Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Impact of Rebalancing on Leveraged and Inverse Funds

Publication date Jun. 09, 2020

Summary

Leveraged and inverse funds have many characteristics that are different from ordinary funds. Among others, this article places a particular focus on rebalancing transactions carried out by leveraged and inverse funds, and tries to explore the resultant fall in investment returns. Investors in those funds need to clearly understand such characteristics, and to take fully into account the inherent risks.

Leveraged and inverse exchange-traded funds (ETFs) have been listed in Korea for a decade, but their overall performance has thus far been short of satisfaction. Since the listing in February 2010, leveraged ETFs climbed only 0.2% whereas the underlying KOSPI 200 rose 22% during the same period.1) This is just above negative returns, and not even close to returns multiplied by 2 (43%). The same is also observed in inverse ETFs based on the KOSPI200 Futures. Since its launch in September 2009, the underlying KOSPI200 Futures rose 15% whereas inverse ETFs posted a -31% return, far below the negative return of the underlying index (-15%). Furthermore, five double-leveraged (2x) inverse ETFs on KOSPI200 Futures launched in September 2016 also reported a 30% loss, which is far lower than the return with a negative multiple of -2 (-3%).

Why did this happen? A primary cause behind poor performance of leveraged and inverse funds could be found in rebalancing. This is a transaction where a fund adjusts its exposure to an underlying index so as to achieve a constant multiple of the daily return of the underlying index. Instead of holding an initial position established to achieve exposure to a certain multiple of the net asset value, those funds normally engage in daily trades aiming to adjust their exposure depending on market situations. More concretely, they repeatedly execute trend following trades every day, which means buying and selling when the stock market goes up and down. In the end, that trading methodology has had a significantly adverse effect on fund performance for the past decade.2)

Characteristics of rebalancing by leveraged and inverse funds

Leveraged and inverse funds sold and traded thus far in Korea usually trace a certain multiple of daily returns on respective underlying indices. For example, a 1% increase in an underlying stock index on a trading day will increase the return of a 2x-leveraged fund to 2%, and that of a 1x inverse fund and a 2x-leveraged inverse fund to –1% and -2%, respectively.3) This is quite appealing to retail investors who have limited access to sophisticated investment strategies based on derivatives and short selling. Although investing in stocks or funds allows investors to seek to achieve performance equal to that of an underlying index (a positive multiple of 1), leveraged and inverse funds seek to deliver multiples (-2 to +2) of the index’s performance. Indeed, retail investors can emulate, albeit partially, institutional investors’ management strategy using derivative and short selling. This also creates an effect of leverage that increases their exposure to risk, and a hedging effect where investors could protect their portfolio performance in a bear market. Going beyond that, investors in those funds can effectively bet on a drop in the market. Such characteristics are also useful from the marketing perspective because the catchy naming (leveraged, inverse, and double-leveraged inverse, etc.) help those funds be more widely recognized and accepted by investors without sufficient financial literacy.

On the flip side, however, those funds also have a characteristic that is barely understood by retail investors: Leveraged and inverse funds need rebalancing that involves a significant large volume of short-term trend following trades. This is a unique and important characteristic that distinguishes those funds from ordinary buy-and-hold funds as well as institutional investors’ investment strategies using derivatives and short selling.

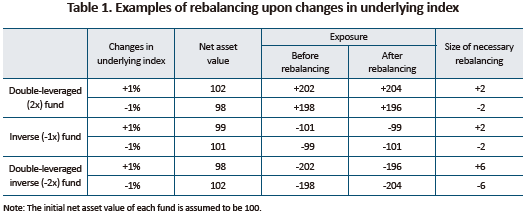

Leveraged and inverse funds rebalance their portfolio as follows. For example, let’s assume that a hypothetical 2x-leveraged fund’s underlying index climbs 1%, which makes the fund’s net asset value rise to 102 from 100. For the fund to maintain its multiple of 2, it needs to increase its exposure from +200 to +204. As the 1% increase in the index leads to a +2 increase in exposure, the fund should take a buy position for another +2 exposure. On the other hand, a 1% fall in the underlying index makes the same 2x fund’s net asset value fall from 100 to 98, in which its exposure should be decreased from +200 to +196. On top of the decrease (-2) from the index fall, the fund should take a sell position (-2). In short, the 2x fund should engage in short-term trend following trades by taking a buy position when the underlying index rises, and a sell position when the index falls. Likewise, -1x fund and -2x fund also carry out trend following trades during their rebalancing effort, as illustrated in Table 1.4)

Impact of portfolio rebalancing on fund performance

The short-term, trend following nature of rebalancing trades is highly likely to have an adverse effect on performance of leveraged and inverse funds tracking a stock index. This is because a short-term reversal prevails in the stock market. For empirical evidence, this article tries to assess the size of rebalancing trades and the changes in performance of three hypothetical leveraged and inverse funds: a double-leveraged (2x) fund, an inverse (-1x) fund, and a double-leveraged inverse (-2x) fund that track the daily return of the KOSPI200 since 2010.5)

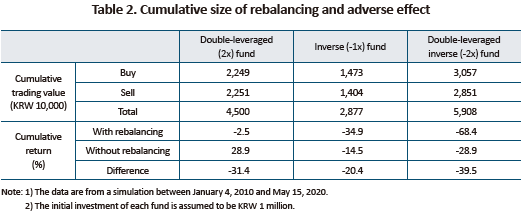

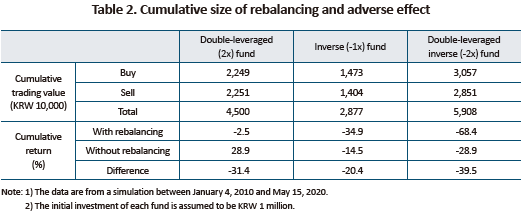

First of all, the size and performance of cumulative trading since 2010 were calculated. Assuming the initial investment of each fund being KRW 1 million, cumulative rebalancing trades of the 2x fund amounted to KRW 45 million, which is as large as 45 times the initial investment for a decade. Moreover, such trades are found to have had a critical impact on fund performance. The cumulative return was solid at 28.9% without rebalancing, but much worse at -2.5% with rebalancing. In other words, the impact of rebalancing on fund performance for a decade, that is, the difference between the return with rebalancing and the return without one, reached -31.4%. In the -1x fund, the cumulative size of rebalancing trades reached KRW 28.77 million, and the return with rebalancing was 20.4% lower than the return without rebalancing. The adverse effect of rebalancing was particularly evident in the -2x fund, with the size of rebalancing trades at KRW 59.08 million and the difference in returns at 39.5%.

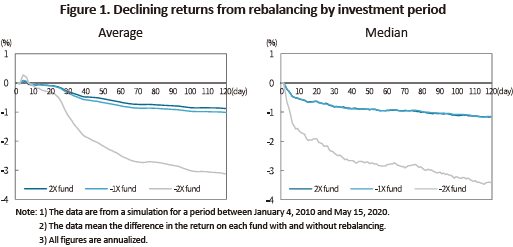

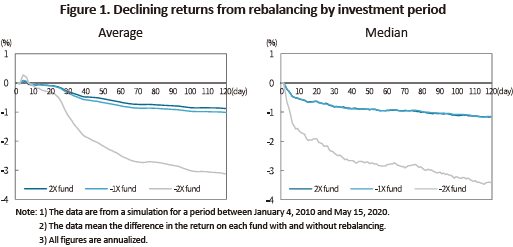

Lower returns of leveraged and inverse funds due to rebalancing are a phenomenon that is not limited to longer investment periods. When the simulation period above was shortened to 1–120 days randomly selected from the period, the three hypothetical funds saw their return decline as demonstrated in Figure 1. For instance, when an investor holds the 2x fund and -1x fund for 120 trading days, the annualized decline in the return was around 1% on average. The figure was approximately 3% in the -2x fund.6) What’s notable is the high likelihood of a decline in the fund return even in short-term investment for less than one week, which is well illustrated in the median value chart on the right hand side of Figure 1.

Conclusion

Arguably, leveraged and inverse funds are differentiated from other ordinary funds. Leveraged and inverse funds could be desirable because they allow investors to emulate sophisticated investment strategies based on derivatives and short selling that have been long considered territory for institutional investors. However, their shortcoming lies in frequent rebalancing, which could somewhat seriously undermine fund performance. Those funds are also related to some other less important issues, e.g., high transaction costs and management fees compared to other passive funds, the disparate ratio and tracking error of ETFs, etc. All of those issues call for investors to fully take into account the characteristics, and to be wary of the risks before they invest in a leveraged or inverse fund.

On another front, the relevant industry could seek for an alternative that could fully exploit strengths of leveraged or inverse funds while effectively dealing with the rebalancing issue. For example, it’s worth considering a product using a rebalancing cycle longer than a day, or tracking a ranged target instead of a specific multiple, which would be of help in addressing the adverse effect of rebalancing on fund returns.7)

1) Cumulative returns presented in this article are calculated based on the closing price of each trading day, and the data are year to date as of May 15, 2020.

2) Leveraged and inverse funds notify such risks in their prospectus. In other words, the prospectus explicitly states that those products aim to meet the daily multiple objective, not the multiple of a cumulative return on the underlying index during a certain period.

3) For convenience, double-leveraged, inverse, and double-leveraged inverse funds are referred to as the ‘2x fund’, ‘-1x fund’, and ‘-2x fund’, respectively throughout this article.

4) The size of rebalancing trades in leveraged and inverse funds increases as the daily return on the underlying index goes up. More concretely, an r% return on the underlying index leads to rebalancing trades as large as 2r% of the previous day’s net asset value of a 2x fund and a -1x fund, and 6r% of a -2x fund.

5) In fact, a diverse range of factors and management strategies are known to affect the performance of leveraged and inverse funds. For example, leveraged fund performance could be affected by stock dividends and financing costs, whereas an inverse fund may see its performance increase due to interest income from deposits and bonds held by the fund. Other factors include fees, charges, and transaction costs. As this article places its focus on the effect of rebalancing, I excluded all of those factors and came up with three hypothetical funds whose performance is purely affected by the multiple of the daily return on an underlying index.

6) With the initial investment of KRW 1 million, the average size of rebalancing trades during 120 trading days is KRW 1.97 million, KRW 1.23 million, and KRW 2.51 million in the 2x, -1x, and -2x funds, respectively.

7) Also worth mentioning is the argument, which has been put forward frequently, that rebalancing trades of leveraged and inverse funds could trigger a shock to the spot and future markets. Although this is beyond the subject of this article, further research would be needed on rebalancing strategies.

Why did this happen? A primary cause behind poor performance of leveraged and inverse funds could be found in rebalancing. This is a transaction where a fund adjusts its exposure to an underlying index so as to achieve a constant multiple of the daily return of the underlying index. Instead of holding an initial position established to achieve exposure to a certain multiple of the net asset value, those funds normally engage in daily trades aiming to adjust their exposure depending on market situations. More concretely, they repeatedly execute trend following trades every day, which means buying and selling when the stock market goes up and down. In the end, that trading methodology has had a significantly adverse effect on fund performance for the past decade.2)

Characteristics of rebalancing by leveraged and inverse funds

Leveraged and inverse funds sold and traded thus far in Korea usually trace a certain multiple of daily returns on respective underlying indices. For example, a 1% increase in an underlying stock index on a trading day will increase the return of a 2x-leveraged fund to 2%, and that of a 1x inverse fund and a 2x-leveraged inverse fund to –1% and -2%, respectively.3) This is quite appealing to retail investors who have limited access to sophisticated investment strategies based on derivatives and short selling. Although investing in stocks or funds allows investors to seek to achieve performance equal to that of an underlying index (a positive multiple of 1), leveraged and inverse funds seek to deliver multiples (-2 to +2) of the index’s performance. Indeed, retail investors can emulate, albeit partially, institutional investors’ management strategy using derivative and short selling. This also creates an effect of leverage that increases their exposure to risk, and a hedging effect where investors could protect their portfolio performance in a bear market. Going beyond that, investors in those funds can effectively bet on a drop in the market. Such characteristics are also useful from the marketing perspective because the catchy naming (leveraged, inverse, and double-leveraged inverse, etc.) help those funds be more widely recognized and accepted by investors without sufficient financial literacy.

On the flip side, however, those funds also have a characteristic that is barely understood by retail investors: Leveraged and inverse funds need rebalancing that involves a significant large volume of short-term trend following trades. This is a unique and important characteristic that distinguishes those funds from ordinary buy-and-hold funds as well as institutional investors’ investment strategies using derivatives and short selling.

Leveraged and inverse funds rebalance their portfolio as follows. For example, let’s assume that a hypothetical 2x-leveraged fund’s underlying index climbs 1%, which makes the fund’s net asset value rise to 102 from 100. For the fund to maintain its multiple of 2, it needs to increase its exposure from +200 to +204. As the 1% increase in the index leads to a +2 increase in exposure, the fund should take a buy position for another +2 exposure. On the other hand, a 1% fall in the underlying index makes the same 2x fund’s net asset value fall from 100 to 98, in which its exposure should be decreased from +200 to +196. On top of the decrease (-2) from the index fall, the fund should take a sell position (-2). In short, the 2x fund should engage in short-term trend following trades by taking a buy position when the underlying index rises, and a sell position when the index falls. Likewise, -1x fund and -2x fund also carry out trend following trades during their rebalancing effort, as illustrated in Table 1.4)

The short-term, trend following nature of rebalancing trades is highly likely to have an adverse effect on performance of leveraged and inverse funds tracking a stock index. This is because a short-term reversal prevails in the stock market. For empirical evidence, this article tries to assess the size of rebalancing trades and the changes in performance of three hypothetical leveraged and inverse funds: a double-leveraged (2x) fund, an inverse (-1x) fund, and a double-leveraged inverse (-2x) fund that track the daily return of the KOSPI200 since 2010.5)

First of all, the size and performance of cumulative trading since 2010 were calculated. Assuming the initial investment of each fund being KRW 1 million, cumulative rebalancing trades of the 2x fund amounted to KRW 45 million, which is as large as 45 times the initial investment for a decade. Moreover, such trades are found to have had a critical impact on fund performance. The cumulative return was solid at 28.9% without rebalancing, but much worse at -2.5% with rebalancing. In other words, the impact of rebalancing on fund performance for a decade, that is, the difference between the return with rebalancing and the return without one, reached -31.4%. In the -1x fund, the cumulative size of rebalancing trades reached KRW 28.77 million, and the return with rebalancing was 20.4% lower than the return without rebalancing. The adverse effect of rebalancing was particularly evident in the -2x fund, with the size of rebalancing trades at KRW 59.08 million and the difference in returns at 39.5%.

Arguably, leveraged and inverse funds are differentiated from other ordinary funds. Leveraged and inverse funds could be desirable because they allow investors to emulate sophisticated investment strategies based on derivatives and short selling that have been long considered territory for institutional investors. However, their shortcoming lies in frequent rebalancing, which could somewhat seriously undermine fund performance. Those funds are also related to some other less important issues, e.g., high transaction costs and management fees compared to other passive funds, the disparate ratio and tracking error of ETFs, etc. All of those issues call for investors to fully take into account the characteristics, and to be wary of the risks before they invest in a leveraged or inverse fund.

On another front, the relevant industry could seek for an alternative that could fully exploit strengths of leveraged or inverse funds while effectively dealing with the rebalancing issue. For example, it’s worth considering a product using a rebalancing cycle longer than a day, or tracking a ranged target instead of a specific multiple, which would be of help in addressing the adverse effect of rebalancing on fund returns.7)

1) Cumulative returns presented in this article are calculated based on the closing price of each trading day, and the data are year to date as of May 15, 2020.

2) Leveraged and inverse funds notify such risks in their prospectus. In other words, the prospectus explicitly states that those products aim to meet the daily multiple objective, not the multiple of a cumulative return on the underlying index during a certain period.

3) For convenience, double-leveraged, inverse, and double-leveraged inverse funds are referred to as the ‘2x fund’, ‘-1x fund’, and ‘-2x fund’, respectively throughout this article.

4) The size of rebalancing trades in leveraged and inverse funds increases as the daily return on the underlying index goes up. More concretely, an r% return on the underlying index leads to rebalancing trades as large as 2r% of the previous day’s net asset value of a 2x fund and a -1x fund, and 6r% of a -2x fund.

5) In fact, a diverse range of factors and management strategies are known to affect the performance of leveraged and inverse funds. For example, leveraged fund performance could be affected by stock dividends and financing costs, whereas an inverse fund may see its performance increase due to interest income from deposits and bonds held by the fund. Other factors include fees, charges, and transaction costs. As this article places its focus on the effect of rebalancing, I excluded all of those factors and came up with three hypothetical funds whose performance is purely affected by the multiple of the daily return on an underlying index.

6) With the initial investment of KRW 1 million, the average size of rebalancing trades during 120 trading days is KRW 1.97 million, KRW 1.23 million, and KRW 2.51 million in the 2x, -1x, and -2x funds, respectively.

7) Also worth mentioning is the argument, which has been put forward frequently, that rebalancing trades of leveraged and inverse funds could trigger a shock to the spot and future markets. Although this is beyond the subject of this article, further research would be needed on rebalancing strategies.