Find out more about our latest publications

Analysis of High-Interest Debt in Listed Companies: Current State and Implications

Issue Papers 23-21 Oct. 30, 2023

- Research Topic Corporate Finance

- Page 23

The recent surge in the US benchmark interest rate and an economic slowdown in China have instigated a sense of crisis in Korea’s capital market, which is heavily dependent on external factors. In addition, firms have experienced a sharp decline in operating performance due to sluggish exports in the first half of the year, intensifying market uncertainties related to worsening profitability and concerns about a debt default. Given a possible structural change in the interest rate trend, it seems challenging to swiftly dispel market uncertainties.

Despite these concerns, the risk of a corporate debt default spreading to the financial system level remains low. This article assesses liquidity and default risks based on the assumption of operating cash flow downturns and collateral value devaluation. The results indicate a moderate increase in default risk among listed companies within a relatively stable range. Overall, there is no major concern regarding the financial soundness in the corporate sector. However, it seems necessary to identify and urgently respond to micro-level issues, particularly in vulnerable sectors such as utilities and construction.

Conversely, the persistence of slowed growth necessitates a more profound discussion. Korean companies have prioritized debt soundness after experiencing major crises like the 1997 Asian financial crisis and the 2008 global financial crisis. Although the cost of debt has been on the decline over the past decade, corporate financial structure policies have neither gone beyond securing soundness through debt reduction nor effectively utilized the low cost of debt to realize the opportunity for growth.

It is commendable that Korea’s corporate sector has the capability to navigate the impending crisis systematically, especially through soaring interest rates and expanding credit risk in the private sector. However, it is also worth considering effective debt management strategies from a forward-looking perspective. Companies that maintained financial soundness and entered a growth phase have proactively reduced debt during the low interest rate phase. To harness debt effectively, they should comprehensively examine diverse internal and external factors for enhancing growth potential.

Despite these concerns, the risk of a corporate debt default spreading to the financial system level remains low. This article assesses liquidity and default risks based on the assumption of operating cash flow downturns and collateral value devaluation. The results indicate a moderate increase in default risk among listed companies within a relatively stable range. Overall, there is no major concern regarding the financial soundness in the corporate sector. However, it seems necessary to identify and urgently respond to micro-level issues, particularly in vulnerable sectors such as utilities and construction.

Conversely, the persistence of slowed growth necessitates a more profound discussion. Korean companies have prioritized debt soundness after experiencing major crises like the 1997 Asian financial crisis and the 2008 global financial crisis. Although the cost of debt has been on the decline over the past decade, corporate financial structure policies have neither gone beyond securing soundness through debt reduction nor effectively utilized the low cost of debt to realize the opportunity for growth.

It is commendable that Korea’s corporate sector has the capability to navigate the impending crisis systematically, especially through soaring interest rates and expanding credit risk in the private sector. However, it is also worth considering effective debt management strategies from a forward-looking perspective. Companies that maintained financial soundness and entered a growth phase have proactively reduced debt during the low interest rate phase. To harness debt effectively, they should comprehensively examine diverse internal and external factors for enhancing growth potential.

Ⅰ. 기업부채 부실화 우려 검토1)

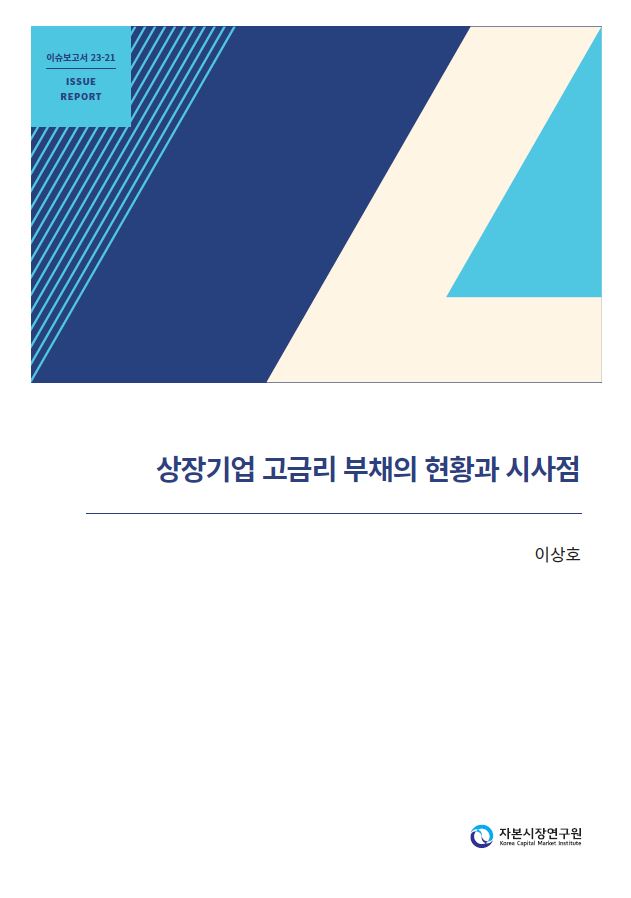

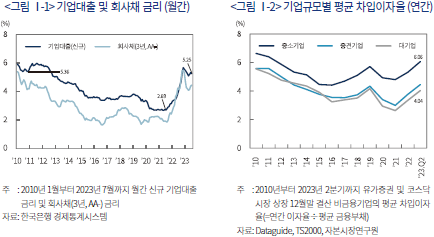

현재 우리나라는 역사상 가장 가파른 기준금리 인상기에 있다.2) 2021년 7월 2.69%이던 기업의 신규 대출 금리는 2023년 7월 기준 2.56%p 오른 5.25%로 집계됐다(<그림 Ⅰ-1> 참조). 글로벌 금융위기 이후 저금리 기조로 10여 년간 완만하게 하락해온 부채 조달 비용이 불과 2년 만에 2010년 수준으로 되돌아간 것이다. 금융부채에 대한 기업의 평균 이자 부담률 역시 상승하여 2023년 2분기 말 비금융업을 영위하는 중소기업(대기업)의 평균 차입이자율은 6.06%(4.04%) 수준으로 파악된다(<그림 Ⅰ-2> 참조).3) 재무제표상 집계하는 차입이자율은 만기 구조에 따라 시장금리를 후행적으로 반영하므로, 기업의 이자 부담은 한동안 증가할 가능성이 높다.

최근 대내외적으로 물가지수의 상승 추세는 다소 둔화하고 있으나, 단기에 상황의 반전을 기대하기 어렵다는 시각이 지배적인 만큼, 과거의 저금리 기조보다 더 높은 수준의 금리가 유지될 가능성을 가정하고 보수적인 시나리오 산정이 필요할 수 있다(강현주, 2023).

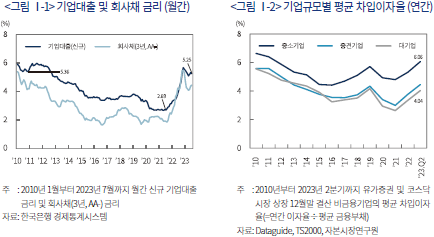

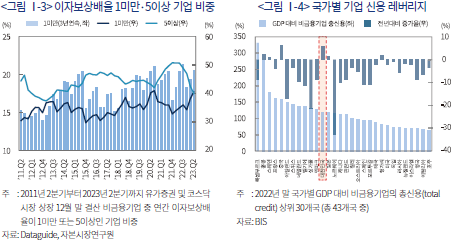

특히, 올해 상반기는 금리상승으로 인한 여러 불안 요소가 주식시장의 불확실성을 확대했다(김필규, 2023; 박용린, 2023). 첫째, 이자 상환 부담의 급격한 증가는 단기 영업현금흐름 악화와 함께 부실ㆍ한계기업의 도산 우려로 이어졌다. 2023년 2분기 말 기준 비금융업종을 영위하는 상장기업의 40.7%는 영업이익으로 이자비용을 충당하지 못한 것으로 나타났고, 3년 연속 그러한 상태가 지속된 기업 비중도 20.5%로 확인된다(<그림 Ⅰ-3> 참조). 동시에, 이자 상환능력에 대한 우려가 비교적 낮은 수준이라 볼 수 있는 이자보상배율 5이상인 기업 비중도 급격히 하락하는 추세다.

둘째, 기업의 재무적 곤경 위험이 증가한 상황에서 레고랜드 사태, 발전 공기업 발행 채권으로의 수급 쏠림 현상 등 자금시장 경색 요인이 확산하자, 한때는 재무적으로 건전한 기업 역시 높은 재금융(refinancing) 비용을 지불해야 했다.

셋째, 할인율이 상승함에 따라 기업의 성장 가치를 보수적으로 평가하면서 혁신기업의 자금조달 환경이 악화하였고, 보다 장기적 관점에서는 성장 둔화 추세의 고착화를 우려하게 되었다. 아울러, 저성장ㆍ성숙기 기업을 중심으로 효율적 자본 배치(capital allocation)의 중요성이 두드러지면서 고금리 상황은 자본의 효율적 이용에 관한 주주 행동주의 확대의 한 요인으로도 작용했다.

실제로 우리나라의 GDP 대비 기업부채 증가 속도가 분석 대상 43개국 중 중국에 이어 두 번째로 높은 것으로 나타나면서(<그림 Ⅰ-4> 참조), IMF는 고금리 상황의 장기화 가능성을 전제로 우리나라를 포함한 아시아권 전반에 대해 기업부채의 건전성 점검이 필요함을 지적하였다(IMF, 2023). 한국은행 역시 대기업을 중심으로 한 가파른 기업대출 증가 추세를 신용위험 확대의 우려 요인으로 언급한 바 있다(한국은행, 2022, 2023).

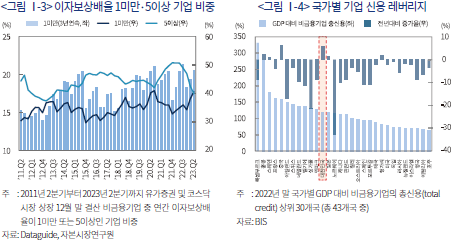

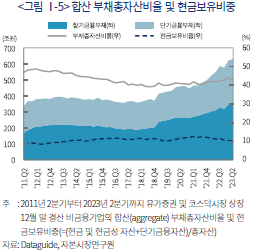

그러나 상기와 같은 우려에도 불구하고, 상장기업 전반의 부채비율은 꽤 양호한 상태를 유지하고 있다. 2023년 2분기 말 기준 상장기업의 합산 부채총자산비율은 42.8%이며, 이는 직전 분기 대비 오히려 1%p 감소한 수준이다(<그림 Ⅰ-5> 참조). 최근 기업대출을 중심으로 금융부채가 가파르게 증가해 온 것은 사실이나, 이는 기업이 회사채를 발행하는 대신 대출을 확대하는 방향으로 부채의 구성을 변화했기 때문이며, 거시적으로 기업부채의 총량은 안정적으로 관리되고 있다. GDP 대비 기업부채 비율이 큰 폭으로 증가한 요인 역시 수출감소로 인해 분모인 GDP가 줄어든 영향이 크다. 무엇보다 총자산의 10.4%를 현금성 자산으로 보유하고 있어, 운전자본 수요 대응을 위한 현금 여력도 절대적으로 부족하지 않다.

즉, 여러 건전성 지표의 수치가 의미하는 바는 시장의 우려와 어느 정도 괴리가 있는 상황이다. 이에 본 보고서에서는 기업부채의 부실화 가능성을 종합적으로 점검하고 향후 효과적인 부채 활용 방안에 대해 논의하고자 한다. 최근 고금리 상황에서의 기업 신용위험에 대한 여러 우려 요인을 Ⅰ장에서 살펴보았다면, 이어지는 Ⅱ장에서는 채무불이행 위험을 추정하여 당면할 수 있는 부실 징후의 현실화 가능성을 진단한다. Ⅲ장에서는 보다 장기적인 관점에서 과거의 부채관리 양상에 대한 평가를 수행하고, 이를 바탕으로 Ⅳ장에서 효과적인 부채 활용을 위한 개선과제를 제시한다.

Ⅱ. 채무불이행 위험 진단

본 장에서는 유가증권ㆍ코스닥시장 상장기업의 채무불이행 위험을 진단한다. 이는 기업의 이자 상환 부담이 급격히 증가하고 자금조달 시장이 원활하지 않은 상황에서 당면할 수 있는 도산 위험을 파악하기 위함이다.

Ⅰ장에서 살펴보았듯, 최근의 금리상승은 민간 신용위험의 급격한 확산 가능성을 우려할 만큼 가팔랐으나, 국내 상장기업 부문은 비교적 풍부한 현금보유량과 안정적인 부채비율을 유지하고 있다. 다만, 재무 상태 지표에 근거한 건전성 판단에는 과거 정보(stale information) 활용에 따른 한계가 내재하므로, 미래의 부실화 가능성을 예측할 수 있는 통계적 모형을 활용하여 정교한 분석을 수행할 필요가 있을 것이다.

이에 우선 ⅰ) 단기적인 자금 압박 위험을 포착하는 현금 유동성 위험(cash crunch risk)과 ⅱ) 장ㆍ단기 채무의 상환 불가능 위험을 포괄하는 부도 위험(default risk)을 각각 추정ㆍ제시한다. 아울러, 회사채 시장에서의 재금융 부담을 점검하여 통계적 모형에 반영하기 어려운 자금시장의 중대한 마찰적 요인을 별도로 평가하며, 심층적인 관리ㆍ감독이 시급한 취약 부문 역시 식별ㆍ제시한다.

1. 현금 유동성 위험

본 절에서 기술하는 현금 유동성 위험은 영업 부문의 현금흐름 손실로 6개월 이내에 보유현금을 소진할 위험에 해당한다(De Vito & Gomez, 2020; 이상호, 2020). 긴축적 통화정책 과정에서 발생할 수 있는 자금시장의 경색(Gertler & Karadi, 2015), 총수요 위축(Christiano et al., 1998) 등의 요인은 재무활동을 통한 현금흐름 유입 가능성을 제한함과 동시에 영업현금흐름의 악화를 유발하므로, 현재 단기적인 관점에서 검토의 필요성이 높은 채무불이행 시나리오라 판단한다.

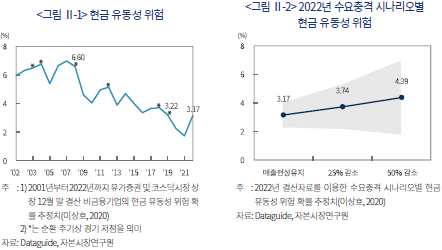

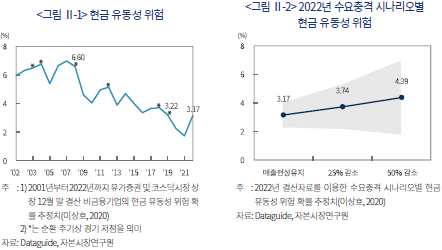

추정한 연도별 현금 유동성 위험 확률은 <그림 Ⅱ-1>과 같다.4) 이상호(2020)는 동 모형으로 추정한 확률이 시장 퇴출 위험과 같은 상장기업의 극단적인 하방 위험(downside risk)에 대해 유의미한 예측력이 있음을 실증한 바 있다. 추정확률의 추이를 살펴보더라도, 순환 주기상 경기 저점(trough) 부근을 단기 고점으로 하여 굴절(kink)하는 양상을 보여 추정의 신뢰도를 확보한 것으로 판단한다.

결과적으로, Ⅰ장에서 제기한 고금리 상황에서의 여러 우려 요인에도 불구하고, 상장기업의 단기적인 채무불이행 위험을 측정하는 현금 유동성 위험은 비교적 안정적인 범위 내에서 소폭 상승한 정도로 파악된다. 구체적으로 최근 결산연도인 2022년 말을 기준으로 단기적인 자금 압박에 직면할 가능성이 있는 기업은 3.17% 수준에 해당한다. 이는 보호무역주의 강화, 내수시장 침체 등의 여파로 기업의 수익성이 악화한 2019년도의 3.22% 수준과 유사하고, 2008년도 글로벌 금융위기 당시 6.6% 수준보다는 상당히 안정적이라 평가할 수 있다(<그림 Ⅱ-1> 참조).

매출의 25%ㆍ50% 감소 등 극단적인 수요충격을 가정한 경우에도 단기적인 채무불이행 위험의 확산 가능성은 제한적으로 나타나(<그림 Ⅱ-2> 참조), 금융당국의 정책적 대응 범위 내에 있을 것으로 판단한다. 실제 2022년 말 상장기업이 보유한 총 단기금융부채 대비 보유현금 비중은 개별(연결) 기준 106%(129%)로, 기업이 운영자금 수요에 탄력적으로 대응할 여력은 충분한 상황이다.

2. 부도 위험

앞선 현금 유동성 위험 분석에서는 단기적인 영업현금흐름 악화 가능성 측면에서 채무불이행 위험을 진단하였다. 본 절에서는 기업의 시장가치 정보를 이용하여, 총부채의 상환능력 관점에서 채무불이행 위험을 진단하고자 한다. 구체적으로, 만기 시점에 기업이 상환해야 할 부채 규모가 총자산의 시장가치를 초과할 위험을 부도 위험으로 정의하고 해당 확률을 추정한다(Merton, 1974). 이는 기업이 청산절차를 거치더라도 채무를 완전히 상환할 수 없는 상황으로 이해할 수 있다.

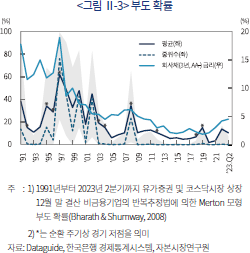

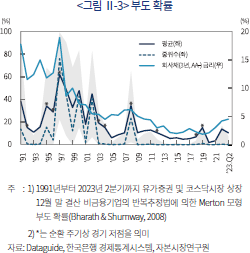

반복추정법(iteration method)에 의한 Merton 모형 부도 확률은 <그림 Ⅱ-3>과 같다.5) 추정확률의 평균 추이를 보면, 3년 만기 회사채(AA- 등급)의 금리와 유사한 흐름을 보여 부도 확률 추정 결과는 시장의 신용위험을 잘 반영하는 것으로 판단한다. 결과적으로 이와 같은 부도 확률은 시장가치에 기초하여 장ㆍ단기 총채무에 대한 상환능력을 추정한 수치이며, 역사적으로 과도하게 우려할 만한 수준은 아님을 확인할 수 있다. 2023년 2분기 말 기준 상장기업의 부도 확률 평균은 10.4% 수준으로 나타나는데, 이는 2021년 말을 기준으로 하는 3.5% 수준보다는 다소 높지만, 과거의 경기 저점을 포함한 여러 차례의 경제위기 시와 비교하여 안정적인 범위 내로 판단한다.

2022년 하반기부터 기업의 대출 규모가 빠르게 증가한 점은 분명 예의주시할 요인이다(한국은행, 2022, 2023). 그러나 이에는 회사채 시장의 일시적 경색으로 기업이 사채의 발행보다 대출을 확대하는 방향으로 부채 구성을 변화한 영향이 크게 작용한 점 또한 고려할 필요가 있다. 앞서 <그림 Ⅰ-5>에서도 살펴보았듯 담보 자산 대비 총부채 비율은 지속적으로 하향 안정화하는 가운데 건전한 수준을 유지하고 있으며, 이는 통계적 모형을 활용한 분석 결과가 시사하는 바와도 일치한다.

3. 재금융 부담

전술한 현금 유동성 위험(Ⅱ장 1절)과 부도 위험(Ⅱ장 2절) 분석을 통해 영업현금흐름의 창출력 및 자산가치의 담보력 측면에서 채무불이행 위험을 종합적으로 점검한 결과, 거시적으로 기업 부문의 재무건전성을 중대하게 우려할 상황은 아닌 것으로 판단한다. 다만, 자금시장의 경색과 같은 외생변수의 변화를 분석에 고려하지 못한 점은 유의하여 해석할 필요가 있다. 대내적으로 장기간 공공요금 인상폭을 제한한 발전 공기업의 자금조달 수요 등이 채권시장에서 저신용 회사채를 몰아내는(crowding out) 변수로 작용할 여지는 여전히 남아있기 때문이다(정화영, 2023).

한편, 미국의 경우 코로나바이러스감염증-19 확산 이후 초저금리로 발행한 회사채의 차환 수요가 2025년부터 큰 폭으로 증가할 전망이다. 실제 연도별 회사채 만기 규모가 2023년 5,250억달러에서 2024년 7,900억달러, 2025년 1조 70억달러로 급격히 확대되기 때문이다. 이에 미국 회사채 시장은 2년 후 재금융 절벽(refinancing wall)을 우려하는 상황이다.6)

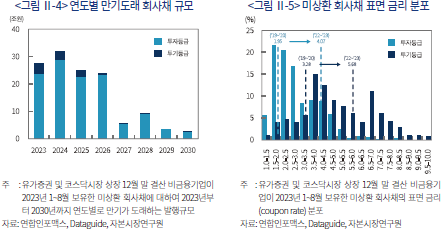

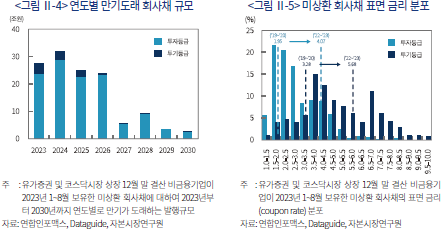

이와 같은 대내외적 불안 요인을 고려하여, 본 절에서는 국내 채권시장의 재금융 부담 요인을 점검한다. 연도별 회사채 만기 규모를 파악한 결과, 2023년 27.3조원에서 2024년 31.9조원으로 소폭 증가하나, 2025년 24.8조원, 2026년 24조원으로 일정한 수준이 유지되는 모습이다(<그림 Ⅱ-4> 참조). 신용등급 BB+ 이하의 투기등급(high yield) 채권 비중도 절대적으로 크지 않다. 전반적으로 우리나라 회사채 시장은 연도별 만기규모가 비교적 균등하게 분포하고 있어 차환 부담의 대대적 확산 가능성은 제한적일 것으로 예상한다.

단, 미상환 회사채의 표면 금리(coupon rate) 분포상, 향후 이자 부담률이 상승할 가능성이 높다는 점은 예의주시할 요인이다(<그림 Ⅱ-5> 참조). 신용등급 BBB- 이상 투자등급(investment grade) 채권의 경우 2019~2020년 평균 1.95%로 발행되었는데, 2022~2023년 발행 물량의 표면 금리는 4.07%로 2.12%p 상승하였으며, 투기등급 채권 역시 해당 기간 3.28%에서 5.68%로 2.4%p 상승했다. 상장기업이 보유한 회사채 중 과거 낮은 수준의 표면 금리로 발행한 물량이 여전히 큰 비중을 차지하고 있어, 향후 재금융 부담은 자금시장의 마찰적 요인보다는 이자 부담 증가에 직접적인 영향을 받을 가능성이 높다.

4. 취약 부문

본 장의 1~3절까지의 결과가 시사하는 바는 최근 시장의 금리상승과 기업의 대출의존도 확대 지적에도 불구하고 장ㆍ단기 채무의 부실화 위험이 시스템적으로 확산할 가능성은 크지 않다는 점이다. 취약 부문을 중심으로 한 미시적 문제의 대응이 필요한 상황으로 판단한다.

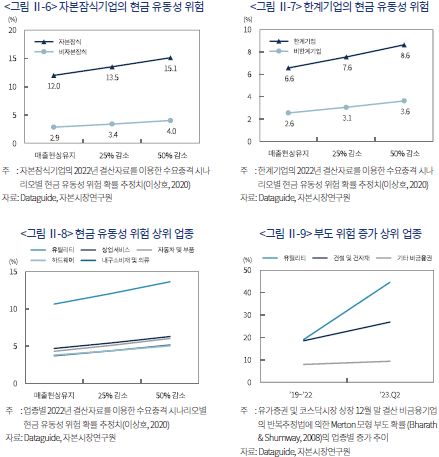

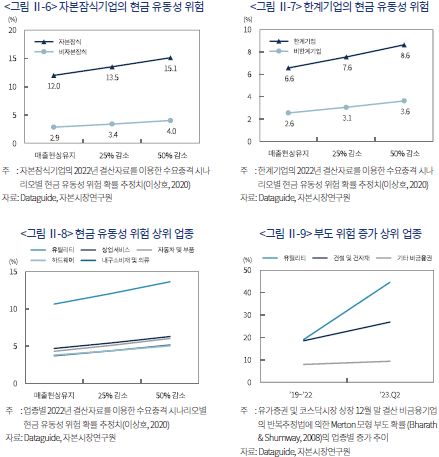

이에 본 절에서는 관리ㆍ감독이 긴요한 취약 부문을 식별하여 제시한다. 우선, 경기 둔화에 의한 수요 감소 시 부실기업을 중심으로 영업현금흐름 악화에 의한 채무불이행 위험의 현실화 가능성이 높을 것으로 예상한다. 실제 자본잠식기업, 한계기업 등 현 상태로도 재무건전성이 부실한 기업군을 살펴보면, 현금 유동성 위험이 상당한 수준으로 나타난다(<그림 Ⅱ-6>, <그림 Ⅱ-7> 참조). 매출의 현상 유지를 가정한 경우에도 자본잠식 기업은 비자본잠식 기업 대비 4.14배, 한계기업은 비한계기업 대비 2.54배 높은 현금 유동성 위험 수준을 보인다. 한편, 한계기업의 경우 이미 장기간 영업 경쟁력을 상실하여 추가적인 수요 감소로 인한 영향은 제한적 범위 내에서 소폭 상승하는 수준으로 파악된다.

업종별로는 고금리 상황에 취약한 유틸리티ㆍ건설 업종을 중심으로 채무불이행 위험의 확대가 예상된다. 특히, 유틸리티 업종은 장기간 원가의 부담을 판가로 전이하지 못하면서 재무구조가 상당히 악화한 상황이다. 매우 높은 수준의 현금 유동성 위험이 예상될 뿐만 아니라(<그림 Ⅱ-8> 참조), 부도 위험 역시 2023년 2분기 재무 상태를 기준으로 과거 4개년 평균 대비 2.34배 급증한 것으로 나타났다(<그림 Ⅱ-9> 참조). 부동산시장 침체, 공사비용 증가의 영향에 크게 노출된 건설 및 건자재 업종 또한 기타 비금융업 대비 부도 위험의 증가 폭이 상당히 높은 수준을 보인다(<그림 Ⅱ-9> 참조).

Ⅲ. 부채관리 양상의 평가

우리나라 기업 부문의 부채관리는 1997년 외환위기, 2008년 금융위기 등 큰 경제위기를 겪으면서 건전성 유지에 집중해왔다. 이는 유동성 경색 등 극단적 위기 상황에서 복원력(resilience)의 원천으로 작용해왔으며(이상호, 2020), Ⅱ장에서의 분석 결과를 상기해보면 이러한 평가는 이번의 금리 인상기에도 유효할 것으로 보인다. 다만, 2010년부터 부채 조달 비용이 추세적으로 하락해온 상황에서도, 기업의 재무구조 정책이 부채의 축소(deleveraging)를 통한 건전성 확보에서 크게 벗어나지 못한 점에 대해서는 심층적인 평가가 필요할 것으로 판단된다.

이에 본 장에서는 그간의 재무구조 정책이 기업의 투자 기회 달성과 성장성 제고 측면에서 효과적이었는지를 평가하고, 개선이 필요한 기업군을 식별하기 위해 세부적인 검토를 수행한다.

1. 재무구조 정책의 성장 기여도

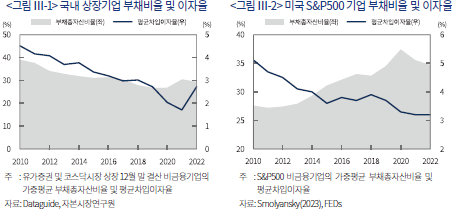

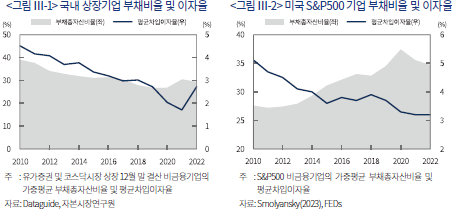

우리나라 기업은 2008년 글로벌 금융위기 이후 기업의 이자 부담률이 지속 하락하는 과정에서 부채비율을 신축적으로 상향 조정하기보다는 안정적 관리에 치중했다(<그림 Ⅲ-1> 참조). 이는 동일 기간 미국 S&P500 기업이 부채비율을 꾸준히 늘려온 것과는 상반된 흐름이다(<그림 Ⅲ-2> 참조).7)

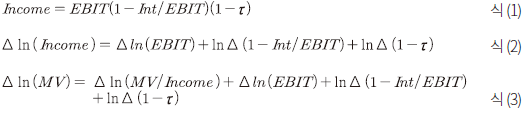

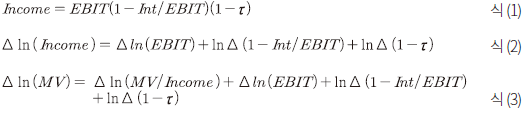

상기와 같은 재무구조 정책이 기업 부문의 실질 이익 성장, 나아가 기업가치 상승에 어떠한 기여를 해왔는지 평가하기 위해, 본 절에서는 회계 항등식을 이용하여 기업의 순이익 증가 및 주가수익률 상승 요인을 분해한다(Smolyansky, 2023).

손익계산서상 기업의 최종 이익( )은 영업이익에서 이자비용, 법인세비용 및 기타 비용을 차감한 순이익이다. 이는 식 (1)과 같이 이자ㆍ법인세비용 차감 전 이익(

)은 영업이익에서 이자비용, 법인세비용 및 기타 비용을 차감한 순이익이다. 이는 식 (1)과 같이 이자ㆍ법인세비용 차감 전 이익( )을 기준으로 이자 부담률(

)을 기준으로 이자 부담률( )과 유효세율(

)과 유효세율( )만큼의 이익을 제하는 형태로 표현할 수 있다. 이를 로그(log) 변환한 후 1차 차분(differencing)하면, 식 (2)와 같이 이익의 성장을 ⅰ) 이자ㆍ법인세비용 차감 전 이익의 성장, ⅱ) 이자 부담률 감소 및 ⅲ) 유효세율 감소 요인으로 분해할 수 있다. 한편, 식 (1)의 양변에 보통주 시가총액ㆍ이익 배수(

)만큼의 이익을 제하는 형태로 표현할 수 있다. 이를 로그(log) 변환한 후 1차 차분(differencing)하면, 식 (2)와 같이 이익의 성장을 ⅰ) 이자ㆍ법인세비용 차감 전 이익의 성장, ⅱ) 이자 부담률 감소 및 ⅲ) 유효세율 감소 요인으로 분해할 수 있다. 한편, 식 (1)의 양변에 보통주 시가총액ㆍ이익 배수( )를 곱하여 식 (2)와 같이 로그 변환 및 차분 과정을 거치면, 식 (2)에서 ⅳ) 이익 평가배수 확대 요인을 추가한 식 (3)의 형태로 주가수익률 상승을 확장하여 표현할 수 있다.

)를 곱하여 식 (2)와 같이 로그 변환 및 차분 과정을 거치면, 식 (2)에서 ⅳ) 이익 평가배수 확대 요인을 추가한 식 (3)의 형태로 주가수익률 상승을 확장하여 표현할 수 있다.

여기서, = 순이익,

= 순이익,  = 이자ㆍ법인세비용 차감 전 이익,

= 이자ㆍ법인세비용 차감 전 이익,  = 이자비용,

= 이자비용,  = 유효세율,

= 유효세율,  = 보통주 시가총액을 의미한다.

= 보통주 시가총액을 의미한다.

상장기업 부문의 실질(real) 성장에 대한 요인별 기여도를 파악하기 위해 모든 변수는 국내총생산에 대한 지출 디플레이터(2015년=100)를 이용하여 실질화하였으며, 시가총액을 기준으로 가중평균하되, 삼성전자 등 시가총액 상위 기업이 절대적인 영향을 미치는 현상을 완화하여 결과의 대표성을 확보하고자 가중치의 한도는 5%로 설정하였다.

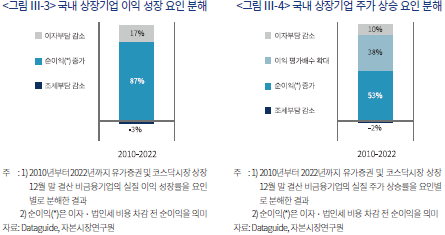

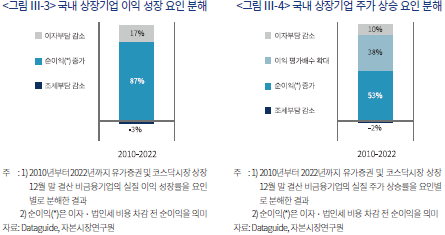

최종적으로 식 (2)와 식 (3)을 이용하여 우리나라 상장기업의 이익 성장 및 주가 상승 요인을 분해한 결과는 <그림 Ⅲ-3> 및 <그림 Ⅲ-4>와 같다. 2010년부터 2022년까지 이어진 추세적인 저금리 기조에도 불구하고, 이자부담 감소는 상장기업 실질 순이익 성장의 17% 정도를 설명하며, 주가 상승에 대한 기여도 역시 10% 수준에 그친 것으로 확인된다.

저금리 시기 미국 기업의 부채 활용 양상을 다룬 관련 선행연구의 분석 결과를 살펴보면, 미국 S&P500 기업의 경우 지난 20년간 저비용 차입자본을 적극적으로 활용하여 신축적으로 재무 레버리지를 확대해왔다. 이러한 재무구조 정책은 미국 기업 부문의 이익 성장을 촉진하였을 뿐 아니라, 가중평균자본비용을 낮추어 주가수익률 상승에도 상당한 기여를 한 것으로 나타났다. 특히, 트럼프 행정부의 전폭적인 법인세율 인하 조치와 맞물려8), 동기간 실질 순이익 성장의 41%, 주가수익률 상승의 28%가 이자ㆍ조세 부담 감소의 영향으로 산출되었다(Smolyansky, 2023).

이상 과거의 저금리 기조가 우리나라 기업 부문의 이익 성장에 제한적으로 기여한 결과는 양면적인 시사점을 제공한다. 우선, 과거 대비 다소 높은 수준으로 금리 기조가 전환하더라도 기업 부문의 수익성 하락에 미치는 영향 역시 제한적일 가능성이 높다는 점이다. 위기 상황의 발현 시에도 기초여건 상 질서정연한 감내가 가능할 것으로 예상한다.

다른 한편으로는, 향후 기업 부문의 효과적인 부채관리 방안에 대해 발전적 논의가 필요하다는 점이다. 저금리 기조 대비 높은 수준의 명목균형금리 유지를 전제로 건전성에 대한 고려는 여전히 중요할 것이나, 건전성 유지가 부채 활용의 목적은 아니다. 적정 부채비율에 관한 여러 이론이 존재하지만, 부채 조달 본연의 순기능 중 하나는 투자 기회의 달성을 촉진하는 것이며, 궁극적으로는 성장을 통해 기업가치를 극대화하는 것이다.

2. 기업수명주기별 부채 활용 양상

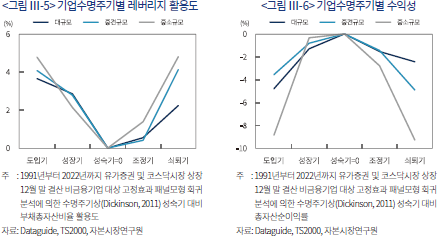

전술한 결과에 따르면, 그간 우리나라 기업 부문의 재무구조 정책은 투자 기회 달성과 성장성 제고 측면에서 효과적이지 못했다. 본 절에서는 세부적인 검토를 위해 어떠한 기업군에서 그러한 경향이 두드러지는지 기업의 수명주기에 따른 부채 활용 양상을 살펴본다.

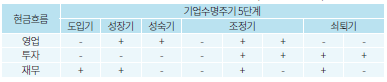

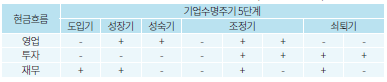

기업수명주기 단계는 Dickinson(2011)이 제안한 영업ㆍ투자ㆍ재무 현금흐름 양상을 기준으로 도입기(introduction), 성장기(growth), 성숙기(mature), 조정기(shake-out), 쇠퇴기(decline)의 5단계로 구분한다.9) 기업의 세 가지 활동별 현금흐름은 각각 수익성, 성장성, 재무적 위험을 대리하므로(Livnat & Zarowin, 1990), 기업의 전략적 자원배분과 운영 능력에 기초한 성장 단계 특성 구분에 유용한 것으로 알려져 있다(Dickinson, 2011; 두서영 외, 2016).

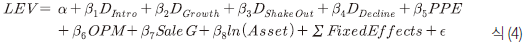

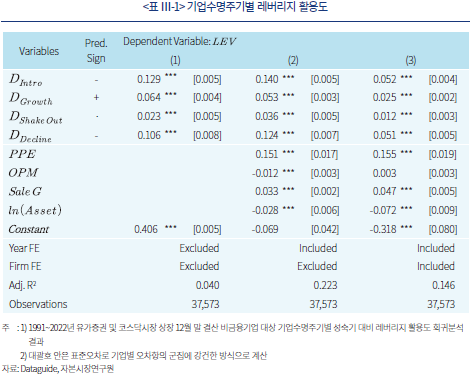

기업수명주기별 레버리지 활용도를 살펴보는 회귀 모형은 식 (4)와 같다. 이는 영업지식이 축적됨에 따라 기업의 운영 효율성이 극대화되는 성숙기를 준거점으로 도입기, 성장기, 조정기, 쇠퇴기의 상대적인 부채 수준을 측정한다. 부채 수준에 영향을 미치는 개별 기업 요인을 충분히 통제하기 위해 자산의 유형성(tangibility), 수익성, 성장성, 규모 특성과 기업 고정효과를 포함하며, 동적인 자본구조 조정 특성을 통제하고자 연도 고정효과를 포함한다(Fama & French, 2002).

여기서, = 부채 총자산 비율,

= 부채 총자산 비율,  = 도입기 기업이면 1, 아니면 0의 값을 갖는 더미변수,

= 도입기 기업이면 1, 아니면 0의 값을 갖는 더미변수,  = 성장기 기업이면 1, 아니면 0의 값을 갖는 더미변수,

= 성장기 기업이면 1, 아니면 0의 값을 갖는 더미변수,  = 조정기 기업이면 1, 아니면 0의 값을 갖는 더미변수,

= 조정기 기업이면 1, 아니면 0의 값을 갖는 더미변수,  = 쇠퇴기 기업이면 1, 아니면 0의 값을 갖는 더미변수,

= 쇠퇴기 기업이면 1, 아니면 0의 값을 갖는 더미변수,  = 유형자산을 총자산으로 나눈 값,

= 유형자산을 총자산으로 나눈 값,  = 매출액 영업이익률,

= 매출액 영업이익률,  = 매출액 성장률,

= 매출액 성장률,  = 총자산의 자연로그 값을 의미한다.

= 총자산의 자연로그 값을 의미한다.

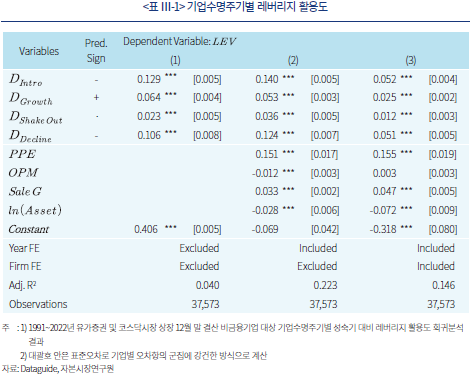

식 (4)의 회귀분석 결과, 모든 열에서 도입기의 부채비율이 가장 높게 나타났다(<표 Ⅲ-1> 참조). 더욱 특징적인 것은 성장기보다 쇠퇴기에 레버리지 활용 수준이 높게 형성되어 있다는 점이다. 즉, 기업의 매출이 확대되고, 수익성이 본격적으로 증가하여 투자 기회가 풍부한 도입ㆍ성장 구간에서 부채의 축소가 이루어지고, 영업경쟁력이 악화하면서 투자 기회가 감소하는 조정ㆍ쇠퇴 구간에서 부채를 확대하는 양상이다.

일반적으로 성장기는 수요 증가 대응, 진입장벽 구축을 위해 대규모 자금조달을 통한 설비투자가 필요한 시기이며, 쇠퇴기는 투자 기회의 감소로 부채ㆍ자본의 효율적인 재조정이 필요한 시기에 해당한다(Spence, 1979, 1981). 자본 조달에 관한 여러 이론이 존재하지만, 파산비용이 이자비용의 감세효과를 초과할 만큼 재무적 곤경 위험이 과도하다거나(trade-off theory: 상충 이론)(Modigliani & Miller, 1963; Scott, 1977), 짧은 업력 등으로 부채 조달을 위한 평판이 구축되지 않아 차입에 제약이 있는(reputation theory: 평판 이론)(Diamond, 1989) 이례적 상황 등을 제외하면, 사내유보 자금이 충분하지 않은 성장기에는 부채의 확대를 우선 고려할 수 있다(pecking order theory: 순위 이론)(Shyam-Sunder & Myers, 1999).

쇠퇴기는 상대적으로 업력이 길어 평판 문제로 인한 차입의 제약 요인은 미미한 가운데, 대리인 비용을 절감하기 위한 목적으로 부채 조달을 통해 채권자의 외부 감시(monitoring) 기능을 확대할 유인은 존재한다(agency theory: 대리인비용 이론)( Jensen & Meckling, 1976). 그러나 낮은 수익성으로 파산위험이 증가하고, 투자 기회가 제한된 쇠퇴기에 성장기보다 더 적극적으로 부채를 활용해야 할 이론적ㆍ실증적 근거를 제시한 문헌은 드물다.

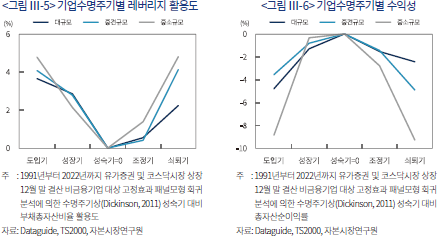

실제, 미국 기업을 대상으로 한 선행연구는 성장기에 부채비율이 가장 높고, 쇠퇴기의 부채비율이 가장 낮아 기업수명주기와 부채비율 간 역 U자에 가까운 관계를 보고한 바 있다(Dickinson, 2011). 반면, 우리나라는 쇠퇴기에 중소ㆍ중견 기업의 레버리지 확대 현상이 두드러져 기업수명주기와 부채비율 간 U자에 해당하는 상반된 결과를 보인다(<그림 Ⅲ-5> 참조). 특히, 기업의 수익성이 악화하는 조정ㆍ쇠퇴 구간과 달리, 본격적으로 마진이 확대되는 성장기에 부채를 축소하는 양상이 뚜렷하다(<그림 Ⅲ-6> 참조). 이와 같은 국내 기업 부문의 보수적인 재무구조 정책은 레버리지 활용의 성장 기여도가 낮은 주요 원인일 가능성이 높은 만큼, 효과적인 부채 활용을 위한 미래지향적 논의가 필요할 것으로 판단한다.10)

Ⅳ. 효과적인 부채 활용 방안

우리나라는 글로벌 금융위기 이후 장기간 이어진 저금리 기조 하에서도 대외의존도가 높은 경제구조 상 보수적인 차입 경영을 내재화해왔다. 해당 기간, 부채자본비율이 200%를 초과하는 등 재무구조가 취약한 기업에 대해 외부감사인을 직권으로 지정한 조치 역시 기업의 적극적 부채 활용에 일부 제약 요인으로 작용했을 것이다.11) 단, 그러한 시기에 주도적으로 부채를 축소한 기업은 상대적으로 기초여건이 우량하고 성장기에 진입한 기업이었다. 앞으로의 부채 활용에는 성장성 제고를 위한 여러 대내외 요인을 종합적으로 고려할 필요가 있다.

그러한 관점에서 첫째, 기업수명주기에 입각한 재무구조의 선택 및 주주환원 정책의 재검토를 제언한다. 도입기ㆍ성장기 기업은 적극적 차입전략을 통해 성장 기회를 모색할 필요가 있으며, 성숙기ㆍ쇠퇴기 기업은 주주환원을 위해 자본을 효율적으로 재배치할 필요성을 점검해야 한다.

둘째, 비핵심사업 매각을 통한 부채 축소를 포함하여 운영 효율을 극대화할 필요가 있다. 향후 잠재 GDP 성장률의 둔화가 예상되는 가운데 매출 확대를 통한 이익 성장의 여지는 제한적일 수 있다. 이에 따라 당분간 마진율 개선이 이익 성장의 주요 경로가 될 가능성이 높다. 이러한 과정에서 한계기업과 같은 취약 부문의 재무구조 개혁은 시급한 과제다. 기업구조조정 촉진법이 일몰한 가운데 차제에 시장 주도의 선제적인 구조조정을 활성화할 수 있도록 상시화한 제도 마련을 검토할 필요가 있다.

셋째, 숨은 부실 위험의 파악과 대응책 마련에도 만전을 기해야 한다. 역사적으로 시스템적인 위기는 대체로 드러나지 않은 위험에서 촉발했다. 재무상태표상 부채로 집계되지 않는 우발채무는 그 규모와 확정 가능성을 면밀히 검토하여 대응계획을 수립해야 한다. 아울러, 숨은 부채 문제를 초래할 수 있는 신종자본증권의 경우 상장기업은 한국채택국제회계기준(K-IFRS)에 따라 부채ㆍ자본 요소를 각각 분리하여 인식하고 있고 자본으로 분류한 금액 또한 2023년 2분기 기준 총자산의 0.3% 수준에 불과하나, 일반기업회계기준(K-GAAP)을 적용하는 비상장기업은 신종자본증권의 부채 요소를 대부분 자본으로 분류하고 있을 가능성이 높아 실체적인 위험 파악과 대비가 필요하다.

아울러, 탈세계화, 탈탄소화, 인구구조 변화 등 향후 장기적 관점에서 글로벌 인플레이션의 구조적 상승을 촉발할 수 있는 요인은 기업의 부외부채와도 밀접한 관련이 있음을 염두에 둘 필요가 있다. 경제 블록화 대응을 위한 이중 투자, 온실가스 감축 및 좌초 자산 대체를 위한 투자, 고령화에 따른 종업원 연금 부담 확대와 노동의 생산성 기여도 하락 등은 기업의 지속가능성 관점에서 장기간 개선해 나가야 할 과제이다. 이는 지속가능성 공시의 측면에서 객관적 식별과 측정ㆍ관리에 대한 이해관계자의 요구가 거세지는 영역이기도 하다.

1) 본 보고서상 기업부채에 관한 실증분석은 주권상장법인을 대상으로 한정한다. 비상장기업의 경우 통계적 모형에 필요한 주요 시장정보 변수의 입수가 불가능하여 엄밀한 분석이 제한되기 때문이다.

2) 한국은행은 2021년 8월부터 2023년 1월까지 10차례에 걸쳐 기준금리를 총 3%p 인상하였으며, 2023년 10월 현재 3.5% 수준을 유지하고 있다.

3) 극단치에 의한 영향을 완화하기 위해 이자비용이 0인 기업 및 차입이자율이 30%를 초과하는 기업은 표본에서 제외하였다.

4) 구체적인 방법론은 <부록 1>에 기술하였다.

5) 구체적인 방법론은 <부록 2>에 기술하였다.

6) Goldman Sachs, 2023. 8. 6, The Corporate Debt Maturity Wall: Implications for Capex and Employment.

7) 해당 기간 우리나라 상장기업 전체의 부채총자산비율과 평균차입이자율 간 Pearson 상관계수는 0.82이며, KOSPI100 및 KOSPI200 지수 편입 대상 기업으로 한정하여 보더라도 각각 0.83, 0.82로 관측된다. 반면, 미국 S&P500 기업의 부채총자산비율과 평균차입이자율 간 Pearson 상관계수는 –0.88로 나타난다.

8) 2018년 1월 1일 시행한 감세와 일자리 법안(Tax Cuts and Jobs Act of 2017)은 법정 최고 법인세율을 35%에서 21%로 14%p 인하했다.

9) 기업수명주기 단계별 현금흐름의 구분 양상은 아래와 같다(Dickinson, 2011; 두서영 외, 2016).

10) 해당 논의에는 성장 기회(growth option)와 관련한 외생적ㆍ구조적 환경 요인을 포함한 종합적 논의가 필요하며, 이는 본 보고서의 분석 범위를 넘어서므로 후속 연구과제로 남겨둔다.

11) 2014년 11월 19일 시행한 외부감사법 시행령은 부채자본비율이 동종업종 대비 1.5배를 초과하고, 절대적으로도 200%를 초과하는 경우, 영업이익이 이자비용에 미달하면 해당 주권상장법인을 감사인 지정 대상에 포함하였으나, 2020년 10월 13일 시행한 시행령 개정안에서 관련 조항을 삭제하였다.

12) 2023년 2분기의 경우 반기 재무제표의 공시일이 속한 8월 말을 기준으로 자본의 시장가치( )와 변동성(

)와 변동성( )의 시초값을 설정하였다.

)의 시초값을 설정하였다.

참고문헌

강현주, 2023, 미국 실물경제의 금리 민감도 하락 및 시사점,『자본시장포커스』 2023-12호.

김필규, 2023, 금리 상승에 따른 기업 부채구조의 변화,『자본시장포커스』 2023-11호.

두서영ㆍ윤성수ㆍ송길성, 2016, 기업수명주기, 시장경쟁과 투자효율성 간 관계에 관한 실증연구,『회계저널』 25(4), 209-255.

박용린, 2023, 최근 벤처투자 감소의 원인 진단과 향후 모험자본시장의 발전과제,『자본시장포커스』 2023-13호.

이상호, 2020,『코로나19 확산의 수요충격에 대비한 상장기업 현금소진위험 스트레스 테스트』, 자본시장연구원 이슈보고서 20-11.

정화영, 2023, 통화긴축기 가계부채 안정성에 대한 소고,『자본시장포커스』 2023-18호.

한국은행, 2022,『금융안정보고서』.

한국은행, 2023,『금융안정보고서』.

Bharath, S.T., Shumway, T., 2008, Forecasting default with the Merton distance to default model, The Review of Financial Studies 21(3), 1339-1369.

Black, F., Scholes, M., 1973, The pricing of options and corporate liabilities, Journal of Political Economy 81(3), 637-654.

Christiano, L.J., Eichenbaum, M., Evans, C.L., 1999, Monetary policy shocks: What have we learned and to what end? Handbook of Macroeconomics 1, 65-148.

De Vito, A., Gómez, J.P., 2020, Estimating the COVID-19 cash crunch: Global evidence and policy, Journal of Accounting and Public Policy 39(2), Article 106741.

Diamond, D.W., 1989, Reputation acquisition in debt markets, Journal of Political Economy 97(4), 828-862.

Dickinson, V., 2011, Cash flow patterns as a proxy for firm life cycle, The Accounting Review 86(6), 1969-1994.

Fama, E.F., French, K.R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33(1), 3–56.

Fama, E.F., French, K.R., 2002, Testing trade-off and pecking order predictions about dividends and debt, Review of Financial Studies 15(1), 1-33.

Gertler, M., Karadi, P., 2015, Monetary policy surprises, credit costs, and economic activity, American Economic Journal: Macroeconomics 7(1), 44-76.

IMF, 2023, Asia and Pacific Regional Economic Outlook.

Jensen, M., Meckling, W., 1976, Theory of the firm: Management behavior, agency costs and capital structure, Journal of Financial Economics 3(4), 305-360.

Kothari, S.P., Leone, A.J., Wasley, C.E., 2005, Performance matched discretionary accrual measures, Journal of Accounting and Economics 39(1), 163–197.

Livnat, J., Zarowin, P., 1990, The incremental information content of cash-flow components, Journal of Accounting and Economics 13(1), 25-46.

Merton, R.C., 1974, On the pricing of corporate debt: The risk structure of interest rates, The Journal of Finance 29(2), 449-470.

Modigliani, F., Miller, M.H., 1963, Corporate income taxes and the cost of capital: A correction, The American Economic Review 53(3), 433-443.

Scott, J.H., 1977, Bankruptcy, secured debt, and optimal capital structure, The Journal of Finance 32(1), 1-19.

Shyam-Sunder, L., Myers, S.C., 1999, Testing static tradeoff against pecking order models of capital structure, Journal of Financial Economics 51(2), 219-244.

Smolyansky, M., 2023, End of an era: The coming long-run slowdown in corporate profit growth and stock returns, FRB finance and economics discussion series.

Spence, A.M., 1979, Investment strategy and growth in a new market, J. Reprints Antitrust L. & Econ 10, 345.

Spence, A.M., 1981, The learning curve and competition, The Bell Journal of Economics 12(1), 49-70.

Vassalou, M., Xing, Y., 2004, Default risk in equity returns, The Journal of Finance 59(2), 831-868.

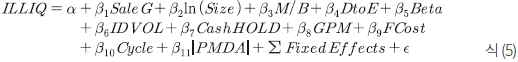

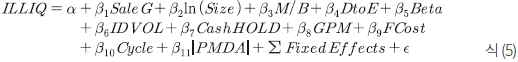

현금 유동성 위험 확률을 추정하기 위한 회귀분석 모형은 식 (5)와 같다. 기업의 현금소진 여부를 결정하는 요인으로 레버리지율과 함께 기업 규모, 성장성, 시장민감도 등 위험자산의 일반적 위험 요인을 고려하고, 기업 고유의 변동성 역시 포함한다(Fama & French, 1993). 개별 기업의 재무 상태를 추정에 반영하고자 단기 현금 유동성과 직결되는 현금보유수준을 통제하며, 전방 수요 변화의 영업현금흐름 민감도와 관련성이 높은 수익성, 고정비 비율, 운전자본 관리의 효율성 또한 고려한다. 기업의 매출이 경영자의 기회주의적인 이익조정에 영향을 받을 경우 발생하는 측정오차 문제를 완화하고자 이익조정 수준을 통제하며(Kothari et al., 2005), 시간 불변(time invariant)의 산업적 특성을 통제하고자 산업 고정 효과를 포함한다.

여기서, = 6개월 이내 현금 보유의 소진 예상 시 1, 아니면 0의 값을 갖는 더미변수로 6개월 이내 현금소진은 (현금 및 현금성자산+단기금융자산)/영업활동현금흐름이 –0.5보다 크고, 0보다 작거나 같은 경우로 정의하며, 현금전환주기가 6개월 미만일 경우 당기 매출채권 발생분을 단기금융자산에 포함(이상호, 2020),

= 6개월 이내 현금 보유의 소진 예상 시 1, 아니면 0의 값을 갖는 더미변수로 6개월 이내 현금소진은 (현금 및 현금성자산+단기금융자산)/영업활동현금흐름이 –0.5보다 크고, 0보다 작거나 같은 경우로 정의하며, 현금전환주기가 6개월 미만일 경우 당기 매출채권 발생분을 단기금융자산에 포함(이상호, 2020),  = 매출액 성장률,

= 매출액 성장률,  = 시가총액(+3월 말)의 자연로그 값,

= 시가총액(+3월 말)의 자연로그 값,  = 시가총액(+3월 말)÷지배주주 장부가치,

= 시가총액(+3월 말)÷지배주주 장부가치,  = 부채÷총자본,

= 부채÷총자본,  = Fama & French(1993) 3요인 모형 시장민감도(+3월 말 기준 과거 36개월),

= Fama & French(1993) 3요인 모형 시장민감도(+3월 말 기준 과거 36개월),  = Fama & French(1993) 3요인 모형 고유변동성(+3월 말 기준 과거 36개월),

= Fama & French(1993) 3요인 모형 고유변동성(+3월 말 기준 과거 36개월),  = (현금 및 현금성자산+단기금융자산)÷총자산,

= (현금 및 현금성자산+단기금융자산)÷총자산,  = (매출액-매출원가)÷매출액,

= (매출액-매출원가)÷매출액,  = (감가상각비+이자비용)÷(매출액-영업이익),

= (감가상각비+이자비용)÷(매출액-영업이익),  = (평균재고자산÷매출원가)+(평균매출채권÷매출액)-(평균매입채무÷매출원가),

= (평균재고자산÷매출원가)+(평균매출채권÷매출액)-(평균매입채무÷매출원가),  = 성과조정 재량적발생액의 절댓값(Kothari et al., 2005)을 의미한다.

= 성과조정 재량적발생액의 절댓값(Kothari et al., 2005)을 의미한다.

최종적으로 식 (5)의 연도별 Probit 회귀분석을 통해 기업별 단기적인 자금 압박 가능성에 관한 예측 확률을 추정하며, 이상호(2020)는 동 모형으로 추정한 확률이 시장 퇴출 확률(미래 3년 이동평균)과 유의미한 관련성이 있음을 실증하였다.

Merton(1974)은 채권 만기 시 주주가 관련 채권을 상환한 이후 잔여 재산에 대하여 청구권(residual claim)을 갖는 점에 착안하여, 자본(equity)을 콜옵션과 유사한 성격으로 보았다. 이에, 식 (6)과 같이 Black-Scholes(1973)의 옵션가격결정모형에 따라 자본의 시장가치를 부채의 만기 시점( )에 부채 상환액(

)에 부채 상환액( )을 행사가격으로 하는 콜옵션 가치로 표현하였다. 또한, 옵션가격결정에 필요한 총자산의 변동성(

)을 행사가격으로 하는 콜옵션 가치로 표현하였다. 또한, 옵션가격결정에 필요한 총자산의 변동성( )을 계산하기 위해 시장에서 관측할 수 있는 자본의 시장가치(

)을 계산하기 위해 시장에서 관측할 수 있는 자본의 시장가치( )와 그 변동성(

)와 그 변동성( )을 이용하여 식 (7)을 유도하였다.

)을 이용하여 식 (7)을 유도하였다.

여기서, = 자본(equity)의 시장가치,

= 자본(equity)의 시장가치,  = 총자산(total asset)의 시장가치,

= 총자산(total asset)의 시장가치,  = 무위험 이자율,

= 무위험 이자율,  = 부채의 만기 상환액,

= 부채의 만기 상환액,  = 누적 표준 정규 분포,

= 누적 표준 정규 분포,  = 자본의 변동성,

= 자본의 변동성,  = 총자산의 변동성,

= 총자산의 변동성,  = 잔여 만기를 의미한다.

= 잔여 만기를 의미한다.

기업의 부도 위험은 만기 시점에 총자산의 시장가치가 부도의 임계 수준보다 작을수록(클수록) 증가(감소)하므로, 식 (8)과 같이 부채 규모가 총자산의 시장가치보다 얼마나 큰지를 총자산의 변동성에 대한 비율로 계산한 후, 이를 표준정규분포의 누적 확률로 표현하면 모형에 내재한 부도 확률을 산출해낼 수 있다.

여기서, = 총자산의 기대수익률을 의미한다.

= 총자산의 기대수익률을 의미한다.

우선, 결산 정보의 공시에 기초하여 시장가치가 형성되는 이듬해 3월 말을 기준으로 자본의 시장가치( )와 변동성(

)와 변동성( )의 초깃값을 설정한다.12) 선행연구와 일관되게 잔여 만기(

)의 초깃값을 설정한다.12) 선행연구와 일관되게 잔여 만기( )는 1년, 부채의 만기 상환액(

)는 1년, 부채의 만기 상환액( )은 유동부채에 비유동부채 50%를 합한 금액으로 가정한다. 무위험이자율(

)은 유동부채에 비유동부채 50%를 합한 금액으로 가정한다. 무위험이자율( )의 대용치로는 통화안정증권 364일물 금리를 이용하며, 연도별 거래일이 50영업일 미만일 경우 변동성 추정치의 측정오차를 감안하여 표본에서 제외한다. 식 (8)에 의한 최종 부도 확률을 산출하기 위해 자본의 시장가치(

)의 대용치로는 통화안정증권 364일물 금리를 이용하며, 연도별 거래일이 50영업일 미만일 경우 변동성 추정치의 측정오차를 감안하여 표본에서 제외한다. 식 (8)에 의한 최종 부도 확률을 산출하기 위해 자본의 시장가치( )와 변동성(

)와 변동성( )의 초기 설정값에서 식 (6)과 식 (7)을 이용하여 총자산의 시장가치(

)의 초기 설정값에서 식 (6)과 식 (7)을 이용하여 총자산의 시장가치( ), 기대수익률(

), 기대수익률( ) 및 그 변동성(

) 및 그 변동성( )을 재계산하는 절차를 거치며, 총자산의 변동성(

)을 재계산하는 절차를 거치며, 총자산의 변동성( )이 수렴할 때까지 이를 반복 수행한다(Vassalou & Xing, 2004; Bharath & Shumway, 2008).

)이 수렴할 때까지 이를 반복 수행한다(Vassalou & Xing, 2004; Bharath & Shumway, 2008).

현재 우리나라는 역사상 가장 가파른 기준금리 인상기에 있다.2) 2021년 7월 2.69%이던 기업의 신규 대출 금리는 2023년 7월 기준 2.56%p 오른 5.25%로 집계됐다(<그림 Ⅰ-1> 참조). 글로벌 금융위기 이후 저금리 기조로 10여 년간 완만하게 하락해온 부채 조달 비용이 불과 2년 만에 2010년 수준으로 되돌아간 것이다. 금융부채에 대한 기업의 평균 이자 부담률 역시 상승하여 2023년 2분기 말 비금융업을 영위하는 중소기업(대기업)의 평균 차입이자율은 6.06%(4.04%) 수준으로 파악된다(<그림 Ⅰ-2> 참조).3) 재무제표상 집계하는 차입이자율은 만기 구조에 따라 시장금리를 후행적으로 반영하므로, 기업의 이자 부담은 한동안 증가할 가능성이 높다.

최근 대내외적으로 물가지수의 상승 추세는 다소 둔화하고 있으나, 단기에 상황의 반전을 기대하기 어렵다는 시각이 지배적인 만큼, 과거의 저금리 기조보다 더 높은 수준의 금리가 유지될 가능성을 가정하고 보수적인 시나리오 산정이 필요할 수 있다(강현주, 2023).

특히, 올해 상반기는 금리상승으로 인한 여러 불안 요소가 주식시장의 불확실성을 확대했다(김필규, 2023; 박용린, 2023). 첫째, 이자 상환 부담의 급격한 증가는 단기 영업현금흐름 악화와 함께 부실ㆍ한계기업의 도산 우려로 이어졌다. 2023년 2분기 말 기준 비금융업종을 영위하는 상장기업의 40.7%는 영업이익으로 이자비용을 충당하지 못한 것으로 나타났고, 3년 연속 그러한 상태가 지속된 기업 비중도 20.5%로 확인된다(<그림 Ⅰ-3> 참조). 동시에, 이자 상환능력에 대한 우려가 비교적 낮은 수준이라 볼 수 있는 이자보상배율 5이상인 기업 비중도 급격히 하락하는 추세다.

둘째, 기업의 재무적 곤경 위험이 증가한 상황에서 레고랜드 사태, 발전 공기업 발행 채권으로의 수급 쏠림 현상 등 자금시장 경색 요인이 확산하자, 한때는 재무적으로 건전한 기업 역시 높은 재금융(refinancing) 비용을 지불해야 했다.

셋째, 할인율이 상승함에 따라 기업의 성장 가치를 보수적으로 평가하면서 혁신기업의 자금조달 환경이 악화하였고, 보다 장기적 관점에서는 성장 둔화 추세의 고착화를 우려하게 되었다. 아울러, 저성장ㆍ성숙기 기업을 중심으로 효율적 자본 배치(capital allocation)의 중요성이 두드러지면서 고금리 상황은 자본의 효율적 이용에 관한 주주 행동주의 확대의 한 요인으로도 작용했다.

실제로 우리나라의 GDP 대비 기업부채 증가 속도가 분석 대상 43개국 중 중국에 이어 두 번째로 높은 것으로 나타나면서(<그림 Ⅰ-4> 참조), IMF는 고금리 상황의 장기화 가능성을 전제로 우리나라를 포함한 아시아권 전반에 대해 기업부채의 건전성 점검이 필요함을 지적하였다(IMF, 2023). 한국은행 역시 대기업을 중심으로 한 가파른 기업대출 증가 추세를 신용위험 확대의 우려 요인으로 언급한 바 있다(한국은행, 2022, 2023).

그러나 상기와 같은 우려에도 불구하고, 상장기업 전반의 부채비율은 꽤 양호한 상태를 유지하고 있다. 2023년 2분기 말 기준 상장기업의 합산 부채총자산비율은 42.8%이며, 이는 직전 분기 대비 오히려 1%p 감소한 수준이다(<그림 Ⅰ-5> 참조). 최근 기업대출을 중심으로 금융부채가 가파르게 증가해 온 것은 사실이나, 이는 기업이 회사채를 발행하는 대신 대출을 확대하는 방향으로 부채의 구성을 변화했기 때문이며, 거시적으로 기업부채의 총량은 안정적으로 관리되고 있다. GDP 대비 기업부채 비율이 큰 폭으로 증가한 요인 역시 수출감소로 인해 분모인 GDP가 줄어든 영향이 크다. 무엇보다 총자산의 10.4%를 현금성 자산으로 보유하고 있어, 운전자본 수요 대응을 위한 현금 여력도 절대적으로 부족하지 않다.

Ⅱ. 채무불이행 위험 진단

본 장에서는 유가증권ㆍ코스닥시장 상장기업의 채무불이행 위험을 진단한다. 이는 기업의 이자 상환 부담이 급격히 증가하고 자금조달 시장이 원활하지 않은 상황에서 당면할 수 있는 도산 위험을 파악하기 위함이다.

Ⅰ장에서 살펴보았듯, 최근의 금리상승은 민간 신용위험의 급격한 확산 가능성을 우려할 만큼 가팔랐으나, 국내 상장기업 부문은 비교적 풍부한 현금보유량과 안정적인 부채비율을 유지하고 있다. 다만, 재무 상태 지표에 근거한 건전성 판단에는 과거 정보(stale information) 활용에 따른 한계가 내재하므로, 미래의 부실화 가능성을 예측할 수 있는 통계적 모형을 활용하여 정교한 분석을 수행할 필요가 있을 것이다.

이에 우선 ⅰ) 단기적인 자금 압박 위험을 포착하는 현금 유동성 위험(cash crunch risk)과 ⅱ) 장ㆍ단기 채무의 상환 불가능 위험을 포괄하는 부도 위험(default risk)을 각각 추정ㆍ제시한다. 아울러, 회사채 시장에서의 재금융 부담을 점검하여 통계적 모형에 반영하기 어려운 자금시장의 중대한 마찰적 요인을 별도로 평가하며, 심층적인 관리ㆍ감독이 시급한 취약 부문 역시 식별ㆍ제시한다.

1. 현금 유동성 위험

본 절에서 기술하는 현금 유동성 위험은 영업 부문의 현금흐름 손실로 6개월 이내에 보유현금을 소진할 위험에 해당한다(De Vito & Gomez, 2020; 이상호, 2020). 긴축적 통화정책 과정에서 발생할 수 있는 자금시장의 경색(Gertler & Karadi, 2015), 총수요 위축(Christiano et al., 1998) 등의 요인은 재무활동을 통한 현금흐름 유입 가능성을 제한함과 동시에 영업현금흐름의 악화를 유발하므로, 현재 단기적인 관점에서 검토의 필요성이 높은 채무불이행 시나리오라 판단한다.

추정한 연도별 현금 유동성 위험 확률은 <그림 Ⅱ-1>과 같다.4) 이상호(2020)는 동 모형으로 추정한 확률이 시장 퇴출 위험과 같은 상장기업의 극단적인 하방 위험(downside risk)에 대해 유의미한 예측력이 있음을 실증한 바 있다. 추정확률의 추이를 살펴보더라도, 순환 주기상 경기 저점(trough) 부근을 단기 고점으로 하여 굴절(kink)하는 양상을 보여 추정의 신뢰도를 확보한 것으로 판단한다.

결과적으로, Ⅰ장에서 제기한 고금리 상황에서의 여러 우려 요인에도 불구하고, 상장기업의 단기적인 채무불이행 위험을 측정하는 현금 유동성 위험은 비교적 안정적인 범위 내에서 소폭 상승한 정도로 파악된다. 구체적으로 최근 결산연도인 2022년 말을 기준으로 단기적인 자금 압박에 직면할 가능성이 있는 기업은 3.17% 수준에 해당한다. 이는 보호무역주의 강화, 내수시장 침체 등의 여파로 기업의 수익성이 악화한 2019년도의 3.22% 수준과 유사하고, 2008년도 글로벌 금융위기 당시 6.6% 수준보다는 상당히 안정적이라 평가할 수 있다(<그림 Ⅱ-1> 참조).

매출의 25%ㆍ50% 감소 등 극단적인 수요충격을 가정한 경우에도 단기적인 채무불이행 위험의 확산 가능성은 제한적으로 나타나(<그림 Ⅱ-2> 참조), 금융당국의 정책적 대응 범위 내에 있을 것으로 판단한다. 실제 2022년 말 상장기업이 보유한 총 단기금융부채 대비 보유현금 비중은 개별(연결) 기준 106%(129%)로, 기업이 운영자금 수요에 탄력적으로 대응할 여력은 충분한 상황이다.

2. 부도 위험

앞선 현금 유동성 위험 분석에서는 단기적인 영업현금흐름 악화 가능성 측면에서 채무불이행 위험을 진단하였다. 본 절에서는 기업의 시장가치 정보를 이용하여, 총부채의 상환능력 관점에서 채무불이행 위험을 진단하고자 한다. 구체적으로, 만기 시점에 기업이 상환해야 할 부채 규모가 총자산의 시장가치를 초과할 위험을 부도 위험으로 정의하고 해당 확률을 추정한다(Merton, 1974). 이는 기업이 청산절차를 거치더라도 채무를 완전히 상환할 수 없는 상황으로 이해할 수 있다.

반복추정법(iteration method)에 의한 Merton 모형 부도 확률은 <그림 Ⅱ-3>과 같다.5) 추정확률의 평균 추이를 보면, 3년 만기 회사채(AA- 등급)의 금리와 유사한 흐름을 보여 부도 확률 추정 결과는 시장의 신용위험을 잘 반영하는 것으로 판단한다. 결과적으로 이와 같은 부도 확률은 시장가치에 기초하여 장ㆍ단기 총채무에 대한 상환능력을 추정한 수치이며, 역사적으로 과도하게 우려할 만한 수준은 아님을 확인할 수 있다. 2023년 2분기 말 기준 상장기업의 부도 확률 평균은 10.4% 수준으로 나타나는데, 이는 2021년 말을 기준으로 하는 3.5% 수준보다는 다소 높지만, 과거의 경기 저점을 포함한 여러 차례의 경제위기 시와 비교하여 안정적인 범위 내로 판단한다.

3. 재금융 부담

전술한 현금 유동성 위험(Ⅱ장 1절)과 부도 위험(Ⅱ장 2절) 분석을 통해 영업현금흐름의 창출력 및 자산가치의 담보력 측면에서 채무불이행 위험을 종합적으로 점검한 결과, 거시적으로 기업 부문의 재무건전성을 중대하게 우려할 상황은 아닌 것으로 판단한다. 다만, 자금시장의 경색과 같은 외생변수의 변화를 분석에 고려하지 못한 점은 유의하여 해석할 필요가 있다. 대내적으로 장기간 공공요금 인상폭을 제한한 발전 공기업의 자금조달 수요 등이 채권시장에서 저신용 회사채를 몰아내는(crowding out) 변수로 작용할 여지는 여전히 남아있기 때문이다(정화영, 2023).

한편, 미국의 경우 코로나바이러스감염증-19 확산 이후 초저금리로 발행한 회사채의 차환 수요가 2025년부터 큰 폭으로 증가할 전망이다. 실제 연도별 회사채 만기 규모가 2023년 5,250억달러에서 2024년 7,900억달러, 2025년 1조 70억달러로 급격히 확대되기 때문이다. 이에 미국 회사채 시장은 2년 후 재금융 절벽(refinancing wall)을 우려하는 상황이다.6)

이와 같은 대내외적 불안 요인을 고려하여, 본 절에서는 국내 채권시장의 재금융 부담 요인을 점검한다. 연도별 회사채 만기 규모를 파악한 결과, 2023년 27.3조원에서 2024년 31.9조원으로 소폭 증가하나, 2025년 24.8조원, 2026년 24조원으로 일정한 수준이 유지되는 모습이다(<그림 Ⅱ-4> 참조). 신용등급 BB+ 이하의 투기등급(high yield) 채권 비중도 절대적으로 크지 않다. 전반적으로 우리나라 회사채 시장은 연도별 만기규모가 비교적 균등하게 분포하고 있어 차환 부담의 대대적 확산 가능성은 제한적일 것으로 예상한다.

단, 미상환 회사채의 표면 금리(coupon rate) 분포상, 향후 이자 부담률이 상승할 가능성이 높다는 점은 예의주시할 요인이다(<그림 Ⅱ-5> 참조). 신용등급 BBB- 이상 투자등급(investment grade) 채권의 경우 2019~2020년 평균 1.95%로 발행되었는데, 2022~2023년 발행 물량의 표면 금리는 4.07%로 2.12%p 상승하였으며, 투기등급 채권 역시 해당 기간 3.28%에서 5.68%로 2.4%p 상승했다. 상장기업이 보유한 회사채 중 과거 낮은 수준의 표면 금리로 발행한 물량이 여전히 큰 비중을 차지하고 있어, 향후 재금융 부담은 자금시장의 마찰적 요인보다는 이자 부담 증가에 직접적인 영향을 받을 가능성이 높다.

4. 취약 부문

본 장의 1~3절까지의 결과가 시사하는 바는 최근 시장의 금리상승과 기업의 대출의존도 확대 지적에도 불구하고 장ㆍ단기 채무의 부실화 위험이 시스템적으로 확산할 가능성은 크지 않다는 점이다. 취약 부문을 중심으로 한 미시적 문제의 대응이 필요한 상황으로 판단한다.

이에 본 절에서는 관리ㆍ감독이 긴요한 취약 부문을 식별하여 제시한다. 우선, 경기 둔화에 의한 수요 감소 시 부실기업을 중심으로 영업현금흐름 악화에 의한 채무불이행 위험의 현실화 가능성이 높을 것으로 예상한다. 실제 자본잠식기업, 한계기업 등 현 상태로도 재무건전성이 부실한 기업군을 살펴보면, 현금 유동성 위험이 상당한 수준으로 나타난다(<그림 Ⅱ-6>, <그림 Ⅱ-7> 참조). 매출의 현상 유지를 가정한 경우에도 자본잠식 기업은 비자본잠식 기업 대비 4.14배, 한계기업은 비한계기업 대비 2.54배 높은 현금 유동성 위험 수준을 보인다. 한편, 한계기업의 경우 이미 장기간 영업 경쟁력을 상실하여 추가적인 수요 감소로 인한 영향은 제한적 범위 내에서 소폭 상승하는 수준으로 파악된다.

업종별로는 고금리 상황에 취약한 유틸리티ㆍ건설 업종을 중심으로 채무불이행 위험의 확대가 예상된다. 특히, 유틸리티 업종은 장기간 원가의 부담을 판가로 전이하지 못하면서 재무구조가 상당히 악화한 상황이다. 매우 높은 수준의 현금 유동성 위험이 예상될 뿐만 아니라(<그림 Ⅱ-8> 참조), 부도 위험 역시 2023년 2분기 재무 상태를 기준으로 과거 4개년 평균 대비 2.34배 급증한 것으로 나타났다(<그림 Ⅱ-9> 참조). 부동산시장 침체, 공사비용 증가의 영향에 크게 노출된 건설 및 건자재 업종 또한 기타 비금융업 대비 부도 위험의 증가 폭이 상당히 높은 수준을 보인다(<그림 Ⅱ-9> 참조).

Ⅲ. 부채관리 양상의 평가

우리나라 기업 부문의 부채관리는 1997년 외환위기, 2008년 금융위기 등 큰 경제위기를 겪으면서 건전성 유지에 집중해왔다. 이는 유동성 경색 등 극단적 위기 상황에서 복원력(resilience)의 원천으로 작용해왔으며(이상호, 2020), Ⅱ장에서의 분석 결과를 상기해보면 이러한 평가는 이번의 금리 인상기에도 유효할 것으로 보인다. 다만, 2010년부터 부채 조달 비용이 추세적으로 하락해온 상황에서도, 기업의 재무구조 정책이 부채의 축소(deleveraging)를 통한 건전성 확보에서 크게 벗어나지 못한 점에 대해서는 심층적인 평가가 필요할 것으로 판단된다.

이에 본 장에서는 그간의 재무구조 정책이 기업의 투자 기회 달성과 성장성 제고 측면에서 효과적이었는지를 평가하고, 개선이 필요한 기업군을 식별하기 위해 세부적인 검토를 수행한다.

1. 재무구조 정책의 성장 기여도

우리나라 기업은 2008년 글로벌 금융위기 이후 기업의 이자 부담률이 지속 하락하는 과정에서 부채비율을 신축적으로 상향 조정하기보다는 안정적 관리에 치중했다(<그림 Ⅲ-1> 참조). 이는 동일 기간 미국 S&P500 기업이 부채비율을 꾸준히 늘려온 것과는 상반된 흐름이다(<그림 Ⅲ-2> 참조).7)

상기와 같은 재무구조 정책이 기업 부문의 실질 이익 성장, 나아가 기업가치 상승에 어떠한 기여를 해왔는지 평가하기 위해, 본 절에서는 회계 항등식을 이용하여 기업의 순이익 증가 및 주가수익률 상승 요인을 분해한다(Smolyansky, 2023).

손익계산서상 기업의 최종 이익(

여기서,

상장기업 부문의 실질(real) 성장에 대한 요인별 기여도를 파악하기 위해 모든 변수는 국내총생산에 대한 지출 디플레이터(2015년=100)를 이용하여 실질화하였으며, 시가총액을 기준으로 가중평균하되, 삼성전자 등 시가총액 상위 기업이 절대적인 영향을 미치는 현상을 완화하여 결과의 대표성을 확보하고자 가중치의 한도는 5%로 설정하였다.

최종적으로 식 (2)와 식 (3)을 이용하여 우리나라 상장기업의 이익 성장 및 주가 상승 요인을 분해한 결과는 <그림 Ⅲ-3> 및 <그림 Ⅲ-4>와 같다. 2010년부터 2022년까지 이어진 추세적인 저금리 기조에도 불구하고, 이자부담 감소는 상장기업 실질 순이익 성장의 17% 정도를 설명하며, 주가 상승에 대한 기여도 역시 10% 수준에 그친 것으로 확인된다.

저금리 시기 미국 기업의 부채 활용 양상을 다룬 관련 선행연구의 분석 결과를 살펴보면, 미국 S&P500 기업의 경우 지난 20년간 저비용 차입자본을 적극적으로 활용하여 신축적으로 재무 레버리지를 확대해왔다. 이러한 재무구조 정책은 미국 기업 부문의 이익 성장을 촉진하였을 뿐 아니라, 가중평균자본비용을 낮추어 주가수익률 상승에도 상당한 기여를 한 것으로 나타났다. 특히, 트럼프 행정부의 전폭적인 법인세율 인하 조치와 맞물려8), 동기간 실질 순이익 성장의 41%, 주가수익률 상승의 28%가 이자ㆍ조세 부담 감소의 영향으로 산출되었다(Smolyansky, 2023).

이상 과거의 저금리 기조가 우리나라 기업 부문의 이익 성장에 제한적으로 기여한 결과는 양면적인 시사점을 제공한다. 우선, 과거 대비 다소 높은 수준으로 금리 기조가 전환하더라도 기업 부문의 수익성 하락에 미치는 영향 역시 제한적일 가능성이 높다는 점이다. 위기 상황의 발현 시에도 기초여건 상 질서정연한 감내가 가능할 것으로 예상한다.

다른 한편으로는, 향후 기업 부문의 효과적인 부채관리 방안에 대해 발전적 논의가 필요하다는 점이다. 저금리 기조 대비 높은 수준의 명목균형금리 유지를 전제로 건전성에 대한 고려는 여전히 중요할 것이나, 건전성 유지가 부채 활용의 목적은 아니다. 적정 부채비율에 관한 여러 이론이 존재하지만, 부채 조달 본연의 순기능 중 하나는 투자 기회의 달성을 촉진하는 것이며, 궁극적으로는 성장을 통해 기업가치를 극대화하는 것이다.

2. 기업수명주기별 부채 활용 양상

전술한 결과에 따르면, 그간 우리나라 기업 부문의 재무구조 정책은 투자 기회 달성과 성장성 제고 측면에서 효과적이지 못했다. 본 절에서는 세부적인 검토를 위해 어떠한 기업군에서 그러한 경향이 두드러지는지 기업의 수명주기에 따른 부채 활용 양상을 살펴본다.

기업수명주기 단계는 Dickinson(2011)이 제안한 영업ㆍ투자ㆍ재무 현금흐름 양상을 기준으로 도입기(introduction), 성장기(growth), 성숙기(mature), 조정기(shake-out), 쇠퇴기(decline)의 5단계로 구분한다.9) 기업의 세 가지 활동별 현금흐름은 각각 수익성, 성장성, 재무적 위험을 대리하므로(Livnat & Zarowin, 1990), 기업의 전략적 자원배분과 운영 능력에 기초한 성장 단계 특성 구분에 유용한 것으로 알려져 있다(Dickinson, 2011; 두서영 외, 2016).

기업수명주기별 레버리지 활용도를 살펴보는 회귀 모형은 식 (4)와 같다. 이는 영업지식이 축적됨에 따라 기업의 운영 효율성이 극대화되는 성숙기를 준거점으로 도입기, 성장기, 조정기, 쇠퇴기의 상대적인 부채 수준을 측정한다. 부채 수준에 영향을 미치는 개별 기업 요인을 충분히 통제하기 위해 자산의 유형성(tangibility), 수익성, 성장성, 규모 특성과 기업 고정효과를 포함하며, 동적인 자본구조 조정 특성을 통제하고자 연도 고정효과를 포함한다(Fama & French, 2002).

여기서,

식 (4)의 회귀분석 결과, 모든 열에서 도입기의 부채비율이 가장 높게 나타났다(<표 Ⅲ-1> 참조). 더욱 특징적인 것은 성장기보다 쇠퇴기에 레버리지 활용 수준이 높게 형성되어 있다는 점이다. 즉, 기업의 매출이 확대되고, 수익성이 본격적으로 증가하여 투자 기회가 풍부한 도입ㆍ성장 구간에서 부채의 축소가 이루어지고, 영업경쟁력이 악화하면서 투자 기회가 감소하는 조정ㆍ쇠퇴 구간에서 부채를 확대하는 양상이다.

일반적으로 성장기는 수요 증가 대응, 진입장벽 구축을 위해 대규모 자금조달을 통한 설비투자가 필요한 시기이며, 쇠퇴기는 투자 기회의 감소로 부채ㆍ자본의 효율적인 재조정이 필요한 시기에 해당한다(Spence, 1979, 1981). 자본 조달에 관한 여러 이론이 존재하지만, 파산비용이 이자비용의 감세효과를 초과할 만큼 재무적 곤경 위험이 과도하다거나(trade-off theory: 상충 이론)(Modigliani & Miller, 1963; Scott, 1977), 짧은 업력 등으로 부채 조달을 위한 평판이 구축되지 않아 차입에 제약이 있는(reputation theory: 평판 이론)(Diamond, 1989) 이례적 상황 등을 제외하면, 사내유보 자금이 충분하지 않은 성장기에는 부채의 확대를 우선 고려할 수 있다(pecking order theory: 순위 이론)(Shyam-Sunder & Myers, 1999).

쇠퇴기는 상대적으로 업력이 길어 평판 문제로 인한 차입의 제약 요인은 미미한 가운데, 대리인 비용을 절감하기 위한 목적으로 부채 조달을 통해 채권자의 외부 감시(monitoring) 기능을 확대할 유인은 존재한다(agency theory: 대리인비용 이론)( Jensen & Meckling, 1976). 그러나 낮은 수익성으로 파산위험이 증가하고, 투자 기회가 제한된 쇠퇴기에 성장기보다 더 적극적으로 부채를 활용해야 할 이론적ㆍ실증적 근거를 제시한 문헌은 드물다.

실제, 미국 기업을 대상으로 한 선행연구는 성장기에 부채비율이 가장 높고, 쇠퇴기의 부채비율이 가장 낮아 기업수명주기와 부채비율 간 역 U자에 가까운 관계를 보고한 바 있다(Dickinson, 2011). 반면, 우리나라는 쇠퇴기에 중소ㆍ중견 기업의 레버리지 확대 현상이 두드러져 기업수명주기와 부채비율 간 U자에 해당하는 상반된 결과를 보인다(<그림 Ⅲ-5> 참조). 특히, 기업의 수익성이 악화하는 조정ㆍ쇠퇴 구간과 달리, 본격적으로 마진이 확대되는 성장기에 부채를 축소하는 양상이 뚜렷하다(<그림 Ⅲ-6> 참조). 이와 같은 국내 기업 부문의 보수적인 재무구조 정책은 레버리지 활용의 성장 기여도가 낮은 주요 원인일 가능성이 높은 만큼, 효과적인 부채 활용을 위한 미래지향적 논의가 필요할 것으로 판단한다.10)

Ⅳ. 효과적인 부채 활용 방안

우리나라는 글로벌 금융위기 이후 장기간 이어진 저금리 기조 하에서도 대외의존도가 높은 경제구조 상 보수적인 차입 경영을 내재화해왔다. 해당 기간, 부채자본비율이 200%를 초과하는 등 재무구조가 취약한 기업에 대해 외부감사인을 직권으로 지정한 조치 역시 기업의 적극적 부채 활용에 일부 제약 요인으로 작용했을 것이다.11) 단, 그러한 시기에 주도적으로 부채를 축소한 기업은 상대적으로 기초여건이 우량하고 성장기에 진입한 기업이었다. 앞으로의 부채 활용에는 성장성 제고를 위한 여러 대내외 요인을 종합적으로 고려할 필요가 있다.

그러한 관점에서 첫째, 기업수명주기에 입각한 재무구조의 선택 및 주주환원 정책의 재검토를 제언한다. 도입기ㆍ성장기 기업은 적극적 차입전략을 통해 성장 기회를 모색할 필요가 있으며, 성숙기ㆍ쇠퇴기 기업은 주주환원을 위해 자본을 효율적으로 재배치할 필요성을 점검해야 한다.

둘째, 비핵심사업 매각을 통한 부채 축소를 포함하여 운영 효율을 극대화할 필요가 있다. 향후 잠재 GDP 성장률의 둔화가 예상되는 가운데 매출 확대를 통한 이익 성장의 여지는 제한적일 수 있다. 이에 따라 당분간 마진율 개선이 이익 성장의 주요 경로가 될 가능성이 높다. 이러한 과정에서 한계기업과 같은 취약 부문의 재무구조 개혁은 시급한 과제다. 기업구조조정 촉진법이 일몰한 가운데 차제에 시장 주도의 선제적인 구조조정을 활성화할 수 있도록 상시화한 제도 마련을 검토할 필요가 있다.

셋째, 숨은 부실 위험의 파악과 대응책 마련에도 만전을 기해야 한다. 역사적으로 시스템적인 위기는 대체로 드러나지 않은 위험에서 촉발했다. 재무상태표상 부채로 집계되지 않는 우발채무는 그 규모와 확정 가능성을 면밀히 검토하여 대응계획을 수립해야 한다. 아울러, 숨은 부채 문제를 초래할 수 있는 신종자본증권의 경우 상장기업은 한국채택국제회계기준(K-IFRS)에 따라 부채ㆍ자본 요소를 각각 분리하여 인식하고 있고 자본으로 분류한 금액 또한 2023년 2분기 기준 총자산의 0.3% 수준에 불과하나, 일반기업회계기준(K-GAAP)을 적용하는 비상장기업은 신종자본증권의 부채 요소를 대부분 자본으로 분류하고 있을 가능성이 높아 실체적인 위험 파악과 대비가 필요하다.

아울러, 탈세계화, 탈탄소화, 인구구조 변화 등 향후 장기적 관점에서 글로벌 인플레이션의 구조적 상승을 촉발할 수 있는 요인은 기업의 부외부채와도 밀접한 관련이 있음을 염두에 둘 필요가 있다. 경제 블록화 대응을 위한 이중 투자, 온실가스 감축 및 좌초 자산 대체를 위한 투자, 고령화에 따른 종업원 연금 부담 확대와 노동의 생산성 기여도 하락 등은 기업의 지속가능성 관점에서 장기간 개선해 나가야 할 과제이다. 이는 지속가능성 공시의 측면에서 객관적 식별과 측정ㆍ관리에 대한 이해관계자의 요구가 거세지는 영역이기도 하다.

1) 본 보고서상 기업부채에 관한 실증분석은 주권상장법인을 대상으로 한정한다. 비상장기업의 경우 통계적 모형에 필요한 주요 시장정보 변수의 입수가 불가능하여 엄밀한 분석이 제한되기 때문이다.

2) 한국은행은 2021년 8월부터 2023년 1월까지 10차례에 걸쳐 기준금리를 총 3%p 인상하였으며, 2023년 10월 현재 3.5% 수준을 유지하고 있다.

3) 극단치에 의한 영향을 완화하기 위해 이자비용이 0인 기업 및 차입이자율이 30%를 초과하는 기업은 표본에서 제외하였다.

4) 구체적인 방법론은 <부록 1>에 기술하였다.

5) 구체적인 방법론은 <부록 2>에 기술하였다.

6) Goldman Sachs, 2023. 8. 6, The Corporate Debt Maturity Wall: Implications for Capex and Employment.

7) 해당 기간 우리나라 상장기업 전체의 부채총자산비율과 평균차입이자율 간 Pearson 상관계수는 0.82이며, KOSPI100 및 KOSPI200 지수 편입 대상 기업으로 한정하여 보더라도 각각 0.83, 0.82로 관측된다. 반면, 미국 S&P500 기업의 부채총자산비율과 평균차입이자율 간 Pearson 상관계수는 –0.88로 나타난다.

8) 2018년 1월 1일 시행한 감세와 일자리 법안(Tax Cuts and Jobs Act of 2017)은 법정 최고 법인세율을 35%에서 21%로 14%p 인하했다.

9) 기업수명주기 단계별 현금흐름의 구분 양상은 아래와 같다(Dickinson, 2011; 두서영 외, 2016).

10) 해당 논의에는 성장 기회(growth option)와 관련한 외생적ㆍ구조적 환경 요인을 포함한 종합적 논의가 필요하며, 이는 본 보고서의 분석 범위를 넘어서므로 후속 연구과제로 남겨둔다.

11) 2014년 11월 19일 시행한 외부감사법 시행령은 부채자본비율이 동종업종 대비 1.5배를 초과하고, 절대적으로도 200%를 초과하는 경우, 영업이익이 이자비용에 미달하면 해당 주권상장법인을 감사인 지정 대상에 포함하였으나, 2020년 10월 13일 시행한 시행령 개정안에서 관련 조항을 삭제하였다.

12) 2023년 2분기의 경우 반기 재무제표의 공시일이 속한 8월 말을 기준으로 자본의 시장가치(

참고문헌

강현주, 2023, 미국 실물경제의 금리 민감도 하락 및 시사점,『자본시장포커스』 2023-12호.

김필규, 2023, 금리 상승에 따른 기업 부채구조의 변화,『자본시장포커스』 2023-11호.

두서영ㆍ윤성수ㆍ송길성, 2016, 기업수명주기, 시장경쟁과 투자효율성 간 관계에 관한 실증연구,『회계저널』 25(4), 209-255.

박용린, 2023, 최근 벤처투자 감소의 원인 진단과 향후 모험자본시장의 발전과제,『자본시장포커스』 2023-13호.

이상호, 2020,『코로나19 확산의 수요충격에 대비한 상장기업 현금소진위험 스트레스 테스트』, 자본시장연구원 이슈보고서 20-11.

정화영, 2023, 통화긴축기 가계부채 안정성에 대한 소고,『자본시장포커스』 2023-18호.

한국은행, 2022,『금융안정보고서』.

한국은행, 2023,『금융안정보고서』.

Bharath, S.T., Shumway, T., 2008, Forecasting default with the Merton distance to default model, The Review of Financial Studies 21(3), 1339-1369.

Black, F., Scholes, M., 1973, The pricing of options and corporate liabilities, Journal of Political Economy 81(3), 637-654.

Christiano, L.J., Eichenbaum, M., Evans, C.L., 1999, Monetary policy shocks: What have we learned and to what end? Handbook of Macroeconomics 1, 65-148.

De Vito, A., Gómez, J.P., 2020, Estimating the COVID-19 cash crunch: Global evidence and policy, Journal of Accounting and Public Policy 39(2), Article 106741.

Diamond, D.W., 1989, Reputation acquisition in debt markets, Journal of Political Economy 97(4), 828-862.

Dickinson, V., 2011, Cash flow patterns as a proxy for firm life cycle, The Accounting Review 86(6), 1969-1994.

Fama, E.F., French, K.R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33(1), 3–56.

Fama, E.F., French, K.R., 2002, Testing trade-off and pecking order predictions about dividends and debt, Review of Financial Studies 15(1), 1-33.

Gertler, M., Karadi, P., 2015, Monetary policy surprises, credit costs, and economic activity, American Economic Journal: Macroeconomics 7(1), 44-76.

IMF, 2023, Asia and Pacific Regional Economic Outlook.

Jensen, M., Meckling, W., 1976, Theory of the firm: Management behavior, agency costs and capital structure, Journal of Financial Economics 3(4), 305-360.

Kothari, S.P., Leone, A.J., Wasley, C.E., 2005, Performance matched discretionary accrual measures, Journal of Accounting and Economics 39(1), 163–197.

Livnat, J., Zarowin, P., 1990, The incremental information content of cash-flow components, Journal of Accounting and Economics 13(1), 25-46.

Merton, R.C., 1974, On the pricing of corporate debt: The risk structure of interest rates, The Journal of Finance 29(2), 449-470.

Modigliani, F., Miller, M.H., 1963, Corporate income taxes and the cost of capital: A correction, The American Economic Review 53(3), 433-443.

Scott, J.H., 1977, Bankruptcy, secured debt, and optimal capital structure, The Journal of Finance 32(1), 1-19.

Shyam-Sunder, L., Myers, S.C., 1999, Testing static tradeoff against pecking order models of capital structure, Journal of Financial Economics 51(2), 219-244.

Smolyansky, M., 2023, End of an era: The coming long-run slowdown in corporate profit growth and stock returns, FRB finance and economics discussion series.

Spence, A.M., 1979, Investment strategy and growth in a new market, J. Reprints Antitrust L. & Econ 10, 345.

Spence, A.M., 1981, The learning curve and competition, The Bell Journal of Economics 12(1), 49-70.

Vassalou, M., Xing, Y., 2004, Default risk in equity returns, The Journal of Finance 59(2), 831-868.

<부록 1> 현금 유동성 위험 추정

현금 유동성 위험 확률을 추정하기 위한 회귀분석 모형은 식 (5)와 같다. 기업의 현금소진 여부를 결정하는 요인으로 레버리지율과 함께 기업 규모, 성장성, 시장민감도 등 위험자산의 일반적 위험 요인을 고려하고, 기업 고유의 변동성 역시 포함한다(Fama & French, 1993). 개별 기업의 재무 상태를 추정에 반영하고자 단기 현금 유동성과 직결되는 현금보유수준을 통제하며, 전방 수요 변화의 영업현금흐름 민감도와 관련성이 높은 수익성, 고정비 비율, 운전자본 관리의 효율성 또한 고려한다. 기업의 매출이 경영자의 기회주의적인 이익조정에 영향을 받을 경우 발생하는 측정오차 문제를 완화하고자 이익조정 수준을 통제하며(Kothari et al., 2005), 시간 불변(time invariant)의 산업적 특성을 통제하고자 산업 고정 효과를 포함한다.

여기서,

최종적으로 식 (5)의 연도별 Probit 회귀분석을 통해 기업별 단기적인 자금 압박 가능성에 관한 예측 확률을 추정하며, 이상호(2020)는 동 모형으로 추정한 확률이 시장 퇴출 확률(미래 3년 이동평균)과 유의미한 관련성이 있음을 실증하였다.

<부록 2> 부도 위험 추정

Merton(1974)은 채권 만기 시 주주가 관련 채권을 상환한 이후 잔여 재산에 대하여 청구권(residual claim)을 갖는 점에 착안하여, 자본(equity)을 콜옵션과 유사한 성격으로 보았다. 이에, 식 (6)과 같이 Black-Scholes(1973)의 옵션가격결정모형에 따라 자본의 시장가치를 부채의 만기 시점(

여기서,

기업의 부도 위험은 만기 시점에 총자산의 시장가치가 부도의 임계 수준보다 작을수록(클수록) 증가(감소)하므로, 식 (8)과 같이 부채 규모가 총자산의 시장가치보다 얼마나 큰지를 총자산의 변동성에 대한 비율로 계산한 후, 이를 표준정규분포의 누적 확률로 표현하면 모형에 내재한 부도 확률을 산출해낼 수 있다.

여기서,

우선, 결산 정보의 공시에 기초하여 시장가치가 형성되는 이듬해 3월 말을 기준으로 자본의 시장가치(