Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

ESG Levels in Korea’s ESG Funds: Analysis and Implications

Publication date Sep. 15, 2020

Summary

Amid the abrupt increase in the size of ESG investing globally, Korea has seen a rush of ESG-themed funds in its asset management industry. However, there have been persistent claims that funds under the ESG label often fail to differentiate themselves from ordinary equity funds. An analysis on Korea’s equity ESG funds in this article reveals that average ESG levels of ESG fund portfolios are not significantly different from those of ordinary equity funds, and that ESG levels widely differ across ESG fund portfolios. As this could undermine investor confidence in ESG funds and activities in the ESG fund market in a long run, Korea’s financial investment industry should exert every effort to differentiate ESG-themed products, while seeking to enhance transparency in ESG funds.

Amid the growing interest in ESG (environmental, social, and governance) investing across the globe,1) the size of ESG investing has been rising rapidly. The Global Sustainable Investment Review reported that global ESG investing grew more than 34.3% from $33.8 trillion in 2016 to $30.7 trillion in 2018. What’s more is that such a large influx to ESG investing is expected to accelerate further as the recent Covid-19 pandemic shed new light on ESG issues such as climate change, public health, and environment protection. Such a trend triggered Korea’s asset management industry to vie for more and more ESG-themed funds: Korea’s equity funds in this category recorded a 222% growth rate with the net asset value jumping from KRW 115.1 billion in 2017 to KRW 370.7 billion in July 2020. However, there have been persistent claims that funds under the ESG label often fail to differentiate themselves in terms of the management style or asset composition from ordinary equity funds.2) It’s hard for investors to find out whether those funds comply with ESG investment principles in a faithful manner or not because quite a few of ESG funds—although their prospectus explicitly states ESG factors as an important criteria—do not disclose sufficient information on how they select or deselect investment targets and how their investment targets perform in terms of ESG. Against the backdrop, it’s particularly worth looking at the current state of Korea’s funds market and the management of ESG funds, which is expected to lead to some meaningful implications.

Korea’s ESG fund market: Current state

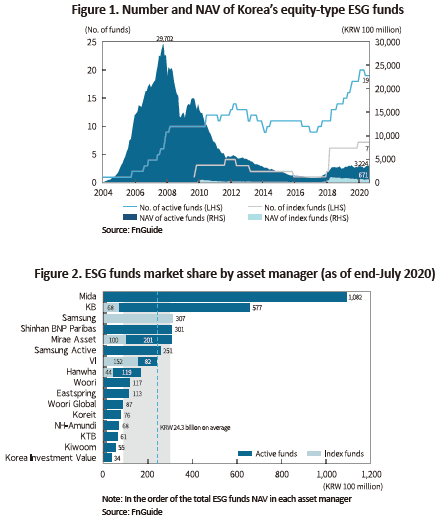

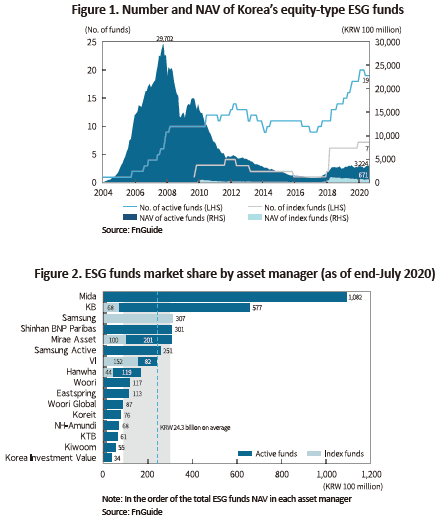

As of end-July, Korea had a total of 41 ESG funds whose NAV stood at approximately KRW 461.8 billion. Figure 1 shows monthly trends on the number and NAV of equity ESG funds launched in Korea since 2004. As of end-July 2020, a total of 7 exchange-traded funds and 19 active funds of this category held the NAV of KRW 67.1 billion and KRW 322.4 billion, respectively. Among those, 17 funds came to the market more recently after July 2017, and their NAV climbed approximately 270% since launch. This shows a heated competition for launching ESG-themed funds during the recent two to three years.

In 2005, the market only had one ESG fund among publicly offered equity funds. After ESG funds had gained momentum at the end of 2005, the market saw more ESG funds and a rapid increase in the market size that once peaked at the high of KRW 2.97 trillion in October 2007.3) However, the market for ESG funds turned to a decrease and even hit the lowest at KRW 105.1 billion in July 2017 as the overall mutual fund market contracted in the aftermath of the 2008 global financial crisis. The market has been picking up more recently as ESG investing has been gaining attention in Korea and the global market.4)

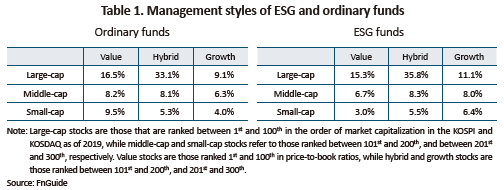

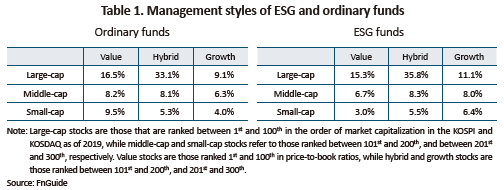

The market share of asset managers in the ESG fund market as illustrated in Figure 2 shows a high level of market concentration where roughly 70% of ESG funds by measure of NAV are managed by top five asset managers such as Midas, KB, Samsung, Mirae Asset, and Shinhan BNP Paribas out of 16 asset managers that are currently managing ESG funds as of July 2020. What’s notable is the different product mix across asset management companies: Some focus on either active or index funds, while others manage both. Midas, Shinhan BNP Paribas, Samsung Active, Eastspring, and Woori focus on active funds, whereas other players including KB, Mirae Asset, VI, Hanhwa manage both active and index funds.

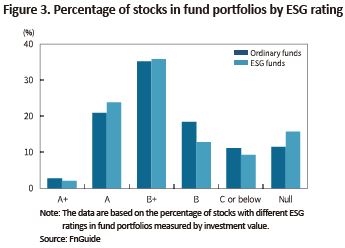

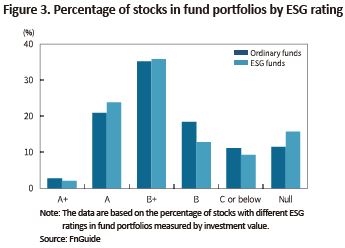

With the focus placed on active equity funds, Korea’s ESG funds have shown the following characteristics.5) Among others, Table 1 demonstrates the management style of ordinary and ESG funds that are active equity funds as of end-December 2019. It is shown that ESG funds like ordinary funds invest more than 50% of their total assets in large-cap value/hybrid stocks. On the other hand, Korea’s ESG funds are found to have a smaller average NAV that is 37.7% of ordinary funds’ (KRW 39.8 billion). Also confirmed is that the average number of stocks held by each fund stands at 59 in ESG funds, lower than 79 in ordinary funds. What those figures suggest is that Korea’s ESG funds hold a small number of stocks most of which are large-cap. This is a classic management style of equity funds that try to beat the market and purse excess returns.

Another measure could be ESG ratings of stocks invested by ESG and ordinary funds. Figure 3 illustrates how ESG and ordinary funds distribute their investments across stocks with different ESG ratings, measured by investment value. It was found that the proportion of stocks with B+ or higher ESG ratings in fund portfolios was 3.2 percentage point higher in ESG funds (62.1%) than ordinary funds (58.9%). A close look, however, reveals that the share of highest-rated stocks (A+) was higher in ordinary funds than ESG funds, whereas the share of stocks without ESG ratings (“null”) was higher in ESG funds.

For a more direct observation, I computed an ESG score of each fund portfolio to have a comparative look at funds’ ESG levels. Such an ESG rating methodology was first introduced by Morningstar which unveils the monthly Portfolio Sustainability Score. The financial services firm uses ESG data from Sustainalytics to compute the score.6)

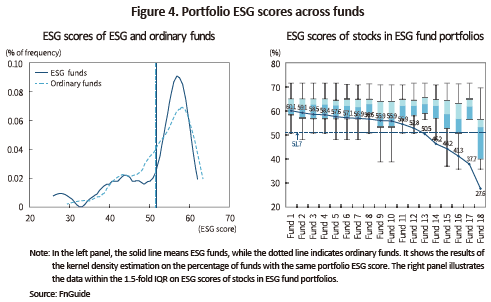

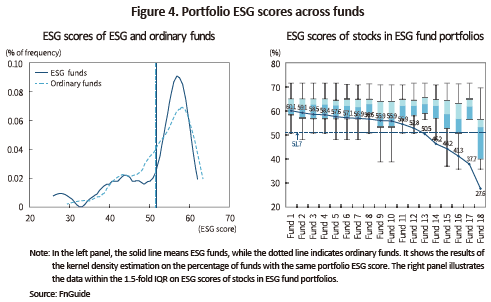

The left penal in Figure 4 shows a comparison of portfolio ESG scores between ESG and ordinary equity funds in Korea. Both types of funds reveal a similar pattern, but the average portfolio ESG score was slightly higher in ESG funds (51.71) than ordinary equity funds (51.47). However, the difference was not statistically significant.7)

The right panel in Figure 4 demonstrates the results of a comparative look at portfolio ESG scores of ESG funds. The band in each box indicates the median value of ESG scores with the length of the box showing the interquartile range (IQR). What’s confirmed here is a tendency where portfolio ESG scores across funds go up as the median value of ESG scores of portfolio stocks increases, and as the IQR decreases. Overall, the funds analyzed in this table show an acceptable level of ESG as more than a half of ESG funds have their portfolio ESG score over 50. In some of the ESG funds, however, their ESG scores were unacceptably low under 40: The portfolio ESG scores of some ESG funds widely diverge with the highest score being more than two-fold higher than lowest one. Those results imply that ESG levels of actual fund portfolios could widely vary even among funds classified as ESG.

Implications

This article explores the current state of Korea’s ESG fund market with the focus placed on portfolio asset composition and ESG levels. According to the analyses, it is observed that active equity ESG funds concentrate in large-cap, hybrid/value stocks, and that their portfolios show the average ESG levels that are not differentiated from ordinary active equity funds. This could hardly evidence an across-the-board problem in ESG funds because the data were certainly affected by few ESG funds with extremely low ESG scores. From the perspective of investors, however, it’s hard to assess a fund’s ESG levels based on the currently available data such as prospectuses at a time when the market still lacks a standardized classification scheme or disclosure guidelines on ESG funds. As this might lead to greenwashing, caution is required.

It’s worth looking into the case of the Europe an SRI Transparency Code of Eurosif, an organization that sets out disclosure guidelines on ESG funds. On top of existing disclosure tools such as prospectuses, Eurosif devised and published guidelines under which SRI funds disclose matters related to ESG assessment such as the methodology, how portfolios reflect ESG assessment results, frequency of assessment, major changes, control procedures ensuring ESG compliance, etc. As of 2018, 800 out of 884 publicly offered SRI funds in Europe were reported to have endorsed the code.8) It’s time for Korea’s financial investment industry including asset management companies to make efforts for bolstering their ESG investment capabilities, developing differentiated ESG fund products, and enhancing transparency of ESG funds towards a vigorous ESG market with higher investor confidence.

1) ESG investing refers to an investment practice that takes into account non-financial factors such as environment protection, social responsibility, superb governance on top of financial performance of firms.

2) Ahn, S.A., 2012, Korea’s SRI: Current state and implications, CG Review; Joongang Daily, November 30, 2012, SRI funds without social responsibility; Asia Today, January 5, 2014, Do SRI funds really invest in “good” companies?; FN Times, July 10, 2017, Are Korea’s SRI funds a sham?; Wee, K., & Kang, Y., 2019, The effect of ESG levels on fund performance and cash flows, Proceedings of the 2019 joint conference of five finance associations; Kong, K.S., 2019, Global ESG funds: Current state and implications, KCMI Capital Market Focus 2019-02.

3) However, it’s improper to conclude that the ESG fund market was fully active in October 2007 because the market at that time had only seven ESG funds one of which took up a large portion (about 92.3% or KRW 2.74 trillion) of the total ESG funds NAV.

4) For the past three years between July 2017 and July 2020, the NAV of ESG active and index funds jumped 200% from KRW 105.1 billion to KRW 305.1 billion, and 556% from KRW 10.0 billion to KRW 65.6 billion, respectively.

5) The analysis is as of December 2019 given that Korea Corporate Governance Service releases their ESG assessment results every September to October. The analysis target is limited to Korea’s active equity funds whose NAV is over KRW 1 billion. Among those, I selected 272 ordinary equity funds and 18 ESG funds that are labeled as ESG-theme funds by FnGuide. As multi-class funds are managed by the same investment portfolio, one of the funds were selected and its investment portfolio was analyzed.

6) More concretely, Morningstar computes the Portfolio Sustainability Report by deducting a fund’s portfolio ESG controversy score from the portfolio ESG score. The portfolio ESG score here means the weighted average of ESG scores of stocks in each fund portfolio where the weight is the share of each stock in an investment portfolio. For details on how to compute ESG scores, please refer to Morningstar Sustainability Rating Methodology (Morningstar, 2019).

7) The t-value of the differences in ESG scores between ESG and ordinary funds stood at –0.11 (p-value=0.91).

8) http://www.eurosif.org/transparency-code/

Korea’s ESG fund market: Current state

As of end-July, Korea had a total of 41 ESG funds whose NAV stood at approximately KRW 461.8 billion. Figure 1 shows monthly trends on the number and NAV of equity ESG funds launched in Korea since 2004. As of end-July 2020, a total of 7 exchange-traded funds and 19 active funds of this category held the NAV of KRW 67.1 billion and KRW 322.4 billion, respectively. Among those, 17 funds came to the market more recently after July 2017, and their NAV climbed approximately 270% since launch. This shows a heated competition for launching ESG-themed funds during the recent two to three years.

In 2005, the market only had one ESG fund among publicly offered equity funds. After ESG funds had gained momentum at the end of 2005, the market saw more ESG funds and a rapid increase in the market size that once peaked at the high of KRW 2.97 trillion in October 2007.3) However, the market for ESG funds turned to a decrease and even hit the lowest at KRW 105.1 billion in July 2017 as the overall mutual fund market contracted in the aftermath of the 2008 global financial crisis. The market has been picking up more recently as ESG investing has been gaining attention in Korea and the global market.4)

The market share of asset managers in the ESG fund market as illustrated in Figure 2 shows a high level of market concentration where roughly 70% of ESG funds by measure of NAV are managed by top five asset managers such as Midas, KB, Samsung, Mirae Asset, and Shinhan BNP Paribas out of 16 asset managers that are currently managing ESG funds as of July 2020. What’s notable is the different product mix across asset management companies: Some focus on either active or index funds, while others manage both. Midas, Shinhan BNP Paribas, Samsung Active, Eastspring, and Woori focus on active funds, whereas other players including KB, Mirae Asset, VI, Hanhwa manage both active and index funds.

The left penal in Figure 4 shows a comparison of portfolio ESG scores between ESG and ordinary equity funds in Korea. Both types of funds reveal a similar pattern, but the average portfolio ESG score was slightly higher in ESG funds (51.71) than ordinary equity funds (51.47). However, the difference was not statistically significant.7)

The right panel in Figure 4 demonstrates the results of a comparative look at portfolio ESG scores of ESG funds. The band in each box indicates the median value of ESG scores with the length of the box showing the interquartile range (IQR). What’s confirmed here is a tendency where portfolio ESG scores across funds go up as the median value of ESG scores of portfolio stocks increases, and as the IQR decreases. Overall, the funds analyzed in this table show an acceptable level of ESG as more than a half of ESG funds have their portfolio ESG score over 50. In some of the ESG funds, however, their ESG scores were unacceptably low under 40: The portfolio ESG scores of some ESG funds widely diverge with the highest score being more than two-fold higher than lowest one. Those results imply that ESG levels of actual fund portfolios could widely vary even among funds classified as ESG.

This article explores the current state of Korea’s ESG fund market with the focus placed on portfolio asset composition and ESG levels. According to the analyses, it is observed that active equity ESG funds concentrate in large-cap, hybrid/value stocks, and that their portfolios show the average ESG levels that are not differentiated from ordinary active equity funds. This could hardly evidence an across-the-board problem in ESG funds because the data were certainly affected by few ESG funds with extremely low ESG scores. From the perspective of investors, however, it’s hard to assess a fund’s ESG levels based on the currently available data such as prospectuses at a time when the market still lacks a standardized classification scheme or disclosure guidelines on ESG funds. As this might lead to greenwashing, caution is required.

It’s worth looking into the case of the Europe an SRI Transparency Code of Eurosif, an organization that sets out disclosure guidelines on ESG funds. On top of existing disclosure tools such as prospectuses, Eurosif devised and published guidelines under which SRI funds disclose matters related to ESG assessment such as the methodology, how portfolios reflect ESG assessment results, frequency of assessment, major changes, control procedures ensuring ESG compliance, etc. As of 2018, 800 out of 884 publicly offered SRI funds in Europe were reported to have endorsed the code.8) It’s time for Korea’s financial investment industry including asset management companies to make efforts for bolstering their ESG investment capabilities, developing differentiated ESG fund products, and enhancing transparency of ESG funds towards a vigorous ESG market with higher investor confidence.

1) ESG investing refers to an investment practice that takes into account non-financial factors such as environment protection, social responsibility, superb governance on top of financial performance of firms.

2) Ahn, S.A., 2012, Korea’s SRI: Current state and implications, CG Review; Joongang Daily, November 30, 2012, SRI funds without social responsibility; Asia Today, January 5, 2014, Do SRI funds really invest in “good” companies?; FN Times, July 10, 2017, Are Korea’s SRI funds a sham?; Wee, K., & Kang, Y., 2019, The effect of ESG levels on fund performance and cash flows, Proceedings of the 2019 joint conference of five finance associations; Kong, K.S., 2019, Global ESG funds: Current state and implications, KCMI Capital Market Focus 2019-02.

3) However, it’s improper to conclude that the ESG fund market was fully active in October 2007 because the market at that time had only seven ESG funds one of which took up a large portion (about 92.3% or KRW 2.74 trillion) of the total ESG funds NAV.

4) For the past three years between July 2017 and July 2020, the NAV of ESG active and index funds jumped 200% from KRW 105.1 billion to KRW 305.1 billion, and 556% from KRW 10.0 billion to KRW 65.6 billion, respectively.

5) The analysis is as of December 2019 given that Korea Corporate Governance Service releases their ESG assessment results every September to October. The analysis target is limited to Korea’s active equity funds whose NAV is over KRW 1 billion. Among those, I selected 272 ordinary equity funds and 18 ESG funds that are labeled as ESG-theme funds by FnGuide. As multi-class funds are managed by the same investment portfolio, one of the funds were selected and its investment portfolio was analyzed.

6) More concretely, Morningstar computes the Portfolio Sustainability Report by deducting a fund’s portfolio ESG controversy score from the portfolio ESG score. The portfolio ESG score here means the weighted average of ESG scores of stocks in each fund portfolio where the weight is the share of each stock in an investment portfolio. For details on how to compute ESG scores, please refer to Morningstar Sustainability Rating Methodology (Morningstar, 2019).

7) The t-value of the differences in ESG scores between ESG and ordinary funds stood at –0.11 (p-value=0.91).

8) http://www.eurosif.org/transparency-code/