Find out more about our latest publications

Analysis on the Causes behind the Korea Discount

Issue Papers 23-05 Feb. 16, 2023

- Research Topic Capital Markets

- Page 26

The "Korea discount" refers to the phenomenon in which the stocks listed in Korea are underpriced compared to those of similar foreign listed companies. More often than not, this expression is used to intensively describe the vulnerability of Korea's stock market. Since it was first observed in the early 2000s, this phenomenon has persisted and been recognized as an issue that needs to be solved for the market to make a new leap forward.

Against the backdrop, this paper looked into the data of 45 companies listed on major stock markets, seeking to identify the causes behind the Korea discount and to carry out empirical analyses. Our empirical analyses confirmed that there is an evident level of the Korea discount that has been persistently observed. During the period between 2012 and 2021, the book-value ratios of Korean listed companies were ranked 41st out of 45 countries, and the ratios were only 52% of those in advanced economies and 58% in emerging markets. Also, the discount has been observed consistently in all sectors except for healthcare. A regression analysis on the causes behind the discount pointed to three problematic areas: low shareholder returns; low profitability and growth potential; and vulnerable corporate governance. However, explanatory power was found relatively low in the factors such as accounting transparency and the share of institutional investors, both of which are known to affect corporate valuation. Moreover, there was no evidence that geopolitical risks and short-termism in investment affect corporate valuation.

Numerous endeavors have been made to improve regulations and practices related to Korea's shareholder return policy and corporate governance, which have long been pointed out as primary causes behind the Korea discount. However, there is still a significant gap between Korea and major advanced economies in terms of the evaluation of shareholder returns and corporate governance. What is needed at the current state is a viable, all-out approach in the long run that is expected to address the Korea discount and to help the Korean stock market to reach a qualitatively new level. This requires not only regulatory improvements but also enhancements in real practices, perception, and active engagement by investors.

Against the backdrop, this paper looked into the data of 45 companies listed on major stock markets, seeking to identify the causes behind the Korea discount and to carry out empirical analyses. Our empirical analyses confirmed that there is an evident level of the Korea discount that has been persistently observed. During the period between 2012 and 2021, the book-value ratios of Korean listed companies were ranked 41st out of 45 countries, and the ratios were only 52% of those in advanced economies and 58% in emerging markets. Also, the discount has been observed consistently in all sectors except for healthcare. A regression analysis on the causes behind the discount pointed to three problematic areas: low shareholder returns; low profitability and growth potential; and vulnerable corporate governance. However, explanatory power was found relatively low in the factors such as accounting transparency and the share of institutional investors, both of which are known to affect corporate valuation. Moreover, there was no evidence that geopolitical risks and short-termism in investment affect corporate valuation.

Numerous endeavors have been made to improve regulations and practices related to Korea's shareholder return policy and corporate governance, which have long been pointed out as primary causes behind the Korea discount. However, there is still a significant gap between Korea and major advanced economies in terms of the evaluation of shareholder returns and corporate governance. What is needed at the current state is a viable, all-out approach in the long run that is expected to address the Korea discount and to help the Korean stock market to reach a qualitatively new level. This requires not only regulatory improvements but also enhancements in real practices, perception, and active engagement by investors.

Ⅰ. 서론

‘코리아 디스카운트(Korea discount)’는 한국 상장기업의 주식 가치평가 수준이 외국 상장기업에 비해 낮게 형성되는 현상을 지칭하는 표현이다. 주당 이익 혹은 주당 순자산가치가 동일하더라도 한국 상장기업의 주가가 외국 상장기업의 주가에 비해 낮다는 것이다. 이 표현은 2000년대 초반에 등장하였는데 20여년이 지난 지금까지도 한국 주식시장의 취약성을 상징하는 표현으로 빈번하게 언급되고 있다. 코리아 디스카운트는 여전히 해소되지 않고 있다고 평가되며 한국 주식시장이 한 단계 도약하기 위해서는 반드시 해결해야 할 문제로 인식되고 있다.

그렇다면 코리아 디스카운트는 왜 발생하는가? 코리아 디스카운트를 유발하는 원인에 대해 지금까지 다양한 요인들이 거론되어 왔다. 가장 대표적인 요인으로 취약한 기업지배구조를 들 수 있다. 한국 상장기업은 지배주주가 존재하고 지배주주의 소유권(cash flow rights)과 지배권(control rights)의 괴리가 큰 특성을 갖는다. 지배주주가 사적이익을 추구할 유인은 높은 반면 무능한 지배주주를 교체하는 것은 어려운 구조다. 반면 지배주주를 견제할 수 있는 소액주주 권리보호 수단, 이사회 기능, 기관투자자 기반은 취약한 것으로 평가된다. 지배주주의 사적이익 추구는 외부주주의 이익을 침해하고 기업가치를 훼손하는 원인이 된다. 두 번째 요인은 미흡한 주주환원이다. 투자자의 주주환원에 대한 수요를 충족시키지 못하는 동시에, 잉여 현금흐름이 과잉투자로 이어지거나 지배주주의 사적이익을 위해 남용될 가능성이 존재한다. 배당을 선호하는 투자자 비중이 높을수록, 기업지배구조가 취약할수록 미흡한 주주환원이 기업가치에 미치는 부정적 영향은 더 크다. 세 번째 요인은 회계정보의 불투명성이다. 회계정보는 기업과 투자자 사이의 정보비대칭을 완화하는 핵심 수단으로 투자 의사결정의 기본 토대를 구성한다. 회계정보의 신뢰성이 낮을 경우 투자자는 기업의 성과와 전망을 보수적으로 평가하거나 추가적인 위험요인을 가진 것으로 간주하므로 기업가치평가에 부정적인 영향을 미친다. 네 번째 요인은 국내 투자자의 단기투자 성향이다. 한국 주식시장은 개인투자자의 비중이 크고 거래회전율이 매우 높은 특성을 갖는다. 개인투자자는 기업의 본질가치보다 단기 가격변동에 편승하여 거래하기 때문에 과도한 주가 변동성이 유발되고 기업의 본질가치가 가격에 효과적으로 반영되기 어렵다. 또한 개인투자자에게 지배주주와 경영자를 감시하고 견제하는 역할을 기대하기도 어렵다. 이는 기업가치의 할인요인으로 작용할 수 있다. 마지막 요인은 지정학적 위험이다. 대북 긴장관계의 변화는 경제적 파급효과를 갖는 한국 고유의 요인으로서 코리아 디스카운트의 원인이 될 수 있다. 지정학적 위험의 확대는 국가신용등급을 하락시킬 수 있으며 자금조달비용의 상승, 외국인투자자의 이탈을 유발한다.

이상의 요인들은 코리아 디스카운트의 원인으로서 충분한 설득력을 갖추고 있다고 판단되나 이를 뒷받침할 실증적 근거는 충분하지 않은 것으로 보인다. 한국 주식시장 또는 상장기업이 특정 요인에 취약하다는 것만으로 해당 요인이 코리아 디스카운트의 원인이라고 단정할 수는 없으므로, 해당 요인이 기업가치평가에 영향을 주는 요인으로서 기업가치평가의 국가간 격차를 설명할 수 있다는 것을 실증적으로 확인할 필요가 있다. 이에 본고는 45개 주요국 상장기업의 자료를 토대로 코리아 디스카운트의 현황과 특징을 분석하고, 이상에서 언급한 요인들이 상장기업 가치평가의 국가간 격차를 설명할 수 있는지, 코리아 디스카운트를 설명할 수 있는지 분석한다. 이러한 분석을 통해 코리아 디스카운트에 대한 시장참여자의 이해를 돕고자 한다.

Ⅱ. 선행연구

코리아 디스카운트와 연관된 실증연구는, 코리아 디스카운트의 현황과 특징을 분석한 연구와 기업가치평가에 영향을 미치는 요인을 국제적 관점에서 분석한 연구로 구분할 수 있다. 후자의 경우 코리아 디스카운트를 명시적으로 다루지는 않으나 기업가치평가 수준의 국가간 격차의 배경을 규명하고 있다는 점에서 코리아 디스카운트의 원인을 밝히는데 중요한 근거를 제공한다.

코리아 디스카운트를 주제로 실증분석을 진행한 연구로는 서정원ㆍ심수연(2007), Choi et al.(2012), 그리고 Ducret & Isakov(2020)가 확인된다. 서정원ㆍ심수연(2007)은 17개국의 2000~2004년 자료를 바탕으로 코리아 디스카운트의 존재 여부를 검토하고 그 원인을 추론하였다. 국내 시가총액 상위 50개 기업과 성장성, 수익성, 위험, 규모가 유사한 기업을 국가별로 50개씩 선정하여 주가-현금흐름 비율을 비교한 결과, 한국 상장기업의 주가-현금흐름 비율이 다른 모든 국가에 비해 유의하게 낮음을 확인하였다. 이들은 코리아 디스카운트의 원인으로 단기ㆍ투기적 투자행태를 지적하고 있다. 단기ㆍ투기적 투자행태로 인해 기업 기초여건과 주가의 괴리가 발생하고 가치평가지표가 미래 기대이익을 충분히 반영하지 못한다고 설명한다. 그러나 단기ㆍ투기적 투자행태가 가치평가에 영향을 주는 요인임을 보여주는 실증적 근거를 제시하지는 않았다.

Choi et al.(2014)은 32개국의 2000~2007년 자료를 바탕으로 내재자본비용(implied cost of capital)과 기업가치평가의 영향요인을 분석하였다. 한국 상장기업의 내재자본비용은 32개국 중 네 번째로 높고, 높은 내재자본비용은 낮은 주가-수익 비율과 연관된 것으로 나타난다. 아울러 부패 인식수준, 국가 거버넌스1), 회계품질 등이 내재자본비용과 기업가치평가에 영향을 미치는 요인임을 보여주고 있다. 다만 이러한 요인을 통제하더라도 여전히 코리아 디스카운트가 관찰되는 것으로 나타난다.

Ducret & Isakov(2020)는 28개국 25,863개 상장기업의 2002~2016년 자료를 바탕으로 코리아 디스카운트의 존재 여부와 특성을 분석하였다. 주가-수익 비율 또는 주가-장부가 비율을 기준으로 평가할 때, 코리아 디스카운트는 국가 단위, 업종 단위, 개별기업 단위 분석 모두에서 일관되게 관찰되며, 기업지배구조, 금융시장발전 수준, 거시경제 여건의 영향을 통제하더라도 여전히 유의하다. 한편 코리아 디스카운트는 재벌기업보다는 비재벌기업에서 크게 나타나는데, 비재벌기업의 낮은 국제적 주목성과 재벌기업의 시장지배력에 따른 비재벌기업의 경쟁력 약화와 연관된 것으로 추정하고 있다. 이 연구는 비교적 최근까지의 대규모 자료를 이용하였다는 점에서 의의가 있으나 코리아 디스카운트의 원인에 대해서는 구체적인 분석을 진행하지 않았다.

국제적 관점에서 기업가치평가의 영향요인을 분석하는 연구는 활발하게 이루어져 왔는데, 이들 연구가 주목한 영향요인은 크게 다섯 가지로 정리해 볼 수 있다. 첫 번째는 기업지배구조이다. La Porta et al.(2002)은 27개 선진국 539개 기업의 1995~1996년 자료를 이용하여 소액주주 보호수단이 잘 갖추어진 국가일수록, 또는 소액주주 보호수단이 미흡한 경우 지배주주의 소유권이 클수록 기업가치가 높다는 것을 확인하였다. 지배주주의 사적이익 추구 가능성은 기업가치 할인요인이며 이를 적절히 통제할 수 있는 수단을 갖추는 것이 중요함을 지적하고 있다. 기업지배구조가 기업가치평가에 미치는 영향은 이후의 많은 후속 연구에서도 입증된다. Lins(2003)는 1995~1997년 18개 신흥국 자료를 통해 경영진의 지배권과 소유권의 격차가 클수록 기업가치가 하락하고, 이러한 관계는 소액주주 보호가 취약한 국가일수록 현저함을 확인하였다. Klapper & Love(2004), Durnev & Kim(2005), Chhaochharia & Laeven(2009), Ammann et al.(2011) 등은 개별기업 기업지배구조 평가지표를 이용하여 기업지배구조가 우수할수록 기업가치가 높다는 결과를 제시하고 있으며, Dahya et al.(2008), Fauver et al.(2017)은 사외이사 비중 확대, 이사회 독립성 강화, 감사위원회 설치 등 지배주주 및 경영자에 대한 견제장치가 기업가치에 긍정적 영향을 미친다는 결과를 보고하고 있다.

두 번째는 회계투명성이다. Bhattacharya et al.(2003)은 1985~1998년 34개국 자료를 토대로 이익지표의 투명성이 높을수록 자본비용이 하락함을 확인하였다. Gaio & Raposo(2011)는 1999~2003년 38개국 자료를 이용하여 이익의 품질이 높을수록 기업가치가 상승하며, 이 관계는 소액주주 보호가 취약한 국가에서 강하다는 결과를 보고하고 있다. 이 두 연구는 투자자가 회계 불투명성을 투자위험요인으로 인식하고 이에 대한 위험 프리미엄을 요구한다는 사실을 입증한다. Daske et al.(2008)은 IFRS를 채택한 26개국 자료를 분석하여 IFRS 도입으로 자본비용이 감소하고 기업가치가 증가하였음을 보고하고 있다. IFRS의 도입으로 회계자료의 품질, 비교가능성, 투명성이 제고된 결과로 평가한다. Neel(2017)은 23개국에 대한 분석을 통해 IFRS 도입의 긍정적 영향은 회계정보의 비교가능성 제고와 연관성이 깊다는 결과를 제시하고 있다.

세 번째는 주주환원 정책이다. Pinkowitz et al.(2006)은 1988~1998년 35개국 자료를 이용하여 배당 수준이 높을수록 기업가치가 높고 그 관계는 투자자보호가 미흡한 국가에서 더 뚜렷함을 밝히고 있다. 즉 투자자보호가 미흡한 국가에서 주주환원은 지배주주의 사적이익 추구 가능성을 낮추는 역할을 수행한다는 사실을 보여준다. 같은 맥락에서, Kalcheva & Lins(2007)는 개별기업의 대리인 비용 척도를 추가적으로 활용하여 Pinkowitz et al.(2006)의 결과를 재확인하고 있으며, Brockman et al.(2014)은 내부자거래 규제가 취약한 국가일수록 배당이 기업가치에 긍정적인 영향을 미친다는 결과를 보고하고 있다. Brockman et al.(2022)은 21개국 자료를 토대로 투자자보호 수준이 낮은 국가일수록 배당 평탄화(smoothing)가 높은 기업가치로 이어진다는 결과를 도출하였다.

마지막 네 번째는 기관투자자의 비중이다. Ferreira & Matos(2008)와 Aggarwal et al.(2011)은 각각 27개국, 23개국 자료를 이용하여 기관투자자 지분율이 높을수록 기업가치가 높다는 분석결과를 보고하고 있다. 외국인 기관투자자, 특히 투자자보호 수준이 높은 국가의 기관투자자일수록 긍정적 영향이 크고, 긍정적 영향은 투자자보호 수준이 낮은 국가에서 두드러지는 것으로 나타난다. 이는 기관투자자가 기업경영을 감시하고 기업지배구조의 개선에 기여하는 역할을 수행하고 있음을 보여준다. Bena et al.(2017)는 30개국 자료를 토대로 외국인투자자가 장기투자와 혁신성과를 이끌어 낸다는 분석결과를 제시하였다. 외국인투자자는 투자대상 기업과 사업적 이해관계가 적고 투자위험을 국제적으로 분산할 수 있기 때문에 강한 규율효과를 발휘하는 것으로 해석한다.

Ⅲ. 코리아 디스카운트의 현황

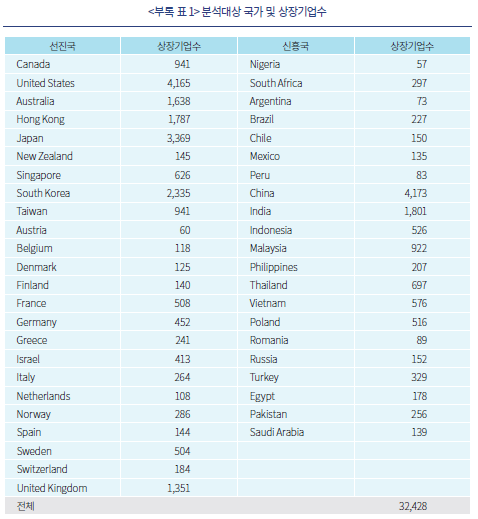

본 장에서는 코리아 디스카운트의 현황과 특징에 대해서 살펴본다. 45개국 32,428개 상장기업의 2005~2021년 자료를 이용하여 분석하며, 분석자료는 Datastream을 통해 수집하였다. 각국 상장기업 중에서 누적 시가총액 1%에 해당하는 시가총액 하위 초소형 기업, 완전자본잠식 기업, 재무제표 자료 및 주가 관련 자료가 미비한 기업은 분석에서 제외하였다.2) 코리아 디스카운트 평가를 위한 가치평가지표는 주가-장부가(Price-to-Book) 비율과 주가-수익(Price-to-Earning) 비율을 이용한다.

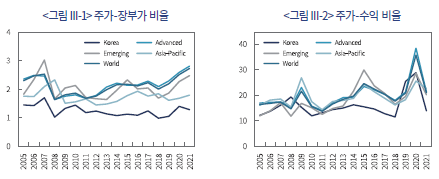

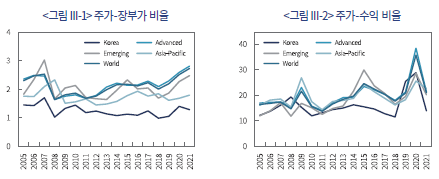

<그림 III-1>은 한국 상장기업과 비교집단 상장기업의 주가-장부가 비율을 시계열적으로 비교하고 있다. 선진국, 신흥국, 아시아 태평양, 세계 등을 비교집단으로 구성하며3), 각 집단 내 상장기업을 합산하여 주가-장부가 비율을 계산하였다. 한국의 주가-장부가 비율은 모든 기간에 걸쳐 비교집단보다 낮게 형성되어 있는 것을 볼 수 있다. 2012년부터 2021년까지 최근 10년을 기준으로 볼 때, 한국의 주가-장부가 비율은 평균 1.2로, 선진국 2.2, 신흥국 2.0, 아시아태평양 1.7, 세계 2.2에 비해 뚜렷하게(31~48%) 낮다. 특히 선진국과의 격차는 글로벌 금융위기 이후 확대되는 모습이 관찰된다.

<그림 III-2>는 비교집단 상장기업의 합산 기준 주가-수익 비율의 추이를 보여준다. 3개년(2008년, 2019년, 2020년)을 제외한 기간에서 한국 상장기업의 주가-수익 비율이 비교집단 중 가장 낮은 수준을 기록하고 있다. 다만 비교집단과의 격차는 주가-장부가 비율에 비해 다소 작게 나타난다. 2012년부터 2021년까지 한국의 주가-수익 비율은 평균 17.0으로, 선진국 22.2, 신흥국 21.3, 아시아 태평양 20.4에 비해 17~23% 낮다. 한편 주가-수익 비율은 글로벌 금융위기 시기와 코로나19 시기에 급등하는 것으로 관찰되는데, 이는 주가-수익 비율의 분모에 해당하는 기업이익이 급감하면서 나타난 결과로 파악된다.

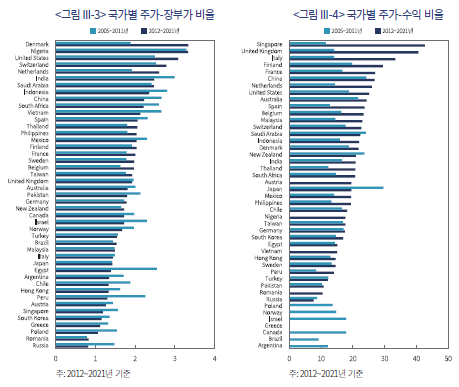

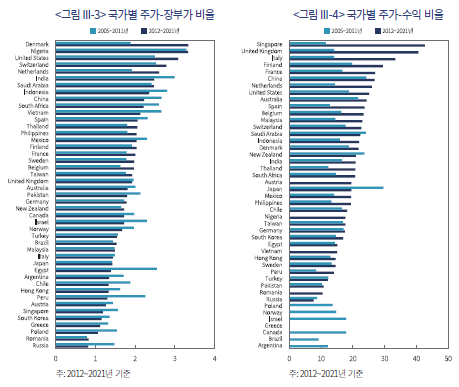

<그림 III-3>과 <그림 III-4>는 주가-장부가 비율과 주가-수익 비율을 국가별로 비교한 것이다. 주가-장부가 비율의 경우, 한국은 2005~2011년 기준 45개국 중 43위, 2012~2021년 기준 45개국 중 41위로 최하위권에 속하며, 2012~2021년 기준으로 상위 5개국의 38%, 표본 국가 평균의 63%에 불과한 것으로 나타난다. 주가-수익 비율의 경우, 한국은 2005~2011년 기준 40개국 중 20위, 2012~2021년 기준 38개국 중 29위로 중하위권에 속한다. 2012~2021년 기준 상위 5개국의 49%, 표본 국가 평균의 81% 수준이다. 참고로 <그림 III-4>에서 주가-수익 비율이 표시되지 않는 국가가 존재하는데 이는 일부 표본 연도의 상장기업 합산 순이익이 음(-)인 관계로 주가-수익 비율을 계산할 수 없는 경우에 해당한다.

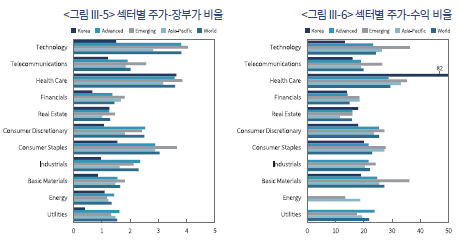

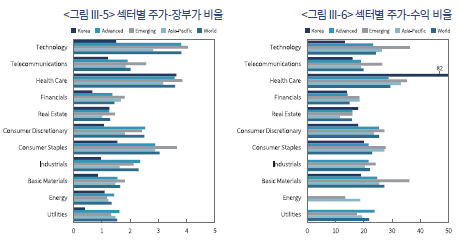

<그림 III-5>와 <그림 III-6>은 한국과 비교집단의 2012~2021년 평균 주가-장부가 비율과 주가-수익 비율을 섹터별로 비교하고 있다. 먼저 주가-장부가 비율을 보면, 의료(health care)와 부동산(real estate)을 제외한 모든 섹터에서 한국이 비교집단에 비해 낮은 것으로 나타난다. 선진국과 비교할 때 가장 격차가 큰 섹터는 유틸리티로 선진국의 25%에 불과하며, 기술(technology), 산업재(industrial), 경기소비재(consumer discretionary), 금융(financials) 등도 40~50% 수준이다. 부동산 섹터에 속하는 국내 상장기업은 8개사에 불과하므로, 사실상 의료를 제외한 모든 섹터에서 국내 상장기업의 가치평가 수준이 낮다고 평가할 수 있다. 이는 코리아 디스카운트가 국내 상장기업의 섹터구성, 즉 가치평가 수준이 낮은 섹터의 비중이 크기 때문에 나타나는 현상이 아니라 섹터와 무관한 할인요인에 의한 현상임을 시사한다.

주가-수익 비율을 기준으로 비교하더라도 결과는 대체로 유사하다. 의료와 부동산을 제외한 모든 섹터에서 국내 상장기업의 주가-수익 비율이 비교집단에 비해 낮다. 반면 국내 의료섹터의 경우 주가-수익 비율이 82로 비교집단에 비해 현저히 높게 나타나는 것이 특징적이다. 한편 <그림 III-6>에서 주가-수익 비율이 표시되지 않는 섹터는 일부 표본연도의 집단 내 합산 순이익이 음(-)인 섹터이다.

이상에서 45개국 상장기업의 가치평가 수준을 비교한 결과는 코리아 디스카운트가 존재함을 명확히 보여준다. 분석기간 전반에 걸쳐, 비교 대상에 관계없이, 그리고 대부분의 섹터에서 코리아 디스카운트가 관찰된다. 특히 주가-장부가 비율을 기준으로 볼 때 더욱 뚜렷하다.

Ⅳ. 코리아 디스카운트의 원인 분석

1. 코리아 디스카운트 영향 요인 평가

코리아 디스카운트의 원인으로 거론되는 요인들에 대해, 국가별 비교의 관점에서 한국 상장기업을 어떻게 평가할 수 있는지 차례로 살펴보자.

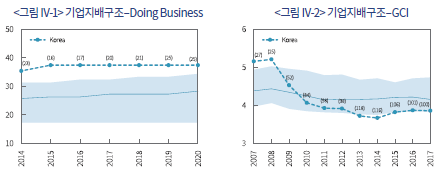

먼저 기업지배구조에 대한 평가는 두 가지 지표를 이용한다. 첫 번째 지표는 Wold Bank가 발표하는 Doing Business의 소액주주보호(Protecting Minority Investors) 항목이다. 이 항목은 공시의무, 이사회 의무, 주주소송 용이성, 주주 권리, 소유 및 지배구조, 기업 투명성 등 6가지 주제와 관련된 38개 사안에 대해 법률상 규정의 존재 여부와 규제의 강도를 토대로 평가한다.4) 두 번째 평가지표는 WEF(World Economic Forum)가 발표하는 GCI(Global Competitiveness Index)의 기업지배구조 관련 항목으로 소액주주 보호, 이사회의 유효성, 기업의 윤리적 행동 등 세 가지이다. 이 지표는 경영자 설문조사(Executive Opinion Survey)를 통해 평가하는데5), 앞서 Doing Business 평가지표가 객관적 평가 방법이라면 이 방법은 주관적 평가 방법이라는 점에서 차이가 있다.

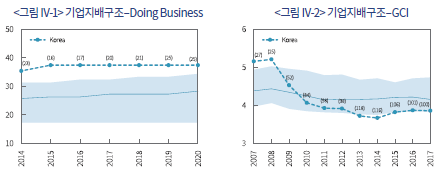

<그림 IV-1>과 <그림 IV-2>는 각각 한국의 기업지배구조에 대한 Doing Business와 GCI의 평가를 보여준다. 점선은 한국의 평가점수, 괄호 안의 숫자는 한국의 순위이며, 하늘색 영역과 실선은 하위 25~상위 25% 구간과 중위값이다. 두 지표의 산출기간이 겹치는 2014~2017년을 기준으로 볼 때, Doing Business 평가에서 한국은 190개국 중 17~23위로 상위권에 속하는 반면, GCI 평가에서 한국은 140개국 중 100~116위로 하위권에 속하는 것으로 나타난다. 한국은 기업지배구조와 관련된 법제도는 잘 갖춰진 반면, 법제도의 실효성이 떨어지거나 기업지배구조에 대한 시장의 신뢰가 낮다고 해석할 수 있다.

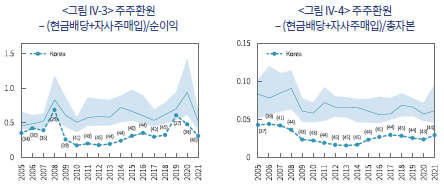

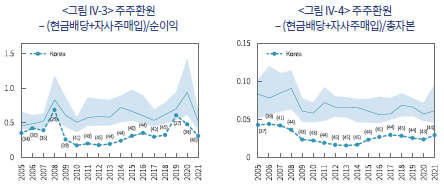

두 번째 요인은 주주환원이다. <그림 IV-3>은 현금배당과 자사주매입 금액을 순이익으로 나눈 값을 제시하고 있다. 한국은 45개국 중 27~45위로 주주환원율이 낮은 것으로 나타난다. 특히 2010년부터 2018년의 기간에는 40위 이하로 최하위권을 기록하고 있다. <그림 IV-4>는 현금배당과 자사주매입 금액을 총자본으로 나누어 주주환원 수준을 측정한 결과다. 한국은 45개국 중 37~45위로 역시 최하위권에 속한다.

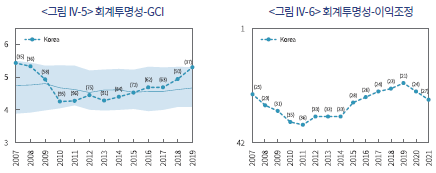

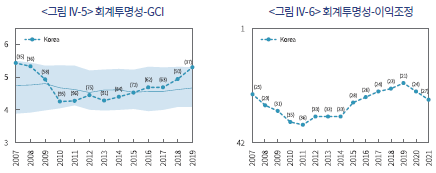

세 번째 요인 회계투명성은 두 가지 지표를 통해 살펴보는데, 첫 번째 지표는 GCI의 감사 및 보고 기준에 대한 항목으로 설문조사를 바탕으로 한 주관적 평가지표이다. 두 번째 지표는 이익조정(earnings management) 수준에 대한 계량적 측정치이다. 이익조정은 회계처리를 통해 기업의 보고이익을 변경하는 것으로 회계정보의 품질을 평가하는 대표적인 척도다. 영업현금흐름 변동성 대비 당기순이익의 변동성, 발생액 변동과 영업현금흐름 변동의 상관계수, 영업현금흐름 절대값 대비 발생액 절대값, 소규모 이익의 초과 발생빈도와 소규모 손실의 초과 발생빈도의 차이 등 네 가지 방법을 이용하여 이익조정을 측정하고 평균 순위를 이용하여 평가한다.6)

<그림 IV-5>의 GCI 지표에 따르면 한국의 회계투명성은 2011년 139개국 중 96위에 불과하였으나 이후 꾸준히 상승하여 2019년 37위를 기록하였다. <그림 IV-6>의 이익조정 측정치에서도 유사한 추세가 관찰된다. 2011년 42개국 중 36위에서 2019년 21위까지 순위가 상승한다. 2011년 IFRS 도입7) 이후 한국 상장기업의 회계투명성은 정성적, 정량적 측면 모두에서 개선된 것으로 나타난다.

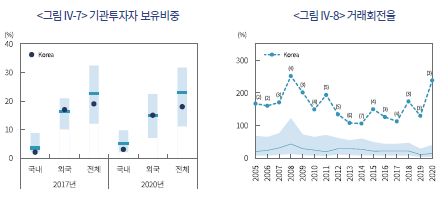

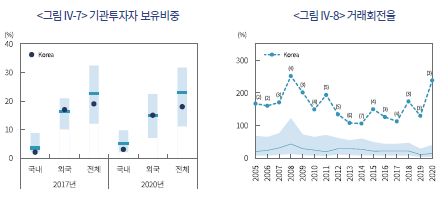

네 번째, 투자자 요인으로 기관투자자 비중과 거래회전율을 살펴보자. 상장기업 합산 기준 기관투자자 보유비중은 OECD가 발간한 2017년과 2020년 자료를 이용하며, 주식시장 거래회전율은 World Bank의 WDI(World Development Indicator)의 자료를 이용한다. <그림 IV-7>에 따르면, 기관투자자 보유비중은 2017년 54개국 평균 24%, 2020년 45개국 평균 25%로 나타난다. 한국의 경우 2017년 19%, 2020년 18%로 낮은 수준이다. 외국인 기관투자자 비중은 중간값에 가까우나 국내 기관투자자의 보유비중이 작다. 반면 <그림 IV-8>에서 한국 주식시장 거래회전율은 표본기간 평균 161%에 달하며, 67개국 중 2~7위 수준이다. 개인투자자의 비중이 높고 단기투자 성향이 강한 특징이 명확하게 드러난다.

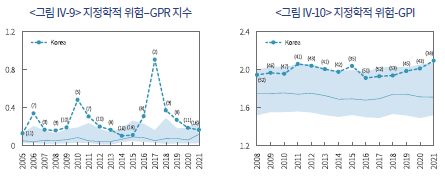

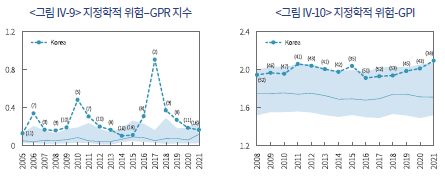

마지막으로 살펴볼 요인은 지정학적 위험이다. 지정학적 위험은 Caldera & Iacoviello의 GPR(Geopolitical Risk) 지수와 IEP(Institute for Economics & Peace)의 GPI(Global Peace Index)를 이용한다.8) <그림 IV-9> GRP 지수의 경우 한국의 평가지표는 북한 핵실험, 북미관계 경색 등의 사건에 따라 큰 변동이 나타나는 가운데, 43개국 중 평균 10위 정도로 지정학적 위험이 높게 평가되고 있다. <그림 IV-10> GPI의 경우 한국의 평가지표는 시계열적으로 안정된 모습이나 상위 25% 수준으로 지정학적 위험이 비교적 높게 평가된다.

이상의 평가를 종합하면, 시장참여자들이 보편적으로 이해하는 바와 같이, 한국은 기업지배구조가 취약하고, 주주환원이 미흡하며, 투자자의 단기투기적 성향이 강하다. 지정학적 위험 역시 높은 것으로 평가할 수 있다. 분석기간 동안 이러한 평가는 대체로 일관되게 나타난다. 다만 회계투명성은 IFRS 도입 이후 꾸준히 개선되고 있는 것으로 보인다.

2. 코리아 디스카운트 원인 분석

본 절에서는 회귀분석을 통해 1절에서 검토한 요인들이 상장기업 가치평가의 국가간 격차를 설명하는지, 코리아 디스카운트의 원인으로 볼 수 있는지 분석한다. 상장기업 가치평가 수준의 국가간 격차에 초점을 맞추기 때문에 개별 상장기업 자료를 국가 단위로 합산(가중평균)하여 국가-년 자료를 구축하며9), 1절에서 검토한 평가지표의 가용성을 고려하여 2012년부터 2021년까지 최근 10년을 기본 분석기간으로 설정한다.

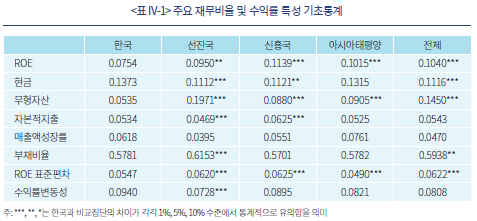

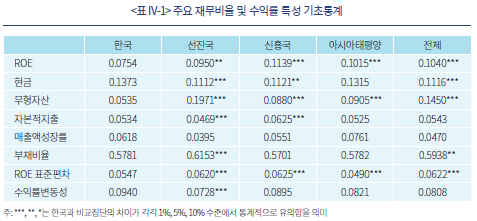

회귀분석에 앞서 각국 상장기업(연간 합산 기준)의 재무적 특성에 대해 살펴보자. 기업의 수익성과 성장성은 기업가치평가의 기본요소이기 때문에 1절에서 논의한 요인들의 영향을 평가하기 위해서는 반드시 통제해야 할 특성이다. <표 IV-1>은 기업가치평가 결정요인에 대한 국제적 연구에서 고려하고 있는 주요 재무비율에 대한 통계를 제시하고 있다.

국내 상장기업의 수익성은 선진국, 신흥국, 아시아태평양 등 모든 비교집단에 비해 낮으며 각 비교집단과의 차이는 모두 통계적으로 유의하다. 성장성 역시 낮은 것으로 판단된다. 선진국과 비교할 때 자본적 지출은 소폭 높으나 무형자산 비중이 현저히 낮으며, 신흥국과 비교할 때 자본적 지출과 무형자산 비중이 모두 낮다. 이는 한국이 전통적 제조업의 비중이 높은 가운데 유무형자산에 대한 투자가 부족하다는 사실을 보여준다. 반면 현금보유 비중은 선진국 및 신흥국에 비해 다소 높다. 이밖에, 안정성 측면에서 부채비율과 ROE 표준편차는 대체로 낮은 편에 속하며, 주가수익률 변동성은 선진국에 다소 높은 것으로 나타난다.

회귀분석의 종속변수는 주가-장부가 비율을 이용한다. 주가-수익 비율은 수익이 음(-)인 경우 정의되지 않고, 수익이 양(+)이더라도 그 값이 0에 가깝다면 주가-수익 비율이 매우 큰 값을 갖기 때문에 기업가치평가 척도로 활용하기에 부적합한 측면이 있다.

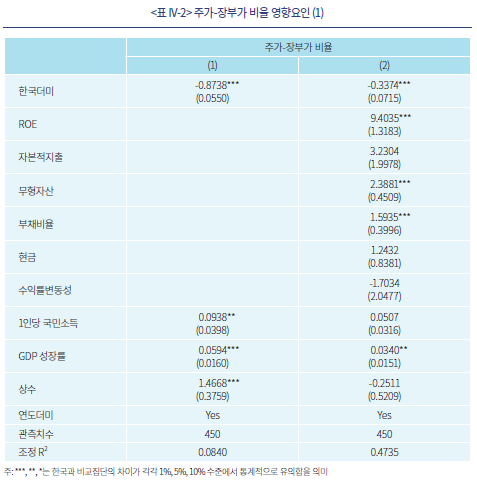

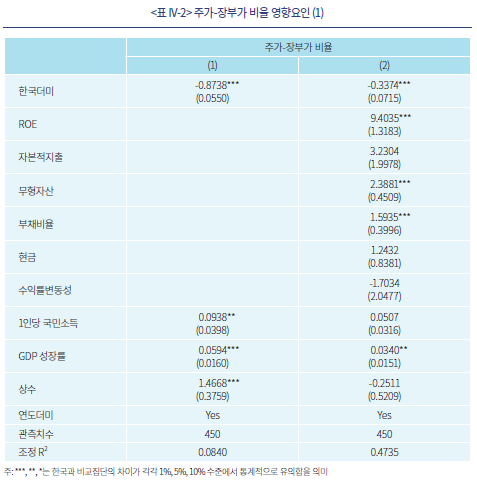

<표 IV-2>는 재무적 특성과 수익률 변동성의 코리아 디스카운트에 대한 영향을 파악하기 위한 회귀분석이다. 모형(1)은 한국더미(dummy)와 거시경제변수를 설명변수로 포함한 분석이며, 모형(2)는 여기에 재무비율 및 수익률 특성 변수를 추가한 분석이다.10) 한국더미는 한국의 경우 1, 이외의 국가의 경우 0의 값을 갖는 변수로, 이 변수의 계수가 코리아 디스카운트의 수준을 측정한다.

모형(1)에서 한국더미의 계수는 -0.8738로, 경제발전수준(1인당 국민소득)과 경제성장전망(GDP성장률)이 한국과 동일한 국가와 비교할 때 한국의 주가-장부가 비율이 0.8738 낮다는 것을 의미한다. 이는 상당한 수준의 코리아 디스카운트가 존재함을 보여준다. 모형(1)에 재무비율 및 수익률 변동성 변수를 추가한 모형(2)의 결과에 따르면 한국더미의 계수는 -0.3374로 줄어든다. 이는 모형(1)에서 측정된 코리아 디스카운트의 약 60%는 재무적 특성의 영향이라는 의미이다. 주가-장부가 비율은 ROE가 높을수록, 무형자산 비중이 클수록, 부채비율이 높을수록 높게 나타나는데, <표 IV-1>에서 확인한 바와 같이 한국은 수익성, 무형자산 비중, 부채비율이 모두 낮고 따라서 주가-장부가 비율이 낮게 나타나는 것이다. 그러나 재무적 특성의 영향을 통제하더라도 여전히 0.3374의 코리아 디스카운트가 존재하며 추가적인 디스카운트 요인이 존재함을 시사한다. 한편, 부채비율이 높을수록 주가-장부가 비율이 높아지는 것은 부채의 규율효과에 의한 것으로 해석할 수 있으며11), 무형자산 비중이 클수록 주가-장부가 비율이 높아지는 것은 정보기술산업의 확대와 함께 지적재산, 정보재산, 조직역량의 중요성이 커지는 것과 연관된 결과로 추정된다.

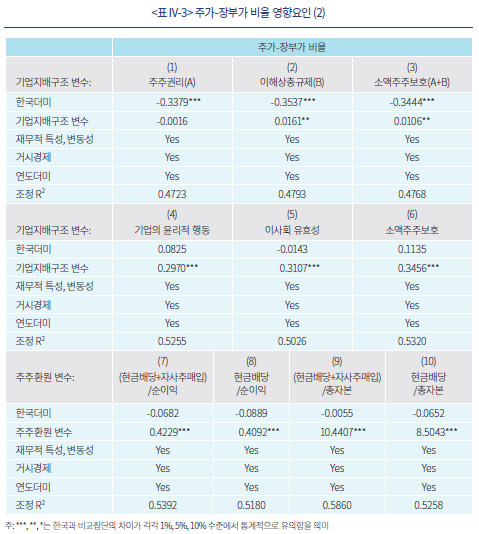

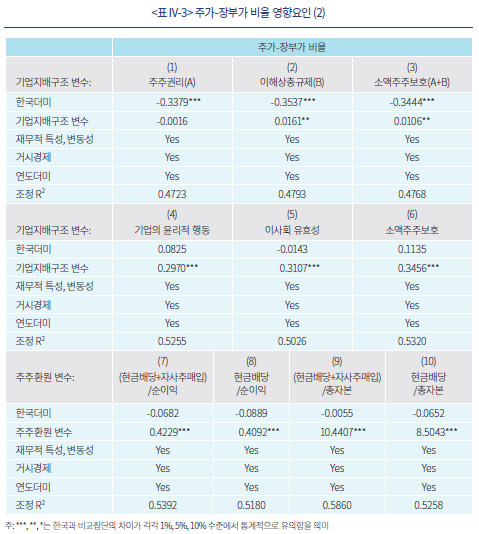

다음으로 1절에서 검토한 요인들의 코리아 디스카운트에 대한 영향을 차례로 분석한다. <표 IV-3>은 <표 IV-2>의 모형(2)에 기업지배구조 관련 변수를 설명변수로 추가한 분석결과이다. 모형(1)~(3)은 기업지배구조에 대한 Doing Business의 제도적 평가지표를 이용하는데, 모형(1)은 주주권리 관련 하위지표, 모형(2)는 이해상충규제 관련 하위지표를 이용하며 모형(3)은 두 지표의 평균값을 이용한다.12) 13) 모형(3)의 결과에 따르면, 기업지배구조 변수의 계수는 5% 수준에서 통계적으로 유의한 양(+)의 값을 갖는다. 각국의 거시경제적 특성, 상장기업의 재무적 특성의 영향을 통제한 후, 제도적 관점에서 기업지배구조가 우수하다고 평가되는 국가일수록 주가-장부가 비율이 높다는 것이다. 다만 모형(1)과 모형(2)의 하위지표 결과를 보면, 주주권리 관련 규제 보다는 이해상충 관련 규제에서 기업가치에 대한 영향이 나타난다. 모형(1)~(3)의 분석에서 한국더미의 계수는 유의한 음(-)의 값으로 추정되어, 기업지배구조에 대한 제도적 평가의 영향을 고려하더라도 코리아 디스카운트가 여전히 존재한다.

모형(4)~(6)은 기업지배구조에 대한 GCI의 정성적 평가지표를 이용한다.14) 모형(4)는 기업의 윤리적 행동, 모형(5)는 이사회의 유효성, 모형(6)은 소액주주 보호에 대한 평가지표를 이용하는데, 세 모형 모두에서 통계적으로 유의한 양(+)의 계수가 관찰된다. 기업지배구조에 대한 정성적 평가가 우수한 국가일수록 주가-장부가 비율이 높다. 중요한 것은 모형(4)~(6) 모두에서 한국더미 계수의 유의성이 사라진다는 것이다. 기업지배구조에 대한 정성적 평가의 영향을 통제하면 한국의 주가-장부가 비율에 추가적인 할인요소가 없다는 것으로, 코리아 디스카운트는 국내 기업지배구조의 낮은 제도적 실효성 또는 낮은 신뢰성과 밀접한 연관이 있다고 해석할 수 있다.

모형(7)~(10)은 주주환원 관련 변수를 설명변수로 이용한 분석결과이다. 모형(7)과 모형(9)는 현금배당액 및 자사주매입액을 각각 순이익과 총자본으로 나눈 값을, 모형(8)과 모형(10)은 현금배당액을 각각 순이익과 총자본으로 나눈 값을 주주환원 변수로 이용한 결과이다. 모든 분석에서 주주환원 변수의 계수는 유의한 양(+)의 값으로, 주주환원 수준이 높을수록 가치평가 수준이 높으며, 현금배당액과 자사주매입액을 합산하여 고려하는 경우 설명력이 더 높다. 한국더미의 계수는 네 가지 분석 모두에서 유의하지 않은 것으로 추정되어, 한국의 낮은 주주환원 수준이 코리아 디스카운트의 한 원인임을 시사한다.

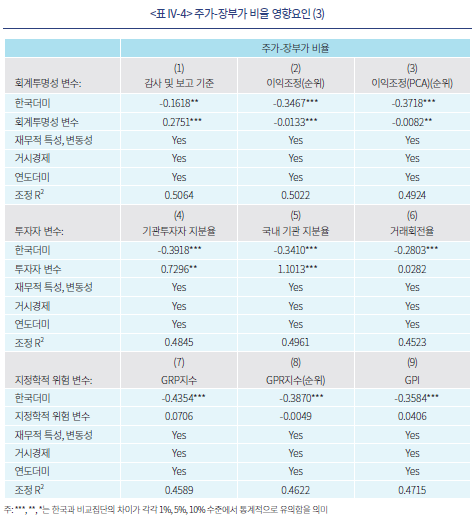

<표 IV-4>와 <표 IV-5>의 분석을 통해, 기업지배구조, 주주환원 수준, 회계투명성, 기관투자자 비중, 기업의 재무적 특성 등의 요인이 45개국 상장기업의 가치평가 수준에 영향을 주는 요인임을 확인하였다. 그리고 그 중 기업지배구조에 대한 정성적 평가, 주주환원 수준, 재무적 특성 등이 코리아 디스카운트와 가장 밀접한 연관이 있는 요인인 것으로 파악된다. 반면 단기거래 행태와 지정학적 위험은 기업가치평가의 영향요인이라는 근거를 찾을 수 없었다.

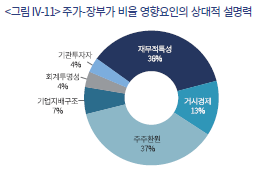

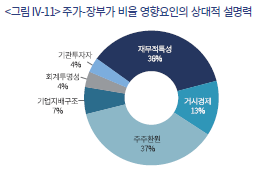

<그림 IV-11>은 주가-장부가 비율 영향요인의 상대적인 설명력을 지배성 분석(dominance analysis)을 통해 비교한 것이다(Budescu, 1993). 그림에 표시된 값은 각 요인별 지배성의 합을 1로 표준화하여 상대적 크기를 측정한 것이다. 2012년부터 2021년까지 10년간 45개국 상장기업의 주가-장부가 비율에 대해 가장 설명력이 높은 요인은 주주환원으로 37%이며, 이어서 재무적 특성 36%, 거시경제 13%, 기업지배구조 7%, 회계투명성 4%, 기관투자자 4% 순으로 나타난다. 거시경제적 특성의 영향을 제외한다면, 코리아 디스카운트는 국내 상장기업의 미흡한 주주환원, 저조한 수익성과 성장성, 취약한 기업지배구조를 가장 주요한 원인으로 평가할 수 있다. 기업지배구조, 회계투명성, 기관투자자 비중의 경우 각각의 설명력은 상대적으로 높지 않으나 주주환원과의 상관관계, 상호간 상관관계가 높은 특성을 갖고 있어 독립적인 요인으로 취급할 수는 없다는 사실에 유념할 필요가 있다.18)

Ⅴ. 맺는말

본고는 45개 주요국 상장기업 자료를 바탕으로 코리아 디스카운트의 현황과 특징을 파악하고 원인을 분석하였다. 실증분석을 통해 확인된 결과는 다음과 같다. 먼저 코리아 디스카운트는 현저한 수준으로 확인된다. 2012년부터 2021년까지 10년간 국내 상장기업(합산 기준)의 주가-장부가 비율은 평균 1.2로, 선진국의 52%, 신흥국의 58%, 아시아태평양 국가의 69%에 불과하며, 분석대상 45개국 중 41위에 해당한다. 또한 코리아 디스카운트는 의료섹터를 제외한 모든 섹터에서 일관되게 관찰된다.

회귀분석을 통해 코리아 디스카운트의 원인을 분석한 결과, 미흡한 주주환원 수준, 저조한 수익성과 성장성이 가장 유력한 원인인 것으로 추정된다. 상대적으로 설명력은 낮으나 기업지배구조 또한 코리아 디스카운트에 영향을 미치는 요인으로 분석된다. 한편, 단기투자 성향과 지정학적 위험의 경우 기업가치평가의 국가간 격차를 설명하는 요인이라는 근거는 확인되지 않았다.

주주환원 정책과 기업지배구조는 코리아 디스카운트의 원인으로 꾸준히 지적되었던 요인이며 관련 제도와 관행의 개선을 위한 많은 노력이 진행되어 왔다. 그럼에도 주주환원 수준이나 기업지배구조 평가에 있어 주요국과의 격차는 여전히 현저하며 코리아 디스카운트 역시 해소되지 않고 있다. 주주환원 정책과 기업지배구조는 단기간에 변화를 기대하기 어려운 사안이다. 법제도적 개선뿐만 아니라 기업의 관행과 인식의 개선, 그리고 투자자의 적극적인 역할이 필수적이다. 코리아 디스카운트를 해소하고 한국 자본시장이 새로운 성장단계에 이르기 위해서는 보다 장기적이고 종합적인 관점에서 실효성 있는 노력이 뒷받침되어야 할 것이다.

<부록>

1) World Bank가 측정하여 발표하는 지표로, 참여와 책임, 정치적 안정성, 정부의 효과성, 규제의 질, 법의 지배, 부패의 통제 등 6가지 항목으로 구성된다.

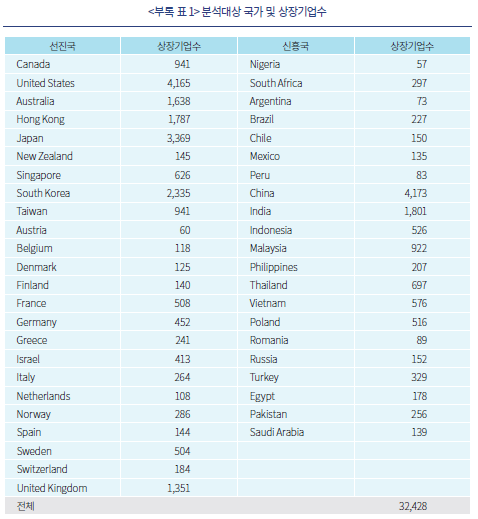

2) 한국의 경우 SPAC을 제외하였다. 분석대상 국가와 상장기업수는 <부록 표 1>에 제시되어 있다.

3) 각국의 비교집단 분류는 IMF의 분류를 따른다. 각 비교집단에서 한국은 제외된다.

4) 예를 들어, 기업이 어떤 계약을 체결하는 경우, 공시의무가 존재하지 않으면 0점, 계약조건에 대한 공시의무만 존재하면 1점, 계약조건과 이해상충에 대한 공시의무가 존재하면 2점을 부여하는 방식이다.

5) 예를 들어, “당신의 국가에서 소액주주의 이익은 법적 시스템을 통해 보호되는가?”라는 질문에 1점에서 7점 사이의 점수를 부여하는 방식이다.

6) 연도별로 최근 5년간의 자료를 이용하여 측정한다. 이익조정 측정치의 개념과 정의와 관련한 구체적인 내용은 Leuz et al.(2003), Burgstahler et al.(2006) 등을 참조하기 바란다.

7) 자산규모 2조원 이상 기업은 2011년부터, 2조원 미만 기업은 2013년부터 도입되었다.

8) GPI는 사회 안전과 안보, 진행 중인 국내외 분쟁, 군사화(militarisation) 등 세 가지 하위지표로 구성되는데, 이 중 사회 안전과 안보를 제외한 두 가지 지표의 평균값을 이용한다.

9) 금융업과 부동산업 기업은 분석에서 제외한다. 다만 금융업과 부동산업 기업을 포함하더라도 결과에 질적인 차이는 없다.

10) <표 IV-1>에서 검토한 변수 중 매출액성장률과 ROE 표준편차는 이후의 모든 회귀분석에서 유의성이 관찰되지 않으므로 분석에서 제외한다.

11) 채권자의 기업 감시가 이루어지는 가운데 주기적인 이자지급 의무는 경영효율성을 제고하고 잉여현금흐름을 감소시킴으로써 기업가치에 긍정적인 영향을 미친다는 설명이다.

12) 지표의 구성에 대한 구체적인 내용은 다음 링크에서 찾아볼 수 있다.

https://archive.doingbusiness.org/en/methodology/protecting-minority-investors

13) 주주권리 관련 하위지표는 2014~2020년의 평가값만이 존재하므로, 2012~2013년은 2014년의 평가값을, 2021년은 2020년의 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

14) GCI 평가지표는 2017년까지 존재하므로, 2018~2021년은 2017년 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

15) GCI의 감사 및 보고 기준에 대한 평가지표는 2019년까지 존재하므로, 2020~2021년은 2019년 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

16) OECD는 2017년말 기준 54개국, 2020년말 기준 46개국의 상장기업 합산 기관투자자 지분율을 발표하였다. 따라서 2012~2019년은 2017년의 자료를, 2020~2021년은 2020년 자료를 적용한다. 2017년과 2020년 자료를 비교할 때 각국 상장기업 기관투자자 지분율에 큰 변화가 없다는 점에서 특정 시점 자료의 적용 기간을 확장하여도 큰 문제는 없을 것으로 본다.

17) 거래회전율 자료는 2020년까지 존재하므로, 2021년은 2020년의 값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

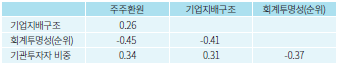

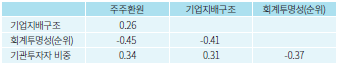

18) 변수간 상관계수는 아래와 같다.

참고문헌

서정원ㆍ심수연, 2007, 코리아 디스카운트의 진단과 원인 분석,『한국증권학회지』 36(4), 621-655.

Aggarwal, R., Erel, I., Ferreira, M., Matos, P., 2011, Does governance travel around the world? Evidence from institutional investors, Journal of Financial Economics 100(1), 154-181.

Ammann, M., Oesch, D., Schmid, M. M., 2011, Corporate governance and firm value: International evidence, Journal of Empirical Finance 18(1), 36-55.

Bena, J., Ferreira, M. A., Matos, P., Pires, P., 2017, Are foreign investors locusts? The long-term effects of foreign institutional ownership, Journal of Financial Economics 126(1), 122-146.

Bhattacharya, U., Daouk, H., Welker, M., 2003, The world price of earnings opacity, The Accounting Review 78(3), 641-678.

Brockman, P., Hanousek, J., Tresl, J., Unlu, E., 2022, Dividend Smoothing and Firm Valuation, Journal of Financial and Quantitative Analysis 1-27.

Brockman, P., Tresl, J., Unlu, E., 2014, The impact of insider trading laws on dividend payout policy, Journal of Corporate Finance 29, 263-287.

Budescu, D.V., 1993, Dominance analysis: a new approach to the problem of relative importance of predictors in multiple regression. Psychological Bulletin 114(3), 542.

Burgstahler, D., Dichev, I., 1997, Earnings management to avoid earnings decreases and losses, Journal of Accounting and Economics 24(1), 99-126.

Burgstahler, D. C., Hail, L., Leuz, C., 2006, The importance of reporting incentives: Earnings management in European private and public firms, The Accounting Review 81(5), 983-1016.

Chhaochharia, V., Laeven, L., 2009, Corporate governance norms and practices, Journal of Financial intermediation 18(3), 405-431.

Choi, T. H., Lee, E., Pae, J., 2012, The equity premium puzzle: empirical evidence for the “Korea Discount”, Asia-Pacific Journal of Accounting & Economics 19(2), 143-166.

Dahya, J., Dimitrov, O., McConnell, J. J., 2008, Dominant shareholders, corporate boards, and corporate value: A cross-country analysis, Journal of Financial Economics 87(1), 73-100.

Daske, H., Hail, L., Leuz, C., Verdi, R., 2008, Mandatory IFRS reporting around the world: Early evidence on the economic consequences, Journal of Accounting Research 46(5), 1085-1142.

De La Cruz, A., Medina, A., Tang, Y., 2019, Owners of the world’s listed companies, OECD Capital Market Series, Paris.

Ducret, R., Isakov, D., 2020, The Korea discount and chaebols, Pacific-Basin Finance Journal 63, 101396.

Durnev, A., Kim, E. H., 2005, To steal or not to steal: Firm attributes, legal environment, and valuation, The Journal of Finance 60(3), 1461-1493.

Fauver, L., Hung, M., Li, X., Taboada, A. G., 2017, Board reforms and firm value: Worldwide evidence, Journal of Financial Economics 125(1), 120-142.

Ferreira, M. A., Matos, P., 2008, The colors of investors’ money: The role of institutional investors around the world, Journal of Financial Economics 88(3), 499-533.

Gaio, C., Raposo, C., 2011, Earnings quality and firm valuation: international evidence, Accounting & Finance 51(2), 467-499.

Kalcheva, I., Lins, K. V., 2007, International evidence on cash holdings and expected managerial agency problems, The Review of Financial Studies 20(4), 1087-1112.

Klapper, L. F., Love, I., 2004, Corporate governance, investor protection, and performance in emerging markets, Journal of Corporate Finance 10(5), 703-728.

La Porta, R., Lopez‐de‐Silanes, F., Shleifer, A., Vishny, R., 2002, Investor protection and corporate valuation, The Journal of Finance 57(3), 1147-1170.

Leuz, C., Nanda, D., Wysocki, P. D., 2003, Earnings management and investor protection: An international comparison, Journal of Financial Economics 69(3), 505-527.

Lins, K. V., 2003, Equity ownership and firm value in emerging markets, Journal of Financial and Quantitative Analysis 38(1), 159-184.

Neel, M., 2017, Accounting comparability and economic outcomes of mandatory IFRS adoption, Contemporary Accounting Research 34(1), 658-690.

OECD, 2022, Corporate ownership and concentration: Background note for the OECD-Asia roundtable on corporate governance (October 2022).

Pinkowitz, L., Stulz, R., Williamson, R., 2006, Does the contribution of corporate cash holdings and dividends to firm value depend on governance? A cross‐country analysis, The Journal of Finance 61(6), 2725-2751.

‘코리아 디스카운트(Korea discount)’는 한국 상장기업의 주식 가치평가 수준이 외국 상장기업에 비해 낮게 형성되는 현상을 지칭하는 표현이다. 주당 이익 혹은 주당 순자산가치가 동일하더라도 한국 상장기업의 주가가 외국 상장기업의 주가에 비해 낮다는 것이다. 이 표현은 2000년대 초반에 등장하였는데 20여년이 지난 지금까지도 한국 주식시장의 취약성을 상징하는 표현으로 빈번하게 언급되고 있다. 코리아 디스카운트는 여전히 해소되지 않고 있다고 평가되며 한국 주식시장이 한 단계 도약하기 위해서는 반드시 해결해야 할 문제로 인식되고 있다.

그렇다면 코리아 디스카운트는 왜 발생하는가? 코리아 디스카운트를 유발하는 원인에 대해 지금까지 다양한 요인들이 거론되어 왔다. 가장 대표적인 요인으로 취약한 기업지배구조를 들 수 있다. 한국 상장기업은 지배주주가 존재하고 지배주주의 소유권(cash flow rights)과 지배권(control rights)의 괴리가 큰 특성을 갖는다. 지배주주가 사적이익을 추구할 유인은 높은 반면 무능한 지배주주를 교체하는 것은 어려운 구조다. 반면 지배주주를 견제할 수 있는 소액주주 권리보호 수단, 이사회 기능, 기관투자자 기반은 취약한 것으로 평가된다. 지배주주의 사적이익 추구는 외부주주의 이익을 침해하고 기업가치를 훼손하는 원인이 된다. 두 번째 요인은 미흡한 주주환원이다. 투자자의 주주환원에 대한 수요를 충족시키지 못하는 동시에, 잉여 현금흐름이 과잉투자로 이어지거나 지배주주의 사적이익을 위해 남용될 가능성이 존재한다. 배당을 선호하는 투자자 비중이 높을수록, 기업지배구조가 취약할수록 미흡한 주주환원이 기업가치에 미치는 부정적 영향은 더 크다. 세 번째 요인은 회계정보의 불투명성이다. 회계정보는 기업과 투자자 사이의 정보비대칭을 완화하는 핵심 수단으로 투자 의사결정의 기본 토대를 구성한다. 회계정보의 신뢰성이 낮을 경우 투자자는 기업의 성과와 전망을 보수적으로 평가하거나 추가적인 위험요인을 가진 것으로 간주하므로 기업가치평가에 부정적인 영향을 미친다. 네 번째 요인은 국내 투자자의 단기투자 성향이다. 한국 주식시장은 개인투자자의 비중이 크고 거래회전율이 매우 높은 특성을 갖는다. 개인투자자는 기업의 본질가치보다 단기 가격변동에 편승하여 거래하기 때문에 과도한 주가 변동성이 유발되고 기업의 본질가치가 가격에 효과적으로 반영되기 어렵다. 또한 개인투자자에게 지배주주와 경영자를 감시하고 견제하는 역할을 기대하기도 어렵다. 이는 기업가치의 할인요인으로 작용할 수 있다. 마지막 요인은 지정학적 위험이다. 대북 긴장관계의 변화는 경제적 파급효과를 갖는 한국 고유의 요인으로서 코리아 디스카운트의 원인이 될 수 있다. 지정학적 위험의 확대는 국가신용등급을 하락시킬 수 있으며 자금조달비용의 상승, 외국인투자자의 이탈을 유발한다.

이상의 요인들은 코리아 디스카운트의 원인으로서 충분한 설득력을 갖추고 있다고 판단되나 이를 뒷받침할 실증적 근거는 충분하지 않은 것으로 보인다. 한국 주식시장 또는 상장기업이 특정 요인에 취약하다는 것만으로 해당 요인이 코리아 디스카운트의 원인이라고 단정할 수는 없으므로, 해당 요인이 기업가치평가에 영향을 주는 요인으로서 기업가치평가의 국가간 격차를 설명할 수 있다는 것을 실증적으로 확인할 필요가 있다. 이에 본고는 45개 주요국 상장기업의 자료를 토대로 코리아 디스카운트의 현황과 특징을 분석하고, 이상에서 언급한 요인들이 상장기업 가치평가의 국가간 격차를 설명할 수 있는지, 코리아 디스카운트를 설명할 수 있는지 분석한다. 이러한 분석을 통해 코리아 디스카운트에 대한 시장참여자의 이해를 돕고자 한다.

Ⅱ. 선행연구

코리아 디스카운트와 연관된 실증연구는, 코리아 디스카운트의 현황과 특징을 분석한 연구와 기업가치평가에 영향을 미치는 요인을 국제적 관점에서 분석한 연구로 구분할 수 있다. 후자의 경우 코리아 디스카운트를 명시적으로 다루지는 않으나 기업가치평가 수준의 국가간 격차의 배경을 규명하고 있다는 점에서 코리아 디스카운트의 원인을 밝히는데 중요한 근거를 제공한다.

코리아 디스카운트를 주제로 실증분석을 진행한 연구로는 서정원ㆍ심수연(2007), Choi et al.(2012), 그리고 Ducret & Isakov(2020)가 확인된다. 서정원ㆍ심수연(2007)은 17개국의 2000~2004년 자료를 바탕으로 코리아 디스카운트의 존재 여부를 검토하고 그 원인을 추론하였다. 국내 시가총액 상위 50개 기업과 성장성, 수익성, 위험, 규모가 유사한 기업을 국가별로 50개씩 선정하여 주가-현금흐름 비율을 비교한 결과, 한국 상장기업의 주가-현금흐름 비율이 다른 모든 국가에 비해 유의하게 낮음을 확인하였다. 이들은 코리아 디스카운트의 원인으로 단기ㆍ투기적 투자행태를 지적하고 있다. 단기ㆍ투기적 투자행태로 인해 기업 기초여건과 주가의 괴리가 발생하고 가치평가지표가 미래 기대이익을 충분히 반영하지 못한다고 설명한다. 그러나 단기ㆍ투기적 투자행태가 가치평가에 영향을 주는 요인임을 보여주는 실증적 근거를 제시하지는 않았다.

Choi et al.(2014)은 32개국의 2000~2007년 자료를 바탕으로 내재자본비용(implied cost of capital)과 기업가치평가의 영향요인을 분석하였다. 한국 상장기업의 내재자본비용은 32개국 중 네 번째로 높고, 높은 내재자본비용은 낮은 주가-수익 비율과 연관된 것으로 나타난다. 아울러 부패 인식수준, 국가 거버넌스1), 회계품질 등이 내재자본비용과 기업가치평가에 영향을 미치는 요인임을 보여주고 있다. 다만 이러한 요인을 통제하더라도 여전히 코리아 디스카운트가 관찰되는 것으로 나타난다.

Ducret & Isakov(2020)는 28개국 25,863개 상장기업의 2002~2016년 자료를 바탕으로 코리아 디스카운트의 존재 여부와 특성을 분석하였다. 주가-수익 비율 또는 주가-장부가 비율을 기준으로 평가할 때, 코리아 디스카운트는 국가 단위, 업종 단위, 개별기업 단위 분석 모두에서 일관되게 관찰되며, 기업지배구조, 금융시장발전 수준, 거시경제 여건의 영향을 통제하더라도 여전히 유의하다. 한편 코리아 디스카운트는 재벌기업보다는 비재벌기업에서 크게 나타나는데, 비재벌기업의 낮은 국제적 주목성과 재벌기업의 시장지배력에 따른 비재벌기업의 경쟁력 약화와 연관된 것으로 추정하고 있다. 이 연구는 비교적 최근까지의 대규모 자료를 이용하였다는 점에서 의의가 있으나 코리아 디스카운트의 원인에 대해서는 구체적인 분석을 진행하지 않았다.

국제적 관점에서 기업가치평가의 영향요인을 분석하는 연구는 활발하게 이루어져 왔는데, 이들 연구가 주목한 영향요인은 크게 다섯 가지로 정리해 볼 수 있다. 첫 번째는 기업지배구조이다. La Porta et al.(2002)은 27개 선진국 539개 기업의 1995~1996년 자료를 이용하여 소액주주 보호수단이 잘 갖추어진 국가일수록, 또는 소액주주 보호수단이 미흡한 경우 지배주주의 소유권이 클수록 기업가치가 높다는 것을 확인하였다. 지배주주의 사적이익 추구 가능성은 기업가치 할인요인이며 이를 적절히 통제할 수 있는 수단을 갖추는 것이 중요함을 지적하고 있다. 기업지배구조가 기업가치평가에 미치는 영향은 이후의 많은 후속 연구에서도 입증된다. Lins(2003)는 1995~1997년 18개 신흥국 자료를 통해 경영진의 지배권과 소유권의 격차가 클수록 기업가치가 하락하고, 이러한 관계는 소액주주 보호가 취약한 국가일수록 현저함을 확인하였다. Klapper & Love(2004), Durnev & Kim(2005), Chhaochharia & Laeven(2009), Ammann et al.(2011) 등은 개별기업 기업지배구조 평가지표를 이용하여 기업지배구조가 우수할수록 기업가치가 높다는 결과를 제시하고 있으며, Dahya et al.(2008), Fauver et al.(2017)은 사외이사 비중 확대, 이사회 독립성 강화, 감사위원회 설치 등 지배주주 및 경영자에 대한 견제장치가 기업가치에 긍정적 영향을 미친다는 결과를 보고하고 있다.

두 번째는 회계투명성이다. Bhattacharya et al.(2003)은 1985~1998년 34개국 자료를 토대로 이익지표의 투명성이 높을수록 자본비용이 하락함을 확인하였다. Gaio & Raposo(2011)는 1999~2003년 38개국 자료를 이용하여 이익의 품질이 높을수록 기업가치가 상승하며, 이 관계는 소액주주 보호가 취약한 국가에서 강하다는 결과를 보고하고 있다. 이 두 연구는 투자자가 회계 불투명성을 투자위험요인으로 인식하고 이에 대한 위험 프리미엄을 요구한다는 사실을 입증한다. Daske et al.(2008)은 IFRS를 채택한 26개국 자료를 분석하여 IFRS 도입으로 자본비용이 감소하고 기업가치가 증가하였음을 보고하고 있다. IFRS의 도입으로 회계자료의 품질, 비교가능성, 투명성이 제고된 결과로 평가한다. Neel(2017)은 23개국에 대한 분석을 통해 IFRS 도입의 긍정적 영향은 회계정보의 비교가능성 제고와 연관성이 깊다는 결과를 제시하고 있다.

세 번째는 주주환원 정책이다. Pinkowitz et al.(2006)은 1988~1998년 35개국 자료를 이용하여 배당 수준이 높을수록 기업가치가 높고 그 관계는 투자자보호가 미흡한 국가에서 더 뚜렷함을 밝히고 있다. 즉 투자자보호가 미흡한 국가에서 주주환원은 지배주주의 사적이익 추구 가능성을 낮추는 역할을 수행한다는 사실을 보여준다. 같은 맥락에서, Kalcheva & Lins(2007)는 개별기업의 대리인 비용 척도를 추가적으로 활용하여 Pinkowitz et al.(2006)의 결과를 재확인하고 있으며, Brockman et al.(2014)은 내부자거래 규제가 취약한 국가일수록 배당이 기업가치에 긍정적인 영향을 미친다는 결과를 보고하고 있다. Brockman et al.(2022)은 21개국 자료를 토대로 투자자보호 수준이 낮은 국가일수록 배당 평탄화(smoothing)가 높은 기업가치로 이어진다는 결과를 도출하였다.

마지막 네 번째는 기관투자자의 비중이다. Ferreira & Matos(2008)와 Aggarwal et al.(2011)은 각각 27개국, 23개국 자료를 이용하여 기관투자자 지분율이 높을수록 기업가치가 높다는 분석결과를 보고하고 있다. 외국인 기관투자자, 특히 투자자보호 수준이 높은 국가의 기관투자자일수록 긍정적 영향이 크고, 긍정적 영향은 투자자보호 수준이 낮은 국가에서 두드러지는 것으로 나타난다. 이는 기관투자자가 기업경영을 감시하고 기업지배구조의 개선에 기여하는 역할을 수행하고 있음을 보여준다. Bena et al.(2017)는 30개국 자료를 토대로 외국인투자자가 장기투자와 혁신성과를 이끌어 낸다는 분석결과를 제시하였다. 외국인투자자는 투자대상 기업과 사업적 이해관계가 적고 투자위험을 국제적으로 분산할 수 있기 때문에 강한 규율효과를 발휘하는 것으로 해석한다.

Ⅲ. 코리아 디스카운트의 현황

본 장에서는 코리아 디스카운트의 현황과 특징에 대해서 살펴본다. 45개국 32,428개 상장기업의 2005~2021년 자료를 이용하여 분석하며, 분석자료는 Datastream을 통해 수집하였다. 각국 상장기업 중에서 누적 시가총액 1%에 해당하는 시가총액 하위 초소형 기업, 완전자본잠식 기업, 재무제표 자료 및 주가 관련 자료가 미비한 기업은 분석에서 제외하였다.2) 코리아 디스카운트 평가를 위한 가치평가지표는 주가-장부가(Price-to-Book) 비율과 주가-수익(Price-to-Earning) 비율을 이용한다.

<그림 III-1>은 한국 상장기업과 비교집단 상장기업의 주가-장부가 비율을 시계열적으로 비교하고 있다. 선진국, 신흥국, 아시아 태평양, 세계 등을 비교집단으로 구성하며3), 각 집단 내 상장기업을 합산하여 주가-장부가 비율을 계산하였다. 한국의 주가-장부가 비율은 모든 기간에 걸쳐 비교집단보다 낮게 형성되어 있는 것을 볼 수 있다. 2012년부터 2021년까지 최근 10년을 기준으로 볼 때, 한국의 주가-장부가 비율은 평균 1.2로, 선진국 2.2, 신흥국 2.0, 아시아태평양 1.7, 세계 2.2에 비해 뚜렷하게(31~48%) 낮다. 특히 선진국과의 격차는 글로벌 금융위기 이후 확대되는 모습이 관찰된다.

<그림 III-2>는 비교집단 상장기업의 합산 기준 주가-수익 비율의 추이를 보여준다. 3개년(2008년, 2019년, 2020년)을 제외한 기간에서 한국 상장기업의 주가-수익 비율이 비교집단 중 가장 낮은 수준을 기록하고 있다. 다만 비교집단과의 격차는 주가-장부가 비율에 비해 다소 작게 나타난다. 2012년부터 2021년까지 한국의 주가-수익 비율은 평균 17.0으로, 선진국 22.2, 신흥국 21.3, 아시아 태평양 20.4에 비해 17~23% 낮다. 한편 주가-수익 비율은 글로벌 금융위기 시기와 코로나19 시기에 급등하는 것으로 관찰되는데, 이는 주가-수익 비율의 분모에 해당하는 기업이익이 급감하면서 나타난 결과로 파악된다.

<그림 III-3>과 <그림 III-4>는 주가-장부가 비율과 주가-수익 비율을 국가별로 비교한 것이다. 주가-장부가 비율의 경우, 한국은 2005~2011년 기준 45개국 중 43위, 2012~2021년 기준 45개국 중 41위로 최하위권에 속하며, 2012~2021년 기준으로 상위 5개국의 38%, 표본 국가 평균의 63%에 불과한 것으로 나타난다. 주가-수익 비율의 경우, 한국은 2005~2011년 기준 40개국 중 20위, 2012~2021년 기준 38개국 중 29위로 중하위권에 속한다. 2012~2021년 기준 상위 5개국의 49%, 표본 국가 평균의 81% 수준이다. 참고로 <그림 III-4>에서 주가-수익 비율이 표시되지 않는 국가가 존재하는데 이는 일부 표본 연도의 상장기업 합산 순이익이 음(-)인 관계로 주가-수익 비율을 계산할 수 없는 경우에 해당한다.

<그림 III-5>와 <그림 III-6>은 한국과 비교집단의 2012~2021년 평균 주가-장부가 비율과 주가-수익 비율을 섹터별로 비교하고 있다. 먼저 주가-장부가 비율을 보면, 의료(health care)와 부동산(real estate)을 제외한 모든 섹터에서 한국이 비교집단에 비해 낮은 것으로 나타난다. 선진국과 비교할 때 가장 격차가 큰 섹터는 유틸리티로 선진국의 25%에 불과하며, 기술(technology), 산업재(industrial), 경기소비재(consumer discretionary), 금융(financials) 등도 40~50% 수준이다. 부동산 섹터에 속하는 국내 상장기업은 8개사에 불과하므로, 사실상 의료를 제외한 모든 섹터에서 국내 상장기업의 가치평가 수준이 낮다고 평가할 수 있다. 이는 코리아 디스카운트가 국내 상장기업의 섹터구성, 즉 가치평가 수준이 낮은 섹터의 비중이 크기 때문에 나타나는 현상이 아니라 섹터와 무관한 할인요인에 의한 현상임을 시사한다.

주가-수익 비율을 기준으로 비교하더라도 결과는 대체로 유사하다. 의료와 부동산을 제외한 모든 섹터에서 국내 상장기업의 주가-수익 비율이 비교집단에 비해 낮다. 반면 국내 의료섹터의 경우 주가-수익 비율이 82로 비교집단에 비해 현저히 높게 나타나는 것이 특징적이다. 한편 <그림 III-6>에서 주가-수익 비율이 표시되지 않는 섹터는 일부 표본연도의 집단 내 합산 순이익이 음(-)인 섹터이다.

이상에서 45개국 상장기업의 가치평가 수준을 비교한 결과는 코리아 디스카운트가 존재함을 명확히 보여준다. 분석기간 전반에 걸쳐, 비교 대상에 관계없이, 그리고 대부분의 섹터에서 코리아 디스카운트가 관찰된다. 특히 주가-장부가 비율을 기준으로 볼 때 더욱 뚜렷하다.

Ⅳ. 코리아 디스카운트의 원인 분석

1. 코리아 디스카운트 영향 요인 평가

코리아 디스카운트의 원인으로 거론되는 요인들에 대해, 국가별 비교의 관점에서 한국 상장기업을 어떻게 평가할 수 있는지 차례로 살펴보자.

먼저 기업지배구조에 대한 평가는 두 가지 지표를 이용한다. 첫 번째 지표는 Wold Bank가 발표하는 Doing Business의 소액주주보호(Protecting Minority Investors) 항목이다. 이 항목은 공시의무, 이사회 의무, 주주소송 용이성, 주주 권리, 소유 및 지배구조, 기업 투명성 등 6가지 주제와 관련된 38개 사안에 대해 법률상 규정의 존재 여부와 규제의 강도를 토대로 평가한다.4) 두 번째 평가지표는 WEF(World Economic Forum)가 발표하는 GCI(Global Competitiveness Index)의 기업지배구조 관련 항목으로 소액주주 보호, 이사회의 유효성, 기업의 윤리적 행동 등 세 가지이다. 이 지표는 경영자 설문조사(Executive Opinion Survey)를 통해 평가하는데5), 앞서 Doing Business 평가지표가 객관적 평가 방법이라면 이 방법은 주관적 평가 방법이라는 점에서 차이가 있다.

<그림 IV-1>과 <그림 IV-2>는 각각 한국의 기업지배구조에 대한 Doing Business와 GCI의 평가를 보여준다. 점선은 한국의 평가점수, 괄호 안의 숫자는 한국의 순위이며, 하늘색 영역과 실선은 하위 25~상위 25% 구간과 중위값이다. 두 지표의 산출기간이 겹치는 2014~2017년을 기준으로 볼 때, Doing Business 평가에서 한국은 190개국 중 17~23위로 상위권에 속하는 반면, GCI 평가에서 한국은 140개국 중 100~116위로 하위권에 속하는 것으로 나타난다. 한국은 기업지배구조와 관련된 법제도는 잘 갖춰진 반면, 법제도의 실효성이 떨어지거나 기업지배구조에 대한 시장의 신뢰가 낮다고 해석할 수 있다.

두 번째 요인은 주주환원이다. <그림 IV-3>은 현금배당과 자사주매입 금액을 순이익으로 나눈 값을 제시하고 있다. 한국은 45개국 중 27~45위로 주주환원율이 낮은 것으로 나타난다. 특히 2010년부터 2018년의 기간에는 40위 이하로 최하위권을 기록하고 있다. <그림 IV-4>는 현금배당과 자사주매입 금액을 총자본으로 나누어 주주환원 수준을 측정한 결과다. 한국은 45개국 중 37~45위로 역시 최하위권에 속한다.

<그림 IV-5>의 GCI 지표에 따르면 한국의 회계투명성은 2011년 139개국 중 96위에 불과하였으나 이후 꾸준히 상승하여 2019년 37위를 기록하였다. <그림 IV-6>의 이익조정 측정치에서도 유사한 추세가 관찰된다. 2011년 42개국 중 36위에서 2019년 21위까지 순위가 상승한다. 2011년 IFRS 도입7) 이후 한국 상장기업의 회계투명성은 정성적, 정량적 측면 모두에서 개선된 것으로 나타난다.

이상의 평가를 종합하면, 시장참여자들이 보편적으로 이해하는 바와 같이, 한국은 기업지배구조가 취약하고, 주주환원이 미흡하며, 투자자의 단기투기적 성향이 강하다. 지정학적 위험 역시 높은 것으로 평가할 수 있다. 분석기간 동안 이러한 평가는 대체로 일관되게 나타난다. 다만 회계투명성은 IFRS 도입 이후 꾸준히 개선되고 있는 것으로 보인다.

2. 코리아 디스카운트 원인 분석

본 절에서는 회귀분석을 통해 1절에서 검토한 요인들이 상장기업 가치평가의 국가간 격차를 설명하는지, 코리아 디스카운트의 원인으로 볼 수 있는지 분석한다. 상장기업 가치평가 수준의 국가간 격차에 초점을 맞추기 때문에 개별 상장기업 자료를 국가 단위로 합산(가중평균)하여 국가-년 자료를 구축하며9), 1절에서 검토한 평가지표의 가용성을 고려하여 2012년부터 2021년까지 최근 10년을 기본 분석기간으로 설정한다.

회귀분석에 앞서 각국 상장기업(연간 합산 기준)의 재무적 특성에 대해 살펴보자. 기업의 수익성과 성장성은 기업가치평가의 기본요소이기 때문에 1절에서 논의한 요인들의 영향을 평가하기 위해서는 반드시 통제해야 할 특성이다. <표 IV-1>은 기업가치평가 결정요인에 대한 국제적 연구에서 고려하고 있는 주요 재무비율에 대한 통계를 제시하고 있다.

국내 상장기업의 수익성은 선진국, 신흥국, 아시아태평양 등 모든 비교집단에 비해 낮으며 각 비교집단과의 차이는 모두 통계적으로 유의하다. 성장성 역시 낮은 것으로 판단된다. 선진국과 비교할 때 자본적 지출은 소폭 높으나 무형자산 비중이 현저히 낮으며, 신흥국과 비교할 때 자본적 지출과 무형자산 비중이 모두 낮다. 이는 한국이 전통적 제조업의 비중이 높은 가운데 유무형자산에 대한 투자가 부족하다는 사실을 보여준다. 반면 현금보유 비중은 선진국 및 신흥국에 비해 다소 높다. 이밖에, 안정성 측면에서 부채비율과 ROE 표준편차는 대체로 낮은 편에 속하며, 주가수익률 변동성은 선진국에 다소 높은 것으로 나타난다.

회귀분석의 종속변수는 주가-장부가 비율을 이용한다. 주가-수익 비율은 수익이 음(-)인 경우 정의되지 않고, 수익이 양(+)이더라도 그 값이 0에 가깝다면 주가-수익 비율이 매우 큰 값을 갖기 때문에 기업가치평가 척도로 활용하기에 부적합한 측면이 있다.

<표 IV-2>는 재무적 특성과 수익률 변동성의 코리아 디스카운트에 대한 영향을 파악하기 위한 회귀분석이다. 모형(1)은 한국더미(dummy)와 거시경제변수를 설명변수로 포함한 분석이며, 모형(2)는 여기에 재무비율 및 수익률 특성 변수를 추가한 분석이다.10) 한국더미는 한국의 경우 1, 이외의 국가의 경우 0의 값을 갖는 변수로, 이 변수의 계수가 코리아 디스카운트의 수준을 측정한다.

다음으로 1절에서 검토한 요인들의 코리아 디스카운트에 대한 영향을 차례로 분석한다. <표 IV-3>은 <표 IV-2>의 모형(2)에 기업지배구조 관련 변수를 설명변수로 추가한 분석결과이다. 모형(1)~(3)은 기업지배구조에 대한 Doing Business의 제도적 평가지표를 이용하는데, 모형(1)은 주주권리 관련 하위지표, 모형(2)는 이해상충규제 관련 하위지표를 이용하며 모형(3)은 두 지표의 평균값을 이용한다.12) 13) 모형(3)의 결과에 따르면, 기업지배구조 변수의 계수는 5% 수준에서 통계적으로 유의한 양(+)의 값을 갖는다. 각국의 거시경제적 특성, 상장기업의 재무적 특성의 영향을 통제한 후, 제도적 관점에서 기업지배구조가 우수하다고 평가되는 국가일수록 주가-장부가 비율이 높다는 것이다. 다만 모형(1)과 모형(2)의 하위지표 결과를 보면, 주주권리 관련 규제 보다는 이해상충 관련 규제에서 기업가치에 대한 영향이 나타난다. 모형(1)~(3)의 분석에서 한국더미의 계수는 유의한 음(-)의 값으로 추정되어, 기업지배구조에 대한 제도적 평가의 영향을 고려하더라도 코리아 디스카운트가 여전히 존재한다.

모형(4)~(6)은 기업지배구조에 대한 GCI의 정성적 평가지표를 이용한다.14) 모형(4)는 기업의 윤리적 행동, 모형(5)는 이사회의 유효성, 모형(6)은 소액주주 보호에 대한 평가지표를 이용하는데, 세 모형 모두에서 통계적으로 유의한 양(+)의 계수가 관찰된다. 기업지배구조에 대한 정성적 평가가 우수한 국가일수록 주가-장부가 비율이 높다. 중요한 것은 모형(4)~(6) 모두에서 한국더미 계수의 유의성이 사라진다는 것이다. 기업지배구조에 대한 정성적 평가의 영향을 통제하면 한국의 주가-장부가 비율에 추가적인 할인요소가 없다는 것으로, 코리아 디스카운트는 국내 기업지배구조의 낮은 제도적 실효성 또는 낮은 신뢰성과 밀접한 연관이 있다고 해석할 수 있다.

모형(7)~(10)은 주주환원 관련 변수를 설명변수로 이용한 분석결과이다. 모형(7)과 모형(9)는 현금배당액 및 자사주매입액을 각각 순이익과 총자본으로 나눈 값을, 모형(8)과 모형(10)은 현금배당액을 각각 순이익과 총자본으로 나눈 값을 주주환원 변수로 이용한 결과이다. 모든 분석에서 주주환원 변수의 계수는 유의한 양(+)의 값으로, 주주환원 수준이 높을수록 가치평가 수준이 높으며, 현금배당액과 자사주매입액을 합산하여 고려하는 경우 설명력이 더 높다. 한국더미의 계수는 네 가지 분석 모두에서 유의하지 않은 것으로 추정되어, 한국의 낮은 주주환원 수준이 코리아 디스카운트의 한 원인임을 시사한다.

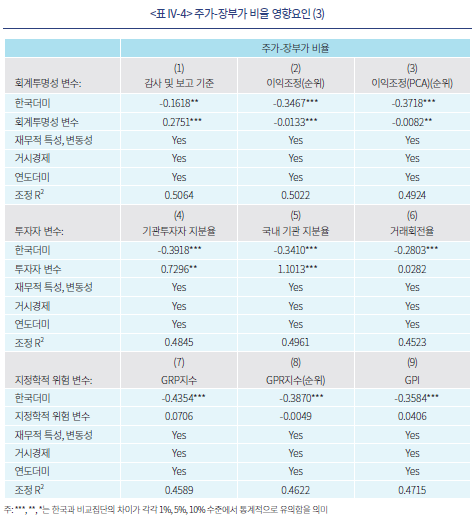

<표 IV-4>의 모형(1)~(3)은 회계투명성의 영향을 분석한 결과이다. 모형(1)은 GCI의 감사 및 보고 기준에 대한 설문평가 점수를 설명변수로 이용한 결과이다.15) 평가점수의 계수는 유의한 양(+)의 값으로 감사 및 보고 수준에 대한 평가가 높은 국가일수록 가치평가 수준이 높은 것으로 분석된다. 모형(2)와 (3)은 이익조정 수준에 대한 계량적 평가를 설명변수로 이용한 결과이다. 모형(2)는 네 가지 이익조정 측정치의 평균 순위를, 모형(3)은 네 가지 측정치에 대해 주성분분석(Principal Component Analysis)를 시행한 뒤 첫 번째 주성분의 순위를 이용한 결과이다. 모형(2)와 (3) 모두에서 이익조정 순위값이 높을수록(이익조정 수준이 높을수록) 가치평가 수준이 낮은 것으로 나타나 모형(1)의 결과와 일관된다. 다만, 회계투명성의 영향을 통제하더라도 한국더미의 계수는 여전히 유의한 음(-)의 값으로 추정된다.

모형(4)와 모형(5)는 코리아 디스카운트의 설명변수로 기관투자자 지분율과 국내 기관투자자 지분율을 이용한 분석이다.16) 두 지분율의 계수는 모두 유의한 양(+)의 값으로, 기관투자자 지분율이 높을수록 가치평가 수준이 더 높고, 특히 국내 기관투자자의 영향력이 더 큰 것으로 나타난다. 그러나 한국더미의 계수는 유의한 음(-)의 값으로 추정된다.

모형(6)은 거래회전율을, 모형(7)~(9)는 지정학적 위험 지표를 설명변수로 이용한 분석이다.17) 거래회전율과 세 가지 지정학적 위험 지표 모두에서 통계적 유의성이 확인되지 않는다. 이들 요인은 기업가치평가에 영향을 미치는 요인으로 평가하기 어려우며 코리아 디스카운트와 연관성이 낮은 것으로 판단된다.모형(4)와 모형(5)는 코리아 디스카운트의 설명변수로 기관투자자 지분율과 국내 기관투자자 지분율을 이용한 분석이다.16) 두 지분율의 계수는 모두 유의한 양(+)의 값으로, 기관투자자 지분율이 높을수록 가치평가 수준이 더 높고, 특히 국내 기관투자자의 영향력이 더 큰 것으로 나타난다. 그러나 한국더미의 계수는 유의한 음(-)의 값으로 추정된다.

<표 IV-4>와 <표 IV-5>의 분석을 통해, 기업지배구조, 주주환원 수준, 회계투명성, 기관투자자 비중, 기업의 재무적 특성 등의 요인이 45개국 상장기업의 가치평가 수준에 영향을 주는 요인임을 확인하였다. 그리고 그 중 기업지배구조에 대한 정성적 평가, 주주환원 수준, 재무적 특성 등이 코리아 디스카운트와 가장 밀접한 연관이 있는 요인인 것으로 파악된다. 반면 단기거래 행태와 지정학적 위험은 기업가치평가의 영향요인이라는 근거를 찾을 수 없었다.

Ⅴ. 맺는말

본고는 45개 주요국 상장기업 자료를 바탕으로 코리아 디스카운트의 현황과 특징을 파악하고 원인을 분석하였다. 실증분석을 통해 확인된 결과는 다음과 같다. 먼저 코리아 디스카운트는 현저한 수준으로 확인된다. 2012년부터 2021년까지 10년간 국내 상장기업(합산 기준)의 주가-장부가 비율은 평균 1.2로, 선진국의 52%, 신흥국의 58%, 아시아태평양 국가의 69%에 불과하며, 분석대상 45개국 중 41위에 해당한다. 또한 코리아 디스카운트는 의료섹터를 제외한 모든 섹터에서 일관되게 관찰된다.

회귀분석을 통해 코리아 디스카운트의 원인을 분석한 결과, 미흡한 주주환원 수준, 저조한 수익성과 성장성이 가장 유력한 원인인 것으로 추정된다. 상대적으로 설명력은 낮으나 기업지배구조 또한 코리아 디스카운트에 영향을 미치는 요인으로 분석된다. 한편, 단기투자 성향과 지정학적 위험의 경우 기업가치평가의 국가간 격차를 설명하는 요인이라는 근거는 확인되지 않았다.

주주환원 정책과 기업지배구조는 코리아 디스카운트의 원인으로 꾸준히 지적되었던 요인이며 관련 제도와 관행의 개선을 위한 많은 노력이 진행되어 왔다. 그럼에도 주주환원 수준이나 기업지배구조 평가에 있어 주요국과의 격차는 여전히 현저하며 코리아 디스카운트 역시 해소되지 않고 있다. 주주환원 정책과 기업지배구조는 단기간에 변화를 기대하기 어려운 사안이다. 법제도적 개선뿐만 아니라 기업의 관행과 인식의 개선, 그리고 투자자의 적극적인 역할이 필수적이다. 코리아 디스카운트를 해소하고 한국 자본시장이 새로운 성장단계에 이르기 위해서는 보다 장기적이고 종합적인 관점에서 실효성 있는 노력이 뒷받침되어야 할 것이다.

<부록>

1) World Bank가 측정하여 발표하는 지표로, 참여와 책임, 정치적 안정성, 정부의 효과성, 규제의 질, 법의 지배, 부패의 통제 등 6가지 항목으로 구성된다.

2) 한국의 경우 SPAC을 제외하였다. 분석대상 국가와 상장기업수는 <부록 표 1>에 제시되어 있다.

3) 각국의 비교집단 분류는 IMF의 분류를 따른다. 각 비교집단에서 한국은 제외된다.

4) 예를 들어, 기업이 어떤 계약을 체결하는 경우, 공시의무가 존재하지 않으면 0점, 계약조건에 대한 공시의무만 존재하면 1점, 계약조건과 이해상충에 대한 공시의무가 존재하면 2점을 부여하는 방식이다.

5) 예를 들어, “당신의 국가에서 소액주주의 이익은 법적 시스템을 통해 보호되는가?”라는 질문에 1점에서 7점 사이의 점수를 부여하는 방식이다.

6) 연도별로 최근 5년간의 자료를 이용하여 측정한다. 이익조정 측정치의 개념과 정의와 관련한 구체적인 내용은 Leuz et al.(2003), Burgstahler et al.(2006) 등을 참조하기 바란다.

7) 자산규모 2조원 이상 기업은 2011년부터, 2조원 미만 기업은 2013년부터 도입되었다.

8) GPI는 사회 안전과 안보, 진행 중인 국내외 분쟁, 군사화(militarisation) 등 세 가지 하위지표로 구성되는데, 이 중 사회 안전과 안보를 제외한 두 가지 지표의 평균값을 이용한다.

9) 금융업과 부동산업 기업은 분석에서 제외한다. 다만 금융업과 부동산업 기업을 포함하더라도 결과에 질적인 차이는 없다.

10) <표 IV-1>에서 검토한 변수 중 매출액성장률과 ROE 표준편차는 이후의 모든 회귀분석에서 유의성이 관찰되지 않으므로 분석에서 제외한다.

11) 채권자의 기업 감시가 이루어지는 가운데 주기적인 이자지급 의무는 경영효율성을 제고하고 잉여현금흐름을 감소시킴으로써 기업가치에 긍정적인 영향을 미친다는 설명이다.

12) 지표의 구성에 대한 구체적인 내용은 다음 링크에서 찾아볼 수 있다.

https://archive.doingbusiness.org/en/methodology/protecting-minority-investors

13) 주주권리 관련 하위지표는 2014~2020년의 평가값만이 존재하므로, 2012~2013년은 2014년의 평가값을, 2021년은 2020년의 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

14) GCI 평가지표는 2017년까지 존재하므로, 2018~2021년은 2017년 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

15) GCI의 감사 및 보고 기준에 대한 평가지표는 2019년까지 존재하므로, 2020~2021년은 2019년 평가값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

16) OECD는 2017년말 기준 54개국, 2020년말 기준 46개국의 상장기업 합산 기관투자자 지분율을 발표하였다. 따라서 2012~2019년은 2017년의 자료를, 2020~2021년은 2020년 자료를 적용한다. 2017년과 2020년 자료를 비교할 때 각국 상장기업 기관투자자 지분율에 큰 변화가 없다는 점에서 특정 시점 자료의 적용 기간을 확장하여도 큰 문제는 없을 것으로 본다.

17) 거래회전율 자료는 2020년까지 존재하므로, 2021년은 2020년의 값을 이용한다. 자료가 존재하는 기간에 대해서만 분석을 진행하더라도 분석결과에 질적인 차이는 없다.

18) 변수간 상관계수는 아래와 같다.

참고문헌

서정원ㆍ심수연, 2007, 코리아 디스카운트의 진단과 원인 분석,『한국증권학회지』 36(4), 621-655.

Aggarwal, R., Erel, I., Ferreira, M., Matos, P., 2011, Does governance travel around the world? Evidence from institutional investors, Journal of Financial Economics 100(1), 154-181.

Ammann, M., Oesch, D., Schmid, M. M., 2011, Corporate governance and firm value: International evidence, Journal of Empirical Finance 18(1), 36-55.

Bena, J., Ferreira, M. A., Matos, P., Pires, P., 2017, Are foreign investors locusts? The long-term effects of foreign institutional ownership, Journal of Financial Economics 126(1), 122-146.

Bhattacharya, U., Daouk, H., Welker, M., 2003, The world price of earnings opacity, The Accounting Review 78(3), 641-678.

Brockman, P., Hanousek, J., Tresl, J., Unlu, E., 2022, Dividend Smoothing and Firm Valuation, Journal of Financial and Quantitative Analysis 1-27.

Brockman, P., Tresl, J., Unlu, E., 2014, The impact of insider trading laws on dividend payout policy, Journal of Corporate Finance 29, 263-287.

Budescu, D.V., 1993, Dominance analysis: a new approach to the problem of relative importance of predictors in multiple regression. Psychological Bulletin 114(3), 542.

Burgstahler, D., Dichev, I., 1997, Earnings management to avoid earnings decreases and losses, Journal of Accounting and Economics 24(1), 99-126.

Burgstahler, D. C., Hail, L., Leuz, C., 2006, The importance of reporting incentives: Earnings management in European private and public firms, The Accounting Review 81(5), 983-1016.

Chhaochharia, V., Laeven, L., 2009, Corporate governance norms and practices, Journal of Financial intermediation 18(3), 405-431.

Choi, T. H., Lee, E., Pae, J., 2012, The equity premium puzzle: empirical evidence for the “Korea Discount”, Asia-Pacific Journal of Accounting & Economics 19(2), 143-166.

Dahya, J., Dimitrov, O., McConnell, J. J., 2008, Dominant shareholders, corporate boards, and corporate value: A cross-country analysis, Journal of Financial Economics 87(1), 73-100.

Daske, H., Hail, L., Leuz, C., Verdi, R., 2008, Mandatory IFRS reporting around the world: Early evidence on the economic consequences, Journal of Accounting Research 46(5), 1085-1142.

De La Cruz, A., Medina, A., Tang, Y., 2019, Owners of the world’s listed companies, OECD Capital Market Series, Paris.

Ducret, R., Isakov, D., 2020, The Korea discount and chaebols, Pacific-Basin Finance Journal 63, 101396.

Durnev, A., Kim, E. H., 2005, To steal or not to steal: Firm attributes, legal environment, and valuation, The Journal of Finance 60(3), 1461-1493.

Fauver, L., Hung, M., Li, X., Taboada, A. G., 2017, Board reforms and firm value: Worldwide evidence, Journal of Financial Economics 125(1), 120-142.

Ferreira, M. A., Matos, P., 2008, The colors of investors’ money: The role of institutional investors around the world, Journal of Financial Economics 88(3), 499-533.

Gaio, C., Raposo, C., 2011, Earnings quality and firm valuation: international evidence, Accounting & Finance 51(2), 467-499.

Kalcheva, I., Lins, K. V., 2007, International evidence on cash holdings and expected managerial agency problems, The Review of Financial Studies 20(4), 1087-1112.

Klapper, L. F., Love, I., 2004, Corporate governance, investor protection, and performance in emerging markets, Journal of Corporate Finance 10(5), 703-728.

La Porta, R., Lopez‐de‐Silanes, F., Shleifer, A., Vishny, R., 2002, Investor protection and corporate valuation, The Journal of Finance 57(3), 1147-1170.

Leuz, C., Nanda, D., Wysocki, P. D., 2003, Earnings management and investor protection: An international comparison, Journal of Financial Economics 69(3), 505-527.

Lins, K. V., 2003, Equity ownership and firm value in emerging markets, Journal of Financial and Quantitative Analysis 38(1), 159-184.

Neel, M., 2017, Accounting comparability and economic outcomes of mandatory IFRS adoption, Contemporary Accounting Research 34(1), 658-690.

OECD, 2022, Corporate ownership and concentration: Background note for the OECD-Asia roundtable on corporate governance (October 2022).

Pinkowitz, L., Stulz, R., Williamson, R., 2006, Does the contribution of corporate cash holdings and dividends to firm value depend on governance? A cross‐country analysis, The Journal of Finance 61(6), 2725-2751.