Find out more about our latest publications

Risk Factors in US Financial Markets, and Spillovers from Financial Unrest

Issue Papers 23-12 Jul. 10, 2023

- Research Topic Macrofinance

- Page 22

In March 2023, a series of bankruptcies among small and mid-sized banks in the US raised the possibility of another financial crisis originating in the US. Fortunately, the authorities quickly stepped in to stabilize the market, and prevented the market shock from growing substantially. However, signs of unrest persist due to the vulnerability of small banks and the ongoing slowdown in the commercial real estate market.

Financial unrest in the US could not only impact the US economy but also spill over into the real and financial sectors of Korea. The empirical analysis suggests that financial unrest slowed down both inflation and the US economy, while the Fed mitigated the impact by adjusting policy rates. An analysis of the spillover effect on Korea revealed that US financial unrest primarily resulted in a slowdown in the manufacturing sector, along with adverse effects on the financial markets. To elaborate, stock prices declined, while there was an increase in the spreads between corporate and government bonds, as well as between CP and call rates, along with fluctuations in the won-dollar exchange rate. It was also noted that the impact on yield spreads and exchange rates persisted for a considerable period. Since this episode of US financial unrest in March was not of significant magnitude, improved market conditions were able to effectively counteract the impact. Considering this, it is unlikely that the Fed will reverse its current stance due to US financial conditions. Furthermore, it is unlikely that the Fed will reduce interest rates this year, as US inflation is not expected to reach the Fed's target in the short term.

As the Fed is expected to maintain its tightening stance, the potential risk factors in the US financial markets could possibly lead to small- or large-scale financial unrest. This necessitates Korea to closely monitor any financial turmoil in the US that has the potential to trigger disturbances in the Korean financial markets. It appears premature to consider altering the monetary policy stance in light of Korea's current inflation status. Nonetheless, it is advisable to promptly address any indications of growing financial stability risks through measures such as targeted liquidity provision. Specifically, it is essential to pre-establish micro-level policy toolkits, particularly in the corporate bonds and CP markets, where any adverse impact could potentially evolve into a long-term issue.

Financial unrest in the US could not only impact the US economy but also spill over into the real and financial sectors of Korea. The empirical analysis suggests that financial unrest slowed down both inflation and the US economy, while the Fed mitigated the impact by adjusting policy rates. An analysis of the spillover effect on Korea revealed that US financial unrest primarily resulted in a slowdown in the manufacturing sector, along with adverse effects on the financial markets. To elaborate, stock prices declined, while there was an increase in the spreads between corporate and government bonds, as well as between CP and call rates, along with fluctuations in the won-dollar exchange rate. It was also noted that the impact on yield spreads and exchange rates persisted for a considerable period. Since this episode of US financial unrest in March was not of significant magnitude, improved market conditions were able to effectively counteract the impact. Considering this, it is unlikely that the Fed will reverse its current stance due to US financial conditions. Furthermore, it is unlikely that the Fed will reduce interest rates this year, as US inflation is not expected to reach the Fed's target in the short term.

As the Fed is expected to maintain its tightening stance, the potential risk factors in the US financial markets could possibly lead to small- or large-scale financial unrest. This necessitates Korea to closely monitor any financial turmoil in the US that has the potential to trigger disturbances in the Korean financial markets. It appears premature to consider altering the monetary policy stance in light of Korea's current inflation status. Nonetheless, it is advisable to promptly address any indications of growing financial stability risks through measures such as targeted liquidity provision. Specifically, it is essential to pre-establish micro-level policy toolkits, particularly in the corporate bonds and CP markets, where any adverse impact could potentially evolve into a long-term issue.

Ⅰ. 논의 배경

불과 몇 개월 전까지만 해도 미국 중소은행들의 연이은 파산은 예상하기 어려운 사태였다. 미 연준이 작년 11월에 발간한 금융안정 보고서에 따르면, 은행 부문은 지급 능력이 충분하게 뒷받침되어 있어 유동성 리스크가 낮은 것으로 평가된 바 있다. 하지만, 금년 3월 들어 실리콘 밸리 은행(SVB)1)에 이어 시그니쳐 은행이 파산하였고, 퍼스트 리퍼블릭 은행은 유동성 위기를 맞는 등 연쇄적으로 금융불안이 발생하였다. 단 몇 개월 전임에도 불구하고 상반된 진단2)이 내려졌다는 점을 보면, 정책 당국도 이러한 사태를 전혀 예견하지 못했다는 점을 알 수 있다.

전술한 중소은행들은 자산ㆍ부채 간 만기불일치, 대규모의 보유자산 평가손, 높은 비부보 예금 비중 등의 문제로 인해 뱅크런을 겪었다. 이러한 문제들은 일차적으로 연준의 고강도 긴축으로 표면화되기는 했지만, 보다 근본적으로는 해당 은행들의 과도한 수익 추구와 관리 부실, 정책 당국의 감독 부족으로 누적되어 온 것으로 생각된다. 그리고 비슷한 불안 요인을 안고 있지만 아직 수면 위로 드러나지 않은 중소은행들이 다수 존재할 것이라는 우려가 여전히 남아 있다.

글로벌 금융위기를 통해 분명히 경험했듯이, 미국의 금융불안은 자국뿐만 아니라 우리나라의 실물 경기와 금융시장에도 상당히 부정적인 영향을 미칠 수 있다. 다행히 3월의 금융불안은 정책 당국의 조치 이후 조기에 진정되어 실질적인 충격의 강도는 크지 않았던 것으로 판단된다. 하지만, 현재 미국 금융시장에는 중소은행을 중심으로 여러 리스크 요인이 잠재해 있어 추가적인 충격에 대비할 필요가 있다. 이에 본고에서는 3월의 불안 이후 미국 내 금융상황과 리스크 요인에 대해 평가하고, 미국발 금융불안 충격의 영향에 대해 분석함으로써 시사점을 제시하고자 한다.

본고의 구성은 다음과 같다. 먼저, Ⅱ장에서는 최근 금융불안에 대해 평가하고 리스크 요인에 대해 살펴본다. 그리고 Ⅲ장에서는 미국의 금융불안이 연준의 통화정책에 미치는 영향과 우리나라의 실물 및 금융시장에 미치는 영향에 대해 구체적으로 분석하도록 하겠다. 마지막으로 Ⅳ장에서는 향후 연준의 통화정책과 정책적 시사점에 대해 논의하고자 한다.

Ⅱ. 최근 금융불안에 대한 평가 및 리스크 요인

본 장에서는 3월의 금융불안 이후 미국 내 금융상황에 대해 평가하고, 현재 미국 금융시장 내에 잠재되어 있는 주요 리스크 요인에 대해 논의하도록 하겠다.

1. 경과 및 평가

SVB 파산 직후, 연준 등 정책 당국은 불안의 확산을 방지하기 위해 신속하게 유동성 공급 및 예금자 보호 조치를 취하였다. 연준은 신규 대출제도(Bank Term Funding Program: BTFP)를 실시하고 재할인 창구(discount window) 대출3)의 담보 인정 비율을 상향4)하여 금융기관들이 유동성을 확보할 수 있게 하였다. 새로 도입된 BTFP에서는 액면가 그대로 담보 가치가 인정되어, 시가평가로 담보 가치를 인정하는 재할인 창구 대출보다 완화된 대출 조건이 적용되었다.5) 또한 연방 예금보험공사(FDIC)는 예금자 보호를 위해 가교 은행을 설립하고 연준이 여기에 자금을 공급하였다. 이에 따라 파산 은행의 예금자들이 가교 은행을 통해 한도의 제약없이 예금을 인출하는 것이 가능해졌다.

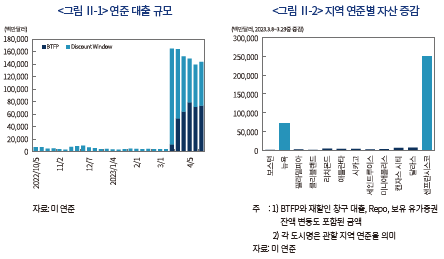

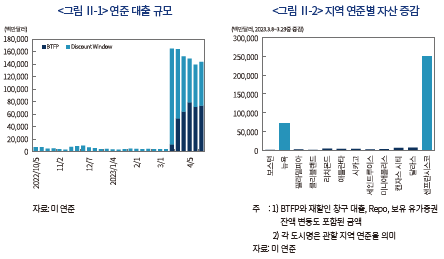

통상적으로 시중은행은 낙인효과6)(stigma effect)에 대한 우려 때문에 재할인 창구 등 중앙은행 대출을 기피하는 경향이 있다. 그럼에도 불구하고, SVB 파산 직후 연준의 대출이 크게 증가했다는 사실은 당시 긴박하게 유동성이 필요했던 은행들이 존재했음을 의미한다. 즉, <그림 Ⅱ-1>과 같이 SVB 파산 직후에 연준의 대출이 급증한 것은, 대량 인출 사태의 확산을 우려한 은행들이 일시에 유동성 지원 프로그램을 이용한 데 따른 것으로 볼 수 있다. 다만, <그림 Ⅱ-2>에서 지역 연준별 자산 증감 내역을 보면, 대출 자금은 뉴욕 연준에서 일부, 샌프란시스코 연준에서 대부분 공급된 것으로 나타나 그러한 필요성은 파산 은행의 소재 지역에 한정되었던 것으로 보인다.

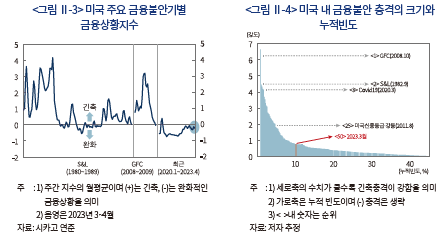

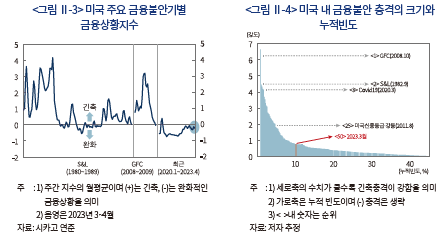

정책 당국의 조치 이후 금융시장이 빠르게 안정되면서 3월 중소은행들의 파산 사태가 미국 금융시장에 큰 타격을 주지는 않은 것으로 판단된다. <그림 Ⅱ-3>은 주요 금융불안기인 저축ㆍ대부조합(S&L) 사태 및 글로벌 금융위기(GFC) 시기와 2020년 1월 이후부터 최근까지의 미국 내 금융상황지수7)(Adjusted National Financial Conditions Index: FCI)를 나타내고 있다. 이에 따르면, 저축ㆍ대부조합 사태나 글로벌 금융위기 당시에는 금융상황이 크게 악화되고 긴축적인 금융상황이 장기간 지속되었다는 점을 확인할 수 있다. 금년 중소은행 파산 사태의 경우, 현재까지는 큰 충격으로 작용하지 않은 것으로 보인다. 3월 들어 FCI가 긴축적인 방향(상승)으로 움직이기는 했지만 그 폭이 크지 않고 FCI의 상승도 일시적인 것으로 나타난다.

아울러 금융상황지수 자체의 변화뿐만 아니라 금융상황지수에 대한 충격을 식별하여8) 비교하는 경우에도 이러한 평가는 크게 달라지지 않는다. <그림 Ⅱ-4>는 1980년 1월부터 2023년 3월까지의 기간에 발생한 금융불안 충격의 크기와 누적 빈도(백분율)를 나타내고 있다. 먼저 크기로 보면, 금융위기 발생 초기9)에 최대, S&L 사태가 본격화된 시기에 그 다음으로 큰 충격이 발생했던 것으로 분석된다. 금년 3월의 충격과 비교하면, 두 위기 때의 최대 충격은 각각 9배 및 6배에 이르는 수준이었고, 해당 기간 중 상당한 크기의 충격이 반복되기도 했다. 아울러 빈도로 보면, 금년 3월의 충격은 약 10%의 누적 확률에 해당하는 수준으로 나타난다. 따라서 경험적으로 볼 때 이것은 이례적으로 큰 충격(tail event)이 아니었다는 점을 알 수 있다.

한편, <그림 Ⅱ-4>에는 정부 부채한도 협상 문제로 미국의 신용등급이 강등(2011년 8월)되면서 발생한 충격도 표시되어 있다. 당시 정치권의 뒤늦은 합의로 인해 S&P가 미 국채의 신용등급을 한 단계 강등하면서 상당한 충격이 야기된 바 있다. 이는 금년 3월의 2배 이상, 누적 확률로는 5% 이내 수준에 해당하여 그 강도가 작지 않았던 것으로 평가된다. 금년에도 부채한도 증액 협상이 교착상태에 빠지면서 시장의 불안감이 한동안 높아진 바 있다. 만약 6월 초에 합의가 마무리되지 못하고 연방 정부의 디폴트 상황이 발생했더라면, 이에 따른 충격은 2011년 신용등급 강등 때보다 한층 더 컸을 것으로 판단된다.

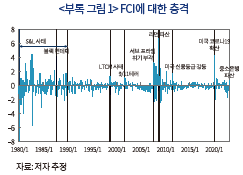

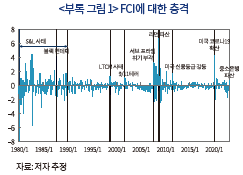

<부록 그림 1>에는 이외에도 블랙 먼데이, LTCM 사태, 9/11 테러, 서브 프라임 위기 부각 시 등에 발생했던 FCI 충격이 전체 시계열과 함께 표시되어 있다. 여기에서는 금년 3월보다 전술한 사례에서 유발된 충격이 상대적으로 컸다는 것을 알 수 있다. 또한 신용등급 강등의 경우, 글로벌 금융위기 이후 발생한 충격 중에서는 상당히 강도가 높은 편이었다는 점도 나타난다.

2. 리스크 요인

연준과 FDIC 등의 조치 이후 금융시장이 빠르게 안정되면서 3월 충격의 여파는 거의 가라앉은 것으로 생각된다. 하지만, 현재 미국 금융시장에는 다수의 리스크 요인이 잠재해 있어 여전히 안심할 수 없는 상황이다. 뉴욕 연준의 최근 서베이10)에 따르면, 은행 부문, 상업용 부동산, 정부 부채한도 문제 등이 주요 불안 요인11)으로 조사되었는데, 학계나 언론에서도 이에 대한 우려가 계속 제기되고 있다. 본 절에서는 당면하고 있는 은행과 상업용 부동산 부문의 문제에 초점을 맞추어 리스크 요인에 대해 논의하고자 한다. 다만, 미 정부 부채 문제로 인한 잠재적 위기상황은 향후에도 드물지 않게 발생할 것으로 생각되므로 장기적인 리스크 요인으로 주시해야 할 필요가 있다.

가. 은행 부문

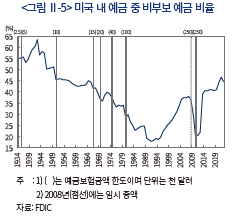

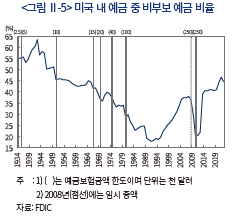

현재 미국 은행권에는 누적된 만기보유 채권의 평가손과 높은 비부보 예금 비율 등으로 인한 뱅크런 발생 위험이 잠재해 있다. Jiang et al.(2023)에 따르면, 미국 은행권 전체적으로 만기 보유채권의 평가손은 약 2.2조 달러(2023년 1분기, 전년동기대비)에 이르는 것으로 추정된다. 이는 자산 총액(장부가)의 약 10%에 해당하는데 동 비율이 20% 이상인 은행도 다수(약 250개)인 것으로 분석되었다. 아울러 2010년대 중반부터 비부보 예금이 급격하게 증가하면서 2021년에는 거의 절반인 47%까지 높아졌는데, 이는 1949년 이래 최대치에 해당한다(<그림 Ⅱ-5>). 2022년 들어 45%로 소폭 낮아지기는 했지만 이 비율도 역사적으로 매우 높은 수준이다.12)

일반적으로, 은행의 건전성이 악화되는 경우 비부보 예금 비율이 높을수록 유동성 위기가 뒤따를 가능성이 크다. 즉, 은행의 자금이 고갈되기 전에 예금을 인출하고자 하는 유인은 부보 예금자들보다 비부보 예금자들이 더 클 것이기 때문에 비부보 예금자들로 인해 예금인출이 가속화될 수 있다. 그러한 대표적인 예가 SVB와 시그니쳐 은행의 파산 사태로, 두 은행의 전체 예금 중 비부보 예금 비율은 90% 내외에 이르는 수준이었다.

Jiang et al.(2023)은 전술한 두 요인(평가손과 비부보 예금)으로 인해 각 은행의 비부보 예금에서 10%만 인출되더라도 미국 내 66개의 은행이 지급불능13) 사태를 겪을 것으로 분석하였다. 이들 개별 은행의 평균적인 규모는 작지만, 총자산은 약 2,100억 달러로 전체 규모는 SVB와 거의 동일한 수준이다. 따라서 상기 시나리오가 현실화된다면 SVB급 은행 하나가 지급불능 사태에 빠지게 되는 것으로 해석할 수 있다. 동 분석은 재무적인 관점에서 직접적인 영향만을 추정한 것이므로, 소셜 미디어나 온라인 뱅킹 등을 통한 파급효과가 작용한다면 그 범위와 규모가 한층 더 확대될 가능성이 있다. 즉, 최근과 같이 예금자들의 주의 수준이 높아진 상황에서 특정 은행의 취약성이 부각된다면, 해당 은행뿐만 아니라 일부 유사성이 있는 여타 은행들로까지 디지털 뱅크런이 확산될 수 있다.

대규모 예금인출로 인해 긴급 유동성이 필요한 은행들은 보유 자산을 담보로 연준의 대출 프로그램을 활용할 수도 있다. 하지만, 여기에서는 높은 조달비용과 담보의 제약이 문제점으로 작용할 수 있다. 즉, 요구불 예금이나 단기 예금은 조달비용14)이 매우 낮은 반면, 연준의 대출은 정책금리(Fed funds rate)15)에 가까운 조달비용이 수반된다. 따라서 예금이 대량 인출되면서 저비용의 예금이 고비용의 연준 대출로 대체된다면 해당 은행의 수익성이 더욱 악화될 수밖에 없다. 또한, 퍼스트 리퍼블릭 은행과 같이 자산에서 국공채 등 안전자산보다 일반대출 비중이 높은 은행들의 경우 연준의 대출 프로그램을 이용하는 데 한계가 있어16) 취약점을 안고 있다.

나. 상업용 부동산 부문

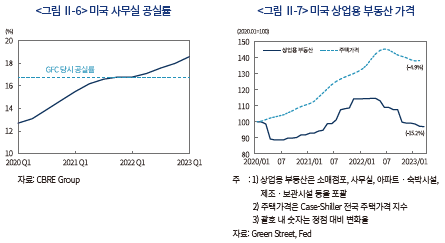

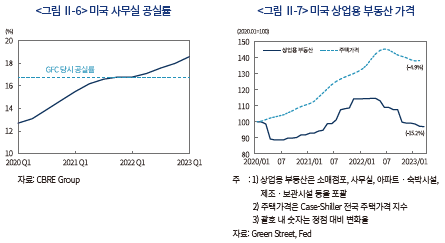

상업용 부동산 측면에서는 가격 급락에 따른 시스템 리스크 발생 가능성이 잠재해 있다. 이는 사무실 등 상업용 부동산에 대한 수요 감소 추세와 함께, 금융기관의 신용 축소와 차주의 상환능력 저하가 맞물리면서 현실화될 수 있다. 먼저, <그림 Ⅱ-6>에서 미국 내 사무실 공실률을 보면, 코로나19 발생 이후 지속적으로 수요가 감소하면서 최근 공실률은 주요 침체기 수준을 넘어서는 것으로 나타난다.17) 여기에 연준의 긴축이 가세하면서 상업용 부동산 가격이 단기간에 큰 폭으로 하락하는 등 시장의 부진이 지속되고 있다(<그림 Ⅱ-7>).

상업용 부동산 구입은 상당 부분 부채로 조달되는데, 현재 동 부채의 잔액은 총 4조 5,000억 달러로 미국 GDP의 약 18%(2022년 기준)에 이르는 수준이다. 이 중 은행과 보험사의 대출이 각각 39% 및 15%, 민간의 유동화증권(commercial mortgage-based securities: CMBS) 기반 대출이 13%의 비중을 차지하고 있다.18) 여기에서 은행 대출은 중소은행19) 중심, CMBS 대출은 대형은행 중심으로 이루어지면서 이원화된 구조를 띤다. 최근 상업용 부동산 가격은 주택 가격보다 가파르게 하락하고 있는데, 이로 인해 상업용 부동산에 대한 은행권의 대출 관리가 특히 강화되고 있는 것으로 보인다.20)

이러한 여건하에서 미국의 경기가 급속하게 둔화된다면, 동 시장에 잠재되어 있던 리스크가 표면으로 드러날 가능성이 있다. 즉, 영업 부진이나 폐업 문제가 심화되면서 차주의 상환능력 저하로 대출이 부실화되고, 신용 축소와 가격 하락이 다시 이어지는 악순환이 발생할 수 있다.21) 특히, 상업용 부동산에 대한 중소은행들의 익스포져22)가 높다는 점을 감안할 때 이 시장의 불안은 중소은행에 보다 큰 영향을 줄 것으로 판단된다.

Ⅲ. 미국 금융불안의 영향

미국 내 금융불안은 자국뿐만 아니라 우리나라의 실물 및 금융 부문에까지 그 영향이 파급될 수 있다. 본 절에서는 계량 분석을 통해 미국과 우리나라의 실물ㆍ금융변수에 미치는 영향에 대해 구체적으로 논의하고자 한다.

1. 미국 내 영향

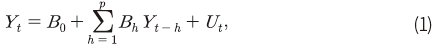

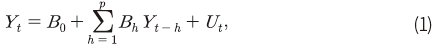

본 절에서는 구조 벡터자기회귀(structural vector autoregression, 이하 구조 VAR) 모형을 바탕으로 금융불안 충격을 식별하고 미국 내 주요 변수들의 반응을 추정한다. 분석에 이용될 모형은 다음과 같이 설정된다.

식 (1)에서  는 내생변수 벡터,

는 내생변수 벡터,  는

는  의 시차변수 벡터이며

의 시차변수 벡터이며  은 상수항 벡터,

은 상수항 벡터,  는 계수 행렬,

는 계수 행렬,  는 오차항의 벡터로 정의된다. 동 모형에서 금융불안 충격은 시카고 연준이 공표하는 FCI에 대한 충격으로 정의된다. 분석에서는 FCI에 대한 충격 발생시 경기와 물가의 변화와 연준의 정책 반응을 추정하는 데 초점을 맞춘다. 추정에 사용되는 FCI는 105개 금융변수에 내재된 공통요인을 포착하여 시장 전반적인 긴축ㆍ완화 정도를 측정하는 지표로 폭넓게 사용되고 있다. 동 지표의 구축방식에 내재된 특성상, 특정 부문의 불안이 일시적으로 부각되더라도 시스템적인 충격이 크지 않다면 FCI가 크게 변화(상승)하지 않게 된다. 따라서 전반적인 금융 여건을 진단하고 이에 따른 거시경제적 변화를 분석하는 데 FCI가 유용하게 활용되고 있다.23) 아울러, FCI를 통해 각 불안기별 금융시장의 위축 정도를 어느 정도 일관되게 비교해 볼 수 있다는 이점이 존재한다. 즉, 금융불안은 각기 다른 배경에서 발생해 왔기 때문에 특정 부문에 한정된 금융변수보다는 FCI를 활용함으로써 종합적인 관점에서 그 강도를 비교할 수 있다.

는 오차항의 벡터로 정의된다. 동 모형에서 금융불안 충격은 시카고 연준이 공표하는 FCI에 대한 충격으로 정의된다. 분석에서는 FCI에 대한 충격 발생시 경기와 물가의 변화와 연준의 정책 반응을 추정하는 데 초점을 맞춘다. 추정에 사용되는 FCI는 105개 금융변수에 내재된 공통요인을 포착하여 시장 전반적인 긴축ㆍ완화 정도를 측정하는 지표로 폭넓게 사용되고 있다. 동 지표의 구축방식에 내재된 특성상, 특정 부문의 불안이 일시적으로 부각되더라도 시스템적인 충격이 크지 않다면 FCI가 크게 변화(상승)하지 않게 된다. 따라서 전반적인 금융 여건을 진단하고 이에 따른 거시경제적 변화를 분석하는 데 FCI가 유용하게 활용되고 있다.23) 아울러, FCI를 통해 각 불안기별 금융시장의 위축 정도를 어느 정도 일관되게 비교해 볼 수 있다는 이점이 존재한다. 즉, 금융불안은 각기 다른 배경에서 발생해 왔기 때문에 특정 부문에 한정된 금융변수보다는 FCI를 활용함으로써 종합적인 관점에서 그 강도를 비교할 수 있다.

한편, 경기와 물가 지표로는 산업생산지수(로그 변환)와 소비자물가지수(로그 변환)를 각각 사용한다. 또한, 유가도 금융시장 상황에 영향을 받고, 물가에 반영될 수 있다는 점을 감안하여 WTI 유가(로그 변환)의 반응을 분석한다. 그리고 연준의 반응은 정책금리(effective Fed funds rate)의 변화를 통해 분석하도록 하겠다. 상기 변수들을 포함한 VAR 모형에서 금융불안 충격은 산업생산지수, 소비자물가지수, 정책금리, 금융상황지수, WTI 유가 순의 축차적 조건(recursive identification)에 따라 식별된다.24) 표본기간은 S&L 사태와 같은 미국 내 주요 금융불안기를 포함하기 위해 1980년 1월부터 2023년 3월까지로 하였다. VAR 모형의 시차는 SIC(Schwarz Information Criterion)에 따라 2개월이 적용되었다.

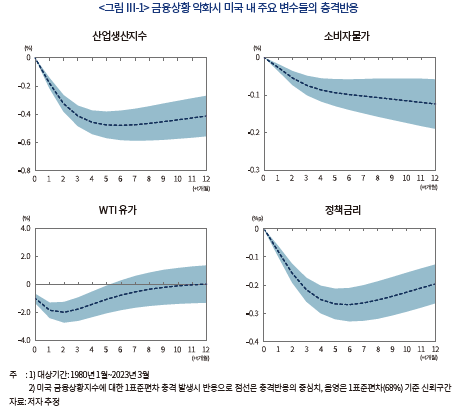

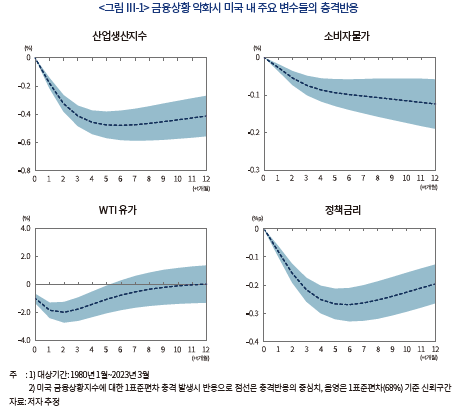

<그림 Ⅲ-1>은 전술한 방법에 따라 추정한 변수별 충격반응을 나타내고 있다. 먼저, 좌측 및 우측 상단의 그림은 FCI에 부정(긴축)적인 충격이 발생하는 경우, 미국 내 산업생산지수와 소비자물가가 유의하게 하락한다는 점을 보여준다. 금융상황의 악화는 가계와 기업의 자금조달에 불리하게 작용함으로써 실물 경기를 둔화시키는 것으로 생각할 수 있다. 물가의 경우 통상 실물 경기에 다소 후행하는 경향이 있지만, 유가가 금융상황에 민감하게 반응함에 따라(<그림 Ⅲ-1> 좌측 하단) 이를 반영하여 큰 시차 없이 하락하는 것으로 판단된다.

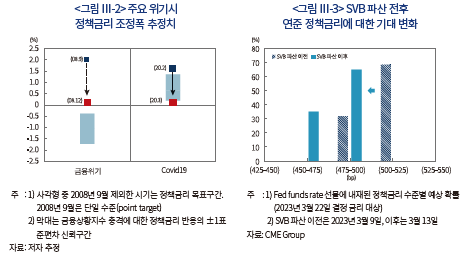

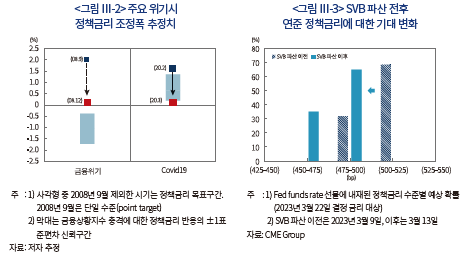

<그림 Ⅲ-1>의 우측 하단은 연준의 정책금리가 유의하게 낮아진다는 점을 나타내고 있다. 이는 연준이 금리 인하를 통해 금융불안 충격에 대응해 왔음을 실증적으로 보여주는 결과라 할 수 있다. 특히, 주요 위기 당시 충격의 강도를 반영하여 비교해 보면, 모형의 추정치와 실제 정책금리 결정이 크게 다르지 않다는 점을 확인할 수 있다. <그림 Ⅲ-2>의 좌측 영역은 2008년 금융위기 충격에 대응하는 경우를 가정하여 추정한 정책금리 구간(±1표준편차)을 막대로, 위기 발생 전후의 실제 정책금리를 사각형으로 표시하고 있다. 모형에서 정책금리는 마이너스 수준(-1.73~-0.39%)으로 추정되는데 실제 정책금리는 실효 하한(zero lower bound: ZLB)인 0% 수준까지 인하된 바 있다.25) 아울러 <그림 Ⅲ-2>의 우측 영역은 코로나19로 인한 금융불안 충격에 대응하는 경우인데, 모형 상 추정치는 0.20~0.72%로 실제 정책금리(0~0.25%)에 상당히 가까운 수준으로 나타난다.

다음으로 3월 발생한 금융불안 충격의 강도를 고려하여 분석하면, 당시 충격은 정책금리를 약 20bp 낮추는 요인으로 작용했던 것으로 분석된다.26) SVB 사태 이전에는 3월 FOMC에서 정책금리가 50bp 인상되는 것이 유력한 결과로 전망되었다. 하지만, 중소은행 파산 사태로 금융상황이 악화되면서 시장참가자들의 3월 정책금리 전망은 50bp 인상에서 25bp 인상으로 하향 조정되었다(<그림 Ⅲ-3>). 그리고 Powell 의장은 FOMC 직후 기자간담회에서 은행 파산이 금리 인상에 준하는 긴축효과를 유발하는 것으로 평가한다고 언급하여27) 금리 인상폭이 당초 계획보다 축소되었음을 시사한 바 있다. 사후적으로 볼 때, 3월 금융불안의 경우 그 충격이 크지 않았고 이후 금융상황이 호전되면서 그 영향이 상당 부분 상쇄될 것으로 보인다. 따라서 전반적인 통화정책 기조는 연준이 은행 파산 사태 이전에 계획했던 방향에서 크게 달라지지 않을 것으로 판단된다.

2. 한국 내 영향28)

본 절에서는 위의 구조 VAR 모형에서 식별된 금융불안 충격을 이용하여 한국 내 변수들의 반응을 분석한다. 미국의 금융불안 충격에 대한 국내 변수의 반응은 아래의 모형을 바탕으로 Jordà(2005)의 국소투영법(local projection)을 이용하여 추정한다.

식 (2)에서  는 분석대상 변수,

는 분석대상 변수,  는 금융불안(FCI) 충격,

는 금융불안(FCI) 충격,  는

는  의 시차가 적용된 통제변수29)들의 벡터로 정의된다. 분석 대상은 전산업(농림어업제외) 및 광공업 산업생산지수(로그 변환), 소비자물가지수(로그 변환), 콜 금리, CP(91일물 A1)와 콜 금리 간 스프레드, 신용 스프레드(회사채 AA- 3년물과 국고채 3년물 금리차), KOSPI지수(로그 변환), 환율(로그 변환)로 하여 주요 실물ㆍ금융변수들의 반응을 종합적으로 살펴보고자 한다.

의 시차가 적용된 통제변수29)들의 벡터로 정의된다. 분석 대상은 전산업(농림어업제외) 및 광공업 산업생산지수(로그 변환), 소비자물가지수(로그 변환), 콜 금리, CP(91일물 A1)와 콜 금리 간 스프레드, 신용 스프레드(회사채 AA- 3년물과 국고채 3년물 금리차), KOSPI지수(로그 변환), 환율(로그 변환)로 하여 주요 실물ㆍ금융변수들의 반응을 종합적으로 살펴보고자 한다.

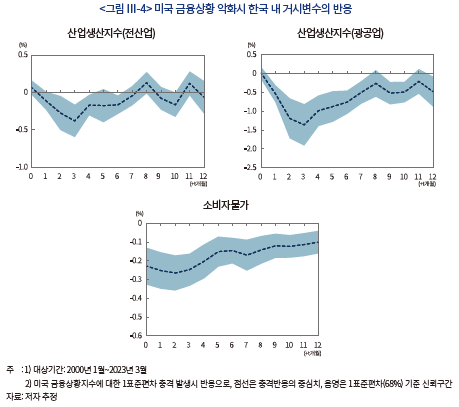

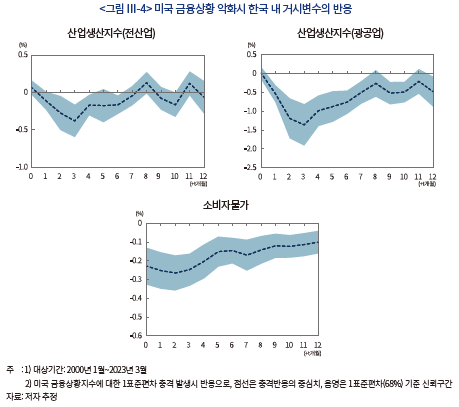

가. 실물

본 절에서는 미국의 금융불안 충격이 국내 경기와 물가에 미치는 영향에 대해 살펴본다. 먼저, <그림 Ⅲ-4>는 미국의 금융불안 충격 발생 시 국내 산업생산지수와 소비자물가지수의 반응을 나타내고 있다. 좌측 및 우측 상단의 그림은 각각 전산업 및 광공업 산업생산지수의 충격반응으로, 반응의 크기와 유의성을 보면 서비스업이 포함된 전산업보다 광공업 부문이 보다 민감하게 영향받는다는 점을 알 수 있다. 이러한 결과는, 수출 비중이 높은 광공업 부문의 특성상 미국 금융불안에 따른 글로벌 경기 둔화에 더 크게 영향을 받기 때문으로 볼 수 있다.

<그림 Ⅲ-4>의 하단을 보면, 국내 소비자물가도 하락하는 모습을 나타낸다. 이러한 물가의 반응은 경기와 함께, 앞서 언급한 유가의 움직임과도 연관지어 해석할 수 있다. 즉, 미국의 금융불안은 국제유가를 하락시켜 국내 석유류 가격 등을 중심으로 소비자물가를 낮추는 요인으로 작용한다는 점이다.

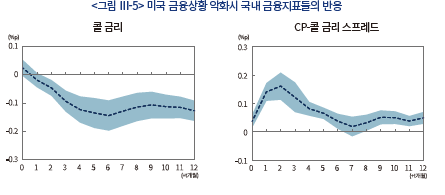

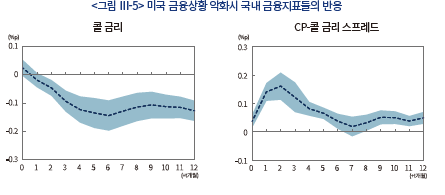

나. 금융시장

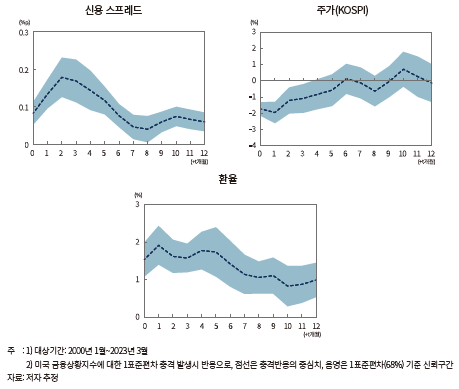

미국의 금융불안은 경기 전망이나 리스크 프리미엄 등의 경로를 통해 국내 금융시장에 부정적인 영향을 미칠 수 있다. <그림 Ⅲ-5>는 국내 주요 금융지표들의 충격 반응을 나타내고 있다. 먼저, 콜 금리(좌측 상단)는 미국의 금융불안 발생시 하락하는 것으로 나타난다. 이러한 콜 금리의 반응은 한국은행이 기준금리 인하나 인상폭 축소 등을 통해 해당 충격을 완화해 왔다는 것을 의미한다. 이러한 정책 대응은 일차적으로 단기물을 중심으로 시장금리 상승을 어느 정도 억제하는 효과30)가 있다. 그럼에도 불구하고, 전반적으로 신용 경계감이 높아지면서 CP와 회사채 시장에 대한 금융불안 충격의 영향은 다소 오래 지속되는 것으로 분석된다. <그림 Ⅲ-5>의 우측 상단을 보면, CP와 콜 금리 간 스프레드가 6개월 내외 확대되는데 회사채 신용 스프레드의 반응도 비슷한 크기와 지속성을 보인다(<그림 Ⅲ-5> 좌측 중앙). 추정 결과에 따르면 3월과 같은 미국의 금융불안은 신용 스프레드를 최대 약 15bp 내외 상승시키고, 그 영향이 6개월 가까이 뚜렷하게 지속되는 것으로 분석된다.

<그림 Ⅲ-5>에서 우측 중앙의 그림은 KOSPI 지수의 충격반응을 나타내고 있다. 3월 충격을 기준으로 환산해보면 국내 주가는 최대 약 1.5% 하락하는 것으로 추정된다. 다만, 그 영향은 2~3개월 이후 거의 소멸되어 여타 금융지표들에 비해 지속성이 상대적으로 낮음을 알 수 있다.

<그림 Ⅲ-5>의 하단에는 원ㆍ달러 환율의 반응이 나타나 있다. 충격 이후 1개월 시점에 원ㆍ달러 환율의 상승폭이 가장 높은데, 3월의 충격을 기준으로 보면 최대 상승폭은 1.5% 내외로 추정된다. 이러한 영향은 6개월 이후에는 거의 반감되지만, 이후에도 상당 기간 충격 이전에 비해 높은 수준의 환율이 유지되는 것으로 보인다.

이상의 결과를 보면, 국내 금융시장 지표들은 미국의 금융불안 충격에 일정 기간 부정적인 영향을 받으면서 앞 절의 실물 지표(산업생산지수)와 크게 괴리되지 않는 흐름을 나타낸다. 이는 기본적으로 금융시장 지표가 경기 상황을 어느 정도 반영하는 데 따른 결과라 할 수 있다. 다만, 주가보다 금리 스프레드와 원ㆍ달러 환율에 대한 영향이 오래 지속되면서 회복 속도에 차이가 존재하는 것은 시장 고유의 마찰 및 구조적인 요인이 작용하기 때문으로 판단된다.

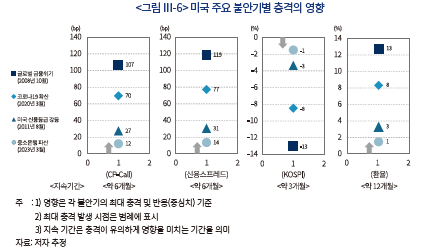

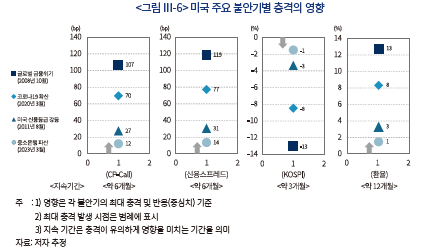

한편, 각 금융시장 지표에 대한 추정 결과를 바탕으로 과거 미국의 주요 금융불안기에 발생한 충격이 국내 금융시장에 미친 영향을 정량적으로 분석해 볼 수 있다. <그림 Ⅲ-6>은 금년 3월 충격과 함께 글로벌 금융위기, 코로나19 확산, 미국 신용등급 강등 당시의 충격31)에 대한 국내 금융지표들의 반응을 나타내고 있다. 이 중 글로벌 금융위기시(리먼 파산 직후)의 영향이 가장 컸는데, 당시 충격은 CPㆍ콜 금리 및 신용 스프레드를 약 110bp 내외(최대 반응, 이하 동일) 확대시키고, 주가를 13% 하락, 환율을 13% 상승시킨 것으로 분석된다. 그리고 코로나19로 인한 미국의 금융불안은 글로벌 금융위기 이후 국내 금융지표를 가장 크게 악화시킨(CPㆍ콜 금리 스프레드: +70bp, 신용 스프레드: +77bp, 주가: –8%, 환율: +8%) 미국발 금융충격에 해당한다. 마지막으로 미국 신용등급 강등의 경우, 금리 스프레드를 +30bp 내외, 주가(하락)와 환율(상승)을 3% 변화시키면서 국내 금융시장에 무시할 수 없는 영향을 준 것으로 나타난다.

Ⅳ. 요약 및 시사점

3월 들어 미국 내 중소은행의 파산이 연이어 발생하면서 미국발 금융위기의 가능성이 고조된 바 있다. 다행히 정책 당국의 조치 이후 시장이 조기에 안정되면서 실질적인 충격의 강도가 크지 않았던 것으로 평가된다. 물론 미국 내 예금의 경우, 기업자금을 중심으로 예금이 MMF로 대거 이동하는 등 순유출이 발생하기도 했다. 하지만, 2008년 금융위기 당시에는 MMF런까지 발생하면서 MMF가 투자했던 ABCP, CD, RP 등 자금시장 전체가 심각한 경색을 보였던 것에 비하면 전반적으로 양호한 상황이라 생각된다.

이러한 점을 고려할 때 최근 미국 내 금융상황이 연준의 금리 인하 시기를 앞당기는 요인으로 작용하지는 않을 것으로 예상된다. 더욱이 현재 미국의 거시경제 상황은 연준이 정책 기조를 전환할 수 있는 여건과는 상당한 거리가 있다. 즉, 미국의 인플레이션은 여전히 연준의 목표 수준인 2%를 크게 상회하고, 노동시장에서는 구직자 우위 상황이 지속되고 있다. 현 국면이 급격하게 전환될 가능성이 크지 않다는 점을 감안하면 연내 금리 인하를 기대하기는 어려운 것으로 판단된다.

한편, 최근 미국에서는 금융시장 내 불안감이 상당 부분 누그러진 가운데, 주식시장이 호조를 나타내면서 긍정적인 전망이 점차 부각되고 있다. 하지만, 일각에서 글로벌 금융위기 직전 금융시장에서는 실상과 무관하게 낙관적인 분위기가 한때 이어졌었다는 점을 지적하고 있다.32) 물론 2008년과 같은 극심한 충격이 재현되지는 않을 것으로 생각되지만, 현재 미국 금융시장에는 여러 리스크 요인(<표 Ⅵ-1> 참고)이 잠재해 있어 크고 작은 불안이 발생할 가능성이 존재한다.

유동성 위기를 겪었던 퍼스트 리퍼블릭 은행은 11개 대형은행들로부터 자금을 공급받았지만 자력 회생에 결국 실패하였다. 이는 중소은행들의 취약성이 근본적으로 해결되지 않는 한 불안이 재발할 수 있음을 보여준 사례라 할 수 있다. 아울러, 이러한 은행권의 문제와 함께 상업용 부동산 시장의 침체도 리스크 요인으로 잠재해 있다는 점을 유념할 필요가 있다. 수요 감소 추세와 함께 신용 축소, 차주의 상환능력 악화가 동반될 경우, 미국 금융 시스템에 상당한 충격을 주고 그 영향이 우리나라에도 전이될 가능성이 있다.

지난해 우리 금융시장에서는 국지적인 자금 경색으로 CP 및 회사채 시장 전체가 냉각된 바 있다. 이러한 문제가 어느 정도 완화되기는 했지만, 부동산PF 관련 리스크가 여전히 존재하는 상황에서 비은행권의 연체율 상승으로 부실 가능성이 점증하는 등 여러 부문에 리스크 요인이 잠재되어 있다. 이러한 점을 감안하여 미국발 금융불안이 우리나라의 금융불안을 촉발하는 계기가 되지 않도록 각별히 유의해야 할 것으로 생각된다. 실증분석에서 논의한 바와 같이 주식시장은 복원력이 상대적으로 큰 편이지만 여타 부문은 회복에 다소 긴 시간이 소요되는 것으로 나타났다. 이는 충격이 몇 차례 발생하더라도 주식시장에서는 부정적인 영향이 비교적 빠르게 소멸되는 반면, 회사채와 CP 시장에서는 그 영향이 쉽게 누적될 수 있다는 점을 의미한다. 따라서, 미국발 금융불안이 회사채 및 CP 시장의 장기 부진을 초래하지 않도록 미시적인 대응 방안을 준비할 필요가 있다.

우리의 물가상황을 고려할 때 긴축적인 통화정책이 아직 필요하지만, 외부 요인으로 인해 긴축 정도가 과도하게 높아지는 것은 정책 당국으로서도 바람직하지 않은 결과일 것이다. 또한 시장의 정상적인 기능이 위협받는 상황에서는, 대응이 지연될수록 수습에 필요한 유동성이 증가하여 기존 통화정책의 효과와 향후 정책운영을 제약하는 부작용이 이어질 가능성이 있다. 즉, 긴급 유동성 공급 규모가 증가할수록 기존 통화정책 방향과의 상충이 커지고, 추후에 유동성을 회수하는 데 보다 강도 높은 긴축이 필요할 수도 있다. 이러한 점을 고려할 때 선별적인(targeted) 유동성 공급을 통해 신속하게 분리 대응하는 것이 장기적으로도 효과적인 대응 방향이라 하겠다.

01) SVB 파산과 관련된 세부 사항에 대해서는 황세운(2023)을 참조할 수 있다.

02) 전 뉴욕 연준 총재였던 Dudley(2023)가 이러한 사실을 지적한 바 있다. Fed가 2022년 11월 발간한 금융안정보고서에서의 원문은 다음과 같다. “Funding risks at domestic banks are low, given their large holdings of liquid assets and limited reliance on short-term wholesale funding.”(p.2)

03) 재할인 창구 대출은 연준이 전통적으로 운영해 오던 금융기관 대상 대출 프로그램이다. 적격담보를 보유한 금융기관들은 연준이 설정한 금리와 헤어컷 비율에 따라 재할인 창구 대출을 통해 자금을 대여할 수 있으며 대출 기간은 최대 90일까지이다.

04) 대표적으로 국채, 공사채, MBS에 대한 헤어컷 비율을 1~6%에서 0%로 낮추었다.

05) BTFP의 대출 기간은 최대 1년으로 재할인 창구 대출(최대 90일)에 비해 길다는 이점도 있다. 다만, 재할인창구 대출은 국공채, MBS뿐만 아니라 시중은행의 대출도 담보로 인정하는 반면, BTFP는 국공채 등 안전자산만을 담보로 인정하기 때문에 적격담보의 종류가 많지 않다.

06) 해당 시중은행이 시장에서 유동성을 조달할 수 없어 중앙은행의 대출에 의존해야 하는 위기상황에 처해 있는 것으로 인식됨을 의미한다.

07) 시카고 연준이 공표하는 자료로 자금시장, 주식·채권시장, 은행·그림자금융 부문에 대한 105개 금융지표의 공통요인을 추출하여 작성된다. Ⅲ장에서 FCI에 대해 보다 자세히 설명하도록 하겠다.

08) 금융상황지수에 대한 충격을 식별하는 방법은 Ⅲ장에서 자세하게 설명하도록 하겠다.

09) 리먼 브라더스의 파산(2008년 9월 15일) 직후 시점이다.

10) 연준이 학자, 시장참가자 등을 대상으로 시행한 서베이로 금년 5월 발간된 금융안정보고서에 수록되어 있다.

11) 미ㆍ중 갈등, 러시아ㆍ우크라이나 전쟁 등도 주요 불안 요인으로 조사되었지만 지정학적 문제는 본 절의 논의에서 제외하였다.

12) 1970년 이후 비부보 예금 비율의 평균은 31%이다.

13) Jiang et al.(2023)은 비부보 예금 인출 후 시가 평가된 자산 총액이 부보 예금 총액에 미달하는 경우를 지급불능 상황으로 정의하였다.

14) 미국 은행들의 요구불 예금(checking account) 금리는 평균 0.07%, 1개월, 3개월, 12개월 CD 금리는 각각 0.26%, 0.62%, 1.59%이다(2023. 5. 15 기준, 자료: FDIC).

15) 엄밀하게는 Fed funds rate에 가산금리가 추가되는 재할인창구 대출과는 달리, BTFP는 1년 OIS(overnight index swap) 금리에 0.1%의 가산금리가 적용되는데, 해당 금리는 정책금리에 가까운 수준이다.

16) 시중은행의 대출은 연준의 BTFP에서 적격담보로 인정되지 않기 때문에 은행들이 대출을 담보로 유동성을 공급받기 위해서는 재할인창구 대출을 이용할 수밖에 없다. 하지만, 국공채 등 안전자산과는 달리 대출에는 높은 헤어컷이 적용(종류에 따라 5~90%)되고, 시가평가에 따라 담보 비율이 결정되기 때문에 유동성 확보에 상당한 제약이 따를 수 있다.

17) 사무실 공실률은 공식 통계가 존재하지 않아 발표 기관(CBRE Group: 17.8%, Cushman & Wakefield: 18.6% 등)마다 그 수치에 다소 차이가 있다. 하지만 2023년 1분기 현재 사무실 공실률이 금융위기 수준을 넘어섰다는 점은 공통적이다.

18) 이외에 공공기관(Fannie Mae, Freddie Mac)과 REITsㆍ기타금융기관이 각각 21% 및 12%의 비중을 차지한다(2022년 4분기 기준, 자료: Mortgage Bankers Association).

19) 은행의 전체 상업용 부동산 대출(잔액) 중 약 2/3가 중소은행의 대출이다. 여기에서 중소은행은 GSIB(global systemically important banks, 25개) 이외의 은행을 의미한다.

20) 최근 연준의 대출태도 조사(Senior Loan Officer Opinion Survey, 2023년 1분기)에 따르면, 일반가계대출, 주택담보대출 등 여타 대출에 비해 상업용 부동산 대출에 대한 기준을 강화했다는 응답률이 더 높게 나타났다.

21) 연준의 금융안정보고서에 따르면 상업용 부동산의 LTV는 50~60% 수준으로, 아직까지는 가격 하락에 대한 완충 여력이 있는 것으로 보인다. 하지만, 사무실의 경우 침체가 심화되면서 팬데믹 이전(2019년) 대비 40% 가까이 가격이 하락할 것이라는 전망이 있다(Boston Consulting Group, 2023).

22) 은행의 자산 중 상업용 부동산 대출 비중은 중소은행(26%)이 대형은행(6%)에 비해 월등히 높다(23년 4월 기준, 자료: Fed).

23) 대표적으로 Adrian et al.(2019)은 미국의 성장 경로에 내재된 리스크(Growth at Risk: GaR)를 분석하는데 FCI를 핵심 지표로 사용한다.

24) 통화정책의 영향 분석 시 경기ㆍ물가 지표 등을 반응이 느린 변수, 금융시장지표를 반응이 빠른 변수로 설정한 Christiano et al.(1999)과 유사한 배열이다. 원유(WTI)의 경우, 선물이 상품거래소에서 거래되어 상당한 정도로 금융화되어 있고 현물가격이 선물가격에 민감하게 영향받으므로, 유가는 금융상품에 준하는 반응 정도를 갖는 것으로 볼 수 있다. 아울러 유가를 FCI 다음으로 배열하더라도 분석 결과에 큰 영향을 미치지는 않는다.

25) 연준은 ZLB의 제약으로 인해 양적 완화 등 비전통적 통화정책을 통해 추가적인 완화 조치를 시행하였다.

26) 언급한 추정치는 3월 발생한 충격(약 0.8표준편차)에 해당하는 수치로 환산한 것이다.

27) “we also assess, as I mentioned, that the events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses, and thereby weigh on demand, on the labor market, and on inflation. …⋯… you can think of it as being the equivalent of a rate hike or perhaps more than that.”(3월 FOMC 직후 기자 간담회 답변)

28) 본 절에서 사용되는 ‘국내’라는 표현은 한국 내를 의미함을 밝혀둔다.

29) 국소투영법은 모형을 신축적으로 구성할 수 있다는 장점이 있으므로(Jordà, 2005), 각 분석대상 변수와 잠재적으로 연관된 변수들을 통제변수로 포함하였다. 분석대상별 통제변수(괄호 내에 나열)는 다음과 같다. 산업생산지수: (소비자물가지수, 콜 금리, 신용 스프레드, CPㆍ콜 금리 스프레드, KOSPI지수, 원ㆍ달러 환율, 미국 산업생산지수, 미국 정책금리, 유가), 소비자물가지수: (전산업 산업생산지수, 콜 금리, 신용 스프레드, CPㆍ콜 금리 스프레드, KOSPI지수, 원ㆍ달러 환율, 미국 산업생산지수, 미국 정책금리, 유가), 콜 금리: (전산업 산업생산지수, 소비자물가지수, 국고채 3년물 금리, 원ㆍ달러 환율, 미국 정책금리, 미 국채 3년물 금리), 신용 스프레드 및 CPㆍ콜 금리 스프레드: (전산업 산업생산지수, 소비자물가지수, 원ㆍ달러 환율, 미국 정책금리, 미 국채 3년물 금리), 주가: (전산업 산업생산지수, 소비자물가지수, 콜 금리, 원ㆍ달러 환율, 국고채 3년물 금리, 미 국채 3년물 금리, S&P500지수, 항셍지수, VIX), 환율: (전산업 산업생산지수, 소비자물가지수, 콜 금리, 국고채 3년물 금리, KOSPI지수, 미국 정책금리, 미 국채 3년물 금리, S&P500지수)

30) CP 금리만의 충격반응을 보면, CP 금리는 충격 초기에 일시적으로 상승하지만 점차 콜 금리와 유사한 형태로 하락하는 모습을 보인다.

31) 글로벌 금융위기 당시와 같이 불안기가 지속된 경우 해당 기간 중 발생한 최대 충격(월 기준)을 기준으로 하였다.

32) JP모건의 CIO인 Michele은 이러한 점을 언급하면서 최근 금융시장 상황은 위장된 평화(deceptive lull)에 가깝다는 의견을 피력한 바 있다(CNBC, 2023. 6. 9).

참고문헌

황세운, 2023, 실리콘밸리은행(SVB) 파산이 국내 금융시장에 미치는 영향 및 시사점, 자본시장연구원 『자본시장포커스』 2023-06호.

Adrian, T., Boyarchenko, N., Giannone D., 2019, Vulnerable Growth, American Economic Review 109(4), 1263–1289.

Board of Governors of the Federal Reserve System, 2022. 11, Financial Stability Report.

Board of Governors of the Federal Reserve System, 2023. 5, Financial Stability Report.

Board of Governors of the Federal Reserve System, 2023, April 2023 Senior loan officer opinion survey on bank lending practices.

Boston Consulting Group, 2023. 5. 11, Countering the curse of zombie buildings.

Christiano, L. J., Eichenbaum, M., Evans, C. L., 1999, Monetary policy shocks: What have we learned and to what end? Handbook of Macroeconomics 1, 65-148.

CNBC, 2023. 6. 9, JPMorgan bond chief Bob Michele sees worrying echoes of 2008 in market calm.

Dudley, C. W. 2023. 5. 11, What the Fed missed in its bank crisis confessional, Bloomberg.

FDIC, 2023. 5. 10, Options for deposit insurance reform.

FDIC Bankers Resource Center, 2023. 6. 20, National rates and rate caps.

Jiang, E. X., Matvos, G., Piskorski, T., Seru, A., 2023, Monetary tightening and U.S. bank fragility in 2023: Mark-to-market losses and uninsured depositor runs? NBER Working Papers 31048.

Jordà, Ò., 2005, Estimation and inference of impulse responses by local projections, American Economic Review 95(1), 161–182.

Federal Reserve Discount Window www.frbdiscountwindow.org

아래의 <부록 그림 1>은 SVAR 모형을 이용하여 추정한 FCI 충격을 막대 그래프로 나타내고 있다. 그래프에는 주요 이벤트가 함께 표시되어 있는데, 이 중 S&L 사태는 종료 시점을 특정하기 어려워 금융기관 개혁법 제정(Financial Institutions Reform, Recovery and Enforcement Act) 시기를 기준으로 하여 1989년까지로 표시하였다. 그리고 서브 프라임 위기 부각 시점은, 미국 내 모기지 회사의 파산, 주요 투자은행(골드만 삭스, 시티)의 손실 발표, 모기지 관련 펀드의 환매 중단 등이 연쇄적으로 발생했던 2007년 8월로 하였다.

불과 몇 개월 전까지만 해도 미국 중소은행들의 연이은 파산은 예상하기 어려운 사태였다. 미 연준이 작년 11월에 발간한 금융안정 보고서에 따르면, 은행 부문은 지급 능력이 충분하게 뒷받침되어 있어 유동성 리스크가 낮은 것으로 평가된 바 있다. 하지만, 금년 3월 들어 실리콘 밸리 은행(SVB)1)에 이어 시그니쳐 은행이 파산하였고, 퍼스트 리퍼블릭 은행은 유동성 위기를 맞는 등 연쇄적으로 금융불안이 발생하였다. 단 몇 개월 전임에도 불구하고 상반된 진단2)이 내려졌다는 점을 보면, 정책 당국도 이러한 사태를 전혀 예견하지 못했다는 점을 알 수 있다.

전술한 중소은행들은 자산ㆍ부채 간 만기불일치, 대규모의 보유자산 평가손, 높은 비부보 예금 비중 등의 문제로 인해 뱅크런을 겪었다. 이러한 문제들은 일차적으로 연준의 고강도 긴축으로 표면화되기는 했지만, 보다 근본적으로는 해당 은행들의 과도한 수익 추구와 관리 부실, 정책 당국의 감독 부족으로 누적되어 온 것으로 생각된다. 그리고 비슷한 불안 요인을 안고 있지만 아직 수면 위로 드러나지 않은 중소은행들이 다수 존재할 것이라는 우려가 여전히 남아 있다.

글로벌 금융위기를 통해 분명히 경험했듯이, 미국의 금융불안은 자국뿐만 아니라 우리나라의 실물 경기와 금융시장에도 상당히 부정적인 영향을 미칠 수 있다. 다행히 3월의 금융불안은 정책 당국의 조치 이후 조기에 진정되어 실질적인 충격의 강도는 크지 않았던 것으로 판단된다. 하지만, 현재 미국 금융시장에는 중소은행을 중심으로 여러 리스크 요인이 잠재해 있어 추가적인 충격에 대비할 필요가 있다. 이에 본고에서는 3월의 불안 이후 미국 내 금융상황과 리스크 요인에 대해 평가하고, 미국발 금융불안 충격의 영향에 대해 분석함으로써 시사점을 제시하고자 한다.

본고의 구성은 다음과 같다. 먼저, Ⅱ장에서는 최근 금융불안에 대해 평가하고 리스크 요인에 대해 살펴본다. 그리고 Ⅲ장에서는 미국의 금융불안이 연준의 통화정책에 미치는 영향과 우리나라의 실물 및 금융시장에 미치는 영향에 대해 구체적으로 분석하도록 하겠다. 마지막으로 Ⅳ장에서는 향후 연준의 통화정책과 정책적 시사점에 대해 논의하고자 한다.

Ⅱ. 최근 금융불안에 대한 평가 및 리스크 요인

본 장에서는 3월의 금융불안 이후 미국 내 금융상황에 대해 평가하고, 현재 미국 금융시장 내에 잠재되어 있는 주요 리스크 요인에 대해 논의하도록 하겠다.

1. 경과 및 평가

SVB 파산 직후, 연준 등 정책 당국은 불안의 확산을 방지하기 위해 신속하게 유동성 공급 및 예금자 보호 조치를 취하였다. 연준은 신규 대출제도(Bank Term Funding Program: BTFP)를 실시하고 재할인 창구(discount window) 대출3)의 담보 인정 비율을 상향4)하여 금융기관들이 유동성을 확보할 수 있게 하였다. 새로 도입된 BTFP에서는 액면가 그대로 담보 가치가 인정되어, 시가평가로 담보 가치를 인정하는 재할인 창구 대출보다 완화된 대출 조건이 적용되었다.5) 또한 연방 예금보험공사(FDIC)는 예금자 보호를 위해 가교 은행을 설립하고 연준이 여기에 자금을 공급하였다. 이에 따라 파산 은행의 예금자들이 가교 은행을 통해 한도의 제약없이 예금을 인출하는 것이 가능해졌다.

통상적으로 시중은행은 낙인효과6)(stigma effect)에 대한 우려 때문에 재할인 창구 등 중앙은행 대출을 기피하는 경향이 있다. 그럼에도 불구하고, SVB 파산 직후 연준의 대출이 크게 증가했다는 사실은 당시 긴박하게 유동성이 필요했던 은행들이 존재했음을 의미한다. 즉, <그림 Ⅱ-1>과 같이 SVB 파산 직후에 연준의 대출이 급증한 것은, 대량 인출 사태의 확산을 우려한 은행들이 일시에 유동성 지원 프로그램을 이용한 데 따른 것으로 볼 수 있다. 다만, <그림 Ⅱ-2>에서 지역 연준별 자산 증감 내역을 보면, 대출 자금은 뉴욕 연준에서 일부, 샌프란시스코 연준에서 대부분 공급된 것으로 나타나 그러한 필요성은 파산 은행의 소재 지역에 한정되었던 것으로 보인다.

아울러 금융상황지수 자체의 변화뿐만 아니라 금융상황지수에 대한 충격을 식별하여8) 비교하는 경우에도 이러한 평가는 크게 달라지지 않는다. <그림 Ⅱ-4>는 1980년 1월부터 2023년 3월까지의 기간에 발생한 금융불안 충격의 크기와 누적 빈도(백분율)를 나타내고 있다. 먼저 크기로 보면, 금융위기 발생 초기9)에 최대, S&L 사태가 본격화된 시기에 그 다음으로 큰 충격이 발생했던 것으로 분석된다. 금년 3월의 충격과 비교하면, 두 위기 때의 최대 충격은 각각 9배 및 6배에 이르는 수준이었고, 해당 기간 중 상당한 크기의 충격이 반복되기도 했다. 아울러 빈도로 보면, 금년 3월의 충격은 약 10%의 누적 확률에 해당하는 수준으로 나타난다. 따라서 경험적으로 볼 때 이것은 이례적으로 큰 충격(tail event)이 아니었다는 점을 알 수 있다.

<부록 그림 1>에는 이외에도 블랙 먼데이, LTCM 사태, 9/11 테러, 서브 프라임 위기 부각 시 등에 발생했던 FCI 충격이 전체 시계열과 함께 표시되어 있다. 여기에서는 금년 3월보다 전술한 사례에서 유발된 충격이 상대적으로 컸다는 것을 알 수 있다. 또한 신용등급 강등의 경우, 글로벌 금융위기 이후 발생한 충격 중에서는 상당히 강도가 높은 편이었다는 점도 나타난다.

2. 리스크 요인

연준과 FDIC 등의 조치 이후 금융시장이 빠르게 안정되면서 3월 충격의 여파는 거의 가라앉은 것으로 생각된다. 하지만, 현재 미국 금융시장에는 다수의 리스크 요인이 잠재해 있어 여전히 안심할 수 없는 상황이다. 뉴욕 연준의 최근 서베이10)에 따르면, 은행 부문, 상업용 부동산, 정부 부채한도 문제 등이 주요 불안 요인11)으로 조사되었는데, 학계나 언론에서도 이에 대한 우려가 계속 제기되고 있다. 본 절에서는 당면하고 있는 은행과 상업용 부동산 부문의 문제에 초점을 맞추어 리스크 요인에 대해 논의하고자 한다. 다만, 미 정부 부채 문제로 인한 잠재적 위기상황은 향후에도 드물지 않게 발생할 것으로 생각되므로 장기적인 리스크 요인으로 주시해야 할 필요가 있다.

가. 은행 부문

현재 미국 은행권에는 누적된 만기보유 채권의 평가손과 높은 비부보 예금 비율 등으로 인한 뱅크런 발생 위험이 잠재해 있다. Jiang et al.(2023)에 따르면, 미국 은행권 전체적으로 만기 보유채권의 평가손은 약 2.2조 달러(2023년 1분기, 전년동기대비)에 이르는 것으로 추정된다. 이는 자산 총액(장부가)의 약 10%에 해당하는데 동 비율이 20% 이상인 은행도 다수(약 250개)인 것으로 분석되었다. 아울러 2010년대 중반부터 비부보 예금이 급격하게 증가하면서 2021년에는 거의 절반인 47%까지 높아졌는데, 이는 1949년 이래 최대치에 해당한다(<그림 Ⅱ-5>). 2022년 들어 45%로 소폭 낮아지기는 했지만 이 비율도 역사적으로 매우 높은 수준이다.12)

Jiang et al.(2023)은 전술한 두 요인(평가손과 비부보 예금)으로 인해 각 은행의 비부보 예금에서 10%만 인출되더라도 미국 내 66개의 은행이 지급불능13) 사태를 겪을 것으로 분석하였다. 이들 개별 은행의 평균적인 규모는 작지만, 총자산은 약 2,100억 달러로 전체 규모는 SVB와 거의 동일한 수준이다. 따라서 상기 시나리오가 현실화된다면 SVB급 은행 하나가 지급불능 사태에 빠지게 되는 것으로 해석할 수 있다. 동 분석은 재무적인 관점에서 직접적인 영향만을 추정한 것이므로, 소셜 미디어나 온라인 뱅킹 등을 통한 파급효과가 작용한다면 그 범위와 규모가 한층 더 확대될 가능성이 있다. 즉, 최근과 같이 예금자들의 주의 수준이 높아진 상황에서 특정 은행의 취약성이 부각된다면, 해당 은행뿐만 아니라 일부 유사성이 있는 여타 은행들로까지 디지털 뱅크런이 확산될 수 있다.

대규모 예금인출로 인해 긴급 유동성이 필요한 은행들은 보유 자산을 담보로 연준의 대출 프로그램을 활용할 수도 있다. 하지만, 여기에서는 높은 조달비용과 담보의 제약이 문제점으로 작용할 수 있다. 즉, 요구불 예금이나 단기 예금은 조달비용14)이 매우 낮은 반면, 연준의 대출은 정책금리(Fed funds rate)15)에 가까운 조달비용이 수반된다. 따라서 예금이 대량 인출되면서 저비용의 예금이 고비용의 연준 대출로 대체된다면 해당 은행의 수익성이 더욱 악화될 수밖에 없다. 또한, 퍼스트 리퍼블릭 은행과 같이 자산에서 국공채 등 안전자산보다 일반대출 비중이 높은 은행들의 경우 연준의 대출 프로그램을 이용하는 데 한계가 있어16) 취약점을 안고 있다.

나. 상업용 부동산 부문

상업용 부동산 측면에서는 가격 급락에 따른 시스템 리스크 발생 가능성이 잠재해 있다. 이는 사무실 등 상업용 부동산에 대한 수요 감소 추세와 함께, 금융기관의 신용 축소와 차주의 상환능력 저하가 맞물리면서 현실화될 수 있다. 먼저, <그림 Ⅱ-6>에서 미국 내 사무실 공실률을 보면, 코로나19 발생 이후 지속적으로 수요가 감소하면서 최근 공실률은 주요 침체기 수준을 넘어서는 것으로 나타난다.17) 여기에 연준의 긴축이 가세하면서 상업용 부동산 가격이 단기간에 큰 폭으로 하락하는 등 시장의 부진이 지속되고 있다(<그림 Ⅱ-7>).

이러한 여건하에서 미국의 경기가 급속하게 둔화된다면, 동 시장에 잠재되어 있던 리스크가 표면으로 드러날 가능성이 있다. 즉, 영업 부진이나 폐업 문제가 심화되면서 차주의 상환능력 저하로 대출이 부실화되고, 신용 축소와 가격 하락이 다시 이어지는 악순환이 발생할 수 있다.21) 특히, 상업용 부동산에 대한 중소은행들의 익스포져22)가 높다는 점을 감안할 때 이 시장의 불안은 중소은행에 보다 큰 영향을 줄 것으로 판단된다.

Ⅲ. 미국 금융불안의 영향

미국 내 금융불안은 자국뿐만 아니라 우리나라의 실물 및 금융 부문에까지 그 영향이 파급될 수 있다. 본 절에서는 계량 분석을 통해 미국과 우리나라의 실물ㆍ금융변수에 미치는 영향에 대해 구체적으로 논의하고자 한다.

1. 미국 내 영향

본 절에서는 구조 벡터자기회귀(structural vector autoregression, 이하 구조 VAR) 모형을 바탕으로 금융불안 충격을 식별하고 미국 내 주요 변수들의 반응을 추정한다. 분석에 이용될 모형은 다음과 같이 설정된다.

한편, 경기와 물가 지표로는 산업생산지수(로그 변환)와 소비자물가지수(로그 변환)를 각각 사용한다. 또한, 유가도 금융시장 상황에 영향을 받고, 물가에 반영될 수 있다는 점을 감안하여 WTI 유가(로그 변환)의 반응을 분석한다. 그리고 연준의 반응은 정책금리(effective Fed funds rate)의 변화를 통해 분석하도록 하겠다. 상기 변수들을 포함한 VAR 모형에서 금융불안 충격은 산업생산지수, 소비자물가지수, 정책금리, 금융상황지수, WTI 유가 순의 축차적 조건(recursive identification)에 따라 식별된다.24) 표본기간은 S&L 사태와 같은 미국 내 주요 금융불안기를 포함하기 위해 1980년 1월부터 2023년 3월까지로 하였다. VAR 모형의 시차는 SIC(Schwarz Information Criterion)에 따라 2개월이 적용되었다.

<그림 Ⅲ-1>은 전술한 방법에 따라 추정한 변수별 충격반응을 나타내고 있다. 먼저, 좌측 및 우측 상단의 그림은 FCI에 부정(긴축)적인 충격이 발생하는 경우, 미국 내 산업생산지수와 소비자물가가 유의하게 하락한다는 점을 보여준다. 금융상황의 악화는 가계와 기업의 자금조달에 불리하게 작용함으로써 실물 경기를 둔화시키는 것으로 생각할 수 있다. 물가의 경우 통상 실물 경기에 다소 후행하는 경향이 있지만, 유가가 금융상황에 민감하게 반응함에 따라(<그림 Ⅲ-1> 좌측 하단) 이를 반영하여 큰 시차 없이 하락하는 것으로 판단된다.

2. 한국 내 영향28)

본 절에서는 위의 구조 VAR 모형에서 식별된 금융불안 충격을 이용하여 한국 내 변수들의 반응을 분석한다. 미국의 금융불안 충격에 대한 국내 변수의 반응은 아래의 모형을 바탕으로 Jordà(2005)의 국소투영법(local projection)을 이용하여 추정한다.

가. 실물

본 절에서는 미국의 금융불안 충격이 국내 경기와 물가에 미치는 영향에 대해 살펴본다. 먼저, <그림 Ⅲ-4>는 미국의 금융불안 충격 발생 시 국내 산업생산지수와 소비자물가지수의 반응을 나타내고 있다. 좌측 및 우측 상단의 그림은 각각 전산업 및 광공업 산업생산지수의 충격반응으로, 반응의 크기와 유의성을 보면 서비스업이 포함된 전산업보다 광공업 부문이 보다 민감하게 영향받는다는 점을 알 수 있다. 이러한 결과는, 수출 비중이 높은 광공업 부문의 특성상 미국 금융불안에 따른 글로벌 경기 둔화에 더 크게 영향을 받기 때문으로 볼 수 있다.

<그림 Ⅲ-4>의 하단을 보면, 국내 소비자물가도 하락하는 모습을 나타낸다. 이러한 물가의 반응은 경기와 함께, 앞서 언급한 유가의 움직임과도 연관지어 해석할 수 있다. 즉, 미국의 금융불안은 국제유가를 하락시켜 국내 석유류 가격 등을 중심으로 소비자물가를 낮추는 요인으로 작용한다는 점이다.

미국의 금융불안은 경기 전망이나 리스크 프리미엄 등의 경로를 통해 국내 금융시장에 부정적인 영향을 미칠 수 있다. <그림 Ⅲ-5>는 국내 주요 금융지표들의 충격 반응을 나타내고 있다. 먼저, 콜 금리(좌측 상단)는 미국의 금융불안 발생시 하락하는 것으로 나타난다. 이러한 콜 금리의 반응은 한국은행이 기준금리 인하나 인상폭 축소 등을 통해 해당 충격을 완화해 왔다는 것을 의미한다. 이러한 정책 대응은 일차적으로 단기물을 중심으로 시장금리 상승을 어느 정도 억제하는 효과30)가 있다. 그럼에도 불구하고, 전반적으로 신용 경계감이 높아지면서 CP와 회사채 시장에 대한 금융불안 충격의 영향은 다소 오래 지속되는 것으로 분석된다. <그림 Ⅲ-5>의 우측 상단을 보면, CP와 콜 금리 간 스프레드가 6개월 내외 확대되는데 회사채 신용 스프레드의 반응도 비슷한 크기와 지속성을 보인다(<그림 Ⅲ-5> 좌측 중앙). 추정 결과에 따르면 3월과 같은 미국의 금융불안은 신용 스프레드를 최대 약 15bp 내외 상승시키고, 그 영향이 6개월 가까이 뚜렷하게 지속되는 것으로 분석된다.

<그림 Ⅲ-5>에서 우측 중앙의 그림은 KOSPI 지수의 충격반응을 나타내고 있다. 3월 충격을 기준으로 환산해보면 국내 주가는 최대 약 1.5% 하락하는 것으로 추정된다. 다만, 그 영향은 2~3개월 이후 거의 소멸되어 여타 금융지표들에 비해 지속성이 상대적으로 낮음을 알 수 있다.

<그림 Ⅲ-5>의 하단에는 원ㆍ달러 환율의 반응이 나타나 있다. 충격 이후 1개월 시점에 원ㆍ달러 환율의 상승폭이 가장 높은데, 3월의 충격을 기준으로 보면 최대 상승폭은 1.5% 내외로 추정된다. 이러한 영향은 6개월 이후에는 거의 반감되지만, 이후에도 상당 기간 충격 이전에 비해 높은 수준의 환율이 유지되는 것으로 보인다.

이상의 결과를 보면, 국내 금융시장 지표들은 미국의 금융불안 충격에 일정 기간 부정적인 영향을 받으면서 앞 절의 실물 지표(산업생산지수)와 크게 괴리되지 않는 흐름을 나타낸다. 이는 기본적으로 금융시장 지표가 경기 상황을 어느 정도 반영하는 데 따른 결과라 할 수 있다. 다만, 주가보다 금리 스프레드와 원ㆍ달러 환율에 대한 영향이 오래 지속되면서 회복 속도에 차이가 존재하는 것은 시장 고유의 마찰 및 구조적인 요인이 작용하기 때문으로 판단된다.

3월 들어 미국 내 중소은행의 파산이 연이어 발생하면서 미국발 금융위기의 가능성이 고조된 바 있다. 다행히 정책 당국의 조치 이후 시장이 조기에 안정되면서 실질적인 충격의 강도가 크지 않았던 것으로 평가된다. 물론 미국 내 예금의 경우, 기업자금을 중심으로 예금이 MMF로 대거 이동하는 등 순유출이 발생하기도 했다. 하지만, 2008년 금융위기 당시에는 MMF런까지 발생하면서 MMF가 투자했던 ABCP, CD, RP 등 자금시장 전체가 심각한 경색을 보였던 것에 비하면 전반적으로 양호한 상황이라 생각된다.

이러한 점을 고려할 때 최근 미국 내 금융상황이 연준의 금리 인하 시기를 앞당기는 요인으로 작용하지는 않을 것으로 예상된다. 더욱이 현재 미국의 거시경제 상황은 연준이 정책 기조를 전환할 수 있는 여건과는 상당한 거리가 있다. 즉, 미국의 인플레이션은 여전히 연준의 목표 수준인 2%를 크게 상회하고, 노동시장에서는 구직자 우위 상황이 지속되고 있다. 현 국면이 급격하게 전환될 가능성이 크지 않다는 점을 감안하면 연내 금리 인하를 기대하기는 어려운 것으로 판단된다.

한편, 최근 미국에서는 금융시장 내 불안감이 상당 부분 누그러진 가운데, 주식시장이 호조를 나타내면서 긍정적인 전망이 점차 부각되고 있다. 하지만, 일각에서 글로벌 금융위기 직전 금융시장에서는 실상과 무관하게 낙관적인 분위기가 한때 이어졌었다는 점을 지적하고 있다.32) 물론 2008년과 같은 극심한 충격이 재현되지는 않을 것으로 생각되지만, 현재 미국 금융시장에는 여러 리스크 요인(<표 Ⅵ-1> 참고)이 잠재해 있어 크고 작은 불안이 발생할 가능성이 존재한다.

지난해 우리 금융시장에서는 국지적인 자금 경색으로 CP 및 회사채 시장 전체가 냉각된 바 있다. 이러한 문제가 어느 정도 완화되기는 했지만, 부동산PF 관련 리스크가 여전히 존재하는 상황에서 비은행권의 연체율 상승으로 부실 가능성이 점증하는 등 여러 부문에 리스크 요인이 잠재되어 있다. 이러한 점을 감안하여 미국발 금융불안이 우리나라의 금융불안을 촉발하는 계기가 되지 않도록 각별히 유의해야 할 것으로 생각된다. 실증분석에서 논의한 바와 같이 주식시장은 복원력이 상대적으로 큰 편이지만 여타 부문은 회복에 다소 긴 시간이 소요되는 것으로 나타났다. 이는 충격이 몇 차례 발생하더라도 주식시장에서는 부정적인 영향이 비교적 빠르게 소멸되는 반면, 회사채와 CP 시장에서는 그 영향이 쉽게 누적될 수 있다는 점을 의미한다. 따라서, 미국발 금융불안이 회사채 및 CP 시장의 장기 부진을 초래하지 않도록 미시적인 대응 방안을 준비할 필요가 있다.

우리의 물가상황을 고려할 때 긴축적인 통화정책이 아직 필요하지만, 외부 요인으로 인해 긴축 정도가 과도하게 높아지는 것은 정책 당국으로서도 바람직하지 않은 결과일 것이다. 또한 시장의 정상적인 기능이 위협받는 상황에서는, 대응이 지연될수록 수습에 필요한 유동성이 증가하여 기존 통화정책의 효과와 향후 정책운영을 제약하는 부작용이 이어질 가능성이 있다. 즉, 긴급 유동성 공급 규모가 증가할수록 기존 통화정책 방향과의 상충이 커지고, 추후에 유동성을 회수하는 데 보다 강도 높은 긴축이 필요할 수도 있다. 이러한 점을 고려할 때 선별적인(targeted) 유동성 공급을 통해 신속하게 분리 대응하는 것이 장기적으로도 효과적인 대응 방향이라 하겠다.

01) SVB 파산과 관련된 세부 사항에 대해서는 황세운(2023)을 참조할 수 있다.

02) 전 뉴욕 연준 총재였던 Dudley(2023)가 이러한 사실을 지적한 바 있다. Fed가 2022년 11월 발간한 금융안정보고서에서의 원문은 다음과 같다. “Funding risks at domestic banks are low, given their large holdings of liquid assets and limited reliance on short-term wholesale funding.”(p.2)

03) 재할인 창구 대출은 연준이 전통적으로 운영해 오던 금융기관 대상 대출 프로그램이다. 적격담보를 보유한 금융기관들은 연준이 설정한 금리와 헤어컷 비율에 따라 재할인 창구 대출을 통해 자금을 대여할 수 있으며 대출 기간은 최대 90일까지이다.

04) 대표적으로 국채, 공사채, MBS에 대한 헤어컷 비율을 1~6%에서 0%로 낮추었다.

05) BTFP의 대출 기간은 최대 1년으로 재할인 창구 대출(최대 90일)에 비해 길다는 이점도 있다. 다만, 재할인창구 대출은 국공채, MBS뿐만 아니라 시중은행의 대출도 담보로 인정하는 반면, BTFP는 국공채 등 안전자산만을 담보로 인정하기 때문에 적격담보의 종류가 많지 않다.

06) 해당 시중은행이 시장에서 유동성을 조달할 수 없어 중앙은행의 대출에 의존해야 하는 위기상황에 처해 있는 것으로 인식됨을 의미한다.

07) 시카고 연준이 공표하는 자료로 자금시장, 주식·채권시장, 은행·그림자금융 부문에 대한 105개 금융지표의 공통요인을 추출하여 작성된다. Ⅲ장에서 FCI에 대해 보다 자세히 설명하도록 하겠다.

08) 금융상황지수에 대한 충격을 식별하는 방법은 Ⅲ장에서 자세하게 설명하도록 하겠다.

09) 리먼 브라더스의 파산(2008년 9월 15일) 직후 시점이다.

10) 연준이 학자, 시장참가자 등을 대상으로 시행한 서베이로 금년 5월 발간된 금융안정보고서에 수록되어 있다.

11) 미ㆍ중 갈등, 러시아ㆍ우크라이나 전쟁 등도 주요 불안 요인으로 조사되었지만 지정학적 문제는 본 절의 논의에서 제외하였다.

12) 1970년 이후 비부보 예금 비율의 평균은 31%이다.

13) Jiang et al.(2023)은 비부보 예금 인출 후 시가 평가된 자산 총액이 부보 예금 총액에 미달하는 경우를 지급불능 상황으로 정의하였다.

14) 미국 은행들의 요구불 예금(checking account) 금리는 평균 0.07%, 1개월, 3개월, 12개월 CD 금리는 각각 0.26%, 0.62%, 1.59%이다(2023. 5. 15 기준, 자료: FDIC).

15) 엄밀하게는 Fed funds rate에 가산금리가 추가되는 재할인창구 대출과는 달리, BTFP는 1년 OIS(overnight index swap) 금리에 0.1%의 가산금리가 적용되는데, 해당 금리는 정책금리에 가까운 수준이다.

16) 시중은행의 대출은 연준의 BTFP에서 적격담보로 인정되지 않기 때문에 은행들이 대출을 담보로 유동성을 공급받기 위해서는 재할인창구 대출을 이용할 수밖에 없다. 하지만, 국공채 등 안전자산과는 달리 대출에는 높은 헤어컷이 적용(종류에 따라 5~90%)되고, 시가평가에 따라 담보 비율이 결정되기 때문에 유동성 확보에 상당한 제약이 따를 수 있다.

17) 사무실 공실률은 공식 통계가 존재하지 않아 발표 기관(CBRE Group: 17.8%, Cushman & Wakefield: 18.6% 등)마다 그 수치에 다소 차이가 있다. 하지만 2023년 1분기 현재 사무실 공실률이 금융위기 수준을 넘어섰다는 점은 공통적이다.

18) 이외에 공공기관(Fannie Mae, Freddie Mac)과 REITsㆍ기타금융기관이 각각 21% 및 12%의 비중을 차지한다(2022년 4분기 기준, 자료: Mortgage Bankers Association).

19) 은행의 전체 상업용 부동산 대출(잔액) 중 약 2/3가 중소은행의 대출이다. 여기에서 중소은행은 GSIB(global systemically important banks, 25개) 이외의 은행을 의미한다.

20) 최근 연준의 대출태도 조사(Senior Loan Officer Opinion Survey, 2023년 1분기)에 따르면, 일반가계대출, 주택담보대출 등 여타 대출에 비해 상업용 부동산 대출에 대한 기준을 강화했다는 응답률이 더 높게 나타났다.

21) 연준의 금융안정보고서에 따르면 상업용 부동산의 LTV는 50~60% 수준으로, 아직까지는 가격 하락에 대한 완충 여력이 있는 것으로 보인다. 하지만, 사무실의 경우 침체가 심화되면서 팬데믹 이전(2019년) 대비 40% 가까이 가격이 하락할 것이라는 전망이 있다(Boston Consulting Group, 2023).

22) 은행의 자산 중 상업용 부동산 대출 비중은 중소은행(26%)이 대형은행(6%)에 비해 월등히 높다(23년 4월 기준, 자료: Fed).

23) 대표적으로 Adrian et al.(2019)은 미국의 성장 경로에 내재된 리스크(Growth at Risk: GaR)를 분석하는데 FCI를 핵심 지표로 사용한다.

24) 통화정책의 영향 분석 시 경기ㆍ물가 지표 등을 반응이 느린 변수, 금융시장지표를 반응이 빠른 변수로 설정한 Christiano et al.(1999)과 유사한 배열이다. 원유(WTI)의 경우, 선물이 상품거래소에서 거래되어 상당한 정도로 금융화되어 있고 현물가격이 선물가격에 민감하게 영향받으므로, 유가는 금융상품에 준하는 반응 정도를 갖는 것으로 볼 수 있다. 아울러 유가를 FCI 다음으로 배열하더라도 분석 결과에 큰 영향을 미치지는 않는다.

25) 연준은 ZLB의 제약으로 인해 양적 완화 등 비전통적 통화정책을 통해 추가적인 완화 조치를 시행하였다.

26) 언급한 추정치는 3월 발생한 충격(약 0.8표준편차)에 해당하는 수치로 환산한 것이다.

27) “we also assess, as I mentioned, that the events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses, and thereby weigh on demand, on the labor market, and on inflation. …⋯… you can think of it as being the equivalent of a rate hike or perhaps more than that.”(3월 FOMC 직후 기자 간담회 답변)

28) 본 절에서 사용되는 ‘국내’라는 표현은 한국 내를 의미함을 밝혀둔다.

29) 국소투영법은 모형을 신축적으로 구성할 수 있다는 장점이 있으므로(Jordà, 2005), 각 분석대상 변수와 잠재적으로 연관된 변수들을 통제변수로 포함하였다. 분석대상별 통제변수(괄호 내에 나열)는 다음과 같다. 산업생산지수: (소비자물가지수, 콜 금리, 신용 스프레드, CPㆍ콜 금리 스프레드, KOSPI지수, 원ㆍ달러 환율, 미국 산업생산지수, 미국 정책금리, 유가), 소비자물가지수: (전산업 산업생산지수, 콜 금리, 신용 스프레드, CPㆍ콜 금리 스프레드, KOSPI지수, 원ㆍ달러 환율, 미국 산업생산지수, 미국 정책금리, 유가), 콜 금리: (전산업 산업생산지수, 소비자물가지수, 국고채 3년물 금리, 원ㆍ달러 환율, 미국 정책금리, 미 국채 3년물 금리), 신용 스프레드 및 CPㆍ콜 금리 스프레드: (전산업 산업생산지수, 소비자물가지수, 원ㆍ달러 환율, 미국 정책금리, 미 국채 3년물 금리), 주가: (전산업 산업생산지수, 소비자물가지수, 콜 금리, 원ㆍ달러 환율, 국고채 3년물 금리, 미 국채 3년물 금리, S&P500지수, 항셍지수, VIX), 환율: (전산업 산업생산지수, 소비자물가지수, 콜 금리, 국고채 3년물 금리, KOSPI지수, 미국 정책금리, 미 국채 3년물 금리, S&P500지수)

30) CP 금리만의 충격반응을 보면, CP 금리는 충격 초기에 일시적으로 상승하지만 점차 콜 금리와 유사한 형태로 하락하는 모습을 보인다.

31) 글로벌 금융위기 당시와 같이 불안기가 지속된 경우 해당 기간 중 발생한 최대 충격(월 기준)을 기준으로 하였다.

32) JP모건의 CIO인 Michele은 이러한 점을 언급하면서 최근 금융시장 상황은 위장된 평화(deceptive lull)에 가깝다는 의견을 피력한 바 있다(CNBC, 2023. 6. 9).

참고문헌

황세운, 2023, 실리콘밸리은행(SVB) 파산이 국내 금융시장에 미치는 영향 및 시사점, 자본시장연구원 『자본시장포커스』 2023-06호.

Adrian, T., Boyarchenko, N., Giannone D., 2019, Vulnerable Growth, American Economic Review 109(4), 1263–1289.

Board of Governors of the Federal Reserve System, 2022. 11, Financial Stability Report.

Board of Governors of the Federal Reserve System, 2023. 5, Financial Stability Report.

Board of Governors of the Federal Reserve System, 2023, April 2023 Senior loan officer opinion survey on bank lending practices.

Boston Consulting Group, 2023. 5. 11, Countering the curse of zombie buildings.

Christiano, L. J., Eichenbaum, M., Evans, C. L., 1999, Monetary policy shocks: What have we learned and to what end? Handbook of Macroeconomics 1, 65-148.

CNBC, 2023. 6. 9, JPMorgan bond chief Bob Michele sees worrying echoes of 2008 in market calm.

Dudley, C. W. 2023. 5. 11, What the Fed missed in its bank crisis confessional, Bloomberg.

FDIC, 2023. 5. 10, Options for deposit insurance reform.

FDIC Bankers Resource Center, 2023. 6. 20, National rates and rate caps.

Jiang, E. X., Matvos, G., Piskorski, T., Seru, A., 2023, Monetary tightening and U.S. bank fragility in 2023: Mark-to-market losses and uninsured depositor runs? NBER Working Papers 31048.

Jordà, Ò., 2005, Estimation and inference of impulse responses by local projections, American Economic Review 95(1), 161–182.

Federal Reserve Discount Window www.frbdiscountwindow.org

<부록 1> 금융상황지수(FCI)에 대한 충격 추정치

아래의 <부록 그림 1>은 SVAR 모형을 이용하여 추정한 FCI 충격을 막대 그래프로 나타내고 있다. 그래프에는 주요 이벤트가 함께 표시되어 있는데, 이 중 S&L 사태는 종료 시점을 특정하기 어려워 금융기관 개혁법 제정(Financial Institutions Reform, Recovery and Enforcement Act) 시기를 기준으로 하여 1989년까지로 표시하였다. 그리고 서브 프라임 위기 부각 시점은, 미국 내 모기지 회사의 파산, 주요 투자은행(골드만 삭스, 시티)의 손실 발표, 모기지 관련 펀드의 환매 중단 등이 연쇄적으로 발생했던 2007년 8월로 하였다.