Find out more about our latest publications

Motivation and Long-term Performance of Acquisition and Resale of Treasury Shares

Research Papers 23-06 Feb. 23, 2023

- Research Topic Capital Markets

- Page 75

Acquisition and disposal of treasury stocks were permitted through revisions to the Securities and Exchange Act in the 1990s, and the listed companies have been actively utilizing treasury stocks. According to the undervaluation hypothesis, the acquisition of treasury stocks is used as a means to inform the market when a company's stock price is undervalued compared to its real value. More than 90% of the acquisition purpose reported in public disclosure was stock price stabilization and shareholder returns.

Outside investors, however, cannot easily evaluate the intrinsic value of a company. There is a possibility that the acquisition of treasury stocks could be used as a false signal. Taking advantage of information asymmetry between insiders and investors, companies may opportunistically use disclosure of treasury stocks. The disclosures can be used for boosting short-term stock price or for the private benefit of corporate insiders.

In addition, regulations on the acquisition and disposal of treasury stocks in Korea differ from those in overseas markets. In most countries, treasury stocks are immediately retired after the acquisition, or disposal is regarded as equivalent to issuing new stocks. On the other hand, domestic regulations are relatively flexible, allowing companies to dispose of the acquired treasury stocks at its discretion. Not only by acquiring treasury stocks directly in the open market, companies can also acquire treasury stocks indirectly through trusts or treasury stock funds, which is a unique method difficult to find in other countries. The indirect acquisition has weaker regulatory constraints compared to direct acquisition in various aspects, such as a longer acquisition period, no compulsion to acquire the entire amount of trust contracts, and permission to dispose of treasury stocks during the trust contract period, making it difficult to assert shareholder return effects.

This paper comprehensively examines on the acquisition and disposal of treasury stocks by domestic listed companies. Using public disclosure data on the acquisition and disposal of treasury stocks from January 2015 to May 2022, empirical analyses are conducted on the real motivation and long-term effects of the acquisition and disposal of treasury stocks.

The results of the empirical analyses are summarized as follows. First, the disclosure itself does not provide sufficient information to determine whether a company is actually undervalued. Regardless of the type of disclosure, stock prices rose significantly after the announcement. On average, however, insiders sold their company stocks prior to the disclosure, and the share of insiders decreased. the trading pattern of insiders is contrary to the prediction of corporate undervaluation, making it impossible for outside investors to distinguish between genuine undervaluation signals and false ones.

Second, repurchase announcements are subject to insider opportunism in cases when insiders sell their shares before repurchase disclosures. The sale of insiders continues even after the announcements. This suggests that insiders do not personally believe that the firm is undervalued, and maintain their thoughts even after the announcement., resulting in the continued sales of shares. Therefore, if insiders sell their holdings even though the company has announced the acquisition of treasury stocks, it is highly likely to be a false signal.

Third, in case of indirect acquisition, it is difficult to regard it as reliable information even if the insider's share increases. Insiders do not sell their stocks after the announcement, whereas in the case of indirect acquisition, they sold a significant amount of their holdings after the share price rose sharply due to the announcement of the acquisition of treasury stocks. Insiders of a company that chooses indirect acquisition may use the flexibility of the indirect acquisition system to induce a rise in stock prices through public disclosure and to pursue private interests by selling individual shares.

Fourth, the disposal of treasury stock is freely used for various purposes such as employee performance compensation and financial structure improvement. In most cases, it has been shown to have a positive effect on stock prices. Depending on the insider's stake, some long-term performance is different, so it is judged that it can be used as a complementary method to judge the effect of disclosure.

According to the above analysis results, there is a possibility that the acquisition of treasury stocks by domestic listed companies is a false signal, unlike the company's disclosure purpose. The background of the disclosure of the acquisition of treasury stocks is questionable because insiders who influence decision-making show a different transaction behavior from the disclosure. If companies use their treasury stocks for opportunistic purposes, the credibility of the company and the market will inevitably be damaged.

Therefore, it is necessary to comprehensively review and prepare countermeasures against private profit-seeking behavior by insiders. In addition, it is necessary to actively consider improving the indirect acquisition of treasury stocks, a system difficult to find overseas. Indirect acquisitions are subject to more flexible regulations than direct acquisitions, making it difficult to determine the effectiveness of disclosures, and are highly likely to be used as false signals. More fundamentally, it is necessary to discuss the validity of the current legal interpretation of treasury stock. Although treasury stocks are not recognized as assets from an economic point of view, they take a contradictory attitude that does not clearly deny their asset properties legally. As a result, the disposal of treasury stocks occurs freely for various purposes, and there are cases where controlling shareholders abuse their treasury stocks for personal gain. It is necessary to supplement the treasury stock regulation system so that it can play a role as a shareholder return method through fundamental improvement and regulation revision.

Outside investors, however, cannot easily evaluate the intrinsic value of a company. There is a possibility that the acquisition of treasury stocks could be used as a false signal. Taking advantage of information asymmetry between insiders and investors, companies may opportunistically use disclosure of treasury stocks. The disclosures can be used for boosting short-term stock price or for the private benefit of corporate insiders.

In addition, regulations on the acquisition and disposal of treasury stocks in Korea differ from those in overseas markets. In most countries, treasury stocks are immediately retired after the acquisition, or disposal is regarded as equivalent to issuing new stocks. On the other hand, domestic regulations are relatively flexible, allowing companies to dispose of the acquired treasury stocks at its discretion. Not only by acquiring treasury stocks directly in the open market, companies can also acquire treasury stocks indirectly through trusts or treasury stock funds, which is a unique method difficult to find in other countries. The indirect acquisition has weaker regulatory constraints compared to direct acquisition in various aspects, such as a longer acquisition period, no compulsion to acquire the entire amount of trust contracts, and permission to dispose of treasury stocks during the trust contract period, making it difficult to assert shareholder return effects.

This paper comprehensively examines on the acquisition and disposal of treasury stocks by domestic listed companies. Using public disclosure data on the acquisition and disposal of treasury stocks from January 2015 to May 2022, empirical analyses are conducted on the real motivation and long-term effects of the acquisition and disposal of treasury stocks.

The results of the empirical analyses are summarized as follows. First, the disclosure itself does not provide sufficient information to determine whether a company is actually undervalued. Regardless of the type of disclosure, stock prices rose significantly after the announcement. On average, however, insiders sold their company stocks prior to the disclosure, and the share of insiders decreased. the trading pattern of insiders is contrary to the prediction of corporate undervaluation, making it impossible for outside investors to distinguish between genuine undervaluation signals and false ones.

Second, repurchase announcements are subject to insider opportunism in cases when insiders sell their shares before repurchase disclosures. The sale of insiders continues even after the announcements. This suggests that insiders do not personally believe that the firm is undervalued, and maintain their thoughts even after the announcement., resulting in the continued sales of shares. Therefore, if insiders sell their holdings even though the company has announced the acquisition of treasury stocks, it is highly likely to be a false signal.

Third, in case of indirect acquisition, it is difficult to regard it as reliable information even if the insider's share increases. Insiders do not sell their stocks after the announcement, whereas in the case of indirect acquisition, they sold a significant amount of their holdings after the share price rose sharply due to the announcement of the acquisition of treasury stocks. Insiders of a company that chooses indirect acquisition may use the flexibility of the indirect acquisition system to induce a rise in stock prices through public disclosure and to pursue private interests by selling individual shares.

Fourth, the disposal of treasury stock is freely used for various purposes such as employee performance compensation and financial structure improvement. In most cases, it has been shown to have a positive effect on stock prices. Depending on the insider's stake, some long-term performance is different, so it is judged that it can be used as a complementary method to judge the effect of disclosure.

According to the above analysis results, there is a possibility that the acquisition of treasury stocks by domestic listed companies is a false signal, unlike the company's disclosure purpose. The background of the disclosure of the acquisition of treasury stocks is questionable because insiders who influence decision-making show a different transaction behavior from the disclosure. If companies use their treasury stocks for opportunistic purposes, the credibility of the company and the market will inevitably be damaged.

Therefore, it is necessary to comprehensively review and prepare countermeasures against private profit-seeking behavior by insiders. In addition, it is necessary to actively consider improving the indirect acquisition of treasury stocks, a system difficult to find overseas. Indirect acquisitions are subject to more flexible regulations than direct acquisitions, making it difficult to determine the effectiveness of disclosures, and are highly likely to be used as false signals. More fundamentally, it is necessary to discuss the validity of the current legal interpretation of treasury stock. Although treasury stocks are not recognized as assets from an economic point of view, they take a contradictory attitude that does not clearly deny their asset properties legally. As a result, the disposal of treasury stocks occurs freely for various purposes, and there are cases where controlling shareholders abuse their treasury stocks for personal gain. It is necessary to supplement the treasury stock regulation system so that it can play a role as a shareholder return method through fundamental improvement and regulation revision.

Ⅰ. 연구 배경

자기주식 취득은 기업의 성과를 주주에게 분배하는 대표적인 주주환원 수단으로, 주요국에서 1990년대 중반부터 활발히 활용되고 있다. 2018년 기준으로 미국 주요 상장기업의 자기주식 취득 규모는 전체 주주환원의 59%를 차지하며 유럽 주요 상장기업의 경우 24%를 차지한다.1) 한국에서는 1992년 자사주펀드 제도가 도입되어 상장기업의 자기주식 취득이 처음으로 가능해졌고 1994년 증권거래법(현 자본시장과 금융투자업에 관한 법률) 개정을 통해 상장기업의 자기주식 직접 취득이 허용되었다.

국내 자기주식 취득은 제도적 관점에서 해외시장과 차별화되는 특성이 존재한다. 기업은 자기주식을 직접 취득할 수 있을 뿐만 아니라 신탁계약이나 자사주펀드를 통해 간접적으로 취득하는 것이 가능하다. 이는 한국시장에만 존재하는 독특한 제도이다. 또한 자기주식의 처분에 대한 규제적 제약이 적어 자기주식의 처분이 비교적 자유롭다. 다른 국가에서는 자기주식을 소각하거나, 금고주(treasury stock)로 보유할 수 있더라도 처분을 신주발행에 준하는 행위로 간주하며 엄격하게 관리하는 것과 비교된다.

이러한 제도적 특성을 고려할 때 국내 자기주식 취득을 전통적인 주주환원 정책의 관점에서만 평가하기는 어렵다. 국내 상장기업이 취득한 자기주식을 소각하는 경우는 극히 일부에 불과하며 대부분 소각하지 않고 보유하거나 처분한다(김우진‧임지은, 2017). 또한 처분 시 기업의 필요에 따라 재량적으로 자기주식을 활용하여 주주환원이 아닌 단기적 주가 부양이나 지배주주의 지배권 보호를 위한 수단으로 활용될 가능성이 우려된다(김효진‧윤순석, 2010; 정성창‧김영환, 2013).

본 보고서는 국내 상장기업의 자기주식 취득과 처분에 대한 제도적, 재무적 논의를 종합적으로 정리하고 자기주식 관련 기업활동의 배경과 효과를 실증적으로 분석하고자 한다. 특히 기존 연구에서 부분적으로 연구되어왔던 자기주식 직접취득과 처분, 간접취득을 동일한 기준을 바탕으로 직접적으로 비교하여 국내 자기주식 시장에 대한 포괄적 이해의 틀을 마련하고자 한다. 아울러 이를 토대로, 기업의 자기주식이 주주환원의 수단으로 효과적으로 활용되고 장기적으로 기업가치에 긍정적 영향을 미칠 수 있도록 하기 위한 제도적 개선방안을 모색하고자 한다.

Ⅱ. 자기주식 취득 및 처분 제도

1. 자기주식 정의 및 법제 현황

자기주식은 일반적으로 시장에서 거래되는 주식을 발행회사가 일시적으로 소유하고 있는 법적 지위를 가리킨다. 회사가 자기의 명의와 계산으로 회사의 주식을 취득하여 스스로 주주가 되는 것이다.2)

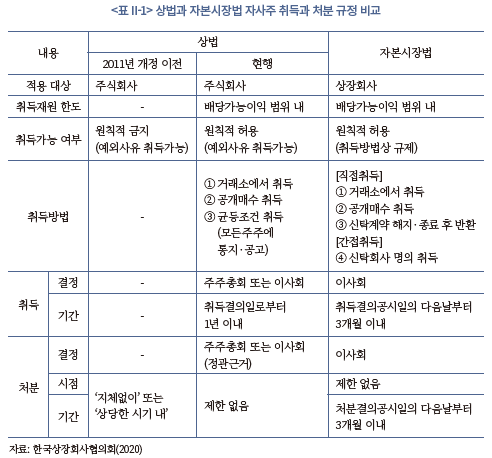

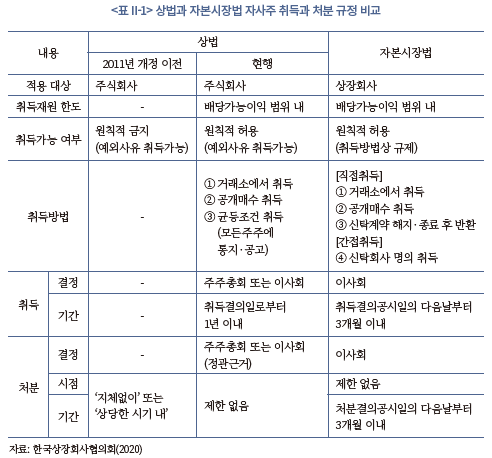

상법상 자기주식 취득에 대한 규제는 2011년을 기준으로 구분된다. 2011년 상법 개정 이전에는 자기주식 취득은 원칙적으로 금지되었다. 예외적으로 주식소각, 합병 또는 영업 전부 양수, 단주처리, 주식매수청구권 행사 등의 경우에만 허용되었다. 2011년 상법이 개정되면서 자기주식 취득을 전면적으로 허용하였다. 이에 따라 기업은 배당가능이익 한도 내에서 일정한 방법에 따라 자기주식을 취득할 수 있게 되었다(상법 제341조).

증권거래법(현 자본시장과 금융투자업에 관한 법률, 이하 자본시장법)은 1994년에 상장회사가 배당가능이익 한도 내에서 자기주식을 취득할 수 있도록 허용하는 규정을 도입하였다(증권거래법 제189조의2). 2011년의 상법 개정은 기존에 증권거래법에서 상장회사에 적용되던 자기주식 취득 규정을 비상장회사로 확대한 것으로 볼 수 있다.

자본시장법상 자기주식 간접취득은 직접취득이 허용되기 이전부터 존재하였다. 간접취득은 자사주펀드와 특정금전신탁의 두 가지 방법을 통해 이루어진다. 자사주펀드는 다수의 기업이 공동으로 투자신탁회사에 자금을 위탁하여 통합적으로 운용하는 방법으로 1992년 처음 도입되었다. 이후 1999년 특정금전신탁을 이용하는 방식이 추가되었는데3), 자사주펀드와 달리 다수의 기업이 아닌 개별기업이 단독으로 계약하는 방식으로 신탁업자는 계약기간 동안 해당 기업을 대신하여 주식을 취득한다.

자기주식 처분에 대한 규제 역시 2011년 상법 개정 전후로 큰 차이가 존재한다. 상법 개정 이전에는 자기주식의 보유기간을 엄격하게 규정하여 ‘지체없이’ 또는 ‘상당한 시기 내’에 반드시 처분해야 했으나 2011년 자기주식 취득 규제가 원칙적 허용으로 전환된 이후에는 회사가 자유롭게 처분 시기를 결정할 수 있게 되었다. 자본시장법상에서도 마찬가지로 처분 시점에 관한 규정이 없으며 취득한 자기주식을 보유하거나 처분할지에 관한 결정은 기업의 선택에 따른다.

2. 자기주식 취득 및 처분 규정

상장기업이 자기주식을 취득하는 방법은 ① 취득예정 주식 수를 공시한 뒤 거래소 또는 장외시장에서 기업이 직접 매수하는 방식(상법 제341조제1항제1호, 상법 시행령 제9조제1항, 자본시장법 제165조의3제1항제1호), ② 기업이 은행이나 신탁회사와 계약을 체결하여 일정 금액을 신탁하고 신탁계약 금융기관이 계약기간 내에 기업을 대신하여 취득하는 방식(자본시장법 제165조의3제4항) 등 크게 두 가지이다. 이 때 자기주식 취득 신탁계약이 해지되거나 계약기간이 종료되면 기업은 신탁업자가 취득한 자기주식을 현물로 반환받을 수 있다(자본시장법 제165조의3제1항제2호). 기업이 시장에서 직접 매수하거나 신탁계약 해지 또는 종료 후 현물로 반환받는 경우 기업이 자기주식을 실질적으로 보유하게 되므로 직접취득이라 하고, ②와 같이 신탁계약 금융기관이 자기주식을 취득하는 경우 자기주식은 신탁해지 전까지 신탁업자의 재산으로 간주하므로 간접취득이라 한다.

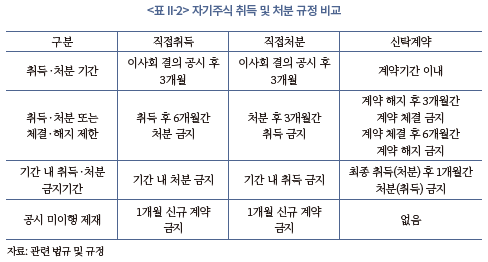

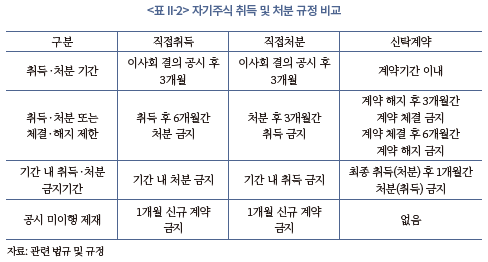

자기주식을 취득하는 방법에 따른 규제 차이는 다음과 같이 정리할 수 있다. 첫째, 일반적으로 직접취득에 비하여 간접취득에 장시간이 소요된다. 자기주식을 직접취득할 경우 공시4) 익일로부터 3개월 이내에 취득을 완료해야 하는 반면(자본시장법 시행령 제176조의2제3항, 발행공시규정 제5-9조제1항), 간접취득을 위한 신탁계약은 통상 6개월 또는 1년 단위로 체결되고 연장이 가능하므로 사실상 완료 시점에 대한 제약이 없다.5) 신탁계약에 의한 현물반환은 신탁계약 종료 또는 해지 후 이루어지므로 신탁계약을 이용한 자기주식 취득의 실제 소요 시간은 길어질 수 있다.

둘째, 직접취득과 간접취득은 공시에서 명시된 목표 규모에 대한 취득 강제성에서 차이가 난다. 직접취득은 결의한 취득예정 수량을 반드시 취득해야 하고 그렇지 못한 경우 해당 기간 만료 후 1개월까지 새로운 이사회 취득결의가 금지된다(발행공시규정 제5-4조제1항). 반면 간접취득은 취득의무와 제재에 관한 규정이 없어 공시에 명시된 신탁계약 금액만큼 취득하지 않아도 문제가 되지 않는다.

셋째, 직접취득은 취득기간 내에 취득만 가능하지만 간접취득의 경우 계약기간 내에 취득과 처분이 모두 가능하다. 신탁업자가 신탁계약 기간 동안 시세차익을 얻기 위해 취득과 처분을 반복하여도 규정 위반이 아니다. 다만 신탁계약 기간 내의 자기주식 처분은 취득일로부터 1개월이 경과된 후 가능하며, 마찬가지로 취득은 처분일로부터 1개월이 경과된 후 가능하다.

넷째, 신탁계약의 해지 또는 종료 후 자기주식의 반환은 현물반환뿐만 아니라 현금반환도 허용된다. 기업이 현금반환을 요청할 경우 신탁업자는 취득한 자기주식을 처분하여 현금으로 돌려줄 수 있다.6) 이 경우 ‘자기주식 취득 신탁계약 체결’로 공시됨에도 불구하고 기업의 실질적인 주식 취득은 발생하지 않는다.

이처럼 직접취득과 비교할 때 간접취득의 경우 기업이 상당한 재량권을 가진다. 간접취득은 사실상 취득기간에 제한이 없고 공시한 신탁계약금액을 전액 취득하지 않아도 되며 자기주식을 취득하였다 하더라도 계약기간 내에 매도하는 것 또한 가능하다.

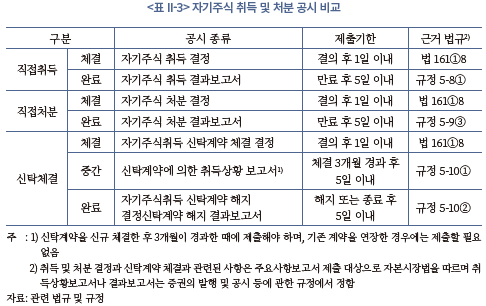

3. 상장기업의 자기주식 취득 및 처분 공시

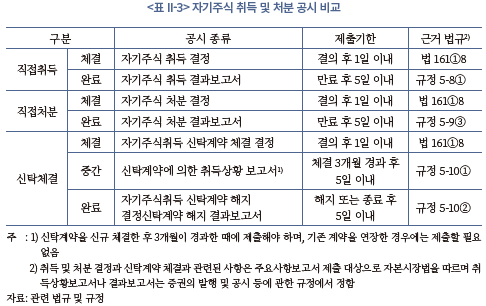

상장기업이 자기주식 직접취득이나 직접처분을 결의한 경우 1일 이내에 해당사항을 공시해야 한다. 취득이나 처분이 완료되거나 기간이 만료되면 ‘자기주식 취득‧처분 결과보고서’를 제출한다. 결과보고서에는 해당 기간 동안 취득하거나 처분한 주식 종류, 거래체결 주식 수, 주문 주식 수, 체결금액 등 비교적 상세한 거래내역이 포함된다.

신탁계약에 따른 취득상황은 두 차례 공시된다. 첫 번째는 자기주식 신탁계약을 체결하고 3개월이 경과한 시점이다. 이때 기업은 ‘신탁계약에 의한 취득상황 보고서’를 제출하게 되는데 3개월 동안 취득하거나 처분한 주식 수, 금액 등의 일자별 내역을 보고한다. 두 번째 시점은 신탁계약이 해지되거나 종료되는 시점이다. 기업은 ‘자기주식취득 신탁계약 해지 결정’을 공시하고 ‘신탁계약 해지 결과보고서’를 제출한다. 결과보고서에는 계약을 최초 체결한 시점부터 해지될 때까지의 전체 거래를 일별, 또는 월별로 공개한다.

‘신탁계약에 의한 취득상황 보고서’는 신탁계약을 신규 체결한 경우에 한하여 3개월 후 한 차례 제출하기 때문에 신탁계약이 장기간 연장될 경우 투자자는 신탁계약 체결 3개월 이후부터 신탁계약의 해지 또는 종료되는 시점까지 자기주식의 취득과 처분 현황을 파악할 수 없다.

Ⅲ. 자기주식 취득 및 처분 현황과 특성

1. 자기주식 취득 및 처분 규모

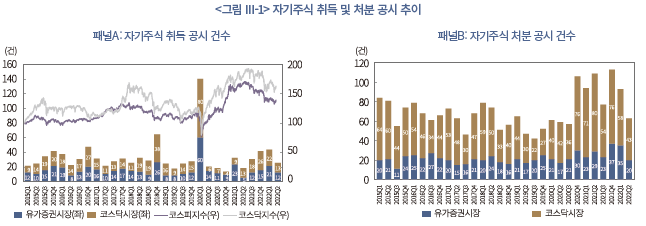

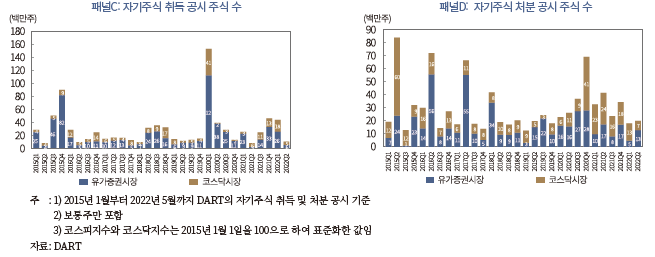

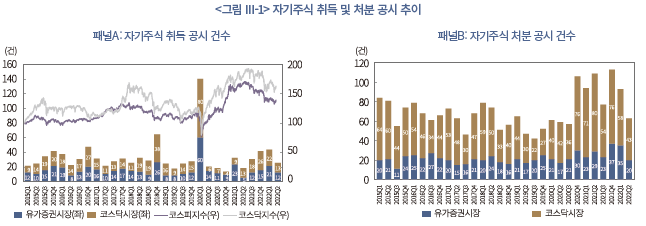

유가증권시장과 코스닥시장 상장기업의 자기주식 취득, 처분 현황을 살펴보자. <그림 Ⅲ-1>은 2015년 1월부터 2022년 5월까지 자기주식 직접취득 및 처분 공시 건수와 공시 수량의 추이를 제시하고 있다.

분석기간 동안 자기주식 취득은 유가증권시장의 경우 분기당 평균 15.2건, 코스닥시장의 경우 분기당 평균 17.7건이 공시되었다. 자기주식 처분은 취득에 비해 빈도가 높아, 유가증권시장의 경우 분기당 평균 22건, 코스닥시장은 평균 48.5건이 공시된 것으로 집계된다.

자기주식 취득은 주가변화에 따라 등락하는 양상을 보인다. 자기주식 취득이 가장 크게 증가한 시기는 코로나19로 주가가 급락하였던 2020년 1분기이다. 당시 정부는 시장안정화조치의 일환으로 자기주식 매입한도를 한시적으로 완화하였는데 이를 계기로 기업의 자기주식 취득 공시 건수와 수량 모두 가장 높은 수준을 기록하였다. 2020년 1분기 자기주식 취득 공시 건수는 유가증권시장 60건, 코스닥시장 80건 등 총 140건으로, 직전 4분기의 분기별 평균 23건의 약 6배에 이른다.

자기주식 처분은 2020년 4분기 이후 증가한 모습이 관찰된다. 자기주식 처분 건수는 2019년까지 분기당 57.3건이었는데 2020년 4분기부터 2022년 1분기까지 분기당 약 98.7건으로 증가하였다. 2020년 4분기부터 주가가 빠르게 회복되어 저점 대비 2배에서 2.5배 수준에 도달하고, 2020년 1분기에 취득한 자기주식에 대한 6개월의 처분금지기간이 종료되면서 자기주식 처분이 증가한 것으로 판단된다.

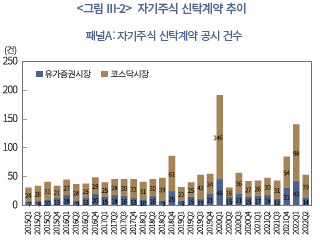

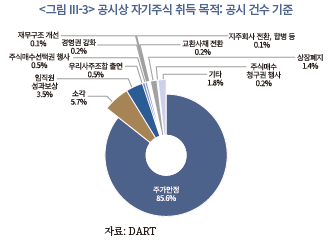

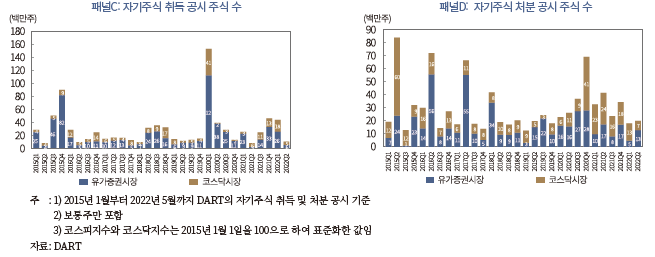

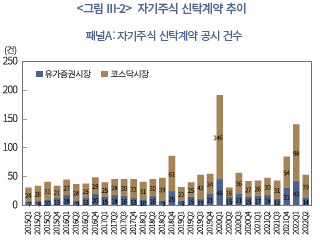

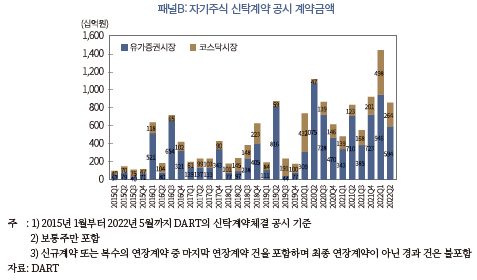

<그림 III-2>는 자기주식 신탁계약 공시 건수와 계약금액 추이를 보여준다. 신규 신탁계약 공시와 신탁계약이 1번 이상 연장된 경우 마지막 연장계약 공시가 반영된 자료이다.

2015년부터 2022년 상반기까지 자기주식 신탁계약은 총 1,623건이며 금액으로는 14조 9천억원이다. 유가증권시장의 신탁계약은 총 508건, 평균 211억원 규모이며, 코스닥시장의 신탁계약은 총 1,115건, 평균 92억원이다. 신탁계약도 직접취득과 마찬가지로 2020년 1분기에 급격히 증가하는 모습이 나타나며, 2020년 1분기부터 유가증권시장의 신탁계약금액이 뚜렷하게 증가한 것이 특징이다.

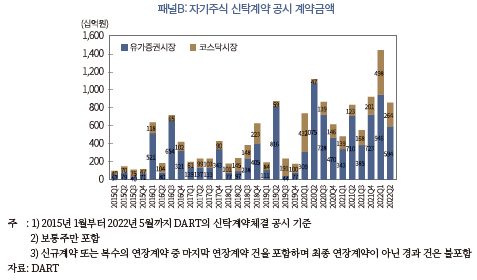

2. 자기주식 취득 및 처분 목적

자기주식 취득 및 처분에 대한 공시자료에 따르면, 기업이 자기주식을 취득하는 가장 큰 목적은 주가안정과 주주이익 제고이다. 자기주식을 취득하는 행위를 통해 기업이 주가에 관심을 가지고 안정적으로 유지하려는 노력을 기울이고 있다는 신호를 투자자에게 전달할 목적으로 보인다.

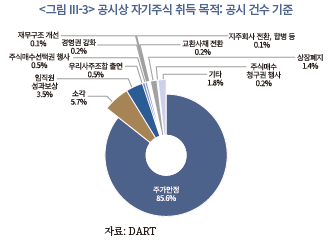

2015년에서 2022년 상반기까지 이루어진 자기주식 직접취득 공시에서 취득목적으로 주가안정을 제시한 경우가 85.6%로 가장 많았다. 이어서 이익소각이 5.7%, 임직원 성과보상, 우리사주 조합 출연, 주식매수선택권 등 임직원 지급목적이 4.5%로 나타난다. 경영권 강화, 재무구조 개선, 지주회사 전환 등 기업구조조정 목적은 1% 미만을 차지한다.

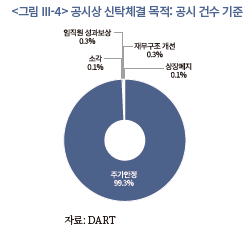

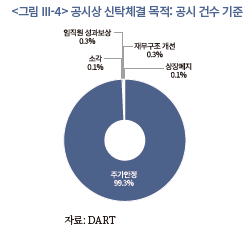

자기주식 간접취득의 목적은 직접취득과 크게 다르지 않은 것으로 나타난다. 전체 신탁계약 체결 공시의 99.4%가 주가안정 및 소각을 목적으로 제시하고 있으며, 임직원 성과보상, 재무구조개선, 상장폐지 등이 1% 미만으로 확인된다.

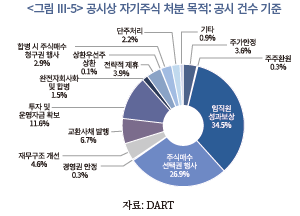

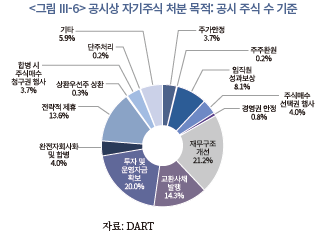

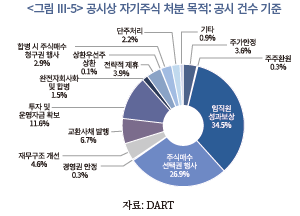

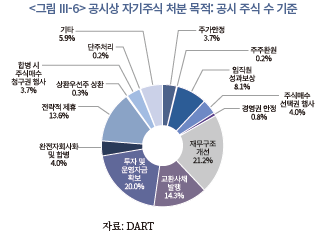

그런데 자기주식 처분목적은 취득목적과 상당한 차이를 보인다. 공시 건수 기준으로, 임직원 성과보상과 주식매수선택권 행사가 각각 34.5%, 26.9%로 비중이 가장 크다. 이어서 투자 및 운용자금 확보가 11.6%, 교환사채 발행이 6.7%, 재무구조 개선이 4.6%를 차지한다. 공시 주식 수 기준으로는, 재무구조 개선이 21.2%로 가장 많고, 투자 및 운영자금 확보 20%, 교환사채 발행 14.3%의 순이다. 기업의 합병, 분할, 주식교환 등 기업의 구조조정 과정에서 자기주식을 합병대가 또는 교환대상으로 활용할 수 있는데, 이러한 목적으로 처분이 이루어진 경우가 17.6%이다.

3. 자기주식 취득 및 처분 방법

자기주식 취득의 경우 취득방법을 법률에서 명시하고 있다. 상법 제341조제1항은 거래소에서 직접취득하거나 모든 주주에게 균등한 방법으로 공개매수하는 방식으로 자기주식을 취득할 수 있다고 규정한다.7)

반면 자기주식 처분은 처분방법에 대한 별도의 규정이 존재하지 않는다. 따라서 자기주식 처분은 장내뿐만 아니라 장외에서도 가능하며 특정인에게 지급 또는 매도하는 방식이 가능하다. 장내처분의 경우 처분수량과 가격을 제한하고 있으나(발행공시규정 제5-9조, 업무규정 제39조) 장외처분에 대해서는 별도의 규정이 없어 적정가격에 거래가 이루어졌는지 판단하기 어렵다. 만일 처분가격과 처분시기가 불합리할 경우 불공정거래행위 규제에 따라 처벌받으며 민형사상 책임이 발생한다.8)

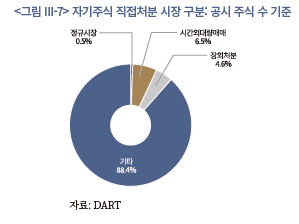

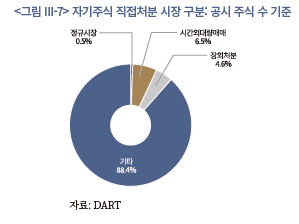

자기주식 직접처분 공시에 따르면 처분경로는 정규시장, 시간외대량매매, 장외처분, 기타 등 네 가지로 구분된다. 여기서 기타는 임직원 상여지급, 우리사주조합 양도, 주식매수선택권 행사 등의 목적으로 기업이 개인이나 조합의 증권계좌로 직접 이체하는 경우와 합병의 대가로 자기주식을 지급하는 경우 등이 포함된다.

공시 주식 수 기준으로, 전체 자기주식 처분 중 88.4%가 기타의 방법으로 거래되었다. 재무구조 개선, 투자재원 확보 등을 위한 시간외 대량매매가 6.5%, 기업간 전략적 제휴 등을 위한 장외처분이 4.6%를 차지한다. 정규시장에서 처분되는 물량은 0.5%에 불과한 것으로 나타난다.

4. 자기주식의 실취득률

앞서 살펴본 바와 같이 자기주식의 직접취득과 간접취득은 취득의 강제성에서 차이가 있다. 직접취득이나 직접처분의 경우 3개월 이내에 완료해야 하며 이행하지 못할 경우 제재가 따른다. 반면 신탁계약을 통한 간접적인 취득과 처분은 이행에 대한 별도의 규정이 존재하지 않는다.

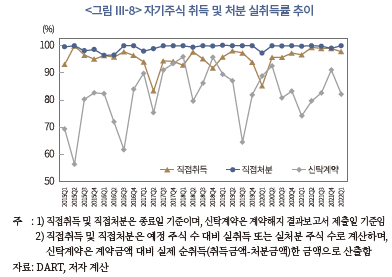

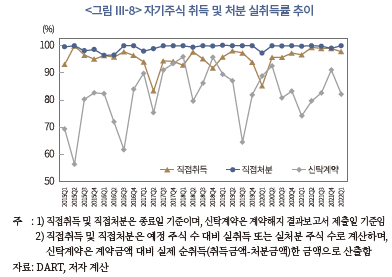

<그림 III-8>은 2015년부터 2022년 1분기까지 자기주식 직접취득과 간접취득의 실취득률, 직접처분의 실처분률의 분기별 평균값을 보여준다. 실취득률(실처분률)은 공시에서 취득(처분)하기로 공시한 주식 수 대비 결과보고서상에 나타난 실제 취득(처분) 주식 수의 비율로 계산한다. 신탁계약의 경우 주식 수가 아닌 계약금액이 명시되므로 계약금액 대비 실제 취득금액으로 산출하였으며, 계약체결 시점이 아닌 결과보고서가 제출되는 계약 해지 또는 종료 시점을 기준으로 한다.

직접취득의 경우 대부분 기간에서 90% 이상의 높은 실취득률을 보인다. 다만 2017년 2분기와 2020년 1분기의 실취득률은 각각 83.4%, 85.2%로 예년에 비해 낮은 수치가 관찰된다. 자기주식 취득은 시장에 미치는 충격을 완화하기 위하여 공시 후 3개월간 분할하여 취득하는데, 주가가 급격하게 상승하여 취득을 중단하거나 유동성 부족으로 체결에 실패할 가능성이 있다. 2020년 1분기의 경우 코로나19 충격 직후 주식시장이 급격히 반등했기 때문으로 실취득률이 저조한 것으로 추정된다.

직접처분의 실처분률은 분기 평균 99.4%로 매우 높게 나타난다. 처분목적이나 처분시장 분석에서 알 수 있듯이 처분대상이 지정되어 있는 경우가 대부분이며, 장내거래나 시간외대량매매 등 시장상황과 주가변화에 영향을 덜 받는 직접 자기주식을 지급하는 방식이 큰 비중을 차지하기 때문으로 보인다.

간접취득의 실취득률은 분기별 평균 81.94%로 직접취득이나 직접처분에 비해 낮다. 신탁계약을 통한 간접취득은 취득이 가능한 기간이 길기 때문에 시장상황 변화에 따라 취득시점을 유연하게 선택할 수 있는 이점이 있다. 그럼에도 불구하고 실취득률이 낮은 것은 이행에 대한 강제성이 없기 때문으로 추정된다.

Ⅳ. 자기주식 취득 및 처분의 허위 정보신호효과

1. 상장기업의 자기주식 취득 및 처분 목적 이론연구

자기주식 취득 동기에 관한 기존의 연구 중 기업 기초여건(fundamental factor)과 관련된 대표적 이론으로 저평가가설(undervaluation hypothesis)이 있다. 저평가가설에 따르면 자기주식 취득은 기업의 주식이 본질가치에 비해 저평가되었을 때 이루어진다.

경영자는 기업의 실질가치에 대해 외부 투자자에 비해 많은 정보를 가지고 있다. 내부자의 관점에서 주가가 기업의 본질가치보다 낮게 형성되어 있다고 판단할 경우, 이 사실을 외부 투자자에게 알리고자 할 것이고 그 수단으로 자사주 취득이 활용된다. 이러한 관점에서 자기주식 취득은 기업의 진정한 가치를 시장에 알리는 신호로서 작용하며 정보신호가설(signaling hypothesis)이라 불린다. Lakonishok & Vermaelan(1990), Dann(1981), Vermaelen(1984) 등은 기업이 자기주식을 취득할 경우 주가가 상승한다는 근거를 보였다.

이와 상반되는 이론으로 자사주 취득 공시가 허위일 가능성에 대해 주장한 경영자 기회주의(managerial opportunism) 가설이 있다. 경영자 기회주의 가설은 자사주 취득이 기업가치 제고가 아닌 사적 목적으로 활용될 수 있다는 점에 주목한다. 주가가 실제로는 저평가되어 있지 않거나 주식을 매입할 실질적 능력 또는 의사가 없음에도 자사주 취득 결정을 내릴 가능성이 있다. 즉, 내부자는 사적이익을 극대화하기 위하여 자사주 매입을 거짓으로 공시하고 주가상승을 유발할 유인이 있다(Fried, 2001).

기업은 자기주식 취득이나 처분 결정에 대한 사항을 공시할 때 그 목적을 공개해야 한다. 그런데 대부분의 경우 주가안정이나 주주환원, 재무구조 개선 등 주주나 기업에 긍정적인 효과를 기대하며 자기주식을 취득하거나 처분한다고 공시한다. 공시 사실만으로 기업이 보내는 신호의 진위여부를 판별하는 것은 불가능하다.

따라서 투자자의 입장에서 기업가치에 비해 주가가 저평가되어 있다는 신호의 진위여부를 판별하는 것은 쉽지 않은 일이다. 투자자들은 내부자와 외부주주 사이의 정보 비대칭으로 인해 내부 경영인과 비교하여 정보열위에 있다. 또한, 자기주식 취득이나 처분과 관련된 의결권은 이사회가 가지고 있으므로 일반 주주는 의사결정에 영향을 미치기 어렵다. 그 결과 외부에서는 자기주식 공시가 진실한 신호를 전달하는 것인지 판단 내리기 어렵다. 공시의 진실성을 판별하기 위해서는 기업가치에 대한 추가적인 정보를 줄 수 있는 보완적 수단이 필요하다.

기업 내부자의 회사 주식 매수 또는 매도는 주가의 저평가 여부에 대한 추가적 정보를 제공할 수 있다. 최대주주, 특수관계인, 임원 등 기업의 내부자는 외부 투자자에 비해 자기 회사에 대해 더 우월한 정보를 보유하고 있다. 따라서 기업의 실질가치에 대해 일반투자자에 비해 판단하기 유리한 위치에 있다. 또한 최대주주 등의 내부자는 자기주식 취득이나 처분 공시 결정과정에 직간접적으로 영향을 미칠 수 있다. 만일 내부자가 공시 이전에 해당 기업의 주식을 개인적으로 매수하였다면 기업이 저평가되었다는 강한 신호라고 해석 가능하다. 반대로 자기 지분을 매도하였다면 저평가 신호는 신뢰하기 어렵다.

Babenko et al.(2012)은 공개시장에서 기업이 자기주식을 취득한 경우 저평가 신호가 강화되는 효과가 있어 내부자 거래를 통해 주가 수익률을 예측할 수 있다고 주장하였다. Bonaime & Ryngaert(2013)는 자기주식 취득 직전 분기의 내부자 거래를 포트폴리오로 구성하여 수익을 창출할 수 있으며 내부자 매수거래가 저평가에 대한 신호역할을 할 수 있음을 보였다. 최근 발표된 Cziraki et al.(2021)에서는 이전 연구와 마찬가지로 자기주식 취득 전 내부자 순매수가 기업의 저평가를 완화하며 기업 경영성과 개선과 자본비용 절감을 예측하는 것으로 나타났다.

국내 시장을 대상으로 한 연구로는 임병권‧박순홍‧윤평식(2015), 김태규(2016), 김인중‧김태규(2019), 박정지‧신정순(2022) 등이 있다. 임병권‧박순홍‧윤평식(2015), 김태규(2016)는 자기주식 취득 전 내부자 거래가 저평가에 대한 추가적 신호를 전달한다고 보고하였다. 또한 박정지‧신정순(2022)은 저평가를 해소하기 위한 목적으로 기업이 자기주식을 취득한 경우라도 내부자가 해당 주식을 강하게 매도하면 장기 수익률은 유의하지 않아 시장정보가 허위신호일 가능성을 보였다. 김인중‧김태규(2019)는 자기주식 처분과 내부자 거래의 관계를 분석한 결과 내부자가 매도했을 때 주가는 변하지 않으나 매수했을 때 주가가 상승하는 것을 발견했다.

자기주식 취득 신호의 진실성을 판단하기 위해 자기주식 취득제도 상의 차이를 이용하는 방법도 있다. 국내시장에서 자기주식을 취득하는 방법에는 취득예정 주식 수를 공시한 뒤 거래소 또는 장외시장에서 기업이 직접 매수하는 직접취득 방법과 신탁계약 금융기관이 계약기간 내에 기업을 대신하여 자사주를 취득하는 간접취득 방법이 있다. 기업이 시장에서 직접 취득하는 경우 공시 다음 날부터 3개월 이내에 공시한 목표 물량을 전량 매수해야 한다. 그러나 간접취득의 경우 직접취득에 비해 유연한 의사결정이 가능하다. 신탁취득은 계약 연장이 가능하여 사실상 취득기한에 제한이 없고 공시한 신탁금액을 전액 취득하지 않아도 되며 실제 자사주를 취득하였다 하더라도 계약기간 내에 매도하는 것 또한 허용된다. 이러한 제도적 특성 차이로 인해 일반적으로 직접취득에 비하여 간접취득의 실제 취득비율이 낮은 수준에서 형성되며(김영환‧정성찬, 2008) 공시의 신뢰도를 악화시킨다. 정성창(2004)은 간접취득이 직접취득에 비해 제도적으로 유연하다는 점에 근거하여 분석한 결과 간접취득이 유상증자를 전후하여 주가관리 수단으로 악용될 가능성이 존재했다. 또한 고윤성‧이정한(2014)은 직접취득에 비해 간접취득이 이익조정 가능성이 더 높다고 주장했다.

본 보고서는 기업의 자기주식 공시가 시장에 보내는 신호의 진위여부를 판단하기 위하여 다각적 관점에서 보조적 판단 수단을 이용하였다. 기업 내부자인 최대주주 및 특수관계인의 공시 전 거래행태를 살펴보고 이들의 매수나 매도에 따라 기업의 장기성과가 다르게 나타나는지를 분석하였다. 선행연구와 달리 자기주식 직접취득, 처분, 간접취득 공시를 모두 포함하여 동일한 기준을 이용하여 분석하였으며 기업이 공시한 목적에 따라 효과가 다르게 나타나는지를 살펴보았다.

2. 연구가설 및 방법

기업 내부자는 이사회를 통해 자기주식 취득이나 처분 등 기업활동 결정에 영향을 미치는 의사결정권자인 동시에 내부자로서 기업의 실질가치를 판단할 수 있는 더 많은 정보를 가지고 있다. 따라서 기업이 자기주식 취득목적을 주가안정을 통한 주주환원이라고 발표한 경우 해당 결정이 실제 저평가를 개선하기 위한 것인지, 일시적인 주가 부양을 위한 목적인지 내부자는 판단할 수 있다. 이를 바탕으로 다음과 같은 가설을 설정하였다.

가설1: 기업의 자기주식 취득 공시가 허위일 경우 내부자는 보유지분을 감소시킬 것이다.

기업이 저평가되었다는 것이 허위정보라 하더라도 외부 투자자는 해당 사실을 인지하지 못하기 때문에 자기주식 취득 공시와 함께 주가는 일시적으로 상승할 수 있다. 그러나 장기적으로는 주가는 기업의 본질가치로 수렴해갈 것이다.

가설2: 기업의 자기주식 취득 공시가 허위일 경우 기업의 장기성과는 개선되지 않을 것이다.

기업가치가 본질가치에 비해 저평가된 상황이고 시장에서는 이에 대해 인지하지 못하여 주가가 낮게 형성되어 있다면 기업은 시장에 저평가에 대한 강력한 신호를 보내고자 할 것이다. 따라서 기업가치와 공시규모 간에 다음과 같은 가설을 설정할 수 있다.

가설3: 기업가치 저평가가 사실이라면 기업은 시장에 저평가에 대한 강력한 신호를 보내기 위해 취득 규모를 증가시킬 것이다.

자기주식 직접취득과 간접취득은 제도 차이로 인해 주가반응이 상이하게 나타날 가능성이 있다. 간접취득의 경우 직접취득에 비해 유연한 규정이 적용되어 실취득기간이 길고, 실취득규모도 목표치보다 낮아 주가반응이 약할 것이다. 또한 기업가치가 사실상 저평가 되어 있지 않아 자기주식을 실제 취득할 의사가 없는 경우 취득 강제성이 낮은 간접취득을 선택할 유인이 크다.

가설4: 직접취득에 비해 간접취득의 장기성과가 저조하며 간접취득에서 허위신호가 나타날 가능성이 높다.

내부자가 공시 전후에 주식을 매수했다면 이 행위는 두 가지로 해석이 가능하다. 정보신호가설에서 주장하는 바와 같이 기업가치가 본질가치에 비해 저평가되어 있다고 판단하고 앞으로 주가가 상승할 것으로 예상하여 개인적으로 자사주를 매수한 경우이다. 기업 측면에서는 내부자의 판단을 시장에 알릴 목적으로 자기주식 취득을 공시하고 예상한 바와 같이 주가는 상승한다.

그러나 저평가에 대한 판단이 배제된 상황에서도 동일한 현상이 나타날 수 있다. 주가가 기업의 본질가치와 무관하게 하락하는 상황이거나 실제 기업가치 하락으로 주가가 떨어지는 경우 내부자는 현재 상황을 일시적으로 개선할 목적으로 자기주식 취득 공시를 이용할 가능성이 있다. 외부 투자자는 기업 공시의 진위여부를 사전적으로 판별하기 어려우므로 주가는 상승할 것이고 이러한 주가변화를 이용하여 내부자가 개인 보유지분을 늘려 자본이득을 취하는 기회주의적 행태를 보일 가능성이 있다.

이를 구분하기 위하여 내부자 지분의 장기추세를 살펴보았다. 만일 자기주식 취득 공시가 기업가치가 저평가된 상황을 알리기 위한 목적이라면 주가가 점진적으로 상승하여 장기적으로 본질가치로 수렴하게 될 것이다. 이 경우 내부자는 주가상승 후 개인 지분을 지속적으로 보유할 것이다. 하지만 자기주식 취득 공시가 저평가에 기반을 두지 않은 허위라면 주가는 다시 하락할 것이므로 내부자는 지분을 계속 유지할 이유가 없다.

가설5: 일시적인 주가부양을 위해 자기주식 취득 공시를 이용하였다면, 해당 기업 주식을 매수한 내부자는 공시 후 보유주식을 매도하여 수익을 실현할 것이고 보유주식을 매도한 내부자는 공시 후 해당 주식을 매수하지 않을 것이다.

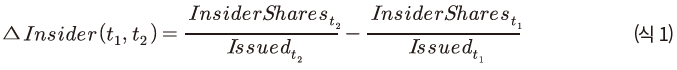

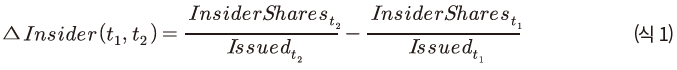

주요 관심변수인 내부자 거래를 측정하기 위한 변수로 내부자의 보유지분율을 이용하였다. 부터

부터  기간 동안 내부자 지분율 변동을 나타내는 변수인

기간 동안 내부자 지분율 변동을 나타내는 변수인  는 대표주주 및 특수관계인이 보유한 해당 기업 주식 수

는 대표주주 및 특수관계인이 보유한 해당 기업 주식 수 를 해당일의 보통주 유통주식 수

를 해당일의 보통주 유통주식 수 로 표준화한 값의 변화량으로 정의하였다.

로 표준화한 값의 변화량으로 정의하였다.  는 -1부터 1까지의 값을 가질 수 있다. 양(+)의 값을 가질 경우 내부자는 순매수를 통해 보유지분율을 증가시켰다는 것을 의미하며 반대로 음(-)의 값을 가질 경우 순매도했다는 것을 의미한다. 내부자 거래는 세 그룹으로 나누어 비교분석하였다. 내부자 거래가 양(+)의 값을 보이면 내부자 지분 증가, 0이면 내부자 지분 불변, 음(-)의 값을 보이면 내부자 지분 감소로 구분한다.

는 -1부터 1까지의 값을 가질 수 있다. 양(+)의 값을 가질 경우 내부자는 순매수를 통해 보유지분율을 증가시켰다는 것을 의미하며 반대로 음(-)의 값을 가질 경우 순매도했다는 것을 의미한다. 내부자 거래는 세 그룹으로 나누어 비교분석하였다. 내부자 거래가 양(+)의 값을 보이면 내부자 지분 증가, 0이면 내부자 지분 불변, 음(-)의 값을 보이면 내부자 지분 감소로 구분한다.

기업의 자기주식 취득이나 처분 규모를 측정하는 변수 는 취득 또는 공시 주식 규모를 유통주식 수로 표준화하여 산출한다. 즉, 자기주식 직접취득(직접처분)은 공시 상의 취득(처분) 주식 수를 공시 시점의 총 유통주식 수

는 취득 또는 공시 주식 규모를 유통주식 수로 표준화하여 산출한다. 즉, 자기주식 직접취득(직접처분)은 공시 상의 취득(처분) 주식 수를 공시 시점의 총 유통주식 수 로 나눈 값으로 정의한다. 간접취득의 경우 취득 예정 주식 수가 아닌 금액을 공시하도록 되어 있다. 따라서 간접취득은 금액을 기준으로 변수를 산출하며, 공시 상의 계약금액을 해당일자의 시가총액으로 나눈 값으로 정의한다.

로 나눈 값으로 정의한다. 간접취득의 경우 취득 예정 주식 수가 아닌 금액을 공시하도록 되어 있다. 따라서 간접취득은 금액을 기준으로 변수를 산출하며, 공시 상의 계약금액을 해당일자의 시가총액으로 나눈 값으로 정의한다.

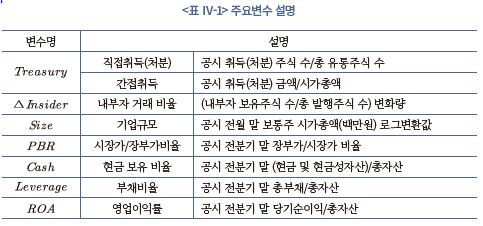

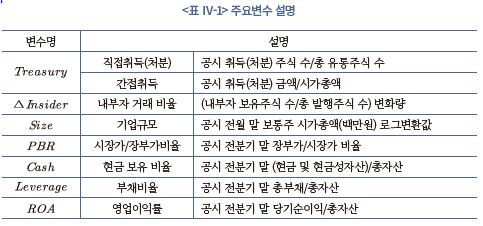

자기주식 취득 및 처분에 영향을 미치는 기업특성을 통제하기 위하여 시장가/장부가 비율(Price-to-Book Ratio: PBR), 기업규모(Size), 영업이익률(Return on Assets: ROA), 현금보유비율(Cash/Asses: Cash), 부채비율(Leverage) 등을 설명변수로 포함한다.

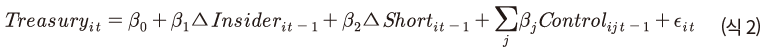

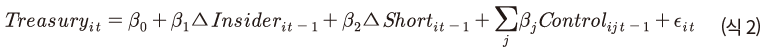

자사주 취득 및 처분 규모와 정보를 보유한 내부자 간의 관계를 분석하기 위해 다음과 같은 모형을 설정한다.

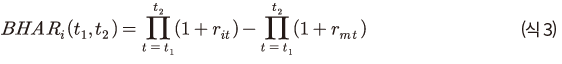

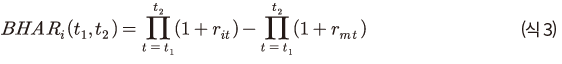

내부자 거래가 기업의 장기성과에 대한 예측력을 가지는지 확인하기 위하여 공시 후 6개월과 1년의 주가 성과를 측정하였다. 장기성과는 아래의 식과 같이 보유초과성과(Buy and Hold Abnormal Return: BHAR)를 기준으로 산출하였으며 해당 기간 동안 주식을 보유해서 얻게 되는 복리 수익률에서 시장수익률을 제외한 초과성과를 의미한다.  는

는  일의

일의 종목 일간수익률이며,

종목 일간수익률이며,  는

는  일의 주가지수 일간수익률이다. 시장수익률 통제변수로 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수를 이용하였다.

일의 주가지수 일간수익률이다. 시장수익률 통제변수로 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수를 이용하였다.

3. 분석자료

본 분석은 2015년 1월부터 2022년 5월까지 유가증권시장과 코스닥시장에 상장된 종목 중 자기주식을 직접취득 또는 직접처분하거나 신탁계약을 체결한 기업을 대상으로 하였다. 자기주식 취득 및 처분에 관한 자료는 DART의 관련 공시를 참고하였으며, 주가 및 재무자료, 내부자 지분 자료는 FnGuide를 이용하였다. 재무자료는 분기별 자료를 이용하였다. 해당 공시 중 다음의 조건을 충족하는 경우를 최종 분석대상으로 선정하였다. 분석에 최종적으로 포함된 자료는 직접취득 공시 564건, 직접처분 공시 1,122건, 신탁계약체결 공시 642건으로 총 2,328건이다.

(1) 보통주

(2) 비금융업

(3) 직접취득 또는 간접취득의 경우 공시 목적이 주가안정 또는 소각9)

(4) 직접처분의 경우 유통주식 수 대비 처분 공시 주식 수 비중이 0.01% 이상10)

(5) 간접취득의 경우 신규 신탁계약 체결11)

(6) 공시 직전 분기 재무자료 및 공시 후 1년간 주가자료 존재

(7) 공시 직전 1개월 이내에 다른 취득 또는 처분 공시가 있을 경우 제외12)

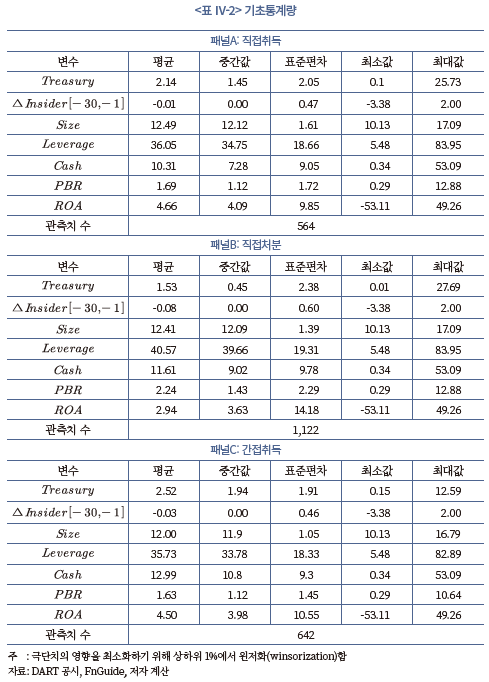

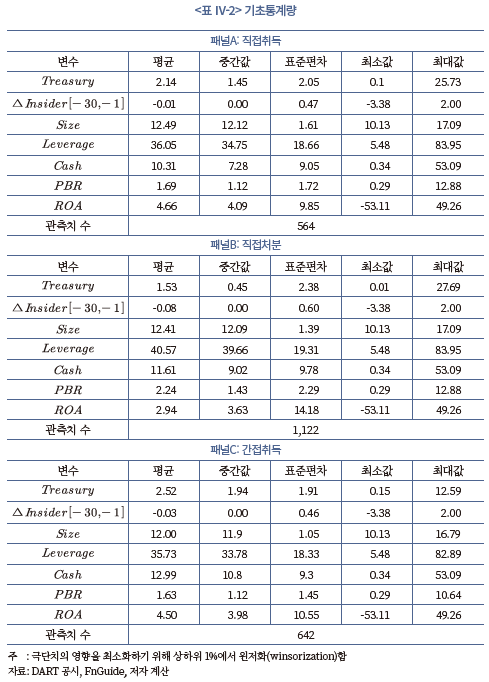

분석에 포함된 변수들의 기초통계량은 다음의 <표 Ⅳ-2>와 같다. 극단치로 인한 왜곡을 완화하기 위하여 변수별로 상하위 1% 값을 윈저화(winsorization)하여 분석하였다.

자사주 취득 및 처분 규모를 나타내는 는 직접취득의 경우 평균 2.14이며 간접취득은 이보다 큰 2.52로 나타났다. 간접취득은 일정 기한 내에 공시한 규모를 모두 취득할 필요가 없고 취득 기한이 길기 때문에 통상적으로 공시 규모가 크고, 직접취득은 공시한 주식 수를 단기간에 모두 취득해야 하므로 무리하게 큰 규모의 공시를 하지 않는 것으로 판단된다. 직접처분은 1.53으로 가장 작은 값을 가졌다. 직접처분 공시 중 가장 빈도가 높은 임직원 성과보상이나 주식매수선택권 행사의 경우 일반적으로 공시당 처분규모가 작으므로 직접처분 평균 공시 규모가 가장 작았다.

공시 전 내부자 거래는 직접취득, 직접처분, 간접취득의 모든 경우에 평균적으로 0%에 가까웠으나 최솟값과 최댓값이 각각 –3.38%, 2.00%로 상당한 격차를 보인다. 자기주식 취득 및 처분 공시 직전 1개월 동안 상당량의 지분을 매수하거나 매도한 지배주주가 존재함을 알 수 있다.

직접취득과 간접취득의 는 평균적으로 약 36% 전후의 값을 보인다. 동일 기간 전체 상장기업의 분기별 평균값인 약 45.49%와 비교하여 자사주를 직간접 취득한 기업의 부채가 적은 것으로 나타났다. 직접취득과 간접취득의 는 각각 10.31%, 12.99%으로 간접취득 기업의 현금보유도가 더 높았다. 간접취득은 직접취득에 비해 장기간 여유자금을 자기자본 취득을 위해 신탁계약 형태로 위탁해야 하므로 자금 사정에 여유가 있는 기업이 간접취득을 택한 것으로 판단된다. 는 직접취득과 간접취득 모두 4.5% 이상의 높은 수익을 달성한 기업이며, 직접처분 기업의 가 2.94%인 것과 비교해도 높은 수치이다. 한편 직접취득과 간접취득의 은 약 1.6~1.7인데, 이는 전체 상장기업 분기별 평균인 2.1에 비해 낮아 주가 저평가를 개선하기 위하여 자기주식 취득 공시를 할 가능성이 있는 것으로 해석된다.

4. 자기주식 취득 및 처분의 장기 주가반응

정보신호가설에 따르면 기업이 저평가 상태에 있을 때 이를 시장에 알리기 위한 목적으로 자기주식 취득 공시를 이용한다. 실제 기업이 적정가치에 비해 저평가되어 있는 상황이고 경영자가 의도한 대로 자기주식 취득을 통해 성공적으로 저평가 상태에서 벗어난다면, 장기적으로 주가가 상승해야 한다.

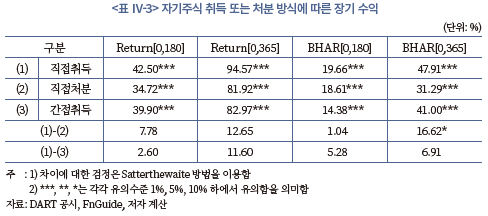

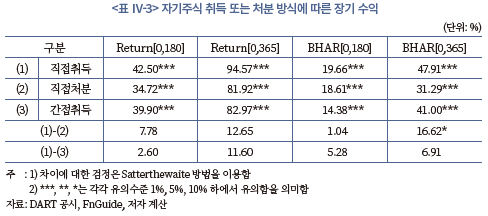

이를 확인하기 위하여 직간접 취득 또는 처분에 따라 공시 후 6개월과 1년이 경과한 시점의 주가수익률을 계산하면 <표 Ⅳ-3>과 같다. Return[0,180]과 Return[0,365]는 공시일(0일)로부터 각각 6개월과 1년 경과 시점의 수익률을 나타낸다. 또한 BHAR[0,180]은 180일이 경과한 시점까지 보유했을 때 시장수익률 대비 초과수익을 나타내며 BHAR[0,365]는 1년간 보유했을 때의 초과수익을 의미한다.

직접취득과 간접취득 공시 이후 주가는 크게 상승하였다. 6개월 경과 시점의 수익률(Return[0,180])은 직접취득이 42.50%로 가장 높았으며, 간접취득 또한 39.90%로 유의미한 상승을 보인다. 단, 그 차이는 통계적으로 유의하지 않았다. 공시 후 1년 동안의 수익률(Return[0,365])은 직접취득과 간접취득이 각각 94.57%과 82.97%로 상당히 높은 수치이다.

주가는 시장 흐름과 비교해서도 큰 차이를 보이며 상승하였다. 공시 후 6개월간 자기주식 직접취득 기업의 주식을 보유했을 때 지수 대비 초과수익률은 19.66%였으며 이는 통계적으로도 유의한 수치이다. 간접취득 또한 14.38%로 상당히 높은 수치를 보인다. 이후 6개월간 주가가 추가 상승하여 1년 초과수익은 직접취득과 간접취득 각각 47.91%, 41.00%였다. 그러나 직접취득과 간접취득간의 초과수익률 차이는 통계적으로 유의하지 않아 취득방법에 따른 주가 상승 정도에 차이가 있다고 보기 어려웠다.

자기주식을 취득했을 때뿐만 아니라 처분한 경우에도 주가는 상승하였다. 직접처분 공시 후 6개월간 주가는 34.72% 상승했고 1년 경과한 시점에서는 공시 전 대비 81.92% 더 높았다. 코스피지수와 코스닥지수를 이용하여 시장수익률을 통제한 이후에도 6개월과 1년 동안 각각 18.61%, 31.29%의 초과수익을 얻을 수 있었다. 자기주식 처분 목적은 자기주식 취득과 대칭적 구조로 분포되어 있지 않다. 즉, 공시 상에 나타나는 자기주식 취득 목적의 대부분이 저평가 신호효과를 통한 기업가치 제고이지만, 자기주식 처분은 기업가치 고평가 해소와 주가안정을 위해 이루어지는 것이 아니다. 처분은 성과보상, 운영자금확보, 기업 구조조정 등 다양한 목적이 있기 때문에 해당 이벤트를 시장에서 어떻게 해석하느냐에 따라 주가상승이 관측될 수 있다.

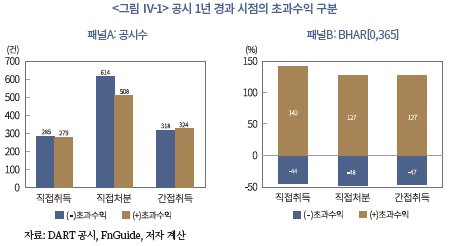

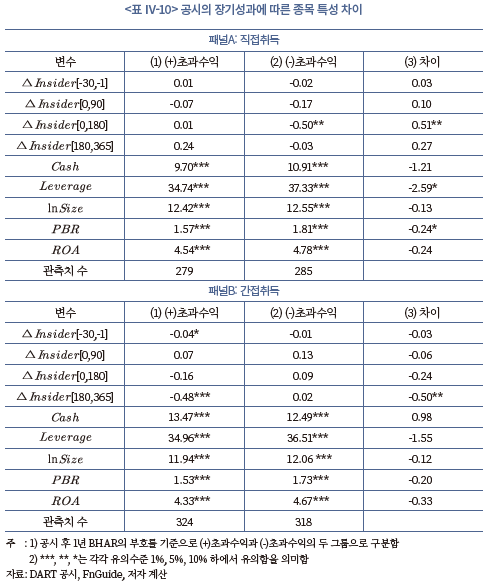

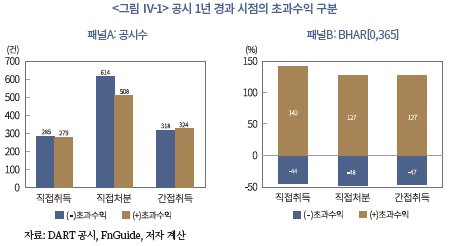

평균적으로 자기주식 취득과 처분은 주가에 긍정적인 영향을 미치지만, 항상 양(+)의 초과수익이 발생하는 것은 아니다. <그림 Ⅳ-1>은 공시 후 1년 시점에 초과수익이 양(+)인 경우와 음(-)인 경우로 구분한 것이다. 직접취득과 간접취득 모두 양(+)의 초과수익과 음(-)의 초과수익이 실현된 건이 거의 절반씩인 것으로 나타났다. 직접취득 564건 중 285건에서 1년 BHAR이 평균적으로 시장대비 43.92%p 낮은 것으로 나타났으며, 간접취득의 경우 총 642건 중 318건이 시장수익률 대비 47.13%p 낮았다. 양(+)의 초과수익과 음(-)의 초과수익의 건수는 비슷한 수준이나 양(+)의 초과수익 크기가 음(-)의 초과수익에 비해 2배 이상 크기 때문에 공시 전체의 수익은 양(+)으로 나타났다.

5. 내부자 거래와 자기주식 공시

앞서 살펴본 바와 같이 모든 공시가 양(+)의 수익을 가져오는 것은 아니며 공시 중 일부는 기업가치 상승 효과가 없는 거짓신호일 가능성이 있다. 그런데 기업 외부의 투자자가 공시 시점에 해당 공시가 실질가치에 기반을 두지 않은 허위 정보신호일 가능성을 판별해내는 것은 쉽지 않다.

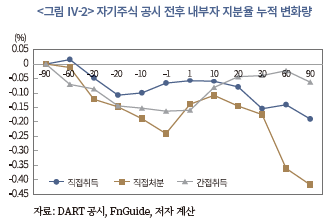

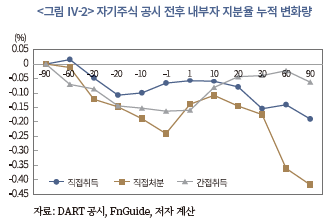

본 절에서는 자기주식 취득목적이 가지는 진실성을 판별할 수 있는지 살펴보기 위하여 일반투자자에 비해 정보우위에 있는 기업 내부자의 행태를 보완적으로 분석하고자 한다. 자기주식 직접취득과 직접처분은 법에 따라 공시 다음 날부터 3개월간 취득이나 처분을 완료해야 한다. 간접취득은 신규 계약체결의 경우 3개월이 경과한 시점에 상황보고서를 제출해야 한다. 취득이나 처분이 공시 후 3개월 이내에 집중적으로 일어날 것으로 판단되므로, 공시일(t=0) 전 3개월(t=-90)부터 공시 후 3개월(t=90)까지의 내부자 지분 변화를 누적하여 나타내면 <그림 Ⅳ-2>와 같다.

내부자는 직접취득, 직접처분, 간접취득의 모든 경우에서 평균적으로 공시 전에 자기 회사 주식을 매도한 것으로 나타났다. 즉, t=0 시점 이전에 내부자의 자기주식 비중은 하락하는 추세를 보였다. 자기주식 취득 공시가 저평가된 기업가치를 제고하기 위한 것이라면, 기업 내부자는 향후 기업가치가 상승할 것이라는 예상을 바탕으로 기업의 자사주 취득과는 별개로 개인적인 이익을 극대화하기 위하여 해당 주식을 매수하는 편이 논리적으로 더 타당하다. 그러나 예상과는 다르게 자기주식 취득과 처분 공시 이전에 평균적으로 내부자는 보유지분을 축소하는 것으로 나타났다.

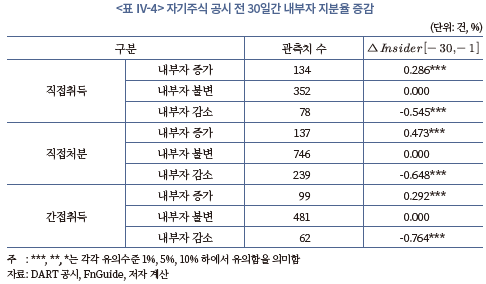

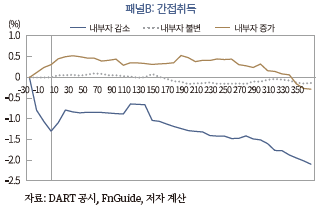

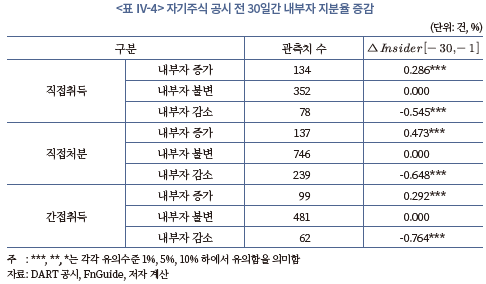

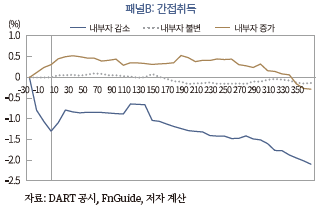

내부자 지분 변화를 보다 세분화하여 공시 전 30일부터 공시 전 1일까지의 지분율을 증가, 불변, 감소의 세 그룹으로 나누어보면, <표 Ⅳ-4>과 같다. 내부자 지분율이 전혀 변하지 않은 경우가 직접취득, 직접처분, 신탁취득 각각 352건(62.4%), 746건(66.5%), 481건(74.9%)으로 가장 큰 비중을 차지했다. 공시 전 내부자 지분율이 증가한 경우는 직접취득의 경우 134건이 존재했으며, 감소한 경우는 78건이었다. 신탁취득의 경우 99건에서 내부자 지분 증가가 관측되었고 내부자 지분이 감소한 경우는 62건이었다. 자기주식 취득 목적을 주가안정 및 주주환원으로 공시했음에도 불구하고 직접취득과 신탁취득 중 140건에서 내부자는 매도 행태를 보였다.

모든 경우에 내부자 지분 증가 또는 감소분은 통계적으로 유의하였으며, 내부자 지분 변화의 절대규모가 내부자가 증가했을 때에 비하여 감소했을 때 더 큰 것으로 나타났다. 직접취득의 경우 내부자 지분율이 증가한 경우 0.286%의 증가가 관측되었고, 감소한 경우에는 이보다 큰 0.545%가 감소하였다. 신탁취득에서는 그 차이가 더 컸다. 내부자 지분율 증가 시 0.292%가 증가했으며 감소폭은 0.764%였다.

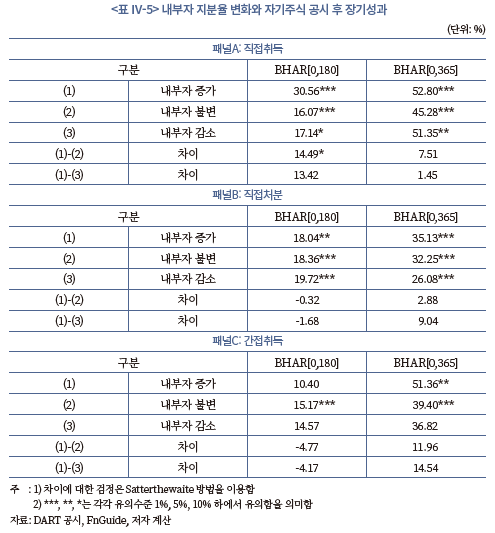

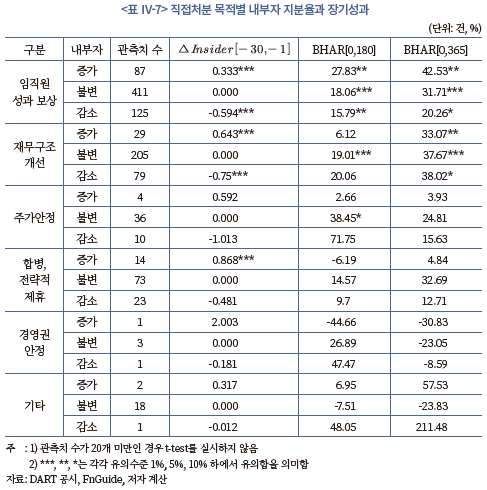

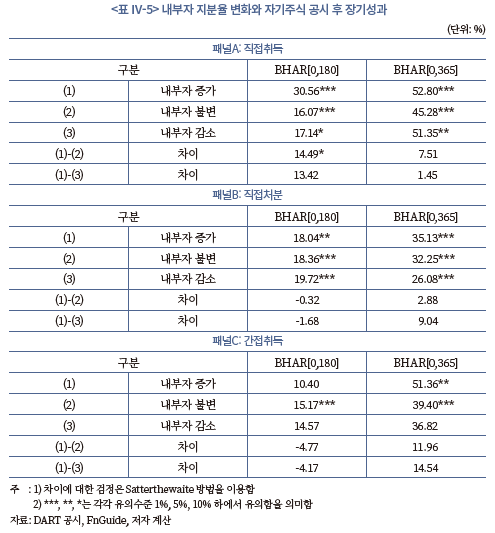

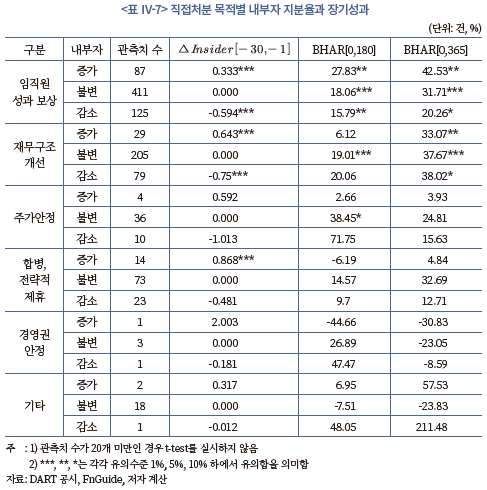

6. 장기성과 예측 가능성과 내부자 지분 장기추세

자기주식 공시 후 주가 변화가 내부자의 자기 회사 주식 매수 여부에 따라 달라지는지 알아보기 위하여 내부자 지분율 변화를 기준으로 장기성과를 산출하였다. <표 Ⅳ-5>는 공시 전 내부자 지분율을 증가, 불변, 감소의 세 그룹으로 구분하고 각각의 경우에 장기성과를 보여준다.

<표 Ⅳ-5> 패널C는 간접취득 공시의 경우에 대해 내부자 지분율 증감에 따른 6개월과 1년 주식 초과수익률을 나타낸다. 이 중 (3)의 결과인 내부자 지분율이 감소한 경우, 예상과 동일한 반응이 도출된 것을 알 수 있다. 6개월, 1년 초과수익이 14.57%, 36.82%로 나타났으나 두 수치 모두 통계적으로 유의하지 않았다. 기업이 주가안정과 주주가치 제고를 위하여 간접취득을 하겠다고 공시했으나 내부자는 기업의 행보와 달리 보유지분을 매도했을 경우, 장기적으로 주가는 유의한 변화를 보이지 않았다는 것을 의미한다. 이는 기업이 자사주 취득 공시를 허위로 이용했음을 의미하며, 내부자의 보유지분 매도가 공시의 허위 가능성을 나타내는 신호로 작용할 수 있다는 것을 시사한다.

간접취득에서 내부자 지분이 증가한 경우에는 <표 Ⅳ-5> 패널C의 (1)에서 알 수 있듯이 처음 6개월 성과는 유의하지 않았으나 1년이 경과한 시점에서는 주가가 시장에 비해 유의하게 상승하였다. 내부자 지분율 증가와 자기주식 취득 공시가 이중으로 주가 상승에 대한 신호를 보낸 경우 주가는 6개월까지는 크게 변화하지 않고 1년이 경과하고 나서 상승 반응이 도출되었다.

한편 직접취득의 경우 6개월 초과수익률은 30.56%이고 1년 초과수익률은 52.80%로 시장 평균수익률에 비해 주가가 크게 상승했다. 내부자 지분율 증가를 통해 자기주식 취득 공시가 현재의 저평가 상황과 향후 주가 상승을 나타내는 신호로 작동할 수 있음을 의미한다.

그러나 직접취득 공시에서 내부자 지분율이 감소한 경우에도 주가는 상승하였다. 패널A의 (3)에서 6개월 초과수익률은 17.14%였으며 1년 초과수익률은 51.35%로 내부자 지분율이 증가했을 때의 수익률과 큰 차이가 없었다. 내부자가 본인 소유의 지분을 매도했음에도 시장에서 주가가 상승하였다는 것은 내부자의 판단과 시장의 반응 간에 괴리가 있다는 것을 의미한다. 내부자가 판단한 기업가치가 맞다면 주가는 저평가가 아니라 고평가되었을 가능성이 높다. 그럼에도 불구하고 일시적 주가 부양을 위해 자기주식 취득을 공시한 경우 시장의 장기 반응은 하락하는 것이 타당하다. 그런데 실제로는 주가는 유의하게 상승하였다.

내부자가 보유지분을 축소하고 반대로 기업은 자사주를 취득하는 대립되는 상황에서 주가가 상승한 현상을 이해하기 위해 공시 이후의 내부자 지분 변화를 살펴보았다. 공시 이후 내부자 지분의 추세가 추가적인 정보를 제공할 수 있다고 판단한 근거는 다음과 같다.

만일 기업이 본질가치를 주가에 반영하기 위한 목적이 아니라 단기적 주가부양을 위해 자기주식 취득 공시를 이용하였다면, 주가가 일시적으로 상승하였다고 하더라도 향후 주가는 기업의 실질가치에 수렴하여 다시 하락할 가능성이 크다. 이 경우 사적이익 극대화를 추구하는 내부자는 본인이 보유한 지분을 유지할 이유가 없다. 즉, 일반투자자들이 취득 공시를 긍정적으로 해석하여 매수세가 강해지면 주가는 상승할 것이나, 공시가 거짓 신호라고 판단한 내부자는 일반투자자들과는 달리 현재 주가를 고평가 상태로 해석하여 본인 보유지분을 매각할 것이다.

내부자 지분의 추세를 살펴볼 때 고려해야 할 또 다른 점은 내부자의 불공정거래 관련 규제이다. 자본시장법은 내부자의 내부정보를 이용한 불공정거래를 방지하기 위하여 내부자의 단기매매차익을 반환하도록 규정하고 있다(자본시장법 제172조). 즉, 기업의 임직원이나 주요 주주가 증권을 매수하거나 매도한 후 6개월 이내에 반대매매를 하여 이익을 얻은 경우 그 이익을 포기해야 한다. 따라서 공시 6개월 이후의 내부자 지분 변화도 추가로 살펴볼 필요가 있다.

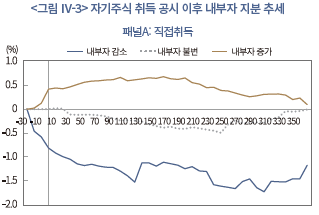

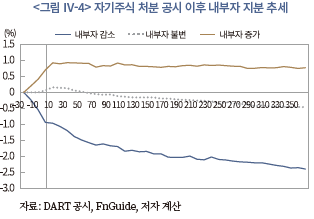

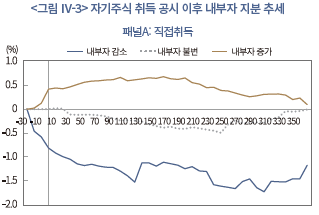

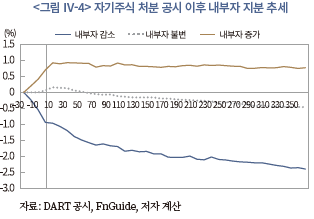

<그림 Ⅳ-3>은 자기주식 취득 및 처분 공시 1개월 이전부터 공시 후 1년이 지난 시점까지의 내부자 지분 변화 추세를 보여준다. 또한 <표 Ⅳ-6>은 주가 상승 반응이 가장 강하게 나타나는 공시 초기인 공시 전후 1일과 30일간의 내부자 지분과 함께 단기매매차익 규제를 회피할 수 있는 180일부터 365일까지의 지분 변화를 산출하고 통계적 유의성을 평가하였다.

내부자 지분이 증가한 경우 취득방법에 따른 결과를 비교해보면 공시 후 직접취득과 간접취득의 내부자 지분 변화에서 차이가 관측된다. <그림 Ⅳ-3>과 <표 Ⅳ-6>의 패널A를 살펴보면 직접취득 중 공시 이전에 내부자가 해당 회사 주식을 매수한 경우 공시 직후와 3개월이 경과한 시점까지도 지속해서 주식을 매수하고 있음을 알 수 있다. 이는 시장에서 공시로 인해 주가가 상승하고 있을 것임에도 불구하고 주가가 내부자가 판단하는 수준에는 미치지 못하고 있다는 것을 의미한다.

<표 Ⅳ-6> 패널A의 (7)행의 결과에 따르면 180일에서 365일 사이에 내부자 지분이 0.539% 하락했다. 공시 전 주식을 매수하여 지분을 증가시킨 내부자라 할지라도 공시 후 6개월이 경과한 시점부터 매도세로 전환된 것이다. 그러나 이는 통계적으로 유의미한 수치라고 보기 어렵다. 공시 전에 내부자가 자기 회사 주식을 매수한 종목에서 공시 6개월 후부터 지분을 매도한 종목이 존재할 것이나 수치가 통계적으로 유의하지 않은 것으로 보아 종목간 편차가 크다는 것을 알 수 있다.

한편 간접취득의 경우 공시 6개월 이후 내부자가 지분을 대량 매도하였다는 것이 여실히 드러난다. <그림 Ⅳ-3>과 <표 Ⅳ-6>의 패널B의 결과를 살펴보면 내부자는 공시 이전 0.292%의 지분을 매수했으나 공시 이후 6개월부터 1년 사이에 0.813%를 매도했다. 공시 1일 전부터 180일 사이에 매수한 지분을 감안하더라도 6개월 이후 매도량이 더 크다는 것을 알 수 있다.

즉, 내부자가 회사 주식을 매수하고 자기주식 신탁계약을 체결한 후 1년이 경과한 시점에서 주가가 크게 오르자 내부자는 보유지분을 매도하였다고 해석 가능하다. 내부자가 공시 후 주가가 상승하자 보유주식을 대량 매도한 것으로 보아 간접취득의 경우 내부자가 주식을 매수한 경우에도 공시의 진위성을 의심할 수밖에 없다.

공시 이전에 내부자가 보유지분을 매도한 경우에는 공시 이후에도 매도세가 지속된다. <그림 Ⅳ-3>의 패널A에서 직접취득의 경우 주가가 유의하게 상승하는 공시 후 2개월 이내에도 지속적으로 매도하였으며 그 이후에도 매도가 이어졌으나 통계적으로 유의한 규모는 아니었다. 즉, 내부자는 자기주식 취득 공시로 주가가 상승하는 중에도 주가가 하락할 것이라는 의견을 고수한 것으로 보인다. 그렇다면 이는 자시주식 주가 하락에 대한 확실한 신호로 볼 수 있다. 간접취득의 경우에도 마찬가지이다. 간접취득을 공시한 경우 중 내부자가 공시 이전에 지분을 매도하였다면 6개월 이후에 지속적으로 주가를 매도하는 양상을 보였다. 공시 후 6개월에서 1년 사이에 매도한 지분은 0.856%였으며 통계적으로도 유의하였다. 향후 주가가 하락할 것이라는 내부자의 판단이 변하지 않은 것이다.

요약하면, 기업이 자기주식을 직접취득할 것으로 발표하면 내부자의 투자행태와 무관하게 주가는 상승하였다. 그런데 공시 전부터 공시 후 1년간의 내부자 지분 변화를 바탕으로 판단해보았을 때 내부자가 보유주식을 매도한 경우 자기주식의 신호효과를 신뢰하기 어렵다. 기업이 자기주식 취득을 공시하여 저평가에 대한 신호를 전달하는 중에도 내부자는 지속해서 보유지분을 매도했기 때문이다.

자기주식 간접취득의 경우에는 시장의 과잉반응 또는 허위 신호의 가능성이 존재한다. 내부자 지분이 증가한 경우 주가는 상승하였고 감소한 경우 유의한 주가변화는 관측되지 않았다. 우선 내부자 지분이 감소한 경우 기업이 주주환원을 목적으로 자기주식을 취득한다고 발표했음에도 시장에서는 확실한 매수 반응을 보이지 않았다는 것을 의미한다. 다시 말해, 저평가 신호가 허위일 가능성이 있으며 시장에서도 공시를 완전히 신뢰하지 않았다. 내부자 지분이 증가한 경우에는 주가가 상승했으므로 표면적으로는 저평가가 개선된 것으로 해석할 수 있으나, 내부자는 주가가 급등한 6개월 이후 지분을 매도하였다. 이것으로 미루어 보아 공시의 진위를 신뢰하기 어렵거나 시장에서 공시에 과잉반응하여 주가가 과도하게 상승하였다고 해석 가능하다.

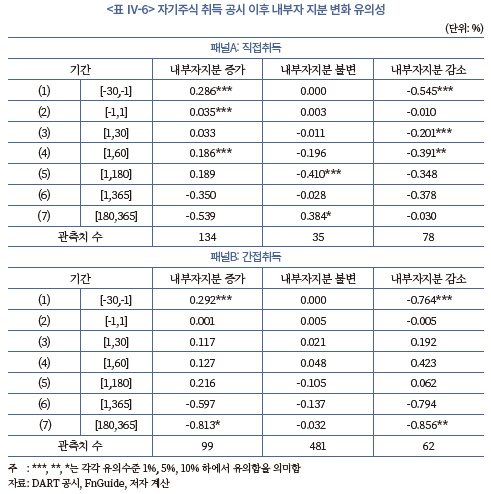

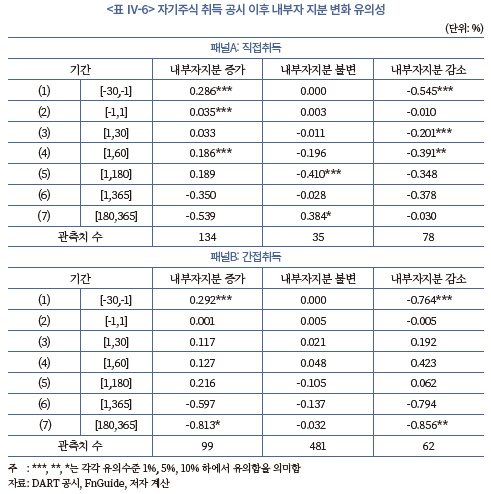

7. 직접처분 목적별 특성과 장기성과

정보신호가설에 따르면 기업은 저평가 상태라는 것을 시장에 알리는 방법으로 자기주식을 취득한다. 정보신호가설을 자기주식 처분에 그대로 적용한다면, 기업은 주가 고평가를 시장에 알리기 위해 자기주식 처분 공시를 이용한다는 논리가 가능하다. 취득의 경우 저평가 신호의 목적에 따라 공시 후 주가가 상승했으므로 처분의 경우에는 하락할 것으로 예상할 수 있다. 그러나 기업은 자발적으로 기업가치가 실질가치에 비해 과도하게 높다는 사실을 전달하여 적극적으로 주가 하락을 유도할 유인이 없다.

앞서 살펴보았다시피 실제 직접처분은 공시 이후 주가가 상승하는 양상을 보였다. 기업의 자기주식 처분 행위가 기업가치에 긍정적인 시그널로 작용하는 원인에 대한 분석이 필요하다.

Ⅲ장 2절의 처분 목적에서도 알 수 있듯이 주가안정을 위해 처분을 이용하는 경우는 극히 드물다. 자기주식 취득은 90%가 넘는 경우에 목적이 주가안정과 주주가치 제고였던 반면에, 기업은 다양한 목적으로 자기주식을 처분한다. 따라서 취득과 달리 목적에 따라 처분 공시를 구분하고 공시효과를 분석할 필요가 있다. <표 Ⅳ-7>은 처분 목적을 임직원 성과보상 등 6개의 항목으로 재분류하여 내부자 거래, 6개월 및 1년 주식성과를 살펴본 것이다.

취득한 자기주식을 임직원 성과보상을 위하여 활용한 경우 내부자 지분이 증가한 것에 비해 감소한 경우가 더 빈번하게 관측되었다. 내부자 지분이 증가한 경우는 87건이었고 감소한 경우는 125건이었다. 나머지 411건에서는 내부자는 지분이 변하지 않았다. 내부자가 기업가치 저평가 상태라고 판단하고 내부자 지분을 늘려가던 중에 기업이 임직원에 자기주식을 이용하여 성과를 지급한 경우 시장에서는 긍정적인 신호로 받아들여진다. 그 결과 1년 초과수익률이 42.53%였다. 그러나 내부자가 지분을 매도하는 시점에서 임직원에 대한 상여가 이루어지면 시장에서는 내부자 지분이 증가했을 때에 미치지 못하는 20.26%의 주가상승이 나타났다.

재무구조 개선을 위하여 보유한 자기주식을 활용하는 기업의 행위는 시장에서 긍정적인 효과를 거두었다. 1년이 경과한 시점에서 주가는 유의하게 상승하였다. 그러나 내부자 지분의 증감이 효과의 차이를 구별하는 신호 역할을 하지 못하는 것으로 보인다. 자기주식 처분 목적을 재무구조 개선으로 공시한 경우 내부자 거래와 무관하게 주가는 상승하였으며 초과수익률은 33~38%로 큰 차이를 보이지 않았다.

합병, 완전 자회사화, 전략적 제휴와 같이 기업의 구조조정 개선을 위해 자기주식을 이용한 경우에 시장은 이를 긍정적으로 받아들이지 않았다. 주가는 시장평균 대비 유의하게 상승하지 않았다. 그런데 이 경우 자기주식 처분 효과와 합병 및 전략적 제휴 등에 따른 구조조정 효과가 혼재되어 주가에 반영될 것이기 때문에 자기주식 처분만의 효과를 구분하기 어렵다.

자기주식 처분 목적을 주가안정으로 밝힌 경우 양(+)의 장기성과가 도출되어 시장은 긍정적으로 반응했다고 볼 수 있으나, 주가안정 목적의 처분은 드물어 통계적으로 안정적인 결과를 도출하기 어려웠다. 또한 지배주주의 경영권 안정을 위해 자기주식을 처분하는 경우 장기성과가 하락하는 것으로 보아 시장이 긍정적으로 받아들이지 않고 있다고 할 수 있으나 역시 관측치가 충분하지 않았다.

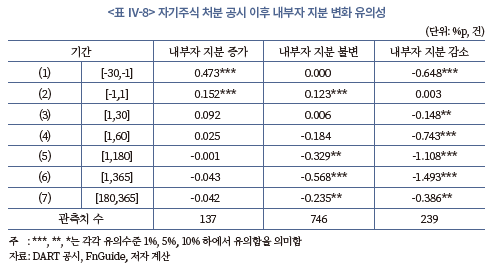

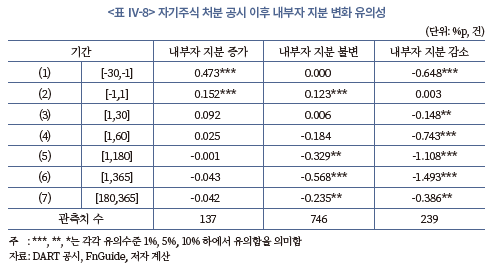

처분 공시 이후 1년간의 내부자 지분변화를 살펴보면 지분율 추세에 큰 반전이 관측되지 않는다. 공시 전에 내부자가 매수한 경우 공시 이후에 큰 지분 변화 없이 보유지분이 유지되었다. <그림 Ⅳ-4>에서 살펴보면 내부자 지분 증가 시 공시 이후에도 지분율이 유지되고 있는 것으로 보이며 <표 Ⅳ-7>에서 통계적으로 검증한 결과에서도 공시 후 지분변화가 유의하지 않았다. 내부자 지분이 감소한 경우에는 내부자가 지속해서 보유주식을 매도하여, 공시 후 1년간 내부자 지분이 1.493%p 추가로 하락한 것으로 나타났다. 즉, 공시 이후에 주가가 유의하게 상승했음에도 내부자는 이에 영향을 받지 않고 공시 전과 마찬가지로 보유지분을 지속해서 매도하였다.

8. 공시 규모와 공시의 허위성

가설3에서 기업가치가 저평가된 것이 사실이라면 기업이 시장에 강력한 신호를 보내기 위해 취득 규모를 크게 공시할 것이라 가정한 바 있다. 이를 실증적으로 검증하기 위해 자기주식 취득 및 처분 규모를 종속변수로 하여 다변량분석을 시행하였다. 구체적인 회귀식은 2절의 (식 2)와 같다. 공시의 진위 여부를 판별하기 위한 보조변수로 내부자 지분율 변화율 변수를 이용하였으며 기업특성을 통제하기 위한 변수로 기업규모, 시장가/장부가비율, 현금보유비율, 부채비율, 영업이익률을 포함하였다.

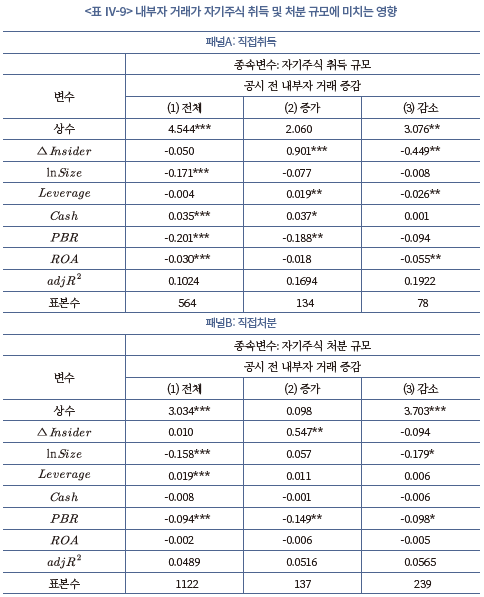

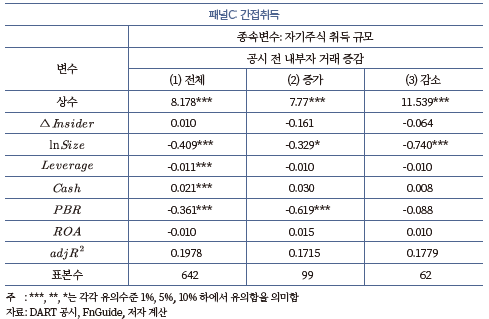

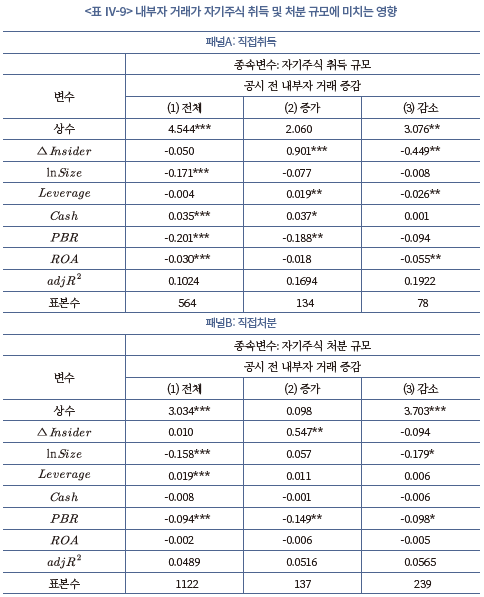

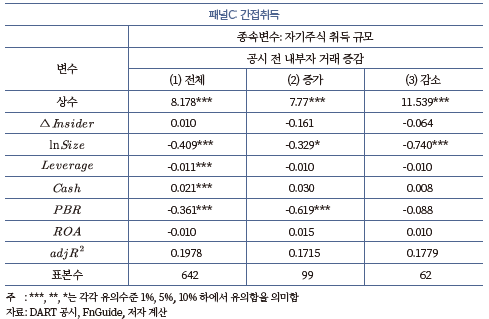

<표 Ⅳ-9>는 직접취득, 직접처분, 간접취득 각각의 경우에 대해 자기주식 공시 규모와 내부자 지분율 및 기업특성 변수간의 관계를 나타낸다. 각 패널의 (1)은 전체 자료를 통합하여 분석한 것이고 (2)와 (3)은 각각 공시 전에 내부자 지분율이 증가한 경우와 감소한 경우를 대상으로 분석한 것이다. 결과 비교를 통해 몇 가지 사실을 확인할 수 있다.

첫째, 각 패널의 (1)에서 알 수 있듯이 전체 자료를 대상으로 분석한 결과에서는 통계적으로 유의한 결과가 도출되지 않아 두 변수 사이의 연관관계를 찾아보기 어려웠다. 이는 내부자 지분율 변화가 공시 규모에 영향을 미치지 못했음을 의미한다.

둘째, 내부자 지분율 증감에 따라 자료를 구분하여 분석한 (2)와 (3)의 결과에서는 일부의 경우에 내부자 지분율이 유의한 설명력을 가졌다. 특히 패널A의 (2)의 결과를 살펴보면, 내부자 지분율 증가 정도가 클수록 취득 공시규모가 큰 것으로 나타났다. 즉, 내부자가 공시 전에 자기 회사 주식을 매수할 경우 실제로 기업가치가 저평가 되었을 가능성이 높으며, 기업 또한 자기주식 취득 규모를 크게 하여 확실한 주가회복을 유도한 것일 수 있다. 자기주식 처분의 경우에도 취득과 마찬가지로 공시 전 내부자 거래 증가가 공시 규모와 양(+)의 상관관계를 가졌다.

셋째, 패널C의 간접취득에서는 직접취득과 달리 내부자 지분율과 공시 규모 간의 관련성을 찾아보기 어려웠다. 내부자 지분율 증감에 따라 자료를 구분하여 분석한 결과에서도 마찬가지로 계수가 유의하지 않은 것으로 나타났다. 직접취득과 간접취득은 취득의 강제성에 차이가 있다. 직접취득은 공시 기한 3개월 이내에 공시에서 명시한 주식 수를 모두 취득해야 한다. 따라서 직접취득은 공시사항을 이행해야 할 강제성이 높다. 그러나 간접취득은 통상 계약기간이 6개월 또는 1년으로 직접취득에 비해 길 뿐만 아니라 공시에 언급한 금액만큼 모두 취득할 의무가 없다.13) 따라서 공시 규모가 모두 취득될 것이라는 기대가 낮으며 Ⅱ장 4절에서 살펴본 바와 같이 간접취득은 평균 실취득률이 80% 정도에 불과하다. 이러한 불확실성 때문에 직접취득이나 직접처분의 결과와 달리 간접취득에서는 설명력이 관측되지 않을 수 있다.

한편 패널A의 (3)에 따르면, 내부자 지분율 변화와 취득규모 간에는 음(-)의 상관관계를 가졌다. (3)은 내부자 거래가 감소한 경우만을 대상으로 분석한 것이므로 내부자 지분율 하락폭이 클수록 취득 규모는 더 큰 것으로 해석된다. 내부자 지분율 감소가 자기주식 취득 공시의 허위성을 나타내는 변수라면 내부자 지분이 많이 감소할수록 공시 규모 또한 작아지는 것이 타당하다. 그러나 본 분석에서는 반대의 결과가 도출되었다. 이에 대한 설명을 위해 추가적인 분석이 필요할 것이다.

직접처분에서는 공시 전 내부자 지분율이 증가한 경우 기업의 자기주식 처분 규모도 유의하게 커지는 것으로 관측된다. 패널B의 (2)의 결과에 따르면 내부자 지분율 변화 변수와 자기주식 공시 규모는 유의한 양(+)의 관계가 존재했다. 즉, 내부자가 매수한 주식이 많을수록 기업에서는 더 많은 주식을 처분한다는 것이다.

9. 공시의 장기성과와 종목 특성

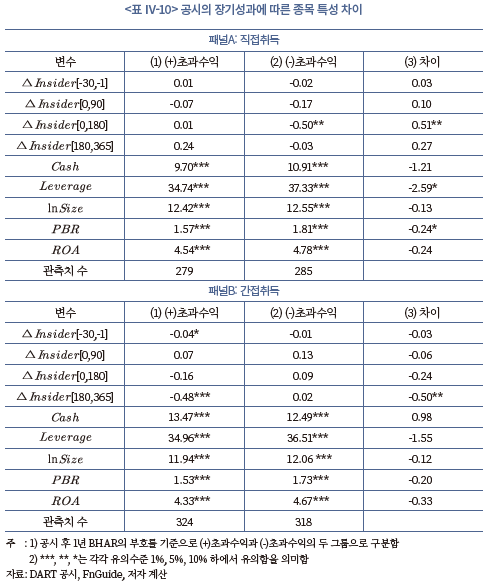

공시 1년 후 주가는 평균적으로 양(+)의 초과수익을 보이지만 모든 종목에서 주가가 상승하는 효과가 나타나는 것은 아니다. 4절에서 살펴본 바와 같이 전체 직접취득과 간접취득 공시 중 약 절반가량에서 음(-)의 초과수익이 발생하였다. 본 절에서는 공시 후 1년 뒤 실현된 초과수익을 기준으로 음(-)의 초과수익과 양(+)의 초과수익으로 나누어 두 그룹 간에 내부자 거래 및 재무적 특성에 차이가 있는지 살펴보았다.

공시 후 1년간 해당 종목을 보유했을 때의 초과성과에 따른 내부자 거래의 특성을 살펴보면, 공시전 30일, 공시 후 90일, 180일, 365일 등 대부분의 변수에서 내부자 거래의 지분율 변화가 통계적으로 유의하지 않은 것으로 나타났다. 이는 공시 전 내부자 지분율이 불변인 경우가 큰 비중을 차지하기 때문이다.

그럼에도 불구하고 일부에서 유의한 지분율 변화가 관측된다. 패널A의 (2)의 결과에 따르면, 직접취득 공시 후 음(-)의 초과수익이 발생한 경우, 180일까지의 내부자 지분( [0,180])이 유의하게 감소한 것을 알 수 있다. 즉, 직접취득 공시에도 불구하고 주가가 다른 종목 대비 하락하여 음(-)의 초과수익이 발생하였을 경우 내부자는 해당 종목을 매도하였다. 통계적으로 유의하지는 않으나 [-30,-1], [0,90], [180,365] 모두 음(-)의 값을 갖는 것으로 보아 내부자는 해당 주식을 최소한 매수하지 않은 것으로 보인다. 패널A의 (1)에서 시장대비 초과수익이 발생한 경우에는 내부 지분율이 유의하지는 않으나 전반적으로 양(+)의 값이 도출되었다.

패널B의 간접취득 결과에 따르면, 공시 후 3개월이 경과한 시점부터 내부자는 양(+)의 초과수익이 발생한 종목을 매도하고 음(-)의 초과수익이 발생한 종목을 매수했다. 만일 기업이 저평가되었다는 판단을 바탕으로 자기주식을 취득하고 내부자 또한 기업의 판단에 동의했다면 내부자는 주가가 상승할 것으로 기대하며 지분을 늘리거나 최소한 매도하지 않을 것이다. 그러나 실제로는 주가가 상승한 종목을 매도하고 하락한 종목을 매수해서 자본이득을 얻으려 했던 것으로 보인다. 간접취득의 경우 공시의 정보신호효과를 신뢰하기 어렵다는 해석이 가능하다.

재무적 특성을 살펴보면, 직접취득 공시의 양(+)의 장기효과가 나타난 종목과 음(-)의 장기효과가 발생한 종목간에 현금보유도, 기업규모, 영업이익률 차이는 존재하지 않았으며, 부채비율, 은 유의한 차이가 나타났다. 양(+)의 공시효과가 나타난 종목과 음(-)의 공시효과가 나타난 종목의 이 각각 1.57, 1.81로 공시 후 주가가 상승한 종목의 이 낮았다. 또한 부채비율의 경우 양(+)의 초과수익이 실현된 종목이 음(-)의 초과수익이 발생한 종목에 비해 낮았다. 즉, 재무건전성이 높고 장부가 대비 저평가된 종목에서 공시 후 양(+)의 성과가 관측되었다.

간접취득의 경우 을 비롯하여 현금보유도, 기업규모, 영업이익률, 부채비율 등의 재무변수에서 양(+)의 초과수익이 발생한 종목과 음(-)의 초과수익이 발생한 종목간에 유의한 차이를 찾아볼 수 없었다. 따라서 재무적 특성을 기반으로 공시효과가 발생한 것이 아니라는 것을 알 수 있으며, 주가가 시장 대비 상승한 경우에도 내부자는 지분을 매도한 것으로 보아 공시를 신뢰하기 어렵다고 판단된다.

10. 소결

본 보고서는 자기주식 취득 또는 처분 공시의 목적을 구분하고 기업의 본질가치에 대한 허위정보를 포함하고 있는지 내부자 지분 증감을 이용하여 분석하였다. 2015년 1월부터 2022년 5월까지 자기주식 취득 및 처분 자료를 토대로 분석한 결과를 요약하면 다음과 같다.

첫째, 공시상 자기주식 취득과 처분 목적은 서로 비대칭적인 분포를 보여준다. 자기주식 직접취득 목적 중 가장 큰 비중을 차지하는 것은 주가안정 및 주주가치 제고로 공시 수 기준으로 전체의 85.6%를 차지한다. 간접취득 또한 직접취득과 마찬가지로 신탁계약 체결 공시의 99.4%가 주가안정 및 소각을 목적으로 제시하였다. 그러나 자기주식 처분의 경우 주가안정 및 주주환원은 4%가 채 되지 않으며 임직원 성과보상, 주식매수선택권 행사, 투자 및 운영자금 확보 등의 다양한 사유가 존재한다. 즉, 국내 법규상 자기주식은 자산으로 해석되기 때문에 취득한 자사주가 기업의 목적에 따라 다양한 용도로 사용된다.

둘째, 자기주식 취득과 처분 공시 이후 주가는 평균적으로 상승하였다. 직접취득과 간접취득은 각각 시장수익률 대비 47.91%, 41.00%의 초과성과가 달성되었으며, 직접처분의 경우 또한 주가는 지수 대비 31.29%p 상승하였다. 그러나 모든 공시에서 양(+)의 초과수익이 발생한 것은 아니며 전체 2,328개 공시 중 1,217개 공시는 시장수익률에 미치지 못했다.

셋째, 자기주식 취득 공시의 허위성을 판단하기 위해 공시 전후 내부자 지분율 변화의 증감을 살펴보았다. 그 결과, 직접취득 공시 이전에 내부자 지분율이 증가한 경우, 공시 이후 유의한 초과성과가 나타나며 취득기간이 종료된 이후에도 내부자의 보유주식 매도가 관찰되지 않는다. 기업이 기업가치가 저평가되었다고 판단했으며, 내부자 또한 해당 종목을 매수함으로써 기업의 신호가 허위가 아님을 보인 결과, 주가상승의 결과가 도출된 것이라 해석된다.

간접취득 공시 이전에 내부자 지분이 증가한 경우에는 유의한 초과성과가 나타나지만, 직접취득의 경우와 달리 내부자가 일정 시점 이후 보유주식을 매도하는 방향으로 전환한 것이 관측된다. 특히 단기매매차익 반환 규제를 받지 않는 6개월 이후 집중적으로 매도하였는데 공시 전에 매수한 분량을 상쇄하는 수준이었다. 이는 애초에 기업가치 저평가에 대한 공시 신호가 허위일 가능성을 시사한다. 하지만 시장에서 공시에 대한 반응이 과도하게 일어나 실질가치를 초과하는 수준의 주가상승이 발생하여 내부자가 보유 지분을 매도한 것일 수도 있으므로 해당 공시의 신뢰성에 대한 판단을 내리기 어렵다.

그런데 공시 전에 내부자 지분율이 감소한 경우에는 공시를 신뢰하기 어렵다는 근거가 발견된다. 우선 간접취득의 경우 내부자가 보유 주식을 매도한 경우 주가가 지수 대비 유의하게 상승했다는 근거를 찾아볼 수 없었다. 또한 직접취득의 경우 주가는 상승했지만 기업이 자사주를 취득하는 중에도 내부자는 기업과 반대로 해당 종목을 매도한 것으로 나타났다.

넷째, 기업이 자기주식을 처분한 경우 주가가 상승한 원인을 공시목적별로 구분하여 살펴본 결과, 임직원 성과보상, 재무구조 개선 등 빈번하게 관측되는 처분 공시 목적에서 주가가 긍정으로 반응한다는 것을 알 수 있었다. 이 또한 내부자 지분 변화에 따라 주가반응에 차이가 발생하는지 살펴보기 위하여 내부자 지분 증감을 기준으로 구분하여 분석하였다. 그 결과 내부자가 주식을 매수하는 상황에서 임직원에게 성과보상을 한 경우에 내부자가 매도한 때에 비해 주가상승이 더 큰 것으로 나타났다. 즉, 내부자가 주가가 향후 상승할 것으로 기대하고 보유지분을 증가시키는 중에 기업이 임직원에게 성과보상을 하면 시장은 이를 긍정적으로 해석하고 주가는 상승하는 결과가 도출되었다. 기업이 임직원 성과보상을 발표할 때, 기업 외부에서는 기업의 성장을 위한 동기부여인지, 기업 상황에 비해 과도한 보상인지 구분하기 어렵다. 이때 기업의 내부자 지분 변화를 통해 기업 내부자가 어떤 판단을 내리는지를 관측하면 판단에 도움이 될 수 있다. 재무구조 개선 등 다른 목적에 따른 처분의 경우에는 내부자 지분 변화에 따라 큰 차이가 관측되지 않거나 관측치 부족으로 통계적 유의성에 대한 검증이 불가능했다.

Ⅴ. 결론 및 시사점

이상의 분석 결과에 따르면 자기주식 취득 또는 처분 공시만으로 주가가 저평가되었는지 여부를 판단하기 어렵다. 기업은 자기주식 취득 공시 중 대부분의 경우에 공시 목적을 주가안정 및 주주가치 제고라고 공시하였으나 모든 경우에 주가가 상승하는 결과가 도출된 것은 아니다. 본 연구에서는 보조적 수단으로 내부자의 보유 지분 변화를 살펴본 결과 자기주식 취득의 저평가 신호가 일부 공시에서는 허위일 가능성이 높다는 것을 알 수 있었다. 기업의 자기주식 취득 공시에도 불구하고 내부자는 지속적으로 주식을 매도하는 사례가 상당수 관측되었다. 이 경우 주가안정을 위해 자사주를 취득한다는 기업의 공시를 신뢰하기 어렵다.

투자자에게 자기주식 취득에 대한 명확한 정보를 제공하기 위하여 현재 명목상으로 이루어지고 있는 공시의 실효성을 제고할 필요가 있다. 분석 기간 동안 자기주식 직접취득과 간접취득 공시의 95%는 주가안정과 주주가치 제고라고 공시하고 있으나 그 이외에는 판단 근거가 명확하게 제시되어 있지 않다. 따라서 투자자는 해당 공시가 기업 저평가를 기반으로 이루어진 신호인지, 시장에 미치는 영향력이 어느 정도 일지 파악하기 어렵다. 자기주식 취득 목적에 대한 보다 상세한 설명과 함께 기업의 결정에 영향을 미친 관련 정보를 제공할 필요가 있다. 즉, 자기주식 취득의 상세한 목적 또는 판단근거, 취득 규모 결정 기준 및 절차, 신탁계약 등 다른 취득 공시 현황 및 영향 등에 대한 자세한 설명이 제시되도록 공시요건을 강화해야 한다.

자기주식 취득 및 처분에 따른 대주주와 일반주주 간의 이해상충 가능성을 검토하고 해결점을 모색할 필요가 있다. 분석 결과에 따르면 자사주 취득을 공시하기 이전에 내부자가 자사주를 매수하는 경우가 상당수 관측된다. 또한 공시 후 6개월이 경과한 시점에서 내부자가 보유지분을 매도하는 모습도 볼 수 있다. 일반투자자에 비해 정보우위에 있는 내부자가 자기주식 공시를 이용하여 사적이익을 추구하는 행위는 시장에 대한 신뢰를 훼손시킨다. 자사주 취득과 관련된 내부자의 지분 변화에 대한 공시를 강화해야 한다. 기업은 자기주식 취득 또는 처분 기간 동안 해당 주식 매매와 관련된 내부자 거래 정책과 절차를 마련할 필요가 있다. 또한 자기주식 취득 공시에 따른 주가반응은 1년 이상 장기간 지속되므로 6개월의 단기매매차익 반환 규정은 자기주식 취득과 관련하여 내부정보를 이용한 부당이득 추구 행위를 방지하기에 충분하지 않다. 자사주 취득에 대한 매매차익 반환 기한을 연장하는 등의 조치를 검토할 필요가 있다.

취득 방법에 따른 차이를 살펴보면, 신탁계약을 통한 자기주식 간접취득은 직접취득에 비해 주가 상승효과가 적었다. 또한 내부자 거래과 연계하여 분석한 결과 자기주식 공시의 신호를 신뢰하기 어려웠다. 내부자가 매도했을 경우 유의미한 주가반응이 나타나지 않았으며 내부자가 매수했을 경우에는 주가가 상승하기는 하였으나 공시에 따른 주가상승 후 내부자는 매수분을 초과하는 양(+)의 지분을 매도하였다.

직접취득과 간접취득이 취득행위의 주체가 다를 뿐 경제적 실질 측면에서 회사의 재산을 주주에게 환급하는 이익배당행위로 동일하게 해석된다. 그런데도 공시 효과와 공시 신뢰성에 차이가 보이는 것은 규제 강도와 취득 과정상의 불확실성에 차이가 있기 때문이다. 취득 방법 간의 규제 차이로 인해 투자자가 제공받는 정보의 양과 시장에 미치는 영향에 차이가 발생하는 현재의 상황을 개선하기 위하여 자기주식 간접취득에 대한 규제를 직접취득에 준하는 수준으로 보완할 필요가 있다. 신탁계약을 통한 취득상황 공시의 빈도를 높일 필요가 있다. 계약 해지 또는 종료 시에 거래내역을 공시하도록 하는 현재의 규정을 변경하여 계약 연장 시 혹은 주기적으로 거래내역을 공시하여 투자자가 간접취득 현황을 파악할 수 있도록 해야 한다. 또한 별도의 제재 없이 관행적으로 이루어지고 있는 신탁계약 연장을 제한할 필요가 있다. 간접취득 현황과 실취득률, 향후 취득 계획, 명확한 연장사유 등을 제시하도록 하고 필요성이 분명한 경우에 한하여 연장을 허용해 간접취득의 불확실성을 완화해야 한다. 아울러 계약기간 내에 취득한 자기주식의 처분을 허용하고, 약정금액을 모두 취득하도록 강제하지 않는 등 완화된 규정의 실익을 검토해볼 필요가 있다. 완화된 규제에 따른 이득보다 정보열위에 있는 투자자가 입는 손해가 더 크다면 제도 개선을 적극적으로 고려해야 할 것이다.

마지막으로 기업의 직접처분 절차를 개선할 필요가 있다. 현재 취득한 자기주식은 다양한 목적으로 이용된다. 자기주식 취득 목적이 주가안정에 집중된 반면에 자기주식 처분 사유는 임직원 성과보상, 기업 운영자금 확보, 재무구조 개선, 기업 인수합병 등 다양하다. 주주환원 목적으로 취득한 자기주식이 처분 시에는 기업의 필요에 따라 자유롭게 활용되고 있으며 주가에 미치는 효과가 불분명한 것으로 나타났다. 게다가 자기주식 취득 시에는 주주평등의 원칙을 훼손하지 않기 위하여 취득 방법을 엄격하게 규정하고 있으나 보유한 자기주식을 처분하는 경우에는 특별한 제한을 두고 있지 않다. 자기주식 처분은 처분 상대방과 처분 방법을 회사의 정관이나 이사회가 정할 수 있어 주주간 형평성을 침해하거나 지배주주의 이익을 위해 이용될 가능성이 있다. 따라서 기업의 자율적 자기주식 처분으로 인해 일반주주에게 피해가 발생하지 않도록 방지 방안을 모색할 필요가 있다. 더 나아가 자기주식 처분의 경제적 본질에 맞는 규정이 마련되어야 한다. 자기주식 처분은 유통주식 수를 늘리고 외부 자금을 조달한다는 측면에서 신주발행과 다르지 않다. 자기주식 처분의 실질에 맞게 신주발행절차를 따르도록 하거나 신주발행절차에 준하는 별도의 처분 절차를 마련하는 등의 논의가 필요하다.

이상의 논의를 통해 기업의 자기주식 취득과 처분 결정은 투자자의 기대와 다른 목적과 효과를 가질 가능성이 있다는 것을 확인했다. 자기주식의 직간접 취득 및 처분 제도의 경제적 실질과 효익, 일반투자자에 미칠 부작용에 대한 고찰을 바탕으로 제도를 재정비해야 한다. 기업의 자기주식 취득 및 처분이 이론에서 주장하는 바와 같이 기업과 투자자 간의 정보 비대칭을 완화하고 진정한 신호로 작용할 수 있도록 다각적으로 검토할 필요가 있다.

1) 미국 S&P500 지수편입 종목과 유럽 S&P350 Europe 지수편입 종목에 대한 통계이다(Dias, 2019).

2) 한국상장회사협의회(2020)

3) 김영환‧정성창(2008)

4) 신탁계약의 해지 또는 종료로 신탁업자가 취득한 자사주를 기업에 반환하는 경우, 신탁계약 종료 또는 해지 공시 일자를 기준으로 판단한다.

5) 신탁계약 체결 후 6개월간 해지가 금지되기 때문에(자본시장법 시행령 176조의2제2항제6호), 신탁계약기간은 통상 6개월 이상으로 계약된다.

6) 자사주 취득과 처분이 빈번하게 발생할 경우 시장가격에 왜곡을 초래할 수 있다. 따라서 자사주 취득 후 처분이 가능한 시점을 법으로 규정하고 있다. 자본시장법에 따르면 자사주 취득 후 6개월간 처분 및 해지가 금지된다

(자본시장법시행령 제176조의2제2항제6호). 그러나 자기주식 신탁계약이 해지 또는 종료되어 자기주식을 현물로 반환받는 경우에는 이러한 규제가 적용되지 않는다(자본시장법시행령 제176조의2제2항제6호제카목). 따라서 신탁계약 종료 즉시 처분하여 현물반환이 가능하다.

7) 거래소의 시간외대량매매를 이용하는 경우 실질적으로는 장외거래이므로 정책목적상 필요한 경우나 투자자보호에 문제가 없다고 인정하는 경우에 제한적으로 허용한다(발행공시규정 제5-5조제2항, 업무규정제39조제4항, 제35조제4항).

8) 한국상장사협의회(2020)

9) 본 분석은 주주환원 및 주가안정을 목적으로 공시한 경우의 진위여부를 평가하기 위한 것이므로 자기주식 직접취득과 신탁계약 공시 중 목적이 주식가격 안정과 주주환원, 소각인 경우만 포함하였다.

10) 직접처분은 일부만 주가안정 목적의 공시에 해당하기 때문에 직접취득이나 신탁취득과 동일 목적 하에 직접적인 비교는 어렵다. 직접처분은 처분 목적에 무관하게 분석에 포함하였다. 단, 단주처리를 비롯하여 소규모의 공시는 시장에 미치는 영향이 미미할 수 있으므로 공시 주식 수가 보통주 기준 유통주식 수 대비 0.01%에 미치지 못하는 경우 제외하였다.

11) 자기주식 신탁계약은 계약기간을 연장하거나, 일부를 해지하는 등 유연하게 운영할 수 있다. 신탁계약을 신규 체결한 경우만 분석에 포함하고 기존의 계약을 연장한 경우는 제외하였다.

12) 자기주식 취득 또는 신탁계약 체결 공시 후 1개월 이내에 다른 건의 자기주식 취득이 발생한 경우, 공시효과를 구분하기 어려우므로 앞의 공시 건만 분석에 포함한다.

13) 단, 신탁계약 신규 체결의 경우 3개월이 경과한 시점에 취득 내역을 공시해야 하기 때문에 3개월의 단기간 동안에는 취득을 일부 강제하는 수단으로 작용할 수 있다.

참고문헌

고윤성‧이정한, 2014, 자기주식 취득방법과 이익조정 및 배당,『세무와회계저널』15(3), pp.175-207.

김영환‧정성창, 2008, 자사주 매입방식의 결정요인과 기회주의 가설의 검증, 『경영학연구』37(5), 1205-1232.

김우진‧임지은, 2017, 한국 기업의 자사주 처분 및 소각에 관한 실증 연구, 『한국증권학회지』46(1), 35-60.

김인중‧김태규, 2019, 자사주 처분과 내부자거래,『산업경제연구』32(3), 967-983.

김태규, 2016, 자사주 매입 기업의 내부자거래 분석,『산업경제연구』29(5), 1681-1702.

김효진‧윤순석, 2010, 소유지배괴리도가 자기주식취득과 현금배당에 미치는 영향,『경영학연구』39(6), 1477-1503.

박정지‧신정순, 2022, 자사주 취득 공시와 내부자거래 관계 분석,『한국증권학회지』 51(3), 335-358.

임병권‧박순홍‧윤평식, 2015, 자사주 취득과 내부자 거래의 정보신호 효과, 『재무연구』 298(3), 351-384.

정성창, 2004, 유상증자와 자사주취득의 동기: 불공정거래 가능성의 제기,『한국증권학회지』33(3), 123-156.

정성창‧김영환, 2013, 경영권 방어수단이 자기주식 취득에 미치는 영향, 『경영학연구』 42(3), 767-803.

한국상장사협의회, 2020, 2020 상장회사 자기주식 취득‧처분 및 소각 실무해설.

Babenkon, I., Tserlukevich, Y., Vedrashko, A., 2012, The credibility of open market share repurchase signaling, Journal of Fianncial and Quantitative Analysis 47(5), 1059-1088.

Bonaime, A.A., Ryngaert, M.D.. 2013, Insider trading and share repurchases: Do insiders and firms trade in the same direction? Journal of Corporate Finance 22, 35-53.

Cziraki, P., Lyandres, E., Michaely, R., 2021, What do insiders know? Evidence from insider trading around share repurchase and SEOs, Journal of Corporate Finance 66, 1-21.

Dann, L.Y., 1981, Common stock repurchase: An analysis of returns to bondholders and stockholders, Journal of Financial Economics 9, 113-138.

Dias, P.M.D.R.B., 2019, Untangling buybacks vs. dividends in Europe and in the US (Doctoral dissertation).

Fried, J.M., 2001, Open market repurchases: Signaling or managerial opportunism? Theoretical Inquiries in Law 2, 865-894.

Lakonishok, J., Vermaelen, T., 1990, Anomalous price behavior around repurchase tender offers, Journal of Finance 45, 455-477.

Vermaelen, T., 1984, Repurchase tender offers, signaling, and managerial incentives, Journal of Financial and Quantitative economics 19, 163-181.

자기주식 취득은 기업의 성과를 주주에게 분배하는 대표적인 주주환원 수단으로, 주요국에서 1990년대 중반부터 활발히 활용되고 있다. 2018년 기준으로 미국 주요 상장기업의 자기주식 취득 규모는 전체 주주환원의 59%를 차지하며 유럽 주요 상장기업의 경우 24%를 차지한다.1) 한국에서는 1992년 자사주펀드 제도가 도입되어 상장기업의 자기주식 취득이 처음으로 가능해졌고 1994년 증권거래법(현 자본시장과 금융투자업에 관한 법률) 개정을 통해 상장기업의 자기주식 직접 취득이 허용되었다.

국내 자기주식 취득은 제도적 관점에서 해외시장과 차별화되는 특성이 존재한다. 기업은 자기주식을 직접 취득할 수 있을 뿐만 아니라 신탁계약이나 자사주펀드를 통해 간접적으로 취득하는 것이 가능하다. 이는 한국시장에만 존재하는 독특한 제도이다. 또한 자기주식의 처분에 대한 규제적 제약이 적어 자기주식의 처분이 비교적 자유롭다. 다른 국가에서는 자기주식을 소각하거나, 금고주(treasury stock)로 보유할 수 있더라도 처분을 신주발행에 준하는 행위로 간주하며 엄격하게 관리하는 것과 비교된다.

이러한 제도적 특성을 고려할 때 국내 자기주식 취득을 전통적인 주주환원 정책의 관점에서만 평가하기는 어렵다. 국내 상장기업이 취득한 자기주식을 소각하는 경우는 극히 일부에 불과하며 대부분 소각하지 않고 보유하거나 처분한다(김우진‧임지은, 2017). 또한 처분 시 기업의 필요에 따라 재량적으로 자기주식을 활용하여 주주환원이 아닌 단기적 주가 부양이나 지배주주의 지배권 보호를 위한 수단으로 활용될 가능성이 우려된다(김효진‧윤순석, 2010; 정성창‧김영환, 2013).

본 보고서는 국내 상장기업의 자기주식 취득과 처분에 대한 제도적, 재무적 논의를 종합적으로 정리하고 자기주식 관련 기업활동의 배경과 효과를 실증적으로 분석하고자 한다. 특히 기존 연구에서 부분적으로 연구되어왔던 자기주식 직접취득과 처분, 간접취득을 동일한 기준을 바탕으로 직접적으로 비교하여 국내 자기주식 시장에 대한 포괄적 이해의 틀을 마련하고자 한다. 아울러 이를 토대로, 기업의 자기주식이 주주환원의 수단으로 효과적으로 활용되고 장기적으로 기업가치에 긍정적 영향을 미칠 수 있도록 하기 위한 제도적 개선방안을 모색하고자 한다.

Ⅱ. 자기주식 취득 및 처분 제도

1. 자기주식 정의 및 법제 현황

자기주식은 일반적으로 시장에서 거래되는 주식을 발행회사가 일시적으로 소유하고 있는 법적 지위를 가리킨다. 회사가 자기의 명의와 계산으로 회사의 주식을 취득하여 스스로 주주가 되는 것이다.2)

상법상 자기주식 취득에 대한 규제는 2011년을 기준으로 구분된다. 2011년 상법 개정 이전에는 자기주식 취득은 원칙적으로 금지되었다. 예외적으로 주식소각, 합병 또는 영업 전부 양수, 단주처리, 주식매수청구권 행사 등의 경우에만 허용되었다. 2011년 상법이 개정되면서 자기주식 취득을 전면적으로 허용하였다. 이에 따라 기업은 배당가능이익 한도 내에서 일정한 방법에 따라 자기주식을 취득할 수 있게 되었다(상법 제341조).

증권거래법(현 자본시장과 금융투자업에 관한 법률, 이하 자본시장법)은 1994년에 상장회사가 배당가능이익 한도 내에서 자기주식을 취득할 수 있도록 허용하는 규정을 도입하였다(증권거래법 제189조의2). 2011년의 상법 개정은 기존에 증권거래법에서 상장회사에 적용되던 자기주식 취득 규정을 비상장회사로 확대한 것으로 볼 수 있다.

자본시장법상 자기주식 간접취득은 직접취득이 허용되기 이전부터 존재하였다. 간접취득은 자사주펀드와 특정금전신탁의 두 가지 방법을 통해 이루어진다. 자사주펀드는 다수의 기업이 공동으로 투자신탁회사에 자금을 위탁하여 통합적으로 운용하는 방법으로 1992년 처음 도입되었다. 이후 1999년 특정금전신탁을 이용하는 방식이 추가되었는데3), 자사주펀드와 달리 다수의 기업이 아닌 개별기업이 단독으로 계약하는 방식으로 신탁업자는 계약기간 동안 해당 기업을 대신하여 주식을 취득한다.

자기주식 처분에 대한 규제 역시 2011년 상법 개정 전후로 큰 차이가 존재한다. 상법 개정 이전에는 자기주식의 보유기간을 엄격하게 규정하여 ‘지체없이’ 또는 ‘상당한 시기 내’에 반드시 처분해야 했으나 2011년 자기주식 취득 규제가 원칙적 허용으로 전환된 이후에는 회사가 자유롭게 처분 시기를 결정할 수 있게 되었다. 자본시장법상에서도 마찬가지로 처분 시점에 관한 규정이 없으며 취득한 자기주식을 보유하거나 처분할지에 관한 결정은 기업의 선택에 따른다.

상장기업이 자기주식을 취득하는 방법은 ① 취득예정 주식 수를 공시한 뒤 거래소 또는 장외시장에서 기업이 직접 매수하는 방식(상법 제341조제1항제1호, 상법 시행령 제9조제1항, 자본시장법 제165조의3제1항제1호), ② 기업이 은행이나 신탁회사와 계약을 체결하여 일정 금액을 신탁하고 신탁계약 금융기관이 계약기간 내에 기업을 대신하여 취득하는 방식(자본시장법 제165조의3제4항) 등 크게 두 가지이다. 이 때 자기주식 취득 신탁계약이 해지되거나 계약기간이 종료되면 기업은 신탁업자가 취득한 자기주식을 현물로 반환받을 수 있다(자본시장법 제165조의3제1항제2호). 기업이 시장에서 직접 매수하거나 신탁계약 해지 또는 종료 후 현물로 반환받는 경우 기업이 자기주식을 실질적으로 보유하게 되므로 직접취득이라 하고, ②와 같이 신탁계약 금융기관이 자기주식을 취득하는 경우 자기주식은 신탁해지 전까지 신탁업자의 재산으로 간주하므로 간접취득이라 한다.

자기주식을 취득하는 방법에 따른 규제 차이는 다음과 같이 정리할 수 있다. 첫째, 일반적으로 직접취득에 비하여 간접취득에 장시간이 소요된다. 자기주식을 직접취득할 경우 공시4) 익일로부터 3개월 이내에 취득을 완료해야 하는 반면(자본시장법 시행령 제176조의2제3항, 발행공시규정 제5-9조제1항), 간접취득을 위한 신탁계약은 통상 6개월 또는 1년 단위로 체결되고 연장이 가능하므로 사실상 완료 시점에 대한 제약이 없다.5) 신탁계약에 의한 현물반환은 신탁계약 종료 또는 해지 후 이루어지므로 신탁계약을 이용한 자기주식 취득의 실제 소요 시간은 길어질 수 있다.

둘째, 직접취득과 간접취득은 공시에서 명시된 목표 규모에 대한 취득 강제성에서 차이가 난다. 직접취득은 결의한 취득예정 수량을 반드시 취득해야 하고 그렇지 못한 경우 해당 기간 만료 후 1개월까지 새로운 이사회 취득결의가 금지된다(발행공시규정 제5-4조제1항). 반면 간접취득은 취득의무와 제재에 관한 규정이 없어 공시에 명시된 신탁계약 금액만큼 취득하지 않아도 문제가 되지 않는다.

셋째, 직접취득은 취득기간 내에 취득만 가능하지만 간접취득의 경우 계약기간 내에 취득과 처분이 모두 가능하다. 신탁업자가 신탁계약 기간 동안 시세차익을 얻기 위해 취득과 처분을 반복하여도 규정 위반이 아니다. 다만 신탁계약 기간 내의 자기주식 처분은 취득일로부터 1개월이 경과된 후 가능하며, 마찬가지로 취득은 처분일로부터 1개월이 경과된 후 가능하다.

넷째, 신탁계약의 해지 또는 종료 후 자기주식의 반환은 현물반환뿐만 아니라 현금반환도 허용된다. 기업이 현금반환을 요청할 경우 신탁업자는 취득한 자기주식을 처분하여 현금으로 돌려줄 수 있다.6) 이 경우 ‘자기주식 취득 신탁계약 체결’로 공시됨에도 불구하고 기업의 실질적인 주식 취득은 발생하지 않는다.

이처럼 직접취득과 비교할 때 간접취득의 경우 기업이 상당한 재량권을 가진다. 간접취득은 사실상 취득기간에 제한이 없고 공시한 신탁계약금액을 전액 취득하지 않아도 되며 자기주식을 취득하였다 하더라도 계약기간 내에 매도하는 것 또한 가능하다.

상장기업이 자기주식 직접취득이나 직접처분을 결의한 경우 1일 이내에 해당사항을 공시해야 한다. 취득이나 처분이 완료되거나 기간이 만료되면 ‘자기주식 취득‧처분 결과보고서’를 제출한다. 결과보고서에는 해당 기간 동안 취득하거나 처분한 주식 종류, 거래체결 주식 수, 주문 주식 수, 체결금액 등 비교적 상세한 거래내역이 포함된다.

‘신탁계약에 의한 취득상황 보고서’는 신탁계약을 신규 체결한 경우에 한하여 3개월 후 한 차례 제출하기 때문에 신탁계약이 장기간 연장될 경우 투자자는 신탁계약 체결 3개월 이후부터 신탁계약의 해지 또는 종료되는 시점까지 자기주식의 취득과 처분 현황을 파악할 수 없다.

Ⅲ. 자기주식 취득 및 처분 현황과 특성

1. 자기주식 취득 및 처분 규모

유가증권시장과 코스닥시장 상장기업의 자기주식 취득, 처분 현황을 살펴보자. <그림 Ⅲ-1>은 2015년 1월부터 2022년 5월까지 자기주식 직접취득 및 처분 공시 건수와 공시 수량의 추이를 제시하고 있다.

분석기간 동안 자기주식 취득은 유가증권시장의 경우 분기당 평균 15.2건, 코스닥시장의 경우 분기당 평균 17.7건이 공시되었다. 자기주식 처분은 취득에 비해 빈도가 높아, 유가증권시장의 경우 분기당 평균 22건, 코스닥시장은 평균 48.5건이 공시된 것으로 집계된다.

자기주식 취득은 주가변화에 따라 등락하는 양상을 보인다. 자기주식 취득이 가장 크게 증가한 시기는 코로나19로 주가가 급락하였던 2020년 1분기이다. 당시 정부는 시장안정화조치의 일환으로 자기주식 매입한도를 한시적으로 완화하였는데 이를 계기로 기업의 자기주식 취득 공시 건수와 수량 모두 가장 높은 수준을 기록하였다. 2020년 1분기 자기주식 취득 공시 건수는 유가증권시장 60건, 코스닥시장 80건 등 총 140건으로, 직전 4분기의 분기별 평균 23건의 약 6배에 이른다.

자기주식 처분은 2020년 4분기 이후 증가한 모습이 관찰된다. 자기주식 처분 건수는 2019년까지 분기당 57.3건이었는데 2020년 4분기부터 2022년 1분기까지 분기당 약 98.7건으로 증가하였다. 2020년 4분기부터 주가가 빠르게 회복되어 저점 대비 2배에서 2.5배 수준에 도달하고, 2020년 1분기에 취득한 자기주식에 대한 6개월의 처분금지기간이 종료되면서 자기주식 처분이 증가한 것으로 판단된다.

2015년부터 2022년 상반기까지 자기주식 신탁계약은 총 1,623건이며 금액으로는 14조 9천억원이다. 유가증권시장의 신탁계약은 총 508건, 평균 211억원 규모이며, 코스닥시장의 신탁계약은 총 1,115건, 평균 92억원이다. 신탁계약도 직접취득과 마찬가지로 2020년 1분기에 급격히 증가하는 모습이 나타나며, 2020년 1분기부터 유가증권시장의 신탁계약금액이 뚜렷하게 증가한 것이 특징이다.

자기주식 취득 및 처분에 대한 공시자료에 따르면, 기업이 자기주식을 취득하는 가장 큰 목적은 주가안정과 주주이익 제고이다. 자기주식을 취득하는 행위를 통해 기업이 주가에 관심을 가지고 안정적으로 유지하려는 노력을 기울이고 있다는 신호를 투자자에게 전달할 목적으로 보인다.

2015년에서 2022년 상반기까지 이루어진 자기주식 직접취득 공시에서 취득목적으로 주가안정을 제시한 경우가 85.6%로 가장 많았다. 이어서 이익소각이 5.7%, 임직원 성과보상, 우리사주 조합 출연, 주식매수선택권 등 임직원 지급목적이 4.5%로 나타난다. 경영권 강화, 재무구조 개선, 지주회사 전환 등 기업구조조정 목적은 1% 미만을 차지한다.

자기주식 간접취득의 목적은 직접취득과 크게 다르지 않은 것으로 나타난다. 전체 신탁계약 체결 공시의 99.4%가 주가안정 및 소각을 목적으로 제시하고 있으며, 임직원 성과보상, 재무구조개선, 상장폐지 등이 1% 미만으로 확인된다.

자기주식 취득의 경우 취득방법을 법률에서 명시하고 있다. 상법 제341조제1항은 거래소에서 직접취득하거나 모든 주주에게 균등한 방법으로 공개매수하는 방식으로 자기주식을 취득할 수 있다고 규정한다.7)

반면 자기주식 처분은 처분방법에 대한 별도의 규정이 존재하지 않는다. 따라서 자기주식 처분은 장내뿐만 아니라 장외에서도 가능하며 특정인에게 지급 또는 매도하는 방식이 가능하다. 장내처분의 경우 처분수량과 가격을 제한하고 있으나(발행공시규정 제5-9조, 업무규정 제39조) 장외처분에 대해서는 별도의 규정이 없어 적정가격에 거래가 이루어졌는지 판단하기 어렵다. 만일 처분가격과 처분시기가 불합리할 경우 불공정거래행위 규제에 따라 처벌받으며 민형사상 책임이 발생한다.8)

자기주식 직접처분 공시에 따르면 처분경로는 정규시장, 시간외대량매매, 장외처분, 기타 등 네 가지로 구분된다. 여기서 기타는 임직원 상여지급, 우리사주조합 양도, 주식매수선택권 행사 등의 목적으로 기업이 개인이나 조합의 증권계좌로 직접 이체하는 경우와 합병의 대가로 자기주식을 지급하는 경우 등이 포함된다.

공시 주식 수 기준으로, 전체 자기주식 처분 중 88.4%가 기타의 방법으로 거래되었다. 재무구조 개선, 투자재원 확보 등을 위한 시간외 대량매매가 6.5%, 기업간 전략적 제휴 등을 위한 장외처분이 4.6%를 차지한다. 정규시장에서 처분되는 물량은 0.5%에 불과한 것으로 나타난다.

앞서 살펴본 바와 같이 자기주식의 직접취득과 간접취득은 취득의 강제성에서 차이가 있다. 직접취득이나 직접처분의 경우 3개월 이내에 완료해야 하며 이행하지 못할 경우 제재가 따른다. 반면 신탁계약을 통한 간접적인 취득과 처분은 이행에 대한 별도의 규정이 존재하지 않는다.

<그림 III-8>은 2015년부터 2022년 1분기까지 자기주식 직접취득과 간접취득의 실취득률, 직접처분의 실처분률의 분기별 평균값을 보여준다. 실취득률(실처분률)은 공시에서 취득(처분)하기로 공시한 주식 수 대비 결과보고서상에 나타난 실제 취득(처분) 주식 수의 비율로 계산한다. 신탁계약의 경우 주식 수가 아닌 계약금액이 명시되므로 계약금액 대비 실제 취득금액으로 산출하였으며, 계약체결 시점이 아닌 결과보고서가 제출되는 계약 해지 또는 종료 시점을 기준으로 한다.

직접처분의 실처분률은 분기 평균 99.4%로 매우 높게 나타난다. 처분목적이나 처분시장 분석에서 알 수 있듯이 처분대상이 지정되어 있는 경우가 대부분이며, 장내거래나 시간외대량매매 등 시장상황과 주가변화에 영향을 덜 받는 직접 자기주식을 지급하는 방식이 큰 비중을 차지하기 때문으로 보인다.

간접취득의 실취득률은 분기별 평균 81.94%로 직접취득이나 직접처분에 비해 낮다. 신탁계약을 통한 간접취득은 취득이 가능한 기간이 길기 때문에 시장상황 변화에 따라 취득시점을 유연하게 선택할 수 있는 이점이 있다. 그럼에도 불구하고 실취득률이 낮은 것은 이행에 대한 강제성이 없기 때문으로 추정된다.

Ⅳ. 자기주식 취득 및 처분의 허위 정보신호효과

1. 상장기업의 자기주식 취득 및 처분 목적 이론연구

자기주식 취득 동기에 관한 기존의 연구 중 기업 기초여건(fundamental factor)과 관련된 대표적 이론으로 저평가가설(undervaluation hypothesis)이 있다. 저평가가설에 따르면 자기주식 취득은 기업의 주식이 본질가치에 비해 저평가되었을 때 이루어진다.

경영자는 기업의 실질가치에 대해 외부 투자자에 비해 많은 정보를 가지고 있다. 내부자의 관점에서 주가가 기업의 본질가치보다 낮게 형성되어 있다고 판단할 경우, 이 사실을 외부 투자자에게 알리고자 할 것이고 그 수단으로 자사주 취득이 활용된다. 이러한 관점에서 자기주식 취득은 기업의 진정한 가치를 시장에 알리는 신호로서 작용하며 정보신호가설(signaling hypothesis)이라 불린다. Lakonishok & Vermaelan(1990), Dann(1981), Vermaelen(1984) 등은 기업이 자기주식을 취득할 경우 주가가 상승한다는 근거를 보였다.

이와 상반되는 이론으로 자사주 취득 공시가 허위일 가능성에 대해 주장한 경영자 기회주의(managerial opportunism) 가설이 있다. 경영자 기회주의 가설은 자사주 취득이 기업가치 제고가 아닌 사적 목적으로 활용될 수 있다는 점에 주목한다. 주가가 실제로는 저평가되어 있지 않거나 주식을 매입할 실질적 능력 또는 의사가 없음에도 자사주 취득 결정을 내릴 가능성이 있다. 즉, 내부자는 사적이익을 극대화하기 위하여 자사주 매입을 거짓으로 공시하고 주가상승을 유발할 유인이 있다(Fried, 2001).

기업은 자기주식 취득이나 처분 결정에 대한 사항을 공시할 때 그 목적을 공개해야 한다. 그런데 대부분의 경우 주가안정이나 주주환원, 재무구조 개선 등 주주나 기업에 긍정적인 효과를 기대하며 자기주식을 취득하거나 처분한다고 공시한다. 공시 사실만으로 기업이 보내는 신호의 진위여부를 판별하는 것은 불가능하다.

따라서 투자자의 입장에서 기업가치에 비해 주가가 저평가되어 있다는 신호의 진위여부를 판별하는 것은 쉽지 않은 일이다. 투자자들은 내부자와 외부주주 사이의 정보 비대칭으로 인해 내부 경영인과 비교하여 정보열위에 있다. 또한, 자기주식 취득이나 처분과 관련된 의결권은 이사회가 가지고 있으므로 일반 주주는 의사결정에 영향을 미치기 어렵다. 그 결과 외부에서는 자기주식 공시가 진실한 신호를 전달하는 것인지 판단 내리기 어렵다. 공시의 진실성을 판별하기 위해서는 기업가치에 대한 추가적인 정보를 줄 수 있는 보완적 수단이 필요하다.

기업 내부자의 회사 주식 매수 또는 매도는 주가의 저평가 여부에 대한 추가적 정보를 제공할 수 있다. 최대주주, 특수관계인, 임원 등 기업의 내부자는 외부 투자자에 비해 자기 회사에 대해 더 우월한 정보를 보유하고 있다. 따라서 기업의 실질가치에 대해 일반투자자에 비해 판단하기 유리한 위치에 있다. 또한 최대주주 등의 내부자는 자기주식 취득이나 처분 공시 결정과정에 직간접적으로 영향을 미칠 수 있다. 만일 내부자가 공시 이전에 해당 기업의 주식을 개인적으로 매수하였다면 기업이 저평가되었다는 강한 신호라고 해석 가능하다. 반대로 자기 지분을 매도하였다면 저평가 신호는 신뢰하기 어렵다.

Babenko et al.(2012)은 공개시장에서 기업이 자기주식을 취득한 경우 저평가 신호가 강화되는 효과가 있어 내부자 거래를 통해 주가 수익률을 예측할 수 있다고 주장하였다. Bonaime & Ryngaert(2013)는 자기주식 취득 직전 분기의 내부자 거래를 포트폴리오로 구성하여 수익을 창출할 수 있으며 내부자 매수거래가 저평가에 대한 신호역할을 할 수 있음을 보였다. 최근 발표된 Cziraki et al.(2021)에서는 이전 연구와 마찬가지로 자기주식 취득 전 내부자 순매수가 기업의 저평가를 완화하며 기업 경영성과 개선과 자본비용 절감을 예측하는 것으로 나타났다.

국내 시장을 대상으로 한 연구로는 임병권‧박순홍‧윤평식(2015), 김태규(2016), 김인중‧김태규(2019), 박정지‧신정순(2022) 등이 있다. 임병권‧박순홍‧윤평식(2015), 김태규(2016)는 자기주식 취득 전 내부자 거래가 저평가에 대한 추가적 신호를 전달한다고 보고하였다. 또한 박정지‧신정순(2022)은 저평가를 해소하기 위한 목적으로 기업이 자기주식을 취득한 경우라도 내부자가 해당 주식을 강하게 매도하면 장기 수익률은 유의하지 않아 시장정보가 허위신호일 가능성을 보였다. 김인중‧김태규(2019)는 자기주식 처분과 내부자 거래의 관계를 분석한 결과 내부자가 매도했을 때 주가는 변하지 않으나 매수했을 때 주가가 상승하는 것을 발견했다.

자기주식 취득 신호의 진실성을 판단하기 위해 자기주식 취득제도 상의 차이를 이용하는 방법도 있다. 국내시장에서 자기주식을 취득하는 방법에는 취득예정 주식 수를 공시한 뒤 거래소 또는 장외시장에서 기업이 직접 매수하는 직접취득 방법과 신탁계약 금융기관이 계약기간 내에 기업을 대신하여 자사주를 취득하는 간접취득 방법이 있다. 기업이 시장에서 직접 취득하는 경우 공시 다음 날부터 3개월 이내에 공시한 목표 물량을 전량 매수해야 한다. 그러나 간접취득의 경우 직접취득에 비해 유연한 의사결정이 가능하다. 신탁취득은 계약 연장이 가능하여 사실상 취득기한에 제한이 없고 공시한 신탁금액을 전액 취득하지 않아도 되며 실제 자사주를 취득하였다 하더라도 계약기간 내에 매도하는 것 또한 허용된다. 이러한 제도적 특성 차이로 인해 일반적으로 직접취득에 비하여 간접취득의 실제 취득비율이 낮은 수준에서 형성되며(김영환‧정성찬, 2008) 공시의 신뢰도를 악화시킨다. 정성창(2004)은 간접취득이 직접취득에 비해 제도적으로 유연하다는 점에 근거하여 분석한 결과 간접취득이 유상증자를 전후하여 주가관리 수단으로 악용될 가능성이 존재했다. 또한 고윤성‧이정한(2014)은 직접취득에 비해 간접취득이 이익조정 가능성이 더 높다고 주장했다.

본 보고서는 기업의 자기주식 공시가 시장에 보내는 신호의 진위여부를 판단하기 위하여 다각적 관점에서 보조적 판단 수단을 이용하였다. 기업 내부자인 최대주주 및 특수관계인의 공시 전 거래행태를 살펴보고 이들의 매수나 매도에 따라 기업의 장기성과가 다르게 나타나는지를 분석하였다. 선행연구와 달리 자기주식 직접취득, 처분, 간접취득 공시를 모두 포함하여 동일한 기준을 이용하여 분석하였으며 기업이 공시한 목적에 따라 효과가 다르게 나타나는지를 살펴보았다.

2. 연구가설 및 방법

기업 내부자는 이사회를 통해 자기주식 취득이나 처분 등 기업활동 결정에 영향을 미치는 의사결정권자인 동시에 내부자로서 기업의 실질가치를 판단할 수 있는 더 많은 정보를 가지고 있다. 따라서 기업이 자기주식 취득목적을 주가안정을 통한 주주환원이라고 발표한 경우 해당 결정이 실제 저평가를 개선하기 위한 것인지, 일시적인 주가 부양을 위한 목적인지 내부자는 판단할 수 있다. 이를 바탕으로 다음과 같은 가설을 설정하였다.

가설1: 기업의 자기주식 취득 공시가 허위일 경우 내부자는 보유지분을 감소시킬 것이다.

기업이 저평가되었다는 것이 허위정보라 하더라도 외부 투자자는 해당 사실을 인지하지 못하기 때문에 자기주식 취득 공시와 함께 주가는 일시적으로 상승할 수 있다. 그러나 장기적으로는 주가는 기업의 본질가치로 수렴해갈 것이다.

가설2: 기업의 자기주식 취득 공시가 허위일 경우 기업의 장기성과는 개선되지 않을 것이다.

기업가치가 본질가치에 비해 저평가된 상황이고 시장에서는 이에 대해 인지하지 못하여 주가가 낮게 형성되어 있다면 기업은 시장에 저평가에 대한 강력한 신호를 보내고자 할 것이다. 따라서 기업가치와 공시규모 간에 다음과 같은 가설을 설정할 수 있다.

가설3: 기업가치 저평가가 사실이라면 기업은 시장에 저평가에 대한 강력한 신호를 보내기 위해 취득 규모를 증가시킬 것이다.

자기주식 직접취득과 간접취득은 제도 차이로 인해 주가반응이 상이하게 나타날 가능성이 있다. 간접취득의 경우 직접취득에 비해 유연한 규정이 적용되어 실취득기간이 길고, 실취득규모도 목표치보다 낮아 주가반응이 약할 것이다. 또한 기업가치가 사실상 저평가 되어 있지 않아 자기주식을 실제 취득할 의사가 없는 경우 취득 강제성이 낮은 간접취득을 선택할 유인이 크다.

가설4: 직접취득에 비해 간접취득의 장기성과가 저조하며 간접취득에서 허위신호가 나타날 가능성이 높다.

내부자가 공시 전후에 주식을 매수했다면 이 행위는 두 가지로 해석이 가능하다. 정보신호가설에서 주장하는 바와 같이 기업가치가 본질가치에 비해 저평가되어 있다고 판단하고 앞으로 주가가 상승할 것으로 예상하여 개인적으로 자사주를 매수한 경우이다. 기업 측면에서는 내부자의 판단을 시장에 알릴 목적으로 자기주식 취득을 공시하고 예상한 바와 같이 주가는 상승한다.

그러나 저평가에 대한 판단이 배제된 상황에서도 동일한 현상이 나타날 수 있다. 주가가 기업의 본질가치와 무관하게 하락하는 상황이거나 실제 기업가치 하락으로 주가가 떨어지는 경우 내부자는 현재 상황을 일시적으로 개선할 목적으로 자기주식 취득 공시를 이용할 가능성이 있다. 외부 투자자는 기업 공시의 진위여부를 사전적으로 판별하기 어려우므로 주가는 상승할 것이고 이러한 주가변화를 이용하여 내부자가 개인 보유지분을 늘려 자본이득을 취하는 기회주의적 행태를 보일 가능성이 있다.

이를 구분하기 위하여 내부자 지분의 장기추세를 살펴보았다. 만일 자기주식 취득 공시가 기업가치가 저평가된 상황을 알리기 위한 목적이라면 주가가 점진적으로 상승하여 장기적으로 본질가치로 수렴하게 될 것이다. 이 경우 내부자는 주가상승 후 개인 지분을 지속적으로 보유할 것이다. 하지만 자기주식 취득 공시가 저평가에 기반을 두지 않은 허위라면 주가는 다시 하락할 것이므로 내부자는 지분을 계속 유지할 이유가 없다.

가설5: 일시적인 주가부양을 위해 자기주식 취득 공시를 이용하였다면, 해당 기업 주식을 매수한 내부자는 공시 후 보유주식을 매도하여 수익을 실현할 것이고 보유주식을 매도한 내부자는 공시 후 해당 주식을 매수하지 않을 것이다.

주요 관심변수인 내부자 거래를 측정하기 위한 변수로 내부자의 보유지분율을 이용하였다.

기업의 자기주식 취득이나 처분 규모를 측정하는 변수

자기주식 취득 및 처분에 영향을 미치는 기업특성을 통제하기 위하여 시장가/장부가 비율(Price-to-Book Ratio: PBR), 기업규모(Size), 영업이익률(Return on Assets: ROA), 현금보유비율(Cash/Asses: Cash), 부채비율(Leverage) 등을 설명변수로 포함한다.

자사주 취득 및 처분 규모와 정보를 보유한 내부자 간의 관계를 분석하기 위해 다음과 같은 모형을 설정한다.

일의

일의 는

는  일의 주가지수 일간수익률이다. 시장수익률 통제변수로 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수를 이용하였다.

일의 주가지수 일간수익률이다. 시장수익률 통제변수로 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수를 이용하였다.

본 분석은 2015년 1월부터 2022년 5월까지 유가증권시장과 코스닥시장에 상장된 종목 중 자기주식을 직접취득 또는 직접처분하거나 신탁계약을 체결한 기업을 대상으로 하였다. 자기주식 취득 및 처분에 관한 자료는 DART의 관련 공시를 참고하였으며, 주가 및 재무자료, 내부자 지분 자료는 FnGuide를 이용하였다. 재무자료는 분기별 자료를 이용하였다. 해당 공시 중 다음의 조건을 충족하는 경우를 최종 분석대상으로 선정하였다. 분석에 최종적으로 포함된 자료는 직접취득 공시 564건, 직접처분 공시 1,122건, 신탁계약체결 공시 642건으로 총 2,328건이다.

(1) 보통주

(2) 비금융업

(3) 직접취득 또는 간접취득의 경우 공시 목적이 주가안정 또는 소각9)

(4) 직접처분의 경우 유통주식 수 대비 처분 공시 주식 수 비중이 0.01% 이상10)

(5) 간접취득의 경우 신규 신탁계약 체결11)

(6) 공시 직전 분기 재무자료 및 공시 후 1년간 주가자료 존재

(7) 공시 직전 1개월 이내에 다른 취득 또는 처분 공시가 있을 경우 제외12)

분석에 포함된 변수들의 기초통계량은 다음의 <표 Ⅳ-2>와 같다. 극단치로 인한 왜곡을 완화하기 위하여 변수별로 상하위 1% 값을 윈저화(winsorization)하여 분석하였다.

공시 전 내부자 거래는 직접취득, 직접처분, 간접취득의 모든 경우에 평균적으로 0%에 가까웠으나 최솟값과 최댓값이 각각 –3.38%, 2.00%로 상당한 격차를 보인다. 자기주식 취득 및 처분 공시 직전 1개월 동안 상당량의 지분을 매수하거나 매도한 지배주주가 존재함을 알 수 있다.

직접취득과 간접취득의 는 평균적으로 약 36% 전후의 값을 보인다. 동일 기간 전체 상장기업의 분기별 평균값인 약 45.49%와 비교하여 자사주를 직간접 취득한 기업의 부채가 적은 것으로 나타났다. 직접취득과 간접취득의 는 각각 10.31%, 12.99%으로 간접취득 기업의 현금보유도가 더 높았다. 간접취득은 직접취득에 비해 장기간 여유자금을 자기자본 취득을 위해 신탁계약 형태로 위탁해야 하므로 자금 사정에 여유가 있는 기업이 간접취득을 택한 것으로 판단된다. 는 직접취득과 간접취득 모두 4.5% 이상의 높은 수익을 달성한 기업이며, 직접처분 기업의 가 2.94%인 것과 비교해도 높은 수치이다. 한편 직접취득과 간접취득의 은 약 1.6~1.7인데, 이는 전체 상장기업 분기별 평균인 2.1에 비해 낮아 주가 저평가를 개선하기 위하여 자기주식 취득 공시를 할 가능성이 있는 것으로 해석된다.

4. 자기주식 취득 및 처분의 장기 주가반응

정보신호가설에 따르면 기업이 저평가 상태에 있을 때 이를 시장에 알리기 위한 목적으로 자기주식 취득 공시를 이용한다. 실제 기업이 적정가치에 비해 저평가되어 있는 상황이고 경영자가 의도한 대로 자기주식 취득을 통해 성공적으로 저평가 상태에서 벗어난다면, 장기적으로 주가가 상승해야 한다.

이를 확인하기 위하여 직간접 취득 또는 처분에 따라 공시 후 6개월과 1년이 경과한 시점의 주가수익률을 계산하면 <표 Ⅳ-3>과 같다. Return[0,180]과 Return[0,365]는 공시일(0일)로부터 각각 6개월과 1년 경과 시점의 수익률을 나타낸다. 또한 BHAR[0,180]은 180일이 경과한 시점까지 보유했을 때 시장수익률 대비 초과수익을 나타내며 BHAR[0,365]는 1년간 보유했을 때의 초과수익을 의미한다.

주가는 시장 흐름과 비교해서도 큰 차이를 보이며 상승하였다. 공시 후 6개월간 자기주식 직접취득 기업의 주식을 보유했을 때 지수 대비 초과수익률은 19.66%였으며 이는 통계적으로도 유의한 수치이다. 간접취득 또한 14.38%로 상당히 높은 수치를 보인다. 이후 6개월간 주가가 추가 상승하여 1년 초과수익은 직접취득과 간접취득 각각 47.91%, 41.00%였다. 그러나 직접취득과 간접취득간의 초과수익률 차이는 통계적으로 유의하지 않아 취득방법에 따른 주가 상승 정도에 차이가 있다고 보기 어려웠다.

자기주식을 취득했을 때뿐만 아니라 처분한 경우에도 주가는 상승하였다. 직접처분 공시 후 6개월간 주가는 34.72% 상승했고 1년 경과한 시점에서는 공시 전 대비 81.92% 더 높았다. 코스피지수와 코스닥지수를 이용하여 시장수익률을 통제한 이후에도 6개월과 1년 동안 각각 18.61%, 31.29%의 초과수익을 얻을 수 있었다. 자기주식 처분 목적은 자기주식 취득과 대칭적 구조로 분포되어 있지 않다. 즉, 공시 상에 나타나는 자기주식 취득 목적의 대부분이 저평가 신호효과를 통한 기업가치 제고이지만, 자기주식 처분은 기업가치 고평가 해소와 주가안정을 위해 이루어지는 것이 아니다. 처분은 성과보상, 운영자금확보, 기업 구조조정 등 다양한 목적이 있기 때문에 해당 이벤트를 시장에서 어떻게 해석하느냐에 따라 주가상승이 관측될 수 있다.

5. 내부자 거래와 자기주식 공시

앞서 살펴본 바와 같이 모든 공시가 양(+)의 수익을 가져오는 것은 아니며 공시 중 일부는 기업가치 상승 효과가 없는 거짓신호일 가능성이 있다. 그런데 기업 외부의 투자자가 공시 시점에 해당 공시가 실질가치에 기반을 두지 않은 허위 정보신호일 가능성을 판별해내는 것은 쉽지 않다.

본 절에서는 자기주식 취득목적이 가지는 진실성을 판별할 수 있는지 살펴보기 위하여 일반투자자에 비해 정보우위에 있는 기업 내부자의 행태를 보완적으로 분석하고자 한다. 자기주식 직접취득과 직접처분은 법에 따라 공시 다음 날부터 3개월간 취득이나 처분을 완료해야 한다. 간접취득은 신규 계약체결의 경우 3개월이 경과한 시점에 상황보고서를 제출해야 한다. 취득이나 처분이 공시 후 3개월 이내에 집중적으로 일어날 것으로 판단되므로, 공시일(t=0) 전 3개월(t=-90)부터 공시 후 3개월(t=90)까지의 내부자 지분 변화를 누적하여 나타내면 <그림 Ⅳ-2>와 같다.

모든 경우에 내부자 지분 증가 또는 감소분은 통계적으로 유의하였으며, 내부자 지분 변화의 절대규모가 내부자가 증가했을 때에 비하여 감소했을 때 더 큰 것으로 나타났다. 직접취득의 경우 내부자 지분율이 증가한 경우 0.286%의 증가가 관측되었고, 감소한 경우에는 이보다 큰 0.545%가 감소하였다. 신탁취득에서는 그 차이가 더 컸다. 내부자 지분율 증가 시 0.292%가 증가했으며 감소폭은 0.764%였다.

6. 장기성과 예측 가능성과 내부자 지분 장기추세

자기주식 공시 후 주가 변화가 내부자의 자기 회사 주식 매수 여부에 따라 달라지는지 알아보기 위하여 내부자 지분율 변화를 기준으로 장기성과를 산출하였다. <표 Ⅳ-5>는 공시 전 내부자 지분율을 증가, 불변, 감소의 세 그룹으로 구분하고 각각의 경우에 장기성과를 보여준다.

간접취득에서 내부자 지분이 증가한 경우에는 <표 Ⅳ-5> 패널C의 (1)에서 알 수 있듯이 처음 6개월 성과는 유의하지 않았으나 1년이 경과한 시점에서는 주가가 시장에 비해 유의하게 상승하였다. 내부자 지분율 증가와 자기주식 취득 공시가 이중으로 주가 상승에 대한 신호를 보낸 경우 주가는 6개월까지는 크게 변화하지 않고 1년이 경과하고 나서 상승 반응이 도출되었다.

한편 직접취득의 경우 6개월 초과수익률은 30.56%이고 1년 초과수익률은 52.80%로 시장 평균수익률에 비해 주가가 크게 상승했다. 내부자 지분율 증가를 통해 자기주식 취득 공시가 현재의 저평가 상황과 향후 주가 상승을 나타내는 신호로 작동할 수 있음을 의미한다.

그러나 직접취득 공시에서 내부자 지분율이 감소한 경우에도 주가는 상승하였다. 패널A의 (3)에서 6개월 초과수익률은 17.14%였으며 1년 초과수익률은 51.35%로 내부자 지분율이 증가했을 때의 수익률과 큰 차이가 없었다. 내부자가 본인 소유의 지분을 매도했음에도 시장에서 주가가 상승하였다는 것은 내부자의 판단과 시장의 반응 간에 괴리가 있다는 것을 의미한다. 내부자가 판단한 기업가치가 맞다면 주가는 저평가가 아니라 고평가되었을 가능성이 높다. 그럼에도 불구하고 일시적 주가 부양을 위해 자기주식 취득을 공시한 경우 시장의 장기 반응은 하락하는 것이 타당하다. 그런데 실제로는 주가는 유의하게 상승하였다.

내부자가 보유지분을 축소하고 반대로 기업은 자사주를 취득하는 대립되는 상황에서 주가가 상승한 현상을 이해하기 위해 공시 이후의 내부자 지분 변화를 살펴보았다. 공시 이후 내부자 지분의 추세가 추가적인 정보를 제공할 수 있다고 판단한 근거는 다음과 같다.

만일 기업이 본질가치를 주가에 반영하기 위한 목적이 아니라 단기적 주가부양을 위해 자기주식 취득 공시를 이용하였다면, 주가가 일시적으로 상승하였다고 하더라도 향후 주가는 기업의 실질가치에 수렴하여 다시 하락할 가능성이 크다. 이 경우 사적이익 극대화를 추구하는 내부자는 본인이 보유한 지분을 유지할 이유가 없다. 즉, 일반투자자들이 취득 공시를 긍정적으로 해석하여 매수세가 강해지면 주가는 상승할 것이나, 공시가 거짓 신호라고 판단한 내부자는 일반투자자들과는 달리 현재 주가를 고평가 상태로 해석하여 본인 보유지분을 매각할 것이다.

내부자 지분의 추세를 살펴볼 때 고려해야 할 또 다른 점은 내부자의 불공정거래 관련 규제이다. 자본시장법은 내부자의 내부정보를 이용한 불공정거래를 방지하기 위하여 내부자의 단기매매차익을 반환하도록 규정하고 있다(자본시장법 제172조). 즉, 기업의 임직원이나 주요 주주가 증권을 매수하거나 매도한 후 6개월 이내에 반대매매를 하여 이익을 얻은 경우 그 이익을 포기해야 한다. 따라서 공시 6개월 이후의 내부자 지분 변화도 추가로 살펴볼 필요가 있다.

내부자 지분이 증가한 경우 취득방법에 따른 결과를 비교해보면 공시 후 직접취득과 간접취득의 내부자 지분 변화에서 차이가 관측된다. <그림 Ⅳ-3>과 <표 Ⅳ-6>의 패널A를 살펴보면 직접취득 중 공시 이전에 내부자가 해당 회사 주식을 매수한 경우 공시 직후와 3개월이 경과한 시점까지도 지속해서 주식을 매수하고 있음을 알 수 있다. 이는 시장에서 공시로 인해 주가가 상승하고 있을 것임에도 불구하고 주가가 내부자가 판단하는 수준에는 미치지 못하고 있다는 것을 의미한다.

<표 Ⅳ-6> 패널A의 (7)행의 결과에 따르면 180일에서 365일 사이에 내부자 지분이 0.539% 하락했다. 공시 전 주식을 매수하여 지분을 증가시킨 내부자라 할지라도 공시 후 6개월이 경과한 시점부터 매도세로 전환된 것이다. 그러나 이는 통계적으로 유의미한 수치라고 보기 어렵다. 공시 전에 내부자가 자기 회사 주식을 매수한 종목에서 공시 6개월 후부터 지분을 매도한 종목이 존재할 것이나 수치가 통계적으로 유의하지 않은 것으로 보아 종목간 편차가 크다는 것을 알 수 있다.

한편 간접취득의 경우 공시 6개월 이후 내부자가 지분을 대량 매도하였다는 것이 여실히 드러난다. <그림 Ⅳ-3>과 <표 Ⅳ-6>의 패널B의 결과를 살펴보면 내부자는 공시 이전 0.292%의 지분을 매수했으나 공시 이후 6개월부터 1년 사이에 0.813%를 매도했다. 공시 1일 전부터 180일 사이에 매수한 지분을 감안하더라도 6개월 이후 매도량이 더 크다는 것을 알 수 있다.

즉, 내부자가 회사 주식을 매수하고 자기주식 신탁계약을 체결한 후 1년이 경과한 시점에서 주가가 크게 오르자 내부자는 보유지분을 매도하였다고 해석 가능하다. 내부자가 공시 후 주가가 상승하자 보유주식을 대량 매도한 것으로 보아 간접취득의 경우 내부자가 주식을 매수한 경우에도 공시의 진위성을 의심할 수밖에 없다.

공시 이전에 내부자가 보유지분을 매도한 경우에는 공시 이후에도 매도세가 지속된다. <그림 Ⅳ-3>의 패널A에서 직접취득의 경우 주가가 유의하게 상승하는 공시 후 2개월 이내에도 지속적으로 매도하였으며 그 이후에도 매도가 이어졌으나 통계적으로 유의한 규모는 아니었다. 즉, 내부자는 자기주식 취득 공시로 주가가 상승하는 중에도 주가가 하락할 것이라는 의견을 고수한 것으로 보인다. 그렇다면 이는 자시주식 주가 하락에 대한 확실한 신호로 볼 수 있다. 간접취득의 경우에도 마찬가지이다. 간접취득을 공시한 경우 중 내부자가 공시 이전에 지분을 매도하였다면 6개월 이후에 지속적으로 주가를 매도하는 양상을 보였다. 공시 후 6개월에서 1년 사이에 매도한 지분은 0.856%였으며 통계적으로도 유의하였다. 향후 주가가 하락할 것이라는 내부자의 판단이 변하지 않은 것이다.

요약하면, 기업이 자기주식을 직접취득할 것으로 발표하면 내부자의 투자행태와 무관하게 주가는 상승하였다. 그런데 공시 전부터 공시 후 1년간의 내부자 지분 변화를 바탕으로 판단해보았을 때 내부자가 보유주식을 매도한 경우 자기주식의 신호효과를 신뢰하기 어렵다. 기업이 자기주식 취득을 공시하여 저평가에 대한 신호를 전달하는 중에도 내부자는 지속해서 보유지분을 매도했기 때문이다.

자기주식 간접취득의 경우에는 시장의 과잉반응 또는 허위 신호의 가능성이 존재한다. 내부자 지분이 증가한 경우 주가는 상승하였고 감소한 경우 유의한 주가변화는 관측되지 않았다. 우선 내부자 지분이 감소한 경우 기업이 주주환원을 목적으로 자기주식을 취득한다고 발표했음에도 시장에서는 확실한 매수 반응을 보이지 않았다는 것을 의미한다. 다시 말해, 저평가 신호가 허위일 가능성이 있으며 시장에서도 공시를 완전히 신뢰하지 않았다. 내부자 지분이 증가한 경우에는 주가가 상승했으므로 표면적으로는 저평가가 개선된 것으로 해석할 수 있으나, 내부자는 주가가 급등한 6개월 이후 지분을 매도하였다. 이것으로 미루어 보아 공시의 진위를 신뢰하기 어렵거나 시장에서 공시에 과잉반응하여 주가가 과도하게 상승하였다고 해석 가능하다.

7. 직접처분 목적별 특성과 장기성과

정보신호가설에 따르면 기업은 저평가 상태라는 것을 시장에 알리는 방법으로 자기주식을 취득한다. 정보신호가설을 자기주식 처분에 그대로 적용한다면, 기업은 주가 고평가를 시장에 알리기 위해 자기주식 처분 공시를 이용한다는 논리가 가능하다. 취득의 경우 저평가 신호의 목적에 따라 공시 후 주가가 상승했으므로 처분의 경우에는 하락할 것으로 예상할 수 있다. 그러나 기업은 자발적으로 기업가치가 실질가치에 비해 과도하게 높다는 사실을 전달하여 적극적으로 주가 하락을 유도할 유인이 없다.

앞서 살펴보았다시피 실제 직접처분은 공시 이후 주가가 상승하는 양상을 보였다. 기업의 자기주식 처분 행위가 기업가치에 긍정적인 시그널로 작용하는 원인에 대한 분석이 필요하다.

Ⅲ장 2절의 처분 목적에서도 알 수 있듯이 주가안정을 위해 처분을 이용하는 경우는 극히 드물다. 자기주식 취득은 90%가 넘는 경우에 목적이 주가안정과 주주가치 제고였던 반면에, 기업은 다양한 목적으로 자기주식을 처분한다. 따라서 취득과 달리 목적에 따라 처분 공시를 구분하고 공시효과를 분석할 필요가 있다. <표 Ⅳ-7>은 처분 목적을 임직원 성과보상 등 6개의 항목으로 재분류하여 내부자 거래, 6개월 및 1년 주식성과를 살펴본 것이다.

재무구조 개선을 위하여 보유한 자기주식을 활용하는 기업의 행위는 시장에서 긍정적인 효과를 거두었다. 1년이 경과한 시점에서 주가는 유의하게 상승하였다. 그러나 내부자 지분의 증감이 효과의 차이를 구별하는 신호 역할을 하지 못하는 것으로 보인다. 자기주식 처분 목적을 재무구조 개선으로 공시한 경우 내부자 거래와 무관하게 주가는 상승하였으며 초과수익률은 33~38%로 큰 차이를 보이지 않았다.

합병, 완전 자회사화, 전략적 제휴와 같이 기업의 구조조정 개선을 위해 자기주식을 이용한 경우에 시장은 이를 긍정적으로 받아들이지 않았다. 주가는 시장평균 대비 유의하게 상승하지 않았다. 그런데 이 경우 자기주식 처분 효과와 합병 및 전략적 제휴 등에 따른 구조조정 효과가 혼재되어 주가에 반영될 것이기 때문에 자기주식 처분만의 효과를 구분하기 어렵다.

자기주식 처분 목적을 주가안정으로 밝힌 경우 양(+)의 장기성과가 도출되어 시장은 긍정적으로 반응했다고 볼 수 있으나, 주가안정 목적의 처분은 드물어 통계적으로 안정적인 결과를 도출하기 어려웠다. 또한 지배주주의 경영권 안정을 위해 자기주식을 처분하는 경우 장기성과가 하락하는 것으로 보아 시장이 긍정적으로 받아들이지 않고 있다고 할 수 있으나 역시 관측치가 충분하지 않았다.

8. 공시 규모와 공시의 허위성

가설3에서 기업가치가 저평가된 것이 사실이라면 기업이 시장에 강력한 신호를 보내기 위해 취득 규모를 크게 공시할 것이라 가정한 바 있다. 이를 실증적으로 검증하기 위해 자기주식 취득 및 처분 규모를 종속변수로 하여 다변량분석을 시행하였다. 구체적인 회귀식은 2절의 (식 2)와 같다. 공시의 진위 여부를 판별하기 위한 보조변수로 내부자 지분율 변화율 변수를 이용하였으며 기업특성을 통제하기 위한 변수로 기업규모, 시장가/장부가비율, 현금보유비율, 부채비율, 영업이익률을 포함하였다.

<표 Ⅳ-9>는 직접취득, 직접처분, 간접취득 각각의 경우에 대해 자기주식 공시 규모와 내부자 지분율 및 기업특성 변수간의 관계를 나타낸다. 각 패널의 (1)은 전체 자료를 통합하여 분석한 것이고 (2)와 (3)은 각각 공시 전에 내부자 지분율이 증가한 경우와 감소한 경우를 대상으로 분석한 것이다. 결과 비교를 통해 몇 가지 사실을 확인할 수 있다.

둘째, 내부자 지분율 증감에 따라 자료를 구분하여 분석한 (2)와 (3)의 결과에서는 일부의 경우에 내부자 지분율이 유의한 설명력을 가졌다. 특히 패널A의 (2)의 결과를 살펴보면, 내부자 지분율 증가 정도가 클수록 취득 공시규모가 큰 것으로 나타났다. 즉, 내부자가 공시 전에 자기 회사 주식을 매수할 경우 실제로 기업가치가 저평가 되었을 가능성이 높으며, 기업 또한 자기주식 취득 규모를 크게 하여 확실한 주가회복을 유도한 것일 수 있다. 자기주식 처분의 경우에도 취득과 마찬가지로 공시 전 내부자 거래 증가가 공시 규모와 양(+)의 상관관계를 가졌다.

셋째, 패널C의 간접취득에서는 직접취득과 달리 내부자 지분율과 공시 규모 간의 관련성을 찾아보기 어려웠다. 내부자 지분율 증감에 따라 자료를 구분하여 분석한 결과에서도 마찬가지로 계수가 유의하지 않은 것으로 나타났다. 직접취득과 간접취득은 취득의 강제성에 차이가 있다. 직접취득은 공시 기한 3개월 이내에 공시에서 명시한 주식 수를 모두 취득해야 한다. 따라서 직접취득은 공시사항을 이행해야 할 강제성이 높다. 그러나 간접취득은 통상 계약기간이 6개월 또는 1년으로 직접취득에 비해 길 뿐만 아니라 공시에 언급한 금액만큼 모두 취득할 의무가 없다.13) 따라서 공시 규모가 모두 취득될 것이라는 기대가 낮으며 Ⅱ장 4절에서 살펴본 바와 같이 간접취득은 평균 실취득률이 80% 정도에 불과하다. 이러한 불확실성 때문에 직접취득이나 직접처분의 결과와 달리 간접취득에서는 설명력이 관측되지 않을 수 있다.

한편 패널A의 (3)에 따르면, 내부자 지분율 변화와 취득규모 간에는 음(-)의 상관관계를 가졌다. (3)은 내부자 거래가 감소한 경우만을 대상으로 분석한 것이므로 내부자 지분율 하락폭이 클수록 취득 규모는 더 큰 것으로 해석된다. 내부자 지분율 감소가 자기주식 취득 공시의 허위성을 나타내는 변수라면 내부자 지분이 많이 감소할수록 공시 규모 또한 작아지는 것이 타당하다. 그러나 본 분석에서는 반대의 결과가 도출되었다. 이에 대한 설명을 위해 추가적인 분석이 필요할 것이다.

직접처분에서는 공시 전 내부자 지분율이 증가한 경우 기업의 자기주식 처분 규모도 유의하게 커지는 것으로 관측된다. 패널B의 (2)의 결과에 따르면 내부자 지분율 변화 변수와 자기주식 공시 규모는 유의한 양(+)의 관계가 존재했다. 즉, 내부자가 매수한 주식이 많을수록 기업에서는 더 많은 주식을 처분한다는 것이다.

9. 공시의 장기성과와 종목 특성

공시 1년 후 주가는 평균적으로 양(+)의 초과수익을 보이지만 모든 종목에서 주가가 상승하는 효과가 나타나는 것은 아니다. 4절에서 살펴본 바와 같이 전체 직접취득과 간접취득 공시 중 약 절반가량에서 음(-)의 초과수익이 발생하였다. 본 절에서는 공시 후 1년 뒤 실현된 초과수익을 기준으로 음(-)의 초과수익과 양(+)의 초과수익으로 나누어 두 그룹 간에 내부자 거래 및 재무적 특성에 차이가 있는지 살펴보았다.

그럼에도 불구하고 일부에서 유의한 지분율 변화가 관측된다. 패널A의 (2)의 결과에 따르면, 직접취득 공시 후 음(-)의 초과수익이 발생한 경우, 180일까지의 내부자 지분( [0,180])이 유의하게 감소한 것을 알 수 있다. 즉, 직접취득 공시에도 불구하고 주가가 다른 종목 대비 하락하여 음(-)의 초과수익이 발생하였을 경우 내부자는 해당 종목을 매도하였다. 통계적으로 유의하지는 않으나 [-30,-1], [0,90], [180,365] 모두 음(-)의 값을 갖는 것으로 보아 내부자는 해당 주식을 최소한 매수하지 않은 것으로 보인다. 패널A의 (1)에서 시장대비 초과수익이 발생한 경우에는 내부 지분율이 유의하지는 않으나 전반적으로 양(+)의 값이 도출되었다.

패널B의 간접취득 결과에 따르면, 공시 후 3개월이 경과한 시점부터 내부자는 양(+)의 초과수익이 발생한 종목을 매도하고 음(-)의 초과수익이 발생한 종목을 매수했다. 만일 기업이 저평가되었다는 판단을 바탕으로 자기주식을 취득하고 내부자 또한 기업의 판단에 동의했다면 내부자는 주가가 상승할 것으로 기대하며 지분을 늘리거나 최소한 매도하지 않을 것이다. 그러나 실제로는 주가가 상승한 종목을 매도하고 하락한 종목을 매수해서 자본이득을 얻으려 했던 것으로 보인다. 간접취득의 경우 공시의 정보신호효과를 신뢰하기 어렵다는 해석이 가능하다.

재무적 특성을 살펴보면, 직접취득 공시의 양(+)의 장기효과가 나타난 종목과 음(-)의 장기효과가 발생한 종목간에 현금보유도, 기업규모, 영업이익률 차이는 존재하지 않았으며, 부채비율, 은 유의한 차이가 나타났다. 양(+)의 공시효과가 나타난 종목과 음(-)의 공시효과가 나타난 종목의 이 각각 1.57, 1.81로 공시 후 주가가 상승한 종목의 이 낮았다. 또한 부채비율의 경우 양(+)의 초과수익이 실현된 종목이 음(-)의 초과수익이 발생한 종목에 비해 낮았다. 즉, 재무건전성이 높고 장부가 대비 저평가된 종목에서 공시 후 양(+)의 성과가 관측되었다.

간접취득의 경우 을 비롯하여 현금보유도, 기업규모, 영업이익률, 부채비율 등의 재무변수에서 양(+)의 초과수익이 발생한 종목과 음(-)의 초과수익이 발생한 종목간에 유의한 차이를 찾아볼 수 없었다. 따라서 재무적 특성을 기반으로 공시효과가 발생한 것이 아니라는 것을 알 수 있으며, 주가가 시장 대비 상승한 경우에도 내부자는 지분을 매도한 것으로 보아 공시를 신뢰하기 어렵다고 판단된다.

10. 소결

본 보고서는 자기주식 취득 또는 처분 공시의 목적을 구분하고 기업의 본질가치에 대한 허위정보를 포함하고 있는지 내부자 지분 증감을 이용하여 분석하였다. 2015년 1월부터 2022년 5월까지 자기주식 취득 및 처분 자료를 토대로 분석한 결과를 요약하면 다음과 같다.

첫째, 공시상 자기주식 취득과 처분 목적은 서로 비대칭적인 분포를 보여준다. 자기주식 직접취득 목적 중 가장 큰 비중을 차지하는 것은 주가안정 및 주주가치 제고로 공시 수 기준으로 전체의 85.6%를 차지한다. 간접취득 또한 직접취득과 마찬가지로 신탁계약 체결 공시의 99.4%가 주가안정 및 소각을 목적으로 제시하였다. 그러나 자기주식 처분의 경우 주가안정 및 주주환원은 4%가 채 되지 않으며 임직원 성과보상, 주식매수선택권 행사, 투자 및 운영자금 확보 등의 다양한 사유가 존재한다. 즉, 국내 법규상 자기주식은 자산으로 해석되기 때문에 취득한 자사주가 기업의 목적에 따라 다양한 용도로 사용된다.

둘째, 자기주식 취득과 처분 공시 이후 주가는 평균적으로 상승하였다. 직접취득과 간접취득은 각각 시장수익률 대비 47.91%, 41.00%의 초과성과가 달성되었으며, 직접처분의 경우 또한 주가는 지수 대비 31.29%p 상승하였다. 그러나 모든 공시에서 양(+)의 초과수익이 발생한 것은 아니며 전체 2,328개 공시 중 1,217개 공시는 시장수익률에 미치지 못했다.

셋째, 자기주식 취득 공시의 허위성을 판단하기 위해 공시 전후 내부자 지분율 변화의 증감을 살펴보았다. 그 결과, 직접취득 공시 이전에 내부자 지분율이 증가한 경우, 공시 이후 유의한 초과성과가 나타나며 취득기간이 종료된 이후에도 내부자의 보유주식 매도가 관찰되지 않는다. 기업이 기업가치가 저평가되었다고 판단했으며, 내부자 또한 해당 종목을 매수함으로써 기업의 신호가 허위가 아님을 보인 결과, 주가상승의 결과가 도출된 것이라 해석된다.

간접취득 공시 이전에 내부자 지분이 증가한 경우에는 유의한 초과성과가 나타나지만, 직접취득의 경우와 달리 내부자가 일정 시점 이후 보유주식을 매도하는 방향으로 전환한 것이 관측된다. 특히 단기매매차익 반환 규제를 받지 않는 6개월 이후 집중적으로 매도하였는데 공시 전에 매수한 분량을 상쇄하는 수준이었다. 이는 애초에 기업가치 저평가에 대한 공시 신호가 허위일 가능성을 시사한다. 하지만 시장에서 공시에 대한 반응이 과도하게 일어나 실질가치를 초과하는 수준의 주가상승이 발생하여 내부자가 보유 지분을 매도한 것일 수도 있으므로 해당 공시의 신뢰성에 대한 판단을 내리기 어렵다.

그런데 공시 전에 내부자 지분율이 감소한 경우에는 공시를 신뢰하기 어렵다는 근거가 발견된다. 우선 간접취득의 경우 내부자가 보유 주식을 매도한 경우 주가가 지수 대비 유의하게 상승했다는 근거를 찾아볼 수 없었다. 또한 직접취득의 경우 주가는 상승했지만 기업이 자사주를 취득하는 중에도 내부자는 기업과 반대로 해당 종목을 매도한 것으로 나타났다.

넷째, 기업이 자기주식을 처분한 경우 주가가 상승한 원인을 공시목적별로 구분하여 살펴본 결과, 임직원 성과보상, 재무구조 개선 등 빈번하게 관측되는 처분 공시 목적에서 주가가 긍정으로 반응한다는 것을 알 수 있었다. 이 또한 내부자 지분 변화에 따라 주가반응에 차이가 발생하는지 살펴보기 위하여 내부자 지분 증감을 기준으로 구분하여 분석하였다. 그 결과 내부자가 주식을 매수하는 상황에서 임직원에게 성과보상을 한 경우에 내부자가 매도한 때에 비해 주가상승이 더 큰 것으로 나타났다. 즉, 내부자가 주가가 향후 상승할 것으로 기대하고 보유지분을 증가시키는 중에 기업이 임직원에게 성과보상을 하면 시장은 이를 긍정적으로 해석하고 주가는 상승하는 결과가 도출되었다. 기업이 임직원 성과보상을 발표할 때, 기업 외부에서는 기업의 성장을 위한 동기부여인지, 기업 상황에 비해 과도한 보상인지 구분하기 어렵다. 이때 기업의 내부자 지분 변화를 통해 기업 내부자가 어떤 판단을 내리는지를 관측하면 판단에 도움이 될 수 있다. 재무구조 개선 등 다른 목적에 따른 처분의 경우에는 내부자 지분 변화에 따라 큰 차이가 관측되지 않거나 관측치 부족으로 통계적 유의성에 대한 검증이 불가능했다.

Ⅴ. 결론 및 시사점

이상의 분석 결과에 따르면 자기주식 취득 또는 처분 공시만으로 주가가 저평가되었는지 여부를 판단하기 어렵다. 기업은 자기주식 취득 공시 중 대부분의 경우에 공시 목적을 주가안정 및 주주가치 제고라고 공시하였으나 모든 경우에 주가가 상승하는 결과가 도출된 것은 아니다. 본 연구에서는 보조적 수단으로 내부자의 보유 지분 변화를 살펴본 결과 자기주식 취득의 저평가 신호가 일부 공시에서는 허위일 가능성이 높다는 것을 알 수 있었다. 기업의 자기주식 취득 공시에도 불구하고 내부자는 지속적으로 주식을 매도하는 사례가 상당수 관측되었다. 이 경우 주가안정을 위해 자사주를 취득한다는 기업의 공시를 신뢰하기 어렵다.

투자자에게 자기주식 취득에 대한 명확한 정보를 제공하기 위하여 현재 명목상으로 이루어지고 있는 공시의 실효성을 제고할 필요가 있다. 분석 기간 동안 자기주식 직접취득과 간접취득 공시의 95%는 주가안정과 주주가치 제고라고 공시하고 있으나 그 이외에는 판단 근거가 명확하게 제시되어 있지 않다. 따라서 투자자는 해당 공시가 기업 저평가를 기반으로 이루어진 신호인지, 시장에 미치는 영향력이 어느 정도 일지 파악하기 어렵다. 자기주식 취득 목적에 대한 보다 상세한 설명과 함께 기업의 결정에 영향을 미친 관련 정보를 제공할 필요가 있다. 즉, 자기주식 취득의 상세한 목적 또는 판단근거, 취득 규모 결정 기준 및 절차, 신탁계약 등 다른 취득 공시 현황 및 영향 등에 대한 자세한 설명이 제시되도록 공시요건을 강화해야 한다.

자기주식 취득 및 처분에 따른 대주주와 일반주주 간의 이해상충 가능성을 검토하고 해결점을 모색할 필요가 있다. 분석 결과에 따르면 자사주 취득을 공시하기 이전에 내부자가 자사주를 매수하는 경우가 상당수 관측된다. 또한 공시 후 6개월이 경과한 시점에서 내부자가 보유지분을 매도하는 모습도 볼 수 있다. 일반투자자에 비해 정보우위에 있는 내부자가 자기주식 공시를 이용하여 사적이익을 추구하는 행위는 시장에 대한 신뢰를 훼손시킨다. 자사주 취득과 관련된 내부자의 지분 변화에 대한 공시를 강화해야 한다. 기업은 자기주식 취득 또는 처분 기간 동안 해당 주식 매매와 관련된 내부자 거래 정책과 절차를 마련할 필요가 있다. 또한 자기주식 취득 공시에 따른 주가반응은 1년 이상 장기간 지속되므로 6개월의 단기매매차익 반환 규정은 자기주식 취득과 관련하여 내부정보를 이용한 부당이득 추구 행위를 방지하기에 충분하지 않다. 자사주 취득에 대한 매매차익 반환 기한을 연장하는 등의 조치를 검토할 필요가 있다.

취득 방법에 따른 차이를 살펴보면, 신탁계약을 통한 자기주식 간접취득은 직접취득에 비해 주가 상승효과가 적었다. 또한 내부자 거래과 연계하여 분석한 결과 자기주식 공시의 신호를 신뢰하기 어려웠다. 내부자가 매도했을 경우 유의미한 주가반응이 나타나지 않았으며 내부자가 매수했을 경우에는 주가가 상승하기는 하였으나 공시에 따른 주가상승 후 내부자는 매수분을 초과하는 양(+)의 지분을 매도하였다.

직접취득과 간접취득이 취득행위의 주체가 다를 뿐 경제적 실질 측면에서 회사의 재산을 주주에게 환급하는 이익배당행위로 동일하게 해석된다. 그런데도 공시 효과와 공시 신뢰성에 차이가 보이는 것은 규제 강도와 취득 과정상의 불확실성에 차이가 있기 때문이다. 취득 방법 간의 규제 차이로 인해 투자자가 제공받는 정보의 양과 시장에 미치는 영향에 차이가 발생하는 현재의 상황을 개선하기 위하여 자기주식 간접취득에 대한 규제를 직접취득에 준하는 수준으로 보완할 필요가 있다. 신탁계약을 통한 취득상황 공시의 빈도를 높일 필요가 있다. 계약 해지 또는 종료 시에 거래내역을 공시하도록 하는 현재의 규정을 변경하여 계약 연장 시 혹은 주기적으로 거래내역을 공시하여 투자자가 간접취득 현황을 파악할 수 있도록 해야 한다. 또한 별도의 제재 없이 관행적으로 이루어지고 있는 신탁계약 연장을 제한할 필요가 있다. 간접취득 현황과 실취득률, 향후 취득 계획, 명확한 연장사유 등을 제시하도록 하고 필요성이 분명한 경우에 한하여 연장을 허용해 간접취득의 불확실성을 완화해야 한다. 아울러 계약기간 내에 취득한 자기주식의 처분을 허용하고, 약정금액을 모두 취득하도록 강제하지 않는 등 완화된 규정의 실익을 검토해볼 필요가 있다. 완화된 규제에 따른 이득보다 정보열위에 있는 투자자가 입는 손해가 더 크다면 제도 개선을 적극적으로 고려해야 할 것이다.

마지막으로 기업의 직접처분 절차를 개선할 필요가 있다. 현재 취득한 자기주식은 다양한 목적으로 이용된다. 자기주식 취득 목적이 주가안정에 집중된 반면에 자기주식 처분 사유는 임직원 성과보상, 기업 운영자금 확보, 재무구조 개선, 기업 인수합병 등 다양하다. 주주환원 목적으로 취득한 자기주식이 처분 시에는 기업의 필요에 따라 자유롭게 활용되고 있으며 주가에 미치는 효과가 불분명한 것으로 나타났다. 게다가 자기주식 취득 시에는 주주평등의 원칙을 훼손하지 않기 위하여 취득 방법을 엄격하게 규정하고 있으나 보유한 자기주식을 처분하는 경우에는 특별한 제한을 두고 있지 않다. 자기주식 처분은 처분 상대방과 처분 방법을 회사의 정관이나 이사회가 정할 수 있어 주주간 형평성을 침해하거나 지배주주의 이익을 위해 이용될 가능성이 있다. 따라서 기업의 자율적 자기주식 처분으로 인해 일반주주에게 피해가 발생하지 않도록 방지 방안을 모색할 필요가 있다. 더 나아가 자기주식 처분의 경제적 본질에 맞는 규정이 마련되어야 한다. 자기주식 처분은 유통주식 수를 늘리고 외부 자금을 조달한다는 측면에서 신주발행과 다르지 않다. 자기주식 처분의 실질에 맞게 신주발행절차를 따르도록 하거나 신주발행절차에 준하는 별도의 처분 절차를 마련하는 등의 논의가 필요하다.

이상의 논의를 통해 기업의 자기주식 취득과 처분 결정은 투자자의 기대와 다른 목적과 효과를 가질 가능성이 있다는 것을 확인했다. 자기주식의 직간접 취득 및 처분 제도의 경제적 실질과 효익, 일반투자자에 미칠 부작용에 대한 고찰을 바탕으로 제도를 재정비해야 한다. 기업의 자기주식 취득 및 처분이 이론에서 주장하는 바와 같이 기업과 투자자 간의 정보 비대칭을 완화하고 진정한 신호로 작용할 수 있도록 다각적으로 검토할 필요가 있다.