Find out more about our latest publications

Implementing Best Execution Obligations in the Face of Market Fragmentation in the Korean Securities Market

Survey Papers 23-02 Dec. 14, 2023

- Research Topic Capital Markets

- Page 102

The domestic trading market is on the brink of a significant shift from a monopolistic exchange-centric system to a competitive regime among multiple trading markets. The concept of best execution, which establishes the criteria for order execution in a complex trading market environment, forms the basis for creating a fair competition system among trading markets and protecting investors. Despite the importance of best execution, the domestic trading market has maintained a single exchange-based trading structure for an extended period, causing best execution to have limited practical impact and be perceived as a relatively less urgent topic.

However, with NextTrade planning to launch an Alternative Trading System(ATS) by early 2025, it is evident that a multi-trading market structure will soon emerge in South Korea. Consequently, each financial investment company is facing the need to establish policies and procedures for best execution and swiftly build a best execution system.

Furthermore, since the introduction of a broad legal framework regarding best execution in the Financial Investment Services And Capital Markets Act(FSCMA) in 2013, specific discussions on implementation methods have not taken place. As a result, there is an absence of concrete guidelines concerning the obligation of best execution, making it challenging for financial investment firms to establish detailed criteria and methods for compliance.

In light of these developments, this report compiles eight key issues related to the obligation of best execution in the domestic trading market, along with proposing specific implementation measures based on international regulations and guidelines.

First and foremost, it is essential to have a clear understanding of the meaning of best execution. Given the complexity of market structures and various trading methods, determining the best course of action is not straightforward. There is no one-size-fits-all approach to best execution, as judgment may vary based on market conditions, order characteristics, investor preferences, and trading methods. It's important to note that achieving the best execution does not guarantee the best outcome for clients; instead, it means establishing appropriate procedures to ensure that the best possible results are obtained for clients, without guaranteeing the best results.

Second, it should be recognized that the entity that must comply with the best execution obligation cannot be a trading market. This responsibility falls on financial investment traders or investment brokers. In the United States, by the way, marketplaces are required to perform order routing under the Order Protection Rule(OPR). However, this complements the best execution obligations of financial investment firms and enhances overall market fairness and investor protection, but it cannot replace the unique obligations of financial investment firms.

Third, the FSCMA limits the securities that can be traded on an ATS to equity securities and equity-related depository receipts. Therefore, it is reasonable for securities subject to best execution to follow these restrictions. However, when using Smart Order Routing(SOR), financial investment firms may need to decide which securities to apply SOR to at their discretion.

Fourth, choosing the trading market where orders will be executed is at the discretion of financial investment firms, based on overseas regulations and guidelines. Like the Japanese case, however, if only exchanges are considered, the expansion of investor choice and the development of the domestic trading market may be delayed. Therefore, it is necessary to devise practical integration measures and regulatory incentives to encourage financial investment firms to consider selecting ATSs as execution markets without reluctance.

Fifth, to enhance the convenience and efficiency of best execution for financial investment companies and investors, it is necessary to distinguish between individual customers and professional customers and establish separate best execution standards. The primary reason for distinguishing individual customers and setting different best execution standards is to simplify the best execution criteria in a complex trading environment, making it more suitable for investor protection. Additionally, due to the nature of individual investors who trade in small quantities of high liquid stocks, there is less need to consider complex variables. Individual customers can request to consider other factors through separate instructions if they wish, so blocking customer choice is not the objective.

Sixth, when determining best execution, the definition of the best outcome can vary depending on factors such as customer type, order characteristics, market conditions, and any specific instructions provided by the customer. Therefore, best execution policies should be established, taking into account various factors. However, for individual customers, as previously mentioned, the benefits of simplifying criteria are higher, so criteria should be restricted to factors like prices and transaction costs.

Seventh, it is essential to note that merely satisfying a customer's specific instructions during order execution does not fulfill a financial investment firm's best execution obligation. While satisfying specific instructions should be prioritized, additional measures should be taken to ensure that the best possible choice is made, considering other requirements.

Finally, as market structures become more complex, risk of conflicts of interest increase due to the interest between trading markets and financial investment firms and unclear order execution processes . However, the domestic trading market is currently in the early stages of market fragmentation, with limited concerns about conflicts of interest arising from practices such as Payment for Order Flow(PFOF) or the opaqueness of SOR. As market maturity and complexity increase, discussions on concrete measures to address conflicts of interest will become more substantial.

Defining best execution and specifying the means to fulfill this obligation require a flexible approach that considers market conditions and the preparedness of market participants. Since specific guidelines have not yet been established in the domestic market, in-depth discussions are required on various topics, including the eight issues mentioned earlier. It is a critical moment where regulatory authorities, financial investment firms obligated to comply with the best execution obligation, and investors evaluating whether orders are being executed in their best interests must collaborate. Regulatory authorities should establish mandatory requirements through guidelines following extensive discussions among market participants. Additionally, they should facilitate the development of criteria by financial investment firms to make the best judgments in the interest of their clients, beyond the specified requirements. As the South Korean trading market progresses into a multi-trading market system, it is hoped that this report contributes to enhancing investor protection and establishing the foundation for a stable and efficient market environment.

However, with NextTrade planning to launch an Alternative Trading System(ATS) by early 2025, it is evident that a multi-trading market structure will soon emerge in South Korea. Consequently, each financial investment company is facing the need to establish policies and procedures for best execution and swiftly build a best execution system.

Furthermore, since the introduction of a broad legal framework regarding best execution in the Financial Investment Services And Capital Markets Act(FSCMA) in 2013, specific discussions on implementation methods have not taken place. As a result, there is an absence of concrete guidelines concerning the obligation of best execution, making it challenging for financial investment firms to establish detailed criteria and methods for compliance.

In light of these developments, this report compiles eight key issues related to the obligation of best execution in the domestic trading market, along with proposing specific implementation measures based on international regulations and guidelines.

First and foremost, it is essential to have a clear understanding of the meaning of best execution. Given the complexity of market structures and various trading methods, determining the best course of action is not straightforward. There is no one-size-fits-all approach to best execution, as judgment may vary based on market conditions, order characteristics, investor preferences, and trading methods. It's important to note that achieving the best execution does not guarantee the best outcome for clients; instead, it means establishing appropriate procedures to ensure that the best possible results are obtained for clients, without guaranteeing the best results.

Second, it should be recognized that the entity that must comply with the best execution obligation cannot be a trading market. This responsibility falls on financial investment traders or investment brokers. In the United States, by the way, marketplaces are required to perform order routing under the Order Protection Rule(OPR). However, this complements the best execution obligations of financial investment firms and enhances overall market fairness and investor protection, but it cannot replace the unique obligations of financial investment firms.

Third, the FSCMA limits the securities that can be traded on an ATS to equity securities and equity-related depository receipts. Therefore, it is reasonable for securities subject to best execution to follow these restrictions. However, when using Smart Order Routing(SOR), financial investment firms may need to decide which securities to apply SOR to at their discretion.

Fourth, choosing the trading market where orders will be executed is at the discretion of financial investment firms, based on overseas regulations and guidelines. Like the Japanese case, however, if only exchanges are considered, the expansion of investor choice and the development of the domestic trading market may be delayed. Therefore, it is necessary to devise practical integration measures and regulatory incentives to encourage financial investment firms to consider selecting ATSs as execution markets without reluctance.

Fifth, to enhance the convenience and efficiency of best execution for financial investment companies and investors, it is necessary to distinguish between individual customers and professional customers and establish separate best execution standards. The primary reason for distinguishing individual customers and setting different best execution standards is to simplify the best execution criteria in a complex trading environment, making it more suitable for investor protection. Additionally, due to the nature of individual investors who trade in small quantities of high liquid stocks, there is less need to consider complex variables. Individual customers can request to consider other factors through separate instructions if they wish, so blocking customer choice is not the objective.

Sixth, when determining best execution, the definition of the best outcome can vary depending on factors such as customer type, order characteristics, market conditions, and any specific instructions provided by the customer. Therefore, best execution policies should be established, taking into account various factors. However, for individual customers, as previously mentioned, the benefits of simplifying criteria are higher, so criteria should be restricted to factors like prices and transaction costs.

Seventh, it is essential to note that merely satisfying a customer's specific instructions during order execution does not fulfill a financial investment firm's best execution obligation. While satisfying specific instructions should be prioritized, additional measures should be taken to ensure that the best possible choice is made, considering other requirements.

Finally, as market structures become more complex, risk of conflicts of interest increase due to the interest between trading markets and financial investment firms and unclear order execution processes . However, the domestic trading market is currently in the early stages of market fragmentation, with limited concerns about conflicts of interest arising from practices such as Payment for Order Flow(PFOF) or the opaqueness of SOR. As market maturity and complexity increase, discussions on concrete measures to address conflicts of interest will become more substantial.

Defining best execution and specifying the means to fulfill this obligation require a flexible approach that considers market conditions and the preparedness of market participants. Since specific guidelines have not yet been established in the domestic market, in-depth discussions are required on various topics, including the eight issues mentioned earlier. It is a critical moment where regulatory authorities, financial investment firms obligated to comply with the best execution obligation, and investors evaluating whether orders are being executed in their best interests must collaborate. Regulatory authorities should establish mandatory requirements through guidelines following extensive discussions among market participants. Additionally, they should facilitate the development of criteria by financial investment firms to make the best judgments in the interest of their clients, beyond the specified requirements. As the South Korean trading market progresses into a multi-trading market system, it is hoped that this report contributes to enhancing investor protection and establishing the foundation for a stable and efficient market environment.

Ⅰ. 조사 배경 및 목적

2013년 5월, 국내 증권 거래시장에 구조적 변화를 불러올 중요한 법 개정이 이루어졌다. 개정「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」은 거래시장 간 경쟁체제를 구축하기 위해 대체거래시스템으로 알려진 다자간매매체결회사(Alternative Trading System: ATS) 설립을 허용하였다. 이와 동시에 다양한 거래시장과 거래조건을 비교하여 최선의 선택을 보장하기 위한 최선집행의무 규정을 마련하였다(자본시장법 제68조 제1항, 제68조 제2항).

그러나 ATS 설립과 최선집행을 위한 근거 규정이 제정된 지 10년이 지나도록 국내시장에 ATS는 등장하지 않았다. 최선집행 규정의 핵심은 다수의 선택지 중에서 고객에게 가장 유리한 조건을 찾는 과정이다. 그런데 비교 가능한 거래시장이 존재하지 않는 거래소 중심의 단일 거래시장 구조에서는 최선집행 개념은 실질적인 의미를 가지기 어려웠다. 그 결과 최선집행 규정은 실질적인 효력을 발휘하지 못했으며 시장참여자는 최선집행의무에 큰 관심을 기울이지 않았다.

시장의 무관심과는 별개로 복수 거래시장 체제에서 최선집행의무는 상당히 중요한 규정이다. 최선집행의무는 금융투자업자가 주어진 시장환경에서 고객의 주문을 가장 유리한 조건으로 집행하기 위해 최선의 노력을 기울이도록 의무화한 것으로 복수 거래시장에서 주문집행의 기준을 설정하는 핵심 조항이라 할 수 있다. 최선집행의무의 구체적인 형태에 따라 거래시장 간 경쟁의 형태와 공정한 경쟁체제 구축 여부, 투자자 보호 수준이 결정된다.

그런데 국내에도 조만간 복수 거래시장 체제가 형성될 예정이다. 넥스트레이드가 2025년 초 출범을 목표로 ATS 설립을 추진하고 있다. 이에 따라 각 금융투자회사는 최선집행을 위한 정책과 절차를 수립하고 집행 시스템을 조속히 구축해야 하는 상황에 직면해 있다.

반면, 그동안 최선집행은 상대적으로 시급하지 않은 주제로 인식되어 왔기 때문에, 2013년 자본시장법에서 최선집행에 관한 개괄적인 법적 형태가 마련된 이래로 이행 방안에 대한 구체적인 논의가 이루어지지 않았다. 그 결과 최선집행의무에 대한 구체적인 지침이 부재한 상황이며, 금융투자업자는 최선집행에 대한 상세한 기준과 이행 방법을 수립하는 데 어려움을 겪고 있다.

또한 투자자들은 ATS가 등장한 이후 시장환경의 변화양상과 고객 관점에서 최선집행의 중요성에 대해 충분히 인지하지 못하고 있다. 최선집행에 대한 이해도 부족은 복잡한 시장구조에서 투자자를 충분히 보호하지 못하는 결과를 초래할 수 있다. 따라서 투자자들이 변화하는 경쟁환경과 선택지의 확대, 최선집행의 중요성을 잘 이해할 수 있도록 정확하고 상세한 정보를 제공할 필요가 있다.

본 보고서는 국내 거래시장에서 ATS 설립을 앞두고 최선집행의무와 관련된 주요 쟁점을 정리하고 최선집행의무 이행을 위한 구체적인 방안을 제시하는 데 목적이 있다. 이를 통해 금융투자회사와 투자자의 최선집행의무에 대한 이해를 돕고, 다변화된 거래시장 환경에서 최선집행의무를 원활히 준수할 수 있는 기반을 마련하고자 한다.

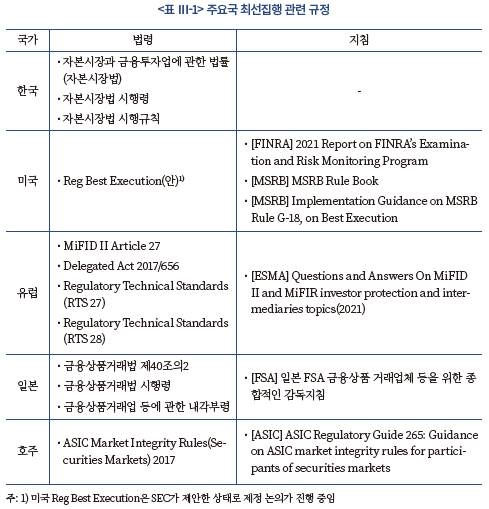

우선 미국, 유럽, 일본, 호주 등 주요국의 최선집행의무에 관한 법령과 자율규제기구의 지침을 검토하고 국내 최선집행의무를 구체화하기 위한 시사점을 도출하고자 한다. 또한 국내 거래시장과 구조적으로 유사한 일본과 호주 거래시장에서 금융투자업자의 최선집행 정책과 절차를 살펴보고 각국의 규정이 실무에서 구체적으로 어떻게 적용되고 있는지 살펴보고자 한다. 마지막으로 최선집행과 관련된 국내 주요 이슈를 정리하고 국내 거래시장의 특성에 맞는 이행 방안을 제안한다.

Ⅱ. 국내시장 복수시장 체제 도입과 최선집행의무 규정

1. 다자간매매체결회사 설립 근거법 도입

한국거래소는 1956년에 설립된 이후 약 70년간 국내 유일의 증권거래시장으로 존재해 왔다. 자본시장법은 수십 년간 거래소 법정설립주의 원칙에 따라 거래소 설립을 규제해 왔으며, 그 결과 한국거래소는 법률에 따라 설립된 거래소로서의 독점권을 갖게 되었다.

그러나 2013년 자본시장법이 개정되면서 시장구조 관련 규정에 변화가 일어났다. 개정 자본시장법에는 복수거래시장 인프라 구조를 구축하기 위한 일련의 제도 변화가 포함되었다. 우선 ATS 설립을 허용하는 조항이 마련됐다. ATS는 ‘다수의 참가자를 거래상대방 또는 당사자로 하여 전자적 방법으로 상장주권 등의 매매 또는 그 중개, 주선, 대리 업무를 하는 것’으로 정의된다(법 제78조). 거래소처럼 경쟁매매 등의 거래방식에 따라 다수의 투자자를 대상으로 매매체결 기능을 수행하게 된다. 새로운 형태의 거래시장이 허용됨에 따라 시장의 개념에 대한 재정립이 필요해졌으며, 거래소와 다자간매매체결회사를 포괄하는 개념인 ‘금융투자상품시장’이 도입되었다(법 제8조의2).

또한 한국거래소 이외에 다른 거래소가 설립되거나 ATS가 거래소로 전환될 것을 대비하여, 기존의 거래소 법정설립주의 대신 거래소 허가제가 도입되었다. 거래소 허가제에 따르면 법에서 정한 요건을 충족하는 경우 금융위원회의 허가를 받아 거래소를 설립할 수 있게 된다(법 제373조). 이는 허가받은 복수의 거래소가 시장에 공존할 수 있다는 것을 의미한다. 거래소 허가제가 도입됨에 따라 ‘거래소 유사시설 개설금지’ 규정(구법 제386조 제2항)이 폐지되고 ‘무허가 시장개설금지’ 규정(법 제373조)이 이를 대체하였다.

최선집행의무 규정도 ATS 관련 규정과 함께 도입되었다. 개정 전까지 금융투자업자는 자본시장법상의 ‘시장매매의무’에 따라 주문을 집행하였다(구법 제68조). 시장매매의무는 투자자로부터 거래소에서 매매하도록 주문을 위탁받으면 반드시 거래소를 통해 매매하도록 규정하였다. 그런데 ATS 설립으로 거래를 체결할 시장을 선택할 수 있게 되면서, 시장매매의무 대신 최선의 거래조건으로 주문을 집행하도록 규정하는 최선집행의무를 부과하게 되었다(법 제68조). 이렇게 2013년 자본시장법 개정으로 거래소의 독점 체제를 경쟁체제로 전화하기 위한 법적 기반이 마련되었다.

2. 다자간매매체결회사 설립 추진

2013년에 다자간매매체결회사 설립을 위한 근거법이 마련되고 2년 후인 2015년에 금융투자협회 주도로 ATS 설립이 추진되었다. 자본시장법에는 ATS 시장점유율 제한 규정이 존재하는데, 당시 ATS 시장점유율 한도는 현재보다 엄격한 수준이었다. ATS가 이용할 수 있는 세 가지 매매체결방식 중 경쟁매매방식을 통하여 체결된 거래 규모는 6개월간 일평균 거래량을 기준으로 전체 증권시장의 5% 이하, 개별종목별로 10% 이하로 제한되었다.1) 경쟁매매의 시장점유율 한도를 초과할 경우, 해당 ATS는 무허가 시장개설행위가 되어 매매체결을 중지하거나 정규거래소로 전환해야 한다. 이러한 높은 강도의 시장점유율 제한 규정은 ATS 설립을 추진하는 주체 입장에서는 부담이 될 수밖에 없었으며, 결국 당시 ATS 설립은 무산되었다. 이후 2016년 ATS 운영 규정을 개정하여 시장 전체 한도와 개별종목별 한도가 각각 15%와 30%로 완화되었다.

ATS 한도 규제가 완화되고 3년 후인 2019년 ATS 설립이 재추진되었다. 2019년 4월 대형 증권사를 중심으로 ATS 설립을 위한 협약서를 체결하였으며, 2022년 11월에는 ATS 설립을 목적으로 한 넥스트레이드 주식회사가 설립되었다. 넥스트레이드 주식회사는 한국금융투자협회를 비롯한 7개 대형 증권사 등 발기인 8사가 각각 6.64%의 지분을 보유하고, 그 외 증권사 19사, 증권유관기관 3사, IT 기업 4사 등 34개사가 출자하였다. 넥스트레이드는 2023년 7월 예비인가를 통과했으며 규정에 따라 18개월 이내에 본인가를 신청할 계획이다. 본인가에서 ATS 설립이 최종적으로 승인되면 2025년 초 영업이 개시될 것이다. 예정대로 ATS가 설립되면 복수시장 체제를 위한 근거법이 마련된 이후 12년여의 기간이 경과한 시점에 ATS가 등장하게 되는 것이다.

3. 최선집행의무 정의와 의미

앞서 설명한 대로 국내 최선집행의무는 2013년 자본시장법 개정 당시 마련되었다. 자본시장법에는 투자매매업자 또는 투자중개업자가 투자자의 청약 또는 주문을 최선의 거래조건으로 집행하기 위해 기준을 마련하고 이에 따라 주문을 집행해야 한다고 규정하고 있다.

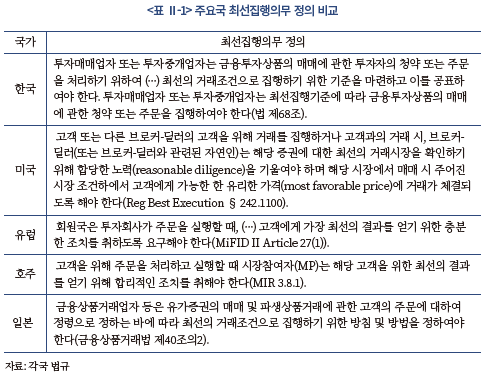

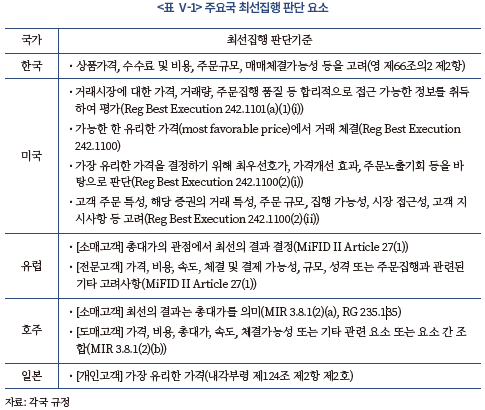

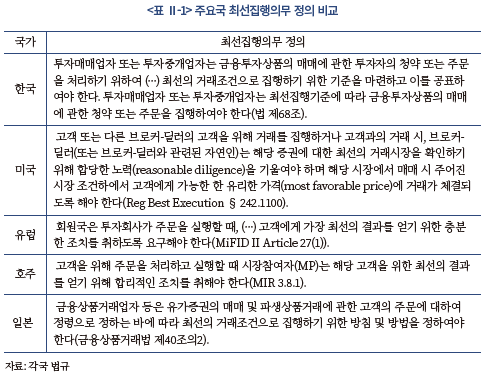

다른 국가도 각국 규정에 최선집행의무를 명시적으로 정의하고 있다. 유럽에서는 MiFID II(Markets in Financial Instruments Directive II)에 따라 고객에게 가능한 최상의 결과를 달성하기 위해 충분한 조치를 취해야 할 의무로 정의된다. 마찬가지로 호주의 시장 건전성 규칙(Market Integrity Rule: MIR)에서는 금융투자업자에 해당하는 시장참여자(Market Participant: MP)2)가 고객을 위해 최선의 결과를 얻기 위해 합리적인 조치를 취해야 한다고 규정한다. 일본의 최선집행의무는 금융상품거래법에서 규정하고 있는데, 금융상품거래업자가 고객 주문을 최선의 거래조건으로 집행하기 위한 방침을 마련해야 한다고 되어 있다. 한편, 미국은 최선집행의무가 SEC 규정으로 아직 도입되기 이전인데, SEC가 제안한 Regulation Best Execution 규제안에 따르면 브로커-딜러가 최선의 거래 시장을 식별하기 위해 합리적인 노력을 기울여야 한다고 강조한다.

최선의 집행 의무에 대한 표현은 국가마다 다소 다르지만, 고객 주문을 가능한 가장 유리한 조건에서 체결하기 위해 성실히 노력해야 한다는 것이 공통된 핵심 원칙이다. 즉, 다양한 거래시장에서 형성된 거래조건을 충분히 비교하여 고객에게 최선의 이익이 돌아갈 수 있는 최선의 선택을 내려야 한다.

그런데 최선집행의무가 기존의 단일 거래소 체제에서는 존재하지 않았던 전혀 새로운 개념인 것은 아니다. 고객의 주문을 위탁받은 금융투자업자가 자신의 이익이 아닌 고객의 이익을 최우선으로 주문을 집행해야 하는 의무는 다수의 거래시장 간에 선택을 내려야 할 때만 주어지는 것은 아니다. 이는 자본시장법 제37조 제1항에서 요구하였던 신의성실원칙의 의무와 핵심적으로 동일하다.3) 즉, 최선집행 관련 법규에서 최선집행을 강제하지 않더라도 금융투자업자는 고객 주문집행 시 최선의 노력을 기울여야 한다. 이러한 관점에서 최선집행의무는 금융투자업자가 준수해야 할 기본적인 의무라 할 수 있다.4)

그런데 다수의 거래시장이 등장하고 주문조건이 복잡해질수록 최선을 판별하고 선택하는 것이 어려워진다. 따라서 최선집행에 대한 일관된 기준을 법에서 명시적으로 정립할 필요가 있다. 법령상의 최선집행의무는 ‘최선’의 의미를 명확하게 규정하고 최선집행을 이행할 수 있는 합리적인 방안을 제시한 것으로 신의성실의 원칙을 구체화한 것이라 할 수 있다.

4. 복수시장 체제와 최선집행 규정 필요성

최선집행의무 규정은 신의성실의무를 구체화한 것이므로, 최선집행의무 규제의 필요성이 시장구조에 따라 결정되지 않는다. 즉, 최선집행의무는 시장의 형태와 무관하게 금융투자업자가 준수해야 할 의무이다. 거래할 수 있는 시장이 하나인 경우에도 금융투자업자는 자신의 이익이 아닌 고객의 이익을 우선시하여 최선을 선택해야 한다. 단지 거래시장이 다양해질 경우 선택 구조가 복잡해져 명확하고 상세한 기준이 필요할 뿐, 고객을 위한 최선의 선택을 해야한다는 점은 동일하다.

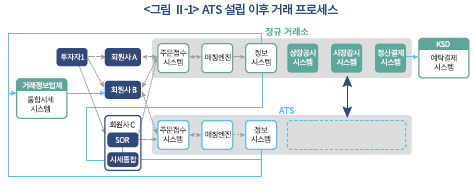

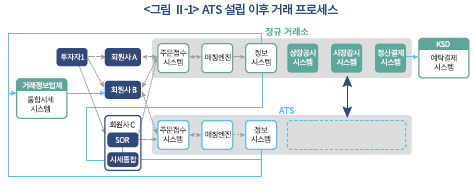

과거 10년 동안 최선집행의무는 실질적인 구속력을 가지지 못했다. 최선집행 규정의 핵심은 다수의 선택지 중에서 고객에게 가장 유리한 조건을 찾는 것인데, 비교 가능한 시장이 존재하지 않는 단일 거래소 중심의 시장구조에서는 큰 의미를 가지기 어려웠다. 즉, 현재까지의 단일 거래소 환경에서는 선택의 여지 없이 거래소를 통해 주문이 집행되었다. 즉, 시장에 하나의 거래소만 존재하는 경우, 금융투자업자는 고객의 주문을 단순하게 거래소에 전송하고, 거래는 거래소의 주문접수 시스템과 매칭엔진을 통해 체결된다(<그림 Ⅱ-1>의 회원사 A). 이에 따라 2013년 최선집행 관련 규정이 마련된 이후에도 최선집행을 구체적으로 구현할 방안에 대한 논의가 이루어지지 않았다.

하지만 국내 거래시장에 ATS가 등장할 경우 국내 증권시장에도 상당한 변화가 일어날 것으로 예상된다. 두 개 이상의 거래시장이 존재하는 상황을 가정하였을 때 <그림 Ⅱ-1>의 ATS와 회원사 B, 회원사 C 상황이 추가되며 거래 프로세스는 복잡해진다. 즉, ATS가 설립되면 시세가 두 개의 시장에 분산되어 형성되므로, 주문을 전송할 때 두 시장 중 어느 시장에서 주문을 집행하는 것이 더 나은지를 판단해야 하는 문제가 발생한다.

금융투자회사는 최선집행의무를 준수하기 위해 주문, 투자자, 거래시장의 특성을 파악하고 각 주문 시점에 최적의 거래조건을 찾아야 한다. 이 과정에서 금융투자회사는 우선 주문을 집행할 대상이 되는 거래시장을 선택해야 한다. 기존에는 한국거래소가 유일한 주문집행시장이었지만 ATS가 설립되면 한국거래소와 ATS를 모두 고려하거나 두 시장 중 일부 시장을 선택해야 한다. 또한 각 거래시장의 정보공개주문시장(lit pool, 리트풀)을 이용할 것인지, 비공개주문시장(dark pool, 다크풀)을 이용할 것인지에 관한 판단 또한 필요하다. 더 나아가 장외시장에서 상대매매를 고려하거나 종합금융투자사업자의 내부주문집행(internalization)을 고려할 수도 있다. 시장을 선택하면 금융투자회사는 해당 시장으로부터 호가 자료를 받아 통합하고 각 시장으로 주문을 전송할 시스템을 구축해야 한다.

또한 각 주문의 최선집행 조건을 판단할 때 고려할 요소를 선택해야 한다. 주문상품의 가격을 최우선시할 것인지, 거래비용을 어디까지 고려할 것인지, 주문 체결속도를 중시할 것인지, 주문체결 가능성을 중점으로 집행할 것인지 등 판단 요소 간의 우선순위를 정해야 한다. 이는 주문의 크기나 투자자의 특성, 투자자의 선호 등에 따라 상당한 영향을 받을 것이다.

이렇게 선택된 최선집행기준과 집행 방법은 금융투자회사마다 다른 형태를 띠게 된다. 그러면 투자자는 주문을 위탁할 적절한 회사를 선택하기 위해 각 금융투자회사가 제시하는 최선집행 정책 및 절차를 비교해야 한다. 그러기 위해서 금융투자회사는 사전에 투자자가 이해하기 쉽고 자세하게 최선집행 정책과 절차를 설명하고 공표해야 한다.

금융투자회사는 이렇게 마련된 최선집행 절차와 방법에 따라 고객의 주문을 집행한다. 금융투자업자는 사전에 선택한 거래시장에 제시된 호가, 거래비용, 체결가능성 등의 조건을 앞서 상정한 우선순위에 따라 면밀하게 분석하여 고객에게 더 유리한 조건을 제시하는 시장으로 주문을 전송할 것이다(<그림 Ⅱ-1>의 회원사 B).

다른 금융투자업자에 비해 주문체결률을 높이고 유리한 방식으로 주문을 집행하기를 원하는 금융투자업자는 스마트주문라우팅(Smart Order Routing: SOR)을 구축하고 최선의 주문조건을 자동으로 선택하고 주문을 처리하는 방식을 택할 것이다. SOR을 이용하는 경우 주문 회송 기준과 방법을 상세하게 설정해야 한다. 또한 금융투자업자 간 속도 경쟁이 심화될 경우 호가 통합과 주문집행 속도를 향상시키기 위해 자체적인 호가 통합 시스템을 개발할 수도 있다(<그림 Ⅱ-1>의 회원사 C).

이처럼 복수의 시장구조에서는 무엇이 최선의 선택인지 판단하는 과정이 복잡해지며 최선을 판단할 기준을 마련하기 위해 많은 요소를 복합적으로 고려해야 한다. 이에 따라 최선집행을 수행할 의무가 있는 금융투자업자의 부담은 단일시장 환경에 비해 높아진다. 또한 정보력과 분석력이 낮은 개인투자자는 주문집행 프로세스를 명확하게 이해하고 파악하기 어려워져 금융투자업자와 개인투자자 사이의 정보비대칭이 높아지고 투자자 보호에 취약해진다. 따라서 시장구조가 복잡해질수록 최선집행의무를 명문화해야 할 필요성이 높아진다.

5. 최선집행의무 관련 규정 현황

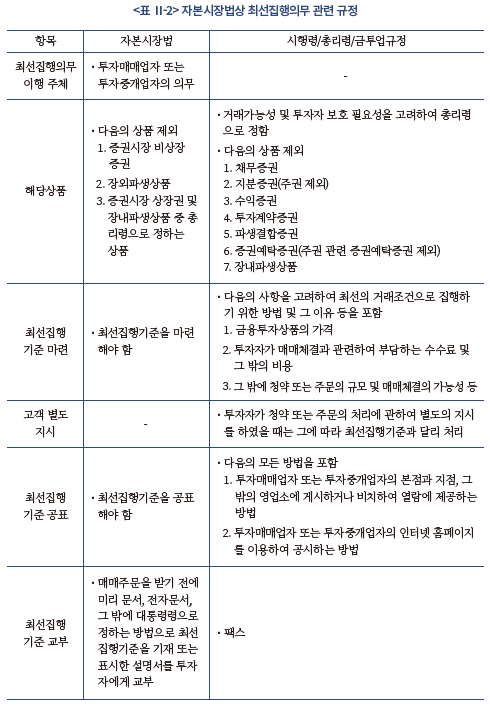

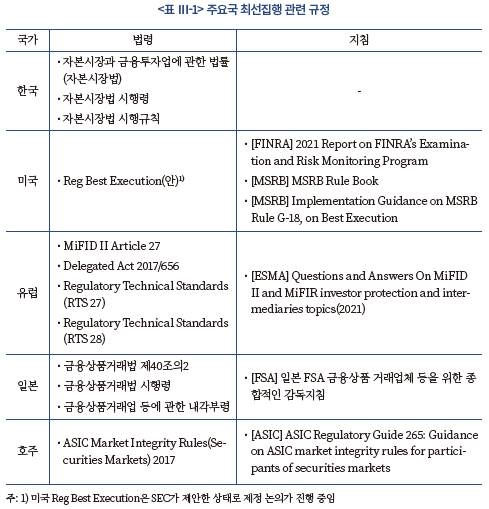

시장구조가 복잡해지면 최선집행의무에 대한 보다 구체적인 실행방안이 필요하다. 그러나 현재 자본시장법은 최선집행에 필요한 일반적인 요건만 규정하고 있을 뿐 세부적인 지침을 포함하고 있지 않다.

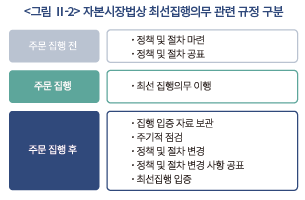

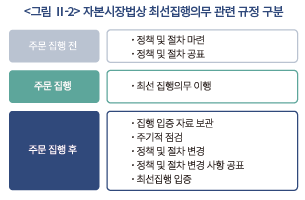

우선 자본시장법 및 관련 규정에서 규정하고 있는 최선집행의무와 관련된 사항을 파악해 볼 필요가 있다.5) 자본시장법상의 최선집행의무는 주문집행 단계에 따라 주문집행 이전의 준비 과정과 주문집행 이행 과정, 주문집행 이후 절차로 구분할 수 있다. 주문집행 이전에는 최선집행 정책 및 절차를 마련하여 공표한다. 이렇게 마련된 기준에 따라 고객의 주문에 대해 최선집행의무를 이행한다. 주문집행 이후에는 집행 입증 자료를 보관하고, 고객이 증빙을 요구할 경우 최선집행 사실을 입증한 근거를 제시해야 한다. 또한 주기적 점검을 통해 최선집행 정책과 절차의 적정성을 점검하여 필요시 변경해야 한다.

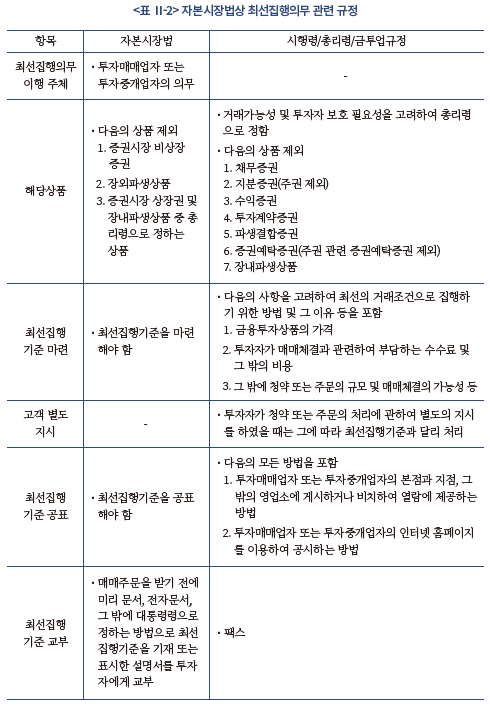

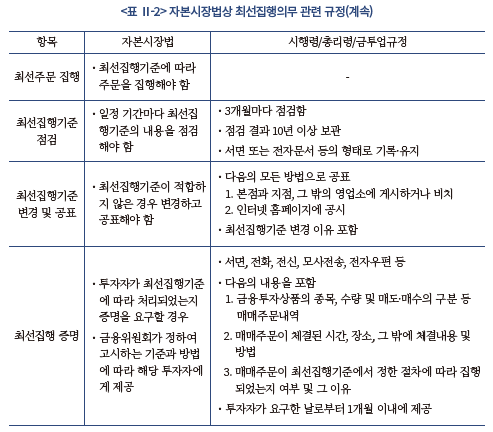

항목별로 자본시장법과 시행령 및 시행규칙, 금융투자업규정에 명시된 사항을 구체적으로 살펴보면 다음과 같다.

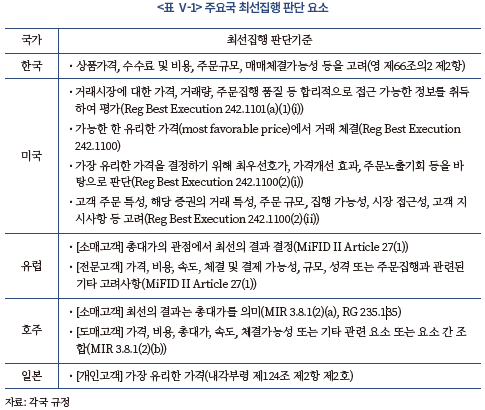

첫째, 금융투자업자는 주문집행 전에 최선집행에 대한 정책과 절차를 마련하고 고객이 주문하기 전에 공표해야 한다(법 제68조 제1항). ‘가격, 비용, 주문 규모, 매매체결 가능성’ 등을 고려하여 최선집행 판단기준을 수립하고 그 기준에 대한 타당한 이유를 제시해야 한다(영 제66조의2 제2항). 이처럼 자본시장법은 최선집행 판단기준 수립과 근거를 마련해야 한다는 기본적 틀을 제시하고 있다. 그러나 판단기준을 어떻게 설정해야 하는지에 대한 구체적 방안이 포함되어 있지 않다.

둘째, 최선집행기준을 공표하고(법 제68조 제1항) 투자자가 주문하기 전에 최선집행기준을 기재 또는 표시한 설명서를 교부해야 한다(법 제68조 제4항). 회사는 투자자에게 최초의 주문을 받기 전에 최선집행기준을 교부하며, 이때 문서, 전자문서, 팩스의 방법을 이용한다(법 제68조 제4항, 영 제66조의2 제6항). 또한 회사가 마련한 최선집행기준을 회사의 본점과 지점, 영업소에 게시하거나 비치하고 회사의 인터넷 홈페이지를 통해 공표하여야 한다(영 제66조의2 제3항). 투자자는 주문 전에 금융투자업자를 선정할 경우 이를 참고하게 될 것이다.

셋째, 금융투자업자는 사전에 마련한 최선집행기준에 따라 고객의 주문을 집행해야 한다(법 제68조 제2항). 단, 법령상 최선집행 절차에 대한 부분은 ‘기준에 따라 주문을 집행해야 한다’는 사실과 ‘고객의 별도지시가 있을 경우 그에 따라야 한다’는 것 이외에 기준은 명시되어 있지 않다(영 제66조의2 제2항).

넷째, 주문이 체결된 이후에는 집행 결과를 평가해야 한다. 최선집행기준을 변경할 필요성이 있는지 3개월마다 점검하고, 기준을 변경할 경우 변경 사실을 공표해야 한다(법 제68조 제3항, 영 제66조의2 제5항). 변경 사실을 고객이 인지할 수 있도록 영업소에 게시하고 인터넷 홈페이지에 공시해야 한다. 이때 변경 이유도 포함되어야 하며 투자자가 이해하기 쉽게 설명해야 한다(영 제66조의2 제3항). 또한 분기별로 이루어지는 최선집행기준 점검 결과를 최소 10년 이상 서면 또는 전자문서 등의 형태로 기록하고 유지해야 한다(규정 제4-17조의3 제2항, 별표12).

다섯째, 주문이 최선집행기준에 따라 처리되었는지에 대한 증명을 요구할 경우, 1개월 이내에 고객에게 제공해야 한다(제66조의2 제4항, 규정 제4-17조의3 제1항 제3호). 투자자의 요구에 따라 최선집행 결과를 증명할 때는 서면으로 교부하거나 전화, 전자우편 등 전자통신의 방법을 이용한다(제4-17조의3 제1항 제1호). 이때 증명 내용에는 매매주문내역, 체결장소 및 시간을 포함한 체결내용 및 방법, 최선집행기준에서 정한 절차에 따라 집행되었는지 여부와 이유를 포함한다(규정 제4-17조의3 제1항 제2호).

자본시장법상의 최선집행의무를 종합적으로 살펴보면 최선집행의무 이행 주체와 최선집행 해당상품에 대해서는 분명하게 명시되어 있다. 또한 최선집행기준 공표 방법이나 주문집행 이후 과정인 기준 점검 및 변경, 증명 방법에 대해서는 비교적 상세히 규정되어 있다. 그러나 최선집행기준을 마련하는 방법과 집행하는 방법에 관해서는 일반적인 원칙을 개괄적으로 규정하고 있을 뿐이며 구체적 지침이 제시되어 있지 않다. 주문체결의 일관성과 투명성, 투자자 보호를 위해 국내 최선집행의무 이행을 위한 세부적 기준을 마련해야 한다.6)

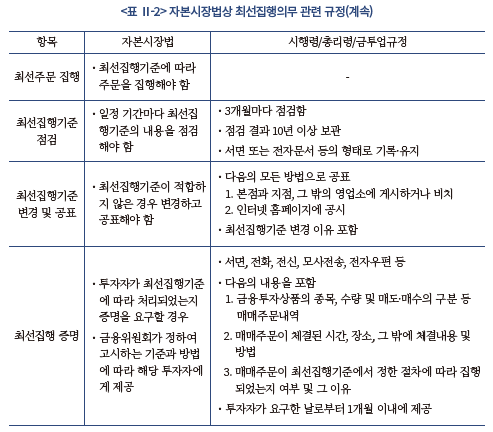

Ⅲ. 주요국 최선집행의무 규제 체계와 특성

현재 국내시장에는 아직 최선집행의무의 기준과 이행 계획에 관한 구체적 지침이 마련되지 않은 반면, 해외 여러 규제기관 및 자율규제기구는 법규와 구체적 지침을 통해 명시적인 기준과 실행방안을 제시하고 있다. 해당 지침에는 최선의 선택을 결정할 때 고려해야 할 요소 및 평가 방법, 주문집행 방법, 정보공개 요건 등 최선집행의무의 실행과 관련된 다양한 측면을 포괄적으로 다루고 있다.

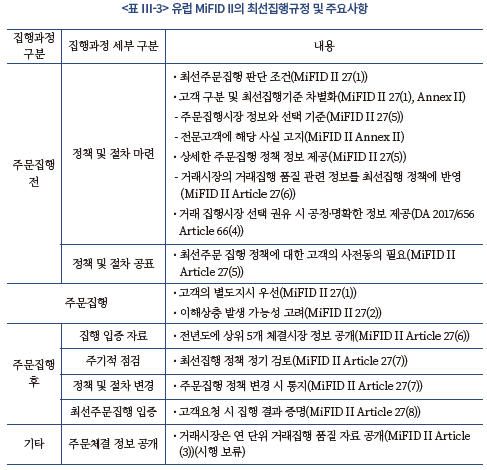

유럽에서는 MiFID II에 명시된 조항과 함께 위임입법(Delegated Act: DA) 및 규제기술표준(Regulatory Technical Standards: RTS)을 통해 최선집행을 위한 규제 체계를 정립하였다. 또한 유럽증권시장감독청(European Securities and Markets Authority: ESMA)은 최선집행의무에 관한 시장참여자의 이해를 돕기 위해 질의응답(QnA) 형식의 지침을 제공하고 있다.

한편 일본 금융감독청(Financial Services Agency: FSA)은 금융상품거래법과 관련 시행령 및 내각부령에 근거한 감독지침을 마련했다. 이러한 규제 체계를 통해 일본 금융시장에서 최선집행 실행을 위한 기준을 제시한다.

특히 호주는 최선집행을 위한 상세하고 포괄적인 접근방식을 마련하고 있어 다른 시장과 차별화된다. 호주증권투자위원회(Australian Securities and Investments Commission: ASIC)는 규제가이드(Regulatory Guide: RG)에 다양한 상황에 대한 최선집행 방안을 세분화하여 설명함으로써 ASIC 규정인 시장건전성규정(ASIC Market Integrity Rule: MIR)의 구현을 지원하고 있다. 이러한 상세한 지침은 호주 시장참여자들이 최선집행의무를 수행하기 위한 명확하고 실행 가능한 방향을 제공하는 역할을 한다.

반면 현재 국내시장에는 최선집행의무와 관련된 구체적 지침이 부재한 상황이다. 명확한 기준이 제공되지 않는 환경에서 금융투자회사는 잠재적 불확실성과 규제 불이행에 따른 제재 우려를 회피하기 위해 소극적으로 대응할 우려가 크다. 이러한 상황은 잠재적으로 투자자의 이익을 훼손하고 시장의 전반적인 활력 및 균형 잡힌 발전을 저해할 수 있다.

따라서 구체적이고 실용적인 사례를 바탕으로 최선집행에 대한 금융업계와 시장참여자의 이해도를 높일 필요가 있다. 본 장에서는 주요국의 시장구조와 최선집행 지침의 특성을 파악하여 향후 국내 금융 환경에서 최선집행의무를 구체화하기 위한 시사점을 얻고자 한다.

1. 미국

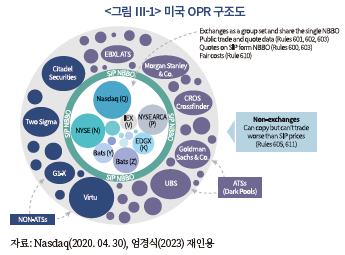

미국은 이미 1970년대에 상당한 시장분할이 이루어지고 있었다. 규정상 거래소 집중의무가 존재하여 상장주식은 상장거래소에서만 거래할 수 있었다. 하지만 당시 미국은 지역 특색에 맞춰 운영되는 복수의 지역거래소(regional exchange)가 존재하여 각 지역을 중심으로 거래가 분산되고 지역별 자연독점 상태가 유지되고 있었다. 이에 더해 거래소는 규정상의 독점력을 최대한 이용하여 높은 거래수수료를 부과하고 있었으며, 그 결과 더 많은 거래가 장외시장으로 빠져나가 시장분할과 정보 불투명성이 가중되던 상황이었다.7)

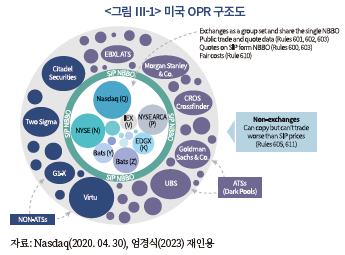

이러한 다양하고 복잡한 시장환경을 효과적으로 통합하기 위하여 전략적으로 마련한 개념이 전국시장시스템(National Market System: NMS)이다. 1975년 증권거래법 개정을 통해 도입된 NMS의 목적은 거래소 이외에 다양한 거래시장(trading center)을 허용하여 투자자의 다양한 수요를 충족하되, 전국적으로 중요도가 높은 증권이 거래되는 미국 내 다수의 거래시장을 포괄하는 하나의 가상시장인 NMS을 확립하는 것이었다.8)

1998년에는 시장에 등장한 다양한 형태의 거래시장에 대한 규제 기준을 수립하기 위해 Reg ATS(Regulation Alternative Trading System)가 도입되었다. Reg ATS는 상장기능 없이 매매체결 서비스를 중점적으로 제공하는 증권거래시스템에 대한 법적 기준이다. ATS는 정보공개 수준에 따라 정보공개주문시장과 비공개주문시장으로 구분할 수 있는데, 미국의 정보공개주문시장은 ECN(Electronic Communication Network)으로 불린다. 2000년대에는 ECN을 통한 거래가 ATS의 주를 이루었다. 그러나 이후 시장에 다양한 거래 수요가 등장하면서 다크풀을 통한 거래가 활발해졌다. 다크풀은 증권 매매체결 전에 주문 가격과 수량 등의 거래 정보가 공개되지 않는다는 특장점을 가진다. 또한 ATS에 포함되지 않는 매매체결 형태인 내부주문집행을 통한 거래도 상당 부분을 차지한다.

NMS 개념이 도입되고 30여 년간 이루어진 다양한 제도 개선 방안은 2007년 시행된 Reg NMS(Regulation National Market System)를 통해 포괄적으로 정립되었다. Reg NMS는 미국 금융시장의 투명성, 공정성, 효율성을 촉진하기 위해 설계된 규제 프레임으로, 전국 주식 및 주식 거래시장을 관리하는 규칙과 시스템에 대한 기준을 제시하였다.

Reg NMS에는 시장통합과 공정 경쟁을 구현하기 위한 네 가지의 필수규정이 포함되었는데, 이 중 주문보호규정(Order Protection Rule: OPR)은 최선집행을 보장하기 위한 것이었다.9) OPR은 NMS에 포함된 전체 거래시장에서 전국최우선매수매도호가(National Best Bid and Offer: NBBO)를 판단하고 NBBO를 최우선으로 거래를 체결하도록 의무화했다. 각 거래시장은 해당 거래시장의 최우선매수매도호가(Best Bid and Offer: BBO)가 NBBO가 아닐 경우, NBBO를 제시하는 다른 거래시장으로 주문을 회송해야 한다. 이때 주문회송의 주체에 주의를 기울일 필요가 있다. 최선집행의무는 브로커-딜러에게 있지만 OPR에 따라 주문을 회송해야 할 책임은 거래시장에 있다.

주문회송이 원활하게 이루어지기 위해서는 실시간으로 NBBO가 존재하는 거래시장을 파악하는 것이 필수적이다. 이를 위해 미국은 다양한 거래시장에 분산된 호가 및 체결자료를 중앙 집중적으로 관리하는 거래자료 통합 시스템을 구축하였다. 각 거래시장에서 생성된 호가와 체결정보는 증권정보제공회사(Securities Information Processor: SIP)에서 통합하여 가상의 단일시장처럼 운영된다. 대표적인 SIP으로는 CTA/CQ Plan(Consolidate Tape Association/ Consolidated Quotation Plan)과 UTP Plan(Unlisted Trading Privileges Plan)이 있다. CTA/CQ Plan은 NYSE 상장증권의 호가 및 거래 정보를 수집, 통합, 분배하기 위해 설계되었으며, UTP Plan은 나스닥 상장증권 자료의 통합분배를 위해 마련되었다. 이 두 시스템을 통해 주식, 상장지수펀드 등 금융상품의 가격과 거래에 대한 실시간 정보를 종합적으로 파악할 수 있었다.

본질적으로 미국 시장은 다양한 형태의 거래시장과 거래방식을 허용하여 경쟁적이고 탈중앙화된 시장 분산 환경을 조성했다. 이를 실질적으로 통합하기 위하여 SIP을 통해 최우선 매수매도호가를 실시간으로 산출하고 모든 참여자가 가격을 최우선으로 주문을 집행할 수 있도록 거래 체제를 구축하여 시장통합과 투명성을 제고했다. 연방법 수준의 최선집행규정은 없으나 OPR을 통해 최선의 가격에서 거래가 체결되도록 보장해 왔다고 이해할 수 있다.

이렇게 Reg NMS에 따라 거래시장이 준수해야 할 OPR은 의무화되어 있는 반면, 현재 미국 법률 체계는 최선집행의무를 명시적으로 규정하고 있지 않다. 대신 금융산업규제기구(Financial Industry Regulatory Authority: FINRA)와 지방정부증권규칙제정위원회(Municipal Securities Rulemaking Board: MSRB)와 같은 자율규제기구에서 최선집행의무에 관한 지침을 제공하고 있다.10) SEC는 최선집행규정을 법제화하지 않고 이와 관련된 성명(statement)을 발표하는 방식으로 규제하고 있다.

그런데 최근 미국의 최선집행 규정과 시세통합 관련 규제가 변화하고 있다. 우선 최선집행 규정의 경우 연방법 차원에서 입법화를 추진 중이다. SEC는 2022년 12월 Reg NMS 상 네 개의 주요 규칙에 대한 제‧개정을 포함한 주식시장 구조 개혁안을 발표했다. 개혁안 중 최선집행기준 수립(the formulation of standards for best execution)을 위한 입법화 방안이 포함되어 있다.11) 이는 미국 연방 차원에서 최선집행원칙을 법제화하려는 최초의 시도이다.

OPR에 따라 거래시장 간 연계를 통해 NBBO가 보장되고, 자율규제기구에서 최선집행을 규율하고 있음에도 불구하고, 미국에서 최선집행의무를 명문화하려는 이유는 소매고객 주문 처리 시 이해상충과 관련된 문제를 명시적으로 해결하기 위해서다(Reg Best Execution 242.1101(b)). 브로커-딜러와 소매고객 사이의 이해상충 문제가 발생하는 배경에는 소매고객 주문을 주로 취급하는 브로커가 90% 이상의 시장가주문(marketable order)을 직접 집행하지 않고 도매 브로커(wholesale broker)에게 회송하는 관행이 만연해 있기 때문이다. 이러한 주문 방식을 PFOF(Payment for Order Flow)라 하는데, 소매 브로커는 투자자 주문정보를 도매 브로커에게 판매하는 대가로 수수료를 수취하여 이익을 얻는 방식으로 운영된다. TD Ameritrade, Robinhood, E*Trade, Charles Schwab 등 해외의 주요 소매거래 브로커의 PFOF 수익은 2020년 기준 25억달러로 상당한 비중을 차지한다. 또한 대표적 도매 브로커인 Citadel Securities가 2021년 6월까지 PFOF 거래를 위해 소매 브로커에게 지불한 수수료가 약 15억달러에 달했다.12)

이처럼 PFOF 거래를 통해 막대한 이익이 창출되는 구조에서 소매 브로커와 고객 사이에 이해상충 문제는 불가피하며 실제 거래 시 최선집행이 이루어지지 않을 가능성이 높다. Reg Best Execution 제정안은 브로커-딜러와 고객 간의 이해상충 문제를 완화하기 위하여, 이해상충의 소지가 있는 주문의 경우 추가로 준수해야 할 의무를 규정한다. 즉, 브로커-딜러가 소매고객의 주문을 자기자본(principal)으로 집행하거나, 계열사로 회송 또는 계열사로부터 주문을 받거나, PFOF를 이용하는 등의 경우 더 다양한 범주의 거래시장을 비교 분석해야 한다. 이해상충 거래에 대한 최선집행기준 준수방안을 문서화하고 최선집행 정책 및 절차를 시행하기 위한 노력과 최선집행기준 준수를 결정한 근거 및 관련 정보를 제시해야 한다. 또한 최근 논란이 되었던 PFOF 계약은 문서화해야 한다.

한편 2021년 주식시장 실시간 자료의 통합 및 분배를 관리하는 새로운 NMS Plan인 CT Plan(Consolidated Tape Plan)이 시행되었다.13) 과거 미국의 통합자료구축 시스템은 독점 SIP인 CTA/CQ Plan과 OTC UTP Plan을 중심으로 운영되었으나, CT Plan의 도입과 함께 경쟁 통합업체 체제(competing consolidator model)로 전환하였다. 거래소가 중심이 되어 운영되었던 기존의 CTA Plan, CQ Plan, UTP Plan은 이해상충 가능성이 내재되어 있었다. 거래소는 NMS Plan에 따라 시장 데이터를 분배할 의무를 수행하는 동시에 거래소 자체적으로 데이터 제품을 판매하여 상업적 이득을 극대화해야 하는 이중적 역할을 수행하고 있다. 따라서 본질적으로 이해충돌 문제가 존재한다. SEC는 특히 CTA/CQ Plan과 UTP Plan의 운영을 책임지고 있던 NYSE와 Nasdaq을 비롯하여 거래소로 구성된 자율규제기구(Self-Regulatory Organization: SRO)의 권한이 과도해 지배구조 개선이 필요하다고 판단했다.14) 새롭게 도입된 CT Plan은 복잡한 이해관계를 해결하고 NMS Plan의 효율성을 개선하고 소매투자자와 도매투자자를 포함한 비자율규제기구(non-SRO) 시장참여자의 요구를 반영하여 NMS를 발전하기 위한 노력의 일환이라 할 수 있다.15)

2. 유럽

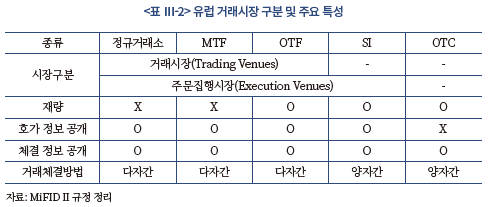

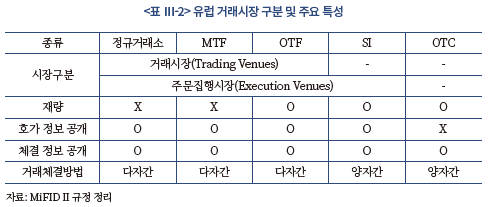

유럽은 미국과 마찬가지로 상당히 복잡한 시장구조로 되어 있다. 유럽의 거래시장은 각국의 정규거래소(Regulated Markets: RM)를 포함하여 MTF(Multilateral Trading Facility), OTF(Organized Trading Facility), SI(Systematic Internaliser)로 구분된다.

유럽은 2007년 미국의 Reg NMS에 해당하는 MiFID I을 도입하였다. 그동안 시장에 존재하던 거래소 집중 원칙을 폐지하고 다양한 형태의 거래시장 간 경쟁을 촉진하기 위하여 MTF와 SI를 제도화하였다. MTF는 금융투자업자 또는 시장운영자가 설립한 금융상품 거래시장으로 비재량적 방법에 따라 다자간 주문을 체결하며, SI는 금융투자업자가 자기계정으로 양자간 주문을 집행하는 매매체결시스템이다.

2008년 글로벌 금융위기를 겪으며 금융시스템의 안정성, 건전성, 투명성에 대한 기존 규제 체계의 한계가 드러났다. 시장의 발달로 규제 범주를 확장할 필요성이 높아지자 2017년 MiFID I을 보완한 MiFID II를 도입하였다.16) MiFID II에서는 기존의 거래시장 이외에 OTF를 새롭게 규정하였는데, OTF는 주권 이외의 상품을 재량적 방법으로 거래하는 조직화된 거래시장으로 정의된다.17)

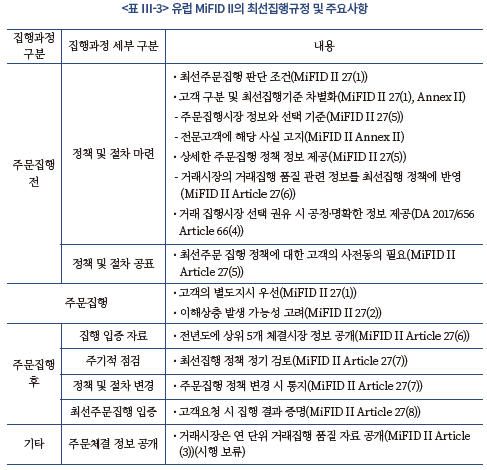

유럽의 최선집행의무는 MiFID I에서 처음으로 도입되었다. MiFID I은 투자회사가 주문을 체결할 때 가격, 비용, 속도, 체결 및 결제 가능성, 규모, 성격 또는 주문집행과 관련된 기타 사항을 고려하여 고객에게 가능한 최선의 결과를 얻기 위해 모든 합리적인 조치(reasonable step)를 취해야 한다고 규정했다(MiFID I Article 21). 그 외에 주문 특성과 고객 유형 및 특성 등을 고려하여 상대적 중요성을 결정하고, 정기적인 최선집행 정책 및 절차 점검, 고객 요청 시 최선집행 결과를 입증하는 등 관련 사항을 의무화했다.

MiFID II의 최선집행규정은 MiFID I과 유사하게 주문집행 기준을 선택하고 상대적 중요도를 결정하도록 규정하였다. 투자업자는 가격, 비용, 속도, 주문집행 및 결제 가능성, 규모, 속성(nature), 주문집행 관련 다른 고려사항을 충분히 고려하여 고객에게 가능한 최선의 결과(best possible result)를 가져다주기 위한 모든 충분한 조치(sufficient steps)를 취해야 한다(Article 27(1)). 이때 투자자의 특성, 주문의 특성, 금융상품의 특성, 거래시장의 특성을 반영하여 상대적 중요도에 따라 결정한다(DA 2017/656 Article 64).

그런데 MiFID I에서는 ‘합당한 조치(reasonable steps)’를 취해야 한다고 명시하고 있는 반면, MiFID II는 ‘충분한 조치’로 표현을 변경하였다. ESMA의 해석에 따르면 ‘충분한’ 조치가 ‘합당한’ 조치에 비해 더 강한 규정이다.18) 금융투자업자가 고객의 이익을 위해 최선을 다해야 한다는 점에서는 공통되지만, 표현 방식을 수정하여 더 높은 수준의 최선집행의무를 충족할 것을 요구하고 있다.

또한 투자자군을 세 개의 집단으로 구분한 후 소매투자자에 대한 최선집행기준을 간소화하였다. MiFID II에 따르면 고객은 소매고객(retail client), 전문고객(professional client), 적격 거래상대방(eligible counterparty)으로 분류된다. 소매고객 주문의 경우 총대가(total consideration)를 기준으로 최선집행 여부를 결정한다. 이때 총대가는 금융상품의 가격과 집행에 관련된 직접 거래비용으로 정의되며, 거래비용에는 투자회사 수수료와 거래시장 수수료가 포함된다. 최선집행기준을 총대가로 간소화한 것은 다른 요건들을 배제하고 금융상품 가격과 직접비용만을 고려하도록 강제한 것이므로 최선집행기준을 강화한 것이라 할 수 있다. 한편 소매고객을 제외한 고객의 주문에 대해서는 최선집행의 일반적 원칙에 따라 가격, 직접 거래비용, 암묵적 거래비용, 속도, 체결 및 결제 가능성 등 다양한 요소를 고려하여 최선집행을 결정한다.

MiFID II의 규제를 받는 투자회사는 주문집행 정책에 대한 상세한 정보를 제공해야 한다(DA 2017/656 Article 66(3)). 해당 정보에는 투자회사가 할당한 상대적 중요성에 대한 설명과 이러한 요소의 상대적 중요성을 결정하는 프로세스를 포함한다. 금융상품별로 소매투자자 및 기관투자자 각각에 대해 거래집행을 하는 거래시장을 구분하여 명시한다. 이때 거래시장 선택은 청산방법, 서킷 브레이커 등의 요소와 상대적 중요도를 고려하여 결정한다. 또한 가격 비용, 속도, 집행 가능성 및 기타 관련 집행 요소 등 최선집행을 위해 고려한 요소와 방법을 설명해야 한다. 단, 고객의 별도지시가 있는 경우, 회사에서 마련한 최선집행기준에 따라 주문을 집행하는 것을 방해할 수 있다는 것을 미리 알려야 한다. 주문을 집행할 거래시장 선택 프로세스, 집행 전략, 집행 품질을 분석하는 데 사용된 절차 및 프로세스, 회사가 고객을 위해 가능한 최선의 결과를 얻었음을 모니터링하고 확인하는 방법에 관해 설명해야 한다.

또한 유럽의 최선집행 규정은 고객에게 거래시장을 선택할 권한을 부여하고 고객과의 이해상충 가능성을 제한하고 있다(DA 2017/656 Article 66(4)). 투자회사가 고객에게 거래집행 시장을 선택하도록 권유하는 경우, 회사에서 책정한 가격 정책만을 기준으로 거래집행 시장을 선택하지 않도록 공정하고 명확하며 오해의 소지가 없는 정보를 제공해야 한다(DA 2017/656 Article 66(5)). 이해상충에 위배되지 않는 제3자의 대가만 받아야 하며, 회사가 거래 집행시장에서 혜택을 받는 경우 고객에게 알려야 한다(DA 2017/656 Article 66(6)).

MiFID II가 MiFID I과 비교하여 차이를 보이는 것은 정보공개 요건이 신설되었다는 점이다. 최선집행을 위한 금융투자업자와 거래시장에 대한 정보를 비교 분석하기 편리하도록 정보공개 기준을 마련한 것이다. 정보공개는 의무 이행 주체에 따라 두 가지로 나뉘는데, 하나는 투자회사에 부과되는 의무이며 다른 하나는 거래시장에 부과되는 의무이다.

우선 투자회사는 고객에게 집행정책에 관한 정보를 제공해야 한다. 이때 공개해야 하는 정보에는 체결시장에 대한 자료가 포함된다. 투자회사는 전년도에 고객 주문을 체결한 거래시장 중 상위 5개 시장에 대한 품질 평가 정보를 매년 금융상품별로 공개하고, 해당 정보를 최선집행 정책에 반영해야 한다(MiFID II Article 27(6), RTS 2017/576 Article 2, Article 3, Annex I). 이는 투자자가 각 금융투자업자의 집행 관행 품질을 평가하기 수월하도록 근거 자료를 제시하는 것으로 투자자 보호를 강화하기 위한 목적으로 마련되었다. 해당 정보는 매년 동일한 형식으로 발표되기 때문에 투자회사 간 성과를 비교하거나 각 투자회사의 과거 성과와의 비교에 유용하게 활용할 수 있다. 구체적인 정보 공개 항목 및 형식은 2016년 발표된 ‘투자회사의 거래집행 시장 및 집행 품질 보고서에 대한 EU의 규제기술표준’19)에 명시되어 있다. RTS 28(Regulatory Technical Standards 28)로도 불리는 이 규제기술표준은 금융상품 종류, 주문집행 시장, 고객 주문 규모 및 빈도, 유동성 소비 주문과 공급 주문 비율 등 상세한 내용을 포함한다.

또한 MiFID II는 투자회사가 공개하는 품질 평가 정보와 별개로, 거래시장가 거래집행 품질을 평가할 수 있는 근거 자료를 제공하도록 의무화하였다. 각 거래시장은 최소 연 단위로 해당 거래시장이 취급하는 금융상품별로 거래집행 품질 자료를 공개해야 한다(MiFID II Article (3)). 거래시장에 자료공개를 의무화하는 것은 투자회사가 근거 자료를 바탕으로 거래시장을 선택하고 최선집행의무를 원활히 수행할 수 있는 환경을 조성하기 위해서다.20)

보고서에 포함되어야 할 세부사항은 RTS 27에서 규정하였는데, RTS 27은 2023년 현재 시행이 유예된 상태이다. RTS 27 보고서에 지나치게 많은 양의 세부 데이터가 포함되어 있어, 투자자 및 기타 사용자가 거래시장의 집행 품질에 대해 의미 있는 비교를 하기 어렵다는 점이 지적되었다.21)

이처럼 미국과 유럽은 금융 시장환경에서 거래시장이 고도로 분산되어 있다는 점에서 공통적 특징을 가지고 있다. 그러나 이렇게 분할된 시장을 효과적으로 연결하고 통합하기 위해 서로 다른 접근법을 채택하였다. 미국은 SIP을 통해 호가 및 체결자료를 통합하고 NBBO를 기반으로 주문을 회송하도록 강제함으로써 실질적으로 시장을 통합하는 전략을 추구해 왔다. 이와 대조적으로 유럽은 중앙에서 거래자료를 통합하기보다는 최선집행에 활용할 수 있는 판단 자료의 형태를 표준화하고 자료공개를 의무화하는 방식을 택하였다. 이러한 다양한 접근방식은 각 국가의 고유한 시장 특성을 반영한 것이다. 유럽은 다양한 국가의 집합체이기 때문에, 미국에 비해 중앙 집중적 시스템을 마련하기 어려운 환경이다.

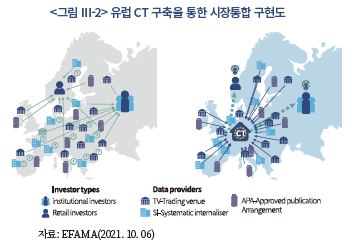

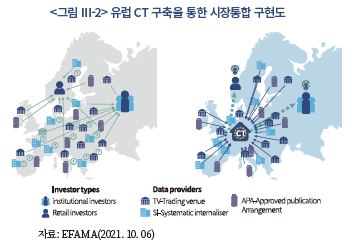

그런데 최근 유럽도 중앙 집중적 자료구축을 위한 규정 개정을 추진하고 있다. EC(European Commission)는 2020년 9월 유럽 자본시장을 진정한 단일시장으로 통합하기 위한 신자본시장연합(New Capital Markets Union: CMU 2020) 실행계획을 발표하였다. 이 계획에는 거래시장 간 통합자료 시스템을 설립하기 위한 계획이 포함되었다.22) EC는 2021년 11월 25일 모든 금융상품에 관한 거래 후(post-trade) 정보를 공개하기 위한 통합자료(Consolidated Tape: CT) 구축 계획을 포함한 MiFID II/MiFIR 프레임워크를 위한 입법 제안을 발표하였다.23) 유럽은 현재 투자회사가 재량에 따라 유럽 내 다수의 거래시장 중 일부의 시장을 선택하여 주문을 집행하기 때문에, 투자자는 제한된 거래정보와 거래 기회를 접하게 된다. CT가 구축되면 시장통합 정도가 제고되고, 투자자의 거래 기회가 확대되며, 시장 감시가 용이해지고, 중소형 투자회사의 사업 기회가 확대되는 등의 긍정적 효과가 있을 것으로 기대된다. 2023년 초 EU의 26개 회원국에 있는 14개의 유럽 거래소 그룹은 주식 유럽 통합자료 애플리케이션을 개발하기 위해 협력하기로 합의하는 등 CT 구축을 위한 업계의 대응이 진행 중이다.24)

이러한 EC의 입법 제한은 RTS 27의 실행이 유예된 것과 밀접하게 연관되어 있다. EC는 입법 제안에서 CT 정보가 최선집행을 증명하는 데 사용될 수 있으므로 MiFID II Article 27(3)에서 규정한 ‘거래장소에 대한 보고의무’ 및 MiFID II Article 27(10)(a)의 ‘규제기술표준 초안 개발을 위한 ESMA에 권한 부여’ 조항을 삭제할 것을 제안하였다. 즉, CT 구축이 계획대로 진행된다면 범유럽적 통합 거래정보가 개별 거래장소가 공개하는 정보를 대체할 수 있으므로 거래시장 개별의 품질 보고서가 불필요할 것으로 판단하였다.25)

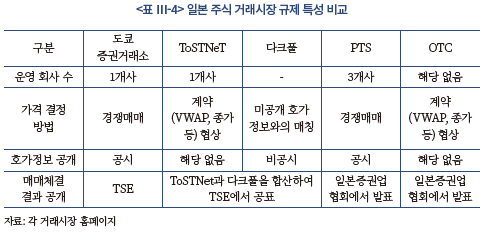

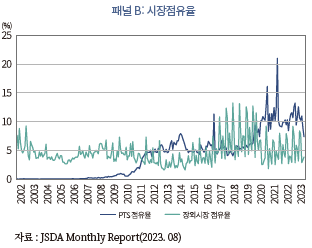

3. 일본

일본의 ATS인 PTS(Proprietary Trading System)에 대한 규제 체계는 국내 자본시장법보다 15여 년 앞선 1998년에 도입되었다. 그 이전에는 주식거래에 대해 거래소 집중의무가 있어, 법적으로 모든 거래는 거래소를 통해 이루어져야 했다. 그런데 1998년 거래소 집중의무를 폐지하고 PTS 운영 업무 인가제를 도입하는 등 다양한 시장 설립을 허용하였다. 시장 간 경쟁을 촉진하고 투자자 거래수요 다변화에 대응하기 위해 PTS 설립 근거법을 마련하였다.

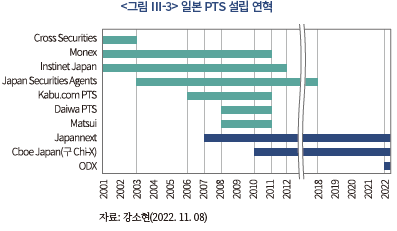

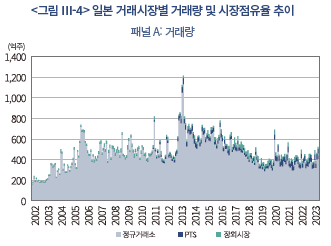

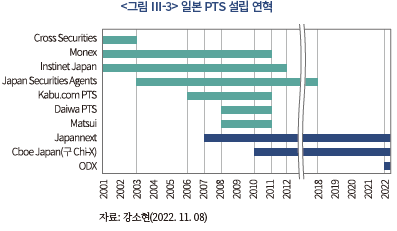

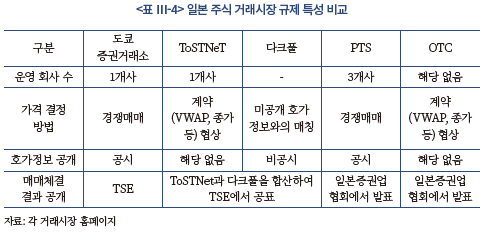

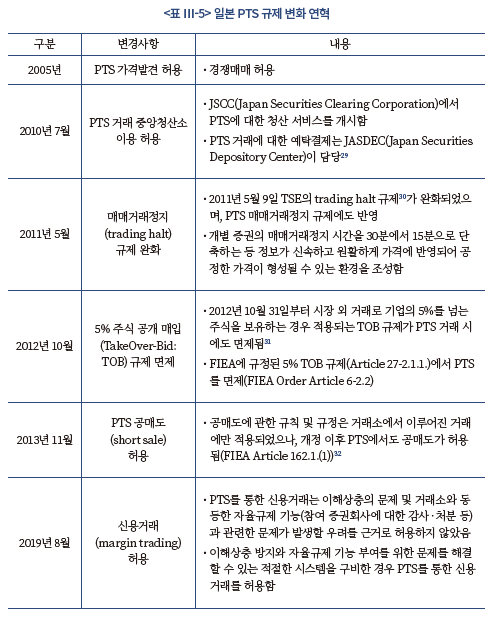

PTS 설립이 허용되자 2000년대에 주식거래를 목적으로 한 다수의 거래시장이 등장했다. 2001년에 Cross Securities, Monex, Instinet Japan 등이 설립되었으며, 2000년대 중반에는 Kabu, Daiwa, Matsui 등 대형 금융상품거래업자가 PTS 설립에 참여했다. 그러나 대부분의 PTS는 2010년대 초에 운영을 중단하였으며, 현재까지 유지되고 있는 PTS는 Japannext와 Cboe Japan, 그리고 2022년 6월에 설립된 ODX(Osaka Digital Exchange) 등 세 개사에 불과하다.

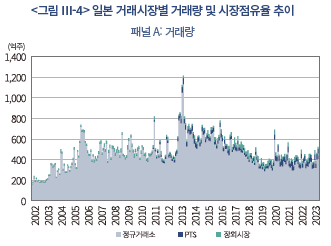

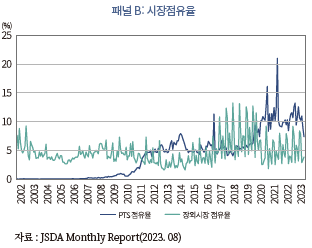

현재 운영 중인 PTS 수는 2000년대에 비해 크게 감소했지만, 시장점유율은 과거에 비해 유례없이 상승하였다. PTS의 시정점유율은 단계적 성장을 보이는데, 2010년 이전, 2010년대, 2020년대로 극명하게 구분된다. PTS 설립이 허용된 이후 10년이 경과한 2000년대 말까지 거래량은 0%대로 저조한 상황이었다. 그러나 2010년에서 2011년의 짧은 기간에 월평균 거래대금 기준 시장점유율이 0.6%에서 5.5%로 급격하게 상승하여 2010년대에는 평균 4.7%를 유지했다. 이후 2020년에 시장점유율이 한 차례 더 급격하게 상승했으며 2022년 7월에는 거래대금 기준 최고 13.22%까지 성장하였다.

2000년대의 저조한 점유율과 대조적으로 2020년 이후 PTS가 크게 성장한 배경에는 몇 가지 원인이 존재한다.

첫째, 2000년대에 설립된 PTS의 시장운영 형태상 유동성을 불러오기에 불리했다. 당시 PTS는 주간거래가 아닌 야간거래를 위한 시장이었다. 일반적으로 야간거래 수요는 정규거래시간에 비해 높지 않았기 때문에 PTS의 시장점유율이 저조할 수밖에 없었다.26)

둘째, 2005년 이전에는 PTS에서의 주문체결 방법에 대한 제한 규정이 있어, 거래소의 매매가격을 이용한 거래만 가능했다. 즉, 2005년까지 PTS는 독자적으로 가격을 형성할 수 없었으며 현실적으로 거래소와의 가격 경쟁이 이루어질 수 없었다. 즉, PTS 제도 도입 초기에는 PTS는 독립적인 거래시장이 아닌 거래소의 보완적인 역할을 하는 시장이라는 인식이 컸다.

셋째, PTS에 대한 규제 변화가 PTS 시장점유율 확대에 상당한 영향을 미쳤다. <그림 Ⅲ-4>의 패널 B를 보면 PTS 점유율이 과거에 비해 계단식 성장을 보이는데, 시장점유율이 단기간 급등한 시점마다 PTS와 관련된 주요 규제가 완화되었다. 우선 2010년을 기준으로 PTS의 점유율이 1년 사이에 1% 미만에서 5%까지 급등하였다. 2010년 7월 이전에는 청산 업무를 담당하는 기구 없이 거래 당사자 간 직접 거래가 이루어져 거래상대방 위험에 노출되었다. 그러나 2010년 7월 이후에는 PTS를 통해 거래할 때도 정규거래소와 동일하게 중앙청산소(Japan Securities Clearing Corporation: JSCC)의 청산 서비스를 이용할 수 있도록 허용하였으며, 이를 계기로 PTS 이용률이 증가하였다. 그 후 2000년대 시장점유율은 5% 이내에서 유지되다가 2019년에 한 차례 더 급등하는 모습을 보인다. 그동안 PTS를 통한 거래 시 이해상충 및 자율규제 관련 문제가 발생할 것을 우려하여 신용거래를 허용하지 않았으나, 해당 제한이 2019년 8월 철회되면서 PTS 이용이 급증하였다.27) 일본시장에서 신용거래는 증권시장 전체 거래대금의 20% 이상을 차지할 정도로 활발하게 이루어지고 있어 PTS를 통한 신용거래 허용은 PTS 성장을 촉진하는 계기가 된 것으로 보인다.28)

넷째, 거래소 거래원칙이 폐지되고 최선집행원칙이 도입된 이후에도 거래소를 우선순위로 주문을 집행하는 금융상품거래업자의 최선집행 관행이 상당 기간 유지되었다. 거래소 거래원칙이란 고객이 PTS 거래를 명시적으로 요청하지 않는 한 원칙적으로 거래소에서 매매하도록 한 규정이다. 거래소 거래 원칙은 PTS 시장의 발전을 저해하고 거래소와 PTS 간 공정한 경쟁이 어려운 상황을 조성한다는 판단하에 2005년에 폐지되었다. 이와 함께 PTS에 경쟁매매가 허용되면서 최선집행의무가 마련되었다. 그러나 그 이후에도 거래소만을 이용하는 관행이 고착화되어 대다수 금융상품거래업자는 거래소 거래원칙이 폐지된 이후에도 지속해서 거래소를 중심으로 주문을 체결하였다.

이러한 시장 관행이 형성된 배경에는 최선집행원칙 가이드라인이 상당한 영향을 미쳤던 것으로 보인다. 일본증권업협회(Japan Securities Dealers Association: JSDA)는 최선집행원칙 도입 초기에 증권사의 부담을 줄여주기 위하여 최선집행원칙에 관한 가이드라인을 마련하였다. 근데, JSDA가 제시한 안은 PTS를 통한 거래가 정규거래소에 비해 후순위로 처리되어도 최선집행의무를 준수한 것으로 인정하는 형태였다.33) 당시 유동성, 주문체결 가능성, 주문체결 속도 등을 고려해 보았을 때 거래소를 통해 주문을 체결하는 것이 PTS 등 거래소 이외의 시스템을 통해 거래하는 것보다 우월하다는 판단이 근저에 있었다. PTS의 시장점유율이 0.1% 미만으로 미미한 수준이었기 때문에 정규거래소를 통한 거래에 집중하도록 하는 것이 불합리한 판단이라고 볼 수 없다고 판단했다. 이에 대부분 금융상품거래업자는 FSA 감사에 따른 번거로움을 회피하기 위하여 JSDA의 가이드라인을 준용하여 정규거래소를 통한 거래에 집중하도록 최선집행 정책을 수립하였다. 결국 금융상품거래업자는 기존과 마찬가지로 거래소를 통해 거래하는 관행을 고수하여 추가적 설비 또는 시스템 투자나 규정 준수 여부에 대한 감사 부담에서 벗어날 수 있었다. 그러나 PTS의 안정적 정착과 거래시장의 성장과 발전이 지연되는 부작용이 발생하였다.

일본 FSA는 2020년 거래시장 간에 충분한 경쟁이 이루어지지 않고 있다는 문제의식 하에 투자자 보호와 투명성 강화를 위하여 최선집행원칙에 대한 재검토를 추진했다. 2020년 12월 특별조사단을 결성하고 ‘금융상품거래업자 등의 최선집행정책 등에 관한 규제’에 대한 검토를 시행하였다. 조사 결과를 바탕으로 2021년 6월에는 '최선집행을 보장하기 위한 최적 방안 TF’ 보고서를 발표했다. TF 보고서는 다수의 금융상품거래업자가 거래소를 우선으로 주문하는 최선집행 정책을 고수하고 있어 거래시장 간 경쟁을 통한 발전에 저해 요인이 되고 있다고 판단했다. 이러한 문제점을 개선하기 위하여 최선집행의무에 관한 규정을 검토하고 개정하도록 권고하였다.

일본 FSA는 특별조사단의 권고를 받아들여 2022년 5월 18일 최선집행원칙에 대한 개정을 포함한 「금융상품거래법 시행령 개정에 관한 내각령」을 확정하여 발표하였다. 해당 규정은 2023년 1월부터 시행되었지만 1년간 유예기간이 부여되었다.

일본 최선집행원칙 개정의 핵심 사항은 두 가지이다. 한 가지는 개인투자자의 최선집행기준을 개정한 것이며, 나머지 한 가지는 SOR 관련 설명의무를 강화한 것이다. 두 가지 모두 투자자 보호와 주문집행 투명성을 제고하기 위한 조치이다. 개인투자자의 최선집행기준과 관련하여 증권사가 최선집행원칙을 수립할 때, 개인투자자의 주문은 가격을 중시하는 방향으로 설정하도록 규정을 개정하였다. 개인투자자의 주문은 기관투자자와 달리 소량 주문이 대부분을 차지하고 있어 일반적으로 가격이 가장 중요한 거래조건이다. 이러한 일반적인 개인투자자 주문의 특성을 반영하여 가격을 중심으로 최선집행원칙을 수립하는 것이 타당하다고 판단했다. 단, 그동안의 주문집행 관행으로 인해 가격을 중심으로 최선집행정책을 일률적으로 변경하도록 강제할 경우 금융상품거래업자에게 부담이 될 것을 우려하여 가격 우선 정책으로 변경하도록 권고하는 방안을 채택하였다. 즉, 가격 이외의 요건을 고려하는 경우 그 취지와 이유를 추가로 설명하도록 규정하여 가격 우선 최선집행기준을 도입하도록 간접적으로 유도하였다.

또한 SOR에 의한 주문집행의 투명성을 높이기 위해 SOR을 사용할 경우 최선집행원칙의 기재 사항에 SOR 이용 취지 및 SOR에 의한 주문집행 원칙을 상세히 설명하도록 의무화하였다. 금융상품거래업자와 계열관계 또는 우호관계에 있는 거래시설에 우선하여 주문을 회송하도록 SOR을 설계한 경우 고객과 금융상품거래업자 사이에 이해상충이 발생할 가능성이 존재한다. 이러한 문제를 완화하기 위하여, SOR에 포함되는 거래시장 범주, 주문집행원칙 및 기준 수립 근거, 복수의 거래시장에 동일한 주문조건이 존재하는 경우 주문 처리 우선순위 등에 대해 투자자가 이해하기 쉽게 명시하도록 의무화하였다.

최근의 일본 최선집행원칙 개정은 개인투자자 관점에서 진일보한 것이라 평가할 수 있다. 2023년 상반기를 기준으로 일본 증권시장에 등록된 270여 개의 등록 증권사 중 20여 개 사가 PTS를 활용하여 주문을 집행하고 있다. PTS를 이용하는 금융상품거래업자가 SOR도 구축하고 있다고 가정하면, 일본 증권업계에서 PTS나 SOR 이용은 대형 증권사를 중심으로 이루어질 뿐 여전히 일반적인 상황은 아니다.34) 그러나 최선집행원칙의 개정으로 가격 중심의 거래집행 원칙을 수립하도록 권고한 상황이므로, 향후 PTS 이용이 중소형 증권사까지 확장될 가능성이 있다. PTS를 이용하는 증권사가 증가하고 PTS 점유율이 높아진다면 일본에서 거래시장 간 본격적인 경쟁이 시작될 것으로 예상된다.

4. 호주

호주의 시장구조 체제는 다른 국가들과는 다른 형태를 가지고 있다. 호주의 거래시장은 금융시장(Financial Market: FM)과 대체거래시스템인 크로싱 시스템(Crossing System: CS)으로 구분된다. 그런데 호주에서 정의하는 금융시장은 광범위하고 포괄적인 개념으로 다양한 형태의 시장을 포함한다.35) 금융시장은 구매자와 판매자 또는 상대방을 일치시키거나 연결하는 거래소, 플랫폼 또는 기타 시설을 포괄한다. CS는 시장참여자(MP)가 자기계정으로 매매를 체결하거나 고객 양자 간 주문을 체결하는 자동화된 서비스로 정의된다.

호주는 금융시장을 공정하고 투명한 방식으로 운영하기 위하여 2001년부터 호주 시장허가(Australian Market License: AML) 제도를 시행하고 있다(기업법 7.2). 호주 기업법 767A(1)에 따라 금융시장은 ‘금융상품의 취득 및 처분에 대한 제안이 정기적으로 이루어지거나 직간접적으로 그러한 의도가 있거나 합리적으로 예상할 수 있는 시설’로 정의된다. 호주에서 금융시장을 운영하기 위해서는 AML을 취득하거나 기업법 791A에 따른 면제 요건을 적용받아야 한다.

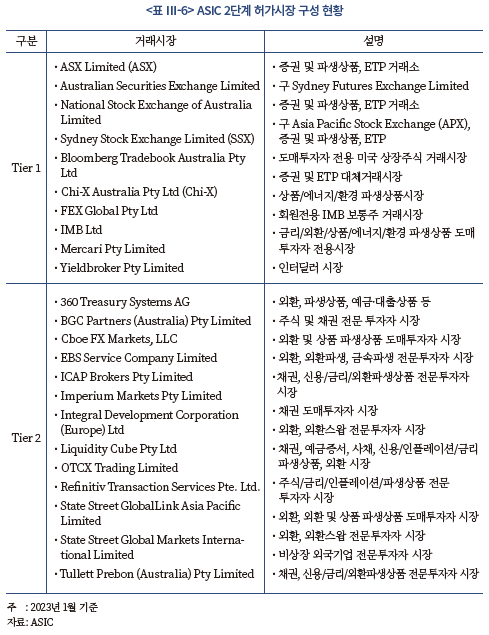

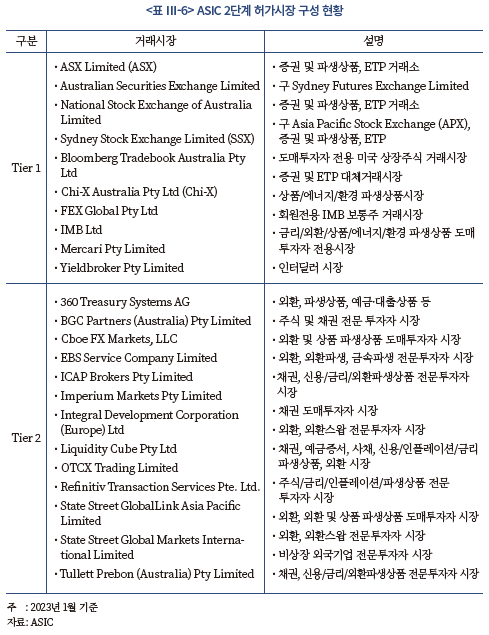

시장에 다양한 형태의 거래시장이 등장하여 규제체계 개선의 필요성이 높아지자 2018년 5월 시장위험 기반의 2단계 시장허가제도(2-tier market license regime)를 도입하였다.36) 2단계 시장허가제도를 도입하기 이전 호주 증권 투자 위원회(Australian Securities and Investments Commission: ASIC)는 상대적 중요도가 낮은 시장인 OTC, FX, 채권 등을 거래하는 전문 거래플랫폼에 면제 요건을 적용하는 방식으로 시장을 관리하였다. 그러나 2단계 시장허가제도 도입 이후 계층에 따라 차등적 규제를 적용하는 방식으로 전환하였다. 시장을 차등화한 이유는 호주 경제 및 금융시장 건전성과 효율성에서 중요도가 낮은 시장에 규제 부담을 완화하기 위해서다. 즉, Tier 1에 해당하는 시장은 시장운영자로서 규제 의무를 모두 준수해야 하며, Tier 2에 해당하는 시장은 일부 의무가 면제된다.

주지해야 할 점은 Tier 1과 Tier 2의 구분은 금융시장의 종류에 따라 결정되는 것이 아니라는 것이다. 그보다는 경제와 금융시장에 미치는 영향력과 위험 정도에 따라 구분된다. Tier 1은 호주 경제 또는 금융시스템의 효율성과 건전성 및 투자자 신뢰 측면에서 중요도가 높은 시장으로 구성된다. 즉, 금융시스템에 미치는 영향력과 위험도를 고려하여 결정된다.37) Tier 1에는 주식 또는 선물거래소를 포함한 전통 거래소와 그 외 중요도가 높은 거래시장이 포함되며, Tier 2는 기타 허가 거래시장이 포함된다.38)

2023년 1월 기준 23개의 허가시장이 포함되어 있으며, Tier 1에 10개, Tier 2에 13개의 시장이 존재한다. 호주의 거래시장 정의에 따르면 ASX 등 정규거래소와 Cboe Australia와 같은 대체거래시스템이 별도로 구분되지 않고 모두 Tier 1의 범주 안에 포함된다. 이는 정규거래소와 대체시장을 구분하여 규정하는 미국, 유럽 등의 규정이나, 정규거래소에 비해 PTS에 상당히 불리한 규정을 적용해 왔던 일본의 사례와 차이를 보이는 지점이다.

호주의 경우 거래시장을 구분하는 기준이 시장에 미치는 중요도이다. Cboe Australia는 해외 규정에서는 정규거래소와 구분되는 대체시장이지만 호주 규정상으로는 경제와 금융시스템의 효율성과 건전성 및 투자자 신뢰도에 큰 영향을 미치는 주요시장으로 구분된다. 즉, 중요도 기준으로 Cboe Australia는 전통 거래소인 ASX와 동일하게 Tier 1 거래시장으로 구분되며 규제 수준에 차이가 없다는 것을 의미한다.

한편 다크풀 등의 거래시설(trading facility)은 AML 체제에 포함되지 않으며, 다크풀 등 운영자는 금융서비스 제공자 허가(Australian Financial Services Licence: AFSL) 제도에 따라 규제된다. AFSL 제도는 금융상품 자문, 거래, 시장 형성, 등록제도 운영, 커스터디 등의 서비스를 제공하는 금융서비스업자를 대상으로 한다. AFSL 보유자는 효율적이고 공정하게 금융서비스를 제공하고, 이해 상충을 관리하고, 라이선스 조건을 준수하는 등의 의무를 충족해야 한다.

AML과 AFSL은 ASIC 보고의무, 투명성 요건 등에서 차이가 있다. AML 보유자는 서비스를 적절하게 제공하고, 서비스 사용자가 운영 규칙을 준수하는지 감시해야 하며, 사용자가 법에서 규정하는 규칙을 위반하고 있거나 위반할 것이라는 의심되는 경우 ASIC에 보고할 의무가 있다. 반면 AFSL 보유자는 ASIC에 보고할 의무가 없다. AML 보유자는 시장 운영 방식과 거래를 투명한 방식으로 운영해야 하나, AFSL 보유자는 운영 방식을 투명하게 공개할 명시적 의무가 없다.

호주 거래시장에 다양한 상품이 등장하고 거래기술 및 거래방식이 정교해진 결과 새로운 형태의 거래시장이 등장하였다. 전통적으로 장외에서 거래되던 상품들이 시장의 형태를 갖추는 경향이 발생하였다. 장기 투자자 또는 전문투자자들이 크로싱 시스템(Crossing System), 다크풀 등 새로운 형태의 거래시장을 이용하는 비중이 증가하여 정규거래소와의 경쟁 구도가 형성되었다.

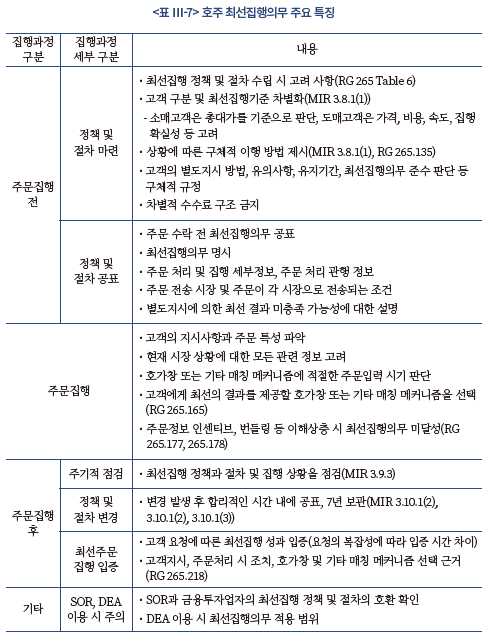

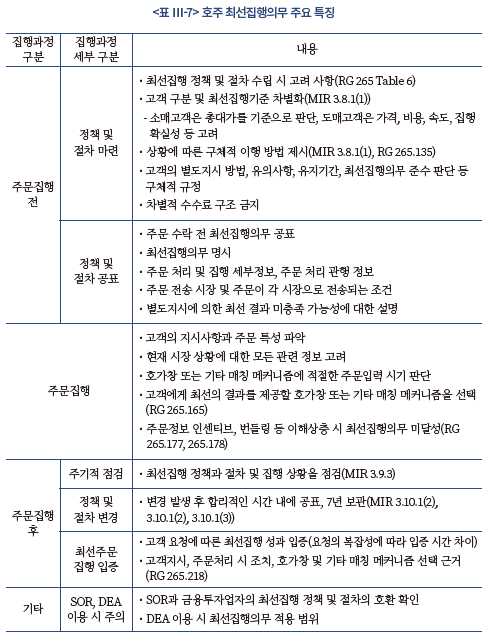

한편 호주의 최선집행기준은 MIR에 규정되어 있다. 2009년 8월 호주 정부는 호주 국내 허가 금융시장에 대한 감독 책임을 시장운영자에서 ASIC로 이전하고, ASIC는 시장운영자와 시장참여자(MP)를 규제하기 위한 MIR을 제정하였다. ASIC은 2018년 MIR을 준수하기 위해 마련된 기존 다수의 지침을 포괄하는 RG 265를 발행했으며, 현재는 2022년 개정된 RG 265가 시행되고 있다.

호주의 최선집행의무 법규와 지침은 최선집행의무에 대한 구체적 실행 방안과 최선집행 이행 과정에서 발생할 수 있는 다양한 상황에 대해 상세한 지침을 제시한다. 이는 다른 국가의 최선집행 규정과 차별화되는 호주 규정의 특장점이다.

최선집행 정책 및 절차 수립 시 고려해야 할 사항에 대해 자세하게 열거하고 있다. 호가창(order book) 및 주문을 전송하는 거래시장을 명시하고, 고객의 주문을 처리하고 집행하는 방법을 설명해야 한다는 점에서는 다른 국가와 동일하다. 그러나 주문집행 정책 및 절차 마련 시 고려해야 할 점을 더 상세히 설명하고 있다. 주문제출 시점부터 결제까지 처리 방법, 최선집행기준 수립 이유, 호가창 및 기타 거래체결 메커니즘 선택 조건, 최선집행 판단 요소 간 상대적 중요도를 평가하기 위한 정책 및 절차, 시장별 다양한 거래시간 및 장 개시/마감 거래 유형, 주문 전송 후 타 시장에 더 나은 호가 게시 시 처리 방안, 지정가주문 처리 방법 등에 대한 정책과 집행 절차를 마련해야 한다.

또한 호주의 RG에는 소매고객의 최선집행 판단기준이 상세하게 설명되어 있다. 소매고객은 총대가를 기준으로 최선집행 여부를 판단한다(MIR 3.8.1(1), RG 265.135). 이때 총대가는 상품가격과 거래비용으로 구성되는데, 호주의 RG는 이러한 규정을 전제로 하되 상황별로 상세한 지침을 제공하고 있다. 예를 들어, 일반적인 소매고객 주문과 달리 유동성이 낮은 상품을 주문할 경우 상품의 가격이나 명시적 비용보다 암묵적 거래비용이 더 중요한 요소일 수 있다. 이 경우 소매고객의 주문이라 할지라도 암묵적 거래비용을 총대가보다 우선할 수 있다는 점을 명시하였다(RG 265.137). 또한 총대가 구성 요소 중 상품가격은 상당한 차이를 보이지만 거래비용에는 유의미한 차이가 없을 경우, 최선의 가격만으로 최선집행을 판단할 수 있다고 설명한다(RG 265.140). 최선 가격에 대해서도 상세한 설명을 덧붙이고 있는데, 최선의 가격은 해당상품이 거래되는 모든 공개주문시장을 포함하여 판단하며(RG 265.141), 비공개주문시장에서 거래를 할 경우에는 가격개선 효과가 있는 경우 최선의 가격으로 인정된다(RG 265.143).

호주의 최선집행 규정에 따르면 고객은 증권사가 제시한 최선집행 정책 및 절차를 따르지 않고 다른 방식을 이용하도록 별도지시를 내릴 수 있다. 이는 다른 국가에서도 마찬가지로 허용하고 있는 사항이다. 그런데 호주의 지침은 별도지시에 대해 상세한 설명을 제시하고 있다. 우선 별도지시를 소매고객의 별도지시와 도매고객의 별도지시로 나누고, 각각에 대해 지시방법, 유의사항, 유지기간, 최선집행의무 준수 판단기준 등을 구체화하였다. 소매고객은 거래시장을 선택할 수 있으며, 거래속도나 시장충격, 집행 확실성 등을 고려하도록 지시를 내릴 수 있다(RG 265.145). 또한 별도지시는 서면 또는 구두로 전달할 수 있으며 7년간 보관해야 한다(RG 265.146). 고객이 특정 지시를 내리도록 권장하거나 유도해서는 안 된다(RG 265.147). 한편 도매고객의 경우에도 소매고객과 마찬가지로 별도지시가 허용되며(RG 265.154), 서면 또는 구두로 전달한 지시는 7년간 보관된다(RG 265.155). 또한 고객이 별도지시를 선택하여 최선집행 보호를 거부하도록 권장하거나 유도하는 행위는 금지된다(RG 265.160). 도매고객의 별도지시는 이에 더하여 일정 기간 유지될 수 있으며, 주기적으로 별도지시의 유효 여부를 검토하는 방식으로 운영 가능하다고 설명한다(RG 265.156). 즉, 소매고객의 경우 해당 주문에만 국한되어 적용되지만, 도매고객은 최장 12개월까지 유지된다(MIR 3.8.1(3), 3.8.1(4), MIR 3.8.1(5), RG 265.156, RG 265.159).

그 외에도 호주의 규정과 지침은 고객 주문 전송 메커니즘을 상세히 설명하도록 규정한다. 자동화 주문처리 프로세스 이용 시 최선집행의무를 준수하도록 설계하였는지 확인해야 한다. 또, SOR 및 자동화 주문처리 프로세스 로직을 문서화해야 하며 모니터링을 위한 적절한 준비가 필요하다.

Ⅳ. 주요국 금융투자업자의 최선집행 사례

미국과 유럽은 시장분할의 역사가 길고 다양한 형태의 대체거래소가 경쟁하는 복잡한 시장구조를 이루고 있다. 미국과 유럽의 사례는 다양한 거래시장의 등장에 따른 시장 변화 양상과 개선 방안에 대한 시사점을 얻기에 적합하나, 단일 거래소 환경에 ATS가 도입되는 국내 상황과는 차이가 있다. 반면 일본과 호주시장은 단일의 정규거래소에 거래가 집중되어 있고 소수의 대체거래소가 나머지 지분을 차지하는 단순한 구조이다.

국내 거래시장은 아직 ATS가 설립되기 이전이며 앞으로도 소수의 ATS가 등장할 것으로 예상되어 시장분할 정도가 낮을 것으로 보인다. 따라서 본 장에서는 국내 환경과 구조적으로 유사한 일본 및 호주 시장의 최선집행규정 사례를 중심으로 국내 금융투자업자의 최선집행 규정 마련에 대한 시사점을 얻고자 한다.

1. 일본 금융상품거래업자 최선집행기준

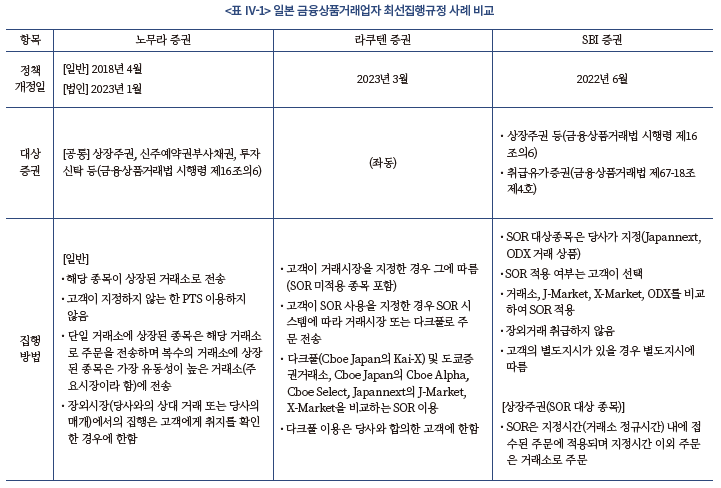

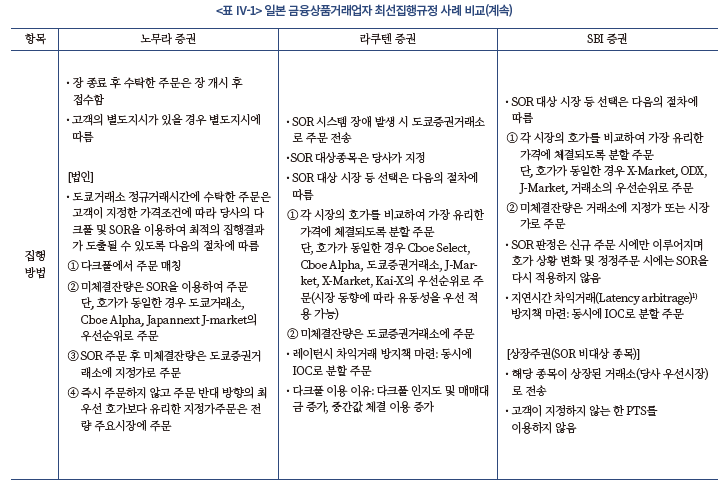

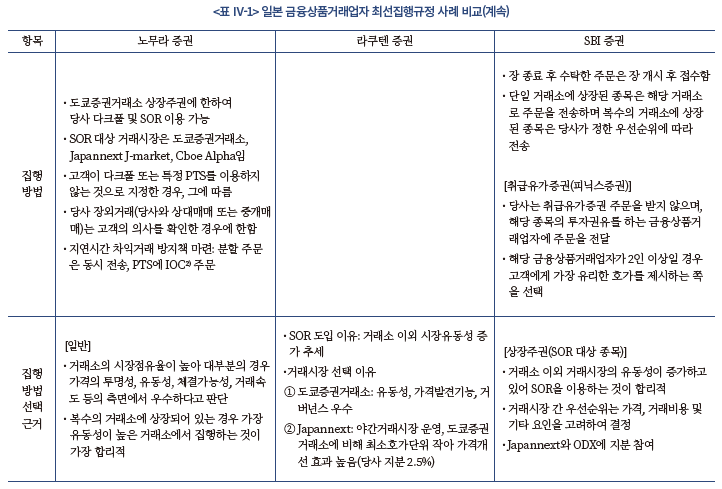

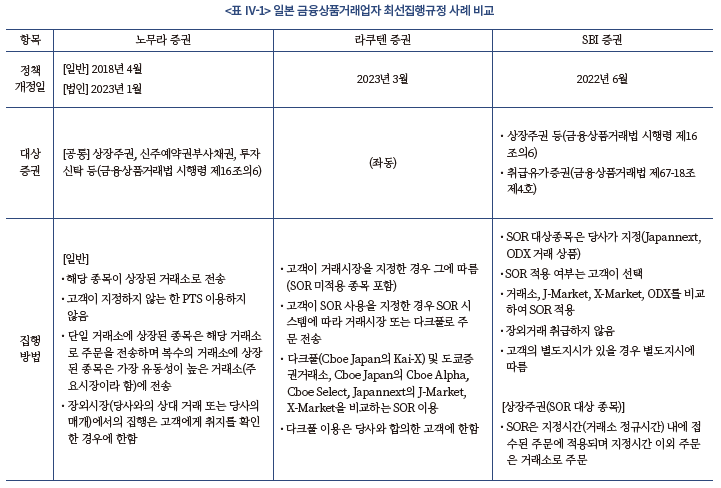

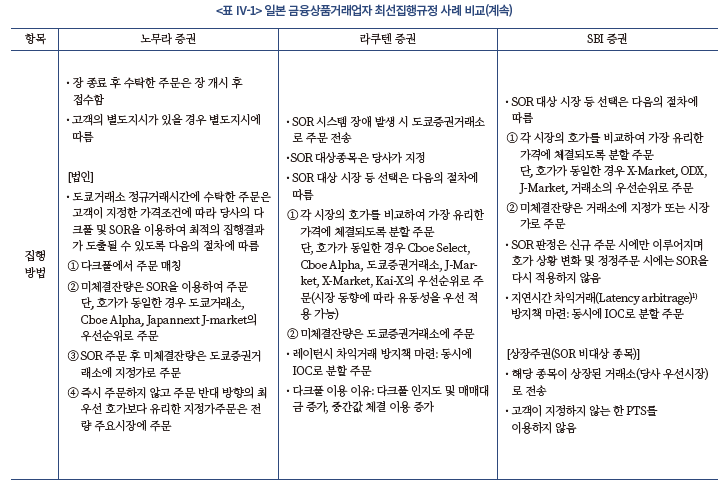

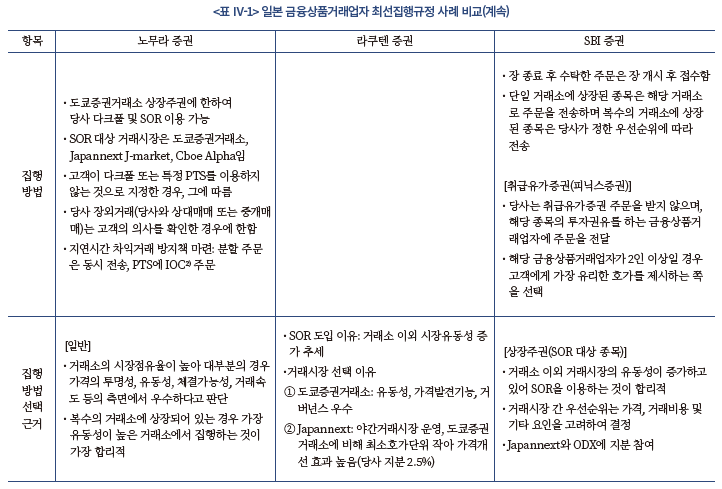

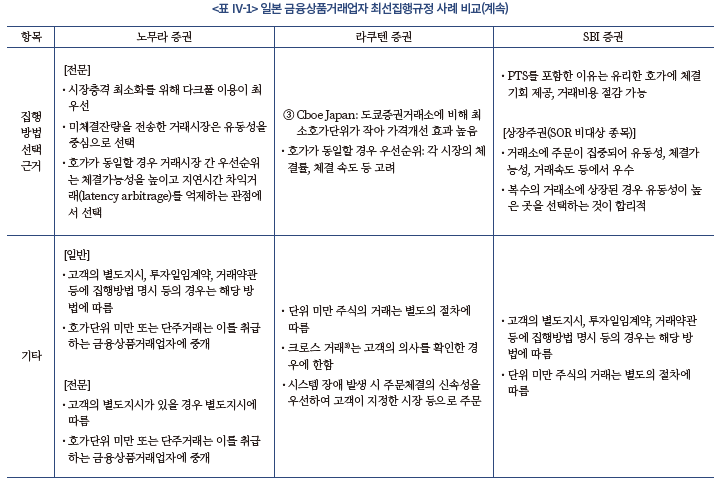

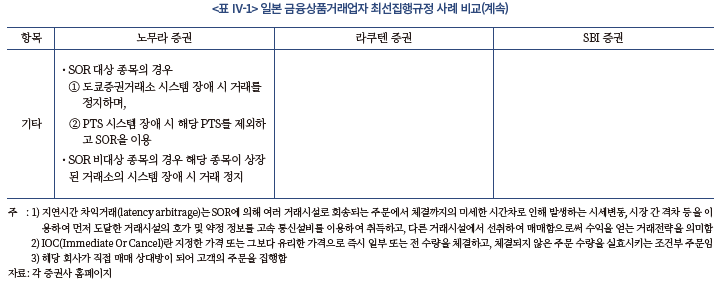

일본 시장에서 최선집행기준이 구체적으로 구현된 형태를 파악하기 위해, 노무라 증권, 라쿠텐 증권, SBI 증권 등 일본 대형 금융상품거래업자의 최선집행규정을 비교해 보았다.

비교 대상인 금융상품거래업자의 최선집행정책은 유사한 구조로 구성되어 있다. 네 개의 항목으로 나뉘어져 있는데, 1) 최선집행 대상이 되는 증권의 범위를 규정하고 2) 각 증권사에서 정한 최선집행 방법과 3) 선택 이유를 제시하였다. 마지막으로 4) 기타 항목에서 고객의 별도지시, 투자일임계약, 단주거래, 시스템 장애 등의 경우에 최선집행 방법에 관해 설명한다.

최선집행 대상 증권은 금융상품거래법의 규정을 따르고 있으며 증권사별로 차이가 없다. 또한 기타 항목에 나타난 사항들도 크게 다르지 않다. 그러나 최선집행 방법과 선택 이유는 증권사의 특성이 반영되어 증권사별로 차별화된다.

노무라 증권의 최선집행규정은 개인고객과 법인고객을 구분하여 차별화된 집행기준을 제시한다. 개인고객의 주문은 거래소를 중심으로 거래하도록 기준이 마련되었다. 즉, 개인고객이 주문 시에 PTS를 이용하도록 지정하지 않는 한 모든 주문은 거래소로 전송된다.

한편 노무라 증권의 법인고객과 라쿠텐 증권 및 SBI 증권 고객 주문의 일부 종목에 SOR을 이용한 최선집행 서비스를 제공한다. SOR은 거래소와 PTS의 거래조건을 비교하여 사전에 설정된 로직에 따라 최적의 거래조건을 판단하고 주문을 집행한다. 우선 SOR을 이용하여 가장 유리한 가격에 주문이 체결되도록 분할 주문한 후 미체결잔량은 유동성이 가장 높은 도쿄증권거래소에 주문한다는 점에서 크게 다르지 않다.

그런데 증권사별로 선정한 비교 대상 시장과 시장 간 우선순위에는 차이가 있다. 노무라 증권은 SOR을 이용하여 주문을 집행하기 전에 자사의 다크풀을 이용하여 주문을 일차적으로 체결한다. 다크풀은 호가가 공개되지 않기 때문에 시장충격을 최소화할 수 있어 노무라 증권은 다크풀을 우선 이용하는 것이 합리적이라고 판단했다. 이후 체결되지 않은 잔량은 SOR을 통해 집행한다. 이때 SOR 대상 거래시장은 도쿄증권거래소, Cboe Alpha, Japannext J-market이다. 라쿠텐 증권과 SBI 증권은 다크풀을 이용하기는 하나 다크풀을 우선 고려하지 않고 모든 시장을 일시에 비교하여 분할 주문한다. 그런데 호가가 동일한 경우 라쿠텐 증권은 Cboe Select, Cboe Alpha, 도쿄증권거래소, J-Market, X-Market, Kai-X(Cboe Japan 다크풀)의 우선순위로 주문을 집행한다. 한편 SBI 증권은 라쿠텐 증권과 다른 우선순위를 적용한다. SBI 증권은 X-Market, ODX, J-Market, 거래소의 우선순위로 주문한다. 동일한 조건이라면 PTS를 거래소에 비해 우선하여 고려하는 이유는 PTS의 호가단위가 거래소에 비해 작아서 보다 유리한 가격에 체결할 가능성이 높고 거래비용이 낮기 때문이라고 설명한다.

일부 종목은 SOR이 적용되지 않는데, SOR 미적용 종목의 최선집행은 노무라 증권의 일반투자자와 마찬가지로 거래소 우선정책이 적용된다. 해당 종목이 상장된 거래소에서 우선 거래가 집행되며 복수의 거래소에 상장된 종목은 해당 증권사가 선정한 우선순위에 따라 전송된다. 단, 라쿠텐 증권의 경우 SOR 미적용 종목은 고객이 거래시장을 지정하도록 한다.

이상 세 금융상품거래업자의 최선집행 규정을 종합적으로 살펴보면 몇 가지 특징을 정리할 수 있다.

첫째, 일본의 최선집행규정은 상당 부분을 SOR 관련 사항을 설명하는 데 할애하고 있다. 이는 최근 SOR과 관련된 최선집행원칙이 강화되면서 SOR을 사용하는 취지와 SOR에 따른 주문집행 원칙을 상세히 설명하도록 의무화한 것과 일관된다. 검토 대상의 최선집행규정은 모두 SOR이 적용되는 거래시장 범주와 주문집행 원칙, 시장 간 우선순위 등에 대해 상세히 설명하였다. 단, 일본시장에서는 최근 PTS의 시장점유율이 증가함에 따라 SOR을 이용하는 증권사가 증가하는 추세이기는 하나, 아직 SOR을 이용하는 증권사는 20여 개사에 불과한 상황이다. 시장 분산 정도가 높아지면 SOR 이용 증권사가 증가할 것으로 예상된다.

둘째, 모든 종목에 SOR이 적용되는 것은 아니며 SOR의 필요성이 높은 종목을 증권사가 선별하여 SOR 서비스를 제공한다. SOR 적용 종목 선별은 해당 종목이 거래되는 시장의 범위에 따라 영향을 받는다. 예를 들어, 한 시장에서만 거래되는 종목의 경우 SOR을 이용할 필요가 없으므로 SOR 적용 종목에서 제외된다. 또한 거래시간에 따라서도 달라지는데, 거래 대상 시장이 종료된 이후에는 비교군이 존재하지 않으므로 SOR이 적용되지 않는다. 일본에는 도쿄증권거래소를 비롯하여 삿포로 증권거래소, 나고야 증권거래소 등 다수의 지역거래소가 존재하지만, 일반적으로 SOR은 도쿄증권거래소 상장종목에 적용되며 도쿄증권거래소의 정규시간에 접수된 주문에 한하여 SOR을 이용하도록 규정한다.

셋째, 노무라 증권의 개인고객 주문과 SOR 미적용 종목은 거래소를 우선으로 주문을 집행하며 별도의 요청이 없는 한 PTS는 이용하지 않는다. 이는 2000년대부터 장기간 일본 최선집행 관행의 중심에 있었던 거래소 거래원칙이나 JSDA의 거래소 중심 가이드라인과 동일한 형태이다. 일본 거래시장 구조상 도쿄거래소에 주문이 집중되어 있고 PTS의 시장점유율이 상대적으로 낮으므로, 일반적으로 유동성, 체결가능성, 거래속도 등의 측면에서 거래소로 주문을 전송하는 것이 합리적이라고 판단했기 때문일 것이다.

그런데 2023년 1월에 개정된 최선집행원칙에 따르면 개인투자자의 주문을 집행할 때 가격을 중심으로 최선집행원칙을 수립하도록 권고하고 있다. 현재와 같이 유동성 등 가격 이외의 요건을 우선시하는 경우 그 취지와 이유에 대한 부가적 설명을 덧붙여야 한다. 이러한 최선집행기준 개정 규정은 1년간 적용이 유예된 상황이기 때문에 현재 최선집행정책에 충분히 반영되지 않은 상황인 것으로 보인다. 일본 시장은 현재 최선집행원칙을 개정하는 과도기적 상황이라고 볼 수 있다. 향후 각 증권사의 최선집행 정책 및 절차의 변화양상, 이에 대한 감독 당국의 지침과 판단을 주의 깊게 지켜볼 필요가 있다.

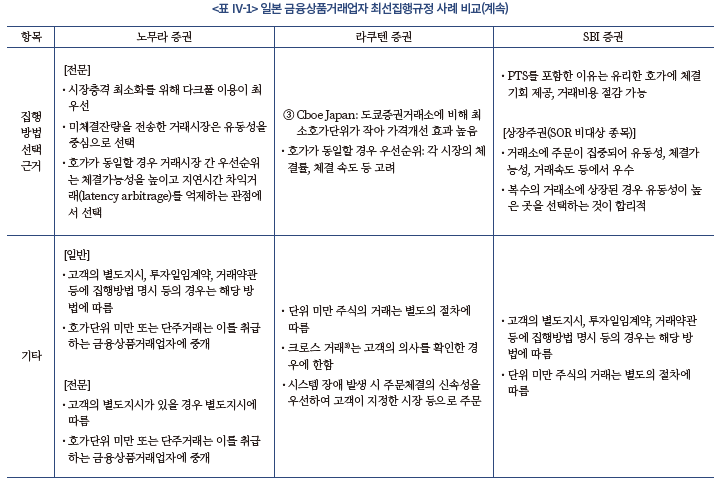

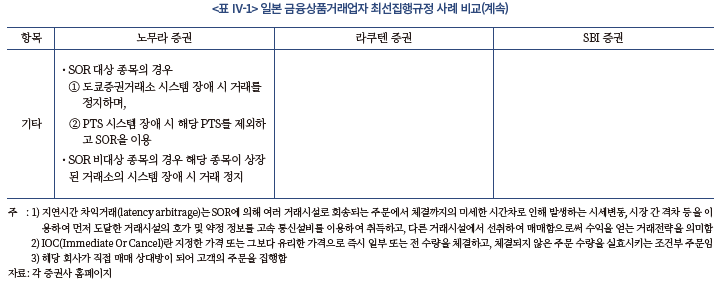

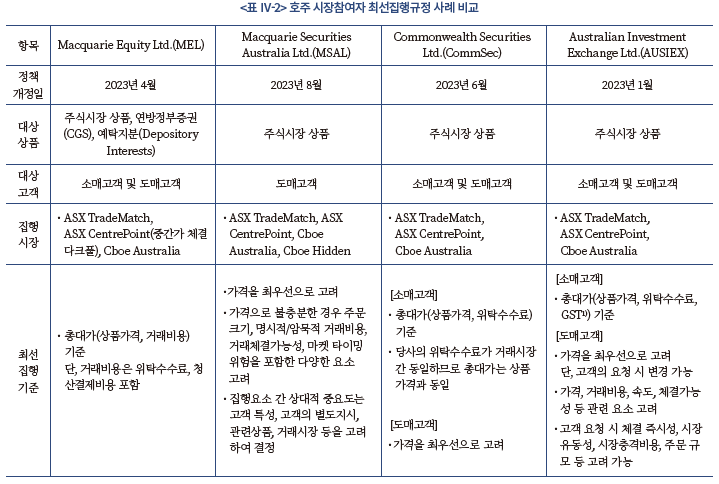

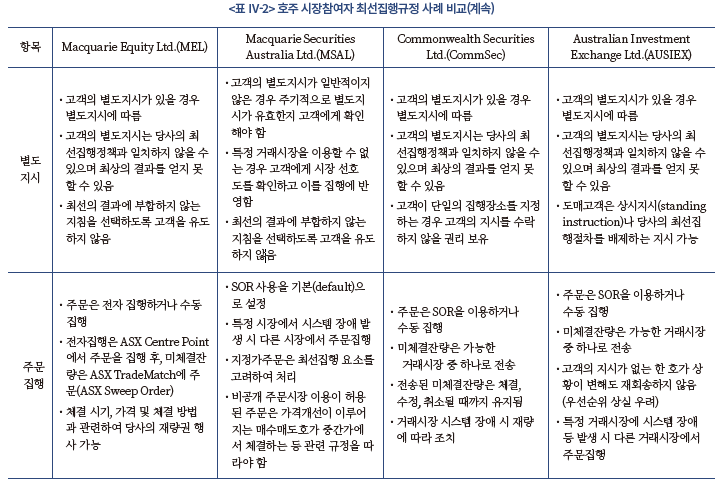

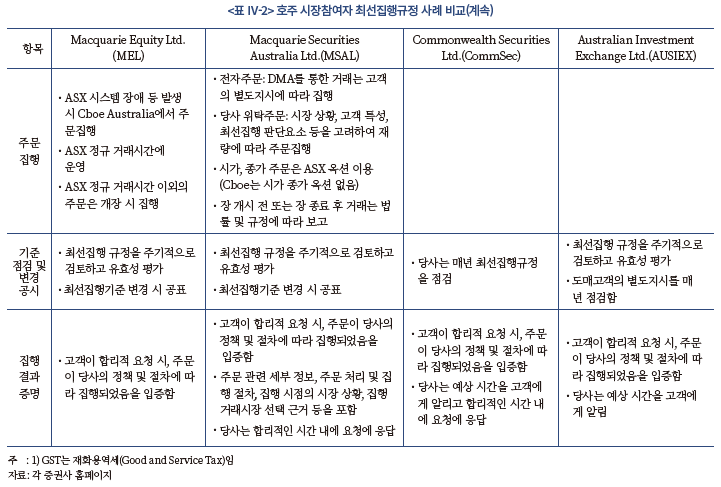

2. 호주 시장참여자 최선집행기준

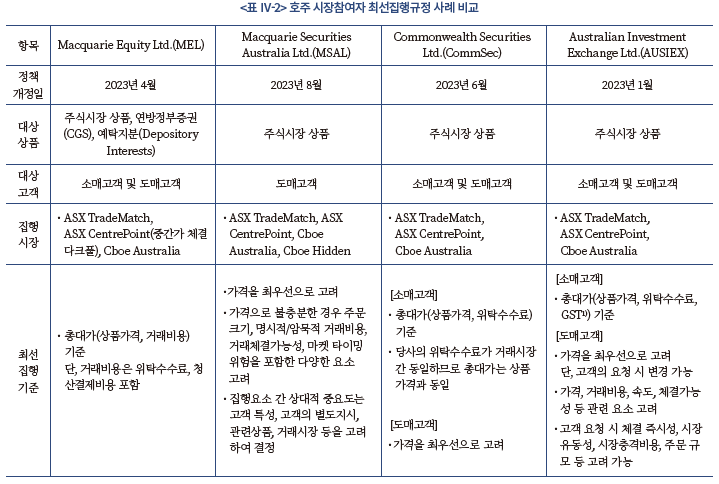

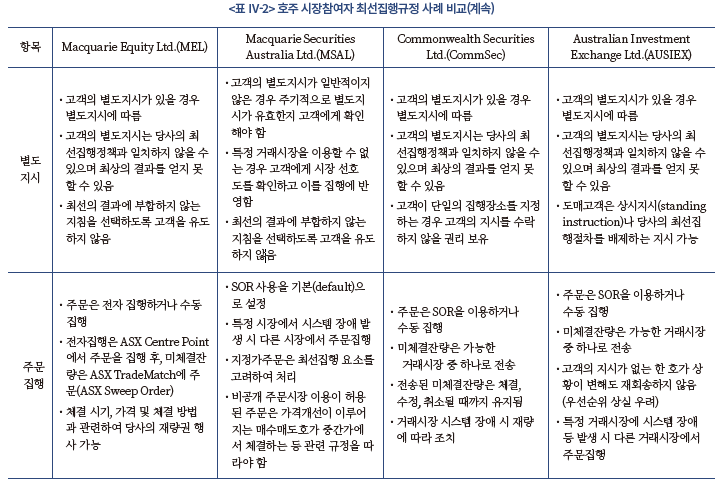

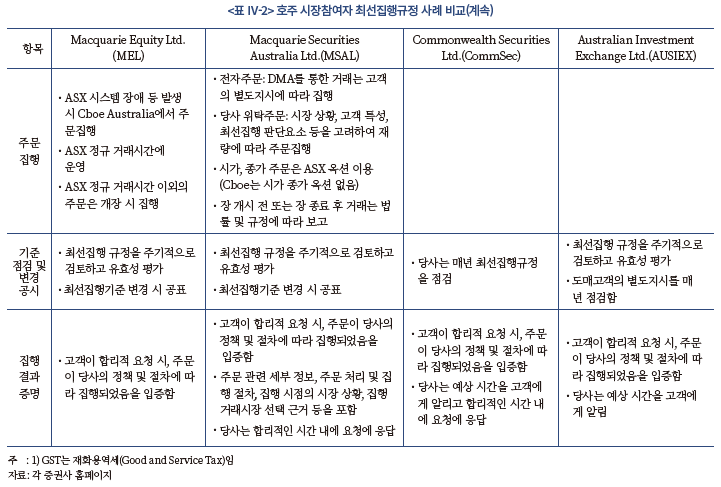

호주에는 ASX와 Cboe Australia의 두 개의 주식상품 거래시장이 존재하며, 각 시장은 공개주문시장과 비공개주문시장을 갖추고 있다. ASX는 공개주문시장인 ASX TradeMatch와 중간가에 체결하는 비공개주문시장인 ASX CentrePoint가 있다. Cboe Australia 또한 연속경쟁매매와 더불어 ASX의 종가, NBBO의 중간가 등에 거래할 수 있는 비공개 주문을 제공한다. 호주 증권사인 Macquarie Equity Ltd.(MEL), Macquarie Securities Australia Ltd.(MSAL), Commonwealth Securities Ltd.(CommSec), Australian Investment Exchange Ltd.(AUSIEX)는 고객의 주문을 최적의 조건으로 체결하기 위하여 두 시장을 모두 이용하여 주문을 집행한다.

해당 증권사는 MIR에 따라 소매고객과 도매고객을 구분하여 각기 다른 최선집행기준을 제시하고 있다. 소매고객의 주문은 총대가를 기준으로 최선집행 절차를 마련하였다. 총대가는 법에서 정한 대로 상품가격과 거래비용으로 구성된다. 그런데 증권사마다 거래비용의 정의에서 다소 차이를 보인다. CommSec은 거래비용을 위탁수수료로 정의한 반면, MEL은 위탁수수료에 청산결제비용을 포함한 것으로 확장했다. 더 나아가 AUSIEX는 재화용역세(Good and Servide Tax: GST)까지 합한 것으로 정의한다. 이는 모든 증권사가 의무적으로 총대가에 거래비용을 포함하지만, 거래비용의 세부 항목을 정하는 방법에는 재량권을 가지고 있는 것으로 해석할 수 있다. 특히 CommSec은 자사 정책상 거래시장과 관계없이 고객에게 균일한 위탁수수료를 적용하여 사실상 총대가는 상품가격만 고려하는 것과 마찬가지라는 점을 최선집행 정책에 밝히고 있다.

도매고객 주문의 경우 가격 및 명시적 비용 이외에 다양한 집행요소를 고려하도록 기준을 설정하였다. 그런데 조사 대상인 증권사는 모두 다양한 요소 중 가격을 최우선으로 고려하고 있다. 이에 암묵적 거래비용, 속도, 체결 가능성 등을 추가로 고려한다. 또한 AUSIEX는 고객이 요청할 경우 체결 즉시성, 시장 유동성, 시장 충격비용, 주문 규모 등을 고려할 수 있다고 명시하였다. 그러나 가격 이외의 요소가 고려되는 정확한 순서는 공표된 최선집행 정책 및 절차에는 명시적으로 자세히 설명되어 있지 않다.

해당 호주 증권사들은 주문체결 시 SOR을 이용한 집행 절차를 확립하였다. SOR은 최적의 거래조건을 파악하여 주문을 체결하는 데 사용되며, 체결되지 않은 잔량은 거래시장 중 한 곳으로 전송된다. 이 과정에서 호가 상황이나 거래조건이 변경되면 최적의 거래시장을 재평가해야 할 수 있으며, 미체결잔량은 다른 시장으로 다시 회송할 필요성이 발생한다. 이에 대해 AUSIEX는 재회송하지 않는 것을 원칙으로 내세우고 있다. 다른 시장에 다시 주문을 전송할 경우 시간우선 순위에서 후순위가 되어 체결가능성이 낮아질 수 있다고 판단한다. 하지만 고객이 요청할 경우 호가 상황 변화에 대응하여 주문을 다시 회송해 준다.

호주의 소매고객에 대한 최선집행기준 수립 사례는 국내 금융투자업자가 일반고객을 위한 최선집행 판단기준에 관한 시사점을 제공한다. 호주 MIR은 소매고객 주문에 대한 명확한 기준을 제시하고 있다. 즉, 소매고객 주문 시 총대가를 기준으로 최적을 판단해야 하며, 여기에는 상품가격과 거래비용이 포함된다. 그런데 앞서 살펴본 바와 같이 거래비용의 세부항목에 관한 판단은 증권사별로 다르다. 이는 MIR를 보완하는 RG 265에 명확히 설명된 바이기도 하다.

RG 265는 상품가격과 거래비용의 상대적 중요도를 고려하도록 지침을 제공하고 있다. 예를 들어, 거래시장별 상품가격 차이에 비해 거래비용에 중대한 차이가 없는 경우 상품가격만을 기준으로 최선집행을 판단할 수 있다고 명시하였다(RG 265.140). 호주 증권사들의 이러한 해석은 최선집행 정책에 반영되어 있다.

반면 국내에서는 아직 ATS의 호가 결정 체계와 거래시장 수수료가 결정되지 않은 상황이다. 또한 각 증권사가 거래시장에 따라 위탁수수료를 차등화할지에 대한 구체적 계획도 마련되어 있지 않다. 따라서 향후 수수료가 확정되면 일반고객의 거래비용에 포함할 항목과 각 항목의 상대적 중요도에 관한 판단이 이루어져야 할 것이다.

호주 사례에서 주목할 만한 또 다른 측면은 SOR에 관한 것이다. SOR 도입을 고려하는 증권사는 SOR의 구체적 구현 형태를 결정해야 한다. SOR을 적용할 거래시장을 선택하고 거래시장 간 우선순위를 정해야 한다. 또한 시장 상황 변화에 따라 주문을 재회송할지 여부와 회송 빈도를 결정해야 한다.

최선주문집행 규정은 최초 주문의 전량을 체결하도록 의무화하지 않는다. 따라서 재회송과 관련된 사항은 증권사의 재량에 따라 결정된다. 호주 증권사도 무조건 미체결잔량을 재회송하지는 않으며 고객의 요청에 따라 결정한다. 따라서 SOR 구축을 고려하는 국내 증권사는 재회송에 대한 고객의 요구, 재회송 시스템 구축 및 유지 보수 비용, 주문 재회송에 따른 주문 체결가능성 등의 장단점을 종합적으로 고려할 필요가 있다. 궁극적으로 재회송 결정 로직을 포함하여 주문을 효율적으로 집행하는 SOR을 구축하는 것은 증권사가 다른 증권사에 비해 우위를 점할 수 있는 경쟁 수단이 될 것이다.

한편 최근 CommSec과 AUSIEX는 MIR 규정과 최선집행기준을 준수하지 않아 법적 문제가 발생했고, 최종적으로 2022년 10월 호주연방법원으로부터 상당한 벌금이 부과되었다.

구체적 위반 사항에는 최선주문집행 규정과 관련된 내용이 포함되어 있다. 2013년 당시 최선집행규정에는 거래시장에 ASX CentrePoint를 고려하도록 포함되어 있었다. 그러나 내부 기술 문제로 인해 ASX CentrePoint를 거래시장에서 제외하기로 결정하였는데, 해당 변경사항이 최선집행규정에 반영되지 않았다. 법원은 이러한 기준 변경을 고지하지 않은 것을 최선집행의무 규정 위반으로 판단했다.

또한, 해당 증권사가 집행 품질에 대한 성능 모니터링을 최선집행 규정상에 명시된 대로 시행하지 않았다는 점이 지적되었다. 2016년 최선집행규정에는 CommSec의 최선집행 성과를 월 단위로 확인할 것이라고 규정하였다. 그러나 2016년 6월부터 2019년 2월 사이 집행 품질 성과평가는 단 9회만 실시된 것으로 밝혀졌다.

그 결과 호주 연방 법원은 2022년 10월 CommSec과 AUSIEX에 각각 2,000만달러와 712만달러의 벌금을 납부하라는 명령을 내렸다.39) 법원의 결정은 해당 두 회사가 MIR 규정, 기업법, ASIC 법을 위반했다는 조사 결과에 근거한 것이다.

호주의 이러한 사례는 증권사가 최선집행 절차 준수와 고객에게 정확한 정보를 제공할 의무가 중요하다는 점을 시사한다. MIR 상의 최선집행 규정은 각 증권사가 최선집행기준을 주기적으로 점검하여 필요한 변경사항을 즉시 반영하고 변경 사항을 고객에게 알릴 것을 의무화하고 있다.

CommSec과 AUSIEX는 ASX CentrePoint를 이용하는 주문이 0.1% 미만이므로 최선집행절차의 중대한 변경이 아니라서 큰 문제가 되지 않을 것으로 생각했으나 법원은 이와 다른 판단을 내렸다.40) 복수의 거래시장 체제에서 고객이 증권사의 집행 절차를 완전히 이해하는 것은 어렵기 때문에 투자자 보호를 위해서는 정보를 명확하고 알기 쉽게 전달하는 것이 중요하다. 호주의 사건은 시장 건전성을 유지하고 투자자의 이익을 보호하기 위해 금융업계에서 투명성과 엄격한 규정 준수가 필요하다는 점을 명확하게 보여준다.

Ⅴ. 국내 최선집행의무 구체화 방안41)

앞서 살펴본 바와 같이 미국, 유럽, 일본, 호주 등의 규제당국과 금융회사는 각국의 시장구조와 규제 환경에 적합한 최적의 최선집행 방안을 모색해 나가고 있다.

미국과 유럽은 다양한 거래시장이 발전해 나가며 고도로 분산화된 시장구조로 되어 있다는 점에서 공통된다. 시장분할을 통해 경쟁체제 구축과 시장 효율성 제고를 동시에 달성하기 위해서는 물리적으로 분산된 거래시장을 가상의 통합을 이루는 작업이 필요하다. 그런데 미국과 유럽은 규제와 시스템에서 시장 간 통합을 위해 서로 다른 접근법을 선택하였다. 미국은 OPR을 도입하여 거래시장을 중심으로 NBBO 기준의 최선집행을 구현하도록 의무화하였다. 또한 OPR을 준수하기 위한 목적에 따라 NBBO를 실시간으로 파악하고 자료를 분배하기 위한 거래자료 통합시스템이 구축되었다. 반면 유럽은 중앙 집중적 통합 시스템을 구축하지 않고 시장의 자율적 선택에 따라 경쟁과 통합이 이루어질 수 있는 환경을 조성하는 측면에서 접근하였다. 즉, 다양한 거래시장 간 경쟁을 제고하기 위하여 금융회사가 준수해야 할 최선집행기준을 마련하고 최선집행을 위한 근거 자료를 비교하기 용이하도록 관련 자료를 공통된 형식으로 제공하도록 규정하였다.

일본에서는 PTS 관련 규제가 시장 발전을 저해하는 걸림돌이 되어왔다. 거래소를 통한 거래를 표준으로 규정한 거래소 거래원칙 이외에도 중앙청산소 이용 금지, 공개매입 규제, 공매도 금지, 신용거래 금지 등 다양한 제약이 존재했다. 그러나 일본은 2010년대에 해당 규제를 점차 완화하였으며 PTS는 장기간의 정체에서 벗어나 시장점유율을 높이며 안정적으로 성장하고 있다. 또한 최근에는 거래시장 간 경쟁을 촉진하기 위해 최선집행 규정을 개정하고 정보 투명성을 높이는 등 시장 발전을 위한 노력을 이어가고 있다. 일본의 이러한 사례는 규제 환경이 ATS의 설립과 시장 발전에 미치는 영향을 이해하는 데 교훈을 주고 있다.

한편 호주는 정규거래소와 ATS를 법규상 동일한 형태의 거래시장으로 간주하여 규제상의 차별이 존재하지 않는다. 또한 호주는 최선집행의무와 관련된 구체적인 지침을 제공하고 있어 국내 금융투자업자의 최선집행 정책과 절차 마련에 시사점을 줄 것으로 기대된다.

본 장에서는 국내 최선집행기준을 구체화하고 최선집행을 이행하는데 다루어야 할 주제에 대해 살펴보고자 한다.42) 구체적인 쟁점을 정리하고 해외 주요국의 규정과 지침을 참고하여 합리적인 대응 방안을 모색해 보도록 한다.

1. 최선집행의무의 최선의 의미

시장구조가 복잡해지고 다양한 유형의 거래시장과 거래기법이 존재하는 환경에서 무엇이 최선인지를 판별하기는 쉬운 일은 아니다. 주문집행에 영향을 미치는 다양한 요인에 따라 주문별로 최선의 선택은 달라질 수 있다.43) 유동성이 높아 주문 즉시 체결될 가능성이 높은 종목을 주문하는 경우 최우선 호가와 거래비용이 가장 중요한 판단 지표가 된다. 그러나 주문 규모가 커서 공개주문시장에 주문을 전송할 경우 전체 주문이 체결되기 어렵고 시장충격을 유발하여 가격이 불리한 방향으로 이동할 가능성이 높다면, 시장충격과 암묵적 거래비용을 우선하여 고려하는 것이 합리적이다. 또한 순간적으로 발생하는 차익거래(arbitrage) 기회를 포착하여 주문을 체결하는 투자전략을 이용하여 수익을 창출하는 투자자 입장에서는 거래속도가 가장 중요한 요소이다. 따라서 최선집행에서 최선의 의미는 일률적으로 정하기 어려우며, 시장환경, 주문 특성, 투자자 성향, 거래기법에 따라 각기 다른 요건을 고려하고 우선순위를 정하여 최선을 판단해야 한다.

또한 최선의 의미를 이해할 때 유의해야 할 점은 최선집행의 최선과 결과의 최선을 구분해야 한다는 것이다. 최선집행의무에서 의미하는 ‘최선’이란 고객 주문집행 시 주어진 환경을 고려하여 최선의 조건을 선택하기 위한 것으로 각 고객 주문에 대해 최상의 결과를 달성해야 하는 것을 의미하는 것은 아니다. 즉, 고객에게 가능한 최선의 결과가 도출되도록 금융투자회사가 충분한 노력을 기울이라는 의미이다. 따라서 금융투자업자는 각 고객 주문에 대해 최선의 결과를 얻기 위해 합당한 조치를 취하는 절차를 수립하는 데 중점을 두어야 한다. 최선집행 결과를 증명할 때도 주문제출 시점에서 최선의 노력을 기울였음을 증명하면 최선집행의무를 준수한 것으로 해석하는 것이 타당하다.

마지막으로 최선집행을 이행할 때 판단 시점과 체결 시점 간에 필연적으로 시간 차이가 존재한다는 점을 인지해야 한다. 금융투자업자가 주문에 영향을 미치는 다양한 요소를 고려하여 특정 시점에 해당 주문에 대한 최선의 거래시장과 거래형태를 선택할 것이다. 그런데 해당 주문을 전송하고 체결하기까지 일정 시간이 소요되므로 최선을 결정하는 시점과 실제 체결시점 사이에는 미세한 시간 차이가 존재한다. 시장 상황과 거래조건은 극히 짧은 시간 동안에도 변화할 수 있으므로 최선을 판단했던 시점의 상황이 유지되지 않아 체결시점에는 불리한 조건으로 주문이 체결될 수 있다.

이러한 가능성에 대해 호주 규정에서는 주문을 전송한 후 시장 상황이 변화하여 가격이 변동할 가능성을 상정하고 있다(RG 265.181). 호주 지침은 정책과 절차에 이러한 상황이 발생할 경우 처리 방법을 개략적으로 설명하도록 한다. 변경된 요건에 맞추어 반드시 주문을 재전송할 필요는 없으며, 재전송 이후 체결가능성이 높을 때만 재전송하도록 권고한다. 즉, 새로운 호가에 상당한 주문량이 있어 더 나은 가격에 주문이 체결될 것이라는 합리적인 확신이 있는 경우 주문을 재전송하는 것이 적절하다고 설명한다.

또한 일본 SBI 증권 등 일부 금융투자업자는 최선을 결정하는 시점과 체결 시점 사이에 극히 짧은 시간 차이가 존재하여 불리한 가격에 체결될 수 있다는 점을 해당 회사의 최선집행규정 및 절차에 직접적으로 명시하고 있다.

국내 금융투자업자는 최선을 판단할 때의 요건이 체결까지 이어질 수 있도록 최선을 다해야 할 것이다. 하지만 밀리세컨드(1/1000초)를 넘어 마이크로세컨드(1/1백만 초) 또는 나노세컨드(1/10억 초) 단위까지 속도 경쟁이 치열해지는 현재의 시장환경에서는 피치 못하게 판단 시점과 체결 시점 간에 차이로 최선의 판단과 최선의 결과가 달라질 수 있으며, 투자자는 이러한 점을 유의할 필요가 있다.

2. 최선집행의무 이행 주체

최선집행의무를 준수해야 하는 주체를 표현하는 용어는 국가마다 다르지만, 원칙은 일관적이다. 국내 자본시장법에서는 최선집행의무가 투자매매업자 또는 투자중개업자에게 있다고 규정한다. 또한 미국은 브로커-딜러(broker-dealer), 유럽은 투자회사(investment firm), 일본은 금융상품거래업자, 호주는 시장참여자(MP)에게 최선집행의무가 있다고 명시하고 있다. 이는 용어의 차이일 뿐 고객의 주문을 집행하는 업자에게 최선집행 준수 의무가 있다는 핵심적인 원칙은 동일하다.

한편 미국에서는 OPR이 최선 주문집행을 촉진하는 방법으로 이용된다. OPR에 따르면 NMS 주식에 대한 주문을 체결할 때 거래시장은 최우선 호가를 제시하는 거래시장을 탐색하여 해당 시장으로 주문을 회송해야 한다. 이 규정에 따르면 최적의 가격을 제공하는 거래시장을 우회하고 그보다 못한 조건의 거래시장에서 주문이 체결되는 trade-through는 발생하지 않는다. 따라서 OPR은 주문집행 시 가격우선 원칙을 보장한다.

그런데 OPR은 거래시장에 부과되는 의무이며 투자업자의 의무가 아니라는 점에 유의해야 한다. OPR과 최선집행의무를 구분하는 것이 중요하다. OPR은 시장에서 최적의 가격 조건을 실현한다는 목표에 부합하지만, 금융투자업자의 의무인 최선집행의무와 혼동해서는 안 된다. OPR이 Trade-through를 방지하고 투자자 보호를 강화하는 역할을 하지만, 거래시장이 OPR을 완전히 실현한다고 해서 금융투자업자의 최선집행의무가 면제되는 것은 아니다.

본질적으로 거래시장이 금융투자업자의 의무를 대신할 수 없다. 최선집행은 금융시장 규제에서 기본적이고 보편적인 원칙이다. 거래시장의 주문체결 시스템은 금융투자업자의 최선집행의무를 보완하는 것으로 보는 것이 합리적이다. 미국의 사례에서 보듯이 거래시장에 최우선 호가 체결을 의무화하거나 거래시장에서 최선 집행을 위한 체결 서비스를 제공한다고 해서 금융투자회사의 최선집행 의무가 대체되거나 약화되는 것이 아니다. 오히려 금융투자업자의 의무에 더하여 거래시장에서 최선집행을 보완함으로써 시장 전반의 공정성과 투자자 보호를 강화하는 것으로 이해해야 한다.

공정하고 투명한 거래 환경을 유지하기 위해서는 최선집행을 이행하는 금융투자업자와 거래시장의 역할을 명확히 이해하는 것이 필수적이다. 각자의 역할에 대한 명확한 구분은 금융시장의 건전성을 유지하고 투자자의 이익을 보호하는 기반이 될 것이다.

3. 최선집행 적용 상품

최선집행의무가 적용되는 증권을 구분하는 것은 비교적 자명하다. 자본시장법과 관련 규정에서는 최선집행의무에서 제외되는 상품을 열거하고 있다(법 제68조 제1항, 영 제66조의2 제1항, 규칙 제7조의3). 비상장증권, 장외파생상품을 포함하여 상장증권 또는 장내파생상품 중 복수의 금융투자상품시장에서의 거래가능성 및 투자자 보호의 필요성 등을 고려하여 규칙에서 정한 상품 등은 최선집행의무가 적용되지 않는다. 즉, 현행 최선집행의무는 상장증권과 주권 관련 증권예탁증권으로 한정된다. 향후 다자간매매체결회사에서 거래할 수 있는 상품군이 확대될 경우 최선집행의무가 적용되는 상품군도 확대되어야 할 것이다.

한편 최선집행을 위해 SOR을 이용하는 경우 SOR을 적용하는 종목과 적용하지 않는 종목에 대한 구분이 필요하다. 이와 관련된 사항은 법에서 규정하고 있는 것이 아니므로 각 금융투자업자가 재량에 따라 결정한다. 모든 상품에 SOR을 적용하여 실시간으로 최적의 거래조건을 탐색하고 주문을 집행할 필요는 없으며 일부는 SOR이 불필요한 종목도 존재한다. 현재 자본시장법상 ATS에서 거래될 수 있는 상품은 제한적이기 때문에 특정 종목은 복수시장에서 거래되지 않고 거래소를 통해서만 거래될 것이다. 단일시장에서 거래되는 상품은 SOR을 적용하지 않고 복수 시장에서 거래되는 상품에 SOR을 이용하는 등 기준이 필요하다.

4. 거래시장 지정 가능 여부와 영향

최선집행의무는 금융투자업자가 고객의 주문을 체결할 때 실현 가능한 최대한의 이익을 구현하기 위해 적극적인 노력을 기울이는 것이다. 그러나 최선집행의무는 해당 종목을 취급하는 모든 거래시장을 고려하도록 의무화하지는 않는다. 대신 고객 주문을 처리할 때 가능한 한 최선의 체결을 보장하는 데 중점을 둔다. 현실적으로 미국이나 유럽과 같이 주식을 거래하는 시장이 100개가 넘는 국가에서는 모든 금융투자업자에게 전체 거래시장을 포괄하여 비교 분석하도록 강제하는 것은 실현 불가능하다. 따라서 복수의 거래시장 중 거래장소를 선택할 수 있도록 하는 것이 타당하다.

그런데 거래시장 선택은 의사결정 주체에 따라 두 가지로 구분할 수 있다. 우선 금융투자업자가 거래시장을 선택하는 경우이다. 금융투자업자는 당사의 최선집행기준을 마련할 때 고객의 주문을 전송할 거래시장을 선택해야 한다. 금융투자업자는 각 시장을 질적으로 평가하여 비교하고 해당 업자의 개별적 특성과 주문집행 여력을 반영하여 주문을 전송할 거래시장을 선택하게 될 것이다. 즉, 거래소와 ATS 모두에 주문을 전송하거나 모든 시장에서 주문을 집행하기 어려운 경우 거래소 또는 ATS 중 일부 거래시장에 주문을 전송할 수도 있다. 금융투자업자가 단일 거래시장을 선택할 경우 그 선택 기준과 사유를 충분히 설명하도록 해야 하며 최선의 집행을 크게 훼손하지 않음을 합리적으로 보일 수 있어야 한다.

국내에서 ATS의 설립이 가시화되면, 국내 금융투자업자들은 필수적으로 주문을 집행할 거래시장을 선택해야 한다. 기관 중심의 수요가 있는 대형 증권사는 추가적 투자를 통해 시스템을 구축하고 복수의 거래시장을 고려할 가능성이 높다. 그러나 일부 증권사는 수십 년 동안 단일 거래소에서 주문을 체결해 온 관행에 따라 기존과 동일하게 단일 거래소에서 주문을 집행하고자 하는 유인이 있을 수 있다. 특히 중소형 증권사는 복수의 거래시장에서 최선집행의무 이행을 위한 시스템 투자와 설비 구축에 부담을 느낄 것이다. 따라서 중소형 증권사에서는 기존대로 거래소를 통해 주문을 집행할 가능성이 있다.

앞서 언급한 대로 최선집행 정책 및 절차를 마련할 때 주문을 집행할 거래시장을 선택하는 것은 금융투자업자의 재량이다. 그러나 복수시장 도입의 취지를 고려해 봤을 때 다수의 금융투자업자가 기존의 관행대로 거래소를 통해서 거래할 경우 시장 발전과 시장 통합이 지연될 우려가 있다.

일본의 경우 거래소 중심의 주문집행 관행이 오랜 시간 고착화 되어 ATS의 정착과 시장 발전을 저해한 대표적인 사례이다. 일본은 PTS 설립 이후에도 정규거래소 중심으로 주문을 집행하는 최선집행 관행이 유지되어 PTS가 정착하는 데까지 상당한 시간이 소요되었다. 1998년 거래소 집중 의무를 철폐하고 PTS 운영 업무 인가제를 도입하였으나, 제도가 도입되고 10년이 경과한 2010년 초까지도 PTS의 시장점유율은 1%를 넘지 못했다. 일본은 2005년 금융상품거래법 개정 전까지 ‘거래소 거래원칙’이 존재하여, 고객이 거래소 밖이라고 명시하지 않는 한 거래소에서 주문이 집행되었다. 그 결과 2000년대에 설립되었던 Cross Securities, Monex, Instinet, Japan Securities Agents, Kabu.com, Daiwa, Matsui 등 다수의 PTS가 영업 부진을 극복하지 못하고 2010년대 초반에 영업을 중단했다.44) 금융투자업자의 부담을 최소화하기 위해 최선집행규정을 이전과 동일하게 거래소를 통한 집행을 우선하도록 마련할 경우, ATS의 정착과 성장이 지연되고 복수 거래시장의 이점이 발현되지 않아 시장 효율성이 도리어 낮아질 우려가 있다.

투자자의 선택권 확대와 복수 거래시장의 안정적 정착을 위해 금융투자업자가 ATS 선택을 기피하지 않고 다양한 거래시장을 고려하는 환경을 조성해야 할 것이다. 거래시장 간 경쟁을 통한 발전을 이루도록 실질적 통합방안과 규제 인센티브를 마련하는 것이 중요하다. 그러나 금융투자업자별로 고객군이나 투자 여력이 다르므로 복수의 거래시장을 선택하도록 강제하는 것은 바람직하지 않을 수 있다. 특히 시장 조성 초기라는 점을 고려하여 금융투자업자에게 과도한 부담이 발생하지 않도록 다수의 거래시장을 고려하도록 의무화하기보다는 합리적 선택을 유도하는 방안이 필요하다.

5. 투자자 유형 구분 필요성45)

최선집행을 판단하는 구체적 기준은 국가별, 증권사별, 금융상품별로 다르다. 그런데 한 가지 공통된 특징은 대부분 국가에서 투자자군을 구분하여 차별화된 최선집행기준을 마련하도록 규정하고 있다는 것이다. 투자자군을 유형화하는 방법은 소매고객(retail client)과 도매고객(wholesale client)으로 구분하거나 소매고객(retail client)과 전문고객(professional client)으로 분류하는 등 다양하지만, 금융시장이나 상품에 대한 이해도가 낮은 개인투자자와 위험을 적절하게 평가할 수 있는 경험과 지식을 갖춘 전문가를 구분한다는 측면에서는 크게 다르지 않다.

개인투자자의 최선집행기준에 대한 국가별 규정을 구체적으로 살펴보면 다음과 같다. 유럽 EC의 MiFID II는 소매고객 주문을 집행하는 경우 총대가를 기준으로 최선의 결과를 결정하도록 판단기준을 명시적으로 단순화하였다(MiFID II Article 27(1)). 이때 총대가는 금융상품의 가격과 집행 관련 비용으로 정의된다. 집행 비용은 고객이 직접 부담하는 비용으로, 거래시장 수수료, 금융투자업자 수수료, 청산 및 결제 수수료 등 거래집행에 직접적으로 관련된 항목들이다. 전문투자자는 가격, 비용, 속도, 거래체결 가능성 등 관련 요소를 복합적으로 고려하여 결정한다. 호주도 유럽과 마찬가지로 총대가를 기준으로 소매고객의 주문을 집행하도록 규정하고 있다(MIR 3.8.1(1)).

일본은 최근 개인투자자에게 가격 우선 원칙을 적용하도록 최선집행원칙을 개정하였다. 개인고객 주문의 경우, ‘가장 유리한 가격으로 집행하는 것 이외의 조건으로 최선의 거래조건을 선택한 경우 그 사유를 설명’하도록 하였다(내각부령 제124조). 즉, 일률적으로 가격을 우선시하는 최선집행정책으로 변경하도록 강제하지는 않으나, 개인고객의 주문집행 시 가격을 우선시하지 않는 경우 이유를 기재하게 함으로써 가격 우선 정책으로 변경을 장려했다.

한편, 미국의 최선집행의무는 현행법상 명문화되어 있지 않다. Ⅱ장에서 설명한 바와 같이 FINRA와 MSRB가 최선집행을 위한 규정과 가이드라인을 마련하고, SEC는 이와 관련한 성명을 제시하는 방식이다. 그런데 미국은 전국 시장의 투명성을 높이고 효과적으로 통합하기 위하여 NMS를 구축하고 가격을 최우선으로 고려하도록 하는 제도가 마련되어 있다. Reg NMS의 OPR에 따르면, 각 거래시장은 전송받은 주문이 NBBO가 아닐 경우 NBBO를 제시하는 다른 거래시장으로 주문을 회송해야 한다. 따라서 미국시장에서는 최초에 어떤 거래시장에 주문을 전송하는지와 무관하게 기관투자자와 개인투자자를 불문하고 NBBO가 충족된다.

각국에서 투자자를 유형별로 구분하여 최선집행기준을 차별화하여 적용하도록 규정하는 이유는 다음과 같다. 첫째, 개인투자자에게 단순화된 기준을 적용하는 것이 개인투자자 보호를 위해 더 적합하다고 판단하기 때문이다. 미국이나 유럽과 같이 시장구조가 복잡하고 다양한 거래집행 방법이 존재하는 환경에서는 투자자가 거래집행 프로세스를 명확하게 파악하기 어렵다. 이러한 복잡성은 금융투자업자와 투자자 간 이해 상충 문제로 이어질 수 있다. 따라서 투자자 보호를 위해 규제를 강화할 필요성이 높으며 강화의 한 방법으로 개인투자자의 주문집행 기준을 단순화한 것이다. 미국이나 유럽에 비해 시장구조가 단순한 일본도 마찬가지이다. 최근 일본의 ATS인 PTS의 점유율이 증가하고 개인투자자 전용 다크풀이 운영되는 등 거래시장이 다변화되고 있다. 또한 다크풀을 포함한 복수의 거래시장 중에서 최선의 가격을 제시하고 있는 거래시장을 검색해 주문을 집행하는 SOR이 주목을 받고 있다. 이에 따라 개인투자자 보호의 필요성이 높아졌으며, 최선집행 여부를 가격을 중심으로 판단하도록 개정하였다.

둘째, 개인투자자 주문은 전형적으로 규모가 작고 유동성이 높은 종목에 집중되어 있다. 본질적으로, 개인투자자의 주문이 상당한 가격변동을 초래하고 암묵적 거래비용과 시장충격을 유발하여 주문집행 가능성을 감소시키는 것은 일반적이라 할 수 없다. 따라서 대부분 개인투자자의 주문을 평가할 때 가격과 명시적 비용, 즉 총대가만을 기준으로 집행해도 실익 측면에서 큰 문제가 되지 않는다. 즉, 이러한 기준은 복잡한 변수를 복합적으로 고려했을 때와 큰 차이를 보이지 않을 것으로 예상된다.

셋째, 개인투자자의 최선집행기준을 단순화하는 경우, 금융투자업자가 최선집행기준을 구현하고 결과를 입증하기 간편하다는 장점이 있다. 가격과 명시적 거래비용을 계산하는 것은 가격 개선 효과, 시장충격비용, 집행 및 결제 가능성 등을 도출하는 것에 비해 훨씬 간단하다. 따라서 거래시장 간 비교가 쉽고 거래시장 선택이 간단해져 최선집행 구현 프로세스가 간소화된다.

넷째, 최선집행기준 단순화는 투자자 관점에서 최선집행 여부를 평가하기 용이하다는 것을 의미하는 것이기도 하다. 금융투자업자는 개인투자자 주문의 결과를 입증할 때 주문집행 당시 각 비교 대상 시장에 제시된 호가와 거래비용만 제시하면 되므로 입증이 간편하다. 상품가격과 직접 거래비용은 산출이 명료하므로 투자자가 최선집행 구현 결과를 평가하기에 더 편리하다. 즉, 최선집행 구현, 실행, 평가 전 과정에서 개인투자자와 금융투자업자의 부담을 줄일 수 있다.

다섯째, 금융투자회사가 개인투자자 주문의 최선집행기준을 총비용으로 설정했다 하더라도 투자자는 다른 요건을 고려하도록 지시를 내릴 수 있다. 자본시장법에 따르면, 고객이 주문집행 판단기준에 대해 별도의 지시를 내리는 경우 금융투자업자는 고객의 지시를 우선시해야 한다. 따라서 개인투자자에 대한 최선집행정책이 가격과 비용을 고려하도록 설정되어 있다고 하더라도, 개인투자자의 선택권을 근본적으로 제약하는 것은 아니다. 고객이 다른 요소에 우선순위를 두도록 지시한 경우 고객의 지시에 따라야 주문이 집행될 수 있다. 예를 들어, 일반적으로 가정하는 개인투자자와 달리 특정 개인투자자는 대규모 주문을 내거나 유동성이 상당히 낮은 종목을 거래하기를 원할 수 있다. 이 경우 투자자는 가격과 직접 거래비용 보다 시장충격이나 집행 가능성 등을 우선으로 고려하는 집행방식을 따르도록 지시할 수 있다.

현행 자본시장법상 최선집행기준 마련 시 투자자군을 구분하는 것은 법 규정 사항은 아니다. 그러나 금융투자회사와 투자자의 최선집행 편의와 효율성을 위해 지침에서 구분하는 것이 합리적이다. 따라서 국내 최선집행기준 이행 방안을 마련할 때 지침에 투자자군을 구분하도록 규정화하거나 각 금융투자업자의 최선집행 정책에 반영하는 방안을 고려해 볼 필요가 있다.

6. 최선집행 판단기준

무엇이 최선집행인지에 대해 모든 주문에 적용할 수 있는 단일의 기준을 제시하는 것은 불가능하다. 고객 유형, 주문별 특성과 거래시장 상황, 고객이 원하는 별도의 지시사항에 따라 최선집행의 정의는 달라질 수 있다. 고객의 특성 관련 항목으로는 고객의 유형에 따라 일반투자자와 기관투자자로 구분할 수 있다. 고객의 주문 관련항목은 가격, 주문규모, 시장가주문, 지정가주문 등 주문유형, 비용, 집행 및 결제 가능성, 주문 속도 등을 고려할 수 있다. 또한 거래시장 관련 항목은 각 거래시장에서 형성된 가격, 수수료 등 비용, 집행 및 결제 가능성, 운영시간, 청산결제 방법, 서킷 브레이커 등 시장운영 규정 등이 해당한다.

주요국은 최선집행규정에서 최선의 선택을 판단하기 위해서 고려해야 할 요소들을 언급하고 있다. 앞서 살펴본 바와 같이 유럽, 호주, 일본 등 국가들은 개인투자자와 전문투자자를 구분하여 차별화된 최선집행기준을 부여한다.

투자자가 일반투자자인 경우, 최선의 결과는 가격과 총비용을 기준으로 판단한다. 이때 총비용은 다른 국가와 마찬가지로 증권의 가격과 주문집행으로 인해 발생하는 거래비용을 의미한다. 거래비용은 특정 주문집행과 관련하여 고객이 직접적으로 지불한 모든 비용으로 정의한다. 거래시장 수수료, 투자자가 회사에 지불하는 수수료, 청산 및 결제 수수료 및 주문집행과 관련하여 지불하는 기타 수수료를 포함하게 될 것이다.

그러나 해외 규정에 따르면 회사가 총비용 이외의 요소가 고객의 주문집행에 더 중요하다고 판단하는 경우, 해당 요소를 총비용보다 우선하여 주문을 집행할 수 있다. 금융투자회사가 총비용 이외의 요소를 고려하기를 원할 경우 이를 허용한 것이다. 또한 호주의 RG와 같이 주문집행시장 간 거래비용에 큰 차이가 없을 경우, 회사는 가격을 최우선시하여 주문을 집행하도록 허용할 수 있다.

일본은 최근 최선집행기준을 개정하여 개인투자자의 주문에 대해 가격을 기준으로 평가하도록 기준을 신설하였다. 그런데 최선집행의무가 도입된 2005년부터 2023년 개정까지 20년 가까이 개인고객에 별도의 기준을 설정하도록 규정하지 않아 왔다. 일본은 최근의 개인고객 규정이 금융투자업자의 시스템 투자 부담을 가중시키는 등의 상황이 발생할 것을 우려하여, 개인고객의 주문을 가격을 중심으로 수립하도록 권고하는 방식을 채택하였다. 개인고객 주문을 가격을 기준으로 판단하는 것이 바람직하나, 최선집행 판단 기준 변경을 강제할 때 발생할 부작용을 우려하여 차선책을 마련한 것이다.

호주의 RG에서도 총대가 이외의 시장충격비용 등 암묵적 거래비용을 고려할 수 있도록 허용하였는데, 이는 일본의 허용 취지와는 다르다. 일본은 최선집행기준 개정에 금융투자업자가 적응할 수 있도록 부담을 완화할 목적이었다면, 호주는 개인투자자의 다양한 수요를 반영하기 위함이다. 일반적인 소매고객은 주문규모가 작고 고유동성 종목을 주로 거래하지만 그렇지 않은 소매고객도 존재한다. 즉, 소매고객이 시장충격을 유발할 수 있는 대규모 거래나 체결가능성이 낮은 저유동성 종목을 주문할 경우에 이러한 수요를 충분히 반영할 수 있도록 총대가 이외의 기준을 적용할 수 있도록 허용한 것이다.

한편 전문투자자의 주문은 개인투자자처럼 공통된 특성을 찾기 어렵다. 대량주문을 하는 전문투자자는 주문체결 가능성과 시장충격이 가장 중요한 요소일 수 있으며, 고빈도매매자(High Frequency Trader: HFT) 등 차익거래 목적으로 거래하는 전문투자자는 시장 상황이 변하기 전에 빠르게 주문을 집행하는 것을 우선시할 수 있다. 이러한 이유로 각국은 전문투자자의 최선집행기준을 수립하고 이행할 때 다양한 요소를 포괄하여 고려하도록 규정하고 있다. 즉, 전문투자자는 가격, 비용, 체결가능성, 속도 등을 복합적으로 고려하여 최선의 결과를 결정하도록 한다.

그러나 법규에서 요소 간의 상대적 중요성과 우선순위를 규정하지는 않는다. 구체적인 최선집행 판단기준은 각 증권사의 판단에 따라 달라진다. 최선집행기준을 회사의 선택을 허용하되 그 조건과 이유를 명확히 밝히도록 하고 있다. 해당 요소를 우선시하는 조건과 이유를 고객에게 충분히 전달하여 금융투자회사의 최선집행기준의 합리성과 적정성을 고객이 판단할 수 있도록 하는 것이다.

국내 규정에는 개인투자자와 기관투자자를 구분하지 않고 있다. 자본시장법은 단지 최선집행 판단 시 상품가격, 수수료 및 비용, 주문규모, 매매체결가능성의 네 가지 요소를 포함하여 다양한 요소를 고려해야 한다고 규정한다. 최선집행을 판단하는 기준은 금융투자업자의 자율적 선택과 판단에 따라 결정할 수 있도록 허용하되, 공통적 기준을 제시하는 것이 이점이 높다고 판단되는 항목은 의무화하는 것이 바람직하다. 특히 투자자군을 구분하여 일반고객의 최선 판단기준을 강화하는 것은 여러 국가에서 이미 시행 중이고 투자자 보호와 시행 편의성 등 여러 측면에서 효율적이므로 의무화를 고려할 필요가 있다.

7. 고객의 별도지시 이행 방안

각국의 최선집행 규정은 증권사가 정한 최선집행 정책과 달리 고객이 별도의 요청을 할 수 있도록 허용한다. 즉, 투자자는 집행방법에 관한 별도지시를 하고 회사에 이를 우선시하도록 요구할 수 있다. 회사는 지시를 준수하여 최선의 결과를 얻을 수 있도록 주문을 집행해야 한다.

하지만 거래집행 시 투자자의 별도지시 사항만 충족하는 것으로 회사가 최선집행의무를 충족한 것으로 인정되는 것은 아니다. 별도지시 사항을 우선하여 충족하고 그 외의 요소를 고려하여 주문을 집행해야 한다. 예를 들어, 고객은 별도지시를 통해 자신의 주문이 특정 거래장소에서 집행되도록 지정할 수 있다. 주문집행 시 금융투자업자는 고객의 별도지시를 우선으로 충족해야 하므로 고객이 선택한 시장에 주문을 전송해야 한다. 그러나 별도지시에 따라 특정 거래장소에서 주문을 집행하더라도 고객이 지정한 조건만을 충족한 것으로 최선집행의무가 충족되는 것은 아니다. 회사는 해당 시장에서 최선의 결과를 얻을 수 있도록 조치를 취해야 한다. 이는 추후 금융투자업자의 최선집행의무 준수 여부와 관련된 법적 분쟁을 불러올 수 있는 중요한 사항이므로 고객과 금융투자회사가 충분히 인지할 필요가 있다.

또한 별도지시는 고객의 선호와 판단에 따른 것이므로 회사는 투자자의 선택에 영향을 미쳐서는 안 된다. 즉, 특정한 지시를 내리도록 권장하거나 유도해서는 안 되며, 투자자의 주도로 이루어져야 한다.

투자자의 별도지시가 항상 금융투자업자가 상정한 최선집행 방법보다 나은 결과를 가져오는 것은 아니다. 투자자의 별도지시에 따를 경우 가능한 최선의 결과를 얻지 못할 수 있으며, 경우에 따라서는 회사의 최선집행기준에 따른 결과에 미치지 못하는 결과가 도출될 수 있다. 이 점을 투자자에게 충분히 설명할 필요가 있다.

호주의 경우 별도지시에 대해 다른 국가에 비해 상세한 기준을 제시하고 있는데 별도지시의 보관형태 및 보관기간, 유효기간을 설명하고 있다. 호주 RG에 따르면 투자자는 서면 또는 구두로 별도지시를 할 수 있다. 별도지시의 유효기간은 고객유형에 따라 다른데, 소매고객의 경우 지시가 일회성으로 해당 주문에만 적용되는 반면 도매고객의 별도지시는 6개월에서 12개월까지 일정 기간 유지된다.

국내법에서는 투자자가 별도의 지시를 할 수 있다는 규정만 있으며 구체적 방법 및 내용에 대한 사항은 없다. 금융투자업자는 해외사례를 준용하여 고객의 별도지시에 대한 보다 자세한 기준을 수립할 필요가 있다.

투자자가 별도지시를 내릴 경우 해당 지시에 대한 보관형태 및 보관기간을 정할 필요가 있다. 예를 들어, 투자자는 서면 또는 구두로 별도지시를 할 수 있다는 등의 기준이 필요하다. 또한 구두지시의 경우 보관형태 및 보관기간에 관한 규정이 필요하다.

8. 이해상충 가능성과 최선집행

시장구조가 진화하고 거래 환경이 복잡해짐에 따라 금융투자업자와 고객 간에 이해상충 유형이 다양해지고 그 위험이 증가한다. 이러한 이해상충은 금융투자업자가 받는 금전적 또는 비금전적 혜택이 고객에게 최선의 이익을 가져오는 결정을 내리는 것을 방해할 때 발생한다. 또한 주문처리방식을 고객이 완전히 인지하기 어려워질 경우 이해상충의 가능성이 더욱 증폭될 수 있다.

이러한 위험을 방지하기 위하여 각국은 금융투자업자가 받은 혜택 때문에 금융투자업자가 자신의 이익을 고객의 이익보다 우선시할 우려에 대해서 명시적인 규제 조치를 시행하고 있다.

유럽연합 규정인 MiFID II는 고객 주문을 특정 거래시장으로 회송하는 과정에서 이해상충 문제가 발생할 가능성을 인정하고 있다. MiFID II Article 27(2)은 최선집행의무를 준수하는 과정에서 이해상충이나 유인(inducement)이 발생할 경우 투자회사는 어떤 형태의 보수, 할인 또는 비금전적 혜택을 받지 못하도록 규정하고 있다.

호주의 RG는 금융투자업자가 PFOF와 같은 특정 유형의 주문을 대가로 인센티브를 받을 경우 고객과 이해상충이 발생할 수 있다는 우려를 제기한다(RG 265.177). 또한 금융투자업자가 거래시장으로부터 번들링(bundling) 형태로 추가 서비스에 대한 혜택을 받을 경우 고객과의 이해상충이 발생할 수 있다는 점을 강조하고 있다(RG 265.178).

미국에서는 브로커-딜러와 소매고객 간의 이해상충 문제가 최선집행의무의 법제화를 추진하는 직접적 동인이 되었다. SEC가 제안한 Reg Best Execution은 잠재적으로 이해상충이 발생할 수 있는 상황에서 브로커-딜러가 준수해야 할 추가적인 규제안을 마련하였다(242.1101(b)(1)). 이 규정은 브로커-딜러가 소매고객 주문을 자기자본 또는 계열사를 이용하여 체결하거나 PFOF를 이용하여 대가를 받는 경우와 같이 이해상충이 발생할 수 있는 구체적 상황을 명시하였다. 이러한 경우 SEC 규정은 이해상충이 발생하는 거래에 대한 최선집행 정책 및 절차 준수 방안과 최선의 선택을 판단하는 기준 등에 대한 정보를 포함하여 문서화하도록 의무화한다.

금융투자업자가 받는 혜택 이외에 주문처리방식이 고도화, 자동화되면서 이해상충 문제가 발생할 가능성이 높아질 수 있다. 금융투자업자와 고객 간 보유정보와 거래집행 과정에 대한 이해도 차이가 벌어지기 때문이다.

일본은 고객이 SOR의 주문처리 프로세스를 충분히 이해하기 어렵다는 점을 지적하고 SOR 관련 규정을 마련하였다. SOR 사용 자체는 금융상품거래업자의 이해관계와 직접적인 관련이 없을 수 있다. 도리어 SOR을 이용하여 최적의 주문 방법을 실시간으로 탐색하고 주문을 자동으로 전송하여 최선 집행의 효율성을 높일 수 있다. 그러나, SOR을 구현하기 위해서는 주문을 회송할 거래시장 간 우선순위를 정해야 하는데, 정당한 이유 없이 계열사 또는 우호관계에 있는 거래시장에 우선권을 부여하는 경우 고객의 이익과 상충될 수 있다. 또한 SOR의 주문집행 과정은 복잡하기 때문에 고객이 SOR 로직을 완전히 파악하기 어렵다. 따라서 일본의 SOR 규정은 거래시장과의 지분 관계를 포함하여 SOR에 사용되는 주문처리 방법을 고객에게 명확하게 공개하도록 규정하고 있다.

이상에서 살펴본 바와 같이 복수 거래시장에서 금융투자업자와 고객 간의 이해상충 가능성은 주문처리 방법의 불투명성과 최선집행 과정에서 거래시장이 금융투자업자에게 제공하는 혜택으로 인해 발생한다. 그러나 이러한 상황의 구체적인 역학관계는 국가별 고유한 시장 상황에 따라 달라진다. 따라서 각 국가의 시장 상황에 맞게 서로 다른 이해상충 상황을 강조하고 해당 상황에 맞는 규정이 마련되었다.

한편 국내 거래시장은 아직 복수 거래시장 체제로 발전해 나가는 초기 단계에 있다. 이러한 시장에서는 이용 가능한 거래 방법과 거래시장이 제한적이며, 주문처리 방법과 관련된 복잡성이 낮고 이해상충 상황의 다양성이 낮다. 따라서 복잡하고 다변화된 해외 금융시장에 비해 고객과 금융투자업자 간의 이해상충 문제가 상대적으로 적을 수 있다.

각국이 시행하는 규제 대응 및 조치는 국가별 시장구조, 거래시장의 발전 수준, 규제 우선순위에 따라 크게 영향을 받는다. 이해상충은 복잡한 시장구조에서 전 세계 금융업계와 규제당국의 주요 관심사다. 하지만 시장분할 초기 단계에서 최선집행의무의 본격적 이행과 최선집행 관련 시스템 구축을 준비하고 있는 국내시장의 특성상 특정한 이해상충 상황을 해결하기 위한 엄격한 규제를 마련할 필요성이 높지 않다.

따라서, 잠재적 이해상충 상황을 규정하고 규제하기보다는 광범위하고 일반적 관점에서 국내 금융투자회사와 고객 간의 이해상충 문제에 접근하는 것이 바람직하다. 즉, PFOF에 대한 대가 수령, SOR의 불투명성 등 이해상충의 가능성을 특정하기보다 일반적인 관점에서 금융투자업자와 고객 간의 이해상충 상황에서 고객의 이익을 최우선시하도록 규제하는 것이 필요하다. 향후 다양한 형태의 거래시장이 등장하고 시장의 성숙도와 복잡성이 증가하여 이해상충 규정을 구체화할 필요성이 높아지면 금융환경의 요구와 상황에 맞게 규제 내용과 수준을 조정해야 할 것이다.

Ⅵ. 결론

국내 거래시장은 거래소 중심의 자연독점 체제에서 복수의 거래시장 간 경쟁체제로의 중대한 전환을 앞두고 있다. 복잡한 거래시장 환경에서 주문 집행의 기준을 제시하는 최선집행은 거래시장 간 공정한 경쟁체제를 형성하고 투자자를 보호하기 위한 기반이 된다. 그러나 2013년에 개정된 자본시장법상의 최선집행규정은 최선집행에 필요한 일반적인 원칙을 개괄적으로 규정하고 있으며 최선집행기준과 집행 방법에 대한 구체적인 지침이 마련되지 않은 상황이다.

시장분할의 오랜 역사를 가진 해외 거래시장의 경우, 규제기관과 자율규제기구가 지침과 가이드라인을 통해 최선집행의 명시적인 기준과 실행방안을 제시하고 있다. 이는 국내 최선집행의무를 구체화하는 데 유용하게 활용할 수 있다. 각국의 규정은 시장환경과 규제 연혁에 따라 차이를 보인다.

미국의 경우 최선집행의무가 연방법 차원에서 명문화되어 있지 않고 자율규제기구가 마련한 최선집행 지침을 통해 규정된다. 대신 NMS 하에 다수의 거래시장을 포괄하는 가상의 통합시장을 구축하고 OPR의 거래회송 의무를 통해 NBBO가 보장될 수 있도록 하였다. 최근에는 소매고객 보호에 한계가 있음을 인지하고 최선집행원칙을 입법화하려는 시도가 진행 중이다.

유럽의 경우 미국과 마찬가지로 고도로 분산된 시장구조로 되어 있으나, 주문을 회송하거나 통합시스템을 의무화하는 전략 대신 최선집행에 활용할 수 있는 판단자료를 비교 가능한 형태로 공개하도록 의무화하였다. 이는 유럽이 다양한 국가의 집합체라는 특성상 중앙 집중적 시스템을 강제하기 어려운 상황이었기 때문에 차선으로 선택한 방법이었다. 그러나 최근 유럽도 최선집행의 효율성을 제고하고 투자자 보호를 강화하기 위해 중앙 집중적 자료구축을 위한 계획을 추진 중이다.

한편 일본은 1998년에 PTS 설립 근거 규정이 마련된 이후에도 10년 넘게 PTS의 점유율이 극히 미미한 수준으로 유의미한 경쟁이 이루어지지 않았다. 그 배경에는 PTS 이용을 방해하는 각종 차별적 규제가 존재했는데, 고객이 PTS 거래를 명시적으로 요청하지 않는 한 원칙적으로 거래소에서 매매하도록 규정한 거래소 거래원칙이 그중 하나이다. 거래소 거래원칙은 2005년에 폐지되었으나 그 이후에도 JSDA의 최선집행 지침에 거래소만을 통해 거래하는 정책을 허용하여 거래소로 주문이 집중되는 관행이 고착화되었다. 이는 일본의 거래시장 발전을 상당 기간 지체시키는 원인이 되었다. FSA는 2023년 거래시장 간 경쟁을 통한 발전을 지원하고 투자자 보호를 강화하기 위하여 개인투자자 및 SOR과 관련된 최선집행의무 규정을 개정하였다.

호주는 최선집행의무에 대한 구체적 실행 방안과 최선집행 이행 과정에서 발생할 수 있는 다양한 상황에 대해 상세한 지침을 제시하는 특장점을 가지고 있다. 최선집행 정책 및 절차 수립 시 고려해야 할 사항에 대해 자세히 열거하고 일반적이지 않은 상황이 발생하였을 경우 집행 방안도 제시하고 있다.

본 고는 해외 주요국의 최선집행 규정과 지침을 바탕으로 국내 최선집행의무와 관련된 주요 이슈를 8가지로 정리하고 최선집행 이행을 위한 구체적인 방안을 제시하였다.

첫째, 최선집행의 의미를 명확히 이해할 필요가 있다. 시장구조가 복잡해지고 다양한 유형의 거래시장과 거래기법이 존재하는 환경에서 최선을 판단하기는 쉬운 일은 아니다. 모든 상황에 적용 가능한 최선의 선택은 존재하지 않으며 시장환경, 주문 특성, 투자자 성향, 거래기법에 따라 최선에 대한 판단은 달라져야 한다. 또한, 최선집행의 최선이 최선의 결과를 담보하는 것은 아니라는 점을 유의해야 한다. 최선집행의 최선은 고객에게 가능한 최선의 결과가 도출되도록 합당한 절차를 마련하라는 의미이며, 결과의 최선을 의미하지는 않는다. 이에 더해 최선을 판단하고 주문을 전송하여 체결하기까지 일정 시간이 소요되므로 최선을 결정하는 시점과 실제 체결시점 사이에 상황이 변경되어 불리한 조건으로 주문이 체결될 수 있다는 점에 대한 이해가 필요하다.

둘째, 최선집행의무를 준수해야 하는 주체는 거래시장이 될 수 없으며 투자매매업자 또는 투자중개업자가 되어야 한다. 미국의 경우 OPR에 따라 거래시장이 주문회송 의무를 수행한다. 하지만, 이는 금융투자업자의 최선집행의무를 보완하여 시장 전반의 공정성과 투자자 보호를 강화하는 것일 뿐, 금융투자업자 고유의 의무를 대신할 수 없다.

셋째, 자본시장법에 따라 ATS에서 거래가능한 상품을 상장주권과 주권 관련 증권예탁증권으로 한정하고 있으므로, 최선집행의무가 적용되는 증권 또한 이를 따르는 것이 타당하다. 단, 금융투자업자가 최선집행을 위해 SOR을 이용하는 경우 금융투자업자별로 SOR을 적용하는 종목과 적용하지 않는 종목을 재량에 따라 결정할 필요가 있다.

넷째, 해외 규정과 지침을 바탕으로 판단해 볼 때 주문을 집행할 거래시장을 선택하는 것은 금융투자업자의 재량이다. 국내 거래시장에도 ATS가 설립되면, 대형 증권사의 경우 복수 거래시장의 이점을 충분히 이용하기 위하여 관련 정책과 시스템을 구축할 것이다. 그러나 일부 증권사는 수십 년 동안 유지해 온 관행에 따라 거래소만을 통해 주문을 집행할 수 있다. 일본의 사례에서 알 수 있듯이 투자자의 선택권 확대와 국내 거래시장의 발전이 지연될 수 있으므로, 금융투자업자가 ATS 선택을 기피하지 않고 다양한 거래시장을 고려하도록 실질적 통합방안과 규제 인센티브를 마련할 필요가 있다.

다섯째, 금융투자회사와 투자자의 최선집행 편의와 효율성을 위해 일반고객과 전문고객을 구분하여 별도의 최선집행기준을 마련할 필요가 있다. 일반고객을 구분하여 전문고객과 다른 최선집행기준을 마련하도록 규정하는 일차적 이유는 복잡한 거래 환경에서 최선의 기준을 단순화하는 것이 최선의 판단, 집행, 입증이 용이해 투자자 보호에 더 적합하기 때문이다. 또한 고유동성 종목에 소규모로 거래하는 일반적인 개인투자자의 특성상 복잡한 변수를 고려할 필요성이 낮으며, 일반고객이 원할 경우 별도지시를 통해 다른 요인을 고려하도록 요청할 수 있으므로 고객의 선택권을 원천적으로 차단하는 것은 아니다.

여섯째, 최선집행을 판단할 때 고객 유형, 주문별 특성, 거래시장 상황 등 고객이 원하는 별도의 지시사항에 따라 최선의 정의는 달라지므로, 다양한 요소를 고려하여 최선집행 정책을 마련하여야 한다. 단, 일반고객의 경우 앞서 설명한 바와 같이 기준 간소화의 이점이 더 높으므로 상품가격과 거래비용 등으로 기준을 제한할 필요가 있다. 투자자군을 구분하여 일반고객의 최선판단 기준을 강화하는 것은 이미 유럽, 일본, 호주 등 여러 국가에서 시행 중이며 투자자 보호와 시행 편의성 등 여러 측면에서 효율적이므로 의무화를 고려할 필요가 있다.

일곱째, 국내 최선집행 규정은 다른 국가와 마찬가지로 고객이 별도의 요청을 할 수 있고 주문집행 시 고객의 별도지시를 우선 적용하도록 규정하고 있다. 하지만 거래집행 시 투자자의 별도지시 사항을 충족하는 것만으로 금융투자업자의 최선집행의무가 충족되는 것은 아니라는 점을 유의할 필요가 있다. 별도지시 사항을 우선 충족하는 것을 전제로 하되, 그 이외의 요건을 고려하여 최선의 선택이 이루어질 수 있도록 조치를 취해야 한다. 또한, 별도지시와 관련된 세부사항, 즉, 별도지시 방법, 보관형태 및 보관기관, 유효기간 등에 대한 구체적 기준을 정할 필요가 있다.

여덟째, 시장구조가 복잡해짐에 따라 거래시장과 금융투자업자 간의 이해 관계나 불투명한 주문처리방식으로 고객과 금융투자업자 간 이행상충 가능성이 높아진다. 각국은 시장 상황 및 규제 우선순위에 따라 이해상충 문제에 대한 규제방안을 마련하였다. 미국은 브로커-딜러가 PFOF를 이용하여 금전적 이익을 취하여 소매고객을 위한 최선의 선택을 방해한다고 판단하여, 이해상충 상황에 대한 최선집행 정책 및 절차 준수방안을 마련하도록 의무화했다. 일본은 주문처리방식이 고도화, 자동화되면서 주문집행과정을 고객이 충분히 파악하기 어렵다는 점을 지적하였으며, SOR을 이용한 주문처리 방식을 고객에게 명확하게 공개하도록 규정하였다. 한편 국내 거래시장은 시장분할 초기 단계로 아직 특정한 이해상충 상황에 대한 규제를 마련할 필요성이 높지 않다. 향후 시장 성숙도와 복잡성이 증가하면 이해상충 규정을 구체화할 방안을 본격적으로 논의해야 할 것이다.

최선의 선택을 정의하고 최선집행의무 이행방안을 구체화하는 것은 시장 상황과 시장참여자의 준비 상태에 따라 유연한 접근이 필요하다. 국내시장에는 아직 구체적 지침이 마련되지 않은 상황이므로 앞서 언급한 8개의 이슈를 포함하여 다양한 주제에 대한 깊이 있는 논의가 필요하다. 새로운 시장환경에서 기준을 제시해야 하는 규제당국, 최선집행의무를 준수해야 하는 금융투자업자, 주문이 고객의 입장에서 최선의 이익을 위해 이루어지고 있는지 판단해야 하는 투자자 사이의 공조가 필요한 시점이다. 규제당국은 시장참여자 간의 충분한 논의를 거쳐 의무적으로 준수해야 할 요건을 지침의 형태로 규정하고, 그 이외 요건은 금융투자업자가 고객의 최선의 이익을 위해 최선의 판단을 할 수 있는 기준을 마련해야 할 것이다. 국내 거래시장이 복수 거래시장으로 진일보하는 시점에서, 본 보고서가 투자자 보호를 강화하는 동시에 안정적이고 효율적인 시장환경의 기반을 마련하는 데 도움이 되기를 바란다.

1) 경쟁매매방식 이외에 거래소에서 형성된 매매가격을 이용하거나 상대매매방식으로 주문체결이 가능한데, 이 경우에도 시장점유율 제한이 존재한다. 그러나 한도를 초과할 경우 ATS로서 운영을 제한하는 것이 아니라, 투자자 보호와 거래의 공정성 확보를 위해 사업계획 및 이해상충 방지체계를 마련하고, 인력과 전산설비 등 물적 설비를 확보하도록 규정하고 있으므로, 경쟁매매방식에 비해 시장점유율 한도 초과에 대한 부담이 덜하다.

2) 호주 규정은 금융투자업자를 시장참여자(Market Participant: MP)로 명명한다. 그런데 일반적 의미의 시장참여자와 혼동할 우려가 있으므로, 본 보고서에서는 호주 규정을 설명할 때 시장참여자, MP, 금융투자업자를 혼용해서 사용하도록 하겠다.

3) 자본시장법에서는 금융투자업자에게 신의성실의 원칙을 준수하여야 할 의무를 부과하여, 금융투자업자의 이해상충행위를 방지하고 고객에게 최선의 이익이 되는 방향으로 고객재산을 성실하게 운용하도록 규정하고 있다.

4) 강소현(2013. 05. 07), 이영철(2014)

5) 최선집행의무는 자본시장법 제68조와 「자본시장과 금융투자업에 관한 법률 시행령(이하 시행령)」 제66조의2, 「자본시장과 금융투자업에 관한 법률 시행규칙(이하 규칙)」 제7조의3 및 「금융투자업규정(이하 규정)」 제4-17조의3에 나타나 있다.

6) 이영철(2014)

7) 엄경식(2023)

8) 엄경식‧장병훈(2007)

9) OPR 이외에 NMS의 NBBO에 공정하고 효율적으로 접근할 수 있도록 규정한 Access Rule, 최소 가격조정 단위를 제한한 Sub-Penny Rule, 시장정보의 효과적인 통합, 분배와 정보수수료 할당방식 개선을 위한 Market Data Rule 등이 있다.

10) 고재종(2018)

11) 미국 SEC는 최근 증권시장에서의 주문가격 책정, 거래체결, 정보공개의 일련의 과정을 대대적으로 개편하는 구조 개혁 작업을 진행 중이다. SEC는 2022년 12월 14일 제정〮개정안을 발표하였는데, 해당 안은 2005년 Reg NMS 도입 이후 가장 근본적인 변화를 불러올 개혁이 될 것이라 일컬어지고 있다. SEC의 주식시장 구조 개혁안은 호가단위〮수수료〮투명성 요건 개정, 거래체결 정보 공개요건 개정, 주문경쟁규칙 제정, 최선집행기준 제정 등 4가지의 Reg NMS 개정 및 신규 규정 도입안이 포함되어 있다.

[개정] 최소호가단위, 시장접근 수수료, 투명성 요건 개정

(34-96494 Reg NMS Minimum Pricing Increments and Access Fee Caps and to Enhance the Transparency of Better Priced Orders)

[개정] 거래체결 정보 공개요건 개정(Reg NMS Rule 605)

(34-96493 Disclosure of Order Execution Information)

[제정] 주문경쟁규칙 신설

(34-96495 Order Competition Rule)

[제정] 최선집행기준 신설

(34-96496 Regulation Best Execution)

12) 이정은(2021. 10. 26)

13) Release No. 34-92586; File No. 4-757(2021. 10. 06)

14) Bloomberg(2022. 07. 06)

15) SEC(2020. 05. 06)

16) MiFID II는 지침(MiFID)과 규정(MiFIR)으로 구성되는데, 지침은 EU 회원국이 달성하기 위해 노력해야 하는 목표를 제시하는 반면, 규정은 모든 국가가 따라야 하는 규칙을 부과한다.

17) 신소희(2018. 07), 이기환〮이건희(2020)

18) ESMA(2021. 11. 19)

19) Commission Delegated Regulation(EU) 2017/576(2016. 06. 08)

20) MiFID II Recital (96)

21) MiFID II Recital (9)

22) Capital Markets Union 2020 action plan, Action 14: Consolidated tape

23) Proposal for a Directive of the European Parliament and of the Council amending Directive 2014/65/EU on markets in financial instruments

Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 600/2014 as regards enhancing market data transparency, removing obstacles to the emergence of a consolidated tape, optimising the trading obligations and prohibiting receiving payments for forwarding client orders

24) Bray(2023. 02. 16)

25) ESMA(2022. 05. 16)

26) 현재 Japannext는 야간시장을 운영하고 있다. 거래 규모는 정규시장의 1/20 수준이다.

27) 이연임(2022)

28) PTS에서 신용거래를 허용한 것뿐만 아니라 코로나19 이후 금융완화 정책과 경기 회복에 대한 기대로 주식시장 활성화된 것도 PTS 시장점유율 증가에 기여했을 것으로 추측된다.

29) CPSS(2012)

30) JPX Business Regulations chapter 3, section 6

31) AM&T(2012)

32) Fuminaga(2013. 09. 08)

33) Tsunoda(2012)

34) Japannext, Cboe Japan, ODX와 인터뷰 중

35) ASIC(2022)

36) ASIC(2022)

37) (a) 거래시장(market venue)에 장애가 발생할 경우 금융시스템에 심각한 혼란을 초래할 가능성이 있는 경우, (b) 금융상품이 다수의 거래시장에서 거래되어 다른 시장으로 위험이 확산될 가능성이 있는 경우, (c) 거래시장의 가격형성기능이 작동하지 않아 금융시스템에서 중요도가 높은 금융상품이나 계약에 해로운 영향을 미칠 경우, (d) 거래시장의 특성상 금융시스템의 효율성과 건전성, 투자자 신뢰에 대한 위험을 증가시키는 경우를 고려한다.

38) Tier 2에 속한 거래시장은 '거래소' 또는 '주식/증권/선물시장'이라는 용어 사용이 금지된다.

39) Federal Court of Australia(2021. 03. 01)

40) 구체적으로 2013년 당시 CommSec 고객 중 일부는 ASB 증권 거래플랫폼을 통해 주문을 제출했다. 그런데 기술적 문제로 인해 해당 주문을 집행할 때 ASB 플랫폼을 통한 주문의 경우 ASX CentrePoint를 일시적으로 제외하기로 결정하였다. 당시 CommSec은 ASB를 통하여 ASX CentrePoint에서 체결되는 주문이 0.08%에 불과하며, ASX CentrePoint가 다크풀이고, 계약서에 크로싱 거래 표기가 의무화되어 있지 않아 최선집행규정을 수정할 필요가 없다고 판단하였다. 그러나 2017년 ASB 플랫폼 이용 고객이 ASX CentrePoint로 전달되는지 확인해달라고 요청하였고, ASX CentrePoint가 최선집행규정에서 명시된 바와 달리 주문집행 시 고려되지 않았다는 것이 확인되었다. 피해액을 추산한 결과, 2013년 10월 2일부터 2018년 3월 26일까지 약 128,133건의 주문이 ASX CentrePoint에서 체결되었을 가능성이 있다는 것을 확인하였다. 그 결과 총 397,271.93달러가 12,796명의 ASB 플랫폼 이용 고객에게 지급되었다.

41) 본 장은 주요국의 규정과 지침을 바탕으로 일반적이고 합리적인 관점에서 국내 최선집행 관련 이슈를 논의하고 대응 방안을 제시하였다. 그러나 향후 사법부의 법리 해석과 규제기관의 규제 지침 및 규제 목적에 따라 해석과 대응이 달라질 수 있다는 점을 유의하기를 바란다.

42) 본 장에서 다루는 국내 최선집행과 관련된 주요 이슈는 2023년 상반기 국내 금융투자회사를 대상으로 진행된 여러 차례의 간담회에서 제기되었던 쟁점과 질의를 바탕으로 수립되었다.

43) 장근영(2013)

44) 강소현(2022. 11. 08)

45) 강소현(2023. 05. 30)

참고문헌

강소현, 2013, ATS 도입에 따른 합리적 최선집행원칙 도입방안, 자본시장연구원 『자본시장포커스』 2013-18.

강소현, 2013, 자본시장법의 다자간매매체결회사 관련규정에 대한 고찰, 자본시장연구원 『자본시장포커스』 2013-42.

강소현, 2022, 일본의 최선집행원칙(Best Execution Policy) 개정과 시사점, 자본시장연구원 『자본시장포커스』 2022-23.

강소현, 2023, 주요국 개인투자자 최선집행(Best Execution)의무 규정과 시사점, 자본시장연구원 『자본시장포커스』 2023-12.

고재종, 2018, 미국에 있어서 최선집행의무의 규제 동향,『증권법연구』19(3), 65-95.

신소희, 2018. 07, MiFIDⅡ의 주요내용과 대응방안, KRX Market 증권·파생상품 144.

엄경식, 2023, 『한국 자본시장의 이해』, 한율.

엄경식‧장병훈, 2007, 미국주식시장의 재개편: Regulation NMS의 도입 및 시사점, 한국증권연구원.

이기환‧이건희, 2020, 유럽의 다자간거래시설(MTF)에 관한 연구,『신용카드리뷰』14(4), 116-135.

이영철, 2014, 개정 자본시장법상 금융투자업자의 최선집행의무에 관한 고찰: 다자간매매체결회사의 도입을 계기로,『증권법연구』15(2), 49-95.

이연임, 2022, 다자간매매체결회사(ATS)의 규제와 그 개선방안에 관한 소고, 『증권법연구』 23(3), 135-195.