Find out more about our latest publications

Analysis of Financial Market Stabilization Facilities and Relevant Policy Implications

Issue Papers 23-04 Feb. 02, 2023

- Research Topic Capital Markets

- Page 25

The shortage of funds began to have a marked effect on Korea’s financial market by October 2022. When reduced market liquidity intensifies anxiety over corporate insolvency, the market function of supplying funds falls apart rapidly. Financial market stabilization facilities gain in importance at a time like this, which requires discussions on institutional reform. The key to running financial market stabilization facilities lies in expedited large-scale funding, appropriate control of credit risk and regulatory operational procedures.

In the course of overcoming the 2008 global financial crisis and the 2020 Covid-19 pandemic, major economies have accumulated experience in how to operate financial market stabilization facilities. In preparation for a crisis, the US has made a distinction between monetary policy responses and financial market stabilization facilities. On the other hand, Europe and Japan have underscored that market stability measures are part of their monetary policy aiming at securing monetary policy transmission mechanism and thus, such measures hardly represent the features of financial market stabilization facilities. In this respect, the experience of the US offers more diverse implications for the operation of financial market stabilization facilities.

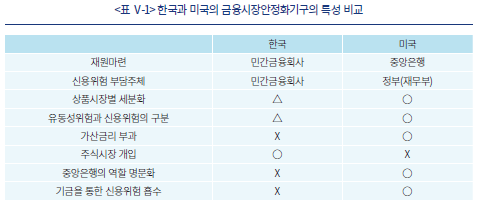

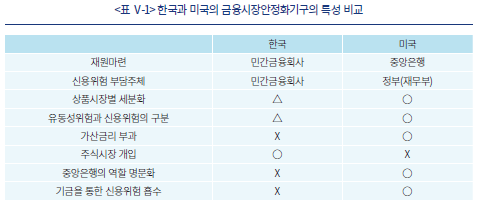

A comparative analysis of the facilities adopted by the US and Korea reveals the following differences. The US uses the Fed’s monetary power to secure funding for stabilization facilities, and the US fiscal authorities (the Department of the Treasury) take over credit risk arising from the operation of facilities. In addition, the Fed’s policy tools are segmented by market. The intervention in the short-term money market is implemented as the first step and the costs of liquidity support are reflected in pricing by applying additional interest rates. It is also noteworthy that US financial market stabilization facilities hardly intervene in the stock market.

As financial market stabilization facilities serve as a safeguard against a financial emergency, their execution method and process should be thoroughly examined and established as a regulatory scheme before any crisis occurs. This requires serious consideration for funding and the role of the central bank and government.

In the course of overcoming the 2008 global financial crisis and the 2020 Covid-19 pandemic, major economies have accumulated experience in how to operate financial market stabilization facilities. In preparation for a crisis, the US has made a distinction between monetary policy responses and financial market stabilization facilities. On the other hand, Europe and Japan have underscored that market stability measures are part of their monetary policy aiming at securing monetary policy transmission mechanism and thus, such measures hardly represent the features of financial market stabilization facilities. In this respect, the experience of the US offers more diverse implications for the operation of financial market stabilization facilities.

A comparative analysis of the facilities adopted by the US and Korea reveals the following differences. The US uses the Fed’s monetary power to secure funding for stabilization facilities, and the US fiscal authorities (the Department of the Treasury) take over credit risk arising from the operation of facilities. In addition, the Fed’s policy tools are segmented by market. The intervention in the short-term money market is implemented as the first step and the costs of liquidity support are reflected in pricing by applying additional interest rates. It is also noteworthy that US financial market stabilization facilities hardly intervene in the stock market.

As financial market stabilization facilities serve as a safeguard against a financial emergency, their execution method and process should be thoroughly examined and established as a regulatory scheme before any crisis occurs. This requires serious consideration for funding and the role of the central bank and government.

Ⅰ. 서론

미국 연준과 한국은행의 기준금리 인상기조가 이어짐에 따라 글로벌 경기침체에 대한 우려가 커짐과 동시에 국내외 금융시장 불안요소가 뚜렷하게 증가하고 있다. 인플레이션을 억제하기 위해 실행되고 있는 통화긴축정책은 소비위축을 초래할 가능성이 높고 기업의 투자유인도 떨어뜨리기 때문에 경기침체는 점차 뚜렷해질 것이라 예상할 수 있다. 기업들은 전반적인 실적부진을 피하기 힘들 것이다. 한편 통화긴축은 시중유동성을 축소시키는 가장 중요한 요인이라 볼 수 있다. 유동성의 축소는 금융회사에만 국한되는 것이 아니라 일반 기업과 가계의 경제활동에 직접적인 영향을 미친다. 경기침체로 인해 기업으로의 현금유입이 줄어들고, 유동성 감소로 인해 자금조달환경마저 나빠지는 상황이 겹쳐지면 금융시장의 자금공급기능이 마비될 위험성이 커진다. 이러한 상황에서 금융시장안정화기구의 필요성은 선명하게 부각된다.

금융시장안정화기구는 자금시장 경색기에 시장의 자금공급기능을 정상으로 유도하기 위하여 마련된 장치이다. 시장유동성이 축소되면서 기업도산에 대한 불안감이 커질 때에는 시장의 자금공급기능이 급속히 퇴화된다. 유동성이 시장으로부터 급속히 빠져나갈 때에는 부실이 누적되어 신용위험이 높아지는 기업들뿐만 아니라 건전한 자산을 보유하고 있는 기업들에 대한 자금공급도 다 같이 위축된다. 기업의 경영활동이 기본적으로 부채성자금에 상당부분 의존하고 있기 때문에 시장의 전반적인 유동성 경색시기에는 건전한 기업들마저 자금확보에 어려움을 겪으면서 예상치 못한 고비를 맞을 수 있다. 건전한 기업들마저 자금압박으로 인해 부도위기에 몰린다면 국가경제 전체에 상당한 충격을 줄 수 있는데, 이러한 상황에서 시장자금흐름의 물꼬를 트는 역할은 정책당국을 제외하면 기대할 수 있는 곳이 없을 것이다. 정책당국의 시장개입이 정당화될 수 있는 이유이다.

시장의 공포감이 시장참가자들의 합리적인 의사결정을 압도할 때 시장에서는 경쟁적인 자산매각이 이루어질 위험성이 커지고, 그 과정에서 정상자산의 부실화로 인한 비용이 급증할 수 있다. 패닉셀링에 의한 무질서한 시장붕괴를 막고 시장기능이 일부라도 정상적으로 작동될 수 있도록 만들기 위해서 금융시장안정화기구를 통한 정부의 시장개입은 합리적인 판단이라 볼 수 있다. 시장안정에 따른 경제주체의 후생도 증가할 것으로 예상할 수 있다. 지난 10월 23일에 발표된 정부의 회사채 및 단기자금시장 유동성 공급조치는 시장기능회복에 있어서 긍정적이고 유의적인 영향을 미칠 것으로 평가할 수 있다.

2022년 10월에 접어들면서 국내 금융시장에는 자금경색 현상이 뚜렷하게 나타났다. 가파른 시장금리 상승기조로 인해 투자자들은 투자시기를 늦추고자 하는 욕구가 강해진 반면 기업으로의 현금유입은 실물시장과 금융시장 양쪽에서 모두 축소되었다. 정부의 신속한 시장개입을 통해 자금경색 현상이 완화될 것으로 예상할 수 있지만, 통화긴축이 지속되고 있어 자금경색은 향후 재차 부각될 가능성이 높을 것으로 보인다. 특히 기준금리의 정점은 2022년이 아니라 2023년에 나타날 가능성이 크다. 이는 경제주체의 이자부담이 2023년에 절정을 이루게 됨을 의미하며, 금리정점 이후 자금경색이 재차 나타날 수 있음을 이해할 필요성이 있다. 과거의 경험들을 살펴보면 금리정점 이후 일정기간이 지나서 대규모 시장경색이 현실화되었던 사례들이 있었다. 연준의 기준금리 인상이 유례를 찾기 어려울 정도로 가파르게 진행되고 있음을 감안할 때 2023년에 강도 높은 자금경색기간이 찾아올 가능성을 배제하기가 어렵다. 추가적인 금융시장안정화기구를 마련할 필요성을 제기해 볼 수 있으며, 앞으로 찾아올 수 있는 자금경색상황은 이전에 비해 더 강도가 높을 수 있음을 고려하여 체계적인 제도개선 방안을 마련하는 것은 중요한 의미를 가진다.

1997년 외환위기, 2008년 글로벌 금융위기, 2020년 코로나19 팬데믹 위기 등을 겪으면서 우리경제는 위기에 대한 대응능력을 시험받아 왔고, 그 과정에서 많은 경험을 축적하였다고 평가할 수 있다. 위기의 전이경로, 발생과정에서 특히 취약성이 있는 섹터, 위기대응방안의 성격 및 재원마련 등에 관하여 의미있는 시도들이 시행되었고, 그 유효성에 대한 이해도를 꾸준히 높여 올 수 있었다. 그럼에도 불구하고 아직 국내의 금융시장안정화기구에는 기능적 효율성을 개선할 수 있는 여지가 있다고 평가할 수 있다. 이에 본고는 자금경색기에 활용될 수 있는 금융시장안정화기구의 유형을 검토하고, 향후 발생할 수 있는 대규모 신용사건에 대비하기 위한 금융시장안정화기구의 정비방향을 모색해보고자 한다. 금융시장안정화기구의 발전방향을 모색하기 위해서 비교분석론에 기반한 방법론을 활용한다. 구체적으로는 2008년 글로벌 금융위기와 2020년 코로나19 팬데믹 위기 과정에서 미국, 유럽, 일본이 시도한 금융시장안정화기구의 특징을 살펴보고, 이를 국내 접근방식과 비교함으로써 정책적 시사점을 도출하고자 한다.

Ⅱ. 국내 금융시장 불안요소에 대한 분석

현재 우리나라 금융시장의 다양한 영역에서 시장불안 요소들이 관찰되고 있다. 시장금리의 상승세, 신용스프레드의 확대, 단기금융상품에 의한 장기물의 대체, 환율 급등 등이 그것이다. 금융시장의 거의 대부분의 영역에서 변동성이 확대되고 불안감이 노출되는 이유는 글로벌 중앙은행들, 특히 미국 연준이 가파른 기준금리인상 기조를 유지하고 있다는 데에서 찾을 수 있다. 글로벌 중앙은행들이 기준금리 인상을 서두르는 이유는 지나치게 높아진 인플레이션을 통제하기 위함이다. 미국의 경우 소비자물가지수(CPI) 기준 인플레이션은 40년 만에 최고치를 기록하고 있다. 2021년 1월 1.4%(전년 동월대비 기준)에 불과하던 미국의 인플레이션은 2021년 12월 7%까지 폭증하였고, 2022년 6월에는 9.1%에 이르렀다. 국내의 경우도 인플레이션의 절대적인 수준은 미국보다 낮지만 상황은 비슷하다. 2021년 1월 0.9%(전년 동월대비 기준)에 불과하던 국내 인플레이션은 12월 3.7%로 상승했고, 2022년 7월에는 6.3%까지 높아졌다.

연준은 2021년 하반기부터 뚜렷해지기 시작한 인플레이션을 억제하기 위하여 2022년 3월부터 기록적인 속도로 기준금리를 인상하기 시작했다. 2022년 1월 상단기준으로 0.25%를 기록했던 연준의 기준금리는 2022년 3월 0.50%로 상승했고, 5월 1.0%, 6월 1.75%, 7월 2.50%, 9월 3.25%로 높아졌다. 연준은 11월에 기준금리를 4.0%까지 상승시켰으며, 12월에는 4.5%로 인상했다. 연준의 기록적인 금리인상 속도는 글로벌 금융시장에 큰 충격을 주고 있으며, 한국은행의 통화정책에도 중대한 영향을 미치고 있다. 한국은행은 코로나19 팬데믹 사태 이후 오랜 기간 기준금리를 0.5%로 유지해오다, 서방국가들에 비해 이른 시기인 2021년 8월부터 기준금리를 인상하기 시작했다. 이후에도 점진적인 기준금리 인상을 통해 2021년 0.5%였던 기준금리를 2022년 1월 1.25%까지 높였다. 한국은행의 기준금리 인상속도는 2022년 들어 높은 국내 인플레이션과 연준의 기준금리 인상속도에 영향을 받아 급격히 빨라졌다. 2022년 1월 1.25%였던 기준금리가 2022년 10월에는 3.0%에 도달하였으며, 11월에는 3.25%로 상승했다. 2023년 1월 한국은행은 기준금리를 또다시 인상해서 3.5%에 이르고 있다.

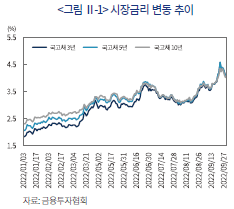

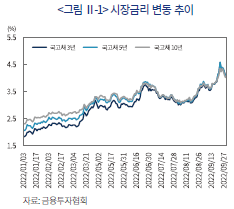

기준금리의 급격한 상승은 금융시장의 유동성을 빠른 속도로 고갈시키는 가장 중요한 요소가 되어왔다. 시장금리는 연준과 한국은행의 기준금리 인상속도를 선반영하며 빠른 속도로 높아졌다. 가장 대표적인 시장금리인 국고채 금리변화를 살펴보면 2022년 1월 3일 국고채 3년물, 5년물, 10년물의 금리는 각각 1.855%, 2.080%, 2.325%로 나타났다. 동일한 만기별 금리는 2022년 10월 31일 기준 각각 4.185%, 4.263%, 4.242%를 기록하여 10개월의 기간동안 각각 무려 2.330%p, 2.183%p, 1.917%p 급등하였다. 3년물과 5년물 금리는 연초 대비 2배 이상 상승했으며, 10년물의 경우도 2배에 육박하는 상승폭을 기록하였다. 시장금리 상승에서 나타나는 또 하나의 특징은 장단기금리가 역전되고 있다는 점이다. 2022년 10월 31일 기준 국고채 5년물 금리(4.263%)는 10년물(4.242%), 20년물(4.152%), 30년물(4.073%), 50년물(4.030%)보다 높게 형성되어 있다. IFRS17의 도입으로 인해 보험사로부터의 국고채 초장기물 수요가 급격히 증가했음을 감안하더라도 현재의 장단기 금리차 역전현상은 경기침체에 대한 우려가 반영되어 나타나는 결과라고 해석함이 타당할 것이다. 유동성 축소국면에서 나타나는 경기침체 우려는 투자자심리를 더욱 저하시키고 시장의 변동성을 증가시킬 수 있다는 점에서 우려되는 부분이다.

신용스프레드의 확대는 시장금리 상승과 더불어 시장의 중요한 불안요소로 주목할 필요가 있다. 시장금리가 상승하는 상황에서 신용스프레드가 확대될 경우 회사채시장에서 기업들이 부담해야 하는 금리는 더욱 큰 폭으로 상승한다. 신용스프레드(국고채 3년물과 동일만기 회사채간의 금리차)는 2022년 1월 3일 AA- 등급의 경우 0.605%, BBB- 등급은 6.461% 수준에서 형성되었다. 반면 10월 31일 기준 신용스프레드는 각각 1.395%와 7.239%를 기록하였다. 이는 연초대비 AA- 등급은 0.790%p, BBB- 등급은 0.778%p 높아진 수준이다. 신용스프레드 변화에 대한 해석은 BBB- 등급보다는 AA- 등급에 대해 적용하는 것이 타당하다. 이는 국내에서 BBB- 등급의 회사채 발행량은 매우 적은 편이어서 금리의 유효성에 대한 신뢰가 충분하다고 평가하기 어렵기 때문이다. AA- 등급 기준으로 신용스프레드를 평가할 경우 연초대비 신용스프레드는 10개월만에 두배 이상 증가했다. 기준이 되는 국고채 3년물이 연초대비 2.330%p 상승하였음을 감안할 때, 회사채 3년물(AA-) 금리는 연초대비 무려 3.120%p나 높아졌음을 알 수 있다. 채권시장에서도 특히 회사채시장에 시장의 불안이 집중되고 있음을 보여주는 지표라고 해석할 수 있다.

Ⅲ. 국내 금융시장안정화기구 특징 및 문제점

1. 국내 금융시장안정화기구의 종류 및 특징

국내에서 활용되는 금융시장안정화기구는 여러 가지 유형이 존재하는데, 가장 대표적인 것으로 채권시장안정펀드(이하 채안펀드), P-CBO, 회사채신속인수제도, 증권시장안정펀드(이하 증안펀드) 등이 있다. 이중 위기상황에서 기업금융지원 효용성이 높은 수단은 채안펀드, P-CBO, 회사채신속인수제도로 볼 수 있는데, 이는 채안펀드, P-CBO, 회사채신속인수제도는 채권시장 경색으로 인해 기업으로의 자금공급이 막혔을 때 시장의 막힌 곳을 뚫어 자금이 다시 흐르게 만듦으로써 기업의 도산가능성을 줄일 수 있기 때문이다. 반면 증안펀드는 주식시장의 가격부양을 목적으로 하기 때문에 기업으로의 자금유입개선이라는 관점에서는 그 효과가 미미하다고 평가할 수 있다.

지난 2020년 코로나19 팬데믹으로 인해 국내 금융시장의 변동성이 극단적으로 확대되는 상황에서 금융당국은 금융시장의 기능정상화를 위하여 상기한 금융시장안정화기구의 실행을 발표하였다.1) 채안펀드는 채권시장 경색으로 일시적인 자금난을 겪고 있는 기업들에 대해 유동성을 지원함과 동시에 신용스프레드가 과도하게 커지는 것을 방지하기 위해 설립된 펀드이다. 정부는 팬데믹으로 인한 채권시장 자금경색을 완화하기 위해 2008년 글로벌 금융위기 과정에서 조성되었던 총 10조원 규모의 채안펀드에 10조원을 추가로 조성하여 자금난을 겪고 있는 기업에 대해 유동성을 공급했다. 채안펀드의 조성은 은행ㆍ증권ㆍ보험ㆍ정책금융기관 등 총 84개 금융회사들의 공동출자를 통해 이루어졌다. 채안펀드의 투자대상은 회사채, 우량기업CP와 전자단기사채(이하 전단채), 금융채 등을 포함하였다. 채안펀드의 조성계획은 2020년 3월 19일에 발표되었고, 채안펀드 세부운영 방안은 3월 24일에 발표되었으며, 1차로 3조원 규모의 Capital call을 결정한 후 4월 2일부터 회사채매입을 시작하였다.

2020년 설립되었던 저신용등급 포함 회사채ㆍ기업어음(CP) 매입기구인 기업유동성지원기구(이하 SPV)도 채안펀드와 유사한 성격을 가진 금융시장안정화기구라 평가할 수 있다. 정부는 코로나19 위기에 대응하여 기업자금조달 애로 해소, 자금시장 경색 차단 등을 위한 저신용등급 포함 회사채ㆍCP 매입기구를 설립하였다.2) SPV는 10조원 규모로 설립되었는데 정부의 1조원 산업은행 출자를 바탕으로 산업은행이 SPV에 대해 1조원을 출자하고 추가로 1조원의 후순위 대출을 실행하였다. 한국은행은 SPV에 8조원의 선순위 대출을 제공하였고,3) 총 10조원의 재원을 마련한 SPV는 회사채ㆍCP 등 매입을 위한 유동성을 지원했다. SPV는 우량등급 채권뿐만 아니라 비우량등급 채권과 CP도 매입했고, 전체 금융시장 안정목적을 위해 특정기업에 집중 지원되지 않도록 동일기업 및 기업군의 매입한도 제한 등 조건도 부과하여 운영되었다. SPV는 금융시장 안정시까지 한시적으로 투자하는 것을 원칙으로 설립되었으며, 매입기간 종료 시점에 6개월간 운영성과와 시장안정 상황을 종합적으로 고려하여 투자기간 연장을 결정할 수 있었다. 다만 SPV는 설립일로부터 4년간만 운영되도록 명시적인 일몰기간을 설정했다.

P-CBO는 회사채시장의 안정화 및 원활한 기업자금조달 지원을 위해 실행되는 제도이다. 이름에서 알 수 있듯이 회사채발행시장에서 회사채를 인수하여 CBO(Collateralized Bond Obligation)의 형태로 유동화시키는 방식이다. 코로나19 팬데믹으로 인해 일시적 유동성 애로를 겪는 중견기업과 대기업의 회사채발행을 지원하려는 목적을 가졌으며, 총 6.7조원(1단계 1.7조원+추가 5조원)을 발행했다. 발행구조는 정책금융기관인 산업은행이 회사채를 인수한 후 주채권은행ㆍ신용보증기금에 매각하고, 신용보증기금의 보증을 통해 신용을 보강하여 시장안정 P-CBO를 발행하는 방식을 따른다.

회사채신속인수제도는 회사채만기가 집중되어 상환에 어려움을 겪는 기업(중견기업+대기업)을 대상으로 회사채의 80%를 산업은행이 총액인수해주는 제도이다. 회사채 만기가 돌아오면 기업은 자체자금으로 20%를 상환하고, 나머지 80%는 산업은행이 인수해 차환하는 방식이다. 산업은행이 인수한 채권(80% 해당분)은 대부분은 신용보증기금의 신용보강을 통해 P-CBO에 편입시켜 시장에 매각하고, 일부는 해당기업 채권은행에 매각함으로써 신용위험을 분산시킨다. 2020년 시행된 회사채신속인수제도는 기업에 대한 순지원 금액 기준 2.2조원 규모로 집행되었다.

증안펀드는 주식시장의 주가급락 및 과도한 시장변동성 완화를 목적으로 조성된 펀드이다. 금융권의 공동출자를 통해 주식시장의 안전판 역할을 수행하기 위해 만들어졌다. 증시가 회복될 때까지 한시적으로 운영하는 것을 원칙으로 하며, 개별종목 주가에 영향을 주지 않도록 시장대표 지수 상품에 대해서만 운용된다. 증안펀드는 채안펀드와 유사하게 Capital call 방식으로 자금을 모집하여 증권시장 전체를 대표하는 지수상품(예: KOSPI200 등)에 투자한다. 증안펀드에 출자한 금융회사에 대해서는 펀드 출자금액에 대해 건전성규제(위험가중치) 비율이 완화되어 적용된다.

2020년말까지 국내에서 증안펀드가 조성된 것은 4차례로 나타나는데, 1990년, 2003년, 2008년, 2020년에 각각 조성된 바 있다. 1990년 최초로 조성된 증안펀드는 명칭이 증시안정기금(이하 증안기금)이었는데 2003년 이후 증안펀드로 변경되었다. 1990년 증안기금은 4.85조원 규모로 조성되었는데 당시 시장규모를 감안할 때 상당히 큰 규모라 평가할 수 있을 것이다. 연구의 진행에 있어서 한 가지 아쉬운 점은 1990년 증안기금의 운영결과 손실이 난 사례가 있었는지를 확인하기가 어렵다는 사실이다. 2003년의 증안펀드는 신용카드 대출 부실사태로 인해 증시가 크게 하락하자 그 대응과정에서 증권유관기관의 출연을 통해 4,000억원 규모로 조성되었다. 2008년의 경우 글로벌 금융위기가 발생하자 그 대응과정에서 증권유관기관의 출연을 통해 5,150억원 규모의 증안펀드가 조성되었다. 증권선물거래소가 2,500억원, 예탁결제원이 2,100억원, 증권업협회가 500억원, 자산운용협회가 50억원을 출연하면서 증안펀드 운용에 참여하였다. 2003년과 2008년 조성된 증안펀드는 증시가 저점 근처에 근접하였을 때 조성되어 집행되었고, 이후 시장상승기에 청산되었기 때문에 증안펀드 운영결과 손실이 난 경우는 없었다.

2020년 코로나19 팬데믹 시기에는 5대 금융지주와 은행ㆍ보험ㆍ증권 각 업권 선도 금융회사(18개 금융회사) 및 증권유관기관(한국거래소, 예탁결제원, 금융투자협회 등)이 10.7조원을 조성했으나, 주식시장이 신속히 반등한 관계로 실제 집행이 이루어지지는 않았다. 증안펀드는 주가하락을 일부 완화하는 효과를 기대할 수 있지만, 기업에 대한 자금공급 기능이 미미하다는 점에서 전술한 금융시장안정화기구와 차별성을 가진다.

2. 국내 금융시장안정화기구의 문제점

국내 금융시장안정화기구는 반복되는 위기상황에서 시장유동성을 개선시키고 투자자들의 심리를 안정시키는 데에 유의적인 영향을 미쳤다고 평가할 수 있다. 그렇지만 금융시장안정화기구의 효율성 및 신속성 측면에서 다음과 같은 문제점을 가진다. 첫째, 금융시장안정화기구의 재원마련을 민간금융회사의 출연에 크게 의존하고 있다. 재원마련을 민간금융회사에 의존하는 것은 금융회사의 도덕적 해이를 완화시키고, 시장안정의 혜택을 받는 주체가 거기에 대한 재원을 마련해야 한다는 측면에서는 긍정적으로 평가할 수 있다. 그러나 금융회사의 출연에 의한 재원마련은 그 규모에서 한계가 존재한다. 경제규모 및 금융거래규모가 커짐에 따라 위기상황에서 필요한 대응자금의 규모도 가파르게 늘어나고 있다. 위기상황에서 금융회사들은 스스로도 유동성확보에 어려움을 겪고 있을 가능성이 높다. 그런 상태에서 금융시장안정화기구의 운영을 위한 재원까지 출연을 해야 하니 위기의 강도가 강해질수록 그 부담은 크게 느껴질 것이다. 일정 수준 금융회사들의 부담이 정당화될 수 있겠지만 다른 방식의 재원조달 필요성을 부인하기는 어렵다.

둘째, 민간금융회사들의 자금출연에 대한 신용위험부담이 충분하게 제거되어 있다고 보기 어렵다. 현재의 금융시장안정화기구의 운영방식을 살펴보면 민간금융회사는 자금의 출연 이후 운영과정에서 발생할 수 있는 신용위험으로부터 절연되어 있다고 평가하기 어렵다. 물론 신용위험은 금융시장안정화기구에 참여하는 정책금융기관에 의해서 우선적으로 흡수되는 경우가 많다. 그렇지만 정책금융기관에 의해 신용위험이 전혀 부담되지 않는 경우도 있으며, 부담하더라도 신용위험의 일부가 민간금융회사로 전이될 가능성은 여전하다고 볼 수 있다. 시장안정의 수혜를 받는 주체가 신용위험을 부담하는 것은 당연하다고 보는 견해도 있으나, 이러한 신용위험 가능성이 민간금융회사의 참여유인을 위축시키고 출연과정에서 더 많은 시간을 소요하게 만들 수 있음에 주목할 필요가 있다.

셋째, 금융시장안정화기구의 출범과 운영에 있어서 중앙은행과 정부의 역할분담 및 협조체계의 구축이 미흡한 편이다. 금융시장안정화기구의 운영에 있어서 핵심적인 사안은 대규모 재원의 신속한 출연, 적절한 신용위험의 통제, 그리고 준칙화된 운영절차로 볼 수 있다. 이러한 요소들의 적절한 관리에 있어서 정부와 중앙은행의 역할은 매우 중요하다. 정부는 위기관리 주체로서의 역할을 이미 상당부분 수행하고 있으나, 금융시장안정화기구의 효율성을 높이기 위하여 한국은행과의 역할 및 협력수준을 강화할 필요가 있다. 신용위험에 대한 통제에 있어서는 금융시장안정화기구의 효율성 제고를 위해 정부의 역할이 특히 중요한 영역이라고 볼 수 있다. 한국은행의 역할도 지금보다는 더욱 적극적인 방식으로 변화할 필요가 있다. 미국 연준법과는 달리 현행 한국은행법에서는 이례적인 위기상황에서 한국은행이 금융시장의 안정을 위해 어떠한 역할을 할 것인가에 관한 내용이 부재하다. 한국은행에 의한 금융시장안정화기구 재원마련의 장단점을 분석해서 그 필요성이 인정된다면 한국은행의 역할확대를 검토함이 타당할 것이다.

넷째, 민간금융회사들의 도덕적 해이를 완화시킬 장치가 미흡하다. 위기상황에서 정부의 시장개입은 경제전반의 후생을 증가시킬 수 있다는 점에서 정당화될 수 있으나, 그러한 개입으로 인해 금융회사들의 도덕적 해이를 부추길 수 있다는 비판으로부터 자유로울 수 없다. 따라서 도덕적 해이를 완화시킬 수 있는 장치를 마련해야 하는데, 현재의 금융시장안정화기구에서 그러한 고민은 상대적으로 미흡하다 볼 수 있다. 정부에 의한 유동성 공급으로 수혜를 보는 주체들이 일정 부분 그 비용을 부담할 수 있도록 만드는 수단이 필요하다. 정부의 유동성공급을 통해 기업들의 부담을 덜어줘야 한다는 시각도 존재하지만 위기상황이 진정된 이후에 발생할 수 있는 도덕적 해이를 완화시키는 것이 위기관리비용의 관점에서 더욱 중요한 의미를 가질 것이다.

Ⅳ. 해외의 금융시장안정화기구

1. 미국의 금융시장안정화기구

가. 금융시장안정화기구의 종류 및 특징

금융위기 또는 경제위기 상황에서 연준이 미국 정부와 협력해 가동하는 금융시장안정화기구는 크게 금융회사에 대한 유동성 지원 프로그램, 자본시장상품 매입 프로그램, 대출지원 프로그램 등으로 구분해볼 수 있다. 금융회사에 대한 유동성지원 프로그램으로는 PDCF(Primary Dealer Credit Facility)가 대표적이다. PDCF는 다양한 금융상품4)을 담보로 PD들에게 유동성을 공급하여 시장기능을 정상화시킬 목적으로 도입된 프로그램이다. 대출지원 프로그램으로는 PPPLF(Paycheck Protection Program Liquidity Facility), MSNLF(Main Street New Loan Facility) 등이 있다. 대출지원 프로그램은 금융회사들이 개인이나 소상공인들에게 대출을 유지 또는 확대할 수 있게 유동성을 공급하기 위한 목적에서 도입되었다. 본고는 국내 금융시장안정화기구와의 비교를 위해 미국의 자본시장상품 매입 프로그램에 대한 분석을 실시할 예정이며, CP매입을 위해 운영하는 CPFF(Commercial Paper Funding Facility), 회사채매입을 위해 운영하는 PMCCF(Primary Market Corporate Credit Facility)와 SMCCF(Secondary Market Corprate Credit Facility), 그리고 유동화증권 발행지원을 위해 운영하는 TALF(Term Asset-Backed Securities Loan Facility)의 특성을 파악해 보고자 한다.

미국이 위기상황에서 운영하는 금융시장안정화기구들은 공통적으로 관찰되는 뚜렷한 특징을 가지는데, 연준이 재원을 마련하고 운영과정에서 발생하는 신용위험은 미국 정부(재무부)가 부담한다는 점이다. 정부와 연준간의 뚜렷한 역할분담 및 협력체계가 마련되어 있는 것이다. 금융시장안정화기구는 위기상황에서 시장의 기능이 유지될 수 있도록 시장참여자들의 심리를 안정시키는 역할을 담당한다. 그러기 위해서는 위기상황에서 신속히 자금이 투입될 수 있어야 하고 자금투입의 규모도 시장이 안정감을 느낄 수 있도록 대규모이어야 한다. 위기상황에서는 대부분의 금융회사가 유동성 경색을 겪고 있을 가능성이 높기 때문에 금융회사로부터의 출연을 통한 재원마련은 신속성 측면에서 떨어지고 대규모 자금마련에도 한계가 있다. 이를 해결하기 위하여 미국의 금융시장안정화기구들은 민간금융회사들에 자금마련에 대한 의무를 부여하는 것이 아니라 중앙은행인 연준이 발권력을 동원하여 재원을 공급하는 방식을 선택하였다.

재원을 마련한 후 운영과정에서 부각되는 것은 신용위험에 대한 우려이다. 금융시장안정화기구가 신용위험이 내재된 회사채나 CP를 매입하다 보면 디폴트가 발생할 가능성을 배제할 수 없다. 물론 매입과정에서 매입대상에 대한 기준을 설정하여 신용사건 발생가능성을 최대한 억제하려는 노력은 하겠지만 그럼에도 불구하고 디폴트 가능성을 완전히 배제할 수는 없다. 미국에서 금융시장안정화기구가 매입한 상품에서 디폴트가 발생할 때 그 위험은 재무부가 부담하며, 연준은 신용위험으로부터 절연된다. 이는 연준은 통화정책을 담당하는 기관으로서 재원마련에 대한 협력은 가능하지만, 그로부터 발생하는 신용위험을 떠안는 최종주체가 되어서는 안된다는 철학에 기반하는 방식이다. 신용위험을 떠안는 것은 산업정책을 주관하는 재정당국의 영역이라고 보는 것이 타당하다는 것이다. 재무부는 통화안정기금(Exchange Stabilization Fund, 이하 ESF)을 활용해 금융시장안정화기구에 대한 에퀴티 트렌치 투자를 실행함으로써 연준의 재원공급을 디폴트로부터 절연시킨다. 에퀴티 트렌치 투자는 전체 매입금액의 10%를 유지하기 때문에 파산절연이 실제로 이루어질 수 있다는 시장의 신뢰를 획득할 수 있다.

금융시장안정화기구중 CPFF와 TALF의 설립은 2008년 글로벌 금융위기로 거슬러 올라간다. 리먼 브라더스의 파산으로 인해 CP시장의 경색이 극심해지자 연준은 재무부의 협조하에 단기자금시장에 대한 긴급유동성 공급을 위해 2008년 10월 27일 CPFF(2008)를 최초로 설립했다. CPFF는 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 CPFF에 자본투자(Equity investment)를 집행한다. CPFF는 사전적으로 매입이 가능한 CP(이하 적격CP)에 대한 기준을 설정하였고, 이를 엄격히 준수하며 일반CP와 ABCP를 매입한다. 적격CP가 되기 위해서는 만기가 3개월이어야 하고, 주요 신용평가회사로부터 부여받은 CP등급이 A1/P1/F1이상이어야 한다. 수수료는 CPFF 최대 잔액에 대해 10bp가 적용되고, 가격산정은 3개월물 OIS(Over-night Index Swap) 금리+110bp로 한다. 연준은 CP매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 등록된 PD들로부터 적격CP를 매입한다. 2008년에 설립된 CPFF는 2010년 2월 1일까지 적격CP를 매입하였고, 이후 2010년 4월 26일 매입하였던 모든 CP의 만기가 도래함에 따라 운영이 종료되었다. 해당기간 동안 매입하였던 CP에서 디폴트가 발생한 경우는 없어서 전액 만기상환이 완료되었다. 코로나19 팬데믹이 발생하면서 단기자금시장의 경색이 극심해지자 연준은 2020년 3월 17일 CPFF(2020)를 재가동하였다. CPFF(2020)의 기본적인 구조는 CPFF(2008)와 동일하다. ESF는 CPFF(2020)에 대해 100억달러의 자본투자를 집행했다. 2020년 3월 17일 이전에는 A1/P1/F1이었다가 3월 17일 이후 신용등급이 떨어진 CP도 적격CP가 될 수 있으나 떨어진 신용등급이 최소 A2/P2/F2 이상이어야 적격CP의 자격을 가진다. ABCP의 경우 3월 17일 이전에 발행이 없었던 발행자에 대해서는 적격CP의 자격을 인정하지 않는다. CPFF(2020)는 2021년 3월 31일까지 CP를 매입하였고, 매입하였던 모든 CP의 만기가 도래함에 따라 2021년 4월 30일 운영이 완전히 종료되었다. CPFF(2020) 운영과정에서 수수료, 이자 등을 통해 발생한 수입의 규모는 6,496만달러였다. 매입하였던 CP에서 디폴트가 발생한 경우는 없었으며, 연준은 SPV에 대출한 전액을 회수하였다.

TALF는 가계 및 소상공인 신용대출을 지원하기 위한 목적으로 설립된 금융시장안정화기구이다. 리먼 브라더스의 파산으로 인해 가계 및 소상공인 대출 경색이 극심해지자 연준은 2008년 11월 25일 재무부의 협조하에 가계 및 소상공인 대출을 기초자산으로 한 자산유동화증권 지원 프로그램(TALF(2008))을 설립했다. TALF는 CPFF와 유사하게 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 TALF에 자본투자를 집행한다. TALF가 지원할 수 있는 자산유동화증권은 기초자산이 학생대출, 자동차대출, 신용카드론, 중소기업청(SBA)이 보증한 대출 등으로 제한된다. 수수료는 CPFF와 동일하게 10bp가 적용되고, 가격산정은 CLO에 대해서는 30일물 SOFR(Secured Over-night Financing Rate)+150bp, SBA 보증론에 대해서는 연방기금금리(Federal Fund Rate)+75bp, 그이외의 기초자산에 대한 유동화증권은 2년물 OIS금리+125pb로 한다. 연준은 적격ABS 매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 등록된 PD들로부터 적격ABS를 매입한다. TALF에 지원된 자금은 비소구(non-recourse) 방식의 대출 성격을 가지며, 담보로 제공된 ABS를 통해 자산안정성을 유지한다. SPV에 대출된 자금의 만기는 3년으로 제한된다. TALF(2008)는 2009년 3월부터 자산유동화증권시장에 자금을 공급하였고 2010년 6월 30일 종료되었다. TALF(2020)는 2020년 3월 23일 설립되었고, 그 기본구조는 TALF(2008)와 동일하다. ESF는 TALF(2020)에 대해 100억달러의 자본투자를 집행했다. 2020년 12월 31일까지 자금을 공급했다. 신규 자금공급은 해당시점을 기점으로 중단되었지만 이미 공급한 자금의 만기가 남아있기 때문에 TALF(2020)는 아직 운영중에 있으며 2022년 9월 30일 기준 TALF(2020)의 잔액은 10.9억달러이다.

PMCCF와 SMCCF는 회사채시장에 대한 유동성공급을 위해 2020년에 설립되었다. 2008년 글로벌 금융위기시에는 만들어지지 않았으나, 2020년 코로나19 팬데믹 이후 미국 회사채시장에서 나타난 극심한 자금경색을 완화하고자 2020년 3월 23일 연준은 재무부의 협조하에 PMCCF와 SMCCF를 설립하였다. 명칭에서 알 수 있듯이 PMCCF는 회사채발행시장에서 회사채를 매입하는 프로그램이었고, SMCCF는 회사채유통시장에서 회사채를 매입하는 프로그램이다. PMCCF와 SMCCF는 TALF 및 CPFF와 유사하게 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 PMCCF와 SMCCF에 자본투자를 집행한다. ESF의 자본투자 규모는 PMCCF에 대해 500억달러, SMCCF에 대해서는 250억달러였고, 이를 통해 PMCCF는 5,000억달러까지, SMCCF는 2,500억달러까지 회사채를 매입할 수 있었다. CPFF(2020) 및 TALF(2020)와 비교할 때 회사채시장으로 유동성공급이 훨씬 대규모로 이루어졌음을 알 수 있다. 연준은 회사채매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 회사채 발행자 또는 등록된 PD로부터 회사채를 매입한다.

PMCCF는 회사채 발행자에 대해 총액인수방식으로 회사채를 매입하거나 신디케이트론이나 신디케이트회사채의 일부를 매입할 수 있다. PMCCF가 매입할 수 있는 회사채(이하 적격회사채)는 만기가 4년 이하이어야 하고, 신디케이션의 경우 전체 발행액의 25% 이하이어야 한다. 회사채매입프로그램은 기본적으로 소구(recourse)형 대출방식을 따른다. 2020년 3월 22일 기준 신용등급이 BBB-/Baa3 이상이어야 하며, 3월 22일 이전까지는 기준을 만족시키고 있었으나 이후에 신용등급이 떨어진 기업일 경우 최소 BB-/Ba3 이상이어야 한다. 신용등급에 대한 기준은 SMCCF에 대해서도 동일하게 적용된다. 가격산정은 PMCCF의 경우 발행기업마다 시장상황을 고려해서 다르게 적용될 수 있으며, 수수료 100bp가 가산된다. SMCCF의 경우 가격산정에 별도의 수수료가 적용되지 않으며, 공정시장가격으로 회사채를 매입하는데, 발행시장과는 달리 유통시장에서 추가로 수수료를 부과할 경우 회사채보유자들이 SMCCF에 회사채를 매각할 유인이 없기 때문이다. PMCCF와 SMCCF는 2020년 12월 31일에 회사채 매입을 종료하였다. 이후 PMCCF와 SMCCF는 보유하던 자산을 모두 시장에 매각하였고, 2021년 9월 30일 기준 보유자산이 없어 완전히 종료되었다. PMCCF와 SMCCF의 운영과정에서 수수료, 이자 등을 통해 발생한 수입의 규모는 5.58억달러였고, 연준은 SPV에 대출한 전액을 회수하였다.

나. 미국 연준법(Federal Reserve Act)의 규정

미국의 금융시장안정화기구는 연준법에 근거하여 실행되고 있기 때문에 관련된 연준법의 내용을 살펴보는 것은 미국 금융시장안정화기구를 이해하는 데에 있어서 중요한 의미를 가진다. 금융시장안정화기구의 설립에 관한 내용은 연준법 13조 3항(Section 13(3))5)이 규정하고 있다. 연준법 13조는 연준의 권한을 정의하고 있는데, 그중에서도 3항은 이례적인 위기상황에서 은행에 의한 신용공급이 정상적으로 이루어지지 않을 경우 연준에 의한 금융시장안정화기구의 운영방법을 다루고 있다. 연준에 의한 긴급자금공급은 기본적으로 할인(discount) 대출방식으로 이루어진다. 할인의 의미는 이자를 미리 선취하고 담보가치보다 적은 금액을 대출하는 것을 의미한다. 연준법은 미국 정부기관이 보증하지 않은 신용증권을 연준이 직접 매입하는 것을 금지하고 있기 때문에 신용위험이 포함된 상품에 투자하는 기관 또는 그러한 상품을 발행하는 기관을 지원하기 위해서는 연준이 SPV를 설립한 후 간접적으로 할인대출 방식을 통해 지원해야 한다.6)

연준은 이례적인 비상상황에서 연준위원 5인 이상의 동의를 받아 할인방식으로 적격자산(note, draft, bill of exchange) 운영프로그램(program 또는 facility)에 대출을 실시할 수 있다(Section 13(3)(A)). 적격자산에는 신용자산(부채성자산)만 포함되며 주식과 같은 지분증권은 포함되지 않는다. 이러한 비상대출 프로그램의 목적은 금융시장에 유동성을 공급하기 위한 것이며, 부실화되어 가는 금융회사를 구제할 목적이 아님을 분명히 밝히고 있다. 신용위험과 유동성위험을 뚜렷하게 구분하는 접근방식은 연준이 운영하는 금융시장안정화기구에서 공통적으로 관찰되는 특징이다. 비상대출은 납세자들의 세금에 어떠한 손실을 끼쳐서도 안 되며, 납세자의 부담을 방지할 보호장치를 마련해야 한다. 보호장치는 정부에 의한 신용보강(credit protection) 또는 자본투자를 통해 마련된다. 비상대출 프로그램의 운영은 미국 재무부 장관의 사전 승인하에서(prior approval of the Secretary of the Treasury) 이루어져야 하며, 적절한 시기에 질서있는 방법으로 종료되어야 한다(Section 13(3)(B)(i),(iv)). 비상대출 프로그램은 지급불능상태에 빠진 채무기관에 자금이 공급되지 않도록 방지체계를 갖추어야 한다(Section 13(3)(B)(ii)).

연준이 운영하는 금융시장안정화기구에는 의회에 대한 정보보고 의무가 부여되어 있다. 이는 발권력에 의존한 연준 프로그램이 과도하게 남용되는 것을 막고자 하는 정책적 판단의 결과이며, 그 감시 역할을 의회에 부여하고 있는 것이다. 연준 이사회는 정기적으로 비상대출 프로그램의 운영현황을 상원과 하원에 보고해야 한다. 보고에는 비상대출 프로그램을 실행해야 하는 이유, 지원을 받게 될 대상자에 대한 정보, 지원 일정ㆍ규모ㆍ방식, 주요한 지원 조건(대출만기, 담보자산 내역, 대출지원을 통해 발생한 수수료ㆍ이자ㆍ기타 부대수입 등, 납세자가 부담하게 될 예상비용 등) 등에 관한 정보가 포함되어야 한다(Section 13(3)(C)).

다. 미국의 통화안정기금(ESF)

통화안정기금(ESF)은 미국 재무부가 통상적으로는 외환시장개입을 위해 사용하는 비상용 예비기금이다. 미국 정부는 ESF를 활용하면서 국내 통화공급량에 직접적인 영향을 미치지 않은 채로 통화환율에 영향력을 행사할 수 있게 되었다. ESF는 1934년 1월에 최초로 설립되었고, 1934년 4월부터 본격적으로 활용되기 시작했다. 설립목적은 외환시장 개입뿐만 아니라 외국정부나 외국 중앙은행에 대한 신용공여를 포함한다. ESF의 사용은 미국 재무부장관의 명시적인 승인하에서만 가능하다. ESF는 미국 재무부가 국제 통화 및 금융정책 수행함에 있어서 중요한 정책적 수단을 제공한다. ESF의 사용은 설립목적을 달성하기 위한 경우뿐만 아니라 재무부가 다양한 정책목적을 수행함에 있어서 활용할 수 있도록 재무부장관에게 상당한 수준의 재량권이 인정되고 있다.

ESF 운영의 가장 중요한 목적은 외환시장개입에 있다. 그런데 반복되어 나타나는 경제위기 또는 금융위기 상황에서 ESF의 운영목적에는 금융시장안정이 추가되었다. 2008년 글로벌 금융위기 과정에서 미국 재무부는 금융시장에 유동성을 공급하기 위한 보증재원으로 500억달러 규모의 ESF 자금을 일시적으로 활용할 것임을 발표했다. 그리고 2020년 코로나19 팬데믹 사태에서는 전염병 사태에 대한 대응으로써 ESF를 활용한 금융시장안정화기구의 실행을 한시적인 조건을 달아 의회가 승인하였다. 외환시장 개입 및 외국정부에 대한 신용공여라는 전통적인 ESF의 활용목적에 위기상황에서 금융시장의 안정성 강화가 새로운 목적으로 추가된 것이다.

ESF의 주된 운영형태는 크게 세가지로 구분된다. 외국통화의 매입이나 매도, 특별인출권(SDR)의 매입이나 활용, 외국정부나 이에 준하는 기관에 대한 대출 또는 신용공여가 ESF의 전통적인 운영형태였다. 코로나19 팬데믹 이후에 ESF의 운영형태에는 시장안정화기구에 대한 직접대출, 대출 보증과 자본투자가 추가되었다. ESF에 의한 직접대출, 대출 보증 및 자본투자의 총량은 5,000억달러를 초과할 수 없다. 이러한 한도의 적용에 있어서 재무부는 460억달러는 직접대출의 목적으로, 나머지 4,540억달러는 대출 보증과 자본투자의 목적으로 사용하였다.

ESF의 자산현황을 살펴보면 코로나19 팬데믹에 대한 대응과정에서 ESF의 자산이 급격히 늘어났다는 점이 관찰된다. 코로나19 팬데믹 발생이전인 2019년 9월말 기준 ESF의 자산규모는 933.2억달러로 나타나지만, 코로나19 팬데믹 이후인 2020년 9월말 기준 자산규모는 무려 6,764.1억달러로 코로나19 팬데믹 이전 기간에 비해 약 7배 규모로 폭증했다. 자산폭증의 가장 중요한 이유는 정부로부터의 기금책정액이 큰 폭으로 증액되었다는 점이다. 미국 정부는 코로나19 팬데믹에 대한 경기부양책을 실행하기 위한 목적으로 2020년에 ESF에 대한 책정금을 5,000억달러 증액했다. 이외에도 ESF가 재원마련을 위해 Fiscal Service로부터 871억달러를 차입했다는 점도 자산증가의 중요한 원인으로 작용했다. 금융시장에 대한 유동성 공급 및 경기부양을 위한 프로그램을 안정적으로 지원하기 위해서 ESF의 자산은 급격히 늘어날 수 밖에 없다. 자산증가의 핵심은 정부로부터의 책정금 확충에 있으며, 일부 부족한 재원은 차입을 통해 마련하고 있음이 관찰된다.

ESF의 자산 확충은 금융시장안정화기구의 신뢰성 확보에 있어서 핵심적인 사안이 된다. 금융시장안정화기구는 위기상황에서 신용자산에 대한 자금집행이 핵심적인 사업이기 때문에 신용위험의 발생 가능성으로부터 자유로울 수 없다. 그러한 신용위험을 통제하기 위해서는 손실에 대한 보전이 확실히 이루어져야 하는데, 이는 손실발생시 투입할 수 있는 재원이 있음을 시장에 확실히 인식시켜야 확보될 수 있다. 미국 정부는 금융시장안정화기구에 대한 시장신뢰를 두텁게 확보하기 위하여 이에 대한 재원마련을 대규모로 집행하고 있음을 알 수 있다.

2. 유럽의 금융시장안정화기구

유럽의 금융시장안정화기구는 ECB(European Cental Bank)에 의해 운영되고 있으며 개별 회원국은 재정정책을 통해 위기상황에 대응하는 방식의 접근법을 따르고 있다. ECB의 시장안정화 정책은 미국이나 일본의 접근방식과는 차별화된 모습을 보여주는데 이는 ECB가 중앙은행으로서 가지는 경제적ㆍ정치적 위치가 다르기 때문이다. ECB는 EU회원국들에 대한 중앙은행의 역할을 담당하기 때문에 다른 국가들의 중앙은행에 비하여 보다 엄격한 정치적 독립성을 갖추고 있다.7) 이로 인해 특정 회원국의 국채매입을 통한 유동성 공급에 상당히 수동적인 포지션을 견지해왔고, 회원국 기업이 발행하는 회사채의 매입에는 더욱 보수적인 관점을 유지하였다. ECB의 이러한 관점은 2008년 글로벌 금융위기에 대한 대응과정에서 뚜렷하게 관찰되는데, 위기상황에서 신속히 자금을 투입한 미국의 경우와는 대조적으로 ECB는 회원국 국채매입을 통한 유동성 공급에 소극적인 관점을 유지했다. 물론 위기상황이 진행되는 과정에서 결국 양적완화와 같은 비전통적인 통화정책을 실시하기는 했지만 글로벌 금융위기에 대한 초기대응은 미국이나 아시아권 국가들에 비해 상당히 보수적으로 진행되었다. ECB의 정책대응에 뚜렷한 변화가 나타나기 시작한 것은 유럽 재정위기 이후부터라고 평가할 수 있다. 회원국에서 재정위기가 급속히 진행됨에 따라 ECB는 국채매입(SMP), 저금리 유동성 공급조치(LTRO), 무제한 국채매입(OMT) 등의 조치를 통해 적극적으로 유동성을 공급하기 시작했다. 그런데 전술한 유동성 공급조치는 통화정책의 전달경로 확보를 목적으로 실시된 통화정책의 일환으로 강조되었기 때문에 미국의 사례처럼 금융시장안정화를 직접적인 목적으로 한 시장안정화조치의 성격은 상대적으로 약하다고 평가할 수 있다.

ECB가 실시하고 있는 유동성 공급장치중 상대적으로 미국의 사례와 비슷한 성격으로 해석할 수 있는 조치로는 2016년 3월에 도입된 CSPP(Corporate Sector Purchase Programme)를 들 수 있다. ECB는 2016년 3월 통화정책회의에서 양적완화 프로그램의 확장계획을 발표하면서 매입대상 자산 유형을 확대했다. 이전까지는 양적완화 대상자산을 국채로만 한정했으나 회사채와 CP까지 그 범위를 확대한 것이다. 지원방식을 살펴보면 유로존 6개국(독일, 프랑스, 스페인, 이탈리아, 벨기에, 핀란드)의 중앙은행을 통해 발행 및 유통시장에서 유로존 내 비은행회사(보험회사 포함, 회원국 국적의 기업에 대해서만 허용)들이 발행한 투자등급(BBB- 이상)의 회사채와 A-2/P-2/F3/R2-L등급 이상의 CP를 매입하는 것을 허용하였다. 잔존만기는 CP의 경우 발행만기는 1년 이하, 그리고 잔존만기는 28일 이상이어야 한다. 회사채의 경우 발행만기는 1년 이상이어야 하고, 잔존만기는 6개월~30년까지만 허용된다. 회사채에 대해서는 발행잔량에 대한 규정이 없으나, CP에 대해서는 발행잔량이 1,000만유로 이상이어야 한다. ECB의 CSPP는 미국 연준의 회사채 매입프로그램과는 달리 회사채와 CP를 구분하여 유동성을 공급하는 방식을 따르지는 않으며 한가지 프로그램으로 양쪽 영역에 대한 유동성을 공급한다. 또한 미국처럼 단일 중앙정부가 신용위험을 전적으로 흡수할 수 있는 구조가 아니며, CSPP의 운영과정에서 발생하는 수익 또는 손실은 회원국에 의해 분담되는 방식을 따른다. ECB의 이러한 접근방식은 복수 국가가 회원국으로 가입하는 유럽연합의 정치적 상황을 반영한 결과이며, 미국의 사례와 비교할 때 운영방식이 더 복잡하다고 평가할 수 있다.

3. 일본의 금융시장안정화기구

일본의 금융시장안정화기구는 양적완화의 매입대상 자산의 범위를 회사채와 CP까지 확장하는 방식을 따르고 있다는 점에서 미국의 접근법보다는 유럽의 접근법과 유사한 특징을 가진다. 통상적인 양적완화가 국공채를 대상으로 하는 것과 대조적으로 일본은 양적완화를 회사채, CP, REIT, 주가지수를 기초자산으로 하는 ETF까지 폭넓게 허용하고 있다. 일본은행은 2008년 글로벌 금융위기가 발생하자 공개시장조작(OMO) 대상증권에 기존의 국채뿐만 아니라 CP와 회사채까지 허용하는 방식으로 대상자산을 확대했다. 이는 미국이나 우리나라와는 상당히 대조적인 유동성 공급방식이라고 평가할 수 있다. 글로벌 금융위기 대응과정에서 허용된 CP 및 회사채매입은 이후 2012년 이후 장기간 실행되고 있는 아베노믹스를 통해 일본의 양적완화정책에서 일관되게 유지되어 왔다.

기업의 자금조달상황이 악화된 것을 개선시키기 위하여 일본은행은 리스크자산을 적극적으로 매입하는 제도를 도입했는데, 공개시장조작을 통해 회사채와 CP를 매입했다. 회사채에 대해서는 사채 및 기업에 관한 증서대출채권 적격성 판정 등에 관한 특칙을 제정하여 적격담보의 범위를 BBB등급까지 확대하였다. CP에 대해서는 적격담보취급기본요령에 CP 등 매입 기본요령을 제정하여 A-1이상의 신용등급을 가지고 잔존만기 3개월 이내의 CP 매입을 허용하였다. 회사채 매입과 CP 매입 프로그램에 대해 각각 매입 최대한도액을 설정하였고, 일본은행의 의결을 통해 매입한도를 지속적으로 증액하는 방식으로 매입량을 증가시켜왔다. 일본은행은 양적완화를 시행함에 있어 CP 및 회사채 매입과 더불어 REIT와 ETF까지 매입을 허용하는 상당히 이례적인 조치를 시행해왔다. REIT는 AA등급 이상의 부동산투자신탁을 매입대상으로 설정하고 있으며, ETF의 경우 동경주가지수 또는 일경평균주가연동 ETF를 매입대상으로 허용하고 있다.

일본의 양적완화조치는 신용위험에 대한 부담을 전적으로 중앙은행이 담당하고 있다는 점에서 미국과 유럽의 금융시장안정화조치와 구별된다. 일본은행의 자산매입은 다른 국가에서 비슷한 사례를 찾기 어려울 정도로 대규모로 실행되고 있는데, 자산매입과 관련하여 일본정부가 신용위험에 대해 특별한 조치를 취하고 있지 않다. 이는 자산매입에 따른 신용위험의 부담이 전적으로 일본은행에 의해 이루어지고 있음을 의미한다. 중앙은행에 의한 유동성 공급이 양적완화의 방식을 따르고 있다는 점과 일본이 가지고 있는 경제구조의 특성을 감안할 때 불가피한 측면이 있다고 볼 수 있겠지만, 이는 다른 국가들로 일반화되기가 상당히 어려운 특성이라고 볼 수 있다. 특히 중앙은행이 대규모로 주식시장에 개입하고 있다는 점은 다른 국가들에서 찾아보기 어려운 사례이다. 실제로 일본은행은 2017년 3월 상장기업의 23%에 대해 대주주의 지위를 가지고 있었는데, 2018년 3월에는 대주주 지위의 비중이 40%, 2019년 3월에는 무려 그 비중이 49.7%까지 상승하였다. 중앙은행에 의한 과도한 개입이 이루어지고 있다고 평가할 수 있으며, 주식시장에서의 시장원리를 상당수준 훼손하고 있다는 비판을 받고 있기에 국내에서 참조하기는 어려운 방식으로 평가해야 할 것이다.

Ⅴ. 금융시장안정화기구의 비교 및 정책적 시사점

2008년 글로벌 금융위기와 2020년 코로나19 팬데믹을 극복하는 과정에서 주요 국가들은 금융시장안정화기구의 운영경험을 축적할 수 있었다. 미국의 경우 위기상황에서 통화정책적 대응과 금융시장안정화기구의 역할을 상대적으로 뚜렷하게 차별화시켰다. 반면 유럽의 시장안정화조치는 통화정책의 전달경로 확보를 목적으로 실시된 통화정책의 일환으로 강조되었기 때문에 금융시장안정화기구로서의 성격은 상대적으로 약하다고 평가할 수 있다. 일본의 경우 자산매입은 다른 국가에서 비슷한 사례를 찾기 어려울 정도로 대규모로 실행되고 있는데, 자산매입에 따른 신용위험의 부담이 전적으로 일본은행에 의해 이루어지고 있다. 이는 다른 국가들로 일반화되기가 상당히 어려운 특성이라고 볼 수 있다. 이러한 차이점들을 종합적으로 평가할 때 미국의 사례가 금융시장안정화기구 운영에 대해 우리에게 더 다양한 시사점을 제공하고 있다.

미국의 금융시장안정화기구에서 나타나는 특징을 우리나라 금융시장안정화기구와 비교해 볼 때 다음과 같은 차이점들을 발견할 수 있다. 첫째, 금융시장안정화기구의 재원마련을 민간금융회사에 크게 의존하고 있는 우리나라와는 달리 미국은 중앙은행의 발권력을 활용해 금융시장안정화기구의 재원을 마련하고 있다. 중앙은행의 발권력을 활용하는 것에 대해 비판적인 견해가 존재하는 것이 사실이지만, 여기에는 자금조달의 신속성, 대규모 장기자금조달의 용이성과 같은 장점이 있음을 주목할 필요가 있다. 민간금융회사를 통해 재원을 마련하는 데에는 출연금 배분 및 동의와 같은 다자간 의견조율 절차가 필요하기에 신속성이 무엇보다도 중요한 금융위기 또는 경제위기 상황에서는 중앙은행에 의한 재원마련이 상대적으로 유리할 가능성이 높다. 또한 민간에 의한 자금출연은 최초에 예상했던 수준 이상의 자금동원이 필요할 경우 자금출연의 신축적인 확장에 제약이 나타날 가능성이 크며, 위기상황이 장기간에 걸쳐 지속될 경우에도 효과에 한계를 보일 가능성이 높다.

둘째, 미국은 금융시장안정화기구의 운영과정에서 현실화될 수 있는 신용위험을 재정당국(재무부)이 부담하는 반면, 우리나라의 경우 신용위험이 금융시장안정화기구에 출연하는 민간금융회사로 전이될 수 있다. 신용위험에 대한 부담을 정부가 떠안을 경우 도덕적 해이에 대한 비판이 나올 수 있다. 그러나 위기상황에서는 도덕적 해이에 대한 우려보다 시장기능의 유지에 훨씬 높은 우선순위를 부여할 필요가 있다. 이는 위기상황에서 정부에 의한 신용위험부담이 충분히 정당화될 수 있음을 의미하며, 우리나라 제도운영에 있어서도 참고할만한 사안이다.

셋째, 미국의 금융시장안정화기구는 시장별로 세분화되어 있으며, 그중에서도 단기자금시장에 대한 개입을 가장 신속히 실행하는 반면, 우리나라에서는 시장별 세분화 수준이 낮고 단기자금시장의 중요성에 대한 인식이 낮은 편이라 볼 수 있다. 전술한 바와 같이 미국의 금융시장안정화기구는 CP시장, 회사채발행시장, 회사채유통시장, 자산유동화증권시장 등으로 세분화되어 정밀타격 방식으로 운영된다. 그리고 2008년과 2020년의 사례에서 알 수 있듯이 기업에 대한 자금공급을 위해 CP시장으로의 개입이 가장 신속하게 일어나고, 그 이후에 회사채시장과 자산유동화증권시장으로의 개입이 일어난다. 이와는 대조적으로 우리나라의 경우 회사채시장과 CP 및 전자단기사채로 구성되는 단기자금시장간의 세분화가 뚜렷하지 못하다. 채안펀드로 회사채와 CP를 모두 매입하는 방식을 가진다. P-CBO도 유동화증권시장에 대한 지원형식을 가지지만 그 경제적 실질은 회사채시장지원에 가깝다고 보아야 할 것이다. 그리고 단기자금시장에 대한 신속한 개입 필요성에 대한 인식도 미국에 비해 상대적으로 낮다고 평가할 수 있다.

넷째, 미국의 경우 유동성 지원에 대한 비용을 가산금리 책정을 통해 확실하게 가격에 반영하는 반면, 우리나라에서는 기업이나 투자자에 대한 지원이 강조되기 때문에 유의적인 가산금리의 부과가 사실상 부재하다. 미국의 금융시장안정화기구의 운영방식을 살펴보면 CPFF는 110bp, TALF는 75~150bp, PMCCF는 100bp의 가산금리가 적용된다. SMCCF만 가산금리의 적용이 면제되는 정도이다. 외견상 상당히 높은 수준의 가산금리가 적용된다고 볼 수 있는데, 이를 통해 금융시장안정화기구의 적용이 정부에 의한 보조금 지급성격을 전혀 가지지 않음을 알 수 있다. 또한 금융시장안정화기구에 의해 혜택을 보는 당사자가 그 혜택에 대한 비용을 지불하는 것이 당연하다는 철학이 반영된 결과로도 볼 수 있다. 이와는 대조적으로 국내의 금융시장안정화기구는 시장금리 또는 더 낮은 수준에서 가격을 산정하는 것이 일반적이다. 위기상황에서 기업에 대해 주어지는 혜택에 대해 비용을 지불하라고 요구하는 것은 너무 가혹하며 오히려 혜택을 주어 기업이 버틸 수 있도록 지원할 필요가 있다는 인식이 강한 것이다. 가산금리의 부재로 인해 금융시장안정화기구에 의한 긴급유동성 지원이 지원대상의 모럴헤저드를 부추길 수 있다는 우려가 이어지고 있다. 유동성공급의 혜택을 보는 당사자가 그에 대한 비용을 일정 수준 지불하는 것은 합리적인 금융시장안정화기구 설계방식으로 평가할 수 있을 것이다.

다섯째, 미국의 금융시장안정화기구는 주식시장으로의 개입은 일반적으로 하지 않는 반면, 국내의 경우에는 주식시장으로의 개입도 이루어진다. 연준이 운영하는 여러 가지 종류의 금융시장안정화기구들을 살펴보면 부채성 자금거래가 이루어지는 영역에서 운영이 이루어지고 있음을 발견할 수 있다. 그러나 주식시장으로의 자금유입이 이루어지는 프로그램을 발견하기는 어렵다.

여섯째, 미국의 경우 중앙은행에 의한 금융시장안정화기구의 운영이 연준법에 의해 중앙은행의 권한으로 규정되어 있다. 연준은 은행에 의한 유동성 공급이 제대로 이루어지지 않고 있다고 판단되면 연준이 SPV를 설립한 후 이에 대해 비상대출을 실행함으로써 금융시장안정화기구를 능동적으로 운영한다. 반면 한국은행은 한국은행법에 금융시장안정화기구의 운영권한에 대한 규정이 전무하다. 이로 인해 한국은행은 SPV를 설립할 권한이 없다고 해석되며, SPV는 금융기관이 아니기 때문에 이에 대한 한국은행 대출도 가능하지 않다는 견해가 지배적이다. 한국은행에 시장안정화에 있어 주도적인 역할을 부여할 필요가 있으며, 한국은행법의 개정도 검토해 볼 수 있을 것이다.

일곱째, 금융시장안정화기구가 시장의 신뢰를 받기 위해서는 신용위험이 현실화되었을 때 이를 해결할 수 있는 재원이 확실히 확보되어 있음을 시장에 인식시켜야 한다. 중앙은행의 재원출연을 파산위험으로 절연시킬 수 있는 가장 확실한 방법이다. 미국의 경우 ESF가 그러한 역할을 충실히 수행하고 있음을 확인할 수 있다. 반면 국내에서는 정책금융기관이 신용위험을 일부 흡수하고 있지만, 한국은행이 재원을 출연하였을 때 발생할 수 있는 신용위험을 절연시킬 수 있는 기금의 존재가 뚜렷하지 않다. 이는 한국은행에 금융시장안정화기구의 운영주체 역할을 부여함에 있어서 가장 중요한 장애요소가 될 것으로 예상된다. 이상의 비교를 표로 정리하면 아래와 같다.

금융시장의 환경이 극심하게 나빠질 때 정부의 시장안정화 조치는 신속하고 과감하게 실행되어야 한다. 위기의 징후가 뚜렷해지면서 금융회사나 일반 기업의 파산위험성이 급증한다면 금융시장안정화 조치는 즉각적으로 그리고 대규모로 집행될 필요가 있다. 시장금리 급등으로 인해 국내 금융시장환경은 점차 심각한 상황으로 변해가고 있다. 금융시장안정화기구의 필요성이 2020년 3월에 이어 다시 급격히 커지고 있으며, 지난 10월 23일에 발표된 정부의 시장유동성공급조치는 이러한 시장상황에 대해 신속하고 적절한 대응방향성을 가진다고 평가할 수 있다. 다만, 향후 시장의 유동성 경색이 다시 나타날 가능성이 있음을 감안하여 추가적인 대응책을 선제적으로 마련할 필요성도 크다.

추가적인 대응책 마련에 있어서 우선적으로 고려해야 할 점은 한국은행과 정부의 역할을 어떠한 방식으로 설정할 것인가에 관한 사안일 것이다. 금융시장안정화기구의 운영에 있어서 한국은행의 역할은 명확하다고 볼 수 있는데, 기구 운영을 위한 재원마련 역할을 담당할 필요가 있다. 전술한 바와 같이 위기상황이 도래했을 때 다수의 민간금융회사들은 유동성 제약을 경험하고 있을 가능성이 높기 때문에 금융시장안정화기구의 운영을 위한 자금 출연에 부담을 느낄 것이다. 또한 출연한 자금이 장기간 묶이게 되는 상황과 추가적인 재원마련이 필요한 경우에 대한 부담도 존재한다. 따라서 시장상황의 악화와는 일정 수준 절연되어 있으며 공급량에 상당한 유연성을 가진 재원마련 경로가 필요한데, 중앙은행의 발권력을 이용한 접근법은 그 대안으로 검토될 수 있는 잠재력을 가진다. 한국은행은 코로나19 팬데믹 대응과정에서 회사채와 CP 매입을 위해 설립된 SPV에 대해 금융통화위원회의 의결을 통해 대출을 실시한 사례가 있다. 미국의 금융시장안정화기구와 상당히 유사한 접근법으로 볼 수 있으며, 필요하다면 한국은행법의 개정을 통해 SPV 대출방식을 명문화함으로써 금융시장안정화기구의 운영을 제도적으로 뒷받침하는 방법을 고려해 볼 수 있을 것이다. 다만 이러한 접근법이 시도되기 위해서는 대출에 수반되는 신용위험을 한국은행 이외의 주체가 부담할 수 있는 방안이 마련되어야 하고, 금융시장안정화기구에 대한 한국은행의 대출이 남용되지 않도록 만드는 통제장치도 필요할 것이다.

한국은행에 의한 재원마련과 더불어 우선적으로 고려할 필요성이 있는 부분은 정부에 의한 신용위험의 통제이다. 한국은행은 발권력을 이용하여 재원공급의 역할을 담당할 수 있지만, 운영과정에서 발생하는 신용위험을 부담하기에 적절한 주체라고 평가하기 어렵다. 한국은행은 통화정책의 실행, 인플레이션 통제, 금융안정유지 등을 목적으로 설정하고 있지만, 일반기업의 부도위험을 부담하는 것은 한국은행의 역할을 벗어난다고 볼 수 있다. 금융시장안정화기구의 운영과정에 발생할 수 있는 신용위험을 통제하는 것은 다양한 산업정책을 통해 국가경제를 관리하는 정부의 역할로 간주함이 타당할 것이다. 따라서 재원마련은 한국은행에 맡기되 운영과정에서 발생하는 신용위험은 정부가 부담하는 방식으로 협력체계를 마련하는 것은 금융시장안정화기구의 효율적 운영에 중요한 의미를 가진다. 정부가 신용위험을 부담하기 위해서는 시장이 신뢰할 수 있는 방법으로 부도발생시 자금을 투입할 수 있어야 한다. 시장의 신뢰를 확보할 수 있는 가장 효과적인 방법은 신용사건 발생에 대비하여 기금을 설치하는 것이다. 금융시장안정화기구의 운영상 발생할 수 있는 신용사건을 충분히 흡수할 수 있는 수준으로 기금을 설치하여 관련된 예산을 배정하는 방안을 검토해 볼 수 있을 것이다.

금융시장안정화기구는 위기상황을 대비하기 위한 제도이기 때문에 위기가 발생하기 전에 그 실행방법과 절차에 대해 충분한 검토가 이루어져야 하고 이를 준칙화시켜야 한다. 준칙화되어 있느냐 아니냐는 분초를 다투는 위기상황에서 기업의 생사를 가르는 중요한 차이를 만들 수 있다. 국내의 금융시장안정화기구들은 여러번의 실행경험이 축적되어 있음에도 불구하고 재원마련과 위험부담 측면에서 준칙화의 정도가 상대적으로 떨어진다고 평가할 수 있을 것이다. 제도개선을 위한 적극적인 노력이 필요해 보인다.

1) 금융위원회(2020. 3. 19), 금융위원회(2020. 3. 24), 금융위원회(2020. 3. 27)

2) 기획재정부(2020. 5. 20), 금융위원회(2020. 7. 17)

3) 한국은행은 금융통화위원회의 의결을 통해 SPV에 대한 대출을 승인했다(2020. 7. 17).

4) 국채, 투자등급 회사채, 국제기구채, CP, 지방채, MBS 등 담보가능자산의 범위가 넓다.

5) Federal Reserve Act, Section 13. Power of Federal Reserve Banks, 3. Discounts for individuals, partnership, and corporations

6) 한국은행(2020. 4. 1)

7) 강유덕(2014)

참고문헌

강유덕, 2014,『유럽 재정위기에 대한 유럽중앙은행의 대응과 역할 변화』, 대외경제정책연구원, 정책연구 브리핑 14-31.

금융위원회, 2020. 3. 19, 코로나19 대응을 위한 민생ㆍ금융안정 패키지 프로그램, 보도자료.

금융위원회, 2020. 3. 24, 코로나19 관련 금융시장 안정화 방안, 보도자료.

금융위원회, 2020. 3. 27, 14개 유관기관이 함께 민생ㆍ금융안정 패키지 프로그램 100조원+@를 차질없이 이행해나가겠습니다, 보도참고자료.

금융위원회, 2020. 7. 17, 저신용등급 포함 회사채ㆍ기업어음(CP) 매입기구인 기업유동성지원기구(SPV)가 설립되어 지원을 개시합니다, 보도참고자료.

기획재정부, 2020. 5. 20, 제4차 비상경제 중앙대책본부 회의 개최, 보도자료.

한국은행, 2020. 4. 1, 연준법 13조3항(긴급대출제도)의 주요 내용 및 적용사례, 조사연구.

금융투자협회 www.kofia.or.kr

블룸버그 www.bloomberg.com

통계청 www.kostat.go.kr

한국은행 www.bok.or.kr

Board of Governors of the Federal Reserve System

www.federalreserve.gov

미국 연준과 한국은행의 기준금리 인상기조가 이어짐에 따라 글로벌 경기침체에 대한 우려가 커짐과 동시에 국내외 금융시장 불안요소가 뚜렷하게 증가하고 있다. 인플레이션을 억제하기 위해 실행되고 있는 통화긴축정책은 소비위축을 초래할 가능성이 높고 기업의 투자유인도 떨어뜨리기 때문에 경기침체는 점차 뚜렷해질 것이라 예상할 수 있다. 기업들은 전반적인 실적부진을 피하기 힘들 것이다. 한편 통화긴축은 시중유동성을 축소시키는 가장 중요한 요인이라 볼 수 있다. 유동성의 축소는 금융회사에만 국한되는 것이 아니라 일반 기업과 가계의 경제활동에 직접적인 영향을 미친다. 경기침체로 인해 기업으로의 현금유입이 줄어들고, 유동성 감소로 인해 자금조달환경마저 나빠지는 상황이 겹쳐지면 금융시장의 자금공급기능이 마비될 위험성이 커진다. 이러한 상황에서 금융시장안정화기구의 필요성은 선명하게 부각된다.

금융시장안정화기구는 자금시장 경색기에 시장의 자금공급기능을 정상으로 유도하기 위하여 마련된 장치이다. 시장유동성이 축소되면서 기업도산에 대한 불안감이 커질 때에는 시장의 자금공급기능이 급속히 퇴화된다. 유동성이 시장으로부터 급속히 빠져나갈 때에는 부실이 누적되어 신용위험이 높아지는 기업들뿐만 아니라 건전한 자산을 보유하고 있는 기업들에 대한 자금공급도 다 같이 위축된다. 기업의 경영활동이 기본적으로 부채성자금에 상당부분 의존하고 있기 때문에 시장의 전반적인 유동성 경색시기에는 건전한 기업들마저 자금확보에 어려움을 겪으면서 예상치 못한 고비를 맞을 수 있다. 건전한 기업들마저 자금압박으로 인해 부도위기에 몰린다면 국가경제 전체에 상당한 충격을 줄 수 있는데, 이러한 상황에서 시장자금흐름의 물꼬를 트는 역할은 정책당국을 제외하면 기대할 수 있는 곳이 없을 것이다. 정책당국의 시장개입이 정당화될 수 있는 이유이다.

시장의 공포감이 시장참가자들의 합리적인 의사결정을 압도할 때 시장에서는 경쟁적인 자산매각이 이루어질 위험성이 커지고, 그 과정에서 정상자산의 부실화로 인한 비용이 급증할 수 있다. 패닉셀링에 의한 무질서한 시장붕괴를 막고 시장기능이 일부라도 정상적으로 작동될 수 있도록 만들기 위해서 금융시장안정화기구를 통한 정부의 시장개입은 합리적인 판단이라 볼 수 있다. 시장안정에 따른 경제주체의 후생도 증가할 것으로 예상할 수 있다. 지난 10월 23일에 발표된 정부의 회사채 및 단기자금시장 유동성 공급조치는 시장기능회복에 있어서 긍정적이고 유의적인 영향을 미칠 것으로 평가할 수 있다.

2022년 10월에 접어들면서 국내 금융시장에는 자금경색 현상이 뚜렷하게 나타났다. 가파른 시장금리 상승기조로 인해 투자자들은 투자시기를 늦추고자 하는 욕구가 강해진 반면 기업으로의 현금유입은 실물시장과 금융시장 양쪽에서 모두 축소되었다. 정부의 신속한 시장개입을 통해 자금경색 현상이 완화될 것으로 예상할 수 있지만, 통화긴축이 지속되고 있어 자금경색은 향후 재차 부각될 가능성이 높을 것으로 보인다. 특히 기준금리의 정점은 2022년이 아니라 2023년에 나타날 가능성이 크다. 이는 경제주체의 이자부담이 2023년에 절정을 이루게 됨을 의미하며, 금리정점 이후 자금경색이 재차 나타날 수 있음을 이해할 필요성이 있다. 과거의 경험들을 살펴보면 금리정점 이후 일정기간이 지나서 대규모 시장경색이 현실화되었던 사례들이 있었다. 연준의 기준금리 인상이 유례를 찾기 어려울 정도로 가파르게 진행되고 있음을 감안할 때 2023년에 강도 높은 자금경색기간이 찾아올 가능성을 배제하기가 어렵다. 추가적인 금융시장안정화기구를 마련할 필요성을 제기해 볼 수 있으며, 앞으로 찾아올 수 있는 자금경색상황은 이전에 비해 더 강도가 높을 수 있음을 고려하여 체계적인 제도개선 방안을 마련하는 것은 중요한 의미를 가진다.

1997년 외환위기, 2008년 글로벌 금융위기, 2020년 코로나19 팬데믹 위기 등을 겪으면서 우리경제는 위기에 대한 대응능력을 시험받아 왔고, 그 과정에서 많은 경험을 축적하였다고 평가할 수 있다. 위기의 전이경로, 발생과정에서 특히 취약성이 있는 섹터, 위기대응방안의 성격 및 재원마련 등에 관하여 의미있는 시도들이 시행되었고, 그 유효성에 대한 이해도를 꾸준히 높여 올 수 있었다. 그럼에도 불구하고 아직 국내의 금융시장안정화기구에는 기능적 효율성을 개선할 수 있는 여지가 있다고 평가할 수 있다. 이에 본고는 자금경색기에 활용될 수 있는 금융시장안정화기구의 유형을 검토하고, 향후 발생할 수 있는 대규모 신용사건에 대비하기 위한 금융시장안정화기구의 정비방향을 모색해보고자 한다. 금융시장안정화기구의 발전방향을 모색하기 위해서 비교분석론에 기반한 방법론을 활용한다. 구체적으로는 2008년 글로벌 금융위기와 2020년 코로나19 팬데믹 위기 과정에서 미국, 유럽, 일본이 시도한 금융시장안정화기구의 특징을 살펴보고, 이를 국내 접근방식과 비교함으로써 정책적 시사점을 도출하고자 한다.

Ⅱ. 국내 금융시장 불안요소에 대한 분석

현재 우리나라 금융시장의 다양한 영역에서 시장불안 요소들이 관찰되고 있다. 시장금리의 상승세, 신용스프레드의 확대, 단기금융상품에 의한 장기물의 대체, 환율 급등 등이 그것이다. 금융시장의 거의 대부분의 영역에서 변동성이 확대되고 불안감이 노출되는 이유는 글로벌 중앙은행들, 특히 미국 연준이 가파른 기준금리인상 기조를 유지하고 있다는 데에서 찾을 수 있다. 글로벌 중앙은행들이 기준금리 인상을 서두르는 이유는 지나치게 높아진 인플레이션을 통제하기 위함이다. 미국의 경우 소비자물가지수(CPI) 기준 인플레이션은 40년 만에 최고치를 기록하고 있다. 2021년 1월 1.4%(전년 동월대비 기준)에 불과하던 미국의 인플레이션은 2021년 12월 7%까지 폭증하였고, 2022년 6월에는 9.1%에 이르렀다. 국내의 경우도 인플레이션의 절대적인 수준은 미국보다 낮지만 상황은 비슷하다. 2021년 1월 0.9%(전년 동월대비 기준)에 불과하던 국내 인플레이션은 12월 3.7%로 상승했고, 2022년 7월에는 6.3%까지 높아졌다.

연준은 2021년 하반기부터 뚜렷해지기 시작한 인플레이션을 억제하기 위하여 2022년 3월부터 기록적인 속도로 기준금리를 인상하기 시작했다. 2022년 1월 상단기준으로 0.25%를 기록했던 연준의 기준금리는 2022년 3월 0.50%로 상승했고, 5월 1.0%, 6월 1.75%, 7월 2.50%, 9월 3.25%로 높아졌다. 연준은 11월에 기준금리를 4.0%까지 상승시켰으며, 12월에는 4.5%로 인상했다. 연준의 기록적인 금리인상 속도는 글로벌 금융시장에 큰 충격을 주고 있으며, 한국은행의 통화정책에도 중대한 영향을 미치고 있다. 한국은행은 코로나19 팬데믹 사태 이후 오랜 기간 기준금리를 0.5%로 유지해오다, 서방국가들에 비해 이른 시기인 2021년 8월부터 기준금리를 인상하기 시작했다. 이후에도 점진적인 기준금리 인상을 통해 2021년 0.5%였던 기준금리를 2022년 1월 1.25%까지 높였다. 한국은행의 기준금리 인상속도는 2022년 들어 높은 국내 인플레이션과 연준의 기준금리 인상속도에 영향을 받아 급격히 빨라졌다. 2022년 1월 1.25%였던 기준금리가 2022년 10월에는 3.0%에 도달하였으며, 11월에는 3.25%로 상승했다. 2023년 1월 한국은행은 기준금리를 또다시 인상해서 3.5%에 이르고 있다.

기준금리의 급격한 상승은 금융시장의 유동성을 빠른 속도로 고갈시키는 가장 중요한 요소가 되어왔다. 시장금리는 연준과 한국은행의 기준금리 인상속도를 선반영하며 빠른 속도로 높아졌다. 가장 대표적인 시장금리인 국고채 금리변화를 살펴보면 2022년 1월 3일 국고채 3년물, 5년물, 10년물의 금리는 각각 1.855%, 2.080%, 2.325%로 나타났다. 동일한 만기별 금리는 2022년 10월 31일 기준 각각 4.185%, 4.263%, 4.242%를 기록하여 10개월의 기간동안 각각 무려 2.330%p, 2.183%p, 1.917%p 급등하였다. 3년물과 5년물 금리는 연초 대비 2배 이상 상승했으며, 10년물의 경우도 2배에 육박하는 상승폭을 기록하였다. 시장금리 상승에서 나타나는 또 하나의 특징은 장단기금리가 역전되고 있다는 점이다. 2022년 10월 31일 기준 국고채 5년물 금리(4.263%)는 10년물(4.242%), 20년물(4.152%), 30년물(4.073%), 50년물(4.030%)보다 높게 형성되어 있다. IFRS17의 도입으로 인해 보험사로부터의 국고채 초장기물 수요가 급격히 증가했음을 감안하더라도 현재의 장단기 금리차 역전현상은 경기침체에 대한 우려가 반영되어 나타나는 결과라고 해석함이 타당할 것이다. 유동성 축소국면에서 나타나는 경기침체 우려는 투자자심리를 더욱 저하시키고 시장의 변동성을 증가시킬 수 있다는 점에서 우려되는 부분이다.

신용스프레드의 확대는 시장금리 상승과 더불어 시장의 중요한 불안요소로 주목할 필요가 있다. 시장금리가 상승하는 상황에서 신용스프레드가 확대될 경우 회사채시장에서 기업들이 부담해야 하는 금리는 더욱 큰 폭으로 상승한다. 신용스프레드(국고채 3년물과 동일만기 회사채간의 금리차)는 2022년 1월 3일 AA- 등급의 경우 0.605%, BBB- 등급은 6.461% 수준에서 형성되었다. 반면 10월 31일 기준 신용스프레드는 각각 1.395%와 7.239%를 기록하였다. 이는 연초대비 AA- 등급은 0.790%p, BBB- 등급은 0.778%p 높아진 수준이다. 신용스프레드 변화에 대한 해석은 BBB- 등급보다는 AA- 등급에 대해 적용하는 것이 타당하다. 이는 국내에서 BBB- 등급의 회사채 발행량은 매우 적은 편이어서 금리의 유효성에 대한 신뢰가 충분하다고 평가하기 어렵기 때문이다. AA- 등급 기준으로 신용스프레드를 평가할 경우 연초대비 신용스프레드는 10개월만에 두배 이상 증가했다. 기준이 되는 국고채 3년물이 연초대비 2.330%p 상승하였음을 감안할 때, 회사채 3년물(AA-) 금리는 연초대비 무려 3.120%p나 높아졌음을 알 수 있다. 채권시장에서도 특히 회사채시장에 시장의 불안이 집중되고 있음을 보여주는 지표라고 해석할 수 있다.

Ⅲ. 국내 금융시장안정화기구 특징 및 문제점

1. 국내 금융시장안정화기구의 종류 및 특징

국내에서 활용되는 금융시장안정화기구는 여러 가지 유형이 존재하는데, 가장 대표적인 것으로 채권시장안정펀드(이하 채안펀드), P-CBO, 회사채신속인수제도, 증권시장안정펀드(이하 증안펀드) 등이 있다. 이중 위기상황에서 기업금융지원 효용성이 높은 수단은 채안펀드, P-CBO, 회사채신속인수제도로 볼 수 있는데, 이는 채안펀드, P-CBO, 회사채신속인수제도는 채권시장 경색으로 인해 기업으로의 자금공급이 막혔을 때 시장의 막힌 곳을 뚫어 자금이 다시 흐르게 만듦으로써 기업의 도산가능성을 줄일 수 있기 때문이다. 반면 증안펀드는 주식시장의 가격부양을 목적으로 하기 때문에 기업으로의 자금유입개선이라는 관점에서는 그 효과가 미미하다고 평가할 수 있다.

지난 2020년 코로나19 팬데믹으로 인해 국내 금융시장의 변동성이 극단적으로 확대되는 상황에서 금융당국은 금융시장의 기능정상화를 위하여 상기한 금융시장안정화기구의 실행을 발표하였다.1) 채안펀드는 채권시장 경색으로 일시적인 자금난을 겪고 있는 기업들에 대해 유동성을 지원함과 동시에 신용스프레드가 과도하게 커지는 것을 방지하기 위해 설립된 펀드이다. 정부는 팬데믹으로 인한 채권시장 자금경색을 완화하기 위해 2008년 글로벌 금융위기 과정에서 조성되었던 총 10조원 규모의 채안펀드에 10조원을 추가로 조성하여 자금난을 겪고 있는 기업에 대해 유동성을 공급했다. 채안펀드의 조성은 은행ㆍ증권ㆍ보험ㆍ정책금융기관 등 총 84개 금융회사들의 공동출자를 통해 이루어졌다. 채안펀드의 투자대상은 회사채, 우량기업CP와 전자단기사채(이하 전단채), 금융채 등을 포함하였다. 채안펀드의 조성계획은 2020년 3월 19일에 발표되었고, 채안펀드 세부운영 방안은 3월 24일에 발표되었으며, 1차로 3조원 규모의 Capital call을 결정한 후 4월 2일부터 회사채매입을 시작하였다.

2020년 설립되었던 저신용등급 포함 회사채ㆍ기업어음(CP) 매입기구인 기업유동성지원기구(이하 SPV)도 채안펀드와 유사한 성격을 가진 금융시장안정화기구라 평가할 수 있다. 정부는 코로나19 위기에 대응하여 기업자금조달 애로 해소, 자금시장 경색 차단 등을 위한 저신용등급 포함 회사채ㆍCP 매입기구를 설립하였다.2) SPV는 10조원 규모로 설립되었는데 정부의 1조원 산업은행 출자를 바탕으로 산업은행이 SPV에 대해 1조원을 출자하고 추가로 1조원의 후순위 대출을 실행하였다. 한국은행은 SPV에 8조원의 선순위 대출을 제공하였고,3) 총 10조원의 재원을 마련한 SPV는 회사채ㆍCP 등 매입을 위한 유동성을 지원했다. SPV는 우량등급 채권뿐만 아니라 비우량등급 채권과 CP도 매입했고, 전체 금융시장 안정목적을 위해 특정기업에 집중 지원되지 않도록 동일기업 및 기업군의 매입한도 제한 등 조건도 부과하여 운영되었다. SPV는 금융시장 안정시까지 한시적으로 투자하는 것을 원칙으로 설립되었으며, 매입기간 종료 시점에 6개월간 운영성과와 시장안정 상황을 종합적으로 고려하여 투자기간 연장을 결정할 수 있었다. 다만 SPV는 설립일로부터 4년간만 운영되도록 명시적인 일몰기간을 설정했다.

P-CBO는 회사채시장의 안정화 및 원활한 기업자금조달 지원을 위해 실행되는 제도이다. 이름에서 알 수 있듯이 회사채발행시장에서 회사채를 인수하여 CBO(Collateralized Bond Obligation)의 형태로 유동화시키는 방식이다. 코로나19 팬데믹으로 인해 일시적 유동성 애로를 겪는 중견기업과 대기업의 회사채발행을 지원하려는 목적을 가졌으며, 총 6.7조원(1단계 1.7조원+추가 5조원)을 발행했다. 발행구조는 정책금융기관인 산업은행이 회사채를 인수한 후 주채권은행ㆍ신용보증기금에 매각하고, 신용보증기금의 보증을 통해 신용을 보강하여 시장안정 P-CBO를 발행하는 방식을 따른다.

회사채신속인수제도는 회사채만기가 집중되어 상환에 어려움을 겪는 기업(중견기업+대기업)을 대상으로 회사채의 80%를 산업은행이 총액인수해주는 제도이다. 회사채 만기가 돌아오면 기업은 자체자금으로 20%를 상환하고, 나머지 80%는 산업은행이 인수해 차환하는 방식이다. 산업은행이 인수한 채권(80% 해당분)은 대부분은 신용보증기금의 신용보강을 통해 P-CBO에 편입시켜 시장에 매각하고, 일부는 해당기업 채권은행에 매각함으로써 신용위험을 분산시킨다. 2020년 시행된 회사채신속인수제도는 기업에 대한 순지원 금액 기준 2.2조원 규모로 집행되었다.

증안펀드는 주식시장의 주가급락 및 과도한 시장변동성 완화를 목적으로 조성된 펀드이다. 금융권의 공동출자를 통해 주식시장의 안전판 역할을 수행하기 위해 만들어졌다. 증시가 회복될 때까지 한시적으로 운영하는 것을 원칙으로 하며, 개별종목 주가에 영향을 주지 않도록 시장대표 지수 상품에 대해서만 운용된다. 증안펀드는 채안펀드와 유사하게 Capital call 방식으로 자금을 모집하여 증권시장 전체를 대표하는 지수상품(예: KOSPI200 등)에 투자한다. 증안펀드에 출자한 금융회사에 대해서는 펀드 출자금액에 대해 건전성규제(위험가중치) 비율이 완화되어 적용된다.

2020년말까지 국내에서 증안펀드가 조성된 것은 4차례로 나타나는데, 1990년, 2003년, 2008년, 2020년에 각각 조성된 바 있다. 1990년 최초로 조성된 증안펀드는 명칭이 증시안정기금(이하 증안기금)이었는데 2003년 이후 증안펀드로 변경되었다. 1990년 증안기금은 4.85조원 규모로 조성되었는데 당시 시장규모를 감안할 때 상당히 큰 규모라 평가할 수 있을 것이다. 연구의 진행에 있어서 한 가지 아쉬운 점은 1990년 증안기금의 운영결과 손실이 난 사례가 있었는지를 확인하기가 어렵다는 사실이다. 2003년의 증안펀드는 신용카드 대출 부실사태로 인해 증시가 크게 하락하자 그 대응과정에서 증권유관기관의 출연을 통해 4,000억원 규모로 조성되었다. 2008년의 경우 글로벌 금융위기가 발생하자 그 대응과정에서 증권유관기관의 출연을 통해 5,150억원 규모의 증안펀드가 조성되었다. 증권선물거래소가 2,500억원, 예탁결제원이 2,100억원, 증권업협회가 500억원, 자산운용협회가 50억원을 출연하면서 증안펀드 운용에 참여하였다. 2003년과 2008년 조성된 증안펀드는 증시가 저점 근처에 근접하였을 때 조성되어 집행되었고, 이후 시장상승기에 청산되었기 때문에 증안펀드 운영결과 손실이 난 경우는 없었다.

2020년 코로나19 팬데믹 시기에는 5대 금융지주와 은행ㆍ보험ㆍ증권 각 업권 선도 금융회사(18개 금융회사) 및 증권유관기관(한국거래소, 예탁결제원, 금융투자협회 등)이 10.7조원을 조성했으나, 주식시장이 신속히 반등한 관계로 실제 집행이 이루어지지는 않았다. 증안펀드는 주가하락을 일부 완화하는 효과를 기대할 수 있지만, 기업에 대한 자금공급 기능이 미미하다는 점에서 전술한 금융시장안정화기구와 차별성을 가진다.

2. 국내 금융시장안정화기구의 문제점

국내 금융시장안정화기구는 반복되는 위기상황에서 시장유동성을 개선시키고 투자자들의 심리를 안정시키는 데에 유의적인 영향을 미쳤다고 평가할 수 있다. 그렇지만 금융시장안정화기구의 효율성 및 신속성 측면에서 다음과 같은 문제점을 가진다. 첫째, 금융시장안정화기구의 재원마련을 민간금융회사의 출연에 크게 의존하고 있다. 재원마련을 민간금융회사에 의존하는 것은 금융회사의 도덕적 해이를 완화시키고, 시장안정의 혜택을 받는 주체가 거기에 대한 재원을 마련해야 한다는 측면에서는 긍정적으로 평가할 수 있다. 그러나 금융회사의 출연에 의한 재원마련은 그 규모에서 한계가 존재한다. 경제규모 및 금융거래규모가 커짐에 따라 위기상황에서 필요한 대응자금의 규모도 가파르게 늘어나고 있다. 위기상황에서 금융회사들은 스스로도 유동성확보에 어려움을 겪고 있을 가능성이 높다. 그런 상태에서 금융시장안정화기구의 운영을 위한 재원까지 출연을 해야 하니 위기의 강도가 강해질수록 그 부담은 크게 느껴질 것이다. 일정 수준 금융회사들의 부담이 정당화될 수 있겠지만 다른 방식의 재원조달 필요성을 부인하기는 어렵다.

둘째, 민간금융회사들의 자금출연에 대한 신용위험부담이 충분하게 제거되어 있다고 보기 어렵다. 현재의 금융시장안정화기구의 운영방식을 살펴보면 민간금융회사는 자금의 출연 이후 운영과정에서 발생할 수 있는 신용위험으로부터 절연되어 있다고 평가하기 어렵다. 물론 신용위험은 금융시장안정화기구에 참여하는 정책금융기관에 의해서 우선적으로 흡수되는 경우가 많다. 그렇지만 정책금융기관에 의해 신용위험이 전혀 부담되지 않는 경우도 있으며, 부담하더라도 신용위험의 일부가 민간금융회사로 전이될 가능성은 여전하다고 볼 수 있다. 시장안정의 수혜를 받는 주체가 신용위험을 부담하는 것은 당연하다고 보는 견해도 있으나, 이러한 신용위험 가능성이 민간금융회사의 참여유인을 위축시키고 출연과정에서 더 많은 시간을 소요하게 만들 수 있음에 주목할 필요가 있다.

셋째, 금융시장안정화기구의 출범과 운영에 있어서 중앙은행과 정부의 역할분담 및 협조체계의 구축이 미흡한 편이다. 금융시장안정화기구의 운영에 있어서 핵심적인 사안은 대규모 재원의 신속한 출연, 적절한 신용위험의 통제, 그리고 준칙화된 운영절차로 볼 수 있다. 이러한 요소들의 적절한 관리에 있어서 정부와 중앙은행의 역할은 매우 중요하다. 정부는 위기관리 주체로서의 역할을 이미 상당부분 수행하고 있으나, 금융시장안정화기구의 효율성을 높이기 위하여 한국은행과의 역할 및 협력수준을 강화할 필요가 있다. 신용위험에 대한 통제에 있어서는 금융시장안정화기구의 효율성 제고를 위해 정부의 역할이 특히 중요한 영역이라고 볼 수 있다. 한국은행의 역할도 지금보다는 더욱 적극적인 방식으로 변화할 필요가 있다. 미국 연준법과는 달리 현행 한국은행법에서는 이례적인 위기상황에서 한국은행이 금융시장의 안정을 위해 어떠한 역할을 할 것인가에 관한 내용이 부재하다. 한국은행에 의한 금융시장안정화기구 재원마련의 장단점을 분석해서 그 필요성이 인정된다면 한국은행의 역할확대를 검토함이 타당할 것이다.

넷째, 민간금융회사들의 도덕적 해이를 완화시킬 장치가 미흡하다. 위기상황에서 정부의 시장개입은 경제전반의 후생을 증가시킬 수 있다는 점에서 정당화될 수 있으나, 그러한 개입으로 인해 금융회사들의 도덕적 해이를 부추길 수 있다는 비판으로부터 자유로울 수 없다. 따라서 도덕적 해이를 완화시킬 수 있는 장치를 마련해야 하는데, 현재의 금융시장안정화기구에서 그러한 고민은 상대적으로 미흡하다 볼 수 있다. 정부에 의한 유동성 공급으로 수혜를 보는 주체들이 일정 부분 그 비용을 부담할 수 있도록 만드는 수단이 필요하다. 정부의 유동성공급을 통해 기업들의 부담을 덜어줘야 한다는 시각도 존재하지만 위기상황이 진정된 이후에 발생할 수 있는 도덕적 해이를 완화시키는 것이 위기관리비용의 관점에서 더욱 중요한 의미를 가질 것이다.

Ⅳ. 해외의 금융시장안정화기구

1. 미국의 금융시장안정화기구

가. 금융시장안정화기구의 종류 및 특징

금융위기 또는 경제위기 상황에서 연준이 미국 정부와 협력해 가동하는 금융시장안정화기구는 크게 금융회사에 대한 유동성 지원 프로그램, 자본시장상품 매입 프로그램, 대출지원 프로그램 등으로 구분해볼 수 있다. 금융회사에 대한 유동성지원 프로그램으로는 PDCF(Primary Dealer Credit Facility)가 대표적이다. PDCF는 다양한 금융상품4)을 담보로 PD들에게 유동성을 공급하여 시장기능을 정상화시킬 목적으로 도입된 프로그램이다. 대출지원 프로그램으로는 PPPLF(Paycheck Protection Program Liquidity Facility), MSNLF(Main Street New Loan Facility) 등이 있다. 대출지원 프로그램은 금융회사들이 개인이나 소상공인들에게 대출을 유지 또는 확대할 수 있게 유동성을 공급하기 위한 목적에서 도입되었다. 본고는 국내 금융시장안정화기구와의 비교를 위해 미국의 자본시장상품 매입 프로그램에 대한 분석을 실시할 예정이며, CP매입을 위해 운영하는 CPFF(Commercial Paper Funding Facility), 회사채매입을 위해 운영하는 PMCCF(Primary Market Corporate Credit Facility)와 SMCCF(Secondary Market Corprate Credit Facility), 그리고 유동화증권 발행지원을 위해 운영하는 TALF(Term Asset-Backed Securities Loan Facility)의 특성을 파악해 보고자 한다.

미국이 위기상황에서 운영하는 금융시장안정화기구들은 공통적으로 관찰되는 뚜렷한 특징을 가지는데, 연준이 재원을 마련하고 운영과정에서 발생하는 신용위험은 미국 정부(재무부)가 부담한다는 점이다. 정부와 연준간의 뚜렷한 역할분담 및 협력체계가 마련되어 있는 것이다. 금융시장안정화기구는 위기상황에서 시장의 기능이 유지될 수 있도록 시장참여자들의 심리를 안정시키는 역할을 담당한다. 그러기 위해서는 위기상황에서 신속히 자금이 투입될 수 있어야 하고 자금투입의 규모도 시장이 안정감을 느낄 수 있도록 대규모이어야 한다. 위기상황에서는 대부분의 금융회사가 유동성 경색을 겪고 있을 가능성이 높기 때문에 금융회사로부터의 출연을 통한 재원마련은 신속성 측면에서 떨어지고 대규모 자금마련에도 한계가 있다. 이를 해결하기 위하여 미국의 금융시장안정화기구들은 민간금융회사들에 자금마련에 대한 의무를 부여하는 것이 아니라 중앙은행인 연준이 발권력을 동원하여 재원을 공급하는 방식을 선택하였다.

재원을 마련한 후 운영과정에서 부각되는 것은 신용위험에 대한 우려이다. 금융시장안정화기구가 신용위험이 내재된 회사채나 CP를 매입하다 보면 디폴트가 발생할 가능성을 배제할 수 없다. 물론 매입과정에서 매입대상에 대한 기준을 설정하여 신용사건 발생가능성을 최대한 억제하려는 노력은 하겠지만 그럼에도 불구하고 디폴트 가능성을 완전히 배제할 수는 없다. 미국에서 금융시장안정화기구가 매입한 상품에서 디폴트가 발생할 때 그 위험은 재무부가 부담하며, 연준은 신용위험으로부터 절연된다. 이는 연준은 통화정책을 담당하는 기관으로서 재원마련에 대한 협력은 가능하지만, 그로부터 발생하는 신용위험을 떠안는 최종주체가 되어서는 안된다는 철학에 기반하는 방식이다. 신용위험을 떠안는 것은 산업정책을 주관하는 재정당국의 영역이라고 보는 것이 타당하다는 것이다. 재무부는 통화안정기금(Exchange Stabilization Fund, 이하 ESF)을 활용해 금융시장안정화기구에 대한 에퀴티 트렌치 투자를 실행함으로써 연준의 재원공급을 디폴트로부터 절연시킨다. 에퀴티 트렌치 투자는 전체 매입금액의 10%를 유지하기 때문에 파산절연이 실제로 이루어질 수 있다는 시장의 신뢰를 획득할 수 있다.

금융시장안정화기구중 CPFF와 TALF의 설립은 2008년 글로벌 금융위기로 거슬러 올라간다. 리먼 브라더스의 파산으로 인해 CP시장의 경색이 극심해지자 연준은 재무부의 협조하에 단기자금시장에 대한 긴급유동성 공급을 위해 2008년 10월 27일 CPFF(2008)를 최초로 설립했다. CPFF는 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 CPFF에 자본투자(Equity investment)를 집행한다. CPFF는 사전적으로 매입이 가능한 CP(이하 적격CP)에 대한 기준을 설정하였고, 이를 엄격히 준수하며 일반CP와 ABCP를 매입한다. 적격CP가 되기 위해서는 만기가 3개월이어야 하고, 주요 신용평가회사로부터 부여받은 CP등급이 A1/P1/F1이상이어야 한다. 수수료는 CPFF 최대 잔액에 대해 10bp가 적용되고, 가격산정은 3개월물 OIS(Over-night Index Swap) 금리+110bp로 한다. 연준은 CP매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 등록된 PD들로부터 적격CP를 매입한다. 2008년에 설립된 CPFF는 2010년 2월 1일까지 적격CP를 매입하였고, 이후 2010년 4월 26일 매입하였던 모든 CP의 만기가 도래함에 따라 운영이 종료되었다. 해당기간 동안 매입하였던 CP에서 디폴트가 발생한 경우는 없어서 전액 만기상환이 완료되었다. 코로나19 팬데믹이 발생하면서 단기자금시장의 경색이 극심해지자 연준은 2020년 3월 17일 CPFF(2020)를 재가동하였다. CPFF(2020)의 기본적인 구조는 CPFF(2008)와 동일하다. ESF는 CPFF(2020)에 대해 100억달러의 자본투자를 집행했다. 2020년 3월 17일 이전에는 A1/P1/F1이었다가 3월 17일 이후 신용등급이 떨어진 CP도 적격CP가 될 수 있으나 떨어진 신용등급이 최소 A2/P2/F2 이상이어야 적격CP의 자격을 가진다. ABCP의 경우 3월 17일 이전에 발행이 없었던 발행자에 대해서는 적격CP의 자격을 인정하지 않는다. CPFF(2020)는 2021년 3월 31일까지 CP를 매입하였고, 매입하였던 모든 CP의 만기가 도래함에 따라 2021년 4월 30일 운영이 완전히 종료되었다. CPFF(2020) 운영과정에서 수수료, 이자 등을 통해 발생한 수입의 규모는 6,496만달러였다. 매입하였던 CP에서 디폴트가 발생한 경우는 없었으며, 연준은 SPV에 대출한 전액을 회수하였다.

TALF는 가계 및 소상공인 신용대출을 지원하기 위한 목적으로 설립된 금융시장안정화기구이다. 리먼 브라더스의 파산으로 인해 가계 및 소상공인 대출 경색이 극심해지자 연준은 2008년 11월 25일 재무부의 협조하에 가계 및 소상공인 대출을 기초자산으로 한 자산유동화증권 지원 프로그램(TALF(2008))을 설립했다. TALF는 CPFF와 유사하게 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 TALF에 자본투자를 집행한다. TALF가 지원할 수 있는 자산유동화증권은 기초자산이 학생대출, 자동차대출, 신용카드론, 중소기업청(SBA)이 보증한 대출 등으로 제한된다. 수수료는 CPFF와 동일하게 10bp가 적용되고, 가격산정은 CLO에 대해서는 30일물 SOFR(Secured Over-night Financing Rate)+150bp, SBA 보증론에 대해서는 연방기금금리(Federal Fund Rate)+75bp, 그이외의 기초자산에 대한 유동화증권은 2년물 OIS금리+125pb로 한다. 연준은 적격ABS 매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 등록된 PD들로부터 적격ABS를 매입한다. TALF에 지원된 자금은 비소구(non-recourse) 방식의 대출 성격을 가지며, 담보로 제공된 ABS를 통해 자산안정성을 유지한다. SPV에 대출된 자금의 만기는 3년으로 제한된다. TALF(2008)는 2009년 3월부터 자산유동화증권시장에 자금을 공급하였고 2010년 6월 30일 종료되었다. TALF(2020)는 2020년 3월 23일 설립되었고, 그 기본구조는 TALF(2008)와 동일하다. ESF는 TALF(2020)에 대해 100억달러의 자본투자를 집행했다. 2020년 12월 31일까지 자금을 공급했다. 신규 자금공급은 해당시점을 기점으로 중단되었지만 이미 공급한 자금의 만기가 남아있기 때문에 TALF(2020)는 아직 운영중에 있으며 2022년 9월 30일 기준 TALF(2020)의 잔액은 10.9억달러이다.

PMCCF와 SMCCF는 회사채시장에 대한 유동성공급을 위해 2020년에 설립되었다. 2008년 글로벌 금융위기시에는 만들어지지 않았으나, 2020년 코로나19 팬데믹 이후 미국 회사채시장에서 나타난 극심한 자금경색을 완화하고자 2020년 3월 23일 연준은 재무부의 협조하에 PMCCF와 SMCCF를 설립하였다. 명칭에서 알 수 있듯이 PMCCF는 회사채발행시장에서 회사채를 매입하는 프로그램이었고, SMCCF는 회사채유통시장에서 회사채를 매입하는 프로그램이다. PMCCF와 SMCCF는 TALF 및 CPFF와 유사하게 연준법(Federal Reserve Act) 13(3)에 근거하여 운영되며, 미국 재무부는 ESF를 활용하여 PMCCF와 SMCCF에 자본투자를 집행한다. ESF의 자본투자 규모는 PMCCF에 대해 500억달러, SMCCF에 대해서는 250억달러였고, 이를 통해 PMCCF는 5,000억달러까지, SMCCF는 2,500억달러까지 회사채를 매입할 수 있었다. CPFF(2020) 및 TALF(2020)와 비교할 때 회사채시장으로 유동성공급이 훨씬 대규모로 이루어졌음을 알 수 있다. 연준은 회사채매입을 위해 설립된 특수목적기구(SPV)에 자금을 대출하고, SPV가 뉴욕연준의 감독하에 회사채 발행자 또는 등록된 PD로부터 회사채를 매입한다.

PMCCF는 회사채 발행자에 대해 총액인수방식으로 회사채를 매입하거나 신디케이트론이나 신디케이트회사채의 일부를 매입할 수 있다. PMCCF가 매입할 수 있는 회사채(이하 적격회사채)는 만기가 4년 이하이어야 하고, 신디케이션의 경우 전체 발행액의 25% 이하이어야 한다. 회사채매입프로그램은 기본적으로 소구(recourse)형 대출방식을 따른다. 2020년 3월 22일 기준 신용등급이 BBB-/Baa3 이상이어야 하며, 3월 22일 이전까지는 기준을 만족시키고 있었으나 이후에 신용등급이 떨어진 기업일 경우 최소 BB-/Ba3 이상이어야 한다. 신용등급에 대한 기준은 SMCCF에 대해서도 동일하게 적용된다. 가격산정은 PMCCF의 경우 발행기업마다 시장상황을 고려해서 다르게 적용될 수 있으며, 수수료 100bp가 가산된다. SMCCF의 경우 가격산정에 별도의 수수료가 적용되지 않으며, 공정시장가격으로 회사채를 매입하는데, 발행시장과는 달리 유통시장에서 추가로 수수료를 부과할 경우 회사채보유자들이 SMCCF에 회사채를 매각할 유인이 없기 때문이다. PMCCF와 SMCCF는 2020년 12월 31일에 회사채 매입을 종료하였다. 이후 PMCCF와 SMCCF는 보유하던 자산을 모두 시장에 매각하였고, 2021년 9월 30일 기준 보유자산이 없어 완전히 종료되었다. PMCCF와 SMCCF의 운영과정에서 수수료, 이자 등을 통해 발생한 수입의 규모는 5.58억달러였고, 연준은 SPV에 대출한 전액을 회수하였다.

나. 미국 연준법(Federal Reserve Act)의 규정

미국의 금융시장안정화기구는 연준법에 근거하여 실행되고 있기 때문에 관련된 연준법의 내용을 살펴보는 것은 미국 금융시장안정화기구를 이해하는 데에 있어서 중요한 의미를 가진다. 금융시장안정화기구의 설립에 관한 내용은 연준법 13조 3항(Section 13(3))5)이 규정하고 있다. 연준법 13조는 연준의 권한을 정의하고 있는데, 그중에서도 3항은 이례적인 위기상황에서 은행에 의한 신용공급이 정상적으로 이루어지지 않을 경우 연준에 의한 금융시장안정화기구의 운영방법을 다루고 있다. 연준에 의한 긴급자금공급은 기본적으로 할인(discount) 대출방식으로 이루어진다. 할인의 의미는 이자를 미리 선취하고 담보가치보다 적은 금액을 대출하는 것을 의미한다. 연준법은 미국 정부기관이 보증하지 않은 신용증권을 연준이 직접 매입하는 것을 금지하고 있기 때문에 신용위험이 포함된 상품에 투자하는 기관 또는 그러한 상품을 발행하는 기관을 지원하기 위해서는 연준이 SPV를 설립한 후 간접적으로 할인대출 방식을 통해 지원해야 한다.6)

연준은 이례적인 비상상황에서 연준위원 5인 이상의 동의를 받아 할인방식으로 적격자산(note, draft, bill of exchange) 운영프로그램(program 또는 facility)에 대출을 실시할 수 있다(Section 13(3)(A)). 적격자산에는 신용자산(부채성자산)만 포함되며 주식과 같은 지분증권은 포함되지 않는다. 이러한 비상대출 프로그램의 목적은 금융시장에 유동성을 공급하기 위한 것이며, 부실화되어 가는 금융회사를 구제할 목적이 아님을 분명히 밝히고 있다. 신용위험과 유동성위험을 뚜렷하게 구분하는 접근방식은 연준이 운영하는 금융시장안정화기구에서 공통적으로 관찰되는 특징이다. 비상대출은 납세자들의 세금에 어떠한 손실을 끼쳐서도 안 되며, 납세자의 부담을 방지할 보호장치를 마련해야 한다. 보호장치는 정부에 의한 신용보강(credit protection) 또는 자본투자를 통해 마련된다. 비상대출 프로그램의 운영은 미국 재무부 장관의 사전 승인하에서(prior approval of the Secretary of the Treasury) 이루어져야 하며, 적절한 시기에 질서있는 방법으로 종료되어야 한다(Section 13(3)(B)(i),(iv)). 비상대출 프로그램은 지급불능상태에 빠진 채무기관에 자금이 공급되지 않도록 방지체계를 갖추어야 한다(Section 13(3)(B)(ii)).

연준이 운영하는 금융시장안정화기구에는 의회에 대한 정보보고 의무가 부여되어 있다. 이는 발권력에 의존한 연준 프로그램이 과도하게 남용되는 것을 막고자 하는 정책적 판단의 결과이며, 그 감시 역할을 의회에 부여하고 있는 것이다. 연준 이사회는 정기적으로 비상대출 프로그램의 운영현황을 상원과 하원에 보고해야 한다. 보고에는 비상대출 프로그램을 실행해야 하는 이유, 지원을 받게 될 대상자에 대한 정보, 지원 일정ㆍ규모ㆍ방식, 주요한 지원 조건(대출만기, 담보자산 내역, 대출지원을 통해 발생한 수수료ㆍ이자ㆍ기타 부대수입 등, 납세자가 부담하게 될 예상비용 등) 등에 관한 정보가 포함되어야 한다(Section 13(3)(C)).

다. 미국의 통화안정기금(ESF)

통화안정기금(ESF)은 미국 재무부가 통상적으로는 외환시장개입을 위해 사용하는 비상용 예비기금이다. 미국 정부는 ESF를 활용하면서 국내 통화공급량에 직접적인 영향을 미치지 않은 채로 통화환율에 영향력을 행사할 수 있게 되었다. ESF는 1934년 1월에 최초로 설립되었고, 1934년 4월부터 본격적으로 활용되기 시작했다. 설립목적은 외환시장 개입뿐만 아니라 외국정부나 외국 중앙은행에 대한 신용공여를 포함한다. ESF의 사용은 미국 재무부장관의 명시적인 승인하에서만 가능하다. ESF는 미국 재무부가 국제 통화 및 금융정책 수행함에 있어서 중요한 정책적 수단을 제공한다. ESF의 사용은 설립목적을 달성하기 위한 경우뿐만 아니라 재무부가 다양한 정책목적을 수행함에 있어서 활용할 수 있도록 재무부장관에게 상당한 수준의 재량권이 인정되고 있다.

ESF 운영의 가장 중요한 목적은 외환시장개입에 있다. 그런데 반복되어 나타나는 경제위기 또는 금융위기 상황에서 ESF의 운영목적에는 금융시장안정이 추가되었다. 2008년 글로벌 금융위기 과정에서 미국 재무부는 금융시장에 유동성을 공급하기 위한 보증재원으로 500억달러 규모의 ESF 자금을 일시적으로 활용할 것임을 발표했다. 그리고 2020년 코로나19 팬데믹 사태에서는 전염병 사태에 대한 대응으로써 ESF를 활용한 금융시장안정화기구의 실행을 한시적인 조건을 달아 의회가 승인하였다. 외환시장 개입 및 외국정부에 대한 신용공여라는 전통적인 ESF의 활용목적에 위기상황에서 금융시장의 안정성 강화가 새로운 목적으로 추가된 것이다.

ESF의 주된 운영형태는 크게 세가지로 구분된다. 외국통화의 매입이나 매도, 특별인출권(SDR)의 매입이나 활용, 외국정부나 이에 준하는 기관에 대한 대출 또는 신용공여가 ESF의 전통적인 운영형태였다. 코로나19 팬데믹 이후에 ESF의 운영형태에는 시장안정화기구에 대한 직접대출, 대출 보증과 자본투자가 추가되었다. ESF에 의한 직접대출, 대출 보증 및 자본투자의 총량은 5,000억달러를 초과할 수 없다. 이러한 한도의 적용에 있어서 재무부는 460억달러는 직접대출의 목적으로, 나머지 4,540억달러는 대출 보증과 자본투자의 목적으로 사용하였다.

ESF의 자산현황을 살펴보면 코로나19 팬데믹에 대한 대응과정에서 ESF의 자산이 급격히 늘어났다는 점이 관찰된다. 코로나19 팬데믹 발생이전인 2019년 9월말 기준 ESF의 자산규모는 933.2억달러로 나타나지만, 코로나19 팬데믹 이후인 2020년 9월말 기준 자산규모는 무려 6,764.1억달러로 코로나19 팬데믹 이전 기간에 비해 약 7배 규모로 폭증했다. 자산폭증의 가장 중요한 이유는 정부로부터의 기금책정액이 큰 폭으로 증액되었다는 점이다. 미국 정부는 코로나19 팬데믹에 대한 경기부양책을 실행하기 위한 목적으로 2020년에 ESF에 대한 책정금을 5,000억달러 증액했다. 이외에도 ESF가 재원마련을 위해 Fiscal Service로부터 871억달러를 차입했다는 점도 자산증가의 중요한 원인으로 작용했다. 금융시장에 대한 유동성 공급 및 경기부양을 위한 프로그램을 안정적으로 지원하기 위해서 ESF의 자산은 급격히 늘어날 수 밖에 없다. 자산증가의 핵심은 정부로부터의 책정금 확충에 있으며, 일부 부족한 재원은 차입을 통해 마련하고 있음이 관찰된다.

ESF의 자산 확충은 금융시장안정화기구의 신뢰성 확보에 있어서 핵심적인 사안이 된다. 금융시장안정화기구는 위기상황에서 신용자산에 대한 자금집행이 핵심적인 사업이기 때문에 신용위험의 발생 가능성으로부터 자유로울 수 없다. 그러한 신용위험을 통제하기 위해서는 손실에 대한 보전이 확실히 이루어져야 하는데, 이는 손실발생시 투입할 수 있는 재원이 있음을 시장에 확실히 인식시켜야 확보될 수 있다. 미국 정부는 금융시장안정화기구에 대한 시장신뢰를 두텁게 확보하기 위하여 이에 대한 재원마련을 대규모로 집행하고 있음을 알 수 있다.

2. 유럽의 금융시장안정화기구

유럽의 금융시장안정화기구는 ECB(European Cental Bank)에 의해 운영되고 있으며 개별 회원국은 재정정책을 통해 위기상황에 대응하는 방식의 접근법을 따르고 있다. ECB의 시장안정화 정책은 미국이나 일본의 접근방식과는 차별화된 모습을 보여주는데 이는 ECB가 중앙은행으로서 가지는 경제적ㆍ정치적 위치가 다르기 때문이다. ECB는 EU회원국들에 대한 중앙은행의 역할을 담당하기 때문에 다른 국가들의 중앙은행에 비하여 보다 엄격한 정치적 독립성을 갖추고 있다.7) 이로 인해 특정 회원국의 국채매입을 통한 유동성 공급에 상당히 수동적인 포지션을 견지해왔고, 회원국 기업이 발행하는 회사채의 매입에는 더욱 보수적인 관점을 유지하였다. ECB의 이러한 관점은 2008년 글로벌 금융위기에 대한 대응과정에서 뚜렷하게 관찰되는데, 위기상황에서 신속히 자금을 투입한 미국의 경우와는 대조적으로 ECB는 회원국 국채매입을 통한 유동성 공급에 소극적인 관점을 유지했다. 물론 위기상황이 진행되는 과정에서 결국 양적완화와 같은 비전통적인 통화정책을 실시하기는 했지만 글로벌 금융위기에 대한 초기대응은 미국이나 아시아권 국가들에 비해 상당히 보수적으로 진행되었다. ECB의 정책대응에 뚜렷한 변화가 나타나기 시작한 것은 유럽 재정위기 이후부터라고 평가할 수 있다. 회원국에서 재정위기가 급속히 진행됨에 따라 ECB는 국채매입(SMP), 저금리 유동성 공급조치(LTRO), 무제한 국채매입(OMT) 등의 조치를 통해 적극적으로 유동성을 공급하기 시작했다. 그런데 전술한 유동성 공급조치는 통화정책의 전달경로 확보를 목적으로 실시된 통화정책의 일환으로 강조되었기 때문에 미국의 사례처럼 금융시장안정화를 직접적인 목적으로 한 시장안정화조치의 성격은 상대적으로 약하다고 평가할 수 있다.

ECB가 실시하고 있는 유동성 공급장치중 상대적으로 미국의 사례와 비슷한 성격으로 해석할 수 있는 조치로는 2016년 3월에 도입된 CSPP(Corporate Sector Purchase Programme)를 들 수 있다. ECB는 2016년 3월 통화정책회의에서 양적완화 프로그램의 확장계획을 발표하면서 매입대상 자산 유형을 확대했다. 이전까지는 양적완화 대상자산을 국채로만 한정했으나 회사채와 CP까지 그 범위를 확대한 것이다. 지원방식을 살펴보면 유로존 6개국(독일, 프랑스, 스페인, 이탈리아, 벨기에, 핀란드)의 중앙은행을 통해 발행 및 유통시장에서 유로존 내 비은행회사(보험회사 포함, 회원국 국적의 기업에 대해서만 허용)들이 발행한 투자등급(BBB- 이상)의 회사채와 A-2/P-2/F3/R2-L등급 이상의 CP를 매입하는 것을 허용하였다. 잔존만기는 CP의 경우 발행만기는 1년 이하, 그리고 잔존만기는 28일 이상이어야 한다. 회사채의 경우 발행만기는 1년 이상이어야 하고, 잔존만기는 6개월~30년까지만 허용된다. 회사채에 대해서는 발행잔량에 대한 규정이 없으나, CP에 대해서는 발행잔량이 1,000만유로 이상이어야 한다. ECB의 CSPP는 미국 연준의 회사채 매입프로그램과는 달리 회사채와 CP를 구분하여 유동성을 공급하는 방식을 따르지는 않으며 한가지 프로그램으로 양쪽 영역에 대한 유동성을 공급한다. 또한 미국처럼 단일 중앙정부가 신용위험을 전적으로 흡수할 수 있는 구조가 아니며, CSPP의 운영과정에서 발생하는 수익 또는 손실은 회원국에 의해 분담되는 방식을 따른다. ECB의 이러한 접근방식은 복수 국가가 회원국으로 가입하는 유럽연합의 정치적 상황을 반영한 결과이며, 미국의 사례와 비교할 때 운영방식이 더 복잡하다고 평가할 수 있다.

3. 일본의 금융시장안정화기구

일본의 금융시장안정화기구는 양적완화의 매입대상 자산의 범위를 회사채와 CP까지 확장하는 방식을 따르고 있다는 점에서 미국의 접근법보다는 유럽의 접근법과 유사한 특징을 가진다. 통상적인 양적완화가 국공채를 대상으로 하는 것과 대조적으로 일본은 양적완화를 회사채, CP, REIT, 주가지수를 기초자산으로 하는 ETF까지 폭넓게 허용하고 있다. 일본은행은 2008년 글로벌 금융위기가 발생하자 공개시장조작(OMO) 대상증권에 기존의 국채뿐만 아니라 CP와 회사채까지 허용하는 방식으로 대상자산을 확대했다. 이는 미국이나 우리나라와는 상당히 대조적인 유동성 공급방식이라고 평가할 수 있다. 글로벌 금융위기 대응과정에서 허용된 CP 및 회사채매입은 이후 2012년 이후 장기간 실행되고 있는 아베노믹스를 통해 일본의 양적완화정책에서 일관되게 유지되어 왔다.

기업의 자금조달상황이 악화된 것을 개선시키기 위하여 일본은행은 리스크자산을 적극적으로 매입하는 제도를 도입했는데, 공개시장조작을 통해 회사채와 CP를 매입했다. 회사채에 대해서는 사채 및 기업에 관한 증서대출채권 적격성 판정 등에 관한 특칙을 제정하여 적격담보의 범위를 BBB등급까지 확대하였다. CP에 대해서는 적격담보취급기본요령에 CP 등 매입 기본요령을 제정하여 A-1이상의 신용등급을 가지고 잔존만기 3개월 이내의 CP 매입을 허용하였다. 회사채 매입과 CP 매입 프로그램에 대해 각각 매입 최대한도액을 설정하였고, 일본은행의 의결을 통해 매입한도를 지속적으로 증액하는 방식으로 매입량을 증가시켜왔다. 일본은행은 양적완화를 시행함에 있어 CP 및 회사채 매입과 더불어 REIT와 ETF까지 매입을 허용하는 상당히 이례적인 조치를 시행해왔다. REIT는 AA등급 이상의 부동산투자신탁을 매입대상으로 설정하고 있으며, ETF의 경우 동경주가지수 또는 일경평균주가연동 ETF를 매입대상으로 허용하고 있다.

일본의 양적완화조치는 신용위험에 대한 부담을 전적으로 중앙은행이 담당하고 있다는 점에서 미국과 유럽의 금융시장안정화조치와 구별된다. 일본은행의 자산매입은 다른 국가에서 비슷한 사례를 찾기 어려울 정도로 대규모로 실행되고 있는데, 자산매입과 관련하여 일본정부가 신용위험에 대해 특별한 조치를 취하고 있지 않다. 이는 자산매입에 따른 신용위험의 부담이 전적으로 일본은행에 의해 이루어지고 있음을 의미한다. 중앙은행에 의한 유동성 공급이 양적완화의 방식을 따르고 있다는 점과 일본이 가지고 있는 경제구조의 특성을 감안할 때 불가피한 측면이 있다고 볼 수 있겠지만, 이는 다른 국가들로 일반화되기가 상당히 어려운 특성이라고 볼 수 있다. 특히 중앙은행이 대규모로 주식시장에 개입하고 있다는 점은 다른 국가들에서 찾아보기 어려운 사례이다. 실제로 일본은행은 2017년 3월 상장기업의 23%에 대해 대주주의 지위를 가지고 있었는데, 2018년 3월에는 대주주 지위의 비중이 40%, 2019년 3월에는 무려 그 비중이 49.7%까지 상승하였다. 중앙은행에 의한 과도한 개입이 이루어지고 있다고 평가할 수 있으며, 주식시장에서의 시장원리를 상당수준 훼손하고 있다는 비판을 받고 있기에 국내에서 참조하기는 어려운 방식으로 평가해야 할 것이다.

Ⅴ. 금융시장안정화기구의 비교 및 정책적 시사점

2008년 글로벌 금융위기와 2020년 코로나19 팬데믹을 극복하는 과정에서 주요 국가들은 금융시장안정화기구의 운영경험을 축적할 수 있었다. 미국의 경우 위기상황에서 통화정책적 대응과 금융시장안정화기구의 역할을 상대적으로 뚜렷하게 차별화시켰다. 반면 유럽의 시장안정화조치는 통화정책의 전달경로 확보를 목적으로 실시된 통화정책의 일환으로 강조되었기 때문에 금융시장안정화기구로서의 성격은 상대적으로 약하다고 평가할 수 있다. 일본의 경우 자산매입은 다른 국가에서 비슷한 사례를 찾기 어려울 정도로 대규모로 실행되고 있는데, 자산매입에 따른 신용위험의 부담이 전적으로 일본은행에 의해 이루어지고 있다. 이는 다른 국가들로 일반화되기가 상당히 어려운 특성이라고 볼 수 있다. 이러한 차이점들을 종합적으로 평가할 때 미국의 사례가 금융시장안정화기구 운영에 대해 우리에게 더 다양한 시사점을 제공하고 있다.

미국의 금융시장안정화기구에서 나타나는 특징을 우리나라 금융시장안정화기구와 비교해 볼 때 다음과 같은 차이점들을 발견할 수 있다. 첫째, 금융시장안정화기구의 재원마련을 민간금융회사에 크게 의존하고 있는 우리나라와는 달리 미국은 중앙은행의 발권력을 활용해 금융시장안정화기구의 재원을 마련하고 있다. 중앙은행의 발권력을 활용하는 것에 대해 비판적인 견해가 존재하는 것이 사실이지만, 여기에는 자금조달의 신속성, 대규모 장기자금조달의 용이성과 같은 장점이 있음을 주목할 필요가 있다. 민간금융회사를 통해 재원을 마련하는 데에는 출연금 배분 및 동의와 같은 다자간 의견조율 절차가 필요하기에 신속성이 무엇보다도 중요한 금융위기 또는 경제위기 상황에서는 중앙은행에 의한 재원마련이 상대적으로 유리할 가능성이 높다. 또한 민간에 의한 자금출연은 최초에 예상했던 수준 이상의 자금동원이 필요할 경우 자금출연의 신축적인 확장에 제약이 나타날 가능성이 크며, 위기상황이 장기간에 걸쳐 지속될 경우에도 효과에 한계를 보일 가능성이 높다.

둘째, 미국은 금융시장안정화기구의 운영과정에서 현실화될 수 있는 신용위험을 재정당국(재무부)이 부담하는 반면, 우리나라의 경우 신용위험이 금융시장안정화기구에 출연하는 민간금융회사로 전이될 수 있다. 신용위험에 대한 부담을 정부가 떠안을 경우 도덕적 해이에 대한 비판이 나올 수 있다. 그러나 위기상황에서는 도덕적 해이에 대한 우려보다 시장기능의 유지에 훨씬 높은 우선순위를 부여할 필요가 있다. 이는 위기상황에서 정부에 의한 신용위험부담이 충분히 정당화될 수 있음을 의미하며, 우리나라 제도운영에 있어서도 참고할만한 사안이다.

셋째, 미국의 금융시장안정화기구는 시장별로 세분화되어 있으며, 그중에서도 단기자금시장에 대한 개입을 가장 신속히 실행하는 반면, 우리나라에서는 시장별 세분화 수준이 낮고 단기자금시장의 중요성에 대한 인식이 낮은 편이라 볼 수 있다. 전술한 바와 같이 미국의 금융시장안정화기구는 CP시장, 회사채발행시장, 회사채유통시장, 자산유동화증권시장 등으로 세분화되어 정밀타격 방식으로 운영된다. 그리고 2008년과 2020년의 사례에서 알 수 있듯이 기업에 대한 자금공급을 위해 CP시장으로의 개입이 가장 신속하게 일어나고, 그 이후에 회사채시장과 자산유동화증권시장으로의 개입이 일어난다. 이와는 대조적으로 우리나라의 경우 회사채시장과 CP 및 전자단기사채로 구성되는 단기자금시장간의 세분화가 뚜렷하지 못하다. 채안펀드로 회사채와 CP를 모두 매입하는 방식을 가진다. P-CBO도 유동화증권시장에 대한 지원형식을 가지지만 그 경제적 실질은 회사채시장지원에 가깝다고 보아야 할 것이다. 그리고 단기자금시장에 대한 신속한 개입 필요성에 대한 인식도 미국에 비해 상대적으로 낮다고 평가할 수 있다.

넷째, 미국의 경우 유동성 지원에 대한 비용을 가산금리 책정을 통해 확실하게 가격에 반영하는 반면, 우리나라에서는 기업이나 투자자에 대한 지원이 강조되기 때문에 유의적인 가산금리의 부과가 사실상 부재하다. 미국의 금융시장안정화기구의 운영방식을 살펴보면 CPFF는 110bp, TALF는 75~150bp, PMCCF는 100bp의 가산금리가 적용된다. SMCCF만 가산금리의 적용이 면제되는 정도이다. 외견상 상당히 높은 수준의 가산금리가 적용된다고 볼 수 있는데, 이를 통해 금융시장안정화기구의 적용이 정부에 의한 보조금 지급성격을 전혀 가지지 않음을 알 수 있다. 또한 금융시장안정화기구에 의해 혜택을 보는 당사자가 그 혜택에 대한 비용을 지불하는 것이 당연하다는 철학이 반영된 결과로도 볼 수 있다. 이와는 대조적으로 국내의 금융시장안정화기구는 시장금리 또는 더 낮은 수준에서 가격을 산정하는 것이 일반적이다. 위기상황에서 기업에 대해 주어지는 혜택에 대해 비용을 지불하라고 요구하는 것은 너무 가혹하며 오히려 혜택을 주어 기업이 버틸 수 있도록 지원할 필요가 있다는 인식이 강한 것이다. 가산금리의 부재로 인해 금융시장안정화기구에 의한 긴급유동성 지원이 지원대상의 모럴헤저드를 부추길 수 있다는 우려가 이어지고 있다. 유동성공급의 혜택을 보는 당사자가 그에 대한 비용을 일정 수준 지불하는 것은 합리적인 금융시장안정화기구 설계방식으로 평가할 수 있을 것이다.

다섯째, 미국의 금융시장안정화기구는 주식시장으로의 개입은 일반적으로 하지 않는 반면, 국내의 경우에는 주식시장으로의 개입도 이루어진다. 연준이 운영하는 여러 가지 종류의 금융시장안정화기구들을 살펴보면 부채성 자금거래가 이루어지는 영역에서 운영이 이루어지고 있음을 발견할 수 있다. 그러나 주식시장으로의 자금유입이 이루어지는 프로그램을 발견하기는 어렵다.

여섯째, 미국의 경우 중앙은행에 의한 금융시장안정화기구의 운영이 연준법에 의해 중앙은행의 권한으로 규정되어 있다. 연준은 은행에 의한 유동성 공급이 제대로 이루어지지 않고 있다고 판단되면 연준이 SPV를 설립한 후 이에 대해 비상대출을 실행함으로써 금융시장안정화기구를 능동적으로 운영한다. 반면 한국은행은 한국은행법에 금융시장안정화기구의 운영권한에 대한 규정이 전무하다. 이로 인해 한국은행은 SPV를 설립할 권한이 없다고 해석되며, SPV는 금융기관이 아니기 때문에 이에 대한 한국은행 대출도 가능하지 않다는 견해가 지배적이다. 한국은행에 시장안정화에 있어 주도적인 역할을 부여할 필요가 있으며, 한국은행법의 개정도 검토해 볼 수 있을 것이다.

일곱째, 금융시장안정화기구가 시장의 신뢰를 받기 위해서는 신용위험이 현실화되었을 때 이를 해결할 수 있는 재원이 확실히 확보되어 있음을 시장에 인식시켜야 한다. 중앙은행의 재원출연을 파산위험으로 절연시킬 수 있는 가장 확실한 방법이다. 미국의 경우 ESF가 그러한 역할을 충실히 수행하고 있음을 확인할 수 있다. 반면 국내에서는 정책금융기관이 신용위험을 일부 흡수하고 있지만, 한국은행이 재원을 출연하였을 때 발생할 수 있는 신용위험을 절연시킬 수 있는 기금의 존재가 뚜렷하지 않다. 이는 한국은행에 금융시장안정화기구의 운영주체 역할을 부여함에 있어서 가장 중요한 장애요소가 될 것으로 예상된다. 이상의 비교를 표로 정리하면 아래와 같다.

금융시장의 환경이 극심하게 나빠질 때 정부의 시장안정화 조치는 신속하고 과감하게 실행되어야 한다. 위기의 징후가 뚜렷해지면서 금융회사나 일반 기업의 파산위험성이 급증한다면 금융시장안정화 조치는 즉각적으로 그리고 대규모로 집행될 필요가 있다. 시장금리 급등으로 인해 국내 금융시장환경은 점차 심각한 상황으로 변해가고 있다. 금융시장안정화기구의 필요성이 2020년 3월에 이어 다시 급격히 커지고 있으며, 지난 10월 23일에 발표된 정부의 시장유동성공급조치는 이러한 시장상황에 대해 신속하고 적절한 대응방향성을 가진다고 평가할 수 있다. 다만, 향후 시장의 유동성 경색이 다시 나타날 가능성이 있음을 감안하여 추가적인 대응책을 선제적으로 마련할 필요성도 크다.

추가적인 대응책 마련에 있어서 우선적으로 고려해야 할 점은 한국은행과 정부의 역할을 어떠한 방식으로 설정할 것인가에 관한 사안일 것이다. 금융시장안정화기구의 운영에 있어서 한국은행의 역할은 명확하다고 볼 수 있는데, 기구 운영을 위한 재원마련 역할을 담당할 필요가 있다. 전술한 바와 같이 위기상황이 도래했을 때 다수의 민간금융회사들은 유동성 제약을 경험하고 있을 가능성이 높기 때문에 금융시장안정화기구의 운영을 위한 자금 출연에 부담을 느낄 것이다. 또한 출연한 자금이 장기간 묶이게 되는 상황과 추가적인 재원마련이 필요한 경우에 대한 부담도 존재한다. 따라서 시장상황의 악화와는 일정 수준 절연되어 있으며 공급량에 상당한 유연성을 가진 재원마련 경로가 필요한데, 중앙은행의 발권력을 이용한 접근법은 그 대안으로 검토될 수 있는 잠재력을 가진다. 한국은행은 코로나19 팬데믹 대응과정에서 회사채와 CP 매입을 위해 설립된 SPV에 대해 금융통화위원회의 의결을 통해 대출을 실시한 사례가 있다. 미국의 금융시장안정화기구와 상당히 유사한 접근법으로 볼 수 있으며, 필요하다면 한국은행법의 개정을 통해 SPV 대출방식을 명문화함으로써 금융시장안정화기구의 운영을 제도적으로 뒷받침하는 방법을 고려해 볼 수 있을 것이다. 다만 이러한 접근법이 시도되기 위해서는 대출에 수반되는 신용위험을 한국은행 이외의 주체가 부담할 수 있는 방안이 마련되어야 하고, 금융시장안정화기구에 대한 한국은행의 대출이 남용되지 않도록 만드는 통제장치도 필요할 것이다.

한국은행에 의한 재원마련과 더불어 우선적으로 고려할 필요성이 있는 부분은 정부에 의한 신용위험의 통제이다. 한국은행은 발권력을 이용하여 재원공급의 역할을 담당할 수 있지만, 운영과정에서 발생하는 신용위험을 부담하기에 적절한 주체라고 평가하기 어렵다. 한국은행은 통화정책의 실행, 인플레이션 통제, 금융안정유지 등을 목적으로 설정하고 있지만, 일반기업의 부도위험을 부담하는 것은 한국은행의 역할을 벗어난다고 볼 수 있다. 금융시장안정화기구의 운영과정에 발생할 수 있는 신용위험을 통제하는 것은 다양한 산업정책을 통해 국가경제를 관리하는 정부의 역할로 간주함이 타당할 것이다. 따라서 재원마련은 한국은행에 맡기되 운영과정에서 발생하는 신용위험은 정부가 부담하는 방식으로 협력체계를 마련하는 것은 금융시장안정화기구의 효율적 운영에 중요한 의미를 가진다. 정부가 신용위험을 부담하기 위해서는 시장이 신뢰할 수 있는 방법으로 부도발생시 자금을 투입할 수 있어야 한다. 시장의 신뢰를 확보할 수 있는 가장 효과적인 방법은 신용사건 발생에 대비하여 기금을 설치하는 것이다. 금융시장안정화기구의 운영상 발생할 수 있는 신용사건을 충분히 흡수할 수 있는 수준으로 기금을 설치하여 관련된 예산을 배정하는 방안을 검토해 볼 수 있을 것이다.

금융시장안정화기구는 위기상황을 대비하기 위한 제도이기 때문에 위기가 발생하기 전에 그 실행방법과 절차에 대해 충분한 검토가 이루어져야 하고 이를 준칙화시켜야 한다. 준칙화되어 있느냐 아니냐는 분초를 다투는 위기상황에서 기업의 생사를 가르는 중요한 차이를 만들 수 있다. 국내의 금융시장안정화기구들은 여러번의 실행경험이 축적되어 있음에도 불구하고 재원마련과 위험부담 측면에서 준칙화의 정도가 상대적으로 떨어진다고 평가할 수 있을 것이다. 제도개선을 위한 적극적인 노력이 필요해 보인다.

1) 금융위원회(2020. 3. 19), 금융위원회(2020. 3. 24), 금융위원회(2020. 3. 27)

2) 기획재정부(2020. 5. 20), 금융위원회(2020. 7. 17)

3) 한국은행은 금융통화위원회의 의결을 통해 SPV에 대한 대출을 승인했다(2020. 7. 17).

4) 국채, 투자등급 회사채, 국제기구채, CP, 지방채, MBS 등 담보가능자산의 범위가 넓다.

5) Federal Reserve Act, Section 13. Power of Federal Reserve Banks, 3. Discounts for individuals, partnership, and corporations

6) 한국은행(2020. 4. 1)

7) 강유덕(2014)

참고문헌

강유덕, 2014,『유럽 재정위기에 대한 유럽중앙은행의 대응과 역할 변화』, 대외경제정책연구원, 정책연구 브리핑 14-31.

금융위원회, 2020. 3. 19, 코로나19 대응을 위한 민생ㆍ금융안정 패키지 프로그램, 보도자료.

금융위원회, 2020. 3. 24, 코로나19 관련 금융시장 안정화 방안, 보도자료.

금융위원회, 2020. 3. 27, 14개 유관기관이 함께 민생ㆍ금융안정 패키지 프로그램 100조원+@를 차질없이 이행해나가겠습니다, 보도참고자료.

금융위원회, 2020. 7. 17, 저신용등급 포함 회사채ㆍ기업어음(CP) 매입기구인 기업유동성지원기구(SPV)가 설립되어 지원을 개시합니다, 보도참고자료.

기획재정부, 2020. 5. 20, 제4차 비상경제 중앙대책본부 회의 개최, 보도자료.

한국은행, 2020. 4. 1, 연준법 13조3항(긴급대출제도)의 주요 내용 및 적용사례, 조사연구.

금융투자협회 www.kofia.or.kr

블룸버그 www.bloomberg.com

통계청 www.kostat.go.kr

한국은행 www.bok.or.kr

Board of Governors of the Federal Reserve System

www.federalreserve.gov