Find out more about our latest publications

Indirect Acquisition of Treasury Stocks: Problems and Proposed Regulatory Improvements

Issue Papers 23-07 Feb. 27, 2023

- Research Topic Capital Markets

- Page 22

Over the past two years, many firms have opted to acquire their treasury stocks through trust contracts, aiming to respond to sudden stock market fluctuations and shocks. Between the first quarter of 2020 and the third quarter of 2022, the number of disclosures related to indirect acquisitions surged to 671, compared to 449 for direct acquisitions. However, indirect acquisitions have been under-researched, contributing to a lack of understanding about this issue among market participants. This study examined the existing regulations on treasury stock acquisition through trust contracts and analyzed the stock price responses both before and after each disclosure.

Regulations concerning indirect acquisitions offer more flexibility compared to those governing direct acquisition. A trust contract can be extended, allowing for a longer duration and potential acquisition or disposal during the contract period. Furthermore, no sanctions are imposed even when the disclosed amount is not acquired. These regulatory aspects make a trust contract an efficient tool for firms to manage their treasury stocks. However, this also presents a challenge: Investors find it difficult to estimate the size or timing of the actual transaction associated with the contract.

Such regulatory aspects inherent in indirect acquisitions influence stock price reactions. Both direct and recent indirect acquisitions caused stock prices to rebound during market downturns. The price increase during the 30 days following the disclosure of indirect acquisitions was 3.94 percentage points lower compared to direct acquisitions. Extensions of trust contracts did not have an immediate impact on the market but resulted in a gradual increase in returns and a significant rise in stock prices. Since the disclosure for contract extension does not provide any details about the plan or balance of the acquisition, investors cannot estimate the timing or size of the actual transaction.

Comprehensive reform is necessary for the regulation of indirect acquisitions, given the significant disparities in regulatory strength between indirect and direct acquisitions. In an effort to reduce the information gap between firms and investors, this study proposes regulatory enhancements that restrict the extension of trust contracts, enhance disclosure regarding contract extensions, and apply regulations on the disposal of treasury stocks by trusts as rigorously as those on direct acquisitions. Looking ahead, it is imperative for market participants to engage in more fundamental discussions about the necessity of trust contracts, considering the intrinsic objectives of acquisitions by trusts and their benefits to the market.

Regulations concerning indirect acquisitions offer more flexibility compared to those governing direct acquisition. A trust contract can be extended, allowing for a longer duration and potential acquisition or disposal during the contract period. Furthermore, no sanctions are imposed even when the disclosed amount is not acquired. These regulatory aspects make a trust contract an efficient tool for firms to manage their treasury stocks. However, this also presents a challenge: Investors find it difficult to estimate the size or timing of the actual transaction associated with the contract.

Such regulatory aspects inherent in indirect acquisitions influence stock price reactions. Both direct and recent indirect acquisitions caused stock prices to rebound during market downturns. The price increase during the 30 days following the disclosure of indirect acquisitions was 3.94 percentage points lower compared to direct acquisitions. Extensions of trust contracts did not have an immediate impact on the market but resulted in a gradual increase in returns and a significant rise in stock prices. Since the disclosure for contract extension does not provide any details about the plan or balance of the acquisition, investors cannot estimate the timing or size of the actual transaction.

Comprehensive reform is necessary for the regulation of indirect acquisitions, given the significant disparities in regulatory strength between indirect and direct acquisitions. In an effort to reduce the information gap between firms and investors, this study proposes regulatory enhancements that restrict the extension of trust contracts, enhance disclosure regarding contract extensions, and apply regulations on the disposal of treasury stocks by trusts as rigorously as those on direct acquisitions. Looking ahead, it is imperative for market participants to engage in more fundamental discussions about the necessity of trust contracts, considering the intrinsic objectives of acquisitions by trusts and their benefits to the market.

Ⅰ. 서론

지난 2년간 주식시장은 급변하는 양상을 보였다. 2020년 3월 코로나19로 주가는 급락하였으나 빠르게 반등하였다. 이후 2021년 7월까지 약 1년 4개월간 상승세를 이어오다 다시 약세로 전환되었다. 글로벌 인플레이션, 국내외 금리인상, 러시아-우크라이나 전쟁 장기화 등 여러 악재로 인한 하락세는 2021년 7월 이후 2022년 말까지 지속되고 있다.

주식시장 충격에 대응하기 위해 기업들은 다양한 방안들을 모색하고 있다. 그중 기업의 자기주식 취득이 두드러지게 증가하였다. 기업이 자기주식 취득 계획을 공시하면 투자자들은 기업 내부에서 주가 상승에 대한 확신이 있는 것이라 해석하여 해당 종목에 대한 투자자들의 선호가 증가한다. 그 결과 일반적으로 주가가 상승하는 효과가 나타난다.

그런데 기업이 자기주식을 취득하는 방법은 두 가지가 있다. 기업이 시장에서 직접 자기주식을 취득하는 방법과 은행 등 특정금전신탁회사와의 계약을 통해 간접 취득하는 방법이다. 간접취득은 해외에서 찾아보기 힘든 국내만의 독특한 제도인데, 취득방식, 취득 강제성, 처분 가능 여부 등 다양한 측면에서 직접취득에 비해 유연한 규제를 적용받는다. 따라서 간접취득이 주주의 부에 미치는 영향 또한 직접취득과 다를 가능성이 크다.

본고는 급변하는 증시 상황에서 간접취득이 주가에 어떠한 영향을 미쳤는지 살펴보기로 한다. 신탁계약을 통한 자사주 취득이 도입된 근거를 바탕으로 신탁계약이 직접취득과 규제상 어떠한 차이를 보이는지 구체적으로 파악한다. 이를 바탕으로 최근 2년간 자기주식 간접취득 전후의 주가 반응을 살펴보도록 한다. 자사주 취득 방법에 따라 기업이 기회주의적인 행태를 보일 가능성을 판단하고 신탁계약의 의미와 필요성을 고찰하여 개선방안을 모색해보고자 한다.

Ⅱ. 간접취득 도입 배경 및 규제 특성

1. 간접취득 도입 배경 및 연혁

기업이 자기주식을 취득하는 방법은 직접취득과 간접취득의 두 가지로 구분되며, 간접취득은 다시 신탁계약에 의한 취득과 자사주펀드를 이용한 취득으로 나뉜다. 자기주식 간접취득 방식은 1992년 8월 자사주펀드의 형태로 처음 도입되었다.1) 90년대 초반 당시는 과열된 건설경기가 진정되고 소비가 둔화되면서 경기가 급속히 위축되고, 대외적으로 선진국의 경제침체가 장기화되어 수출 부진이 우려되던 상황이었다.2) 자사주펀드는 침체된 주식시장을 회생시키기 위해 마련된 ‘증시 안정을 위한 종합대책’의 일환으로 시작되었다.3)

자사주펀드는 기업이 투자신탁회사의 수익증권을 매입하고 투신사가 자사주펀드를 설정하여 형성된 자금으로 펀드에 포함된 기업들의 주식을 운용한다. 자사주펀드는 한 종목이 아닌 여러 기업으로 구성되며, 주식 이외의 상품도 포함할 수 있다. 주식 운용 비율은 90%이며 동일 종목투자 한도는 20%이다. 자사주펀드는 기업들의 편리한 주가 관리와 지분확보를 위해 도입되었으나, 다수의 기업이 합동으로 운용하게 되어 있어 개별기업의 직접적인 주가 관리에 한계가 있었다.4) 실제 최근 자사주펀드 활용 사례는 극히 일부에 불과하다.

1999년에는 특정금전신탁 계약을 통한 자기주식 취득 방식이 추가로 허용되었다. 이는 다수의 기업이 아닌 개별기업의 자사주를 취득하는 것으로, 현재 일반적으로 활용되고 있는 간접취득 방법이다. 기업은 은행이나 증권사 등 신탁업자와 자기주식 신탁계약을 체결하고 계약금액을 예탁하면 신탁업자가 계약기간 내에 기업을 대신하여 자기주식을 취득하거나 처분하는 방식으로 운영한다. 자사주신탁계약을 통해 신탁업자가 취득한 주식은 실질적으로 기업의 소유이므로 신탁업자는 취득한 주식에 대한 의결권과 배당권을 가지지 않는다.

계약기간이 종료되거나 계약을 해지하면, 기업은 계약금 잔액과 함께 신탁업자가 취득한 자사주를 반환받을 수 있다. 신탁업자가 보유하고 있던 자기주식이 기업에 반환되면 간접취득 형태에서 직접취득 형태로 전환된다.

2. 간접취득 규제 특성5)

자기주식 간접취득은 직접취득과 비교하여 다양한 측면에서 규제 차이를 보인다. 첫째, 직접취득에 비해 간접취득의 취득 기간이 길다. 간접취득 기간은 계약에 따라 달라지는데 일반적으로 6개월에서 1년 정도이다. 직접취득에 허용되는 3개월에 비해 기본 계약기간이 길뿐만 아니라, 신탁계약은 연장이 가능해 반복적인 계약 연장으로 수년에서 수십 년 동안 유지되기도 한다. 신탁계약이 직접취득에 비해 장기간 유지되는 핵심 원인은 계약 연장이 가능하다는 점에 있다.

신탁계약 연장이 빈번하게 발생하는 원인은 연혁적 배경에서 찾아볼 수 있다. 2005년 이전에는 신탁업자가 취득한 자사주는 현물반환이 허용되지 않았다. 따라서 계약이 종료 또는 해지되면, 기업은 신탁업자가 보유한 자기주식을 전량 매각하고 매각대금을 현금으로 반환받거나 신탁계약을 연장할 수밖에 없었다. 간접취득한 자기주식을 매각할 경우 주가가 하락할 우려가 있으므로 기업은 만기를 연장하는 편을 택하는 경우가 많았다.6) 이러한 문제점을 보완하기 위해 2005년 11월 증권거래법 개정을 통해 신탁계약이 해지나 종료되면 기업이 자기주식을 직접 반환받을 수 있게 허용하였다. 그러나 현물반환이 가능해진 후에도 자기주식 신탁계약 연장은 별도의 제재 없이 허용되고 있으며 기업의 신탁계약 연장은 관례화되어 현재까지 이어지고 있다.

둘째, 직접취득은 취득 기간 내에 자사주 취득행위만 가능하지만 간접취득은 취득과 처분이 모두 가능하다. 기업이 자사주를 취득하는 목적은 다양하나 신탁취득의 경우 제도 도입 취지를 고려했을 때 주가 관리와 자본이득이 주된 목적일 것으로 추측된다. 실제 제도상으로 신탁계약은 처분이 허용되므로 보유한 자사주의 주가가 상승할 때 이를 처분하여 이익을 실현하고 주가가 하락하면 저가에 다시 매수하는 것이 가능하다.

셋째, 직접취득은 공시에 명시한 전량을 취득해야 하지만 간접취득은 별도의 제약을 받지 않는다. 직접취득은 법에서 규정한 취득 기간인 3개월 이내에 신고 주식 수량을 모두 취득하지 못하면 기간 만료 후 1개월까지 이사회 결의가 금지된다. 그러나 신탁계약은 공시에서 명시한 취득금액을 이행하지 않는다고 하더라도 별도의 제재를 받지 않는다. 따라서 간접취득은 신탁계약 금액을 전량 취득하지 않을 가능성이 크다.

넷째, 신탁취득은 여러 건을 동시에 체결하는 것이 가능하다. 예를 들어, 현재 시점에 6개월 만기의 신탁계약을 체결하고 다음 달에 또 다른 신탁계약을 체결하는 것이 가능하며, 한 날 여러 신탁업자와 복수의 신탁계약을 체결할 수도 있다. 따라서 동일 시점에 여러 개의 신탁계약이 동시에 존재한다.

이러한 제도적 유연성을 고려했을 때 기업의 입장에서 신탁취득을 이용하는 장점은 분명해진다. 기업이 자사주 신탁계약을 통해 일정 금액을 위탁하면 신탁업자가 주가 하락 시 자사주를 매수해주어 기업은 주가를 용이하게 관리할 수 있다. 또한 취득한 주식은 계약을 해지하지 않고도 처분할 수 있어서 자사주가 필요한 경우 일부를 해지하여 이용하거나 주가가 상승한 경우 매도하여 자본이득을 취할 수 있다. 특히 자기주식을 직접 관리할 여력이 부족한 중소기업에 신탁계약은 자사주를 손쉽게 관리할 수 있는 효율적 수단이다.

그런데 외부 투자자 입장에서는 신탁취득과 관련된 사실을 적시에 파악하기 어렵다. 공시 규정에 따르면 신탁계약이 체결되고 3개월이 경과한 시점에 취득상황 보고서를 제출해야 한다. 따라서 계약을 체결하고 3개월 동안의 취득 및 처분 내역을 확인할 수 있다. 그러나 그 이후의 상황은 파악하기 어렵다. 계약이 해지되거나 종료되어야 기업은 ‘신탁계약 해지 결과보고서’를 제출하며 이 보고서를 통해 3개월 이후 기간의 거래 내역이 공개된다. 신탁계약 연장이 빈번하게 이루어지는 현재 상황에서 신탁계약이 장기간 지속되면 투자자는 기업의 자사주 관리 현황을 파악하기 어려워진다.

3. 간접취득 관련 선행연구

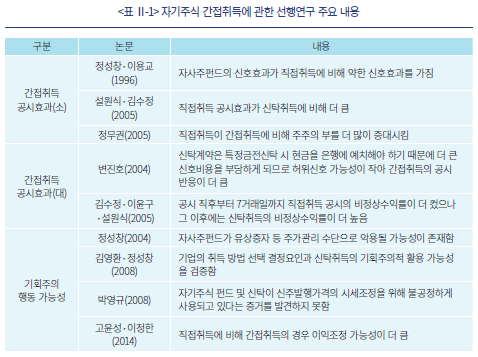

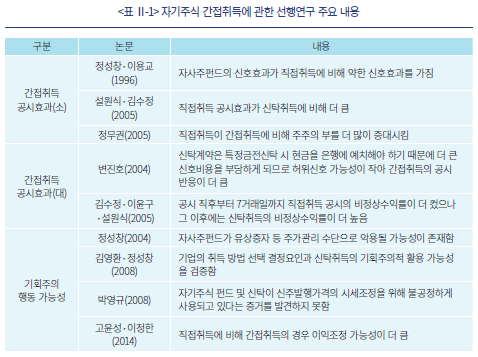

자기주식 간접취득은 제도적, 관행적으로 직접취득과 상당한 차이가 있다. 따라서 기업의 취득 방법 선택에 따른 주가 반응이 직접취득과 다르게 나타날 가능성이 크다. 그런데 자기주식 직접취득에 관한 연구는 국내외에서 비교적 활발히 이루어지고 있는 반면, 간접취득에 대한 연구는 제한적이다. 간접취득은 해외에서 찾아보기 어려운 국내 고유의 제도이기 때문에 해외 문헌연구는 존재하지 않으며, 국내에서 진행된 연구 또한 대부분이 자기주식 취득제도가 도입되었던 2000년대 중반 이전에 한정되어 있다.

간접취득에 관한 선행연구는 크게 두 종류로 나뉜다. 그중 하나는 신탁계약의 공시반응에 관한 연구인데, 직접취득 대비 신탁취득의 주가 수익률을 연구한 것이다. 그런데 그 연구 결과는 일관되지 않으며 상반된 해석이 존재한다. 정성창ㆍ이용교(1996), 설원식ㆍ김수정(2005)과 정무권(2005)은 간접취득의 공시효과가 직접취득에 비해 더 작으며 주주의 부에 기여하는 정도가 적다고 주장하였다. 반대로 변진호(2004), 김수정ㆍ이윤구ㆍ설원식(2005)의 연구 결과에 따르면 신탁취득의 비정상수익률이 더 높아 허위신호일 가능성이 작다고 보았다.

또 다른 연구는 신탁취득이 기회주의적 목적에 이용될 가능성에 관한 것이다. 김영환ㆍ정성창(2008)은 신탁취득의 경우 반드시 공시에서 목표한 규모를 취득해야 하는 의무가 없는 제도적 특성을 바탕으로 실취득규모를 조사하였다. 그 결과 간접취득의 실취득비율이 직접취득에 비해 현저하게 낮아 투자자들에게 거짓신호를 보낼 우려가 있음을 보였다.

더 나아가 정성창(2004), 고윤성ㆍ이정한(2014)은 유상증자, 이익조정 등의 특정 기업 이벤트 전후에 간접취득을 이용하여 기업에 유리한 방향으로 주가를 의도적으로 움직이는 등 불공정거래의 가능성이 있다고 주장하였다. 정성창(2004)은 자사주펀드가 유상증자를 전후하여 주가관리 수단으로 활용될 수 있음을 보였으며, 고윤성ㆍ이정한(2014)은 이익조정과 자기주식 취득방법 사이의 연관성에 관한 연구를 통해 직접취득에 비해 간접취득이 이익조정의 가능성이 더 크다는 결론에 다다랐다. 요컨대, 직접취득을 이용해서도 기회주의적 행위가 가능하지만, 간접취득은 제도상 유연성 때문에 악용될 소지가 간접취득에 비해 더 큰 것으로 나타났다.

Ⅲ. 간접취득 현황 및 취득기업 특성

1. 간접취득 시장 규모

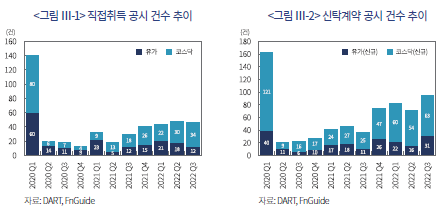

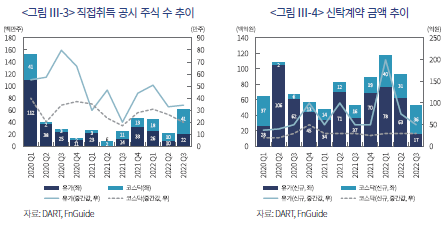

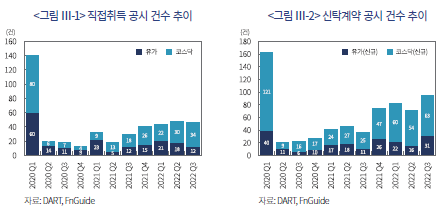

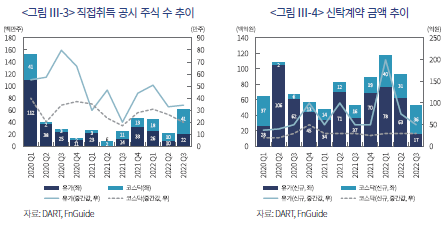

최근 기업의 간접취득 현황을 파악하기 위하여 2020년 1월부터 2022년 9월까지의 자기주식 공시자료를 살펴보았다. 자기주식 간접취득 관련 정보는 DART의 자기주식 취득 신탁계약 체결 결정 공시, 자기주식 취득 신탁계약 해지 결정 공시, 신탁계약 취득 상황보고서, 신탁계약 해지 결과보고서를 이용하였으며 주가 및 기업정보는 FnGuide를 이용하였다. <그림 Ⅲ-1>부터 <그림 Ⅲ-4>는 자기주식 직접취득과 간접취득 각각에 대하여 공시 건수와 공시 규모 추이를 분기별로 나타낸 것이다.

자기주식 취득 규모 추이를 통해 알 수 있는 특징은 2020년 1분기에 자기주식 취득이 크게 증가했다는 점이다. 2020년 1분기 동안 자기주식 직접취득이 140건, 신탁취득이 161건으로 2020년 이후 전체 공시 건수의 약 27%가 2020년 1분기에 집중되어 있다. 당시 코로나19 발발로 주가가 급등락하고 정부가 시장 안정을 위하여 자기주식 취득 완화 조치를 시행한 것을 계기로 기업의 자기주식 취득 활용도가 급격하게 높아졌다.

주된 원인은 최근 코스닥 상장기업의 자기주식 취득이 증가했기 때문으로 보인다. <그림 Ⅲ-3>과 <그림 Ⅲ-4>에서 유가증권시장과 코스닥시장 상장종목을 구분하여 공시별 규모를 살펴보면, 유가증권시장 취득 규모에 비해 코스닥시장 취득 규모가 작다는 것을 알 수 있다. 점선으로 표시된 코스닥시장의 분기별 공시 규모 중간값이 실선으로 표시된 유가증권시장 상장종목에 비해 전 분기에서 낮았다. 즉, 공시 규모가 작은 코스닥 상장종목의 자기주식 취득이 증가하면서 공시 빈도는 증가하였으나 규모는 증가세를 찾아보기 어려웠다.

2. 자기주식 신탁계약 특성

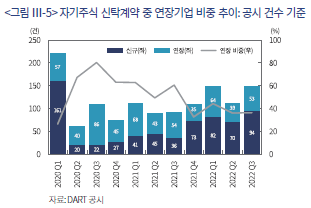

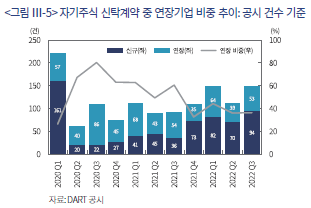

앞서 살펴본 바와 같이 간접취득은 직접취득과 다른 제도적 특징을 가진다. 간접취득은 직접취득과 달리 기간 연장이 가능하다. 기존 계약기간이 종료되고 계약을 연장하기로 결정하면 새로운 계약기간을 반영하여 연장 결정 또는 기재 정정 공시를 제출한다. <그림 Ⅲ-5>는 자사주 간접취득을 위한 신규 신탁계약 공시 건수와 함께 연장계약 공시 건수의 추이를 보여준다. 분석기간 동안 신규계약이 671건이었던 것과 비교하여 연장계약은 584건으로 상당한 수의 계약이 연장되고 있음을 알 수 있다.

연장기간을 포함한 신탁계약의 실제 계약기간을 살펴보기 위하여 2020년 1월부터 2022년 9월 사이에 제출된 신탁계약 해지결과 보고서 자료를 취합하여 분석하였다. <표 Ⅲ-1>은 계약기간을 6개의 구간으로 나누어 구간별 공시 건수를 나타낸 것이다. 전체 695건의 해지 공시 중 계약기간이 1년 미만인 경우가 65.5%로 가장 많았으며 나머지는 240건은 1년 이상 유지되었다. 이는 최초 계약기간을 1년으로 상정했을 경우 최소 1/3 이상의 계약이 1회 이상 연장되었다는 것을 의미한다. 2년 이상 중장기 계약은 전체의 14.2%이며 계약기간이 10년 이상인 초장기 신탁계약도 25건 존재했다.

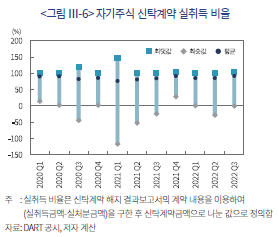

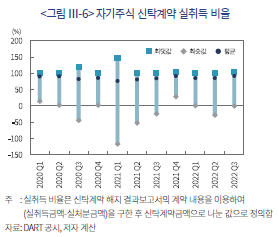

자사주 신탁계약은 규정상 신탁금액을 전액 취득할 의무가 없다. 따라서 직접취득에 비해 실제 취득률이 낮을 가능성이 크다. <그림 Ⅲ-6>은 신탁취득 결과 자료를 바탕으로 실취득률을 산출한 후, 신탁계약을 해지한 분기를 기준으로 평균 및 최댓값, 최솟값을 나타낸 것이다. 실취득률은 공시별로 전체 계약기간 동안 취득총액에서 처분금액을 제한 후 신탁계약 금액으로 나눈 값으로 정의하였다.

2020년 이후 해지된 신탁계약 실취득률은 평균 83.88%로 대부분 기업이 신탁계약 금액에 미치지 못하는 규모를 취득하였다. 직접취득의 경우 강제적으로 공시한 주식 수를 전량 취득하도록 규정하고 있으므로 시장 상황이 급변하거나 유동성이 급격히 하락하는 특수한 상황이 아니라면 공시된 규모만큼 취득될 것이라 예상할 수 있다. 그러나 간접취득의 경우 실제 취득 규모를 예측하기 어렵다. 취득 강제성이 없어 기업은 취득 규모를 재량에 따라 조정할 수 있다. 선행연구에서 또한 기업이 신탁취득 공시 이후에 실질적으로 자사주를 취득하지 않는 기회주의적 행동을 보일 수 있음을 주장한 바 있다.

또한 신탁계약은 처분도 가능하므로 실취득률이 평균치에 비해서 현저히 떨어지는 경우가 발생한다. 분기별 실취득률 최솟값을 살펴보면, 음의 실취득률이 일부 분포하고 있음을 알 수 있다. 실취득률이 음수라는 것은 취득금액에 비해 처분금액이 더 크다는 것으로 투자자의 기대와 달리 실제 자사주 취득이 이루어졌다고 보기 어렵다.

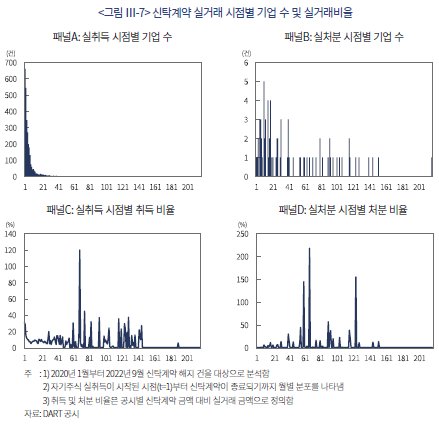

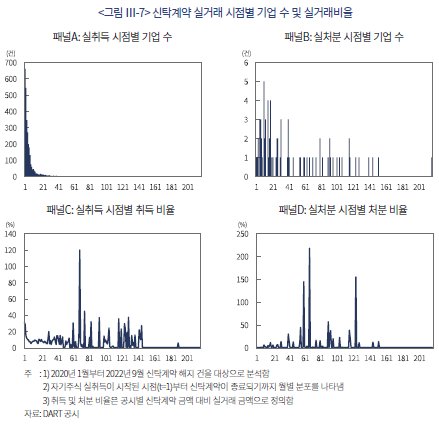

간접취득은 투자자가 취득 시점을 예측하는 것 또한 쉽지 않다. 직접취득은 규정에 따라 3개월 이내에 취득이 완료되어야 하나 신탁계약은 계약연장이 빈번하게 이루어지기 때문에 실제 어느 시점에 취득이 이루어졌는지 가늠하기 어렵다. 신탁계약의 거래 분포를 실질적으로 확인하기 위하여 신탁계약 거래자료를 이용하여 거래 시점별로 실거래 분포를 산출하였다. <그림 Ⅲ-7>은 신탁계약별로 거래가 시작된 시점을 1로 하여 계약이 종료될 때까지의 월별 분포를 나타낸다. 패널A와 패널B는 취득과 처분으로 구분하여 월별로 거래가 발생한 기업 수를 나타낸 것이며 패널C와 패널D는 계약규모 대비 취득 및 처분 비율의 월별 평균을 도시한 것이다.

<그림 Ⅲ-7>의 패널A와 패널C를 살펴보면 신탁계약 취득은 대부분 계약기간 초기에 집중되어 있음을 알 수 있다. 자기주식 신탁취득을 시작한 후 처음 3개월간 평균적으로 전체 취득 예정 금액의 73.58%의 주식을 취득하였다. 이후 급격하게 취득 기업 수가 감소하기는 하나, 공시 이후 2년이 경과한 시점까지도 월별 10개 이상의 기업이 평균 약 8%의 자사주를 취득한 것으로 나타났다. 자기주식 신탁취득 내역은 3개월 이후에는 해지 전까지 확인할 수 없다는 점에서 신탁취득 규모에 대한 기업과 투자자 간 정보 비대칭이 존재한다고 볼 수 있다.

우려했던 것과 달리 간접취득에서 처분은 거의 발생하지 않는 것으로 보인다. 월별 취득 기업 수는 최대 5개를 넘지 않았으며 대부분 기간에서 처분이 관측되지 않았다. 그러나 패널D에서 확인해 볼 수 있듯이 공시 후 4년 이상 기간이 경과한 시점에서 간헐적으로 나타나는 처분 규모가 상당히 크다는 것을 알 수 있다. 해당 처분이 공개시장에서 일반투자자를 대상으로 매도한 것이라면 시장충격을 유발했을 가능성이 있다. 특히 신탁계약 내에서 이루어지는 처분은 직접처분과 달리 별도 공시되지 않는다. 직접처분과 신탁계약 내 처분은 경제적 실질이 동일함에도 불구하고 규제 강도에 큰 차이가 존재하여 문제의 소지가 있다.

Ⅳ. 간접취득의 주가반응

1. 자사주 취득방법과 주가반응

자사주 취득방법 간의 제도적 차이로 직접취득과 간접취득의 주가반응이 상이하게 나타날 가능성이 존재한다. 신탁취득은 취득 규모가 직접취득에 비해 크기 때문에 시장에 더 큰 영향을 미칠 가능성이 존재한다. 반면 신탁취득의 규제 강도가 직접취득보다 낮다는 점을 고려하면 신탁취득의 실취득이 예상보다 저조하고 취득에 장기간이 소요될 수 있다. 투자자가 자사주 취득 규정에 따른 차이를 인지하고 있다면 간접취득의 신호효과가 더 약할 것이다.

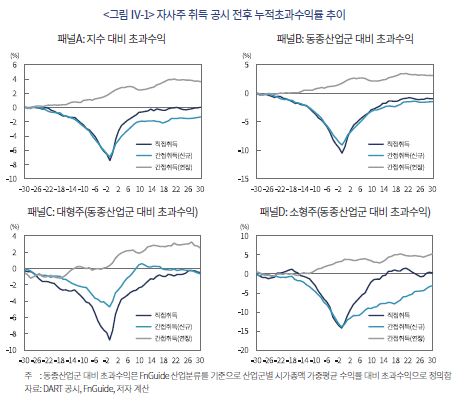

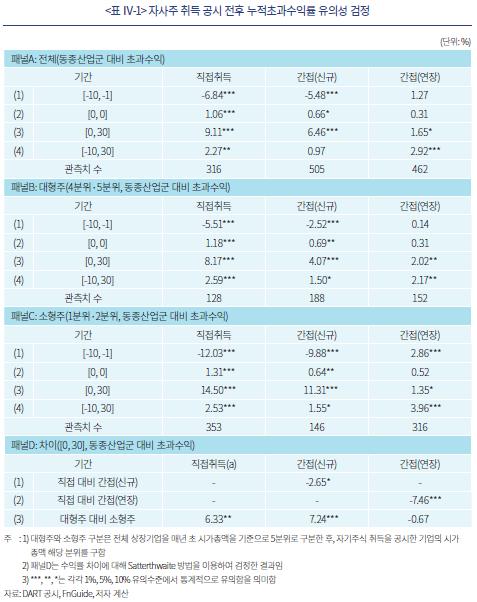

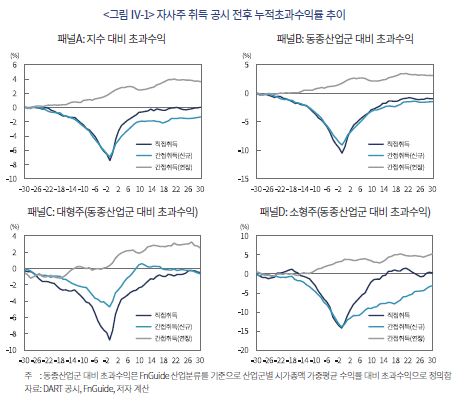

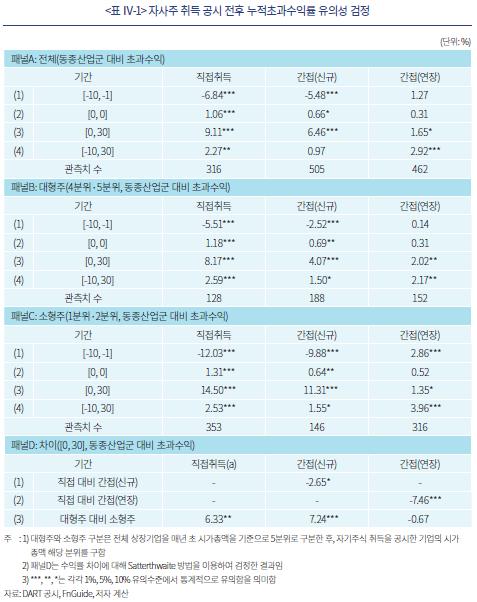

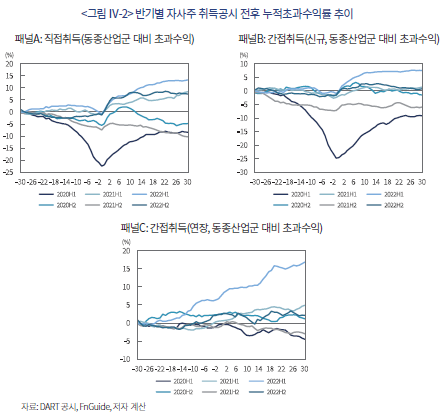

<그림 Ⅳ-1>은 자사주 취득을 직접취득, 간접취득 신규계약, 간접취득 연장계약의 세 그룹으로 나누어 공시 전 30일부터 공시 후 30일까지의 주가반응을 도시한 것이다. 또한 <표 Ⅳ-1>은 각 구간별 누적초과수익의 유의성을 분석한 결과이다. 주가반응은 지수 대비 초과수익과 동종산업군 대비 초과수익의 두 가지 기준으로 산출하였다. 지수 대비 초과수익은 해당 기업의 상장시장에 따라 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수 대비 초과수익을 계산하였다. 동종산업군 대비 초과수익은 FnGuide 산업분류를 기준으로 10개의 산업군 각각에 대해 일별 시가총액 가중평균 수익률을 산출한 후 각 공시 종목의 수익률에서 차감하여 이용하였다.7)

분석 결과를 요약하면 다음과 같다. 첫째, 직접취득과 신규 간접취득 모두 주가를 반등시키는 효과가 있었다. 공시 전 기준수익률 대비 하락하던 주가는 공시를 기점으로 상승추세로 전환되었다. 기업의 자사주 취득 공시가 주가상승에 대한 신호로 효과적으로 작용한 결과이다.8)

둘째, 직접취득에 비해 신규 간접취득의 주가 반응이 더 약했다. <표 Ⅳ-1> 패널A (3)행의 결과에 따르면, 공시 시점부터 공시 이후 30일까지의 누적초과수익률이 직접취득과 신규 간접취득 모두에서 유의한 양의 초과수익을 보였다. 직접취득 공시 기업의 수익률은 같은 산업군에 속한 다른 기업에 비해 공시 이후 9.11%p 더 상승했으며 신규 간접취득은 6.46%의 초과수익이 발생했다. 두 경우 모두 통계적으로 유의한 수준이었으나, 차이에 대해 검정한 결과인 패널D의 (1)행에 따르면 간접취득의 경우가 수익률 초과 상승 정도가 유의하게 낮다는 것을 알 수 있다.

셋째, 대형주에 비해 소형주의 주가가 공시 후 더 큰 상승세를 보였다. 공시 후 30일 동안 대형주는 직접취득과 신규 간접취득 각각 8.17%, 4.07%의 초과수익이 발생했으며, 소형주의 경우 14.50%, 11.31%로 더 높았다. 패널D의 (3)행에서 알 수 있듯이 대형주와 소형주 차이는 통계적으로 유의한 것으로 나타났다. 대형주에 비해 소형주의 주가 변동성이 더 높아 공시 전 주가 하락폭이 컸던 만큼 공시 후 상승폭도 큰 것으로 보인다. 대형주와 소형주 모두 공시 전 10일 이후의 누적초과수익률([-10, 30])이 유의한 양의 값을 갖는 것으로 판단해보건대, 자사주 취득공시는 공시 전 주가 하락을 상쇄하는 것 이상의 긍정적 시그널 효과가 있었다.

넷째, 간접취득 연장 공시의 주가 반응은 직접취득이나 신규 간접취득과 다른 움직임이 관측된다. 우선 간접취득의 경우 공시 전후에 추세상의 뚜렷한 반전은 나타나지 않았다. 즉, 공시 시점([0, 0])에도 주가는 유의한 변화를 보이지 않았다. 이는 신탁취득 연장 공시가 주가 저평가 신호를 통해 주가를 반등시킬 목적에 따라 이루어진 것이 아니며 기존 계약을 관례적으로 연장하였기 때문으로 해석할 수 있다. 이에 따라 시장이 즉각적으로 반응하지 않았을 가능성이 크다. 그러나 공시 이전부터 주가는 서서히 상승하기 시작하여 공시 전 10일부터 공시 후 30일까지의 누적수익률은([-10, 30]) 통계적으로 유의한 양의 값을 가졌다. 즉, 연장 공시의 주가 반응은 공시 시점에 즉각적으로 나타나지 않았으나 서서히 수익률이 증가하여 유의미한 주가 상승이 발생하였다.

간접취득 연장공시 후 주가가 유의하게 상승하는 원인에 대해서는 기업이 연장공시 후 실제 자기주식을 취득하고 이에 따라 주가가 상승했을 가능성이 있다. 그러나 <그림 III-7>에서 살펴보았듯 신탁계약 취득의 대부분은 신규 공시 후 초기 3개월에 집중적으로 나타나므로 연장공시 후 취득 규모가 실제로는 크지 않을 것으로 예상된다. 또한 투자자들이 연장 공시를 주가에 긍정적인 신호로 해석했을 수 있다. 문제는 외부투자자의 입장에서 연장공시 후 자기주식 취득이 실제 발생했는지 여부와 그 규모를 가늠하기 어렵다는 점이다. 해당 신탁계약을 연장하기로 결정했다는 사실 이외의 정보가 주어지지 않으므로 투자자는 연장공시에 대한 충분한 정보를 얻기 어렵다.

2. 시장충격과 주가 반응

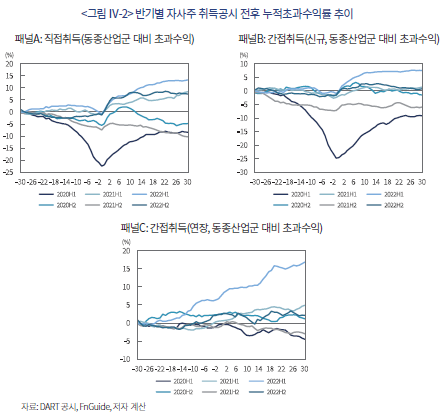

2020년 초 코로나19의 발발은 증권시장에 전례 없는 급등락 사태를 불러왔다. 당시 다수의 기업이 주가 폭락에 대응하고 주가 관리를 위해 적극적으로 노력하고 있다는 신호를 투자자에게 보내기 위하여 자기주식 취득공시에 참여하였다. 주가 급락기에 이루어졌던 자기주식 취득공시의 효과를 분리해서 살펴보고, 주가가 급변동하지 않은 시기에도 주가 부양 효과가 있는지 확인하기 위하여 분석기간을 반기 단위로 구분하여 주가 반응을 살펴보았다.

<그림 Ⅳ-2>의 2020년 상반기(2020H1) 누적초과수익률 추세를 살펴보면 예상했던 바와 같이 공시가 주가를 반전시키는 데 효과적이었던 것으로 보인다. 공시 전 동종업체 대비 하락세를 보이던 주가는 공시 직후부터 초과수익을 실현했으며 공시 후 30일이 경과한 시점까지도 상승세가 이어졌다.

시장충격이 발생하지 않았던 기간에도 직접취득 공시 이후 주가는 상승하는 패턴을 보였다. 특히 2022년 상반기의 공시가 주가 상승효과가 가장 컸으며 2021년 상반기와 2022년 하반기 또한 공시 후 주가가 크게 상승하였다. 반면 2020년과 2021년 하반기에는 공시 직후 주가가 소폭 상승하고 다시 하락추세가 이어지는 일시적 효과에 그쳤다. 패널B의 신규 신탁취득 공시의 경우 2020년 상반기와 2022년 상반기에 직접취득과 마찬가지로 주가 반등이 나타난다. 그러나 이를 제외하고는 두드러진 상승세가 관찰되지 않는다.

한편 간접취득 연장 공시의 경우 주가 급변동기에도 신호로서 효과가 없었던 것으로 보인다. 패널C의 2020년 상반기(2020H1) 추세를 살펴보면, 공시 시점 이후에도 주가는 소폭 하락하고 있다. 직접취득이나 신규 신탁취득 공시가 극적인 반등세를 이끌었던 것과 대조적이다.

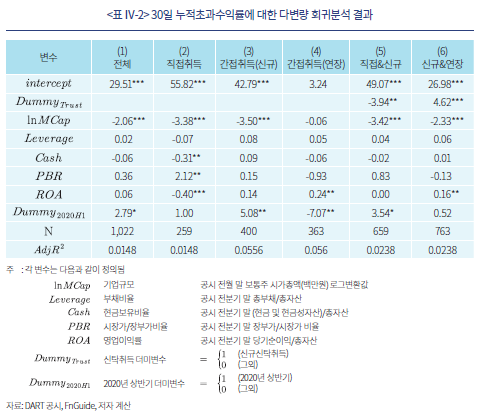

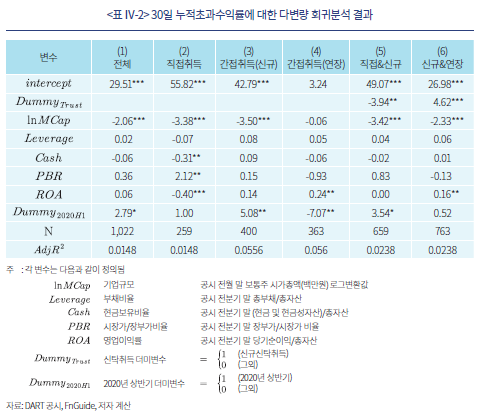

3. 재무지표에 따른 공시효과 차이

기업의 자기주식 취득 방법 선택이나 재무지표에 따라 수익률에 차이가 존재하는지 알아보았다. 공시 시점부터 공시 후 30일까지의 누적초과수익률([0, 30])을 피설명변수로 하여, 기업규모, 부채비율, 현금보유도, PBR, ROA 등의 재무변수가 설명력을 가지는지 분석하였다. 취득 방법에 따라 수익률에 차이가 발생하는지 확인하기 위하여 신규 신탁취득 더미변수( )를 분석에 포함하였다.

)를 분석에 포함하였다.  는 신규 신탁계약일 경우 1을 부여하며 아닐 경우 0의 값을 가진다. 또한 코로나 상황에 따른 주가 급등락 시점을 통제하기 위하여 2020년 상반기에 1을 부여하는 더미변수(

는 신규 신탁계약일 경우 1을 부여하며 아닐 경우 0의 값을 가진다. 또한 코로나 상황에 따른 주가 급등락 시점을 통제하기 위하여 2020년 상반기에 1을 부여하는 더미변수( )를 포함하였다.

)를 포함하였다.

<표 Ⅵ-2>의 (1)열은 직접취득, 신규 간접취득, 연장 간접취득의 모든 공시를 포함한 분석 결과이며, (2)열부터 (4)열은 각 공시 유형에 따라 구분하여 분석한 것이다. (1)열의 결과에 따르면 기업규모가 작을수록 초과수익률이 높게 나타났다. 소형주의 경우 대형주에 비하여 시장에 공개된 정보량이 적기 때문에 자기주식 취득 공시가 발표되면 공시정보가 가진 영향력이 상대적으로 더 커서 시장은 민감하게 반응한다. 또한 소형주의 주가 변동성이 더 크기 때문에 공시효과가 대형주에 비해 더 큰 것으로 해석할 수 있다.

기업규모는 (2)열과 (3)열에서 직접취득과 간접취득을 구분하여 분석한 결과에서도 마찬가지로 유의한 음의 값을 가졌다. 직접취득의 경우 그 외의 재무 특성변수가 주가수익률에 영향을 미치는 것으로 나타났다. 현금보유도가 낮고 장부가 대비 주가가 높으며 수익성이 낮은 종목일수록 공시반응이 더 컸다. 그러나 간접취득의 신규 신탁계약이나 연장 신탁계약 모두에서 대부분의 재무변수가 설명력을 가지지 못했다.

(5)열과 (6)열은 취득방법 선택이나 연장 여부에 따라 공시효과가 다르게 나타나는지 분석하기 위하여 더미변수를 이용한 결과이다. (5)열은 직접취득과 신규 간접취득 공시자료를 비교한 것이다. 재무변수를 통제한 이후에도 취득 방법 선택은 주가에 유의한 영향을 미치는 것으로 나타났다. 계수가 유의한 음의 값을 가지는 것으로 보아, 직접취득에 비해 간접취득의 주가 반응이 더 작다는 것을 알 수 있다. (6)열은 신규 간접취득과 연장 간접취득의 효과를 비교한 것인데,

계수가 유의한 음의 값을 가지는 것으로 보아, 직접취득에 비해 간접취득의 주가 반응이 더 작다는 것을 알 수 있다. (6)열은 신규 간접취득과 연장 간접취득의 효과를 비교한 것인데,  변수가 양의 값을 가져, 기업의 재무적 특성을 통제한 이후에도 연장 간접취득에 비해 신규 간접취득의 효과가 더 크다고 해석할 수 있다.

변수가 양의 값을 가져, 기업의 재무적 특성을 통제한 이후에도 연장 간접취득에 비해 신규 간접취득의 효과가 더 크다고 해석할 수 있다.

Ⅴ. 결론 및 시사점

본 보고서는 신탁계약을 통한 자기주식 취득제도를 검토하고 2020년 1월부터 2022년 9월까지 자료를 이용하여 신탁계약의 주가 반응을 연구하였다. 분석 결과 상당수 기업이 관행적으로 계약을 연장하였으며 자사주 취득이 장기에 걸쳐 이루어지는 것으로 나타났다. 그러나 자사주 취득 비율은 평균 83.88%로 목표 비율에 미치지 못했으며, 심지어 일부 기업은 신탁계약 기간 내에 취득한 자사주를 처분하여 실질적인 취득이 일어나지 않는 경우도 존재한다는 사실을 알 수 있었다.

신탁계약을 이용할 경우 직접취득의 번거로움을 피하여 손쉽게 주가를 관리할 수 있기 때문에 자사주를 직접 관리할 여력이 부족한 기업은 신탁계약에 대한 선호도가 높을 것으로 보인다. 게다가 신탁계약은 취득 강제성이 없어 취득 규모를 재량에 따라 조정할 수 있으며 기업의 상황에 따라 언제든 연장하거나 해지할 수 있으므로 운영 부담이 적다. 또한 공시요건이 강하지 않아 계약체결 후 3개월이 경과한 시점을 제외하고는 계약 해지까지 취득처분 상황에 대한 별도의 공시가 요구되지 않는다.

간접취득의 이러한 규제적 특성은 주가 반응 차이로 나타났다. 직접취득과 신규 체결한 간접취득 모두 주가 하락 시기에 주가를 반등시키는 효과가 있었으나, 간접취득이 직접취득에 비해 효력이 약했다. 기업의 재무적 특성을 통제한 후에도 간접취득 공시 후 30일간 주가 상승률이 직접취득에 비해 3.94%p 낮았다. 투자자가 자사주 취득 규정에 따른 차이를 일부 인지하고 있으며 이러한 사실이 주가에 반영된 결과로 판단된다.

투자자의 관점에서 간접취득은 파악하기 어렵고 불확실성이 높은 제도임이 분명하다. 신탁계약을 체결한 시점이 아닌 연장한 경우를 대상으로 분석을 시행한 결과 신탁계약 연장 공시는 시장에 즉각적인 영향을 미치지는 않으나 서서히 수익률이 증가하여 유의미한 주가 상승이 발생하였다. 그런데 투자자는 연장계약에 큰 관심을 기울이지 않을 뿐만 아니라 주의 깊게 살펴본다고 하더라도 공시에 취득 계획이나 취득 잔액 등에 대한 자세한 내용이 포함되지 않기 때문에 실제 취득 시점이나 규모를 예측하기 어렵다. 또한 신탁계약 내에서 이루어지는 처분은 직접처분과 달리 별도로 공시되지 않기 때문에 대량의 매도가 발생하여 주가가 하락한다고 하더라도 투자자는 이를 파악하기 불가능하다. 자기주식 신탁계약에 허용된 제도적 유연성으로 인해 기업과 외부 투자자 간 정보 비대칭은 심화된다고 볼 수 있다.

그런데 자기주식 취득에 대한 이론에 따르면 자기주식 취득의 핵심은 기업과 외부 투자자 간의 정보 비대칭을 완화하는 것이다. 대표적 이론인 저평가가설이나 정보신호가설은 기업가치가 저평가되어 있다는 사실을 외부 투자자에게 알리기 위한 수단으로 자기주식 취득이 이용된다고 해석한다. 또 다른 이론인 잉여현금흐름가설에서 주장하는 자사주 취득목적은 잉여현금을 자사주 취득에 이용하면 과잉투자 가능성이 낮아져 대리인비용을 줄일 수 있다는 정보를 시장에 전달하기 위한 것이다. 이론적 관점에서 자기주식 간접취득은 신규 취득 시점에서는 일부 효과가 있으나 계약이 장기화될수록 기업이 제공하는 정보가 불충분하며 시장에 보내는 신호가 모호해진다. 연구 결과에 따라 논란이 있으나 자사주 간접취득을 이용한 사적이익추구 및 내부정보를 이용한 불공정거래 가능성에 대한 의심에서 벗어날 수 없는 이유이기도 하다.

이처럼 기업이 직접 취득하거나 처분하는 자사주가 신탁계약을 이용한 자사주와 실질적으로 다르지 않음에도 불구하고 규제 차이로 인해 투자자가 제공받는 정보의 양과 시장에 미치는 영향에 차이가 발생한다. 기업과 투자자간의 정보 격차를 줄이기 위하여 신탁취득의 공시를 강화할 필요가 있다. 현재 신탁계약 체결에 따른 자사주 취득 및 처분 내역은 신탁 체결 후 3개월이 경과한 시점에 제공하게 되어 있다. 실제 신탁계약 체결 3개월 이후에도 자사주 취득이 빈번하게 일어나기 때문에 취득상황에 대한 공시 빈도를 높일 필요가 있다. 또한 별도의 제재 없이 관행적으로 이루어지고 있는 신탁계약 연장을 취득 현황과 향후 취득 계획, 연장 목적 등을 고려하여 필요성이 분명한 경우로 제한해야 한다. 또한 신탁계약 내에 이루어지는 처분에 대해서도 직접처분에 준하는 공시 수준을 적용하여 투자자에게 정보가 적시에 제공되도록 해야 한다.

더 나아가 신탁취득 제도의 본질적인 목적과 시장에 미치는 효익에 대해 고찰해볼 필요가 있다. 신탁취득은 급변하는 기업 내부 상황과 시장 불확실성에 대응하여 기업이 용이하게 주가를 관리할 수 있는 수단인 것은 사실이다. 그러나 기업이 별도의 공시 없이 일반투자자를 대상으로 자기주식 거래를 통한 차익을 실현하는 행위가 정당하다고 볼 수 있는지 의문이다. 주가 관리는 공시를 통해 시장에 명확한 신호를 전달하고 실제 공시한 사항을 충실히 이행하는 형태로 이루어지는 것이 바람직하며 가장 효과가 높을 것이다. 또한 신탁취득 제도가 도입되었던 90년대 말의 시장 환경과 비교하여 자본시장은 많은 발전을 이루었다. 국내 증권시장의 시장 규모와 유동성을 고려했을 때 기업이 직접 자사주를 관리하는 데 큰 제약이 있을 것으로 생각되지 않는다. 특히 직접취득과 규제 강도에 상당한 차이가 있는 신탁취득을 유지할 필요성을 검토하고 간접취득 제도를 전면적으로 개편할 필요가 있다.9)

1) 자사주펀드는 자기주식 취득 방법 중 가장 먼저 도입되었다. 기업이 자사주를 직접 취득하는 방법은 이보다 2년 후인 1994년 5월에 허용되었다.

2) 통계청(2014. 6. 11)

3) 정성창ㆍ김영환(2002)

4) 김영환ㆍ정성창(2008)

5) 강소현(2020), 강소현(2023)

6) 김효석(2005)

7) 지수 대비 초과수익률을 기준으로 산출한 누적초과수익률은 동종산업군 대비 초과수익률을 이용한 경우와 유사한 결과가 도출되어 이하의 분석에서는 동종산업군 대비 초과수익률을 이용한 결과만 보고한다.

8) 강소현(2023) 등의 연구 결과에 따르면 공시 이후 양의 초과수익이 발생하는 현상은 최근 기간에만 국한된 결과로 보이지 않는다. 그러나 본 보고서는 주가가 급등락하였던 2020년 1분기를 포함하여 그 이후 자료만을 포함하고 있어 분석기간을 확장할 경우 공시 전후의 반등 양상이 완화될 것으로 예상된다.

9) 본고는 자기주식 간접취득의 문제를 중점적으로 다루었다. 그러나 직접취득 및 처분에도 여전히 개선해야 할 문제점이 존재한다. 국내 시장에서 취득한 자사주는 대부분 소각되지 않고 기업 내부에 보유되며 보유한 자사주는 기업의 필요에 따라 자유롭게 처분된다. 또한 저평가가설과 달리 자기주식 취득이 기업의 본질가치에 대한 신호가 아닌 기회주의적으로 이용될 가능성이 존재한다. 따라서 자기주식 취득과 처분에 대한 전반적인 개선이 필요하다. 직접취득에 대한 보다 자세한 논의는 강소현(2023), 김준석(2023)을 참고하기를 바란다.

참고문헌

강소현, 2020, 자사주 취득 방법과 주주가치 제고 효과에 대한 소고, 자본시장연구원『자본시장포커스』2020-20호.

강소현, 2023,『국내 상장기업의 자기주식 취득 및 처분 동기와 장기효과』, 자본시장연구원 연구보고서 23-06.

고윤성ㆍ이정한, 2014, 자기주식 취득방법과 이익조정 및 배당,『세무와회계저널』15(3), 175-207.

김수정ㆍ이윤구ㆍ설원식, 2005, 이익소각 공시가 주주의 부에 미치는 영향: 일반 목적의 자사주 매입 공시와의 비교를 중심으로,『대한경영학회지』18(1), 107-133.

김영환ㆍ정성창, 2008, 자사주 매입방식의 결정요인과 기회주의 가설의 검증,『한국경영학회지』37(5), 1205-1232.

김준석, 2023,『인적분할과 자사주 마법』, 자본시장연구원 이슈보고서 23-06.

김효석, 2005, 증권거래법 일부개정법률안.

박영규, 2008, 자기주식매입의 유상증자에 대한 신호효과,『재무관리연구』25(1), 50-84.

변진호, 2004, 저평가 자사주 매입 공시의 허위정보 신호효과와 장기성과,『한국증권학회지』 33(1), 207-248.

설원식ㆍ김수정, 2005, 자기주식 취득 및 처분 공시가 주주의 부에 미치는 영향: 취득 및 처분목적을 중심으로,『재무관리연구』22(1), 37-69.

정무권, 2005, 자사주매입 선언에 따른 주주 및 채권자의 부의 변화,『재무연구』18, 67-99.

정성창, 2004, 유상증자와 자사주취득의 동기: 불공정거래 가능성의 제기,『한국증권학회지』33(3), 123-156.

정성창ㆍ김영환, 2002, 코스닥시장의 자기주식 취득에 대한 연구, 춘계학술대회 발표논문.

정성창ㆍ이용교, 1996, 자사주매입과 자사주펀드 제도의 유효성 분석,『재무연구』11, 241-271.

통계청, 2014. 6. 11, 최근 경기순환기의 기준순환일 설정안, 보도자료.

지난 2년간 주식시장은 급변하는 양상을 보였다. 2020년 3월 코로나19로 주가는 급락하였으나 빠르게 반등하였다. 이후 2021년 7월까지 약 1년 4개월간 상승세를 이어오다 다시 약세로 전환되었다. 글로벌 인플레이션, 국내외 금리인상, 러시아-우크라이나 전쟁 장기화 등 여러 악재로 인한 하락세는 2021년 7월 이후 2022년 말까지 지속되고 있다.

주식시장 충격에 대응하기 위해 기업들은 다양한 방안들을 모색하고 있다. 그중 기업의 자기주식 취득이 두드러지게 증가하였다. 기업이 자기주식 취득 계획을 공시하면 투자자들은 기업 내부에서 주가 상승에 대한 확신이 있는 것이라 해석하여 해당 종목에 대한 투자자들의 선호가 증가한다. 그 결과 일반적으로 주가가 상승하는 효과가 나타난다.

그런데 기업이 자기주식을 취득하는 방법은 두 가지가 있다. 기업이 시장에서 직접 자기주식을 취득하는 방법과 은행 등 특정금전신탁회사와의 계약을 통해 간접 취득하는 방법이다. 간접취득은 해외에서 찾아보기 힘든 국내만의 독특한 제도인데, 취득방식, 취득 강제성, 처분 가능 여부 등 다양한 측면에서 직접취득에 비해 유연한 규제를 적용받는다. 따라서 간접취득이 주주의 부에 미치는 영향 또한 직접취득과 다를 가능성이 크다.

본고는 급변하는 증시 상황에서 간접취득이 주가에 어떠한 영향을 미쳤는지 살펴보기로 한다. 신탁계약을 통한 자사주 취득이 도입된 근거를 바탕으로 신탁계약이 직접취득과 규제상 어떠한 차이를 보이는지 구체적으로 파악한다. 이를 바탕으로 최근 2년간 자기주식 간접취득 전후의 주가 반응을 살펴보도록 한다. 자사주 취득 방법에 따라 기업이 기회주의적인 행태를 보일 가능성을 판단하고 신탁계약의 의미와 필요성을 고찰하여 개선방안을 모색해보고자 한다.

Ⅱ. 간접취득 도입 배경 및 규제 특성

1. 간접취득 도입 배경 및 연혁

기업이 자기주식을 취득하는 방법은 직접취득과 간접취득의 두 가지로 구분되며, 간접취득은 다시 신탁계약에 의한 취득과 자사주펀드를 이용한 취득으로 나뉜다. 자기주식 간접취득 방식은 1992년 8월 자사주펀드의 형태로 처음 도입되었다.1) 90년대 초반 당시는 과열된 건설경기가 진정되고 소비가 둔화되면서 경기가 급속히 위축되고, 대외적으로 선진국의 경제침체가 장기화되어 수출 부진이 우려되던 상황이었다.2) 자사주펀드는 침체된 주식시장을 회생시키기 위해 마련된 ‘증시 안정을 위한 종합대책’의 일환으로 시작되었다.3)

자사주펀드는 기업이 투자신탁회사의 수익증권을 매입하고 투신사가 자사주펀드를 설정하여 형성된 자금으로 펀드에 포함된 기업들의 주식을 운용한다. 자사주펀드는 한 종목이 아닌 여러 기업으로 구성되며, 주식 이외의 상품도 포함할 수 있다. 주식 운용 비율은 90%이며 동일 종목투자 한도는 20%이다. 자사주펀드는 기업들의 편리한 주가 관리와 지분확보를 위해 도입되었으나, 다수의 기업이 합동으로 운용하게 되어 있어 개별기업의 직접적인 주가 관리에 한계가 있었다.4) 실제 최근 자사주펀드 활용 사례는 극히 일부에 불과하다.

1999년에는 특정금전신탁 계약을 통한 자기주식 취득 방식이 추가로 허용되었다. 이는 다수의 기업이 아닌 개별기업의 자사주를 취득하는 것으로, 현재 일반적으로 활용되고 있는 간접취득 방법이다. 기업은 은행이나 증권사 등 신탁업자와 자기주식 신탁계약을 체결하고 계약금액을 예탁하면 신탁업자가 계약기간 내에 기업을 대신하여 자기주식을 취득하거나 처분하는 방식으로 운영한다. 자사주신탁계약을 통해 신탁업자가 취득한 주식은 실질적으로 기업의 소유이므로 신탁업자는 취득한 주식에 대한 의결권과 배당권을 가지지 않는다.

계약기간이 종료되거나 계약을 해지하면, 기업은 계약금 잔액과 함께 신탁업자가 취득한 자사주를 반환받을 수 있다. 신탁업자가 보유하고 있던 자기주식이 기업에 반환되면 간접취득 형태에서 직접취득 형태로 전환된다.

2. 간접취득 규제 특성5)

자기주식 간접취득은 직접취득과 비교하여 다양한 측면에서 규제 차이를 보인다. 첫째, 직접취득에 비해 간접취득의 취득 기간이 길다. 간접취득 기간은 계약에 따라 달라지는데 일반적으로 6개월에서 1년 정도이다. 직접취득에 허용되는 3개월에 비해 기본 계약기간이 길뿐만 아니라, 신탁계약은 연장이 가능해 반복적인 계약 연장으로 수년에서 수십 년 동안 유지되기도 한다. 신탁계약이 직접취득에 비해 장기간 유지되는 핵심 원인은 계약 연장이 가능하다는 점에 있다.

신탁계약 연장이 빈번하게 발생하는 원인은 연혁적 배경에서 찾아볼 수 있다. 2005년 이전에는 신탁업자가 취득한 자사주는 현물반환이 허용되지 않았다. 따라서 계약이 종료 또는 해지되면, 기업은 신탁업자가 보유한 자기주식을 전량 매각하고 매각대금을 현금으로 반환받거나 신탁계약을 연장할 수밖에 없었다. 간접취득한 자기주식을 매각할 경우 주가가 하락할 우려가 있으므로 기업은 만기를 연장하는 편을 택하는 경우가 많았다.6) 이러한 문제점을 보완하기 위해 2005년 11월 증권거래법 개정을 통해 신탁계약이 해지나 종료되면 기업이 자기주식을 직접 반환받을 수 있게 허용하였다. 그러나 현물반환이 가능해진 후에도 자기주식 신탁계약 연장은 별도의 제재 없이 허용되고 있으며 기업의 신탁계약 연장은 관례화되어 현재까지 이어지고 있다.

둘째, 직접취득은 취득 기간 내에 자사주 취득행위만 가능하지만 간접취득은 취득과 처분이 모두 가능하다. 기업이 자사주를 취득하는 목적은 다양하나 신탁취득의 경우 제도 도입 취지를 고려했을 때 주가 관리와 자본이득이 주된 목적일 것으로 추측된다. 실제 제도상으로 신탁계약은 처분이 허용되므로 보유한 자사주의 주가가 상승할 때 이를 처분하여 이익을 실현하고 주가가 하락하면 저가에 다시 매수하는 것이 가능하다.

셋째, 직접취득은 공시에 명시한 전량을 취득해야 하지만 간접취득은 별도의 제약을 받지 않는다. 직접취득은 법에서 규정한 취득 기간인 3개월 이내에 신고 주식 수량을 모두 취득하지 못하면 기간 만료 후 1개월까지 이사회 결의가 금지된다. 그러나 신탁계약은 공시에서 명시한 취득금액을 이행하지 않는다고 하더라도 별도의 제재를 받지 않는다. 따라서 간접취득은 신탁계약 금액을 전량 취득하지 않을 가능성이 크다.

넷째, 신탁취득은 여러 건을 동시에 체결하는 것이 가능하다. 예를 들어, 현재 시점에 6개월 만기의 신탁계약을 체결하고 다음 달에 또 다른 신탁계약을 체결하는 것이 가능하며, 한 날 여러 신탁업자와 복수의 신탁계약을 체결할 수도 있다. 따라서 동일 시점에 여러 개의 신탁계약이 동시에 존재한다.

이러한 제도적 유연성을 고려했을 때 기업의 입장에서 신탁취득을 이용하는 장점은 분명해진다. 기업이 자사주 신탁계약을 통해 일정 금액을 위탁하면 신탁업자가 주가 하락 시 자사주를 매수해주어 기업은 주가를 용이하게 관리할 수 있다. 또한 취득한 주식은 계약을 해지하지 않고도 처분할 수 있어서 자사주가 필요한 경우 일부를 해지하여 이용하거나 주가가 상승한 경우 매도하여 자본이득을 취할 수 있다. 특히 자기주식을 직접 관리할 여력이 부족한 중소기업에 신탁계약은 자사주를 손쉽게 관리할 수 있는 효율적 수단이다.

그런데 외부 투자자 입장에서는 신탁취득과 관련된 사실을 적시에 파악하기 어렵다. 공시 규정에 따르면 신탁계약이 체결되고 3개월이 경과한 시점에 취득상황 보고서를 제출해야 한다. 따라서 계약을 체결하고 3개월 동안의 취득 및 처분 내역을 확인할 수 있다. 그러나 그 이후의 상황은 파악하기 어렵다. 계약이 해지되거나 종료되어야 기업은 ‘신탁계약 해지 결과보고서’를 제출하며 이 보고서를 통해 3개월 이후 기간의 거래 내역이 공개된다. 신탁계약 연장이 빈번하게 이루어지는 현재 상황에서 신탁계약이 장기간 지속되면 투자자는 기업의 자사주 관리 현황을 파악하기 어려워진다.

3. 간접취득 관련 선행연구

자기주식 간접취득은 제도적, 관행적으로 직접취득과 상당한 차이가 있다. 따라서 기업의 취득 방법 선택에 따른 주가 반응이 직접취득과 다르게 나타날 가능성이 크다. 그런데 자기주식 직접취득에 관한 연구는 국내외에서 비교적 활발히 이루어지고 있는 반면, 간접취득에 대한 연구는 제한적이다. 간접취득은 해외에서 찾아보기 어려운 국내 고유의 제도이기 때문에 해외 문헌연구는 존재하지 않으며, 국내에서 진행된 연구 또한 대부분이 자기주식 취득제도가 도입되었던 2000년대 중반 이전에 한정되어 있다.

또 다른 연구는 신탁취득이 기회주의적 목적에 이용될 가능성에 관한 것이다. 김영환ㆍ정성창(2008)은 신탁취득의 경우 반드시 공시에서 목표한 규모를 취득해야 하는 의무가 없는 제도적 특성을 바탕으로 실취득규모를 조사하였다. 그 결과 간접취득의 실취득비율이 직접취득에 비해 현저하게 낮아 투자자들에게 거짓신호를 보낼 우려가 있음을 보였다.

더 나아가 정성창(2004), 고윤성ㆍ이정한(2014)은 유상증자, 이익조정 등의 특정 기업 이벤트 전후에 간접취득을 이용하여 기업에 유리한 방향으로 주가를 의도적으로 움직이는 등 불공정거래의 가능성이 있다고 주장하였다. 정성창(2004)은 자사주펀드가 유상증자를 전후하여 주가관리 수단으로 활용될 수 있음을 보였으며, 고윤성ㆍ이정한(2014)은 이익조정과 자기주식 취득방법 사이의 연관성에 관한 연구를 통해 직접취득에 비해 간접취득이 이익조정의 가능성이 더 크다는 결론에 다다랐다. 요컨대, 직접취득을 이용해서도 기회주의적 행위가 가능하지만, 간접취득은 제도상 유연성 때문에 악용될 소지가 간접취득에 비해 더 큰 것으로 나타났다.

Ⅲ. 간접취득 현황 및 취득기업 특성

1. 간접취득 시장 규모

최근 기업의 간접취득 현황을 파악하기 위하여 2020년 1월부터 2022년 9월까지의 자기주식 공시자료를 살펴보았다. 자기주식 간접취득 관련 정보는 DART의 자기주식 취득 신탁계약 체결 결정 공시, 자기주식 취득 신탁계약 해지 결정 공시, 신탁계약 취득 상황보고서, 신탁계약 해지 결과보고서를 이용하였으며 주가 및 기업정보는 FnGuide를 이용하였다. <그림 Ⅲ-1>부터 <그림 Ⅲ-4>는 자기주식 직접취득과 간접취득 각각에 대하여 공시 건수와 공시 규모 추이를 분기별로 나타낸 것이다.

자기주식 취득 규모 추이를 통해 알 수 있는 특징은 2020년 1분기에 자기주식 취득이 크게 증가했다는 점이다. 2020년 1분기 동안 자기주식 직접취득이 140건, 신탁취득이 161건으로 2020년 이후 전체 공시 건수의 약 27%가 2020년 1분기에 집중되어 있다. 당시 코로나19 발발로 주가가 급등락하고 정부가 시장 안정을 위하여 자기주식 취득 완화 조치를 시행한 것을 계기로 기업의 자기주식 취득 활용도가 급격하게 높아졌다.

2020년 1분기를 제외하고 2020년 2분기부터 2022년 3분기까지 자기주식 취득 건수는 증가하는 추세를 보인다. 직접취득과 신탁계약을 구분하여 공시 빈도를 나타낸 <그림 Ⅲ-1>과 <그림 Ⅲ-2>를 살펴보면, 신탁계약의 증가가 더 두드러진다. 직접취득과 간접취득 모두 2020년 2분기에 20건으로 동일한 빈도였으나 2022년 3분기에는 직접취득이 46건으로 약 2.3배 증가하는 동안 신탁취득은 94건으로 4.7배 더 많아졌다.

그러나 신탁계약 취득 규모는 분기별로 큰 차이를 보이지 않는다. <그림 Ⅲ-3>과 <그림 Ⅲ-4>는 각각 직접취득 공시 주식 수와 간접취득 계약금액 추이를 보여준다. 공시 건수 추이와는 달리 공시 규모 추이는 뚜렷한 추세를 보이지 않고 등락하는 양상이 나타난다. 주된 원인은 최근 코스닥 상장기업의 자기주식 취득이 증가했기 때문으로 보인다. <그림 Ⅲ-3>과 <그림 Ⅲ-4>에서 유가증권시장과 코스닥시장 상장종목을 구분하여 공시별 규모를 살펴보면, 유가증권시장 취득 규모에 비해 코스닥시장 취득 규모가 작다는 것을 알 수 있다. 점선으로 표시된 코스닥시장의 분기별 공시 규모 중간값이 실선으로 표시된 유가증권시장 상장종목에 비해 전 분기에서 낮았다. 즉, 공시 규모가 작은 코스닥 상장종목의 자기주식 취득이 증가하면서 공시 빈도는 증가하였으나 규모는 증가세를 찾아보기 어려웠다.

2. 자기주식 신탁계약 특성

앞서 살펴본 바와 같이 간접취득은 직접취득과 다른 제도적 특징을 가진다. 간접취득은 직접취득과 달리 기간 연장이 가능하다. 기존 계약기간이 종료되고 계약을 연장하기로 결정하면 새로운 계약기간을 반영하여 연장 결정 또는 기재 정정 공시를 제출한다. <그림 Ⅲ-5>는 자사주 간접취득을 위한 신규 신탁계약 공시 건수와 함께 연장계약 공시 건수의 추이를 보여준다. 분석기간 동안 신규계약이 671건이었던 것과 비교하여 연장계약은 584건으로 상당한 수의 계약이 연장되고 있음을 알 수 있다.

연장기간을 포함한 신탁계약의 실제 계약기간을 살펴보기 위하여 2020년 1월부터 2022년 9월 사이에 제출된 신탁계약 해지결과 보고서 자료를 취합하여 분석하였다. <표 Ⅲ-1>은 계약기간을 6개의 구간으로 나누어 구간별 공시 건수를 나타낸 것이다. 전체 695건의 해지 공시 중 계약기간이 1년 미만인 경우가 65.5%로 가장 많았으며 나머지는 240건은 1년 이상 유지되었다. 이는 최초 계약기간을 1년으로 상정했을 경우 최소 1/3 이상의 계약이 1회 이상 연장되었다는 것을 의미한다. 2년 이상 중장기 계약은 전체의 14.2%이며 계약기간이 10년 이상인 초장기 신탁계약도 25건 존재했다.

자사주 신탁계약은 규정상 신탁금액을 전액 취득할 의무가 없다. 따라서 직접취득에 비해 실제 취득률이 낮을 가능성이 크다. <그림 Ⅲ-6>은 신탁취득 결과 자료를 바탕으로 실취득률을 산출한 후, 신탁계약을 해지한 분기를 기준으로 평균 및 최댓값, 최솟값을 나타낸 것이다. 실취득률은 공시별로 전체 계약기간 동안 취득총액에서 처분금액을 제한 후 신탁계약 금액으로 나눈 값으로 정의하였다.

또한 신탁계약은 처분도 가능하므로 실취득률이 평균치에 비해서 현저히 떨어지는 경우가 발생한다. 분기별 실취득률 최솟값을 살펴보면, 음의 실취득률이 일부 분포하고 있음을 알 수 있다. 실취득률이 음수라는 것은 취득금액에 비해 처분금액이 더 크다는 것으로 투자자의 기대와 달리 실제 자사주 취득이 이루어졌다고 보기 어렵다.

간접취득은 투자자가 취득 시점을 예측하는 것 또한 쉽지 않다. 직접취득은 규정에 따라 3개월 이내에 취득이 완료되어야 하나 신탁계약은 계약연장이 빈번하게 이루어지기 때문에 실제 어느 시점에 취득이 이루어졌는지 가늠하기 어렵다. 신탁계약의 거래 분포를 실질적으로 확인하기 위하여 신탁계약 거래자료를 이용하여 거래 시점별로 실거래 분포를 산출하였다. <그림 Ⅲ-7>은 신탁계약별로 거래가 시작된 시점을 1로 하여 계약이 종료될 때까지의 월별 분포를 나타낸다. 패널A와 패널B는 취득과 처분으로 구분하여 월별로 거래가 발생한 기업 수를 나타낸 것이며 패널C와 패널D는 계약규모 대비 취득 및 처분 비율의 월별 평균을 도시한 것이다.

<그림 Ⅲ-7>의 패널A와 패널C를 살펴보면 신탁계약 취득은 대부분 계약기간 초기에 집중되어 있음을 알 수 있다. 자기주식 신탁취득을 시작한 후 처음 3개월간 평균적으로 전체 취득 예정 금액의 73.58%의 주식을 취득하였다. 이후 급격하게 취득 기업 수가 감소하기는 하나, 공시 이후 2년이 경과한 시점까지도 월별 10개 이상의 기업이 평균 약 8%의 자사주를 취득한 것으로 나타났다. 자기주식 신탁취득 내역은 3개월 이후에는 해지 전까지 확인할 수 없다는 점에서 신탁취득 규모에 대한 기업과 투자자 간 정보 비대칭이 존재한다고 볼 수 있다.

우려했던 것과 달리 간접취득에서 처분은 거의 발생하지 않는 것으로 보인다. 월별 취득 기업 수는 최대 5개를 넘지 않았으며 대부분 기간에서 처분이 관측되지 않았다. 그러나 패널D에서 확인해 볼 수 있듯이 공시 후 4년 이상 기간이 경과한 시점에서 간헐적으로 나타나는 처분 규모가 상당히 크다는 것을 알 수 있다. 해당 처분이 공개시장에서 일반투자자를 대상으로 매도한 것이라면 시장충격을 유발했을 가능성이 있다. 특히 신탁계약 내에서 이루어지는 처분은 직접처분과 달리 별도 공시되지 않는다. 직접처분과 신탁계약 내 처분은 경제적 실질이 동일함에도 불구하고 규제 강도에 큰 차이가 존재하여 문제의 소지가 있다.

Ⅳ. 간접취득의 주가반응

1. 자사주 취득방법과 주가반응

자사주 취득방법 간의 제도적 차이로 직접취득과 간접취득의 주가반응이 상이하게 나타날 가능성이 존재한다. 신탁취득은 취득 규모가 직접취득에 비해 크기 때문에 시장에 더 큰 영향을 미칠 가능성이 존재한다. 반면 신탁취득의 규제 강도가 직접취득보다 낮다는 점을 고려하면 신탁취득의 실취득이 예상보다 저조하고 취득에 장기간이 소요될 수 있다. 투자자가 자사주 취득 규정에 따른 차이를 인지하고 있다면 간접취득의 신호효과가 더 약할 것이다.

<그림 Ⅳ-1>은 자사주 취득을 직접취득, 간접취득 신규계약, 간접취득 연장계약의 세 그룹으로 나누어 공시 전 30일부터 공시 후 30일까지의 주가반응을 도시한 것이다. 또한 <표 Ⅳ-1>은 각 구간별 누적초과수익의 유의성을 분석한 결과이다. 주가반응은 지수 대비 초과수익과 동종산업군 대비 초과수익의 두 가지 기준으로 산출하였다. 지수 대비 초과수익은 해당 기업의 상장시장에 따라 유가증권시장 상장종목은 코스피지수, 코스닥시장 상장종목은 코스닥지수 대비 초과수익을 계산하였다. 동종산업군 대비 초과수익은 FnGuide 산업분류를 기준으로 10개의 산업군 각각에 대해 일별 시가총액 가중평균 수익률을 산출한 후 각 공시 종목의 수익률에서 차감하여 이용하였다.7)

분석 결과를 요약하면 다음과 같다. 첫째, 직접취득과 신규 간접취득 모두 주가를 반등시키는 효과가 있었다. 공시 전 기준수익률 대비 하락하던 주가는 공시를 기점으로 상승추세로 전환되었다. 기업의 자사주 취득 공시가 주가상승에 대한 신호로 효과적으로 작용한 결과이다.8)

둘째, 직접취득에 비해 신규 간접취득의 주가 반응이 더 약했다. <표 Ⅳ-1> 패널A (3)행의 결과에 따르면, 공시 시점부터 공시 이후 30일까지의 누적초과수익률이 직접취득과 신규 간접취득 모두에서 유의한 양의 초과수익을 보였다. 직접취득 공시 기업의 수익률은 같은 산업군에 속한 다른 기업에 비해 공시 이후 9.11%p 더 상승했으며 신규 간접취득은 6.46%의 초과수익이 발생했다. 두 경우 모두 통계적으로 유의한 수준이었으나, 차이에 대해 검정한 결과인 패널D의 (1)행에 따르면 간접취득의 경우가 수익률 초과 상승 정도가 유의하게 낮다는 것을 알 수 있다.

셋째, 대형주에 비해 소형주의 주가가 공시 후 더 큰 상승세를 보였다. 공시 후 30일 동안 대형주는 직접취득과 신규 간접취득 각각 8.17%, 4.07%의 초과수익이 발생했으며, 소형주의 경우 14.50%, 11.31%로 더 높았다. 패널D의 (3)행에서 알 수 있듯이 대형주와 소형주 차이는 통계적으로 유의한 것으로 나타났다. 대형주에 비해 소형주의 주가 변동성이 더 높아 공시 전 주가 하락폭이 컸던 만큼 공시 후 상승폭도 큰 것으로 보인다. 대형주와 소형주 모두 공시 전 10일 이후의 누적초과수익률([-10, 30])이 유의한 양의 값을 갖는 것으로 판단해보건대, 자사주 취득공시는 공시 전 주가 하락을 상쇄하는 것 이상의 긍정적 시그널 효과가 있었다.

넷째, 간접취득 연장 공시의 주가 반응은 직접취득이나 신규 간접취득과 다른 움직임이 관측된다. 우선 간접취득의 경우 공시 전후에 추세상의 뚜렷한 반전은 나타나지 않았다. 즉, 공시 시점([0, 0])에도 주가는 유의한 변화를 보이지 않았다. 이는 신탁취득 연장 공시가 주가 저평가 신호를 통해 주가를 반등시킬 목적에 따라 이루어진 것이 아니며 기존 계약을 관례적으로 연장하였기 때문으로 해석할 수 있다. 이에 따라 시장이 즉각적으로 반응하지 않았을 가능성이 크다. 그러나 공시 이전부터 주가는 서서히 상승하기 시작하여 공시 전 10일부터 공시 후 30일까지의 누적수익률은([-10, 30]) 통계적으로 유의한 양의 값을 가졌다. 즉, 연장 공시의 주가 반응은 공시 시점에 즉각적으로 나타나지 않았으나 서서히 수익률이 증가하여 유의미한 주가 상승이 발생하였다.

2. 시장충격과 주가 반응

2020년 초 코로나19의 발발은 증권시장에 전례 없는 급등락 사태를 불러왔다. 당시 다수의 기업이 주가 폭락에 대응하고 주가 관리를 위해 적극적으로 노력하고 있다는 신호를 투자자에게 보내기 위하여 자기주식 취득공시에 참여하였다. 주가 급락기에 이루어졌던 자기주식 취득공시의 효과를 분리해서 살펴보고, 주가가 급변동하지 않은 시기에도 주가 부양 효과가 있는지 확인하기 위하여 분석기간을 반기 단위로 구분하여 주가 반응을 살펴보았다.

<그림 Ⅳ-2>의 2020년 상반기(2020H1) 누적초과수익률 추세를 살펴보면 예상했던 바와 같이 공시가 주가를 반전시키는 데 효과적이었던 것으로 보인다. 공시 전 동종업체 대비 하락세를 보이던 주가는 공시 직후부터 초과수익을 실현했으며 공시 후 30일이 경과한 시점까지도 상승세가 이어졌다.

시장충격이 발생하지 않았던 기간에도 직접취득 공시 이후 주가는 상승하는 패턴을 보였다. 특히 2022년 상반기의 공시가 주가 상승효과가 가장 컸으며 2021년 상반기와 2022년 하반기 또한 공시 후 주가가 크게 상승하였다. 반면 2020년과 2021년 하반기에는 공시 직후 주가가 소폭 상승하고 다시 하락추세가 이어지는 일시적 효과에 그쳤다. 패널B의 신규 신탁취득 공시의 경우 2020년 상반기와 2022년 상반기에 직접취득과 마찬가지로 주가 반등이 나타난다. 그러나 이를 제외하고는 두드러진 상승세가 관찰되지 않는다.

한편 간접취득 연장 공시의 경우 주가 급변동기에도 신호로서 효과가 없었던 것으로 보인다. 패널C의 2020년 상반기(2020H1) 추세를 살펴보면, 공시 시점 이후에도 주가는 소폭 하락하고 있다. 직접취득이나 신규 신탁취득 공시가 극적인 반등세를 이끌었던 것과 대조적이다.

3. 재무지표에 따른 공시효과 차이

기업의 자기주식 취득 방법 선택이나 재무지표에 따라 수익률에 차이가 존재하는지 알아보았다. 공시 시점부터 공시 후 30일까지의 누적초과수익률([0, 30])을 피설명변수로 하여, 기업규모, 부채비율, 현금보유도, PBR, ROA 등의 재무변수가 설명력을 가지는지 분석하였다. 취득 방법에 따라 수익률에 차이가 발생하는지 확인하기 위하여 신규 신탁취득 더미변수(

<표 Ⅵ-2>의 (1)열은 직접취득, 신규 간접취득, 연장 간접취득의 모든 공시를 포함한 분석 결과이며, (2)열부터 (4)열은 각 공시 유형에 따라 구분하여 분석한 것이다. (1)열의 결과에 따르면 기업규모가 작을수록 초과수익률이 높게 나타났다. 소형주의 경우 대형주에 비하여 시장에 공개된 정보량이 적기 때문에 자기주식 취득 공시가 발표되면 공시정보가 가진 영향력이 상대적으로 더 커서 시장은 민감하게 반응한다. 또한 소형주의 주가 변동성이 더 크기 때문에 공시효과가 대형주에 비해 더 큰 것으로 해석할 수 있다.

기업규모는 (2)열과 (3)열에서 직접취득과 간접취득을 구분하여 분석한 결과에서도 마찬가지로 유의한 음의 값을 가졌다. 직접취득의 경우 그 외의 재무 특성변수가 주가수익률에 영향을 미치는 것으로 나타났다. 현금보유도가 낮고 장부가 대비 주가가 높으며 수익성이 낮은 종목일수록 공시반응이 더 컸다. 그러나 간접취득의 신규 신탁계약이나 연장 신탁계약 모두에서 대부분의 재무변수가 설명력을 가지지 못했다.

(5)열과 (6)열은 취득방법 선택이나 연장 여부에 따라 공시효과가 다르게 나타나는지 분석하기 위하여 더미변수를 이용한 결과이다. (5)열은 직접취득과 신규 간접취득 공시자료를 비교한 것이다. 재무변수를 통제한 이후에도 취득 방법 선택은 주가에 유의한 영향을 미치는 것으로 나타났다.

Ⅴ. 결론 및 시사점

본 보고서는 신탁계약을 통한 자기주식 취득제도를 검토하고 2020년 1월부터 2022년 9월까지 자료를 이용하여 신탁계약의 주가 반응을 연구하였다. 분석 결과 상당수 기업이 관행적으로 계약을 연장하였으며 자사주 취득이 장기에 걸쳐 이루어지는 것으로 나타났다. 그러나 자사주 취득 비율은 평균 83.88%로 목표 비율에 미치지 못했으며, 심지어 일부 기업은 신탁계약 기간 내에 취득한 자사주를 처분하여 실질적인 취득이 일어나지 않는 경우도 존재한다는 사실을 알 수 있었다.

신탁계약을 이용할 경우 직접취득의 번거로움을 피하여 손쉽게 주가를 관리할 수 있기 때문에 자사주를 직접 관리할 여력이 부족한 기업은 신탁계약에 대한 선호도가 높을 것으로 보인다. 게다가 신탁계약은 취득 강제성이 없어 취득 규모를 재량에 따라 조정할 수 있으며 기업의 상황에 따라 언제든 연장하거나 해지할 수 있으므로 운영 부담이 적다. 또한 공시요건이 강하지 않아 계약체결 후 3개월이 경과한 시점을 제외하고는 계약 해지까지 취득처분 상황에 대한 별도의 공시가 요구되지 않는다.

간접취득의 이러한 규제적 특성은 주가 반응 차이로 나타났다. 직접취득과 신규 체결한 간접취득 모두 주가 하락 시기에 주가를 반등시키는 효과가 있었으나, 간접취득이 직접취득에 비해 효력이 약했다. 기업의 재무적 특성을 통제한 후에도 간접취득 공시 후 30일간 주가 상승률이 직접취득에 비해 3.94%p 낮았다. 투자자가 자사주 취득 규정에 따른 차이를 일부 인지하고 있으며 이러한 사실이 주가에 반영된 결과로 판단된다.

투자자의 관점에서 간접취득은 파악하기 어렵고 불확실성이 높은 제도임이 분명하다. 신탁계약을 체결한 시점이 아닌 연장한 경우를 대상으로 분석을 시행한 결과 신탁계약 연장 공시는 시장에 즉각적인 영향을 미치지는 않으나 서서히 수익률이 증가하여 유의미한 주가 상승이 발생하였다. 그런데 투자자는 연장계약에 큰 관심을 기울이지 않을 뿐만 아니라 주의 깊게 살펴본다고 하더라도 공시에 취득 계획이나 취득 잔액 등에 대한 자세한 내용이 포함되지 않기 때문에 실제 취득 시점이나 규모를 예측하기 어렵다. 또한 신탁계약 내에서 이루어지는 처분은 직접처분과 달리 별도로 공시되지 않기 때문에 대량의 매도가 발생하여 주가가 하락한다고 하더라도 투자자는 이를 파악하기 불가능하다. 자기주식 신탁계약에 허용된 제도적 유연성으로 인해 기업과 외부 투자자 간 정보 비대칭은 심화된다고 볼 수 있다.

그런데 자기주식 취득에 대한 이론에 따르면 자기주식 취득의 핵심은 기업과 외부 투자자 간의 정보 비대칭을 완화하는 것이다. 대표적 이론인 저평가가설이나 정보신호가설은 기업가치가 저평가되어 있다는 사실을 외부 투자자에게 알리기 위한 수단으로 자기주식 취득이 이용된다고 해석한다. 또 다른 이론인 잉여현금흐름가설에서 주장하는 자사주 취득목적은 잉여현금을 자사주 취득에 이용하면 과잉투자 가능성이 낮아져 대리인비용을 줄일 수 있다는 정보를 시장에 전달하기 위한 것이다. 이론적 관점에서 자기주식 간접취득은 신규 취득 시점에서는 일부 효과가 있으나 계약이 장기화될수록 기업이 제공하는 정보가 불충분하며 시장에 보내는 신호가 모호해진다. 연구 결과에 따라 논란이 있으나 자사주 간접취득을 이용한 사적이익추구 및 내부정보를 이용한 불공정거래 가능성에 대한 의심에서 벗어날 수 없는 이유이기도 하다.

이처럼 기업이 직접 취득하거나 처분하는 자사주가 신탁계약을 이용한 자사주와 실질적으로 다르지 않음에도 불구하고 규제 차이로 인해 투자자가 제공받는 정보의 양과 시장에 미치는 영향에 차이가 발생한다. 기업과 투자자간의 정보 격차를 줄이기 위하여 신탁취득의 공시를 강화할 필요가 있다. 현재 신탁계약 체결에 따른 자사주 취득 및 처분 내역은 신탁 체결 후 3개월이 경과한 시점에 제공하게 되어 있다. 실제 신탁계약 체결 3개월 이후에도 자사주 취득이 빈번하게 일어나기 때문에 취득상황에 대한 공시 빈도를 높일 필요가 있다. 또한 별도의 제재 없이 관행적으로 이루어지고 있는 신탁계약 연장을 취득 현황과 향후 취득 계획, 연장 목적 등을 고려하여 필요성이 분명한 경우로 제한해야 한다. 또한 신탁계약 내에 이루어지는 처분에 대해서도 직접처분에 준하는 공시 수준을 적용하여 투자자에게 정보가 적시에 제공되도록 해야 한다.

더 나아가 신탁취득 제도의 본질적인 목적과 시장에 미치는 효익에 대해 고찰해볼 필요가 있다. 신탁취득은 급변하는 기업 내부 상황과 시장 불확실성에 대응하여 기업이 용이하게 주가를 관리할 수 있는 수단인 것은 사실이다. 그러나 기업이 별도의 공시 없이 일반투자자를 대상으로 자기주식 거래를 통한 차익을 실현하는 행위가 정당하다고 볼 수 있는지 의문이다. 주가 관리는 공시를 통해 시장에 명확한 신호를 전달하고 실제 공시한 사항을 충실히 이행하는 형태로 이루어지는 것이 바람직하며 가장 효과가 높을 것이다. 또한 신탁취득 제도가 도입되었던 90년대 말의 시장 환경과 비교하여 자본시장은 많은 발전을 이루었다. 국내 증권시장의 시장 규모와 유동성을 고려했을 때 기업이 직접 자사주를 관리하는 데 큰 제약이 있을 것으로 생각되지 않는다. 특히 직접취득과 규제 강도에 상당한 차이가 있는 신탁취득을 유지할 필요성을 검토하고 간접취득 제도를 전면적으로 개편할 필요가 있다.9)

1) 자사주펀드는 자기주식 취득 방법 중 가장 먼저 도입되었다. 기업이 자사주를 직접 취득하는 방법은 이보다 2년 후인 1994년 5월에 허용되었다.

2) 통계청(2014. 6. 11)

3) 정성창ㆍ김영환(2002)

4) 김영환ㆍ정성창(2008)

5) 강소현(2020), 강소현(2023)

6) 김효석(2005)

7) 지수 대비 초과수익률을 기준으로 산출한 누적초과수익률은 동종산업군 대비 초과수익률을 이용한 경우와 유사한 결과가 도출되어 이하의 분석에서는 동종산업군 대비 초과수익률을 이용한 결과만 보고한다.

8) 강소현(2023) 등의 연구 결과에 따르면 공시 이후 양의 초과수익이 발생하는 현상은 최근 기간에만 국한된 결과로 보이지 않는다. 그러나 본 보고서는 주가가 급등락하였던 2020년 1분기를 포함하여 그 이후 자료만을 포함하고 있어 분석기간을 확장할 경우 공시 전후의 반등 양상이 완화될 것으로 예상된다.

9) 본고는 자기주식 간접취득의 문제를 중점적으로 다루었다. 그러나 직접취득 및 처분에도 여전히 개선해야 할 문제점이 존재한다. 국내 시장에서 취득한 자사주는 대부분 소각되지 않고 기업 내부에 보유되며 보유한 자사주는 기업의 필요에 따라 자유롭게 처분된다. 또한 저평가가설과 달리 자기주식 취득이 기업의 본질가치에 대한 신호가 아닌 기회주의적으로 이용될 가능성이 존재한다. 따라서 자기주식 취득과 처분에 대한 전반적인 개선이 필요하다. 직접취득에 대한 보다 자세한 논의는 강소현(2023), 김준석(2023)을 참고하기를 바란다.

참고문헌

강소현, 2020, 자사주 취득 방법과 주주가치 제고 효과에 대한 소고, 자본시장연구원『자본시장포커스』2020-20호.

강소현, 2023,『국내 상장기업의 자기주식 취득 및 처분 동기와 장기효과』, 자본시장연구원 연구보고서 23-06.

고윤성ㆍ이정한, 2014, 자기주식 취득방법과 이익조정 및 배당,『세무와회계저널』15(3), 175-207.

김수정ㆍ이윤구ㆍ설원식, 2005, 이익소각 공시가 주주의 부에 미치는 영향: 일반 목적의 자사주 매입 공시와의 비교를 중심으로,『대한경영학회지』18(1), 107-133.

김영환ㆍ정성창, 2008, 자사주 매입방식의 결정요인과 기회주의 가설의 검증,『한국경영학회지』37(5), 1205-1232.

김준석, 2023,『인적분할과 자사주 마법』, 자본시장연구원 이슈보고서 23-06.

김효석, 2005, 증권거래법 일부개정법률안.

박영규, 2008, 자기주식매입의 유상증자에 대한 신호효과,『재무관리연구』25(1), 50-84.

변진호, 2004, 저평가 자사주 매입 공시의 허위정보 신호효과와 장기성과,『한국증권학회지』 33(1), 207-248.

설원식ㆍ김수정, 2005, 자기주식 취득 및 처분 공시가 주주의 부에 미치는 영향: 취득 및 처분목적을 중심으로,『재무관리연구』22(1), 37-69.

정무권, 2005, 자사주매입 선언에 따른 주주 및 채권자의 부의 변화,『재무연구』18, 67-99.

정성창, 2004, 유상증자와 자사주취득의 동기: 불공정거래 가능성의 제기,『한국증권학회지』33(3), 123-156.

정성창ㆍ김영환, 2002, 코스닥시장의 자기주식 취득에 대한 연구, 춘계학술대회 발표논문.

정성창ㆍ이용교, 1996, 자사주매입과 자사주펀드 제도의 유효성 분석,『재무연구』11, 241-271.

통계청, 2014. 6. 11, 최근 경기순환기의 기준순환일 설정안, 보도자료.