오, KT 등을 금융업에 진출한 빅테크로 분류했으며 토스는 빅테크가 아닌 핀테크로 분류했다. IMF(2022) 역시 빅테크를 획일적으로 정의하는 것은 쉽지 않음을 언급했으며 양면 플랫폼 서비스를 통해 다수의 소비자와 서비스 공급자를 연결해주며 시장 지배력을 확장해가는 대형 기술 기반 회사를 빅테크로 정의하고 있다.

한편 유럽, 미국, 중국 등은 빅테크 또는 온라인 플랫폼 회사의 독점력 남용으로 소비자 피해가 발생하는 것을 억제하기 위해 빅테크 또는 온라인 플랫폼에 대한 규제안을 마련했으며 해당 규제안에서 빅테크를 계량적으로 정의하고 있다. 예를 들어 유럽 디지털시장법(Digital Market Act: DMA)에서는 3년간 연간 매출액이 75억유로(약 10조 5천억원17)) 이상이거나 시가총액 또는 시장가치가 750억유로(약 105조원) 이상이고, 월간 이용자수가 4,500만명을 초과하고, 해당 플랫폼을 이용하는 사업자수가 연간 10,000개를 초과하는 조건을 모두 만족하는 플랫폼 회사를 게이트키퍼(Gatekeeper)로 정의했다. 유럽 디지털시장법(DMA)에서는 이렇게 정한 게이트키퍼로 하여금 이용자의 활동으로 얻은 정보를 이용자와 경쟁하는데 사용하는 것을 제한하고 자사 상품 또는 서비스를 우대하는 행위 등을 금지했으며 이용자로 하여금 타 서비스로 이동하는 행위 제한을 금지하였다.

미국은 유럽의 규제안을 참고하여 빅테크의 독점력 남용 및 불공정거래 행위를 억제하기 위해 5개의 플랫폼 규제안을 마련했다.18) 이때 규제 대상이 되는 대형 플랫폼 회사는 시가총액이 6천억달러(약 836조원19)) 이상이고 미국 내 월간 이용자수가 5,000만명을 초과하고, 해당 플랫폼을 이용하는 사업자수가 연간 100,000개를 초과하는 조건을 모두 만족하는 회사로 정의했다. 일본의 경우 온라인 플랫폼 사업자의 공정경쟁 환경 조성을 목적으로 특정 디지털 플랫폼의 투명성 및 공정성 향상에 관한 법률을 제정하여 대형 온라인 플랫폼 사업자로 하여금 상품노출 순서 결정기준을 공개하도록 하고 해당 플랫폼 사업자가 계약조건을 변경하는 경우 사전통지 의무 등을 부여했다. 일본 플랫폼 규제안을 적용받는 기업은 일본 내 플랫폼 기업 중에서 연간 매출액 기준 2천억엔(약 2조원20)) 이상의 앱스토어 운영자나 연간 매출액 기준 3천억엔(약 3조원) 이상의 온라인 중개 사업자 등이 해당된다. 이상을 요약하면 유럽, 미국, 일본 등 주요국은 빅테크 또는 온라인 플랫폼을 규제하기 위해 매출액 또는 시가총액 등의 규모 요건, 플랫폼 이용자수 요건, 플랫폼 입점 사업자수 요건 등을 명시하고 있다.

이에 본 연구에서는 주요국 빅테크 또는 온라인 플랫폼 규제안에서 정의한 온라인 플랫폼 요건, 규모 요건, 이용자수 요건을 기준으로 빅테크를 정의하고 해당 빅테크에 대해 금융리스크 분석을 수행하고자 한다. 구체적으로 ① 온라인에서 양면 플랫폼 서비스를 제공하며 ② 금융업의 본질적 업무와 관련한 금융서비스를 제공하며 ③ 시가총액이 10조원 이상이거나 10조원과 유사한 수준이며 ④ 플랫폼 월간 이용자수가 2,000만명 이상인 조건들을 모두 만족하는 기업에 대해 빅테크로 정의하고, 해당 빅테크의 금융리스크를 분석하고자 한다. 또한 ①과 ②의 조건을 모두 만족하고 ③ 또는 ④의 조건을 만족하는 경우에 한해 잠재 빅테크(또는 대형 핀테크)로 정의하고 해당 잠재 빅테크에 대해서도 금융리스크 수준을 분석한다. 이와 같은 조건에 따르면 <표 Ⅲ-1>에서 확인할 수 있듯이 한국 내 빅테크는 네이버, 카카오가 해당되며 잠재 빅테크로는 토스, KT 등이 해당될 수 있다.21) 일반 금융회사는 주가 수익률 정보 수집이 용이한 은행 기반 금융지주회사, 대형 보험회사, 대형 증권회사를 대상으로 하였다.

가. 핵심 금융위험

본 연구에서 빅테크의 금융리스크는 핵심 금융위험과 비핵심 금융위험 그리고 시스템위험으로 구분하여 금융리스크 수준을 분석하고자 한다. 금융회사의 경우 핵심 금융위험은 시장위험, 신용위험, 운영위험 등으로 구성하는데 해당 위험들은 자기자본 규제 비율을 측정할 때 분모 값으로 사용되는 경우가 많다. 즉 시장위험, 신용위험, 운영위험 등이 커지면 자기자본 규제 비율이 낮아지도록 설계되어 있다. 이와 같은 시장위험, 신용위험, 운영위험 등은 국내외 금융감독기구가 표준화된 위험 산출 방식을 제시하고 있어 금융회사에 대해서는 계량화된 방법으로 해당 위험을 측정하는 것이 가능하다. 다만 금융업에 진출한 빅테크에 대해 시장위험, 신용위험, 운영위험 등을 상업은행과 동일한 수준으로 측정하는 것에 한계가 있으므로 본 연구에서는 시장위험가중자산, 신용위험가중자산, 순이익, 자산총계 대비 월간 이용자수 등을 빅테크의 시장위험, 신용위험, 운영위험의 대용치로 사용하여 빅테크와 금융회사 간 위험 수준을 비교한다.

1) 시장위험과 신용위험

우선 2022년 6월말 기준 주요 시중은행과 빅테크 계열 인터넷전문은행의 핵심 금융위험을 비교하면 시장위험과 신용위험의 경우 시중은행이 빅테크 또는 잠재 빅테크에 비해 높은 것을 확인할 수 있다. 이는 주요 시중은행의 경우 오랜 기간에 걸쳐 가계 및 기업 수신과 여신 업무 등을 통해 각각 700조원 규모의 자산을 축적해왔기 때문으로 추정할 수 있다. 반면 빅테크 계열 인터넷전문은행은 설립된 지 수년에 불과하고 온라인에서 개인을 대상으로 수신과 여신 업무를 수행해왔기 때문에 자산 규모가 시중은행의 1/10 수준에도 미치지 못하는 등 시장위험과 신용위험의 절대 수준은 크지 않다.23) 다만 운영위험 측면에서는 빅테크 계열 인터넷전문은행이 시중 은행보다 크다고 말할 수 있다. <표 Ⅲ-2>에서 볼 수 있듯이 2022년 6월말 3개 인터넷전문은행의 상반기 평균 순이익은 200억원 내외에 불과한데 동기간 대형 시중은행의 상반기 평균 순이익은 1.7조원을 기록하고 있다. 자산규모 대비 월간 이용자수를 비교해도 인터넷전문은행이 시중은행을 크게 상회하고 있어 다수의 이용자를 대상으로 서비스를 제공하는 과정에서 인터넷전문은행이 시스템 오작동, 내부통제 미흡 등 각종 운영위험을 보다 많이 내재한 것으로 추정할 수 있다.

금융회사의 운영위험은 부적절하거나 잘못된 내부 프로세스, 인력, 시스템 및 외부 사건으로 인해 발생하는 손실 위험을 뜻한다. 2022년 10월 판교 데이터센터의 화재로 카카오 그룹이 제공해 온 금융서비스, SNS 서비스가 수일 동안 중단되어 대규모 이용자 피해가 발생한 사건이 운영위험이 현실화된 대표적 사례로 꼽을 수 있다.26) 당시 판교 데이터센터 화재로 카카오톡 뿐 아니라 카카오뱅크, 카카오페이 등 주요 금융서비스가 중단되어 계좌이체, 입출금, 결제서비스 등이 최대 127시간 30분 동안 중단되었으며 데이터센터 화재 사고 이후 첫 거래일에 카카오 그룹 주식의 시가총액은 개장 10분 만에 3조원 넘게 하락하기도 했다.27) 이처럼 운영위험은 평상시에 위험 수준을 객관적으로 측정하기 어려우나 운영위험이 현실화되면 매우 큰 규모의 피해가 발생할 수 있는 특징을 가진다.