Find out more about our latest publications

Current State of Household Debt in Korea and its Risk Factors

Issue Papers 23-23 Nov. 08, 2023

- Research Topic Macrofinance

- Page 22

The prolonged accumulation of household debt in Korea presents a considerable threat to the stability of the domestic economy. Korea’s household debt, characterized by its high level and rapid growth, requires careful management strategies to ensure stability. A close examination with a focus on individual households reveals a rising concentration of debt, particularly among households headed by those aged 44 and below.

Analyzing the impact of household leverage on consumption, this article finds that the growing debt servicing burden arising from leverage expansion hampers household consumption. Notably, households with excessive leverage experience a prominent slowdown in consumption, suggesting that future consumption growth could be limited despite income increases. Furthermore, as higher leverage magnifies household vulnerability, heavily leveraged households tend to hold smaller financial and net assets, rendering them more susceptible to economic shocks. The effects of monetary tightening become more pronounced, underscoring household vulnerabilities. If high interest rates persist over the long term, loan delinquency rates could rise among heavily indebted households, exacerbating financial distress.

While household debt is likely to weigh on the macroeconomic stability, there remains a high risk of continuous surge in household debt, primarily driven by real estate-related loans. The prevalent trend of a preference for real estate investment among households raises concerns about the expansion of household debt fueled by expectations of rising property prices. In addition, the potential leverage expansion through jeonse deposit loans, most of which are bullet loans and are exempt from the Debt Service Ratio (DSR) rules, poses an additional threat to future household debt management.

The increasing likelihood of a prolonged high-interest environment requires caution for the risk associated with the expansion of household debt. If the high-interest regime persists, the principal and interest repayment burden may rise rapidly, driven by high leverage levels. This may result in a more sluggish growth of consumption than expected, intensifying downside risks to the economy. Furthermore, an extended period of high interest rates may expose heavily indebted households to deteriorating financial soundness, increasing the risk of insolvency. Hence, it is necessary to closely monitor vulnerable borrowers and take proactive measures such as building loan-loss provisions, aiming to prevent insolvencies within the household sector from spreading to financial institutions.

Analyzing the impact of household leverage on consumption, this article finds that the growing debt servicing burden arising from leverage expansion hampers household consumption. Notably, households with excessive leverage experience a prominent slowdown in consumption, suggesting that future consumption growth could be limited despite income increases. Furthermore, as higher leverage magnifies household vulnerability, heavily leveraged households tend to hold smaller financial and net assets, rendering them more susceptible to economic shocks. The effects of monetary tightening become more pronounced, underscoring household vulnerabilities. If high interest rates persist over the long term, loan delinquency rates could rise among heavily indebted households, exacerbating financial distress.

While household debt is likely to weigh on the macroeconomic stability, there remains a high risk of continuous surge in household debt, primarily driven by real estate-related loans. The prevalent trend of a preference for real estate investment among households raises concerns about the expansion of household debt fueled by expectations of rising property prices. In addition, the potential leverage expansion through jeonse deposit loans, most of which are bullet loans and are exempt from the Debt Service Ratio (DSR) rules, poses an additional threat to future household debt management.

The increasing likelihood of a prolonged high-interest environment requires caution for the risk associated with the expansion of household debt. If the high-interest regime persists, the principal and interest repayment burden may rise rapidly, driven by high leverage levels. This may result in a more sluggish growth of consumption than expected, intensifying downside risks to the economy. Furthermore, an extended period of high interest rates may expose heavily indebted households to deteriorating financial soundness, increasing the risk of insolvency. Hence, it is necessary to closely monitor vulnerable borrowers and take proactive measures such as building loan-loss provisions, aiming to prevent insolvencies within the household sector from spreading to financial institutions.

Ⅰ. 논의 배경

가계부채가 우리나라 경제의 안정성을 위협하는 위험요인으로 부각되고 있다.1) 국내 가계부채는 2000년대 초반 카드사태 이후 뚜렷한 디레버리징 과정 없이 증가세가 이어져 왔다. 오랜 기간에 걸쳐 가계부채가 실물경제에 비해 더 빠른 속도로 늘어나면서 우리나라는 세계에서 가계부채비율이 가장 높은 국가 중 하나가 되었다.

2022년 이후 글로벌 통화긴축 강도가 높아지면서 시장금리가 가파르게 상승하였다. 국내 가계대출은 변동금리 비중이 높아 금리상승에 취약한데2) 높은 부채 수준과 대출금리의 가파른 상승이 맞물려 가계의 원리금 상환부담이 크게 늘어난 상황이다. 이에 따라 가계 레버리지3) 확대가 경제에 미치는 부정적인 영향에 대한 우려가 커지고 있다.

물가상승세가 둔화하고 있으나 여전히 목표수준을 상회하고 있으며, 향후 인플레이션 둔화가 예상보다 더디게 진행될 가능성이 높아지고 있다. 인플레이션 불확실성으로 인해 고금리 여건이 장기화되는 경우 높은 수준의 가계부채가 경제에 미치는 부정적 영향이 심화될 수 있다. 따라서 우리나라 가계부채 현황을 면밀하게 파악하고 레버리지 확대에 따른 위험요인을 이해하는 것은 정책당국자뿐 아니라 민간 경제주체에게도 그 중요성이 크다.

본 보고서는 미시데이터 분석을 중심으로 장기간 누증된 국내 가계부채의 현황 및 위험요인을 살펴보고 이를 바탕으로 시사점을 제시하고자 한다. 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 주요국과의 비교를 통해 가계부채 현황을 파악하고 마이크로데이터를 분석하여 가구단위 수준에서 국내 가계부채의 변화 양상을 살펴본다. Ⅲ장에서는 레버리지 확대에 따른 가계의 소비 약화 및 취약성 증대를 분석한다. Ⅳ장에서는 향후 가계부채 증가세가 확대될 위험을 점검하고, 마지막 Ⅴ장에서는 분석내용을 바탕으로 시사점을 도출한다.

Ⅱ. 우리나라 가계부채 현황

1. 주요국과의 비교

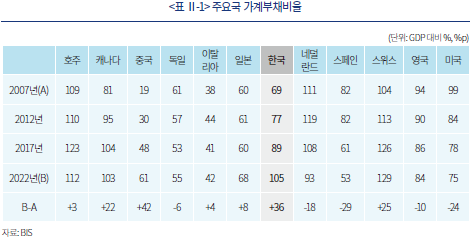

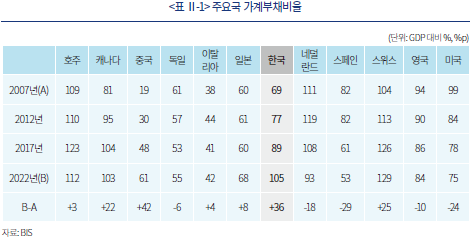

우리나라 가계부채는 다른 나라에 비해 수준이 높을 뿐 아니라 증가 속도도 빨라 안정적으로 관리할 필요성이 높다. <표 Ⅱ-1>은 2007년 이후 주요국의 GDP 대비 가계부채비율을 5년 단위로 비교하고 있다. 2007-2008년 금융위기 이후 미국, 영국 등에서는 가계부채의 디레버리징이 진행되었던 데 반해 우리나라 가계부채비율은 완연한 상승세가 이어지면서 2022년말 기준 스위스, 호주에 이어 3번째로 높은 수준을 기록하고 있다.4) 2007년 이후 주요국의 가계부채비율 변동폭을 비교해 보아도 우리나라는 중국, 태국에 이어 3번째로 상승폭이 크다.

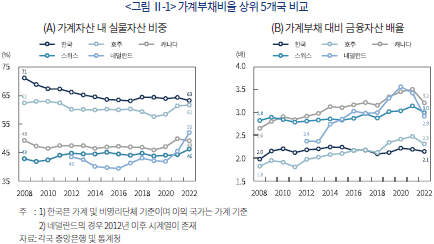

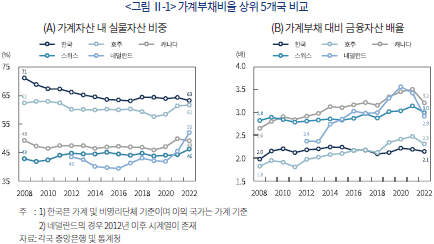

가계부채의 안정적인 관리를 위해서는 국내 가계부채의 특성과 취약성을 이해하는 것이 중요하다. 우리나라 가계는 실물자산에 대한 집중도가 높은 특징을 보인다. <그림 Ⅱ-1>(A)는 가계부채비율 상위 5개 국가의 가계자산 내 실물자산 비중을 비교하고 있는데, 우리나라 가계의 실물자산 비중이 가장 높은 것을 확인할 수 있다. 반면 가계부채 대비 금융자산 보유는 가장 낮은 수준을 나타낸다(<그림 Ⅱ-1>(B)). 가계 재무상황을 악화시킬 수 있는 예상치 못한 충격이 발생하는 경우 금융자산은 충격의 영향을 완화하는 역할을 하는데, 우리나라 가계는 금융자산 보유가 적어 취약성이 높다고 할 수 있다. 최근 가파른 금리상승으로 원리금 상환에 어려움을 겪거나 전세가격 하락 충격으로 임대보증금 상환에 어려움을 겪는 가구들 모두 이러한 국내 가계의 취약성이 드러난 예라고 할 수 있다.

2. 부채 보유가구 현황

Ⅱ-1절에서는 총량지표를 이용하여 가계 전반의 부채 수준을 주요국과 비교해보았다. 그러나 가계부채 현황을 정확하게 파악하기 위해서는 부채 보유가구를 면밀히 살펴볼 필요가 있다. 이에 본 절에서는 가계금융복지조사 마이크로데이터를 활용하여 가구단위로 부채 현황을 살펴본다.5)

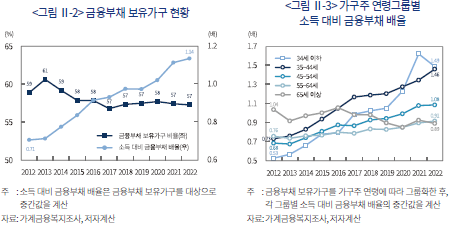

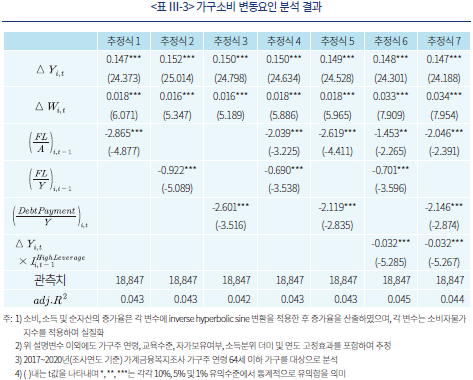

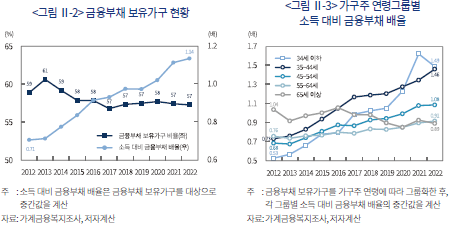

<그림 Ⅱ-2>는 전체 가구 중 금융부채를 보유한 가구의 비율과 이들 가구의 소득 대비 금융부채 배율(중간값) 추이를 나타낸다. 가계부채 총량이 장기간 큰 폭으로 늘어났음에도 불구하고 금융부채 보유가구 비율은 2015년 이후 큰 변화 없이 일정 수준(57~58%)에 머물고 있는데6), 이를 통해 가계 전반에 걸쳐 부채를 보유한 가구가 크게 늘어난 것이 아님을 확인할 수 있다. 이와 같은 결과는 가계부채의 가구 집중도가 높아지고 있음을 시사한다. 금융부채 보유 가구의 부채규모는 2012년 소득의 0.71배 수준이었으나 2022년에는 1.14배 수준까지 높아지며 소득에 비해 빠른 증가세를 보이고 있다.7)

특히, 44세(가구주 연령 기준) 이하 가구에 가계부채 증가세가 집중되는 모습이다. <그림 Ⅱ-3>은 금융부채 보유가구를 가구주 연령에 따라 그룹화한 후 각 그룹별 소득 대비 금융부채 배율을 비교하고 있다. 34세 이하와 35~44세 그룹의 금융부채 배율은 가파른 오름세가 지속되면서 2017년 이후 연령그룹 중 가장 높은 수준을 나타내고 있는데, 코로나19 팬데믹 이후 다른 연령그룹과의 격차가 더욱 확대되었다. 한편 65세 이상의 경우 금융부채를 보유한 가구비율이 크게 낮을 뿐 아니라 부채규모도 상대적으로 작은 모습이다.8) 이를 감안하여 이하에서는 65세 이상 가구를 제외한 나머지 그룹을 대상으로 분석을 진행한다.

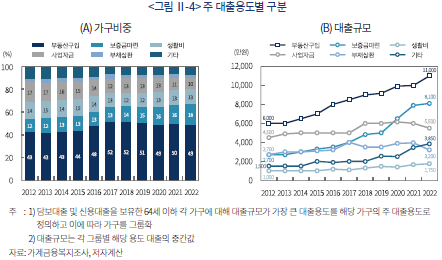

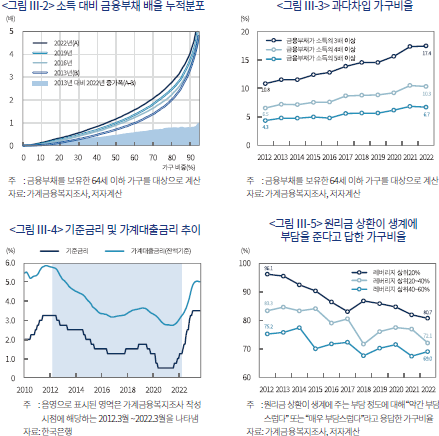

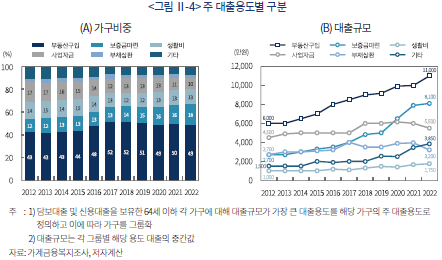

가계부채의 빠른 증가세는 부동산관련 대출에 주로 기인한다. <그림 Ⅱ-4>(A)는 담보대출 및 신용대출을 보유한 64세 이하 가구를 주 대출용도에 따라 구분한 후, 각 용도별 가구비중 추이를 계산한 그래프이다. 부동산구입 및 보증금마련을 위해 대출을 받은 가구비중이 2012년 55%에서 지속적으로 확대되어 2022년 67%까지 높아진 것을 볼 수 있다. 부동산관련 대출은 타 용도 대출에 비해 대출규모도 크게 늘어나고 있다. <그림 Ⅱ-4>(B)는 주 대출용도에 따른 가구그룹별로 해당 용도 대출규모(중간값)의 변화를 나타낸다. 2022년 부동산구입과 보증금마련을 위한 가구 대출규모는 2012년 대비 각각 5,000만원, 5,400만원 늘어나며 대출용도 중 증가폭이 가장 크다. 앞서 44세 이하 가구 금융부채가 빠르게 늘어났던 것도 부동산관련 대출 증가와 상당 부분 연결된 것으로 판단된다. 44세 이하 가구는 다른 연령그룹에 비해 상대적으로 주택소유율이 낮아 부동산가격 상승과 함께 주택구입, 전세자금마련 등 부동산관련 대출이 크게 늘어난 것으로 보인다.

Ⅲ. 가계 레버리지 확대에 따른 위험요인 분석

Ⅱ장에서 살펴본 바와 같이 국내 가계부채는 주요국에 비해 빠른 속도로 늘어난 가운데 부채의 가구 집중도가 높아졌는데, 이는 향후 거시경제 운용에 있어 성장과 안정성을 저해하는 요인으로 작용할 수 있다. 가계 레버리지 확대가 경제에 미치는 영향은 많은 문헌에서 연구된 바 있다. Mian et al.(2017)과 IMF(2017)는 가계부채 증가가 단기적으로는 경제성장에 있어 양(+)의 효과를 나타내나 중장기적으로는 성장률 하락 및 실업률 상승으로 이어진다는 결과를 제시하였다. Cecchetti et al.(2011)은 GDP 대비 가계부채비율이 85% 수준을 넘어서면 성장을 저해하는 것으로 추정9)하였으며, Lombardi et al.(2017)도 이와 유사한 결과10)를 도출하였다. 한편, Schularick & Taylor(2012)와 Jorda et al.(2013)은 신용 증가폭이 과도할수록 위기 발생 가능성이 높아지고 경기 침체시 그 정도가 심화된다는 결과를 제시하고 있다.

위와 같은 연구 결과들은 가계부채가 누증될수록 경제에 미치는 부정적인 영향이 확대될 수 있음을 시사한다. 가계 레버리지의 확대는 소비 약화를 유발하여 경제성장세 둔화로 이어질 수 있을 뿐 아니라 금리 상승기에는 과다차입 가구를 중심으로 재무건전성을 악화시킬 수 있다. 이에 본 장에서는 레버리지 확대에 따른 위험요인으로 가계의 소비 약화 및 취약성 증대를 분석한다.

1. 레버리지 그룹별 가구 특성

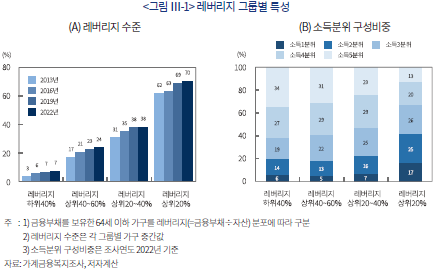

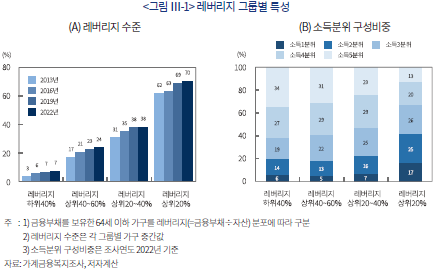

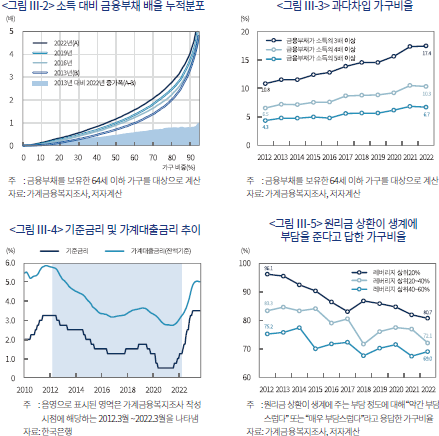

분석에 앞서 자산 대비 금융부채 비율을 레버리지로 정의하고 레버리지 그룹별 가구 특성을 살펴본다. <그림 Ⅲ-1>(A)는 금융부채를 보유한 64세 이하 가구를 레버리지 분포에 따라 그룹화한 후 각 그룹별 레버리지의 중간값을 나타낸다. 부채 보유가구 전반에 걸쳐 레버리지가 확대되는 모습을 확인할 수 있는데, 이에 따른 원리금 상환부담 증가 및 가처분소득 감소는 소비둔화 요인으로 작용한다. 특히 고레버리지(레버리지 상위 20%) 그룹은 다른 그룹에 비해 상당히 높은 레버리지 수준을 나타낸다. 고레버리지 가구는 악화된 재무구조로 인해 금융기관으로부터 추가적인 대출이 어려움에 따라 소비를 줄이고 저축을 늘리는 방식으로 레버리지를 축소할 가능성이 높다.

한편, 고레버리지 그룹 내에 충격에 취약한 소득 중하위가구의 비중이 상대적으로 높다는 점에도 유의해야 한다. <그림 Ⅲ-1>(B)는 각 레버리지 그룹의 소득분위 구성비중을 비교하고 있다. 고레버리지 이외 그룹의 경우 소득이 높은 4~5분위 비중이 절반 이상을 차지하는 데 반해 고레버리지 그룹에서는 소득 4~5분위 비중이 상대적으로 작고 소득 1~3분위 비중이 큰 것을 확인할 수 있다. 이에 따라 소득감소 또는 금리상승과 같은 충격 발생시, 부채가 과다한 소득 중하위가구를 중심으로 충격의 영향을 충분히 흡수하지 못해 가계 부실로 이어질 위험이 커질 수 있다.

2. 가계 레버리지 확대에 따른 소비 약화

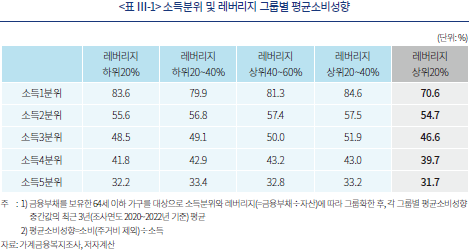

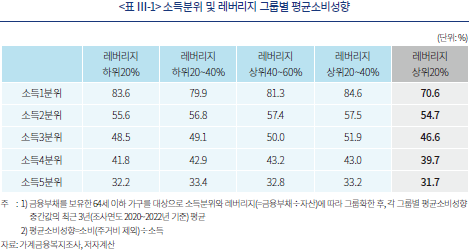

<표 Ⅲ-1>은 금융부채 보유 64세 이하 가구를 소득분위 및 레버리지 수준에 따라 그룹화한 후, 각 그룹별 가구 평균소비성향의 중간값(최근 3년 평균)을 계산한 값이다. 표를 통해 동일한 소득분위 내에서 고레버리지 그룹의 평균소비성향이 다른 그룹에 비해 낮은 것을 확인할 수 있다. 이와 같은 결과는 과도한 레버리지가 가계소비를 제약하는 요인으로 작용하고 있음을 시사한다.

이에 본 절에서는 가계금융복지조사를 활용하여 레버리지가 소비에 미치는 영향을 분석한다. 가계금융복지조사의 소득항목이 2017년(조사연도 기준) 이후 행정자료를 통해 보완되었다는 점, 그리고 코로나19 충격 직후 소비위축이 발생했던 점 등을 감안하여 조사연도 기준 2017년부터 2020년까지의 가구 데이터를 활용하여 회귀분석을 수행한다.11) 금융부채 보유가구뿐 아니라 미보유가구를 모두 포함한 64세 이하 가구를 분석대상으로 한다.12)

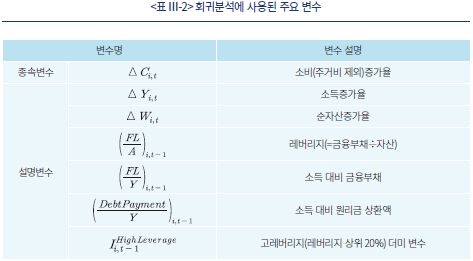

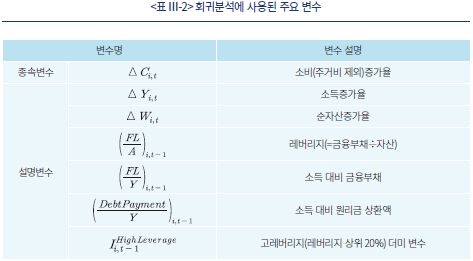

과다부채가 소비에 미치는 영향을 분석한 Dynan(2012)의 회귀분석 모형을 참고하여 주거비를 제외한 소비의 증가율을 종속변수로 사용하였으며, 주요 설명변수로는 소득증가율, 순자산증가율 및 금융부채의 부담 정도를 나타내는 변수들을 포함하였다(<표 Ⅲ-2>). 각 변수는 소비자물가지수를 적용하여 실질화하였다. 금융부채 부담을 나타내는 설명변수의 경우, 직전 시기(t-1)의 값을 사용함으로써 가계 재무상황의 사후적(ex post) 결과가 아니라 사전적(ex ante) 여건이 소비변동에 미치는 영향을 분석하였다. 추가적으로 가구주 연령, 교육수준, 자가 보유여부, 소득분위 더미 등 가구 특성을 나타내는 설명변수와 연도 고정효과를 함께 고려하였다.13)

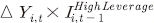

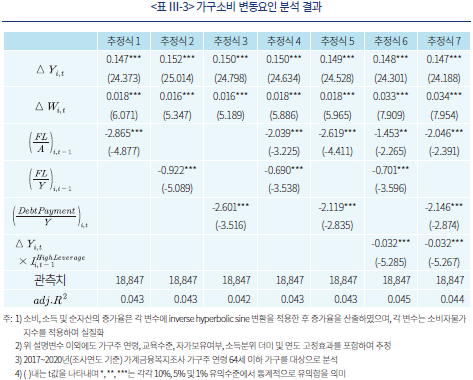

<표 Ⅲ-3>은 7개 회귀식(추정식 1~7)에 대한 추정 결과를 정리하고 있다. 먼저 소득증가율( )과 순자산증가율(

)과 순자산증가율( )의 계수는 각각 소득탄력성(income elasticity)과 순자산탄력성(wealth elasticity)으로 해석될 수 있는데, 모든 추정식에서 통계적으로 유의한 양(+)의 값으로 추정되며 소득 및 순자산의 증가가 소비 증가로 이어짐을 보여준다. 다만 순자산탄력성에 비해 소득탄력성의 추정값이 훨씬 큰 값을 나타내며 자산가격 상승에 따른 부의 효과(wealth effect)보다는 소득 증가가 소비에 더 강한 영향을 미치는 것으로 나타난다.

)의 계수는 각각 소득탄력성(income elasticity)과 순자산탄력성(wealth elasticity)으로 해석될 수 있는데, 모든 추정식에서 통계적으로 유의한 양(+)의 값으로 추정되며 소득 및 순자산의 증가가 소비 증가로 이어짐을 보여준다. 다만 순자산탄력성에 비해 소득탄력성의 추정값이 훨씬 큰 값을 나타내며 자산가격 상승에 따른 부의 효과(wealth effect)보다는 소득 증가가 소비에 더 강한 영향을 미치는 것으로 나타난다.

추정식 1~5는 금융부채의 부담 정도를 나타내는 설명변수들(레버리지, 소득 대비 금융부채, 소득 대비 원리금 상환액)을 포함하고 있는데, 해당 변수의 계수들이 모두 통계적으로 유의한 음(-)의 값으로 추정된다. 이와 같은 결과는 레버리지 확대에 따른 부채 상환부담 증가가 소비 제약요인으로 작용함을 나타낸다.

추정식 6과 7은 각각 추정식 4와 5에 소득증가율과 고레버리지 그룹을 나타내는 더미변수의 교차항( )을 추가하였는데, 추정식 6과 7 모두에서 교차항의 추정계수가 유의한 음(-)의 값을 나타낸다. 이는 다른 그룹에 비해 고레버리지 그룹의 소득탄력성이 낮은 수준임을 의미하며 한계소비성향이 낮아지는 것으로도 해석될 수 있다.14) 앞서 <표 Ⅲ-1>에서 확인했던 바와 같이 재무안정성이 크게 훼손된 가구에서 소비둔화가 심화될 수 있다는 결과를 보여주고 있다.

)을 추가하였는데, 추정식 6과 7 모두에서 교차항의 추정계수가 유의한 음(-)의 값을 나타낸다. 이는 다른 그룹에 비해 고레버리지 그룹의 소득탄력성이 낮은 수준임을 의미하며 한계소비성향이 낮아지는 것으로도 해석될 수 있다.14) 앞서 <표 Ⅲ-1>에서 확인했던 바와 같이 재무안정성이 크게 훼손된 가구에서 소비둔화가 심화될 수 있다는 결과를 보여주고 있다.

이상의 분석 결과는 가계 레버리지 확대가 소비의 제약요인으로 작용하며, 특히 고레버리지 그룹의 경우 향후 소득이 늘어나더라도 소비 증가세가 낮은 수준에 그칠 가능성을 시사한다. 잠재성장률 하락에 따른 미래 소득에 대한 기대 약화가 기조적인 가계 소비둔화 요인으로 작용하는 가운데(노산하, 2021) 부채부담 증가가 소비 부진을 심화시켜 잠재성장률을 추가적으로 하락하게 만드는 요인이 될 수 있다.

3. 가계 레버리지 확대에 따른 취약성 증대

가계 레버리지 확대로 인해 가계의 취약성이 높아졌다. 취약성이 높다는 것은 가계가 예상치 못한 금리상승 또는 소득감소 등의 충격이 발생할 경우 이에 대한 대응이 어려워 부실화 가능성이 높다는 것을 의미한다. <그림 Ⅲ-2>는 금융부채를 보유한 64세 이하 가구의 소득 대비 금융부채 배율의 누적분포를 나타낸다. 2013년과 2022년의 누적분포를 비교해보면 부채 보유가구 전반에 걸쳐 소득보다 금융부채가 더 빠르게 늘어난 것을 확인할 수 있다.15) 특히 부채규모가 소득수준을 크게 상회하는 가구들에 해당하는 분포의 오른쪽 영역에서 금융부채 배율의 상승폭이 더 크다. 이에 따라 금융부채 보유가구 중 차입규모가 과다한 가구의 비율이 상당폭 증가했다. 2022년 3월말 기준 금융부채 규모가 소득의 3배, 4배 이상인 가구비율은 각각 17.4%, 10.3%까지 높아졌으며, 5배 이상인 가구비율도 6.7%에 달한다(<그림 Ⅲ-3>).16) 금리 하락기에는 레버리지 확대에 따른 취약성이 드러나지 않았으나 금리가 상승하는 시기에는 원리금 상환부담이 빠르게 늘어나면서 과다부채 가구를 중심으로 부채상환에 어려움을 겪는 가계가 증가한다.

가계 레버리지가 지속적으로 확대된 것은 장기간 금리 하락세가 이어지면서 레버리지 활용에 대한 가계의 위험 인식이 약화된 데 기인한다. <그림 Ⅲ-4>에서 2012년 이후 십여 년 동안 기준금리와 가계대출금리의 하락세가 이어졌음을 확인할 수 있다. 레버리지 수준이 높았던 가구들 중에서 원리금 상환의 어려움을 답한 가구비율 또한 금리 하락과 함께 대체로 감소해왔는데(<그림 Ⅲ-5>), 레버리지 확대에도 불구하고 가계의 부채 상환부담은 금리가 하락함에 따라 지속적으로 완화되었던 것으로 추정된다. 이는 금리상승에 대한 가계의 위험 인식을 크게 약화시키는 요인으로 작용하여 레버리지 활용에 대한 적절한 자기규율이 작동하지 않았던 것으로 판단된다.

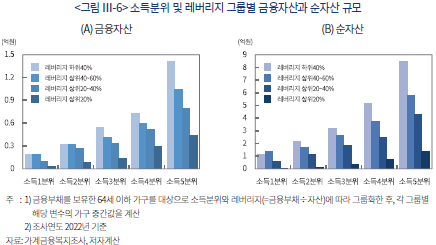

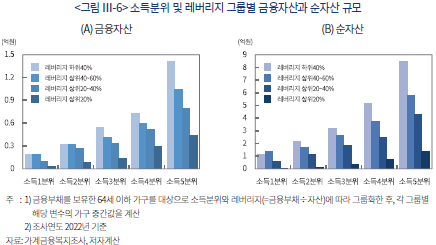

레버리지가 높은 가구일수록 취약성이 높은 재무구조를 나타내고 있어 예상치 못한 충격 발생시 고레버리지 가구를 중심으로 가계대출의 부실화 위험이 커질 수 있다. <그림 Ⅲ-6>은 64세 이하 금융부채 보유가구를 소득분위와 레버리지에 따라 그룹화한 후, 각 그룹별 금융자산과 순자산의 중간값을 나타낸다. 동일 소득분위를 기준으로 레버리지 상위 그룹일수록 금융자산과 순자산 규모가 작은 것을 확인할 수 있는데, 이는 레버리지가 확대될수록 충격에 더 취약함을 의미한다. 특히 고레버리지(레버리지 상위 20%) 그룹은 금융자산과 순자산 규모가 크게 작아 작은 충격에도 재무건전성이 악화될 수 있다. 예를 들어, 소득감소와 같은 유동성 충격에 직면하는 경우 유동성이 높은 금융자산 보유가 충분치 않음에 따라 대응 여력이 크게 낮아진다. Ⅲ-1절에서 언급했듯이 고레버리지 그룹 내에 소득 중하위가구의 비중이 상대적으로 높다는 점도 유동성 충격의 영향을 확대시킬 수 있는 요인이다. 또한 자산가격 하락 충격 발생시 자산가치가 부채규모를 하회할 가능성이 높아지는 가운데 추가적인 대출에 사용할 수 있는 담보도 부족해 가계부실로 이어질 위험이 크다.

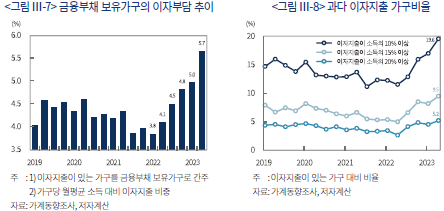

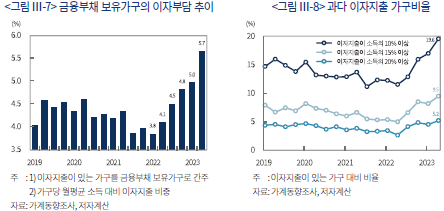

통화긴축의 효과가 본격화되면서 금리상승에 대한 가계의 취약성이 드러나고 있다. <그림 Ⅲ-7>은 가계동향조사 마이크로데이터를 활용하여 계산한 금융부채 보유가구의 소득 대비 이자지출 비중을 나타낸다.17) 2022년 이후 금리가 가파르게 상승하면서 가계의 이자부담이 빠르게 늘어나는 가운데 이자지출이 과다한 가구비율도 높아지는 것을 확인할 수 있다. 2023년 2분기 기준 금융부채 보유가구 중 이자지출이 소득의 10%, 15%, 20%를 상회하는 가구비율이 각각 19.6%, 9.5%, 5.2%까지 상승했다(<그림 Ⅲ-8>). 향후 고금리 여건이 장기화되는 경우 과다부채 가구가 이자 비용을 감당하지 못해 가계대출 연체율이 상승하는 등 부실위험이 커질 수 있다.

Ⅳ. 향후 가계부채 관리의 불안요인

Ⅲ장에서 살펴본 것과 같이 높은 수준의 국내 가계부채는 소비둔화를 유발하여 경제성장을 저해하고 가계 취약성을 증대시키는 등 향후 거시경제 운용에 부담으로 작용할 가능성이 크다. 따라서 경제의 안정성 제고를 위해 가계부채의 안정적 관리가 요구되나 가계부채 증가세가 확대될 위험이 여전히 높다. 이에 본 장에서는 향후 가계부채 관리의 불안요인을 점검한다.

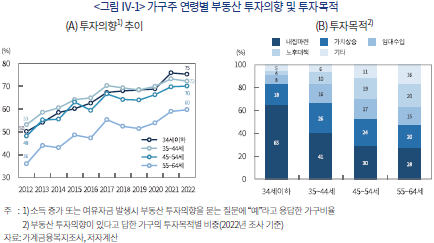

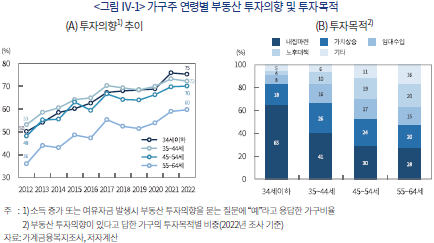

국내 가계부채는 부동산관련 대출을 중심으로 빠르게 늘어날 위험이 상존하고 있다. <그림 Ⅳ-1>(A)는 가구주 연령별로 부동산 투자의향이 있다고 답한 가구비율을 나타내는데 가계 전반에 걸쳐 부동산 투자의향이 높아지는 추세를 확인할 수 있다. 2022년 조사 기준 부동산 투자의향이 있다고 응답한 가구비율이 44세 이하 가구에서 70%를 상회하며, 45~54세와 55~64세 가구도 각각 70%와 60%로 높은 수준을 기록하고 있다.18) 최근 부동산가격 상승기를 거치며 소득보다는 부동산가격이 부의 증가에 더 중요한 요인으로 작용했는데(정화영, 2022), 이러한 경험이 가계의 부동산 투자의향 확대에 영향을 미쳤을 것으로 판단된다.

투자목적에 있어서는 연령별로 차이를 나타내는데, 34세 이하 그룹에서는 자가마련이 가장 높은 비중을 차지하고 있는 반면 연령이 높아질수록 가치상승, 임대수입, 노후대책 등 자가마련 이외의 비중이 높다(<그림 Ⅳ-1>(B)). 그러나 투자목적과 관계없이 가계 전반의 부동산 투자의향 강화는 주택가격상승에 대한 기대를 바탕으로 가계부채 증가세를 확대시킬 수 있다.

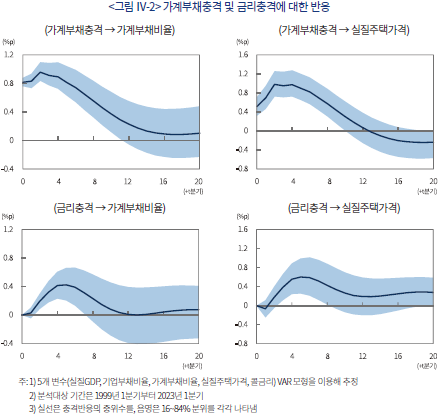

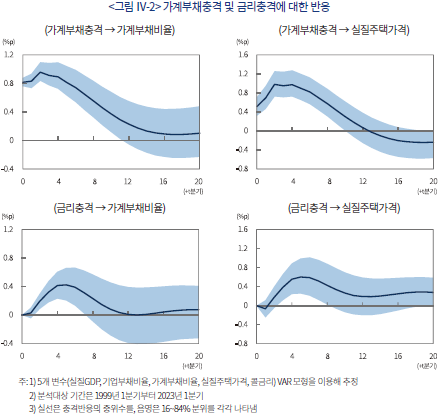

특히, 주택가격에 대한 영향력이 큰 부동산 대출규제 완화 및 기준금리 인하와 맞물려 가계부채 증가세가 확대될 가능성이 크다. IMF(2017)의 방법론을 이용하여 5개 변수(실질GDP, 기업부채비율, 가계부채비율, 실질주택가격, 콜금리) VAR 모형을 설정하고, 가계대출 및 금리가 가계부채비율과 주택가격에 미치는 영향을 분석해보았다.19) <그림 Ⅳ-2>는 가계부채와 기준금리에 각각 1 표준편차 충격 발생시 가계부채비율과 실질주택가격의 반응을 나타낸다. 부동산 대출규제 완화 등으로 가계부채가 늘어나는 충격(가계부채충격)이 발생하면, 이후 약 3년에 걸쳐 가계부채비율이 높아지고 주택가격도 상승하는 것으로 분석된다. 기준금리 인하 충격 발생시에도 가계부채충격에 비해 영향력은 작지만 가계부채비율과 주택가격이 상승하는 것으로 나타난다. 한편, 대출과 금리의 실제 변화뿐 아니라 그에 대한 기대변화 역시 가계의 행태에 영향을 미칠 수 있으므로 이에 유의할 필요가 있다. 대출규제 완화 및 금리인하에 대한 과도한 기대가 형성되는 경우에도 가계부채 증가세로 이어질 수 있다.

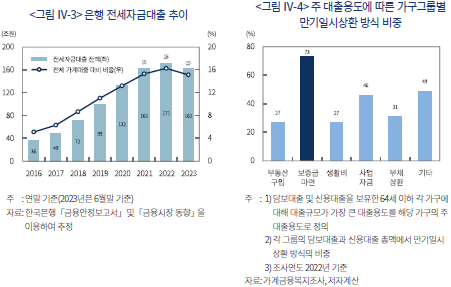

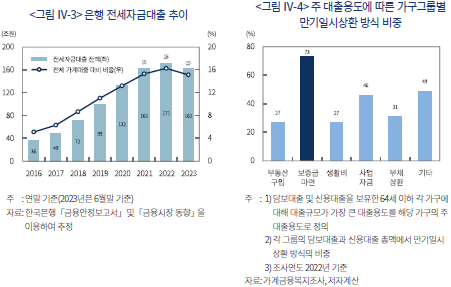

DSR(Debt Service Ratio) 규제가 적용되지 않는 전세자금대출을 통해 가계 레버리지가 확대될 가능성도 가계부채 관리의 또 다른 불안요인이다.20) 최근 가계대출 증가 추이를 살펴보면, 실제 주택구입을 위한 대출보다 전세자금대출이 공적보증을 바탕으로 더 빠른 속도로 늘어났다(<그림 Ⅳ-3>). 은행을 통해 가계에 공급된 대출 중 전세자금대출이 차지하는 비중은 2016년말 5%에 불과했으나 2023년 6월말에는 15%까지 높아지며 가계대출의 가파른 증가를 견인하였다. 특히, 다른 유형의 대출에 비해 전세자금대출은 만기일시상환 비중이 높아 가계대출의 변동성 확대요인으로 작용할 가능성이 크다(<그림 Ⅳ-4>).

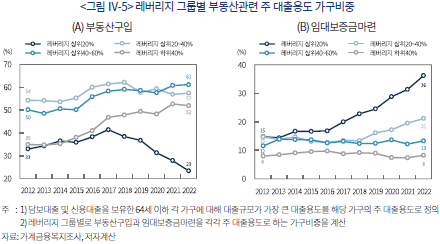

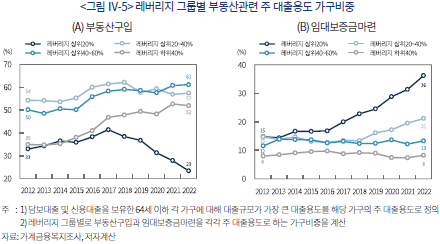

향후 금리인하 사이클로 전환되는 경우 전세자금대출이 빠르게 늘어나며 가계대출 관리에 어려움을 겪을 수 있다. <그림 Ⅳ-5>는 레버리지 그룹별로 부동산구입과 임대보증금마련을 각각 주 대출용도로 하는 가구비중을 나타낸다. 저금리환경이 지속된 최근 수년간 임대보증금마련을 주 대출목적으로 하는 가구비중이 레버리지 상위 그룹에서 더 크게 확대되었던 것을 확인할 수 있다. 특히 레버리지 상위 20% 그룹의 경우 부동산구입을 목적으로 대출받은 가구비중은 오히려 줄어든 것으로 나타난다. Jing, Park & Zhang(2022)은 국내 주택시장에 대한 금리의 영향이 전세시장을 통해 확대될 수 있으며, 금리변화에 따른 전세보증금(가격) 변동성 확대가 금융불안으로 이어질 위험이 크다고 분석하였다. 이와 같은 전세자금대출의 특수성으로 인해 향후 가계부채 관리의 어려움이 커질 수 있다.

Ⅴ. 요약 및 시사점

본 보고서는 미시적 분석을 중심으로 장기간 확대된 가계 레버리지 현황과 그에 따른 위험요인을 살펴보았다. 국내 가계부채는 실물경제에 비해 빠른 속도로 늘어난 가운데 부채의 가구 집중도가 높아지고 있어 경제 성장과 안정성을 저해하는 요인으로 작용할 수 있다. 레버리지 확대에 따른 부채부담 증가는 소비 제약요인으로 작용하며, 특히 고레버리지 가구에서 소비 둔화가 심화되는 것으로 나타났다. 또한 레버리지 확대로 인해 금리상승에 대한 가계 취약성이 증대되었는데, 2022년 이후 금리가 가파르게 상승하면서 과다차입 가구를 중심으로 원리금 상환에 어려움을 겪는 가구가 증가할 것으로 판단된다. 한편 가계 전반에 걸쳐 부동산 투자의향이 높아지는 추세를 나타내고 있어 부동산관련 대출을 중심으로 가계부채 증가세가 확대될 위험이 높으며, DSR 규제가 적용되지 않는 전세자금대출이 향후 가계부채 관리에 어려움으로 작용할 수 있다.

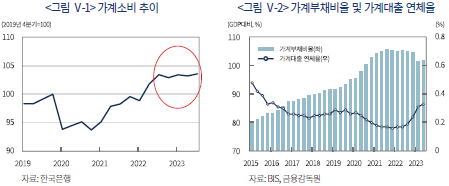

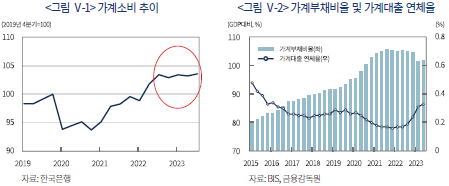

고금리 여건이 장기화될 가능성이 높아지고 있어 가계 레버리지 확대에 따른 위험요인이 현실화될 가능성에 유의할 필요가 있다. 향후 물가와 경기에 대한 불확실성이 큰 가운데 높은 레버리지 수준과 맞물려 원리금 상환부담이 빠르게 늘어나면서 가계소비 둔화세가 심화될 위험이 크다. 가계소비 증가세가 지난해 4분기 이후 크게 둔화되는 모습을 나타내는데(<그림 Ⅴ-1>), 고금리 기조가 장기화되는 경우 향후 소비 증가세가 예상보다 낮은 수준에 그칠 수 있어 경기 하방위험이 증대될 수 있다.

또한 가계대출 연체율도 작년 하반기 이후 상승세가 이어지고 있다(<그림 Ⅴ-2>). 고금리 여건 지속시 취약성이 높은 과다채무 가구를 중심으로 재무건전성이 악화되며 부실위험의 현실화 가능성이 크다. 가계 부실이 빠르게 늘어나는 경우 가계대출 연체 증가 등을 통해 금융기관 부실로 이어질 수 있으며, 부동산시장과의 연계성이 높은 국내 가계대출 특성으로 인해 부동산시장 위축을 유발할 수 있어 경제 전반의 금융불안으로 확산될 수 있다. 따라서 취약차주에 대한 관리를 강화하는 한편 충당금 적립 등을 통해 가계부문의 부실이 금융기관의 부실로 이어지지 않도록 대비가 필요하다.

중장기적인 시계에서 점진적인 디레버리징을 위해 가계부채 증가세가 확대되지 않도록 안정적인 부채관리가 요구된다. 특히, 부동산관련 대출을 중심으로 가계 레버리지가 확대될 위험이 높으므로 부동산시장 정책의 신뢰성를 확보하여 과도한 부동산가격 상승 기대를 억제할 필요가 있다. 만기일시상환 비중이 높고 DSR 규제가 적용되지 않는 전세자금대출에 대해서도 제도적 대책 마련이 필요하다. 이와 함께 가계자산의 높은 부동산 집중도를 완화하기 위한 정책적 노력도 요구된다. 마지막으로 과거와 같은 저금리 기조로의 회귀 가능성이 크게 낮아짐에 따라 가계는 부채를 활용함에 있어 과도한 수준의 위험감내를 지양할 필요가 있다.

1) 한국은행이 반기별로 실시하는 「시스템 리스크 서베이」에서 가계부채는 2021년부터 주요 위험요인으로 꾸준히 지목되어 오고 있으며(단순 응답빈도수 기준), 특히 2022년 하반기 이후에는 주요 위험요인 중 가장 높은 응답빈도를 기록하고 있다.

2) 은행 가계대출(잔액기준)의 변동금리 비중은 2022년 9월 79.1%까지 확대되기도 하였으나 이후 고정금리 대출이 늘어나면서 2023년 8월 70.8%로 다소 축소되었다.

3) 가계 레버리지(household leverage)에 대해 합의된 정의는 없으나 일반적으로 소득 또는 자산 대비 가계부채의 비율로 정의되며, 국가 단위의 분석에 있어서는 GDP대비 가계부채비율이 주로 사용된다. 본 보고서는 가구 마이크로데이터 중심으로 가계부채의 영향을 살펴보는 데 초점을 두고 있음에 따라 Ⅲ장에서 가계 레버리지를 자산 대비 금융부채 비율로 정의하고 분석을 진행한다.

4) 한편, 전ㆍ월세 임대보증금을 가계부채에 포함하는 경우 가계부채비율은 더욱 높아진다. 김세직ㆍ이정한ㆍ고제헌(2021)은 추정 방법에 따라 2020년 임차보증금 규모를 720~901조원 수준으로 추산하였는데, 2022년 임차보증금 규모를 동 수준으로 가정할 경우 2022년말 우리나라의 가계부채비율은 138~146%에 달한다.

5) 본 보고서는 가계가 보유한 금융부채에 초점을 두고 가계부채를 분석하고 있음에 따라 임대보증금은 분석대상에서 제외한다. 한편 가구 미시자료는 일반적으로 오른쪽 꼬리가 긴 분포를 가지며 평균값이 이상치(outlier)에 크게 영향을 받는 문제가 발생한다. 이에 본 보고서는 이상치의 영향을 적게 받는 중간값을 중심으로 분석을 진행한다.

6) 부채의 범위를 금융부채뿐 아니라 임대보증금까지 확대하여 살펴보아도 2015년 이후 부채(임대보증금 포함) 보유가구 비율은 일정 수준(63~65%)에 머물며 큰 변화를 나타내지 않는다.

7) 조사연도 2017년 이후 가계금융복지조사 소득항목이 행정자료를 통해 보완되면서 시계열 연속성에 문제가 발생한다는 점에 유의할 필요가 있다. 행정자료 보완으로 인해 2017년(조사연도 기준) 가구 평균 소득은 2016년에 비해 큰 폭(+12.2%)으로 증가했는데, 이를 감안할 때 행정자료 보완이 이루어지지 않은 2016년 이전 기간의 소득은 과소 추정된 것으로 판단된다. 따라서 소득 대비 금융부채 배율은 <그림 Ⅱ-2>에 나타난 것보다 더 가파르게 높아졌을 가능성이 크다.

8) 2022년 기준 65세 이상 가구의 금융부채 보유비율은 39.2%로 64세 이하 가구의 72.1%에 비해 크게 낮다. 65세 이상 금융부채 보유가구의 대출규모(중간값)도 3,000만원으로 64세 이하의 7,600만원에 비해 상당히 작다. 이는 소득에 기반한 부채상환 능력을 바탕으로 금융기관이 대출을 실행하고 있는 가운데 65세 이상 가구의 지속적인 대출상환이 반영된 결과로 판단된다.

9) Cecchetti et al.(2011)은 성장을 저해하는 부채 수준의 임계치(threshold)를 경제주체별로 추정하였는데 정부, 비금융기업, 가계의 부채가 각각 GDP 대비 85%, 90%, 85% 수준을 넘어서는 경우 성장에 부정적인 영향을 미치는 것으로 나타났다. 다만, 임계치 추정에 있어 가계는 다른 부문에 비해 통계적 신뢰도가 상대적으로 낮았다.

10) Lombardi et al.(2017)은 GDP 대비 가계부채비율이 80%를 넘어서면 장기적인 경제성장률에 부정적인 영향을 미친다고 분석하였다.

11) 가계금융복지조사의 소득과 소비는 직전 연도를 기준으로 작성된다. 이에 따라 2021년 조사에서는 코로나19의 충격이 컸던 2020년의 소득과 소비가 기록된다.

12) 퇴직 후 소득이 급격히 감소하는 65세 이상 가구는 제외하였다.

13) 회귀분석에 사용된 변수의 변환 및 처리에 관한 자세한 설명은 <부록>을 참고하기 바란다.

14) 한계소비성향은 다음과 같이 소득탄력성과 평균소비성향의 곱으로 표현할 수 있다.

△C/△Y=(△C/C)/(△Y/Y)×(C/Y)

이에 따라 평균소비성향이 동일하다고 가정하면 소득탄력성의 하락은 한계소비성향의 하락을 의미한다.

15) 각주 7에서 설명한 바와 같이 2016년 이전 기간의 소득 대비 금융부채 배율이 과소 추정되었을 가능성이 크다는 점에 유의할 필요가 있다.

16) 가계금융복지조사의 부채는 당해 연도 3월말 시점을 기준으로, 소득은 직전 연도를 기준으로 각각 작성된다. 예를 들어, 2022년 가계금융복지조사의 부채는 2022년 3월말 시점을 기준으로 작성되며 소득은 2021년을 기준으로 작성된다.

17) 연 단위로 실시되는 가계금융복지조사는 조사대상 시점과 통계 공표 시점 간 1년 이상의 시차가 존재한다. 이에 분기 단위로 실시되며 조사대상 시점과 통계 공표 시점 간 시차가 짧은 가계동향조사를 사용하여 최근의 이자부담을 살펴본다. 한편, 가계동향조사는 가구의 대출 원리금 상환 중 원금 상환을 제외한 이자지출만을 조사하고 있어 이자지출이 있는 가구를 금융부채 보유가구로 간주하였다.

18) 65세 이상 가구에서도 부동산 투자의향이 있다고 응답한 가구비율이 2012년 15%에서 2022년 31%로 꾸준히 높아지고 있으나 다른 연령그룹에 비해 낮은 수준이다.

19) IMF(2017)는 1998년부터 2015년까지의 27개국 패널 데이터를 사용하여 분석대상 국가의 평균적인 영향을 추정하였으나, 본 분석에서는 우리나라의 특성이 추정치에 반영될 수 있도록 1999년 1분기부터 2023년 1분기까지의 국내 데이터를 사용하였다. 구조적 충격(structural shock)의 식별은 IMF(2017)와 동일하게 Cholesky 분해를 이용하였다. 추정에 대한 구체적인 방법론은 IMF(2017)의 Box 2.4를 참조하기 바란다.

20) 한편 전세자금대출 외에도 중도금 대출, 1억원 이하 신용대출 등도 DSR 규제를 적용받지 않고 있는데, 가계부채 연착륙을 위해 DSR 예외대상 축소의 필요성이 제기되고 있다(이경태ㆍ강환구, 2023).

21) 가계금융복지조사 조사가구 중 순자산이 0 이하의 값을 갖는 가구 비중은 2017~2020년(조사연도 기준) 평균 3.0%이다.

22) 동 변환에 대한 자세한 논의는 Pence(2006)를 참고하기 바란다.

참고문헌

김세직ㆍ이정환ㆍ고제헌, 2021,『주택 전월세 보증금 규모 추정 및 잠재위험 분석』, 소득주도성장특별위원회 연구용역보고서.

노산하, 2021, 『한국 가계소비 둔화 요인에 대한 논의 및 시사점』, 자본시장연구원 이슈보고서 21-02.

이경태ㆍ강환구, 2023, 『장기구조적 관점에서 본 가계부채 증가의 원인과 영향 및 연착륙 방안』, BOK 이슈노트 제2023-22호.

정화영, 2022, 『부동산가격 상승이 가계의 자산ㆍ부채에 미치는 영향과 시사점』, 자본시장연구원 이슈보고서 22-27.

Cecchetti, S.G., Mohanty, M., Zampolli, F., 2011, The real effects of debt, BIS Working Paper No 352.

Dynan, K., 2012, Is a household debt overhang holding back consumption? Brookings papers on economic activity 299-362.

IMF, 2017, Household Debt and Financial Stability, In Global Financial Stability Report (October) Chapter 2.

Jing, B., Park, S., Zhang, A.L., 2022, The credit channel of monetary policy transmission: Evidence from the chonsei system, Working paper.

Jorda, O., Schularick, M., Taylor, A.M., 2013, When credit bites back, Journal of Money, Credit and Banking 45(s2), 3-28.

Lombardi, M., Mohanty, M., Shim, I., 2017, The real effects of household debt in the short and long run, BIS Working Paper No 607.

Mian, A., Sufi, A., Verner, E., 2017, Household debt and business cycles worldwide, The Quarterly Journal of Economics 132(4), 1755-1817.

Pence, K.M., 2006, The role of wealth transformations: An application to estimating the effect of tax incentives on saving, The B.E. Journal of Economic Analysis & Policy 5(1), 1-26.

Schularick, M., Taylor, A.M., 2012, Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870-2008, American Economic Review 102(2), 1029-1061.

가구변수 증가율을 계산하는 데 있어 순자산과 같이 0이하의 값을 갖는 변수는 로그차분 값을 사용할 수 없는 문제가 발생한다.21) 이에 Dynan(2012)의 분석방법론과 같이 소비, 순자산 및 소득 변수에 inverse hyperbolic sine 변환을 적용한 후 차분한 값을 사용하고 편의상 이를 증가율로 해석한다. 변수 x에 대해 inverse hyperbolic sine 변환은 로 정의되는데, x값이 매우 작은 값을 갖는 경우를 제외하고는 동 변환의 차분은 대체로 로그 차분과 유사한 값을 갖는다.22)

로 정의되는데, x값이 매우 작은 값을 갖는 경우를 제외하고는 동 변환의 차분은 대체로 로그 차분과 유사한 값을 갖는다.22)

한편 극단치의 영향을 배제하기 위해 각 변수에 대해 윈저화(winsorize)하였다. 연도별 소비증가율, 소득증가율, 순자산증가율의 경우 상하위 1%에서 윈저화하였으며, 금융부채 부담을 나타내는 변수(레버리지, 소득 대비 금융부채, 소득 대비 원리금 상환액)는 상위 1%에서 윈저화하였다.

가계부채가 우리나라 경제의 안정성을 위협하는 위험요인으로 부각되고 있다.1) 국내 가계부채는 2000년대 초반 카드사태 이후 뚜렷한 디레버리징 과정 없이 증가세가 이어져 왔다. 오랜 기간에 걸쳐 가계부채가 실물경제에 비해 더 빠른 속도로 늘어나면서 우리나라는 세계에서 가계부채비율이 가장 높은 국가 중 하나가 되었다.

2022년 이후 글로벌 통화긴축 강도가 높아지면서 시장금리가 가파르게 상승하였다. 국내 가계대출은 변동금리 비중이 높아 금리상승에 취약한데2) 높은 부채 수준과 대출금리의 가파른 상승이 맞물려 가계의 원리금 상환부담이 크게 늘어난 상황이다. 이에 따라 가계 레버리지3) 확대가 경제에 미치는 부정적인 영향에 대한 우려가 커지고 있다.

물가상승세가 둔화하고 있으나 여전히 목표수준을 상회하고 있으며, 향후 인플레이션 둔화가 예상보다 더디게 진행될 가능성이 높아지고 있다. 인플레이션 불확실성으로 인해 고금리 여건이 장기화되는 경우 높은 수준의 가계부채가 경제에 미치는 부정적 영향이 심화될 수 있다. 따라서 우리나라 가계부채 현황을 면밀하게 파악하고 레버리지 확대에 따른 위험요인을 이해하는 것은 정책당국자뿐 아니라 민간 경제주체에게도 그 중요성이 크다.

본 보고서는 미시데이터 분석을 중심으로 장기간 누증된 국내 가계부채의 현황 및 위험요인을 살펴보고 이를 바탕으로 시사점을 제시하고자 한다. 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 주요국과의 비교를 통해 가계부채 현황을 파악하고 마이크로데이터를 분석하여 가구단위 수준에서 국내 가계부채의 변화 양상을 살펴본다. Ⅲ장에서는 레버리지 확대에 따른 가계의 소비 약화 및 취약성 증대를 분석한다. Ⅳ장에서는 향후 가계부채 증가세가 확대될 위험을 점검하고, 마지막 Ⅴ장에서는 분석내용을 바탕으로 시사점을 도출한다.

Ⅱ. 우리나라 가계부채 현황

1. 주요국과의 비교

우리나라 가계부채는 다른 나라에 비해 수준이 높을 뿐 아니라 증가 속도도 빨라 안정적으로 관리할 필요성이 높다. <표 Ⅱ-1>은 2007년 이후 주요국의 GDP 대비 가계부채비율을 5년 단위로 비교하고 있다. 2007-2008년 금융위기 이후 미국, 영국 등에서는 가계부채의 디레버리징이 진행되었던 데 반해 우리나라 가계부채비율은 완연한 상승세가 이어지면서 2022년말 기준 스위스, 호주에 이어 3번째로 높은 수준을 기록하고 있다.4) 2007년 이후 주요국의 가계부채비율 변동폭을 비교해 보아도 우리나라는 중국, 태국에 이어 3번째로 상승폭이 크다.

가계부채의 안정적인 관리를 위해서는 국내 가계부채의 특성과 취약성을 이해하는 것이 중요하다. 우리나라 가계는 실물자산에 대한 집중도가 높은 특징을 보인다. <그림 Ⅱ-1>(A)는 가계부채비율 상위 5개 국가의 가계자산 내 실물자산 비중을 비교하고 있는데, 우리나라 가계의 실물자산 비중이 가장 높은 것을 확인할 수 있다. 반면 가계부채 대비 금융자산 보유는 가장 낮은 수준을 나타낸다(<그림 Ⅱ-1>(B)). 가계 재무상황을 악화시킬 수 있는 예상치 못한 충격이 발생하는 경우 금융자산은 충격의 영향을 완화하는 역할을 하는데, 우리나라 가계는 금융자산 보유가 적어 취약성이 높다고 할 수 있다. 최근 가파른 금리상승으로 원리금 상환에 어려움을 겪거나 전세가격 하락 충격으로 임대보증금 상환에 어려움을 겪는 가구들 모두 이러한 국내 가계의 취약성이 드러난 예라고 할 수 있다.

2. 부채 보유가구 현황

Ⅱ-1절에서는 총량지표를 이용하여 가계 전반의 부채 수준을 주요국과 비교해보았다. 그러나 가계부채 현황을 정확하게 파악하기 위해서는 부채 보유가구를 면밀히 살펴볼 필요가 있다. 이에 본 절에서는 가계금융복지조사 마이크로데이터를 활용하여 가구단위로 부채 현황을 살펴본다.5)

<그림 Ⅱ-2>는 전체 가구 중 금융부채를 보유한 가구의 비율과 이들 가구의 소득 대비 금융부채 배율(중간값) 추이를 나타낸다. 가계부채 총량이 장기간 큰 폭으로 늘어났음에도 불구하고 금융부채 보유가구 비율은 2015년 이후 큰 변화 없이 일정 수준(57~58%)에 머물고 있는데6), 이를 통해 가계 전반에 걸쳐 부채를 보유한 가구가 크게 늘어난 것이 아님을 확인할 수 있다. 이와 같은 결과는 가계부채의 가구 집중도가 높아지고 있음을 시사한다. 금융부채 보유 가구의 부채규모는 2012년 소득의 0.71배 수준이었으나 2022년에는 1.14배 수준까지 높아지며 소득에 비해 빠른 증가세를 보이고 있다.7)

특히, 44세(가구주 연령 기준) 이하 가구에 가계부채 증가세가 집중되는 모습이다. <그림 Ⅱ-3>은 금융부채 보유가구를 가구주 연령에 따라 그룹화한 후 각 그룹별 소득 대비 금융부채 배율을 비교하고 있다. 34세 이하와 35~44세 그룹의 금융부채 배율은 가파른 오름세가 지속되면서 2017년 이후 연령그룹 중 가장 높은 수준을 나타내고 있는데, 코로나19 팬데믹 이후 다른 연령그룹과의 격차가 더욱 확대되었다. 한편 65세 이상의 경우 금융부채를 보유한 가구비율이 크게 낮을 뿐 아니라 부채규모도 상대적으로 작은 모습이다.8) 이를 감안하여 이하에서는 65세 이상 가구를 제외한 나머지 그룹을 대상으로 분석을 진행한다.

가계부채의 빠른 증가세는 부동산관련 대출에 주로 기인한다. <그림 Ⅱ-4>(A)는 담보대출 및 신용대출을 보유한 64세 이하 가구를 주 대출용도에 따라 구분한 후, 각 용도별 가구비중 추이를 계산한 그래프이다. 부동산구입 및 보증금마련을 위해 대출을 받은 가구비중이 2012년 55%에서 지속적으로 확대되어 2022년 67%까지 높아진 것을 볼 수 있다. 부동산관련 대출은 타 용도 대출에 비해 대출규모도 크게 늘어나고 있다. <그림 Ⅱ-4>(B)는 주 대출용도에 따른 가구그룹별로 해당 용도 대출규모(중간값)의 변화를 나타낸다. 2022년 부동산구입과 보증금마련을 위한 가구 대출규모는 2012년 대비 각각 5,000만원, 5,400만원 늘어나며 대출용도 중 증가폭이 가장 크다. 앞서 44세 이하 가구 금융부채가 빠르게 늘어났던 것도 부동산관련 대출 증가와 상당 부분 연결된 것으로 판단된다. 44세 이하 가구는 다른 연령그룹에 비해 상대적으로 주택소유율이 낮아 부동산가격 상승과 함께 주택구입, 전세자금마련 등 부동산관련 대출이 크게 늘어난 것으로 보인다.

Ⅲ. 가계 레버리지 확대에 따른 위험요인 분석

Ⅱ장에서 살펴본 바와 같이 국내 가계부채는 주요국에 비해 빠른 속도로 늘어난 가운데 부채의 가구 집중도가 높아졌는데, 이는 향후 거시경제 운용에 있어 성장과 안정성을 저해하는 요인으로 작용할 수 있다. 가계 레버리지 확대가 경제에 미치는 영향은 많은 문헌에서 연구된 바 있다. Mian et al.(2017)과 IMF(2017)는 가계부채 증가가 단기적으로는 경제성장에 있어 양(+)의 효과를 나타내나 중장기적으로는 성장률 하락 및 실업률 상승으로 이어진다는 결과를 제시하였다. Cecchetti et al.(2011)은 GDP 대비 가계부채비율이 85% 수준을 넘어서면 성장을 저해하는 것으로 추정9)하였으며, Lombardi et al.(2017)도 이와 유사한 결과10)를 도출하였다. 한편, Schularick & Taylor(2012)와 Jorda et al.(2013)은 신용 증가폭이 과도할수록 위기 발생 가능성이 높아지고 경기 침체시 그 정도가 심화된다는 결과를 제시하고 있다.

위와 같은 연구 결과들은 가계부채가 누증될수록 경제에 미치는 부정적인 영향이 확대될 수 있음을 시사한다. 가계 레버리지의 확대는 소비 약화를 유발하여 경제성장세 둔화로 이어질 수 있을 뿐 아니라 금리 상승기에는 과다차입 가구를 중심으로 재무건전성을 악화시킬 수 있다. 이에 본 장에서는 레버리지 확대에 따른 위험요인으로 가계의 소비 약화 및 취약성 증대를 분석한다.

1. 레버리지 그룹별 가구 특성

분석에 앞서 자산 대비 금융부채 비율을 레버리지로 정의하고 레버리지 그룹별 가구 특성을 살펴본다. <그림 Ⅲ-1>(A)는 금융부채를 보유한 64세 이하 가구를 레버리지 분포에 따라 그룹화한 후 각 그룹별 레버리지의 중간값을 나타낸다. 부채 보유가구 전반에 걸쳐 레버리지가 확대되는 모습을 확인할 수 있는데, 이에 따른 원리금 상환부담 증가 및 가처분소득 감소는 소비둔화 요인으로 작용한다. 특히 고레버리지(레버리지 상위 20%) 그룹은 다른 그룹에 비해 상당히 높은 레버리지 수준을 나타낸다. 고레버리지 가구는 악화된 재무구조로 인해 금융기관으로부터 추가적인 대출이 어려움에 따라 소비를 줄이고 저축을 늘리는 방식으로 레버리지를 축소할 가능성이 높다.

한편, 고레버리지 그룹 내에 충격에 취약한 소득 중하위가구의 비중이 상대적으로 높다는 점에도 유의해야 한다. <그림 Ⅲ-1>(B)는 각 레버리지 그룹의 소득분위 구성비중을 비교하고 있다. 고레버리지 이외 그룹의 경우 소득이 높은 4~5분위 비중이 절반 이상을 차지하는 데 반해 고레버리지 그룹에서는 소득 4~5분위 비중이 상대적으로 작고 소득 1~3분위 비중이 큰 것을 확인할 수 있다. 이에 따라 소득감소 또는 금리상승과 같은 충격 발생시, 부채가 과다한 소득 중하위가구를 중심으로 충격의 영향을 충분히 흡수하지 못해 가계 부실로 이어질 위험이 커질 수 있다.

2. 가계 레버리지 확대에 따른 소비 약화

<표 Ⅲ-1>은 금융부채 보유 64세 이하 가구를 소득분위 및 레버리지 수준에 따라 그룹화한 후, 각 그룹별 가구 평균소비성향의 중간값(최근 3년 평균)을 계산한 값이다. 표를 통해 동일한 소득분위 내에서 고레버리지 그룹의 평균소비성향이 다른 그룹에 비해 낮은 것을 확인할 수 있다. 이와 같은 결과는 과도한 레버리지가 가계소비를 제약하는 요인으로 작용하고 있음을 시사한다.

이에 본 절에서는 가계금융복지조사를 활용하여 레버리지가 소비에 미치는 영향을 분석한다. 가계금융복지조사의 소득항목이 2017년(조사연도 기준) 이후 행정자료를 통해 보완되었다는 점, 그리고 코로나19 충격 직후 소비위축이 발생했던 점 등을 감안하여 조사연도 기준 2017년부터 2020년까지의 가구 데이터를 활용하여 회귀분석을 수행한다.11) 금융부채 보유가구뿐 아니라 미보유가구를 모두 포함한 64세 이하 가구를 분석대상으로 한다.12)

과다부채가 소비에 미치는 영향을 분석한 Dynan(2012)의 회귀분석 모형을 참고하여 주거비를 제외한 소비의 증가율을 종속변수로 사용하였으며, 주요 설명변수로는 소득증가율, 순자산증가율 및 금융부채의 부담 정도를 나타내는 변수들을 포함하였다(<표 Ⅲ-2>). 각 변수는 소비자물가지수를 적용하여 실질화하였다. 금융부채 부담을 나타내는 설명변수의 경우, 직전 시기(t-1)의 값을 사용함으로써 가계 재무상황의 사후적(ex post) 결과가 아니라 사전적(ex ante) 여건이 소비변동에 미치는 영향을 분석하였다. 추가적으로 가구주 연령, 교육수준, 자가 보유여부, 소득분위 더미 등 가구 특성을 나타내는 설명변수와 연도 고정효과를 함께 고려하였다.13)

<표 Ⅲ-3>은 7개 회귀식(추정식 1~7)에 대한 추정 결과를 정리하고 있다. 먼저 소득증가율(

추정식 1~5는 금융부채의 부담 정도를 나타내는 설명변수들(레버리지, 소득 대비 금융부채, 소득 대비 원리금 상환액)을 포함하고 있는데, 해당 변수의 계수들이 모두 통계적으로 유의한 음(-)의 값으로 추정된다. 이와 같은 결과는 레버리지 확대에 따른 부채 상환부담 증가가 소비 제약요인으로 작용함을 나타낸다.

추정식 6과 7은 각각 추정식 4와 5에 소득증가율과 고레버리지 그룹을 나타내는 더미변수의 교차항(

이상의 분석 결과는 가계 레버리지 확대가 소비의 제약요인으로 작용하며, 특히 고레버리지 그룹의 경우 향후 소득이 늘어나더라도 소비 증가세가 낮은 수준에 그칠 가능성을 시사한다. 잠재성장률 하락에 따른 미래 소득에 대한 기대 약화가 기조적인 가계 소비둔화 요인으로 작용하는 가운데(노산하, 2021) 부채부담 증가가 소비 부진을 심화시켜 잠재성장률을 추가적으로 하락하게 만드는 요인이 될 수 있다.

3. 가계 레버리지 확대에 따른 취약성 증대

가계 레버리지 확대로 인해 가계의 취약성이 높아졌다. 취약성이 높다는 것은 가계가 예상치 못한 금리상승 또는 소득감소 등의 충격이 발생할 경우 이에 대한 대응이 어려워 부실화 가능성이 높다는 것을 의미한다. <그림 Ⅲ-2>는 금융부채를 보유한 64세 이하 가구의 소득 대비 금융부채 배율의 누적분포를 나타낸다. 2013년과 2022년의 누적분포를 비교해보면 부채 보유가구 전반에 걸쳐 소득보다 금융부채가 더 빠르게 늘어난 것을 확인할 수 있다.15) 특히 부채규모가 소득수준을 크게 상회하는 가구들에 해당하는 분포의 오른쪽 영역에서 금융부채 배율의 상승폭이 더 크다. 이에 따라 금융부채 보유가구 중 차입규모가 과다한 가구의 비율이 상당폭 증가했다. 2022년 3월말 기준 금융부채 규모가 소득의 3배, 4배 이상인 가구비율은 각각 17.4%, 10.3%까지 높아졌으며, 5배 이상인 가구비율도 6.7%에 달한다(<그림 Ⅲ-3>).16) 금리 하락기에는 레버리지 확대에 따른 취약성이 드러나지 않았으나 금리가 상승하는 시기에는 원리금 상환부담이 빠르게 늘어나면서 과다부채 가구를 중심으로 부채상환에 어려움을 겪는 가계가 증가한다.

가계 레버리지가 지속적으로 확대된 것은 장기간 금리 하락세가 이어지면서 레버리지 활용에 대한 가계의 위험 인식이 약화된 데 기인한다. <그림 Ⅲ-4>에서 2012년 이후 십여 년 동안 기준금리와 가계대출금리의 하락세가 이어졌음을 확인할 수 있다. 레버리지 수준이 높았던 가구들 중에서 원리금 상환의 어려움을 답한 가구비율 또한 금리 하락과 함께 대체로 감소해왔는데(<그림 Ⅲ-5>), 레버리지 확대에도 불구하고 가계의 부채 상환부담은 금리가 하락함에 따라 지속적으로 완화되었던 것으로 추정된다. 이는 금리상승에 대한 가계의 위험 인식을 크게 약화시키는 요인으로 작용하여 레버리지 활용에 대한 적절한 자기규율이 작동하지 않았던 것으로 판단된다.

레버리지가 높은 가구일수록 취약성이 높은 재무구조를 나타내고 있어 예상치 못한 충격 발생시 고레버리지 가구를 중심으로 가계대출의 부실화 위험이 커질 수 있다. <그림 Ⅲ-6>은 64세 이하 금융부채 보유가구를 소득분위와 레버리지에 따라 그룹화한 후, 각 그룹별 금융자산과 순자산의 중간값을 나타낸다. 동일 소득분위를 기준으로 레버리지 상위 그룹일수록 금융자산과 순자산 규모가 작은 것을 확인할 수 있는데, 이는 레버리지가 확대될수록 충격에 더 취약함을 의미한다. 특히 고레버리지(레버리지 상위 20%) 그룹은 금융자산과 순자산 규모가 크게 작아 작은 충격에도 재무건전성이 악화될 수 있다. 예를 들어, 소득감소와 같은 유동성 충격에 직면하는 경우 유동성이 높은 금융자산 보유가 충분치 않음에 따라 대응 여력이 크게 낮아진다. Ⅲ-1절에서 언급했듯이 고레버리지 그룹 내에 소득 중하위가구의 비중이 상대적으로 높다는 점도 유동성 충격의 영향을 확대시킬 수 있는 요인이다. 또한 자산가격 하락 충격 발생시 자산가치가 부채규모를 하회할 가능성이 높아지는 가운데 추가적인 대출에 사용할 수 있는 담보도 부족해 가계부실로 이어질 위험이 크다.

통화긴축의 효과가 본격화되면서 금리상승에 대한 가계의 취약성이 드러나고 있다. <그림 Ⅲ-7>은 가계동향조사 마이크로데이터를 활용하여 계산한 금융부채 보유가구의 소득 대비 이자지출 비중을 나타낸다.17) 2022년 이후 금리가 가파르게 상승하면서 가계의 이자부담이 빠르게 늘어나는 가운데 이자지출이 과다한 가구비율도 높아지는 것을 확인할 수 있다. 2023년 2분기 기준 금융부채 보유가구 중 이자지출이 소득의 10%, 15%, 20%를 상회하는 가구비율이 각각 19.6%, 9.5%, 5.2%까지 상승했다(<그림 Ⅲ-8>). 향후 고금리 여건이 장기화되는 경우 과다부채 가구가 이자 비용을 감당하지 못해 가계대출 연체율이 상승하는 등 부실위험이 커질 수 있다.

Ⅳ. 향후 가계부채 관리의 불안요인

Ⅲ장에서 살펴본 것과 같이 높은 수준의 국내 가계부채는 소비둔화를 유발하여 경제성장을 저해하고 가계 취약성을 증대시키는 등 향후 거시경제 운용에 부담으로 작용할 가능성이 크다. 따라서 경제의 안정성 제고를 위해 가계부채의 안정적 관리가 요구되나 가계부채 증가세가 확대될 위험이 여전히 높다. 이에 본 장에서는 향후 가계부채 관리의 불안요인을 점검한다.

국내 가계부채는 부동산관련 대출을 중심으로 빠르게 늘어날 위험이 상존하고 있다. <그림 Ⅳ-1>(A)는 가구주 연령별로 부동산 투자의향이 있다고 답한 가구비율을 나타내는데 가계 전반에 걸쳐 부동산 투자의향이 높아지는 추세를 확인할 수 있다. 2022년 조사 기준 부동산 투자의향이 있다고 응답한 가구비율이 44세 이하 가구에서 70%를 상회하며, 45~54세와 55~64세 가구도 각각 70%와 60%로 높은 수준을 기록하고 있다.18) 최근 부동산가격 상승기를 거치며 소득보다는 부동산가격이 부의 증가에 더 중요한 요인으로 작용했는데(정화영, 2022), 이러한 경험이 가계의 부동산 투자의향 확대에 영향을 미쳤을 것으로 판단된다.

투자목적에 있어서는 연령별로 차이를 나타내는데, 34세 이하 그룹에서는 자가마련이 가장 높은 비중을 차지하고 있는 반면 연령이 높아질수록 가치상승, 임대수입, 노후대책 등 자가마련 이외의 비중이 높다(<그림 Ⅳ-1>(B)). 그러나 투자목적과 관계없이 가계 전반의 부동산 투자의향 강화는 주택가격상승에 대한 기대를 바탕으로 가계부채 증가세를 확대시킬 수 있다.

특히, 주택가격에 대한 영향력이 큰 부동산 대출규제 완화 및 기준금리 인하와 맞물려 가계부채 증가세가 확대될 가능성이 크다. IMF(2017)의 방법론을 이용하여 5개 변수(실질GDP, 기업부채비율, 가계부채비율, 실질주택가격, 콜금리) VAR 모형을 설정하고, 가계대출 및 금리가 가계부채비율과 주택가격에 미치는 영향을 분석해보았다.19) <그림 Ⅳ-2>는 가계부채와 기준금리에 각각 1 표준편차 충격 발생시 가계부채비율과 실질주택가격의 반응을 나타낸다. 부동산 대출규제 완화 등으로 가계부채가 늘어나는 충격(가계부채충격)이 발생하면, 이후 약 3년에 걸쳐 가계부채비율이 높아지고 주택가격도 상승하는 것으로 분석된다. 기준금리 인하 충격 발생시에도 가계부채충격에 비해 영향력은 작지만 가계부채비율과 주택가격이 상승하는 것으로 나타난다. 한편, 대출과 금리의 실제 변화뿐 아니라 그에 대한 기대변화 역시 가계의 행태에 영향을 미칠 수 있으므로 이에 유의할 필요가 있다. 대출규제 완화 및 금리인하에 대한 과도한 기대가 형성되는 경우에도 가계부채 증가세로 이어질 수 있다.

DSR(Debt Service Ratio) 규제가 적용되지 않는 전세자금대출을 통해 가계 레버리지가 확대될 가능성도 가계부채 관리의 또 다른 불안요인이다.20) 최근 가계대출 증가 추이를 살펴보면, 실제 주택구입을 위한 대출보다 전세자금대출이 공적보증을 바탕으로 더 빠른 속도로 늘어났다(<그림 Ⅳ-3>). 은행을 통해 가계에 공급된 대출 중 전세자금대출이 차지하는 비중은 2016년말 5%에 불과했으나 2023년 6월말에는 15%까지 높아지며 가계대출의 가파른 증가를 견인하였다. 특히, 다른 유형의 대출에 비해 전세자금대출은 만기일시상환 비중이 높아 가계대출의 변동성 확대요인으로 작용할 가능성이 크다(<그림 Ⅳ-4>).

향후 금리인하 사이클로 전환되는 경우 전세자금대출이 빠르게 늘어나며 가계대출 관리에 어려움을 겪을 수 있다. <그림 Ⅳ-5>는 레버리지 그룹별로 부동산구입과 임대보증금마련을 각각 주 대출용도로 하는 가구비중을 나타낸다. 저금리환경이 지속된 최근 수년간 임대보증금마련을 주 대출목적으로 하는 가구비중이 레버리지 상위 그룹에서 더 크게 확대되었던 것을 확인할 수 있다. 특히 레버리지 상위 20% 그룹의 경우 부동산구입을 목적으로 대출받은 가구비중은 오히려 줄어든 것으로 나타난다. Jing, Park & Zhang(2022)은 국내 주택시장에 대한 금리의 영향이 전세시장을 통해 확대될 수 있으며, 금리변화에 따른 전세보증금(가격) 변동성 확대가 금융불안으로 이어질 위험이 크다고 분석하였다. 이와 같은 전세자금대출의 특수성으로 인해 향후 가계부채 관리의 어려움이 커질 수 있다.

Ⅴ. 요약 및 시사점

본 보고서는 미시적 분석을 중심으로 장기간 확대된 가계 레버리지 현황과 그에 따른 위험요인을 살펴보았다. 국내 가계부채는 실물경제에 비해 빠른 속도로 늘어난 가운데 부채의 가구 집중도가 높아지고 있어 경제 성장과 안정성을 저해하는 요인으로 작용할 수 있다. 레버리지 확대에 따른 부채부담 증가는 소비 제약요인으로 작용하며, 특히 고레버리지 가구에서 소비 둔화가 심화되는 것으로 나타났다. 또한 레버리지 확대로 인해 금리상승에 대한 가계 취약성이 증대되었는데, 2022년 이후 금리가 가파르게 상승하면서 과다차입 가구를 중심으로 원리금 상환에 어려움을 겪는 가구가 증가할 것으로 판단된다. 한편 가계 전반에 걸쳐 부동산 투자의향이 높아지는 추세를 나타내고 있어 부동산관련 대출을 중심으로 가계부채 증가세가 확대될 위험이 높으며, DSR 규제가 적용되지 않는 전세자금대출이 향후 가계부채 관리에 어려움으로 작용할 수 있다.

고금리 여건이 장기화될 가능성이 높아지고 있어 가계 레버리지 확대에 따른 위험요인이 현실화될 가능성에 유의할 필요가 있다. 향후 물가와 경기에 대한 불확실성이 큰 가운데 높은 레버리지 수준과 맞물려 원리금 상환부담이 빠르게 늘어나면서 가계소비 둔화세가 심화될 위험이 크다. 가계소비 증가세가 지난해 4분기 이후 크게 둔화되는 모습을 나타내는데(<그림 Ⅴ-1>), 고금리 기조가 장기화되는 경우 향후 소비 증가세가 예상보다 낮은 수준에 그칠 수 있어 경기 하방위험이 증대될 수 있다.

또한 가계대출 연체율도 작년 하반기 이후 상승세가 이어지고 있다(<그림 Ⅴ-2>). 고금리 여건 지속시 취약성이 높은 과다채무 가구를 중심으로 재무건전성이 악화되며 부실위험의 현실화 가능성이 크다. 가계 부실이 빠르게 늘어나는 경우 가계대출 연체 증가 등을 통해 금융기관 부실로 이어질 수 있으며, 부동산시장과의 연계성이 높은 국내 가계대출 특성으로 인해 부동산시장 위축을 유발할 수 있어 경제 전반의 금융불안으로 확산될 수 있다. 따라서 취약차주에 대한 관리를 강화하는 한편 충당금 적립 등을 통해 가계부문의 부실이 금융기관의 부실로 이어지지 않도록 대비가 필요하다.

중장기적인 시계에서 점진적인 디레버리징을 위해 가계부채 증가세가 확대되지 않도록 안정적인 부채관리가 요구된다. 특히, 부동산관련 대출을 중심으로 가계 레버리지가 확대될 위험이 높으므로 부동산시장 정책의 신뢰성를 확보하여 과도한 부동산가격 상승 기대를 억제할 필요가 있다. 만기일시상환 비중이 높고 DSR 규제가 적용되지 않는 전세자금대출에 대해서도 제도적 대책 마련이 필요하다. 이와 함께 가계자산의 높은 부동산 집중도를 완화하기 위한 정책적 노력도 요구된다. 마지막으로 과거와 같은 저금리 기조로의 회귀 가능성이 크게 낮아짐에 따라 가계는 부채를 활용함에 있어 과도한 수준의 위험감내를 지양할 필요가 있다.

1) 한국은행이 반기별로 실시하는 「시스템 리스크 서베이」에서 가계부채는 2021년부터 주요 위험요인으로 꾸준히 지목되어 오고 있으며(단순 응답빈도수 기준), 특히 2022년 하반기 이후에는 주요 위험요인 중 가장 높은 응답빈도를 기록하고 있다.

2) 은행 가계대출(잔액기준)의 변동금리 비중은 2022년 9월 79.1%까지 확대되기도 하였으나 이후 고정금리 대출이 늘어나면서 2023년 8월 70.8%로 다소 축소되었다.

3) 가계 레버리지(household leverage)에 대해 합의된 정의는 없으나 일반적으로 소득 또는 자산 대비 가계부채의 비율로 정의되며, 국가 단위의 분석에 있어서는 GDP대비 가계부채비율이 주로 사용된다. 본 보고서는 가구 마이크로데이터 중심으로 가계부채의 영향을 살펴보는 데 초점을 두고 있음에 따라 Ⅲ장에서 가계 레버리지를 자산 대비 금융부채 비율로 정의하고 분석을 진행한다.

4) 한편, 전ㆍ월세 임대보증금을 가계부채에 포함하는 경우 가계부채비율은 더욱 높아진다. 김세직ㆍ이정한ㆍ고제헌(2021)은 추정 방법에 따라 2020년 임차보증금 규모를 720~901조원 수준으로 추산하였는데, 2022년 임차보증금 규모를 동 수준으로 가정할 경우 2022년말 우리나라의 가계부채비율은 138~146%에 달한다.

5) 본 보고서는 가계가 보유한 금융부채에 초점을 두고 가계부채를 분석하고 있음에 따라 임대보증금은 분석대상에서 제외한다. 한편 가구 미시자료는 일반적으로 오른쪽 꼬리가 긴 분포를 가지며 평균값이 이상치(outlier)에 크게 영향을 받는 문제가 발생한다. 이에 본 보고서는 이상치의 영향을 적게 받는 중간값을 중심으로 분석을 진행한다.

6) 부채의 범위를 금융부채뿐 아니라 임대보증금까지 확대하여 살펴보아도 2015년 이후 부채(임대보증금 포함) 보유가구 비율은 일정 수준(63~65%)에 머물며 큰 변화를 나타내지 않는다.

7) 조사연도 2017년 이후 가계금융복지조사 소득항목이 행정자료를 통해 보완되면서 시계열 연속성에 문제가 발생한다는 점에 유의할 필요가 있다. 행정자료 보완으로 인해 2017년(조사연도 기준) 가구 평균 소득은 2016년에 비해 큰 폭(+12.2%)으로 증가했는데, 이를 감안할 때 행정자료 보완이 이루어지지 않은 2016년 이전 기간의 소득은 과소 추정된 것으로 판단된다. 따라서 소득 대비 금융부채 배율은 <그림 Ⅱ-2>에 나타난 것보다 더 가파르게 높아졌을 가능성이 크다.

8) 2022년 기준 65세 이상 가구의 금융부채 보유비율은 39.2%로 64세 이하 가구의 72.1%에 비해 크게 낮다. 65세 이상 금융부채 보유가구의 대출규모(중간값)도 3,000만원으로 64세 이하의 7,600만원에 비해 상당히 작다. 이는 소득에 기반한 부채상환 능력을 바탕으로 금융기관이 대출을 실행하고 있는 가운데 65세 이상 가구의 지속적인 대출상환이 반영된 결과로 판단된다.

9) Cecchetti et al.(2011)은 성장을 저해하는 부채 수준의 임계치(threshold)를 경제주체별로 추정하였는데 정부, 비금융기업, 가계의 부채가 각각 GDP 대비 85%, 90%, 85% 수준을 넘어서는 경우 성장에 부정적인 영향을 미치는 것으로 나타났다. 다만, 임계치 추정에 있어 가계는 다른 부문에 비해 통계적 신뢰도가 상대적으로 낮았다.

10) Lombardi et al.(2017)은 GDP 대비 가계부채비율이 80%를 넘어서면 장기적인 경제성장률에 부정적인 영향을 미친다고 분석하였다.

11) 가계금융복지조사의 소득과 소비는 직전 연도를 기준으로 작성된다. 이에 따라 2021년 조사에서는 코로나19의 충격이 컸던 2020년의 소득과 소비가 기록된다.

12) 퇴직 후 소득이 급격히 감소하는 65세 이상 가구는 제외하였다.

13) 회귀분석에 사용된 변수의 변환 및 처리에 관한 자세한 설명은 <부록>을 참고하기 바란다.

14) 한계소비성향은 다음과 같이 소득탄력성과 평균소비성향의 곱으로 표현할 수 있다.

△C/△Y=(△C/C)/(△Y/Y)×(C/Y)

이에 따라 평균소비성향이 동일하다고 가정하면 소득탄력성의 하락은 한계소비성향의 하락을 의미한다.

15) 각주 7에서 설명한 바와 같이 2016년 이전 기간의 소득 대비 금융부채 배율이 과소 추정되었을 가능성이 크다는 점에 유의할 필요가 있다.

16) 가계금융복지조사의 부채는 당해 연도 3월말 시점을 기준으로, 소득은 직전 연도를 기준으로 각각 작성된다. 예를 들어, 2022년 가계금융복지조사의 부채는 2022년 3월말 시점을 기준으로 작성되며 소득은 2021년을 기준으로 작성된다.

17) 연 단위로 실시되는 가계금융복지조사는 조사대상 시점과 통계 공표 시점 간 1년 이상의 시차가 존재한다. 이에 분기 단위로 실시되며 조사대상 시점과 통계 공표 시점 간 시차가 짧은 가계동향조사를 사용하여 최근의 이자부담을 살펴본다. 한편, 가계동향조사는 가구의 대출 원리금 상환 중 원금 상환을 제외한 이자지출만을 조사하고 있어 이자지출이 있는 가구를 금융부채 보유가구로 간주하였다.

18) 65세 이상 가구에서도 부동산 투자의향이 있다고 응답한 가구비율이 2012년 15%에서 2022년 31%로 꾸준히 높아지고 있으나 다른 연령그룹에 비해 낮은 수준이다.

19) IMF(2017)는 1998년부터 2015년까지의 27개국 패널 데이터를 사용하여 분석대상 국가의 평균적인 영향을 추정하였으나, 본 분석에서는 우리나라의 특성이 추정치에 반영될 수 있도록 1999년 1분기부터 2023년 1분기까지의 국내 데이터를 사용하였다. 구조적 충격(structural shock)의 식별은 IMF(2017)와 동일하게 Cholesky 분해를 이용하였다. 추정에 대한 구체적인 방법론은 IMF(2017)의 Box 2.4를 참조하기 바란다.

20) 한편 전세자금대출 외에도 중도금 대출, 1억원 이하 신용대출 등도 DSR 규제를 적용받지 않고 있는데, 가계부채 연착륙을 위해 DSR 예외대상 축소의 필요성이 제기되고 있다(이경태ㆍ강환구, 2023).

21) 가계금융복지조사 조사가구 중 순자산이 0 이하의 값을 갖는 가구 비중은 2017~2020년(조사연도 기준) 평균 3.0%이다.

22) 동 변환에 대한 자세한 논의는 Pence(2006)를 참고하기 바란다.

참고문헌

김세직ㆍ이정환ㆍ고제헌, 2021,『주택 전월세 보증금 규모 추정 및 잠재위험 분석』, 소득주도성장특별위원회 연구용역보고서.

노산하, 2021, 『한국 가계소비 둔화 요인에 대한 논의 및 시사점』, 자본시장연구원 이슈보고서 21-02.

이경태ㆍ강환구, 2023, 『장기구조적 관점에서 본 가계부채 증가의 원인과 영향 및 연착륙 방안』, BOK 이슈노트 제2023-22호.

정화영, 2022, 『부동산가격 상승이 가계의 자산ㆍ부채에 미치는 영향과 시사점』, 자본시장연구원 이슈보고서 22-27.

Cecchetti, S.G., Mohanty, M., Zampolli, F., 2011, The real effects of debt, BIS Working Paper No 352.

Dynan, K., 2012, Is a household debt overhang holding back consumption? Brookings papers on economic activity 299-362.

IMF, 2017, Household Debt and Financial Stability, In Global Financial Stability Report (October) Chapter 2.

Jing, B., Park, S., Zhang, A.L., 2022, The credit channel of monetary policy transmission: Evidence from the chonsei system, Working paper.

Jorda, O., Schularick, M., Taylor, A.M., 2013, When credit bites back, Journal of Money, Credit and Banking 45(s2), 3-28.

Lombardi, M., Mohanty, M., Shim, I., 2017, The real effects of household debt in the short and long run, BIS Working Paper No 607.

Mian, A., Sufi, A., Verner, E., 2017, Household debt and business cycles worldwide, The Quarterly Journal of Economics 132(4), 1755-1817.

Pence, K.M., 2006, The role of wealth transformations: An application to estimating the effect of tax incentives on saving, The B.E. Journal of Economic Analysis & Policy 5(1), 1-26.

Schularick, M., Taylor, A.M., 2012, Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870-2008, American Economic Review 102(2), 1029-1061.

<부록> 가구소비 변동요인 회귀분석에 사용된 변수의 변환 및 처리

가구변수 증가율을 계산하는 데 있어 순자산과 같이 0이하의 값을 갖는 변수는 로그차분 값을 사용할 수 없는 문제가 발생한다.21) 이에 Dynan(2012)의 분석방법론과 같이 소비, 순자산 및 소득 변수에 inverse hyperbolic sine 변환을 적용한 후 차분한 값을 사용하고 편의상 이를 증가율로 해석한다. 변수 x에 대해 inverse hyperbolic sine 변환은

한편 극단치의 영향을 배제하기 위해 각 변수에 대해 윈저화(winsorize)하였다. 연도별 소비증가율, 소득증가율, 순자산증가율의 경우 상하위 1%에서 윈저화하였으며, 금융부채 부담을 나타내는 변수(레버리지, 소득 대비 금융부채, 소득 대비 원리금 상환액)는 상위 1%에서 윈저화하였다.