Find out more about our latest publications

Analysis of Pension Tax Systems: Characteristics and Directions for Improvement

Survey Papers 24-01 Mar. 14, 2024

- Research Topic Asset Management/Pension

- Page 89

The swift advancement of aging populations combined with declining birth rates is increasingly highlighting the critical role of pensions. Growing skepticism about the long-term viability of public pension systems is fueling a shift toward reinforcing private pension schemes. This shift is notably evident in key nations including South Korea. A pivotal factor in bolstering private pensions is the structure of the pension tax system. Indeed, tax incentives are the primary motivators for private pension plans. The configuration of this tax system profoundly affects how individuals allocate their pension assets and can also influence the evolution of capital markets.

In South Korea, the pension framework is broadly categorized into public and private systems. The public pension system encompasses national pensions and occupational pensions, while private pensions comprise employer-based retirement plans such as Defined Benefit (DB) and Defined Contribution (DC) schemes, along with individual retirement plans like IRP and pension savings. The taxation approach for pensions predominantly adheres to the EET method. This method entails exemption (non-taxation) at the contribution phase, exemption on earnings at the management phase, and taxation at the pension income distribution phase.

Challenges within the domestic private pension tax system include a lack of diversity in tax-advantaged pension plans, insufficient tax incentives to encourage the pensionization of retirement benefits, and relatively low limits on income deductions (or tax credits) compared to overseas, with inflexible limit adjustments.

This study undertook a comparative examination of pension tax systems in key international jurisdictions to investigate the evolving trends in these systems. Through the analysis of pension tax systems in the United States, Japan, Australia, and Germany, it was confirmed that various tax incentives are being provided for the development of the private pension market. A critical observation from studying these international pension tax systems is the recognition that the essence of an effective pension tax system hinges on the strategic design of tax benefits for pensions. In the case of private pensions, while there are some retirement plans where enrollment is compulsory like retirement pensions, many retirement plans operate based on the voluntary will of the subscribers. The most powerful incentives to induce voluntary subscription of the participants are tax benefits.

This study of international pension systems suggests several key legislative measures to develop the domestic pension tax system. Firstly, bolstering private pensions requires increasing the limits on tax benefits. Legislative reforms should allow for periodic adjustments to these limits, using economic indicators like the growth rate, inflation, and average wage increases. Secondly, to discourage the trend of opting for lump-sum withdrawals of retirement contributions, there's a need to consider higher tax rates on such lump-sum withdrawals. This approach would promote the receipt of retirement income in the form of pensions. Thirdly, the mechanism for offering tax benefits on pension contributions should shift from a tax credit method to an income deduction method. Fourthly, a variety of methods for providing tax benefits ought to be allowed. Specifically, introducing a TEE pension system could offer a new framework, where contributions are taxed, but earnings and withdrawals are exempt. Lastly, it is recommended to consider implementing a refundable tax credit system or a matching subsidy scheme for pension contributions made by socially vulnerable groups, ensuring a more inclusive and equitable pension system.

In South Korea, the pension framework is broadly categorized into public and private systems. The public pension system encompasses national pensions and occupational pensions, while private pensions comprise employer-based retirement plans such as Defined Benefit (DB) and Defined Contribution (DC) schemes, along with individual retirement plans like IRP and pension savings. The taxation approach for pensions predominantly adheres to the EET method. This method entails exemption (non-taxation) at the contribution phase, exemption on earnings at the management phase, and taxation at the pension income distribution phase.

Challenges within the domestic private pension tax system include a lack of diversity in tax-advantaged pension plans, insufficient tax incentives to encourage the pensionization of retirement benefits, and relatively low limits on income deductions (or tax credits) compared to overseas, with inflexible limit adjustments.

This study undertook a comparative examination of pension tax systems in key international jurisdictions to investigate the evolving trends in these systems. Through the analysis of pension tax systems in the United States, Japan, Australia, and Germany, it was confirmed that various tax incentives are being provided for the development of the private pension market. A critical observation from studying these international pension tax systems is the recognition that the essence of an effective pension tax system hinges on the strategic design of tax benefits for pensions. In the case of private pensions, while there are some retirement plans where enrollment is compulsory like retirement pensions, many retirement plans operate based on the voluntary will of the subscribers. The most powerful incentives to induce voluntary subscription of the participants are tax benefits.

This study of international pension systems suggests several key legislative measures to develop the domestic pension tax system. Firstly, bolstering private pensions requires increasing the limits on tax benefits. Legislative reforms should allow for periodic adjustments to these limits, using economic indicators like the growth rate, inflation, and average wage increases. Secondly, to discourage the trend of opting for lump-sum withdrawals of retirement contributions, there's a need to consider higher tax rates on such lump-sum withdrawals. This approach would promote the receipt of retirement income in the form of pensions. Thirdly, the mechanism for offering tax benefits on pension contributions should shift from a tax credit method to an income deduction method. Fourthly, a variety of methods for providing tax benefits ought to be allowed. Specifically, introducing a TEE pension system could offer a new framework, where contributions are taxed, but earnings and withdrawals are exempt. Lastly, it is recommended to consider implementing a refundable tax credit system or a matching subsidy scheme for pension contributions made by socially vulnerable groups, ensuring a more inclusive and equitable pension system.

Ⅰ. 연구의 배경 및 목적

현재 우리나라에서는 급속한 고령화와 심각한 저출산으로 인해 경제성장이 둔화되고 노년층의 경제불안이 심각해질 것이라는 우려가 크게 대두되고 있다. OECD가 발행한 보고서에 따르면 우리나라는 2060년경 OECD 회원국 중에서 가장 고령화된 사회가 될 것으로 보인다.1) 2010년 65세 이상 인구의 비중은 10.8%였으나, 2021년에는 16.6%로 상승했다. 2025년에는 65세 이상 인구의 비중이 20%를 넘어서면서 초고령사회가 될 것으로 전망되고, 2035년에는 그 비중이 무려 30%에 이를 것으로 보인다. 급격한 출산률의 하락을 감안할 때 고령화의 속도는 더 빨라질 수 있다. 2023년 2분기 국내 합계출산율은 0.7명으로 역대 최저치를 경신했다. 인구절벽으로 인한 경제충격과 노년층의 경제불안은 피할 수 없는 미래가 된 것이다.

우리나라에서 고령화가 진행되면서 나타나는 가장 큰 문제점 중의 하나가 고령층의 빈곤화이다. 우리나라의 빈곤율을 살펴보면 18~65세까지의 인구에 대해서는 2019년 기준 11.1%였으나 66세 이상은 43.2%로 급상승한다. 이러한 노인빈곤율은 주요국 통계와 비교할 때 매우 높은 수준이다. 미국, 영국, 프랑스, 캐나다의 노인빈곤율은 2019년 기준 각각 23.0%, 15.5%, 4.4%, 12.3%로 나타난다. 높은 노인빈곤율은 노년층의 삶의 질이 현저하게 떨어진다는 것을 의미하며, 다양한 사회불안을 야기할 수 있다.

고령층의 빈곤화를 완화하기 위해서 가장 중요한 대응수단은 연금제도의 강화이다. 국내 연금제도는 공적연금, 사적연금의 중층구조로 발전해왔다. 공적연금은 강제가입방식으로 설계되어 있는데, 현재의 수급구조로는 2055년 이후 연금고갈이 불가피할 것으로 보인다. 소득대체율도 낮은 편이다. 국민연금의 소득대체율은 31.2%에 불과해 국민연금만으로는 은퇴 이후의 경제적 안정성을 확보하기 어렵다. 공적연금의 기능강화를 위해 더 많이 내고 더 늦게 받는 방식으로 연금개혁에 대한 논의가 지속되고 있는 이유이다.

퇴직연금과 개인연금의 기능도 확대될 필요가 있다. 퇴직연금은 은퇴 이후 소득확보에 매우 중요한 역할을 담당하며, 장기간 적립되어 운용될 경우 국민연금의 낮은 소득대체율을 보완할 수 있다. 개인연금은 자발적인 참여를 바탕으로 운영되는데, 그 필요성에 비해 적립수준은 낮은 편이다. 가입이 강제되는 연금에 대한 개혁도 중요하지만, 본인의 선택으로 이루어지는 연금들에 대한 정책적 배려도 충실히 이루어져야 할 것이다. 기여금 적립강화 및 운용수익률 제고방안들이 모색될 필요가 있다.

연금기능의 강화를 위해서 고려해야 할 중요한 요소로 연금세제를 들 수 있다. 연금세제의 설계방식은 개인들의 연금자산 구성에 큰 영향을 미치게 되며, 자본시장의 발전에도 상당한 차이를 가져올 수 있다. 연금에 대한 세제혜택은 사실상 개인의 연금적립에 있어 가장 중요한 유인이 된다. 해외의 주요 선진국들도 국민의 노후자산 축적을 지원하기 위하여 다양한 방식의 세제를 도입하여 운영하고 있다. 연금납입에 대한 과세이연, 운용수익에 대한 과세이연, 보조금지급 등은 대표적 세제혜택 사례이다. 우리나라의 연금세제는 연금납입과 운용수익에 대한 과세이연 허용이 가장 중요한 특징으로 볼 수 있다. 다만 국내 연금세제는 세제혜택 제공방식이 다양하지 못하고, 취약계층의 보호기능이 상대적으로 부족하다는 지적이 이어지고 있다.

국내외 연금세제의 특성을 분석하기 위한 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 우리나라 연금과세 제도의 특성을 종합적으로 분석한다. 대표적인 공적연금인 국민연금, 사적연금인 기업형 퇴직연금과 개인형 퇴직연금에 대한 과세제도 특징을 정리할 것이다. Ⅲ장에서는 주요국의 연금과세제도에 대한 분석을 실시한다. 미국, 일본, 호주 등의 국가에서 연금과세제도를 어떻게 설계해서 운영하고 있는지를 파악할 것이다. Ⅳ장에서는 해외 연금세제에 대한 분석을 바탕으로 연금세제에 대한 비교분석을 실시할 것이다. 외국의 연금세제가 우리나라의 연금세제와 어떠한 차이를 가지고 있는지 비교하고, 이를 바탕으로 우리나라 연금세제에 대한 개선방향을 제시할 것이다.

Ⅱ. 우리나라의 연금과세제도 특성 분석

1. 개요: 연금제도 분류체계

우리나라 연금제도는 일반적으로 공적연금과 사적연금으로 구분된다. 국내 소득과세 체계는 공사(公私) 구분방식을 명확히 법제화하였기 때문에, 본 보고서의 연금과세제도 특성 분석에 있어서도 국내 법령상의 공사 구분방식을 따랐다. 이러한 국내 연금제도 구분방식은 세계은행, OECD 등의 국제기구 분류체계(taxonomy)와도 높은 정합성을 가진다.

공적연금은 국민연금과 직역연금(공무원연금, 사립학교교직원연금, 군인연금, 별정우체국직원연금)으로 구성된다. 국내 소득세법이 규정하는 ‘공적연금 관련법’은 국민연금법, 공무원연금법, 군인연금법, 사립학교교직원연금법, 별정우체국법 등을 포함한다.2) 해당 공적연금 관련법은 모두 수급자의 가입을 강제하고 있으며, 예외 없이 제1조에서 해당 법의 목적을 수급자의 생활안정으로 규정한다. 공적연금은 가입이 법률에 의해 강제되고 있으며, 사회보장(social security)적 성격을 강하게 가지고 있다. 국내 공적연금제도가 가지는 특징인 공권력에 의한 강제성과 사회보장적 성격은 OECD의 공적연금제도의 개념적 특징과도 일치한다.3) 공적연금 간의 동일한 특징4)을 바탕으로 공적연금은 ‘국민연금과 직역연금의 연계에 관한 법률’ 등에 의해 상호연계성을 높이고 있다. 또한 국민연금과 직역연금으로부터의 소득은 ‘공적연금소득’5)으로 분류되어 동일한 세제 원칙이 적용된다.

사적연금으로는 기업형 퇴직연금인 확정급여형퇴직연금(Defined Benefits: DB)과 확정기여형퇴직연금(Defined Contribution: DC), 개인형 퇴직연금인 개인형퇴직연금(Individual Retirement Pension, 이하 IRP)과 연금저축이 있다. 소득세법은 퇴직연금(DB, DC, IRP)계좌와 연금저축계좌를 사적 연금계좌로 정의한다.6) 사적 연금계좌로부터의 소득은 합산하여 선택적 분리과세의 대상7)이 되는 등 공적연금과는 다른 세제적 취급을 받는다. 우리 정부도 다층노후소득보장 정책집행에 있어 사적연금을 퇴직연금과 개인연금(연금저축)으로 분류하여 각각의 활성화 방안을 마련하여 집행 중이다.8) 세계은행 등이 제시하는 다층(multi-pillar) 연금구조에 따르면 기업형 퇴직연금은 2층(Pillar Ⅱ)에 해당하고 개인형 퇴직연금은 3층(Pillar Ⅲ)에 해당한다.9) 연금구조상 2층과 3층에 위치한 사적연금은 1층의 공적연금이 제공하는 사회보장적 성격의 기본연금을 보충하여 추가적인 노후 소득을 확보하려는 목적을 가진다. 2층의 기업형 퇴직연금과 비교하여 3층의 개인형 퇴직연금은 개인의 선택, 자율적 운용, 추가적 소득의 성격이 더욱 강하다.

우리나라에서 연금에 부과되는 세금의 특성을 살펴보면 가장 기본적인 원칙으로 납입단계에 대한 비과세(Exempt), 운용과정에서 발생하는 수익에 대한 비과세(Exempt), 연금소득 수급단계에서의 과세(Taxed)로 요약되는 EET방식이 기준이 되고 있다. 일부 연금 유사상품의 경우 납입단계에서 과세하고 이후 운용 및 수급단계에서는 비과세하는 TEE 유형의 특성을 가지기도 하지만 대부분의 연금에 대해서 EET방식이 적용된다. 공적연금은 모두 EET방식의 세제가 적용되며 퇴직연금 및 IRP에 대해서도 EET방식이 적용된다. 개인연금의 경우 연금저축은 EET방식이 적용되고, 연금보험은 일종의 TEE방식10)이 적용된다. 주택연금의 경우 공적연금 및 사적연금과 비교할 때 운영하는 방식이 완전히 다르다. 주택연금에 대한 과세체계는 기본적으로 부동산에 대한 과세체계를 기본으로 하고 있으며 부동산과세에서 일부 항목에 대해 세제혜택을 주는 방식으로 운영되고 있다.

2. 공적연금에 대한 과세제도

공적연금은 국민연금을 비롯해 공무원연금, 군인연금, 사립학교교직원연금 등의 다양한 형태로 운영되고 있다. 본 장에서 공적연금의 특징은 국민연금을 중심으로 설명하고, 공적연금에 대한 과세체계도 국민연금에 대한 과세방식을 중심으로 설명할 것이다. 이는 국민연금이 공적연금에서 가장 중요한 대표적인 연금으로 인식되고 있으며, 다른 종류의 공적연금에 대한 과세체계도 기본적으로 국민연금과 유사하기 때문이다.

국민연금은 가장 대표적인 공적연금으로서 1988년부터 제도를 시행하고 있다. 현재 국민연금의 연금보험료율은 사업장 가입자의 경우 기준소득월액(상한액 590만원)의 9%이다. 이중 절반은 사업장의 사용자가 부담하고 나머지 절반은 근로자 본인이 부담한다. 지역가입자와 임의가입자의 경우 9%의 연금보험료 전액을 본인이 부담한다. 농어업인의 경우 일정 조건에 해당하면 연금보험료의 일부를 국고에서 지원받을 수 있다. 연금급여를 지급하는 방식은 노령연금, 장애연금, 유족연금, 반환일시금이 있다. 최소가입기간은 10년이며, 1969년생 이후 출생자는 만 65세부터 노령연금의 수급이 가능하다. 소득이 없을 경우에는 만 55세부터 조기노령연금의 수급이 가능하다. 국민연금의 소득대체율은 40년 가입한 평균 소득자를 기준으로 40% 수준이다.

국민연금에 대한 과세체계는 3단계로 구분된다. 연금부담금을 납입하는 시기(납입단계), 납입된 연금부담금을 운용하는 단계(운용단계), 그리고 최종적으로 연금이 지급되는 단계(수급단계)이다. 국민연금을 포함한 공적연금에 대한 과세체계는 기본적으로 납입단계에서의 비과세-운용단계에서 발생한 수익에 대한 비과세-수급단계에서 연금소득세를 과세하는 방식(EET)이 적용된다. 납입단계와 운용단계에서의 비과세가 실질적으로는 과세이연의 성격을 가지기 때문에 비과세가 아니라고 보는 견해가 있으나, 소득발생 시기에 과세되지 않는다면 비과세로 분류하는 것이 OECD를 비롯한 국제기구의 기본적인 분류체계이며, 본 보고서도 이러한 분류체계를 따라 구분한다.

사용자가 납입하는 연금부담금은 근로자의 과세소득이 아니며, 사용자는 이를 손금으로 처리할 수 있다. 근로자가 납입하는 연금부담금은 근로자의 종합소득 계산 시 전액 소득공제되기 때문에 납입단계에서 완전한 비과세라고 평가할 수 있다. 소득세법은 종합소득이 있는 거주자가 공적연금 관련법에 따른 기여금11) 또는 개인부담금을 납입한 경우에는 해당 과세기간의 종합소득금액에서 그 과세기간에 납입한 연금보험료를 공제하도록 허용하며12), 이를 연금보험료공제로 정의한다.13) 운용단계에서 발생하는 운용수익은 발생시점에서는 과세하지 않으며, 연금으로 최종수급하는 단계에서 과세한다.

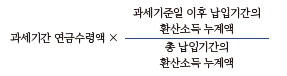

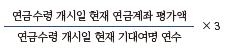

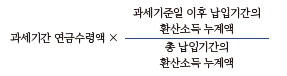

공적연금이 지급하는 연금급여인 공적연금소득은 해당 과세기간에 수급한 공적연금에 대하여 공적연금의 지급자별로 과세기준일(2002년 1월 1일)을 기준으로 과세기준금액을 계산한다.14) 공적연금의 과세기준일이 2002년 1월 1일이므로 2001년 이전에 납입한 연금보험료로부터 지급받은 연금소득은 비과세되지만, 2002년 이후 납입한 연금보험료는 소득공제를 받았기 때문에 이로부터 발생하는 연금소득은 과세된다.15) 공적연금소득 중 국민연금으로부터 지급받는 연금소득에 대한 과세기준금액은 아래와 같이 계산한다.16) 식에서 표시된 환산소득은 가입자의 가입기간 중 매년의 기준소득월액을 보건복지부장관이 고시하는 연도별 재평가율에 따라 연금수급 개시 전년도의 현재가치로 환산한 금액이다.17) 기준소득월액은 전년도 중 해당 사업장에서 종사한 기간에 받은 소득액을 그 기간의 총일수로 나눈 금액의 30배에 해당하는 금액을 소득월액으로 하여 매년 국민연금공단이 결정한다.18)

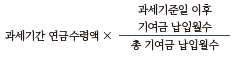

공적연금 중 국민연금 이외의 연금소득에 대한 과세기준 금액은 아래와 같이 계산한다.19)

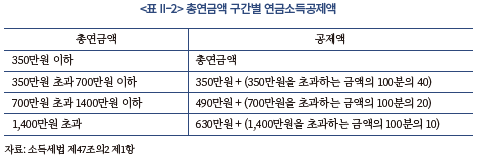

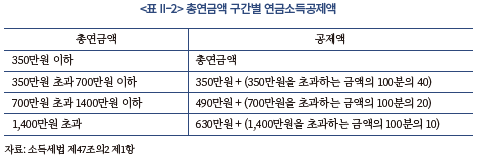

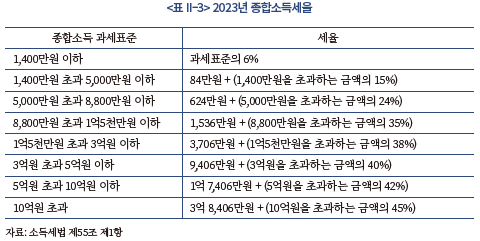

공적연금소득에 대한 과세기준 금액을 계산한 후 연금소득공제를 적용하여 연금소득금액을 확정한다. 연금소득공제는 350만원 이하일 경우 총연금액 전액이 공제되고, 700만원 이하에 대해서는 350만원을 초과하는 금액의 40%, 1,400만원 이하에 대해서는 700만원을 초과하는 금액의 20%, 1400만원을 초과에 대해서는 1,400만원을 초과하는 금액의 10%이다. 다만, 공제액이 900만원을 초과하는 경우에는 900만원까지만 공제한다.20) 공적연금소득에 대해서는 원칙적으로 종합과세가 적용된다. 연금소득금액에 다른 종합소득금액(이자소득, 배당소득, 사업소득, 근로소득, 기타소득 합계액)을 합산하여 과세표준을 계산하고 기본세율이 적용된다. 공적연금소득이외에 다른 소득이 없을 경우 계산된 기본세율을 적용하여 원천징수되며21) 과세표준확정신고가 면제된다.22) 다만 실무상의 처리에 있어서는 매월분의 공적연금소득에 대한 원천징수세율을 적용할 때 연금소득 간이세액표를 적용하여 징수하게 된다.23)

3. 사적연금에 대한 과세제도

가. 개요: 퇴직금제도와 퇴직연금제도

본 연구에서 국내 근로자의 퇴직급여에 대한 과세체계 분류는 소득세법과 더불어 ‘근로자퇴직급여 보장법’(이하 퇴직급여법)을 따랐다. 퇴직급여법은 ‘근로자 퇴직급여제도의 설정 및 운영에 필요한 사항을 정함으로써 근로자의 안정적인 노후생활 보장에 이바지함을 목적’24)으로 2005년 1월 27일 처음 제정되었다. 해당 법률에 따르면 퇴직급여제도는 퇴직금제도, 퇴직연금제도, 중소기업퇴직연금기금제도로 구성된다. 퇴직급여법상의 퇴직연금제도와 소득세법상의 연금저축제도가 합해져서 국내 사적연금계좌 과세제도의 주축을 이룬다.25)

중소기업퇴직연금기금제도는 둘 이상의 중소기업 고용주와 직원이 공동으로 납입한 부담금을 사용하여 공동 기금을 조성하고 운영함으로써, 근로자의 안정된 노후생활을 지원하기 위한 급여를 제공하는 시스템을 의미한다.26) 중소기업퇴직연금기금제도는 매우 중요한 퇴직급여제도이기는 하지만, 그 대상이 상시 30명 이하의 근로자를 사용하는 중소기업에 국한된다. 따라서 근로자 전반의 퇴직급여 과세제도 분석을 지향하는 본 연구의 제도 분석 대상에서 중소기업퇴직연금기금제도는 제외하기로 한다.

퇴직급여제도 중 가장 중요한 두 축은 퇴직금제도와 퇴직연금제도이다. 퇴직금제도란 ‘계속근로기간 1년에 대하여 30일분 이상의 평균임금을 퇴직금으로 퇴직 근로자에게 지급할 수 있는 제도’이다.27) 사용자는 퇴직금 지급사유가 발생한 날부터 14일 이내에 해당 근로자에게 퇴직금을 지급하여야 한다. 이때 근로자는 퇴직급여를 일시금 방식으로 지급받거나 연금 방식으로 지급받을 수 있으며, 지급 방식에 따라 퇴직급여에 대한 과세가 다르다. 즉, 근로자가 퇴직급여를 일시 수급하는 경우 퇴직소득세가 적용되며, 연금 형태로 분할 수급하는 경우 연금소득세가 적용된다. 또한 일정한 사유로 인해 퇴직급여를 중도 인출하는 경우 기타소득세가 적용된다.

퇴직연금제도란 근로자가 노후에 정기적으로 전체 퇴직급여 중 일정 금액을 지급받는 제도이다. 퇴직연금제도는 확정급여형퇴직연금제도(DB), 확정기여형퇴직연금제도(DC), 개인형퇴직연금제도(IRP) 등으로 구분된다.28) 확정급여형퇴직연금제도는 가입자에게 지급될 퇴직급여의 수준이 미리 결정되어 있는 퇴직연금제도이다. 확정기여형퇴직연금제도는 퇴직급여 지급을 위한 가입자의 부담금 수준이 미리 결정되어 있는 퇴직연금제도이다. 개인형퇴직연금제도는 가입자의 납입금(일시금 혹은 부담금) 또는 사용자의 납입 부담금을 가입자의 자유로운 선택에 따라 적립‧운용하기 위하여 설정한 퇴직연금제도이다. 개인형퇴직연금제도는 확정급여형 또는 확정기여형의 퇴직연금제도와는 다르게 지급받을 퇴직급여의 수준 또는 지급해야 할 부담금의 수준이 확정되지 아니한 특징이 있다.

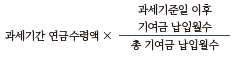

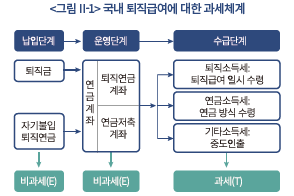

국내 퇴직급여에 대한 과세체계를 납입단계, 운영단계, 수급단계로 나누어 도식화하면 <그림 Ⅱ-1>과 같다. <그림 Ⅱ-1>에서 나타난 바와 같이, 국내 퇴직급여는 납입단계에서 납입금에 대해서는 비과세(Exempted), 운용단계에서 수익에 대한 비과세(Exempted), 수급단계에서 퇴직소득에 대한 과세(Taxed)가 이루어지는 EET 구조를 원칙적으로 갖는다.

나. 퇴직소득 과세제도

1) 퇴직소득의 의의

퇴직소득이란 근로자가 자신의 근로관계를 종료할 때 받는 일시적 급여를 의미한다. 퇴직소득은 법정퇴직급여와 법정외퇴직급여로 나눌 수 있다. 법정퇴직급여는 퇴직금제도, 확정급여형퇴직연금제도, 확정기여형퇴직연금제도에서 일시금으로 지급받는 퇴직급여이다. 법정퇴직급여는 공적연금을 기초로 하는 일시금과 사적 사용자 부담금을 기초로 하는 일시금을 모두 포함한다. 법정외퇴직급여는 희망퇴직금, 명예퇴직금 등 법정되지 않은 퇴직급여이다.29)

퇴직소득은 후불급여적 성격을 가짐과 동시에 ‘사회보장적 급여로서의 성격’30)을 가진다는 점에서, 종합소득에서 제외되고 과세상 우대된다. 또한 퇴직소득은 장기간 집적된 후불급여라는 점에서, 조세정책상 이러한 결집효과(increased effect)를 완화할 필요가 있다. 이러한 퇴직소득의 결집효과를 완화하기 위해서 현행 소득세법은 퇴직소득의 계산에 있어 근속연수공제, 연분연승법 등을 적용한다.

2) 퇴직소득에 대한 과세

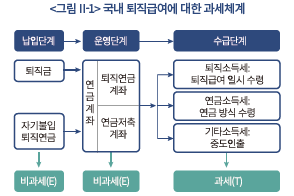

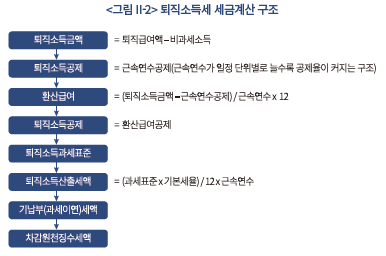

근로자의 퇴직금은 그 지급사유가 발생한 날부터 14일 이내에 사용자가 IRP 계정으로 지급되어야 한다.31) 다만, 근로자가 55세 이후에 퇴직한 경우 등 일부 예외사항에 해당하면 사용자가 직접 근로자 일반 계좌로 퇴직금을 지급할 수도 있다. 퇴직소득세는 퇴직소득금액에서 일정한 공제금을 공제하는 방식으로 과세표준을 정하는 점에서 근로소득과 유사한 측면이 있다. 다만 소득공제의 방식에 있어 근속연수공제를 하고, 환산급여를 계산한 후, 환산급여별공제를 한다는 점에서 다른 종합소득에 비해 과세표준이 줄어든다. 예를 들어 퇴직자 A가 20년 근속 후 퇴직금 1억원을 일시불로 받았다고 가정하자. 근속연수에 따라 누진적으로 늘어나는 근속연수공제 방식에 따라, 20년 근속자는 4,000만원의 공제금 혜택을 받게 된다.32) 퇴직소득에서 근속연수공제를 제한 금액은 다시 근속연수가 길수록 유리하게 환산된다. 즉 20년 근속자는 1억원 퇴직소득에서 4,000만원을 공제한 금액 6,000만원에 환산율(12/정산근속연수)33)을 곱하면 환산급여는 3,600만원이 된다. 환산급여는 급여구간 누진방식에 따라 다시 환산급여별 공제를 받게 된다.34) 따라서 앞선 예에 따른 3,600만원의 환산급여에 대해 다시 공제를 적용하면, 과세표준이 1,120만원이 된다.

산출된 과세표준에 세율을 적용함에 있어, 다른 종합소득과 다르게 환산산출세액 방식에 따라 세액을 계산한다. 즉 해당 과세기간의 ‘퇴직소득과세표준에 법정된 세율을 적용한 금액’을 ‘12로 나눈 금액에 근속연수를 곱’하여 퇴직소득 산출세액을 계산한다.35) 앞선 예에서 20년 근속 퇴직자의 과세표준에 법정 세율을 적용하면 67만 2천원이 계산되며, 해당 금액을 12로 나눈 금액에 근속연수 20년을 곱하면 퇴직소득 산출세액은 최종 112만원(지방소득세 10%를 감안하면, 123만 2천원)이 된다. 20년 근속 퇴직자가 1억원의 퇴직소득에 대해 실질적으로 1.232%의 세율만 부담하게 하는 조세정책적 이유는 퇴직소득이 가진 노후를 위한 사회보장적 성격에서 찾을 수 있다. 앞서 설명한 퇴직소득세의 세금계산 구조를 도표로 나타내면 <그림 Ⅱ-2>와 같다.

전술한 바와 같이 퇴직소득의 일시 인출에 대한 실질세율이 1.232%에 이를 정도로 낮을 경우 퇴직자가 퇴직소득을 연금화할 유인을 줄인다. 일시금으로 수령해도 세금부담이 아주 낮기 때문이다. 종합과세나 연금과세가 적용될 경우 일시금으로 큰 금액을 받는 것보다 연금으로 분할해서 수령하는 것이 세금부담을 줄이는 데 유리하다. 그러나 퇴직소득세율이 매우 낮은 경우에는 연금으로 받을 세제적 유인은 줄어들게 된다.

다. 연금소득 과세제도

1) 연금소득의 의의

연금소득이란 근로자가 일정 기간 납입한 금액을 노후에 정기적으로 지급받는 수단(연금)으로부터의 수입을 의미한다. 연금소득은 사전 지정된 기간 또는 해당 연금소득 수급자가 사망할 때까지 지급된다. 연금소득은 크게 공적연금소득과 사적연금소득으로 나눌 수 있다. 공적연금소득에는 국민연금, 공무원연금, 군인연금, 사학연금, 별정우체국연금 등이 있다. 또한 사적연금소득에는 연금저축계좌에서 수령하는 소득과 퇴직연금계좌에서 수령하는 소득이 있다.36)

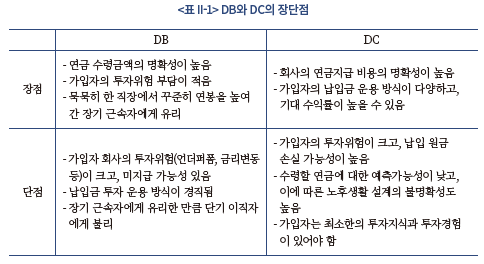

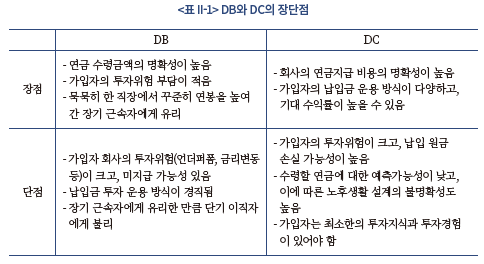

기업형 퇴직연금은 연금 구조(납부방식, 수령방식 등)에 따라 DB(확정급여형퇴직연금제도)와 DC(확정기여형퇴직연금제도)로 나눌 수 있다. DB와 DC는 납입단계, 운영단계, 수급단계에 따라 다음과 같은 차이점이 있다. 납입단계에 있어, DB는 납입금액이 미래에 지급될 급여 수준에 의해 정해짐에 반하여, DC는 납입금액이 해당 연도의 급여 수준에 따라 정하여진다. 운영단계에 있어, DB는 회사가 지정한 전문 운영기관 납입금액을 관리하고 투자수익률이 낮은 경우 해당 회사가 부족분을 보충할 의무가 있음에 반하여, DC는 가입자가 자신의 계좌를 직접 관리하며 회사는 관련 투자손실에 대한 추가 납입의무가 없다. 수급단계에 있어, DB는 최종 급여수준, 근속연수 등을 고려한 산식에 따라 연금을 지급받음에 반하여, DC는 가입자의 관리·운영에 따른 투자성과에 따라 연금을 지급받는다. 이러한 DB와 DC의 특성을 고려할 때, 각각의 장단점을 살펴보면 <표 Ⅱ-1>과 같다.

DB와 DC 각각의 고유한 장단점이 있기 때문에, 어떤 연금 구조가 더 좋은가라는 일률적 판단보다는 어떤 연금 구조가 특정 개인에게 더 적합한 것인가라는 구체적 판단이 더 중요하다. 예를 들어, 투자전문가인 연금 가입자에게는 DB보다 DC가 더 유리할 수 있다. 반면 안정적 노후 생활에 대한 선호도가 매우 높은 가입자에게는 DC보다 DB가 더 선호될 것이다. 가입자의 개인적 상황과 주변 환경에 따라 최적화된 연금 구조를 설계하기 위한 제도적 제안을 위해서는 연금소득 과세제도에 대한 면밀한 분석이 필요하다.

2) 연금소득에 대한 과세

가) 납입단계 및 운용단계에서의 과세

국내 연금소득 EET 기본 구조상 납입단계에서의 연금보험료(공적연금 관련법에 따른 기여금 또는 개인부담금)는 원칙적으로 비과세(연금보험료 공제)이다.37) 다만 퇴직연금, 연금저축, IRP 등 사적연금은 납입금을 소득공제해 주는 것이 아니라 제한된 방식(납입한도액, 세액공제율)으로 세액공제해 준다. 즉 근로자 또는 종합소득납세자의 연금저축 납입금액은 연간 600만원으로 제한된다. 이중 총급여액 종합소득금액 4,500만원(근로소득만 있는 경우 총급여액 5,500만원) 이하 납세자는 연금저축과 IRP의 납입금액 15%를 세액공제 받는다. 종합소득금액 4,500만원(근로소득만 있는 경우 총급여액 5,500만원) 초과 납세자는 연금저축과 IRP의 납입금액 12%를 세액공제 받는다. 이에 더하여 연금저축계좌 납입금액(600만원 한도)과 퇴직연금계좌 납입금액을 합산하여 연간 총 900만원까지 세액공제를 받을 수 있다.38) 개인종합자산관리계좌(ISA)에 만기가 도래하여 운용금액의 전부 또는 일부를 연금계좌로 이체할 경우 추가적인 세액공제가 가능하다. 연금계좌로 이체한 ISA 만기금액 중 10%, 최대 300만원까지 추가 세액공제가 허용된다.

연금 납입금액 운용단계에서 발생한 수익은 과세되지 않고 향후 수급단계에서 과세된다. 운용단계에서의 비과세 혜택은 금융소득(이자소득과 배당소득)이 연 2,000만원을 초과하기 때문에 초과분이 다른 소득과 합산되어 종합과세되는 금융소득 종합과세 대상자에게 더욱 유리하다. 그러나 운용단계에서의 비과세 혜택은 납입단계에서 1,800만원 연금계좌 납입한도 제한으로 인해 한계를 갖는다.39)

나) 수급단계에서의 과세

연금소득의 수급단계에서의 과세는 연금소득의 수입시기에 이루어진다. 공적연금소득의 수입시기는 관련법에 따라 연금이 지급되는 날임에 반하여, 사적연금소득의 수입시기는 실제 해당 연금을 수령한 날이다. 사적연금소득은 55세 이상 연령, 가입일부터 5년 경과, 연금수령한도에 기반한 분할 수급 등의 법정 요건을 충족한 가입자가 연금수령 개시를 신청한 후 인출가능하다.40)

과세대상인 연금소득금액은 수급받은 총연금액에서 연금소득공제를 차감하여 계산한다. 공적연금의 납입단계에서 연금보험료 소득공제를 받지 않은 경우, 해당 금액은 과세제외기여금으로서 과세대상에서 제외된다.41) 연금소득공제율은 소득수준에 반비례하며, 900만원이 한도액이다. 연금소득구간별 연금소득공제액을 표로 나타내면 <표 Ⅱ-2>와 같다.

소득세법상 연금소득은 원칙상 종합소득으로 과세된다.42) 다만 세액공제를 받은 연금계좌 납입액과 해당 연금계좌의 운용수익을 부득이한 사유없이 연금외 수령하는 경우에는 기타소득으로 분리과세된다.43) 또한 i) 연금계좌에서 연금으로 수령하는 이연퇴직소득, ii) 대통령령으로 정하는 부득이한 사유(천재지변, 의료목적 등)에 따라 인출하는 연금소득, iii) 연내 합계 1,500만원 이하 연금계좌에서 발생한 연금소득(앞선 2가지 사유 제외)은 원칙상 분리과세된다.44) 이 경우 부득이한 사유없이 연금외 수령하는 경우에 비해 우대 세율이 적용된다. 이연퇴직소득에 대해서는 연금외수령 원천징수세율의 60% 또는 70%의 원천징수세율을 적용한다.45)

연내 합계 1,500만원(2023년까지는 1,200만원) 이하의 연금계좌 원천의 연금소득이 있는 거주자는 분리과세를 선택할 수도 있고, 해당 소득을 종합소득 과세표준에 합산하는 선택을 할 수도 있다. 연금계좌 원천의 연금소득을 분리과세하는 경우, 적용 세율은 연금을 수령하는 연령에 반비례한다. 해당 적용 세율은 70세 미만이면 수령액의 5%, 70세 이상 80세 미만이면 4%, 80세 이상이면 3%이다.46) 산출된 세액은 통상 원천징수의무자가 원천징수한다.

연금계좌에서 발생한 연금소득이 연내 합계 1,500만원을 초과하는 경우, 종전에는 해당 소득에 대해 종합과세 하였다. 그러나 2022년 12월 31일 소득세법 개정을 통해, 납세자가 해당 소득에 대해 분리과세 또는 종합과세를 선택할 수 있도록 하였다.47) 결과적으로 연금계좌에서 발생한 연금소득은 수령금액에 상관없이 선택적 분리과세가 가능해졌다. 연내 합계 1,500만원을 초과하는 연금소득에 대해 종합소득 세율을 적용하지 않는 경우, 해당 분리과세연금소득 외의 연금소득에 대해 15% 세율(지방세 제외)을 적용할 수 있다. 이 경우 연금 수령자가 다른 소득이 거의 없고 주로 연금계좌 원천의 연금소득만 받는다면 분리과세보다 종합과세가 더 유리할 수도 있다.

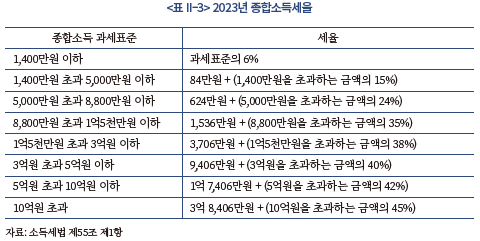

예를 들어 A씨의 2023년 과세대상 소득이 연금계좌 원천에서 받은 2,500만원이라고 가정하자. 분리과세연금소득 외의 연금소득 2,500만원(총연금액)에서 위의 표에 따른 연금소득공제액 740만원을 공제하면 연금소득금액은 1,760만원이 된다. 종합소득공제금액을 기본공제금액인 150만원이라고 가정(최소 가정)할 때, 과세표준 1,610만원에 대해 <표 Ⅱ-3>의 종합소득세율을 적용하면 종합소득산출세액은 115만 5천원이 된다.

위의 경우 A씨가 2,500만원의 총연금액에 대해 종합소득세율이 아닌 15% 분리과세 세율(지방세 제외)을 적용하는 경우, 산출세액은 375만원으로서 종합소득세율을 적용하는 경우보다 세액이 많다. 따라서 연금소득자가 분리과세를 선택하여야 하는 때는 다른 소득이 많고 공제 사유가 적어서 합산 시 종합소득 누진과세 부담이 커지는 경우에 한정된다. 결국 연금소득 세제는 일의적으로 무엇이 좋다고 할 수 없으며, 관련 세제상품의 다양성을 전제로 연금가입자가 자유롭게 선택하는 것이 바람직하다.

라. 국내 사적연금 과세제도의 문제점

국내 사적연금 과세제도에 대한 문제점을 발전방향의 관점에서 고려한다면 다음과 같다. 첫째, 사적연금 세제혜택 상품의 다양성 부족을 들 수 있다. 퇴직연금 수급자의 다양한 경제환경과 수요에 부응하기 위한 퇴직연금 과세상품이 해외에 비해 부족하다. 국내 퇴직연금 과세제도는 EET 방식에만 지나치게 편중되어 있다. 글로벌 주요국의 경우, 원금 납입은 과세(T), 운용 수익은 과세(T), 연금 수급은 비과세(E) 하는 TTE 방식, 미국 Roth IRA와 같은 TEE 방식 등 납입-운용-수급 측면에서 다양한 세제상품이 정비되어 있다.

둘째, 퇴직급여의 연금화를 위한 세제 정비가 부족하다. 퇴직급여의 중도인출 및 일시금 수령을 방지하기 위해서는 세제상 당근과 채찍이 필요하다. 채찍 측면에서 조기인출에 대한 페널티 강화, 퇴직소득 일시인출에 대한 과세 강화가 필요하다. 더불어 당근 측면에서 장기 분할수급에 대한 다양한 세제 인센티브 방안이 요구된다.

4. 연금 유사상품에 대한 과세제도

가. 연금보험

국내에서 존재하는 종신형 연금보험(이하 연금보험)은 대표적인 세제비적격 연금상품이다. 연금보험으로부터 발생하는 보험차익은 기본적으로 이자소득의 성격을 가진다. 세제혜택이 적용되는 연금보험으로 인정받기 위해서는 보험계약 체결시점부터 아래의 요건을 모두 만족시켜야 한다.48) 계약자가 보험료 납입 계약기간 만료 후 55세 이후부터 사망시까지 보험금‧수익 등을 연금으로 지급받아야 한다. 연금 외의 형태로 보험금‧수익 등을 지급하면 안된다. 가입자의 사망시(통계법 제18조에 따라 통계청장이 승인하여 고시하는 통계표에 따른 성별‧연령별 기대여명 연수 이내에서 보험금‧수익 등을 연금으로 지급하기로 보증한 기간이 설정된 경우로서 계약자가 해당 보증기간 이내에 사망한 경우에는 해당 보증기간의 종료시를 말함) 보험계약 및 연금재원은 소멸된다. 계약자와 피보험자 및 수익자가 동일하고 최초 연금지급개시 이후 사망일 전에 중도해지할 수 없어야 한다. 매년 수령하는 연금액(연금수령 개시 후에 금리변동에 따라 변동된 금액과 이연(移延)하여 수령하는 연금액은 포함하지 않는다)이 아래의 계산식에 따라 계산한 금액을 초과하지 말아야 한다.

임의가입 형태인 연금보험은 적립금 납입시에 세제혜택이 주어지는 세제적격 연금저축과는 대조적으로 적립금 납입시에는 세제혜택이 없다. 이로 인해 운용과정에서 발생하는 수익을 연금으로 수령할 때에 연금소득세를 부과하지 않는다. 납입금에 대해 세제혜택이 전혀 없으나 일정 조건을 만족할 경우 연금수령액에 대해 과세하지 않기 때문에 TEE방식으로 간주할 수 있다. 연금보험은 납입금에 대한 세제혜택은 없기 때문에 소득세를 납부한 이후의 세후소득으로 납입하게 된다. 비과세 요건을 충족하였을 경우 연금보험으로부터의 연금수령액에 대해서는 아무런 세금이 부과되지 않는다. 비과세 요건을 충족하지 못했을 경우 보험차익을 이자소득으로 간주하여 소득세가 부과된다.

저축성보험의 비과세 요건은 최초로 보험료를 납부한 날부터 만기일 또는 중도해지일까지의 기간이 10년 이상이며, 계약자 1명당 납입할 보험료 합계액이 1억원 이하(2017년 4월 1일 이후 계약체결분에 한함)이어야 한다. 월적립식 저축성보험의 비과세 요건은 보험료를 월 150만원 이내로 5년 이상 매월 납부하고 계약을 10년 이상 유지해야 한다는 것이다. 또한 최초납입일로부터 매월 납입하는 기본보험료가 균등하고, 기본보험료의 선납기간이 6개월 이내이어야 한다. 전술한 요건을 만족시킬 경우 저축성 보험차익과 월적립식 보험차익에 대해서 비과세되며, 만족시키지 못할 경우 이자소득으로 간주되어 소득세가 부과된다.

나. 주택연금

주택연금제도는 2007년 최초로 도입되었고 한국주택금융공사에 의해 제공되고 있다. 주택연금은 소득세법상 세제적격 연금상품으로 분류되지 않는다. 그러나 우리 정부는 주택연금을 다층적 노후소득보상체계의 4층에 위치시키며 그 중요성을 강조하고 있다.49) 통계청은 전국민의 다층적 노후소득보장정책 수립을 뒷받침하기 위해 포괄적 연금통계를 개발하여 공표하였는데, 해당 연금통계에 주택연금이 포함되어 있다.50)

주택연금의 정식명칭은 주택담보노후연금보증이다. 주택소유자가 주택에 저당권 설정 또는 주택소유자와 한국주택금융공사가 체결하는 신탁계약(주택소유자 또는 주택소유자의 배우자를 수익자로 하되, 공사를 공동수익자로 하는 계약)에 따른 신탁을 등기하고 금융기관으로부터 시행령으로 정하는 연금 방식으로 노후생활자금을 대출받음으로써 부담하는 금전채무를 한국주택금융공사의 부담으로 보증하는 행위를 말한다. 이 경우 주택소유자 또는 주택소유자의 배우자가 시행령으로 정하는 연령 이상이어야 하며, 그 연령은 공사의 보증을 받기 위하여 최초로 주택에 저당권 설정 등기 또는 신탁 등기를 하는 시점을 기준으로 한다.

주택연금은 전술한 공적연금, 퇴직연금, 개인연금과는 운영방식이 완전히 다르다는 특징을 가진다. 연금가입자의 연금부담금을 운영하는 과정에서 발생하는 수익과 연금부담금 원본을 연금가입자에게 연금급여로 지급하는 것이 일반적인 연금의 운영유형이다. 반면 주택연금은 주택을 보유하고 있는 가입자가 보유주택에 거주하면서 해당 주택을 담보로 월지급방식의 연금급여를 받는 역모기지성 연금상품이다. 연금지급의 실질적인 주체는 금융회사들이며 한국주택금융공사는 연금지급에 대해 주택매도자금을 담보로 보증을 선다. 가입자가 연금지급을 위해 주택금융공사에 보증을 신청하면 주택금융공사는 신청자의 주택에 대한 심사를 바탕으로 보증서를 금융회사에 발급한다. 금융회사는 주택금융공사의 보증을 기반으로 가입자에게 주택연금대출을 제공한다. 금융회사에 의한 장기에 걸친 주택연금대출이 가능한 것은 신용위험을 주택금융공사가 전적으로 부담하기 때문이다. 주택금융공사는 가입자의 주택가치를 담보로 보증을 제공하는 방식이다.

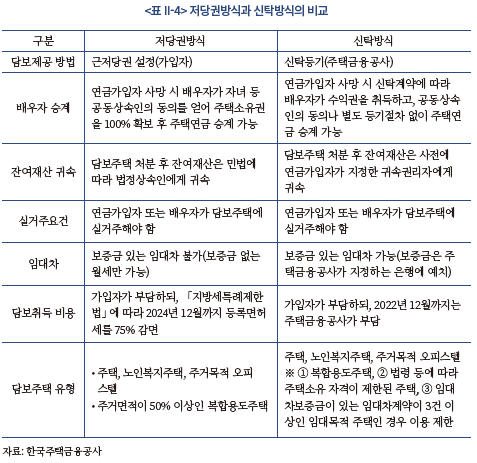

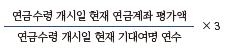

주택연금은 주택소유자 또는 주택소유자의 배우자가 55세 이상인 경우 주택소유자가 소유주택에 근저당권을 설정하거나 또는 주택소유자와 한국주택금융공사와 체결한 신탁계약(주택소유자 또는 주택소유자의 배우자를 수익자로 하되, 한국주택금융공사를 공동수익자로 하는 신탁계약)에 따른 신탁을 등기하여 금융회사로부터 평생 또는 일정기간 동안 연금방식으로 노후생활자금을 대출받는다.51) 저당권방식과 신탁방식의 세부적인 차이는 <표 Ⅱ-4>와 같다.

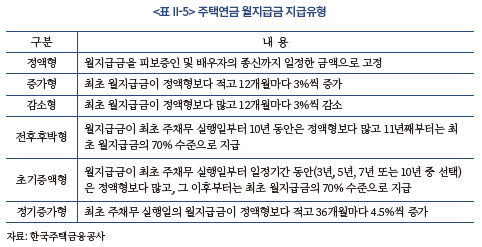

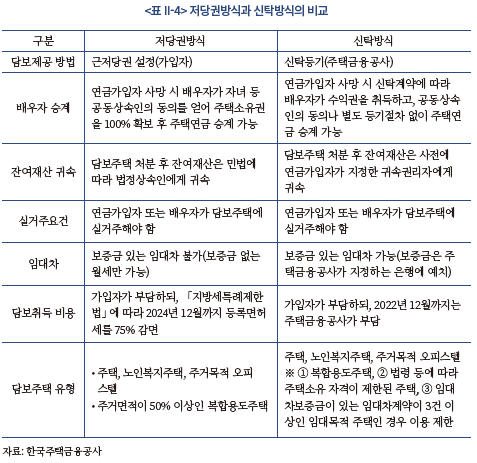

연금방식은 다양하게 선택할 수 있다. 주택소유자가 생존해 있는 동안 노후생활자금을 매월 지급받는 방식(종신지급방식), 주택소유자가 선택하는 일정한 기간(10년 이상) 동안 노후생활자금을 매월 지급받는 방식(확정기간방식), 종신지급방식과 목돈방식을 혼합한 종신혼합방식, 확정기간방식과 목돈방식을 혼합한 확정기간혼합방식 등이 가능하다. 주택연금 가입자는 월지급금의 지급유형을 선택할 수 있다. 정액형, 증가형, 감소형 등 다양한 유형의 월지급금 지급유형이 있으며, 그 세부적인 내용은 <표 Ⅱ-5>와 같다.

주택연금을 신청할 수 있는 가입대상주택은 부동산 가격공시에 관한 법률에 따라 공시 또는 고시되는 가격(해당가격이 없는 경우에는 주택금융운영위원회가 정한 주택연금 보증기준에 따른 가격)이 9억원을 초과하지 않는 주택 또는 시설을 포함한다.52) 구체적인 유형을 살펴보면 일반주택(단독주택과 공동주택으로 구분), 노인복지법에 따른 노인복지주택 중 분양된 노인복지주택, 소득세법에 따른 실지거래가액 합계액이 9억원을 초과하는 고가주택의 기준에 해당하는 주택, 주택법에 따른 준주택 중 주거목적으로 사용되는 오피스텔 등이 가입대상주택으로 인정된다.

주택연금에 대한 과세체계는 일반적인 연금에 대한 과세체계와 상당한 차이를 보인다. 이는 근본적으로 주택연금이 연금부담금의 적립과 운용에 의존하지 않고, 이미 개인이 확보한 주택을 담보로 생활자금대출의 형태로 이루어지기 때문이다. 따라서 주택연금에 대한 세제는 기본적으로 부동산에 대한 과세체계를 기본으로 하고 있으며, 부동산과세에서 일부 항목에 대해 세제혜택을 주는 방식으로 운영되고 있다. 공적연금이나 사적연금에 대한 세제혜택과는 그 부여방식에서 큰 차이가 나타난다.

주택연금에 대한 세제혜택은 등록면허세 감면, 재산세 감면, 주택연금 이자비용공제로 나누어 볼 수 있다. 등록면허세 감면의 경우 주택연금보증을 위해 설립된 한국주택금융공사와 연금을 지급하는 금융회사가 주택금융운영위원회가 심의·의결한 연금보증의 보증기준에 해당되는 주택을 담보로 하는 등기에 대해 그 담보의 대상이 되는 주택(주택법 제2조 제4호의 준주택 중 주거목적으로 사용되는 오피스텔 포함)을 제공하는 자가 등록면허세를 부담하는 경우에는 등록면허세가 감면된다.53) 지방세법 제4조에 따른 시가표준액이 5억원 이하인 주택으로서 지방세특례제한법 시행령으로 정하는 1가구 1주택 소유자의 주택을 담보로 하는 등기에 대해서는 등록면허세의 75%를 경감한다. 그 밖의 등기에 대해서는 등록면허세액이 300만원 이하인 경우에는 등록면허세의 75%를 경감하고, 등록면허세액이 300만원을 초과하는 경우에는 225만원을 공제한다.54)

주택연금에 대한 세제혜택 중에서 가장 중요한 부분은 재산세 감면이다. 등록면허세 감면이나 주택연금 이자비용공제에 비해 세제혜택 금액규모에서 압도적으로 큰 것이 재산세 감면이다. 주택연금 가입을 위해 담보로 제공된 주택(1가구 1주택인 경우로 한정)에 대해서는 다음의 구분에 따라 재산세가 감면된다.55) 시가표준액이 5억원 이하인 주택의 경우에는 재산세의 25%를 감면하고, 시가표준액이 5억원을 초과하는 경우에는 해당 연도 시가표준액이 5억원에 해당하는 재산세액의 25%를 공제한다. 한국주택금융공사법상의 금융기관으로부터 연금 방식으로 생활자금 등을 지급받기 위해 장기주택저당대출에 가입한 사람이 담보로 제공하는 주택(1가구 1주택인 경우로 한정)에 대해서는 다음의 구분에 따라 감면된다.56) 주택공시가격 등이 5억원 이하인 주택의 경우에는 재산세의 25%를 감면하고, 주택공시가격 등이 5억원을 초과하는 경우에는 해당 연도 주택공시가격 등이 5억원에 해당하는 재산세액의 25%를 공제한다.57)

주택연금 이자비용공제는 국민연금, 개인연금 등 연금소득이 있는 주택연금 가입자가 주택연금을 받은 경우에 그 받은 연금에 대해서 해당 과세기간에 발생한 이자비용 상당액을 해당 과세기간 연금소득금액에서 공제받는 것을 말한다.58) 공제할 이자 상당액이 200만원을 초과하는 경우에는 200만원을 공제하고, 연금소득금액을 초과하는 경우에는 그 초과금액은 없는 것으로 한다. 주택연금을 지급받은 경우 그 지급받은 연금에 대해 발생한 이자상당액은 해당 주택연금을 지급한 금융회사 또는 한국주택금융공사가 발급한 주택담보노후연금 이자비용증명서에 적힌 금액으로 한다.59) 주택연금 이자비용공제를 받으려면 과세표준확정신고서에 주택담보노후연금 이자비용증명서를 첨부하여 납세지관할세무서장에게 제출해야 한다.60)

Ⅲ. 주요국의 연금과세제도 분석

해외 국가들의 연금세제 사례분석은 국내 연금세제 개선방향을 모색함에 있어서 중요한 의미를 가진다. 해외의 연금세제가 소득유형의 분류, 소득공제 적용여부 및 한도의 설정, 은퇴 이후 소득을 보장하려는 목적에서 연금소득으로 선택할 수 있는 유인부여 등의 측면에서 어떠한 접근법을 선택하는지를 살펴봄으로써 향후 우리나라 연금세제에 추가적으로 보완되어야 할 사안들을 점검해 낼 수 있기 때문이다.

해외 연금세제사례를 분석하기 위해 미국, 일본, 호주, 독일의 연금세제를 분석대상으로 선정하였다. 이들 국가를 분석대상으로 선정한 이유로는 글로벌 연금시장에서 중요한 비중을 차지하고 있으며, 사적연금시장이 뚜렷하게 발달하고 있다는 점을 들 수 있다. 미국의 경우 세계 최대 규모의 연금시장을 발전시켜 왔으며, 제도적 다양성이 매우 높은 수준이기 때문에 연금세제 연구에 있어서 중요한 분석대상 국가라고 평가할 수 있다. 특히 미국 사적연금시장의 발전은 높은 소득대체율의 중요한 기반이 되기 때문에 사적연금에 대한 세제적 지원이 어떠한 방식으로 이루어지는지를 살펴볼 필요성이 크다. 일본의 경우 금융시장 환경이 국내 금융시장과 상당히 유사한 측면이 있고, 사적연금시장의 발전도 2000년대 이후 본격화되고 있다는 점, 서구권에 비해 낮은 소득대체율을 높이기 위해 사적연금의 역할 강화를 모색하고 있다는 점에서 참고할만한 국가라고 평가할 수 있다. 호주는 강제적인 퇴직연금제도가 중요한 역할을 하고 있는 국가이다. 호주의 연금세제가 가진 중요한 특징으로 TEE방식의 과세체계를 들 수 있는데, 이는 우리나라와 일본, 다수의 영미권 국가들이 EET방식의 연금과세체계를 채택하고 있다는 점과 대조를 이룬다. 호주는 취약계층에 대한 연금적립을 적극적으로 지원하고 있다는 점에서도 이전의 사례들과 구별된다. 미국이나 일본에 비하여 상당히 독특한 방식으로 연금세제를 발전시켜 왔다고 평가할 수 있다. 호주 퇴직연금의 성공적인 운영과 이에 대한 다양한 세제적 지원방식을 분석함으로써 국내 연금세제에 유용한 함의를 도출할 수 있을 것으로 판단된다. 독일은 급속한 고령화와 출산율 저하를 우리나라보다 먼저 경험하였다. 인구구조의 이러한 변화는 공적연금의 지속가능성에 문제를 일으키게 되고, 독일은 연금개혁을 통해 공적연금의 역할축소와 사적연금의 기능강화를 추진해 왔다. 독일이 경험한 이러한 문제점은 우리나라의 연금제도가 가지고 있는 문제점과 유사하기 때문에 독일의 연금제도와 연금세제에 대한 분석은 의미있는 유럽사례가 될 것이다.

1. 미국의 연금과세제도

가. 개요

미국은 퇴직연금 시장의 규모, 다양한 연금과세체계, 연금제도의 운영경험 측면에서 연금세제의 핵심적 분석 대상 국가이다. 미국은 다양한 사적연금을 통해 연금 수급자의 소득 대체율을 글로벌 기준 대비 월등히 높였다는 점도 본 연구에서 주목해야 할 사항이다. 미국도 우리나라와 같이 퇴직 후 연금은 공적연금과 사적연금으로 구성되어 있다. 우리나라의 국민연금에 비견되는 미국의 공적연금으로 사회보장연금(social security benefits)을 들 수 있다. 근로자가 납부하는 사회보장세(social security tax)는 사회보장연금의 재원이 된다. 사회보장세는 근로자가 연간 근로소득의 6.2%를 부담하고, 사용자가 해당 근로소득의 6.2%를 부담하여 연간 근로소득(2024년 기준 최대 168,600달러)의 12.4%이다. 2024년 기준 FICA61) 납부금 1,730달러마다 1 크레딧(credit)을 인정받으며, 연간 최대 4 크레딧을 받을 수 있다. 퇴직연금을 받을 수 있는 최소 크레딧은 40 크레딧이기 때문에, 근로자가 매년 최대 4 크레딧씩 FICA를 납부하여도 최소 10년 동안 납부하여야 사회보장연금 혜택을 누릴 수 있다. 사회보장연금은 근로자가 62세부터 조기 수급이 가능하다. 그러나 감액 없는 혜택(full retirement)을 누리기 위해서는 67세(1960년 이후 출생자의 경우)에 이르러야 한다. 67세 이후에도 수급을 연기하면 더 큰 혜택을 누릴 수 있으나, 70세 이상이 된 경우 추가 혜택은 없다. 사회보장연금 수급액은 과세 대상이며 종합소득이 높을수록 과세부담이 커진다. 조정총소득(Adjusted Gross Income, 이하 AGI)62), 비과세 이자, 사회보장연금 수급액의 절반 금액을 합한 결합 소득(이하 결합 소득)이 2만 5천달러에서 3만 4천달러(부부합산신고의 경우, 3만 2천달러에서 4만 4천달러) 구간에 있는 근로자는 사회보장연금 수급액의 50%가 소득세 과세대상이 된다. 결합소득이 3만 4천달러(부부합산신고의 경우, 4만 4천달러)를 초과하는 근로자는 사회보장연금 수급액에 대해 최대 85%가 소득세 과세대상이 된다.63)

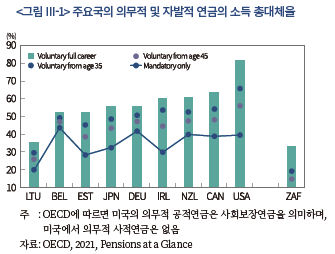

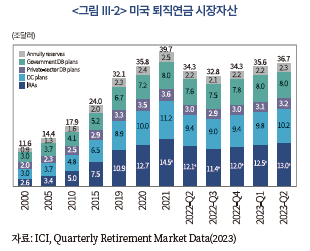

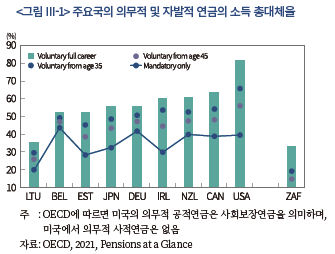

사회보장연금은 <그림 Ⅲ-1>에서 나타난 바와 같이, 2021년 OECD 보고서 기준 미국의 사회보장연금의 소득대체율은 40% 미만으로 OECD 선진국 평균 51.8%에 미치지 못한다. 따라서 미국의 80% 이상의 소득 총대체율은 다양한 사적연금을 기반으로 발생한다. 이러한 점에서 본고의 미국 퇴직연금 소득과세 분석은 사적연금에 초점을 맞추었다.64)

미국의 사적 퇴직연금 제도는 적격연금(Qualified Plan), IRA(Individual Retirement Account), 적격연금 유사연금, 비적격연금 4가지로 분류된다. 첫째, 적격연금은 IRC §401에 따라 사용자가 근로자를 위해 개설한 세제혜택 퇴직연금이다. 적격연금에는 401(k) 플랜 등의 이익배분연금, 주식보너스연금, ESOP(Employee Stock Ownership Plans), TBP(Target Benefit Plan), DB(Defined Benefit)연금, Keogh연금(자영업자연금) 등이 있다.

둘째, IRA는 사적연금으로서 은행 또는 투자중개업자 등을 통해 개설한다. 노후자산 증식을 위해, IRA에는 다양한 종류의 세제혜택이 부여된다. IRA에는 전통적 IRA, Roth IRA, SEP(Simplified Employee Pension) IRA, SIMPLE(Savings Incentive Match Plan for Employees) IRA, Rollover IRA, Conduit IRA 등이 있다.

셋째, 적격연금 유사연금은 적격연금 또는 IRA는 아니지만, 적격연금과 다방면에서 유사한 특성을 갖는 연금이다. 적격연금 유사연금에는 적격종신연금(Qualified Annuity Plan), 과세이연종신연금(Tax-Deferred Annuities) 등이 있다.

넷째, 비적격연금은 적격연금 또는 IRA가 아니며, 적격연금과 유사한 특성도 갖지 않는 연금이다. 적격연금과 같이 비차별적 혜택에 해당하지 않는 특정 임직원에 대한 특혜성 연금이다. 이중 본 연구에 있어 가장 큰 시사점을 주는 퇴직연금 제도인 적격연금과 IRA에 대한 과세제도를 구체적으로 살펴보면 다음과 같다.

나. 적격연금에 대한 과세제도

1) 적격연금의 일반적 특징

적격연금으로서 세제혜택을 받기 위해서는 내국세법(Internal Revenue Code, 이하 IRC) 제401조가 정하는 요건을 충족하여야 한다. 적격연금의 특징은 연금의 종류에 따라 다르지만, 다음과 같은 공통적 특징을 가진다.

첫째, 납입단계 또는 수급단계 비과세이다. 기여분에 대해 납입 시 과세유예를 받거나(기본 유형), 기여분에 대해 납입 시 과세한 후 연금 수급 시(Roth 유형) 비과세 혜택을 받는 특징이 있다. 둘째, 운용이익에 대한 과세유예 또는 비과세이다. 기여분을 운용하여 발생한 이익(배당, 이자 등)은 과세유예(기본 유형) 되거나 비과세(Roth 유형)되는 특징이 있다. 셋째, 근무기간 조건(Vesting Schedule)이다. 사용자는 근로자를 위해 불입해주는 매칭금액을 근로자에게 귀속시키기 위한 근무기간에 관한 조건을 붙일 수 있는 특징이 있다. 넷째, 채권자로부터 보호이다. 채권자가 채무자의 적격연금에 대해 채권추심을 할 수 없는 특징이 있다. 다섯째, 연간 납입 한도의 제한이다. 모든 종류의 적격연금은 연간 납입 한도를 갖는 특징이 있다. 여섯째, 원칙적 중도 인출 제한이다. 곤경한 상황에서 의료비용 등 불가피한 인출(hardship withdrawal)이 아닌 경우, 원칙적으로 중도인출에 대해 가산세를 부과하는 특징이 있다.65)

2) 적격연금 과세

적격연금에 대한 과세는 401(k) 플랜, DB 플랜, 주식보너스 플랜, ESOP, TBP, Keogh 플랜 등에 따라 다르다. 대표적인 적격연금인 401(k) 플랜과 DB 플랜에 대한 과세를 구체적으로 살펴보면 다음과 같다.

가) 401(k) 플랜에 대한 과세

401(k) 플랜은 IRC §401(k) 조항에 따른 적격연금이다. 연금 계획을 세우는 근로자의 관점에서, 401(k) 플랜은 사용자의 매칭(matching) 기여금, 높은 수준의 연간 납입 한도, 자금운용 방식의 자율성, 이직 시 손쉬운 롤오버(rollover) 등에서 장점을 가진다. 401(k) 플랜 기여분은 납입 시 과세유예를 받는다. 기여분을 운용하여 발생한 이익에 대해서는 비과세되며 수급 시 과세된다. 즉 401(k) 플랜은 전형적인 EET 구조이다. 연간 납입 한도는 2023년 기준 사용자 및 근로자의 납부액 합산 6만 6천달러(50세 이상 7만 3천 5백달러)이다.

사용자 기여분은 반드시 있어야 하는 것이 아니지만, 일반적으로 사용자가 근로자의 납입금에 매칭(matching)하여 협의된 기여율을 부담하겠다는 약정이 401(k) 플랜에 포함된다. 또한 사용자가 근로자 납입금액의 일정 비율이 아닌 급여의 일정 비율을 부담하겠다고 약정한 경우, 해당 근로자의 기여금이 없는 경우에도 사용자 기여분은 납입된다. 예를 들어, 사용자인 X회사가 근로자 급여의 5%를 부담한다는 401(k) 플랜에 합의하였다고 가정하자. 연봉 5만달러를 받는 X회사의 근로자 A가 자녀 학자금 부담이 커서 2022년 401(k) 플랜에 납입한 금액이 없다고 하더라도, 사용자인 X회사는 2022년 A의 401(k) 계좌에 2,500달러를 납입하여야 한다. 401(k) 납입금의 운용에 대해서는 가입자인 근로자는 결정 권한이 없으며 사용자가 금융상품 등을 결정한다.

401(k) 계좌의 적립금을 연령이 59세 6개월(이하 ‘59½세’) 미만인 가입자가 인출하는 경우, 일반 과세에 더하여 10%의 가산세를 부담하여야 한다. 10% 가산세 부담을 줄이기 위해, 연령이 59½세 이전의 가입자는 401(k) 자금을 사적연금인 IRA로 이전하여 수급시기를 연장(rollover, 이하 롤오버)할 수 있다. 이러한 점에서 조기 인출 가산세는 연금의 장기 분할 수급을 촉진하는 과세 제도로서 작용한다. 55세 이상 퇴직 또는 곤경한 상황(hardship withdrawal)에서 조기 인출하는 경우, 10% 가산세가 부과되지 않는다.

401(k) 계좌 적립금의 수급 시점은 원칙적으로 수급대상자가 정한다. 그러나 수급대상자의 나이가 72세가 넘어도 수급을 하지 않는 경우 미수급 금액에 대해 소비세(excise tax) 형식의 페널티가 부과될 수 있다. 이러한 페널티를 회피하기 위해 72세 이상 수급자는 의무적 최소분배금(Required Minimum Distribution, 이하 RMD) 이상을 수령하여야 한다. RMD는 직전 과세연도 401(k) 계좌 잔고를 지급기간(기대수명66)에 기반하여 계산)으로 나누어 계산한다.

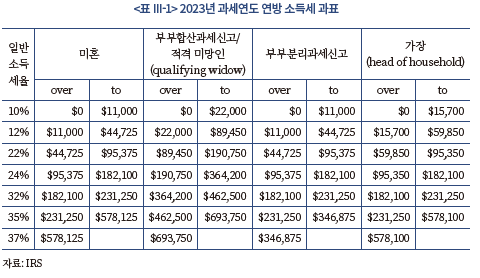

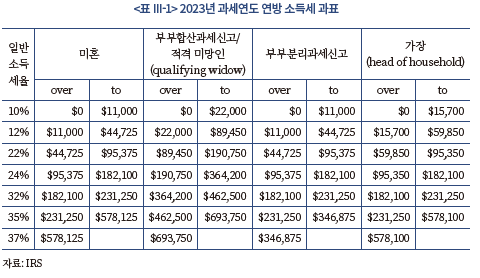

401(k) 플랜을 수급하는 경우, 연령이 59½세 이상인 수급자는 일반소득세 과표의 적용을 받는다. 미국의 2022년 연방소득세 과표는 <표 Ⅲ-1>과 같다.

<표 Ⅲ-1>에서 나타난 바와 같이, 401(k) 플랜으로부터의 연금소득에 대해서는 누진세율이 적용된다. 이러한 누진세율 구조는 연령이 59½세 이상인 연금수급자가 장기 과세연도에 걸쳐 연금소득을 수령함으로써 세부담을 줄이는 장기 분할 수급의 유인을 높인다. 연령이 59½세 이상인 401(k) 플랜 수급대상자가 다른 소득이 많아서 누진세 부담이 큰 경우 401(k) 자금을 사적연금인 IRA로 롤오버하여 만기를 연장하는 것이 가능하다.

나) DB 플랜에 대한 과세

DB 플랜은 고용기간과 보수수준 등의 요소를 바탕으로 정해진 혜택을 지급하는 적격연금이다. DB 플랜은 설계·운용 및 투자위험 부담을 사용자가 전적으로 담당하는 특징이 있다. DB 플랜의 혜택을 볼 근로자가 사망하는 경우에도, 생존 배우자가 혜택을 받는 경우도 있다.

사용자가 납부하는 DB 플랜 기여분은 납입 시 과세유예를 받는다. 해당 기여분을 운용하여 발생한 이익에 대해서는 비과세되며, 수급 시 과세된다는 점에서, DB 플랜도 EET 구조를 갖는다. 앞서 언급한 401(k) 플랜의 경우 연간 납입 한도를 가짐에 반하여, DB 플랜의 경우 연간 수급 한도를 갖는다. 2023년 기준 연간 수급 한도는 26만 5천달러이다. DB 플랜 가입자는 퇴직후 해당 퇴직급여를 일시불 방식, 분할납부 방식, 연금 방식(annuity payments) 등 다양한 방식으로 지급받을 수 있다. DB 수급이 일시불로 이루어지는 경우, 일반 소득으로 누진 과세가 되기 때문에 세부담이 매우 크다. 따라서 해당 일시지급금을 IRA 등으로 롤오버하는 경우도 많다. DB 수급이 분할납부 방식 또는 연금 방식으로 이루어지는 경우에도, 일반 소득으로 누진 과세가 되지만 분할 지급으로 인해 세부담이 경감된다. 또한 DB 수급액 중 세후 기여분(after-tax contributions)이 있는 경우, 해당 기여분을 고려하여 세금배제율(exclusion ratio)이 적용된다. 예를 들어 DB 플랜 가입자 A가 10만 달러의 세후 기여분이 있고 종신 연금 예상액이 100만달러라고 가정해보자. 이 경우 A의 DB 수급액 중 10%는 세금배제가 되며 90%가 납세대상이 된다.

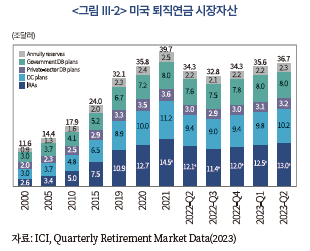

DB 플랜은 연금소득이 안정적이며 가입자가 투자위험을 부담하지 않는다는 점에서 가입자인 근로자에게 큰 이점이 있다. 또한 사용자의 입장에서도 우수 인재를 유치하기 좋고 퇴직자금 운영의 자율성이 높아진다는 장점이 있다. 다만 사용자의 투자위험과 재무적 부담이 크고 연금혜택을 계산하기 어렵다는 단점이 크다는 점에서 401(k) 플랜 기타 DC형 연금상품에 비해 선호도는 낮다. 미국 퇴직연금시장에서 DC형 연금상품에 비해 DB형이 덜 선호되는 상황은 <그림 Ⅲ-2>에 잘 반영되어 있다.

다. IRA에 대한 과세제도

1) IRA의 일반적 특징

IRA는 근로소득이 있는 개인이 노후자금 마련을 위해 저축 내지는 투자하면서 세제혜택을 누릴 수 있는 장기 연금계좌이다. 앞서 설명한 적격연금계좌인 401(k) 플랜이 대형 회사의 근로자에게 접근성이 높은 제도임에 반하여, IRA는 모든 근로자 및 자영업자에 대한 일반적 접근성이 매우 높다. 근본적으로 401(k) 플랜은 사용자가 제공함에 반하여, IRA는 회사와 관계없이 개인이 시중 상품을 선택하여 가입할 수 있기 때문이다. 또한 IRA는 납입금 운용상의 자율성이 401(k) 플랜보다 높다. IRA 계좌를 통해 가입자는 주식, 채권, 펀드, CD(Certificates of Deposit), 기타 대체투자상품 등에 대해 자유롭게 투자할 수 있다. 그러나 납입금액 한도가 적고 사용자 매칭 납부가 없는 점에서, IRA의 혜택은 401(k) 플랜에 비해 적다고 할 수 있다. 은퇴플랜(retirement plan)이 없는 직장 가입자 또는 자영업자에게는 소득 수준에 관계 없이 IRA 세금공제 혜택을 부여한다는 점에서, IRA는 직장 연금제도를 제도적으로 일정 부분 대체해주는 특성을 가진다고도 볼 수 있다.

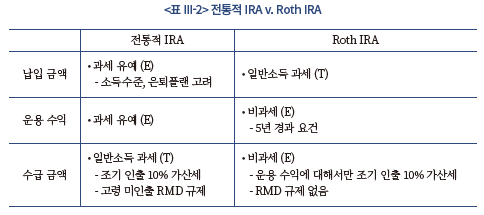

IRA는 전통적 IRA, Roth IRA, SEP IRA, SIMPLE IRA 등 다양한 종류가 있다. 전통적 IRA처럼 납입단계에서 과세이연 혜택이 주어지는 경우가 있고, Roth IRA처럼 인출단계에서 비과세 혜택이 주어지는 경우가 있는 등 과세혜택에 있어 종류별 차이가 있다. 그러나 운영단계에 있어서의 과세이연 또는 비과세는 모든 IRA 상품의 공통된 특성이다.

2) IRA에 대한 과세

IRA에 대한 과세는 전통적 IRA, Roth IRA, SEP IRA, SIMPLE IRA 등에 따라 다르다. 대표적인 IRA인 전통적 IRA와 Roth IRA에 대한 과세를 구체적으로 살펴보면 다음과 같다.

가) 전통적 IRA

전통적 IRA의 납입금액은 납입과 운용 단계에 있어 과세유예를 받고, 수급단계에서 과세되는 EET 구조를 가진다. 전통적 IRA의 연간 납입 한도는 2023년 기준 연간 6천5백달러(과세연도말 50세 이상인 경우 7천5백달러)이다. 전통적 IRA 가입자는 직장 내 은퇴플랜 가입 여부 및 소득 수준에 따라 납입금에 대한 공제혜택을 달리 받는다.67)

전통적 IRA 가입자가 미혼, 한부모 가장, 적격 미망인 또는 부부가 모두 은퇴플랜(401(k) 플랜 등)이 없는 기혼인 경우, AGI에 관계없이 IRA 납입금 한도 범위에서 전액 공제 받을 수 있다. 2022년 기준 AGI가 6만 8천달러 이하인 미혼 또는 한부모 가장인 가입자는 다른 은퇴플랜이 있더라도 IRA 납입금 한도 범위에서 전액 공제 받을 수 있다.68) 2022년 기준 AGI가 6만 8천 달러에서 7만 8천달러 사이에 있는 미혼 또는 한부모 가장인 가입자가 다른 은퇴플랜이 있는 경우, 소득에 비례하여 IRA 납입금 공제 수준이 줄어든다(phaseout).69) 2022년 기준 AGI가 7만 8천달러 이상인 미혼 또는 한부모 가장인 가입자가 다른 은퇴플랜이 있는 경우, IRA 납입금 공제 혜택을 받지 못한다.70) 이러한 점에서 IRA 납입금 공제는 공제 측면에서 누진과세적 성격이 강하다.

위의 설명에 대한 예시를 들어보자. 2022년 X회사에 다니는 37세 A씨는 AGI가 6만달러이고, 회사가 제공한 401(k) 플랜에 가입되어 있으며, 전통적 IRA 계좌에 2022년 기준 납입금 한도인 6천달러를 납입하였다고 가정하자. 2022년 A씨는 AGI가 6만 8천달러 이하이기 때문에, IRA 납입금 6천달러를 전액 공제 받을 수 있다. 이 경우 만약 A씨의 AGI가 8만달러라고 가정하면, IRA 납입금 공제 가능 한계인 7만 8천달러 이상이기 때문에 A씨는 IRA 납입금 공제를 받지 못한다. 이 경우 만약 A씨가 은퇴플랜에 가입되어 있지 않다고 가정하면, A씨는 IRA 납입금 6천달러를 전액 공제 받을 수 있다.

전통적 IRA 계좌에서 가입자가 59½세 이전에 적립금을 조기 인출할 경우, 기본 과세 외에 추가로 10%의 가산세를 부담하게 된다. 단, 곤경한 상황에서 의료비용, 교육비용, 첫주택구매비용 등을 불가피하게 인출(hardship withdrawal) 하는 경우, 10% 가산세는 부과되지 않는다. 또한 가입자 본인이 영구 장애 판정을 받거나 사망하는 경우에도 10% 가산세 조항은 적용되지 않는다. 59½세 이상의 수급대상자는 IRA 수급의 시작 시기를 본인이 정할 수 있다. 그러나 72세 이상인 수급대상자가 의무적 최소분배금인 RMD 이상의 금액을 IRS 계좌에서 수령하지 않는 경우, 페널티가 부과된다.

연령이 59½세 이상인 수급자가 받는 IRA 수급금액은 일반소득으로서 누진과세된다. 따라서 노후에 지속적인 고수입이 있는 IRA 가입자는 RMD가 적용되는 72세 이전까지 수급을 늦추어 누진과세 부담을 줄일 수 있다. 근본적으로 노후에도 고수입이 예상되는 납세자는 IRA 납입금에 대한 세금을 납부시기에 납입함으로써 수급시기에 비과세혜택을 받는 Roth IRA를 선택할 수 있다.

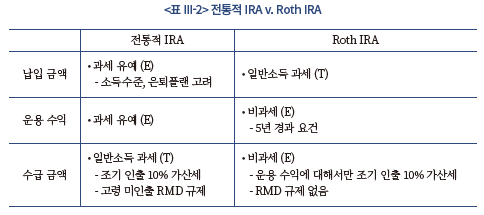

나) Roth IRA

Roth IRA는 납입 단계에서 세금을 납부하고, 운용 단계와 수급 단계에서 비과세 혜택을 받는 TEE 구조를 가진다. 운용 단계에서의 수익에 대해 세금을 납부하지 않는 점에서, Roth IRA는 전통적 IRA와 공통점을 갖는다. 그러나 전통적 IRA의 운용 수익은 수급 시점까지 과세 이연됨에 반하여, Roth IRA의 운용 수익은 비과세된다는 점에서 차이가 있다. Roth IRA의 연간 납입 한도액(2023년 기준)은 전통적 IRA와 같이 과세연도말 기준 50세 미만 6천5백달러, 50세 이상 7천5백달러이다. 세제 혜택에 있어, 전통적 IRA 가입자는 소득 수준 등에 따라 납입 단계에서의 공제 혜택을 달리하지만, Roth IRA 가입자는 소득 수준에 관계 없이 수급 단계에서의 비과세 혜택을 동일하게 누린다.

Roth IRA 계좌의 적립금 인출에 있어, 전통적 IRA에서와 같이 가입자가 59½세 이전에 적립금을 조기 인출하게 되면 수익금에 대해서는 10%의 가산세를 부담하게 된다. 다만 세후(after-tax) 납입 원금에 대해서는 가산세가 적용되지 않는다. Roth IRA는 5년 경과요건(5-year rule)이 적용되기 때문에, 가입 후 5년이 경과하기 이전에 적립금을 인출하면 연령에 관계없이 수익금에 대한 비과세 혜택이 박탈된다. Roth IRA는 일정 고령(2023년 기준 73세)에 이르더라도 의무적 최소분배금 즉 RMD를 수급할 의무가 없다. 즉 연금수령 시기를 무기한 연장할 수 있다.

위에서 언급한 설명을 종합적으로 고려할 때, 전통적 IRA는 은퇴 시 낮은 소득세 구간에 있는 자에게 유리한 반면 Roth IRA는 은퇴 시 높은 소득세 구간에 있는 자에게 유리하다. 미국에서 대표적 EET 상품인 전통적 IRA와 대표적 TEE 상품인 Roth IRA를 비교하면 <표 Ⅲ-2>와 같다.

라. 미국 연금과세제도의 특징

미국 연금과세제도의 특징은 다양화, 연금화, 사회보장화에서 찾을 수 있다.

첫째, 미국 연금 특히 사적 퇴직연금은 매우 다양한 상품으로 구성되어 있다. 사적 퇴직연금에는 위에서 설명한 적격연금 및 IRA 이외에도 다양한 형태의 적격연금 유사연금과 비적격연금이 있다. 이에 따라 미국의 사용자와 근로자는 자신의 다양한 수요에 맞는 퇴직연금상품을 자유롭게 선택할 수 있다. 예를 들어, 근로자 100명 이하의 소형기업 사용자는 SIMPLE IRA(Savings Incentive Match Plan for Employees)를 선택함으로써 401(k) 플랜에 비해 행정적 부담을 줄일 수 있다. 또한 프리랜서 및 자영업자는 SEP IRA(Simplified Employee Pension)를 선택함으로써 적은 비용으로 401(k) 플랜의 효과를 거둘 수 있다. 미국에서 변화하는 사회·경제환경에 부응하여 다양한 사적 퇴직연금상품이 계속 개발되고 있으며, 과세당국도 이러한 상품들을 시장 수요에 맞추어 제도화하고 있다.

둘째, 미국 퇴직연금은 일시금 인출과 중도 인출에 대한 누진과세 및 페널티를 강화함으로써 수급 단계에서 연금화된 장기 인출을 제도적으로 유도하는 특징이 있다. 국내에서 일시불로 받는 퇴직소득은 종합소득으로부터 분리과세되어 큰 세제혜택을 받음에 반하여, 미국에서 일시불로 받는 퇴직소득은 일반소득으로 과세되어 높은 누진세율을 적용받는다. 이로 인해 많은 수급자는 IRA 등의 연금계좌로 해당 퇴직소득을 롤오버하여 과세를 이연한다. 결과적으로 일시 퇴직소득이 연금소득화하여 근로자의 노후를 위한 장기 분할수급이 이루어지는 것이다. 또한 Roth IRA와 같은 수급 시 비과세 상품, 조기 인출에 대한 가산세 등도 퇴직급여의 연금화를 유도한다.

셋째, 미국 퇴직연금 과세제도는 저소득층에 대한 사회보장적 성격이 크다. 특히 공적연금인 사회보장연금인 경우, 퇴직 후 중위층 이상 소득자에 대해 비과세혜택을 누진적으로 제한함으로써 사회보장연금의 혜택을 주로 저소득층에 돌아가게 하였다. 또한 사적연금에 있어서도 저소득자에 대해 상대적 과세 혜택을 많이 주고 있다. 예를 들어, 전통적 IRA에 있어 고소득자에게 납입금액 소득공제를 제한하며, 은퇴플랜이라는 추가 소득이 없는 전통적 IRA 가입자에게는 소득 요건의 적용을 면제한다.

2. 일본의 연금과세제도

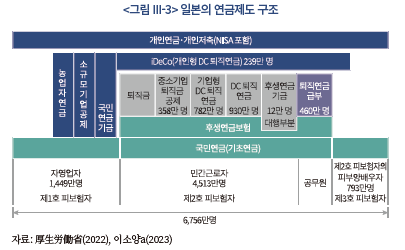

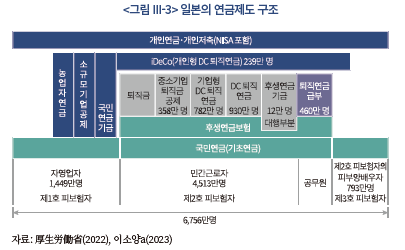

가. 연금체계

일본의 연금체계는 크게 공적연금과 사적연금으로 구성된다. 공적연금은 우리나라의 기초연금과 비슷한 성격을 가지는 국민연금과 우리나라의 국민연금과 비슷한 성격을 가지는 후생연금으로 나누어진다.71) 국민연금은 20세 이상 거주자라면 모두 가입해야 한다. 국민연금의 가입자는 제1호 피보험자(자영업자, 프리랜서로 일하는 자, 학교에 다니고 있는 학생 등), 제2호 피보험자(일반기업 근로자), 제3호 피보험자(직업이 없는 제2호 피보험자의 피부양배우자)이다. 일반기업 근로자의 경우 후생연금에 기본적으로 가입해야 하는데, 국민연금 가입도 의무적이기 때문에 후생연금과 국민연금을 모두 가입하게 되며, 직종에 관계없이 동일한 금액의 국민연금보험료를 납부한다. 국민연금의 재정은 정액의 보험료와 국고지원을 통해 충당되기 때문에 변형된 부과방식으로 평가할 수 있다.

국민연금을 통해 지급되는 연금형태로는 노령기초연금, 장애기초연금, 유족기초연금이 있다. 노령기초연금은 연금보험료를 10년 이상 납입한 사람이 65세가 되면 수령하게 된다. 수령금액은 납입한 기간에 따라 달라진다. 장애기초연금은 사고나 질병 등으로 장애를 입었을 경우 수령할 수 있다. 수급금액은 장애의 종류와 정도, 자녀의 유무에 따라 달라진다. 유족기초연금은 소득을 담당하던 가입자의 사망 후 유족의 생활고를 지원하기 위한 것이며, 사망한 사람의 배우자가 18세 미만의 자녀를 양육하고 있을 경우 수급할 수 있다. 2023회계연도(2023년 4월~2024년 3월)의 국민연금 급여지급액은 한달에 16,590엔이다.

후생연금은 일반기업의 근로자와 공무원, 사립학교교직원 등을 대상으로 하는 공적연금이다. 가입조건으로 1주일에 20시간 이상을 근무하고 있어야 하며, 매월 소득이 88,000엔 이상이어야 한다. 기초연금을 통한 소득확보가 충분하다고 평가하기 어렵기 때문에 이를 보충하는 소득비례형 연금제도라고 평가할 수 있다. 후생연금을 통해 지급되는 연금형태는 국민연금과 유사한데, 노령후생연금, 장애후생연금, 유족후생연금의 세가지 유형이 있다. 후생연금에 가입한 사람은 국민연금에도 가입하기 때문에 국민연금으로부터의 수령금액과 중복해서 후생연금으로부터 연금급여를 지급받는다. 후생연금의 재정방식은 부과방식이다.

일본은 공적연금의 지속가능성을 확보하고 취약계층에 대한 지원을 강화하는 방향으로 공적연금의 개혁을 꾸준히 지속해오고 있다. 후생연금 대상기업의 경우 2022년에 후생연금 적용대상 사업장을 근로자 500명 이상 사업장에서 100명 이상 사업장으로 확대하였으며, 2024년에는 50명 이상 사업장으로 다시 확대할 예정이다. 5인 이상의 근로자를 고용하고 있는 변호사, 세무사, 사회보험노무사의 개인사업장도 적용대상에 포함된다. 일본은 일반기업의 은퇴연령이 65세 이상으로 강제됨에 따라 고령근로자가 증가하고 있음을 감안하여 공적연금의 수령가능시기도 기존의 60~70세에서 60~75세로 변경하였다. 이와 더불어 공적연금의 연기연금72) 지급연령을 최대 70세에서 75세로 상향 조정할 예정이다.

공적연금을 통한 근로자의 노후보장이 충분하다고 평가하기 어려우며 저출산‧고령화로 인해 부과방식으로 운영되는 공적연금의 지속가능성에 대한 우려가 강하게 제기됨에 따라 일본에서는 사적연금의 중요성이 강조되고 있다. 사적연금은 크게 근로자의 퇴직급여제도의 성격을 가진 퇴직연금과 개인의 자발적인 참여로 이루어지는 개인연금이 있다. 이중에서 노후소득 확보에 있어서 가장 중요한 부분은 퇴직연금이라 볼 수 있다. 일본의 퇴직연금은 크게 국민연금기금, 확정급여기업연금(DB형 퇴직연금), 확정갹출연금(DC형 퇴직연금) 등으로 구분할 수 있다.

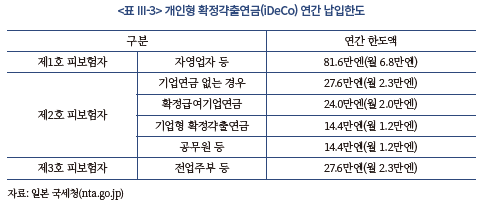

일본의 퇴직연금은 기본적으로 임의가입 방식을 따른다. 이중에서 연금으로의 중요성이 높은 부분은 확정급여기업연금, 확정갹출연금, 개인이 임의로 가입하는 개인연금상품이라고 볼 수 있다. 공적연금이 1940년대에 도입된 것과 대조적으로 확정급여기업연금은 2002년에 도입되었다. 확정급여기업연금은 우리나라의 DB형 퇴직연금과 운영방식측면에서 유사하다고 평가할 수 있다. 규약형과 기금형 두가지 방식으로 운영되고 있는데, 규약형은 고용주가 근로자와 합의한 내용을 바탕으로 금융회사와 계약을 체결하여 적립금을 사외에서 위탁운용하는 방식이다. 기금형은 300인 이상의 기업이 기업연금기금을 설치하고 고용주와 근로자 대표들이 이사회를 구성하여 운용에 관한 주요 의사결정을 담당한다. 확정갹출연금은 2001년에 도입되었으며, 기업이 운영하고 근로자가 가입하는 기업형과 국민연금기금연합회가 운영하고 자영업자 및 기업연금 미가입 근로자가 자발적인 의사로 가입하는 개인형이 있다. 기업형은 일본식 401(k)로 평가할 수 있으며, 우리나라의 DC형 퇴직연금과 비슷하다고 볼 수 있다. 개인형은 가입범위가 20~60세 미만의 모든 국민이며 iDeCo라는 이름으로 운영되고 있다. 개인연금상품은 생보사가 취급하는 보험형

(개인연금보험)과 타 금융기관에 의해 서비스가 제공되는 저축형으로 구분된다.

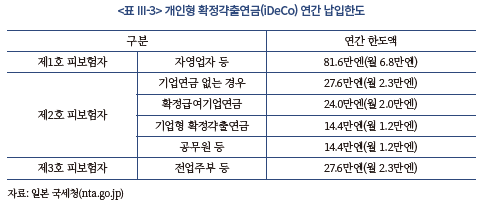

일본의 사적연금체계에서 가장 뚜렷한 변화를 가져온 것은 2001년 10월에 도입된 확정갹출연금이라고 볼 수 있다. 확정갹출연금은 기업형과 개인형으로 구분된다. 기업형은 기업이 운영하고 근로자는 자발적 의사에 따라 가입하는 형태이며, 기업이 매월 근로자의 연금계좌 적립금을 납입한다. 근로자는 스스로 연금자산의 운용방식을 결정하고 운용성적에 따라 미래에 받을 수 있는 연금의 규모가 결정된다. 60세 이후에 운용결과에 따라 연금을 일시금 또는 연금의 형태로 선택해서 받을 수 있다. 기업이 매월 적립하는 금액에는 한도가 있는데 근로자가 다른 기업연금에 가입되어 있는 경우에는 월액 27,500엔이 한도이며, 다른 기업연금에 가입되어 있지 않은 경우에는 월액 55,000엔이 한도이다. 기업형 확정갹출연금에 대해서는 기업이 부담하는 적립금에 근로자가 자발적인 의사로 매칭기여금을 적립할 수 있다. 근로자의 자발적인 매칭기여금에는 한도가 있다. 근로자의 매칭기여금이 기업이 적립하는 기여금을 넘어설 수 없으며, 기업의 기여금과 근로자의 매칭기여금의 합계가 위에서 설명한 매월 적립한도를 넘어설 수 없다. 개인형은 국민연금기금연합회가 운영하고 개인은 스스로의 의사에 따라 자유롭게 가입하는 형태이다. 우리나라의 DC형 퇴직연금과 상당히 유사한 방식이라 평가할 수 있다.

나. 연금세제

일본에서 공적연금에 대해서는 일반적으로 종합과세의 원칙이 적용된다.73) 따라서 노령기초연금이나 노령후생연금으로부터 수령하는 금액이 있을 경우 과세소득으로 인정된다. 다만 공적연금에 대해서는 일정수준 소득공제을 허용하여 소득금액을 줄여주고 있다. 국민연금과 후생연금은 부과방식으로 운영하면서 중앙정부가 세금으로 지원하는 제도인만큼 세제도 단순하게 적용된다고 평가할 수 있다.

일본의 연금세제에 있어서 중요한 부분은 사적연금에 대한 과세제도라고 볼 수 있다. 일본 국민들의 은퇴 이후 소득확보에 있어서 사적연금의 중요성이 강조되고 있다. 따라서 일본정부는 다양한 종류의 퇴직연금과 개인연금제도가 은퇴 이후 생활에 실질적인 도움이 될 수 있도록 세제적으로 배려하고 있다. 일본의 사적연금에 대한 과세형태는 기본적으로 EET 형태이다. 우리나라를 포함한 다수의 국가가 사적 퇴직연금에 대해 EET방식의 과세제도를 적용하고 있다는 점과 비교할 때 유사하다고 평가할 수 있다.

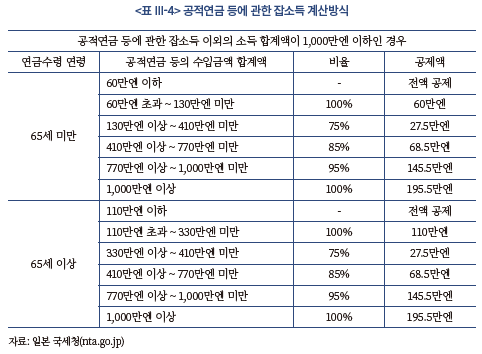

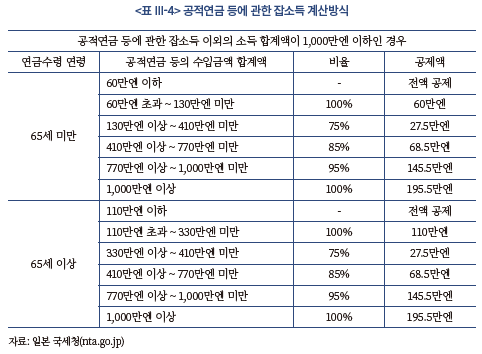

일본은 공적연금으로부터 지급받는 수령액에 대해 원칙적으로 종합과세한다. 공적연금으로부터 지급받는 연금형태는 노령연금, 장애연금, 유족연금이 있다. 이중에서 유족연금과 장애연금은 비과세되지만, 노령연금으로 수령하는 금액에 대해서는 잡소득으로 분류하여 다른 종류의 잡소득과 합산하여 소득세와 주민세를 부과한다. 잡소득으로 분류되어 과세되는 공적연금 등의 소득에는 국민연금으로부터 지급받는 노령기초연금, 후생연금으로부터 지급받는 노령후생연금, 확정급여기업연금, 기업형 확정갹출연금, 개인형 확정갹출연금(iDeCo) 등이 포함된다. 구체적인 공적연금 등의 소득계산방식은 <표 Ⅲ-4>와 같으며, 공적연금 등에 관한 잡소득 금액은 공적연금 등의 수입금액 합계액에 비율을 곱한 후 공제액을 차감하여 계산한다.

공적연금 등에 관한 잡소득을 수령할 경우 전액이 과세의 대상이 되는 것은 아니며, 소정의 계산식으로 구해진 일정 금액에 대해서만 과세된다. 공적연금은 노후생활에 있어 귀중한 수입원이기 때문에 특별한 공제제도가 적용되어 일정금액을 세금계산에서 제외해주는 방식을 활용하고 있다. 계산된 잡소득은 다른 소득 금액과 합산된 후 종합과세된다. 종합과세 시 주민세가 추가적으로 부과되며, 주민세는 누진세율이 적용되지 않고 일률적으로 10%가 동일하게 부과된다. 공적연금 등에 관한 잡소득은 수령 시 사회보험료와 각종 공제액을 차감한 후 5.105%(소득세 5%+부흥특별소득세 1.021%) 세율로 원천징수된다. 노령연금은 연 6회로 나누어 2개월분씩 지급된다. 따라서 원천징수되는 세액은 연금 지급액으로부터 2개월분의 사회보험료와 각종 공제가 차감된 금액에 5.105%를 곱하여 계산된다. 원천징수되는 것은 임시금액이므로 본래의 소득세나 부흥특별소득세의 금액과 다른 경우에는 확정신고를 통해 정산해야 한다.

사적연금에 대한 세제는 기본적으로 EET원칙이 적용된다. 납입단계와 운용단계에서의 비과세, 그리고 수급단계에서 종합과세되는 방식이다. 사적연금의 적립금에 대해서는 기본적으로 소득공제가 적용된다. 확정급여기업연금, 기업형 확정갹출연금, 개인형 확정갹출연금에 대해 기여금은 근로자의 통상소득에서 제외된다. 확정급여기업연금은 기여금에 대한 한도가 없으며, 기업형 확정갹출연금은 가입자 유형에 따라 연간 330,000엔~660,000엔의 한도를 가진다. 개인형 확정갹출연금에 대한 한도는 가입자 유형에 따라 144,000엔~816,000엔의 한도를 가진다. 운용이익에 대해서도 비과세로 재투자하는 것이 허용된다. 일본은 금융투자상품의 운용이익에 대해서는 정률(20.315%)로 분리과세하지만, 확정급여기업연금, 확정갹출연금의 운용과정에서 발생한 수익에 대해서는 과세하지 않는다. 사적연금에 대한 과세는 수급단계에서 발생하는데 이때에도 일정수준의 세금감면 혜택을 부여한다. 수급연령에 도달하여 연금을 일시금으로 수급하는 경우에는 퇴직소득공제를 허용하고 있으며, 연금으로 수급하는 경우에는 공적연금 등에 관한 잡소득 공제를 허용하고 있다.

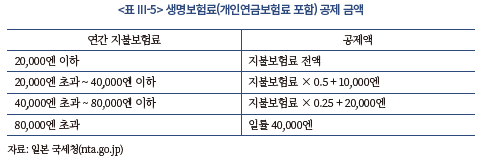

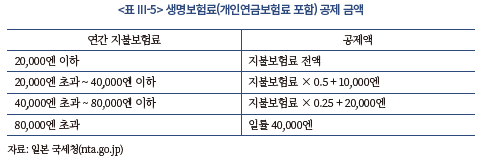

개인연금상품중에서 세제혜택이 부여되는 상품은 보험형 개인연금상품이다. 일본에서 생명보험계약의 보험료에는 생명보험료 공제가 적용되기 때문에 세제상 혜택이 부여된다. 이와는 별도로 보험형 개인연금상품에 대해서는 추가적인 소득공제가 허용된다. 이는 저축형 개인연금상품과 대조적인 보험형에 대한 특별혜택이라고 평가할 수 있다. 개인연금보험료공제를 받기 위해서는 연금수령인은 계약자 또는 그 배우자라야 하며, 보험료 지불기간이 10년 이상, 연금지급 개시일에 피보험자의 연령이 60세 이상이고 연금지불 기간이 10년 이상이어야 한다. 소득보험형 개인연금상품에 대해서는 연간 최대 4만엔의 소득공제가 허용되는데, 보험료가 높아질수록 세제혜택이 줄어드는 방식으로 설계되어 있다.

보험형 개인연금상품은 연금을 수령하는 단계에서 세금이 부과된다. 계약형태(계약자와 연금수령인이 동일인가의 여부), 수령방법에 따라 부과되는 세금이 달라지는데, 계약내용 및 수급단계의 상황에 따라 소득세(주민세 포함), 증여세, 상속세가 부과될 수 있다. 계약자와 연금수령인이 동일하고 매년 연금의 형태로 수령할 경우 해당 소득은 잡소득으로 분류되며, 소득세와 주민세가 과세된다. 계약자와 연금수령인이 동일하고 일시금으로 수령할 경우 일시소득 또는 잡소득으로 분류되며 소득세와 주민세가 과세된다. 계약자와 연금수령인이 다른 경우에는 수령 첫해에 증여세가 부과되고, 이후에는 매년 잡소득으로 분류되어 소득세와 주민세가 부과된다. 유족이 연계해 연금을 받는 경우에는 상속세가 부과되고 이후에는 매년 연금에 대해 소득세와 주민세가 부과된다.

3. 호주의 연금과세제도

가. 연금체계

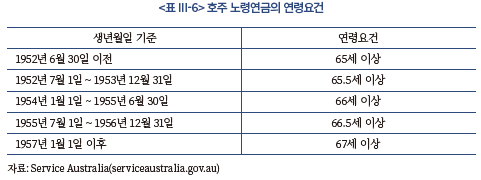

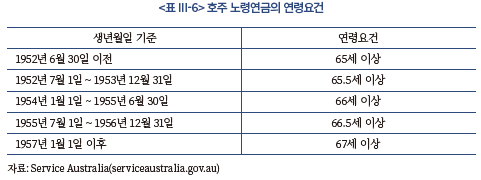

호주의 연금체계는 공적부조 형태의 노령연금(age pension), 가입이 강제되는 퇴직연금, 그리고 임의가입 형태의 개인연금저축으로 구성된다. 우리나라와 유사한 3단구조의 연금체계를 가지고 있으나, 공적연금이 정부의 공적부조인 노령연금으로만 구성되어 있다는 점에서 차이가 있다. 노령연금은 세금으로 운영되는 복지프로그램의 성격을 가진다. 노령연금은 연방정부의 재정으로 운영되며, 지정된 수급요건을 만족시키는 거주자를 대상으로 지급한다. 노령연급을 지급받기 위해서는 우선적으로 연령요건을 만족시켜야 한다. 연령요건은 65세에서 시작되었으나 현재에는 67세로 상향조정되었다.

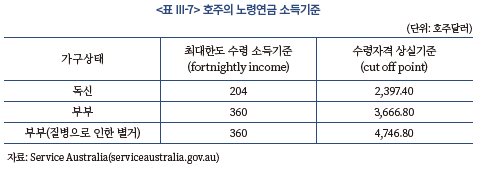

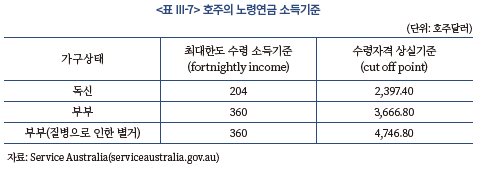

노령연금을 수령하기 위해서는 소득기준(income test)과 재산기준(asset test)을 충족해야 한다. 소득기준은 배우자의 유무에 따라 달라지는데, 독신 거주자의 경우 2주당 소득이 204호주달러 이하라면 노령연금을 최대한도로 수령할 수 있다. 2주당 소득이 204호주달러를 초과하게 되면 204호주달러 초과분에 대해 달러당 40센트가 줄어들게 된다. 독신 거주자의 2주 소득이 2,397.40호주달러를 초과하게 되면 노령연금의 수령자격을 상실하게 된다. 배우자가 있는 경우에는 본인과 배우자의 합산소득이 360호주달러 이하일 때 노령연금을 최대한도로 수령할 수 있다. 합산소득이 360호주달러를 초과할 경우 초과분에 대해 달러당 40센트가 줄어들게 된다. 배우자 합산소득이 3,666.80호주달러를 초과하게 되면 노령연금의 수령자격을 상실하게 된다. 배우자가 있더라도 질병으로 인해 별거상태일 경우 한도가 4,746.80호주달러로 증가한다.

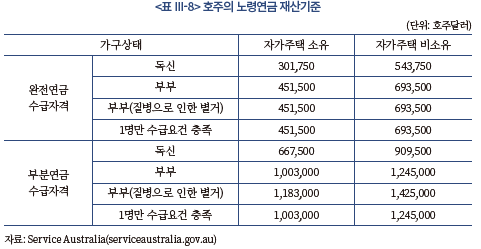

노령연금 수령을 위해서는 소득기준과 더불어 재산기준도 만족시켜야 한다. 재산기준은 배우자의 유무와 주택소유 여부에 따라 달라진다. 자가주택을 소유한 독신거주자의 경우 재산수준이 301,750호주달러 이하라면 노령연금을 최대한도로 수령할 수 있다. 자가주택을 소유하고 있지 않을 경우 재산기준은 543,750호주달러로 상승한다. 배우자가 있는 경우라면 자가주택 소유 배우자 합산재산이 451,500호주달러 이하일 때 노령연금을 최대한도로 수령할 수 있다. 자가주택을 소유하고 있지 않을 경우 재산기준은 693,500호주달러로 상승한다.

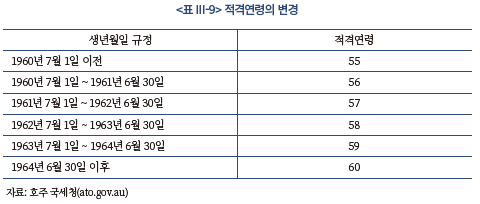

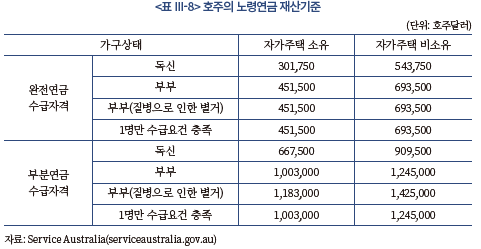

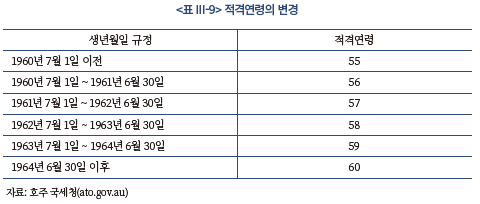

호주의 연금체계에서 가장 중요한 역할을 담당하고 있는 것은 가입이 강제되는 퇴직연금이라 볼 수 있다. 2023년 하반기 기준 고용주는 통상임금(ordinary time income)의 최소 11%를 의무적립해야 한다. 고용주의 의무적립 기여율은 1990년대 초반 5%에 머물렀으나 지속적으로 상승하고 있으며, 2026년 이후에는 12%로 상향조정될 예정이다. 퇴직연금 가입대상자는 호주에 거주하는 근로자와 자영업자들이다. 다만 월급여가 450호주달러 미만이거나 주당 30시간 이하로 근무하는 18세 미만의 미성년자는 퇴직연금 가입대상이 아니다. 퇴직연금의 지급시기는 은퇴를 한 경우는 60세이며, 은퇴를 하지 않은 경우에는 65세이다. 은퇴를 가정하여 퇴직연금이 지급되는 연령을 적격연령(preservation age)으로 정의하며, 생년월일에 따라 55세에서 60세까지 다른 적격연령이 설정되어 있다. 1964년 6월 30일 이후에 출생한 가입자들은 모두 60세가 적격연령으로 정해졌다. 출생연도별 적격연령은 아래의 표와 같다. 퇴직연금에 대한 중도인출은 엄격히 제한하고 있는데, 사망, 영구적 장애, 재정적 곤란 등의 특수한 상황이 아니라면 중도인출은 허용되지 않는다.

퇴직연금의 운용은 다양한 종류의 퇴직연금 기금(super fund)에 의해 이루어진다. 퇴직연금 가입자는 운용을 담당할 퇴직연금 기금을 선택할 수 있는데, 가입자가 근무하는 기업이나 업종에서 설립한 기금, 다른 업종에서 설립된 기금, 금융회사가 설립한 기금 등 다양한 종류의 기금중에서 선택할 수 있다. 기금의 종류는 산업형 기금(industry funds), 소매형 기금(retail funds), 기업형 기금(corporate funds), 공공형 기금(public sector funds), 자기관리형 기금(self-managed super funds)의 5가지로 분류된다.

나. 연금세제

호주에서 공적연금에 대해서는 일반적으로 종합과세의 원칙이 적용된다.74) 따라서 노령연금으로부터 수령하는 금액이 있을 경우 과세소득으로 인정된다. 다만 노령연금이 유일한 은퇴소득일 경우 소득세 부과가 면제된다. 노령연금은 연방정부가 세금으로 운영하는 제도인만큼 세제도 단순하게 적용된다고 평가할 수 있다.

호주의 연금세제에 있어서 가장 핵심적인 부분은 퇴직연금에 대한 과세제도라고 볼 수 있다. 호주 국민들의 은퇴 이후 소득확보에 있어서 가장 중요한 역할을 하는 것은 의무가입 퇴직연금과 가입자의 자발적인 의사로 납입되는 추가기여금제도라고 볼 수 있다. 따라서 호주정부는 의무가입 퇴직연금과 추가기여금제도가 은퇴 이후 생활에 실질적인 도움이 될 수 있도록 세제적으로 배려하고 있다. 호주의 퇴직연금에 대한 과세형태는 기본적으로 TTE 형태이며, 연금수령시기에 따라 TEE로 변경하는 것이 가능하다. 우리나라를 포함한 다수의 국가가 퇴직연금에 대해 EET방식의 과세제도를 적용하고 있다는 점과 비교할 때 상당히 대조적이라 할 것이다.

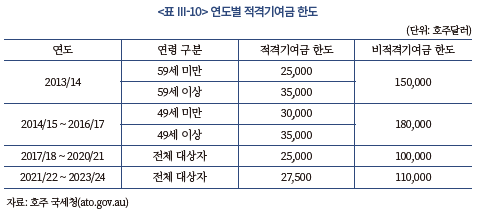

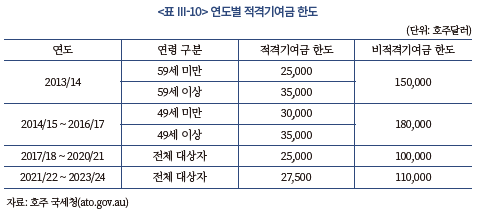

호주의 퇴직연금 기여금은 세제혜택이 있는 적격기여금(concessional (before-tax) contribution)과 세제혜택이 없는 비적격기여금(non-concessional (after-tax) contribution)으로 구분된다. 적격기여금은 고용주가 부담하는 11%의 의무적립금(Super Guarantee, 이하 SG)과 근로자의 세전급여기여금(salary sacrifice)을 포함한다. 비적격기여금은 가입자가 누진세율이 적용되는 소득세를 납부한 이후의 세후소득으로 적립하는 자발적인 기여금이다. 호주정부는 일정한도 이내에서 근로자가 자발적으로 비적격기여금을 퇴직연금계좌에 추가로 납부하는 것을 허용하고 있다. 호주정부는 2018년 7월 1일부터 가입자가 적격기여금한도를 채우지 못했을 경우 최대 5년간 사용하지 않은 한도분을 이월할 수 있도록 허용하고 있다.75) 적격기여금과 비적격기여금은 세제혜택이 주어지기 때문에 한도를 설정하여 운영하고 있으며, 각각의 기여금에 대한 한도변화는 <표 Ⅲ-10>과 같다.

호주정부는 적격기여금에 대해 기본적으로 15%의 분리과세를 적용하지만 고소득자에 대해서는 추가적인 세금(Division 293 tax)을 부과하고 있다. 가입자의 소득과 적격기여금의 합이 250,000호주달러를 초과할 경우 초과분 또는 적격기여금중에서 더 적은 금액을 기준으로 15%의 추가적인 세금을 부과한다. 따라서 소득과 적격기여금의 합이 250,000호주달러 이하인 근로자의 경우 적격기여금에 대해 15%의 세금을 납부하게 된다. 반면 소득과 적격기여금이 각각 240,000호주달러와 15,000호주달러인 근로자의 경우 소득과 적격기여금이 250,000호주달러를 초과하게 되어 초과분인 5,000호주달러와 적격기여금 15,000호주달러중에서 더 적은 금액인 5,000호주달러에 대해 추가적으로 15%의 세금을 더 납부해야 한다.

퇴직연금에 대한 적격기여금 및 비적격기여금은 모두 적립단계에서 소득세가 과세되지만 과세에 적용되는 세율에서 차이가 관찰된다. 고용주가 부담하는 의무적립금인 SG와 근로자가 세전소득으로 적립하는 적격기여금에 대해서는 15%의 세율로 분리과세된다. 비적격기여금은 근로자가 이미 소득세를 납부한 세후소득으로 적립하기 때문에 일반적으로 적격기여금보다 더 높은 세율이 적용된다고 평가할 수 있다. 운용과정에서 발생하는 운용수익에 대해서는 원칙적으로 15%의 세율로 분리과세된다. 다만 60세 이후 연금으로 수령할 경우 운용수익에 대해서도 비과세된다. 적립단계와 운용단계에서 원칙적으로 과세가 이루어지기 때문에 수급단계에서는 비과세된다. 따라서 60세 이상의 연령에서 연금으로 수령할 경우 운용수익에 대해서 비과세되기 때문에 수령시점에서 세금이 부과되지 않는다. 반면 60세 이상의 연령이라고 하더라도 연금이 아니라 일시금의 형태로 수령하게 될 경우 운용수익에 대해 세금이 부과되고 세후운용소득을 일시금으로 수령하게 된다. 물론 일시금으로 수령하더라도 투자수익에 대해 15%의 세율이 적용되므로 퇴직연금이 아닌 일반적인 투자수익에 대한 과세와 비교할 때 상당한 세제혜택이 부과되고 있음을 알 수 있다.

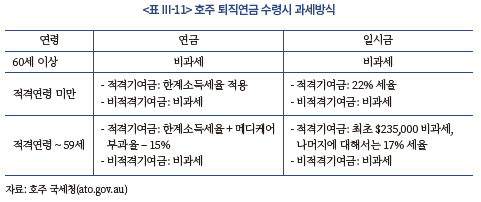

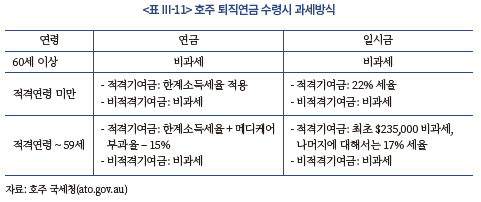

호주정부는 60세 이후에 퇴직연금으로부터 수령하는 소득에 대해서는 비과세한다. 연금의 형태이거나 일시금의 형태 모두 비과세한다. 그러나 60세 미만 조기수령하는 퇴직연금의 경우 특수한 경우를 제외하고 과세되며, 연금의 형태로 수령하는 경우와 일시금의 형태로 수령하는 경우에 대해 세금의 부과가 달라진다. 60세 미만의 일시금 인출은 비적격기여금에 해당하는 부분에 대해서는 비과세한다. 그 외의 일시금 인출에 대해서는 인출자가 적격연령(preservation age) 미만일 경우 22%의 세율이 적용되고, 적격연령과 59세 사이일 경우 최초 235,000호주달러에 대해서는 비과세되고 나머지에 대해서는 17%로 과세된다. 60세 미만의 연금 인출은 비적격기여금에 해당하는 부분에 대해서는 비과세 된다. 그 외의 연금 인출에 대해서는 인출자가 적격연령(preservation age) 미만일 경우 한계소득세율이 적용되고, 적격연령과 59세 사이일 경우 한계소득세율에 메디케어 부과율을 합산한 후 15%를 차감하여 과세된다. 이를 정리하면 <표 Ⅲ-11>과 같다.

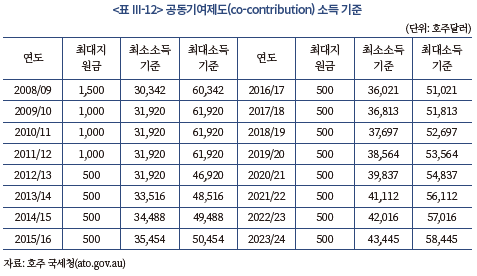

호주의 연금세제에 있어서 관찰되는 중요한 특징 중의 하나로 정부에 의한 퇴직연금 공동기여제도(super co-contribution)를 들 수 있다. 의무가입 또는 임의가입 방식의 퇴직연금은 가입자들의 은퇴 이후 소득 확보에 중요한 의미를 가지기 때문에 정부는 이에 대한 세제지원을 통해 자발적인 기여금 적립을 촉진한다. 그런데 이러한 방식의 세제지원은 상대적으로 높은 수준의 임금을 받는 고소득계층에 세제지원 효과가 집중되는 문제점을 가진다. 11%의 고용주 적립금과 자발적인 선택에 의해 이루어지는 추가적립금에 대해 고소득계층은 한도까지 최대한 활용할 수 있는 경제적 여유가 있는 반면, 저소득계층의 경우 적립금의 절대적인 규모도 적을뿐만 아니라 세제혜택을 충분히 누릴만큼의 자발적인 적립금을 쌓을 경제적 여유가 없는 경우가 많다. 이러한 상황에서는 은퇴 이후의 소득을 보호할 필요성이 상대적으로 큰 저소득계층에 대해 퇴직연금의 역할이 상대적으로 미흡할 가능성이 높아진다.

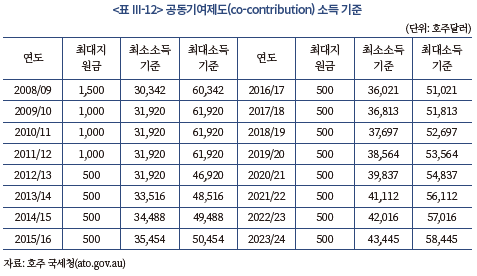

호주는 이러한 문제점을 완화하기 위하여 단순히 적립금에 대한 세제혜택을 부여하는 수준이 아니라 저소득층에 대해서는 정부가 일정 부분 퇴직연금의 적립금을 공동기여하는 제도를 운영하고 있다. 정부의 공동기여제도의 대상이 되기 위해서는 연간 소득이 2023/2024회계연도 기준 58,445호주달러 이하(income threshold)여야 한다. 총소득의 10%이상은 근로소득(10% eligible income test)이어야 한다. 연령은 71세 이하이어야 하고, 퇴직연금잔고기준을 통과해야 한다.

개별가입자는 정부의 공동기여 신청을 할 필요가 없으며, 소득요건 기준에 의해 대상자가 되면 계좌식별번호(tax file number)를 통해 해당계좌에 정부가 자동적으로 공동기여분을 적립하는 방식으로 이루어진다. 정부의 공동기여는 가입자가 자발적으로 퇴직연금에 비적격기여금을 적립하는 경우에 대해서만 적용되며, 기여비율(matching rate)은 최대 50%이지만, 소득수준 증가에 따라 정부기여비율은 하향 조정된다. 연간소득이 최소소득기준 이하인 경우 50%의 기여비율에 따라 정부 공동기여금이 지원되지만 최소소득기준보다 연간소득이 높을 경우 단계적으로 정부기여비율이 하향 조정되며, 연간소득이 최대소득기준보다 높은 경우 정부공동기여금은 지급되지 않는다. 호주정부에 의한 최대지원금은 2013/2014 회계연도 이후 500호주달러로 조정되어 유지되고 있다. 2013/2014 회계연도 이후 최소소득기준은 AWOTE(Average Weekly Ordinary Time Earnings)에 연동되어 매년 조정된다. 최대소득기준은 최소소득기준에 15,000호주달러를 더하여 계산한다. 호주정부의 공동기여분은 해당근로자의 과세대상소득에 포함되지 않는다.

호주정부는 저소득층의 퇴직연금 적립을 지원하기 위하여 공동기여제도 이외에 저소득층 퇴직연금 세금환급제도(Low Income Superannuation Tax Offset, 이하 LISTO)도 운영하고 있다. 2017년 7월 1일부터 시행되고 있는 LISTO제도는 과세대상 소득이 연간 37,000호주달러 이하인 근로자에 대해 퇴직연금 적격기여금으로부터 발생하는 세금을 최대 500호주달러까지 해당 계좌로 환급해주는 제도이다. 정부공동기여제도와 유사하게 가입자는 세금환급을 신청할 필요가 없으며, 자격요건을 갖출 경우 호주정부에 의해 자동적으로 세금환급이 해당계좌로 이루어진다.

4. 독일의 연금과세제도

가. 연금체계

독일의 연금체계는 공적연금, 퇴직연금, 개인연금으로 구성되는 다층 체계로 구성된다. 추가적으로 노인과 장애인의 최저생활보장을 위해 사회부조제도인 기초보장제도를 정부 재정으로 운영하고 있다. 이는 우리나라의 다층 연금구조 및 기초연금제도와 유사한 형태를 가진다고 평가할 수 있다. 공적연금은 가장 큰 비중을 차지하고 있는 국민연금과 공무원연금, 농민연금, 자영업자 직능연금 등으로 구성된다. 독일은 소득비례연금제도를 중심으로 공적연금을 운영해 왔다.

가장 대표적인 공적연금인 국민연금은 모든 임금근로자와 일부자영업자들에 대해 가입이 강제화되며, 임의가입제도를 통해 자발적인 가입도 가능하다. 수급형태는 노령연금, 장애연금, 유족연금으로 구분된다. 노령연금은 최소가입기간이 5년이며 연금수급 연령은 1964년 이후 출생한 근로자에 대해 67세로 상향조정되었다. 국민연금에 대한 재원마련은 부과방식에 의한 연금보험료와 정부보조금에 의해 이루어진다. 이중 연금보험료의 비중은 약 75% 수준에서 형성되고 있으며, 정부보조금이 나머지 25% 수준이다. 국민연금 보험료는 임금근로자는 사용자와 근로자가 각각 절반을 부담하고, 자영업자는 본인이 전액을 부담한다. 연금보험료율은 약 20% 내외에서 결정되고 있는데, 매년 조정된다. 다만 보험료율은 법률에 의해 22%의 상한을 가진다. 독일은 고령화 및 저출산으로 인해 부과방식으로 운영되는 국민연금 보험료율이 2030년경에 법정 한도인 22%를 초과할 것으로 예상하고 있으며, 소득대체율도 지속적으로 떨어질 것으로 전망된다. 이러한 문제점을 해결하기 위하여 독일도 퇴직연금과 개인연금의 역할을 강화하는 방향으로 연금개혁을 추진해 왔다.

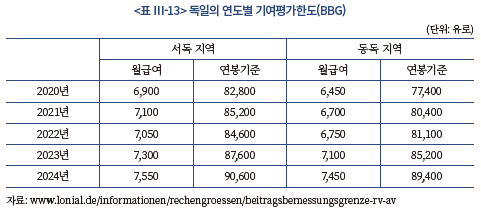

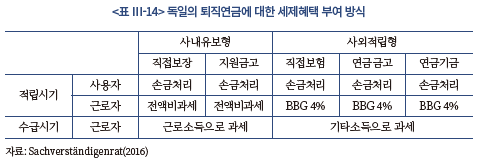

독일의 퇴직연금제도는 법정의무가 아니기 때문에 가입이 강제되지 않는다. 퇴직연금 적립에 대한 조건들도 사용자와 근로자 간의 협의에 의해서 정해진다. 독일의 퇴직연금은 확정급여방식이 중심을 이루고 있다. 운용과정에 대한 책임이 근로자에게 있는 순수한 형태의 확정기여형 퇴직연금은 법적으로 허용되지 않는다. 확정급여형 이외에 변형확정급여형 퇴직연금, 최저급여보장 확정기여형 퇴직연금제도가 운영되고 있는데, 확정급여형과 변형확정급여형이 퇴직연금의 중심을 이룬다. 퇴직연금은 부분적인 일시금과 연금으로만 지급된다. 전액 일시금 지급이 가능한 우리나라의 퇴직연금제도와 달리 독일은 전액 일시금은 허용되지 않는다.

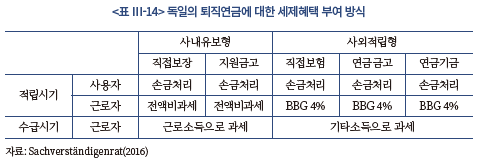

퇴직연금은 연금액의 사내보유 여부 및 관리방식에 따라 5가지로 구분된다.76) 퇴직연금을 사내보유하고 관리하는 방식은 직접보장(Direktzusagen)과 지원금고(Unterstuetzungskasse)로 나누어진다. 직접보장의 경우 근로자는 기업에 대해 연금지급청구권을 가지며, 기업은 퇴직연금 지급을 위한 재정을 전적으로 부담해야 한다. 사용자가 지급불능상황에 이르게 될 경우 연금급여는 외부기관인 연금보장협회(PSVaG)에 의해 지급된다. 기업은 해당 부담금에 대해 손금으로 처리할 수 있으며, 근로자가 받는 연금소득에 대해서는 소득세가 과세된다. 퇴직연금중에 가장 높은 비중을 차지하는 유형이다.

지원금고의 경우 직접보장의 경우와 동일하게 근로자는 기업에 대해 연금지급청구권을 가지고 기업은 재정을 전적으로 부담한다. 사용자는 외부기관인 지원금고에 사용자가 전적으로 부담하는 기여금을 적립하여 운용한 후, 근로자에게 퇴직연금을 지급한다. 사용자가 지급불능상황에 이르게 될 경우 연금급여는 외부기관인 연금보장협회(PSVaG)에 의해 지급된다는 점은 직접보장과 동일하다. 기업은 급여권의 보장을 위해 외부기관인 연금보장금고에 가입할 의무가 있다. 세금의 부과는 직접보장과 동일하다.

퇴직연금을 사외적립하고 관리하는 방식은 직접보험(Direktversicherung), 연금금고(Pensionkassen), 연금기금(Pensionsfunds)으로 구분된다. 직접보험은 기업이 사용자의 명의로 근로자를 위해 민간보험사와 연금보험계약을 체결하는 방식으로 제공된다. 근로자는 사용자가 아니라 보험회사에 대해 연급금지급청구권을 가지게 된다는 점에서 사내보유형과 차이가 있다. 민간보험사가 연금지급의무를 부담하게 되므로 PSVaG로 지급의무가 넘어가지 않는다. 연금재정은 사용자와 근로자가 공동부담할 수 있으며 세금의 부과는 사내유보형과 동일하다.

연금금고는 기업이 외부기관인 연금금고를 통해 민간보험사와 연금보험계약을 맺는 방식이다. 근로자는 보험회사가 아니라 연금금고에 대해 연금지급청구권을 가진다. 연금재정은 원칙적으로 사용자가 부담하고 세금의 부과는 직접보험과 동일하다. 연금기금은 연금금고와 운영방식이 유사한데, 연금금고의 역할을 연금기금이 담당한다고 볼 수 있다. 따라서 근로자는 연금기금에 대해 연금지급청구권을 가진다.

독일의 개인연금은 퇴직연금과 동일하게 임의가입 방식이 유지되고 있다. 오랜 기간에 걸쳐 다양한 개인연금상품이 발전해 왔는데, 그 중심은 생명보험형태의 상품에 있었다. 저축형 개인연금상품과 투자형 개인연금상품도 존재한다. 그런데 제도적인 측면에서 개인연금중 특히 주목할만한 부분은 리스터연금(Riester-Rente)와 뤼룹연금(Rürup-Rente)이다. 이는 이 두가지 상품이 공적연금의 급여수준 하향을 보완하고자 하는 목적에서 도입된 개인연금이기 때문이다. 2001년 사적연금의 기능을 활성화하기 위한 목적으로 리스터연금이 도입되었다. 국민연금 의무가입자가 적용대상이며, 공무원, 국민연금 당연 가입자인 자영업자, 군인, 실습생 등이 지원대상이 된다. 리스터연금의 가장 중요한 특징은 연금가입자에게 보조금과 소득공제의 혜택이 주어진다는 점이다.77) 가입자가 일정한도의 보험료를 납입할 경우 정부로부터의 보조금을 받을 수 있다. 보조금은 기본보조금과 자녀보조금으로 구성되는데, 가입자의 소득이 낮을수록, 그리고 가입자의 부양가족이 많을수록 더 많은 보조금이 지급된다. 보조금은 정액방식으로 지원되는데, 저소득층에 대한 지원을 강화하기 위해 보험료에서 보조금을 차감한 금액을 납부하는 방식을 채택하였다. 세제적격 사적연금으로서 보험료 납입에 대한 소득공제도 허용된다.

뤼룹연금제도는 고소득 자영업자를 위한 세제적격 개인연금제도이다. 다른 국가에서 찾아보기 힘든 독특한 형태의 개인연금제도라 할 수 있다. 저소득 자영업자의 경우 국민연금의 의무가입대상인 반면 고소득 자영업자는 국민연금 의무가입대상이 아니기 때문에 리스터연금제도상의 세제혜택을 받기가 어렵다는 점을 감안하여 소득공제 혜택이 부여되는 개인연금제도로 도입되었다. 공적연금과 퇴직연금을 통해 노후소득을 준비할 수 없는 계층에 대한 정책적 배려인 것이다. 납입금에 대하여 일정한도 내에서 소득공제가 가능하고, 수급시점에서는 연금급여에 대해 소득세가 부과된다.78) 뤼룹연금은 종신연금으로 지급되며 일시금으로의 지급은 허용되지 않는다. 2005년에 도입된 뤼룹연금은 시장규모가 아직은 작은 편이지만 가입과 적립수준이 꾸준히 증가하고 있다.

나. 연금세제

독일의 연금세제는 기본적으로 EET방식을 따른다. 공적연금과 사적연금에 공통적으로 EET방식으로 과세한다. 2005년 이전의 기간에는 운용단계의 발생수익에 대해 일부 과세가 이루어졌지만, 2005년 1월부터 EET방식의 과세체계가 채택되어 현재까지 이어지고 있다.79) 납입단계의 연금보험료에 대해서는 소득공제가 허용되고, 운용단계의 운용수익에 대해서는 수급단계까지의 과세이연이 허용된다. 연금급여를 수급하는 단계에서는 원칙적으로 소득세가 과세된다.

공적연금에 납입하는 연금보험료 중 사용자에 부담하는 금액은 근로자의 과세대상 소득이 아니다. 공적연금 연금보험료의 절반은 근로자가 부담하고 나머지 절반은 사용자가 부담하는데, 공적연금은 부과방식으로 운영되기 때문에 연금보험료의 계산은 근로자의 급여를 기준으로 약 20%로 산정된다. 이중에서 근로자 부담 연금보험료는 급여에 대한 세금으로 부과된다. 사용자 부담 연금보험료는 근로자의 급여를 기준으로 계산된 후 사용자에 의해 부담되지만 추가적인 과세대상 소득이 아닌 것으로 간주된다. 연금수급 시기에 받게되는 공적연금소득은 기타소득으로 과세된다.80)

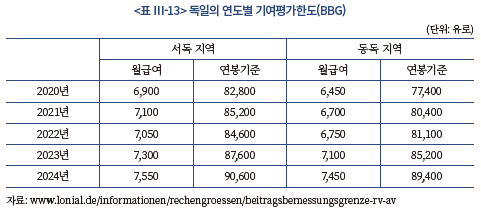

퇴직연금에 납입하는 사용자의 연금부담액은 과세대상 근로소득으로 인정81)하지만, 사내유보형인 직접보장 및 지원금고의 경우 퇴직연금을 지급하는 시기까지 근로자의 과세대상소득으로 보지 않기 때문에 적립시기에는 실질적으로 소득세가 면제되고 연금수령시에 소득세가 부과된다. 사외적립형인 직접보험, 연금금고, 연금기금에 납입한 사용자의 연금부담액은 최대 기여평가한도(Beitragsbemessungsgrenze, 이하 BBG)의 4%를 한도(2023년 기준 3,504유로)로 소득공제가 허용된다.82) 한도를 초과한 사용자의 연금부담액은 근로자의 과세대상소득으로 본다. 2005년 이후에 계약된 사외유보형에 대해서는 최대 1,800유로의 추가 소득공제도 허용된다.

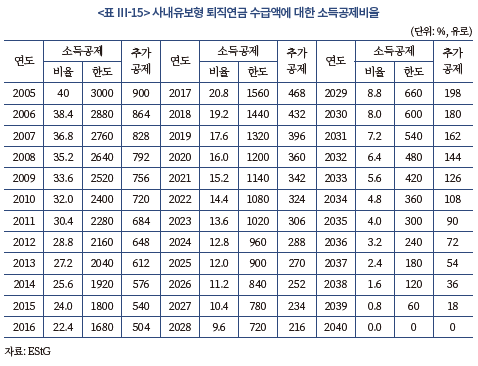

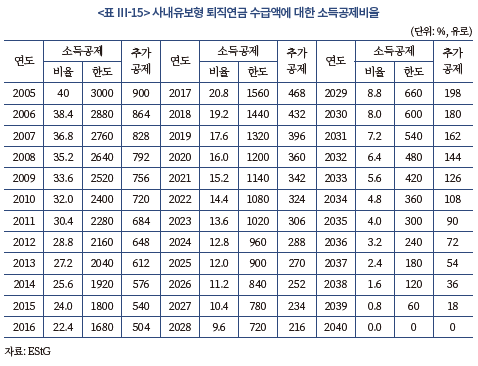

퇴직연금의 운용과정에서 발생하는 수익에 대해서는 비과세가 허용된다. 퇴직연금 수급단계에서의 과세는 퇴직연금의 유형에 따라 다르게 이루어진다. 사외적립형인 직접보험, 연금금고, 연금기금에 대해서는 수급단계에서의 연금소득을 기타소득으로 과세한다.83) 연금급여 전체를 기타소득으로 과세하는 것이 아니라 단계적으로 과세비율을 상향하고 있다. 2005년 연금급여의 50%를 기타소득으로 과세하기 시작하여 이후 매년 2%씩 연금과세비율을 인상했고, 2021년부터는 매년 1%씩 연금과세비율을 인상하여 2040년에 100% 과세를 실시할 예정이다. 연금급여가 시작되는 연도에 따라 연금과세비율이 달라지는 것이다. 2005년 이전에 연금급여가 개시되었다면 연금수령액의 50%만 기타소득으로 과세된다.

사내유보형 퇴직연금인 직접보장, 지원금고로부터 지급받는 연금수령액에 대해서는 근로소득으로 과세된다. 연금수령액 전체에 대해 근로소득세가 부과되는 것은 아니며, 일정비율과 한도로 소득공제를 허용한다.84) 2023년 기준 소득공제비율은 13.6%이며, 소득공제 최대한도는 1,020유로이다. 연금수령자가 63세 이상인 경우에는 추가 소득공제가 허용되며, 2023년 기준 추가 소득공제금액은 306유로이다. 독일정부는 2040년까지 기타소득 연금수령액 전액과 근로소득 연금수령액 전액에 대해 소득세를 부과할 예정이다.

수급단계에서 연금이 아니라 일시금의 형태로 수령할 경우 기타소득이나 근로소득이 아닌 자본소득으로 과세한다. 2005년 이전에 체결된 연금계약으로부터 지급받은 일시금 수령액에 대해서는 비과세가 허용되는데, 이 경우 운용시기에 발생한 수익에 대해서는 과세가 이루어진다. 자본소득으로 과세될 경우 총 30.5%의 세율로 과세가 이루어진다. 다만 자본소득과세에 대해서는 일정수준의 공제가 허용되는데, 연간 단위로 801유로(부부합산의 경우 1,602유로)의 자본소득 공제가 가능하다.

Ⅳ. 연금세제의 국제비교 및 국내 연금세제 개선방향

1. 연금세제의 비교분석 및 시사점

해외의 연금세제 분석에서 공통적으로 관찰되는 중요한 특징은 연금세제의 핵심은 퇴직연금과 개인연금에 대한 세제혜택을 어떻게 설계하느냐에 있다는 점이다. 공적연금은 의무가입이 원칙이며 공적연금보험료의 규모도 법적으로 정해져 있기 때문에 일반근로자들이나 개인들은 선택의 여지가 없다. 그런데 많은 국가들에서 공적연금에 의한 소득대체율이 25~30% 수준에 머물고 있으며, 특히 저출산‧고령화 문제를 직면하고 있는 국가에서는 공적연금의 지속가능성에 대한 우려가 이어지고 있다. 이러한 상황에서 국민들의 노후생활을 안정시키기 위해서는 사적연금의 역할확대가 중요해진다. 사적연금의 경우 퇴직연금처럼 가입이 강제되는 영역이 존재하지만 가입자들의 자발적인 가입의사에 의지해 운영되는 제도가 많다. 가입자들의 자발적인 가입을 유도할 수 있는 가장 강력한 유인은 세제혜택이다. 국내와 해외의 다양한 임의가입 방식의 연금상품을 살펴볼 때 그 운영은 세제혜택을 어떻게 설계하느냐에 결정적인 영향을 받고 있음이 관찰된다. 따라서 우리나라의 연금제도 운영에 있어서도 사적연금에 대한 세제설계는 향후 연금제도의 역할 변화에 있어 가장 중요한 고려사항이 될 것이다.

해외에서 운영되는 공적연금의 상당수는 부과방식으로 운영되고 있다. 부과방식은 근로자가 납부하는 연금보험료(또는 세금)를 현행 수급자들에게 나눠주는 방식이다. 적립식으로 운영되는 사적연금은 적립-운용-수급의 세단계로 구분되는 반면 부과방식으로 운영되는 공적연금은 적립과 운용단계가 부재하다. 공적연금을 적립방식으로 시도했던 나라들이 많았으나 공적연금의 운영기간이 길어짐에 따라 적립금이 모두 소진된 후에 부과방식으로 전환한 사례가 많다. 우리나라 국민연금도 현재는 부분적립방식으로 운영되고 있으나 적립금의 소진이 예상되고 있기 때문에 궁극적으로는 부과방식으로의 전환이 불가피할 것으로 예상된다.

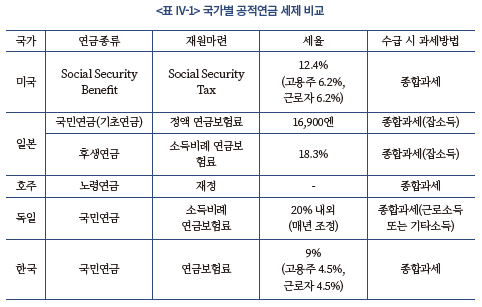

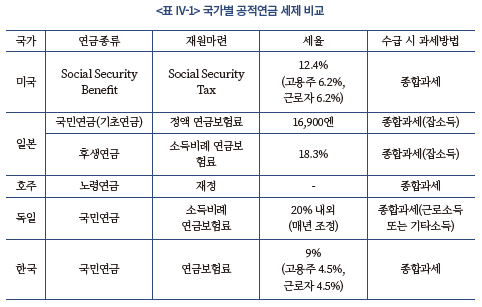

공적연금의 재원은 정부의 재정으로 마련하거나 연금보험료(또는 세금)의 부과를 통해 이루어지는 경우가 대부분이다. 우리나라 국민연금은 부분적립방식이라 재정의 투입이 없지만, 호주는 재정을 투입해 노령연금을 운영하고 있다. 미국은 social security tax를 부과하여 social security benefit에 소요되는 재원을 마련하고 있으며, 일본은 국민연금(기초연금)과 후생연금지급을 위해 정액과 비례방식을 사용한 연금보험료로 재원을 마련하고 있다. 독일도 미국과 유사한 형태의 세금을 부과하여 국민연금의 재원을 마련하고 있다. 공적연금으로부터 발생하는 연금소득에 대해 우리나라를 포함한 조사대상 국가들은 원칙적으로 종합과세하고 있다. 다만 종합과세 하더라도 은퇴 이후 소득임을 감안하여 특별공제를 허용하는 국가도 존재한다. 공적연금에 대한 세제적 특성을 정리하면 아래의 표와 같다.

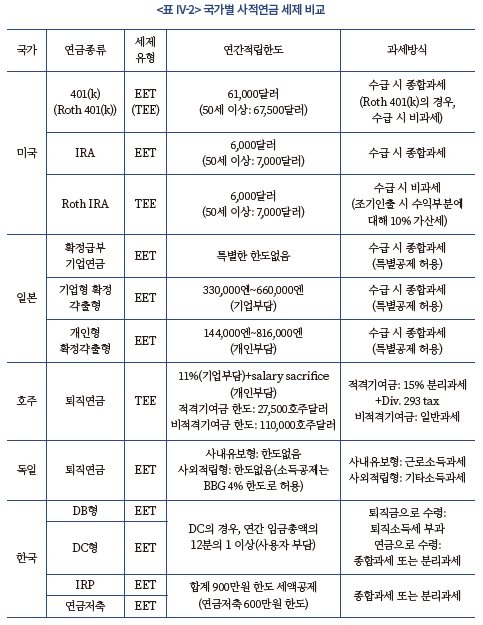

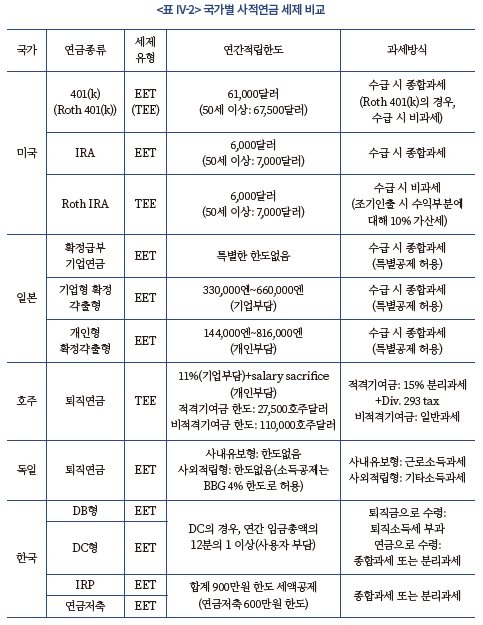

해외 사례에서 나타나는 중요한 특징 중의 하나는 은퇴 이후의 소득확보에 있어서 공적연금보다 사적연금의 중요성이 점점 더 커지고 있다는 사실이다. OECD의 권고안을 살펴보면 은퇴 이후 연금에 의한 적정 소득대체율로 65~75%를 권장하고 있다. 그런데 다수의 선진국들은 저출산‧고령화로 인해 공적연금의 역할이 축소될 위험에 빠져있다. 공적연금의 축소위험성을 완화하기 위해서는 사적연금의 역할을 증가시켜야 한다. 사례분석에서 사적연금의 역할 확대를 위해서 가장 부각되는 부분은 세제혜택을 어떻게 설계하느냐가 연금의 역할설정에 있어 핵심적이라는 사실이다. 연금의 소득대체율이 상대적으로 높은 미국과 호주의 경우 사적연금에 대한 세제혜택이 상대적으로 대규모로 이루어진다는 특징이 관찰된다. 국가별로 사적연금에 대한 세제적 특성을 비교하면 <표 Ⅳ-2>와 같다.

해외의 연금세제 사례 비교분석을 통해 다음과 같은 시사점을 도출할 수 있다. 먼저 분석국가 중에서 연금의 소득대체율이 가장 높은 미국의 경우를 살펴보면 사적연금에 대한 세제혜택 규모가 상대적으로 매우 크며, 다양한 방식으로 세제혜택이 제공되고 있다. 노후소득의 보장을 두텁게 하기 위해서는 사적연금으로부터의 수급액이 늘어날 필요성이 크다. 이를 위해서는 근로시기에 사적연금에 많은 금액을 납입할 수 있어야 한다. 미국과 호주의 사례를 살펴보면 사적연금에 대해 세제혜택이 주어지는 납입한도가 상당히 높게 설정되어 있음을 알 수 있다. 미국의 401(k) 적립한도는 61,000달러이며, 호주의 퇴직연금 기여금한도는 적격기여금이 27,500호주달러, 비적격기여금이 110,000호주달러이다. 우리나라와 일본과 비교할 때 매우 높은 수준이라는 것을 알 수 있다. 은퇴 이후 소득을 충분하게 보장하기 위해서는 더 많은 소득이 사적연금에 축적되어야 하는데 이를 위해서 가장 중요한 부분이 기여금에 대한 세제혜택임을 알 수 있다.

세제혜택 한도와 더불어 근로자들에게 중요한 부분은 다양한 유형의 연금상품이 필요하다는 점이다. 근로자들의 은퇴설계는 개인의 소득흐름과 주변 가족상황 등에 따라 달라진다. 따라서 연금상품을 다양한 유형으로 제공하여 근로자들이 자신에게 최적화되는 상품을 선택하여 은퇴설계를 효율적으로 할 수 있도록 지원할 필요성이 있다. 미국의 경우 연금상품은 기본적으로 EET방식으로 설계하지만 Roth 연금상품을 통해 알 수 있듯이 TEE방식의 연금상품도 다양하게 제공하고 있다. 미래의 소득흐름에 대한 예상을 바탕으로 은퇴 이후의 소득설계를 최적화하기 위해서는 EET방식뿐만 아니라 TEE방식의 상품도 유용하게 활용될 수 있음에 주목할 필요가 있을 것이다.

연금세제 설계에 있어 주목할 필요성이 있는 부분은 취약계층에 대한 연금지원이라고 볼 수 있다. 미국, 호주, 독일의 경우 저소득층에 대한 연금지원과 연금자산 축적을 위해 추가적인 배려를 하고 있음이 관찰된다. 저소득층에 대한 배려는 기초연금 수급을 위한 소득기준이나 자산기준의 마련과 같은 형태로 나타나고 있다. 호주나 독일의 사례를 살펴보면 저소득층의 연금자산 형성 촉진을 위해 조금 더 적극적인 접근방식을 선택하고 있다. 호주정부는 일정요건을 갖춘 근로자의 비적격기여금에 대해 최대 50%의 매칭기여금을 지원한다. 또한 일정요건을 갖춘 근로자의 적격기여금에 대한 세금을 최대 500호주달러까지 해당 연금계좌로 환급해서 연금자산으로 축적할 수 있도록 배려하고 있다. 독일의 경우 일정한도의 보험료를 납입할 경우 정부로부터 정액의 보조금을 지원받는데, 소득수준이 낮을수록 정액의 보조금 비중이 높아지는 방식으로 설계되어 있다. 사적연금상품에 대한 일반적인 세제혜택이 경제적 여유가 있는 고소득층과 중산층에 더 많은 혜택을 주고 있음을 감안할 때 호주와 독일 정부의 이러한 적극적인 보조금지원정책은 세제정책상 충분히 의미있는 조세방향이라고 평가할 수 있을 것이다.

해외사례로부터 도출할 수 있는 또 하나의 시사점은 연금수령 방법중 일시금 수령에 대해서는 상당한 제약을 가하고 있다는 점이다. 연금을 적립하는 가장 중요한 목적은 노후에 안정적인 수익흐름을 만들어내는 것이다. 안정적인 수익흐름은 연금방식이 일시금방식에 비하여 우위에 있다고 볼 수 있다. 따라서 해외 국가들은 연금지급방식에서 가급적 일시금보다는 연금방식으로 이루어지도록 배려하고 있다. 호주의 경우 일시금 수령을 소수의 특별한 상황에 대해서만 허용하고 있으며, 일시금으로 수령할 경우 운용수익에 대한 과세가 추가적으로 이루어지기도 한다. 미국의 경우도 일시금 수령에 대해 일정수준의 불이익을 주고 있음이 관찰된다. 독일의 경우 퇴직연금의 경우 일시금 수령을 사실상 허용하지 않고 있다.

2. 향후 연금세제 개선방향

우리나라와 해외의 연금세제를 비교하면서 발견할 수 있는 중요한 시사점은 급속한 고령화와 출산율의 저하가 공적연금의 지속가능성에 큰 부담을 가져오고 있기 때문에 공적연금의 역할 축소는 피하기 어려운 현실이라는 점이다. 고령화와 출산율의 저하는 이민정책 등의 차이로 인해 미국, 호주보다는 독일과 일본에서 상대적으로 더 뚜렷하게 나타나고 있는데, 일본과 독일은 이로 인한 공적연금의 안정성 저하를 사적연금의 기능강화로 보충하겠다는 정책적 의지를 보여주고 있다. 그리고 사적연금의 기능강화를 위해 적극적인 가입을 유도하겠다는 목적으로 세제지원을 주요 정책적 도구로 활용하고 있다. 그러한 사례들의 분석을 통해 연금세제의 설계는 공적연금보다 사적연금의 역할에 훨씬 중대한 영향을 미친다는 사실을 파악할 수 있다.

우리나라의 경우 공적연금과 퇴직연금은 의무가입이 강제되고 있다. 의무가입인 경우 세제혜택을 어떻게 설계하느냐는 연금가입 여부의 결정 및 연금자산의 축적에 크게 영향을 미치지 않는다. 가입에 대한 선택권이 없기 때문에 가입에 대한 결정보다는 의무적립비율을 얼마로 설정할 것인가와 운용에 대한 책임을 어떻게 분담할 것인가, 운용가능 대상자산을 어떻게 정의할 것인가 등에 관한 결정이 가입자들의 자산형성에 중대한 영향을 미친다. 물론 의무가입인 경우에도 세제혜택의 부여는 필요하다. 공적연금과 퇴직연금을 강제하는 이유는 가입자들의 노후생활을 안정화시키는 것이며, 소득대체율이 충분히 높지 않은 상황에서는 세제혜택을 통하여 은퇴 이후의 연금수령가능액을 높이는 것이 합리적이기 때문이다.

임의가입으로 운영되는 IRP와 개인연금(연금저축, 연금보험)의 경우 세제혜택이 어떠한 방식으로 주어지느냐에 따라 가입과 연금자산의 축적정도가 상당히 달라질 수 있다. 공적연금만으로는 은퇴 이후의 경제적 안정성을 충분히 확보할 수 없기에 IRP와 개인연금에 대한 세제혜택은 적극적인 형태로 부여되는 것이 바람직하다. IRP와 개인연금에 대한 적립유인 중 가장 중요한 부분은 납입시점에 주어지는 세액공제라고 볼 수 있다. 은퇴 이후의 경제적 안정성을 확보하는 데에 있어서 가장 중요한 요소는 젊은 시기에 적립금을 충분히 쌓아서 이를 오래동안 운용하는 것이다. 납입 시의 세제혜택을 꾸준히 증가시키고, 세제상품에 대한 선택권을 다양하게 제공하며, 취약계층의 연금자산적립을 지원하는 방향으로 제도개선이 추진되어야 할 것이다.

향후 연금세제는 국민연금과 퇴직연금에 대해서는 현행 연금세제의 틀을 대체적으로 유지하되 IRP와 개인연금에 대해 납입유인을 강화하는 방식으로 세제지원을 개선할 필요가 있다. 기본적으로 국민연금과 퇴직연금은 가입이 강제되기 때문에 가입자들의 참여를 유도할 필요가 없다. 따라서 적립시기의 세제정책은 적립금에 대한 비과세가 합리적인 선택이 될 가능성이 높다. 국민연금의 경우 고령화 및 저출산 기조로 인해 고갈에 대한 우려가 훨씬 큰 상황이므로 세제정책을 통한 자산축적 확대보다는 기본적인 보험료율의 조정, 연금수급 조건의 조정 등이 연금수령 가능성에 훨씬 큰 영향을 미치게 된다. 적립, 운용 및 수급시기에 대한 과세정책에 변화의 필요성이 뚜렷하지 않다. 해외 공적연금에 대한 과세방식과의 비교를 통해서도 개선의 필요성이 뚜렷하지 않음을 발견할 수 있다.

퇴직연금의 경우도 세제적인 측면을 평가하면 국민연금과 비슷한 상황이라고 볼 수 있다. 가입이 강제되며 납입규모도 법적으로 정해져 있어 가입자들의 참여를 유도할 필요가 없다. 안정적인 은퇴소득을 확보하기 위해서는 의무적립율의 조정, 운용가능 대상자산의 확대 등이 중요한 요소이다. 이는 국민연금과 마찬가지로 적립, 운용 및 수급시기에 대한 과세정책에 변화의 필요성이 뚜렷하지 않음을 의미한다. 해외사례와 비교해 볼 때에도 퇴직연금에 대한 과세체계는 현재와 같이 EET방식을 유지하는 것이 합리적이라는 사실을 파악할 수 있다.

IRP와 개인연금의 경우 가입자의 의사에 따라 적립수준, 운용기간, 수급방식에 큰 차이가 나타날 수 있다. 국민연금의 역할이 줄어들 가능성이 높은 상황에서 IRP와 개인연금이 그 부족분을 일부 대체하기 위해서는 가입자들이 적극적으로 해당 계좌에 가입할 유인을 부여할 필요가 있다. 의무가입에 비하여 임의가입 계좌들에 세제혜택이 필요한 가장 중요한 이유라고 볼 수 있다. 세제혜택을 부여함으로써 더 많은 자산을 IRP와 개인연금에 납입하고, 중도인출 없이 더 오랜 기간 운용하며, 은퇴 이후의 수급시기에 일시금이 아닌 연금의 형태로 장기간에 걸쳐 수익을 나누어 받을 수 있도록 유도함이 타당하다.

사적연금의 기능강화를 위해서는 세제혜택의 한도를 높일 필요가 있다. 미국을 비롯한 해외국가들의 경우 연금납입에 대한 세제혜택 한도가 우리나라에 비해 높은 국가가 다수 관찰된다. 은퇴 이후의 경제적 안정성 강화를 위해 가장 중요한 부분은 근로소득이 발생하는 시기에 더 많은 소득을 연금납입금으로 적립하는 것이라 볼 수 있다. 공적연금에 의한 소득대체율이 높지 않은 상황에서 사적연금이 역할을 확대하도록 만들기 위해서는 세제혜택의 부여가 가장 중요하다는 사실을 부인하기 어렵다. 다수의 국가가 국민들의 자발적인 참여를 통한 연금기능의 강화를 달성하기 위하여 우리나라에 비해 상대적으로 높은 수준의 세제혜택을 부여하고 있다는 점을 감안하여 연금납입에 대한 세제혜택 한도를 상향시켜 갈 필요가 있다.

해외의 사적연금 세제혜택이 주로 소득공제방식임을 감안할 때 국내 세제혜택 방식인 세액공제는 세제혜택 효과에 있어서 해외사례에 비하여 낮은 편이다. 소득공제의 부활까지는 아니더라도 세액공제 한도를 점진적으로 높여갈 필요성이 있다. ISA 만기 시 IRP로 이전할 때 세액공제혜택이 또 한번 주어지지만 한도가 300만원으로 그 규모가 크다고 평가하기는 어렵다. 성격이 다소 다르기는 하지만 미국의 401(k)의 경우 연간 적립한도가 61,000달러, 호주의 경우 적격기여금의 한도가 연간 27,500호주달러로 상당히 높은 반면, 우리나라의 DB/DC 퇴직연금의 부담률은 8.33%로 미국이나 호주에 비해 많이 떨어진다고 볼 수 있다.85) 따라서 연금계좌에 대한 세제혜택은 최소 지금보다 2배 이상으로 증액할 필요성이 있다고 판단된다. 추가적으로 연금계좌에 대한 세제혜택은 경제상황을 반영하여 정기적으로 조정될 필요성이 있으며, 가능하다면 매년 조정하는 방안도 검토해 볼 수 있을 것이다. 우리나라의 연금세제는 세제혜택의 한도조정에 지나치게 경직적이라는 지적이 꾸준히 이어지고 있다. 경제성장률, 인플레이션, 평균임금성장률 등의 지표를 활용하여 세제혜택의 한도를 주기적(또는 매년)으로 조정할 수 있도록 제도적 기반을 마련할 필요성이 있다.

사적연금을 연금의 형태가 아니라 일시금의 형태로 수령하는 관행을 줄이기 위해 일시금 수령에 대한 세율을 높이는 방안도 검토할 필요성이 있다. 사적연금에 대해 다양한 방식으로 세제혜택을 제공하는 근본적인 목적은 은퇴 이후의 삶이 안정적으로 유지될 수 있도록 일정한 수준의 소득흐름을 유지하고자 함에 있다. 연금의 형태가 아니라 일시금의 형태로 수급하게 될 경우 안정적인 소비활동으로 연결되는 것이 아니라 다른 목적으로 전용될 위험성이 높아진다. 따라서 일시금보다는 연금형태로의 수급을 촉진하기 위해서 일시금 수령에 대한 세율을 높여갈 수 있도록 제도적 보완이 필요하다. 해외사례의 분석에서도 미국이나 독일의 경우 일시금 수령에 대해 세제적 불리함을 주거나 또는 금지하는 방식으로 접근하고 있다. 과도하게 높은 일시금 수령을 연금수령으로 전환할 수 있도록 세제적 유인을 부여해야 할 것이다.

연금납입에 대해 세액공제를 제공하는 방식을 연말정산을 통해 환급해주는 방식에서 연금계좌로 환급하는 방식으로 전환하는 방안도 고려해 볼 수 있는 개선안일 것이다. 우리나라의 세액공제방식은 연말정산을 통해 납부해야할 소득세를 감면해주는 방식으로 이루어지고 있다. 그런데 사적연금활성화라는 정부정책의 취지를 고려해 볼 때 이러한 방식보다는 세액공제금액을 개인들의 연금계좌로 환급해서 자동적으로 연금자산에 편입될 수 있게 만드는 방식이 노후자산 축적에 더 도움이 될 가능성이 높다. 호주의 경우 세제혜택을 이러한 방식으로 부여하고 있음을 감안하여 국내 사적연금에 대한 세제혜택 방식도 연금계좌로 환급할 수 있는 방식으로 전환할 필요성이 있을 것이다.

세제혜택의 제공방식도 다양화할 필요가 있다. 우리나라 연금세제의 기본방식은 EET방식이라 볼 수 있다. 연금보험에 대해서는 예외적으로 TEE방식의 세제가 적용되고 있지만, 지금보다 다양한 형태의 세제혜택 제공을 긍정적으로 검토해야 할 것이다. 연금가입자에게는 과세이연수단과 세후소득으로 연금에 가입하고 수급단계에서 소득세를 면제받을 수 있는 수단이 모두 제공되어야 한다. 연금가입자가 본인의 현재 소득과 은퇴 이후의 소득을 감안하여 선택할 수 있도록 허용해야 최적의 연금자산 적립을 달성할 가능성이 높아진다. 선택의 폭이 줄어들 경우 연금가입자는 최적보다 낮은 수준의 연금자산을 적립하게 될 것이다. 해외 국가들이 다양한 유형으로 EET 및 TEE 방식의 세제혜택을 허용하고 있음을 감안하여 국내에서도 연금가입자의 선택의 폭을 확대할 필요가 있다. 미국의 사례를 참고하여 Roth IRA와 유사한 방식으로 세후소득으로 납입하되 운용과 수급단계에서 비과세되는 연금상품을 더 다양하게 제공할 필요성이 있다.

사적연금의 가입 및 연금납입을 촉진하기 위하여 세제혜택을 부여할 때 흔히 관찰되는 현상은 세제혜택이 상대적으로 소득수준이 높은 계층에 더욱 뚜렷하게 나타난다는 점이다. 세제혜택이 있음에도 저소득층은 저축여력이 매우 제한적이라서 세제혜택을 충분히 누릴 수 있을만큼의 연금납입을 유지하기 어렵다. 취약계층이 연금관련 세제혜택으로부터 소외받는 현상을 완화하기 위해서는 지금보다 더 적극적인 형태의 세제지원이 필요하다. 가입자들의 연금납부와 운용수익에 대해 세제혜택을 부과하는 방식에서 한 걸음 더 나아가 취약계층의 연금납부에 대해 환급형 세액공제방식이나 매칭방식의 보조금을 지급하는 방안을 검토해 볼 수 있을 것이다. OECD 회원국의 경우를 살펴볼 때에도 사적연금에 대해 보조금을 지급하는 국가는 늘어나는 추세에 있다.86) 사적연금에 대해 국가보조금을 지급하는 국가는 2020년 기준 6개(독일, 미국, 아이슬란드, 이탈리아, 뉴질랜드, 폴란드)이며, 매칭보조금은 12개 국가가 지급하고 있다.87) 2023년 6월 높은 우대금리와 지원금을 제공하는 청년도약계좌가 출시되었다는 점을 감안할 때 환급형 세액공제나 매칭방식의 연금세제 지원방안은 연금 취약계층의 노후생활 안정화에 유의적인 개선을 가져올 수 있을 것이다.

1) OECD(2022)

2) 소득세법 제12조 제4호 가

3) OECD, 2002, Revised taxonomy for pension plans, pension funds and pension entities, p.3

4) 공적연금 간의 동일한 특징으로 인해 공적연금 제도 간 격차의 해소방안이 논의되고 있다. 국민연금연구원, 2021, 공적연금 제도 간 격차와 해소방안

5) 소득세법 제20조의3 제1항 제1호

6) 소득세법 제20조의3 제1항 제2호

7) 소득세법 제64조의4

8) 보건복지부, 2023. 10. 30, 제5차 국민연금 종합운영계획(안), pp.61-62

9) World Bank, 1994, Averting the Old Age Crisis; OECD, 2005, Private Pensions: OECD Classification and Glossary 참조

10) 본고에서 EET, TEE 등 연금의 세제혜택 형식 관련 분류는 OECD(Organization for Economic Cooperation and Development)의 연금세제 분류방식을 따랐다. OECD, 2016, Pensions Outlook 2016, Chapter 2 참조

11) 국민연금법, 공무원연금법, 사립학교교직원연금법, 별정우체국법에 따른 기여금이 포함된다.

12) 소득세법 제51조의3(연금보험료공제) 제1항

13) 소득세법 제51조의3(연금보험료공제) 제2항

14) 소득세법 제20조의3(연금소득) 제1항 제1호, 소득세법 시행령 제40조(공적연금소득의 계산) 제1항

15) 소득세법 제20조의3(연금소득) 제2항

16) 소득세법 시행령 제40조(공적연금소득의 계산) 제1항 제1호

17) 국민연금법 제51조(기본연금액) 제1항 제2호

18) 국민연금법 제3조(정의 등) 제1항 제5호, 제4항, 국민연금법 시행령 제7조(가입기간 중 기준소득월액의 결정 및 적용 기간) 제1항

19) 소득세법 시행령 제40조(공적연금소득의 계산) 제1항 제2호

20) 소득세법 제47조의2(연금소득공제) 제1항 및 제2항

21) 소득세법 제129조(원천징수세율) 제1항 제5호

22) 소득세법 제73조(과세표준확정신고의 예외) 제1항 제3호

23) 소득세법 제129조(원천징수세율) 제3항, 소득세법 시행령 제189조(간이세액표) 제2항 및 별표 3

24) 퇴직급여법 제1조 (2005. 1. 27. 제정)

25) 소득세법 제20조의3 제1항 제2호

26) 퇴직급여법 제2조 제14호 (2022)

27) 퇴직급여법 제8조 제1항 (2022)

28) 퇴직급여법 제2조 제8호-제10호 (2022)

29) 소득세법 제22조, 소득세법시행령 제42조의2

30) 대법원 2014. 7. 16. 선고 2013므2250 전원합의체 판결

31) 퇴직급여법 제9조

32) 소득세법 제48조 제1호에 따르면, 퇴직소득공제액은 다음과 같이 근속연수에 따라 누진적으로 증가한다. 5년 이하: 100만원×근속연수, 5년 초과 10년 이하: 500만원+200만원×(근속연수-5년), 10년 초과 20년 이하: 1천500만원+250만원×(근속연수-10년), 20년 초과: 4천만원+300만원×(근속연수-20년)

33) 소득세법시행령 제42조2 제1항 제2호

34) 소득세법 제 48조 제2호에 따르면, 근속연수 공제가 반영된 환산급여에 대해 다음과 같은 환산급여별 공제가 적용된다. 8백만원 이하: 환산급여의 100%, 8백만원 초과 7천만원 이하: 8백만원+(8백만원 초과분의 60%), 7천만원 초과 1억원 이하: 4천 520만원+(7천만원 초과분의 55%), 1억원 초과 3억원 이하: 6천170만원+(1억원 초과분의 45%), 3억원 초과: 1억5천170만원+(3억원 초과분의 35%)

35) 소득세법 제55조

36) 연금계좌에서 연금형태로 인출하는 금액 중 i) 원천징수되지 아니한 퇴직소득, ii) 세액공제를 받은 연금계좌 납입금, iii) 운용수익, iv) 연금계좌에 이체 또는 입금되어 해당 금액에 대한 소득세가 이연된 소득으로서 대통령령으로 정하는 소득 등이 과세대상 사적연금소득이다. 소득세법 제20조의3 제1항 제2호

37) 소득세법 제51조의3 제1항

38) 소득세법 제59조의3

39) 소득세법시행령 제40조의2 제2항 제1호 가목

40) 소득세법시행령 제40조의2 제3항

41) 소득세법시행령 제40조 제3항

42) 소득세법 제4조 제1항 제1호

43) 소득세법 제14조 제3항 제8호 나목. 이때 세율은 지방세 포함 16.5%이다. 소득세법 제129조 제1항 제6호 나목

연금계좌에서 일부 금액을 인출하는 경우, 해당 금액이 과세대상인 납입금액 또는 운용수익인지의 여부는 법령이 정한 연금계좌 인출순서에 따른다. 법정 연금계좌 인출순서는 세액공제 없었던 납입금 – 이연퇴직소득 - 세액공제 받은 납입금 – 운용수익의 순이다. 소득세법시행령 제40조의3 제1항

44) 소득세법 제14조 제3항 제9호. 2023년 12월 31일 소득세법 개정을 통해, 분리과세하는 연금소득의 기준금액이 연간 연금소득 합계액 1천200만원 이하에서 1천500만원 이하로 상향 조정되었다.

45) 소득세법 제129조 제1항 제5의3호. 연금 실제 수령연차가 10년 이하인 경우는 연금외수령 원천징수세율의 70%, 연금 실제 수령연차가 10년을 초과하는 경우는 연금외수령 원천징수세율의 60%를 적용한다.

46) 소득세법 제129조 제1항 제5의2호

47) 소득세법 제64조의4 제2호

48) 소득세법 제16조(이자소득) 제1항 제9호 나목, 소득세법 시행령 제25조(저축성보험의 보험차익) 제4항

49) 고제헌, 2002, 다층노후소득보장체계와 주택연금, 주택금융리서치 통권 제27호 1부, p.37

50) 통계청, 2023. 10. 26, 2016~2021년 「연금통계」개발 결과, 보도자료, p.47

51) 한국주택금융공사법 제2조(정의) 제8의2호, 한국주택금융공사법 시행령 제3조의2(연금의 방식 등) 제1항 및 제2항

52) 한국주택금융공사법 제43조의11(주택담보노후연금보증 대상 주택에 대한 특례) 제1항

53) 지방세특례제한법 제35조(주택담보노후연금보증 대상 주택에 대한 감면) 제1항, 한국주택금융공사법 제9조(설치 및 기능) 제1항, 제2항 제5호

54) 등록면허세 감면은 현행 지방세특례제한법에 의해 2024년 12월 31일까지 허용된다. 다만, 지방세특례제한법의 개정을 통해 등록면허세 감면은 추가적으로 계속해서 허용될 것으로 예상된다.

55) 지방세특례제한법 제35조(주택담보노후연금보증 대상 주택에 대한 감면) 제2항

56) 지방세특례제한법 제35조(주택담보노후연금보증 대상 주택에 대한 감면) 제3항

57) 재산세 감면은 현행 지방세특례제한법에 의해 2024년 12월 31일까지 허용된다. 다만, 지방세특례제한법의 개정을 통해 재산세 감면은 추가적으로 계속해서 허용될 것으로 예상된다.

58) 소득세법 제51조의4(주택담보노후연금 이자비용공제) 제1항

59) 소득세법 제51조의4(주택담보노후연금 이자비용공제) 제3항, 소득세법 시행령 제108조의3(주택담보노후연금 이자비용공제) 제2항, 소득세법 시행규칙 제101조(과세표준확정신고 관련서식) 제8호의3 및 별지 제38호의3서식

60) 소득세법 시행령 제108조의3(주택담보노후연금 이자비용공제) 제3항

61) 사회보장세와 메디케어세(medicare tax)를 합하여 FICA(Federal Insurance Contributions Act)세라고 한다.

FICA세는 근로소득의 15.3%(사회보장세 12.4%, 메디케어세 2.9%)이며, 근로자는 사회보장세 6.2%, 메디케어세 1.45%를 부담한다.

62) AGI에 대한 구체적 산식에 대해서는, IRS Form 1040, Income 파트 11 참조

63) IRS, 2023, Publication 554, p.14

64) 2022년 12월 바이든 대통령이 서명한 Secure Act 2.0의 입법 취지에서 나타나는 바와 같이, 미국은 사적연금 활성화에 정책적 주안점을 두고 있다.

65) 26 USC §72(t)

66) IRS, 2023, Publication 590-B, Appendix B. Uniform Lifetime Table, p.65

67) 26 USC §219(g)

68) 2022년 기준 AGI가 10만 9천달러 이하인 부부(세금신고 합산) 또는 적격 미망인인 가입자가 다른 은퇴플랜이 있는 경우, IRA 납입금을 한도 범위에서 전액 공제받을 수 있다.

69) 2022년 기준 AGI가 10만 9천달러에서 12만 9천달러 사이에 있는 부부(세금신고 합산) 또는 적격 미망인인

가입자가 다른 은퇴플랜이 있는 경우, IRA 납입금 공제 수준이 phaseout 된다. IRA 납입금 phaseout 공제에 대한 구체적인 산식에 대해서는, IRS, 2023, Publication 590-A, Worksheet 1-2, p.17 참조

70) 2022년 기준 AGI가 12만 9천달러 이상인 부부(세금신고 합산) 또는 적격 미망인인 가입자가 다른 은퇴플랜이 있는 경우, IRA 납입금 공제 혜택을 받지 못한다.

71) 김헌수‧김재현‧류성경(2017)

72) 일본의 공적연금 수령연령은 65세인데, 본인이 원할 경우 수령시기를 늦출 수 있다. 수령시기를 늦출 경우 65세 수령 금액에 연기한 기간×8.4%를 가산하여 수령하게 된다.

73) 한국조세재정연구원(2020)

74) 홍범교‧박수진‧정경화(2012), 한국조세재정연구원(2020)

75) Unused concessional cap carry forward(ato.gov.au 참조)

76) 유호선‧김진수‧Christina Hiessl(2017)

77) 이소양b(2023)

78) 독일 소득세법(Einkommensteuergesetz, EStG) 제10조, 제22조

79) 홍범교‧박수진‧정경화(2012), 한국조세재정연구원(2020)

80) 독일 소득세법(Einkommensteuergesetz, EStG) 제22조

81) 독일 소득세법(Einkommensteuergesetz, EStG) 제19조

82) 독일 소득세법(Einkommensteuergesetz, EStG) 제3조

83) 독일 소득세법(Einkommensteuergesetz, EStG) 제22조

84) 독일 소득세법(Einkommensteuergesetz, EStG) 제19조

85) 예를 들어 연봉 5,000만원을 가정하면, 국내 DB/DC 적립금액은 연봉의 8.33%인 416만원이다.

86) OECD(2020)

87) 송홍선(2022)

참고문헌

김완석, 2020,『소득세법론』, 삼일인포마인.

김헌수‧김재현‧류성경, 2017, 『일본의 공‧사적 연금제도 연구』, 국민연금공단 국민연금연구원 프로젝트 2017-07.

박성욱, 2023,『소득세법』, 삼일인포마인.

송홍선, 2022, 『DC형 퇴직연금의 노후안전망 역할 강화 연구』, 자본시장연구원 연구보고서 22-03.

유호선‧김진수‧Christina Hiessl, 2017, 『독일의 공‧사적 연금제도 연구』, 국민연금공단 국민연금연구원 프로젝트 2017-04.

이소양a, 2023, 일본, 연금제도 개혁의 최근 동향, KIRI 리포트, 보험연구원.

홍범교‧박수진‧정경화, 2013, 『주요국의 연금세제 연구』, 한국조세재정연구원 세법연구 13-07.

대한민국 국민연금법

대한민국 국민연금법 시행령

대한민국 소득세법

대한민국 소득세법 시행령

대한민국 소득세법 시행규칙

대한민국 주택법

대한민국 지방세법

대한민국 지방세특례제한법

대한민국 한국주택금융공사법

대한민국 한국주택금융공사법 시행령

IRS, 2023, Publication 590-A.

IRS, 2023, Publication 590-B.

OECD, 2016, Pensions Outlook 2016.

OECD, 2020, Financial incentives for funded private pension plans, OECD Country Profiles 2020.

OECD, 2021, Pensions at a Glance.

OECD, 2022, Social and Welfare Statistics.

Richmond, G.L., Pietruszkiewicz, C.M., 2020, Mastering Income Tax, Carolina Academic Press.

Rosenbloom, J.S., 2017, Retirement Plans: 401(k)s, IRAs, and Other Deferred Compensation Approaches, McGraw-Hill Higher Education.

Sachverständigenrat zur Begutachtung der Gesamtwirtschaftlichen Entwicklung (Ed.) (2016): Zeit für Reformen. Jahresgutachten 2016/17, Jahresgutachten, Sachverständigenrat zur Begutachtung der Gesamtwirtschaftlichen Entwicklung, No. 2016/17.

厚生労働省, 2022, 私的年金制度(企業年金‧個人年金)の現状等

국가법령정보센터 www.law.go.kr

국민연금 www.nps.or.kr

대한민국 국세청 www.nts.go.kr

독일 국세청 www.bzst.de

독일 법률정보센터 www.gesetze-im-internet.de

미국 국세청 www.irs.gov

미국 재무부 www.treasury.gov

일본 국세청 nat.go.jp

한국주택금융공사 www.hf.go.kr

호주 국세청 ato.gov.au

호주정부서비스 serviceaustralia.gov.au

현재 우리나라에서는 급속한 고령화와 심각한 저출산으로 인해 경제성장이 둔화되고 노년층의 경제불안이 심각해질 것이라는 우려가 크게 대두되고 있다. OECD가 발행한 보고서에 따르면 우리나라는 2060년경 OECD 회원국 중에서 가장 고령화된 사회가 될 것으로 보인다.1) 2010년 65세 이상 인구의 비중은 10.8%였으나, 2021년에는 16.6%로 상승했다. 2025년에는 65세 이상 인구의 비중이 20%를 넘어서면서 초고령사회가 될 것으로 전망되고, 2035년에는 그 비중이 무려 30%에 이를 것으로 보인다. 급격한 출산률의 하락을 감안할 때 고령화의 속도는 더 빨라질 수 있다. 2023년 2분기 국내 합계출산율은 0.7명으로 역대 최저치를 경신했다. 인구절벽으로 인한 경제충격과 노년층의 경제불안은 피할 수 없는 미래가 된 것이다.

우리나라에서 고령화가 진행되면서 나타나는 가장 큰 문제점 중의 하나가 고령층의 빈곤화이다. 우리나라의 빈곤율을 살펴보면 18~65세까지의 인구에 대해서는 2019년 기준 11.1%였으나 66세 이상은 43.2%로 급상승한다. 이러한 노인빈곤율은 주요국 통계와 비교할 때 매우 높은 수준이다. 미국, 영국, 프랑스, 캐나다의 노인빈곤율은 2019년 기준 각각 23.0%, 15.5%, 4.4%, 12.3%로 나타난다. 높은 노인빈곤율은 노년층의 삶의 질이 현저하게 떨어진다는 것을 의미하며, 다양한 사회불안을 야기할 수 있다.

고령층의 빈곤화를 완화하기 위해서 가장 중요한 대응수단은 연금제도의 강화이다. 국내 연금제도는 공적연금, 사적연금의 중층구조로 발전해왔다. 공적연금은 강제가입방식으로 설계되어 있는데, 현재의 수급구조로는 2055년 이후 연금고갈이 불가피할 것으로 보인다. 소득대체율도 낮은 편이다. 국민연금의 소득대체율은 31.2%에 불과해 국민연금만으로는 은퇴 이후의 경제적 안정성을 확보하기 어렵다. 공적연금의 기능강화를 위해 더 많이 내고 더 늦게 받는 방식으로 연금개혁에 대한 논의가 지속되고 있는 이유이다.

퇴직연금과 개인연금의 기능도 확대될 필요가 있다. 퇴직연금은 은퇴 이후 소득확보에 매우 중요한 역할을 담당하며, 장기간 적립되어 운용될 경우 국민연금의 낮은 소득대체율을 보완할 수 있다. 개인연금은 자발적인 참여를 바탕으로 운영되는데, 그 필요성에 비해 적립수준은 낮은 편이다. 가입이 강제되는 연금에 대한 개혁도 중요하지만, 본인의 선택으로 이루어지는 연금들에 대한 정책적 배려도 충실히 이루어져야 할 것이다. 기여금 적립강화 및 운용수익률 제고방안들이 모색될 필요가 있다.

연금기능의 강화를 위해서 고려해야 할 중요한 요소로 연금세제를 들 수 있다. 연금세제의 설계방식은 개인들의 연금자산 구성에 큰 영향을 미치게 되며, 자본시장의 발전에도 상당한 차이를 가져올 수 있다. 연금에 대한 세제혜택은 사실상 개인의 연금적립에 있어 가장 중요한 유인이 된다. 해외의 주요 선진국들도 국민의 노후자산 축적을 지원하기 위하여 다양한 방식의 세제를 도입하여 운영하고 있다. 연금납입에 대한 과세이연, 운용수익에 대한 과세이연, 보조금지급 등은 대표적 세제혜택 사례이다. 우리나라의 연금세제는 연금납입과 운용수익에 대한 과세이연 허용이 가장 중요한 특징으로 볼 수 있다. 다만 국내 연금세제는 세제혜택 제공방식이 다양하지 못하고, 취약계층의 보호기능이 상대적으로 부족하다는 지적이 이어지고 있다.

국내외 연금세제의 특성을 분석하기 위한 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 우리나라 연금과세 제도의 특성을 종합적으로 분석한다. 대표적인 공적연금인 국민연금, 사적연금인 기업형 퇴직연금과 개인형 퇴직연금에 대한 과세제도 특징을 정리할 것이다. Ⅲ장에서는 주요국의 연금과세제도에 대한 분석을 실시한다. 미국, 일본, 호주 등의 국가에서 연금과세제도를 어떻게 설계해서 운영하고 있는지를 파악할 것이다. Ⅳ장에서는 해외 연금세제에 대한 분석을 바탕으로 연금세제에 대한 비교분석을 실시할 것이다. 외국의 연금세제가 우리나라의 연금세제와 어떠한 차이를 가지고 있는지 비교하고, 이를 바탕으로 우리나라 연금세제에 대한 개선방향을 제시할 것이다.

Ⅱ. 우리나라의 연금과세제도 특성 분석

1. 개요: 연금제도 분류체계

우리나라 연금제도는 일반적으로 공적연금과 사적연금으로 구분된다. 국내 소득과세 체계는 공사(公私) 구분방식을 명확히 법제화하였기 때문에, 본 보고서의 연금과세제도 특성 분석에 있어서도 국내 법령상의 공사 구분방식을 따랐다. 이러한 국내 연금제도 구분방식은 세계은행, OECD 등의 국제기구 분류체계(taxonomy)와도 높은 정합성을 가진다.

공적연금은 국민연금과 직역연금(공무원연금, 사립학교교직원연금, 군인연금, 별정우체국직원연금)으로 구성된다. 국내 소득세법이 규정하는 ‘공적연금 관련법’은 국민연금법, 공무원연금법, 군인연금법, 사립학교교직원연금법, 별정우체국법 등을 포함한다.2) 해당 공적연금 관련법은 모두 수급자의 가입을 강제하고 있으며, 예외 없이 제1조에서 해당 법의 목적을 수급자의 생활안정으로 규정한다. 공적연금은 가입이 법률에 의해 강제되고 있으며, 사회보장(social security)적 성격을 강하게 가지고 있다. 국내 공적연금제도가 가지는 특징인 공권력에 의한 강제성과 사회보장적 성격은 OECD의 공적연금제도의 개념적 특징과도 일치한다.3) 공적연금 간의 동일한 특징4)을 바탕으로 공적연금은 ‘국민연금과 직역연금의 연계에 관한 법률’ 등에 의해 상호연계성을 높이고 있다. 또한 국민연금과 직역연금으로부터의 소득은 ‘공적연금소득’5)으로 분류되어 동일한 세제 원칙이 적용된다.

사적연금으로는 기업형 퇴직연금인 확정급여형퇴직연금(Defined Benefits: DB)과 확정기여형퇴직연금(Defined Contribution: DC), 개인형 퇴직연금인 개인형퇴직연금(Individual Retirement Pension, 이하 IRP)과 연금저축이 있다. 소득세법은 퇴직연금(DB, DC, IRP)계좌와 연금저축계좌를 사적 연금계좌로 정의한다.6) 사적 연금계좌로부터의 소득은 합산하여 선택적 분리과세의 대상7)이 되는 등 공적연금과는 다른 세제적 취급을 받는다. 우리 정부도 다층노후소득보장 정책집행에 있어 사적연금을 퇴직연금과 개인연금(연금저축)으로 분류하여 각각의 활성화 방안을 마련하여 집행 중이다.8) 세계은행 등이 제시하는 다층(multi-pillar) 연금구조에 따르면 기업형 퇴직연금은 2층(Pillar Ⅱ)에 해당하고 개인형 퇴직연금은 3층(Pillar Ⅲ)에 해당한다.9) 연금구조상 2층과 3층에 위치한 사적연금은 1층의 공적연금이 제공하는 사회보장적 성격의 기본연금을 보충하여 추가적인 노후 소득을 확보하려는 목적을 가진다. 2층의 기업형 퇴직연금과 비교하여 3층의 개인형 퇴직연금은 개인의 선택, 자율적 운용, 추가적 소득의 성격이 더욱 강하다.

우리나라에서 연금에 부과되는 세금의 특성을 살펴보면 가장 기본적인 원칙으로 납입단계에 대한 비과세(Exempt), 운용과정에서 발생하는 수익에 대한 비과세(Exempt), 연금소득 수급단계에서의 과세(Taxed)로 요약되는 EET방식이 기준이 되고 있다. 일부 연금 유사상품의 경우 납입단계에서 과세하고 이후 운용 및 수급단계에서는 비과세하는 TEE 유형의 특성을 가지기도 하지만 대부분의 연금에 대해서 EET방식이 적용된다. 공적연금은 모두 EET방식의 세제가 적용되며 퇴직연금 및 IRP에 대해서도 EET방식이 적용된다. 개인연금의 경우 연금저축은 EET방식이 적용되고, 연금보험은 일종의 TEE방식10)이 적용된다. 주택연금의 경우 공적연금 및 사적연금과 비교할 때 운영하는 방식이 완전히 다르다. 주택연금에 대한 과세체계는 기본적으로 부동산에 대한 과세체계를 기본으로 하고 있으며 부동산과세에서 일부 항목에 대해 세제혜택을 주는 방식으로 운영되고 있다.

2. 공적연금에 대한 과세제도

공적연금은 국민연금을 비롯해 공무원연금, 군인연금, 사립학교교직원연금 등의 다양한 형태로 운영되고 있다. 본 장에서 공적연금의 특징은 국민연금을 중심으로 설명하고, 공적연금에 대한 과세체계도 국민연금에 대한 과세방식을 중심으로 설명할 것이다. 이는 국민연금이 공적연금에서 가장 중요한 대표적인 연금으로 인식되고 있으며, 다른 종류의 공적연금에 대한 과세체계도 기본적으로 국민연금과 유사하기 때문이다.

국민연금은 가장 대표적인 공적연금으로서 1988년부터 제도를 시행하고 있다. 현재 국민연금의 연금보험료율은 사업장 가입자의 경우 기준소득월액(상한액 590만원)의 9%이다. 이중 절반은 사업장의 사용자가 부담하고 나머지 절반은 근로자 본인이 부담한다. 지역가입자와 임의가입자의 경우 9%의 연금보험료 전액을 본인이 부담한다. 농어업인의 경우 일정 조건에 해당하면 연금보험료의 일부를 국고에서 지원받을 수 있다. 연금급여를 지급하는 방식은 노령연금, 장애연금, 유족연금, 반환일시금이 있다. 최소가입기간은 10년이며, 1969년생 이후 출생자는 만 65세부터 노령연금의 수급이 가능하다. 소득이 없을 경우에는 만 55세부터 조기노령연금의 수급이 가능하다. 국민연금의 소득대체율은 40년 가입한 평균 소득자를 기준으로 40% 수준이다.

국민연금에 대한 과세체계는 3단계로 구분된다. 연금부담금을 납입하는 시기(납입단계), 납입된 연금부담금을 운용하는 단계(운용단계), 그리고 최종적으로 연금이 지급되는 단계(수급단계)이다. 국민연금을 포함한 공적연금에 대한 과세체계는 기본적으로 납입단계에서의 비과세-운용단계에서 발생한 수익에 대한 비과세-수급단계에서 연금소득세를 과세하는 방식(EET)이 적용된다. 납입단계와 운용단계에서의 비과세가 실질적으로는 과세이연의 성격을 가지기 때문에 비과세가 아니라고 보는 견해가 있으나, 소득발생 시기에 과세되지 않는다면 비과세로 분류하는 것이 OECD를 비롯한 국제기구의 기본적인 분류체계이며, 본 보고서도 이러한 분류체계를 따라 구분한다.

사용자가 납입하는 연금부담금은 근로자의 과세소득이 아니며, 사용자는 이를 손금으로 처리할 수 있다. 근로자가 납입하는 연금부담금은 근로자의 종합소득 계산 시 전액 소득공제되기 때문에 납입단계에서 완전한 비과세라고 평가할 수 있다. 소득세법은 종합소득이 있는 거주자가 공적연금 관련법에 따른 기여금11) 또는 개인부담금을 납입한 경우에는 해당 과세기간의 종합소득금액에서 그 과세기간에 납입한 연금보험료를 공제하도록 허용하며12), 이를 연금보험료공제로 정의한다.13) 운용단계에서 발생하는 운용수익은 발생시점에서는 과세하지 않으며, 연금으로 최종수급하는 단계에서 과세한다.

공적연금이 지급하는 연금급여인 공적연금소득은 해당 과세기간에 수급한 공적연금에 대하여 공적연금의 지급자별로 과세기준일(2002년 1월 1일)을 기준으로 과세기준금액을 계산한다.14) 공적연금의 과세기준일이 2002년 1월 1일이므로 2001년 이전에 납입한 연금보험료로부터 지급받은 연금소득은 비과세되지만, 2002년 이후 납입한 연금보험료는 소득공제를 받았기 때문에 이로부터 발생하는 연금소득은 과세된다.15) 공적연금소득 중 국민연금으로부터 지급받는 연금소득에 대한 과세기준금액은 아래와 같이 계산한다.16) 식에서 표시된 환산소득은 가입자의 가입기간 중 매년의 기준소득월액을 보건복지부장관이 고시하는 연도별 재평가율에 따라 연금수급 개시 전년도의 현재가치로 환산한 금액이다.17) 기준소득월액은 전년도 중 해당 사업장에서 종사한 기간에 받은 소득액을 그 기간의 총일수로 나눈 금액의 30배에 해당하는 금액을 소득월액으로 하여 매년 국민연금공단이 결정한다.18)

3. 사적연금에 대한 과세제도

가. 개요: 퇴직금제도와 퇴직연금제도

본 연구에서 국내 근로자의 퇴직급여에 대한 과세체계 분류는 소득세법과 더불어 ‘근로자퇴직급여 보장법’(이하 퇴직급여법)을 따랐다. 퇴직급여법은 ‘근로자 퇴직급여제도의 설정 및 운영에 필요한 사항을 정함으로써 근로자의 안정적인 노후생활 보장에 이바지함을 목적’24)으로 2005년 1월 27일 처음 제정되었다. 해당 법률에 따르면 퇴직급여제도는 퇴직금제도, 퇴직연금제도, 중소기업퇴직연금기금제도로 구성된다. 퇴직급여법상의 퇴직연금제도와 소득세법상의 연금저축제도가 합해져서 국내 사적연금계좌 과세제도의 주축을 이룬다.25)

중소기업퇴직연금기금제도는 둘 이상의 중소기업 고용주와 직원이 공동으로 납입한 부담금을 사용하여 공동 기금을 조성하고 운영함으로써, 근로자의 안정된 노후생활을 지원하기 위한 급여를 제공하는 시스템을 의미한다.26) 중소기업퇴직연금기금제도는 매우 중요한 퇴직급여제도이기는 하지만, 그 대상이 상시 30명 이하의 근로자를 사용하는 중소기업에 국한된다. 따라서 근로자 전반의 퇴직급여 과세제도 분석을 지향하는 본 연구의 제도 분석 대상에서 중소기업퇴직연금기금제도는 제외하기로 한다.

퇴직급여제도 중 가장 중요한 두 축은 퇴직금제도와 퇴직연금제도이다. 퇴직금제도란 ‘계속근로기간 1년에 대하여 30일분 이상의 평균임금을 퇴직금으로 퇴직 근로자에게 지급할 수 있는 제도’이다.27) 사용자는 퇴직금 지급사유가 발생한 날부터 14일 이내에 해당 근로자에게 퇴직금을 지급하여야 한다. 이때 근로자는 퇴직급여를 일시금 방식으로 지급받거나 연금 방식으로 지급받을 수 있으며, 지급 방식에 따라 퇴직급여에 대한 과세가 다르다. 즉, 근로자가 퇴직급여를 일시 수급하는 경우 퇴직소득세가 적용되며, 연금 형태로 분할 수급하는 경우 연금소득세가 적용된다. 또한 일정한 사유로 인해 퇴직급여를 중도 인출하는 경우 기타소득세가 적용된다.

퇴직연금제도란 근로자가 노후에 정기적으로 전체 퇴직급여 중 일정 금액을 지급받는 제도이다. 퇴직연금제도는 확정급여형퇴직연금제도(DB), 확정기여형퇴직연금제도(DC), 개인형퇴직연금제도(IRP) 등으로 구분된다.28) 확정급여형퇴직연금제도는 가입자에게 지급될 퇴직급여의 수준이 미리 결정되어 있는 퇴직연금제도이다. 확정기여형퇴직연금제도는 퇴직급여 지급을 위한 가입자의 부담금 수준이 미리 결정되어 있는 퇴직연금제도이다. 개인형퇴직연금제도는 가입자의 납입금(일시금 혹은 부담금) 또는 사용자의 납입 부담금을 가입자의 자유로운 선택에 따라 적립‧운용하기 위하여 설정한 퇴직연금제도이다. 개인형퇴직연금제도는 확정급여형 또는 확정기여형의 퇴직연금제도와는 다르게 지급받을 퇴직급여의 수준 또는 지급해야 할 부담금의 수준이 확정되지 아니한 특징이 있다.

국내 퇴직급여에 대한 과세체계를 납입단계, 운영단계, 수급단계로 나누어 도식화하면 <그림 Ⅱ-1>과 같다. <그림 Ⅱ-1>에서 나타난 바와 같이, 국내 퇴직급여는 납입단계에서 납입금에 대해서는 비과세(Exempted), 운용단계에서 수익에 대한 비과세(Exempted), 수급단계에서 퇴직소득에 대한 과세(Taxed)가 이루어지는 EET 구조를 원칙적으로 갖는다.

1) 퇴직소득의 의의

퇴직소득이란 근로자가 자신의 근로관계를 종료할 때 받는 일시적 급여를 의미한다. 퇴직소득은 법정퇴직급여와 법정외퇴직급여로 나눌 수 있다. 법정퇴직급여는 퇴직금제도, 확정급여형퇴직연금제도, 확정기여형퇴직연금제도에서 일시금으로 지급받는 퇴직급여이다. 법정퇴직급여는 공적연금을 기초로 하는 일시금과 사적 사용자 부담금을 기초로 하는 일시금을 모두 포함한다. 법정외퇴직급여는 희망퇴직금, 명예퇴직금 등 법정되지 않은 퇴직급여이다.29)