OPINION

2020 Mar/31

Covid-19’s Impact on Korea’s Stock Market

Mar. 31, 2020

PDF

- Summary

- With the spread of a deadly new coronavirus from China to the globe and plunging international oil prices, the Covid-19 epidemic has now evolved into a new phase. As Covid-19 became a common threat to the global stock markets, stock bourses in major economies are showing a synchronized downturn. Under the circumstances, Korea’s stock price declines appear to be determined by individual stocks’ sensitivity to external factors. Faced with uncontrollable global risk factors, Korea’s stock market will be inevitably exposed to high volatility for the time being. The seemingly long-term nature of the economic shock from Covid-19 requires Korea to focus on seeking ways to help Korea’s listed companies cope with the shock, rather than turning to short-term action against panic selling by foreign investors.

Since Korea has confirmed the first case in January 20, the number of Covid-19 infections in Korea has surpassed the 8,000 mark as of March 14, 2020. Although contagions are growing at a slower pace in Korea and China, the number of infections has ballooned in other countries including the US, Italy, Germany, France, and Spain. Thus far, a total of 142,000 patients were confirmed across 110 countries, with new infections outside Korea and China for ten days from March 4 reaching 46,000.

As the Covid-19 pandemic has become a reality, concerns are rapidly growing over the new virus’s long-term impact on the global economy. If the outbreak was limited to China, this could have been only a temporary shock. As the threat from the novel coronavirus spread to developed countries to subsequently escalate into a global pandemic, the shock is accumulating further. How Covid-19 panned out so far shows that even if one country successfully contains the virus, its economic recovery is unavoidably deterred by a series of external shocks that are likely to arise sporadically in other countries. Arguably, Covid-19’s economic impacts will be completely different in magnitude from those of past global epidemics like SARS or MERS. Recently, the IMF hinted its possible downward revisions on global economic outlook from 3.3% to 2.9% or below, whereas the OECD already downgraded its growth outlook to 2.4% from 2.9% with an estimation that the headline figure could fall to as low as 1.5% if the Covid-19 outbreak lengthens further.

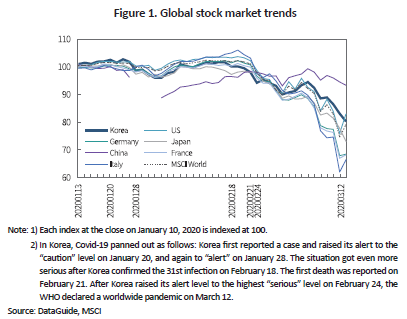

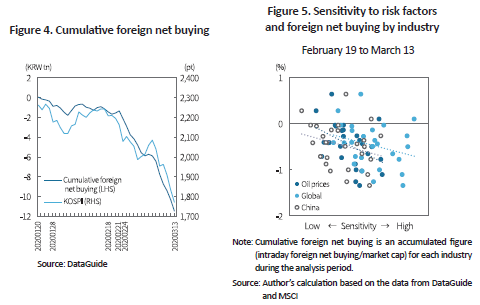

Amid such concerns, stock markets in major economies are plunging day after day. From January 11 when Covid-19 was first confirmed in China to mid-February when the outbreak began surging in certain areas in China, global stock markets appeared to recover from a mild downturn. However, the spread of the virus outside China has sent the stock markets tumbling (Figure 1). For 17 trading days between February 20 and March 13, market returns in major stock bourses fell into negative territory: –20% in the US, –26% in Japan, -33% in Germany, and -37% in Italy.1) The stock market meltdown in the those economies seemed to accelerate amid the plunge in oil prices after the collapse of OPEC output cut talks, as well as mounting concerns about US stocks being overvalued after the decade-long rally. More concretely, the March 9 collapse in the oil market sent the US stock market into a panic, with S&P500 tumbling over 7% to trigger a circuit breaker for the first time since 1997.

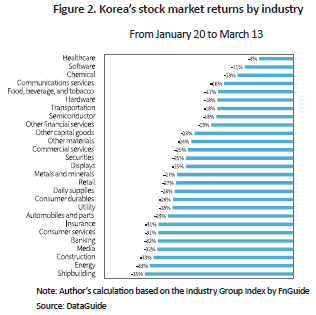

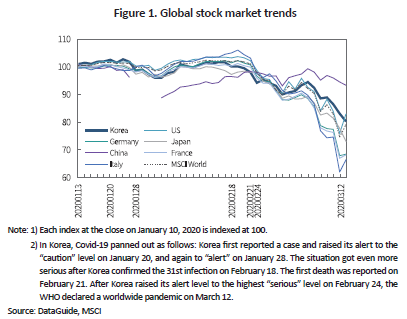

As of March 13, Korea’s stock market slid 20% after the Covid-19 outbreak, which is a small decline compared to major developed countries. More precisely, the size of declines was more severe during the early stage of the outbreak, but overall Korea’s decline has been relatively mild compared to developed countries since the epidemic became more visible across the globe and oil prices began tumbling. Korea’s listed stocks showed a varying degree of declines by industry: Healthcare, chemical, and communication stocks fell relatively mildly whereas shipbuilding, software, construction, media, banking and insurance, and consumer services stocks experienced a sharp fall (Figure 2). During the early stage, the impact was concentrated on industries that are likely to be affected by movement restrictions and falling Chinese demand, e.g., consumer services, daily supplies, and retail sectors. Since major stock markets observed a synchronized plunge, the size of declines has abruptly risen in wider areas including shipbuilding, automobile and parts that are sensitive to global economic conditions, and the financial sector including banking and insurance that is deemed sensitive to macroeconomic stability.

As evidenced in Figure 1, stock indexes in major economies including Korea have shown a synchronized move. The correlation between the returns on major stock indices stood at over 0.6, which is higher than 0.3 during the SARS (2002 to 2003) outbreak, and 0.4 during the 2009 H1N1 influenza and 2015 MERS epidemics. Such a high correlation is because major stock markets are weighed down by common risk factors of Covid-19, a possible contraction in the Chinese economy, a global economic recession, and an abrupt plunge in international oil prices.

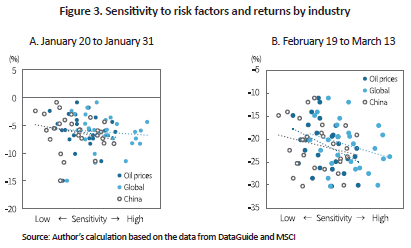

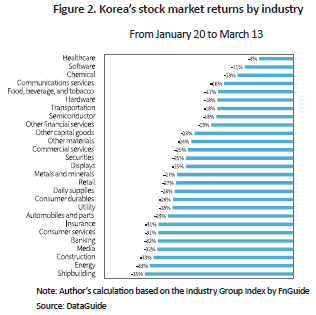

To figure out more precisely how Korea’s stock market is affected by the three factors mentioned above, this article measures the sensitivity2) of Korea’s listed stocks to those three factors across industries, and compares the data with stock price fluctuations after the Covid-19 outbreak. First of all, the first round of the stock market decline between January 20 and 31 seems insensitive to those three factors (Figure 3-A). Also confirmed—albeit statistically insignificant—is that an industry more sensitive to each factor sees a wider decline, with a larger impact of the Chinese factor among others. What’s implied here is a short-term shock Covid-19 had on the major stock markets, which is evidenced by most stock declines followed by a rebound, and a particularly large fall in the Chinese market.

As the coronavirus spread from China to the globe and international oil prices plunged further, the Covid-19 epidemic seems to have evolved into a new phase. If oil producing nations agree to cut production, this may be possible to stabilize oil prices. However, if not effectively contained at the early stage, Covid-19—already infecting the US and major European nations—is expected to have a serious blow to the global economy. What bodes ill for the Korean economy is that the pandemic is now tightening its grip on the US after China. This could be the worst-case scenario for Korea. Finding a coronavirus vaccine and treatment will certainly turn this epidemic around, but it will take considerable time.

Currently, Korea’s listed stocks see their price-to-book ratio fall under 0.7 with the lowest profitability among major economies. The relatively small decline Korea has experienced since the Covid-19 outbreak might have nothing to do with the size of shock. Rather, this is due to Korea’s already low stock prices. Now, inarguably, Korea’s stock market is facing uncontrollable risks. It’s inevitable for the economy to be exposed to high volatility for the time being. Furthermore, the economic impact of Covid-19 is expected to linger for a long time. The most imminent challenge ahead of Korea is seeking ways to help Korea’s listed companies—already challenged by their low profitability and low growth potential—to better cope with the long-term shock, which is far more important than turning to short-term action against panic selling by foreigners.

1) Measured by the Nikkei225 (Japan), S&P500 (US), DAX (Germany), CAC40 (France), and FTSE MIB (Italy) indices

2) Sensitivity to risk factors across 27 industries is measured by using the correlation coefficient between monthly returns on each industry index and on the SSE Index (Chinese factor), the MSCI World Index (global factor), and the WTI prices (oil price factor). Because the MSCI World Index excludes the Korean and Chinese stock markets, the Chinese factor is excluded from the global factor, both of which do not reflect Korea-specific factors.

As the Covid-19 pandemic has become a reality, concerns are rapidly growing over the new virus’s long-term impact on the global economy. If the outbreak was limited to China, this could have been only a temporary shock. As the threat from the novel coronavirus spread to developed countries to subsequently escalate into a global pandemic, the shock is accumulating further. How Covid-19 panned out so far shows that even if one country successfully contains the virus, its economic recovery is unavoidably deterred by a series of external shocks that are likely to arise sporadically in other countries. Arguably, Covid-19’s economic impacts will be completely different in magnitude from those of past global epidemics like SARS or MERS. Recently, the IMF hinted its possible downward revisions on global economic outlook from 3.3% to 2.9% or below, whereas the OECD already downgraded its growth outlook to 2.4% from 2.9% with an estimation that the headline figure could fall to as low as 1.5% if the Covid-19 outbreak lengthens further.

Amid such concerns, stock markets in major economies are plunging day after day. From January 11 when Covid-19 was first confirmed in China to mid-February when the outbreak began surging in certain areas in China, global stock markets appeared to recover from a mild downturn. However, the spread of the virus outside China has sent the stock markets tumbling (Figure 1). For 17 trading days between February 20 and March 13, market returns in major stock bourses fell into negative territory: –20% in the US, –26% in Japan, -33% in Germany, and -37% in Italy.1) The stock market meltdown in the those economies seemed to accelerate amid the plunge in oil prices after the collapse of OPEC output cut talks, as well as mounting concerns about US stocks being overvalued after the decade-long rally. More concretely, the March 9 collapse in the oil market sent the US stock market into a panic, with S&P500 tumbling over 7% to trigger a circuit breaker for the first time since 1997.

As of March 13, Korea’s stock market slid 20% after the Covid-19 outbreak, which is a small decline compared to major developed countries. More precisely, the size of declines was more severe during the early stage of the outbreak, but overall Korea’s decline has been relatively mild compared to developed countries since the epidemic became more visible across the globe and oil prices began tumbling. Korea’s listed stocks showed a varying degree of declines by industry: Healthcare, chemical, and communication stocks fell relatively mildly whereas shipbuilding, software, construction, media, banking and insurance, and consumer services stocks experienced a sharp fall (Figure 2). During the early stage, the impact was concentrated on industries that are likely to be affected by movement restrictions and falling Chinese demand, e.g., consumer services, daily supplies, and retail sectors. Since major stock markets observed a synchronized plunge, the size of declines has abruptly risen in wider areas including shipbuilding, automobile and parts that are sensitive to global economic conditions, and the financial sector including banking and insurance that is deemed sensitive to macroeconomic stability.

As evidenced in Figure 1, stock indexes in major economies including Korea have shown a synchronized move. The correlation between the returns on major stock indices stood at over 0.6, which is higher than 0.3 during the SARS (2002 to 2003) outbreak, and 0.4 during the 2009 H1N1 influenza and 2015 MERS epidemics. Such a high correlation is because major stock markets are weighed down by common risk factors of Covid-19, a possible contraction in the Chinese economy, a global economic recession, and an abrupt plunge in international oil prices.

To figure out more precisely how Korea’s stock market is affected by the three factors mentioned above, this article measures the sensitivity2) of Korea’s listed stocks to those three factors across industries, and compares the data with stock price fluctuations after the Covid-19 outbreak. First of all, the first round of the stock market decline between January 20 and 31 seems insensitive to those three factors (Figure 3-A). Also confirmed—albeit statistically insignificant—is that an industry more sensitive to each factor sees a wider decline, with a larger impact of the Chinese factor among others. What’s implied here is a short-term shock Covid-19 had on the major stock markets, which is evidenced by most stock declines followed by a rebound, and a particularly large fall in the Chinese market.

By contrast, stock price declines between February 19 and March 13 during which Covid-19 spread across the globe and oil prices plummeted is found to have a higher correlation to all of the three factors above (Figure 3-B). Among others, oil prices are found to have largest and the most significant impact. Industries falling under the lowest-quartile sensitivity group saw their stock prices fall only 20%, whereas the highest-quartile group stocks declined about 25%.

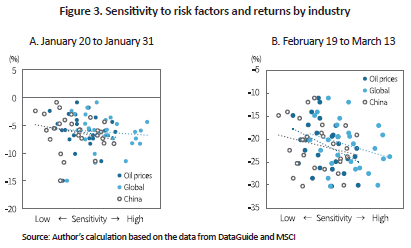

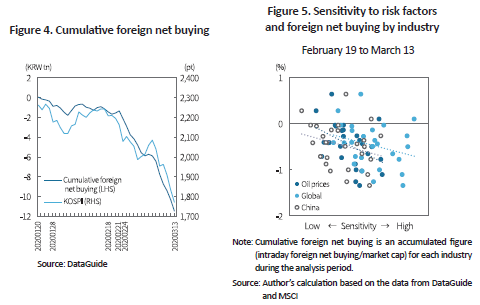

On another front, the fall in Korea’s stock markets after the Covid-19 outbreak seems to be driven by sell-off by foreign investors. As of March 13, foreigners net sold KRW 11.5 trillion in the KOSPI. The cumulative foreign net selling during the same period shows a pattern quite in sync with the KOSPI (Figure 4). More often than not, Korea’ stock indexes have a close correlation with foreign net buying, and that correlation becomes more evident during market downturns. Such a tendency has been pronounced during price declines since the coronavirus outbreak. When major global stock markets entered a full-fledged downward trend, foreign net selling was found to be concentrated on the industries that are highly sensitive to the Chinese, global, and oil price factors (Figure 5). Among those factors, oil prices have the highest explanatory power for foreign net selling. The proportion of cumulative net selling to industry market cap stands at 0.18% in industries in the lowest-quartile sensitivity group, while the figure grows three-fold to 0.57% in those in the highest-quartiles sensitivity group.

Taken together, the aforementioned three factors behind a synchronized downturn in major developed stock markets can effectively explain the changes in stock market returns as well as the pattern of industry returns in Korea since the Covid-19 outbreak, which is also confirmed in line with the pattern of foreign net selling.

Taken together, the aforementioned three factors behind a synchronized downturn in major developed stock markets can effectively explain the changes in stock market returns as well as the pattern of industry returns in Korea since the Covid-19 outbreak, which is also confirmed in line with the pattern of foreign net selling.

Currently, Korea’s listed stocks see their price-to-book ratio fall under 0.7 with the lowest profitability among major economies. The relatively small decline Korea has experienced since the Covid-19 outbreak might have nothing to do with the size of shock. Rather, this is due to Korea’s already low stock prices. Now, inarguably, Korea’s stock market is facing uncontrollable risks. It’s inevitable for the economy to be exposed to high volatility for the time being. Furthermore, the economic impact of Covid-19 is expected to linger for a long time. The most imminent challenge ahead of Korea is seeking ways to help Korea’s listed companies—already challenged by their low profitability and low growth potential—to better cope with the long-term shock, which is far more important than turning to short-term action against panic selling by foreigners.

1) Measured by the Nikkei225 (Japan), S&P500 (US), DAX (Germany), CAC40 (France), and FTSE MIB (Italy) indices

2) Sensitivity to risk factors across 27 industries is measured by using the correlation coefficient between monthly returns on each industry index and on the SSE Index (Chinese factor), the MSCI World Index (global factor), and the WTI prices (oil price factor). Because the MSCI World Index excludes the Korean and Chinese stock markets, the Chinese factor is excluded from the global factor, both of which do not reflect Korea-specific factors.